Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Silver Bay Realty Trust Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

ý |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

Common Stock |

| | | (2) | | Aggregate number of securities to which transaction applies:

2,231,511 |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

Based on the average of the high and low prices of the registrant's common stock of $16.085 per share on August 1, 2014. The 2,231,511 common units of Silver Bay Operating Partnership L.P. to be received in this transaction are redeemable for shares of the registrant's common stock on a one-for-one basis. |

| | | (4) | | Proposed maximum aggregate value of transaction:

$35,893,854.44 |

| | | (5) | | Total fee paid:

$7,178.77 |

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

SILVER BAY REALTY TRUST CORP.

[ ], 2014

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders of Silver Bay Realty Trust Corp. (the "Company") to be held at [9:00] a.m., Central Time, on [ ], 2014 at Plymouth Woods Office Center, 3300 Fernbrook Lane North, Suite [ ], Plymouth, MN 55447.

At the Special Meeting, you will be asked to consider and vote upon a proposal that will allow us to internalize the management of the Company (the "Internalization"). This matter is described briefly below and in greater detail in the enclosed materials, which I urge you to read carefully.

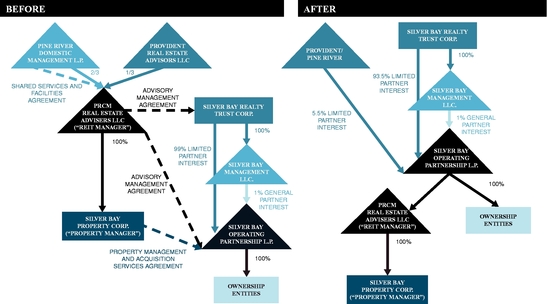

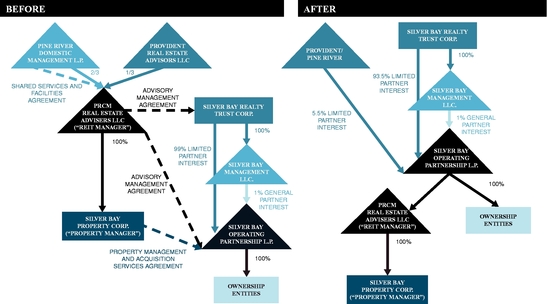

Since our initial public offering in December 2012, we have been externally managed by PRCM Real Estate Advisers LLC (the "Manager"), a joint venture between Pine River Domestic Management L.P. ("Pine River") and Provident Real Estate Advisors LLC ("Provident"). We have relied on the Manager to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own. During this time, the Manager and its operating subsidiary together have provided us with a suite of investment, acquisition and property management services, using the combined expertise of Pine River and Provident. Our relationship with Pine River and Provident was instrumental to our formation as a publicly traded REIT and the establishment of our business operations. However, since our initial public offering, as our business has matured, the Manager's systems and personnel have grown increasingly dedicated to the Company. The Internalization should allow us to internalize the systems, personnel and management of our business with minimal disruption to our operations and compelling benefits to the Company and our stockholders.

To effect the Internalization, the Company entered into a contribution agreement dated as of August 3, 2014 (the "Contribution Agreement") among us, Silver Bay Operating Partnership L.P., our wholly owned subsidiary (the "Operating Partnership"), the Manager, Pine River and Provident. Pursuant to the Contribution Agreement, we will acquire the Manager in exchange for 2,231,511 common units of our Operating Partnership, which are redeemable for cash or, at the election of our Operating Partnership, a number of shares of Company common stock, on a one-for-one basis. The common units represent approximately 5.8% of the outstanding capital stock of Silver Bay as of June 30, 2014 (or 5.5% of fully-diluted shares as of June 30, 2014 assuming issuance and redemption for common shares of the 2,231,511 common units to be received by Pine River and Provident in the Internalization). You will find a more detailed description of the terms of the Contribution Agreement, including a description of the treatment of management fees under the current agreements and mechanics around a net worth adjustment, in the accompanying materials.

The Internalization will benefit our stockholders through reduced expense in the combined general and administrative and advisory management fee expense categories, improved cash flow and a simplified corporate structure. The impact of these benefits will cause the Internalization to be accretive over time to net income and funds from operations ("FFO") on a per share basis because the savings from the reduction in management fees will more than offset the dilutive issuance of common units in our Operating Partnership and increased personnel and other expenses. Assuming the exclusion of one-time transaction costs related to the Internalization, we expect to begin recognizing this net income and FFO accretion no later than the quarter following closing.

Following the proposed Internalization, Silver Bay will own all material assets and intellectual property rights of the Manager currently used in the conduct of its business. The existing employees of the Manager's operating subsidiary, including our Chief Operating Officer, will remain employees of that entity, which will then reside in our corporate structure. We also plan to hire employees of Pine River who provide dedicated services to Silver Bay, including our Chief Executive Officer and Chief Financial Officer. The net effect is that following the Internalization, we will be managed by officers and employees who currently manage our business through the Manager and its operating subsidiary.

Table of Contents

All of our officers and some of our directors are partners or employees of the Manager, its operating subsidiary, Pine River or Provident. These relationships result in those directors and officers having material financial interests in the Internalization. To address these potential conflicts of interest, our Board formed a special committee comprised entirely of independent and disinterested directors in connection with the proposed Internalization (the "Special Committee"). None of the members of the Special Committee are affiliated with Pine River or Provident and none have a financial interest in the proposed Internalization that differs from those of our stockholders. Our Board authorized the Special Committee to review, consider and negotiate the terms and conditions of the Internalization and to make a recommendation to our entire Board on whether to pursue the Internalization and, if so, on what terms and conditions. In evaluating the Internalization, the Special Committee engaged independent legal and financial advisors and received a fairness opinion from its independent financial advisor, as more fully described in the accompanying proxy statement.

You are being asked to vote on a proposal to approve the Contribution Agreement and the transactions contemplated by the Contribution Agreement, including the issuance of 2,231,511 common units in our Operating Partnership to Pine River and Provident in connection with the Internalization.

After careful consideration and the unanimous recommendation of the Special Committee that the Internalization is advisable, fair and reasonable to, and in the best interests of the Company and its stockholders,THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU: (1) VOTE TO APPROVE THE INTERNALIZATION AND (2) VOTE FOR THE PROPOSAL TO ADJOURN THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES.

The proxy statement attached to this letter provides you with information about the Company, the Manager, the Internalization and the Special Meeting. The Company encourages you to read the entire proxy statement carefully. You may also obtain more information about the Company and the Manager from documents the Company has filed with the Securities and Exchange Commission. Shares of Company common stock are listed on the New York Stock Exchange under the ticker symbol "SBY."

Consummation of the Internalization requires the approval of a majority of the votes cast at the Special Meeting. The Company has agreed to exclude for this purpose, in the circumstances described in the accompanying proxy statement, the votes of shares owned of record or beneficially owned by any stockholders affiliated with Pine River or Provident. It is important that your shares be represented at the Special Meeting, regardless of the number of shares you hold and whether or not you plan to attend the meeting in person. Accordingly, whether or not you plan to attend the Special Meeting, you are requested to promptly grant a proxy for your shares by completing, signing and dating the enclosed proxy card and returning it in the envelope provided, or by telephone or over the Internet as instructed in these materials. If you sign, date and mail your proxy card without indicating how you wish to vote, your vote will be counted as a vote FOR approval of the Internalization, and FOR approval of adjourning the special meeting, if necessary or appropriate, to solicit additional proxies.

