Exhibit 99.1

1 st Quarter 2017 Webinar Series

First Quarter 2017 Investor Presentation Platform Advisor To Investment Programs

Important Information 3 Risk Factors For a discussion of the risks which should be considered in connection with our company, see the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K filed with the SEC on March 21 , 2017 . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward - looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and our Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a more complete list of risk factors and discussion of forward - looking statements .

Healthcare Trust, Inc. 4 Healthcare Trust, Inc. (including, as required by context, Healthcare Trust Operating Partnership, L.P. and its subsidiaries, the “Company” or “HTI”) invests in healthcare real estate, focusing on seniors housing and medical office buildings (“MOB”), in the United States for investment purposes.

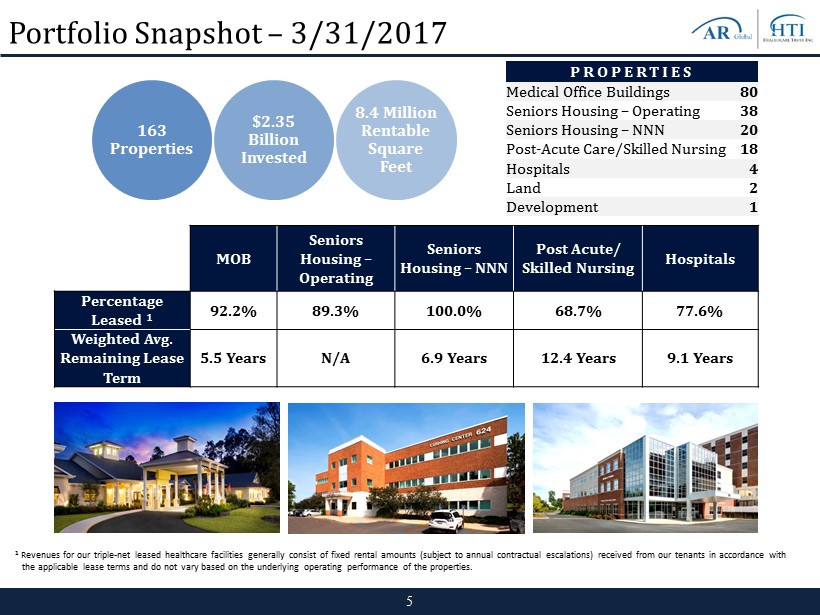

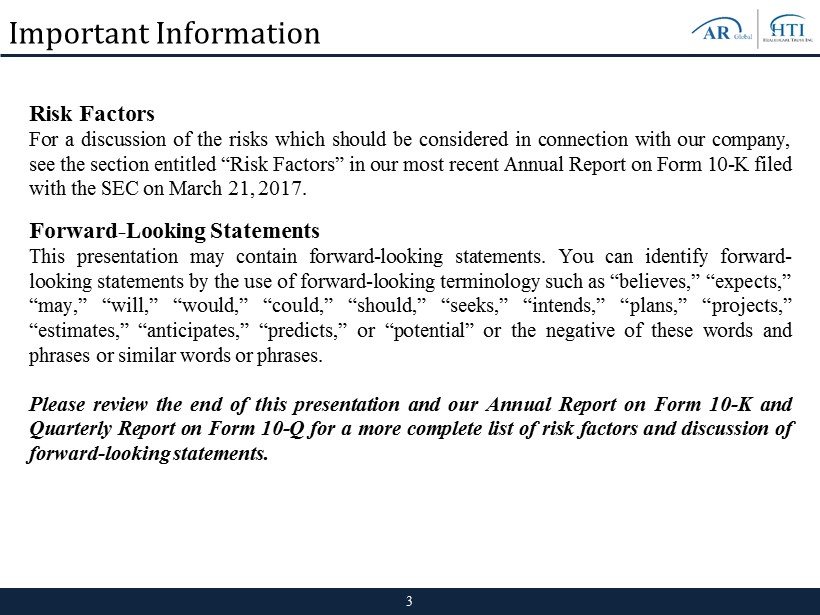

Portfolio Snapshot – 3/31/2017 5 PROPERTIES Medical Office Buildings 80 Seniors Housing – Operating 38 Seniors Housing – NNN 20 Post - Acute Care/Skilled Nursing 18 Hospitals 4 Land 2 Development 1 MOB Senior s Housing – Operating Senior s Housing – NNN Post Acute/ Skilled Nursing Hospitals Percentage Leased 1 92.2% 89.3% 100.0% 68.7% 77.6% Weighted Avg. Remaining Lease Term 5.5 Years N/A 6.9 Years 12.4 Years 9.1 Years 163 Properties $2.35 Billion Invested 8.4 Million Rentable Square Feet 1 Revenues for our triple - net leased healthcare facilities generally consist of fixed rental amounts (subject to annual contractua l escalations) received from our tenants in accordance with the applicable lease terms and do not vary based on the underlying operating performance of the properties.

