SILVER BAY REALTY TRUST CORP. 2 0 1 3 I n v e s t o r S i t e V i s i t P r e s e n t a t i o n

2 S A F E H A R B O R S T A T E M E N T F O R W A R D - L O O K I N G S T A T E M E N T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include: Silver Bay‟s ability to execute share repurchases upon terms acceptable to the company; adverse economic or real estate developments in Silver Bay‟s target markets; defaults on, early terminations of or non-renewal of leases by residents; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession and renovate properties; Silver Bay‟s failure to successfully operate its properties; Silver Bay‟s ability to obtain financing arrangements; Silver Bay‟s failure to meet the conditions to draw under the credit facility; general volatility of the markets in which it participates; interest rates and the market value of Silver Bay‟s target assets; the impact of changes in governmental regulations, tax law and rates, and similar matters. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Silver Bay does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Silver Bay‟s most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

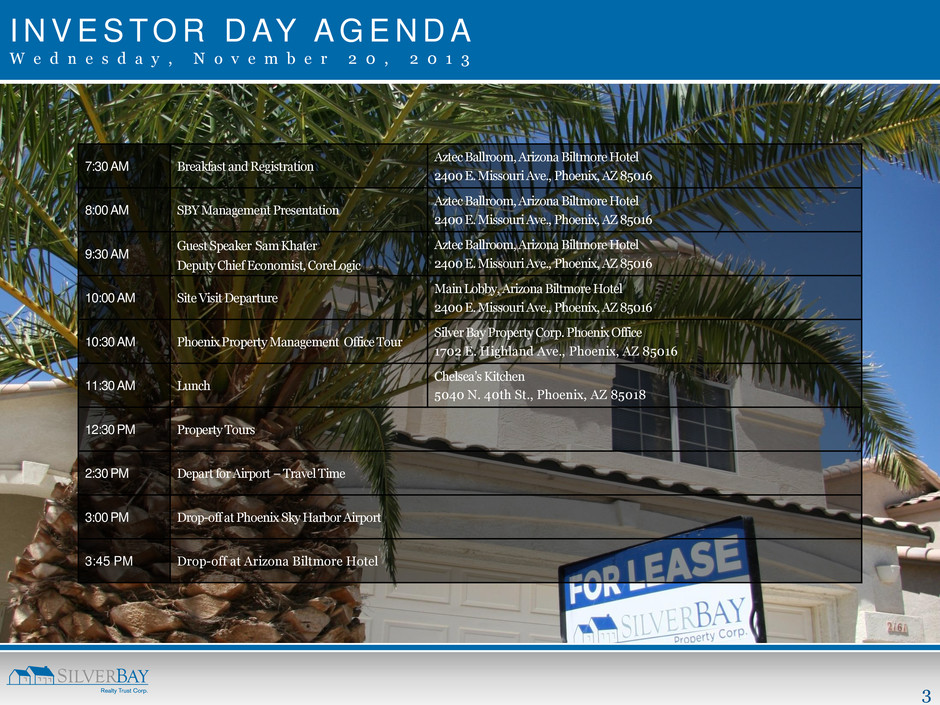

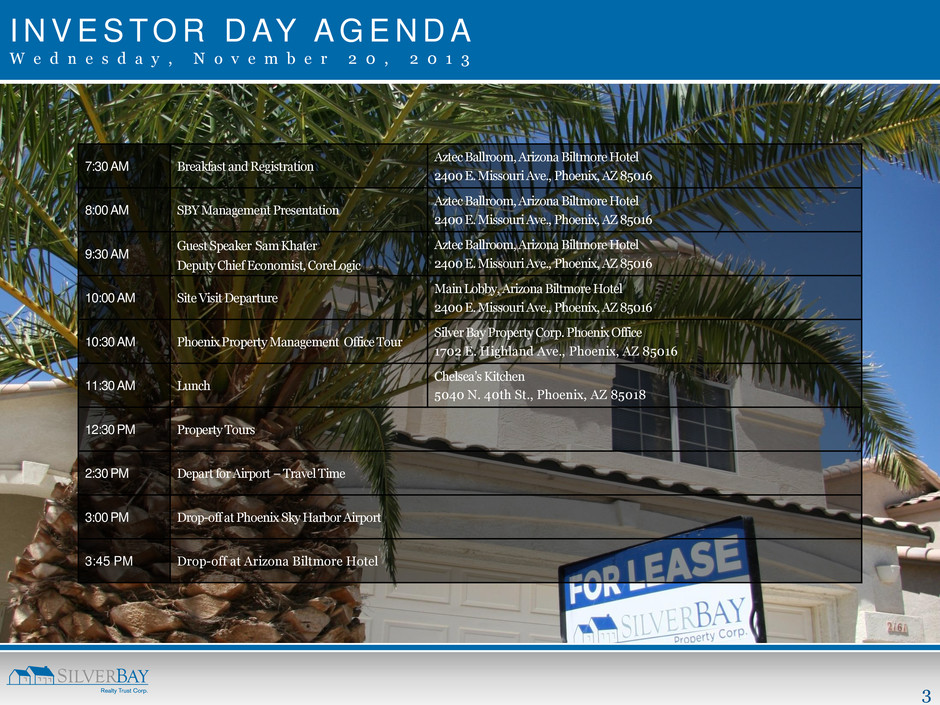

3 I N V E S T O R D AY A G E N D A W e d n e s d a y , N o v e m b e r 2 0 , 2 0 1 3 7:30 AM Breakfast and Registration Aztec Ballroom, Arizona Biltmore Hotel 2400 E. Missouri Ave., Phoenix, AZ 85016 8:00 AM SBY Management Presentation Aztec Ballroom, Arizona Biltmore Hotel 2400 E. Missouri Ave., Phoenix, AZ 85016 9:30 AM Guest Speaker Sam Khater Deputy Chief Economist, CoreLogic Aztec Ballroom, Arizona Biltmore Hotel 2400 E. Missouri Ave., Phoenix, AZ 85016 10:00 AM Site Visit Departure Main Lobby, Arizona Biltmore Hotel 2400 E. Missouri Ave., Phoenix, AZ 85016 10:30 AM Phoenix Property Management Office Tour Silver Bay Property Corp. Phoenix Office 1702 E. Highland Ave., Phoenix, AZ 85016 11:30 AM Lunch Chelsea‟s Kitchen 5040 N. 40th St., Phoenix, AZ 85018 12:30 PM Property Tours 2:30 PM Depart for Airport – Travel Time 3:00 PM Drop-off at Phoenix Sky Harbor Airport 3:45 PM Drop-off at Arizona Biltmore Hotel

4 P R E S E N T I N G M A N A G E M E N T Previously a Managing Director at Pine River Capital Management L.P. and Two Harbors Investment Corp. Formerly Chief Investment Officer of the Troubled Asset Relief Program (TARP) Previously a Vice President in the Special Situations Investing Group at Goldman Sachs & Co. Received an MBA from Harvard Business School and a B.A. in Economics from Dartmouth College Previously President of Provident Real Estate Advisors LLC Served as Chief Financial Officer of Rottlund Homes Received an MBA from University of Wisconsin and a B.S.B. in Accounting from University of Minnesota Previously President and Chief Operating Officer of Northbrook Partners, LLC, a multifamily management company with over $1.2 billion in assets under management for BlackRock and RREEF Real Estate Received an MBA from the Johnson School of Management at Cornell University and a B.S. in Engineering from Cornell University Previously Director of Architecture and Infrastructure of CarVal Investors Served as Director of Enterprise and Architecture for Cision, Head of Architecture and Quality for Calamos Investments and co-founded ePlanet Solutions, Inc. Received a B.S. in Biomedical Engineering from University of Iowa DAVID N. MILLER CEO LARRY SHAPIRO Head of Acquisitions and Renovations PATRICK FREYDBERG COO TODD JABLE CTO

5 CO M PANY O VERVI EW AND I NVESTM ENT THESI S

6 SILVER BAY REALTY TRUST CORP. First publicly traded single-family residential REIT Mission of bringing institutional excellence to the single-family rental market Capitalize on generational opportunity created by dislocations in U.S. housing market − Acquire single-family properties at significant discounts to replacement cost − Focus on markets with strong demographic and macroeconomic indicators Diversified portfolio of ~5,600(1) single-family properties in Arizona, California, Florida, Georgia, Nevada, North Carolina, Ohio and Texas Trading on NYSE provides investors liquidity and exposure to the single-family residential asset class (1) As of November 1, 2013, Silver Bay owned a portfolio of approximately 5,600 single-family properties.

7 C O M P A N Y H I S T O R Y A N D K E Y M I L E S T O N E S (1) Silver Bay acquired Silver Bay Property Investment LLC (formerly Two Harbors Property Investment LLC), a wholly owned subsidiary of Two Harbors Investment Corp. The Company refers to Silver Bay Property Investment LLC as our Predecessor. (2) Silver Bay acquired five limited liability companies managed by Provident Real Estate Advisors LLC that we refer to as the Provident Entities. September 2009 Provident Entities commenced acquisition of single-family properties February 2012 Two Harbors Investment Corp. begins acquiring single-family properties December 13, 2012 IPO pricing of 13,250,000 shares of commons stock at $18.50 per share December 14, 2012 SBY begins trading on the New York Stock Exchange December 19, 2012 Completed formation transactions and IPO, simultaneously combining portfolios of single- family homes owned by Two Harbors(1) and Provident Entities(2) for a total of over 3,100 homes January 7, 2013 Over-allotment option exercised for the sale of an additional 1,987,500 shares bringing total net proceeds of $263 million February 15, 2013 Portfolio exceeded 4,000 homes March 28, 2013 Added to the MSCI REIT Index March 29, 2013 Added to the Russell 2000 Index April 30, 2013 Portfolio exceeded 5,000 homes May 13, 2013 Secured a $200 million revolving credit facility July 31, 2013 Portfolio exceeded 5,600 homes

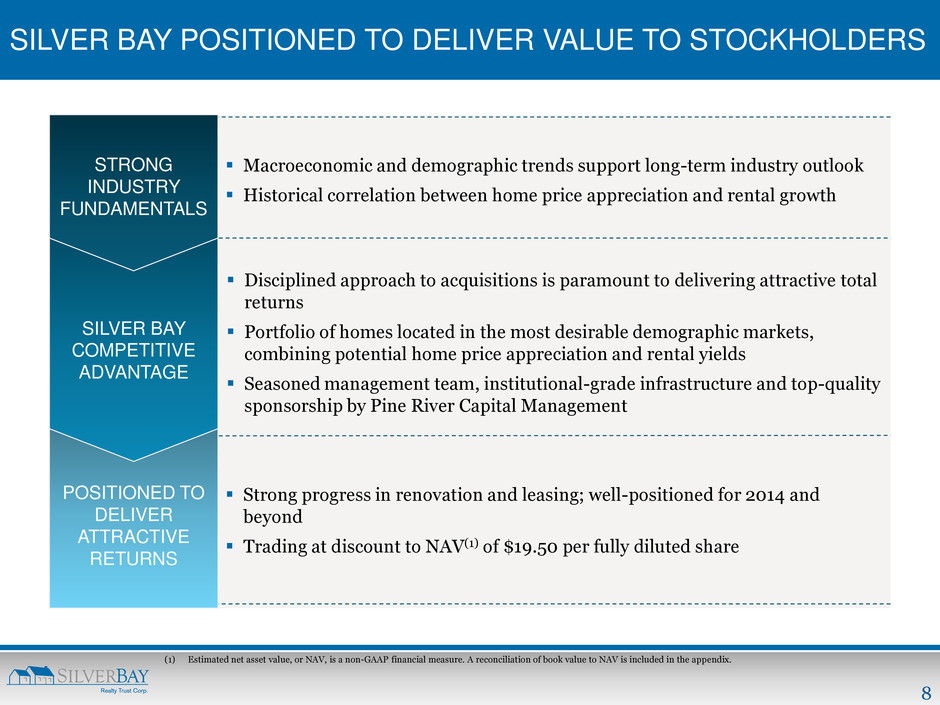

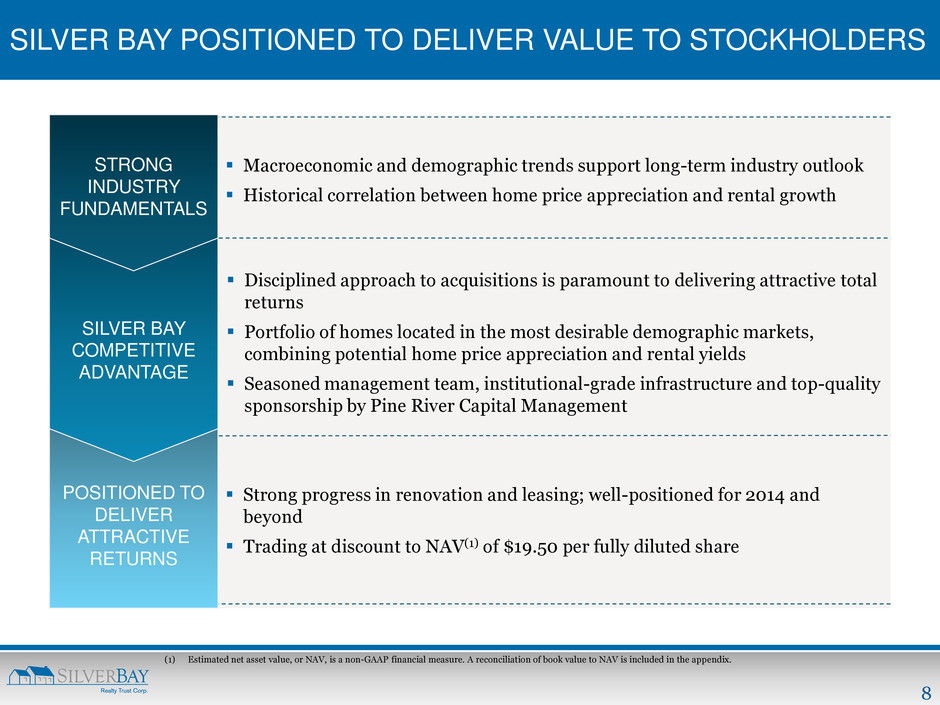

8 SILVER BAY POSITIONED TO DELIVER VALUE TO STOCKHOLDERS (1) Estimated net asset value, or NAV, is a non-GAAP financial measure. A reconciliation of book value to NAV is included in the appendix. Disciplined approach to acquisitions is paramount to delivering attractive total returns Portfolio of homes located in the most desirable demographic markets, combining potential home price appreciation and rental yields Seasoned management team, institutional-grade infrastructure and top-quality sponsorship by Pine River Capital Management STRONG INDUSTRY FUNDAMENTALS POSITIONED TO DELIVER ATTRACTIVE RETURNS Macroeconomic and demographic trends support long-term industry outlook Historical correlation between home price appreciation and rental growth Strong progress in renovation and leasing; well-positioned for 2014 and beyond Trading at discount to NAV(1) of $19.50 per fully diluted share SILVER BAY COMPETITIVE ADVANTAGE

