PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 6, 2015

ENGAGED CAPITAL MASTER FEEDER I, LP

___________________, 2015

Dear Fellow Rovi Stockholder:

Engaged Capital Master Feeder I, LP (together with its affiliates, “Engaged Capital” or “we”) and the participants in this solicitation are the beneficial owners of an aggregate of 549,900 shares of common stock, par value $0.001 per share (the “Common Stock”), of Rovi Corporation, a Delaware corporation (“Rovi” or the “Company”), including 100 shares of Common Stock held in record name, representing approximately 0.61% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe significant changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests. We are seeking your support for the election of our three nominees at the annual meeting of stockholders scheduled to be held at Rovi’s corporate offices located at 2830 De La Cruz Boulevard, Santa Clara, California 95050 on Wednesday, May 13, 2015 at 9:00 a.m., local time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”). We are seeking representation on the Board because we believe that the Board will benefit from the additional directors with relevant skill sets and a shared objective of enhancing value for the benefit of all Rovi stockholders. The individuals we have nominated are highly-qualified, capable and ready to serve stockholders to help make Rovi a stronger, more profitable, and ultimately more valuable company.

Our interests are fully aligned with the interests of all Rovi stockholders. We believe there is significant value to be realized at Rovi. However, we are concerned that the Board is not taking the appropriate action to address the Company’s perennial underperformance. Given the Company’s poor financial and stock price performance under the oversight of the current Board, we strongly believe that the Board must be reconstituted to ensure that the directors take the necessary steps for the Company’s stockholders to realize the maximum value of their investment, including developing a strategy that maximizes value of Rovi’s IP licensing and products businesses, implementing a strategically coherent capital allocation plan, optimizing costs and restructuring executive compensation.

The Board is currently composed of seven (7) directors, all of whom are up for election at the Annual Meeting. Through the attached Proxy Statement, we are soliciting proxies to elect not only our three (3) nominees, but also the candidates who have been nominated by the Company other than [ ], [ ] and [ ]. This gives stockholders who wish to vote for our nominees the ability to vote for a full slate of seven nominees in total. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Engaged Capital believes that any attempt to increase or decrease the size of the current Board or the number of directors up for election at the Annual Meeting would constitute an improper manipulation of Rovi’s corporate machinery. Your vote to elect our nominees will have the legal effect of replacing three incumbent directors with our nominees. If elected, our nominees will constitute a minority on the Board and there can be no guarantee that our nominees will be able to implement the actions that they believe are necessary to unlock stockholder value.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the stockholders on or about ____________, 2015.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated WHITE proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Morrow & Co., LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support, |

| |

| /s/ Glenn W. Welling |

| |

| Glenn W. Welling |

| Engaged Capital Master Feeder I, LP |

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Engaged Capital’s proxy materials, please contact Morrow & Co., LLC at the phone numbers or email listed below.

MORROW & CO., LLC 470 West Avenue Stamford, CT 06902 Call Toll Free: (800) 662-5200 Call Direct: (203) 658-9400 Email: engaged@morrowco.com |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 6, 2015

2015 ANNUAL MEETING OF STOCKHOLDERS

OF

ROVI CORPORATION

_________________________

PROXY STATEMENT

OF

ENGAGED CAPITAL MASTER FEEDER I, LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Engaged Capital Master Feeder I, LP (“Engaged Capital Master I”), Engaged Capital Master Feeder II, LP (“Engaged Capital Master II”), Engaged Capital I, LP (“Engaged Capital I”), Engaged Capital I Offshore, Ltd. (“Engaged Capital Offshore”), Engaged Capital II, LP (“Engaged Capital II”), Engaged Capital II Offshore Ltd. (“ Engaged Capital Offshore II”), Engaged Capital, LLC (“Engaged Capital LLC”), Engaged Capital Holdings, LLC (“Engaged Holdings”) and Glenn W. Welling (collectively, “Engaged Capital” or “we”) are stockholders of Rovi Corporation, a Delaware corporation (“Rovi” or the “Company”), who, together with the other participants in this solicitation, beneficially own 549,900 shares of common stock, par value $0.001 per share (the “Common Stock”), of the Company, including 100 shares of Common Stock held in record name, representing approximately 0.61% of the outstanding shares of Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be significantly reconstituted to ensure that the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investment. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the annual meeting of stockholders scheduled to be held at Rovi’s corporate offices located at 2830 De La Cruz Boulevard, Santa Clara, California 95050 on Wednesday, May 13, 2015 at 9:00 a.m., local time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| | 1. | To elect Engaged Capital’s three (3) director nominees, [David Lockwood, Raghavendra Rau, Philip A. Vachon and Glenn W. Welling] (each a “Nominee” and, collectively, the “Nominees”), to the Board as directors to serve until the 2016 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| | 2. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| | 3. | To hold an advisory vote on executive compensation; and |

| | 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

This Proxy Statement is soliciting proxies to elect not only our three Nominees, but also the candidates who have been nominated by the Company other than [ ], [] and [ ]. This gives stockholders who wish to vote for our Nominees the ability to vote for a full slate of seven nominees in total. As of the date hereof, the members of Engaged Capital and the Nominees collectively own 549,900 shares of Common Stock (the “Engaged Capital Group Shares”). We intend to vote the Engaged Capital Group Shares FOR the election of the Nominees, [FOR] the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2015, and [AGAINST] the approval of the advisory vote to approve executive compensation, as described herein.

The Company has set the close of business on March 16, 2015 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 2830 De La Cruz Boulevard, Santa Clara, California 95050. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 90,531,529 shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY ENGAGED CAPITAL AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ENGAGED CAPITAL IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

ENGAGED CAPITAL URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

[_______________________]

______________________________

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Engaged Capital urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Engaged Capital’s recommendations on the other proposals on the agenda for the Annual Meeting.

| | · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Engaged Capital, c/o Morrow & Co., LLC (“Morrow”), in the enclosed postage-paid envelope today. |

| | · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| | · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our three Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Engaged Capital’s proxy materials, please contact Morrow & Co., LLC at the phone numbers or email listed below.

