Filed pursuant to Rule 424(b)(5)

Registration No. 333-195129

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 21, 2014)

NEW SOURCE ENERGY PARTNERS L.P.

3,000,000 COMMON UNITS

REPRESENTING LIMITED PARTNER INTERESTS

We are offering 3,000,000 common units representing limited partner interests. Our common units trade on the New York Stock Exchange under the symbol “NSLP.” The last reported trading price of our common units on the New York Stock Exchange on April 23, 2014 was $23.50.

Investing in our common units involves risks. Limited partnerships are inherently different from corporations. You should carefully consider each of the risk factors described under “Risk Factors” beginning on page S-11 of this prospectus supplement and page 1 in the accompanying base prospectus and in the documents incorporated herein before you make an investment in our common units.

| | | | | | | | | | |

| | | Per Common

Unit | | Total |

Price to the public | | | $ | 23.25 | | | | $ | 69,750,000 | |

Underwriting discounts and commissions | | | $ | 1.04625 | | | | $ | 3,138,750 | |

Proceeds to New Source Energy Partners L.P. (before expenses) | | | $ | 22.20375 | | | | $ | 66,611,250 | |

We have granted the underwriters a 30-day option to purchase up to an additional 450,000 common units on the same terms and conditions set forth above.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these common units or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units on or about April 29, 2014.

Joint Book-Running Managers

| | |

| Baird | | Stifel |

| Oppenheimer & Co. | | BMO Capital Markets |

Co-Managers

| | | | |

| Janney Montgomery Scott | | Wunderlich Securities | | Sterne Agee |

Prospectus Supplement dated April 23, 2014

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus. The second part is the accompanying base prospectus, which gives more general information. Generally, when we refer to the prospectus, we are referring to both this prospectus supplement and the accompanying base prospectus. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying base prospectus, the information in this prospectus supplement controls. Before you invest in our common units, you should carefully read this prospectus supplement, the accompanying base prospectus, and the information contained in the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus, including the risk factors under the heading “Risk Factors” in this prospectus and in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2013 (the “2013 Annual Report”).

You should rely only on the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus prepared by or on behalf of us and the documents incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy our common units in any jurisdictions where the offer or solicitation is unlawful. Neither the delivery of this prospectus nor sale of our common units means that information contained in this prospectus supplement, the accompanying base prospectus and any free writing prospectus relating to this offering or the information we have previously filed with the Securities and Exchange Commission (the “SEC”) that is incorporated by reference herein is accurate as of any date other than its respective date. Our business, financial condition, results of operations and prospects may have changed since those dates. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

CERTAIN DEFINED TERMS

As used in this prospectus supplement, unless we indicate otherwise, the following terms have the following meanings:

| | — | | “July Scintilla Acquired Properties” refers to a 10% working interest in certain oil and gas properties located in Oklahoma we acquired from Scintilla on July 23, 2013; |

| | — | | “March Acquired Properties” refers to certain oil and gas properties located in Oklahoma we acquired from New Source Energy, Scintilla, and W.K. Chernicky, LLC on March 29, 2013; |

| | — | | “May Acquired Properties” refers to certain oil and gas properties located in Oklahoma we acquired from New Source Energy on May 31, 2013; |

| | — | | “MCE Acquisition” refers to the acquisition of the MCE Entities we completed in November 2013; |

| | — | | “MCE Entities” refers collectively to MCE, LP and MCE GP, LLC; |

| | — | | “New Dominion” refers to New Dominion, LLC, the entity that serves as our contract operator and provides certain operational services to us; |

| | — | | “New Source Energy” refers to New Source Energy Corporation, an independent energy company engaged in the development and production of onshore oil and liquids-rich natural gas projects in the United States; |

| | — | | “New Source Group” collectively refers to New Source Energy, New Dominion and Scintilla; however, when used in the context of the development agreement described herein, the New Source Group refers to the parties (other than us) party thereto; |

| | — | | “our general partner” refers to New Source Energy GP, LLC, our general partner; |

S-ii

| | — | | “our management,” “our employees,” or similar terms refer to the management and personnel of our general partner who perform managerial and administrative services on our behalf; |

| | — | | “Scintilla” refers to Scintilla, LLC, the entity from which New Source Energy acquired substantially all of its assets in August 2011; |

| | — | | “Southern Dome Acquired Properties” refers to working interests in 25 producing wells and related undeveloped leasehold rights in the Southern Dome field in Oklahoma County, Oklahoma we acquired from Scintilla on October 4, 2013; and |

| | — | | “we,” “our,” “us,” and like terms refer collectively to New Source Energy Partners L.P. and its subsidiaries. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this prospectus supplement includes “forward-looking statements.” Theseforward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “continue,” “potential,” “should,” “could,” and similar terms and phrases. All statements, other than statements of historical facts, included herein concerning, among other things, planned capital expenditures, potential increases in oil and natural gas production, the number of anticipated wells to be drilled after the date hereof, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other plans and objectives for future operations, are forward-looking statements. Although we believe that the expectations reflected in theseforward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, among others:

| | — | | our ability to replace oil and natural gas reserves; |

| | — | | declines or volatility in the prices we receive for our oil, natural gas and NGLs; |

| | — | | our financial position; |

| | — | | our ability to generate sufficient cash flow and liquidity from operations, borrowings or other sources to enable us to pay our obligations and maintain our non-operated acreage positions; |

| | — | | future capital requirements and uncertainty of obtaining additional funding on terms acceptable to us; |

| | — | | our ability to finance equipment, working capital and capital expenditures; |

| | — | | there are significant interlocking relationships between us and the New Source Group, and there can be no assurance that these interlocking relationships may not result in conflicts of interest and other risks to decision-making actions by our officers and directors in the future; |

| | — | | our ability to continue our working relationship with the New Source Group; |

| | — | | general economic conditions, whether internationally, nationally or in the regional and local market areas in which we do business; |

| | — | | economic downturns may adversely affect consumption of oil and natural gas by businesses and consumers; |

| | — | | the presence or recoverability of estimated oil and natural gas reserves and the actual future production rates and associated costs; |

| | — | | uncertainties associated with estimates of proved oil and natural gas reserves and various assumptions underlying such estimates; |

| | — | | our ability to successfully acquire additional working interests through the efforts of the New Source Group in forced pooling processes; |

| | — | | the impact of environmental, health and safety, and other governmental regulations and of current or pending legislation; |

| | — | | geographical concentration of our operations; |

| | — | | constraints imposed on our business and operations by our revolving credit facility and our ability to generate sufficient cash flows to repay our debt obligations; |

| | — | | availability of borrowings under our revolving credit facility; |

| | — | | drilling and operating risks; |

| | — | | exploration and development risks; |

S-iii

| | — | | competition in the oil, natural gas and oilfield services industries; |

| | — | | increases in the cost of drilling, completion and gas gathering or other costs of production and operations; |

| | — | | the inability of the New Source Group to successfully drill wells on our properties that produce oil or natural gas in commercially viable quantities; |

| | — | | failure to meet the proposed drilling schedule on our properties; |

| | — | | adverse variations from estimates of reserves, production, production prices and expenditure requirements, and our inability to replace our reserves through exploration and development activities; |

| | — | | drilling operations and adverse weather and environmental conditions; |

| | — | | limited control over non-operated properties; |

| | — | | reliance on a limited number of customers; |

| | — | | management’s ability to execute our plans to meet our goals; |

| | — | | our ability to retain key members of our management and key technical employees; |

| | — | | a shortage of qualified workers; |

| | — | | conflicts of interest with regard to our directors and executive officers; |

| | — | | access to adequate gathering systems and pipeline take-away capacity to execute our drilling program; |

