Exhibit 99.2

August 2023 Investor Presentation Nasdaq: ISPC The Online Marketplace for Human Biospecimens Transforming Biospecimen Procurement

This presentation may contain forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Such forward - looking statements are characterized by future or conditional verbs such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate” and “continue” or similar words . You should read statements that contain these words carefully because they discuss future expectations and plans, which contain projections of future results of operations or financial condition or state other forward - looking information . Such statements are only predictions and our actual results may differ materially from those anticipated in these forward - looking statements . We believe that it is important to communicate future expectations to investors . However, there may be events in the future that we are not able to accurately predict or control . Factors that may cause such differences include, but are not limited to, those discussed under Risk Factors in our filings filed with the Securities and Exchange Commission (the "SEC"), including the uncertainties associated with our lack of profitability, our continued capital needs, our lack of a long operating history, our growth strategy, the uncertain effect of geopolitical developments, our technology development plans, and the regulatory environment in which we operate . We do not assume any obligation to update forward - looking statements as circumstances change . Certain market data information in this presentation is based on management's estimates . We obtained the industry, market and competitive position data used throughout this presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties . We believe our estimates to be accurate as of the date of this presentation . However, this information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data, and the nature of the data gathering process . You may access our SEC filings by visiting the SEC’s website at http : //www . sec . gov . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with us or our affiliates . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . 2 Forward - Looking Statements

Our Vision To transform the biospecimen industry with an online marketplace connecting researchers to patients, biospecimens, and data, through our global network. 3

4 1. Similar to Amazon, iSpecimen has developed an online marketplace to seamlessly connect researchers with healthcare providers and supplier organizations 2. First mover advantage that addresses an inefficient and fragmented global biospecimen supply chain that is poised to be disrupted by an online solution 3. $3B - $4B global biospecimen market growing at 10 - 15% per year 4. Strong revenue growth with a 7 - year CAGR of 48% fueled by precision and regenerative medicine research 5. Plans to enhance existing platform and develop new service offering to increase revenue opportunities Investor Highlights >200 Healthcare Provider / Supplier Organizations >500 Customer Organizations

Biospecimens are Essential for Life Science R&D Basic Research Biomarker Identification & Validation Drug Discovery & Development Diagnostics Discovery & Validation Biofluids Solid Tissue Stem & Immune Cells Plasma, Serum, Urine, Saliva Industry Academia Government 5 Lung, Breast, Colon, Brain Bone Marrow, Blood, Tonsils, Lymph Nodes Applications Patients SUPPLY SIDE HEALTHCARE PROVIDERS DEMAND SIDE LIFE SCIENCE RESEARCHERS Biospecimens Data Organizations Medical Record

Biospecimen Supply Chain Challenges Providers miss revenue and research opportunities > 3 Billion clinical specimens are discarded annually worldwide 5 > 1 Billion Patient encounters yearly in the U.S. where a specimen could be provided for research 4 > 800 Million banked specimens are in biorepository inventories worldwide 6 6 Researchers limit their work … in 2022, 78% of researchers said they find it difficult - to - extremely difficult to find the type and quantity of specimens they need 8 “Challenging” and “Inefficient” most common words used to describe biospecimen procurement process by researchers 8 10 years ago, 81% of researchers said they limit the scope of their work due to difficulties obtaining biospecimens 7 4,5,6,7,8 “Sources Cited” page 28

Biospecimen Supply Chain Challenges 7 - Difficult to Connect, Search and Compliantly Transact - Average time to develop relationships is 6 - 12 months ᶟ 3 “Sources Cited” page 28 PROVIDERS RESEARCHERS CHALLENGE

The iSpecimen Marketplace Solution 8 - iSpecimen Customer Base: 70% of the Top 20 Pharma Companies and IVD Companies Worldwide PROVIDERS RESEARCHERS SOLUTION

Full - Service Procurement Offering - Connect Suppliers with Researchers - Manage the Entire Procurement Process SPECIMEN SEARCH & SELECTION SPECIMEN LOGISTICS SPECIMEN MANAGEMENT DATA MANAGEMENT STUDY/ORDER MANAGEMENT SUPPLIER SITE TRAINING COLLECTION KIT BUILDING COMPLIANCE MANAGEMENT STUDY DESIGN & SPECIFICATION CONTRACTING 9 iSpecimen Services

Advance Scientific Discovery Support research mission and advance diagnostic, therapeutic and vaccine research Monetize Banked Biospecimens Instantly connect to a global network of researchers in search for biospecimens Ensure Compliance Protect the privacy and security of patient information Accelerate Research Search for specimens anytime, anywhere, through easy - to - use online marketplace Save Time and Money Instantly connect to global network of specimen providers Reduce Risk Manage contracting and regulatory compliance Providers… Researchers… 10 iSpecimen Value Proposition

Global Footprint United States Dominican Republic United Kingdom Jamaica Germany Spain France Mexico Ukraine Netherlands Georgia Venezuela Bulgaria Turkey Russian Federation Romania India Armenia Peru 11 Agreements with 200+ Supplier Organizations ✔ 1,000+ Hospitals ✔ 1,000s of Clinics and Practice Groups ✔ 150+ Clinical Research Centers ✔ 60+ Clinical and Pathology Labs ✔ 55+ Biorepositories ✔ 8 Blood Centers Growing Researcher Adoption ✔ 500+ Buyside Customers ✔ Work with 70% of Top - 20 Pharma and IVD Companies in the World ✔ Cumulatively delivered 175,000+ Specimens Across 2,400+ Projects • 82% CAGR – Registered Users (2015 - 2023) • 42% CAGR – Marketplace Logins (2015 - 2022) • Approximately 2,700 Unique Searches Performed by Researchers in 2022 Comprehensive Supplier & Researcher Networks

Strategic Growth Initiatives 12

Enhance iSpecimen Marketplace Technology 13 Increased investment and ongoing advancements of iSpecimen Marketplace technology: ● Improve integration with provider partners (first patient data electronic record integrations) ● Improve iSpecimen Marketplace search and request capabilities ● Update back - end architecture to support growth and scale, enhance security and prepare data - as - a - service pilot ● Utilize insights provided by supplier and researcher interactions to evolve matchmaking capabilities

2023 – 2025 iSpecimen Product Roadmap 2023 Revamp Customer Search Experience, Unify data, and Automate Matchmaking 2024 Enhance Supplier Experience though enablement, reporting and workflow. Expand Prospective search capabilities 2025 Continue to evolve Efficiencies, Matchmaking and Data. iSpecimen is committed to continual product evolution supporting constituents on all sides of our Marketplace 14