MORROW & CO., LLC 470 West Avenue Stamford, CT 06902 Call Toll Free: (800) 662-5200 Call Direct: (203) 658-9400 Email: engaged@morrowco.com |

Background to the Solicitation

The following is a chronology of events leading up to this proxy solicitation:

| | · | On May 6, 2013, representatives of Engaged Capital met with the Company’s Chief Financial Officer (the “Chief Financial Officer”) to discuss the Company’s product strategy, expense structure, and capital allocation strategy. At this meeting, Engaged Capital presented the Chief Financial Officer with a slide presentation detailing its analysis and concerns. |

| | · | On August 21, 2013, representatives of Engaged Capital met with the Company’s Chief Executive Officer (the “Chief Executive Officer”) and the Chief Financial Officer to further discuss the Company’s product strategy, expense structure, patent portfolio, and capital allocation strategy. At this meeting, Engaged Capital presented management with a second, more detailed slide presentation showing in greater depth Engaged Capital’s concerns on the issues facing the Company and its supporting analysis. |

| | · | On October 9, 2013, Engaged Capital sent a private letter to the Chief Executive Officer, with copies to the Chairman of the Board (the “Chairman”) and the Chief Financial Officer, detailing concerns and recommendations regarding the Company’s capital structure, capital allocation strategy, cost structure, and investor communications. The letter also requested a meeting with the Chairman. |

| | · | On November 20, 2013, representatives of Engaged Capital met with the Chairman, the Chief Executive Officer, and the Chief Financial Officer at the Company’s offices in Santa Clara, California. At the meeting, Engaged Capital laid out its views on the Company’s strategy, cost structure, capital allocation, and corporate governance practices as well as actions within the control of the Board to address these issues. |

| | · | On December 9, 2013, Christopher Hetrick of Engaged Capital sent an email to the Chief Executive Officer, the Chief Financial Officer, and the head of Investor Relations which included examples of other public company presentations on capital allocation, segment reporting, and cost structure/operating models as the Company was preparing for its Annual Investor event in early January 2014. |

| | · | On February 19, 2014, representatives of Engaged Capital met with the Chief Financial Officer to discuss issues with respect to the Company’s cost structure, R&D investments, sales and marketing costs, and capital allocation strategy. |

| | · | On March 19, 2014, Mr. Welling met with the Chief Executive Officer in Sunnyvale, California to discuss Engaged Capital’s views regarding the Company’s need to reduce costs, better align incentive compensation with stockholder value, and the need to add cost management and capital allocation expertise to the Board. |

| | · | On April 23, 2014, representatives of Engaged Capital had a conference call with the Chairman and the Chief Financial Officer, to provide Engaged Capital’s input on executive compensation in advance of the Company’s annual meeting of stockholders on April 29, 2014. |

| | · | On June 2, 2014, Engaged Capital sent a letter to the Chairman of the Board and the Chairman of the Compensation Committee of the Board outlining certain issues with the Company’s executive compensation programs and laying out corresponding recommendations for actions within the Board’s control that could be taken to improve the Company’s executive compensation practices. |

| | · | On June 16, 2014, Engaged Capital received a brief letter from the Company in response to Engaged Capital’s June 2 letter. The Company’s response letter generally asserted a commitment to tackle the executive compensation problems but did not address the specific issues identified by Engaged Capital. |

| | · | On August 8, 2014, Mr. Welling had a conference call with the Chief Executive Officer regarding Engaged Capital’s strong conviction that new directors should be added to the Board who possess relevant industry expertise as well as cost-cutting and capital allocation experience. On the call, Mr. Welling indicated that Engaged Capital would prefer to work constructively to add new directors to the Board and that Engaged Capital had identified highly qualified director candidates and that he would introduce them to the Chief Executive Officer so that the Company could evaluate the individuals as potential new directors. Mr. Welling emphasized Engaged Capital’s willingness to work constructively with the Company to enhance the Board. |

| | · | On August 9, 2014, Mr. Welling, via email, introduced the Chief Executive Officer to a potential new director. |

| | · | On September 3, 2014, this potential new director met with the Chief Executive Officer in the Company’s Radnor, Pennsylvania offices. |

| | · | On September 12, 2014, Mr. Welling, via email, introduced the Chief Executive Officer to an additional potential new director, David Lockwood. |

| | · | On September 22, 2014, the Chief Executive Officer spoke on the phone to Mr. Lockwood. |

| | · | On October 8, 2014, a call took place between Mr. Welling and the Chief Executive Officer. The parties discussed the need for change in Board composition as well as the Company’s cost initiatives, cloud-based platform, and upcoming big four intellectual property license renewals. The Chief Executive Officer indicated that he had met or talked with both potential director candidates introduced by Engaged Capital. The Chief Executive Officer indicated he was impressed with Mr. Lockwood and that he intended to recommend Mr. Lockwood be included in the Company’s nominee evaluation process. |

| | · | On October 20, 2014, a call took place between Mr. Welling and the Chairman regarding Engaged Capital’s strong belief that new, highly qualified directors be added to the Board and expressed Engaged Capital’s frustration on the lack of progress in light of the upcoming nomination deadline. The Chairman indicated on the call that the Company was considering adding at least one additional director to the Board and that they planned to hire an executive search firm to identify candidates and that Engaged Capital’s recommended directors would be included in the list of potential candidates. |

| | · | On October 29, 2014, a call took place between Mr. Welling and the Chief Executive Officer regarding the upcoming director nomination deadline with respect to the Annual Meeting. Engaged Capital suggested they would be open to an extension of the nomination deadline, if the Company needed more time to work together with Engaged Capital in selecting additional directors. |

| | · | On November 7, 2014, the Company announced an extension of the deadline for submission of stockholder nominations of directors for election at the Annual Meeting through December 31, 2014. |

| | · | On November 21, 2014, a call took place between representatives of Engaged Capital and the Chairman, Executive Vice President of Human Resources and the Chairman of the Compensation Committee of the Board to discuss changes proposed by Engaged Capital to the Company’s executive compensation program. |

| | · | On December 3, 2014, in a phone call, Mr. Welling and the Chief Executive Officer discussed Board composition as well as various Company operational and strategic issues. Mr. Welling suggested the Company consider Raghavendra Rau, as a potential director candidate. The Chief Executive Officer confirmed he knew Mr. Rau and thought very highly of him. |

| | · | On December 29, 2014, in light of the impending nomination deadline, Engaged Capital delivered a letter to Rovi notifying the Company, in accordance with its Bylaws, of Engaged Capital’s nomination of Messrs. Lockwood, Rau, Vachon and Welling for election to the Board at the Annual Meeting. |

