The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q will be available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Fund voted proxies relating to Fund securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-855-480-NASH; and (ii) on the Commission’s website at http://www.sec.gov.

Percentages are based on Net Assets of $6,507,818.

As of October 31, 2013, all of the Fund’s investments were considered Level 1 of the fair value hierarchy, in accordance with the authoritative guidance under U.S. GAAP.

For the period ended October 31, 2013, there have been no transfers between Level 1, Level 2 or Level 3 investments.

For the period ended October 31, 2013, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

1. ORGANIZATION

LocalShares Investment Trust (the “Trust”), was formed on August 23, 2012 and is authorized to have multiple series or portfolios. The Trust is an open-end, non-diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is currently offering one portfolio, the Nashville Area ETF (the “Fund”). LocalShares, Inc. (the “Investment Adviser”) serves as the investment adviser to the Fund. Decker Wealth Management LLC (the “Sub-Adviser”) serves as the sub-adviser and is responsible for day-to-day management of the Fund. The Fund is considered to be “non-diversified” under the 1940 Act.

The investment objective of Fund is to seek to replicate as closely as possible, before fees and expenses, the price and yield performance of the LocalShares Nashville Index (the “Index”). The Fund does not try to beat the Index and does not seek temporary defensive positions when equity markets decline or appear to be overvalued.

Shares of the Funds will be listed and traded on the NYSE Arca, Inc. Market prices for the Shares may be different from their net asset value (“NAV”). The Fund will issue and redeem Shares on a continuous basis at NAV only in large blocks of Shares, typically 50,000 Shares, called “Creation Units.” Creation Units will be issued and redeemed principally in-kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the Significant Accounting Policies followed by the Fund.

Use of Estimates and Indemnifications — The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

In the normal course of business, the Trust enters into contracts that contain a variety of representations which provide general indemnifications. The Trust’s maximum exposure under these arrangements cannot be known; however, the Trust expects any risk of loss to be remote.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent quoted bid. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Securities for which market prices are not “readily available” are valued in accordance with Fair Value Procedures established by the Board. The Fund’s Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Fund may fair value its securities if an event that may materially affect the value of the Fund’s securities that traded outside of the United States (a “Significant Event”) has occurred between the time of the security’s last close and the time that the Fund calculates its net asset value. A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If the Adviser becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its net asset value, it may request that a Committee meeting be called.

When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | • | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | Level 2 – Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | • | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The valuation techniques used by the Fund to measure fair value during the period ended October 31, 2013 maximized the use of observable inputs and minimized the use of unobservable inputs.

For the period ended October 31, 2013, there have been no significant changes to the Fund’s fair valuation methodologies.

Federal and Other Income Taxes — It is the Fund’s intention to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provisions for Federal income taxes have been made in the financial statements.

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of October 31, 2013, the Fund did not have any interest or penalties associated with the underpayment of any income taxes. All tax years since inception remain open and subject to examination by tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on its tax returns.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis.

Dividends and Distributions to Shareholders — The Fund distributes substantially all of its net investment income annually. Any net realized capital gains are distributed annually. All distributions are recorded on the ex-dividend date.

Creation Units — The Fund issues and redeems shares (“Shares”) at Net Asset Value (“NAV”) and only in large blocks of Shares (each block of Shares for a Fund is called a “Creation Unit” or multiples thereof). Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee of $500 per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an investor on the same day. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard Redemption Fee of $500 per transaction to the custodian on the date of such redemption, regardless of the number of Creation Units redeemed that day.

Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed an Authorized Participant Agreement with the Fund’s distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the Shares directly from the Fund. Rather, most retail investors will purchase Shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

If a Creation Unit is purchased or redeemed for cash, a higher Transaction Fee will be charged. The following table discloses Creation Unit breakdown:

| | | | | | | | | | | | | |

| LocalShares Nashville Area ETF | | | 50,000 | | | $ | 500 | | | $ | 1,281,500 | | | $ | 500 | |

Organizational Expenses — All organizational and offering expenses of the Trust will be borne by the Investment Adviser and will not be subject to future recoupment. As a result, organizational and offering expenses are not reflected in the statement of assets and liabilities.

Concentration of Credit Risk — Cash at October 31, 2013 is on deposit at Brown Brothers Harriman in a non-interest bearing account.

