UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22761

Investment Company Act file number

Stone Ridge Trust

(Exact name of registrant as specified in charter)

405 Lexington Avenue, 55th Floor

New York, New York 10174

(Address of principal executive offices) (Zip code)

Jane Korach

Stone Ridge Trust

405 Lexington Avenue, 55th Floor

New York, New York 10174

(Name and address of agent for service)

(212) 257-4778

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2013

Date of reporting period: October 31, 2013

Item 1. Reports to Stockholders.

Table of Contents

Shareholder letter

December 2013

Dear Fellow Shareholder,

In 2013, Stone Ridge launched its first funds. Our growth – from a start-up working out of my apartment – to a global firm with 80 incredible clients and six funds – has been greater than we ever could have anticipated. How did this happen?

First, we are a kind firm. We are kind to each other. We are kind to our clients. We are kind to every vendor and counterpart we work with. Our portfolio managers are compensated, as detailed publicly in our SAI, based on the consistency of their kindness.

Second, we are a humble firm. Being humble is how we learn. Without this as a core principle, no single employee could keep up with the pace of innovation at Stone Ridge, nor in the markets. If anyone at Stone Ridge thinks that they already know everything, how can they possibly learn anything new? How can they be open to new ideas? If we are arrogant and the data changes, how are we going to let go of our beliefs if they are wrong? Instead, at Stone Ridge even the black belts come to work in their white belts and start every day with a beginner’s mind.

Third, we are focused. Very, very, very focused. This year we only did two things: Reinsurance and Variance Risk Premium. Imagine an entire firm focused every single day on just two things. That’s powerful. A real danger is that success leads to a dramatically increased opportunity set, which can be distracting. So, as an organization, we are world class at saying no.

Fourth, we got lucky. In our portfolio, there were no hurricanes. There were no earthquakes. There were no equity market crashes. That collective calmness drove the unusually strong risk-adjusted performance of our Reinsurance and Variance Risk Premium funds since launch. In future years, there will be tragic, terrible natural disasters and financial market shocks. The risk premiums we access will not deliver positive returns every year.

Stone Ridge, at its most basic, is about delivering access to valuable risks. That’s it. Risk taking is the most reliable way we know to build wealth in the long run. There are no shortcuts or free lunches. At Stone Ridge, we specialize in taking remote risks which, in any asset class, tend to have a higher ratio of risk premium to expected loss. And while we believe these risks will pay off on average and over the long term, the payoff periods are unpredictable. So are the drawdowns. If you want to realize the potential benefits of the risk taking, you have to stay in the trade.

I’m most proud of the 50/50 partnership Stone Ridge has with you, our clients. Both sides are equally important. You contribute the capital necessary to sustain and propel groundbreaking product development. We contribute our collective careers’ worth of experience in sourcing, structuring, execution, and risk management. Together, it works. In that spirit, I offer my deepest gratitude to you for sharing responsibility for your wealth with us this year. We look forward to serving you again in 2014.

Sincerely,

Ross L. Stevens

Founder, CEO

The opinions expressed are those of Stone Ridge Asset Management through the end of the period of this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is no guarantee of future results.

| | | | | | | | | | | | | | | | |

| 2 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

Shareholder Letter

The Funds are generally available only to registered investment advisors (“RIAs”) meeting certain qualifications and that have completed a training program provided by the Advisor. Before allocating shares of the Funds to a client’s account, RIAs should carefully consider the Fund’s risks and investment objectives, as an investing in the Funds may not be appropriate for all clients and is not designed to be a complete investment program. An investment in the Fund involves a high degree of risk. The event-linked securities in which the Fund invests are considered “high yield” or “junk bonds”. It is possible that investing in the Fund may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, an RIA should (i) consider the suitability of this investment with respect to a client’s investment objectives and individual situation and (ii) consider factors such as a client’s net worth, income, age, and risk tolerance. Allocation to client accounts should be avoided where a client has a short-term investing horizon and/or cannot bear the loss of some or all of their investment.

Mutual fund investing involves risk; Principal loss is possible. Event-linked, catastrophe bonds and reinsurance related securities carry large uncertainties and major risk exposures to adverse conditions. If a trigger event, as defined within the terms of the bond (such as a major natural disaster), involves losses or other metrics exceeding a specific magnitude in the geographic region and time period specified therein, the Fund may lose a portion or all of its investment in such security, including accrued interest and/or principal invested in such security. The Funds may invest in illiquid or restricted securities which may be difficult or impossible to sell at a time that the Funds would like or at the price that the Fund believes the security is worth. For additional risks, please refer to the prospectus.

The US Master Variance Risk Premium Fund, US Variance Risk Premium Fund, and US Small Cap Variance Risk Premium funds’ use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of counterparty or due to tax or regulatory constraints. Derivatives may create economic leverage in the Fund, which magnifies the Fund’s exposure to the underlying investment. When derivatives are used to gain or limit exposure to a particular market or market segment, their performance may not correlate as expected to the performance of such market thereby causing the Fund to fail to achieve its original purpose for using such derivatives. The use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Derivative instruments may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. Investing in an ETF exposes the Fund to all of the risks of that ETF’s investments. As a result, the cost of investing in ETF shares may exceed the costs of investing directly in its underlying investments. ETF shares trade on an exchange at a market price which may vary from the ETF’s net asset value. The Fund is subject to leveraging risk. Leverage magnifies the Fund’s exposure to declines in the value of one or more underlying investments or creates investment risk with respect to a larger pool of assets than the Fund would otherwise have. The stocks of smaller, less seasoned companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk. If, in any year, the Fund fails to qualify as a RIC under the Code for any reason, such a failure would have a material adverse effect on the Fund and its shareholders.

This information is intended for the shareholders of the Funds and is not for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The Stone Ridge Funds are distributed by Quasar Distributors, LLC.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 3 |

| | | | | | | | | | |

| | |

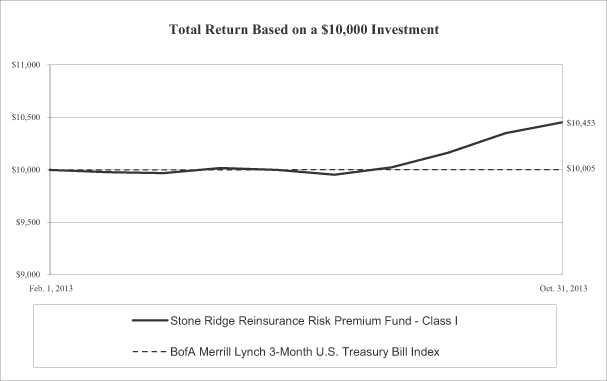

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | |

|

| PERFORMANCE DATA (Unaudited) |

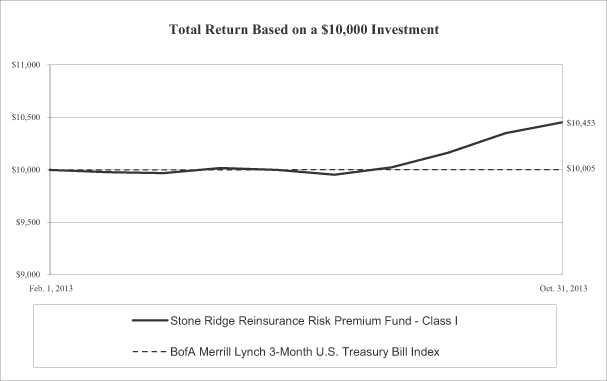

This chart assumes an initial gross investment of $10,000 made on February 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction for fees, taxes or expenses, and are not available for investment.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2013) (Unaudited) | | | |

| | | Since

Inception

(02/01/13) | |

| Stone Ridge Reinsurance Risk Premium Fund — Class I | | | 4.53% | |

| Stone Ridge Reinsurance Risk Premium Fund — Class M | | | 4.48% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.05% | |

| | | | | | | | | | | | | | | | |

| 4 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | |

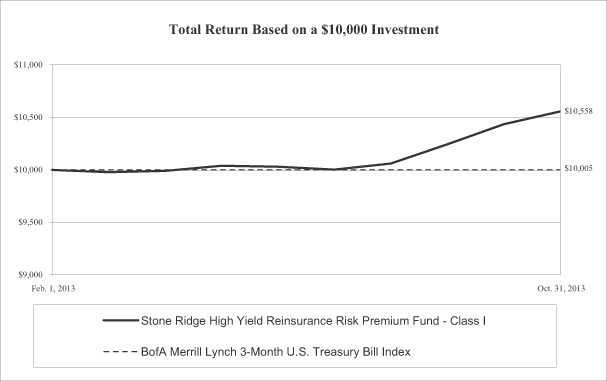

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | |

|

| PERFORMANCE DATA (Unaudited) |

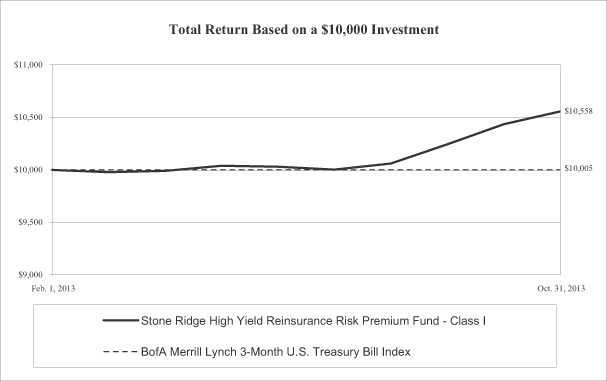

This chart assumes an initial gross investment of $10,000 made on February 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction for fees, taxes or expenses, and are not available for investment.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2013) (Unaudited) | | | |

| | | Since

Inception

(02/01/13) | |

| Stone Ridge High Yield Reinsurance Risk Premium Fund — Class I | | | 5.58% | |

| Stone Ridge High Yield Reinsurance Risk Premium Fund — Class M | | | 5.43% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.05% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 5 |

| | | | | | | | | | |

| | |

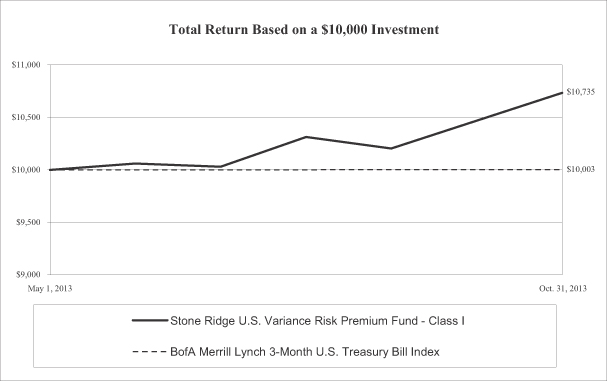

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

|

| PERFORMANCE DATA (Unaudited) |

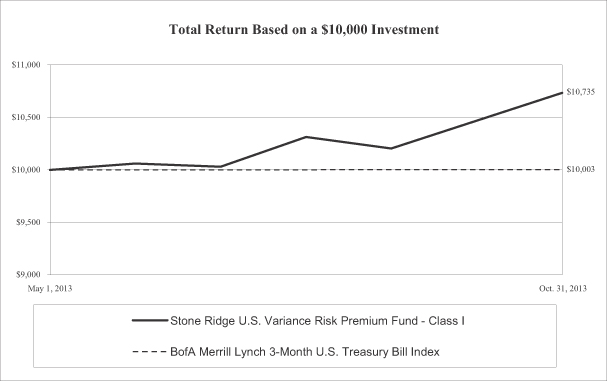

This chart assumes an initial gross investment of $10,000 made on May 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction for fees, taxes or expenses, and are not available for investment.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2013) (Unaudited) | | | |

