Exhibit 2.2

EXECUTION VERSION

Panhandle 2

PURCHASE AND SALE AGREEMENT

by and among

PATTERN ENERGY GROUP INC.

Purchaser

and

PANHANDLE B HOLDCO 2 LLC,

Seller

and (solely for purposes of Section 7.1)

PATTERN ENERGY GROUP LP,

Guarantor

Dated as of

December 20, 2013

Direct or Indirect Interests

in

*** Certain information has been omitted pursuant to a request for confidential treatment and filed separately with the U.S. Securities and Exchange Commission.

| ARTICLE 1 PURCHASE AND SALE OF THE ACQUIRED INTERESTS | 1 |

| | 1.1 | Agreement to Sell and Purchase | 1 |

| | 1.2 | Signing Date Deliverables | 1 |

| | 1.3 | Purchase Price | 1 |

| | 1.4 | The Closing | 2 |

| | 1.5 | Conduct of Closing | 2 |

| | | |

| ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF SELLER | 3 |

| | 2.1 | Organization and Status | 3 |

| | 2.2 | Power; Authority; Enforceability | 3 |

| | 2.3 | No Violation | 3 |

| | 2.4 | No Litigation | 4 |

| | 2.5 | Consents and Approvals | 4 |

| | 2.6 | Acquired Interests | 4 |

| | 2.7 | Solvency | 4 |

| | 2.8 | Compliance with Law | 5 |

| | 2.9 | Taxes | 5 |

| | 2.10 | Unregistered Securities | 5 |

| | 2.11 | Broker’s Fees | 5 |

| | 2.12 | Matters Relating to the Acquired Interests, the Project Company and the Wind Project | 5 |

| | | |

| ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF PURCHASER | 5 |

| | 3.1 | Organization and Status | 6 |

| | 3.2 | Power; Authority; Enforceability | 6 |

| | 3.3 | No Violation | 6 |

| | 3.4 | No Litigation | 6 |

| | 3.5 | Consents and Approvals | 6 |

| | 3.6 | Solvency | 7 |

| | 3.7 | Compliance with Law | 7 |

| | 3.8 | No Reliance | 7 |

| | 3.9 | Investment Intent | 7 |

| | 3.10 | Accredited Investor | 7 |

| | 3.11 | Broker’s Fee | 7 |

| | | |

| ARTICLE 4 COVENANTS; OTHER OBLIGATIONS | 8 |

| | 4.1 | Covenants Between Signing and Closing | 8 |

| | 4.2 | Other Covenants | 8 |

| | | |

| ARTICLE 5 CONDITIONS TO CLOSING; TERMINATION | 11 |

| | 5.1 | Conditions Precedent to Each Party’s Obligations to Close | 11 |

| | 5.2 | Conditions Precedent to Obligations of Purchaser to Close | 11 |

| | 5.3 | Conditions Precedent to the Obligations of Seller to Close | 12 |

| | 5.4 | Termination. If the Closing Date is not the date of this Agreement, the following termination provisions shall be applicable: | 13 |

| | | |

| ARTICLE 6 REMEDIES FOR BREACHES OF THIS AGREEMENT | 13 |

| | 6.1 | Indemnification | 13 |

| | 6.2 | Limitations on Seller’s or Purchaser’s Indemnification | 14 |

| | 6.3 | Reimbursements; Refunds | 15 |

| | 6.4 | Right to Control Proceedings for Third Party Claims | 15 |

| | 6.5 | Mitigation; Treatment of Indemnification | 16 |

| | 6.6 | Exclusive Remedy | 17 |

| | | |

| ARTICLE 7 MISCELLANEOUS | 17 |

| | 7.1 | Guarantee | 17 |

| | 7.2 | Entire Agreement | 17 |

| | 7.3 | Notices | 17 |

| | 7.4 | Successors and Assigns | 18 |

| | 7.5 | Jurisdiction; Service of Process; Waiver of Jury Trial | 18 |

| | 7.6 | Headings; Construction; and Interpretation | 20 |

| | 7.7 | Further Assurances | 20 |

| | 7.8 | Amendment and Waiver | 20 |

| | 7.9 | No Other Beneficiaries | 20 |

| | 7.10 | Governing Law | 20 |

| | 7.11 | Schedules | 20 |

| | 7.12 | Limitation of Representation and Warranties | 21 |

| | 7.13 | Counterparts | 21 |

| | 7.14 | Severability | 21 |

| | 7.15 | Limit on Damages | 21 |

| | 7.16 | Specific Performance | 21 |

| Appendix A-1: General Definitions | 1 |

| Appendix A-2: Rules of Construction | 1 |

| LIST OF APPENDICES |

| |

| Appendix A-1 | General Definitions |

| | |

| Appendix A-2 | Rules of Construction |

| | |

| Appendix B | Transaction Terms and Conditions |

| | |

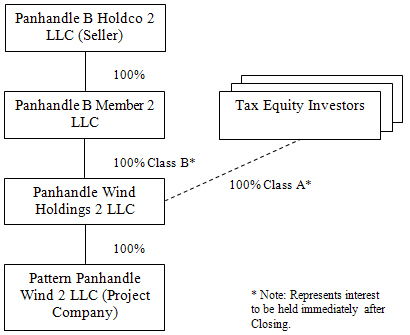

| Appendix C | Acquired Interests; Ownership Structure; and Wind Project Information |

| | |

| Appendix D | Documents and Key Counterparties |

| | |

| | |

| LIST OF SCHEDULES |

| |

| Schedule 2.5 | Seller Consents and Approvals |

| | |

| Schedule 2.12 | Matters Relating to the Acquired Interests, the Project Company and the Wind Project |

| | |

| Schedule 3.5 | Purchaser Consents and Approvals |

| | |

| Schedule 4.1(a) | Seller’s Pre-Closing Covenants |

| | |

| Schedule 6.4(b) | Control of Defense of Third Party Claims |

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”), dated as of December 20, 2013, is made by and among Pattern Energy Group Inc., a Delaware corporation (“Purchaser”), Panhandle B Holdco 2 LLC, a Delaware limited liability company (“Seller”) and, solely for purposes of Section 7.1, Pattern Energy Group LP, a Delaware limited partnership (“Guarantor”). Capitalized terms used in this Agreement shall have the respective meanings specified in Appendix A-1 attached hereto.

RECITALS

WHEREAS, Seller owns, directly or indirectly through one or more Seller Affiliates (each such Seller Affiliate, a “Subsidiary Transferor”), some or all of the membership or partnership interest, shares, voting securities, or other equity interests, as applicable, in the project company which owns the wind project (herein referred to as the “Project Company”, as described on Part I of Appendix C attached hereto; and the “Wind Project”, as described on Part II of Appendix C); and

WHEREAS, Seller desires to sell to Purchaser, and Purchaser desires to purchase from Seller, the Acquired Interests defined and described in Part I of Appendix C attached hereto (herein referred to as the “Acquired Interests”).

NOW, THEREFORE, in consideration of the foregoing premises and the mutual terms, conditions and agreements set forth herein, and for other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

ARTICLE 1

PURCHASE AND SALE OF THE ACQUIRED INTERESTS

1.1 Agreement to Sell and Purchase. Subject to the satisfaction or waiver (by the party for whose benefit such condition exists) of the conditions set forth in Article 5 and the other terms and conditions of this Agreement, at the Closing (a) Seller shall sell, assign, transfer and convey (or, if applicable, cause the Subsidiary Transferors to sell, assign, transfer and convey) the Acquired Interests to Purchaser, and (b) Purchaser shall purchase the Acquired Interests from Seller (or, if applicable, the Subsidiary Transferors), for the Purchase Price. Purchaser shall have the right to designate a Subsidiary of Purchaser (“Subsidiary Transferee”) to receive the Acquired Interests at Closing.

1.2 Signing Date Deliverables. On the date of this Agreement, each of Seller and Purchaser shall deliver to the other party the deliverables set forth in Part II of Appendix B.

1.3 Purchase Price. The purchase price payable by Purchaser to the Seller (or, if applicable, the Subsidiary Transferor) for the Acquired Interests at Closing shall be the Purchase Price set forth in Part I of Appendix B as determined, if applicable, by the Method of Calculation (if any) set forth in Part I of Appendix B. The Purchase Price shall be subject to adjustment by the Purchase Price Adjustment (if any) set forth in Part I of Appendix B. All payments of the

Purchase Price and any Purchase Price Adjustment shall be paid by wire transfer of same day funds in the applicable Currency to the applicable accounts set forth in Part I of Appendix B.

