- GLOB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

Globant (GLOB) CORRESPCorrespondence with SEC

Filed: 8 Jul 14, 12:00am

| DLA Piper LLP (US) 1251 Avenue of the Americas www.dlapiper.com

Christopher C. Paci Christopher.paci@dlapiper.com T 212.335.4970 F 212.335.4501 |

| July 8, 2014 | OUR FILE NO. 378173-000005 |

| CERTAIN PORTIONS OF THIS LETTER AS FILED VIA EDGAR HAVE BEEN OMITTED AND FILED SEPARATELY WITH THE COMMISSION. CONFIDENTIAL TREATMENT HAS BEEN REQUESTED WITH RESPECT TO THE OMITTED PORTIONS. OMITTED INFORMATION HAS BEEN REPLACED IN THIS LETTER AS FILED VIA EDGAR WITH A PLACEHOLDER IDENTIFIED BY THE MARK “[***].” |

| FOIA – CONFIDENTIAL TREATMENT REQUESTED PURSUANT TO RULES 83 AND 418(b) UNDER THE SECURITIES ACT |

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 4561

100 F Street, N.E.

Washington, D.C. 20549

Attention: Gabriel Eckstein

| Re: | Globant S.A. Registration Statement on Form F-1 |

| Registration No. 333-190841 |

| Supplemental Correspondence |

Dear Mr. Eckstein:

On behalf of our client Globant S.A. (the “Company”), we are submitting this letter in connection with the review by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) of the Company’s Registration Statement on Form F-1 (Registration No. 333-190841) (the “Registration Statement”). Pursuant to 17 C.F.R. §200.83 (“Rule 83”), the SEC’s rule adopted under the Freedom of Information Act, 5 U.S.C. §552, and due to the commercially sensitive nature of information contained herein, we request on behalf of the Company that the SEC grant confidential treatment to certain information (the “Confidential Information”) contained in this letter and attached asExhibit A. Each page ofExhibit A has been clearly marked “Confidential Treatment Requested by Globant S.A.” in accordance with the requirements of Rule 83 and the Company seeks confidential treatment for selected portions ofExhibit A. Pursuant to Rule 418(b) of the Securities Act, the Company also hereby requests the return of the Confidential Information at such time as the staff of the SEC determines that the Confidential Information is no longer of relevant use to the staff in connection with the Company’s securities offering under the Registration Statement.

| |

United States Securities and Exchange Commission July 8, 2014 Page 2 | CONFIDENTIAL TREATMENT REQUESTED BY GLOBANT S.A. |

The purpose of this letter is to notify the Staff of certain pricing-related information, in compliance with an earlier request of the Staff, in order to enable the Staff to complete its review of the Registration Statement and provide an update regarding offering timing considerations.

Reverse Share Split, Price Range and Number of Common Shares Offered

The Company respectfully informs the Staff that the managing underwriters have recommended to the Company’s management a [***]-for-[***] reverse share split. Furthermore, the managing underwriters have recommended including a price range of $[***] to $[***] per common share (with an assumed initial offering price equal to the midpoint of the range), together with a total number of [***] common shares to be offered (comprised of [***] primary shares and [***] secondary shares), for the Company’s offering on the cover pages and elsewhere in the prospectus to be included in Amendment No. 5 to the Registration Statement, assuming the offering were to launch in the next 10 days. During their discussions with the Company’s management, the representatives of the managing underwriters indicated that the proposed range and number of common shares to be offered was subject to fluctuation based on market conditions.

The Company is hereby submitting under cover of this letter changed pages to the Registration Statement that contain revisions to the disclosure giving effect to the [***]-for-[***] reverse share split, midpoint of the price range and number of common shares offered described in the previous paragraph. Specifically, the pages of the Registration Statement submitted hereby include the following sections of the prospectus:

| § | Front cover page; |

| § | Summary—The Offering (page 7-8); |

| § | Summary Consolidated Financial Data (page 9); |

| § | Use of Proceeds (page 51); |

| |

United States Securities and Exchange Commission July 8, 2014 Page 3 | CONFIDENTIAL TREATMENT REQUESTED BY GLOBANT S.A. |