| | | Since

Inception

(05/01/13) | |

| Stone Ridge U.S. Variance Risk Premium Fund — Class I | | | 7.35% | |

| Stone Ridge U.S. Variance Risk Premium Fund — Class M | | | 7.25% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.03% | |

| | | | | | | | | | | | | | | | |

| 6 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | |

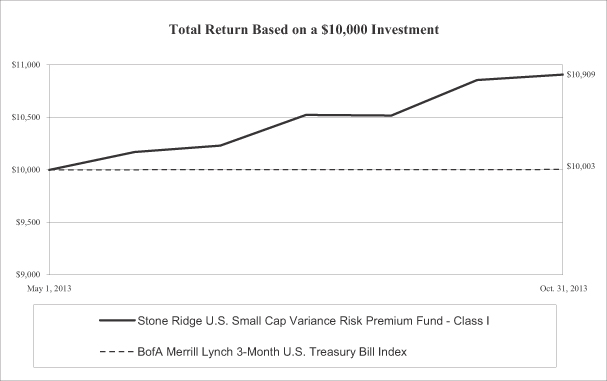

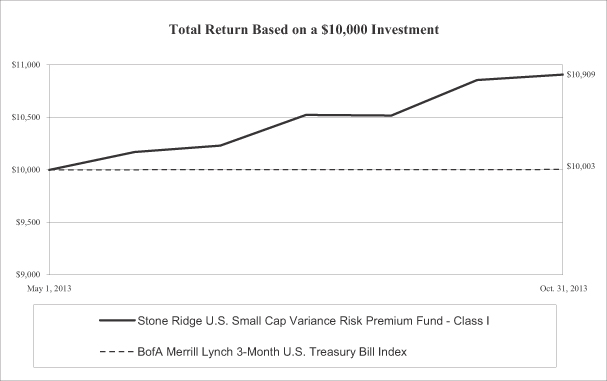

| STONE RIDGE U.S. SMALL CAP VARIANCE RISK PREMIUM FUND | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on May 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction for fees, taxes or expenses, and are not available for investment.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2013) (Unaudited) | | | |

| | | Since

Inception

(05/01/13) | |

| Stone Ridge U.S. Small Cap Variance Risk Premium Fund — Class I | | | 9.09% | |

| Stone Ridge U.S. Small Cap Variance Risk Premium Fund — Class M | | | 8.99% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.03% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 7 |

| | | | | | | | | | |

| | |

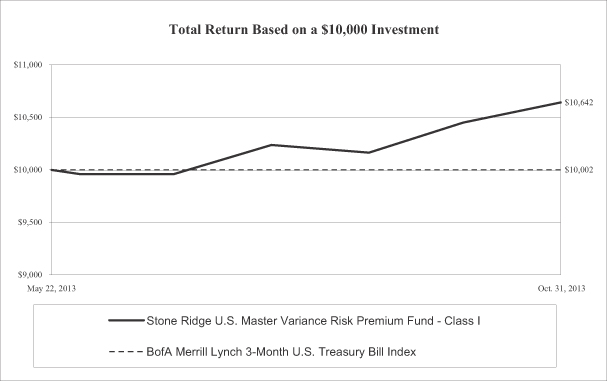

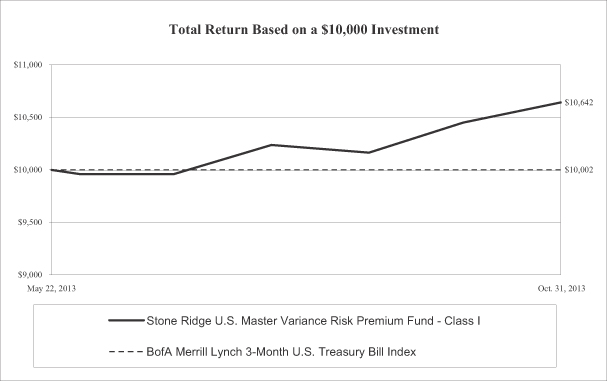

| STONE RIDGE U.S. MASTER VARIANCE RISK PREMIUM FUND | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on May 22, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction for fees, taxes or expenses, and are not available for investment.

| | | | |

AVERAGE ANNUAL TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2013) (Unaudited) | | | |

| | | Since

Inception

(05/22/13) | |

| Stone Ridge U.S. Master Variance Risk Premium Fund — Class I | | | 6.42% | |

| Stone Ridge U.S. Master Variance Risk Premium Fund — Class M | | | 6.36% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | |

| | | | | | | | | | | | | | | | |

| 8 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | |

| ALLOCATION OF PORTFOLIO HOLDINGS AT OCTOBER 31, 2013 (Unaudited) |

| | | | | | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY YEAR OF SCHEDULED MATURITY | |

| | |

| 2014 | | | $60,587,720 | | | | 11.9% | |

| | |

| 2015 | | | 71,206,664 | | | | 13.9% | |

| | |

| 2016 | | | 141,110,688 | | | | 27.6% | |

| | |

| 2017 | | | 130,840,269 | | | | 25.6% | |

| | |

| 2018 | | | 55,072,028 | | | | 10.8% | |

| | |

| 2019 | | | 40,420,751 | | | | 7.9% | |

| | |

| Not Applicable | | | 2,494,350 | | | | 0.5% | |

| | |

| Cash(1) | | | 9,118,222 | | | | 1.8% | |

| | | $510,850,692 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Consumer Discretionary | | | $13,931,413 | | | | 3.8% | |

| | |

| Information Technology | | | 13,089,230 | | | | 3.6% | |

| | |

| Health Care | | | 7,951,631 | | | | 2.2% | |

| | |

| Industrials | | | 6,802,319 | | | | 1.9% | |

| | |

| Energy | | | 6,754,548 | | | | 1.9% | |

| | |

| Financials | | | 6,462,269 | | | | 1.8% | |

| | |

| Materials | | | 5,342,801 | | | | 1.5% | |

| | |

| Consumer Staples | | | 4,854,360 | | | | 1.3% | |

| | |

| Telecommunication Services | | | 744,202 | | | | 0.2% | |

| | |

| Utilities | | | 632,232 | | | | 0.2% | |

| | |

| Cash(1) | | | 295,699,442 | | | | 81.6% | |

| | | $362,264,447 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. MASTER VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY HOLDINGS | |

| | |

| Stone Ridge U.S. Variance Risk Premium Fund - Class I | | | $150,827,835 | | | | 66.6% | |

| | |

| Stone Ridge U.S. Small Cap Variance Risk Premium Fund - Class I | | | 74,977,437 | | | | 33.1% | |

| | |

| Cash(1) | | | 508,406 | | | | 0.3% | |

| | | $226,313,678 | | | | | |

| | | | | | | | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY YEAR OF SCHEDULED MATURITY | |

| | |

| 2014 | | | $21,591,992 | | | | 10.4% | |

| | |

| 2015 | | | 30,411,909 | | | | 14.7% | |

| | |

| 2016 | | | 52,248,695 | | | | 25.2% | |

| | |

| 2017 | | | 62,884,078 | | | | 30.3% | |

| | |

| 2018 | | | 20,479,236 | | | | 9.9% | |

| | |

| 2019 | | | 15,610,875 | | | | 7.5% | |

| | |

| Not Applicable | | | 831,450 | | | | 0.4% | |

| | |

| Cash(1) | | | 3,170,485 | | | | 1.6% | |

| | | $207,228,720 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. SMALL CAP VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Health Care | | | $1,179,464 | | | | 1.0% | |

| | |

| Information Technology | | | 1,132,956 | | | | 1.0% | |

| | |

| Consumer Discretionary | | | 749,825 | | | | 0.7% | |

| | |

| Materials | | | 363,470 | | | | 0.3% | |

| | |

| Energy | | | 294,884 | | | | 0.3% | |

| | |

| Industrials | | | 225,803 | | | | 0.2% | |

| | |

| Telecommunication Services | | | 143,021 | | | | 0.1% | |

| | |

| Consumer Staples | | | 133,010 | | | | 0.1% | |

| | |

| Financials | | | 49,704 | | | | 0.0% | |

| | |

| Cash(1) | | | 109,552,682 | | | | 96.3% | |

| | | $113,824,819 | | | | | |

(1) Cash, cash equivalents and assets in excess of liabilities.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard and Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 9 |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| EVENT LINKED BONDS - 82.2% | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| FINANCIAL SERVICES - 82.2% | | | | | | | | |

| | |

| Europe - 8.3% | | | | | | | | |

Atlas Re VII B

3.650%, 01/07/2016 (a)(b)(c) | | € | 2,250,000 | | | $ | 3,077,673 | |

Atlas VI 2011-2 A

8.000%, 04/09/2015 (a)(b)(c) | | € | 1,875,000 | | | | 2,582,852 | |

Calypso 2010-1 A

3.735%, 01/10/2014 (a)(b)(c) | | € | 9,500,000 | | | | 12,843,579 | |

Calypso 2011-1 A

4.100%, 01/09/2015 (a)(b)(c) | | € | 5,000,000 | | | | 6,846,699 | |

Calypso Capital II Class B

1.500%, 01/08/2018 (a)(b)(c) | | € | 2,750,000 | | | | 3,732,596 | |

Pylon II A

5.624%, 05/05/2016 (a)(b)(c) | | € | 1,000,000 | | | | 1,428,616 | |

Queen Street III

4.796%, 07/28/2014 (a)(b)(c) | | $ | 12,000,000 | | | | 12,035,540 | |

| | | | | | | | |

| | | | | | | 42,547,555 | |

| | | | | | | | |

| Global - 8.8% | | | | | | | | |

Blue Danube 2012-1 B

10.796%, 04/10/2015 (a)(b)(c) | | | 2,298,000 | | | | 2,471,907 | |

Blue Danube II 2013-1 A

4.368%, 05/23/2016 (a)(b)(c) | | | 10,042,000 | | | | 10,182,273 | |

EOS B

6.546%, 05/26/2014 (a)(b)(c) | | | 1,772,000 | | | | 1,800,436 | |

Galileo Re 2013-1

7.400%, 01/09/2017 (a)(b)(c) | | | 5,500,000 | | | | 5,497,593 | |

Montana Re 2010-1 E

9.758%, 01/08/2014 (a)(b)(c) | | | 904,000 | | | | 912,906 | |

Mythen Re 2012-2 A

8.613%, 01/05/2017 (a)(b)(c) | | | 578,000 | | | | 602,796 | |

Queen Street II

7.546%, 04/09/2014 (a)(b)(c) | | | 1,181,000 | | | | 1,198,071 | |

Queen Street IV

7.546%, 04/09/2015 (a)(b)(c) | | | 1,181,000 | | | | 1,218,711 | |

Queen Street V

8.546%, 04/09/2015 (a)(b)(c) | | | 1,181,000 | | | | 1,232,381 | |

Queen Street VI

10.396%, 04/09/2015 (a)(b)(c) | | | 2,515,000 | | | | 2,626,612 | |

Queen Street VIII

6.546%, 06/08/2016 (a)(b)(c) | | | 3,250,000 | | | | 3,271,215 | |

Successor X 2012-1 V-AA3

16.546%, 01/27/2015 (a)(b)(c) | | | 1,293,000 | | | | 1,348,211 | |

Tradewynd Re 2013-1 1

8.296%, 07/09/2018 (a)(b)(c) | | | 10,357,000 | | | | 10,766,757 | |

Tramline Re II 2013-1 A

3.296%, 07/07/2017 (a)(b)(c) | | | 1,750,000 | | | | 1,747,993 | |

| | | | | | | | |

| | | | | | | 44,877,862 | |

| | | | | | | | |

| Japan - 1.3% | | | | | | | | |

Nakama Re 2013-1

2.796%, 09/29/2016 (a)(b)(c) | | | 6,500,000 | | | | 6,531,123 | |

| | | | | | | | |

| | |

| Mexico - 1.8% | | | | | | | | |

MultiCat Mexico 2012-1 A

8.046%, 12/04/2015 (a)(b)(c) | | | 6,199,000 | | | | 6,401,707 | |

MultiCat Mexico 2012-1 B

7.796%, 12/04/2015 (a)(b)(c) | | | 1,875,000 | | | | 1,993,688 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| Mexico - 1.8% (continued) | | | | | | | | |