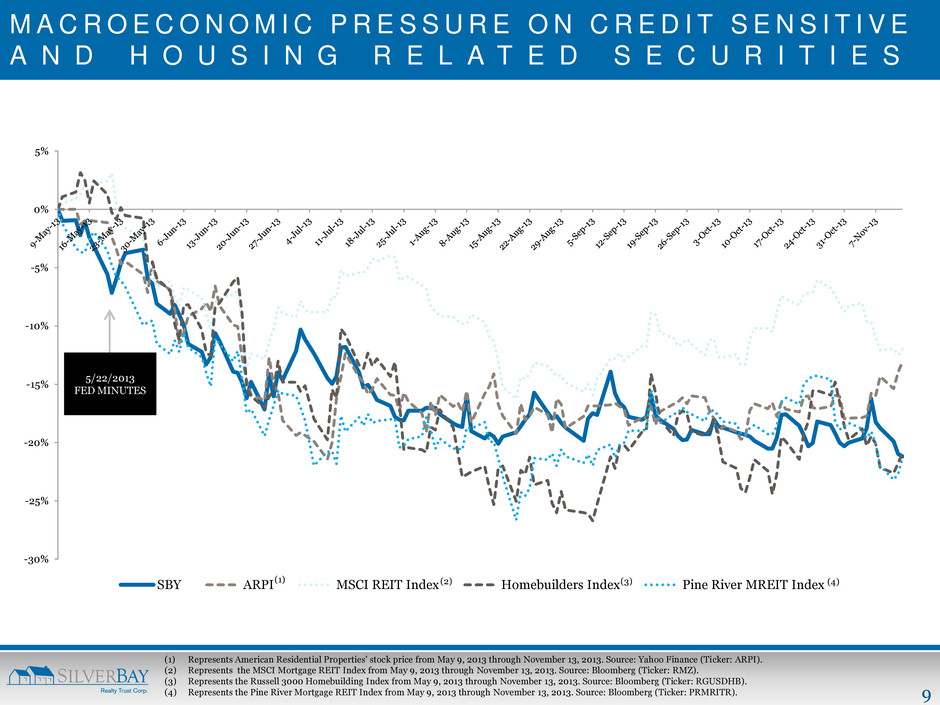

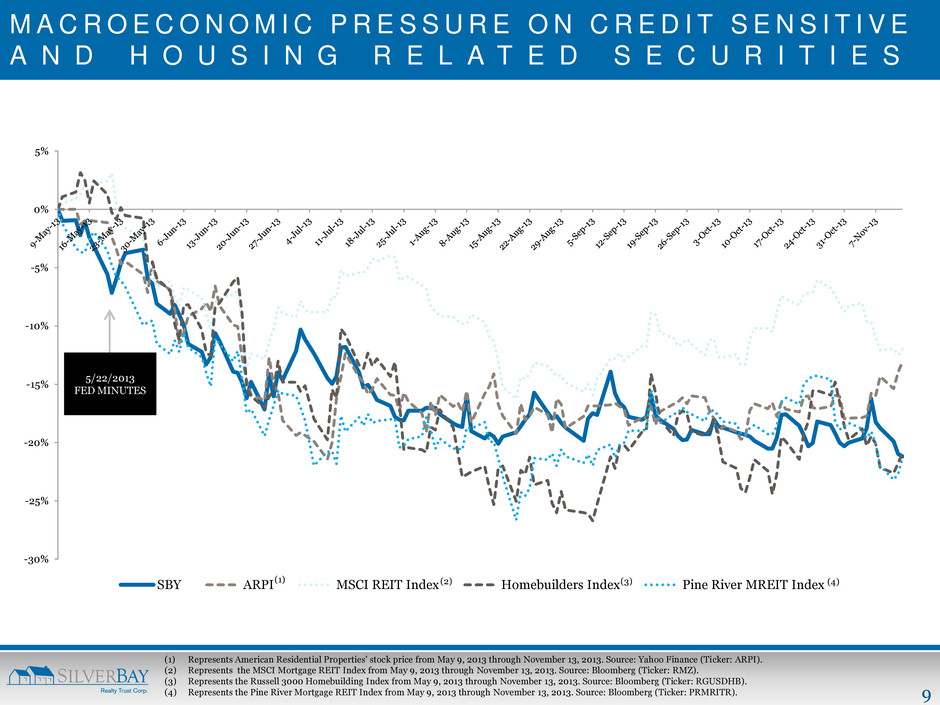

9 -30% -25% -20% -15% -10% -5% 0% 5% SBY ARPI MSCI REIT Index Homebuilders Index Pine River MREIT Index M A C R O E C O N O M I C P R E S S U R E O N C R E D I T S E N S I T I V E A N D H O U S I N G R E L A T E D S E C U R I T I E S 5/22/2013 FED MINUTES (1) Represents American Residential Properties‟ stock price from May 9, 2013 through November 13, 2013. Source: Yahoo Finance (Ticker: ARPI). (2) Represents the MSCI Mortgage REIT Index from May 9, 2013 through November 13, 2013. Source: Bloomberg (Ticker: RMZ). (3) Represents the Russell 3000 Homebuilding Index from May 9, 2013 through November 13, 2013. Source: Bloomberg (Ticker: RGUSDHB). (4) Represents the Pine River Mortgage REIT Index from May 9, 2013 through November 13, 2013. Source: Bloomberg (Ticker: PRMRITR). (1) (2) (3) (4)

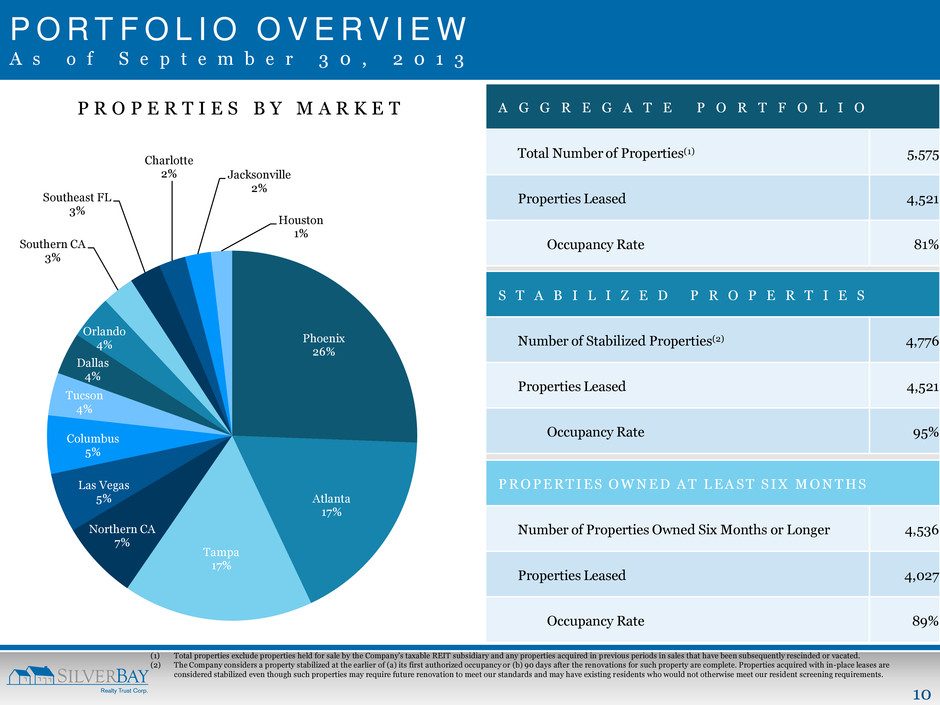

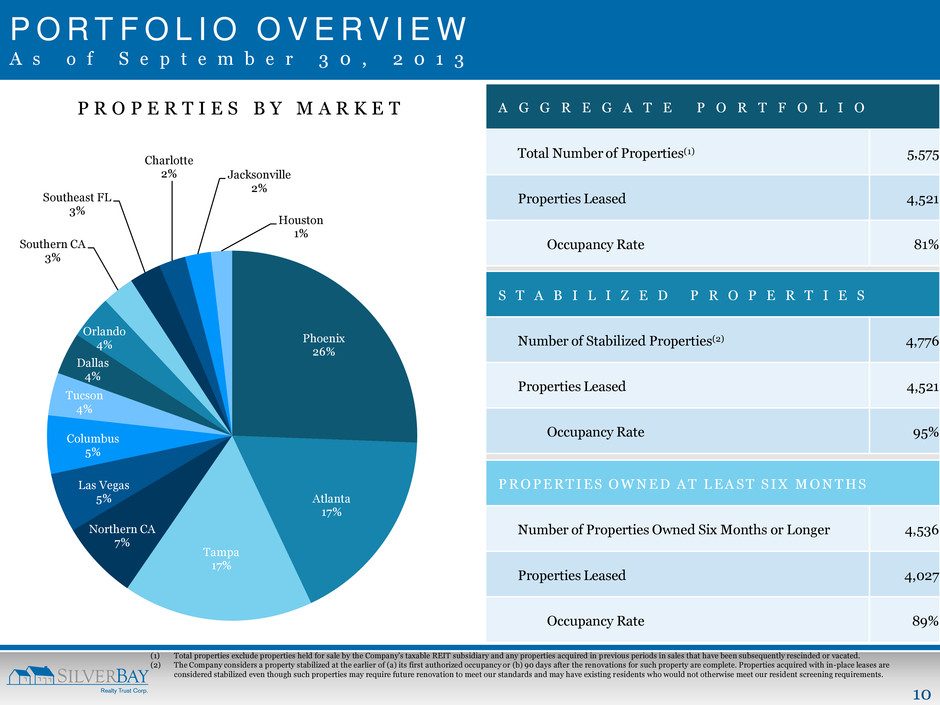

10 P O R T F O L I O O V E R V I E W A s o f S e p t e m b e r 3 0 , 2 0 1 3 A G G R E G A T E P O R T F O L I O Total Number of Properties(1) 5,575 Properties Leased 4,521 Occupancy Rate 81% S T A B I L I Z E D P R O P E R T I E S Number of Stabilized Properties(2) 4,776 Properties Leased 4,521 Occupancy Rate 95% P R O P E R T I E S O W N E D A T L E A S T S I X M O N T H S Number of Properties Owned Six Months or Longer 4,536 Properties Leased 4,027 Occupancy Rate 89% P R O P E R T I E S B Y M A R K E T (1) Total properties exclude properties held for sale by the Company‟s taxable REIT subsidiary and any properties acquired in previous periods in sales that have been subsequently rescinded or vacated. (2) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. Phoenix 26% Atlanta 17% Tampa 17% Northern CA 7% Las Vegas 5% Columbus 5% Tucson 4% Dallas 4% Orlando 4% Southern CA 3% Southeast FL 3% Charlotte 2% Jacksonville 2% Houston 1%

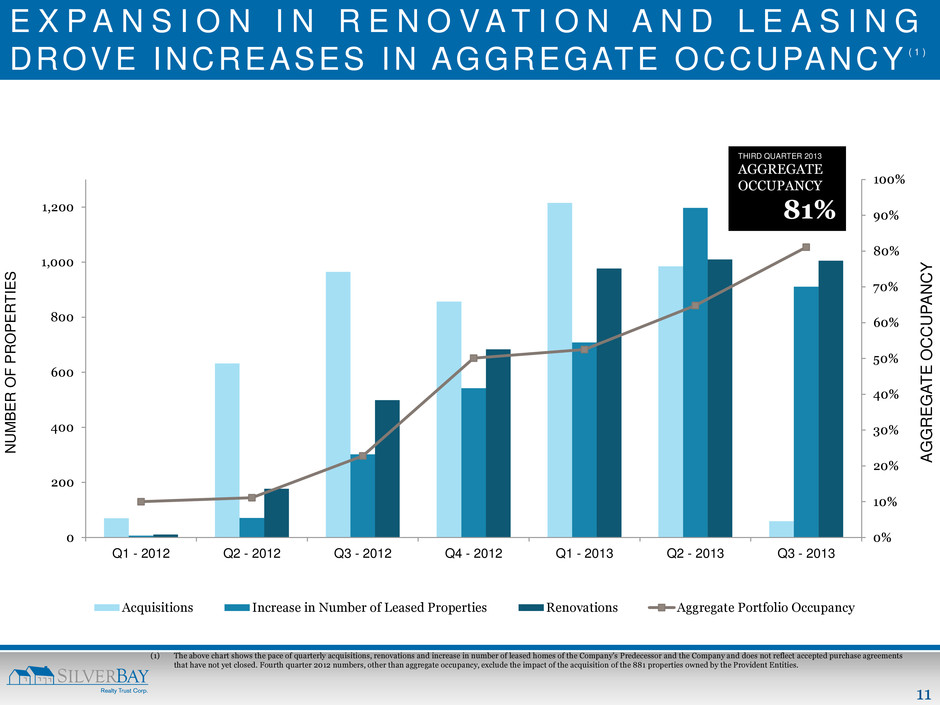

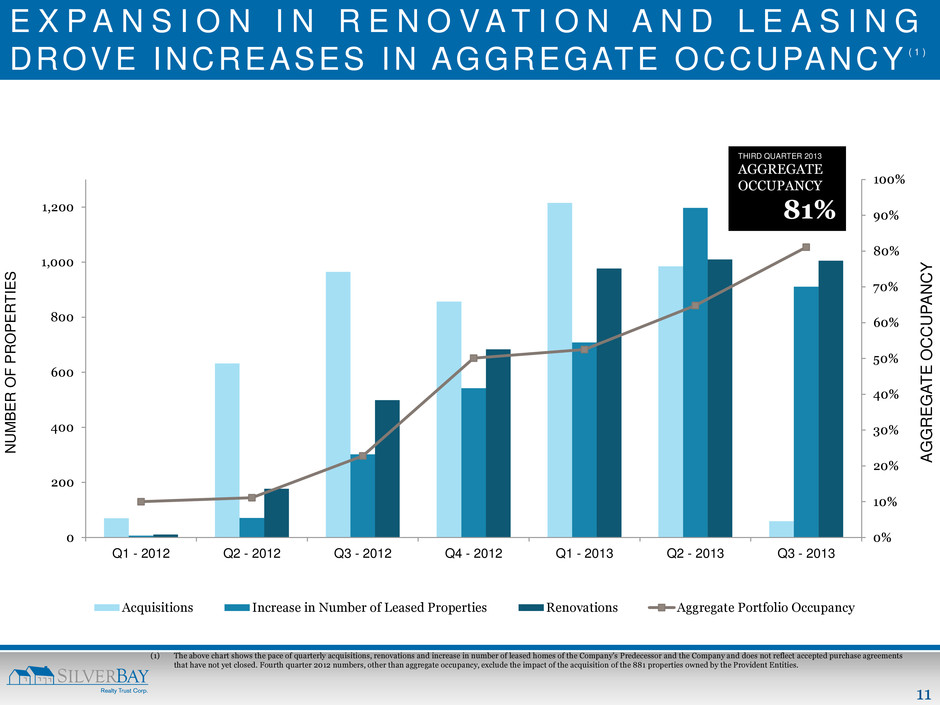

11 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 200 400 600 800 1,000 1,200 Q1 - 2012 Q2 - 2012 Q3 - 2012 Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 AG G RE G AT E OCC UP AN CY NU M BE R O F PR O PE RT IE S Acquisitions Increase in Number of Leased Properties Renovations Aggregate Portfolio Occupancy E X P A N S I O N I N R E N O V A T I O N A N D L E A S I N G DROVE INCREASES IN AGGREGATE OCCUPANCY ( 1 ) (1) The above chart shows the pace of quarterly acquisitions, renovations and increase in number of leased homes of the Company‟s Predecessor and the Company and does not reflect accepted purchase agreements that have not yet closed. Fourth quarter 2012 numbers, other than aggregate occupancy, exclude the impact of the acquisition of the 881 properties owned by the Provident Entities. THIRD QUARTER 2013 AGGREGATE OCCUPANCY 81%

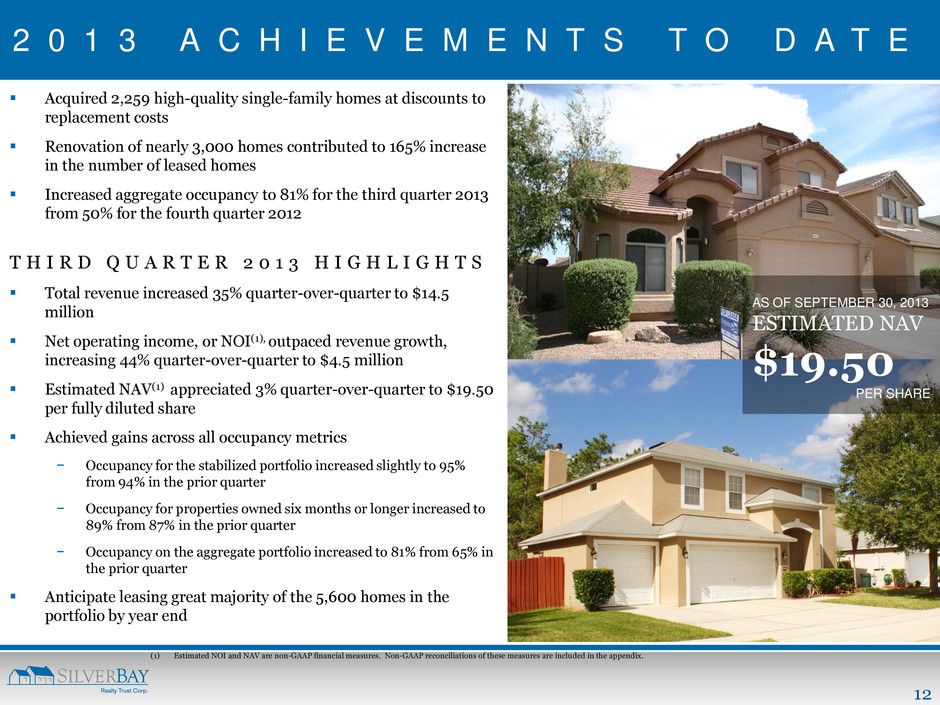

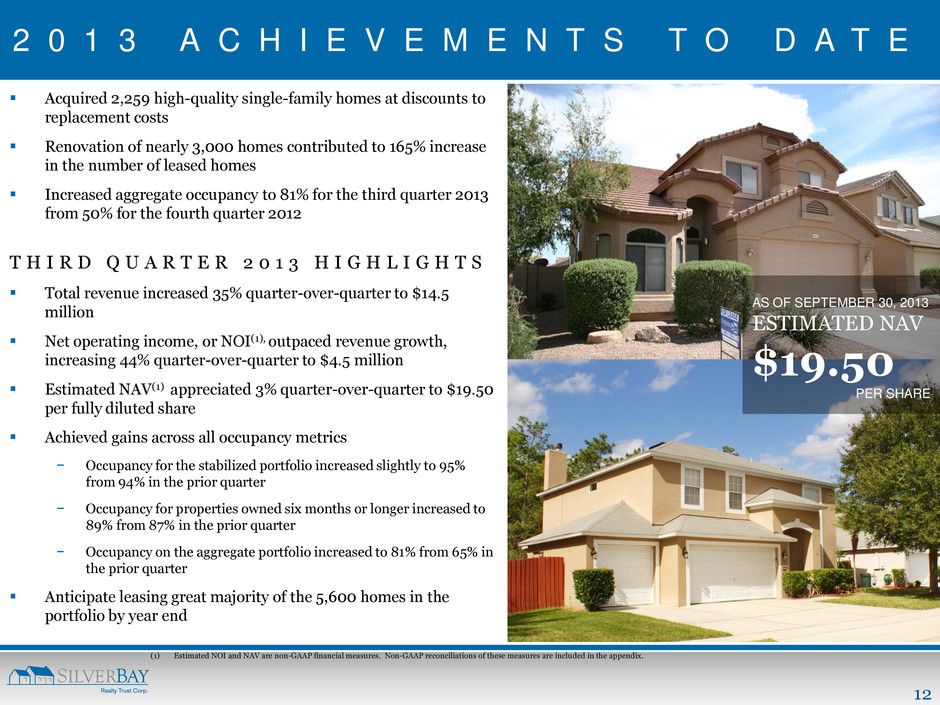

12 2 0 1 3 A C H I E V E M E N T S T O D A T E Acquired 2,259 high-quality single-family homes at discounts to replacement costs Renovation of nearly 3,000 homes contributed to 165% increase in the number of leased homes Increased aggregate occupancy to 81% for the third quarter 2013 from 50% for the fourth quarter 2012 T H I R D Q U A R T E R 2 0 1 3 H I G H L I G H T S Total revenue increased 35% quarter-over-quarter to $14.5 million Net operating income, or NOI(1), outpaced revenue growth, increasing 44% quarter-over-quarter to $4.5 million Estimated NAV(1) appreciated 3% quarter-over-quarter to $19.50 per fully diluted share Achieved gains across all occupancy metrics − Occupancy for the stabilized portfolio increased slightly to 95% from 94% in the prior quarter − Occupancy for properties owned six months or longer increased to 89% from 87% in the prior quarter − Occupancy on the aggregate portfolio increased to 81% from 65% in the prior quarter Anticipate leasing great majority of the 5,600 homes in the portfolio by year end (1) Estimated NOI and NAV are non-GAAP financial measures. Non-GAAP reconciliations of these measures are included in the appendix. AS OF SEPTEMBER 30, 2013 ESTIMATED NAV $19.50 PER SHARE