| | — | | marketing and transportation constraints in the Hunton formation in east-central Oklahoma; |

| | — | | our ability to sell the oil and natural gas we produce at market prices; |

| | — | | costs associated with perfecting title for mineral rights in some of our properties; |

| | — | | title defects to our properties and inability to retain our leases; |

| | — | | federal, state, and tribal regulations and laws; |

| | — | | our current level of indebtedness and the effect of any increase in our level of indebtedness; |

| | — | | risks relating to potential acquisitions and the integration of significant acquisitions; |

| | — | | volatility of oil, natural gas and NGL prices and the effect that lower prices may have on our net income and unitholders’ equity; |

| | — | | a decline in oil or natural gas production or oil, natural gas or NGL prices and the impact of general economic conditions on the demand for oil and natural gas and the availability of capital; |

| | — | | the effect of seasonal factors; |

| | — | | lack of availability of drilling rigs, equipment, supplies, insurance, personnel and oilfield services; |

| | — | | further sales or issuances of common units or other equity or debt securities; |

| | — | | accidental damage to or malfunction of equipment; |

| | — | | costs of purchasing electricity and disposing of saltwater; |

| | — | | continued hostilities in the Middle East and other sustained military campaigns or acts of terrorism or sabotage; and |

| | — | | other economic, competitive, governmental, legislative, regulatory, geopolitical and technological factors that may negatively impact our businesses, operations or pricing. |

Finally, our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed below in “Risk Factors” and those described in Item 1A of the 2013 Annual Report. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph and elsewhere in this prospectus supplement and speak only as of the date of this prospectus supplement. Other than as required under the securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, changes in expectations or otherwise.

INDUSTRY AND MARKET DATA

A portion of the market data and certain other statistical information used throughout this prospectus supplement and the information incorporated by reference herein is based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates and our management’s understanding of industry conditions. While we are not aware of any misstatements regarding our

S-iv

market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports with and furnish other information to the SEC. You may read and copy any document we file with or furnish to the SEC at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-732-0330 for further information on their public reference room. Our SEC filings are also available at the SEC’s website at www.sec.gov. You can also obtain information about us at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

We also make available free of charge on our website located at www.newsource.com all of the documents that we file with or furnish to the SEC as soon as reasonably practicable after we electronically file such material with the SEC. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website as part of this prospectus unless specifically so designated and filed with the SEC.

The SEC allows us to “incorporate by reference” the information we file with the SEC. This means we can disclose important information to you without actually including the specific information in this prospectus supplement by referring to those documents. The information incorporated by reference is an important part of this prospectus supplement. If information in incorporated documents conflicts with information in this prospectus supplement, you should rely on the most recent information. If information in an incorporated document conflicts with information in another incorporated document, you should rely on the most recent incorporated document.

The documents listed below have been filed by us pursuant to the Exchange Act and are incorporated by reference into this prospectus:

| | — | | Our Annual Report on Form 10-K for the year ended December 31, 2013 filed on April 4, 2014; |

| | — | | Our Current Reports on Form 8-K or 8-K/A filed on December 19, 2013, January 28, 2014, February 5, 2014, February 18, 2014, April 8, 2014 and April 18, 2014 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report on Form 8-K or 8-K/A); and |

| | — | | The description of our common units contained in our Registration Statement on Form 8-A filed on February 6, 2013, and including any other amendments or reports filed for the purpose of updating such description. |

In addition, we incorporate by reference into this prospectus any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (excluding any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report on Form 8-K), after the date on which the registration statement that includes this prospectus was initially filed with the SEC and until all offerings under that registration statement are terminated.

You may request a copy of any document incorporated by reference into this prospectus supplement and any exhibit specifically incorporated by reference into those documents, at no cost, by writing or telephoning us at the following address or phone number:

New Source Energy Partners L.P.

914 North Broadway, Suite 230

Oklahoma City, Oklahoma 73102

(405) 272-3028

S-v

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information from this prospectus supplement and the accompanying base prospectus. It is not complete and may not contain all of the information that you should consider before investing in our common units. This prospectus supplement and the accompanying base prospectus include specific terms of this offering of our common units. We urge you to read carefully the entire prospectus supplement, the accompanying base prospectus and the documents we have incorporated by reference, including our financial statements and the notes to those statements, before making an investment decision. We also encourage you to read “Risk Factors” and our discussion of other risks and uncertainties in our reports filed with the SEC under the Exchange Act, particularly our 2013 Annual Report, which is incorporated by reference into this prospectus supplement and the accompanying base prospectus.

New Source Energy Partners L.P.

Overview

We are a Delaware limited partnership formed in October 2012 by New Source Energy to own and acquire oil and natural gas properties in the United States. In November 2013, we acquired an oilfield services business, and now we report our results of operations and describe our business in two segments: (i) exploration and production and (ii) oilfield services. Our primary business objective is to generate stable cash flows, allowing us to make quarterly cash distributions to our unitholders and, over time, to increase those quarterly cash distributions.

Exploration and Production. — Our oil and natural gas properties consist of non-operated working interests primarily in the Misener-Hunton formation, or Hunton formation, a conventional resource reservoir located in east-central Oklahoma. This formation has a 90-year history of exploration and development and thousands of wellbore penetrations that have led to more accurate geologic mapping.

As of December 31, 2013, we had proved reserves of approximately 20.6 MMBoe, of which approximately 60.5% were classified as proved developed reserves. Of those proved developed reserves, 73.8% were comprised of oil and natural gas liquids, or “NGLs,” and 26.2% was natural gas. As of December 31, 2013, we had 124,759 gross (54,989 net) acres, of which 9,079 gross (3,230 net) acres were undeveloped. As of December 31, 2013, we had 161 gross (40.1 net) proved undeveloped drilling locations, of which 60 gross (21.6 net) were infill drilling locations. During the year ended December 31, 2013, our average net daily production was approximately 3,658 Boe/d.

