0001559109virtus:BloombergUSAggregateBondIndex19218BroadBasedIndexMember2017-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22819

ETFis Series Trust I

(Exact name of registrant as specified in charter)

31 West 52nd Street, 16th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

ETFis Series Trust I

c/o Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 593-4383

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

InfraCap REIT Preferred ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the InfraCap REIT Preferred ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| InfraCap REIT Preferred ETF | $52 | 0.45% |

Portfolio Manager Commentary by Infrastructure Capital Advisors, LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 29.17%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 37.86%, and the Indxx REIT Preferred Stock Index, which serves as the style-specific index, returned 29.98%.

What factors impacted Fund performance over the reporting period?

The Fund seeks exposure to preferred securities held by Real Estate Investment Trusts (REITs). During the period, exposure to sub-sectors, such as Mortgage REITs and Office REITs, were factors that contributed positively to the Fund's relative performance. Vornado, AGNC Investment Corp and Annaly Capital Management were three companies that were primary contributors to relative performance within these factors. During the period, exposure to the Self-Storage and Residential REITs sub-sectors were factors that detracted from relative performance because these sub-sectors underperformed versus other REIT sub-sectors. Overall, REIT preferreds benefited from the Federal Reserve’s commencement of an interest rate cut cycle and continued tightening of corporate credit spreads.

AGNC Investment Corp (AGNC) and Annaly Capital Management, Inc. (NLY) were two of the primary contributors for this factor’s positive performance.

Among office REITs, Vornado was the primary contributor for this factor’s positive performance.

While the sector performed positively, it was a relative underperformer versus other REIT sub-sectors.

While the sector performed positively, it was a relative underperformer versus other REIT sub-sectors.

InfraCap REIT Preferred ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

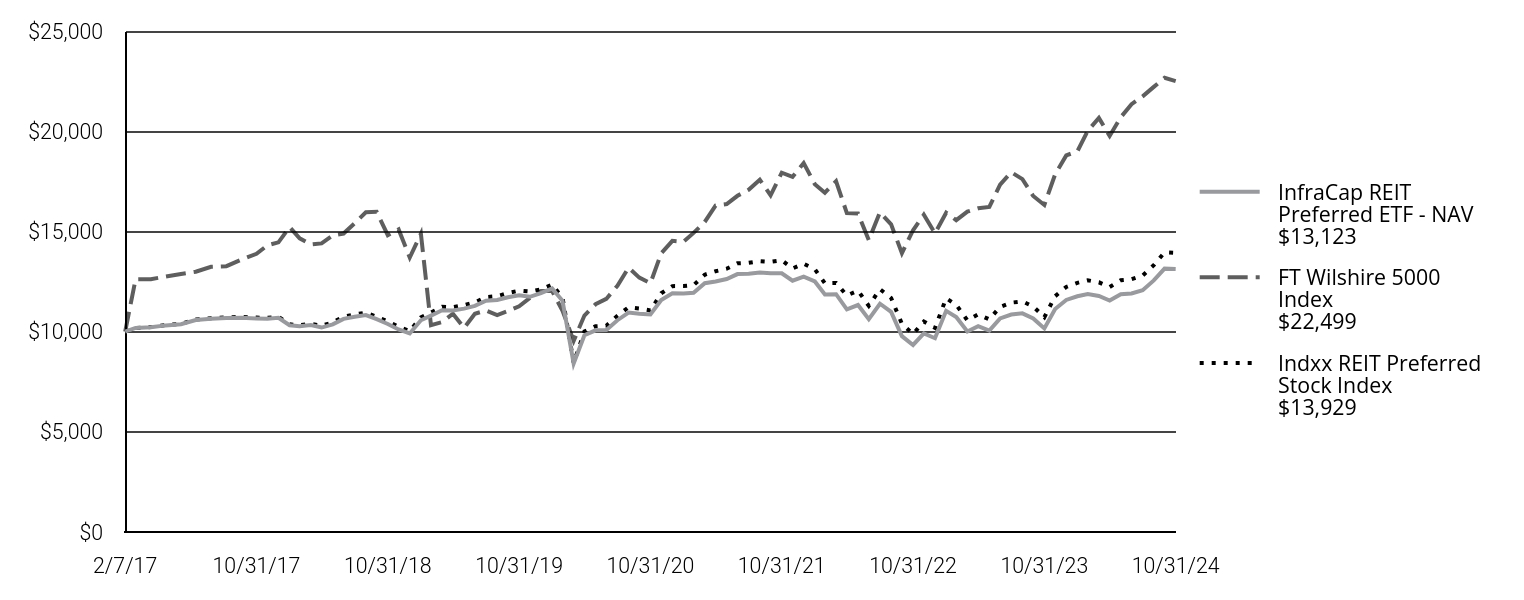

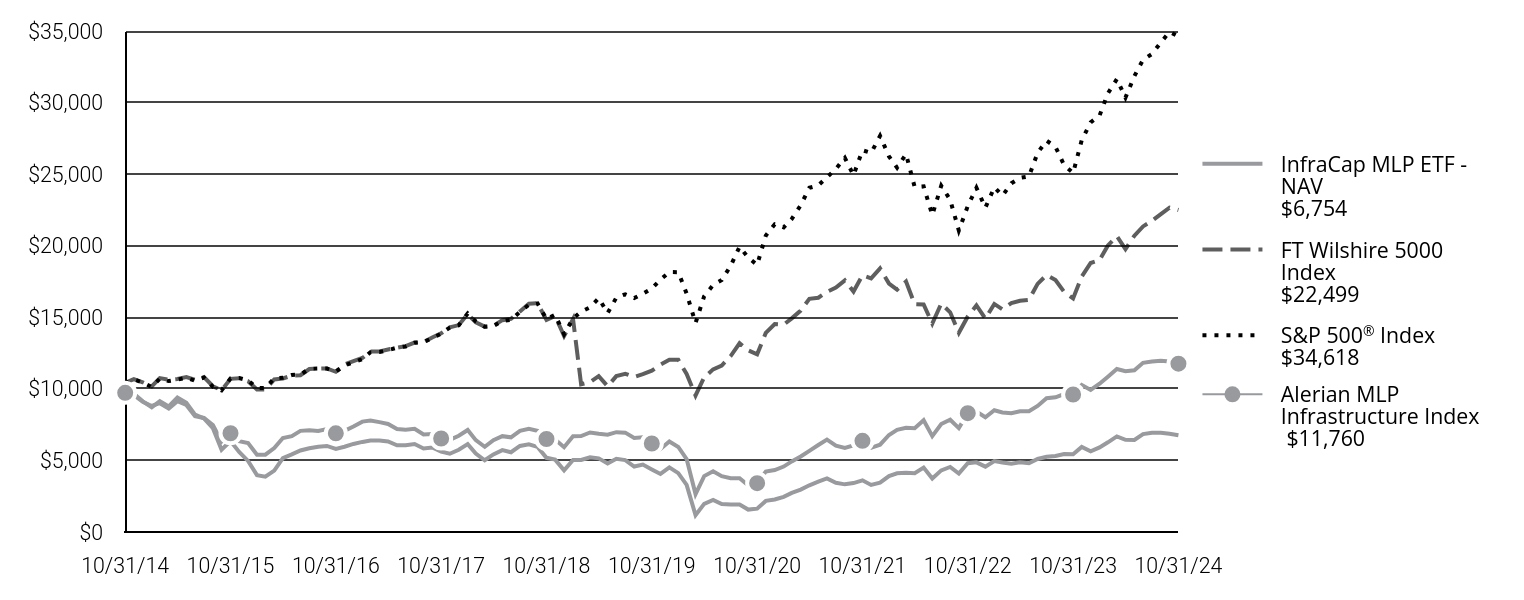

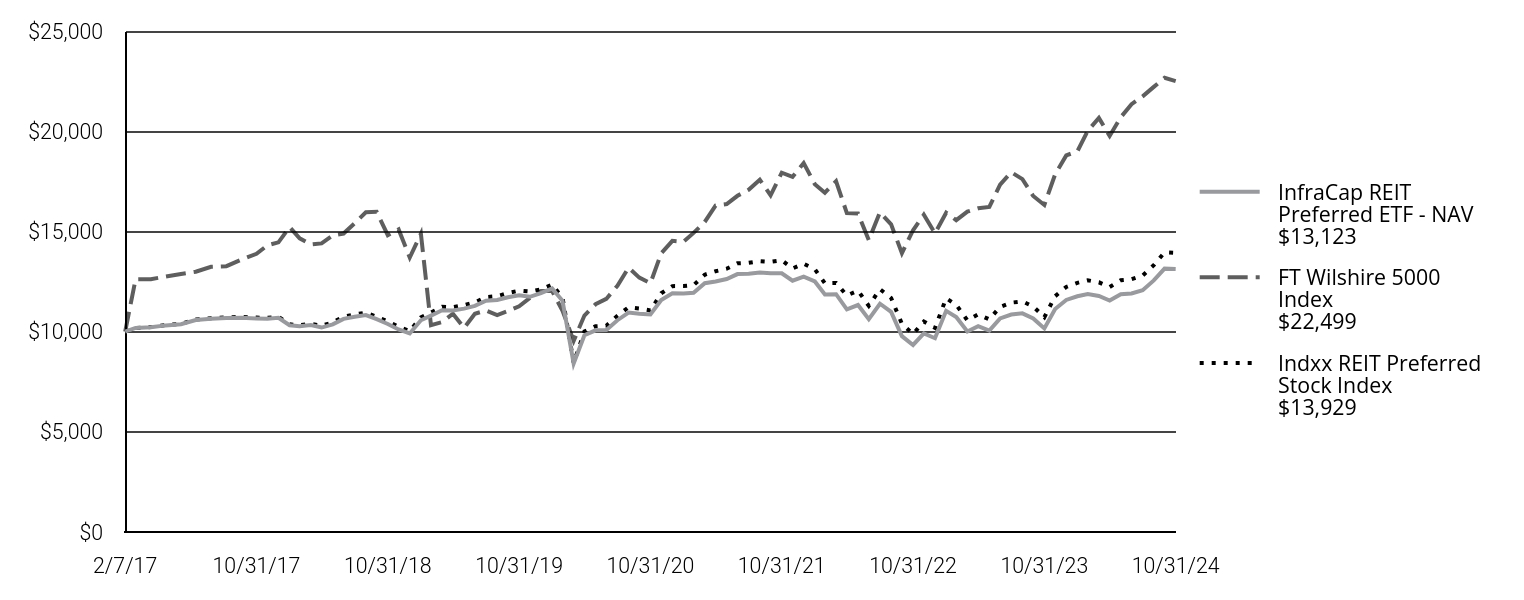

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index and style-specific index for the same period.

| InfraCap REIT Preferred ETF - NAV $13,123 | FT Wilshire 5000 Index $22,499 | Indxx REIT Preferred Stock Index $13,929 |

|---|

| 2/7/17 | $10,000 | $10,000 | $10,000 |

| 2/28/17 | $10,185 | $12,609 | $10,183 |

| 3/31/17 | $10,215 | $12,615 | $10,223 |

| 4/30/17 | $10,310 | $12,747 | $10,323 |

| 5/31/17 | $10,369 | $12,875 | $10,390 |

| 6/30/17 | $10,579 | $12,987 | $10,600 |

| 7/31/17 | $10,638 | $13,234 | $10,663 |

| 8/31/17 | $10,675 | $13,266 | $10,708 |

| 9/30/17 | $10,690 | $13,586 | $10,732 |

| 10/31/17 | $10,654 | $13,879 | $10,698 |

| 11/30/17 | $10,636 | $14,301 | $10,685 |

| 12/31/17 | $10,687 | $14,455 | $10,740 |

| 1/31/18 | $10,317 | $15,214 | $10,365 |

| 2/28/18 | $10,263 | $14,653 | $10,319 |

| 3/31/18 | $10,325 | $14,345 | $10,382 |

| 4/30/18 | $10,202 | $14,402 | $10,293 |

| 5/31/18 | $10,362 | $14,798 | $10,459 |

| 6/30/18 | $10,634 | $14,894 | $10,744 |

| 7/31/18 | $10,739 | $15,411 | $10,856 |

| 8/31/18 | $10,825 | $15,952 | $10,946 |

| 9/30/18 | $10,623 | $15,978 | $10,741 |

| 10/31/18 | $10,377 | $14,812 | $10,517 |

| 11/30/18 | $10,108 | $15,098 | $10,242 |

| 12/31/18 | $9,909 | $13,694 | $10,027 |

| 1/31/19 | $10,566 | $14,878 | $10,708 |

| 2/28/19 | $10,798 | $10,323 | $10,957 |

| 3/31/19 | $11,062 | $10,473 | $11,238 |

| 4/30/19 | $11,057 | $10,893 | $11,213 |

| 5/31/19 | $11,146 | $10,182 | $11,319 |

| 6/30/19 | $11,282 | $10,892 | $11,462 |

| 7/31/19 | $11,537 | $11,054 | $11,721 |

| 8/31/19 | $11,577 | $10,828 | $11,766 |

| 9/30/19 | $11,715 | $11,025 | $11,930 |

| 10/31/19 | $11,807 | $11,266 | $12,043 |

| 11/30/19 | $11,737 | $11,684 | $12,001 |

| 12/31/19 | $11,922 | $12,026 | $12,111 |

| 1/31/20 | $12,154 | $12,027 | $12,339 |

| 2/29/20 | $11,538 | $11,041 | $11,693 |

| 3/31/20 | $8,412 | $9,537 | $8,439 |

| 4/30/20 | $9,817 | $10,802 | $10,002 |

| 5/31/20 | $10,063 | $11,364 | $10,267 |

| 6/30/20 | $10,083 | $11,631 | $10,296 |

| 7/31/20 | $10,568 | $12,289 | $10,794 |

| 8/31/20 | $10,949 | $13,187 | $11,213 |

| 9/30/20 | $10,893 | $12,694 | $11,152 |

| 10/31/20 | $10,855 | $12,414 | $11,053 |

| 11/30/20 | $11,580 | $13,908 | $11,913 |

| 12/31/20 | $11,909 | $14,531 | $12,269 |

| 1/31/21 | $11,897 | $14,483 | $12,271 |

| 2/28/21 | $11,937 | $14,925 | $12,319 |

| 3/31/21 | $12,413 | $15,473 | $12,840 |

| 4/30/21 | $12,504 | $16,290 | $13,014 |

| 5/31/21 | $12,621 | $16,366 | $13,139 |

| 6/30/21 | $12,869 | $16,777 | $13,408 |

| 7/31/21 | $12,888 | $17,077 | $13,434 |

| 8/31/21 | $12,953 | $17,580 | $13,516 |

| 9/30/21 | $12,915 | $16,801 | $13,481 |

| 10/31/21 | $12,910 | $17,931 | $13,561 |

| 11/30/21 | $12,539 | $17,721 | $13,150 |

| 12/31/21 | $12,746 | $18,410 | $13,382 |

| 1/31/22 | $12,500 | $17,356 | $13,114 |

| 2/28/22 | $11,856 | $16,932 | $12,414 |

| 3/31/22 | $11,866 | $17,499 | $12,429 |

| 4/30/22 | $11,109 | $15,916 | $11,802 |

| 5/31/22 | $11,326 | $15,892 | $12,039 |

| 6/30/22 | $10,621 | $14,563 | $11,285 |

| 7/31/22 | $11,390 | $15,954 | $12,117 |

| 8/31/22 | $10,985 | $15,349 | $11,677 |

| 9/30/22 | $9,773 | $13,916 | $10,393 |

| 10/31/22 | $9,334 | $15,058 | $9,876 |

| 11/30/22 | $9,914 | $15,832 | $10,505 |

| 12/31/22 | $9,670 | $14,905 | $10,183 |

| 1/31/23 | $11,036 | $15,932 | $11,662 |

| 2/28/23 | $10,731 | $15,560 | $11,340 |

| 3/31/23 | $10,003 | $15,986 | $10,563 |

| 4/30/23 | $10,274 | $16,152 | $10,858 |

| 5/31/23 | $10,050 | $16,221 | $10,609 |

| 6/30/23 | $10,659 | $17,334 | $11,233 |

| 7/31/23 | $10,849 | $17,956 | $11,445 |

| 8/31/23 | $10,911 | $17,607 | $11,506 |

| 9/30/23 | $10,658 | $16,766 | $11,252 |

| 10/31/23 | $10,159 | $16,320 | $10,716 |

| 11/30/23 | $11,128 | $17,844 | $11,765 |

| 12/31/23 | $11,580 | $18,794 | $12,230 |

| 1/31/24 | $11,764 | $18,995 | $12,433 |

| 2/29/24 | $11,878 | $20,019 | $12,559 |

| 3/31/24 | $11,779 | $20,664 | $12,460 |

| 4/30/24 | $11,552 | $19,764 | $12,223 |

| 5/31/24 | $11,868 | $20,697 | $12,565 |

| 6/30/24 | $11,905 | $21,347 | $12,613 |

| 7/31/24 | $12,068 | $21,740 | $12,797 |

| 8/31/24 | $12,554 | $22,212 | $13,316 |

| 9/30/24 | $13,143 | $22,663 | $13,952 |

| 10/31/24 | $13,123 | $22,499 | $13,929 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 2/7/17 |

|---|

| InfraCap REIT Preferred ETF - NAV | 29.17 | 2.14 | 3.58 |

| FT Wilshire 5000 Index | 37.86 | 14.84 | 13.94 |

| Indxx REIT Preferred Stock Index | 29.98 | 2.95 | 4.38 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