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Continued)

3. AGREEMENTS

Investment Advisory Agreement

The Investment Adviser has entered into an investment advisory agreement (“Advisory Agreement”) with respect to the Fund. Under the Advisory Agreement, the Investment Adviser has overall responsibility for the general management and administration of the Trust. The Investment Adviser provides an investment program for the Fund. The Investment Adviser also arranges for sub-advisory, transfer agency, custody, fund administration, and all other non-distribution related services necessary for the Fund to operate. Pursuant to that Advisory Agreement, the Fund pays the Investment Adviser an annual advisory fee based on its average daily net assets for the services and facilities it provides payable at an annual rate of 0.65%. Additionally, The Investment Advisor has contractually agreed to waive or reimburse expenses so that the total annual operating expenses will not exceed 0.49% based on its average daily net assets through December 31, 2016.

The Investment Adviser is responsible for all expenses of the Fund, the costs of sub-advisory, transfer agency, custody, fund administration, legal, audit and other services, except for brokerage expenses, taxes, interest, litigation expenses, and other extraordinary expenses. The Advisory Agreement for the Fund provides that it may be terminated at any time, without the payment of any penalty, by the Board of Trustees or, with respect to the Fund, by a majority of the outstanding shares of the Fund, on 60 days’ written notice to the Investment Adviser, and by the Investment Adviser on 60 days’ written notice to the Trust and that it shall be automatically terminated if it is assigned.

The Investment Sub-Adviser, a Tennessee limited liability company, is responsible for making investment decisions for the Fund and continuously reviews, supervises and administers the investment program of the Fund, subject to the supervision of the Adviser and the Board. Under a Sub-Advisory Agreement, the Adviser pays the Investment Sub-Adviser an annual fee of $62,500, plus 0.03% of the daily net assets of the Fund, which is calculated daily and paid monthly.

Administrator, Custodian and Transfer Agent

SEI Investments Global Funds Services (the “Administrator”) serves as the Fund’s Administrator pursuant to an administration agreement. Brown Brothers Harriman (the “Custodian” and “Transfer Agent”) serves as the Fund’s Custodian and Transfer Agent pursuant to a Custody Agreement and a Transfer Agency and Service Agreement. The Adviser of the Fund pays these fees.

SEI Investments Distribution Co. (the “Distributor”) serves as the Fund’s underwriter and distributor of Shares pursuant to a Distribution Agreement. Under the Distribution Agreement, the Distributor, as agent, receives orders to purchase shares in Creation Units and transmits such orders to the Trust’s custodian and transfer agent. The Distributor has no obligation to sell any specific quantity of Fund shares. The Distributor bears the following costs and expenses relating to the distribution of shares: (i) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (ii) filing fees; and (iii) all other expenses incurred in connection with the distribution services, that are not reimbursed by the Adviser, as contemplated in the Distribution Agreement. The Distributor does not maintain any secondary market in Fund Shares.

Certain officers and/or interested trustees of the Fund are also officers of the Distributor, the Advisor or the Administrator.

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Continued)

4. INVESTMENT TRANSACTIONS

For the period ended October 31, 2013, the purchases and sales of investments in securities, excluding in-kind transactions, long-term U.S. Government and short-term securities were:

| | | | | | | |

LocalShares Nashville Area ETF(1) | | $ | 678,580 | | | $ | 659,757 | |

| (1) | Commenced operations on July 31, 2013. |

There were no purchases or sales of long-term U.S. Government securities by the Fund.

For the period ended October 31, 2013, in-kind transactions associated with Creations were:

| | | | | | | | | | |

LocalShares Nashville Area ETF(1) | | $ | 6,238,500 | | | $ | — | | | $ | — | |

| (1) | Commenced operations on July 31, 2013. |

5. TAX INFORMATION

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid-in capital, as appropriate, in the period that the differences arise.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be used prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, preenactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments held by the Fund at October 31, 2013, were as follows:

| | | | | | Aggregated Gross Unrealized Appreciation | | | Aggregated Gross Unrealized Depreciation | | | Net Unrealized Appreciation | |

| LocalShares Nashville Area ETF | | $ | 6,231,559 | | | $ | 369,143 | | | $ | (240,847 | ) | | $ | 128,296 | |

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Continued)

6. CONCENTRATION OF RISKS

As with all exchange traded funds (“ETFs”), a shareholder of Funds is subject to the risk that his or her investment could lose money. The Funds are subject to the principal risks noted below, any of which may adversely affect a Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. A more complete description of principal risks is included in the prospectus under the heading “Principal Risks”.

