A copy of the Proxy Statement/Prospectus relating to the transaction described herein accompanies this brochure and is also available for free at sec.gov and cpa18global.com. You are urged to read the Proxy Statement/Prospectus and the documents incorporated by reference in it because they contain important information. Important Information for CPA®:18 – Global Stockholders Your Board of Directors requests your approval of a proposal to merge CPA®:18 – Global and W. P. Carey Inc. Please vote by July 25, 2022 Filed pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Filing Person: Corporate Property Associates 18 – Global Incorporated Subject Company: Corporate Property Associates 18 – Global Incorporated Commission File Number: 000-54970

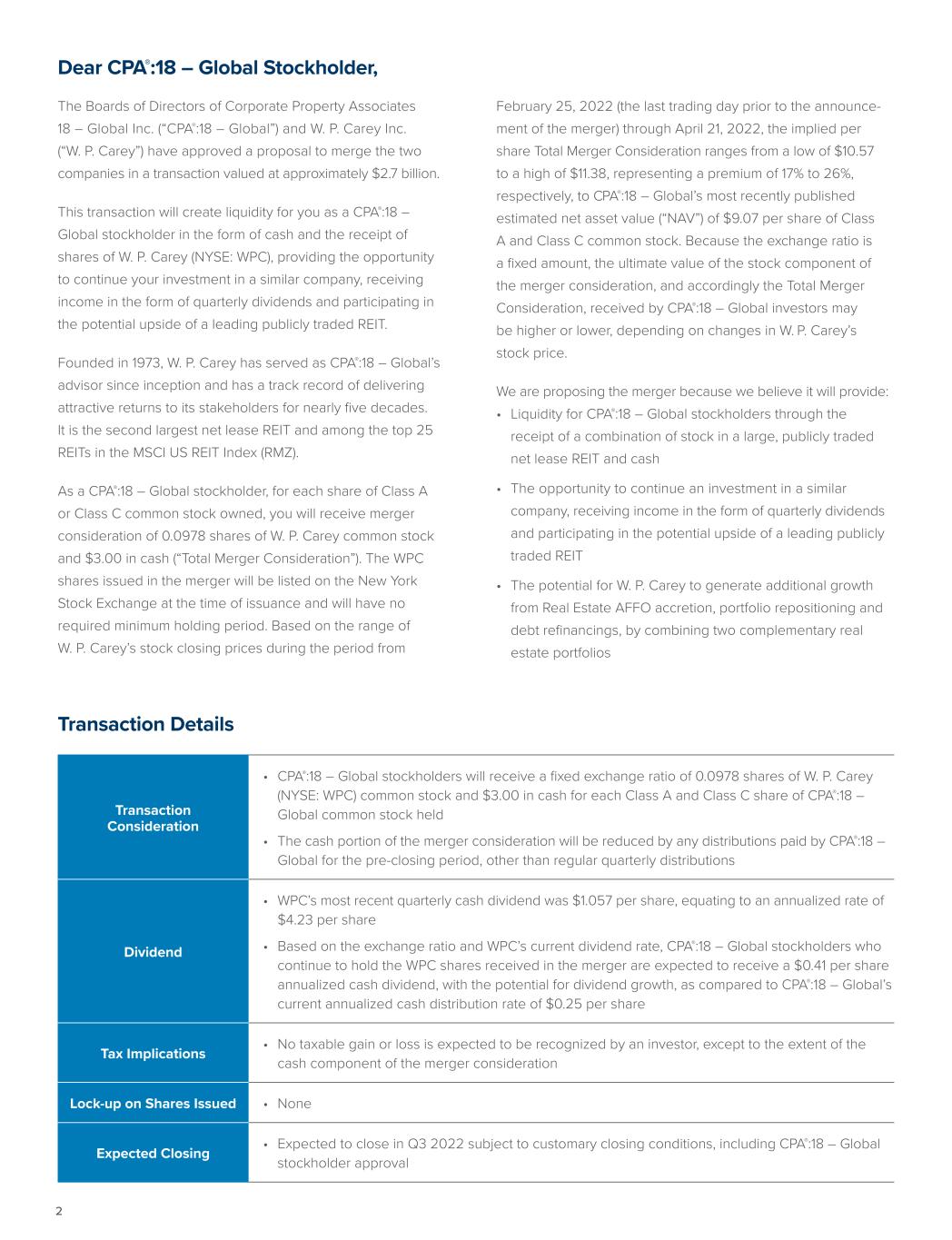

Dear CPA®:18 – Global Stockholder, The Boards of Directors of Corporate Property Associates 18 – Global Inc. (“CPA®:18 – Global”) and W. P. Carey Inc. (“W. P. Carey”) have approved a proposal to merge the two companies in a transaction valued at approximately $2.7 billion. This transaction will create liquidity for you as a CPA®:18 – Global stockholder in the form of cash and the receipt of shares of W. P. Carey (NYSE: WPC), providing the opportunity to continue your investment in a similar company, receiving income in the form of quarterly dividends and participating in the potential upside of a leading publicly traded REIT. Founded in 1973, W. P. Carey has served as CPA®:18 – Global’s advisor since inception and has a track record of delivering attractive returns to its stakeholders for nearly five decades. It is the second largest net lease REIT and among the top 25 REITs in the MSCI US REIT Index (RMZ). As a CPA®:18 – Global stockholder, for each share of Class A or Class C common stock owned, you will receive merger consideration of 0.0978 shares of W. P. Carey common stock and $3.00 in cash (“Total Merger Consideration”). The WPC shares issued in the merger will be listed on the New York Stock Exchange at the time of issuance and will have no required minimum holding period. Based on the range of W. P. Carey’s stock closing prices during the period from February 25, 2022 (the last trading day prior to the announce- ment of the merger) through April 21, 2022, the implied per share Total Merger Consideration ranges from a low of $10.57 to a high of $11.38, representing a premium of 17% to 26%, respectively, to CPA®:18 – Global’s most recently published estimated net asset value (“NAV”) of $9.07 per share of Class A and Class C common stock. Because the exchange ratio is a fixed amount, the ultimate value of the stock component of the merger consideration, and accordingly the Total Merger Consideration, received by CPA®:18 – Global investors may be higher or lower, depending on changes in W. P. Carey’s stock price. We are proposing the merger because we believe it will provide: • Liquidity for CPA®:18 – Global stockholders through the receipt of a combination of stock in a large, publicly traded net lease REIT and cash • The opportunity to continue an investment in a similar company, receiving income in the form of quarterly dividends and participating in the potential upside of a leading publicly traded REIT • The potential for W. P. Carey to generate additional growth from Real Estate AFFO accretion, portfolio repositioning and debt refinancings, by combining two complementary real estate portfolios Transaction Details Transaction Consideration • CPA®:18 – Global stockholders will receive a fixed exchange ratio of 0.0978 shares of W. P. Carey (NYSE: WPC) common stock and $3.00 in cash for each Class A and Class C share of CPA®:18 – Global common stock held • The cash portion of the merger consideration will be reduced by any distributions paid by CPA®:18 – Global for the pre-closing period, other than regular quarterly distributions Dividend • WPC’s most recent quarterly cash dividend was $1.057 per share, equating to an annualized rate of $4.23 per share • Based on the exchange ratio and WPC’s current dividend rate, CPA®:18 – Global stockholders who continue to hold the WPC shares received in the merger are expected to receive a $0.41 per share annualized cash dividend, with the potential for dividend growth, as compared to CPA®:18 – Global’s current annualized cash distribution rate of $0.25 per share Tax Implications • No taxable gain or loss is expected to be recognized by an investor, except to the extent of the cash component of the merger consideration Lock-up on Shares Issued • None Expected Closing • Expected to close in Q3 2022 subject to customary closing conditions, including CPA®:18 – Global stockholder approval 2 1,850% 1,750% 1,650% 1,550% 1,450% 1,350% 1,250% 1,150% 1,050% 950% 850% 750% 650% 550% 450% 350% 250% 150% 50% 0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 WPC RMS S&P 500

