|

Exhibit 99.1

|

Pattern

PATTERN ENERGY GROUP INC.

Investor Day

JUNE 24, 2015

SAFE HARBOR STATEMENT

The following information contains, or may be deemed to contain, “forward-looking statements” defined(as in the UPrivate. Securities Litigation Reform Act of 1995 and Canadian securities laws) The. words “may,” “plan,” “forecast,” “seek,” “target,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statementsYou. should not place undue reliance on these forward-looking statements about Pattern Energy Group Inc (the. “Company”) By. their nature, forward-looking statements are not statements of historical facts and involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future, many of which are outside the Company’s controlSuch. risks and uncertainties could cause the actual results, performance or achievements of the Company to be materially different from its current expectations and include, but are not limited to: the Company’s ability to complete construction of its construction projects and transition them into financially successful operating projects; the Company’s ability to complete acquisition of power projects; fluctuations in supply, demand, prices and other conditions for electricity; the Company’s electricity generation, projections thereof and factors affecting production including wind and other conditions, other weather conditions, availability and curtailment; changes in law; and the Company’s ability to keep pace with and take advantage of new technologies.

In particular, this presentation contains the Company’s Adjusted EBITDA and cash available for distribution, which are not generally accepted accounting principles in the United States (“U . GAAP”) Adjusted. EBITDA and cash available for distribution have been disclosed because the Company believes that these measures may assist investors in evaluating its financial performance and its ability to pay dividendsNeither. Adjusted EBITDA nor cash available for distribution should be considered the sole measure of the Company’s performance and should not be considered in isolation from, or as a substitute for, the Company’s U GAAP. measures, including, but not limited to, the most directly comparable UGAAP. measures, net income and(loss) net cash provided by (used in) operating activities, respectivelySee. pages 85-87 for a reconciliation of net cash provided by operating activities to cash available for distribution and net income to adjusted EBITDAThe. forecasts included in this presentation should not be relied upon as fact or as an accurate representation of future results Assumptions. and estimates underlying the forecast are inherently uncertain and the Company’s future operating results are subject to a wide variety of risks and uncertainties, including significant business, economic, and competitive risks and uncertaintiesThere. can be no assurance that such assumptions will be realized or that the Company will generate cash available for distribution during the forecast periods at the levels forecasted, in which event the Company may not be able to pay cash dividends at the Company’s initial dividend level or at allForward. looking measures of CAFD, run-rate CAFD and CAFD per share growth are non-GAAP measures that cannot be reconciled to net cash provided by operating activities as the most directly comparable GAAP financial measure with unreasonable effort A. description of the adjustments to determine CAFD can be found on page 74 of Pattern Energy’s 2014 Annual Report on Form 10-K.

All forward-looking statements speak only as of the date made, and the Company expressly disclaims any intention or obligation to revise or publicly update any forward-looking statements, including Adjusted EBITDA and cash available for distribution, whether as a result of new information, future events, or otherwise except as may be required by applicable law For. additional information regarding known material risks that could cause the Company’s actual results to differ from its projected results please read “Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 201431, and our quarterly report on Form 10-Q for the fiscal quarter ended March 201531, .

PATTERN ENERGY GROUP INC. 2

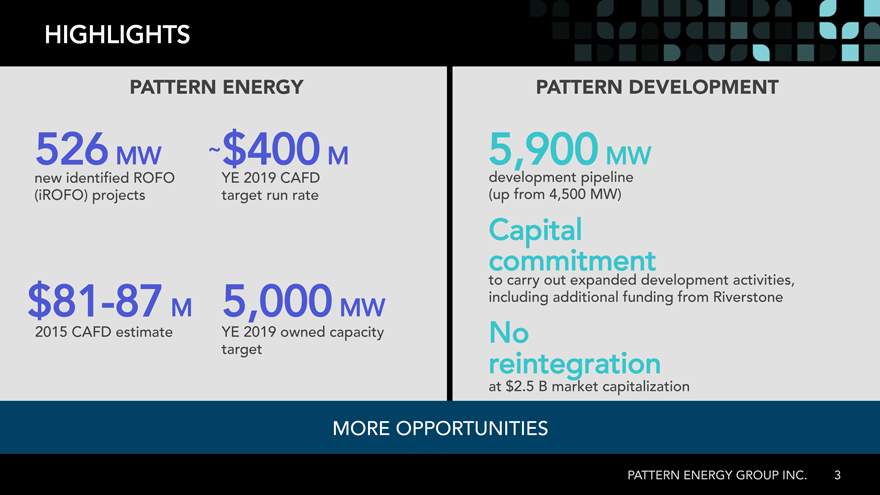

HIGHLIGHTS

PATTERN ENERGY_ PATTERN DEVELOPMENT_

526 MW ~ M 5,900 MW

new identified ROFO YE 2019 CAFD development pipeline projects(iROFO) target run rate from(up 4,500 MW)

Capital

commitment to carry out expanded development activities, -87 M 5,000 MW including additional funding from Riverstone 2015 CAFD estimate YE 2019 owned capacity No

target reintegration

at 5.2$ B market capitalization

MORE OPPORTUNITIES

PATTERN ENERGY GROUP INC. 3

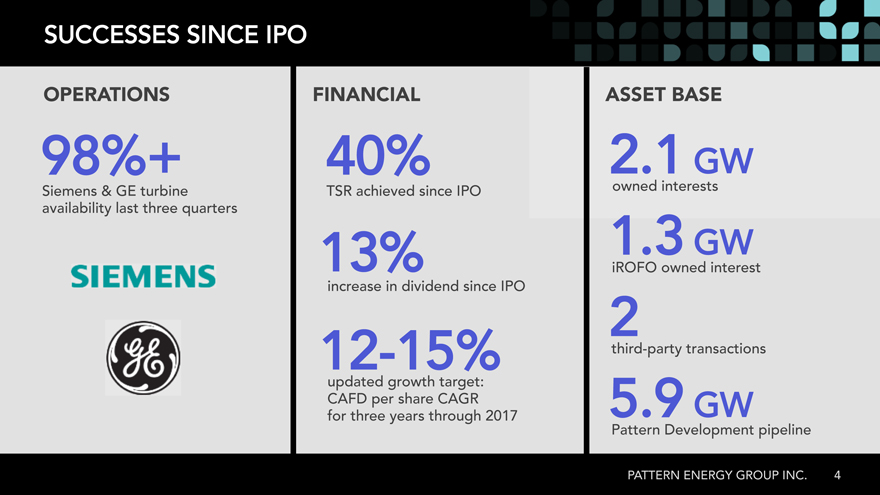

SUCCESSES SINCE IPO

OPERATIONS_ FINANCIAL_ ASSET BASE_

98%+ 40% 1.2 GW

Siemens GE& turbine TSR achieved since IPO owned interests availability last three quarters 3.1

13% GW

iROFO owned interest increase in dividend since IPO 2

12-15% third-party transactions updated growth target: CAFD per share CAGR 9.5 GW for three years through 2017 Pattern Development pipeline

PATTERN ENERGY GROUP INC. 4

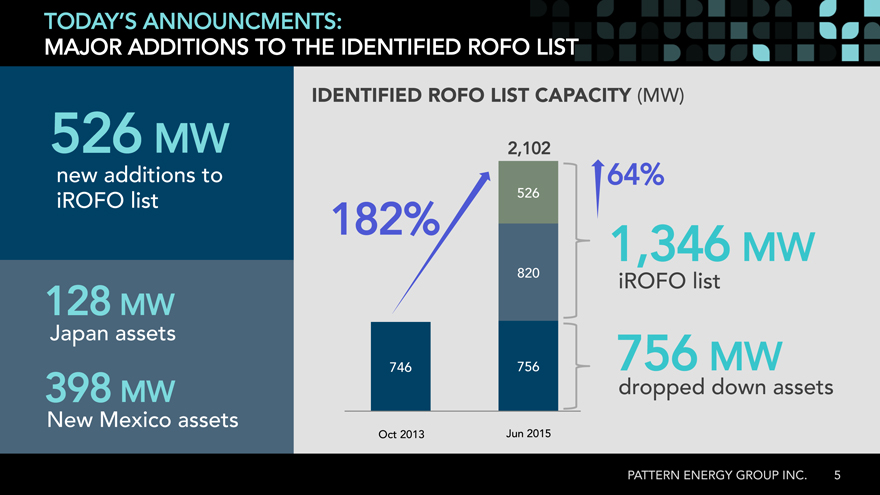

TODAY’S ANNOUNCMENTS:

MAJOR ADDITIONS TO THE IDENTIFIED ROFO LIST

IDENTIFIED ROFO LIST CAPACITY (MW)

526 MW 2,102

new additions to 64% iROFO list 182% 526

1,346 MW

820 iROFO list

128 MW

Japan assets

746 756 756 MW

398 MW dropped down assets New Mexico assets

Oct 2013 Jun 2015

Identified ROFO list capacity

(MW) PATTERN ENERGY GROUP INC. 5

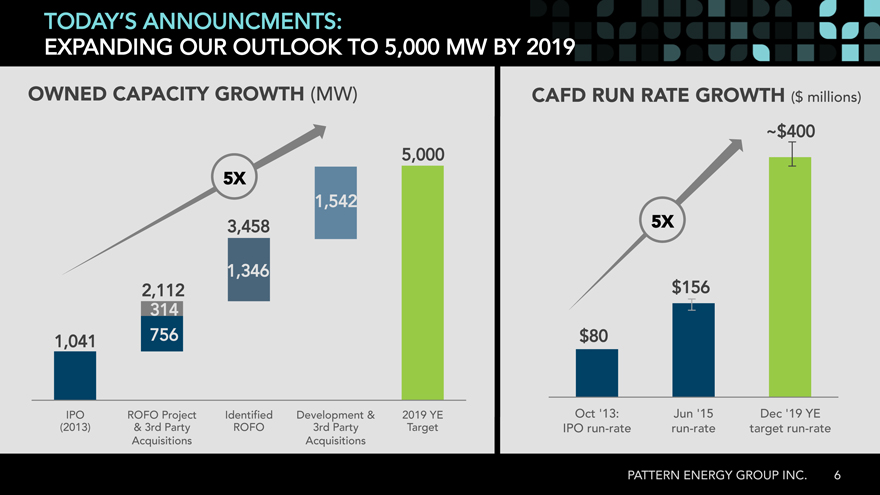

TODAY’S ANNOUNCMENTS:

EXPANDING OUR OUTLOOK TO 5,000 MW BY 2019

OWNED CAPACITY GROWTH (MW) CAFD RUN RATE GROWTH ($ millions)

~ 5,000

5X_

1,542

3,458 5X 1,346 2,112 156$ 314 1,041 756

IPO ROFO Project Identified Development 2019& YE Oct Jun’13: Dec’15 YE’19 (2013) 3rd& Party ROFO 3rd Party Target IPO run-rate run-rate target run-rate Acquisitions Acquisitions

PATTERN ENERGY GROUP INC 6.

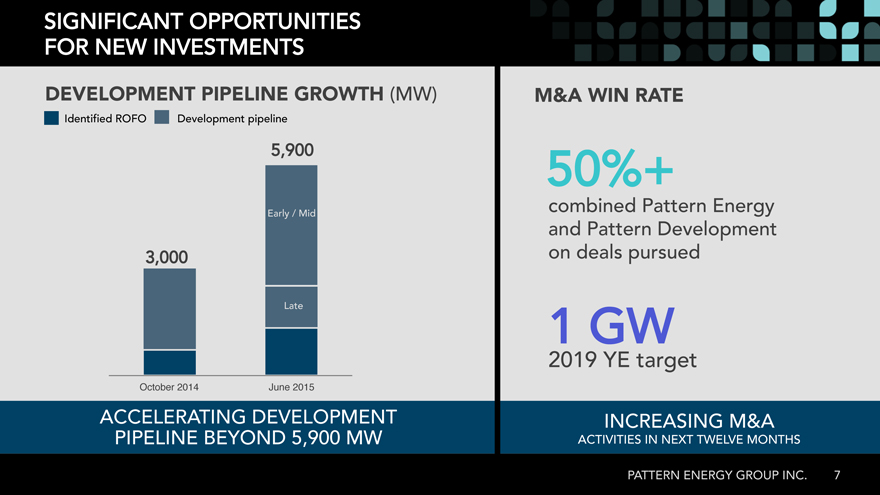

SIGNIFICANT OPPORTUNITIES FOR NEW INVESTMENTS

DEVELOPMENT PIPELINE GROWTH (MW) M&A WIN RATE

Identified ROFO Development pipeline

5,900 50%+

Early / Mid combined Pattern Energy and Pattern Development 3,000 on deals pursued

Late 1 GW

2019 YE target

October 2014 June_ 2015_

ACCELERATING DEVELOPMENT INCREASING M&A

PIPELINE BEYOND 5,900 MW ACTIVITIES IN NEXT TWELVE MONTHS PATTERN ENERGY GROUP INC. 7

TODAY’S ANNOUNCEMENT:

