VIA EMAIL/EDGAR

James E. O’Connor

Attorney/Advisor

Division of Investment Management

Securities Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| RE: | Stone Ridge Trust (the “Trust”) (File Nos. 333-184477 and 811-22761)1 |

| | |

Dear Mr. O’Connor:

Thank you for your attention to this matter. On December 17, 2012, you provided oral comments to pre-effective amendment No. 1 to the Trust’s registration statement filed on December 7, 2012 (“Pre-Effective Amendment No. 1”). On December 20, 2012 you provided additional oral comments to Pre-Effective Amendment No. 1. All oral comments and the Trust’s responses are set forth below. We are aware that the Commission staff (the “staff”) prefers to establish a formal record of correspondence with registrants. Accordingly, please find the Trust’s formal responses to your comments below.

For your convenience, we have repeated below each comment, followed by the response thereto. Capitalized terms have the same meaning as in the Registration Statement, unless otherwise indicated.

Background

Before addressing the specific comments raised by the staff, we wanted to take the opportunity to point out important changes to be made in the next amendment to the Funds’ registration statement, further explain generally the CAT bond market, address some of the key issues raised by the staff, describe the need for prompt approval of the Funds’ registration statement and explain the use of Swiss Re data as a proxy for the CAT bond market generally.

In response to certain of the staff’s comments, the following changes will be reflected in the Funds’ next amendment to their registration statement.

1 Stone Ridge Asset Management LLC (“Stone Ridge”) participated in the preparation of this letter and accordingly, factual information and data presented in this letter have been provided by Stone Ridge.

A. Investment by RIA Firms Only.

Although the Funds will be registered under the 1933 Act, shares will be sold only to firms registered with the SEC as investment advisers (“RIA Firms”) that have full discretion over client assets, act on behalf of investors in a fiduciary capacity and typically have in excess of $1 billion in assets under management. In addition, subject to waiver by the Funds’ Board of Trustees,2 RIA Firms will be: (1) required to purchase initially at least $10 million (in the aggregate) in shares of the Funds on behalf of accounts the particular RIA Firm manages;3 and (2) limited to purchasing no more than 10% of a Fund’s net assets (calculated at the time of investment).4 Prior to investing, each RIA Firm’s Investment Committee, or similar body, is required to attend a two-hour, interactive educational session provided by Stone Ridge that is presented to one RIA Firm at a time, and which educates the RIA Firm about CAT bond structures, risks and management. The educational session requires the RIA Firm to complete multiple assessments along the way to ensure the RIA Firm understands the nature and risks of CAT bond investing.

B. Initial Asset Caps.

To ensure Stone Ridge’s ability to allocate the Funds’ assets and construct the Funds’ portfolios in a manner consistent with Stone Ridge’s strategy, the Funds will impose Initial Asset Caps on the amount of assets the Funds will accept in share purchases—Stone Ridge Reinsurance Risk Premium Fund will have an Initial Asset Cap of $250 million and Stone Ridge High Yield Reinsurance Risk Premium Fund will have an Initial Asset Cap of $100 million. Upon reaching such asset levels, the Funds will close to new investments. The Funds may re-open to new investors and subsequently close again to new investors at any time at the discretion of the Adviser. Any such opening and closing of the Funds will be disclosed to investors via a supplement to the registration statement. In the event there are significant fund redemptions, the Board, in consultation with Stone Ridge, may determine that it would be in the best interests of the relevant Fund and its shareholders to offer additional Fund shares to offset such redemption amounts. Stone Ridge believes that by imposing the Initial Assets Caps yet maintaining the ability to re-open the Funds in the event of significant redemptions, Stone Ridge will be able to maintain a high degree of control over the Funds’ portfolios and efficiently manage investor redemptions. In addition, Stone Ridge expects in the future to establish a credit facility (bank borrowings) for the benefit of the Funds which will provide further flexibility to Stone Ridge to maintain a stable portfolio for each Fund. If and when the Funds enter into such borrowing facility, it will amend its registration statement via a supplement (or “sticker”) to reflect the costs of such borrowings in each Fund’s fee table.

3 Due to the minimum purchase requirement, the next pre-effective amendment to the registration statement will reflect the removal of the Class N shares (minimum $1 million investment).

4 The second requirement is expected to be achieved within six months of each Fund’s launch.

C. Minimizing Fund Risk to Single Catastrophic Event.

Stone Ridge will seek to manage the Funds in a manner that minimizes a Fund’s exposure to any single catastrophic event. Stone Ridge will construct a portfolio that will include exposures to a highly varied group of available perils and geographic regions. In order to mitigate the risk to the portfolio of any single event, Stone Ridge imposes limits on the expected loss any peril or region that may contribute to the overall portfolio. Further, within each region and peril, Stone Ridge seeks to hold a balance of exposures to underlying insurance carriers, trigger types, and lines of business. Once fully invested, Stone Ridge expects that the Stone Ridge Reinsurance Risk Premium Fund will gain exposure to a significant percentage of the recently issued outstanding catastrophe bonds while the Stone Ridge High Yield Reinsurance Risk Premium Fund will hold approximately 50%-75% of that range of bonds.

D. The Funds are High Yield Bond Funds.

The Trust’s registration statement will be revised to reflect that the Funds are high yield bond funds. The Funds invest primarily in CAT bonds, which are bonds that are typically (but not always) rated below investment grade by one or more major rating agencies. The fact that the Funds invest in bonds that are exposed to catastrophic insurance risk means that the bonds are subject to risks that are different from typical high yield bonds which are exposed to the potential default of a financially distressed issuer.

CAT bonds should not be viewed as alternative investments as they are nothing more than a subset of high yield bonds. The fact that the risks underlying CAT bonds differ from the risks associated with other types of high yield bonds should be viewed as a disclosure issue rather than one of suitability, especially when the purchasers of the Funds are large, sophisticated RIA Firms run by investment professionals, acting as fiduciaries on behalf of their clients on a discretionary basis.