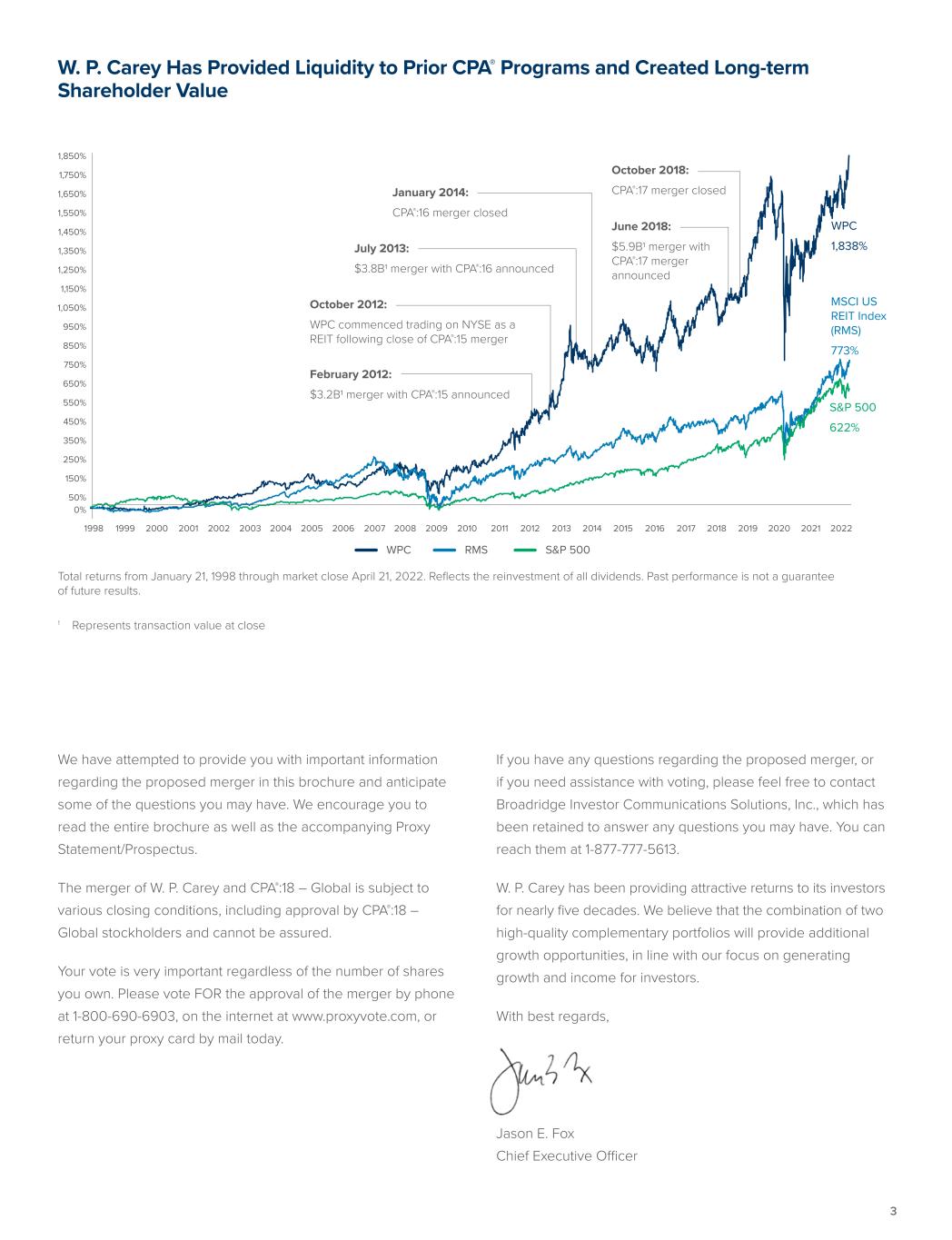

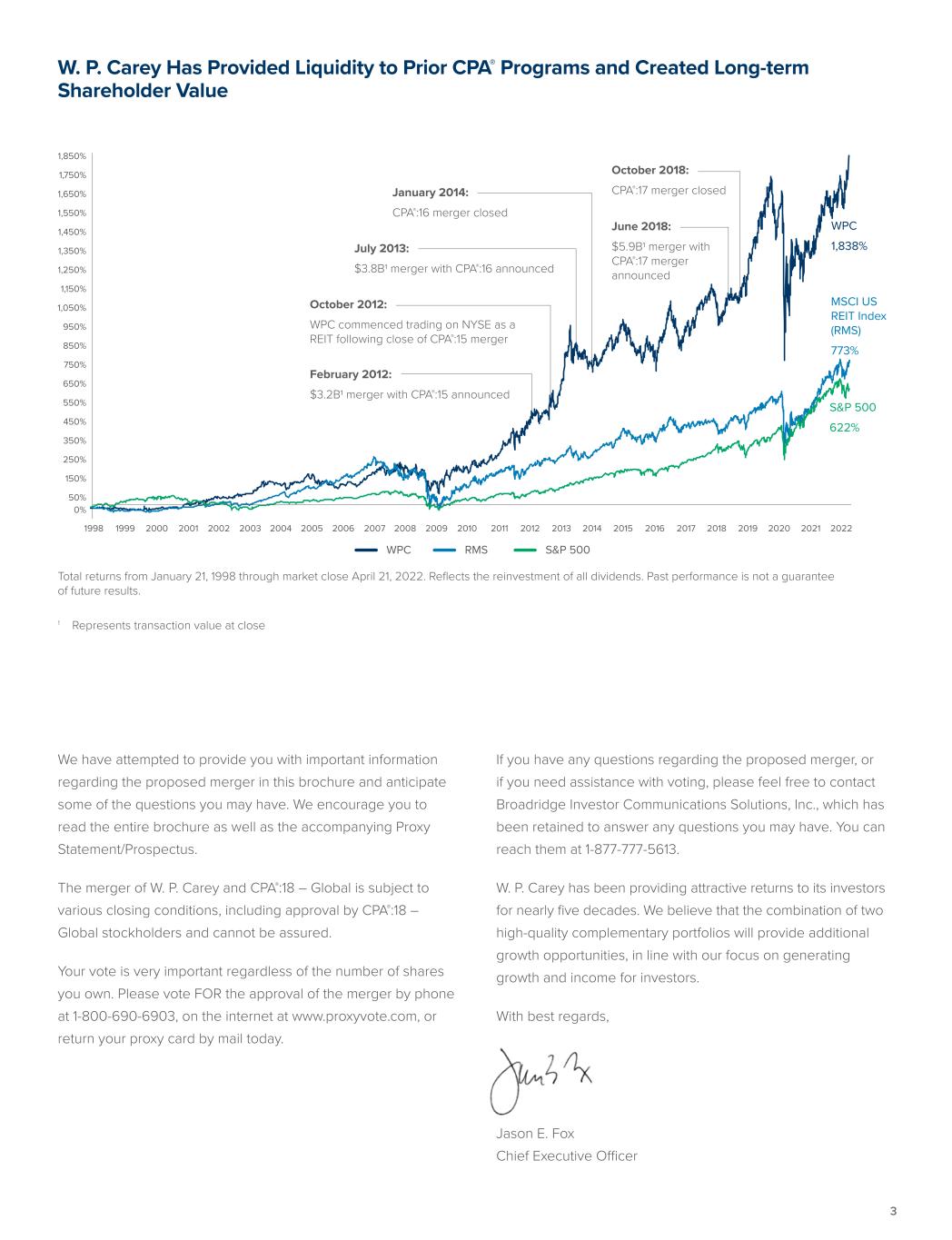

W. P. Carey Has Provided Liquidity to Prior CPA® Programs and Created Long-term Shareholder Value Total returns from January 21, 1998 through market close April 21, 2022. Reflects the reinvestment of all dividends. Past performance is not a guarantee of future results. 1 Represents transaction value at close Jason E. Fox Chief Executive Officer We have attempted to provide you with important information regarding the proposed merger in this brochure and anticipate some of the questions you may have. We encourage you to read the entire brochure as well as the accompanying Proxy Statement/Prospectus. The merger of W. P. Carey and CPA®:18 – Global is subject to various closing conditions, including approval by CPA®:18 – Global stockholders and cannot be assured. Your vote is very important regardless of the number of shares you own. Please vote FOR the approval of the merger by phone at 1-800-690-6903, on the internet at www.proxyvote.com, or return your proxy card by mail today. If you have any questions regarding the proposed merger, or if you need assistance with voting, please feel free to contact Broadridge Investor Communications Solutions, Inc., which has been retained to answer any questions you may have. You can reach them at 1-877-777-5613. W. P. Carey has been providing attractive returns to its investors for nearly five decades. We believe that the combination of two high-quality complementary portfolios will provide additional growth opportunities, in line with our focus on generating growth and income for investors. With best regards, 3 1,850% 1,750% 1,650% 1,550% 1,450% 1,350% 1,250% 1,150% 1,050% 950% 850% 750% 650% 550% 450% 350% 250% 150% 50% 0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 WPC RMS S&P 500 MSCI US REIT Index (RMS) 773% S&P 500 622% February 2012: $3.2B1 merger with CPA®:15 announced WPC 1,838% October 2012: WPC commenced trading on NYSE as a REIT following close of CPA®:15 merger July 2013: $3.8B1 merger with CPA®:16 announced January 2014: CPA®:16 merger closed June 2018: $5.9B1 merger with CPA®:17 merger announced October 2018: CPA®:17 merger closed

