Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON DECEMBER 18, 2012

Registration No. 333-184551

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Starz, LLC

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 7010 (Primary Standard Industrial Classification Code Number) | 20-8988475 (I.R.S. Employer Identification No.) |

Starz Finance Corp.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 7010 (Primary Standard Industrial Classification Code Number) | 38-3885500 (I.R.S. Employer Identification No.) |

Starz Entertainment, LLC

(Exact Name of Registrant of Guarantee as Specified in Its Charter)

| Colorado (State or other jurisdiction of incorporation or organization) | 4841 (Primary Standard Industrial Classification Code Number) | 20-8988475 (I.R.S. Employer Identification No.) |

8900 Liberty Circle

Englewood, Colorado 80112

(720) 852-7700

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Scott Macdonald

Starz, LLC

8900 Liberty Circle

Englewood, Colorado 80112

(720) 852-7700

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

COPIES OF ALL COMMUNICATIONS TO:

Steven D. Miller, Esq.

Jeffrey R. Kesselman, Esq.

Sherman & Howard L.L.C.

633 Seventeenth Street, Suite 3000

Denver, Colorado 80202

(303) 297-2900

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the "Securities Act"), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

| Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) | o | |

| Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) | o |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not commence the exchange offer or sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities or a solicitation of an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 18, 2012

PROSPECTUS

$500,000,000

Starz, LLC

Starz Finance Corp.

Exchange Offer for 5.00% Senior Notes due 2019

We are offering to exchange up to $500,000,000 aggregate principal amount of our registered 5.00% Senior Notes due 2019, or the "exchange notes," for any and all of the unregistered 5.00% Senior Notes due 2019, or the "original notes," that we issued in a private offering on September 13, 2012. We refer to the original notes and the exchange notes together in this prospectus as the "notes." We refer to this exchange as the "exchange offer." The exchange notes are substantially identical to the original notes, except the exchange notes are registered under the Securities Act of 1933, as amended, or the "Securities Act," and the transfer restrictions and registration rights, and related special interest provisions applicable to the original notes will not apply to the exchange notes. The exchange notes will represent the same debt as the original notes and we will issue the exchange notes under the same indenture used in issuing the original notes. If you fail to tender your original notes, you will continue to hold unregistered notes that you will not be able to transfer freely.

No public market currently exists for the original notes or the exchange notes.

Terms of the exchange offer:

- •

- The exchange offer expires at 5:00 p.m., New York City time, on [ ], 2012, unless we extend it.

- •

- We will exchange all outstanding original notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer for an equal principal amount of exchange notes. All interest due and payable on the original notes will become due on the same terms under the exchange notes.

- •

- You may withdraw your tender of original notes at any time prior to the expiration of the exchange offer.

- •

- The exchange offer is subject to customary conditions, which we may waive.

- •

- The exchange of exchange notes for original notes will not be a taxable transaction for U.S. federal income tax purposes, but you should see the discussion under the caption "United States Federal Income Tax Consequences" on page 155 for more information.

See "Risk Factors" beginning on page 12 for a discussion of risks you should consider in connection with the exchange offer and an investment in the exchange notes.

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2012.

| | Page | |||

|---|---|---|---|---|

Summary | 1 | |||

Risk Factors | 12 | |||

Use of Proceeds | 30 | |||

The Exchange Offer | 32 | |||

Selected Historical Consolidated Financial And Other Data | 42 | |||

Ratio of Earnings to Fixed Charges | 45 | |||

Unaudited Pro Forma Consolidated Financial Data | 46 | |||

Management's Discussion and Analysis of Financial Condition And Results Of Operations | 51 | |||

Business | 68 | |||

Management and Corporate Governance | 85 | |||

Executive Compensation | 87 | |||

Certain Relationships and Related Party Transactions | 103 | |||

Description of Other Indebtedness | 114 | |||

Description of Notes | 116 | |||

United States Federal Income Tax Consequences | 155 | |||

Plan of Distribution | 160 | |||

Book-Entry Settlement and Clearance | 162 | |||

Legal Matters | 165 | |||

Experts | 165 | |||

Where You Can Find More Information | 165 | |||

Index to Consolidated Financial Statements | F-1 | |||

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS AND IN THE LETTER OF TRANSMITTAL ACCOMPANYING THIS PROSPECTUS. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH ANY INFORMATION OR REPRESENT ANYTHING ABOUT US, OUR PARENT, LIBERTY MEDIA CORPORATION, OR THIS PROSPECTUS THAT IS NOT CONTAINED IN THIS PROSPECTUS. IF GIVEN OR MADE, ANY SUCH OTHER INFORMATION OR REPRESENTATION SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY US. WE TAKE NO RESPONSIBILITY FOR, AND CAN PROVIDE NO ASSURANCE AS TO THE ACCURACY OF, ANY OTHER INFORMATION THAT OTHERS MAY GIVE YOU. WE ARE NOT MAKING AN OFFER TO EXCHANGE THESE NOTES IN ANY JURISDICTION WHERE SUCH OFFER IS NOT PERMITTED, YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROSPECTUS IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF THIS PROSPECTUS. OUR BUSINESS, FINANCIAL CONDITIONS, RESULTS OF OPERATIONS AND PROSPECTUS MAY HAVE CHANGED SINCE THAT DATE.

Each broker-dealer that receives exchange notes in exchange for original notes acquired for its own account as a result of market making or other trading activities must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an underwriter within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by broker-dealers in connection with such resales. We have agreed to make this prospectus available for a period ending on the earlier of 180 days from the effective date of the registration statement of which this prospectus forms a part and the date on which a broker-dealer is no longer required to deliver a prospectus in connection with market-making or other trading activities. In addition, until [ ], 2013 (90 days after the date of this prospectus), all dealers effecting transactions in the exchange notes may be required to deliver a prospectus. See "Plan of Distribution."

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as forward-looking statements. All statements included in this prospectus, other than statements of historical fact or current fact, that address activities, events or developments that we or our management expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements represent our reasonable judgment on the future based on various factors and using numerous assumptions and are subject to known and unknown risks, uncertainties and other factors, many of which are beyond our control that could cause our actual results and financial position to differ materially from those contemplated by the statements. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as "anticipate," "estimate," "project," "forecast," "plan," "may," "will," "should," "could," "expect," or the negative thereof or other words of similar meaning. In particular, these include, but are not limited to, statements of our current views and estimates of future economic circumstances, industry conditions in domestic and international markets, our proposed separation from Liberty Media Corporation and our future performance and financial results. These forward-looking statements are subject to a number of factors and uncertainties that could cause our actual results and experiences to differ materially from the anticipated results and expectations expressed in such forward-looking statements. We caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the factors that may cause actual results and experiences to differ from the anticipated results and expectations expressed in such forward-looking statements are the following:

- •

- changes in the nature of key strategic relationships with multichannel video distributors and content providers; and our ability to maintain and renew affiliation agreements with multichannel video distributors and programming output agreements with content providers on terms acceptable to us;

- •

- distributor demand for our products and services and our ability to adapt to changes in demand;

- •

- customer demand for our products and services, including changes resulting from the unwillingness of certain distributors to allow us to participate in cooperative marketing campaigns, and our ability to adapt to changes in demand;

- •

- competitor responses to our products and services;

- •

- the cost of, and our ability to acquire or produce desirable original programming and to acquire theatrical movie content for our networks and film distribution business;

- •

- disruption in the production of theatrical films or television programs due to strikes by unions representing writers, directors or actors;

- •

- changes in distribution and viewing of television programming, including the expanded deployment of personal video recorders, video on demand, and IP television and their impact on media content consumption;

- •

- uncertainties inherent in the development and integration of new business lines and business strategies;

- •

- uncertainties associated with product and service development and market acceptance, including the development and provision of programming for new television and telecommunications technologies;

- •

- our future financial performance, including availability, terms and deployment of capital;

ii

- •

- our ability to successfully integrate and recognize anticipated efficiencies and benefits from the businesses we acquire;

- •

- the ability of suppliers and vendors to deliver products, equipment, software and services;

- •

- the outcome of any pending or threatened litigation, including matters described in the notes to our consolidated financial statements;

- •

- availability of qualified personnel;

- •

- the regulatory and competitive environment of the industries in which we, and the entities in which we have interests, operate;

- •

- changes in, or failure or inability to comply with, government regulations, including, without limitation, regulations of the Federal Communications Commission, and adverse outcomes from regulatory proceedings;

- •

- changes in tax requirements, including tax rate changes, new tax laws and revised tax law interpretations;

- •

- the satisfaction or, if applicable, waiver of the conditions to our proposed separation from Liberty Media Corporation;

- •

- general economic and business conditions and industry trends including the current economic downturn;

- •

- consumer spending levels, including the availability and amount of individual consumer debt;

- •

- continued consolidation of the broadband distribution and movie studio industries;

- •

- rapid technological changes;

- •

- capital spending for the acquisition and/or development of telecommunications networks and services;

- •

- threatened terrorist attacks and ongoing military action in the Middle East and other parts of the world; and

- •

- fluctuations in foreign currency exchange rates and political unrest in international markets.

Any or all of our forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond our control, including those set forth under "Risk Factors."

In addition, there may be other factors that could cause our actual results to be materially different from the results referenced in the forward-looking statements. Many of these factors will be important in determining our actual future results. Consequently, no forward-looking statement can be guaranteed. Our actual future results may vary materially from those expressed or implied in any forward-looking statements.

All forward-looking statements contained in this prospectus are qualified in their entirety by this cautionary statement.

PRESENTATION OF FINANCIAL INFORMATION

Starz, LLC operates, directly and through its subsidiaries: Starz Entertainment, LLC, Film Roman, LLC, Starz Media Group, LLC, Starz Media, LLC, Anchor Bay Entertainment, LLC, Overture Films, LLC and certain other immaterial subsidiaries. Starz, LLC is primarily a holding company with limited operating activities. Starz Entertainment, LLC is a wholly-owned restricted subsidiary of Starz, LLC and the sole guarantor of the notes. All of our subsidiaries other than Starz

iii

Entertainment, LLC and Starz Finance Corp. are unrestricted subsidiaries that will not guarantee the notes (such subsidiaries are collectively referred to herein as the "Unrestricted Group"). The Unrestricted Group will not be subject to the covenants in the indenture governing the notes. You should not rely on the assets or cash flow of the Unrestricted Group to pay principal or interest on the notes. We have presented financial information in this prospectus showing Starz, LLC and its subsidiaries on a consolidated basis. See audited and unaudited consolidated financial statements of Starz, LLC for unaudited consolidating financial information of the sole guarantor, Starz Entertainment, LLC.

SPECIAL NOTE REGARDING NON-GAAP FINANCIAL MEASURES

The body of generally accepted accounting principles in the United States ("U.S.") is commonly referred to as GAAP. A non-GAAP financial measure is generally defined by the SEC as one that purports to measure historical or future financial performance, financial position or cash flows but excludes or includes amounts that could not be so adjusted in the most comparable GAAP measure. Adjusted OIBDA, as presented in this prospectus, is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP.

We define Adjusted OIBDA as revenue less programming costs, production and acquisition costs, home video cost of sales, operating expenses, advertising and marketing costs and general and administrative expenses. Our chief operating decision maker uses this measure of performance in conjunction with other measures to evaluate our operating segments and make decisions about allocating resources among our operating segments. We believe that Adjusted OIBDA is an important indicator of the operational strength and performance of our operating segments, including each operating segment's ability to service debt and fund investments in films and television programs. In addition, this measure allows management to view operating results and perform analytical comparisons and benchmarking between operating segments and identify strategies to improve performance. This measure of performance excludes phantom stock appreciation rights, long-term incentive plan and stock compensation and depreciation and amortization that are included in the measurement of operating income pursuant to GAAP. Accordingly, Adjusted OIBDA should be considered in addition to, but not as a substitute for, operating income, income (loss) from continuing operations before income taxes, net income (loss), net cash provided by operating activities and other measures of financial performance prepared in accordance with GAAP. Adjusted OIBDA has several limitations that are discussed in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Adjusted Operating Income Before Depreciation and Amortization (Adjusted OIBDA)," which section also provides for a quantitative reconciliation of Adjusted OIBDA to income from continuing operations before income taxes.

Market data and other statistical data regarding us and our subsidiaries, and used throughout this prospectus, are based on independent industry publications, government publications, reports by market research firms, including Rentrak, Three, Inc., Kadence International, Nielsen and SNL Kagan, or other published independent sources, as well as management's knowledge of, experience in and estimates about the industry and markets in which we operate. Although we believe the third-party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Similarly, our internal research and forecasts are based upon our management's understanding of industry conditions and such information has not been verified by any independent sources. Although we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors."

iv

NON-RELIANCE ON LIBERTY MEDIA CORPORATION

We are a wholly-owned subsidiary of Liberty Media Corporation, which we refer to as "LMC" in this prospectus. LMC is a company whose securities are registered under the Securities Exchange Act of 1934, as amended, or the "Exchange Act," and is therefore required to file periodic and current reports and other materials with the SEC. While such information is available, investors are cautioned that LMC is not the issuer of the notes and is not otherwise a guarantor or obligor (contingent or otherwise) with respect to the notes, and will not otherwise provide credit support for the notes.Therefore, you are directed to rely solely on this prospectus in making your decision with respect to the exchange offer.