E. The Funds will Not Invest in ILWs.

The Funds will amend the Trust’s registration statement to reflect that neither Fund will invest in ILWs.

F. The Funds will Treat Quota Shares as Illiquid.

The Funds will initially treat quota shares as illiquid investments and count such investments towards the 15% limit on illiquid investments. Going forward, pursuant to the Trust’s policies on liquidity determinations, the Funds will monitor the liquidity of quota shares in light of secondary market activity and the extent to which the Funds have exhibited a consistent ability to sell quota shares on the secondary market.

| 2. | General Information Regarding the CAT Bond Market. |

| | |

Event-linked or “catastrophe” bonds (commonly referred to as “CAT bonds”), became significant in the early 1990’s in the wake of various natural disasters, including the Northridge California earthquake and southern Florida’s hurricane Andrew. Such disasters stressed insurance and reinsurance companies and they sought alternative sources of risk capacity. The

capital markets provided a sufficiently large base to assume and spread the risk of these catastrophes and thus were created catastrophe bonds.

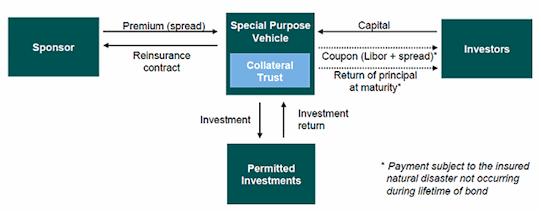

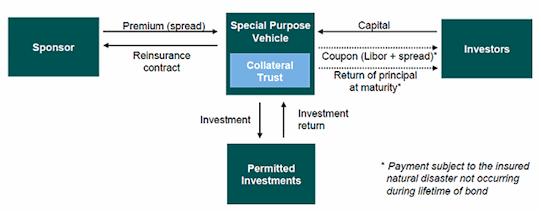

A catastrophe bond is a form of insurance-linked security (“ILS”) that is sold in the capital markets. To issue a catastrophe bond, the sponsor, typically a reinsurance company, creates a special purpose vehicle (“SPV”) that issues individual notes to capital markets investors. Unlike a corporate bond, the money contributed by investors is held by the SPV in low-risk securities, such as U.S. treasuries, and not on the sponsor's balance sheet. The coupon that is paid to investors is made up of the return on these low-risk investments and the premiums paid to the SPV by the sponsor.

Catastrophe bonds typically mature in three years, although terms generally range from one to five years, depending on the bond and issue quarterly interest payments (coupons). Most CAT bonds are rated, by S&P, Moody’s, or AM Best, below investment grade, although certain bonds may be rated investment grade. CAT bonds derive their value from the frequency of natural phenomena, thus, they are relatively uncorrelated with fluctuations in the financial markets, making them attractive fixed income investments for investors looking to diversify their portfolios and hedge against other market volatility.

Catastrophe bonds are structured around the likelihood of "super" catastrophes, with approximately 1-2% annual probability (though over the past 15 years, average annual realized loss rate to CAT bonds was 0.66%).5 Damage from hurricanes and earthquakes are the most common types of losses against which sponsors protect themselves, but bonds protecting against damage from other events such as tornadoes and large hailstorms are also created. In the event that the specific natural catastrophe mentioned in the bond causes a specified amount of damage, the bond is "triggered" and all or a portion of the original principal can be used to pay those obligations.

As an initial matter, the market for event-linked or “catastrophe” bonds has matured significantly in the past 10 years and in particular in the past 5 years. The current notional amount of currently outstanding CAT bonds is approximately $16 billion.6 Daily and monthly trading volume in the CAT bond market is approximately $15-$20 million and $300-$400

5 Information obtained from publicly available records.

6 See attached article from Reuters News Agency, October 30, 2012, “Catastrophe bonds unbowed by Hurricane Sandy.”

million, respectively.7 Furthermore, CAT bonds are just that: “catastrophe” related bonds and cover extraordinary events. Thus, single storms such as superstorm Sandy have not resulted in a freezing of the markets for such bonds.

These bonds are typically purchased on an initial offering basis and held to maturity. However, there is a robust secondary market maintained by leading institutional brokers. A number of brokers, including but not limited to Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America, facilitate secondary market trading of CAT bonds. These firms provide both indicative and firm bid/ask prices and match buyers and sellers of CAT bonds. The typical purchasers of CAT bonds on the secondary market are other investors like dedicated ILS funds, institutional investors, and open and closed end registered investment companies, such as those listed in Appendix A. As stated above, average monthly trading volume on the secondary market is approximately $300 million.

A. SPVs Structure is Similar to that of Securitization Vehicles Contemplated by the 1940 Act, but Offers Enhanced Investor Protections and Lower Systemic Risk.

The structure of SPVs underlying CAT bonds is familiar to the Commission and to the investment community in that the structure is in many respects similar to the structure of special purpose vehicles set up as securitization vehicles for typical asset-backed securities structures (“Securitization Vehicles”). Asset-backed securities structures have been a part of the investment landscape since the mid-1980s, and a great number of mutual funds invest in Securitization Vehicles.8 Asset-backed securities are contemplated by the Investment Company Act of 1940, as amended (the “1940 Act”), in Section 3(c)(5) thereof and Rule 3a-7, so the CAT bond structure should not be viewed as presenting novel issues. CAT bond SPVs, however, offer enhanced investor protections and pose less systemic risk than do Securitization Vehicles. First, the ceding insurer of CAT bonds typically retains a large portion (often up to 90%) of the overall risk of the designated catastrophe whereas sponsors of Securitization Vehicles often retain very little, if any risk, of the defaulting event. Second, the SPVs underlying CAT bonds are unlevered while Securitization Vehicles are highly levered. Finally, the collateral underlying the CAT bonds is comprised of U.S. Treasuries (or other low-risk investments), as opposed to Securitization Vehicles which are comprised of debt obligations dependent upon the uncertain payment stream of numerous underlying borrowers.