InfraCap REIT Preferred ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $114,644,915 |

| Total number of portfolio holdings | 110 |

| Total advisory fees paid | $362,420 |

| Portfolio turnover rate | 14% |

ASSET ALLOCATION Footnote Reference(1)

| Real Estate | 60.80% |

| Financials | 38.50% |

| Money Market fund | 0.70% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

InfraCap REIT Preferred ETF | 3

Virtus InfraCap U.S. Preferred Stock ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus InfraCap U.S. Preferred Stock ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus InfraCap U.S. Preferred Stock ETF | $291 | 2.48% |

Portfolio Manager Commentary by Infrastructure Capital Advisors, LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 34.95%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 37.86%, and the S&P U.S. Preferred Stock Index, which serves as the style-specific index, returned 24.20%.

What factors impacted Fund performance over the reporting period?

Sector allocation, interest rate sensitives, and credit qualities were factors that positively contributed to the Fund's relative outperformance to the S&P U.S. Preferred Stock Index (“Benchmark”) for the 12-month period. Overweight exposure to the Utilities and Real Estate sectors also positively contributed to the Fund's high income and total return. Underweight exposure to the Commercial Services and Media Sectors detracted from relative performance. In addition, overweight exposure to select small company issuers detracted from relative performance. Finally, factors such as interest rate sensitives, credit qualities, and market betas helped to increase income and total return as a result of the Fund's overweight exposure to non-investment grade securities and preferred securities with higher market betas, such as mandatory convertible preferred securities.

Overweight exposure to utilities and Real Estate sectors relative to the Benchmark contributed to relative outperformance.

Credits/ Interest Rates/ Market Beta

Overweight exposure to mandatory convertibles preferred securities and non-investment grade credits that provided enhanced income and contributed to relative outperformance.

Media/ Commercial Services

Underweight exposure to Media and Commercial Services sectors relative to the Benchmark detracted from relative performance.

Overweight exposure to select small company issuers which that underperformed during the period due to idiosyncratic credit considerations.

Virtus InfraCap U.S. Preferred Stock ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

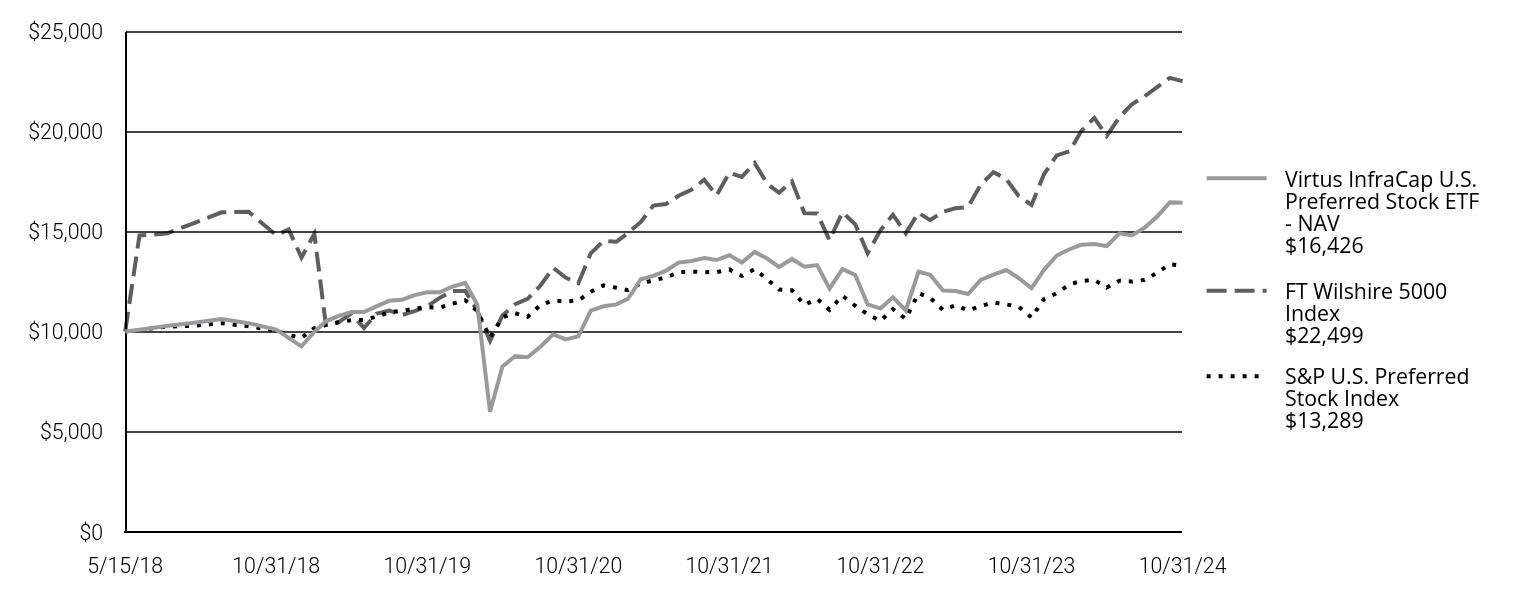

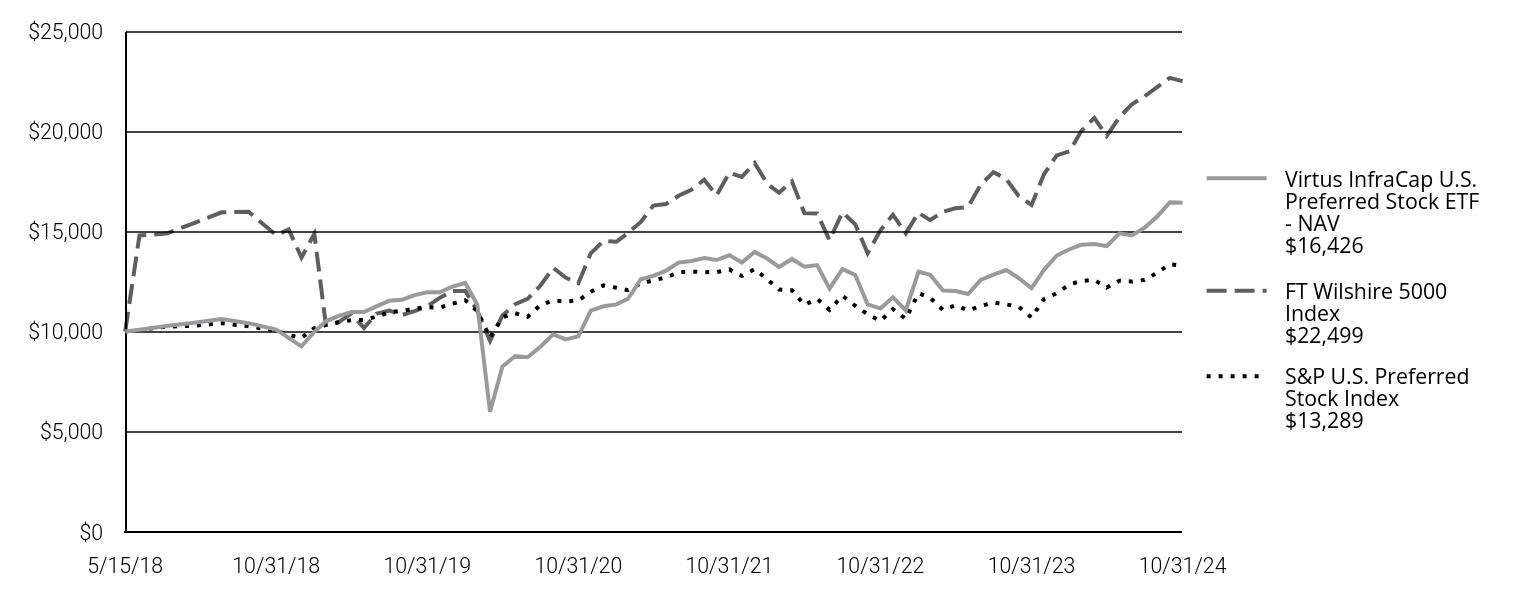

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index and style-specific index for the same period.

| Virtus InfraCap U.S. Preferred Stock ETF - NAV $16,426 | FT Wilshire 5000 Index $22,499 | S&P U.S. Preferred Stock Index $13,289 |

|---|

| 5/15/18 | $10,000 | $10,000 | $10,000 |

| 5/31/18 | $10,087 | $14,798 | $10,085 |

| 6/30/18 | $10,279 | $14,894 | $10,244 |

| 7/31/18 | $10,444 | $15,411 | $10,295 |

| 8/31/18 | $10,626 | $15,952 | $10,417 |

| 9/30/18 | $10,421 | $15,978 | $10,265 |

| 10/31/18 | $10,102 | $14,812 | $10,049 |

| 11/30/18 | $9,687 | $15,098 | $9,829 |

| 12/31/18 | $9,264 | $13,694 | $9,686 |

| 1/31/19 | $9,990 | $14,878 | $10,178 |

| 2/28/19 | $10,514 | $10,323 | $10,341 |

| 3/31/19 | $10,787 | $10,473 | $10,463 |

| 4/30/19 | $10,973 | $10,893 | $10,569 |

| 5/31/19 | $10,980 | $10,182 | $10,582 |

| 6/30/19 | $11,255 | $10,892 | $10,744 |

| 7/31/19 | $11,537 | $11,054 | $10,959 |

| 8/31/19 | $11,588 | $10,828 | $11,042 |

| 9/30/19 | $11,819 | $11,025 | $11,143 |

| 10/31/19 | $11,958 | $11,266 | $11,215 |

| 11/30/19 | $11,963 | $11,684 | $11,190 |

| 12/31/19 | $12,241 | $12,026 | $11,394 |

| 1/31/20 | $12,426 | $12,027 | $11,565 |

| 2/29/20 | $11,346 | $11,041 | $11,029 |

| 3/31/20 | $6,004 | $9,537 | $9,695 |

| 4/30/20 | $8,256 | $10,802 | $10,720 |

| 5/31/20 | $8,784 | $11,364 | $10,916 |

| 6/30/20 | $8,719 | $11,631 | $10,741 |

| 7/31/20 | $9,247 | $12,289 | $11,333 |

| 8/31/20 | $9,860 | $13,187 | $11,551 |

| 9/30/20 | $9,612 | $12,694 | $11,504 |

| 10/31/20 | $9,762 | $12,414 | $11,554 |

| 11/30/20 | $11,050 | $13,908 | $11,988 |

| 12/31/20 | $11,265 | $14,531 | $12,303 |

| 1/31/21 | $11,359 | $14,483 | $12,190 |

| 2/28/21 | $11,638 | $14,925 | $12,071 |

| 3/31/21 | $12,612 | $15,473 | $12,399 |

| 4/30/21 | $12,784 | $16,290 | $12,559 |

| 5/31/21 | $13,042 | $16,366 | $12,700 |

| 6/30/21 | $13,445 | $16,777 | $12,964 |

| 7/31/21 | $13,524 | $17,077 | $12,992 |

| 8/31/21 | $13,667 | $17,580 | $12,967 |

| 9/30/21 | $13,573 | $16,801 | $12,969 |

| 10/31/21 | $13,815 | $17,931 | $13,100 |

| 11/30/21 | $13,448 | $17,721 | $12,779 |

| 12/31/21 | $13,976 | $18,410 | $13,119 |

| 1/31/22 | $13,632 | $17,356 | $12,598 |

| 2/28/22 | $13,224 | $16,932 | $12,098 |

| 3/31/22 | $13,625 | $17,499 | $12,061 |

| 4/30/22 | $13,235 | $15,916 | $11,334 |

| 5/31/22 | $13,317 | $15,892 | $11,631 |

| 6/30/22 | $12,144 | $14,563 | $11,085 |

| 7/31/22 | $13,118 | $15,954 | $11,792 |

| 8/31/22 | $12,830 | $15,349 | $11,289 |

| 9/30/22 | $11,355 | $13,916 | $10,862 |

| 10/31/22 | $11,151 | $15,058 | $10,531 |

| 11/30/22 | $11,711 | $15,832 | $11,118 |

| 12/31/22 | $11,053 | $14,905 | $10,636 |

| 1/31/23 | $12,987 | $15,932 | $11,912 |

| 2/28/23 | $12,840 | $15,560 | $11,688 |

| 3/31/23 | $12,051 | $15,986 | $11,082 |

| 4/30/23 | $12,027 | $16,152 | $11,316 |

| 5/31/23 | $11,875 | $16,221 | $11,053 |

| 6/30/23 | $12,576 | $17,334 | $11,274 |

| 7/31/23 | $12,847 | $17,956 | $11,452 |

| 8/31/23 | $13,070 | $17,607 | $11,354 |

| 9/30/23 | $12,665 | $16,766 | $11,242 |

| 10/31/23 | $12,171 | $16,320 | $10,699 |

| 11/30/23 | $13,079 | $17,844 | $11,623 |

| 12/31/23 | $13,796 | $18,794 | $11,915 |

| 1/31/24 | $14,111 | $18,995 | $12,357 |

| 2/29/24 | $14,335 | $20,019 | $12,526 |

| 3/31/24 | $14,370 | $20,664 | $12,581 |

| 4/30/24 | $14,262 | $19,764 | $12,199 |

| 5/31/24 | $14,904 | $20,697 | $12,537 |

| 6/30/24 | $14,796 | $21,347 | $12,498 |

| 7/31/24 | $15,188 | $21,740 | $12,582 |

| 8/31/24 | $15,755 | $22,212 | $12,944 |

| 9/30/24 | $16,451 | $22,663 | $13,365 |

| 10/31/24 | $16,426 | $22,499 | $13,289 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 5/15/18 |

|---|

| Virtus InfraCap U.S. Preferred Stock ETF - NAV | 34.95 | 6.56 | 7.97 |

| FT Wilshire 5000 Index | 37.86 | 14.84 | 13.51 |

| S&P U.S. Preferred Stock Index | 24.20 | 3.45 | 4.49 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus InfraCap U.S. Preferred Stock ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $1,380,264,248 |

| Total number of portfolio holdings | 216 |

| Total advisory fees paid | $7,653,469 |

| Portfolio turnover rate | 62% |

ASSET ALLOCATION Footnote Reference(1)

| Financials | 64.2%Footnote Reference+ |

| Real Estate | 25.4%Footnote Reference+ |

| Industrials | 11.5% |

| Utilities | 8.9% |

| Communication Services | 7.4% |

| Energy | 4.3% |

| Consumer Discretionary | 0.9% |

| Health Care | 0.1% |

| Information Technology | 0.0% |

| Corporate Bond | 0.0% |

| Money Market Funds | 0.4% |

| Liabilities in Excess of Other Assets | (23.1)% |

| Total | 100.0% |

|

| Footnote | Description |

Footnote+ | Amounts represent investments in particular sectors. No industry within these sectors represented more than 25% of the Fund’s total assets at the time of investment. |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus InfraCap U.S. Preferred Stock ETF | 3

Virtus LifeSci Biotech Clinical Trials ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus LifeSci Biotech Clinical Trials ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus LifeSci Biotech Clinical Trials ETF | $102 | 0.79% |

Portfolio Manager Commentary by Virtus ETF Advisers LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 59.09%. For the same period, the FT Wilshire 5000 Index and the S&P 500 Index, each a broad-based securities market index, returned 37.86% and 38.02%, respectively, and the Lifesci Biotechnology Clinical Trials Index, which serves as the style-specific index, returned 61.46%.

