Exhibit 99.1

1 Healthcare Trust, Inc. First Quarter 2022 Investor Webcast Presentation

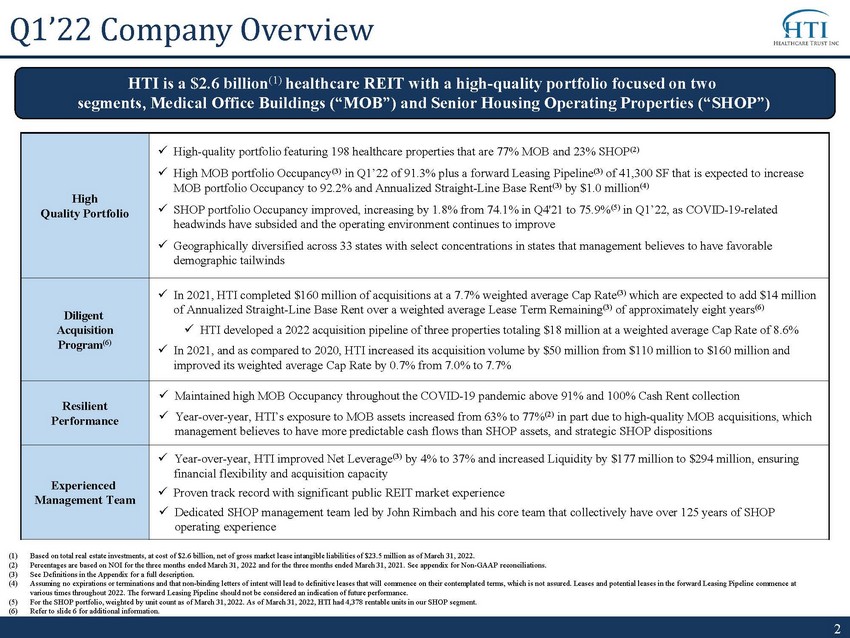

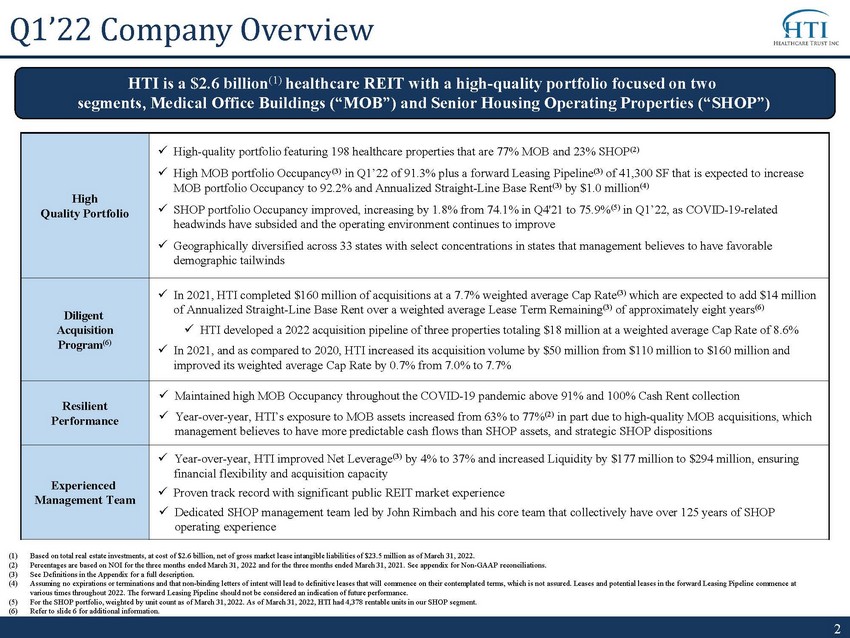

2 Q1’22 Company Overview (1) Based on total real estate investments, at cost of $2.6 billion, net of gross market lease intangible liabilities of $23.5 mi lli on as of March 31, 2022. (2) Percentages are based on NOI for the three months ended March 31, 2022 and for the three months ended March 31, 2021. See app end ix for Non - GAAP reconciliations. (3) See Definitions in the Appendix for a full description. (4) Assuming no expirations or terminations and that non - binding letters of intent will lead to definitive leases that will commence on their contemplated terms, which is not assured. Leases and potential leases in the forward Leasing Pipeline commence at various times throughout 2022. The forward Leasing Pipeline should not be considered an indication of future performance. (5) For the SHOP portfolio, weighted by unit count as of March 31, 2022. As of March 31, 2022, HTI had 4,378 rentable units in ou r S HOP segment. (6) Refer to slide 6 for additional information. HTI is a $2.6 billion (1) healthcare REIT with a high - quality portfolio focused on two segments, Medical Office Buildings (“MOB”) and Senior Housing Operating Properties (“SHOP”) High Quality Portfolio x High - quality portfolio featuring 198 healthcare properties that are 77% MOB and 23% SHOP (2) x High MOB portfolio Occupancy (3) in Q1’22 of 91.3% plus a forward Leasing Pipeline (3) of 41,300 SF that is expected to increase MOB portfolio Occupancy to 92.2% and Annualized Straight - Line Base Rent (3) by $1.0 million (4) x SHOP portfolio Occupancy improved, increasing by 1.8% from 74.1% in Q4'21 to 75.9% (5) in Q1’22, as COVID - 19 - related headwinds have subsided and the operating environment continues to improve x Geographically diversified across 33 states with select concentrations in states that management believes to have favorable demographic tailwinds Diligent Acquisition Program (6) x In 2021, HTI completed $160 million of acquisitions at a 7.7% weighted average Cap Rate (3) which are expected to add $14 million of Annualized Straight - Line Base Rent over a weighted average Lease Term Remaining (3) of approximately eight years (6) x HTI developed a 2022 acquisition pipeline of three properties totaling $18 million at a weighted average Cap Rate of 8.6% x In 2021, and as compared to 2020, HTI increased its acquisition volume by $50 million from $110 million to $160 million and improved its weighted average Cap Rate by 0.7% from 7.0% to 7.7% Resilient Performance x Maintained high MOB Occupancy throughout the COVID - 19 pandemic above 91% and 100% Cash Rent collection x Year - over - year, HTI’s exposure to MOB assets increased from 63% to 77% (2) in part due to high - quality MOB acquisitions, which management believes to have more predictable cash flows than SHOP assets, and strategic SHOP dispositions Experienced Management Team x Year - over - year, HTI improved Net Leverage (3) by 4% to 37% and increased Liquidity by $177 million to $294 million, ensuring financial flexibility and acquisition capacity x Proven track record with significant public REIT market experience x Dedicated SHOP management team led by John Rimbach and his core team that collectively have over 125 years of SHOP operating experience

3 (1) Based on square feet as of March 31, 2022 and excludes the SHOP portfolio. Including the SHOP portfolio, portfolio occupancy wou ld have been 84.6% as of March 31, 2022. (2) Excludes two land assets. (3) Based on total real estate investments, at cost of $2.6 billion, net of gross market lease intangible liabilities of $23.5 mi lli on as of March 31, 2022. (4) See Definitions in the Appendix for a full description. For the SHOP portfolio, weighted by unit count as of March 31, 2022. As of March 31, 2022, HTI had 4,378 rentable units in our SHOP segment. (5) Represents approximately 87% of HTI’s MOB segment. Approximately 84% are fixed - rate, 3% are based on the Consumer Price Index an d 13% do not contain any escalation provisions. Portfolio Snapshot HTI’s dynamic portfolio features an MOB portfolio that is 91% occupied (1) with embedded long - term rent growth and an over 4,300 - unit SHOP portfolio with significant Occupancy upside that is operated by four operators with ($ in millions and SF in thousands) MOB SHOP Rentable Square Feet 5,018 4,030 Properties (2) 146 50 States 28 14 Real Estate assets at cost (3) $1,397 $1,151 Percentage of NOI 77.4% 22.6% Occupancy (4) 91.3% 75.9% Annual Rent Escalations 1.8% (5) Market Rates Weighted Average Remaining Lease Term (4) 5.0 Years N/A