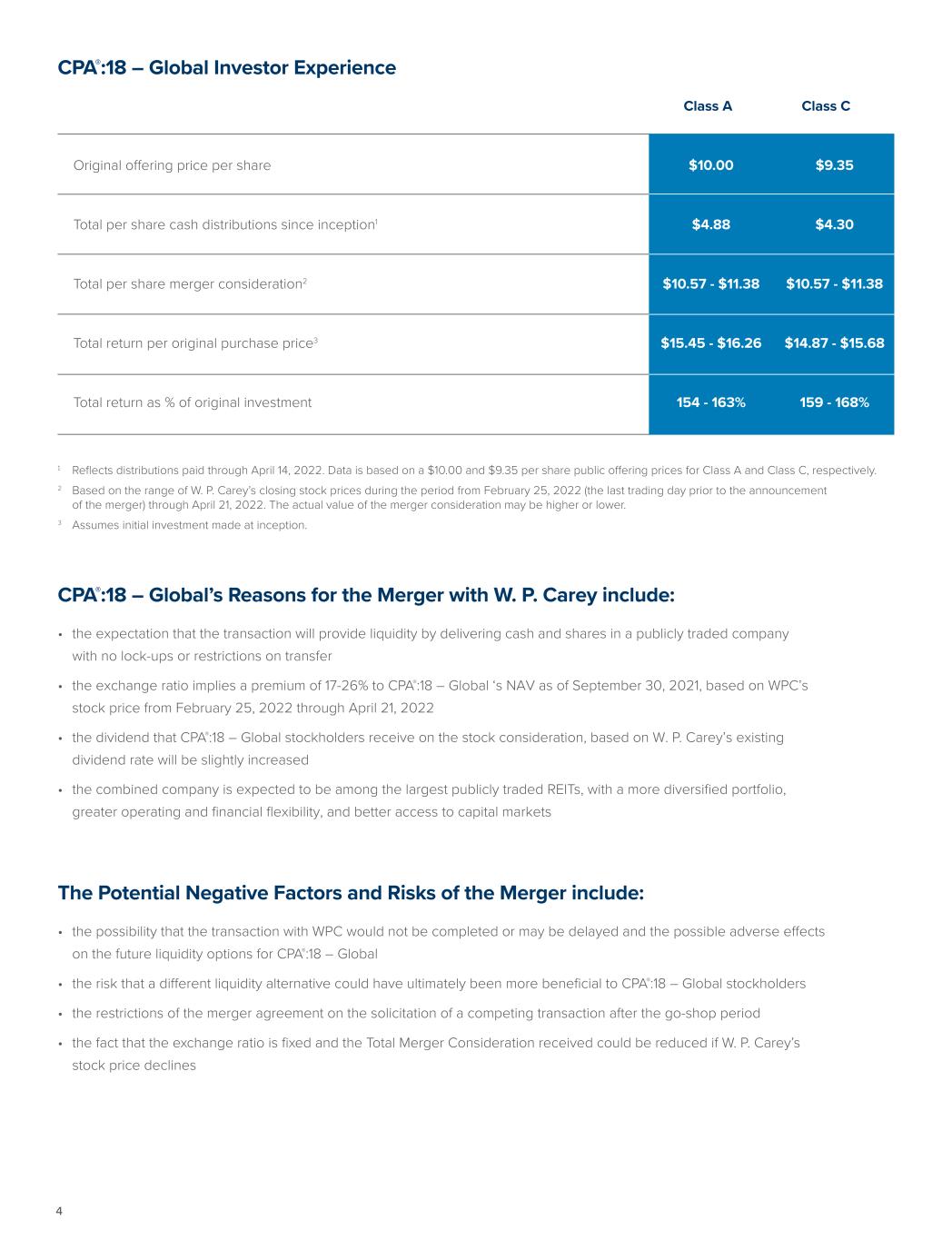

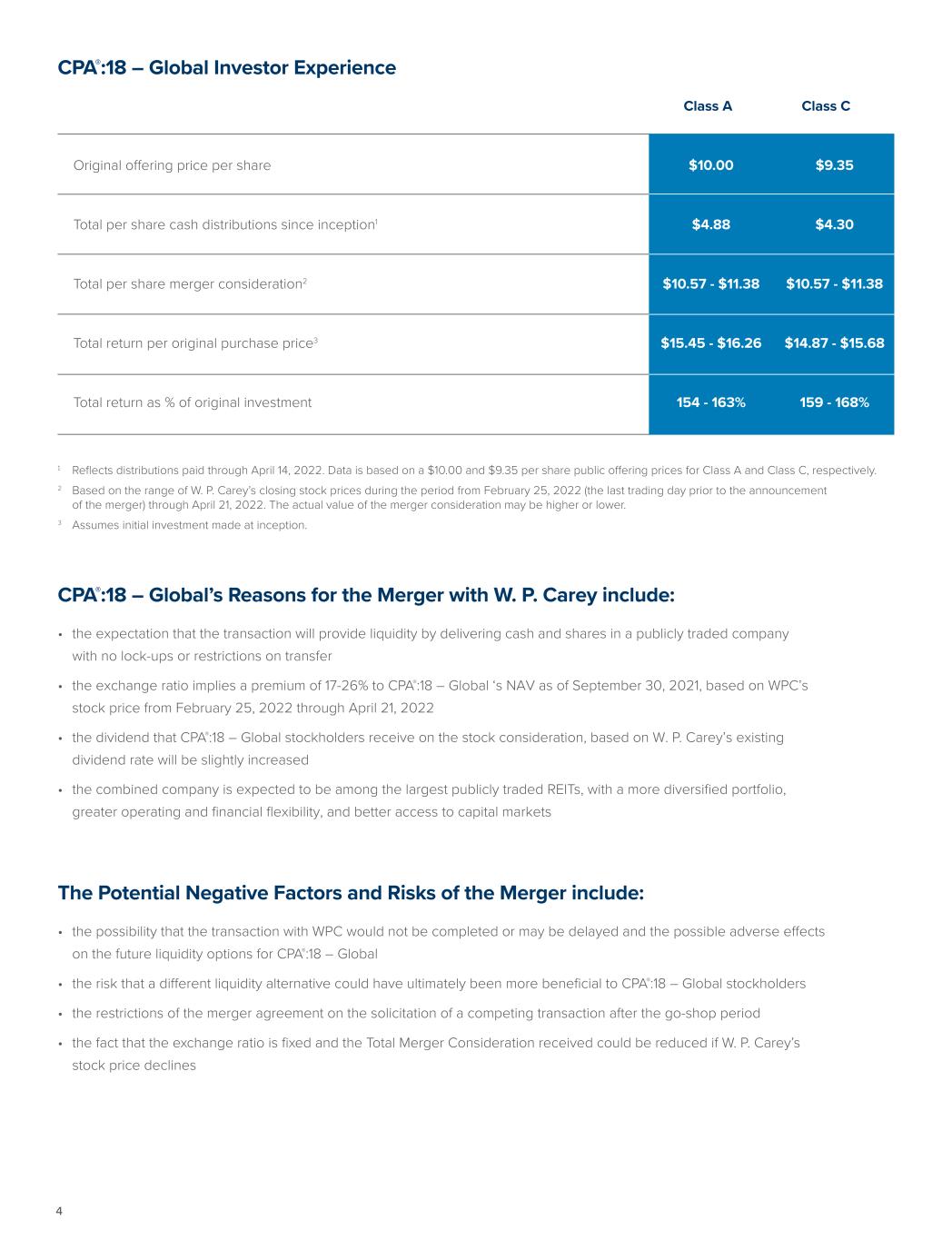

CPA®:18 – Global’s Reasons for the Merger with W. P. Carey include: • the expectation that the transaction will provide liquidity by delivering cash and shares in a publicly traded company with no lock-ups or restrictions on transfer • the exchange ratio implies a premium of 17-26% to CPA®:18 – Global ‘s NAV as of September 30, 2021, based on WPC’s stock price from February 25, 2022 through April 21, 2022 • the dividend that CPA®:18 – Global stockholders receive on the stock consideration, based on W. P. Carey’s existing dividend rate will be slightly increased • the combined company is expected to be among the largest publicly traded REITs, with a more diversified portfolio, greater operating and financial flexibility, and better access to capital markets The Potential Negative Factors and Risks of the Merger include: • the possibility that the transaction with WPC would not be completed or may be delayed and the possible adverse effects on the future liquidity options for CPA®:18 – Global • the risk that a different liquidity alternative could have ultimately been more beneficial to CPA®:18 – Global stockholders • the restrictions of the merger agreement on the solicitation of a competing transaction after the go-shop period • the fact that the exchange ratio is fixed and the Total Merger Consideration received could be reduced if W. P. Carey’s stock price declines CPA®:18 – Global Investor Experience Class A Class C Original offering price per share $10.00 $9.35 Total per share cash distributions since inception1 $4.88 $4.30 Total per share merger consideration2 $10.57 - $11.38 $10.57 - $11.38 Total return per original purchase price3 $15.45 - $16.26 $14.87 - $15.68 Total return as % of original investment 154 - 163% 159 - 168% 1 Reflects distributions paid through April 14, 2022. Data is based on a $10.00 and $9.35 per share public offering prices for Class A and Class C, respectively. 2 Based on the range of W. P. Carey’s closing stock prices during the period from February 25, 2022 (the last trading day prior to the announcement of the merger) through April 21, 2022. The actual value of the merger consideration may be higher or lower. 3 Assumes initial investment made at inception. 4