What factors impacted Fund performance over the reporting period?

Momentum and volatility exposures contributed positively to Fund returns relative to the Fund’s broad-based securities market index, the FT Wilshire 5000 Index, for the 12-month period. Exposures in the biotechnology and pharmaceuticals sectors contributed the most to relative performance. Underweight exposures to the information technology and health care sectors detracted from relative performance. Sector allocations and specific stock index weightings contributed to overall Fund performance, as tracking error was minimal to the FT Wilshire 5000 Index. On a relative weighting measure, being equal weight while seeking to reduce concentration risk resulted in overweight positions in biotechnology stocks including Longboard Pharmaceutics and Summit Therapeutics. Contributors among pharmaceutical stocks included Viking Therapeutics, which experienced strong gains due to sales of its obesity pill, and from products in its pipeline for liver disease.

Biotechnology/ Pharmaceuticals

Issue selection, particularly in Longboard Pharmaceuticals and Summit Therapeutics, enhanced relative returns. In addition, Viking Therapeutics contributed to performance.

Overweight exposure to these factors enhanced relative returns.

Information Technology/ Healthcare

Index exposures to these sectors relative to the FT Wilshire 5000 Index detracted from performance.

Underweight exposure to these factors detracted from performance over the period, as they are more sensitive to economic changes including higher interest rates and tighter monetary policy.

Virtus LifeSci Biotech Clinical Trials ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

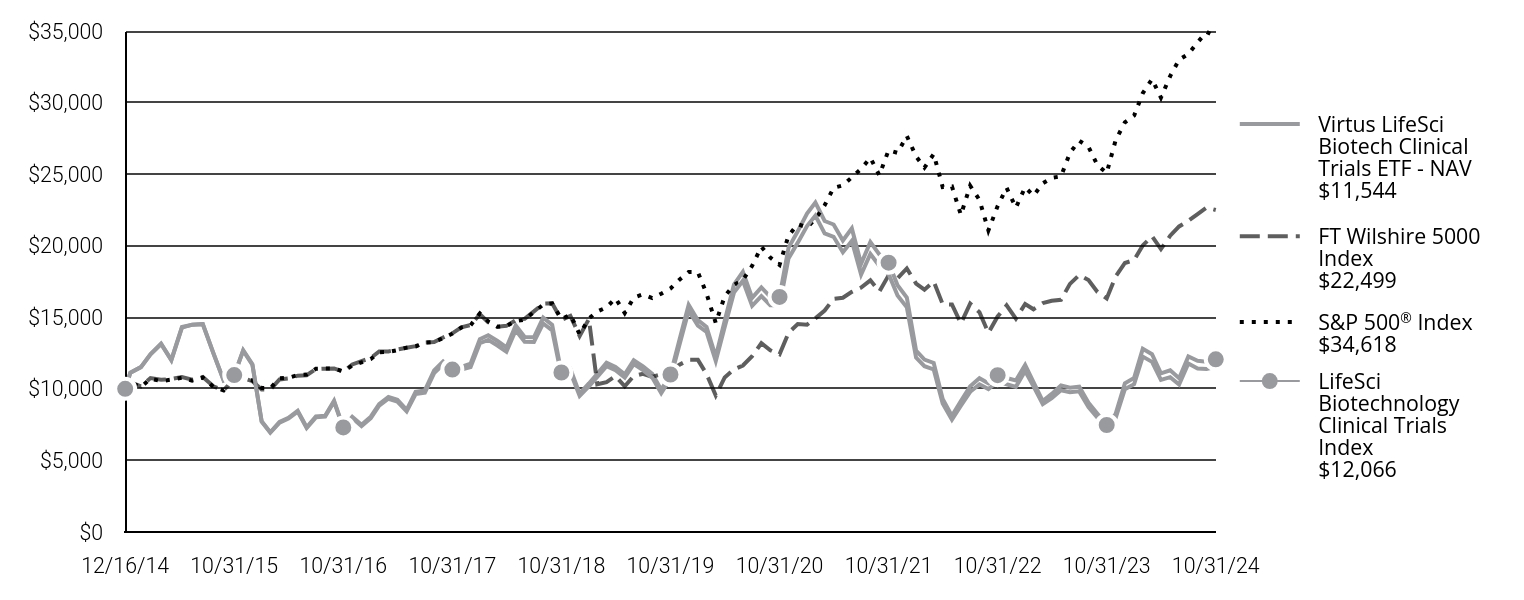

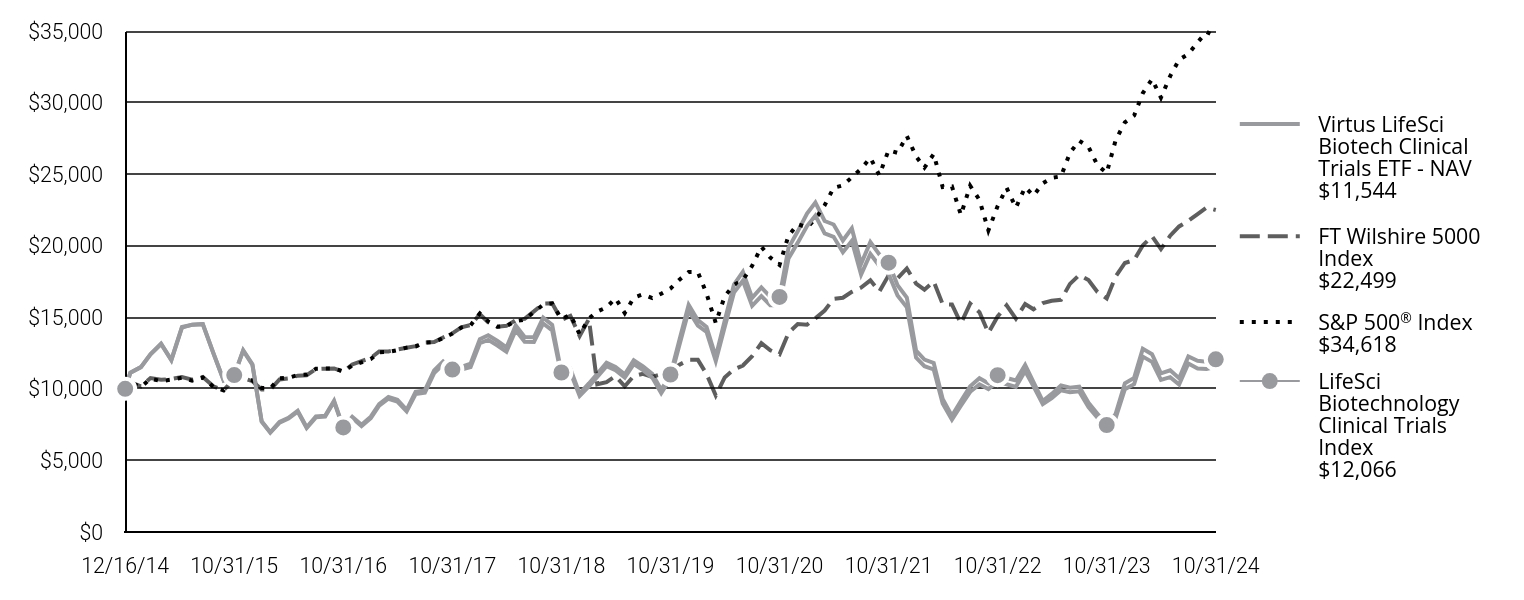

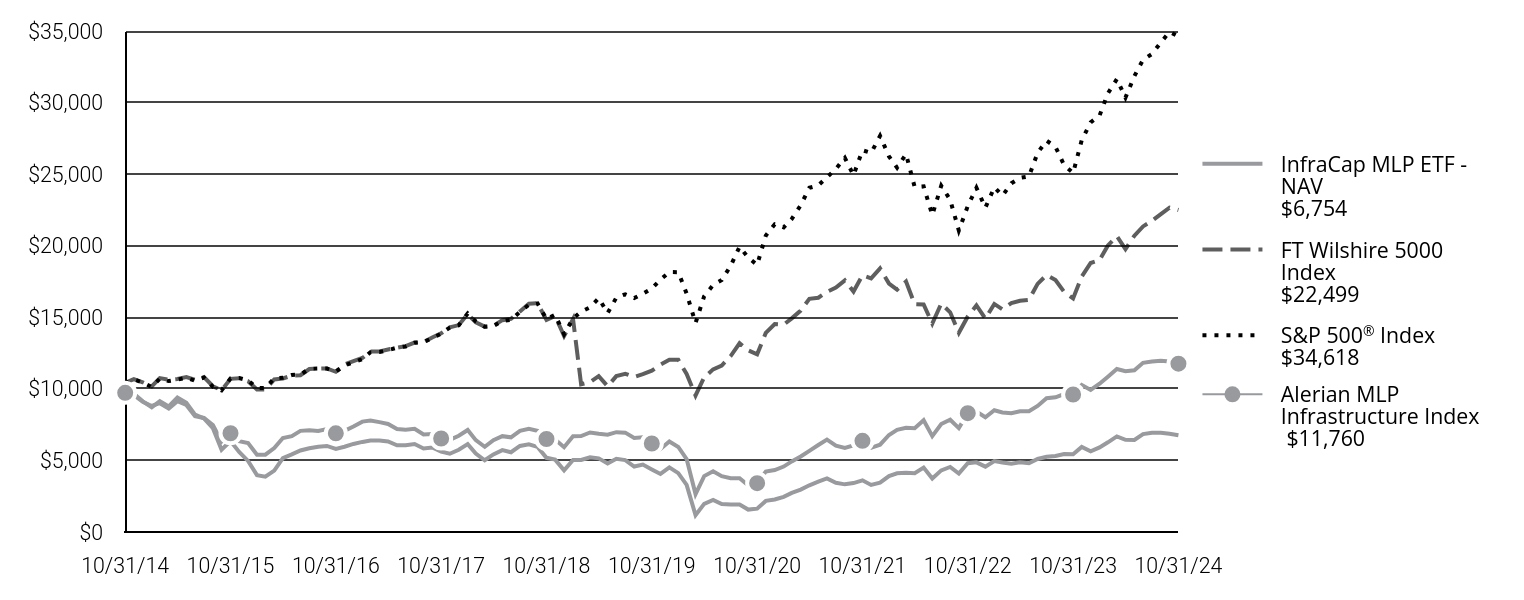

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market indexes and a style-specific index for the same period. The Fund has changed its broad-based index to the FT Wilshire 5000 Index, which includes large, mid, small and micro- capitalization companies.

| Virtus LifeSci Biotech Clinical Trials ETF - NAV $11,544 | FT Wilshire 5000 Index $22,499 | S&P 500® Index $34,618 | LifeSci Biotechnology Clinical Trials Index $12,066 |

|---|

| 12/16/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 12/31/14 | $11,128 | $10,462 | $10,444 | $11,119 |

