UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

EVERTEC, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ý | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

| | | | | |

| Evertec, Inc. | |

| 2021 Proxy Statement and Notice of Annual Meeting of Stockholders | |

| May 27, 2021 | |

Dear Stockholder:

On behalf of the Board of Directors and officers of Evertec, Inc. (“we,” “us,” “Evertec” or the “Company”) we are pleased to hereby invite you to attend our 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on Thursday, May 27, 2021 at 9:00 a.m. Atlantic Standard Time. To support the health and well-being of our stockholders, we have adopted a completely virtual format and you will not be able to attend the Annual Meeting physically. At our virtual Annual Meeting, stockholders will be able to attend, vote their shares, and submit questions by visiting www.virtualshareholdermeeting.com/EVTC2021.

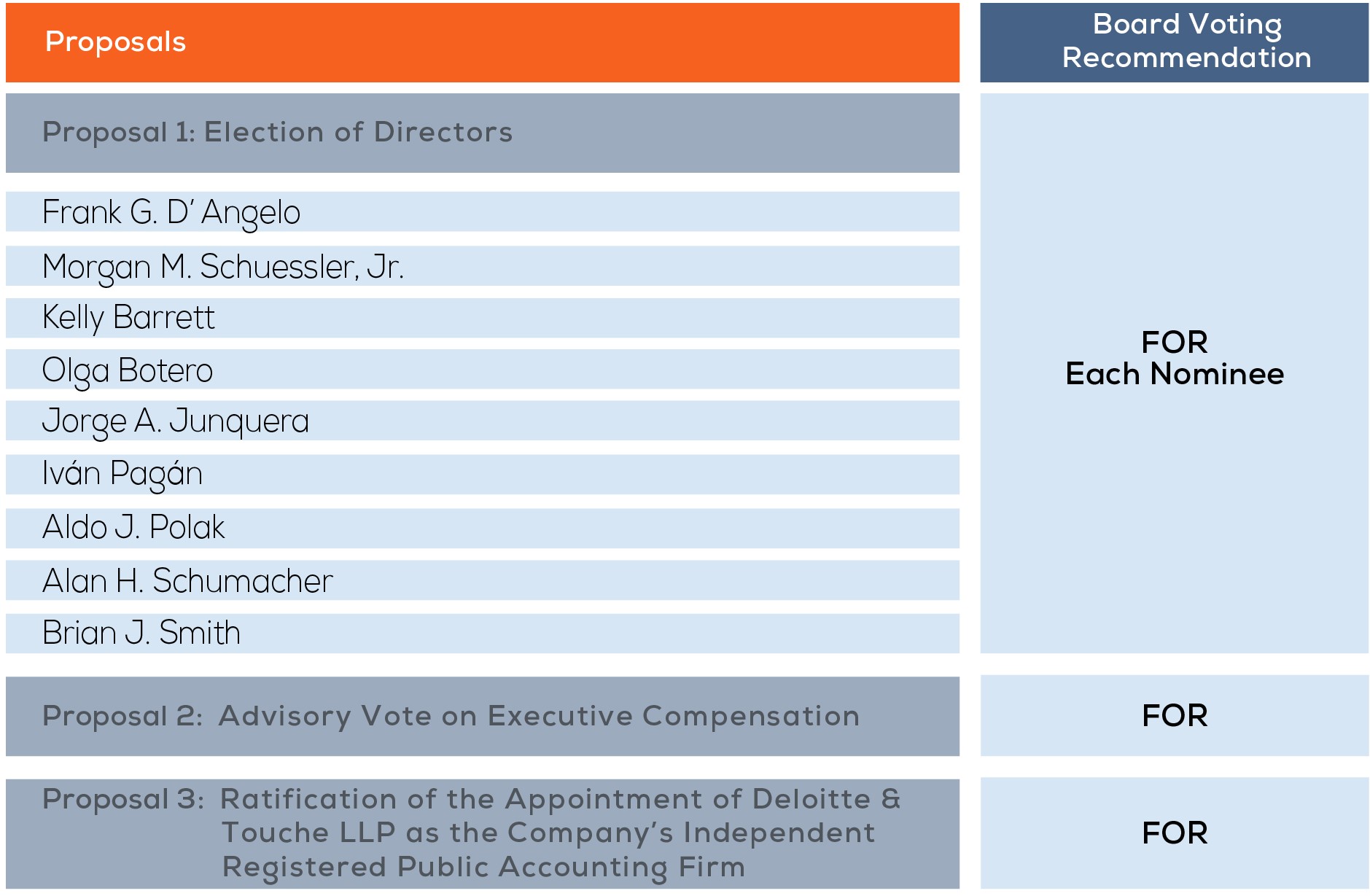

At the Annual Meeting, you will be asked to vote on three proposals described in detail in the accompanying notice of the Annual Meeting and Proxy Statement. The Proxy Statement also contains other information that you should read and consider before voting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting, please submit your proxy or voting instructions over the Internet, telephone, or by mail as soon as possible to ensure that your shares are represented at the Annual Meeting and your vote is properly recorded. If you decide to attend the Annual Meeting, you will be able to vote, even if you previously submitted your proxy.

If you have any questions concerning the Annual Meeting, and you are the shareholder of record of your shares, please contact our Investor Relations department at IR@evertecinc.com or (787) 773-5442. If your shares are held by a broker or other nominee, please contact your broker or other nominee for questions concerning the Annual Meeting.

Sincerely,

| | | | | |

| |

Frank G. D’Angelo

Chairman of the Board of Directors | Morgan M. Schuessler, Jr.

President and Chief Executive Officer |

NOTICE OF THE 2021 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| DATE AND TIME | Thursday, May 27, 2021 at 9:00 a.m. Atlantic Standard Time |

| |

| VIRTUAL MEETING ACCESS | To access the Annual Meeting, please visit:

www.virtualshareholdermeeting.com/EVTC2021 |

| |

| ITEMS OF BUSINESS | To address the following proposals to be voted on at the Annual Meeting: 1. Election of Directors; 2. Advisory Vote on Executive Compensation; and 3. Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm. Stockholders may also transact any other business that may be properly brought before the Annual Meeting or any adjournments or postponements thereof. |

| |

| RECORD DATE | Close of business on March 29, 2021 (the “Record Date”).

Only stockholders of record as of the Record Date are entitled to notice of, and to vote at the Annual Meeting or at any adjournments or postponements thereof. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING: The Company’s Proxy Statement and Annual Report are available at www.proxyvote.com. Your vote is important to us. Please exercise your stockholder right to vote.

By Order of the Board of Directors,

Luis A. Rodríguez

Executive Vice President, Chief Legal and Corporate Development Officer, and Secretary of the Board of Directors

TABLE OF CONTENTS

Evertec, Inc. - 2021 Proxy Statement i

PROXY SUMMARY

Introduction

Please read this Proxy Statement, and our Form 10-K, as amended by our Post-Effective Amendment No. 1 to Form 10-K filed on April 1, 2021, and Annual Report for the fiscal year ended on December 31, 2020 for complete information regarding the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), the proposals to be voted on at the Annual Meeting and our performance for the year ended on December 31, 2020. Except as otherwise indicated or unless the context requires otherwise, the terms “Evertec,” “we,” “us,” “our Company,” and “the Company” refer to Evertec, Inc. and its subsidiaries on a consolidated basis. The enclosed Proxy Statement and notice of the Annual Meeting was first mailed to stockholders on or about April 9, 2021. Annual Meeting Information

| | | | | | | | | | | | | | |

Date and Time: Thursday, May 27, 2021 9:00 a.m. (AST)

| | Virtual Meeting Access: www.virtualshareholdermeeting.com/EVTC2021 | | Record Date: March 29, 2021 |

Voting Proposals

Cast Your Vote

| | | | | | | | | | | | | | |

| | | | |

| At the Annual Meeting | Internet | QR Code | Phone | Mail |

Visit www.virtualshareholdermeeting.com/EVTC2021. You will need the 16-digit number included in your proxy card or notice. | Visit www.proxyvote.com. You will need the 16-digit number included in your proxy card or notice. | Scan this QR code with your phone to vote. You will need the 16-digit number included in your proxy card or notice. | Call 1-800-690-6903. You will need the 16-digit number included in your proxy card or notice. | Send your completed and signed proxy card to the address on your proxy card. |

Evertec, Inc. - 2021 Proxy Statement 1

EXECUTIVE SUMMARY

All amounts are approximates. For more information, please refer to our Annual Report on Form 10-K for the fiscal year ended on December 31, 2020, as amended by our Post-Effective Amendment No. 1 to Form 10-K filed on April 1, 2021. For purposes of this Proxy Statement, “Adjusted EBITDA” is not presented in accordance with accounting principles generally accepted in the United States of America (commonly known as “GAAP”). For further information on this and other non-GAAP measures used by management, please refer to the “2020 Performance Highlights” section under the “Compensation Discussion and Analysis” of this Proxy Statement. 2 Evertec, Inc. 2021 Proxy Statement

SUMMARY—DIRECTOR NOMINEES

For more information, see Proposal 1 of this Proxy Statement. The committee assignments delineated in the graphic above reflect the current committee memberships of our nominees, as recommended and ratified in February 2021 by the Company’s Nominating and Corporate Governance Committee and the Board, respectively. Ms. Kelly Barrett, our new director nominee, is not a member of the Board’s committees because she is not currently a director on the Board. Mr. Thomas W. Swidarski (not pictured) is currently a member of both the Nominating and Corporate Governance and Information Technology Committees. Upon the successful election of our slate of nominees during our Annual Meeting, the Board will re-evaluate the composition of its committees and accordingly assign Ms. Barrett to one or more of the Board’s committees.

