Exhibit 17(c)

Annual Report

October 31, 2015

Stone Ridge Reinsurance Risk Premium Fund

Stone Ridge High Yield Reinsurance Risk Premium Fund

Stone Ridge U.S. Large Cap Variance Risk Premium Fund

Stone Ridge U.S. Small Cap Variance Risk Premium Fund

Stone Ridge U.S. Variance Risk Premium Master Fund

Stone Ridge International Developed Markets Variance Risk Premium Fund

Stone Ridge Emerging Markets Variance Risk Premium Fund

Stone Ridge International Variance Risk Premium Master Fund

Stone Ridge Global Equity Variance Risk Premium Master Fund

Table of Contents

Shareholder Letter

December 2015

Dear Fellow Shareholder:

Like all firms, Stone Ridge was once a startup – no products, no clients. Now, with over 150 institutional clients, 11 funds, and $790 million of trading profits since inception, I hope we’re always a startup. As the brilliant Peter Thiel wrote in Zero to One:

The best startups might be considered slightly less extreme kinds of cults. The biggest difference is that cults tend to be fanatically wrong about something important. People at successful startups are fanatically right about something those outside it have missed.

What are we fanatically right about?

Stone Ridge is an ecosystem of optimism and possibilities. Our power comes from knowing that kindness has no downside. It works. Not every time, but always. Can you build a financial services firm based on “Focus. Be Humble. Be Kind.”? Our experiment is ongoing, but so far the results are encouraging.

Our Firm Principles are aspirational – we’re far from perfect – though our approach to moving though the world, applied consistently, has resulted in a culture we cherish. At Stone Ridge, our people – powered by an almost childlike sense of wonder – are everything. So how do new people join?

The recruiting process requires candidates – no matter how senior, no matter how junior – to meet with each member of our Management Committee twice. That part alone is 18 meetings. The entire process, which takes months and ultimately includes completion and presentation of a challenging project, is “off market.” This is on purpose. The higher up you go in most organizations, the more detached the senior executives get from the hiring process. I believe the opposite should be true. The objective is to create a hiring culture that resists compromise. Our most treasured achievement since inception is not the $790 million of trading profits. It’s that zero employees have chosen to leave.

While our firm’s growth has felt natural to us at every step along the way, some outsiders are surprised. The part they miss is the part they don’t see: the commitment of everyone at Stone Ridge to ongoing personal improvement. When you’re committed to getting better at something, progress is not always visible or tangible in the moment, but micro improvements accumulate. Breakthroughs eventually happen, though patience is required. We have chosen the path of personal improvement for its own sake, but also so that we can be our best selves to support our shared journey. Together we want to find out what’s possible in asset management.

In 2015, we introduced the concept of Antifragile at Stone Ridge. Coined by the brave Nassim Taleb, something Antifragile goes beyond surviving shocks, which is resiliency. For something Antifragile, shocks actually make it stronger. Firms are fragile. Could Stone Ridge become Antifragile? For example, after a disaster could our internal relationships actually strengthen amidst the chaos? In the aftermath, could our investors make more money, not less? Let me share two concrete examples of how we began our Antifragile journey this year.

First, about 6 months ago, I assigned a question to everyone at the firm:

Who are you committed to being, and how are you committed to responding, when the firm experiences its first disaster?

It’s a heavy question and I wasn’t looking for conceptual answers. I wanted bullet points and concrete action items. “Be specific. Show me your list.” Individual answers were presented to managers, who synthesized the views of their teams, and presented the overall results to our Management Committee. The details of our answers are private to us, but I can share that the process of answering this question changed us as a firm.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

3

Shareholder Letter

Of course, we don’t wish for a disaster, but the firm will be stronger afterwards. The power in that confidence, in that knowing, is palpable inside Stone Ridge. It has caused a real shift in the firm. You can feel it in the office. I invite you to visit us in 2016 and feel it for yourself.

The second Antifragile step we took in 2015 was the filing of the prospectus for the Stone Ridge Post-Event Reinsurance Fund (SRPEX). SRPEX will activate and collect client assets only after industry-changing disasters, the same kind of “CNN events” that will cause our Reinsurance Funds to have material drawdowns. Historically, such industry-changing events (e.g., devastating hurricanes Denis, Emily, Katrina, Rita, and Wilma occurred during four consecutive months in 2005) have caused post-event reinsurance yields to increase considerably the following renewal season. Upon triggering, SRPEX will become the sole channel to access the Stone Ridge Reinsurance Funds. SRPEX is available only to existing clients at the time of its activation and it does not charge any additional management fees or fund expenses.

How can a fund that charges no fees and has no assets help a firm, its clients, and its reinsurance partners become Antifragile? For clients, SRPEX means access to valuable post-event capacity with the largest global reinsurers, so long-term wealth creation becomes Antifragile. For our reinsurance partners, SRPEX means balance sheet security and the ability to play post-event offense, so their capital structure becomes Antifragile. And for Stone Ridge, SRPEX means post-event assets under management (AUM) goes up instead of down, so our firm becomes Antifragile.

The journey towards Antifragile is a long one, but we’ve taken the first steps.

2015 was far from a smooth ride and, given the diversity of our risk exposures, it never will be. Our reinsurance portfolios took many hits this year, including the Tianjin explosion in China, the Pemex explosion in the Gulf, Hurricane Patricia hitting the Jalisco coast, Cyclone Marcia smashing the Queensland coast, and brutal hailstorms in Sydney. We also suffered from the August volatility spikes in financial risk markets. Yet across all products, Stone Ridge delivered $404 million of trading profits through November. Even in August, trading profits were positive, as gains from our reinsurance portfolios more than offset losses from our Variance Risk Premium (VRP) franchise.

The Sharpe Ratio of 2015’s $404 million trading profits was an unsustainable 4.2, following last year’s $281 million trading profits and similarly unsustainable 5.5 Sharpe Ratio. Our performance since inception materially understates the true risk of our strategies. In particular, historical volatility is an often misleading and always incomplete measure of risk for any strategy, but especially for those involving insurance-related investments. Do not get lulled into a false sense of security when you look at the consistency of our past results. In future years, there will be tragic earthquakes and hurricanes. There will be market crashes.

We don’t court sharp losses, but they are part of the business and part of life. Reinsurers and option sellers – kindred spirits – must accept disasters, or else they would have no clients and our funds would make no money. Simply put, if you never pay claims, no one buys insurance. The real determinative of long-term wealth creation is how those providing risk transfer services to the markets – our clients via Stone Ridge funds – behave after losses.

When crashes happen, we will be standing shoulder to shoulder with you, arms locked together, drawing on centuries of wisdom about insurance markets, and reminding you that the best reinsurers sell more reinsurance after the storm.

Stone Ridge is most proud of the 50/50 partnership we have with you, our clients. We are on the path together. You contribute the capital necessary to sustain and propel groundbreaking product development. We contribute our collective careers’ worth of experience in sourcing, structuring, execution, and risk management. Together it works. In that spirit, I offer my deepest gratitude to you for sharing responsibility for your wealth with us this year. We look forward to serving you again in 2016.

Sincerely,

Ross L. Stevens

Founder, CEO

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

4

Shareholder Letter

Standardized returns as September 30, 2015 for: U.S. Large Cap Variance Risk Premium Fund (“VRLIX”) 1Yr=1.67%, since inception (5/1/13)=7.13%; U.S. Small Cap Variance Risk Premium Fund (“VRSIX”) 1Yr=2.32%, since inception (5/1/13)=5.65%; U.S. Variance Risk Premium Master Fund (“VRPIX”) 1Yr=1.77%, since inception (5/21/13)=6.01%; International Developed Markets Variance Risk Premium Fund (“VRFIX”) 1Yr=-3.18%, since inception (2/11/14)=-0.44%; Emerging Markets Variance Risk Premium Fund (“VRMIX”) 1Yr=-13.05%, since inception (2/11/14)=-6.66%; International Variance Risk Premium Master Fund (“VRIIX”) 1Yr=-6.82%, since inception (2/11/14)=-2.90%; Global Equity Variance Risk Premium Master Fund (“VRGIX”) since inception (11/14/14)=-2.85%; All Asset Variance Risk Premium Fund (“AVRPX”) since inception (4/13/2015)=2.40%; Reinsurance Risk Premium Fund (“SREIX”) 1Yr=4.73%, since inception (2/1/13)=6.22%; High Yield Reinsurance Risk Premium Fund (“SHRIX”) 1Yr=5.69%, since inception (2/1/13)=7.30%; Reinsurance Risk Premium Interval Fund (“SRRIX”) 1YR=7.22%, since inception (12/9/2013)=8.38%. Returns over one year are annualized. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results for funds are net of fees and reflect the reinvestment of dividends and earnings. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent quarter end may be obtained by calling 855-609-3680.

The gross expense ratio for the funds: VRLIX 1.62%; VRSIX 1.60%; VRFIX 2.24%; VRMIX 2.41%; SREIX 1.71%; SHRIX 1.78%; SRRIX 2.38%; VRPIX 1.76%; VRIIX 2.62%; VRGIX 2.02%; AVRPX 2.28%

The Funds are generally available only to registered investment advisors (“RIAs”) meeting certain qualifications and that have completed a training program provided by the Advisor. Before allocating shares of the Funds to a client’s account, RIAs should carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing, as investing in the Funds may not be appropriate for all clients and is not designed to be a complete investment program. Each Fund’s prospectus contains this and other information about the Fund. A prospectus and other information about the Funds may be obtained by calling 855-609-3680 or visiting www.stoneridgefunds.com. Please read the prospectus carefully before investing. The information in this letter to shareholders regarding the Stone Ridge Post-Event Reinsurance Fund and in the Post-Event Reinsurance Fund prospectus (or Statement of Additional Information) is not complete and may be changed. The Advisor may not sell the Post-Event Reinsurance Fund until the registration statement filed with the Securities and Exchange Commission is effective. The Post-Event Reinsurance Fund’s prospectus (or Statement of Additional Information) is not an offer to sell the fund and is not soliciting an offer to buy the fund in any state where the offer or sale is not permitted.

An investment in the Funds involves a high degree of risk. Before making an investment/allocation decision, an RIA should (i) consider the suitability of this investment with respect to a client’s investment objectives and individual situation and (ii) consider factors such as a client’s net worth, income, age, and risk tolerance. Allocation to client accounts should be avoided where a client has a short-term investing horizon and/or cannot bear the loss of some or all of their investment.