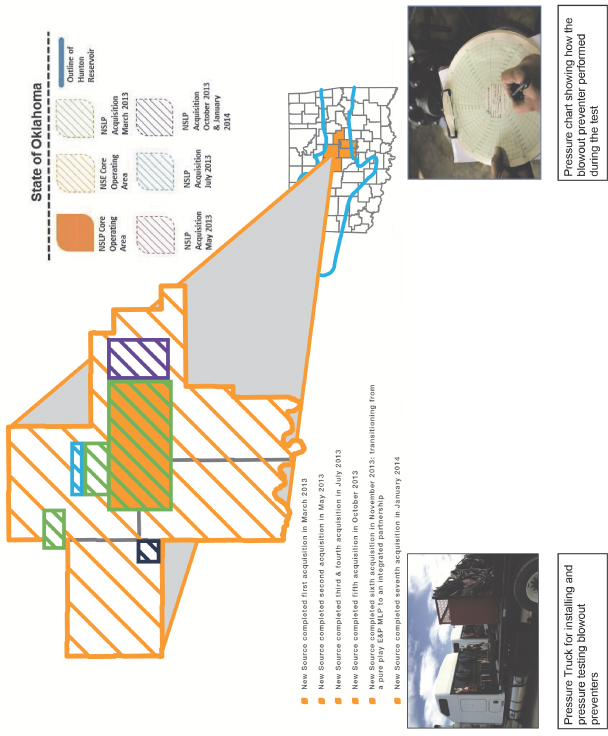

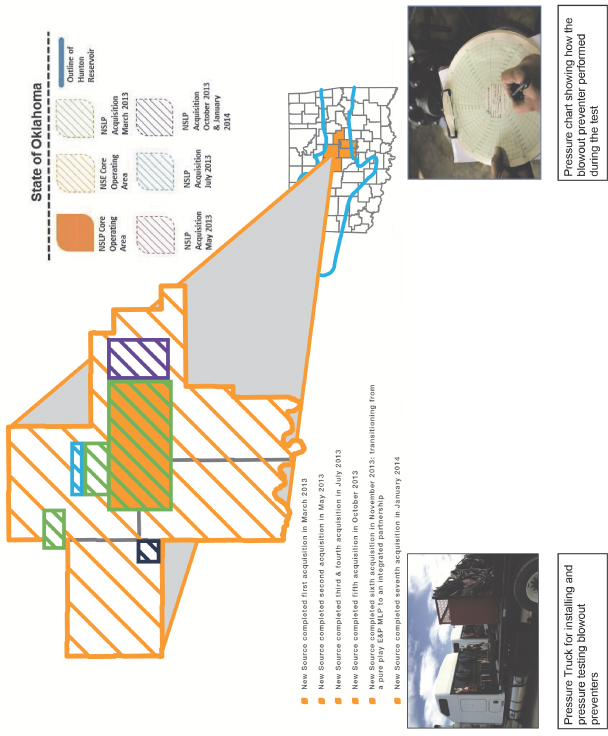

Since completing our initial public offering on February 13, 2013, we have completed six acquisitions to expand our exploration and production business. Aggregate closing date consideration for these acquisitions consisted of 2,281,212 common units and approximately $27.9 million in cash. The acquisitions grew our current footprint in the Golden Lane field and allowed us to expand into the Luther and Southern Dome fields.

Oilfield Services. — We operate an oilfield services business headquartered in Oklahoma City, Oklahoma, and offer full service blowout prevention installation and pressure testing services throughout the Mid-Continent region, South Texas and West Texas, along with the provision of certain ancillary equipment necessary to perform such services. Our oilfield services business generated $23.6 million of revenue during the year ended December 31, 2013, and contributed $3.7 million of revenue to us from November 12, 2013 (the acquisition date) to December 31, 2013. For more details regarding our oilfield services business acquisition, see “Recent Developments—Acquisitions.”

S-1

Our Properties and Operations

Our oil and natural gas properties are located in the Greater Golden Lane, Luther and Southern Dome fields primarily within the Hunton Formation of east-central Oklahoma and consist of mature, legacy oil and natural gas reservoirs. Our oil and natural gas properties consist of non-operated working interests in producing and undeveloped leasehold acreage. Our properties include 302 gross (139.7 net) producing wells with working interests ranging from 7.5% to 100% (46.3% weighted average); and 161 gross (40.1 net) proved undeveloped drilling locations with working interests ranging from 1% to 96.4% (24.9% weighted average).

As of December 31, 2013, two rigs are being used to drill on our oil and natural gas properties, and the number of rigs may be increased to up to four rigs over the next twelve months. Since our initial public offering, 28 gross (10.6 net) wells have been completed on our properties.

The following table summarizes information related to our estimated oil and natural gas reserves as of December 31, 2013 and the average net production for the year ended December 31, 2013 from our oil and gas properties.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Estimated Proved Reserves as of December 31, 2013(1) | | | | Production for

the Year Ended

December 31, 2013(3) | | Number of Wells/Drilling

Locations as of

December 31, 2013 |

| Proved Reserves | | Total

Proved

(MBoe) | | Percent

of Total | | Percent

Oil | | Percent

NGLs | | Percent

Natural

Gas | | PV-10

(MM)(2) | | Average

Net Daily

Production

(Boepd) | | Average

Working

Interest | | Gross | | Net |

Producing | | | | 11,930.8 | | | | | 57.8 | | | | | 7.7 | | | | | 66.5 | | | | | 25.8 | | | | $ | 158.3 | | | | | 3,658 | | | | | 46.3 | % | | | | 302 | | | | | 139.7 | |

Non-Producing | | | | 552.8 | | | | | 2.7 | | | | | 1.5 | | | | | 64.1 | | | | | 34.4 | | | | | 7.6 | | | | | — | | | | | 32.3 | % | | | | 6 | | | | | 1.9 | |

Undeveloped | | | | 8,155.0 | | | | | 39.5 | | | | | 6.3 | | | | | 59.7 | | | | | 34.0 | | | | | 46.8 | | | | | — | | | | | 24.9 | % | | | | 161 | | | | | 40.1 | |

Total | | | | 20,638.6 | | | | | 100.0 | | | | | 7.0 | | | | | 63.8 | | | | | 29.2 | | | | $ | 212.7 | | | | | 3,658 | | | | | 38.7 | % | | | | 469 | | | | | 181.7 | |

| (1) | Proved reserves were calculated using prices equal to the twelve-month unweighted arithmetic average of the first-day-of-the-month price for each of the preceding twelve months, which were $96.78 per Bbl of crude oil, $36.78 per Bbl of NGLs and $3.67 per Mcf of natural gas. Adjustments were made for location and the grade of the underlying resource, which resulted in an average decrease of $3.07 per Bbl of crude oil, an average decrease of $1.17 per Bbl of NGLs and an average decrease of $0.12 per Mcf of natural gas. |

| (2) | PV-10 is a non-GAAP financial measure and represents the present value of estimated future cash inflows from proved oil and natural gas reserves, less future development and production costs, discounted at 10% per annum to reflect timing of future cash flows and using the twelve-month unweighted arithmetic average of the first-day-of-the-month price for each of the preceding twelve months. PV-10 typically differs from the Standardized Measure of Discounted Future Net Cash Flows (“Standardized Measure”) because it does not include the effects of income tax. We are a partnership that is not treated as a taxable entity for federal income tax purposes and, as a result, our PV-10 and Standardized Measure are equivalent. Neither PV-10 nor Standardized Measure represents an estimate of fair market value of our natural gas and crude oil properties. PV-10 is used by the industry and by our management as an arbitrary reserve asset value measure to compare against past reserve bases and the reserve bases of other business entities that are not dependent on the taxpaying status of the entity. |

| (3) | Includes production for the March Acquired Properties, the May Acquired Properties, the July Scintilla Acquired Properties and Southern Dome Acquired Properties from the effective date of the respective acquisition. |

S-2

We use the term “conventional resource play” to refer to high water saturation (35-99%) hydrocarbon reservoirs that typically have been deemed not prospective by others. Conventional resource plays are usually located around and below conventional reservoirs, although they can exist independently. These reservoirs tend to be continuous hydrocarbon zones existing over a contiguous and potentially large geographical area. Conventional resource plays exhibit low exploration risk with consistent results, and with the implementation of specialized processes, we believe we have the ability to economically develop these large-scale reservoirs.

We have access to the development and operational experience of the New Source Group in support of our operating activities. The senior geologist and other professional staff members of the New Source Group have developed conventional resource plays for 25 years, which has provided them with insights on the physical processes at work and a significant amount of practical operating experience in how to economically produce from these reservoirs. As a result of this experience, the New Source Group has developed and refined processes that it will utilize in developing our conventional resource plays. Prior conventional resource plays in which the senior geologist for New Source Energy has used these specialized processes to successfully and economically produce oil and natural gas include the Red Fork formation in the Mount Vernon field in central Oklahoma, which was developed in the late 1980s, and the Hunton formation in the Carney and Golden Lane fields in central Oklahoma, which the New Source Group commenced developing in 1999. Each of these projects had been passed over by other industry operators because of its high saltwater content. The cumulative production from these fields from January 1, 1989 through December 31, 2013 following application of their specialized processes is 40.3 MMBoe.