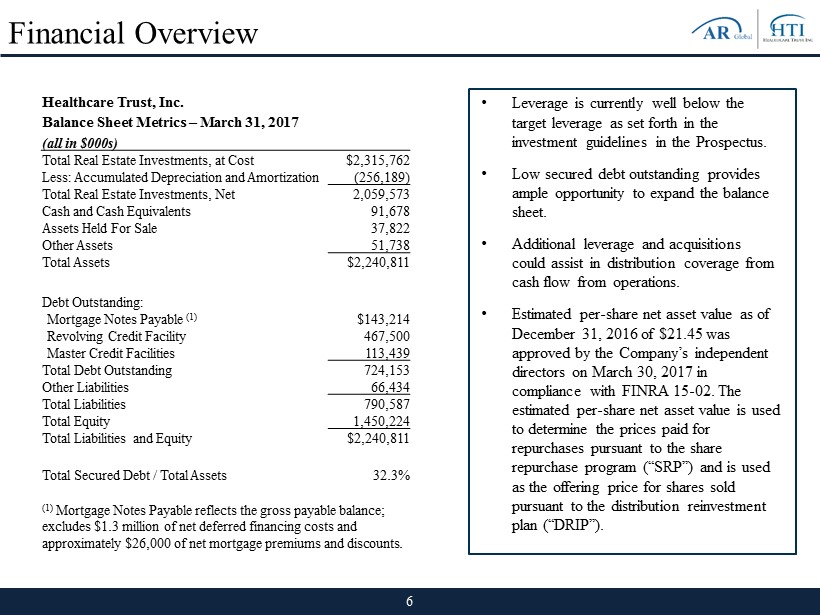

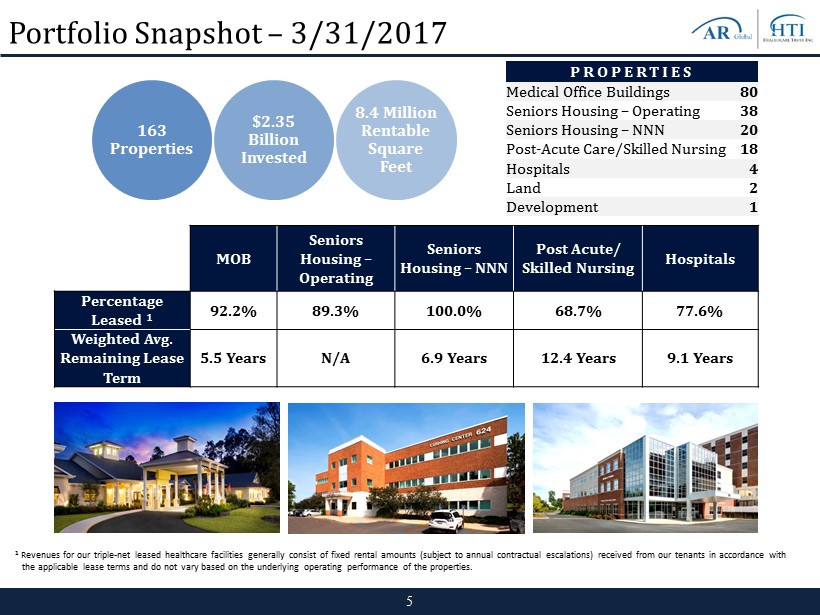

Financial Overview • Leverage is currently well below the target leverage as set forth in the investment guidelines in the Prospectus. • Low secured debt outstanding provides ample opportunity to expand the balance sheet. • Additional leverage and acquisitions could assist in distribution coverage from cash flow from operations. • Estimated per - share net asset value as of December 31, 2016 of $21.45 was approved by the Company’s independent directors on March 30, 2017 in compliance with FINRA 15 - 02. The estimated per - share net asset value is used to determine the prices paid for repurchases pursuant to the share repurchase program (“SRP”) and is used as the offering price for shares sold pursuant to the distribution reinvestment plan (“DRIP”). 6 Healthcare Trust, Inc. Balance Sheet Metrics – March 31, 2017 (all in $000s) Total Real Estate Investments, at Cost $2,315,762 Less: Accumulated Depreciation and Amortization (256,189) Total Real Estate Investments, Net 2,059,573 Cash and Cash Equivalents 91,678 Assets Held For Sale 37,822 Other Assets 51,738 Total Assets $2,240,811 Debt Outstanding: Mortgage Notes Payable (1) $143,214 Revolving Credit Facility 467,500 Master Credit Facilities 113,439 Total Debt Outstanding 724,153 Other Liabilities 66,434 Total Liabilities 790,587 Total Equity 1,450,224 Total Liabilities and Equity $2,240,811 Total Secured Debt / Total Assets 32.3% (1) Mortgage Notes Payable reflects the gross payable balance; excludes $1.3 million of net deferred financing costs and approximately $26,000 of net mortgage premiums and discounts.

Corporate Initiatives 7 • Deploy additional capital : HTI will continue to focus on the most attractive sectors in healthcare, particularly medical office and seniors housing, and is actively pursuing acquisitions . • Access additional debt sources : Total secured debt to total assets remains low at 32 . 3 % as of March 31 , 2017 . • During 1 Q 17 , HTI completed a $ 53 . 4 million expansion of the Fannie Mae credit facility . Additional leverage is expected to improve cash flow and distribution coverage . • Master Credit Facilities : $ 113 . 