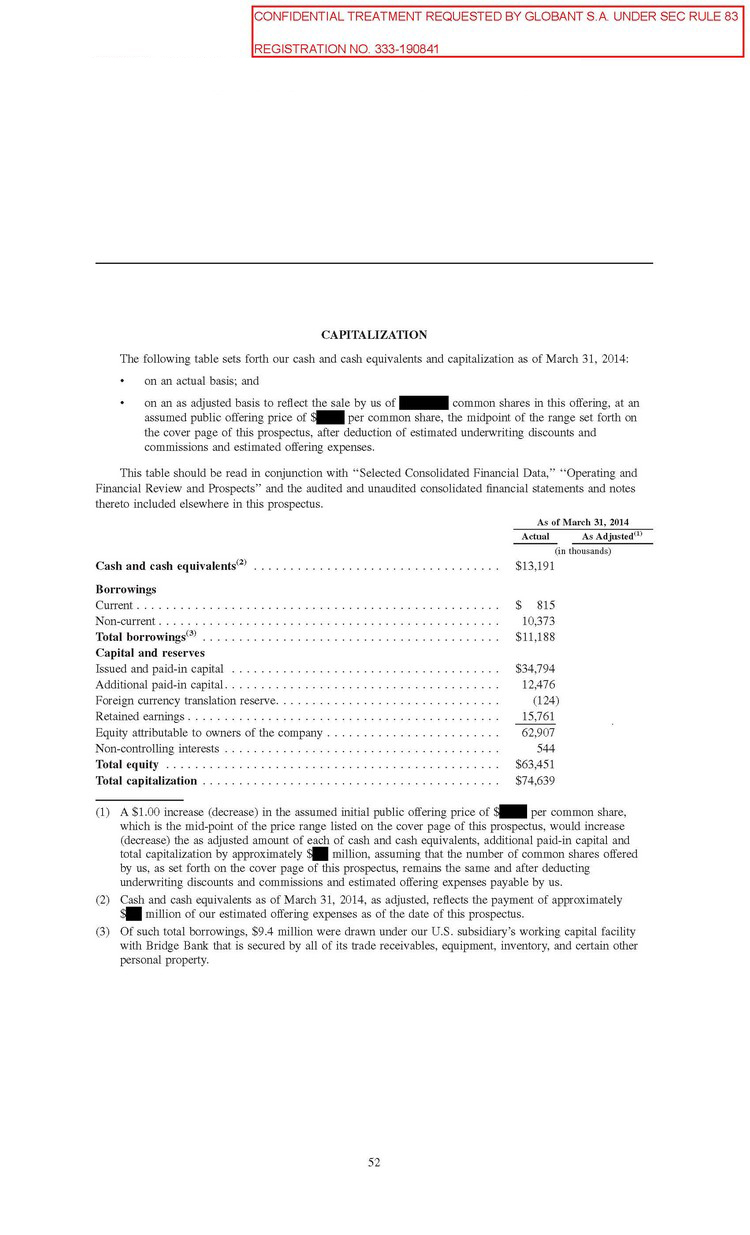

| § | Capitalization (page 52); |

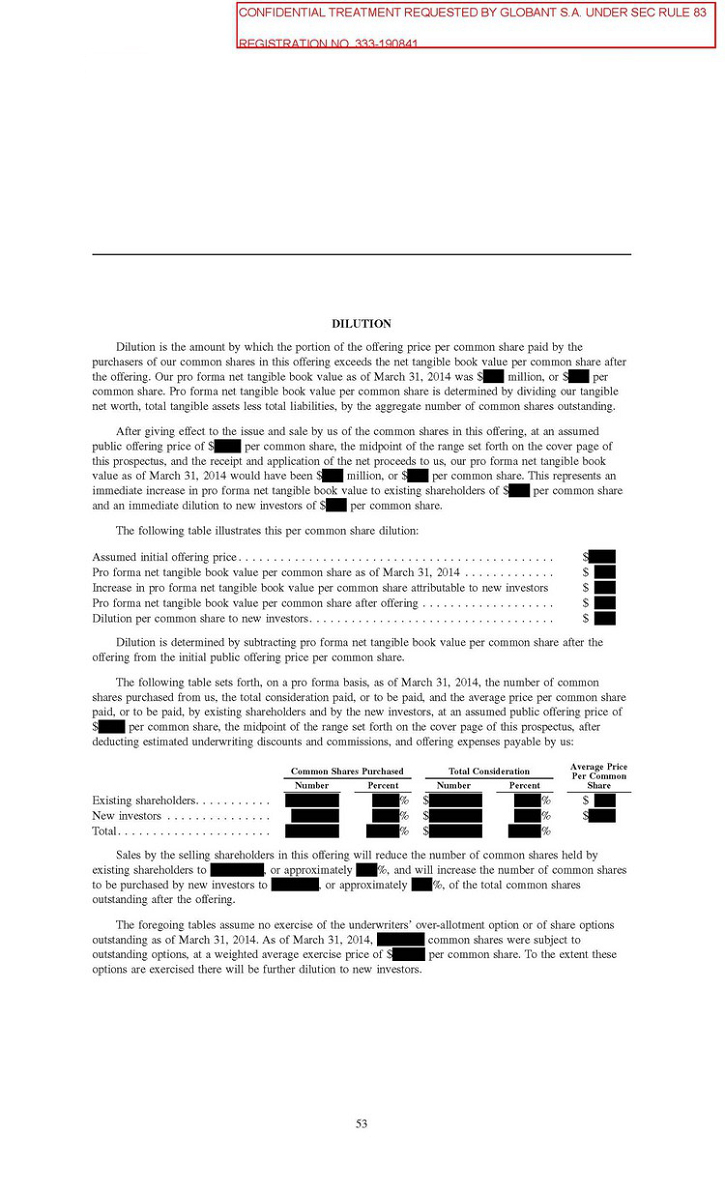

| § | Dilution (page 53); |

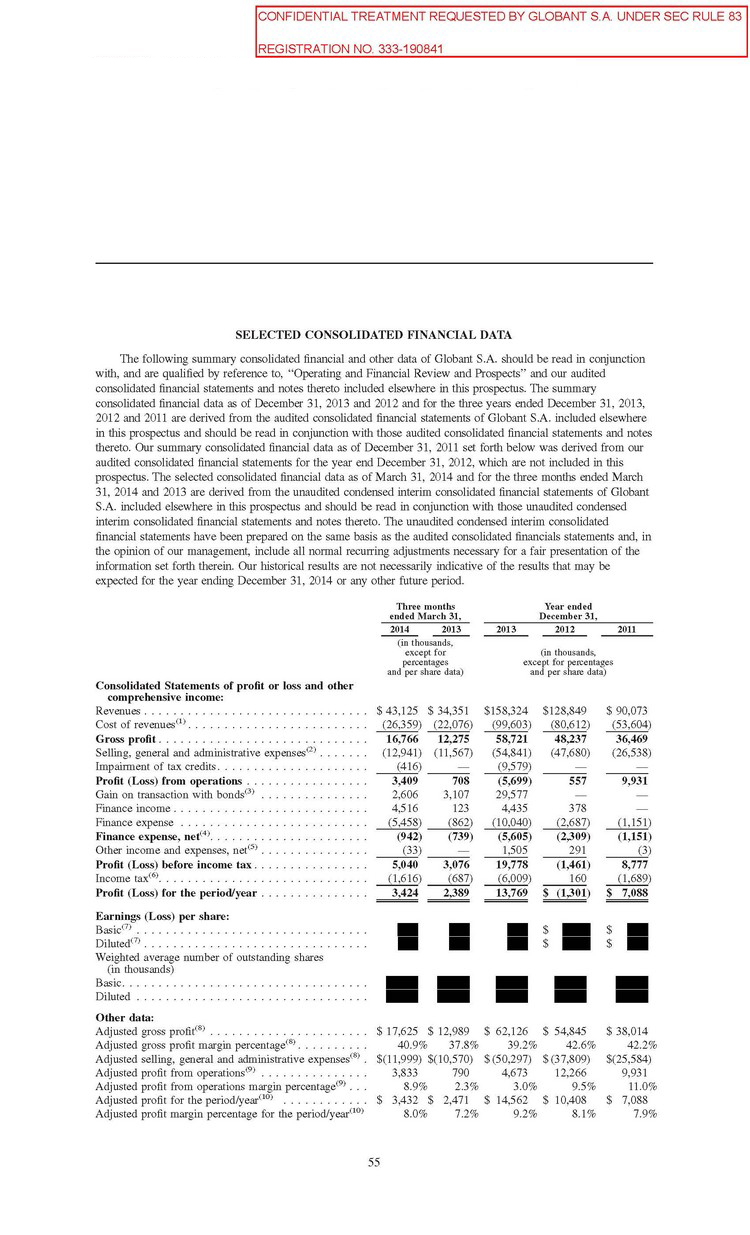

| § | Selected Consolidated Financial Data (page 55); |

| § | Operating and Financial Review and Prospects—Equity Compensation Arrangements (pages 88-89); |