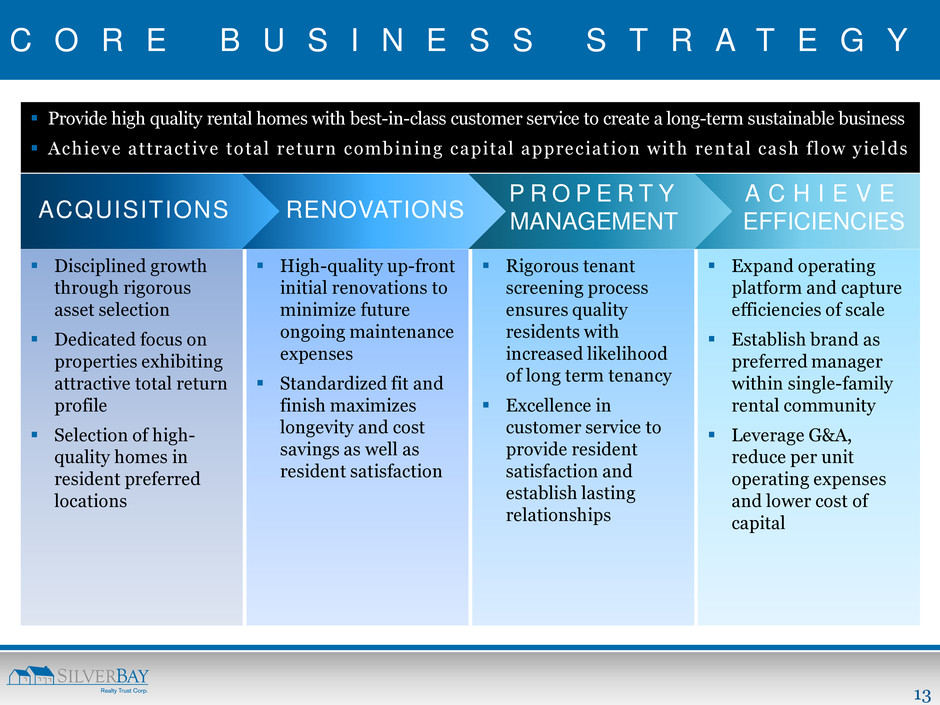

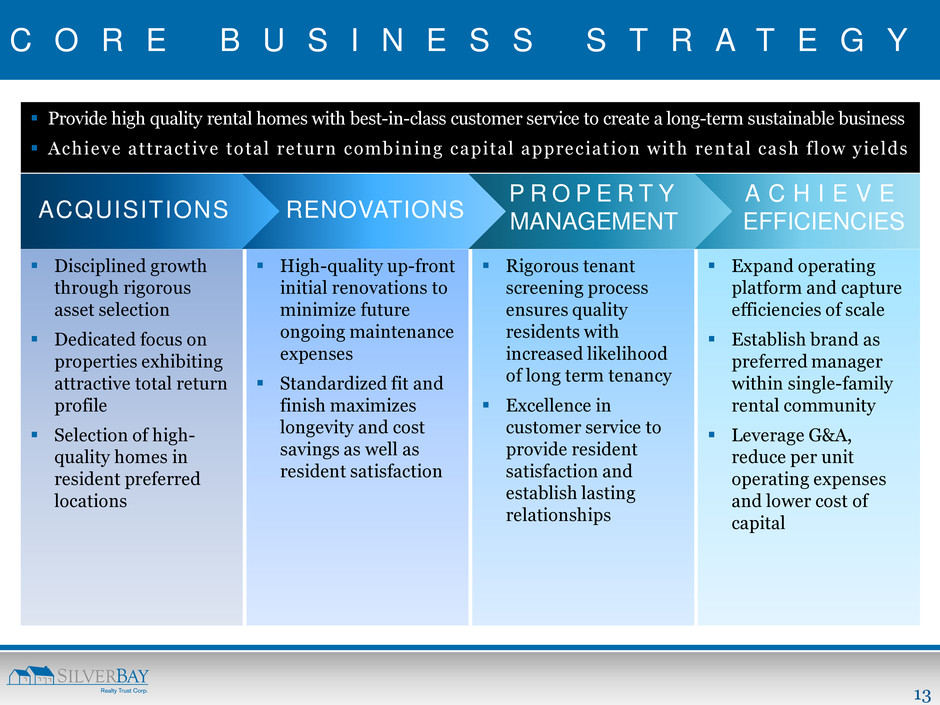

13 C O R E B U S I N E S S S T R A T E G Y Provide high quality rental homes with best-in-class customer service to create a long-term sustainable business Achieve attractive total return combining capital appreciation with rental cash flow yields ACQUISITIONS RENOVATIONS P R O P E R T Y MANAGEMENT A C H I E V E EFFICIENCIES Disciplined growth through rigorous asset selection Dedicated focus on properties exhibiting attractive total return profile Selection of high- quality homes in resident preferred locations High-quality up-front initial renovations to minimize future ongoing maintenance expenses Standardized fit and finish maximizes longevity and cost savings as well as resident satisfaction Rigorous tenant screening process ensures quality residents with increased likelihood of long term tenancy Excellence in customer service to provide resident satisfaction and establish lasting relationships Expand operating platform and capture efficiencies of scale Establish brand as preferred manager within single-family rental community Leverage G&A, reduce per unit operating expenses and lower cost of capital

14 A C Q U I S I T I O N S

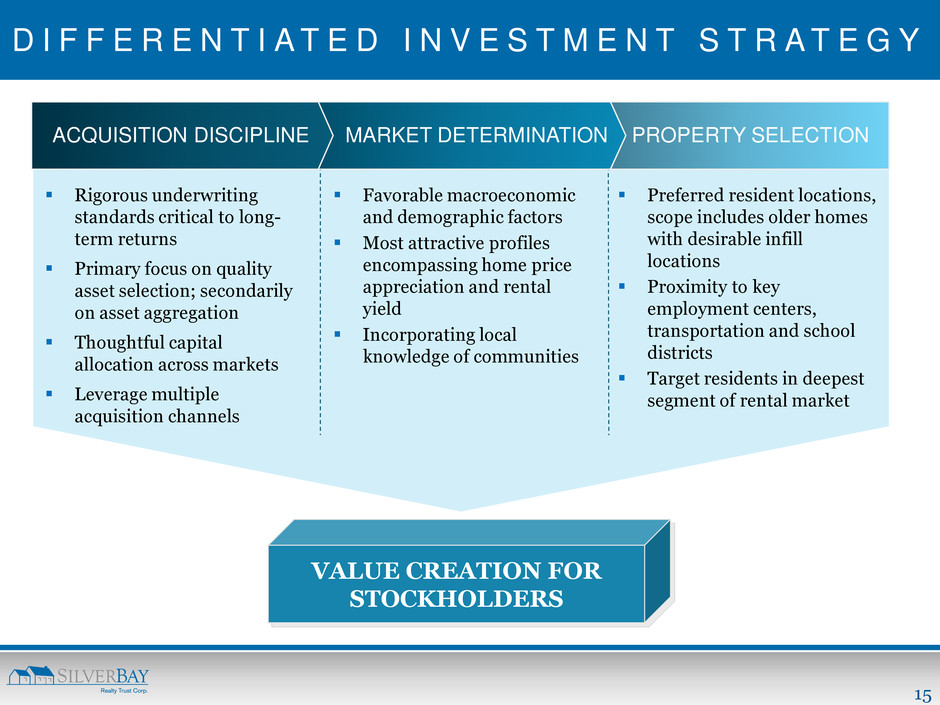

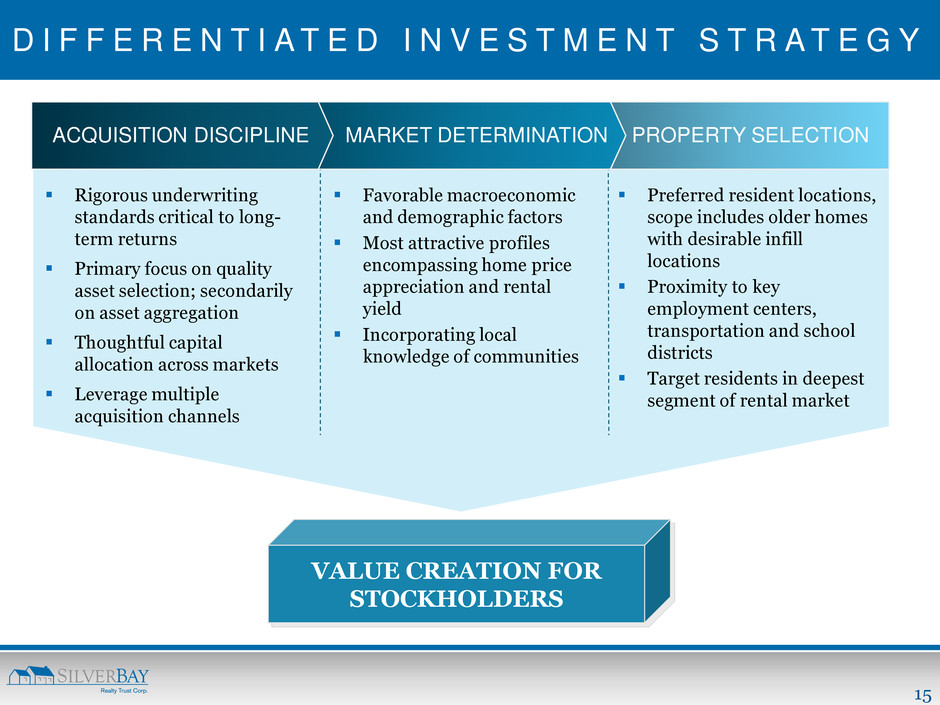

15 D I F F E R E N T I A T E D I N V E S T M E N T S T R A T E G Y PROPERTY SELECTION MARKET DETERMINATION ACQUISITION DISCIPLINE Rigorous underwriting standards critical to long- term returns Primary focus on quality asset selection; secondarily on asset aggregation Thoughtful capital allocation across markets Leverage multiple acquisition channels Favorable macroeconomic and demographic factors Most attractive profiles encompassing home price appreciation and rental yield Incorporating local knowledge of communities Preferred resident locations, scope includes older homes with desirable infill locations Proximity to key employment centers, transportation and school districts Target residents in deepest segment of rental market VALUE CREATION FOR STOCKHOLDERS

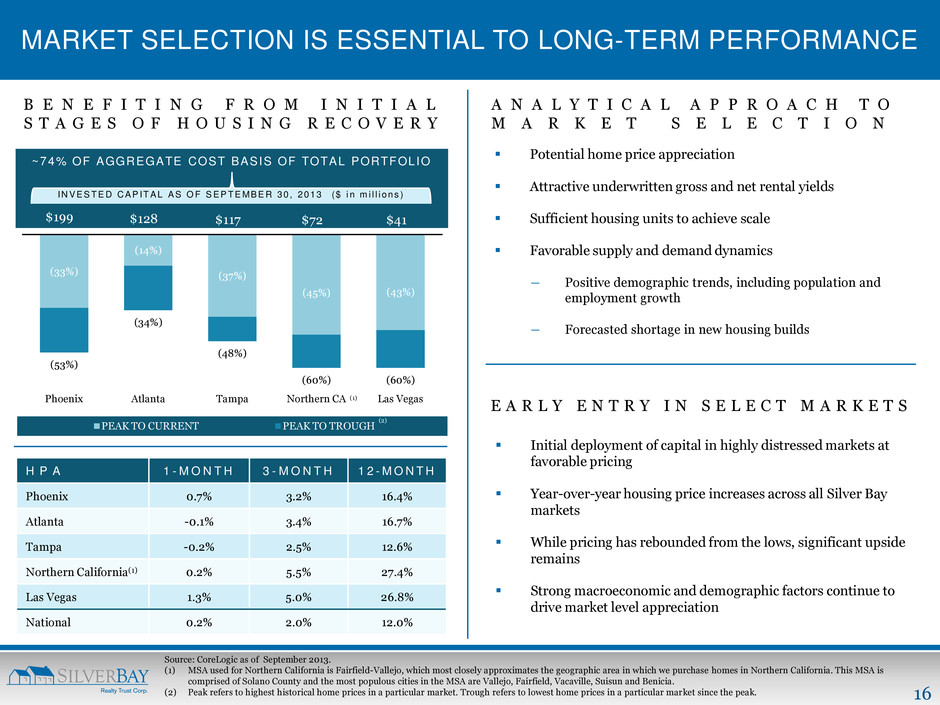

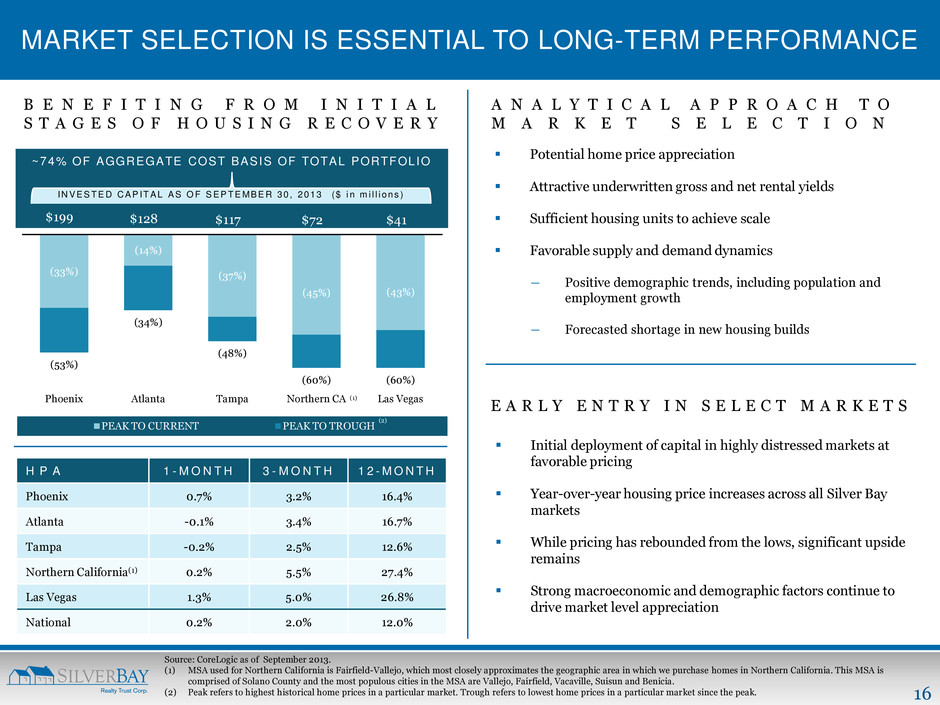

16 (33%) (14%) (37%) (45%) (43%) (53%) (34%) (48%) (60%) (60%) Phoenix Atlanta Tampa Northern CA Las Vegas PEAK TO CURRENT PEAK TO TROUGH MARKET SELECTION IS ESSENTIAL TO LONG-TERM PERFORMANCE A N A L Y T I C A L A P P R O A C H T O M A R K E T S E L E C T I O N Potential home price appreciation Attractive underwritten gross and net rental yields Sufficient housing units to achieve scale Favorable supply and demand dynamics ― Positive demographic trends, including population and employment growth ― Forecasted shortage in new housing builds Source: CoreLogic as of September 2013. (1) MSA used for Northern California is Fairfield-Vallejo, which most closely approximates the geographic area in which we purchase homes in Northern California. This MSA is comprised of Solano County and the most populous cities in the MSA are Vallejo, Fairfield, Vacaville, Suisun and Benicia. (2) Peak refers to highest historical home prices in a particular market. Trough refers to lowest home prices in a particular market since the peak. B E N E F I T I N G F R O M I N I T I A L S T A G E S O F H O U S I N G R E C O V E R Y H P A 1 - M O N T H 3 - M O N T H 1 2 - M O N T H Phoenix 0.7% 3.2% 16.4% Atlanta -0.1% 3.4% 16.7% Tampa -0.2% 2.5% 12.6% Northern California(1) 0.2% 5.5% 27.4% Las Vegas 1.3% 5.0% 26.8% National 0.2% 2.0% 12.0% E A R L Y E N T R Y I N S E L E C T M A R K E T S Initial deployment of capital in highly distressed markets at favorable pricing Year-over-year housing price increases across all Silver Bay markets While pricing has rebounded from the lows, significant upside remains Strong macroeconomic and demographic factors continue to drive market level appreciation $128 $199 $117 $72 $41 ~74% OF AGGREGATE COST BASIS OF TOTAL PORTFOLIO (2) (1) INV E S T E D CA P IT A L A S OF S E P T E MB E R 30 , 2013 ($ i n m i l l i ons )