v

This summary contains a general summary of the information contained in this prospectus. The following information is qualified in its entirety by the more detailed information and financial statements and the notes related thereto appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in the notes. Investing in the notes involves significant risks, including those described herein under "Risk Factors." In this prospectus unless otherwise indicated or the context otherwise requires, the terms "Starz, LLC," the "Company," "we," "us" and "our" refer to Starz, LLC, the co-issuer of the notes and its subsidiaries; the term "Finance Corp." refers to Starz Finance Corp., the co-issuer of the notes; the term "LMC" refers to Liberty Media Corporation, the parent corporation of Starz, LLC (which will be renamed Starz after the reorganization described below under "LMC Relationship and Recent Developments"); the term "Starz Entertainment" refers to Starz Entertainment, LLC, a wholly-owned restricted subsidiary of Starz, LLC and the sole guarantor of the notes; the term "Film Roman" refers to Film Roman, LLC, a wholly-owned unrestricted and non-guarantor subsidiary; the term "Starz Media" refers to Starz Media Group, LLC, a majority-owned unrestricted and non-guarantor subsidiary which is 25% owned by The Weinstein Company LLC ("TWC") and 75% owned by Starz, LLC; the terms "Starz Media, LLC," "Anchor Bay Entertainment," and "Overture Films" refer to indirect, majority-owned unrestricted and non-guarantor subsidiaries of Starz, LLC. Unless otherwise specified, the operations and financial information in this prospectus (including the Consolidated Financial Statements) includes the Unrestricted Group.

COMPANY OVERVIEW

Starz, LLC's principal businesses are conducted by our wholly-owned subsidiaries Starz Entertainment and Film Roman and by our majority-owned subsidiary Starz Media. Our operations are managed by and organized around our Starz Channels, Starz Distribution and Starz Animation operating segments.

Starz Entertainment

Starz Entertainment's principal business includes the operations of our Starz Channels' operating segment. Starz Channels is a leading provider of premium subscription video programming to U.S. multichannel video distributors, including cable operators (such as Comcast and Time Warner Cable), satellite television providers (such as DIRECTV and Dish Network), and telecommunications companies (such as AT&T and Verizon). Starz Channels' flagship premium networks areStarz andEncore. As of September 30, 2012, these networks were available for subscription in approximately 100 million U.S. multichannel households, defined as households subscribing to services offered by multichannel video distributors, as well as over the internet. As of September 30, 2012, Starz Channels had 20.8 millionStarz subscribers and 34.3 millionEncore subscribers. Starz Channels' subscriber numbers do not include subscribers who receiveStarz programming over the internet or who receive our programming free as part of a promotional offer. Our third network,MoviePlex, offers a variety of library content, art house, independent films and classic movies.Starz andEncore, along withMoviePlex, air over 1,000 movies monthly across 17 linear channels complemented by On Demand and internet services.

Starz Entertainment's financial results also include the ancillary revenue and expenses related to Starz Channels' original programming content that is managed within our Starz Media subsidiary. Starz Entertainment pays Starz Media a distribution fee for managing its original content.

Starz Media and Other Businesses

Starz Media and Other Businesses include the operations of our Starz Distribution and Starz Animation operating segments. As discussed above, the ancillary revenue and expenses of the Starz

1

Channels' original programming content is managed by Starz Media through the Starz Distribution operating segment for a distribution fee. Starz Distribution includes our Home Video, Digital Media and Worldwide Distribution businesses. A summary of the businesses included within Starz Media and Other Businesses are as follows:

- •

- Home Video. Through our majority-owned subsidiary Anchor Bay Entertainment, our Home Video business unit sells or rents DVDs (standard definition and Blu-ray) under the Anchor Bay and Manga brands, in the United States, Canada, the United Kingdom, Australia and other international territories to the extent we have rights to such content in international territories. Anchor Bay Entertainment develops and produces certain of its content and also acquires and licenses various titles from third parties. Anchor Bay Entertainment also distributes other titles acquired or produced by us including the Starz Channels' original programming content, Overture Films' titles (as discussed below), and TWC's titles. These titles are sold to and distributed by regional and national retailers and other distributors, including Wal-Mart, Target, Best Buy, Ingram Entertainment, Amazon and Netflix.

- •

- Digital Media. Our Digital Media business unit performs digital distribution, licensing, syndication, content and vendor partnerships for our owned content and content for which we have licensed the digital ancillary rights (including Overture Films' titles) in the United States and throughout the world to the extent we have rights to such content in international territories. Digital Media receives fees for such services from a wide array of partners and distributors. These range from traditional multichannel video distributors, internet/mobile distributors, game developers/publishers and consumer electronics companies. Digital Media also distributes Starz Channels' original programming content and TWC's titles.

- •

- Worldwide Distribution. Our Worldwide Distribution business unit exploits our owned content and content for which we have licensed ancillary rights (including Overture Films' titles) on free or pay television in the United States and throughout the world on free or pay television and other media to the extent that we have rights to such content in international territories. Worldwide Distribution also distributes Starz Channels' original programming content.

- •

- Animation. Our Animation operating segment, through our wholly-owned subsidiary Film Roman, develops and produces two-dimensional animated content on a for-hire basis for distribution theatrically and on television for various third party entertainment companies.

Prior to July 2010, Starz Media also produced and acquired live action theatrical motion pictures for release domestically and throughout the world through our subsidiary Overture Films. In July 2010, we shut down Overture Films' theatrical production and distribution operations. Overture Films' library of 19 released films was retained and continues to be exploited by Starz Distribution.

2

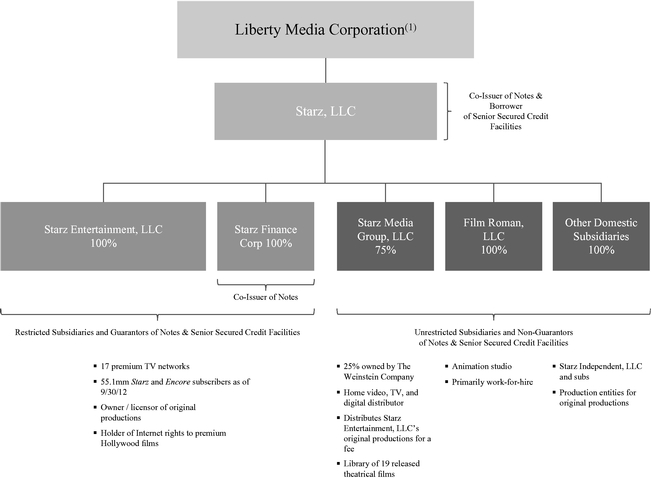

ORGANIZATIONAL STRUCTURE

The following chart represents a summary of our current legal structure, excluding certain third tier subsidiaries:

- (1)

- LMC is not a guarantor of the notes. LMC will be renamed Starz following the separation of LMC and Starz, LLC described in "LMC Relationship and Recent Developments."