1.4 The Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) will take place on the date and at the location specified in Part III of Appendix B or such other time and place as the parties hereto shall mutually agree (including Closing by facsimile or “PDF” electronic mail transmission exchange of executed documents or signature pages followed by the exchange of originals as soon thereafter as practicable), and will be effective as of 12:01 a.m. Eastern Standard Time on the day the Closing occurs; provided, however, that the Closing shall occur no later than thirty days after each of the conditions precedent in Sections 5.1, 5.2, and 5.3 have been satisfied (or waived in accordance with the terms of this Agreement).

1.5 Conduct of Closing.

(a) At or prior to the Closing, Seller shall deliver, or cause to be delivered, to Purchaser:

| | (i) | The original certificates representing the Acquired Interests duly endorsed for transfer by Seller (or, if applicable, the Subsidiary Transferors) to Purchaser (or, if applicable, Subsidiary Transferee) or with appropriate powers with respect thereto duly endorsed by Seller (or, if applicable, such Subsidiary Transferors); provided, that if the Acquired Interests are not in certificated form, Seller (or, if applicable, such Subsidiary Transferors) shall deliver to Purchaser (or, if applicable, Subsidiary Transferee) a duly executed assignment agreement or other instrument conveying such Acquired Interests to Purchaser (or, if applicable, Subsidiary Transferee) in form and substance reasonably acceptable to Purchaser; |

| | (ii) | Any other documents and certificates contemplated by Article 4 and Article 5 hereof to be delivered by or on behalf of Seller, including the certificate referred to in Section 5.2(e); and |

| | (iii) | Any other Closing deliverables set forth in Appendix B-1. |

(b) At or prior to the Closing, Purchaser shall deliver to Seller:

| | (i) | The documents and certificates contemplated by Article 4 and Article 5 hereof to be delivered by or on behalf of Purchaser, including the certificate referred to in Section 5.3(d); and |

| | (ii) | Any other Closing deliverables set forth in Appendix B-2. |

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF SELLER

Except as set forth in, or qualified by any matter set forth in, the Schedules attached hereto, Seller hereby represents and warrants to Purchaser as set forth in this Article 2 as of (A) the date hereof and (B) if the Closing Date is not the date of this Agreement, the Closing Date, in each case, unless otherwise specified in the representations and warranties below, in which case the representation and warranty is made as of such date. Whether or not a particular Section of this Article 2 refers to a specific, numbered Schedule, such Section shall, to the extent applicable, be subject to the exceptions, qualifications, and other matters set forth in the Schedules to the extent that the relevance of such exceptions, qualifications or other matters is reasonably apparent on the face thereof.

2.1 Organization and Status. Each of Seller, each Subsidiary Transferor and Guarantor (a) is duly formed, validly existing and in good standing under the laws of the jurisdiction of its formation as set forth in the preamble to this Agreement, (b) is duly qualified, authorized to do business and in good standing in each other jurisdiction where the character of its properties or the nature of its activities makes such qualification necessary, and (c) has all requisite power and authority to own or hold under lease the property it purports to own or hold under lease and to carry on its business as now being conducted. Seller has made available to Purchaser complete and correct copies of the Organization Documents for Seller, each Subsidiary Transferor and Guarantor.

2.2 Power; Authority; Enforceability. Each of Seller, each Subsidiary Transferor and Guarantor has the legal capacity and power to enter into and perform its obligations under this Agreement and has been duly authorized, in accordance with its Organization Documents, to enter into and perform its obligations under this Agreement. This Agreement has been duly executed and delivered by each of Seller and Guarantor and constitutes the legal valid and binding obligation of each of Seller and Guarantor, enforceable against it in accordance with its terms, except as may be limited by applicable bankruptcy, insolvency, moratorium, reorganization and similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity regardless of whether enforceability is considered in a proceeding in equity or at law.

2.3 No Violation. The execution, delivery and performance by each of Seller and Guarantor of its obligations under this Agreement, and the performance by each Subsidiary Transferor of this Agreement, in each case including without limitation the sale of the Acquired Interests to the Purchaser, do not, and will not, (a) violate any Governmental Rule to which Seller, any Subsidiary Transferor or Guarantor is subject or the Organization Documents of Seller, any Subsidiary Transferor or Guarantor, (b) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel or require any notice under any agreement, contract, lease, license, instrument or other arrangement to which Seller, any Subsidiary Transferor or Guarantor is a party or by which Seller, any Subsidiary Transferor or Guarantor is bound or (c) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel or require any notice under any Material Contract, except, in the case of this clause (c), as would not reasonably be expected to be material in the

context of the Wind Project or otherwise prevent or materially impair or delay the consummation of the transactions contemplated by this Agreement.

2.4 No Litigation. None of Seller or its Affiliates (other than the Project Company and its Subsidiaries, which, for the avoidance of doubt, are provided for in Section 2.12) is a party to or has received written notice of any pending or, to the Knowledge of Seller, threatened litigation, action, suit, proceeding or governmental investigation (other than for such matters as relate to Panhandle Holdco or its Subsidiaries or the Wind Project, which, for the avoidance of doubt, are provided for in Section 2.12) against Seller or its Affiliates which would reasonably be expected to be material to the Project Company and the Wind Project or the ownership of the Acquired Interests or which seeks the issuance of an order restraining, enjoining, altering or materially delaying the consummation of the transactions contemplated by this Agreement.

2.5 Consents and Approvals. Except as set forth in Schedule 2.5, no consent, approval, order or Authorization of or registration, declaration or filing with or exemption by (collectively, the “Consents”) any Governmental Authority or any other Person, is required by or with respect to Seller in connection with the execution and delivery of this Agreement by Seller or Guarantor, or the consummation by Seller, any Subsidiary Transferor or Guarantor of the transaction contemplated hereby, except for any consents which if not obtained would not reasonably be expected to be material in the context of the Wind Project or to otherwise prevent or materially impair or delay the consummation of the transactions contemplated by this Agreement.

2.6 Acquired Interests. Seller owns, directly or indirectly through one or more Seller Affiliates as identified in Part I of Appendix C, of record and beneficially one hundred percent (100%) of the Acquired Interests. Part I of Appendix C sets forth the equity capitalization of the Project Company. All of the interests described in Part I of Appendix C have been duly authorized, validly issued and are fully-paid and non-assessable and, except as set forth on Part I of Appendix C, there are no outstanding (i) equity interests or voting securities of Panhandle Holdco or any of its Subsidiaries, (ii) securities of Panhandle Holdco or any of its Subsidiaries convertible into or exchangeable for any equity interests or voting securities of Panhandle Holdco or any of its Subsidiaries or (iii) options or other rights to acquire from Panhandle Holdco or any of its Subsidiaries, or other obligation of Panhandle Holdco or any of its Subsidiaries to issue, any equity interests or voting securities or securities convertible into or exchangeable for equity interests or voting securities of Panhandle Holdco or any of its Subsidiaries, or any obligations of Panhandle Holdco or any of its Subsidiaries to repurchase, redeem or otherwise acquire any of the foregoing. The Seller (or, if applicable, the Subsidiary Transferors) has good and valid title to, and has, or will have, full power and authority to convey, the Acquired Interests, as of the Closing Date. The Acquired Interests have been, or will be, validly issued, and are, or will be, fully paid and non-assessable. On the Closing Date, Seller (or, if applicable, the Subsidiary Transferors) will convey to Purchaser (or, if applicable, Subsidiary Transferee) good and valid title to the Acquired Interests free and clear of all Liens other than Permitted Liens.

2.7 Solvency. There are no bankruptcy, reorganization or arrangement proceedings pending against, being contemplated by or, to the Knowledge of Seller, threatened against, Seller, any Subsidiary Transferor or Guarantor. None of Seller, any Subsidiary Transferor or

Guarantor (a) has had a receiver, receiver and manager, liquidator, sequestrator, trustee or other officer with similar powers appointed over all or part of the business or its assets, and to the Knowledge of Seller, no application therefore is pending or threatened, (b) is insolvent or presumed to be insolvent under any law or is unable to pay its debts as and when they fall due, (c) has made a general assignment for the benefit of its creditors, or (d) has taken any action to approve any of the foregoing.

