UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Robert Griffith, Esq. | | Stephen H. Bier, Esq. |

Goldman Sachs & Co. LLC | | Dechert LLP |

200 West Street | | 1095 Avenue of the Americas |

New York, New York 10282 | | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds Semi-Annual Report April 30, 2024 Active Equity Multi-Manager Funds Multi-Manager International Equity Multi-Manager U.S. Small Cap Equity Active Equity Multi-Manager Funds _ MULTI-MANAGER INTERNATIONAL EQUITY _ MULTI-MANAGER U.S. SMALL CAP EQUITY

Active Equity Multi-Manager Funds

| | |

| ∎ | | MULTI-MANAGER INTERNATIONAL EQUITY |

| | |

| ∎ | | MULTI-MANAGER U.S. SMALL CAP EQUITY |

TABLE OF CONTENTS

Effective January 24, 2023, open-end mutual funds and exchange-traded funds are required to provide shareholders with streamlined annual and semi-annual shareholder reports (“Tailored Shareholder Reports”). Funds will be required to prepare a separate Tailored Shareholder Report for each share class of a fund that highlights key information to investors. Other information, including financial statements, will no longer appear in a fund’s shareholder report, but will be available online, delivered free of charge upon request, and filed with the Securities and Exchange Commission on a semi-annual basis on Form N-CSR. The new requirements have a compliance date of July 24, 2024.

| | | | | | |

| | | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee | | |

MARKET REVIEW

Active Equity Multi-Manager Funds

Market Review

Looking Ahead

The following are highlights both of key factors affecting the global equity and credit markets and of any key changes made to the Active Equity Multi-Manager Funds (the “Funds”) during the six months ended April 30, 2024 (the “Reporting Period”). A streamlined annual shareholder report covering the 12 months ended October 31, 2024 will be provided to Fund shareholders, per new Securities and Exchange Commission (“SEC”) requirements with a compliance date of July 24, 2024.

Market and Economic Review

Global Equity Markets

| ∎ | The broad global equity market, as represented by the MSCI* All Country World Index (“MSCI ACWI”) Investable Market Index, returned 19.64% during the Reporting Period. |

| ∎ | When the Reporting Period began in November 2023, global equities were in the midst of a rally. |

| | ∎ | The rally, which had started in late October 2023, followed a period of considerable volatility, as market participants weighed the probabilities for various U.S. economic scenarios, ranging from a “soft landing” to a “hard landing” to stagflation.1 |

| | ∎ | Late October 2023 marked a turning point in market sentiment, as the soft landing narrative became dominant. Investors appeared to believe the U.S. Federal Reserve (“Fed”) would not hike interest rates again, and they started pricing in interest rate cuts for 2024. (The Fed had last raised the target federal funds rate in July 2023.) |

| ∎ | Global equities continued to rally through the end of March 2024, delivering strongly positive returns. |

| ∎ | In April 2024, the global equity market gave back some of its gains, as persistent inflation led investors to scale back their expectations for the number of potential Fed rate cuts. |

| ∎ | From a style perspective, growth stocks and value stocks generated positive returns during the Reporting Period overall, with growth stocks outpacing their value counterparts. |

| | ∎ | From a regional perspective, developed markets equities and emerging markets equities produced gains, with developed markets equities outperforming emerging markets equities. |

| | ∎ | Within developed markets equities, the Japanese stock market was a particularly strong performer amid investor optimism about corporate governance reforms and potential changes to the Bank of Japan’s monetary policy. |

| | ∎ | Within emerging markets equities, China was the weakest performer due to that country’s economic challenges, including an ongoing property crisis and weak consumer sentiment. |

Credit Markets

| ∎ | Credit markets broadly advanced during the Reporting Period, as bond yields fell and credit spreads (or yield differentials versus duration-equivalent U.S. Treasury securities) tightened. |

| ∎ | In the first two months of the Reporting Period, bond yields plunged amidst speculation the Fed had reached the peak of its interest rate hikes and would begin cutting rates in 2024. |

| ∎ | Bond yields rose during the last four months of the Reporting Period, as markets came to terms with the possibility that interest rates could remain higher for longer. |

| | ∎ | Also, due to persistent inflation, investors had moderated their expectations for Fed rate cuts in 2024, which contributed further to the rise in yields. |

| | ∎ | Credit spreads continued to tighten as a result of strong demand and a drop in supply, especially net new supply. |

| 1 | A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing. Stagflation is characterized by slow economic growth and high inflation. |

MARKET REVIEW

| ∎ | High yield corporate bonds and bank loans delivered strong performance during the Reporting Period overall, with high yield corporate bonds outpacing bank loans. |

| | ∎ | The outperformance of high yield corporate bonds was driven largely by spread tightening and their comparatively longer duration. (Duration is a measure of a security’s sensitivity to changes in interest rates.) |

| | ∎ | The default rate for bank loans and high yield corporate bonds increased modestly during the Reporting Period but remained below long-term averages. |

| ∎ | Investment grade corporate bonds also benefited from their longer duration profile, though they underperformed high yield corporate bonds during the Reporting Period overall. |

| | ∎ | As yields fell in the first two months of the Reporting Period, investment grade corporate bonds outperformed high yield corporate bonds. However, they lagged during the last four months of the Reporting Period when yields moved higher. |

| | ∎ | Among market segments, financial and industrial investment grade corporate bonds performed best, while utilities turned in the weakest performance. |

| ∎ | U.S. dollar-denominated emerging markets debt was the strongest performing credit sector of the Reporting Period, benefiting from spread compression across the credit spectrum and strong gains among the lowest rated credits. |

| | ∎ | Local currency-denominated bonds generally underperformed other credit sectors during the Reporting Period, largely because of a strong U.S. dollar and higher-for-longer central bank policy that anchored interest rates above market expectations. |

Fund Changes and Highlights

No material changes were made to the Funds during the Reporting Period.

FUND BASICS

Multi-Manager International Equity Fund

as of April 30, 2024

| | | | | | | | |

| | | | |

November 1, 2023–April 30, 2024 | | Fund Total

Return (based on NAV)1 | | | | MSCI*® EAFE® Index

(Net, USD, Unhedged)2 | | |

| | | | |

Class P Shares | | 17.07% | | | | 18.63% | | |

| | 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | The MSCI® EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada. The Index figures do not reflect any deductions for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

|

TOP TEN HOLDINGS AS OF 4/30/24± |

| | | | | | | | |

| | | | |

Holding | | % of Net Assets | | | | Line of Business | | |

| | | | |

Novo Nordisk AS | | 2.8% | | | | Pharmaceuticals | | |

Rolls-Royce Holdings PLC | | 2.2 | | | | Aerospace & Defense | | |

AstraZeneca PLC | | 1.9 | | | | Pharmaceuticals | | |

Schneider Electric SE | | 1.9 | | | | Electrical Equipment | | |

Samsung Electronics Co. Ltd. | | 1.8 | | | | Technology Hardware, Storage & Peripherals | | |