CORPORATE GOVERNANCE HIGHLIGHTS

Evertec, Inc. 2021 Proxy Statement 3

RECENT ESG HIGHLIGHTS

RESULTS OF THE 2020 ADVISORY VOTE ON EXECUTIVE COMPENSATION

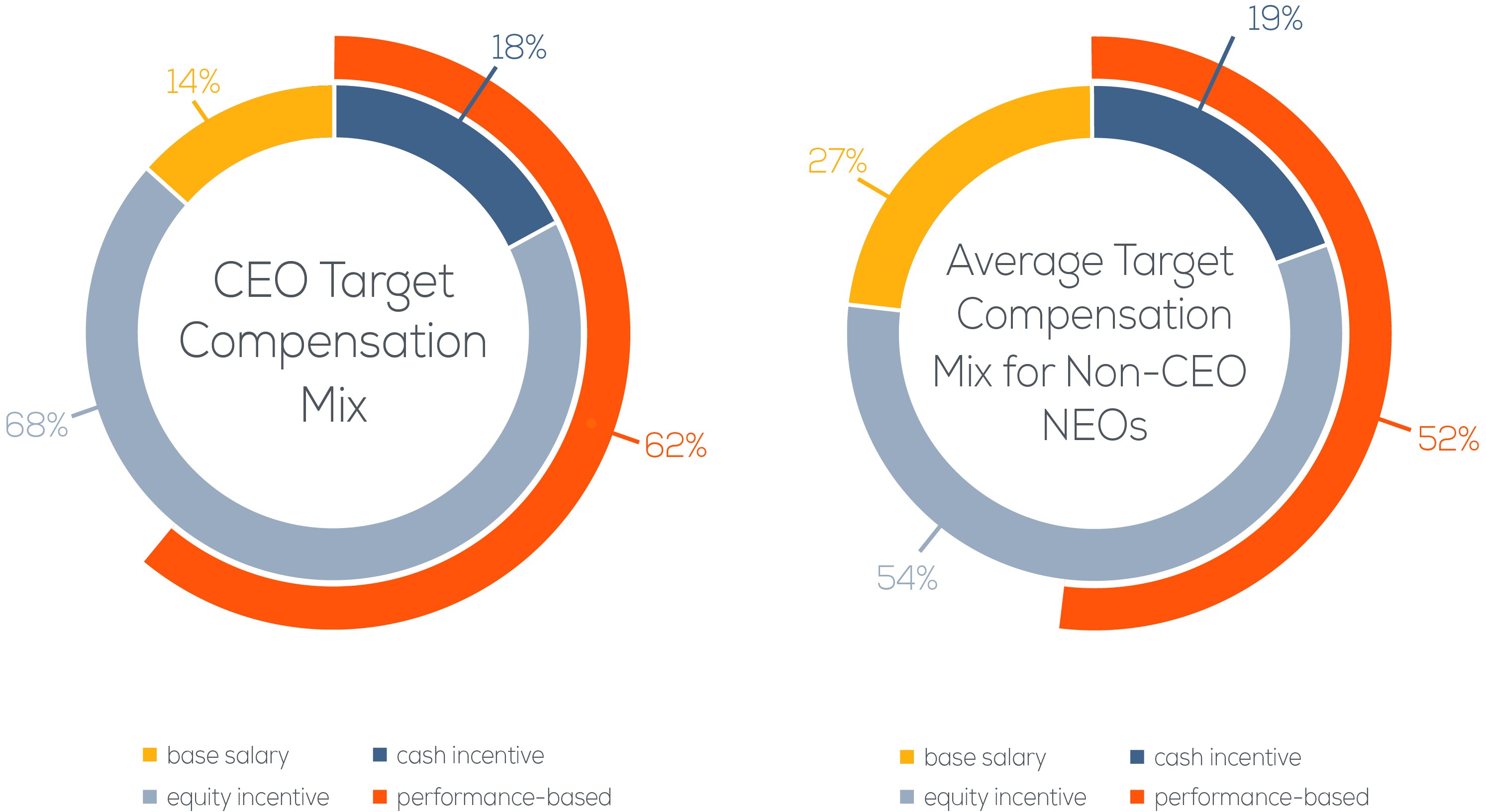

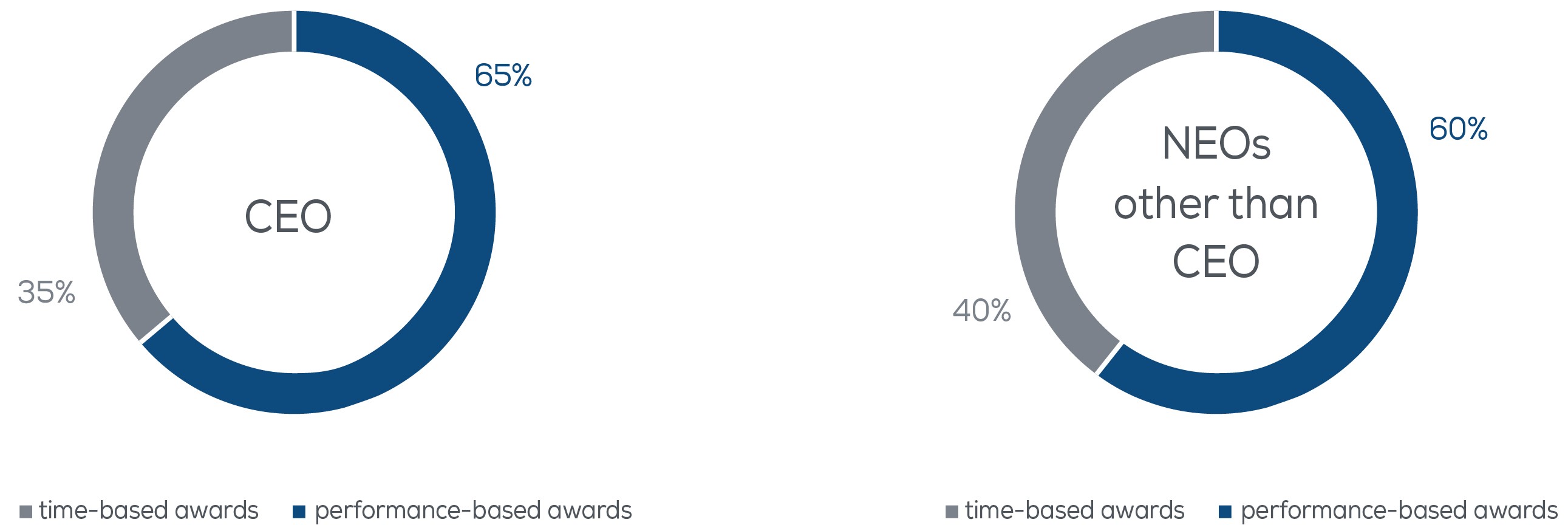

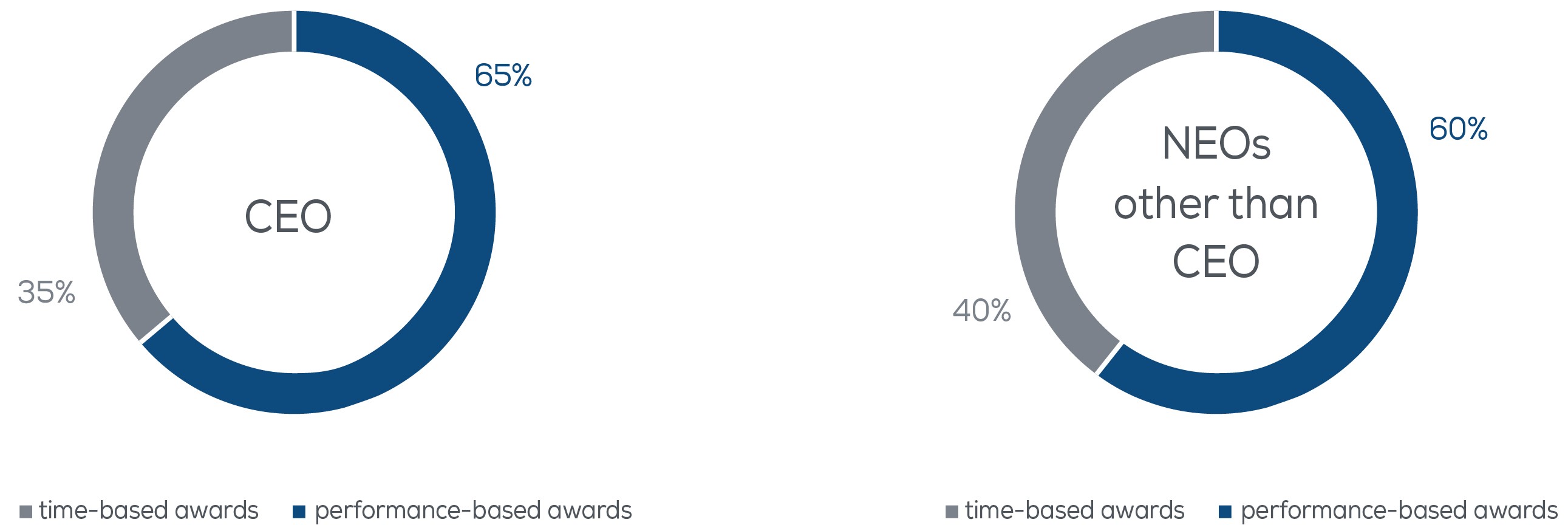

2020 EXECUTIVE TARGET COMPENSATION MIX

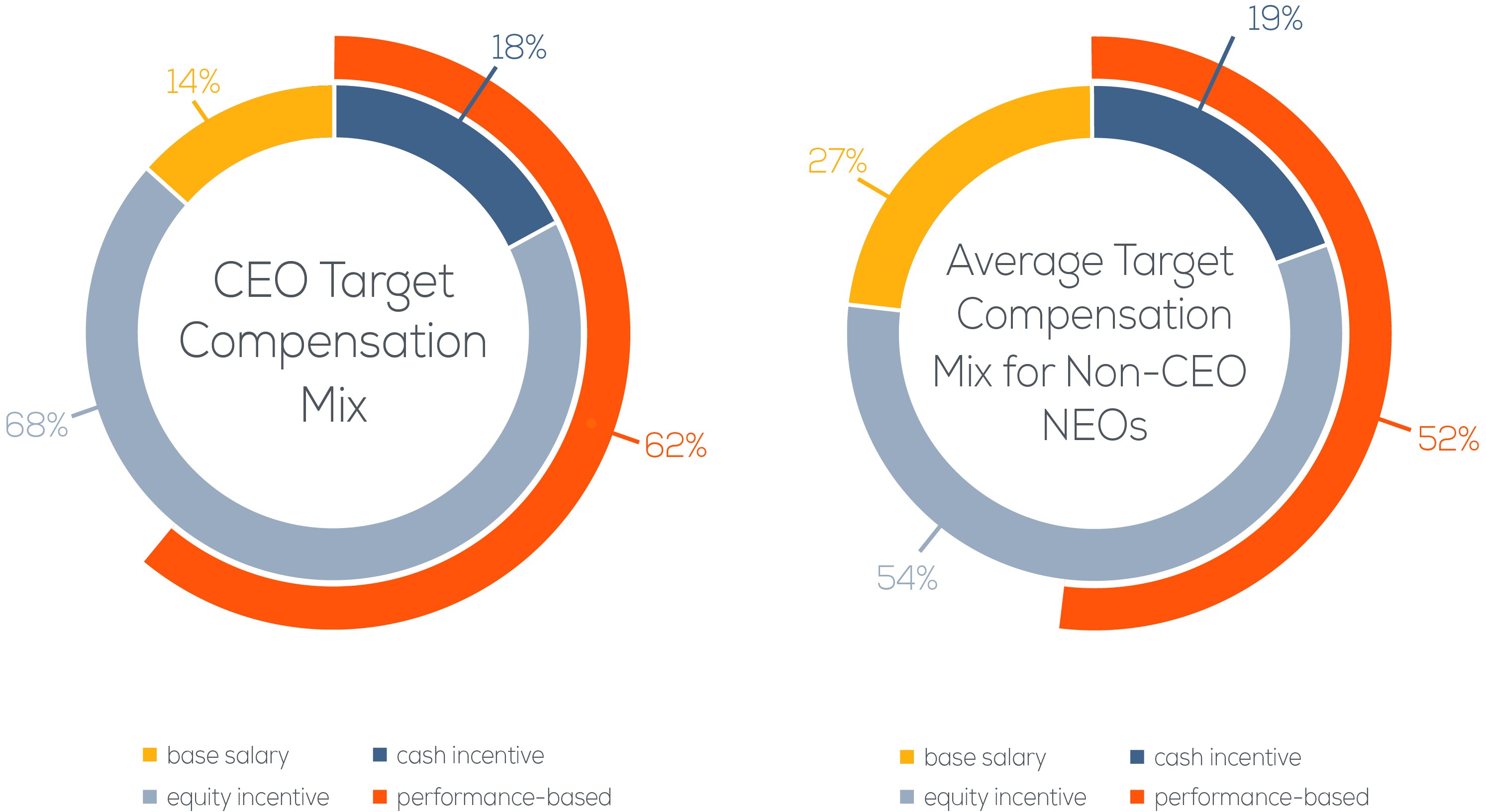

For more information, see the “Compensation Discussion and Analysis” section of this Proxy Statement. The charts below set forth the target compensation mix for our Chief Executive Officer (the “CEO”) and the average target compensation mix for the rest of our Named Executive Officers (“NEOs”) during 2020:

Evertec® and ATH® are trademarks of Evertec, Inc. or its subsidiaries in the United States of America and/or other countries. Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (“SEC”).

4 Evertec, Inc. 2021 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| | |

| Information About Director Nominees |

The individuals identified below have been nominated to stand for election for a term that expires at the Company’s 2022 annual meeting of stockholders. Each of these individuals has consented to be named as a nominee in this Proxy Statement and to serve as a director until the expiration of his or her respective term and until such nominee’s successor has been duly elected or qualified or until the earlier resignation or removal of such nominee.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| Age: 75 | Age: 50 | Age: 56 | Age:57 | Age:72 |

| | | | |

| | | | |

| | | | |

| Age: 62 | Age: 46 | Age: 74 | Age: 65 | |

| | | | |

| All ages are as of the Record Date. | |

Pursuant to the terms of our Stockholder Agreement by and among the Company, Popular, Inc. (“Popular”) and the other stockholder parties thereto, as amended (the “Stockholder Agreement”), and as described in more detail in the “Certain Relationships and Related Transactions” section of this Proxy Statement, Popular has re-nominated Messrs. Pagán and Polak as members of our Board of Directors (the “Board”).

The Nominating and Corporate Governance Committee of the Board has recommended Ms. Kelly Barrett join the Board. Except as described above, all other director nominees are currently on our Board. There are no family relationships between any current director, executive officer or director nominee.

Should any one or more of the nominees named in this Proxy Statement become unable to serve for any reason, the Board may designate substitute nominees, unless the Board by resolution provides for a lesser number of directors. In this event, the proxy holders will vote for the election of such substitute nominee or nominees. The following is a summary of each director nominee’s principal occupation, experience and qualifications:

Frank G. D’Angelo. Mr. D’Angelo has been Chairman of the Board since February 2014 and a director since September 2013. He currently serves as Operating Partner in Hill Path, a private equity partnership, and as a partner in Bridgeport Partners, a private investment firm. Mr. D'Angelo currently serves as an advisor to Trebia Acquisition Corp. a special purpose acquisition company. Until 2020, he served as Executive Vice President and President of NCR Banking. Mr. D’Angelo has over 40 years of experience in the financial services, digital banking and payments industries. He is a former chairman of the Electronic Funds Transfer Association, served on the Payments Advisory Council of the Federal Reserve Bank of Philadelphia, and served as a director for Walsh University (Ohio).

Evertec, Inc. 2021 Proxy Statement 5

Mr. D’Angelo’s experience in the financial services industry, as well as in operations and management, provides great value to our Board.

Morgan M. Schuessler, Jr. Mr. Schuessler has been a director and the Company’s President and Chief Executive Officer (“CEO”) since April 2015. Previously, he served as President of International for Global Payments, Inc., overseeing the company’s business outside of the Americas, spanning 23 countries throughout Europe and Asia. Mr. Schuessler currently serves on the Board of Directors of Endeavor Puerto Rico and the Dean’s Advisory Board of Emory University’s Goizueta Business School.

Mr. Schuessler has over 20 years of experience in the payments industry; accordingly, he thoroughly understands the Company’s core business and has developed management and oversight skills that allow him to make significant contributions to the Board.

Kelly Barrett. Prior to her retirement in 2018, Ms. Barrett was employed by The Home Depot for sixteen years, serving in various roles of increasing responsibility including most recently as Senior Vice President–Home Services where she ran the $5 billion Home Services division of The Home Depot, including in-home sales and installation, operations, customer contact centers as well as contractor sourcing, onboarding and compliance. She also held the positions of Vice President–Internal Audit and Corporate Compliance, Senior Vice President–Enterprise Program Management and Vice President–Corporate Controller. Before joining The Home Depot, Ms. Barrett served for more than 10 years in senior management positions and ultimately as Senior Vice President and Chief Financial Officer of Cousins Properties Incorporated, a publicly traded real estate investment trust. Ms. Barrett currently serves on the Board of Directors of Piedmont Office Realty Trust, a real estate investment trust, and also on the Board of Directors of Americold Realty and The Aaron’s Company, Inc., both since May 2019. She previously served on the Board of Directors of State Bank Financial Corporation from 2011 to 2016 and Aaron’s, Inc. and Aaron’s Holdings Company, Inc. from May 2019 to November 2020. Her leadership positions in the community include currently serving as Chair of the Board of the Metro Atlanta YMCA, the Georgia Tech Foundation Board of Trustees and a member of the Advisory Board of Scheller College of Business at Georgia Tech. She has previously served on the Board of the Girl Scouts of Greater Atlanta, Partnership Against Domestic Violence and the Atlanta Rotary Club.

Ms. Barrett’s substantial experience in leadership roles, strategy and enterprise risk management, coupled with service on several boards, will be of great service to the Company.

Olga Botero. Ms. Botero has been a director since September 2014. She is the founder and Managing Director of C&S Customer and Strategy, and has been a Senior Advisor to the Boston Consulting Group since 2011. She is the Co-Chair of the Women Corporate Directors Foundation Colombia Chapter, a fellow at the National Association of Corporate Directors’ (NACD) Board Leadership Fellow program, and an advisor to the Information Technology Committee of Banco Pichincha in Ecuador. She also serves as an independent director and member of the Audit and Risk Committee, Management Committee, and Human Resources Committee of each of ESVAL S.A. and ESSBIO S.A., which are both publicly traded water utilities companies in Chile. She served in the Information Technology Committee of Interbank in Perú until 2020.

Ms. Botero has over 25 years of experience in leadership roles in financial services, telecommunications and technology. Her experience, expertise in cybersecurity and technology, and knowledge of Latin American markets are an asset to the Company.

Jorge A. Junquera. Mr. Junquera has been a director since April 2012. He currently serves as Managing Partner at Kohly Capital, LLC, a private investment company. He has over 40 years of experience in the banking and financial services industries. Until his retirement in February 2015, Mr. Junquera was Vice Chairman of the Board of Directors of Popular. Prior to becoming Vice Chairman, he was the Chief Financial Officer of Popular and Supervisor of Popular’s Financial Management Group. He currently serves as a director for Sacred Heart University (PR) and Bluestone Community Development Fund.

Mr. Junquera’s substantial experience managing financial institutions and serving on various boards of directors provides him with unique expertise and valuable perspective to assist the Board.

6 Evertec, Inc. 2021 Proxy Statement

Iván Pagán. Mr. Pagán has been a director since May 2019. For over 25 years, he held various financial management and corporate development positions at Popular and Banco Popular de Puerto Rico. As Head of Corporate Development for 22 years, he managed mergers and acquisitions, divestitures, corporate reorganizations and strategic alliances for Popular, completing significant transactions in the United States, Latin America, Puerto Rico and the Caribbean. Mr. Pagán currently serves as a member of the Board of Directors of Banco BHD León, S.A. in the Dominican Republic.