| | · | On January 7, 2015, Mr. Welling met with the Chief Executive Officer during the Company’s Investor Day event. The two discussed Board composition and other significant strategic and operational issues of concern to Engaged Capital. |

| | · | On January 22, 2015, a call took place between Mr. Welling and the Company’s Executive Vice President of Human Resources to review the list of potential directors sourced by the Company’s executive search firm and to seek Engaged Capital’s views on the candidates. |

| | · | On February 4, 2015, the Company’s search firm directly contacted Raghavendra Rau, one of Engaged Capital’s Nominees, in order to schedule an interview with the Company’s Nominating Committee. The Company did not contact Engaged Capital regarding this interview and did not request to interview any of Engaged Capital’s other Nominees. |

| | · | On February 13, 2015, a call took place between Mr. Welling and the Chairman regarding Engaged Capital’s continued frustration with the lack of progress in discussing a mutually-acceptable resolution on Board composition in the best interest of stockholders. |

| | · | On February 16, 2015, a call took place between Mr. Welling and the Chairman. On the call, Engaged Capital explained that despite the Company’s search firm reaching out to Mr. Rau to schedule interviews with the Board, Engaged Capital was prepared to make Mr. Rau available once the Company shared a good faith settlement proposal. Later that day, the Chairman indicated via email that the Company would not be able to propose such a framework until after the Company’s upcoming Board meeting at the end of the week. |

| | · | On March 5, 2015, Mr. Welling contacted the Chairman via email to request an update regarding the framework for settlement proposal raised on their previous call, almost three weeks prior. |

| | · | Also, on March 5, 2015, a call took place between Mr. Welling and the Chief Financial Officer to discuss an article written about the Company by Reuters the week prior. On the call, Mr. Welling expressed his continued desire to work constructively with the Board to find a mutually agreeable resolution on Board composition. |

| | · | On March 9, 2015, a call took place between Mr. Welling and the Chairman during which the Chairman informed Mr. Welling that the Company intended to proceed with its own search process for Board candidates that excluded all of Engaged Capital’s Nominees. By that time, after initially fully participating in the Board’s search process and introducing numerous candidates for interviews with Mr. Carson, Engaged Capital had begun to doubt how seriously its candidates were being considered given a 3-4 month stall in the search process, the lack of progress towards any settlement framework regarding Board composition and the Company’s offer to include only one of the Nominees in the search process. As a result, Engaged Capital determined to withdraw its offer to include the Nominees in the Board’s search process. |

| | · | On March 12, 2015, Engaged Capital sent a letter to the Board expressing its frustration with the Company’s lack of progress regarding changes to the Board and publicly disclosed its Nominees. |

| | · | On March 23, 2015, the Company filed its preliminary proxy materials and announced the addition of N. Steven Lucas to the Board. |

REASONS FOR THE SOLICITATION

WE BELIEVE THAT SIGNIFICANT IMPROVEMENT TO ROVI’S BOARD IS NEEDED NOW

Engaged Capital has been a stockholder of Rovi for nearly two years. Over this time, we have maintained an ongoing dialogue with the Board and management. During numerous meetings and discussions we have privately provided materials that demonstrate the causes for our concerns with Rovi. These materials have clearly articulated our views on the challenges Rovi faces and the future opportunities it can hope to capture over the long term. However, as the Company has continued to struggle under the current Board’s watch, we have come to the conclusion that significant change in the boardroom is necessary as a predicate to any meaningful improvement at Rovi.

Over a year of effort to reach a mutually-agreeable resolution regarding Board composition in the best interests of stockholders has failed and reactive changes, such as the unilateral appointment of N. Steven Lucas to the Board, apparently provoked by our involvement have fallen short of what is needed. Overall, we are disappointed by this Board’s failure to adequately address the issues we have identified and question whether the Board as currently composed will take the necessary steps to maximize opportunities for value creation, including developing a strategy that maximizes value of Rovi’s IP licensing and products businesses, implementing a strategically coherent capital allocation plan, optimizing costs and restructuring executive compensation.

We believe that urgent change is needed on the Rovi Board. We have little confidence that the current Board is committed to, or capable of, taking the steps necessary to enhance stockholder value at Rovi. Therefore, we are soliciting your support to elect our Nominees at the Annual Meeting, who we believe would bring significant and relevant experience, new insight and fresh perspectives to the Board.

We Are Concerned with the Company’s Prolonged Underperformance

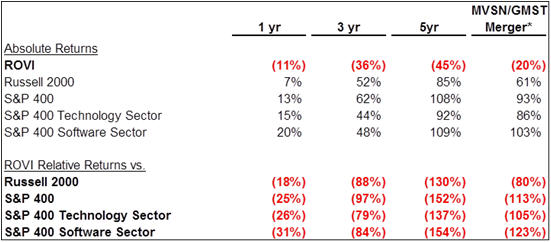

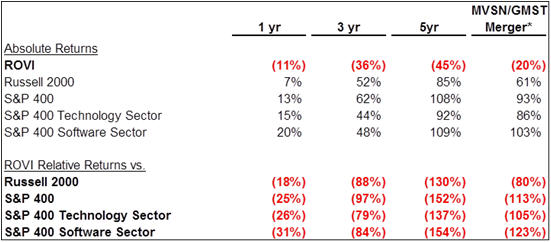

Over the past one, three, and five-year periods, and since the announced merger of Macrovision and Gemstar in December 2007, Rovi shares have generated a negative total return for stockholders and have underperformed the S&P 400 Software & Services Index by 154% over the past five years. We believe stockholders should be seriously concerned with the Company’s stock price underperformance over any relevant period.

|

*As of date Macrovision/Gemstar merger announced Note: As of close of business on March 24, 2015. |

We Are Concerned with the Board’s Poor Capital Allocation Decisions

In 2011, five out of seven members of current Board, including the Chairman, approved the acquisition of Sonic Solutions for $763 million. The Company’s subsequent management team would later deem Sonic to be “non-core” and has proceeded to divest all of Sonic’s operations in pieces for approximately $60 million, resulting in a loss of value for stockholders of over $700 million on a Company that today has a market capitalization of approximately $2 billion.