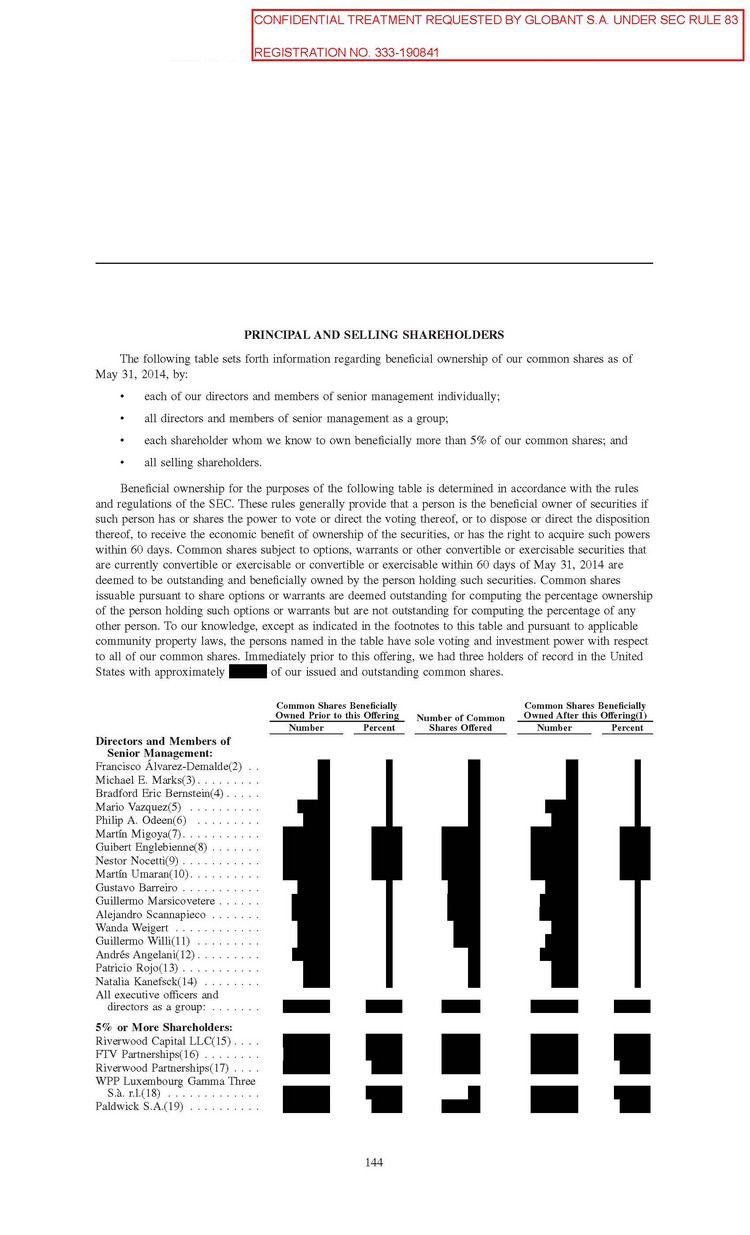

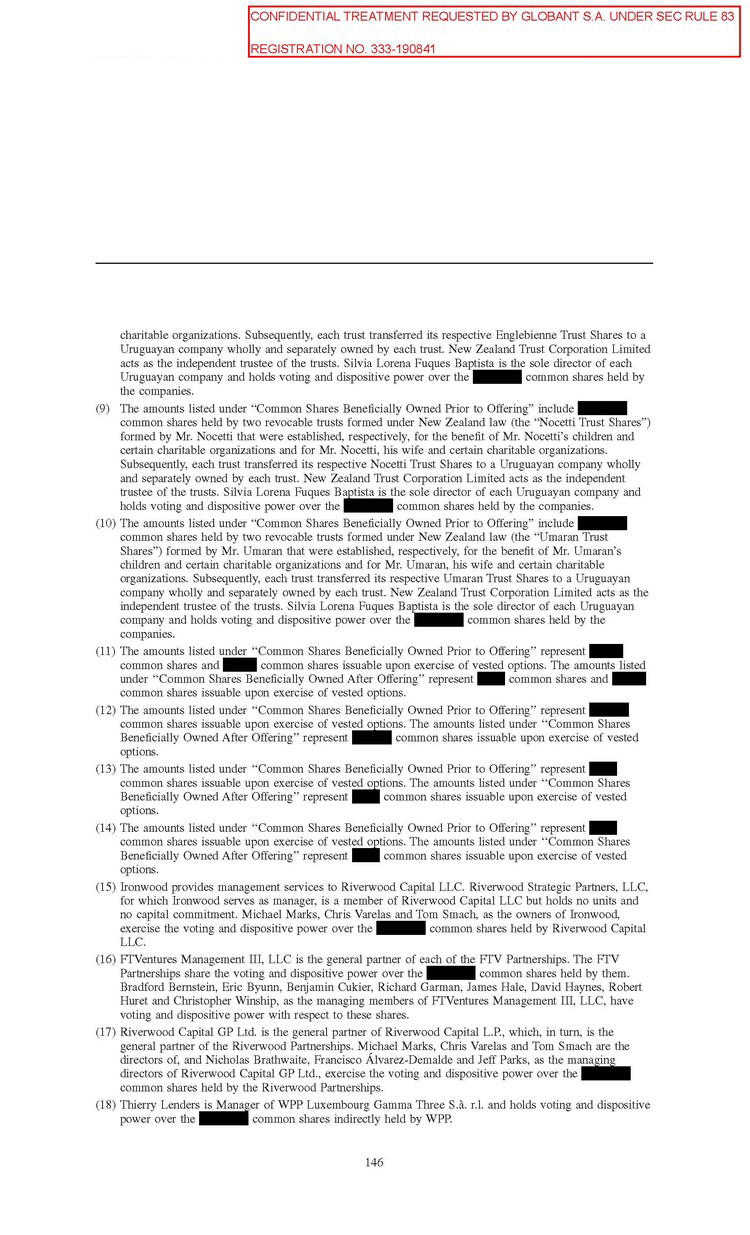

| § | Principal and Selling Shareholders (pages 144-147); |

| § | Related Party Transactions (page 148); |

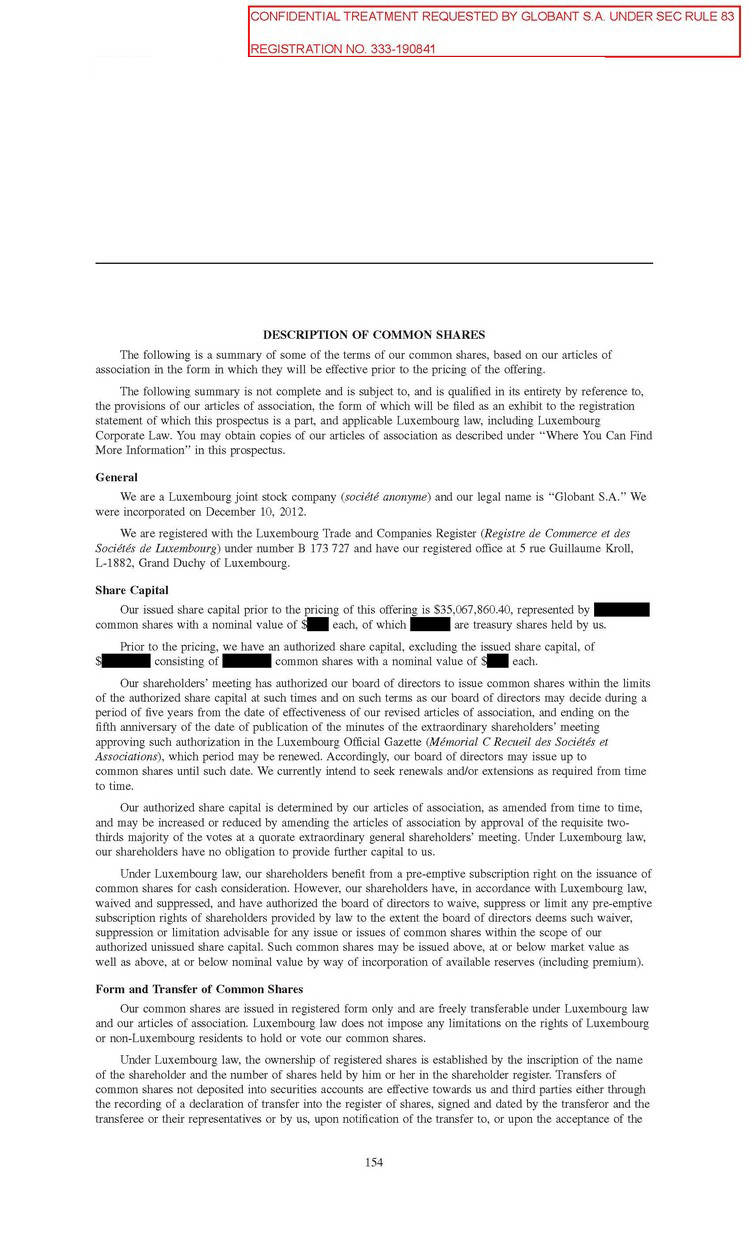

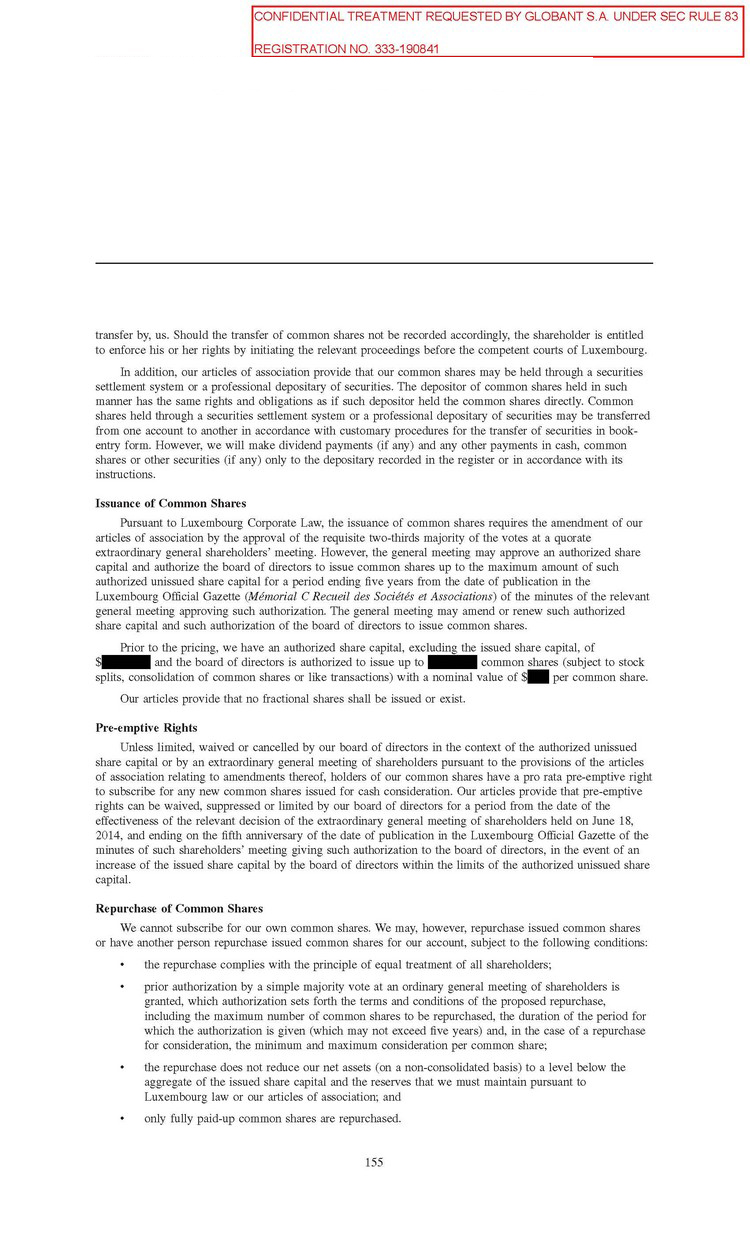

