Filed Pursuant to Rule 424(b)(3) and Rule 424(c)

Registration No. 333-198847

Prospectus Supplement No. 7

(To Prospectus filed on July 26, 2016, as supplemented

by Prospectus Supplement No. 1 dated August 1, 2016, Prospectus Supplement No. 2 dated

August 10, 2016, Prospectus Supplement No. 3 dated August 12, 2016 and Prospectus Supplement No. 4 dated August 19, 2016, Prospectus Supplement No. 5 dated September 16, 2016, and Prospectus Supplement No. 6 dated September 23, 2016)

ENUMERAL BIOMEDICAL HOLDINGS, INC.

This Prospectus Supplement No. 7 supplements the information contained in the Prospectus, dated as of July 26, 2016, as amended by Prospectus Supplement No. 1 dated August 1, 2016, Prospectus Supplement No. 2 dated August 10, 2016, Prospectus Supplement No. 3 dated August 12, 2016, Prospectus Supplement No. 4 dated August 19, 2016, Prospectus Supplement No. 5 dated September 16, 2016, and Prospectus Supplement No. 6 dated September 23, 2016, relating to the resale of up to 47,674,386 shares of our common stock by selling stockholders.

This Prospectus Supplement No. 7 is being filed to include the information set forth in our Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission on November 10, 2016.

You should read this Prospectus Supplement No. 7 in conjunction with the Prospectus. This Prospectus Supplement No. 7 is qualified by reference to the Prospectus, except to the extent that the information contained in this Prospectus Supplement No. 7 supersedes the information contained in the Prospectus. This Prospectus Supplement No. 7 is not complete without, and may not be utilized except in connection with, the Prospectus.

You should consider carefully the risks that we have described in “Risk Factors” beginning on page 8 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is November 10, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016.

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 000-55415

ENUMERAL BIOMEDICAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 99-0376434 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | |

200 CambridgePark Drive, Suite 2000

Cambridge, Massachusetts | | 02140 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(617) 945-9146

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ | | Accelerated Filer ¨ |

| | | |

| Non-accelerated Filer ¨ | | Smaller reporting company x |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 52,073,481 shares of the Registrant’s common stock, $0.001 par value per share, issued and outstanding as of November 8, 2016.

TABLE OF CONTENTS

Forward-Looking Statements

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “intend,” “plan,” target,” “goal,” “anticipate,” “believe,” “estimate,” “continue,” or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 30, 2016.

Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission (the “SEC”), we explicitly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. You are advised, however, to consult any further disclosure we make in our reports filed with the SEC.

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Enumeral Biomedical Holdings, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 1,893,414 | | | $ | 3,596,262 | |

| Accounts receivable | | | 265,537 | | | | 306,012 | |

| Prepaid expenses and other current assets | | | 213,386 | | | | 280,479 | |

| Total current assets | | | 2,372,337 | | | | 4,182,753 | |

| Property and equipment, net | | | 1,031,192 | | | | 1,511,493 | |

| Other assets: | | | | | | | | |

| Restricted cash | | | 534,780 | | | | 534,780 | |

| Other assets | | | 111,556 | | | | 114,572 | |

| Total assets | | $ | 4,049,865 | | | $ | 6,343,598 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 436,734 | | | $ | 343,736 | |

| Accrued expenses | | | 485,449 | | | | 714,384 | |

| Deferred revenue | | | 29,009 | | | | 130,539 | |

| Equipment lease financing | | | 248,794 | | | | 240,473 | |

| Promissory notes | | | 2,615,049 | | | | - | |

| Derivative liabilities | | | 905,666 | | | | 2,138,091 | |

| Total current liabilities | | | 4,720,701 | | | | 3,567,223 | |

| Deferred rent | | | 57,446 | | | | 36,847 | |

| Long-term equipment lease financing | | | 78,822 | | | | 266,471 | |

| Total liabilities | | | 4,856,969 | | | | 3,870,541 | |

| Commitments and contingencies | | | | | | | | |

| Stockholders' equity (deficiency): | | | | | | | | |

| Preferred stock, $.001 par value; 10,000,000 shares authorized: -0- shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively | | | - | | | | - | |

| Common stock, $.001 par value; 300,000,000 shares authorized: 52,073,481 and 51,932,571 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively | | | 52,074 | | | | 51,933 | |

| Additional paid-in-capital | | | 17,713,257 | | | | 16,830,100 | |

| Accumulated deficit | | | (18,572,435 | ) | | | (14,408,976 | ) |

| Total stockholders’ equity (deficiency) | | | (807,104 | ) | | | 2,473,057 | |

| Total liabilities and stockholders’ equity (deficiency) | | $ | 4,049,865 | | | $ | 6,343,598 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

Enumeral Biomedical Holdings, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

| | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | |

| Collaboration and license revenue | | $ | 226,115 | | | $ | 395,448 | | | $ | 1,878,599 | | | $ | 894,132 | |

| Grant revenue | | | 94,696 | | | | 88,377 | | | | 375,641 | | | | 245,728 | |

| Total revenue | | | 320,811 | | | | 483,825 | | | | 2,254,240 | | | | 1,139,860 | |

| Cost of revenue and expenses: | | | | | | | | | | | | | | | | |

| Research and development | | | 1,026,317 | | | | 1,798,241 | | | | 3,737,161 | | | | 4,833,911 | |

| General and administrative | | | 812,974 | | | | 1,354,064 | | | | 3,752,512 | | | | 4,271,024 | |

| Total cost of revenue and expenses | | | 1,839,291 | | | | 3,152,305 | | | | 7,489,673 | | | | 9,104,935 | |

| Loss from operations | | | (1,518,480 | ) | | | (2,668,480 | ) | | | (5,235,433 | ) | | | (7,965,075 | ) |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Interest income (expense) | | | (152,261 | ) | | | 5,358 | | | | (160,451 | ) | | | 12,978 | |

| Change in fair value of derivative liabilities | | | 409,891 | | | | 3,281,406 | | | | 1,232,425 | | | | 10,833,156 | |

| Total other income (expense), net | | | 257,630 | | | | 3,286,764 | | | | 1,071,974 | | | | 10,846,134 | |

| Net income (loss) before income taxes | | | (1,260,850 | ) | | | 618,284 | | | | (4,163,459 | ) | | | 2,881,059 | |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

| Net income (loss) | | $ | (1,260,850 | ) | | $ | 618,284 | | | $ | (4,163,459 | ) | | $ | 2,881,059 | |

| Other comprehensive income (loss): | | | | | | | | | | | | | | | | |

| Reclassification for loss included in net income | | | - | | | | - | | | | - | | | | 19,097 | |

| Net unrealized holding losses on available-for-sale securities arising during the period | | | - | | | | - | | | | - | | | | (9,320 | ) |

| Comprehensive income (loss) | | $ | (1,260,850 | ) | | $ | 618,284 | | | $ | (4,163,459 | ) | | $ | 2,890,836 | |

| | | | | | | | | | | | | | | | | |

| Basic net income (loss) per share | | $ | (0.02 | ) | | $ | 0.01 | | | $ | (0.08 | ) | | $ | 0.06 | |

| | | | | | | | | | | | | | | | | |

| Diluted net income (loss) per share | | $ | (0.02 | ) | | $ | 0.01 | | | $ | (0.08 | ) | | $ | 0.05 | |

| | | | | | | | | | | | | | | | | |

| Weighted-average number of common shares attributable to common stockholders - basic | | | 52,073,481 | | | | 51,699,028 | | | | 52,071,933 | | | | 51,648,800 | |

| | | | | | | | | | | | | | | | | |

| Weighted-average number of common shares attributable to common stockholders - diluted | | | 52,073,481 | | | | 52,986,588 | | | | 52,071,933 | | | | 53,727,593 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

Enumeral Biomedical Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | Nine Months Ended