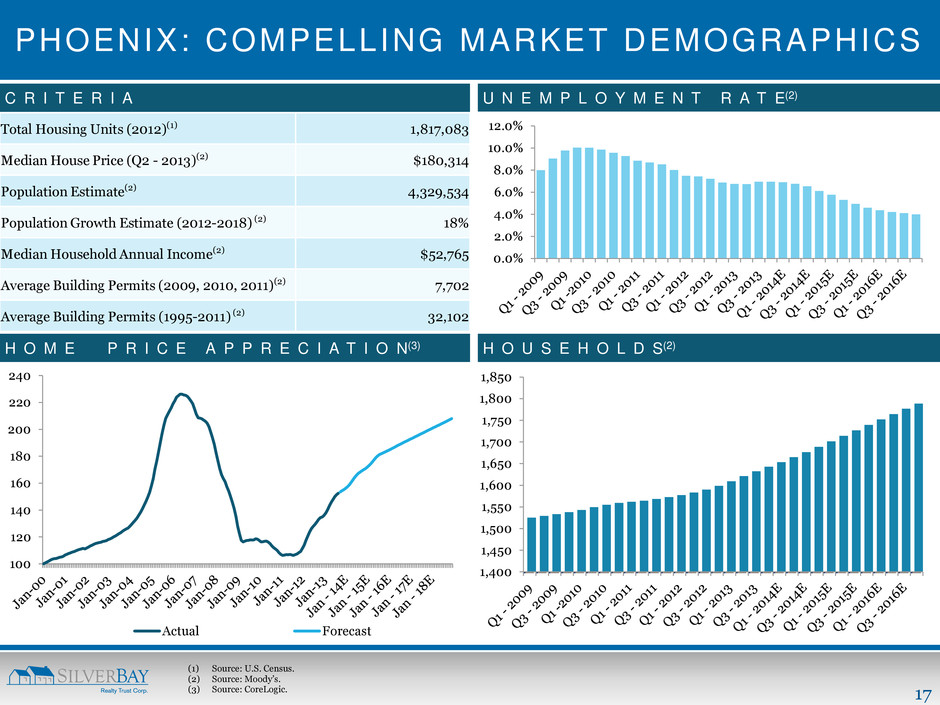

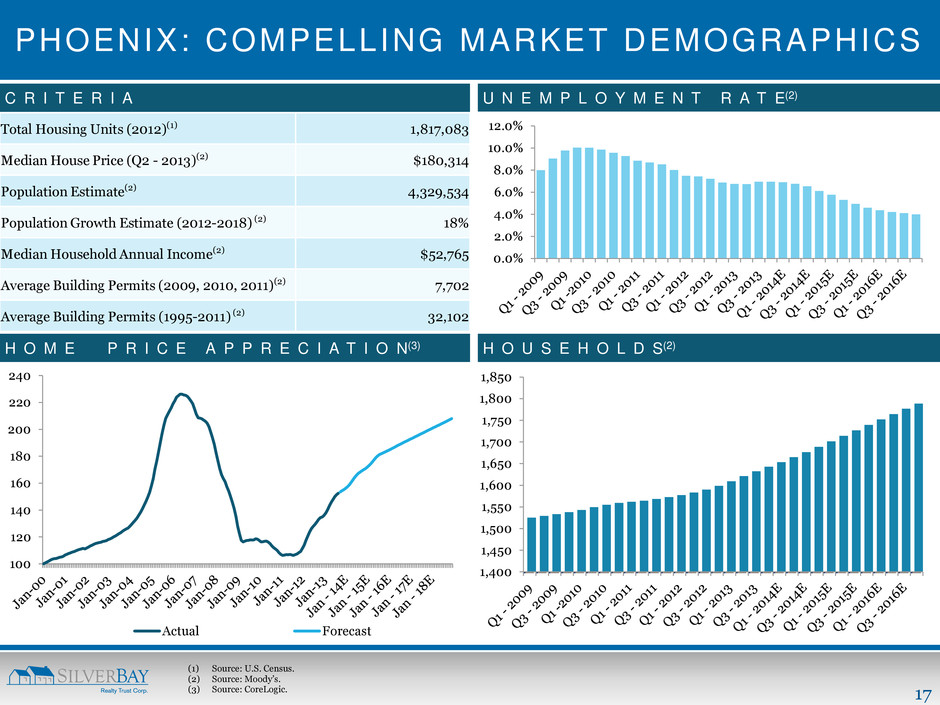

17 PHOENIX: COMPELLING MARKET DEMOGRAPHICS U N E M P L O Y M E N T R A T E(2) C R I T E R I A Total Housing Units (2012)(1) 1,817,083 Median House Price (Q2 - 2013)(2) $180,314 Population Estimate(2) 4,329,534 Population Growth Estimate (2012-2018) (2) 18% Median Household Annual Income(2) $52,765 Average Building Permits (2009, 2010, 2011)(2) 7,702 Average Building Permits (1995-2011) (2) 32,102 H O M E P R I C E A P P R E C I A T I O N(3) (1) Source: U.S. Census. (2) Source: Moody‟s. (3) Source: CoreLogic. 100 120 140 160 180 200 220 240 Actual Forecast H O U S E H O L D S(2) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 1,400 1,450 1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850

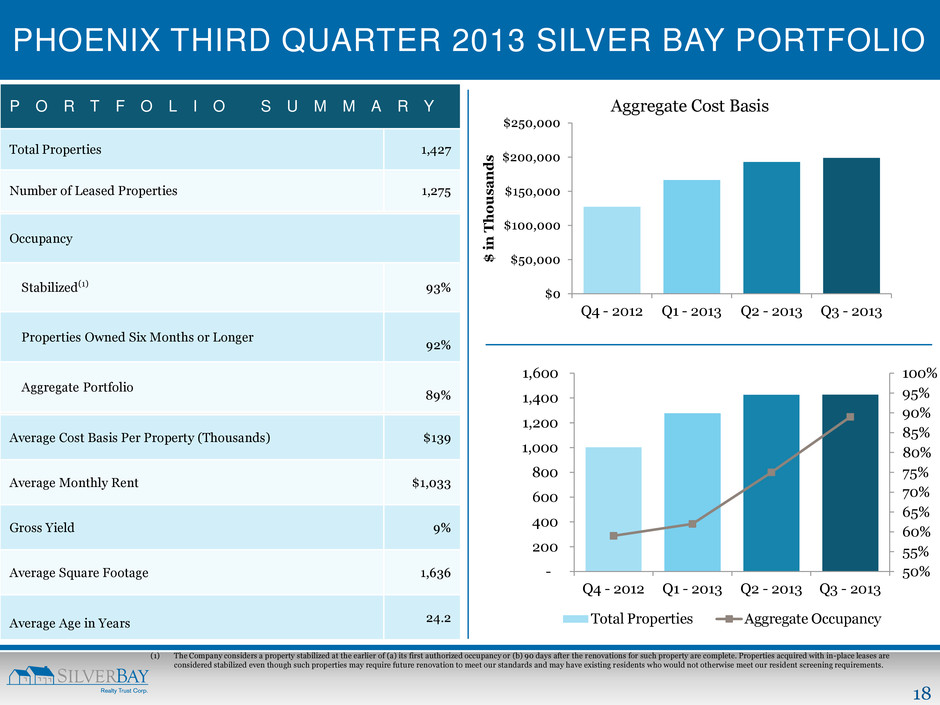

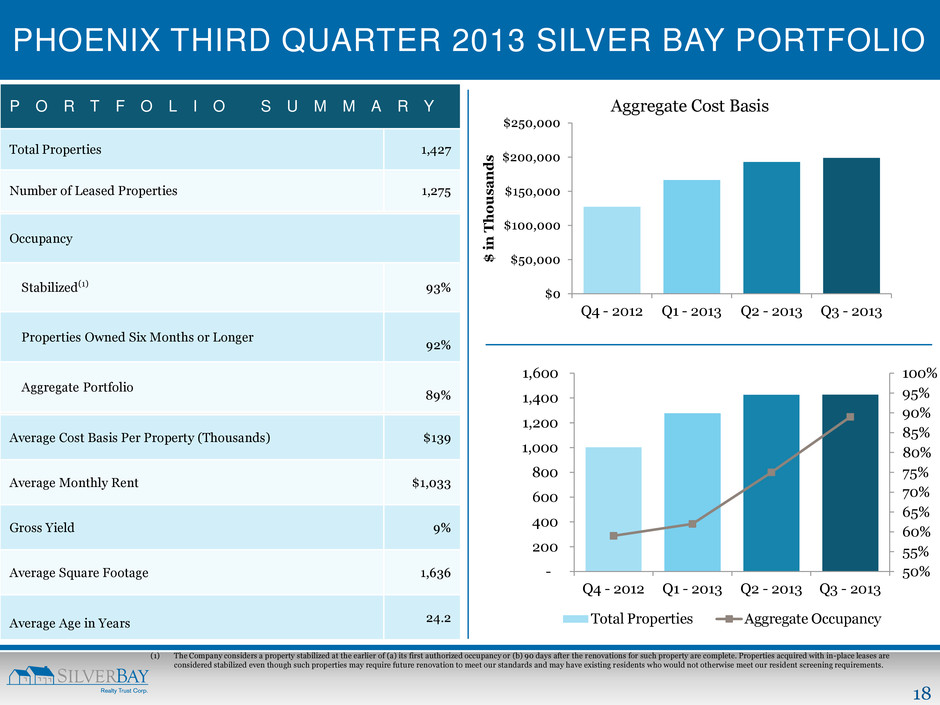

18 PHOENIX THIRD QUARTER 2013 SILVER BAY PORTFOLIO $0 $50,000 $100,000 $150,000 $200,000 $250,000 Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 $ in T ho u s a n d s Aggregate Cost Basis 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% - 200 400 600 800 1,000 1,200 1,400 1,600 Q4 - 2012 Q1 - 2013 Q2 - 2013 Q3 - 2013 Total Properties Aggregate Occupancy P O R T F O L I O S U M M A R Y Total Properties 1,427 Number of Leased Properties 1,275 Occupancy Stabilized(1) 93% Properties Owned Six Months or Longer 92% Aggregate Portfolio 89% Average Cost Basis Per Property (Thousands) $139 Average Monthly Rent $1,033 Gross Yield 9% Average Square Footage 1,636 Average Age in Years 24.2 (1) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements.

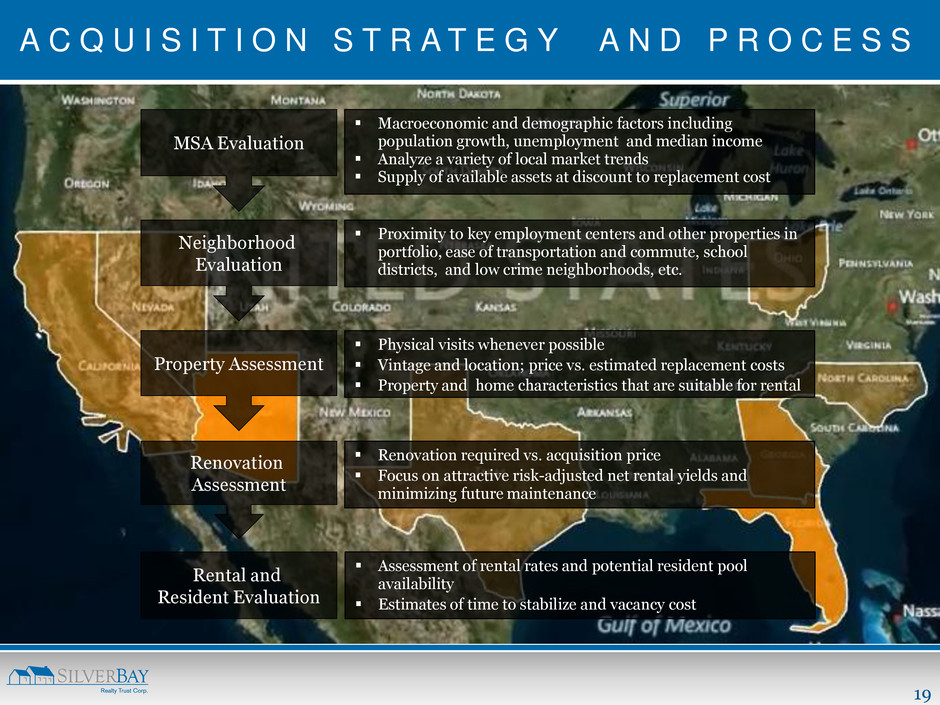

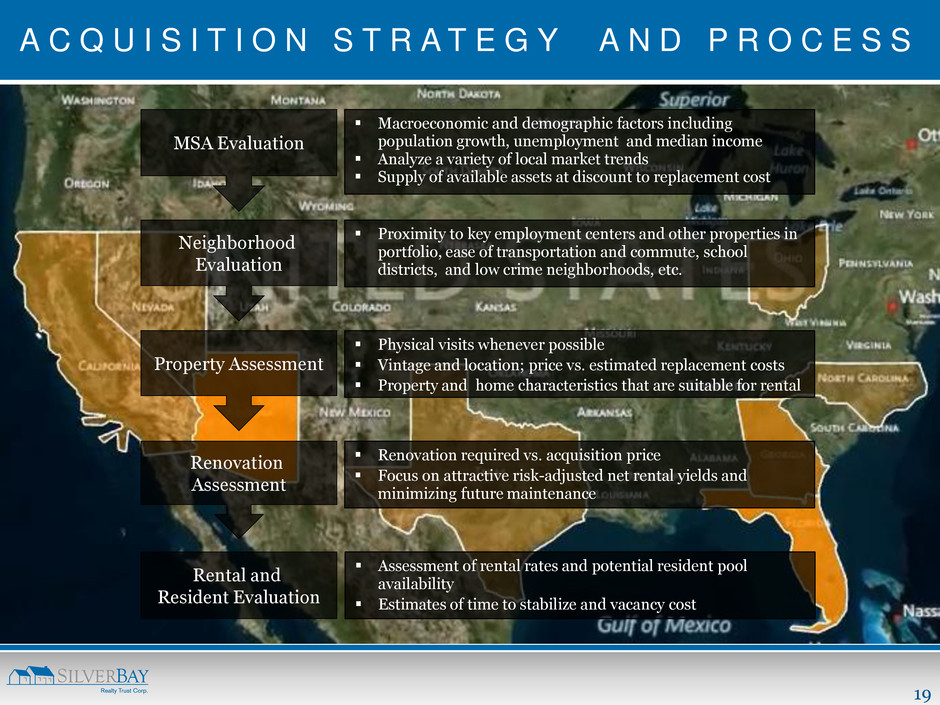

19 A C Q U I S I T I O N S T R A T E G Y A N D P R O C E S S MSA Evaluation Neighborhood Evaluation Property Assessment Renovation Assessment Rental and Resident Evaluation Macroeconomic and demographic factors including population growth, unemployment and median income Analyze a variety of local market trends Supply of available assets at discount to replacement cost Physical visits whenever possible Vintage and location; price vs. estimated replacement costs Property and home characteristics that are suitable for rental Proximity to key employment centers and other properties in portfolio, ease of transportation and commute, school districts, and low crime neighborhoods, etc. Renovation required vs. acquisition price Focus on attractive risk-adjusted net rental yields and minimizing future maintenance Assessment of rental rates and potential resident pool availability Estimates of time to stabilize and vacancy cost