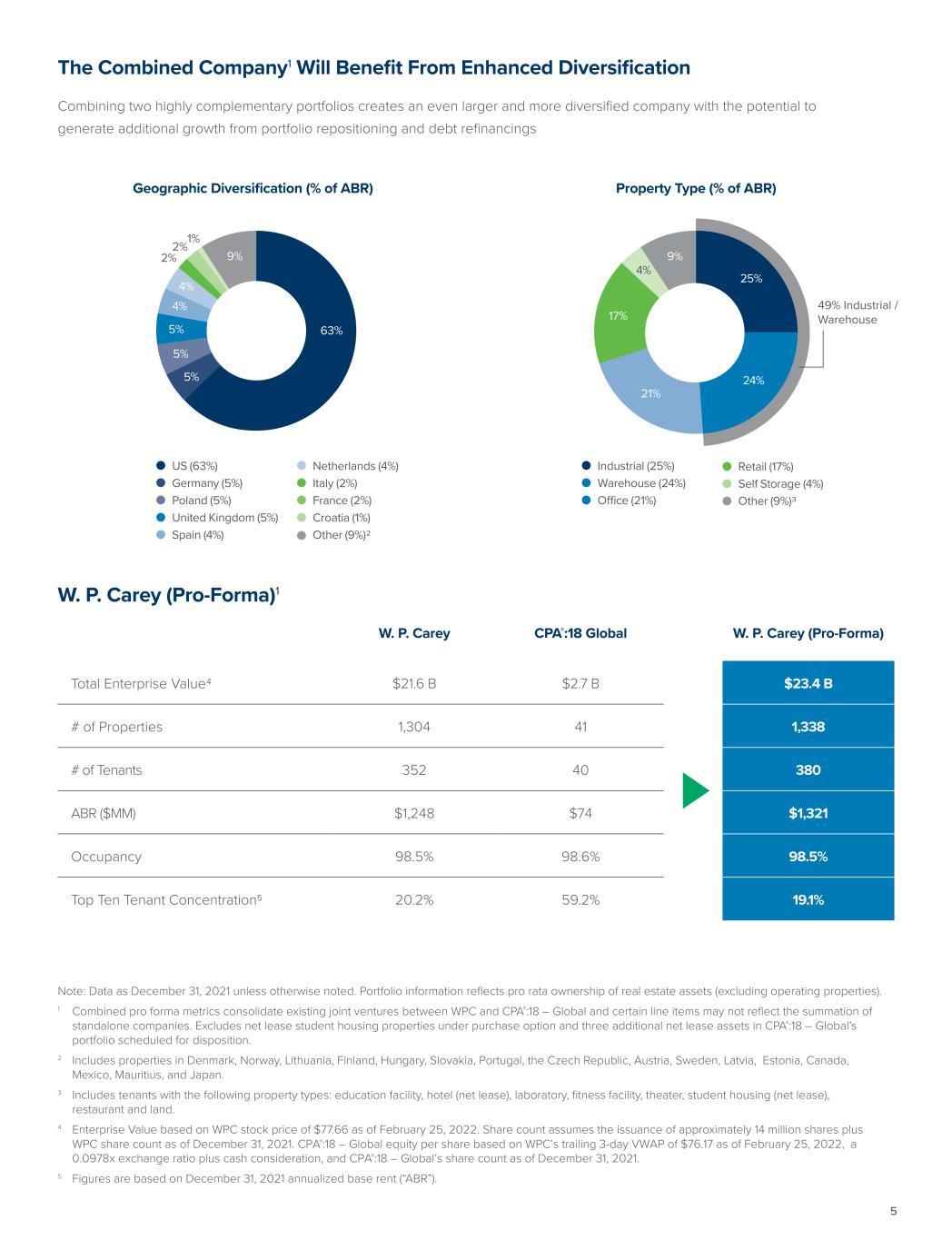

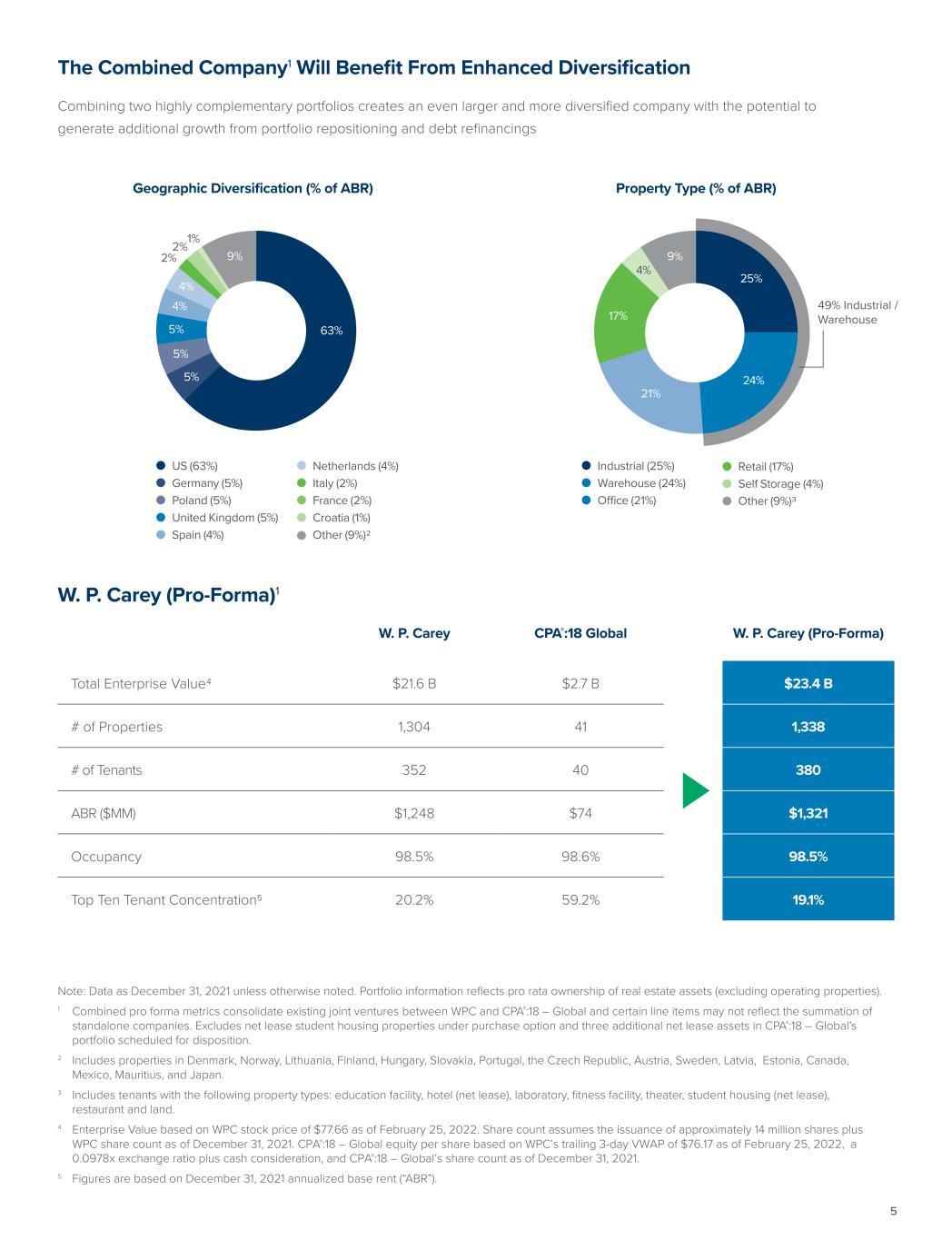

W. P. Carey CPA®:18 Global Total Enterprise Value4 $21.6 B $2.7 B # of Properties 1,304 41 # of Tenants 352 40 ABR ($MM) $1,248 $74 Occupancy 98.5% 98.6% Top Ten Tenant Concentration5 20.2% 59.2% W. P. Carey (Pro-Forma) $23.4 B 1,338 380 $1,321 98.5% 19.1% W. P. Carey (Pro-Forma)1 The Combined Company1 Will Benefit From Enhanced Diversification Combining two highly complementary portfolios creates an even larger and more diversified company with the potential to generate additional growth from portfolio repositioning and debt refinancings Geographic Diversification (% of ABR) Property Type (% of ABR) Industrial (25%) Warehouse (24%) O ce (21%) Retail (17%) Self Storage (4%) Other (9%)3 25% 24% 21% 17% 4% 9% 49% Industrial / Warehouse Note: Data as December 31, 2021 unless otherwise noted. Portfolio information reflects pro rata ownership of real estate assets (excluding operating properties). 1 Combined pro forma metrics consolidate existing joint ventures between WPC and CPA®:18 – Global and certain line items may not reflect the summation of standalone companies. Excludes net lease student housing properties under purchase option and three additional net lease assets in CPA®:18 – Global’s portfolio scheduled for disposition. 