Granting a proxy will not prevent you from voting your shares in person if you choose to attend the special meeting.

Thank you for your support in this exciting next step for Silver Bay.

| | |

| | | Very truly yours, |

|

|

|

|

|

David N. Miller

Chief Executive Officer, President and Director |

Questions and requests for assistance in voting your common shares may be directed to [Morrow & Co, LLC], which is assisting us with the solicitation of proxies, toll-free at [ ].

Table of Contents

SILVER BAY REALTY TRUST CORP.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [ ], 2014

To our Stockholders:

On behalf of the Board of Directors of Silver Bay Realty Trust Corp., it is my pleasure to invite you to a Special Meeting of Stockholders of Silver Bay Realty Trust Corp., a Maryland corporation (the "Company"), to be held at Plymouth Woods Office Center, 3300 Fernbrook Lane North, Suite [ ], Plymouth, MN 55447, on [ ], [ ], 2014, at [9:00] a.m. Central Time, for the following purposes:

- (1)

- To approve the Contribution Agreement by and among the Company, Silver Bay Operating Partnership L.P., Pine River Domestic Management L.P., Provident Real Estate Advisors LLC, and PRCM Real Estate Advisers LLC, and the transactions contemplated by the Contribution Agreement, pursuant to which we will internalize the management of the Company through the acquisition of our external manager in exchange for the issuance of 2,231,511 common units of our operating partnership.

- (2)

- To adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies.

Stockholders of record at the close of business on [record date], 2014, are entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement of the meeting. The accompanying Proxy Statement contains further information about the business to be conducted at the Special Meeting.

It is important that your shares be represented at the Special Meeting, regardless of the number of shares you hold and whether or not you plan to attend the meeting in person. Accordingly, we encourage you to authorize your vote as soon as possible by following the instructions contained in the proxy statement for the Special Meeting. The proxy statement includes instructions on how to authorize a proxy to vote via the Internet, by telephone (toll free) or by mail.

| | |

| | | BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

|

|

|

Timothy W.J. O'Brien

General Counsel and Secretary |

August [ ], 2014

Table of Contents

ADMISSION TO THE SPECIAL MEETING OF STOCKHOLDERS

Only stockholders who own shares of our common stock as of the close of business on [record date], 2014 will be entitled to attend the Special Meeting of Stockholders to be held on [meeting date], 2014. If you wish to attend the Special Meeting in person, please register in advance by contacting our Investor Relations Department at (952) 358- 4400. Attendance at the Special Meeting will be limited to persons presenting proof of stock ownership as of the record date and a form of government-issued photo identification.

- •

- If your shares are registered in your name, proof of ownership could include a copy of your account statement from our transfer agent or a copy of your stock certificate.

- •

- If you hold shares through an intermediary, such as a broker, bank or other nominee, proof of stock ownership could include a form of proxy from your broker, bank or other nominee or a copy of your brokerage or bank account statement.Please note: If you hold your shares through an intermediary and wish to vote your shares at the meeting, you must request a "legal proxy" from your broker, bank or other nominee and bring that proxy to the meeting.

No cameras, recording devices or large packages will be permitted in the meeting room.

Table of Contents

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

PROXY STATEMENT | | | 1 | |

SPECIAL MEETING OF STOCKHOLDERS | | |

1 | |

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING | | |

1 | |

The Special Meeting | | |

1 | |

Purpose of the Special Meeting | | |

1 | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on [meeting date], 2014 | | |

1 | |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING | | |

3 | |

Why am I receiving these proxy materials? | | |

3 | |

What am I voting on? | | |

3 | |

Why is Silver Bay proposing to internalize the management of the Company? | | |

3 | |

What is the Internalization? | | |

3 | |

How does the Board of Directors recommend that I vote? | | |

4 | |

Who can vote at the Special Meeting? | | |

4 | |

How can I vote? | | |

4 | |

Can I change my vote? | | |

5 | |

How will votes be counted? | | |

5 | |

What vote is required to approve the Internalization? | | |

5 | |

Who is paying for this proxy solicitation? | | |

6 | |

What happens if the Special Meeting is postponed or adjourned? | | |

6 | |

Whom should I call with questions about the Internalization being voted on at the Special Meeting? | | |

6 | |

How can I find out the results of the voting at the Special Meeting? | | |

6 | |

SUMMARY OF THE INTERNALIZATION | | |

7 | |

RISK FACTORS | | |

16 | |

PROPOSAL 1: | | |

20 | |

APPROVAL OF THE CONTRIBUTION AGREEMENT, AND THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT, PURSUANT TO WHICH WE WILL INTERNALIZE THE MANAGEMENT OF THE COMPANY THROUGH THE ACQUISITION OF PRCM REAL ESTATE ADVISERS LLC IN EXCHANGE FOR THE ISSUANCE OF 2,231,511 COMMON UNITS OF SILVER BAY OPERATING PARTNERSHIP L.P. | | |

20 | |

Our Company | | |

20 | |

The Manager and the Advisory Management Agreement | | |

20 | |

i

Table of Contents

| | | | |

| | Page | |

|---|

Reasons for the Internalization | | | 22 | |

Background of the Internalization | | |

23 | |

Proceedings of the Special Committee and Our Board | | |

24 | |

Recommendations of the Special Committee and Our Board of Directors | | |

29 | |

Opinion of the Financial Advisor | | |

32 | |

No Appraisal Rights | | |

38 | |

Independent Registered Public Accountant | | |

38 | |

Interests of Certain Persons in the Internalization | | |

38 | |

Votes Required | | |

38 | |

Recommendation of the Board | | |

39 | |

DESCRIPTION OF THE INTERNATIONALIZATION AND THE CONTRIBUTION AGREEMENT | | |

40 | |

General | | |

40 | |

Payment of Internalization Consideration | | |

40 | |

Closing | | |

41 | |

Conduct of Business Prior to Closing | | |

41 | |

Actions and Documents Delivered at Closing | | |

43 | |

Conditions to Closing | | |

43 | |

Certain Pre-Closing Covenants | | |

44 | |

Management Fees and Expense Reimbursement under Existing Agreements | | |

45 | |

Post-Closing Covenants | | |

45 | |

Representations and Warranties | | |

46 | |

Indemnification | | |

48 | |

Amendment; Waiver; Assignment; Termination | | |

49 | |

Expenses | | |

50 | |

Redemption, Exchange and Registration Rights | | |

50 | |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | | |

51 | |

PROPOSAL 2: | | |

53 | |

APPROVAL OF ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES IN THE EVENT THAT THERE ARE NOT SUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE INTERNALIZATION | | |

53 | |

General | | |

53 | |

Votes Required | | |

53 | |

Recommendation of the Board | | |

53 | |

ii

Table of Contents

| | | | |

| | Page | |

|---|

OTHER MATTERS | | | 54 | |

OTHER INFORMATION | | |

54 | |

WHERE YOU CAN FIND MORE INFORMATION | | |

54 | |

Annex A Contribution Agreement | | |

| |

Annex B Opinion of Jefferies LLC | | |

| |

iii

Table of Contents

SILVER BAY REALTY TRUST CORP.