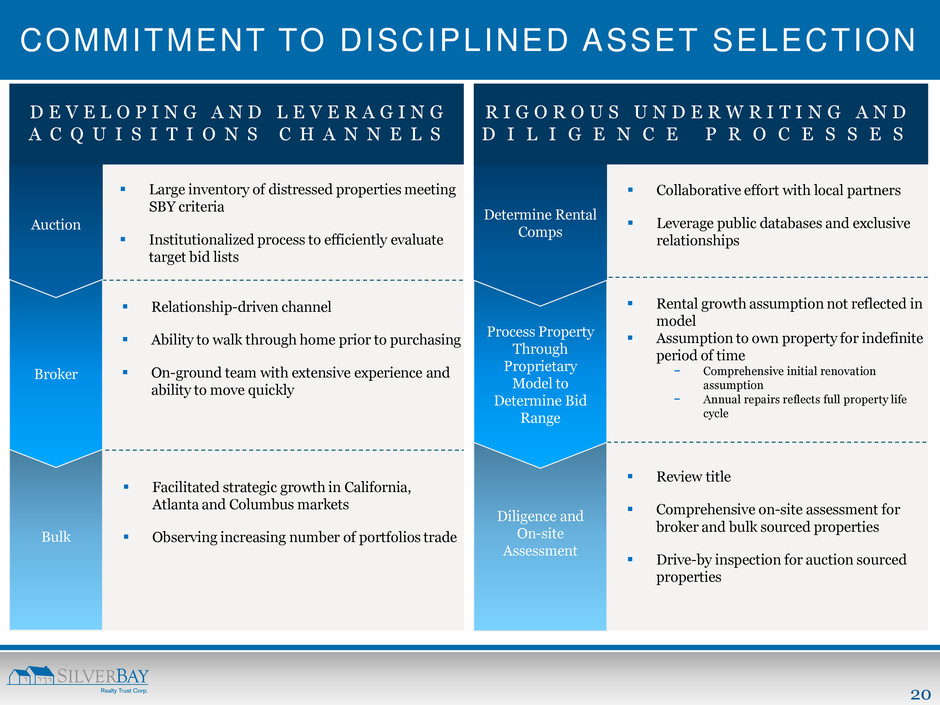

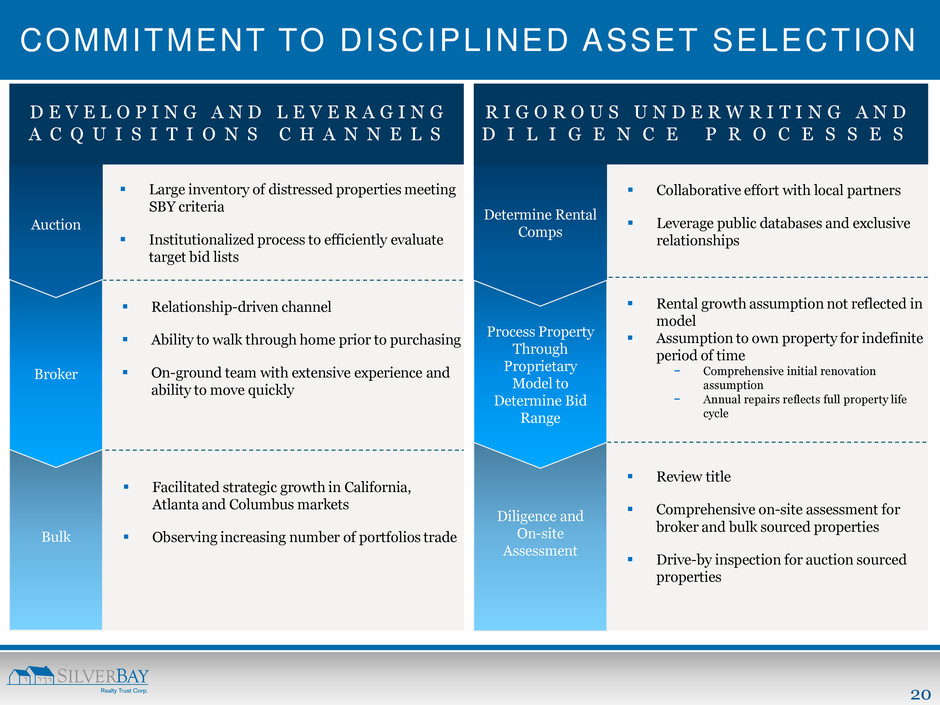

20 Determine Rental Comps Auction Bulk Diligence and On-site Assessment COMMITMENT TO DISCIPLINED ASSET SELECTION Large inventory of distressed properties meeting SBY criteria Institutionalized process to efficiently evaluate target bid lists Relationship-driven channel Ability to walk through home prior to purchasing On-ground team with extensive experience and ability to move quickly Facilitated strategic growth in California, Atlanta and Columbus markets Observing increasing number of portfolios trade R I G O R O U S U N D E R W R I T I N G A N D D I L I G E N C E P R O C E S S E S D E V E L O P I N G A N D L E V E R A G I N G A C Q U I S I T I O N S C H A N N E L S Collaborative effort with local partners Leverage public databases and exclusive relationships Process Property Through Proprietary Model to Determine Bid Range Rental growth assumption not reflected in model Assumption to own property for indefinite period of time − Comprehensive initial renovation assumption − Annual repairs reflects full property life cycle Review title Comprehensive on-site assessment for broker and bulk sourced properties Drive-by inspection for auction sourced properties Broker

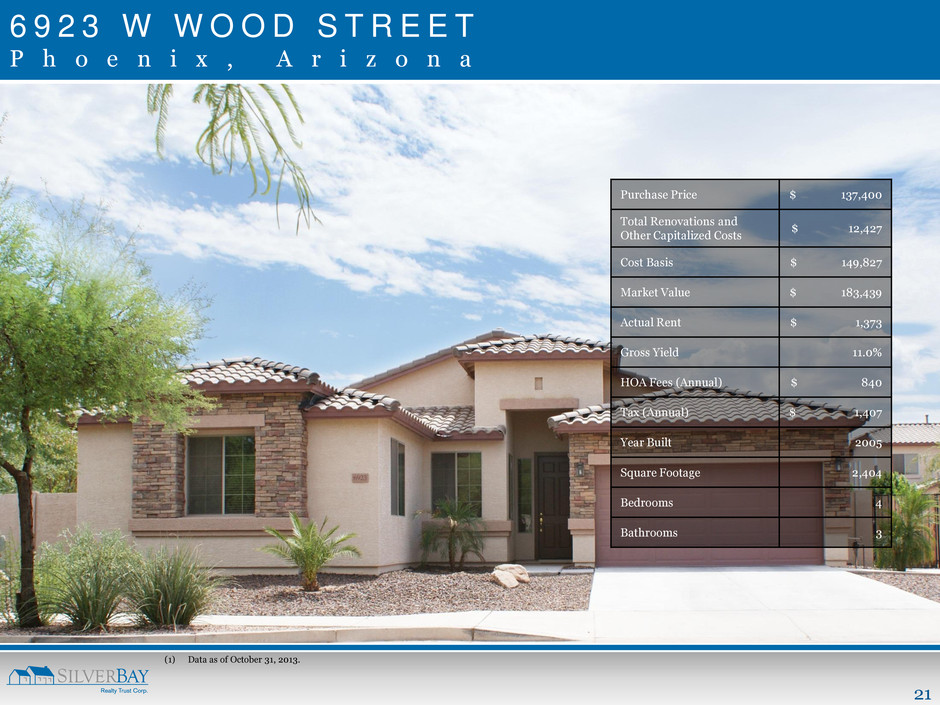

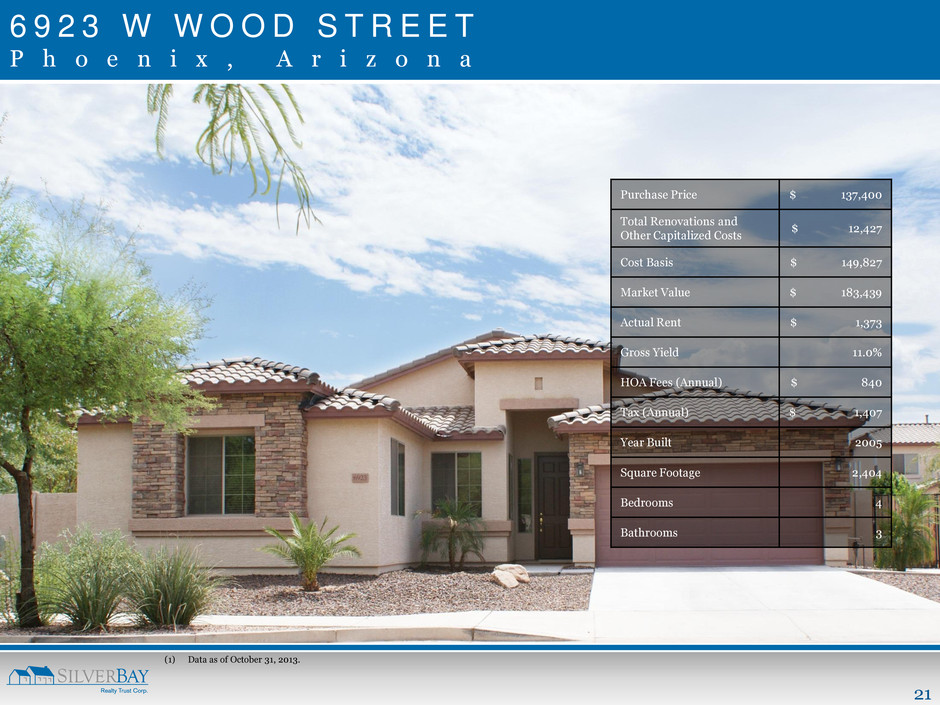

21 6 9 2 3 W W O O D S T R E E T P h o e n i x , A r i z o n a Purchase Price $ 137,400 Total Renovations and Other Capitalized Costs $ 12,427 Cost Basis $ 149,827 Market Value $ 183,439 Actual Rent $ 1,373 Gross Yield 11.0% HOA Fees (Annual) $ 840 Tax (Annual) $ 1,407 Year Built 2005 Square Footage 2,404 Bedrooms 4 Bathrooms 3 (1) Data as of October 31, 2013.

22 6 2 0 S U N B L U F F L A N E O r l a n d o , F l o r i d a Purchase Price $ 120,100 Total Renovations and other Capitalized Costs $ 25,311 Cost Basis $ 145,411 Market Value $ 177,371 Actual Rent $ 1,350 Gross Yield 11.1% HOA Fees (Annual) none Tax (Annual) $ 1,984 Year Built 2001 Square Footage 2,222 Bedrooms 3 Bathrooms 3 (1) Data as of October 31, 2013.

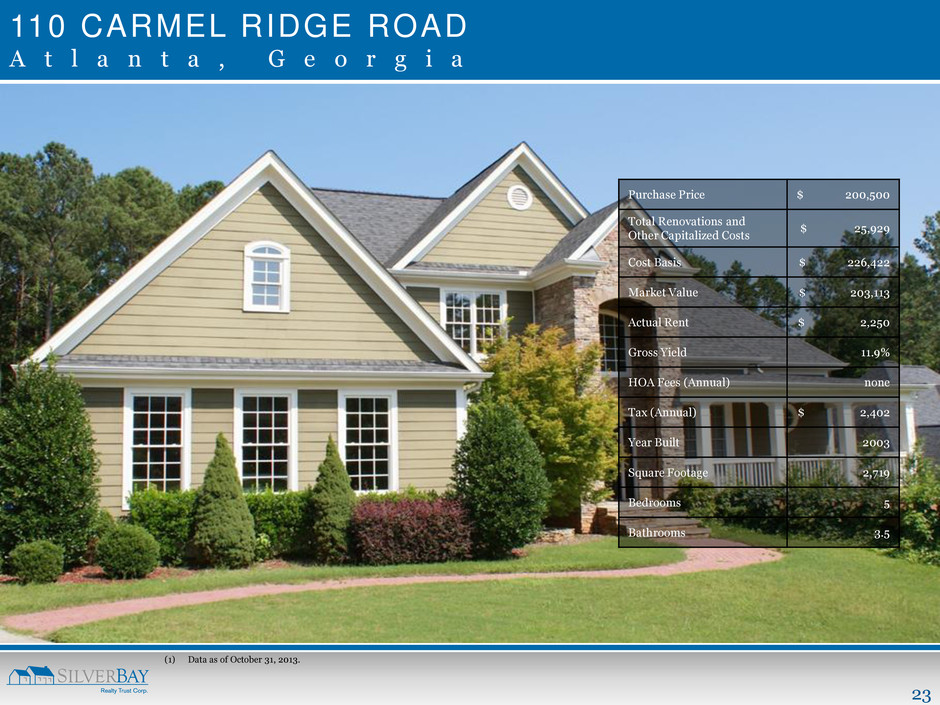

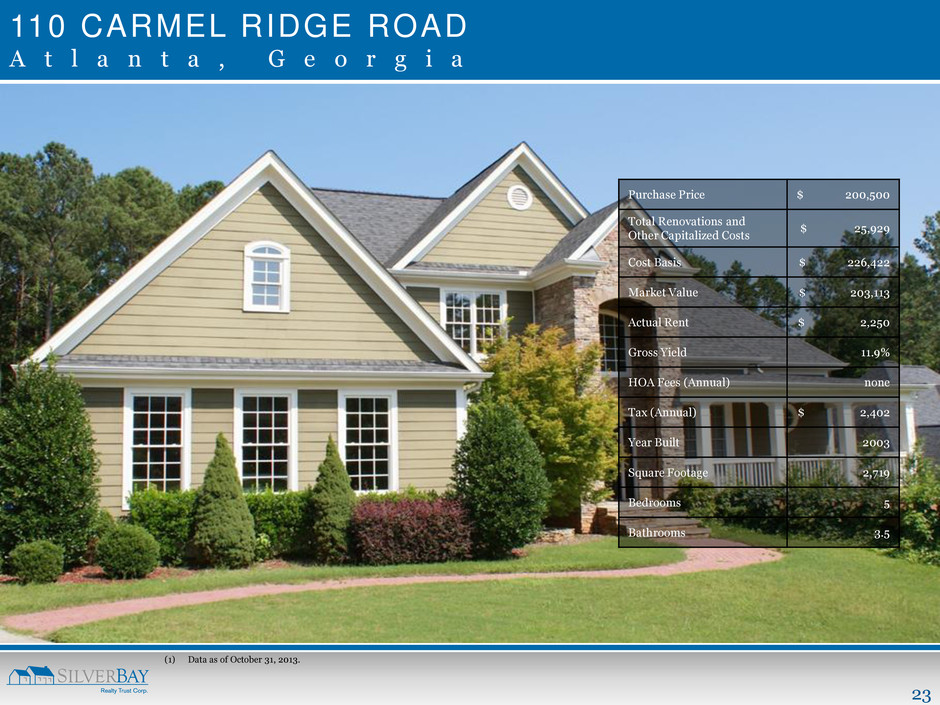

23 110 CARMEL RIDGE ROAD A t l a n t a , G e o r g i a Purchase Price $ 200,500 Total Renovations and Other Capitalized Costs $ 25,929 Cost Basis $ 226,422 Market Value $ 203,113 Actual Rent $ 2,250 Gross Yield 11.9% HOA Fees (Annual) none Tax (Annual) $ 2,402 Year Built 2003 Square Footage 2,719 Bedrooms 5 Bathrooms 3.5 (1) Data as of October 31, 2013.