September 30, | |

| | | 2016 | | | 2015 | |

| | | | | | | |

| Cash flows from operating activities: | | | | | | | | |

| Net income (loss) | | $ | (4,163,459 | ) | | $ | 2,881,059 | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | |

| Depreciation and amortization | | | 480,301 | | | | 425,788 | |

| Exit costs associated with write-off of net carrying value of leasehold improvements | | | - | | | | 22,962 | |

| Stock-based compensation | | | 883,298 | | | | 477,666 | |

| Change in fair value of derivative liabilities | | | (1,232,425 | ) | | | (10,833,156 | ) |

| Realized loss on marketable securities | | | - | | | | 19,097 | |

| Accretion of debt discount | | | 84,642 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 40,475 | | | | (101,939 | ) |

| Prepaid expenses and other assets | | | 70,109 | | | | (145,456 | ) |

| Accounts payable | | | 92,998 | | | | 423,364 | |

| Accrued expenses and other liabilities | | | (228,935 | ) | | | 454,843 | |

| Deferred rent | | | 20,599 | | | | (6,623 | ) |

| Deferred revenue | | | (101,530 | ) | | | (62,036 | ) |

| Net cash used in operating activities | | | (4,053,927 | ) | | | (6,444,431 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchases of property and equipment | | | - | | | | (1,133,299 | ) |

| Proceeds from sale of marketable securities | | | - | | | | 3,000,799 | |

| Receipt of security deposit | | | - | | | | 27,630 | |

| Net cash provided by investing activities | | | - | | | | 1,895,130 | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from issuance of promissory notes, net of issuance costs | | | 2,530,407 | | | | - | |

| Proceeds from the exercise of stock options | | | - | | | | 29,675 | |

| Payments on equipment lease financing | | | (179,328 | ) | | | - | |

| Net cash provided by financing activities | | | 2,351,079 | | | | 29,675 | |

| | | | | | | | | |

| Net decrease in cash and cash equivalents | | | (1,702,848 | ) | | | (4,519,626 | ) |

| Cash and cash equivalents, beginning of period | | | 3,596,262 | | | | 10,460,117 | |

| Cash and cash equivalents, end of period | | $ | 1,893,414 | | | $ | 5,940,491 | |

| | | | | | | | | |

| Supplemental cash flow disclosures: | | | | | | | | |

| Cash paid for interest | | $ | 78,381 | | | $ | - | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements

ENUMERAL BIOMEDICAL HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1 - NATURE OF BUSINESS

Enumeral Biomedical Corp. (“Enumeral”) was founded in 2009 in the State of Delaware as Enumeral Technologies, Inc. The name was later changed to Enumeral Biomedical Corp.

On July 31, 2014 (the “Closing Date”), Enumeral entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Enumeral Biomedical Holdings, Inc., which was formerly known as Cerulean Group, Inc. (“Enumeral Biomedical” or the “Company”), and Enumeral Acquisition Corp., a wholly owned subsidiary of Enumeral Biomedical (“Acquisition Sub”), pursuant to which the Acquisition Sub merged with and into Enumeral (the “Merger”). Enumeral was the surviving corporation in the Merger and became a wholly owned subsidiary of the Company.

As a result of the Merger, all issued and outstanding common and preferred shares of Enumeral were exchanged for common shares of Enumeral Biomedical Holdings, Inc. The Merger is considered to be a recapitalization of the Company which has been retrospectively applied to these unaudited condensed consolidated financial statements for all periods presented.

Upon the closing of the Merger and under the terms of a split-off agreement and a general release agreement (the “Split-Off Agreement”), the Company transferred all of its pre-Merger operating assets and liabilities to its wholly-owned special-purpose subsidiary, Cerulean Operating Corp. (the “Split-Off Subsidiary”). Thereafter, pursuant to the Split-Off Agreement, the Company transferred all of the outstanding shares of capital stock of the Split-Off Subsidiary to the pre-Merger majority stockholder of the Company, and the former sole officer and director of the Company (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 23,100,000 shares of the Company’s common stock held by such stockholder (which were cancelled and resumed the status of authorized but unissued shares of the Company’s common stock) and (ii) certain representations, covenants and indemnities.

As a result of the Merger and the Split-Off, the Company discontinued its pre-Merger business, acquired the business of Enumeral, and changed its name to Enumeral Biomedical Holdings, Inc.

Also on July 31, 2014, the Company closed a private placement offering (the “PPO”) of 21,549,510 Units (the “Units”) of its securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of the Company’s common stock and a warrant to purchase one share of the Company’s common stock at an exercise price of $2.00 per share with a term of five years (the “PPO Warrants”). Additional information concerning the PPO and PPO Warrants is presented below in Note 10.

Following the Merger, the Company has continued Enumeral’s business of discovering and developing novel antibody immunotherapies that help the immune system fight cancer and other diseases. The Company utilizes a proprietary platform technology that facilitates the rapid high resolution measurement of immune cell function within small tissue biopsy samples. The Company’s initial focus is on the development of a pipeline of next generation monoclonal antibody drugs targeting established and novel immunomodulatory receptors.

In its lead antibody program, the Company has characterized certain anti-PD-1 antibodies, or simply “PD-1 antibodies,” using patient biopsy samples, in an effort to identify next generation PD-1 antagonists with enhanced selectivity for the immune effector cells that carry out anti-tumor functions. The Company has identified two antagonist PD-1 antibodies that inhibit PD-1 activity in distinctly different ways. One of the antibodies blocks binding of the ligand PD-L1 to PD-1, while the other antibody does not. However, both display activity in various biological assays. In addition to its PD-1 antibody program, the Company is pursuing a pipeline focused on next-generation checkpoint modulators, with initial targets including TIM-3, LAG-3, CD39, TIGIT, and VISTA.

The Company’s proprietary platform technology, exclusively licensed from the Massachusetts Institute of Technology (“MIT”), is a microwell array technology that detects secreted molecules (such as antibodies and cytokines) and cell surface markers, at the level of single live cells and enables recovery of single live cells of interest. The platform technology is a multipurpose tool that is valuable for activities ranging from antibody discovery to target discovery and patient stratification in clinical development. The platform yields multidimensional, functional read-outs from single live cells, such as tumor infiltrating lymphocytes, or TILs, from human tumor biopsy samples, and it enables the Company’s researchers to examine the responses of different classes of human immune cells to treatment with immunomodulators in the context of human disease, as opposed to animal models of disease.

The Company continues to be a “smaller reporting company,” as defined under the Exchange Act, following the Merger. The Company believes that as a result of the Merger, it has ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)).

2 - GOING CONCERN AND LIQUIDITY

The Company’s unaudited condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”) which contemplate the Company’s continuation as a going concern. As of September 30, 2016, the Company had a working capital deficit of $2,348,364 including $905,666 of derivative liabilities and an accumulated deficit of $18,572,435. As of December 31, 2015, the Company had working capital of $615,530 including $2,138,091 of derivative liabilities and an accumulated deficit of $14,408,976.

On July 29, 2016 the Company entered into a Subscription Agreement (the “Subscription Agreement”) with certain accredited investors, pursuant to which these investors purchased the Company’s 12% Senior Secured Promissory Notes (the “Notes”) in the aggregate principal amount of $3,038,256 (before deducting placement agent fees and expenses of $385,337), which includes $38,256 pursuant to an over-allotment option (the “Note Offering”). The Company also incurred additional legal fees of $122,512 associated with the Notes. The Company is using the net proceeds from this Note Offering for working capital and general corporate purposes. Additional information concerning the Note Offering is presented below in Note 7, “Debt”.

As of the date of this filing, the Company believes it has sufficient liquidity to fund operations into December 2016. The Company has commenced an issuer tender offer, as further described below, and is continuing to explore a range of potential transactions, which may include public or private equity offerings, debt financings, collaborations and licensing arrangements, and/or other strategic alternatives, including a merger, sale of assets or other similar transactions. If the Company is unable to raise additional capital on terms acceptable to the Company and on a timely basis, the Company may be required to downsize or wind down its operations through liquidation, bankruptcy, or a sale of its assets. The unaudited condensed consolidated financial statements do not include any adjustments related to the recovery and classification of asset carrying amounts or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern. The Company expects to incur significant expenses and operating losses for the foreseeable future, and the Company’s net losses may fluctuate significantly from quarter to quarter and from year to year. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

On October 28, 2016, the Company commenced an issuer tender offer with respect to certain warrants to purchase common stock of the Company in order to provide the holders thereof with the opportunity to amend and exercise their warrants upon the terms and subject to the conditions set forth in the Company’s tender offer statement on Schedule TO and the related exhibits included therein (the “Offering Materials”). See Note 13 “Subsequent Events” for further details.