Mutual fund investing involves risk; Principal loss is possible.

The event-linked securities in which the Reinsurance Risk Premium Fund, High Yield Reinsurance Risk Premium Fund, and Reinsurance Risk Premium Interval Fund invest are considered “high yield” or “junk bonds”. It is possible that investing in the Funds may result in a loss of some or all of the amount invested. Event-linked, catastrophe bonds and reinsurance related securities carry large uncertainties and major risk exposures to adverse conditions. If a trigger event, as defined within the terms of the bond (such as a major natural disaster), involves losses or other metrics exceeding a specific magnitude in the geographic region and time period specified therein, the Funds may lose a portion or all of their investments in such security, including accrued interest and/or principal invested in such security. The Funds may invest in illiquid or restricted securities which may be difficult or impossible to sell at a time that the Funds would like or at the price that the Funds believe the security is worth. For additional risks, please refer to the prospectus.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

5

Shareholder Letter

The US Variance Risk Premium Master Fund’s, US Large Cap Variance Risk Premium Fund’s, US Small Cap Variance Risk Premium Fund’s, and All Asset Variance Risk Premium Fund’s use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create economic leverage in the Funds, which magnifies the Funds’ exposure to the underlying investment. When derivatives are used to gain or limit exposure to a particular market or market segment, their performance may not correlate as expected to the performance of such market thereby causing the Funds to fail to achieve its original purpose for using such derivatives. The use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Derivative instruments may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. Investing in an ETF exposes the Fund to all of the risks of that ETF’s investments. As a result, the cost of investing in ETF shares may exceed the costs of investing directly in its underlying investments. ETF shares trade on an exchange at a market price which may vary from the ETF’s net asset value. The Funds are subject to leveraging risk. Leverage magnifies the Funds’ exposure to declines in the value of one or more underlying investments or creates investment risk with respect to a larger pool of assets than the Funds would otherwise have. The stocks of smaller, less seasoned companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk. If, in any year, the Funds fail to qualify as a RIC under the Code for any reason, such a failure would have a material adverse effect on the Funds and their shareholders.

The opinions expressed are those of Stone Ridge Asset Management through the end of the period of this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance is no guarantee of future results.

This information is intended for the shareholders of the Funds and is not for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Sharpe Ratio is a measure that indicates the average return minus the risk-free return divided by the standard deviation of return on an investment.

The Stone Ridge Funds are distributed by Quasar Distributors, LLC.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

6

| | | | |

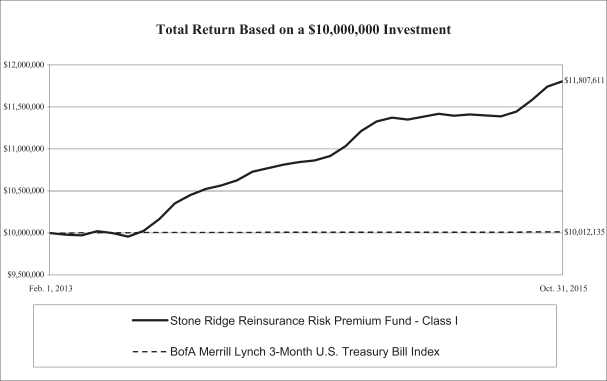

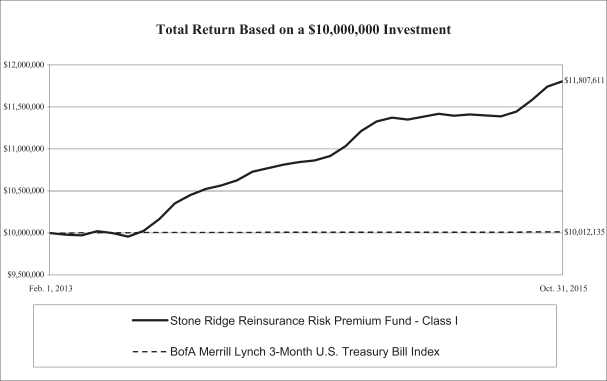

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on February 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(02/01/13) | |

Stone Ridge Reinsurance Risk Premium Fund — Class I | | | 4.22% | | | | 6.24% | |

Stone Ridge Reinsurance Risk Premium Fund — Class M | | | 4.06% | | | | 6.09% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

7

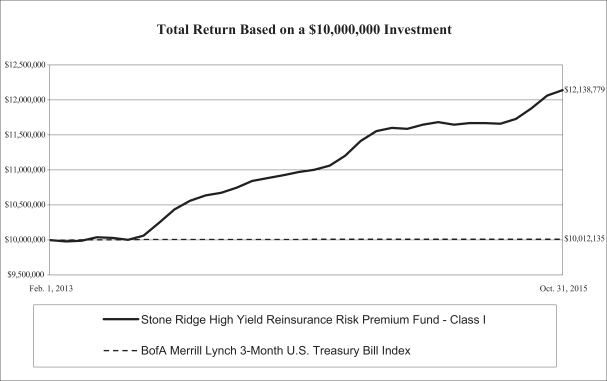

| | | | |

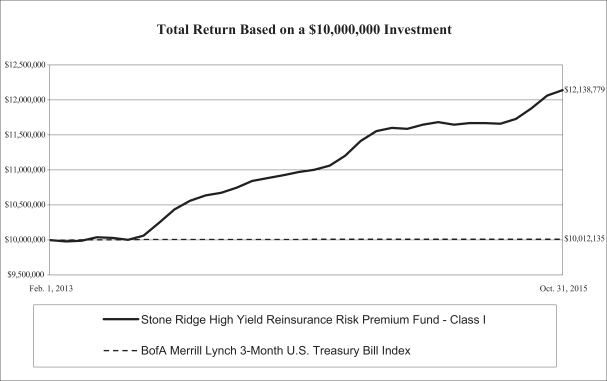

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on February 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(02/01/13) | |

Stone Ridge High Yield Reinsurance Risk Premium Fund — Class I | | | 5.06% | | | | 7.32% | |

Stone Ridge High Yield Reinsurance Risk Premium Fund — Class M | | | 4.90% | | | | 7.16% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

8

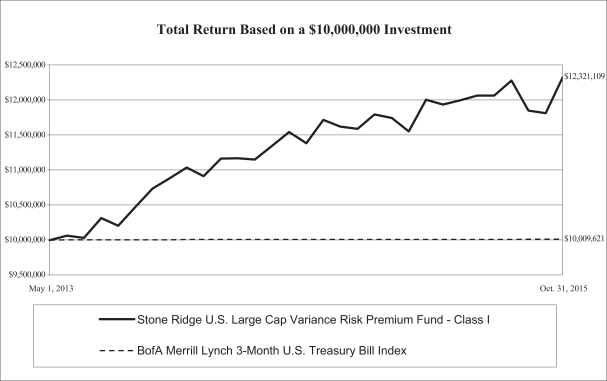

| | | | |

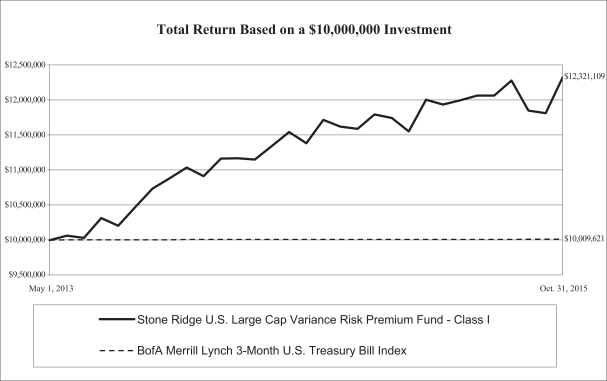

| STONE RIDGE U.S. LARGE CAP VARIANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on May 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(05/01/13) | |

Stone Ridge U.S. Large Cap Variance Risk Premium Fund — Class I | | | 6.33% | | | | 8.69% | |

Stone Ridge U.S. Large Cap Variance Risk Premium Fund — Class M | | | 6.15% | | | | 8.50% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

9

| | | | |

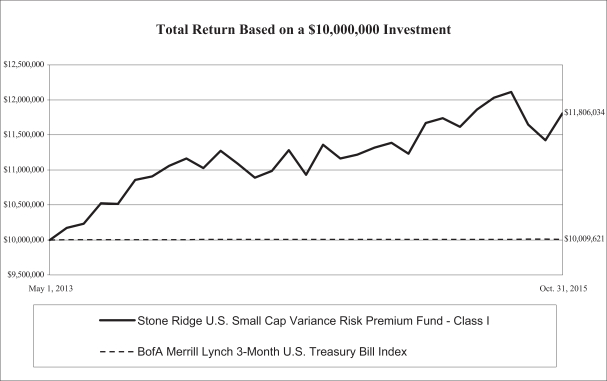

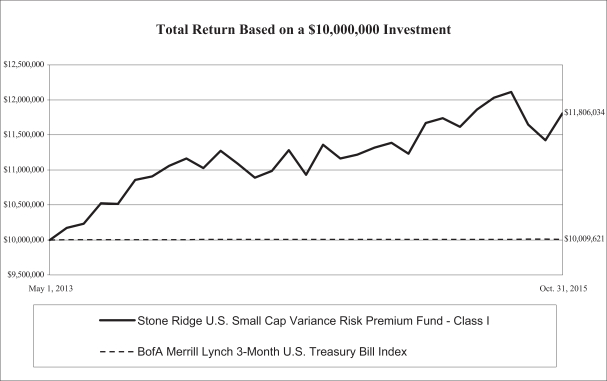

| STONE RIDGE U.S. SMALL CAP VARIANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on May 1, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(05/01/13) | |

Stone Ridge U.S. Small Cap Variance Risk Premium Fund — Class I | | | 5.23% | | | | 6.86% | |

Stone Ridge U.S. Small Cap Variance Risk Premium Fund — Class M | | | 5.15% | | | | 6.70% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