The Fund employs a “passive management” or indexing investment approach by tracking the investment of the Index. The Fund uses this replication method as its primary strategy, meaning that it holds the same stocks, in approximately the same proportions, as the stocks of the Index. The Investment Adviser does not intend to use a sampling strategy in an attempt to manage the portfolio, but will do so only when required by regulatory, legal, or market considerations. In these circumstances, the Fund will employ a strategy whereby the Fund will invest in securities that, in the aggregate, are deemed by the Investment Adviser to approximate the Index in terms of key characteristics.

Lack of Diversification Risk

The Fund is considered to be non-diversified. A non-diversified classification means that the Fund is not limited by the 1940 Act with regard to the percentage of its assets that may be invested in the securities of a single issuer. As a result, the Fund may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were as a diversified fund. Thus, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a small number of issuers than a fund that invests more widely, which may have a greater impact on the Fund’s volatility and performance. However, there are limits on the percentage of any one security the Fund because the Index does not weight the securities of any single issuer at more than twice its equal weighting. For example, if there are 20 stocks in the Index (which is currently the minimum number of stocks the index is permitted to have), an equal weighting would be 5% each. Accordingly, the maximum percentage of the securities of any single issuer is 10%.

Geographic Concentration Risk

Because the Fund will invest substantially all of its assets in the securities of companies that have their headquarters or principal place of business located in the Nashville, Tennessee region, the Fund may be impacted by events or conditions affecting the region to a greater extent than a fund that did not focus its investments in that manner. For example, political and economic conditions and changes in regulatory, tax, or economic policy in Tennessee could significantly affect Nashville’s market. Furthermore, a natural or other disaster could occur in the Nashville, Tennessee region, which could affect the economy or particular business operations of companies in that region.

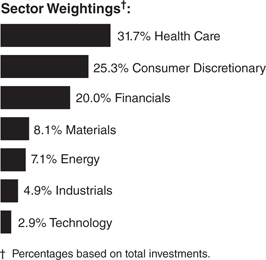

Healthcare Sector Risk

Due to the concentration of the healthcare industry in middle Tennessee, the Fund is expected to invest a relatively large percentage of its assets in the healthcare sector, and therefore the performance of the Fund will be impacted by events affecting this sector. Approximately 36% of the Index was comprised of securities of companies in the healthcare sector. This sector can be significantly affected by changes in government regulation including federal healthcare policy, reimbursement, price competition, the availability and cost of capital funds and escalating cost of care. In particular, this sector is subject to risk and uncertainty related to the enactment and implementation of the Budget Control Act of 2011 and the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (collectively, the “Health Reform Law”), the possible enactment of additional federal or state healthcare reforms and possible changes to the Health Reform Law and other federal, state or local laws or regulations affecting the healthcare industry.

LocalShares Investment Trust

Nashville Area ETF

Notes to the Financial Statements

October 31, 2013 (Unaudited) (Concluded)

6. CONCENTRATION OF RISKS (continued)

Small-Capitalization Investing

The Fund is expected to invest a relatively large percentage of its assets in the securities of small-capitalization companies. The securities of small -capitalization companies may be less mature compared to larger companies and the value of such securities may be more volatile than those of larger issuers.

As with all index funds, the performance of the Fund and the Index may vary somewhat for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund will incur a “tracking error” as it may not be fully invested in the securities of the Index at all times, may lag changes in the Index or may hold securities not included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions.

7. OTHER

At October 31, 2013, the records of the Trust reflected that 100% of the Fund’s total Shares outstanding were held by three Authorized Participants, in the form of Creation Units. However, the individual shares comprising such Creation Units are listed and traded on the NYSE Arca, Inc. and have been purchased and sold by persons other than Authorized Participants.

8. SUBSEQUENT EVENTS

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements.

LocalShares Investment Trust

Nashville Area ETF

Approval of Advisory Agreements & Board Considerations

The 1940 Act requires that the full Board and a majority of the Independent Trustees approve the Trust’s Investment Advisory Agreement dated July 19, 2013 between LocalShares, Inc. and LocalShares Investment Trust (the “Investment Advisory Agreement”), with respect to the Fund. At a meeting held in-person on July 19, 2013, the Board, including a majority of the Independent Trustees on behalf of the Nashville Area ETF (the “Fund”), considered and approved the Investment Advisory Agreement with respect to the Fund with LocalShares, Inc. for an initial term of two years ending July 18, 2015.