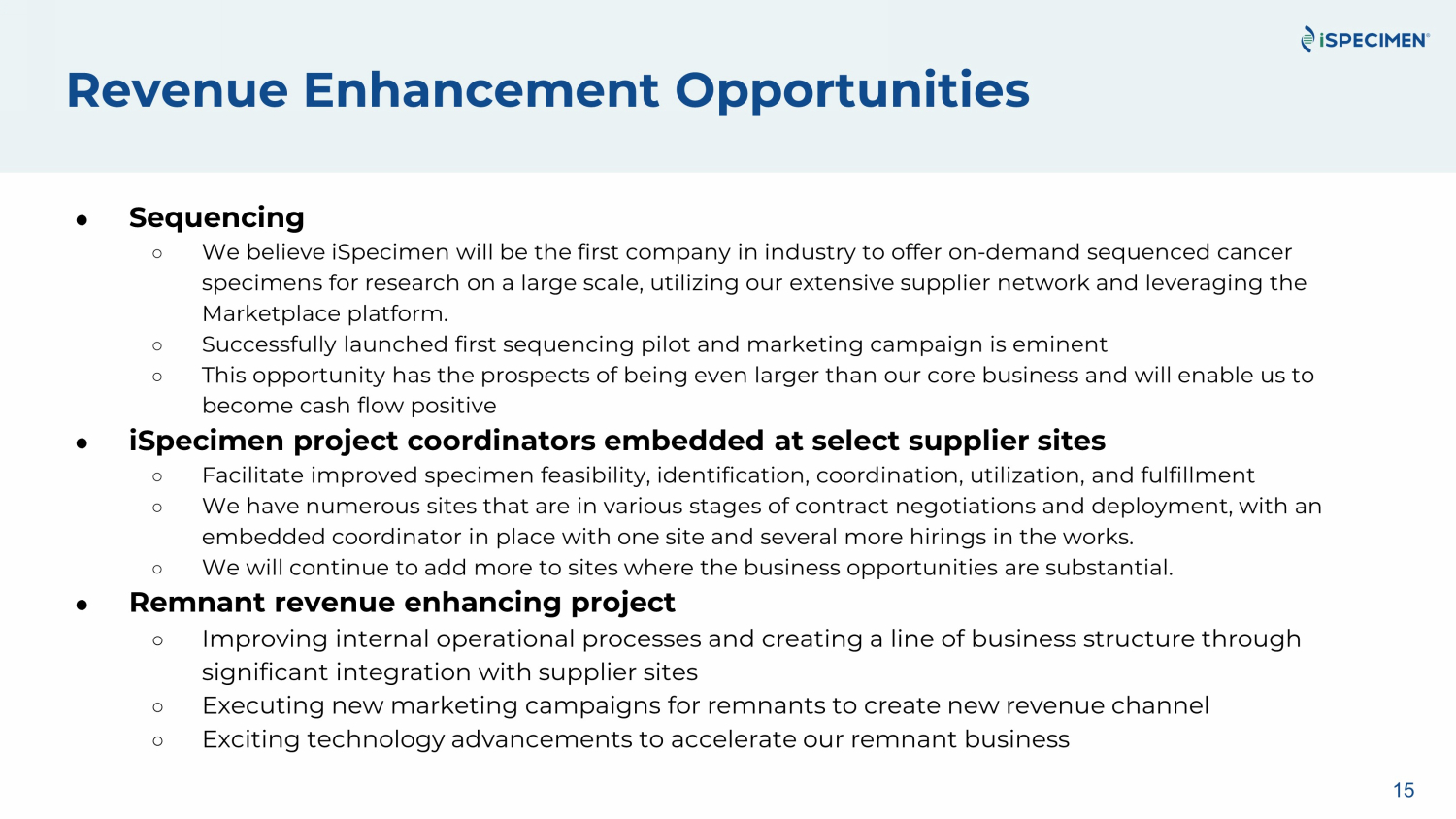

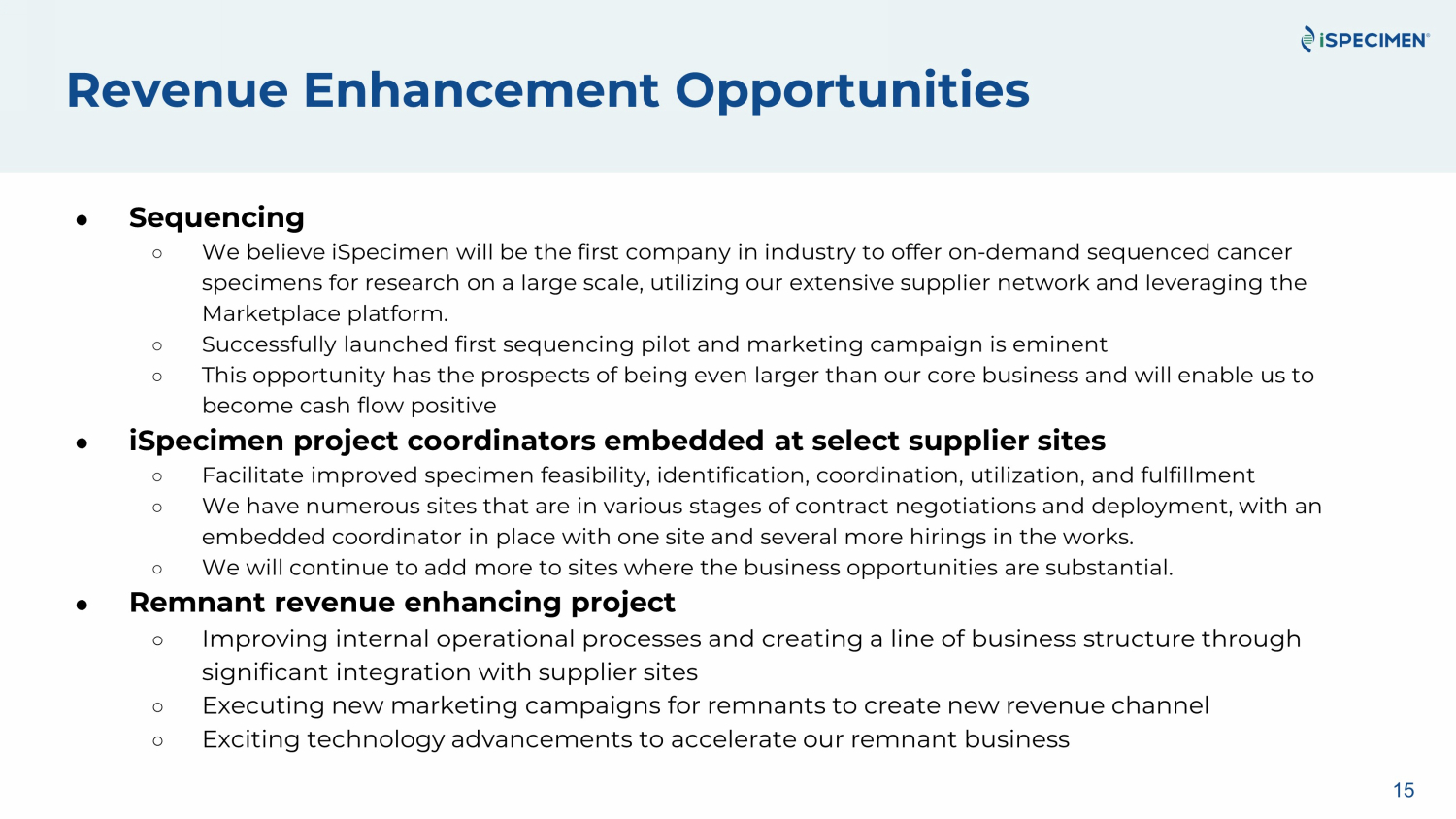

Revenue Enhancement Opportunities 15 ● Sequencing ○ We believe iSpecimen will be the first company in industry to offer on - demand sequenced cancer specimens for research on a large scale, utilizing our extensive supplier network and leveraging the Marketplace platform. ○ Successfully launched first sequencing pilot and marketing campaign is eminent ○ This opportunity has the prospects of being even larger than our core business and will enable us to become cash flow positive ● iSpecimen project coordinators embedded at select supplier sites ○ Facilitate improved specimen feasibility, identification, coordination, utilization, and fulfillment ○ We have numerous sites that are in various stages of contract negotiations and deployment, with an embedded coordinator in place with one site and several more hirings in the works. ○ We will continue to add more to sites where the business opportunities are substantial. ● Remnant revenue enhancing project ○ Improving internal operational processes and creating a line of business structure through significant integration with supplier sites ○ Executing new marketing campaigns for remnants to create new revenue channel ○ Exciting technology advancements to accelerate our remnant business