10

| | | | |

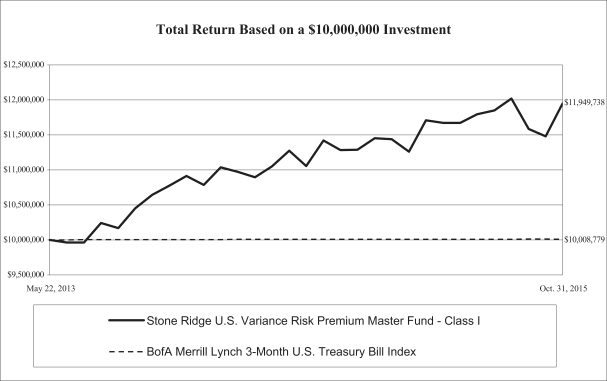

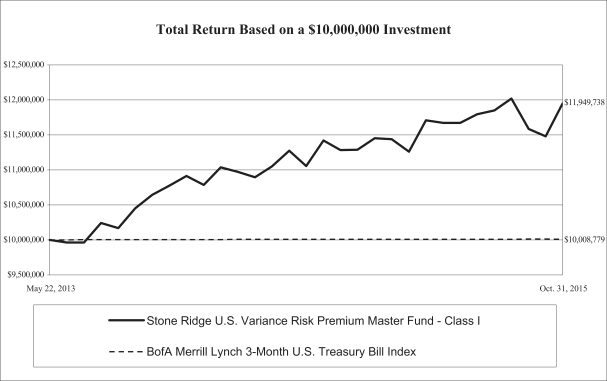

| STONE RIDGE U.S. VARIANCE RISK PREMIUM MASTER FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on May 22, 2013 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(05/22/13) | |

Stone Ridge U.S. Variance Risk Premium Master Fund — Class I | | | 5.81% | | | | 7.52% | |

Stone Ridge U.S. Variance Risk Premium Master Fund — Class M | | | 5.57% | | | | 7.33% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

11

| | | | |

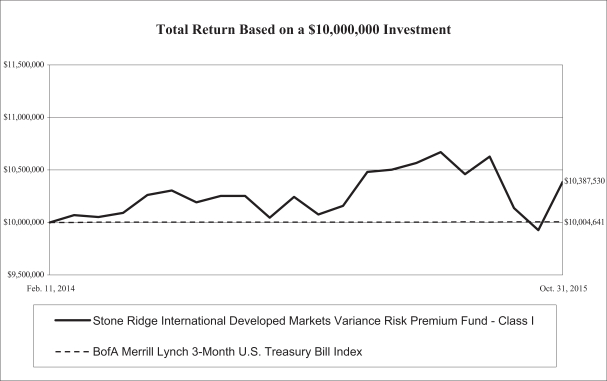

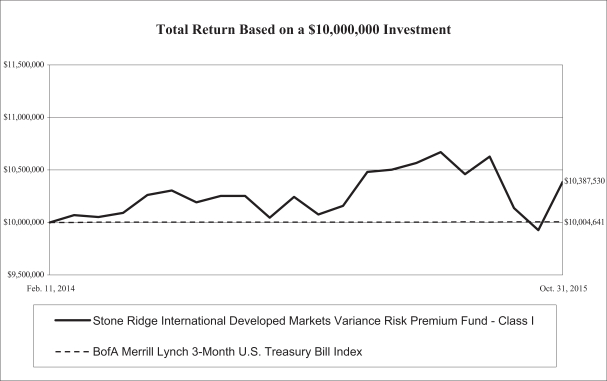

| STONE RIDGE INTERNATIONAL DEVELOPED MARKETS VARIANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on February 11, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(02/11/14) | |

Stone Ridge International Developed Markets Variance Risk Premium

Fund — Class I | | | 3.40% | | | | 2.24% | |

Stone Ridge International Developed Markets Variance Risk Premium

Fund — Class M | | | 3.30% | | | | 2.12% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.03% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

12

| | | | |

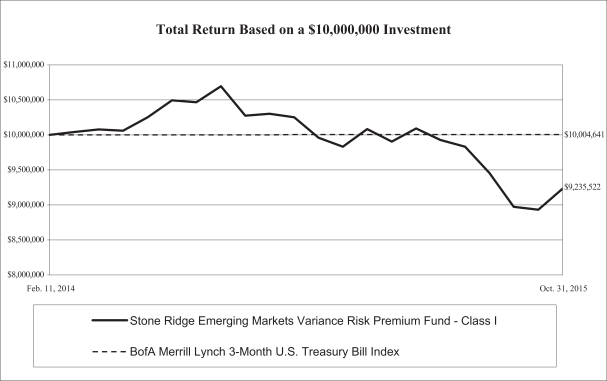

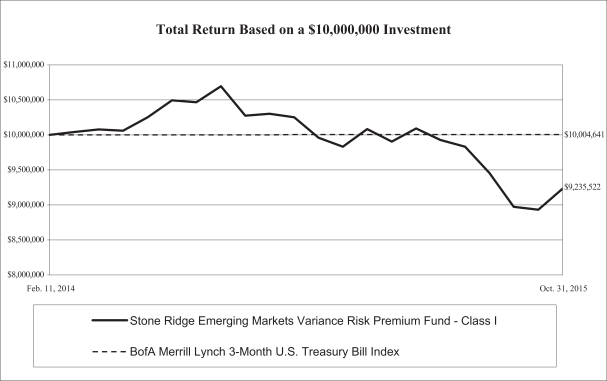

| STONE RIDGE EMERGING MARKETS VARIANCE RISK PREMIUM FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on February 11, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(02/11/14) | |

Stone Ridge Emerging Markets Variance Risk Premium Fund — Class I | | | (10.37%) | | | | (4.52%) | |

Stone Ridge Emerging Markets Variance Risk Premium Fund — Class M | | | (10.48%) | | | | (4.64%) | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.03% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

13

| | | | |

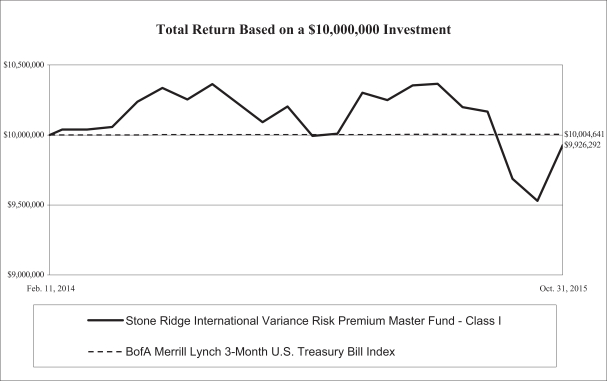

| STONE RIDGE INTERNATIONAL VARIANCE RISK PREMIUM MASTER FUND | | | | |

|

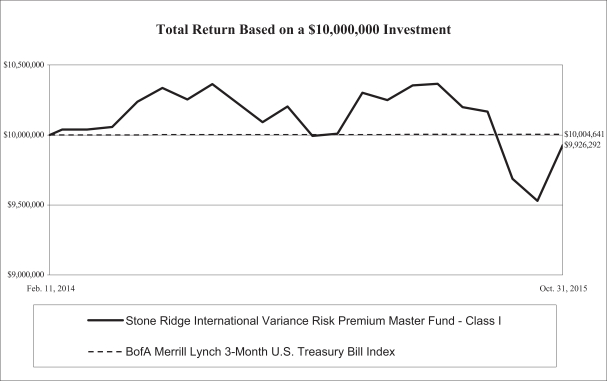

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on February 11, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED OCTOBER 31, 2015) | | | | | | |

| | | 1-year

period

ended

10/31/2015 | | | Since

Inception

(02/11/14) | |

Stone Ridge International Variance Risk Premium Master Fund — Class I | | | (1.63%) | | | | (0.42%) | |

Stone Ridge International Variance Risk Premium Master Fund — Class M | | | (1.77%) | | | | (0.56%) | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | | | | 0.03% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

14

| | | | |

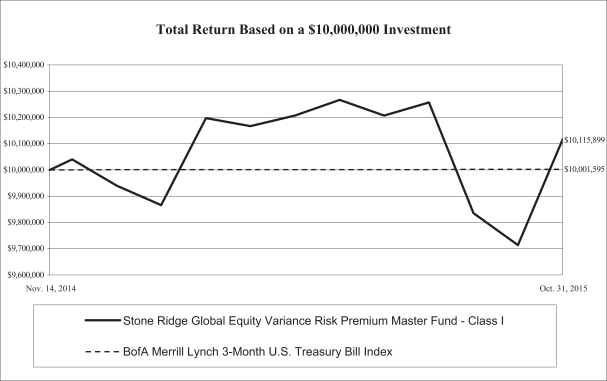

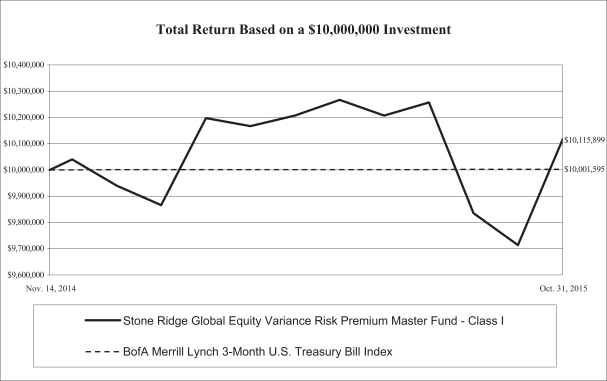

| STONE RIDGE GLOBAL EQUITY VARIANCE RISK PREMIUM MASTER FUND | | | | |

|

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000,000 made on November 14, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Bank of America (BofA) Merrill Lynch 3-Month U.S. Treasury Bill Index is an index of short-term U.S. Government securities with a remaining term to final maturity of less than three months. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment.

| | | | |

| TOTAL RETURNS (FOR PERIOD ENDED OCTOBER 31, 2015) | | | |

| | | Since

Inception

(11/14/14) | |

Stone Ridge Global Equity Variance Risk Premium Master Fund — Class I | | | 1.17% | |

Stone Ridge Global Equity Variance Risk Premium Master Fund — Class M | | | 1.05% | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.02% | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