The Company’s business has not generated (nor does the Company anticipate that in the foreseeable future it will generate) the cash necessary to finance its operations, and the Company will require additional capital to continue its operations beyond December 2016.

The Company’s near-term capital needs depend on many factors, including:

| · | the Company’s ability to carefully manage its costs; |

| · | the amount and timing of revenue received from grants or the Company’s collaboration and license arrangements; and |

| · | the Company’s ability to raise additional capital through public or private equity offerings, debt financings, or strategic collaborations and licensing arrangements, and/or the Company’s success in promptly establishing a strategic alternative that is in its stockholders’ best interests. |

If the Company is unable to raise additional capital through one or more of the means listed above prior to the end of December 2016, the Company could face substantial liquidity problems and might be required to implement further cost reduction strategies in addition to the cash conservation steps that the Company has already taken. These reductions could significantly affect the Company’s research and development activities, and could result in significant harm to the Company’s business, financial condition and results of operations. In addition, these reductions could cause the Company to further curtail its operations, or take other actions that would adversely affect the Company’s stockholders. If the Company is unable to raise additional capital on acceptable terms and on a timely basis, the Company may be required to downsize or wind down its operations through liquidation, bankruptcy, or a sale of its assets.

In addition, to the extent additional capital is raised through the sale of equity or convertible debt securities, such securities may be sold at a discount from the market price of the Company’s common stock. The issuance of these securities could also result in significant dilution to some or all of the Company’s stockholders, depending on the terms of the transaction. For example, the PPO Warrants contain anti-dilution protection in the event that the Company issues common stock or securities convertible into or exercisable for shares of the Company’s common stock at a price lower than the warrant exercise price prior to the warrant expiration date. The anti-dilution protection provisions are subject to exceptions for certain issuances, including but not limited to (a) shares of common stock issued in an underwritten public offering, (b) issuances of awards under the Company’s 2014 Equity Incentive Plan, and (c) other exempt issuances. In the event that the Company is able to successfully complete the tender offer to amend and exercise the PPO Warrants that the Company launched in October 2016 (described in greater detail in Note 13 below), the PPO Warrants would be amended to remove this anti-dilution provision with the consent of holders of a majority of the underlying PPO Warrants.

3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements were prepared using GAAP for interim financial information and the instructions to Form 10-Q and Regulation S-X. Accordingly, these unaudited condensed consolidated financial statements do not include all information or notes required by GAAP for annual financial statements and should be read in conjunction with the 2015 Financial Statements as filed on the Company's Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the Securities Exchange Commission (the “SEC”) on March 30, 2016.

The preparation of the unaudited condensed consolidated financial statements in conformity with these accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the unaudited condensed consolidated financial statements and the reported amounts of expenses during the reported period. Ultimate results could differ from the estimates of management.

In the opinion of management, the unaudited condensed consolidated financial statements included herein contain all adjustments necessary to present fairly the Company's financial position as of September 30, 2016 and the results of its operations and cash flows for the nine months ended September 30, 2016 and 2015. Such adjustments are of a normal recurring nature. The results of operations for the three and nine months ended September 30, 2016 may not be indicative of results for the full year.

Principles of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries, Enumeral Biomedical Corp. and Enumeral Securities Corporation. In these unaudited condensed consolidated financial statements, “subsidiaries” are companies that are wholly owned, the accounts of which are consolidated with those of the Company. Intercompany transactions and balances are eliminated in consolidation.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of 90 days or less from the purchase date to be cash equivalents. Cash and cash equivalents are held in depository and money market accounts and are reported at fair value.

Concentration of Credit Risk

The Company has no significant off-balance sheet concentrations of credit risk such as foreign currency exchange contracts, option contracts or other hedging arrangements. Financial instruments that subject the Company to credit risk consist primarily of cash and cash equivalents. The Company generally invests its cash in money market funds, U.S. Treasury securities and U.S. Agency securities that are subject to minimal credit and market risk. Management has established guidelines relative to credit ratings and maturities intended to safeguard principal balances and maintain liquidity. At times, the Company’s cash balances may exceed the current insured amounts under the Federal Deposit Insurance Corporation.

Fair Value of Financial Instruments

Fair values of financial instruments included in current assets and current liabilities are estimated to approximate their book values, due to the short maturity of such instruments. All debt is based on current rates at which the Company could borrow funds with similar remaining maturities and approximates fair value. The Company’s assets and liabilities that are measured at fair value on a recurring basis are measured in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures, which establishes a three-level valuation hierarchy for measuring fair value and expands financial statement disclosures about fair value measurements.

The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows:

| · | Level 1: Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets in active markets. |

| · | Level 2: Inputs to the valuation methodology included quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| · | Level 3: Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company’s cash equivalents, carried at fair value, are comprised of investments in federal agency backed money market funds. The valuation of the Company’s derivative liabilities is discussed below and in Note 11. The following table presents information about the Company’s financial assets and liabilities measured at fair value on a recurring basis as of September 30, 2016 and December 31, 2015:

| | | September 30,

2016 | | | Quoted Prices in

Active Markets

(Level 1) | | | Observable

Inputs

(Level 2) | | | Unobservable

Inputs

(Level 3) | |

| Assets | | | | | | | | | | | | | | | | |

| Cash | | $ | 611,201 | | | $ | 611,201 | | | $ | - | | | $ | - | |

| Money Market funds, included in cash equivalents | | $ | 1,282,213 | | | $ | 1,282,213 | | | $ | - | | | $ | - | |

| Liabilities | | | | | | | | | | | | | | | | |

| Derivative liabilities | | $ | 905,666 | | | $ | - | | | $ | - | | | $ | 905,666 | |

| | | | | | | | | | | | | | | | | |

| | | December 31,

2015 | | | Quoted Prices in

Active Markets

(Level 1) | | | Observable

Inputs

(Level 2) | | | Unobservable

Inputs

(Level 3) | |

| Assets | | | | | | | | | | | | | | | | |

| Cash | | $ | 815,890 | | | $ | 815,890 | | | $ | - | | | $ | - | |

| Money Market funds, included in cash equivalents | | $ | 2,780,372 | | | $ | 2,780,372 | | | $ | - | | | $ | - | |

| Liabilities | | | | | | | | | | | | | | | | |

| Derivative liabilities | | $ | 2,138,091 | | | $ | - | | | $ | - | | | $ | 2,138,091 | |

The following table provides a roll forward of the fair value of the Company’s derivative liabilities, using Level 3 inputs:

| Balance as of December 31, 2015 | | $ | 2,138,091 | |

| Change in fair value | | | (1,232,425 | ) |

| Balance as of September 30, 2016 | | $ | 905,666 | |

Accounts Receivable and Allowance for Doubtful Accounts

Trade receivables are recorded at the invoiced amount. The Company maintains allowances for doubtful accounts, if needed, for estimated losses resulting from the inability of customers to make required payments. This allowance is based on specific customer account reviews and historical collections experience. There was no allowance for doubtful accounts as of September 30, 2016 or December 31, 2015.

Property and Equipment

Property and equipment are recorded at cost. Expenditures for maintenance and repairs are charged to expense as incurred, whereas major betterments are capitalized as additions to property and equipment. Depreciation is provided using the straight-line method over the estimated useful lives of the assets as follows:

| Lab equipment | | 3-5 years |

| Computer equipment and software | | 3 years |

| Furniture | | 3 years |

| Leasehold improvements | | Shorter of useful life or life of the lease |

Impairment of Long-Lived Assets

Long-lived assets are reviewed for impairment annually or whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. When such events occur, the Company compares the carrying amounts of the assets to their undiscounted expected future cash flows. If this comparison indicated that there is impairment, the amount of the impairment is calculated as the difference between the carrying value and fair value. There have been no impairments recognized during the three and nine months ended September 30, 2016 and 2015, respectively.