Our oilfield services segment operates an oilfield services business headquartered in Oklahoma City, Oklahoma and offers full service blowout prevention installation and pressure testing services throughout the Mid-Continent region, along with the provision of certain ancillary equipment necessary to perform such services, which may include spacer spools, double-stud adapters, blowout preventers, ram blocks, choke manifolds, accumulators and other various pressure components. In addition to our presence in the Mid-Continent region, we recently leased field offices in South Texas to focus on the Eagle Ford Shale and in West Texas to focus on the Permian Basin.

Business Strategies

Our primary business objective is to generate stable cash flows, allowing us to make quarterly cash distributions to our unitholders, and over time, to increase those quarterly cash distributions. To achieve our objective, we intend to execute the following business strategies:

| | — | | Develop Existing Proved Undeveloped Inventory. As of December 31, 2013, our oil and natural gas properties, most of which were produced from the Hunton formation, included 8.2 MMBoe of estimated proved undeveloped reserves through 161 gross (40.1 net) proved undeveloped drilling locations, of which 60 gross (21.6 net) were infill drilling locations. New Dominion, our contract operator, drilled 28 gross (10.6 net) wells on our properties during the year ended December 31, 2013. There currently are two rigs drilling on our properties, and this could increase to up to four rigs over the next twelve months. |

| | — | | Reduce Exposure to Commodity Price Risk and Stabilize Cash Flow Through Commodity Hedging Policy. We are party to commodity derivative contracts covering approximately 71% of our estimated oil, natural gas and NGL production for the year ending December 31, 2014, based on production estimates contained in our reserve report as of December 31, 2013. Our hedging strategy includes entering into commodity derivative contracts covering approximately 50% to 90% of our estimated total production over a three-to-five year period at any given point in time. We may, however, from time to time hedge more or less than this approximate range. |

| | — | | Continue to Leverage Strategic Relationship with the New Source Group. We intend to continue maximizing the benefits of our relationship with the New Source Group to access existing infrastructure and acquire producing oil and natural gas properties that meet our acquisition criteria. Since the closing of our initial public offering, we have made four |

S-3

| | acquisitions of oil and natural gas properties from members of the New Source Group, and we believe that additional transactions are possible in the future. We may also have the opportunity to work jointly with New Source Energy to pursue certain acquisitions of oil and natural gas properties. |

| | — | | Pursue Accretive Third Party Acquisitions of Long-Lived, Low-Risk, Producing Properties. Independent of the New Source Group, we intend to pursue acquisitions of producing properties from third parties. We will pursue additional acquisition opportunities when we believe we possess a strategic or technical advantage due to our existing liquidity, operational experience and access to infrastructure. We believe that the knowledge and experience of the MCE Entities’ management team and the customer base they have developed at the MCE Entities will be advantageous to us in our pursuit of future acquisition opportunities and will facilitate our expansion into other resource plays where the MCE Entities operate. |

| | — | | Pursue Accretive Third Party Oilfield Services Acquisitions and Expand Organically at MCE. We intend to pursue accretive acquisitions of third-party oilfield services companies that we believe would complement the MCE Entities’ operations. Additionally, we intend to expand organically at MCE by expanding into new geographic regions and new service lines for which we believe we have the expertise to gain market share. |

Our Relationship with the New Source Group

New Source Energy is controlled by its principal stockholder, chairman and senior geologist, David J. Chernicky. Mr. Chernicky owns approximately 89% of New Source Energy’s outstanding common stock, and all of the membership interests in New Dominion and Scintilla as of December 31, 2013. Mr. Chernicky has historically acquired oil and natural gas properties through Scintilla, and New Dominion has acted as the operator for properties held by Scintilla for over 12 years, completing and economically producing more than 98% of all wells New Dominion has drilled in the Hunton formation. New Source Energy acquired substantially all of its assets from Scintilla in August 2011. As of December 31, 2013, Mr. Chernicky and entities he controls, including New Source Energy, collectively held (i) 30.6% of our general partner (ii) 28% of our then outstanding 9,599,578 common units and (iii) 100% of our 2,205,000 subordinated units.

Recent Developments

Oilfield Services Acquisition. — On November 12, 2013, we acquired entities comprising an oilfield services business from MCE, LLC. Through our oilfield services business, we offer full service blowout prevention installation and pressure testing services throughout the Mid-Continent region, along with the provision of certain ancillary equipment necessary to perform such services. Aggregate consideration to acquire the oilfield services business was approximately $43.6 million, which consisted of approximately $3.8 million in cash and 1,847,265 common units, and certain of the MCE, LLC sellers retained Class B interests in MCE, LP, which entitle the holders thereof to receive distributions of cash distributed by MCE above specified thresholds in increasing amounts. We also agreed to issue 99,768 common units, valued at $21.55 per common unit to certain employees under our long-term incentive plan, for aggregate total consideration of approximately $45.7 million. In addition, we agreed to provide additional consideration in the form of common units in the second quarter of 2015 based on specified performance metrics of the business we acquired for the nine-month period ending March 31, 2015, which is subject to a $120 million cap. For more information regarding this acquisition, please read Note 2 “Acquisitions—MCE Acquisition” to our audited historical financial statements included in our 2013 Annual Report, which is incorporated by reference herein.

Kristian B. Kos, the President and Chief Executive Officer and a director of our general partner, was a beneficial owner of the MCE Entities prior to the MCE Acquisition. The conflicts committee of the board of directors of our general partner, which, at the time, consisted of two independent directors, reviewed the MCE Acquisition and related terms and agreements, engaged and consulted with independent financial and legal advisors with respect

S-4

thereto, and granted “special approval” under our partnership agreement with respect to the contribution agreement governing the MCE Acquisition. This transaction was unanimously approved by the board of directors of our general partner, based on the approval and recommendation of its conflicts committee.

Exploration and Production Acquisition. — On January 31, 2014, we completed an acquisition of working interests in 23 producing wells and related undeveloped leasehold rights (the “CEU Acquired Properties”) in the Southern Dome field in Oklahoma County, Oklahoma from CEU Paradigm, LLC (the “CEU Acquisition”). The CEU Acquired Properties generated average daily production of approximately 490 Boe per day during the period between October 1, 2013 and December 31, 2013, of which the commodity breakdown was 51% natural gas, 34% oil and 15% natural gas liquids.

As consideration for the CEU Acquisition, we paid $6.9 million in cash to the seller at closing and issued 488,667 common units to the seller. We also agreed to provide additional consideration to the seller in November 2014 if the production attributable to the working interests for the nine-month period ending September 30, 2014 exceeds the previous production average described above. We may satisfy any such additional consideration in cash, common units, or a combination thereof at our discretion.

Common Unit Distribution. — On April 21, 2014, the board of directors of our general partner declared a cash distribution to our unitholders of $0.58 per common unit for the quarter ended March 31, 2014. The cash distribution will be paid on May 15, 2014 to unitholders of record at the close of business on May 1, 2014.

Principal Executive Offices

Our principal executive offices are located at 914 North Broadway, Suite 230, Oklahoma City, Oklahoma, and our phone number is (405) 272-3028. Our website address is www.newsource.com. We expect to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into, and does not constitute a part of, this prospectus.

Additional Information

For additional information as to our business, properties and financial condition, please refer to the documents cited in “Where You Can Find More Information.”