Mr. Pagán’s substantial expertise in financial and M&A matters, experience in the Caribbean and Latin American markets, and knowledge of the Company’s operations are an asset to the Company.

Aldo J. Polak. Mr. Polak has been a director since May 2019. He currently serves as Managing Member at Ionos Capital Partners LLC, an investment firm. He is the former Chief Investment & Development Officer at Cisneros Group of Companies. Prior to Cisneros, he spent over 15 years as an investment banker in Wall Street, most recently heading the Latin America efforts at LionTree, a global investment and merchant banking firm. He currently serves as a director for LatinoU and Reaching U, and is also involved with Endeavor as a panelist and mentor to entrepreneurs.

Mr. Polak’s significant experience in M&A and corporate development, and his knowledge and contacts in Latin America provide great value to the Board.

Alan H. Schumacher. Mr. Schumacher has been a director since April 2013. For 23 years he worked at American National Can Corporation as well as at American National Can Group, where he served as Vice President, Controller and Chief Accounting Officer until 1997 and as Executive Vice President and Chief Financial Officer from 1997 until his retirement in 2000. He is a former member of the Federal Accounting Standards Advisory Board, and currently serves as a director of BlueLinx Holdings, Blue Bird Corporation, Warrior Met Coal, Albertsons Companies, Inc., and Pendrick Capital Partners LLC.

Mr. Schumacher has substantial expertise in accounting, reporting, audit and financial matters and, as such, is able to provide valuable contributions to our Board in its oversight functions.

Brian J. Smith. Mr. Smith has been a director since February 2016. Mr. Smith is currently the President and Chief Operating Officer of The Coca-Cola Company. He has also held other strategic and management roles since joining The Coca-Cola Company in 1997, including serving as Group President for its operations in Europe, Middle East & Africa and Latin America. Mr. Smith serves as a director for the Coca-Cola European Partners Board.

Like other members of the Board, Mr. Smith has substantial managerial experience in Latin America. His extensive expertise in management and corporate strategy makes him a valuable asset to the Company.

Evertec, Inc. 2021 Proxy Statement 7

CORPORATE GOVERNANCE

The Company’s business affairs are conducted under the direction of the Company’s Board in accordance with the Puerto Rico General Corporation Act of 2009, as amended, the Company’s charter (the “Charter”), and Amended and Restated By-Laws (the “By-Laws”). Members of the Board are informed of the Company’s business through discussions with management, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

Under the Company’s Charter, By-Laws and the Stockholder Agreement, the size of the Board is currently fixed at nine, with each director serving until the Company’s next annual meeting of stockholders and until their successors are duly elected and qualified. Below please find the current Board composition:

| | | | | | | | | | | | | | |

| | | | |

| Frank G. D'Angelo* | Morgan M. Schuessler, Jr. | Olga Botero* | Jorge A. Junquera* | Iván Pagán* |

| | | | |

| | | | |

| Aldo J. Polak* | Alan H. Schumacher* | Brian J. Smith* | Thomas W. Swidarski* | |

| *The Board has determined that this director is independent. |

Mr. Schuessler has been the management director since April 1, 2015. Pursuant to the Stockholder Agreement, Mr. Schuessler shall continue to be the management director for so long as he holds the office of CEO of Evertec, after which the individual holding the office of CEO of Evertec will become the management director.

For 2021 Popular has re-nominated Messrs. Pagán and Polak to be elected to serve as directors until the Company’s 2022 annual meeting of stockholders and until their successors are duly elected and qualified.

A majority of the directors of the Board must meet the criteria for independence established by the Board in accordance with the New York Stock Exchange (“NYSE”) general independence standards. The Board has determined that eight of the nine directors serving as of the Record Date (Ms. Botero, and Messrs. D’Angelo, Junquera, Pagán, Polak, Schumacher, Smith and Swidarski) are independent in accordance with NYSE rules.

| | | | | | | | |

| 8 of 9 directors are independent in compliance with NYSE rules | |

| |

| |

| |

| |

| |

| |

| |

8 Evertec, Inc. 2021 Proxy Statement

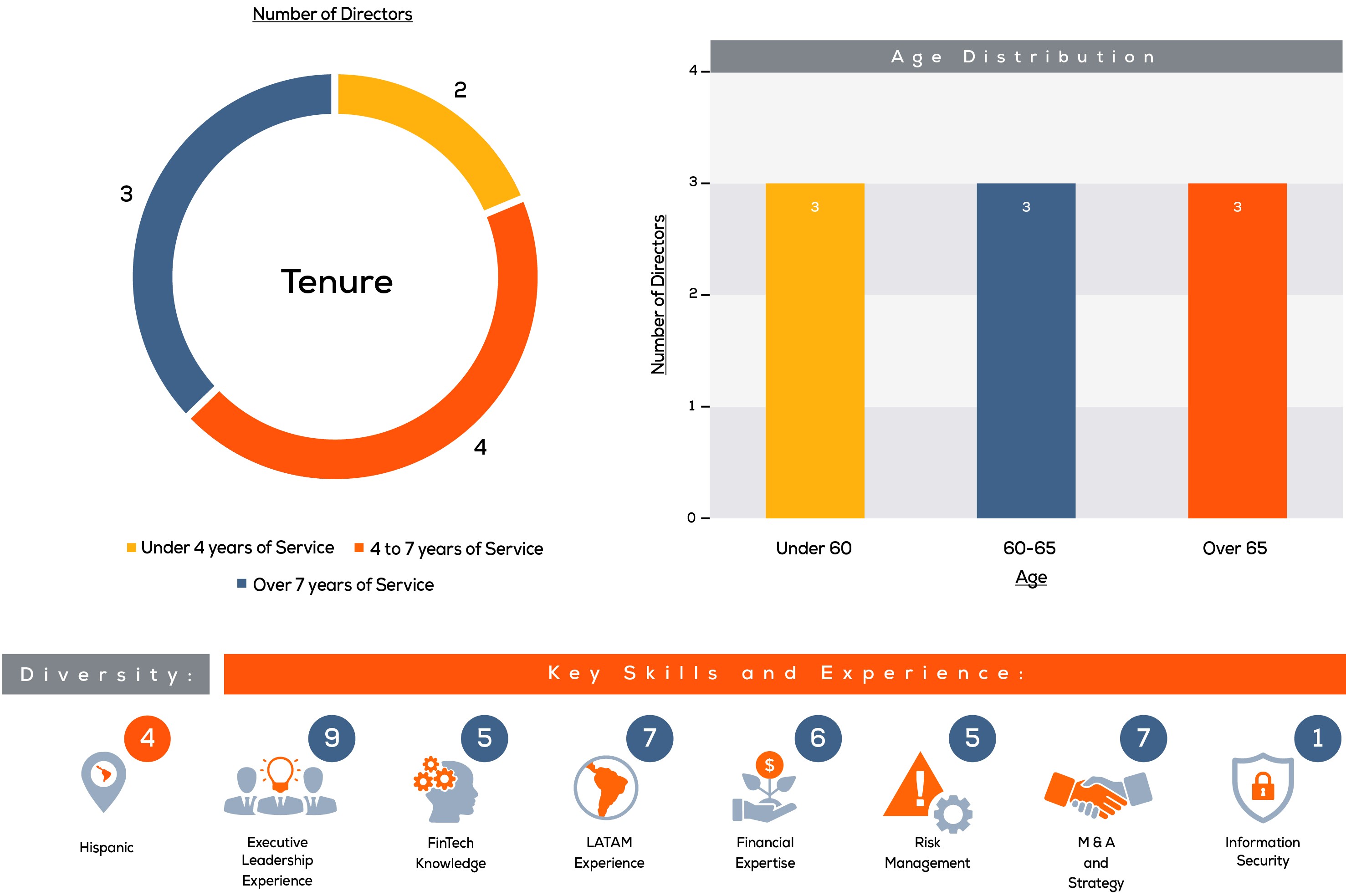

Below please find our current Board profile:

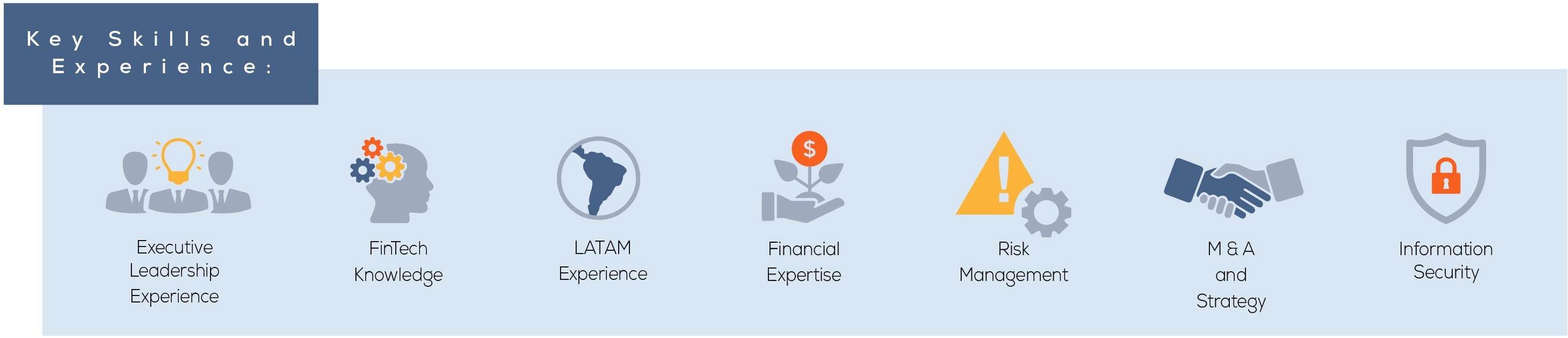

*If our slate of nominees is elected during the Annual Meeting, the profile of our Board will be modified as follows:

(a) Tenure: three directors with under 4 years of service, three directors with 4 to 7 years of service, and three directors with over 7 years of service; (b) Age Distribution: four directors under 60, two directors between the ages of 60 and 65, and three directors over 65; (c) Diversity: four Hispanic directors and two female directors; and (d) Skills and Experience: eight directors with executive leadership experience, five directors with FinTech knowledge, seven directors with experience in Latin America, seven directors with financial experience, six directors with risk management experience, eight directors with M&A and/or strategy experience, and one director with information security experience.

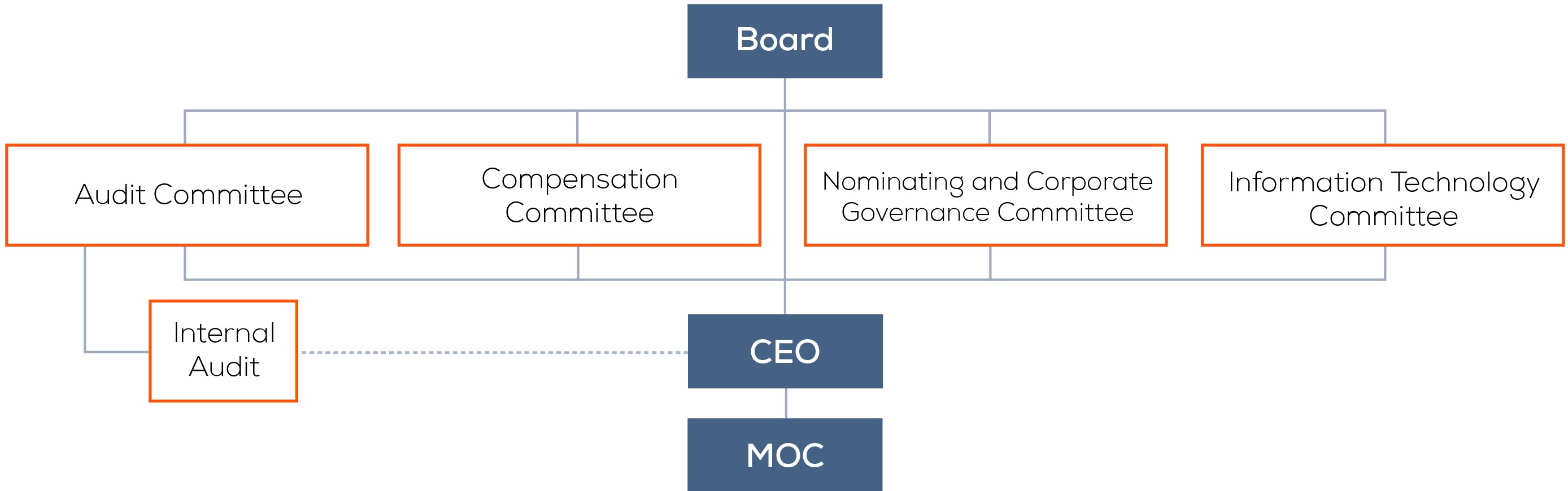

The Board has four standing committees:

Our By-Laws provide that our Board may establish one or more additional committees. As of the Record Date, the Board has not established any additional committees besides those described in this Proxy Statement. Popular has the right to representation on each committee of the Board in the same proportion as the number of directors, if any, nominated by Popular out of the total number of directors—for so long as Popular owns, together with its affiliates, at least 5% of our outstanding common stock.