2.8 Compliance with Law. To the Knowledge of Seller, there has been no actual violation by Seller, any Subsidiary Transferor or Guarantor of or failure of Seller, any Subsidiary Transferor or Guarantor to comply with any Governmental Rule that is applicable to it, or allegation by any Governmental Authority of such a violation, that would reasonably be expected to be material and relates to the Wind Project or would otherwise reasonably be expected to prevent or materially impair or delay the consummation of the transactions contemplated by this Agreement.

2.9 Taxes. Each of the representations by the Class B Member (as defined in the ECCA pursuant to Section 3.5 of the ECCA, for this purpose treating each reference therein to Panhandle Holdco as if it was a reference to Panhandle Holdco and Panhandle B Member 2 LLC, is true and correct at and as of the date hereof and the Closing Date as if made at and as of such dates (other than any representations or warranties that are made as of a specific date, which shall be true and correct as of such date).

2.10 Unregistered Securities. It is not necessary in connection with the sale of the Acquired Interests, under the circumstances contemplated by this Agreement, to register such Acquired Interests under the Securities Act of 1933 (the “Securities Act”) or under any other applicable securities laws.

2.11 Broker’s Fees. None of Seller, any Subsidiary Transferor or Guarantor has any liability or obligation for any fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement.

2.12 Matters Relating to the Acquired Interests, the Project Company and the Wind Project. A true, complete and correct list of all Material Contracts as of the date hereof is set forth on Parts I, III, IV and V of Appendix D. To the Knowledge of Seller, all representations and warranties set forth in Schedule 2.12 (disregarding all qualifications set forth therein as to materiality, material adverse effect or other similar qualifications) are true and correct at and as of the date hereof and the Closing Date as if made at and as of such dates (other than any representations or warranties that are made as of a specific date, which shall be true and correct as of such date), with only such exceptions as would not, individually or in the aggregate, reasonably be expected to have a Material Impact.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Except as set forth in, or qualified by any matter set forth in, the Schedules attached hereto, Purchaser hereby represents and warrants to Seller as set forth in this Article 3 as of (A) the date hereof and (B) if the Closing Date is not the date of this Agreement, the Closing Date, in

each case, unless otherwise specified in the representations and warranties below, in which case the representation and warranty is made as of such date. Whether or not a particular Section of this Article 3 refers to a specific, numbered Schedule, such Section shall, to the extent applicable, be subject to the exceptions, qualifications, and other matters set forth in the Schedules to the extent that the relevance of such exceptions, qualifications or other matters is reasonably apparent on the face thereof.

3.1 Organization and Status. Each of Purchaser and Subsidiary Transferee, if applicable, (a) is duly formed, validly existing and in good standing under the laws of the jurisdiction of its formation as set forth in the preamble to this Agreement, (b) is duly qualified, authorized to do business and in good standing in each other jurisdiction where the character of its properties or the nature of its activities makes such qualification necessary, and (c) has all requisite power and authority to own or hold under lease the property it purports to own or hold under lease and to carry on its business as now being conducted. Purchaser has made available to Seller complete and correct copies of the Organization Documents for Purchaser (and, if applicable, Subsidiary Transferee).

3.2 Power; Authority; Enforceability. Each of Purchaser and Subsidiary Transferee, if applicable, has the legal capacity and power to enter into and perform its obligations under this Agreement and has been duly authorized, in accordance with its Organization Documents, to enter into and perform its obligations under this Agreement. This Agreement has been duly executed and delivered by Purchaser and constitutes the legal valid and binding obligation of Purchaser, enforceable against it in accordance with its terms, except as may be limited by applicable bankruptcy, insolvency, moratorium, reorganization and similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity regardless of whether enforceability is considered in a proceeding in equity or at law.

3.3 No Violation. The execution, delivery and performance by Purchaser of its obligations under this Agreement, including without limitation the purchase of the Acquired Interests from Seller or the Subsidiary Transferors, do not, and will not, (a) violate any Governmental Rule to which Purchaser is subject or the Organization Documents of Purchaser, or (b) conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel or require any notice under any agreement, contract, lease, license, instrument or other arrangement to which Purchaser is a party or by which Purchaser is bound.

3.4 No Litigation. Purchaser is not a party to or has not received written notice of any pending or, to the Knowledge of Purchaser, threatened litigation, action, suit, proceeding or governmental investigation against Purchaser, which, in either case, would not reasonably be expected to result in a material adverse effect on the ability of Purchaser to perform its obligations under this Agreement or which seeks the issuance of an order restraining, enjoining, altering or materially delaying the consummation of the transactions contemplated by this Agreement.

3.5 Consents and Approvals. Except as set forth in Schedule 3.5, no Consent of any Governmental Authority or any other Person, is required by or with respect to Purchaser (or if applicable, Subsidiary Transferee) in connection with the execution and delivery of this

Agreement by Purchaser, or the consummation by Purchaser (or if applicable, Subsidiary Transferee) of the transaction contemplated hereby, except for any consents which if not obtained would not reasonably be expected to result in a material adverse effect on the ability of Purchaser (or if applicable, Subsidiary Transferee) to perform its obligations under this Agreement.

3.6 Solvency. There are no bankruptcy, reorganization or arrangement proceedings pending against, being contemplated by or, to the Knowledge of Purchaser, threatened against Purchaser (or, if applicable, Subsidiary Transferee). None of Purchaser or, if applicable, Subsidiary Transferee (a) has had a receiver, receiver and manager, liquidator, sequestrator, trustee or other officer with similar powers appointed over all or part of the business or assets, and to the Knowledge of Purchaser, no application therefore is pending or threatened, (b) is insolvent or presumed to be insolvent under any law and is able to pay its debts as and when they fall due, (c) has made a general assignment for the benefit of its creditors, and (d) has taken any action to approve any of the foregoing.

3.7 Compliance with Law. To the Knowledge of Purchaser, there has been no actual violation by Purchaser (or, if applicable, Subsidiary Transferee) of or failure of Purchaser (or, if applicable, Subsidiary Transferee) to comply with any Governmental Rule that is applicable to it, or allegation by any Governmental Authority of such a violation, that would reasonably be expected to prevent or materially impair or delay the consummation of the transactions contemplated by this Agreement.

3.8 No Reliance. Purchaser has had the opportunity to inspect all of the information made available by Seller and to ask questions of and receive answers from Seller with respect to the Acquired Interests, the Project Company, the Seller Affiliates (if any) and the Wind Project. Purchaser acknowledges and warrants to Seller as of the date hereof and the Closing Date (as applicable) that, in accepting the transfer of the Acquired Interests, except for the representations and warranties expressly provided herein, it has (a) relied on its own investigations and assessments including its own inquiries into the Acquired Interests, the Project Company, the Seller Affiliates (if any) and the Wind Project; and (b) not relied on any other representations or warranties (written or oral) of Seller or its Affiliates.

3.9 Investment Intent. Purchaser is acquiring the Acquired Interests for its own account, for investment and with no view to the distribution thereof in violation of the Securities Act or the securities laws of any state of the United States or any other jurisdiction.

3.10 Accredited Investor. Purchaser is an “accredited investor” within the meaning of Rule 501(a)(1), (2), (3), (7) or (8) of the Securities Act, and is able to bear the economic risk of losing its entire investment in the Acquired Interests.

3.11 Broker’s Fee. None of Purchaser or, if applicable, Subsidiary Transferee has any liability or obligation for any fees or commissions payable to any broker, finder or agent with respect to the transactions contemplated by this Agreement.

ARTICLE 4

COVENANTS; OTHER OBLIGATIONS

4.1 Covenants Between Signing and Closing. If the Closing Date is not the date of this Agreement, the provisions of this Section 4.1 shall apply during the period from the date hereof to the Closing Date:

(a) Project Specific Pre-Closing Covenants of Seller. Unless consented or otherwise agreed to by Purchaser (such consent not to be unreasonably withheld or delayed) and except as required by Governmental Rule, Seller agrees to comply with the provisions, if any, of Schedule 4.1(a).

