PROMISSORYNOTE

| | | Darin R. Pastor |

| | | Newport Beach, California |

| | | |

| | | |

| Principal LoanAmount: | | |

| $1,339,772.50 | Date: | December 31, 2012 |

FOR VALUE RECEIVED, the undersigned Capstone Affluent Strategies, Inc. ("Borrower") of895Dove Street 3rd Floor, Newport Beach, CA 92660, promises to pay to the order of Darin R. Pastor ("Pastor")at his office at 895 Dove Street,3rdFloor,Newport Beach, CA 92660, or at such other place as theholder thereof may designate, in lawful money of the United States of America and in immediatelyavailable funds, the principal loan amount of$1,339,772.50("Principal"), or so much thereof as may beoutstanding with interest thereon, whether before or after any breachhereof.

Subject to the obligation of Pastor to forgive the principal and interest on the Note in accordancewithprovisions below, Borrower will be required to repay the Principal on this Note no later thanOctober4, 2017(the"Maturity Date") or upon an Event of Default as described below, whichever occurs first.The Principal balance shall bear interest at the minimum federal rate per annum published by theInternal Revenue Service (computed on the basis of a 360-day year, actual days elapsed). Interest shallbeginaccruingon the date proceeds are advanced under thisNote.

Prepayment. Borrower may from time to time partially or wholly repay the outstanding principal.All payments under this Note shall be applied first to current interest, second to accrued and unpaidinterest, and third toPrincipal.

Forgiveness of Principal and Interest. Pastor shall forgive the Principal plus calculated accruedinterestonthisNoteinaccordancewiththetermssetforthinExhibit Ahereto.TheforgivenessofPrincipal and interest under this Note will cease upon the occurrence of an Event of Default asdefinedbelow. Upontheoccurrence of an Event of Default (defined below) this Note shall bear interest ontheremaining unpaid principal balance at the default rate of interest equal to the interest ratedetermined as stated in the 2nd paragraph above PLUS an additional three percent(3%).

Income Taxes.Borrower hereby acknowledges responsibility for the payment of incometaxesm connection with the forgiveness of principal and interest under thisNote.

Right to Offset.Borrower acknowledges and agrees that in order to contribute to the satisfaction ofthe repayment obligation hereunder, Pastor is authorized to the necessary deductions from Borrower'sinterest or entitlement in any commissions or fees payable by Pastor to Borrower, or in any other amounts owed byPastortoBorrower.BorroweralsoagreesthatPastorhasandshallhavetherighttoapplyany funds held in Borrower's accounts in which Pastor is legally entitled to satisfy any amounts remaining outstanding pursuant to the terms of theNote.

BorrowerInitials _______

LenderInitials _______

EventsofDefault.ADefaultunderthisNoteshallconsistofanyofthefollowingevents:(i)anypaymenttoPastorisnot made when due(including when there isamaterial defaultonany othermaterial obligation Borrowerhaswith Pastor);thereis material failure to abide byanyoftheterms and conditions contained in any agreement Borrower has with Pastor but only after Pastor gives Borrower written notice of any such failure and a reasonable opportunity to cure;(iii) any warranty,representation or statement made or furnished to Pastor by or on behalf of the Borrower proves to have been false in anymaterial respect when made orfurnished;(iv) the death,dissolution, termination of existence, merger, consolidation,insolvency,business failure, appointment of a receiver of any part of the propertyof,assignment for the benefit of creditors by,or the commencement of any proceedings under bankruptcy or insolvency laws by or against the Borrower or any guarantor or surety forBorrower;(v) any violationor breach of any provision or, or any defined event of default under, any addendum to this note, letteragreement,guaranty,security agreement,deed of trust or other contract or instrument executedin connection with this note or securing this note;or (vi) Pastor has a good faith belief that the prospect of timely repayment is impaired based on Pastor's commercially reasonable assessment that Borrower's prospects of repayment are materially diminished.

UpontheoccurrenceofanyEventofDefaultdescribedunderclauses(i)through(vi)above,Pastor,athisoption,may declare all sums of principal and interest outstanding hereunder to be immediately dueand payable without presentment,demand,protest or advice of dishonor,all of which are expressly waivedby Borrower.Inthe Event of Default,the Borrower agrees that Pastor may offset any outstanding principal and interest due under this Note against any amounts due from Pastor forBorrower,up to the maximum amount legally permitted.