LMC RELATIONSHIP AND RECENT DEVELOPMENTS

We are a wholly-owned subsidiary of LMC (NASDAQ: LMCA, LMCB). LMC is not a guarantor and has no obligations under the notes. Prior to September 23, 2011, we were an indirect subsidiary of Liberty Interactive Corporation (then known as Liberty Media Corporation) and attributed to its Liberty Starz tracking stock. Pursuant to a corporate restructuring, on September 23, 2011, LMC (formerly known as Liberty CapStarz, Inc.), our direct parent, split-off from Liberty Interactive Corporation and we were then attributed to the Liberty Starz tracking stock of LMC. As a tracking stock, Liberty Starz did not represent a separate legal entity; rather it represented those businesses, assets and liabilities which LMC attributed to that group. Effective November 28, 2011, LMC eliminated its tracking stock structure and converted shares of the Liberty Starz tracking stock into shares of common stock of LMC.

During August 2012, LMC's board of directors authorized a plan to distribute to the stockholders of LMC shares of a wholly-owned subsidiary, Liberty Spinco, Inc. ("Liberty Spinco"), that will hold all of the businesses, assets and liabilities of LMC not associated with Starz, LLC (with the exception of the Starz, LLC Englewood, Colorado corporate office building) (the "Spin-Off"). The transaction will

3

be effected as a pro-rata dividend of shares of Liberty Spinco to the stockholders of LMC. Liberty Spinco, which will become a separate public company, will be renamed Liberty Media Corporation. The businesses, assets and liabilities not included in Liberty Spinco will be part of a separate public company to be named Starz. In connection with the reorganization transaction, LMC currently contemplates that the Company will distribute approximately $1.8 billion to LMC (inclusive of distributions in the aggregate of $600.0 million already paid as follows: $100.0 million on July 9, 2012, $250.0 million on August 17, 2012, $50.0 million on September 4, 2012 and $200.0 million on November 16, 2012), funded by a combination of cash on hand and borrowings under our senior secured revolving credit facility (under which $995.0 million was available to be drawn as of September 30, 2012), and such distributed cash will be contributed to Liberty Spinco. The total amount of the distribution will depend on the financial performance and net cash provided by operating activities generated by Starz, LLC prior to the reorganization transaction, as well as the undrawn amount under our senior secured revolving credit facility at that time. An evaluation of such measures will be performed by LMC's treasury department in connection with the determination of the total amount of cash to be distributed. The distribution of a minimum amount of cash by Starz, LLC to LMC is not a condition to the Spin-Off. Additionally, in connection with the reorganization transaction, the Company will distribute its Englewood, Colorado corporate office building and related building improvements to LMC (and LMC will subsequently transfer such building and related improvements to a subsidiary of Liberty Spinco) and then lease back the use of such facilities from such Liberty Spinco subsidiary. Although the terms of such lease are still being negotiated, we anticipate that the lease agreement will be completed prior to the Spin-Off. As such, we have estimated the amount of the future capital lease to be $50.0 million, which approximates the net book value of the building and building improvements at September 30, 2012. The Spin-Off is intended to be tax-free to stockholders of LMC and its completion will be subject to various conditions, including the registration of the shares to be distributed, the receipt of an IRS private letter ruling (the "Ruling"), the opinions of tax counsel and any required government approvals. These conditions, as well as all other conditions to the Spin-Off, may be waived by the LMC board of directors in its sole discretion. The Spin-Off will not require a stockholder vote. The Spin-Off is currently expected to occur in early 2013. LMC's board of directors has reserved the right, in its sole discretion, to amend, modify, delay or abandon the Spin-Off at any time prior to the date on which shares of Liberty Spinco are distributed to the stockholders of LMC (the "distribution date"). Any such material amendment, modification or delay, or the abandonment, of the Spin-Off will be notified to the market by LMC in a Form 8-K filing. Following the Spin-Off, Liberty Spinco and Starz will operate independently, and neither will have any stock ownership, beneficial or otherwise, in the other.

CORPORATE INFORMATION

Starz, LLC is a Delaware limited liability company, Starz Finance Corp. is a Delaware corporation and Starz Entertainment, LLC is a Colorado limited liability company, each with principal executive offices located at 8900 Liberty Circle, Englewood, Colorado 80112. Our main telephone number at that location is (720) 852-7700.

4

THE EXCHANGE OFFER

On September 13, 2012, we completed a private offering of the original notes in reliance on Section 4(2) of the Securities Act, and Rule 144A and Regulation S thereunder. As part of that offering, we entered into a registration rights agreement with the initial purchasers of the original notes, which we refer to as the registration rights agreement, in which we agreed, among other things, to offer to exchange the original notes for the exchange notes. The following is a summary of the principal terms of the exchange offer. A more detailed description is contained in the section of this prospectus entitled "The Exchange Offer."

Original Notes | $500 million aggregate principal amount of 5.00% Senior Notes due September 15, 2019, which were issued in a private placement on September 13, 2012. | |

Exchange Notes | 5.00% Senior Notes due September 15, 2019. The terms of the exchange notes are substantially identical to the terms of the original notes, except that the exchange notes are registered under the Securities Act, and the transfer restrictions, registration rights and related special interest provisions applicable to the original notes will not apply to the exchange notes. | |

Exchange Offer | Pursuant to the registration rights agreement, we are offering to exchange up to $500 million principal amount of our exchange notes that have been registered under the Securities Act for an equal principal amount of our original notes. | |

The exchange notes will evidence the same debt as the original notes, including principal and interest, and will be issued under and be entitled to the benefits of the same indenture that governs the original notes. Holders of the original notes do not have any appraisal or dissenter's rights in connection with the exchange offer. Because the exchange notes will be registered, the exchange notes will not be subject to transfer restrictions and holders of original notes that tender and have their original notes accepted in the exchange offer will no longer have registration rights or the right to receive the related special interest under the circumstances described in the registration rights agreement. | ||

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on [ ], 2012, which we refer to as the "Expiration Date," unless we decide to extend it or terminate it early. We do not currently intend to extend the exchange offer. A tender of original notes pursuant to this exchange offer may be withdrawn at any time on or prior to the Expiration Date if we receive a valid written withdrawal request before the expiration of the exchange offer. |

5

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may, but are not required to, waive. We will not be required to accept for exchange, or to issue exchange notes in exchange for, any original notes, and we may terminate or amend the exchange offer if we determine in our reasonable judgment that the exchange offer would violate applicable law or any applicable interpretation of the staff of the SEC. Please see "The Exchange Offer—Conditions to the Exchange Offer" for more information regarding the conditions to the exchange offer. We reserve the right, in our sole discretion, to waive any and all conditions to the exchange offer on or prior to the Expiration Date. | |

Procedures for Tendering Original | To participate in the exchange offer, on or prior to the Expiration Date you must tender your original notes by using the book-entry transfer procedures described in "The Exchange Offer—Procedures for Tendering Original Notes," including transmission or delivery to the exchange agent of an agent's message or a properly completed and duly executed letter of transmittal, with any required signature guarantee. In order for a book-entry transfer to constitute a valid tender of your original notes in the exchange offer, U.S. Bank National Association, as registrar and exchange agent, must receive a confirmation of book-entry transfer of your original notes into the exchange agent's account at The Depository Trust Company prior to the Expiration Date. By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: | |