Canadian Pacific Kansas City Ltd. | | 1.8 | | | | Ground Transportation | | |

SAP SE | | 1.8 | | | | Software | | |

Air Liquide SA | | 1.7 | | | | Chemicals | | |

Roche Holding AG | | 1.7 | | | | Pharmaceuticals | | |

| | | | |

Compass Group PLC | | 1.6 | | | | Hotels, Restaurants & Leisure | | |

| | ± | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

FUND BASICS

|

|

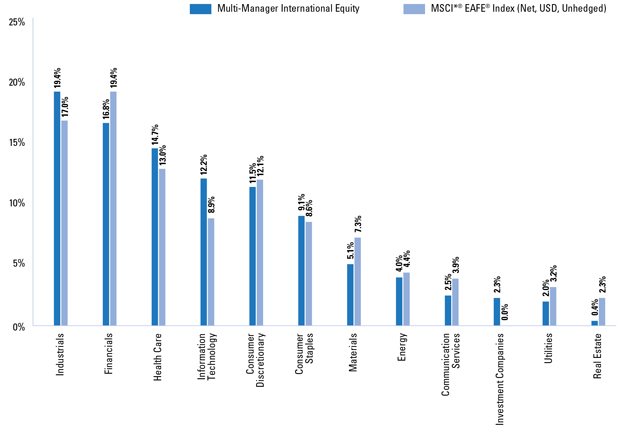

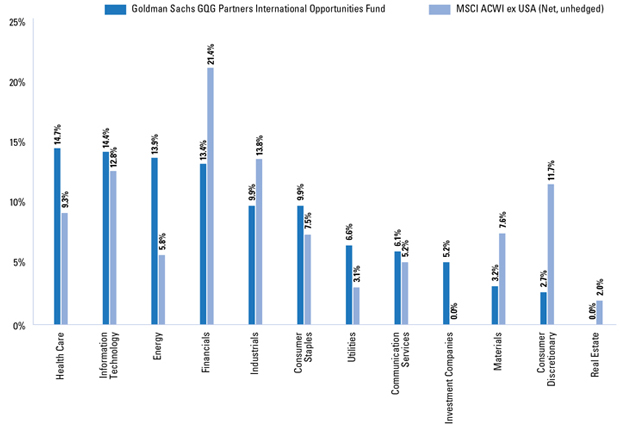

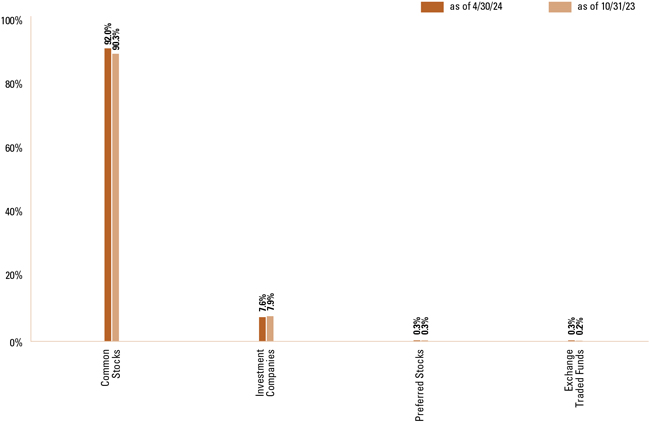

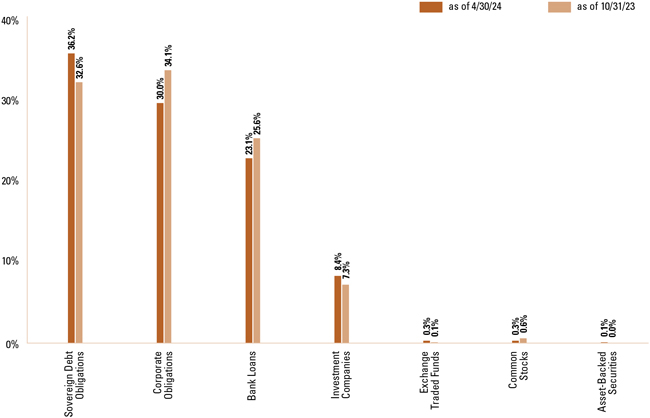

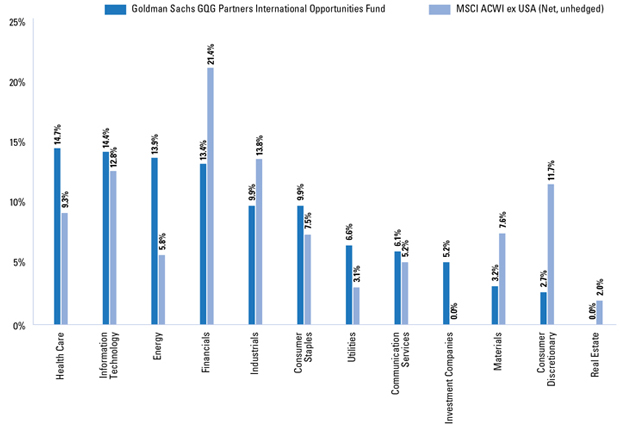

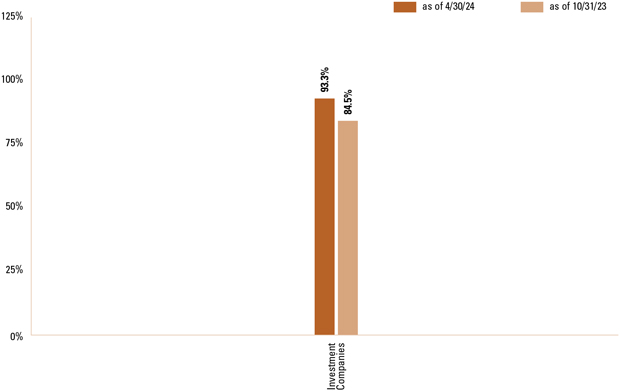

FUND VS. BENCHMARK SECTOR ALLOCATION† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s equity investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. |

| | For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

FUND BASICS

Multi-Manager U.S. Small Cap Equity Fund

as of April 30, 2024

| | | | | | | | |

| | | | |

November 1, 2023–April 30, 2024 | | Fund Total

Return (based on NAV)1 | | | | Russell 2000®

Total Return Index2 | | |

| | | | |

Class P Shares | | 17.07% | | | | 19.66% | | |

| | 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | The Russell 2000® Total Return Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. It is not possible to invest directly in an index. |

| | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

|

TOP TEN HOLDINGS AS OF 4/30/24± |

| | | | | | | | |

| | | | |

Holding | | % of Net Assets | | | | Line of Business | | |

| | | | |

Ascendis Pharma AS | | 1.5% | | | | Biotechnology | | |

Casella Waste Systems, Inc. | | 1.1 | | | | Commerical Services & Supplies | | |

ChampionX Corp. | | 1.1 | | | | Energy Equipment & Services | | |

Wintrust Financial Corp. | | 0.9 | | | | Banks | | |

Comfort Systems USA, Inc. | | 0.9 | | | | Construction & Engineering | | |

AZEK Co., Inc. | | 0.8 | | | | Building Products | | |

Bright Horizons Family Solutions, Inc. | | 0.8 | | | | Diversified Consumer Services | | |

Insight Enterprises, Inc. | | 0.8 | | | | Electronic Equipment, Instruments & Components | | |

HB Fuller Co. | | 0.8 | | | | Chemicals | | |

| | | | |

Haemonetics Corp. | | 0.8 | | | | Health Care Equipment & Supplies | | |

| | ± | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

FUND BASICS

|

|

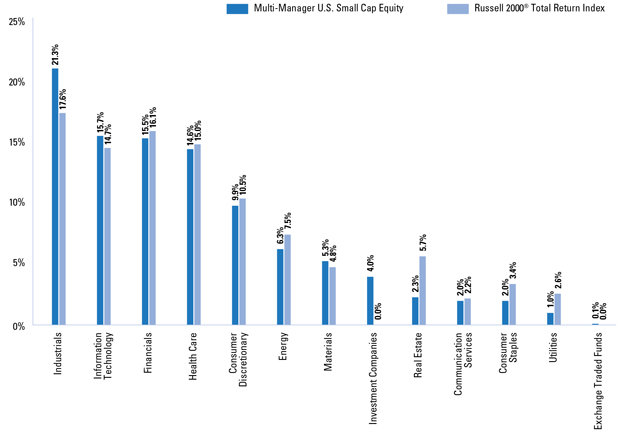

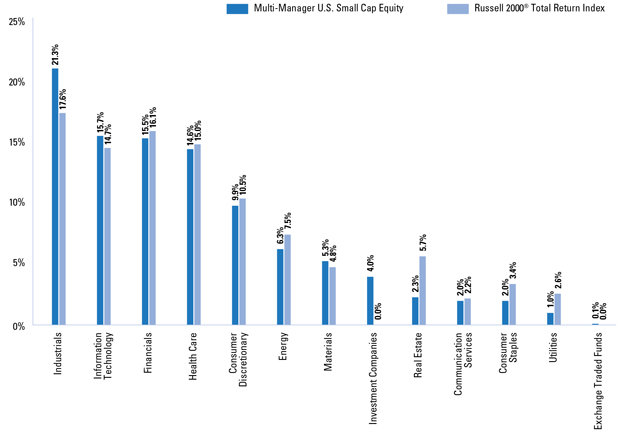

FUND VS. BENCHMARK SECTOR ALLOCATION† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s equity investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. |

| | For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

|

Schedule of Investments April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – 97.0% | |

| |

| | Belgium – 0.9% | |

| | 149,953 | | Anheuser-Busch InBev SA (Beverages) | | $ | 8,963,258 | |

| | 48,728 | | KBC Group NV (Banks) | | | 3,619,718 | |

| | | | | | | | |

| | | | | | | 12,582,976 | |

| | | |

| |

| | Bermuda* – 0.8% | |

| | 119,810 | | Arch Capital Group Ltd. (Insurance) | | | 11,207,027 | |

| | | |

| |

| | Brazil – 0.7% | |

| | 739,275 | | Banco Bradesco SA (Banks) | | | 1,996,042 | |

| | 798,630 | | NU Holdings Ltd. Class A* (Banks) | | | 8,673,122 | |

| | | | | | | | |

| | | | | | | 10,669,164 | |

| | | |

| |

| | Canada – 4.5% | |

| | 65,416 | | Canadian National Railway Co. (Ground Transportation) | | | 7,944,119 | |

| | 105,570 | | Canadian Natural Resources Ltd. (Oil, Gas & Consumable Fuels) | | | 7,999,900 | |

| | 331,513 | | Canadian Pacific Kansas City Ltd. (Ground Transportation) | | | 26,002,655 | |

| | 26,321 | | Intact Financial Corp. (Insurance) | | | 4,326,192 | |

| | 153,825 | | Suncor Energy, Inc. (Oil, Gas & Consumable Fuels) | | | 5,869,631 | |

| | 53,430 | | Thomson Reuters Corp. (Professional Services) | | | 8,070,098 | |

| | 97,693 | | Toronto-Dominion Bank (Banks) | | | 5,795,654 | |

| | | | | | | | |

| | | | | | | 66,008,249 | |

| | | |

| |

| | China – 1.3% | |

| | 210,100 | | NetEase, Inc. (Entertainment) | | | 3,938,246 | |

| | 302,800 | | Tencent Holdings Ltd. (Interactive Media & Services) | | | 13,287,828 | |

| | 62,422 | | Yum China Holdings, Inc. (Hotels, Restaurants & Leisure) | | | 2,279,027 | |

| | | | | | | | |

| | | | | | | 19,505,101 | |

| | | |

| |

| | Denmark – 3.2% | |

| | 49,940 | | Carlsberg AS Class B (Beverages) | | | 6,717,572 | |

| | 319,169 | | Novo Nordisk AS Class B (Pharmaceuticals) | | | 40,930,934 | |

| | | | | | | | |

| | | | | | | 47,648,506 | |

| | | |

| |

| | France – 15.4% | |

| | 126,513 | | Air Liquide SA (Chemicals) | | | 24,743,243 | |

| | 748,571 | | Alstom SA (Machinery) | | | 11,803,522 | |

| | 166,745 | | AXA SA (Insurance) | | | 5,761,303 | |

| | 61,957 | | BNP Paribas SA (Banks) | | | 4,458,541 | |

| | 65,772 | | Capgemini SE (IT Services) | | | 13,824,025 | |

| | 302,087 | | Carrefour SA (Consumer Staples Distribution & Retail) | | | 5,082,077 | |

| | 152,162 | | Cie de Saint-Gobain SA (Building Products) | | | 12,033,373 | |

| | 148,628 | | Cie Generale des Etablissements Michelin SCA (Automobile Components) | | | 5,710,086 | |

| | 118,491 | | Danone SA (Food Products) | | | 7,416,036 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | France (continued) | |

| | 75,534 | | Dassault Systemes SE (Software) | | $ | 2,964,855 | |

| | 71,908 | | Edenred SE (Financial Services) | | | 3,412,169 | |

| | 476,383 | | Engie SA* (Multi-Utilities) | | | 8,270,299 | |

| | 47,169 | | EssilorLuxottica SA (Health Care Equipment & Supplies) | | | 10,057,922 | |

| | 32,488 | | Kering SA (Textiles, Apparel & Luxury Goods) | | | 11,386,043 | |

| | 53,517 | | Legrand SA (Electrical Equipment) | | | 5,499,761 | |

| | 18,640 | | L’Oreal SA (Personal Products) | | | 8,739,423 | |

| | 28,323 | | LVMH Moet Hennessy Louis Vuitton SE (Textiles, Apparel & Luxury Goods) | | | 23,265,532 | |

| | 43,636 | | Pernod Ricard SA (Beverages) | | | 6,599,601 | |

| | 58,270 | | Safran SA (Aerospace & Defense) | | | 12,634,806 | |

| | 74,378 | | Sanofi SA (Pharmaceuticals) | | | 7,348,030 | |

| | 120,369 | | Schneider Electric SE (Electrical Equipment) | | | 27,445,742 | |