We Are Concerned with the Company’s Struggling Product Strategy

Rovi has continued to invest significant amounts of capital on a product strategy despite limited the apparent failure of past projects such as Rovi Entertainment Store, DivX Plus Streaming, and Total Guide. Despite this poor track record, Rovi is currently investing over $150 million a year on “growth” products, including approximately $75 million on pre-revenue projects. Management does not anticipate meaningful revenue growth from these product investments until 2017.

We Are Concerned with the Company’s Inflated Cost Structure

We believe that historic failings in Rovi’s product strategy have contributed to a persistently bloated cost structure. As compared to 2010, the last reported year prior to the apparently ill-fated Sonic acquisition, the Company currently anticipates revenue in 2015 to increase by $8.5 million over 2010 levels and Adjusted EBITDA to decrease by $52.5 million compared to 2010. Additionally, Rovi anticipates spending over $50 million on corporate expenses, or approximately 10% of sales.

We Are Concerned with the Company’s Poor Executive Compensation Structure and Practices

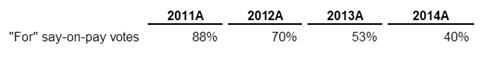

Stockholder support for “say-on-pay” proposals regarding executive compensation has declined in each of the past three years as the Board has failed to address stockholders’ apparently increasing discontent with the Company’s pay practices.

In addition, leading proxy advisory firms Institutional Stockholders Services (ISS) and Glass Lewis & Co. have consistently raised serious concerns over executive compensation at the Company.

We are Concerned Rovi’s Board is Stale and Lacks Sufficient Stock Ownership

Change on the Board is critical to ensure renewed focus and commitment on delivering stockholder value. We believe Rovi’s current Board is stale, as the average tenure of the incumbents, excluding new nominee N. Steven Lucas, is nearly 10 years, with director James E. Meyer having spent 18 years on the Board and each of directors James P. O’Shaughnessy and Ruthann Quindlen having spent 11 years on the Board. It is evident to us that the current Board has not been interested in proactively and continually adding new talent to the Board absent stockholder intervention. We believe that Rovi’s stock price has suffered due to the lack of fresh perspective on the Board.

Furthermore, we believe the Board’s ineffectiveness at tackling the persistent destruction of stockholder value is in large part a function of a troubling misalignment of interests between the directors and Rovi’s stockholders. Collectively, the members of the Board directly own approximately 0.2% of the outstanding stock of the Company (excluding unvested restricted stock), even when including the ownership of President and CEO Thomas Carson. When Mr. Carson’s ownership and unvested restricted stock is excluded, the Board collectively owns approximately 0.1% of the outstanding stock of the Company, despite a minimal ownership policy for the Company’s directors. Rovi’s incumbent directors collectively have sold an aggregate of 1,117,357 shares and have made only one purchase of 15,000 shares in the open market. We believe that the Board’s collective lack of a substantial ownership interest in shares of Rovi has affected the Board’s ability to properly evaluate and address the serious challenges facing the Company. In contrast to the incumbents who have collectively been net sellers of Rovi stock while directors, the Nominees, although they do not currently own Rovi shares, intend if elected to directly invest in the stock of the Company by purchasing shares in the open market as long as market conditions permit.

We Are Concerned with the Company’s Poor Corporate Governance

We are also concerned with the poor corporate governance that severely limits the ability of stockholders to seek effective change at Rovi. Stockholders are prohibited from taking action by written consent, can call special meetings only with the support of 20% of the voting power, and can amend the organizational documents of the Company only with a prohibitively high vote of 80% of all outstanding shares. If elected, our Nominees will work hard to improve corporate governance at Rovi by seeking to eliminate these anti-stockholder provisions. We believe that the Board should not be able to utilize Rovi’s corporate machinery to insulate itself and prevent change that would benefit all stockholders.

OUR THREE NOMINEES HAVE THE EXPERIENCE, QUALIFICATIONS AND COMMITMENT NECESSARY TO FULLY EXPLORE AVAILABLE OPPORTUNITIES TO UNLOCK VALUE FOR STOCKHOLDERS

We have identified three highly-qualified, independent directors with relevant business and financial experience who we believe will bring fresh perspective into the boardroom and would be valuable in assessing and executing on initiatives to unlock value at the Company. Further, we believe Rovi’s continued underperformance at this critical time for the future of the Company warrants the addition of directors whose interests are closely aligned with those of all stockholders, and who will work constructively with the other members of the Board to protect the best interests of Rovi’s stockholders.

[David Lockwood is the Chief Executive Officer and President of EnergySolutions, Inc., an environmental services and technology company, where he also previously served as a director. Previously, Mr. Lockwood served as the Chairman and Chief Executive Officer of Liberate Technologies, Inc., a publicly traded provider of applications and services to the telecommunications, satellite and cable industries, and the Chief Executive Officer and President of Intertrust Technologies, Inc., a supplier of digital rights management and computing systems, where he also served as a director. He also previously served as a director of each of Unwired Planet, Inc., an intellectual property licensing company focused on the mobile technology sector, Steinway Musical Instruments, Inc., a manufacturer of musical instruments, and BigBand Networks, Inc., a leader in digital video networking. His professional experience also includes work in the financial services industry, such as serving as Managing Partner of the Valueact Small Cap Fund and a Managing Director of Goldman Sachs. Mr. Lockwood’s extensive experience leading public companies and his expertise in the technology industry will be a valuable asset to the Board.]

[Raghavendra Rau is an accomplished global executive who has led transformative change in the technology and software industries. Mr. Rau currently serves as a director of iProf Learning Solutions, an e-learning company. Previously, Mr. Rau served as the CEO and as a director of SeaChange International Inc., a manufacturer of digital video systems and provider of related services. He also previously served as a director of each of Aviat Networks, Inc., a leader in wireless networking solutions, and Microtune, Inc., a global leader in RF integrated circuits and subsystem modules. In the course of his career, Mr. Rau also held various leadership positions with Motorola, Inc., including most recently as Senior Vice President of the Mobile TV Solutions Business. Mr. Rau’s extensive experience in the technology industry, together with his management experience, will enable him to provide the Company with valuable financial and executive insights, well qualifying him to serve on the Board.]