• you are acquiring exchange notes in the ordinary course of your business; | ||

• you are not engaged in, and you do not intend to engage in, and you have no arrangement or understanding with any person or entity to participate in a distribution of the exchange notes; | ||

• you are transferring good and marketable title to the original notes free and clear of all liens, security interests, encumbrances, or rights or interests of others except your own; | ||

• if you are a broker-dealer that will receive exchange notes for your own account in exchange for original notes that were acquired by you as a result of market-making or other trading activities, that you will deliver a prospectus, as required by law, in connection with any resale of your exchange notes; and | ||

• you are not our "affiliate" as defined in Rule 405 of the Securities Act. If you are a broker-dealer, you may not participate in the exchange offer as to any original notes you purchased directly from us. |

6

Withdrawal | You may withdraw any original notes tendered in the exchange offer by sending the exchange agent notice of withdrawal at any time prior to 5:00 p.m., New York City time, on the Expiration Date. If we decide for any reason not to accept any original notes tendered for exchange or to withdraw the exchange offer, the original notes will be returned promptly after the expiration or termination of the exchange offer. For further information regarding the withdrawal of tendered original notes, please see "The Exchange Offer—Withdrawal of Tenders." | |

Acceptance of Original Notes and | If you fulfill all conditions required for proper acceptance of the original notes, we will accept any and all original notes that you properly tender in the exchange offer before 5:00 p.m., New York City time, on the Expiration Date. For more information, please read "The Exchange Offer—Terms of the Exchange Offer." | |

United States Federal Income Tax | The exchange of exchange notes for original notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please see "United States Federal Income Tax Consequences" for more information regarding the tax consequences to you of the exchange offer. | |

Use of Proceeds | The issuance of the exchange notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement we entered into with the initial purchasers of the original notes. | |

Fees and Expenses | We will pay all expenses incident to the exchange offer. | |

Exchange Agent | We have appointed U.S. Bank National Association as our exchange agent for the exchange offer. You should tender your notes, direct questions and requests for assistance and requests for additional copies of this prospectus (including the letter of transmittal) to the exchange agent as follows: | |

Delivery by Mail: | ||

Courier or Overnight Delivery: | ||

To Confirm by Telephone or for Information: |

7

Facsimile Transmissions: | ||

You can find more information regarding the exchange agent elsewhere in this prospectus under the caption "The Exchange Offer—Exchange Agent." | ||

Resales of Exchange Notes | Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties, we believe that the exchange notes you receive in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act so long as certain conditions are met. See "The Exchange Offer—Resale of Exchange Notes" and "Plan of Distribution" for more information regarding resales. | |

Consequences of Not Exchanging | If you do not exchange your original notes in this exchange offer, you will continue to hold unregistered original notes and you will no longer be entitled to registration rights or the special interest provisions related thereto, except in the limited circumstances set forth in the registration rights agreement. See "The Exchange Offer—Consequences of Failure to Exchange." In addition, you will not be able to resell, offer to resell or otherwise transfer your original notes unless you do so in a transaction exempt from the registration requirements of the Securities Act and applicable state securities laws or unless we register the offer and resale of your original notes under the Securities Act. Following the exchange offer, we will be under no obligation to register your original notes, except under the limited circumstances set forth in the registration rights agreement. | |

For information regarding the limited circumstances under which we may be required to file a registration statement after this exchange offer and the consequences of not tendering your original notes in this exchange offer, please see "The Exchange Offer—Consequences of Failure to Exchange". | ||

Additional Documentation; Further | Any questions or requests for assistance or additional documentation regarding the exchange offer may be directed to the exchange agent at the number set forth above. Beneficial owners of original notes should contact their broker, dealer, commercial bank, trust company or other nominee for assistance in tendering their original notes in the exchange offer. |

8

TERMS OF THE EXCHANGE NOTES

The terms of the exchange notes and those of the outstanding original notes are substantially identical, except that the exchange notes are registered under the Securities Act, and the transfer restrictions, registration rights and related special interest provisions applicable to the original notes will not apply to the exchange notes. The exchange notes represent the same debt as the original notes for which they are being exchanged. Both the original notes and the exchange notes are governed by the same indenture.

| Issuers | Starz, LLC and Starz Finance Corp. (together, the "Issuers"). | |

Starz Finance Corp., a Delaware corporation, is a wholly-owned subsidiary of Starz, LLC that has been formed for the sole purpose of co-issuing the notes offered hereby and the notes issued in any future offerings. Starz Finance Corp. does not and will not have any operations, assets or subsidiaries of its own and does not and will not have any revenue. | ||

Notes Offered | $500.0 million aggregate principal amount of 5.00% senior notes due 2019. | |

Maturity | The notes will mature on September 15, 2019. | |

Interest Payment Dates | Interest will be payable, entirely in cash, semi-annually, in arrears, on March 15 and September 15 of each year, beginning on March 15, 2013. Interest will accrue from September 13, 2012. | |

Guarantees | The notes will be guaranteed, jointly and severally, on a senior basis, by each of our existing and future subsidiaries that guarantee the obligations under our senior secured credit facilities. Initially, Starz Entertainment will be the only guarantor of the notes. | |

See "Description of Notes—Note Guarantees." | ||

Ranking | The notes will rank equally in right of payment to all of our existing and future senior obligations and senior in right of payment to all of our existing and future subordinated obligations. The guarantees will rank equally in right of payment with the guarantors' existing and future senior obligations and senior in right of payment to their existing and future subordinated obligations. The notes and guarantees will be effectively subordinated to any existing and future secured obligations to the extent of the value of the assets securing the obligations, including indebtedness under our senior secured credit facilities. The notes and guarantees will be structurally subordinated to all the liabilities of any of our subsidiaries that do not guarantee the notes. See "Description of Notes—Ranking." |

9

| Optional Redemption | We may redeem some or all of the notes at any time on or after September 15, 2015 at the redemption prices set forth in "Description of Notes—Optional Redemption." We may also redeem up to 35% of the aggregate principal amount of the notes using the proceeds from certain equity offerings completed before September 15, 2015. In addition, prior to September 15, 2015, we may redeem the notes, in whole or from time to time in part, at a redemption price equal to 100% of the principal amount of the notes plus accrued and unpaid interest, if any, to the applicable redemption date plus the applicable "make-whole" premium set forth in "Description of Notes." | |

Change of Control | If we experience specific kinds of changes of control, we will be required to make an offer to purchase the notes at a purchase price of 101% of the principal amount thereof, plus accrued and unpaid interest to the purchase date. See "Description of Notes—Change of Control." | |

Certain Covenants | The indenture governing the notes will restrict our ability and the ability of our restricted subsidiaries to, among other things: | |