The structure of the SPV underlying a CAT bond is similar to a Securitization Vehicle in that the sponsoring entity is creating a vehicle to reduce balance sheet risk exposure to a particular event (i.e., a catastrophic event). The ceding entity designates a claims agent, which is responsible, on behalf of the debt holders, for assuring that payments from the SPV to the ceding entity are

7 Monthly trading volume from Swiss Re. Daily trading volume calculated based on monthly trading volume and assumes equal trading on each trading day of any given month.

8 To name a few, the following registered, open-end investment companies invest in Securitization Vehicles as part of their primary investment objectives: BlackRock LifePath 2025 Portfolio, John Hancock Total Bond Market Trust B, Putnam Short Duration Income Fund, Nuveen Core Plus Bond Fund, Nuveen Intermediate Government Bond Fund, Prudential Conservative Balanced Portfolio, Western Asset Short Term Yield Fund and The Hartford Global Alpha Fund.

appropriate. Debt holders receive audited financial statements and other information showing the holdings of the Securitization Vehicle (i.e., the relevant collateral pool). In addition, the SPV underlying a CAT bond is limited in the instruments in which it can invest cash held in the collateral pool(s); in the case of an asset-backed securitization, the SPV is limited in the types of debt, loan and mortgage instruments it can hold, and the types of cash management instruments it may use. Both CAT bond SPVs and Securitization Vehicles may issue debt in single or multiple tranches.

B. CAT Bond Trading.

The Fund anticipates purchasing CAT bonds in both the primary and secondary markets. For both, the Fund will call the brokers in the CAT bond market (including but not limited to Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America,) to purchase CAT bonds. Once a Fund purchases a CAT bond, the goal is not to sell the bond or to trade around, but to hold the bond to maturity, get the coupon, and at maturity, get the principal back (if no triggering event occurs). This is true for most CAT bond investors (e.g., dedicated ILS funds, funds listed in Appendix A, etc), who tend to be buy-and-hold investors. However, if, due to redemption, desire to free up capacity for a new issuance, or other reason, a Fund wishes to sell a bond prior to bond maturity, the Fund would call one of the brokers listed above, who would facilitate the trade with interested buyers of the bond. The buyers, again, are the other investors in the market (dedicated ILS funds, funds in Appendix A, etc). The broker may also purchase the bonds on their own account, in their capacity as market makers. Historically, the traded price is between the most recent bid and ask prices.

3. Key Issues Raised by the Staff.

A. Liquidity.

As discussed in greater detail below, the CAT bond market is highly liquid, especially for holders of CAT bonds that wish to sell those bonds on the secondary market. Daily and monthly trading volume in the CAT bond market is approximately $15-$20 million and $300-$400 million, respectively.9 The trading market is generally comprised of the same investors that make up the 144A or “qualified institutional buyer” market, including sophisticated investors such as pension funds, private funds and, as demonstrated by Appendix A hereto, a large and growing number open- and closed-end registered investment companies. Major institutional market participants, including Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America (“CAT Bond Brokers”), facilitate secondary market trading in CAT bonds. CAT Bond Brokers also often make a market in CAT bonds and buy and sell for their own account.

B. Valuation.

As discussed in more detail below, consistent and reliable valuations are available for CAT bonds. There are several pricing services that value CAT bonds. One such entity, Interactive Data Corporation (“IDC”), provides daily CAT bond pricing, and the Funds intend to use IDC as pricing agent. IDC is the same service used by many of the funds listed on Appendix A. CAT Bond Brokers usually present their bid/ask prices on at least a weekly basis. IDC takes quotes and through matrix pricing and other available sources, issues daily prices. Spreads on CAT bonds generally range approximately 1.2%, and in Stone Ridge’s experience, most CAT bond trades take place within the spread, and near the valuations set by IDC.

Other than supply and demand, CAT bond prices only change when there is new information that is relevant to the underlying natural catastrophe risk of the CAT bond. For example, in the weeks leading up to and following superstorm Sandy, non-hurricane CAT bonds (i.e. bonds with no exposure to hurricanes) did not see any material price movement, because Sandy did not impact their underlying risks. In addition, about 40% of the hurricane CAT bonds had no exposure to the Northeast, and thus, these CAT bonds also did not see price movement. The rest of the CAT bonds that did have Northeast US hurricane exposure moved roughly according to the level of vulnerability to Sandy. For example, the CAT bonds that were most exposed to losses due to a hurricane in the Northeast saw prices drop the most, while CAT bonds that were only marginally exposed to Northeast hurricane losses saw very small price movements.

Additionally, CAT bond prices are not correlated with those of the broader fixed income or equity markets, exhibited by CAT bonds remarkable stability through recent financial crises during which prices of many other asset classes experienced great volatility.10

Finally, as discussed below, a number of existing registered investment companies (see Appendix A) invest in CAT bonds and are able to fulfill their valuation requirements under the 1940 Act. The CAT bonds in which those funds invest are no different from those in which the Funds will invest, so there is no reason to believe that the Funds will be unable to appropriately value their respective CAT bond holdings.

C. Suitability.

Retail investors will not be permitted to directly purchase shares in a Fund. The Funds will also not be distributed through traditional commission-based brokerage systems that might normally be used in the context of selling an open-end registered investment company. Rather, only investment professionals, with full discretion acting in a fiduciary capacity on behalf of their clients will be eligible to make investments in the Funds. The Investment Committee, or similar body, of each RIA Firm must attend an educational session from Stone Ridge that is presented to one RIA Firm at a time, and which educates the RIA Firm about CAT bond

10 For example, during the credit crisis (Sep 2007 – Feb 2009), the Swiss Re Global CAT Bond index returned -4.0% versus -26.4% for High Yield Corporate Bonds (BofA Merrill Lynch US High Yield Corporate Total Return Index) and -51.3% for the S&P 500. During this period, the volatility of CAT bonds was also significantly more modest than that of the broader fixed income and equity markets.

structures, risks and management. As a further level of protection, each RIA Firm must purchase a substantial dollar amount of Fund shares for its client accounts, which provides the RIA Firm a strong incentive to fully understand the risk and terms of an investment in a Fund. Additionally, each RIA Firm is limited in the total percentage of Fund shares it may own. This protects a Fund and its shareholders from the risk that a significant redemption by one RIA Firm will cause significant portfolio management issues for the Fund. Finally, as shown in Appendix A, many existing registered investment companies invest in CAT bonds, and we do not believe the Funds should be treated any differently than other open-end funds that seek to invest in CAT bonds.

