Filed Pursuant to Rule Number 424(b)(3)

Registration No. 333-184677

AMERICAN REALTY CAPITAL HEALTHCARE TRUST II, INC.

SUPPLEMENT NO. 1, DATED APRIL 12, 2013,

TO THE PROSPECTUS, DATED FEBRUARY 14, 2013

This prospectus supplement, or this Supplement No. 1, is part of the prospectus of American Realty Capital Healthcare Trust II, Inc., dated February 14, 2013, or the Prospectus. This Supplement No. 1 supplements, modifies or supersedes certain information contained in our Prospectus and should be read in conjunction with our Prospectus. This Supplement No. 1 will be delivered with the Prospectus. Unless the context suggests otherwise, the terms “we,” “us” and “our” used herein refer to the Company, together with its consolidated subsidiaries.

The purpose of this Supplement No. 1 is to, among other things:

| | • | update the status of our initial public offering, the shares currently available for sale and the declaration of distributions; |

| | | |

| | • | disclose changes to investor suitability standards for Texas investors; |

| | | |

| | • | add disclosure relating to our potential property investments; |

| | | |

| | • | replace Appendix C – American Realty Capital Healthcare Trust II, Inc. Subscription Agreement with Appendix C-1 – Subscription Agreement; and |

| | | |

| | • | add Appendix C-2 – Multi-Offering Subscription Agreement. |

Status of the Offering

We commenced our reasonable best efforts initial public offering of up to 68.0 million shares of common stock on February 14, 2013 (excluding shares to be issued under the distribution reinvestment plan, or DRIP). On April 12, 2013, we satisfied the general escrow conditions of our public offering of common stock. On such date, we received and accepted aggregate subscriptions equal to the minimum of $2.0 million in shares of common stock, broke escrow and issued shares to its initial investors. Subscriptions from residents of Pennsylvania will be held in escrow until the Company has received aggregate subscriptions of at least $85.0 million.

We will offer shares of our common stock until February 14, 2015, unless the offering is extended in accordance with the Prospectus, provided that the offering will be terminated if all 68.0 million shares of our common stock are sold before such date (subject to our right to reallocate shares offered pursuant to the DRIP for sale in our primary offering).

Shares Currently Available for Sale

As of April 10, 2013, there are 0.1 million shares of our common stock outstanding, including unvested restricted stock. As of April 10, 2013, there are approximately 67.9 million shares of our common stock available for sale, excluding shares available under our DRIP.

Declaration of Distributions

On April 9, 2013, our board of directors authorized, and we declared, a distribution rate which will be calculated based on stockholders of record each day during the applicable period at a rate of $0.00465753425 per day, based on a per share price of $25.00. The distribution will begin to accrue upon the earlier of: (i) June 1, 2013; and (ii) 15 days following our initial property acquisition. The distributions will be payable by the 5th day following each month end to stockholders of record at the close of business each day during the prior month.

There can be no assurance that any such distribution will be paid to stockholders.

The amount of distributions payable to our stockholders is determined by our board of directors and is dependent on a number of factors, including funds available for distribution, financial condition, capital expenditure requirements, as applicable, requirements of Maryland law and annual distribution requirements needed to qualify and maintain our status as a real estate investment trust under the Internal Revenue Code of 1986, as amended. Our board of directors may reduce the amount of distributions paid or suspend distribution payments at any time.

As of the date hereof, we own no operating property and have no historical operating cash flows. Additionally, our organizational documents permit us to pay distributions from unlimited amounts of any source, and we may use sources other than operating cash flows to fund distributions, including proceeds from this offering, which may reduce the amount of capital we ultimately invest in properties or other permitted investments, and negatively impact the value of your investment.

PROSPECTUS UPDATES

Investor Suitability Standards

The following disclosure is hereby added immediately following the paragraph “Alabama” on page iii of the Prospectus.

“Texas

| | • | An investor must have had, during the last tax year, or estimate that the investor will have during the current tax year, (a) a minimum net worth of $100,000 and a minimum annual gross income of $100,000, or (b) a minimum net worth of $500,000. The investor’s maximum investment in this offering shall not exceed 10% of the investor’s liquid net worth.” |

Description of Real Estate Investments

The following disclosure is hereby added as a new section immediately prior to “Selected Financial Data” on page 133 of the Prospectus.

“Description of Real Estate Investments

Potential Property Investments

On April 9, 2013, our board of directors approved the following property acquisition. Although we believe that the acquisition of the property is probable, there can be no assurance that the acquisition will be consummated.

Fresenius Dialysis Center

We, through our sponsor, have entered into arrangements to acquire the fee simple interest in a Fresenius dialysis center located in Winfield, Alabama.

Our obligation to close upon the acquisition is subject to the satisfactory completion of a due diligence review of the property, among other conditions. Our arrangements contain customary representations and warranties by the seller. Although we believe that the acquisition of the property is probable, there can be no assurance that the acquisition will be consummated.

Capitalization

The purchase price of the property is $1.9 million at a capitalization rate of 7.81% (calculated by dividing annualized rental income on a straight-line basis less estimated property operating costs by the purchase price). We intend to fund 100% of the purchase price with proceeds from our ongoing initial public offering.

Major Tenants /Lease Expiration

The property will be 100% leased to Fresenius Medical Care and the lease is guaranteed by the tenant’s parent, Fresenius Medical Care Holdings, Inc. The original lease term was 15 years and the lease and has approximately 10 years remaining. The lease will be net whereby we, as landlord, are responsible for maintaining the roof and structure of the building and the tenant is required to pay substantially all other operating expenses, in addition to base rent. The lease contains 10% rental escalations every five years and three five-year renewal options. The total annual rent for the initial lease term will be approximately $150,000.

Other

We intend to adequately insure the property.

The annual real estate taxes payable on the building for the calendar year 2013 are unknown at the present time. Such real estate taxes are required to be paid directly by the tenant under the terms of the lease.

The tenant is a German-based holding and kidney dialysis company, operating in the fields of dialysis products and dialysis services. Its dialysis business is vertically integrated, providing dialysis treatment at its own dialysis clinics and supplying these clinics with a range of products. In addition, the tenant sells dialysis products to other dialysis service providers. The tenant operates in two business segments: North America; and International.

Set forth below are summary financial statements of the parent of the guarantor to the lessee of the property described above. Fresenius Medical Care AG & Co. KGaA, or Fresenius, currently files its financial statements in reports filed with the SEC, and the following summary financial data regarding Fresenius are taken from such filings:

| | | | | | |

| | | Year Ended | |

| (Amounts in Thousands) | December 31,

2012 | | December 31,

2011 | | December 31, 2010 |

| Consolidated Condensed Statements of Income | | | | | | | | | | | | |

| Net revenue | | $ | 13,800,282 | | | $ | 12,570,515 | | | $ | 11,844,194 | |

| Operating income | | | 2,218,573 | | | | 2,074,892 | | | | 1,923,805 | |

| Net income | | | 1,186,809 | | | | 1,071,154 | | | | 987,517 | |

| | | | | | |

| (Amounts in Thousands) | | December 31,

2012 | | December 31, 2011 | | December 31, 2010 |

| Consolidated Condensed Balance Sheets | | | | | | | | | | | | |

| Total assets | | $ | 22,325,998 | | | $ | 19,532,850 | | | $ | 17,094,661 | |

| Long-term obligations | | | 7,841,914 | | | | 5,494,810 | | | | 4,309,676 | |

| Total liabilities | | | 12,595,478 | | | | 11,061,342 | | | | 9,291,041 | |

| Total shareholders’ equity | | | 9,207,260 | | | | 8,061,017 | | | | 7,523,911” | |

Subscription Agreements

The form of subscription agreement included in this Supplement No. 1 is hereby added as Appendix C-1 to the Prospectus. Appendix C-1 will hereby replace Appendix C – American Realty Capital Healthcare Trust II, Inc. Subscription Agreement of the Prospectus.

The form of multi-offering subscription agreement included in this Supplement No. 1 is hereby added as Appendix C-2 to the Prospectus.

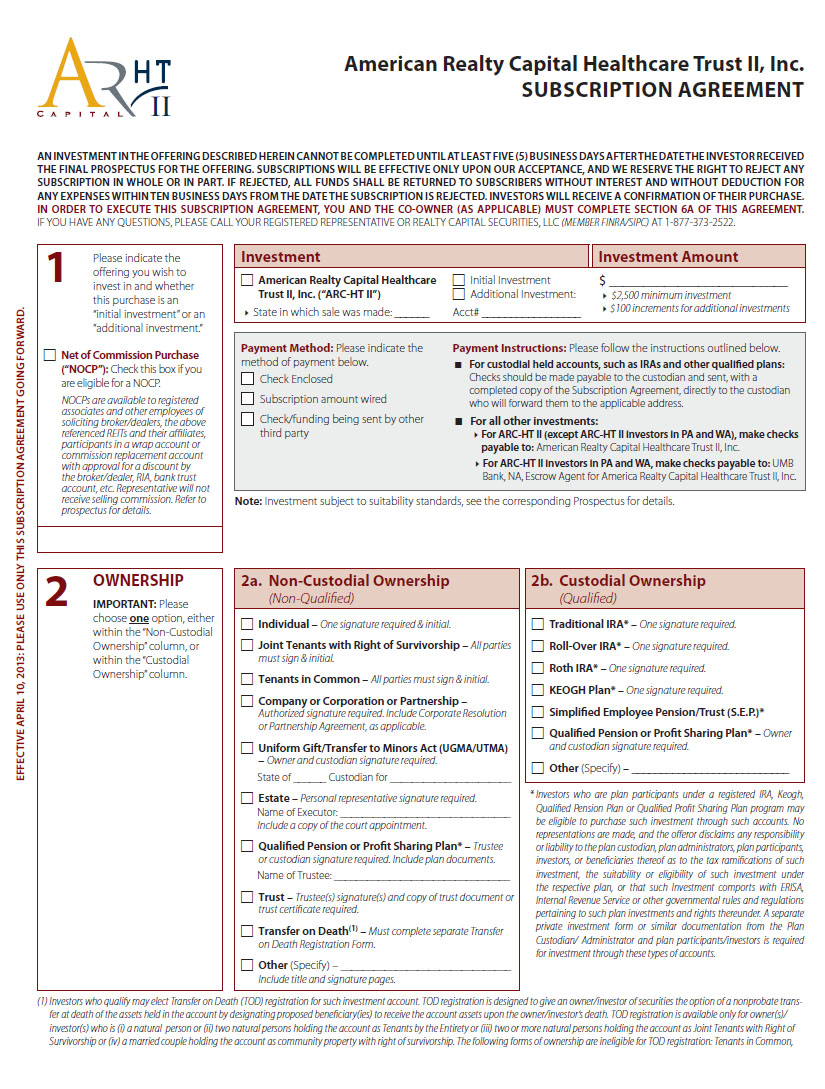

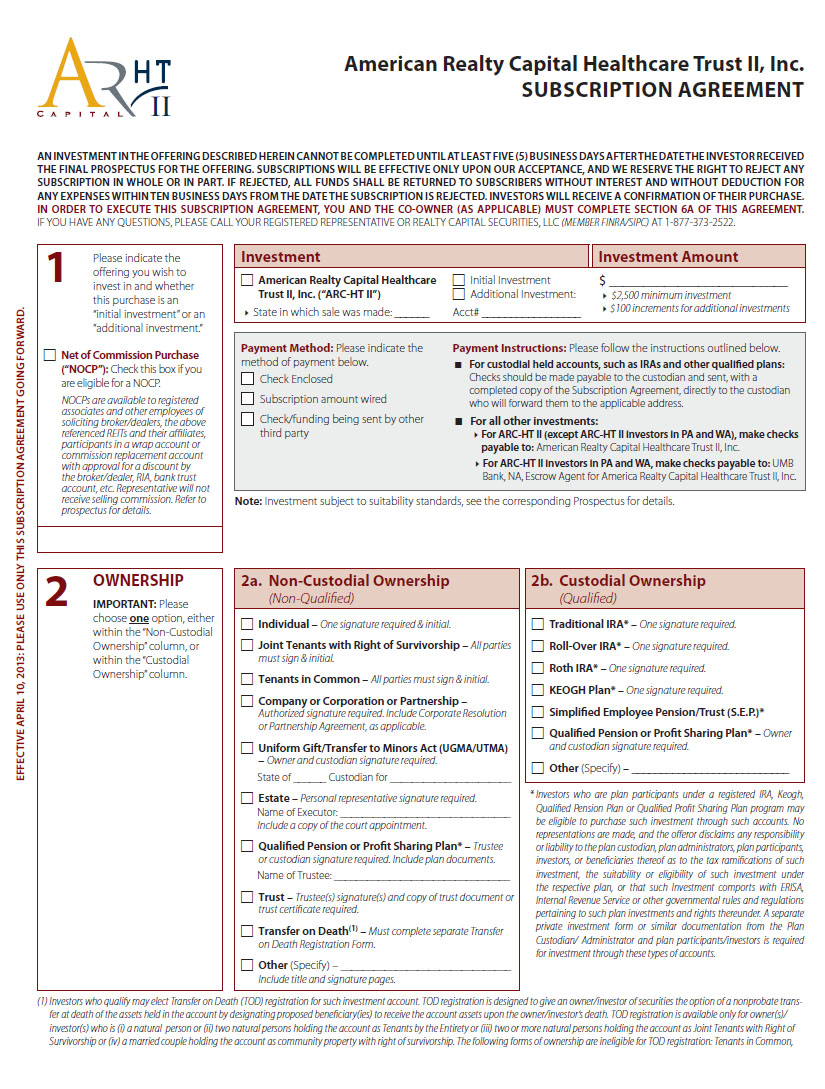

Appendix C-1

American Realty Capital Healthcare Trust II, Inc. SUBSCRIPTION AGREEMENT AN INVESTMENT IN THE OFFERING DESCRIBED HEREIN CANNOT BE COMPLETED UNTIL AT LEAST FIVE (5) BUSINESS DAYS AFTER THE DATE THE INVESTOR RECEIVED THE FINAL PROSPECTUS FOR THE OFFERING. SUBSCRIPTIONS WILL BE EFFECTIVE ONLY UPON OUR ACCEPTANCE, AND WE RESERVE THE RIGHT TO REJECT ANY SUBSCRIPTION IN WHOLE OR IN PART. IF REJECTED, ALL FUNDS SHALL BE RETURNED TO SUBSCRIBERS WITHOUT INTEREST AND WITHOUT DEDUCTION FOR ANY EXPENSES WITHIN TEN BUSINESS DAYS FROM THE DATE THE SUBSCRIPTION IS REJECTED. INVESTORS WILL RECEIVE A CONFIRMATION OF THEIR PURCHASE. IN ORDER TO EXECUTE THIS SUBSCRIPTION AGREEMENT, YOU AND THE CO-OWNER (AS APPLICABLE) MUST COMPLETE SECTION 6A OF THIS AGREEMENT. IF YOU HAVE ANY QUESTIONS, PLEASE CALL YOUR REGISTERED REPRESENTATIVE OR REALTY CAPITAL SECURITIES, LLC (MEMBER FINRA/SIPC) AT 1-877-373-2522. 1 Please indicate the offering you wish to invest in and whether this purchase is an “initial investment” or an ”additional investment.” Net of Commission Purchase (“NOCP”): Check this box if you are eligible for a NOCP. NOCPs are available to registered associates and other employees of soliciting broker/dealers, the above referenced REITs and their affiliates, participants in a wrap account or commission replacement account with approval for a discount by the broker/dealer, RIA, bank trust account, etc. Representative will not receive selling commission. Refer to prospectus for details. Investment Investment Amount American Realty Capital Healthcare Trust II, Inc. (“ARC-HT II”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments Payment Method: Please indicate the method of payment below. Check Enclosed Subscription amount wired Check/funding being sent by other third party Payment Instructions: Please follow the instructions outlined below. For custodial held accounts, such as IRAs and other qualified plans: Checks should be made payable to the custodian and sent, with a completed copy of the Subscription Agreement, directly to the custodian who will forward them to the applicable address. For all other investments: For ARC-HT II (except ARC-HT II investors in PA and WA), make checks payable to: American Realty Capital Healthcare Trust II, Inc. For ARC-HT II investors in PA and WA, make checks payable to: UMB Bank, NA, Escrow Agent for America Realty Capital Healthcare Trust II, Inc. Note: Investment subject to suitability standards, see the corresponding Prospectus for details. EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD. American Realty Capital Healthcare Trust II, Inc. SUBSCRIPTION AGREEMENT

community property without survivorship, non-natural account owners (i.e., entities such as corporations, trusts or partnerships), and investors who are not residents of a state that has adopted the Uniform Transfer on Death Security Registration Act. 3 IMPORTANT: Send all paperwork directly to the custodian. Note: This section is only for accounts specified in Section 2b and not for Custodial Accounts for Minors. Custodial Ownership (Must be completed by Custodian/Trustee for accounts identified in Section 2b) Name of Trust or Business Entity (Does not apply to IRA accounts) Name of Custodian or Trustee Mailing Address City, State, Zip Business Phone Custodian/Trust/Business Entity Tax ID# Account # Name of Custodian or Other Administrator 4 IMPORTANT: Investor Information is required. Note: Please provide all necessary corporate documents, partnership agreement, or trust powers (specified in Section 2) to establish authority to act. Investor Information Mr. Mrs. Ms. Other ______ Name of Account Owner Date of Birth Social Security Number or Taxpayer ID # Legal Address (No P.O. Boxes) City, State, Zip Citizenship: Please indicate Citizenship Status (Required) U.S. Citizen Resident Alien Non-Resident Alien* Employee, Affiliate or Board Member NOTE: Any and all U.S. Taxpayers are required to complete W-9 form in Section 6b * If non-resident alien, investor must submit the appropriate W-8 form (W-8BEN, W-8ECI, W-8EXP or W-8IMY) in order to make an investment. (Again, if a foreign national who is, in fact, a U.S taxpayer, complete W-9 form.) Employer: | RETIRED Mr. Mrs. Ms. Other ______ Name of Joint Account Owner or Minor Entity Name Date of Birth Social Security Number or Taxpayer ID# If Non-U.S. Citizen, specify Country of Citizenship Mailing Address (if different than legal address) City, State, Zip Home Phone Business Phone Government ID: (Foreign Citizens only) Identification documents must have a reference number and photo. Please attach a photocopy. Place of Birth: ____________________________________________________________________________________ City State/Province Country Immigration Status: Permanent resident Non-permanent resident Non-resident Check which type of document you are providing: US Driver's License INS Permanent resident alien card Passport with U.S. Visa Employment Authorization Document Passport without U.S. Visa Bank Name (required):________________________ Account No. (required):_______________________________________________________________________________ Foreign national identity documents Bank Name (required):____________________________________________ Phone No. (required):_____________________________________________ Number for the document checked above and country of issuance: ______________________ EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