• incur additional debt; | ||

• pay dividends and make certain distributions, investments and other restricted payments; | ||

• create certain liens or use assets as security in other transactions; | ||

• transfer or sell assets; | ||

• change our line of business; | ||

• enter into transactions with affiliates; | ||

• limit the ability of restricted subsidiaries to make payments to us; | ||

• enter into sale and leaseback transactions; | ||

• merge, consolidate, sell or otherwise dispose of all or substantially all of our assets; and | ||

• designate subsidiaries as unrestricted subsidiaries. | ||

These covenants are subject to important exceptions and qualifications. See "Description of Notes—Certain Covenants." | ||

If the notes are assigned investment grade ratings by both Moody's and Standard & Poor's and no default or event of default has occurred and is continuing, certain covenants will be eliminated. The eliminated covenants will not be reinstated if the notes subsequently fail to be rated investment grade. See "Description of Notes—Certain Covenants—Fall-Away Event." |

10

| Transfer Restrictions | The notes generally will be freely transferable. | |

No Prior Market; No Listing | The notes will be new securities for which there is currently no market, and the notes will not be listed on any securities exchange or quoted on any quotation system. Although the initial purchasers of the original notes have informed us that they intend to make a market in the notes, they are not obligated to do so and may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a liquid market for the notes will develop or be maintained. | |

Form and Denomination | The notes will be book-entry only and registered in the name of DTC or its nominee. The notes will be issuable in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. | |

Risk Factors | See "Risk Factors" beginning on page 12 and the other information contained in this prospectus for a discussion of factors you should carefully consider prior to making an investment decision regarding the notes. | |

For additional information regarding the notes, see the "Description of Notes" section of this prospectus. |

11

An investment in the notes involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as the other information included in this prospectus, before making an investment in the notes. The risks described below are not the only ones facing our company. In the event any of the following risks actually occurs, our business, financial condition and results of operations could be materially adversely affected. The value of the notes could decline due to any of these risks, and you may lose all or part of your investment in the notes. The risks described below are those that we currently believe may materially affect us. Additional risks not presently known to us, or that we currently consider immaterial, may also materially adversely affect us.

This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below and elsewhere in this prospectus. See "Cautionary Note Regarding Forward-Looking Statements."

Risks Related to our Business

If economic instability persists in the U.S. or in other parts of the world, our results of operations could be adversely affected.

Our business is affected by prevailing economic conditions. Financial instability or a general decline in economic conditions in the U.S. could affect our business in an adverse manner. Decreases in U.S. consumer discretionary spending, which is sensitive to general economic conditions, may affect cable television and other video service subscriptions, in particular with respect to digital service tiers on which ourEncore andMovieplex networks are sometimes carried and premium video tiers and premiuma la carte where ourStarz networks are typically carried. This reduction in spending could lead to a decrease in the number of subscribers to our networks from multichannel video distributors, which would have a material adverse impact on our business, financial condition and results of operations.

We depend on multichannel video distributors that carry our programming, and no assurance can be given that we will be able to maintain and renew our affiliation agreements on favorable terms or at all.

We currently distribute our programming through affiliation agreements with many multichannel video distributors, including Comcast, DIRECTV, Dish Network, Time Warner Cable, Charter, Cox, Cablevision, AT&T and Verizon. Our affiliation agreements with distributors are scheduled to expire at various dates through 2019. Affiliation agreements accounting for approximately 30% of Starz Channels' revenue for the nine months ended September 30, 2012 are set to expire or are subject to renegotiation in the fourth quarter of 2012. A substantial majority of the 30% is accounted for by two distributors who exercised options to renegotiate their affiliation agreements. Recently, we agreed to multi-year extensions with these two distributors. The financial terms of the extensions are generally less favorable than the financial terms in the prior affiliation agreements. These less favorable financial terms would have resulted in an approximate reduction of 3% of Starz Channels' revenue for the nine months ended September 30, 2012, on a proforma basis had the extended agreements been in effect on January 1, 2012. Each of these agreements provide for contractually agreed upon increases in the amounts we receive on an annual basis beginning on the first anniversary of the extensions. The largest multichannel video distributors have significant leverage in their relationship with certain programming networks. The two largest cable distributors provide service to approximately 34% of U.S. multichannel households, while the two largest direct broadcast satellite distributors provide service to an additional 34% of such households. Further consolidation among multichannel video distributors could increase this leverage.

12

In some cases, if a distributor is acquired, the affiliation agreement of the acquiring distributor will govern following the acquisition. In those circumstances, the acquisition of a distributor that is party to affiliation agreements with us that are more favorable to us would adversely impact our business, financial condition and results of operations.

The renewal negotiation process for affiliation agreements is typically lengthy. In certain cases, renewals are not agreed upon prior to the expiration of a given agreement, while the programming continues to be carried by the relevant distributor pursuant to the other terms and conditions in the affiliation agreement. We may be unable to obtain renewals with our current distributors on acceptable terms, if at all. We may also be unable to successfully negotiate affiliation agreements with new or existing distributors to carry our programming. Although we consider our current levels of distribution pursuant to affiliation agreements with terms expiring during 2012 to be ordinary course, the failure to successfully renew or negotiate new affiliation agreements covering a material portion of multichannel television households could result in a discontinuation of carriage that would materially adversely affect our subscriber growth, revenue and earnings which would materially adversely affect our business, financial condition and results of operations.

Because a limited number of multichannel video distributors account for a large portion of our business, the loss of any significant distributor would materially adversely affect our business, financial condition and results of operations.

Our programming networks depend upon agreements with a limited number of multichannel video distributors. For the nine months ended September 30, 2012 and the year ended December 31, 2011, Comcast and DIRECTV each accounted for at least 10% of our revenue. The loss of any significant distributor could have a material adverse effect on our business, financial condition and results of operations.

Occasionally we have disputes with our distributors over the terms of our carriage, such as how the distributor markets our services (such as free offers), or other contract terms. If not resolved through business negotiation, such disputes could result in litigation or termination of an existing agreement. Termination of an existing agreement resulting in the loss of distribution of our programming to a material portion of our multichannel television households would materially adversely affect our subscriber growth, revenue and earnings and have an adverse effect on our business, financial condition and results of operations. See "Business—Legal Proceedings."

Increasing rates paid by multichannel video distributors to other programmers may result in increased rates charged to their subscribers for their services, making it more costly for subscribers to purchase our Starz and Encore services, which may result in fewer subscribers to our services and may materially adversely affect our business, financial condition and results of operations.

The amounts paid by certain programming networks for the rights to carry broadcast networks and sports networks have increased substantially in recent years. As a result, these networks have taken large increases in the rates they charge for their networks to multichannel video distributors who in turn have passed on some of these increases to their subscribers. The rates that subscribers pay for programming from multichannel video distributors continue to increase each year and these increases may impact our ability, as a premium subscription video provider, to increase or even maintain our subscriber levels and may adversely impact our revenue and earnings which would have a materially adverse effect on our business, financial condition and results of operations.