| 1/31/15 | $11,519 | $10,172 | $10,131 | $11,519 |

| 2/28/15 | $12,408 | $10,752 | $10,713 | $12,415 |

| 3/31/15 | $13,136 | $10,630 | $10,544 | $13,152 |

| 4/30/15 | $12,001 | $10,688 | $10,645 | $12,023 |

| 5/31/15 | $14,278 | $10,826 | $10,782 | $14,316 |

| 6/30/15 | $14,484 | $10,636 | $10,573 | $14,473 |

| 7/31/15 | $14,522 | $10,824 | $10,794 | $14,522 |

| 8/31/15 | $12,488 | $10,181 | $10,143 | $12,492 |

| 9/30/15 | $10,588 | $9,904 | $9,892 | $10,596 |

| 10/31/15 | $10,946 | $10,697 | $10,727 | $10,963 |

| 11/30/15 | $12,668 | $10,747 | $10,759 | $12,698 |

| 12/31/15 | $11,669 | $10,535 | $10,589 | $11,721 |

| 1/31/16 | $7,709 | $9,960 | $10,063 | $7,740 |

| 2/29/16 | $6,938 | $9,955 | $10,050 | $6,971 |

| 3/31/16 | $7,640 | $10,658 | $10,732 | $7,686 |

| 4/30/16 | $7,932 | $10,727 | $10,773 | $7,983 |

| 5/31/16 | $8,410 | $10,922 | $10,967 | $8,469 |

| 6/30/16 | $7,265 | $10,956 | $10,995 | $7,316 |

| 7/31/16 | $8,010 | $11,386 | $11,400 | $8,072 |

| 8/31/16 | $8,061 | $11,413 | $11,416 | $8,127 |

| 9/30/16 | $9,099 | $11,425 | $11,419 | $9,178 |

| 10/31/16 | $7,254 | $11,192 | $11,210 | $7,309 |

| 11/30/16 | $7,965 | $11,702 | $11,626 | $8,048 |

| 12/31/16 | $7,405 | $11,943 | $11,855 | $7,487 |

| 1/31/17 | $7,961 | $12,156 | $12,080 | $8,054 |

| 2/28/17 | $8,826 | $12,609 | $12,560 | $8,931 |

| 3/31/17 | $9,309 | $12,615 | $12,574 | $9,428 |

| 4/30/17 | $9,114 | $12,747 | $12,704 | $9,231 |

| 5/31/17 | $8,423 | $12,875 | $12,882 | $8,526 |

| 6/30/17 | $9,643 | $12,987 | $12,963 | $9,795 |

| 7/31/17 | $9,734 | $13,234 | $13,229 | $9,891 |

| 8/31/17 | $11,096 | $13,266 | $13,270 | $11,290 |

| 9/30/17 | $11,695 | $13,586 | $13,544 | $11,908 |

| 10/31/17 | $11,147 | $13,879 | $13,860 | $11,347 |

| 11/30/17 | $11,341 | $14,301 | $14,285 | $11,531 |

| 12/31/17 | $11,519 | $14,455 | $14,444 | $11,753 |

| 1/31/18 | $13,188 | $15,214 | $15,270 | $13,471 |

| 2/28/18 | $13,422 | $14,653 | $14,708 | $13,741 |

| 3/31/18 | $13,026 | $14,345 | $14,334 | $13,341 |

| 4/30/18 | $12,587 | $14,402 | $14,389 | $12,891 |

| 5/31/18 | $14,089 | $14,798 | $14,735 | $14,432 |

| 6/30/18 | $13,291 | $14,894 | $14,826 | $13,619 |

| 7/31/18 | $13,274 | $15,411 | $15,378 | $13,605 |

| 8/31/18 | $14,568 | $15,952 | $15,879 | $14,970 |

| 9/30/18 | $14,086 | $15,978 | $15,969 | $14,472 |

| 10/31/18 | $10,918 | $14,812 | $14,878 | $11,142 |

| 11/30/18 | $11,153 | $15,098 | $15,181 | $11,396 |

| 12/31/18 | $9,504 | $13,694 | $13,810 | $9,667 |

| 1/31/19 | $10,177 | $14,878 | $14,917 | $10,377 |

| 2/28/19 | $10,833 | $10,323 | $15,396 | $11,053 |

| 3/31/19 | $11,586 | $10,473 | $15,695 | $11,829 |

| 4/30/19 | $11,298 | $10,893 | $16,331 | $11,535 |

| 5/31/19 | $10,780 | $10,182 | $15,293 | $11,013 |

| 6/30/19 | $11,726 | $10,892 | $16,371 | $11,998 |

| 7/31/19 | $11,307 | $11,054 | $16,606 | $11,573 |

| 8/31/19 | $10,786 | $10,828 | $16,343 | $11,044 |

| 9/30/19 | $9,698 | $11,025 | $16,649 | $9,931 |

| 10/31/19 | $10,735 | $11,266 | $17,009 | $11,002 |

| 11/30/19 | $13,072 | $11,684 | $17,627 | $13,412 |

| 12/31/19 | $15,453 | $12,026 | $18,159 | $15,871 |

| 1/31/20 | $14,416 | $12,027 | $18,152 | $14,797 |

| 2/29/20 | $13,972 | $11,041 | $16,657 | $14,328 |

| 3/31/20 | $11,948 | $9,537 | $14,600 | $12,242 |

| 4/30/20 | $14,321 | $10,802 | $16,472 | $14,768 |

| 5/31/20 | $16,724 | $11,364 | $17,256 | $17,288 |

| 6/30/20 | $17,553 | $11,631 | $17,599 | $18,179 |

| 7/31/20 | $15,797 | $12,289 | $18,592 | $16,362 |

| 8/31/20 | $16,482 | $13,187 | $19,928 | $17,085 |

| 9/30/20 | $15,845 | $12,694 | $19,171 | $16,428 |

| 10/31/20 | $15,835 | $12,414 | $18,661 | $16,421 |

| 11/30/20 | $19,116 | $13,908 | $20,704 | $19,853 |

| 12/31/20 | $20,215 | $14,531 | $21,500 | $21,005 |

| 1/31/21 | $21,377 | $14,483 | $21,283 | $22,239 |

| 2/28/21 | $22,106 | $14,925 | $21,869 | $23,020 |

| 3/31/21 | $20,861 | $15,473 | $22,827 | $21,726 |

| 4/30/21 | $20,620 | $16,290 | $24,045 | $21,482 |

| 5/31/21 | $19,545 | $16,366 | $24,213 | $20,360 |

| 6/30/21 | $20,334 | $16,777 | $24,779 | $21,208 |

| 7/31/21 | $17,980 | $17,077 | $25,367 | $18,732 |

| 8/31/21 | $19,423 | $17,580 | $26,139 | $20,262 |

| 9/30/21 | $18,597 | $16,801 | $24,923 | $19,400 |

| 10/31/21 | $18,028 | $17,931 | $26,669 | $18,817 |

| 11/30/21 | $16,520 | $17,721 | $26,484 | $17,233 |

| 12/31/21 | $15,697 | $18,410 | $27,671 | $16,382 |

| 1/31/22 | $12,184 | $17,356 | $26,239 | $12,675 |

| 2/28/22 | $11,586 | $16,932 | $25,454 | $12,047 |

| 3/31/22 | $11,356 | $17,499 | $26,399 | $11,810 |

| 4/30/22 | $8,977 | $15,916 | $24,097 | $9,299 |

| 5/31/22 | $7,851 | $15,892 | $24,141 | $8,111 |

| 6/30/22 | $8,818 | $14,563 | $22,148 | $9,144 |

| 7/31/22 | $9,795 | $15,954 | $24,190 | $10,185 |

| 8/31/22 | $10,315 | $15,349 | $23,204 | $10,739 |

| 9/30/22 | $9,982 | $13,916 | $21,067 | $10,392 |

| 10/31/22 | $10,517 | $15,058 | $22,772 | $10,959 |

| 11/30/22 | $10,322 | $15,832 | $24,045 | $10,759 |

| 12/31/22 | $10,143 | $14,905 | $22,660 | $10,585 |

| 1/31/23 | $11,249 | $15,932 | $24,083 | $11,677 |

| 2/28/23 | $10,171 | $15,560 | $23,496 | $10,475 |

| 3/31/23 | $8,931 | $15,986 | $24,358 | $9,143 |

| 4/30/23 | $9,356 | $16,152 | $24,739 | $9,649 |

| 5/31/23 | $9,903 | $16,221 | $24,846 | $10,245 |

| 6/30/23 | $9,759 | $17,334 | $26,488 | $10,085 |

| 7/31/23 | $9,824 | $17,956 | $27,339 | $10,153 |

| 8/31/23 | $8,728 | $17,607 | $26,904 | $9,027 |

| 9/30/23 | $7,985 | $16,766 | $25,621 | $8,261 |

| 10/31/23 | $7,256 | $16,320 | $25,082 | $7,473 |

| 11/30/23 | $7,972 | $17,844 | $27,373 | $8,248 |

| 12/31/23 | $9,977 | $18,794 | $28,616 | $10,388 |

| 1/31/24 | $10,327 | $18,995 | $29,097 | $10,765 |

| 2/29/24 | $12,253 | $20,019 | $30,651 | $12,793 |

| 3/31/24 | $11,885 | $20,664 | $31,637 | $12,417 |

| 4/30/24 | $10,628 | $19,764 | $30,345 | $11,088 |

| 5/31/24 | $10,819 | $20,697 | $31,850 | $11,295 |

| 6/30/24 | $10,298 | $21,347 | $32,992 | $10,740 |

| 7/31/24 | $11,771 | $21,740 | $33,394 | $12,258 |

| 8/31/24 | $11,421 | $22,212 | $34,204 | $11,958 |

| 9/30/24 | $11,381 | $22,663 | $34,934 | $11,898 |

| 10/31/24 | $11,544 | $22,499 | $34,618 | $12,066 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 12/16/14 |

|---|

| Virtus LifeSci Biotech Clinical Trials ETF - NAV | 59.09 | 1.46 | 1.46 |

| FT Wilshire 5000 Index | 37.86 | 14.84 | 13.03 |

S&P 500® Index | 38.02 | 15.27 | 13.39 |

| LifeSci Biotechnology Clinical Trials Index | 61.46 | 1.86 | 1.92 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus LifeSci Biotech Clinical Trials ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $11,320,824 |

| Total number of portfolio holdings | 121 |

| Total advisory fees paid | $84,796 |

| Portfolio turnover rate | 77% |

ASSET ALLOCATION Footnote Reference(1)

| Health Care | 93.60% |

| Money Market Fund | 6.40% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus LifeSci Biotech Clinical Trials ETF | 3

Virtus LifeSci Biotech Products ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus LifeSci Biotech Products ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus LifeSci Biotech Products ETF | $93 | 0.79% |

Portfolio Manager Commentary by Virtus ETF Advisers LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 35.53%. For the same period, the FT Wilshire 5000 Index and the S&P 500 Index, each a broad-based securities market index, returned 37.86% and 38.02%, respectively, and the Lifesci Biotechnology Products Index, which serves as the style-specific index, returned 37.44%.

What factors impacted Fund performance over the reporting period?

Excess growth and volatility exposures contributed a mild positive to the index returns relative to the Fund's broad-based securities market index, the FT Wilshire 5000 Index, for the 12-month period. Exposures in the smaller market capitalization companies enhanced the performance of the Fund relative to the FT Wilshire 5000 Index, which includes larger-capitalization companies and more diversified holdings. Underweight exposures to the medical equipment, device manufacturing, and software sectors detracted from relative performance. The Fund seeks to reduce concentration risk by maintaining equal exposure to all of its holdings. This strategy resulted in the Fund slightly underperforming the FT Wilshire 5000 Index for the fiscal year.

Issue selection, particularly in ADMA Biologics and TGTX Therapeutics, enhanced relative returns. In addition, Iovance Biotherapeutics and Tarsus Pharmaceuticals contributed to performance.

Owning a higher concentration of smaller-capitalization companies enhanced relative returns, as the FT Wilshire 5000 Index includes larger-capitalization companies and more diversified holdings.

Underweight exposures to the medical equipment, device manufacturing, and software sectors detracted from relative performance.

While holding a less diversified portfolio than the FT Wilshire 5000 Index, the Fund produced higher idiosyncratic returns over the 12-month period that may not be able to be reproduced going forward.

Virtus LifeSci Biotech Products ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

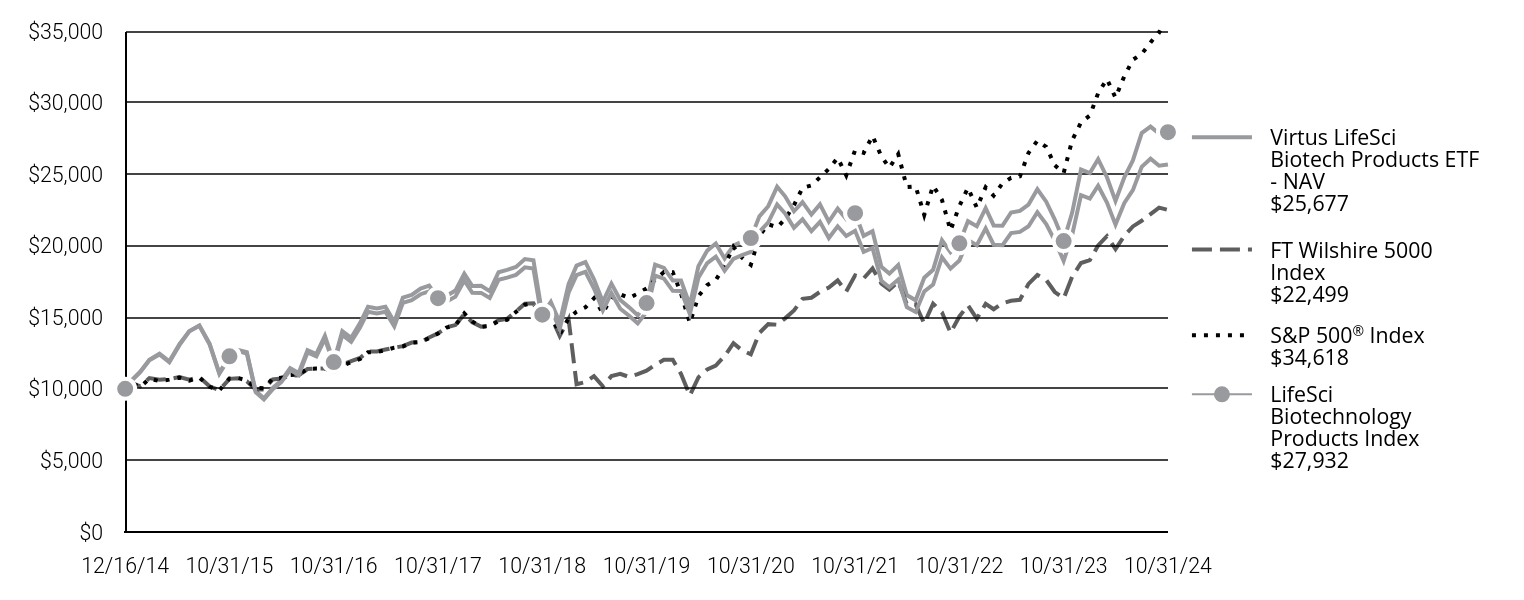

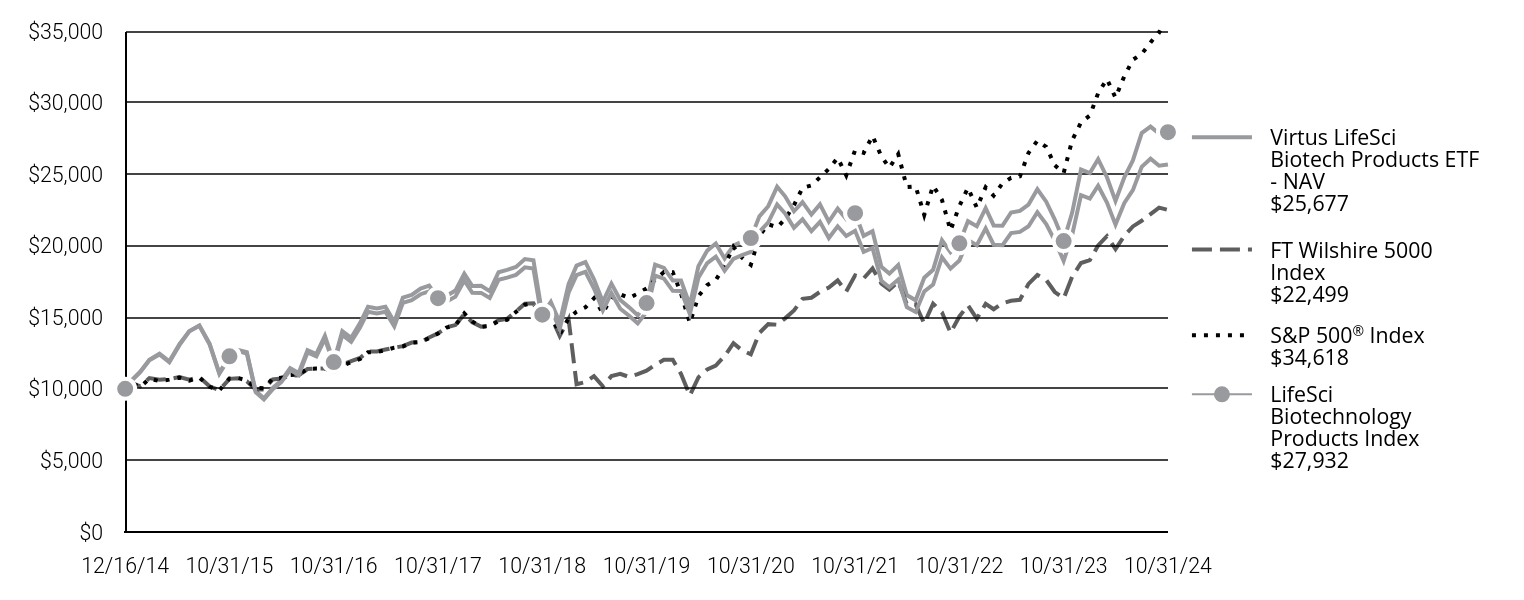

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market indexes and a style-specific index for the same period. The Fund has changed its broad-based index to the FT Wilshire 5000 Index, which includes large, mid, small and micro- capitalization companies.