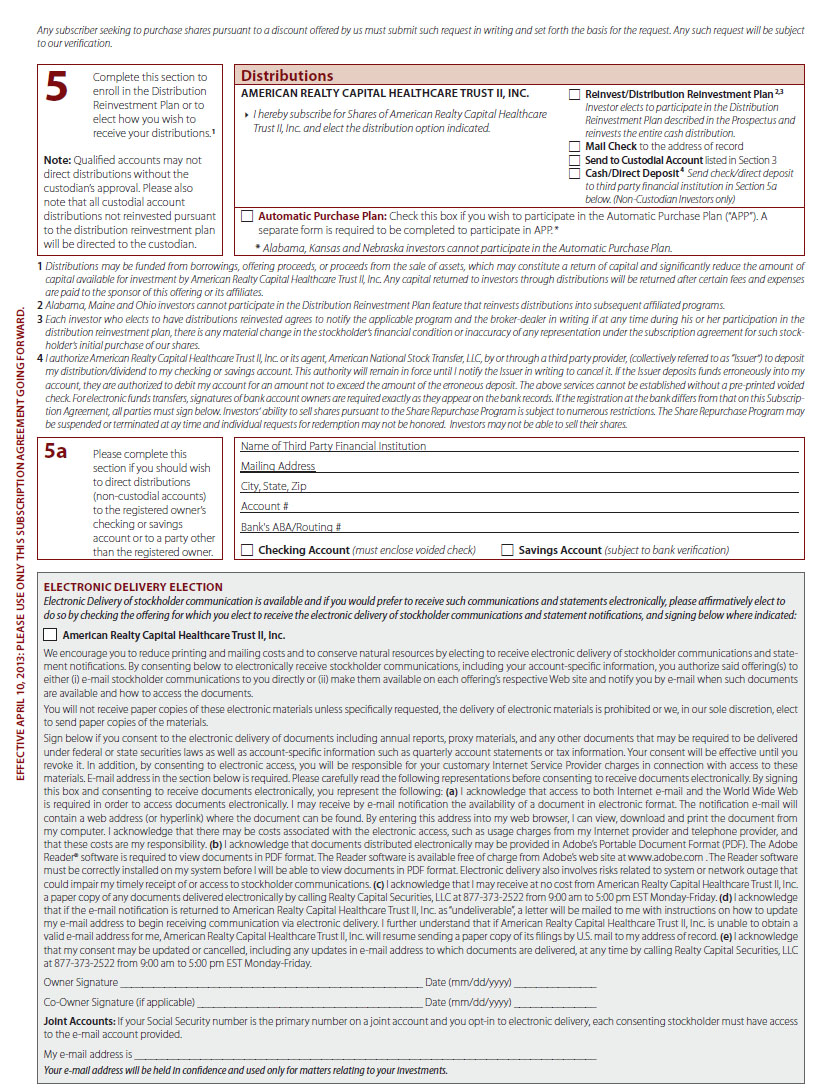

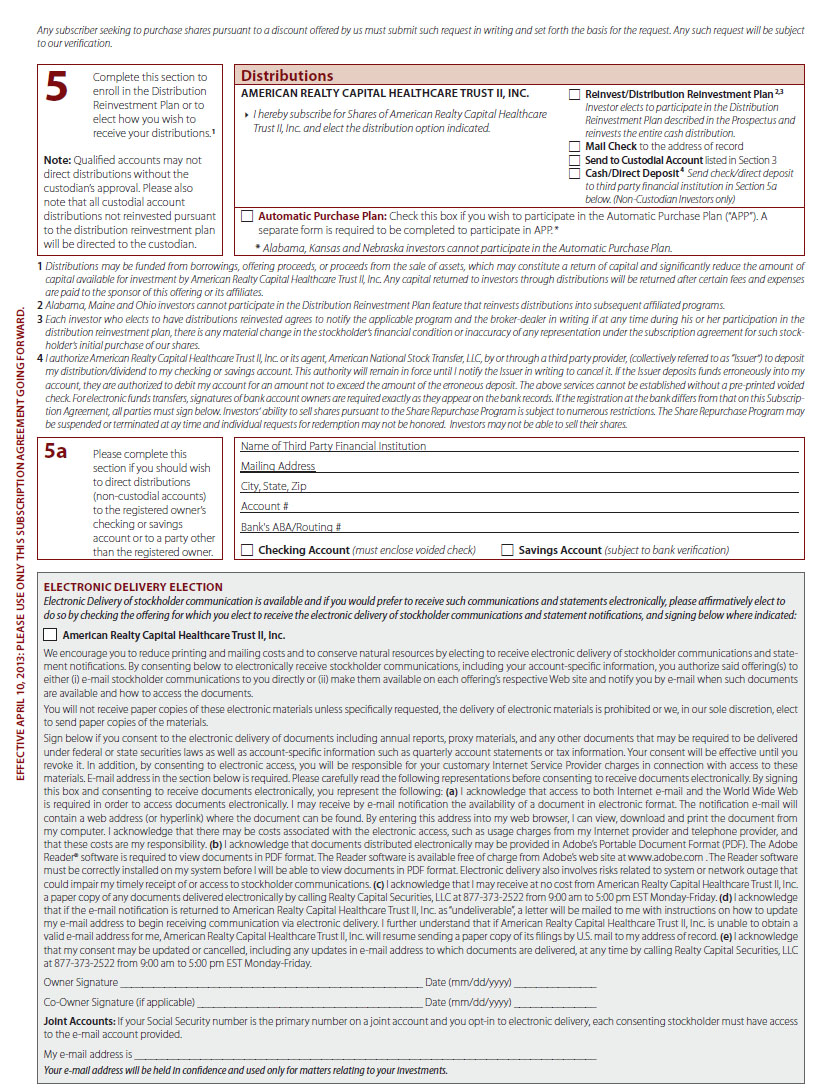

Any subscriber seeking to purchase shares pursuant to a discount offered by us must submit such request in writing and set forth the basis for the request. Any such request will be subject to our verification. 5 Complete this section to enroll in the Distribution Reinvestment Plan or to elect how you wish to receive your distributions. 1 Note: Qualified accounts may not direct distributions without the custodian’s approval. Please also note that all custodial account distributions not reinvested pursuant to the distribution reinvestment plan will be directed to the custodian. Distributions AMERICAN REALTY CAPITAL HEALTHCARE TRUST II, INC. I hereby subscribe for Shares of American Realty Capital Healthcare Trust II, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) Automatic Purchase Plan: Check this box if you wish to participate in the Automatic Purchase Plan (“APP”). A separate form is required to be completed to participate in APP. * * Alabama, Kansas and Nebraska investors cannot participate in the Automatic Purchase Plan. 1 Distributions may be funded from borrowings, offering proceeds, or proceeds from the sale of assets, which may constitute a return of capital and significantly reduce the amount of capital available for investment by American Realty Capital Healthcare Trust II, Inc. Any capital returned to investors through distributions will be returned after certain fees and expenses are paid to the sponsor of this offering or its affiliates. 2 Alabama, Maine and Ohio investors cannot participate in the Distribution Reinvestment Plan feature that reinvests distributions into subsequent affiliated programs. 3 Each investor who elects to have distributions reinvested agrees to notify the applicable program and the broker-dealer in writing if at any time during his or her participation in the distribution reinvestment plan, there is any material change in the stockholder’s financial condition or inaccuracy of any representation under the subscription agreement for such stockholder’s initial purchase of our shares. 4 I authorize American Realty Capital Healthcare Trust II, Inc. or its agent, American National Stock Transfer, LLC, by or through a third party provider, (collectively referred to as “Issuer”) to deposit my distribution/dividend to my checking or savings account. This authority will remain in force until I notify the Issuer in writing to cancel it. If the Issuer deposits funds erroneously into my account, they are authorized to debit my account for an amount not to exceed the amount of the erroneous deposit. The above services cannot be established without a pre-printed voided check. For electronic funds transfers, signatures of bank account owners are required exactly as they appear on the bank records. If the registration at the bank differs from that on this Subscription Agreement, all parties must sign below. Investors’ ability to sell shares pursuant to the Share Repurchase Program is subject to numerous restrictions. The Share Repurchase Program may be suspended or terminated at ay time and individual requests for redemption may not be honored. Investors may not be able to sell their shares. 5a Please complete this section if you should wish to direct distributions (non-custodial accounts) to the registered owner’s checking or savings account or to a party other than the registered owner. Name of Third Party Financial Institution Mailing Address City, State, Zip Account # Bank's ABA/Routing # Checking Account (must enclose voided check) Savings Account (subject to bank verification) ELECTRONIC DELIVERY ELECTION Electronic Delivery of stockholder communication is available and if you would prefer to receive such communications and statements electronically, please affirmatively elect to do so by checking the offering for which you elect to receive the electronic delivery of stockholder communications and statement notifications, and signing below where indicated: American Realty Capital Healthcare Trust II, Inc. We encourage you to reduce printing and mailing costs and to conserve natural resources by electing to receive electronic delivery of stockholder communications and statement notifications. By consenting below to electronically receive stockholder communications, including your account-specific information, you authorize said offering(s) to either (i) e-mail stockholder communications to you directly or (ii) make them available on each offering’s respective Web site and notify you by e-mail when such documents are available and how to access the documents. You will not receive paper copies of these electronic materials unless specifically requested, the delivery of electronic materials is prohibited or we, in our sole discretion, elect to send paper copies of the materials. Sign below if you consent to the electronic delivery of documents including annual reports, proxy materials, and any other documents that may be required to be delivered under federal or state securities laws as well as account-specific information such as quarterly account statements or tax information. Your consent will be effective until you revoke it. In addition, by consenting to electronic access, you will be responsible for your customary Internet Service Provider charges in connection with access to these materials. E-mail address in the section below is required. Please carefully read the following representations before consenting to receive documents electronically. By signing this box and consenting to receive documents electronically, you represent the following: (a) I acknowledge that access to both Internet e-mail and the World Wide Web is required in order to access documents electronically. I may receive by e-mail notification the availability of a document in electronic format. The notification e-mail will contain a web address (or hyperlink) where the document can be found. By entering this address into my web browser, I can view, download and print the document from my computer. I acknowledge that there may be costs associated with the electronic access, such as usage charges from my Internet provider and telephone provider, and that these costs are my responsibility. (b) I acknowledge that documents distributed electronically may be provided in Adobe’s Portable Document Format (PDF). The Adobe Reader® software is required to view documents in PDF format. The Reader software is available free of charge from Adobe’s web site at www.adobe.com . The Reader software must be correctly installed on my system before I will be able to view documents in PDF format. Electronic delivery also involves risks related to system or network outage that could impair my timely receipt of or access to stockholder communications. (c) I acknowledge that I may receive at no cost from American Realty Capital Healthcare Trust II, Inc. a paper copy of any documents delivered electronically by calling Realty Capital Securities, LLC at 877-373-2522 from 9:00 am to 5:00 pm EST Monday-Friday. (d) I acknowledge that if the e-mail notification is returned to American Realty Capital Healthcare Trust II, Inc. as “undeliverable”, a letter will be mailed to me with instructions on how to update my e-mail address to begin receiving communication via electronic delivery. I further understand that if American Realty Capital Healthcare Trust II, Inc. is unable to obtain a valid e-mail address for me, American Realty Capital Healthcare Trust II, Inc. will resume sending a paper copy of its filings by U.S. mail to my address of record. (e) I acknowledge that my consent may be updated or cancelled, including any updates in e-mail address to which documents are delivered, at any time by calling Realty Capital Securities, LLC at 877-373-2522 from 9:00 am to 5:00 pm EST Monday-Friday. Owner Signature _______________________________________________________ Date (mm/dd/yyyy) _______________ Co-Owner Signature (if applicable) _________________________________________ Date (mm/dd/yyyy) _______________ Joint Accounts: If your Social Security number is the primary number on a joint account and you opt-in to electronic delivery, each consenting stockholder must have access to the e-mail account provided. My e-mail address is ____________________________________________________________________________________ Your e-mail address will be held in confidence and used only for matters relating to your investments. EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

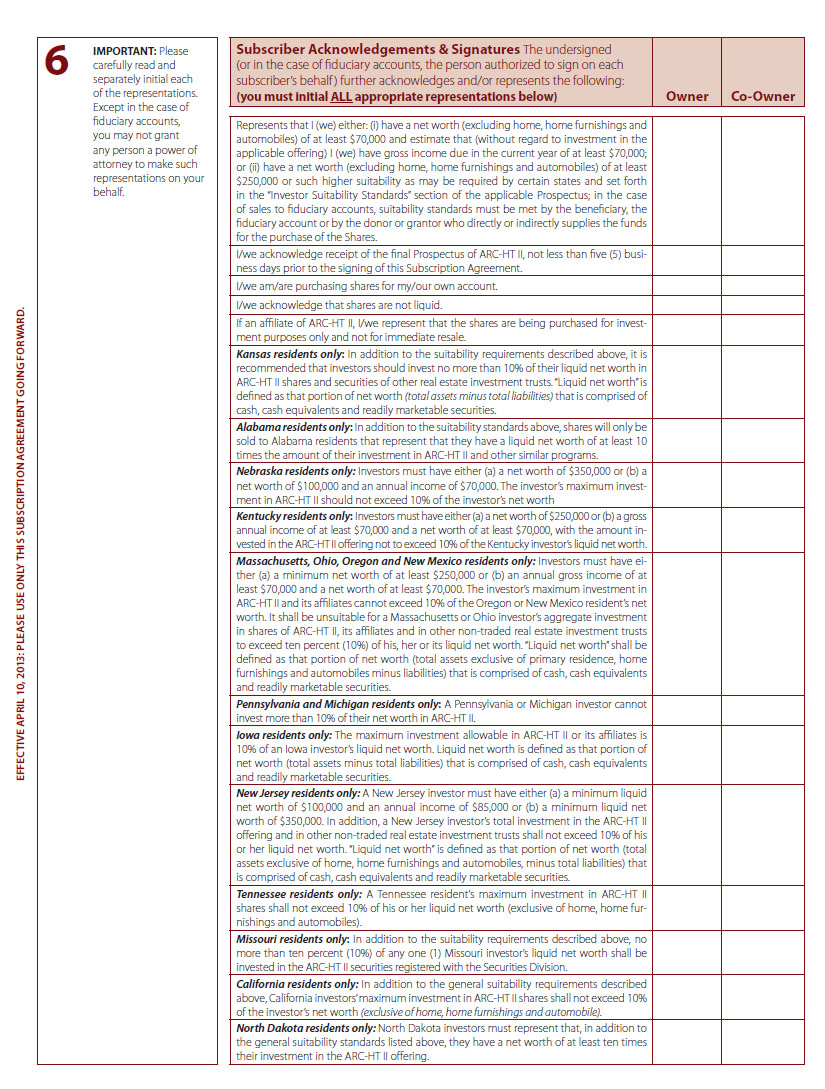

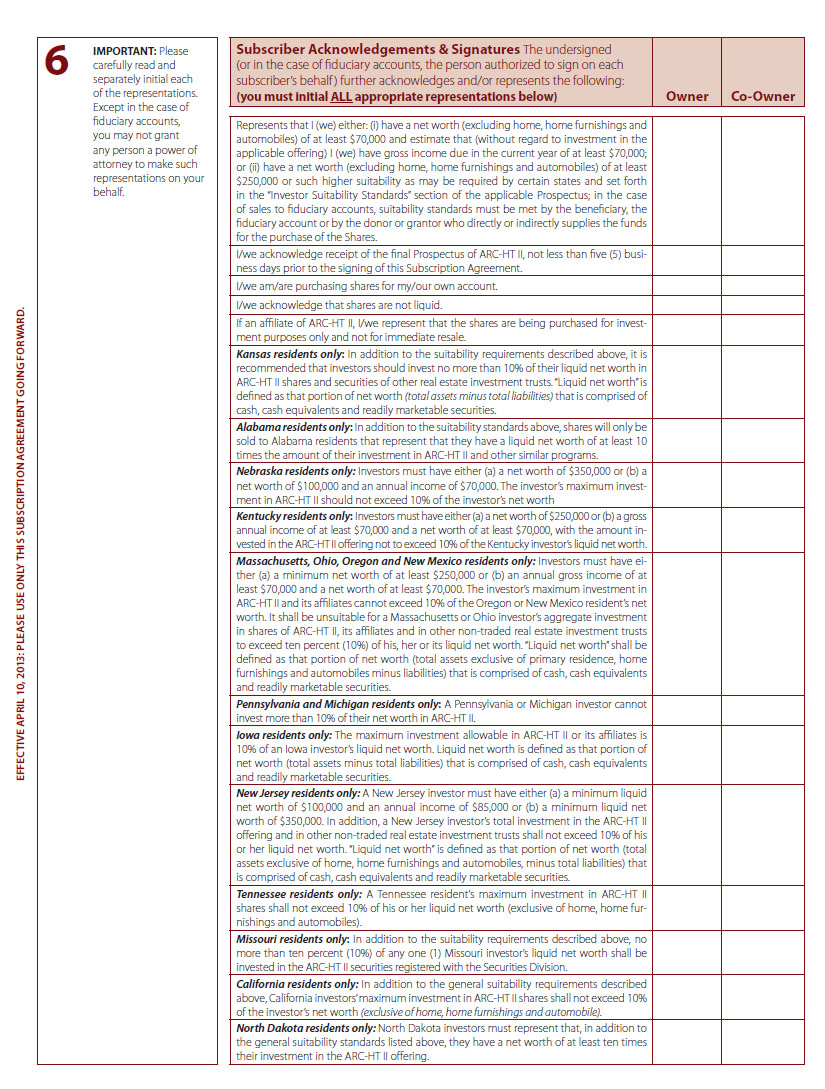

6 IMPORTANT: Please carefully read and separately initial each of the representations. Except in the case of fiduciary accounts, you may not grant any person a power of attorney to make such representations on your behalf. Subscriber Acknowledgements & Signatures The undersigned (or in the case of fiduciary accounts, the person authorized to sign on each subscriber’s behalf ) further acknowledges and/or represents the following: (you must initial ALL appropriate representations below) Owner Co-Owner Represents that I (we) either: (i) have a net worth (excluding home, home furnishings and automobiles) of at least $70,000 and estimate that (without regard to investment in the applicable offering) I (we) have gross income due in the current year of at least $70,000; or (ii) have a net worth (excluding home, home furnishings and automobiles) of at least $250,000 or such higher suitability as may be required by certain states and set forth in the “Investor Suitability Standards” section of the applicable Prospectus; in the case of sales to fiduciary accounts, suitability standards must be met by the beneficiary, the fiduciary account or by the donor or grantor who directly or indirectly supplies the funds for the purchase of the Shares. I/we acknowledge receipt of the final Prospectus of ARC-HT II, not less than five (5) business days prior to the signing of this Subscription Agreement. I/we am/are purchasing shares for my/our own account. I/we acknowledge that shares are not liquid. If an affiliate of ARC-HT II, I/we represent that the shares are being purchased for investment purposes only and not for immediate resale. Kansas residents only: In addition to the suitability requirements described above, it is recommended that investors should invest no more than 10% of their liquid net worth in ARC-HT II shares and securities of other real estate investment trusts. “Liquid net worth” is defined as that portion of net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Alabama residents only: In addition to the suitability standards above, shares will only be sold to Alabama residents that represent that they have a liquid net worth of at least 10 times the amount of their investment in ARC-HT II and other similar programs. Nebraska residents only: Investors must have either (a) a net worth of $350,000 or (b) a net worth of $100,000 and an annual income of $70,000. The investor’s maximum investment in ARC-HT II should not exceed 10% of the investor’s net worth Kentucky residents only: Investors must have either (a) a net worth of $250,000 or (b) a gross annual income of at least $70,000 and a net worth of at least $70,000, with the amount invested in the ARC-HT II offering not to exceed 10% of the Kentucky investor’s liquid net worth. Massachusetts, Ohio, Oregon and New Mexico residents only: Investors must have either (a) a minimum net worth of at least $250,000 or (b) an annual gross income of at least $70,000 and a net worth of at least $70,000. The investor’s maximum investment in ARC-HT II and its affiliates cannot exceed 10% of the Oregon or New Mexico resident’s net worth. It shall be unsuitable for a Massachusetts or Ohio investor’s aggregate investment in shares of ARC-HT II, its affiliates and in other non-traded real estate investment trusts to exceed ten percent (10%) of his, her or its liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of primary residence, home furnishings and automobiles minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Pennsylvania and Michigan residents only: A Pennsylvania or Michigan investor cannot invest more than 10% of their net worth in ARC-HT II. Iowa residents only: The maximum investment allowable in ARC-HT II or its affiliates is 10% of an Iowa investor’s liquid net worth. Liquid net worth is defined as that portion of net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. New Jersey residents only: A New Jersey investor must have either (a) a minimum liquid net worth of $100,000 and an annual income of $85,000 or (b) a minimum liquid net worth of $350,000. In addition, a New Jersey investor’s total investment in the ARC-HT II offering and in other non-traded real estate investment trusts shall not exceed 10% of his or her liquid net worth. “Liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings and automobiles, minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Tennessee residents only: A Tennessee resident’s maximum investment in ARC-HT II shares shall not exceed 10% of his or her liquid net worth (exclusive of home, home furnishings and automobiles). Missouri residents only: In addition to the suitability requirements described above, no more than ten percent (10%) of any one (1) Missouri investor’s liquid net worth shall be invested in the ARC-HT II securities registered with the Securities Division. California residents only: In addition to the general suitability requirements described above, California investors’ maximum investment in ARC-HT II shares shall not exceed 10% of the investor’s net worth (exclusive of home, home furnishings and automobile). North Dakota residents only: North Dakota investors must represent that, in addition to the general suitability standards listed above, they have a net worth of at least ten times their investment in the ARC-HT II offering. EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