24 R E N O VAT I O N S

25 W H Y R E N O V A T I N G W E L L I S I M P O R T A N T Direct impact on total returns − Rental revenue − Cost basis − Portfolio appreciation Successful repositioning contributes to efficient lease- up and maximizes rental rates − Silver Bay homes more attractive compared to majority of single-family rentals − Curb appeal increases leasing inquiries and minimizes on-market time − Greater livability factor: newer condition, more comfortable and fewer problems − Encourages resident to stay longer Balanced perspective is key to cost control − Objective of optimizing initial investments − Initial investments to minimize future ongoing repairs and maintenance − Standardized process with scope of work tailored to each individual property

26 I N S T I T U T I O N A L I Z E D R E N O VAT I O N P R O C E S S Take possession of newly acquired homes − Closing − Preliminary inspection and scoping − Complete legal process to take Define project scope − Underwritten estimates depend on market, age, and condition of property − Solicit preliminary bids for contracts − Comprehensive project scope applying Silver Bay standards Review major building systems, including roof, HVAC, plumbing, electrical and pool Kitchen, bathroom and fixtures Carpet/flooring and paint Landscaping and cleanup Implement life/safety standards Project management − Internal team − Receive and award bids − Relationship with pool of contractors − Discount volume pricing through local and national buying programs

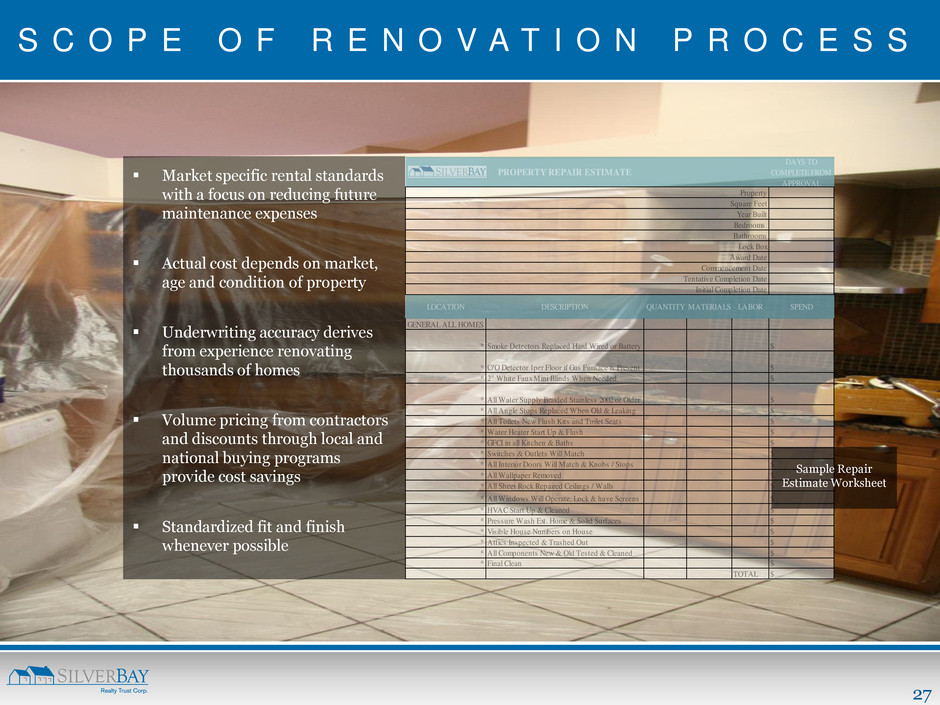

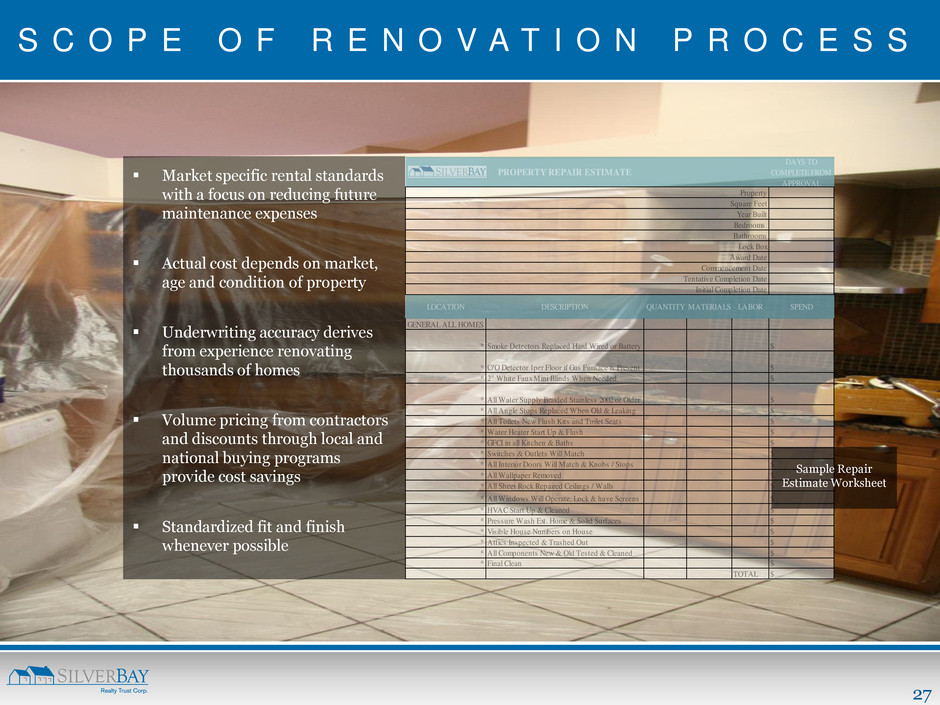

27 S C O P E O F R E N O V A T I O N P R O C E S S PROPERTY REPAIR ESTIMATE DAYS TO COMPLETE FROM APPROVAL GENERAL ALL HOMES * Smoke Detectors Replaced Hard Wired or Battery $ * C/O Detector 1per Floor if Gas Furnace is Present $ * 2" White Faux Mini Blinds When Needed $ * All Water Supply Braided Stainless 2002 or Older $ * All Angle Stops Replaced When Old & Leaking $ * All Toilets New Flush Kits and Toilet Seats $ * Water Heater Start Up & Flush $ * GFCI in all Kitchen & Baths $ * Switches & Outlets Will Match $ * All Interior Doors Will Match & Knobs / Stops $ * All Wallpaper Removed $ * All Sheet Rock Repaired Ceilings / Walls $ * All Windows Will Operate, Lock & have Screens $ * HVAC Start Up & Cleaned $ * Pressure Wash Ext. Home & Solid Surfaces $ * Visible House Numbers on House $ * Attics Inspected & Trashed Out $ * All Components New & Old Tested & Cleaned $ * Final Clean $ TOTAL $ Lock Box Award Date Commencement Date Property Square Feet Year Built Bedrooms Bathrooms Initial Completion Date Tentative Completion Date SPENDLABORLOCATION DESCRIPTION QUANTITY MATERIALS Market specific rental standards with a focus on reducing future maintenance expenses Actual cost depends on market, age and condition of property Underwriting accuracy derives from experience renovating thousands of homes Volume pricing from contractors and discounts through local and national buying programs provide cost savings Standardized fit and finish whenever possible Sample Repair Estimate Worksheet

28 EXTERIOR RENOVATIONS B E F O R E A F T E R Exterior work may include: Landscaping and yard cleanup Paint or exterior wash Driveway cleaning Roof replacement if necessary

29 I N T E R I O R R E N O VAT I O N B E F O R E A F T E R Interior renovation may include: Thorough clean-up of all areas New carpet or refinished flooring Paint of all interior walls including molding and trim All mechanical systems in the house are inspected and repaired or replaced if necessary Safety items – smoke detectors, GFCI outlets, etc. - are in good working order or installed

30 B E F O R E B E F O R E A F T E R A F T E R

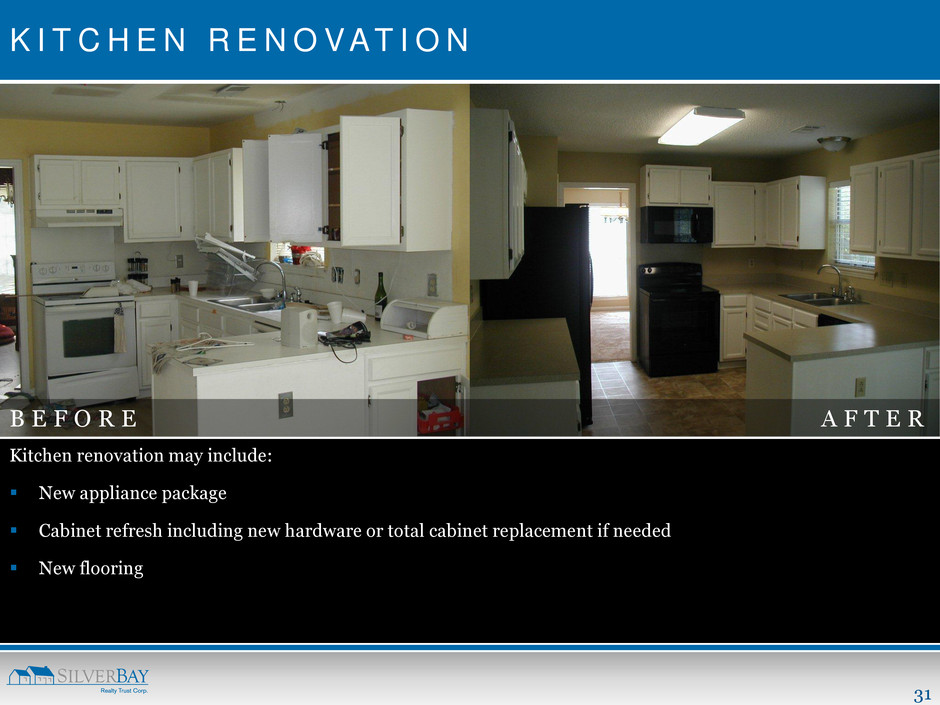

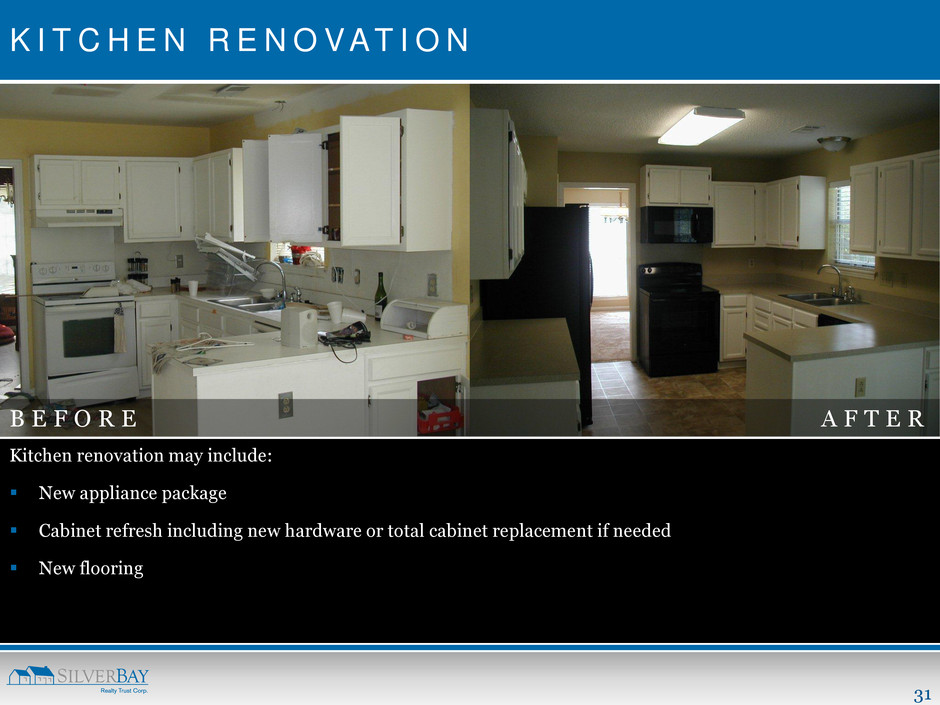

31 K I T C H E N R E N O VAT I O N B E F O R E A F T E R Kitchen renovation may include: New appliance package Cabinet refresh including new hardware or total cabinet replacement if needed New flooring

32 P R O P E R T Y M A N A G E M E N T

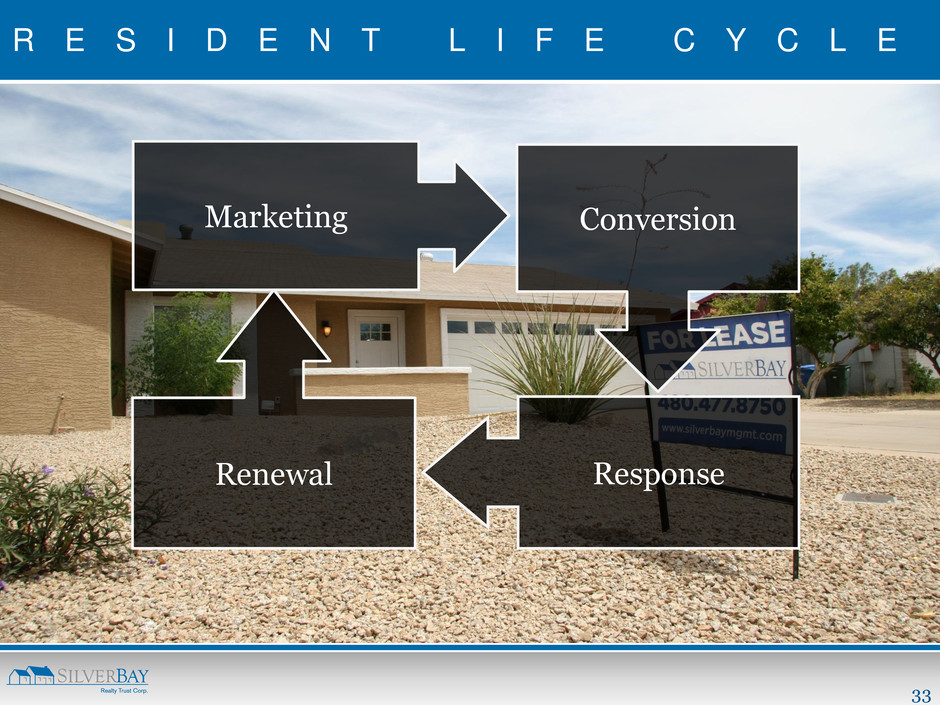

33 R E S I D E N T L I F E C Y C L E Marketing Conversion Response Renewal

34 M A R K E T I N G Leverage local market knowledge to target best channels for advertising MLS broker relationships help drive leasing process Yard signage displayed once a property nears renovation completion to start driving the lead process Substantial web presence includes featured listing relationships with online major listing services Focus on establishing and growing Silver Bay‟s brand through increased advertising presence, including billboards to present the Company as a preferred operator Standardization of renovations and amenities attracts prospective residents to an institutional grade rental home Silver Bay Management website is consistently updated and refined for ease of users, and traffic driven through Pay Per Click campaigns and Search Engine Optimization Existing satisfied residents are encouraged to provide referrals

35 C O N V E R S I O N Leasing agents show homes to pre-screened prospective residents, using resident defined characteristics to match a potential resident to the home that best fits their needs Maintaining high quality resident screening process critical to reducing evictions, future turnover and associated costs Resident screening includes credit checks, employment history, landlord verification, residential history, criminal background checks and income verification while remaining Fair Housing compliant Online application process for resident convenience and increased processing speed Application process transferable for residents so that if they miss out on one Silver Bay home, they can easily choose another without having to reapply Once a lease is signed, our goal is to walk the home with every resident prior to move-in to answer questions and familiarize the resident with Silver Bay guidelines for service call procedures, operation of the home‟s HVAC, electrical systems and appliances

36 R E S P O N S E Primary goal to provide high quality customer service experience, which drives resident satisfaction and establishes lasting relationships Plan to employ check-up calls after move-in to ensure residents are satisfied with their home Implementing use of convenient online resident portal system that allows residents to log-in to a web based application to pay bills, request service or manage their lease renewal directly over the internet Once a service call is made, responses are usually issued within 24 hours especially in cases that qualify as an emergency situation Use regional servicing companies with greater resources to deploy, ensuring responsiveness, competitive pricing and cost effectiveness Committed to issue resolution on the first attempt and providing a positive experience for residents by using select , professional vendors in each market and implementing follow-up calls to ensure resident satisfaction

37 R E N E W A L By maintaining good communication with residents through the course of the resident lease cycle, an established relationship is built that enhances the portfolio for successful resident retention Once the end of a lease approaches, residents are contacted 60 days prior to lease expiration Confirmation of renewal or move out 30 days prior to lease expiration ensures sufficient lead time for turns Every effort is made to renew leases and retain residents, without sacrificing modest marked-to-market rental increases Renewal offers are made based on several factors, including „Market Rent‟ as determined by a comparable rent analysis for each home with a lease expiration date within each month

38 M A N A G I N G T U R N O V E R Efficient and cost effective turnover process critical to generating cash flows Leverages same renovations project management team and network of contractors familiar with Silver Bay standards and processes For Rent sign is placed in yard before lease expiration Goal to complete project scope prior to resident move-out and schedule contractors within one or two days of resident move- out Homes pass same 60-point quality control inspection used during initial renovation process

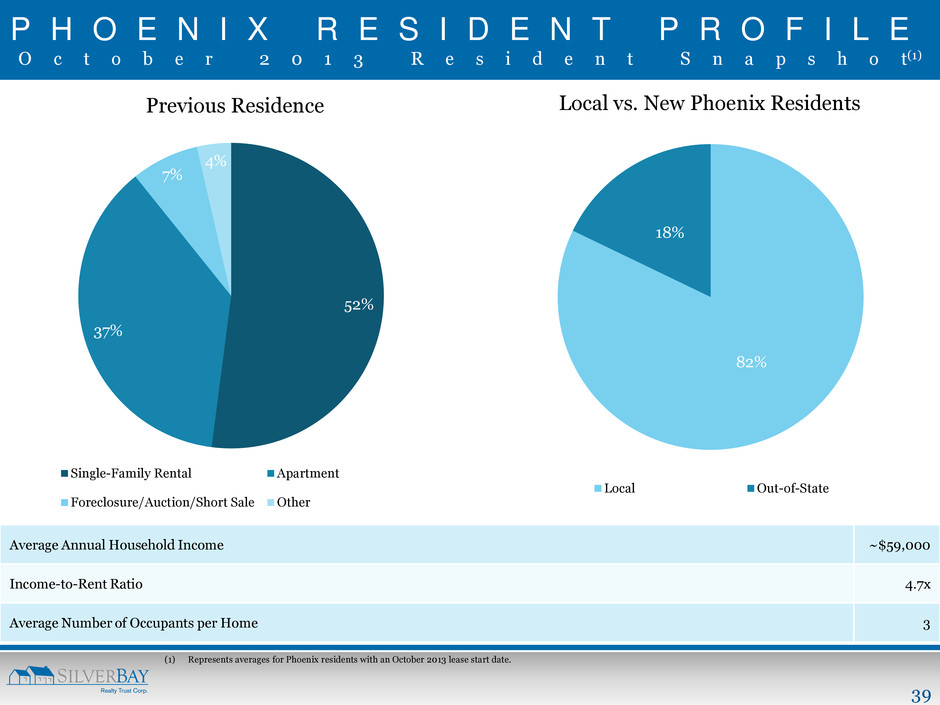

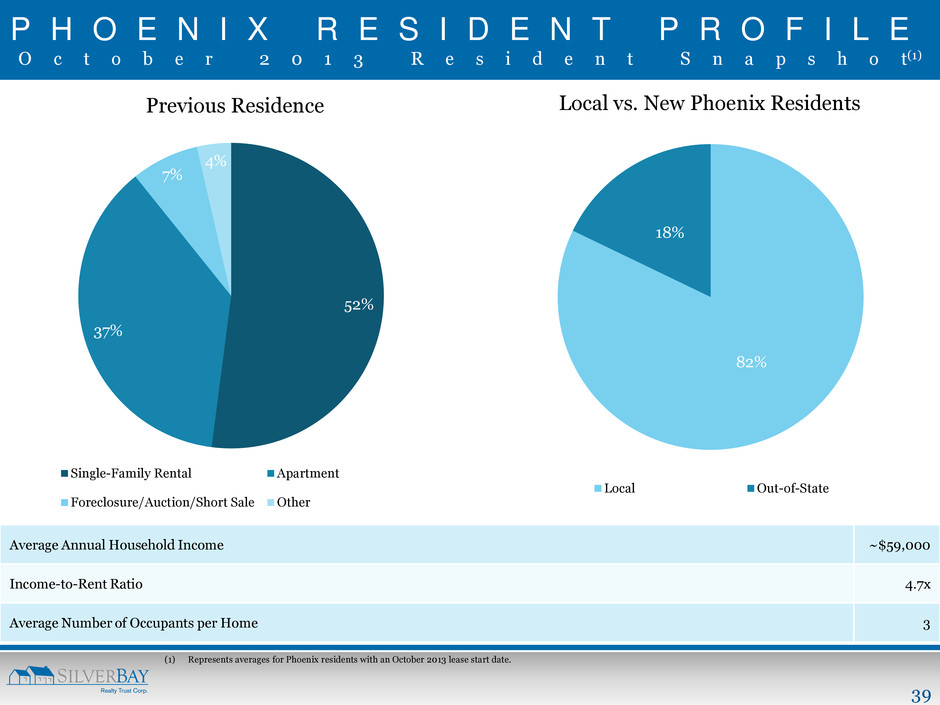

39 P H O E N I X R E S I D E N T P R O F I L E O c t o b e r 2 0 1 3 R e s i d e n t S n a p s h o t(1) 52% 37% 7% 4% Previous Residence Single-Family Rental Apartment Foreclosure/Auction/Short Sale Other 82% 18% Local vs. New Phoenix Residents Local Out-of-State (1) Represents averages for Phoenix residents with an October 2013 lease start date. Average Annual Household Income ~$59,000 Income-to-Rent Ratio 4.7x Average Number of Occupants per Home 3