| Virtus LifeSci Biotech Products ETF - NAV $25,677 | FT Wilshire 5000 Index $22,499 | S&P 500® Index $34,618 | LifeSci Biotechnology Products Index $27,932 |

|---|

| 12/16/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 12/31/14 | $10,466 | $10,462 | $10,444 | $10,487 |

| 1/31/15 | $11,163 | $10,172 | $10,131 | $11,193 |

| 2/28/15 | $11,989 | $10,752 | $10,713 | $12,029 |

| 3/31/15 | $12,402 | $10,630 | $10,544 | $12,461 |

| 4/30/15 | $11,865 | $10,688 | $10,645 | $11,929 |

| 5/31/15 | $13,049 | $10,826 | $10,782 | $13,131 |

| 6/30/15 | $14,019 | $10,636 | $10,573 | $14,022 |

| 7/31/15 | $14,407 | $10,824 | $10,794 | $14,421 |

| 8/31/15 | $13,122 | $10,181 | $10,143 | $13,170 |

| 9/30/15 | $11,055 | $9,904 | $9,892 | $11,116 |

| 10/31/15 | $12,199 | $10,697 | $10,727 | $12,275 |

| 11/30/15 | $12,638 | $10,747 | $10,759 | $12,723 |

| 12/31/15 | $12,472 | $10,535 | $10,589 | $12,569 |

| 1/31/16 | $9,765 | $9,960 | $10,063 | $9,845 |

| 2/29/16 | $9,265 | $9,955 | $10,050 | $9,347 |

| 3/31/16 | $9,974 | $10,658 | $10,732 | $10,068 |

| 4/30/16 | $10,467 | $10,727 | $10,773 | $10,574 |

| 5/31/16 | $11,312 | $10,922 | $10,967 | $11,443 |

| 6/30/16 | $10,967 | $10,956 | $10,995 | $11,106 |

| 7/31/16 | $12,538 | $11,386 | $11,400 | $12,707 |

| 8/31/16 | $12,272 | $11,413 | $11,416 | $12,438 |

| 9/30/16 | $13,497 | $11,425 | $11,419 | $13,697 |

| 10/31/16 | $11,715 | $11,192 | $11,210 | $11,872 |

| 11/30/16 | $13,760 | $11,702 | $11,626 | $14,037 |

| 12/31/16 | $13,282 | $11,943 | $11,855 | $13,561 |

| 1/31/17 | $14,291 | $12,156 | $12,080 | $14,598 |

| 2/28/17 | $15,392 | $12,609 | $12,560 | $15,729 |

| 3/31/17 | $15,273 | $12,615 | $12,574 | $15,613 |

| 4/30/17 | $15,390 | $12,747 | $12,704 | $15,737 |

| 5/31/17 | $14,358 | $12,875 | $12,882 | $14,666 |

| 6/30/17 | $16,012 | $12,987 | $12,963 | $16,369 |

| 7/31/17 | $16,198 | $13,234 | $13,229 | $16,569 |

| 8/31/17 | $16,611 | $13,266 | $13,270 | $17,003 |

| 9/30/17 | $16,810 | $13,586 | $13,544 | $17,217 |

| 10/31/17 | $15,942 | $13,879 | $13,860 | $16,333 |

| 11/30/17 | $16,095 | $14,301 | $14,285 | $16,500 |

| 12/31/17 | $16,441 | $14,455 | $14,444 | $16,865 |

| 1/31/18 | $17,573 | $15,214 | $15,270 | $18,047 |

| 2/28/18 | $16,716 | $14,653 | $14,708 | $17,183 |

| 3/31/18 | $16,704 | $14,345 | $14,334 | $17,194 |

| 4/30/18 | $16,345 | $14,402 | $14,389 | $16,829 |

| 5/31/18 | $17,617 | $14,798 | $14,735 | $18,146 |

| 6/30/18 | $17,772 | $14,894 | $14,826 | $18,308 |

| 7/31/18 | $17,962 | $15,411 | $15,378 | $18,513 |

| 8/31/18 | $18,488 | $15,952 | $15,879 | $19,072 |

| 9/30/18 | $18,399 | $15,978 | $15,969 | $18,990 |

| 10/31/18 | $14,748 | $14,812 | $14,878 | $15,183 |

| 11/30/18 | $15,594 | $15,098 | $15,181 | $16,079 |

| 12/31/18 | $14,173 | $13,694 | $13,810 | $14,647 |

| 1/31/19 | $16,714 | $14,878 | $14,917 | $17,316 |

| 2/28/19 | $17,943 | $10,323 | $15,396 | $18,606 |

| 3/31/19 | $18,174 | $10,473 | $15,695 | $18,857 |

| 4/30/19 | $17,005 | $10,893 | $16,331 | $17,651 |

| 5/31/19 | $15,488 | $10,182 | $15,293 | $16,085 |

| 6/30/19 | $16,688 | $10,892 | $16,371 | $17,345 |

| 7/31/19 | $15,595 | $11,054 | $16,606 | $16,204 |

| 8/31/19 | $15,105 | $10,828 | $16,343 | $15,695 |

| 9/30/19 | $14,576 | $11,025 | $16,649 | $15,143 |

| 10/31/19 | $15,370 | $11,266 | $17,009 | $15,991 |

| 11/30/19 | $17,906 | $11,684 | $17,627 | $18,674 |

| 12/31/19 | $17,699 | $12,026 | $18,159 | $18,454 |

| 1/31/20 | $16,849 | $12,027 | $18,152 | $17,563 |

| 2/29/20 | $16,843 | $11,041 | $16,657 | $17,567 |

| 3/31/20 | $15,214 | $9,537 | $14,600 | $15,858 |

| 4/30/20 | $17,765 | $10,802 | $16,472 | $18,563 |

| 5/31/20 | $18,790 | $11,364 | $17,256 | $19,658 |

| 6/30/20 | $19,243 | $11,631 | $17,599 | $20,155 |

| 7/31/20 | $18,248 | $12,289 | $18,592 | $19,113 |

| 8/31/20 | $19,086 | $13,187 | $19,928 | $20,015 |

| 9/30/20 | $19,338 | $12,694 | $19,171 | $20,292 |

| 10/31/20 | $19,562 | $12,414 | $18,661 | $20,539 |

| 11/30/20 | $20,975 | $13,908 | $20,704 | $22,053 |

| 12/31/20 | $21,627 | $14,531 | $21,500 | $22,761 |

| 1/31/21 | $22,881 | $14,483 | $21,283 | $24,116 |

| 2/28/21 | $22,248 | $14,925 | $21,869 | $23,452 |

| 3/31/21 | $21,256 | $15,473 | $22,827 | $22,404 |

| 4/30/21 | $21,841 | $16,290 | $24,045 | $23,044 |

| 5/31/21 | $21,016 | $16,366 | $24,213 | $22,176 |

| 6/30/21 | $21,664 | $16,777 | $24,779 | $22,888 |

| 7/31/21 | $20,534 | $17,077 | $25,367 | $21,685 |

| 8/31/21 | $21,357 | $17,580 | $26,139 | $22,588 |

| 9/30/21 | $20,678 | $16,801 | $24,923 | $21,867 |

| 10/31/21 | $21,041 | $17,931 | $26,669 | $22,274 |

| 11/30/21 | $19,570 | $17,721 | $26,484 | $20,688 |

| 12/31/21 | $19,846 | $18,410 | $27,671 | $21,009 |

| 1/31/22 | $17,550 | $17,356 | $26,239 | $18,527 |

| 2/28/22 | $17,101 | $16,932 | $25,454 | $18,051 |

| 3/31/22 | $17,640 | $17,499 | $26,399 | $18,649 |

| 4/30/22 | $15,709 | $15,916 | $24,097 | $16,552 |

| 5/31/22 | $15,367 | $15,892 | $24,141 | $16,191 |

| 6/30/22 | $16,799 | $14,563 | $22,148 | $17,766 |

| 7/31/22 | $17,280 | $15,954 | $24,190 | $18,317 |

| 8/31/22 | $19,189 | $15,349 | $23,204 | $20,382 |

| 9/30/22 | $18,400 | $13,916 | $21,067 | $19,548 |

| 10/31/22 | $18,962 | $15,058 | $22,772 | $20,166 |

| 11/30/22 | $20,391 | $15,832 | $24,045 | $21,715 |

| 12/31/22 | $20,038 | $14,905 | $22,660 | $21,356 |

| 1/31/23 | $21,207 | $15,932 | $24,083 | $22,631 |

| 2/28/23 | $20,071 | $15,560 | $23,496 | $21,418 |

| 3/31/23 | $20,039 | $15,986 | $24,358 | $21,398 |

| 4/30/23 | $20,879 | $16,152 | $24,739 | $22,318 |

| 5/31/23 | $20,966 | $16,221 | $24,846 | $22,427 |

| 6/30/23 | $21,360 | $17,334 | $26,488 | $22,876 |

| 7/31/23 | $22,338 | $17,956 | $27,339 | $23,946 |

| 8/31/23 | $21,518 | $17,607 | $26,904 | $23,076 |

| 9/30/23 | $20,351 | $16,766 | $25,621 | $21,829 |

| 10/31/23 | $18,945 | $16,320 | $25,082 | $20,323 |

| 11/30/23 | $20,773 | $17,844 | $27,373 | $22,313 |

| 12/31/23 | $23,533 | $18,794 | $28,616 | $25,320 |

| 1/31/24 | $23,298 | $18,995 | $29,097 | $25,079 |

| 2/29/24 | $24,188 | $20,019 | $30,651 | $26,045 |

| 3/31/24 | $23,015 | $20,664 | $31,637 | $24,785 |

| 4/30/24 | $21,470 | $19,764 | $30,345 | $23,123 |

| 5/31/24 | $22,985 | $20,697 | $31,850 | $24,783 |

| 6/30/24 | $23,881 | $21,347 | $32,992 | $25,954 |

| 7/31/24 | $25,510 | $21,740 | $33,394 | $27,870 |

| 8/31/24 | $26,079 | $22,212 | $34,204 | $28,322 |

| 9/30/24 | $25,586 | $22,663 | $34,934 | $27,834 |

| 10/31/24 | $25,677 | $22,499 | $34,618 | $27,932 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 12/16/14 |

|---|

| Virtus LifeSci Biotech Products ETF - NAV | 35.53 | 10.81 | 10.01 |

| FT Wilshire 5000 Index | 37.86 | 14.84 | 13.03 |

S&P 500® Index | 38.02 | 15.27 | 13.39 |

| LifeSci Biotechnology Products Index | 37.44 | 11.80 | 10.95 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus LifeSci Biotech Products ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $22,138,886 |

| Total number of portfolio holdings | 65 |

| Total advisory fees paid | $153,294 |

| Portfolio turnover rate | 46% |

ASSET ALLOCATION Footnote Reference(1)

| Health Care | 98.50% |

| Money Market Fund | 1.50% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus LifeSci Biotech Products ETF | 3

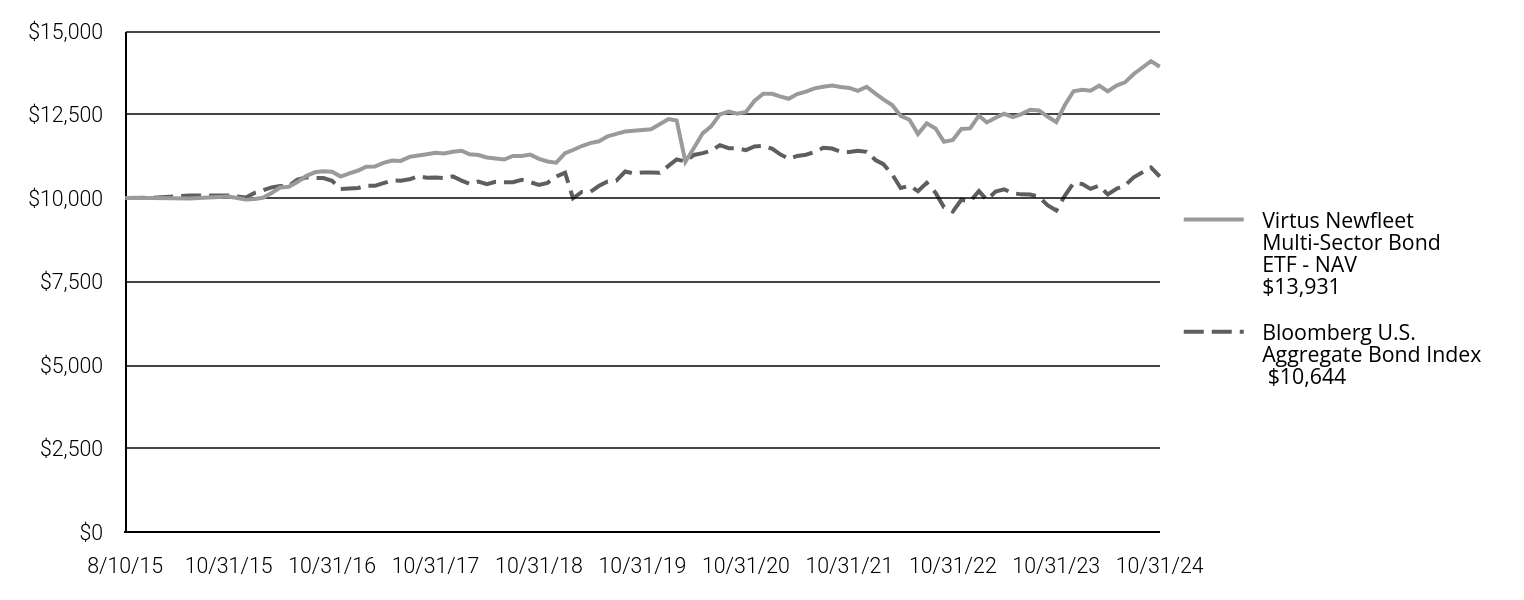

Virtus Newfleet Multi-Sector Bond ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus Newfleet Multi-Sector Bond ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus Newfleet Multi-Sector Bond ETF | $52 | 0.49% |

Portfolio Manager Commentary by Newfleet Asset Management

For the fiscal year ended October 31, 2024, the Fund at NAV returned 13.51%. For the same period, the Bloomberg U.S. Aggregate Bond Index, a broad-based securities market index, returned 10.55%.

What factors impacted Fund performance over the reporting period?

Sector allocation and issue selection contributed positively to Fund returns relative to the Bloomberg U.S. Aggregate Bond Index for the period ended October 31, 2024. The Fund’s underweight to U.S. Treasuries was a key contributor to the positive performance. Allocation to and issue selection within high yield corporate bonds was additive to performance. The Fund’s underweight to agency mortgage-backed securities versus the benchmark detracted from performance. In addition, the Fund’s yield curve exposure versus the benchmark detracted from performance.

The Fund’s underweight to U.S. Treasuries had a positive impact, as spread sectors had positive excess returns during the period.

Allocation to and selection within high yield corporate bonds was additive to performance. Stable fundamentals, strong technicals, and attractive yields contributed to the positive performance.

Agency mortgage- backed securities (MBS)

The Fund’s underweight to MBS had a negative impact on performance as spreads tightened during the period. Fundamentals are strong as housing supply and demand provide a strong foundation. We prefer non-agency residential mortgage-backed securities (RMBS) for the additional carry they offer for ratings and duration.

Curve positioning relative to the Bloomberg U.S. Aggregate Bond Index was a detractor from performance during the period.

