Exhibit 99.1

Enumeral Overview October 2016 OTCQB: ENUM

Forward Looking Statements This presentation contains forward - looking statements that are based on the company’s current expectations, assumptions, estimates and projections about the company and the pharmaceutical industry . The company makes no representations about the accuracy of such statements estimates or projections . Forward - looking statements are indicated by words such as : may, will, should, predict, continue, plan, expect, anticipate, estimate, intend, believe, could, goal objectives and similar expressions . Forward - looking statements may include, but are not limited to, statements concerning the company’s anticipated performance, including revenue and profit expectations ; development and implementation of our collaborations ; duration ; size ; scope and revenue associated with collaboration partnerships ; benefits provided to collaboration partners by our technology ; business mix ; revenues and growth in our partner base ; market opportunities ; competing technologies, industry conditions and trends ; and regulatory developments . Actual results may differ materially from the anticipated results due to substantial risks and uncertainties related to the company and the biopharmaceutical industry in which the company operates . 2

Company Highlights • Enumeral is a biotechnology company u tilizing a patented platform to identify novel therapeutics and advance treatments in cancer and other diseases mediated by the immune system • Platform is based on technology exclusively licensed from MIT • Enumeral’s platform has been validated through the identification and advancement of diverse and differentiated antibodies against a variety of targets • Enumeral has a promising pre - clinical pipeline in immuno oncology • Enumeral is publicly traded on OTCQB under ticker symbol ENUM 3

What’s New • New Management • Wael Fayad appointed Chairman, President, and CEO • Robert Schaub joined as Interim Head of R&D • New Direction • Focus on partnerships and strategic collaborations • Focus on exploiting platform across therapeutic areas and applications • Focus on discovery to build own pipeline • New Pipeline Activities • Initiated pre - clinical studies with lead PD - 1 program to further elucidate potential for differentiation and safety/efficacy profile • Advancing TIM - 3 program to humanized lead candidate • Identifying high value targets • Refocusing on platform 4 Focus on Value Creation

New Leadership Recently Appointed Wael Fayad • Appointed Chairman, President and CEO in September 2016 • > 20 years of executive and business experience in pharma • 14 years business development track record • Head of business development at Forest Laboratories Inc. • Secured transactions and collaborations which ultimately supported the acquisition of the company for $28 Billion • History of working with science and R&D teams to achieve business goals • Broad network and deep rolodex with senior executives in Pharma /Biotech and major biotech institutional investors 5

Strengthened Management Team 6 Wael Fayad Chairman, President and CEO Bob Schaub, Ph.D. Interim Head of Research and Development • 35 years scientific and executive leadership in pharma and biotech • Expert in translational drug discovery and development of small molecules and biologics • Author of 150 peer reviewed publications and 8 Patents • Track record of managing R&D teams and programs Kevin G. Sarney Vice President of Finance, Treasurer, and Chief Accounting Officer Matthew A. Ebert General Counsel

4 Point Plan To Create Near Term Value • Prioritize strategic collaborations and partnerships to realize the potential of our platform for discovery and development of novel therapeutics • Advance pipeline to near term value inflection points • Secure funding to support plan execution • Position company for future capital raises or strategic options 7

Growth Strategy • Raise growth capital • Further invest in discovery engine and build a deeper pipeline of therapeutics for high value targets • Close additional transformative deals • Up - list to Nasdaq 8 Focus on Creation of Shareholder Value