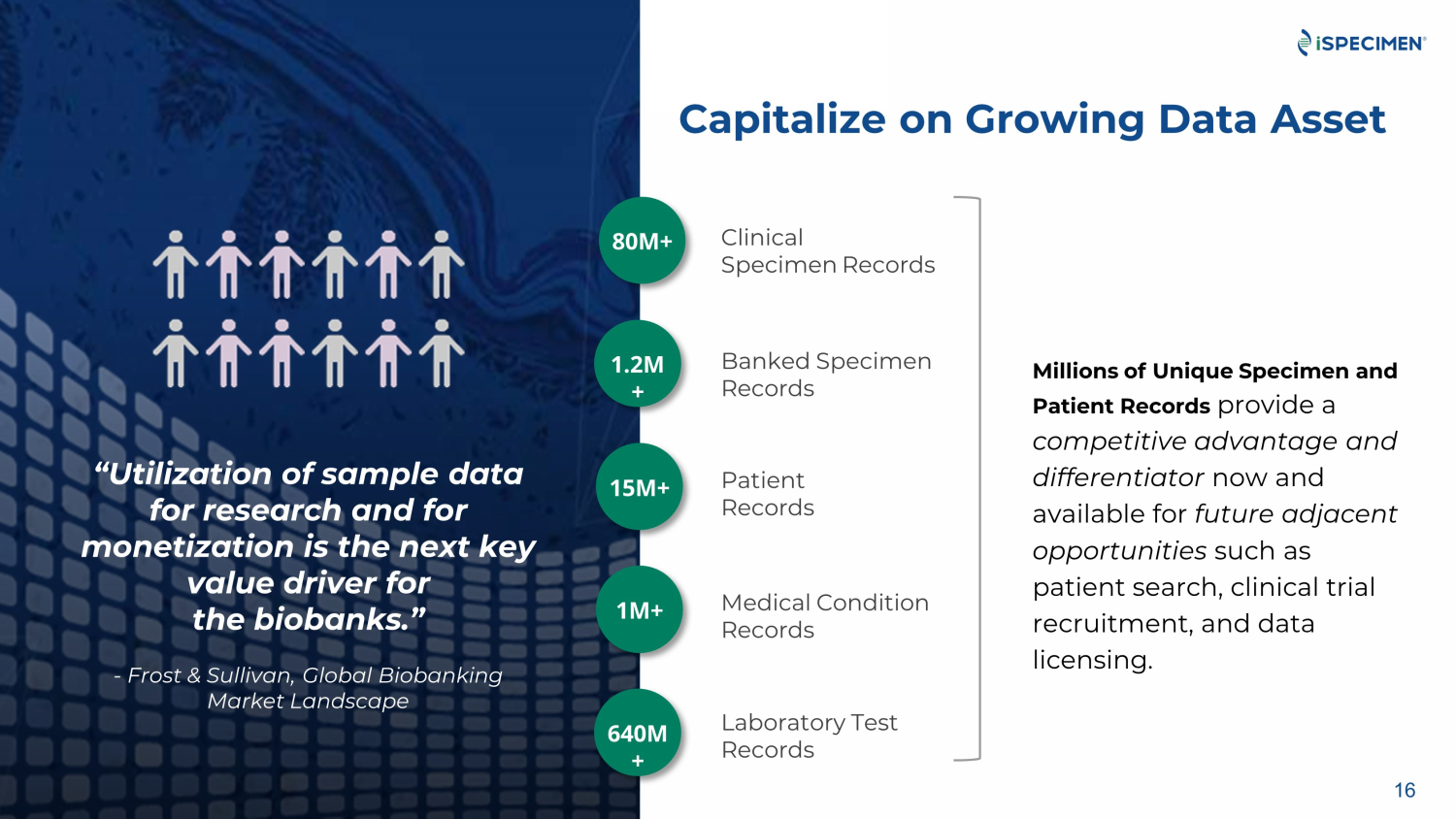

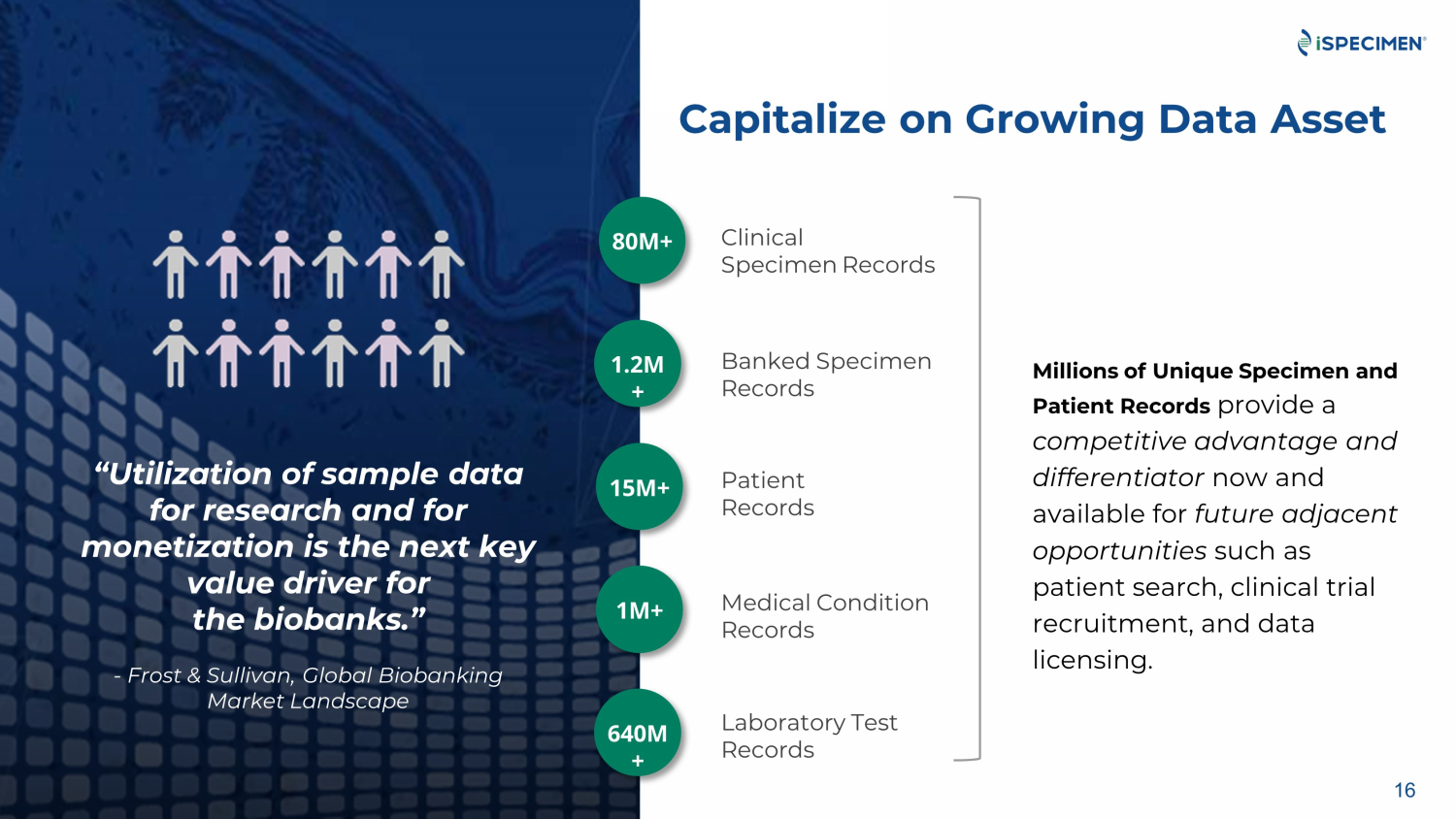

“Utilization of sample data for research and for monetization is the next key value driver for the biobanks.” - Frost & Sullivan, Global Biobanking Market Landscape Capitalize on Growing Data Asset Banked Specimen Records Patient Records Medical Condition Records Clinical Specimen Records Laboratory Test Records Millions of Unique Specimen and Patient Records provide a competitive advantage and differentiator now and available for future adjacent opportunities such as patient search, clinical trial recruitment, and data licensing. 80M+ 16 1.2M + 15M+ 1M+ 640M + 1

Financial Overview 17

$700 $1,448 $3,067 $4,395 $4,298 $8,184 $11,135 $10,402 $4,575 2015 2016 2017 2018 2019 2020 2021 2022 1H23 Annual Revenue ($000) 2015 – Q2 2023 (Unaudited) ▲ 48% CAGR Revenue (2015 – 2022) Annual Revenue 18