Evertec, Inc. 2021 Proxy Statement 9

Each of our Board committees acts pursuant to a written charter (as amended and restated) adopted by the Board. You may find copies of each charter on the Company’s website at https://ir.evertecinc.com/govdocs. Below please find a description of each of the Board’s four standing committees:

| | | | | | | | |

| Audit Committee |

| | Responsibilities and Risk Oversight: |

| •overseeing: (i) our financial reporting process with respect to the integrity of our financial statements and our internal controls over financial reporting, (iii) the performance of our internal audit function, (iii) our management policies regarding risk assessment and management, and (iv) our compliance with laws and regulations

•discussing with management and the Company’s independent registered public accounting firm the Company’s major financial and control-related risk exposures, and steps that management has taken to monitor and control such exposures

•reviewing the overall implementation of the Company’s Enterprise Risk Management (“ERM”) framework and program, which includes (i) ensuring the placement of controls needed to establish a strong internal control environment, and receiving periodic status reports on management’s ERM progress, and (ii) overseeing the Company’s risk exposure, and validating management’s active role in assessing, managing and mitigating risks

•establishing procedures for handling complaints regarding accounting or auditing matters |

|

|

| Alan Schumacher (Chairperson) | |

| Olga Botero | |

| Jorge A. Junquera | |

| Iván Pagán | |

| |

•Met 13 times during 2020

•Must consist of at least 3 board members (including a chairperson) who must meet at least 4 times a year, including once every fiscal quarter

•All members are “independent” under SEC and NYSE rules

•All members are “financial literate” under NYSE rules

•Each of Messrs. Schumacher, Junquera and Pagán is considered a “financial expert” under SEC rules | |

| | | | | | | | |

| Compensation Committee |

| | Responsibilities and Risk Oversight: |

| •reviewing and recommending policy relating to the compensation and benefits of our officers, directors and employees, including reviewing and approving corporate goals and objectives relevant to the compensation of the CEO and other senior officers

•evaluating the performance of senior officers in light of the Company’s goals and objectives, and reviewing and approving the compensation of senior officers based on such evaluations

•producing a report on executive officer compensation as required by the SEC, which is included in this Proxy Statement

•overseeing risks related to the Company’s cash and equity-based compensation programs and practices

•overseeing succession planning for the CEO and senior management

|

|

|

| Frank G. D'Angelo (Chairperson) | |

| Jorge A. Junquera | |

| Aldo J. Polak | |

| Brian J. Smith | |

| |

•Met 5 times during 2020

•Must consist of at least 3 board members (including a chairperson) who must meet at least once a year

•Each member is a non-employee independent director | |

10 Evertec, Inc. 2021 Proxy Statement

| | | | | | | | |

| Nominating and Corporate Governance Committee |

| | Responsibilities and Risk Oversight: |

| •evaluating the composition of the Board, its committees and planning for Board member succession

•assisting the Board in identifying individuals qualified to serve as members of the Board and recommending to the Board the director nominees for the next annual meeting of stockholders

•leading the Board in its review of the performance of the Board and its committees

•overseeing management initiatives related to environmental, social and governance (“ESG”) matters

•reviewing and recommending to the Board a set of corporate governance guidelines

•overseeing risks related to the composition and structure of the Board and its committees and the Company's corporate governance practices |

|

|

| Brian J. Smith (Chairperson) | |

| Aldo J. Polak | |

| Alan H. Schumacher | |

| Thomas W. Swidarski | |

| |

•Met once during 2020

•Must consist of at least 3 board members (including a chairperson) who must meet at least once a year

•Each member is a non-employee independent director | |

| | | | | | | | |

| Information Technology Committee |

| | Responsibilities and Risk Oversight: |

| •assisting the Board in overseeing the integrity of the Company’s information and technology systems, information technology (“IT”) systems, IT-related risks, IT security and cybersecurity, and IT infrastructure and strategy

•advising and making recommendations to the Board regarding the state of the Company’s cybersecurity preparedness, and reviewing the threat landscape facing the Company

•reviewing and reassessing the adequacy of the Company’s IT program, policies and procedures and recommending proposed changes to the Board for approval, if required

•overseeing the Company’s internal IT Governance Committee

•monitoring and evaluating the effectiveness of the Company’s IT security and cybersecurity protocols, including IT disaster recover capabilities |

|

|

| Olga Botero (Chairperson) | |

| Frank G. D'Angelo | |

| Iván Pagán | |

| Thomas W. Swidarski | |

| |

•Met 4 times during 2020

•Must consist of at least 3 board members (including a chairperson) who must meet at least twice a year | |

Under the Company’s Charter, By-Laws and the Stockholder Agreement, the size of the Board is currently fixed at nine. The Stockholder Agreement grants Popular director nominee rights and it provides that, unless otherwise prohibited by applicable law, regulation or the NYSE rules (including the independence requirements described above), Popular has the right to representation on each committee of the Board in the same proportion as the number of directors, if any, nominated by Popular out of the total number of directors—for so long as Popular owns, together with its affiliates, at least 5% of our outstanding common stock.

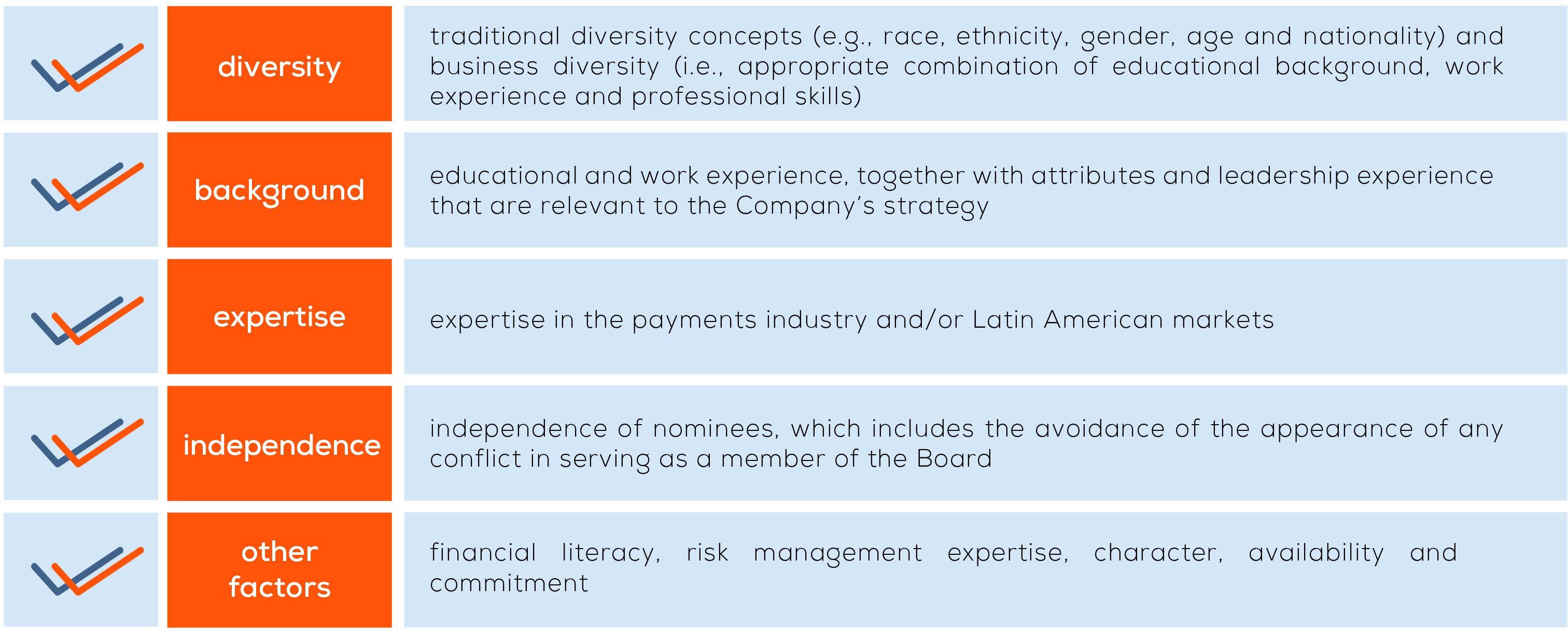

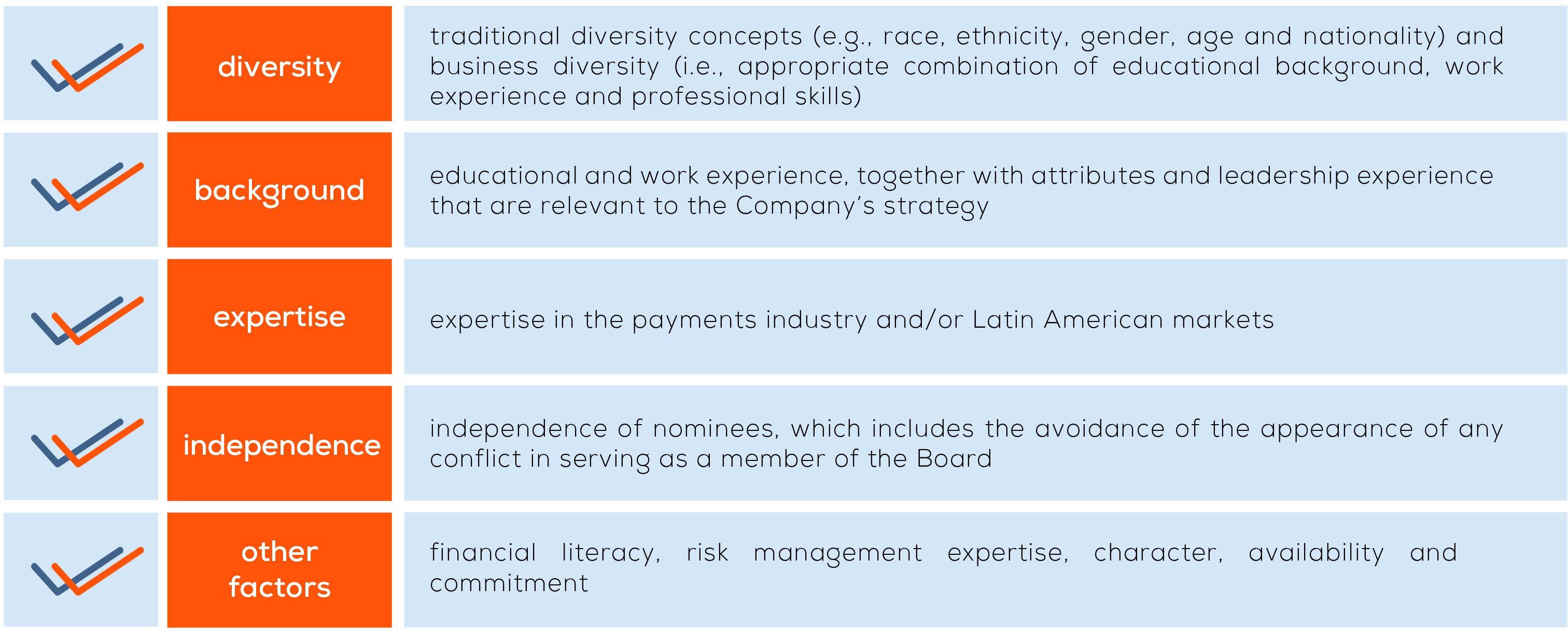

In making its recommendations of nominees to the Board, the Nominating and Corporate Governance Committee identifies candidates who meet the current challenges and needs of the Board. The Nominating and Corporate Governance Committee considers the following factors when determining whether a person is a suitable candidate for nomination for election to the Board: (i) diversity, (ii) background, (iii) expertise, (iv) independence, and (v) other factors.

Evertec, Inc. 2021 Proxy Statement 11

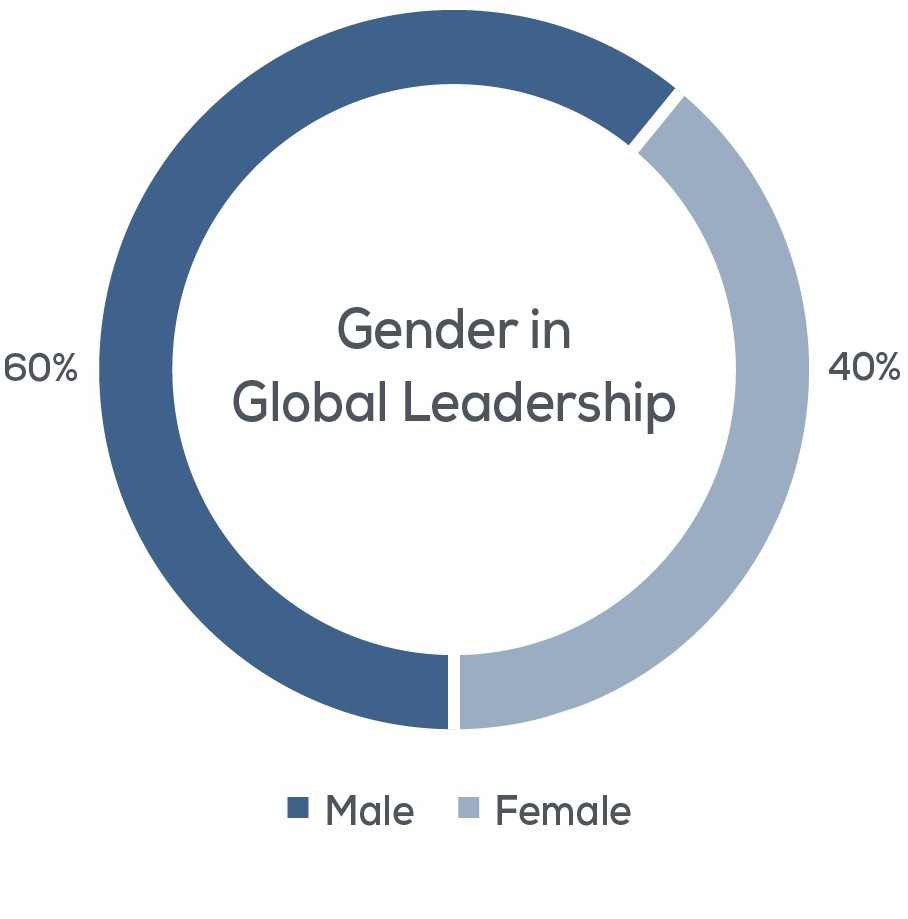

The Board believes that diversity is key to our success. As discussed above, the Nominating and Corporate Governance Committee considers diversity, among other factors such as expertise, professional background, independence and other appropriate qualities, in determining whether a person is a suitable candidate for nomination for election to our Board. Pursuant to our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee not only considers traditional demographical diversity concepts (e.g., race, ethnicity, gender, age and nationality) but also diversity of work experiences, academic backgrounds, skills and viewpoints. Our Board currently has one female director, and four of its directors identify as Hispanic; the slate of nominees for the Annual Meeting includes two female and four Hispanic director nominees. For further discussion of our diversity efforts, please refer to the “Environmental, Social and Governance (ESG) Matters” section under the “Compensation Discussion and Analysis” of this Proxy Statement.

The Nominating and Corporate Governance Committee and the Board will evaluate recommendations for director nominees submitted by directors, management, professional search firms or stockholders in the same manner, using the criteria stated above. All director nominees must submit a completed form of directors’ and officers’ questionnaire, as well as a completed questionnaire to determine independence, financial literacy, risk management experience, and any possible conflict of interest in relation to the Company or its business as part of the nominating process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating and Corporate Governance Committee or the Board.

In accordance with the Stockholder Agreement, if there are any vacancies on our Board, then a committee consisting of our entire Board (other than any directors who are to be replaced because Popular has lost the right to nominate them) has the right to nominate the individuals to fill such vacancies, which nominees must be reasonably acceptable to Popular for so long as it owns, together with its affiliates, at least 5% of our outstanding common stock. To maintain flexibility to nominate, appoint or retain qualified Board members, regardless of age, Evertec does not have an age limit for directors nor a mandatory retirement policy. Our Corporate Governance Guidelines are available on our website at https://ir.evertecinc.com/govdocs.

| | |

| Board Leadership Structure |

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. In furtherance of that objective, the Board has separated the positions of Chairman and CEO, subject to any temporary combination of those roles in connection with a CEO transition. The Board believes that a separation of the positions is in the best interests of the Company as it allows the Board to properly ensure that our businesses and risks are properly and effectively managed.

Board and committee processes and procedures, including regular executive sessions of non-management directors and a regular review of the Company’s and our executive officers’ performance, provide substantial independent oversight of our management’s performance.