| § | Description of Common Shares (pages 154-155); |

| § | Shares Eligible for Future Sale (page 163); |

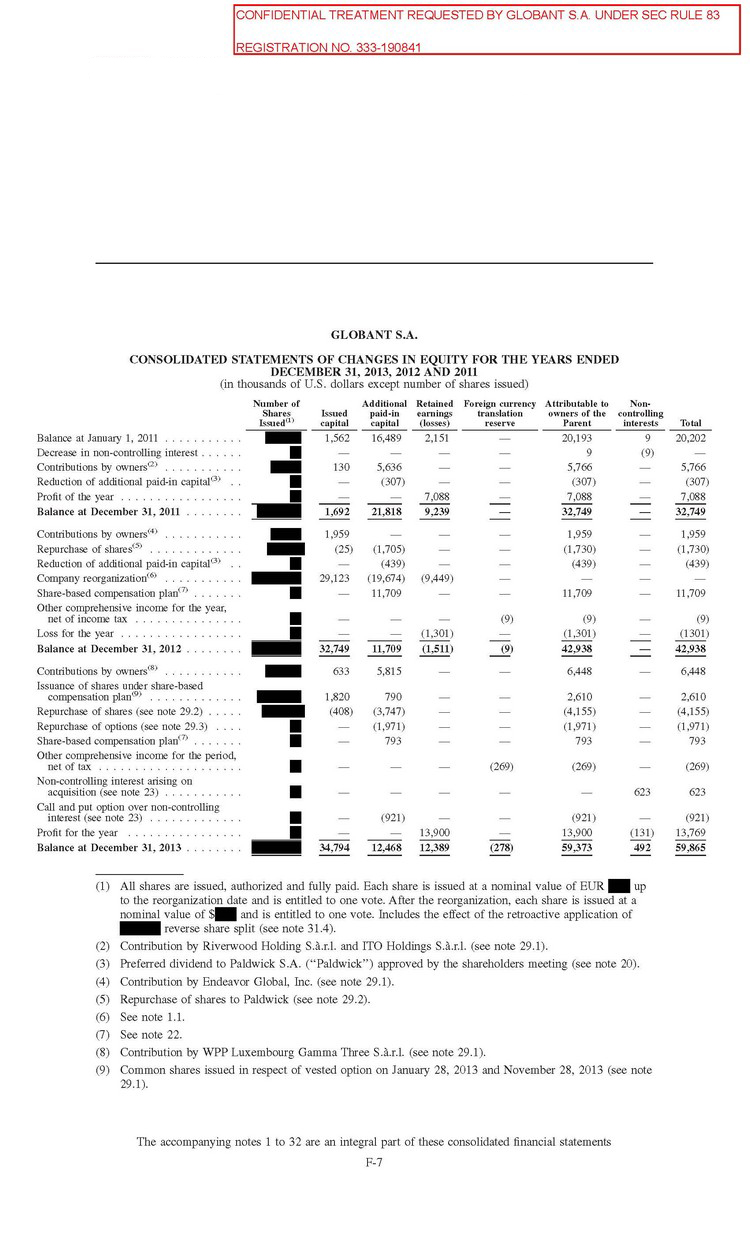

| § | Consolidated Statements of Profit or Loss and Other Comprehensive Income (page F-4); Consolidated Statements of Changes in Equity (page F-7); |