| | 23,411 | | Valeo SE (Automobile Components) | | | 296,699 | |

| | 40,687 | | Vinci SA (Construction & Engineering) | | | 4,767,544 | |

| | 146,249 | | Worldline SA*(a) (Financial Services) | | | 1,516,967 | |

| | | | | | | | |

| | | | | | | 225,037,599 | |

| | | |

| |

| | Germany – 6.5% | |

| | 12,886 | | Allianz SE (Insurance) | | | 3,656,854 | |

| | 79,793 | | Beiersdorf AG (Personal Products) | | | 11,993,173 | |

| | 59,079 | | Deutsche Boerse AG (Capital Markets) | | | 11,389,955 | |

| | 459,964 | | Deutsche Telekom AG (Diversified Telecommunication Services) | | | 10,535,735 | |

| | 206,233 | | Infineon Technologies AG (Semiconductors & Semiconductor Equipment) | | | 7,156,912 | |

| | 198,874 | | Lanxess AG (Chemicals) | | | 5,620,781 | |

| | 58,341 | | Merck KGaA (Pharmaceuticals) | | | 9,270,482 | |

| | 14,956 | | MTU Aero Engines AG (Aerospace & Defense) | | | 3,603,153 | |

| | 173,983 | | RWE AG (Independent Power and Renewable Electricity Producers) | | | 6,060,791 | |

| | 143,894 | | SAP SE (Software) | | | 25,982,528 | |

| | | | | | | | |

| | | | | | | 95,270,364 | |

| | | |

| |

| | Hong Kong – 0.8% | |

| | 1,201,000 | | AIA Group Ltd. (Insurance) | | | 8,796,548 | |

| | 609,700 | | Link REIT (Retail REITs) | | | 2,612,437 | |

| | | | | | | | |

| | | | | | | 11,408,985 | |

| | | |

| |

| | India – 1.3% | |

| | 396,575 | | HDFC Bank Ltd. (Banks) | | | 7,202,033 | |

| | 382,070 | | ICICI Bank Ltd. (Banks) | | | 10,518,387 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | India (continued) | |

| | 46,551 | | Tata Consultancy Services Ltd. (IT Services) | | $ | 2,124,592 | |

| | | | | | | | |

| | | | | | | 19,845,012 | |

| | | |

| |

| | Ireland – 5.4% | |

| | 766,572 | | AIB Group PLC (Banks) | | | 3,967,909 | |

| | 37,390 | | Aon PLC Class A (Insurance) | | | 10,544,354 | |

| | 429,418 | | Experian PLC (Professional Services) | | | 17,320,122 | |

| | 56,600 | | ICON PLC* (Life Sciences Tools & Services) | | | 16,860,008 | |

| | 36,523 | | Linde PLC (Chemicals) | | | 16,105,182 | |

| | 104,561 | | Ryanair Holdings PLC (Passenger Airlines) | | | 14,241,208 | |

| | | | | | | | |

| | | | | | | 79,038,783 | |

| | | |

| |

| | Israel* – 0.4% | |

| | 35,599 | | Check Point Software Technologies Ltd. (Software) | | | 5,319,203 | |

| | | |

| |

| | Italy – 4.0% | |

| | 1,757,862 | | Enel SpA (Electric Utilities) | | | 11,553,444 | |

| | 449,206 | | Eni SpA (Oil, Gas & Consumable Fuels) | | | 7,215,006 | |

| | 45,760 | | Ferrari NV (Automobiles) | | | 18,819,926 | |

| | 2,549,302 | | Intesa Sanpaolo SpA (Banks) | | | 9,542,051 | |

| | 302,826 | | UniCredit SpA (Banks) | | | 11,115,037 | |

| | | | | | | | |

| | | | | | | 58,245,464 | |

| | | |

| |

| | Japan – 9.3% | |

| | 48,900 | | Daikin Industries Ltd. (Building Products) | | | 6,674,424 | |

| | 473,800 | | Denso Corp. (Automobile Components) | | | 8,075,029 | |

| | 424,200 | | FANUC Corp. (Machinery) | | | 12,564,500 | |

| | 279,700 | | Fujitsu Ltd. (IT Services) | | | 4,320,845 | |

| | 177,800 | | Hitachi Ltd. (Industrial Conglomerates) | | | 16,403,947 | |

| | 18,300 | | Hoya Corp. (Health Care Equipment & Supplies) | | | 2,121,699 | |

| | 57,100 | | Kose Corp. (Personal Products) | | | 2,944,308 | |

| | 156,600 | | Kubota Corp. (Machinery) | | | 2,511,821 | |

| | 460,600 | | Kyocera Corp. (Electronic Equipment, Instruments & Components) | | | 5,614,087 | |

| | 384,300 | | Mitsubishi Electric Corp. (Electrical Equipment) | | | 6,698,321 | |

| | 472,100 | | Murata Manufacturing Co. Ltd. (Electronic Equipment, Instruments & Components) | | | 8,626,286 | |

| | 372,500 | | Olympus Corp. (Health Care Equipment & Supplies) | | | 5,188,817 | |

| | 501,900 | | Renesas Electronics Corp. (Semiconductors & Semiconductor Equipment) | | | 8,148,724 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | Japan (continued) | |

| | 927,100 | | Seven & i Holdings Co. Ltd. (Consumer Staples Distribution & Retail) | | $ | 11,979,239 | |

| | 150,400 | | Shin-Etsu Chemical Co. Ltd. (Chemicals) | | | 5,821,824 | |

| | 10,300 | | SMC Corp. (Machinery) | | | 5,411,276 | |

| | 89,300 | | Sony Group Corp. (Household Durables) | | | 7,380,764 | |

| | 261,200 | | Takeda Pharmaceutical Co. Ltd. (Pharmaceuticals) | | | 6,864,876 | |

| | 331,700 | | Terumo Corp. (Health Care Equipment & Supplies) | | | 5,627,000 | |

| | 141,900 | | ZOZO, Inc. (Specialty Retail) | | | 3,056,309 | |

| | | | | | | | |

| | | | | | | 136,034,096 | |

| | | |

| |

| | Netherlands – 5.4% | |

| | 8,113 | | Adyen NV*(a) (Financial Services) | | | 9,719,375 | |

| | 175,910 | | Akzo Nobel NV (Chemicals) | | | 11,606,883 | |

| | 21,370 | | ASM International NV (Semiconductors & Semiconductor Equipment) | | | 13,442,561 | |

| | 13,710 | | ASML Holding NV (Semiconductors & Semiconductor Equipment) | | | 11,961,564 | |

| | 27,234 | | Heineken NV (Beverages) | | | 2,650,403 | |

| | 1,020,881 | | ING Groep NV (Banks) | | | 16,140,400 | |

| | 508,428 | | Koninklijke Philips NV (Health Care Equipment & Supplies) | | | 13,501,912 | |

| | | | | | | | |

| | | | | | | 79,023,098 | |

| | | |

| |

| | Portugal – 0.4% | |

| | 267,480 | | Galp Energia SGPS SA (Oil, Gas & Consumable Fuels) | | | 5,745,780 | |

| | | |

| |

| | Singapore – 0.9% | |

| | 299,780 | | DBS Group Holdings Ltd. (Banks) | | | 7,631,620 | |

| | 230,000 | | United Overseas Bank Ltd. (Banks) | | | 5,103,881 | |

| | | | | | | | |

| | | | | | | 12,735,501 | |

| | | |

| |

| | South Korea – 2.6% | |

| | 435,420 | | Coupang, Inc.* (Broadline Retail) | | | 9,796,950 | |

| | 121,113 | | Samsung Electronics Co. Ltd. (Technology Hardware, Storage & Peripherals) | | | 26,171,079 | |

| | 18,898 | | SK Hynix, Inc. (Semiconductors & Semiconductor Equipment) | | | 2,332,119 | |

| | | | | | | | |

| | | | | | | 38,300,148 | |

| | | |

| |

| | Spain – 1.5% | |

| | 38,444 | | Aena SME SA(a) (Transportation Infrastructure) | | | 7,006,019 | |

| | 182,390 | | Amadeus IT Group SA (Hotels, Restaurants & Leisure) | | | 11,577,009 | |

| | 320,905 | | Iberdrola SA (Electric Utilities) | | | 3,934,801 | |

| | | | | | | | |

| | | | | | | 22,517,829 | |

| | | |

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | Sweden – 0.8% | |

| | 85,100 | | Assa Abloy AB Class B (Building Products) | | $ | 2,248,461 | |

| | 83,160 | | Evolution AB(a) (Hotels, Restaurants & Leisure) | | | 9,187,945 | |

| | | | | | | | |

| | | | | | | 11,436,406 | |

| | | |

| |

| | Switzerland – 4.6% | |

| | 78,217 | | Cie Financiere Richemont SA Class A (Textiles, Apparel & Luxury Goods) | | | 10,811,704 | |

| | 107,242 | | Julius Baer Group Ltd. (Capital Markets) | | | 5,754,429 | |

| | 175,887 | | Novartis AG (Pharmaceuticals) | | | 17,071,148 | |

| | 15,941 | | Sika AG (Chemicals) | | | 4,534,599 | |

| | 14,006 | | Sonova Holding AG (Health Care Equipment & Supplies) | | | 3,871,708 | |

| | 616,080 | | UBS Group AG (Capital Markets) | | | 16,180,274 | |

| | 18,140 | | Zurich Insurance Group AG (Insurance) | | | 8,780,600 | |

| | | | | | | | |

| | | | | | | 67,004,462 | |

| | | |

| |

| | Taiwan – 1.2% | |

| | 455,249 | | Taiwan Semiconductor Manufacturing Co. Ltd. (Semiconductors & Semiconductor Equipment) | | | 17,959,173 | |

| | | |

| |

| | United Kingdom – 18.1% | |

| | 182,930 | | AstraZeneca PLC (Pharmaceuticals) | | | 27,667,955 | |

| | 6,155,904 | | Barclays PLC (Banks) | | | 15,520,833 | |

| | 52,674 | | Berkeley Group Holdings PLC (Household Durables) | | | 3,093,313 | |

| | 2,449,071 | | BP PLC (Oil, Gas & Consumable Fuels) | | | 15,785,823 | |

| | 255,181 | | British American Tobacco PLC (Tobacco) | | | 7,491,163 | |

| | 866,489 | | Compass Group PLC (Hotels, Restaurants & Leisure) | | | 24,100,272 | |

| | 522,705 | | Diageo PLC (Beverages) | | | 18,064,513 | |

| | 57,230 | | Ferguson PLC (Trading Companies & Distributors) | | | 12,067,279 | |

| | 475,967 | | GSK PLC (Pharmaceuticals) | | | 9,874,845 | |

| | 974,267 | | Kingfisher PLC (Specialty Retail) | | | 3,001,058 | |

| | 1,605,992 | | Legal & General Group PLC (Insurance) | | | 4,714,389 | |

| | 66,635 | | London Stock Exchange Group PLC (Capital Markets) | | | 7,345,847 | |