MultiCat Mexico 2012-1 C

7.546%, 12/04/2015 (a)(b)(c) | | $ | 541,000 | | | $ | 568,158 | |

| | | | | | | | |

| | | | | | | 8,963,553 | |

| | | | | | | | |

| Turkey - 3.5% | | | | | | | | |

Bosphorus 1 Re 2013-1 A

2.546%, 05/03/2016 (a)(b)(c) | | | 18,000,000 | | | | 17,956,812 | |

| | | | | | | | |

| | |

| United States - 58.2% | | | | | | | | |

Armor Re 2013-1 A

4.250%, 05/14/2014 (a)(b)(c) | | | 9,453,000 | | | | 9,579,076 | |

Atlas Re VII A

8.118%, 01/07/2016 (a)(b)(c) | | | 1,772,000 | | | | 1,828,922 | |

Caelus Re 2013-1 A

5.296%, 03/07/2016 (a)(b)(c) | | | 6,021,000 | | | | 6,093,746 | |

Caelus Re 2013-2 A

6.896%, 04/07/2017 (a)(b)(c) | | | 20,494,000 | | | | 21,050,994 | |

Combine Re C

17.796%, 01/07/2015 (a)(b)(c) | | | 1,255,000 | | | | 1,382,634 | |

Compass Re 2011-1 2

10.296%, 01/08/2015 (a)(b)(c) | | | 4,140,000 | | | | 4,353,960 | |

Compass Re 2011-1 3

11.296%, 01/08/2015 (a)(b)(c) | | | 4,730,000 | | | | 4,996,000 | |

East Lane IV 2011-1 A

5.796%, 03/14/2014 (a)(b)(c) | | | 1,750,000 | | | | 1,773,215 | |

East Lane IV 2011-1 B

6.696%, 03/13/2015 (a)(b)(c) | | | 4,238,000 | | | | 4,434,920 | |

Embarcadero Re 2011-1 A

6.680%, 08/04/2014 (a)(b)(c) | | | 3,125,000 | | | | 3,179,528 | |

Embarcadero Re 2012-1 A

7.394%, 02/13/2015 (a)(b)(c) | | | 1,647,000 | | | | 1,704,981 | |

Embarcadero Re 2012-2 A

5.046%, 08/07/2015 (a)(b)(c) | | | 6,750,000 | | | | 6,996,667 | |

Everglades Re 2012-1 A

17.796%, 04/30/2014 (a)(b)(c) | | | 5,731,000 | | | | 6,173,951 | |

Everglades Re 2013-1 A

10.046%, 03/28/2016 (a)(b)(c) | | | 12,600,000 | | | | 13,360,399 | |

Foundation Re III 2010-1 A

5.796%, 02/03/2014 (a)(b)(c) | | | 1,093,000 | | | | 1,102,953 | |

Golden State Re 2011-1

3.796%, 01/08/2015 (a)(b)(c) | | | 2,750,000 | | | | 2,792,954 | |

Green Fields II 2013-1 A

2.750%, 01/09/2017 (a)(b)(c) | | € | 2,250,000 | | | | 3,067,474 | |

Ibis Re II 2013-1 A

4.046%, 06/28/2016 (a)(b)(c) | | $ | 3,250,000 | | | | 3,318,782 | |

Ibis Re II 2013-1 B

4.546%, 06/28/2016 (a)(b)(c) | | | 4,500,000 | | | | 4,579,492 | |

Ibis Re II 2013-1 C

8.046%, 06/28/2016 (a)(b)(c) | | | 3,250,000 | | | | 3,362,092 | |

Johnston Re 2011-1 B

6.946%, 05/08/2014 (a)(b)(c) | | | 2,500,000 | | | | 2,564,311 | |

Lakeside Re III

8.046%, 01/08/2016 (a)(b)(c) | | | 10,975,000 | | | | 11,635,571 | |

Lodestone Re 2010-2 A-1

6.046%, 01/08/2014 (a)(b)(c) | | | 585,000 | | | | 588,306 | |

Lodestone Re 2010-2 A-2

7.296%, 01/08/2014 (a)(b)(c) | | | 3,544,000 | | | | 3,568,894 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| 10 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| United States - 58.2% (continued) | | | | | | | | |

Long Point Re III 2013-1 A

4.046%, 05/18/2016 (a)(b)(c) | | $ | 13,639,000 | | | $ | 13,899,253 | |

Merna Re IV

2.546%, 04/08/2016 (a)(b)(c) | | | 6,250,000 | | | | 6,302,515 | |

Metrocat Re 2013-1 A

4.546%, 08/05/2016 (a)(b)(c) | | | 3,750,000 | | | | 3,854,381 | |

Mona Lisa Re 2013-2 A

7.346%, 07/07/2017 (a)(b)(c) | | | 16,164,000 | | | | 16,834,137 | |

Montana Re 2010-1 C

12.158%, 01/08/2014 (a)(b)(c) | | | 586,000 | | | | 595,127 | |

Mystic Re III 2012-1 B

12.046%, 03/12/2015 (a)(b)(c) | | | 2,024,000 | | | | 2,176,335 | |

Mythen Re 2013-1 B

8.046%, 07/09/2015 (a)(b)(c) | | | 9,700,000 | | | | 10,100,610 | |

Northshore Re 2013-1 A

7.296%, 07/05/2016 (a)(b)(c) | | | 14,621,000 | | | | 15,029,318 | |

Pelican Re 2013-1 A

6.046%, 05/15/2017 (a)(b)(c) | | | 10,862,000 | | | | 11,115,377 | |

Residential Re 2011-1 1

9.046%, 06/06/2015 (a)(b)(c) | | | 1,186,000 | | | | 1,255,739 | |

Residential Re 2011-1 5

8.796%, 06/06/2015 (a)(b)(c) | | | 577,000 | | | | 619,335 | |

Residential Re 2011-2 1

8.946%, 12/06/2015 (a)(b)(c) | | | 2,358,000 | | | | 2,481,230 | |

Residential Re 2012-1 3

10.046%, 06/06/2016 (a)(b)(c) | | | 2,332,000 | | | | 2,592,563 | |

Residential Re 2012-2 2

5.796%, 12/06/2016 (a)(b)(c) | | | 1,149,000 | | | | 1,205,431 | |

Residential Re 2012-2 4

19.046%, 12/06/2016 (a)(b)(c) | | | 2,570,000 | | | | 2,820,261 | |

Residential Re 2013-1 11

8.046%, 06/06/2017 (a)(b)(c) | | | 24,900,000 | | | | 25,857,152 | |

Residential Re 2013-1 3

9.296%, 06/06/2017 (a)(b)(c) | | | 14,400,000 | | | | 14,881,768 | |

Sanders Re 2013-1 A

3.546%, 05/05/2017 (a)(b)(c) | | | 22,000,000 | | | | 22,047,046 | |

Sanders Re 2013-1 B

4.046%, 05/05/2017 (a)(b)(c) | | | 8,110,000 | | | | 8,137,939 | |

Successor X 2011-2 IV-AL3

13.046%, 02/25/2014 (a)(b)(c) | | | 2,593,000 | | | | 2,671,827 | |

Successor X 2012-1 V-D3

11.046%, 01/27/2015 (a)(b)(c) | | | 591,000 | | | | 620,373 | |

Tar Heel 2013-1 A

8.546%, 05/09/2016 (a)(b)(c) | | | 8,289,000 | | | | 8,780,250 | |

| | | | | | | | |

| | | | | | | 297,367,789 | |

| | | | | | | | |

| Unites States - 0.3% | | | | | | | | |

Atlas IX 2013-1 Class B

3.676%, 01/17/2019 (a)(b)(c) | | | 1,250,000 | | | | 1,256,626 | |

| | | | | | | | |

TOTAL EVENT LINKED BONDS

(Cost $410,637,816) | | | | | | | 419,501,320 | |

| | | | | | | | |

| PARTICIPATION NOTES (QUOTA SHARES) - 15.6% | |

|

| FINANCIAL SERVICES - 15.6% | |

|

| Global - 7.9% | |

Sector Re V LTD Series 3 Class A

03/01/2018 (b)(d)(e)(f) | | | 35,750,000 | | | | 40,572,675 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| United States - 7.7% | | | | | | | | |

Sector Re V LTD Series 3 Class F

03/01/2019 (b)(d)(e)(g) | | $ | 35,750,000 | | | $ | 39,164,125 | |

| | | | | | | | |

TOTAL PARTICIPATION NOTES

(QUOTA SHARES)

(Cost $71,500,000) | | | | | | | 79,736,800 | |

| | | | | | | | |

| | |

| PREFERENCE SHARES (QUOTA SHARES) - 0.5% | | | SHARES | | | | | |

| FINANCIAL SERVICES - 0.5% | | | | | | | | |

| | |

| Global - 0.5% | | | | | | | | |

| Lorenz Re Class B (b)(d)(e)(h) | | | 22,500 | | | | 2,494,350 | |

| | | | | | | | |

TOTAL PREFERENCE SHARES (QUOTA SHARES)

(Cost $2,250,000) | | | | | | | 2,494,350 | |

| | | | | | | | |

| |

| SHORT-TERM INVESTMENTS - 0.0% | | | | | |

| | |

| Money Market Funds - 0.0% | | | | | | | | |

| Fidelity Institutional Money Market Funds - Money Market Portfolio - 0.04% (i) | | | 38,676 | | | | 38,676 | |

| First American Government Obligations Fund - Class Z - 0.01% (i) | | | 38,676 | | | | 38,676 | |

| First American Prime Obligations Fund - Class Z - 0.02% (i) | | | 38,675 | | | | 38,675 | |

| Short Term Investments Trust - Liquid Assets Portfolio - Institutional Class - 0.02% (i) | | | 38,676 | | | | 38,676 | |

| Short Term Investments Trust - Treasury Portfolio - Institutional Class - 0.07% (i) | | | 38,676 | | | | 38,676 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $193,379) | | | | | | | 193,379 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $484,581,195) - 98.3% | | | | | | | 501,925,849 | |

| | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 1.7% | | | | | | | 8,924,843 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 510,850,692 | |

| | | | | | | | |

Principal amounts stated in U.S. dollars unless otherwise noted.