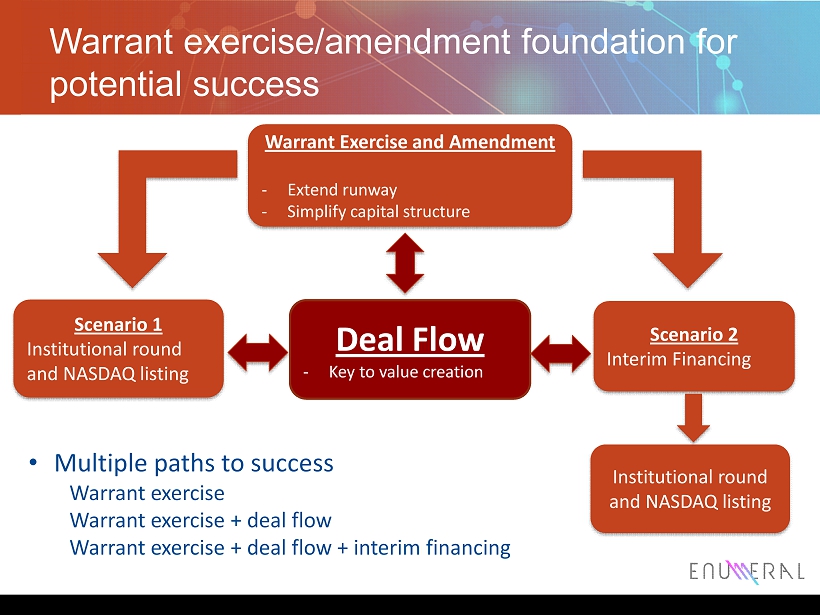

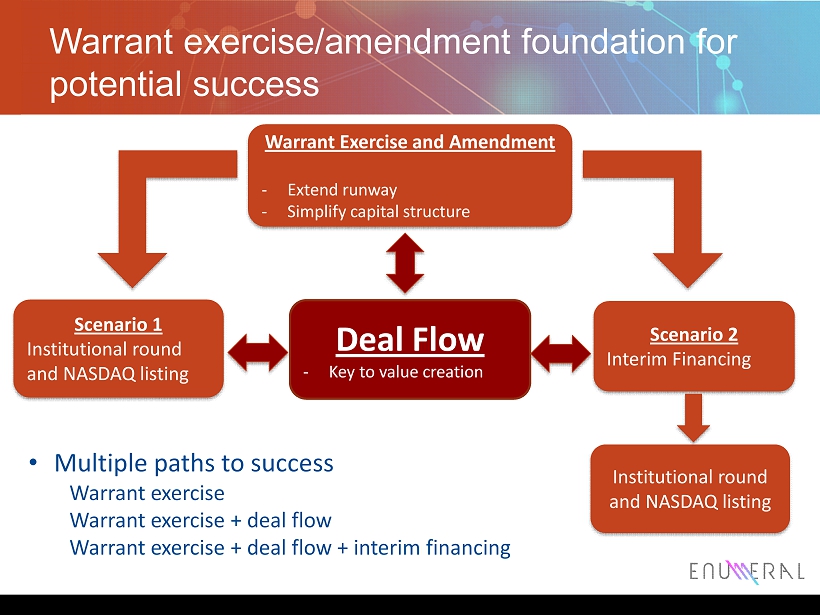

Warrant exercise/amendment foundation for potential success 9 Warrant Exercise and Amendment - Extend runway - Simplify capital s tructure Scenario 1 Institutional round and NASDAQ listing Scenario 2 Interim Financing Deal Flow - Key to value creation Institutional round and NASDAQ listing • Multiple paths to success Warrant exercise Warrant exercise + deal flow Warrant exercise + deal flow + interim financing

Planning for Success • Partner outreach ongoing • Institutional outreach ongoing • Interim financing outreach ongoing • R&D plan in place to advance pipeline to near term value inflection 10 x Management experience x Relationships x Deal making acumen Ingredients for Success High Energy and Motivated Management

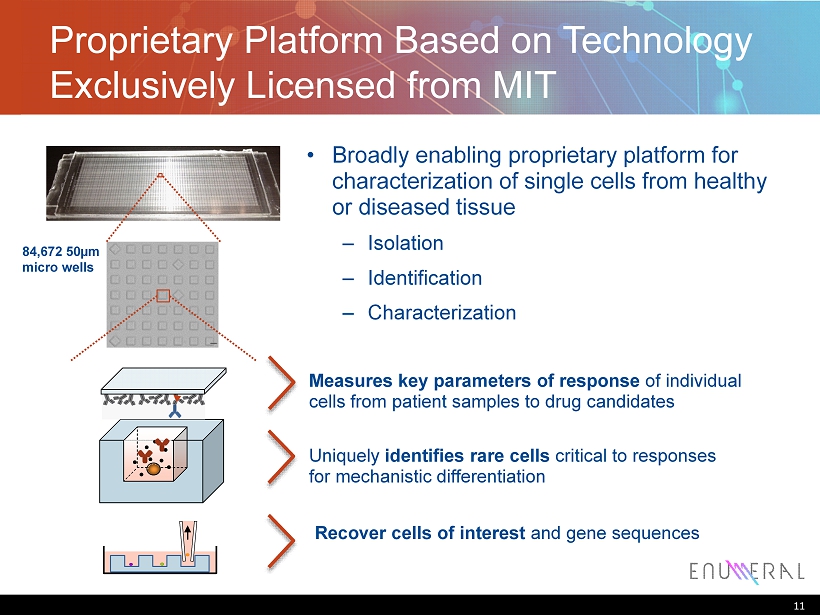

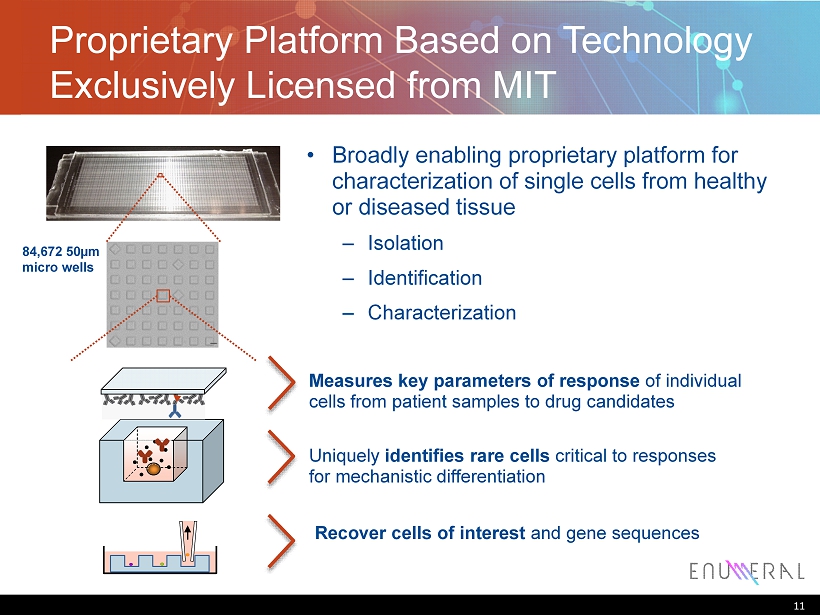

Proprietary Platform Based on Technology Exclusively Licensed from MIT 11 84,672 50µm micro wells • Broadly enabling proprietary platform for characterization of single cells from healthy or diseased tissue – Isolation – Identification – Characterization Measures key parameters of response of individual cells from patient samples to drug candidates Uniquely identifies rare cells critical to responses for mechanistic differentiation Recover cells of interest and gene sequences