2 Includes properties in Denmark, Norway, Lithuania, Finland, Hungary, Slovakia, Portugal, the Czech Republic, Austria, Sweden, Latvia, Estonia, Canada, Mexico, Mauritius, and Japan. 3 Includes tenants with the following property types: education facility, hotel (net lease), laboratory, fitness facility, theater, student housing (net lease), restaurant and land. 4 Enterprise Value based on WPC stock price of $77.66 as of February 25, 2022. Share count assumes the issuance of approximately 14 million shares plus WPC share count as of December 31, 2021. CPA®:18 – Global equity per share based on WPC’s trailing 3-day VWAP of $76.17 as of February 25, 2022, a 0.0978x exchange ratio plus cash consideration, and CPA®:18 – Global’s share count as of December 31, 2021. 5 Figures are based on December 31, 2021 annualized base rent (“ABR”). 63% 5% 5% 5% 9% 4% 4% 2% 2%1% US (63%) Germany (5%) Poland (5%) United Kingdom (5%) Spain (4%) Netherlands (4%) Italy (2%) France (2%) Croatia (1%) Other (9%)2 63% 5% 5% 5% 9% 4% 4% 2% 2%1% US (63%) Germany (5%) Poland (5%) United Kingdom (5%) Spain (4%) Netherlands (4%) Italy (2%) France (2%) Croatia (1%) Other (9%)2 5