S-5

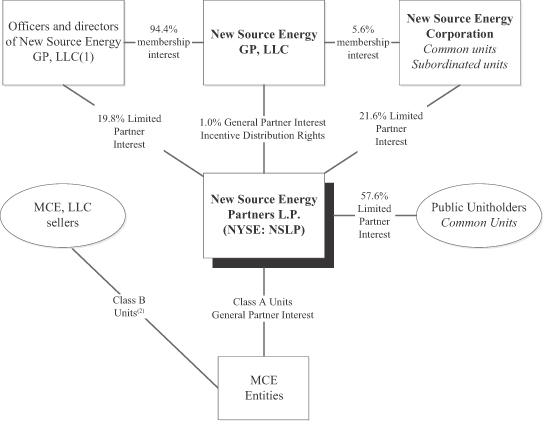

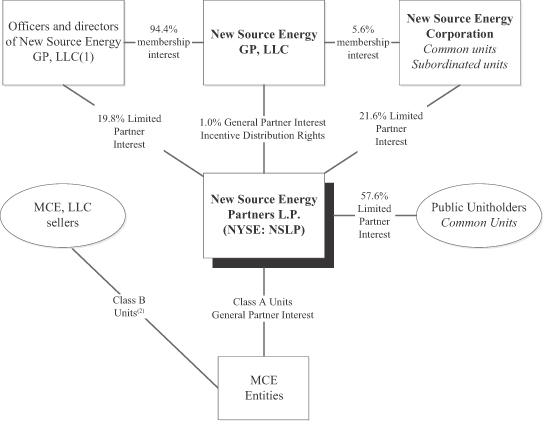

Our Ownership and Organizational Structure

The table and diagram below illustrates our ownership and organizational structure as of April 21, 2014 based on total units outstanding after giving effect to this offering and assumes that the underwriters do not exercise their option to purchase additional common units to cover over-allotments, if any, and that our general partner does not make a capital contribution to maintain its current general partner interest.

| | | | | | | | | | |

| | | Units | | Ownership

Interest |

Common units held by the public | | | | 8,910,022 | | | | | 57.6 | % |

Common units held by New Source Energy | | | | 1,125,500 | | | | | 7.3 | % |

Common units held by officers and directors of New Source Energy GP, LLC | | | | 3,052,723 | | | | | 19.8 | % |

Subordinated units held by New Source Energy | | | | 2,205,000 | | | | | 14.3 | % |

General partner units | | | | 155,102 | | | | | 1.0 | % |

| | | | | | | | | | |

Total | | | | 15,448,347 | | | | | 100.0 | % |

| | | | | | | | | | |

| | | | | | | | | | | |

| (1) | As of December 31, 2013, our general partner is owned 69.4% by an entity controlled by Kristian B. Kos, the President and Chief Executive Officer and a director of our general partner, 25% by an entity controlled by David J. Chernicky, the Chairman of the board of directors of our general partner, and 5.6% by New Source Energy. Mr. Chernicky is also the Chairman and controlling shareholder of New Source Energy. Mr. Kos is the President and Chief Executive Officer of New Source Energy. |

| (2) | Certain of the MCE, LLC sellers, including Mr. Kos, retained Class B Units in MCE, LP, which entitle the holders thereof to receive incentive distributions of cash distributed by MCE above specified thresholds, up to a maximum level of 50%. Please read Exhibit 10.20 to our 2013 Annual Report for a detailed description of the Class B Units in MCE, LP. |

S-6

The Offering

The summary below describes the principal terms of the offering of the common units.

Issuer | New Source Energy Partners L.P. |

Securities Offered | 3,000,000 common units (or 3,450,000 common units if the underwriters exercise in full their option to purchase additional common units). |

Units to be Outstanding After The Offering | 13,088,245 common units (or 13,538,245 common units if the underwriters exercise in full their option to purchase additional common units) and 2,205,000 subordinated units. |

New York Stock Exchange Symbol | Our common units are listed on the New York Stock Exchange under the symbol “NSLP.” |

Use of Proceeds | We expect to receive net proceeds of approximately $65.8 million from the sale of the common units offered hereby, after deducting underwriting discounts and estimated offering expenses payable by us. If the underwriters exercise their option to purchase additional common units in full, the net proceeds, after deducting underwriting discounts and estimated offering expenses payable by us, will be approximately $75.8 million. We intend to use all of the net proceeds from this offering to repay a portion of the indebtedness outstanding under our revolving credit facility. Please read “Use of Proceeds.” |

| | Affiliates of certain of the underwriters are lenders under, and an affiliate of BMO Capital Markets Corp. is the administrative agent of, our revolving credit facility, and, accordingly, certain of the underwriters or their affiliates will receive a portion of the net proceeds of this offering. Please read “Underwriting.” |

Cash Distributions | We expect to make cash distributions on our common units on a quarterly basis, to the extent we have sufficient cash after establishment of cash reserves and payment of fees and expenses, including payments to our general partner and its affiliates. On April 21, 2014, the board of directors of our general partner declared a cash distribution to our unitholders of $0.58 per common unit for the quarter ended March 31, 2014. The cash distribution will be paid on May 15, 2014 to unitholders of record at the close of business on May 1, 2014. |

S-7

Risk Factors | An investment in the common units involves risks. You should consider carefully the information under the heading “Risk Factors” on page S-11 of this prospectus supplement, on page 1 of the accompanying base prospectus and all other information contained or incorporated by reference herein before deciding to invest in our common units. |

Limited Voting Rights | Our general partner will manage us and operate our business. Unlike stockholders of a corporation, our unitholders will have only limited voting rights on matters affecting our business. Our unitholders will have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2⁄3% of the outstanding common and subordinated units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon the closing of this offering, New Source Energy and the officers and directors of our general partner will own an aggregate of approximately 41.7% of our outstanding common and subordinated units (or 40.5% of our outstanding common and subordinated units if the underwriters exercise their option to purchase additional common units in full) and will therefore be able to prevent the removal of our general partner. Please read “The Partnership Agreement—Limited Voting Rights.” |

Estimated Ratio of Taxable Income to Distributions | We estimate that if our unitholders own the common units purchased in this offering through the record date for distributions for the period ending December 31, 2015, such unitholders will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be less than 40% of the cash distributed to such unitholders with respect to that period. Please read “Material U.S. Federal Income Tax Considerations—Ratio of Taxable Income to Distributions” for information regarding the bases for this estimate. |

Material U.S. Federal Income Tax Considerations | For a discussion of other material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material U.S. Federal Income Tax Considerations.” |

S-8

Summary Historical Financial and Operating Data

We were formed in October 2012 and do not have historical financial or operating results for periods prior to our formation. The contribution of the properties to us by New Source Energy in connection with our IPO in February 2013 was a transaction between businesses under common control. Accordingly, we have reflected the properties acquired in connection with our IPO in our financial statements retroactively at carryover basis. The summary financial and operating data presented below are qualified in their entirety by reference to, and should be read in conjunction with, “Capitalization” included in this prospectus supplement and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited historical financial statements in our 2013 Annual Report, which is incorporated by reference herein. Our historical results are not necessarily indicative of future financial or operating results.

| | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2013 | | 2012 |

| | | (in thousands) |

Revenues: | | | | | | | | | | |

Oil sales | | | $ | 8,090 | | | | $ | 5,570 | |

Natural gas sales | | | | 10,000 | | | | | 6,030 | |

Natural gas liquids sales | | | | 28,847 | | | | | 23,996 | |

Service and rentals | | | | 3,738 | | | | | — | |

| | | | | | | | | | |

Total revenues | | | | 50,675 | | | | | 35,596 | |

| | | | | | | | | | |

Operating Costs and Expenses: | | | | | | | | | | |

Oil and natural gas production expenses | | | | 12,631 | | | | | 6,217 | |

Oil and natural gas production taxes | | | | 2,669 | | | | | 1,144 | |

Cost of providing service and rentals | | | | 2,040 | | | | | — | |

General and administrative | | | | 14,760 | | | | | 12,660 | |

Depreciation, depletion, and amortization | | | | 18,556 | | | | | 14,409 | |

Accretion expense | | | | 209 | | | | | 116 | |

| | | | | | | | | | |

Total operating costs and expenses | | | | 50,865 | | | | | 34,546 | |

| | | | | | | | | | |

Operating (loss) income | | | | (190 | ) | | | | 1,050 | |

Other Income (Expense): | | | | | | | | | | |

Interest expense | | | | (4,078 | ) | | | | (3,202 | ) |

Net gain (loss) on commodity derivatives | | | | (5,548 | ) | | | | 7,057 | |

Gain on investment in acquired business | | | | 22,709 | | | | | — | |

Other income (expense) | | | | 1,603 | | | | | — | |

| | | | | | | | | | |

Income before income taxes | | | | 14,496 | | | | | 4,905 | |

Income tax benefit (expense) | | | | 12,126 | | | | | (1,796 | ) |

| | | | | | | | | | |

Net income (loss) | | | $ | 26,622 | | | | $ | 3,109 | |

| | | | | | | | | | |

| | | | | | | | | | | |

S-9

| | | | | | | | | | |

| | | As of December 31, |

| | | 2013 | | 2012 |

| | | (in thousands) |

Balance Sheet Data: | | | | | |

Accounts receivable | | | $ | 12,609 | | | | $ | 5,663 | |

Other current assets | | | | 8,405 | | | | | 25 | |

Total property and equipment, net | | | | 171,034 | | | | | 91,423 | |

Other assets | | | | 62,662 | | | | | 2,823 | |

| | | | | | | | | | |

Total assets | | | $ | 254,710 | | | | $ | 99,934 | |

| | | | | | | | | | |

Current liabilities | | | $ | 17,281 | | | | $ | 1,973 | |

Long-term debt | | | | 80,014 | | | | | 68,000 | |

Other long-term liabilities | | | | 10,162 | | | | | 13,986 | |

Partners’ capital / Total parent net investment | | | | 147,253 | | | | | 15,975 | |

| | | | | | | | | | |

Total liabilities and parent net investment | | | $ | 254,710 | | | | $ | 99,934 | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2013 | | 2012 |

Sales Volumes: | | | | | |

Crude oil (Bbls) | | | | 84,273 | | | | | 61,010 | |

Natural gas (Mcf) | | | | 2,764,336 | | | | | 2,278,342 | |

Natural gas liquids (Bbls) | | | | 790,234 | �� | | | | 711,195 | |

| | | | | | | | | | |

Total crude oil equivalent (Boe)(1) | | | | 1,335,230 | | | | | 1,151,929 | |

| | | | | | | | | | |

Average Sales Price (Excluding Derivatives): | | | | | |

Crude oil (per Bbl) | | | $ | 95.14 | | | | $ | 91.30 | |

Natural gas (per Mcf) | | | $ | 3.61 | | | | $ | 2.65 | |

Natural gas liquids (per Bbl) | | | $ | 36.50 | | | | $ | 33.74 | |

Average Sales Price (per Boe) | | | $ | 35.15 | | | | $ | 30.90 | |

| (1) | Determined using the ratio of 6 Mcf of natural gas to 1 Bbl of crude oil |

S-10

RISK FACTORS

Limited partner interests are inherently different from the capital stock of a corporation, although many of the business and operational risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. You should consider carefully the risk factors and all of the other information included in, or incorporated by reference into, this prospectus supplement and accompanying base prospectus, including those described under the heading “Risk Factors” included in Item 1A of our 2013 Annual Report, which is incorporated by reference in this prospectus supplement, together with all of the other information included in this prospectus supplement, accompanying base prospectus and the documents we incorporate by reference.

If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our securities could decline, and you could lose all or part of your investment. Also, please read “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business

We may not have sufficient cash to pay the minimum quarterly distribution on our common units following the establishment of cash reserves and payment of fees and expenses, including payments to our general partner and its affiliates.

We may not have sufficient available cash each quarter to pay the minimum quarterly distribution of $0.525 per unit or any other amount. Under the terms of our partnership agreement, the amount of cash available for distribution will be reduced by our operating expenses and the amount of any cash reserves established by our general partner to provide for future operations, future capital expenditures, including acquisitions of additional oil and natural gas properties, growing our oilfield services business, future debt service requirements and future cash distributions to our unitholders.

The amount of cash we distribute on our units principally depends on the cash we generate from operations, which depends on, among other things:

| | — | | the amount of oil, natural gas and NGLs we produce; |

| | — | | the prices at which we sell our oil, natural gas and NGL production; |

| | — | | the amount and timing of settlements of our commodity derivatives; |

| | — | | the level of our operating costs, including maintenance capital expenditures and payments to our general partner; |

| | — | | the level of drilling activity and demand for our oilfield services; and |

| | — | | the level of our interest expense, which depends on the amount of our indebtedness and the interest payable thereon. |

For a description of additional restrictions and factors that may affect our ability to make cash distributions to our unitholders, see “Item 5—Market for Registrant’s Common Equity, Related Unitholder Matters and Issuer Purchases of Equity Securities” in our 2013 Annual Report.

We rely on New Source Energy and New Dominion, our contract operator, to execute our drilling program. If either New Source Energy or New Dominion fails to perform or inadequately performs, our operations will be adversely affected and our costs could increase or our reserves may not be developed, reducing our future levels of production and our cash flow from operations, which could affect our ability to make cash distributions to our unitholders.

We have entered into agreements with New Source Energy and New Dominion, under which we rely on New Dominion to operate all of our existing producing wells and coordinate our development drilling program. For

S-11

example, pursuant to our development agreement with New Source Energy and New Dominion, our general partner has the ability to propose an annual drilling schedule as well as to determine our annual maintenance drilling budget. We are a party to these agreements, pursuant to which New Dominion serves as the contract operator for certain of our properties. While under the terms of the development agreement, New Dominion is required to use its commercially reasonable efforts to ensure that our proportionate share of capital costs under the Golden Lane Participation Agreement are equal to our general partner’s proposed annual maintenance budget, New Dominion has the ability to propose upward or downward revisions to that budget subject to the approval of our general partner. Similarly, while our general partner is required to establish an annual drilling schedule, New Dominion may propose additions, substitutions or deletions subject to the approval of our general partner. Changes to either the budget or the drilling schedule could result from non-participation elections from other parties to the participation agreements, weather related events that interrupt the drilling schedule, operating results from completed or development wells or forced pooling. To the extent any of these events results in the development of less additional production or reserves than we currently anticipate, our cash flow from operations may be materially impaired.

Although we monitor our cost and work with New Dominion to actively manage our expenses, we have seen a significant rise in our lease operating expenses compared to last year. Our lease operating expenses increased $7.7 million, or 154%, to $12.6 million in 2013 from $5.0 million in 2012 primarily due to the acquisition of oil and gas properties and increased operator fees and vendor costs.

Producing oil and natural gas reservoirs are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our future oil and natural gas reserves and production and therefore our cash flow and ability to make distributions are highly dependent on our success in efficiently developing and exploiting our current reserves. Our production decline rates may be significantly higher than currently estimated if our wells do not produce as expected. Further, our decline rate may change when we drill additional wells or make acquisitions.

A decline in oil, natural gas and NGL prices may adversely affect our business, financial condition or results of operations and our ability to meet our capital expenditure obligations and financial commitments.