(b) Access, Information and Documents. Seller will give to Purchaser and to Purchaser’s counsel, accountants and other representatives reasonable access during normal business hours to all material Books and Records and the Wind Project (subject to all applicable safety and insurance requirements and any limitations on Seller’s rights to, or right to provide others with, access) and will furnish to Purchaser all such documents and copies of documents and all information, including operational reports, with respect to the affairs of the Project Company, the Seller Affiliates, and the Wind Project as Purchaser may reasonably request subject to any confidentially obligations imposed on Seller by any unaffiliated counterparties to such contracts and agreements. Purchaser agrees to comply with any confidentiality obligations which would be applicable to it under any such contracts, documents or agreements received from Seller hereunder.

(c) Updating of Disclosure Schedules. Seller shall notify Purchaser in writing of any material changes, additions, or events occurring after the date of this Agreement which require a representation and warranty of Seller (other than any representations or warranties in Sections 2.6 and 2.11) to be supplemented with a new Schedule or cause any material change in or addition to a Schedule promptly after Seller becomes aware of the same by delivery of such new Schedule or appropriate updates to any such Schedule (each, an “Updated Disclosure Schedule”) to Purchaser. Each Updated Disclosure Schedule shall (i) expressly state that it is being made pursuant to this Section 4.1(c), (ii) specify the representations and warranties to which it applies and (iii) describe in reasonable detail the changes, additions or events to which it relates. No Updated Disclosure Schedule delivered pursuant to this Section 4.1(c) shall be deemed to cure any breach of any representation or warranty unless Purchaser specifically agrees thereto in writing or, as provided in and subject to Article 5, consummates the Closing under this Agreement after receipt of such written notification, nor shall any such Updated Disclosure Schedule be considered to constitute or give rise to a waiver by Purchaser of any condition set forth in this Agreement, unless Purchaser specifically agrees thereto in writing or consummates the Closing under this Agreement after receipt of such written notification.

(d) Further Assurances. Each of the parties hereto shall use commercially reasonable efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable to consummate the transactions contemplated hereby as soon as practicable.

4.2 Other Covenants

(a) Costs, Expenses. Except as may be specified elsewhere in this Agreement, Purchaser shall pay all costs and expenses, including legal fees and the fees of any broker, environmental consultant, insurance consultant, independent engineer, and title company retained by Purchaser for Purchaser’s due diligence and the negotiation, performance of and compliance with this Agreement by Purchaser. Seller shall pay all costs and expenses (including in connection with any reports, studies or other documents listed in Part II of Appendix D, unless specifically noted in Part II of Appendix D), including legal fees and the fees of any broker of Seller or its Affiliates, relating to or resulting from the negotiation, performance of and compliance with this Agreement by Seller.

(b) Public Announcement; Confidentiality. No party hereto shall make or issue, or cause to be made or issued, any public announcement or written statement concerning this Agreement or the transactions contemplated hereby without the prior written consent of the other party, except to the extent required by law (including any disclosure which, in the reasonable judgment of the disclosing party, is necessary or appropriate to comply with Governmental Rules and standards governing disclosures to investors) or in accordance with the rules, regulations and orders of any stock exchange. Seller shall not, and shall cause its Affiliates and directors, officers, employees, agents, consultants advisors and partners not to, disclose any confidential information in or relating to this Agreement other than (a) to its Affiliates and its and their directors, officers, employees, agents, consultants, advisors and partners, provided in each case that such recipient is bound by reasonable confidentiality obligations, (b) as required by applicable law or regulation or (c) with the prior consent of Purchaser. Seller shall not use, and shall not enable any third party to use, any confidential information in or relating to this Agreement that constitutes material non-public information regarding Purchaser in a manner that is prohibited by the U.S. securities laws.

(c) Other Obligations of Seller and Purchaser. The parties mutually covenant as follows:

| | (i) | to cooperate with each other in determining whether filings are required to be made or consents required to be obtained in any jurisdiction in connection with the consummation of the transactions contemplated by this Agreement and in making or causing to be made any such filings promptly and in seeking to obtain timely any such consents; |

| | (ii) | to use all reasonable efforts in good faith to obtain promptly the satisfaction of the conditions to Closing of the transactions contemplated herein, including obtaining all required consents and approvals; |

| | (iii) | to furnish to the other party and to the other party’s counsel all such information as may be reasonably required in order to effectuate the foregoing actions; and |

| | (iv) | to advise the other party promptly if such party determines that any condition precedent to its obligations hereunder will not be satisfied in a timely manner. |

(d) Tax Characterization; Allocation of Purchase Price.

| | (i) | Purchaser and Seller acknowledge and agree that the transactions contemplated hereby will be treated for federal income tax purposes as a purchase of the assets of the Project Company, subject to the liabilities of the Project Company. Neither Purchaser nor Seller shall file any income Tax Return inconsistent with such treatment. |

| | (ii) | Within 60 days after the Closing, Purchaser shall prepare a schedule allocating the Purchase Price among the Project Company’s assets in a manner consistent with Code sections 755 and 1060 and consistent with the percentages allocated to different classes of assets in the Cost Segregation Consultant Report to be provided to Class A Equity Investors (as defined in the ECCA) pursuant to Section 5.3(aa) of the ECCA. Purchaser shall deliver such schedule to Seller for its approval, not to be unreasonably denied or delayed. If Seller objects to Purchaser’s schedule, Seller shall notify Purchaser within fifteen days of its receipt of the schedule and Seller and Purchaser shall negotiate in good faith to resolve any differences. If any dispute cannot be resolved with fifteen days, Purchaser and Seller shall jointly retain an accounting firm that is nationally recognized in the United States (the “Accountant”). Accountant shall decide (a) as to whether Seller’s objections are unreasonable and (b) as to the resolution of Seller’s objections as are reasonable, shall be final; provided that such Accountant’s decision shall be consistent with the Cost Segregation Consultant Report referred to above. Purchaser, Seller and their respective Affiliates shall use the allocation in the schedule, as modified by the negotiations of Seller and Purchaser and by the resolutions of Accountant for all federal income Tax purposes and shall not file any Tax Returns inconsistent with such allocation. |

(e) No Tax-Exempt Controlled Entity. So long as Seller and its Affiliates own an interest greater than 10% in Purchaser, Seller’s and its Affiliates’ ownership shall not cause Purchaser to be a “tax-exempt controlled entity” within the meaning of Code Section 168(h)(6)(F)(iii)(I).

ARTICLE 5

CONDITIONS TO CLOSING; TERMINATION

5.1 Conditions Precedent to Each Party’s Obligations to Close. The obligations of the parties to proceed with the Closing under this Agreement are subject to the fulfillment prior to or at Closing of the following conditions (any one or more of which may be waived in whole or in part by both parties in their sole discretion):

(a) No Violations. The consummation of the transactions contemplated hereby shall not violate any applicable Governmental Rule.

(b) No Adverse Proceeding. No order of any court or administrative agency shall be in effect which restrains or prohibits the transactions contemplated hereby, and there shall not have been threatened, nor shall there be pending, any action or proceeding by or before any court or Governmental Authority challenging any of the transactions contemplated by this Agreement or seeking monetary relief by reason of the consummation of such transactions.

(c) No Termination. This Agreement shall not have been terminated pursuant to Section 5.4.

(d) Other Conditions Precedent to Closing to Each Party’s Obligations. The conditions precedent, if any, set forth on Appendix B-3 shall have been satisfied.

5.2 Conditions Precedent to Obligations of Purchaser to Close. The obligations of Purchaser to proceed with the Closing under this Agreement with respect to the purchase of the Acquired Interests are subject to the fulfillment prior to or at Closing of the following conditions (any one or more of which may be waived in whole or in part by Purchaser in Purchaser’s sole discretion):

(a) Representations and Warranties. The representations and warranties of Seller set forth in Article 2 shall be true and correct at and as of the Closing Date as if made at and as of such date (other than any representations or warranties that are made as of a specific date, which shall be true and correct as of such date), except to the extent that (i) Seller has delivered to Purchaser any Updated Disclosure Schedules and (ii) Purchaser has specifically agreed in writing that such Updated Disclosure Schedules shall be deemed to cure a breach of any representation or warranty, in each case of clause (i) and (ii) in accordance with Section 4.1(c).