13

We depend on our distributors to market our networks and other services, the lack of which may result in reduced customer demand.

Currently, certain of our distributors are not allowing us to participate in cooperative marketing campaigns to market our networks and services. Our inability to participate in the marketing of our networks and other services may put us at a competitive disadvantage. Also, our distributors are often focused more on marketing their bundled service offerings (video, internet and telephone) than premium video services. If our distributors do not sign up new subscribers to our networks, we may lose subscribers which would have a materially adverse effect on our business, financial condition and results of operations.

We may not be able to adapt to new content distribution platforms and to changes in consumer behavior resulting from these new technologies, which may materially adversely affect our business, financial condition and results of operations.

We must successfully adapt to technological advances in our industry, including the emergence of alternative distribution platforms. Our ability to exploit new distribution platforms and viewing technologies will affect our ability to maintain or grow our business and may increase our capital expenditures. Additionally, we must adapt to changing consumer behavior driven by advances such as digital video recorders (or "DVRs"), video-on-demand, internet-based content delivery, Blu-ray players and mobile devices. Such changes may impact the revenue we are able to generate from our traditional distribution methods by decreasing the viewership of our programming networks on cable and other multichannel video distribution systems. If we fail to adapt our distribution methods and content to emerging technologies, our appeal to our targeted audiences might decline and there would be a materially adverse effect on our business, financial condition and results of operations.

Our business depends on the appeal of our programming to our distributors and our viewers, which is difficult to predict.

Our business depends in part upon viewer preferences and audience acceptance of the programming on our networks. These factors are difficult to predict, and subject to influences that are beyond our control, such as the quality and appeal of competing programming, general economic conditions and the availability of other entertainment activities. We may not be able to anticipate and react effectively to shifts in tastes and interests in our markets. A change in viewer preferences could cause our programming to decline in popularity, which could jeopardize renewal of our contracts with multichannel video distributors. In addition, our competitors may have more flexible programming arrangements, as well as greater amounts of available content, distribution and capital resources, and may be able to react more quickly than we can to shifts in tastes and interests.

To an increasing extent, the success of our business depends on exclusive original programming and our ability to accurately predict how audiences will respond to our original programming. Because original programming often involves a greater degree of financial commitment, as compared to acquired programming that we license from third parties, and because our network branding strategies depend significantly on a relatively small number of original programs, a failure to anticipate viewer preferences for such programs could be especially detrimental to our business.

In addition, theatrical feature films constitute a significant portion of the programming on ourStarz andEncore programming networks. In general, the popularity of feature-film content on linear television is declining, due in part to the broad availability of such content through an increasing number of distribution platforms prior to our linear window. Should the popularity of feature-film programming suffer significant further declines, we may lose subscribership or be forced to rely more heavily on original programming, which could increase our costs.

14

If our programming does not gain the level of audience acceptance we expect, or if we are unable to maintain the popularity of our programming, we may have a diminished negotiating position when dealing with distributors, which could reduce our revenue and earnings. We cannot assure you that we will be able to maintain the success of any of our current programming, or generate sufficient demand and market acceptance for our original programming. This would materially adversely impact our business, financial condition and results of operations.

Our programming networks' success depends upon the availability of programming that is adequate in quantity and quality, and we may be unable to secure or maintain such programming.

Our programming networks' success depends upon the availability of quality programming, particularly original programming and films, that is suitable for our target markets. While we produce some of our original programming, we obtain most of our programming (including some of our original programming, films and other acquired programming) through agreements with third parties that have produced or control the rights to such programming. These agreements expire at varying times and may be terminated by the other party if we are not in compliance with their terms.

We compete with other programming networks to secure desired programming. Competition for programming has increased as the number of programming networks has increased. Other programming networks that are affiliated with programming sources such as movie or television studios or film libraries may have a competitive advantage over us in this area. In addition to other cable programming networks, we also compete for programming with national broadcast television networks, local broadcast television stations video-on-demand services and internet-based content delivery services such as Netflix, iTunes, Amazon and Hulu. Some of these competitors have exclusive contracts with motion picture studios or independent motion picture distributors or own film libraries. In December 2012, Disney informed us that they would not extend their licensing agreement with us beyond its expiration on December 31, 2015. We will continue to receive films from Disney's Walt Disney Pictures, Walt Disney Animation Studios, Disney-Pixar, Touchstone Pictures, Marvel Entertainment and Hollywood Pictures labels through December 31, 2015 with initial license periods for such films extending into 2017. We are evaluating our options with respect to replacement of the Disney content following expiration of the licensing agreement, including the production of additional original content.

We cannot assure you that we will ultimately be successful in negotiating renewals of our programming rights agreements or in negotiating adequate substitute agreements. In the event that these agreements expire or are terminated and are not replaced by programming content, including additional original programming, acceptable to our distributors and subscribers, it would have a material adverse impact on our business, financial condition and results of operations.

Piracy of films and television programs is an increasingly prevalent problem and could adversely affect our business over time.

Piracy is prevalent in many parts of the world and has been made easier in recent years by the availability of digital copies of content and technological advances allowing conversion of films into digital formats, which facilitates the creation, transmission and sharing of high quality unauthorized copies of films. Piracy has long-term implications for our business, as it may eventually force film studios to invest less in films, resulting in the release of fewer films and/or an increase in the use of other channels for releasing films. If film piracy were to increase, it would have a material adverse effect on our business, financial condition and results of operations.

15

We have entered into long-term output licensing agreements that require substantial payments over long periods of time.

We have entered into long-term agreements to acquire theatrical releases from Disney and Sony. Such agreements expire at December 31, 2015 and 2016, respectively. Each agreement requires us to pay for films released by each studio at rates calculated on a pricing grid that is based on the film's domestic box office performance (subject to maximum amounts payable per film and a cap on the maximum number of films that can be put to us each year), and the amounts payable over the term of the respective agreements will be substantial. We believe that the theatrical performance of the films we will receive under the agreements will perform at levels consistent with the performance of films we have received from Disney and Sony in the past. We also assume a certain number of annual releases of first run films by Disney and Sony's studios consistent with the number we received in 2011. Should the films perform at higher levels across the slate of films we receive or the quantity of films increase, then our payment obligations under these agreements would increase and would have a materially adverse effect on our business, financial condition and results of operations.

Changes in foreign, state and local tax incentives may increase the cost of original programming content to such an extent that they are no longer feasible.

Original programming requires substantial financial commitment. In some cases the financial commitment can be offset by foreign, state or local tax incentives. However, there is a risk as the result of current economic conditions that the tax incentives will not remain available for the duration of a series. If tax incentives are no longer available or reduced substantially, it may result in increased costs for us to complete the production or make the production of additional seasons more expensive. If we are unable to produce original programming content on a cost effective basis our business, financial condition and results of operations may be materially adversely affected.