4. | Need for Prompt Approval of the Registration Statement. |

| | |

There a number of factors contributing to a significant need for the staff to act promptly in approving the Funds’ registration statement as early as possible in January 2013. First, a significant issuance of CAT bonds, especially those tied to hurricanes, are made early in the year. If the Funds’ registration statement is not declared effective by mid-January 2013, the Funds will not be able to take advantage of these attractive investment opportunities, and may not be able to obtain sufficient amounts of CAT bonds tied to hurricanes in the secondary market transactions because, secondary market demands often exceeds supply. Second, Stone Ridge may have difficulty retaining some of its key investment personnel in the event of a substantial delay in the launch of the Funds. Specifically, key employees of Stone Ridge that have specialized experience and expertise in evaluating and purchasing CAT bonds potentially could leave Stone Ridge if the Funds are not able to take advantage of the investment opportunities that will be available early in the year. Finally, the significant interest in the Funds by RIA Firms may be compromised by undue delay in effectiveness of the Funds’ registration statements. Similar to the Funds, RIA Firms that are anticipated purchasers of Fund shares may see attractive investment opportunities early in the year, and may be concerned that the Funds will be unable to participate in those opportunities.

Notably, as shown in Appendix A, there are numerous existing open-end and closed-end investment companies that invest in CAT bonds as part of their principal investment strategy. One such fund that operates as an open-end fund and typically invests at least 80% of its assets in CAT bonds, disclosed in its annual report for the year ended September 30 that most of its securities were Level 2 securities, with some Level 1 but no Level 3 holdings. In our review of other registered funds that invest in CAT bonds (see Appendix A), they treat such securities in a similar manner. The operation of these registered funds presents strong support that a sufficiently liquid market exists for CAT bonds such that a mutual fund may readily meet its requirement to be at all times at least 85% in liquid securities. The issues presented by the Funds are not novel, and given the existing activities of these other funds, we do not believe that it is appropriate to delay the effectiveness of the Funds’ registration statement.

| 5. | Use of Information Provided by Swiss Re. |

| | |

In many cases we will provide herein examples, market information and data provided by Swiss Re. Swiss Re accounts for approximately 20-25% of CAT bond market trading and Stone Ridge views Swiss Re’s data as representative of the overall CAT bond market. Swiss Re also sponsors, maintains and publishes multiple CAT bond indices that are highly correlated with CAT bond indices maintained and published by other large institutions, e.g. Aon Benfield.

Swiss Re is a major participant in the CAT bond market, and collects and presents reliable data about the entire CAT bond market. Swiss Re was one of the first institutions to create a dedicated CAT bond index, and while there are other sources of CAT bond market information available, Swiss Re, as one of the largest and most established participants in the CAT bond market, represents the broadest and most reliable source of market-wide information.

SEC Staff Oral Comments Received December 17, 2012

Oral Comment 1: Please describe whether reinsurers have “unfettered” access to the trusts established by SPVs when a triggering event occurs. What recourse do investors in the SPVs have? Is their only recourse a possible clawback?

Response: As described above, the structure and operation of CAT bond SPVs are similar to that of Securitization Vehicles although CAT bond SPVs provide greater protections for debt holders by, among other things, limiting investment of the collateral to low-risk investments and establishing agreed upon procedures pursuant to which the SPV sponsor may gain access to the collateral.

A. No Unfettered Access.

Reinsurers do not have unfettered access to trusts established by SPV’s, either before or following the occurrence or alleged occurrence of a triggering event. Such access is restricted by a tri-party or trust agreement between the SPV, a third party administrator/manager and the ceding insurer whereby the third party/administrator holds the collateral in a trust or similar fiduciary capacity.

B. Claims by Ceding Insurer.

SPVs enter into a claims review agreement with an independent third party, usually a major accounting firm, such as KPMG or Ernst & Young. If the ceding (re)insurer11 believes a trigger event has occurred, the ceding (re)insurer must provide to the claims reviewer proof of loss containing information required under the claims review agreement. The claims reviewer will then follow established procedures to substantiate the (re)insurer’s claim, including any mathematical calculations undertaken and reported by the (re)insurer. If the claims reviewer rejects the ceding (re)insurer’s claims, the ceding (re)insurer is generally not allowed to withdraw the rejected portion of the claims until it has resolved the dispute through applicable dispute resolution procedures. If the claims reviewer approves the (re)insurer’s claim for payment, the appropriate amount of collateral will be released to the ceding (re)insurer consistent with the terms of the tri-party or trust agreement, which would reduce the outstanding principal amount of the collateral. If the payout is a partial recovery, then the investor would continue to earn the coupon price on the remaining outstanding principal.

11 The “ceding insurer” is the insurance company that has sought to reduce its risk by establishing the SPV and issuing CAT bonds that the Fund may purchase.

C. Investor Protections and Recourse.

The SPV board of directors has a duty to manage the SPV in the best interests of the SPV investors. Additionally, the collateral agent and claims agent, both independent third parties, each have a duty to protect the interests of the SPV and its investors by ensuring appropriate management of the collateral and protecting the collateral from erroneous or fraudulent loss claims by the ceding (re)insurer. The indenture trustees who hold the collateral are large financial institutions, such as Bank of New York Mellon, Deutsche Bank Trust Company Americas and Citibank N.A. Although the SPV investors may not have a contractual right to enforce the underlying agreements in their own name, there are multiple parties responsible for protecting their interests and their position and rights in the CAT bond SPV structure is similar to that with respect to investors in Securitization Vehicles and often of debt holders in more conventional corporate structures.