Virtus Newfleet Multi-Sector Bond ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

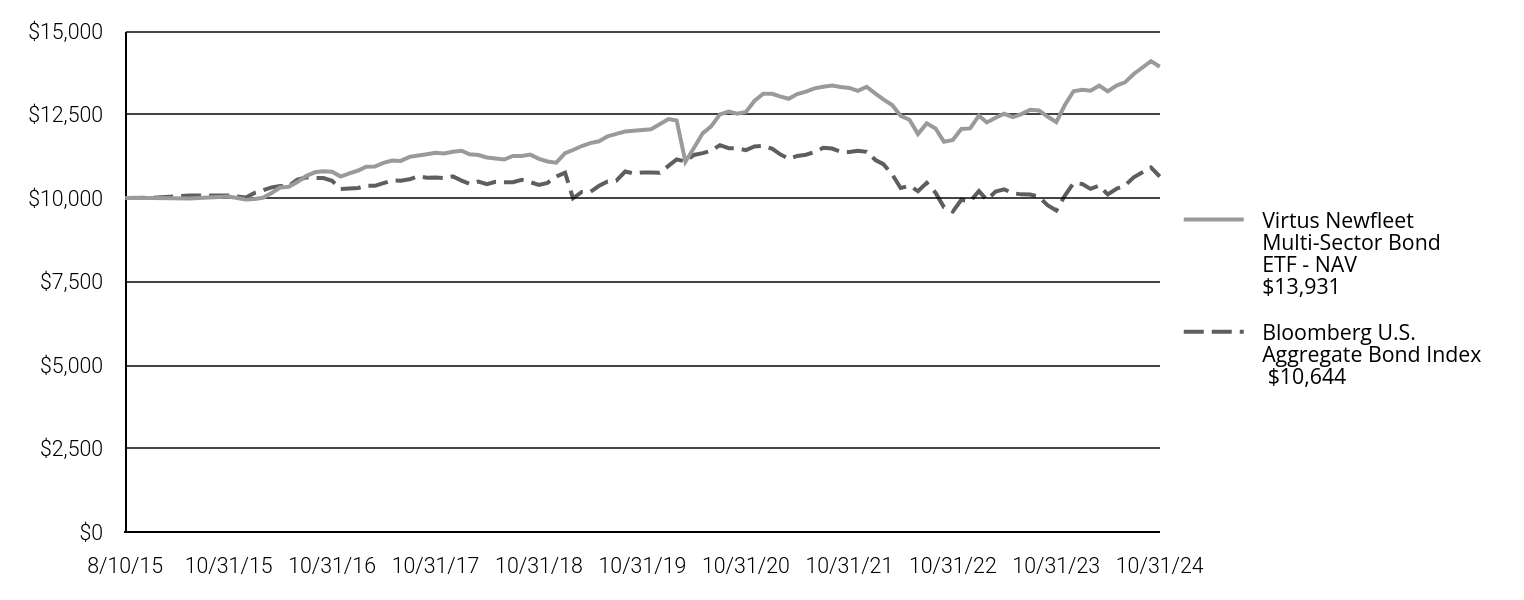

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index for the same period.

| Virtus Newfleet Multi-Sector Bond ETF - NAV $13,931 | Bloomberg U.S. Aggregate Bond Index $10,644 |

|---|

| 8/10/15 | $10,000 | $10,000 |

| 8/31/15 | $10,000 | $10,005 |

| 9/30/15 | $9,984 | $10,073 |

| 10/31/15 | $10,047 | $10,075 |

| 11/30/15 | $9,999 | $10,048 |

| 12/31/15 | $9,958 | $10,016 |

| 1/31/16 | $9,968 | $10,154 |

| 2/29/16 | $10,007 | $10,226 |

| 3/31/16 | $10,152 | $10,319 |

| 4/30/16 | $10,313 | $10,359 |

| 5/31/16 | $10,337 | $10,362 |

| 6/30/16 | $10,478 | $10,548 |

| 7/31/16 | $10,658 | $10,614 |

| 8/31/16 | $10,769 | $10,602 |

| 9/30/16 | $10,802 | $10,596 |

| 10/31/16 | $10,787 | $10,515 |

| 11/30/16 | $10,643 | $10,266 |

| 12/31/16 | $10,740 | $10,281 |

| 1/31/17 | $10,823 | $10,301 |

| 2/28/17 | $10,934 | $10,370 |

| 3/31/17 | $10,940 | $10,365 |

| 4/30/17 | $11,051 | $10,445 |

| 5/31/17 | $11,119 | $10,525 |

| 6/30/17 | $11,111 | $10,515 |

| 7/31/17 | $11,231 | $10,560 |

| 8/31/17 | $11,273 | $10,655 |

| 9/30/17 | $11,312 | $10,604 |

| 10/31/17 | $11,355 | $10,610 |

| 11/30/17 | $11,334 | $10,596 |

| 12/31/17 | $11,383 | $10,645 |

| 1/31/18 | $11,416 | $10,522 |

| 2/28/18 | $11,308 | $10,423 |

| 3/31/18 | $11,286 | $10,489 |

| 4/30/18 | $11,213 | $10,411 |

| 5/31/18 | $11,182 | $10,486 |

| 6/30/18 | $11,151 | $10,473 |

| 7/31/18 | $11,259 | $10,475 |

| 8/31/18 | $11,257 | $10,543 |

| 9/30/18 | $11,298 | $10,475 |

| 10/31/18 | $11,171 | $10,392 |

| 11/30/18 | $11,093 | $10,454 |

| 12/31/18 | $11,059 | $10,646 |

| 1/31/19 | $11,342 | $10,759 |

| 2/28/19 | $11,437 | $9,991 |

| 3/31/19 | $11,556 | $10,183 |

| 4/30/19 | $11,643 | $10,185 |

| 5/31/19 | $11,697 | $10,366 |

| 6/30/19 | $11,848 | $10,496 |

| 7/31/19 | $11,919 | $10,520 |

| 8/31/19 | $11,992 | $10,792 |

| 9/30/19 | $12,014 | $10,735 |

| 10/31/19 | $12,035 | $10,767 |

| 11/30/19 | $12,059 | $10,762 |

| 12/31/19 | $12,206 | $10,754 |

| 1/31/20 | $12,366 | $10,961 |

| 2/29/20 | $12,323 | $11,158 |

| 3/31/20 | $11,085 | $11,093 |

| 4/30/20 | $11,495 | $11,290 |

| 5/31/20 | $11,936 | $11,342 |

| 6/30/20 | $12,143 | $11,414 |

| 7/31/20 | $12,504 | $11,584 |

| 8/31/20 | $12,586 | $11,491 |

| 9/30/20 | $12,526 | $11,484 |

| 10/31/20 | $12,578 | $11,433 |

| 11/30/20 | $12,906 | $11,545 |

| 12/31/20 | $13,122 | $11,561 |

| 1/31/21 | $13,121 | $11,478 |

| 2/28/21 | $13,043 | $11,313 |

| 3/31/21 | $12,970 | $11,171 |

| 4/30/21 | $13,111 | $11,260 |

| 5/31/21 | $13,186 | $11,296 |

| 6/30/21 | $13,283 | $11,376 |

| 7/31/21 | $13,332 | $11,503 |

| 8/31/21 | $13,369 | $11,481 |

| 9/30/21 | $13,326 | $11,382 |

| 10/31/21 | $13,295 | $11,379 |

| 11/30/21 | $13,206 | $11,412 |

| 12/31/21 | $13,330 | $11,383 |

| 1/31/22 | $13,124 | $11,138 |

| 2/28/22 | $12,951 | $11,013 |

| 3/31/22 | $12,785 | $10,708 |

| 4/30/22 | $12,460 | $10,301 |

| 5/31/22 | $12,344 | $10,368 |

| 6/30/22 | $11,917 | $10,205 |

| 7/31/22 | $12,234 | $10,454 |

| 8/31/22 | $12,084 | $10,159 |

| 9/30/22 | $11,681 | $9,720 |

| 10/31/22 | $11,737 | $9,594 |

| 11/30/22 | $12,066 | $9,947 |

| 12/31/22 | $12,083 | $9,902 |

| 1/31/23 | $12,466 | $10,207 |

| 2/28/23 | $12,263 | $9,943 |

| 3/31/23 | $12,403 | $10,195 |

| 4/30/23 | $12,522 | $10,257 |

| 5/31/23 | $12,424 | $10,145 |

| 6/30/23 | $12,511 | $10,109 |

| 7/31/23 | $12,642 | $10,102 |

| 8/31/23 | $12,623 | $10,038 |

| 9/30/23 | $12,440 | $9,783 |

| 10/31/23 | $12,273 | $9,628 |

| 11/30/23 | $12,776 | $10,064 |

| 12/31/23 | $13,197 | $10,450 |

| 1/31/24 | $13,238 | $10,421 |

| 2/29/24 | $13,214 | $10,274 |

| 3/31/24 | $13,362 | $10,368 |

| 4/30/24 | $13,190 | $10,107 |

| 5/31/24 | $13,368 | $10,278 |

| 6/30/24 | $13,462 | $10,375 |

| 7/31/24 | $13,712 | $10,618 |

| 8/31/24 | $13,907 | $10,770 |

| 9/30/24 | $14,097 | $10,914 |

| 10/31/24 | $13,931 | $10,644 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 8/10/15 |

|---|

| Virtus Newfleet Multi-Sector Bond ETF - NAV | 13.51 | 2.97 | 3.66 |

| Bloomberg U.S. Aggregate Bond Index | 10.55 | -0.23 | 1.48 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus Newfleet Multi-Sector Bond ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $191,287,377 |

| Total number of portfolio holdings | 803 |

| Total advisory fees paid | $218,118 |

| Portfolio turnover rate | 92% |

ASSET ALLOCATION Footnote Reference(1)

| Corporate Bond | 26.88% |

| Foreign Bond | 19.64% |

| Term Loan | 12.58% |

| Asset Backed Security | 11.04% |

| Residential Mortgage Backed Security | 9.46% |

| U.S. Government Securities | 5.77% |

| Mortgage Backed Security | 5.57% |

| Commercial Mortgage Backed Security | 4.13% |

| Money Market Fund | 2.95% |

| Exchange Traded Fund | 1.98% |

| Common Stock | 0.00% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus Newfleet Multi-Sector Bond ETF | 3

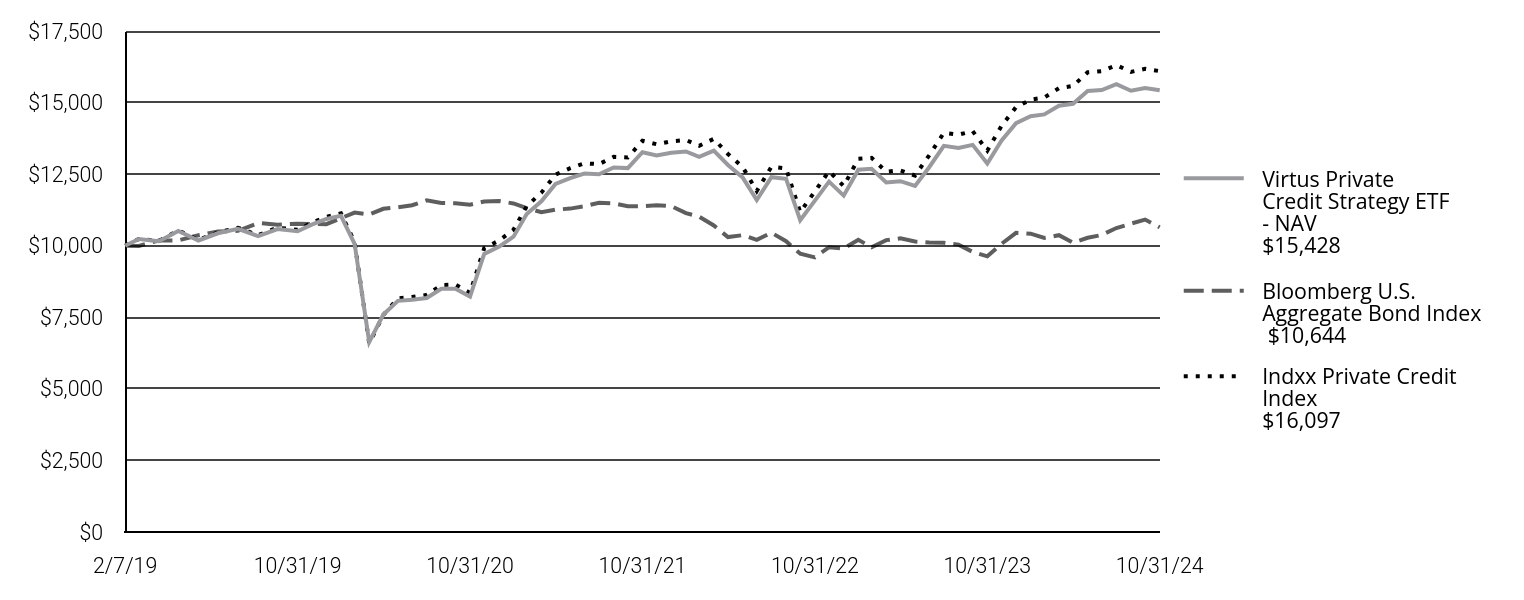

Virtus Private Credit Strategy ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus Private Credit Strategy ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus Private Credit Strategy ETF | $82 | 0.75% |

Portfolio Manager Commentary by Virtus ETF Advisers LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 19.85%. For the same period, the Bloomberg U.S. Aggregate Bond Index, a broad-based securities market index, returned 10.55%, and the Indxx Private Credit Index, which serves as the style-specific index, returned 20.83%.

What factors impacted Fund performance over the reporting period?

Sector exposure decisions contributed positively to Fund returns relative to the Bloomberg U.S. Aggregate Bond Index, for the 12-month period. Overweight exposure in the asset management industry contributed the most to relative performance, as it is also necessary to meet the Fund’s investment objectives. Underweight exposures to the semiconductors, software, technology hardware, internet media & services, and biopharmaceuticals industries detracted from relative performance. Shorter duration credit allocations and specific Fund weightings aided performance. On a relative weighting measure, the Fund’s components are weighted based on dividend yields while seeking to reduce concentration risk.

Asset management/ Collateralized loan obligations (CLOs)

Overweight exposures to these sectors benefited from performance in the short term, as they are more sensitive to the overall economy, including regulatory changes.

Overweight exposure to the U.S. detracted somewhat from Fund returns.

Shorter duration credit allocations and underweight exposures to Treasury, securitized, and government-related securities relative to the Bloomberg U.S. Aggregate Bond Index enhanced performance.

Underweight exposures to the semiconductors, software, technology hardware, internet media & services and biopharmaceuticals industries detracted from relative performance.