15

| | |

| Management’s Discussion and Analysis | | |

Stone Ridge Reinsurance Risk Premium Fund is designed to capture the reinsurance risk premium through investing in a broadly diversified set of reinsurance-linked securities, primarily focused on catastrophe bonds. For the twelve months ending 10/31/2015, the Fund returned 4.22%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected natural and man-made catastrophes around the world that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge High Yield Reinsurance Risk Premium Fund is designed to capture the reinsurance risk premium through investing in a broadly diversified set of reinsurance-linked securities, primarily focused on higher yielding catastrophe bonds. For the twelve months ending 10/31/2015, the Fund returned 5.06%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected natural and man-made catastrophes around the world that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge U.S. Large Cap Variance Risk Premium Fund is designed to capture the returns of the variance risk premium in U.S. large company stocks. For the 12 months ended October 31, 2015, total returns were 6.33%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge U.S. Small Cap Variance Risk Premium Fund is designed to capture the returns of the variance risk premium in U.S. small company stocks. For the 12 months ended October 31, 2015, total returns were 5.23%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge U.S. Variance Risk Premium Master Fund is designed to capture the returns of the variance risk premium in U.S. stocks by purchasing shares of the Stone Ridge U.S. Small Cap Variance Risk Premium Fund and the Stone Ridge U.S. Large Cap Variance Risk Premium Fund. For the 12 months ended October 31, 2015, total returns were 5.81%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge International Developed Markets Variance Risk Premium Fund is designed to capture the returns of the variance risk premium in international developed market company stocks. For the 12 months ended October 31, 2015, total returns were 3.40%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge International Emerging Markets Variance Risk Premium Fund is designed to capture the returns of the variance risk premium in emerging market company stocks. For the 12 months ended October 31, 2015, total returns were -10.37%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

Stone Ridge International Variance Risk Premium Master Fund is designed to capture the returns of the variance risk premium in international developed market and emerging market company stocks by purchasing shares of the Stone Ridge International Developed Markets Variance Risk Premium Fund and the Stone Ridge Emerging Markets Variance Risk Premium Fund. For the 12 months ended October 31, 2015, total returns were -1.63%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

16

| | |

| Management’s Discussion and Analysis | | |

Stone Ridge Global Equity Variance Risk Premium Master Fund is designed to capture the returns of the variance risk premium in U.S., international developed market and emerging market company stock by purchasing shares of the Stone Ridge U.S. Small Cap Variance Risk Premium Fund, the Stone Ridge U.S. Large Cap Variance Risk Premium Fund, the Stone Ridge International Developed Markets Variance Risk Premium Fund and the Stone Ridge Emerging Markets Variance Risk Premium Fund. For the period ended October 31, 2015, total returns were 1.17%. Given the diversification of the Fund’s risk exposures, there were a number of unexpected volatility spikes throughout the year that negatively impacted certain of the Fund’s risk exposures, and therefore negatively impacted Fund performance, which we expect to be true every year.

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

17

| | | | |

| ALLOCATION OF PORTFOLIO HOLDINGS AT OCTOBER 31, 2015 (Unaudited) | | | | |

| | | | | | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY YEAR OF SCHEDULED MATURITY | |

| | |

| 2015 | | | $18,727,305 | | | | 1.8% | |

| | |

| 2016 | | | 172,339,230 | | | | 16.8% | |

| | |

| 2017 | | | 311,112,218 | | | | 30.4% | |

| | |

| 2018 | | | 296,544,390 | | | | 28.9% | |

| | |

| 2019 | | | 70,042,360 | | | | 6.8% | |

| | |

| 2020 | | | 47,263,543 | | | | 4.6% | |

| | |

| 2023 | | | 7,623,589 | | | | 0.7% | |

| | |

| 2034 | | | 11,984,323 | | | | 1.2% | |

| | |

| Not Applicable | | | 82,072,719 | | | | 8.0% | |

| | |

| Other(1) | | | 6,832,737 | | | | 0.8% | |

| | | $1,024,542,414 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. LARGE CAP VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Consumer Discretionary | | | $11,994,869 | | | | 3.2% | |

| | |

| Information Technology | | | 10,112,271 | | | | 2.7% | |

| | |

| Health Care | | | 7,722,825 | | | | 2.0% | |

| | |

| Industrials | | | 4,659,428 | | | | 1.2% | |

| | |

| Financials | | | 3,646,815 | | | | 1.0% | |

| | |

| Consumer Staples | | | 3,325,720 | | | | 0.9% | |

| | |

| Energy | | | 3,197,990 | | | | 0.8% | |

| | |

| Materials | | | 3,188,651 | | | | 0.8% | |

| | |

| Utilities | | | 589,568 | | | | 0.2% | |

| | |

| Telecommunication Services | | | 455,976 | | | | 0.1% | |

| | |

| Other(1) | | | 329,855,956 | | | | 87.1% | |

| | | $378,750,069 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. VARIANCE RISK PREMIUM MASTER FUND PORTFOLIO ALLOCATION BY HOLDINGS | |

| | |

| Stone Ridge U.S. Large Cap Variance Risk Premium Fund - Class I | | | $132,115,117 | | | | 66.5% | |

| | |

| Stone Ridge U.S. Small Cap Variance Risk Premium Fund - Class I | | | 66,268,075 | | | | 33.4% | |

| | |

| Other(1) | | | 210,393 | | | | 0.1% | |

| | | $198,593,585 | | | | | |

| | | | | | | | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY YEAR OF SCHEDULED MATURITY | |

| | |

| 2015 | | | $11,622,179 | | | | 2.3% | |

| | |

| 2016 | | | 73,537,470 | | | | 14.8% | |

| | |

| 2017 | | | 139,166,055 | | | | 28.1% | |

| | |

| 2018 | | | 156,017,592 | | | | 31.5% | |

| | |

| 2019 | | | 37,988,392 | | | | 7.7% | |

| | |

| 2020 | | | 11,655,760 | | | | 2.4% | |

| | |

| 2023 | | | 3,201,165 | | | | 0.6% | |

| | |

| 2034 | | | 10,828,753 | | | | 2.2% | |

| | |

| Not Applicable | | | 48,114,789 | | | | 9.7% | |

| | |

| Other(1) | | | 3,529,563 | | | | 0.7% | |

| | | $495,661,718 | | | | | |

| | | | | | | | |

| STONE RIDGE U.S. SMALL CAP VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Health Care | | | $1,341,227 | | | | 1.0% | |

| | |

| Information Technology | | | 680,365 | | | | 0.5% | |

| | |

| Consumer Discretionary | | | 619,603 | | | | 0.5% | |

| | |

| Industrials | | | 293,014 | | | | 0.2% | |

| | |

| Telecommunication Services | | | 129,052 | | | | 0.1% | |

| | |

| Materials | | | 109,230 | | | | 0.1% | |

| | |

| Energy | | | 41,411 | | | | 0.0% | |

| | |

| Financials | | | 48,553 | | | | 0.1% | |

| | |

| Consumer Staples | | | 24,808 | | | | 0.0% | |

| | |

| Other(1) | | | 127,005,824 | | | | 97.5% | |

| | | $130,293,087 | | | | | |

| | | | | | | | |

| STONE RIDGE INTERNATIONAL DEVELOPED MARKETS VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Health Care | | | $170,958 | | | | 0.2% | |

| | |

| Information Technology | | | 140,101 | | | | 0.1% | |

| | |

| Consumer Discretionary | | | 121,559 | | | | 0.1% | |

| | |

| Telecommunication Services | | | 116,115 | | | | 0.1% | |

| | |

| Financials | | | 113,644 | | | | 0.1% | |

| | |

| Consumer Staples | | | 82,256 | | | | 0.1% | |

| | |

| Energy | | | 42,840 | | | | 0.1% | |

| | |

| Utilities | | | 35,800 | | | | 0.0% | |

| | |

| Industrials | | | 31,668 | | | | 0.0% | |

| | |

| Materials | | | 31,616 | | | | 0.0% | |

| | |

| Other(1) | | | 110,644,461 | | | | 99.2% | |

| | | $111,531,018 | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

18

| | | | |

| ALLOCATION OF PORTFOLIO HOLDINGS AT OCTOBER 31, 2015 (Unaudited) | | | | |

| | | | | | | | |

| STONE RIDGE EMERGING MARKETS VARIANCE RISK PREMIUM FUND PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Information Technology | | | $468,157 | | | | 0.9% | |

| | |

| Consumer Discretionary | | | 148,075 | | | | 0.3% | |

| | |

| Financials | | | 111,345 | | | | 0.2% | |

| | |

| Materials | | | 41,411 | | | | 0.1% | |

| | |

| Telecommunication Services | | | 16,029 | | | | 0.0% | |

| | |

| Energy | | | 15,616 | | | | 0.0% | |

| | |

| Other(1) | | | 49,615,878 | | | | 98.5% | |

| | | $50,416,511 | | | | | |

| | | | | | | | |

| STONE RIDGE GLOBAL EQUITY VARIANCE RISK PREMIUM MASTER FUND PORTFOLIO ALLOCATION BY HOLDINGS | |

| | |

| Stone Ridge U.S. Large Cap Variance Risk Premium Fund - Class I | | | $16,074,468 | | | | 33.2% | |

| | |

| Stone Ridge International Developed Markets Variance Risk Premium Fund - Class I | | | 16,001,599 | | | | 33.1% | |

| | |

| Stone Ridge U.S. Small Cap Variance Risk Premium Fund - Class I | | | 8,081,490 | | | | 16.7% | |

| | |

| Stone Ridge Emerging Markets Variance Risk Premium Fund - Class I | | | 7,896,466 | | | | 16.3% | |

| | |

| Other(1) | | | 308,941 | | | | 0.7% | |

| | | $48,362,964 | | | | | |

| | | | | | | | |

| STONE RIDGE INTERNATIONAL VARIANCE RISK PREMIUM MASTER FUND PORTFOLIO ALLOCATION BY HOLDINGS | |

| | |

| Stone Ridge International Developed Markets Variance Risk Premium Fund - Class I | | | $19,504,736 | | | | 66.3% | |

| | |

| Stone Ridge Emerging Markets Variance Risk Premium Fund - Class I | | | 9,663,390 | | | | 32.8% | |

| | |

| Other(1) | | | 262,008 | | | | 0.9% | |

| | | $29,430,134 | | | | | |

| (1) | Cash, cash equivalents, short term investments and other assets less liabilities. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