Country shown is geographic area of peril risk.

Percentages are stated as a percent of net assets.

| (a) | Security is restricted to resale to institutional investors. The Fund’s Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. The aggregate value of these securities at October 31, 2013 was $419,501,320 which represents 82.2% of net assets. |

| (b) | Foreign issued security. Total foreign securities by country of domicile are $501,732,470. Foreign concentration is as follows: Bermuda 57.1%, Cayman Islands 30.2%, Ireland 10.9%. |

| (c) | Variable rate security. The rate shown is as of 10/31/2013. |

| (d) | Non-income producing security. |

| (e) | Security is considered illiquid and may be difficult to sell. The aggregate value of illiquid securities at October 31, 2013 was $82,231,150 which represented 16.1% of net assets. |

| (f) | Security is restricted to resale. Cost: $35,750,000. Acquisition date: March 19, 2013. |

| (g) | Security is restricted to resale. Cost: $35,750,000. Acquisition date: March 12, 2013. |

| (h) | Security is restricted to resale. Cost: $2,250,000. Acquisition date: March 25, 2013. |

| (i) | Rate shown is 7-day effective yield. |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 11 |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| EVENT LINKED BONDS - 82.7% | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| FINANCIAL SERVICES - 82.7% | | | | | | | | |

| | |

| Europe - 0.7% | | | | | | | | |

Atlas VI 2011-2 A

8.000%, 04/09/2015 (a)(b)(c) | | € | 1,125,000 | | | $ | 1,549,711 | |

| | | | | | | | |

| | |

| Global - 12.1% | | | | | | | | |

Blue Danube 2012-1 B

10.796%, 04/10/2015 (a)(b)(c) | | $ | 1,702,000 | | | | 1,830,804 | |

Blue Danube II 2013-1 A

4.368%, 05/23/2016 (a)(b)(c) | | | 6,958,000 | | | | 7,055,194 | |

EOS B

6.546%, 05/26/2014 (a)(b)(c) | | | 1,228,000 | | | | 1,247,706 | |

Galileo Re 2013-1

7.400%, 01/09/2017 (a)(b)(c) | | | 4,000,000 | | | | 3,998,249 | |

Montana Re 2010-1 E

9.758%, 01/08/2014 (a)(b)(c) | | | 596,000 | | | | 601,872 | |

Mythen Re 2012-2 A

8.613%, 01/05/2017 (a)(b)(c) | | | 422,000 | | | | 440,104 | |

Queen Street II

7.546%, 04/09/2014 (a)(b)(c) | | | 819,000 | | | | 830,838 | |

Queen Street IV

7.546%, 04/09/2015 (a)(b)(c) | | | 819,000 | | | | 845,152 | |

Queen Street V

8.546%, 04/09/2015 (a)(b)(c) | | | 819,000 | | | | 854,632 | |

Queen Street VI

10.396%, 04/09/2015 (a)(b)(c) | | | 1,735,000 | | | | 1,811,996 | |

Queen Street VIII

6.546%, 06/08/2016 (a)(b)(c) | | | 250,000 | | | | 251,632 | |

Successor X 2012-1 V-AA3

16.546%, 01/27/2015 (a)(b)(c) | | | 957,000 | | | | 997,864 | |

Tradewynd Re 2013-1 1

8.296%, 07/09/2018 (a)(b)(c) | | | 4,143,000 | | | | 4,306,911 | |

| | | | | | | | |

| | | | | | | 25,072,954 | |

| | | | | | | | |

| Mexico - 3.2% | | | | | | | | |

MultiCat Mexico 2012-1 A

8.046%, 12/04/2015 (a)(b)(c) | | | 4,801,000 | | | | 4,957,993 | |

MultiCat Mexico 2012-1 B

7.796%, 12/04/2015 (a)(b)(c) | | | 1,125,000 | | | | 1,196,212 | |

MultiCat Mexico 2012-1 C

7.546%, 12/04/2015 (a)(b)(c) | | | 459,000 | | | | 482,042 | |

| | | | | | | | |

| | | | | | | 6,636,247 | |

| | | | | | | | |

| United States - 66.7% | | | | | | | | |

Armor Re 2013-1 A

4.250%, 05/14/2014 (a)(b)(c) | | | 6,547,000 | | | | 6,634,318 | |

Atlas Re VII A

8.118%, 01/07/2016 (a)(b)(c) | | | 1,228,000 | | | | 1,267,447 | |

Caelus Re 2013-1 A

5.296%, 03/07/2016 (a)(b)(c) | | | 4,229,000 | | | | 4,280,095 | |

Caelus Re 2013-2 A

6.896%, 04/07/2017 (a)(b)(c) | | | 14,506,000 | | | | 14,900,250 | |

Combine Re C

17.796%, 01/07/2015 (a)(b)(c) | | | 945,000 | | | | 1,041,106 | |

Compass Re 2011-1 2

10.296%, 01/08/2015 (a)(b)(c) | | | 2,860,000 | | | | 3,007,808 | |

Compass Re 2011-1 3

11.296%, 01/08/2015 (a)(b)(c) | | | 3,270,000 | | | | 3,453,894 | |

East Lane IV 2011-1 B

6.696%, 03/13/2015 (a)(b)(c) | | | 1,637,000 | | | | 1,713,064 | |

Embarcadero Re 2011-1 A

6.680%, 08/04/2014 (a)(b)(c) | | | 1,875,000 | | | | 1,907,717 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

| United States - 66.7% (continued) | | | | | |

Embarcadero Re 2012-1 A

7.394%, 02/13/2015 (a)(b)(c) | | $ | 1,253,000 | | | $ | 1,297,111 | |

Everglades Re 2012-1 A

17.796%, 04/30/2014 (a)(b)(c) | | | 4,019,000 | | | | 4,329,630 | |

Everglades Re 2013-1 A

10.046%, 03/28/2016 (a)(b)(c) | | | 8,400,000 | | | | 8,906,933 | |

Foundation Re III 2010-1 A

5.796%, 02/03/2014 (a)(b)(c) | | | 757,000 | | | | 763,893 | |

Ibis Re II 2013-1 C

8.046%, 06/28/2016 (a)(b)(c) | | | 2,000,000 | | | | 2,068,979 | |

Lakeside Re III

8.046%, 01/08/2016 (a)(b)(c) | | | 8,700,000 | | | | 9,223,642 | |

Lodestone Re 2010-2 A-1

6.046%, 01/08/2014 (a)(b)(c) | | | 415,000 | | | | 417,345 | |

Lodestone Re 2010-2 A-2

7.296%, 01/08/2014 (a)(b)(c) | | | 2,456,000 | | | | 2,473,252 | |

Long Point Re III 2013-1 A

4.046%, 05/18/2016 (a)(b)(c) | | | 2,861,000 | | | | 2,915,592 | |

Mona Lisa Re 2013-2 A

7.346%, 07/07/2017 (a)(b)(c) | | | 1,836,000 | | | | 1,912,118 | |

Montana Re 2010-1 C

12.158%, 01/08/2014 (a)(b)(c) | | | 414,000 | | | | 420,448 | |

Mystic Re III 2012-1 B

12.046%, 03/12/2015 (a)(b)(c) | | | 1,476,000 | | | | 1,587,090 | |

Mythen Re 2013-1 B

8.046%, 07/09/2015 (a)(b)(c) | | | 300,000 | | | | 312,390 | |

Northshore Re 2013-1 A

7.296%, 07/05/2016 (a)(b)(c) | | | 5,379,000 | | | | 5,529,218 | |

Pelican Re 2013-1 A

6.046%, 05/15/2017 (a)(b)(c) | | | 7,388,000 | | | | 7,560,340 | |

Residential Re 2011-1 1

9.046%, 06/06/2015 (a)(b)(c) | | | 814,000 | | | | 861,865 | |

Residential Re 2011-1 5

8.796%, 06/06/2015 (a)(b)(c) | | | 423,000 | | | | 454,036 | |

Residential Re 2011-2 1

8.946%, 12/06/2015 (a)(b)(c) | | | 1,642,000 | | | | 1,727,812 | |

Residential Re 2012-1 3

10.046%, 06/06/2016 (a)(b)(c) | | | 1,668,000 | | | | 1,854,372 | |

Residential Re 2012-2 2

5.796%, 12/06/2016 (a)(b)(c) | | | 851,000 | | | | 892,795 | |

Residential Re 2012-2 4

19.046%, 12/06/2016 (a)(b)(c) | | | 1,780,000 | | | | 1,953,332 | |

Residential Re 2013-1 11

8.046%, 06/06/2017 (a)(b)(c) | | | 16,600,000 | | | | 17,238,102 | |

Residential Re 2013-1 3

9.296%, 06/06/2017 (a)(b)(c) | | | 9,600,000 | | | | 9,921,179 | |

Sanders Re 2013-1 B

4.046%, 05/05/2017 (a)(b)(c) | | | 6,890,000 | | | | 6,913,736 | |

Successor X 2011-2 IV-AL3

13.046%, 02/25/2014 (a)(b)(c) | | | 1,907,000 | | | | 1,964,973 | |

Successor X 2012-1 V-D3

11.046%, 01/27/2015 (a)(b)(c) | | | 409,000 | | | | 429,327 | |

Tar Heel 2013-1 A

8.546%, 05/09/2016 (a)(b)(c) | | | 5,711,000 | | | | 6,049,464 | |

| | | | | | | | |

| | | | | | | 138,184,673 | |

| | | | | | | | |

TOTAL EVENT LINKED BONDS

(Cost $167,322,395) | | | | | | | 171,443,585 | |

| | | | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| 12 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR VALUE | |

PARTICIPATION NOTES

(QUOTA SHARES) - 15.4% | |

| FINANCIAL SERVICES - 15.4% | |

|

| Global - 7.8% | |

Sector Re V LTD Series 3 Class A

03/01/2018 (b)(d)(e)(f) | | $ | 14,250,000 | | | $ | 16,172,325 | |

| | | | | | | | |

| | |

| United States - 7.6% | | | | | | | | |

Sector Re V LTD Series 3 Class F

03/01/2019 (b)(d)(e)(g) | | | 14,250,000 | | | | 15,610,875 | |

| | | | | | | | |

TOTAL PARTICIPATION NOTES (QUOTA SHARES)

(Cost $28,500,000) | | | | | | | 31,783,200 | |

| | | | | | | | |

| PREFERENCE SHARES (QUOTA SHARES) - 0.4% | | | SHARES | | | | | |

| FINANCIAL SERVICES - 0.4% | | | | | | | | |

| | |

| Global - 0.4% | | | | | | | | |

| Lorenz Re Class B (b)(d)(e)(h) | | | 7,500 | | | | 831,450 | |

| | | | | | | | |

TOTAL PREFERENCE SHARES (QUOTA SHARES)

(Cost $750,000) | | | | | | | 831,450 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS - 0.2% | | | | | |

| | |

| Money Market Funds - 0.2% | | | | | | | | |

| Fidelity Institutional Money Market Funds -Money Market Portfolio -0.04% (i) | | | 87,793 | | | | 87,793 | |

| First American Government Obligations Fund - Class Z - 0.01% (i) | | | 87,793 | | | | 87,793 | |

| First American Prime Obligations Fund - Class Z - 0.02% (i) | | | 87,793 | | | | 87,793 | |

| Short Term Investments Trust - Liquid Assets Portfolio -Institutional Class - 0.02% (i) | | | 87,792 | | | | 87,792 | |

| Short Term Investments Trust - Treasury Portfolio - Institutional Class - 0.07% (i) | | | 87,793 | | | | 87,793 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $438,964) | | | | | | | 438,964 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $197,011,359) - 98.7% | | | | | | | 204,497,199 | |

| | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 1.3% | | | | 2,731,521 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 207,228,720 | |

| | | | | | | | |

Principal amounts stated in U.S. dollars unless otherwise noted.