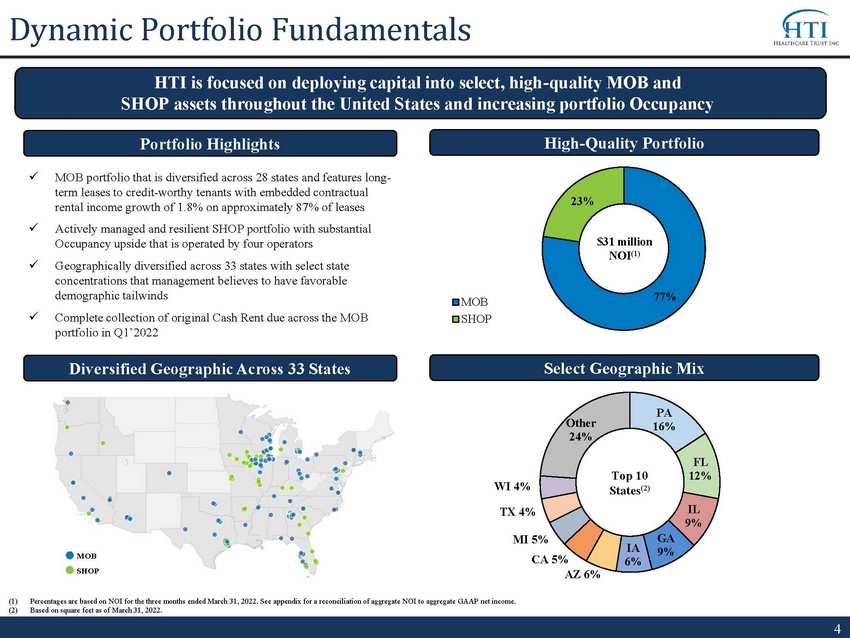

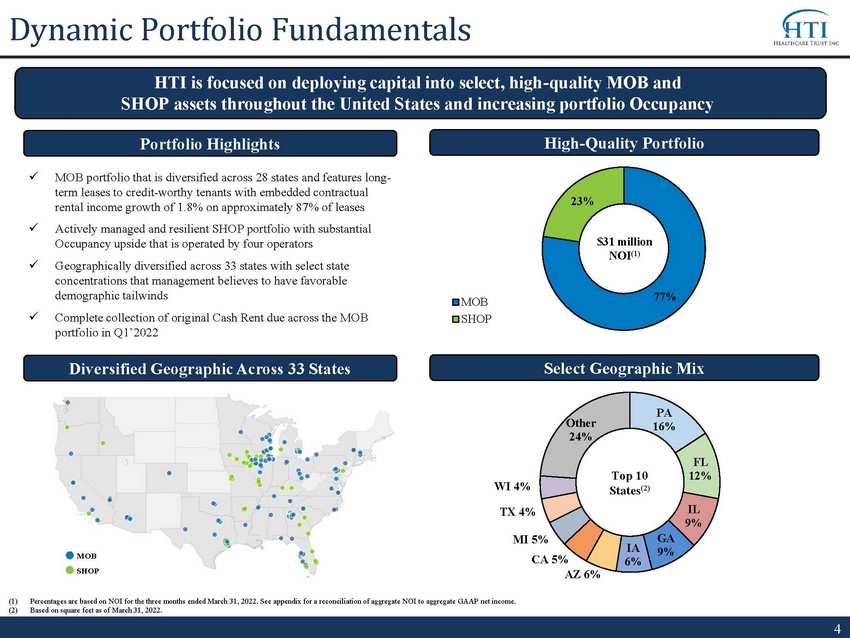

4 77% 23% MOB SHOP PA 16% FL 12% IL 9% GA 9% IA 6% AZ 6% CA 5% MI 5% TX 4% WI 4% Other 24% Dynamic Portfolio Fundamentals HTI is focused on deploying capital into select, high - quality MOB and SHOP assets throughout the United States and increasing portfolio Occupancy Select Geographic Mix (1) Percentages are based on NOI for the three months ended March 31, 2022. See appendix for a reconciliation of aggregate NOI to aggregate GAAP net income. (2) Based on square feet as of March 31, 2022. $ 31 million NOI (1) Diversified Geographic Across 33 States High - Quality Portfolio Top 10 States (2) x MOB portfolio that is diversified across 28 states and features long - term leases to credit - worthy tenants with embedded contractual rental income growth of 1.8% on approximately 87% of leases x Actively managed and resilient SHOP portfolio with substantial Occupancy upside that is operated by four operators x Geographically diversified across 33 states with select state concentrations that management believes to have favorable demographic tailwinds x Complete collection of original Cash Rent due across the MOB portfolio in Q1’2022 Portfolio Highlights MOB SHOP

5 x DaVita (NYSE: DVA) and Fresenius (NYSE: FMS) are industry leading publicly traded companies with a combined market cap of $31 billion (1) x Streamlined SHOP portfolio to only four operators, including two industry leaders, from over 15 operators in 2019 x Developed strong tenant relationships with leading medical institutions such as UPMC, a leading health enterprise with over 92,000 employees and 800 clinical locations x HTI remains committed to developing strong partnerships with leading healthcare brands that we believe benefit patients and other stakeholders Strategic Partners HTI partners with top healthcare brands in well - established markets MOB SHOP (1) Market capitalization data as of March 31, 2022.