[Philip A. Vachon is a founder and principal owner of IPMG AG, a privately held global intellectual property licensing firm. He is also the Chairman and Principal Executive Officer of Unwired Planet, Inc. an intellectual property and technology licensing company, where he was responsible for closing a $100 million dollar revenue transaction with Lenovo, which together with cost controls gave Unwired Planet its first profitable year in seventeen years. Previously, Mr. Vachon served as a consultant to Intellectual Ventures, one of the world’s largest patent holders on licensing to the telecommunications industry, the President of Liberate International, a software and services firm that serviced the telecommunications industry, and held various positions with Oracle Corporation, including Vice President of sales in the telecommunications vertical organization. Mr. Vachon’s experience as an executive officer and a director at several technology companies and in the telecommunications licensing industry qualifies him to serve on the Board.]

[Glenn W. Welling is the Founder and Chief Investment Officer of Engaged Capital, LLC, a California based investment firm and registered advisor with the SEC focused on investing in small and mid-cap North American equities. Mr. Welling also currently serves as a director of Jamba, Inc., a leading health and wellness brand and the leading retailer of freshly squeezed juice. Mr. Welling’s leadership and financial expertise is well respected after previously serving as a Managing Director and consultant to Relational Investors LLC, a $6 billion activist equity fund and registered investment adviser with the SEC; Managing Director at Credit Suisse Group AG, a leading global financial services company; Partner and Managing Director of HOLT Value Associates L.P., a then leading provider of independent research and valuation services to asset managers; Managing Director of Valuad U.S., a financial software and training company; and senior manager at A.T. Kearney, one of the world’s largest global management consulting firms. Mr. Welling’s senior executive experience as an investor, consultant, and investment banker at Credit Suisse advising senior executives and boards of directors in developing strategies that will increase the value of their companies along with his expertise in improving governance structures including developing executive compensation plans that align pay with performance, will enable him to provide effective oversight of the Company as a member of the Board.]

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of seven directors whose terms expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three Nominees, [David Lockwood, Raghavendra Rau, Philip A. Vachon and Glenn W. Welling], in opposition to three of the Company’s director nominees. Your vote to elect the Nominees will have the legal effect of replacing three incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value as described in further detail above.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States.

[David Lockwood, age 55, has served as the Chief Executive Officer and President of EnergySolutions, Inc. (formerly NYSE:ES), an environmental services and technology company, since June 2012, where he also served as a director from November 2010 to May 2013. From January 2013 to October 2014, Mr. Lockwood served as a director of Unwired Planet, Inc. (NASDAQ:UPIP) (“Unwired Planet”), an intellectual property licensing company focused on the mobile technology sector. Mr. Lockwood also served as a director of Steinway Musical Instruments, Inc. (formerly NYSE:LVB), a manufacturer of musical instruments, from January 2008 to September 2013. From July 2010 to October 2011, Mr. Lockwood served as a director of BigBand Networks, Inc. (formerly NASDAQ:BBND), a leader in digital video networking. Mr. Lockwood served as the Chairman and Chief Executive Officer of Liberate Technologies, Inc. (formerly NASDAQ:LBRT), a publicly traded provider of applications and services to the telecommunications, satellite and cable industries, from 2003 to 2006. Prior to that, he served as the Chief Executive Officer and President of Intertrust Technologies, Inc. (formerly NASDAQ:ITRU), a supplier of digital rights management and computing systems, where he also served as a director. In addition to his experience leading public companies, Mr. Lockwood has worked in the financial services industry, including serving as Managing Partner of the Valueact Small Cap Fund and a Managing Director of Goldman Sachs. Mr. Lockwood has been a lecturer on the faculty of the Stanford Graduate School of Business and currently serves as a board member of USTAR, the Utah Science and Technology Research Initiative. Mr. Lockwood holds a B.A. from Miami University of Ohio and an M.B.A from the Graduate School of Business at the University of Chicago.

Engaged Capital believes that Mr. Lockwood’s extensive experience leading public companies and his expertise in the technology industry will be a valuable asset to the Board.

Raghavendra Rau, age 65, is an accomplished global executive who has led transformative change in the technology and software industries. Mr. Rau currently serves as a director of iProf Learning Solutions, an e-learning company that he co-founded in 2008. From November 2011 until October 2014, Mr. Rau served as the CEO of SeaChange International Inc. (NASDAQ:SEAC), a manufacturer of digital video systems and provider of related services to cable, telecommunications and broadcast television companies worldwide, where he also served as a director from July 2010 until October 2014 and as a member of the Compensation Committee. From November 2010 until December 2014, Mr. Rau served as a director of Aviat Networks, Inc. (NASDAQ:AVNW), a leader in wireless networking solutions, where he also served as a member of the Audit Committee. Mr. Rau also previously served as a director of Microtune, Inc. (formerly NASDAQ:TUNE), a global leader in RF integrated circuits and subsystem modules, from May 2010 until its acquisition by Zoran Corporation in December 2010, where he also served as a member of the Audit Committee. Mr. Rau served as Senior Vice President of the Mobile TV Solutions Business of Motorola, Inc. (“Motorola”), from May 2007 until January 2008, and as Senior Vice President of Strategy and Business Development, Networks & Enterprise of Motorola from March 2006 to May 2007. Mr. Rau served as Corporate Vice President of Global Marketing and Strategy for Motorola from 2005 to 2006, and as Corporate Vice President, Marketing and Professional Services, from 2001 to 2005. From October 1992 to 2001, Mr. Rau served in various positions within Motorola, including as Vice President of Strategic Business Planning and Vice President of Sales and Operations and held positions in Asia and Europe. Mr. Rau is a former Chairman of the QuEST Forum, a collaboration of service providers and suppliers dedicated to telecom supply chain quality and performance, and was a director of the Center for Telecom Management at the University of Southern California. Mr. Rau also served on the Motorola Partnership Board of France Telecom. Mr. Rau holds a Bachelor’s degree in Engineering from the National Institute of Technology, India and an MBA from the Indian Institute of Management.

Engaged Capital believes that Mr. Rau’s extensive experience in the technology industry, together with his management experience, will enable him to provide the Company with valuable financial and executive insights, well qualifying him to serve on the Board.