Country shown is geographic area of peril risk.

Percentages are stated as a percent of net assets.

| (a) | Security is restricted to resale to institutional investors. The Fund’s Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. The aggregate value of these securities at October 31, 2013 was $171,443,585 which represents 82.7% of net assets. |

| (b) | Foreign issued security. Total foreign securities by country of domicile are $204,058,235. Foreign concentration is as follows: Bermuda 54.5%, Cayman Islands 40.3%, Ireland 3.6%. |

| (c) | Variable rate security. The rate shown is as of 10/31/2013. |

| (d) | Non-income producing security. |

| (e) | Security is considered illiquid and may be difficult to sell. The aggregate value of illiquid securities at October 31, 2013 was $32,614,650 which represented 15.74% of net assets. |

| (f) | Security is restricted to resale. Cost: $14,250,000. Acquisition date: March 19, 2013. |

| (g) | Security is restricted to resale. Cost: $14,250,000. Acquisition date: March 12, 2013. |

| (h) | Security is restricted to resale. Cost: $750,000. Acquisition date: March 25, 2013. |

| (i) | Rate shown is the 7-day effective yield. |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 13 |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| COMMON STOCKS - 18.1% | | | | | | | | |

| | |

| Automobiles & Components - 0.3% | | | | | | | | |

| Delphi Automotive PLC (a)(b) | | | 300 | | | $ | 17,160 | |

| Ford Motor Co. (b) | | | 13,600 | | | | 232,696 | |

| General Motors Co. (b)(c) | | | 5,700 | | | | 210,615 | |

| Goodyear Tire & Rubber Co. (b)(c) | | | 9,100 | | | | 190,918 | |

| Harley-Davidson, Inc. (b) | | | 400 | | | | 25,616 | |

| Tesla Motors, Inc. (b)(c) | | | 2,700 | | | | 431,838 | |

| | | | | | | | |

| | | | | | | 1,108,843 | |

| | | | | | | | |

| Banks - 0.4% | | | | | | | | |

| BB&T Corp. (b) | | | 6,200 | | | | 210,614 | |

| CIT Group, Inc. (b)(c) | | | 4,200 | | | | 202,272 | |

| Comerica, Inc. (b) | | | 700 | | | | 30,310 | |

| Huntington Bancshares, Inc. (b) | | | 2,000 | | | | 17,600 | |

| Nationstar Mortgage Holdings, Inc. (b)(c) | | | 3,600 | | | | 184,752 | |

| Ocwen Financial Corp. (b)(c) | | | 3,644 | | | | 204,902 | |

| Popular, Inc. (a)(b)(c) | | | 8,100 | | | | 204,525 | |

| The PNC Financial Services Group, Inc. (b) | | | 2,700 | | | | 198,531 | |

| Wells Fargo & Co. (b) | | | 5,600 | | | | 239,064 | |

| | | | | | | | |

| | | | | | | 1,492,570 | |

| | | | | | | | |

| Capital Goods - 1.3% | | | | | | | | |

| 3M Co. (b) | | | 1,800 | | | | 226,530 | |

| Actuant Corp. (b) | | | 100 | | | | 3,756 | |

| Alliant Techsystems, Inc. (b) | | | 500 | | | | 54,435 | |

| Boeing Co. (b) | | | 1,800 | | | | 234,900 | |

| Caterpillar, Inc. (b) | | | 2,400 | | | | 200,064 | |

| Chicago Bridge & Iron Co. NV (a)(b) | | | 59 | | | | 4,371 | |

| Colfax Corp. (b)(c) | | | 500 | | | | 27,980 | |

| Cummins, Inc. (b) | | | 1,700 | | | | 215,934 | |

| Deere & Co. (b) | | | 2,800 | | | | 229,152 | |

| Fluor Corp. (b) | | | 2,900 | | | | 215,238 | |

| General Dynamics Corp. (b) | | | 2,600 | | | | 225,238 | |

| General Electric Co. (b) | | | 8,500 | | | | 222,190 | |

| Honeywell International, Inc. (b) | | | 400 | | | | 34,692 | |

| Joy Global, Inc. (b) | | | 700 | | | | 39,725 | |

| Lennox International, Inc. (b) | | | 200 | | | | 15,612 | |

| Lockheed Martin Corp. (b) | | | 600 | | | | 80,004 | |

| Masco Corp. (b) | | | 9,400 | | | | 198,622 | |

| Navistar International Corp. (b)(c) | | | 4,800 | | | | 173,568 | |

| Nordson Corp. (b) | | | 1,200 | | | | 86,508 | |

| Pall Corp. (b) | | | 2,500 | | | | 201,300 | |

| Rockwell Collins, Inc. (b) | | | 400 | | | | 27,932 | |

| SolarCity Corp. (b)(c) | | | 3,000 | | | | 159,840 | |

| Terex Corp. (b)(c) | | | 6,000 | | | | 209,700 | |

| Textron, Inc. (b) | | | 6,000 | | | | 172,740 | |

| TransDigm Group, Inc. (b) | | | 1,600 | | | | 232,656 | |

| Trinity Industries, Inc. (b) | | | 3,600 | | | | 182,268 | |

| United Rentals, Inc. (b)(c) | | | 2,700 | | | | 174,393 | |

| United Technologies Corp. (b) | | | 1,900 | | | | 201,875 | |

| Valmont Industries, Inc. (b) | | | 1,300 | | | | 182,650 | |

| Watsco, Inc. (b) | | | 900 | | | | 85,761 | |

| WW Grainger, Inc. (b) | | | 700 | | | | 188,279 | |

| | | | | | | | |

| | | | | | | 4,507,913 | |

| | | | | | | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Commercial & Professional Services - 0.1% | | | | | |

| Pitney Bowes, Inc. (b) | | | 8,700 | | | $ | 185,658 | |

| The ADT Corp. (b) | | | 4,423 | | | | 191,826 | |

| | | | | | | | |

| | | | | | | 377,484 | |

| | | | | | | | |

| Consumer Durables & Apparel - 0.8% | | | | | | | | |

| D.R. Horton, Inc. (b) | | | 13,900 | | | | 263,405 | |

| Fossil Group, Inc. (b)(c) | | | 1,800 | | | | 228,492 | |

| Garmin Ltd. (a)(b) | | | 600 | | | | 28,050 | |

| Lennar Corp. (b) | | | 8,600 | | | | 305,730 | |

| Michael Kors Holdings Ltd. (a)(b)(c) | | | 2,800 | | | | 215,460 | |

| Mohawk Industries, Inc. (b)(c) | | | 1,600 | | | | 211,872 | |

| NIKE, Inc. (b) | | | 2,900 | | | | 219,704 | |

| PulteGroup, Inc. (b) | | | 12,800 | | | | 225,920 | |

| PVH Corp. (b) | | | 1,400 | | | | 174,398 | |

| Ralph Lauren Corp. (b) | | | 1,300 | | | | 215,332 | |

| Standard Pacific Corp. (b)(c) | | | 19,000 | | | | 150,670 | |

| Toll Brothers, Inc. (b)(c) | | | 2,900 | | | | 95,352 | |

| Under Armour, Inc. (b)(c) | | | 2,800 | | | | 227,220 | |

| VF Corp. (b) | | | 800 | | | | 172,000 | |

| Whirlpool Corp. (b) | | | 1,400 | | | | 204,414 | |

| Wolverine World Wide, Inc. (b) | | | 500 | | | | 28,870 | |

| | | | | | | | |

| | | | | | | 2,966,889 | |

| | | | | | | | |

| Consumer Services - 0.4% | | | | | | | | |

| Burger King Worldwide, Inc. (b) | | | 1,000 | | | | 21,180 | |

| Caesars Entertainment Corp. (b)(c) | | | 1,000 | | | | 17,420 | |

| Chipotle Mexican Grill, Inc. (b)(c) | | | 400 | | | | 210,788 | |

| Darden Restaurants, Inc. (b) | | | 600 | | | | 30,918 | |

| International Game Technology (b) | | | 8,000 | | | | 150,400 | |

| Las Vegas Sands Corp. (b) | | | 2,400 | | | | 168,528 | |

| McDonald’s Corp. (b) | | | 2,100 | | | | 202,692 | |

| MGM Resorts International (b)(c) | | | 8,700 | | | | 165,648 | |

| Panera Bread Co. (b)(c) | | | 400 | | | | 63,168 | |

| Sotheby’s (b) | | | 600 | | | | 31,140 | |

| Starbucks Corp. (b) | | | 2,700 | | | | 218,835 | |

| Starwood Hotels & Resorts Worldwide, Inc. (b) | | | 1,600 | | | | 117,792 | |

| Wynn Resorts Ltd. (b) | | | 700 | | | | 116,375 | |

| Yum! Brands, Inc. (b) | | | 2,100 | | | | 142,002 | |

| | | | | | | | |

| | | | | | | 1,656,886 | |

| | | | | | | | |

| Diversified Financials - 0.6% | | | | | | | | |

| American Express Co. (b) | | | 2,100 | | | | 171,780 | |

| Bank of America Corp. (b) | | | 10,000 | | | | 139,600 | |

| BlackRock, Inc. (b) | | | 600 | | | | 180,486 | |

| Capital One Financial Corp. (b) | | | 2,500 | | | | 171,675 | |

| Citigroup, Inc. (b) | | | 5,600 | | | | 273,168 | |

| Discover Financial Services (b) | | | 1,500 | | | | 77,820 | |

| Goldman Sachs Group, Inc. (b) | | | 1,500 | | | | 241,290 | |

| JPMorgan Chase & Co. (b) | | | 4,400 | | | | 226,776 | |

| Morgan Stanley (b) | | | 1,300 | | | | 37,349 | |

| Northern Trust Corp. (b) | | | 100 | | | | 5,642 | |

| State Street Corp. (b) | | | 3,100 | | | | 217,217 | |

| The Bank of New York Mellon Corp. (b) | | | 7,200 | | | | 228,960 | |

| | | | | | | | |

| | | | | | | 1,971,763 | |

| | | | | | | | |

| Energy - 1.9% | | | | | | | | |

| Anadarko Petroleum Corp. (b) | | | 2,300 | | | | 219,167 | |

| Apache Corp. (b) | | | 2,900 | | | | 257,520 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| 14 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Energy - 1.9% (continued) | | | | | | | | |