4 million of aggregate borrowings outstanding as of March 31 , 2017 on two separate master credit facility agreements . The Company may re quest additional advances under the master credit facilities by either borrowing - up on the existing properties or by adding additional properties to the collateral pool . • Actively manage assets to optimize profitability : Management continues to actively manage the portfolio, which includes : incremental leasing ; where possible, replacing under performing managers ; and replacing tenants for improved earnings and value .

Medical Office Building and Hospital Portfolio: • On April 7, 2017, the Company closed on a $12.5 million acquisition of an MOB in Lancaster, CA. • Executed LOIs to increase occupancy in the hospital and MOB assets. • Continue to negotiate and execute lease extensions with existing tenants and leases and LOIs with new tenants for the purpose of generating incremental net operating income. Seniors Housing Portfolio: • Executing on the acquisition strategy with an LOI of an assisted living and memory care facility in the Southeast. • Converting twelve net - leased assets to RIDEA structure with a new operator. • Continue to work with operators to improve performance of the seniors housing portfolio, including meetings with senior management. • Evaluating properties for potential dispositions to create value. Skilled Nursing Portfolio: • Continue focused management of skilled nursing assets (8.5% of Gross Asset Value) to maximize income and value. • In 1Q17, HTI terminated the tenant of eight Missouri properties and leased to a new operator with option to purchase. • Seeking replacement tenants for six Illinois assets currently in receivership. 9 Portfolio Initiatives

Investing in Healthcare: Why Now? Rising Demand Due to Aging Demographics Affordable Care Act Increased Access to Healthcare; Rise in Demand Significant Growth in Healthcare Industry & Employment Deeply Fragmented Industry [1] “National Health Expenditure Projections 2016 - 2025. Table 2: National Health Expenditure Amounts and Annual Percent Change by Type of Expenditure: Calendar Years 2009 - 2025. Centers for Medicare & Medicaid Services, Office of the Actuary. Healthcare is a $3.4 trillion industry projected to grow to over $5.5 trillion by 2025¹