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

The Board of Directors of Silver Bay Realty Trust Corp., a Maryland corporation, is using this proxy statement to solicit your proxy for use at our 2014 Special Meeting of Stockholders (the "Special Meeting"). We expect to commence mailing of the proxy materials for the Special Meeting on or about [ ], 2014 to our stockholders of record as of the close of business on [record date], 2014.

References in this proxy statement to "Silver Bay," "Company," "we," "us," "our" and similar terms refer to Silver Bay Realty Trust Corp.

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

The Special Meeting

The Special Meeting will be held on [meeting date], 2014 at [9:00] a.m. Central Time at Plymouth Woods Office Center, 3300 Fernbrook Lane North, Suite [ ], Plymouth, MN 55447. For information on how to obtain directions to be able to attend the meeting and vote in person, please contact our Investor Relations general inquiries line at (952) 358-4400.

Purpose of the Special Meeting

The purpose of the Special Meeting is to vote on the following items:

- (1)

- A proposal to approve the Contribution Agreement by and among the Company, Silver Bay Operating Partnership L.P., Pine River Domestic Management L.P., Provident Real Estate Advisors LLC and PRCM Real Estate Advisers LLC, and the transactions contemplated by the Contribution Agreement, pursuant to which we will internalize the management of the Company through the acquisition of our external manager in exchange for the issuance of 2,231,511 common units of our operating partnership.

- (2)

- A proposal to adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of the above proposal.

The Board of Directors is not aware of any other matter to be presented for action at the Special Meeting. Should any other matter requiring a vote of stockholders arise, it is intended that the persons named in the enclosed proxy card and acting thereunder will vote the proxies in accordance with their discretion on any such matter.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on [meeting date], 2014

The Notice of Special Meeting and this Proxy Statement are available on the Internet at www.proxyvote.com. You will need the 12-digit control number included on your proxy card or voting instruction form to access these materials. You may also obtain additional copies of the notice of the Special Meeting and proxy statement, as well as copies of our proxy statement, annual report to security holders and form of proxy for all of our future stockholder meetings, by calling [1-800-579-1639], by email at [sendmaterial@proxyvote.com] and by Internet at [www.proxyvote.com]. [If requesting materials by email, please send a blank email with your control number. Please make the request as instructed above on or before [ ], 2014 to facilitate timely delivery.]

We have adopted a practice approved by the Securities and Exchange Commission ("SEC") called "householding." Under this practice, stockholders who have the same address and last name and who

1

Table of Contents

do not participate in electronic delivery of proxy materials will receive only one mailed copy of our proxy materials, unless one or more of these stockholders notifies us that he or she wishes to continue receiving individual copies. Stockholders who participate in householding will continue to receive separate proxy cards. If you are a stockholder of record and would like to request a copy of these materials, you can request a copy by any of the methods described in the preceding paragraph or by writing to us at the following address: Silver Bay Realty Trust Corp. 3300 Fernbrook Lane North, Suite 210, Plymouth, Minnesota 55447, Attention: Secretary.

Our principal executive offices are located at 3300 Fernbrook Lane North, Suite 210, Plymouth, Minnesota 55447.

2

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

Why am I receiving these proxy materials?

We have sent you these proxy materials because the Board of Directors of Silver Bay is soliciting your proxy to vote at the Special Meeting of stockholders on [meeting date], 2014. You are invited to attend the Special Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply vote by Internet or by telephone or complete, sign and return the enclosed proxy card as described below.

What am I voting on?

At the Special Meeting you will be asked to vote on the following proposals:

- (1)

- A proposal to approve the Contribution Agreement by and among the Company, Silver Bay Operating Partnership L.P., Pine River Domestic Management L.P. ("Pine River"), Provident Real Estate Advisors LLC ("Provident"), and PRCM Real Estate Advisers LLC, and the transactions contemplated by the Contribution Agreement, pursuant to which we will internalize the management of the Company through the acquisition of our external manager in exchange for the issuance of 2,231,511 common units of our operating partnership.

- (2)

- A proposal to adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of the above proposal.

Why is Silver Bay proposing to internalize the management of the Company?

We believe we can internalize the management of our Company with minimal disruptions to our operations and compelling benefits to the Company and our stockholders. This internalization will benefit our stockholders through reduced expense in the combined general and administrative and advisory management fee expense categories, improved cash flow and a simplified corporate structure. The impact of these benefits will cause the internalization to be accretive over time to net income and funds from operations ("FFO") on a per share basis because the anticipated savings from the reduction in management fees will more than offset the dilutive issuance of common units in Silver Bay Operating Partnership L.P. (our "Operating Partnership") and any increased personnel and other expenses. Assuming the exclusion of one-time transaction costs related to the internalization, we expect to begin recognizing this net income and FFO accretion no later than the quarter following closing.

What is the Internalization?

Since inception, we have been externally managed by PRCM Real Estate Advisers LLC (the "Manager"). We have relied on the Manager to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own. "Internalization" refers to the transaction by which we will move the systems, personnel and management of the Company into to the Company's corporate structure. Following the Internalization, Silver Bay will own all material assets and intellectual property rights of the Manager currently used in the conduct of its business and will be managed by officers and employees who currently work for the Manager and who are expected to become employees of Silver Bay or a subsidiary thereof as a result of the Internalization.

To accomplish the Internalization, we have entered into a Contribution Agreement wherein we will acquire the Manager in exchange for 2,231,511 common units of our Operating Partnership, which are redeemable for cash or, at the election of our Operating Partnership, a number of shares of Company common stock, on a one-for-one basis, that represents approximately 5.8% of the outstanding capital stock of Silver Bay as of June 30, 2014 (or 5.5% of fully-diluted shares as of June 30, 2014 assuming issuance and redemption for common shares of the 2,231,511 common units to be received by Pine

3

Table of Contents

River and Provident in the Internalization). The Contribution Agreement includes a net worth adjustment, payable in cash, in the event that the closing net worth of the Manager is greater or less than zero dollars, after making an adjustment to exclude any liabilities for accrued bonus compensation payable to Silver Bay's Chief Executive Officer and personnel providing data analytics directly supporting the investment function of the Company. The Manager will receive management fees under the existing advisory management agreement and property management and acquisition services agreement through September 30, 2014, regardless of when the Internalization closes. The Manager will not receive any additional management fees after September 30, 2014. The Manager will continue to receive expense reimbursement under these management agreements through the closing date and, from September 30, 2014 through the closing, will receive expense reimbursement for the compensation of Silver Bay's Chief Executive Officer and personnel providing data analytics directly supporting the investment function. The Contribution Agreement also contemplates other related transactions, including licensing certain intellectual property of the Manager to Pine River and providing both Pine River and Provident (which we collectively refer to as the "Contributors") with registration rights for the shares of our common stock they may receive upon the exchange of the common units received in this transaction.