The Board has the ability to change its structure, subject to any limitations under the Stockholder Agreement, should it deem a restructuring of the Board to be appropriate and in the best interests of the Company and its stockholders.

12 Evertec, Inc. 2021 Proxy Statement

In the event a non-independent director serves as Chairperson of the Board, as per the Company’s Corporate Governance Guidelines, the Board will appoint a lead independent director to serve as the liaison between the Chairperson and the independent and non-employee directors. For more information about our Corporate Governance Guidelines, please visit our website at https://ir.evertecinc.com/govdocs.

As an independent Chairman of the Board, Mr. D’Angelo leads the activities of the Board. As part of his duties and responsibilities, Mr. D’Angelo is charged with, among other matters: (i) convening and presiding over all Board meetings, (ii) setting the agenda for the Board, in conjunction with the CEO and the Secretary of the Board, (iii) advising the CEO on Company strategy, and (iv) acting as liaison between non-management directors and management of the Company.

The Board’s Independent Director Compensation Policy (the “Director Compensation Policy”) has been designed to ensure that the Company attracts, retains and compensates skilled and experienced directors to serve on the Board. It is our Board’s policy that only non-employee directors who qualify as independent directors (as such determination is made by the Board in accordance with Section 303A.01 of the NYSE rules for listed companies) are eligible to receive compensation for their services. Pursuant to the Director Compensation Policy, our independent directors are compensated as follows:

| | | | | | | | | | | | | | |

| Annual Retainers | Chair | Member |

Board Retainer: Cash + Equity Compensation | $ | 297,500 | | (1) | $ | 207,500 | | (2) |

Committee Retainers (in addition to Board compensation):(3) | | | | |

| Audit Committee | $ | 25,000 | | | $ | 12,500 | | |

| Compensation Committee | $ | 20,000 | | | $ | 10,000 | | |

| Nominating and Corporate Governance Committee | $ | 10,000 | | | $ | 5,000 | | |

| Information Technology Committee | $ | 10,000 | | | $ | 5,000 | | |

(1)Includes $127,500 paid in cash and $170,000 paid in equity, which represents approximately 43% and 52% of the total Board chair retainer, respectively.

(2)Includes $82,500 paid in cash and $125,000 paid in equity, which represents 40% and 60% of the total member Board retainer, respectively.

(3)All committee retainers are paid in cash.

Pursuant to the Director Compensation Policy, each independent director may elect to receive all or a portion of his or her Board cash retainer as equity compensation. Furthermore, independent directors shall be paid a per-meeting cash fee of $1,500 if the number of meetings in a service year (i.e., as measured from one annual meeting of stockholders to the next) exceeds the established threshold number of meetings. During 2020 the Company did not pay any per-meeting fees. The threshold number of meetings after which the $1,500 per-meeting cash fee would apply are set forth in the table below; in each case (i) per service year and (ii) regardless of whether the meetings are in person or via teleconference.

| | | | | |

| Board and Committee | Threshold Number of Meetings |

| Board | 14 |

| Audit Committee | 14 |

| Compensation Committee | 10 |

| Nominating and Corporate Governance Committee | 8 |

| Information Technology Committee | 8 |

In accordance with the above compensation structure, the Company granted restricted stock units (“RSUs”) to the non-management independent directors, with vesting of the RSUs occurring on May 31, 2021. If a non-management independent director is appointed to the Board other than as a result of election or reelection at the Company’s annual meeting of stockholders, his or her award of RSUs will be made as soon as practicable following such appointment. Other restrictions may apply; for more details, please refer to the “Stock Ownership Guidelines” section under the “Compensation Discussion and Analysis” of this Proxy Statement.

Evertec, Inc. 2021 Proxy Statement 13

The following table shows the compensation earned by our non-employee directors for their services in 2020:

| | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total

($) |

| Frank G. D’Angelo | 152,500 | 149,444 | 301,944 |

| Olga Botero | 105,000 | 111,442 | 216,442 |

| Jorge A. Junquera | 105,000 | 111,442 | 216,442 |

| Iván Pagán | 100,000 | 111,442 | 211,442 |

| Aldo J. Polak | 97,500 | 111,442 | 208,942 |

| Alan H. Schumacher | 112,500 | 111,442 | 223,942 |

| Brian J. Smith | 102,500 | 111,442 | 213,942 |

| Thomas W. Swidarski | 92,500 | 111,442 | 203,942 |

(1)Includes the annual retainer amounts earned during 2020 pursuant to the Director Compensation Policy.

(2)Includes grants of RSUs pursuant to the Director Compensation Policy. The grant date fair value for awards granted to all directors was $29.35 per share. For further discussion about share-based compensation, refer to Note 16 of the Audited Consolidated Financial Statements included in the Company’s Annual Report. The number of outstanding RSUs held by our non-employee directors as of December 31, 2020 was as follows:

| | | | | |

| Name | Grant Date: June 1, 2020

RSUs

(#) |

| Frank G. D’Angelo | 5,792 |

| Olga Botero | 4,258 |

| Jorge A. Junquera | 4,258 |

| Iván Pagán | 4,258 |

| Aldo J. Polak | 4,258 |

| Alan H. Schumacher | 4,258 |

| Brian J. Smith | 4,258 |

| Thomas W. Swidarski | 4,258 |

| | |

| Director Attendance Matters |

The Board’s operation and responsibilities are governed by the Charter, the By-Laws, the charters for the Board’s standing committees, Puerto Rico law and the Stockholder Agreement.

The Company does not have a formal policy with regards to Board member attendance at the Company’s annual meetings of stockholders. All directors are encouraged to attend each annual meeting of stockholders to provide our stockholders with an opportunity to communicate with directors about issues affecting the Company; however, attendance is not mandatory. As required by the Company’s By-Laws, the Board meets immediately after the Company’s annual meeting of stockholders.

Last year, due to the COVID-19 pandemic, none of our directors standing for election at the Company’s 2020 annual meeting of stockholders were able to attend the meeting.

The Board met 15 times during 2020. None of our directors attended less than 90% of their Board and respective committee meetings. Each director’s attendance percentage for meetings of the Board and the committees on which he or she served during 2020 is listed below:

| | | | | |

| Director | Attendance Percentage |

| Frank G. D’Angelo | 96% |

| Morgan M. Schuessler | 100% |

| Olga Botero | 100% |

| Jorge A. Junquera | 100% |

| Iván Pagán | 100% |

| Aldo J. Polak | 100% |

| Alan H. Schumacher | 100% |

| Brian J. Smith | 90% |

| Thomas W. Swidarski | 95% |

14 Evertec, Inc. 2021 Proxy Statement

| | |

| Board and Committee Evaluations |

Each year, the Nominating and Corporate Governance Committee and the Board conduct a self-assessment to determine whether the Board and its committees are functioning effectively. The self-assessment requires each director to answer a questionnaire containing a series of statements that are designed to obtain the director’s opinions and comments regarding the performance of the Board and each committee. To ensure absolute confidentiality during this process, the questionnaires are submitted on an anonymous basis. The results of the assessment, which ultimately help enhance the Board enhance its overall effectiveness, are reviewed by the Nominating and Corporate Governance Committee and presented to the Board and each of its committees for discussion.

| | |

| Indemnification of Directors and Officers |

The Charter and By-Laws generally eliminate the personal liability of each of our directors for breaches of fiduciary duty as a director and indemnify directors and officers as described herein. Our Charter and By-Laws limit the liability of our directors to the maximum extent permitted by Puerto Rico law. However, if Puerto Rico law is amended to authorize corporate action further limiting or eliminating the personal liability of directors, then the liability of our directors will be limited or eliminated to the fullest extent permitted by Puerto Rico law, as so amended.

Our Charter and By-Laws provide that we will, from time to time, to the fullest extent permitted by law, indemnify our directors and officers against all liabilities and expenses in any suit or proceeding, arising out of their status as an officer or director or their activities in these capacities. We will also indemnify any person who, at our request, is or was serving as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, and is involved in a suit or proceeding arising out of such position.

We may, by action of our Board, provide indemnification to our employees and agents within the same scope and effect as the foregoing indemnification of directors and officers. The right to be indemnified includes the right of an officer or a director to be paid expenses, including, without limitation, attorneys’ fees, in advance of the final disposition of any proceeding, provided that, if required by law, we receive an undertaking (from the relevant officer or director) to repay such expenses if it is determined that such officer or director is not entitled to be indemnified.

Our Board may take certain action it deems necessary to carry out these indemnification provisions, including purchasing insurance policies. Neither the amendment nor the repeal of these indemnification provisions, nor the adoption of any provision of our Charter and By-Laws inconsistent with these indemnification provisions, will eliminate, reduce or adversely affect any rights to indemnification relating to such person’s status or any activities prior to such amendment, repeal or adoption.

Our By-Laws provide that we may maintain insurance covering certain liabilities of our officers, directors, employees and agents, whether or not we would have the power or would be required under Puerto Rico law to indemnify them against such liabilities. We maintain a directors’ and officers’ liability insurance policy (the “D&O Liability Insurance”) for the protection of our directors and certain of our officers.

We have entered into separate indemnification agreements with each of our directors in connection with his or her appointment to the Board. These indemnification agreements will require us to, among other things, indemnify our directors against liabilities that may arise by reason of their status or service as directors. We believe these provisions will assist in attracting and retaining qualified individuals to serve as directors and officers. These indemnification agreements also require us to advance any expenses incurred by the directors as a result of any proceeding against them as to which they could be indemnified and to use reasonable efforts to cause our directors to be covered by our D&O Liability Insurance policy. A director is not entitled to indemnification by us under such agreements if (i) the director did not act in good faith and in a manner he or she deemed to be reasonable and consistent with, and not opposed to, our best interests or (ii) with respect to any criminal action or proceeding, the director had reasonable cause to believe his or her conduct was unlawful.

To the best of our knowledge, currently there is no pending litigation or proceeding involving any of our directors or officers in which indemnification by us is sought, nor are we aware of any threatened litigation or proceeding that may result in such a claim for indemnification.

Evertec, Inc. 2021 Proxy Statement 15

The Company has in place an Enterprise Risk Management Policy (the “ERM Policy”), the overall purpose and scope of which is the execution of risk management processes that provide for risk and exposure monitoring, the embedding or integration of risk management into all activities as an integral part of the Company’s business activities, and the development of comprehensive internal controls and assurance processes linked to key risks. As a result, the Company continuously implements risk management processes that ensure the Company complies with existing regulatory and industry standards, thereby protecting the value of the Evertec brand and reputation by applying a disciplined approach to risk management, governance and internal controls.

Our Board is involved in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management by the Board and its committees. Among other areas, the Board is directly involved in overseeing risks related to the Company’s overall strategy, including product, go-to-market and sales strategy, executive officer succession, business continuity, crisis preparedness, cybersecurity, and corporate reputational risks. In addition, the Company, under the supervision of the Audit Committee, has established procedures available to all employees for the anonymous and confidential submission of complaints or concerns relating to any matter to encourage employees to report questionable activities directly to the Company’s senior management and the Audit Committee.

A Management Operating Committee (the “MOC”) that is comprised of members of senior management (including our CEO, Chief Operating Officer (“COO”), Chief Financial Officer (“CFO”), Chief Legal and Corporate Development Officer, Chief Administrative Officer (“CAO”), heads of our business segments and such other officers of the Company as the CEO deems necessary or advisable for the proper conduct of the business of the Company) was created to assist the Audit Committee with risk oversight responsibilities. The MOC delegates risk responsibilities throughout the Company through the Company’s Risk Officer, risk owners and risk working groups in order to define the Company’s risk appetite through a combination of limits and tolerances, and ensure that processes are implemented to identify, measure and assess risks.

The ERM Policy requires regular reporting to ensure proper documentation of the Company’s ERM activities. The Risk Officer has been delegated the primary responsibility of reporting risk summaries to the Audit Committee and compiling an annual ERM report. Members of senior management also report information regarding the Company’s risk profile directly to the Board from time to time. The Board believes that the work undertaken by the Board, the Board’s committees, the MOC and the Company’s senior management team enables the Board to effectively oversee the Company’s risk management processes.

The chart below illustrates the key roles assisting the Board in its risk oversight function.

The Board has delegated to the Information Technology Committee the responsibility of exercising oversight with respect to the Company’s cybersecurity risk management and controls. Our CAO and her staff regularly update the Information Technology Committee on the Company’s cybersecurity program particularly with regards to monitoring, auditing, implementation, controls and procedures. The Audit Committee also receives regular updates from our CAO and Director of Internal Audit on cybersecurity audits. The Information Technology Committee and Board review the Company’s Information Security Policy on an annual basis to ensure that (i) our policies and procedures

16 Evertec, Inc. 2021 Proxy Statement

promote the resilience of the Company’s infrastructure at a level commensurate to its risk appetite, and (ii) it is compliant with current applicable regulatory requirements and leading industry standards and best practices. The Board has appointed a Chief Information Security Officer (“CISO”), who is responsible for establishing and maintaining the enterprise vision, strategy and programs to ensure information assets as adequately protected. The CISO reports directly to our CAO.

| | |

| Procedures for Communications with the Board |

Stockholders and any interested party may communicate directly with the Board. All communications should be directed to our Secretary of the Board at the address below and should prominently indicate on the outside of the envelope that it is intended for the Board or for non-management directors. If no director is specified, the communication will be forwarded to the entire Board. Communications to the Board should be sent to: Evertec, Inc., Board of Directors, care of the Secretary of the Board, Road 176, Kilometer 1.3, San Juan, Puerto Rico 00926. This process is also described in our website at https://ir.evertecinc.com/BoardofDirectors.

| | |

| Section 16(a) Report Compliance |

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires that our directors, executive officers, and holders who own more than 10% percent of any registered class of the Company’s equity securities file with the SEC initial reports of beneficial ownership and report changes in beneficial ownership of common stock and other equity securities. Such reports are filed on Form 3, Form 4 and Form 5 under the Exchange Act, as appropriate. Reporting persons holding the Company’s stock are required by the Exchange Act to furnish the Company with copies of all Section 16(a) reports they file.

To the Company’s knowledge, based solely on the Company’s review of copies of these reports, and written representations from such reporting persons that no other reports were required, the Company believes that all filings required to be made by reporting persons holding the Company’s stock were correctly and timely filed for the fiscal year ended December 31, 2020 in accordance with Section 16A(a), except for one late filing by Mr. Castrillo, in relation to the reporting of a sale in December 2020.

| | |

| Management Succession Planning |

The Company has in place a management succession plan applicable to our NEOs, the rest of our senior management team and other key positions within the Company. Pursuant to its charter, the Compensation Committee is responsible for developing and reviewing a succession plan for both our CEO and senior management and recommending the approval of such succession plan to the Board. This succession plan is revised annually and includes both a long-term succession plan and an emergency succession plan.