NO REINTEGRATION

CONTINUE TO EXPAND THE SUCCESS OF THE EXISTING STRUCTURE

PATTERN ENERGY GROUP INC. 8

clean renewable

energy infrastructure

transforming the

production delivery&

of power

PATTERN ENERGY GROUP INC. 9

Hunter Armistead

PATTERN DEVELOPMENT OVERVIEW

Pattern

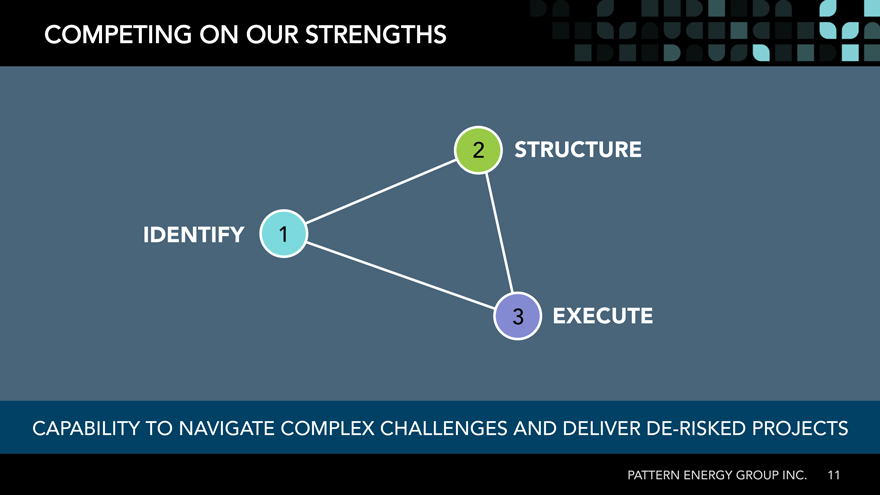

COMPETING ON OUR STRENGTHS

CAPABILITY TO NAVIGATE COMPLEX CHALLENGES AND DELIVER DE-RISKED PROJECTS

PATTERN ENERGY GROUP INC. 11

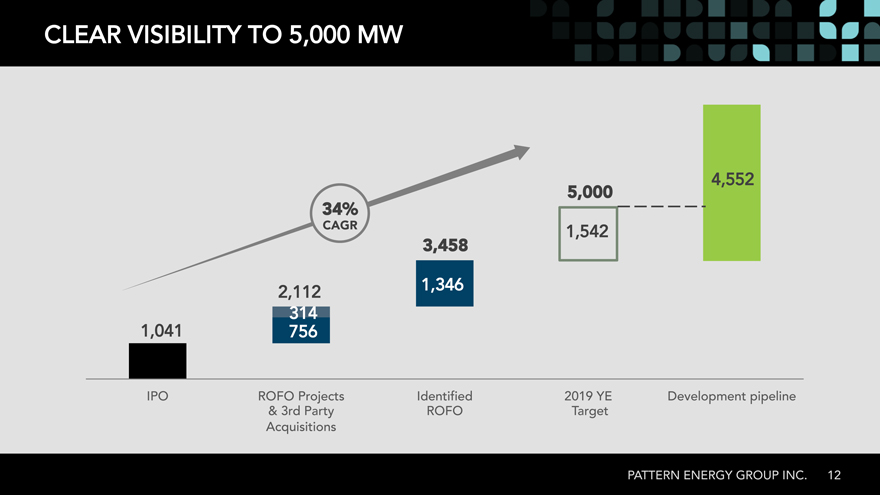

CLEAR VISIBILITY TO 5,000 MW

4,552

34%_ 5,000_

CAGR_ 1,542

3,458_

2,112 1,346 1,041 314 756

IPO ROFO Projects Identified 2019 YE Development pipeline

& 3rd Party ROFO Target Acquisitions

PATTERN ENERGY GROUP INC. 12

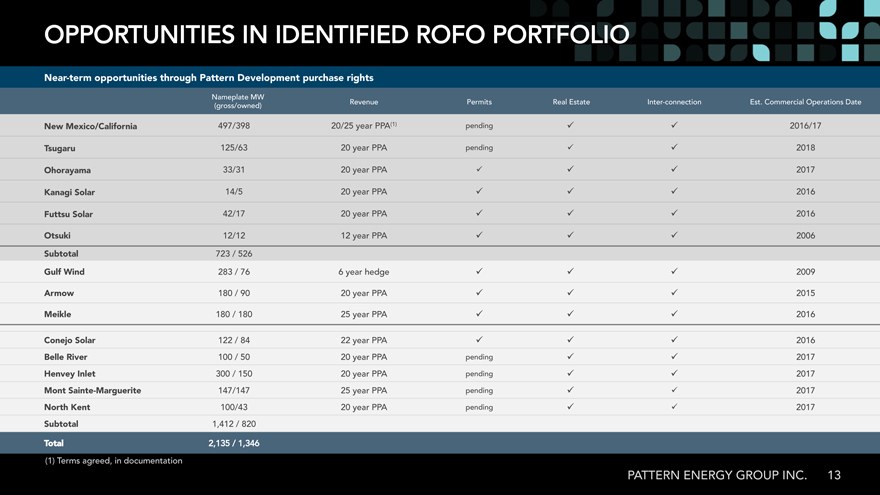

OPPORTUNITIES IN IDENTIFIED ROFO PORTFOLIO

Near-term opportunities through Pattern Development purchase rights_

Nameplate MW

Revenue Permits Real Estate Inter-connection EstCommercial. Operations Date (gross/owned)

New Mexico/California_ 20/25497/398 year PPA(1) pending 2016/17 Tsugaru _ 20125/63 year PPA pending 2018 Ohorayama_ 2033/31 year PPA 2017 Kanagi Solar_ 2014/5 year PPA 2016 Futtsu Solar _2042/17 year PPA 2016 Otsuki 1212/12 year PPA 2006 Subtotal 723_ / 526 Gulf Wind 283_ / 676 year hedge 2009 Armow 180_ / 2090 year PPA 2015 Meikle 180_ / 25180 year PPA 2016

Conejo Solar 122_ / 2284 year PPA 2016 Belle River 100_ / 2050 year PPA pending 2017 Henvey Inlet 300_ / 20150 year PPA pending 2017 Mont Sainte-Marguerite 25147/147 year PPA pending 2017 North Kent 20100/43 year PPA pending 2017 Subtotal 1,412_ / 820

Total 2,135_ / 1,346 Terms(1) agreed, in documentation

PATTERN ENERGY GROUP INC13.

EXPANDING OUR CORE MARKETS

U Canada. Chile

+

Japan Mexico

Green Power CEMEX Investments Energia

STRONG PARTNERS IN INTERNATIONAL MARKETS

PATTERN ENERGY GROUP INC 14.

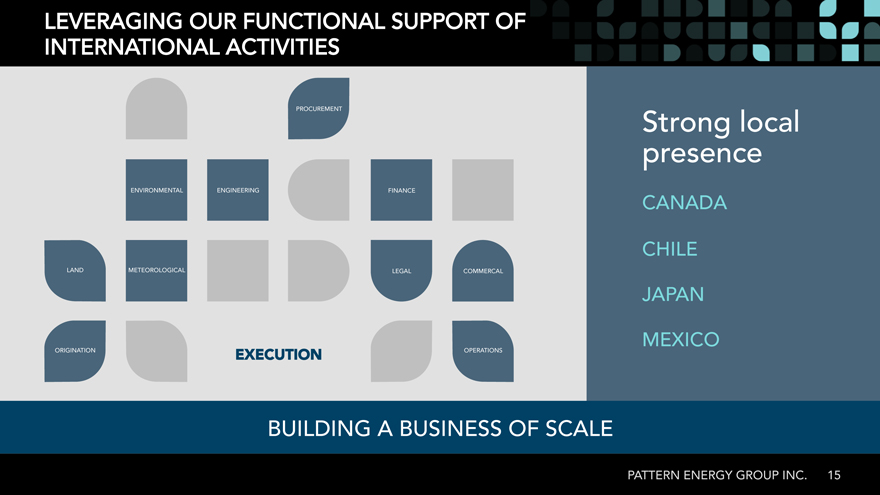

LEVERAGING OUR FUNCTIONAL SUPPORT OF INTERNATIONAL ACTIVITIES

PROCUREMENT Strong local presence

ENVIRONMENTAL ENGINEERING FINANCE

CANADA

CHILE

LAND METEOROLOGICAL LEGAL COMMERCAL

JAPAN

ORIGINATION OPERATIONS MEXICO

EXECUTION_

BUILDING A BUSINESS OF SCALE

PATTERN ENERGY GROUP INC 15.

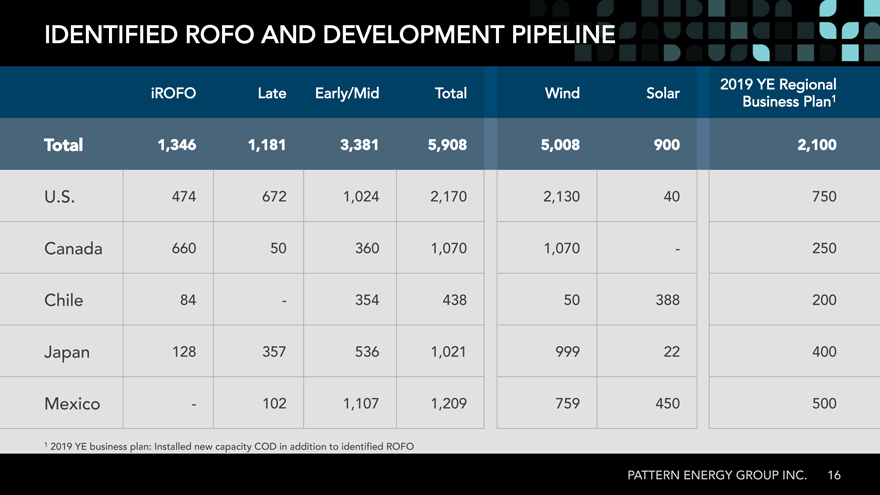

IDENTIFIED ROFO AND DEVELOPMENT PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

U.S. 474 672 1,024 2,170 2,130 40 750 Canada 660 50 360 1,070 1,070 — 250 Chile 84 — 354 438 50 388 200 Japan 128 357 536 1,021 999 22 400

Mexico — 102 1,107 1,209 759 450 500

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 16

Pattern Development’s

track record

generates more opportunities:

SUCCESS BREEDS SUCCESS

PATTERN ENERGY GROUP INC 17.

Pattern

Hunter Armistead

BUSINESS DEVELOPMENT

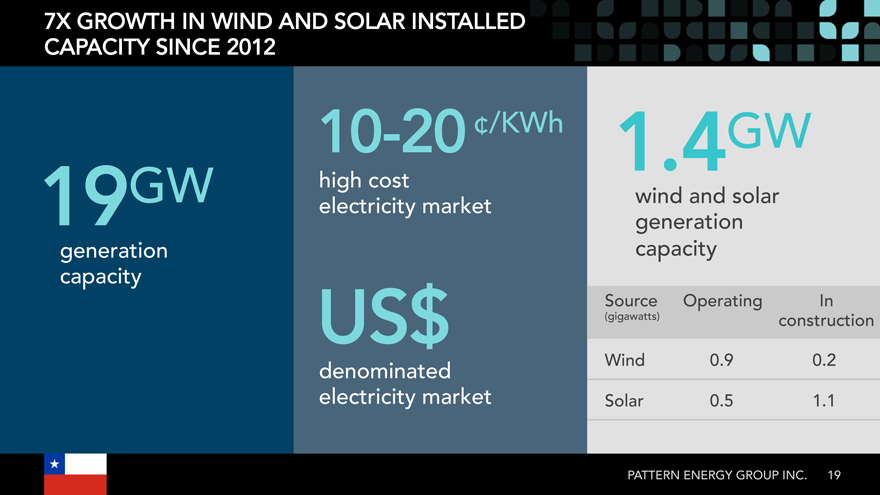

CHILE_

7X GROWTH IN WIND AND SOLAR INSTALLED

CAPACITY SINCE 2012

10-20 ¢/KWh 1.4GW

GW high cost

19 electricity market wind and solar generation generation capacity capacity

Source Operating In

US$ (gigawatts) construction

denominated Wind 0.9 0.2

electricity market Solar 0.5 1.1

PATTERN ENERGY GROUP INC. 19

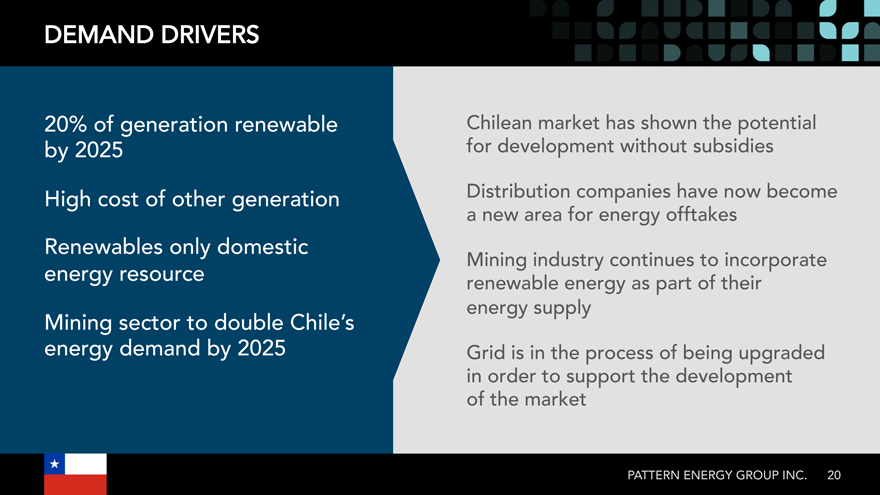

DEMAND DRIVERS

20% of generation renewable Chilean market has shown the potential by 2025 for development without subsidies High cost of other generation Distribution companies have now become a new area for energy offtakes

Renewables only domestic

Mining industry continues to incorporate energy resource renewable energy as part of their energy supply

Mining sector to double Chile’s

energy demand by 2025 Grid is in the process of being upgraded in order to support the development of the market

PATTERN ENERGY GROUP INC 20.

PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

Chile 84 — 354 438 50 388 200

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 21

COMPETITIVE ADVANTAGE

Early entrant into market

Respected pioneer in Chilean renewables market, STRUCTURE first PPA with non-traditional buyer

IDENTIFY

Diversified wind and solar portfolio 3

EXECUTE_

Experienced and well-established local team

PATTERN ENERGY GROUP INC 22.