| | 1,086,133 | | NatWest Group PLC (Banks) | | | 4,099,480 | |

| | 1,827,817 | | Prudential PLC (Insurance) | | | 15,897,160 | |

| | 233,318 | | Reckitt Benckiser Group PLC (Household Products) | | | 13,044,110 | |

| | 425,578 | | RELX PLC (Professional Services) | | | 17,490,159 | |

| | 73,656 | | Rio Tinto PLC (Metals & Mining) | | | 4,983,618 | |

| | 6,247,900 | | Rolls-Royce Holdings PLC* (Aerospace & Defense) | | | 32,039,381 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | United Kingdom (continued) | |

| | 334,913 | | Segro PLC (Industrial REITs) | | $ | 3,522,656 | |

| | 443,029 | | Shell PLC (Oil, Gas & Consumable Fuels) | | | 15,831,108 | |

| | 1,316,708 | | Tesco PLC (Consumer Staples Distribution & Retail) | | | 4,861,376 | |

| | 302,720 | | WH Smith PLC (Specialty Retail) | | | 4,140,691 | |

| | | | | | | | |

| | | | | | | 264,637,029 | |

| | | |

| |

| | United States – 6.2% | |

| | 2,151 | | Accenture PLC Class A (IT Services) | | | 647,257 | |

| | 64,950 | | Atlassian Corp. Class A* (Software) | | | 11,190,885 | |

| | 19,680 | | EPAM Systems, Inc.* (IT Services) | | | 4,629,917 | |

| | 26,220 | | Monday.com Ltd.* (Software) | | | 4,964,233 | |

| | 151,919 | | Nestle SA (Food Products) | | | 15,252,691 | |

| | 107,368 | | Qiagen NV* (Life Sciences Tools & Services) | | | 4,482,792 | |

| | 101,368 | | Roche Holding AG (Pharmaceuticals) | | | 24,289,212 | |

| | 28,060 | | Spotify Technology SA* (Entertainment) | | | 7,869,146 | |

| | 40,080 | | STERIS PLC (Health Care Equipment & Supplies) | | | 8,198,765 | |

| | 54,040 | | Waste Connections, Inc. (Commerical Services & Supplies) | | | 8,759,344 | |

| | | | | | | | |

| | | | | | | 90,284,242 | |

| | | |

| |

| | Uruguay* – 0.8% | |

| | 7,710 | | MercadoLibre, Inc. (Broadline Retail) | | | 11,246,577 | |

| | | |

| | TOTAL COMMON STOCKS (Cost $1,135,496,036) | | $ | 1,418,710,774 | |

| | | |

| | | |

| | | Shares | | Dividend Rate | | Value | |

| |

| | Investment Company(b) – 2.3% | |

| | |

| | Goldman Sachs Financial Square Government Fund — Institutional Shares | | | | |

| | 33,345,532 | | 5.223% | | $ | 33,345,532 | |

| | (Cost $33,345,532) | | | | |

| | | |

| | TOTAL INVESTMENTS – 99.3% (Cost $1,168,841,568) | | $ | 1,452,056,306 | |

| | | |

| | OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.7% | | | 10,436,728 | |

| | | |

| | NET ASSETS – 100.0% | | $ | 1,462,493,034 | |

| | | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | |

| |

| (a) | | Exempt from registration under Rule 144A of the Securities Act of 1933. |

| |

| (b) | | Represents an Affiliated Issuer. |

| | |

|

| SECTOR ALLOCATION AS OF APRIL 30, 2024 |

| |

| Sector | | % of Total Market Value |

| |

Industrials | | 19.4% |

| |

Financials | | 16.8 |

| |

Health Care | | 14.7 |

| |

Information Technology | | 12.2 |

| |

Consumer Discretionary | | 11.5 |

| |

Consumer Staples | | 9.1 |

| |

Materials | | 5.1 |

| |

Energy | | 4.0 |

| |

Communication Services | | 2.5 |

| |

Investment Company | | 2.3 |

| |

Utilities | | 2.0 |

| |

Real Estate | | 0.4 |

| |

| | | 100.0% |

|

|

ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At April 30, 2024, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency Purchased | | | | | | Currency Sold | | | | | | Settlement

Date | | | | Unrealized Loss |

|

|

| | | | | | | | | |

State Street Bank and Trust | | EUR | | | 186,881 | | | | | | | USD | | | 199,578 | | | | | | | 05/03/24 | | | | $(116) |

|

|

| | |

|

|

| Currency Abbreviations: |

| EUR | | —Euro |

| USD | | —U.S. Dollar |

|

|

| | |

|

|

| Investment Abbreviations: |

| PLC | | —Public Limited Company |

| REIT | | —Real Estate Investment Trust |

|

|

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

|

Schedule of Investments April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – 96.3% | |

| |

| | Aerospace & Defense – 1.1% | |

| | 20,963 | | AAR Corp.* | | $ | 1,449,382 | |

| | 11,990 | | Curtiss-Wright Corp. | | | 3,038,506 | |

| | 12,510 | | Hexcel Corp. | | | 803,267 | |

| | 43,500 | | Mercury Systems, Inc.* | | | 1,226,700 | |

| | 17,892 | | Woodward, Inc. | | | 2,904,945 | |

| | | | | | | | |

| | | | | | | 9,422,800 | |

| | | |

| |

| | Air Freight & Logistics – 0.5% | |

| | 89,600 | | Air Transport Services Group, Inc.* | | | 1,148,672 | |

| | 73,600 | | Hub Group, Inc. Class A | | | 2,960,192 | |

| | | | | | | | |

| | | | | | | 4,108,864 | |

| | | |

| |

| | Automobile Components – 0.7% | |

| | 12,100 | | LCI Industries | | | 1,258,158 | |

| | 28,527 | | Phinia, Inc. | | | 1,112,553 | |

| | 24,300 | | Visteon Corp.* | | | 2,688,309 | |

| | 10,299 | | XPEL, Inc.* | | | 541,212 | |

| | | | | | | | |

| | | | | | | 5,600,232 | |

| | | |

| |

| | Automobiles – 0.1% | |

| | 8,650 | | Thor Industries, Inc. | | | 859,983 | |

| | | |

| |

| | Banks – 5.1% | |

| | 23,275 | | Bank of Hawaii Corp. | | | 1,319,460 | |

| | 29,264 | | Dime Community Bancshares, Inc. | | | 532,605 | |

| | 42,791 | | First Merchants Corp. | | | 1,430,075 | |

| | 28,839 | | Hancock Whitney Corp. | | | 1,309,002 | |

| | 74,850 | | Heritage Commerce Corp. | | | 594,309 | |

| | 74,593 | | Hope Bancorp, Inc. | | | 747,422 | |

| | 23,200 | | Independent Bank Corp. | | | 1,165,568 | |

| | 35,400 | | Lakeland Financial Corp. | | | 2,080,458 | |

| | 90,954 | | OceanFirst Financial Corp. | | | 1,342,481 | |

| | 91,561 | | Old National Bancorp | | | 1,514,419 | |

| | 36,311 | | Peapack-Gladstone Financial Corp. | | | 812,640 | |

| | 19,839 | | Preferred Bank | | | 1,501,614 | |

| | 78,825 | | Prosperity Bancshares, Inc. | | | 4,884,785 | |

| | 91,500 | | Renasant Corp. | | | 2,658,990 | |

| | 26,741 | | S&T Bancorp, Inc. | | | 806,241 | |

| | 54,957 | | SouthState Corp. | | | 4,160,245 | |

| | 41,000 | | UMB Financial Corp. | | | 3,266,060 | |

| | 86,200 | | United Bankshares, Inc. | | | 2,798,052 | |

| | 38,316 | | Western Alliance Bancorp | | | 2,177,498 | |

| | 81,332 | | Wintrust Financial Corp. | | | 7,859,925 | |

| | | | | | | | |

| | | | | | | 42,961,849 | |

| | | |

| |

| | Biotechnology* – 5.0% | |

| | 162,230 | | 89bio, Inc. | | | 1,380,577 | |

| | 91,772 | | Alkermes PLC | | | 2,252,085 | |

| | 89,708 | | Ascendis Pharma AS | | | 12,419,175 | |

| | 90,620 | | Bicycle Therapeutics PLC | | | 2,125,039 | |

| | 18,188 | | Blueprint Medicines Corp. | | | 1,661,292 | |

| | 59,152 | | Catalyst Pharmaceuticals, Inc. | | | 890,238 | |

| | 50,077 | | Cytokinetics, Inc. | | | 3,070,722 | |

| | 20,816 | | Halozyme Therapeutics, Inc. | | | 793,090 | |

| | 21,978 | | Immunome, Inc. | | | 309,011 | |

| | 64,538 | | MoonLake Immunotherapeutics | | | 2,640,249 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Biotechnology* – (continued) | |