How does the Board of Directors recommend that I vote?

After careful consideration and based in part on the unanimous recommendation of a special committee comprised of the Company's independent directors (the "Special Committee"), the Board (with each interested director abstaining from voting) unanimously recommends that you vote:

FOR approving the Contribution Agreement, and the transactions contemplated by the Contribution Agreement, pursuant to which we will internalize the management of the Company through the acquisition of our external manager in exchange for the issuance of 2,231,511 common units of our Operating Partnership; and

FOR adjourning the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of the Internalization.

Who can vote at the Special Meeting?

The Board of Directors has fixed the close of business on [record date], 2014, as the record date for determining the holders of our common stock entitled to receive notice of and to vote at the Special Meeting and any postponements or adjournments thereof. On the record date, there were [ ] shares of our common stock outstanding. Only stockholders as of the record date are entitled to vote at the Special Meeting and such stockholders will be entitled to one vote for each share of our common stock held on the record date, which may be exercised in person or by proxy duly authorized in writing.

How can I vote?

Stockholders of Record. Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods:

- •

- By Internet—You may authorize your proxy on-line via the Internet by accessing the website [www.proxyvote.com] and following the instructions provided on the Notice or proxy card. Internet voting facilities will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on [date], 2014.

- •

- By Telephone—You may authorize your proxy by touch-tone telephone by calling 1-800-690-6903. Telephone voting facilities will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on [date], 2014.

4

Table of Contents

- •

- By Mail—If you request paper copies of the proxy materials to be sent to you by mail, you may authorize your proxy by completing, signing and dating your proxy card and returning it in the enclosed reply envelope that is provided.

- •

- In Person—You may vote in person at the Special Meeting by completing a ballot; however, attending the Special Meeting without completing a ballot will not count as a vote.

Beneficial Owners. If you are the beneficial owner of your shares of common stock (that is, you hold your shares in "street name" through an intermediary such as a broker, bank or other nominee), you will receive instructions from your broker, bank or nominee. Your broker, bank or nominee will not vote your shares of stock on many matters unless you provide them instructions on how to vote your shares of stock. You should instruct your broker or nominee how to vote your shares of stock by following the directions provided by your broker or nominee. Alternatively, obtain a proxy from your bank, broker or other holder of record and bring it with you to hand in with a ballot in order to be able to vote your shares at the meeting.

Can I change my vote?

You may change your vote at any time before the proxy is exercised. For stockholders of record, if you voted by mail, you may revoke your proxy at any time before it is voted by executing and delivering a timely and valid later-dated proxy, by voting by ballot at the meeting or by giving written notice of revocation to the Secretary at 3300 Fernbrook Lane North, Suite 210, Plymouth, Minnesota 55447. If you voted via the Internet or by telephone you may also change your vote with a timely and valid later Internet or telephone vote, as the case may be, or by voting by ballot at the meeting. Attendance at the meeting will not have the effect of revoking a proxy unless (1) you give proper written notice of revocation to the Secretary before the proxy is exercised; or (2) you vote by ballot at the meeting.

How will votes be counted?

Shares represented by valid proxies will be voted in accordance with instructions contained therein. If no specification is made, such shares will be voted (i) "FOR" the Internalization and (ii) "FOR" adjourning the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of the Internalization.

If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under the rules of the New York Stock Exchange (the "NYSE"), your broker or nominee has discretion to vote your shares on routine matters, such as Proposal 2, but does not have discretion to vote your shares on non-routine matters, such as Proposal 1. Therefore, if you do not instruct your broker as to how to vote your shares on Proposal 1, this would be a "broker non-vote" and your shares would not be counted as having been voted on the applicable proposal. We strongly encourage you to instruct your broker or nominee on how you wish to vote your shares.

The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Special Meeting will constitute a quorum for the transaction of business at the Special Meeting. Shares represented by proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting. Pursuant to Maryland law, broker non-votes and abstentions are counted for quorum purposes.

What vote is required to approve the Internalization?

Issuance of the common units must be approved by a vote of our stockholders under Section 312.03(b) of the New York Stock Exchange Listed Company Manual (the "NYSE Manual"), which requires stockholder approval prior to the issuance of common stock, or securities exchangeable

5

Table of Contents

for common stock, in excess of 1% of the Company's outstanding shares in a transaction with a related party. The NYSE Manual requires the approval by a majority of votes cast on the Internalization at the Special Meeting, assuming that a quorum is present.

The Contribution Agreement requires as a closing condition that the Internalization be approved by the affirmative vote of at least a majority of the votes cast by the stockholders entitled to vote on the matter, other than the votes of shares held by any of the Contributors or their affiliates. This provision of the Contribution was agreed to because the Internalization involves a transaction in which some of our directors and our officers have a material financial interest. Pursuant to Maryland law, transactions in which directors have a material financial interest are not void or voidable solely because of such fact if, among other things, disinterested director approval or ratification occurs, stockholder approval or ratification is obtained or the transaction is otherwise fair and reasonable to the corporation. Our interested directors and their affiliates own approximately 6.0% of the outstanding common stock of the Company as of August 4, 2014 (based on 38,473,376 shares outstanding as of August 4, 2014).

If you "Abstain" from voting, it will have no effect on the Internalization under Maryland law, and it will have the same effect as an "Against" vote on the Internalization under the NYSE rules. Broker non-votes will have no effect on the Internalization under either Maryland law or the NYSE rules.

Who is paying for this proxy solicitation?

We will pay all of the expenses incurred in connection with the solicitation of proxies, including preparing, assembling, printing and mailing of the materials used in the solicitation of proxies. We may make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward soliciting materials, at our expense, to the beneficial owners of common shares held of record by such persons. Solicitation of proxies will be primarily by mail. However, certain of our directors or officers and certain officers, managers or members of the Manager and other affiliates of us or the Manager, also may solicit proxies by telephone, Internet or in person.

In addition, we have engaged Morrow & Co., LLC, a professional proxy solicitation firm, to aid in the solicitation of proxies at a fee estimated to be approximately $[8,500]. We have agreed to indemnify such proxy solicitation firm against certain liabilities that it may incur arising out of the services it provides in connection with the Special Meeting.

What happens if the Special Meeting is postponed or adjourned?

If the Special Meeting is postponed or adjourned, your proxy will still be good and may be voted at the postponed or adjourned meeting. You will be able to change or revoke your proxy until it is voted.

Whom should I call with questions about the Internalization being voted on at the Special Meeting?

You should call our proxy solicitor, [Morrow & Co, LLC], at [ ] (toll-free).

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K filed with the SEC within four business days after the Special Meeting.

Even if you currently plan to attend the Special Meeting, we recommend that you also submit your proxy as described above so that your vote will be counted in case you later decide not to attend the meeting. Submitting your proxy in advance of the meeting does not affect your right to attend the Special Meeting and vote in person.