Oral Comment 2: Please describe in further detail the basis for determining that the market for CAT bonds and quota shares is liquid. We noted in prior comments FINRA’s investor alert regarding liquidity, see also GAO report 3-1033. Provide to the staff more information on (1) how often these instruments trade and whether and what the secondary market looks like, (2) reliability of prices and what are the spreads, (3) transparency of the SPV’s, (4) how long has the market been “liquid,” (5) what is the likelihood that the market will become illiquid, (6) who is the dealer of the other side of the transaction that a Fund will enter into on both the buy and sell side, (7) are there market makers for these securities, and (8) where are these traded and who is regulating these trades/transactions.

Response: In order to adequately address each point raised by the staff, we have separated our response to each item. First, we discuss the GAO Report and FINRA’s investor alert, followed by a separate response for each of the numbered items.

A. GAO Report.

Regarding the referenced GAO report, there have been substantial increases in secondary market activity since the report was released in 2002. While there has been an increase in issuances over the past ten years, there has been an even more dramatic increase in the market participants that seek to invest in CAT bonds. Many new investors have entered the market, including but not limited to a number of open- and close-end registered investment companies, some of which are listed on Appendix A hereto. Additionally, a number of reliable and consistent pricing sources have developed providing daily, weekly and monthly pricing information and the increased number of issuances and higher demand for CAT bond exposure have drastically changed the landscape of the CAT bond market. Accordingly, we believe the GAO report no longer accurately portrays the CAT bond market activity or secondary market liquidity.

We have included below a summary of some of the market developments since 2002:

| | Before January 1, 2002 | January 1, 2002 to November 31, 2012 |

| | | |

| Total Bonds Issued | 67 | 439 |

| | | |

| Total Notional Issued | ~$4.4B | ~$43.1B |

| | | |

| Average Size of Issuance | ~$65M | ~$98M |

| | | |

| Current Notional Outstanding | | ~$16B |

| | | |

| Total Number of CAT Bond Sponsors | 17 | 66 |

| | | |

| Published index that tracks the asset class for reference | No | Yes: |

| | | ● | Swiss Re Global CAT Bond Price, Coupon, and Total Return Indices |

| | | ● | Swiss Re Global Unhedged CAT Bond Price, Coupon, and Total Return Indices |

| | | ● | Swiss Re USD CAT Bond Price, Coupon Total Return Indices |

| | | ● | Swiss Re BB CAT Bond Price, Coupon, Total Return Indices |

| | | ● | Swiss Re US Wind CAT Bond Price, Coupon, Total Return Indices |

| | | ● | Aon Benfield All CAT Bond Index |

| | | ● | Aon Benfield BB-rated CAT Bond Index |

| | | ● | Aon Benfield US Hurricane CAT Bond Index |

| | | ● | Aon Benfield US Earthquake CAT Bond Index |

| | | ● | Lane Financial Insurance Return Index (tracks only CAT bond returns) |

| | | ● | Lane Financial Insurance Total Return Index (tracks only CAT bond returns) |

| | | |

| Number of Peril Types | 7 (California earthquake, Central US earthquake, European windstorm, Japan earthquake, Japan typhoon, multiperil, US hurricane) | 21 (Atlantic windstorm, auto, California earthquake, Central US earthquake, credit, European windstorm, event cancellation, extreme morbidity, extreme mortality, industrial accident, Japan earthquake, Japan typhoon, longevity divergence, Mexico earthquake, multiperil, other, Pacific wind, Pacific Northwest earthquake, US convective storm, US earthquake, US hurricane) |

| | | |

| Collateral Management Strategies | Total Return Swaps | US Treasury Money Market funds, Puttable Floating Rate Notes (issued by AAA-rated entities) |

| | | |

(Source: public offering circular data, public CAT bond indices)

B. FINRA Investor Alert.

The thrust of the investor alert is that investors in registered funds that invest in CAT bonds should understand the risks of CAT bonds, and should be sure that the investment manager of the fund has the expertise and experience to meaningfully manage the CAT bond portfolio and exposure. The Funds precisely address the concerns identified by FINRA.

Experienced Investment Adviser. The Funds will invest primarily in CAT bonds, and Stone Ridge, the Funds’ investment adviser, is staffed with a number of employees who have significant experience and expertise with CAT bonds. In short, the Funds and their adviser have precisely the types of experience and investment focus that FINRA suggested was appropriate.

Clear Prospectus Disclosure. Because CAT bonds will be the primary investment of the Funds, the Funds' prospectus will contain significant discussions of the risks and operations of CAT bonds, as well as how Stone Ridge plans to address and mitigate those risks, so that investors in the Funds will have clear and comprehensive disclosure about precisely the issues that FINRA in its investor alert advised investors to learn about.

Limited Exposure to Single Catastrophic Event. The Funds and Stone Ridge will limit Fund exposure to any single catastrophic event, and will otherwise manage the portfolio of CAT bonds to seek broad exposure across geographic regions and types of catastrophic risks. This type of professional and experienced management of a CAT bond portfolio is consistent with the types of safeguards recommended by FINRA.

Shares Sold Only to Large RIA Firms. Fund shares can be purchased solely by sophisticated RIA Firms acting with full discretion and as fiduciaries on behalf of their clients. This is a significant additional layer of protection for Fund investors, and again is fully consistent with the suggestions and safeguards recommended by FINRA.