Statement of Operations 19

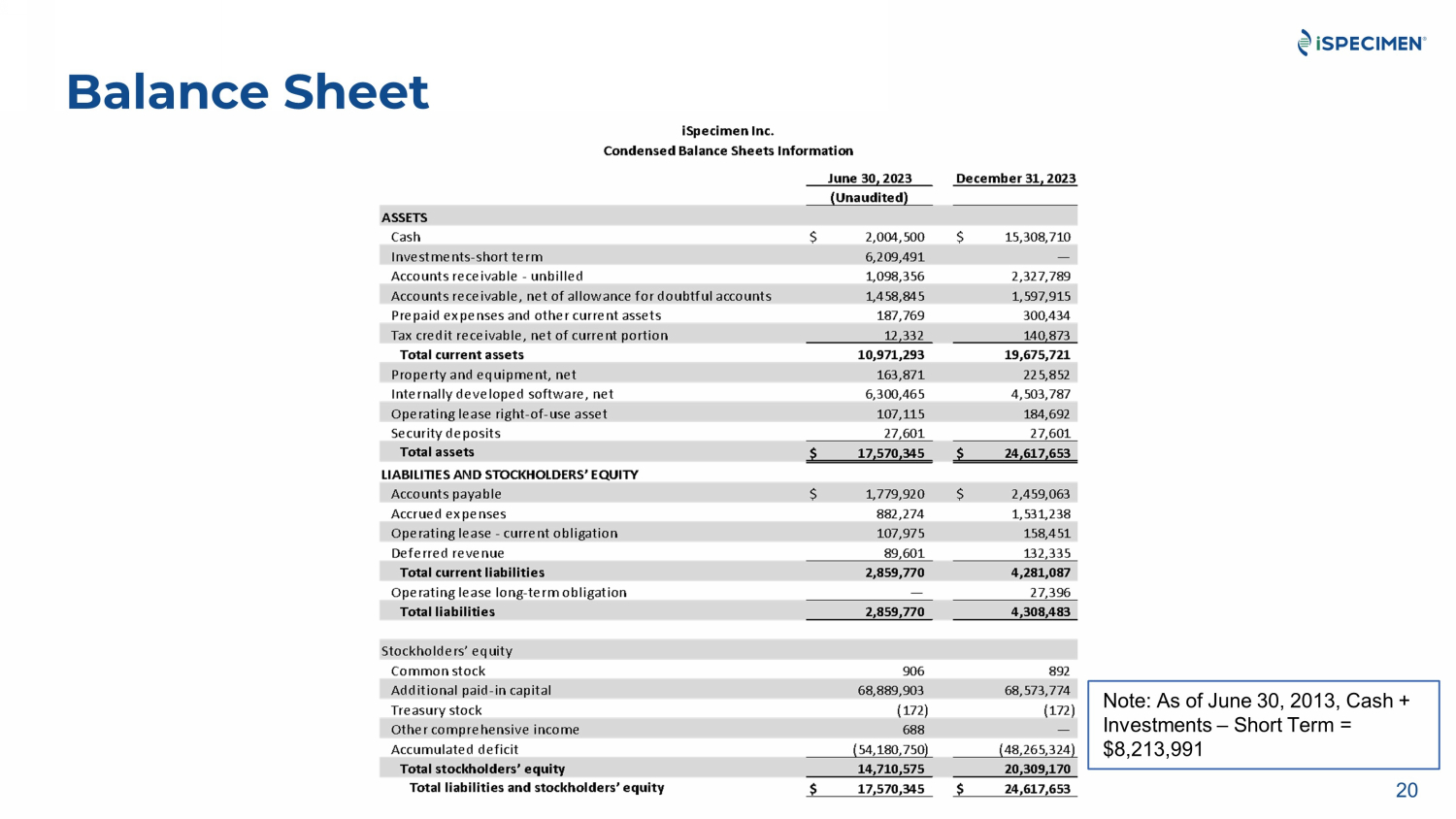

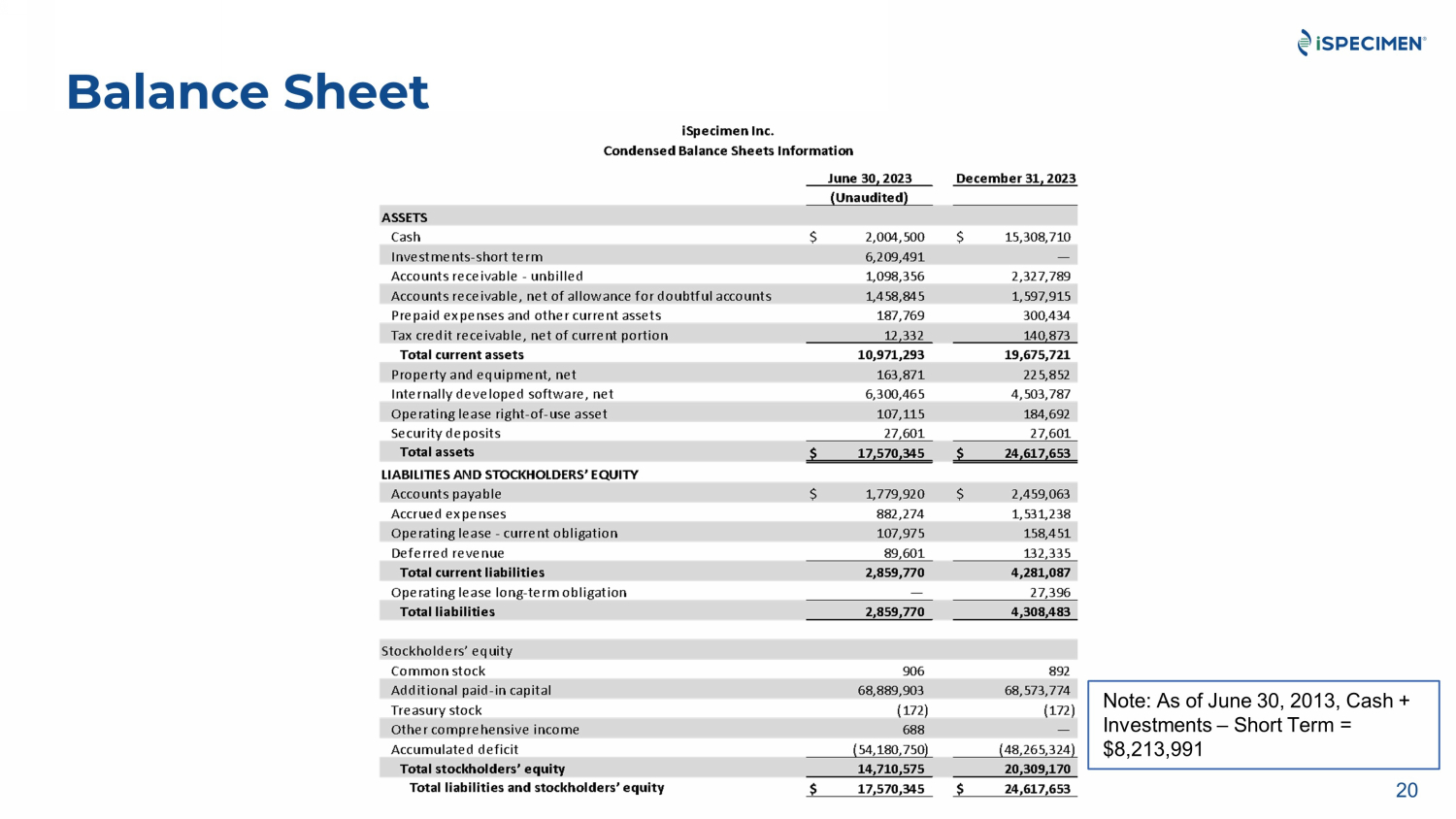

Balance Sheet 20 Note: As of June 30, 2013, Cash + Investments – Short Term = $8,213,991 2

Common Stock Information 21

Tracy Curley | Chief Executive Officer, Chief Financial Officer and Treasurer Ms . Curley brings three decades of experience in public accounting and corporate finance for both publicly traded companies and emerging companies like iSpecimen and joined iSpecimen in August 2020 . She came to iSpecimen after over a decade with national accounting firms such as CohnReznick where she focused on serving clients in the middle markets . During her time as a partner in public accounting firms, she was responsible for creating and leading teams to provide audit and consulting services to a growing clientele of private and public emerging growth companies primarily in the technology and life sciences industries . Ms . Curley received her Master of Accountancy and Bachelor of Science in Business Administration with a concentration in accounting from Kansas State University . She also attended the United States Military Academy . She is a certified public accountant licensed in the Commonwealth of Massachusetts . Benjamin Bielak | Chief Information Officer and Secretary Mr . Bielak has been serving as our Chief Information Officer since June 2018 . He served as the Chief Information Officer at GNS Healthcare, a leading casual machine learning product and services company, from January 2017 to May 2018 and as Director of Academic Technology at Harvard University, from February 2015 to January 2017 . Prior to his work at GNS and Harvard, Mr . Bielak was the Chief Information Officer at Dovetail Health from November 2006 to April 2014 . He previously held roles as Manager of Development and Integration at Boston Medical Center and Senior Manager of Technology at Sapient, a global services company, from December 1997 to July 2005 . Mr . Bielak holds a Masters of Business Administration degree from Bentley University, where his studies focused on change management, and a master’s degree from Boston University in computer science . Eric Langlois | Chief Revenue Officer 22 Management Team 9 “Sources Cited” page 28 Mr . Langlois has been serving as Chief Revenue Officer since January 2023 . Prior he served as iSpecimen’s SVP of Sales and Business Development since arriving in January of 2016 . Prior to joining iSpecimen, Mr . Langlois served as Global Head of Sales for The Reprocell Group helping to integrate sales teams driven by the demands of integrating four portfolio companies with products and services in Cellular Reprogramming, Stem Cells, 3 D cell culture, genomics, and biospecimens . Prior to that, he held rapidly increasing positions from Regional Sales Manager to VP of Sales with Genomics Collaborative, SeraCare Life Sciences, SeqWright, and BioServe . Mr . Langlois has amassed 25 years of experience in life science research going from bench laboratory science into business development and executive management . Mr . Langlois holds a BS in Biotechnology/Biochemistry from Worcester Polytechnic Institute .