Virtus Private Credit Strategy ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

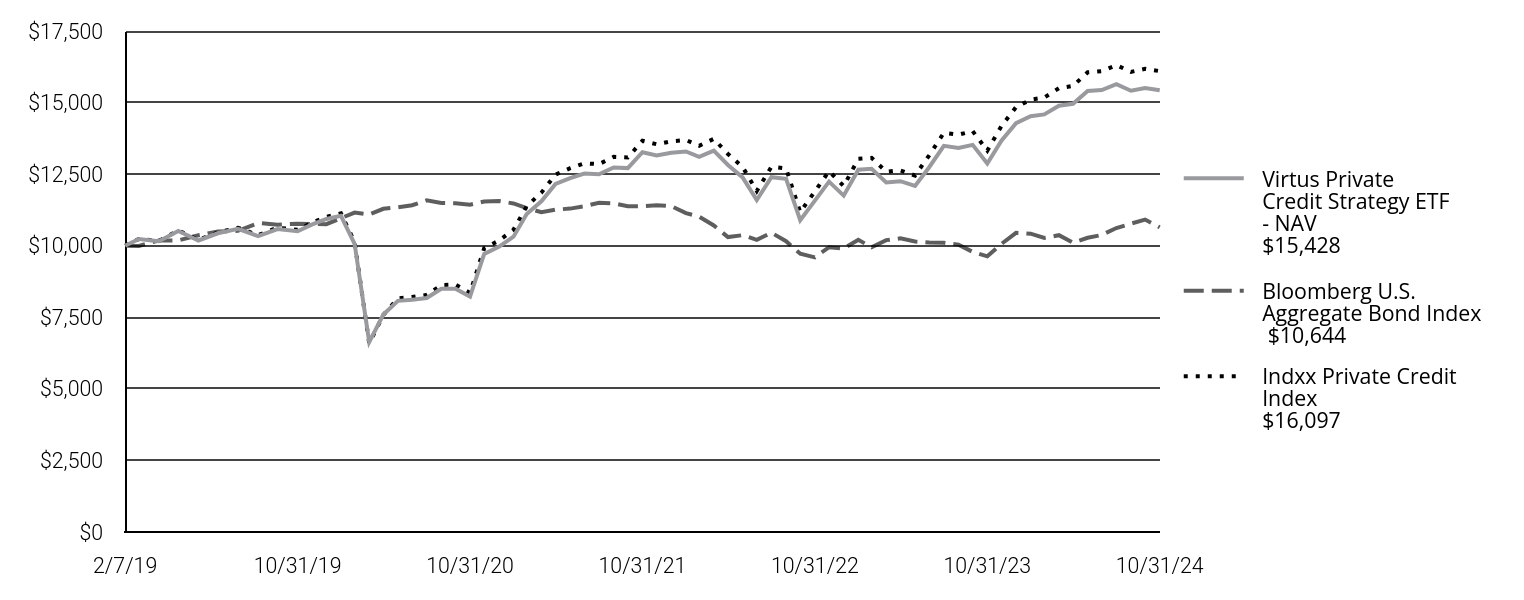

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index and style-specific index for the same period.

| Virtus Private Credit Strategy ETF - NAV $15,428 | Bloomberg U.S. Aggregate Bond Index $10,644 | Indxx Private Credit Index $16,097 |

|---|

| 2/7/19 | $10,000 | $10,000 | $10,000 |

| 2/28/19 | $10,232 | $9,991 | $10,237 |

| 3/31/19 | $10,156 | $10,183 | $10,163 |

| 4/30/19 | $10,514 | $10,185 | $10,534 |

| 5/31/19 | $10,183 | $10,366 | $10,203 |

| 6/30/19 | $10,434 | $10,496 | $10,464 |

| 7/31/19 | $10,588 | $10,520 | $10,628 |

| 8/31/19 | $10,334 | $10,792 | $10,367 |

| 9/30/19 | $10,583 | $10,735 | $10,629 |

| 10/31/19 | $10,503 | $10,767 | $10,554 |

| 11/30/19 | $10,737 | $10,762 | $10,800 |

| 12/31/19 | $10,935 | $10,754 | $11,011 |

| 1/31/20 | $11,046 | $10,961 | $11,129 |

| 2/29/20 | $10,067 | $11,158 | $10,124 |

| 3/31/20 | $6,634 | $11,093 | $6,588 |

| 4/30/20 | $7,596 | $11,290 | $7,583 |

| 5/31/20 | $8,074 | $11,342 | $8,161 |

| 6/30/20 | $8,116 | $11,414 | $8,210 |

| 7/31/20 | $8,173 | $11,584 | $8,281 |

| 8/31/20 | $8,497 | $11,491 | $8,627 |

| 9/30/20 | $8,499 | $11,484 | $8,642 |

| 10/31/20 | $8,223 | $11,433 | $8,353 |

| 11/30/20 | $9,715 | $11,545 | $9,916 |

| 12/31/20 | $9,959 | $11,561 | $10,178 |

| 1/31/21 | $10,316 | $11,478 | $10,555 |

| 2/28/21 | $11,107 | $11,313 | $11,382 |

| 3/31/21 | $11,551 | $11,171 | $11,853 |

| 4/30/21 | $12,155 | $11,260 | $12,485 |

| 5/31/21 | $12,363 | $11,296 | $12,707 |

| 6/30/21 | $12,522 | $11,376 | $12,878 |

| 7/31/21 | $12,494 | $11,503 | $12,849 |

| 8/31/21 | $12,734 | $11,481 | $13,103 |

| 9/30/21 | $12,711 | $11,382 | $13,081 |

| 10/31/21 | $13,265 | $11,379 | $13,665 |

| 11/30/21 | $13,151 | $11,412 | $13,545 |

| 12/31/21 | $13,249 | $11,383 | $13,647 |

| 1/31/22 | $13,293 | $11,138 | $13,693 |

| 2/28/22 | $13,102 | $11,013 | $13,493 |

| 3/31/22 | $13,322 | $10,708 | $13,732 |

| 4/30/22 | $12,822 | $10,301 | $13,205 |

| 5/31/22 | $12,386 | $10,368 | $12,751 |

| 6/30/22 | $11,595 | $10,205 | $11,911 |

| 7/31/22 | $12,392 | $10,454 | $12,758 |

| 8/31/22 | $12,336 | $10,159 | $12,700 |

| 9/30/22 | $10,890 | $9,720 | $11,171 |

| 10/31/22 | $11,574 | $9,594 | $11,900 |

| 11/30/22 | $12,237 | $9,947 | $12,604 |

| 12/31/22 | $11,749 | $9,902 | $12,082 |

| 1/31/23 | $12,656 | $10,207 | $13,035 |

| 2/28/23 | $12,686 | $9,943 | $13,069 |

| 3/31/23 | $12,210 | $10,195 | $12,584 |

| 4/30/23 | $12,253 | $10,257 | $12,631 |

| 5/31/23 | $12,089 | $10,145 | $12,452 |

| 6/30/23 | $12,742 | $10,109 | $13,157 |

| 7/31/23 | $13,487 | $10,102 | $13,943 |

| 8/31/23 | $13,414 | $10,038 | $13,878 |

| 9/30/23 | $13,523 | $9,783 | $14,002 |

| 10/31/23 | $12,873 | $9,628 | $13,323 |

| 11/30/23 | $13,669 | $10,064 | $14,178 |

| 12/31/23 | $14,281 | $10,450 | $14,842 |

| 1/31/24 | $14,521 | $10,421 | $15,101 |

| 2/29/24 | $14,586 | $10,274 | $15,175 |

| 3/31/24 | $14,889 | $10,368 | $15,501 |

| 4/30/24 | $14,959 | $10,107 | $15,580 |

| 5/31/24 | $15,406 | $10,278 | $16,059 |

| 6/30/24 | $15,439 | $10,375 | $16,096 |

| 7/31/24 | $15,640 | $10,618 | $16,309 |

| 8/31/24 | $15,413 | $10,770 | $16,073 |

| 9/30/24 | $15,506 | $10,914 | $16,179 |

| 10/31/24 | $15,428 | $10,644 | $16,097 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 2/7/19 |

|---|

| Virtus Private Credit Strategy ETF - NAV | 19.85 | 8.00 | 7.86 |

| Bloomberg U.S. Aggregate Bond Index | 10.55 | -0.23 | 1.09 |

| Indxx Private Credit Index | 20.83 | 8.81 | 8.66 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus Private Credit Strategy ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $51,896,511 |

| Total number of portfolio holdings | 63 |

| Total advisory fees paid | $297,103 |

| Portfolio turnover rate | 29% |

ASSET ALLOCATION Footnote Reference(1)

| Financials | 58.00% |

| Closed-End Funds | 33.20% |

| Money Market Fund | 8.80% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus Private Credit Strategy ETF | 3

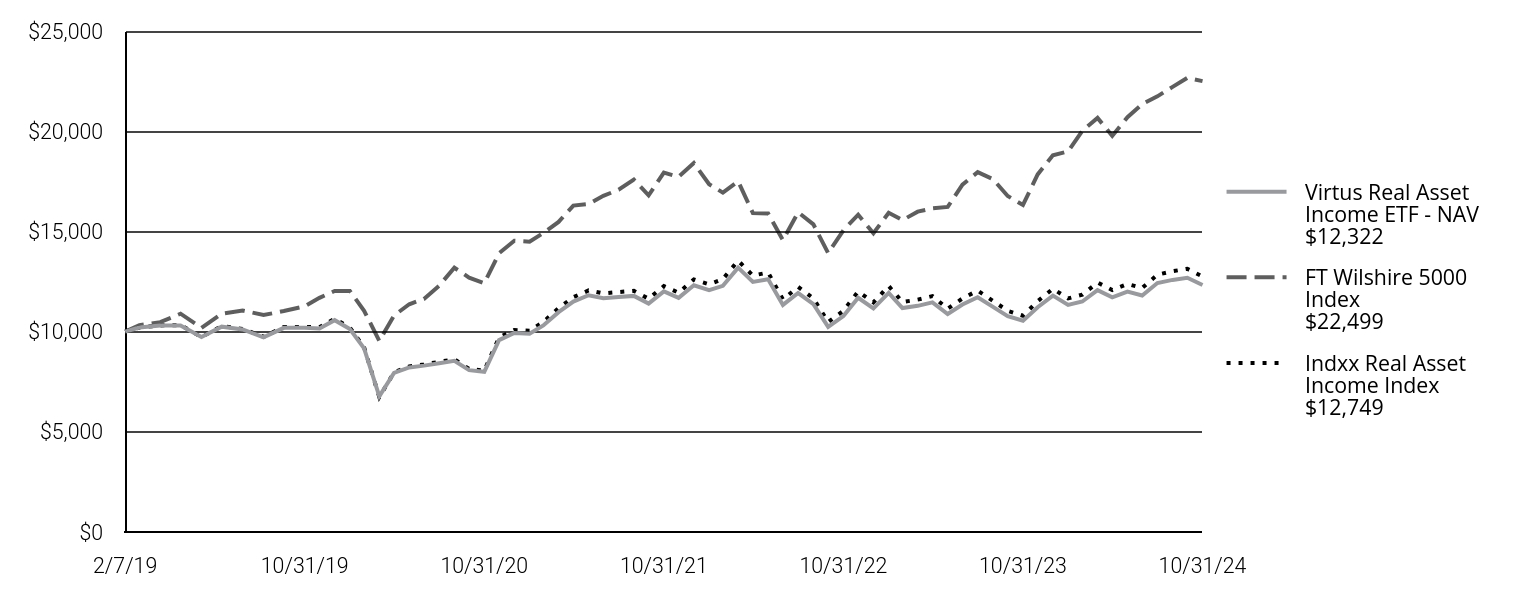

Virtus Real Asset Income ETF

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus Real Asset Income ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus Real Asset Income ETF | $60 | 0.55% |

Portfolio Manager Commentary by Virtus ETF Advisers LLC

For the fiscal year ended October 31, 2024, the Fund at NAV returned 16.89%. For the same period, the FT Wilshire 5000 Index, a broad-based securities market index, returned 37.86%, and the Indxx Real Asset Income Index, which serves as the style-specific index, returned 18.14%.

What factors impacted Fund performance over the reporting period?

Exposure to certain sectors such as Oil and Gas as well as REITS contributed negatively to Fund returns relative to the Fund’s broad-based securities index, the FT Wilshire 5000 Index, for the 12-month period. Factors such as Quality and Dividend Yields enhanced the Fund’s relative returns. The Fund does seek to reduce concentration risk by maintaining equal exposure to all of its holding. This limits exposure to momentum stocks which led to some relative underperformance. The Fund did maintain exposure to utilities, materials and communication companies which elevated the Fund’s relative returns.

Sectors: Oil & Gas and REITS

Positions in New Fortress Energy Inc. and APA Corp. as well as Barry Corp. and Vale S.A. detracted from relative returns.

Factors: Momentum and Value

Underweight exposure to these factors was a headwind for the Fund’s relative return.

Overweight exposures to utilities, materials, and communications relative to the FT Wilshire 5000 Index enhanced performance.

Factors: Quality and dividend yield

Overweight in companies that exhibited quality factors and high dividend yields relative to the FT Wilshire 500 Index made a favorable impact on the Fund’s performance.

Virtus Real Asset Income ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

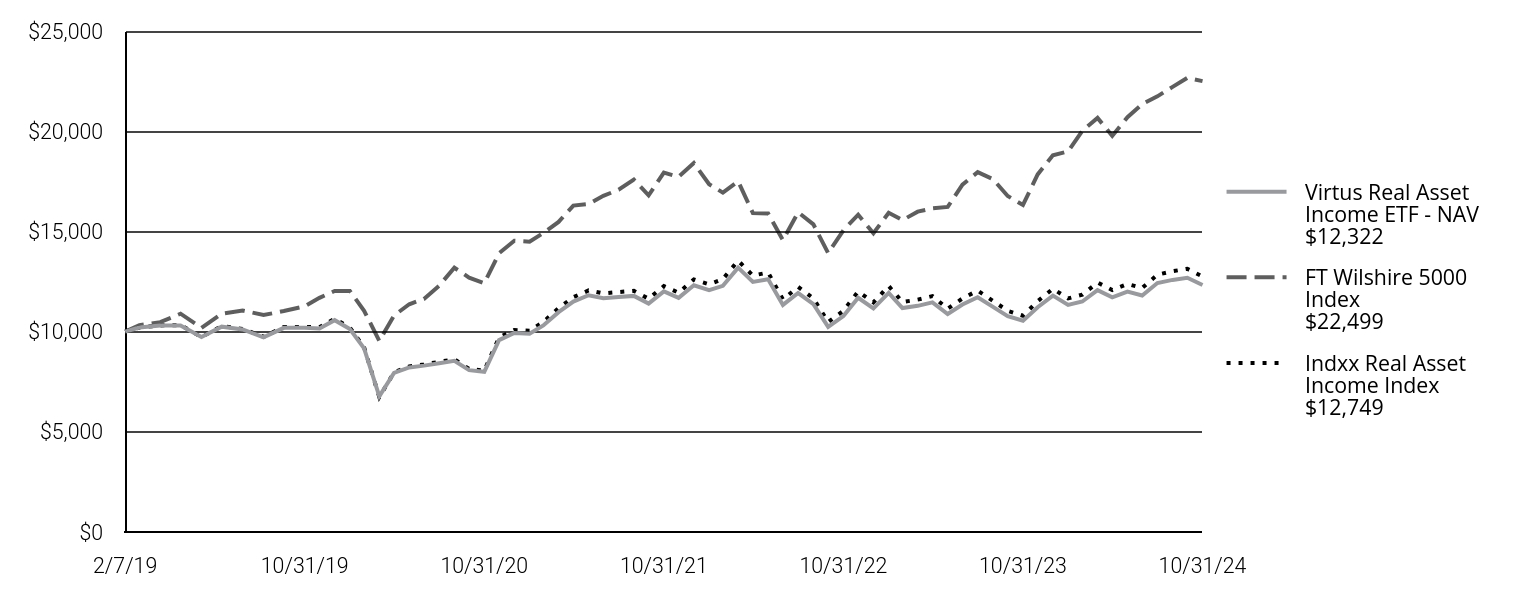

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index and style-specific index for the same period.

