| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: EGONZALEZ@OLSHANLAW.COM

DIRECT DIAL: 212.451.2206

April 23, 2021

VIA EDGAR AND ELECTRONIC MAIL

Nicholas P. Panos

Senior Special Counsel

Office of Mergers & Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| Re: | OneSpan Inc. (the “Company” or “OneSpan”)

DFAN14A preliminary proxy statement filing made on Schedule 14A Filed on April 15, 2021 by Legion Partners Holdings LLC, et al. (“Legion”)

File No. 000-24389 |

Dear Mr. Panos:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission, dated April 19, 2021 (the “Staff Letter”), with regard to the above-referenced matter. We have reviewed the Staff Letter with Legion and provide the following responses on Legion’s behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Unless specifically stated otherwise, the page numbers in the responses refer to pages of the DFAN14A (the “DFAN”), and the defined terms used herein have the definitions given to them in the DFAN.

Definitive Additional Materials filed on Schedule 14A

| 1. | Please refer to the following statement: “If the Company were to monetize the declining Hardware business, doing so would immediately transform OneSpan into a pure play software company and likely rerate its shares closer to peer levels, or roughly 70% higher than current levels.” In future communications, please present any identical or similar statement as an opinion. Given the suggestion that, as a smaller company with less revenue after selling the hardware operation, OneSpan’s market value would rise with no change in the fundamentals underlying its software revenue, please provide us with a reasonable factual basis for the 70% estimate and advise us what consideration, if any, the participants gave to adhering to the disclosure standards enunciated in Release No. 34-16833 (May 23, 1980). |

Legion acknowledges the Staff’s comment and will present any identical or similar statement as opinion in future correspondence.

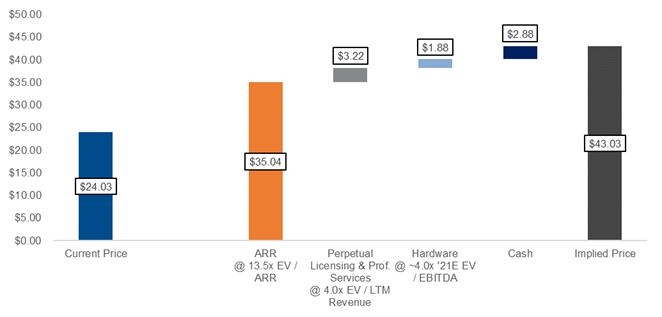

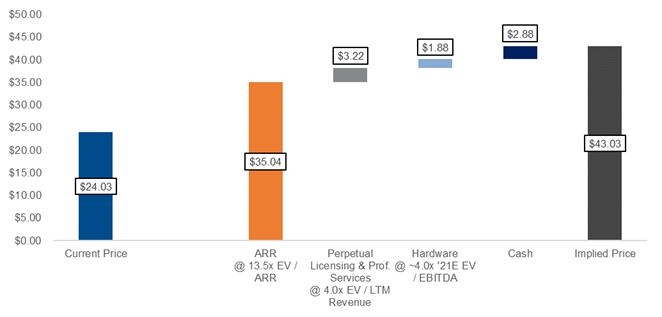

With respect to Legion’s belief that a sale of the Company’s Hardware business could yield a roughly 70% higher stock price than current levels, Legion refers the Staff to its detailed breakdown of how it derived this projection in its letter dated February 25, 2021 that was filed with the SEC on the same date and is copied, in relevant part, below.

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

Given OneSpan’s overall Annual Recurring Revenue metric, or “ARR” is growing roughly 30% per annum, with its term license and SaaS ARR growing north of 50% per annum, Legion conservatively utilized a discounted 13.5x EV / ARR in its valuation analysis below to imply a fair value of OneSpan shares at roughly $43 per share, or nearly 80% higher than current levels.

Source: Capital IQ (as of 2/24/21), Company Filings, Legion Partners’ Estimates

With the sale of the Hardware business, Legion believes investors will be able to analyze and appropriately value the Company’s remaining high-value, high-growth components, to unlock significant shareholder value as outlined above. Legion considered the disclosure standards enunciated in Release No. 34-16833 (May 23, 1980) by outlining in its February 25, 2021 letter, the basis for and the limitations on the projected realizable values. In future communications from Legion, Legion affirms to the Staff that it will include such basis for and limitations in its price projections directly in the same communication.

| 2. | Please refer to the following assertion: “four of the Company’s long-tenured directors who we believe lack the independence and skillsets to help ensure an appropriate valuation for OneSpan.” Nine out of 10 OneSpan directors, however, qualify as independent under the applicable standards codified within NASDAQ rules. Given that only one non-independent director exists, please advise us, with a view toward corrective disclosure, of the factual foundation for the assertion that four of OneSpan’s directors lack “independence.” |

Legion acknowledges the Staff’s comment and respectfully advises the Staff that, when discussing the subject directors’ “independence” in this context, Legion was not referring to their independence under the applicable NASDAQ listing standards, which, as Legion notes in its Proxy Statement on page 21, is determined by the Board under such standards. Rather, Legion was providing its belief that given their long tenure on the Board, which averages 11 years, four of the Company’s longest serving directors lacked the independence to adequately hold management accountable given the Company’s poor total shareholder returns over their tenure, as also detailed in Legion’s letter. In addition, Legion notes that three directors currently live or previously lived in the Chicago area where the Company is headquartered, which further supports Legion’s opinion that these four directors lacked sufficient independence from management to assess their performance. Nonetheless, in future correspondence, Legion will avoid making assertions regarding these directors’ independence without making clear that they are otherwise deemed independent by the Company under NASDAQ listing standards.

| 3. | Please refer to the following statement: “Rather than proactively address this structural issue through a strategic review of the Hardware business over a year ago when we first raised the issue and when its revenue and value were much higher, the Board chose not to act.” The Board, however, disclosed that it formed a new Finance and Strategy Committee in September 2020. On December 9, 2020, OneSpan retained an investment bank to act as an independent financial advisor in connection with a strategic review. Please advise us, with a view toward corrective disclosure, the basis for the assertion that the Board “chose not to act” with respect to performing a strategic review of OneSpan, including its hardware business. |

Legion acknowledges the Staff’s comment and advises the Staff that within the same sentence, Legion very clearly notes that it believes the Company should have undertaken a strategic review of the Hardware business over a year ago (and before the COVID pandemic hit) rather than wait to act in late 2020. That being said, with regard to the Finance and Strategy Committee formed by the Board in September 2020, the committee’s mandate and/or charter states a broad purpose to “review potential mergers, acquisitions and divestiture activities,” so it is unclear, at least to Legion, to what degree the committee was tasked with undertaking a strategic review of a sale of the Hardware business or, instead, reviewing other alternatives for the Company. Similarly, while the Company may have indeed retained an independent financial advisor in connection with a purported strategic review, it remains unclear to Legion whether such independent financial advisor has received a specific mandate to explore a sale of the Hardware business. Legion believes that if the Company was, in fact, exploring a strategic review of the Hardware business, it would expect more specific disclosure not only at the time of hiring of an independent financial advisor (versus burying it in a proxy statement), but also with respect to its specific mandate.

Nonetheless, in future correspondence, Legion will avoid asserting that the Board “chose not to act” without including disclosure regarding the formation of a Finance and Strategy Committee and the Company’s retention of a financial advisor.

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

Sincerely,

/s/ Elizabeth Gonzalez-Sussman

Elizabeth Gonzalez-Sussman

| Cc: | Christopher S. Kiper, Legion Partners Holdings, LLC |