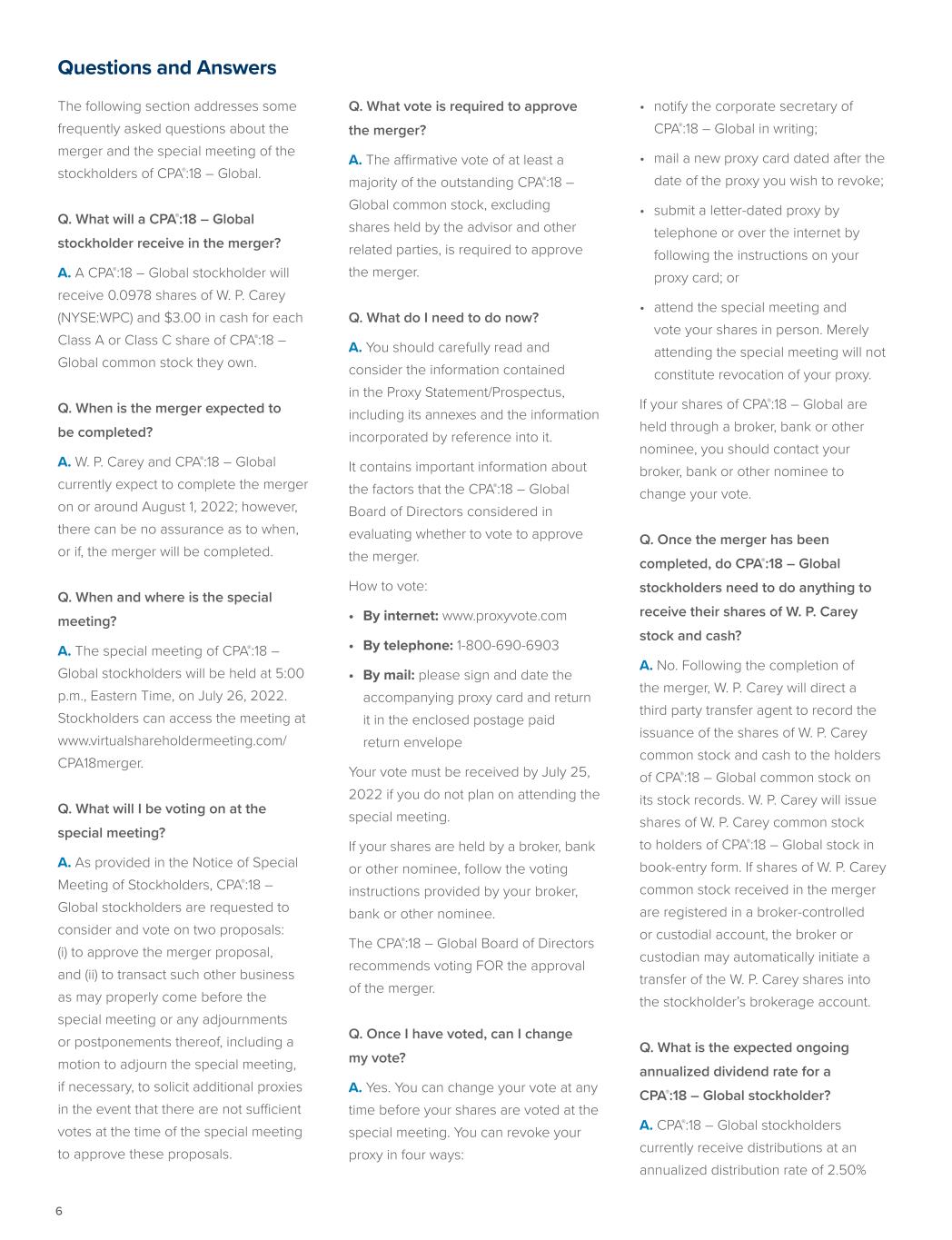

Questions and Answers The following section addresses some frequently asked questions about the merger and the special meeting of the stockholders of CPA®:18 – Global. Q. What will a CPA®:18 – Global stockholder receive in the merger? A. A CPA®:18 – Global stockholder will receive 0.0978 shares of W. P. Carey (NYSE:WPC) and $3.00 in cash for each Class A or Class C share of CPA®:18 – Global common stock they own. Q. When is the merger expected to be completed? A. W. P. Carey and CPA®:18 – Global currently expect to complete the merger on or around August 1, 2022; however, there can be no assurance as to when, or if, the merger will be completed. Q. When and where is the special meeting? A. The special meeting of CPA®:18 – Global stockholders will be held at 5:00 p.m., Eastern Time, on July 26, 2022. Stockholders can access the meeting at www.virtualshareholdermeeting.com/ CPA18merger. Q. What will I be voting on at the special meeting? A. As provided in the Notice of Special Meeting of Stockholders, CPA®:18 – Global stockholders are requested to consider and vote on two proposals: (i) to approve the merger proposal, and (ii) to transact such other business as may properly come before the special meeting or any adjournments or postponements thereof, including a motion to adjourn the special meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the special meeting to approve these proposals. Q. What vote is required to approve the merger? A. The affirmative vote of at least a majority of the outstanding CPA®:18 – Global common stock, excluding shares held by the advisor and other related parties, is required to approve the merger. Q. What do I need to do now? A. You should carefully read and consider the information contained in the Proxy Statement/Prospectus, including its annexes and the information incorporated by reference into it. It contains important information about the factors that the CPA®:18 – Global Board of Directors considered in evaluating whether to vote to approve the merger. How to vote: • By internet: www.proxyvote.com • By telephone: 1-800-690-6903 • By mail: please sign and date the accompanying proxy card and return it in the enclosed postage paid return envelope Your vote must be received by July 25, 2022 if you do not plan on attending the special meeting. If your shares are held by a broker, bank or other nominee, follow the voting instructions provided by your broker, bank or other nominee. The CPA®:18 – Global Board of Directors recommends voting FOR the approval of the merger. Q. Once I have voted, can I change my vote? A. Yes. You can change your vote at any time before your shares are voted at the special meeting. You can revoke your proxy in four ways: • notify the corporate secretary of CPA®:18 – Global in writing; • mail a new proxy card dated after the date of the proxy you wish to revoke; • submit a letter-dated proxy by telephone or over the internet by following the instructions on your proxy card; or • attend the special meeting and vote your shares in person. Merely attending the special meeting will not constitute revocation of your proxy. If your shares of CPA®:18 – Global are held through a broker, bank or other nominee, you should contact your broker, bank or other nominee to change your vote. Q. Once the merger has been completed, do CPA®:18 – Global stockholders need to do anything to receive their shares of W. P. Carey stock and cash? A. No. Following the completion of the merger, W. P. Carey will direct a third party transfer agent to record the issuance of the shares of W. P. Carey common stock and cash to the holders of CPA®:18 – Global common stock on its stock records. W. P. Carey will issue shares of W. P. Carey common stock to holders of CPA®:18 – Global stock in book-entry form. If shares of W. P. Carey common stock received in the merger are registered in a broker-controlled or custodial account, the broker or custodian may automatically initiate a transfer of the W. P. Carey shares into the stockholder’s brokerage account. Q. What is the expected ongoing annualized dividend rate for a CPA®:18 – Global stockholder? A. CPA®:18 – Global stockholders currently receive distributions at an annualized distribution rate of 2.50% 6