19

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| EVENT-LINKED BONDS - 81.3% | | | | | | |

| | | | | | | | |

| China - 0.1% | | | | | | |

| | | | | | | | |

| Earthquake - 0.1% | | | | | | |

Panda Re 2015-1

4.096%, 06/30/2018 (a)(b)(c) | | $ | 1,397,000 | | | $ | 1,393,654 | |

| | | | | | | | |

| | | | | | | | |

| Europe - 0.8% | | | | | | |

| | | | | | | | |

| Windstorm - 0.8% | | | | | | |

Atlas Re VII B

3.650%, 01/07/2016 (a)(b)(c) | | EUR | 2,250,000 | | | | 2,459,121 | |

Calypso Capital II Class B

3.710%, 01/08/2018 (a)(b)(c) | | EUR | 2,750,000 | | | | 3,067,433 | |

Green Fields II 2013-1 A

2.750%, 01/09/2017 (a)(b)(c) | | EUR | 2,250,000 | | | | 2,482,378 | |

| | | | | | | | |

| | | | | | | 8,008,932 | |

| | | | | | | | |

| Global - 23.5% | | | | | | |

| | | | | | | | |

| Earthquake - 1.1% | | | | | | |

Acorn Re 2015-1

3.663%, 07/17/2018 (a)(b)(c) | | $ | 6,595,000 | | | | 6,647,100 | |

Market Re 2014-4 Class A

4.000%, 10/01/2016 (a)(b)(c) | | | 2,121,000 | | | | 2,119,515 | |

Market Re 2014-4 Class B

4.000%, 12/01/2016 (a)(b)(c) | | | 771,000 | | | | 770,460 | |

Tramline Re II 2013-1 A

3.296%, 07/07/2017 (a)(b)(c) | | | 1,750,000 | | | | 1,730,838 | |

| | | | | | | | |

| | | | | | | 11,267,913 | |

| | | | | | | | |

| Mortality/Longevity - 2.5% | |

Benu Capital Class B

3.350%, 01/08/2020 (a)(b)(c) | | EUR | 12,000,000 | | | | 13,187,227 | |

Chesterfield Re 2014-1

4.500%, 12/15/2034 (c) | | $ | 11,945,054 | | | | 11,984,323 | |

Vitality Re VI Class B

2.146%, 01/08/2018 (a)(b)(c) | | | 1,000,000 | | | | 1,004,450 | |

| | | | | | | | |

| | | | | | | 26,176,000 | |

| | | | | | | | |

| Multiperil - 19.5% | |

Atlas IX 2015-1

7.161%, 01/07/2019 (a)(b)(c) | | | 4,910,000 | | | | 4,931,359 | |

Blue Danube II 2013-1 A

4.368%, 05/23/2016 (a)(b)(c) | | | 10,042,000 | | | | 10,039,992 | |

Galileo Re 2013-1

7.446%, 01/09/2017 (a)(b)(c) | | | 5,500,000 | | | | 5,570,950 | |

Galileo Re 2015-1 Class A

13.546%, 01/08/2018 (a)(b)(c) | | | 8,929,000 | | | | 9,153,564 | |

Kilimanjaro Re 2014-1 Class B

4.546%, 04/30/2018 (a)(b)(c) | | | 10,802,000 | | | | 10,743,669 | |

Kilimanjaro Re 2014-2 Class C

3.796%, 11/25/2019 (a)(b)(c) | | | 28,158,000 | | | | 27,887,683 | |

Loma Re 2013-1 A

8.316%, 01/08/2018 (a)(b)(c) | | | 2,271,000 | | | | 2,360,705 | |

Loma Re 2013-1 B

10.616%, 01/08/2018 (a)(b)(c) | | | 6,814,000 | | | | 7,117,223 | |

Loma Re 2013-1 C

16.546%, 01/08/2018 (a)(b)(c) | | | 11,781,000 | | | | 12,479,024 | |

Mythen Re 2012-2 A

8.646%, 01/05/2017 (a)(b)(c) | | | 578,000 | | | | 596,727 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Multiperil - 19.5% (continued) | |

RW003 (Horseshoe Segregated Account)

13.794%, 07/22/2016 (a)(b)(d)(e)(f) | | $ | 1,839,810 | | | $ | 1,705,603 | |

Tradewynd Re 2013-1 1

8.906%, 07/09/2018 (a)(b)(c) | | | 10,357,000 | | | | 11,398,914 | |

Tradewynd Re 2013-2 3-A

6.036%, 01/09/2017 (a)(b)(c) | | | 12,481,000 | | | | 12,650,742 | |

Tradewynd Re 2013-2 3-B

6.586%, 01/09/2017 (a)(b)(c) | | | 10,698,000 | | | | 10,847,772 | |

Tradewynd Re 2014-1 Class 3-A

5.000%, 01/08/2018 (a)(b)(c) | | | 10,554,000 | | | | 10,555,583 | |

Tradewynd Re 2014-1 Class 3-B

7.000%, 01/08/2018 (a)(b)(c) | | | 28,143,000 | | | | 28,399,101 | |

Tramline Re II 2014-1 Class A

9.796%, 01/04/2019 (a)(b)(c) | | | 18,115,000 | | | | 18,600,482 | |

VenTerra Re 2013-1 A

3.796%, 01/09/2017 (a)(b)(c) | | | 14,596,000 | | | | 14,600,379 | |

| | | | | | | | |

| | | | | | | 199,639,472 | |

| | | | | | | | |

| Windstorm - 0.4% | |

Queen Street VIII

6.546%, 06/08/2016 (a)(b)(c) | | | 3,250,000 | | | | 3,258,938 | |

Queen Street X Re

5.796%, 06/08/2018 (a)(b)(c) | | | 901,000 | | | | 890,413 | |

| | | | | | | | |

| | | | | | | 4,149,351 | |

| | | | | | | | |

| | | | | | | 241,232,736 | |

| | | | | | | | |

| Japan - 3.1% | | | | | | |

| | | | | | | | |

| Earthquake - 3.1% | | | | | | |

Kizuna Re II 2015-1

2.000%, 04/05/2019 (a)(b)(c) | | JPY | 500,000,000 | | | | 4,142,496 | |

Kizuna Re II Class A

2.296%, 04/06/2018 (a)(b)(c) | | $ | 6,750,000 | | | | 6,762,825 | |

Kizuna Re II Class B

2.556%, 04/06/2018 (a)(b)(c) | | | 4,500,000 | | | | 4,512,150 | |

Nakama Re

2.556%, 04/13/2018 (a)(b)(c) | | | 4,250,000 | | | | 4,264,875 | |

Nakama Re 2013-1

2.806%, 09/29/2016 (a)(b)(c) | | | 6,500,000 | | | | 6,518,200 | |

Nakama Re 2014-2 Class 2

2.931%, 01/16/2020 (a)(b)(c) | | | 5,250,000 | | | | 5,264,963 | |

| | | | | | | | |

| | | | | | | 31,465,509 | |

| | | | | | | | |

| Mexico - 0.8% | | | | | | |

| | | | | | | | |

| Earthquake - 0.6% | | | | | | |

MultiCat Mexico 2012-1 A

8.046%, 12/04/2015 (a)(b)(c) | | | 6,199,000 | | | | 6,208,918 | |

| | | | | | | | |

| | | | | | | | |

| Windstorm - 0.2% | | | | | | |

MultiCat Mexico 2012-1 B

7.796%, 12/04/2015 (a)(b)(c) | | | 1,875,000 | | | | 1,878,563 | |

MultiCat Mexico 2012-1 C

7.546%, 12/04/2015 (a)(b)(c) | | | 541,000 | | | | 21,640 | |

| | | | | | | | |

| | | | | | | 1,900,203 | |

| | | | | | | | |

| | | | | | | 8,109,121 | |

| | | | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

20

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Turkey - 2.1% | | | | | | |

| | | | | | | | |

| Earthquake - 2.1% | | | | | | |

Bosphorus 1 Re 2013-1 A

2.556%, 05/03/2016 (a)(b)(c) | | $ | 18,000,000 | | | $ | 17,956,800 | |

Bosphorus Re 2015-1

3.579%, 08/17/2018 (a)(b)(c) | | | 3,250,000 | | | | 3,237,325 | |

| | | | | | | | |

| | | | | | | 21,194,125 | |

| | | | | | | | |

| United States - 50.9% | | | | | | |

| | | | | | | | |

| Earthquake - 6.5% | | | | | | |

Golden State Re II

2.246%, 01/08/2019 (a)(b)(c) | | | 4,200,000 | | | | 4,178,790 | |

Lakeside Re III

8.046%, 01/08/2016 (a)(b)(c) | | | 10,975,000 | | | | 11,034,265 | |

Merna Re 2015-1

2.046%, 04/09/2018 (a)(b)(c) | | | 1,478,000 | | | | 1,474,083 | |

Merna Re IV

2.556%, 04/08/2016 (a)(b)(c) | | | 6,250,000 | | | | 6,246,250 | |

Ursa Re 2014-1 Class A

3.500%, 12/07/2017 (a)(b)(c) | | | 5,631,000 | | | | 5,582,573 | |

Ursa Re 2014-1 Class B

5.000%, 12/07/2017 (a)(b)(c) | | | 20,237,000 | | | | 20,186,408 | |

Ursa Re 2015-1

5.000%, 09/21/2018 (a)(b)(c) | | | 17,550,000 | | | | 17,496,473 | |

| | | | | | | | |

| | | | | | | 66,198,842 | |

| | | | | | | | |

| Multiperil - 25.9% | | | | | | |

Atlas Re VII A

8.322%, 01/07/2016 (a)(b)(c) | | | 1,772,000 | | | | 1,785,999 | |

Caelus Re 2013-1 A

5.296%, 03/07/2016 (a)(b)(c) | | | 6,021,000 | | | | 6,069,469 | |

Caelus Re 2013-2 A

6.896%, 04/07/2017 (a)(b)(c) | | | 20,494,000 | | | | 21,187,722 | |

East Lane Re VI

2.796%, 03/14/2018 (a)(b)(c) | | | 14,467,000 | | | | 14,346,924 | |

East Lane VI 2015-1

3.806%, 03/13/2023 (a)(b)(c) | | | 7,597,000 | | | | 7,623,589 | |

Ibis Re II 2013-1 A

4.056%, 06/28/2016 (a)(b)(c) | | | 3,250,000 | | | | 3,282,500 | |

Ibis Re II 2013-1 B

4.546%, 06/28/2016 (a)(b)(c) | | | 4,500,000 | | | | 4,556,700 | |

Ibis Re II 2013-1 C

8.046%, 06/28/2016 (a)(b)(c) | | | 3,250,000 | | | | 3,359,850 | |

Long Point Re III 2015-1

3.750%, 05/23/2018 (a)(b)(c) | | | 10,569,000 | | | | 10,742,332 | |

Mona Lisa Re 2013-2 A

7.346%, 07/07/2017 (a)(b)(c) | | | 16,164,000 | | | | 16,976,241 | |

Northshore Re 2013-1 A

7.296%, 07/05/2016 (a)(b)(c) | | | 14,621,000 | | | | 14,971,904 | |

PennUnion Re 2015-1

4.556%, 12/07/2018 (a)(b)(c) | | | 1,825,000 | | | | 1,827,099 | |

Residential Re 2015-1 Class 10

11.046%, 06/06/2019 (a)(b)(c) | | | 4,070,000 | | | | 4,170,529 | |

Residential Re 2015-1 Class 11

6.046%, 06/06/2019 (a)(b)(c) | | | 4,428,000 | | | | 4,495,084 | |

Residential Re 2011-2 1

8.946%, 12/06/2015 (a)(b)(c) | | | 2,358,000 | | | | 2,365,663 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Multiperil - 25.9% (continued) | | | | | | |