Prior to the meeting, the Independent Trustees requested information from LocalShares, Inc. This information, together with other information provided by LocalShares, Inc., and the information provided to the Independent Trustees throughout the launch of the Fund, formed the primary (but not exclusive) basis for the Board’s determinations as summarized below. In addition to the information identified above, other material factors and conclusions that formed the basis for the Board’s subsequent approval are described below.

Information Received

Materials Received. The Independent Trustees requested and received a variety of information regarding LocalShares, Inc. and its proposed services to the Fund, including information regarding (i) LocalShares, Inc.’s financial condition and structure, (ii) the proposed services, operations and personnel, (iii) the compliance procedures of LocalShares, Inc., (iv) LocalShares, Inc.’s investment philosophy and approach to investment management for the Fund, (v) disaster recovery planning, (vi) current legal matters and (vii) other information relating to the nature, extent and quality of services to be provided by LocalShares, Inc. to the Fund.

Review Process. The Board received assistance and advice regarding legal and industry standards from Fund counsel. The Board discussed the approval of the Investment Advisory Agreement both with LocalShares, Inc. representatives and in a private session with Fund counsel at which representatives of LocalShares, Inc. were not present. In deciding to approve the Investment Advisory Agreement, the Independent Trustees considered the total mix of information requested by and made available to them and did not identify any single issue or particular information that, in isolation, was the controlling factor. This summary describes the most important, but not all, of the factors considered by the Board.

Nature, Extent and Quality of Services

LocalShares, Inc., its personnel and its resources. The Board considered the depth and quality of LocalShares, Inc.’s investment management process; the experience, capability and integrity of its senior management and other personnel; noting that the company’s leadership includes three independently successful CEOs with deep support from their respective organizations which focus on accounting and corporate management; marketing and communications and investment strategy. The Board also considered that LocalShares, Inc. made available to its investment professionals a variety of professional resources relating to investment management, compliance, accounting, trading, distribution and administration and portfolio accounting. The Board, however, also noted the fact that LocalShares, Inc. just recently became a federally-registered investment adviser, has relatively no assets under management, is not yet profitable and does not have a proven track record in managing exchange-traded funds.

Other Services. The Board considered, in connection with the performance of its proposed investment management services to the Fund, the following: LocalShares, Inc.’s policies, procedures and systems to ensure compliance with applicable laws and regulations and its commitment to these programs; its articulated plan to keep the Trustees informed; and its attention to matters that may involve conflicts of interest with the Fund.

In light of the totality of the considerations, the Board concluded that LocalShares, Inc. had the quality and depth of personnel and investment methods essential to performing its proposed duties under the Investment Advisory Agreement, and that the nature, extent and overall quality of such proposed services were satisfactory.

LocalShares Investment Trust

Nashville Area ETF

Approval of Advisory Agreements & Board Considerations

Investment Performance

The Board considered the Fund’s stated investment objectives and LocalShares, Inc.’s goals with respect to investment performance. Given that the Fund had not yet commenced operations, the Trustees were unable to consider investment performance as a factor. Nevertheless, the Board was presented with extensive and detailed information regarding the proposed investment approach of LocalShares, Inc. for the Fund, its focus on marketing the Fund, and related information that may impact Fund performance. While the Board had no investment results to review due to the Fund being newly created, it did receive a satisfactory explanation of the growth strategy for the Fund and ultimately concluded that LocalShares, Inc.’s objectives and goals for managing the new Fund were satisfactory. The Board also considered the fact that the Adviser has not previously managed funds registered under the investment company act and, as such, was not able to provide performance information for similarly managed funds for consideration by the Board.

Management Fees and Total Operating Expenses

The Board reviewed the anticipated management fees and anticipated total operating expenses of the Fund and compared such amounts with the management fees and total operating expenses of other exchange-traded funds in the industry that are found within the same style category, or peer group. The Board was advised of the anticipated advisory fees and anticipated total fees and expenses of the Fund in comparison to the advisory fees and other fees and expenses of other exchange-traded funds in the Fund’s relevant peer group. The Board was informed of the Adviser’s contractual undertaking, through December 31, 2016, to waive its advisory fees in the amount of 0.16% of the Fund’s average daily net assets so that the Fund will pay the Adviser an advisory fee at an annual rate of 0.49% of the Fund’s average daily net assets. The Board noted that total net management fees expected to be charged to the Fund, after taking into account these expense limitations and voluntary waivers,were consistent with the industry averages for comparable exchange-traded funds. The Board also observed that each Fund’s anticipated total operating expenses were consistent with the industry average for other comparable funds.