(b) Performance and Compliance. Seller shall have performed, in all material respects, all of the covenants and complied with all of the provisions required by this Agreement to be performed or complied with by it on or before the Closing.

(c) [Reserved].

(d) Material Contracts. (i) Each of the Material Contracts shall be in full force and effect and shall not have been amended, waived (in whole or in part), supplemented or otherwise modified in any manner that has a Material Impact without the prior written approval of Purchaser (which approval shall not be unreasonably withheld or delayed).

(e) Certificate of Seller. Purchaser shall have received a certificate of Seller dated the date of the Closing confirming the matters set forth in Sections 5.2(a), (b) and (d) in a form reasonably acceptable to Purchaser.

(f) Good Standing Certificate. Purchaser shall have received a good standing certificate of Seller, each Subsidiary Transferor and Guarantor, in each case issued by the secretary of state of the state or provincial authority of the province (as applicable) of its formation.

(g) Satisfactory Instruments. All instruments and documents reasonably required on the part of Seller and any Subsidiary Transferor to effectuate and consummate the transactions contemplated hereby shall be delivered to Purchaser and shall be in form and substance reasonably satisfactory to Purchaser.

(h) Other Conditions Precedent to Purchaser’s Obligation to Close. The conditions precedent, if any, set forth in Appendix B-4 shall have been satisfied.

5.3 Conditions Precedent to the Obligations of Seller to Close. The obligations of Seller to proceed with the Closing hereunder with respect to Seller’s sale of the Acquired Interests are subject to the fulfillment prior to or at Closing of the following conditions (any one or more of which may be waived in whole or in part by Seller in its sole discretion):

(a) Purchase Price. Purchaser shall have transferred (or caused to be transferred) in immediately available funds the Purchase Price pursuant to, in accordance with and into the account or accounts designated in, Part I of Appendix B.

(b) Representations and Warranties. The representations and warranties set forth in Article 3 shall be true and correct at and as of the Closing Date as if made at and as of such date (other than any representations or warranties that are made as of a specific date, which shall be true and correct as of such date).

(c) Performance and Compliance. Purchaser shall have performed all of the covenants and complied, in all material respects, with all the provisions required by this Agreement to be performed or complied with by it on or before the Closing.

(d) Certificate of Purchaser. Seller shall have received a certificate of Purchaser dated the date of the Closing confirming the matters set forth in Section 5.3(b) and (c) in a form reasonably acceptable to Seller.

(e) Satisfactory Instruments. All instruments and documents required on the part of Purchaser (or, if applicable, Subsidiary Transferee) to effectuate and consummate the transactions contemplated hereby shall be delivered to Seller and shall be in form and substance reasonably satisfactory to Seller.

(f) Other Conditions Precedent to Seller’s Obligation to Close. The conditions precedent, if any, set forth in Appendix B-5 shall have been satisfied.

5.4 Termination. If the Closing Date is not the date of this Agreement, the following termination provisions shall be applicable:

(a) By the Parties. This Agreement may be terminated at any time by mutual written consent of Purchaser and Seller.

(b) By Either Purchaser Or Seller. This Agreement may be terminated at any time prior to the Closing by either Seller or Purchaser, if (i) a Government Approval required to be obtained as set forth on Part VII of Appendix B shall have been denied and all appeals of such denial have been taken and have been unsuccessful, (ii) one or more courts of competent jurisdiction in the United States or Canada (as applicable), any state, provincial or any other applicable jurisdiction has issued an order permanently restraining, enjoining, or otherwise prohibiting the Closing, and such order has become final and non-appealable, or (iii) the Closing has not occurred by the Outside Closing Date.

(c) Other Termination Rights. This Agreement may be terminated at any time prior to the Closing by the applicable party if and to the extent permitted in Part V of Appendix B.

(d) Termination Procedure. In the event of termination of this Agreement by either or both parties pursuant to this Section 5.4, written notice thereof will forthwith be given by the terminating party to the other party and this Agreement will terminate and the transactions contemplated hereby will be abandoned, without further action by any party. If this Agreement is terminated as permitted by this Section 5.4, such termination shall be without liability of any party (or any stockholder, director, officer, employee, agent, consultant or representative of such party) to any other party to this Agreement; provided that (i) the foregoing will not relieve any party for any liability for willful and intentional material breaches of its obligations hereunder occurring prior to such termination and (ii) except as specifically set forth herein, nothing in this Agreement shall derogate from the provisions of the Purchase Rights Agreement, which agreement shall remain in full force and effect after termination of this Agreement.

ARTICLE 6

REMEDIES FOR BREACHES OF THIS AGREEMENT

6.1 Indemnification

(a) By Seller. Subject to the limitations set forth in this Article 6 and Section 7.15, from and after the Closing, Seller agrees to indemnify and hold harmless Purchaser and Purchaser’s Affiliates together with their respective directors, officers, managers, employees and agents (each a “Purchaser Indemnified Party”) from and against any and all Losses that any Purchaser Indemnified Party incurs by reason of or in connection with any of the following circumstances:

| | (i) | Any breach by Seller of any representation or warranty made by it in Article 2 (subject to any Updated Disclosure Schedules delivered pursuant to Section 4.1(c) that are deemed to cure a breach of any representation or warranty in accordance with the last sentence of Section 4.1(c)) or any breach or violation of any |

| | | covenant, agreement or obligation of Seller or Guarantor contained herein; and |

| | (ii) | As set forth in Part VI of Appendix B. |

(b) By Purchaser. Subject to the limitations set forth in this Article 6 and Section 7.15, from and after the Closing Purchaser agrees to indemnify and hold harmless Seller and Seller’s Affiliates together with their respective directors, officers, managers, employees and agents (each a “Seller Indemnified Party”) from and against any and all Losses that any Seller Indemnified Party incurs by reason of or in connection with any of the following circumstances:

| | (i) | Any breach by Purchaser of any representation or warranty made by it in Article 3 or any breach or violation of any covenant, agreement or obligation of Purchaser contained herein; and |

| | (ii) | As set forth in Part VI of Appendix B. |

6.2 Limitations on Seller’s or Purchaser’s Indemnification.

(a) Minimum Limit on Claims. A party required to provide indemnification under this Article 6 (an “Indemnifying Party”) shall not be liable under this Article 6 to an Indemnified Party for any Claim for breach of any representation or warranty unless and until the aggregate amount of all Claims for which it would, in the absence of this provision, be liable exceeds the Basket Amount, and in such event the Indemnified Party will be liable for the amount of all Claims, including the Basket Amount; provided that the foregoing limitation shall not apply in the case of actual fraud by the Indemnifying Party.

(b) Maximum Limit on Claims.

| | (i) | Limitation on Seller’s Liability. Seller’s maximum aggregate liability for Claims for breaches of representations and warranties under this Agreement is limited to Seller’s Maximum Liability set forth in Part VI of Appendix B; provided that the Seller’s Maximum Liability will not apply to any Claim based on (A) actual fraud or (B) any breach of the representations and warranties set forth in Sections 2.1, 2.2, 2.3, 2.5, 2.6, 2.9 and 2.11. |

| | (ii) | Limitation on Purchaser’s Liability. Purchaser’s maximum aggregate liability for Claims for breaches of representations and warranties under this Agreement is limited to Purchaser’s Maximum Liability set forth in Part VI of Appendix B; provided that the Purchaser’s Maximum Liability will not apply to any Claim based on (A) actual fraud or (B) any breach of the representations and warranties set forth in Sections 3.1, 3.2, 3.3, 3.5 and 3.11. |

(c) Time Limit for Claims. No Indemnified Party may make a Claim for indemnification under Section 6.1 in respect of any Claim unless Notice in writing of the Claim,

incorporating a statement setting out in reasonable detail the grounds on which the Claim is based, has been given by the Indemnified Party prior to the expiration of the applicable Survival Period as set forth in Part VI of Appendix B.