6

Table of Contents

SUMMARY OF THE INTERNALIZATION

This summary highlights selected information from this proxy statement in connection with the Special Meeting regarding the Internalization pursuant to the terms and conditions of the Contribution Agreement, which is attached to this proxy statement as Annex A. You are urged to carefully read the entire proxy statement and the other documents referred to in this proxy statement because the information in this section does not provide all the information that might be important to you with respect to the Internalization.

| | |

Information about the Parties: | | Silver Bay Realty Trust Corp. We are a Maryland corporation focused on the acquisition, renovation, leasing and management of single-family properties. We generate virtually all of our revenue by leasing our portfolio of single family properties and from this revenue, expect to pay the operating costs associated with our business and any distributions to our stockholders. We are externally managed by PRCM Real Estate Advisers LLC, our manager. Upon completion of the Internalization we will no longer be externally managed and will assume the responsibilities of our manager and its subsidiary. Our principal executive offices are located at 3300 Fernbrook Lane North, Suite 210, Plymouth, Minnesota 55447. Our telephone number at that address is (952) 358-4400. |

| | Silver Bay Operating Partnership L.P.(the "Operating Partnership"). We conduct our business and own all of our properties through our Operating Partnership, a Delaware limited partnership. As of June 30, 2014, we owned, through a combination of direct and indirect interests, 100.0% of the partnership interests in our Operating Partnership. We have no material assets or liabilities other than our investment in our Operating Partnership. |

7

Table of Contents

| | |

| | PRCM Real Estate Advisers LLC(the "Manager"). We rely on the Manager and the Manager's wholly owned operating subsidiary, Silver Bay Property Corp., to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own. The Manager and its operating subsidiary together provide us with a suite of investment, acquisition and property management services. The Manager was formed in December 2011 as a joint venture between Pine River Domestic Management L.P. ("Pine River") and Provident Real Estate Advisors LLC ("Provident"). Pine River is an affiliate of both Pine River Capital Management L.P. and PRCM Advisers LLC, the external manager of Two Harbors Investment Corp. |

| | Pine River Domestic Management L.P.("Pine River"). Pine River is a two-thirds owner of the Manager and an affiliate of Pine River Capital Management L.P. Pine River is a global asset management firm with institutional capabilities in asset valuation and management, capital markets, financial transactions, managing new ventures, risk management, compliance and reporting. The address of Pine River is 601 Carlson Parkway, Suite 330, Minnetonka, MN 55305. |

| | Provident Real Estate Advisors LLC("Provident"). Provident, a private capital management firm based in Minnesota, has been engaged in the acquisition, renovation, management and leasing oversight of a portfolio of predominantly single-family properties since 2009. Between 2009 and 2012, Provident acquired approximately 880 properties, which portfolios of homes were contributed to us in connection with our initial public offering ("IPO") in December 2012. Provident is the one-third owner of the Manager. The address of Provident is 2800 Niagara Lane, Plymouth, MN 55447. |

8

Table of Contents

| | |

Contribution Agreement: | | We have entered into a Contribution Agreement (the "Contribution Agreement") wherein, among other matters, (i) the members of the Manager, which are Pine River and Provident (which we refer to collectively as the "Contributors"), will contribute and assign to our Operating Partnership all of their right, title and interest in the membership interests in the Manager, and (ii) PRCM Real Estate Adviser LLC, our subsidiary after the closing, will license to Pine River rights relating to the use of certain intellectual property. The Contribution Agreement is attached to this proxy statement as Annex A. |

Consideration: | | At the Closing, the Contributors will contribute all membership and economic interests in the Manager to our Operating Partnership in exchange for the issuance of 2,231,511 common units in our Operating Partnership. The common units are redeemable for cash or, at the election of our Operating Partnership, a number of our common shares on a one-for-one basis, that represents approximately 5.8% of our outstanding common shares as of June 30, 2014 (or 5.5% of fully-diluted shares as of June 30, 2014 assuming issuance and redemption for common shares of the 2,231,511 common units to be received by the Contributors in the Internalization). |

Net Worth Adjustment: | | The Contribution Agreement contains a net worth adjustment, payable in cash, in the event that the closing net worth of the Manager is greater or less than zero dollars, which includes an adjustment to reflect the exclusion of any liabilities for accrued bonus compensation payable to our Chief Executive Officer and personnel providing data analytics directly supporting the investment function of the Company. |

| | |

9

Table of Contents

| | |

Management Fees and Expense Reimbursement under Existing Agreements: | | The Contribution Agreement provides that the Manager will receive management fees under the existing advisory management agreement and the property management and acquisition services agreement through September 30, 2014, regardless of when the Internalization closes. The Manager will not receive any additional management fees after September 30, 2014. The Manager will continue to receive expense reimbursement under these management agreements through the closing date and, from September 30, 2014 through the closing, will receive expense reimbursement for the compensation of Silver Bay's Chief Executive Officer and personnel providing data analytics directly supporting the investment function. |

Background of the Internalization: | | At the time of the Company's IPO in December 2012, the Company chose to be externally managed given the previous success of Pine River and Provident in launching and managing externally managed vehicles and because the Company sought to leverage the resources, experience and expertise of Pine River and Provident in the early days of its development. In addition, because the Company was the first publicly traded REIT focused on the acquisition, renovation, leasing and management of single-family properties, no standards existed as to whether this new category of REITs would generally be externally or internally managed. Subsequent to the IPO, additional single-family REITs have gone public, and the Company believes that internally managed structures will predominate this asset class going forward. |

10

Table of Contents

| | |

| | Following the completion of our IPO, several investors and analysts have inquired about the Company's management structure, expressed concerns regarding the management fee and encouraged the Company to consider an internalization of the Company's management. The advisory management agreement has an initial term which expires on December 19, 2015, automatically renews each year thereafter and contains limited rights of the Company with respect to termination as more fully described above in the section entitled "—The Manager and the Advisory Management Agreement." In March 2014, in light of investor feedback and the limited circumstances under which the advisory management agreement may be terminated, the Contributors and management began discussions, including with members of the Board, concerning structures for an internalization and various related considerations. Thereafter, the Board formed a Special Committee consisting of all of the disinterested members of the Board to consider and evaluate an internalization of the management structure. See "Background of the Internalization" under "PROPOSAL 1: APPROVAL OF THE CONTRIBUTION AGREEMENT, AND THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT, PURSUANT TO WHICH WE WILL INTERNALIZE THE MANAGEMENT OF THE COMPANY THROUGH THE ACQUISITION OF PRCM REAL ESTATE ADVISERS LLC IN EXCHANGE FOR THE ISSUANCE OF 2,231,511 COMMON UNITS OF SILVER BAY OPERATING PARTNERSHIP L.P." |

Principal Reasons for the Internalization: | | Since inception, we have been externally managed by the Manager, a joint venture between Pine River and Provident. We have relied on the Manager to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own. As our business has matured, the Manager's systems and personnel have grown increasingly dedicated to the Company, which should enable us to internalize the systems, personnel and management with minimal disruptions to our operations and compelling benefits to the Company. |