40 R E S I D E N T F E E D B A C K “Thank you for responding so quickly when we had an issue at the house.” “I have been a satisfied resident of one of your homes for the last ten months. I have enjoyed my stay, recommend your office, and will certainly be returning for any future housing needs.” “Silver Bay and their representatives worked with us to help us stay in our home although they had no obligation to do so. I would recommend them highly and appreciate their assistance and understanding.” “We were working with an agent in the Atlanta office and the customer service was top notch. The agent listened to our needs, and when we lost the house we were interested in to another tenant he pointed us to a house they recently acquired that was not even on the market yet. He worked with us to meet our needs in the limited time frame we had and we wound up getting a great rental at a very fair price. After disappointing experiences with other property management companies in the area, working with Silver Bay of Atlanta was a breath of fresh air.”

41 T E C H N O L O G Y Image Shown: Foreclosure Auction Central Courthouse Phoenix, Arizona

42 T E C H N O L O G Y S T R A T E G I C O B J E C T I V E S Provide an integrated platform to facilitate operational excellence Ensure regulatory compliance and high standards of information security Implement a scalable, flexible and pragmatic infrastructure to meet evolving business needs Deliver effective, reliable and accessible information to support data-driven decision making processes

43 O P P O R T U N I T I E S S I N G L E - F A M I L Y R E N T A L I N D U S T R Y Nascent industry for institutional players Standardized processes managed at corporate and market level Complexities of scale and evolving business requirements S I L V E R B A Y National and geographically diverse organization Public company requirements Young and developing company with focus on cost effective and scalable solutions T O D A Y ‟ S T E C H N O L O G Y Advancements in cloud capabilities Technology mobility Maturity of service-orientation

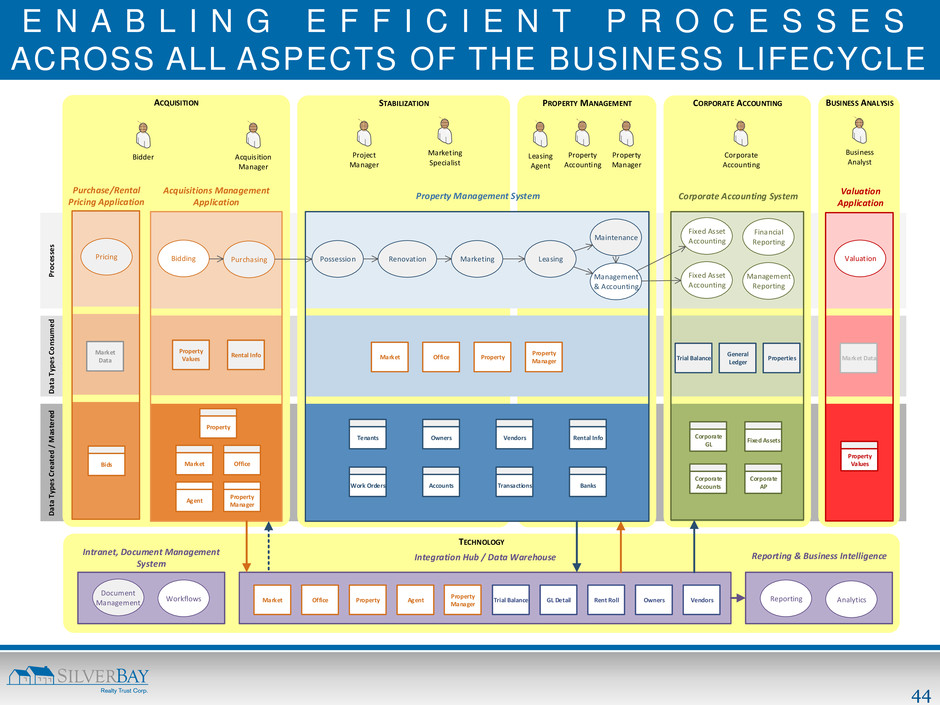

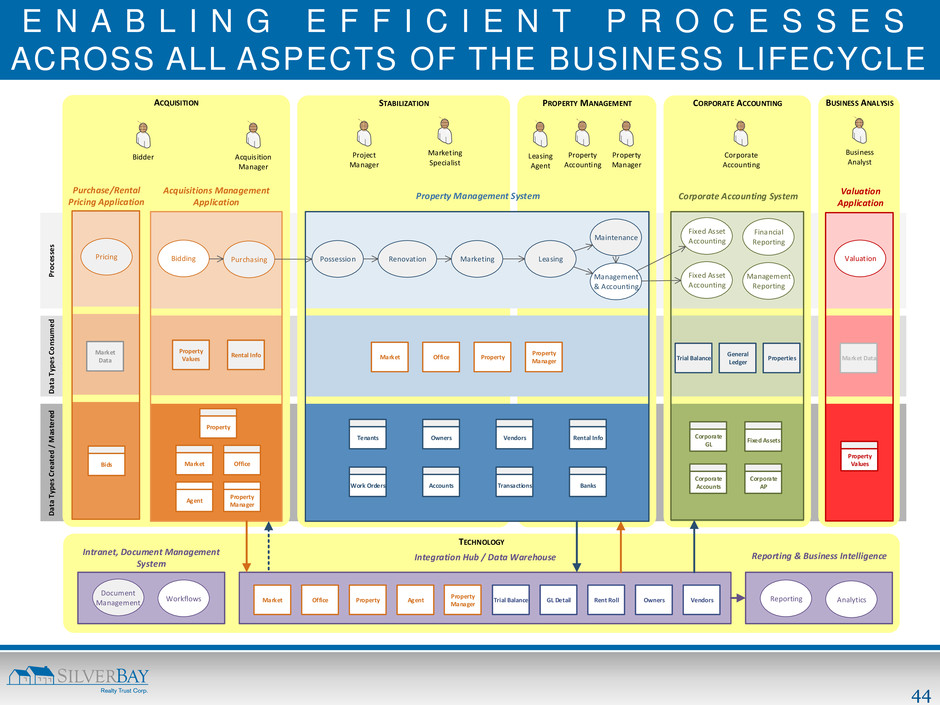

44 E N A B L I N G E F F I C I E N T P R O C E S S E S ACROSS ALL ASPECTS OF THE BUSINESS LIFECYCLE BUSINESS ANALYSIS TECHNOLOGY STABILIZATION Da ta Ty pe s C re at ed / M as te re d Da ta Ty pe s C on su m ed Pr oc es se s ACQUISITION PROPERTY MANAGEMENT Bidding Purchasing Possession Renovation Leasing Property Values Property OfficeMarket Agent Property Manager Maintenance Management & Accounting Property Rental InfoOwnersTenants BanksAccounts Market Office Vendors Work Orders Transactions Acquisitions Management Application CORPORATE ACCOUNTING Fixed Asset Accounting Financial Reporting Trial Balance Corporate GL Corporate Accounts Fixed Assets Corporate Accounting System Rental Info Management Reporting General Ledger Properties PropertyMarket Office Agent Property Manager Trial Balance GL Detail Rent Roll Owners Vendors Property Management System Integration Hub / Data Warehouse Intranet, Document Management System Valuation Valuation Application Market Data Fixed Asset Accounting Corporate AP Bidder Acquisition Manager Project Manager Marketing Specialist Property Accounting Property Manager Corporate Accounting MarketingPricing Purchase/Rental Pricing Application Market Data Bids Property Manager Leasing Agent Document Management Workflows Reporting & Business Intelligence Reporting Analytics Property Values Business Analyst

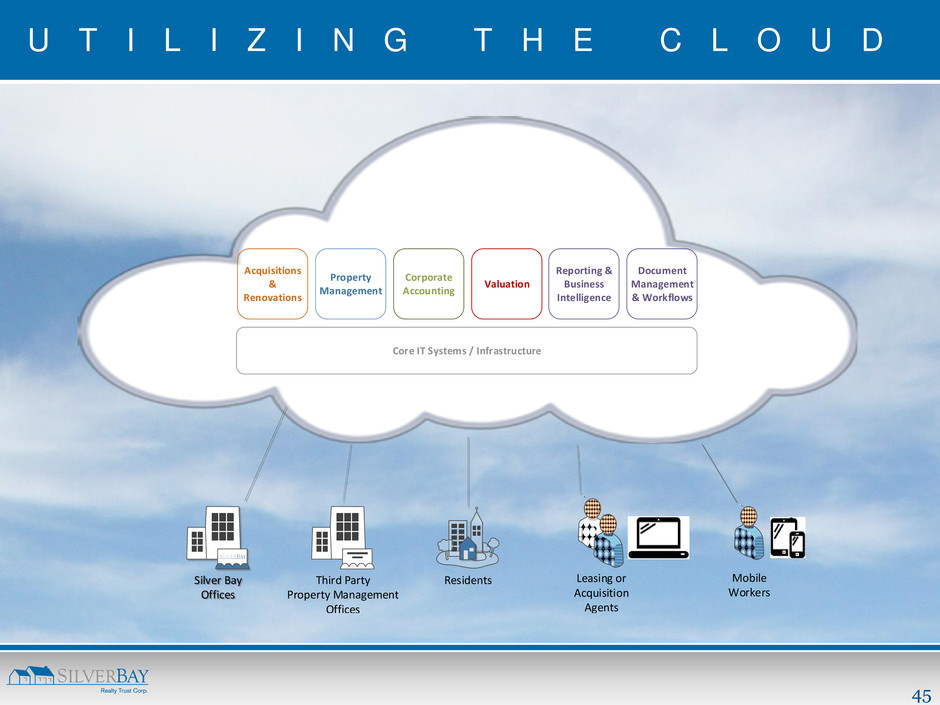

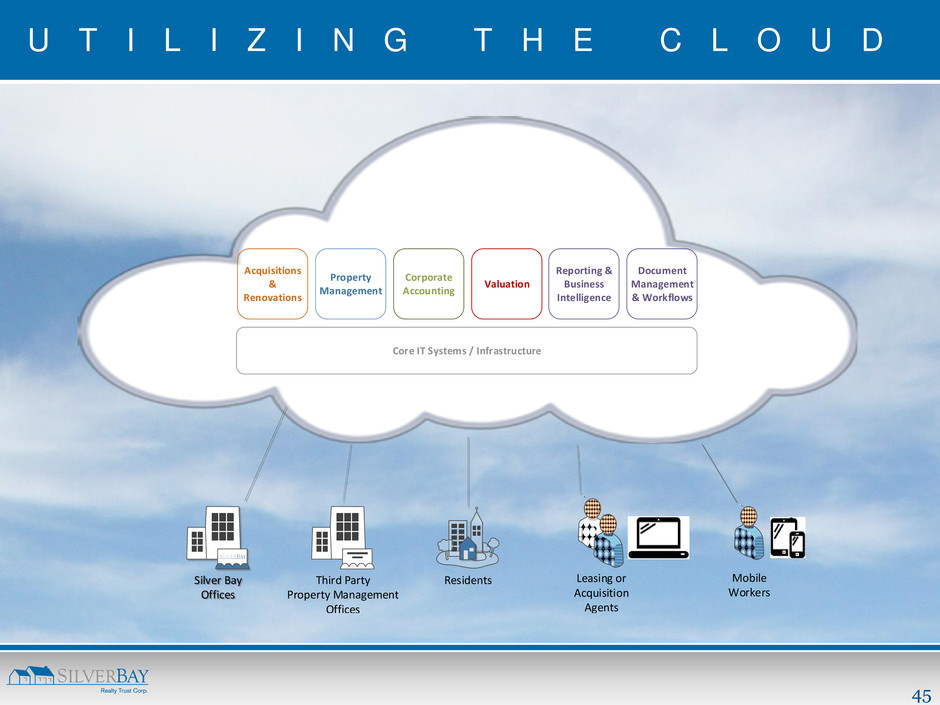

45 U T I L I Z I N G T H E C L O U D Acquisitions & Renovations Property Management Reporting & Business Intelligence Corporate Accounting Valuation Core IT Systems / Infrastructure Third Party Property Management Offices ResidentsSilver Bay Offices Leasing or Acquisition Agents Mobile Workers Document Management & Workflows

46 REGULATORY COMPLIANCE AND INFORMATION SECURITY Sarbanes-Oxley Business continuity and disaster recovery SSAE16 compliant providers Security best practices

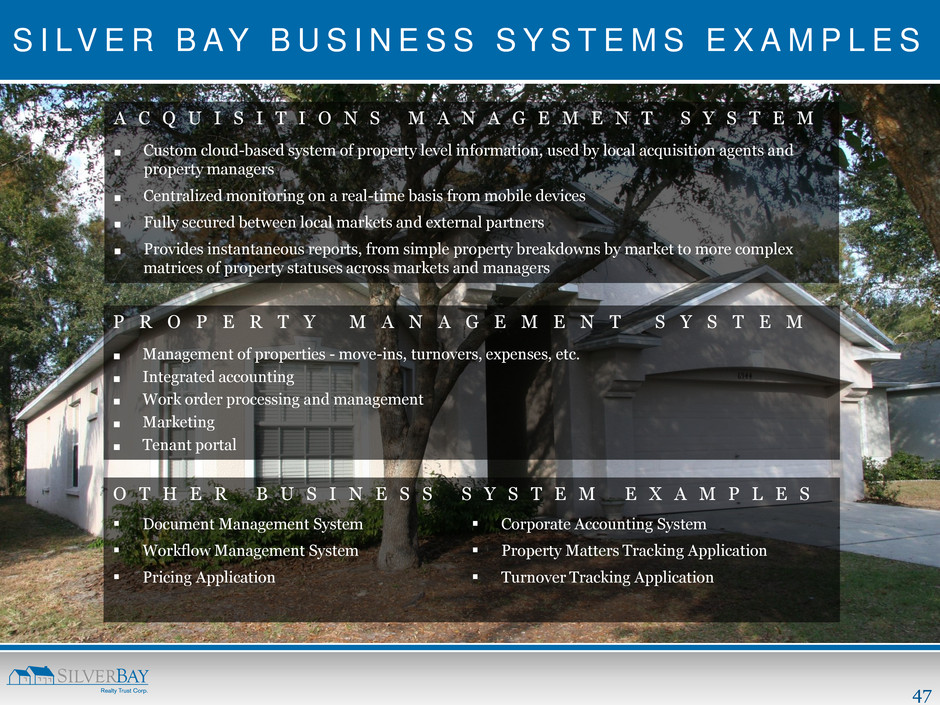

47 S I LV E R B AY B U S I N E S S S Y S T E M S E X A M P L E S A C Q U I S I T I O N S M A N A G E M E N T S Y S T E M ■ Custom cloud-based system of property level information, used by local acquisition agents and property managers ■ Centralized monitoring on a real-time basis from mobile devices ■ Fully secured between local markets and external partners ■ Provides instantaneous reports, from simple property breakdowns by market to more complex matrices of property statuses across markets and managers P R O P E R T Y M A N A G E M E N T S Y S T E M ■ Management of properties - move-ins, turnovers, expenses, etc. ■ Integrated accounting ■ Work order processing and management ■ Marketing ■ Tenant portal Document Management System Workflow Management System Pricing Application Corporate Accounting System Property Matters Tracking Application Turnover Tracking Application O T H E R B U S I N E S S S Y S T E M E X A M P L E S