2 3 1. Similar to Amazon, iSpecimen has developed an online marketplace to seamlessly connect researchers with healthcare providers and supplier organizations 2. First mover advantage that addresses an inefficient and fragmented global biospecimen supply chain that is poised to be disrupted by an online solution 3. $3B - $4B global biospecimen market growing at 10 - 15% per year 4. Strong revenue growth with a 7 - year CAGR of 48% fueled by precision and regenerative medicine research 5. Plans to enhance existing platform and develop new service offering to increase revenue opportunities Investor Highlights >200 Healthcare Provider / Supplier Organizations >500 Customer Organizations

Sign up for a free iSpecimen Marketplace account at iSpecimen.com Contact us. iSpecimen Inc. 450 Bedford Street Lexington, MA 02420 investors@ispecimen.com Be a part of the biospecimen revolution

Appendix 25

PHASE 3 Expansion via the Online iSpecimen Marketplace Œ START UP Company Ideation and Self - Funding PHASE 1 Proof of Concept PHASE 2 Critical Mass of Suppliers and Early Customer Adoption �� � 2010 – 2011 2012 – 2013 2014 – 2017 2018 – 2022 0 Customers 1 Supplier Agreement 0 Specimen Records 0 Patient Records 0 FTEs $500K Friends and Family Covert. Debt 1 Customer 3 Supplier Agreements 2+ Million Specimen Records 400+ Thousand Patient Records 7 FTEs $2.5M Series A 140+ Customers 60+ Supplier Agreement 26+ Million Specimen Records 5+ Million Patient Records 33 FTEs $8M Series B 500+ Customers 200+ Supplier Agreement 80+ Million Specimen Records 15+ Million Patient Records 74 FTEs $20.7M + $21M IPO + Private Placement 26 Strategic Evolution

iSpecimen Marketplace UI/UX Click Search to start searching for specimens 27

2 8 iSpecimen Marketplace UI/UX Use search bar to quickly find specimens that match search criteria

