1 National Healthcare Properties, Inc. Investor Webcast Presentation (February 28, 2025) Fourth Quarter 2024

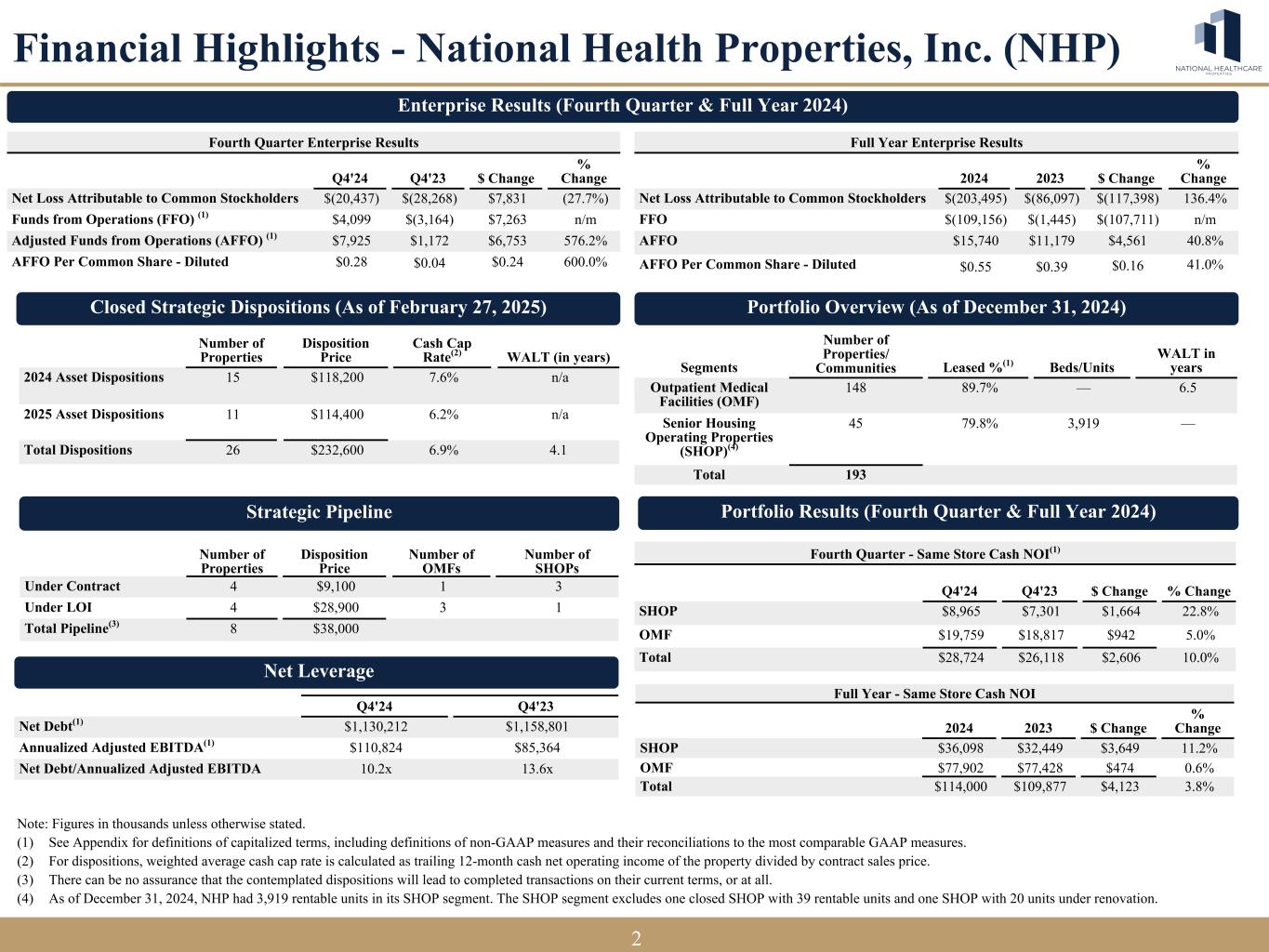

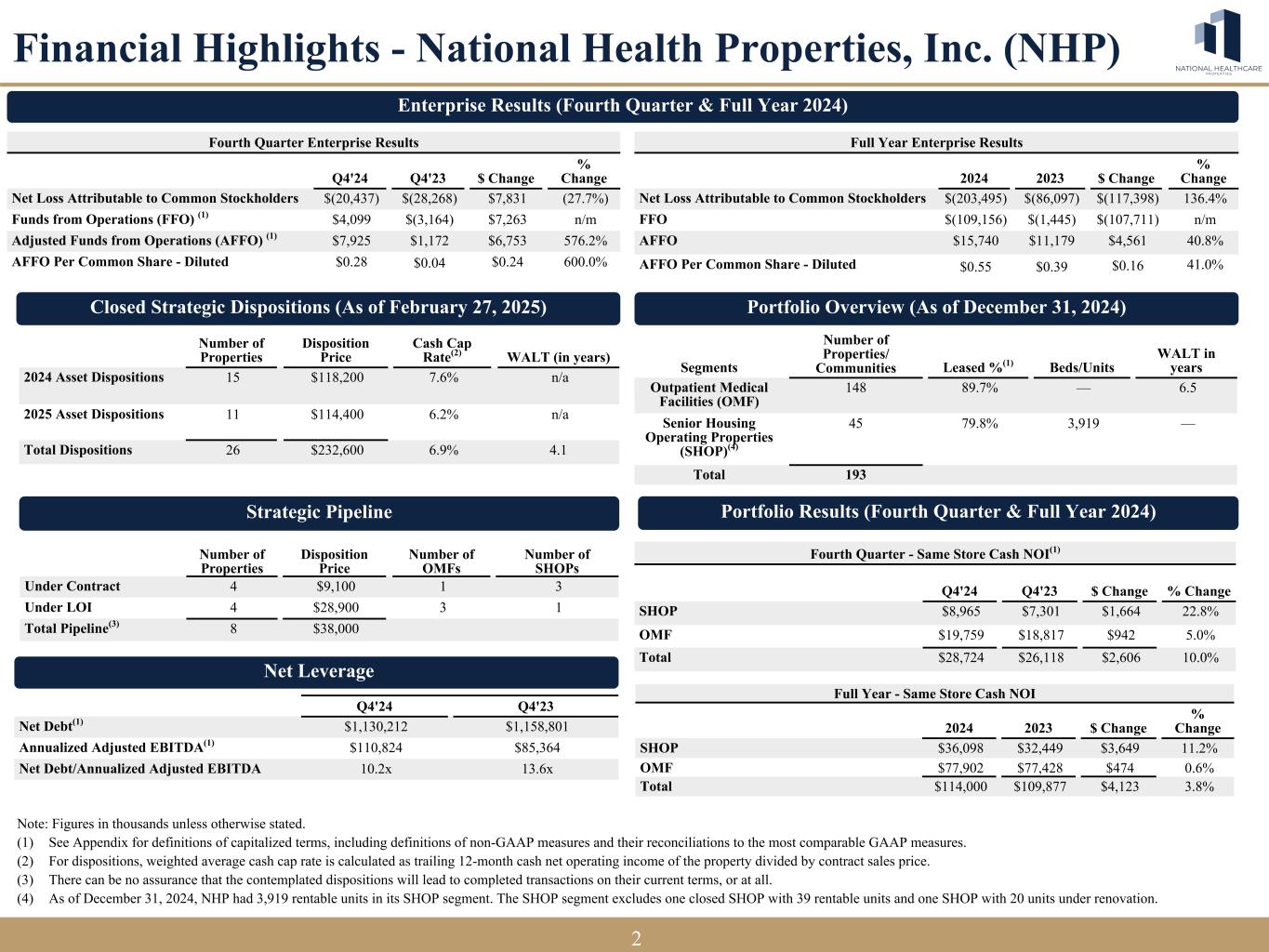

2 Portfolio Overview (As of December 31, 2024) Note: Figures in thousands unless otherwise stated. (1) See Appendix for definitions of capitalized terms, including definitions of non-GAAP measures and their reconciliations to the most comparable GAAP measures. (2) For dispositions, weighted average cash cap rate is calculated as trailing 12-month cash net operating income of the property divided by contract sales price. (3) There can be no assurance that the contemplated dispositions will lead to completed transactions on their current terms, or at all. (4) As of December 31, 2024, NHP had 3,919 rentable units in its SHOP segment. The SHOP segment excludes one closed SHOP with 39 rentable units and one SHOP with 20 units under renovation. Financial Highlights - National Health Properties, Inc. (NHP) 2 Segments Number of Properties/ Communities Leased %(1) Beds/Units WALT in years Outpatient Medical Facilities (OMF) 148 89.7% — 6.5 Senior Housing Operating Properties (SHOP)(4) 45 79.8% 3,919 — Total 193 Enterprise Results (Fourth Quarter & Full Year 2024) Fourth Quarter Enterprise Results Q4'24 Q4'23 $ Change % Change Net Loss Attributable to Common Stockholders $(20,437) $(28,268) $7,831 (27.7%) Funds from Operations (FFO) (1) $4,099 $(3,164) $7,263 n/m Adjusted Funds from Operations (AFFO) (1) $7,925 $1,172 $6,753 576.2% AFFO Per Common Share - Diluted $0.28 $0.04 $0.24 600.0% Full Year Enterprise Results 2024 2023 $ Change % Change Net Loss Attributable to Common Stockholders $(203,495) $(86,097) $(117,398) 136.4% FFO $(109,156) $(1,445) $(107,711) n/m AFFO $15,740 $11,179 $4,561 40.8% AFFO Per Common Share - Diluted $0.55 $0.39 $0.16 41.0% Portfolio Results (Fourth Quarter & Full Year 2024) Fourth Quarter - Same Store Cash NOI(1) Q4'24 Q4'23 $ Change % Change SHOP $8,965 $7,301 $1,664 22.8% OMF $19,759 $18,817 $942 5.0% Total $28,724 $26,118 $2,606 10.0% Full Year - Same Store Cash NOI 2024 2023 $ Change % Change SHOP $36,098 $32,449 $3,649 11.2% OMF $77,902 $77,428 $474 0.6% Total $114,000 $109,877 $4,123 3.8% Net Leverage Q4'24 Q4'23 Net Debt(1) $1,130,212 $1,158,801 Annualized Adjusted EBITDA(1) $110,824 $85,364 Net Debt/Annualized Adjusted EBITDA 10.2x 13.6x Closed Strategic Dispositions (As of February 27, 2025) Number of Properties Disposition Price Cash Cap Rate(2) WALT (in years) 2024 Asset Dispositions 15 $118,200 7.6% n/a 2025 Asset Dispositions 11 $114,400 6.2% n/a Total Dispositions 26 $232,600 6.9% 4.1 Strategic Pipeline Number of Properties Disposition Price Number of OMFs Number of SHOPs Under Contract 4 $9,100 1 3 Under LOI 4 $28,900 3 1 Total Pipeline(3) 8 $38,000

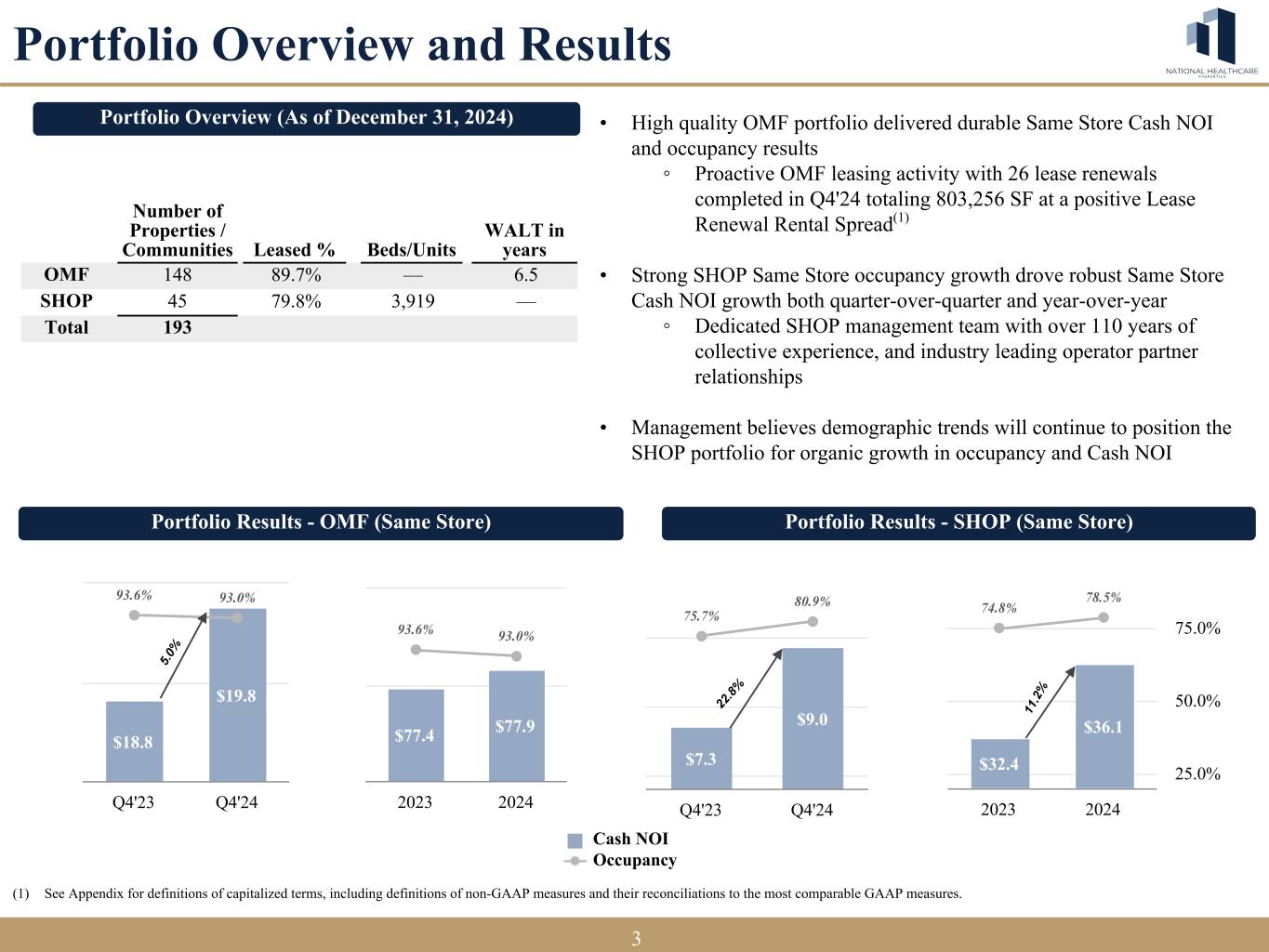

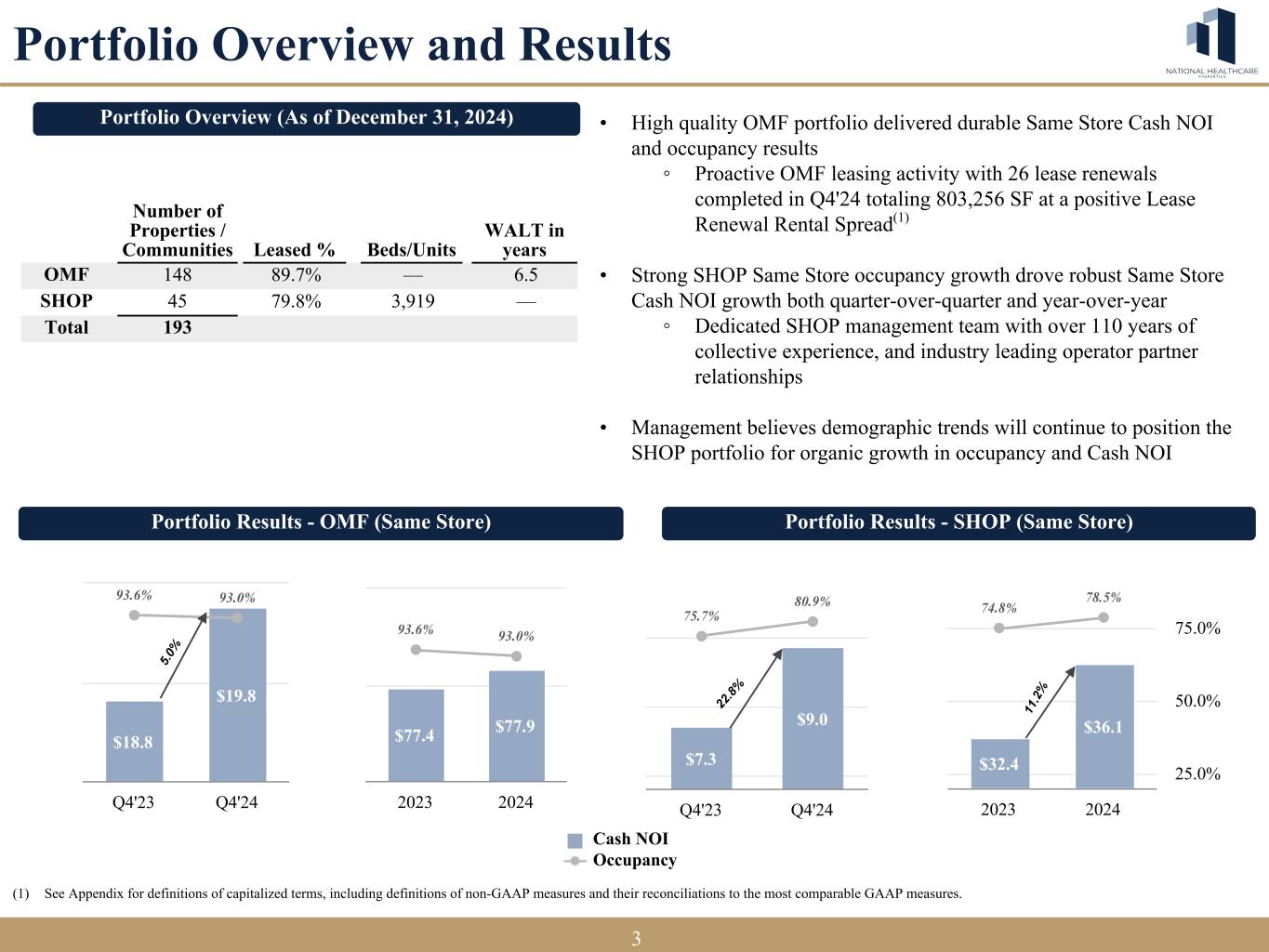

3 • High quality OMF portfolio delivered durable Same Store Cash NOI and occupancy results ◦ Proactive OMF leasing activity with 26 lease renewals completed in Q4'24 totaling 803,256 SF at a positive Lease Renewal Rental Spread(1) • Strong SHOP Same Store occupancy growth drove robust Same Store Cash NOI growth both quarter-over-quarter and year-over-year ◦ Dedicated SHOP management team with over 110 years of collective experience, and industry leading operator partner relationships • Management believes demographic trends will continue to position the SHOP portfolio for organic growth in occupancy and Cash NOI Portfolio Overview (As of December 31, 2024) (1) See Appendix for definitions of capitalized terms, including definitions of non-GAAP measures and their reconciliations to the most comparable GAAP measures. Portfolio Overview and Results 3 Number of Properties / Communities Leased % Beds/Units WALT in years OMF 148 89.7% — 6.5 SHOP 45 79.8% 3,919 — Total 193 Portfolio Results - SHOP (Same Store)Portfolio Results - OMF (Same Store) $7.3 $9.0 75.7% 80.9% Q4'23 Q4'24 $32.4 $36.1 74.8% 78.5% 2023 2024 25.0% 50.0% 75.0% $18.8 $19.8 93.6% 93.0% Q4'23 Q4'24 $77.4 $77.9 93.6% 93.0% 2023 2024 5. 0% 22 .8% 11 .2 % 3 Cash NOI Occupancy