| Baker Hughes, Inc. (b) | | | 1,000 | | | $ | 58,090 | |

| Cheniere Energy, Inc. (b)(c) | | | 8,800 | | | | 350,240 | |

| Chesapeake Energy Corp. (b) | | | 6,000 | | | | 167,760 | |

| Chevron Corp. (b) | | | 1,700 | | | | 203,932 | |

| Cobalt International Energy, Inc. (b)(c) | | | 7,300 | | | | 169,433 | |

| ConocoPhillips (b) | | | 3,300 | | | | 241,890 | |

| CONSOL Energy, Inc. (b) | | | 4,200 | | | | 153,300 | |

| CVR Energy, Inc. (b) | | | 5,200 | | | | 206,544 | |

| Devon Energy Corp. (b) | | | 3,006 | | | | 190,039 | |

| Dresser-Rand Group, Inc. (b)(c) | | | 2,000 | | | | 121,540 | |

| Energen Corp. (b) | | | 300 | | | | 23,496 | |

| EOG Resources, Inc. (b) | | | 1,600 | | | | 285,440 | |

| Exxon Mobil Corp. (b) | | | 2,400 | | | | 215,088 | |

| FMC Technologies, Inc. (b)(c) | | | 600 | | | | 30,330 | |

| Gulfport Energy Corp. (b)(c) | | | 3,300 | | | | 193,677 | |

| Halliburton Co. (b) | | | 4,200 | | | | 222,726 | |

| Hess Corp. (b) | | | 2,600 | | | | 211,120 | |

| HollyFrontier Corp. (b) | | | 7,100 | | | | 327,026 | |

| Kinder Morgan, Inc./DE (b) | | | 5,300 | | | | 187,143 | |

| Marathon Oil Corp. (b) | | | 4,300 | | | | 151,618 | |

| Marathon Petroleum Corp. (b) | | | 1,100 | | | | 78,826 | |

| Nabors Industries Ltd. (a)(b) | | | 9,600 | | | | 167,808 | |

| National Oilwell Varco, Inc. (b) | | | 400 | | | | 32,472 | |

| Newfield Exploration Co. (b)(c) | | | 6,100 | | | | 185,745 | |

| Occidental Petroleum Corp. (b) | | | 2,200 | | | | 211,376 | |

| Oil States International, Inc. (b)(c) | | | 2,000 | | | | 217,260 | |

| Peabody Energy Corp. (b) | | | 16,400 | | | | 319,472 | |

| Phillips 66 (b) | | | 3,500 | | | | 225,505 | |

| Schlumberger Ltd. (a)(b) | | | 2,700 | | | | 253,044 | |

| Seadrill Ltd. (a)(b) | | | 3,800 | | | | 177,156 | |

| Southwestern Energy Co. (b)(c) | | | 5,500 | | | | 204,710 | |

| Tesoro Corp. (b) | | | 3,500 | | | | 171,115 | |

| The Williams Cos., Inc. (b) | | | 5,700 | | | | 203,547 | |

| Valero Energy Corp. (b) | | | 2,900 | | | | 119,393 | |

| | | | | | | | |

| | | | | | | 6,754,548 | |

| | | | | | | | |

| Food & Staples Retailing - 0.3% | | | | | | | | |

| Casey’s General Stores, Inc. (b) | | | 400 | | | | 29,152 | |

| Costco Wholesale Corp. (b) | | | 1,800 | | | | 212,400 | |

| CVS Caremark Corp. (b) | | | 3,500 | | | | 217,910 | |

| Kroger Co. (b) | | | 1,400 | | | | 59,976 | |

| Rite Aid Corp. (b)(c) | | | 20,000 | | | | 106,600 | |

| Safeway, Inc. (b) | | | 200 | | | | 6,980 | |

| Walgreen Co. (b) | | | 3,000 | | | | 177,720 | |

| Wal-Mart Stores, Inc. (b) | | | 2,700 | | | | 207,225 | |

| Whole Foods Market, Inc. (b) | | | 2,714 | | | | 171,335 | |

| | | | | | | | |

| | | | | | | 1,189,298 | |

| | | | | | | | |

| Food, Beverage & Tobacco - 0.7% | | | | | | | | |

| Archer-Daniels-Midland Co. (b) | | | 5,100 | | | | 208,590 | |

| Beam, Inc. (b) | | | 3,200 | | | | 215,360 | |

| Bunge Ltd. (a)(b) | | | 2,600 | | | | 213,538 | |

| Constellation Brands, Inc. (b)(c) | | | 3,700 | | | | 241,610 | |

| General Mills, Inc. (b) | | | 4,200 | | | | 211,764 | |

| Green Mountain Coffee Roasters, Inc. (b)(c) | | | 4,700 | | | | 295,207 | |

| Kraft Foods Group, Inc. (b) | | | 900 | | | | 48,942 | |

| Lorillard, Inc. (b) | | | 4,500 | | | | 229,545 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Food, Beverage & Tobacco - 0.7% (continued) | | | | | |

| Mead Johnson Nutrition Co. (b) | | | 2,700 | | | $ | 220,482 | |

| Mondelez International, Inc. (b) | | | 5,300 | | | | 178,292 | |

| PepsiCo, Inc. (b) | | | 2,100 | | | | 176,589 | |

| Philip Morris International, Inc. (b) | | | 2,000 | | | | 178,240 | |

| The Coca-Cola Co. (b) | | | 5,000 | | | | 197,850 | |

| The Hershey Co. (b) | | | 300 | | | | 29,772 | |

| Tyson Foods, Inc. (b) | | | 100 | | | | 2,767 | |

| | | | | | | | |

| | | | | | | 2,648,548 | |

| | | | | | | | |

| Health Care Equipment & Services - 0.9% | | | | | |

| Abbott Laboratories (b) | | | 6,800 | | | | 248,540 | |

| Aetna, Inc. (b) | | | 3,501 | | | | 219,512 | |

| Baxter International, Inc. (b) | | | 3,300 | | | | 217,371 | |

| Becton Dickinson & Co. (b) | | | 300 | | | | 31,539 | |

| Boston Scientific Corp. (b)(c) | | | 13,200 | | | | 154,308 | |

| Catamaran Corp. (a)(b)(c) | | | 600 | | | | 28,176 | |

| Cerner Corp. (b)(c) | | | 3,400 | | | | 190,502 | |

| Cigna Corp. (b) | | | 2,600 | | | | 200,148 | |

| Community Health Systems, Inc. (b) | | | 3,660 | | | | 159,686 | |

| Cooper Cos, Inc. (b) | | | 1,400 | | | | 180,894 | |

| Express Scripts Holding Co. (b)(c) | | | 3,300 | | | | 206,316 | |

| HCA Holdings, Inc. (b) | | | 7 | | | | 330 | |

| Health Management Associates, Inc. (b)(c) | | | 11,300 | | | | 144,866 | |

| Hologic, Inc. (b)(c) | | | 4,600 | | | | 102,994 | |

| Intuitive Surgical, Inc. (b)(c) | | | 600 | | | | 222,900 | |

| Laboratory Corp of America (b) Holdings (b)(c) | | | 1,800 | | | | 181,620 | |

| Medtronic, Inc. (b) | | | 2,000 | | | | 114,800 | |

| Quest Diagnostics, Inc. (b) | | | 1,500 | | | | 89,865 | |

| St. Jude Medical, Inc. (b) | | | 500 | | | | 28,695 | |

| UnitedHealth Group, Inc. (b) | | | 800 | | | | 54,608 | |

| WellPoint, Inc. (b) | | | 2,500 | | | | 212,000 | |

| | | | | | | | |

| | | | | | | 2,989,670 | |

| | | | | | | | |

| Household & Personal Products - 0.3% | | | | | | | | |

| Colgate-Palmolive Co. (b) | | | 500 | | | | 32,365 | |

| Herbalife Ltd. (a)(b) | | | 5,700 | | | | 369,474 | |

| Nu Skin Enterprises, Inc. (b) | | | 2,200 | | | | 257,246 | |

| The Clorox Co. (b) | | | 900 | | | | 81,171 | |

| The Estee Lauder Cos., Inc. (b) | | | 2,300 | | | | 163,208 | |

| The Procter & Gamble Co. (b) | | | 1,400 | | | | 113,050 | |

| | | | | | | | |

| | | | | | | 1,016,514 | |

| | | | | | | | |

| Insurance - 0.4% | | | | | | | | |

| Aflac, Inc. (b) | | | 3,600 | | | | 233,928 | |

| American International Group, Inc. (b) | | | 4,500 | | | | 232,425 | |

| Amtrust Financial Services, Inc. (b) | | | 1,500 | | | | 57,540 | |

| Assured Guaranty Ltd. (a)(b) | | | 3,300 | | | | 67,650 | |

| Berkshire Hathaway, Inc. (b)(c) | | | 1,400 | | | | 161,112 | |

| Chubb Corp. (b) | | | 300 | | | | 27,624 | |

| Hartford Financial Services Group, Inc. (b) | | | 3,917 | | | | 132,003 | |

| Lincoln National Corp. (b) | | | 600 | | | | 27,246 | |

| MBIA, Inc. (b)(c) | | | 17,600 | | | | 200,112 | |

| MetLife, Inc. (b) | | | 3,300 | | | | 156,123 | |

| Prudential Financial, Inc. (b) | | | 2,900 | | | | 236,031 | |

| The Allstate Corp. (b) | | | 3,300 | | | | 175,098 | |

| | | | | | | | |

| | | | | | | 1,706,892 | |

| | | | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 15 |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Materials - 1.5% | | | | | | | | |