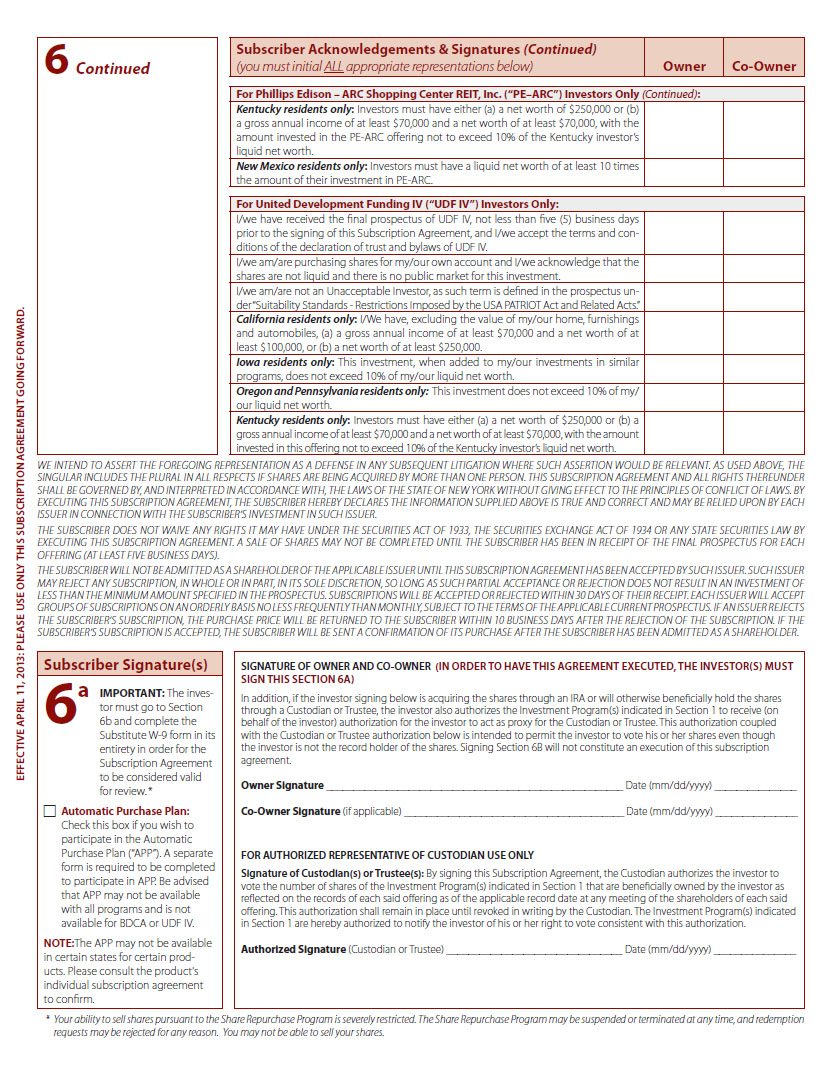

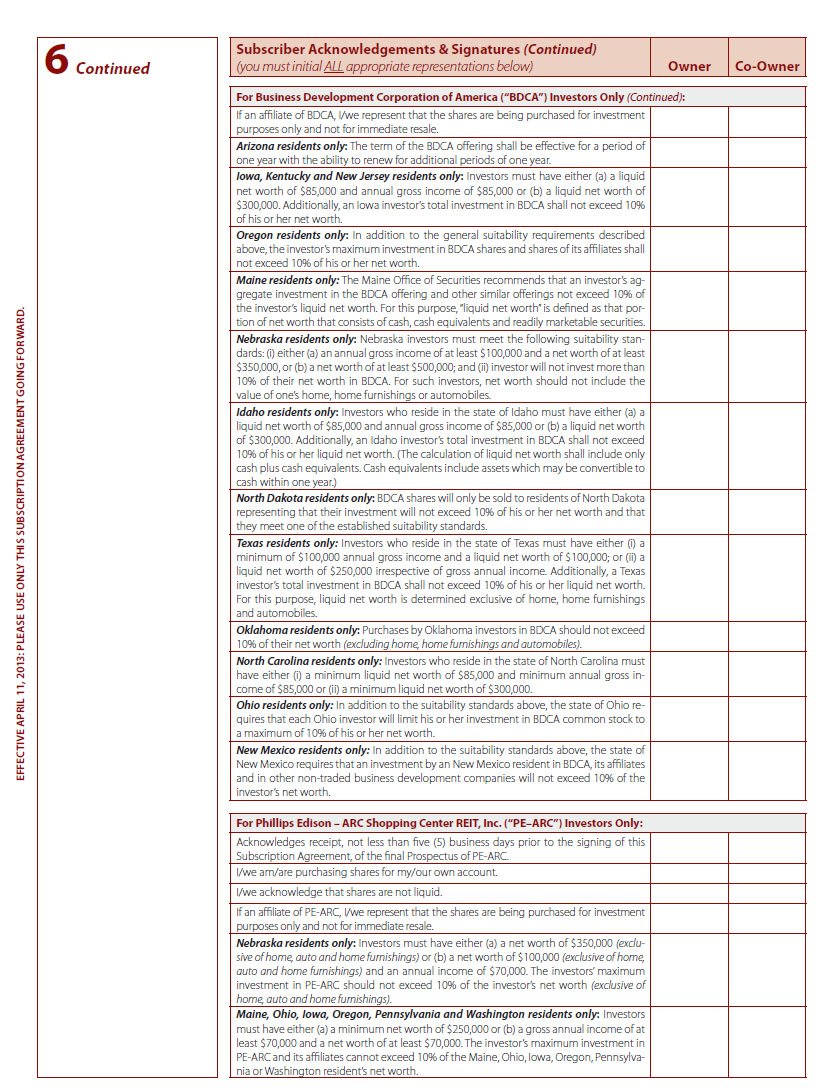

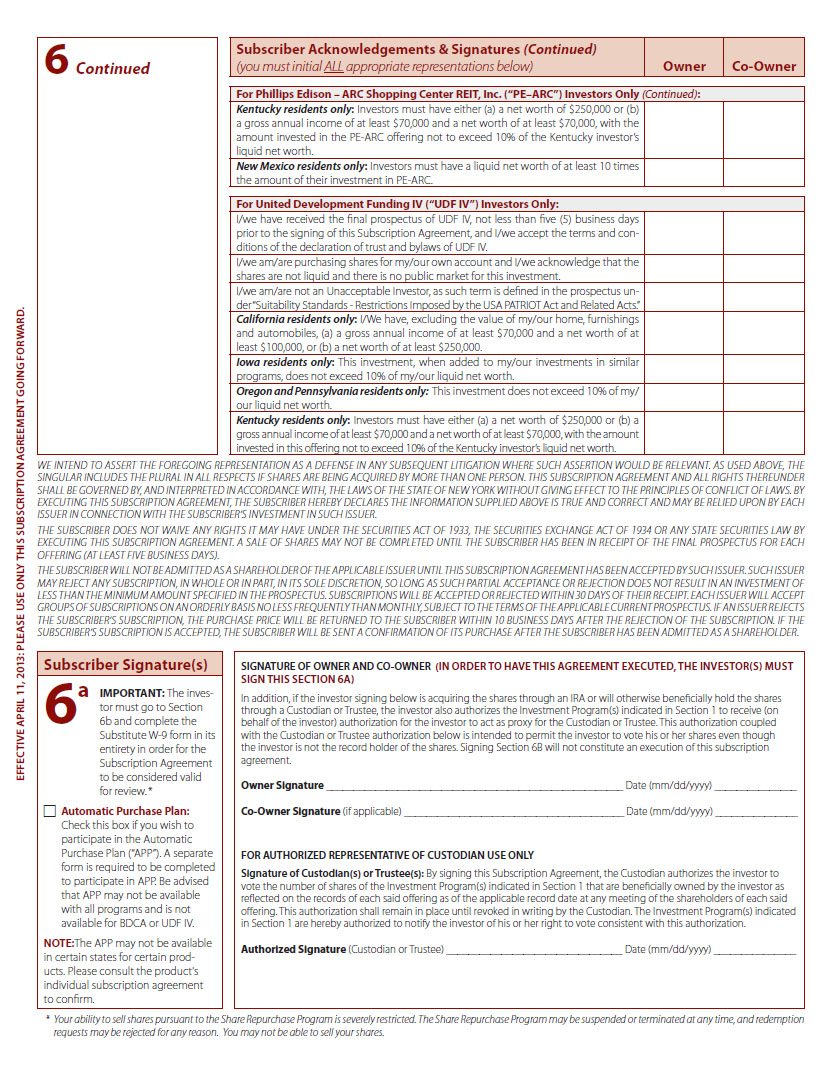

6 Continued Subscriber Acknowledgements & Signatures (Continued) (you must initial ALL appropriate representations below) Owner Co-Owner Maine residents only: The Maine Office of Securities recommends that an investor’s aggregate investment in the ARC-HT II offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. Texas Residents Only: An investor must have had, during the last tax year, or estimate that the investor will have during the current tax year, (a) a minimum net worth of $100,000 and a minimum annual gross income of $100,000, or (b) a minimum net worth of $500,000. The investor’s maximum investment in the ARC-HT II offering shall not exceed 10% of the investor’s liquid net worth WE INTEND TO ASSERT THE FOREGOING REPRESENTATION AS A DEFENSE IN ANY SUBSEQUENT LITIGATION WHERE SUCH ASSERTION WOULD BE RELEVANT. AS USED ABOVE, THE SINGULAR INCLUDES THE PLURAL IN ALL RESPECTS IF SHARES ARE BEING ACQUIRED BY MORE THAN ONE PERSON. THIS SUBSCRIPTION AGREEMENT AND ALL RIGHTS THEREUNDER SHALL BE GOVERNED BY, AND INTERPRETED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT GIVING EFFECT TO THE PRINCIPLES OF CONFLICT OF LAWS. BY EXECUTING THIS SUBSCRIPTION AGREEMENT, THE SUBSCRIBER HEREBY DECLARES THE INFORMATION SUPPLIED ABOVE IS TRUE AND CORRECT AND MAY BE RELIED UPON BY EACH ISSUER IN CONNECTION WITH THE SUBSCRIBER’S INVESTMENT IN SUCH ISSUER. THE SUBSCRIBER DOES NOT WAIVE ANY RIGHTS IT MAY HAVE UNDER THE SECURITIES ACT OF 1933, THE SECURITIES EXCHANGE ACT OF 1934 OR ANY STATE SECURITIES LAW BY EXECUTING THIS SUBSCRIPTION AGREEMENT. A SALE OF SHARES MAY NOT BE COMPLETED UNTIL THE SUBSCRIBER HAS BEEN IN RECEIPT OF THE FINAL PROSPECTUS FOR THIS OFFERING (AT LEAST FIVE BUSINESS DAYS). THE SUBSCRIBER WILL NOT BE ADMITTED AS A SHAREHOLDER OF THE APPLICABLE ISSUER UNTIL THIS SUBSCRIPTION AGREEMENT HAS BEEN ACCEPTED BY SUCH ISSUER. SUCH ISSUER MAY REJECT ANY SUBSCRIPTION, IN WHOLE OR IN PART, IN ITS SOLE DISCRETION, SO LONG AS SUCH PARTIAL ACCEPTANCE OR REJECTION DOES NOT RESULT IN AN INVESTMENT OF LESS THAN THE MINIMUM AMOUNT SPECIFIED IN THE PROSPECTUS. SUBSCRIPTIONS WILL BE ACCEPTED OR REJECTED WITHIN 30 DAYS OF THEIR RECEIPT. EACH ISSUER WILL ACCEPT GROUPS OF SUBSCRIPTIONS ON AN ORDERLY BASIS NO LESS FREQUENTLY THAN MONTHLY, SUBJECT TO THE TERMS OF THE CURRENT PROSPECTUS. IF AN ISSUER REJECTS THE SUBSCRIBER’S SUBSCRIPTION, THE PURCHASE PRICE WILL BE RETURNED TO THE SUBSCRIBER WITHIN 10 BUSINESS DAYS AFTER THE REJECTION OF THE SUBSCRIPTION. IF THE SUBSCRIBER’S SUBSCRIPTION IS ACCEPTED, THE SUBSCRIBER WILL BE SENT A CONFIRMATION OF ITS PURCHASE AFTER THE SUBSCRIBER HAS BEEN ADMITTED AS A SHAREHOLDER. Subscriber Signature(s) SIGNATURE OF OWNER AND CO-OWNER (IN ORDER TO HAVE THIS AGREEMENT EXECUTED, THE INVESTOR(S) MUST SIGN THIS SECTION 6A) In addition, if the investor signing below is acquiring the shares through an IRA or will otherwise beneficially hold the shares through a Custodian or Trustee, the investor also authorizes the Investment Program(s) indicated in Section 1 to receive (on behalf of the investor) authorization for the investor to act as proxy for the Custodian or Trustee. This authorization coupled with the Custodian or Trustee authorization below is intended to permit the investor to vote his or her shares even though the investor is not the record holder of the shares. Signing Section 6B will not constitute an execution of this subscription agreement. Owner Signature _______________________________________________________ Date (mm/dd/yyyy) _______________ Co-Owner Signature (if applicable) _________________________________________ Date (mm/dd/yyyy) _______________ FOR AUTHORIZED REPRESENTATIVE OF CUSTODIAN USE ONLY Signature of Custodian(s) or Trustee(s): By signing this Subscription Agreement, the Custodian authorizes the investor to vote the number of shares of the Investment Program(s) indicated in Section 1 that are beneficially owned by the investor as reflected on the records of each said offering as of the applicable record date at any meeting of the shareholders of each said offering. This authorization shall remain in place until revoked in writing by the Custodian. The Investment Program(s) indicated in Section 1 are hereby authorized to notify the investor of his or her right to vote consistent with this authorization. Authorized Signature (Custodian or Trustee) _________________________________ Date (mm/dd/yyyy) _______________ 6a IMPORTANT: The investor must go to Section 6b and complete the Substitute W-9 form in its entirety in order for the Subscription Agreement to be considered valid for review. * * Your ability to sell shares pursuant to the Share Repurchase Program is severely restricted. The Share Repurchase Program may be suspended or terminated at any time, and redemption requests may be rejected for any reason. You may not be able to sell your shares. EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

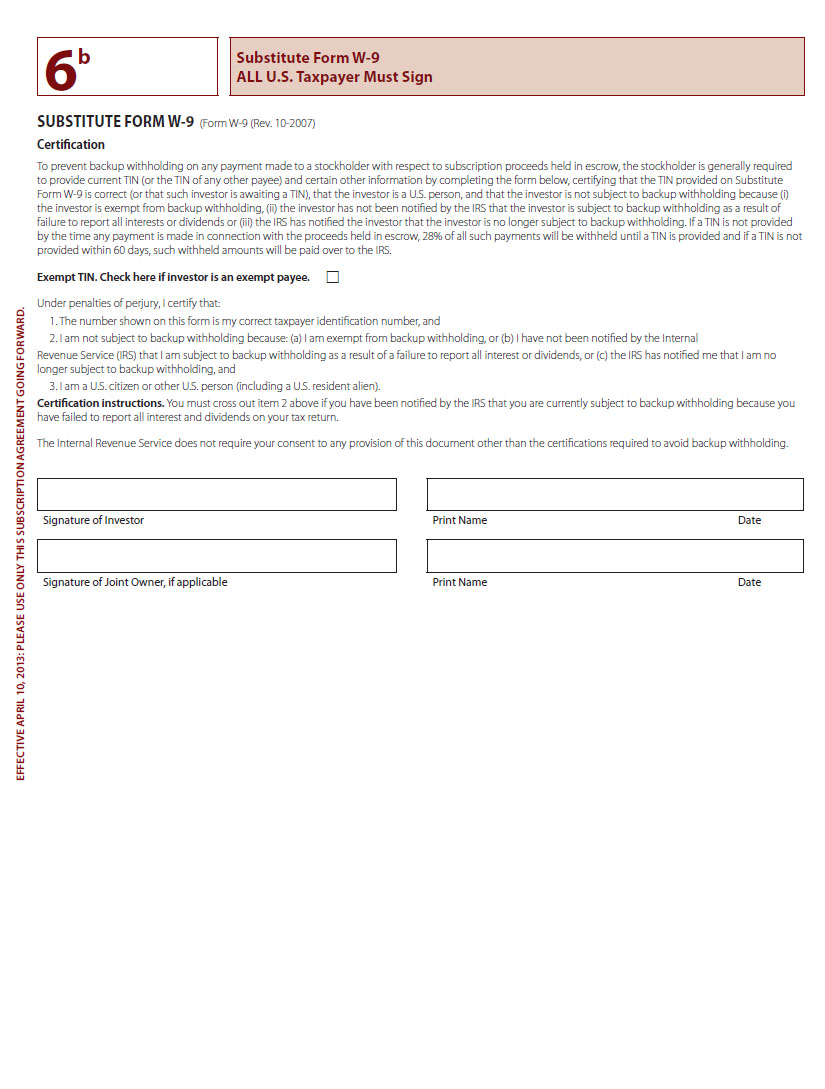

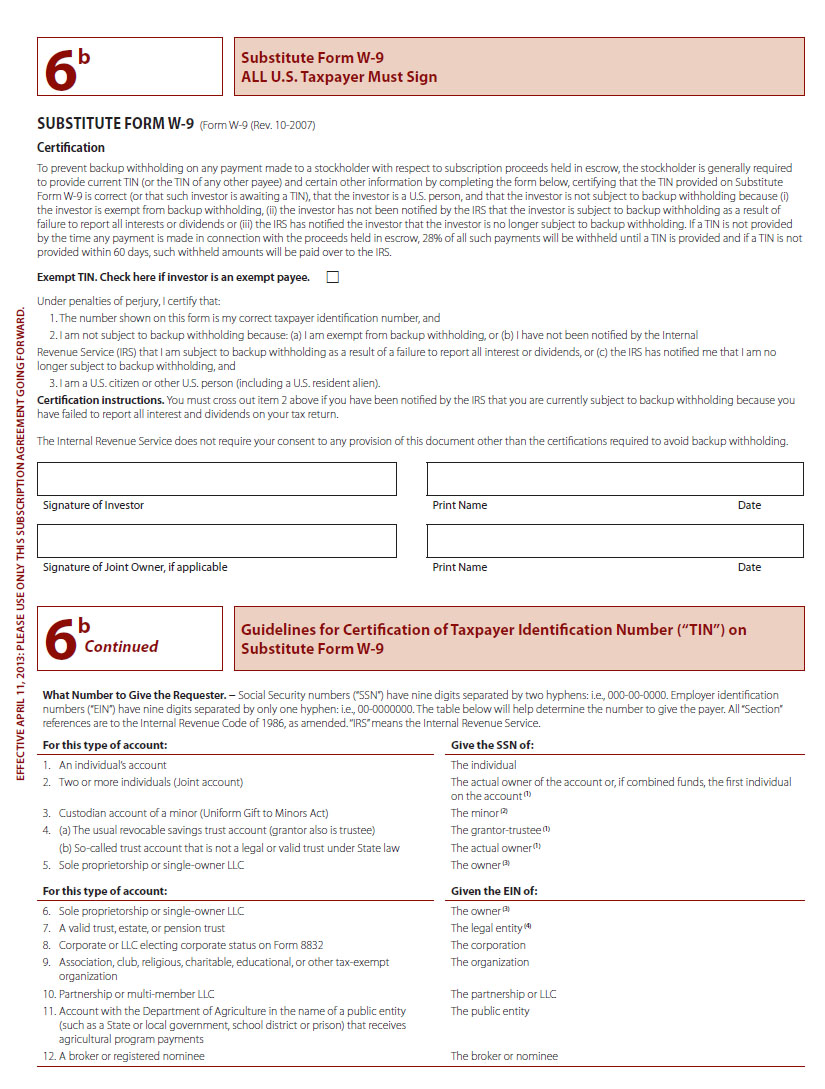

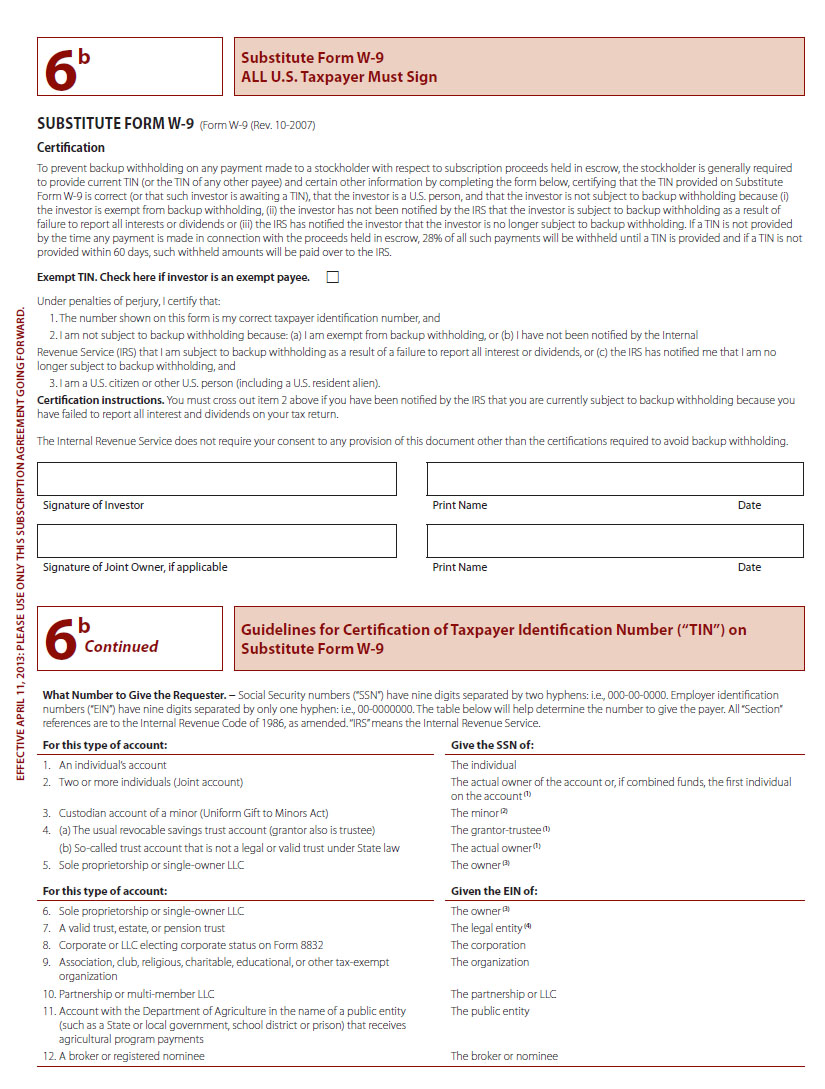

6b Substitute Form W-9 ALL U.S. Taxpayer Must Sign SUBSTITUTE FORM W-9 (Form W-9 (Rev. 10-2007) Certification To prevent backup withholding on any payment made to a stockholder with respect to subscription proceeds held in escrow, the stockholder is generally required to provide current TIN (or the TIN of any other payee) and certain other information by completing the form below, certifying that the TIN provided on Substitute Form W-9 is correct (or that such investor is awaiting a TIN), that the investor is a U.S. person, and that the investor is not subject to backup withholding because (i) the investor is exempt from backup withholding, (ii) the investor has not been notified by the IRS that the investor is subject to backup withholding as a result of failure to report all interests or dividends or (iii) the IRS has notified the investor that the investor is no longer subject to backup withholding. If a TIN is not provided by the time any payment is made in connection with the proceeds held in escrow, 28% of all such payments will be withheld until a TIN is provided and if a TIN is not provided within 60 days, such withheld amounts will be paid over to the IRS. Exempt TIN. Check here if investor is an exempt payee. Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number, and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (including a U.S. resident alien). Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Signature of Investor Print Name Date Signature of Joint Owner, if applicable Print Name Date EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