Revenue Recognition

Collaboration and license revenue

Non-refundable license fees are recognized as revenue when the Company has a contractual right to receive such payment, the contract price is fixed or determinable, the collection of the resulting receivable is reasonably assured and the Company has no further performance obligations under the license agreement. Multiple element arrangements, such as license and development arrangements are analyzed to determine whether the deliverables, which often include license and performance obligations such as research and steering committee services, can be separated or whether they must be accounted for as a single unit of accounting in accordance with GAAP.

The Company recognizes up-front license payments as revenue upon delivery of the license only if the license has stand-alone value and the fair value of the undelivered performance obligations, typically including research and/or steering committee services, can be determined. If the fair value of the undelivered performance obligations can be determined, such obligations would then be accounted for separately as performed. If the license is considered to either (i) not have stand-alone value or (ii) have stand-alone value but the fair value of any of the undelivered performance obligations cannot be determined, the arrangement would then be accounted for as a single unit of accounting and the license payments and payments for performance obligations are recognized as revenue over the estimated period of when the performance obligations are performed.

Whenever the Company determines that an arrangement should be accounted for as a single unit of accounting, it must determine the period over which the performance obligations will be performed and revenue will be recognized. Revenue will be recognized using either a relative performance or straight-line method. The Company recognizes revenue using the relative performance method provided that it can reasonably estimate the level of effort required to complete its performance obligations under an arrangement and such performance obligations are provided on a best-efforts basis. Direct labor hours or full-time equivalents are typically used as a measure of performance. Revenue recognized under the relative performance method would be determined by multiplying the total payments under the contract, excluding royalties and payments contingent upon achievement of substantive milestones, by the ratio of level of effort incurred to date to estimated total level of effort required to complete the Company’s performance obligations under the arrangement. Revenue is limited to the lesser of the cumulative amount of payments received or the cumulative amount of revenue earned, as determined using the relative performance method, as of each reporting period.

If the Company cannot reasonably estimate the level of effort required to complete its performance obligations under an arrangement, the performance obligations are provided on best-efforts basis and the Company can reasonably estimate when the performance obligation ceases or the remaining obligations become inconsequential and perfunctory. At that time, the total payments under the arrangement, excluding royalties and payments contingent upon achievement of substantive milestones, would be recognized as revenue on a straight-line basis over a period the Company expects to complete its performance obligations. Revenue is limited to the lesser of the cumulative amount of payments received or the cumulative amount of revenue earned, as determined using the straight-line basis, as of the period ending date.

In December 2014, the Company entered into a study agreement with Merck Sharp & Dohme Corp., or Merck (the “Merck Agreement”). In February 2016, the Company and Merck subsequently amended the work plan under the Merck Agreement to also include non-small cell lung cancer tissues. Pursuant to the Merck Agreement, the Company is conducting a specified research program using its platform technology to identify functional response of single cell types in colorectal cancer and non-small cell lung cancer in the presence or absence of immunomodulatory receptor modulators identified by Merck. In this collaboration, Merck is reimbursing the Company for the cost of performing the work plan set forth in the Merck Agreement, for up to a specified number of full-time employees at a pre-determined annual rate. In addition, Merck will make certain milestone payments to the Company upon the completion of specified objectives set forth in the Merck Agreement and related work plan. In September 2015, the Company announced the achievement of the first milestone under the Merck Agreement.

In January 2016, the Company and The University of Texas M.D. Anderson Cancer Center (“MDACC”) entered into a Collaborative Research and Development Agreement (the “MDACC Agreement”). Under the MDACC Agreement, the Company and MDACC plan to collaborate on the discovery and development of novel monoclonal antibodies against selected targets in immune-oncology, utilizing the Company’s antibody discovery and immune profiling platform and MDACC’s preclinical and development expertise and infrastructure.

Pursuant to the terms of the MDACC Agreement, the Company and MDACC will share the costs of research and development activities necessary to take development candidates through successful completion of a Phase I clinical trial. The MDACC Agreement provides for a structure whereby the Company and MDACC are each granted the right to receive a percentage of the net income from product sales or any payments associated with licensing or otherwise partnering a program with a third party.

In April 2016, the Company entered into a License and Transfer Agreement (the “Original License Agreement”) with Pieris Pharmaceuticals, Inc. and Pieris Pharmaceuticals GmbH (collectively, “Pieris”). Pursuant to the terms and conditions of the Original License Agreement, Pieris is licensing from the Company specified intellectual property related to the Company’s anti-PD-1 antibody program ENUM 388D4 for the potential development and commercialization by Pieris of novel multispecific therapeutic proteins comprising fusion proteins based on Pieris’ Anticalins ® class of therapeutic proteins and the Company’s antibodies in the field of oncology.

Under the Original License Agreement, Pieris paid the Company a $250,000 initial license fee. In June 2016, the Company entered into a Definitive License and Transfer Agreement (the “Definitive Agreement”) with Pieris, and as contemplated in the Original License Agreement, Pieris paid the Company a $750,000 license maintenance fee to continue the licensing arrangements under the Original License Agreement. In accordance with its terms, the Definitive Agreement superseded the Original License Agreement.

Under the Definitive Agreement, the Company has granted Pieris an option until May 31, 2017 to license specified patent rights and know-how of the Company covering two additional undisclosed antibody programs on the same terms and conditions as for the Company’s 388D4 anti-PD-1 antibody (each, a “Subsequent Option”). Pieris may exercise the Subsequent Options separately and on different dates during the option period. Pieris will pay the Company additional license fees in the event that Pieris exercises one or both Subsequent Options.

The Company recognized $226,115 and $395,448 of collaboration and license revenue for the three months ended September 30, 2016 and 2015, respectively. The Company recognized $1,878,599 and $894,132 of collaboration and license revenue for the nine months ended September 30, 2016 and 2015, respectively.