| Air Products & Chemicals, Inc. (b) | | | 1,600 | | | $ | 174,416 | |

| Alcoa, Inc. (b) | | | 22,300 | | | | 206,721 | |

| Allegheny Technologies, Inc. (b) | | | 2,000 | | | | 66,200 | |

| Ashland, Inc. (b) | | | 300 | | | | 27,765 | |

| Avery Dennison Corp. (b) | | | 4,100 | | | | 193,192 | |

| Celanese Corp. (b) | | | 3,341 | | | | 187,129 | |

| CF Industries Holdings, Inc. (b) | | | 1,800 | | | | 388,080 | |

| Cliffs Natural Resources, Inc. (b) | | | 13,100 | | | | 336,408 | |

| Crown Holdings, Inc. (b)(c) | | | 4,300 | | | | 187,480 | |

| Cytec Industries, Inc. (b) | | | 2,111 | | | | 175,403 | |

| Eagle Materials, Inc. (b) | | | 2,900 | | | | 217,529 | |

| Eastman Chemical Co. (b) | | | 2,900 | | | | 228,491 | |

| El Du Pont de Nemours & Co. (b) | | | 3,600 | | | | 220,320 | |

| FMC Corp. (b) | | | 100 | | | | 7,276 | |

| Freeport-McMoRan Copper & Gold, Inc. (b) | | | 6,400 | | | | 235,264 | |

| Huntsman Corp. (b) | | | 9,800 | | | | 227,556 | |

| International Paper Co. (b) | | | 4,500 | | | | 200,745 | |

| LyondellBasell Industries NV (a)(b) | | | 500 | | | | 37,300 | |

| Monsanto Co. (b) | | | 2,200 | | | | 230,736 | |

| Newmont Mining Corp. (b) | | | 10,900 | | | | 297,134 | |

| Nucor Corp. (b) | | | 4,300 | | | | 222,611 | |

| Southern Copper Corp. (b) | | | 6,700 | | | | 187,265 | |

| The Dow Chemical Co. (b) | | | 5,700 | | | | 224,979 | |

| The Mosaic Co. (b) | | | 8,700 | | | | 398,895 | |

| United States Steel Corp. (b) | | | 9,800 | | | | 243,922 | |

| WR Grace & Co. (b)(c) | | | 2,400 | | | | 219,984 | |

| | | | | | | | |

| | | | | | | 5,342,801 | |

| | | | | | | | |

| Media - 0.5% | | | | | | | | |

| Charter Communications, Inc. (b)(c) | | | 600 | | | | 80,544 | |

| Comcast Corp. (b) | | | 3,400 | | | | 161,772 | |

| DirectTV (b)(c) | | | 3,600 | | | | 224,964 | |

| Discovery Communications, Inc. (b)(c) | | | 2,500 | | | | 222,300 | |

| DISH Network Corp. (b) | | | 4,800 | | | | 231,360 | |

| Interpublic Group of Cos., Inc. (b) | | | 6,000 | | | | 100,800 | |

| Omnicom Group, Inc. (b) | | | 2,727 | | | | 185,736 | |

| The Walt Disney Co. (b) | | | 3,100 | | | | 212,629 | |

| Time Warner, Inc. (b) | | | 2,600 | | | | 178,724 | |

| Viacom, Inc. (b) | | | 2,500 | | | | 208,225 | |

| | | | | | | | |

| | | | | | | 1,807,054 | |

| | | | | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 1.3% | |

| Actavis Plc (a)(b)(c) | | | 1,500 | | | | 231,870 | |

| Aegerion Pharmaceuticals, Inc. (b)(c) | | | 2,500 | | | | 207,050 | |

| Agilent Technologies, Inc. (b) | | | 4,100 | | | | 208,116 | |

| Alexion Pharmaceuticals, Inc. (b)(c) | | | 1,800 | | | | 221,310 | |

| Allergan, Inc./United States (b) | | | 2,200 | | | | 199,342 | |

| Alnylam Pharmaceuticals, Inc. (b)(c) | | | 1,500 | | | | 86,415 | |

| Amgen, Inc. (b) | | | 3,100 | | | | 359,600 | |

| Biogen Idec, Inc. (b)(c) | | | 900 | | | | 219,771 | |

| Biomarin Pharmaceutical, Inc. (b)(c) | | | 3,000 | | | | 188,460 | |

| Bristol-Myers Squibb Co. (b) | | | 4,400 | | | | 231,088 | |

| Celgene Corp. (b)(c) | | | 1,300 | | | | 193,037 | |

| Cubist Pharmaceuticals, Inc. (b)(c) | | | 2,000 | | | | 124,000 | |

| Eli Lilly & Co. (b) | | | 3,900 | | | | 194,298 | |

| Forest Laboratories, Inc. (b)(c) | | | 100 | | | | 4,703 | |

| Gilead Sciences, Inc. (b)(c) | | | 2,600 | | | | 184,574 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Pharmaceuticals, Biotechnology & Life Sciences - 1.3% (continued) | |

| Illumina, Inc. (b)(c) | | | 2,600 | | | $ | 243,126 | |

| Incyte Corp. Ltd. (b)(c) | | | 700 | | | | 27,300 | |

| Jazz Pharmaceuticals Plc. (a)(b)(c) | | | 800 | | | | 72,592 | |

| Johnson & Johnson (b) | | | 500 | | | | 46,305 | |

| Medivation, Inc. (b)(c) | | | 3,600 | | | | 215,496 | |

| Merck & Company, Inc. (b) | | | 4,300 | | | | 193,887 | |

| Pharmacyclics, Inc. (b)(c) | | | 1,700 | | | | 201,688 | |

| Questcor Pharmaceuticals, Inc. (b) | | | 3,900 | | | | 239,343 | |

| Regeneron Pharmaceuticals, Inc. (b)(c) | | | 700 | | | | 201,320 | |

| Theravance, Inc. (b)(c) | | | 4,900 | | | | 179,536 | |

| Thermo Fisher Scientific, Inc. (b) | | | 800 | | | | 78,224 | |

| Vertex Pharmaceuticals, Inc. (b)(c) | | | 2,900 | | | | 206,886 | |

| Zoetis, Inc. (b) | | | 6,400 | | | | 202,624 | |

| | | | | | | | |

| | | | | | | 4,961,961 | |

| | | | | | | | |

| Real Estate - 0.1% | | | | | | | | |

| Howard Hughes Corp. (b)(c) | | | 1,800 | | | | 210,690 | |

| | | | | | | | |

| | |

| Retailing - 1.8% | | | | | | | | |

| Abercrombie & Fitch Co. (b) | | | 5,900 | | | | 221,132 | |

| Amazon.com, Inc. (b)(c) | | | 700 | | | | 254,821 | |

| American Eagle Outfitters, Inc. (b) | | | 8,900 | | | | 137,861 | |

| AutoZone, Inc. (b)(c) | | | 500 | | | | 217,345 | |

| Bed Bath & Beyond, Inc. (b)(c) | | | 2,800 | | | | 216,496 | |

| Best Buy Co., Inc. (b) | | | 4,700 | | | | 201,160 | |

| CarMax, Inc. (b)(c) | | | 600 | | | | 28,194 | |

| Dillard’s, Inc. (b) | | | 400 | | | | 32,792 | |

| Dollar General Corp. (b)(c) | | | 2,900 | | | | 167,562 | |

| Dollar Tree, Inc. (b)(c) | | | 2,900 | | | | 169,360 | |

| DSW, Inc. (b) | | | 2,100 | | | | 184,107 | |

| Expedia, Inc. (b) | | | 5,000 | | | | 294,400 | |

| Family Dollar Stores, Inc. (b) | | | 2,500 | | | | 172,200 | |

| GameStop Corp. (b) | | | 4,625 | | | | 253,542 | |

| Genuine Parts Co. (b) | | | 600 | | | | 47,298 | |

| GNC Holdings, Inc. (b) | | | 3,800 | | | | 223,516 | |

| Groupon, Inc. (b)(c) | | | 15,100 | | | | 137,863 | |

| J.C. Penney Co., Inc. (b)(c) | | | 30,200 | | | | 226,500 | |

| LKQ Corp. (b)(c) | | | 800 | | | | 26,424 | |

| Lowe’s Cos., Inc. (b) | | | 4,900 | | | | 243,922 | |

| Lumber Liquidators Holdings, Inc. (b)(c) | | | 800 | | | | 91,352 | |

| Macy’s, Inc. (b) | | | 5,500 | | | | 253,605 | |

| Netflix, Inc. (b)(c) | | | 1,400 | | | | 451,472 | |

| Nordstrom, Inc. (b) | | | 100 | | | | 6,047 | |

| priceline.com, Inc. (b)(c) | | | 200 | | | | 210,766 | |

| Ross Stores, Inc. (b) | | | 2,300 | | | | 177,905 | |

| Sears Holdings Corp. (b)(c) | | | 3,400 | | | | 197,472 | |

| Signet Jewelers Ltd. (a)(b) | | | 400 | | | | 29,864 | |

| Staples, Inc. (b) | | | 11,600 | | | | 186,992 | |

| Target Corp. (b) | | | 2,900 | | | | 187,891 | |

| The Gap, Inc. (b) | | | 5,000 | | | | 184,950 | |

| The Home Depot, Inc. (b) | | | 2,800 | | | | 218,092 | |

| Tiffany & Co. (b) | | | 2,900 | | | | 229,593 | |

| TripAdvisor, Inc. (b)(c) | | | 3,900 | | | | 322,569 | |

| Urban Outfitters, Inc. (b)(c) | | | 4,700 | | | | 178,036 | |

| | | | | | | | |

| | | | | | | 6,383,101 | |

| | | | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| 16 | | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Semiconductors & Semiconductor Equipment - 0.7% | |