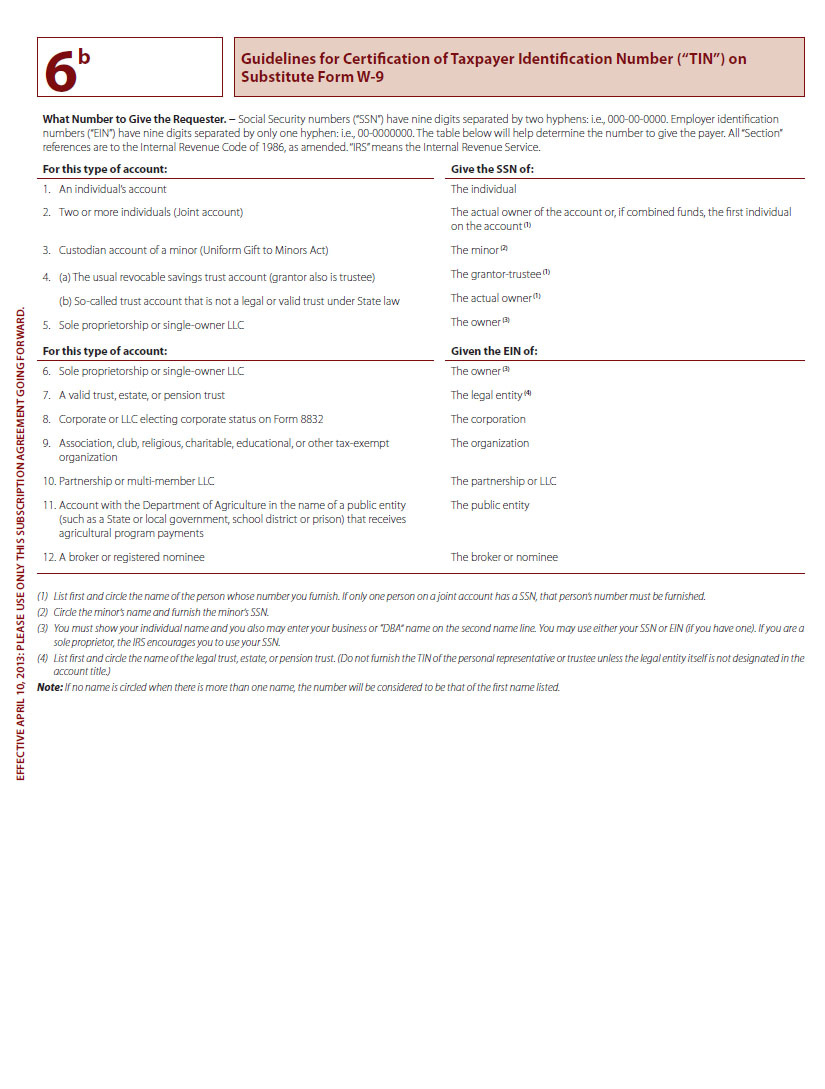

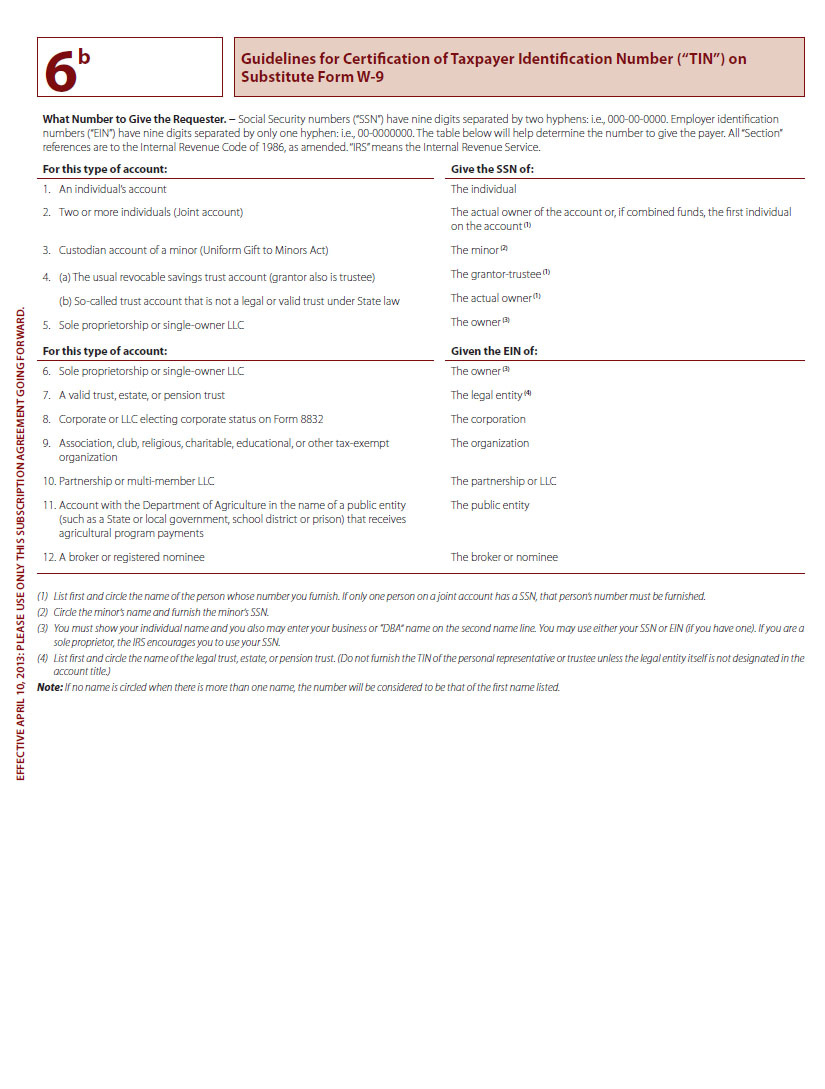

6b Guidelines for Certification of Taxpayer Identification Number (“TIN”) on Substitute Form W-9 What Number to Give the Requester. − Social Security numbers (‘‘SSN’’) have nine digits separated by two hyphens: i.e., 000-00-0000. Employer identification numbers (‘‘EIN’’) have nine digits separated by only one hyphen: i.e., 00-0000000. The table below will help determine the number to give the payer. All ‘‘Section’’ references are to the Internal Revenue Code of 1986, as amended. ‘‘IRS’’ means the Internal Revenue Service. For this type of account: Give the SSN of: 1. An individual’s account 2. Two or more individuals (Joint account) 3. Custodian account of a minor (Uniform Gift to Minors Act) 4. (a) The usual revocable savings trust account (grantor also is trustee) (b) So-called trust account that is not a legal or valid trust under State law 5. Sole proprietorship or single-owner LLC The individual The actual owner of the account or, if combined funds, the first individual on the account (1) The minor (2) The grantor-trustee (1) The actual owner (1) The owner (3) For this type of account: Given the EIN of: 6. Sole proprietorship or single-owner LLC 7. A valid trust, estate, or pension trust 8. Corporate or LLC electing corporate status on Form 8832 9. Association, club, religious, charitable, educational, or other tax-exempt organization 10. Partnership or multi-member LLC 11. Account with the Department of Agriculture in the name of a public entity (such as a State or local government, school district or prison) that receives agricultural program payments 12. A broker or registered nominee The owner (3) The legal entity (4) The corporation The organization The partnership or LLC The public entity The broker or nominee EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

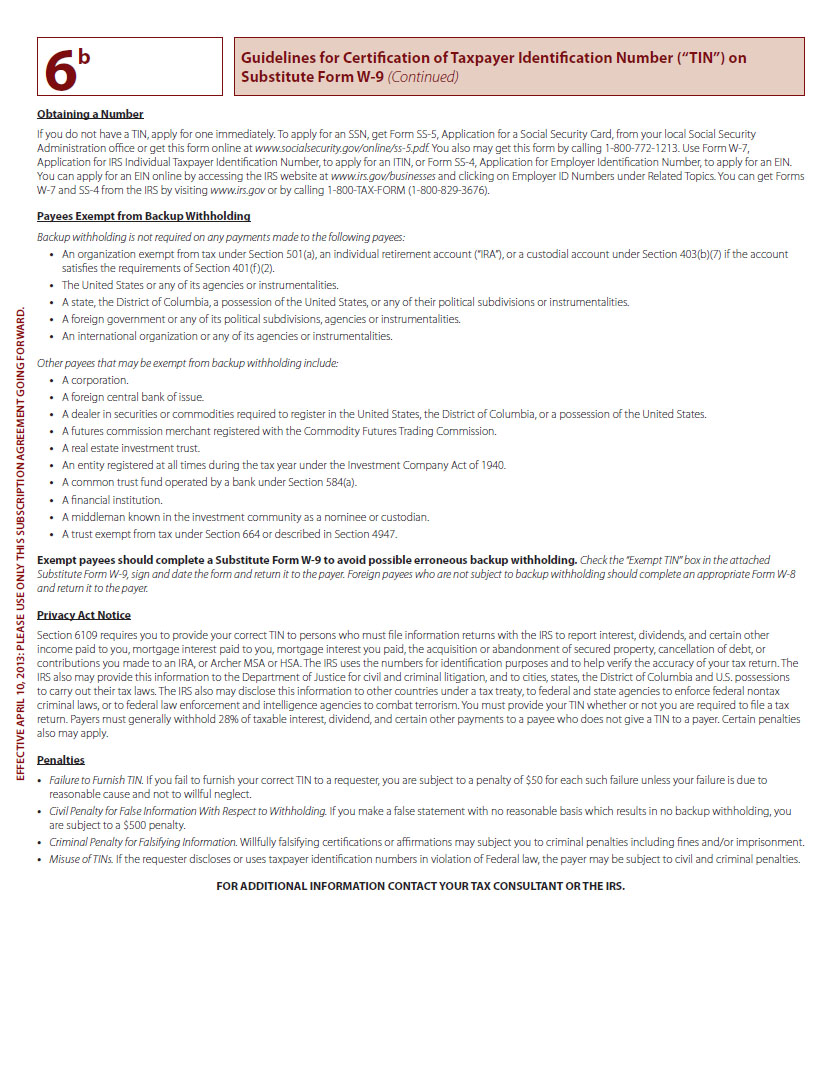

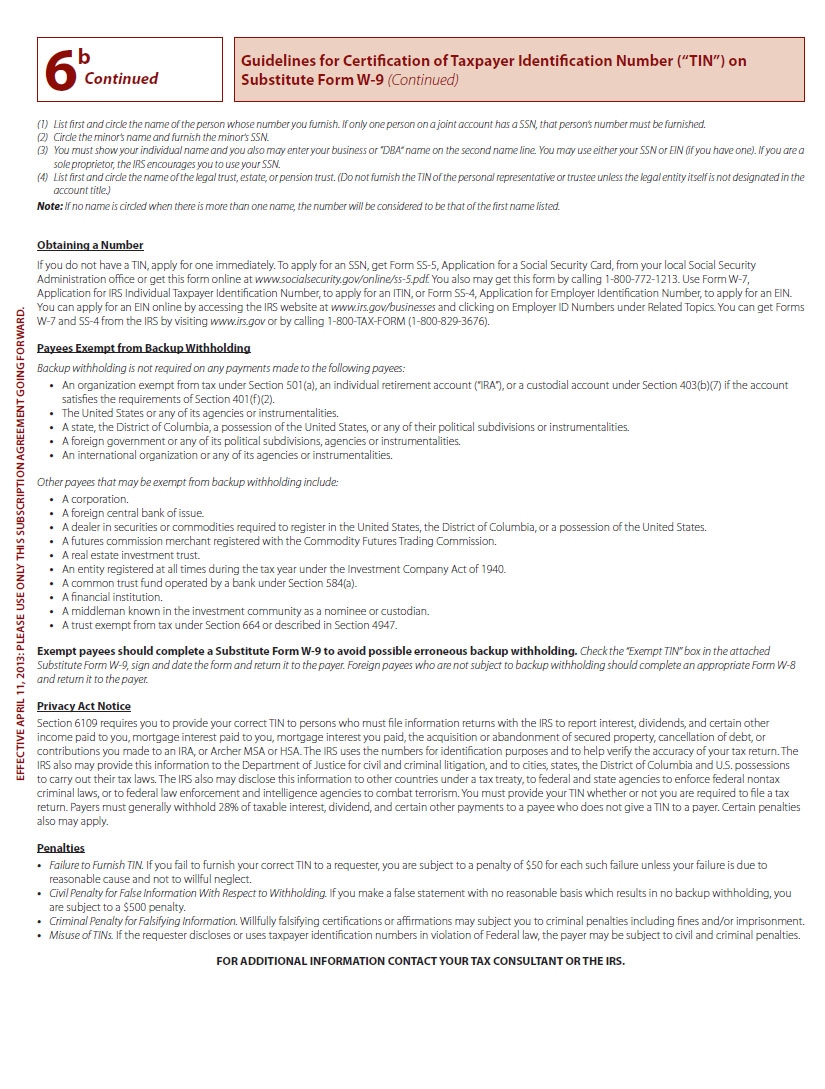

6b Guidelines for Certification of Taxpayer Identification Number (“TIN”) on Substitute Form W-9 (Continued) Obtaining a Number If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local Social Security Administration office or get this form online at www.socialsecurity.gov/online/ss-5.pdf. You also may get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/businesses and clicking on Employer ID Numbers under Related Topics. You can get Forms W-7 and SS-4 from the IRS by visiting www.irs.gov or by calling 1-800-TAX-FORM (1-800-829-3676). Payees Exempt from Backup Withholding Backup withholding is not required on any payments made to the following payees: • An organization exempt from tax under Section 501(a), an individual retirement account (‘‘IRA’’), or a custodial account under Section 403(b)(7) if the account satisfies the requirements of Section 401(f )(2). • The United States or any of its agencies or instrumentalities. • A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities. • A foreign government or any of its political subdivisions, agencies or instrumentalities. • An international organization or any of its agencies or instrumentalities. Other payees that may be exempt from backup withholding include: • A corporation. • A foreign central bank of issue. • A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States. • A futures commission merchant registered with the Commodity Futures Trading Commission. • A real estate investment trust. • An entity registered at all times during the tax year under the Investment Company Act of 1940. • A common trust fund operated by a bank under Section 584(a). • A financial institution. • A middleman known in the investment community as a nominee or custodian. • A trust exempt from tax under Section 664 or described in Section 4947. Exempt payees should complete a Substitute Form W-9 to avoid possible erroneous backup withholding. Check the ‘‘Exempt TIN’’ box in the attached Substitute Form W-9, sign and date the form and return it to the payer. Foreign payees who are not subject to backup withholding should complete an appropriate Form W-8 and return it to the payer. Privacy Act Notice Section 6109 requires you to provide your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA, or Archer MSA or HSA. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The IRS also may provide this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia and U.S. possessions to carry out their tax laws. The IRS also may disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to a payer. Certain penalties also may apply. Penalties • Failure to Furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. • Civil Penalty for False Information With Respect to Withholding. If you make a false statement with no reasonable basis which results in no backup withholding, you are subject to a $500 penalty. • Criminal Penalty for Falsifying Information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment. • Misuse of TINs. If the requester discloses or uses taxpayer identification numbers in violation of Federal law, the payer may be subject to civil and criminal penalties. FOR ADDITIONAL INFORMATION CONTACT YOUR TAX CONSULTANT OR THE IRS. EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