Pattern

Hunter Armistead

BUSINESS DEVELOPMENT

CANADA_

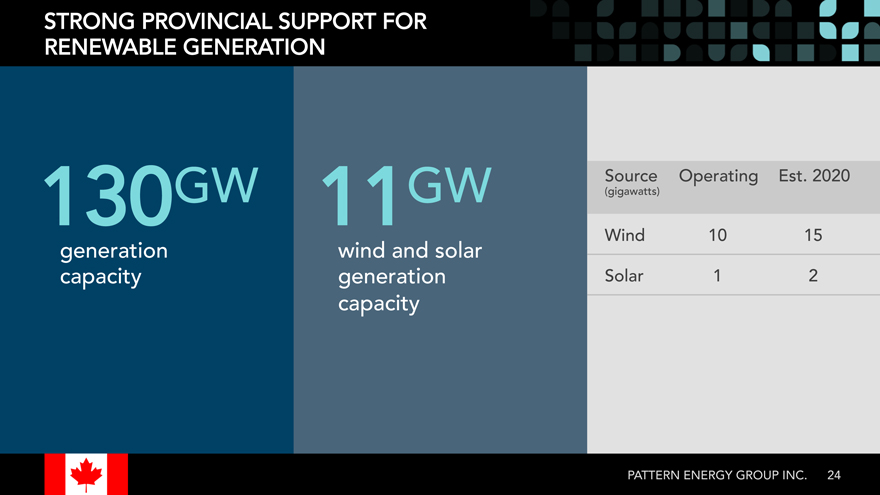

STRONG PROVINCIAL SUPPORT FOR RENEWABLE GENERATION

Source Operating Est2020.

11130 GW GW (gigawatts)

Wind 1510

generation wind and solar capacity generation Solar 21 capacity

PATTERN ENERGY GROUP INC 24.

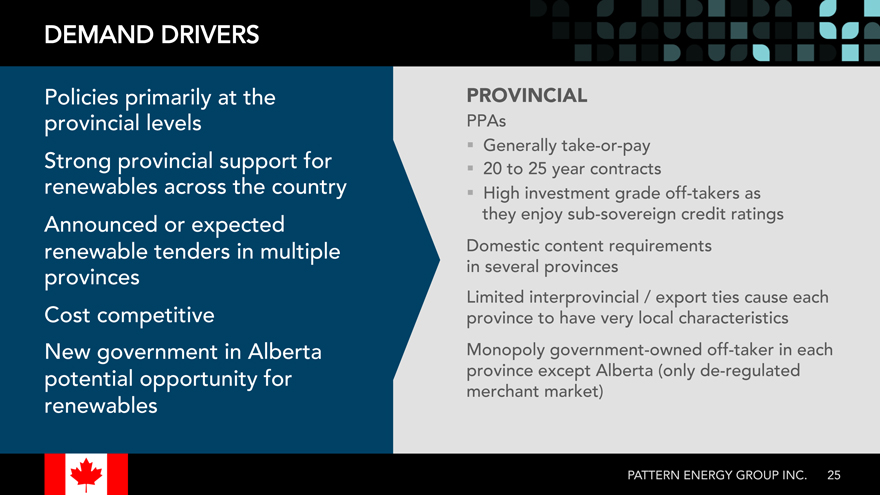

DEMAND DRIVERS

Policies primarily at the PROVINCIAL_ provincial levels PPAs

_? Generally take-or-pay

Strong provincial support for _? 20 to 25 year contracts

renewables across the country _? High investment grade off-takers as Announced or expected they enjoy sub-sovereign credit ratings

renewable tenders in multiple Domestic content requirements

provinces in several provinces

Limited interprovincial / export ties cause each Cost competitive province to have very local characteristics New government in Alberta Monopoly government-owned off-taker in each potential opportunity for province except Alberta de(only -regulated merchant market)

renewables

PATTERN ENERGY GROUP INC. 25

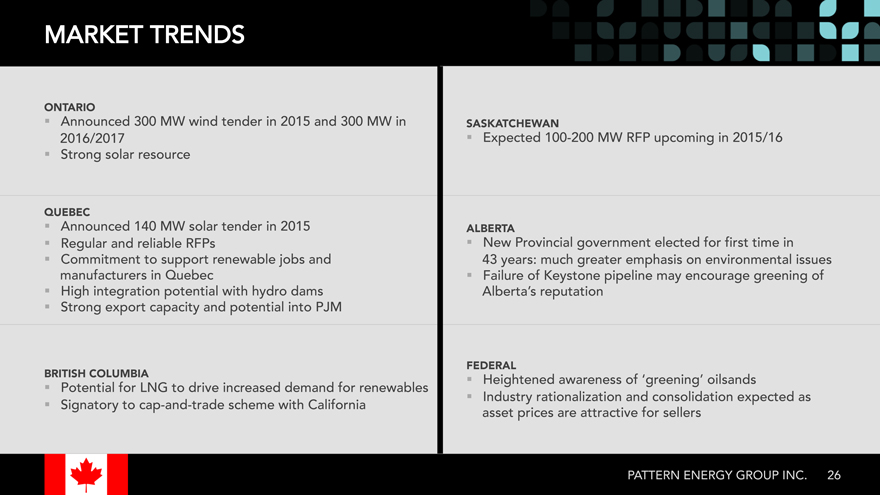

MARKET TRENDS

ONTARIO_

_? Announced 300 MW wind tender in 2015 and 300 MW in SASKATCHEWAN_

2016/2017 _? Expected 100-200 MW RFP upcoming in 2015/16 _? Strong solar resource

QUEBEC_

_? Announced 140 MW solar tender in 2015 ALBERTA_

_? Regular and reliable RFPs _? New Provincial government elected for first time in _? Commitment to support renewable jobs and 43 years: much greater emphasis on environmental issues manufacturers in Quebec _? Failure of Keystone pipeline may encourage greening of _? High integration potential with hydro dams Alberta’s reputation _? Strong export capacity and potential into PJM

FEDERAL_

BRITISH COLUMBIA_ ‘greening’ oilsands _? Heightened awareness of _? Potential for LNG to drive increased demand for renewables

_? Industry rationalization and consolidation expected as _? Signatory to cap-and-trade scheme with California asset prices are attractive for sellers

PATTERN ENERGY GROUP INC 26.

PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

Canada 660 50 360 1,070 1,070 — 250

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 27

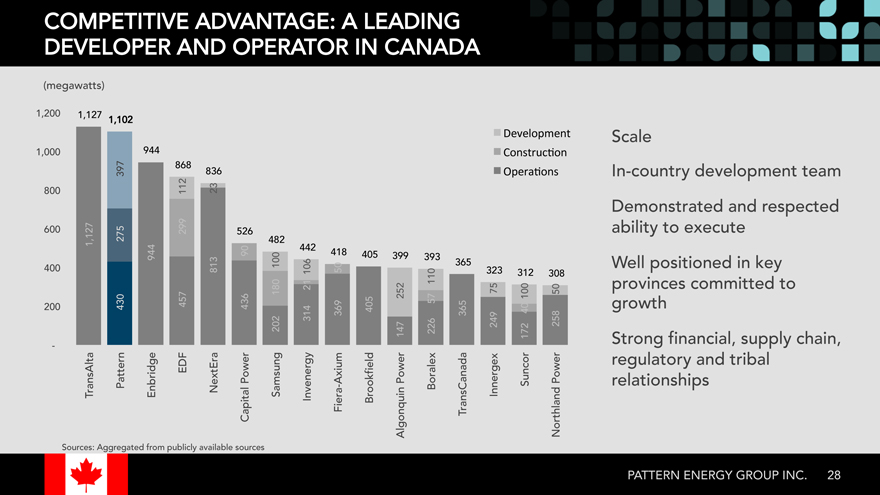

COMPETITIVE ADVANTAGE: A LEADING DEVELOPER AND OPERATOR IN CANADA

(megawatts)

1,200 1,127 1,102

Scale

1,000 944 __

__

868

397 836

In-country development team

23 800 112

Demonstrated and respected ability to execute

600 299 526 275 482 1,127

90 442 418

944 405 399 393

365 Well positioned in key

400 813100 106 50 323

312 308 110

21 provinces committed to

180 75 50 252 100 57

200 457 436 growth 430 405 40 369 365 314 249 258 202 226 147 172

— Strong financial, supply chain,

EDF Power Power Power regulatory and tribal TransAlta Pattern Enbridge NextEra Samsung Invenergy Fiera-Axium Brookfield Boralex TransCanada Innergex Suncor relationships Capital Algonquin Northland

Sources: Aggregated from publicly available sources

PATTERN ENERGY GROUP INC28.

Pattern

Hunter Armistead

BUSINESS DEVELOPMENT

UNITED STATES_

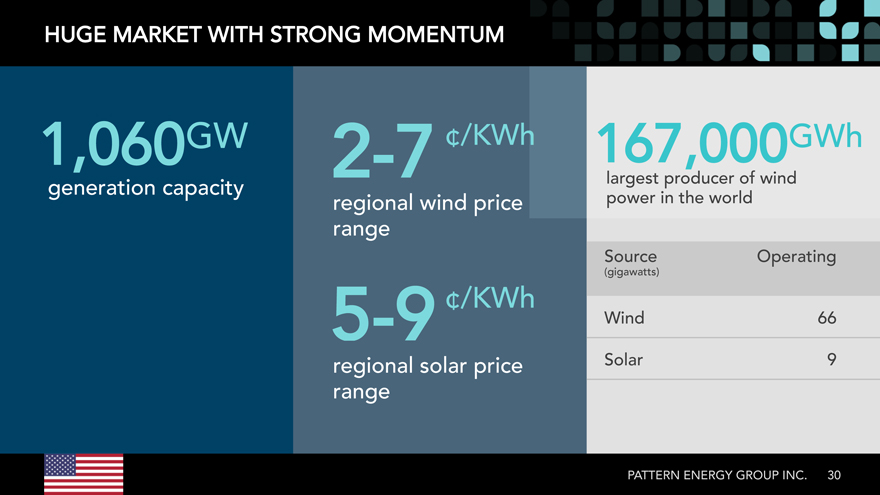

HUGE MARKET WITH STRONG MOMENTUM

1,060GW 2-7 ¢/KWh 167,000GWh

generation capacity largest producer of wind

regional wind price power in the world range

Source Operating

(gigawatts)

¢/KWh

5-9 Wind 66

regional solar price Solar 9 range

PATTERN ENERGY GROUP INC 30.

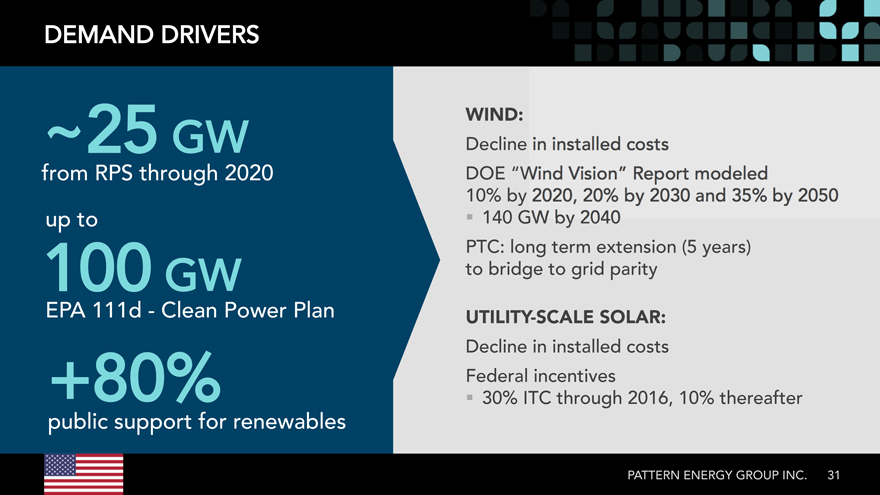

DEMAND DRIVERS

WIND:

~25 GW Decline

from RPS through 2020 DOE

10% by

up to _? 140 GW

PTC: long term extension (5 years) 100 GW to bridge to grid parity

EPA 111d—Clean Power Plan UTILITY-SCALE SOLAR:_

Decline in installed costs +80% Federal incentives

_? 30% ITC through 2016, 10% thereafter

public support for renewables

PATTERN ENERGY GROUP INC. 31

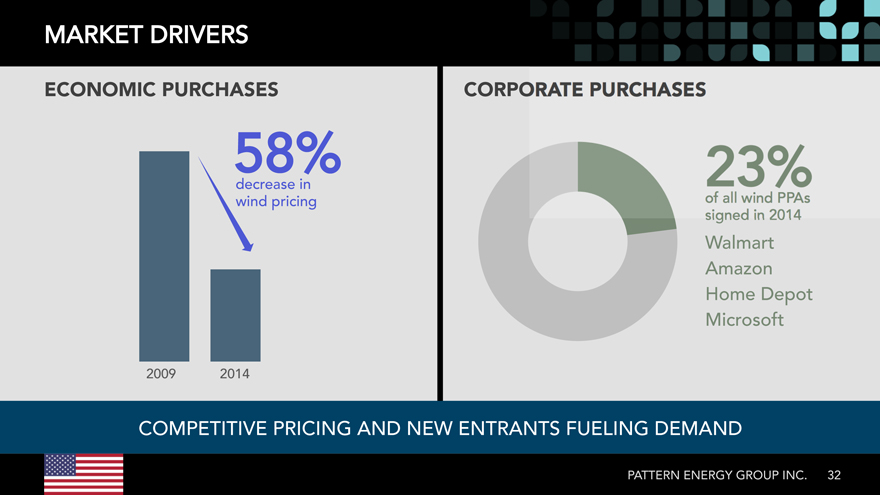

MARKET DRIVERS

ECONOMIC PURCHASES_ CORPORA

58%

decrease in wind pricing

Walmart Amazon Home Depot Microsoft

2009 2014

COMPETITIVE PRICING AND NEW ENTRANTS FUELING DEMAND

PATTERN ENERGY GROUP INC. 32

PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

U.S. 474 672 1,024 2,170 2,130 40 750

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 33

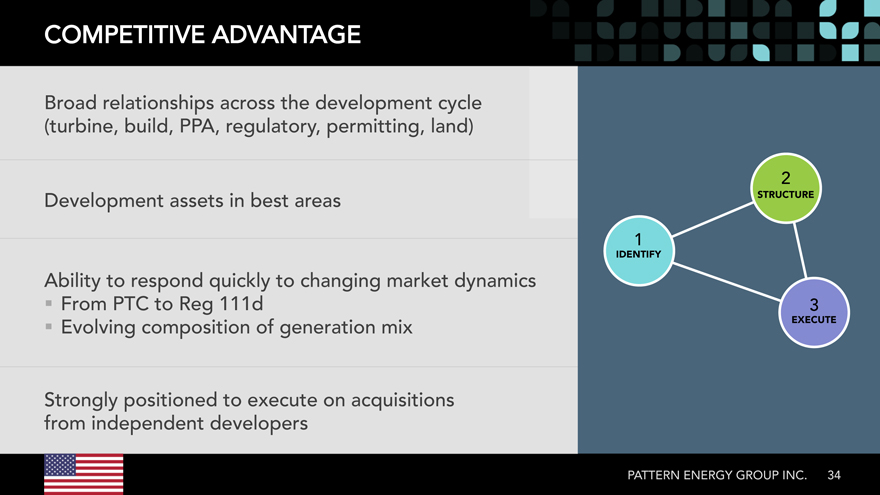

COMPETITIVE ADVANTAGE

Broad relationships across the development cycle (turbine, build, PPA, regulatory, permitting, land)

Development assets in best areas STRUCTURE

IDENTIFY

Ability to respond quickly to changing market dynamics

_? From PTC to Reg 111d 3

EXECUTE_

_? Evolving composition of generation mix

Strongly positioned to execute on acquisitions from independent developers

PATTERN ENERGY GROUP INC 34.

Pattern

Glen Hodges

BUSINESS DEVELOPMENT

MEXICO_

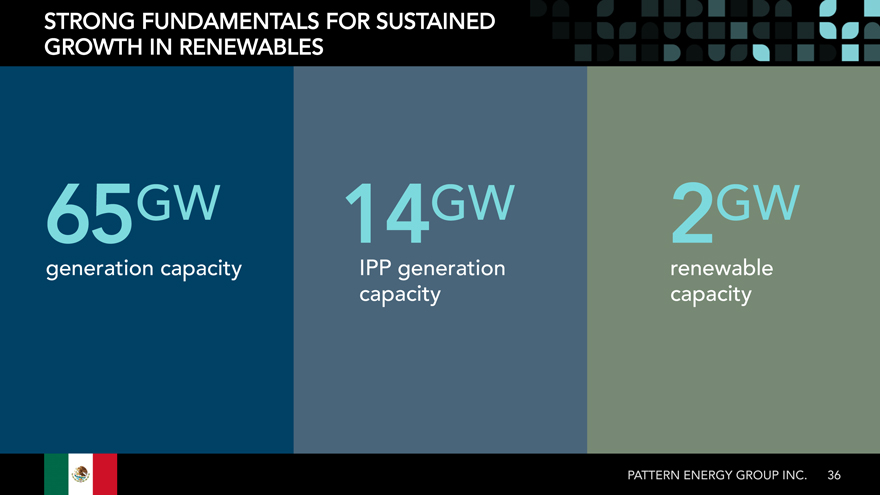

STRONG FUNDAMENTALS FOR SUSTAINED GROWTH IN RENEWABLES

GW 1465 GW 2GW

generation capacity IPP generation renewable capacity capacity

PATTERN ENERGY GROUP INC 36.

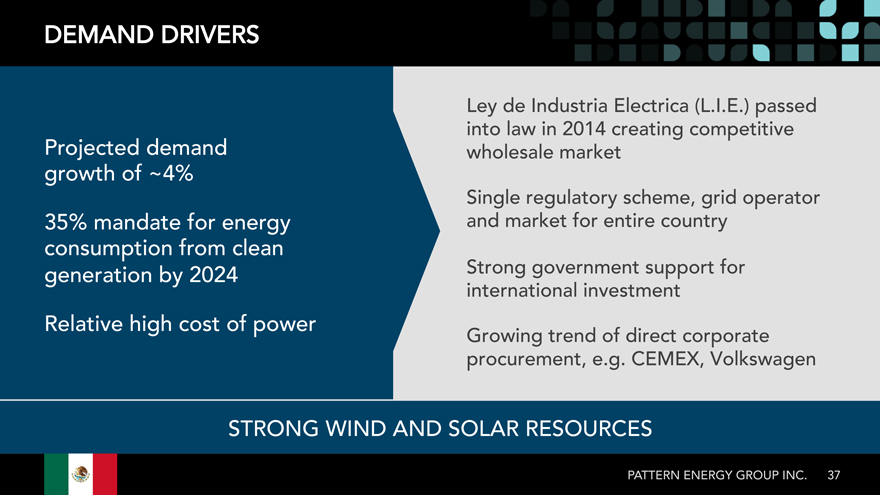

DEMAND DRIVERS

Ley de Industria Electrica (L . passed) into law in 2014 creating competitive

Projected demand wholesale market growth of ~4%

Single regulatory scheme, grid operator 35% mandate for energy and market for entire country

consumption from clean

generation by 2024 Strong government support for international investment

Relative high cost of power

Growing trend of direct corporate procurement, e . CEMEX, Volkswagen

STRONG WIND AND SOLAR RESOURCES

PATTERN ENERGY GROUP INC 37.

CEMEX: AN IDEAL PARTNER FOR MEXICO

Locations throughout Mexico CEMEX responsibilities:_ Pattern responsibilities:_

and 50 countries

_? Real estate _? Resource assessment

US B market cap:

NYSE MX& Bolsa _? Environmental _? Project design

One of the largest consumers _? Permitting _? Procurement of power in Mexico Financing

_? Interconnection _?

One of the largest procurers

of renewable energy in “BOOTS ON THE GROUND” OUR AREAS OF STRENGTH

Mexico

Pioneer and leading player in private generation and self-supply, as well as supply to other major consumers

PATTERN ENERGY GROUP INC 38.

PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

Mexico — 102 1,107 1,209 759 450 500

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 39

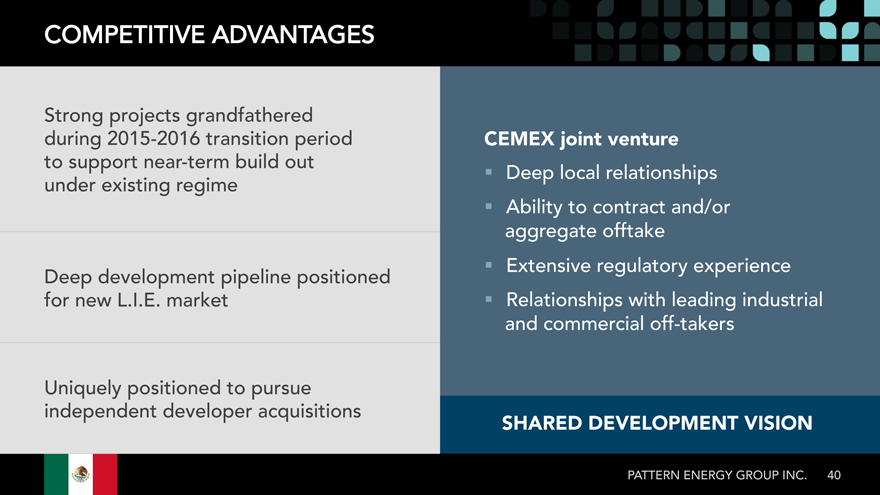

COMPETITIVE ADVANTAGES

Strong projects grandfathered during 2015-2016 transition period CEMEX joint venture_ to support near-term build out _? Deep local relationships under existing regime _? Ability to contract and/or aggregate offtake _? Extensive regulatory experience Deep development pipeline positioned for new Lmarket. _? Relationships with leading industrial and commercial off-takers

Uniquely positioned to pursue independent developer acquisitions

SHARED DEVELOPMENT VISION_

PATTERN ENERGY GROUP INC 40.

Pattern

Mark Anderson

BUSINESS DEVELOPMENT

JAPAN_

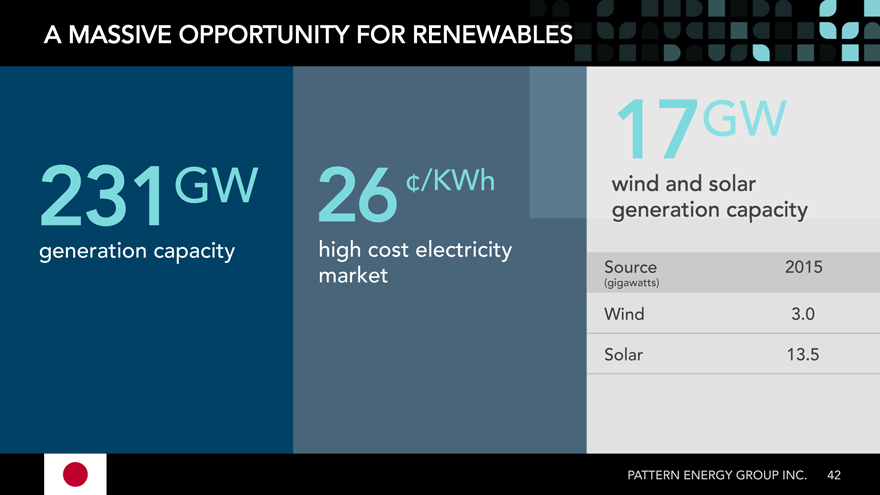

A MASSIVE OPPORTUNITY FOR RENEWAB

231GW 26 ¢/KWh

generation capacity high cost electricity

market Source 2015

(gigawatts)

Wind 0.3

Solar 5.13

PATTERN ENERGY GROUP INC 42.

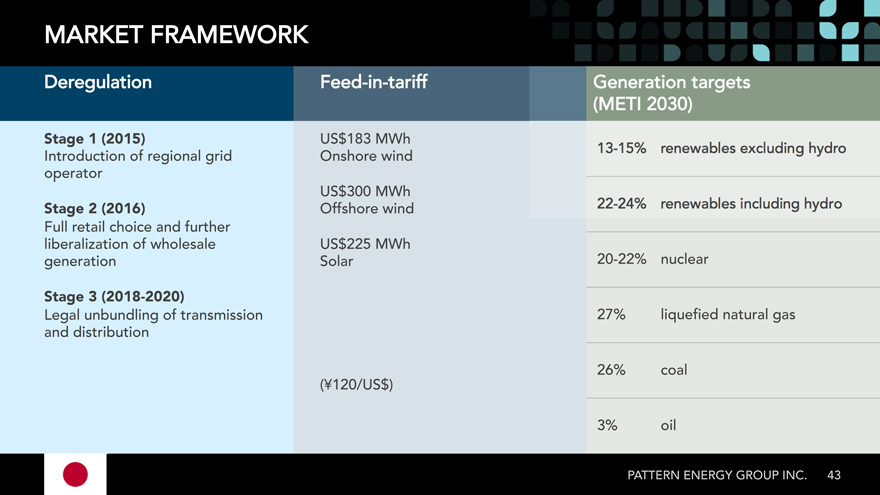

MARKET FRAMEWORK

Deregulation Feed-in-tariff

Stage 1 (2015)_ US$183 MWh Introduction of regional grid Onshore wind operator US$300 MWh

Stage 2 (2016)_ Offshore wind Full retail choice and further liberalization of wholesale US$225 MWh 20-22% nuclear generation Solar

Stage 3 (2018-2020)_

Legal unbundling of transmission 27% liquefied natural gas and distribution

26% coal

(¥120/US$)

3% oil

PATTERN ENERGY GROUP INC. 43

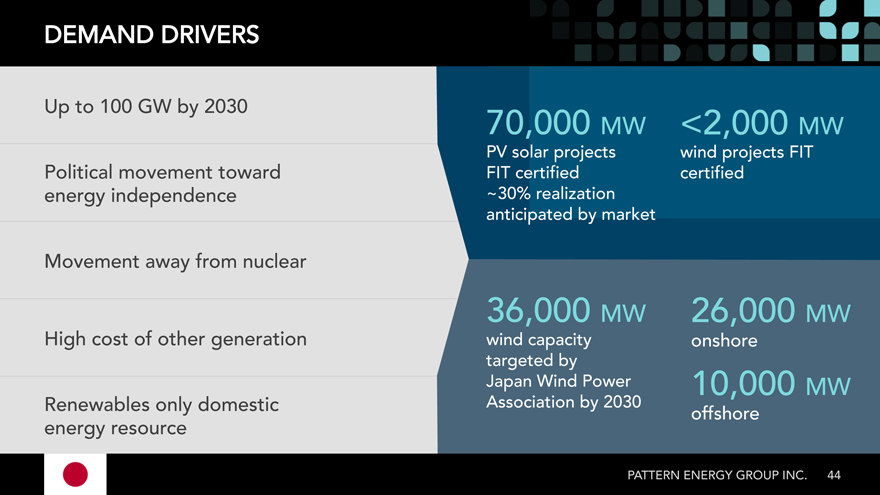

DEMAND DRIVERS

Up to 100 GW by 2030 70,000

MW <2,000 MW

PV solar projects wind projects FIT

Political movement toward FIT certified certified energy independence ~30% realization

anticipated by market

Movement away from nuclear

36,000 MW 26,000 MW

High cost of other generation wind capacity onshore

targeted by

Japan Wind Power 10,000 MW

Renewables only domestic Association by 2030 offshore energy resource

PATTERN ENERGY GROUP INC 44.