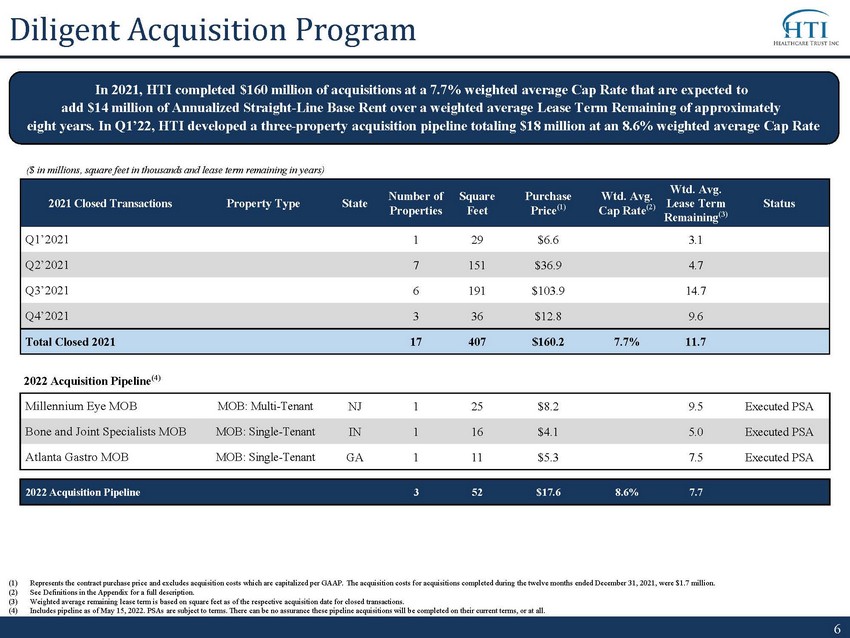

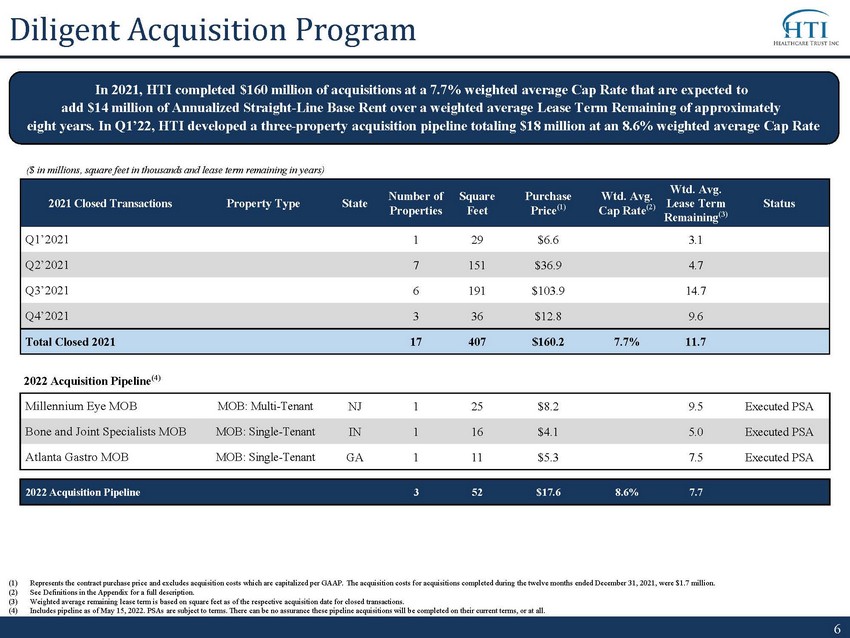

6 In 2021, HTI completed $160 million of acquisitions at a 7.7% weighted average Cap Rate that are expected to add $14 million of Annualized Straight - Line Base Rent over a weighted average Lease Term Remaining of approximately eight years. In Q1’22, HTI developed a three - property acquisition pipeline totaling $18 million at an 8.6% weighted average Cap Rate (1) Represents the contract purchase price and excludes acquisition costs which are capitalized per GAAP. The acquisition costs f or acquisitions completed during the twelve months ended December 31, 2021, were $ 1.7 million. (2) See Definitions in the Appendix for a full description. (3) Weighted average remaining lease term is based on square feet as of the respective acquisition date for closed transactions. (4) Includes pipeline as of May 15, 2022. PSAs are subject to terms. There can be no assurance these pipeline acquisitions will b e c ompleted on their current terms, or at all. ($ in millions, square feet in thousands and lease term remaining in years) Diligent Acquisition Program 2022 Acquisition Pipeline (4) Millennium Eye MOB MOB: Multi - Tenant NJ 1 25 $8.2 9.5 Executed PSA Bone and Joint Specialists MOB MOB: Single - Tenant IN 1 16 $4.1 5.0 Executed PSA Atlanta Gastro MOB MOB: Single - Tenant GA 1 11 $5.3 7.5 Executed PSA 2022 Acquisition Pipeline 3 52 $17.6 8.6% 7.7 2021 Closed Transactions Property Type State Number of Properties Square Feet Purchase Price (1) Wtd . Avg. Cap Rate (2) Wtd . Avg. Lease Term Remaining (3) Status Q1’2021 1 29 $6.6 3.1 Q2’2021 7 151 $36.9 4.7 Q3’2021 6 191 $103.9 14.7 Q4’2021 3 36 $12.8 9.6 Total Closed 2021 17 407 $160.2 7.7% 11.7