| | 89,941 | | Mural Oncology PLC | | $ | 332,782 | |

| | 28,204 | | Neurocrine Biosciences, Inc. | | | 3,879,178 | |

| | 137,890 | | Rocket Pharmaceuticals, Inc. | | | 2,967,393 | |

| | 66,354 | | Vaxcyte, Inc. | | | 4,017,735 | |

| | 26,070 | | Viking Therapeutics, Inc. | | | 2,074,650 | |

| | 37,830 | | Xenon Pharmaceuticals, Inc. | | | 1,537,789 | |

| | | | | | | | |

| | | | | | | 42,351,005 | |

| | | |

| |

| | Building Products – 2.3% | |

| | 26,100 | | Apogee Enterprises, Inc. | | | 1,612,458 | |

| | 157,044 | | AZEK Co., Inc.* | | | 7,167,488 | |

| | 19,100 | | Gibraltar Industries, Inc.* | | | 1,364,886 | |

| | 19,030 | | Griffon Corp. | | | 1,246,846 | |

| | 100,000 | | Hayward Holdings, Inc.* | | | 1,358,000 | |

| | 150,824 | | Janus International Group, Inc.* | | | 2,173,374 | |

| | 18,300 | | UFP Industries, Inc. | | | 2,062,410 | |

| | 90,479 | | Zurn Elkay Water Solutions Corp. | | | 2,830,183 | |

| | | | | | | | |

| | | | | | | 19,815,645 | |

| | | |

| |

| | Capital Markets – 1.4% | |

| | 340,534 | | BGC Group, Inc. Class A | | | 2,666,381 | |

| | 39,400 | | Cohen & Steers, Inc. | | | 2,709,932 | |

| | 20,945 | | Evercore, Inc. Class A | | | 3,801,517 | |

| | 12,689 | | Houlihan Lokey, Inc. | | | 1,617,721 | |

| | 18,293 | | StoneX Group, Inc.* | | | 1,328,072 | |

| | | | | | | | |

| | | | | | | 12,123,623 | |

| | | |

| |

| | Chemicals – 3.6% | |

| | 58,975 | | AdvanSix, Inc. | | | 1,489,709 | |

| | 15,921 | | Ashland, Inc. | | | 1,517,749 | |

| | 97,380 | | Avient Corp. | | | 4,130,860 | |

| | 129,320 | | Axalta Coating Systems Ltd.* | | | 4,065,821 | |

| | 152,075 | | Ecovyst, Inc.* | | | 1,434,067 | |

| | 88,420 | | HB Fuller Co. | | | 6,605,858 | |

| | 22,000 | | Innospec, Inc. | | | 2,640,000 | |

| | 23,931 | | Methanex Corp. | | | 1,146,534 | |

| | 30,900 | | Minerals Technologies, Inc. | | | 2,252,301 | |

| | 27,294 | | Orion SA | | | 645,776 | |

| | 17,665 | | Quaker Chemical Corp. | | | 3,295,052 | |

| | 16,400 | | Stepan Co. | | | 1,361,036 | |

| | | | | | | | |

| | | | | | | 30,584,763 | |

| | | |

| |

| | Commerical Services & Supplies – 4.0% | |

| | 17,705 | | Brady Corp. Class A | | | 1,044,595 | |

| | 52,765 | | Brink’s Co. | | | 4,614,827 | |

| | 100,301 | | Casella Waste Systems, Inc. Class A* | | | 9,067,210 | |

| | 130,743 | | CoreCivic, Inc.* | | | 1,948,071 | |

| | 20,347 | | MSA Safety, Inc. | | | 3,670,599 | |

| | 86,084 | | Rentokil Initial PLC | | | 2,205,472 | |

| | 13,900 | | UniFirst Corp. | | | 2,225,807 | |

| | 37,103 | | Vestis Corp. | | | 683,437 | |

| | 72,775 | | Viad Corp.* | | | 2,509,282 | |

| | 36,562 | | Waste Connections, Inc. | | | 5,926,335 | |

| | | | | | | | |

| | | | | | | 33,895,635 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Communications Equipment* – 0.9% | |

| | 29,300 | | Ciena Corp. | | $ | 1,354,539 | |

| | 34,029 | | Clearfield, Inc. | | | 1,024,954 | |

| | 15,490 | | F5, Inc. | | | 2,560,652 | |

| | 530,755 | | Infinera Corp. | | | 2,558,239 | |

| | | | | | | | |

| | | | | | | 7,498,384 | |

| | | |

| |

| | Construction & Engineering – 2.5% | |

| | 23,520 | | Comfort Systems USA, Inc. | | | 7,277,323 | |

| | 65,175 | | Fluor Corp.* | | | 2,628,508 | |

| | 29,374 | | Granite Construction, Inc. | | | 1,630,257 | |

| | 6,500 | | MYR Group, Inc.* | | | 1,080,625 | |

| | 33,992 | | Primoris Services Corp. | | | 1,584,027 | |

| | 17,842 | | Valmont Industries, Inc. | | | 3,654,042 | |

| | 93,980 | | WillScot Mobile Mini Holdings Corp.* | | | 3,473,501 | |

| | | | | | | | |

| | | | | | | 21,328,283 | |

| | | |

| |

| | Construction Materials – 0.3% | |

| | 2,900 | | Eagle Materials, Inc. | | | 727,059 | |

| | 8,981 | | Knife River Corp.* | | | 702,224 | |

| | 37,400 | | Summit Materials, Inc. Class A* | | | 1,454,860 | |

| | | | | | | | |

| | | | | | | 2,884,143 | |

| | | |

| |

| | Consumer Finance – 1.0% | |

| | 27,214 | | FirstCash Holdings, Inc. | | | 3,074,638 | |

| | 253,518 | | SLM Corp. | | | 5,372,046 | |

| | | | | | | | |

| | | | | | | 8,446,684 | |

| | | |

| |

| | Consumer Staples Distribution & Retail – 0.8% | |

| | 15,261 | | Casey’s General Stores, Inc. | | | 4,877,110 | |

| | 29,200 | | Performance Food Group Co.* | | | 1,982,096 | |

| | | | | | | | |

| | | | | | | 6,859,206 | |

| | | |

| |

| | Containers & Packaging – 0.6% | |

| | 59,200 | | Silgan Holdings, Inc. | | | 2,762,272 | |

| | 47,700 | | Sonoco Products Co. | | | 2,673,585 | |

| | | | | | | | |

| | | | | | | 5,435,857 | |

| | | |

| |

| | Diversified Consumer Services – 2.1% | |

| | 66,432 | | Bright Horizons Family Solutions, Inc.* | | | 6,889,663 | |

| | 99,685 | | Frontdoor, Inc.* | | | 3,059,333 | |

| | 9,110 | | Grand Canyon Education, Inc.* | | | 1,184,482 | |

| | 148,541 | | Laureate Education, Inc. | | | 2,153,844 | |

| | 497,995 | | Mister Car Wash, Inc.* | | | 3,331,586 | |

| | 59,126 | | Perdoceo Education Corp. | | | 1,082,006 | |

| | | | | | | | |

| | | | | | | 17,700,914 | |

| | | |

| |

| | Diversified Telecommunication Services – 0.3% | |

| | 38,906 | | Cogent Communications Holdings, Inc. | | | 2,496,987 | |

| | | |

| |

| | Electric Utilities – 0.6% | |

| | 32,200 | | IDACORP, Inc. | | | 3,051,916 | |

| | 22,900 | | MGE Energy, Inc. | | | 1,793,528 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Electric Utilities – (continued) | |

| | 11,097 | | Portland General Electric Co. | | $ | 479,723 | |

| | | | | | | | |

| | | | | | | 5,325,167 | |

| | | |

| |

| | Electrical Equipment – 2.1% | |

| | 10,822 | | Acuity Brands, Inc. | | | 2,687,103 | |

| | 12,681 | | Atkore, Inc. | | | 2,222,979 | |

| | 4,668 | | Encore Wire Corp. | | | 1,304,052 | |

| | 14,540 | | EnerSys | | | 1,315,143 | |

| | 99,510 | | NEXTracker, Inc. Class A* | | | 4,258,033 | |

| | 150,250 | | Sensata Technologies Holding PLC | | | 5,756,078 | |

| | | | | | | | |

| | | | | | | 17,543,388 | |

| | | |

| |

| | Electronic Equipment, Instruments & Components – 3.5% | |

| | 23,100 | | Advanced Energy Industries, Inc. | | | 2,213,904 | |

| | 9,083 | | Arrow Electronics, Inc.* | | | 1,159,627 | |

| | 51,679 | | Avnet, Inc. | | | 2,525,553 | |

| | 14,466 | | Belden, Inc. | | | 1,175,652 | |

| | 39,840 | | Coherent Corp.* | | | 2,176,459 | |

| | 24,700 | | Crane NXT Co. | | | 1,502,007 | |

| | 13,580 | | Fabrinet* | | | 2,350,290 | |

| | 37,105 | | Insight Enterprises, Inc.* | | | 6,774,260 | |

| | 20,384 | | Littelfuse, Inc. | | | 4,701,366 | |

| | 13,030 | | OSI Systems, Inc.* | | | 1,712,663 | |

| | 20,300 | | Rogers Corp.* | | | 2,417,527 | |

| | 20,375 | | ScanSource, Inc.* | | | 848,007 | |

| | | | | | | | |

| | | | | | | 29,557,315 | |

| | | |

| |

| | Energy Equipment & Services – 3.5% | |

| | 60,136 | | Archrock, Inc. | | | 1,154,010 | |

| | 52,310 | | Cactus, Inc. Class A | | | 2,596,668 | |

| | 269,082 | | ChampionX Corp. | | | 9,033,083 | |

| | 92,464 | | Expro Group Holdings NV* | | | 1,734,625 | |

| | 66,100 | | Helmerich & Payne, Inc. | | | 2,599,713 | |

| | 32,555 | | Noble Corp. PLC | | | 1,444,791 | |

| | 369,981 | | Patterson-UTI Energy, Inc. | | | 4,003,194 | |

| | 157,701 | | Select Water Solutions, Inc. | | | 1,457,157 | |

| | 21,127 | | Tidewater, Inc.* | | | 1,940,515 | |

| | 53,468 | | U.S. Silica Holdings, Inc.* | | | 825,011 | |

| | 22,803 | | Weatherford International PLC* | | | 2,818,907 | |

| | | | | | | | |

| | | | | | | 29,607,674 | |

| | | |

| |

| | Entertainment* – 0.4% | |

| | 20,878 | | Liberty Media Corp.-Liberty Live | | | | |

| | | | Class A | | | 748,685 | |

| | 11,299 | | Take-Two Interactive Software, Inc. | | | 1,613,610 | |

| | 140,589 | | Vivid Seats, Inc. Class A | | | 739,498 | |

| | | | | | | | |

| | | | | | | 3,101,793 | |

| | | |

| |

| | Financial Services – 3.6% | |

| | 30,662 | | Enact Holdings, Inc. | | | 911,581 | |

| | 43,949 | | Essent Group Ltd. | | | 2,327,978 | |

| | 46,600 | | EVERTEC, Inc. | | | 1,748,898 | |

| | 22,690 | | Federal Agricultural Mortgage Corp. Class C | | | 4,223,290 | |

| | 156,550 | | Flywire Corp.* | | | 3,209,275 | |

| | | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Financial Services – (continued) | |