6.3 Reimbursements; Refunds.

(a) Right of Reimbursement. The amount of Losses payable under Section 6.1 by an Indemnifying Party shall be net of any (i) amounts recovered by the Indemnified Party under applicable insurance policies or from any other Person responsible therefor, and (ii) any Tax benefit actually realized by the Indemnified Party arising from the incurrence or payment of any such Losses. If the Indemnified Party receives any amounts under applicable insurance policies, or from any other Person responsible for any Losses subsequent to an indemnification payment by the Indemnifying Party and such amounts would result in a duplicative recovery, then such Indemnified Party shall promptly reimburse the Indemnifying Party for any payment made or expense incurred by such Indemnifying Party in connection with providing such indemnification payment up to the amount received by the Indemnified Party, net of any expenses incurred by such Indemnified Party in collecting such amount.

(b) Other Refund Obligations. In addition to the obligations set forth in Section 6.3(a), the applicable Indemnified Party shall be obligated to reimburse or refund to the Indemnifying Party for payments made by it to such Indemnified Party under this Article 6 as set forth in Part VI of Appendix B.

6.4 Right to Control Proceedings for Third Party Claims.

(a) If a third party shall notify any party with respect to any matter that may give rise to a Claim (a “Third Party Claim”), the Indemnified Party must give notice to the Indemnifying Party of the Third Party Claim (a “Third Party Claim Notice”) within twenty (20) Business Days after it becomes aware of the existence of the Third Party Claim and that it may constitute a Third Party Claim. The Indemnified Party’s failure to give a Third Party Claim Notice in compliance with this Section 6.4(a) of any Third Party Claim which may give rise to a right of indemnification hereunder shall not relieve the Indemnifying Party of any liability which it may have to the Indemnified Party unless, and solely to the extent that, the failure to give such notice materially and adversely prejudiced the Indemnifying Party.

(b) The Indemnifying Party shall have the right to participate in, or by giving written notice to the Indemnified Party, to assume control of the defense of any Third Party Claim with the Indemnifying Party’s own counsel, in each case at the Indemnifying Party’s own cost and expense (provided that prior to assuming control of such defense, the Indemnifying Party must acknowledge its indemnity obligations under this Article 6), and the Indemnified Party shall cooperate in good faith in such defense. The Indemnified Party shall have the right, at its own cost and expense, to participate in the defense of any Third Party Claim with separate counsel selected by it, subject to the Indemnifying Party’s right to control the defense thereof; provided that in such event the Indemnifying Party shall pay the fees and expenses of such separate counsel (i) incurred by the Indemnified Party prior to the date the Indemnifying Party assumes control of the defense of the Third Party Claim, (ii) if such Third Party Claim would reasonably be expected to be materially detrimental to the business, reputation or future

prospects of any Indemnified Party or (iii) if representation of both the Indemnifying Party and the Indemnified Party by the same counsel would create a conflict of interest. If the Indemnifying Party (i) fails to promptly notify the Indemnified Party in writing of its election to defend or fails to acknowledge its indemnity obligations under this Article 6 as provided in this Agreement, (ii) elects not to defend (or compromise at its sole cost and expense) such Third Party Claim, (iii) has elected to defend such Third Party Claim but fails to promptly and diligently pursue the defense such Third Party Claim, (iv) otherwise breaches any of its obligations under this Article 6 or (v) as set forth on Schedule 6.4(b) hereto, or if the Third Party Claim is reasonably expected by the Indemnified Party to result in a payment obligation on the Indemnified Party in an amount that exceeds the maximum indemnification then available to the Indemnified Party pursuant to this Article 6, then the Indemnifying Party shall not be entitled to assume or maintain control of the defense of such Third Party Claim and the Indemnified Party may (by written notice to the Indemnifying Party) assume control of such defense (in which case the Indemnifying Party shall pay the fees and expenses of counsel retained by the Indemnified Party) and/or compromise such Third Party Claim and seek indemnification for any and all Losses based upon, arising from or relating to such Third Party Claim. The Parties shall cooperate with each other in all reasonable respects in connection with the defense of any Third Party Claim.

(c) Notwithstanding any other provision of this Agreement, the Indemnifying Party shall not enter into any settlement of any Third Party Claim without the prior written consent of the Indemnified Party (which consent shall not be unreasonably withheld or delayed), except as provided in this Section 6.4(c). If a firm offer is made to settle a Third Party Claim that (i) does not (A) result in any liability or create any financial or other obligation on the part of the Indemnified Party and (B) result in the loss of any right or benefit on the part of any Indemnified Party, (ii) does not impose injunctive or other equitable relief against any Indemnified Party, and (iii) provides, in customary form, for the unconditional release of each Indemnified Party from all liabilities and obligations in connection with such Third Party Claim, and the Indemnifying Party desires to accept and agree to such firm offer, then the Indemnifying Party shall give written notice to that effect to the Indemnified Party. If the Indemnified Party fails to consent to such firm offer within ten days after its receipt of such notice, the Indemnified Party may continue to contest or defend such Third Party Claim and in such event, the maximum liability of the Indemnifying Party as to such Third Party Claim shall not exceed the amount of such settlement offer. If the Indemnified Party fails to consent to such firm offer within such 20 day period and also fails to assume defense of such Third Party Claim, the Indemnifying Party may settle the Third Party Claim upon the terms set forth in such firm offer to settle such Third Party Claim. If the Indemnified Party has assumed the defense pursuant to Section 6.4(b), it may settle the Third Party Claim; provided that if the settlement is made without the prior written consent of the Indemnifying Party (which consent shall not be unreasonably withheld or delayed), the Indemnifying Party shall have no indemnity obligation pursuant to this Article 6 with respect to such Third Party Claim.

6.5 Mitigation; Treatment of Indemnification.

(a) An Indemnified Party shall use commercially reasonable efforts to mitigate all Losses relating to a Claim for which indemnification is sought under this Article 6.

(b) All indemnification payments under this Article 6 shall be deemed adjustments to the Purchase Price.

6.6 Exclusive Remedy. Each of Seller and Purchaser acknowledges and agrees that, should the Closing occur, and excluding liability for actual fraud, the foregoing indemnification provisions of this Article 6 and the provisions of Section 7.16 shall be the sole and exclusive remedy of Seller and Purchaser with respect to any misrepresentation, breach of warranty, covenant or other agreement (other than any Purchase Price Adjustment set forth in Part I of Appendix B) or other claim arising out of this Agreement or the transactions contemplated hereby. Without limiting the generality of the foregoing, effective as of the Closing each of Purchaser and Seller covenants to the other party that in respect of any matters under or contemplated in this Agreement, it will not make any Claim whatsoever against any Affiliate (other than Guarantor) of the other party or the directors, officers, managers, shareholders, member, controlling persons, employees and agents of any of the foregoing, in each case in their capacities as such, and its rights in respect of any such Claim for breach of any provision of this Agreement are limited solely to such rights as it may have against Seller (and Guarantor) or Purchaser, as the case may be, under this Agreement.

ARTICLE 7

MISCELLANEOUS

7.1 Guarantee. Guarantor hereby guarantees the due, prompt and faithful payment, performance and discharge by Seller of, and the compliance by Seller with, all of the covenants, agreements, obligations, undertakings and liabilities of Seller under this Agreement in accordance with the terms of this Agreement, and covenants and agrees to take all actions necessary or advisable to ensure such payment, performance, discharge and compliance hereunder.

7.2 Entire Agreement. This Agreement and the Schedules and Appendices hereto, each of which is hereby incorporated herein, set forth all of the promises, covenants, agreements, conditions, undertakings, representations and warranties between the parties hereto with respect to the subject matter hereof and supersede all prior and contemporaneous agreements and understandings, inducements or conditions, express or implied, oral or written.

7.3 Notices. All notices, requests, demands and other communications hereunder shall be in writing (including facsimile transmission) and shall be deemed to have been duly given if personally delivered, telefaxed (with confirmation of transmission) or, if mailed, when mailed by United States first-class or Canadian Lettermail or Letter-post (as the case may be), certified or registered mail, postage prepaid, or by any international or national overnight delivery service, to the recipient party at the addresses as set forth in Part VII of Appendix B (or at such other address as shall be given in writing by any party to such other party). All such notices, requests, demands and other communications shall be deemed received on the date of receipt by the recipient thereof if received prior to 5 p.m. in the place of receipt and such day is a Business Day in the place of receipt. Otherwise, any such notice, request or communication shall be deemed not to have been received until the next succeeding Business Day in the place of receipt.