11

Table of Contents

| | |

| | We expect the Internalization to benefit our stockholders through reduced expense in the combined general and administrative and advisory management fee expense categories, improved cash flow and a simplified corporate structure. We believe that the Internalization will be accretive over time to funds from operations ("FFO") on a per share basis because the savings from the reduction in management fees will more than offset the dilutive issuance of common units in our Operating Partnership and any increased employment and other expenses See "Reasons for the Internalization" under "PROPOSAL 1: APPROVAL OF THE CONTRIBUTION AGREEMENT, AND THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT, PURSUANT TO WHICH WE WILL INTERNALIZE THE MANAGEMENT OF THE COMPANY THROUGH THE ACQUISITION OF PRCM REAL ESTATE ADVISERS LLC IN EXCHANGE FOR THE ISSUANCE OF 2,231,511 COMMON UNITS OF SILVER BAY OPERATING PARTNERSHIP L.P." |

Our Management Following the Internalization: | | Our Chief Executive Officer, David N. Miller, our Chief Financial Officer, Christine Battist, and our Chief Operating Officer, Lawrence B. Shapiro, will continue to hold their offices after the completion of the Internalization but will be employed by us. Our current General Counsel and Secretary, Timothy O'Brien, will resign upon completion of the Internalization. |

Closing Conditions: | | The Contribution Agreement contains a number of conditions to the respective obligations of the Company, Pine River and Provident that must be satisfied prior to the closing of the Internalization, including the following: |

| | • approval by the affirmative vote of at least a majority of the votes cast by the stockholders entitled to vote on the matter other than the votes of shares owned of record or beneficially by any of the Contributors or their respective affiliates; |

| | • the representations and warranties contained in the Contribution Agreement of the Company and our Operating Partnership, and of the Contributors, must be true and correct in all material respects; |

12

Table of Contents

| | |

| | • absence of any material adverse effect with respect to us or our Operating Partnership, or with respect to the Manager or its wholly owned subsidiary; |

| | • absence of any enactment, entering into, promulgation or enforcement of any statute, rule, regulation, order, decree or injunction by a governmental authority that prohibits the consummation of the transactions contemplated by the Contribution Agreement and other Internalization documents; |

| | • absence of any action, suit or proceeding that is pending before any governmental authority that is likely to result in an injunction, judgment, order, decree or ruling that would prevent the consummation of the transactions contemplated by the Contribution Agreement and other Internalization documents; |

| | • any necessary consents and approvals of any governmental authority required for the consummation of the transactions contemplated by the Contribution Agreement and other Internalization documents shall have been obtained; and |

| | • the delivery by all parties of the documents required to be executed and delivered pursuant to the Contribution Agreement. |

| | Any condition to the consummation of the Internalization may be waived in writing by the party to the Contribution Agreement entitled to the benefit of such condition. |

Certain Termination Rights: | | If the stockholder approval contemplated in the Contribution Agreement has not been obtained on or before December 31, 2014, either the Company or a Contributor may terminate the Contribution Agreement. If the Contribution Agreement is validly terminated pursuant to the Contribution Agreement, it will be void and have no effect, without liability on the part of any party or its affiliates, directors, managers, officers, stockholders or members, except as specifically contemplated in the Contribution Agreement. The Contribution Agreement does not provide for the payment of a termination fee by any party. |

Lockup: | | Under the Contribution Agreement, the Contributors will be required to hold their ownership of the common units (or any common shares received on redemption thereof) for 12 months following closing of the transaction. |

13

Table of Contents

| | |

Registration Rights Agreement: | | We have granted the Contributors registration rights for the shares of our common stock they may receive upon the redemption of the common units in accordance with the limited partnership agreement of our Operating Partnership. |

Interests of Certain Persons: | | Brian C. Taylor, Irvin R. Kessler and Thomas Siering are members of our Board of Directors, Timothy O'Brien is our General Counsel and Secretary, and each is a partner of Pine River or, in the case of Mr. Kessler, a member and manager of Provident. As a result of their relationships with the Contributors, these individuals have interests in the Internalization that differ from those of our stockholders as each will have an indirect beneficial interest in a portion of the consideration received by the Contributors in the Internalization. David N. Miller, Christine Battist and Lawrence B. Shapiro are officers of Silver Bay and employees of Pine River or the Manager's operating subsidiary. In addition, we expect to enter into employment arrangements with Mr. Miller, Ms. Battist and Mr. Shapiro, all of whom are employees of Pine River or the Manager's operating subsidiary. |

Special Committee of the Board: | | On April 16, 2014, recognizing that certain members of our Board were associated with the Manager, and considering the recommendations of the Company's inside and outside counsel, our Board adopted resolutions forming the Special Committee. The Board delegated to the Special Committee broad powers to, among other things, represent the Company in the negotiation and determination of the terms and conditions of the Internalization, consider and review potential alternative structures for alternatives to the Internalization and determine whether the Internalization is in the best interests of the Company and our stockholders. None of the members of the Special Committee are affiliated with either Pine River or Provident. |

14

Table of Contents

| | |

Opinion of the Special Committee's Financial Advisor: | | The Special Committee retained Jefferies LLC ("Jefferies") on May 13, 2014 to provide it with financial advisory services in connection with the possible acquisition of the Manager and an opinion as to the fairness, from a financial point of view, to the Company of the consideration to be paid in connection with the Internalization. On August 3, 2014, Jefferies rendered its opinion to the Special Committee and the Board to the effect that, as of that date and based upon and subject to the various assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken as set forth therein, the consideration to be paid pursuant to the Contribution Agreement was fair, from a financial point of view, to the Company. |

| | Jefferies' opinion sets forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken by Jefferies in rendering its opinion. Jefferies' opinion was directed to the Special Committee and the Board and addresses only the fairness, from a financial point of view, of the consideration to be paid pursuant to the Contribution Agreement as of the date of the opinion. It does not address any other aspects of the Internalization and does not constitute a recommendation as to how any holder of shares of common stock should vote on the Internalization or the issuance of the common units pursuant to the Internalization or any matter related thereto. |

| | The full text of the written opinion of Jefferies is attached hereto as Annex B. The Company encourages you to read the opinion carefully and in its entirety. |

Consequences of Not Obtaining Stockholder Approval of the Proposal: | | A condition to the completion of the Internalization is the approval by our stockholders as provided in the Contribution Agreement. If our stockholders do not approve the Internalization as described herein, then the transactions contemplated by the Contribution Agreement will not be consummated, the Contribution Agreement will be terminated without the payment of fees by any party, and the Manager will continue to act as external manager of the Company pursuant to the existing advisory management agreement. |

Regulatory Matters: | | No regulatory approvals or filings are required in order to effect the Internalization. |

15

Table of Contents

RISK FACTORS

This proxy statement contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements may include statements about the expected closing of the Internalization, the integration of the systems and personnel of the Manager into the Company, and the expected benefits of the Internalization, including reduction of expenses and expected net income and FFO accretion per share.