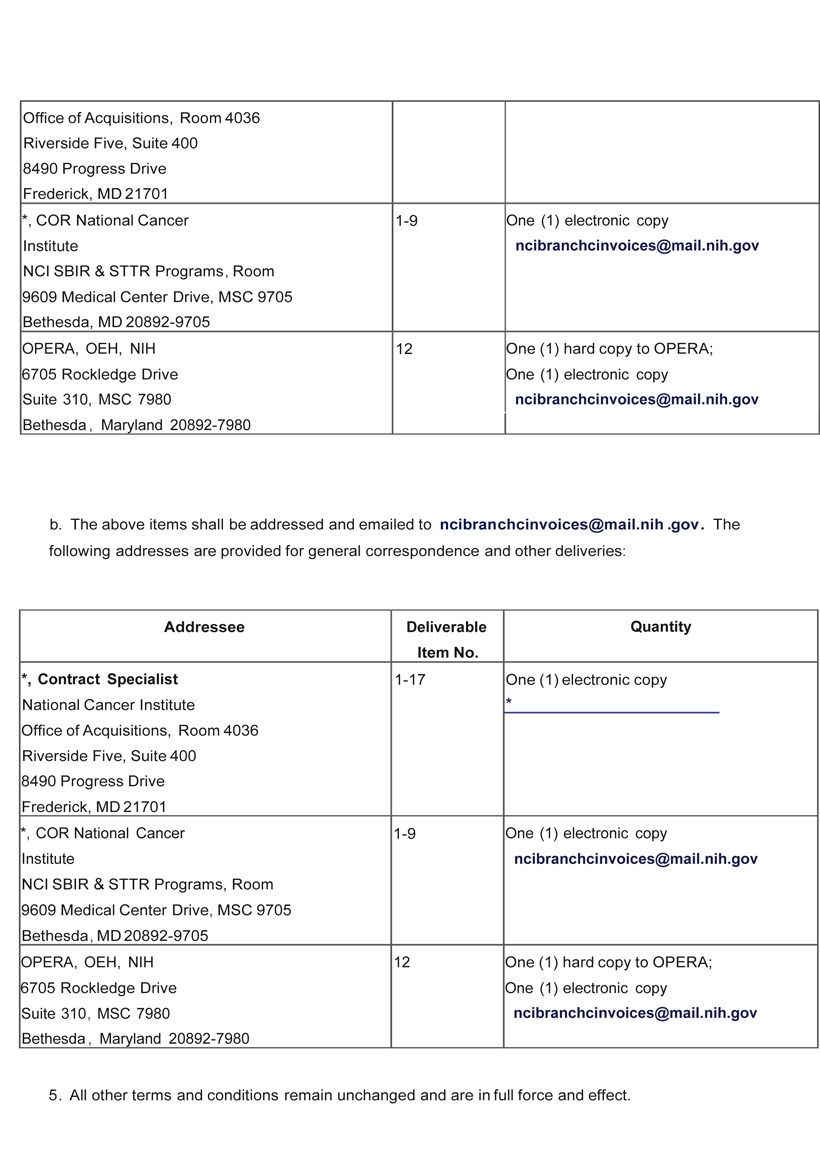

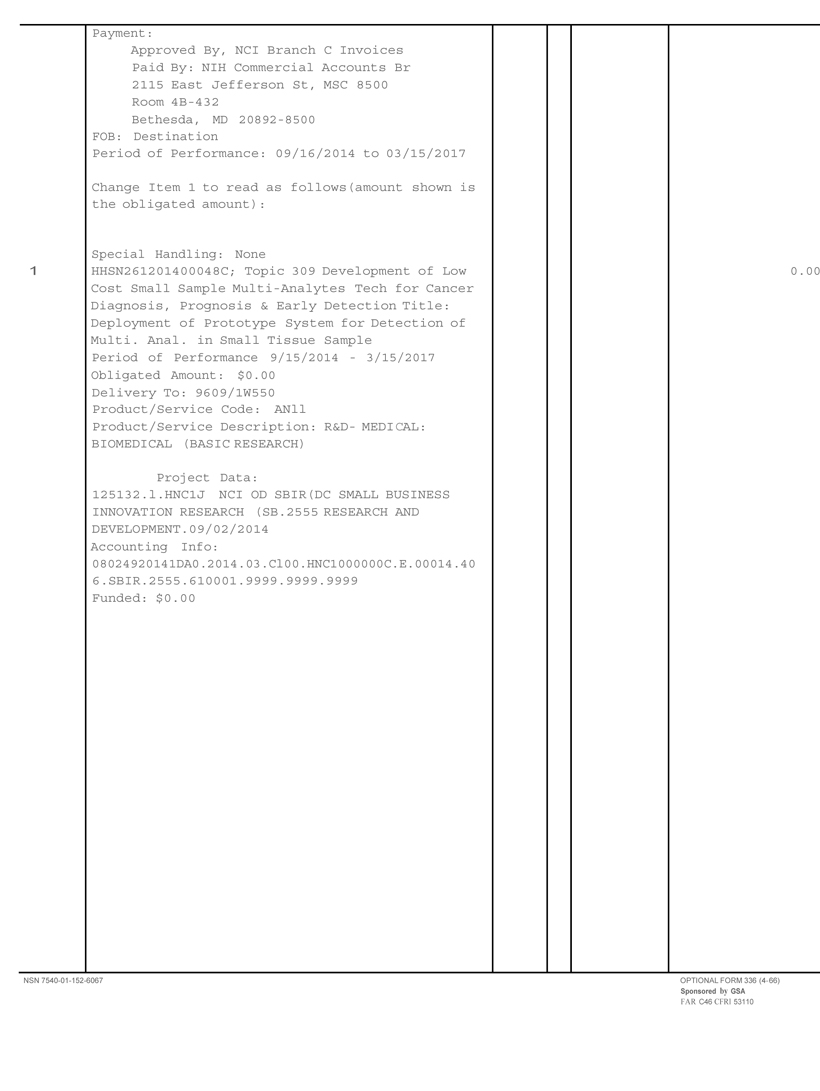

Grant Revenue

In September 2014, the Company was awarded a Phase II Small Business Innovation Research contract from the National Cancer Institute (“NCI”), a unit of the National Institutes of Health, for up to $999,967 over two years. In September 2016, the Company signed an amendment with the NCI to extend the contract an additional six months. Grant revenue consists of a portion of the funds received to date by the NCI. Revenue is recognized as the related research services are performed in accordance with the terms of the agreement. The Company recognized $94,696 and $88,377 of revenue associated with the NCI Phase II grant for the three months ended September 30, 2016 and 2015, respectively. The Company recognized $375,641 and $245,728 of revenue associated with the NCI Phase II grant for the nine months ended September 30, 2016 and 2015, respectively. The difference between the total consideration received to date and the revenue recognized is recorded as deferred revenue. Deferred revenue totaled $29,009 as of September 30, 2016 and $130,539 as of December 31, 2015.

Research and Development Expenses

Research and development expenditures are charged to the unaudited condensed consolidated statement of operations and comprehensive income (loss) as incurred. Research and development expenses are comprised of costs incurred in performing research and development activities, including salaries and benefits, facilities costs, clinical supply costs, contract services, depreciation and amortization expense and other related costs. Costs associated with acquired technology, in the form of upfront fees or milestone payments, are charged to research and development expense as incurred. Legal fees incurred in connection with patent applications, along with fees associated with the license to the Company’s core technology, are expensed as research and development expense.

Derivative Liabilities

The Company’s derivative liabilities relate to (a) warrants to purchase an aggregate of 23,549,509 shares of the Company’s common stock that were issued in connection with the PPO and (b) warrants to purchase 41,659 shares of Enumeral Series A Preferred Stock that were issued in December 2011 and June 2012 pursuant to Enumeral’s debt financing arrangement with Square 1 Bank that were subsequently converted into warrants to purchase 66,574 shares of the Company’s common stock in connection with the Merger in July 2014. Additional detail regarding these warrants can be found in Note 11.

Due to the price protection provision included in the warrant agreements, the warrants were deemed to be liabilities and, therefore, the fair value of the warrants is recorded in the current liabilities section of the unaudited condensed consolidated balance sheet. As such, the outstanding warrants are revalued each reporting period with the resulting gains and losses recorded as the change in fair value of derivative liabilities on the unaudited condensed consolidated statements of operations and comprehensive income (loss).

The Company used the Black-Scholes option-pricing model to estimate the fair values of the issued and outstanding warrants. As of January 1, 2016, the Company began using a blended average of the Company’s historical volatility and the historical volatility of a group of similarly situated companies (as described in greater detail below) to calculate the expected volatility when valuing its derivative liabilities.

Comprehensive Income (Loss)

Other comprehensive income (loss) was comprised of unrealized holding gains and losses arising during the period on available-for-sale securities that are not other-than-temporarily impaired. The unrealized gains and losses are reported in accumulated other comprehensive income (loss), until sold or mature, at which time they are reclassified to earnings. The Company recognized no reclassifications out of accumulated other comprehensive loss or unrealized holding losses on available-for-sale securities for the three and nine months ended September 30, 2016. The Company recognized no reclassifications out of accumulated other comprehensive loss or unrealized holding losses on available-for-sale securities for the three months ended September 30, 2015. The Company reclassified $19,097 out of accumulated other comprehensive loss to net income and recognized $9,320 of unrealized holding losses on available-for-sale securities for the nine months ended September 30, 2015.

Stock-Based Compensation

The Company accounts for its stock-based compensation awards to employees and directors in accordance with FASB ASC Topic 718, Compensation - Stock Compensation (“ASC 718”). ASC 718 requires all stock-based payments to employees, including grants of employee stock options and restricted stock, to be recognized in the unaudited condensed consolidated statements of operations and comprehensive income (loss) based on their grant date fair values. Compensation expense related to awards to employees is recognized on a straight-line basis based on the grant date fair value over the associated service period of the award, which is generally the vesting term. Share-based payments issued to non-employees are recorded at their fair values, and are periodically revalued as the equity instruments vest and are recognized as expense over the related service period in accordance with the provisions of ASC 718 and ASC Topic 505, Equity, and are expensed using an accelerated attribution model.