Specialized Training. Prior to investing, each RIA Firm’s Investment Committee, or similar body, is required to attend a two-hour, interactive educational session provided by Stone Ridge that is presented to one RIA Firm at a time, and which educates the RIA Firm about the structure and risks of CAT bond investing. The educational session requires the RIA Firm to complete multiple assessments along the way to ensure the RIA Firm understands the nature and risks of investments in CAT bonds. This type of educational session goes beyond anything even suggested by FINRA in its investor alert.

History of CAT Bond Investing by Registered Funds. It is also notable that in this 2008 investor alert, FINRA already was aware of a significant and apparently growing number of registered funds that invest in CAT bonds. This further reinforces the point that the proposed investment activities of the Fund are not novel, but are in fact a type of investment activity in which many registered funds have been engaged for a number of years (see also Attachment A).

Increase in Availability of Pricing Information and Liquidity. In its investor alert, FINRA stated that “[s]econdary trading for CAT bonds is very limited” and that “pricing information is not generally available to the public.” As described in more detail below, secondary trading in CAT bonds is readily available on a daily basis. Additionally, it is important to note that CAT bonds are sold in the “qualified institutional buyer” (“QIB”) (i.e., 144A) marketplace and are not

available for purchase by retail investors. Thus, while specific pricing information may not be available to the general public, such information is widely available to QIBs. The Funds will be QIBs and we anticipate that many of the Fund’s investors, which are generally large sophisticated RIA Firms, are also likely to be QIBs. Accordingly, the Funds and their RIA Firm investors will have access to pricing and other related information.

C. Below are responses to the numbered questions, addressed separately with respect to CAT Bonds.

| (1) | How often are CAT bonds traded and what does the secondary market look like? |

CAT bonds are traded on the secondary market on a daily basis through CAT Bond Brokers which include but are not limited to Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America,. Currently, average daily and monthly secondary market trading volume in CAT bonds is approximately $15-$20 million and $300-$400 million, respectively. This annualizes to approximately $4 billion of annual secondary market volume, which represents roughly 25% of the total CAT bond notional outstanding currently (approximately $16 billion). Refer to “Lifecycle of CAT Bond Trade” section above in “Background.”

CAT bond indices, which are based on weekly indicative CAT bond prices for all outstanding bonds, have been in existence since 2002. In addition, many CAT Bond Brokers, including Aon Benfield, Goldman Sachs, and RBC, have provided indicative and/or firm pricing sheets for several years. This information provides quantitative evidence that an active secondary market has existed for some period of time. (see charts below).

Swiss Re alone has facilitated about $1 billion/year in trades on the secondary market in 2009-2011, and estimates that they are approximately 20-25% of the market. This suggests the secondary market as a whole is about $4 billion - $5 billion/year. Please see below for representative secondary market volume statistics:

| | Source: Swiss Re, Insurance-linked Securities Market Update, July 2010 (discussing CAT bond secondary market trading volume) |

| (2) | Describe the reliability of prices and spreads. |

| | |

Since 2002, bid/ask spreads have averaged approximate 1.2%. IDC provides daily pricing and CAT Bond Brokers such as Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America, provide weekly and/or monthly pricing on CAT bonds. Trades historically tend to happen at or very near these quoted prices.

Current CAT bond bid/ask spread averages 1.1%, which is comparable to the average of available bid/ask spreads of current high yield corporate bonds of 1.1%.

| (3) | Transparency of the SPVs. |

| | |

As discussed above, CAT bond SPVs are structured similar to Securitization Vehicles in which many registered investment companies invest. Investor access to information to CAT bond SPVs is similar to that with respect to Securitization Vehicles.

A. Information about SPV Terms.

The terms and structure of each SPV are described in the applicable offering circulars. SPVs have independent administrators, auditors, and boards of directors, and their documents are publicly available without charge. In addition, ratings agencies S&P, Moody’s, and AM Best who rate CAT bonds, provide the service of verifying the structure and documentation of the SPV and the key value add they provide to the market is providing additional information on the validity and rigor of the SPV set up.

B. Underwriting Standards and Financial Stability of the Ceding Insurer.

Financial information regarding the ceding insurer, which often is a highly regarded financial organization, is included in the applicable offering circular which is made available to investors and potential investors. This information includes, among other things, the dollar amount of premiums received and the net assets of the ceding insurer. In addition, it also includes information regarding the ceding insurer’s claim-paying capacity. Moreover, offering circulars often include a link to the ceding insurer’s website where more information can be found about the ceding insurer’s operations, such as materials for the ceding insurer’s most recent governing board meeting. Offering circulars also typically contain information regarding the insurance policies written by the ceding insurer, including what is included and what is excluded from policy coverage.

C. Investments of the Collateral Pool.

Investments of the collateral are disclosed in the offering circulars and are restricted by the tri-party or trust agreement between the SPV, ceding insurer and third party administrator/trustee. There are typically tight restrictions on permissible investments of the collateral to provide protection that the collateral will be intact and returned to SPV investors upon maturity of the bond. Of the CAT bonds issued in 2012, approximately 85% of the collateral are restricted to investing in US Treasury Money Market Funds, while the remaining

are permitted to invest in puttable structured notes issued from AAA-rated supranational entities (International and European Banks of Reconstruction and Development).

D. Identity, Appointment and Replacement of Collateral Pool Manager.

Independent third party professional managers and trustees are often engaged to manage collateral and the third party generally will supply independent directors to operate the SPV. The manager of the collateral is disclosed in the offering circular, although SPV investors generally do not have the ability to appoint, remove or replace the collateral pool manager.