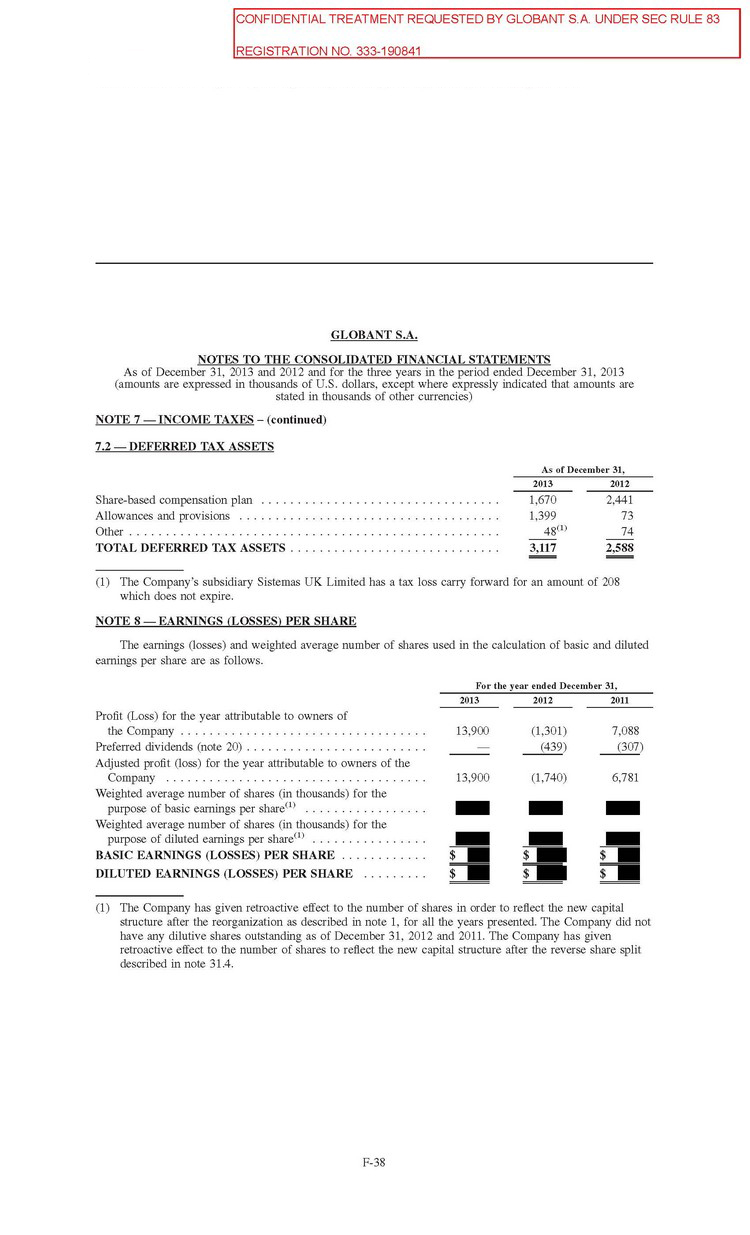

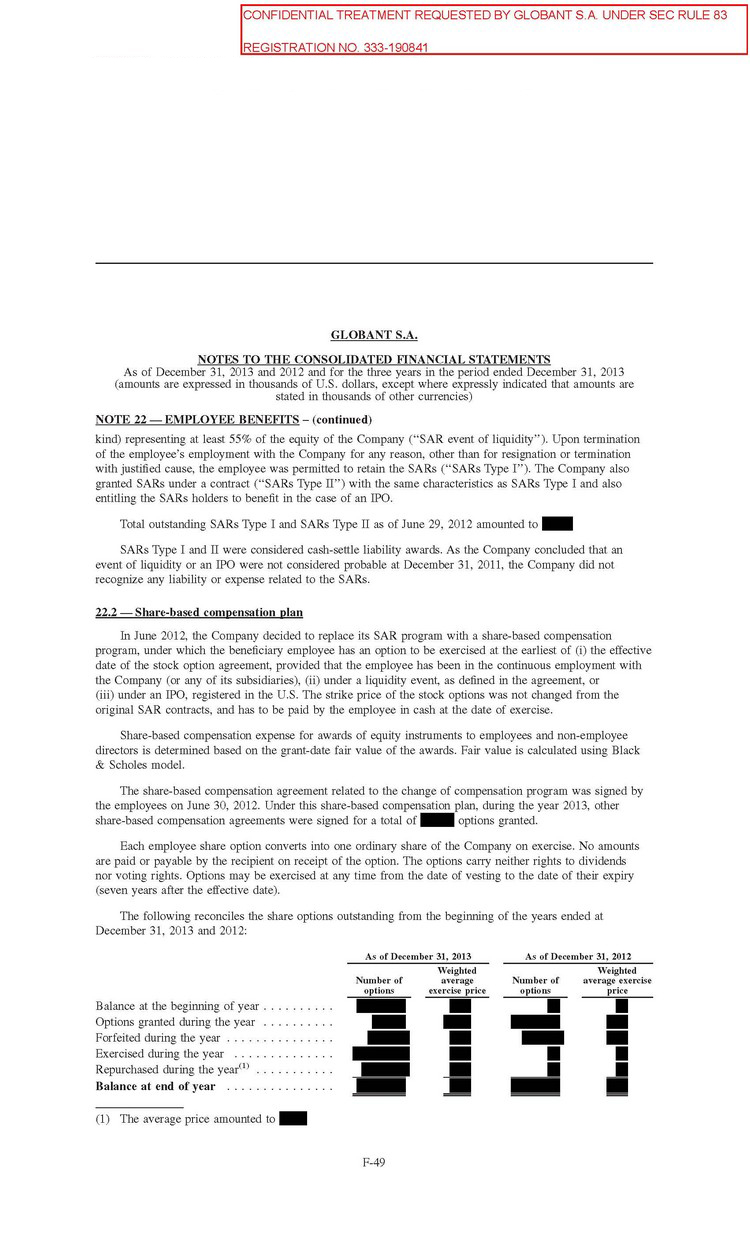

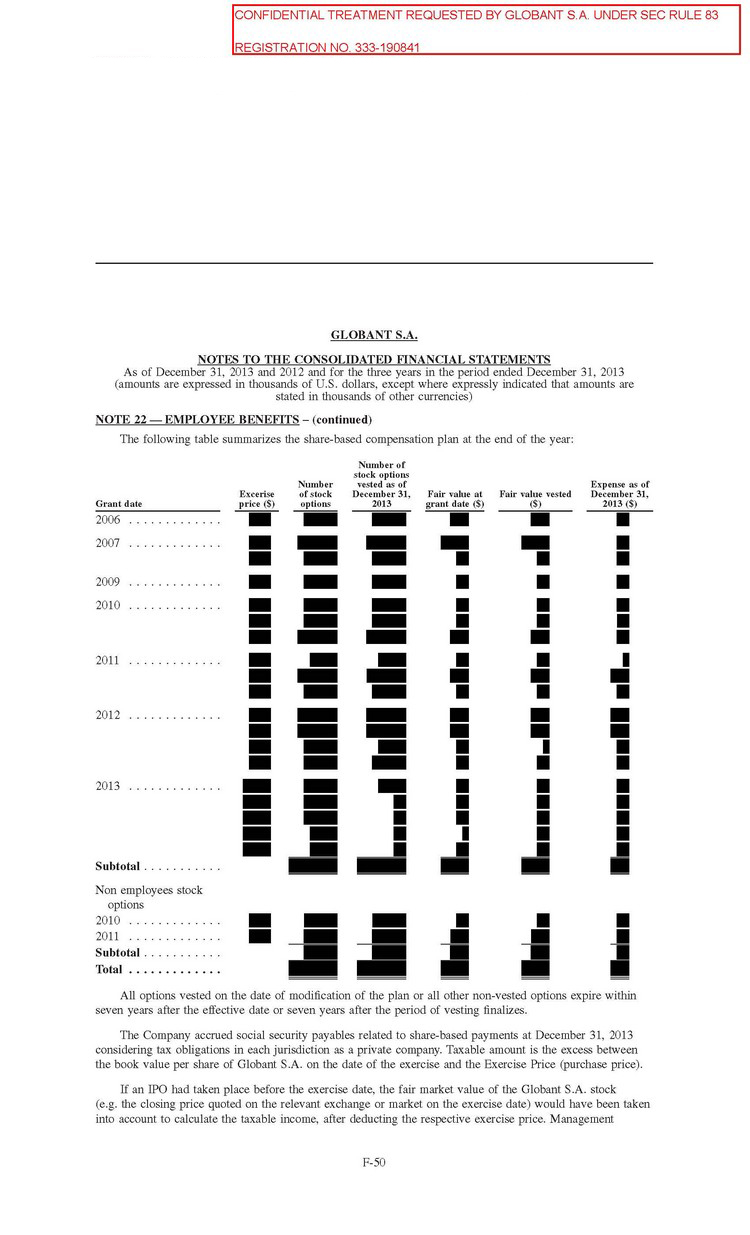

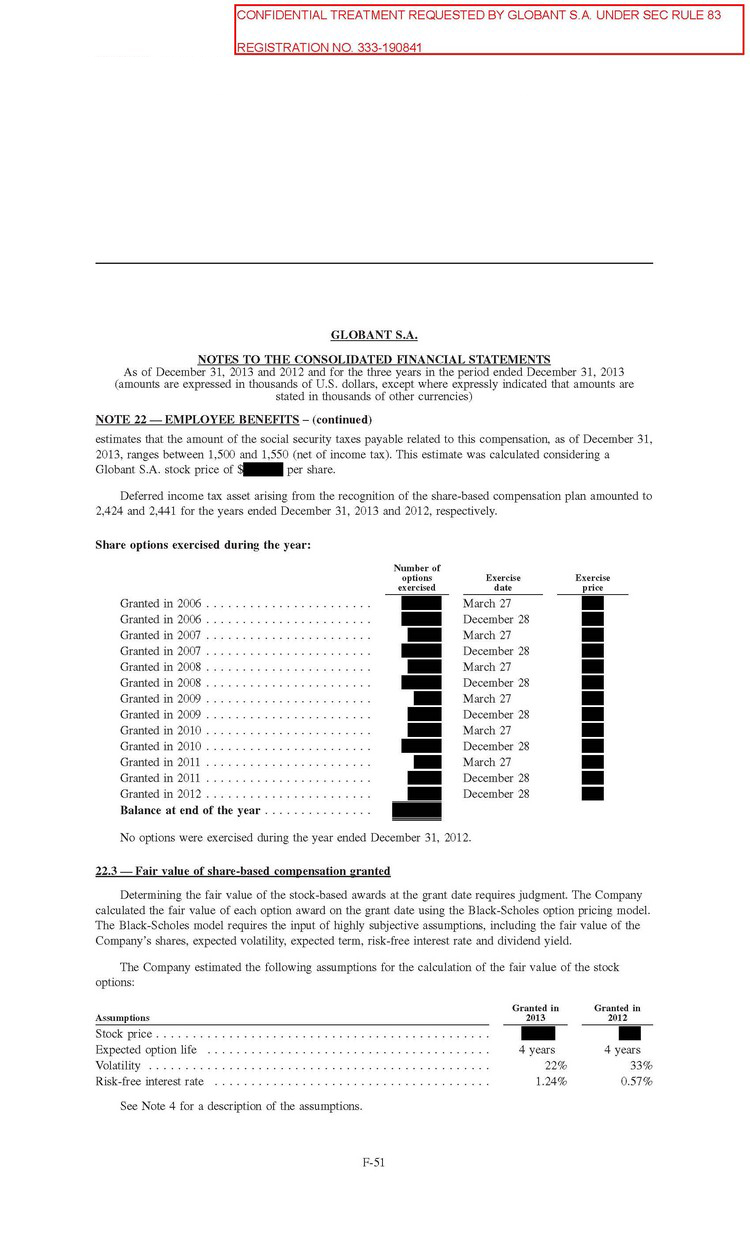

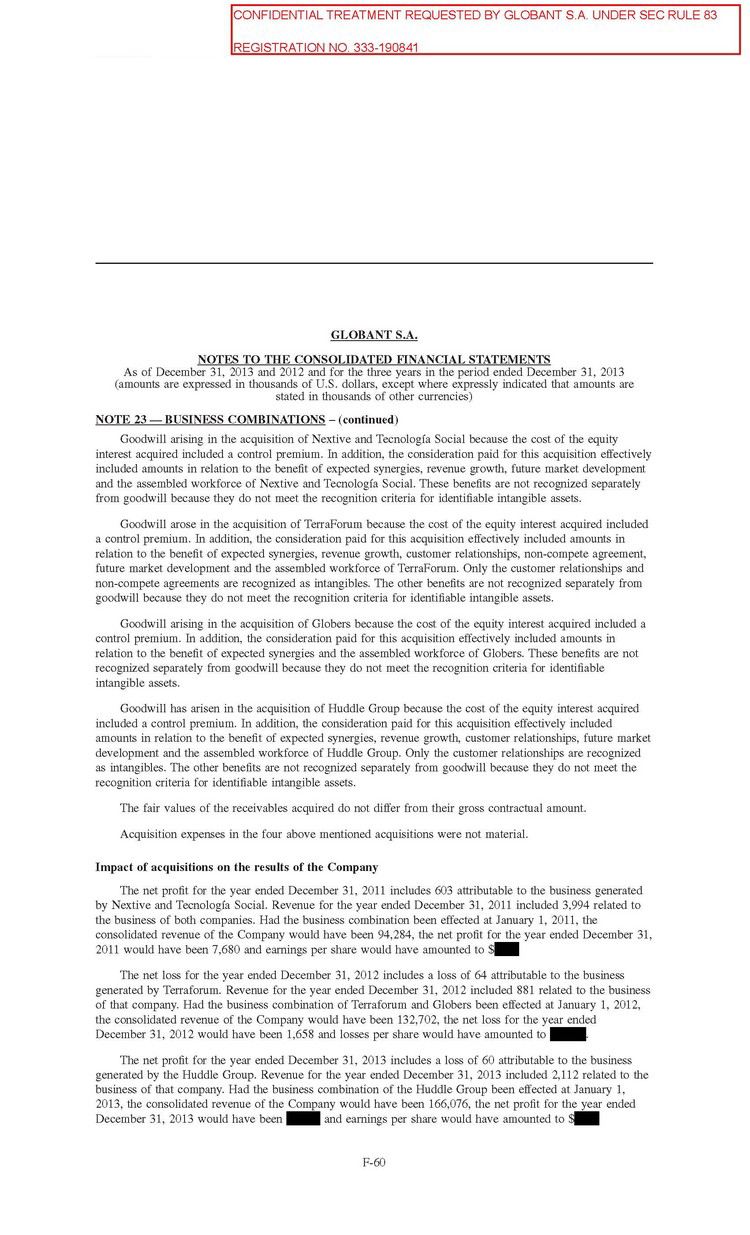

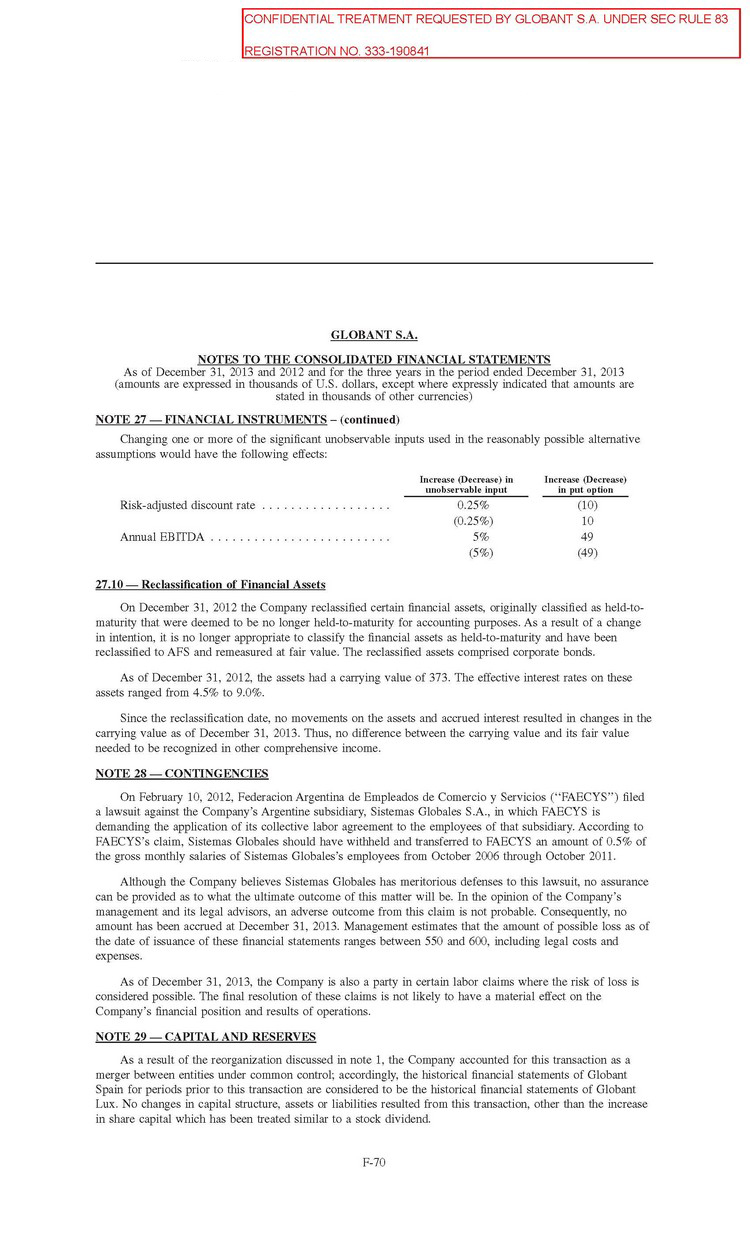

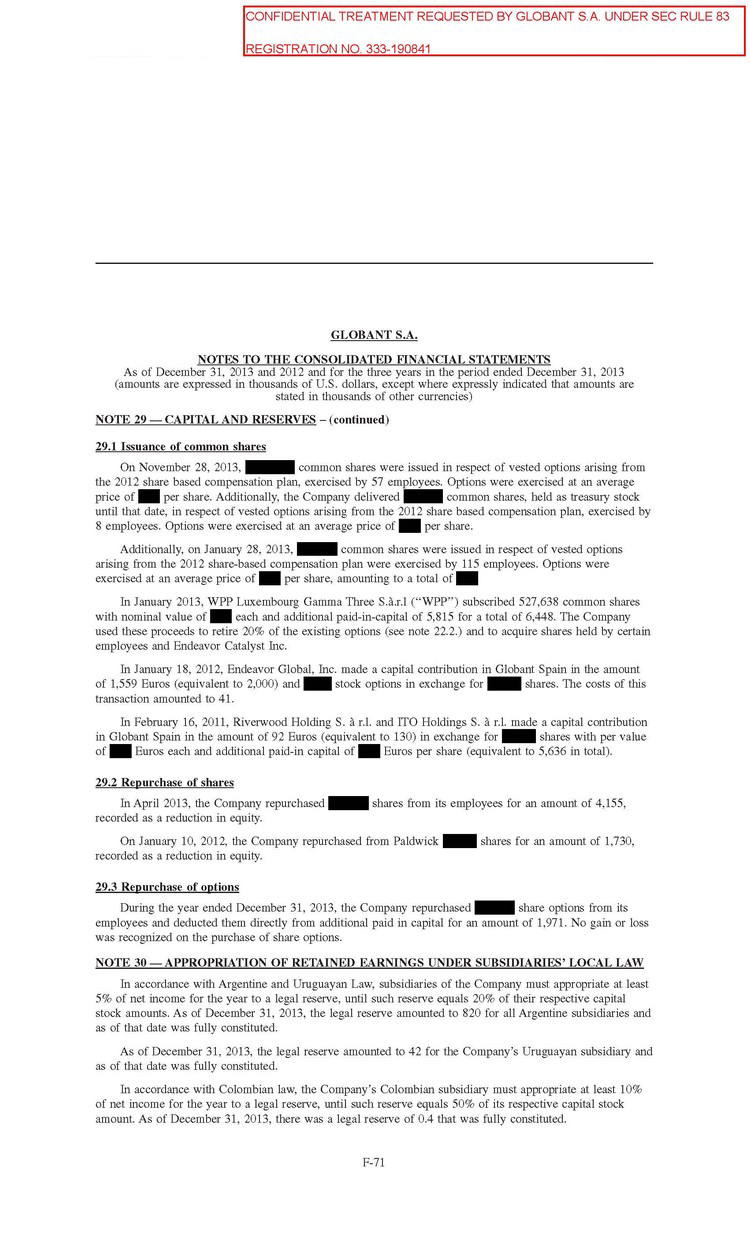

| § | Note 1.1 to Consolidated Financial Statements, “Basis of Presentation” (pages F-10, F-11 and F-12); Note 8 to Consolidated Financial