The price we receive for our oil, natural gas and NGLs heavily influences our revenue, profitability, access to capital and future rate of growth. Oil, natural gas and NGLs are commodities and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile. These markets will likely continue to be volatile in the future. The prices we receive for our production, and the levels of our production, depend on numerous factors beyond our control. These factors include the following:

| | — | | worldwide and regional economic and political conditions impacting the global supply and demand for oil, natural gas and NGLs; |

| | — | | the price and quantity of imports of foreign oil and natural gas; |

| | — | | the level of global oil and natural gas exploration and production; |

| | — | | the level of global oil and natural gas inventories; |

| | — | | localized supply and demand fundamentals and transportation availability; |

| | — | | weather conditions and natural disasters; |

| | — | | domestic and foreign governmental regulations; |

| | — | | speculation as to the future price of oil and the speculative trading of oil and natural gas futures contracts; |

| | — | | price and availability of competitors’ supplies of oil and natural gas; |

| | — | | the actions of the Organization of Petroleum Exporting Countries, or OPEC; |

S-12

| | — | | technological advances affecting energy consumption; and |

| | — | | the price and availability of alternative fuels. |

Further, oil prices and natural gas prices do not necessarily fluctuate in direct relationship to each other. Because approximately 71% of our estimated proved reserves as of December 31, 2013 were oil and NGLs reserves, our financial results are more sensitive to movements in oil and NGL prices. The price of oil has been extremely volatile, and we expect this volatility to continue. During the year ended December 31, 2013, the daily NYMEX West Texas Intermediate oil spot price ranged from a high of $110.62 per Bbl to a low of $86.65 per Bbl, and the NYMEX natural gas Henry Hub spot price ranged from a high of $4.52 to a low of $3.08 per MMBtu.

Substantially all of our oil production is sold to purchasers under short-term (less than twelve months) contracts at market based prices. Lower oil and NGL prices and, to a lesser extent, natural gas prices will reduce our cash flows, borrowing ability and the present value of our reserves. Lower commodity prices may also reduce the amount of oil and natural gas that we can produce economically and may affect our proved reserves.

Unless we replace the oil and natural gas reserves we produce, our revenues and production will decline, which would adversely affect our cash flow from operations and our ability to make distributions to our unitholders.

We will be unable to sustain our minimum quarterly distribution without substantial capital expenditures that maintain our asset base. In general, production from oil and natural gas properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Our current proved reserves will decline as reserves are produced and, therefore, our level of production and cash flows will be affected adversely unless we participate in successful development activities or acquire properties containing proved reserves. Thus, our future oil and natural gas production and, therefore, our cash flow from operations are highly dependent upon the level of success we, in conjunction with the New Source Group, have in finding or acquiring additional reserves. However, we cannot assure you that our future activities will result in any specific amount of additional proved reserves or that the New Source Group will be able to drill productive wells at acceptable costs. We may not be able to develop, find or acquire additional reserves to replace our current and future production at economically acceptable terms, which would adversely affect our business, financial condition and results of operations and reduce cash available for distribution to our unitholders.

According to estimates included in our proved reserve report, if on December 31, 2013 drilling and development on our properties had ceased, including recompletions and workovers, then our proved developed producing reserves would decline at an annual effective rate of 10.6% over 10 years. If we fail to replace reserves, our level of production and cash flows will be affected adversely. Our total proved reserves will decline as reserves are produced unless the New Source Group conducts other successful exploration and development activities or we acquire properties containing proved reserves, or both. In addition, estimates of maintenance capital expenditures may not be sufficient to maintain production.

We do not currently operate any of our drilling locations, and therefore, we will not be able to control the timing of exploration or development efforts, associated costs, or the rate of production of our assets.

We do not currently operate any of our properties and do not have plans to develop the capacity to operate any of our properties. As a non-operated working interest owner, we are dependent on the New Source Group to develop our properties. Other than as provided in our development agreement, our ability to achieve targeted returns on capital in drilling or acquisition activities and to achieve production growth rates will be materially affected by decisions made by the New Source Group over which we have little or no control. Such decisions include:

| | — | | the timing of capital expenditures; |

| | — | | the timing of initiating the drilling and recompleting of wells; |

S-13

| | — | | the extent of operating costs; |

| | — | | selection of technology and drilling and completion methods; and |

| | — | | the rate of production of reserves, if any. |

Although we monitor our cost and work with New Dominion to actively manage our expenses, we have seen a significant rise in our lease operating expenses compared to last year. Our lease operating expenses increased $7.7 million, or 154%, to $12.6 million in 2013 from $5.0 million in 2012 primarily due to the acquisition of oil and gas properties and increased operator fees and vendor costs.

The participation agreements contain terms that may be disadvantageous to us.

In connection with our entry into the development agreement with New Source Energy and New Dominion, we became a party to the Golden Lane Participation Agreement, which includes both affiliated and third party lease holders in the Golden Lane field. While our general partner has the ability to establish our annual maintenance drilling budget and drilling schedule and New Dominion has agreed to use its commercially reasonable best efforts to comply with each, New Dominion serves as the contract operator under the terms of the Golden Lane Participation Agreement and, as among the balance of the participants in that agreement, has the sole right to propose new wells. Similarly, as the operator, New Dominion has the sole right to propose new wells under the other participation agreements. In addition, New Dominion has the ability to propose changes to either our annual maintenance drilling budget or the drilling schedule under the development agreement, with such changes being subject to the approval of our general partner. In addition, the participation agreements contain negotiated terms that may depart from those typical in operating agreements, which grants New Dominion a high degree of control over the development of the properties. Such terms include the following:

| | — | | with few exceptions, New Dominion may retain record title to our interest in any undeveloped properties that New Dominion acquires in the future for our benefit until after the drilling of and production from such properties. |

| | — | | subject to our general partner’s approval in certain circumstances, New Dominion may substitute one or more wells intended to be drilled with a new well or add additional wells. We are obligated to pay our proportionate share of any additional costs incurred. |

| | — | | if we decline to participate in a new well that New Dominion proposes, we will not be eligible to participate in certain additional wells and we also would be obligated to pay for our share of the applicable acquisition costs associated with the leasehold interests underlying the proposed new well even though we have elected not to participate in the well and the associated costs themselves. In addition, if we decline to participate in a new well that New Dominion proposes, we will relinquish our interest in the new well and our share of production from the new well at least for a period of time intended to compensate other parties for our election not to participate. |

| | — | | we are obligated to pay both a well connection fee and a fee per barrel of saltwater disposed and a proportionate share of the cost to maintain such disposal wells; however, we do not obtain any ownership rights in such disposal wells, pipelines or other infrastructure. |

| | — | | our annual maintenance drilling budget includes a proportionate share of the capital costs of oil, gas, water and electrical infrastructure; however, such infrastructure remains the property of our contract operator. |

| | — | | our contract operator may increase certain of the fees and costs charged to us. |

| | — | | certain costs charged to us are “turnkey” costs, which may be higher or lower than the actual costs incurred. |

| | — | | we may be liable for certain legacy liabilities related to the properties. |

| | — | | our share of oil and gas production is committed to sale arrangements that we do not control and may not reflect market terms at any given time. |

| | — | | our right to sell or commit the properties to other ventures is limited by rights held by our contract operator. |

Our contract operator does not own a working interest in any of the properties it operates on our behalf. As a result, our contract operator may have interests in developing and operating our properties that differ from and may be contrary to our interests.

S-14

If our contract operator fails to perform its obligations under its agreements with us, becomes subject to bankruptcy proceedings or otherwise proves to be an undesirable operator, our business could be adversely affected.

The successful execution of our strategy depends on continued utilization of New Dominion’s oil and gas infrastructure and technical staff as the operator of our properties. Failure to continue this relationship through (i) the termination or expiration of the operating agreements governing such relationship, or New Source Energy’s other arrangements with New Dominion and its affiliates or (ii) the bankruptcy or dissolution of New Dominion could have a material adverse effect on our operations and our financial results. In particular, if New Dominion becomes subject to bankruptcy proceedings, New Dominion or the bankruptcy trustee may be able to cancel one or more of its agreements with us on the basis that they are “executory contracts.” If this were to occur, we would be required either (i) to renegotiate with New Dominion or its successor to continue to serve as the operator of our properties and provide us with access to the saltwater disposal and other infrastructure serving our properties or (ii) to select another operator and obtain access to similar infrastructure from other sources, any of which would most likely result in higher costs to us for such services and infrastructure.