Evertec engages with various stakeholder groups in a variety of ways. We review recent business trends, regulatory changes and stakeholder expectations. We also consider ESG rating agencies, corporate peers and Evertec’s leadership input. Our Head of Investor Relations, CEO and/or CFO regularly engage with investors, prospective investors and analysts through earnings calls, direct engagement and/or investor conferences. Other senior management members may also participate in such meetings to provide insight on the Company’s services, performance, strategy, and growth. Further, Board members may be included in areas of shareholder concerns regarding significant governance matters. In 2020 we engaged with our top 50 investors representing close to 60% of our outstanding common stock.

Evertec’s ethical principles of integrity, honesty and good faith provide the foundation for our ethical business practices and standards. We have adopted a Code of Ethics that applies to all our directors, officers and employees, including our CEO and CFO. The purpose of this Code of Ethics is to promote honest and ethical conduct and compliance with the law, while serving as a guide on our vision, mission and values. The Code of Ethics includes the Company’s Human Rights Policy. Each year our directors, officers and employees receive the Code of Ethics and agree to comply with its provisions. Our Code of Ethics is published on our website at https://ir.evertecinc.com/codeofethics. We intend to include on our website any amendments to, or waivers from, a provision of the Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, or controller that relates to any element of the “code of ethics,” as defined by the SEC.

Evertec, Inc. 2021 Proxy Statement 17

We also have in place a Code of Ethics for Vendors and Service Providers which defines and reaffirms these high standards and helps our vendors and service providers fully understand their duty to comply with ethical principles and all laws, rules and regulations applicable to the engaged service. When service providers make a commitment to work with Evertec, they also commit to the terms of our Code of Ethics for Vendors and Service Providers and to maintaining high standards, ethical business practices and compliance requirements materially similar to those stated in our Code of Ethics for Vendors and Service Providers. Our Code of Ethics for Vendors and Service Providers is published on our website at https://ir.evertecinc.com/vendorcode.

| | |

| Environmental, Social and Governance (ESG) Matters |

ESG is woven into our culture and values. We believe it is our responsibility to deliver business success while at the same time doing what is best for our employees, customers, communities and the world around us. The Nominating and Corporate Governance Committee is responsible for monitoring, reviewing and making recommendations on ESG matters. Our Board, senior management and the ESG working group are committed to developing strong ESG practices that are essential for generating long-term value for all of our stakeholders.

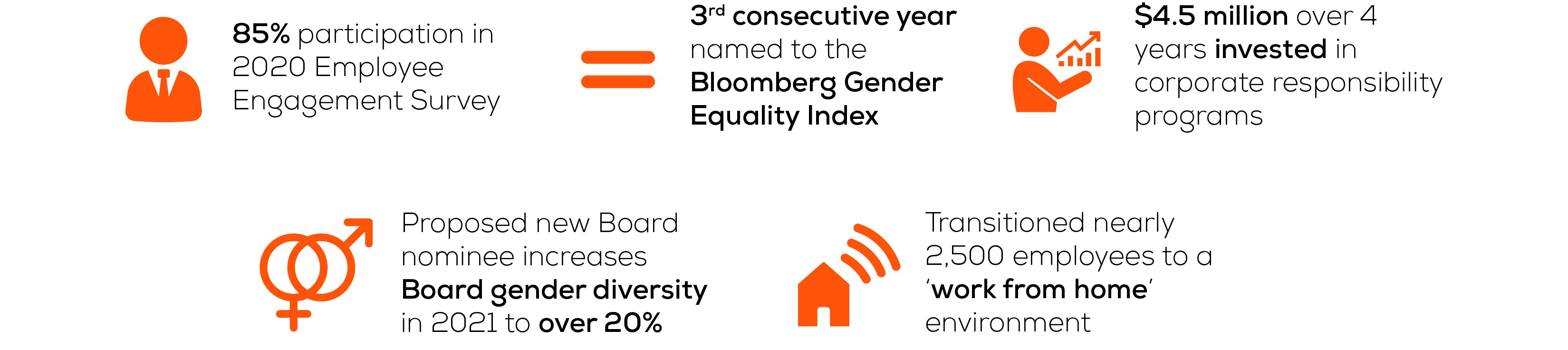

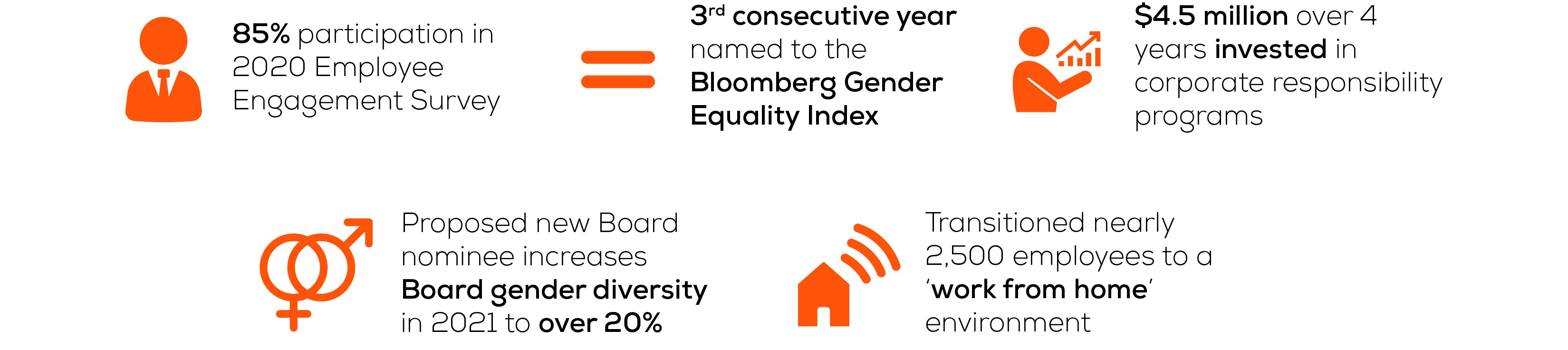

We are focused on making continuous progress on our ESG priorities, making a real difference and increasing transparency with all of our stakeholders. As such, some of our recent accomplishments under our ESG program include: (i) obtaining a participation of 85% in the Company’s 2020 Engagement Survey; (ii) being named to the Bloomberg Gender Equality Index for three consecutive years; (iii) investing $4.5 million over four years in corporate responsibility programs; (iv) increasing our Board gender diversity to over 20% with the proposed Board nominees for 2021; and (v) transitioning nearly 2,500 employees to a “work from home” environment.

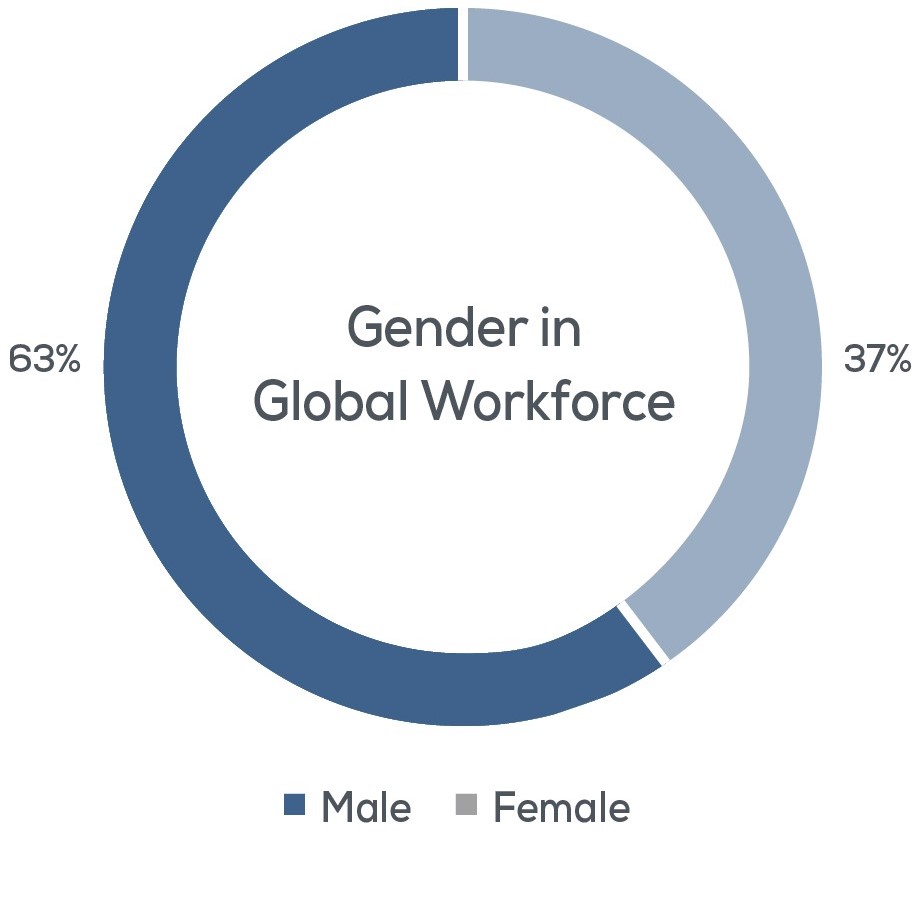

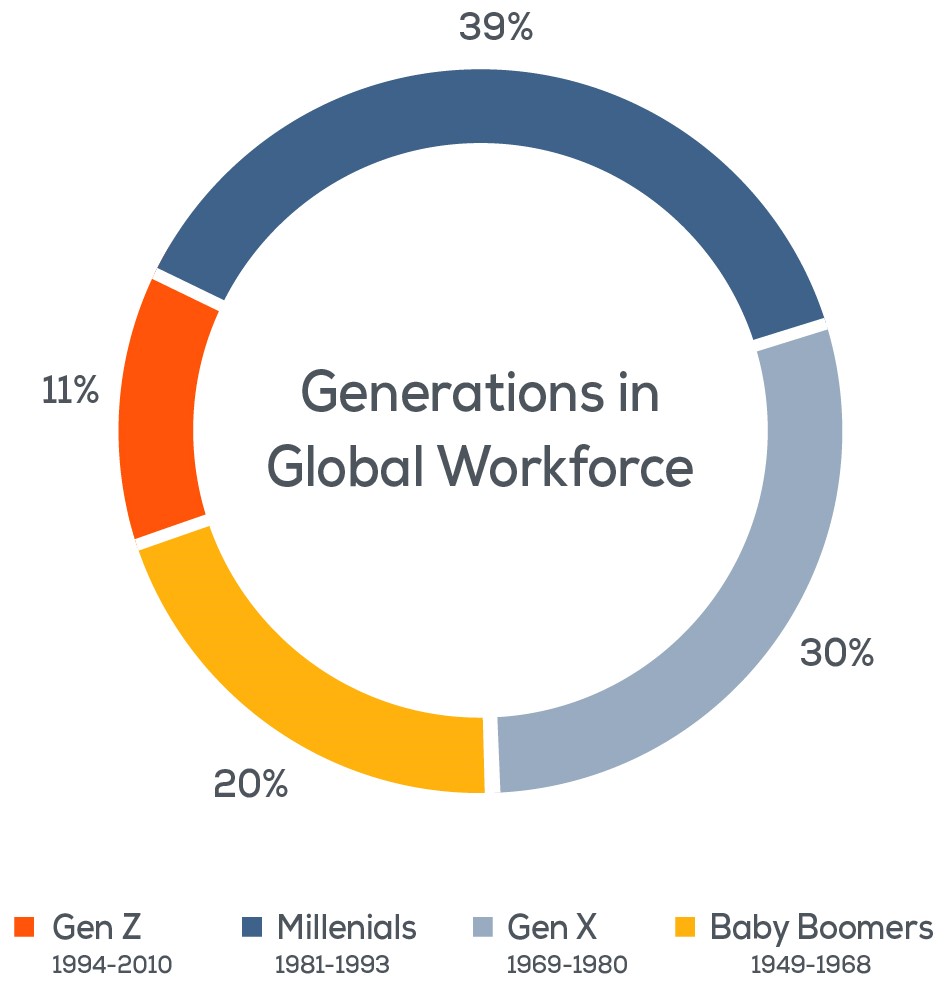

We promote diversity and inclusion as part of our formula for innovation. As such, we value diversity of ideas, thoughts and opinions. We embrace inclusion of our people, products and services, and integrating diversity in our strategies and business decisions. Over 99% of our employees and 98% of our managers are Hispanic.

Our vision, mission and values are embedded in our corporate culture and in the way we manage our relationships with employees, clients, vendors and service providers. Thus, they are an integral part of our ethical business practices and standards.

18 Evertec, Inc. 2021 Proxy Statement

For additional information related to the Company’s ESG program, including, but not limited to, governance practices, environmental footprint and resource reduction efforts, employee development initiatives, community involvement details and data security, please refer to our ESG tear sheet available on our website at https://ir.evertecinc.com/ESGdoc.