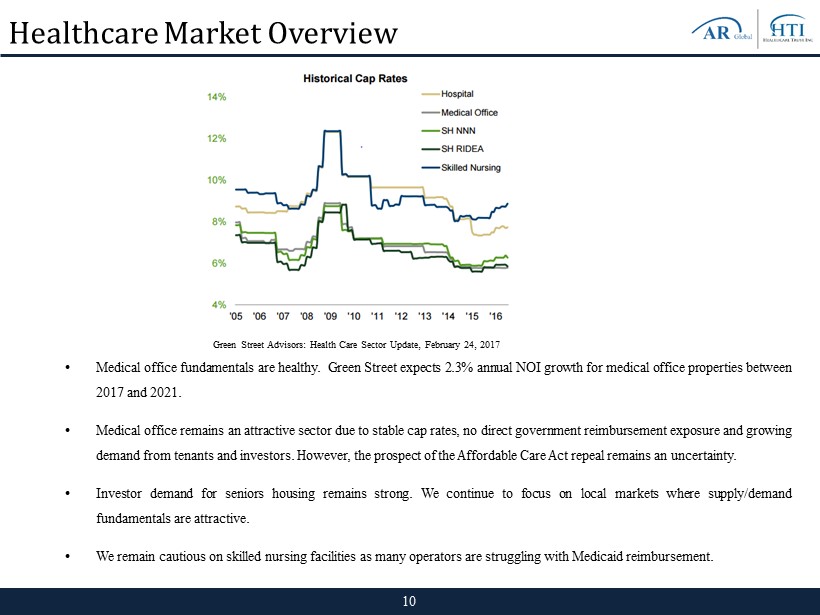

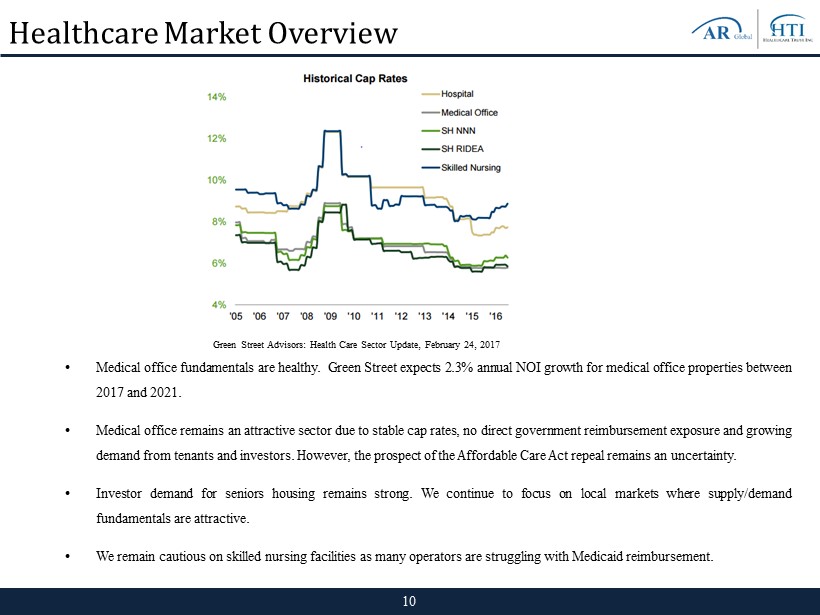

Healthcare Market Overview 10 Green Street Advisors: Health Care Sector Update, February 24, 2017 • Medical office fundamentals are healthy . Green Street expects 2 . 3 % annual NOI growth for medical office properties between 2017 and 2021 . • Medical office remains an attractive sector due to stable cap rates, no direct government reimbursement exposure and growing demand from tenants and investors . However, the prospect of the Affordable Care Act repeal remains an uncertainty . • Investor demand for seniors housing remains strong . We continue to focus on local markets where supply/demand fundamentals are attractive . • We remain cautious on skilled nursing facilities as many operators are struggling with Medicaid reimbursement .