Cautionary Statement Concerning Forward-Looking Statements: Certain of the matters discussed in this communication constitute forward-looking statements within the meaning of the federal securities laws. These forward-looking statements include, among other things, statements regarding intent, belief or expectations of CPA®:18 – Global and generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “assume,” “outlook,” “seek,” “forecast,” and similar expressions. These forward-looking statements include, but are not limited to, statements regarding: the benefits of the proposed merger, annualized dividends, funds from operations coverage, integration plans and expected synergies, the expected benefits of the proposed merger, anticipated future financial and operating performance and results, including estimates of growth, and the expected timing of completion of the proposed merger. These statements are based on current expectations. It is important to note that actual results could be materially different from those projected in such forward- looking statements. There are a number of risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. Other unknown or unpredictable risks or uncertainties, like the risks related to the effects of pandemics and global outbreaks of contagious diseases (such as the current COVID-19 pandemic) or the fear of such outbreaks, could also have material adverse effects on our business, financial condition, liquidity, results of operations, and prospects. You should exercise caution in relying on forward-looking statements as they involve known and unknown risks, uncertainties, and other factors that may materially affect our future results, performance, achievements, or transactions. Information on some of these factors are contained in CPA®:18 – Global’s and W. P. Carey’s filings with the SEC and are available at the SEC’s website at http://www.sec.gov, including, but not limited to, Part I, Item 1A.Risk Factors in each company’s Annual Report on Form 10-K for the year ended December 31, 2021. These risks, as well as other risks associated with the proposed merger, are more fully discussed in the Proxy Statement/Prospectus that is included in the Registration Statement on Form S-4 filed by W. P. Carey with the SEC in connection with the proposed merger. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this com- munication may not occur. Moreover, because we operate in a very competitive and rapidly changing environment, new risks are likely to emerge from time to time. Readers are cautioned not to place undue reliance on these forward-looking statements as a prediction of future results, which speak only as of the date of this communication, unless noted otherwise. Except as required under the federal securities laws and the rules and regulations of the SEC, CPA®:18 – Global does not undertake to revise or update any forward-looking statements. Additional Information and Where to Find It: This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdic- tion in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of the Proxy Statement/Prospectus. WE URGE INVESTORS TO READ THE PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED BY CPA®:18 – GLOBAL AND W. P. CAREY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT CPA®:18 – GLOBAL, W. P. CAREY AND THE PROPOSED TRANSACTIONS. INVESTORS ARE URGED TO READ THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY. Investors are able to obtain these materials and other documents filed with the SEC free of charge at the SEC’s website (http:/www.sec.gov). In addition, these materials are also available free of charge by accessing CPA®:18 – Global’s website (http://www.cpa18global.com) or by accessing W. P. Carey’s website (http:// www.wpcarey.com). Investors may also read and copy any reports, statements and other information filed by CPA®:18 – Global or W. P. Carey with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Participants in the Proxy Solicitation Information regarding W. P. Carey’s directors and executive officers is available in its proxy statement filed with the SEC by W. P. Carey on March 28, 2022 in connection with its 2022 annual meeting of stockholders, and information regarding CPA®:18 – Global’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC by CPA®:18 – Global on February 25, 2022. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Proxy Statement/ Prospectus, relevant materials filed by W. P. Carey on April 25, 2022, and other relevant materials filed with the SEC. April 2022 for Class A common stock and 2.67% for Class C common stock. Following the merger, CPA®:18 – Global stockholders who hold their W. P. Carey shares will be entitled to receive future dividends paid by W. P. Carey. Based on W. P. Carey’s current annualized dividend rate and the exchange ratio, each holder of CPA®:18 – Global common stock is expected to receive dividends at an annualized rate equivalent to 4.13% on an original investment of $10.00 per share of CPA®:18 – Global Class A common stock and 4.42% on an original investment of $9.35 per share of CPA®:18 – Global Class C common stock. Q. Will CPA®:18 – Global stockholders who participated in CPA®:18 – Global’s dividend reinvestment plan automatically participate in W. P. Carey’s dividend reinvestment and stock purchase plan (the “W. P. Carey DRIP”)? A. No. Each CPA®:18 – Global stockholder who desires to participate in the W. P. Carey DRIP following the completion of the merger will need to enroll in the W. P. Carey DRIP. Stockholders should contact W. P. Carey’s Investor Relations department at 1-800-WP CAREY (972- 2739) or IR@wpcarey.com. Q. Will CPA®:18 – Global stockholders have to pay federal income taxes as a result of the merger? A. No taxable gain or loss is expected to be recognized by an investor, except to the extent of the cash component of the merger consideration. Q. Who can help answer my questions? A. If you have additional questions about the proposed merger, please contact: W. P. Carey Investor Relations Department at 1-800-WP CAREY (972-2739) or IR@wpcarey.com or Broadridge Investor Communications Solutions, Inc. at 1-877-777-5613. 7

How to Vote If you do not vote, the effect will be the same as voting against the merger Internet 1. Go to www.proxyvote.com 2. Please have your proxy card/voting instruction form available 3. Follow the simple instructions QR Code 1. Go to www.proxyvote.com 2. Please have your proxy card/voting instruction form available 3. Follow the simple instructions Telephone Call toll free 1-800-690-6903 There is no charge for this call; please have your proxy card/voting instruction form in hand. Mail Please sign and date the accompanying proxy card and return it in the enclosed postage paid return envelope. If you sign and return the proxy card without indicating your choices, you will have been deemed to have voted in favor of the Merger. If you have any questions or need assistance in completing your proxy card, please call Broadridge Investor Communications Solutions, Inc. at 1-877-777-5613. Your vote must be received by July 25, 2022 if you don’t plan to attend the Special Meeting. Your vote is important. Please act promptly.