Philip A. Vachon, age 56, is a founder and a principal owner of IPMG AG (“IPMG”), a privately held global intellectual property licensing firm, formed in 2008. Mr. Vachon has served as a director of Unwired Planet (NASDAQ:UPIP), an intellectual property and technology licensing company, since June 2013, as the Chairman of the Board, since September 2013, and as its Principal Executive Officer, since June 2014. In those capacities in March 2014, Mr. Vachon was responsible for closing a $100 million dollar revenue transaction with Lenovo, which together with cost controls gave Unwired Planet its first profitable year in seventeen years. From 2006 to 2008, Mr. Vachon served as a consultant to Intellectual Ventures, one of the world’s largest patent holders on licensing to the telecommunications industry. Mr. Vachon served as President of Liberate International (“Liberate”), a software and services firm that serviced the telecommunications industry, from 2003 to 2007. Prior to his employment at Liberate, Mr. Vachon was employed for 8 years at Oracle Corporation in various capacities including in the last three years as Vice President of sales in the telecommunications vertical organization. Mr. Vachon previously served on the board of directors of Hostess Brands from 2007 to 2009.

Engaged Capital believes that Mr. Vachon’s experience as an executive officer and a director at several technology companies and in the telecommunications licensing industry qualifies him to serve on the Board.

Glenn W. Welling, age 44, is the Founder and Chief Investment Officer of Engaged Capital, LLC, a California based investment firm and registered advisor with the SEC focused on investing in small and mid-cap North American equities. Mr. Welling has also served as a director of Jamba, Inc. (NASDAQ:JMBA), a leading health and wellness brand and the leading retailer of freshly squeezed juice, since January 2015, where he is also a member of the Compensation and Executive Development Committee. Prior to founding Engaged Capital in February 2012, Mr. Welling was Principal and Managing Director at Relational Investors LLC (“Relational”), a $6 billion activist equity fund and registered investment adviser with the SEC, from June 2008 to October 2011 and served as its consultant from October 2011 until April 2012. Mr. Welling managed Relational’s consumer, healthcare and utility investments and was responsible for investment selection, strategic development and catalyzing change at Relational’s portfolio companies. Prior to Relational and from February 2002 to May 2008, Mr. Welling was a Managing Director at Credit Suisse Group AG (“Credit Suisse”) (NYSE:CS), a leading global financial services company, where he was the Global Head of the Investment Banking Department's Advisory Businesses, which included The Buy-Side Insights (HOLT) Group, Financial Strategy Group and Ratings Advisory Group. Previously, Mr. Welling served as Partner and Managing Director of HOLT Value Associates L.P. (“HOLT”), a then leading provider of independent research and valuation services to asset managers, from October 1999 until January 2002 when HOLT was acquired by Credit Suisse. Prior to HOLT, he was the Managing Director of Valuad U.S., a financial software and training company, and senior manager at A.T. Kearney, one of the world’s largest global management consulting firms. Mr. Welling also teaches executive education courses at The Wharton School of Business and is a frequent speaker at finance and investing conferences. He graduated from The Wharton School of the University of Pennsylvania where he currently serves as the Chairman of the school’s tennis program and as a member of the Wharton School’s Executive Education Board.

Engaged Capital believes that Mr. Welling’s senior executive experience as an investor, consultant, and investment banker at Credit Suisse advising senior executives and boards of directors in developing strategies that will increase the value of their companies along with his expertise in improving governance structures including developing executive compensation plans that align pay with performance, will enable him to provide effective oversight of the Company as a member of the Board.]

The principal business address of [Mr. Lockwood is c/o EnergySolutions, Inc., 423 West 300 South, Suite 200, Salt Lake City, Utah 84101. The principal business address of Mr. Rau is 18 Landmark Road, Westford, Massachusetts 01886. The principal business address of Mr. Vachon is 2020 Maltby Road, Ste 7, #119, Bothell, Washington 98021. The principal business address of Mr. Welling is c/o Engaged Capital, LLC, 610 Newport Center Drive, Suite 250, Newport Beach, California 92660.]

As of the date hereof, Messrs. [Lockwood, Rau and Vachon] do not directly or indirectly own any securities of the Company. Depending on market conditions and other factors, if elected, Messrs. [Lockwood, Rau and Vachon] intend to acquire shares of Common Stock. [Mr. Welling, by virtue of his relationship with Engaged Capital LLC as further explained elsewhere in this Proxy Statement, may be deemed the beneficial owner of the 549,900 shares of Common Stock owned in the aggregate by Engaged Capital Master I and Engaged Capital Master II.]

Each of the Nominees may be deemed to be a member of the Group (as defined below) for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each of the Nominees specifically disclaims beneficial ownership of shares of Common Stock that he does not directly own. For information regarding purchases and sales during the past two years by the Nominees and by the members of the Group of securities of the Company, see Schedule I.

The members of Engaged Capital have signed letter agreements pursuant to which they agree to indemnify Messrs. [Lockwood, Rau and Vachon] against claims arising from the solicitation of proxies from the Company stockholders in connection with the Annual Meeting and any related transactions.

The members of Engaged Capital and the Nominees are collectively referred to as the “Group” herein.

Other than as stated herein, there are no arrangements or understandings between members of Engaged Capital and any of the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed WHITE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under Rovi’s Amended and Restated Bylaws (the “Bylaws”) and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominees in accordance with the Company’s Bylaws and shares of Common Stock represented by the enclosed WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Engaged Capital that any attempt to increase the size of the current Board or to classify the Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 and is proposing that stockholders ratify such selection. The Company is submitting the selection of Ernst & Young LLP for ratification of the stockholders at the Annual Meeting.

As disclosed in the Company’s proxy statement, stockholder approval is not required to appoint Ernst & Young LLP as the Company’s independent registered public accounting firm, but the Company is submitting the selection of Ernst & Young LLP to stockholders for ratification as a matter of good corporate governance. If the stockholders do not ratify the selection, the selection might be reconsidered by the Audit Committee. Even if stockholders ratify the selection, the Audit Committee of the Board has the authority to change the Company’s independent registered public accounting firm at any time.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015 AND INTEND TO VOTE OUR SHARES [“FOR”] THIS PROPOSAL.

PROPOSAL NO. 3

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “Say-on-Pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the company’s proxy statement for the 2015 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the related compensation tables and the narrative disclosure to such tables.”