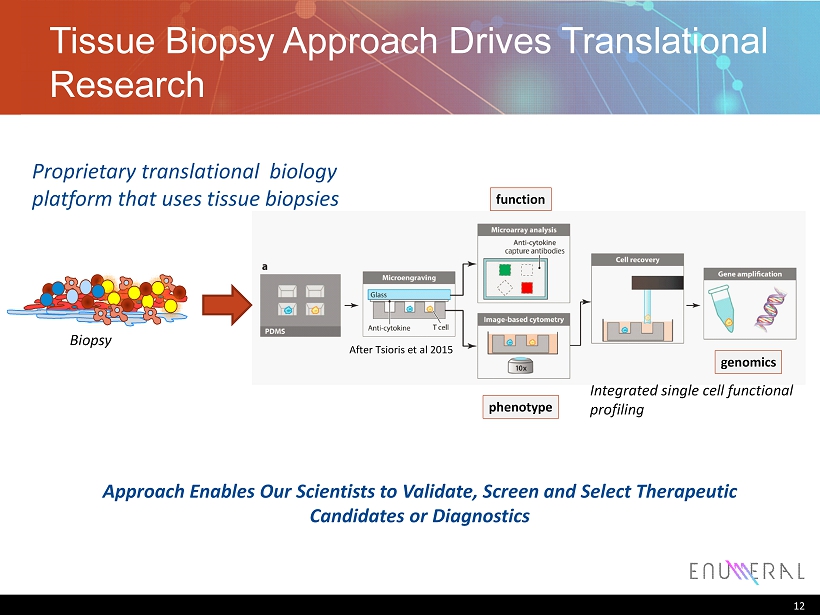

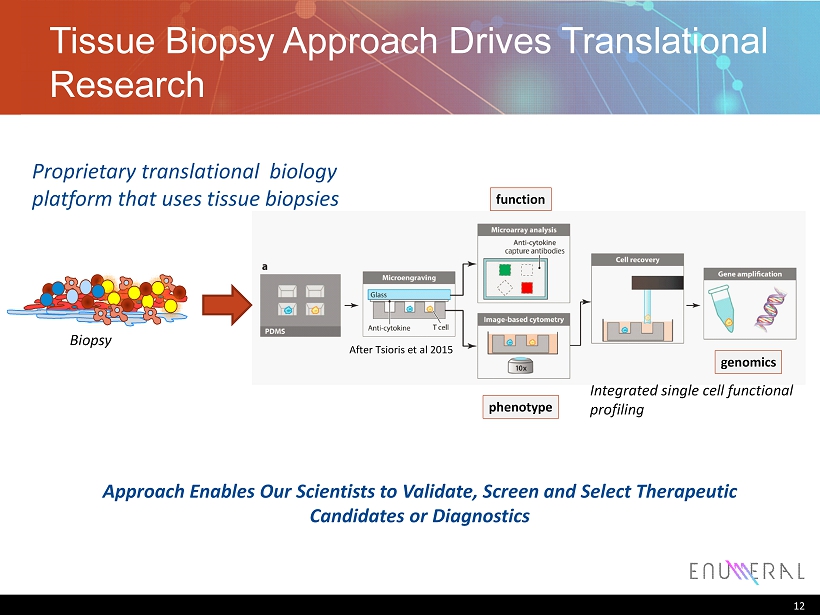

Tissue Biopsy Approach Drives Translational Research 12 function phenotype genomics Integrated single cell functional profiling Biopsy Proprietary translational biology platform that uses tissue biopsies After Tsioris et al 2015 Approach Enables Our Scientists to Validate, Screen and Select Therapeutic Candidates or Diagnostics