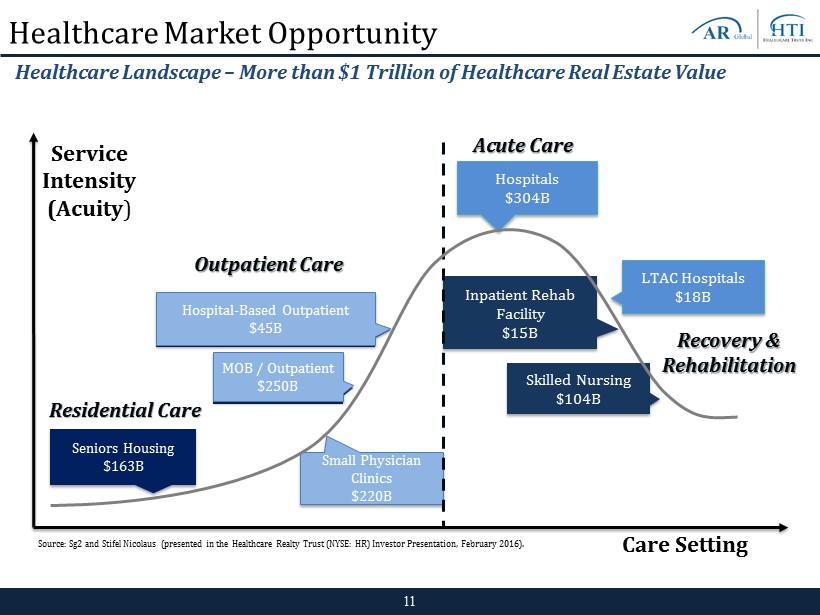

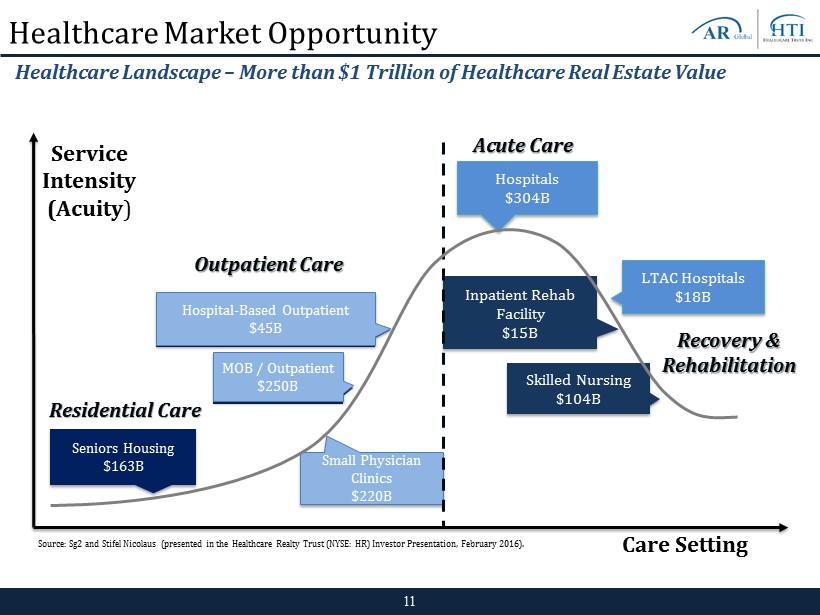

Healthcare Market Opportunity 11 Healthcare Landscape – More than $1 Trillion of Healthcare Real Estate Value Hospital - Based Outpatient $42B Medical Office $250B Seniors Housing $163B Inpatient Rehab Facility $15B Skilled Nursing $104B LTAC Hospitals $18B Hospitals $304B Hospital - Based Outpatient $45B Small Physician Clinics $220B MOB / Outpatient $250B Residential Care Outpatient Care Recovery & Rehabilitation Acute Care Service Intensity (Acuity ) Source: Sg2 and Stifel Nicolaus (presented in the Healthcare Realty Trust (NYSE: HR) Investor Presentation, February 2016). Care Setting