| | 32,907 | | International Money Express, Inc.* | | $ | 665,709 | |

| | 234,730 | | Marqeta, Inc. Class A* | | | 1,302,751 | |

| | 73,100 | | NCR Atleos Corp.* | | | 1,456,883 | |

| | 12,625 | | PennyMac Financial Services, Inc. | | | 1,081,205 | |

| | 59,880 | | Shift4 Payments, Inc. Class A* | | | 3,464,657 | |

| | 19,969 | | Voya Financial, Inc. | | | 1,361,087 | |

| | 27,132 | | Walker & Dunlop, Inc. | | | 2,486,105 | |

| | 30,257 | | WEX, Inc.* | | | 6,392,094 | |

| | | | | | | | |

| | | | | | | 30,631,513 | |

| | | |

| |

| | Food Products – 0.4% | |

| | 78,221 | | Nomad Foods Ltd. | | | 1,412,671 | |

| | 60,464 | | Simply Good Foods Co.* | | | 2,203,913 | |

| | | | | | | | |

| | | | | | | 3,616,584 | |

| | | |

| |

| | Gas Utilities – 0.2% | |

| | 18,901 | | New Jersey Resources Corp. | | | 825,785 | |

| | 19,550 | | ONE Gas, Inc. | | | 1,261,366 | |

| | | | | | | | |

| | | | | | | 2,087,151 | |

| | | |

| |

| | Ground Transportation – 0.9% | |

| | 3,025 | | Knight-Swift Transportation | | | | |

| | | | Holdings, Inc. | | | 139,846 | |

| | 98,400 | | Marten Transport Ltd. | | | 1,664,928 | |

| | 7,197 | | Saia, Inc.* | | | 2,855,985 | |

| | 82,900 | | Werner Enterprises, Inc. | | | 2,835,180 | |

| | | | | | | | |

| | | | | | | 7,495,939 | |

| | | |

| |

| | Health Care Equipment & Supplies* – 3.8% | |

| | 76,446 | | Establishment Labs Holdings, Inc. | | | 3,823,064 | |

| | 71,642 | | Haemonetics Corp. | | | 6,587,482 | |

| | 58,606 | | Inari Medical, Inc. | | | 2,188,348 | |

| | 12,100 | | Inspire Medical Systems, Inc. | | | 2,924,086 | |

| | 15,400 | | Integer Holdings Corp. | | | 1,719,102 | |

| | 24,000 | | Integra LifeSciences Holdings Corp. | | | 700,080 | |

| | 36,003 | | iRhythm Technologies, Inc. | | | 3,945,209 | |

| | 91,894 | | Lantheus Holdings, Inc. | | | 6,114,627 | |

| | 57,742 | | OrthoPediatrics Corp. | | | 1,710,895 | |

| | 155,950 | | SI-BONE, Inc. | | | 2,223,847 | |

| | | | | | | | |

| | | | | | | 31,936,740 | |

| | | |

| |

| | Health Care Providers & Services – 3.2% | |

| | 191,917 | | Accolade, Inc.* | | | 1,464,327 | |

| | 7,915 | | Addus HomeCare Corp.* | | | 761,027 | |

| | 56,276 | | agilon health, Inc.* | | | 309,518 | |

| | 9,626 | | Amedisys, Inc.* | | | 886,073 | |

| | 20,411 | | AMN Healthcare Services, Inc.* | | | 1,224,252 | |

| | 1,122 | | Chemed Corp. | | | 637,296 | |

| | 44,902 | | Encompass Health Corp. | | | 3,743,929 | |

| | 48,759 | | HealthEquity, Inc.* | | | 3,847,573 | |

| | 212,041 | | LifeStance Health Group, Inc.* | | | 1,310,413 | |

| | 300,749 | | NeoGenomics, Inc.* | | | 4,186,426 | |

| | 184,010 | | Option Care Health, Inc.* | | | 5,500,059 | |

| | 70,911 | | Pediatrix Medical Group, Inc.* | | | 628,981 | |

| | 65,832 | | PetIQ, Inc.* | | | 1,074,378 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Health Care Providers & Services – (continued) | |

| | 102,953 | | R1 RCM, Inc.* | | $ | 1,265,292 | |

| | | | | | | | |

| | | | | | | 26,839,544 | |

| | | |

| |

| | Health Care Technology* – 0.5% | |

| | 140,703 | | Definitive Healthcare Corp. | | | 976,479 | |

| | 144,232 | | Phreesia, Inc. | | | 2,991,372 | |

| | | | | | | | |

| | | | | | | 3,967,851 | |

| | | |

| |

| | Hotel & Resort REITs – 0.2% | |

| | 115,400 | | Apple Hospitality REIT, Inc. | | | 1,703,304 | |

| | | |

| |

| | Hotels, Restaurants & Leisure – 2.6% | |

| | 150,013 | | Bowlero Corp. Class A | | | 1,762,653 | |

| | 14,865 | | Boyd Gaming Corp. | | | 795,426 | |

| | 20,558 | | Brinker International, Inc.* | | | 1,101,909 | |

| | 23,400 | | Choice Hotels International, Inc. | | | 2,767,284 | |

| | 40,075 | | Churchill Downs, Inc. | | | 5,169,675 | |

| | 41,532 | | First Watch Restaurant Group, Inc.* | | | 1,059,897 | |

| | 22,530 | | Texas Roadhouse, Inc. | | | 3,622,373 | |

| | 14,860 | | Wingstop, Inc. | | | 5,717,979 | |

| | | | | | | | |

| | | | | | | 21,997,196 | |

| | | |

| |

| | Household Durables – 2.0% | |

| | 37,300 | | Beazer Homes USA, Inc.* | | | 1,045,519 | |

| | 12,450 | | Installed Building Products, Inc. | | | 2,934,838 | |

| | 28,376 | | M/I Homes, Inc.* | | | 3,297,859 | |

| | 33,684 | | Meritage Homes Corp. | | | 5,582,786 | |

| | 6,539 | | TopBuild Corp.* | | | 2,646,137 | |

| | 121,936 | | Vizio Holding Corp. Class A* | | | 1,292,522 | |

| | | | | | | | |

| | | | | | | 16,799,661 | |

| | | |

| |

| | Household Products* – 0.3% | |

| | 67,800 | | Central Garden & Pet Co. Class A | | | 2,402,154 | |

| | | |

| |

| | Industrial REITs – 0.8% | |

| | 15,844 | | EastGroup Properties, Inc. | | | 2,461,524 | |

| | 36,200 | | First Industrial Realty Trust, Inc. | | | 1,644,204 | |

| | 64,970 | | STAG Industrial, Inc. | | | 2,234,318 | |

| | | | | | | | |

| | | | | | | 6,340,046 | |

| | | |

| |

| | Insurance – 4.4% | |

| | 25,000 | | AMERISAFE, Inc. | | | 1,140,000 | |

| | 33,957 | | Assured Guaranty Ltd. | | | 2,604,502 | |

| | 79,130 | | Axis Capital Holdings Ltd. | | | 4,853,043 | |

| | 32,337 | | BRP Group, Inc. Class A* | | | 861,458 | |

| | 20,577 | | Employers Holdings, Inc. | | | 876,374 | |

| | 66,927 | | First American Financial Corp. | | | 3,585,279 | |

| | 24,200 | | Hanover Insurance Group, Inc. | | | 3,141,644 | |

| | 5,970 | | Kinsale Capital Group, Inc. | | | 2,168,603 | |

| | 30,416 | | Palomar Holdings, Inc.* | | | 2,392,827 | |

| | 15,290 | | Primerica, Inc. | | | 3,239,339 | |

| | 37,700 | | Ryan Specialty Holdings, Inc. | | | 1,860,118 | |

| | 28,600 | | Safety Insurance Group, Inc. | | | 2,275,702 | |

| | 42,745 | | Selective Insurance Group, Inc. | | | 4,345,029 | |

| | 16,400 | | Stewart Information Services Corp. | | | 1,016,964 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Insurance – (continued) | |

| | 1,435 | | White Mountains Insurance Group Ltd. | | $ | 2,551,631 | |

| | | | | | | | |

| | | | | | | 36,912,513 | |

| | | |

| |

| | Interactive Media & Services* – 0.6% | |

| | 47,851 | | Bumble, Inc. Class A | | | 483,295 | |

| | 67,047 | | Cars.com, Inc. | | | 1,120,355 | |

| | 82,228 | | Pinterest, Inc. Class A | | | 2,750,527 | |

| | 41,777 | | TripAdvisor, Inc. | | | 1,099,989 | |

| | | | | | | | |

| | | | | | | 5,454,166 | |

| | | |

| |

| | IT Services – 0.2% | |

| | 31,324 | | Hackett Group, Inc. | | | 679,418 | |

| | 26,650 | | Perficient, Inc.* | | | 1,259,479 | |

| | | | | | | | |

| | | | | | | 1,938,897 | |

| | | |

| |

| | Leisure Products – 0.7% | |

| | 15,300 | | Acushnet Holdings Corp. | | | 932,994 | |

| | 17,100 | | Brunswick Corp. | | | 1,378,944 | |

| | 193,467 | | Clarus Corp. | | | 1,224,646 | |

| | 135,900 | | Mattel, Inc.* | | | 2,489,688 | |

| | 126,975 | | Solo Brands, Inc. Class A* | | | 238,713 | |

| | | | | | | | |

| | | | | | | 6,264,985 | |

| | | |

| |

| | Life Sciences Tools & Services – 1.4% | |

| | 7,010 | | Bio-Rad Laboratories, Inc. Class A* | | | 1,890,947 | |

| | 27,567 | | Bio-Techne Corp. | | | 1,742,510 | |

| | 39,555 | | Bruker Corp. | | | 3,085,686 | |

| | 10,000 | | Charles River Laboratories International, Inc.* | | | 2,290,000 | |

| | 42,330 | | Fortrea Holdings, Inc.* | | | 1,548,855 | |

| | 26,400 | | Qiagen NV* | | | 1,117,512 | |

| | | | | | | | |

| | | | | | | 11,675,510 | |

| | | |

| |

| | Machinery – 4.6% | |

| | 8,000 | | Alamo Group, Inc. | | | 1,555,040 | |

| | 12,450 | | Albany International Corp. Class A | | | 992,888 | |

| | 34,048 | | Allison Transmission Holdings, Inc. | | | 2,504,230 | |

| | 41,500 | | Astec Industries, Inc. | | | 1,734,700 | |

| | 33,076 | | Atmus Filtration Technologies, Inc.* | | | 1,001,872 | |

| | 25,044 | | Blue Bird Corp.* | | | 825,325 | |

| | 7,848 | | Chart Industries, Inc.* | | | 1,130,583 | |

| | 8,825 | | Crane Co. | | | 1,235,588 | |

| | 10,809 | | Enpro, Inc. | | | 1,622,755 | |

| | 63,050 | | Hillenbrand, Inc. | | | 3,008,746 | |

| | 7,817 | | IDEX Corp. | | | 1,723,336 | |

| | 42,880 | | ITT, Inc. | | | 5,546,099 | |

| | 46,376 | | John Bean Technologies Corp. | | | 4,131,638 | |

| | 67,700 | | Kennametal, Inc. | | | 1,592,981 | |

| | 13,480 | | Lincoln Electric Holdings, Inc. | | | 2,959,264 | |

| | 27,900 | | Mueller Industries, Inc. | | | 1,557,378 | |

| | 123,172 | | Mueller Water Products, Inc. Class A | | | 1,951,045 | |

| | 12,600 | | SPX Technologies, Inc.* | | | 1,534,806 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Machinery – (continued) | |