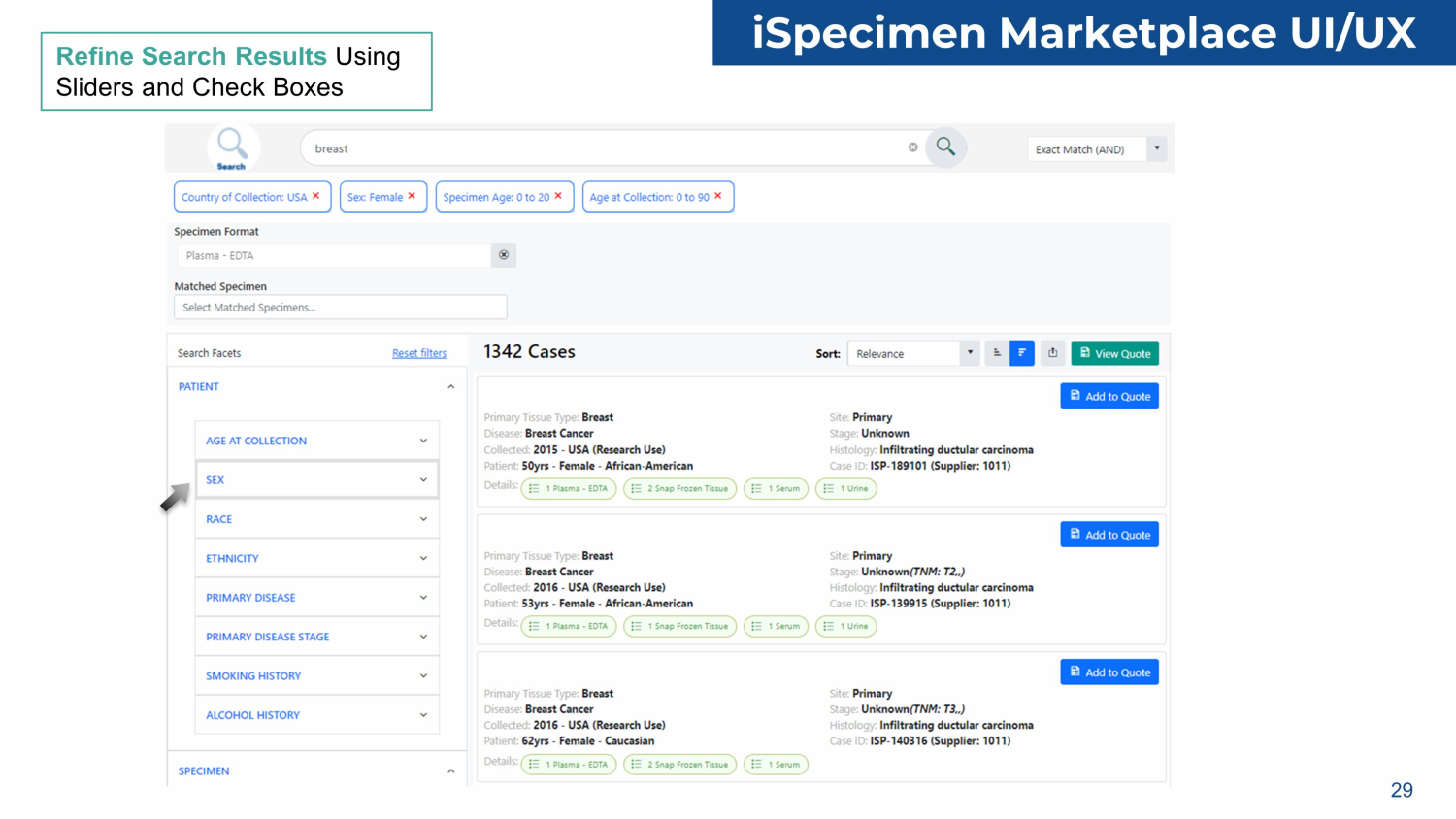

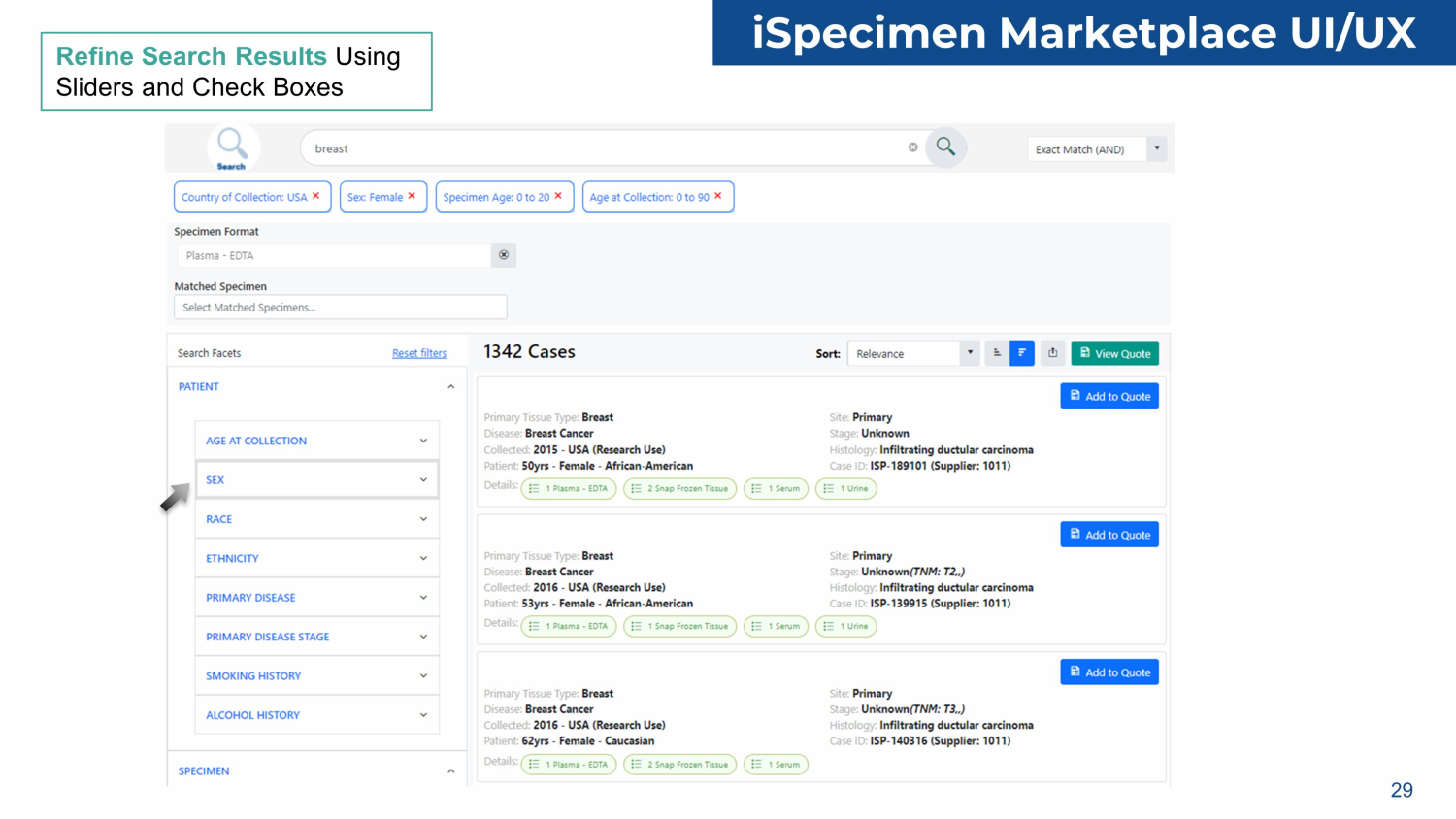

Refine Search Results Using Sliders and Check Boxes iSpecimen Marketplace UI/UX 29

View Quote Request and Add More Specimens Request a Quote iSpecimen Marketplace UI/UX 30 Track and Manage Requests

