Exhibit 3.1

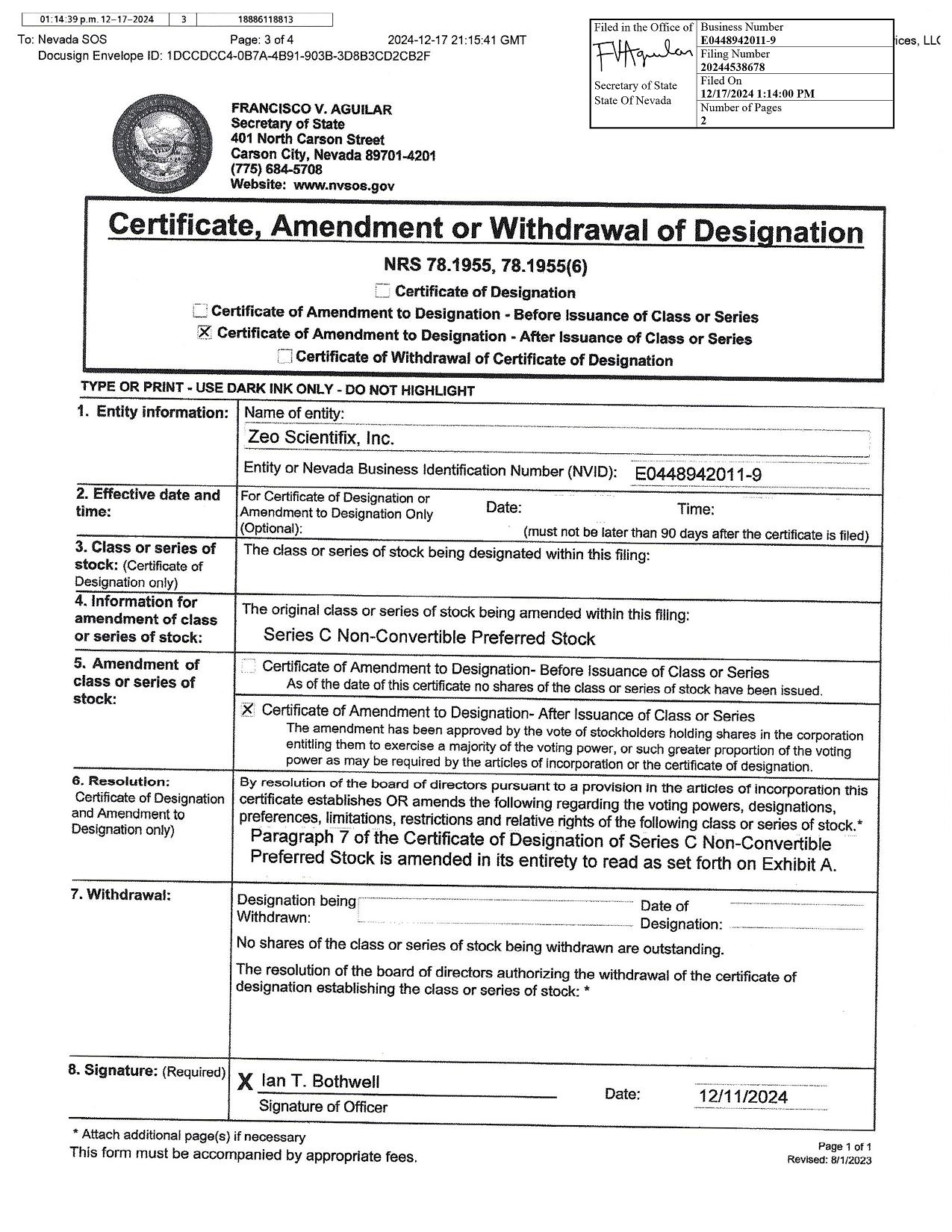

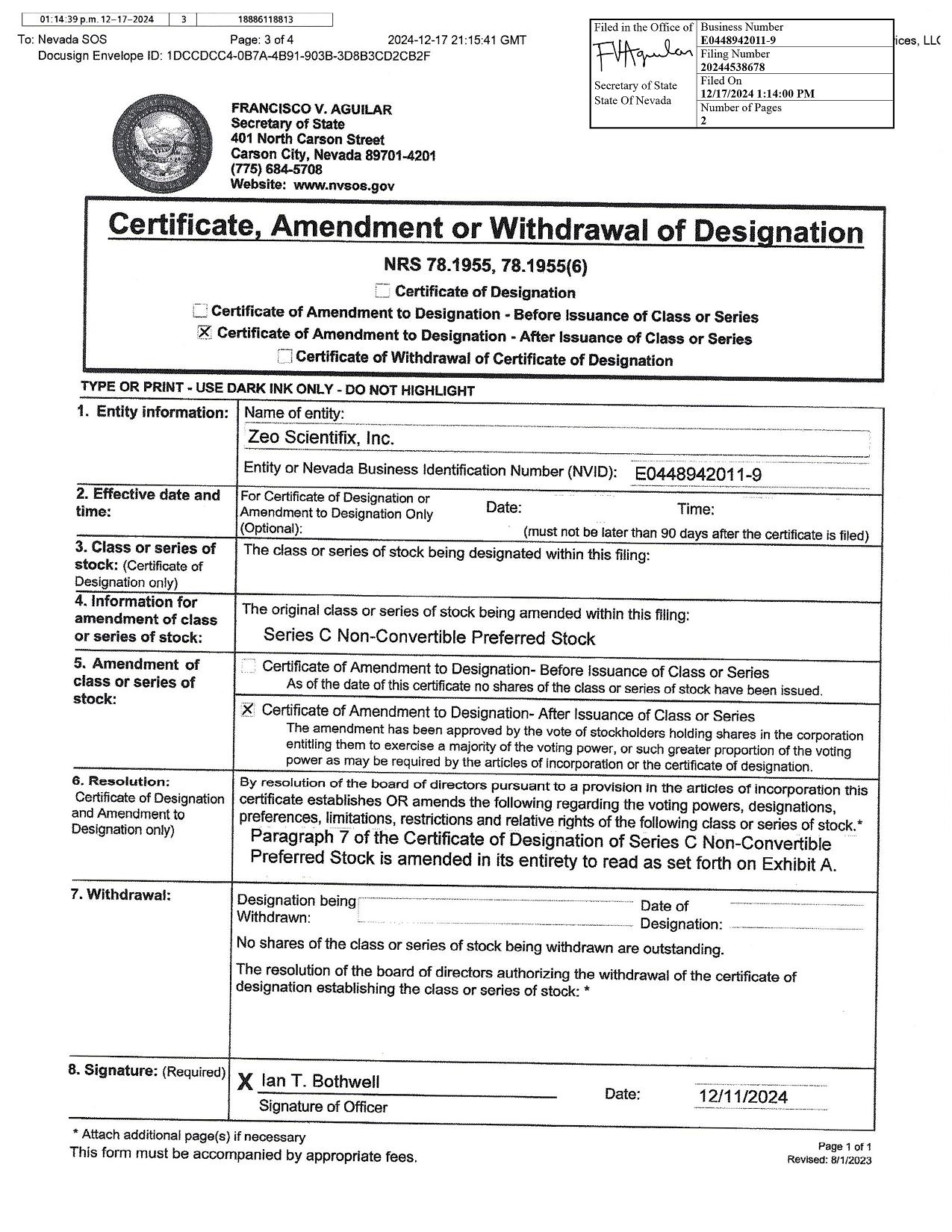

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20244538678 Filed On 12/17/2024 1:14:00 PM Number of Pages 2

4 1 J 01 : 14 : 39p . m . 1 2 1 1 - 2 024 To : Nevada SOS 188s61188n Page : 4of4 2024 - 12 - 1721 : 15:41 GMT Oocusign Envelope ID : 1DCCDCC4 - 0B7A - 4891 - 9038 - 3O883CO2CB2F 18886118813 From : Vcorp Services , LL( EXHIBIT A TO CERTIFICATE OF AMENDMENT TO CERTIFICATE OF DESIGNATION OF SERIES C CONVERTIBLE PREFERRED STOCK " 7 . Redemption . Reference is made to that Securities Purchase Agreement dated August 19 , 2022 (the "Purchase Agreement"), by and among the Company , Skycrest Holdings , LLC ( " Skycrest") and Greyt Ventures LLC ("Greyt") . The Series C Preferred Stock held by Skycrest or Greyt or any permitted assignee of Skycrest or Greyt (a "Permitted Assignee") shall be automatically redeemed by the Company and cease to be outstanding at a redemption price of $ 1 . 00 per share, at such time as (a) with respect to Skycrest or a Permitted Assignee of Skycrest , Skycrest no longer beneficially owns more than fifty percent ( 50 % ) of the shares (of Common Stock of the Company purchased by the Skycrest pursuant to the Purchase Agreement ; (b) with respect to Greyt or a Permitted Assignee of Greyt, Greyt no longer beneficially owns more than fifty percent ( 50 % ) o f the shares (of Common Stock of the Company purchased by Greyt pursuant to the Purchase Agreement ; or (b) if Skycrest , Greyt or an Permitted Assignee ofSkycrest or Greyt , transfers or attempts to transfer ownership of the shares of Series C Preferred Stock held by it to any third party , other than with the affirmative vote or the unanimous written consent of the Company ' s board of directors" .

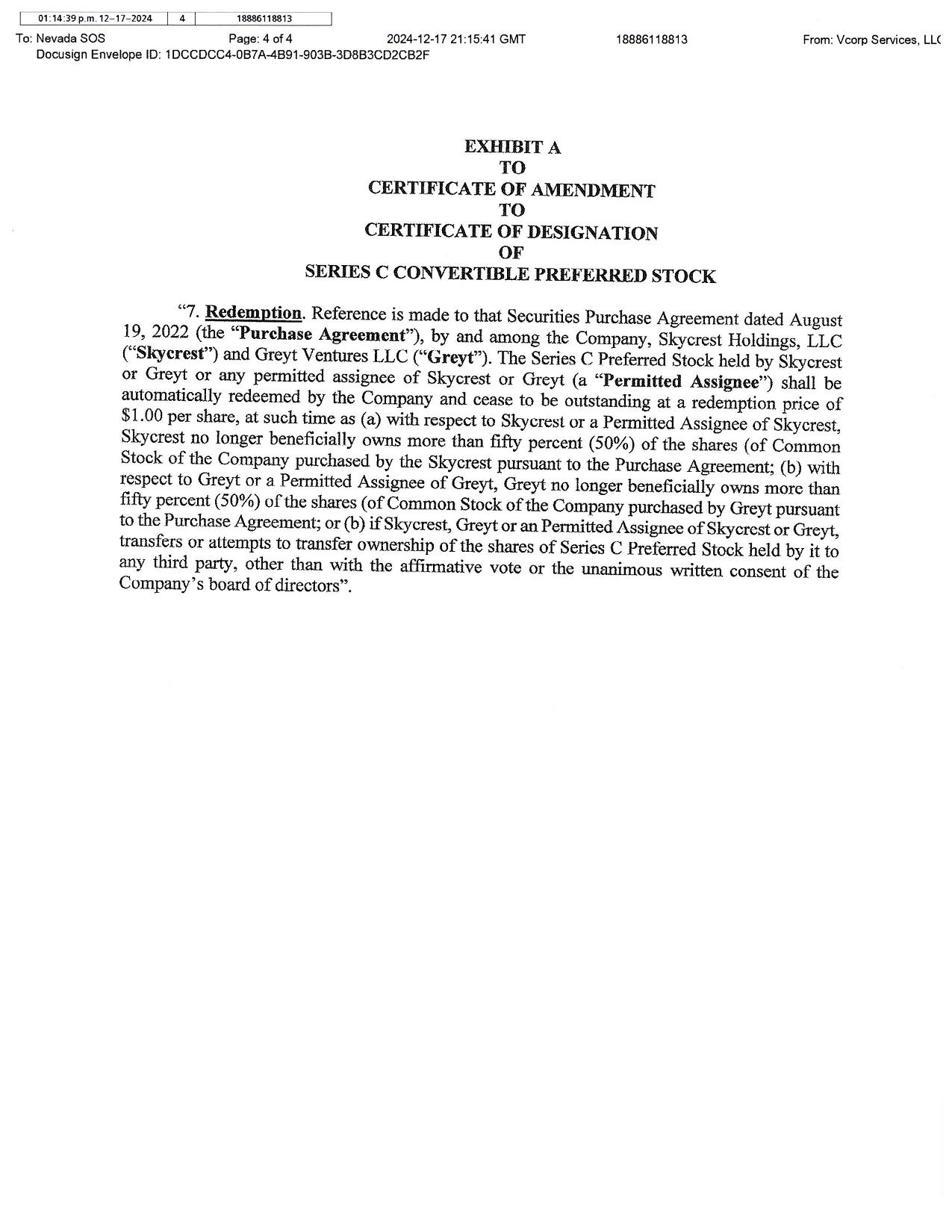

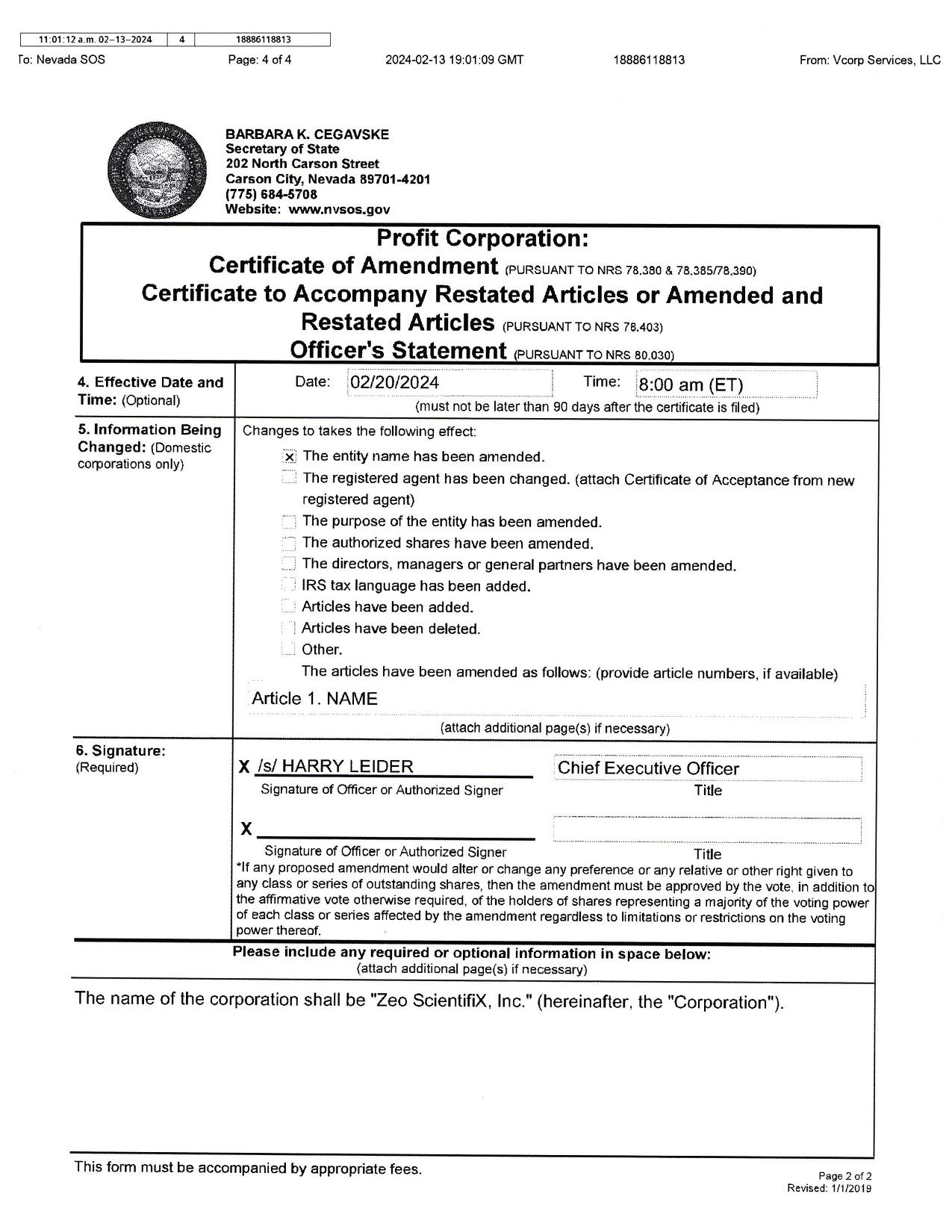

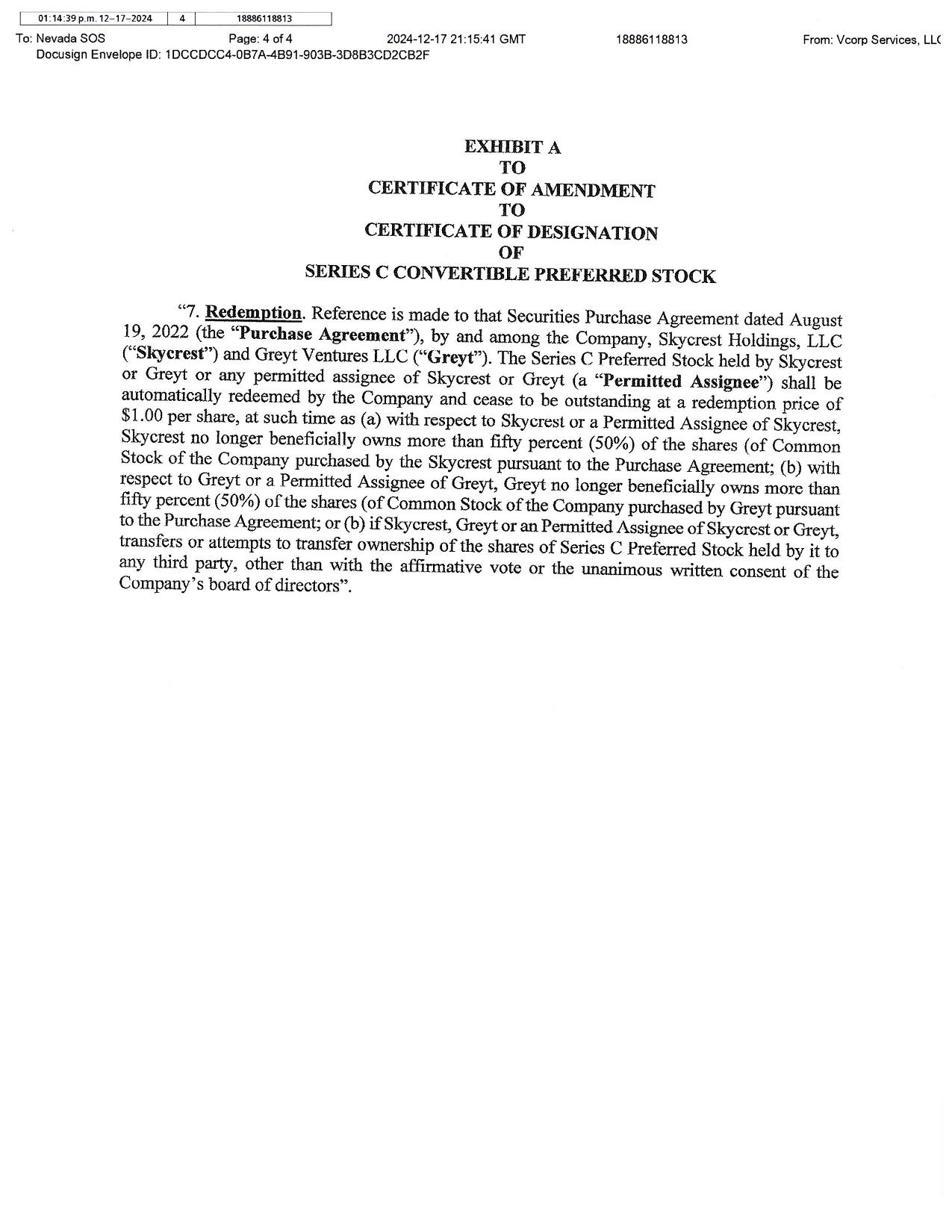

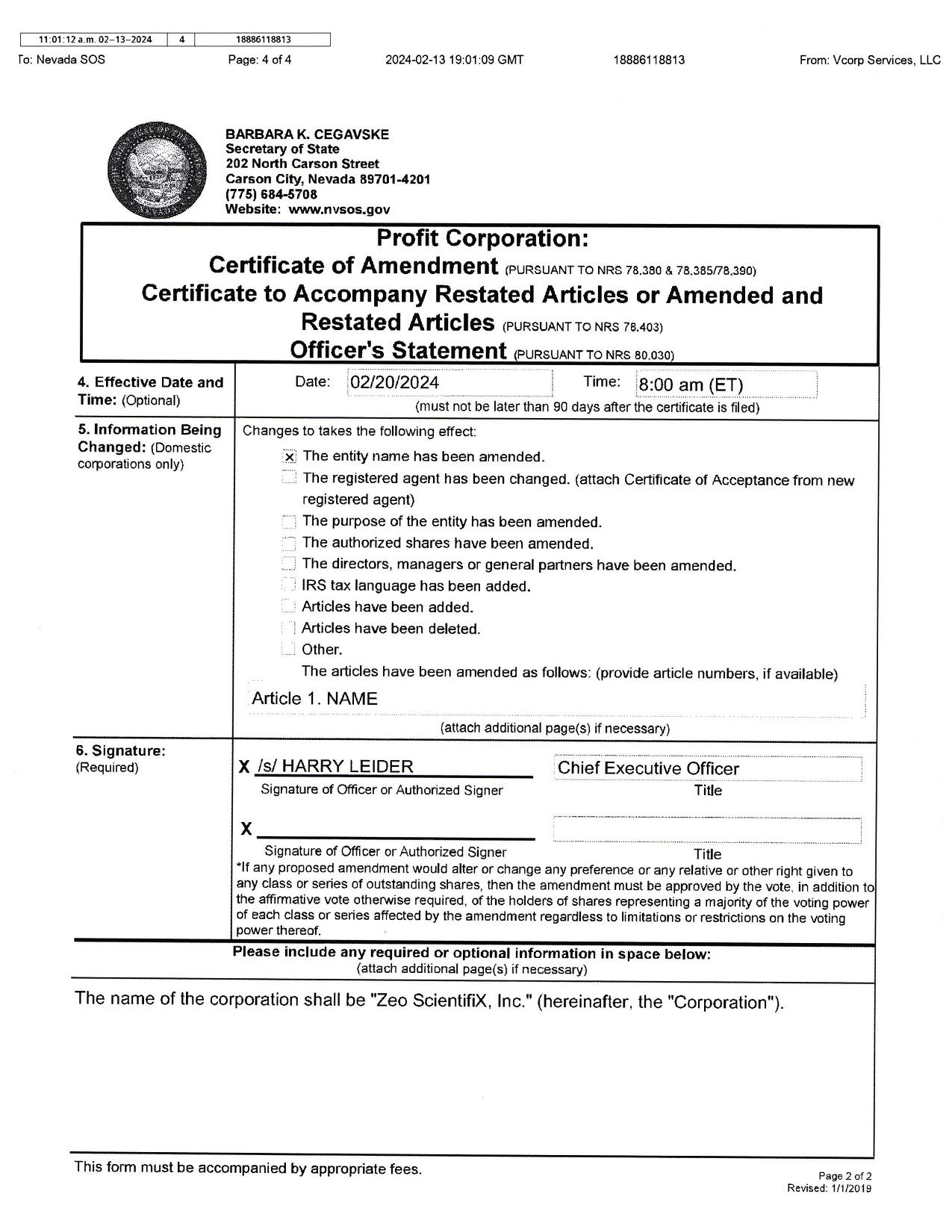

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20243819841 Filed On 2/13/2024 11:01:00 AM Number of Pages 2