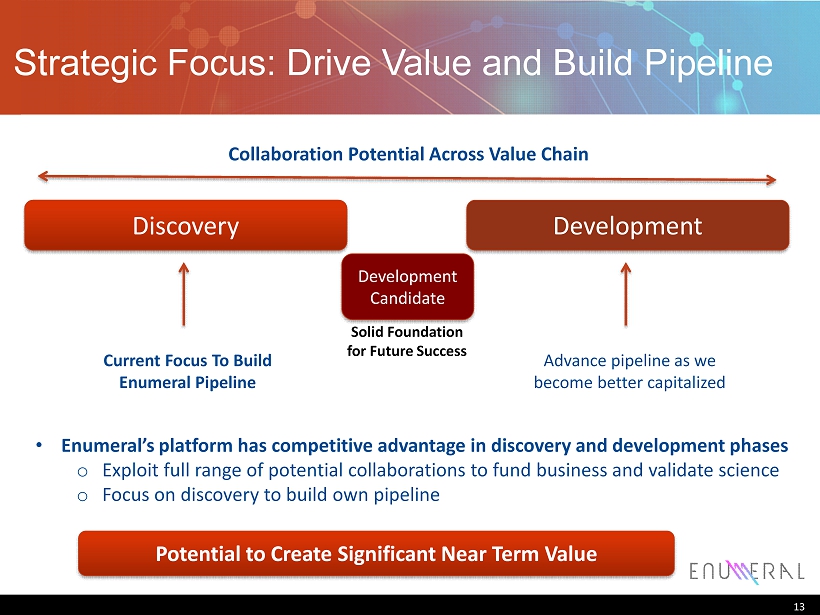

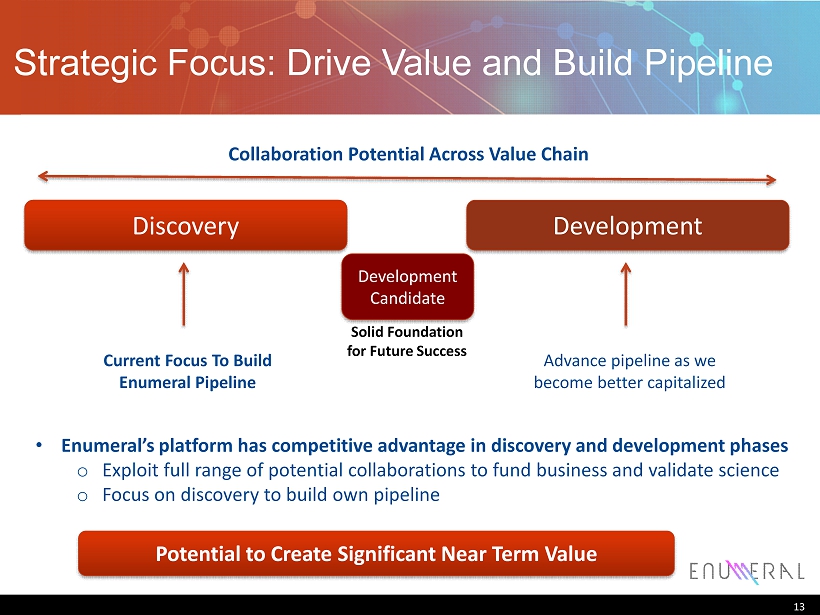

Strategic Focus: Drive Value and Build Pipeline 13 Solid Foundation for Future Success Discovery • Enumeral’s platform has competitive advantage in discovery and development phases o Exploit full range of potential collaborations to fund business and validate science o Focus on discovery to build own pipeline Development Development Candidate Collaboration Potential Across Value Chain Current Focus To Build Enumeral Pipeline Advance pipeline as we become better capitalized Potential to Create S ignificant N ear T erm V alue

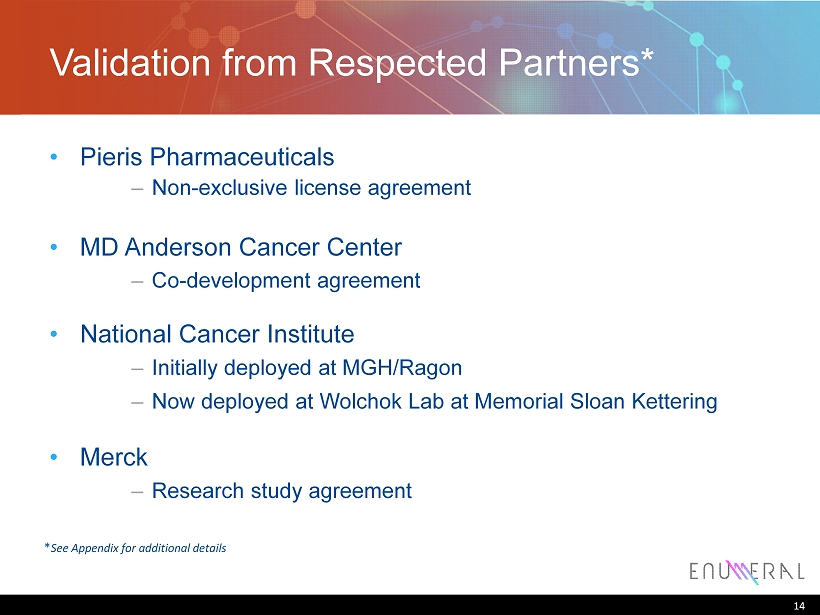

Validation from Respected Partners* • Pieris Pharmaceuticals – Non - exclusive license agreement • MD Anderson Cancer Center – Co - development agreement • National Cancer Institute – Initially deployed at MGH/ Ragon – Now deployed at Wolchok Lab at Memorial Sloan Kettering • Merck – Research study agreement 14 * See Appendix for additional details