7.4 Successors and Assigns.

(a) No party shall assign this Agreement or any of its rights or obligations herein without the prior written consent of each other party, in its sole discretion. Subject to the foregoing, this Agreement, and all rights and powers granted hereby, will bind and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

(b) Notwithstanding Section 7.4(a), (i) Seller may assign this Agreement without the consent of the Purchaser as specified in Part VII of Appendix B and (ii) from and after Closing, Purchaser may assign its rights pursuant to Article 6 to Subsidiary Transferee without the consent of any other party.

7.5 Jurisdiction; Service of Process; Waiver of Jury Trial.

(a) EACH OF THE PARTIES HERETO WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY SUIT, ACTION, PROCEEDING OR COUNTERCLAIM (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

(b) Any and all claims, counterclaims, demands, causes of action, disputes, controversies, and other matters in question arising out of or relating to this Agreement, or the alleged breach hereof, or in any way relating to the subject matter of this Agreement or the relationship between the Parties created by this Agreement (hereafter, a “Dispute”) shall be finally resolved by binding arbitration administered by the American Arbitration Association (“AAA”) under the AAA Commercial Arbitration Rules, including the Procedures for Large, Complex Commercial Disputes (the “Rules”) then in force to the extent such Rules are not inconsistent with the provisions of this Agreement. The party commencing arbitration shall deliver to the party or parties against whom a claim is made a written notice of intent to arbitrate (a “Demand”) in accordance with Rule R-4. The arbitration shall be governed by the Federal Arbitration Act, 9 U.S.C. §§1 et seq.

| | (i) | Selection of Arbitrators. Disputes shall be resolved by a panel of three independent and impartial arbitrators, (the “Arbitrators”). The party or parties initiating the arbitration shall appoint an arbitrator in its Demand; the responding party or parties shall appoint an arbitrator in its answering statement, which is due 30 days after receipt of the Demand. If any party fails or refuses to timely nominate an arbitrator within the time permitted, such arbitrator shall be appointed by the AAA from individuals with significant experience in renewable energy projects from its Large, Complex Commercial Case Panel. Within 30 days of the appointment of the second arbitrator, the two party-appointed arbitrators shall appoint the third arbitrator, who shall act as the chair of the arbitration panel. If the two party-appointed arbitrators fail or refuse to appoint the third arbitrator within such 30-day period, the third arbitrator shall be appointed by the AAA from individuals with significant experience in renewable energy |

| | | projects from its Large, Complex Commercial Case Panel in accordance with Rule R-12. The Arbitrators, acting by majority vote, shall resolve all Disputes. |

| | (ii) | To the fullest extent permitted by law, the arbitration proceedings and award shall be maintained in confidence by the parties. |

| | (iii) | Place of Arbitration. The place of arbitration shall be New York, New York. Any action in connection therewith shall be brought in the United States District Court for the Southern District of New York or, if that court does not have jurisdiction, any New York state court in New York County. Each party consents to the exclusive jurisdiction of such courts in any such suit, action or proceeding, and irrevocably waives, to the fullest extent permitted by law, any objection which it may now or hereafter have to the laying of the venue of any such suit, action or proceeding in any such court or that any such suit, action or proceeding which is brought in any such court has been brought in an inconvenient forum. Each party further agrees to accept service of process out of any of the before mentioned courts in any such dispute by registered or certified mail addressed to the party at the address set forth in Part VII of Appendix B. |

| | (iv) | Conduct of the Arbitration. The arbitration shall be conducted in accordance with the Rules and in a manner that effectuates the Parties’ intent that Disputes be resolved expeditiously and with minimal expense. The Arbitrators shall endeavor to commence the arbitration hearing within 180 days of the third arbitrator’s appointment. |

| | (v) | Interim Relief. Each party may apply to the Arbitrators seeking injunctive relief until the arbitration award is rendered or the controversy is otherwise resolved. Each party also may, without waiving any remedy under this agreement, seek from any court having jurisdiction any interim or provisional relief that is necessary to protect the rights or property of that party, pending the establishment of the arbitral tribunal (or pending the Arbitrators’ determination of the merits of the controversy). |

| | (vi) | Discovery. The Arbitrators, upon a showing of good cause, may require and facilitate such limited discovery as it shall determine is appropriate in the circumstances, taking into account the needs of the parties, the burden on the parties, and the desirability of making discovery limited, expeditious, and cost-effective. The Arbitrators shall issue orders to protect the confidentiality of proprietary information, trade secrets and other sensitive information disclosed in discovery. |

| | (vii) | Arbitration Award. The Arbitrators shall endeavor to issue a reasoned, written award within 30 days of the conclusion of the arbitration hearing. The Arbitrators shall have the authority to assess some or all of the costs and expenses of the arbitration proceeding (including the Arbitrators’ fees and expenses) against any party. The Arbitrators shall also have the authority to award attorneys’ fees and expenses to the prevailing party or parties. In assessing the costs and expenses of the arbitration and/or awarding attorneys’ fee and expenses, the Arbitrators shall consider the relative extent to which each party has prevailed on the disputed issues and the relative importance of those issues. The limitations of Section 7.15 shall apply to any award by the Arbitrators. |

7.6 Headings; Construction; and Interpretation. The headings preceding the text of the sections and subsections hereof are inserted solely for convenience of reference and shall not constitute a part of this Agreement, nor shall they affect its meaning, construction or effect. Except as otherwise expressly provided, the rules of construction set forth in Appendix A-2 shall apply to this Agreement. The parties agree that any rule of law or any legal decision that would require interpretation of any claimed ambiguities in this Agreement against the party that drafted it has no application and is expressly waived.

7.7 Further Assurances. Each party shall cooperate and take such action as may be reasonably requested by the other party in order to carry out the provisions and purposes of this Agreement and the transactions contemplated hereby.

7.8 Amendment and Waiver. The parties may by mutual agreement amend this Agreement in any respect, and any party, as to such party, may (a) extend the time for the performance of any of the obligations of any other party, (b) waive any inaccuracies in representations by any other party, (c) waive compliance by any other party with any of the agreements contained herein and performance of any obligations by such other party, and (d) waive the fulfillment of any condition that is precedent to the performance by such party of any of its obligations under this Agreement. To be effective, any such amendment or waiver must be in writing and be signed by the party against whom enforcement of the same is sought.

7.9 No Other Beneficiaries. This Agreement is being made and entered into solely for the benefit of Purchaser and Seller, and neither Purchaser nor Seller intends hereby to create any rights in favor of any other person as a third party beneficiary of this Agreement or otherwise.

7.10 Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the jurisdiction specified in Part VII of Appendix B.

7.11 Schedules. References to a Schedule shall include any disclosure expressly set forth on the face of any other Schedule even if not specifically cross-referenced to such other Schedule to the extent that the relevance of such matter is reasonably apparent on the face thereof. The fact that any item of information is contained in a disclosure schedule shall not be construed as an admission of liability under any Governmental Rule, or to mean that such

information is material. Such information shall not be used as the basis for interpreting the term “material”, “materially,” “Material Impact,” or any similar qualification in this Agreement.

7.12 Limitation of Representation and Warranties. EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES SET FORTH IN ARTICLE 2, SELLER HAS NOT MADE AND SELLER EXPRESSLY DISCLAIMS ANY REPRESENTATIONS OR WARRANTIES, OF ANY KIND OR NATURE, WRITTEN OR ORAL, STATUTORY, EXPRESS OR IMPLIED, WITH RESPECT TO THE ACQUIRED INTERESTS, SELLER OR SELLER AFFILIATES, THE PROJECT COMPANY, THE WIND PROJECT OR THE SUBJECT MATTER OF THIS AGREEMENT. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, EXCEPT AS EXPRESSLY PROVIDED IN ARTICLE 2, THE ACQUIRED INTERESTS ARE BEING CONVEYED “AS IS” IN ALL RESPECTS, AND SELLER EXPRESSLY DISCLAIMS ANY REPRESENTATION OR WARRANTY OF FITNESS, MERCHANTABILITY OR SUITABILITY FOR A PARTICULAR PURPOSE. Purchaser acknowledges that except as expressly provided in Article 2 of this Agreement, Seller has not made, and Seller hereby expressly disclaims and negates, and Purchaser hereby expressly waives, any other representation or warranty, express, implied, at common law, by statute or otherwise relating to the Acquired, Seller or Seller Affiliates, the Project Company, the Wind Project or this Agreement.