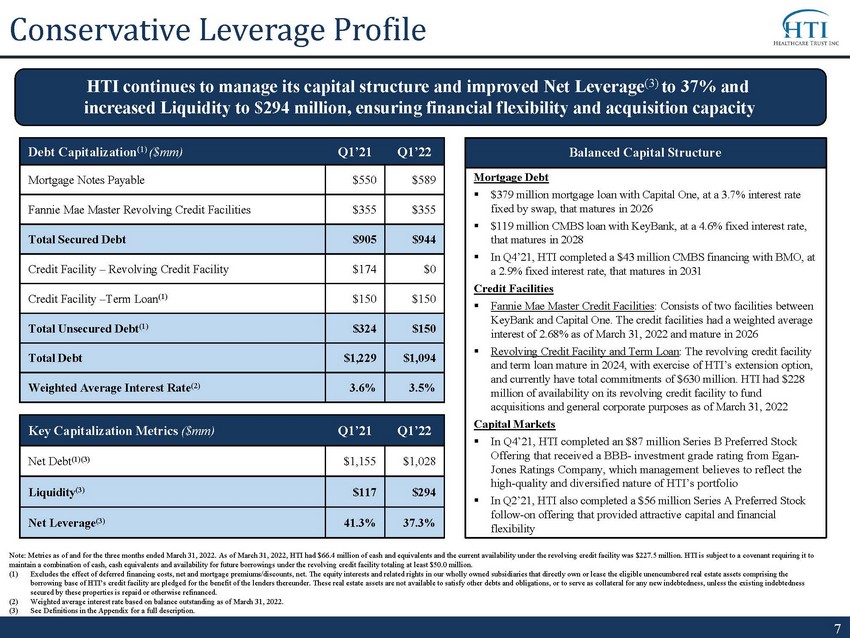

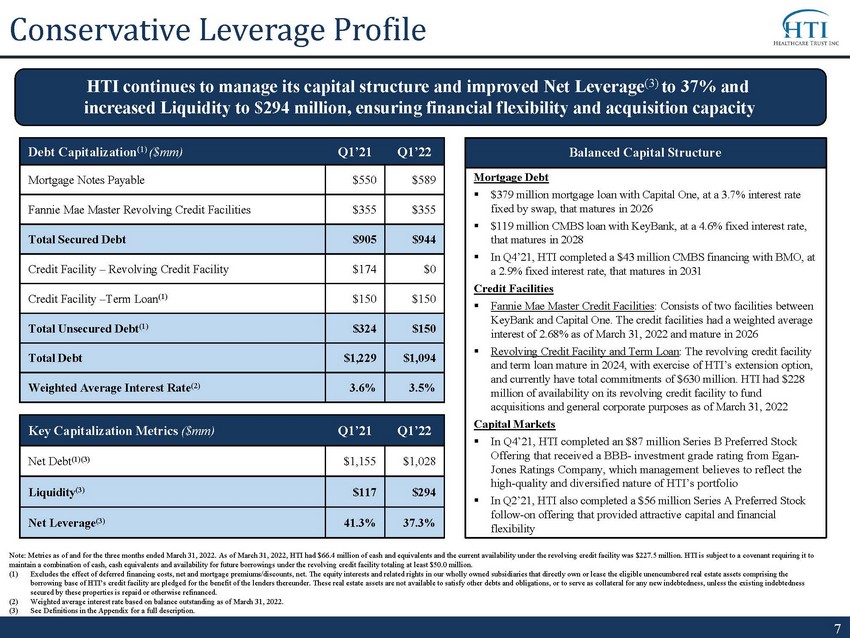

7 Mortgage Debt ▪ $379 million mortgage loan with Capital One, at a 3.7 % interest rate fixed by swap, that matures in 2026 ▪ $119 million CMBS loan with KeyBank, at a 4.6% fixed interest rate, that matures in 2028 ▪ In Q4’21 , HTI completed a $43 million CMBS financing with BMO, at a 2.9% fixed interest rate, that matures in 2031 Credit Facilities ▪ Fannie Mae Master Credit Facilities : Consists of two facilities between KeyBank and Capital One. The credit facilities had a weighted average interest of 2.68% as of March 31, 2022 and mature in 2026 ▪ Revolving Credit Facility and Term Loan : The revolving credit facility and term loan mature in 2024, with exercise of HTI’s extension option, and currently have total commitments of $630 million. HTI had $228 million of availability on its revolving credit facility to fund acquisitions and general corporate purposes as of March 31, 2022 Capital Markets ▪ In Q4’21, HTI completed an $ 87 million Series B Preferred Stock Offering that received a BBB - investment grade rating from Egan - Jones Ratings Company, which management believes to reflect the high - quality and diversified nature of HTI’s portfolio ▪ In Q2’21, HTI also completed a $56 million Series A Preferred Stock follow - on offering that provided attractive capital and financial flexibility Debt Capitalization (1) ($mm) Q1’21 Q1’22 Mortgage Notes Payable $550 $589 Fannie Mae Master Revolving Credit Facilities $355 $355 Total Secured Debt $905 $944 Credit Facility – Revolving Credit Facility $174 $0 Credit Facility – Term Loan (1) $150 $150 Total Unsecured Debt (1) $324 $150 Total Debt $1,229 $1,094 Weighted Average Interest Rate (2) 3.6% 3.5% Key Capitalization Metrics ($mm) Q1’21 Q1’22 Net Debt (1) (3) $1,155 $1,028 Liquidity (3) $117 $294 Net Leverage (3) 41.3% 37.3% Balanced Capital Structure HTI continues to manage its capital structure and improved Net Leverage (3) to 37% and increased Liquidity to $294 million, ensuring financial f lexibility and acquisition capacity Note: Metrics as of and for the three months ended March 31 , 2022. As of March 31 , 2022, HTI had $ 66.4 million of cash and equivalents and the current availability under the revolving credit facility was $ 227.5 million. HTI is subject to a covenant requiring it to maintain a combination of cash, cash equivalents and availability for future borrowings under the revolving credit facility t ota ling at least $50.0 million. (1) Excludes the effect of deferred financing costs, net and mortgage premiums/discounts, net. The equity interests and related r igh ts in our wholly owned subsidiaries that directly own or lease the eligible unencumbered real estate assets comprising the borrowing base of HTI’s credit facility are pledged for the benefit of the lenders thereunder. These real estate assets are n ot available to satisfy other debts and obligations, or to serve as collateral for any new indebtedness, unless the existing ind ebt edness secured by these properties is repaid or otherwise refinanced. (2) Weighted average interest rate based on balance outstanding as of March 31 , 2022. (3) See Definitions in the Appendix for a full description. Conservative Leverage Profile

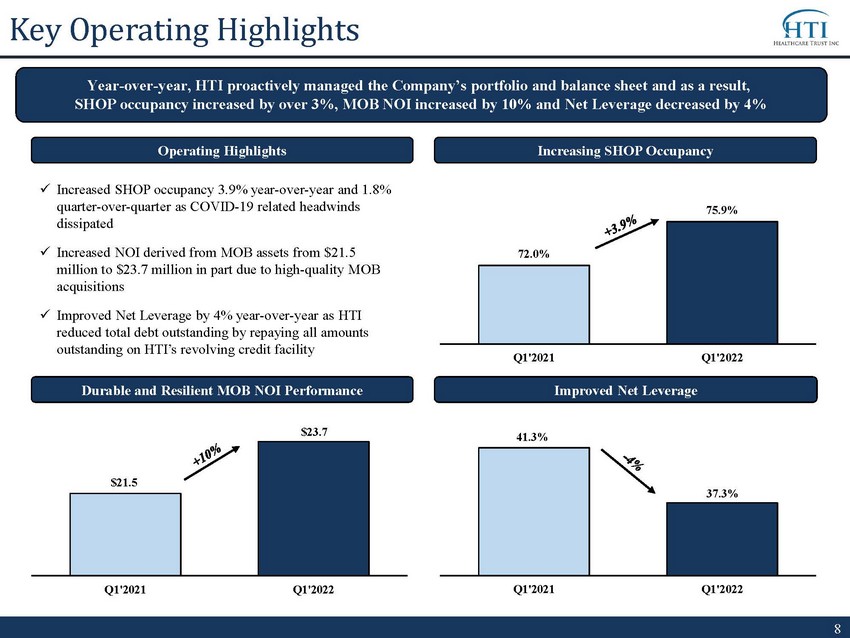

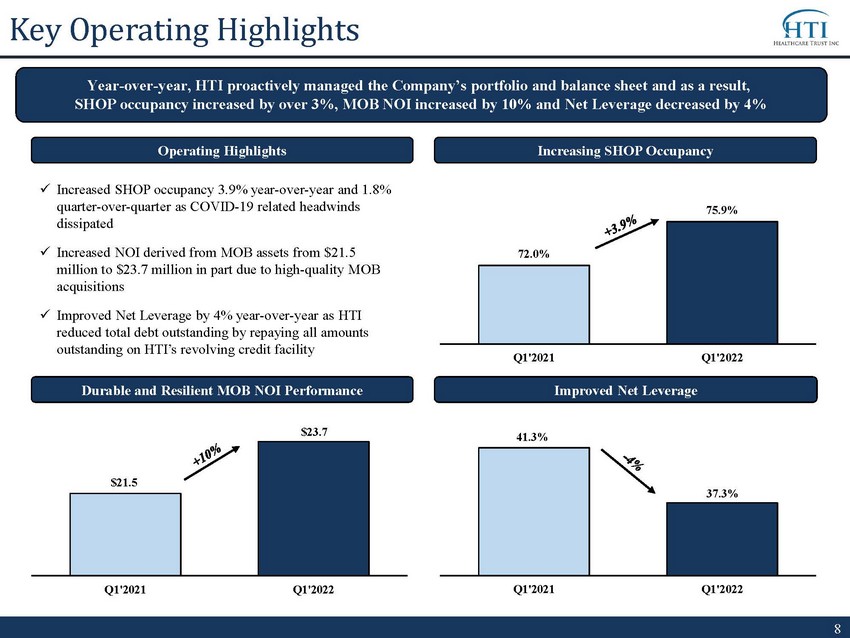

8 Key Operating Highlights Year - over - year, HTI proactively managed the Company’s portfolio and balance sheet and as a result, SHOP occupancy increased by over 3%, MOB NOI increased by 10% and Net Leverage decreased by 4% Durable and Resilient MOB NOI Performance Improved Net Leverage Increasing SHOP Occupancy x Increased SHOP occupancy 3.9% year - over - year and 1.8% quarter - over - quarter as COVID - 19 related headwinds dissipated x Increased NOI derived from MOB assets from $21.5 million to $23.7 million in part due to high - quality MOB acquisitions x Improved Net Leverage by 4% year - over - year as HTI reduced total debt outstanding by repaying all amounts outstanding on HTI’s revolving credit facility Operating Highlights 72.0% 75.9% Q1'2021 Q1'2022 $21.5 $23.7 Q1'2021 Q1'2022 41.3% 37.3% Q1'2021 Q1'2022