Properties that we acquire may not produce oil or natural gas as projected, and we may be unable to determine reserve potential, identify liabilities associated with the properties or obtain protection from sellers against them, which could cause us to incur losses.

One of our principal growth strategies is to pursue selective acquisitions of producing and proved undeveloped properties in conventional resource reservoirs. If we choose to participate in an acquisition, we will perform a review of the target properties that we believe is consistent with industry practices. However, these reviews are inherently incomplete. Generally, it is not feasible to review in depth every individual property involved in each acquisition. Even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it permit a buyer to become sufficiently familiar with the properties to assess fully their deficiencies and potential. We may not perform an inspection on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, we may not be able to obtain effective contractual protection against all or part of those problems, and we may contractually assume environmental and other risks and liabilities in connection with the acquired properties.

There are risks relating to our acquisition strategy. If we are unable to successfully integrate and manage businesses that we have acquired and any businesses acquired in the future, our results of operations and financial condition could be adversely affected.

One of our business strategies is to acquire technologies, operations and assets that are complementary to our existing businesses. There are financial, operational and legal risks inherent in any acquisition strategy, including:

| | — | | increased financial leverage; |

| | — | | ability to obtain additional financing or issue additional securities; |

| | — | | increased interest expense and/or unitholder distributions; and |

| | — | | difficulties involved in combining disparate company cultures and facilities. |

The success of any completed acquisition will depend on our ability to effectively integrate the acquired business into our existing operations. The process of integrating acquired businesses may involve unforeseen difficulties and may require a disproportionate amount of our managerial and financial resources. In addition, possible future acquisitions may be larger and for purchase prices significantly higher than those paid for earlier acquisitions. No

S-15

assurance can be given that we will be able to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms, obtain financing for acquisitions on acceptable terms or successfully acquire identified targets. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operation. See “Business-Acquisitions” and “Business-Recent Developments” in our 2013 Annual Report.

Most of our oil and gas properties are currently located in the Hunton Formation in east-central Oklahoma, making us vulnerable to risks associated with operating in one primary geographic area.

Most of our oil and gas properties are currently located in the Hunton Formation in east-central Oklahoma. As a result, we may be disproportionately exposed to the impact of delays or interruptions of production from wells in which we have an interest that are caused by transportation capacity constraints, curtailment of production, availability of equipment, facilities, personnel or services, significant governmental regulation, natural disasters, adverse weather conditions, plant closures for scheduled maintenance or interruption of transportation of oil or natural gas produced from the wells in this area. In addition, the effect of fluctuations on supply and demand may become more pronounced within specific geographic oil and gas producing areas such as in Oklahoma, which may cause these conditions to occur with greater frequency or magnify the effect of these conditions. Due to the concentrated nature of our portfolio of properties, a number of our properties could experience any of the same conditions at the same time, resulting in a relatively greater impact on our results of operations than they might have on other companies that have a more diversified portfolio of properties. Such delays or interruptions could have a material adverse effect on our financial condition and results of operations.

We are subject to significant risks associated with the drilling and completion of wells in which we participate.

There are risks associated with the drilling of oil and natural gas wells, including landing the wellbore in the desired drilling zone, staying in the desired drilling zone while drilling horizontally through the formation, running casing the entire length of the wellbore and being able to run tools and other equipment consistently through the horizontal wellbore, fires and spills, among others. Risks in completing our wells include, but are not limited to, being able to produce the formation, being able to run tools the entire length of the wellbore during completion operations and successfully cleaning out the wellbore. The occurrence or non-occurrence, as appropriate, of any of these events could significantly reduce our revenues or cause substantial losses, impairing our future operating results. We may become subject to liability for pollution, blowouts or other hazards. The payment of such liabilities could reduce the funds available to us or could, in an extreme case, result in a total loss of our properties and assets.

Our reliance on specialized processes creates uncertainties that could adversely affect our results of operations and financial condition.

One of our business strategies is to commercially develop conventional resource reservoirs using specialized processes employed by the New Source Group. One technique utilized by the New Source Group is the installation of electric submersible pumps to depressurize the targeted hydrocarbon-bearing reservoir, allowing the gas to expand and push oil and natural gas out of the pores in which they are trapped, in order to increase the production of oil and natural gas. The additional production and reserves attributable to the use of these techniques is inherently difficult to predict. If these specialized processes do not allow for the extraction of additional oil and natural gas production in the manner or to the extent that we anticipate, our future results of operations and financial condition could be materially adversely affected.

S-16

Our oilfield services business and financial performance depends on the level of drilling and completion activity in the oil and natural gas industry.

The number of rigs drilling for natural gas has recently declined as a result of low natural gas prices; however, the number of rigs drilling for oil has offset this decline as a result of relatively high prices for oil. To the extent that the recent fluctuations in global crude oil prices develop into a prolonged decline, this drop could result in a reduction in the growth rate of active oil rigs and a decline in the number of active oil rigs from current levels.

Oil and natural gas producers’ expectations for lower market prices for oil and natural gas, as well as the availability of capital for operating and capital expenditures, may cause them to curtail spending. Industry conditions that impact the activity levels of oil and natural gas producers are influenced by numerous factors over which we have no control, including:

| | — | | governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves; |

| | — | | global weather conditions and natural disasters; |

| | — | | worldwide political, military, and economic conditions; |

| | — | | the cost of producing and delivering oil and natural gas; |

| | — | | potential acceleration of development of alternative energy sources. |

A prolonged reduction in natural gas and oil prices would generally depress the level of natural gas and oil exploration, development, production and well completion activity and result in a corresponding decline in the demand for the oilfield services we provide. In addition, any future decreases in the rate at which oil and natural gas reserves are developed, whether due to increased governmental regulation, limitations on exploration and drilling activity or other factors, could have a material adverse effect on our business, even in a stronger natural gas and oil price environment.

If we are not able to acquire new oilfield services equipment or our equipment becomes technologically obsolete, our results of operations may be adversely affected.

The market for oilfield services is characterized by changing technology and product introduction. As a result, our success is dependent upon our ability to acquire new services and equipment on a cost-effective basis and to introduce them into the marketplace in a timely manner. While we intend to continue committing substantial financial resources and effort to the development of new services and equipment, we may not be able to successfully differentiate our services from those of our competitors. Our clients may not consider our proposed services to be of value to them; or if the proposed services are of a competitive nature, our clients may not view them as superior to our competitors’ services and products. In addition, we may not be able to adapt to evolving markets and technologies or achieve and maintain technological advantages.

We depend on our key management personnel, and the loss of any of these individuals could adversely affect our business.

If we lose the services of our key management personnel (including Kristian B. Kos, David J. Chernicky and Dikran Tourian) or are unable to attract additional qualified personnel, our business, financial condition, results of operations, development efforts and ability to grow could suffer. We depend upon the knowledge, skill and experience of these individuals to assist us in improving the performance and reducing the risks associated with our participation in oil and natural gas development projects. In addition, the success of our business depends, to a significant extent, upon the abilities and continued efforts of our management.

S-17

Our key management personnel (including Kristian B. Kos, David J. Chernicky, and Dikran Tourian) may terminate their employment with us at any time for any reason with little or no notice. Upon termination of their employment, such persons may engage in businesses that compete with us.

We may be unable to attract and retain skilled and technically knowledgeable employees, which could adversely affect our business.