The forward-looking statements contained in this proxy statement reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed or implied in any forward-looking statement. We are not able to predict all of the factors that may affect future results. For a discussion of these and other factors that could cause our actual results to differ materially from any forward-looking statements, see the risk factors discussed below and in Item 1A, "Risk Factors," and in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and other risks and uncertainties detailed in such annual report and our other reports and filings with the SEC. These risks, contingencies and uncertainties include:

- •

- Our ability to successfully employ a new and untested business model in a new industry with no proven track record;

- •

- The availability of additional properties that meet our criteria and our ability to purchase such properties on favorable terms;

- •

- Real estate appreciation or depreciation in our target markets and the supply of single-family homes in our target markets;

- •

- General economic conditions in our target markets, such as changes in employment and household earnings and expenses or the reversal of population, employment, or homeownership trends in our target markets that could affect the demand for rental housing;

- •

- Competition from other investors in identifying and acquiring single-family properties that meet our underwriting criteria and leasing such properties to qualified residents;

- •

- Our ability to maintain high occupancy rates and to attract and retain qualified residents in light of increased competition in the leasing market for quality residents and the relatively short duration of our leases;

- •

- Our ability to maintain rents at levels that are sufficient to keep pace with rising costs of operations;

- •

- Lease defaults by our residents;

- •

- Our ability to contain renovation, maintenance, marketing and other operating costs for our properties;

- •

- The Manager's ability to continue to build its operational expertise and to establish its platform and processes related to residential management;

16

Table of Contents

- •

- Our dependence on key personnel to carry our business and investment strategies and our ability to hire and retain skilled managerial, investment, financial and operational personnel, and the performance of third-party vendors and service providers other than the Manager, including third-party acquisition and management professionals, maintenance providers, leasing agents and property management;

- •

- Our ability to obtain additional capital or debt financing to expand our portfolio of single-family properties and our ability to repay our debt, including borrowings under our revolving credit facility and to meet our other obligations under our revolving credit facility;

- •

- The accuracy of assumptions in determining whether a particular property meets our investment criteria, including assumptions related to estimated time of possession and estimated renovation costs and time frames, annual operating costs, market rental rates and potential rent amounts, time from purchase to leasing, and resident default rates;

- •

- Our ability to accurately estimate the time and expense required to possess, renovate, repair, upgrade and rent properties and to keep them maintained in rentable condition, unforeseen defects and problems that require extensive renovation and capital expenditures;

- •

- The concentration on our investments in single family properties which subject us to risks inherent in investments in a single type of property and seasonal fluctuations in rental demand;

- •

- The concentration of our properties in our target markets, which increases the risk of adverse changes in our operating results if there were adverse developments in local economic conditions or the demand for single-family rental homes or natural disasters in these target markets;

- •

- Failure to qualify as a real estate investment trust ("REIT") or to remain qualified as a REIT, which will subject us to federal income tax as a regular corporation and could subject us to a substantial tax liability and compliance with the REIT distribution requirements.

- •

- Our ability to consummate the transactions contemplated under existing and future agreements; and

- •

- Failure of closing conditions to be satisfied in connection with certain transactions, including the proposed Internalization.

The forward-looking statements in this proxy statement represent our views as of the date of this proxy statement. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable laws. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this proxy statement.

Certain of the Company's directors and officers have interests in the Internalization that diverge from the interests of the Company's stockholders.

Certain of our officers and directors have potential conflicts of interest arising out of their relationship with one or more of the Manager, the Manager's operating subsidiary, Pine River, Provident and each of their affiliates. The Manager is a joint venture owned by Pine River and Provident. Each of Brian C. Taylor (a director and Chairman of the Board), Thomas Siering (a director) and Timothy O'Brien (the Company's General Counsel and Secretary) is a partner and owner of equity interests in Pine River. Irvin R. Kessler (a director) is the managing member and owner of equity interests in Provident. These individuals will have a beneficial interest in the consideration paid to the Contributors in the Internalization and could make substantial profits as a result of the transaction.

17

Table of Contents

The Contributors will have the ability to redeem the common units received in the Internalization for cash, or at the Company's election, shares of Company common stock. If the Contributors exercise their redemption rights and the Company elects to redeem for common shares, the Contributors will own 2,231,511 common shares, representing approximately 5.8% of the Company's outstanding common shares as of June 30, 2014 (or 5.5% of fully-diluted shares as of June 30, 2014 assuming issuance and redemption for common shares of the 2,231,511 common units to be received by the Contributors in the Internalization).

In addition, the Company expects to enter into employment arrangements with David N. Miller, Lawrence B. Shapiro and Christine Battist effective as of or soon after the closing of the Internalization. The Compensation Committee of the Company's Board of Directors has engaged an independent compensation consultant and has had preliminary discussions related to the compensation of our executive officers following the Internalization but has not yet made final determinations on the composition of the post-Internalization compensation program. These new employment arrangements could provide for annual salaries that are more than what is currently paid to such individuals by Pine River or the Manager's operating subsidiary, as applicable, and may contain other benefits that differ from existing employment arrangements. Following the Internalization, Mr. Miller will also be eligible for equity grants, pursuant to the terms of Silver Bay's 2012 Equity Incentive Plan. Prior to the Internalization, Mr. Miller was not eligible to receive awards under the plan.

Sales of common stock in the future may have adverse effects on our share price.

As of the closing of the Internalization, Pine River and Provident will receive an aggregate of 2,231,511 common units, representing approximately 5.8% of the Company's outstanding common shares as of June 30, 2014 (or 5.5% of fully-diluted shares as of June 30, 2014 assuming issuance and redemption for common shares of the 2,231,511 common units to be received by the Contributors in the Internalization). Common units (or shares issued on redemption thereof) will be subject to a one-year lock-up period, subject to certain exceptions. Following expiration of the lock-up, these shares will be freely transferable without restriction. The market price of our common stock may decline significantly when the restrictions on resale by the Contributors lapse, especially if the Contributors were to sell a significant portion of their common stock within a short timeframe. Sales of substantial amounts of common stock or the perception that such sales could occur may adversely affect the prevailing market price for our common stock.

We may compete with the Contributors in ancillary lines of business and, after the end of the restricted period, the Contributors may engage in competitive businesses or solicit our employees for hire, which could have an adverse effect on our business.

Each Contributor has agreed that, commencing on the closing date and ending on December 19, 2017, it will not compete with the Company or solicit its employees, subject to certain exceptions as forth in the Contribution Agreement. After the expiration of this restricted period, however, the Contributors will be free to acquire or manage single-family real estate portfolios, which could result in them competing directly with us for acquisition opportunities, financing opportunities, tenants and in other aspects of our business, and they may solicit and hire key employees, each of which could have an adverse effect on our business.

Additionally, the restrictions do not limit Contributors from engaging in lines of business ancillary to single-family rentals or other lines of business that the Company might consider in the future. As a result, if the Company were to expand its business strategy, it might compete with one or both Contributors in such line of business.

18

Table of Contents

Our net income and FFO may decrease in the near term as a result of the Internalization.

We will expense all cash and non-cash costs involved in the Internalization. As a result, our net income and FFO will decrease in the period in which the Internalization closes, driven predominately by the non-cash charge related to the issuance of common units and, to a lesser extent, other transaction related costs. We expect the Internalization to be accretive to net income and FFO per share because the savings from the reduction in management fees will more than offset the dilutive issuance of common units in our Operating Partnership and any increased personnel and other expenses beginning in the quarter following closing. However, if the expenses we assume as a result of the Internalization are higher than we anticipate, our net income per share and FFO per share would be adversely affected.