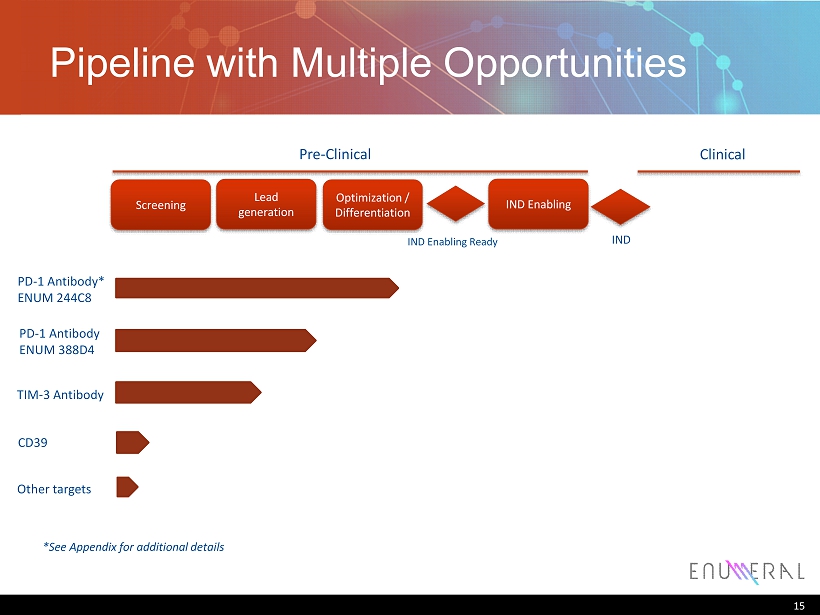

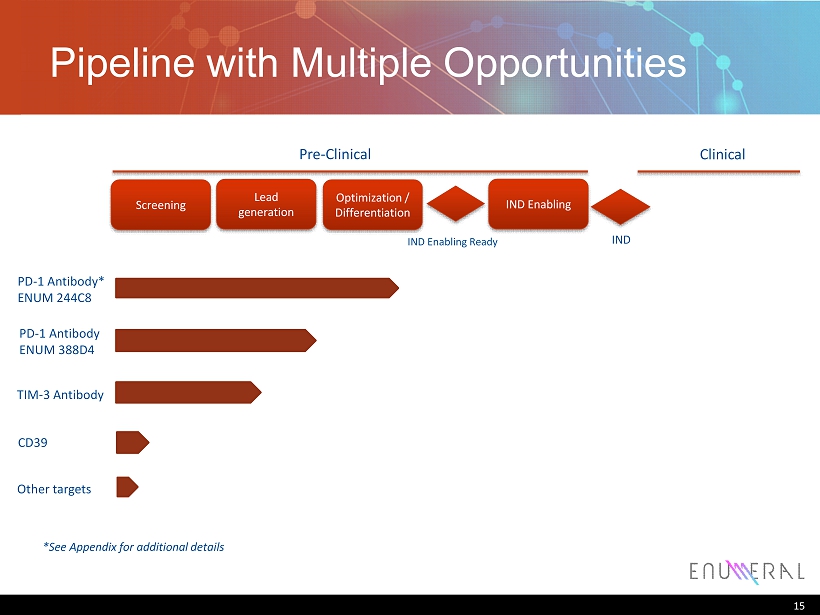

Pipeline with Multiple Opportunities 15 PD - 1 Antibody* ENUM 244C8 PD - 1 Antibody ENUM 388D4 TIM - 3 Antibody CD39 Lead generation Screening Optimization / Differentiation Pre - Clinical Clinical IND Enabling IND Enabling Ready IND Other targets *See Appendix for additional details

Platform with Multiple Applications • Characterization of patient derived samples to identify – New targets – Differentiation of therapeutic agents – Clinical status – Drug development strategies • Identification of novel and diverse antibodies for – Therapeutic intervention – Diagnostics • Characterization of human immune response to vaccines, pathogens, etc. 16 Potential for Multiple Value Creating Collaborations

Near Term Milestones • Generate robust deal flow – Strategic platform based collaborations – Multiple assets to partner – Two assets of PD - 1, C8 and D4, can be partnered together or separately for different indications – TIM - 3 - can be partnered together or separately for multiple indications • Generate data in relevant pre - clinical models to confirm efficacy and safety profile of lead PD - 1 product – Available by year - end 2016 • Advance TIM - 3 program to development candidate stage ready for IND enabling program – Expected during first half 2017 • Initiate a new discovery program for a high value target • Expected first quarter 2017 17

Significant Value Often Recognized at Pre - Clinical Stage • Discovery and early stage biotechs can have high valuations ‒ CTMX: ~$600M market cap ‒ RGNX: ~$400M market cap • Lucrative deals recently made at the pre - clinical stage ‒ Jounce/Celgene, July 2106 ‒ $225 million upfront + downstream ‒ Zymeworks/GSK, April 2016 ‒ $36M upfront + downstream ‒ Juno/AbVitro, January 2016 ‒ $78M + 1.2M shares of Juno ‒ Xoma/Novartis, October 2015 ‒ $37.5M upfront + downstream ‒ Cerulean/Novartis, October 2016 ‒ $5 million upfront + downstream 18 Successful Programs Against Desired Targets and Disease Areas Receive High Value

Key Takeaways • Enumeral science works and has potential to create significant value – Deal flow – D ata flow – Institutional capital • Enumeral now has right management and right plan – Experience to execute business plan – Relationships to attract corporate partners and institutional investors • Warrant exercise and amendment key to potential future success – Extend runway – Simplify capital structure to attract growth capital 19 Potential to Create Significant Shareholder Value

Thank You Contact: Wael Fayad Chairman, President, and CEO 200 Cambridge Park Drive Cambridge, MA, 02140 wael@enumeral.com O: 617 - 500 - 1613