As disclosed in the Company’s proxy statement, the stockholder vote on the Say-on-Pay Proposal is an advisory vote only, and is not binding on the Company, the Board, or the Compensation Committee of the Board; however, the Compensation Committee of the Board may take into account the outcome of the vote in deciding future compensation decisions.

As discussed in further detail in the “Reasons for the Solicitation” section above we have serious concerns over the Company’s executive compensation practices.

WE RECOMMEND A VOTE [“AGAINST”] THIS SAY-ON-PAY PROPOSAL AND INTEND TO VOTE OUR SHARES [“AGAINST”] THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Stockholders are entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Engaged Capital believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, [FOR] the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015, and [AGAINST] the Say-on-Pay Proposal, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate seven candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect our three Nominees. To the extent that seven directors are up for election at the Annual Meeting, stockholders who vote on the enclosed WHITE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than [ ], [ ] and [ ]. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominees while also allowing stockholders to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our Nominees to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as a director if any or all of our Nominees are elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least 45,265,765 shares of Common Stock, which represents a majority of the 90,531,529 shares of Common Stock outstanding as of the Record Date, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under rules of The NASDAQ Stock Market, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on those proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a majority vote standard for non-contested elections and a plurality vote standard for contested director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, so the seven nominees for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Ratification of the Selection of Accounting Firm ─ According to the Company’s proxy statement, assuming that a quorum is present, the selection of Ernst & Young LLP will be deemed to have been ratified if the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting vote in favor of ratification. The Company has indicated that broker non-votes will have no effect on the ratification of the selection, but abstentions will act as a vote against ratification of the selection.

Advisory Vote on Executive Compensation ─ According to the Company’s proxy statement, although the vote is non-binding, assuming that a quorum is present, the advisory vote on executive compensation will be approved if the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting vote in favor of approval of the resolution. The Company has indicated that broker non-votes will have no effect on the approval of the resolution, but abstentions will act as a vote against approval of the resolution.

Under applicable Delaware law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your WHITE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Engaged Capital’s recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Engaged Capital in care of Morrow at the address set forth on the back cover of this Proxy Statement or to the Company at 2830 De La Cruz Boulevard, Santa Clara, California 95050 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Engaged Capital in care of Morrow at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, Morrow may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Engaged Capital. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Members of Engaged Capital have entered into an agreement with Morrow for solicitation and advisory services in connection with this solicitation, for which Morrow will receive a fee not to exceed $[____], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Morrow will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Engaged Capital has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Engaged Capital will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Morrow will employ approximately [____] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Engaged Capital. Costs of this solicitation of proxies are currently estimated to be approximately $[___________] (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). Engaged Capital estimates that through the date hereof its expenses in connection with this solicitation are approximately $[___________]. Engaged Capital intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. Engaged Capital does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The Nominees and the members of Engaged Capital are participants in this solicitation. The principal business of each of Engaged Capital Master I and Engaged Capital Master II is investing in securities. Each of Engaged Capital I and Engaged Capital Offshore is a private investment partnership that serves as a feeder fund of Engaged Capital Master I. Each of Engaged Capital II and Engaged Capital Offshore II is a private investment partnership that serves as a feeder fund of Engaged Capital Master II. Engaged Capital LLC is a registered investment advisor and serves as the investment advisor to each of Engaged Capital Master I, Engaged Capital Master II, Engaged Capital I, Engaged Capital Offshore, Engaged Capital II and Engaged Capital Offshore II. Engaged Holdings serves as the managing member of Engaged Capital LLC. Mr. Welling is the Founder and Chief Investment Officer of Engaged Capital LLC, the sole member of Engaged Holdings and a director of each of Engaged Capital Offshore and Engaged Capital Offshore II.

The address of the principal office of each of Engaged Capital Master I, Engaged Capital Master II, Engaged Capital Offshore and Engaged Capital Offshore II is c/o Codan Trust Company (Cayman) Ltd., Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman KY1-1111, Cayman Islands. The address of the principal office of each of Engaged Capital I, Engaged Capital II, Engaged Capital LLC, Engaged Holdings and Mr. Welling is 610 Newport Center Drive, Suite 250, Newport Beach, California 92660.

As of the date hereof, Engaged Capital Master I beneficially owned 207,172 shares of Common Stock. As of the date hereof, Engaged Capital Master II beneficially owned 342,728 shares of Common Stock. Engaged Capital I, as a feeder fund of Engaged Capital Master I, may be deemed the beneficial owner of the 207,172 shares of Common Stock beneficially owned by Engaged Capital Master I. Engaged Capital Offshore, as a feeder fund of Engaged Capital Master I, may be deemed the beneficial owner of the 207,172 shares of Common Stock beneficially owned by Engaged Capital Master I. Engaged Capital II, as a feeder fund of Engaged Capital Master II, may be deemed the beneficial owner of the 342,728 shares of Common Stock beneficially owned by Engaged Capital Master II. Engaged Capital Offshore II, as a feeder fund of Engaged Capital Master II, may be deemed the beneficial owner of the 342,728 shares of Common Stock beneficially owned by Engaged Capital Master II. Engaged Capital LLC, as the investment adviser to each of Engaged Capital Master I and Engaged Capital Master II, may be deemed to beneficially own the 549,900 shares of Common Stock owned in the aggregate by Engaged Capital Master I and Engaged Capital Master II. Engaged Holdings, as the managing member of Engaged Capital LLC, may be deemed to beneficially own the 549,900 shares of Common Stock owned in the aggregate by Engaged Capital Master I and Engaged Capital Master II. Mr. Welling, as the founder and chief investment officer of Engaged Capital LLC and the sole member of Engaged Holdings, may be deemed to beneficially own the 549,900 shares of Common Stock owned in the aggregate by Engaged Capital Master I and Engaged Capital Master II.

Each participant in this solicitation is a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act. The Group may be deemed to beneficially own the 549,900 shares of Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

The shares of Common Stock directly owned by each of Engaged Capital Master I and Engaged Capital Master II were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Engaged Capital is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Engaged Capital is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed WHITE proxy card will vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) must, in order to be included in the Company’s proxy statement and the form of proxy for the 2016 Annual Meeting, be delivered to the Company’s Corporate Secretary at 2830 De La Cruz Boulevard, Santa Clara, California 95050 by December 1, 2015.