E. Reports to Investors.

Investors are provided with periodic reports (typically monthly) that include the market value of the collateral pool, performance of the collateral pool, income/dividends earned. Annual financial statements are prepared in accordance with US GAAP and audited by a major independent accounting firm and are generally available for investors.

| (4) | How long has the market been “liquid”? |

| | |

The market has become increasingly liquid over the past decade since the GAO report with the increasing number of institutional market participants and the development of more reliable pricing sources.

| (5) | What is the likelihood that the market will become illiquid? |

| | |

We do not believe it is likely that the CAT bond market will become illiquid. As described above, steady growth in initial issuance and secondary trading volume over the past decade indicate a healthy market, and expectations are calling for further growth in the future.12 Perhaps most telling is that despite some of the worst financial market cycles and catastrophic events in United States history occurring over the past ten years, and particularly very recently, the CAT bond market was not materially affected. Additionally, CAT bonds are simply another subset within the broad high yield bond asset class. The high yield bond sector and many of its sub-asset classes are the focal point of many registered investment companies. These asset classes have established markets with regular trading activity and daily liquidity, and the likelihood (or lack thereof) of the CAT bond market becoming illiquid should not be viewed as any different from that relating such other high yield asset classes.

| (6) | Who is the dealer on the other side of the transaction that the Funds will enter into on both the buy and sell side? |

| | |

The brokers discussed above, including Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America, generally act as intermediaries to secondary market trades. On the other side of the transactions are other investors, including dedicated ILS funds, multi-strategy hedge funds, open- and closed-end registered investment companies (see Appendix A) and

12 See “Issuance of CAT bonds set to rise as reinsurance industry offloads tail risk,” Hedge Funds Review, July 9, 2012.

pension funds that invest in ILS products. These brokers also stand ready to act on both sides of the market and will release prices at which they are willing to buy or sell CAT bonds themselves.

| (7) | Are there market makers for these securities? |

| | |

As described above, there is an active secondary market and a number of intermediary brokers in the CAT bond space who facilitate trading and provide liquidity, including, among others, Swiss Re, Goldman Sachs, Aon Benfield, GC Securities, RBC, BNP Paribas, Deutsche Bank, JP Morgan, Willis Capital Markets, and Merrill Lynch/Bank of America, . Also as described above, there are market making dealers for CAT bonds who stand ready to transact, if needed, in the absence of other buyers.

| (8) | Where are CAT bonds traded and who is regulating these trades/transactions? |

| | |

CAT bonds are traded over-the-counter (“OTC”) by leading institutions. Regulatory treatment of CAT bonds in the U.S. is still evolving. The SEC, CFTC, banking regulators and insurance regulators are among those who may have some level of regulatory jurisdiction over CAT bond issuance and trading. In addition, the state of California is in the preliminary stages of establishing a secondary market for California CAT bonds tied to earthquakes.

Due to the liquidity and demand for CAT bonds, there is a nascent effort to list CAT bonds on some exchanges (i.e. Bermuda Stock Exchange), but this is still in the early stages and few bonds currently participate.

D. Below are responses to the numbered questions with respect to Quota shares.

The Funds will initially treat quota shares as illiquid investments and count such investments towards the 15% limit on illiquid investments. Going forward, pursuant to the Trust’s policies on liquidity determinations, the Funds will monitor the liquidity of quota shares in light of secondary market activity and the extent to which the Funds have exhibited a consistent ability to sell quota shares on the secondary market.

Oral Comment 3: ILWs appear to the staff to be analogous to credit default swaps for which the full notional value of the instrument must be covered pursuant to Release 10666. Please explain in further detail why a Fund may cover it net obligation and not the full notional value in this regard in order to comply with 10666?

Response: The Funds will not invest in ILWs. Accordingly, the Funds will remove disclosure related to ILWs from the registration statement in the next pre-effective amendment.

Oral Comment 4: Please provide additional information regarding “moral hazards” as a risk of a Fund’s investment in reinsurance-related securities.

Response: Moral hazard only may be a risk in indemnity CAT bonds. Since such bonds are triggered by actual losses of the ceding sponsor, the ceding sponsor may have an incentive to take actions and/or risks that would have an adverse effect on the Fund. The Fund will make additional detailed risk disclosures regarding moral hazards in its registration statement in the next pre-effective amendment. Additionally, most primary insurers will retain roughly 90% of

the risks they source, seeking protection from reinsurers of only 10% of such risks.13 With so much risk retained by the primary insurers, the interests of the ceding insurer and the reinsurer are aligned, resulting in reduced risk of moral hazard is reduced. Many jurisdictions impose risk retention requirements on insurance companies which limit an insurance company’s ability to pass on risk to reinsurers.

SEC Staff Oral Comments Received December 20, 2012

Oral Comment 5: Please describe to us the impact of an increase in the issuance of new CAT bonds because insurance and reinsurance companies are looking to reduce their risk would have on the Funds or their investors. Does oversupply in the market create an environment where investors are chasing yield?

Response: The Adviser believes additional issuances of CAT bonds will further enhance the market. As noted above, there is an oversupply of buyers for CAT bonds in the secondary market. An increase in the availability of such bonds will increase the diversification of such bonds, improve pricing and potentially result in more favorable terms for investors such as the Funds. Furthermore, an increase in availability will likely also increase the trading volume for such bonds as more market participants get involved due to better availability. The yield on such bonds is not driven by the availability of the bonds, thus a change in the supply of the bonds would not materially change investors appetite for yield.

Oral Comment 6: Please address the staff’s concerns regarding the suitability of such Funds for retail investors in a yield chasing environment, are such investors sophisticated enough to understand the risk associated with the Funds?

Response: Supplementally, we note that the level and degree of risks associated with an investment in the Funds are similar to those associated with investments in funds that invest primarily in high yield corporate debt or emerging markets debt. These are relatively high risk asset classes and intended to be a portion of an investor’s overall diversified portfolio and not the only investment held by an investor. Furthermore, as described above, only large, professional RIA Firms acting in a fiduciary capacity with full discretion on behalf of their clients will be permitted to invest and may do so only in substantial minimum amounts. Such fiduciary relationships and substantial investment minimums provide a strong incentive for the RIA Firms to understand the Funds which will bolstered by RIA Firms’ required attendance at an educational session presented by Stone Ridge describing the terms, structure and risks of an investment in CAT bonds. In this regard, we believe that the Funds’ risk disclosure is similar in scope to other relatively high risk asset classes and consistent with or greater than the disclosure related to CAT bonds in other open-end funds that invest in such securities as a primary investment strategy, and is more than appropriate.