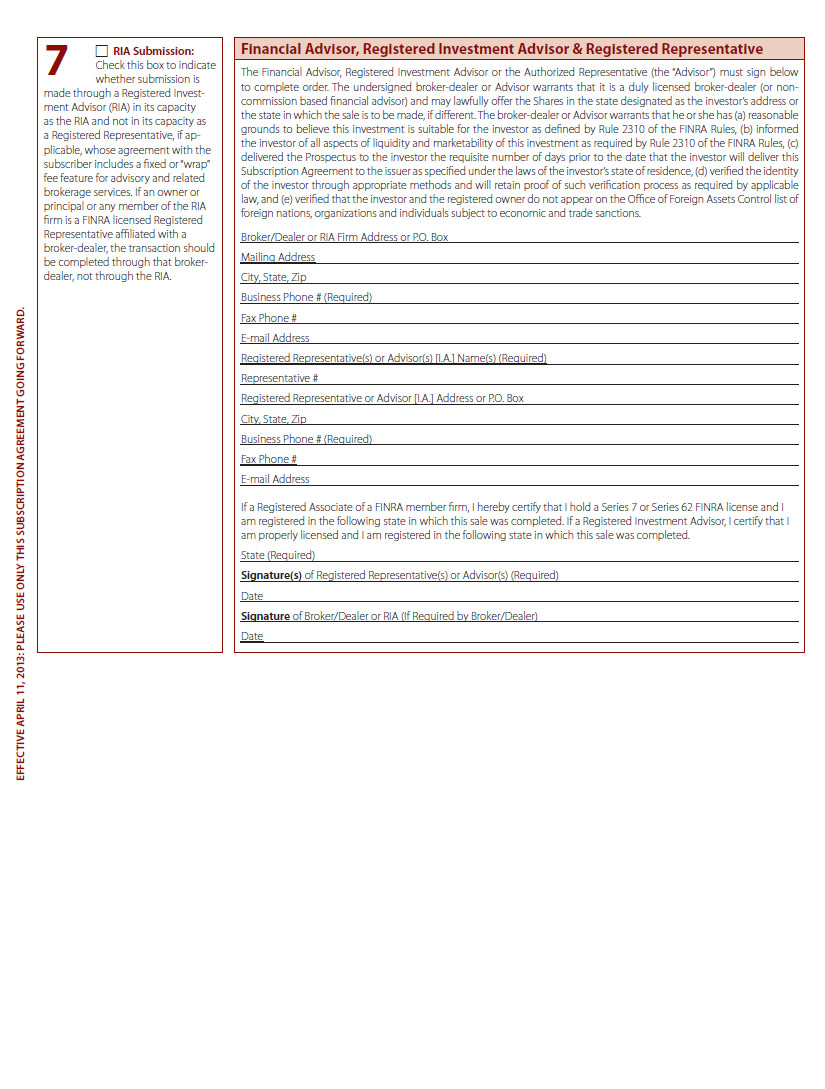

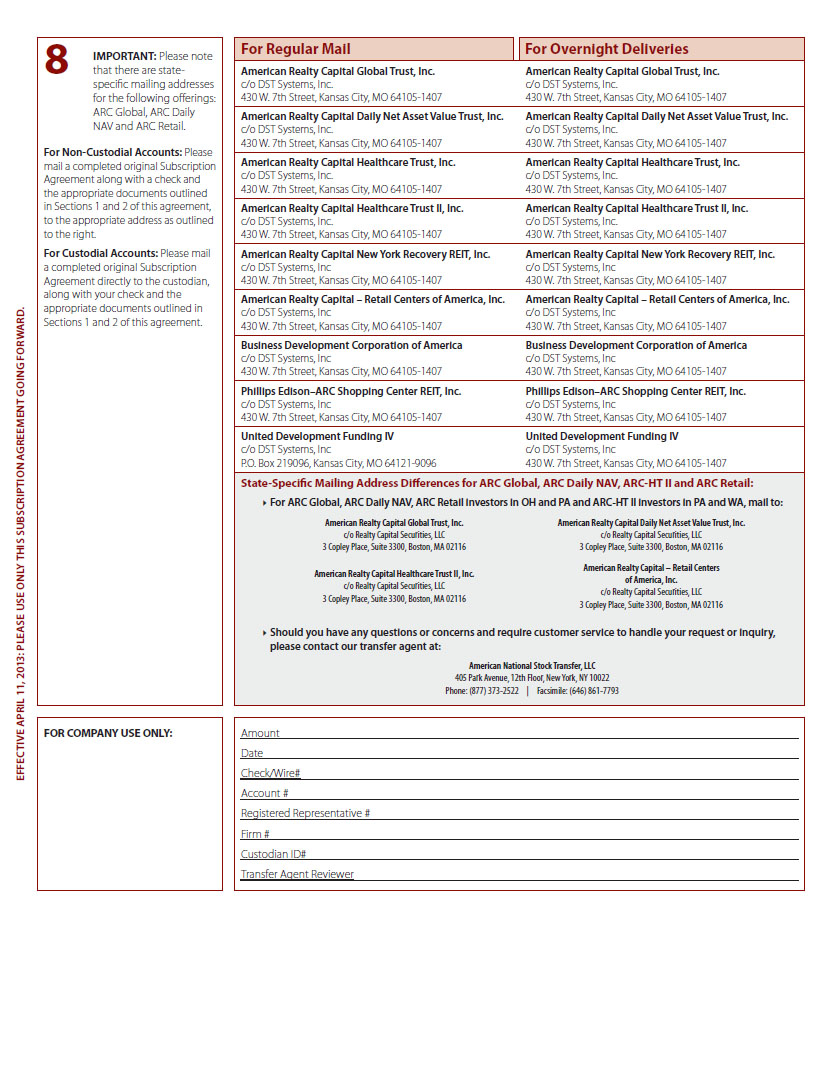

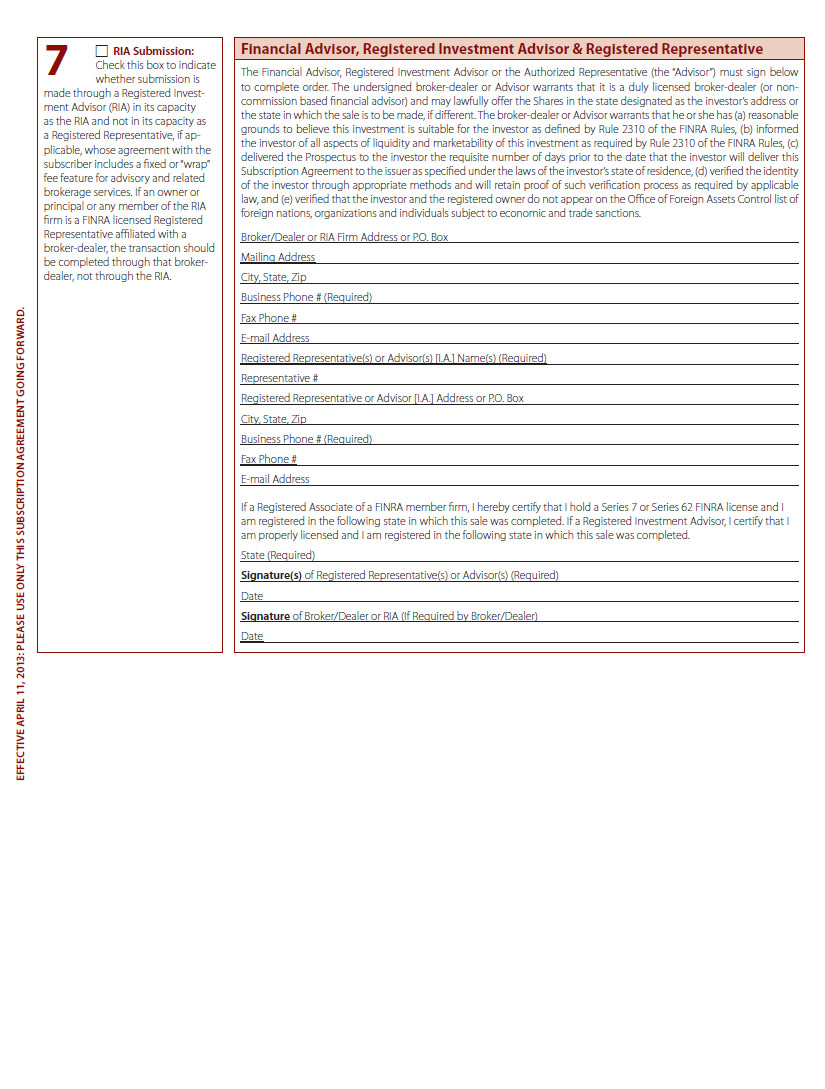

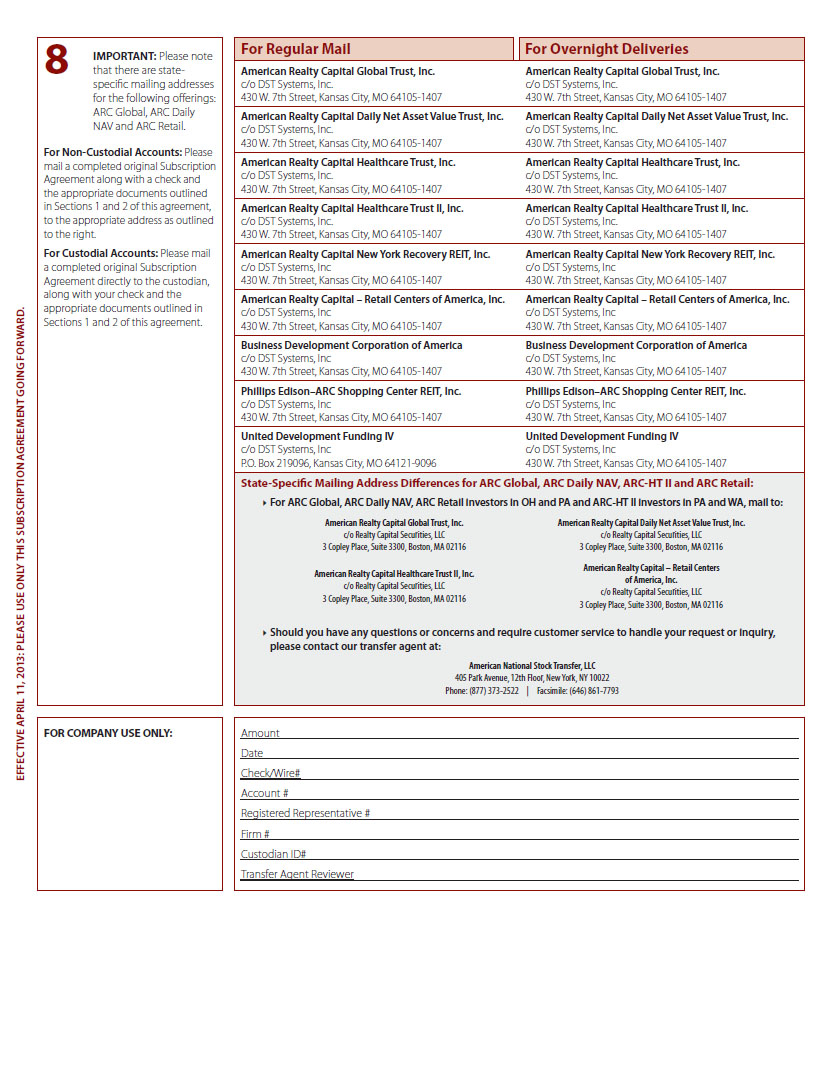

7 RIA Submission: Check this box to indicate whether submission is made through a Registered Investment Advisor (RIA) in its capacity as the RIA and not in its capacity as a Registered Representative, if applicable, whose agreement with the subscriber includes a fixed or “wrap” fee feature for advisory and related brokerage services. If an owner or principal or any member of the RIA firm is a FINRA licensed Registered Representative affiliated with a broker-dealer, the transaction should be completed through that broker-dealer, not through the RIA. Special Alabama Undertaking Regarding APP: The Firm must check this box if the Automatic Purchase Plan (“APP”) box in Section 5 is checked and either the sale was made in Alabama or Alabama is the state designated as the investor’s address. By checking the box at the beginning of this paragraph, the Firm covenants and agrees that: (1) the Firm will obtain updated suitability information from such investor on a quarterly basis; (2) this updated information will be provided in writing and signed by the investor; (3) if written suitability information is more than 90 days old, then the investor may not participate in the Automatic Purchase Plan until the information is updated; and (4) the updated information shall consist of the information that an investor is required to provide under Section 6 of this Subscription Agreement. Financial Advisor, Registered Investment Advisor & Registered Representative The Financial Advisor, Registered Investment Advisor or the Authorized Representative (the “Advisor”) must sign below to complete order. The undersigned broker-dealer or Advisor warrants that it is a duly licensed broker-dealer (or non-commission based financial advisor) and may lawfully offer the Shares in the state designated as the investor’s address or the state in which the sale is to be made, if different. The broker-dealer or Advisor warrants that he or she has (a) reasonable grounds to believe this investment is suitable for the investor as defined by Rule 2310 of the FINRA Rules, (b) informed the investor of all aspects of liquidity and marketability of this investment as required by Rule 2310 of the FINRA Rules, (c) delivered the Prospectus to the investor the requisite number of days prior to the date that the investor will deliver this Subscription Agreement to the issuer as specified under the laws of the investor’s state of residence, (d) verified the identity of the investor through appropriate methods and will retain proof of such verification process as required by applicable law, and (e) verified that the investor and the registered owner do not appear on the Office of Foreign Assets Control list of foreign nations, organizations and individuals subject to economic and trade sanctions. Broker/Dealer or RIA Firm Address or P.O. Box Mailing Address City, State, Zip Business Phone # (Required) Fax Phone # E-mail Address Registered Representative(s) or Advisor(s) [I.A.] Name(s) (Required) Representative # Registered Representative or Advisor [I.A.] Address or P.O. Box City, State, Zip Business Phone # (Required) Fax Phone # E-mail Address If a Registered Associate of a FINRA member firm, I hereby certify that I hold a Series 7 or Series 62 FINRA license and I am registered in the following state in which this sale was completed. If a Registered Investment Advisor, I certify that I am properly licensed and I am registered in the following state in which this sale was completed. State (Required) Signature(s) of Registered Representative(s) or Advisor(s) (Required) Date Signature of Broker/Dealer or RIA (If Required by Broker/Dealer) Date 8 For Non-Custodial Accounts: Please mail a completed original Subscription Agreement along with a check and the appropriate documents outlined in Sections 1 and 2 of this agreement, to the appropriate address as outlined to the right. For Custodial Accounts: Please mail a completed original Subscription Agreement directly to the custodian, along with your check and the appropriate documents outlined in Sections 1 and 2 of this agreement. For Regular Mail For Overnight Deliveries American Realty Capital Healthcare Trust II, Inc. (except for ARC-HT II investors in PA and WA) c/o DST Systems, Inc. 430 W. 7th Street, Kansas City, MO 64105-1407 American Realty Capital Healthcare Trust II, Inc. (except for ARC-HT II investors in PA and WA) c/o DST Systems, Inc. 430 W. 7th Street, Kansas City, MO 64105-1407 State-Specific Mailing Address Differences for ARC-HT II: For ARC-HT II investors in PA and WA, mail to: American Realty Capital Healthcare Trust II, Inc. c/o Realty Capital Securities, LLC 3 Copley Place, Suite 3300, Boston, MA 02116 FOR COMPANY USE ONLY: Amount Date Check/Wire# Account # Registered Representative # Firm # Custodian ID# Transfer Agent Reviewer EFFECTIVE APRIL 10, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

Appendix C-2

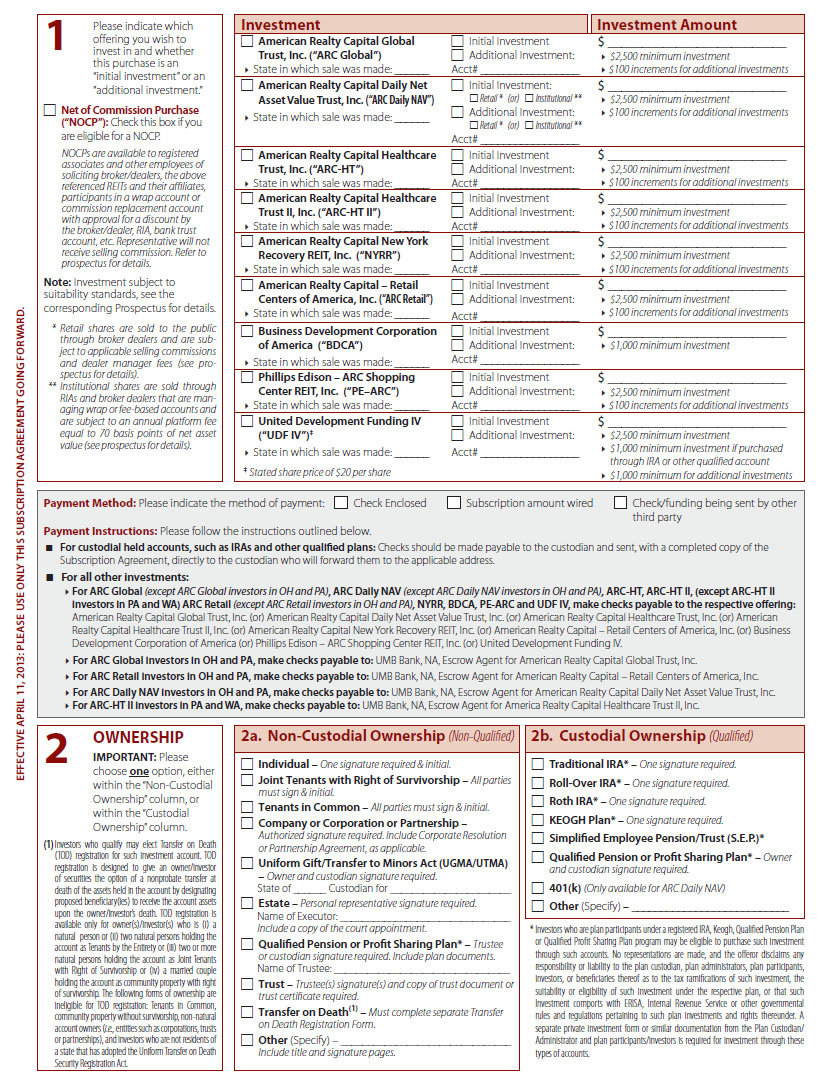

EFFECTIVE APRIL 11, 2013 PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD. Multi-Offering SUBSCRIPTION AGREEMENT AN INVESTMENT IN THE OFFERINGS DESCRIBED HEREIN CANNOT BE COMPLETED UNTIL AT LEAST FIVE (5) BUSINESS DAYS AFTER THE DATE THE INVESTOR RECEIVED THE FINAL PROSPECTUS FOR EACH OFFERING. SUBSCRIPTIONS WILL BE EFFECTIVE ONLY UPON OUR ACCEPTANCE, AND WE RESERVE THE RIGHT TO REJECT ANY SUBSCRIPTION IN WHOLE OR IN PART. IF REJECTED, ALL FUNDS SHALL BE RETURNED TO SUBSCRIBERS WITHOUT INTEREST AND WITHOUT DEDUCTION FOR ANY EXPENSES WITHIN TEN BUSINESS DAYS FROM THE DATE THE SUBSCRIPTION IS REJECTED. INVESTORS WILL RECEIVE A CONFIRMATION OF THEIR PURCHASE. INVESTORS IN ALABAMA, ARKANSAS, MARYLAND, MASSACHUSETTS OR TENNESSEE (OR ARC-HT INVESTORS IN SOUTH CAROLINA) MAY NOT USE THIS MULTI-OFFERING SUBSCRIPTION AGREEMENT TO SUBSCRIBE FOR SHARES OF ANY OFFERING DESCRIBED HEREIN BUT INSTEAD SHOULD REFER TO THE SUBSCRIPTION AGREEMENT FOR EACH OFFERING. IN ORDER TO EXECUTE THIS SUBSCRIPTION AGREEMENT, YOU AND THE CO-OWNER (AS APPLICABLE) MUST COMPLETE SECTION 6A OF THIS AGREEMENT. IF YOU HAVE ANY QUESTIONS, PLEASE CALL YOUR REGISTERED REPRESENTATIVE OR REALTY CAPITAL SECURITIES, LLC (MEMBER FINRA/SIPC) AT 1-877-373-2522. ARC Daily NAV ARC-HT ARC-HT II NYRR ARC Retail PE-ARC UDF IV BDCA ARC Global SUBSCRIPTION AGREEMENT 9