The Company estimates the fair value of its stock options using the Black-Scholes option pricing model, which requires the input of subjective assumptions, including (a) the expected stock price volatility, (b) the expected term of the award, (c) the risk-free interest rate, (d) expected dividends, and (e) the estimated fair value of its common stock on the measurement date. As of January 1, 2016, the Company began using a blended average of the Company’s historical volatility and the historical volatility of a group of similarly situated companies to calculate the expected volatility when valuing its stock options. For purposes of calculating this blended volatility, the Company selected companies with comparable characteristics to it, including enterprise value, risk profiles, position within the industry, and with historical share price information sufficient to meet the expected term of the stock-based awards. The Company computes historical volatility data using the daily closing prices for the Company’s and the selected companies’ shares during the equivalent period of the calculated expected term of the stock-based awards. Prior to January 1, 2016, due to the lack of a public market for the trading of its common stock and a lack of company specific historical and implied volatility data, the Company has based its estimate of expected volatility only on the historical volatility of a group of similarly situated companies that were publicly traded. Due to the lack of Company specific historical option activity, the Company has estimated the expected term of its employee stock options using the “simplified” method, whereby, the expected term equals the arithmetic average of the vesting term and the original contractual term of the option. The expected term for non-employee awards is the remaining contractual term of the option. The risk-free interest rates are based on the U.S. Treasury securities with a maturity date commensurate with the expected term of the associated award. The Company has never paid dividends and does not expect to pay dividends in the foreseeable future.

The fair value of the restricted stock awards granted to employees is based upon the fair value of the Company’s common stock on the date of grant. Expense is recognized over the vesting period.

The Company has recorded stock-based compensation expense of $280,976 and $184,775 for the three months ended September 30, 2016 and 2015, respectively. The Company has recorded stock-based compensation expense of $883,298 and $477,666 for the nine months ended September 30, 2016 and 2015, respectively. The Company has an aggregate of $272,771 of unrecognized stock-based compensation expense as of September 30, 2016 to be amortized over a weighted average period of 1.9 years.

Effective January 1, 2016, the Company has elected to account for forfeitures as they occur, as permitted by Accounting Standards Update (“ASU”) ASU No. 2016-09, Compensation-Stock Compensation (Topic 718), Improvements to Employee Share-Based Payment Accounting. See the Accounting Standards Adopted in the Period section below for further details.

Prior to the adoption of ASU No. 2016-09, the Company estimated the number of stock-based awards that were expected to vest, and only recognized compensation expense for such awards. The estimation of stock-based awards that will ultimately vest required judgment, and to the extent actual results or updated estimates differed from current estimates, such amounts were recorded as a cumulative adjustment in the period estimates were revised. The Company considered many factors when estimating expected forfeitures, including type of awards granted, employee class, and historical experience.

Earnings (Loss) Per Share

Basic earnings (loss) per common share amounts are based on the weighted average number of common shares outstanding. Diluted earnings (loss) per common share amounts are based on the weighted average number of common shares outstanding, plus the incremental shares that would have been outstanding upon the assumed exercise of all potentially dilutive stock options, warrants and convertible debt, subject to anti-dilution limitations. As of September 30, 2016 and 2015, the number of shares underlying options and warrants that were anti-dilutive were approximately 33.6 million and 25.9 million, respectively.

Income Taxes

Income taxes are recorded in accordance with FASB ASC Topic 740, Income Taxes (“ACS 740”), which provides for deferred taxes using an asset and liability approach. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and the tax reporting basis of assets and liabilities and are measured using the enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. The Company provides a valuation allowance against net deferred tax assets unless, based upon the available evidence, it is more likely than not that the deferred tax assets will be realized. The Company has evaluated available evidence and concluded that the Company may not realize the benefit of its deferred tax assets; therefore a valuation allowance has been established for the full amount of the deferred tax assets. The Company accounts for uncertain tax positions in accordance with the provisions of ASC 740. When uncertain tax positions exist, the Company recognizes the tax benefit of tax positions to the extent that the benefit will more likely than not be realized. The determination as to whether the tax benefit will more likely than not be realized is based upon the technical merits of the tax position as well as consideration of the available facts and circumstances.

The Company has no uncertain tax liabilities as of September 30, 2016 or December 31, 2015. The guidance requires the Company to determine whether it is more likely than not that a tax position will be sustained upon examination by the appropriate taxing authority. If a tax position meets the more likely than not recognition criteria, the guidance requires the tax position be measured at the largest amount of benefit greater than 50% likely of being realized upon ultimate settlement.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606). ASU No. 2014-09 provides for a single comprehensive model for use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance. The accounting standard is effective for interim and annual periods beginning after December 15, 2016 with no early adoption permitted. In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which deferred the effective date of ASU No. 2014-09 to annual periods beginning after December 15, 2017, along with an option to permit early adoption as of the original effective date. The Company is required to adopt the amendments in ASU No. 2014-09 using one of two acceptable methods. The Company’s management is currently in the process of determining which adoption method it will apply and evaluating the impact of the guidance on the Company’s unaudited condensed consolidated financial statements. In April 2016, the FASB issued ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing. The ASU clarifies the following two aspects of Topic 606: (a) identifying performance obligations; and (b) the licensing implementation guidance. The ASU does not change the core principle of the guidance in Topic 606. The effective date and transition requirements for the ASU are the same as the effective date and transition requirements in Topic 606. Public entities should apply the ASU for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein (i.e., January 1, 2018, for a calendar year entity). Early application for public entities is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is currently evaluating the impact of this new standard on its unaudited condensed consolidated financial statements.

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements-Going Concern (Subtopic 205-40). ASU No 2014-15 requires all entities to evaluate for the existence of conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the issuance date of the financial statements. The accounting standard is effective for interim and annual periods ending after December 15, 2016, and is not expected to have a material impact on the Company’s unaudited condensed consolidated financial statements, but may impact the Company’s footnote disclosures.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). ASU No. 2016-02 is effective for annual periods beginning after December 15, 2018, and requires a lessee to recognize assets and liabilities for leases with a maximum possible term of more than 12 months. A lessee would recognize a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the leased asset (the underlying asset) for the lease term. Early application is permitted. The Company is currently evaluating the impact the adoption of the accounting standard will have on its unaudited condensed consolidated financial statements.

Accounting Standards Adopted in the Period

In March 2016, the FASB issued ASU No. 2016-09, which simplified several aspects of employee share-based payment accounting. In particular, the ASU permits entities to make an accounting policy election to either estimate forfeitures on share-based payment awards, as previously required, or to recognize forfeitures as they occur. Effective January 1, 2016, the Company elected to recognize forfeitures as they occur. The impact of that change in accounting policy has been recorded as an $8,333 cumulative effect adjustment to accumulated deficit, as of December 31, 2015. The Company expects that it will recognize slightly higher share-based payment expense for the remainder of 2016, relative to prior periods, as the effects of forfeitures will not be recognized until they occur, rather than being estimated at the time of grant and subsequently adjusted as and when necessary. The effects of adopting the remaining provisions in ASU No. 2016-09 affecting the income tax consequences of share-based payments, classification of awards as either equity or liabilities when an entity partially settles the award in cash in excess of the employer’s minimum statutory withholding requirements and classification in the statement of cash flows did not have any impact on the Company’s financial position, results of operations or cash flows.

In April 2015, the FASB issued ASU No. 2015-03,Interest – Imputation of Interest (Subtopic 305-40): Simplifying the Presentation of Debt Issuance Costs. The new guidance requires the debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability. This guidance will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. Accordingly, the standard is effective for the Company on January 1, 2016. The Company’s unaudited condensed consolidated balance sheet as of September 30, 2016 includes $423,207 of debt issuance costs recorded as a reduction to the promissory notes.

Other accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s unaudited condensed consolidated financial statements upon adoption.