Organizational Leadership 12 Leslie D. Michelson | Non - Executive Chairman, Audit Committee Chair Mr. Michelson has served as the chairman and chief executive officer of Private Health Management, a retainer - based primary care medical practice management company since April 2007. Mr. Michelson served as Vice Chairman and Chief Executive Officer of the Prostate Cancer Fo undation, the world’s largest private source of prostate cancer research funding, from April 2002 until December 2006 and served on its boa rd of directors from January 2002 until April 2013. Mr. Michelson received his B.A. from The Johns Hopkins University in 1973 and a J.D. from Yal e L aw School in 1976. W. Todd Jensen | Interim Chief Executive Officer and President Mr. Jensen currently serves as Interim Chief Executive Officer and President of the Company. He is also Chief Investment Officer of our advisor, Healthcare Trust Advisors, LLC (the “Advisor”). He has over 25 years of executive experience in healthcare real estate and ha s a cquired, developed, financed, leased or managed more than $5 billion of healthcare property. He earned an MBA in Finance from the Wharton Graduat e S chool of the University of Pennsylvania and a B.A. from Kalamazoo College. Ms. Kurtz currently serves as the Chief Financial Officer, Treasurer and Secretary of the Company. Ms. Kurtz is also Senior V ice President, Finance for AR Global Investments, LLC (“AR Global”), the parent of the Company’s sponsor. She is a certified public accountant in New York Sta te, holds a B.S. in Accountancy and a B.A. in German from Wake Forest University and a Master of Science in Accountancy from Wake Forest Universi ty. Katie P. Kurtz | Chief Financial Officer, Secretary and Treasurer Ms. Pirrello currently serves as Senior Vice President with a primary focus on asset management of the seniors housing portfo lio . Ms. Pirrello brings to the Company over 25 years of real estate experience, with a particular emphasis on seniors housing properties. Recent positions h eld include Managing Director of Blue Moon Capital Partners LLC, a strategic capital source to seniors housing operating partners, and Senior Vice Presiden t f or Bay North Capital. She holds a B.S from Bentley University. Janet Pirrello | Senior Vice President, Asset Management Mr. Leahy currently serves as Vice President with a focus on asset management of the medical office portfolio. Mr. Leahy serv ed as a member of the management team of American Realty Capital Healthcare Trust, Inc., which was sold to Ventas, Inc. (NYSE: VTR) in January 2015 . Prior to joining AR Global, Mr. Leahy was a Regional Vice President of Asset Management for Healthcare Trust of America, Inc. and Director of Por tfo lio Management and Director of Real Estate for Cole Real Estate Investments. Sean Leahy | Vice President, Asset Management