PIPELINE

2019 YE Regional iROFO Late Early/Mid Total Wind Solar 1 Business Plan

Total_ 1,346 1,181 _ 3,381 5,908 5,008 900 _ 2,100_

Japan 128 357 536 1,021 999 22 400

1 | | 2019 YE business plan: Installed new capacity COD in addition to identified ROFO |

PATTERN ENERGY GROUP INC. 45

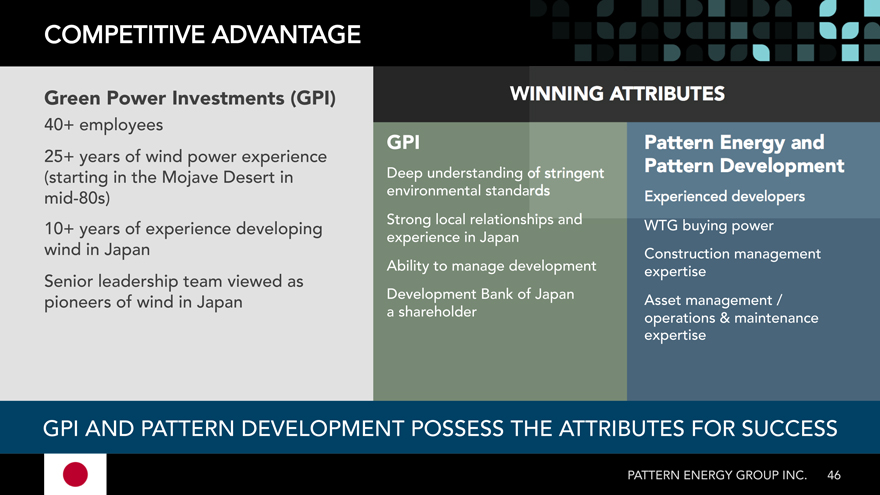

Green Power Investments (GPI)

40+ employees

25+ years of wind power experience

(starting in the Mojave Desert in

mid-80s)

10+ years of experience developing

wind in Japan

Senior leadership team viewed as

pioneers of wind in Japan

COMPETITIVE ADVANTAGE

WINNING ATTRIBUTES?

46

Pattern Energy and

Pattern Development?

Experienced developers

WTG buying power

Construction management

expertise

Asset management /

operations & maintenance

expertise

GPI?

Deep understanding of stringent

environmental standards

Strong local relationships and

experience in Japan

Ability to manage development

Development Bank of Japan

a shareholder

PATTERN ENERGY GROUP INC.

GPI AND PATTERN DEVELOPMENT POSSESS THE ATTRIBUTES FOR SUCCESS

Pattern

Esben Pedersen

INVESTMENT OVERVIEW & M&A OUTLOOK

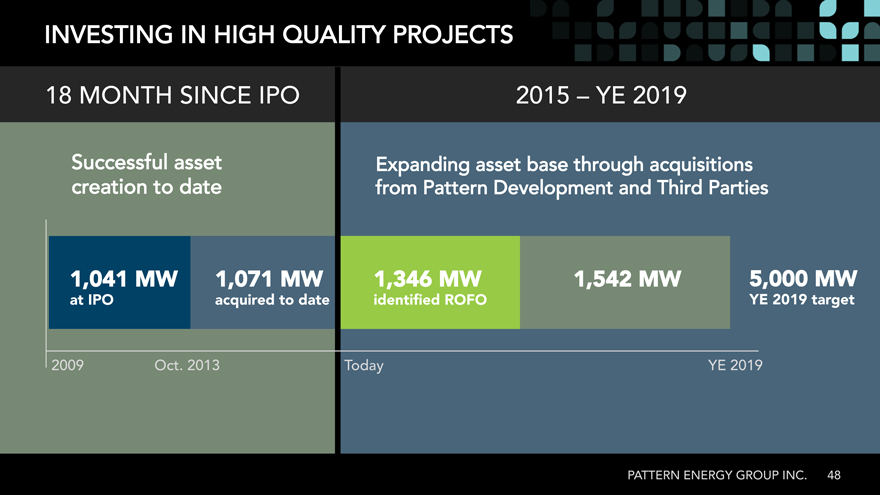

INVESTING IN HIGH QUALITY PROJECTS

18 MONTH SINCE IPO 2015 – YE 2019

Successful asset Expanding asset base through acquisitions creation to date from Pattern Development and Third Parties

1,041 MW 1,071 MW 1,346_ MW_ 1,542 MW_ 5,000 MW

at IPO acquired_ to date identi_ ?ed ROFO_ YE 2019 target_

2009 Oct 2013. Today YE 2019

PATTERN ENERGY GROUP INC 48.

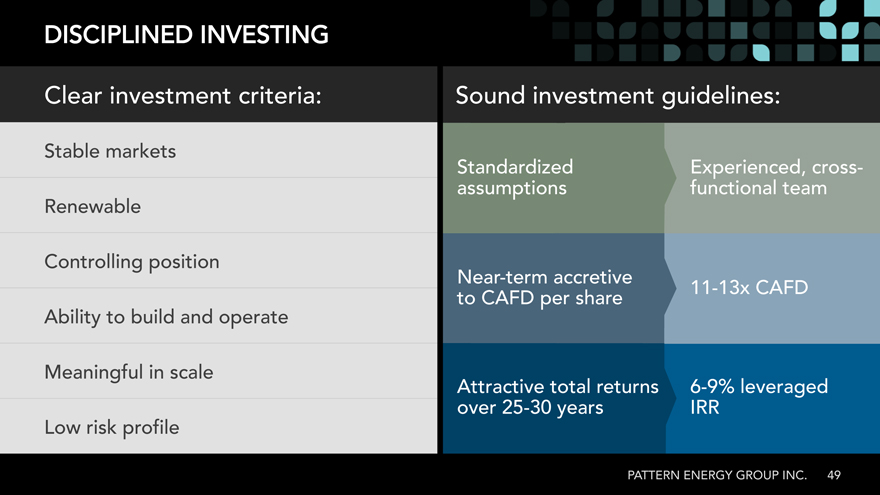

DISCIPLINED INVESTING

Clear investment criteria: Sound investment guidelines:

Stable markets

Standardized Experienced, cross-assumptions functional team Renewable

Controlling position

Near-term accretive

11-13x CAFD

Ability to build and operate to CAFD per share Meaningful in scale

Attractive total returns 6-9% leveraged Low risk profile over 25-30 years IRR

PATTERN ENERGY GROUP INC 49.

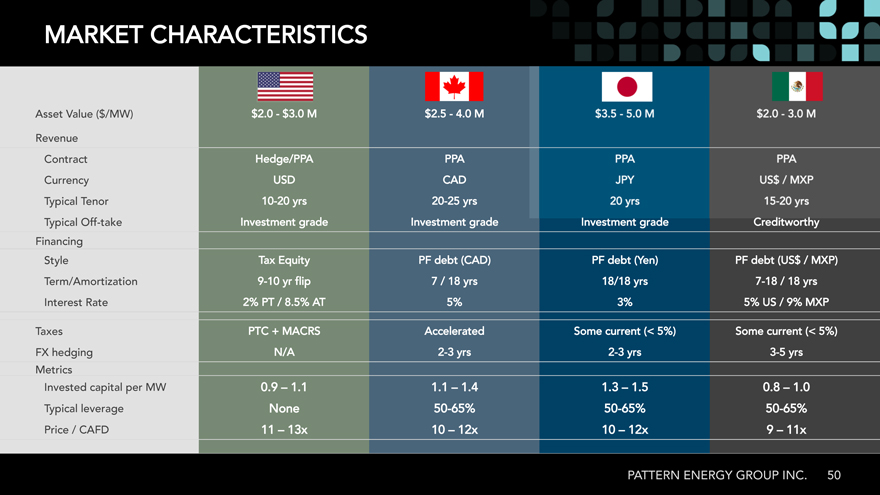

MARKET CHARACTERISTICS

Asset Value ($/MW) 0.2$—0.3$ M 5.2$—0.4 M Revenue Contract Hedge/PPA PPA

Currency USD CAD Typical Tenor 10-20 yrs 20-25 yrs

Typical Off-take Investment grade Investment grade Investment grade Creditworthy Financing Style Tax Equity PF debt (CAD) PF debt (Yen) PF debt (US$ / MXP) Term/Amortization 9-10 yr flip 7 / 18 yrs 18/18 yrs 7-18 / 18 yrs Interest Rate 2% PT / 8.5% AT 5% 3% 5% US / 9% MXP

Taxes PTC MACRS+ Accelerated Some current (< 5%) Some current (< 5%) FX hedging N/A 2-3 yrs 2-3 yrs 3-5 yrs Metrics Invested capital per MW 9.0 – 1.1 1.1 – 4.1 3.1 – 5.1 8.0 – 0.1

Typical leverage None 50-65% 50-65% 50-65% Price / CAFD 11 – 13x 10 – 12x 10 – 12x 9 – 11x

PATTERN ENERGY GROUP INC 50.

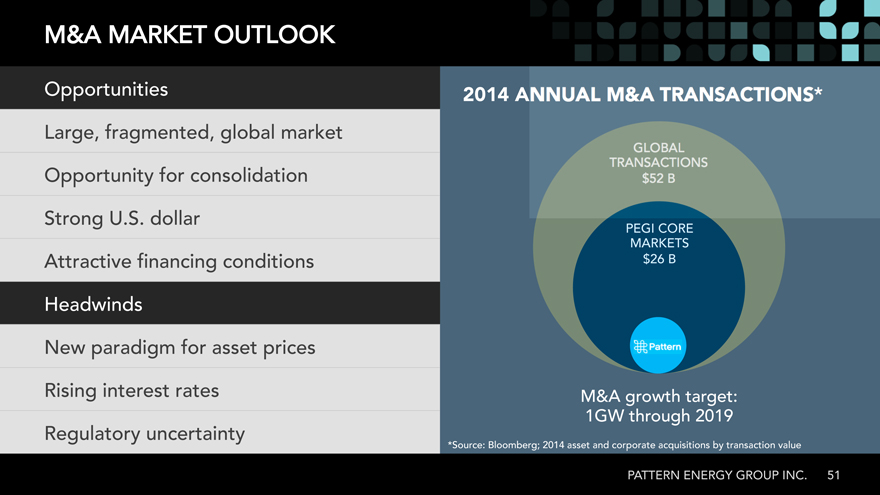

M&A MARKET OUTLOOK

Opportunities 2014 Large, fragmented, global market Opportunity for consolidation Strong U dollar.

PEGI CORE MARKETS

Attractive financing conditions B Headwinds New paradigm for asset prices Rising interest rates M&A growth target:

1GW through 2019

Regulatory uncertainty

*Source: Bloomberg; 2014 asset and corporate acquisitions by transaction value

PATTERN ENERGY GROUP INC 51.

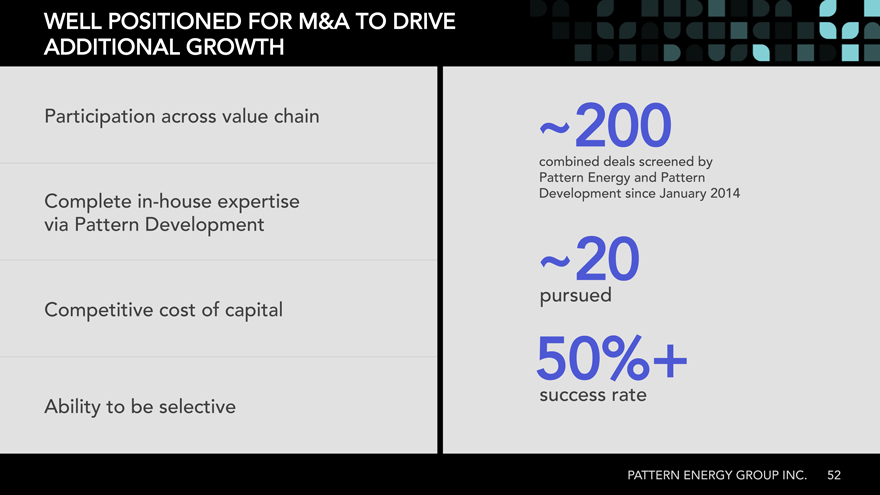

WELL POSITIONED FOR M&A TO DRIVE ADDITIONAL GROWTH

Participation across value chain ~200

combined deals screened by Pattern Energy and Pattern Complete in-house expertise Development since January 2014

via Pattern Development ~20 pursued Competitive cost of capital

50%+

success rate Ability to be selective

PATTERN ENERGY GROUP INC 52.