We are subject to intense competition, which may have a negative effect on our profitability or on our ability to expand our business.

The cable programming industry is highly competitive. OurStarz andEncore networks compete with other programming networks and other types of video programming services for marketing and distribution by multichannel video distributors. We face competition with other providers of programming networks for the right to be carried by a particular multichannel video distributor and for the right to be carried by such system on a particular "tier" or in a particular "package" of service.

Certain programming networks affiliated with broadcast networks like NBC, ABC, CBS or Fox have a competitive advantage over our programming networks in obtaining distribution through the "bundling" of carriage agreements for such programming networks with a distributor's right to carry the affiliated broadcasting network. In addition, our ability to compete with certain programming networks for distribution may be hampered because the multichannel video distributors through which we seek distribution may be affiliated with these programming networks. Because such distributors may have a substantial number of subscribers, the ability of such programming networks to obtain distribution on the systems of affiliated distributors may lead to increased revenue for these programming networks because of their increased penetration compared to our programming networks. Even if the affiliated distributors carry our programming networks, they may place their affiliated programming network on a more desirable tier or programming package, thereby giving their affiliated programming network a competitive advantage over our own which would have a material adverse effect on our business, financial condition and results of operations.

16

Any continued or permanent inability to transmit our programming via satellite would result in lost revenue and could result in lost subscribers.

Our success is dependent upon our continued ability to transmit our programming to multichannel video distributors from our satellite uplink facility, which transmissions are subject to Federal Communications Commission (the "FCC") compliance in the U.S. We have entered into long-term satellite transponder leases that expire between 2018 and 2021 in the U.S. for carriage of our network's programming. These leases provide for the continued carriage of our programming on available replacement transponders and/or replacement satellites, as applicable, throughout the term of the leases, in the event of a failure of either the transponders and/or satellites currently carrying our programming. Although we believe we take reasonable and customary measures to ensure continued satellite transmission capability, termination or interruption of satellite transmissions may occur and would have a material adverse effect on our business, financial condition and results of operations. Despite our efforts to secure transponder capacity with long-term satellite transponder leases, there is a risk that when these leases expire, we may not be able to secure capacity on a transponder or may not be able to secure capacity on a transponder on the same or similar terms. This may result in an inability to transmit the content and could result in significant lost revenue and lost subscribers and would have a material adverse effect on our business, financial condition and results of operations.

If our technology facility fails or its operations are disrupted, our performance could be hindered.

Our programming is transmitted from a facility we currently own at our corporate headquarters in Englewood, Colorado, and will continue to lease following the reorganization described above in "Summary—LMC Relationship and Recent Developments." We use our facility for a variety of purposes, including signal processing, satellite uplinking, program editing, promotions, creation of programming segments (i.e., interstitials) to fill short gaps between featured programs, quality control, and live and recorded playback. Like other facilities, this facility is subject to interruption from fire, lightning, adverse weather conditions and other natural causes. Equipment failure, employee misconduct or outside interference could also disrupt the facility's services. Although we have made arrangements at a third party facility to uplink certain of our channels to our satellites in the event we are unable to do so from our facility at our corporate headquarters, we currently do not have a backup operations facility that allows us to uplink all of our channels (including the ability to uplink our high definition signals). Any significant interruption at our facility affecting the distribution of our programming could have a material adverse effect on our business, financial condition and results of operations.

Our business is limited by regulatory constraints which may adversely impact our operations.

Although our business generally is not directly regulated by the FCC, under the Communications Act of 1934 and the 1992 Cable Act, there are certain FCC regulations that govern our business either directly or indirectly. See "Business—Regulatory Matters." Furthermore, to the extent that regulations and laws, either presently in force or proposed, hinder or stimulate the growth of the cable television and satellite industries, our business will be affected.

The regulation of cable television services and satellite carriers is subject to the political process and has been in constant flux over the past two decades. Further material changes in the law and regulatory requirements must be anticipated. We cannot assure you that we will be able to anticipate material changes in laws or regulatory requirements or that future legislation, new regulation or deregulation will not have a material adverse effect on our business, financial condition and results of operations.

17

We may fail to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties.

We regard our intellectual property rights, including service marks, trademarks, domain names, copyrights (including our programming and our websites), trade secrets and similar intellectual property, as critical to our success. Our business also relies heavily upon software codes, informational databases and other components that aide in the provision of our networks to our multichannel video distributors.

From time to time, we are subject to legal proceedings and claims in the ordinary course of business, including claims of alleged infringement of the trademarks, patents, copyrights and other intellectual property rights of third parties. In addition, litigation may be necessary to enforce our intellectual property rights, protect trade secrets or to determine the validity and scope of proprietary rights claimed by others. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs and diversion of management and technical resources, any of which could adversely affect our business, financial condition and results of operations. Our failure to protect our intellectual property rights, particularly our brand, in a meaningful manner or challenges to related contractual rights could result in erosion of our brand and limit our ability to control marketing of our networks, which could have a material adverse effect on our business, financial condition and results of operations.

The loss of any of our key personnel and artistic talent could adversely affect our business.

We believe that our future success will depend to a significant extent upon the performance of our senior executives. We do not maintain "key man" insurance. In addition, we depend on the availability of a number of writers, directors, producers and others, who are employees of third-party production companies that create our original programming. The loss of any significant personnel or talent could have a material adverse effect on our business, financial condition and results of operations.

Labor disputes may disrupt our operations and adversely affect the profitability of our business.

Certain of our production employees at our Film Roman subsidiary are covered by collective bargaining agreements. In addition, our content providers' talent, including writers, directors, actors and production personnel and those working on our original productions, may be covered by labor agreements. In general, a labor dispute involving our employees, the employees of our subsidiaries, or talent involved in content production at our content providers or working on our original productions may disrupt our operations or result in work stoppages. Labor disputes may impair our ability to complete our original productions or restrict our access to available content, resulting in increased costs and decreased revenue which would have an adverse effect on our business, financial condition and results of operations. The resolution of labor disputes can be costly. Additionally, we cannot assure that we will renew our collective bargaining agreements as they expire or that we can renew them on favorable terms without any work stoppages. Such labor disputes may have a material adverse effect on our business, financial condition and results of operations.

Our Starz Distribution operating segment is subject to intense competition, which may have a material adverse effect on our profitability or on our ability to expand our business.

The home entertainment industry is highly competitive. Our Home Video, Digital Media and Worldwide Distribution businesses compete to sell DVDs and other media (e.g., digital and television programs) with all of the major Hollywood studios, including Warner Brothers, Twentieth Century Fox, Disney, Sony, Paramount and Universal as well as smaller studios such as Lionsgate. All of these studios distribute their theatrical, television and titles acquired from third parties on DVD and other media and have marketing budgets that are well in excess of the amounts we are able to spend to

18