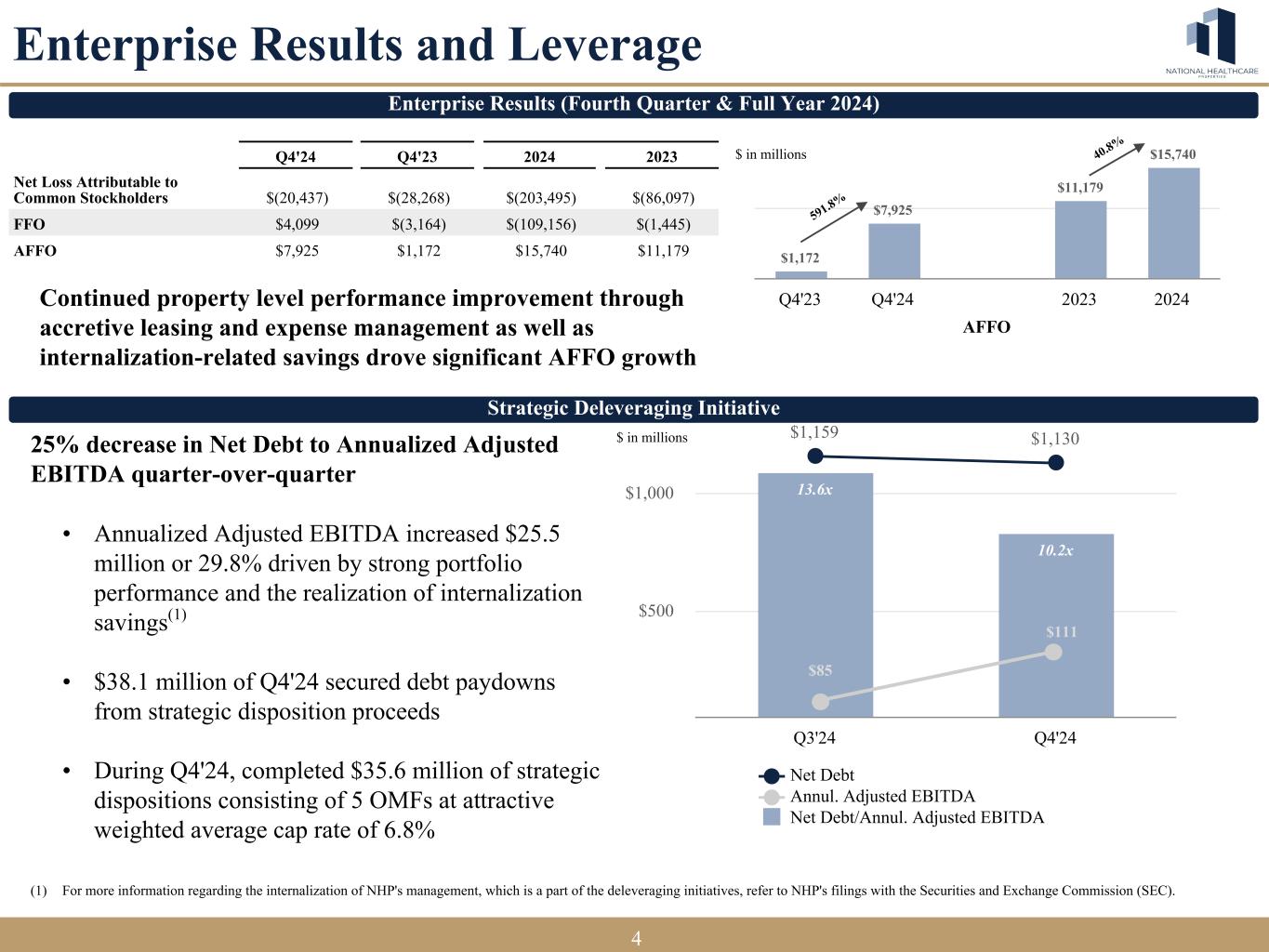

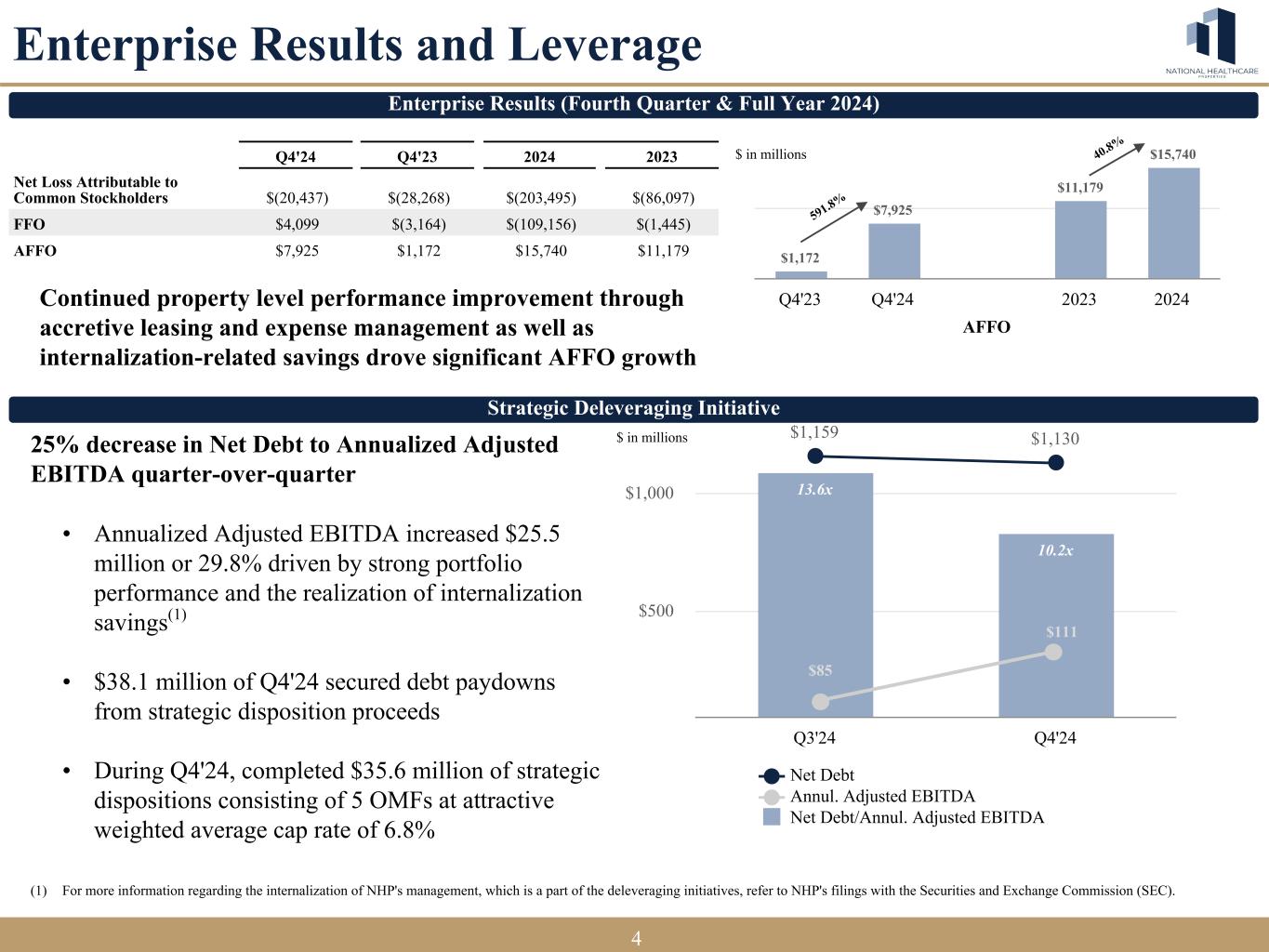

4 13.6x 10.2x $1,159 $1,130 Net Debt Annul. Adjusted EBITDA Net Debt/Annul. Adjusted EBITDA Q3'24 Q4'24 $500 $1,000 Continued property level performance improvement through accretive leasing and expense management as well as internalization-related savings drove significant AFFO growth (1) For more information regarding the internalization of NHP's management, which is a part of the deleveraging initiatives, refer to NHP's filings with the Securities and Exchange Commission (SEC). Enterprise Results and Leverage 4 Enterprise Results (Fourth Quarter & Full Year 2024) Q4'24 Q4'23 2024 2023 Net Loss Attributable to Common Stockholders $(20,437) $(28,268) $(203,495) $(86,097) FFO $4,099 $(3,164) $(109,156) $(1,445) AFFO $7,925 $1,172 $15,740 $11,179 Strategic Deleveraging Initiative AFFO $1,172 $7,925 $11,179 $15,740 Q4'23 Q4'24 2023 2024 591.8% 40.8% 25% decrease in Net Debt to Annualized Adjusted EBITDA quarter-over-quarter • Annualized Adjusted EBITDA increased $25.5 million or 29.8% driven by strong portfolio performance and the realization of internalization savings(1) • $38.1 million of Q4'24 secured debt paydowns from strategic disposition proceeds • During Q4'24, completed $35.6 million of strategic dispositions consisting of 5 OMFs at attractive weighted average cap rate of 6.8% $ in millions $ in millions $111 $85

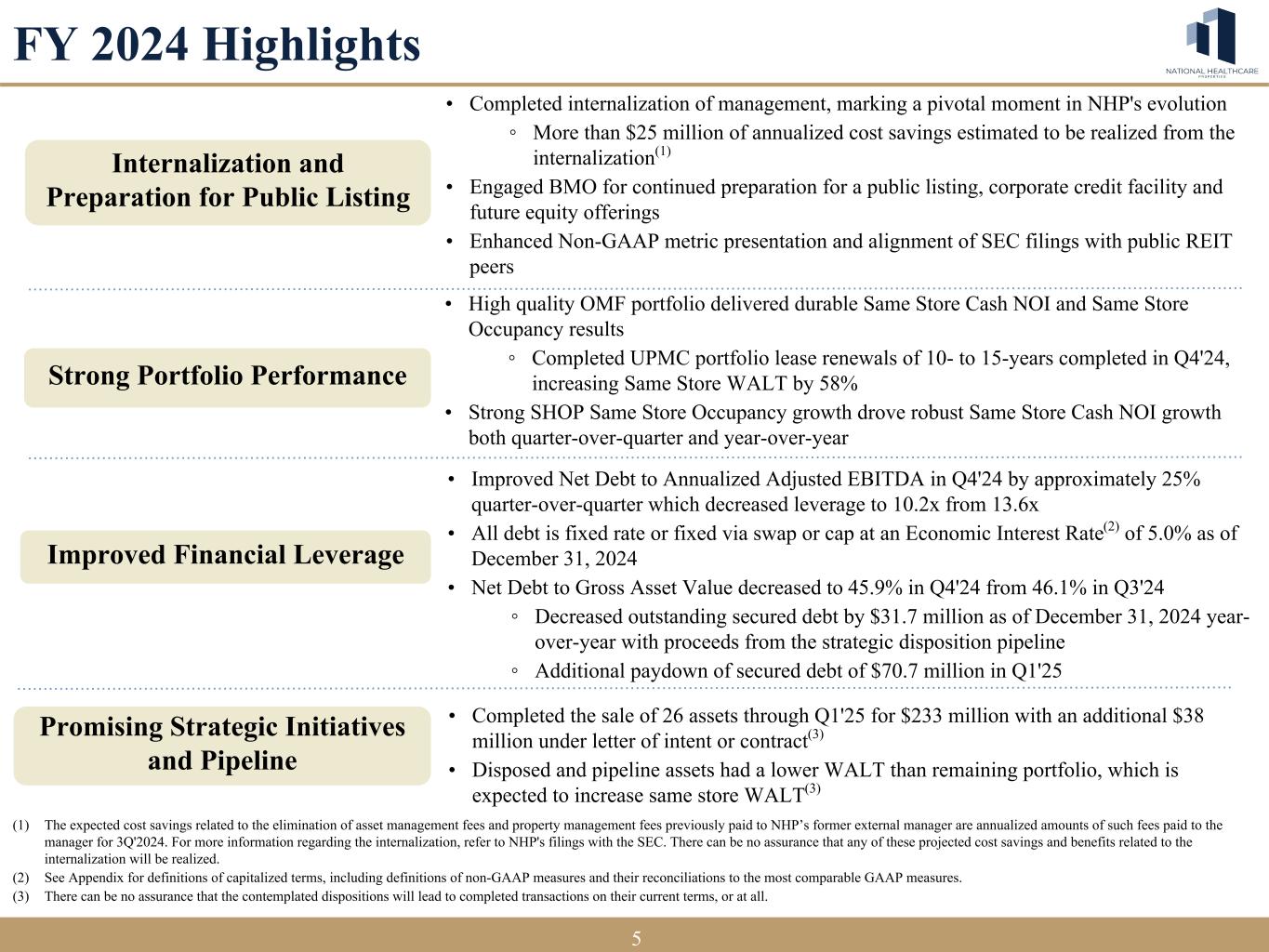

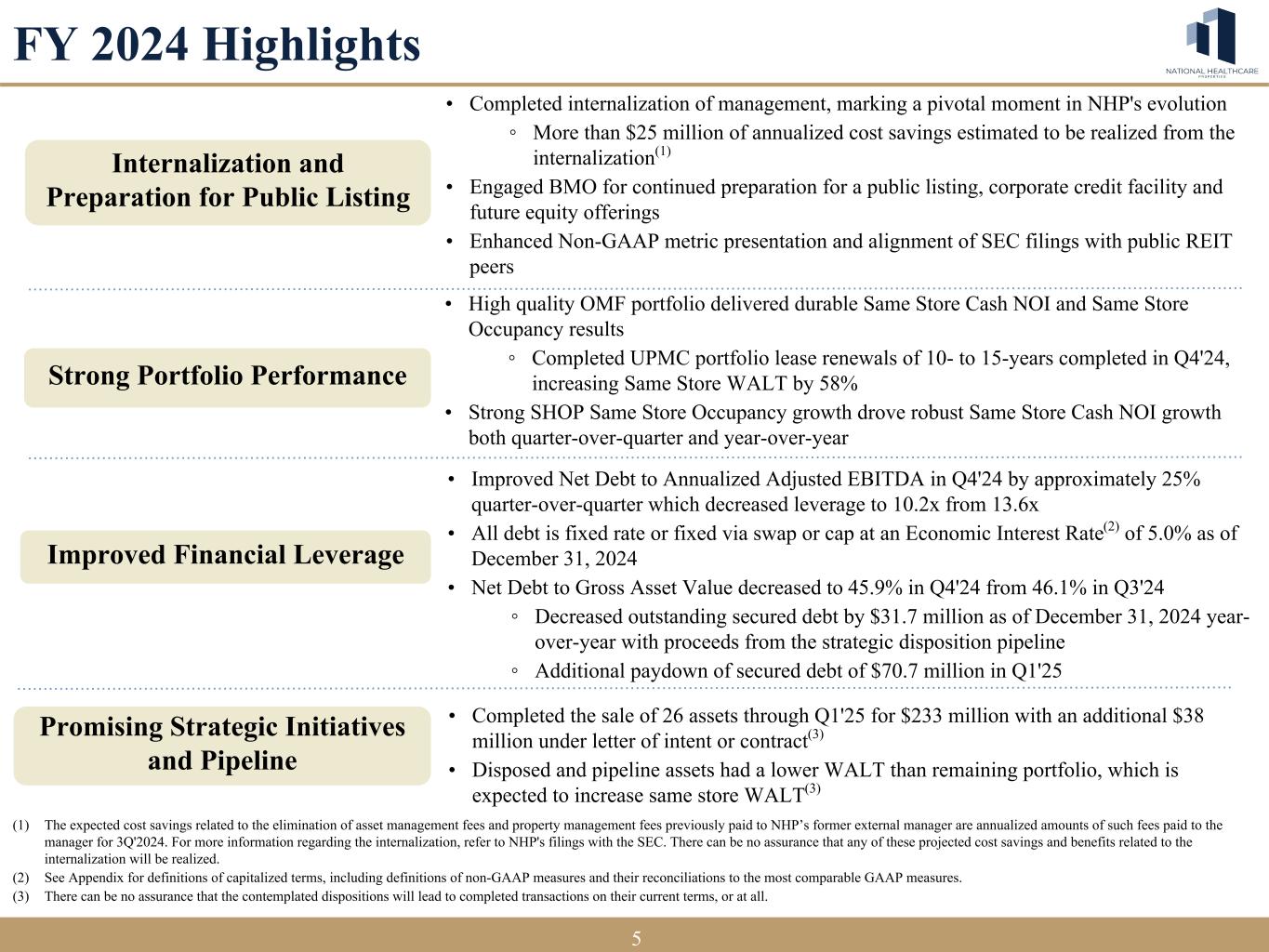

5 Internalization and Preparation for Public Listing (1) The expected cost savings related to the elimination of asset management fees and property management fees previously paid to NHP’s former external manager are annualized amounts of such fees paid to the manager for 3Q'2024. For more information regarding the internalization, refer to NHP's filings with the SEC. There can be no assurance that any of these projected cost savings and benefits related to the internalization will be realized. (2) See Appendix for definitions of capitalized terms, including definitions of non-GAAP measures and their reconciliations to the most comparable GAAP measures. (3) There can be no assurance that the contemplated dispositions will lead to completed transactions on their current terms, or at all. FY 2024 Highlights 5 Strong Portfolio Performance Improved Financial Leverage Promising Strategic Initiatives and Pipeline • Completed internalization of management, marking a pivotal moment in NHP's evolution ◦ More than $25 million of annualized cost savings estimated to be realized from the internalization(1) • Engaged BMO for continued preparation for a public listing, corporate credit facility and future equity offerings • Enhanced Non-GAAP metric presentation and alignment of SEC filings with public REIT peers • High quality OMF portfolio delivered durable Same Store Cash NOI and Same Store Occupancy results ◦ Completed UPMC portfolio lease renewals of 10- to 15-years completed in Q4'24, increasing Same Store WALT by 58% • Strong SHOP Same Store Occupancy growth drove robust Same Store Cash NOI growth both quarter-over-quarter and year-over-year • Improved Net Debt to Annualized Adjusted EBITDA in Q4'24 by approximately 25% quarter-over-quarter which decreased leverage to 10.2x from 13.6x • All debt is fixed rate or fixed via swap or cap at an Economic Interest Rate(2) of 5.0% as of December 31, 2024 • Net Debt to Gross Asset Value decreased to 45.9% in Q4'24 from 46.1% in Q3'24 ◦ Decreased outstanding secured debt by $31.7 million as of December 31, 2024 year- over-year with proceeds from the strategic disposition pipeline ◦ Additional paydown of secured debt of $70.7 million in Q1'25 • Completed the sale of 26 assets through Q1'25 for $233 million with an additional $38 million under letter of intent or contract(3) • Disposed and pipeline assets had a lower WALT than remaining portfolio, which is expected to increase same store WALT(3)

6 ☑ Developed strong tenant relationships with leading healthcare institutions such as University of Pittsburgh Medical Center (UPMC), Advocate Aurora Health, Trinity Healthcare, Ascension and Dignity Health with significant footprints throughout the U.S. ☑ NHP remains committed to developing strong partnerships with leading healthcare brands which NHP believes benefits patients and other stakeholders ☑ Strategic partnership with top national senior housing operators and their dedicated in-house teams to deliver strong returns and exceptional services • Developed exclusive brands such as Arvum Senior Living with Discovery Senior Living for NHP's SHOP properties • Utilized operators' in-house expertise in sales and marketing, asset management operations and nursing to drive operational efficiency and grow Cash NOI Strategic Partners NHP tenants and partners include some of the top healthcare brands in well-established markets OMF SHOP 66

