Exhibit 99.2

December 7, 2016

Mr. Mark E. Speese

Chairman of the Board

Rent-A-Center, Inc.

5501 Headquarters Drive

Plano, Texas 75024

Dear Mark:

Thank you for taking the time to speak with me on Monday. Your candor in discussing both the opportunities and challenges to creating shareholder value at Rent-A-Center (“RCII” or “the Company”) was appreciated. As a follow up to our call, and given the abrupt departure of the Company’s Chief Financial Officer, I wanted to share with you and the rest of the Board our thoughts regarding actions the Board should consider to create shareholder value at RCII. As you know, together with its affiliates, Engaged Capital, LLC (“Engaged”) currently owns over 4% of the outstanding shares of the Company, making us a top five shareholder. I hope the Board finds our thoughts, as one of the Company’s largest shareholders, to be helpful as it deliberates the best path forward for the Company.

From our conversation it was clear we agree that RCII’s largest asset is perhaps its largest (public market) liability. The nature of the rent-to-own (“RTO”) transaction itself provides a unique and protective moat around the business compared to the significant secular pressures being felt by almost all areas of the retail sector. As I think you stated in our call, and to which we agree, the RTO industry is less vulnerable to being “Amazoned” given the role collections, both of cash and of merchandise, play in properly managing a RTO business. The defensible nature of the business is what initially attracted us to RCII and has proven true given the substantial cash the business will generate this year, despite woefully poor operating performance.

This strength of the business, however, is also its Achilles’ heel to public market investors. The RTO industry straddles both retail and consumer finance and therefore is largely misunderstood by investors. Issues of business complexity are further compounded by the (incorrect) impression that RTO businesses are predatory lenders, taking advantage of a financially-challenged customer by locking them into expensive obligations which perpetuates a “cycle-of-debt.” While we agree this is not the case, the unfortunate truth is that perception is reality, especially in the case of public market investors. We have a hard time believing that any RTO company can receive a fair public market valuation given the above issues.

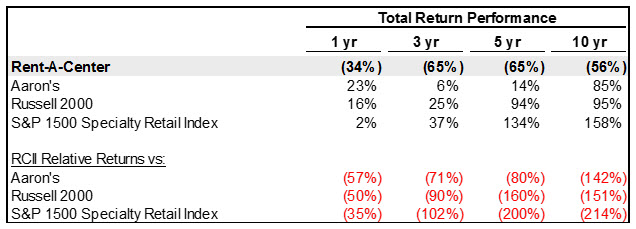

In the specific case of RCII, the Company finds itself not only fighting an uphill battle against false assumptions regarding the RTO industry, but additionally battling a number of self-inflicted issues that have helped to destroy significant shareholder value. In fact, over almost any time period over the last ten years, RCII has materially underperformed both its largest public peer and the relevant equity indices. Worse, on an absolute basis, RCII has destroyed half of its shareholders’ value over the last ten years.

RCII shareholders have suffered one self-inflicted setback after another, whether it be a failed international growth strategy in Mexico, the write-down of over $35 million in mobile phone inventory, hiccups in Acceptance Now growth and profitability, and, most recently, major problems with the Company’s internally developed Store Information Management System. Compounding the above issues was the $1.2 billion impairment charge taken by the Company at the end of 2015 which forced the annual dividend to be reduced from $0.96 per share to $0.32 per share and has effectively handcuffed any flexibility the Company had to drive value through capital allocation in the near future. Lacking any confidence in the Board or management to right the ship, it is no wonder that shareholders have run for the exits. From the Company’s October 11th preannouncement until now, over 115% of RCII’s outstanding shares have traded in the open market.

Shareholder frustration with RCII was further compounded this week by the departure of Guy Constant as CFO. The timing was very unusual given he presented to investors at the BofA Merrill Lynch Conference two days prior to his termination. We believe Guy was well respected by the investment community and added a much needed degree of credibility to RCII. His departure sends a very negative signal to the market about the Company’s commitment to stabilizing profitability and driving value for shareholders. The Board should take note of the stock’s reaction to this announcement as it is crystal clear from yesterday’s 10% decline in the Company’s valuation that shareholders viewed this as another material disappointment.

Given all that has happened to bring RCII to where it is today, I strongly believe the Company has reached a fork in the road. Status quo is simply unacceptable. We believe the Company has no choice but to execute a major turnaround – the question is whether to execute that in the public or private markets. Either path has the potential to create shareholder value, but we believe it is highly likely the private path generates a higher risk-adjusted return for all investors. As such, we believe you should immediately explore the opportunity to take the Company private at an appropriate premium to today’s share price. Given the capital structure of the Company, a rather minimal increase to enterprise value has a material impact on equity valuation. For example, based on yesterday’s closing price of $10.77, an acquisition price of $16/share would represent a 50% premium for shareholders yet only a 24% premium to the Company’s enterprise value. We are well aware of past interest in the Company and are highly confident that if the Board were to explore strategic alternatives for RCII, a number of qualified buyers would emerge. Therefore, we believe the Board has an opportunity to negotiate a sale of the Company that would provide a significant gain to equity investors from current levels. While a valuation in the mid-teens may seem low given the Company’s share price was above $20 in the not too distant past, the path to get back to that valuation level is highly uncertain given the Company’s operational failures, levered capital structure, and macro-economic headwinds. Further, over 100% of your shares have traded hands at prices between $9.00 and $12.00/share.

The alternative to attempting a turnaround in the private markets is to attempt the turnaround in the public markets – an option that we believe is far riskier. It would necessitate a significant reconstitution of the Board and major senior management change. The current board and management team have lost all credibility with investors. As a result, the only way to garner the patience needed from RCII’s public shareholders to stomach a multi-year turnaround effort would be under new leadership. We, at Engaged Capital, have years of experience shepherding such a process of transformation and are ready, if need be, to play such a role at RCII.

In the spirit of our initial call with you, we desire to maintain an open, constructive, and collaborative dialogue. As someone who currently sits on three public boards, I realize these boardroom deliberations are never easy. However, I think it is fair to say that RCII’s shareholders have borne the brunt of numerous failures in leadership over the past few years. As our fiduciaries, now is the time for the Board to take aggressive action on behalf of the Company’s shareholders to make the best of an otherwise challenging situation. I strongly suggest you immediately begin the search for a private market alternative.

As a follow up to this letter and with the goal of maintaining a private and constructive dialogue, I request a call with you and a subset of the Board to discuss these important matters further.

Best Regards,

Glenn W. Welling

| cc: | Robert D. Davis, Chief Executive Officer |

| Michael J. Gade, Director |

| Rishi Garg, Director |

| Jeffery M. Jackson, Director |

| J. V. Lentell, Director |

| Steven L. Pepper, Director |

| Leonard H. Roberts, Director |