Attorney’s Fees.The Borrower shall pay Pastor the full amount of all costs andexpenses,including reasonable attorney's fees (to include outside counsel fees) incurred by the holderinconnection with the enforcement of the holder's rights and/or the collection of any amountwhichbecomes due to Pastor under this Note or the prosecution and defense of any action in any way relatedtothisNote,including without limitation any action to declaratoryrelief.

Binding on Heirs and Assigns.This Note inures to and binds the heirs,legal representatives,successors and assigns of Borrower and Pastor; provided,however, that Borrower may not assign this Note orany proceedsofitorassignordelegateanyofits rightsorobligationswithoutPastor'spriorwrittenconsentin eachinstance.Pastor,inhissolediscretion,may transferthis Note andmaysell orassign interest without notice to Borrower.

ChoiceofLaw.Thisnoteshallbeconstruedinaccordancewiththelawsofthestate ofCalifornia.

DARIN R.PASTORCAPSTONE AFFLUENT STRATEGIES, INC

BY:___________________________________________

TITLE:___________________________________________

BorrowerInitials _______

LenderInitials _______

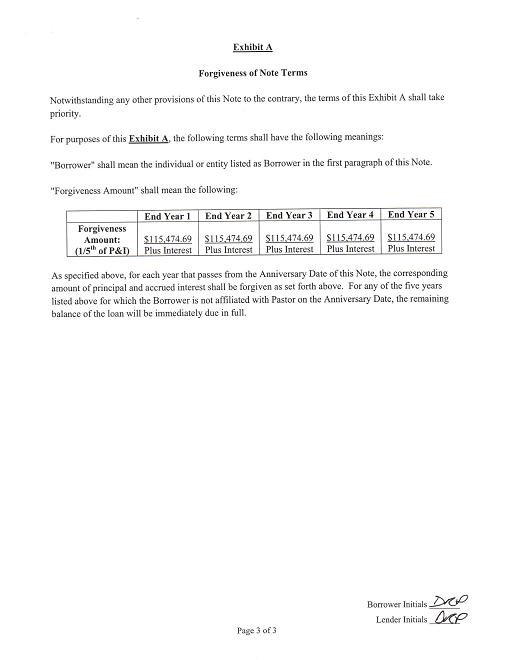

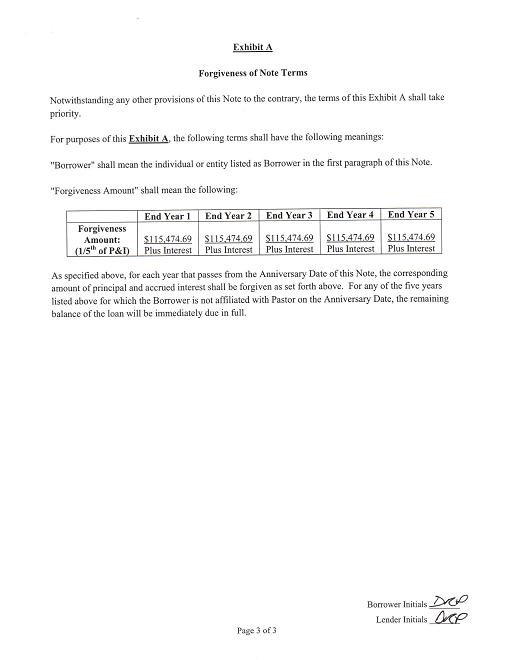

ExhibitA Forgiveness of NoteTerms

Notwithstanding any other provisions of this Note to the contrary, the terms of this Exhibit Ashalltake priority.

For purposes of thisExhibit A,the following terms shall have the followingmeanings:

"Borrower" shall mean the individual or entity listed as Borrower in the first paragraph of thisNote. "Forgiveness Amount" shall mean thefollowing:

| | End Year1 | End Year2 | End Year3 | End Year4 | End Year5 |

| Forgiveness Amount: (1/5thofP&I) | $115,474.69 PlusInterest | $115,474.69 PlusInterest | $115,474.69 PlusInterest | $115,474.69 PlusInterest | $115,474.69 PlusInterest |

Asspecifiedabove,foreachyearthatpassesfromtheAnniversaryDateofthisNote,thecorresponding amountofprincipalandaccruedinterestshallbeforgivenas setforthabove.Foranyof thefive years listed aboveforwhichtheBorrower is notaffiliatedwithPastoron the AnniversaryDate,theremaining balance of the loan will be immediately due infull.

BorrowerInitials _______

LenderInitials _______