7 Portfolio Performance Outpatient Medical Facilities (OMF) Bowie Gateway Medical Center Bowie, Maryland 7

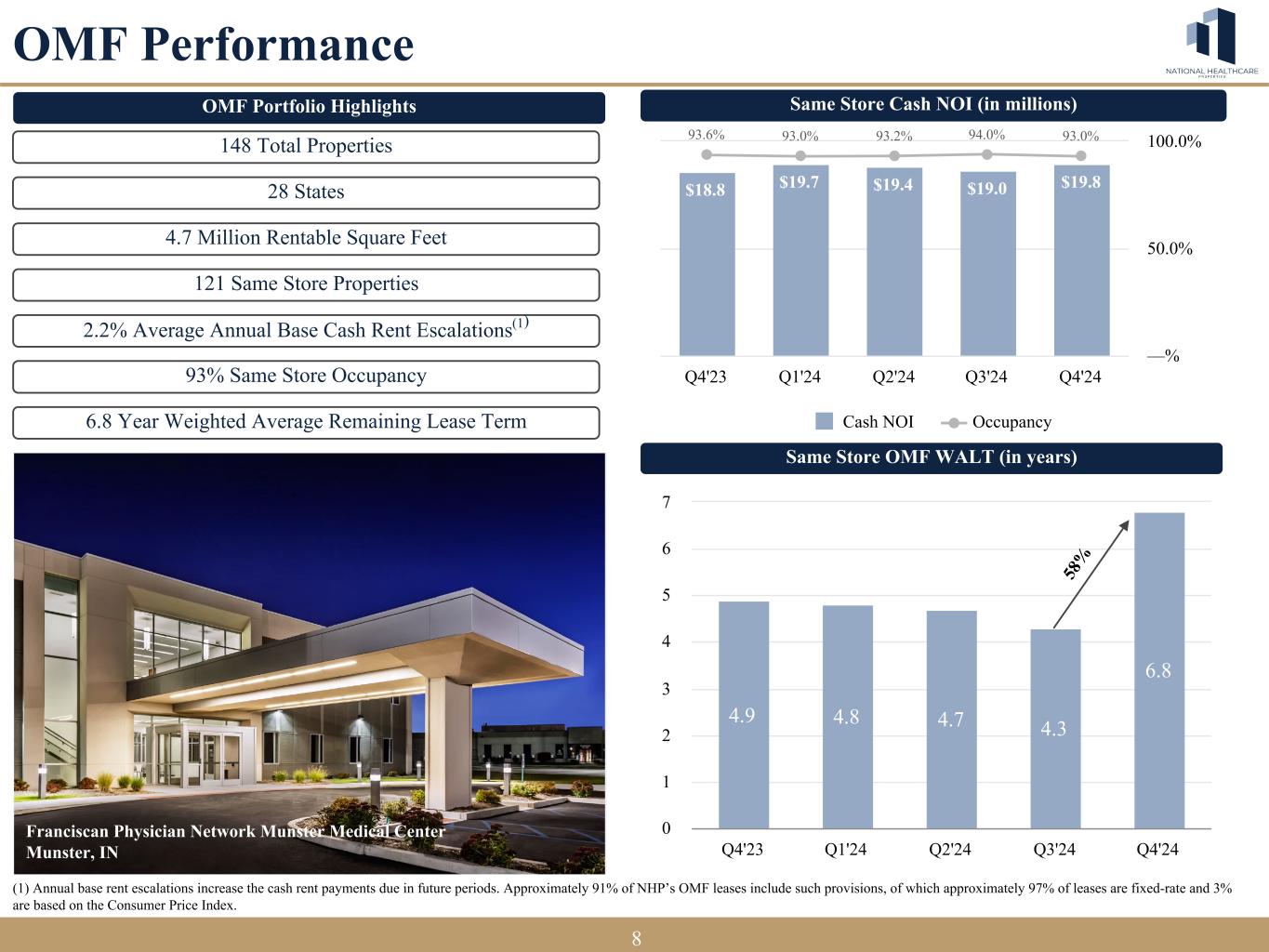

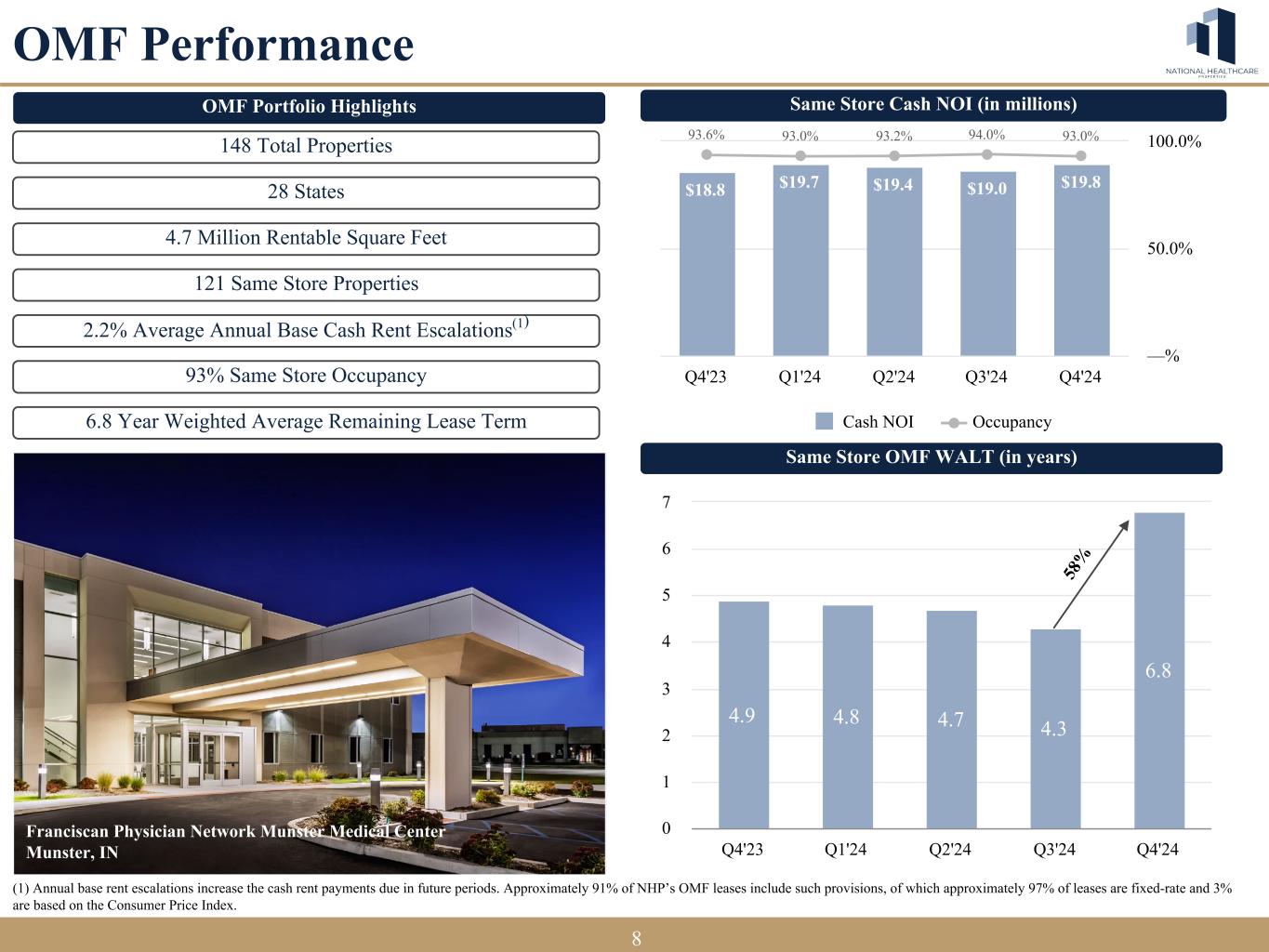

8 OMF Performance 8 OMF Portfolio Highlights Same Store OMF WALT (in years) 148 Total Properties 28 States 4.7 Million Rentable Square Feet 93% Same Store Occupancy 2.2% Average Annual Base Cash Rent Escalations(1) 6.8 Year Weighted Average Remaining Lease Term 4.9 4.8 4.7 4.3 6.8 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 0 1 2 3 4 5 6 7 121 Same Store Properties Same Store Cash NOI (in millions) $18.8 $19.7 $19.4 $19.0 $19.8 93.6% 93.0% 93.2% 94.0% 93.0% Cash NOI Occupancy Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 —% 50.0% 100.0% Franciscan Physician Network Munster Medical Center Munster, IN 58 % (1) Annual base rent escalations increase the cash rent payments due in future periods. Approximately 91% of NHP’s OMF leases include such provisions, of which approximately 97% of leases are fixed-rate and 3% are based on the Consumer Price Index.

9 Outpatient Medical Facility Tenant Highlight UPMC Portfolio Lease Renewals • In 2014, NHP acquired a portfolio of eight outpatient medical facilities in Central Pennsylvania from Pinnacle Health Hospitals (predecessor to UPMC). At the time of acquisition, five of the assets were fully leased with a remaining lease term of 8.75 years. • In Q4'24, NHP executed eight lease renewals with UPMC (rated "A" by Fitch, "A" by S&P and "A2" by Moody's, all with positive/stable outlook) comprised of 724,096 sq. ft. and annualized straight line rent (SLR) of $17.1 million. • NHP’s relationship with top executives at UPMC was vital as the transaction unfolded over the course of twelve months. • At the time, only three of the eight property leases were set to expire. • NHP was able to structure a deal to secure long-term commitments while protecting UPMC’s tax exempt status. • The deal resulted in long-term commitments at expiring rates (without rate reductions) and no additional capital investment. • UPMC remains NHP’s largest tenant by both sq. ft. and SLR. UPMC 8 Lease Renewals 0.6 12.8 $12.0 $17.1 WALT (years) Annualized SLR (millions) Pre-renewal Post-renewal $8.0 $12.0 $16.0 $20.0 0.0 5.0 10.0 15.0 FOC Clinical OMF Mechanicsburg, Pennsylvania 9

10 Addington Place of Jupiter Jupiter, FL Portfolio Performance Senior Housing Operating Properties (SHOP) 10

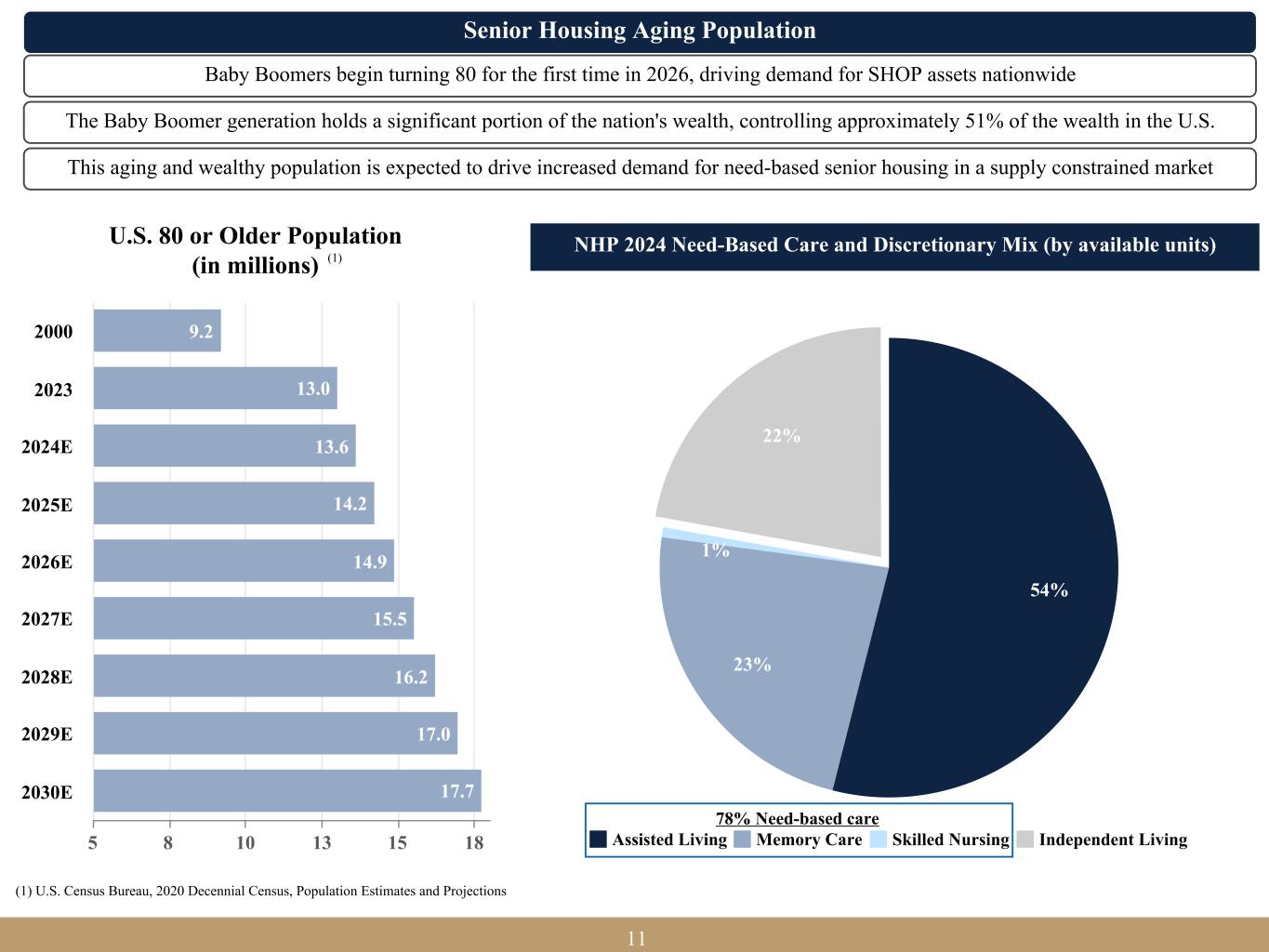

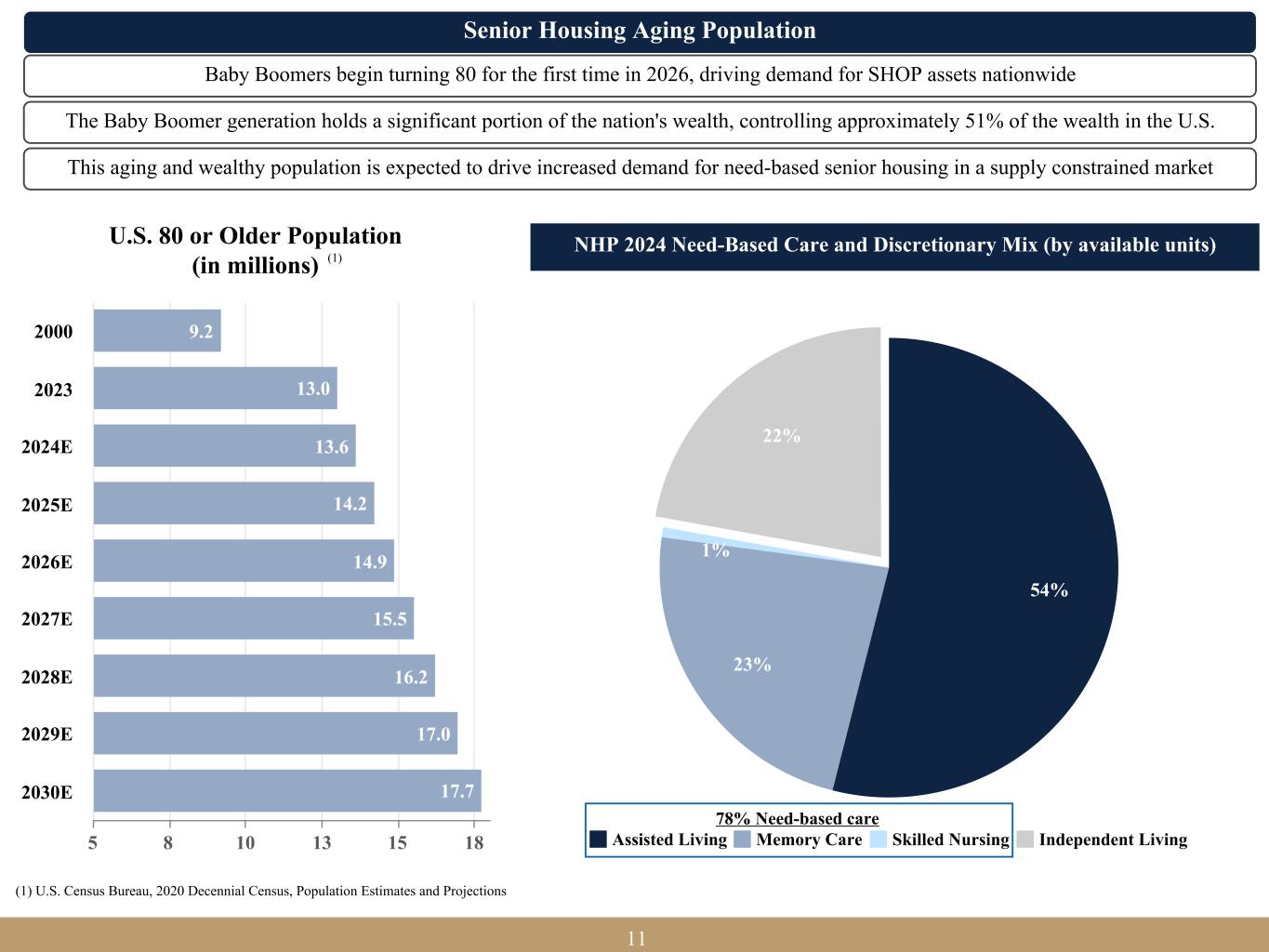

11 54% 23% 1% 22% Assisted Living Memory Care Skilled Nursing Independent Living Senior Housing Aging Population The Baby Boomer generation holds a significant portion of the nation's wealth, controlling approximately 51% of the wealth in the U.S. Baby Boomers begin turning 80 for the first time in 2026, driving demand for SHOP assets nationwide U.S. 80 or Older Population (in millions) 9.2 13.0 13.6 14.2 14.9 15.5 16.2 17.0 17.7 5 8 10 13 15 18 2000 2023 2024E 2025E 2026E 2027E 2028E 2029E 2030E (1) U.S. Census Bureau, 2020 Decennial Census, Population Estimates and Projections NHP 2024 Need-Based Care and Discretionary Mix (by available units) 78% Need-based care (1) This aging and wealthy population is expected to drive increased demand for need-based senior housing in a supply constrained market 11

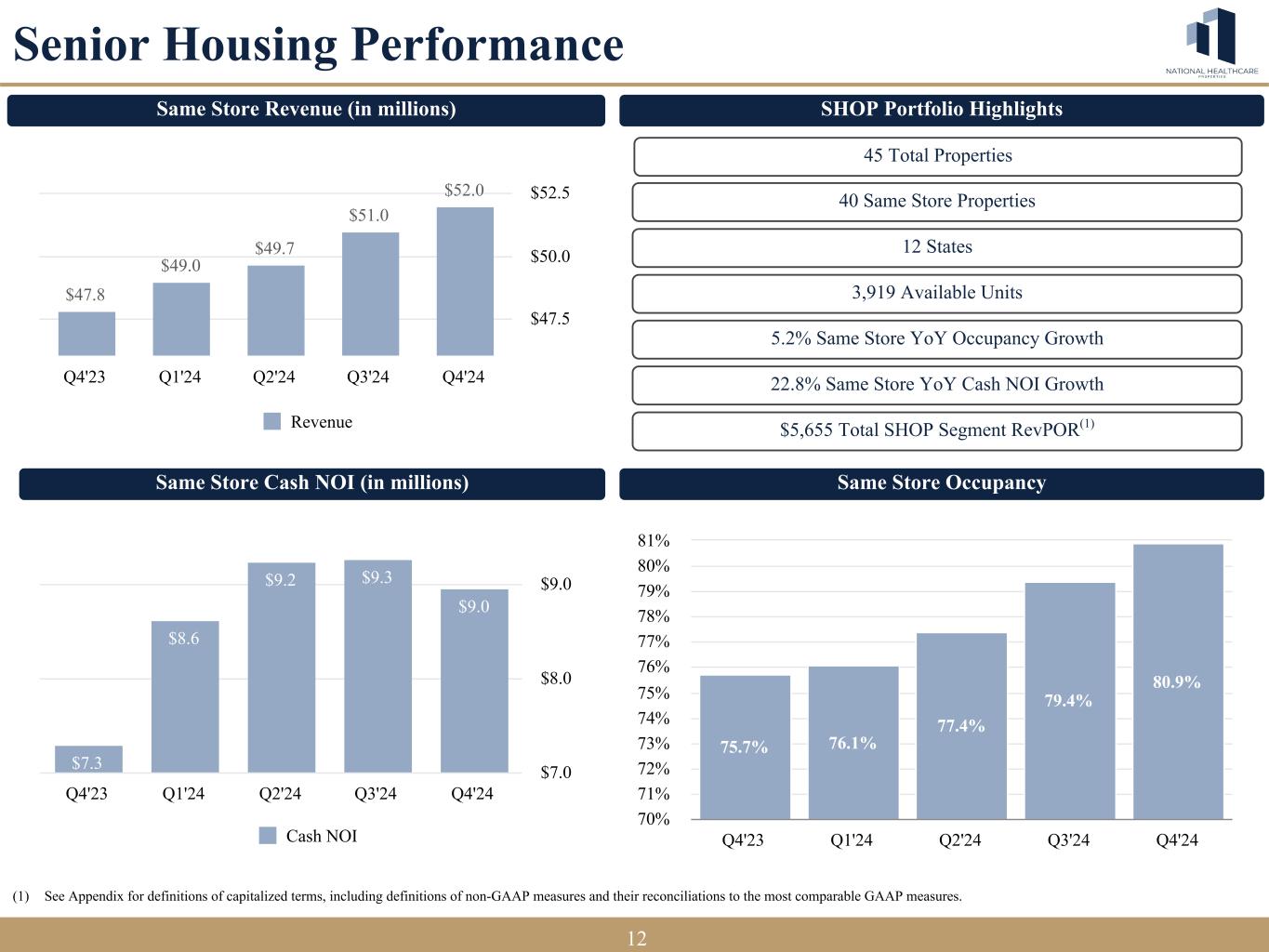

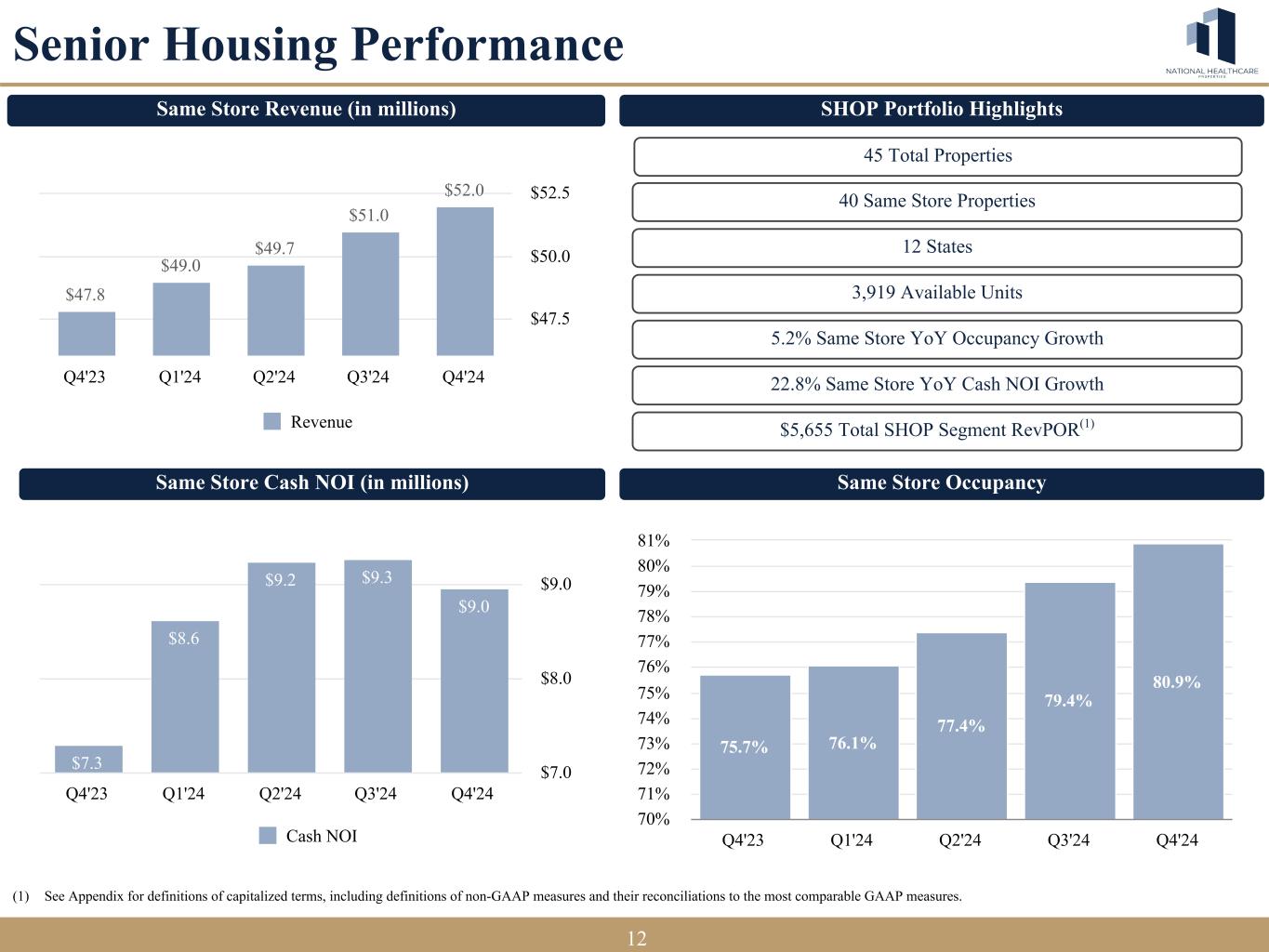

12 (1) See Appendix for definitions of capitalized terms, including definitions of non-GAAP measures and their reconciliations to the most comparable GAAP measures. Senior Housing Performance 12 SHOP Portfolio Highlights 12 States 3,919 Available Units 5.2% Same Store YoY Occupancy Growth 22.8% Same Store YoY Cash NOI Growth $5,655 Total SHOP Segment RevPOR(1) 75.7% 76.1% 77.4% 79.4% 80.9% Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 70% 71% 72% 73% 74% 75% 76% 77% 78% 79% 80% 81% Same Store Occupancy 40 Same Store Properties $47.8 $49.0 $49.7 $51.0 $52.0 Revenue Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 $47.5 $50.0 $52.5 $7.3 $8.6 $9.2 $9.3 $9.0 Cash NOI Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 $7.0 $8.0 $9.0 Same Store Revenue (in millions) Same Store Cash NOI (in millions) 12 45 Total Properties

13 Addington Place of Stuart Stuart, FL Strategic Initiatives 13

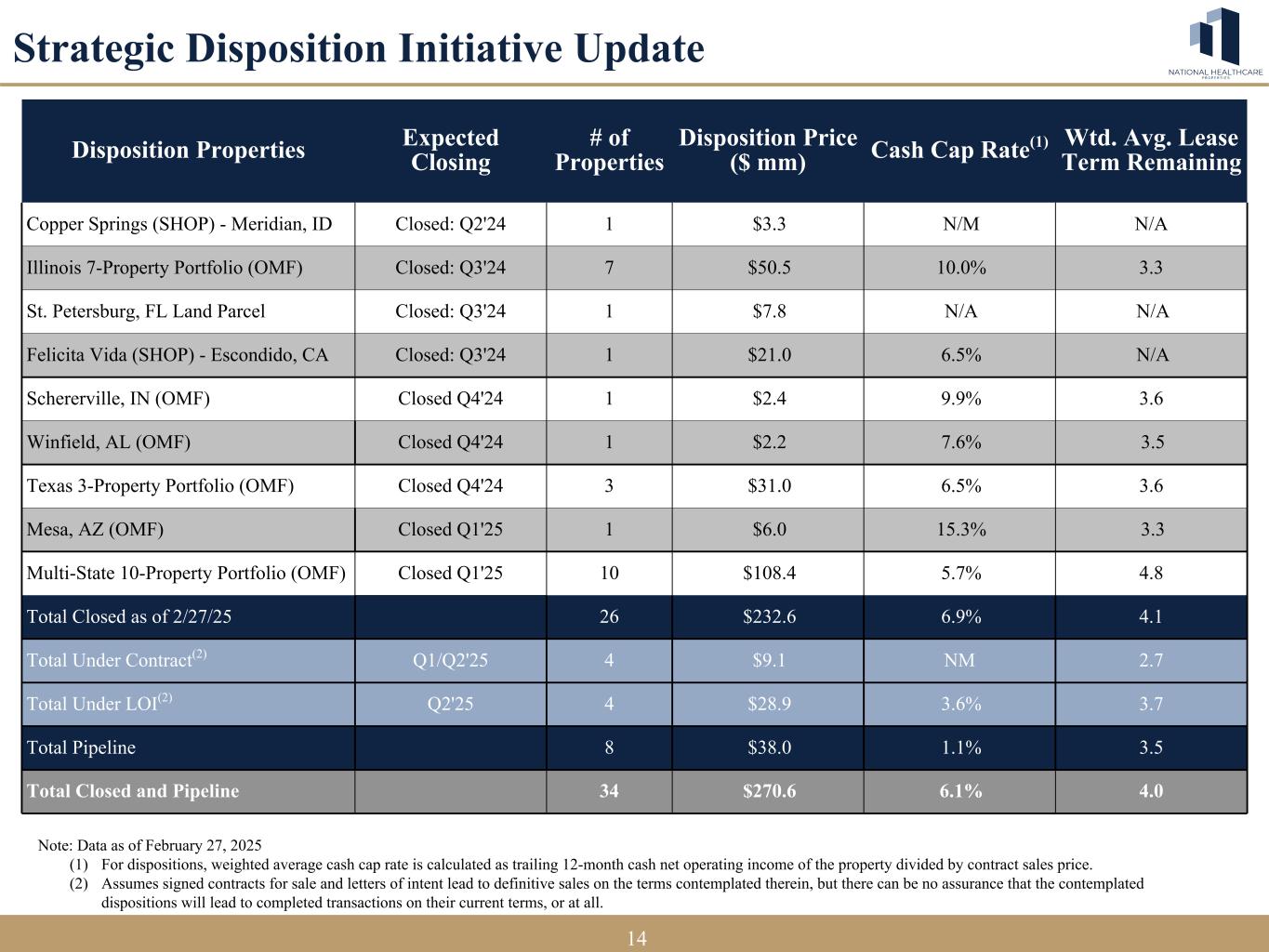

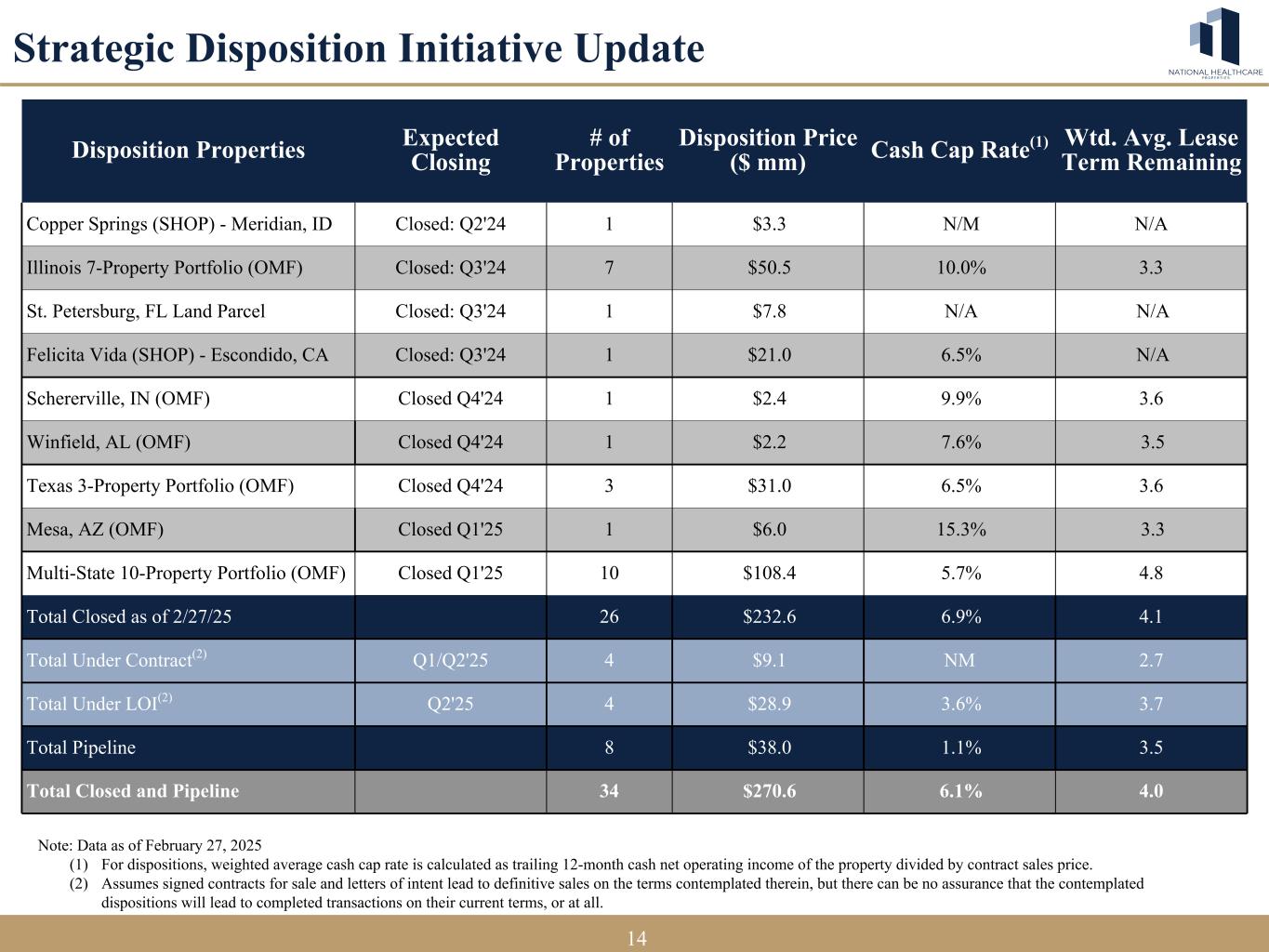

14 14 Disposition Properties Expected Closing # of Properties Disposition Price ($ mm) Cash Cap Rate(1) Wtd. Avg. Lease Term Remaining Copper Springs (SHOP) - Meridian, ID Closed: Q2'24 1 $3.3 N/M N/A Illinois 7-Property Portfolio (OMF) Closed: Q3'24 7 $50.5 10.0% 3.3 St. Petersburg, FL Land Parcel Closed: Q3'24 1 $7.8 N/A N/A Felicita Vida (SHOP) - Escondido, CA Closed: Q3'24 1 $21.0 6.5% N/A Schererville, IN (OMF) Closed Q4'24 1 $2.4 9.9% 3.6 Winfield, AL (OMF) Closed Q4'24 1 $2.2 7.6% 3.5 Texas 3-Property Portfolio (OMF) Closed Q4'24 3 $31.0 6.5% 3.6 Mesa, AZ (OMF) Closed Q1'25 1 $6.0 15.3% 3.3 Multi-State 10-Property Portfolio (OMF) Closed Q1'25 10 $108.4 5.7% 4.8 Total Closed as of 2/27/25 26 $232.6 6.9% 4.1 Total Under Contract(2) Q1/Q2'25 4 $9.1 NM 2.7 Total Under LOI(2) Q2'25 4 $28.9 3.6% 3.7 Total Pipeline 8 $38.0 1.1% 3.5 Total Closed and Pipeline 34 $270.6 6.1% 4.0 Strategic Disposition Initiative Update 14 Note: Data as of February 27, 2025 (1) For dispositions, weighted average cash cap rate is calculated as trailing 12-month cash net operating income of the property divided by contract sales price. (2) Assumes signed contracts for sale and letters of intent lead to definitive sales on the terms contemplated therein, but there can be no assurance that the contemplated dispositions will lead to completed transactions on their current terms, or at all. 14

15 FOC Clinical OMF Mechanicsburg, Pennsylvania Capitalization 15

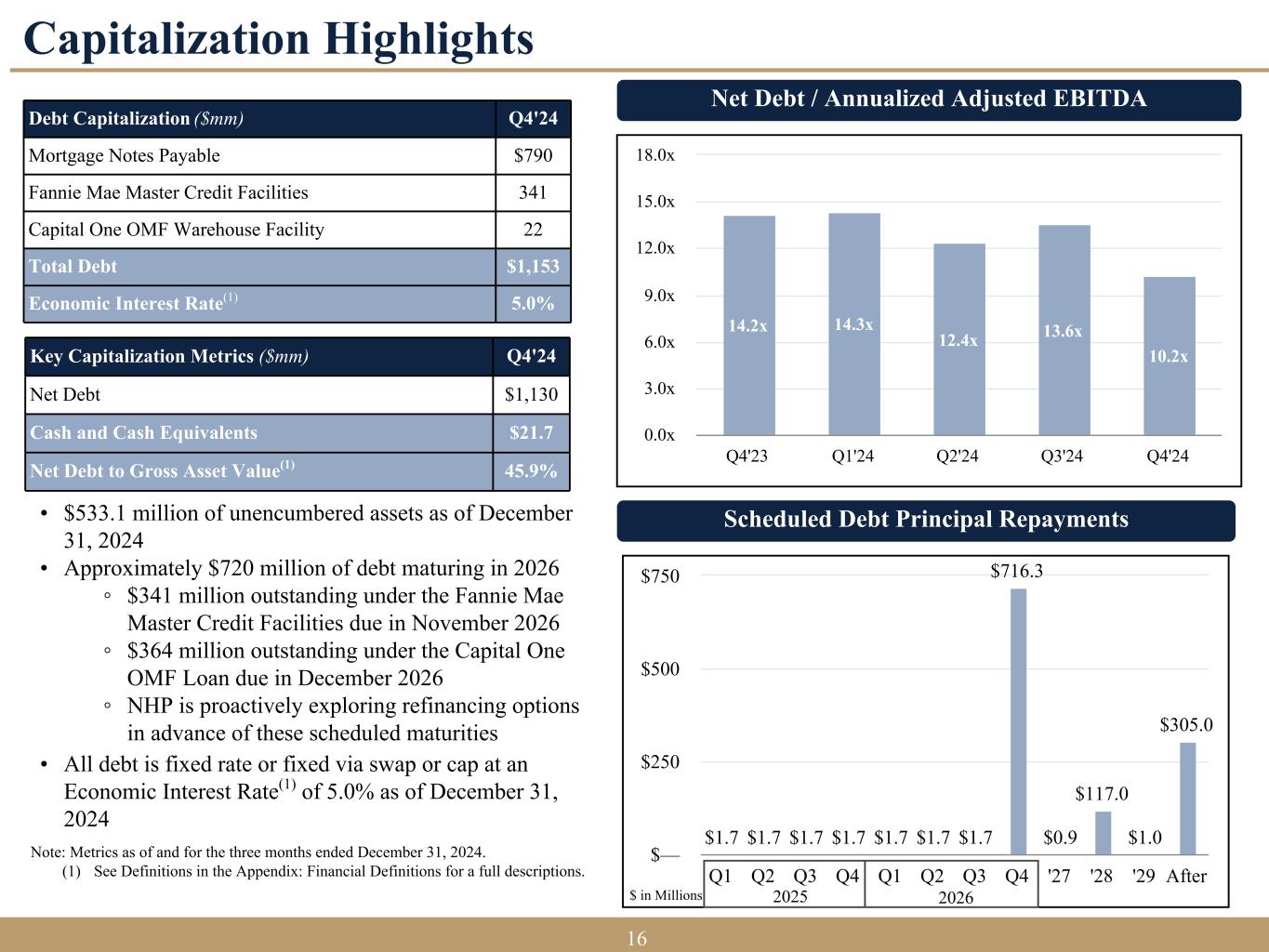

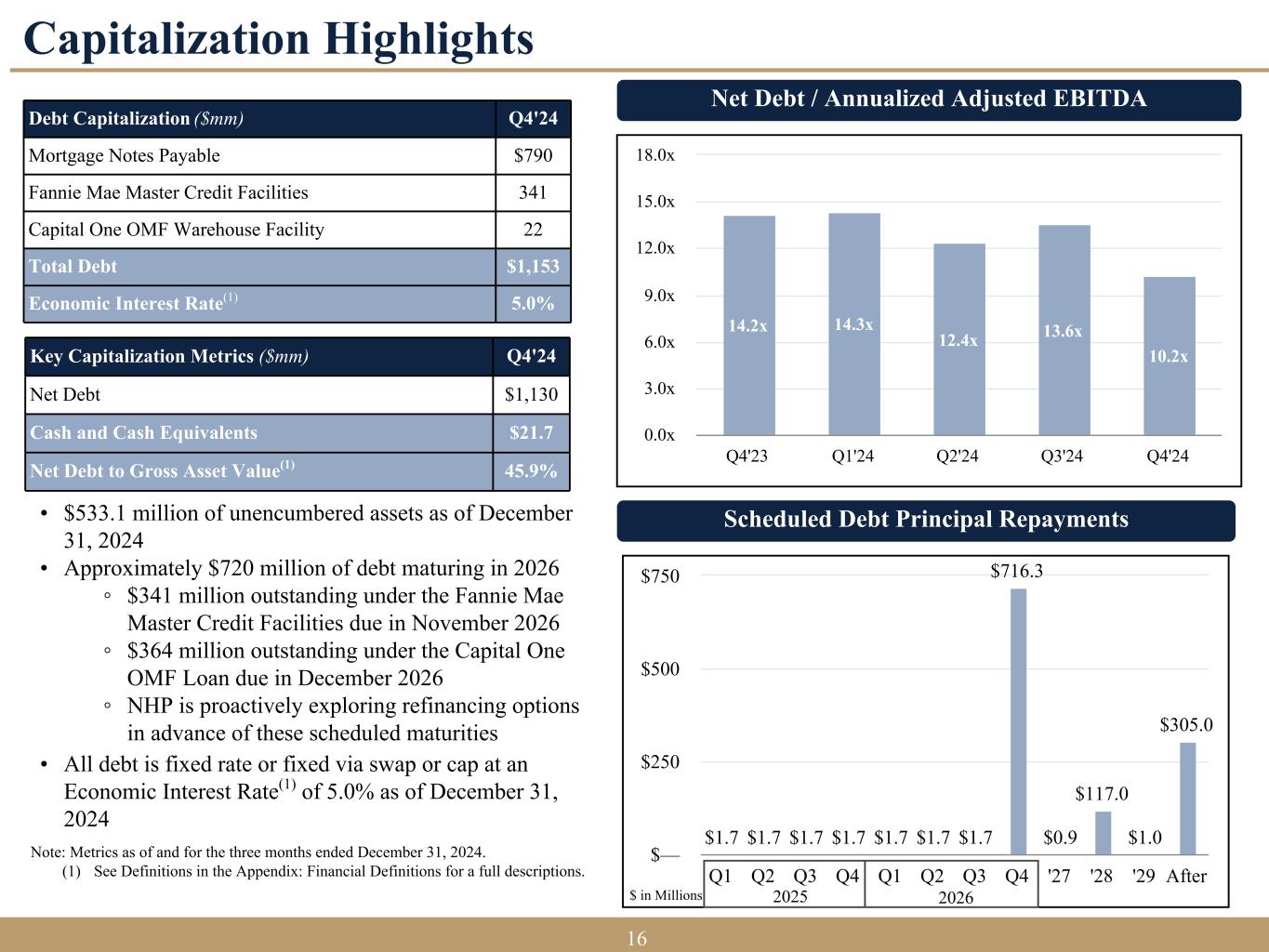

16 14.2x 14.3x 12.4x 13.6x 10.2x Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 0.0x 3.0x 6.0x 9.0x 12.0x 15.0x 18.0x Net Debt / Annualized Adjusted EBITDA Debt Capitalization ($mm) Q4'24 Mortgage Notes Payable $790 Fannie Mae Master Credit Facilities 341 Capital One OMF Warehouse Facility 22 Total Debt $1,153 Economic Interest Rate(1) 5.0% Key Capitalization Metrics ($mm) Q4'24 Net Debt $1,130 Cash and Cash Equivalents $21.7 Net Debt to Gross Asset Value(1) 45.9% $1.7 $1.7 $1.7 $1.7 $1.7 $1.7 $1.7 $716.3 $0.9 $117.0 $1.0 $305.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 '27 '28 '29 After $— $250 $500 $750 Scheduled Debt Principal Repayments Capitalization Highlights $ in Millions Note: Metrics as of and for the three months ended December 31, 2024. (1) See Definitions in the Appendix: Financial Definitions for a full descriptions. • $533.1 million of unencumbered assets as of December 31, 2024 • Approximately $720 million of debt maturing in 2026 ◦ $341 million outstanding under the Fannie Mae Master Credit Facilities due in November 2026 ◦ $364 million outstanding under the Capital One OMF Loan due in December 2026 ◦ NHP is proactively exploring refinancing options in advance of these scheduled maturities • All debt is fixed rate or fixed via swap or cap at an Economic Interest Rate(1) of 5.0% as of December 31, 2024 16 2025 2026

17 Leadership Team Estate at Hyde Park Tampa, Florida 17

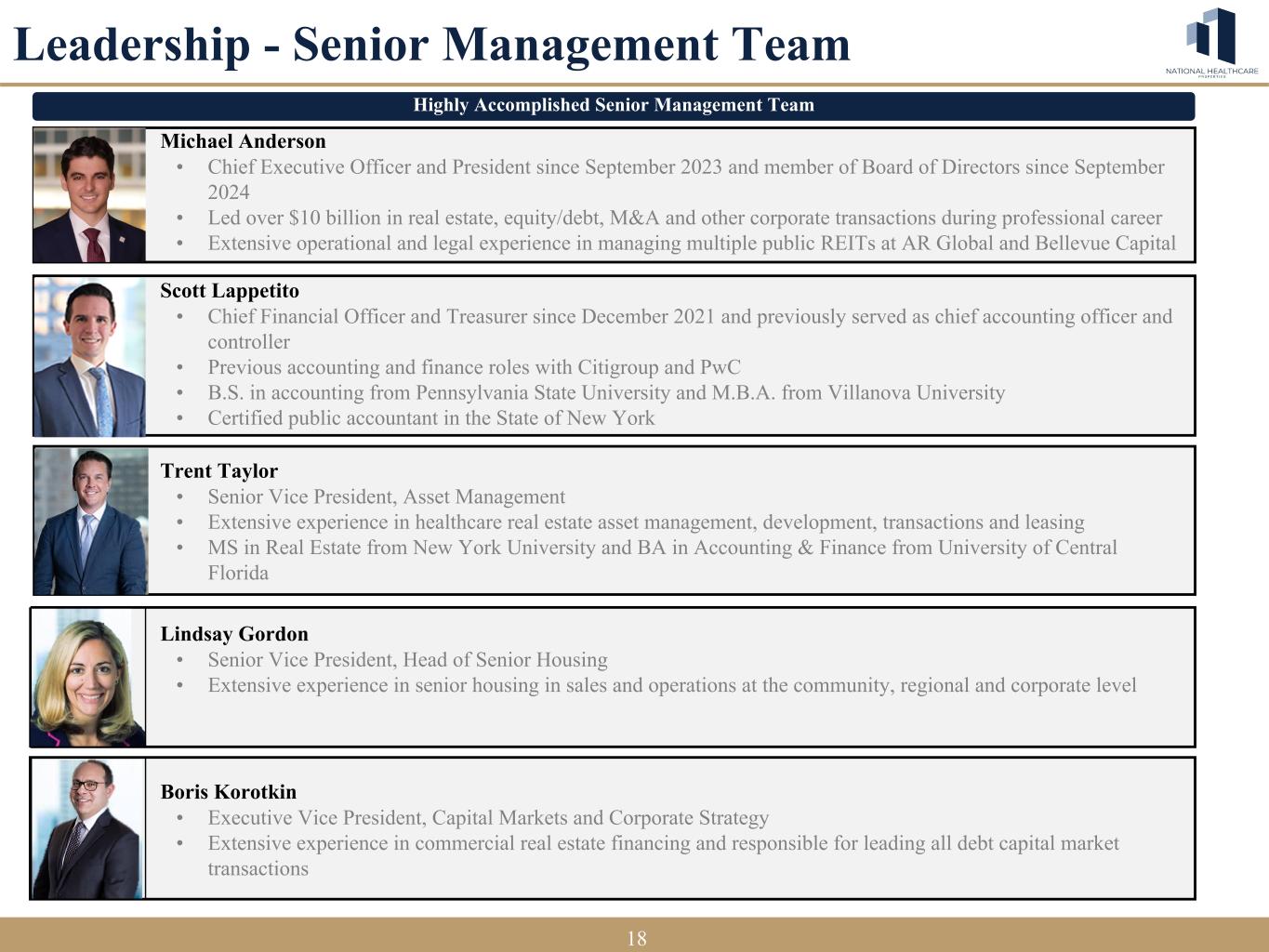

18 Leadership - Senior Management Team Trent Taylor • Senior Vice President, Asset Management • Extensive experience in healthcare real estate asset management, development, transactions and leasing • MS in Real Estate from New York University and BA in Accounting & Finance from University of Central Florida Scott Lappetito • Chief Financial Officer and Treasurer since December 2021 and previously served as chief accounting officer and controller • Previous accounting and finance roles with Citigroup and PwC • B.S. in accounting from Pennsylvania State University and M.B.A. from Villanova University • Certified public accountant in the State of New York Michael Anderson • Chief Executive Officer and President since September 2023 and member of Board of Directors since September 2024 • Led over $10 billion in real estate, equity/debt, M&A and other corporate transactions during professional career • Extensive operational and legal experience in managing multiple public REITs at AR Global and Bellevue Capital Boris Korotkin • Executive Vice President, Capital Markets and Corporate Strategy • Extensive experience in commercial real estate financing and responsible for leading all debt capital market transactions Lindsay Gordon • Senior Vice President, Head of Senior Housing • Extensive experience in senior housing in sales and operations at the community, regional and corporate level Highly Accomplished Senior Management Team 18

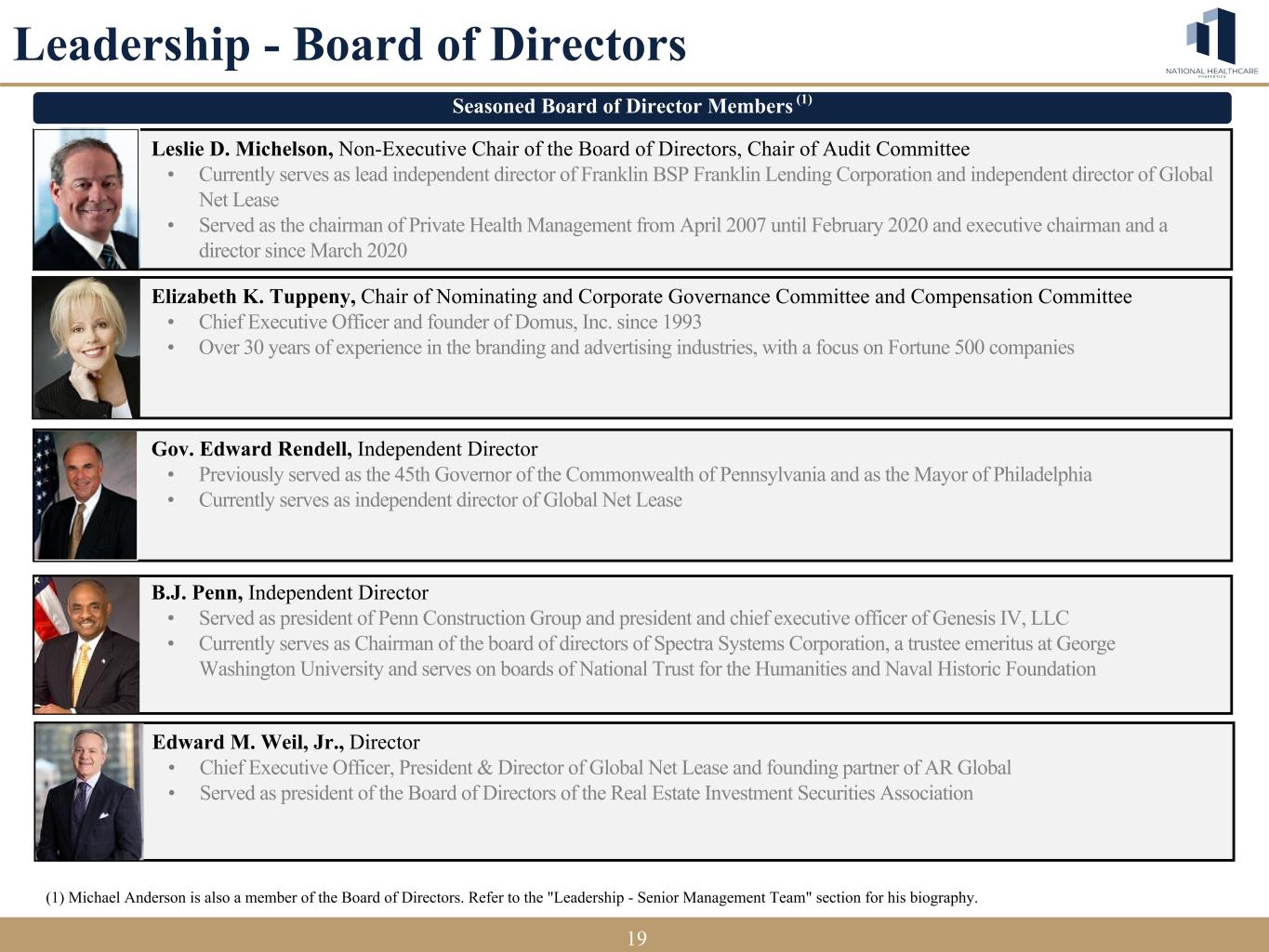

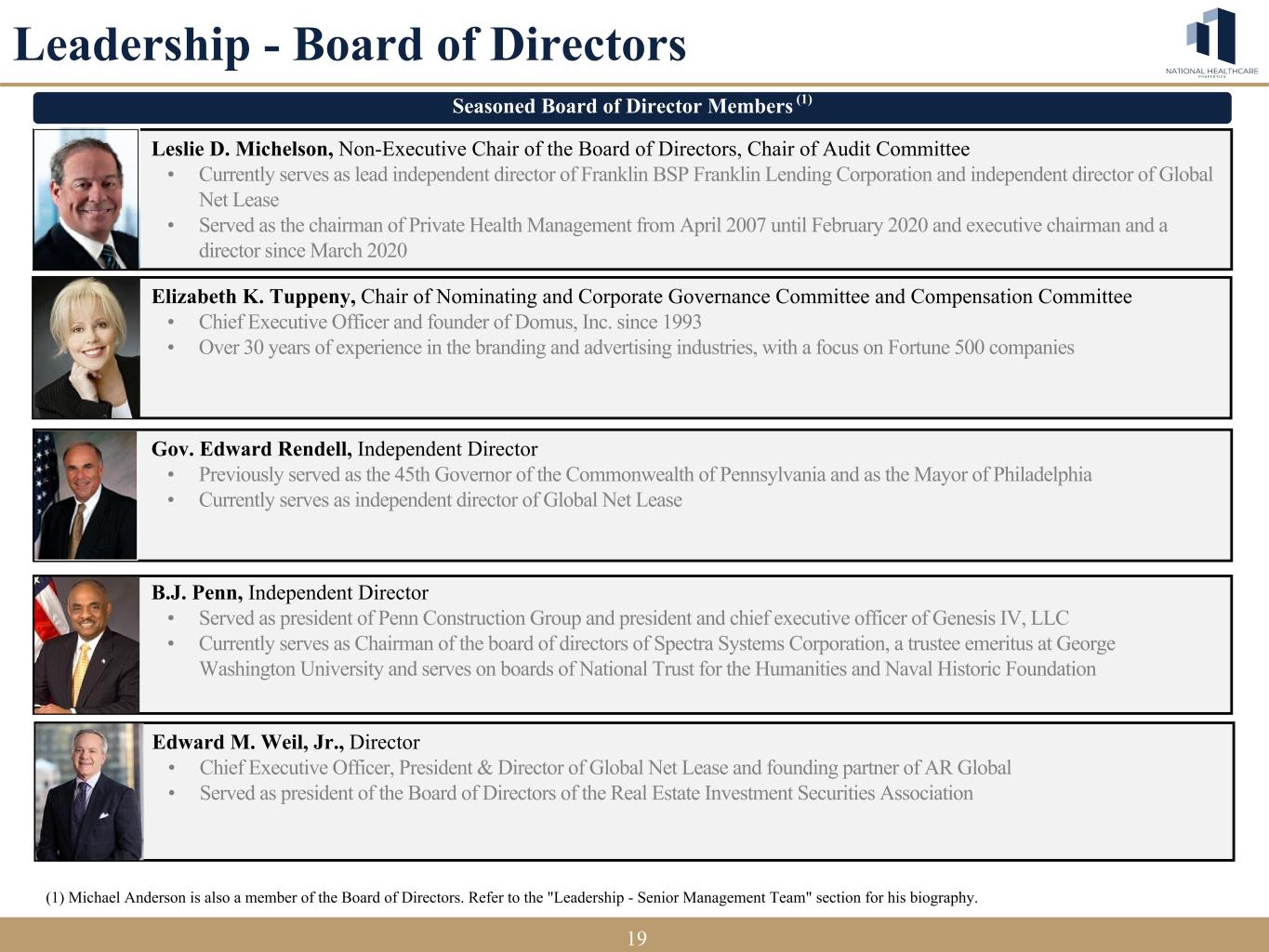

19 Leadership - Board of Directors Leslie D. Michelson, Non-Executive Chair of the Board of Directors, Chair of Audit Committee • Currently serves as lead independent director of Franklin BSP Franklin Lending Corporation and independent director of Global Net Lease • Served as the chairman of Private Health Management from April 2007 until February 2020 and executive chairman and a director since March 2020 19 Elizabeth K. Tuppeny, Chair of Nominating and Corporate Governance Committee and Compensation Committee • Chief Executive Officer and founder of Domus, Inc. since 1993 • Over 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies Gov. Edward Rendell, Independent Director • Previously served as the 45th Governor of the Commonwealth of Pennsylvania and as the Mayor of Philadelphia • Currently serves as independent director of Global Net Lease B.J. Penn, Independent Director • Served as president of Penn Construction Group and president and chief executive officer of Genesis IV, LLC • Currently serves as Chairman of the board of directors of Spectra Systems Corporation, a trustee emeritus at George Washington University and serves on boards of National Trust for the Humanities and Naval Historic Foundation Edward M. Weil, Jr., Director • Chief Executive Officer, President & Director of Global Net Lease and founding partner of AR Global • Served as president of the Board of Directors of the Real Estate Investment Securities Association Seasoned Board of Director Members (1) (1) Michael Anderson is also a member of the Board of Directors. Refer to the "Leadership - Senior Management Team" section for his biography. 19

20 Disclaimer References in this presentation to the “NHP,” “we,” “us” and “our” refer to National Healthcare Properties, Inc. and its consolidated subsidiaries. This presentation contains “forward-looking statements,” as that term is defined under Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the intent, belief or current expectations of NHP and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,”, “projects,” “potential,” “predicts,” “intends,” “would,” “could,” “should” or similar expressions, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those contemplated by such forward-looking statements. NHP believes these forward-looking statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations. Further, forward-looking statements speak only as of the date they are made, and NHP undertakes no obligation to update or revise forward- looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of NHP's control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks that any potential future acquisitions by NHP are subject to market conditions and capital availability and may not be identified or completed on favorable terms, or at all. Some of the additional risks and uncertainties, although not all risks and uncertainties, that could cause NHP's actual results to differ materially from those presented in its forward-looking statements are set forth in the section titled Risk Factors of NHP’s Annual Report on Form 10-K for the year ended December 31, 2024 and all other filings with the SEC after that date. This presentation also includes estimated projections of future operating results. These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to NHP and other factors described in the section titled Risk Factors of NHP’s Annual Report on Form 10-K for the year ended December 31, 2024 and all other filings with the SEC after that date. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized. Unless otherwise indicated herein, the financial results and other information included in this presentation are based on the financial results and information disclosed in NHP's Form 10-K for the year ended December 31, 2024. 2020

21 Appendix: Financial Definitions 2121

22 Appendix: Financial Definitions Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including funds from operations (“FFO”), adjusted funds from operations (“AFFO”), Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”), net operating income (“NOI”), cash net operating income (“Cash NOI”) and same store NOI / Cash NOI. While NOI, Cash NOI and same store NOI / Cash NOI are property-level measures, FFO and AFFO are based on total NHP performance and therefore reflect the impact of other items not specifically associated with NOI, Cash NOI and same store NOI / Cash NOI, such as interest expense, general and administrative expenses and operating fees to related parties. Additionally, NOI and FFO, as defined herein, do not reflect an adjustment for straight-line rent but AFFO does include this adjustment. A description of these non-GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income (loss), is provided below. These non-GAAP measures of NHP's financial performance should not be considered as an alternative to net income (loss) or any other performance measure derived in accordance with generally accepted accounting principles in the U.S. (“GAAP”) and it should not be construed as an inference that NHP's future results will be unaffected by unusual or non-recurring items. Reconciliations of these non-GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income (loss), are provided below. Caution on the Use of Non-GAAP Measures FFO, AFFO, EBITDA, Adjusted EBITDA, NOI, Cash NOI and same store NOI / Cash NOI should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income (loss) or in its applicability in evaluating NHP's operating performance. The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non-GAAP measures. Other REITs may not define FFO in accordance with the current National Association of Real Estate Investment Trusts (“Nareit”) definition (as NHP does), or may interpret the current Nareit definition differently than NHP does, or may calculate FFO or AFFO differently than NHP does. Consequently, NHP's presentation of FFO and AFFO may not be comparable to other similarly-titled measures presented by other REITs. NHP considers FFO and AFFO useful indicators of its performance. Because FFO and AFFO calculations exclude such factors as depreciation and amortization of real estate assets and gain or loss from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), FFO and AFFO presentations facilitate comparisons of operating performance between periods and between other REITs in NHP's peer group. 2222

23 Appendix: Financial Definitions Caution on the Use of Non-GAAP Measures (continued) As a result, NHP believes that the use of FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of its operating performance including relative to its peers and a more informed and appropriate basis on which to make decisions involving operating, financing and investing activities. However, FFO and AFFO are not indicative of cash available to fund ongoing cash needs, including the ability to make cash distributions. Investors are cautioned that FFO and AFFO should only be used to assess the sustainability of NHP's operating performance excluding these activities, as they exclude certain costs that have a negative effect on NHP's operating performance during the periods in which these costs are incurred. The historical accounting convention used for real estate requires straight-line depreciation of buildings and improvements, and straight- line amortization of intangibles, which implies that the value of real estate diminishes predictably over time. NHP believes that, because real-estate values historically rise and fall with market conditions, including inflation, interest rates, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation and certain other items may be less informative. Historical accounting involves the use of GAAP. Any other method of accounting for real estate such as the fair value method cannot be construed as any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP. Nevertheless, NHP believes that the use of FFO and AFFO, which exclude the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of its performance to investors and to management, and, when compared year-over-year, reflects the impact on its operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, which may not be immediately apparent from net income or loss as determined under GAAP. Funds from Operations Due to certain unique operating characteristics of real estate companies, as discussed above, Nareit, an industry trade group, has promulgated a measure known as FFO, which NHP believes to be an appropriate supplemental measure to reflect the operating performance of a REIT. FFO is not equivalent to net income or loss as determined under GAAP. NHP calculates FFO, a non-GAAP measure, consistent with the standards established over time by Nareit. Nareit defines FFO as net income or loss (computed in accordance with GAAP), adjusted for (i) real estate-related depreciation and amortization, (ii) impairment charges on depreciable real property, (iii) gains or losses from sales of depreciable real property and (iv) similar adjustments for non- controlling interests and unconsolidated entities. 2323

24 Appendix: Financial Definitions Adjusted Funds from Operations NHP also believes that AFFO is a meaningful supplemental non-GAAP measure of its operating results. NHP calculates AFFO by further adjusting FFO to reflect the performance of its portfolio for items it believes are not directly attributable to its operations. NHP believes that AFFO is a beneficial indicator of its ongoing portfolio performance and isolates the financial results of its operations. NHP's adjustments to FFO to arrive at AFFO include removing the impacts of (i) acquisition and transaction related costs (including certain expenses directly related to its recent internalization and the reverse stock-split), (ii) amortization of market-lease intangible assets and liabilities, (iii) adjustments for straight-line rent, (iv) termination fees to related parties, (v) equity-based compensation expense, (vi) depreciation and amortization related to non-real estate related assets, (vii) mark-to-market gains and losses from its non-designated derivatives, (viii) non-cash components of interest expense, (ix) casualty-related charges, (x) gains or losses on extinguishment of debt and (xi) similar adjustments for non-controlling interests and unconsolidated entities. NHP believes that AFFO is a recognized measure of sustainable operating performance by the REIT industry and is useful in comparing the sustainability of NHP's operating performance with the sustainability of the operating performance of other real estate companies. Earnings before Interest, Taxes, Depreciation and Amortization and Adjusted Earnings before Interest, Taxes, Depreciation and Amortization NHP believes that EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization is an appropriate measure of its ability to incur and service debt. NHP also believes that Adjusted EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization adjusted for acquisition and transaction related costs, termination fees to related parties, interest and other income and other non-cash items including equity-based compensation, impairment charges, casualty-related charges, gains and losses on sale of real estate investments, gains or losses on extinguishment of debt and gains and losses on derivative investments is an appropriate measure of NHP's ability to incur and service debt. Both EBITDA and Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of NHP's liquidity or as an alternative to net income (loss) as an indicator of its operating activities. Other REITs may calculate EBITDA and Adjusted EBITDA differently and NHP's calculation should not be compared to that of other REITs. 2424

25 Appendix: Financial Definitions Net Operating Income Net Operating Income (“NOI”) is a non-GAAP financial measure equal to total revenues from tenants, less property operating costs. NHP evaluates the performance of the combined properties in each segment based NOI. As such, this excludes all other items of expense and income included in the financial statements in calculating net loss. NHP uses NOI to assess and compare property level performance and to make decisions concerning the operation of the properties. NHP believes that NOI is useful as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating expenses and acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net loss. Cash Net Operating Income Cash Net Operating Income (“Cash NOI”) is a non-GAAP financial measure that is intended to reflect the performance of NHP's properties. NHP defines Cash NOI as NOI excluding net amortization of above/below market lease and lease intangibles and straight-line rent adjustments that are included in GAAP revenue from tenants and property operating and maintenance. NHP believes that Cash NOI is a helpful measure that both investors and management can use to evaluate the current financial performance of NHP's properties and it allows for comparison of its operating performance between periods and to other REITs. Same Store NOI or Cash NOI Same Store (as defined below) NOI or Cash NOI are non-GAAP financial measures that are intended to reflect the performance of NHP's properties using a consistent population which controls for changes in the composition of its portfolio. NHP believes that Same-Store NOI or Cash NOI are helpful measures that both investors and management can use to evaluate the current financial performance of NHP's properties and it allows for comparison of its operating performance between periods and to other REITs. Cash Paid for Interest Cash Paid for Interest is calculated based on interest expense net of the non-cash portion of interest expense, such as amortization of mortgage discounts and premiums. NHP believes that Cash Paid for Interest provides useful information to investors to assess its overall solvency and financial flexibility. 2525

26 Appendix: Financial Definitions Annualized Straight-Line Base Rent: Represents the total contractual base rents on a straight-line basis to be received throughout the duration of the lease currently in place expressed as a per annum value. Includes adjustments for non-cash portions of rent. Cash Rent: Represents total of all contractual rents on a cash basis due from tenants as stipulated in the originally executed lease agreements at inception or any lease amendments thereafter. Economic Interest Rate: Includes the economic impact of all hedging instruments. Lease Renewal Rental Spread: Percentage change from prior lease annualized straight-line rent to renewal lease annualized straight-line rent. Net Debt: Total gross debt less cash and cash equivalents. Net Debt to Annualized Adjusted EBITDA or Net Leverage: Net Debt divided by Annualized Adjusted EBITDA (annualized based on Adjusted EBITDA for the quarter multiplied by four). Net Debt to Gross Asset Value: Equal to “Net Debt” as defined above divided by the total real estate investments, at cost, net of gross market lease intangibles. Non-Core Properties: Assets that have been deemed not essential to generating future economic benefit or value to NHP's day-to-day operations and/or are scheduled to be sold (with executed letters of intent or purchase and sale agreements). Occupancy or Leased %: Occupancy for the OMF segment is presented as of the end of the period shown; occupancy for the SHOP segment is presented for the duration of the period shown. RevPOR: Revenue per occupied room for the SHOP segment. RevPOR is calculated as total revenue generated by occupied rooms divided by the number of occupied rooms. Same Store: NHP defines “same store” as operational properties owned for the full period in both comparison periods and that are not otherwise excluded. Properties are excluded from same store if they are (i) Non-Core Properties (as defined above), (ii) sold, classified as held for sale, or classified as discontinued operations in accordance with GAAP; or (iii) impacted by materially disrupted events. Refer to the reconciliation of Same Store properties below. Metrics calculated based on Same Store properties may have different adjustments compared to NHP's filings elsewhere. Weighted-Average Remaining Lease Term or WALT: Current portfolio calculated as of December 31, 2024. Weighted based on square feet. 2626

27 Appendix: Non-GAAP Reconciliations 2727

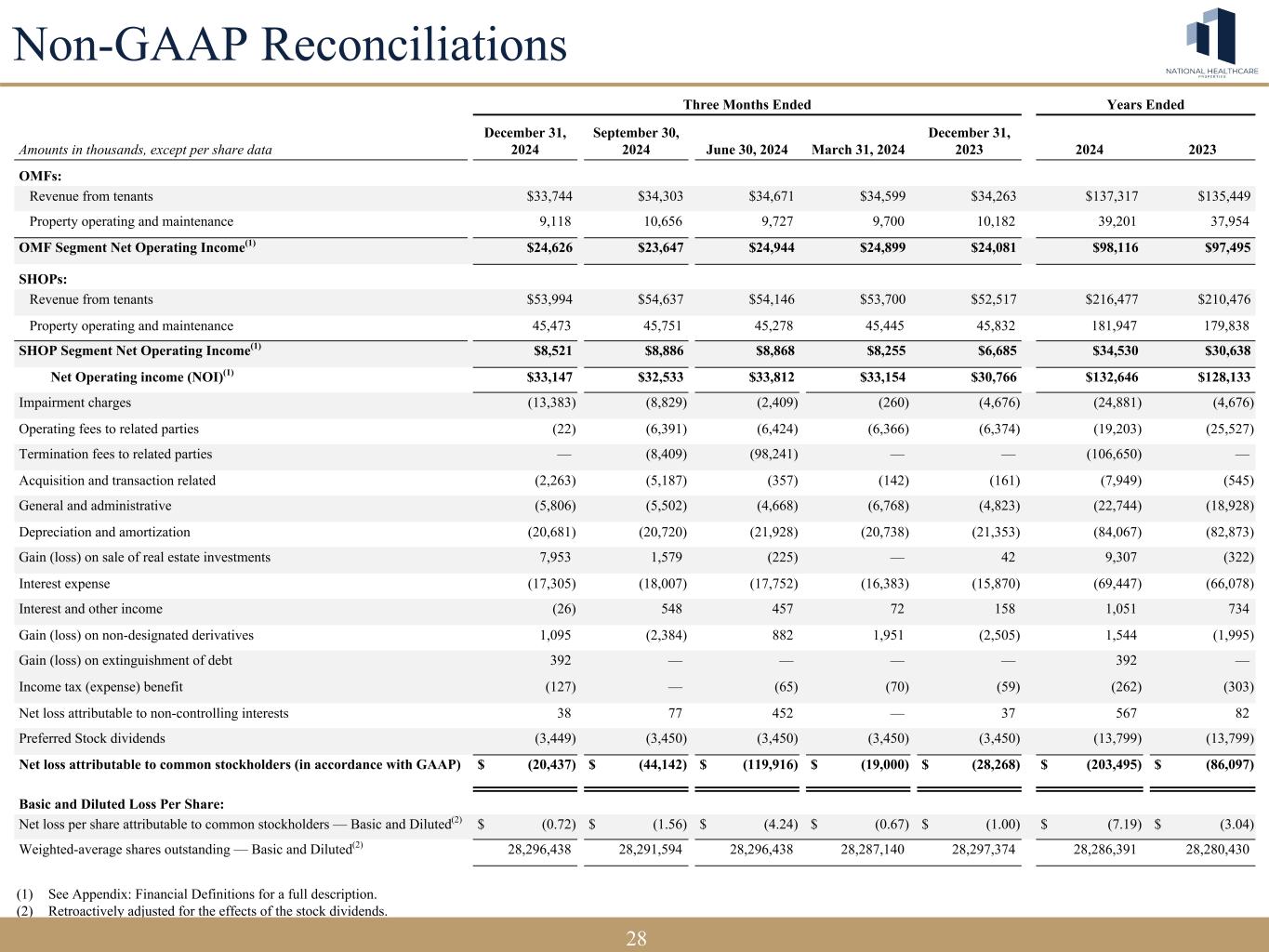

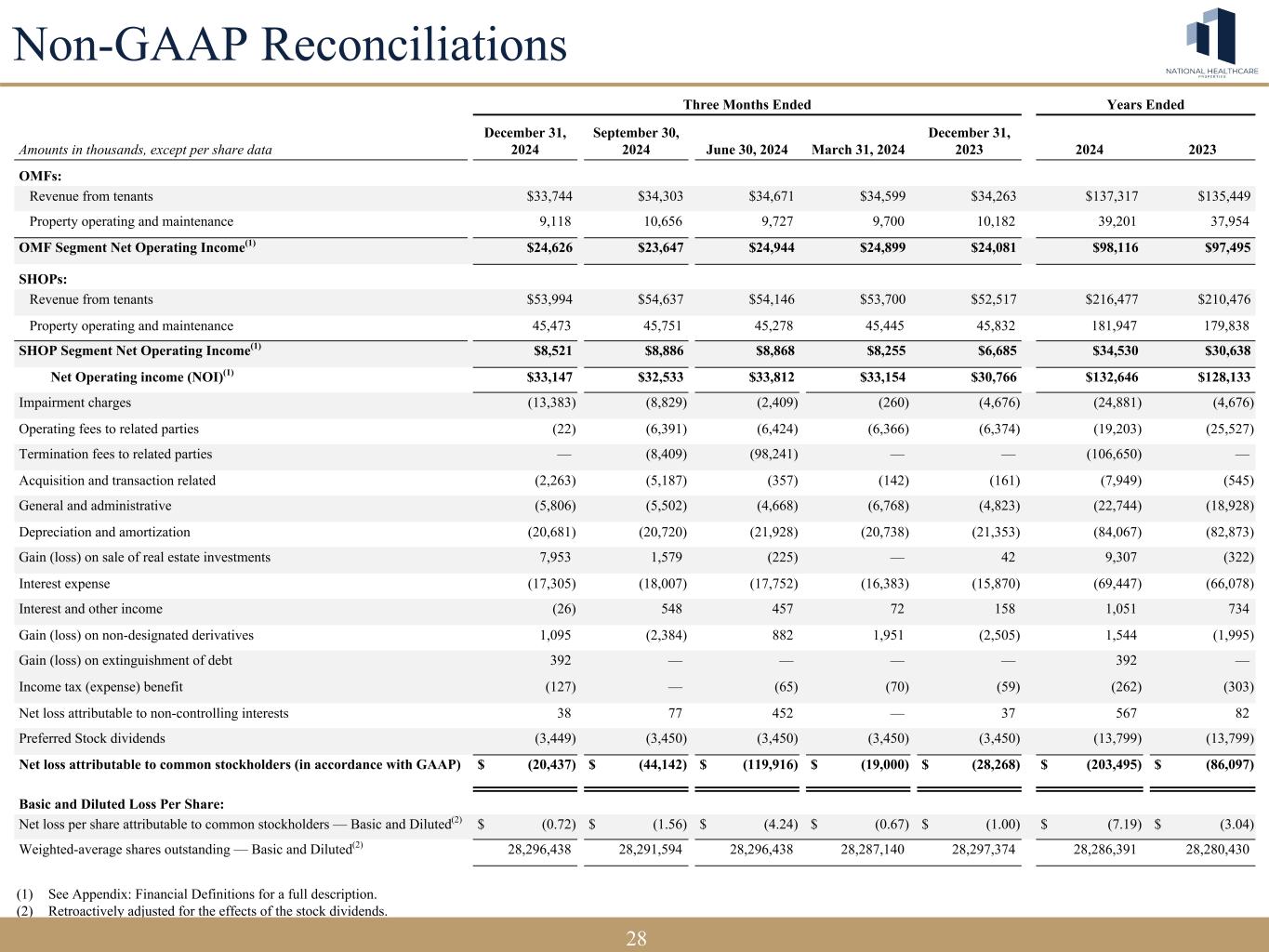

28 (1) See Appendix: Financial Definitions for a full description. (2) Retroactively adjusted for the effects of the stock dividends. Non-GAAP Reconciliations Three Months Ended Years Ended Amounts in thousands, except per share data December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 2024 2023 OMFs: Revenue from tenants $33,744 $34,303 $34,671 $34,599 $34,263 $137,317 $135,449 Property operating and maintenance 9,118 10,656 9,727 9,700 10,182 39,201 37,954 OMF Segment Net Operating Income(1) $24,626 $23,647 $24,944 $24,899 $24,081 $98,116 $97,495 SHOPs: Revenue from tenants $53,994 $54,637 $54,146 $53,700 $52,517 $216,477 $210,476 Property operating and maintenance 45,473 45,751 45,278 45,445 45,832 181,947 179,838 SHOP Segment Net Operating Income(1) $8,521 $8,886 $8,868 $8,255 $6,685 $34,530 $30,638 Net Operating income (NOI)(1) $33,147 $32,533 $33,812 $33,154 $30,766 $132,646 $128,133 Impairment charges (13,383) (8,829) (2,409) (260) (4,676) (24,881) (4,676) Operating fees to related parties (22) (6,391) (6,424) (6,366) (6,374) (19,203) (25,527) Termination fees to related parties — (8,409) (98,241) — — (106,650) — Acquisition and transaction related (2,263) (5,187) (357) (142) (161) (7,949) (545) General and administrative (5,806) (5,502) (4,668) (6,768) (4,823) (22,744) (18,928) Depreciation and amortization (20,681) (20,720) (21,928) (20,738) (21,353) (84,067) (82,873) Gain (loss) on sale of real estate investments 7,953 1,579 (225) — 42 9,307 (322) Interest expense (17,305) (18,007) (17,752) (16,383) (15,870) (69,447) (66,078) Interest and other income (26) 548 457 72 158 1,051 734 Gain (loss) on non-designated derivatives 1,095 (2,384) 882 1,951 (2,505) 1,544 (1,995) Gain (loss) on extinguishment of debt 392 — — — — 392 — Income tax (expense) benefit (127) — (65) (70) (59) (262) (303) Net loss attributable to non-controlling interests 38 77 452 — 37 567 82 Preferred Stock dividends (3,449) (3,450) (3,450) (3,450) (3,450) (13,799) (13,799) Net loss attributable to common stockholders (in accordance with GAAP) $ (20,437) $ (44,142) $ (119,916) $ (19,000) $ (28,268) $ (203,495) $ (86,097) Basic and Diluted Loss Per Share: Net loss per share attributable to common stockholders — Basic and Diluted(2) $ (0.72) $ (1.56) $ (4.24) $ (0.67) $ (1.00) $ (7.19) $ (3.04) Weighted-average shares outstanding — Basic and Diluted(2) 28,296,438 28,291,594 28,296,438 28,287,140 28,297,374 28,286,391 28,280,430 2828

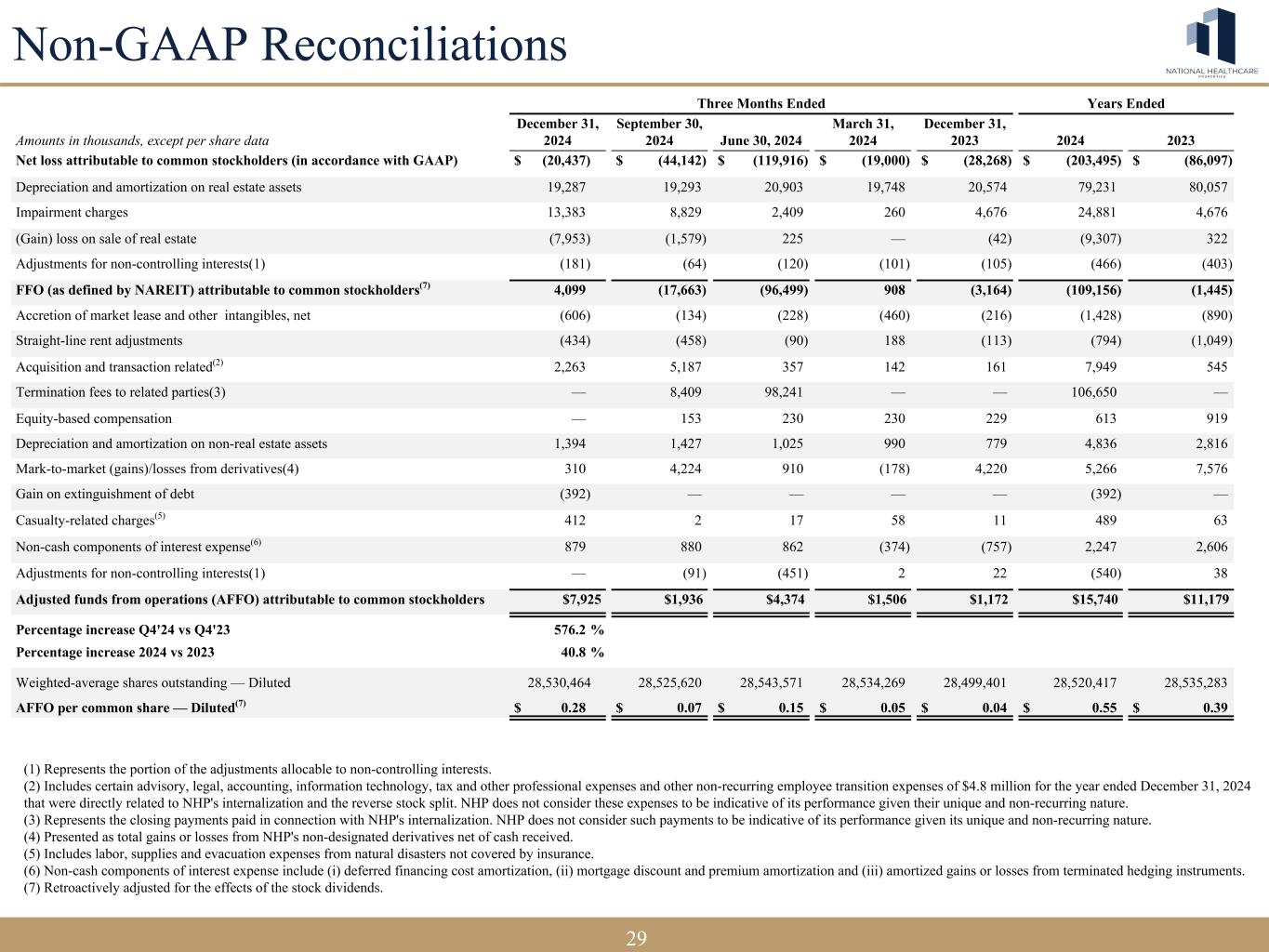

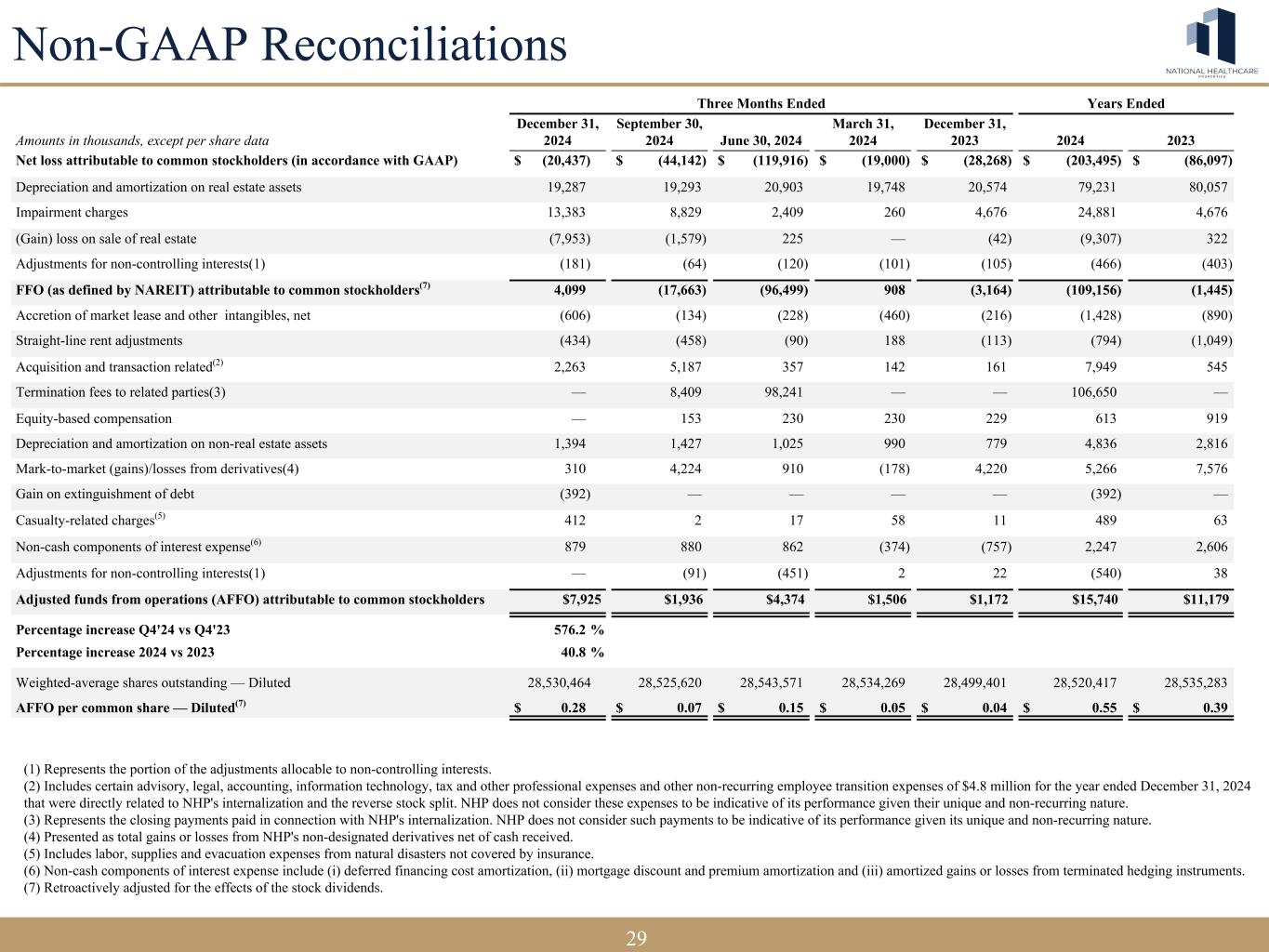

29 Non-GAAP Reconciliations (1) Represents the portion of the adjustments allocable to non-controlling interests. (2) Includes certain advisory, legal, accounting, information technology, tax and other professional expenses and other non-recurring employee transition expenses of $4.8 million for the year ended December 31, 2024 that were directly related to NHP's internalization and the reverse stock split. NHP does not consider these expenses to be indicative of its performance given their unique and non-recurring nature. (3) Represents the closing payments paid in connection with NHP's internalization. NHP does not consider such payments to be indicative of its performance given its unique and non-recurring nature. (4) Presented as total gains or losses from NHP's non-designated derivatives net of cash received. (5) Includes labor, supplies and evacuation expenses from natural disasters not covered by insurance. (6) Non-cash components of interest expense include (i) deferred financing cost amortization, (ii) mortgage discount and premium amortization and (iii) amortized gains or losses from terminated hedging instruments. (7) Retroactively adjusted for the effects of the stock dividends. Three Months Ended Years Ended Amounts in thousands, except per share data December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 2024 2023 Net loss attributable to common stockholders (in accordance with GAAP) $ (20,437) $ (44,142) $ (119,916) $ (19,000) $ (28,268) $ (203,495) $ (86,097) Depreciation and amortization on real estate assets 19,287 19,293 20,903 19,748 20,574 79,231 80,057 Impairment charges 13,383 8,829 2,409 260 4,676 24,881 4,676 (Gain) loss on sale of real estate (7,953) (1,579) 225 — (42) (9,307) 322 Adjustments for non-controlling interests(1) (181) (64) (120) (101) (105) (466) (403) FFO (as defined by NAREIT) attributable to common stockholders(7) 4,099 (17,663) (96,499) 908 (3,164) (109,156) (1,445) Accretion of market lease and other intangibles, net (606) (134) (228) (460) (216) (1,428) (890) Straight-line rent adjustments (434) (458) (90) 188 (113) (794) (1,049) Acquisition and transaction related(2) 2,263 5,187 357 142 161 7,949 545 Termination fees to related parties(3) — 8,409 98,241 — — 106,650 — Equity-based compensation — 153 230 230 229 613 919 Depreciation and amortization on non-real estate assets 1,394 1,427 1,025 990 779 4,836 2,816 Mark-to-market (gains)/losses from derivatives(4) 310 4,224 910 (178) 4,220 5,266 7,576 Gain on extinguishment of debt (392) — — — — (392) — Casualty-related charges(5) 412 2 17 58 11 489 63 Non-cash components of interest expense(6) 879 880 862 (374) (757) 2,247 2,606 Adjustments for non-controlling interests(1) — (91) (451) 2 22 (540) 38 Adjusted funds from operations (AFFO) attributable to common stockholders $7,925 $1,936 $4,374 $1,506 $1,172 $15,740 $11,179 Percentage increase Q4'24 vs Q4'23 576.2 % Percentage increase 2024 vs 2023 40.8 % Weighted-average shares outstanding — Diluted 28,530,464 28,525,620 28,543,571 28,534,269 28,499,401 28,520,417 28,535,283 AFFO per common share — Diluted(7) $ 0.28 $ 0.07 $ 0.15 $ 0.05 $ 0.04 $ 0.55 $ 0.39 2929

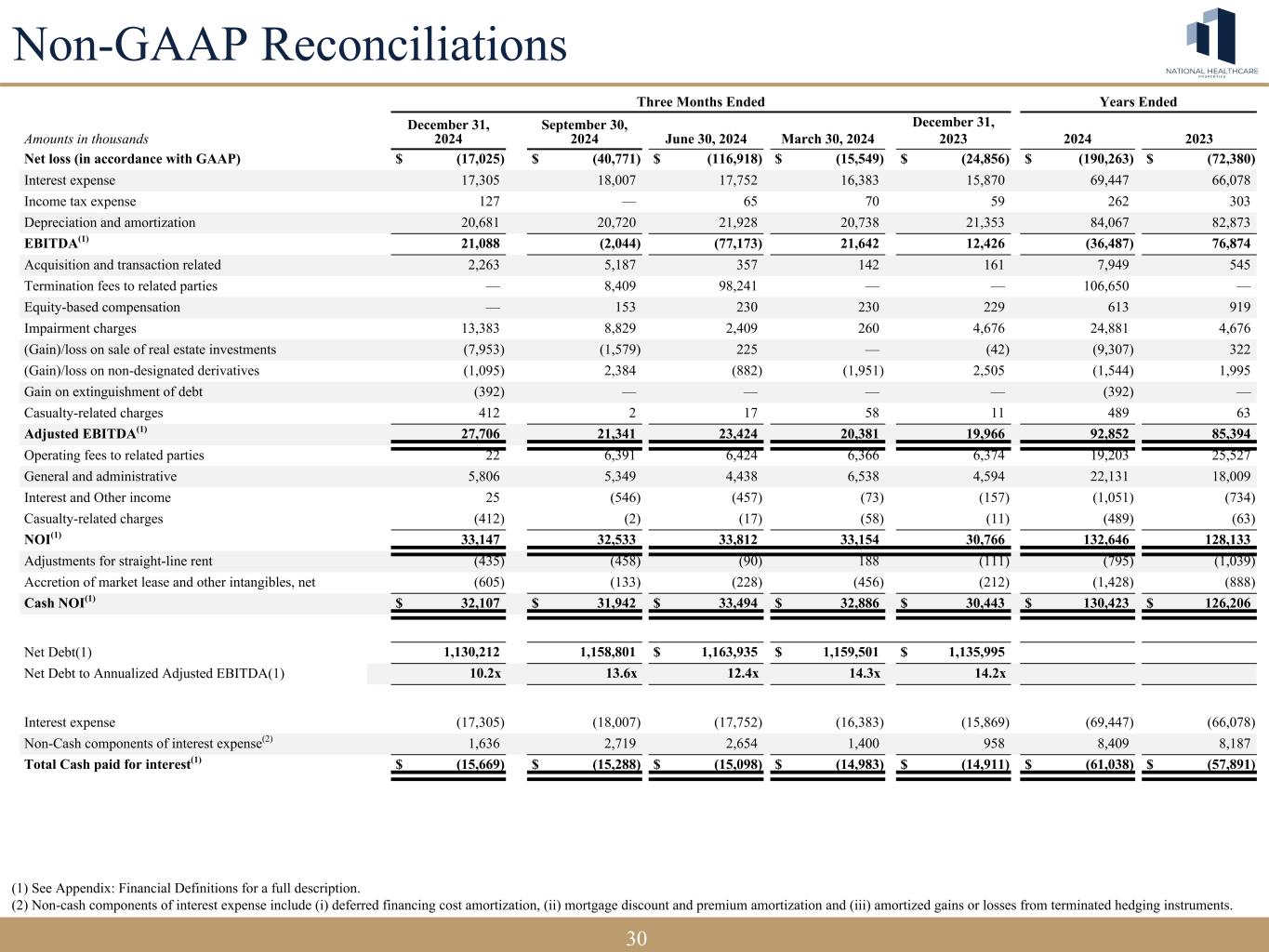

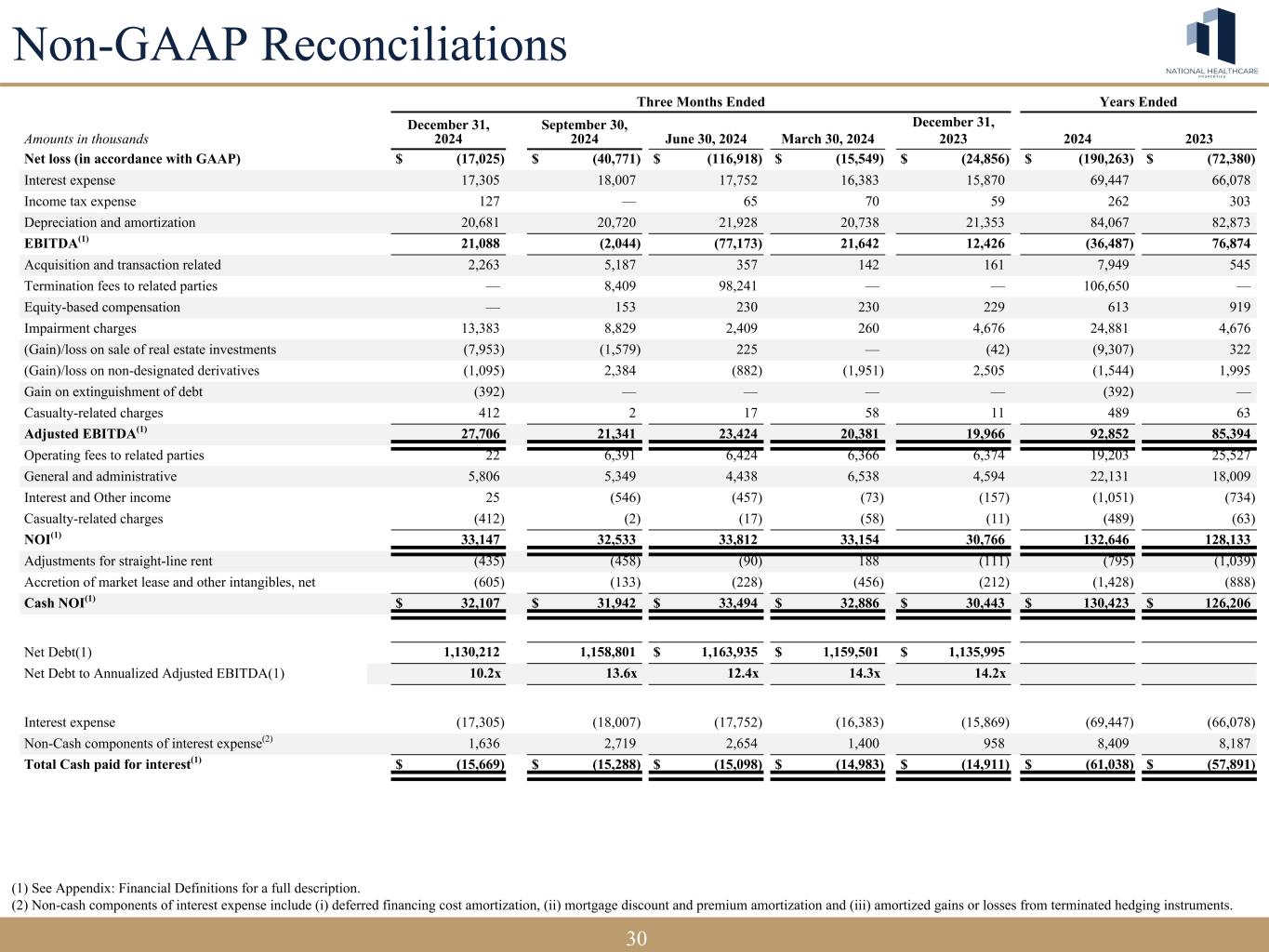

30 Non-GAAP Reconciliations Three Months Ended Years Ended Amounts in thousands December 31, 2024 September 30, 2024 June 30, 2024 March 30, 2024 December 31, 2023 2024 2023 Net loss (in accordance with GAAP) $ (17,025) $ (40,771) $ (116,918) $ (15,549) $ (24,856) $ (190,263) $ (72,380) Interest expense 17,305 18,007 17,752 16,383 15,870 69,447 66,078 Income tax expense 127 — 65 70 59 262 303 Depreciation and amortization 20,681 20,720 21,928 20,738 21,353 84,067 82,873 EBITDA(1) 21,088 (2,044) (77,173) 21,642 12,426 (36,487) 76,874 Acquisition and transaction related 2,263 5,187 357 142 161 7,949 545 Termination fees to related parties — 8,409 98,241 — — 106,650 — Equity-based compensation — 153 230 230 229 613 919 Impairment charges 13,383 8,829 2,409 260 4,676 24,881 4,676 (Gain)/loss on sale of real estate investments (7,953) (1,579) 225 — (42) (9,307) 322 (Gain)/loss on non-designated derivatives (1,095) 2,384 (882) (1,951) 2,505 (1,544) 1,995 Gain on extinguishment of debt (392) — — — — (392) — Casualty-related charges 412 2 17 58 11 489 63 Adjusted EBITDA(1) 27,706 21,341 23,424 20,381 19,966 92,852 85,394 Operating fees to related parties 22 6,391 6,424 6,366 6,374 19,203 25,527 General and administrative 5,806 5,349 4,438 6,538 4,594 22,131 18,009 Interest and Other income 25 (546) (457) (73) (157) (1,051) (734) Casualty-related charges (412) (2) (17) (58) (11) (489) (63) NOI(1) 33,147 32,533 33,812 33,154 30,766 132,646 128,133 Adjustments for straight-line rent (435) (458) (90) 188 (111) (795) (1,039) Accretion of market lease and other intangibles, net (605) (133) (228) (456) (212) (1,428) (888) Cash NOI(1) $ 32,107 $ 31,942 $ 33,494 $ 32,886 $ 30,443 $ 130,423 $ 126,206 Net Debt(1) 1,130,212 1,158,801 $ 1,163,935 $ 1,159,501 $ 1,135,995 Net Debt to Annualized Adjusted EBITDA(1) 10.2x 13.6x 12.4x 14.3x 14.2x Interest expense (17,305) (18,007) (17,752) (16,383) (15,869) (69,447) (66,078) Non-Cash components of interest expense(2) 1,636 2,719 2,654 1,400 958 8,409 8,187 Total Cash paid for interest(1) $ (15,669) $ (15,288) $ (15,098) $ (14,983) $ (14,911) $ (61,038) $ (57,891) (1) See Appendix: Financial Definitions for a full description. (2) Non-cash components of interest expense include (i) deferred financing cost amortization, (ii) mortgage discount and premium amortization and (iii) amortized gains or losses from terminated hedging instruments. 3030

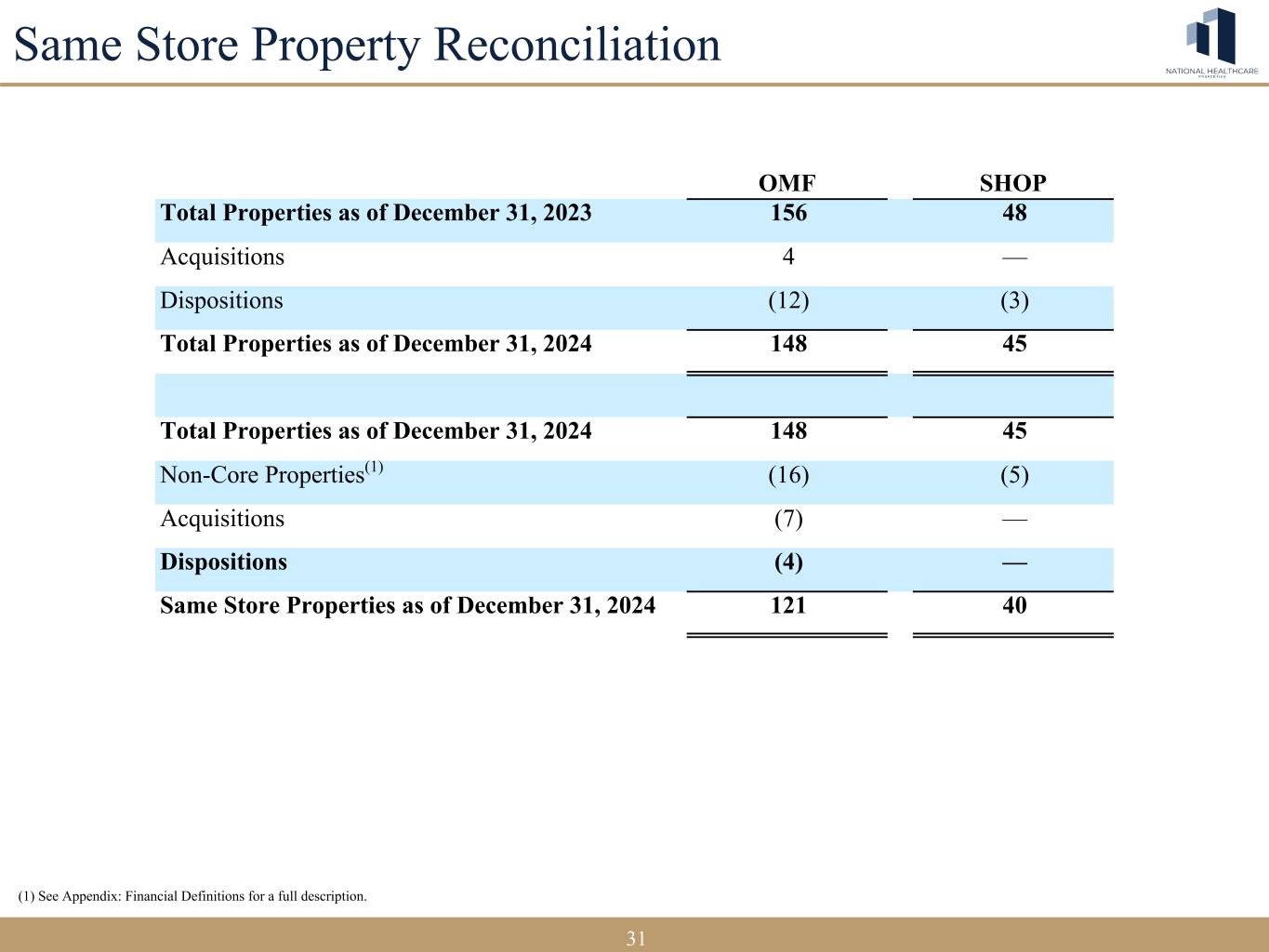

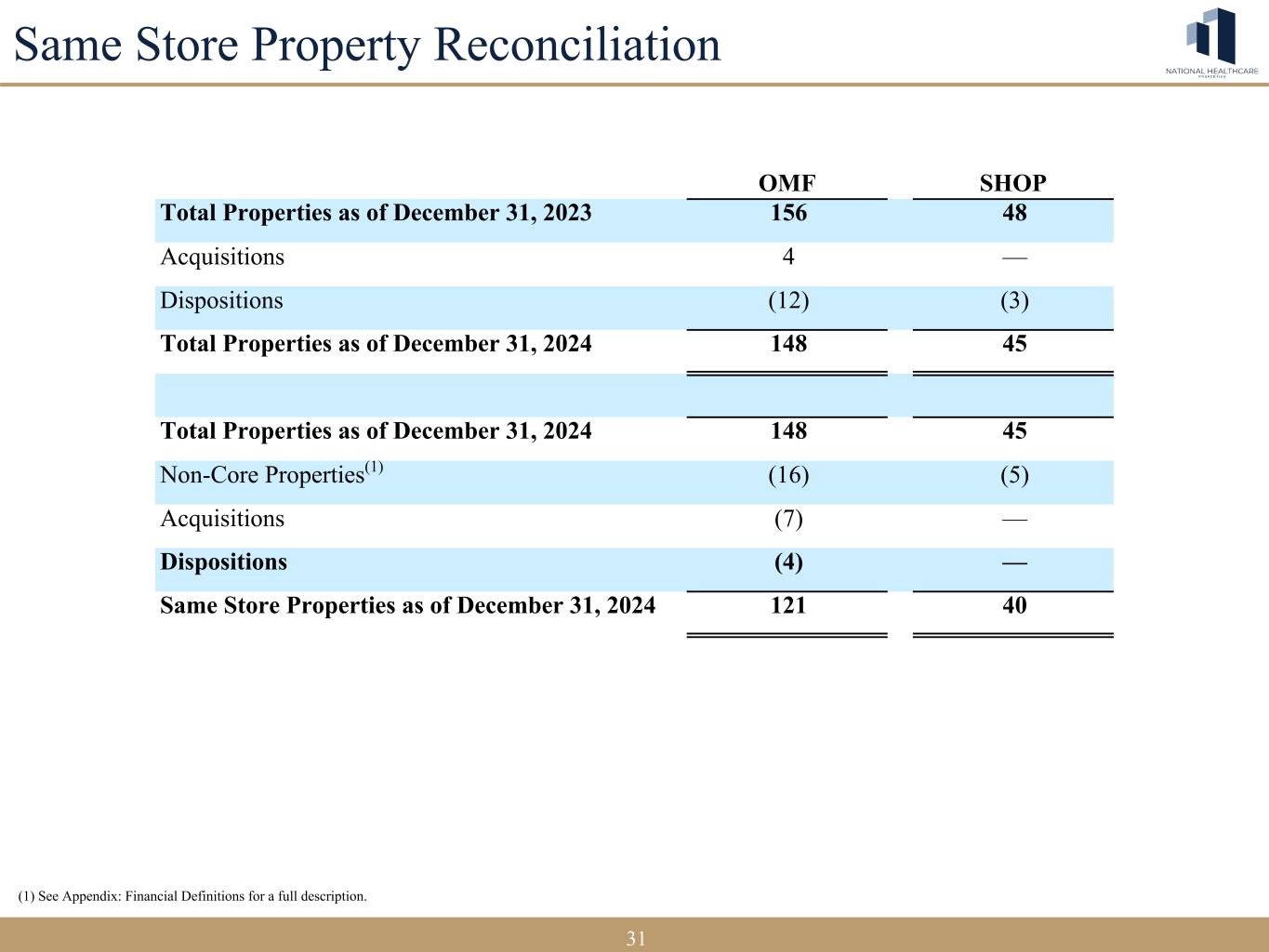

31 Same Store Property Reconciliation (1) See Appendix: Financial Definitions for a full description. 31 OMF SHOP Total Properties as of December 31, 2023 156 48 Acquisitions 4 — Dispositions (12) (3) Total Properties as of December 31, 2024 148 45 Total Properties as of December 31, 2024 148 45 Non-Core Properties(1) (16) (5) Acquisitions (7) — Dispositions (4) — Same Store Properties as of December 31, 2024 121 40 31

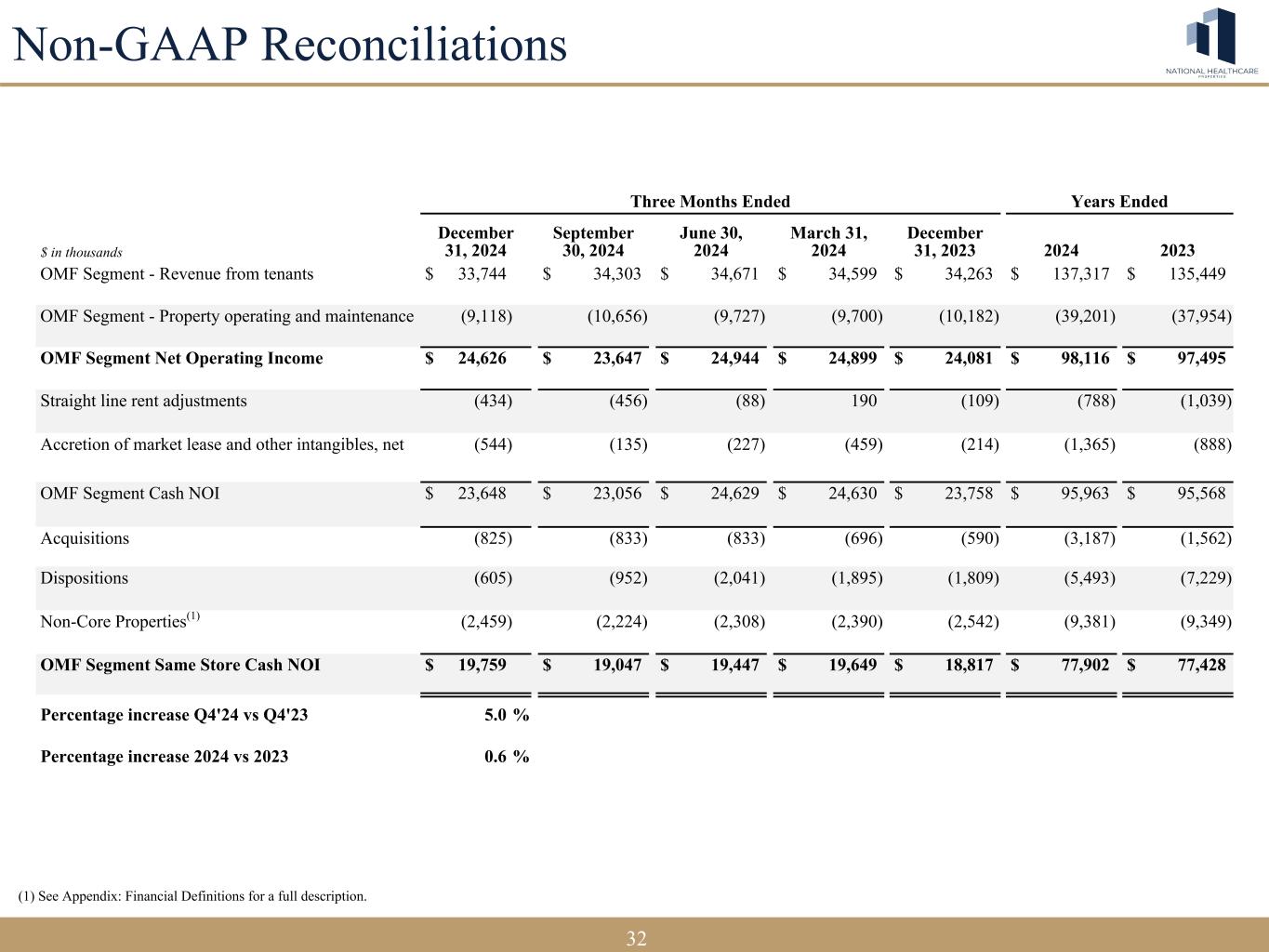

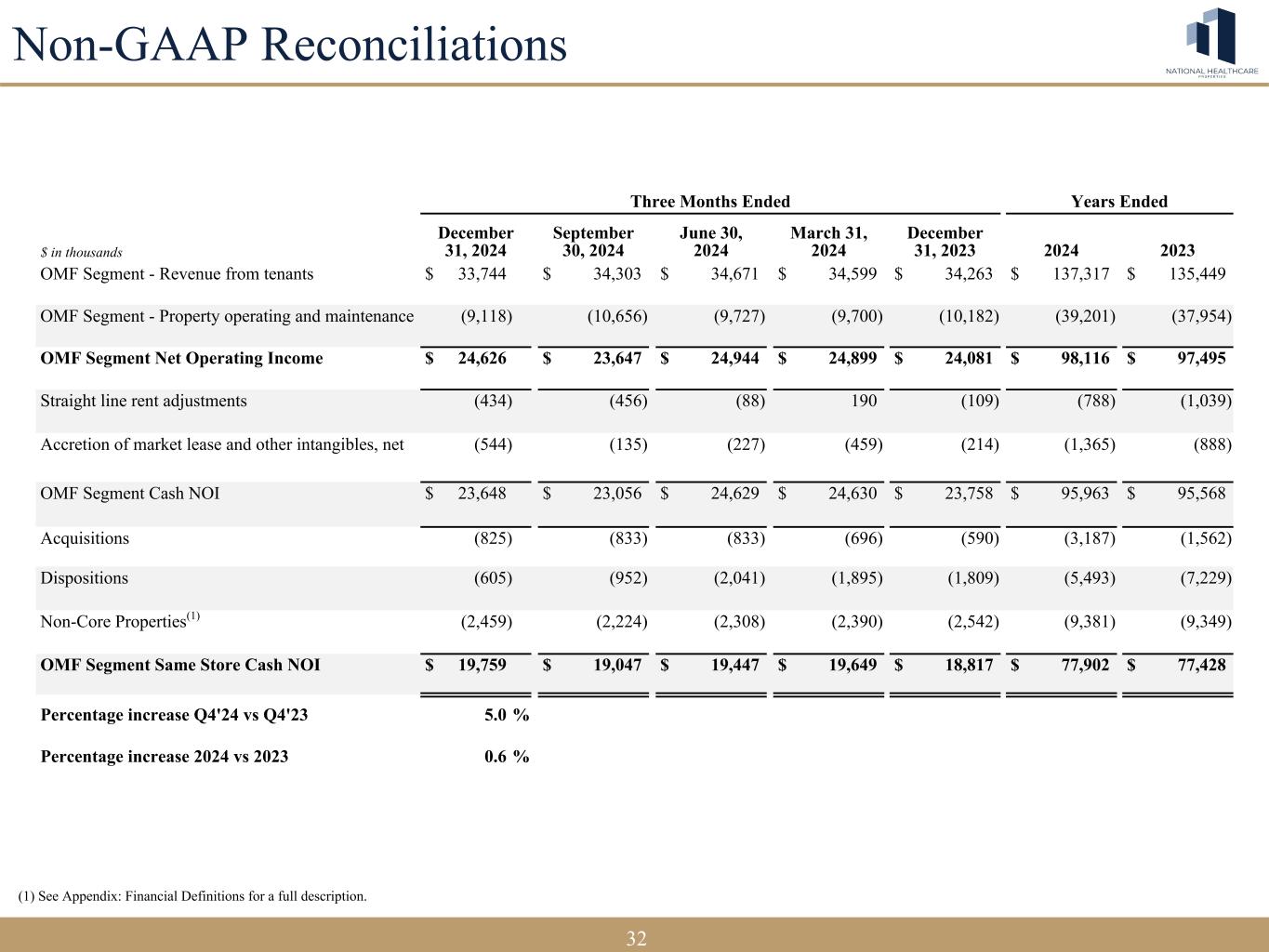

32 Three Months Ended Years Ended $ in thousands December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 2024 2023 OMF Segment - Revenue from tenants $ 33,744 $ 34,303 $ 34,671 $ 34,599 $ 34,263 $ 137,317 $ 135,449 OMF Segment - Property operating and maintenance (9,118) (10,656) (9,727) (9,700) (10,182) (39,201) (37,954) OMF Segment Net Operating Income $ 24,626 $ 23,647 $ 24,944 $ 24,899 $ 24,081 $ 98,116 $ 97,495 Straight line rent adjustments (434) (456) (88) 190 (109) (788) (1,039) Accretion of market lease and other intangibles, net (544) (135) (227) (459) (214) (1,365) (888) OMF Segment Cash NOI $ 23,648 $ 23,056 $ 24,629 $ 24,630 $ 23,758 $ 95,963 $ 95,568 Acquisitions (825) (833) (833) (696) (590) (3,187) (1,562) Dispositions (605) (952) (2,041) (1,895) (1,809) (5,493) (7,229) Non-Core Properties(1) (2,459) (2,224) (2,308) (2,390) (2,542) (9,381) (9,349) OMF Segment Same Store Cash NOI $ 19,759 $ 19,047 $ 19,447 $ 19,649 $ 18,817 $ 77,902 $ 77,428 Percentage increase Q4'24 vs Q4'23 5.0 % Percentage increase 2024 vs 2023 0.6 % Non-GAAP Reconciliations (1) See Appendix: Financial Definitions for a full description. 3232

33 Non-GAAP Reconciliations (1) See Appendix: Financial Definitions for a full description. 33 Three Months Ended Years Ended $ in thousands December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 2024 2023 SHOP Segment - Revenue from tenants $ 53,994 $ 54,637 $ 54,145 $ 53,701 $ 52,516 216,477 210,476 SHOP Segment - Property operating and maintenance (45,472) (45,751) (45,279) (45,445) (45,831) (181,947) (179,838) SHOP Segment Net Operating Income $ 8,522 $ 8,886 $ 8,866 $ 8,256 $ 6,685 $ 34,530 $ 30,638 SHOP Segment Cash NOI $ 8,459 $ 8,886 $ — $ 8,866 $ — $ 8,256 $ — $ 6,685 $ 34,467 $ 30,636 Acquisitions — — — — — — — Dispositions (2) (292) (130) 39 149 (385) (71) Non-Core Properties(1) 508 675 508 327 467 2,016 1,884 SHOP Segment Same Store Cash NOI $ 8,965 $ 9,269 $ 9,244 $ 8,622 $ 7,301 $ 36,098 $ 32,449 Percentage increase Q4'24 vs Q4'23 22.8 % Percentage increase 2024 vs 2023 11.2 % 33

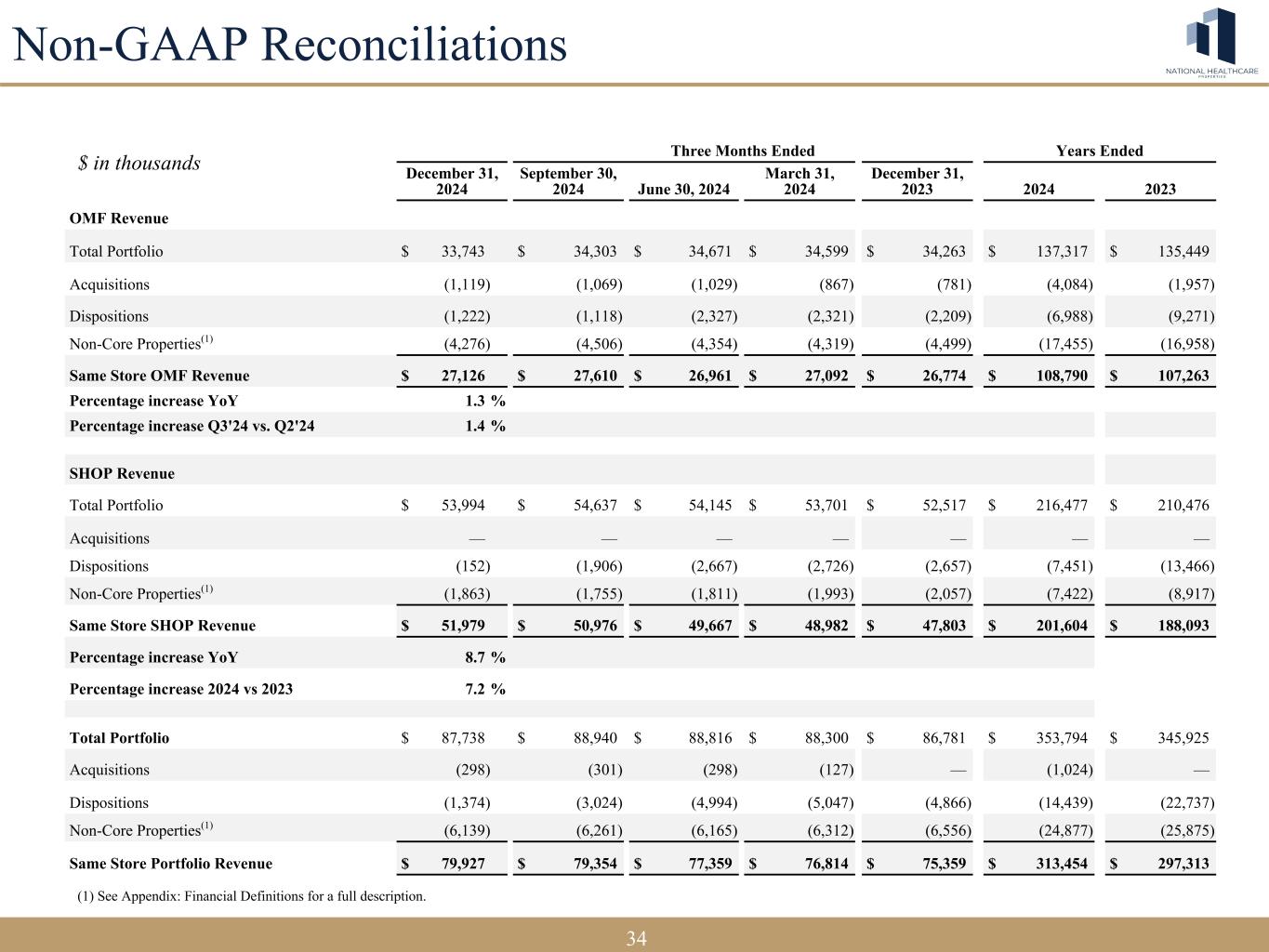

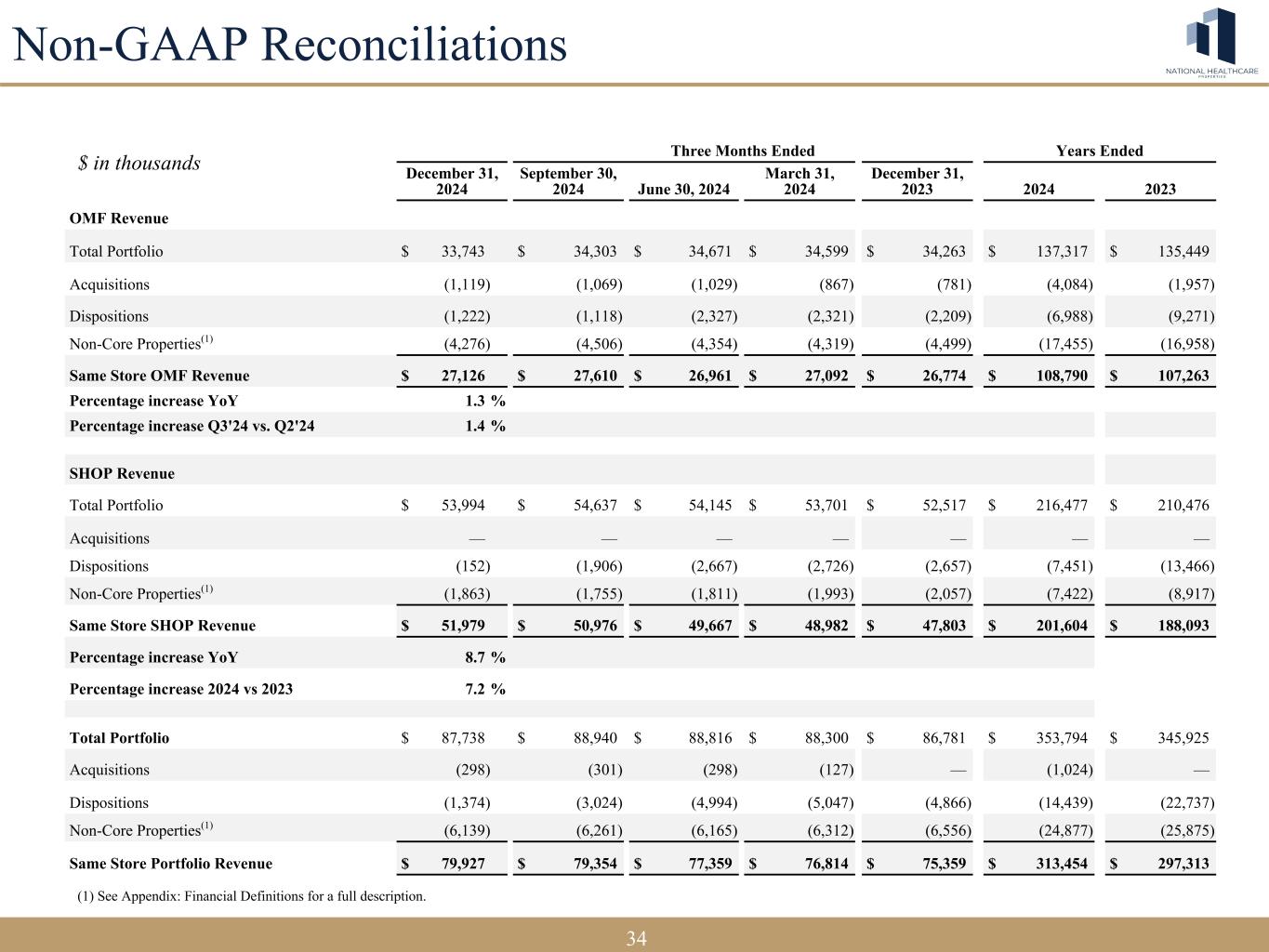

34 Non-GAAP Reconciliations (1) See Appendix: Financial Definitions for a full description. 34 $ in thousands Three Months Ended Years Ended December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 2024 2023 OMF Revenue Total Portfolio $ 33,743 $ 34,303 $ 34,671 $ 34,599 $ 34,263 $ 137,317 $ 135,449 Acquisitions (1,119) (1,069) (1,029) (867) (781) (4,084) (1,957) Dispositions (1,222) (1,118) (2,327) (2,321) (2,209) (6,988) (9,271) Non-Core Properties(1) (4,276) (4,506) (4,354) (4,319) (4,499) (17,455) (16,958) Same Store OMF Revenue $ 27,126 $ 27,610 $ 26,961 $ 27,092 $ 26,774 $ 108,790 $ 107,263 Percentage increase YoY 1.3 % Percentage increase Q3'24 vs. Q2'24 1.4 % SHOP Revenue Total Portfolio $ 53,994 $ 54,637 $ 54,145 $ 53,701 $ 52,517 $ 216,477 $ 210,476 Acquisitions — — — — — — — Dispositions (152) (1,906) (2,667) (2,726) (2,657) (7,451) (13,466) Non-Core Properties(1) (1,863) (1,755) (1,811) (1,993) (2,057) (7,422) (8,917) Same Store SHOP Revenue $ 51,979 $ 50,976 $ 49,667 $ 48,982 $ 47,803 $ 201,604 $ 188,093 Percentage increase YoY 8.7 % Percentage increase 2024 vs 2023 7.2 % Total Portfolio $ 87,738 $ 88,940 $ 88,816 $ 88,300 $ 86,781 $ 353,794 $ 345,925 Acquisitions (298) (301) (298) (127) — (1,024) — Dispositions (1,374) (3,024) (4,994) (5,047) (4,866) (14,439) (22,737) Non-Core Properties(1) (6,139) (6,261) (6,165) (6,312) (6,556) (24,877) (25,875) Same Store Portfolio Revenue $ 79,927 $ 79,354 $ 77,359 $ 76,814 $ 75,359 $ 313,454 $ 297,313 34

35 NHPREIT.com § For account information, including balances and the status of submitted paperwork, please call us at 1-888-796-2490 § Financial Advisors may view client accounts at www.computershare.com/ advisorportal § Shareholders may access their accounts at www.computershare.com/hti 35