Residential Re 2012-1 3

10.046%, 06/06/2016 (a)(b)(c) | | $ | 2,332,000 | | | $ | 2,429,711 | |

Residential Re 2012-2 2

5.796%, 12/06/2016 (a)(b)(c) | | | 1,149,000 | | | | 1,177,782 | |

Residential Re 2012-2 4

19.046%, 12/06/2016 (a)(b)(c) | | | 2,570,000 | | | | 2,788,835 | |

Residential Re 2013-1 11

8.056%, 06/06/2017 (a)(b)(c) | | | 23,100,000 | | | | 24,216,885 | |

Residential Re 2013-1 3

9.296%, 06/06/2017 (a)(b)(c) | | | 12,600,000 | | | | 13,352,850 | |

Residential Re 2013-2 1

20.046%, 12/06/2017 (a)(b)(c) | | | 4,580,000 | | | | 4,808,542 | |

Residential Re 2013-2 4

5.296%, 12/06/2017 (a)(b)(c) | | | 3,600,000 | | | | 3,604,140 | |

Residential Re 2014-1 10

15.046%, 06/06/2018 (a)(b)(c) | | | 9,197,000 | | | | 9,506,479 | |

Residential Re 2014-1 13

3.546%, 06/06/2018 (a)(b)(c) | | | 2,544,000 | | | | 2,574,274 | |

Residential Re 2014-2 Class 4

4.846%, 12/06/2018 (a)(b)(c) | | | 5,653,000 | | | | 5,574,423 | |

Riverfront Re 2014

4.056%, 01/06/2017 (a)(b)(c) | | | 4,512,000 | | | | 4,504,330 | |

Sanders Re 2013-1 A

3.546%, 05/05/2017 (a)(b)(c) | | | 22,000,000 | | | | 22,027,500 | |

Sanders Re 2013-1 B

4.046%, 05/05/2017 (a)(b)(c) | | | 8,110,000 | | | | 8,152,172 | |

Sanders Re 2014-1 B

3.056%, 05/25/2018 (a)(b)(c) | | | 18,750,000 | | | | 18,507,188 | |

Sanders Re 2014-1 C

3.286%, 05/25/2018 (a)(b)(c) | | | 19,000,000 | | | | 18,789,100 | |

Sanders Re 2014-2

3.896%, 06/07/2017 (a)(b)(c) | | | 4,247,000 | | | | 4,297,539 | |

Skyline Re 2014-1 A

14.046%, 01/23/2017 (a)(b)(c) | | | 1,426,000 | | | | 1,490,883 | |

| | | | | | | | |

| | | | | | | 265,564,238 | |

| | | | | | | | |

| Windstorm - 18.5% | | | | | | |

Alamo Re 2015-1 Class A

5.956%, 06/07/2018 (a)(b)(c) | | | 8,540,000 | | | | 8,881,600 | |

Alamo Re 2015-1 Class B

4.646%, 06/07/2018 (a)(b)(c) | | | 4,176,000 | | | | 4,312,346 | |

Alamo Re Ltd.

5.296%, 06/07/2017 (a)(b)(c) | | | 12,108,000 | | | | 12,484,559 | |

Armor Re Ltd.

4.126%, 12/15/2016 (a)(b)(c) | | | 5,450,000 | | | | 5,497,960 | |

Citrus Re 2014-1

4.506%, 04/18/2017 (a)(b)(c) | | | 6,353,000 | | | | 6,368,565 | |

Citrus Re 2014-2

4.336%, 04/24/2017 (a)(b)(c) | | | 1,410,000 | | | | 1,418,460 | |

Citrus Re 2015-1 Class A

4.946%, 04/09/2018 (a)(b)(c) | | | 5,985,000 | | | | 6,025,698 | |

Citrus Re 2015-1 Class B

6.366%, 04/09/2018 (a)(b)(c) | | | 8,977,000 | | | | 9,078,440 | |

Citrus Re 2015-1 Class C

9.526%, 04/09/2018 (a)(b)(c) | | | 2,768,000 | | | | 2,824,190 | |

Compass Re II 2015-1

9.762%, 12/08/2015 (a)(b)(c)(d) | | | 8,284,000 | | | | 8,252,521 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

21

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Windstorm - 18.5% (continued) | | | | | | |

Cranberry Re 2015-1

3.856%, 07/06/2018 (a)(b)(c) | | $ | 2,609,000 | | | $ | 2,667,181 | |

Everglades Re 2013-1 A

9.526%, 03/28/2016 (a)(b)(c) | | | 12,600,000 | | | | 12,945,240 | |

Everglades Re 2014

7.496%, 04/28/2017 (a)(b)(c) | | | 28,200,000 | | | | 29,359,020 | |

Everglades Re II 2015-1

5.196%, 05/03/2018 (a)(b)(c) | | | 6,897,000 | | | | 7,046,665 | |

Gator Re 2014

6.726%, 01/09/2017 (a)(b)(c) | | | 13,750,000 | | | | 12,955,250 | |

Kilimanjaro Re 2014-1 Class A

4.796%, 04/30/2018 (a)(b)(c) | | | 9,269,000 | | | | 9,276,878 | |

Long Point Re III 2013-1 A

4.246%, 05/18/2016 (a)(b)(c) | | | 13,639,000 | | | | 13,752,204 | |

Manatee Re 2015-1

5.056%, 12/22/2017 (a)(b)(c) | | | 2,424,000 | | | | 2,442,180 | |

Market Re 2015-2

6.950%, 06/07/2016 (a)(b)(c)(d) | | | 2,709,000 | | | | 2,846,888 | |

Metrocat Re 2013-1 A

4.546%, 08/05/2016 (a)(b)(c) | | | 3,750,000 | | | | 3,811,687 | |

Pelican Re 2013-1 A

6.056%, 05/15/2017 (a)(b)(c) | | | 8,862,000 | | | | 9,170,841 | |

Queen City

3.546%, 01/06/2017 (a)(b)(c) | | | 10,000,000 | | | | 9,971,500 | |

Tar Heel 2013-1 A

8.546%, 05/09/2016 (a)(b)(c) | | | 8,289,000 | | | | 8,534,769 | |

| | | | | | | | |

| | | | | | | 189,924,642 | |

| | | | | | | | |

| | | | | | 521,687,722 | |

| | | | | | | | |

TOTAL EVENT-LINKED BONDS

(Cost $824,195,937) | | | | | | | 833,091,799 | |

| | | | | | | | |

PARTICIPATION NOTES

(QUOTA SHARES) - 10.0% | | | | | | |

| | | | | | | | |

| Global - 7.4% | | | | | | |

| | | | | | | | |

| Multiperil - 7.4% | | | | | | |

Atlas Re X Class A

04/03/2017 (a)(c)(e) | | | 24,789,000 | | | | 28,074,272 | |

Eden Re 2015-1

04/19/2018 (a)(e)(f)(g) (Cost: $4,000,000; Acquisition Date: 12/29/2014) | | | 4,000,000 | | | | 4,427,534 | |

Eden Re II 2015-1

04/19/2018 (a)(e)(f)(g) (Cost: $13,624,875; Acquisition Date: 03/19/2015) | | | 13,500,000 | | | | 14,330,587 | |

Sector Re V LTD Series 4 Class A

03/30/2019 (a)(f) (Cost: $30,766; Acquisition Date: 04/24/2014) | | | 30,766 | | | | 723,490 | |

Sector Re V LTD Series 5 Class B

03/01/2020 (a)(f)(g) (Cost: $17,790,802; Acquisition Date: 04/30/2015) | | | 17,790,802 | | | | 19,317,253 | |

Sector Re V LTD Series 5 Class F

03/01/2020 (a)(f)(g) (Cost: $9,000,000; Acquisition Date: 04/27/2015) | | | 9,000,000 | | | | 9,494,100 | |

| | | | | | | | |

| | | | | | | 76,367,236 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| United States - 2.6% | |

| | | | | | | | |

| Multiperil - 2.6% | | | | | | |

Sector Re V LTD Series 3 Class F

03/01/2019 (a)(f) (Cost: $178,750; Acquisition Date: 03/12/2013) | | $ | 178,750 | | | $ | 912,447 | |

Sector Re V LTD Series 5 Class G

06/26/2016 (a)(f)(g) (Cost: $24,083,000; Acquisition Date: 06/26/2015) | | | 24,083,000 | | | | 25,265,476 | |

| | | | | | | | |

| | | | | | 26,177,923 | |

| | | | | | | | |

TOTAL PARTICIPATION NOTES (QUOTA SHARES)

(Cost $93,497,193) | | | | | | | 102,545,159 | |

| | | | | | | | |

| | |

PREFERENCE SHARES

(QUOTA SHARES) - 8.0% | | SHARES | | | FAIR

VALUE | |

|

| Global - 8.0% | |

| | | | | | | | |

| Multiperil - 8.0% | | | | | | |

Biscayne (Kane Segregated Account Company) (a)(e)(f) (Cost: $17,415,491; Original Acquisition Date: 04/30/2014) | | | 17,296 | | | | 19,659,384 | |