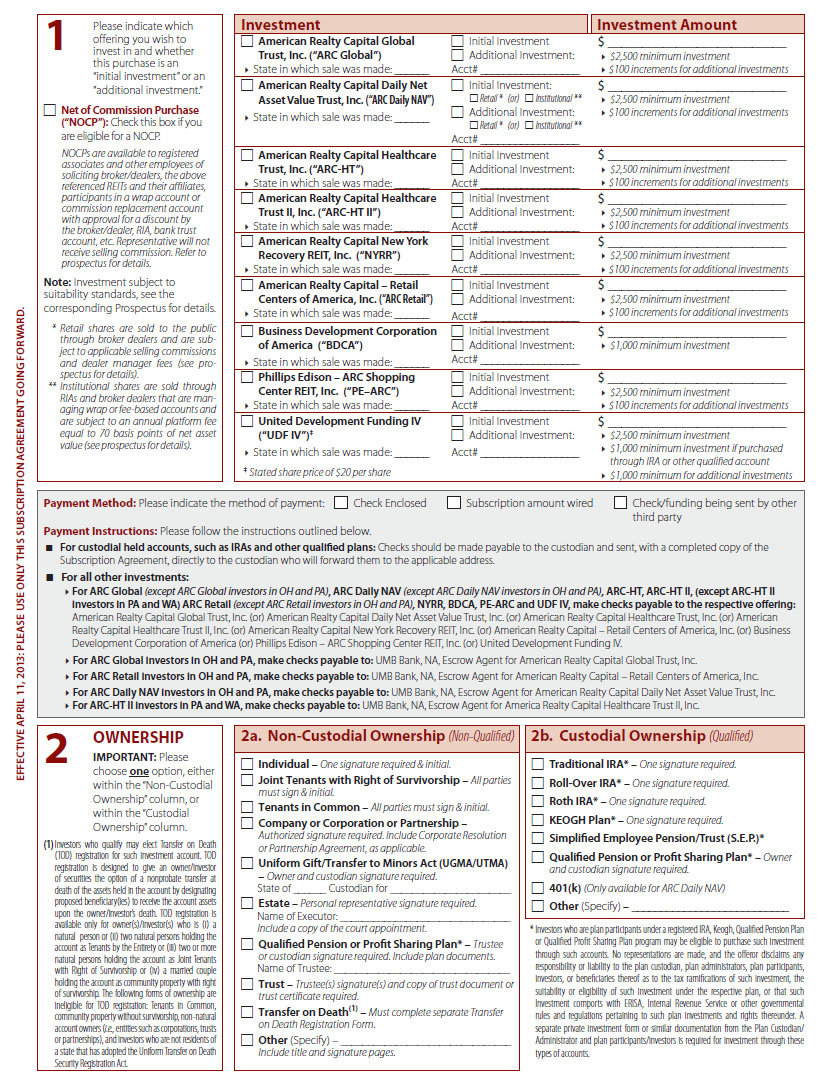

1 Please indicate which offering you wish to invest in and whether this purchase is an “initial investment” or an ”additional investment.” Net of Commission Purchase (“NOCP”): Check this box if you are eligible for a NOCP. NOCPs are available to registered associates and other employees of soliciting broker/dealers, the above referenced REITs and their affiliates, participants in a wrap account or commission replacement account with approval for a discount by the broker/dealer, RIA, bank trust account, etc. Representative will not receive selling commission. Refer to prospectus for details. Note: Investment subject to suitability standards, see the corresponding Prospectus for details. * Retail shares are sold to the public through broker dealers and are subject to applicable selling commissions and dealer manager fees (see prospectus for details). * ** Institutional shares are sold through RIAs and broker dealers that are managing wrap or fee-based accounts and are subject to an annual platform fee equal to 70 basis points of net asset value (see prospectus for details). Investment Investment Amount American Realty Capital Global Trust, Inc. (“ARC Global”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments American Realty Capital Daily Net Asset Value Trust, Inc. (“ARC Daily NAV”) State in which sale was made: ______ Initial Investment: Retail * (or) Institutional ** Additional Investment: Retail * (or) Institutional ** Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments American Realty Capital Healthcare Trust, Inc. (“ARC-HT”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments American Realty Capital Healthcare Trust II, Inc. (“ARC-HT II”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments American Realty Capital New York Recovery REIT, Inc. (“NYRR”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments American Realty Capital – Retail Centers of America, Inc. (“ARC Retail”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments Business Development Corporation of America (“BDCA”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $1,000 minimum investment Phillips Edison – ARC Shopping Center REIT, Inc. (“PE–ARC”) State in which sale was made: ______ Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $100 increments for additional investments United Development Funding IV (“UDF IV”)‡ State in which sale was made: ______ ‡ Stated share price of $20 per share Initial Investment Additional Investment: Acct# _________________ $ __________________________ $2,500 minimum investment $1,000 minimum investment if purchased through IRA or other qualified account $1,000 minimum for additional investments Payment Method: Please indicate the method of payment: Check Enclosed Subscription amount wired Check/funding being sent by other third party Payment Instructions: Please follow the instructions outlined below. For custodial held accounts, such as IRAs and other qualified plans: Checks should be made payable to the custodian and sent, with a completed copy of the Subscription Agreement, directly to the custodian who will forward them to the applicable address. For all other investments: For ARC Global (except ARC Global investors in OH and PA), ARC Daily NAV (except ARC Daily NAV investors in OH and PA), ARC-HT, ARC-HT II, (except ARC-HT II investors in PA and WA) ARC Retail (except ARC Retail investors in OH and PA), NYRR, BDCA, PE-ARC and UDF IV, make checks payable to the respective offering: American Realty Capital Global Trust, Inc. (or) American Realty Capital Daily Net Asset Value Trust, Inc. (or) American Realty Capital Healthcare Trust, Inc. (or) American Realty Capital Healthcare Trust II, Inc. (or) American Realty Capital New York Recovery REIT, Inc. (or) American Realty Capital – Retail Centers of America, Inc. (or) Business Development Corporation of America (or) Phillips Edison – ARC Shopping Center REIT, Inc. (or) United Development Funding IV. For ARC Global investors in OH and PA, make checks payable to: UMB Bank, NA, Escrow Agent for American Realty Capital Global Trust, Inc. For ARC Retail investors in OH and PA, make checks payable to: UMB Bank, NA, Escrow Agent for American Realty Capital – Retail Centers of America, Inc. For ARC Daily NAV investors in OH and PA, make checks payable to: UMB Bank, NA, Escrow Agent for American Realty Capital Daily Net Asset Value Trust, Inc. For ARC-HT II investors in PA and WA, make checks payable to: UMB Bank, NA, Escrow Agent for America Realty Capital Healthcare Trust II, Inc. 2 OWNERSHIP IMPORTANT: Please choose one option, either within the “Non-Custodial Ownership” column, or within the “Custodial Ownership” column. (1) Investors who qualify may elect Transfer on Death (TOD) registration for such investment account. TOD registration is designed to give an owner/investor of securities the option of a nonprobate transfer at death of the assets held in the account by designating proposed beneficiary(ies) to receive the account assets upon the owner/investor’s death. TOD registration is available only for owner(s)/investor(s) who is (i) a natural person or (ii) two natural persons holding the account as Tenants by the Entirety or (iii) two or more natural persons holding the account as Joint Tenants with Right of Survivorship or (iv) a married couple holding the account as community property with right of survivorship. The following forms of ownership are ineligible for TOD registration: Tenants in Common, community property without survivorship, non-natural account owners (i.e., entities such as corporations, trusts or partnerships), and investors who are not residents of a state that has adopted the Uniform Transfer on Death Security Registration Act. 2a. Non-Custodial Ownership (Non-Qualified) 2b. Custodial Ownership (Qualified) Individual – One signature required & initial. Joint Tenants with Right of Survivorship – All parties must sign & initial. Tenants in Common – All parties must sign & initial. Company or Corporation or Partnership – Authorized signature required. Include Corporate Resolution or Partnership Agreement, as applicable. Uniform Gift/Transfer to Minors Act (UGMA/UTMA) – Owner and custodian signature required. State of ______ Custodian for ______________________ Estate – Personal representative signature required. Name of Executor: _______________________________ Include a copy of the court appointment. Qualified Pension or Profit Sharing Plan* – Trustee or custodian signature required. Include plan documents. Name of Trustee: ________________________________ Trust – Trustee(s) signature(s) and copy of trust document or trust certificate required. Transfer on Death(1) – Must complete separate Transfer on Death Registration Form. Other (Specify) – _______________________________ Include title and signature pages. Traditional IRA* – One signature required. Roll-Over IRA* – One signature required. Roth IRA* – One signature required. KEOGH Plan* – One signature required. Simplified Employee Pension/Trust (S.E.P.)* Qualified Pension or Profit Sharing Plan* – Owner and custodian signature required. 401(k) (Only available for ARC Daily NAV) Other (Specify) – ___________________________ ** Investors who are plan participants under a registered IRA, Keogh, Qualified Pension Plan or Qualified Profit Sharing Plan program may be eligible to purchase such investment through such accounts. No representations are made, and the offeror disclaims any responsibility or liability to the plan custodian, plan administrators, plan participants, investors, or beneficiaries thereof as to the tax ramifications of such investment, the suitability or eligibility of such investment under the respective plan, or that such Investment comports with ERISA, Internal Revenue Service or other governmental rules and regulations pertaining to such plan investments and rights thereunder. A separate private investment form or similar documentation from the Plan Custodian/ Administrator and plan participants/investors is required for investment through these types of accounts. EFFECTIVE APRIL 11, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

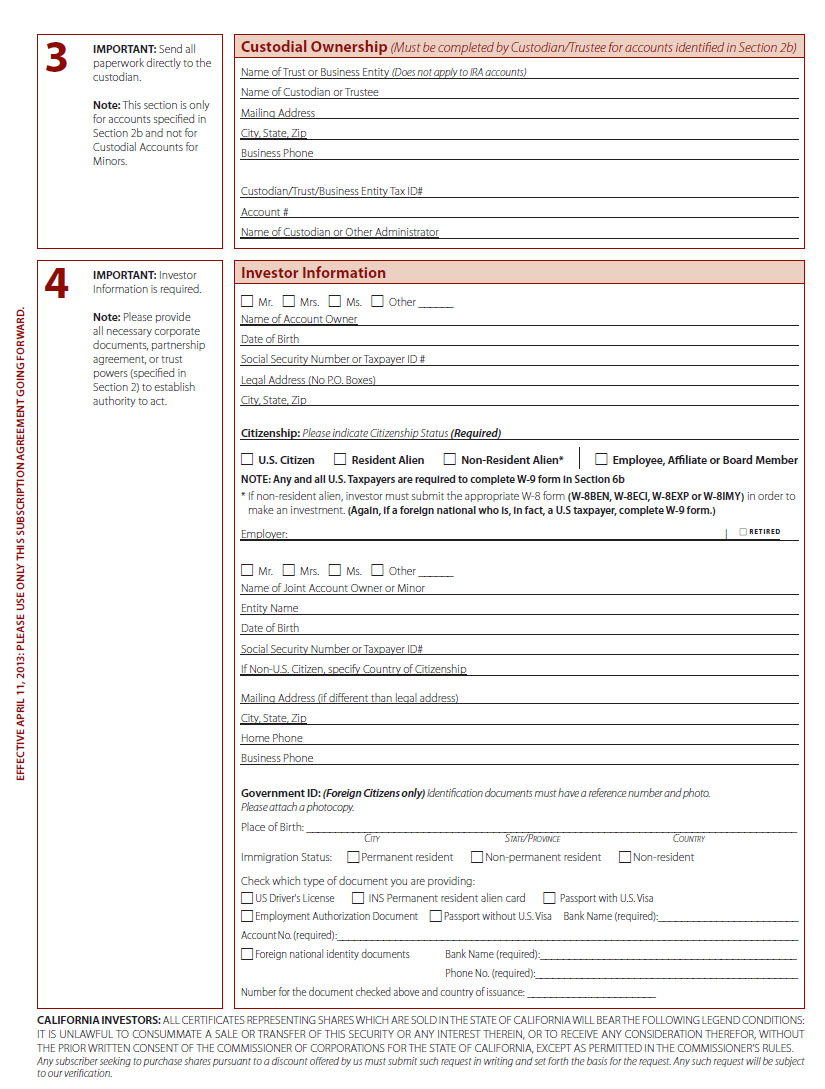

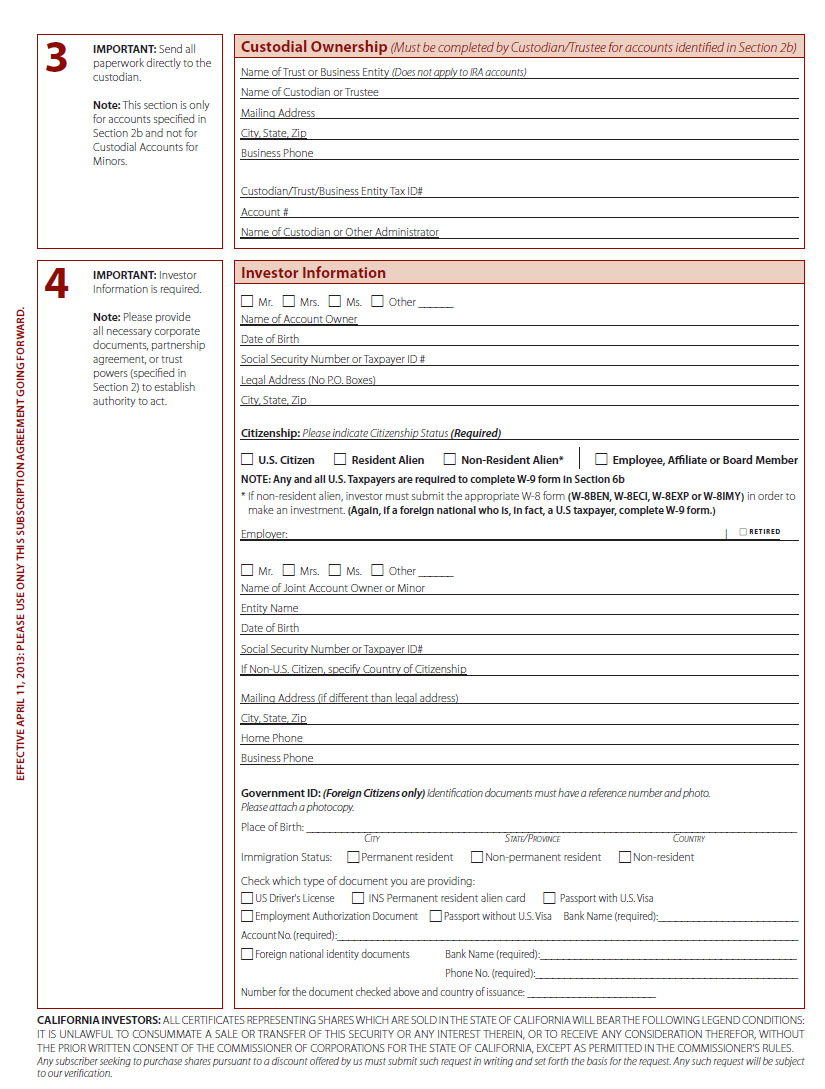

3 IMPORTANT: Send all paperwork directly to the custodian. Note: This section is only for accounts specified in Section 2b and not for Custodial Accounts for Minors. Custodial Ownership (Must be completed by Custodian/Trustee for accounts identified in Section 2b) Name of Trust or Business Entity (Does not apply to IRA accounts) Name of Custodian or Trustee Mailing Address City, State, Zip Business Phone Custodian/Trust/Business Entity Tax ID# Account # Name of Custodian or Other Administrator 4 IMPORTANT: Investor Information is required. Note: Please provide all necessary corporate documents, partnership agreement, or trust powers (specified in Section 2) to establish authority to act. Investor Information Mr. Mrs. Ms. Other ______ Name of Account Owner Date of Birth Social Security Number or Taxpayer ID # Legal Address (No P.O. Boxes) City, State, Zip Citizenship: Please indicate Citizenship Status (Required) U.S. Citizen Resident Alien Non-Resident Alien* Employee, Affiliate or Board Member NOTE: Any and all U.S. Taxpayers are required to complete W-9 form in Section 6b * If non-resident alien, investor must submit the appropriate W-8 form (W-8BEN, W-8ECI, W-8EXP or W-8IMY) in order to make an investment. (Again, if a foreign national who is, in fact, a U.S taxpayer, complete W-9 form.) Employer: | RETIRED Mr. Mrs. Ms. Other ______ Name of Joint Account Owner or Minor Entity Name Date of Birth Social Security Number or Taxpayer ID# If Non-U.S. Citizen, specify Country of Citizenship Mailing Address (if different than legal address) City, State, Zip Home Phone Business Phone Government ID: (Foreign Citizens only) Identification documents must have a reference number and photo. Please attach a photocopy. Place of Birth: ____________________________________________________________________________________ City State/Province Country Immigration Status: Permanent resident Non-permanent resident Non-resident Check which type of document you are providing: US Driver's License INS Permanent resident alien card Passport with U.S. Visa Employment Authorization Document Passport without U.S. Visa Bank Name (required):________________________ Account No. (required):_______________________________________________________________________________ Foreign national identity documents Bank Name (required):____________________________________________ Phone No. (required):_____________________________________________ Number for the document checked above and country of issuance: ______________________ CALIFORNIA INVESTORS: ALL CERTIFICATES REPRESENTING SHARES WHICH ARE SOLD IN THE STATE OF CALIFORNIA WILL BEAR THE FOLLOWING LEGEND CONDITIONS: IT IS UNLAWFUL TO CONSUMMATE A SALE OR TRANSFER OF THIS SECURITY OR ANY INTEREST THEREIN, OR TO RECEIVE ANY CONSIDERATION THEREFOR, WITHOUT THE PRIOR WRITTEN CONSENT OF THE COMMISSIONER OF CORPORATIONS FOR THE STATE OF CALIFORNIA, EXCEPT AS PERMITTED IN THE COMMISSIONER’S RULES. Any subscriber seeking to purchase shares pursuant to a discount offered by us must submit such request in writing and set forth the basis for the request. Any such request will be subject to our verification. EFFECTIVE APRIL 11, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

