Game-Changing Industry Leadership NASDAQ: HIIQ March 2016 Exhibit 99.1

Certain statements included herein, including those that express management’s expectations or estimates of Health Insurance Innovations, Inc.’s (“HII”) future performance, constitute “forward-looking statements” within the meaning of applicable securities laws. These statements may include words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management when made, are inherently subject to significant business, economic and competitive uncertainties and contingencies. We caution that such forward-looking statements involve known and unknown risks, uncertainties and other risks that may cause our actual financial results, performance, or achievements to be materially different from our estimated future results, performance or achievements expressed or implied by those forward-looking statements. Numerous factors could cause actual results to differ materially from those in the forward-looking statements, including without limitation, our ability to maintain relationships and develop new relationships with health insurance carriers and distributors and the risk of customer attrition; our ability to retain our members, the demand for our products, the amount of commissions paid to us or changes in health insurance plan pricing practices, competition and our ability to compete successfully; changes and developments in the United States health insurance system and laws, the ability to maintain and enhance our name recognition; our ability to build the necessary infrastructure and Disclosure processes to maintain effective controls over financial reporting; our ability to identify and complete acquisitions, manage our growth and integrate acquisitions, including the risk that the HealthPocket acquisition will not be integrated successfully; potential liability for the use of incorrect or incomplete data; interruption of our operations due to outside sources; maintaining our intellectual property rights and litigation involving intellectual property rights; our ability to obtain, use or successfully integrate third-party licensed technology; compliance with existing laws, regulations and industry initiatives and future change in laws or regulations in the healthcare industry; breach of our security by third parties; our dependence on the expertise of our key personnel; and potential write-offs of goodwill or other intangible assets. This list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other risk factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements are discussed in HII’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) as well as other documents that may be filed by HII from time to time with the Securities and Exchange Commission, which are available at www.sec.gov. Investors are cautioned not to put undue reliance on forward-looking statements. All subsequent written and oral forward-looking statements attributable to HII or persons acting on our behalf are expressly qualified in their entirety by this notice. We disclaim any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise. This presentation also contains certain non-GAAP financial measures. The non-GAAP financial measures used in this presentation are reconciled in HII’s form 10-Q filed November 9, 2015 with the SEC unless otherwise stated. These non-GAAP financial measures should not be considered an alternative to the GAAP financial measures.

Health Insurance Innovations at a Glance Double-digit revenue growth for the past 3 years NASDAQ: HIIQ Founded 2008 IPO in February 2013 Development of top quality Health Insurance products HII takes no insurance risk Large captive distribution network Core Offices: Tampa, Florida Mountain View, California Consumer driven Efficient sales process Powered by HealthPocket Unique online capability Quote-Buy-Print system Increased operational leverage

Sustainable and Unique High Growth Platform = Well Positioned for a Dynamic Market Leader in individual term policy design Proprietary, direct to consumer technology Strong, long standing carrier relationships Extensive, growing and scalable distribution network Seasoned management team poised for growth 1 2 3 4 5

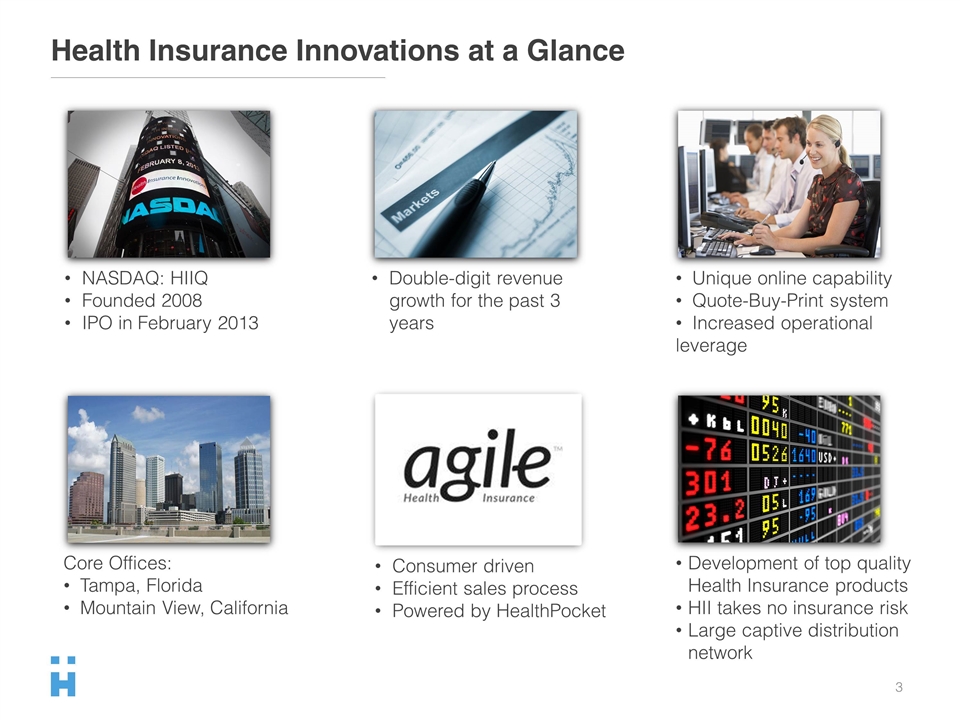

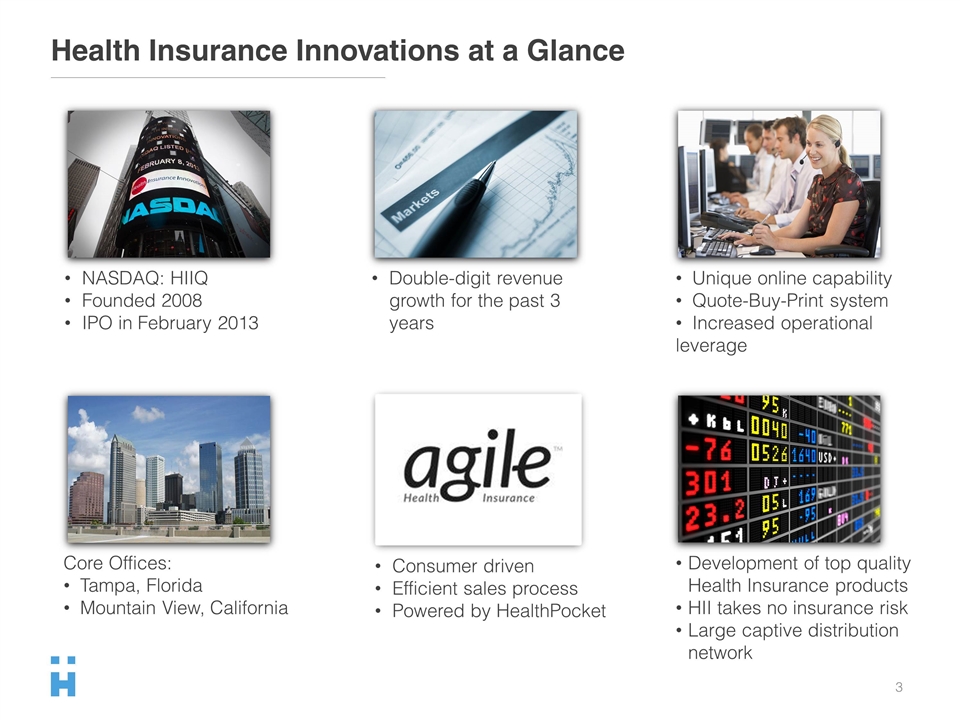

Untapped Market Opportunity Individual Market $35 Billion (1) Premium Equivalent Distribution $166 Million (2) <1% Market Penetration Affordable Care Act Non-ACA Individual Plans Individual and Family Plans Supplemental Products (1) Source: Milliman, CMS, Kaiser Foundation, ERBI and CBO (2010 data) (2) Product mix for LTM Premium Equivalents

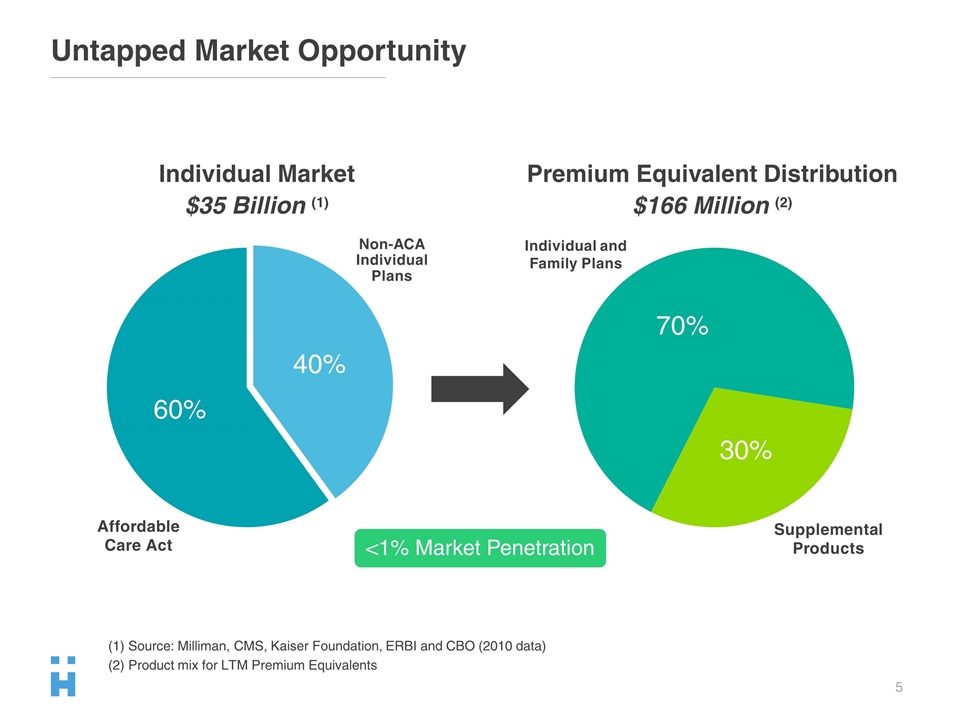

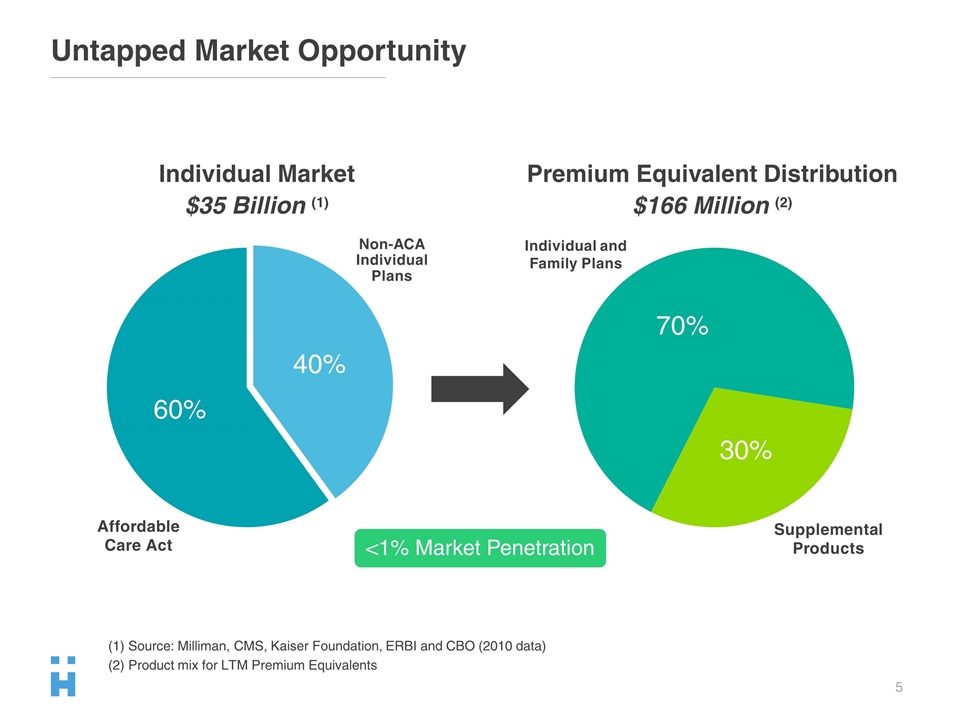

Demand Growth

HII OPERATING MODEL

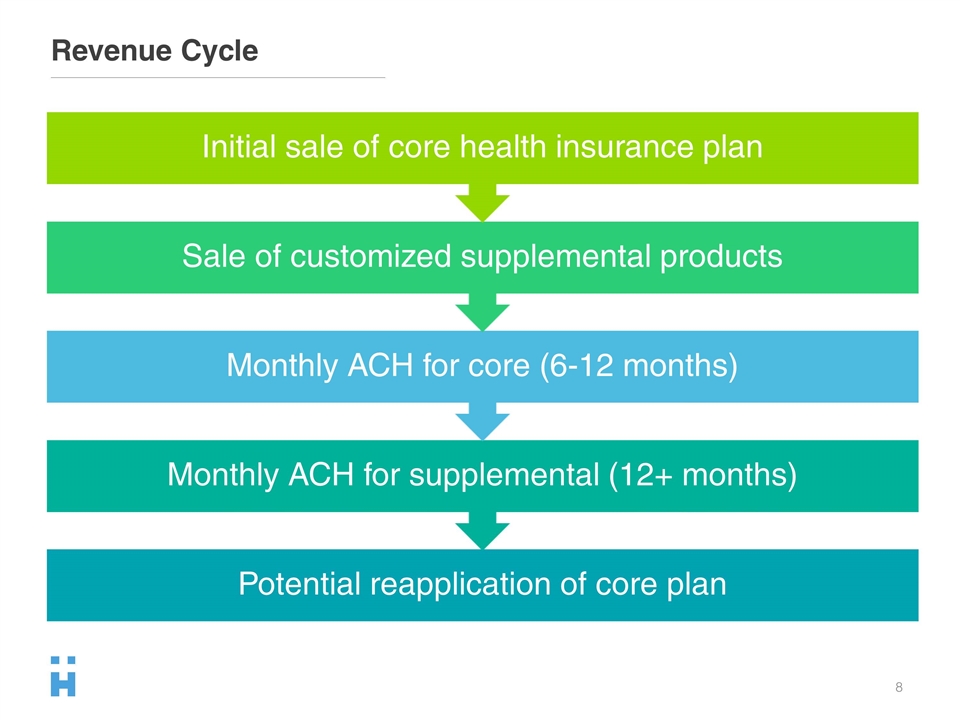

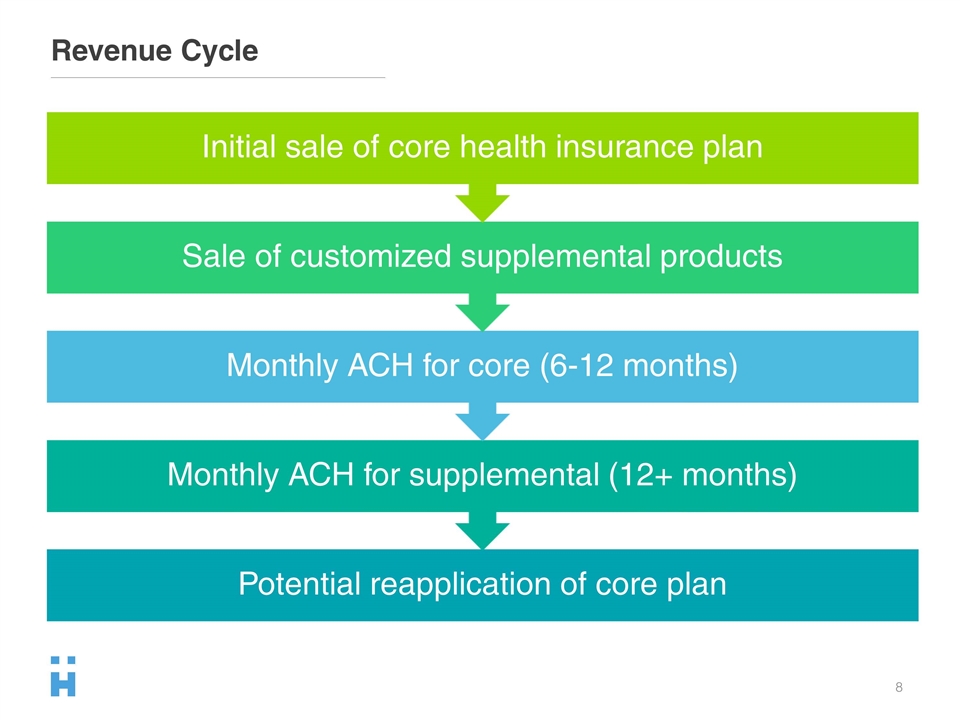

Innovate Top Quality Products & Product Bundles Revenue Cycle Initial sale of core health insurance plan Sale of customized supplemental products Monthly ACH for core (6-12 months) Monthly ACH for supplemental (12+ months) Potential reapplication of core plan

Individual Insurance Purchase Process Quote Buy Print STM Quote Example w/ available options Insurance Application w/ Medical History Q&A, selected options, agreement and agent information Welcome letter and ID card Real-time data streams and online input simplify the process to three easy steps Quote-Buy-Print

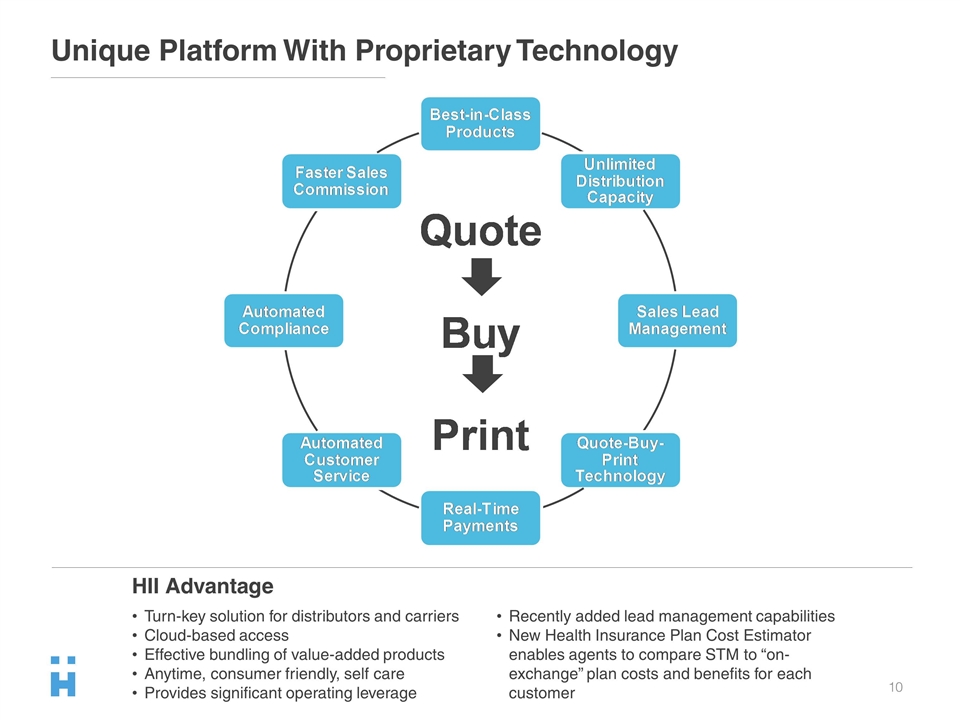

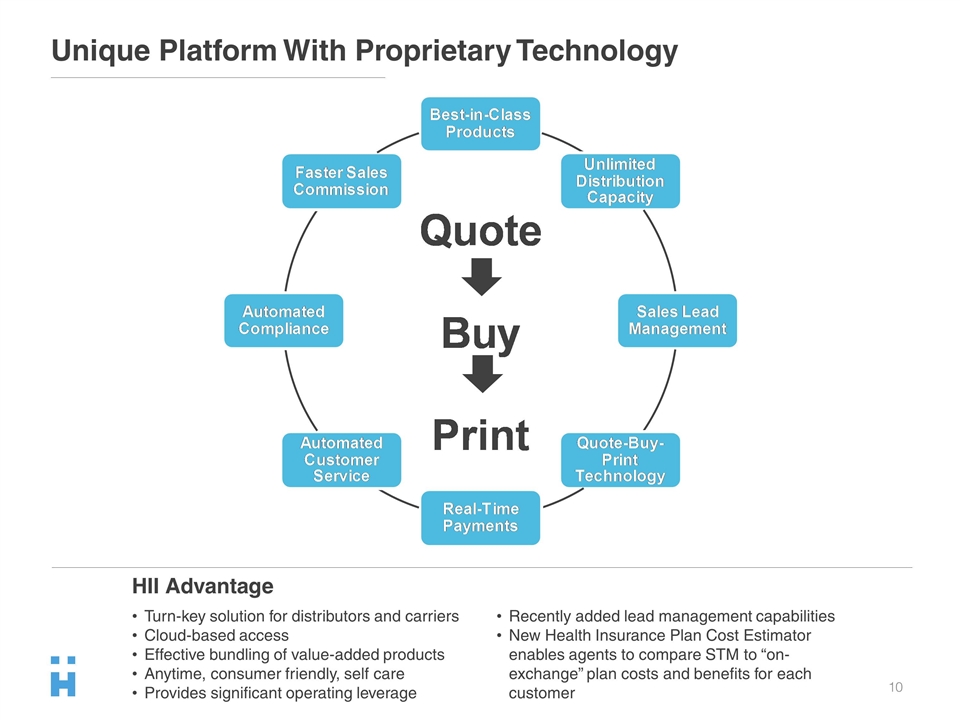

Unique Platform With Proprietary Technology HII Advantage Turn-key solution for distributors and carriers Cloud-based access Effective bundling of value-added products Anytime, consumer friendly, self care Provides significant operating leverage Recently added lead management capabilities New Health Insurance Plan Cost Estimator enables agents to compare STM to “on-exchange” plan costs and benefits for each customer

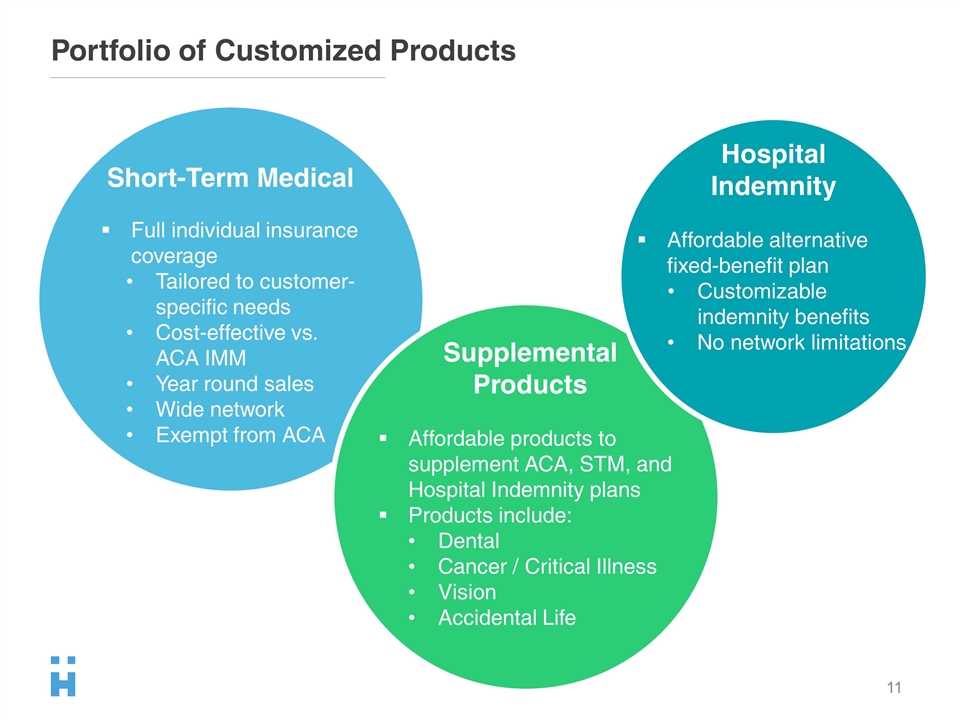

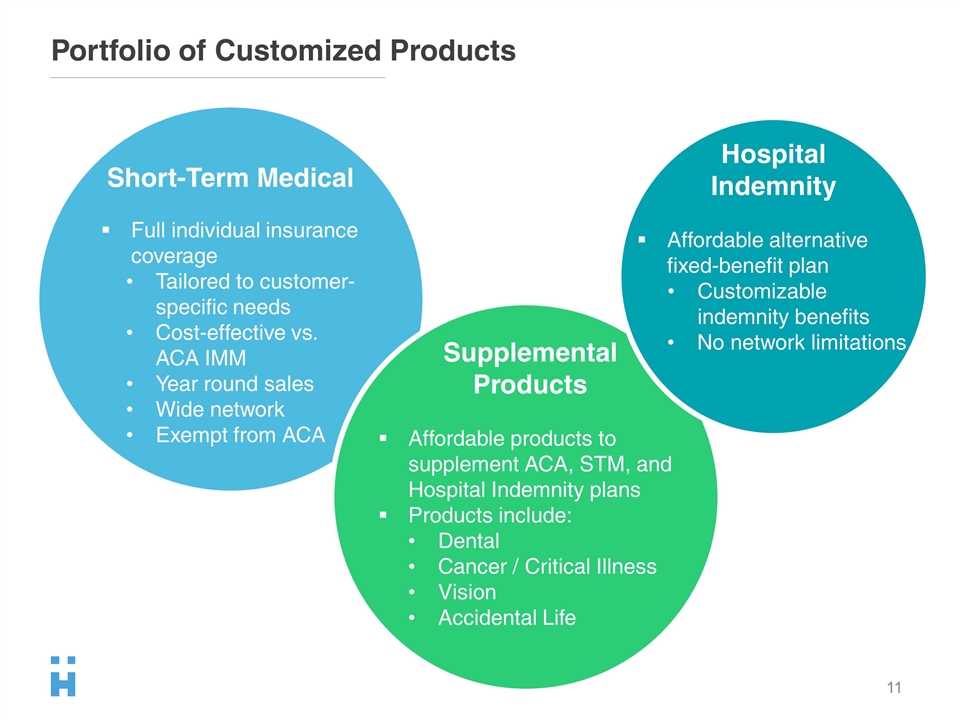

Portfolio of Customized Products Short-Term Medical Full individual insurance coverage Tailored to customer-specific needs Cost-effective vs. ACA IMM Year round sales Wide network Exempt from ACA Supplemental Products Affordable products to supplement ACA, STM, and Hospital Indemnity plans Products include: Dental Cancer / Critical Illness Vision Accidental Life Hospital Indemnity Affordable alternative fixed-benefit plan Customizable indemnity benefits No network limitations

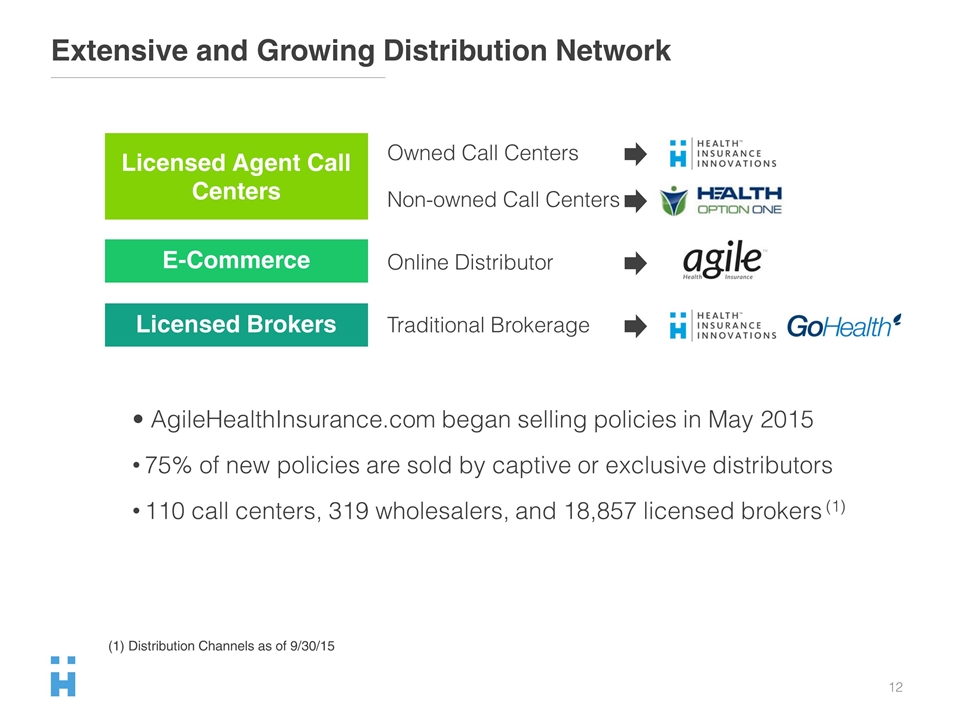

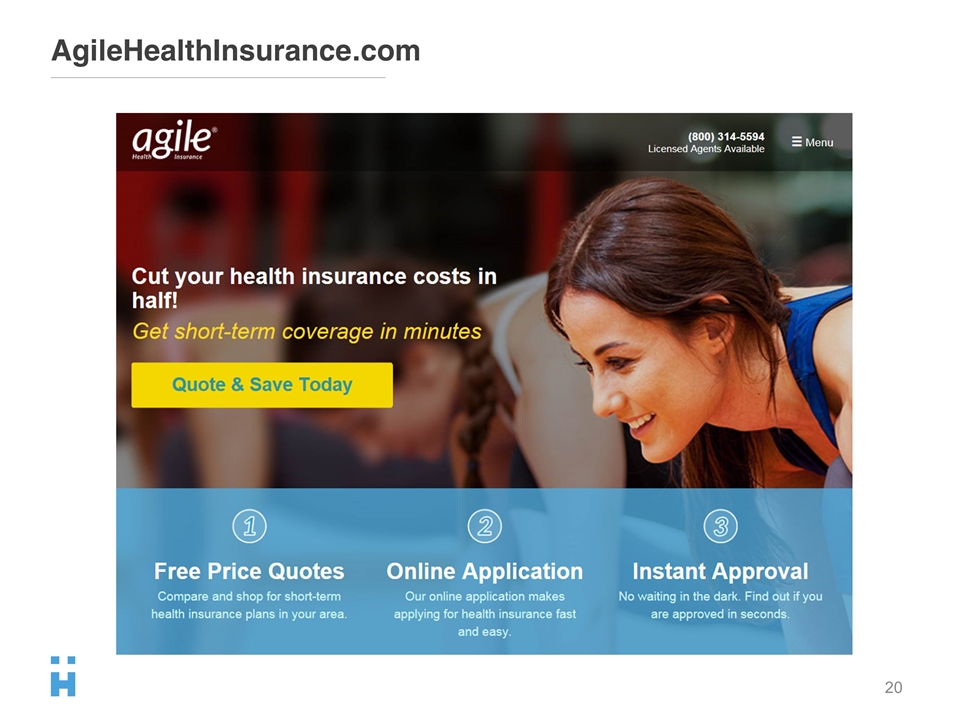

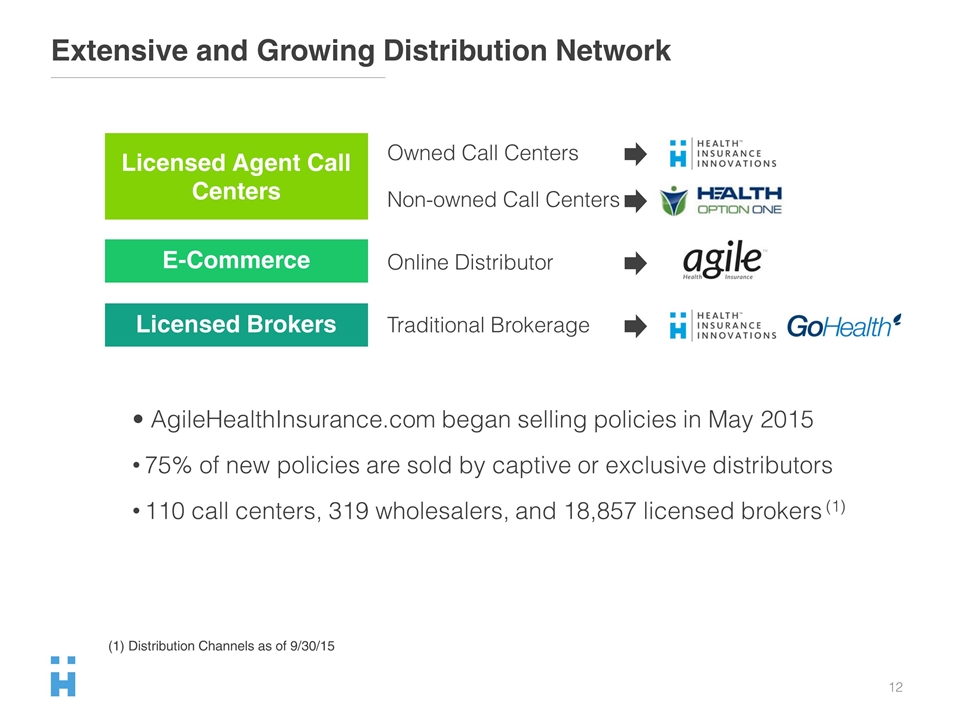

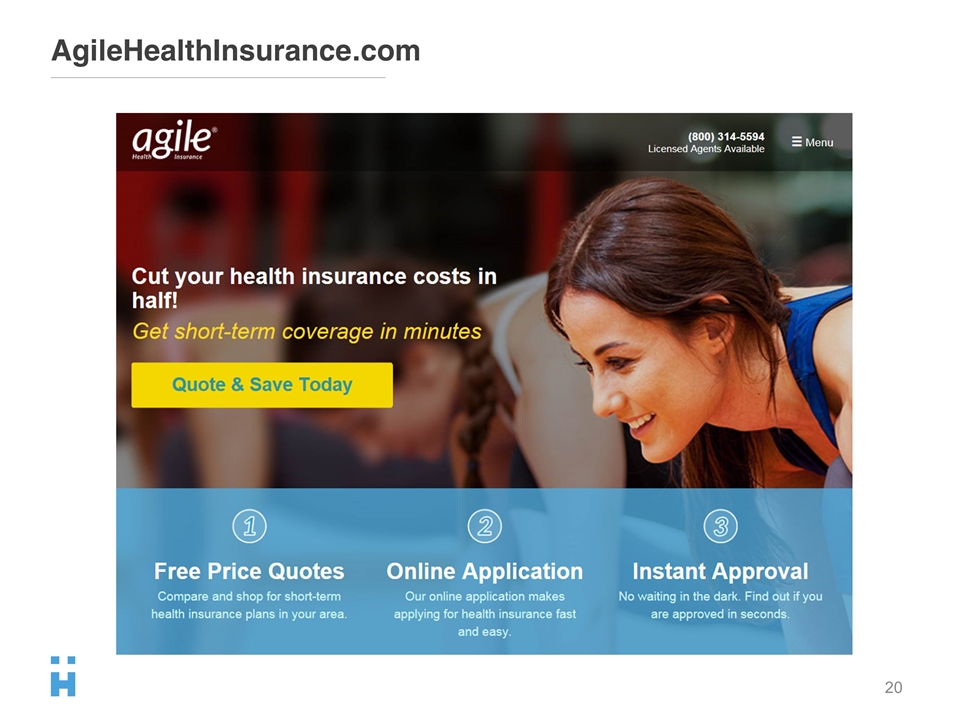

110 18,857 • AgileHealthInsurance.com began selling policies in May 2015 75% of new policies are sold by captive or exclusive distributors 110 call centers, 319 wholesalers, and 18,857 licensed brokers (1) Extensive and Growing Distribution Network Licensed Agent Call Centers Licensed Brokers Owned Call Centers Non-owned Call Centers Online Distributor Traditional Brokerage Licensed Agent Call Centers E-Commerce Licensed Brokers (1) Distribution Channels as of 9/30/15

Key partnerships with A to A++ Carriers A.M. Best Ratings Carriers assume all underwriting risk and claims payment responsibility Innovative, customized, consumer-driven products Best-In-Class Carriers and Benefit Providers

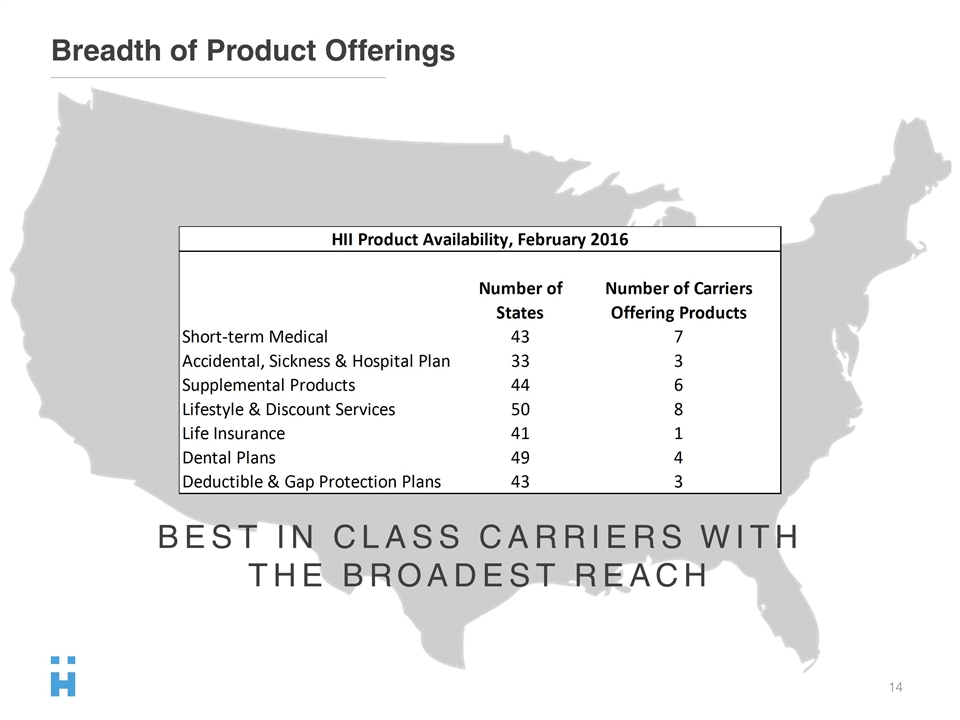

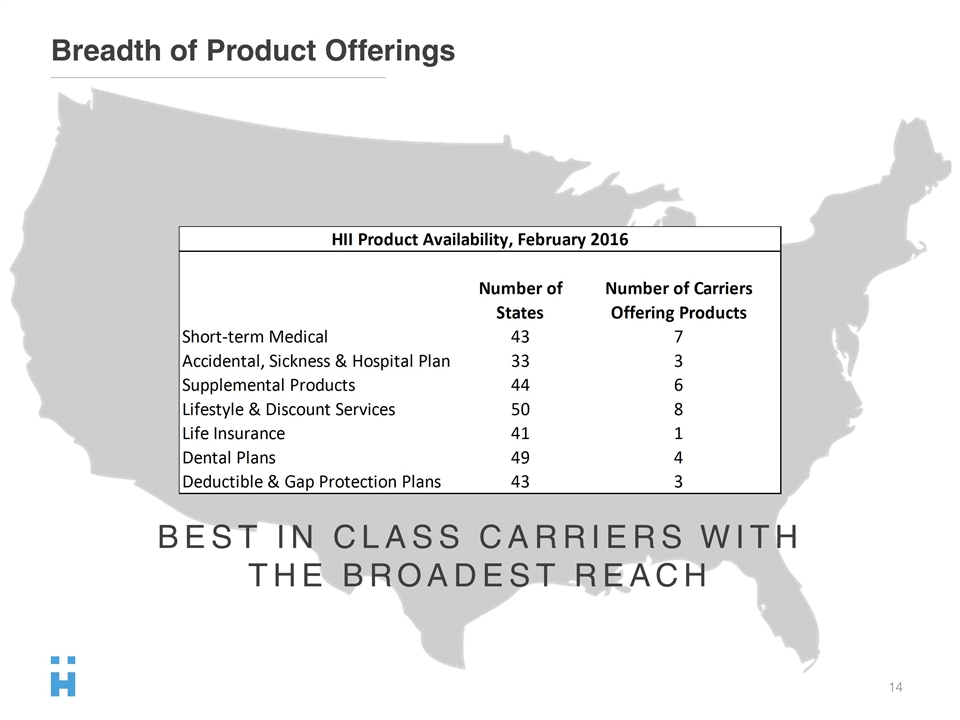

Breadth of Product Offerings BEST IN CLASS CARRIERS WITH THE BROADEST REACH

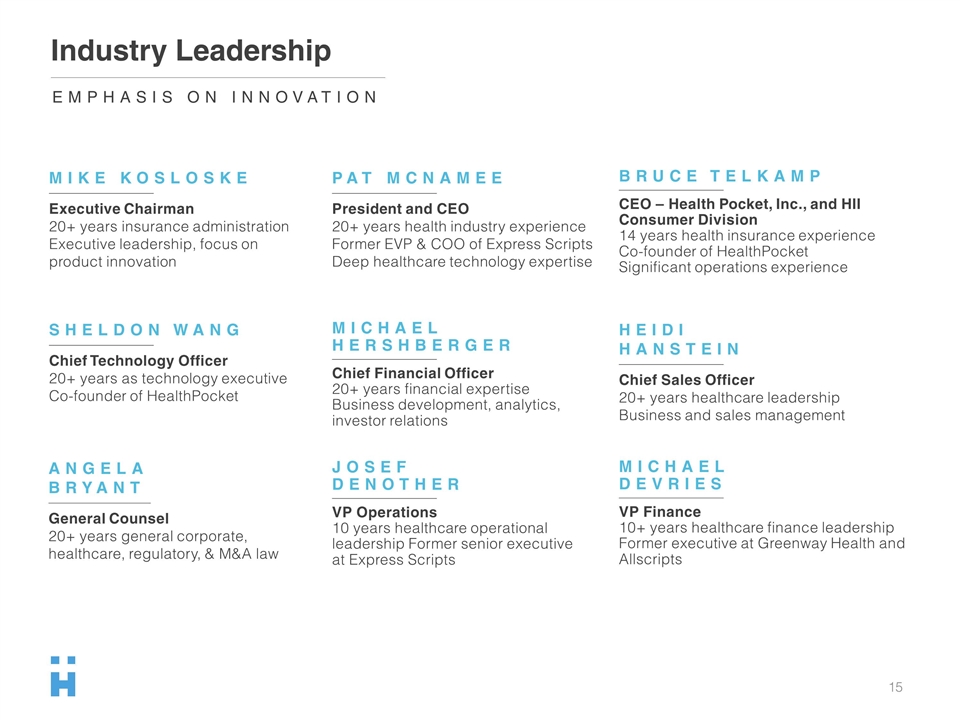

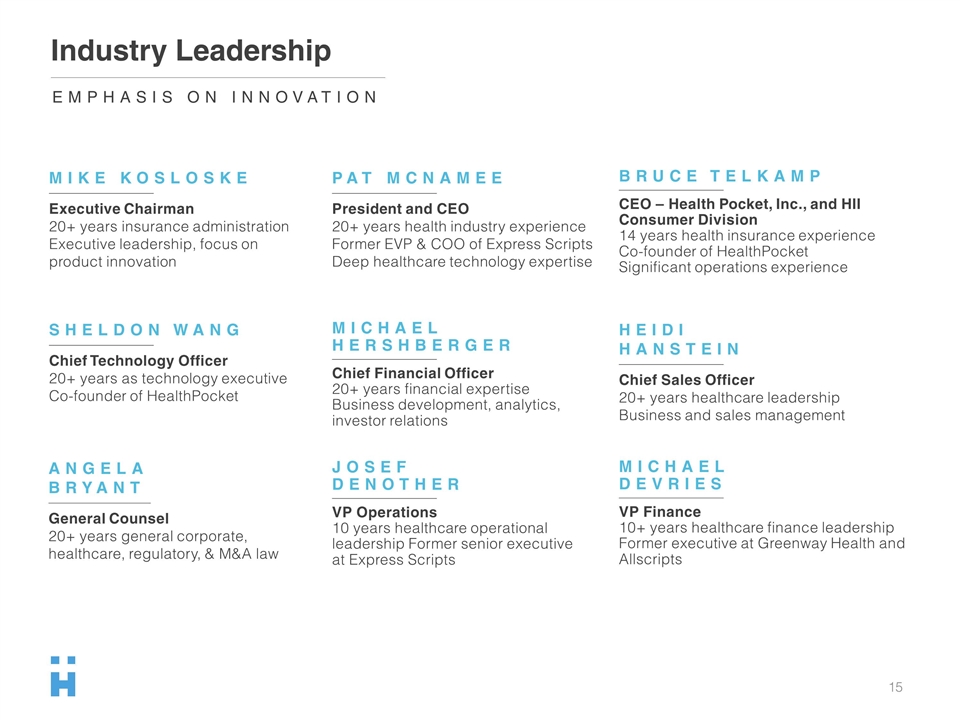

EMPHASIS ON INNOVATION MIKE KOSLOSKE ______________________________________ Executive Chairman 20+ years insurance administration Executive leadership, focus on product innovation PAT MCNAMEE ______________________________________ President and CEO 20+ years health industry experience Former EVP & COO of Express Scripts Deep healthcare technology expertise HEIDI HANSTEIN ______________________________________ Chief Sales Officer 20+ years healthcare leadership Business and sales management SHELDON WANG ______________________________________ Chief Technology Officer 20+ years as technology executive Co-founder of HealthPocket ANGELA BRYANT _____________________________________ General Counsel 20+ years general corporate, healthcare, regulatory, & M&A law MICHAEL HERSHBERGER ______________________________________ Chief Financial Officer 20+ years financial expertise Business development, analytics, investor relations Industry Leadership BRUCE TELKAMP ______________________________________ CEO – Health Pocket, Inc., and HII Consumer Division 14 years health insurance experience Co-founder of HealthPocket Significant operations experience JOSEF DENOTHER ______________________________________ VP Operations 10 years healthcare operational leadership Former senior executive at Express Scripts MICHAEL DEVRIES ______________________________________ VP Finance 10+ years healthcare finance leadership Former executive at Greenway Health and Allscripts

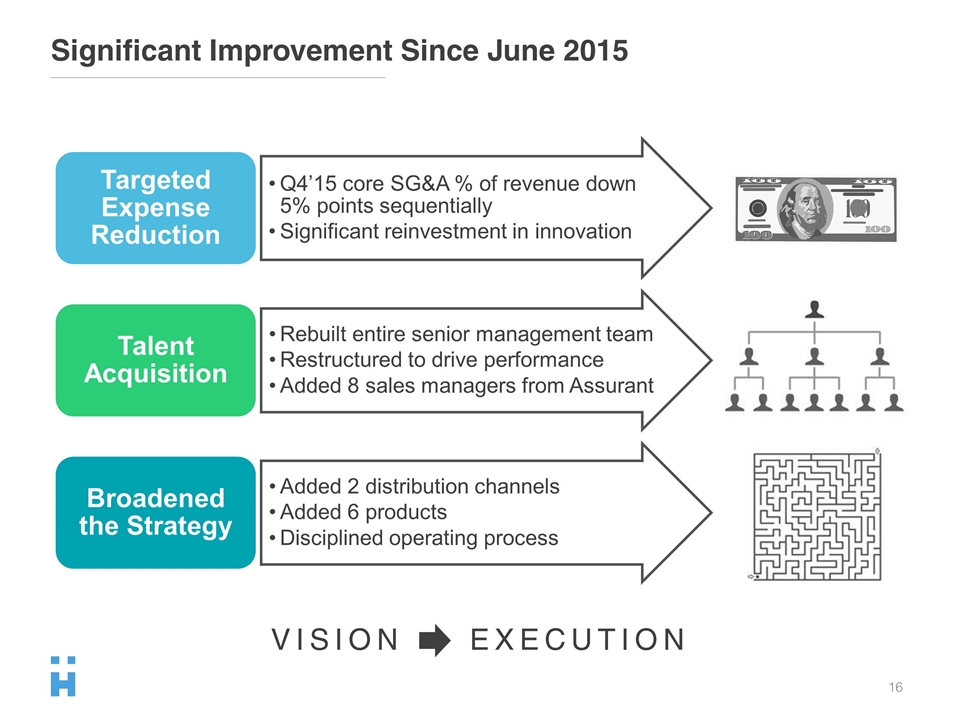

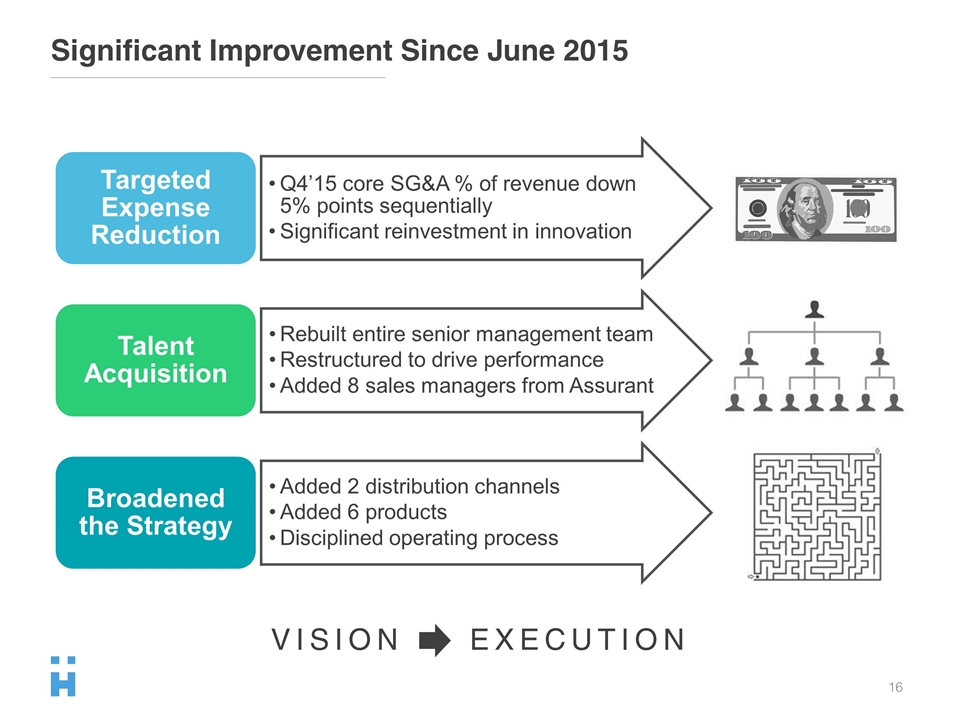

Significant Improvement Since June 2015 VISION EXECUTION Targeted Expense Reduction Q4’15 core SG&A % of revenue down 5% points sequentially Significant reinvestment in innovation Talent Acquisition Broadened the Strategy Rebuilt entire senior management team Added 8 sales managers from Assurant Restructured to drive performance Added 2 distribution channels Disciplined operating process Added 6 products

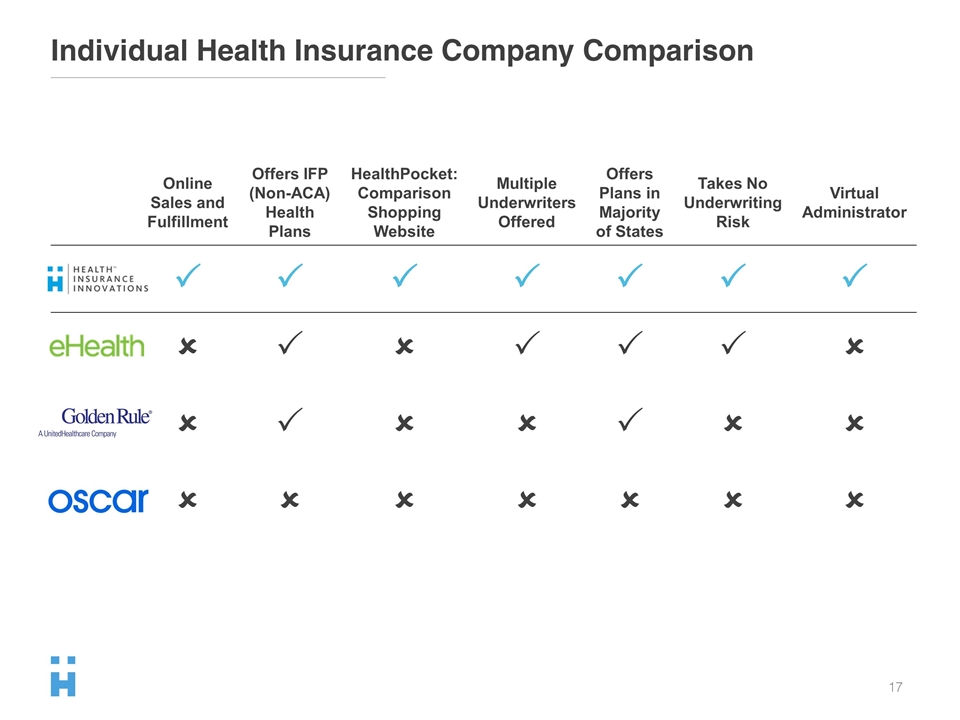

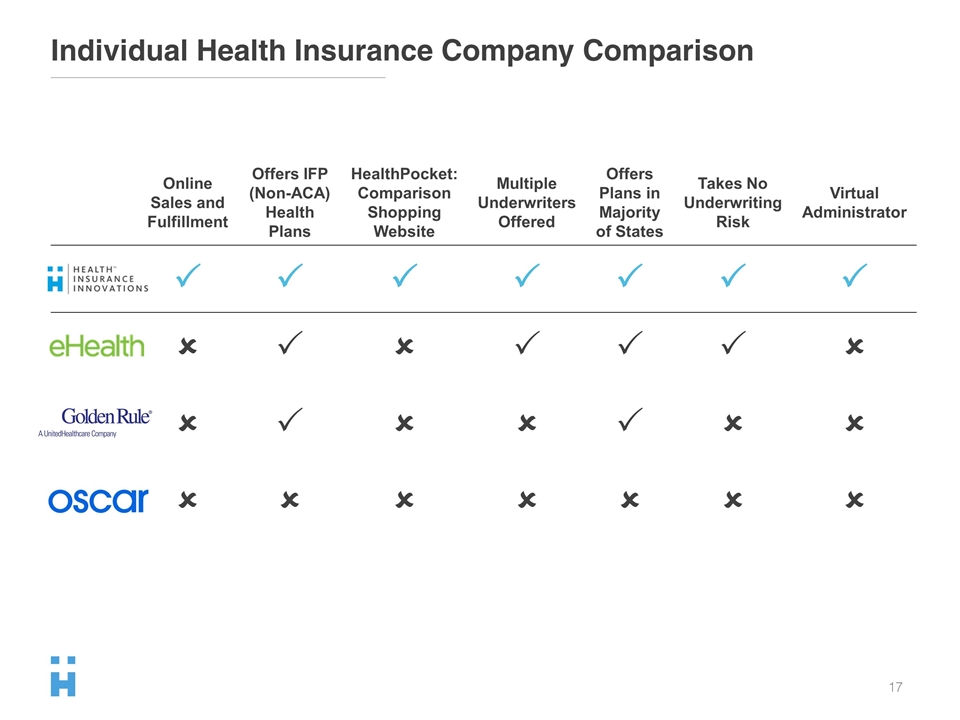

Individual Health Insurance Company Comparison Online Sales and Fulfillment Offers IFP (Non-ACA) Health Plans HealthPocket: Comparison Shopping Website Multiple Underwriters Offered Offers Plans in Majority of States Takes No Underwriting Risk Virtual Administrator HII P P P P P P P E- Health û P û P P P û Golden Rule û P û û P û û Oscar û û û û û û û

GROWTH STRATEGY

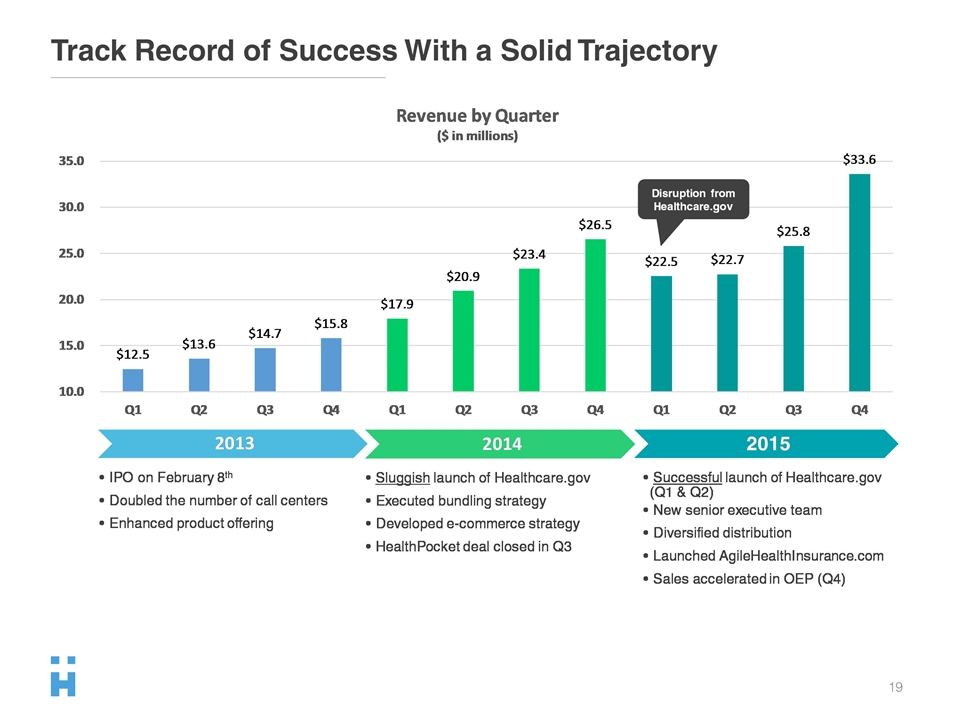

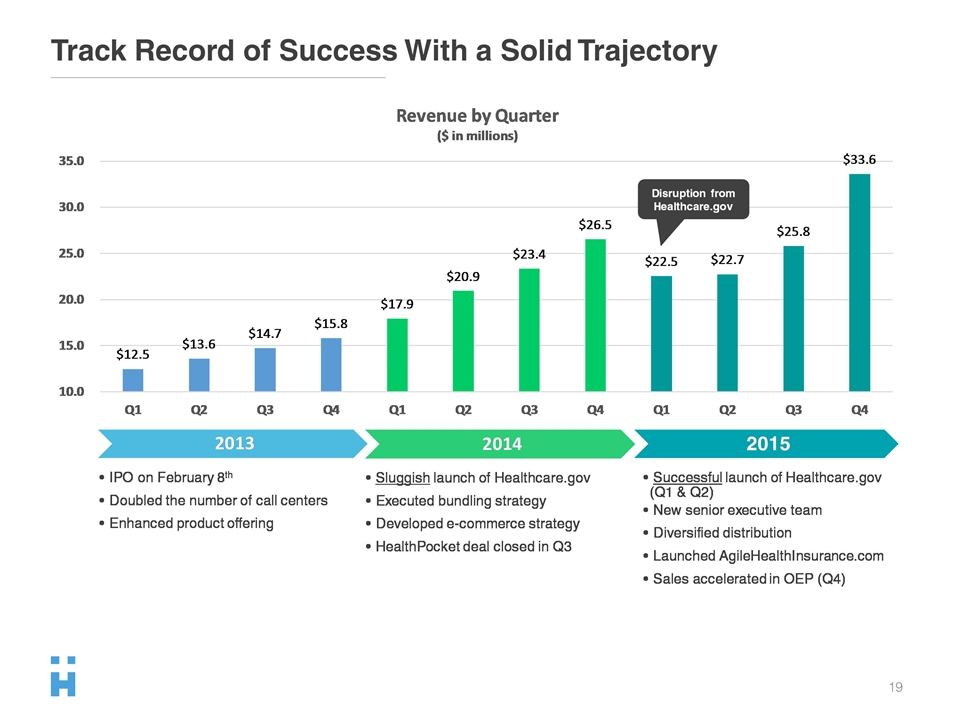

1 3 4 Track Record of Success With a Solid Trajectory

AgileHealthInsurance.com

HII and HealthPocket POWERED BY OUR PROPRIETARY VIRTUAL ADMINISTRATOR TECHNOLOGY DRIVEN INNOVATION

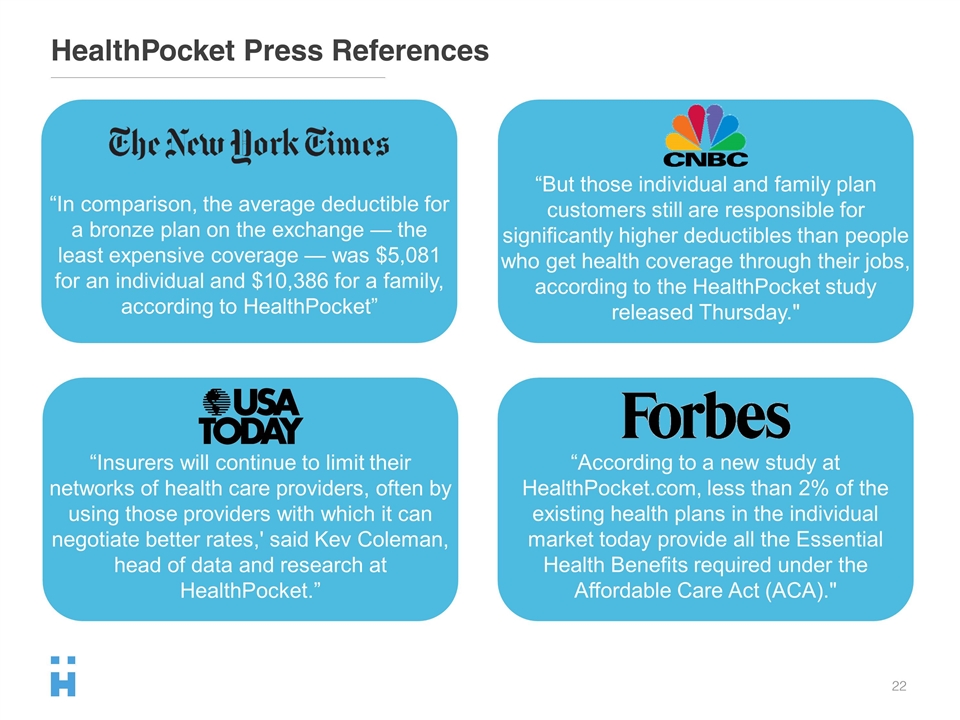

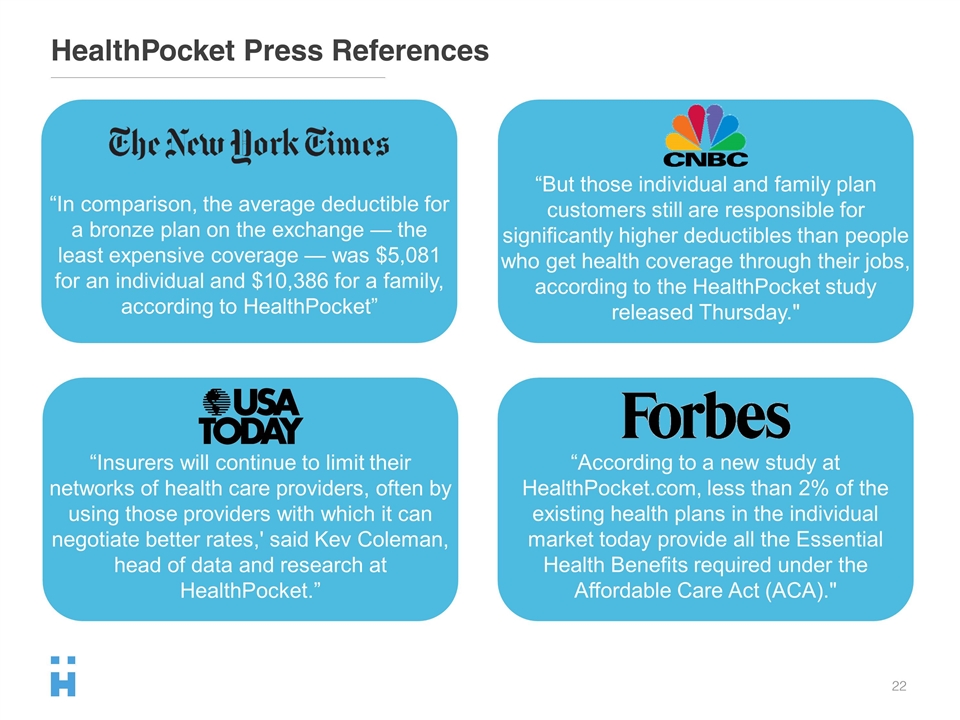

HealthPocket Press References “In comparison, the average deductible for a bronze plan on the exchange — the least expensive coverage — was $5,081 for an individual and $10,386 for a family, according to HealthPocket” “Insurers will continue to limit their networks of health care providers, often by using those providers with which it can negotiate better rates,' said Kev Coleman, head of data and research at HealthPocket.” “According to a new study at HealthPocket.com, less than 2% of the existing health plans in the individual market today provide all the Essential Health Benefits required under the Affordable Care Act (ACA)." “But those individual and family plan customers still are responsible for significantly higher deductibles than people who get health coverage through their jobs, according to the HealthPocket study released Thursday."

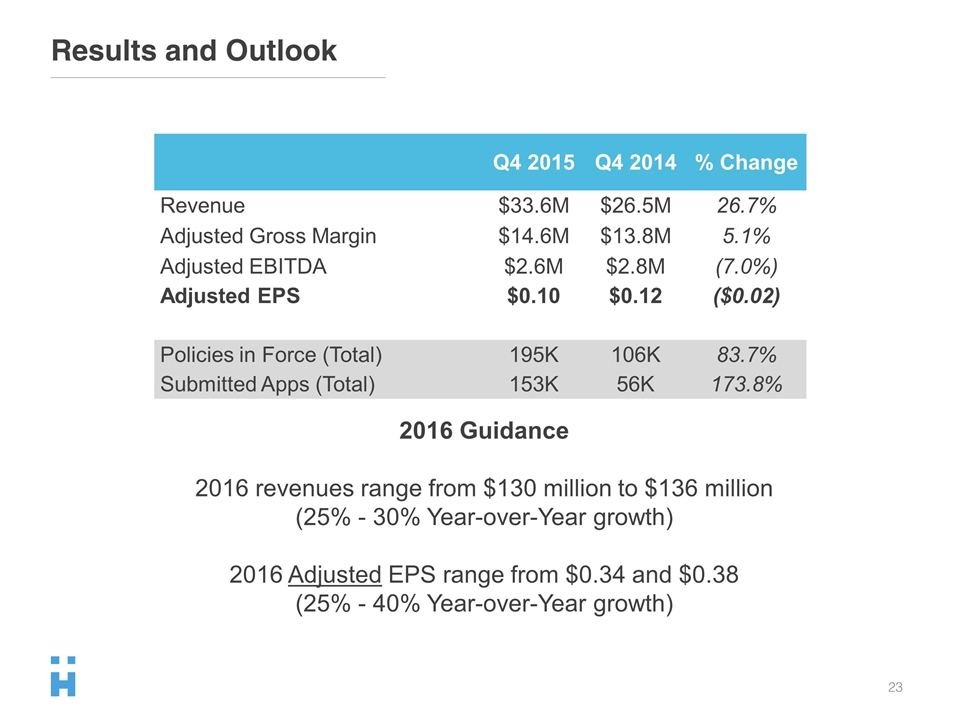

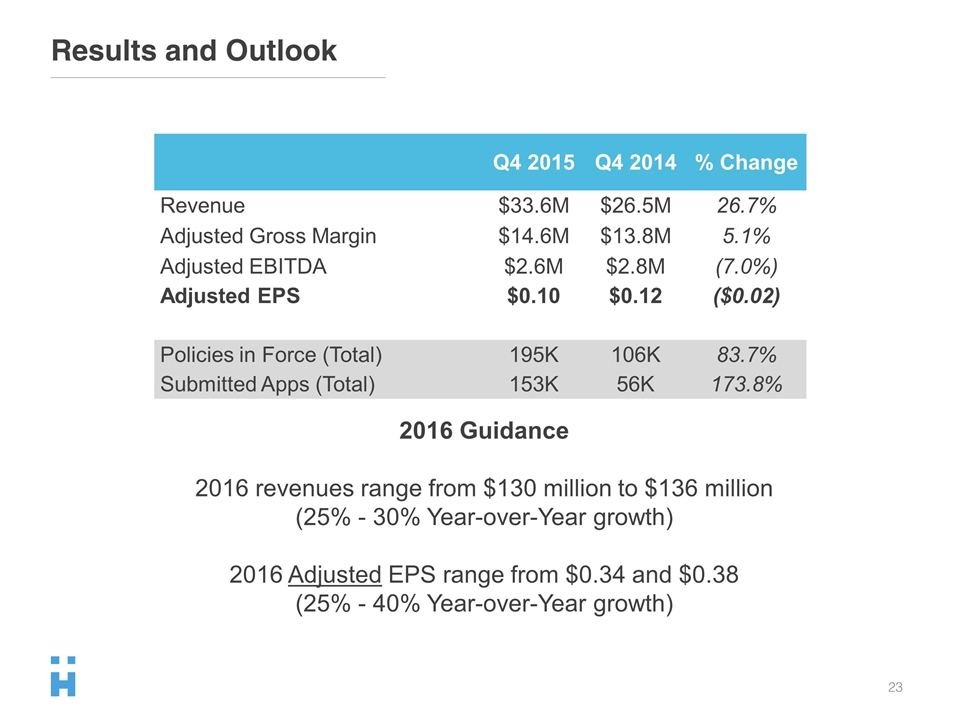

Results and Outlook Q4 2015 Q4 2014 % Change Revenue $33.6M $26.5M 26.7% Adjusted Gross Margin $14.6M $13.8M 5.1% Adjusted EBITDA $2.6M $2.8M (7.0%) Adjusted EPS $0.10 $0.12 ($0.02) Policies in Force (Total) 195K 106K 83.7% Submitted Apps (Total) 153K 56K 173.8% 2016 Guidance 2016 revenues range from $130 million to $136 million (25% - 30% Year-over-Year growth) 2016 Adjusted EPS range from $0.34 and $0.38 (25% - 40% Year-over-Year growth)

= Well Positioned for a Dynamic Market Leader in individual term policy design Proprietary, direct to consumer technology Strong, long standing carrier relationships Extensive, growing and scalable distribution network Seasoned management team poised for growth Sustainable and Unique High Growth Platform 1 2 3 4 5