9 Company Highlights HTI continues to remain focused on capitalizing on the Company’s leasing upside, acquiring high - quality MOB and SHOP properties, and constructing and maintaining a conservative balance sheet x High - Quality Portfolio of 198 healthcare properties comprised of 77% MOB and 23% SHOP properties (1) x Diligent Acquisition Program (2) of over $160 million in 2021 at a 7.7% weighted average Cap Rate that is expected to add $14 million of Annualized Straight - Line Base Rent over a weighted average Lease Term Remaining of approximately eight years, plus a 2022 acquisition pipeline of three properties totaling $18 million at an 8.6% weighted average Cap Rate x Resilient MOB Performance with year - over - year increases in MOB portfolio exposure (1) plus a forward Leasing Pipeline of 41,300 SF that is expected to increase MOB Occupancy to 92.2% (3) x Increased SHOP Occupancy by 3.9% year - over - year and 1.8% quarter - over - quarter as COVID - 19 related headwinds dissipated x Collected 100% of the Cash Rent due from HTI’s MOB portfolio in 2021 and Q1’2022 x Conservative Balance Sheet with Net Leverage of 37.3%, an improvement of 4% year - over - year, and Liquidity of $294 million (4) as of Q1’22 x Streamlined SHOP Portfolio operators to only four operators, including two industry leaders, from over 15 operators in 2019 x Experienced Management Team with a proven track record and significant public REIT experience (1) Percentages based on NOI for the three months ended March 31, 2022. See appendix for Non - GAAP reconciliations. (2) See slide 6 for further details. (3) Assuming no expirations or terminations and that non - binding letters of intent will lead to definitive leases that will commence on their contemplated terms, or at all, which is not assured. Leases and potential leases in the forward Leasing Pipeline com me nce at various times during 2022. The forward Leasing Pipeline should not be considered an indication of future performance. (4) See slide 7 for further details. HTI is subject to a covenant requiring it to maintain a combination of cash, cash equivalent s a nd availability for future borrowings under the revolving credit facility totaling at least $50.0 million.

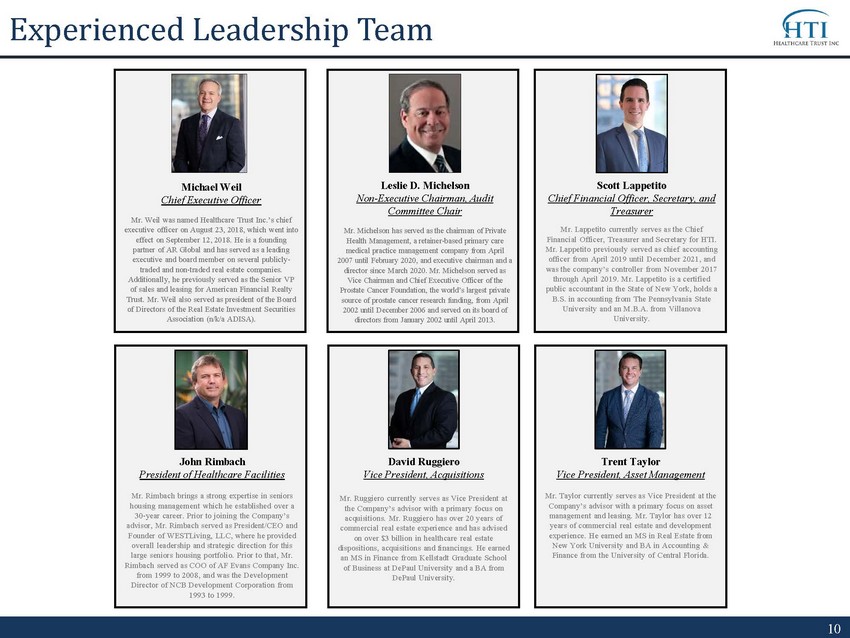

10 Experienced Leadership Team Scott Lappetito Chief Financial Officer, Secretary, and Treasurer Mr. Lappetito currently serves as the Chief Financial Officer, Treasurer and Secretary for HTI. Mr. Lappetito previously served as chief accounting officer from April 2019 until December 2021, and was the company’s controller from November 2017 through April 2019. Mr. Lappetito is a certified public accountant in the State of New York, holds a B.S. in accounting from The Pennsylvania State University and an M.B.A. from Villanova University. Leslie D. Michelson Non - Executive Chairman, Audit Committee Chair Mr. Michelson has served as the chairman of Private Health Management, a retainer - based primary care medical practice management company from April 2007 until February 2020, and executive chairman and a director since March 2020. Mr. Michelson served as Vice Chairman and Chief Executive Officer of the Prostate Cancer Foundation, the world’s largest private source of prostate cancer research funding, from April 2002 until December 2006 and served on its board of directors from January 2002 until April 2013. David Ruggiero Vice President, Acquisitions Mr. Ruggiero currently serves as Vice President at the Company’s advisor with a primary focus on acquisitions. Mr. Ruggiero has over 20 years of commercial real estate experience and has advised on over $3 billion in healthcare real estate dispositions, acquisitions and financings. He earned an MS in Finance from Kellstadt Graduate School of Business at DePaul University and a BA from DePaul University. Trent Taylor Vice President, Asset Management Mr. Taylor currently serves as Vice President at the Company’s advisor with a primary focus on asset management and leasing. Mr. Taylor has over 12 years of commercial real estate and development experience. He earned an MS in Real Estate from New York University and BA in Accounting & Finance from the University of Central Florida. Michael Weil Chief Executive Officer Mr. Weil was named Healthcare Trust Inc.’s chief executive officer on August 23, 2018, which went into effect on September 12, 2018. He is a founding partner of AR Global and has served as a leading executive and board member on several publicly - traded and non - traded real estate companies. Additionally, he previously served as the Senior VP of sales and leasing for American Financial Realty Trust. Mr. Weil also served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA). John Rimbach President of Healthcare Facilities Mr. Rimbach brings a strong expertise in seniors housing management which he established over a 30 - year career. Prior to joining the Company’s advisor, Mr. Rimbach served as President/CEO and Founder of WESTLiving , LLC, where he provided overall leadership and strategic direction for this large seniors housing portfolio. Prior to that, Mr. Rimbach served as COO of AF Evans Company Inc. from 1999 to 2008, and was the Development Director of NCB Development Corporation from 1993 to 1999.