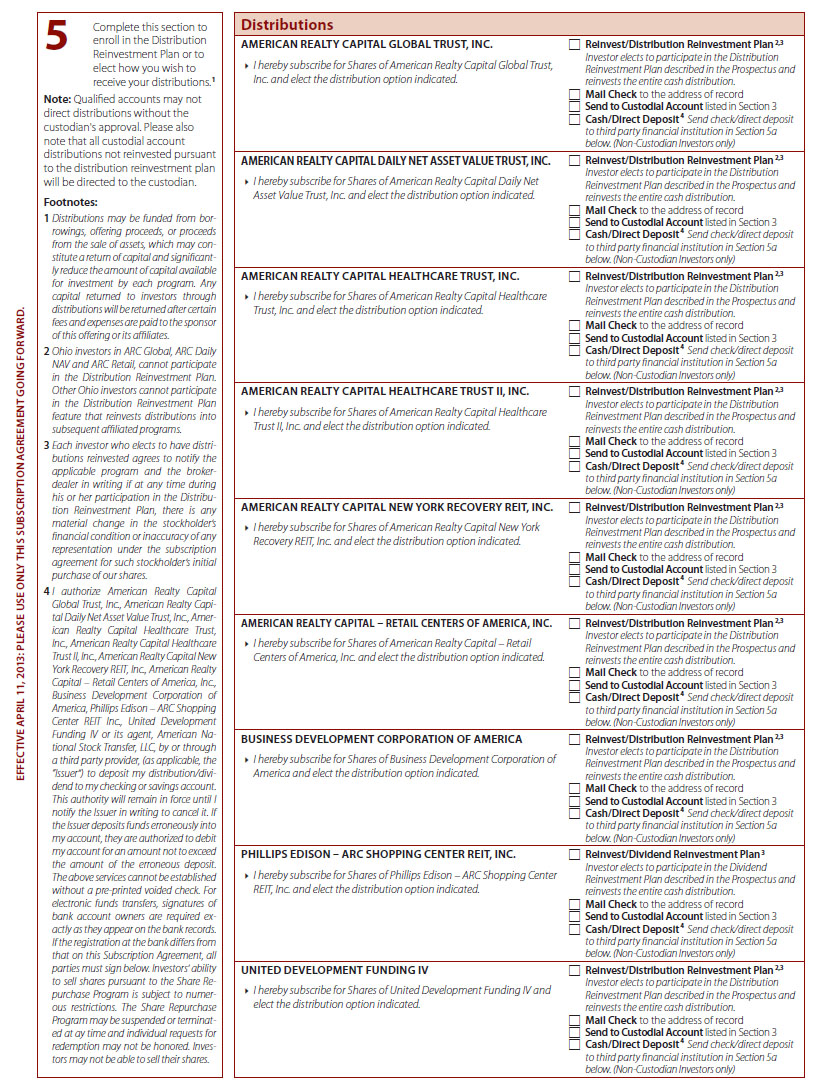

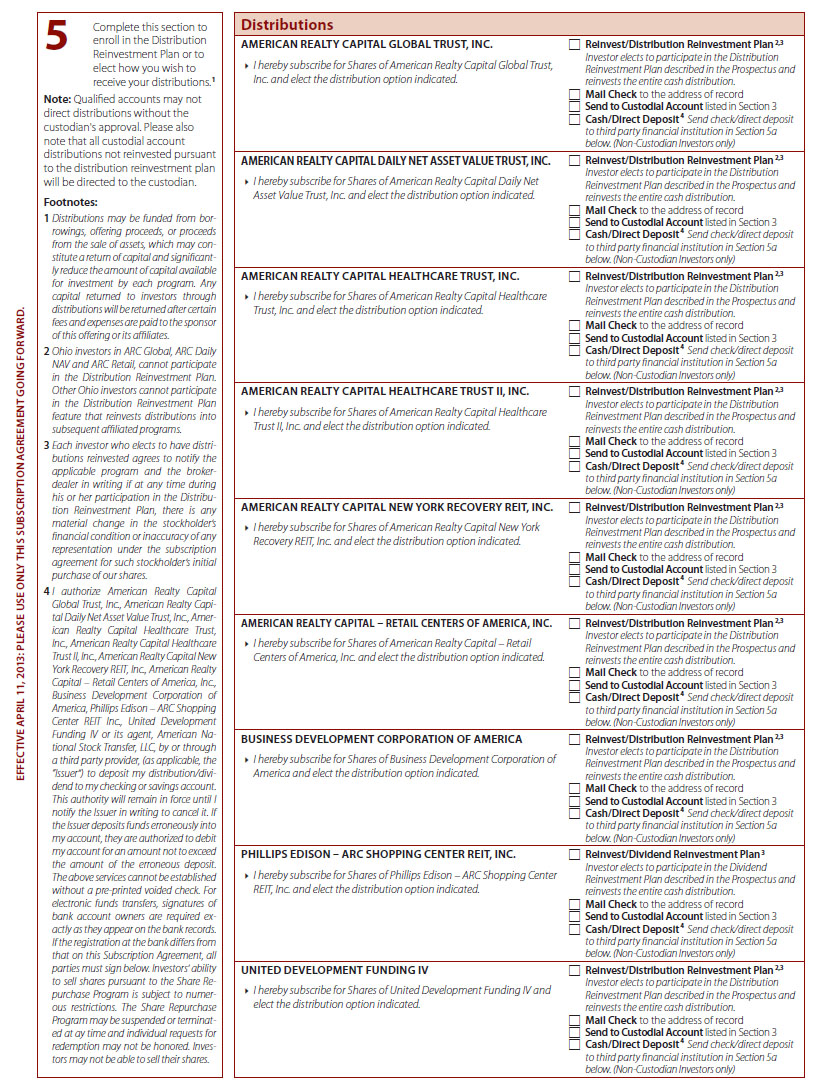

5 Complete this section to enroll in the Distribution Reinvestment Plan or to elect how you wish to receive your distributions. 1 Note: Qualified accounts may not direct distributions without the custodian's approval. Please also note that all custodial account distributions not reinvested pursuant to the distribution reinvestment plan will be directed to the custodian. Footnotes: 1 Distributions may be funded from borrowings, offering proceeds, or proceeds from the sale of assets, which may constitute a return of capital and significantly reduce the amount of capital available for investment by each program. Any capital returned to investors through distributions will be returned after certain fees and expenses are paid to the sponsor of this offering or its affiliates. 2 Ohio investors in ARC Global, ARC Daily NAV and ARC Retail, cannot participate in the Distribution Reinvestment Plan. Other Ohio investors cannot participate in the Distribution Reinvestment Plan feature that reinvests distributions into subsequent affiliated programs. 3 Each investor who elects to have distributions reinvested agrees to notify the applicable program and the broker-dealer in writing if at any time during his or her participation in the Distribution Reinvestment Plan, there is any material change in the stockholder’s financial condition or inaccuracy of any representation under the subscription agreement for such stockholder’s initial purchase of our shares. 4 I authorize American Realty Capital Global Trust, Inc., American Realty Capital Daily Net Asset Value Trust, Inc., American Realty Capital Healthcare Trust, Inc., American Realty Capital Healthcare Trust II, Inc., American Realty Capital New York Recovery REIT, Inc., American Realty Capital – Retail Centers of America, Inc., Business Development Corporation of America, Phillips Edison – ARC Shopping Center REIT Inc., United Development Funding IV or its agent, American National Stock Transfer, LLC, by or through a third party provider, (as applicable, the “Issuer”) to deposit my distribution/dividend to my checking or savings account. This authority will remain in force until I notify the Issuer in writing to cancel it. If the Issuer deposits funds erroneously into my account, they are authorized to debit my account for an amount not to exceed the amount of the erroneous deposit. The above services cannot be established without a pre-printed voided check. For electronic funds transfers, signatures of bank account owners are required exactly as they appear on the bank records. If the registration at the bank differs from that on this Subscription Agreement, all parties must sign below. Investors’ ability to sell shares pursuant to the Share Repurchase Program is subject to numerous restrictions. The Share Repurchase Program may be suspended or terminated at ay time and individual requests for redemption may not be honored. Investors may not be able to sell their shares. Distributions AMERICAN REALTY CAPITAL GLOBAL TRUST, INC. I hereby subscribe for Shares of American Realty Capital Global Trust, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) AMERICAN REALTY CAPITAL DAILY NET ASSET VALUE TRUST, INC. I hereby subscribe for Shares of American Realty Capital Daily Net Asset Value Trust, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) AMERICAN REALTY CAPITAL HEALTHCARE TRUST, INC. I hereby subscribe for Shares of American Realty Capital Healthcare Trust, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) AMERICAN REALTY CAPITAL HEALTHCARE TRUST II, INC. I hereby subscribe for Shares of American Realty Capital Healthcare Trust II, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) AMERICAN REALTY CAPITAL NEW YORK RECOVERY REIT, INC. I hereby subscribe for Shares of American Realty Capital New York Recovery REIT, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) AMERICAN REALTY CAPITAL – RETAIL CENTERS OF AMERICA, INC. I hereby subscribe for Shares of American Realty Capital – Retail Centers of America, Inc. and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) BUSINESS DEVELOPMENT CORPORATION OF AMERICA I hereby subscribe for Shares of Business Development Corporation of America and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) PHILLIPS EDISON – ARC SHOPPING CENTER REIT, INC. I hereby subscribe for Shares of Phillips Edison – ARC Shopping Center REIT, Inc. and elect the distribution option indicated. Reinvest/Dividend Reinvestment Plan 3 Investor elects to participate in the Dividend Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) UNITED DEVELOPMENT FUNDING IV I hereby subscribe for Shares of United Development Funding IV and elect the distribution option indicated. Reinvest/Distribution Reinvestment Plan 2,3 Investor elects to participate in the Distribution Reinvestment Plan described in the Prospectus and reinvests the entire cash distribution. Mail Check to the address of record Send to Custodial Account listed in Section 3 Cash/Direct Deposit 4 Send check/direct deposit to third party financial institution in Section 5a below. (Non-Custodian Investors only) EFFECTIVE APRIL 11, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.