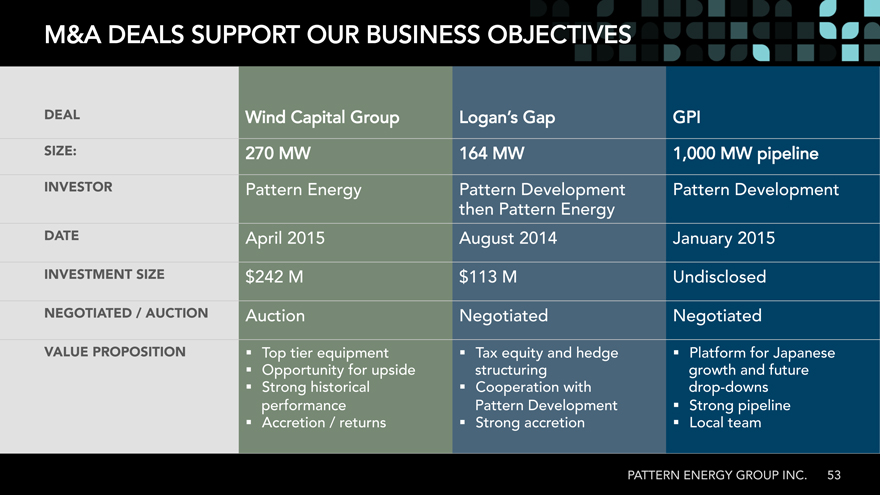

M&A DEALS SUPPORT OUR BUSINESS OBJECTIVES

DEAL_ Wind Capital Group Logan’s Gap GPI

SIZE:_ 270 MW 164 MW 1,000 MW pipeline INVESTOR_ Pattern Energy Pattern Development Pattern Development then Pattern Energy DATE_ April 2015 August 2014 January 2015

INVESTMENT SIZE_ M M Undisclosed

NEGOTIATED / AUCTION_ Auction Negotiated Negotiated

VALUE PROPOSITION ? Top tier equipment _? Tax equity and hedge _? Platform for Japanese _? Opportunity for upside structuring growth and future _? Strong historical _? Cooperation with drop-downs performance Pattern Development _? Strong pipeline _? Accretion / returns _? Strong accretion _? Local team

PATTERN ENERGY GROUP INC 53.

Pattern

Chris Shugart

OPERATIONS

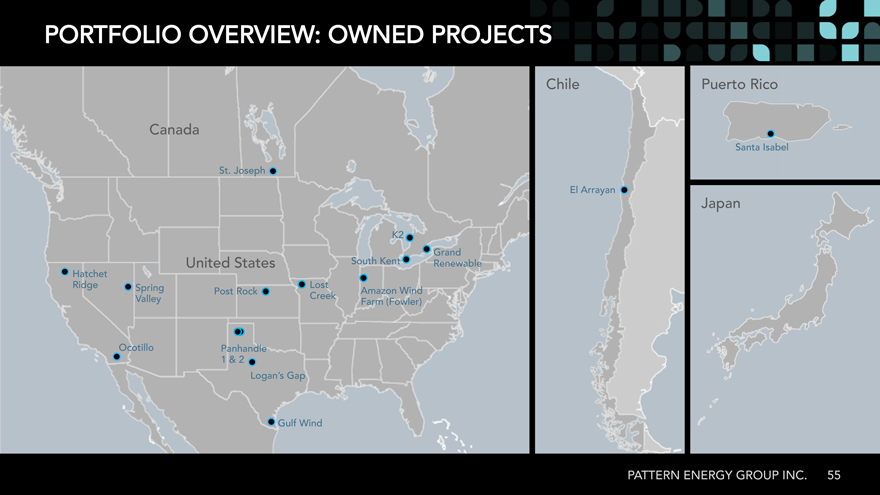

PORTFOLIO OVERVIEW: OWNED PROJECTS

Chile Puerto Rico

Canada

Santa Isabel

St. Joseph

El Arrayan Japan K2 Grand United States South Kent Renewable Hatchet Ridge Spring Lost Post Rock Amazon Wind Valley Creek Farm (Fowler)

Ocotillo Panhandle

Logan’s Gap

Gulf Wind

PATTERN ENERGY GROUP INC. 55

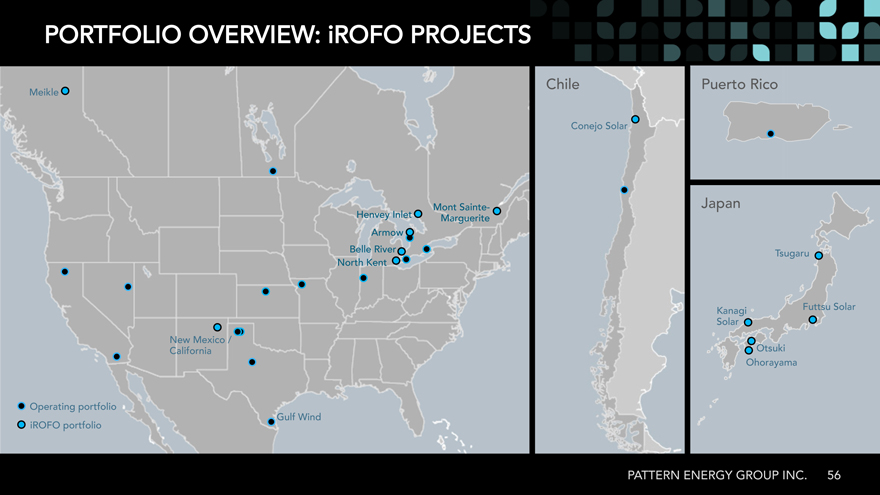

PORTFOLIO OVERVIEW: iROFO PROJECTS

Chile Puerto Rico

Meikle

Conejo Solar

Henvey Inlet Mont Sainte- Japan Marguerite Armow

Belle River Tsugaru North Kent

Kanagi Futtsu Solar Solar New Mexico / California Otsuki Ohorayama

Operating portfolio

Gulf Wind iROFO portfolio

PATTERN ENERGY GROUP INC. 56

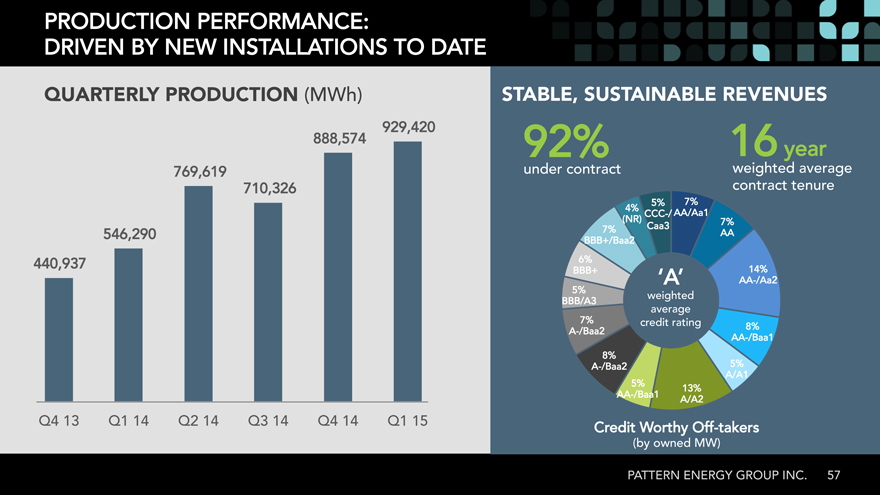

PRODUCTION PERFORMANCE:

DRIVEN BY NEW INSTALLATIONS TO DATE

QUARTERLY PRODUCTION (MWh) STABLE, SUSTAINABLE REVENUES

929,420

888,574 92% 16 year 769,619 under contract weighted average 710,326 contract tenure

5% 7%

4% AA/Aa1 CCC-/ (NR) 7%

7% Caa3

546,290 AA

BBB+/Baa2

440,937 6% 14%

BBB+ /Aa2

5% ‘A’ AA- weighted

BBB/A3 average 7% credit rating

A-/Baa2 8% AA-/Baa1 8% A-/Baa2 5% A/A1

5% 13% AA-/Baa1 A/A2

Q4 Q113 Q214 Q314 Q414 Q114 15 Credit Worthy Off-takers

owned(by MW)

PATTERN ENERGY GROUP INC 57.

OPERATIONS DRIVE LONG TERM VALUE

CASH FLOW = (wind x equipment x price) – (costs)

forecast availability contract tenor O&M power curve creditworthiness financing

PATTERN ENERGY GROUP INC. 58

PROJECT OPERATIONS: CORE VALUES

Protect the safety of our employees, contractors and the public

Respect the land and the environment

Support the communities in our project areas

PATTERN ENERGY GROUP INC. 59

SOPHISTICATED METEOROLOGICAL CAPABILITIES

_? Team of seven atmospheric sciences degrees _? Project prospecting through high performance computing center and(MHPCC) mapping _? Project siting and optimization _? Turbine site suitability analysis _? GIS and environmental mapping _? Operational wind farm assessments and development feedback _? Forecasting and day ahead market analysis

PATTERN ENERGY GROUP INC60.

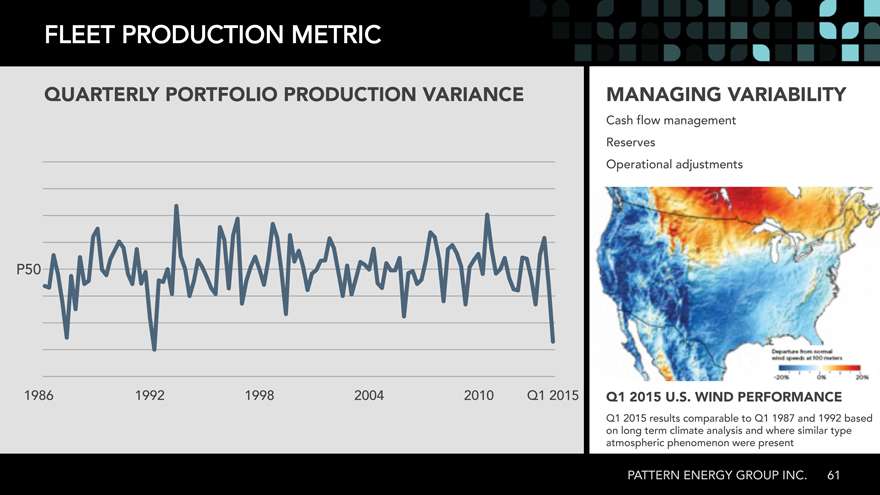

FLEET PRODUCTION METRIC

QUARTERLY PORTFOLIO PRODUCTION VARIANCE MANAGING VARIABILITY_

Cash flow management Reserves Operational adjustments

P50

1986 1992 1998 2004 2010 Q1 2015 Q1 2015 U.S. WIND PERFORMANCE_

Q1 2015 results comparable to Q1 1987 and 1992 based on long term climate analysis and where similar type atmospheric phenomenon were present

PATTERN ENERGY GROUP INC. 61

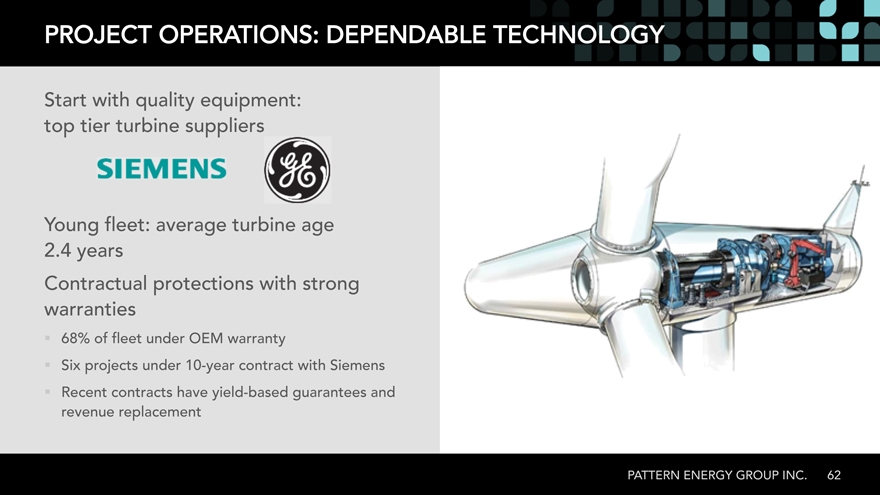

PROJECT OPERATIONS: DEPENDABLE TE

Start with quality equipment: top tier turbine suppliers

Young fleet: average turbine age 4.2 years Contractual protections with strong warranties

_? 68% of fleet under OEM warranty

_? Six projects under 10-year contract with Siemens _? Recent contracts have yield-based guarantees and revenue replacement

PATTERN ENERGY GROUP INC 62.