11 : 01 : 12a . m . 0 2 - 13 - 2024 4 I 18886118813 fa: Nevada SOS Page: 4 of4 2024 - 02 - 1319:01 : 09 GMT BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov 18886118813 From: Vcorp Services , LLC 4 T 5 C c 6 ( T Profit Corporation: Certificate of Amendment cPuRsuANTTo NRs 78.380 & 78.385178.390) Certificate to Accompany Restated Articles or Amended and Restated Articles (PuRsuANT To NRs 76.403) Officer's Statement PuRsuANT To NRs ao . 030 Date : f 02/20/:2¢? : =: Time : i a: _ q - o rTl (ET . ) . .. . (must not be later than 90 days after the cert i ficate is filed) . Effective Date and ime: (Optional) Changes to takes the following effect: '. x } The entity name has been amended. The registered agent has been changed. (attach Cert i ficate of Acceptance from new registered agent) The purpose of the entity has been amended . - i The authorized shares have been amended. The directors , managers or general partners have been amended. : IRS tax language has been added. ' Articles have been added. 1 Articles have been deleted . - " Other. The articles have been amended as follows : (provide article numbers , if available) Article 1. NAME ( attach add i t i onal page(s) if necessary) . Information Being hanged: (Domestic orporations only) X /s/ HARRY LEIDER • Chief Executive Officer . Signature: Required) Signature of Officer or Authorized Signer Title X - ------------- - i ' ······· ----- ··· · - --- ··· •• .! Signature of Officer or Au thorized Signer Title *If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares , then the amendment must be approved by the vote , in addition to the affirmative vote otherwise requ i red , of the holders of shares representing a majority of the voting power of each class o r series affected by the amendment regardless to limitations or restrictions on the voting power thereof. Please include any required or optional information in space below: (attach additional page(s ) if necessary) he name of the corporation shall be "Zeo ScientifiX , Inc." (hereinafter , the "Corporation"). This form must be accompanied by appropriate fees. Pag e 2 of 2 Revised : 1 /1/2019

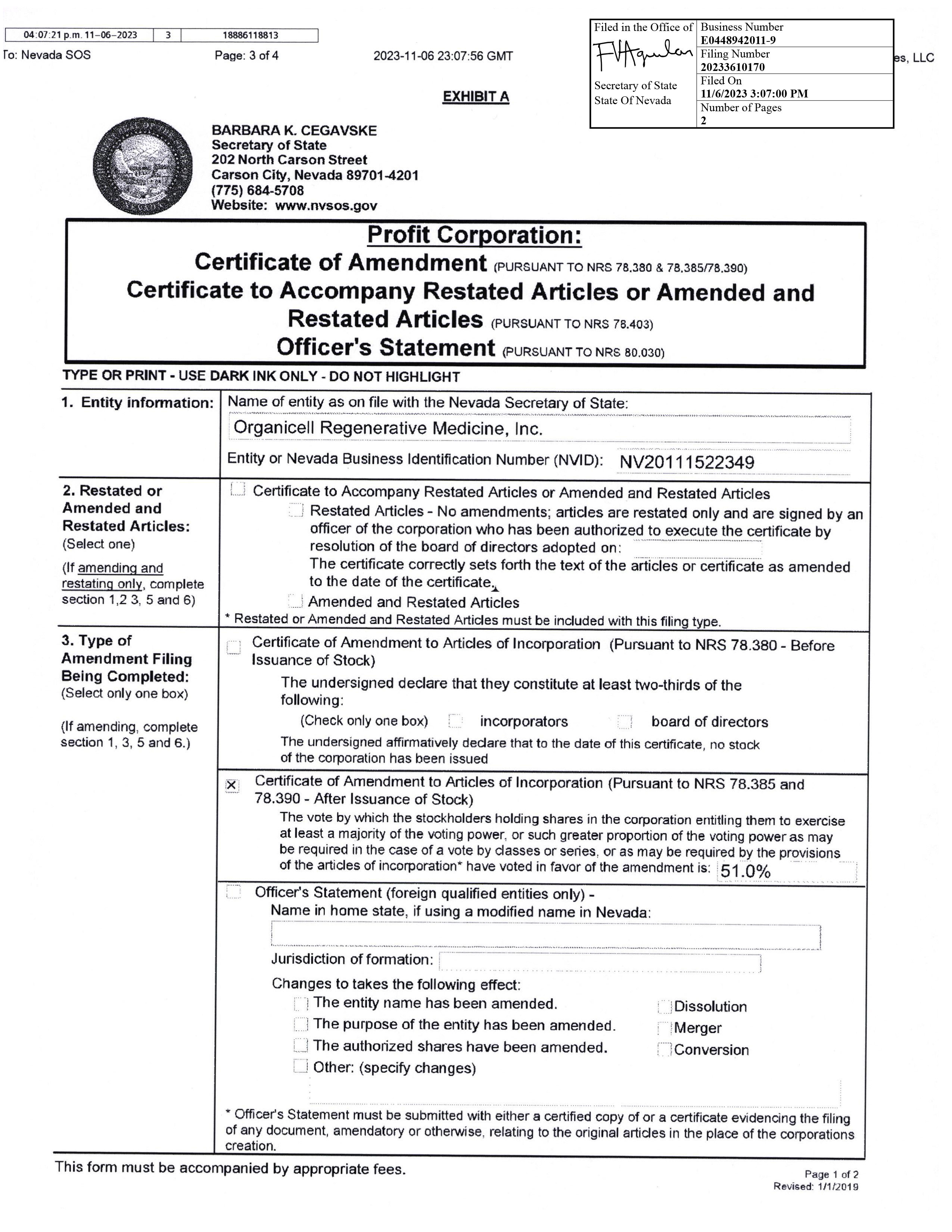

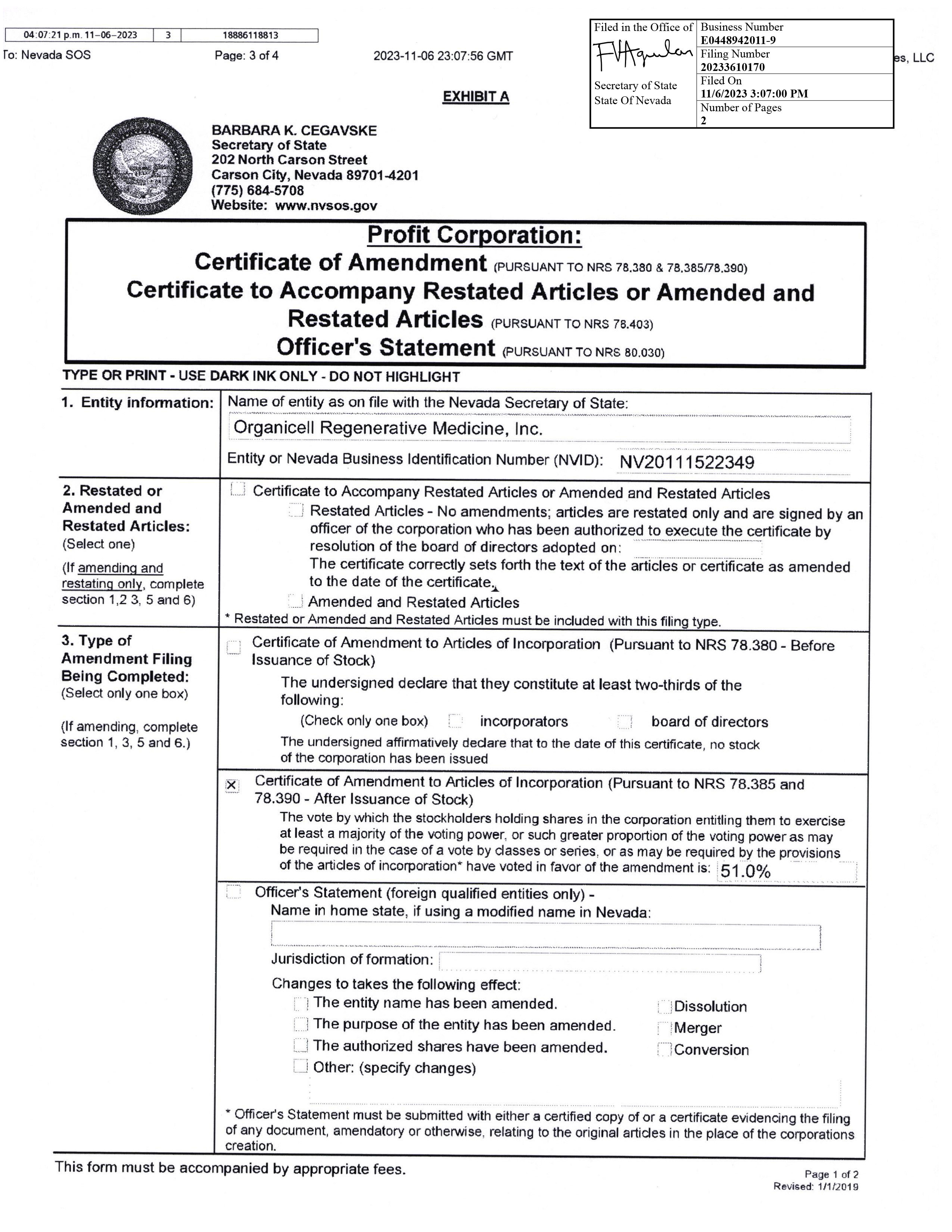

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20233610170 Filed On 11/6/2023 3:07:00 PM Number of Pages 2

04 : 07 : 21 p . m . 11 - 06 - 2023 4 I 18886118813 ro: Nevada SOS Page : 4 of4 2023 - 11 - 06 23 : 07 : 56 GMT From : Vcorp Services , LLC BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov Profit Corporation: Certificate of Amendment cPuRsuANTTO NRs 78.380 & 78.385/78 . 390) Certificate to Accompany Restated Articles or Amended and Restated Articles <PURSUANT To NRs 76.403) Officer's Statement PuRsuANT To NRs ao.o30 18886118813 4. Effective Date and Time: (Optional) Date : : Time : ' . , i ...... . . ..... . (must not be later than 90 days after the certificate is filed) •• ··········· 1 5. lnfonnation Being Changed: (Domestic corporations only ) Changes to takes the following effect: ::: The entity name has been amended. The registered agent has been changed. (attach Certificate of Acceptance from new registered agent) The purpose of the entity has been amended. :; The authorized shares have been amended . . : : The directors , managers or general partners have been amended. :_ : IRS tax language has been added. _, Articles have been added. ! Articles have been deleted . • - Other. The articles have been amended as follows : (provide article numbers, if available) Article Ill is hereby amended as further indicated below. {attach additional page(s) if necessary) 6. Signature: (Required) X /s/ HARRY LEIDER Signature of Officer or Authorized Signer x _ : Chief Executive Officer · - · - · - · -- ··· --- · -- · · - · - ·· · - · -- · - · - ···· - · --- ·· - ·· - · · - Title Signature of Officer or Authorized Signer Title •it any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares , then the amendment must be approved by the vote , in addition to the affirmative vote otherwise required , of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof. Please include any required or optional information in space below: (attach additional page(s) i f necessary) Article Ill of the Corporation's Articles of Incorporation is hereby amended by adding the following language : "Each share of common stock of the Corporation issued and outstanding as of the record date set by the Corporation will be subject to a 1 - for - 200 reverse stock split, with all fractional shares being rounded up to the nearest whole share. The par value of the shares of common stock will remain $0.001. The reverse stock split (i) will not change the number of authorized shares of common stock or preferred stock and (i i ) shall become effective upon the date announced by the Financial Industry Regulatory Authority." This form must be accompanied by appropriate fees. Pag e 2 o f 2 Revised : 1/ 1 /20 1 9