Hatteras (Kane Segregated Account Company) (a)(e)(f)(g) (Cost: $6,300,000; Acquisition Date: 12/30/2014) | | | 6,300 | | | | 7,166,424 | |

Hilo (Kane Segregated Account Company) (a)(e)(f)(g) (Cost: $2,469,074; Acquisition Date: 06/09/2015) | | | 2,469 | | | | 2,658,186 | |

Hudson Charles 2 (Mt. Logan Re) (a)(f) (Cost: $8,062,500; Acquisition Date: 04/02/2014) | | | 8,063 | | | | 9,287,479 | |

Hudson Charles 3 (Mt. Logan Re) (a)(f) (Cost: $11,904,000; Acquisition Date: 06/19/2014) | | | 11,904 | | | | 13,577,169 | |

Hudson Paul 3 (Mt. Logan Re) (a)(f) (Cost: $8,062,500; Acquisition Date: 04/02/2014) | | | 8,063 | | | | 9,680,203 | |

Kona (Kane Segregated Account Company) (a)(e)(f)(g) (Cost: $2,412,000; Acquisition Date: 07/23/2015) | | | 2,412 | | | | 2,591,475 | |

Lorenz Re Class B (a)(e)(f)(g) (Cost: $49,349; Acquisition Date: 03/25/2013) | | | 493 | | | | 58,507 | |

LRe 2015 (a)(e)(f)(g) (Cost: $5,165,574; Acquisition Date: 03/31/2015) | | | 51,656 | | | | 5,847,694 | |

Minnewaska (Kane Segregated Account Company) (a)(e)(f)(g) (Cost: $3,744,456; Original Acquisition Date: 05/29/2015) | | | 3,216 | | | | 4,128,497 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

22

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Multiperil - 8.0% (continued) | | | | | | |

Rondout (Kane Segregated Account Company) (a)(e)(f) (Cost: $6,891,227; Acquisition Date: 05/29/2015) | | | 6,083 | | | $ | 7,417,701 | |

| | | | | | | | |

TOTAL PREFERENCE SHARES (QUOTA SHARES)

(Cost $72,476,171) | | | | | | | 82,072,719 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $990,169,301) - 99.3% | | | | | | | 1,017,709,677 | |

| | | | | | | | |

OTHER ASSETS IN EXCESS OF

LIABILITIES - 0.7% | | | | | 6,832,737 | |

| | | | | | | | |

| TOTAL NET ASSETS - 100.0% | | | | | $1,024,542,414 | |

| | | | | | | | |

Principal amounts stated in U.S. dollars unless otherwise stated.

Country shown is geographic area of peril risk.

Percentages are stated as a percent of net assets.

| (a) | Foreign issued security. Total foreign securities by country of domicile are $1,005,725,354. Foreign concentration is as follows: Bermuda: 77.3%, Cayman Islands: 18.1%, Ireland: 2.8%. |

| (b) | Variable rate security. The rate shown is as of October 31, 2015. |

| (c) | Security is restricted to resale to institutional investors. The Fund’s Adviser has deemed this security to be liquid based upon procedures approved by the Board of Trustees. The aggregate value of these securities at October 31, 2015 was $859,460,468, which represents 83.9% of net assets. |

| (d) | Zero-coupon bond. The rate shown is the yield to maturity. |

| (e) | Security is fair valued by the Adviser pursuant to procedures approved by the Board of Trustees. The aggregate value of these securities is $98,065,864, which represents 9.6% of net assets. |

| (f) | Security is restricted to resale. The aggregate value of these securities at October 31, 2015 was $158,249,209, which represents 15.4% of net assets. |

| (g) | Non-income producing security. |

Open Futures Contracts

| | | | | | | | | | | | |

| DESCRIPTION | | NUMBER OF

CONTRACTS

SOLD | | | NOTIONAL

VALUE | | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

| | | |

| FUTURES CONTRACTS SOLD | | | | | | | | | |

Euro Fx, December 2015 Settlement | | | 164 | | | $ | 22,568,450 | | | $ | 257,027 | |

Japanese Yen, December 2015 Settlement | | | 40 | | | | 4,144,000 | | | | 30,507 | |

U.S. Treasury 5-Year Note, December 2015 Settlement | | | 77 | | | | 9,222,555 | | | | (12,799) | |

| | | | | | | | | | | | |

TOTAL FUTURES CONTRACTS SOLD | | | | | | $ | 35,935,005 | | | $ | 274,735 | |

| | | | | | | | | | | | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

23

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| EVENT-LINKED BONDS - 80.6% | | | | |

| | | | | | | | |

| China - 0.1% | | | | |

| | | | | | | | |

| Earthquake - 0.1% | | | | | | |

Panda Re 2015-1

4.096%, 06/30/2018 (a)(b)(c) | | $ | 668,000 | | | $ | 666,400 | |

| | | | | | | | |

| | |

| Global - 20.6% | | | | | | |

| | | | | | | | |

| Earthquake - 0.9% | | | | | | |

Acorn Re 2015-1

3.663%, 07/17/2018 (a)(b)(c) | | | 3,155,000 | | | | 3,179,925 | |

Market Re 2014-4 Class A

4.000%, 10/01/2016 (a)(b)(c) | | | 944,000 | | | | 943,339 | |

Market Re 2014-4 Class B

4.000%, 12/01/2016 (a)(b)(c) | | | 343,000 | | | | 342,760 | |

| | | | | | | | |

| | | | | | | 4,466,024 | |

| | | | | | | | |

| Mortality/Longevity - 2.2% | | | | | | |

Chesterfield Re 2014-1

4.500%, 12/15/2034 (c) | | | 10,793,270 | | | | 10,828,753 | |

| | | | | | | | |

| | |

| Multiperil - 17.4% | | | | | | |

Atlas IX 2015-1

7.161%, 01/07/2019 (a)(b)(c) | | | 2,074,000 | | | | 2,083,022 | |

Blue Danube II 2013-1 A

4.368%, 05/23/2016 (a)(b)(c) | | | 6,958,000 | | | | 6,956,608 | |

Galileo Re 2013-1

7.446%, 01/09/2017 (a)(b)(c) | | | 4,000,000 | | | | 4,051,600 | |

Galileo Re 2015-1 Class A

13.546%, 01/08/2018 (a)(b)(c) | | | 3,793,000 | | | | 3,888,394 | |

Kilimanjaro Re 2014-1 Class B

4.546%, 04/30/2018 (a)(b)(c) | | | 5,944,000 | | | | 5,911,902 | |

Kilimanjaro Re 2014-2 Class C

3.796%, 11/25/2019 (a)(b)(c) | | | 11,842,000 | | | | 11,728,317 | |

Loma Re 2013-1 A

8.316%, 01/08/2018 (a)(b)(c) | | | 1,394,000 | | | | 1,449,063 | |

Loma Re 2013-1 B

10.616%, 01/08/2018 (a)(b)(c) | | | 3,181,000 | | | | 3,322,554 | |

Loma Re 2013-1 C

16.546%, 01/08/2018 (a)(b)(c) | | | 7,230,000 | | | | 7,658,378 | |

Mythen Re 2012-2 A

8.646%, 01/05/2017 (a)(b)(c) | | | 422,000 | | | | 435,673 | |

RW003 (Horseshoe Segregated Account)

13.794%, 07/22/2016 (a)(b)(d)(e)(g) | | | 683,093 | | | | 633,264 | |

Tradewynd Re 2013-1 1

8.906%, 07/09/2018 (a)(b)(c) | | | 4,143,000 | | | | 4,559,786 | |

Tradewynd Re 2013-2 3-A

6.036%, 01/09/2017 (a)(b)(c) | | | 5,019,000 | | | | 5,087,258 | |

Tradewynd Re 2013-2 3-B

6.586%, 01/09/2017 (a)(b)(c) | | | 4,302,000 | | | | 4,362,228 | |

Tradewynd Re 2014-1 Class 3-A

5.000%, 01/08/2018 (a)(b)(c) | | | 4,446,000 | | | | 4,446,667 | |

Tradewynd Re 2014-1 Class 3-B

7.000%, 01/08/2018 (a)(b)(c) | | | 11,857,000 | | | | 11,964,899 | |

Tramline Re II 2014-1 Class A

9.796%, 01/04/2019 (a)(b)(c) | | | 7,635,000 | | | | 7,839,618 | |

| | | | | | | | |

| | | | | | | 86,379,231 | |

| | | | | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Windstorm - 0.1% | | | | | | |