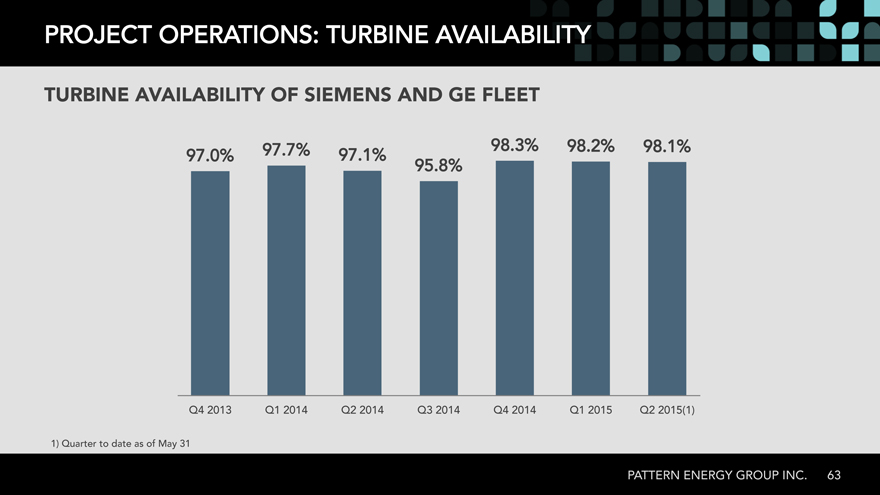

PROJECT OPERATIONS: TURBINE AVAILABILITY

TURBINE AVAILABILITY OF SIEMENS AND GE FLEET_

97.7% 98.3% 98.2% 98.1%

97.0% 97.1%

95.8%

Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015(1)

1) Quarter to date as of May 31

PATTERN ENERGY GROUP INC. 63

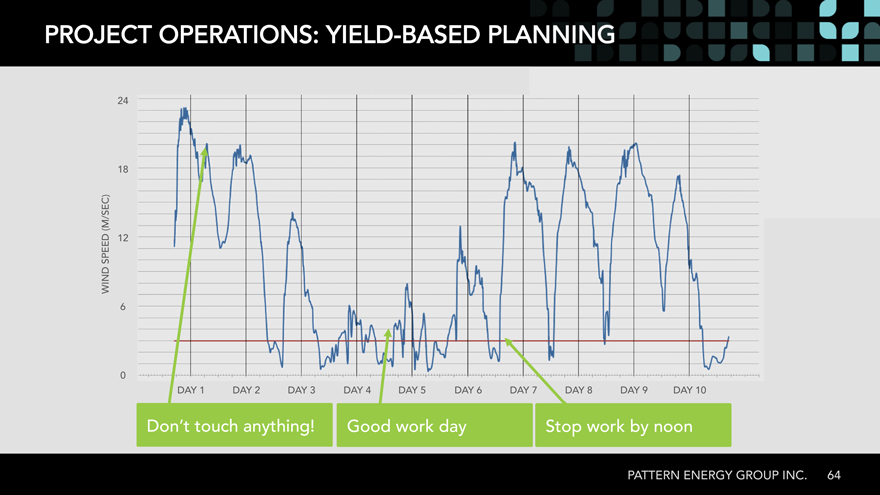

PROJECT OPERATIONS: YIELD-BASED PLA

24

18

(M/SEC) SPEED 12 WIND

0

DAY 1 DAY 2 DAY 3 DAY 4 DAY 5 DAY 6 DAY 7 DAY 8 DAY 9 DAY 10

Don’t touch anything! Good work day Stop work by noon

PATTERN ENERGY GROUP INC. 64

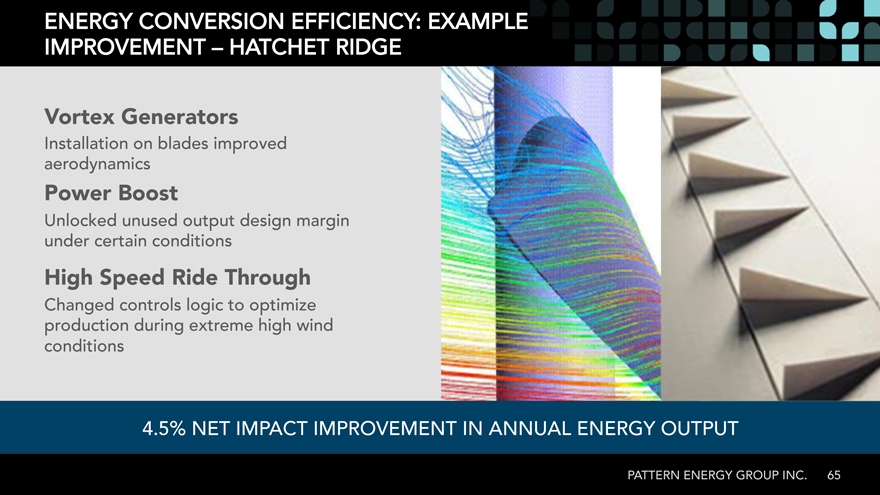

ENERGY CONVERSION EFFICIENCY: EXAMPLE IMPROVEMENT – HATCHET RIDGE

Vortex Generators_

Installation on blades improved aerodynamics

Power Boost_

Unlocked unused output design margin under certain conditions

High Speed Ride Through_

Changed controls logic to optimize production during extreme high wind conditions

4.5% NET IMPACT IMPROVEMENT IN ANNUAL ENERGY OUTPUT

PATTERN ENERGY GROUP INC 65.

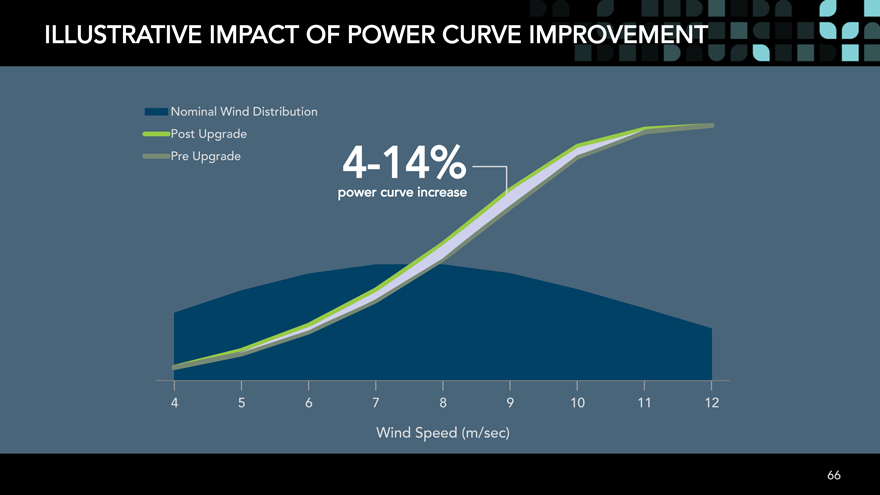

ILLUSTRATIVE IMPACT OF POWER CURVE IMPROVEMENT

Nominal Wind Distribution Post Upgrade

Pre Upgrade 4-14% power curve increase

Wind Speed (m/sec)

66

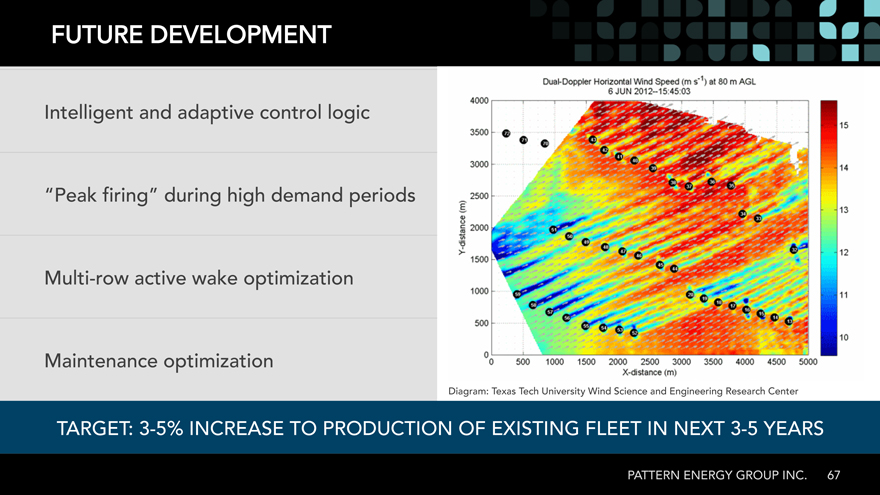

FUTURE DEVELOPMENT

Intelligent and adaptive control logic “Peak firing” during high demand periods Multi-row active wake optimization

Maintenance optimization

Diagram: Texas Tech University Wind Science and Engineering Research Center

TARGET: 3-5% INCREASE TO PRODUCTION OF EXISTING FLEET IN NEXT 3-5 YEARS

PATTERN ENERGY GROUP INC 67.

Pattern

Mike Lyon

FINANCIALS

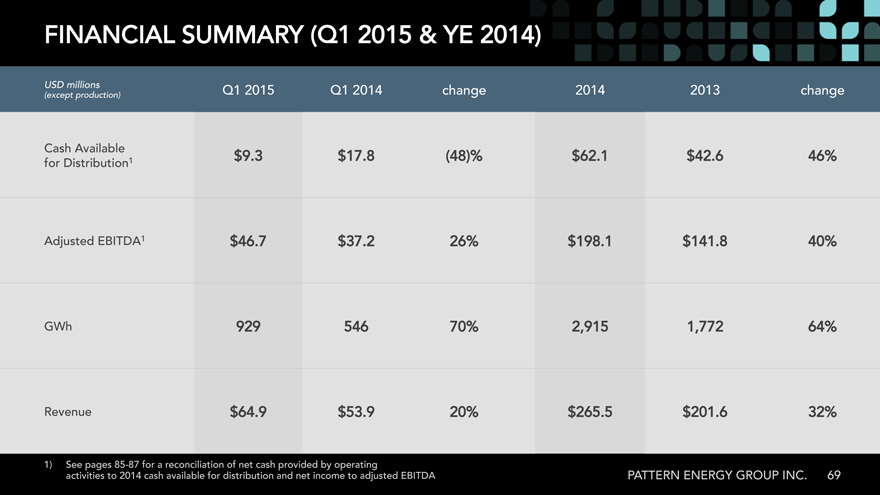

FINANCIAL SUMMARY 2015(Q1 YE& 2014)

USD millions Q1 Q12015 2014 change 2014 2013 change

(except production)

Cash Available 8.17$3.9$ (48)% 1.62$ 46%6.42$

for Distribution1

Adjusted EBITDA1 26%2.37$7.46$ 1.198$ 40%8.141$

GWh 70%546929 2,915 64%1,772

Revenue 20%9.53$9.64$ 5.265$ 32%6.201$

1)? See pages ##- for## a reconciliation of net cash provided by operating activities to

1)cash ? See available pages for distribution 85-87 for and a reconciliation net income to adjusted of net EBITDA cash provided by operating activities to 2014 cash available for distribution and net income to adjusted EBITDA PATTERN ENERGY GROUP INC 69.

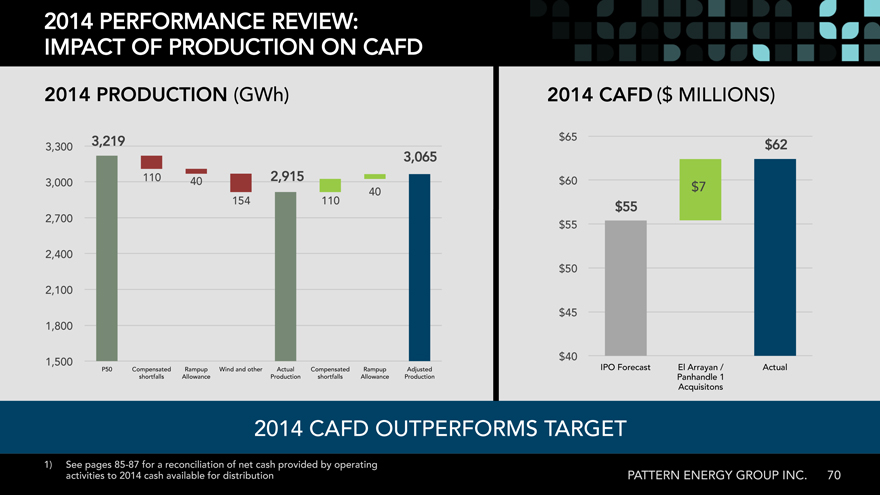

2014 PERFORMANCE REVIEW: IMPACT OF PRODUCTION ON CAFD

2014 PRODUCTION (GWh) 2014 CAFD ($ MILLIONS)

3,219

3,300

3,065

110 40 2,915

3,000 40 110154 55$ 2,700

2,400

2,100

1,800

1,500

P50 Compensated Rampup Wind and other Actual Compensated Rampup Adjusted IPO Forecast El Arrayan / Actual shortfalls Allowance Production shortfalls Allowance Production Panhandle 1

Acquisitons

2014 CAFD OUTPERFORMS TARGET

1)? See pages 85-87 for a reconciliation of net cash provided by operating activities to 2014 cash available for distribution PATTERN ENERGY GROUP INC. 70

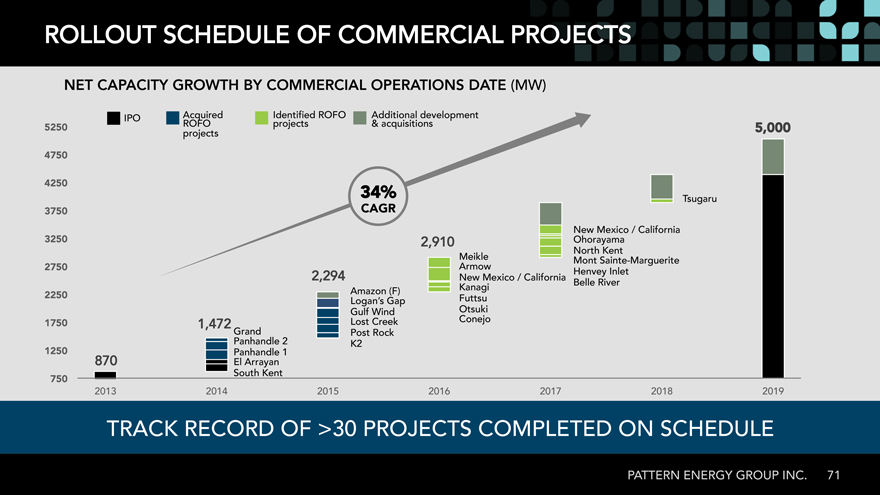

ROLLOUT SCHEDULE OF COMMERCIAL PROJECTS

NET CAPACITY GROWTH BY COMMERCIAL OPERATIONS DATE (MW)

IPO Acquired Identified ROFO Additional development

5250_ ROFO projects projects acquisitions& 5,000_

4750_

4250_ 34%_

Tsugaru

3750_ CAGR_

3250_ 2,910 Ohorayama New Mexico / California North Kent Meikle Armow Mont Sainte-Marguerite 2750_ Henvey Inlet 2,294 New Mexico / California Kanagi Belle River 2250_ Amazon (F) Logan’s Gap Futtsu Gulf Wind Conejo Otsuki 1750_ 1,472 Lost Creek Grand Post Rock 1250_ Panhandle 2 K2 El Panhandle Arrayan 1

870

South Kent

750_

2019201820172016201520142013

TRACK RECORD OF >30 PROJECTS COMPLETED ON SCHEDULE

PATTERN ENERGY GROUP INC 71.