Appendix

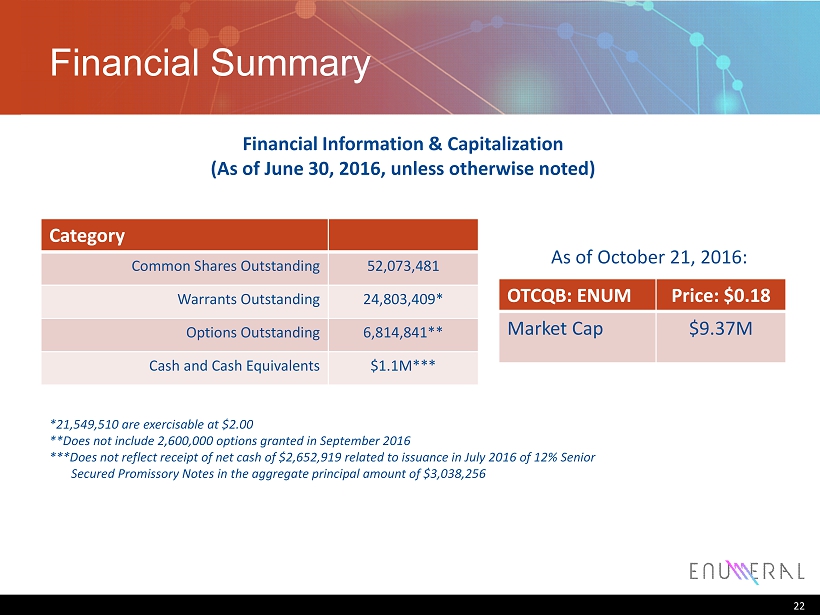

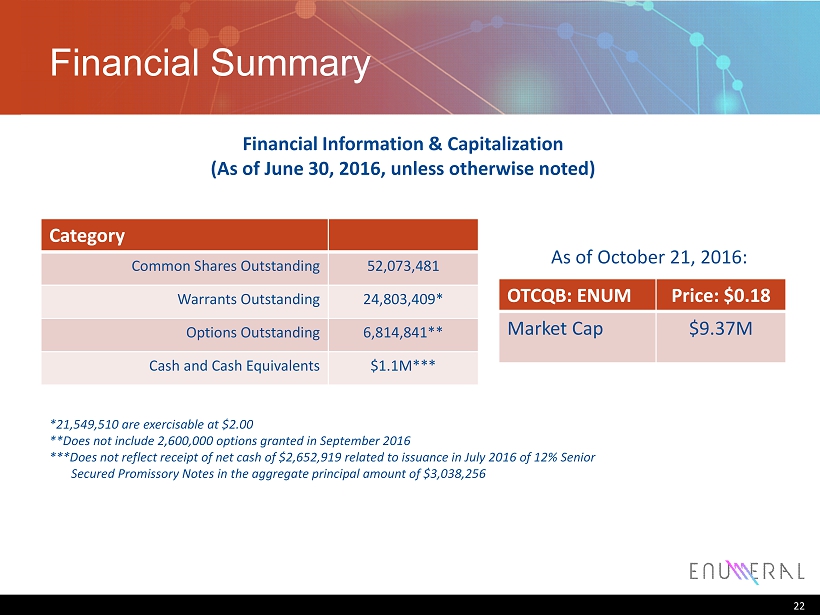

Financial Summary Category Common Shares Outstanding 52,073,481 W arrants Outstanding 24,803,409 * Options Outstanding 6,814,841 ** Cash and Cash Equivalents $1.1M *** 22 OTCQB: ENUM Price: $0.18 Market Cap $9.37M Financial Information & Capitalization (As of June 30, 2016, unless otherwise noted) *21,549,510 are exercisable at $2.00 **Does not include 2,600,000 options granted in September 2016 ***Does not reflect receipt of net cash of $2,652,919 related to issuance in July 2016 of 12 % Senior Secured Promissory Notes in the aggregate principal amount of $3,038,256 As of October 21, 2016:

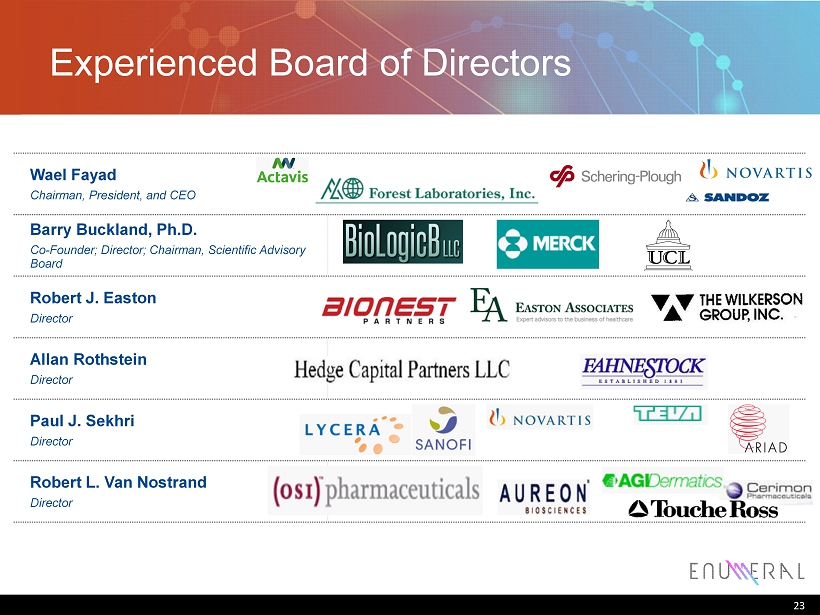

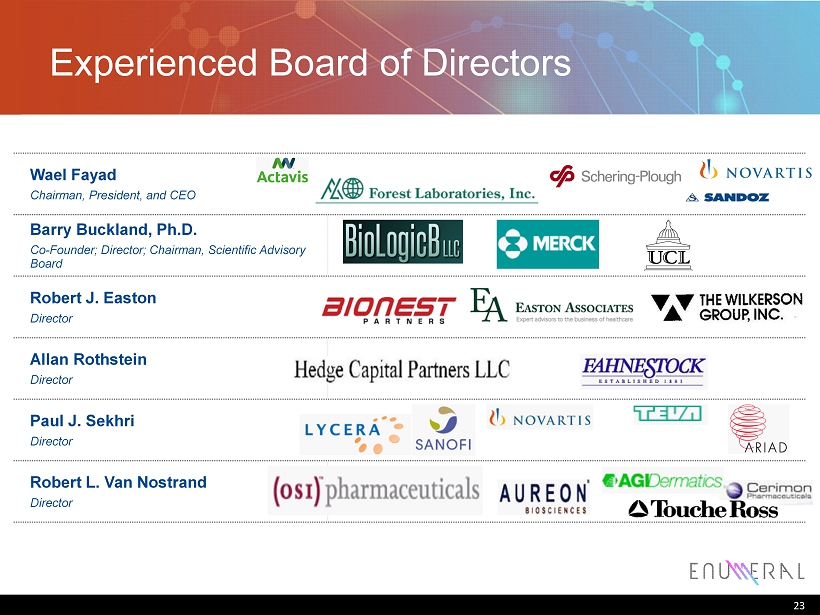

Experienced Board of Directors 23 Wael Fayad Chairman, President, and CEO Barry Buckland, Ph.D. Co - Founder; Director; Chairman, Scientific Advisory Board Robert J. Easton Director Allan Rothstein Director Paul J. Sekhri Director Robert L. Van Nostrand Director