| Virtus Real Asset Income ETF - NAV $12,322 | FT Wilshire 5000 Index $22,499 | Indxx Real Asset Income Index $12,749 |

|---|

| 2/7/19 | $10,000 | $10,000 | $10,000 |

| 2/28/19 | $10,201 | $10,323 | $10,205 |

| 3/31/19 | $10,301 | $10,473 | $10,308 |

| 4/30/19 | $10,309 | $10,893 | $10,322 |

| 5/31/19 | $9,728 | $10,182 | $9,738 |

| 6/30/19 | $10,246 | $10,892 | $10,271 |

| 7/31/19 | $10,109 | $11,054 | $10,136 |

| 8/31/19 | $9,712 | $10,828 | $9,740 |

| 9/30/19 | $10,186 | $11,025 | $10,228 |

| 10/31/19 | $10,187 | $11,266 | $10,238 |

| 11/30/19 | $10,159 | $11,684 | $10,215 |

| 12/31/19 | $10,571 | $12,026 | $10,646 |

| 1/31/20 | $10,131 | $12,027 | $10,204 |

| 2/29/20 | $9,166 | $11,041 | $9,215 |

| 3/31/20 | $6,770 | $9,537 | $6,735 |

| 4/30/20 | $7,938 | $10,802 | $7,964 |

| 5/31/20 | $8,212 | $11,364 | $8,262 |

| 6/30/20 | $8,302 | $11,631 | $8,365 |

| 7/31/20 | $8,419 | $12,289 | $8,489 |

| 8/31/20 | $8,543 | $13,187 | $8,619 |

| 9/30/20 | $8,076 | $12,694 | $8,138 |

| 10/31/20 | $7,994 | $12,414 | $8,058 |

| 11/30/20 | $9,575 | $13,908 | $9,705 |

| 12/31/20 | $9,930 | $14,531 | $10,076 |

| 1/31/21 | $9,893 | $14,483 | $10,045 |

| 2/28/21 | $10,305 | $14,925 | $10,478 |

| 3/31/21 | $10,972 | $15,473 | $11,176 |

| 4/30/21 | $11,497 | $16,290 | $11,716 |

| 5/31/21 | $11,813 | $16,366 | $12,053 |

| 6/30/21 | $11,667 | $16,777 | $11,905 |

| 7/31/21 | $11,729 | $17,077 | $11,974 |

| 8/31/21 | $11,782 | $17,580 | $12,034 |

| 9/30/21 | $11,398 | $16,801 | $11,641 |

| 10/31/21 | $12,004 | $17,931 | $12,271 |

| 11/30/21 | $11,682 | $17,721 | $11,943 |

| 12/31/21 | $12,314 | $18,410 | $12,600 |

| 1/31/22 | $12,070 | $17,356 | $12,361 |

| 2/28/22 | $12,284 | $16,932 | $12,623 |

| 3/31/22 | $13,192 | $17,499 | $13,541 |

| 4/30/22 | $12,477 | $15,916 | $12,796 |

| 5/31/22 | $12,615 | $15,892 | $12,948 |

| 6/30/22 | $11,331 | $14,563 | $11,608 |

| 7/31/22 | $11,925 | $15,954 | $12,232 |

| 8/31/22 | $11,374 | $15,349 | $11,659 |

| 9/30/22 | $10,237 | $13,916 | $10,478 |

| 10/31/22 | $10,773 | $15,058 | $11,040 |

| 11/30/22 | $11,687 | $15,832 | $12,003 |

| 12/31/22 | $11,161 | $14,905 | $11,457 |

| 1/31/23 | $11,931 | $15,932 | $12,278 |

| 2/28/23 | $11,173 | $15,560 | $11,474 |

| 3/31/23 | $11,286 | $15,986 | $11,595 |

| 4/30/23 | $11,460 | $16,152 | $11,772 |

| 5/31/23 | $10,877 | $16,221 | $11,143 |

| 6/30/23 | $11,349 | $17,334 | $11,654 |

| 7/31/23 | $11,714 | $17,956 | $12,048 |

| 8/31/23 | $11,236 | $17,607 | $11,533 |

| 9/30/23 | $10,772 | $16,766 | $11,038 |

| 10/31/23 | $10,541 | $16,320 | $10,792 |

| 11/30/23 | $11,219 | $17,844 | $11,518 |

| 12/31/23 | $11,797 | $18,794 | $12,138 |

| 1/31/24 | $11,331 | $18,995 | $11,657 |

| 2/29/24 | $11,501 | $20,019 | $11,842 |

| 3/31/24 | $12,066 | $20,664 | $12,448 |

| 4/30/24 | $11,712 | $19,764 | $12,072 |

| 5/31/24 | $11,993 | $20,697 | $12,376 |

| 6/30/24 | $11,803 | $21,347 | $12,178 |

| 7/31/24 | $12,422 | $21,740 | $12,839 |

| 8/31/24 | $12,580 | $22,212 | $13,013 |

| 9/30/24 | $12,685 | $22,663 | $13,133 |

| 10/31/24 | $12,322 | $22,499 | $12,749 |

| ANNUAL AVERAGE TOTAL RETURNS | 1 Year | 5 Years | Since Inception 2/7/19 |

|---|

| Virtus Real Asset Income ETF - NAV | 16.89 | 3.88 | 3.71 |

| FT Wilshire 5000 Index | 37.86 | 14.84 | 15.19 |

| Indxx Real Asset Income Index | 18.14 | 4.48 | 4.33 |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit virtus.com for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

Virtus Real Asset Income ETF | 2

KEY FUND STATISTIC (as of October 31, 2024)

| Fund net assets | $15,530,790 |

| Total number of portfolio holdings | 91 |

| Total advisory fees paid | $93,166 |

| Portfolio turnover rate | 67% |

ASSET ALLOCATION Footnote Reference(1)

| Energy | 33.50% |

| Real Estate | 32.40% |

| Utilities | 15.50% |

| Materials | 9.50% |

| Communication Services | 5.70% |

| Money Market Fund | 2.10% |

| Consumer Staples | 1.30% |

| Footnote | Description |

Footnote(1) | Percentage of total investments as of October 31, 2024. |

Where can I find additional information about the Fund?

For more information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please contact us at 1-888-383-0553, or visit https://www.virtus.com/investor-resources/etf-documents.

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this

consent or request additional copies by calling Virtus ETFs at 1-888-383-0553.

Virtus Real Asset Income ETF | 3

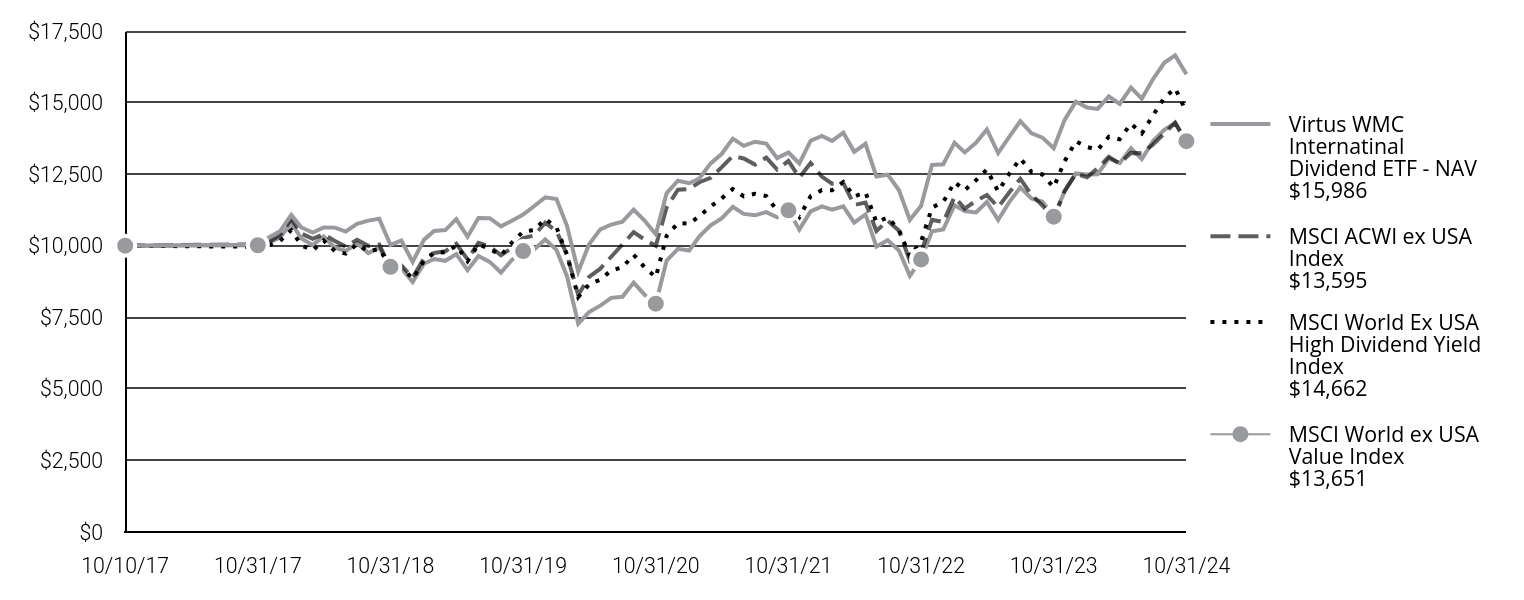

Virtus WMC International Dividend ETF

VWID / Cboe BZX Exchange, Inc.

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about the Virtus WMC International Dividend ETF ("Fund") for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at https://www.virtus.com/investor-resources/etf-documents.You can also request this information by contacting us at 1-888-383-0553.

What were the Fund costs for the period?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Virtus WMC International Dividend ETF | $54 | 0.49% |

Portfolio Manager Commentary by Wellington Management Company LLP

For the fiscal year ended October 31, 2024, the Fund at NAV returned 19.23%. For the same period, the MSCI ACWI ex USA Index, a broad-based securities market index, returned 24.33%, and the MSCI World ex USA Value Index and the MSCI World Ex USA High Dividend Yield Index, each a style-specific index, returned 23.93% and 21.80%, respectively.

What factors impacted Fund performance over the reporting period?

The Fund seeks income by investing in equity securities that will generate above market yield through a well-diversified portfolio. The Fund’s European exposures contributed most to absolute yield and was supplemented by yield from exposures in other regions, notably Canada. Sector allocation, a fallout of our risk-based construction process as we look to provide above market yield over time through a broadly diversified portfolio, was the primary driver of relative underperformance. Our underweight exposure to the information technology sector and our overweight exposure to the energy sector detracted from relative performance while our overweight exposure to the financials sector contributed to relative performance. Security selection also detracted, driven by not owning Taiwan Semiconductor (information technology) and our overweight positions in Aker BP (energy) and TotalEnergies (energy). Our overweight positions in Manulife (financials), Intesa Sanpaolo (financials) and SITC International (industrials) contributed to relative performance. From a regional perspective, our exposure in the Middle East detracted, while our exposure in Canada contributed to relative performance.

Our underweight exposure to information technology stocks detracted from relative performance. This positioning is a natural byproduct of the portfolio’s income focus as technology names tend to be lower yielding relative to other areas of the market.

Exposure to the Middle East names detracted from relative performance, driven by challenged security selection in the region.

An overweight exposure to financials contributed. Strong security selection, particularly in Manulife and Intesa Sanpaolo, also contributed to relative performance.

Our overweight exposure to dividend paying stocks contributed to relative performance as investors favored these names over other areas of the market.

Virtus WMC International Dividend ETF | 1

The preceding information is the opinion of the investment adviser and/or sub-adviser, as appropriate, through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

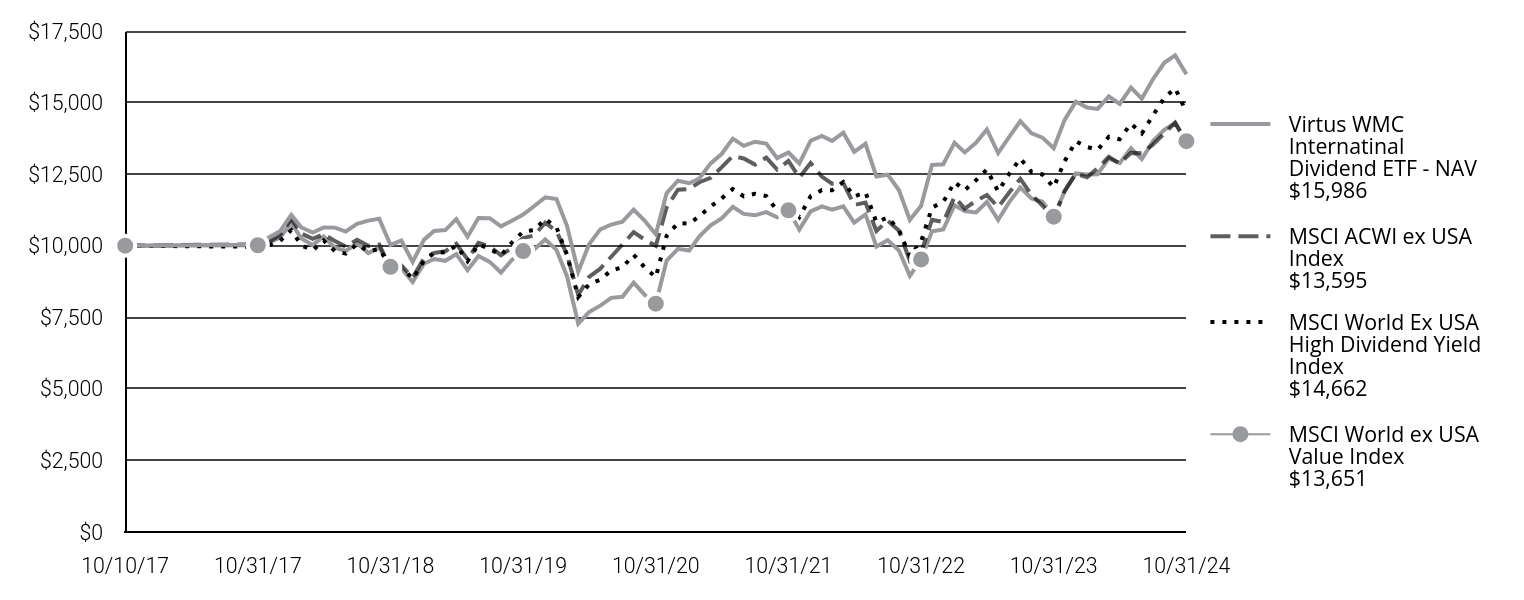

How has the Fund historically performed?

The following graph and table compare the initial and subsequent account values over the life of the Fund. It assumes a $10,000 initial investment from inception in an appropriate broad-based securities market index and style-specific indexes for the same period. The Fund has changed its style-specific index from the MSCI World ex USA High Dividend Yield Index to the MSCI World ex USA Value Index, which employs an index methodology that more closely aligns with the investment process used in managing the Fund’s portfolio.

| Virtus WMC Internatinal Dividend ETF - NAV $15,986 | MSCI ACWI ex USA Index $13,595 | MSCI World Ex USA High Dividend Yield Index $14,662 | MSCI World ex USA Value Index $13,651 |

|---|

| 10/10/17 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/17 | $10,038 | $10,053 | $9,963 | $10,017 |

| 11/30/17 | $10,289 | $10,135 | $10,010 | $10,108 |

| 12/31/17 | $10,503 | $10,362 | $10,167 | $10,280 |

| 1/31/18 | $11,080 | $10,939 | $10,543 | $10,796 |

| 2/28/18 | $10,637 | $10,423 | $10,012 | $10,250 |

| 3/31/18 | $10,457 | $10,239 | $9,840 | $10,021 |

| 4/30/18 | $10,638 | $10,402 | $10,185 | $10,322 |

| 5/31/18 | $10,632 | $10,162 | $9,813 | $9,928 |

| 6/30/18 | $10,496 | $9,971 | $9,724 | $9,815 |

| 7/31/18 | $10,765 | $10,210 | $10,054 | $10,088 |

| 8/31/18 | $10,878 | $9,996 | $9,802 | $9,744 |

| 9/30/18 | $10,943 | $10,042 | $9,886 | $9,928 |