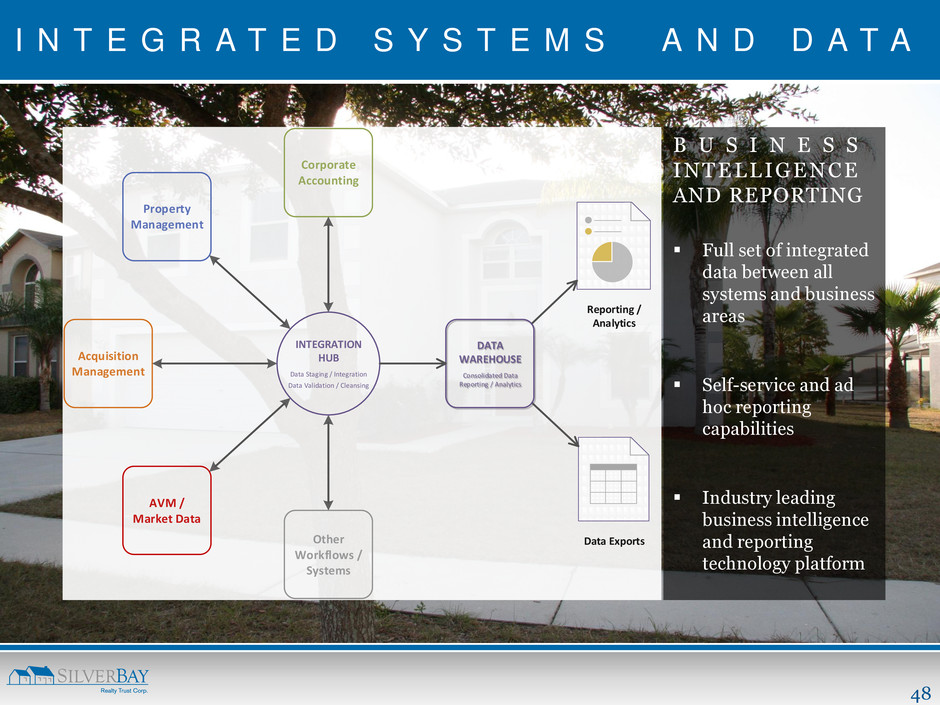

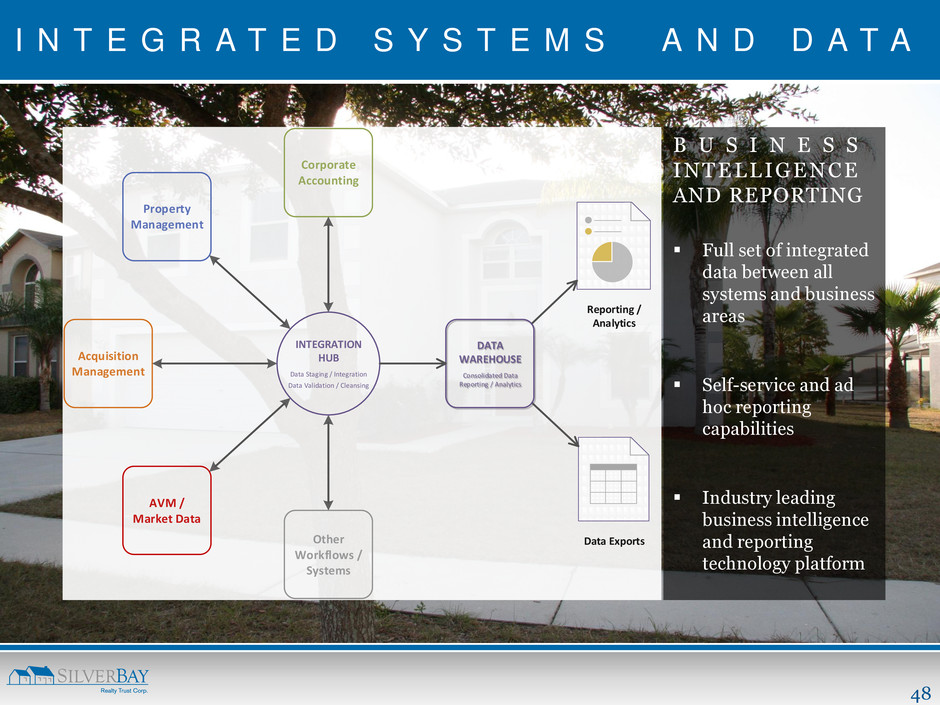

48 I N T E G R A T E D S Y S T E M S A N D D A T A Acquisition Management Other Workflows / Systems Property Management AVM / Market Data Corporate Accounting INTEGRATION HUB Data Staging / Integration Data Validation / Cleansing Reporting / Analytics Data Exports DATA WAREHOUSE Consolidated Data Reporting / Analytics B U S I N E S S I N T E L L I G E N C E AND REPORTING Full set of integrated data between all systems and business areas Self-service and ad hoc reporting capabilities Industry leading business intelligence and reporting technology platform

49 A P P E N D I X

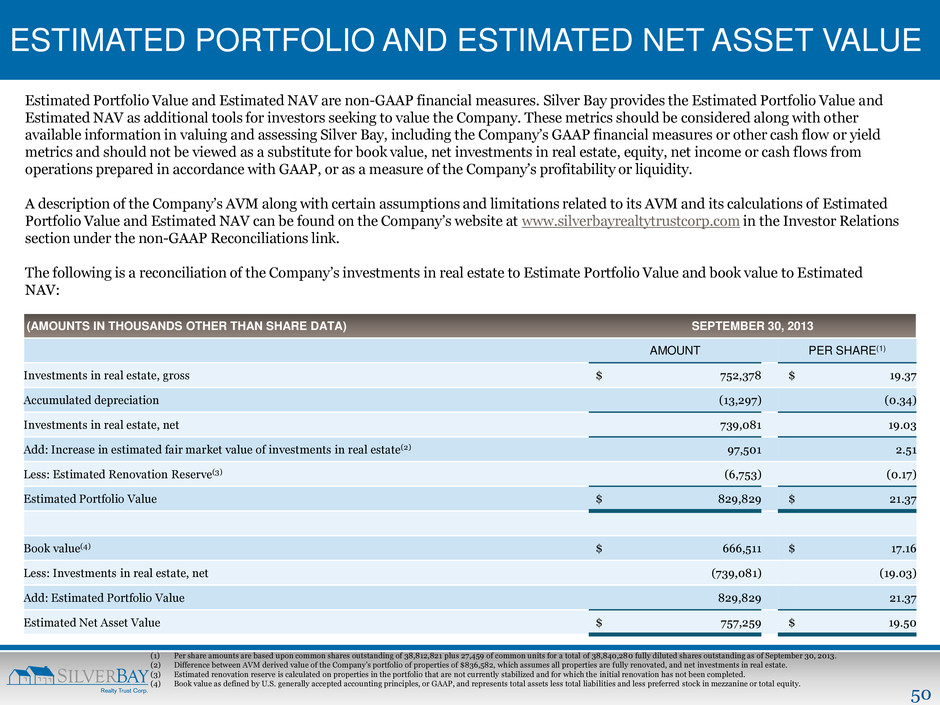

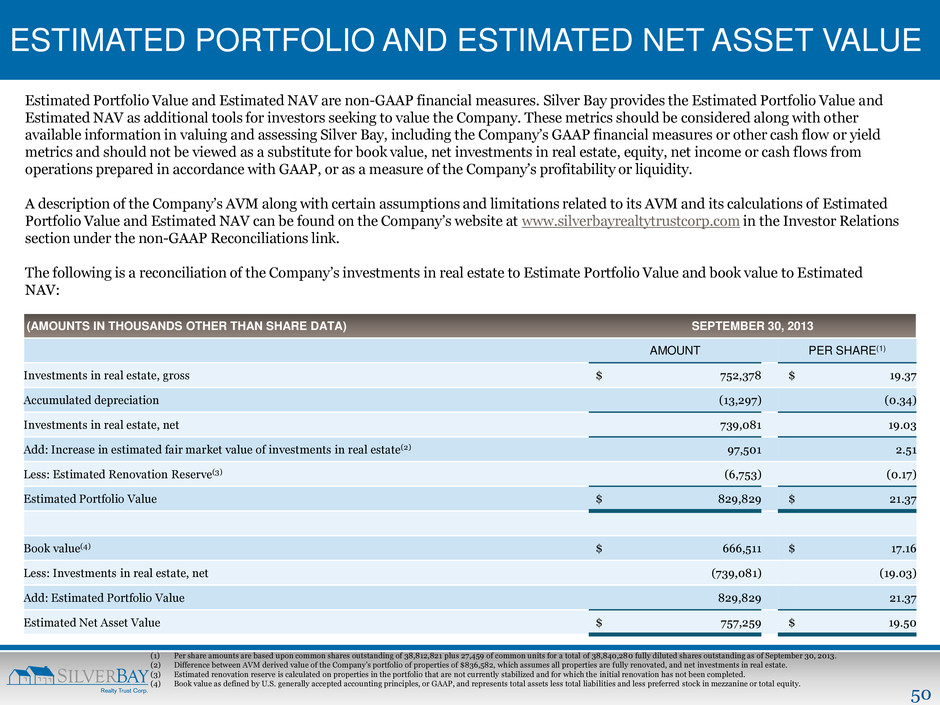

50 ESTIMATED PORTFOLIO AND ESTIMATED NET ASSET VALUE Estimated Portfolio Value and Estimated NAV are non-GAAP financial measures. Silver Bay provides the Estimated Portfolio Value and Estimated NAV as additional tools for investors seeking to value the Company. These metrics should be considered along with other available information in valuing and assessing Silver Bay, including the Company‟s GAAP financial measures or other cash flow or yield metrics and should not be viewed as a substitute for book value, net investments in real estate, equity, net income or cash flows from operations prepared in accordance with GAAP, or as a measure of the Company‟s profitability or liquidity. A description of the Company‟s AVM along with certain assumptions and limitations related to its AVM and its calculations of Estimated Portfolio Value and Estimated NAV can be found on the Company‟s website at www.silverbayrealtytrustcorp.com in the Investor Relations section under the non-GAAP Reconciliations link. The following is a reconciliation of the Company‟s investments in real estate to Estimate Portfolio Value and book value to Estimated NAV: (1) Per share amounts are based upon common shares outstanding of 38,812,821 plus 27,459 of common units for a total of 38,840,280 fully diluted shares outstanding as of September 30, 2013. (2) Difference between AVM derived value of the Company‟s portfolio of properties of $836,582, which assumes all properties are fully renovated, and net investments in real estate. (3) Estimated renovation reserve is calculated on properties in the portfolio that are not currently stabilized and for which the initial renovation has not been completed. (4) Book value as defined by U.S. generally accepted accounting principles, or GAAP, and represents total assets less total liabilities and less preferred stock in mezzanine or total equity. (AMOUNTS IN THOUSANDS OTHER THAN SHARE DATA) SEPTEMBER 30, 2013 AMOUNT PER SHARE(1) Investments in real estate, gross $ 752,378 $ 19.37 Accumulated depreciation (13,297) (0.34) Investments in real estate, net 739,081 19.03 Add: Increase in estimated fair market value of investments in real estate(2) 97,501 2.51 Less: Estimated Renovation Reserve(3) (6,753) (0.17) Estimated Portfolio Value $ 829,829 $ 21.37 Book value(4) $ 666,511 $ 17.16 Less: Investments in real estate, net (739,081) (19.03) Add: Estimated Portfolio Value 829,829 21.37 Estimated Net Asset Value $ 757,259 $ 19.50

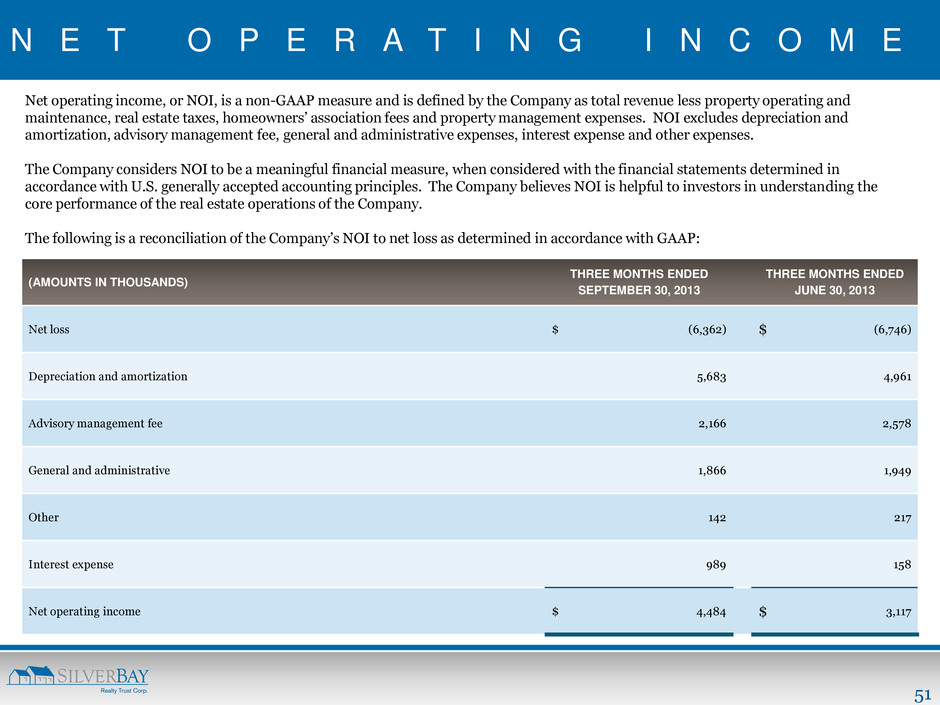

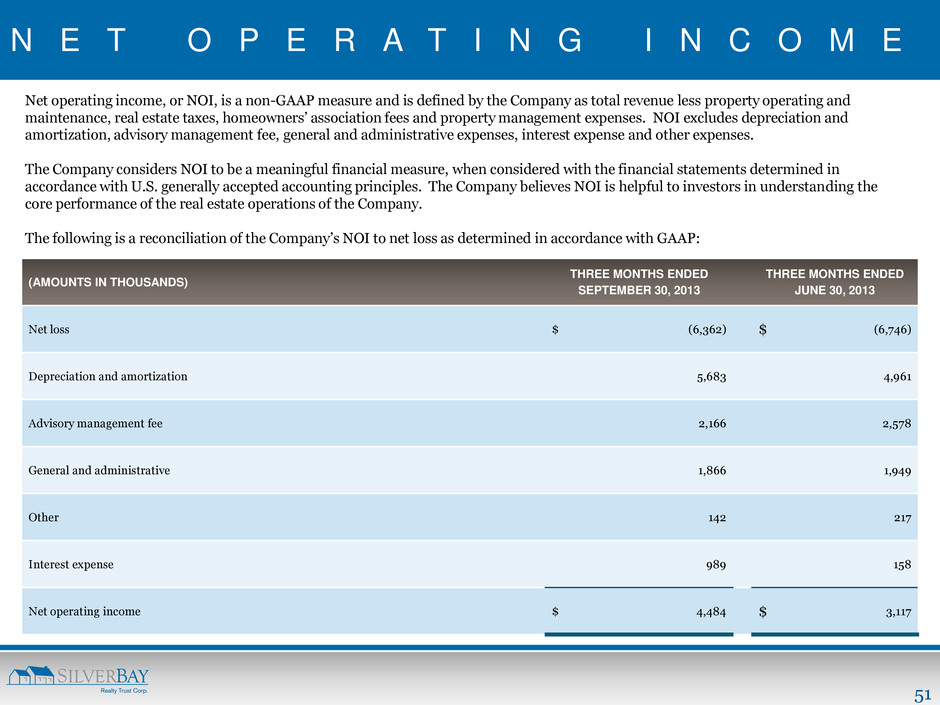

51 N E T O P E R A T I N G I N C O M E Net operating income, or NOI, is a non-GAAP measure and is defined by the Company as total revenue less property operating and maintenance, real estate taxes, homeowners‟ association fees and property management expenses. NOI excludes depreciation and amortization, advisory management fee, general and administrative expenses, interest expense and other expenses. The Company considers NOI to be a meaningful financial measure, when considered with the financial statements determined in accordance with U.S. generally accepted accounting principles. The Company believes NOI is helpful to investors in understanding the core performance of the real estate operations of the Company. The following is a reconciliation of the Company‟s NOI to net loss as determined in accordance with GAAP: (AMOUNTS IN THOUSANDS) THREE MONTHS ENDED SEPTEMBER 30, 2013 THREE MONTHS ENDED JUNE 30, 2013 Net loss $ (6,362) $ (6,746) Depreciation and amortization 5,683 4,961 Advisory management fee 2,166 2,578 General and administrative 1,866 1,949 Other 142 217 Interest expense 989 158 Net operating income $ 4,484 $ 3,117

52 601 CARLSON PARKWAY | SUITE 250 | MINNETONKA | MN | 55305 P: 952.358.4400 | E: INVES TO RS@ SILVERBAYMGMT .C OM