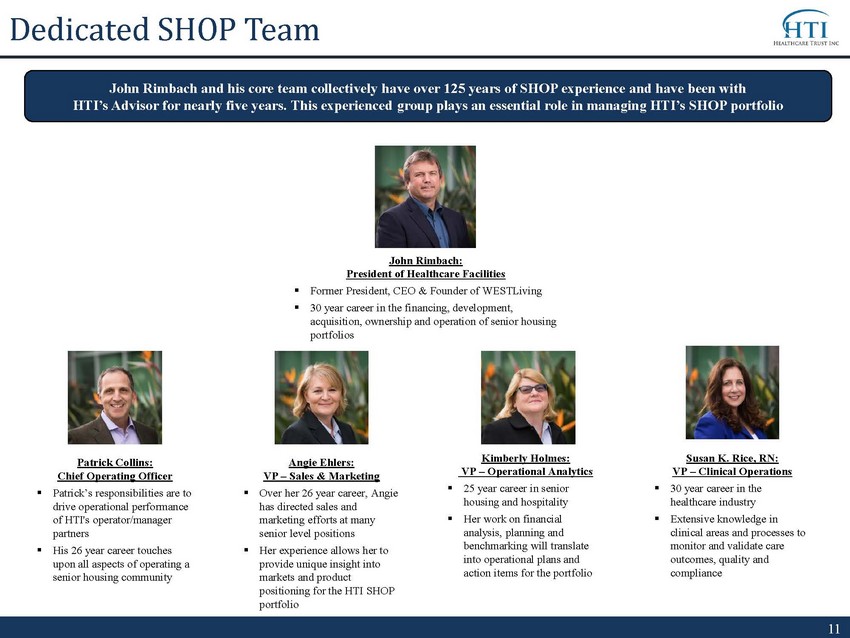

11 Dedicated SHOP Team Kimberly Holmes: VP – Operational Analytics ▪ 25 year career in senior housing and hospitality ▪ Her work on financial analysis, planning and benchmarking will translate into operational plans and action items for the portfolio Susan K. Rice, RN: VP – Clinical Operations ▪ 30 year career in the healthcare industry ▪ Extensive knowledge in clinical areas and processes to monitor and validate care outcomes, quality and compliance Patrick Collins: Chief Operating Officer ▪ Patrick’s responsibilities are to drive operational performance of HTI's operator/manager partners ▪ His 26 year career touches upon all aspects of operating a senior housing community John Rimbach: President of Healthcare Facilities ▪ Former President, CEO & Founder of WESTLiving ▪ 30 year career in the financing, development, acquisition, ownership and operation of senior housing portfolios Angie Ehlers: VP – Sales & Marketing ▪ Over her 26 year career, Angie has directed sales and marketing efforts at many senior level positions ▪ Her experience allows her to provide unique insight into markets and product positioning for the HTI SHOP portfolio John Rimbach and his core team collectively have over 125 years of SHOP experience and have been with HTI’s Advisor for nearly five years. This experienced group plays an essential role in managing HTI’s SHOP portfolio

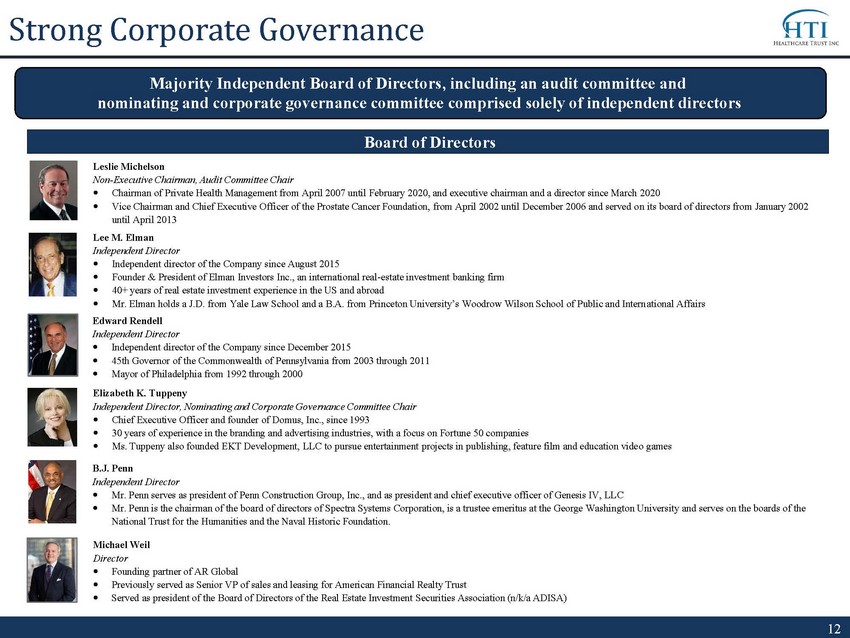

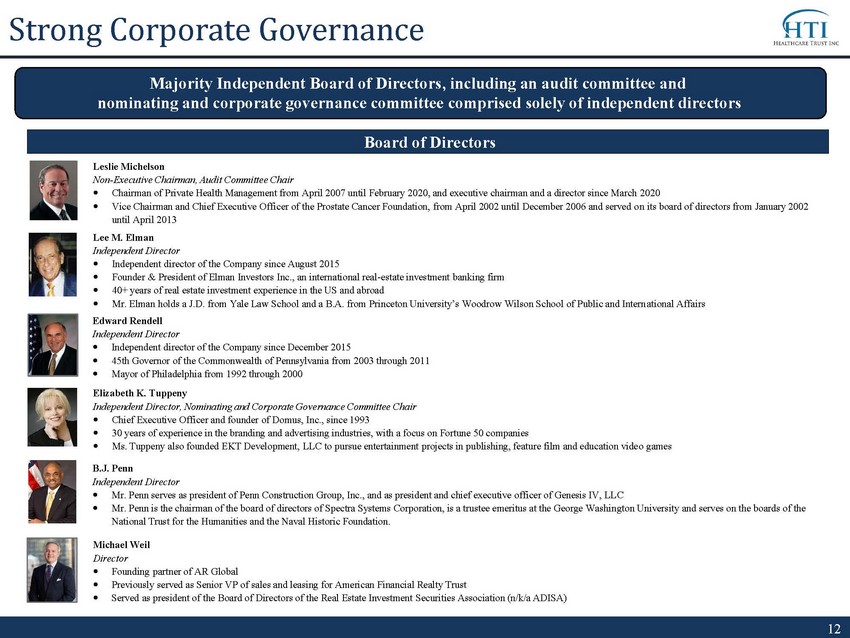

12 Board of Directors Lee M. Elman Independent Director Independent director of the Company since August 2015 Founder & President of Elman Investors Inc., an international real - estate investment banking firm 40+ years of real estate investment experience in the US and abroad Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and Intern ati onal Affairs Leslie Michelson Non - Executive Chairman, Audit Committee Chair Chairman of Private Health Management from April 2007 until February 2020, and executive chairman and a director since March 202 0 Vice Chairman and Chief Executive Officer of the Prostate Cancer Foundation, from April 2002 until December 2006 and served o n i ts board of directors from January 2002 until April 2013 B.J. Penn Independent Director Mr. Penn serves as president of Penn Construction Group, Inc., and as president and chief executive officer of Genesis IV, LL C Mr. Penn is the chairman of the board of directors of Spectra Systems Corporation, is a trustee emeritus at the George Washin gto n University and serves on the boards of the National Trust for the Humanities and the Naval Historic Foundation. Edward Rendell Independent Director Independent director of the Company since December 2015 45th Governor of the Commonwealth of Pennsylvania from 2003 through 2011 Mayor of Philadelphia from 1992 through 2000 Strong Corporate Governance Elizabeth K. Tuppeny Independent Director, Nominating and Corporate Governance Committee Chair Chief Executive Officer and founder of Domus, Inc., since 1993 30 years of experience in the branding and advertising industries, with a focus on Fortune 50 companies Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education vide o g ames Majority Independent Board of Directors, including an audit committee and nominating and corporate governance committee comprised solely of independent directors Michael Weil Director Founding partner of AR Global Previously served as Senior VP of sales and leasing for American Financial Realty Trust Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA)