7.13 Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but which together shall constitute one and the same instrument. A facsimile or electronically imaged version of this Agreement may be executed by one or more parties hereto and an executed copy of this Agreement may be delivered by one or more parties hereto by facsimile or “PDF” electronic mail pursuant to which the signature of or on behalf of such party can be seen, and such execution and delivery shall be considered valid, binding and effective for all purposes.

7.14 Severability. If any provision of this Agreement or any other agreement entered into pursuant hereto is contrary to, prohibited by or deemed invalid under applicable law or regulation, such provision shall be inapplicable and deemed omitted to the extent so contrary, prohibited or invalid, but the remainder hereof shall not be invalidated thereby and shall be given full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any party. Upon such a determination, the parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated to the fullest extent possible.

7.15 Limit on Damages. Each party hereto acknowledges and agrees that no party shall be liable to the other party for any punitive damages (except to the extent paid to a third party in respect of a Third Party Claim) or damages that were not reasonably foreseeable.

7.16 Specific Performance. The parties hereto agree that irreparable damage would occur if any provision of this Agreement were not performed in accordance with the terms hereof and that the parties shall be entitled to an injunction or injunctions to prevent breaches of this Agreement or to enforce specifically the performance of the terms and provisions hereof in the

courts and other bodies specified in Section 7.5, in addition to any other remedy to which they are entitled at law or in equity.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have executed this Purchase and Sale Agreement as of the day and year first above written.

PATTERN ENERGY GROUP INC. | |

| | |

| | | |

| By: | /s/ Dyann Blaine | |

| Its: | Vice President | |

[Signature Page to Panhandle 2 Purchase and Sale Agreement]

| |

| | |

| | | |

| By: | /s/ Dyann Blaine | |

| Its: | Vice President | |

Solely for purposes of Section 7.1:

| |

| | |

| | | |

| By: | /s/ Dyann Blaine | |

| Its: | Vice President | |

[Signature Page to Panhandle 2 Purchase and Sale Agreement]

APPENDIX A-1: GENERAL DEFINITIONS

“AAA” shall have the meaning set forth in Section 7.5(b).

“Accountant” shall have the meaning set forth in Section 4.2(d)(ii).

“Acquired Interests” shall have the meaning set forth in the recitals, as more fully described in Part I of Appendix C.

“Affiliate” means, with respect to any Person, any other Person that directly, or indirectly through one or more intermediaries, controls, is controlled by or is under common control with the Person specified, or who holds or beneficially owns 50% or more of the equity interest in the Person specified or 50% or more of any class of voting securities of the Person specified; provided that notwithstanding the foregoing (i) Purchaser and its Subsidiaries shall not be deemed to be Affiliates of Seller and (ii) Seller and its Affiliates (other than Purchaser and its Subsidiaries) shall not be deemed to be Affiliates of Purchaser.

“Agreement” shall have the meaning set forth in the preamble to this Agreement.

“Arbitrators” shall have the meaning set forth in Section 7.5(b).

“Authorization” means any authorization, consent, approval, waiver, exception, variance, order, franchise, permit, license or exemption issued by any Governmental Authority, including filing, report, registration, notice, application, or other submission to or with any Governmental Authority.

“Basket Amount” shall have the meaning set forth in Part VI of Appendix B.

“Books and Records” means books, Tax Returns, contracts, commitments, and records of a Person.

“Business Day” means any day other than a Saturday, a Sunday or any other day on which banks are authorized to be closed in New York, New York.

“Claim” means a claim by an Indemnified Party for indemnification pursuant to Section 6.1.

“Closing” shall have the meaning set forth in Section 1.4.

“Closing Date” shall mean the date a Closing occurs.

“Code” shall mean the United States Internal Revenue Code of 1986, as amended.

“Completion Adjustment” shall have the meaning set forth in Part I of Appendix B.

“Completion Adjustment Date” shall have the meaning set forth in Part I of Appendix B.

“Consents” shall have the meaning set forth in Section 2.5.

“Deficit Amount” shall have the meaning set forth in Part I of Appendix B.

“Delayed Turbine Adjustment” shall have the meaning set forth in Part I of Appendix B.

“Demand” shall have the meaning set forth in Section 7.5(b).

“Dispute” shall have the meaning set forth in Section 7.5(b).

“Dollars” or “$” means the lawful currency of the United States of America or Canada, as identified in Part I of Appendix B.

“ECCA” shall have the meaning set forth in Part IV of Appendix D.

“GAAP” means generally accepted accounting principles in the United States, consistently applied throughout the specified period and in the immediately prior comparable period.

“Governmental Authority” means any federal or national, state, provincial, county, municipal or local government or regulatory or supervisory department, body, political subdivision, commission, agency, instrumentality, ministry, court, judicial or administrative body, taxing authority, or other authority thereof (including any corporation or other entity owned or controlled by any of the foregoing) having jurisdiction over the matter or Person in question.

“Governmental Rule” means, with respect to any Person, any applicable law, statute, treaty, rule, regulation, ordinance, order, code, judgment, decree, injunction or writ issued by any Governmental Authority.

“Guarantor” shall have the meaning set forth in the preamble to this Agreement.

“Indemnified Party” means either a Purchaser Indemnified Party or a Seller Indemnified Party, as the case may be.

“Indemnifying Party” shall have the meaning set forth in Section 6.2(c).

“Knowledge” means (a) with respect to Seller, the actual knowledge of the persons identified in Part VII of Appendix B, and (b) with respect to Purchaser, the actual knowledge of the persons identified in Part VII of Appendix B.

“Lien” on any asset means any mortgage, deed of trust, lien, pledge, charge, security interest, restrictive covenant, easement or encumbrance of any kind in respect of such asset, whether or not filed, recorded or otherwise perfected or effective under applicable law, as well as the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement relating to such asset.

“Loss” means any and all losses (including loss of profit and loss of expected profit), claims, actions, liabilities, damages, expenses, diminution in value or deficiencies of any kind or character including all interest and other amounts payable to third parties, all liabilities on account of Taxes and all reasonable legal fees and expenses and other expenses reasonably incurred in connection with investigating or defending any claims or actions, whether or not resulting in any liability.

“Material Contracts” means each contract, agreement or instrument to which Panhandle Holdco or its Subsidiaries is a party or by which Panhandle Holdco or its Subsidiaries (including, from and after the Closing, the Purchaser and its Affiliates), or any of their respective assets, is bound (or in the case of the Purchaser and its Affiliates, after the Closing will be bound) that is material in the context of the Project Company, the Wind Project or the Acquired Interests, including without limitation any (i) partnership, joint venture, or other similar agreement or arrangement; (ii) contract containing covenants materially limiting the freedom of Panhandle Holdco or its Subsidiaries (or, from and after the Closing, the Purchaser and its Affiliates) from competing in any line of business or in any geographic area; (iii) Tax Equity Document (as defined in the ECCA); (iv) Principal Project Document (as defined in the ECCA); and (v) material contract that was not entered into in the ordinary course of business consistent with past practices; except in each case of clauses (i) through (v) for change orders to the Turbine Supply Agreement, the Transformer Purchase Agreements and BOP Contract (as such terms are defined in the ECCA) that do not amend or modify any warranty or rights or obligations of the Project Company under the Turbine Supply Agreement, the Transformer Purchase Agreements or BOP Contract that could reasonably be expected to be material to the operation or maintenance of the Wind Project.

“Material Impact” means any impact, effect or result that is material and adverse to the Wind Project and Panhandle Holdco and its Subsidiaries, taken as a whole, or the ownership of the Acquired Interests.

“Method of Calculation” shall have the meaning set forth in Part I of Appendix B.

“MOMA” shall have the meaning set forth in Part VII of Appendix B.

“Organization Documents” means, with respect to (a) any corporation, its articles or certificate of incorporation and by-laws, (b) any limited partnership, its certificate of limited partnership and its partnership agreement, (c) any limited liability company, its articles or certificate of organization or formation and its operating agreement or limited liability company agreement, or (d) documents of similar substance.

“Outside Closing Date” shall have the meaning set forth in Part III of Appendix B.

“Panhandle Holdco” shall have the meaning set forth in Part I of Appendix C.