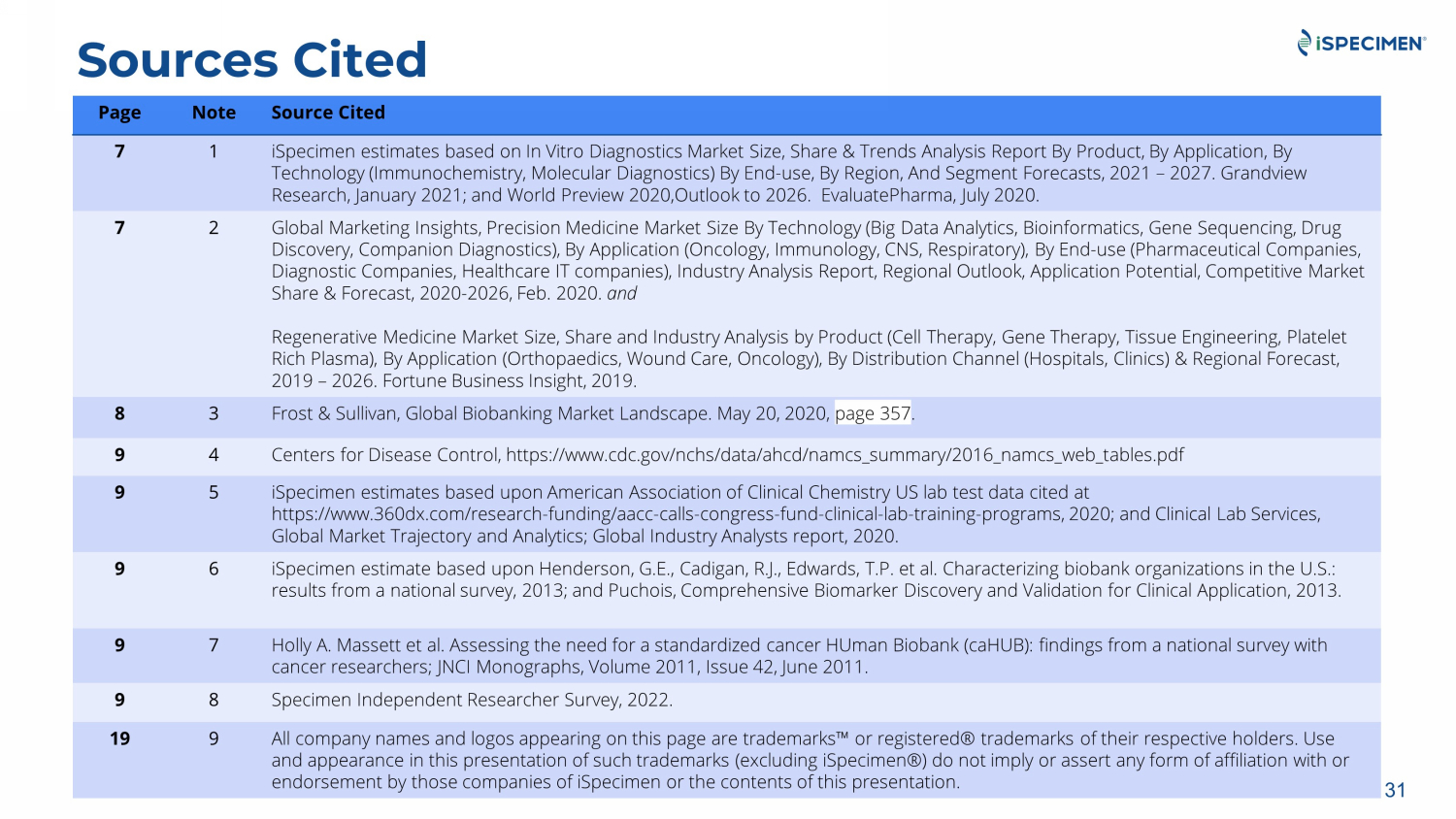

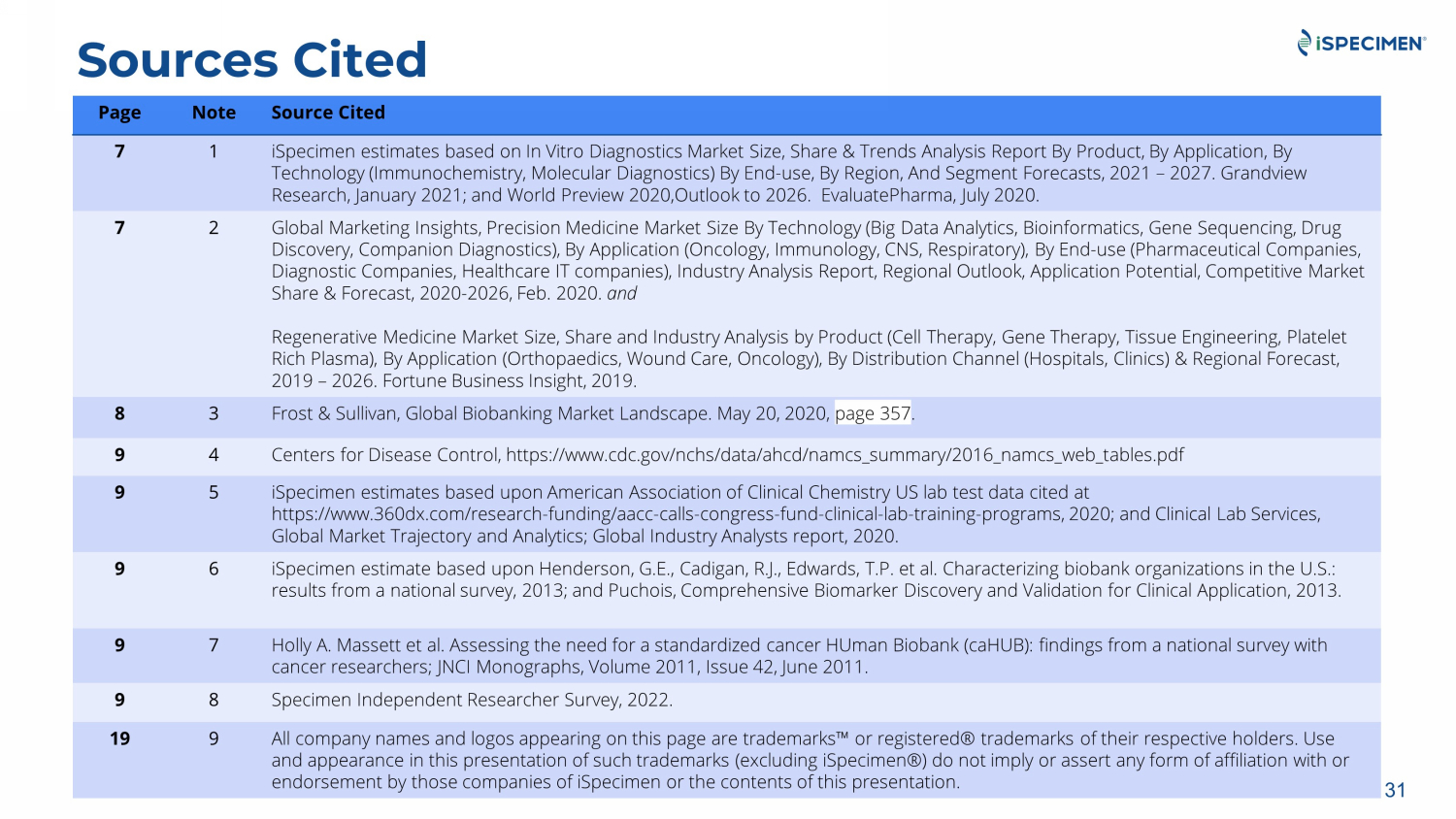

31 Page Note Source Cited 7 1 iSpecimen estimates based on In Vitro Diagnostics Market Size, Share & Trends Analysis Report By Product, By Application, By Technology (Immunochemistry, Molecular Diagnostics) By End - use, By Region, And Segment Forecasts, 2021 – 2027. Grandview Research, January 2021; and World Preview 2020,Outlook to 2026. EvaluatePharma, July 2020. 7 2 Global Marketing Insights, Precision Medicine Market Size By Technology (Big Data Analytics, Bioinformatics, Gene Sequencing, Dr ug Discovery, Companion Diagnostics), By Application (Oncology, Immunology, CNS, Respiratory), By End - use (Pharmaceutical Companies , Diagnostic Companies, Healthcare IT companies), Industry Analysis Report, Regional Outlook, Application Potential, Competitiv e M arket Share & Forecast, 2020 - 2026, Feb. 2020. and Regenerative Medicine Market Size, Share and Industry Analysis by Product (Cell Therapy, Gene Therapy, Tissue Engineering, Pl ate let Rich Plasma), By Application (Orthopaedics, Wound Care, Oncology), By Distribution Channel (Hospitals, Clinics) & Regional Fo rec ast, 2019 – 2026. Fortune Business Insight, 2019. 8 3 Frost & Sullivan, Global Biobanking Market Landscape. May 20, 2020, page 357 . 