| | 10,500 | | Watts Water Technologies, Inc. Class A | | $ | 2,083,830 | |

| | | | | | | | |

| | | | | | | 38,692,104 | |

| | | |

| |

| | Media – 0.7% | |

| | 101,850 | | EW Scripps Co. Class A* | | | 382,956 | |

| | 15,166 | | Nexstar Media Group, Inc. | | | 2,427,470 | |

| | 122,130 | | Stagwell, Inc.* | | | 726,674 | |

| | 155,846 | | TEGNA, Inc. | | | 2,125,739 | |

| | | | | | | | |

| | | | | | | 5,662,839 | |

| | | |

| |

| | Metals & Mining – 0.7% | |

| | 38,329 | | Commercial Metals Co. | | | 2,059,800 | |

| | 85,415 | | Eldorado Gold Corp.* | | | 1,218,018 | |

| | 23,675 | | Kaiser Aluminum Corp. | | | 2,142,351 | |

| | 56,000 | | MP Materials Corp.* | | | 896,000 | |

| | | | | | | | |

| | | | | | | 6,316,169 | |

| | | |

| |

| | Mortgage Real Estate Investment Trusts (REITs) – 0.1% | |

| | 111,640 | | Redwood Trust, Inc. | | | 617,369 | |

| | | |

| |

| | Multi-Utilities – 0.2% | |

| | 29,100 | | Northwestern Energy Group, Inc. | | | 1,467,804 | |

| | | |

| |

| | Office REITs – 0.4% | |

| | 84,400 | | COPT Defense Properties | | | 2,023,068 | |

| | 44,521 | | Cousins Properties, Inc. | | | 1,021,312 | |

| | | | | | | | |

| | | | | | | 3,044,380 | |

| | | |

| |

| | Oil, Gas & Consumable Fuels – 2.8% | |

| | 47,200 | | Civitas Resources, Inc. | | | 3,396,512 | |

| | 57,550 | | Delek U.S. Holdings, Inc. | | | 1,572,841 | |

| | 165,271 | | Kosmos Energy Ltd.* | | | 937,087 | |

| | 136,100 | | Magnolia Oil & Gas Corp. Class A | | | 3,412,027 | |

| | 48,200 | | Matador Resources Co. | | | 3,002,860 | |

| | 125,840 | | Northern Oil & Gas, Inc. | | | 5,133,014 | |

| | 50,372 | | Par Pacific Holdings, Inc.* | | | 1,551,458 | |

| | 91,100 | | Viper Energy, Inc. | | | 3,476,376 | |

| | 61,967 | | World Kinect Corp. | | | 1,456,224 | |

| | | | | | | | |

| | | | | | | 23,938,399 | |

| | | |

| |

| | Personal Products* – 0.2% | |

| | 22,490 | | BellRing Brands, Inc. | | | 1,240,774 | |

| | 13,345 | | Oddity Tech Ltd. Class A | | | 434,246 | |

| | | | | | | | |

| | | | | | | 1,675,020 | |

| | | |

| |

| | Pharmaceuticals – 0.8% | |

| | 13,074 | | Arvinas, Inc.* | | | 415,361 | |

| | 177,085 | | Innoviva, Inc.* | | | 2,675,754 | |

| | 42,385 | | Organon & Co. | | | 788,785 | |

| | 30,826 | | Perrigo Co. PLC | | | 1,006,777 | |

| | 31,800 | | Prestige Consumer Healthcare, Inc.* | | | 2,281,968 | |

| | | | | | | | |

| | | | | | | 7,168,645 | |

| | | |

| |

| | Professional Services – 2.5% | |

| | 115,948 | | Alight, Inc. Class A* | | | 1,045,851 | |

| | 19,700 | | ASGN, Inc.* | | | 1,900,065 | |

| | | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Professional Services – (continued) | |

| | 11,687 | | Concentrix Corp. | | $ | 638,928 | |

| | 68,340 | | First Advantage Corp. | | | 1,113,942 | |

| | 19,292 | | FTI Consulting, Inc.* | | | 4,125,208 | |

| | 13,904 | | Huron Consulting Group, Inc.* | | | 1,296,409 | |

| | 10,825 | | ICF International, Inc. | | | 1,561,939 | |

| | 29,773 | | Kelly Services, Inc. Class A | | | 682,993 | |

| | 131,314 | | Legalzoom.com, Inc.* | | | 1,569,202 | |

| | 31,300 | | Maximus, Inc. | | | 2,512,764 | |

| | 15,815 | | Science Applications International Corp. | | | 2,035,391 | |

| | 56,870 | | WNS Holdings Ltd.* | | | 2,383,422 | |

| | | | | | | | |

| | | | | | | 20,866,114 | |

| | | |

| |

| | Real Estate Management & Development – 0.5% | |

| | 15,900 | | Colliers International Group, Inc. | | | 1,654,236 | |

| | 92,000 | | Cushman & Wakefield PLC* | | | 887,800 | |

| | 87,895 | | DigitalBridge Group, Inc. | | | 1,444,994 | |

| | | | | | | | |

| | | | | | | 3,987,030 | |

| | | |

| |

| | Semiconductors & Semiconductor Equipment – 3.9% | |

| | 26,705 | | Amkor Technology, Inc. | | | 863,907 | |

| | 7,656 | | Axcelis Technologies, Inc.* | | | 792,549 | |

| | 74,100 | | Cohu, Inc.* | | | 2,246,712 | |

| | 60,730 | | Credo Technology Group Holding Ltd.* | | | 1,085,245 | |

| | 26,717 | | Entegris, Inc. | | | 3,551,224 | |

| | 24,200 | | Ichor Holdings Ltd.* | | | 938,476 | |

| | 21,973 | | Impinj, Inc.* | | | 3,502,057 | |

| | 47,400 | | Kulicke & Soffa Industries, Inc. | | | 2,193,672 | |

| | 20,627 | | Lattice Semiconductor Corp.* | | | 1,415,012 | |

| | 15,650 | | Nova Ltd.* | | | 2,658,935 | |

| | 5,049 | | Onto Innovation, Inc.* | | | 936,539 | |

| | 31,433 | | Photronics, Inc.* | | | 861,579 | |

| | 34,678 | | Power Integrations, Inc. | | | 2,313,716 | |

| | 23,645 | | Rambus, Inc.* | | | 1,296,219 | |

| | 22,140 | | Semtech Corp.* | | | 832,907 | |

| | 18,660 | | SiTime Corp.* | | | 1,662,979 | |

| | 69,400 | | Tower Semiconductor Ltd.* | | | 2,281,178 | |

| | 27,551 | | Ultra Clean Holdings, Inc.* | | | 1,152,458 | |

| | 15,290 | | Universal Display Corp. | | | 2,415,514 | |

| | | | | | | | |

| | | | | | | 33,000,878 | |

| | | |

| |

| | Software – 7.0% | |

| | 125,390 | | Adeia, Inc. | | | 1,233,837 | |

| | 2,594 | | Bentley Systems, Inc. Class B | | | 136,263 | |

| | 51,157 | | BlackLine, Inc.* | | | 2,969,664 | |

| | 507,754 | | CCC Intelligent Solutions Holdings, Inc.* | | | 5,697,000 | |

| | 122,272 | | Clear Secure, Inc. Class A | | | 2,136,092 | |

| | 30,395 | | Clearwater Analytics Holdings, Inc. Class A* | | | 479,633 | |

| | 110,607 | | Dynatrace, Inc.* | | | 5,011,603 | |

| | 82,115 | | Envestnet, Inc.* | | | 5,096,878 | |

| | 60,430 | | Gitlab, Inc. Class A* | | | 3,170,762 | |

| | 18,067 | | Guidewire Software, Inc.* | | | 1,994,597 | |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – (continued) | |

| |

| | Software – (continued) | |

| | 31,232 | | InterDigital, Inc. | | $ | 3,083,535 | |

| | 177,100 | | Lightspeed Commerce, Inc.* | | | 2,316,468 | |

| | 23,889 | | LiveRamp Holdings, Inc.* | | | 767,076 | |

| | 1,321 | | MicroStrategy, Inc. Class A* | | | 1,406,905 | |

| | 150,933 | | NCR Voyix Corp.* | | | 1,848,929 | |

| | 11,263 | | Pegasystems, Inc. | | | 669,247 | |

| | 102,721 | | PROS Holdings, Inc.* | | | 3,364,113 | |

| | 148,680 | | Samsara, Inc. Class A* | | | 5,193,392 | |

| | 88,490 | | Smartsheet, Inc. Class A* | | | 3,347,577 | |

| | 29,737 | | Sprout Social, Inc. Class A* | | | 1,500,232 | |

| | 59,160 | | Tenable Holdings, Inc.* | | | 2,660,425 | |

| | 71,100 | | Verint Systems, Inc.* | | | 2,152,908 | |

| | 34,160 | | Workiva, Inc.* | | | 2,691,808 | |

| | | | | | | | |

| | | | | | | 58,928,944 | |

| | | |

| |

| | Specialized REITs – 0.5% | |

| | 92,400 | | Four Corners Property Trust, Inc. | | | 2,166,780 | |

| | 70,600 | | Rayonier, Inc. | | | 2,093,996 | |

| | | | | | | | |

| | | | | | | 4,260,776 | |

| | | |

| |

| | Specialty Retail – 1.0% | |

| | 32,889 | | Caleres, Inc. | | | 1,211,302 | |

| | 5,171 | | Group 1 Automotive, Inc. | | | 1,520,377 | |

| | 3,900 | | Murphy USA, Inc. | | | 1,613,898 | |

| | 138,802 | | Revolve Group, Inc.* | | | 2,763,548 | |

| | 15,900 | | Signet Jewelers Ltd. | | | 1,558,677 | |

| | | | | | | | |

| | | | | | | 8,667,802 | |

| | | |

| |

| | Technology Hardware, Storage & Peripherals* – 0.3% | |

| | 2,697 | | Super Micro Computer, Inc. | | | 2,316,184 | |

| | | |

| |

| | Textiles, Apparel & Luxury Goods – 0.7% | |

| | 17,300 | | Columbia Sportswear Co. | | | 1,377,599 | |

| | 26,875 | | Kontoor Brands, Inc. | | | 1,667,863 | |

| | 9,700 | | Oxford Industries, Inc. | | | 1,045,466 | |

| | 50,664 | | Steven Madden Ltd. | | | 2,047,332 | |

| | | | | | | | |

| | | | | | | 6,138,260 | |

| | | |

| |

| | Tobacco – 0.3% | |

| | 22,174 | | Universal Corp. | | | 1,140,409 | |

| | 93,807 | | Vector Group Ltd. | | | 970,902 | |

| | | | | | | | |

| | | | | | | 2,111,311 | |

| | | |

| |

| | Trading Companies & Distributors – 0.9% | |

| | 32,723 | | Beacon Roofing Supply, Inc.* | | | 3,224,197 | |

| | 66,403 | | DNOW, Inc.* | | | 936,947 | |

| | 15,000 | | McGrath RentCorp | | | 1,599,900 | |

| | 10,773 | | SiteOne Landscape Supply, Inc.* | | | 1,690,176 | |

| | | | | | | | |

| | | | | | | 7,451,220 | |

| | | |

| |

| | Wireless Telecommunication Services*(a) – 0.0% | |

| | 29,864 | | GCI Liberty, Inc. | | | — | |

| | | |

| | TOTAL COMMON STOCKS (Cost $737,375,364) | | $ | 813,885,196 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Exchange Traded Funds – 0.1% | |