Evertec, Inc. 2021 Proxy Statement 19

BIOGRAPHICAL INFORMATION OF OUR EXECUTIVE OFFICERS

| | | | | |

| Morgan M. Schuessler, Jr. Age: 50

Mr. Schuessler joined the Company in April 2015 as our President and CEO. Please refer to the “Information About Director Nominees” section under Proposal 1 for Mr. Schuessler’s biographical information. |

| |

| Joaquín A. Castrillo Age: 38

Mr. Castrillo has served as our Executive Vice President, CFO and Treasurer since 2018. He has worked at the Company since 2012 serving in roles of increasing responsibility. Prior to joining the Company, Mr. Castrillo was an Audit Manager in the Banking and Capital Markets group of PwC. Mr. Castrillo holds a B.B.A. with a double concentration in Finance and Accounting from Villanova University. He is also a Certified Public Accountant. |

| |

| Rodrigo Del Castillo Age: 59

Mr. Del Castillo has served as our Executive Vice President and Chief Commercial Officer for Latin America since February 2020. He joined the Company in 2017 with the acquisition of the business formerly known as PayGroup. Mr. Del Castillo has more than 30 years of experience in the development and commercialization of products, IT services and transactional financial solutions. He holds a Bachelor of Science degree in Industrial Engineering from the Universidad de Santiago in Chile and a Master of Business Management from the Universidad Adolfo Ibáñez, also in Chile. |

| |

| Paola Pérez Age: 37

Ms. Pérez has served as our Executive Vice President and CAO since March 2020. She joined the Company in 2011 as Director of Internal Audit. Before joining Evertec, Ms. Pérez worked at Chartis as an External Reporting Manager for the Latin America Region, and PwC where she worked as a senior auditor. She obtained her Bachelor of Science in Accounting from Fairfield University and is a Certified Public Accountant. |

| |

20 Evertec, Inc. 2021 Proxy Statement

| | | | | |

| Carlos J. Ramírez Age: 59

Mr. Ramírez is our Executive Vice President—Puerto Rico Sales. He joined the Company in April 2004 and became an Executive Vice President in 2012. Before joining the Company, Mr. Ramírez worked for 21 years at GM Group, Inc., holding various senior positions in product and sales management. Mr. Ramírez received his Bachelor of Science degree in Computer and Systems Engineering from Rensselaer Polytechnic Institute. |

| |

| Luis A. Rodríguez Age: 43

Mr. Rodríguez has served as our Executive Vice President, Chief Legal and Corporate Development Officer, and Secretary of the Board since 2016. Prior to joining the Company in 2015, Mr. Rodríguez served as Executive Director at J.P. Morgan in New York. Mr. Rodríguez possesses a bachelor’s degree from the Woodrow Wilson School of Public and International Affairs at Princeton University and holds a Juris Doctor from Stanford Law School. |

| |

| Guillermo Rospigliosi Age: 47

Mr. Rospigliosi is our Executive Vice President and Chief Product and Innovation Officer. Before joining the Company in 2016, he served as Chief Risk Officer for Visa in Latin America and before that he was the Managing Director for Latin America at CyberSource, a Visa subsidiary. He graduated from the Universidad de Lima with a Bachelor of Science in Business Administration and holds an MBA from the University of Texas in Austin. |

| |

| Philip E. Steurer Age: 52

Mr. Steurer has served as our Executive Vice President and COO since 2012. Before joining the Company, Mr. Steurer worked for over 11 years at First Data Corporation, where he last served as Senior Vice President—Latin America and Caribbean from 2003 to 2012. Mr. Steurer holds an MBA in Finance from Indiana University, and a Bachelor of Business Administration degree in Finance from the University of Notre Dame. |

| |

| Miguel Vizcarrondo Age: 47

Mr. Vizcarrondo is our Executive Vice President and Chief Commercial Officer for Puerto Rico and the Caribbean. Prior to joining the Company in 2010, Mr. Vizcarrondo worked in Banco Popular de Puerto Rico for 14 years. Mr. Vizcarrondo holds a Bachelor of Science in Management, with a concentration in Finance, from Tulane University. |

| |

| All ages are as of the Record Date. |

Evertec, Inc. 2021 Proxy Statement 21

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to Item 402 of Regulation S-K of the Exchange Act, stockholders are being asked to approve, on an advisory basis, the compensation of the NEOs, as set forth and discussed in the “Compensation Discussion & Analysis” section of this Proxy Statement, which includes compensation tables and related narrative discussion and analysis.

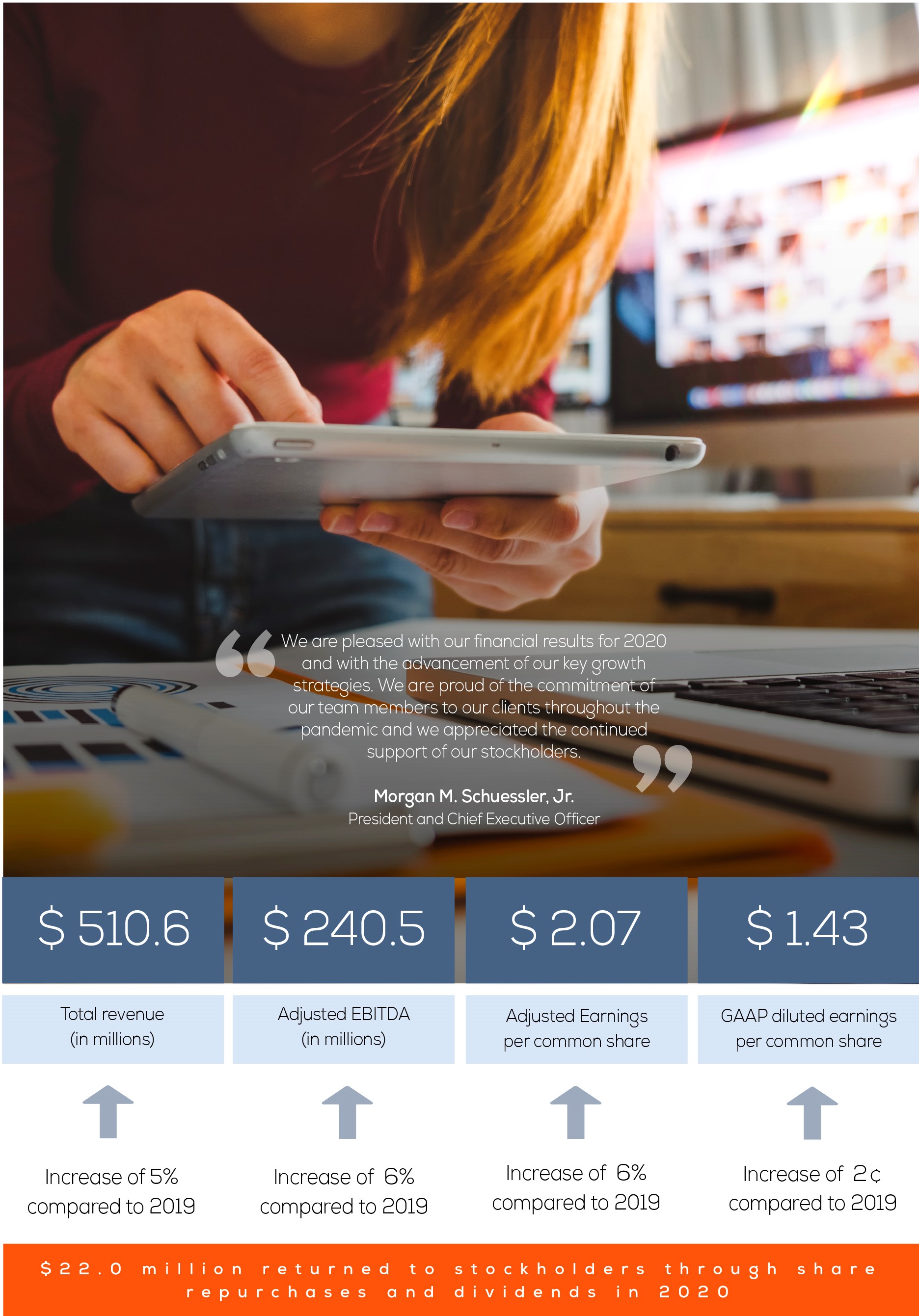

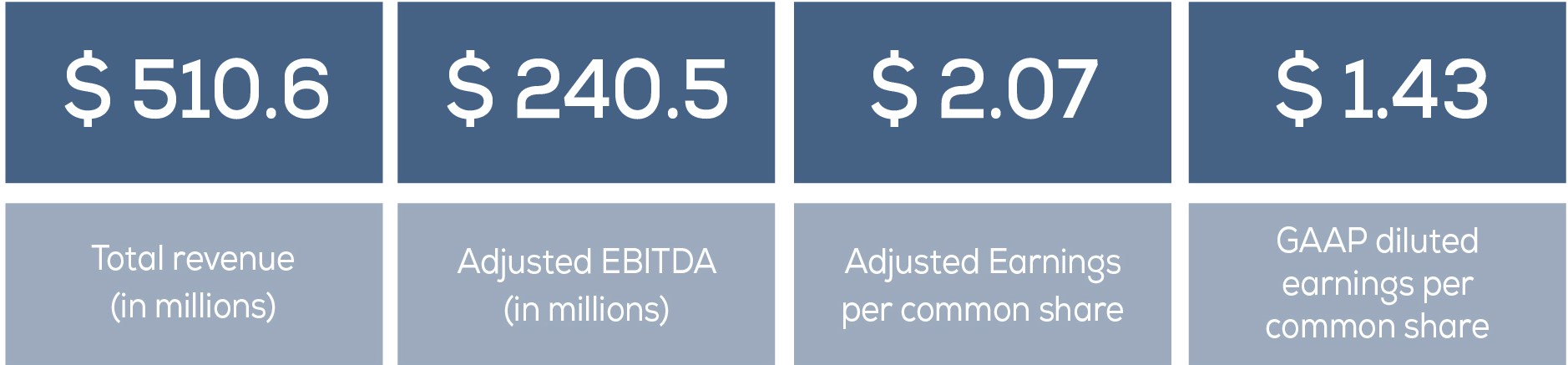

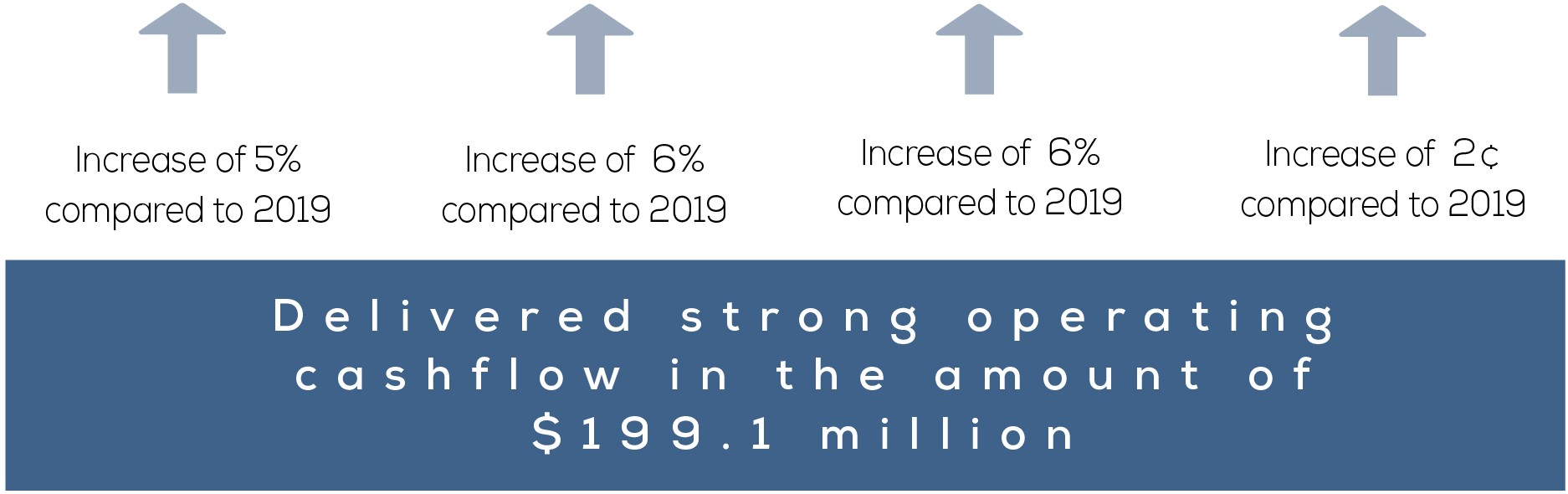

In spite of the challenges brought by the COVID-19 pandemic, 2020 was a strong year for our Company as we increased many of our key financial indicators compared to the previous year, including but not limited to our revenues, adjusted EBITDA, adjusted net income and GAAP diluted earnings per common share.

Our executive compensation program is designed to attract, motivate and retain talented executive officers and align their interests with the long-term interests of the Company’s stockholders. Our compensation program:

•compensates executive officers fairly and competitively, which promotes management stability and supports the short- and long-term well-being of the Company

•rewards performance that meets or exceeds established goals

•develops incentives to achieve a high level of performance while discouraging excessive risk-taking in the business

For more details of our compensation program, please refer to the “Compensation Philosophy and Objectives” section under the “Compensation Discussion & Analysis” of this Proxy Statement.

Because your vote is advisory, it will be non-binding on the Board and the Company. However, your vote will provide information to our Compensation Committee regarding investor sentiment about our executive compensation philosophy, policies and practices, which the Compensation Committee will be able to consider when determining future executive compensation arrangements.

| | |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS |

| THAT YOU VOTE “FOR” THE APPROVAL OF OUR |

| EXECUTIVE COMPENSATION ON AN ADVISORY BASIS. |

22 Evertec, Inc. 2021 Proxy Statement

COMPENSATION DISCUSSION AND ANALYSIS

| | |

| 2020 Performance Highlights |

We displayed strong commitments to our communities, clients, employees, and stockholders during 2020. Some of the financial highlights for the fiscal year ended December 31, 2020 include:

All amounts are approximates. For more information on the Company’s financial performance in 2020, please refer to our Annual Report on Form 10-K for the fiscal year ended on December 31, 2020, as amended by our Post-Effective Amendment No. 1 to Form 10-K filed on April 1, 2021. In addition to GAAP measures, management uses non-GAAP measures to focus on the factors the Company believes are pertinent to the daily management of the Company’s operations as it is frequently used by securities analysts, investors and other interested parties to evaluate companies in this industry. We define “EBITDA” as earnings before interest, taxes, depreciation and amortization and “Adjusted EBITDA” as EBITDA further adjusted to exclude unusual items and other adjustments.

For purposes of this discussion, “Adjusted Earnings per common share” is a supplemental measure of the Company’s performance; it is not required by, or presented in accordance with, GAAP. It is not a measurement of the Company’s financial performance under GAAP, and should not be considered as an alternative to total revenue, net income or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities, as an indicator of cash flow or as a measure of the Company’s liquidity.

We define “Adjusted Net Income” as net income adjusted to exclude unusual items and other adjustments. We define “Adjusted Earnings per common share” as Adjusted Net Income divided by diluted shares outstanding. EBITDA, Adjusted EBITDA, and Adjusted Earnings per common share are not measurements of liquidity or financial performance under GAAP. For additional details, refer to our reconciliation of GAAP to non-GAAP results provided in the Company’s Form 10-K for the fiscal year ended December 31, 2020, as amended by our Post-Effective Amendment No. 1 to Form 10-K filed on April 1, 2021. Return to Stockholders

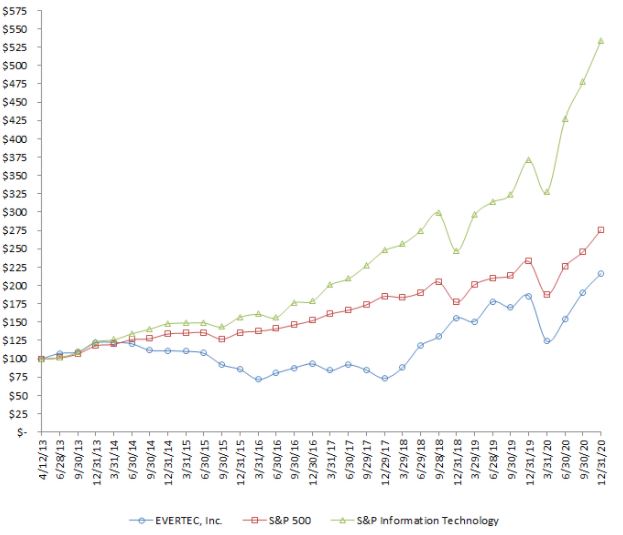

The following graph shows a comparison from April 12, 2013 (the date our common stock commenced trading on the NYSE) through December 31, 2020 of the cumulative total return for our common stock, the S&P 500 Index and the S&P Technology Index. The graph assumes that $100 was invested on April 12, 2013 in our common stock, and in each index, and that all dividends were reinvested.