| Advanced Micro Devices, Inc. (b)(c) | | | 10,000 | | | $ | 33,400 | |

| Analog Devices, Inc. (b) | | | 3,600 | | | | 177,480 | |

| Applied Materials, Inc. (b) | | | 7,000 | | | | 124,950 | |

| Avago Technologies Ltd. (b) | | | 3,600 | | | | 163,548 | |

| Broadcom Corp. (b) | | | 9,000 | | | | 240,480 | |

| First Solar, Inc. (b)(c) | | | 6,600 | | | | 331,782 | |

| Intel Corp. (b) | | | 7,800 | | | | 190,554 | |

| Linear Technology Corp. (b) | | | 4,400 | | | | 181,016 | |

| Marvell Technology Group Ltd. (a)(b) | | | 15,700 | | | | 188,400 | |

| Micron Technology, Inc. (b)(c) | | | 11,700 | | | | 206,856 | |

| NVIDIA Corp. (b) | | | 1,000 | | | | 15,180 | |

| Skyworks Solutions, Inc. (b)(c) | | | 6,300 | | | | 162,414 | |

| Texas Instruments, Inc. (b) | | | 5,500 | | | | 231,440 | |

| Xilinx, Inc. (b) | | | 3,000 | | | | 136,260 | |

| | | | | | | | |

| | | | | | | 2,383,760 | |

| | | | | | | | |

| Software & Services - 2.0% | | | | | | | | |

| Accenture PLC (a)(b) | | | 2,800 | | | | 205,800 | |

| Activision Blizzard, Inc. (b) | | | 10,800 | | | | 179,712 | |

| Adobe Systems, Inc. (b)(c) | | | 3,300 | | | | 178,860 | |

| Akamai Technologies, Inc. (b)(c) | | | 1,000 | | | | 44,740 | |

| Alliance Data Systems Corp. (b)(c) | | | 700 | | | | 165,942 | |

| Ansys, Inc. (b)(c) | | | 900 | | | | 78,705 | |

| Autodesk, Inc. (b)(c) | | | 5,000 | | | | 199,550 | |

| Automatic Data Processing, Inc. (b) | | | 200 | | | | 14,994 | |

| CommVault Systems, Inc. (b)(c) | | | 800 | | | | 62,464 | |

| Computer Sciences Corp. (b) | | | 3,400 | | | | 167,484 | |

| Concur Technologies, Inc. (b)(c) | | | 1,900 | | | | 198,740 | |

| eBay, Inc. (b)(c) | | | 3,300 | | | | 173,943 | |

| Electronic Arts, Inc. (b)(c) | | | 4,100 | | | | 107,625 | |

| Facebook, Inc. (b)(c) | | | 8,200 | | | | 412,132 | |

| Factset Research Systems, Inc. (b) | | | 300 | | | | 32,682 | |

| Fidelity National Information Systems, Inc. (b) | | | 600 | | | | 29,250 | |

| Fiserv, Inc. (b)(c) | | | 200 | | | | 20,946 | |

| Fleetcor Technologies, Inc. (b)(c) | | | 100 | | | | 11,535 | |

| Google, Inc. (b)(c) | | | 300 | | | | 309,174 | |

| Guidewire Software, Inc. (b)(c) | | | 3,591 | | | | 182,136 | |

| Informatica Corp. (b)(c) | | | 1,400 | | | | 54,040 | |

| International Business Machines Corp. (b) | | | 1,100 | | | | 197,131 | |

| Jack Henry & Associates, Inc. (b) | | | 500 | | | | 27,305 | |

| LinkedIn Corp. (b)(c) | | | 1,700 | | | | 380,239 | |

| MasterCard, Inc. (b) | | | 300 | | | | 215,130 | |

| Microsoft Corp. (b) | | | 4,600 | | | | 162,610 | |

| Oracle Corp. (b) | | | 4,000 | | | | 134,000 | |

| Pandora Media, Inc. (b)(c) | | | 9,500 | | | | 238,735 | |

| Rackspace Hosting, Inc. (b)(c) | | | 4,100 | | | | 210,043 | |

| Salesforce.com, Inc. (b)(c) | | | 3,500 | | | | 186,760 | |

| ServiceNow, Inc. (b)(c) | | | 3,500 | | | | 191,135 | |

| Splunk, Inc. (b)(c) | | | 2,769 | | | | 173,644 | |

| Symantec Corp. (b) | | | 9,300 | | | | 211,482 | |

| Tableau Software, Inc. (b)(c) | | | 2,700 | | | | 165,942 | |

| Teradata Corp. (b)(c) | | | 3,400 | | | | 149,838 | |

| TIBCO Software, Inc. (b)(c) | | | 4,700 | | | | 115,432 | |

| VeriSign, Inc. (b)(c) | | | 600 | | | | 32,568 | |

| Visa, Inc. (b) | | | 1,800 | | | | 354,006 | |

| VMware, Inc. (b)(c) | | | 4,300 | | | | 349,504 | |

| Workday, Inc. (b)(c) | | | 2,205 | | | | 165,088 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Software & Services - 2.0% (continued) | | | | | |

| Yahoo, Inc. (b)(c) | | | 10,700 | | | $ | 352,351 | |

| Yelp, Inc. (b)(c) | | | 3,300 | | | | 223,575 | |

| Zillow, Inc. (b)(c) | | | 2,479 | | | | 197,403 | |

| Zynga, Inc. (b)(c) | | | 5,000 | | | | 17,950 | |

| | | | | | | | |

| | | | | | | 7,282,325 | |

| | | | | | | | |

| Technology Hardware & Equipment - 0.9% | | | | | |

| 3D Systems Corp. (b)(c) | | | 4,000 | | | | 248,960 | |

| Amphenol Corp. New (b) | | | 1,900 | | | | 152,551 | |

| Apple, Inc. (b) | | | 600 | | | | 313,410 | |

| Brocade Communications Systems, Inc. (b)(c) | | | 4,200 | | | | 33,684 | |

| Ciena Corp. (b)(c) | | | 6,511 | | | | 151,511 | |

| Cisco Systems, Inc. (b) | | | 6,000 | | | | 135,000 | |

| Corning, Inc. (b) | | | 11,000 | | | | 187,990 | |

| EMC Corp. (b) | | | 8,200 | | | | 197,374 | |

| F5 Networks, Inc. (b)(c) | | | 2,400 | | | | 195,624 | |

| Hewlett-Packard Co. (b) | | | 5,000 | | | | 121,850 | |

| JDS Uniphase Corp. (b)(c) | | | 2,000 | | | | 26,180 | |

| Juniper Networks, Inc. (b)(c) | | | 1,000 | | | | 18,640 | |

| Motorola Solutions, Inc. (b) | | | 3,400 | | | | 212,568 | |

| NetApp, Inc. (b) | | | 6,000 | | | | 232,860 | |

| Palo Alto Networks, Inc. (b)(c) | | | 4,000 | | | | 168,640 | |

| Qualcomm, Inc. (b) | | | 3,200 | | | | 222,304 | |

| SanDisk Corp. (b) | | | 3,000 | | | | 208,500 | |

| Stratasys Ltd. (a)(b)(c) | | | 2,000 | | | | 226,460 | |

| Western Digital Corp. (b) | | | 5,300 | | | | 369,039 | |

| | | | | | | | |

| | | | | | | 3,423,145 | |

| | | | | | | | |

| Telecommunication Services - 0.2% | | | | | | | | |

| AT&T, Inc. (b) | | | 2,900 | | | | 104,980 | |

| Crown Castle International Corp. (b)(c) | | | 2,300 | | | | 174,846 | |

| Sprint Corp. (b)(c) | | | 7,224 | | | | 48,618 | |

| T-Mobile US, Inc. (b)(c) | | | 8,800 | | | | 244,024 | |

| Verizon Communications, Inc. (b) | | | 3,400 | | | | 171,734 | |

| | | | | | | | |

| | | | | | | 744,202 | |

| | | | | | | | |

| Transportation - 0.5% | | | | | | | | |

| Alaska Air Group, Inc. (b) | | | 3,200 | | | | 226,112 | |

| Avis Budget Group Inc. (b)(c) | | | 5,200 | | | | 162,916 | |

| Copa Holdings SA (a) | | | 100 | | | | 14,954 | |

| CSX Corp. (b) | | | 1,600 | | | | 41,696 | |

| Delta Air Lines, Inc. (b) | | | 7,000 | | | | 184,660 | |

| FedEx Corp. (b) | | | 400 | | | | 52,400 | |

| Hertz Global Holdings, Inc. (b)(c) | | | 2,000 | | | | 45,920 | |

| Kansas City Southern (b) | | | 1,800 | | | | 218,736 | |

| Norfolk Southern Corp. (b) | | | 800 | | | | 68,816 | |

| Union Pacific Corp. (b) | | | 1,800 | | | | 272,520 | |

| United Continental Holdings, Inc. (b)(c) | | | 6,500 | | | | 220,675 | |

| United Parcel Service, Inc. (b) | | | 1,800 | | | | 176,832 | |

| US Airways Group, Inc. (b)(c) | | | 10,500 | | | | 230,685 | |

| | | | | | | | |

| | | | | | | 1,916,922 | |

| | | | | | | | |

| Utilities - 0.2% | | | | | | | | |

| CenterPoint Energy, Inc. (b) | | | 2,000 | | | | 49,200 | |

| Duke Energy Corp. (b) | | | 400 | | | | 28,692 | |

| ONEOK, Inc. (b) | | | 7,300 | | | | 412,450 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 2013 | | 17 |

| | | | | | | | | | |

| | | | |

| Schedule of Investments | | | October 31, 2013 | |

| | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM FUND | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Utilities - 0.2% (continued) | | | | | | | | |

| Sempra Energy (b) | | | 300 | | | $ | 27,342 | |

| The Southern Co. (b) | | | 2,800 | | | | 114,548 | |

| | | | | | | | |

| | | | | | | 632,232 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $62,118,256) | | | | | | | 65,476,011 | |

| | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS - 0.3% | | | | | |

| | |

| Real Estate - 0.3% | | | | | | | | |

| American Capital Agency Corp. | | | 8,000 | | | | 173,760 | |

| American Tower Corp. | | | 2,400 | | | | 190,440 | |

| Annaly Capital Management, Inc. | | | 12,600 | | | | 148,554 | |

| Boston Properties, Inc. | | | 100 | | | | 10,350 | |

| CommonWealth REIT | | | 7,000 | | | | 170,590 | |

| Digital Realty Trust, Inc. | | | 2,700 | | | | 128,682 | |

| Simon Property Group, Inc. (b) | | | 1,400 | | | | 216,370 | |

| Weyerhaeuser Co. | | | 1,000 | | | | 30,400 | |

| | | | | | | | |

| | | | | | | 1,069,146 | |

| | | | | | | | |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $1,112,888) | | | | 1,069,146 | |

| | | | | | | | |

| INVESTMENT COMPANY - 0.0% | |

|

| Closed-End Mutual Fund - 0.0% | |

| American Capital Ltd. (c) | | | 800 | | | | 11,208 | |

| | | | | | | | |

TOTAL INVESTMENT COMPANY

(Cost $10,745) | | | | | | | 11,208 | |

| | | | | | | | |

| | |

| RIGHTS - 0.0% | | | | | | | | |

| | |

| Consumer Services - 0.0% | | | | | | | | |

Caesars Entertainment Corp. (Acquired 8/12/13) (c)(d) | | | 1,000 | | | | 8,640 | |

| | | | | | | | |

TOTAL RIGHTS

(Cost $0) | | | | | | | 8,640 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS - 81.2% | | | | | |

| | |

| Money Market Funds - 0.3% | | | | | | | | |

Fidelity Institutional Money Market Funds - Money Market

Portfolio - 0.04% (g) | | | 182,563 | | | | 182,563 | |

| First American Government Obligations Fund - Class Z - 0.01% (g) | | | 182,563 | | | | 182,563 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Money Market Funds - 0.3% (continued) | | | | | |

| First American Prime Obligations Fund - Class Z - 0.02% (g) | | | 182,563 | | | $ | 182,563 | |

Short Term Investments Trust - Liquid Assets Portfolio - Institutional

Class - 0.02% (g) | | | 182,564 | | | | 182,564 | |

Short Term Investments Trust - Treasury Portfolio - Institutional

Class - 0.07% (g) | | | 182,564 | | | | 182,564 | |

| | | | | | | | |

| | | | | | | 912,817 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | | |

| U.S. Treasury Bills - 80.9% | | | | | | | | |

| 0.032%, 12/05/2013 (e)(f) | | $ | 40,000,000 | | | | 39,998,772 | |

| 0.032%, 12/12/2013 (e)(f) | | | 40,000,000 | | | | 39,998,519 | |

| 0.035%, 12/19/2013 (e)(f) | | | 40,000,000 | | | | 39,998,133 | |

| 0.025%, 01/09/2014 (e)(f) | | | 53,400,000 | | | | 53,397,331 | |

| 0.020%, 01/16/2014 (e)(f) | | | 40,000,000 | | | | 39,997,880 | |

| 0.025%, 01/23/2014 (e)(f) | | | 40,000,000 | | | | 39,996,760 | |

| 0.035%, 01/30/2014 (e)(f) | | | 40,000,000 | | | | 39,996,480 | |

| | | | | | | | |

| | | | | | | 293,383,875 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $294,298,188) | | | | | | | 294,296,692 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $357,540,077) - 99.6% | | | | | | | 360,861,697 | |

| | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.4% (h) | | | | | | | 1,402,750 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 362,264,447 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| (a) | Foreign issued security. Total foreign securities are $2,753,652 which represents 0.8% of net assets. |

| (b) | All or a portion of this security may be subject to call options written. |

| (c) | Non-income producing security. |