13 Legal Notice

14 Disclaimer References in this presentation to the “Company,” “we,” “us” and “our” refer to Healthcare Trust, Inc. (“ HTI”) and its consolidated subsidiaries. The statements in this presentation that are not historical facts may be forward - looking statements. These forward - looking state ments involve risks and uncertainties that could cause actual results or events to be materially different. Forward - looking statements may include, but are not limited to, statements regarding stockholder liquidity and investment value and returns. The words “anticipates,” “believes,” “expects,” “estimates, ” “ projects,” “plans,” “intends,” “may,” “will,” “would” and similar expressions are intended to identify forward - looking statements, although not all forward - loo king statements contain these identifying words. Actual results may differ materially from those contemplated by such forward - looking statements, including th ose set forth in the section titled Risk Factors of HTI’s Annual Report on Form 10 - K for the year ended December 31, 2021 filed on March 18, 2022 and all other filings with the SEC after that date, as such risks, uncertainties and other important factors may be updated from time to time in HTI’s subsequen t r eports. Please see slide s 16 and 17 for further information. Further, forward - looking statements speak only as of the date they are made, and HTI undertakes no o bligation to update or revise any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operat ing results, unless required to do so by law. This presentation includes estimated projections of future operating results. These projections were not prepared in accordan ce with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections were pr epared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual results an d cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described in the section titled Risk Factors of HTI’s Annual Report on Form 10 - K for the year ended December 31, 2021 filed on March 18, 2022 and all other filings with the SEC after that date. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results ma y differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized. This presentation includes certain non - GAAP financial measures, including net operating income (“NOI”). NOI is a non - GAAP measur e of our financial performance and should not be considered as an alternative to net income as a measure of financial performance, or any other per formance measure derived in accordance with GAAP and it should not be construed as an inference that our future results will be unaffected by unusual or non - recurring items. The reconciliation of net income to NOI for the applicable period is set forth on slide 20 to this presentation. Securities Ratings A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at a ny time. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating.

15 Forward Looking Statements Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Exchange Act), w hich reflect the expectations of the Company regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, market and other expectations, objectives, and intentions, as well as any other statements that are not historical facts. Our potential risks and uncertainties are presented in the section titled “Item 1A - Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2021 filed with the SEC on March 18, 2022 and all other filings with the SEC after that date. We disclaim any ob lig ation to update and revise statements contained in these materials to reflect changed assumptions, the occurrence of unanticipated events or changes to fut ure operating results over time, unless required by law. The following are some of the risks and uncertainties relating to us, although not all risks and unce rta inties, that could cause our actual results to differ materially from those presented in our forward - looking statements: • Our operating results are affected by economic and regulatory changes that have an adverse impact on the real estate market i n g eneral. • Our property portfolio has a high concentration of properties located in Florida. Our properties may be adversely affected by ec onomic cycles and risks inherent to those states. • Our Credit Facility restricts us from paying cash distributions on or repurchasing our common stock until we satisfy certain con ditions and there can be no assurance we will be able to resume paying distributions on our common stock, and at what rate, or continue paying dividends on our 7.375% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share (the “Series A Preferred Stock”) and our 7.125% Se rie s B Cumulative Redeemable Perpetual Preferred Stock, par value $0.01 par value per share (the “Series B Preferred Stock”). • Our Credit Facility restricts our ability to use cash that would otherwise be available to us, and there can be no assurance our available liquidity will be sufficient to meet our capital needs. • We are subject to risks associated with a pandemic, epidemic or outbreak of a contagious disease, such as the ongoing global COV ID - 19 pandemic, including negative impacts on our tenants and operators and their respective businesses. • Starting in March 2020, the COVID - 19 pandemic and measures to prevent its spread began to affect us in a number of ways. Occupan cy in our SHOP portfolio has trended lower since the second half of March 2020 to a low of 72.0% as of March 31, 2021 and has subsequently begun to re cov er, reaching 75.9% as of March 31, 2022, as government policies and implementation of infection control best practices and prospective residents’ conc ern s about communal - setting COVID - 19 spread limited resident move - ins. We have also continued to experience lower inquiry volumes and reduced in - person tour s. These and other impacts of the COVID - 19 pandemic have affected and could continue to affect our ability to fill vacancies. • Inflation and continuing increases in the inflation rate will have an adverse effect on our investments and results of operat ion s. • Geopolitical instability due to the ongoing military conflict between Russia and Ukraine may adversely impact the U.S. and gl oba l economies. • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • In owning properties we may experience, among other things, unforeseen costs associated with complying with laws and regulati ons and other costs, potential difficulties selling properties and potential damages or losses resulting from climate change.

16 Forward Looking Statements (Continued) • We focus on acquiring and owning a diversified portfolio of healthcare - related assets located in the United States and are subje ct to risks inherent in concentrating investments in the healthcare industry. • The healthcare industry is heavily regulated, and we and our tenants may be impacted by new laws or regulations, including th e C ARES Act and the auditing and reporting requirements instituted by the CARES Act, changes to existing laws or regulations. • Loss of licensure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic v iab ility of our tenants. Lease terminations, tenant default and bankruptcy have adversely affected and could in the future adversely affect our income and c ash flow. • We assume additional operating risks and are subject to additional regulation and liability because we depend on eligible ind epe ndent contractors to manage some of our facilities. • We have substantial indebtedness and may be unable to repay, refinance, restructure or extend our indebtedness as it becomes due . Increases in interest rates could increase the amount of our debt payments. We will likely incur additional indebtedness in the future. • We depend on our Advisor and our Property Manager to provide us with executive officers, key personnel and all services requi red for us to conduct our operations and our operating performance may be impacted by an adverse changes in the financial health or reputation of our Advisor and our Property Manager. • All of our executive officers face conflicts of interest, such as conflicts created by the terms of our agreements with the A dvi sor and compensation payable thereunder, conflicts allocating investment opportunities to us, and conflicts in allocating their time and attention to our mat ters. Conflicts that arise may not be resolved in our favor and could result in actions that are adverse to us. • We have long - term agreements with our Advisor and its affiliates that may be terminated only in limited circumstances and may re quire us to pay a termination fee in some cases. • Estimated Per - Share NAV may not accurately reflect the value of our assets and may not represent what a stockholder may receive on a sale of the shares, what they may receive upon a liquidation of our assets and distribution of the net proceeds or what a third party may pay to acquire us . • The stockholder rights plan adopted by our board of directors, our classified board and other aspects of our corporate struct ure and Maryland law may discourage a third party from acquiring us in a manner that might result in a premium price to our stockholders. • Restrictions on share ownership contained in our charter may inhibit market activity in shares of our stock and restrict our bus iness combination opportunities. • We may fail to continue to qualify as a REIT.