4 - PROPERTY AND EQUIPMENT, NET

Property and equipment, net consist of the following:

| | | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| Laboratory equipment | | $ | 2,559,986 | | | $ | 2,559,986 | |

| Computer/office equipment and software | | | 187,337 | | | | 187,337 | |

| Furniture, fixtures and office equipment | | | 73,734 | | | | 73,734 | |

| Leasehold improvements | | | 75,262 | | | | 75,262 | |

| | | | 2,896,319 | | | | 2,896,319 | |

| Less - Accumulated depreciation and amortization | | | (1,865,127 | ) | | | (1,384,826 | ) |

| | | $ | 1,031,192 | | | $ | 1,511,493 | |

Depreciation and amortization expense for the three and nine months ended September 30, 2016 was $126,301 and $480,301, respectively. Depreciation and amortization expense for the three and nine months ended September 30, 2015 was $149,901 and $425,788, respectively. During the nine months ended September 30, 2015, the Company expensed $22,962 associated with the write-down of leasehold improvements due to a relocation of the Company’s corporate office and research laboratories in March 2015 (see Note 8).

5 - RESTRICTED CASH

The Company held $534,780 in restricted cash as of September 30, 2016 and December 31, 2015, respectively. The balances are primarily held on deposit with a bank to collateralize a standby letter of credit in the name of the Company’s facility lessor in accordance with the Company’s facility lease agreement.

6 - ACCRUED EXPENSES

The Company’s accrued expenses consist of the following as of:

| | | September 30, | | | December 31, | |

| | | 2016 | | | 2015 | |

| Accrued wages and benefits | | $ | 287,662 | | | $ | 447,769 | |

| Accrued professional fees | | | 154,887 | | | | 213,475 | |

| Accrued other | | | 42,900 | | | | 53,140 | |

| Total accrued expenses | | $ | 485,449 | | | $ | 714,384 | |

7 - DEBT

Equipment Lease Financing

In December 2015, the Company and Fountain Leasing 2013 LP (“Fountain”) entered into a master lease agreement and related transaction documents, pursuant to which Fountain provided the Company with $506,944 for the purchase of research and development lab equipment (the “Fountain Lease”). Fountain’s security under the Fountain Lease is the equipment purchased and a security deposit in the amount of $101,389. The initial term of the Fountain Lease is 36 months, with payments of $21,545 per month for the first 24 months and then $1,267 for the 12 months thereafter. Pursuant to the terms of the Fountain Lease, the Company has an option at the end of the initial term to purchase the equipment for the greater of $25,347 or current fair market value, provided that such amount shall not be in excess of $152,083. In addition, the Company also has the option to extend the Fountain Lease for an additional 12 month period at a rate of $8,872 per month with the right at the end of such extension term to purchase the equipment for fair value or to return the equipment to Fountain. The Fountain Lease has a lease rate factor of 4.25% per month for the first 24 months and 0.25% for the final 12 months of the initial term.

The Company has recorded current equipment lease financing of $248,794 and long-term equipment lease financing of $78,822 as of September 30, 2016. The Company has recorded current equipment lease financing of $240,473 and long-term equipment lease financing of $266,471 as of December 31, 2015. The equipment has been included in property and equipment on the Company’s unaudited condensed consolidated balance sheets.

Future payments on the equipment lease financing are as follows:

| For the twelve months ended September 30, | | Amount | |

| 2017 | | $ | 258,541 | |

| 2018 | | | 76,042 | |

| 2019 | | | 3,802 | |

| Total equipment lease financing payments | | $ | 338,385 | |

| | | | | |

| As of September 30, 2016 | | Amount | |

| Current equipment lease financing payments | | $ | 258,541 | |

| Less: Amount representing interest | | | (9,747 | ) |

| Current equipment lease financing, net | | $ | 248,794 | |

| Long-term equipment lease financing payments | | $ | 79,844 | |

| Less: Amount representing interest | | | (1,022 | ) |

| Long-term equipment lease financing, net | | $ | 78,822 | |

Promissory Notes

On July 29, 2016 (the “Closing Date”), the Company entered into a Subscription Agreement (the “Subscription Agreement”) with certain accredited investors (the “Buyers”), pursuant to which the Buyers purchased the Company’s 12% Senior Secured Promissory Notes (the “Notes”) in the aggregate principal amount of $3,038,256 (before deducting placement agent fees and expenses of $385,337), which includes $38,256 pursuant to an over-allotment option (the “Note Offering”). The Company incurred additional legal fees of $122,512 associated with the Notes. The Company is using the net proceeds from this Note Offering for working capital and general corporate purposes.

The Notes have an aggregate principal balance of $3,038,256, and a stated maturity date of 12 months from the date of issuance. The principal on the Notes bears interest at a rate of 12% per annum, payable monthly commencing on September 1, 2016. Interest is payable in shares (the “Repayment Shares”) of the Company’s common stock; provided, however, that interest will not be calculated or accrued in a manner that triggers anti-dilution adjustment on the PPO Warrants. In the event that on an interest payment date, the PPO Warrants’ anti-dilution provision would be triggered by the payment of interest in shares of the Company’s common stock, interest payments on the Notes may be paid in cash. The Notes will rank senior to all existing indebtedness of the Company, except as otherwise set forth in the Notes.

The maturity date of the outstanding principal amount of the Notes, together with accrued and unpaid interest due thereon, will accelerate to the date (on or after September 1, 2016) on which the Company completes and closes certain financing transactions that achieve minimum thresholds, as specified in the Notes. In such specified transactions, the Notes will convert at a valuation per share equal to 50% of the price per share of securities sold in that financing transaction. In addition, in the event of a sale of the Company during the term of the Notes, noteholders will be entitled to receive 1.5x of the principal amount of the Notes plus accrued interest, paid in either cash or securities of acquiring entity at the acquiring entity’s discretion.

The Company’s obligations under the Notes are secured, pursuant to the terms of an Intellectual Property Security Agreement (the “Security Agreement”), dated as of the Closing Date, among the Company, Enumeral, the Buyers and the collateral agent for the Buyers named therein, by a first priority security interest in all now owned or hereafter acquired intellectual property of the Company and Enumeral, except to the extent such intellectual property cannot be assigned or the creation of a security interest would be prohibited by applicable law or contract.

As part of the issuance of the Notes, the Company incurred $507,849 of transaction costs, which are recorded as a reduction of the promissory notes on the unaudited condensed consolidated balance sheet as of September 30, 2016. These transaction costs are being accreted to interest expense over the term of the Notes. Interest expense associated with these transaction costs of $84,642 was accreted during the three months ended September 30, 2016. As of September 30, 2016 the remaining transaction costs of $423,207 were recorded as a reduction to the promissory notes on the unaudited condensed consolidated balance sheet.

8 – COMMITMENTS

Operating Leases

In March 2015, the Company relocated its offices and research laboratories to 200 CambridgePark Drive in Cambridge, Massachusetts. The Company is leasing 16,825 square feet at this facility (the “Premises”) pursuant to Indenture of Lease (the “Lease”) that the Company entered into in November 2014. The term of the Lease is for five years, and the initial base rent is $42.50 per square foot, or approximately $715,062 on an annual basis. The base rent will increase incrementally over the term of the Lease, reaching approximately $804,739 on an annual basis in the fifth year of the term. In addition, the Company is obligated to pay a proportionate share of the operating expenses and applicable taxes associated with the premises, as calculated pursuant to the terms of the Lease. The Company is also obligated to deliver a security deposit to the landlord in the amount of $529,699, either in the form of cash or an irrevocable letter of credit, which may be reduced to $411,988 following the second anniversary of the commencement date under the Lease, provided that the Company meets certain financial conditions set forth in the Lease. The Company has recorded deferred rent in connection with the Lease in the amount of $57,446 and $36,847 as of September 30, 2016 and December 31, 2015, respectively.