Evertec, Inc. 2021 Proxy Statement 23

Historical stock price performance is not necessarily indicative of future stock price performance.

The Compensation Committee uses Frederic W. Cook & Co. (“F.W. Cook”) to assist it in its review of our entire executive and director compensation program. The Compensation Committee assessed the independence of F.W. Cook and whether its work raised any conflict of interest, taking into consideration the independence factors set forth in applicable SEC and NYSE rules, and determined that F.W. Cook was independent and its work raised no conflict of interest. Aside from its work for the Compensation Committee, F.W. Cook does no other work for the Company.

| | |

| Executive Compensation Highlights |

Our compensation program for our NEOs consists of the following core elements:

24 Evertec, Inc. 2021 Proxy Statement

The charts below set forth the target compensation mix for the CEO and the average target compensation mix for the rest of our NEOs during 2020:

| | |

| Named Executive Officers (NEOs) |

The table below sets forth a list of our NEOs for 2020. All of our NEOs are employed by Evertec Group, LLC (“Evertec Group”) and also serve in similar functions for the Company.

| | | | | |

| Name | Title |

| Morgan M. Schuessler, Jr. | President and Chief Executive Officer |

| Joaquín A. Castrillo | Executive Vice President, Chief Financial Officer and Treasurer |

| Luis A. Rodríguez | Executive Vice President, Chief Legal and Corporate Development Officer, and Secretary of the Board of Directors |

| Guillermo Rospigliosi | Executive Vice President and Chief Product and Innovation Officer |

| Miguel Vizcarrondo | Executive Vice President and Chief Commercial Officer for Puerto Rico and the Caribbean |

| | |

| Compensation Philosophy and Objectives |

The Compensation Committee is responsible for establishing, implementing and continually monitoring adherence with our general compensation philosophy and objectives. As part of its duties and responsibilities, the Compensation Committee determines our CEO’s compensation, approves the compensation of our other executive officers and directors, and administers our equity-based compensation plans, in which our NEOs may participate. The Compensation Committee is also charged with (i) overseeing the risk assessment of the compensation arrangements applicable to our executive officers and other employees and (ii) reviewing and considering the relationship between risk management policies and practices, and compensation.

The Compensation Committee meets as often as necessary, but at least once annually. While ultimate responsibility for compensation recommendations rests with the Compensation Committee, it has the authority to hire a compensation consultant to assist it in fulfilling its duties. As previously noted, the Compensation Committee has engaged F.W. Cook to advise it in the fulfillment of its duties.

Evertec, Inc. 2021 Proxy Statement 25

The Compensation Committee’s intent is to ensure that the total compensation paid to our executive officers is fair, reasonable and competitive. Furthermore, Evertec’s compensation philosophy has been and continues to be to target the 25th percentile of our approved compensation peer group in recognition of the size differentials that exist between Evertec and the compensation peer group companies, as well as the challenges in identifying good business matches within desired size parameters. Compensation for our NEOs has been designed to provide rewards commensurate with each NEO’s contribution.

The philosophy embedded in our compensation program is to: (i) support an environment that rewards performance against established goals; (ii) provide fair base compensation, benefits and incentive compensation in order to foster stability at the management level and support our short- and long-term success; (iii) align the interests of executives with the long-term interests of stockholders through equity-based awards; and (iv) develop incentives to achieve high levels of performance without encouraging excessive risk-taking.

Our executive compensation strategy is designed to: (i) attract and retain highly qualified executives; (ii) provide executives with compensation that is competitive within the industry in which we operate; (iii) establish compensation packages that take into consideration the executive's role, qualifications, experience, responsibilities, leadership potential, creativity, individual goals and performance; and (iv) align executive compensation with the achievement of our business objectives.

This Compensation Discussion and Analysis (“CD&A”) reflects a discussion of our compensation objectives and philosophy, as well as the elements of our total NEO compensation packages including, but not limited to, information regarding certain compensation changes implemented for 2020.

The Compensation Committee may conduct further review of the executive compensation philosophy and objectives from time to time and reserves the right to make changes to the executive compensation practices as it considers appropriate.

26 Evertec, Inc. 2021 Proxy Statement

The Board carefully considers the results of our stockholders’ advisory say-on-pay vote. Our stockholders continue to express support for the Company’s executive compensation program with the Company receiving approximately 96% advisory approval in 2020. In consideration of this continued support, the Board maintained the principal features and performance-based elements of the executive compensation program in 2020. At the Annual Meeting, the Company’s stockholders will again have the opportunity to approve Evertec’s executive compensation program through the advisory say-on-pay vote included as Proposal 2 in this Proxy Statement.

| | |

| Role of Executive Officers in Compensation Decisions |

Our CEO defines and recommends to the Compensation Committee the corporate and individual objectives for each of our other NEOs annually. The Compensation Committee has the authority to modify these objectives as it deems necessary and approve the final incentive opportunity which will be communicated by the CEO to such NEOs.

Our CEO reviews the performance of each of our other NEOs annually and formulates recommendations based on these reviews, including recommendations with respect to salary adjustments, annual incentive award targets and actual payout amounts. These recommendations are presented to the Compensation Committee, which has the discretion to modify any recommended adjustments or awards to executives, including our NEOs.

The Compensation Committee has final approval over all compensation decisions for our NEOs and approves recommendations regarding cash and equity awards for all of our NEOs. Although the CEO is present to discuss recommendations pertaining to each of our other NEOs, our CEO is not permitted to attend those portions of meetings of the Compensation Committee during which the CEO’s performance and/or compensation is discussed, unless specifically invited by the Compensation Committee.

| | |

| Competitive Compensation Practices |

As part of the Company’s comprehensive review of its compensation programs and practices, the Compensation Committee, with the assistance of F.W. Cook, established an executive compensation peer group to assist in evaluating the competitiveness of NEO compensation in terms of both dollar opportunity and compensation structure and design.

In narrowing its focus of comparable companies for consideration, the Compensation Committee considered:

| | | | | | | | |

•the extent to which the peer companies compete with Evertec in one or more lines of business, for executive talent and for investors | | •comparability of revenues, market capitalization, total assets and number of employees |

| | |

•statistical reliability in terms of the total number of companies in the peer set | | •“peer of peer” analysis |

F.W. Cook last conducted a review of our peer group of companies in December 2020. The Compensation Committee continues to use the following compensation peer group of companies to make its NEO compensation decisions:

| | | | | |

| ACI Worldwide | EVO Payments |

| Bottomline Technologies | Jack Henry & Associates |

| Black Knight | MoneyGram International |

| Cardtronics | Q2 Holdings |

| Euronet Worldwide | WEX |

| Everi Holdings | |

Evertec, Inc. 2021 Proxy Statement 27

Evertec’s compensation philosophy has been and continues to be to target the 25th percentile of the above peer group in recognition of the size differentials that exist between Evertec and the peer companies, as well as the challenges in identifying good business matches within the desired size parameters. Given the Company’s location in Puerto Rico, the Compensation Committee must balance the challenges of attracting and retaining experienced local executive talent with talent from the mainland United States and elsewhere. To this end, the Compensation Committee also reviews from time to time the compensation data for several publicly-traded companies based in Puerto Rico (i.e., Popular, First BanCorp., OFC Bancorp and Triple-S Management Corporation) as additional reference points in an effort to monitor the local marketplace for executive talent.

The Compensation Committee’s access to competitive benchmarking is a critical element to understanding the current environment for executive talent. Along with other factors, this information enables the Compensation Committee to make well-informed decisions on recruitment and retention of key executives. F.W. Cook last prepared a benchmark compensation study on behalf of the Compensation Committee for NEOs in February 2021 and for directors in July 2019.

The Compensation Committee believes the compensation packages provided to our executives, including our NEOs, should include both cash and equity-based incentives that reward performance against established business goals and that discourage management from taking unnecessary and/or excessive risks that may harm the Company. Our compensation program for our NEOs consists of the following core elements:

We provide our NEOs and other employees with a base salary to compensate them for services rendered during the year. This fixed element of our compensation program is determined for each executive based on position and scope of responsibility. Annual base salary for our NEOs is subject to review and approval by the Compensation Committee. In reviewing base salaries, the Compensation Committee may consider, among other factors:

| | | | | |

| ü | changes in the executive’s individual responsibility |

| ü | analysis of the executive’s compensation both internally (i.e., relative to other Evertec officers) and externally (i.e., relative to similarly situated executives at peer companies) |

| ü | the executive’s individual performance |

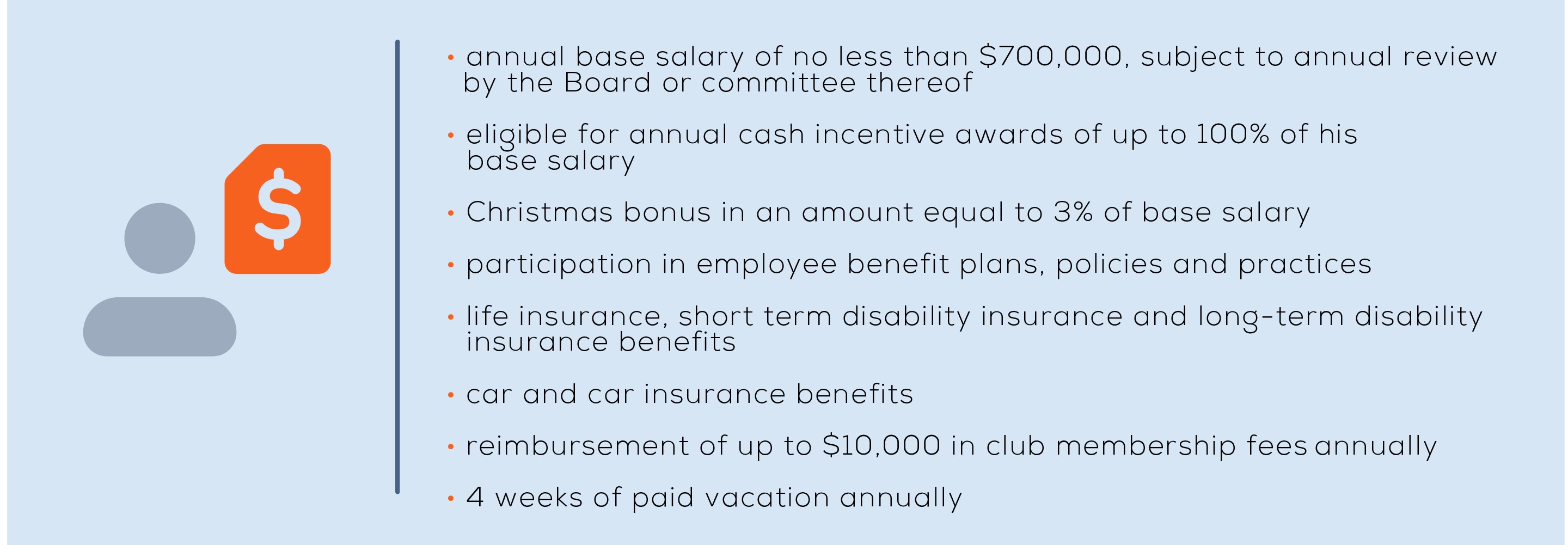

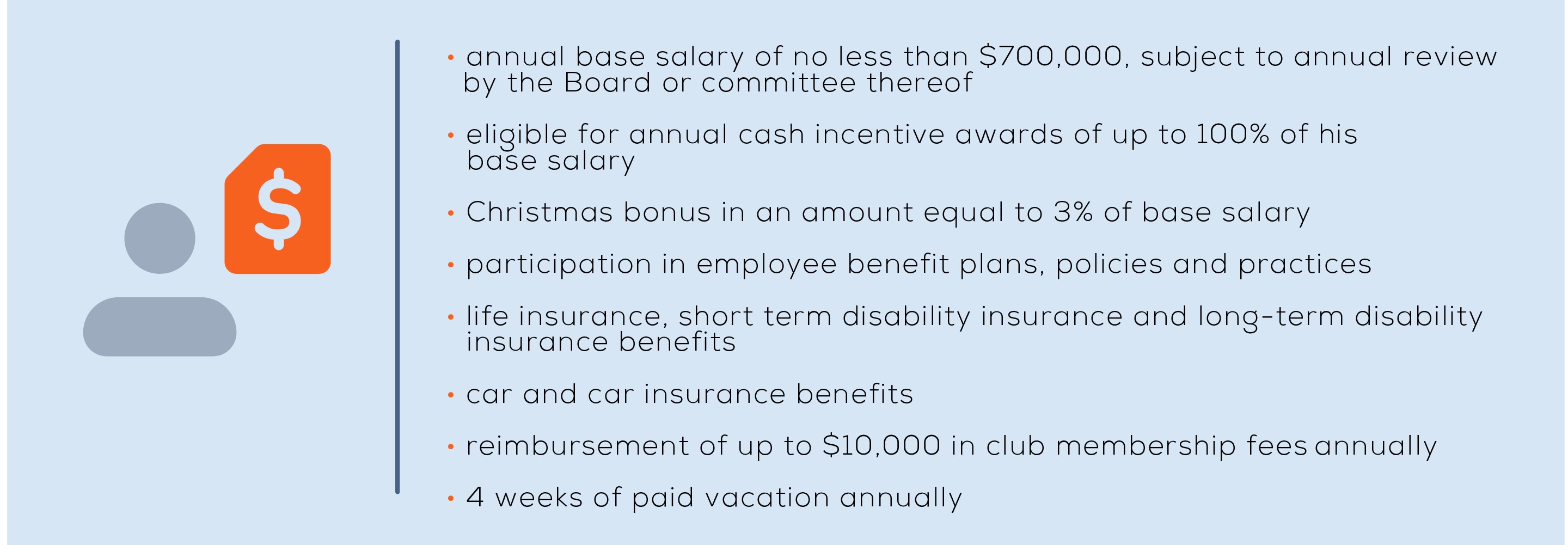

Having considered these factors, and to ensure that our total compensation packages are competitive with those provided by our peer companies and our competitors for top executive talent, and after consultation with F.W. Cook, the Compensation Committee approved the following base salaries for our NEOs for 2020, including base salary increases for Messrs. Schuessler, Castrillo, Rodríguez, Rospigliosi and Vizcarrondo to $740,000, $375,000, $320,000, $360,000 and $360,000, respectively, which became effective on September 1, 2020. Below please find base salaries for our NEOs:

| | | | | | | | | | | |

| Name | 2020 Base Salary ($)(1) | 2019 Base Salary ($)(2) | Percent Change(%) |

| Morgan M. Schuessler, Jr. | 740,000 | 700,000 | 5.71% |

| Joaquín A. Castrillo | 375,000 | 325,000 | 15.38% |

| Luis A. Rodríguez | 320,000 | 300,000 | 6.67% |