17 Appendix

18 Definitions Annualized Straight - Line Base Rent : Represents the total contractual base rents on a straight - line basis to be received throughout the duration of the lease currently in place expressed as a per annum value . Includes adjustments for non - cash portions of rent . Cap Rate : Capitalization rate is a rate of return on a real estate investment property based on the expected, annualized straight - lined rental income that the property will generate under its existing lease during its first year of ownership . Capitalization rate is calculated by dividing the annualized straight - lined rental income the property will generate (before debt service and depreciation and after fixed costs and variable costs) and the purchase price of the property . The weighted average capitalization rate is based upon square feet . Cash Rent : Represents total of all contractual rents on a cash basis due from tenants as stipulated in the originally executed lease agreements at inception or any lease amendments thereafter prior to a rent deferral agreement (see slide 3 for further information) . We calculate “original Cash Rent collections” by comparing the total amount of rent collected during the period to the original Cash Rent due . Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements . Leasing Pipeline : Includes ( i ) all leases fully executed by both parties as of May 15 , 2022 , but after March 31 , 2022 and (ii) all leases under negotiation with an executed LOI by both parties as of May 15 , 2022 . This represents six executed new leases totaling approximately 22 , 200 square feet and five LOIs totaling approximately 22 , 100 square feet . Includes one lease expiration totaling approximately 3 , 000 square feet that occurred during this period . There can be no assurance that the LOIs will lead to definitive leases or will commence on their current terms, or at all . Leasing pipeline should not be considered an indication of future performance . Lease Term Remaining : Current portfolio calculated from March 31 , 2022 . Weighted based on square feet . Liquidity : As of March 31 , 2022 , HTI had $ 66 . 4 million in cash and cash equivalents, and $ 227 . 5 million available for future borrowings under the HTI's credit facility . As of March 31 , 2021 , HTI had $ 74 . 1 million in cash and cash equivalents, and $ 42 . 8 million available for future borrowings under HTI's credit facility . Net Debt : Total gross debt of $ 1 . 1 billion per slide 7 less cash and cash equivalents of $ 66 . 4 million as of March 31 , 2022 . NOI : Defined as a non - GAAP financial measure used by us to evaluate the operating performance of our real estate . NOI is equal to revenue from tenants, less property operating and maintenance . NOI excludes all other items of expense and income included in the financial statements in calculating net income (loss) . Net Leverage : Represents “Net Debt” as defined above as debt less cash and cash equivalents divided by total assets of $ 2 . 2 billion (which includes cash and cash equivalents) plus accumulated depreciation and amortization of $ 563 . 7 million as of March 31 , 2022 . Occupancy : For MOB properties, occupancy represents percentage of square footage of which the tenant has taken possession of divided by the respective total rentable square feet as of the date or period end indicated . For SHOP, occupancy represents total units occupied divided by total units available as of the date or period end indicated .

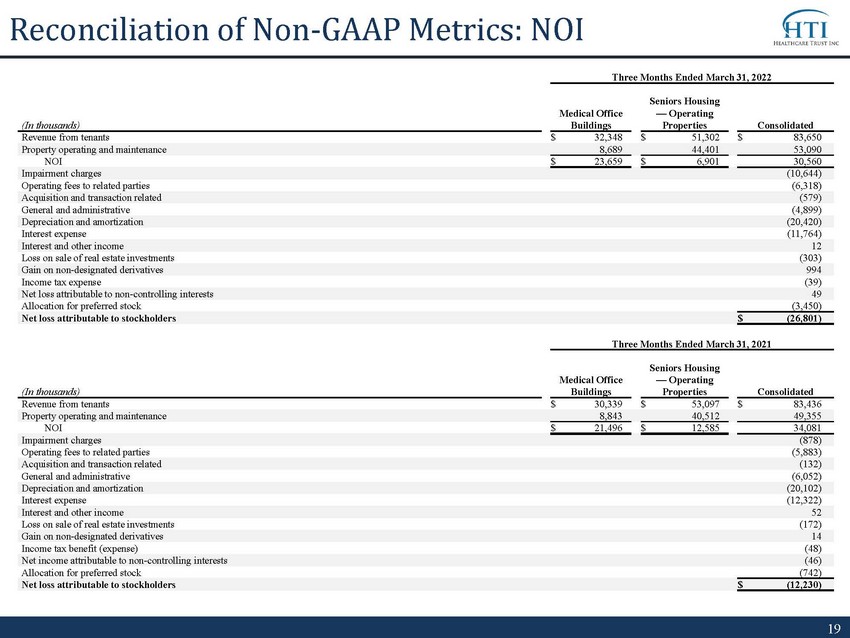

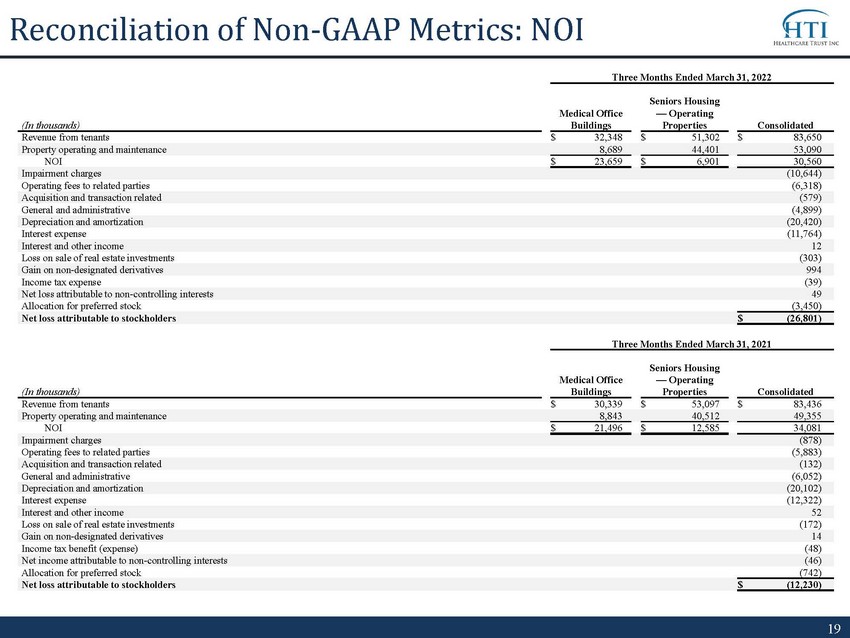

19 Reconciliation of Non - GAAP Metrics: NOI Three Months Ended March 31, 2022 (In thousands) Medical Office Buildings Seniors Housing — Operating Properties Consolidated Revenue from tenants $ 32,348 $ 51,302 $ 83,650 Property operating and maintenance 8,689 44,401 53,090 NOI $ 23,659 $ 6,901 30,560 Impairment charges (10,644) Operating fees to related parties (6,318) Acquisition and transaction related (579) General and administrative (4,899) Depreciation and amortization (20,420) Interest expense (11,764) Interest and other income 12 Loss on sale of real estate investments (303) Gain on non - designated derivatives 994 Income tax expense (39) Net loss attributable to non - controlling interests 49 Allocation for preferred stock (3,450) Net loss attributable to stockholders $ (26,801) Three Months Ended March 31, 2021 (In thousands) Medical Office Buildings Seniors Housing — Operating Properties Consolidated Revenue from tenants $ 30,339 $ 53,097 $ 83,436 Property operating and maintenance 8,843 40,512 49,355 NOI $ 21,496 $ 12,585 34,081 Impairment charges (878) Operating fees to related parties (5,883) Acquisition and transaction related (132) General and administrative (6,052) Depreciation and amortization (20,102) Interest expense (12,322) Interest and other income 52 Loss on sale of real estate investments (172) Gain on non - designated derivatives 14 Income tax benefit (expense) (48) Net income attributable to non - controlling interests (46) Allocation for preferred stock (742) Net loss attributable to stockholders $ (12,230)

20 HealthcareTrustInc.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts at www.computershare.com/advisorportal ▪ Shareholders may access their accounts at www.computershare.com/hti