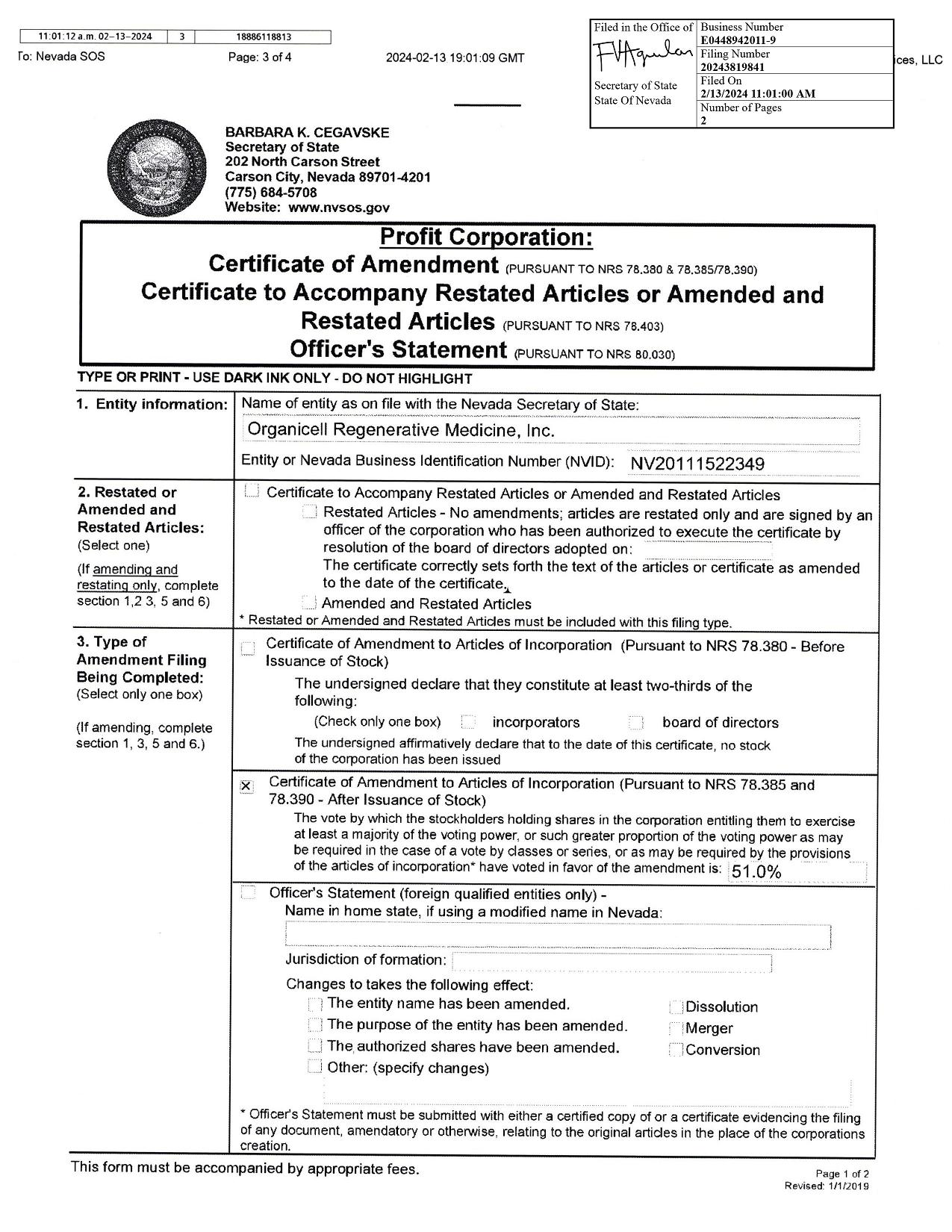

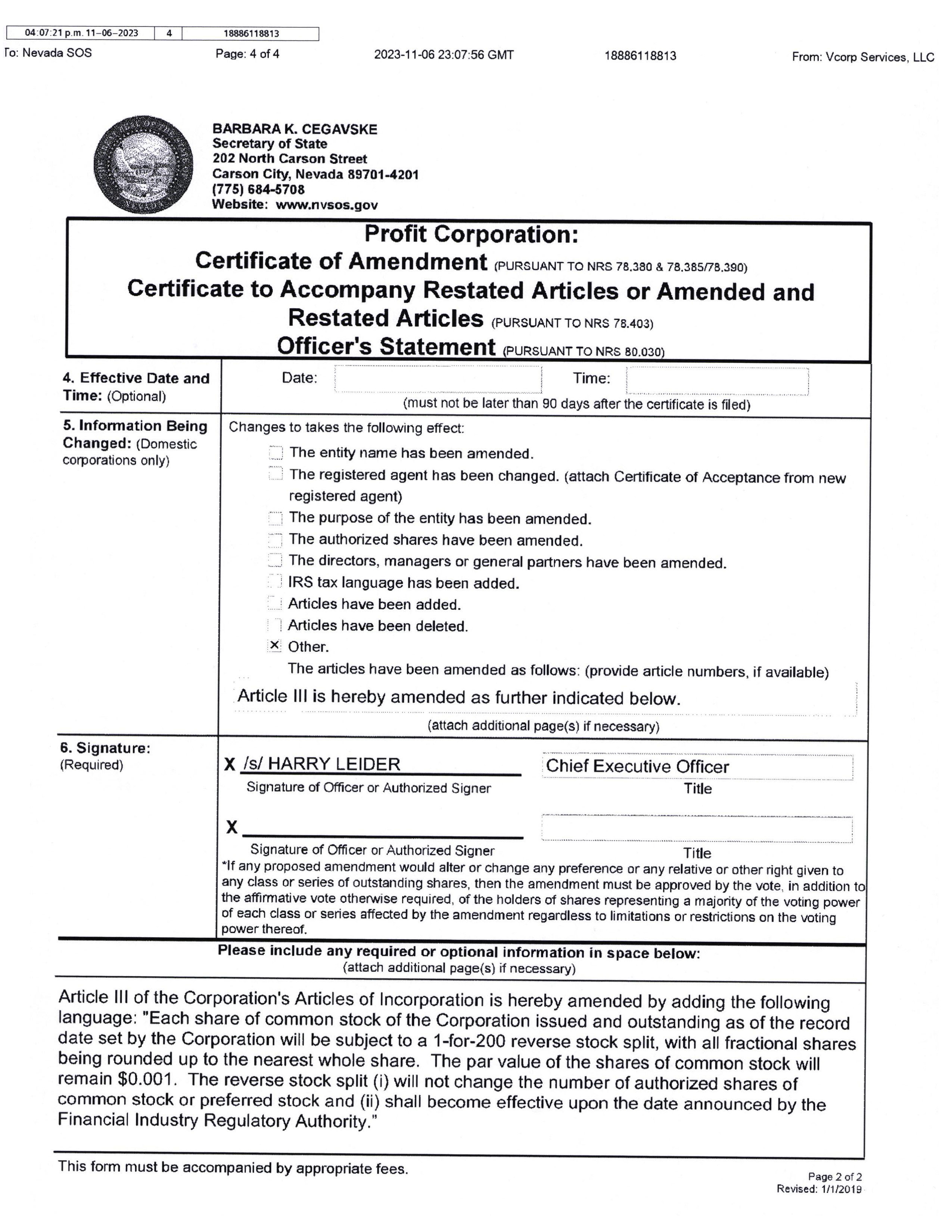

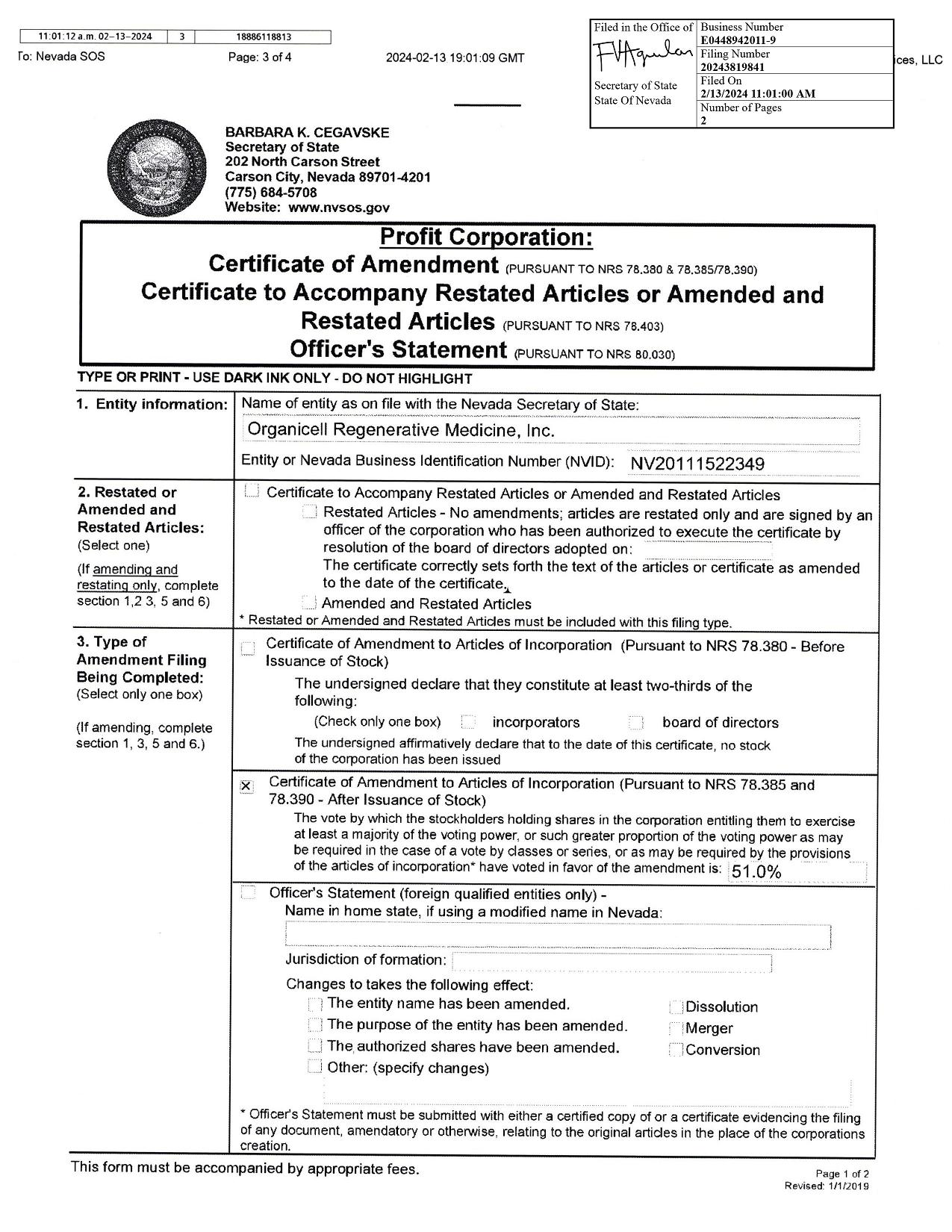

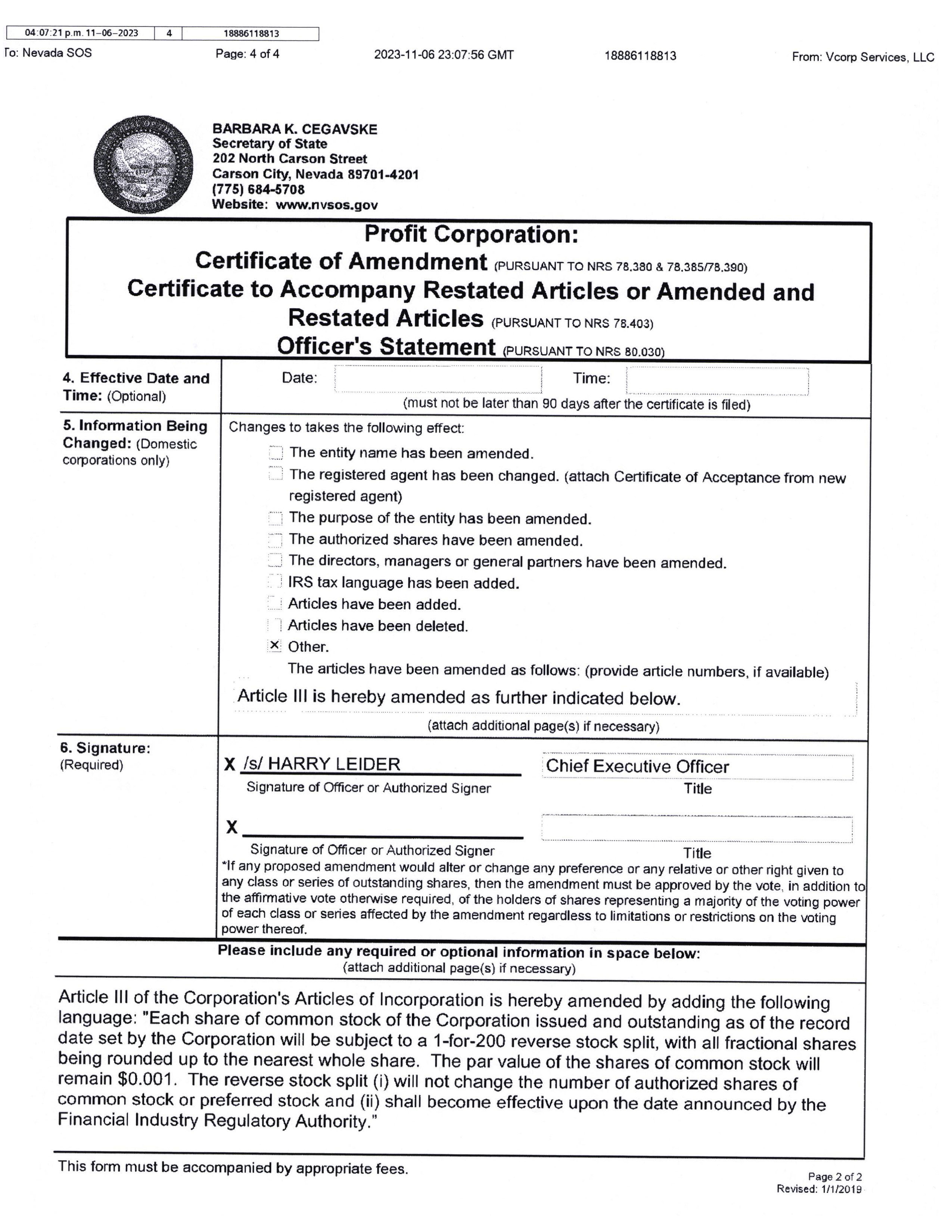

TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT Name of entity: ORGANICELL REGENERATIVE MEDICINE, INC. Entity or Nevada Business Identification Number (NVID): NV20111522349 1. Entity information: Time: For Certificate of Designation or Date: 2. Effective date and time: Amendment to Designation Only (Optional): (must not be later than 90 days after the certificate is filed) The class or series of stock being designated within this filing: SERIES C NON - CONVERTIBLE PREFERRED STOCK 3. Class or series of stock: (Certificate of Designation only) The original class or series of stock being amended within this filing: 4. Information for amendment of class or series of stock: Certificate of Amendment to Designation - Before Issuance of Class or Series As of the date of this certificate no shares of the class or series of stock have been issued. 5 . Amendment of class or series of stock : Certificate of Amendment to Designation - After Issuance of Class or Series The amendment has been approved by the vote of stockholders holding shares in the corporation entitling them to exercise a majority of the voting power, or such greater proportion of the voting power as may be required by the articles of incorporation or the certificate of designation. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes OR amends the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.* 6.Resolution: (Certificate of Designation and Amendment to Designation only) Designation being Date of Withdrawn: Designation: No shares of the class or series of stock being withdrawn are outstanding. The resolution of the board of directors authorizing the withdrawal of the certificate of designation establishing the class or series of stock: * 7. Withdrawal: X Matthew Sinnreich Date: 08/17/2022 Signature of Officer 8. Signature: (Required) BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov www.nvsilverflume.gov Certificate, Amendment or Withdrawal of Designation NRS 78.1955, 78.1955(6) Certificate of Designation Certificate of Amendment to Designation - Before Issuance of Class or Series Certificate of Amendment to Designation - After Issuance of Class or Series Certificate of Withdrawal of Certificate of Designation This form must be accompanied by appropriate fees. page1 of 1 Revised: 1/1/2019 Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20222553657 Filed On 08/17/2022 13:32:40 PM Number of Pages 5

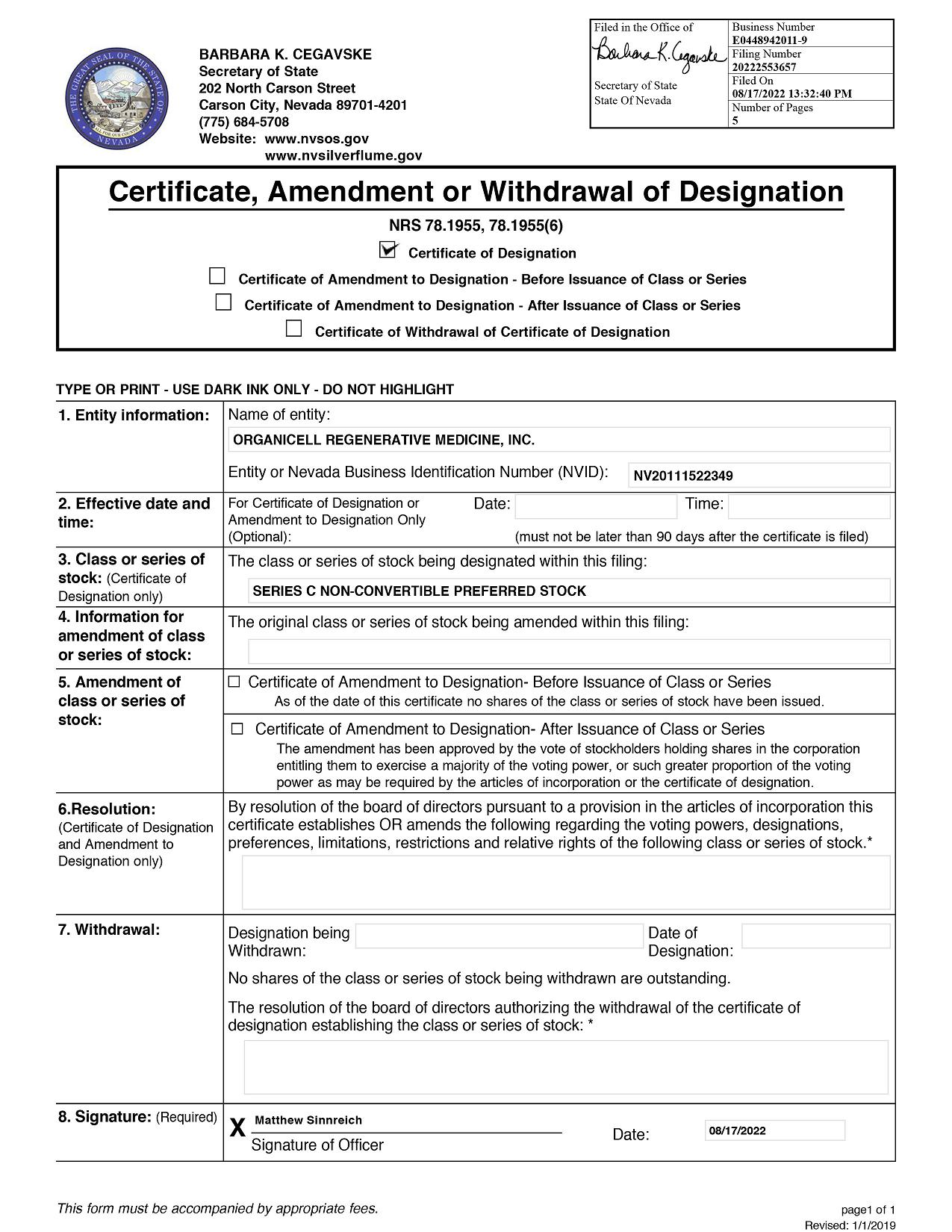

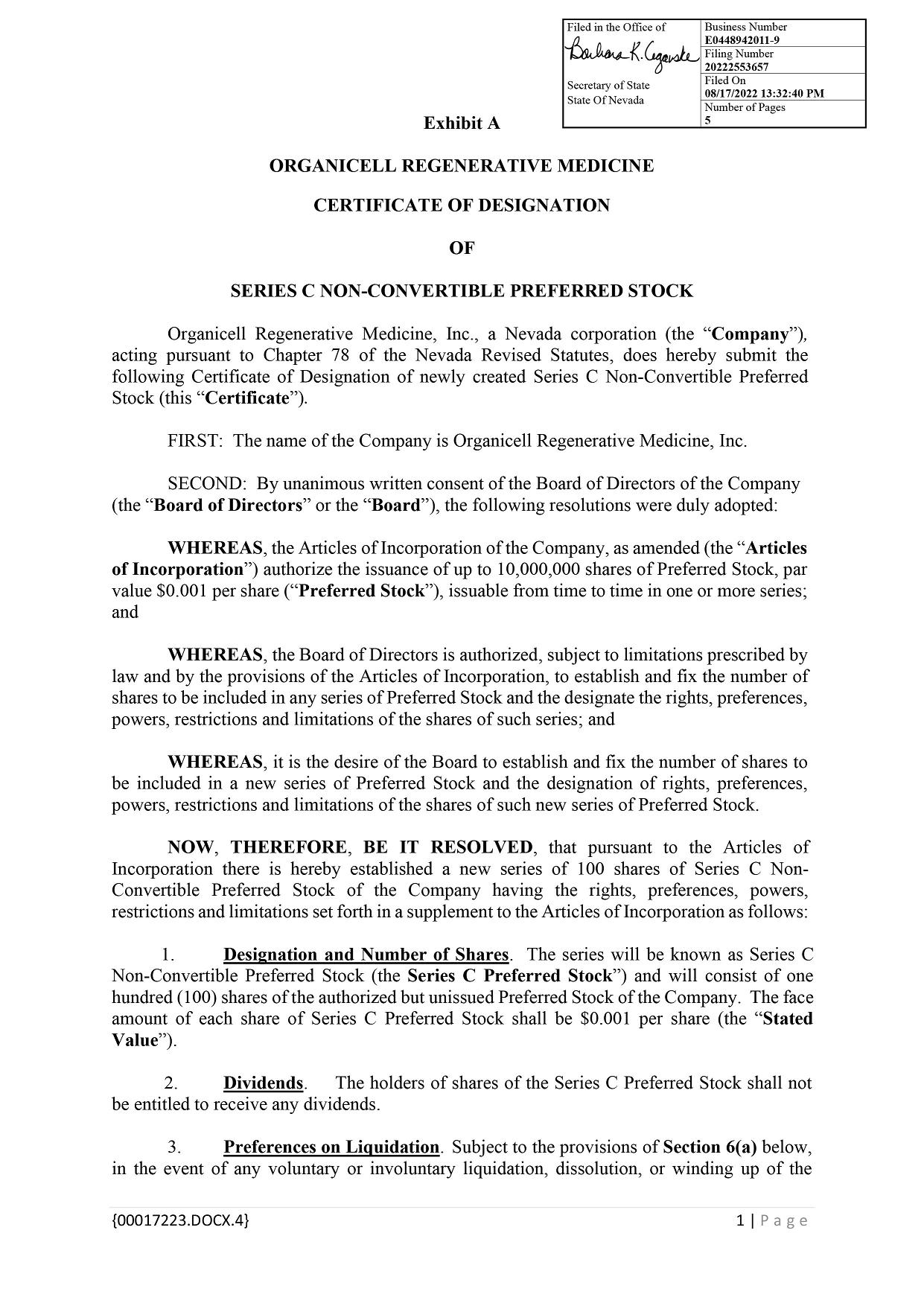

Exhibit A ORGANICELL REGENERATIVE MEDICINE CERTIFICATE OF DESIGNATION OF SERIES C NON - CONVERTIBLE PREFERRED STOCK Organicell Regenerative Medicine, Inc . , a Nevada corporation (the “ Company ”) , acting pursuant to Chapter 78 of the Nevada Revised Statutes, does hereby submit the following Certificate of Designation of newly created Series C Non - Convertible Preferred Stock (this “ Certificate ”) . FIRST: The name of the Company is Organicell Regenerative Medicine, Inc. SECOND : By unanimous written consent of the Board of Directors of the Company (the “ Board of Directors ” or the “ Board ”), the following resolutions were duly adopted : WHEREAS , the Articles of Incorporation of the Company, as amended (the “ Articles of Incorporation ”) authorize the issuance of up to 10 , 000 , 000 shares of Preferred Stock, par value $ 0 . 001 per share (“ Preferred Stock ”), issuable from time to time in one or more series ; and WHEREAS , the Board of Directors is authorized, subject to limitations prescribed by law and by the provisions of the Articles of Incorporation, to establish and fix the number of shares to be included in any series of Preferred Stock and the designate the rights, preferences, powers, restrictions and limitations of the shares of such series ; and WHEREAS , it is the desire of the Board to establish and fix the number of shares to be included in a new series of Preferred Stock and the designation of rights, preferences, powers, restrictions and limitations of the shares of such new series of Preferred Stock . NOW , THEREFORE , BE IT RESOLVED , that pursuant to the Articles of Incorporation there is hereby established a new series of 100 shares of Series C Non - Convertible Preferred Stock of the Company having the rights, preferences, powers, restrictions and limitations set forth in a supplement to the Articles of Incorporation as follows : 1. Designation and Number of Shares . The series will be known as Series C Non - Convertible Preferred Stock (the Series C Preferred Stock ”) and will consist of one hundred ( 100 ) shares of the authorized but unissued Preferred Stock of the Company . The face amount of each share of Series C Preferred Stock shall be $ 0 . 001 per share (the “ Stated Value ”) . 2. Dividends . The holders of shares of the Series C Preferred Stock shall not be entitled to receive any dividends . 3. Preferences on Liquidation . Subject to the provisions of Section 6 (a) below, in the event of any voluntary or involuntary liquidation, dissolution, or winding up of the Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20222553657 Filed On 08/17/2022 13:32:40 PM Number of Pages 5 {00017223.DOCX.4} 1 | P a g e

Company, the holders of shares of the Series C Preferred Stock then outstanding shall be entitled to be paid, out of the assets of the Company available for distribution to its stockholders, whether from capital, surplus or earnings, an amount equal to one dollar ( $ 1 . 00 ) per share . 4. Voting Rights . Except as otherwise required by law or by the Articles of Incorporation and except as set forth in Section 6 (b) below, the outstanding shares of Series C Preferred Stock shall vote together with the Company’s outstanding shares of Common Stock and other voting securities of the Company as a single class and, each the total of all shares of Series C Preferred Stock outstanding shall represent 51 percent ( 51 % ) of all votes entitled to be voted at any annual or special meeting of stockholders of the Company or action by written consent of stockholders . 5. No Impairment . The Company will not, by amendment to the Articles of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Company, but will at all times in good faith assist in the carrying out of all the provisions of the Articles of Incorporation and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the holders of the Series C Preferred Stock against impairment . 6. Ranking; Changes Affecting Series. (a) The Series C Preferred Stock shall, with respect to distribution rights on liquidation, winding up and dissolution, (i) rank senior to any of the shares of Common Stock of the Company, and any other class or series of stock of the Company which by its terms shall rank junior to the Series C Preferred Stock ; and (ii) rank junior to any other series or class of preferred stock of the Company and any other class or series of stock of the Company which by its term shall rank senior to the Series C Preferred Stock . (b) So long as any shares of Series C Preferred Stock are outstanding, the Company shall not (i) alter or change any of the powers, preferences, privileges or rights of the Series C Preferred Stock : or (ii) amend the provisions of this Section 6 ; in each case, without first obtaining the approval by vote or written consent, in the manner provided by law, of the holders of at least a majority of the outstanding shares of Series C Preferred Stock, as to changes affecting the Series C Preferred Stock . 7. Redemption . The Series C Preferred Stock held by a holder thereof (the “ Holder ”) shall be automatically redeemed by the Company and cease to be outstanding at a redemption price of $ 1 . 00 per share, at such time as the Holder (a) no longer beneficially owns more than fifty percent ( 50 % ) of (i) the shares of Common Stock of the Company purchased by the Holder pursuant to that certain Securities Purchase Agreement dated August , 2022 , by and among the Company, Skycrest Holdings, LLC and Greyt Ventures, LLC ; and (ii) the Warrants issued by the Company to the Holder pursuant to a Consulting Services Agreement dated August , 2022 and the shares of Common Stock of the Company issued or issuable or pursuant to exercise of the Warrants ; or (b) if the Holder transfers or attempts to transfer ownership of the shares of Series C Preferred Stock to any third party, other than by the laws of descent and distribution . {00017223.DOCX.4} 2 | P a g e