The Company previously occupied offices and research laboratories in approximately 4,782 square feet of space at One Kendall Square in Cambridge, Massachusetts, at an annual rent of $248,664 (the “Kendall Lease”). For the three months ended March 31, 2015, the Company recorded an accrual of $55,352 for exit costs associated with its move to new offices and research laboratories in March 2015. The amount accrued at March 31, 2015 includes rent paid for April and May of 2015 related to the Kendall Lease. In June 2015, Enumeral entered into a lease termination agreement with the landlord for Enumeral’s former facility at One Kendall Square, pursuant to which the Kendall Lease was terminated as of June 17, 2015. In accordance with the terms of the lease termination agreement, Enumeral is not obligated to pay rent for the One Kendall Square facility after May 31, 2015. Enumeral had maintained a security deposit relating to the facility, recorded as restricted cash on the unaudited condensed consolidated balance sheet as of March 31, 2015. This security deposit was returned to Enumeral pursuant to the lease termination agreement.

In addition, the Company maintains a small corporate office at 1370 Broadway in New York, New York, at a current annual rate of $23,100. The lease for the Company’s New York office expires on December 31, 2016, and the Company does not contemplate renewing such lease.

Rent expense was $282,423 and $278,652 for the three months ended September 30, 2016 and 2015, respectively. Rent expense was $929,243 and $730,140 for the nine months ended September 30, 2016 and 2015, respectively.

Future operating lease commitments as of September 30, 2016 are as follows:

| For the twelve months ended September 30, | | Amount | |

| 2017 | | $ | 755,231 | |

| 2018 | | | 771,889 | |

| 2019 | | | 794,995 | |

| 2020 | | | 335,308 | |

| Total | | $ | 2,657,423 | |

Employment Agreements

The Company has employment letter agreements with members of management which contain minimum annual salaries and severance benefits if terminated prior to the term of the agreements. In conjunction with the closing of the Note Offering, Arthur H. Tinkelenberg, Ph.D. was terminated by the Company from his position as President and Chief Executive Officer, effective July 28, 2016. During the nine months ended September 30, 2016, the Company recorded charges related to severance and benefits owed to Dr. Tinkelenberg as a result of his termination. Dr. Tinkelenberg resigned as a director of the Company on September 19, 2016.

On September 21, 2016, John J. Rydzewski resigned as Executive Chairman of the Company, and also resigned from the Board of Directors. In connection with Mr. Rydzewski’s resignation, the Company entered into a separation letter agreement with Mr. Rydzewski, dated September 21, 2016. As part of Mr. Rydzewski’s separation letter agreement, 703,326 options became fully vested and the Company incurred a one-time stock-based compensation charge of $83,361 during the three months ended September 30, 2016. In addition, the terms of Mr. Rydzewski’s separation letter agreement provide that the Company will continue to pay 100% of the cost of Mr. Rydzewski’s continuation of health and dental benefits through COBRA, until the earlier of 18 months from Mr. Rydzewski’s separation date from the Company or such time as Mr. Rydzewski becomes eligible for similar benefits from another employer.

The Company appointed Wael Fayad to serve as President and Chief Executive Officer of the Company, effective as of September 21, 2016, and, in connection therewith, appointed Mr. Fayad as a director of the Company and Chairman of the Board of Directors. In connection with Mr. Fayad’s appointment, the Board of Directors designated Mr. Fayad as the Company’s “Principal Executive Officer” for U.S. Securities and Exchange Commission reporting purposes, effective as of September 21, 2016.

In addition, the Company entered into an offer letter with Mr. Fayad, dated September 21, 2016 (the “Letter Agreement”), which sets forth the terms pursuant to which Mr. Fayad shall serve as the Company’s Chairman of the Board, President and Chief Executive Officer. The Letter Agreement provides that Mr. Fayad will receive a base salary at the rate of $325,000 per annum. Mr. Fayad will also be eligible to earn a target bonus of up to 50% of the base salary, payable in cash, based upon achievement of corporate objectives, individual objectives, and the Company’s finances, all as determined and at the discretion of the independent members of the Board or the Board’s Compensation Committee. Mr. Fayad was granted 2,600,000 options to purchase shares of the Company’s common stock in connection with the offer letter. The Company granted Mr. Fayad 850,000 options under the Company’s 2014 Equity Incentive Plan (the “2014 Plan”) and 1,750,000 options outside of the 2014 Plan. Of these, 100,000 options vested immediately upon grant, and the remaining 2,500,000 options vest upon achievement of certain performance-based milestones.

9 - LICENSE AGREEMENT AND RELATED-PARTY TRANSACTIONS

License Agreement

In April 2011, Enumeral licensed certain intellectual property from MIT, then a related party (as one of Enumeral’s scientific co-founders was an employee of MIT), pursuant to an Exclusive License Agreement (the “License Agreement”), in exchange for the payment of upfront license fees and a commitment to pay annual license fees, patent costs, milestone payments, royalties on sublicense income and, upon product commercialization, royalties on the sales of products covered by the licenses or income from corporate partners, and the issuance of 66,303 shares of Enumeral common stock. This intellectual property portfolio includes patents owned by Harvard University or co-owned by MIT and The Whitehead Institute, or MIT and Massachusetts General Hospital.

All amounts incurred related to the license fees have been expensed as research and development expenses by Enumeral as incurred. The Company incurred $10,000 and $7,500 in the three months ended September 30, 2016 and 2015, respectively. The Company incurred $30,000 and $22,500 in the nine months ended September 30, 2016 and 2015, respectively.

In addition to potential future royalty and milestone payments that Enumeral may have to pay MIT per the terms of the License Agreement, Enumeral paid an annual fee of $40,000 in 2016, and is obligated to pay $50,000 every year thereafter unless the License Agreement is terminated. During the nine months ended September 30, 2016, the Company recorded expense of $100,000 for the required percentage of the Pieris license payments owed to MIT pursuant to the terms of the License Agreement. No royalty payments have been payable as Enumeral has not commercialized any products as set forth in the License Agreement. Enumeral reimburses the costs to MIT and Harvard University for the continued prosecution of the licensed patent estate. For the three months ended September 30, 2016 and 2015, Enumeral paid $23,052 and $15,646 for MIT and $2,351 and $3,730 for Harvard, respectively. For the nine months ended September 30, 2016 and 2015, Enumeral paid $162,692 and $256,189 for MIT and $17,692 and $22,367 for Harvard, respectively. The Company had accounts payable and accrued expenses of $38,346 and $168,726 associated with the reimbursement of costs and fees owed to MIT and Harvard as of September 30, 2016 and December 31, 2015, respectively.

The License Agreement also contained a provision whereby after the date upon which $7,500,000 of funding which was met in April of 2013, MIT and other licensing institutions set forth in the License Agreement have a right to participate in certain future equity issuances by Enumeral. In addition, pursuant to that provision Enumeral may have to issue additional shares to MIT and other licensing institutions set forth in the License Agreement if Enumeral issues common stock at a price per share that is less than the fair market value per share of the common stock issued to MIT and such licensing institutions based upon a weighted average formula set forth in the License Agreement. In March 2013, Enumeral and MIT entered into a first amendment to the License Agreement to clarify how equity issuances were to be made thereunder. In July 2014, Enumeral and MIT entered into a second amendment to the License Agreement, pursuant to which MIT’s participation rights and anti-dilution rights under the License Agreement were terminated. Other than the exchange of Enumeral’s common stock for the Company’s common stock in connection with the Merger, the Company did not issue any shares of common stock to MIT and such other licensing institutions in connection with the License Agreement in 2014.

In April 2015, Enumeral and MIT entered into a third amendment to the License Agreement, which revised the timetable for Enumeral to complete certain diligence obligations relating to the initiation of clinical studies in support of obtaining regulatory approval of a Diagnostic Product (as such term is defined in the License Agreement), as well as the timetable by which Enumeral is required to make the first commercial sale of a Diagnostic Product.

In April 2016, Enumeral and MIT entered into a fourth amendment to the License Agreement, which revised the timetable for Enumeral to complete certain diligence obligations relating to the establishment of sublicenses and/or corporate partner agreements for the development of Licensed Products and/or Diagnostic Products, as well as the timetable by which an Investigational New Drug Application shall be filed on a Therapeutic Product (as such terms are defined in the License Agreement).

Consulting Agreements