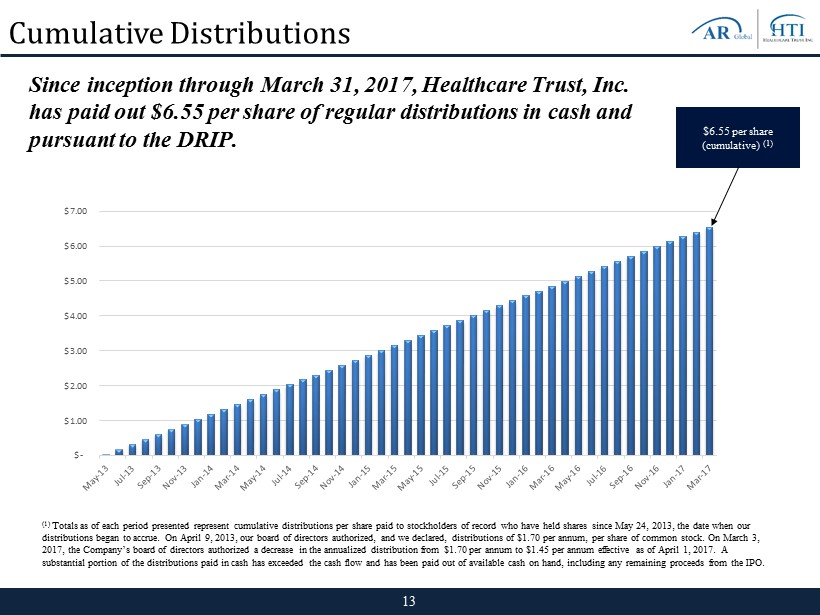

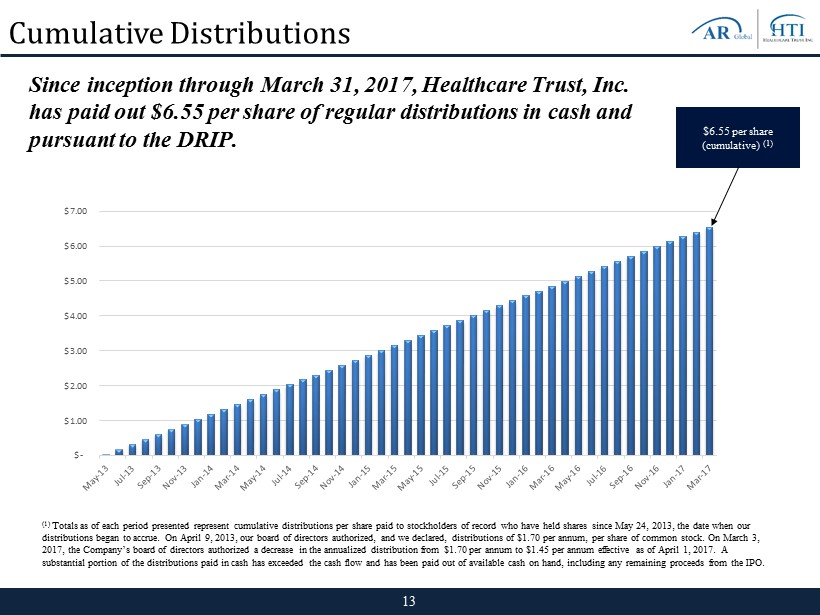

Cumulative Distributions 13 Since inception through March 31, 2017 , Healthcare Trust, Inc. has paid out $ 6.55 per share of regular distributions in cash and pursuant to the DRIP. $ 6.55 per share (cumulative) (1) (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sha res since May 24, 2013, the date when our distributions began to accrue. On April 9, 2013, our board of directors authorized, and we declared, distributions of $1.70 p er annum, per share of common stock. On March 3, 2017, the Company’s board of directors authorized a decrease in the annualized distribution from $1.70 per annum to $1.45 per an num effective as of April 1, 2017. A substantial portion of the distributions paid in cash has exceeded the cash flow and has been paid out of available cash on h and , including any remaining proceeds from the IPO. $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00

Amended and Restated Advisory Agreement 14 On February 17, 2017, HTI entered into the Second Amended and Restated Advisory Agreement (the “Advisory Agreement”). The Advisory Agreement was recommended and approved by a special committee (the “Special Committee”). The Special Committee retained independent legal counsel and an independent financial advisor to assist the Special Committee in the process. The Adv isory Agreement: • Eliminates any acquisition fees, financing coordination fees, annual subordinated performance fees and real estate commission s payable to the Advisor; • Aligns the monthly asset management fee payable to the Advisor with equity raised, consistent with market standards. The Advisory Agreement amends the monthly asset management fee from 0.0625% multiplied by the lesser of the cost or fair market value of the Company’s assets to $1.625 million plus one - twelfth of 1.25% of the cumulative net proceeds of any equity (includin g convertible debt) raised subsequent to the effective date of the Advisory Agreement; • Provides for a quarterly variable management/incentive fee equal to 15% of the applicable prior quarter’s core earnings per s har e in excess of $0.375 per share plus 10% of the applicable prior quarter’s core earnings per share in excess of $0.47 per share ; • Extends the initial term until February 2027, subject to the ability to terminate at any time for cause or good reason; • Provides for a termination right in connection with a change of control or a transition to self - management, subject to the payme nt of a change of control fee or transition fee. The change of control fee would be equal to the sum of (i) four multiplied by t he asset management fee plus (ii) four multiplied by the actual variable management/incentive fee, in each of clauses (i) and (ii), pa yab le for the fiscal quarter immediately prior to the fiscal quarter in which the change of control occurs, plus, (iii) without dup lic ation, the annual increase in the asset management fee resulting from the cumulative net proceeds of any equity raised in respect of th e fiscal quarter immediately prior to the fiscal quarter in which the change of control occurs; and • Allows for the Advisor to assign the Advisory Agreement to any party with expertise in commercial real estate which has, toge the r with its affiliates, over $100.0 million in assets under management.