We may be exposed to risks to which we have not historically been exposed.

We currently have no employees of our own but will following the Internalization. As their employer, we will be subject to those potential liabilities that are commonly faced by employers, such as workers disability and compensation claims, potential labor disputes and other employee- related liabilities and grievances. Further, we will bear the costs of the establishment and maintenance of health, retirement and similar benefit plans for our employees.

We may not be able to hire the Pine River employees who are currently managing our business and operations and may not adequately replace Pine River personnel who dedicate only a portion of their time to Silver Bay.

The Contribution Agreement provides that Pine River will use commercially reasonably efforts to encourage the employees who currently provide dedicated services to Silver Bay to become employees of Silver Bay following the closing of the Internalization, including our Chief Executive Officer and Chief Financial Officer; however, these employees have not yet been offered employment and may decide not to accept employment with Silver Bay. If we need to recruit and hire additional personnel, there may be delays in doing so, the compensation to such employees may be higher, and there could be disruptions to our business.

In addition to having employees who provide dedicated services to us, Pine River has employees and partners who provide services to us as needed. We do not expect to hire any of these people, which includes Mr. O'Brien, our General Counsel and Secretary who will resign on or before the closing of the Internalization. Instead, we will need to find others to provide the services currently performed by these resources. If we need to recruit and hire additional personnel to replace these resources, there may be delays in doing so, the compensation to such employees may be higher, and there could be disruptions to our business.

We may not manage the Internalization effectively.

The Internalization could be a time consuming and costly process. If we fail to plan and manage the Internalization efficiently and effectively, our ability to manage our properties and business may be adversely affected and we may not realize the anticipated cost savings benefits.

19

Table of Contents

PROPOSAL 1:

APPROVAL OF THE CONTRIBUTION AGREEMENT, AND THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT, PURSUANT TO WHICH WE WILL INTERNALIZE THE MANAGEMENT OF THE COMPANY THROUGH THE ACQUISITION OF PRCM REAL ESTATE ADVISERS LLC IN EXCHANGE FOR THE ISSUANCE OF 2,231,511 COMMON UNITS OF SILVER BAY OPERATING PARTNERSHIP L.P.

Our Company

We are an externally-managed Maryland corporation focused on the acquisition, renovation, leasing and management of single-family properties in select markets in the United States. Our objective is to generate attractive risk-adjusted returns for our stockholders over the long term through dividends and capital appreciation. We generate virtually all of our revenue by leasing our portfolio of single-family properties. As of June 30, 2014, we owned 5,987 single-family properties, excluding properties held for sale, in Arizona, California, Florida, Georgia, Nevada, North Carolina, Ohio and Texas, 90.5% of which were leased.

Silver Bay Realty Trust Corp. was incorporated in Maryland in June 2012. We completed our IPO and a series of contribution and merger transactions on December 19, 2012 in which we received net proceeds of approximately $263.0 million (including the closing of the underwriters' overallotment option on January 7, 2013 by which we received net proceeds of approximately $34.5 million) and acquired an initial portfolio of more than 3,300 single-family properties. Prior to that time, we had no substantive operations though we are considered a continuation of the business operations of Silver Bay Property Investment LLC (formerly known as Two Harbors Property Investment LLC).

We have elected to be treated as a REIT for U.S. federal tax purposes, commencing with, and in connection with the filing of our federal tax return for, the taxable year ended December 31, 2012. As a REIT, we generally are not subject to federal income tax on the taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income or property. In addition, the income of any taxable REIT subsidiary that we own will be subject to taxation at regular corporate rates.

We conduct our business and own all of our properties through our Operating Partnership. As of June 30, 2014, we owned, through a combination of direct and indirect interests, 100.0% of the partnership interests in our Operating Partnership. We have no material assets or liabilities other than our investment in our Operating Partnership. The General Partner, our wholly owned subsidiary, is the sole general partner of our Operating Partnership.

The Manager and the Advisory Management Agreement

Since inception, we have been externally managed by the Manager. The Manager is a joint venture of Pine River and Provident. We have relied on the Manager to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own. During this time, the Manager and its operating subsidiary together have provided us with a suite of investment, acquisition and property management services, using the combined expertise of Pine River and Provident.

In December 2012, in connection with our IPO, we entered into an advisory management agreement with the Manager. Pursuant to this advisory management agreement, the Manager designs and implements our business strategy and administers our business activities and day-to-day operations,

20

Table of Contents

subject to oversight by our board of directors. The Manager is responsible for, among other duties: (1) performing and administering all our day-to-day operations, (2) determining investment criteria in cooperation with our board of directors, (3) sourcing, analyzing and executing asset acquisitions, sales and financings, (4) performing asset management duties and (5) performing certain financial, accounting and tax management services. The Manager has agreed not to provide these services to anyone other than us, our subsidiaries, and any future joint venture in which we are an investor, prior to December 19, 2015. In addition, the Manager and Pine River Capital Management L.P. have agreed not to compete with us, our subsidiaries or any of our future joint ventures before December 19, 2015.

Under the advisory management agreement, the Manager is compensated on a fee plus pass-through-of-expenses basis. We pay the Manager 0.375% of the daily average of our fully-diluted market capitalization for the preceding quarter (a 1.5% annual rate), less any property management fees received by the Manager's operating subsidiary or its affiliates under the property management and acquisition services agreement described below. We also reimburse the Manager for all expenses incurred on our behalf or otherwise in connection with the operation of its business, other than compensation for our Chief Executive Officer and personnel providing data analytics directly supporting the investment function. If the Manager provides services to a party other than us or one of our subsidiaries, a portion of these expenses will be allocated to and reimbursed by such other party in a fair and equitable manner as determined by the Manager in good faith; the Manager is not currently providing such third-party services.

Under the advisory management agreement, all intellectual property created in connection with the agreement is the property of the Manager, and the Manager has granted us a non-exclusive, royalty-free license and right to use the intellectual property during the term of the advisory management agreement.

The initial term of the advisory management agreement expires on December 19, 2015 and automatically renews for a one-year term on such date and each anniversary thereafter unless terminated. Following the initial term, the advisory management agreement may be terminated by us upon the affirmative vote of at least two-thirds of our independent directors based upon unsatisfactory performance that is materially detrimental to us. We must provide notice of any such termination at least 180 days prior to the expiration of the then-current term and pay the Manager a termination fee as described below. We may also terminate the advisory management agreement at any time, including during the initial term, without the payment of any termination fee, with at least 30 days' prior written notice to the Manager for cause, as described in the advisory management agreement, in the absence of the Manager's timely cure. Except as stated above, we do not have the right to decline to renew the advisory management agreement. The Manager may terminate the agreement with at least 60 days' prior written notice for cause, as described in the advisory management agreement, in the absence of our timely cure, in which case we would owe a termination fee. The Manager also may decline to renew the advisory management agreement by providing us with 180 days' prior notice, in which case we would not owe a termination fee. Upon termination of the advisory management agreement by us for reasons other than cause, or by the Manager for cause that we are unwilling or unable to timely cure, we are required pay the Manager a termination fee equal to 4.5% of the daily average of our fully-diluted market capitalization in the quarter preceding such termination.