9 4 Centers for Disease Control, https://www.cdc.gov/nchs/data/ahcd/namcs_summary/2016_namcs_web_tables.pdf 9 5 iSpecimen estimates based upon American Association of Clinical Chemistry US lab test data cited at https://www.360dx.com/research - funding/aacc - calls - congress - fund - clinical - lab - training - programs, 2020; and Clinical Lab Services, Global Market Trajectory and Analytics; Global Industry Analysts report, 2020. 9 6 iSpecimen estimate based upon Henderson, G.E., Cadigan, R.J., Edwards, T.P. et al. Characterizing biobank organizations in th e U .S.: results from a national survey, 2013; and Puchois, Comprehensive Biomarker Discovery and Validation for Clinical Application, 20 13. 9 7 Holly A. Massett et al. Assessing the need for a standardized cancer HUman Biobank (caHUB): findings from a national survey w ith cancer researchers; JNCI Monographs, Volume 2011, Issue 42, June 2011. 9 8 Specimen Independent Researcher Survey, 2022. 19 9 All company names and logos appearing on this page are trademarks Ƞ or registered® trademarks of their respective holders. Use and appearance in this presentation of such trademarks (excluding iSpecimen®) do not imply or assert any form of affiliation wit h or endorsement by those companies of iSpecimen or the contents of this presentation. Sources Cited