Supplemental Information 15 Distribution Rate: • On March 9, 2017, HTI filed a current report on Form 8 - K to announce that the Board had authorized a reduction in the distribution rate from $1.70 per share on an annualized basis to $1.45 per share on an annualized basis. This represents a change in the annualized distribution yield, based on the original purchase price of $25.00 per share, from 6.8% to 5.8%. Share Repurchase Program: • On March 3, 2017, the Board authorized, with respect to repurchase requests received during the fiscal year ended December 31, 2016, the repurchase of shares validly submitted for repurchase in an amount equal to 1.5% of the weighted average number of shares of common stock outstanding during the fiscal year ended December 31, 2015, representing less than all the shares validly submitted for repurchase during the fiscal year ended December 31, 2016. Accordingly, 1.3 million shares (including all shares submitted for death or disability) were approved for repurchase and subsequently repurchased for $27.5 million in March 2017. • For calendar year 2017 and going forward, repurchases of shares of the Company's common stock, when requested, are generally made semiannually (each six - month period ending June 30 or December 31, a “fiscal semester”). Repurchases for any fiscal semester are limited to a maximum of 2.5% of the weighted average number of shares of common stock outstanding during the previous fiscal year (the "Prior Year Outstanding Shares"), with a maximum for any fiscal year of 5.0% of the Prior Year Outstanding Shares. In addition, the Company is only authorized to repurchase shares in a given fiscal semester up to the amount of proceeds received from its DRIP in that same fiscal semester. The Company’s SRP and any share repurchases are at the sole discretion of the board.

Risk Factors 16 Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10K for the year ended December 31, 2016 and updated in our Quarterly Reports on Form 10 - Q from time to time. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ mate ria lly from those presented in our forward looking statements: • Certain of our executive officers and directors are also officers, managers or holders of a direct or indirect controlling in ter est in Healthcare Trust Advisors, LLC (our "Advisor") and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, "AR Global"), the parent of our sponsor, American Realty Capital VII, LLC (the "Sponsor"). As a result, certain of our execut ive officers and directors, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor' s c ompensation arrangements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among the se investment programs and us. These conflicts could result in unanticipated actions that adversely affect us. • Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affil iat es of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and su ch conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the investment return to ou r s tockholders. • Although we intend to seek a listing of our shares of common stock on a national stock exchange when we believe market condit ion s are favorable to do so, there is no assurance that our shares of common stock will be listed. No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • We focus on acquiring and owning a diversified portfolio of healthcare - related assets located in the United States and are subje ct to risks inherent in concentrating investments in the healthcare industry. • If our Advisor loses or is unable to obtain qualified personnel, our ability to continue to achieve our investment strategies co uld be delayed or hindered. • The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of l ice nsure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We are depending on our Advisor to select investments and conduct our operations. Adverse changes in the financial condition of our Advisor and its affiliates or our relationship with our Advisor could adversely affect us. • We may be unable to fund distributions from cash flows from operations, or maintain cash distributions or increase distributi ons over time. • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates.

Risk Factors (cont’d) 17 • We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of ou r t enants. • We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which m ay impact our results of operations. • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions. • Any distributions, especially those not covered by our cash flows from operations, may reduce the amount of capital available fo r other purposes included investment in properties and other permitted investments and may negatively impact the value of our stockho lde rs' investment. • We have not and may not in the future generate cash flows sufficient to pay our distributions to stockholders and, as such, w e m ay be required to fund distributions from borrowings, which may be at unfavorable rates and could restrict the amount we can borrow fo r investments and other purposes, or depend on our Advisor or our property manager, Healthcare Trust Properties, LLC (the "Prop ert y Manager") to waive fees or reimbursement of certain expenses and fees to fund our operations. There is no assurance these ent iti es will waive such amounts or that we will be able to borrow funds at all. • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States from time to time. • We are subject to risks associated with changes in general economic, business and political conditions including the possibil ity of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending, capital an d f inancing markets. • We may fail to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes ("REI T") , which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock a nd the cash available for distributions. • We may be deemed to be an investment company under the Investment Company Act of 1940, as amended, and thus subject to regula tio n under the Investment Company Act. • The offering price and repurchase price for our shares, including shares sold pursuant to our DRIP may not, among other thing s, accurately reflect the value of our assets and may not represent what a stockholder may receive on a sale of the shares, what they may r ece ive upon a liquidation of our assets and distribution of the net proceeds or what a third party may pay to acquire the Company.

▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com www.HealthcareTrustInc.com