In response to the staff’s comment, the Funds propose adding the following disclosure to the Summary section of the prospectus:

13 Reinsurance and Financial Stability, International Association of Insurance Supervisors (IAIS), July 19, 2012.

| | | An investment in the Fund involves a high degree of risk. It is possible that an investor may lose some or all of his/her investment. Before making an investment decision, an investor and/or his/her advisor should (i) consider the suitability of this investment with respect to its investment objectives and individual situation and (ii) consider factors such as personal net worth, income, age, and risk tolerance. Short-term investors and investors who cannot bear the loss of some or all of their investment should not invest in the Fund. | | | |

* * *

Thank you for your attention to these matters. If you have any questions regarding these comments, please feel free to call either Michael S. Caccese, at (617) 261-3133, or me at (617) 261-3246.

| | | | | | | | | | Sincerely, /s/Clair E. Pagnano Clair E. Pagnano |

Appendix A

Representative List of Funds Using CAT Bonds

(all open-end investment companies)

Brookfield Investment Funds (four funds) (disclosure only in SAI): http://www.brookfieldim.com/_Global/49/img/content/Brookfield%20Investment%20Funds%20-%20SAI%20-%20April%2030%202012.pdf

Eaton Vance Commodity Strategy Fund: http://www.sec.gov/Archives/edgar/data/31266/000094039412000557/sitcommoditystrategy497kasre.htm

James Alpha Global Enhanced Real Return Portfolio (a series of the Saratoga Advantage Trust): http://www.saratogacap.com/images/stories/layout/Prospetus/JamesAlphaProspectus.pdf

Oppenheimer Capital Income Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/45156/000072888911001304/capitalincome485a.htm

Oppenheimer Currency Opportunities Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/1488080/000072888911000895/currencyopportunities485a.htm

Oppenheimer Diversified Alternatives Fund (Note: this fund has not yet been declared effective): http://www.sec.gov/Archives/edgar/data/1560050/000072888912001870/formn1a-a.htm

Oppenheimer Emerging Markets Debt Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/1488175/000072888912001193/body.htm

Oppenheimer Global Allocation Fund: http://www.sec.gov/Archives/edgar/data/817982/000072888911001572/qfv485a.htm

Oppenheimer Global Multi Strategies Fund: http://www.sec.gov/Archives/edgar/data/1368083/000072888912002007/body.htm

Oppenheimer International Bond Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/939800/000072888911001386/intbf485aposfiling.htm

Oppenheimer Master Event Linked Bond Fund: http://www.sec.gov/Archives/edgar/data/1433742/000072888912000111/posami.htm

Oppenheimer Strategic Income Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/850134/000072888911001387/globalstrategic485a.htm

Orinda SkyView Macro Opportunities Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/1027596/000089418912002308/oam_485b.htm

Pioneer Absolute Return Credit Fund: http://www.sec.gov/Archives/edgar/data/1174520/000119312512328386/d388962d497k.htm

Pioneer Bond Fund: http://www.sec.gov/Archives/edgar/data/276776/000119312512503628/d453536d497k.htm

Pioneer Classic Balanced Fund: http://www.sec.gov/Archives/edgar/data/1331854/000119312512487102/d447558d497k.htm

Pioneer Floating Rate Fund: http://www.sec.gov/Archives/edgar/data/1380192/000119312511355361/d277371d497k.htm

Pioneer Global Aggregate Bond Fund: http://www.sec.gov/Archives/edgar/data/1140157/000119312512092043/d310026d497k.htm

Pioneer Global High Yield Fund: http://www.sec.gov/Archives/edgar/data/1140157/000119312512091912/d310030d497k.htm

Pioneer High Yield Fund: http://www.sec.gov/Archives/edgar/data/1094521/000119312512091571/d310042d497k.htm

Pioneer Ibbotson Asset Allocation Series (trust, 4 funds): http://www.sec.gov/Archives/edgar/data/1288255/000128825512000011/ibbpartc.txt

Pioneer Multi-Asset Income Fund: http://www.sec.gov/Archives/edgar/data/1331854/000119312512487131/d447255d497k.htm

Pioneer Multi-Asset Real Return Fund: http://www.sec.gov/Archives/edgar/data/1380192/000119312512190531/d341938d497k.htm

Pioneer Multi-Asset Ultrashort Income Fund: http://www.sec.gov/Archives/edgar/data/1174520/000119312512503515/d453528d497k.htm

Pioneer Strategic Income Fund: http://www.sec.gov/Archives/edgar/data/1077452/000119312512503634/d453524d497k.htm

Pioneer Short Term Income Fund: http://www.sec.gov/Archives/edgar/data/1286364/000119312511351840/d273506d497k.htm

UBS Multi-Asset Income Fund: http://www.sec.gov/Archives/edgar/data/886244/000110465912073701/a12-21220_20497k.htm

Wilmington Funds Multi-Manager Real Asset Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/830744/000119312512372114/d341745d485bpos.htm

Wilmington Funds Rock Maple Alternatives Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/830744/000119312512372114/d341745d485bpos.htm

Wilmington Strategic Allocation Aggressive Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/830744/000119312512372114/d341745d485bpos.htm

Wilmington Conservative Asset Allocation Fund (disclosure only in SAI): http://www.sec.gov/Archives/edgar/data/830744/000119312512372114/d341745d485bpos.htm

The Hartford Alternative Strategies Fund (disclosure only in SAI):

The Hartford Quality Bond Fund (disclosure only in SAI):

The Hartford Total Return Bond HLS Fund (disclosure only in SAI):

Estabrook Value Fund and Estabrook Investment Grade Fixed Income Fund (series of FundVantage Trust) (disclosure only in SAI):

- 20 -