Statements, “Earnings (Losses) Per Share” (page F-38); Note 21.5 to Consolidated Financial Statements, “Related Parties Balances and Transactions—Compensation of key management personnel” (pages F-48); Note 22 to Consolidated Financial Statements, “Employee Benefits” (pages F-48, F-49, F-50 and F-51); Note 23 to Consolidated Financial Statements, “Business Combinations—Impact of acquisitions on the results of the Company” (pages F-60); Note 29 to Consolidated Financial Statements, “Capital and Reserves” (pages F-70 and F-71); Note 31 to Consolidated Financial Statements, “Subsequent Events” (pages F-72 and F-73); |

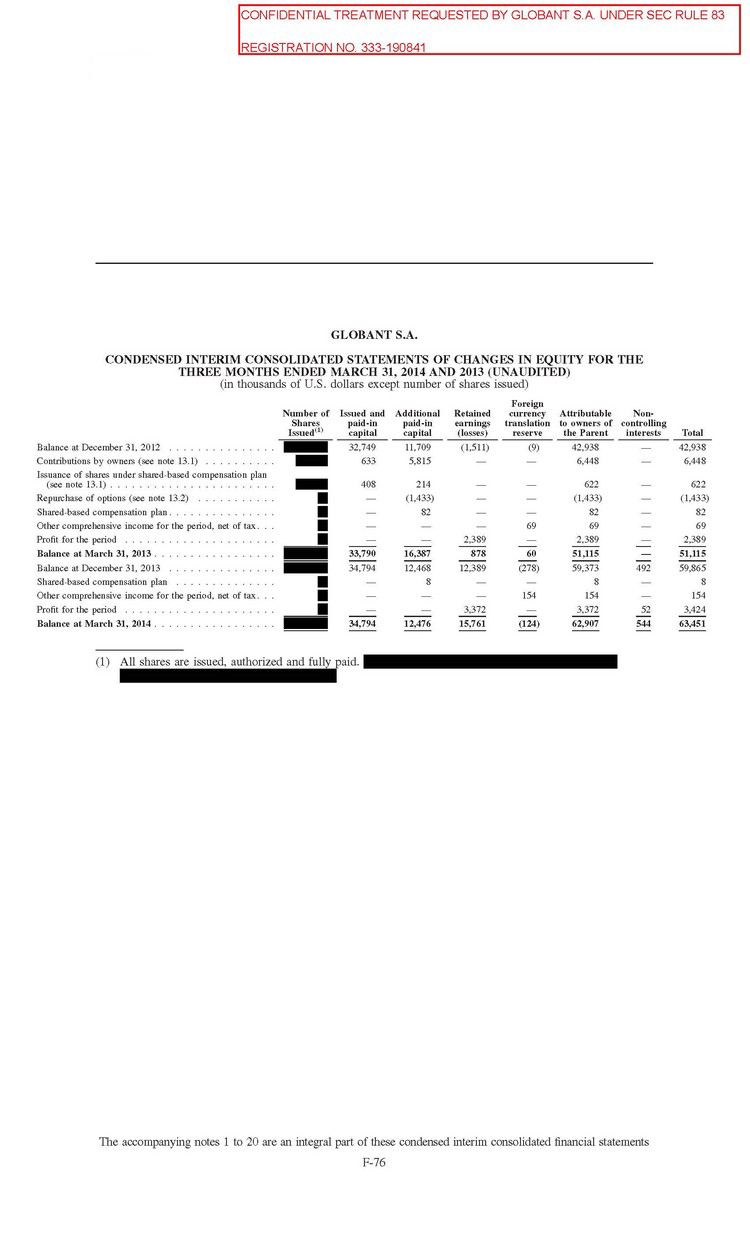

| § | Condensed Interim Consolidated Statements of Profit or Loss and Other Comprehensive Income (page F-74); Condensed Interim Consolidated Statements of Changes in Equity (page F-76); and |