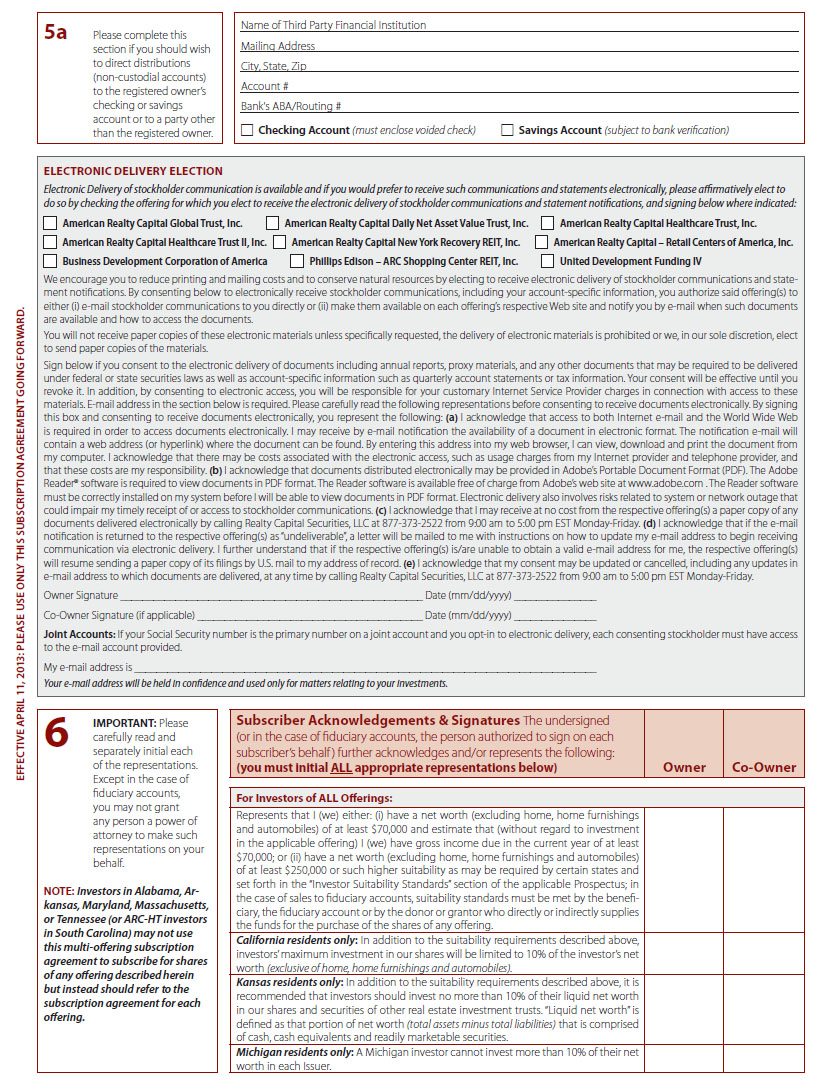

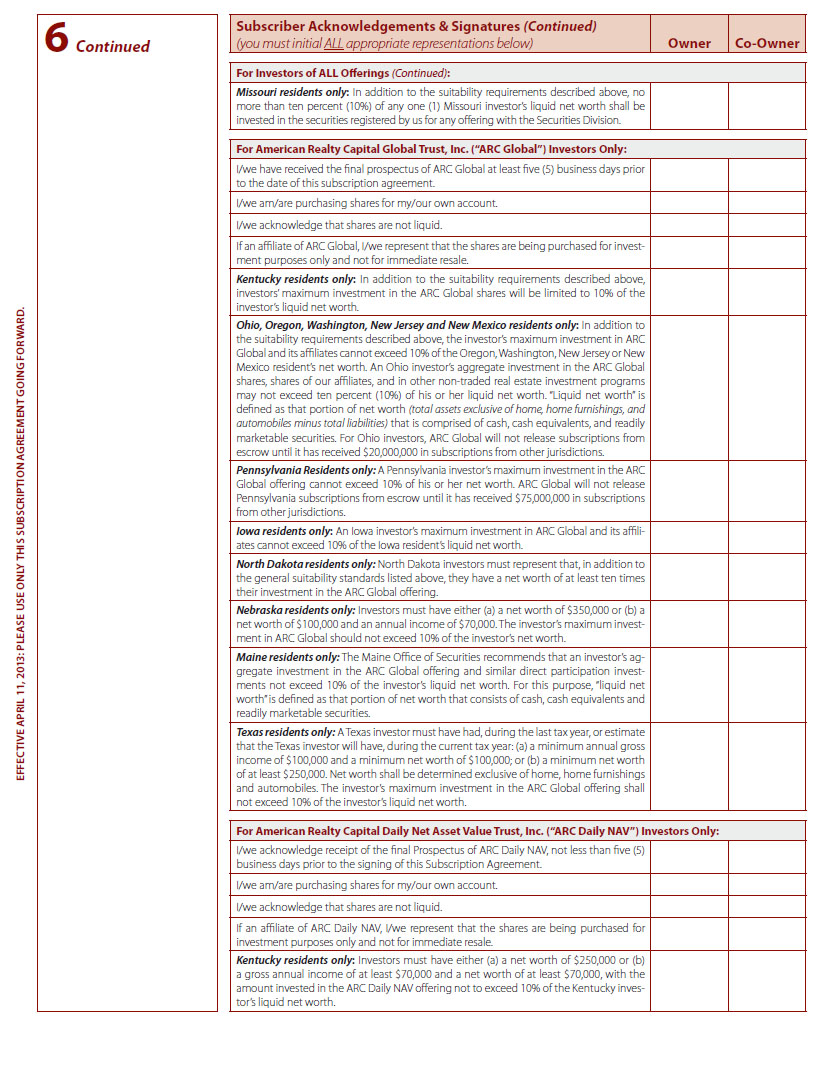

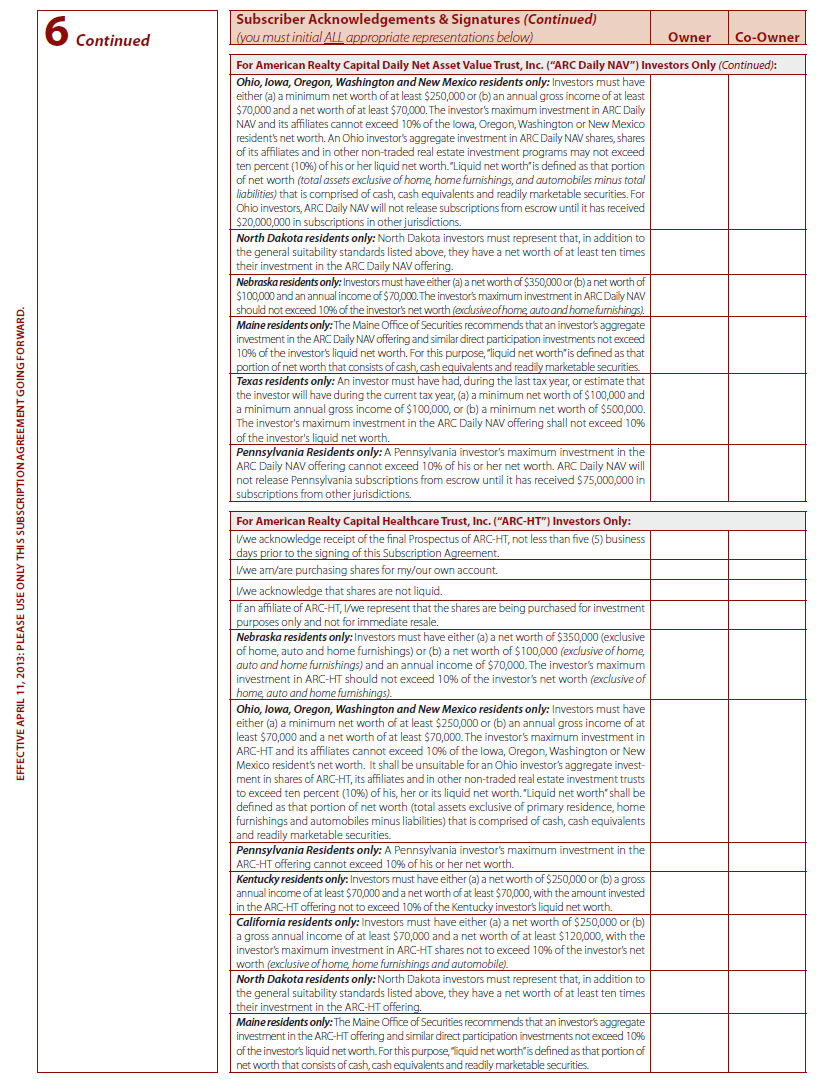

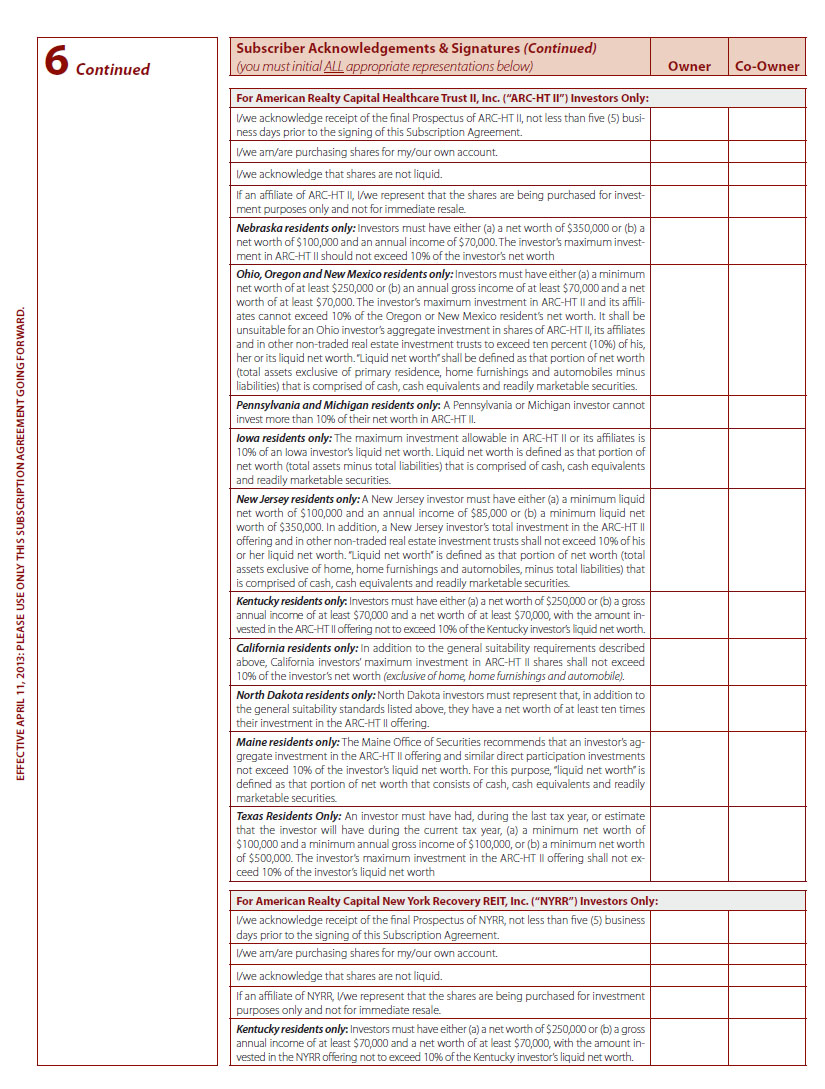

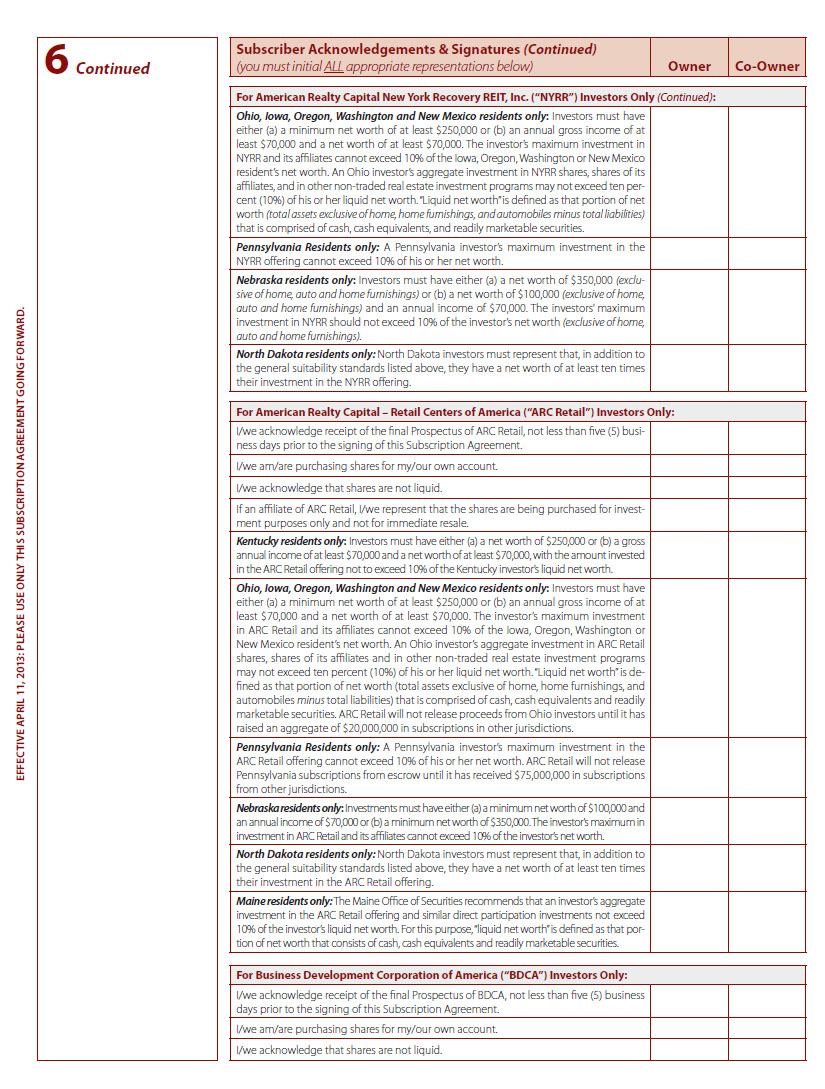

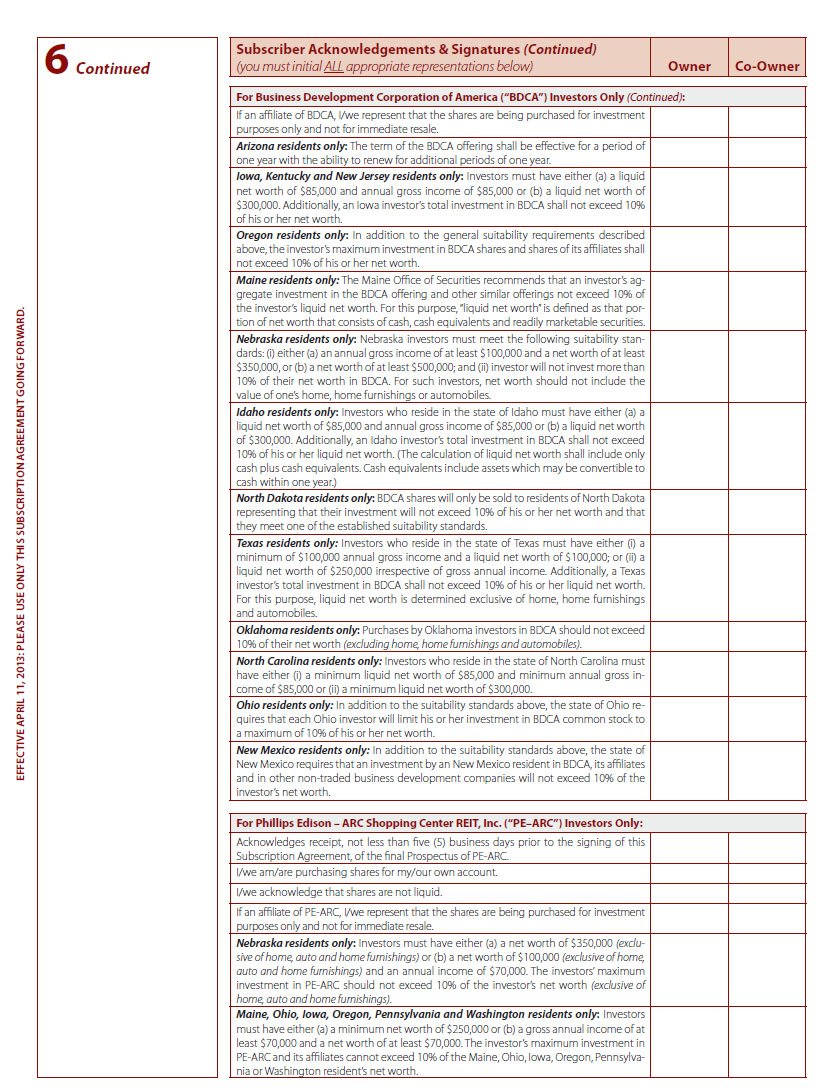

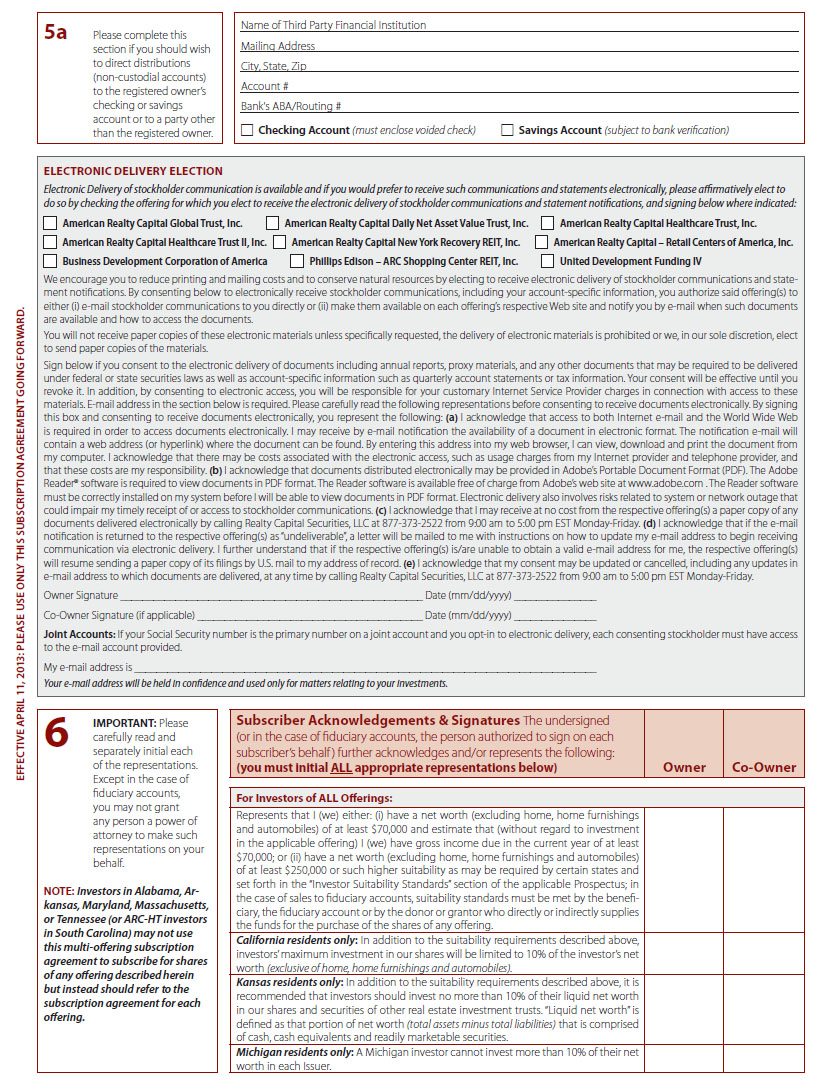

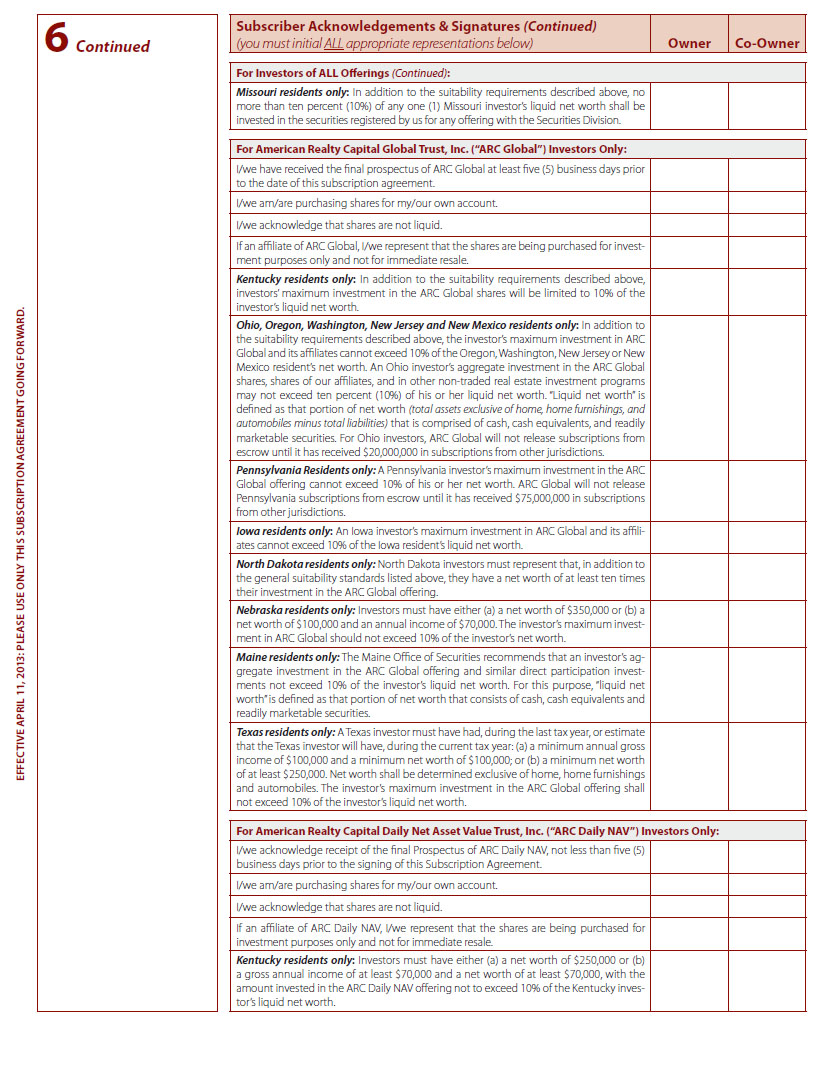

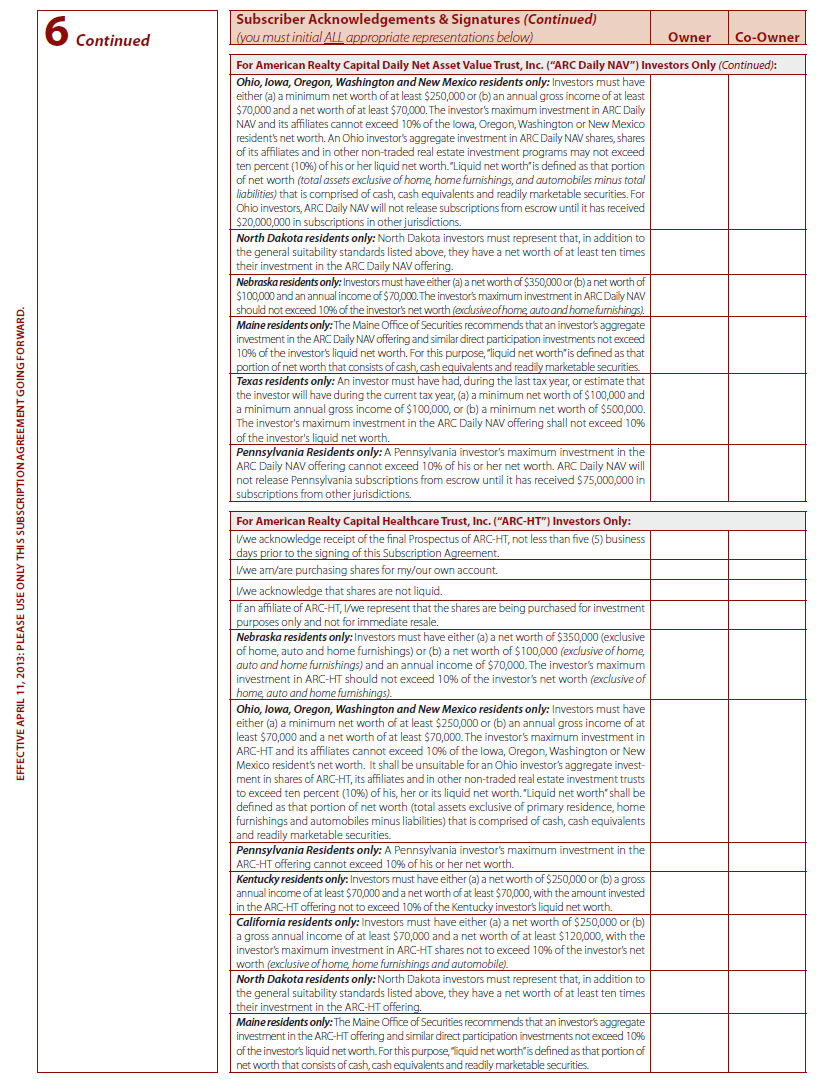

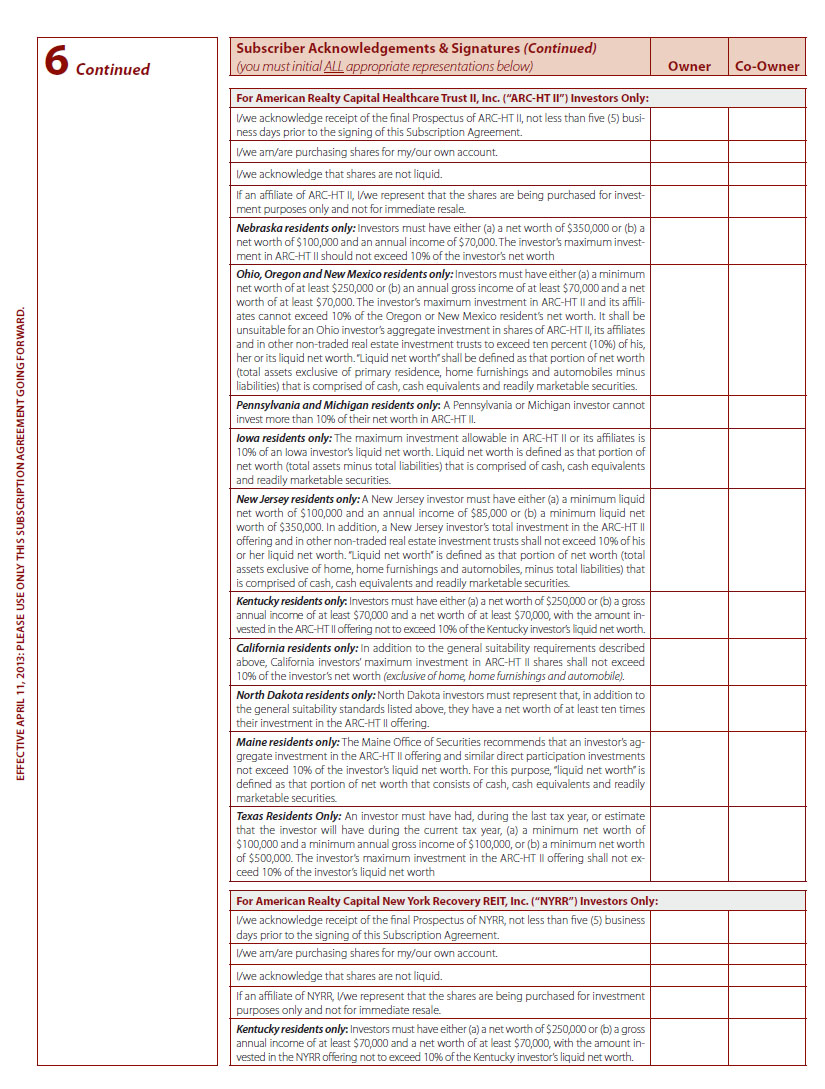

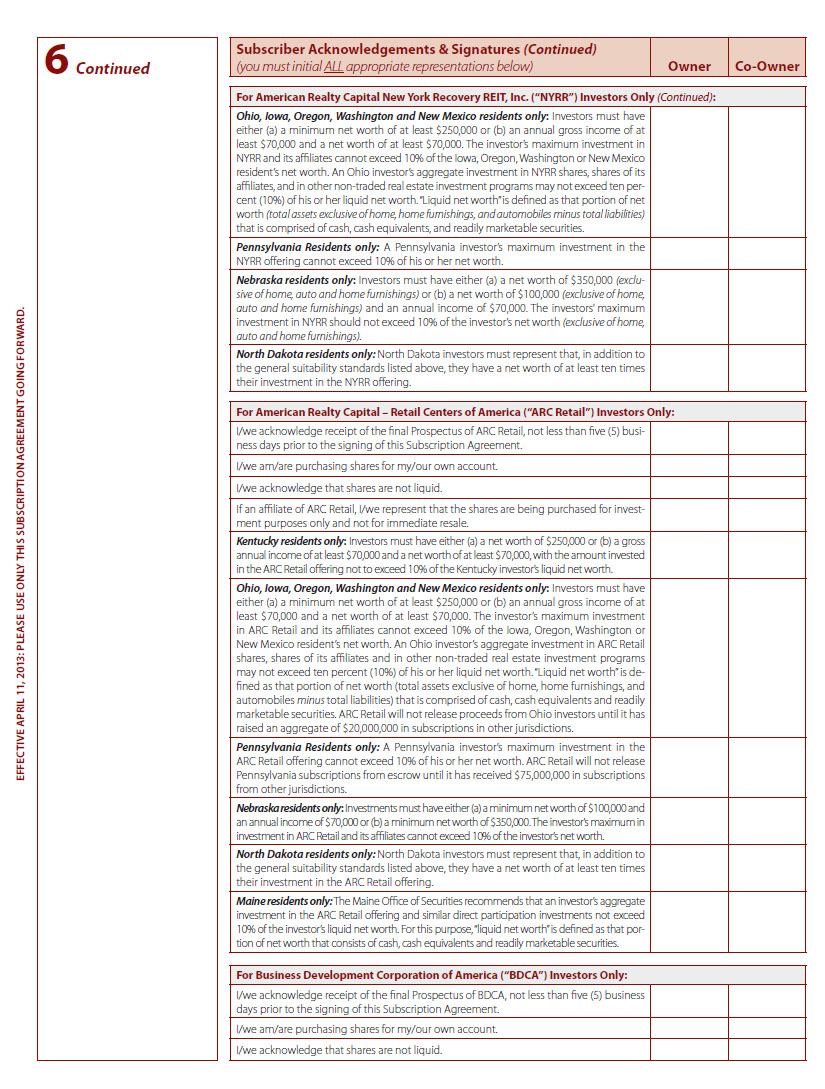

5a Please complete this section if you should wish to direct distributions (non-custodial accounts) to the registered owner’s checking or savings account or to a party other than the registered owner. Name of Third Party Financial Institution Mailing Address City, State, Zip Account # Bank's ABA/Routing # Checking Account (must enclose voided check) Savings Account (subject to bank verification) ELECTRONIC DELIVERY ELECTION Electronic Delivery of stockholder communication is available and if you would prefer to receive such communications and statements electronically, please affirmatively elect to do so by checking the offering for which you elect to receive the electronic delivery of stockholder communications and statement notifications, and signing below where indicated: American Realty Capital Global Trust, Inc. American Realty Capital Daily Net Asset Value Trust, Inc. American Realty Capital Healthcare Trust, Inc. American Realty Capital Healthcare Trust II, Inc. American Realty Capital New York Recovery REIT, Inc. American Realty Capital – Retail Centers of America, Inc. Business Development Corporation of America Phillips Edison – ARC Shopping Center REIT, Inc. United Development Funding IV We encourage you to reduce printing and mailing costs and to conserve natural resources by electing to receive electronic delivery of stockholder communications and statement notifications. By consenting below to electronically receive stockholder communications, including your account-specific information, you authorize said offering(s) to either (i) e-mail stockholder communications to you directly or (ii) make them available on each offering’s respective Web site and notify you by e-mail when such documents are available and how to access the documents. You will not receive paper copies of these electronic materials unless specifically requested, the delivery of electronic materials is prohibited or we, in our sole discretion, elect to send paper copies of the materials. Sign below if you consent to the electronic delivery of documents including annual reports, proxy materials, and any other documents that may be required to be delivered under federal or state securities laws as well as account-specific information such as quarterly account statements or tax information. Your consent will be effective until you revoke it. In addition, by consenting to electronic access, you will be responsible for your customary Internet Service Provider charges in connection with access to these materials. E-mail address in the section below is required. Please carefully read the following representations before consenting to receive documents electronically. By signing this box and consenting to receive documents electronically, you represent the following: (a) I acknowledge that access to both Internet e-mail and the World Wide Web is required in order to access documents electronically. I may receive by e-mail notification the availability of a document in electronic format. The notification e-mail will contain a web address (or hyperlink) where the document can be found. By entering this address into my web browser, I can view, download and print the document from my computer. I acknowledge that there may be costs associated with the electronic access, such as usage charges from my Internet provider and telephone provider, and that these costs are my responsibility. (b) I acknowledge that documents distributed electronically may be provided in Adobe’s Portable Document Format (PDF). The Adobe Reader® software is required to view documents in PDF format. The Reader software is available free of charge from Adobe’s web site at www.adobe.com . The Reader software must be correctly installed on my system before I will be able to view documents in PDF format. Electronic delivery also involves risks related to system or network outage that could impair my timely receipt of or access to stockholder communications. (c) I acknowledge that I may receive at no cost from the respective offering(s) a paper copy of any documents delivered electronically by calling Realty Capital Securities, LLC at 877-373-2522 from 9:00 am to 5:00 pm EST Monday-Friday. (d) I acknowledge that if the e-mail notification is returned to the respective offering(s) as “undeliverable”, a letter will be mailed to me with instructions on how to update my e-mail address to begin receiving communication via electronic delivery. I further understand that if the respective offering(s) is/are unable to obtain a valid e-mail address for me, the respective offering(s) will resume sending a paper copy of its filings by U.S. mail to my address of record. (e) I acknowledge that my consent may be updated or cancelled, including any updates in e-mail address to which documents are delivered, at any time by calling Realty Capital Securities, LLC at 877-373-2522 from 9:00 am to 5:00 pm EST Monday-Friday. Owner Signature _______________________________________________________ Date (mm/dd/yyyy) _______________ Co-Owner Signature (if applicable) _________________________________________ Date (mm/dd/yyyy) _______________ Joint Accounts: If your Social Security number is the primary number on a joint account and you opt-in to electronic delivery, each consenting stockholder must have access to the e-mail account provided. My e-mail address is ____________________________________________________________________________________ Your e-mail address will be held in confidence and used only for matters relating to your investments. 6 IMPORTANT: Please carefully read and separately initial each of the representations. Except in the case of fiduciary accounts, you may not grant any person a power of attorney to make such representations on your behalf. NOTE: Investors in Alabama, Arkansas, Maryland, Massachusetts, or Tennessee (or ARC-HT investors in South Carolina) may not use this multi-offering subscription agreement to subscribe for shares of any offering described herein but instead should refer to the subscription agreement for each offering. Subscriber Acknowledgements & Signatures The undersigned (or in the case of fiduciary accounts, the person authorized to sign on each subscriber’s behalf ) further acknowledges and/or represents the following: (you must initial ALL appropriate representations below) Owner Co-Owner For Investors of ALL Offerings: Represents that I (we) either: (i) have a net worth (excluding home, home furnishings and automobiles) of at least $70,000 and estimate that (without regard to investment in the applicable offering) I (we) have gross income due in the current year of at least $70,000; or (ii) have a net worth (excluding home, home furnishings and automobiles) of at least $250,000 or such higher suitability as may be required by certain states and set forth in the “Investor Suitability Standards” section of the applicable Prospectus; in the case of sales to fiduciary accounts, suitability standards must be met by the beneficiary, the fiduciary account or by the donor or grantor who directly or indirectly supplies the funds for the purchase of the shares of any offering. California residents only: In addition to the suitability requirements described above, investors’ maximum investment in our shares will be limited to 10% of the investor’s net worth (exclusive of home, home furnishings and automobiles). Kansas residents only: In addition to the suitability requirements described above, it is recommended that investors should invest no more than 10% of their liquid net worth in our shares and securities of other real estate investment trusts. “Liquid net worth” is defined as that portion of net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Michigan residents only: A Michigan investor cannot invest more than 10% of their net worth in each Issuer. EFFECTIVE APRIL 11, 2013: PLEASE USE ONLY THIS SUBSCRIPTION AGREEMENT GOING FORWARD.