Queen Street VIII

6.546%, 06/08/2016 (a)(b)(c) | | $ | 250,000 | | | $ | 250,687 | |

Queen Street X Re

5.796%, 06/08/2018 (a)(b)(c) | | | 378,000 | | | | 373,559 | |

| | | | | | | | |

| | | | | | | 624,246 | |

| | | | | | | | |

| | | | | | | 102,298,254 | |

| | | | | | | | |

| Mexico - 1.2% | | | | | | |

| | | | | | | | |

| Earthquake - 1.0% | | | | | | |

MultiCat Mexico 2012-1 A

8.046%, 12/04/2015 (a)(b)(c) | | | 4,801,000 | | | | 4,808,682 | |

| | | | | | | | |

| | |

| Windstorm - 0.2% | | | | | | |

MultiCat Mexico 2012-1 B

7.796%, 12/04/2015 (a)(b)(c) | | | 1,125,000 | | | | 1,127,137 | |

MultiCat Mexico 2012-1 C

7.546%, 12/04/2015 (a)(b)(c) | | | 459,000 | | | | 18,360 | |

| | | | | | | | |

| | | | | | | 1,145,497 | |

| | | | | | | | |

| | | | | | | 5,954,179 | |

| | | | | | | | |

| United States - 58.7% | | | | | | |

| | | | | | | | |

| Earthquake - 6.2% | | | | | | |

Golden State Re II

2.246%, 01/08/2019 (a)(b)(c) | | | 2,900,000 | | | | 2,885,355 | |

Lakeside Re III

8.046%, 01/08/2016 (a)(b)(c) | | | 8,700,000 | | | | 8,746,980 | |

Ursa Re 2014-1 Class A

3.500%, 12/07/2017 (a)(b)(c) | | | 2,369,000 | | | | 2,348,627 | |

Ursa Re 2014-1 Class B

5.000%, 12/07/2017 (a)(b)(c) | | | 8,513,000 | | | | 8,491,717 | |

Ursa Re 2015-1

5.000%, 09/21/2018 (a)(b)(c) | | | 8,450,000 | | | | 8,424,228 | |

| | | | | | | | |

| | | | | | | 30,896,907 | |

| | | | | | | | |

| Multiperil - 22.0% | | | | | | |

Atlas Re VII A

8.322%, 01/07/2016 (a)(b)(c) | | | 1,228,000 | | | | 1,237,701 | |

Caelus Re 2013-1 A

5.296%, 03/07/2016 (a)(b)(c) | | | 4,229,000 | | | | 4,263,043 | |

Caelus Re 2013-2 A

6.896%, 04/07/2017 (a)(b)(c) | | | 11,506,000 | | | | 11,895,478 | |

East Lane Re VI

2.796%, 03/14/2018 (a)(b)(c) | | | 6,340,000 | | | | 6,287,378 | |

East Lane VI 2015-1

3.806%, 03/13/2023 (a)(b)(c) | | | 3,190,000 | | | | 3,201,165 | |

Ibis Re II 2013-1 C

8.046%, 06/28/2016 (a)(b)(c) | | | 2,000,000 | | | | 2,067,600 | |

Long Point Re III 2015-1

3.750%, 05/23/2018 (a)(b)(c) | | | 4,431,000 | | | | 4,503,668 | |

Mona Lisa Re 2013-2 A

7.346%, 07/07/2017 (a)(b)(c) | | | 1,836,000 | | | | 1,928,259 | |

Northshore Re 2013-1 A

7.296%, 07/05/2016 (a)(b)(c) | | | 5,379,000 | | | | 5,508,096 | |

PennUnion Re 2015-1

4.556%, 12/07/2018 (a)(b)(c) | | | 1,004,000 | | | | 1,005,155 | |

Residential Re 2015-1 Class 10

11.046%, 06/06/2019 (a)(b)(c) | | | 1,983,000 | | | | 2,031,980 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

24

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |

| STONE RIDGE HIGH YIELD REINSURANCE RISK PREMIUM FUND | | | | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Multiperil - 22.0% (continued) | | | | | | |

Residential Re 2015-1 Class 11

6.046%, 06/06/2019 (a)(b)(c) | | $ | 2,157,000 | | | $ | 2,189,679 | |

Residential Re 2011-2 1

8.946%, 12/06/2015 (a)(b)(c) | | | 1,642,000 | | | | 1,647,337 | |

Residential Re 2012-1 3

10.046%, 06/06/2016 (a)(b)(c) | | | 1,668,000 | | | | 1,737,889 | |

Residential Re 2012-2 2

5.796%, 12/06/2016 (a)(b)(c) | | | 851,000 | | | | 872,318 | |

Residential Re 2012-2 4

19.046%, 12/06/2016 (a)(b)(c) | | | 1,780,000 | | | | 1,931,567 | |

Residential Re 2013-1 11

8.056%, 06/06/2017 (a)(b)(c) | | | 15,400,000 | | | | 16,144,590 | |

Residential Re 2013-1 3

9.296%, 06/06/2017 (a)(b)(c) | | | 8,400,000 | | | | 8,901,900 | |

Residential Re 2013-2 1

20.046%, 12/06/2017 (a)(b)(c) | | | 2,420,000 | | | | 2,540,758 | |

Residential Re 2013-2 4

5.296%, 12/06/2017 (a)(b)(c) | | | 1,900,000 | | | | 1,902,185 | |

Residential Re 2014-1 10

15.046%, 06/06/2018 (a)(b)(c) | | | 3,965,000 | | | | 4,098,422 | |

Residential Re 2014-1 13

3.546%, 06/06/2018 (a)(b)(c) | | | 1,097,000 | | | | 1,110,054 | |

Residential Re 2014-2 Class 4

4.846%, 12/06/2018 (a)(b)(c) | | | 2,347,000 | | | | 2,314,377 | |

Riverfront Re 2014

4.056%, 01/06/2017 (a)(b)(c) | | | 1,966,000 | | | | 1,962,658 | |

Sanders Re 2013-1 B

4.046%, 05/05/2017 (a)(b)(c) | | | 6,890,000 | | | | 6,925,828 | |

Sanders Re 2014-1 D

3.916%, 05/28/2019 (a)(b)(c) | | | 8,705,000 | | | | 8,578,342 | |

Sanders Re 2014-2

3.896%, 06/07/2017 (a)(b)(c) | | | 1,826,000 | | | | 1,847,729 | |

Skyline Re 2014-1 A

14.046%, 01/23/2017 (a)(b)(c) | | | 408,000 | | | | 426,564 | |

| | | | | | | | |

| | | | | | | 109,061,720 | |

| | | | | | | | |

| Windstorm - 30.5% | | | | | | |

Alamo Re 2015-1 Class A

5.956%, 06/07/2018 (a)(b)(c) | | | 24,557,000 | | | | 25,539,280 | |

Alamo Re 2015-1 Class B

4.646%, 06/07/2018 (a)(b)(c) | | | 12,015,000 | | | | 12,407,290 | |

Armor Re Ltd.

4.126%, 12/15/2016 (a)(b)(c) | | | 15,700,000 | | | | 15,838,160 | |

Citrus Re 2014-1

4.506%, 04/18/2017 (a)(b)(c) | | | 2,703,000 | | | | 2,709,623 | |

Citrus Re 2014-2

4.336%, 04/24/2017 (a)(b)(c) | | | 607,000 | | | | 610,642 | |

Citrus Re 2015-1 Class A

4.946%, 04/09/2018 (a)(b)(c) | | | 2,514,000 | | | | 2,531,095 | |

Citrus Re 2015-1 Class B

6.366%, 04/09/2018 (a)(b)(c) | | | 3,770,000 | | | | 3,812,601 | |

Citrus Re 2015-1 Class C

9.526%, 04/09/2018 (a)(b)(c) | | | 1,163,000 | | | | 1,186,609 | |

Compass Re II 2015-1

9.762%, 12/08/2015 (a)(b)(c)(d) | | | 4,036,000 | | | | 4,020,663 | |

Cranberry Re 2015-1

3.856%, 07/06/2018 (a)(b)(c) | | | 1,097,000 | | | | 1,121,463 | |

Everglades Re 2013-1 A

9.526%, 03/28/2016 (a)(b)(c) | | | 8,400,000 | | | | 8,630,160 | |

| | | | | | | | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| Windstorm - 30.5% (continued) | | | | | | |

Everglades Re 2014

7.496%, 04/28/2017 (a)(b)(c) | | $ | 24,042,000 | | | $ | 25,030,126 | |

Everglades Re II 2015-1

5.196%, 05/03/2018 (a)(b)(c) | | | 19,103,000 | | | | 19,517,535 | |

Gator Re 2014

6.726%, 01/09/2017 (a)(b)(c) | | | 6,026,000 | | | | 5,677,697 | |

Kilimanjaro Re 2014-1 Class A

4.796%, 04/30/2018 (a)(b)(c) | | | 3,991,000 | | | | 3,994,392 | |

Long Point Re III 2013-1 A

4.246%, 05/18/2016 (a)(b)(c) | | | 2,861,000 | | | | 2,884,746 | |

Manatee Re 2015-1

5.056%, 12/22/2017 (a)(b)(c) | | | 1,005,000 | | | | 1,012,538 | |

Market Re 2015-2

6.950%, 06/07/2016 (a)(b)(c)(d) | | | 1,319,000 | | | | 1,386,137 | |

Pelican Re 2013-1 A

6.056%, 05/15/2017 (a)(b)(c) | | | 7,388,000 | | | | 7,645,472 | |

Tar Heel 2013-1 A

8.546%, 05/09/2016 (a)(b)(c) | | | 5,711,000 | | | | 5,880,331 | |

| | | | | | | | |

| | | | | | | 151,436,560 | |

| | | | | | | | |

| | | | | | | 291,395,187 | |

| | | | | | | | |

TOTAL EVENT-LINKED BONDS

(Cost $393,350,916) | | | | 400,314,020 | |

| | | | | | | | |

| | |

PARTICIPATION NOTES

(QUOTA SHARES) - 8.8% | | | | | | |

| | | | | | | | |

| Global - 7.8% | | | | | | |

| | | | | | | | |

| Multiperil - 7.8% | | | | | | |

Atlas Re X Class A

04/03/2017 (a)(c)(e) | | | 15,211,000 | | | | 17,226,905 | |

Eden Re 2015-1

04/19/2018 (a)(e)(f)(g) (Cost: $1,500,000; Acquisition Date: 12/29/2014) | | | 1,500,000 | | | | 1,660,325 | |

Eden Re II 2015-1 04/19/2018 (a)(e)(f)(g) (Cost: $7,317,063; Acquisition Date: 03/19/2015) | | | 7,250,000 | | | | 7,696,056 | |

Sector Re V LTD Series 4 Class A 03/30/2019 (a)(g) (Cost: $12,263; Acquisition Date: 04/24/2014) | | | 12,263 | | | | 288,376 | |

Sector Re V LTD Series 5 Class B 03/01/2020 (a)(f)(g) (Cost: $7,091,439; Acquisition Date: 04/30/2015) | | | 7,091,439 | | | | 7,699,885 | |

Sector Re V LTD Series 5 Class F 03/01/2020 (a)(f)(g) (Cost: $3,750,000; Acquisition Date: 04/27/2015) | | | 3,750,000 | | | | 3,955,875 | |

| | | | | | | | |

| | | | | | | 38,527,422 | |

| | | | | | | | |

| United States - 1.0% | | | | | | |

| | | | | | | | |

| Multiperil - 1.0% | | | | | | |

Sector Re V LTD Series 3 Class F 03/01/2019 (a)(g) (Cost: $71,250; Acquisition Date: 03/12/2013) | | | 71,250 | | | | 363,703 | |

| | | | |

| | The accompanying footnotes are an integral part of these Schedules of Investments. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Stone Ridge Funds | | | | | | Annual Report | | | | | | October 31, 2015 | | |

| | | | | | | | | | |

25

| | |

| Schedule of Investments | | as of October 31, 2015 |

| | | | |