8. No Conversion . The Series C Preferred Stock is not convertible into Common Stock or any other capital stock of the Company . 9. Protective Provisions . So long as any shares of Series C Preferred Stock are outstanding, the Company shall not, without first obtaining the approval (by vote or written consent, as provided by Chapter 78 of the Nevada Revised Statutes) of the Holders of at least a majority of the then outstanding shares of Series C Preferred Stock : (a) alter or change the rights, preferences or privileges of the Series C Preferred Stock ; (b) alter or change the rights, preferences or privileges of any capital stock of the Company so as to affect adversely the Series C Preferred Stock ; (c) create any new class or series of capital stock having a preference over the Series C Preferred Stock as to distribution of assets upon liquidation, dissolution or winding up of the Company (as previously defined, “ Senior Securities ”) ; (d) create any new class or series of capital stock ranking pari passu with the Series C Preferred Stock as to distribution of assets upon liquidation, dissolution or winding up of the Company (as previously defined, “ Pari Passu Securities ”) ; (e) increase the authorized number of shares of Series C Preferred Stock; (f) issue any shares of Series C Preferred Stock other than pursuant to the Securities Purchase Agreement with the original parties thereto ; (g) issue any additional shares of Senior Securities; or (h) redeem, declare or pay any cash dividend or distribution on, any Junior Securities. If holders of at least a majority of the then outstanding shares of Series C Preferred Stock agree to allow the Company to alter or change the rights, preferences or privileges of the shares of Series C Preferred Stock pursuant to subsection (a) above, then the Company shall deliver notice of such approved change to the Holders of the Series C Preferred Stock that did not agree to such alteration or change . 10. Merger, Consolidation, Etc. (a) If at any time or from time to time there shall be (i) a merger, or consolidation of the Company with or into another corporation, (ii) the sale of all or substantially all of the Company’s capital stock or assets to any other person, (iii) any other form of business combination or reorganization in which the Company shall not be the continuing or surviving entity of such business combination or reorganization, or (iv) any transaction or series of transactions by the Company in which in excess of fifty percent ( 50 % ) of the Company’s voting power is transferred (each, a “ Reorganization ”), then as a part of such Reorganization, provision shall be made so that the holders of the Series C Preferred Stock shall thereafter be entitled to receive the same kind and amount of stock or other securities or {00017223.DOCX.4} 3 | P a g e

property (including cash) of the Company, or of the successor corporation resulting from such Reorganization. (b) The provisions of this Section 10 are in addition to and not in lieu of the provisions of Section 2 hereof. 11 . Lost or Stolen Certificates . Upon receipt by the Company of (a) evidence of the loss, theft, destruction or mutilation of any Preferred Stock Certificate(s) ; (b) in the case of loss, theft or destruction, of indemnity reasonably satisfactory to the Company ; or (c) in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Company shall execute and deliver new Preferred Stock Certificate(s) of like tenor and date . IN WITNESS WHEREOF , this Certificate of Designation is executed on behalf of the Company by its Authorized Officer this 17th day of August, 2022. By: /s/ Matthew Sinnreich Matthew Sinnreich, Acting CEO {00017223.DOCX.4} 4 | P a g e

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20211232319 Filed On 2/10/2021 3:13:00 PM Number of Pages 1

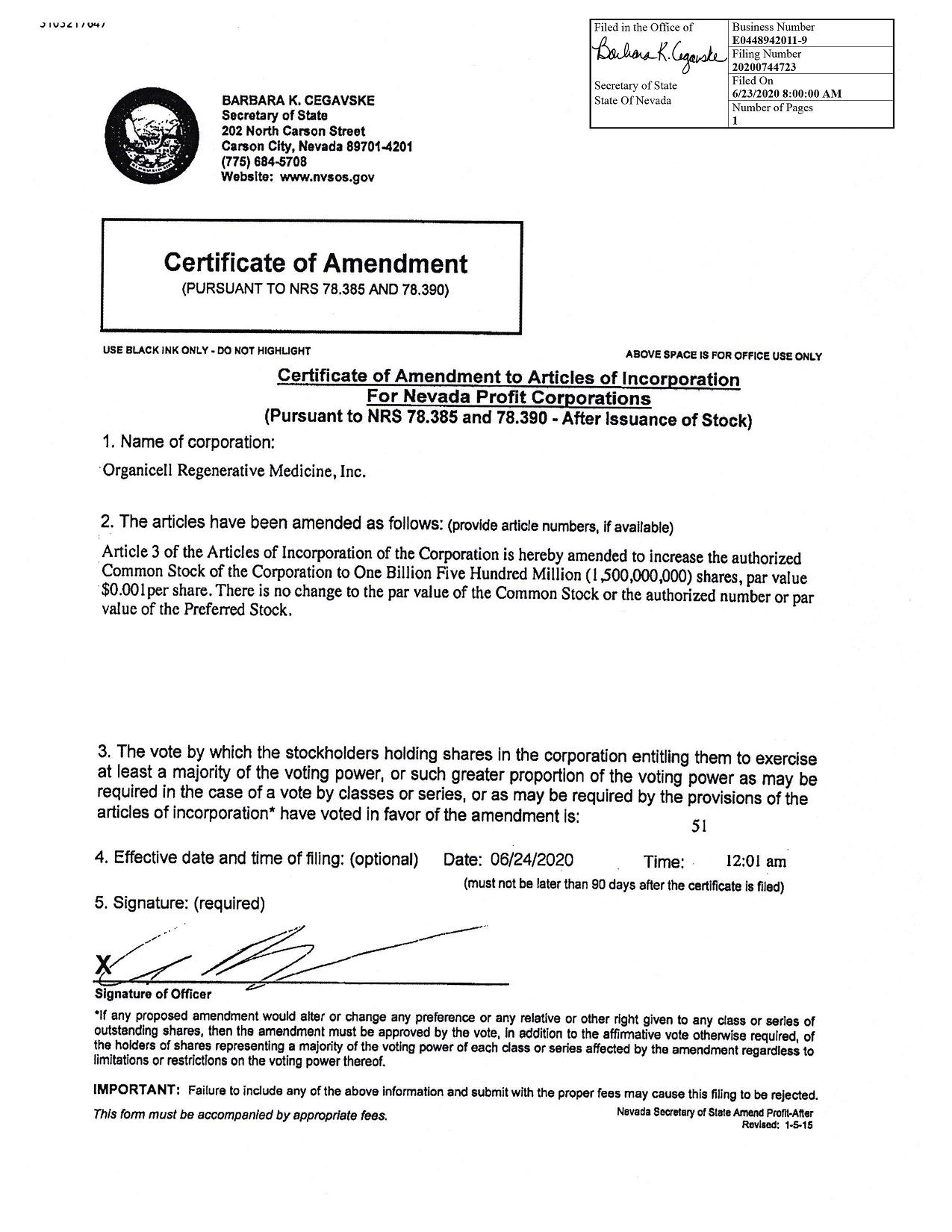

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20200744723 Filed On 6/23/2020 8:00:00 AM Number of Pages 1

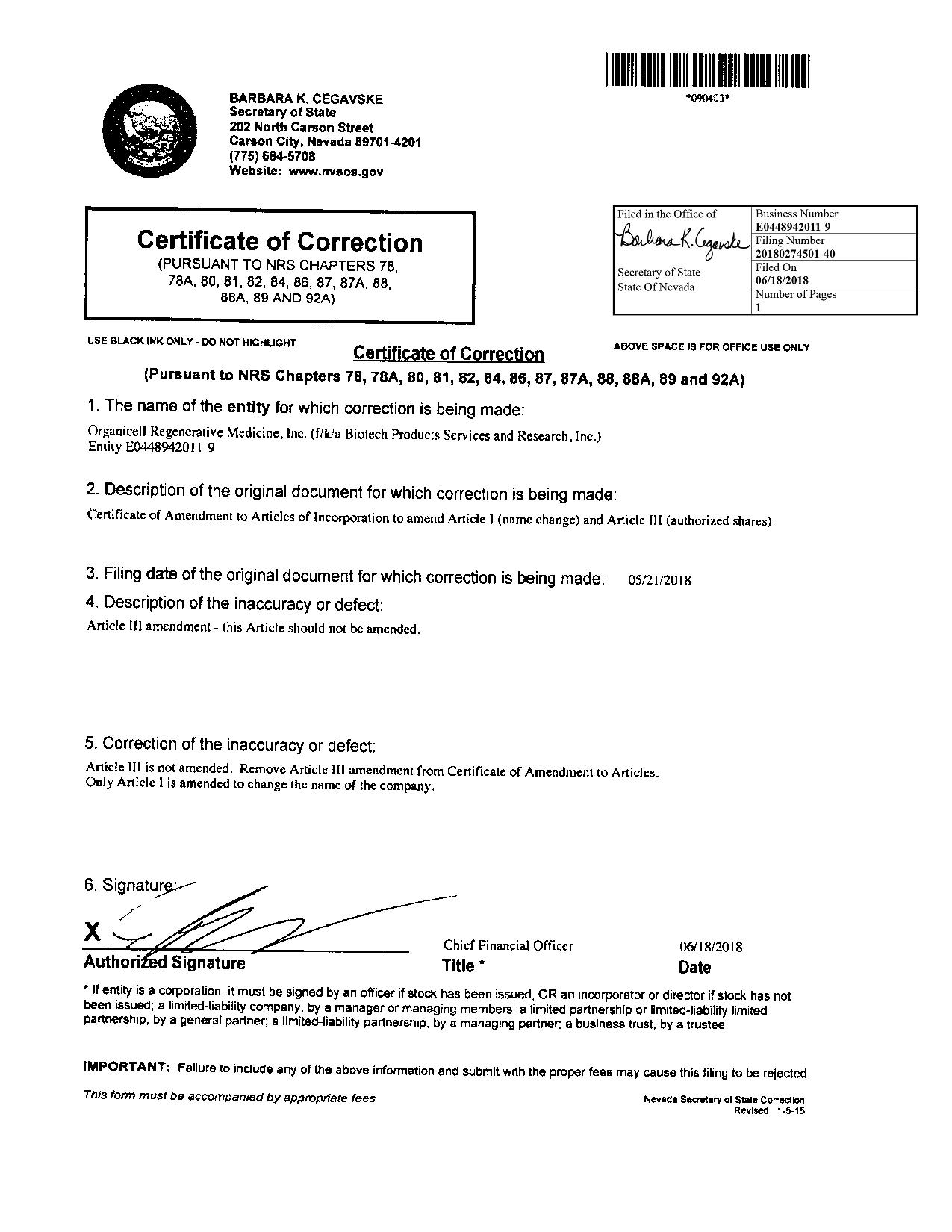

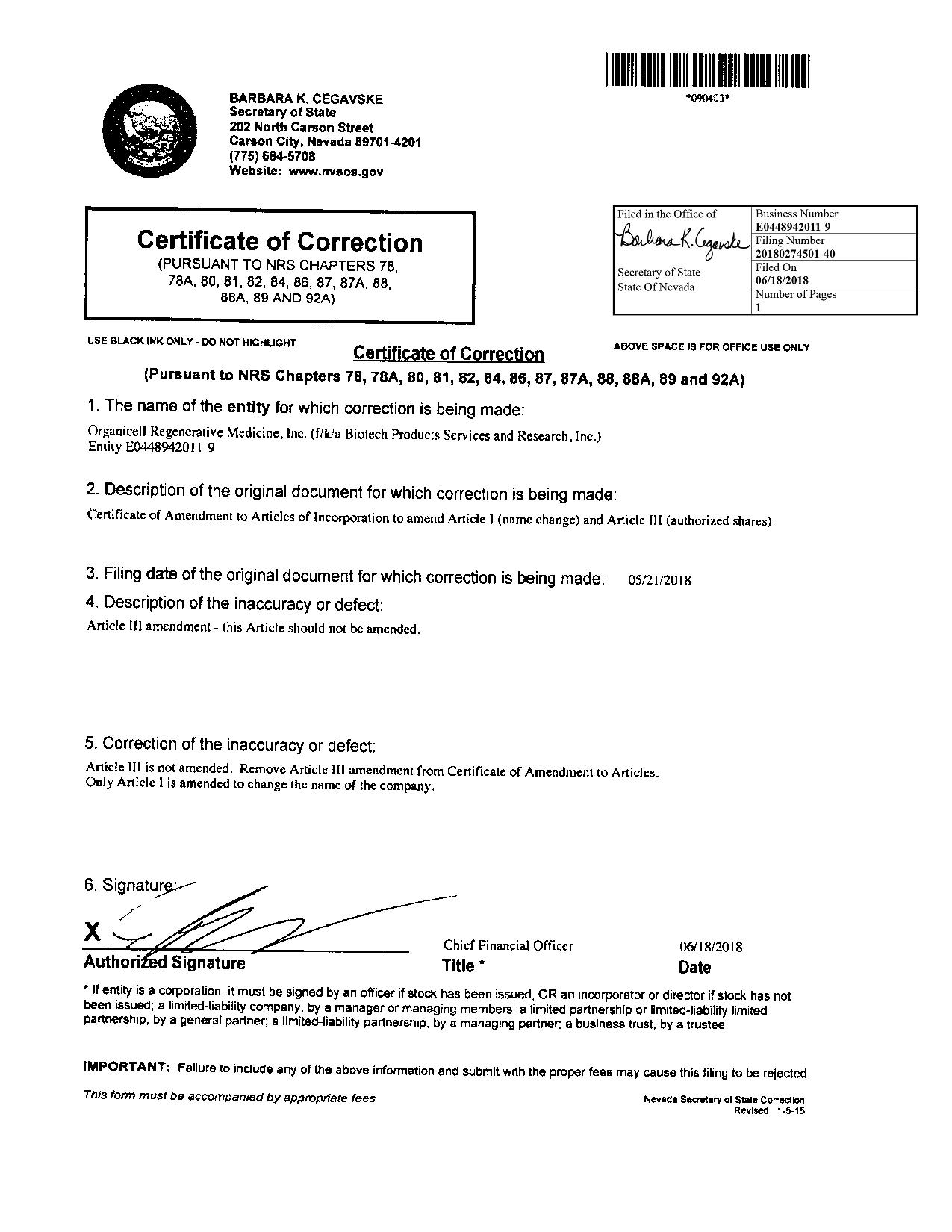

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20180274501 - 40 Filed On 06/18/2018 Number of Pages 1

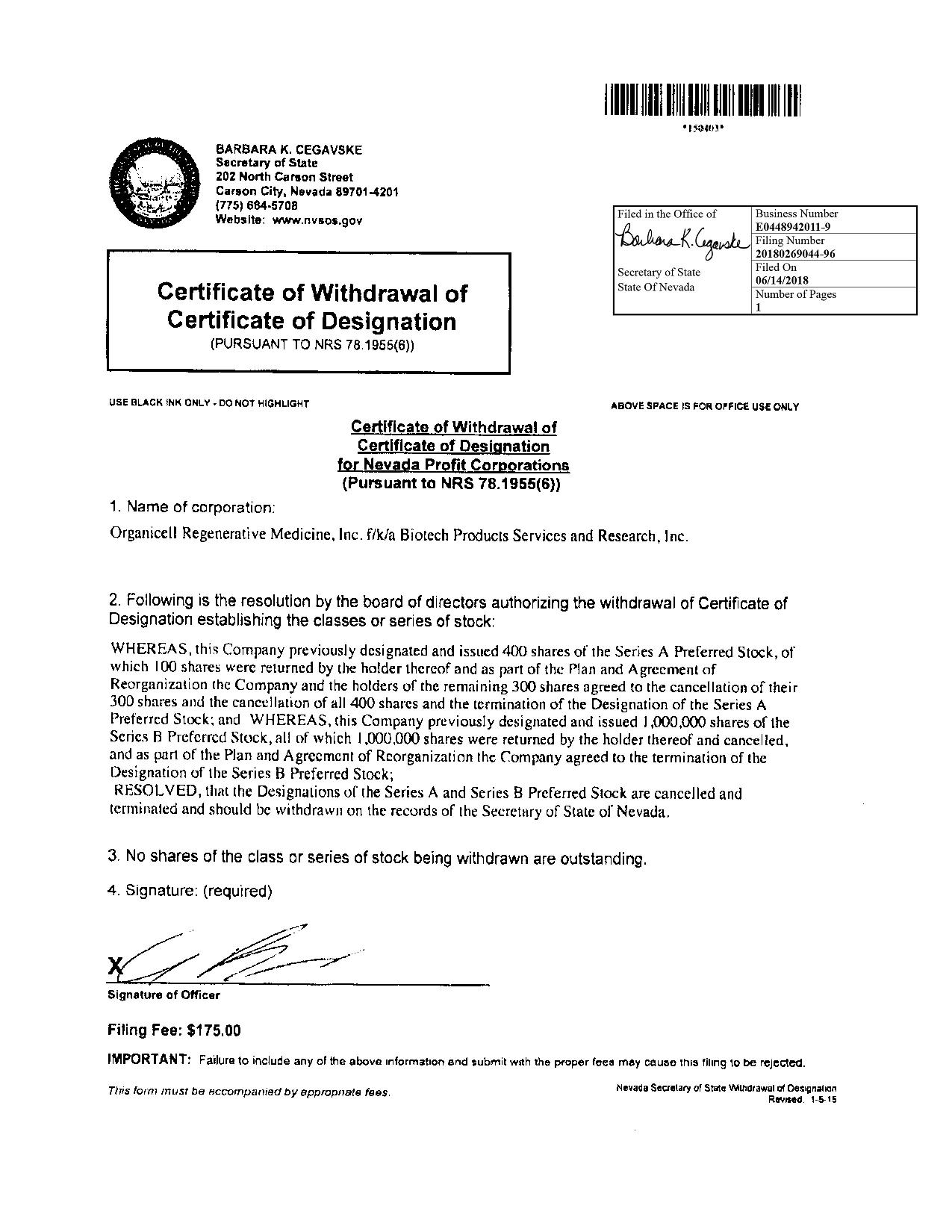

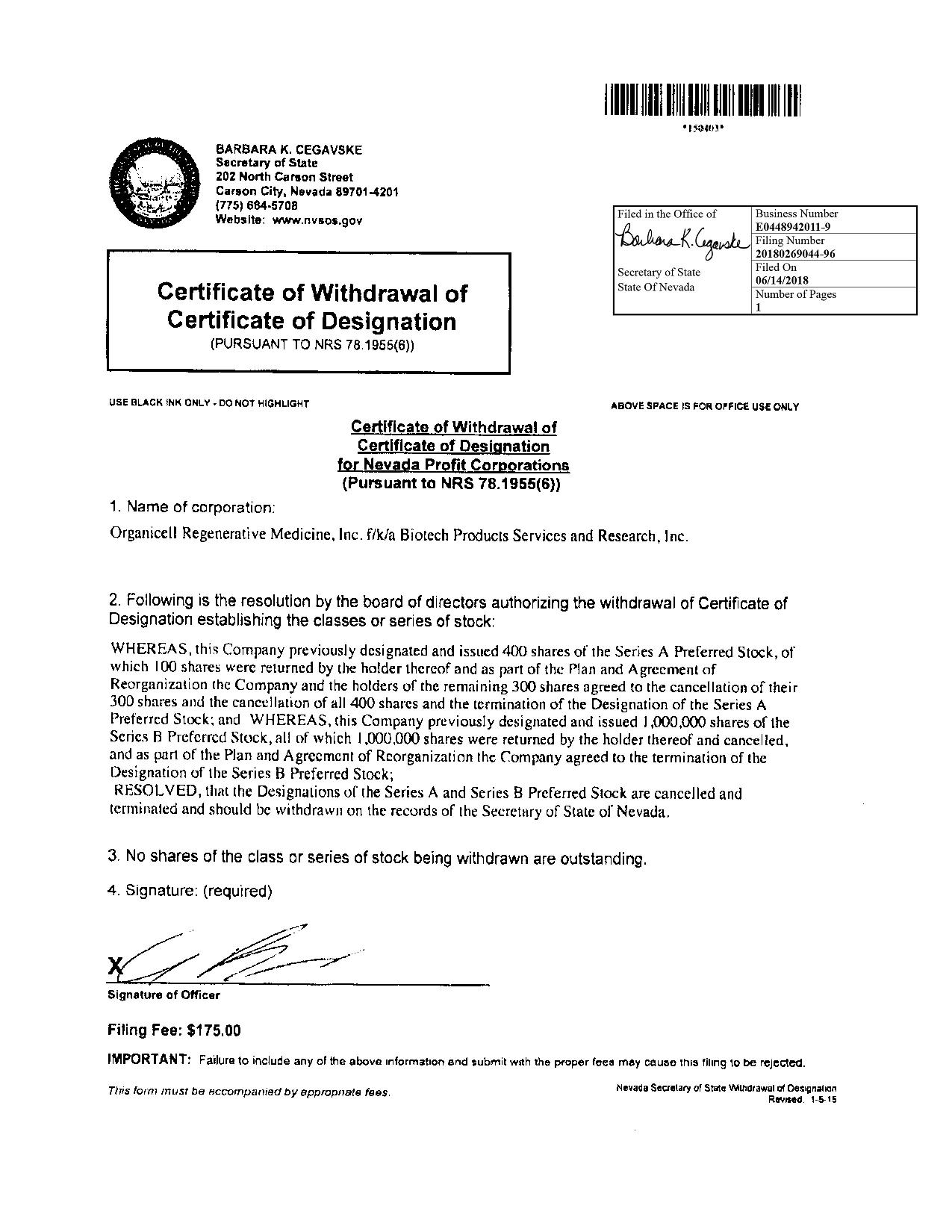

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20180269044 - 96 Filed On 06/14/2018 Number of Pages 1

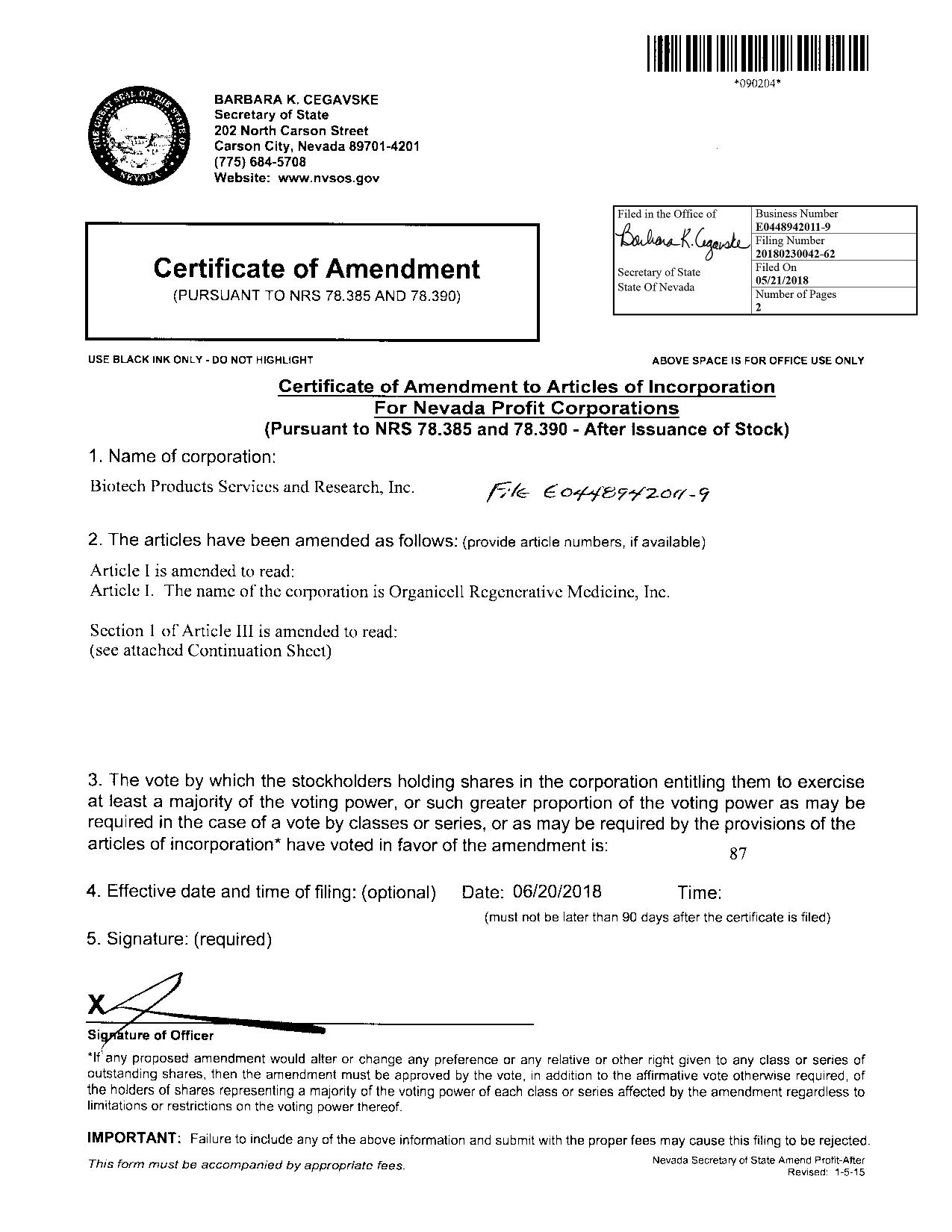

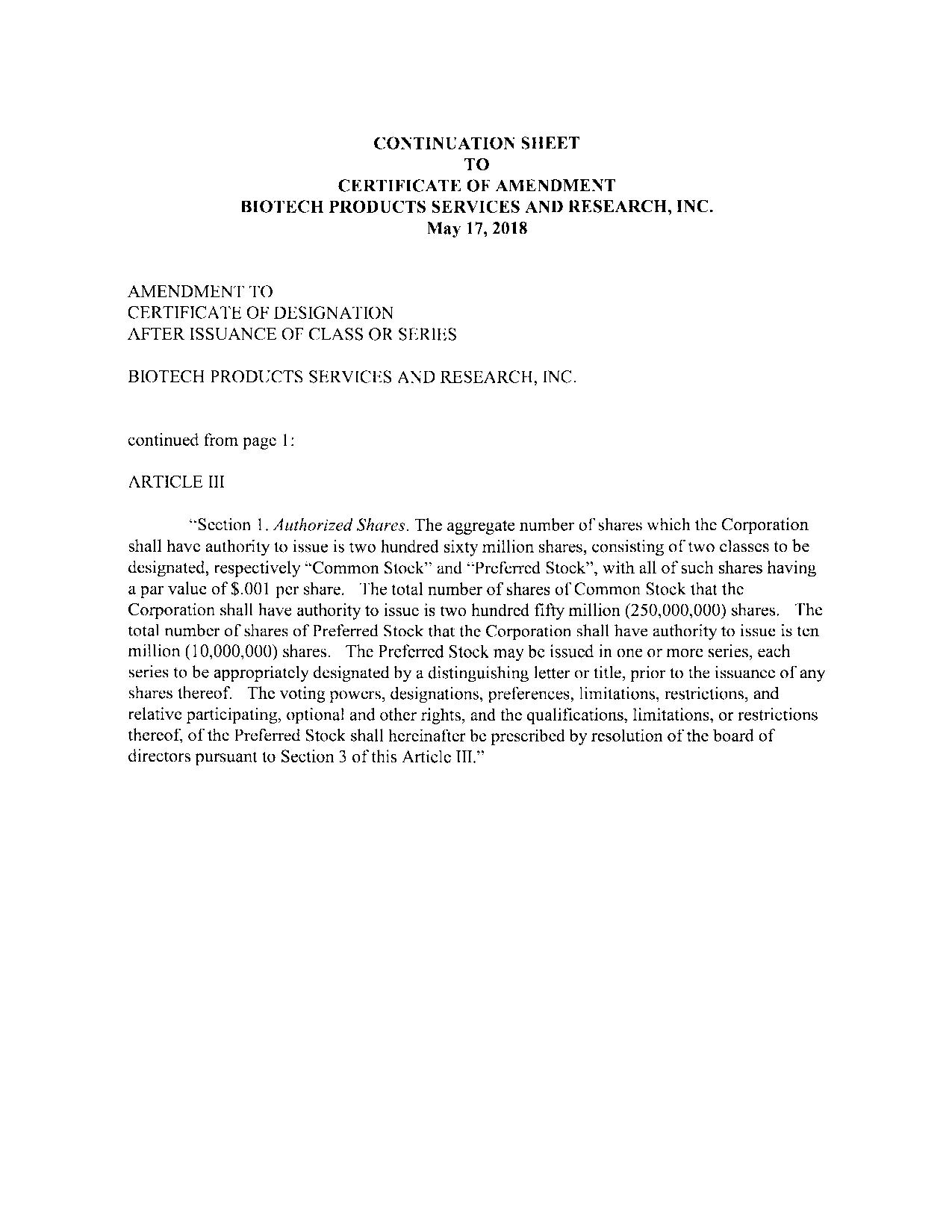

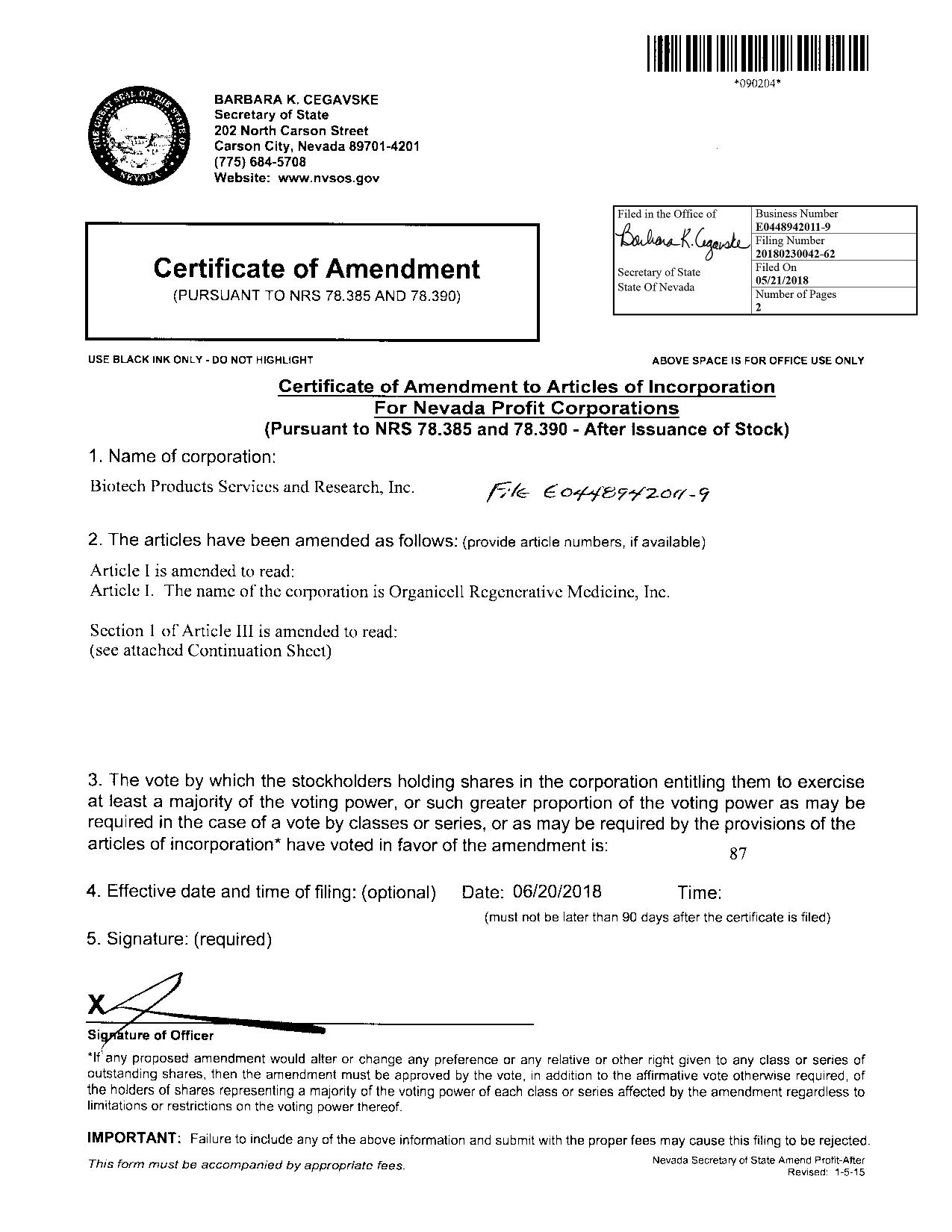

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20180230042 - 62 Filed On 05/21/2018 Number of Pages 2

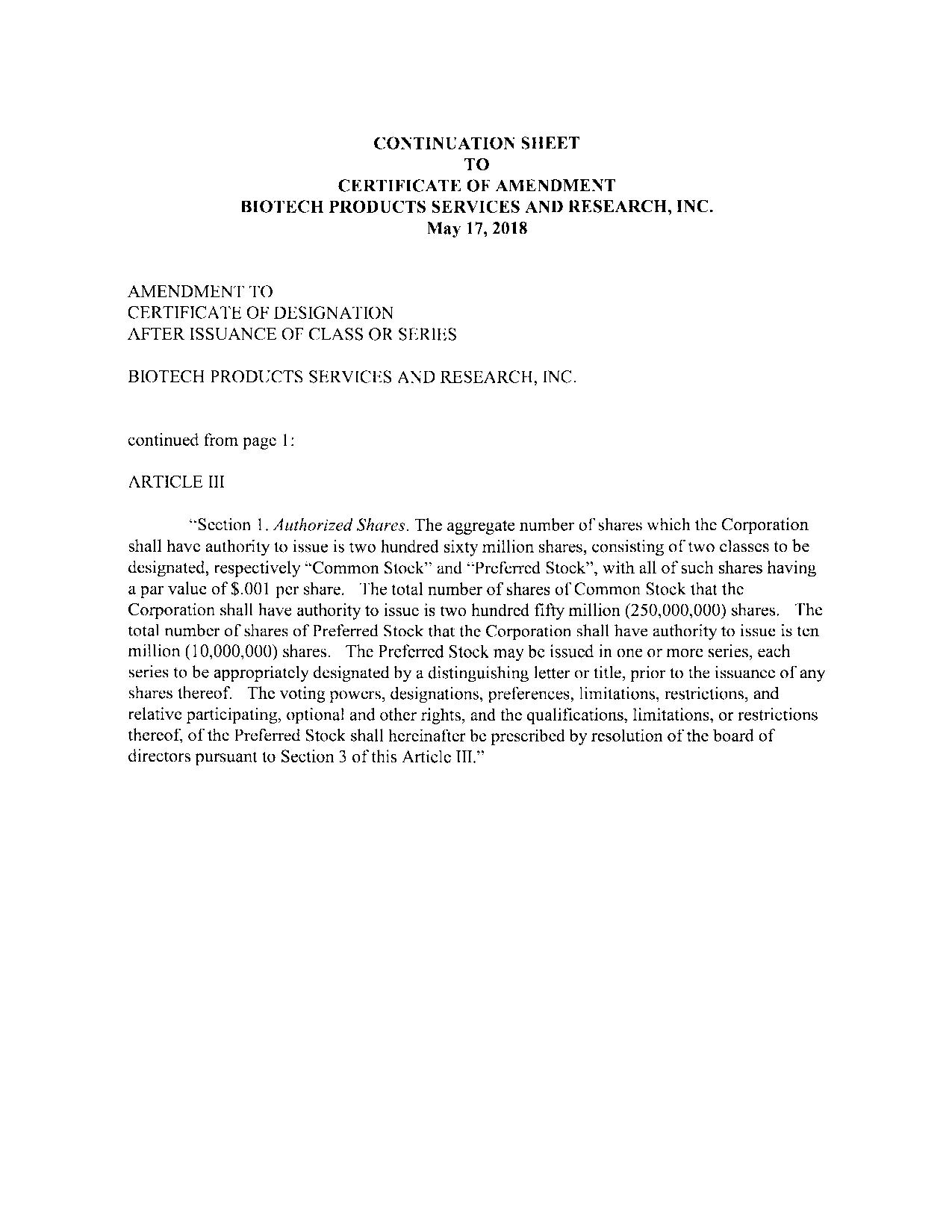

COl \ TINCATIOl \ SIIEET TO CERTIFICATE OF AMENDME'.'/T BIOTECH PRODUCTS SERVICES AND RESEARCH, INC. May 17, 2018 AMENDMENT TO CERTIFICATE OF DESIGNATION AFTER ISSUANCE or CLASS OR SERIES BIOTECH PROD!:CTS SERVICES A: \ D RESEARCH, INC. continued from page I: ARTICLE lll ··Section 1. Authorized Shares. The aggregate number or shares which the Corporation shall have authority to issue is two hundred sixty million shares, consisting of two classes to be designated, respectively ··common Stock'" and ··Prcfr:rrcd Stock", with all of such shares having a par value of $.001 per share. ·1·he total number of shares of Common Stock that the Corporation shall have authority to issue is two hundred fifty million (250,000,000) shares. ·rhc total number of shares of Preferred Stock that the Corporation shall have authority to issue is ten million(] 0,000,000) shares. The Preferred Stock may be issued in one or more series, each series to be appropriately designated by a distinguishing letter or title, prior to the issuance of any shares thereof. The voting powers, designations, preferences, limitations, restrictions, and relative participating, optional and other rights, and the qualifications, limitations, or restrictions thereof of the Preferred Stock shall hereinafter be prescribed by resolution of the board of directors pursuant to Section 3 of this Article TTL''

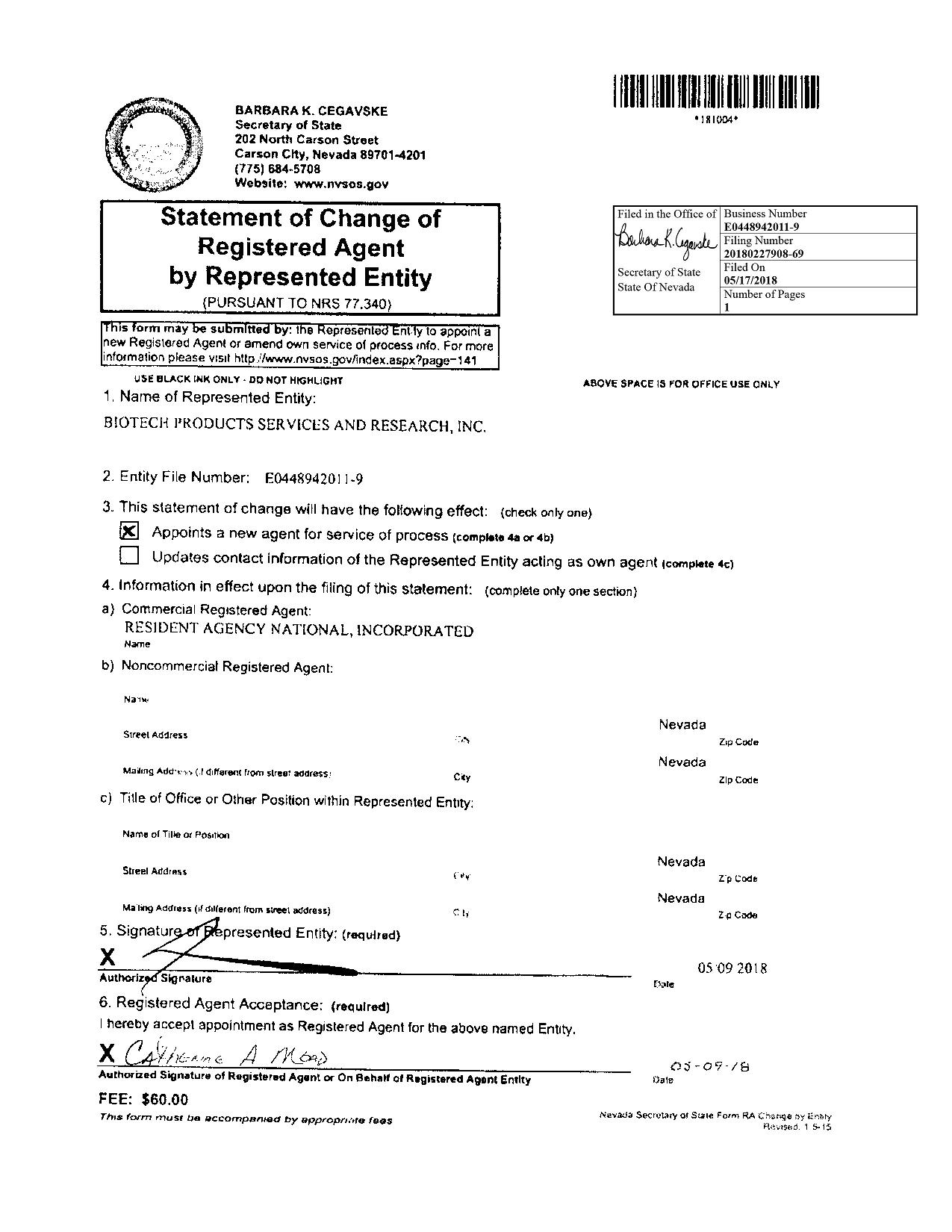

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20180227908 - 69 Filed On 05/17/2018 Number of Pages 1

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20170268311 - 91 Filed On 06/22/2017 Number of Pages 1

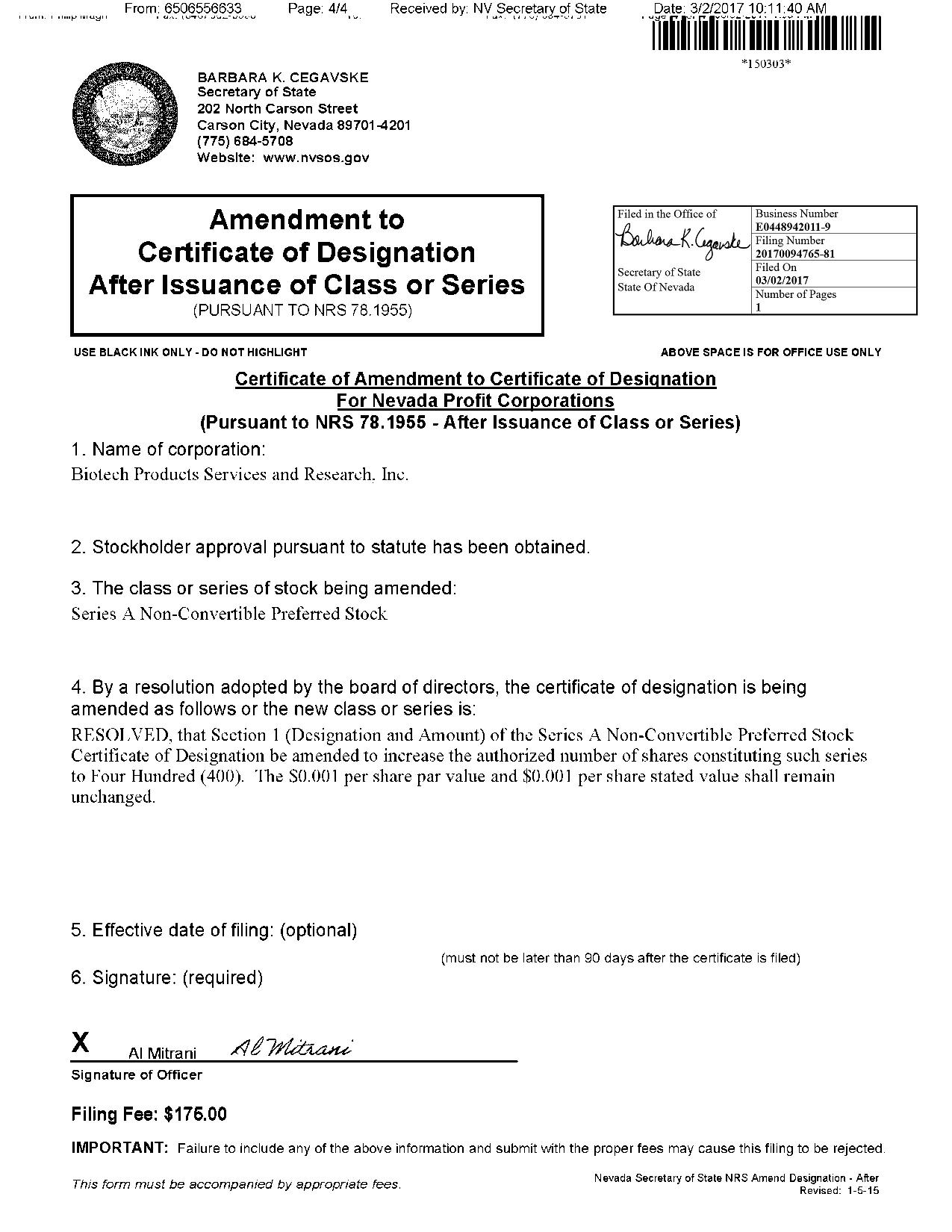

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20170094765 - 81 Filed On 03/02/2017 Number of Pages 1

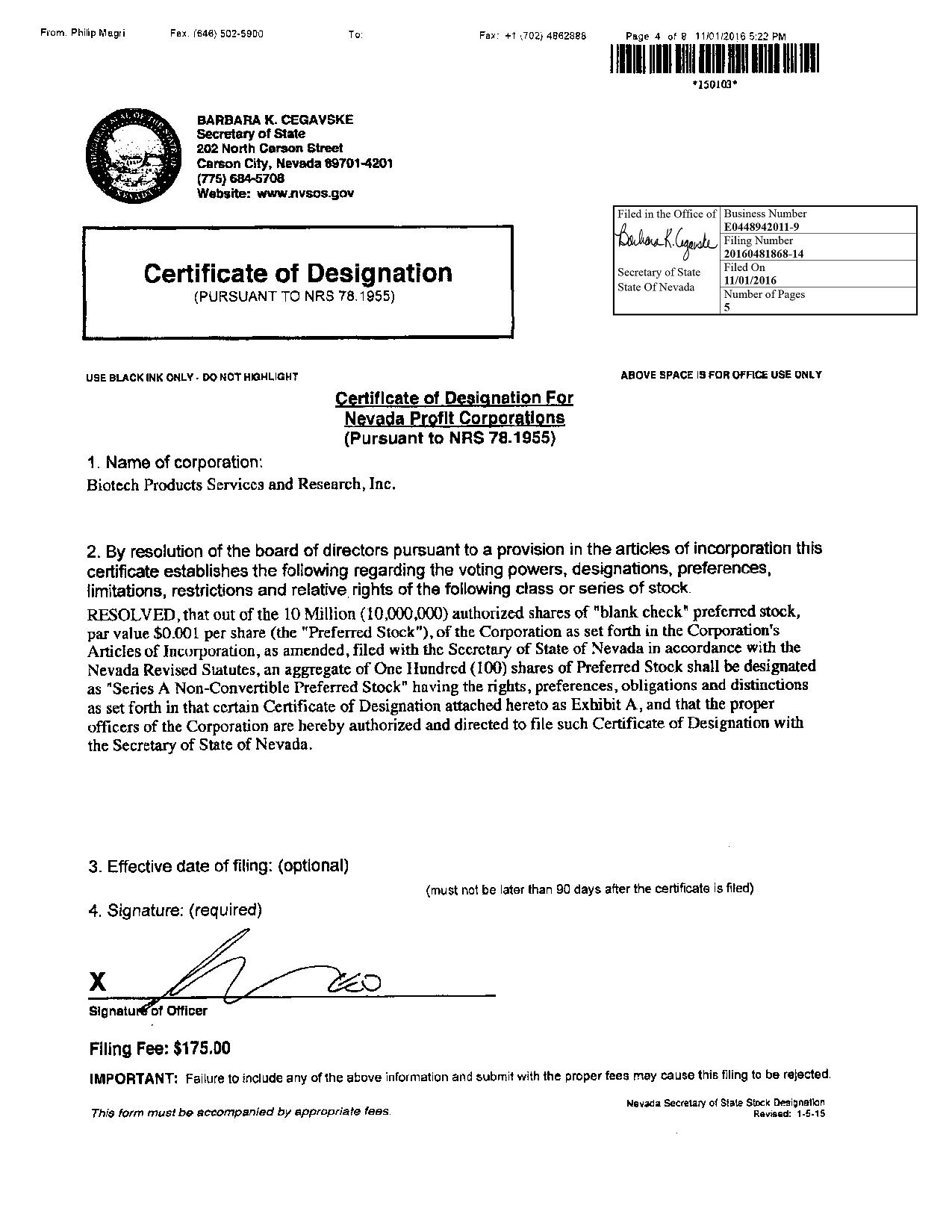

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20160481868 - 14 Filed On 11/01/2016 Number of Pages 5

F1om Philip Megri Fu /64 ) 502 - 5900 fo P g S o/8 111()1120165:Z PM Exhibit A CERTIFICATE OF THE UESJG: - ,JATIONS, POWERS, PREft'EREJ' \ 'CES A"iD RIGHTS OF THE SERIF,S A N'O: - ,J - COJ'li"VERTIBLE PREFERRED STOCK ($0.001 PAR VALUI<: P:rn SHARI•:) OF BIOTECII PRODUCTS SF,RVICES A'•m RESEARCH, l'. \ 'C. (a evada corporation) Pursuant to the - : - .revada Revised Statutes and the bylaws of BIOTECH PRODUCTS SERVICES A D RESEARCH, INC., a corporation orgamzed and existing under the laws of the state of Nevada (the "Corporation"), the Corporation does hereby submit the following. WHEREAS, the Articles of Incorporation of the Corporation (the "Art ides of Incorporation") authonzes the issuance of up to 10,000.000 shares of preforrcd stock. par value $0.001 per share, of the Corporation ("Preferred Stock") in one or more series, and expressly authorizes the Board of Directors of the Corporation (the "Board"), su ject to limitations prescribed by law. to provide, out of the unissued shares of Preferred Stock for series of Preferred Stock, and, with respect to each such series, to establish and fix the number of shares to be included in any series of Preferred Stock and the designation, nghts, preferences, powers, restrictions and limitations of the shares of such sencs, and \ 1/HERRAS, it 1s the desire of the Board to establish a ne \ .v senes of Preferred Stock to be designated "Series A Non - Convertible Preferred Stock" consisting of 100 shares and havmg the 11ghts, preferences and limitations set forth herein .' \ 'OW, THEREFORE, BE IT RESOLVED, that the Board does hereby establish a series of Preferred Stock designated as "Series A :Kon - Convertible Preferred Stock" and does hereby in this Certificate of Designation (the "Certificate of Designation") establish and fix and herein state and express the designation, rights, preferences, powers, restrictions and limitations of such series of Preferred Stock as follows: 1. Des1gnat10n and Amow1t. This series of Preferred Stock shall be designated "Series A : \ "on - Converti hie Preferred Stock" and the authorized number of shares constituting such series shall be One Hundred ( 100 ) The par value of the Senes A Non - Convertible Preferred Stock shall be SO 001 per share . Shares of the Senes A Non Convertible Preferred Stock shall have a stated value of $ 0 . 001 per share (the "'Stated Value'') .

F1om Philip Magri Fa . 1646) 50 - 5900 fo Fa,, +1 ,702.' 48628S8 Page 6 of8 11/01l201652 PM The holders of shares of Series A ! \ on - Convertible Preferred Stock shall not be entitled to receive any dividends . 3. Preferences on Liquidation. Subject to the pruvJS 1 ons of Section 6 (a) below, in the event of any voluntary or involuntary liquidation, dissolution, or winding up of the Corporation, the holders of shares of the Senes A Non Convertible Preferred Stock then outstanding shall be entitled to be paid, out of the assets of the Corporation available for distribution to its stockholders, whether from capital, surplus or eammgs, an amount equal tu one dolbr ( $ 1 00 ) per shMe . 4. Voting Rights. Except as otherwise required by law or by tht : Articles of Incorporation and except as , ; et forth in Section 6 (b) below, the outstanding shares of Sencs A "' . 'l"on - Convert 1 ble Preferred Stock shall vote together with the shares of Common Stock and other voting securities of the Corporation 11 s a single class and, regardless of the number of shares of Senes A Kon - Convertible Preferred Stock outstanding and as long as at least one of such shares of Series A Non - Convertible Preferred Stock is outstanding, shall represent eighty percent ( 80 % ) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders Each out tanding share of the Senes A ' \ 'on - Convertible Preferred Stock shall represent its proportionate share of the 80 % which is allocated to the outstanding shares of Series A Kon - Convertible Preferred Stock . 5. :'Jegll:tivc Coven_<.!_nts The Corporation will not, by amendment of the Articles of Incorporat 10 n or through any reorganization, tr 11 nsfcr of assets, consolidation, merger, dissolution . issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times m good faith assist in the carrying out of all the provisions of this Articles of Incorporation and m the taking of all such action as may be necessary or appropriate in order to protect the rights of the holders of the Series A . I \ on Convertible Preferred Stock against unpairment . 6. Ranking; Chan_ges t_ \ :ffccting Se_ries. (a) The Series A} \ ."on - Convertible Preferred Stock shall, with respect to distribution nghts on liquidation, winding up and dissolution, (i) rank senior to any of the shMes of Common Stock of the Corporation, and any other class or series of stock of the Corporation which by its terms shall rank.Junior to the Scncs A :'. \ "on - Convertible Preferred Stock, and (ii) rankjumor to any other senes or class of preferred stock of the Corporation and any other class or series of stock of the Corporation which by its term shall rank senior to the Series A '."Jon - Convertible Preferred Stock. (b) So long as any shares of Scnes A Non - Convertible Preferred Stock are outstanding, the Corporation shall not (i) alter or change any of the powers, preferences, privileges or rights of the Series A Non - Convertible Preferred Stock, or (ti) amend the provmons of this Section 6; m each case, without first obtaining the approval by vote or written consent, m the manner provided by law, of the holders oLlt least a majonty of the outstandmg shares of Series A "'.'l"on - Convertible Preferred Stock, as to changes affecting the Series A ' \ "on - Convertible Preferred Stock. 2

From. Ph1l1p Magri 3 Fax. /646) 502 - 5900 fo Fa, -- +1 17021 4H62888 Page 7 or a 1'10112016 5·2:? PM 7. ' \ lo Redemption The shares of the Series A Non - Convertible Preferred Stock are not redeemable. 8. Protection Prov1s1ons. So long as any shares of Sencs A on - Convertible Preferred Stock are outstandmg, the Corporation shall not, without first obtaining the approval (by vote or written consent, as provided by the : \ cvada Business Corporation Act) of the Holders of at least a majority of the then outstandmg shares of Series A Non - Convertible; Preferred Stock: (a) alter or change the rights, preferences or privileges of the Series A Non - Convertible Preferred Stock; (b) alter or change the rights, preferences or pnv1lcgcs of any capital stock of the Corporation so as to affect adversely the Senes A Non - Convertible Preferred Stock; (c) create any new class or series of capital stock having a preference over the Series A :' \ /on Convertible Preferred Stock as to distribution of assets upon liquidation, dissolution or winding up ofthe Corporation (as previously defined, "Senior Securities"); (d) create any new class or series of capital stock ranking pari passu with the Senes A Non Convertible Preferred Stock as to distribution of assets upon liquidation, dissolution or wmding up of the Corporation (as previously defined, "Pari Passu Securities''), (e) increase the authorized number of shares of Senes A Kun - Convertible Preferred Strn.:k; (f) issue any shares of Sencs A Non - Convertible Preferred Stock other than pursuant to the Securities Purchase Agreement with the original parties thereto; (g) issue any additional shares of Senior Securities, or (h) redeem, or declare or pay any cash drvidend or distribution on, any Jumor Securities. If holders of at least a maJority of the then outstanding shares of Series A 1 \ "on - Convcrtrble Preferred Stock agree to allow the Coiporation to alter or change the rights, preferences or pnvilcgcs of the shares of Senes A Non - Convertible Preferred Stock pursuant to subsection (a) above, then the Corporation shall deliver notice of such approved change to the Holders of the Senes A Non - Convertible Preferred Stock that did not agree to such alteration or change (the "Dissenting Holders"). 9. Merger, Consolidation, Etc. (a) If at any time or from time to time there shall be (i) a merger, or consolidation of the Corporation with or into another corporation, (ii) the sale of all or substantially all of the Corporation's c . apital stock or assets to any other person, (iii) any other form of business combination or reorgamzation

Frnm Philip Magri 4 Fu. (646 \ 502 - 5900 fo. Fu +1 17D2J 4862888 Page a of a 1110112nm 5 22 PM in which the C - 0rporation shall not be the continuing or surviving entity of such busmess combinatrnn or reorgamzation, or (iv) any transaction or series of transactions by the Corporation in which in excess of 50 percent of the Corporation's voting power is transferred (each, a '"Reorganization"), then as a part of such Reorganization, provision shall be made so that the holders of the Series A "'.'Jon - Convertible Preferred Stock shall thereafter be ent1tkd to n:ceivc the same kind and amount of stock or other securities or property (mcluding cash) of the Corporation, or of1he successor corporation resulting from such Reorgamzatmn (b) The provmons of this Section 9 are in addition to and not m heu of the provisions of Section 2 hereof 10. No Impairment_ The Corporation will not, by amendment of its Articles of Incorporation or through any reorgamzation, recapitalizatmn, transfer of assets, consohdat10n, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or perfonned hereunder by the Corporation, but will at all tin1cs m good faith assist in the carrying out of all the prov1s10ns of this Certificate of Designation and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Series A ' \ Jon - Convertible Preferred Stock against impairment. I I I,ost or Stolen c:crtificates . Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any Preferred Stock Certificate( s) and (ii) 111 the case of loss, theft or destruction, of indemnity reasonably satisfactory to the Corporation, or (iii) in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s). the Corporation shall execute and deliver new Preferred Stock Ccrt.Ificatc(s) of like tenor and date. I WITJ \ ""ESS WHEREOF, this Certificate of Designation is executed on behalf of the Corporation by its Authorized Officer this 31st day of October, 2016 By /s/ Albert . \ 1itram :'.'.Jame: Albert . \ 11trani Title: President and Director

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20160481895 - 44 Filed On 11/01/2016 Number of Pages 9

F,om. Philip Magri Fax. (648) 502 - 59D0 To, Fa . +11702., 4862888 Page 5 of121110112018528PM Exhibit B CERTIFICATE OF THEDESIGNATIOl \ ;S, POWERS, PREFERK: \ CES Al \ TI RIGHTS OF THE SERIES B CO:' \ \ l'ERTIBLE PREFF.RRED STOCK (S0.001 PAR VALUE PER SHARE) OF BIOTECII PRODUCTS SI<;RVICES A='l"D RESEARCH, INC. (a Kevada corporation) Pursuant to Section 78 . 1955 of Chapter 78 of the Nevada Revised Statutes, BIOTRCH PRODUCTS SERVICI< ; S AND RESEARCH, 1 : \ C, corpor ; ition organiLed and existing under the Stak of "' . ' - Jevada (the "Corporation"), m accordance with the provisions thereof' . does hereby submit the following· \ VHEREAS, the Certificate of Incorporation of the Corporation (the "Certificate of Incorporation") authonzes the issuance of up to 10 , 000 , 000 shares of preferred stock, par value S 0 . 001 per share, of the Corporation (''Preferred Stock") m one or more series, and expressly authonzes the Board of Directors of the Corporation (the "Board"), subject to limitations prescribed by law, to provide, out of the unissued shares of Preferred Stock, for series of Preferred Stock, and, with respect to each such series, to establish and fix the number of shares to be included in any series of Preferred Stock and the designation, rights, preferences, powers, restrictions and limitatiom of the shares of such scncs ; and \ \ - 11 EREAS, that pursuant to the authority vested m tht : Board by the C - 0 rporation's Articles of Incorporation, as amended, a new senes of Preferred Stock of the Corporation 1 s created out of the authonzcd but unissued shares of Preferred Stock of the Corporation, rnch series to be designated Series B Convertible Preferred Stock, to com 1 st of Om : Millmn ( 1 , 000 , 000 ) shares, with the nghts, preferences, pnvi!eges and restnctions of which shall be as follows· NOW, THEREFORE, BE IT RESOLVI< : D, that the Board does hereby in this Certificate of Designation (the "Certificate of Designation") establish and fix and herein state and express the designation, rights, preferences . powers, restrictions and limitations of a series of Preferred Stock as follows . 1. DESIGNATIONS A : "lD AMOUNT One Million ( 1 , 000 , 000 ) shares of the Preferred Stock of the Corporation, S 0 . 001 par value per share, shall constitute a new class of Preferred Stock designated as "Series B Convertible Preferred Stock" (the "Series B Preferred Stock'') with a stated value of $ 0 . 00 I per shart : (the "Stated Value") 2. (;ff' \ VRRSIOX (a) Conversion at the Option of the Holder . Each holder of Series B Preferred Stock ("Holder'') shall have tht : nght, at such Holder's option, at any time or from time tu timt : from and after the day immediately follow mg the date the Series B Preferred Stock is first issued, to convert each I

From. Phmp Magri 2 Fax /646: - 502 - 5900 fo Fa, +1 t7021 4862888 Pag 6 f12111{)1120165:28PM share ("Share") of Series B Prcfcm:d Stock mto Twenty (20) fully - paid and non - assessable share of common stock, par value SO DD I per share, of the Corporation (the "'Common Stock"). (b) ri . - lechanics of Conversion . In order to effect a Conversion, a Holder shall : (x) fax (or otherwise deliver) a copy of the fully executed : \ otice of Conversion (attached hereto) to the Corporation for the Common Stock and (y) surrender or cause to be surrendered the original certificates representing the Scm : s B Preferred Stock being converted (the '"Preferred Stock Certificates"), duly endorsed . along with a copy of the Notice of Conversion as soon as practicable thereafter to the Corporation or the transfer agent . The Corporatrnn shall not be obligated to issue shares of Common Stock upon a conversion unless either the Preferred Stock Certificates are delivered lo the Corporation or the transfer agent as provided above, or the Holder notifies the Corporation or the transfer agent that such certificates have been lost, stolen or destroyed (subjed to the requirements of Section 11 ) . "Conversion Date" means the date specified m the "' . 'Jotice of Convers 10 n m the form attached hereto, so long as the copy of the Notice of Convers 10 n is faxed (or delivered by other means resulting in notice) to the Corporation before Midnight, Eastern U . S . time, on the Conversion Date indicated in the : \ "otice of Conversion . If the Xobce of Conversion is not so faxed or otherwise delivered bd"ore such time, then the Conversion Date shall be the date a Holder faxes or otherv,'JSC delivers the Xotice of Conversion to the Corporation . (i) Delivery of Common Stock upon (_ ;:: onversion . Cpon the surrender of Preferred Stock Certificates from a Holder of Scncs B Preferred Stock accompanied by a Notice of Conversion (attached hereto), the Corporation shall, no later than the ten business days following the later of (a) the Conversion Date (heremafter defined) and (b) the date of such surrender (or, in the case of lost . stolen or destroyed certificates, after provision of indemnity pursmmt to Section 11 (the '"Delivery Period"), issue and deliver to the Holder (x) that number of shares of Common Stock issuable upon conversion of such shares of Scnes B Preferred Stock bcmg com·erted and (y) a certificate representing the number of shares of Series B Preferred Stock not being converted, if any . (ii) Taxes . The Corporation shall pay any and all taxes and all other reasonable expenses, which may be imposed upon it with respect to the issuance and delivery of the shares of Common Stock upon the converston of the Series B Preferred Stock . (iii) No Fra( 2 ; honal Shares . If any conversion of Series B Preferred Stock would result in the issuance of a fractional share of Common Stock . such fractional share shall be disregarded and the number of shares of Common Stock issuable upon conversion of the Series I 3 Preferred Stock shall be the next higher whole nwnber of shares . (c) Partial Conversion . In the event some but not all of the shares of Sem :: s B Preferred Stock represented by a certificate(s) surrendered by a Holder are converted, the Corporation shall execute and deliver to or on the order of the Holder, at the expense of the Corporabon, a new certificate representing the number of shares of Scncs B Preferred Stock which were not converted .