| | | |

| | 7,000 | | iShares Russell 2000 Value ETF | | $ | 1,043,280 | |

| | (Cost $1,075,867) | | | | |

| | | |

| | | |

| | | Shares | | Dividend Rate | | Value | |

| |

| | Investment Company(b) – 4.0% | |

| |

| | Goldman Sachs Financial Square Government

Fund — Institutional Shares | |

| | 33,679,160 | | 5.223% | | $ | 33,679,160 | |

| | (Cost $33,679,160) | | | | |

| | | |

| | TOTAL INVESTMENTS – 100.4% (Cost $772,130,391) | | $ | 848,607,636 | |

| | | |

| | LIABILITIES IN EXCESS OF OTHER

ASSETS – (0.4)% | | | (3,040,753 | ) |

| | | |

| | NET ASSETS – 100.0% | | $ | 845,566,883 | |

| | | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

| |

| (a) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e., Level 3. |

| |

| (b) | | Represents an Affiliated Issuer. |

| | |

|

|

| Investment Abbreviations: |

| ETF | | —Exchange Traded Fund |

| PLC | | —Public Limited Company |

| REIT | | —Real Estate Investment Trust |

|

|

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

ACTIVE EQUITY MULTI-MANAGER FUNDS

|

Statements of Assets and Liabilities April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | |

| | | | |

| | | | | Multi-Manager International Equity Fund | | | | | | Multi-Manager U.S. Small Cap Equity Fund | |

| | | | |

| | Assets: | | | | | | | | | | | | |

| | | | |

| | Investments in unaffiliated issuers, at value (cost $1,135,496,036 and $738,451,231, respectively) | | $ | 1,418,710,774 | | | | | | | $ | 814,928,476 | |

| | | | |

| | Investments in affiliated issuers, at value (cost $33,345,532 and $33,679,160, respectively) | | | 33,345,532 | | | | | | | | 33,679,160 | |

| | | | |

| | Cash | | | 677,707 | | | | | | | | 738,961 | |

| | | | |

| | Foreign currencies, at value (cost $1,176,288 and $0, respectively) | | | 1,174,336 | | | | | | | | — | |

| | | | |

| | Receivables: | | | | | | | | | | | | |

| | | | |

| | Dividends | | | 5,024,028 | | | | | | | | 300,116 | |

| | | | |

| | Foreign tax reclaims | | | 4,347,752 | | | | | | | | — | |

| | | | |

| | Investments sold | | | 3,096,552 | | | | | | | | 2,973,328 | |

| | | | |

| | Fund shares sold | | | 239,900 | | | | | | | | 270,900 | |

| | | | |

| | Other assets | | | 30,892 | | | | | | | | 36,560 | |

| | | |

| | | | |

| | Total assets | | | 1,466,647,473 | | | | | | | | 852,927,501 | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| | Liabilities: | | | | | | | | | | | | |

| | | | |

| | Unrealized loss on forward foreign currency exchange contracts | | | 116 | | | | | | | | — | |

| | | | |

| | Payables: | | | | | | | | | | | | |

| | | | |

| | Investments purchased | | | 1,888,329 | | | | | | | | 4,458,076 | |

| | | | |

| | Management fees | | | 505,805 | | | | | | | | 408,728 | |

| | | | |

| | Fund shares redeemed | | | 481,880 | | | | | | | | 1,975,900 | |

| | | | |

| | Investments purchased on an extended-settlement basis | | | 364,044 | | | | | | | | — | |

| | | | |

| | Transfer agency fees | | | 24,511 | | | | | | | | 14,373 | |

| | | | |

| | Accrued expenses | | | 889,754 | | | | | | | | 503,541 | |

| | | |

| | | | |

| | Total liabilities | | | 4,154,439 | | | | | | | | 7,360,618 | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| | Net Assets: | | | | | | | | | | | | |

| | | | |

| | Paid-in capital | | | 1,148,216,901 | | | | | | | | 763,962,407 | |

| | | | |

| | Total distributable earnings | | | 314,276,133 | | | | | | | | 81,604,476 | |

| | | |

| | | | |

| | NET ASSETS | | $ | 1,462,493,034 | | | | | | | $ | 845,566,883 | |

| | | |

| | | | |

| | Shares Outstanding $0.001 par value (unlimited shares authorized): | | | 101,974,514 | | | | | | | | 62,862,315 | |

| | | | |

| | Net asset value, offering and redemption price per share: | | $ | 14.34 | | | | | | | $ | 13.45 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

ACTIVE EQUITY MULTI-MANAGER FUNDS

|

Statements of Operations For the Six Months Ended April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | |

| | | | |

| | | | | Multi-Manager International Equity Fund | | | | | | Multi-Manager U.S. Small Cap Equity Fund | |

| | | | |

| | Investment Income: | | | | | | | | | | | | |

| | | | |

| | Dividends — unaffiliated issuers (net of tax withholding of $894,811 and $9,753, respectively) | | $ | 16,408,253 | | | | | | | $ | 4,308,361 | |

| | | | |

| | Dividends — affiliated issuers | | | 981,175 | | | | | | | | 1,009,883 | |

| | | |

| | | | |

| | Total investment income | | | 17,389,428 | | | | | | | | 5,318,244 | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| | Expenses: | | | | | | | | | | | | |

| | | | |

| | Management fees | | | 4,244,291 | | | | | | | | 3,157,641 | |

| | | | |

| | Custody, accounting and administrative services | | | 402,965 | | | | | | | | 278,063 | |

| | | | |

| | Transfer Agency fees | | | 141,476 | | | | | | | | 84,204 | |

| | | | |

| | Professional fees | | | 112,231 | | | | | | | | 82,716 | |

| | | | |

| | Registration fees | | | 25,753 | | | | | | | | 37,787 | |

| | | | |

| | Trustee fees | | | 21,633 | | | | | | | | 19,726 | |

| | | | |

| | Printing and mailing costs | | | 7,937 | | | | | | | | 6,960 | |

| | | | |

| | Other | | | 26,516 | | | | | | | | 18,345 | |

| | | |

| | | | |

| | Total expenses | | | 4,982,802 | | | | | | | | 3,685,442 | |

| | | |

| | | | |

| | Less — expense reductions | | | (1,313,392 | ) | | | | | | | (758,658) | |

| | | |

| | | | |

| | Net expenses | | | 3,669,410 | | | | | | | | 2,926,784 | |

| | | |

| | | | |

| | NET INVESTMENT INCOME | | | 13,720,018 | | | | | | | | 2,391,460 | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| | Realized and unrealized gain (loss): | | | | | | | | | | | | |

| | | | |

| | Net realized gain (loss) from: | | | | | | | | | | | | |

| | | | |

| | Investments — unaffiliated issuers (including commission recapture of $6,859 and $20,982, respectively) | | | 58,486,763 | | | | | | | | 26,468,253 | |

| | | | |

| | Forward foreign currency exchange contracts | | | 11,253 | | | | | | | | — | |

| | | | |

| | Foreign currency transactions | | | (125,795 | ) | | | | | | | (92) | |

| | | | |

| | Net change in unrealized gain (loss) on: | | | | | | | | | | | | |

| | | | |

| | Investments — unaffiliated issuers (including the effects of foreign capital gains tax of $(36,388) and $0, respectively) | | | 136,471,243 | | | | | | | | 94,098,526 | |

| | | | |

| | Forward foreign currency exchange contracts | | | (116 | ) | | | | | | | — | |

| | | | |

| | Foreign currency translation | | | (27,269 | ) | | | | | | | — | |

| | | |

| | | | |

| | Net realized and unrealized gain | | | 194,816,079 | | | | | | | | 120,566,687 | |

| | | |

| | | | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 208,536,097 | | | | | | | $ | 122,958,147 | |

| | | |

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

ACTIVE EQUITY MULTI-MANAGER FUNDS

|

Statements of Changes in Net Assets |

| | | | | | | | | | | | | | | | | | | | |

| | | | | Multi-Manager International Equity Fund | | | Multi-Manager U.S. Small Cap Equity Fund | | | |

| | | | | | |

| | | | | For the Six Months Ended April 30, 2024 (Unaudited) | | | For the Fiscal Year Ended October 31, 2023 | | | For the Six Months Ended April 30, 2024 (Unaudited) | | | For the Fiscal Year Ended October 31, 2023 | | | |

| | | | | | |

| | From operations: | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Net investment income | | | $ 13,720,018 | | | | $ 21,687,381 | | | | $ 2,391,460 | | | | $ 4,265,931 | | | |

| | | | | | |

| | Net realized gain | | | 58,372,221 | | | | 14,300,109 | | | | 26,468,161 | | | | 9,768,523 | | | |

| | | | | | |

| | Net change in unrealized gain (loss) | | | 136,443,858 | | | | 139,803,878 | | | | 94,098,526 | | | | (53,130,896 | ) | | |

| | |

| | | | | | |

| | Net increase (decrease) in net assets resulting from operations | | | 208,536,097 | | | | 175,791,368 | | | | 122,958,147 | | | | (39,096,442 | ) | | |

| | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | From distributable earnings | | | (22,657,088 | ) | | | (16,119,210 | ) | | | (5,116,836 | ) | | | (3,365,968 | ) | | |

| | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | From share transactions: | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Proceeds from sales of shares | | | 149,416,310 | | | | 143,090,181 | | | | 75,490,070 | | | | 139,489,002 | | | |

| | | | | | |

| | Reinvestment of distributions | | | 22,657,088 | | | | 16,119,210 | | | | 5,116,836 | | | | 3,365,968 | | | |

| | | | | | |

| | Cost of shares redeemed | | | (116,510,707 | ) | | | (256,849,962 | ) | | | (74,495,983 | ) | | | (59,610,549 | ) | | |

| | |

| | | | | | |

| | Net increase (decrease) in net assets resulting from share transactions | | | 55,562,691 | | | | (97,640,571 | ) | | | 6,110,923 | | | | 83,244,421 | | | |

| | |

| | | | | | |

| | TOTAL INCREASE | | | 241,441,700 | | | | 62,031,587 | | | | 123,952,234 | | | | 40,782,011 | | | |

| | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Net assets: | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Beginning of period | | | 1,221,051,334 | | | | 1,159,019,747 | | | | 721,614,649 | | | | 680,832,638 | | | |

| | |

| | | | | | |