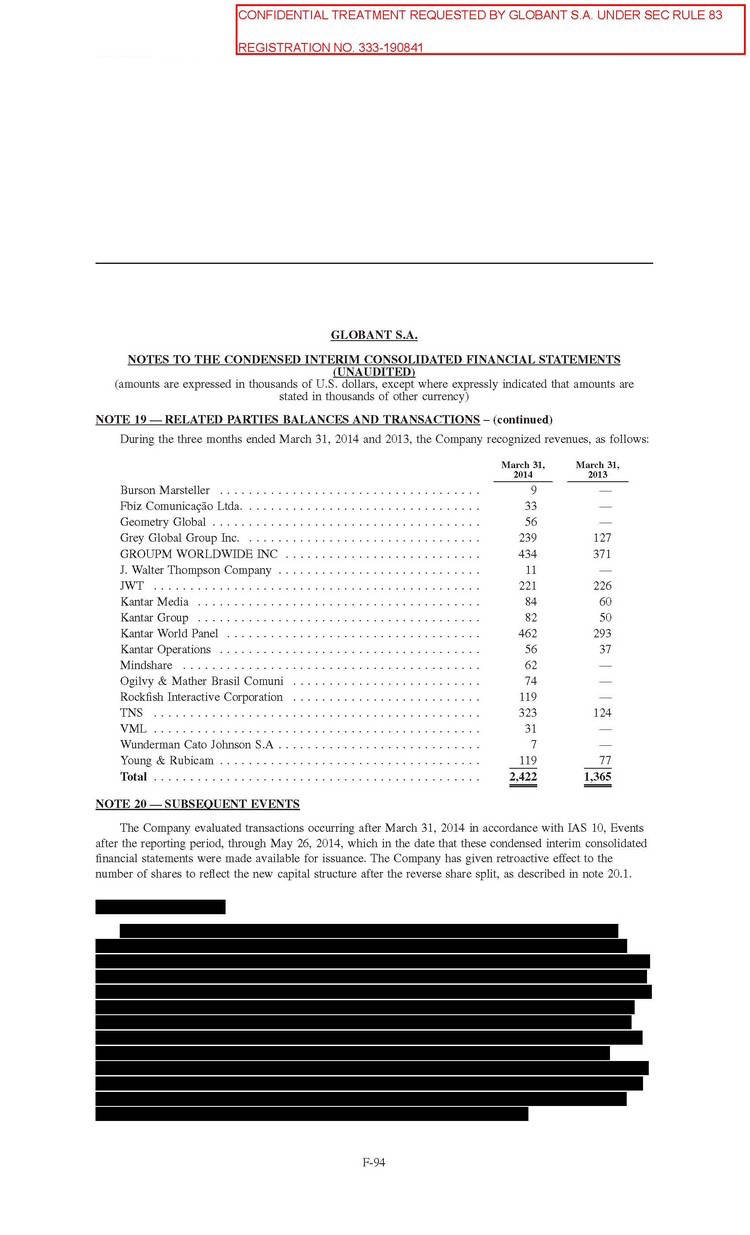

| § | Note 13 to Condensed Interim Consolidated Financial Statements, “Capital and Reserves” (pages F-90 and F-91); Note 15 to Condensed Interim Consolidated Financial Statements, “Share-Based Compensation—Employee Benefits” (page F-91); Note 20 to Condensed Interim Consolidated Financial Statements, “Subsequent Events” (pages F-94 and F-95). |

| |

United States Securities and Exchange Commission July 8, 2014 Page 4 | CONFIDENTIAL TREATMENT REQUESTED BY GLOBANT S.A. |

In connection with the Staff’s completing its review of the Company’s option pricing and fair value determinations, the Company respectfully directs the Staff’s attention to the sections captioned “Equity Compensation Arrangements,” “Fair Value Measurements—Fair value of stock appreciation rights” and “—Fair value of ordinary shares” on pages 88-89 and 93-95 in Operating and Financial Review and Prospects in Amendment No. 3 to the Registration Statement. These disclosures explain the Company’s accounting for share-based compensation, the methodology used by the Company to determine the fair value of its common shares on dates when options were granted by the Board of Directors and at each reporting date, factors and approaches considered by the Company in determining fair value of the common shares and factors that caused the fair value to change over time.

Timing of Reverse Share Split

The Company respectfully informs the Staff that at an extraordinary general meeting held on June 18, 2014 (“EGM I”), the Company’s shareholders conditionally approved the amendment of the Company’s issued share capital to reflect [***] common shares having a nominal value of $[***] per share, conditional upon and with effect solely from and after the approval at a subsequent extraordinary general meeting of shareholders of the Company of a change in the nominal value of its existing shares from $0.10 per share to $[***] per share and, concurrently therewith, the effecting of a [***]-for-[***] reverse share split, such subsequent extraordinary general meeting to occur not later than the business day prior to the business day on which the Commission declares the Registration Statement effective (“EGM II). As disclosed in Note 31.4 to the Consolidated Financial Statements and Note 21.1 to the Interim Condensed Consolidated Financial Statements included in the Registration Statement, all issued and outstanding shares and options exercisable for shares have been retroactively adjusted to reflect the reverse share split for all periods presented in those financial statements.

As discussed with the Staff in a telephone conversation on June 19, 2014, because the reverse share split will not be effective until the EGM II has occurred, the audit report of the Company’s independent registered public accounting firm that will be included in the red-herring preliminary prospectus and the pre-effective amendment to the Registration Statement filed with the Commission concurrently therewith will be preceded by a legend (signed on behalf of such firm) to the effect that the unsigned report that follows such legend is in the form that will be furnished by such firm upon the effective date of the reverse share split described in Note 31.4 to the Consolidated Financial Statements and assuming that from December 31, 2013 to the date of the EGM II no material events have occurred that would affect the Consolidated Financial Statements or required disclosure therein. Promptly following the EGM II and prior to the Commission’s declaration of effectiveness of the Registration Statement, the Company will file with the Commission an amendment to the Registration Statement that contains the unlegended and signed audit report of its independent registered public accounting firm.

| |

United States Securities and Exchange Commission July 8, 2014 Page 5 | CONFIDENTIAL TREATMENT REQUESTED BY GLOBANT S.A. |

Offering Timing Considerations

The Company is seeking to print its preliminary prospectus and commence its road show on July 7, 2014, with a target pricing prior to the end of July 2014. To achieve this schedule, the Company respectfully requests that the Staff complete its review within sufficient time so as to enable the Company to clear any remaining comments prior to the commencement of its road show.

* * *

If you have any questions regarding the information conveyed in this letter and its enclosures, please do not hesitate to call me at (212) 335-4970.

| Very truly yours, | |

| DLA Piper LLP (US) | |

| /s/ Christopher C. Paci | |

| Christopher C. Paci | |

| Partner |

Enclosures

| cc: | Martin Migoya |

| Alejandro Scannapieco | |

| S. Todd Crider |

| |

United States Securities and Exchange Commission July 8, 2014 Page 6 | CONFIDENTIAL TREATMENT REQUESTED BY GLOBANT S.A. |

Exhibit A

(see the following pages)