Under the Bylaws, any stockholder intending to present any proposal (other than a proposal made by, or at the direction of, the Board) at the 2016 Annual Meeting, must give written notice of that proposal to the Company’s Secretary not less than 120 days prior to the first anniversary of the preceding year’s annual meeting (subject to certain exceptions if the annual meeting is advanced or delayed a certain number of days). Therefore, to be presented at the 2016 Annual Meeting, such a proposal must be given on or before January 14, 2016.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2016 Annual Meeting is based on information contained in the Company’s proxy statement and the Bylaws. The incorporation of this information in this proxy statement should not be construed as an admission by Engaged Capital that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

Engaged Capital Master Feeder I, LP

_________________, 2015

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

Shares of Common Stock Purchased / (Sold) | Date of Purchase / Sale |

ENGAGED CAPITAL MASTER FEEDER I, LP |

| | |

| 27,755 | 04/12/2013 |

| 65,673 | 04/15/2013 |

| 63,000 | 04/17/2013 |

| 26,430 | 04/18/2013 |

| 18,157 | 05/01/2013 |

| 11,667 | 06/03/2013 |

| 8,738 | 07/01/2013 |

| 4,200 | 08/01/2013 |

| 36,045 | 09/26/2013 |

| 69,296 | 09/27/2013 |

| 20,869 | 09/30/2013 |

| 36,435 | 10/08/2013 |

| 7,745 | 12/02/2013 |

| 40,617 | 12/05/2013 |

| 38,586 | 12/06/2013 |

| 40,300 | 12/09/2013 |

| 18,577 | 12/10/2013 |

| 10,127 | 12/30/2013 |

| 81 | 12/31/2013 |

| (212,921) | 01/01/2014 |

| 34,665 | 01/06/2014 |

| (2,000) | 03/04/2014 |

| (100) | 03/06/2014 |

| (2,500) | 03/07/2014 |

| (3,926) | 03/10/2014 |

| (3,800) | 03/11/2014 |

| (15,850) | 03/17/2014 |

| (13,600) | 03/18/2014 |

| (13,650) | 03/18/2014 |

| (15,150) | 03/18/2014 |

| (13,600) | 03/18/2014 |

| (13,811) | 03/19/2014 |

| 19,020 | 04/08/2014 |

| 14,850 | 04/08/2014 |

| 27,620 | 04/08/2014 |

| (47,350) | 05/19/2014 |

| (35,250) | 05/22/2014 |

| (4,153) | 05/29/2014 |

| (58,230) | 06/30/2014 |

| (10,475) | 08/06/2014 |

| 8,938 | 09/30/2014 |

| 3,128 | 09/30/2014 |

| 70 | 09/30/2014 |

| 5,363 | 09/30/2014 |

| 4,081 | 09/30/2014 |

| 4,469 | 09/30/2014 |

| 1,000 | 01/05/2015 |

| 15,489 | 01/05/2015 |

| 1,400 | 01/05/2015 |

| (967) | 01/12/2015 |

| (6,250) | 01/12/2015 |

| (6,336) | 01/13/2015 |

| (4,150) | 01/13/2015 |

| (3,300) | 01/13/2015 |

| (8,800) | 02/03/2015 |

| (2,050) | 02/04/2015 |

| 19,000 | 02/27/2015 |

| 2,100 | 03/02/2015 |

| ENGAGED CAPITAL MASTER FEEDER II, LP |

| | |

| 3,110 | 04/12/2013 |

| 7,362 | 04/15/2013 |

| 7,000 | 04/17/2013 |

| 2,790 | 04/18/2013 |

| 365 | 05/01/2013 |

| 2,009 | 06/03/2013 |

| 375 | 07/01/2013 |

| 2,042 | 08/01/2013 |

| 4,205 | 09/26/2013 |

| 7,800 | 09/27/2013 |

| 2,350 | 09/30/2013 |

| 4,000 | 10/08/2013 |

| 1,424 | 11/01/2013 |

| 1,991 | 12/02/2013 |

| 4,650 | 12/05/2013 |

| 4,500 | 12/06/2013 |

| 4,700 | 12/09/2013 |

| 2,200 | 12/10/2013 |

| 1,500 | 12/30/2013 |

| 19 | 12/31/2013 |

| 212,921 | 01/01/2014 |

| 28,781 | 01/06/2014 |

| (800) | 03/07/2014 |

| (2,974) | 03/10/2014 |

| (3,400) | 03/11/2014 |

| (14,750) | 03/17/2014 |

| (11,400) | 03/18/2014 |

| (12,750) | 03/18/2014 |

| (11,350) | 03/18/2014 |

| (11,400) | 03/18/2014 |

| (11,250) | 03/19/2014 |

| 12,490 | 04/08/2014 |

| 22,380 | 04/08/2014 |

| 15,980 | 04/08/2014 |

| (39,650) | 05/19/2014 |

| (29,750) | 05/22/2014 |

| (2,560) | 05/29/2014 |

| 5,051 | 09/30/2014 |

| 9,930 | 09/30/2014 |

| 6,637 | 09/30/2014 |

| 11,062 | 09/30/2014 |

| 5,531 | 09/30/2014 |

| 3,872 | 09/30/2014 |

| 14,000 | 01/05/2015 |

| 20,795 | 01/05/2015 |

| 13,600 | 01/05/2015 |

| 10,000 | 01/05/2015 |

| 1,587 | 01/06/2015 |

| (1,333) | 01/12/2015 |

| (8,750) | 01/12/2015 |

| (8,664) | 01/13/2015 |

| (5,850) | 01/13/2015 |

| (4,700) | 01/13/2015 |

| (12,900) | 02/03/2015 |

| (950) | 02/04/2015 |

| 75,800 | 02/27/2015 |

| 3,100 | 03/02/2015 |

SCHEDULE II

The following table is reprinted from the definitive proxy statement filed by Rovi Corporation with the Securities and Exchange Commission on [___], 2015.

IMPORTANT

Tell the Board what you think! Your vote is important. No matter how many shares of Common Stock you own, please give Engaged Capital your proxy FOR the election of the Nominees and in accordance with Engaged Capital’s recommendations on the other proposals on the agenda for the Annual Meeting by taking two steps:

| | ● | SIGNING the enclosed WHITE proxy card; |

| | ● | DATING the enclosed WHITE proxy card; and |

| | ● | MAILING the enclosed WHITE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |