Filed Pursuant to Rule 424(b)(3)

Registration No. 333-198847

ENUMERAL BIOMEDICAL HOLDINGS, INC.

Prospectus

52,154,760 Shares

Common Stock

This prospectus relates to the resale of up to 52,154,760 shares of common stock, par value $0.001 per share (“Common Stock”), of Enumeral Biomedical Holdings, Inc. (“we” or the “Company”) held by certain selling stockholders, consisting of the following:

| · | 42,895,497 shares of Common Stock issued to investors in our July 2014 private placement, consisting of 21,345,987 shares of Common Stock currently outstanding and 21,549,510 shares of Common Stock issuable upon exercise of common stock purchase warrants; |

| · | 2,000,000 shares of Common Stock issuable upon exercise of common stock purchase warrants issued to the placement agents in our July 2014 private placement; |

| · | 5,565,516 shares of Common Stock issued to the former holders of common and preferred stock of Enumeral Biomedical Corp (“Enumeral”) pursuant to the terms of the merger agreement (the “Merger Agreement”) in connection with the merger (the “Merger”) of a wholly owned subsidiary of the Company with and into Enumeral, consisting of 5,381,834 shares of Common Stock currently outstanding and 183,682 shares of Common Stock issuable upon exercise of common stock purchase warrants; and |

| · | 1,693,747 shares of Common Stock issued to the pre-Merger stockholders of the Company pursuant to anti-dilution provisions of the Merger Agreement. |

The distribution of the shares by the selling stockholders is not subject to any underwriting agreement. The selling stockholders may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices, or a combination of these methods

We will not receive any proceeds from the resale of any of the shares of Common Stock being registered hereby. However, we received $21,549,510 in gross proceeds in the July 2014 private placement, and in the future may receive up to an aggregate of $45,186,979 in additional gross proceeds upon the exercise of the warrants for which shares issuable upon exercise thereof are being registered (to the extent the registration statement of which this prospectus is a part is then effective and, if applicable, the “cashless exercise” provision is not utilized by the holder).

The Company is paying all of the registration expenses incurred in connection with the registration of the shares. We will not pay any of the selling commissions, brokerage fees and related expenses.

Our common stock is quoted on the OTC Markets under the symbol “ENUM.” On June 30, 2015, the last reported sale price of our common stock on the OTC Markets was $0.64 per share.

Our business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you should read and carefully consider risks described in the “Risk Factors” section beginning on page 10 of this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless when the time of delivery of this prospectus or the sale of any common stock. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, our Common Stock in any jurisdiction in which the offer or sale is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated July 6, 2015.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including, without limitation, in the sections captioned “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this Prospectus that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Prospectus may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Prospectus appears in the section captioned “Risk Factors” and elsewhere in this Prospectus.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Prospectus to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Prospectus in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Prospectus, and other documents which we may file from time to time with the Securities and Exchange Commission (the “SEC”).

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that should be considered before investing in our common stock. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided below in the “Business” section, the risks of purchasing our common stock discussed under the “Risk Factors” section, and our consolidated financial statements and the accompanying notes to the consolidated financial statements.

Unless the context indicates otherwise, all references in this registration statement to “Enumeral Biomedical Holdings,” the “Company,” “we,” “us” and “our” refer to Enumeral Biomedical Holdings, Inc., and its wholly-owned subsidiaries, Enumeral Biomedical Corp. and Enumeral Securities Corporation; and references to “Enumeral” refer to Enumeral Biomedical Corp.

Overview

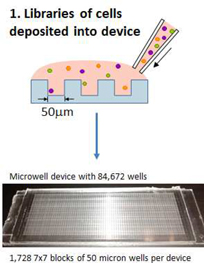

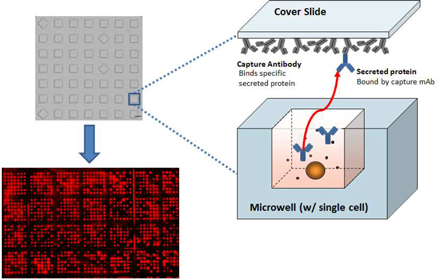

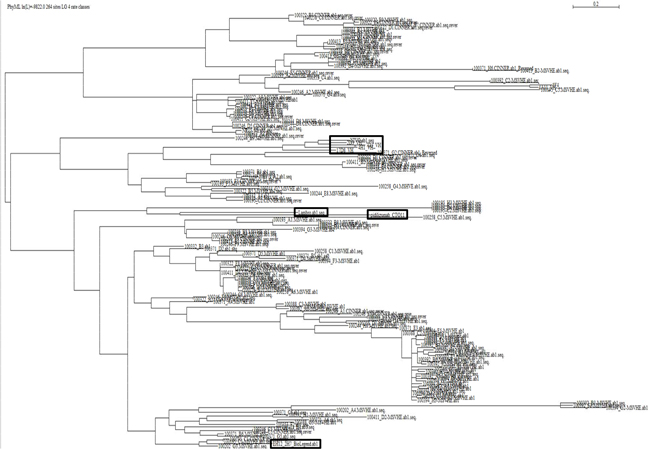

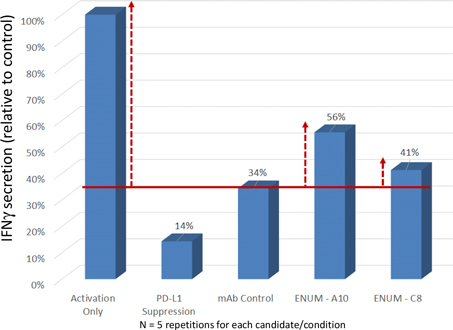

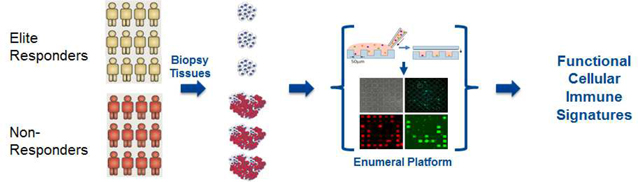

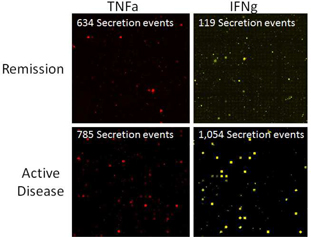

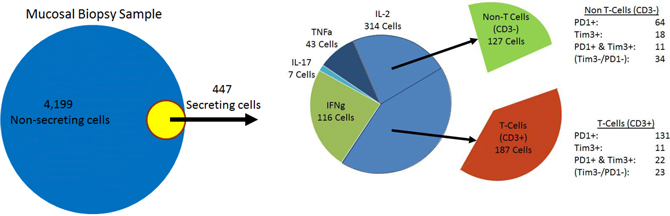

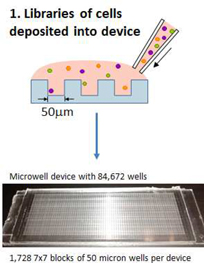

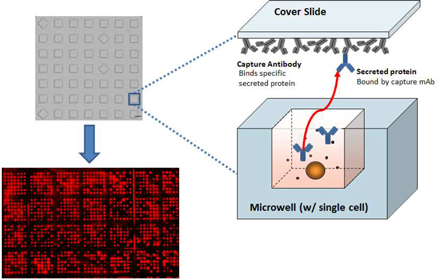

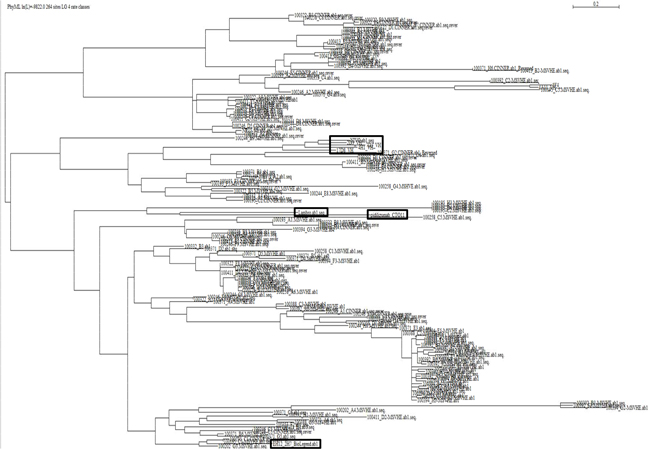

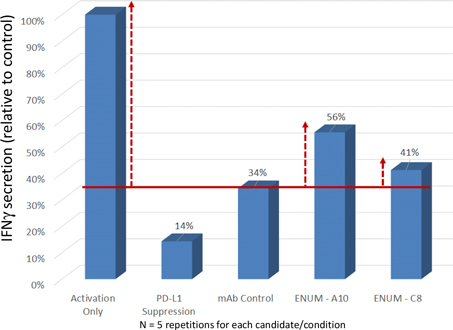

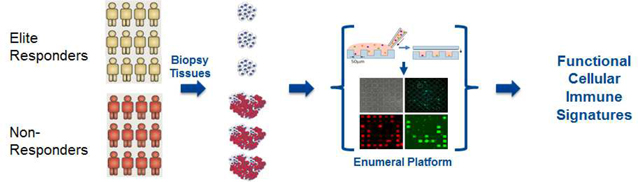

We are in the business of discovering and developing novel antibody therapeutics that help the immune system attack diseased cells (“immunomodulators”). We believe that we have a unique ability to extensively interrogate cells of the human immune system for drug candidate validation and that this ability gives us a distinct advantage in selecting potential best-in-class therapeutic candidates. We are building a pipeline of drug candidates for the treatment of cancer and inflammatory diseases and leveraging the breadth of our technology in order to drive near-term cash flows from out-licensing of our drug candidates and through strategic collaboration partnerships. Our near-term goals include performance of preclinical testing on drug candidates resulting from our internal programs to generate data to support our ability to obtain revenue from co-development partners. The Company has focused its research efforts on using its proprietary drug discovery platform utilizing, in part, technology licensed by Enumeral from M.I.T., Harvard University and other institutions to identify and elucidate antibodies and antigens that are relevant to diseases that affect millions of individuals and are underserved by current therapeutic alternatives. These diseases have included cancer, infectious, and inflammatory diseases. We believe that the breadth of our drug discovery platform offers us the potential to grow our business through revenue-generating collaborative research and development partnerships.

Our strategy is to generate superior antibodies that we will co-develop, either through collaborative partnerships, or out-licensing partnerships, with larger biotechnology or pharmaceutical companies. Our goal initially is to obtain such partners following completion of “ex vivo” human and animal preclinical studies, and prior to completion of full investigational new drug (“IND”)-enabling studies, or we may fund IND-enabling studies and seek collaboration partners at that point. The immediate commercial goal of our programs is to reach significant value inflection points in the next twelve to eighteen months in order to obtain from the sale or license of product discovery programs a combination of up-front payments; subsequent milestone payments as the candidate clears pre-clinical and clinical regulatory hurdles; and royalty payments upon future sales of the marketed drug.

Organizational History

We were incorporated in Nevada as Cerulean Group, Inc. on February 27, 2012, and converted to a Delaware corporation on July 10, 2014. Our original business was to develop and operate a website for self-travelers and backpackers that would allow a person with a mobile device or computer and access to the Internet to build a trip. Prior to the Merger, our Board of Directors determined to discontinue operations in this area to seek a new business opportunity. As a result of the Merger, we have acquired the business of Enumeral. In connection with the Merger, we have also changed our name to Enumeral Biomedical Holdings, Inc.

Our authorized capital stock currently consists of 300,000,000 shares of common stock, par value $0.001 (the “Common Stock”), and 10,000,000 shares of “blank check” preferred stock, par value $0.001. Our common stock is quoted on the OTC Markets (OTCQB) under the symbol “ENUM,” which changed from “CEUL” on July 21, 2014.

Enumeral was incorporated on December 11, 2009 under the laws of the State of Delaware.

On July 25, 2014, we completed a 4.62-for-1 forward split of our Common Stock in the form of a dividend, with the result that the 6,190,000 shares of Common Stock outstanding immediately prior to the stock split became 28,597,804 shares of Common Stock outstanding immediately thereafter. All share and per share numbers in this Prospectus relating to our Common Stock have been adjusted to give effect to this stock split, unless otherwise stated.

On July 31, 2014, our wholly owned subsidiary, Enumeral Acquisition Corp., a corporation formed in the State of Delaware on July 21, 2014 (“Acquisition Sub”) merged with and into Enumeral (the “Merger”). Enumeral was the surviving corporation in the Merger and became our wholly owned subsidiary. All of the outstanding Enumeral stock was converted into shares of our Common Stock, as described in more detail below.

Upon the closing of the Merger and under the terms of a split-off agreement and a general release agreement (the “Split-Off Agreement”), the Company transferred all of its pre-Merger operating assets and liabilities to its wholly-owned special-purpose subsidiary, Cerulean Operating Corp., a Delaware corporation (“Split-Off Subsidiary”), formed on July 24, 2014. Thereafter, pursuant to the split-off agreement, the Company transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to the pre-Merger majority stockholder of the Company, and the former sole officer and director of the Company (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 23,100,000 shares of our Common Stock held by such stockholder (which were cancelled and will resume the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities.

As a result of the Merger and transactions effected pursuant to the Split-Off Agreement, we discontinued our pre-Merger business and acquired the business of Enumeral, and will continue the existing business operations of Enumeral as a publicly-traded company under the name Enumeral Biomedical Holdings, Inc.

Also on July 31, 2014, we closed a private placement offering (the “PPO”) of 21,549,510 Units of our securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of our Common Stock and a warrant to purchase one share of Common Stock at an exercise price of $2.00 per share and with a term of five years (the “PPO Warrants”). Additional information concerning the PPO and PPO Warrants is presented below under “Business—The Merger and Related Transactions—the PPO” and “Description of Securities.”

In accordance with “reverse merger” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Merger will be replaced with the historical financial statements of Enumeral prior to the Merger in all future filings with the SEC.

Also on July 31, 2014, we changed our fiscal year from a fiscal year ending on October 31 of each year to one ending on December 31 of each year, which was the fiscal year end of Enumeral.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Merger. We believe that as a result of the Merger, we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

See “Business – The Merger and Related Transactions” below for more information about the Merger and related transactions.

Capital Needs

As of March 31, 2015, the Company believes that its existing cash, cash equivalents and marketable securities, as well as anticipated cash flow from its collaborations, will be sufficient to support the Company’s operations into the second quarter of 2016. The Company will determine when and if to proceed with any additional financing in the future, and there can be no assurance financing will be available to us when required on acceptable terms or at all.

About This Offering

This prospectus relates to the public offering, which is not being underwritten, by the selling stockholders listed in this prospectus, of up to 52,154,760 shares of our common stock. Of the shares being offered, 28,421,568 are presently issued and outstanding, and 23,733,192 are issuable upon exercise of common stock purchase warrants.

The selling stockholders may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices, or a combination of these methods

We will not receive any proceeds from the resale of any of the shares of Common Stock being registered hereby. However, we received $21,549,510 in gross proceeds in the July 2014 private placement, and in the future may receive up to an aggregate of $45,186,979 in additional gross proceeds upon the exercise of the warrants for which shares issuable upon exercise thereof are being registered (to the extent the registration statement of which this prospectus is a part is then effective and, if applicable, the “cashless exercise” provision is not utilized by the holder).

The Company is paying all of the registration expenses incurred in connection with the registration of the shares. We will not pay any of the selling commissions, brokerage fees and related expenses.

Corporate Information

Our principal executive offices are located at 200 CambridgePark Drive, Suite 2000, Cambridge, MA 02140. Our telephone number is (617) 945-9146. Our website address iswww.enumeral.com.

THE OFFERING

| Common stock currently outstanding | | 51,673,792 shares (1) |

| | | |

| Common stock offered by the Company | | None |

| | | |

| Common stock offered by the selling stockholders | | 52,154,760 shares (2) |

| | | |

| Use of proceeds | | We will not receive any of the proceeds from the sales of our common stock by the selling stockholders. However, we received $21,549,510 in gross proceeds in the July 2014 private placement, and in the future may receive up to an aggregate of $45,186,979 in additional gross proceeds upon the exercise of the warrants for which shares issuable upon exercise thereof are being registered. |

| | | |

| OTC Markets symbol | | ENUM |

| | | |

| Risk Factors | | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| | (1) | As of June 30, 2015. |

| | (2) | Consists of 28,421,568 outstanding shares of common stock and 23,733,192 shares of common stock issuable upon exercise of common stock purchase warrants. |

RISK FACTORS

An investment in our securities is speculative and involves various risks that may affect our operations or financial results. Many of those risks are driven by factors and events that we cannot control or predict. Before investing in our securities you should carefully consider the following risks, together with the financial and other information contained in this Prospectus.

This prospectus contains certain statements relating to future events or the future financial performance of our company. Prospective investors are cautioned that such statements are only predictions and involve risks and uncertainties, and actual events or results may differ materially. In evaluating such statements, prospective investors should specifically consider the various factors identified in this Prospectus, including the matters set forth below, which could cause actual results to differ materially from those indicated by such forward-looking statements.

If any of the following or other risks materialize, our business, financial condition, and results of operations could be materially adversely affected which could adversely affect the value of our common stock. In such a case, investors in our common stock could lose all or part of their investment.

Prospective investors should consider carefully whether an investment in our company is suitable for them in light of the information contained in this prospectus and the financial resources available to them. The risks described below do not purport to be all the risks to which we could be exposed. This section is a summary of certain risks and is not set out in any particular order of priority. They are the risks that we presently believe are material to our operations. Additional risks of which we are not presently aware or which we presently deem immaterial may also impair our business, financial condition or results of operations.

Risks Related to our Business and the Industry in Which We Operate

We face technological uncertainties.

To date, we have not developed or commercialized any products utilizing our proprietary platform technology. There can be no assurance that our approach will enable us to successfully discover and develop novel therapeutics that help the immune system attack diseased cells. The discovery and development of such novel therapeutics for use in the diagnosis and treatment of cancer, infectious, autoimmune and inflammatory diseases also will be subject to the risks of failure inherent in the development of products based on new technologies. These risks include the possibilities that products based on these technologies will be ineffective or toxic, or otherwise fail to receive necessary regulatory approvals; that the products, if safe and effective, will be difficult or uneconomical to manufacture on a large scale; that third party patent rights will preclude us or our partners from marketing products; or that third parties will market equivalent or superior competing products. As a result, there can be no assurance that our research and development activities will lead to any commercially viable products in a relevant timeframe.

Biotechnology and pharmaceutical technologies have undergone and are expected to continue to undergo rapid and significant change. Our future success will depend in large part on our ability to maintain a competitive position with respect to these technologies. Rapid technological developments by our company or others may result in products or processes becoming obsolete before we recover any expenses that we incur in connection with the development of such products.

We may not achieve profitability.

We have incurred operating losses in each year since our inception and expect to continue to have negative cash flow from operations. We experienced net losses of approximately $3.9 million and $8.2 million for the years ended December 31, 2013 and 2014, respectively. We experienced a net gain of approximately $2.3 million for the quarter ended March 31, 2015, principally due to the change in fair value of the liability associated with our outstanding warrants as a result of the decrease in our stock price between December 31, 2014 and March 31, 2015. We have accumulated losses as of March 31, 2015 of approximately $15.4 million. Our future profitability will depend on our ability to increase our revenues, which is subject to a number of factors, including our ability to successfully enter into collaborations with third parties, the success of our core platform technology and research and development efforts, our ability to compete effectively in a crowded field, availability of public funding through grants and other federal funds, the time required to reach commercial revenue and profitability, if at all, and global economic and political conditions.

Our future profitability also depends on our expense levels, which are influenced by a number of factors, including the resources we devote to developing and supporting our projects and potential products, the continued progress of our research and development of potential products, our ability to improve research and development efficiencies, license fees or royalties we may be required to pay, and the potential need to acquire licenses to new technology, the availability of intellectual property for licensing or acquisition, or to use our technology in new markets, which could require us to pay unanticipated license fees and royalties in connection with these licenses.

Our expansion efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues to offset higher expenses. These expenses, among other things, may cause our net income and working capital to decrease. If we fail to grow our revenue and manage our expenses, we may never achieve profitability, which would adversely and materially affect our ability to provide a return to our investors.

We will require additional capital to support business growth, and such capital might not be available when needed.

Continued investment will be needed to support the anticipated growth of our company. Our future capital requirements will depend on a number of factors, including, but not limited to:

| · | the size and complexity of, and continued scientific progress in, our research and development programs; |

| · | our entry into new partnerships, and the terms of such partnering agreements; |

| · | competing technological and market developments; |

| · | the time and expense of building and maintaining our patent portfolio and enforcing patent claims; and |

| · | the cost of conducting commercialization activities and potentially in-licensing products, if it proves necessary to do so. |

We intend to continue to make investments to support business growth and may require additional funds to respond to business challenges, which may include the need to develop new products, conduct clinical trials (on our own or with our partners), enhance our operating infrastructure, and acquire complementary businesses and technologies. Equity and debt financing, however, might not be available when needed or, if available, might not be available on terms satisfactory to us. From time to time, capital markets may experience periods of disruption and instability, which can contribute to worsening economic conditions that materially adversely impact broader financial and credit markets and reduce the availability of debt and equity capital for the market as a whole and for small capitalization businesses such as ours in particular.

In addition, to the extent additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in dilution to our shareholders. These securities may also be sold at a discount from the market price of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired and there would be a material adverse effect on our business and financial condition.

We rely on relationships with third parties for product development and commercialization, and those third parties could fail to perform as expected.

We believe that our success depends on developing and maintaining scientific and business relationships with other companies. Relying on such collaborative relationships entails risk to our future success because, among other things:

| · | our partners may not devote sufficient resources to the success of our collaboration; |

| · | our partners may not obtain regulatory approvals necessary to continue the collaborations in a timely manner, if at all; |

| · | our partners may be acquired by another company and decide to terminate our collaborative partnership or cease doing business or become insolvent; |

| · | our partners may develop or license technologies or components competitive with our products; |

| · | disagreements with partners could result in litigation or termination of the relationship; |

| · | collaborators may not have sufficient capital resources; |

| · | our existing collaborations may preclude us from entering into additional future arrangements; and |

| · | we may not be able to negotiate future partnerships, or renew existing collaborative agreements, on acceptable terms, if at all. |

Because these and other factors may be beyond our control, the development or commercialization of our products may be delayed or otherwise adversely affected.

If we or any of our partners terminate a collaborative arrangement, we may be required to devote additional resources to product development and commercialization, or we may need to cancel some development programs, which could adversely affect our product pipeline and business.

Successful development of products is uncertain.

Our development of future product candidates is subject to the risks inherent in the development of new biotechnology products, which include:

| · | delays in research and development, clinical testing or manufacturing; |

| · | unplanned expenditures in product development, clinical testing or manufacturing; |

| · | failure in clinical trials or failure to receive regulatory approvals; |

| · | emergence of equivalent or superior products; |

| · | inability to manufacture product candidates on a commercial scale; |

| · | inability to market products due to third-party patent rights; |

| · | decisions by our partners not to pursue product development; and |

| · | failure to achieve market acceptance after regulatory approval. |

Because of these and other risks, our research and development efforts or those of our partners may not result in any commercially viable products. If a significant portion of these development efforts is not successfully completed, required regulatory approvals are not obtained, or any approved products are not commercially successful, our business, financial condition and results of operations may be materially adversely affected.

The regulatory approval process is lengthy, expensive and uncertain.

Prior to marketing, any new therapeutic product must undergo an extensive regulatory approval process in the United States (and in other countries, as applicable) to establish that the product meets minimum requirements for safety and efficacy. This regulatory process, which includes preclinical studies and clinical trials (and may also include post-marketing surveillance), can take many years to complete and require the expenditure of substantial resources. The commencement or completion of clinical trials may be delayed or halted for various reasons, including difficulty in patient accrual, inadequate drug supply, adverse medical events, lack of efficacy, and issues with evaluator institutional review boards. Data obtained from preclinical studies and clinical trials are susceptible to varying interpretations that could delay, limit or prevent regulatory approval. In addition, previously unknown problems associated with a product that come to light after marketing approval might lead to a requirement for additional clinical studies or withdrawal of the product from the market.

We have not submitted an investigational new drug, or IND, application for any product candidate, and no product candidate has been approved for commercialization in the United States or elsewhere. No assurance can be given that we or any of our partners will be able to identify a product candidate to submit for approval, conduct clinical testing, or obtain the necessary approvals from the U.S. Food and Drug Administration or other regulatory authorities for any products.

Our use of our platform technology depends on a third party license that could be terminated.

We utilize our platform technology under an exclusive license from the Massachusetts Institute of Technology. The license agreement contains certain diligence obligations relating to research and development milestones, clinical milestones, and commercialization milestones. If we fail to achieve those milestones, we could lose certain rights under the license, or even lose the license entirely, which would have a material adverse effect on our business.

We operate in a highly competitive industry, and if our competitors develop superior products and technologies, our competitive position could be compromised.

We face various types of actual and potential competition. Competition could come from both established and emerging pharmaceutical and biotechnology companies (including companies specializing in immunotherapy), academic institutions, governmental agencies, and public and private research institutions. Many of the companies against which we are likely to compete have significantly greater financial resources and expertise in research and development, preclinical testing, clinical trials, manufacturing, regulatory affairs, and marketing than we do. We also compete with small and early-stage companies, particularly with respect to collaborative arrangements with large and established companies and with respect to acquiring technologies that may be complementary to our programs. In addition, we face competition in recruiting and retaining qualified scientific and management personnel. If we are unable to compete effectively against these companies, our business, financial condition and results of operations could be materially adversely affected. Additional information concerning competition is set forth in the section entitled “Business – Description of Business – Competition.”

Claims that our platform technology or our products infringe third party patents could result in costly litigation.

We cannot be certain that our platform technology, our products, or their respective use, do not infringe third party patents. Third parties might allege that we are infringing their patent rights and resort to litigation against us. Although we have conducted freedom-to-operate studies, it is possible that we have failed to identify relevant patents or applications. New patent applications in the United States and elsewhere are published approximately 18 months after their initial filing. Therefore, it is possible that relevant third party patent applications have been filed, but are not yet publicly available.

We are aware of a third party U.S. patent that contains broad claims potentially relevant to some uses of our platform technology, and we are aware of a pair of third party patents that contain broad claims potentially relevant to certain therapeutic uses of our anti-PD-1 antibodies. Nevertheless, based on our analyses, if any claims in these patents were asserted against us, we do not believe our activities would be found to infringe any valid claim. If we were to challenge the validity of any claim in an issued U.S. patent in court, we would need to overcome a statutory presumption of validity that attaches to every U.S. patent. This means that in order to prevail, we would have to present clear and convincing evidence as to the invalidity of the claim(s) in question. There is no assurance that a court would find in our favor on questions of infringement or validity.

In order to avoid or to settle potential patent infringement claims, we may choose to seek a license from a third party and pay license fees, or royalties, or both. Necessary licenses might not be available on commercially reasonable terms, if at all. Ultimately, we could be prevented from commercializing a product, or forced to cease using our technology platform, as a result of patent infringement claims. Defending against claims of patent infringement or misappropriation of trade secrets could be costly and time consuming, even if we prevail in the litigation, which could materially adversely affect our business, financial condition and results of operation.

We could be unsuccessful in obtaining adequate patent protection for one or more of our potential products.

The patent position of biotechnology and pharmaceutical companies is often uncertain because it involves complex legal and factual considerations. The standards applied by the U.S. Patent and Trademark Office and foreign patent offices in granting patents are not always applied uniformly or predictably, and such standards are subject to change based on court decisions, such as recent U.S. Supreme Court cases involving patents. Consequently, patents might not issue from all of our patent applications. In the event that we are unsuccessful in obtaining adequate patent protection for one or more of our products in the future, our business could be adversely affected.

Our competitors might successfully evade our patent protection.

Notwithstanding valid patents that we may own or control through an exclusive license, our competitors may independently develop and market alternative products that are similar to ours, without infringing any of our patent rights. In addition, they may design around our patented platform technology. This could diminish our competitive advantage, particularly if the competitor is a large company with marketing resources greater than ours.

One or more of our patents could be found invalid or unenforceable if challenged in court.

If we were to initiate legal proceedings against a third party to enforce a patent covering our platform technology or one of our products, the defendant might argue successfully that the claims we are asserting are invalid or unenforceable. Even though all of our issued patents will have undergone examination by the U.S. Patent and Trademark Office or a foreign patent office, we cannot be certain that there is no invalidating prior art. If a defendant were to prevail on a legal assertion of invalidity or unenforceability, we could lose part or all of the patent protection on one or our products, or on our platform technology, which could have a materially adverse effect on our business.

In the course of litigation, we could be subject to unfavorable publicity.

During the course of any patent litigation, there could be public announcements regarding hearings, rulings on motions, or other interim developments. If securities analysts or investors perceive such announcements as negative, our business could be adversely affected and the market price of our stock could decline.

If we fail to retain key members of our staff, or fail to attract and train skilled new employees, our ability to conduct and expand our business would be impaired.

The loss of any of our key employees could seriously harm our product development and commercialization efforts. Furthermore, as our company continues to grow, we will require additional highly trained technical and business personnel. The market for such individuals is highly competitive in the biotechnology industry, particularly in the greater Cambridge, Massachusetts area where our main office and laboratory is located. If we fail to hire, train and retain a sufficient number of qualified employees to match our growth, our ability to conduct and expand our business could be impaired.

If we become subject to claims relating to improper handling, storage or disposal of hazardous materials, we could expend significant resources to bring our company into compliance.

Our research and development processes involve the controlled storage, use and disposal of hazardous materials. We are subject to federal, state and local regulations governing the use, manufacture, storage, handling and disposal of hazardous materials and waste products. We may incur significant costs complying with both existing and future environmental laws and regulations, and we are unable to predict whether any agency will adopt regulations in the future that would have a material adverse effect on our operations. The risk of accidental contamination or injury from hazardous materials cannot be eliminated completely. In the event of an accident, we could be held liable for damages that result, and the associated liability could exceed the limits or fall outside our existing insurance coverage.

If a catastrophe strikes our research facilities, we may be unable to complete our projects for a substantial amount of time, we would experience lost revenue, and our business operations would suffer.

Our research and development facilities are located in Cambridge, Massachusetts. Although we have commercial insurance, our facilities and some pieces of equipment and biological samples are difficult to replace and could require substantial replacement lead-time. Various types of disasters, including earthquakes, fires, floods, and acts of terrorism, may affect our research and development facilities. In the event our existing research and development facilities or equipment is affected by man-made or natural disasters, we may be unable to continue research and development activities, and may fail to meet our internal objectives or our partner demands. If our research and development operations were curtailed or ceased, it would seriously harm our business. Although we have access to back-up power generators, in the event of a prolonged or even short-term power failure, we may lose biological samples stored in our freezers or growing in our incubators that could affect our ability to complete projects for ourselves or partners.

We may face product liability claims related to the use or misuse of products employing our antibody technology.

The administration of drugs to humans, in clinical trials or after commercialization, may expose us to product liability claims. Consumers, healthcare producers or persons selling products derived from our research and development programs may be able to bring claims against us based on the use of those products in clinical trials or the sale of those products. Product liability claims may be expensive to defend and may result in significant judgments against us, which could exceed our insurance coverage.

Pharmaceutical pricing, reimbursement and related matters are uncertain.

Our business, financial condition and results of operation may be materially and adversely affected by the continuing efforts of the government and third party payors to contain or reduce the costs of healthcare. Federal and state proposals to implement government controls, as well as ongoing emphasis on managed care in the U.S. healthcare industry, may continue to put pressure on the pricing of pharmaceutical products and diagnostic tests. Cost control initiatives could decrease the price that we or our partners receives for products commercialized in the future, and also may have a material adverse effect on our business, financial condition and results of operations. To the extent that cost control initiatives have a material adverse effect on our partners, our ability to commercialize products and to realize royalties may be adversely affected.

Investment Risks

You could lose all of your investment.

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in our securities may go down as well as up. In addition, there can be no certainty that the market value of an investment in our securities will fully reflect its underlying value. You could lose your entire investment.

Failure to develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares.

Our common stock is currently quoted on the OTC Markets. The OTC Markets is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not be able to satisfy the requirements of a national securities exchange for our common stock to be listed on such an exchange, which is often a more widely-traded and liquid market. Among the factors which may delay or prevent the listing of our common stock on a more widely-traded and liquid market are the following: our stockholders’ equity may be insufficient; the market value of our outstanding securities may be too low; our net income from operations may be too low; our common stock may not be sufficiently widely held; we may not be able to secure market makers for our common stock; and we may fail to meet the rules and requirements mandated by the various national exchanges and markets to have our common stock listed. Should we fail to satisfy the listing standards of the national exchanges or if our common stock is otherwise rejected for listing, or if our common stock remains listed on the OTC Markets or is suspended from the OTC Markets, the trading price of our common stock could suffer. In addition, the trading market for our common stock may continue to be less liquid and our common stock price may be subject to increased volatility, making it difficult or impossible for stockholders to sell shares of our common stock.

Our stock may be traded infrequently and in low volumes, so you may be unable to sell your shares at or near the quoted bid prices if you need to sell your shares.

Unless we are able to meet the listing requirements of a national securities exchange, such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our common stock to remain eligible for quotation on the OTC Markets, or on another over-the-counter quotation system, or in the “pink sheets.” In those venues, however, the shares of our common stock may trade infrequently and in low volumes, meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. An investor may find it difficult to obtain accurate quotations as to the market value of our common stock or to sell his, her or its shares at or near bid prices, if at all. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are authorized to issue an aggregate of 300,000,000 shares of our common stock and 10,000,000 shares of “blank check” preferred stock. We will need to raise additional capital in the near future to meet our working capital needs, and there can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with these capital raising efforts, including at a price (or exercise price) below the price you paid for your stock. We may issue additional shares of our common stock or other securities that are convertible into or exercisable for our common stock in connection with hiring, promoting or retaining employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock may create downward pressure on our stock’s trading price.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

The Exchange Act establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer take a number of additional steps to approve a person’s account for transactions in penny stocks, including obtaining financial information and investment experience objectives of the person, making a reasonable determination that the transactions in penny stocks are suitable for that person, and making a reasonable determination that the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. In addition, the rules require that the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. Due to the additional burdens imposed by these rules, brokers may be less willing to execute transactions in securities subject to the penny stock rules, and this may make it more difficult for investors to dispose of our common stock and consequently cause a decline in the market value of our common stock.

We do not anticipate paying dividends on our common stock, and investors may lose the entire amount of their investment.

Cash dividends have never been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their shares of common stock. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure stockholders that they will not lose the entire amount of their investment.

Being a public company is expensive and administratively burdensome.

As a public reporting company, we are subject to the information and reporting requirements of the Securities Act, the Exchange Act, and other federal securities laws, rules and regulations related thereto, including compliance with the Sarbanes-Oxley Act. Complying with these laws and regulations requires the time and attention of our board of directors and management, and increases our expenses. Among other things, we are required to:

| · | prepare and distribute periodic reports in compliance with our obligations under federal securities laws; |

| · | institute a comprehensive compliance function, including with respect to corporate governance; |

| · | maintain and evaluate a system of internal controls over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board; |

| · | maintain policies relating to our disclosure controls and procedures; and |

| · | involve, to a greater degree, our outside legal counsel and accountants in the above activities. |

The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders are significant, and much greater than that of a privately-held company. Continued compliance with the rules and regulations applicable to publicly-traded companies may require us to hire additional financial reporting, internal controls and other finance personnel, and will involve a material increase in regulatory, legal and accounting expenses and the attention of management. There can be no assurance that we will be able to continue to comply with the applicable regulations in a timely manner, if at all. In addition, being a public company makes it more expensive for us to obtain director and officer liability insurance. In the future, we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified executives and members of our board of directors, particularly directors willing to serve on our audit committee.

As an emerging growth company, we may follow certain permitted corporate governance practices, and may delay adoption of new or revised accounting standards, which may make our stock less attractive and result in less protection than is accorded to investors in a non-emerging growth company.

As an emerging growth company, we are permitted to follow certain corporate governance practices and disclosure requirements that are less robust than those otherwise required by the SEC. This may provide our stockholders with less information and less protection than what is accorded to investors under a national stock exchange’s listing requirements applicable to non-emerging growth company issuers.

In addition, as an emerging growth company, we have elected to take advantage of an extended transition period for any new or revised accounting standards that may be issued by the Financial Accounting Standards Board or the SEC. This means that when a standard is issued or revised and it has different application dates for public or private companies, we can delay adoption of the standard until it applies to private companies. This may make a comparison of our financial statements with any other public company that is not an emerging growth company, or is an emerging growth company that has opted out of using the extended transition period, difficult, as different or revised standards may be used. As a result, investors may find our common stock less attractive and there may be a less active trading market for our common stock. Consequently, our stock price may be more volatile and could decline.

Any failure to maintain effective internal control over our financial reporting could materially adversely affect us.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to include in our annual reports on Form 10-K an assessment by management of the effectiveness of our internal control over financial reporting. In addition, at such time, if any, as we are no longer a “smaller reporting company,” our independent registered public accounting firm will have to attest to and report on management’s assessment of the effectiveness of such internal control over financial reporting. Our compliance with Section 404 may require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we may need to retain the services of additional accounting and financial staff or consultants with appropriate public company experience and technical accounting knowledge to satisfy the ongoing requirements of Section 404.

While we intend to diligently and thoroughly document, review, test and improve our internal control over financial reporting in order to ensure compliance with Section 404, management may not be able to conclude that our internal control over financial reporting is effective. Furthermore, even if management were to reach such a conclusion, if our independent registered public accounting firm is not satisfied with the adequacy of our internal control over financial reporting, or if the independent auditors interpret the requirements, rules or regulations differently than we do, then they may decline to attest to management’s assessment or may issue a report that is qualified. Any of these events could result in a loss of investor confidence in the reliability of our financial statements, which in turn could negatively impact the price of our common stock.

Provisions in our charter documents and under Delaware law could discourage a takeover that stockholders may consider favorable.

Certain provisions in our certificate of incorporation and by-laws may have the effect of delaying or preventing a change of control or changes in our management. These provisions include the following:

| · | authorize “blank check” preferred stock that could be issued by our board of directors to defend against a takeover attempt; |

| · | establish a classified board of directors, as a result of which the successors to the directors whose terms have expired will be elected to serve from the time of election and qualification until the third annual meeting following their election; |

| · | require that directors only be removed from office for cause and only upon a supermajority stockholder vote; |

| · | provide that vacancies on the board of directors, including newly created directorships, may be filled only by a majority vote of directors then in office rather than by stockholders; |

| · | prevent stockholders from calling special meetings; and |

| · | prohibit stockholder action by written consent, requiring all actions to be taken at a meeting of the stockholders. |

In addition, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which generally prohibits a Delaware corporation from engaging in a broad range of business combinations with any “interested” stockholder for a period of three years following the date on which the stockholder becomes an “interested” stockholder.

Also, in connection with the Merger, certain of our stockholders (who hold approximately 70% of the common stock), including all of the investors in the PPO, all of our pre-Merger stockholders and certain of the Enumeral stockholders (including all of Enumeral’s officers directors and principal stockholders) entered into a Voting Agreement in which they have agreed to vote their shares of our stock to elect certain directors specified in the Voting Agreement. The Voting Agreement will terminate two years from the date of closing of the Merger.

The ability of our Board of Directors to issue additional stock may prevent or make more difficult certain transactions, including a sale or merger of our company.

Our board of directors is authorized to issue up to 10,000,000 shares of preferred stock with powers, rights and preferences designated by it. Shares of voting or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to create voting impediments or to frustrate persons seeking to effect a takeover or otherwise gain control of our company. The ability of our board of directors to issue such additional shares of preferred stock, with rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of our company by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price for their shares or the temporary increase in market price that such an attempt could cause. Moreover, the issuance of such additional shares of preferred stock to persons friendly to our board of directors could make it more difficult to remove incumbent officers and directors from office even if such change were to be favorable to stockholders generally.

The sale of a significant number of registered shares of our common stock may cause our stock price to decline.

This prospectus relates to the public offering, which is not being underwritten, by the selling stockholders listed in this prospectus, of up to 52,154,760 shares of our common stock. Of the shares being offered, 28,421,568 are presently issued and outstanding, and 23,733,192 are issuable upon exercise of common stock purchase warrants. The sale of these shares of our common stock will lead to an increase in the public float of our common stock, and such increase may cause the market price of our common stock to decline or fluctuate significantly.

***

The risks above do not necessarily comprise all of those associated with an investment in our company. This Prospectus contains forward looking statements that involve unknown risks, uncertainties and other factors that may cause the actual results, financial condition, performance or achievements of our company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Factors that might cause such a difference include, but are not limited to, those set out above.

SELLING STOCKHOLDERS

This Prospectus covers the resale from time to time by the selling stockholders identified in the table below of:

| · | up to 42,895,497 shares of Common Stock (the “PPO Shares”) issued to investors in our July 2014 private placement, consisting 21,345,987 shares of Common Stock currently outstanding and 21,549,510 shares of common stock issuable upon exercise of common stock purchase warrants; |

| · | up to 2,000,000 shares of Common Stock (the “Agent Warrant Shares”) issuable upon exercise of common stock purchase warrants issued to the placement agents in our July 2014 private placement; |

| · | 5,565,516 shares of Common Stock (the “Enumeral Shares”) issued to the former holders of common and preferred stock of Enumeral pursuant to the terms of the Merger Agreement, consisting 5,381,834 shares of Common Stock currently outstanding and 183,682 shares of common stock issuable upon exercise of common stock purchase warrants; and |

| · | 1,693,747 shares of Common Stock (the “True-Up Shares”) issued to the pre-Merger stockholders of the Company pursuant to anti-dilution provisions of the Merger Agreement. |

The selling stockholders identified in the table below may from time to time offer and sell under this Prospectus any or all of the shares of common stock described under the columns “Shares of common stock owned prior to this Offering and Registered hereby” and “Shares Issuable Upon Exercise of Warrants owned Prior to this Offering and Registered hereby” in the table below.

Certain selling stockholders may be deemed to be “underwriters” as defined in the Securities Act. Any profits realized by such selling stockholder may be deemed to be underwriting commissions.

The table below has been prepared based upon the information furnished to us by the selling stockholders as of the date of this prospectus. The selling stockholders identified below may have sold, transferred or otherwise disposed of some or all of their shares since the date on which the information in the following table is presented in transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning the selling stockholders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly. We cannot give an estimate as to the number of shares of common stock that will actually be held by the selling stockholders upon termination of this offering because the selling stockholders may offer some or all of their common stock under the offering contemplated by this prospectus or acquire additional shares of common stock. The total number of shares that may be sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution” in this prospectus.

The following table sets forth the name of each selling stockholder, the number of shares of our common stock beneficially owned by such stockholder before this offering, the number of shares to be offered for such stockholder’s account and the number and (if one percent or more) the percentage of the class to be beneficially owned by such stockholder after completion of the offering. The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares of our common stock as to which a person has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within 60 days after June 30, 2015 (the “Determination Date”), through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person.

Unless otherwise set forth below, based upon the information furnished to us, (a) the persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite the selling stockholder’s name, subject to community property laws, where applicable, (b) no selling stockholder had any position, office or other material relationship within the past three years, with us or with any of our predecessors or affiliates, and (c) no selling stockholder is a broker-dealer or an affiliate of a broker-dealer. Selling stockholders who are broker-dealers or affiliates of broker-dealers are indicated by footnote. We have been advised that these broker-dealers and affiliates of broker-dealers purchased our common stock in the ordinary course of business, not for resale, and at the time of purchase, did not have any agreements or understandings, directly or indirectly, with any person to distribute such common stock. The number of shares of common stock shown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to us at the timing of the filing of the registration statement of which this prospectus forms a part.

| Selling Stockholder | | Shares of

common stock

beneficially

owned prior to

the Offering | | | Shares of

common

stock owned

prior to this

Offering and

registered

hereby | | | Shares

issuable upon

exercise of

warrants

owned prior to

this Offering

and registered

hereby (1) | | | Shares of

common stock

beneficially

owned upon

completion of

this Offering (2) | | | Percentage

of

Common

Stock

beneficially

owned upon

completion

of this

Offering (3) | |

| | | | | | | | | | | | | | | | |

| A.G. Family L.P. (4)(6) | | | 600,000 | | | | 300,000 | | | | 300,000 | | | | - | | | | - | |

| Aaron Segal (5) | | | 756,628 | | | | 55,798 | | | | 363,624 | | | | 337,206 | | | | * | |

| Alan F. Bilzi (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Alden Thomas Leith (6) | | | 416,000 | | | | 208,000 | | | | 208,000 | | | | - | | | | - | |

| Alec H. Jaret (6) | | | 70,000 | | | | 35,000 | | | | 35,000 | | | | - | | | | - | |

| Alfred J. Difiore, Jr. (6) | | | 30,000 | | | | 15,000 | | | | 15,000 | | | | - | | | | - | |

| Allan Rothstein (7) | | | 2,111,638 | | | | 50,000 | | | | 50,000 | | | | 2,011,638 | | | | 3.9 | % |

| Allen Chase Foundation - Special Investment Account (6)(8) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Allan Lipkowitz Revocable Living Trust 8/26/2005 (6)(9) | | | 150,000 | | | | 75,000 | | | | 75,000 | | | | - | | | | - | |

| Alyson D. Schlosser (6) | | | 80,000 | | | | 40,000 | | | | 40,000 | | | | - | | | | - | |

| AME Capital Group, LLC (6)(10) | | | 500,000 | | | | 250,000 | | | | 250,000 | | | | - | | | | - | |

| American Portfolios Financial Services Inc. (11) | | | 43,917 | | | | - | | | | 43,917 | | | | - | | | | - | |

| Amir Zaghloul and Mona Zaghloul (6) (12) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Anders J. Maxwell and Carlene S. Maxwell (13) | | | 137,766 | | | | 68,883 | | | | - | | | | 68,883 | | | | * | |

| Andrea Bedan (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Adrienne M. Baker (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Andrew Fisher and Melissa Fisher (6)(14) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Andrew S. Brenner (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Anthony Iannotta (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Anthony Liberti and Barbara Liberti (6)(15) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Anthony Naer and Mary Naer (6)(16) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Selling Stockholder | | Shares of

common stock

beneficially

owned prior to

the Offering | | | Shares of

common

stock owned

prior to this

Offering and

registered

hereby | | | Shares

issuable upon

exercise of

warrants

owned prior to

this Offering

and registered

hereby (1) | | | Shares of

common stock

beneficially

owned upon

completion of

this Offering (2) | | | Percentage

of

Common

Stock

beneficially

owned upon

completion

of this

Offering (3) | |

| | | | | | | | | | | | | | | | |

| Anthony Ziniti (6) | | | 45,000 | | | | 20,000 | | | | 25,000 | | | | - | | | | - | |

| Anton Bogner and Barbara D. Bogner (6)(17) | | | 600,000 | | | | 300,000 | | | | 300,000 | | | | - | | | | - | |

| Arielle E. Crothers(6) | | | 20,000 | | | | 10,000 | | | | 10,000 | | | | - | | | | - | |

| Arun Penmetsa (18) | | | 137,766 | | | | 68,883 | | | | - | | | | 68,883 | | | | * | |

| Ashish Jhingan and Dolly Jhingan (6)(19) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Bantam Group, LLC (6)(20) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Barclay Armitage (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Barry Cohn (21) | | | 21,959 | | | | - | | | | 21,959 | | | | - | | | | - | |

| Barry J. Bentley (18) | | | 344,414 | | | | 172,207 | | | | - | | | | 172,207 | | | | * | |

| Barry J. Shemaria (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Biological E. Limited (18)(22) | | | 344,414 | | | | 172,207 | | | | - | | | | 172,207 | | | | * | |

| BlackBook (18)(23) | | | 112,004 | | | | - | | | | 56,002 | | | | 56,002 | | | | * | |

| Borca Dynasty Trust (6)(24) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Boris Shames (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Brian E. Peierls (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Brian Fischhoff and Andrea Fischhoff (6)(25) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Brian M. Miller (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Brio Capital Master Fund LTD (6)(26) | | | 575,700 | | | | 275,700 | | | | 300,000 | | | | - | | | | - | |

| Bruce A. Haverberg and Donna R. Haverberg (6)(27) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Bruce Rosen (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Sergey Brudanin and Inna Mamuta (6)(28) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Byron Hughey (6) | | | 30,000 | | | | 15,000 | | | | 15,000 | | | | - | | | | - | |

| Carnahan Trust (6)(29) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Carol Cody (6) | | | 300,000 | | | | 150,000 | | | | 150,000 | | | | - | | | | - | |

| Carol Giorello and Anthony Giorello (6)(30) | | | 20,000 | | | | 10,000 | | | | 10,000 | | | | - | | | | - | |

| Cathy D. Guerriera (6) | | | 20,000 | | | | 10,000 | | | | 10,000 | | | | - | | | | - | |

| Cede & Co. (31) | | | 12,329 | | | | 3,089 | | | | - | | | | 9,240 | | | | * | |

| Chad Forti (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Charles Freeland (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Charles Freeland and Beverly Freeland (6)(32) | | | 300,000 | | | | 150,000 | | | | 150,000 | | | | - | | | | - | |

| Charles Loegering (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Charles Medici and Diane Medici (6)(33) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Chinn Family Limited Partnership (6)(34) | | | 500,000 | | | | 250,000 | | | | 250,000 | | | | - | | | | - | |

| Choi Family Trust Dated March 15, 2001 (6)(35) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Selling Stockholder | | Shares of

common stock

beneficially

owned prior to

the Offering | | | Shares of

common

stock owned

prior to this

Offering and

registered

hereby | | | Shares

issuable upon

exercise of

warrants

owned prior to

this Offering

and registered

hereby (1) | | | Shares of

common stock

beneficially

owned upon

completion of

this Offering (2) | | | Percentage

of

Common

Stock

beneficially

owned upon

completion

of this

Offering (3) | |

| | | | | | | | | | | | | | | | |

| Christopher Cozzolino (6) | | | 11,700 | | | | - | | | | 11,700 | | | | - | | | | - | |

| Christopher Innace (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Christopher Warren Lamar (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Christopher William Washburn (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Clay Godfrey Lebhar | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Clayton A. Struve (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Clyde S. McGregor Revocable Trust dtd 6/6/97 (6)(36) | | | 500,000 | | | | 250,000 | | | | 250,000 | | | | - | | | | - | |

| Coover Multi-Generational Trust (6)(37) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Craig R. Francis (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Craig H. Millet (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Craig I. Leipold (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Craig Whited (6) | | | 150,000 | | | | 75,000 | | | | 75,000 | | | | - | | | | - | |

| Currie Family Trust (6)(38) | | | 260,000 | | | | 130,000 | | | | 130,000 | | | | - | | | | - | |

| Cynthia Warenik Serini (6) | | | 40,000 | | | | 20,000 | | | | 20,000 | | | | - | | | | - | |

| Daniel Regan (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Daniel Chestler (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Daniel Michael (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Daniel Salvas (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Daniel Woods (18) | | | 68,884 | | | | 34,442 | | | | - | | | | 34,442 | | | | * | |

| Daryl Squicciarini(6) | | | 500,000 | | | | 250,000 | | | | 250,000 | | | | - | | | | - | |

| Dave Rickey & Daughters Foundation Charitable Trust (6)(39) | | | 25,000 | | | | 10,000 | | | | 15,000 | | | | - | | | | - | |

| David Blau (6) | | | 250,000 | | | | 125,000 | | | | 125,000 | | | | - | | | | - | |

| David E. Weiss, Jr. (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| David Frydrych (18) | | | 289,306 | | | | 144,653 | | | | - | | | | 144,653 | | | | * | |

| David Gerald Tompkins (6) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| David Landskowsky (40) | | | 465,774 | | | | 89,523 | | | | 150,722 | | | | 225,529 | | | | * | |

| David M. Rickey Trust dtd 5/8/02 (6)(41) | | | 55,000 | | | | 20,000 | | | | 35,000 | | | | - | | | | - | |

| David Routenberg (18)(144) | | | 35,132 | | | | 690 | | | | - | | | | 34,442 | | | | * | |

| David Schechter (18) | | | 34,442 | | | | 17,221 | | | | - | | | | 17,221 | | | | * | |

| David Stollwerk and Susan S.Stollwerk | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Dean Greenberg (6)(42) | | | 50,000 | | | | 25,000 | | | | 25,000 | | | | - | | | | - | |

| Delux Investment Group LLC (6)(43) | | | 30,000 | | | | 15,000 | | | | 15,000 | | | | - | | | | - | |

| Dennis McKee (6) | | | 20,000 | | | | 10,000 | | | | 10,000 | | | | - | | | | - | |

| Dennis T. Brooks (6) | | | 60,000 | | | | 30,000 | | | | 30,000 | | | | - | | | | - | |

| Diana Pocapalia Trust dated July 8, 2013 (18)(44) | | | 96,438 | | | | 48,219 | | | | - | | | | 48,219 | | | | * | |

| Domenic Strazzulla (6) | | | 80,000 | | | | 40,000 | | | | 40,000 | | | | - | | | | - | |

| Donald Cooper (6) | | | 200,000 | | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| Donald P. Sesterhenn (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Double Add Investments I LLC(6)(45) | | | 30,000 | | | | 15,000 | | | | 15,000 | | | | - | | | | - | |

| Selling Stockholder | | Shares of

common stock

beneficially

owned prior to

the Offering | | | Shares of

common

stock owned

prior to this

Offering and

registered

hereby | | | Shares

issuable upon

exercise of

warrants

owned prior to

this Offering

and registered

hereby (1) | | | Shares of

common stock

beneficially

owned upon

completion of

this Offering (2) | | | Percentage

of

Common

Stock

beneficially

owned upon

completion

of this

Offering (3) | |

| | | | | | | | | | | | | | | | |

| Douglas Kohrs (6) | | | 400,000 | | | | 200,000 | | | | 200,000 | | | | - | | | | - | |

| Douglas Lee Krohn (6) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| Due Mondi Investments, LTD (6)(46) | | | 100,000 | | | | 50,000 | | | | 50,000 | | | | - | | | | - | |

| E. Jeffrey Peierls (6) | | | 240,000 | | | | 120,000 | | | | 120,000 | | | | - | | | | - | |