F1om. Ph1l,p M gri 3 Fax. /646) 502·5900 fo "••· +1 \ 702/4862888 Poge 7 ol1211, \ l1l2016528PM (d) Reservation of Common Stock . The Corporation shall at all times reserve and keep available out of iL authonzed but umssued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of the Series B Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of the Series B Preferrr ;: d Stock ; and 1 f at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the convers 10 n of all then outstandmg shares of the Series B Preferred Stock, m addibon to such other remedies as shall be available to the Holder of such Series B Preferred Stock . the Corporatmn shall take such corporate action as may, m the opmion of its counsel, be necessary to increase, and shall increase, its authonzed but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes . (e) No Reissuance of Series B Preferred Stock . In the event any shares of Senes H Preferred Stock shall he converted pursuant to this Section 2 or otherwise reacquired by the Corporation, the shares so converted or reacquired shall be canceled . The Certificate of Incorporation of the Corporation may be appropriately amended from time to time to effect the corresponding reduction in the Corporation's authorized capital stock . ( 1 ) Notices . In the e,,ent of any taking by the Corporation of a record of the holders of any class of securities for the purpose of detennmmg the holders thereof who are entitled to recerve any distribution, any right to subscribe for, purchase or otherwise acqmre any shares of stock of any class or any other securities or property, or to receive any other nght . , the Corporation shall mail to each Holder of Series B Preferred Stock . at least twenty ( 20 ) days prior to the date specified therein, a notice specifying the date on which any such record is to be taken for the purpose of such dividend, distribution or right, and the amount and character of such dividend, disttibution or right . (g) Transactional Taxes . The Corporation shall pay all documentary, stamp or other transactional taxes attributable to the issuance or delivery of shares of capital stock of the Corporation upon conversion of any shares of Senes I 3 Preferred Stock ; pmv 1 ded, however, that the Corporation shall not be required to pay any taxes which may be payable in respect of any transfer mvolved in the issuance or delivery of any certificate for such shares in a name other than that of the Holder of the shares of Series I 3 Preferred Stock in respect of which such shares are being issued . (h) Validity of Common Stock . All shares of Common Stock which may be issued in connection with the conversmn provisions set forth herem w 1 lL upon tssuance by the Corporation, be validly issued, fully paid and nonassessahle and free from all taxes (except income taxes), liens or charges with respect tht . 7 clo . 3. RAJ \ "K.Except as specifically provided below, the Scncs B Preferred Stock shall, with respect to dividend rights. rights on liquidation, wmding up and dissolution, rank Jimior to the Scncs A Kon -

Fram Philip Magri 4 F• - (MB) 502 - 59D0 fo Fay: +1 · - 7021 4862888 Page 8 of 121110·,120!6 5·28 PM Convertible Preferred Stock of the Corporation and senior to (i) all classes of Common Stock of the Corporation and {ii) any class or series of capital stock of the Corporation hereafter created (unless, with the consent of the Ilolder(s) of Sen es I 3 Preferred Stock) . 4. LIQUIDATTOI \ ' PREFERF . NrE . Except as otherwise prnvided by the Kevada Revised Statutes and subJc I to the provis 10 rn of Section 3 . or elsewhere m this Certificate of Designation, in the event of any voluntary or involuntary liquidation, d 1 ssolution, or wmdmg up of the Corporation, the Holders of shares of the Senes I 3 Preferred Stock then outstanding shall be entitled to be paid . out of the assets of the Corporation available for distribution to its stockholders, whether from capital, surplus or earnings, an amount equal to the Stated Value . 5. LIQUTDATTOJ \ ' Subject to the provisions of Section 3 , in the event of any voluntary or mvoluntary liquidation, dissolution, or winding up of the Corporation, the Holders of shares of the Series B Preferred Stock then outstanding shall be entitled to be paid, out of the asset< ; of the Corporation available for distribution to its stockholders, whether from capital, surplus or earnings, an amount equal to the Stated Value per share . 6. DIVIDE S/STOCK SPLITS. (a) If the Corporation declares or pays a dividend or distnbutmn on the C'ommon Stock, whether such dividend or dJStribution is payable m cash, securities or other properly, including the purchase 01 redemption by the Corporation of shares of C - 0 mmon Stock for cash, securities or property, but excluding any repwchases of Common Stock held by employees or conqu \ tants of the Corporation upon termination of their employment or services pursuant to agreements providing for such repurchase . the Corporation shall simultaneously declare and pay a dividend on the Series B Preferred Stock on a pro rata basis with the Common Stock determined on an as converted basis assummg all outstanding shares of Senes B Preferred Stock had been converted pursuant lo St!Ction 2 as of immediakly pr 10 r to the record date of the applicable dividend (or if no record date is fixed, the date as of which the record holders of Common Stock entitled to such dividends are to be determmed) . (b) The number of shares of Common Stock of the Corporation issuable pursuant to the conversion of outstanding shares of Series B Preferred Stuck shall be adjusted for any forward stock splits, but not any reverse stock splits, by the Company of its outstandmg shares of Common Stock . 7. VOTI.'IIG RIGHTS. (a) Each holder of outstanding Shares of Series B Preferred Stock shall be entitled to vote with holders of outstanding shares of Common Stock . voting together as a smgle class, with respect to any and all matters presented to the stockholders of the Corporation for their action or consideration (whether at a meeting of stockholders of the Corporation, by written action of stockholders in lieu of a meeting or otherwise), except as provided by law or by the provisions of Section 8 below . In any such vote, each Share of Series I 3 Preferred Stock shall be entitled to a

F1om. Philip Magri 5 ax /646) 50 - 5900 fo Fo,. +1 t7 Ƒ 2J 4862888 Poge 9 cf1211/01l2016528PM number of votes equal to the number of shares of Common Stock mto which the Share is convertible pursuant to Section 2 herem as of the record date for such vote or v .. ritten consent or, if there 1 s no specified record date, as of the date of sm : h vote or written consent . Each holder of outstanding Shares of Sencs B Preferred Stock shall be entitled to notice of all stockholder meetmgs (or requests for written consent) in accordance with the Corporation's bylaws . (b) To the extent that under the Kevada Revised Statutes the vote of tht : Holders of the Series B Preferred Stock, voting separately as a class or series, as applicable, is rcqmrcd tu authorize a gJVen action of the Corporation, the affirmative vote or consent of the Holders of at least a maJority of the shares of the Series Il Preferred Stock represented at a duly held meeting at which a quorum is pre . sent or by written consent of a maJonty of the shares of Series B Preferred Stock (except as otherwise may be required under the Nevada Rensed Statutes) shall constitute the approval of such action by the class . To the extent that under the Nevada Revised Statutes, Holders of the Senes D Preferred Stock are entitled to vote on a matter with Holders of Common Stock, voting together as one class . each share of Scnes B Preferred Stock shall be entitled to twenty ( 20 ) vote(s) . 8. PROTECTIO : ' 11 PROVISIOl \ "S . So long as any shares of Series B Preferred Stock are outstanding, the Corporation shall not, without first obtaining the approval (by vote or written consent, as provided by the Nevada Revised Statutes) of the Holders of at least a maJority of the then outstandmg shares of Series B Preferred Stock : (a) alter or change the nghL,;, preferences or privileges of the Series B Preferred Stock; (b) alter or change the nghts, preferences or privileges of any capital stock of the Corporation so as to affect adversely the Senes B Preferred Stock, (c) create any nev . - class or scncs of capital stock havmg a preference over the Series B Preferred Stock as to distribution of assets upon liquidation, dissolution or wmding up of the Corporation (as prevwusly defined, "Senior Securities"), (d) create any new class or series of capital stock ranking pari passu with the Series H Preferred Stuck as to distribution of assets upon liquidation, dissolution or wmding up of the Corporation (as prr . ,·vwusly defined, "Pari Passu Securities") ; (e) mcrease the authorued nwnber of shares of Senes B Preferred Stock, (f) issue any additional shares of Senior Securities; or (g) redeem, or declare or pay any cash dividend or distribution on, any Jurnor Securities. If Holders of at least a maJority of the then outstanding shares of Senes B Preferred Stock agree to allow the Corporation to alter or change tl1c nghts, preferences or privileges of the shares of Series B Preferred Stock

F,om. Philip M gr, 6 Fax (646) 502 - 5900 fo Page 10of 121'.101l2016528PM pursuant to subsection (a) above. then the Corporation shall deliver notice of such approved change to the Holders of the Series I3 Preferred Stock that did not agree to such alteration or change (the '"Dissenting Holders"). 9. MERGER, CO::XSOLIDATION, ETC. (a) If at any time or from time to time there shall be (i) a merger, or consolidation of the Corporation with or into another corporation, (ii) the sale of all or substantially all of the C',orporation 's capital stock or assets to any other person, (iii) an}' other form of business combination or reorganization m which the Corporation shall not be the continumg or surviving entity of such busmess combination or rcorgamzat 10 n, or (iv) any transaction or Series oftransachons by the Corporation in which in excess of 50 percent of the Corporation's voting power 1 s transferred (each, a "Reorganization"), then as a part of such Reorganizatmn, provision shall be made so that the Holders of the Series R Preferred Stock shall thereafter be entitled to receive the same kind and amount of stock or other securities or property (rncluding cash) of the Corporation . or of the successor corporation resulting from such Reorgamzation . (b) The provisions of this Section 9 arc in addition to and not m lieu of the prov1S1ons of Section 6 hereof. 10. NO IMPAIRMENT . The Corporation will not, by amendment of its Certificate of Incorporation or through any reorganization, recapitalization, transfer of assets, consolidation . merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the obseivance m performance of any of the tcnns to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the canying out of all the provisions of this Certificate of Designation a . nd in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the Holders of the Series R Preferred Stock against imparrment 11. LOST OR STOLEJ \ ' C . RRTIFICATES . Cpon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilatwn of any PrdCrred Stock Ccrtificate(s) and (ii) (y) in the case of loss . theft or destruction, of indemnity reasonably satisfactory to the Corporation, or (z) in the case of mutilation, upon surrender and cancellation of the Preferred Stock Ccrtificate(s), the Corporation shall ext : cute and dehve 1 new Preferred Stock Certificate(s) of like tenor and date . [SIGKATURE PAGE FOLLOWS]

Frnm. Philip Magri 7 Fa,, /846) 50:1 - 5900 fo Fa,·· +1 17021 4862288 Page 110( 1217J01120165:2SPM I:'J \ \ ·'ITl \ "ESS \ \ 'HEREOF, this Certificate of Designation 1s executed on behalf of the Corporation by its Authonze<l Officr.:r this October 31, 2016. BIOTECH PRODUCTS SERVICES AND RESEARCll, l:XC. Ry /s/ J)bcrt : rvlitJ : ani "' . 'Jame : Albert v 1 itrani Title : President

F1om. Philip Magri Fax (646) 502 - 5900 Fax +1 {702,, 4862888 Page 12of 1211101120165:28PM NOTICE OF CO' \ 'VERSION (To be Executed by the Registered Holder in order to Convert the Series I3 Preferred Stock) The undersigned hereby irrevocably elects to convert shares of Series B Preferred Stock (the ''Conversion"), represented by stock certificate : ' . \ lo . (s) . (the ··Preferred Stock Certificates") into shares of common stock, par value $ 0 . 001 per share (the '"Common Stock"'), of I 3 IOTECH PRODUCTS SERV 1 CES MD RESEARCH, Inc . , a "' . 'J"evada corporation (the ··corporation"), according to the conditions of the Certificate of Designations, Preferences and Rights of Senes D Preferred Stock (the '"Certificate of Designation"), as of the date written below . If securities are to be issued m the name of a person other than the undersigned, the undersigned wi!l pay all transfer taxes payable with respect thereto . :: \ o fee will be charged to the Holder for any convers 10 n, except for transfer taxes, if any A copy of each Preferred Stock Certificate 1 s attached hereto (or evidence of loss, theft or destrnctwn thereof) . The undersigned represents and warrants that all offers and sales by the undersigned of the securities issuable to the undersigned upon conversion of the Series H Preferred Stock shall be made pursuant to registration of the Common Stock under the Securities Act of 1933 . as amended (the "Act"), or pursuant to an exemption from registration under the Act . [ l The undersigned hereby requests that the Coll)oration transmit the Common Stock issuable pursuant to this Notice ofConversrnn tu the address of the undersigned. Date of Conversion" Applicable ConvE!rsion Rate· Each share of Series B Preferred Stock is convertible mto one share of Common Stock ] \ umber of Shares of Common Stock to be Issued: _ Signature. "' The Corporation is not required to issue shares of Common Stock until the original Preferred Stock Ccrtificate(s) (or evidence of loss, theft or destruction thereof) to be converted arc received by the Corporation or its transfer agent The Corporation shall issue and deliver shares of Common Stock to an overnight courier not later than the later of (a) two ( 2 ) business days followmg receipt of this : \ "ohcc of Conversion and (b) delivery of the original Preferred Stock Certificates (or evidence of loss, theft or destruction thereof) and shall make payments pursuant to the Certificate of Designation for the failure to make tuncly delivery . 8

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20150392163 - 82 Filed On 09/01/2015 Number of Pages 3

Certificate of Amendment to Articles of Incorporation For Nevada Profit Corporations (Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock) CONTINUED FROM PAGE 1 ARTICLE III CAPITAL STOCK Section I . Authorized Shares The aggregate number of shares which the Corporation shall have authority to issue is two hundred and sixty million ( 260 , 000 , 000 ) shares, consisting of two classes to he designated, respectively, "Common Stock" and "Preferred Stock," with all of such shares having a par value of S . 001 per share . The total number of shares of Common Stock that the Corporation shall have authority to issue is two hundred and fifty mi!lion ( 250 , 000 , 000 ) . The total number of shares of Preferred Stock that the Corporation sha!l have authority to issue is ten million ( 10 , 000 , 000 ) shares . The Preferred Stock may be issued in one or more series, each series to he appropriately designated by a distinguishing letter or title, prior to the issuance of any shares thereof . The voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Preferred Stock shall hereinafter be prescribed by resolution of the board of directors pursuant to Section 3 of this Article Ill . Section 2. Common Stock. (a) Dividend Rate . Subject to the rights of holders of any Preferred Stock having preference as to dividends and except as otherwise provided by these Articles of Incorporation, as amended from time to time (hereinafter, the "Articles") or the " \ /evada Revised Statues (hereinafter, the "! \ RS"), the holders of Common Stock shall be entitled to receive dividends when, as and if declared by the board of directors out of assets legally available therefor . (b) Voting Rights . Except as otherwise provided by the " \ IRS, the holders of the issued and outstanding shares of Common Stock shall be entitled to one vote for each share of Common Stock . Ko holder of shares of Common Stock shall have the right to cumulate votes . (c) Liquidation Rights. In the event of liquidation, dissolution. or winding up of the affairs of the Corporation, whether "oluntary or involuntary, subject to the prior rights of holders of Preferred Stock to share ratably in the Corporation's assets. the Common Stock and any shares of Preferred Stock which are not entitled to any preference in liquidation shall 5hare equally and ratabl)' in the Corporation's assets available for distribution after giving effect to any liquidation preference of any shares of Preferred Stock. A merger, conversion, exchange or consolidation of the Corporation with or into any other person or sale or transfer of all or any part ofthc assets ofthe Corporation (which shall not in fact result in the liquidation of1hc Corporation and the distribution of <bsets to stockholders) shall not be deemed to be a voluntary or involuntlli)' liquidation, dissolution or winding up of the affairs of the Corporation. (d) ,Vo Conversion, Redemption, or Preemptive Rights. The holders of Common Stock shall not have any conversion, redemption, or preemptive rights. (e) Consideration for Shares . The Common Stock authorized by this Article shall be issued for such consideration as shall be fixed, from time to time, by the board of directors . Section 3. Preferred Stock. (a) Designation. The hoard of directors is hereby vested with the authority from time to time to provide by resolution for the issuance of shares of Preferred Stock in one or more series not exceeding Pg.2

the aggregate number of shares of Preferred Stock authorized by these Articles, and to prescribe with respect to each such series the voting powers, if any, designations, preferences, and relative, participating, optional, or other special rights, and the qualifications, limitations, or restrictions relating thereto, including, without limiting the generality of the foregoing : the voting rights relating to the shares of Preferred Stock of any series (which voting rights, if any, may be full or limited, may vary over time, and may be applicable generally or only upon any stated fact or event) ; the rate of dividends (which may be cumulative or noncumulative), the condition or time for payment of dividends and the preference or relation of such dividends to dividends payable on any other class or series of capital stock ; the rights of holders of Preferred Stock of any series in the event of liquidation, dissolution, or winding up of the affairs of the Corporation ; the rights, if any, of holders of Preferred Stock of any series to convert or exchange such shares of Preferred Stock of such series for shares of any other class or series of capital stock or for any other securities, property, or assets of the Corporation or any subsidiary (including the determination of the price or prices or the rate or rates applicable to such rights to convert or exchange and the adjustment thereof, the time or times during which the right to convert or exchange shall be applicable, and the time or times during which a particular price or rate shall be applicable) ; whether the shares of any series of Preferred Stock shall be subject to redemption by the Corporation and if subject to redemption, the times, prices, rates, adjustments and other terms and conditions of such redemption . The powers, designations, preferences, limitations, restrictions and relative rights may be made dependent upon any fact or event which may be ascertained outside the Articles or the resolution if the manner in which the fact or event may operate on such series is stated in the Articles or resolution . As used in this section "fact or event" includes, without limitation, the existence of a fact or occurrence of an event, including, without limitation, a determination or action by a person, government, governmental agency or political subdivision of a government . The board of directors is further authorized to increase or decrease (but not below the number of such shares of such series then outstanding) the number of shares of any series subsequent to the issuance of shares of that series . Unless the board of directors provides to the contrary in the resolution which fixes the characteristics of a series of Preferred Stock, neither the consent by series, or otherwise, of the holders of any outstanding Preferred Stock nor the consent of the holders of any outstanding Common Stock shall be required for the issuance of any new series of Preferred Stock regardless of whether the rights and preferences of the new series of Preferred Stock are senior or superior, in any way, to the outstanding series of Preferred Stock or the Common Stock . (b) Certificate . Before the Corporation shall issue any shares of Preferred Stock of any series, a certificate of designation setting forth a copy of the resolution or resolutions of the board of directors, and establishing the voting powers, designations, preferences, the relative, participating, optional . or other rights, if any, and the 4 ualifications . limitations, and restrictions . if any, relating to the shares of Preferred Stock of such series . and the number of shares of PrcfCrred Stock of such series authorized by the board of directors to be i sued shall be made and signed by an officer of the corpora 1 ion and filed in the manner prescribed by the NRS . Section 4 . Non - Assessment of Stock . The capital stock of the Corporation, after the amount of the subscription price has been fully paid, shall not he asse sable for any purpose, and no stock issued as fully paid shall ever be assessable or assessed, and the Articles shall not be amended in this particular . No stockholder of the Corporation is individually liable for the debts or liabilities of the Corporation . Pg.3