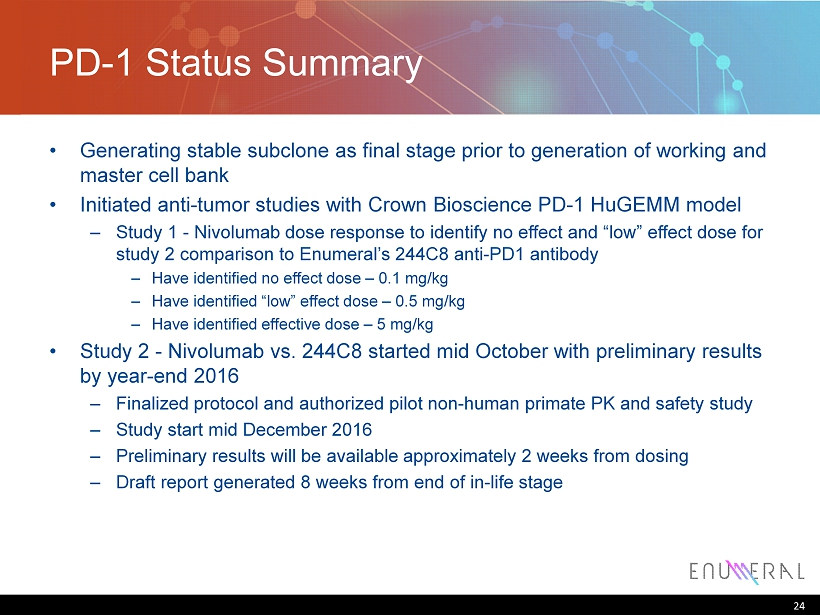

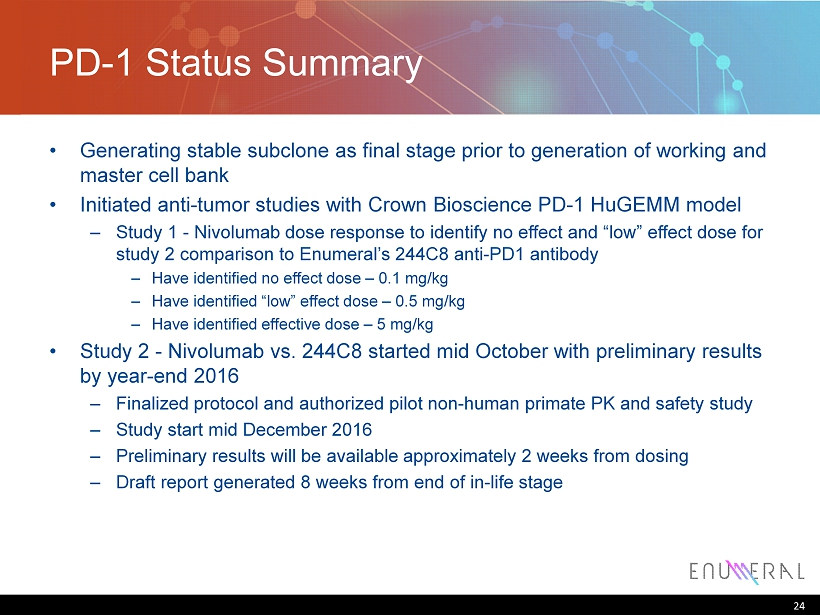

PD - 1 Status Summary • Generating stable subclone as final stage prior to generation of working and master cell bank • Initiated anti - tumor studies with Crown Bioscience PD - 1 HuGEMM model – Study 1 - Nivolumab dose response to identify no effect and “low” effect dose for study 2 comparison to Enumeral’s 244C8 anti - PD1 antibody – Have identified no effect dose – 0.1 mg/kg – Have identified “low” effect dose – 0.5 mg/kg – Have identified effective dose – 5 mg/kg • Study 2 - Nivolumab vs. 244C8 started mid October with preliminary results by year - end 2016 – Finalized protocol and authorized pilot non - human primate PK and safety study – Study start mid December 2016 – Preliminary results will be available approximately 2 weeks from dosing – Draft report generated 8 weeks from end of in - life stage 24

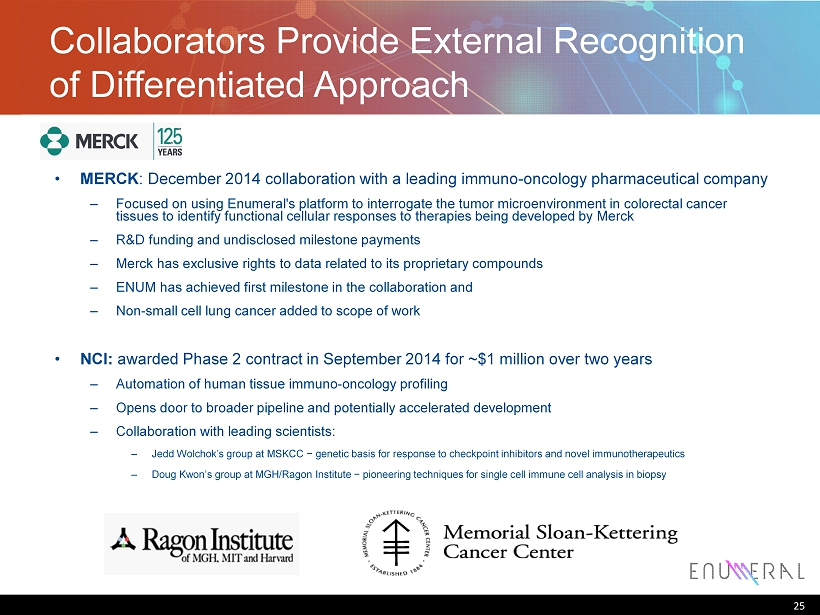

Collaborators Provide External Recognition of Differentiated Approach • MERCK : December 2014 collaboration with a leading immuno - oncology pharmaceutical company – Focused on using Enumeral's platform to interrogate the tumor microenvironment in colorectal cancer tissues to identify functional cellular responses to therapies being developed by Merck – R&D funding and undisclosed milestone payments – Merck has exclusive rights to data related to its proprietary compounds – ENUM has achieved first milestone in the collaboration and – Non - small cell lung cancer added to scope of work • NCI: awarded Phase 2 contract in September 2014 for ~$1 million over two years – Automation of human tissue immuno - oncology profiling – Opens door to broader pipeline and potentially accelerated development – Collaboration with leading scientists: – Jedd Wolchok’s group at MSKCC − genetic basis for response to checkpoint inhibitors and novel immunotherapeutics – Doug Kwon’s group at MGH/Ragon Institute − pioneering techniques for single cell immune cell analysis in biopsy 25

Collaboration with MD Anderson Cancer Center – January 2016 • Goal to Discover and Develop Novel Antibodies Against Specified Immunotherapy Targets – Utilizes Enumeral’s antibody discovery and patient - centric immune profiling platform – Leverages MD Anderson’s preclinical and development expertise and infrastructure – Enumeral and MD Anderson will jointly fund research and development activities – Will share net income from product sales or any payments associated with third party partnering – Collaboration has not yet formally launched • Impact on Potential Future Collaborations • Goal is for ENUM and MDACC to jointly out - license following clinical proof of concept with a partner continuing development 26

License and Transfer Agreement with Pieris Pharmaceuticals – Spring 2016 • Non - exclusive license under specified Enumeral patent rights and know - how to research, develop and market fusion proteins that comprise a moiety derived from Enumeral’s 388D4 anti - PD - 1 antibody linked to one or more Pieris Anticalin ® proteins for use in the field of oncology. – In April and May 2016, Enumeral received upfront license fees in an aggregate amount of $1,000,000. – Potential for future development milestones of up to an aggregate of $37.8 million and net sales milestone payments of up to an aggregate of $67.5 million, each upon achievement of specified targets. – Potential for royalties in the low - to - lower middle single digits as a percentage of net sales, depending on the amount of net sales in applicable years. • Pieris has an option until May 31, 2017 to license specified Enumeral patent rights and know - how covering two additional undisclosed antibody programs on the same terms and conditions as for the 388D4 antibody. Pieris will pay Enumeral additional undisclosed license fees in the event that Pieris exercises one or both of these options. • Enumeral can continue to develop or partner the 388D4 PD - 1 program, as well as the other antibody programs subject to the option described above, provided that Enumeral has agreed not to conduct, or assist third parties in conducting, activities that involve an antibody licensed under the Pieris License and Transfer Agreement fused with or linked to one or more Anticalin proteins in the field of oncology. 27