Adviser, Costs, Level of Profits, Economies of Scale and Ancillary Benefits

The Board was advised of LocalShares, Inc.’s costs of providing services to the Fund, the significant investment that had already been made by LocalShares, Inc. in the start-up of the Fund, as well as the targeted revenues to LocalShares, Inc. The Independent Trustees were advised of the financial structure and other information from LocalShares, Inc., in addition to a representation from LocalShares, Inc. that its anticipated profits were not excessive. The Board further considered the start-up nature of the Fund, the fact that further investments may need to be made byLocalShares, LLC in order to sustain the fund. The Board also considered that LocalShares, Inc. would not receive substantial indirect benefits from managing the Fund (one example of an indirect benefit is research paid for by Fund brokerage commissions – LocalShares, Inc. currently does not seek to supplement its fees with such “soft dollar” benefits). On the basis of the foregoing, together with the other information provided to it prior to and at the July 19, 2013 meeting, the Board concluded that the Fund’s cost structure was reasonable.

Conclusions

Based on their review, including but not limited to their consideration of each of the factors referred to above, the Board concluded that the Investment Advisory Agreement is and would be fair and reasonable to the Fund and its shareholders, that the Fund’s shareholders should receive reasonable value in return for the advisory fees and management fees paid to LocalShares, Inc. by the Fund, and that the approval of the Investment Advisory Agreement was in the best interests of the Fund and its shareholders.

LocalShares Investment Trust

Nashville Area ETF

Disclosure of Fund Expenses

All Exchange Traded Funds (“ETF”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, brokerage fees and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these are deducted from an ETF’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the ETF’s average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | Beginning Account Value 07/31/13 | Ending Account Value 10/31/13 | | |

| Nashville Area ETF | | | | |

| Actual Fund Return | $1,000.00 | $1,024.80 | 0.49% | $1.26(1) |

| Hypothetical 5% Return | $1,000.00 | $1,011.49 | 0.49% | $2.48(2) |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 92/365 (to reflect the actual time the Fund was operational from 07/31/13-10/31/13). |

| (2) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 184/365 (to reflect the one-half year period). |

LocalShares Investment Trust

Nashville Area ETF

Supplemental Information

Net asset value, or “NAV”, is the price per share at which the Fund issues and redeems shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the market value of the Fund’s holdings. The NAV of the Fund may also be impacted by the accrual of deferred taxes. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

Further information regarding premiums and discounts is available on the Fund’s website at www.nashvilleetf.com.

Investment Adviser:

Local Shares

618 Church Street, Suite 220

Nashville, Tennessee 37219

Investment Sub-Adviser:

Decker Wealth Management LLC

4535 Harding Pike,

Suite 300,

Nashville, Tennessee 37205

Distributor:

SEI Investments Distribution Co.

One Freedom Valley Drive

Oaks, PA 19456

Legal Counsel:

Reed Smith,

LLP, 1301 K Street,

NW, Suite 1100, Washington, D.C.

Independent Registered Public Accounting Firm:

Ernst & Young LLP

55 Ivan Allen Jr. Boulevard,

Suite 1000, Atlanta, GA 30308

This information must be preceded or accompanied by a current prospectus for the Fund.

SPR- SA-001-0100

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the Report to Shareholders filed under Item 1 of this form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable. Effective for closed-end management investment companies for fiscal years ending on or after December 31, 2005.

Item 9. Purchases of Equity Securities by Closed-End Management Company and Affiliated Purchasers.

Not applicable to open-end management investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees during the period covered by this report.

Item 11. Controls and Procedures.

(a) The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) as of a date within 90 days of the filing date of the report, are effective based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There has been no change in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Items 12. Exhibits.

(a)(1) Not applicable for semi-annual report.

(a)(2) A separate certification for the principal executive officer and the principal financial officer of the Registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(a)), are filed herewith.

(b) Officer certifications as required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(b)) also accompany this filing as an Exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | LocalShares Investment Trust | |

| | | |

| By (Signature and Title) | /s/ Elizabeth S. Courtney | |

| | Elizabeth S. Courtney, President | |

| | | |

| Date: January 6, 2014 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ Elizabeth S. Courtney | |

| | Elizabeth S. Courtney, President | |

| | | |

| Date: January 6, 2014 | | |

| | | |

| By (Signature and Title) | /s/ Elizabeth S. Courtney | |

| | Elizabeth S. Courtney, President & Treasurer | |

| | | |

| Date: January 6, 2014 | | |