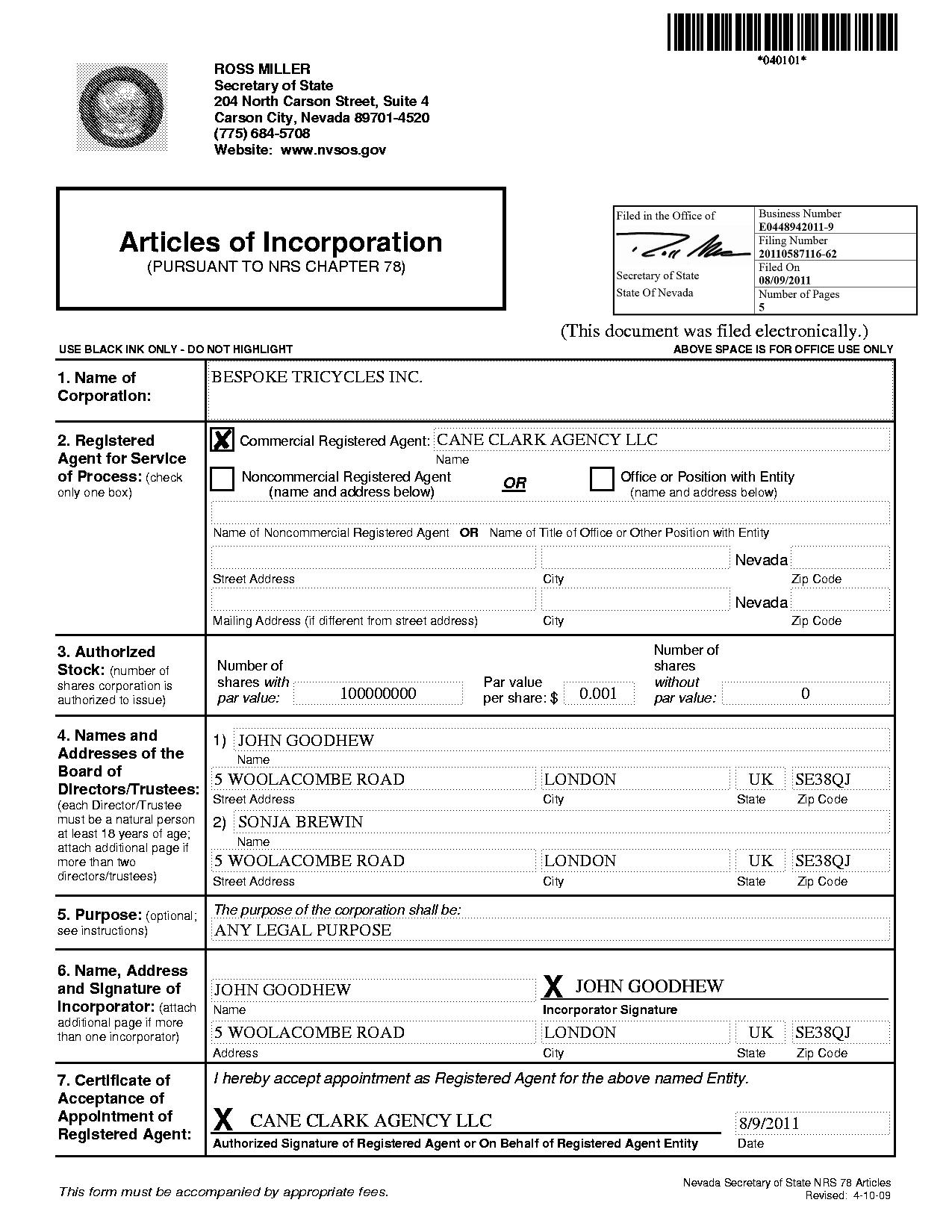

Business Number E0448942011 - 9 Filed in the Office of Secretary of State State Of Nevada Filing Number 20110587116 - 62 Filed On 08/09/2011 Number of Pages 5

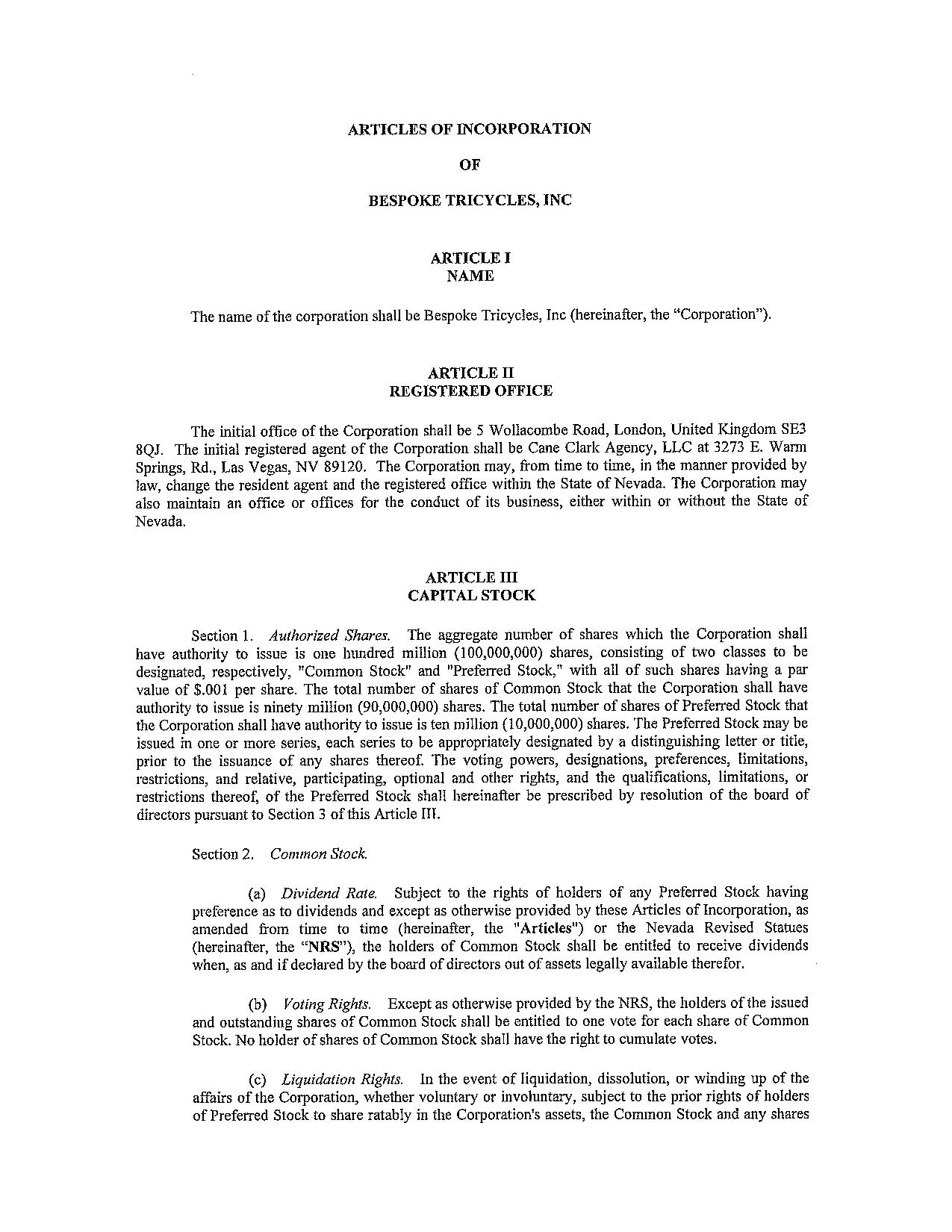

ARTICLES OF INCORPORATION OF BESPOKE TRICYCLES, INC ARTICLE I NAME The name of the corporation shall be Bespoke Tricycles, Inc (hereinafter, the "Corporation"). ARTICLE II REGISTERED OFFICE The initial office of the Corporation shall be 5 Wollacombe Road, London, United Kingdom SE 3 8 QJ . The initial registered agent of the Corporation shall be Cane Clark Agency, LLC at 3273 E . Warm Springs, Rd . , Las Vegas, NV 89120 . The Corporation may, from time to time, in the manner provided by law, change the resident agent and the registered office within the State of Nevada . The Corporation may also maintain an office or offices for the conduct of its business, either within or without the State of Nevada . ARTICLE III CAPITAL STOCK Section l . Authorized Shares . The aggregate number of shares which the Corporation shall have authority to issue is one hundred million { 100 , 000 , 000 ) shares, consisting of two classes to be designated, respectively, "Common Stock" and "Preferred Stock," with all of such shares having a par value of $ . 00 l per share . The total number of shares of Common Stock that the Corporation shall have authority to issue is ninety million ( 90 , 000 , 000 } shares . The total number of shares of Preferred Stock that the Corporation shall have authority to issue is ten million ( 10 , 000 , 000 } shares . The Preferred Stock may be issued in one or more series, each series to be appropriately designated by a distinguishing letter or title, prior to the issuance of any shares thereof . The voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Preferred Stock shall hereinafter be prescribed by resolution of the board of directors pursuant to Section 3 of this Article rn. Section 2. Common Stock. (a) Dividend Rate . Subject to the rights of holders of any Preferred Stock having preference as to dividends and except as otherwise provided by these Articles of Incorporation, as amended from time to time (hereinafter, the "Articles") or the Nevada Revised Statues (hereinafter, the "NRS"), the holders of Common Stock shall be entitled to receive dividends when, as and if declared by the board of directors out of assets legally available therefor . (b) Voting Rights . Except as otherwise provided by the NRS, the holders of the issued and outstanding shares of Common Stock shall be entitled to one vote for each share of Common Stock . No holder of shares of Common Stock shall have the right to cumulate votes . (c) Liquidation Rights . In the event of liquidation, dissolution, or winding up of the affairs of the Corporation, whether voluntary or involuntary, subject to the prior rights of holders of Preferred Stock to share ratably in the Corporation's assets, the Common Stock and any shares

2 of Preferred Stock which are not entitled to any preference in liquidation shall share equally and ratably in the Corporation's assets available for distribution after giving effect to any liquidation preference of any shares of Preferred Stock . A merger, conversion, exchange or consolidation of the Corporation with or into any other person or sale or transfer of all or any part of the assets of the Corporation (which shall not in fact result in the liquidation of the Corporation and the distribution of assets to stockholders) shall not be deemed to be a voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation . (d) No Conversion, Redemption, or Preemptive Rights . The holders of Common Stock shall not have any conversion, redemption, or preemptive rights . (e) Consideration for Shares . The Common Stock authorized by this Article shall be issued for such consideration as shall be fixed, from time to time, by the board of directors . Section 3 . Preferred Stock . (a) Designation . The board of directors is hereby vested with the authority from time to time to provide by resolution for the issuance of shares of Preferred Stock in one or more series not exceeding the aggregate number of shares of Preferred Stock authorized by these Articles, and to prescribe with respect to each such series the voting powers, if any, designations, preferences, and relative, participating, optional, or other special rights, and the qualifications, limitations, or restrictions relating thereto, including, without limiting the generality of the foregoing : the voting rights relating to the shares of Preferred Stock of any series (which voting rights, if any, may be full or limited, may vary over time, and may be applicable generally or only upon any stated fact or event) ; the rate of dividends (which may be cumulative or noncumulative), the condition or time for payment of dividends and the preference or relation of such dividends to dividends payable on any other class or series of capital stock ; the rights of holders of Preferred Stock of any series in the event of liquidation, dissolution, or winding up of the affairs of the Corporation ; the rights, if any, of holders of Preferred Stock of any series to convert or exchange such shares of Preferred Stock of such series for shares of any other class or series of capital stock or for any other securities, property, or assets of the Corporation or any subsidiary (including the determination of the price or prices or the rate or rates applicable to such rights to convert or exchange and the adjnstment thereof, the time or times dtrring which the right to convert or exchange shall be applicable, and the time or times during which a particular price or rate shall be applicable) ; whether the shares of any series of Prefemid Stock shall be subject to redemption by the Corporation and if subject to redemption, the times, prices, rates, adjustments and other tenns and conditions of such redemption . The powers, designations, preferences, limitations, restrictions and relative rights may be made dependent upon any fact or event which may be ascertained outside the Articles or the resolution if the manner in which the fact or event may operate on such series is stated in the A 1 ticles or resolution . As used in this section "fact or event" includes, without limitation, the existence of a fact or occmrence of an event, including, without limitation, a determination or action by a person, government, governmental agency or political subdivision of a government . The board of directors is further authorized to increase or decrease (but not below the number of such shares of such series then outstanding) the number of shares of any series subsequent to the issuance of shares of that series . Unless the board of directors provides to the contrary in the resolution which fixes the characteristics of a series of Preferred Stock, neither the consent by series, or otherwise, of the holders of any outstanding Prefe,red Stock nor the consent of the holders of any outstanding Common Stock shall be required for the issuance of any new series of Prefe 1 ,ed Stock regardless of whether the rights and preferences of the new series of Preferred Stock are senior or superior, in any way, to the outstanding series of Preferred Stock or the Common Stock . (b) Certificate . Before the Corporation shall issue any shares of Preferred Stock of any series, a certificate of designation setting forth a copy of the resolution or resolutions of the board of directors, and establishing the voting powers, designations, preferences, the relative,

3 participating, optional, or other rights, if any, and the qualifications, limitations, and restrictions, if any, relating to the shares of Preferred Stock of such series, and the number of shares of Preferred Stock of such series authorized by the board of directors to be issued shall be made and signed by an officer of the corporation and filed in the manner prescribed by the NRS . Section 4 . Non - Assessment of Stock . The capital stock of the Corporation, after the amount of the subscription price has been fully paid, shall not be assessable for any purpose, and no stock issued as fully paid shall ever be assessable or assessed, and the Articles shall not be amended in this particular . No stockholder of the Corporation is individually liable for the debts or liabilities of the Corporation . ARTICLE IV DIRECTORS AND OFFICERS Section l . Number of Directors . The members of the governing board of the Corporation are styled as directors . The board of directors of the Corporation shall be elected in such manner as shall be provided in the bylaws of the Corporation . The board of directors shall consist ofat least one {l} individual and not more than thirteen { 13 ) individuals . The number of directors may be changed from time to time in such manner as shall be provided in the bylaws ofthe Corporation . Section 2 . Initial Directors . The name and post office box or street address of the director(s} constituting the initial board of directors is : Name John Goodhew Sonja Brewin Address 5 Wollacombe Road, London, United Kingdom SE3 BQJ 5 Wollacombe Road, London, United Kingdom SE3 BQJ Section 3 . Limitation of Liability . The liability of directors and officers of the Corporation shall be eliminated or limited to the fullest extent permitted by the NRS . If the NRS is amended to further eliminate or limit or authorize corporate action to further eliminate or limit the liability of directors or officers, the liability of directors and officers of the Corporation shall be eliminated or limited to the fullest extent permitted by the NRS, as so amended from time to ti . me . Section 4 . Payment of Expenses . In addition to any other rights of indemnification permitted by the laws of the State of Nevada or as may be provided for by the Corporation in its bylaws or by agreement, the expenses of officers and directors incurred in defending any threatened, pending, or completed action, suit or proceeding (including without limitation, an action, suit or proceeding by or in the right of the Corporation), whether civil, criminal, administrative or investigative, involving alleged acts or omissions of such officer or director in his or her capacity as an officer or director of the Corporation or member, manager, or managing member of a predecessor limited liability company or affiliate of such limited liability company or while serving in any capacity at the request of the Corporation as a director, officer, employee, agent, member, manager, managing member, pmtner, or fiduciary of, or in any other capacity for, another corporation or any pmtnership,joint venture, trust, or other enterprise, shall be paid by the Corporation or through insurance purchased and maintained by the Corporation or through other financial arrangements made by the Corporation, as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by the Corporation . To the extent that an officer or director is successful on the merits in defense of any such action, suit or proceeding, or in the defense of any claim, issue or matter therein, the Corporation shall indemnify him or her against expenses, including attorneys' fees, actually and reasonably incurred by him or her in coilllection with the defense . Notwithstanding anything to the contrary contained herein or in the bylaws, no director or officer may be indemnified for expenses incurred in defending any threatened, pending, or completed action, suit or proceeding (including without limitation, an action, suit or proceeding by or in the right of the Corporation), whether civil, criminal, administrative or investigative, that such director or officer incurred in his or her capacity as a stockholder, including, but not

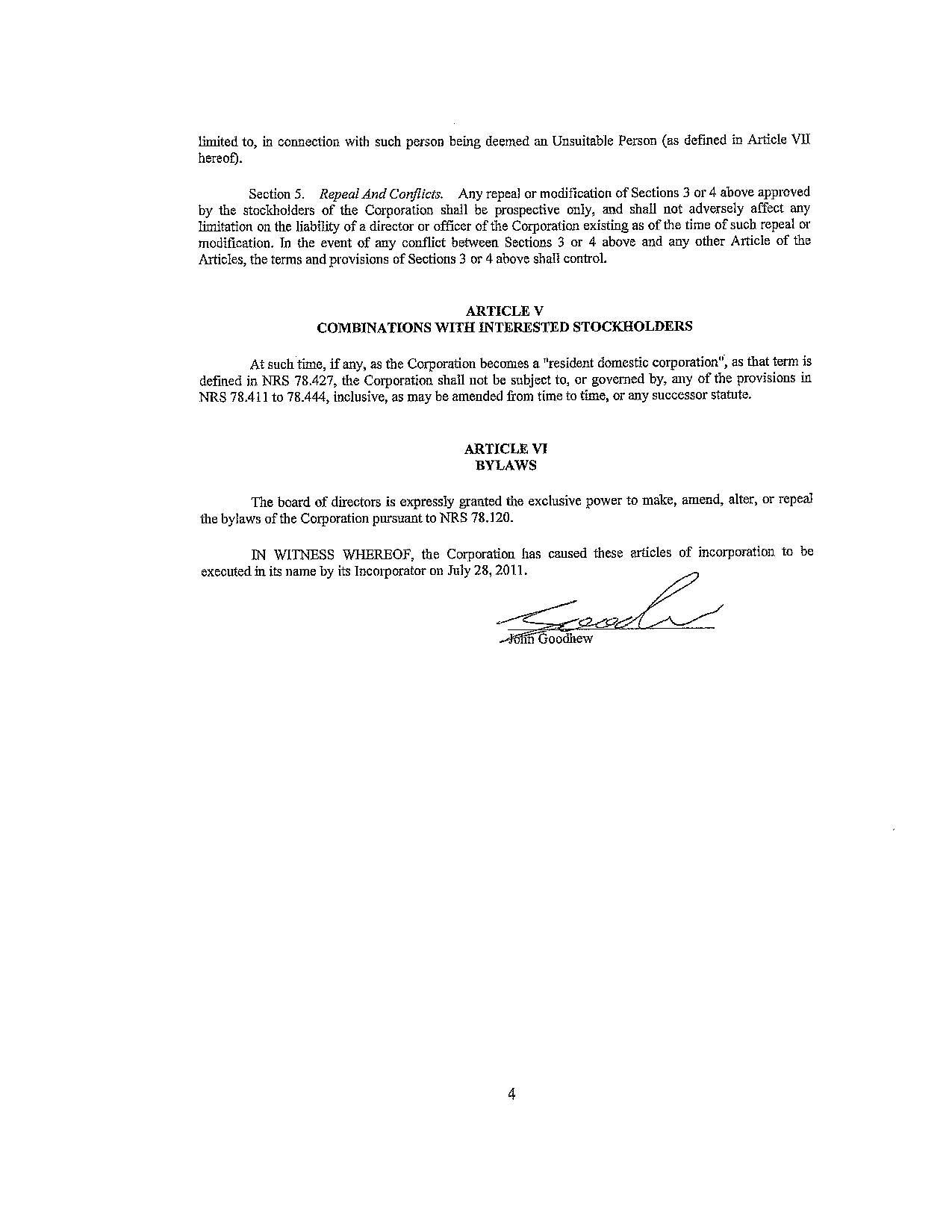

limited to, in connection with such person being deemed an Unsuitable Person (as defined in Article VII hereof). Section 5 . Repeal And Conflicts . Any repeal or modification of Sections 3 or 4 above approved by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation on the liability of a director or officer of the Corporation existing as of the time of such repeal or modification . Jn the event of any conflict between Sections 3 or 4 above and any other Article of the Articles, the tenns and provisions of Sections 3 or 4 above shall control . ARTICLEV COMBINATlONS WITH INTERESTED STOCKHOLDERS At such time, if any, as the Corporation becomes a 11 resident domestic corporation \ as that tenn is defined in NRS 78 . 427 , the Corporation shall not be subject to, or governed by, any of the provisions in NRS 78 . 411 to 78 . 444 , inclusive, as may be amended from time to time, or any successor statute . ARTICLE VI BYLAWS The board of directors is expressly granted the exclusive power to make, amend, alter, or repeal the bylaws of the Corporation pursuant to NRS 78.120. IN WITNESS WHEREOF, the Corporation has caused these articles of incorporation to be executed mis ,,,m, by i• lncmporatoc o" July 28, 2011. L - 4