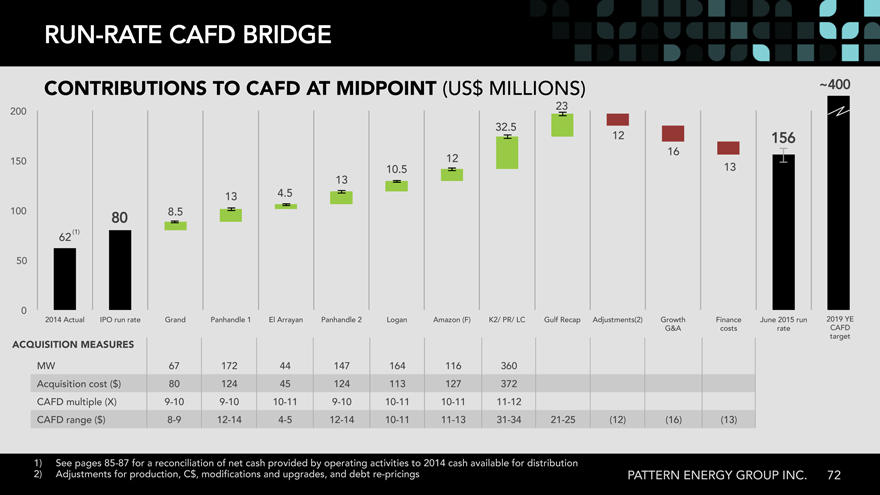

RUN-RATE CAFD BRIDGE

CONTRIBUTIONS TO CAFD AT MIDPOINT (US$ MILLIONS) ~400

200 23 5.32

12 156 16

150 12

5.10 13 13

13 5.4

100 80 5.8

62 (1)

50

0 2019 YE

2014 Actual IPO run rate Grand Panhandle 1 El Arrayan Panhandle 2 Logan Amazon (F) K2/ PR/ LC Gulf Recap Adjustments(2) Growth Finance June 2015 run CAFD G&A costs rate target

ACQUISITION MEASURES_

MW 3601161641474417267 Acquisition cost ($3721271131244512480) CAFD multiple 9(X) -910 -1010—911 —1010 —1011 -1111 -12

CAFD range ($ 8) —129 —414 —125 —1014 -1111—3113 -2134 -(12)25 (16) (13)

1)? See pages 85-87 for a reconciliation of net cash provided by operating activities to 2014 cash available for distribution

2)? Adjustments for production, C$ modifications, and upgrades, and debt re-pricings PATTERN ENERGY GROUP INC72.

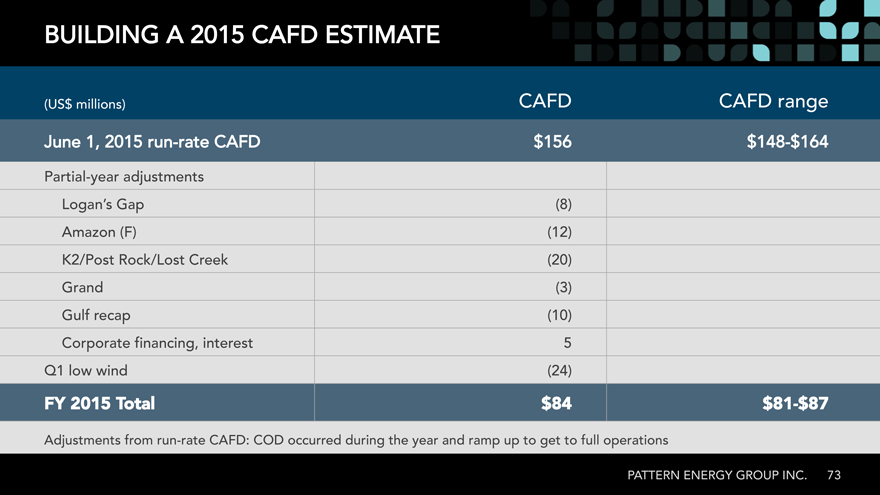

BUILDING A 2015 CAFD ESTIMATE

(US$ millions) CAFD CAFD range

June 20151, run-rate CAFD —

Partial-year adjustments

Logan’s Gap (8) Amazon (F) (12) K2/Post Rock/Lost Creek (20) Grand (3) Gulf recap (10) Corporate financing, interest 5 Q1 low wind (24)

FY 2015 Total_ 84$ _ 81$—87$ _

Adjustments from run-rate CAFD: COD occurred during the year and ramp up to get to full operations

PATTERN ENERGY GROUP INC 73.

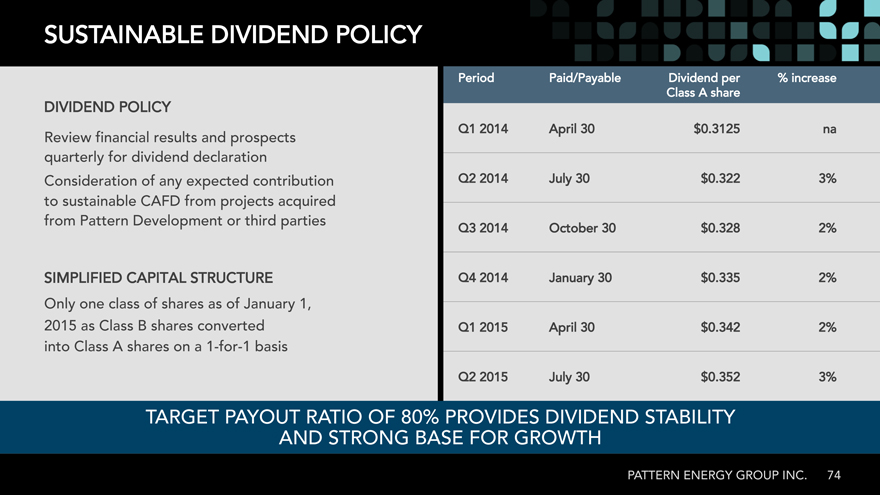

SUSTAINABLE DIVIDEND POLICY

Period Paid/Payable Dividend per increase% Class A share

DIVIDEND POLICY

Q1 2014 April 3125.0$30 na

Review financial results and prospects quarterly for dividend declaration

Consideration of any expected contribution Q2 2014 July 3%322.0$30 to sustainable CAFD from projects acquired from Pattern Development or third parties

Q3 2014 October 2%328.0$30

SIMPLIFIED CAPITAL STRUCTURE Q4 2014 January 30 2%335.0$ Only one class of shares as of January 1, 2015 as Class B shares converted Q1 2015 April 2%342.0$30 into Class A shares on a 1-for-1 basis

Q2 2015 July 3%352.0$30

TARGET PAYOUT RATIO OF 80% PROVIDES DIVIDEND STABILITY AND STRONG BASE FOR GROWTH

PATTERN ENERGY GROUP INC 74.

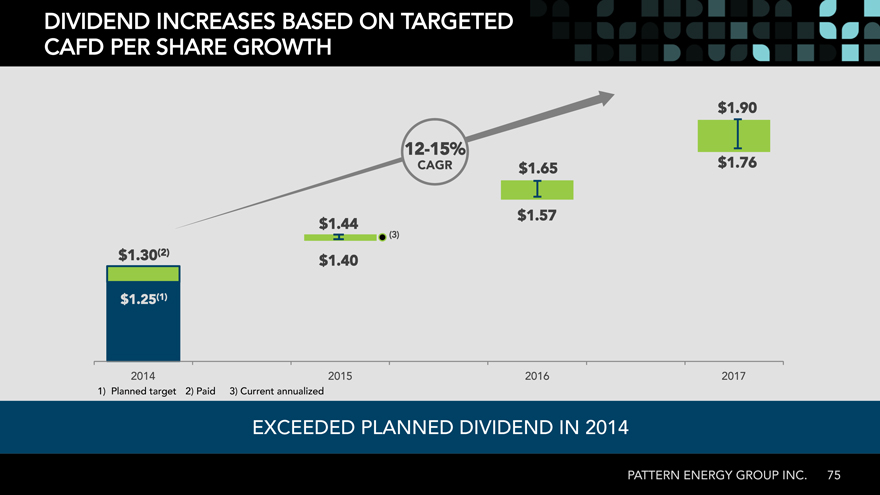

DIVIDEND INCREASES BASED ON TARGETED CAFD PER SHARE GROWTH

$1.90_

12-15%_

$1.76_ CAGR_ $1.65_

$1.57_

$1.44_

$1.30(2)_

$1.40_

$1.25(1)_

2014 2015 2016 2017

1)? Planned target 2) Paid 3) Current annualized

EXCEEDED PLANNED DIVIDEND IN 2014

PATTERN ENERGY GROUP INC. 75

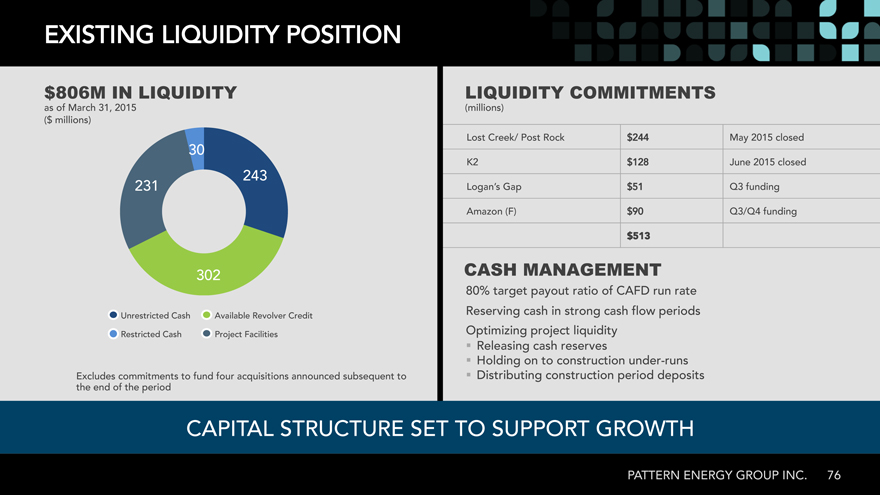

EXISTING LIQUIDITY POSITION

IN LIQUIDITY LIQUIDITY COMMITMENTS

as of March 201531, (millions) ($ millions)

30 Lost Creek/ Post Rock May 2015 closed 243 K2 June 2015 closed 231 Logan’s Gap Q3 funding Amazon (F) Q3/Q4 funding

513$ _

302 CASH MANAGEMENT

80% target payout ratio of CAFD run rate Unrestricted Cash Available Revolver Credit Reserving cash in strong cash flow periods

Restricted Cash Project Facilities Optimizing project liquidity

_? Releasing cash reserves

_? Holding on to construction under-runs

Excludes commitments to fund four acquisitions announced subsequent to _? Distributing construction period deposits the end of the period

CAPITAL STRUCTURE SET TO SUPPORT GROWTH

PATTERN ENERGY GROUP INC. 76

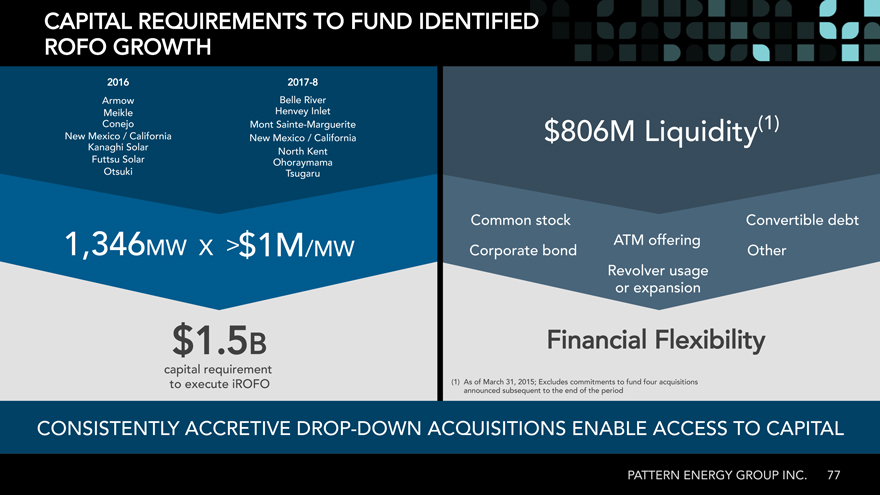

CAPITAL REQUIREMENTS TO FUND IDENTIFIED ROFO GROWTH

20172016 -8 Armow Belle River Meikle Henvey Inlet

Conejo Mont Sainte-Marguerite (1) New Mexico / California New Mexico / California Liquidity Kanaghi Solar North Kent Futtsu Solar Ohoraymama Otsuki Tsugaru

Common stock Convertible debt 1,346MW X > ATM offering /MW Corporate bond Other Revolver usage or expansion

5.1$ B Financial Flexibility

capital requirement

to execute iROFO As(1) of March 31, 2015; Excludes commitments to fund four acquisitions announced subsequent to the end of the period

CONSISTENTLY ACCRETIVE DROP-DOWN ACQUISITIONS ENABLE ACCESS TO CAPITAL

PATTERN ENERGY GROUP INC77.

Pattern

Mike Garland

PATTERN DEVELOPMENT RELATIONSHIP

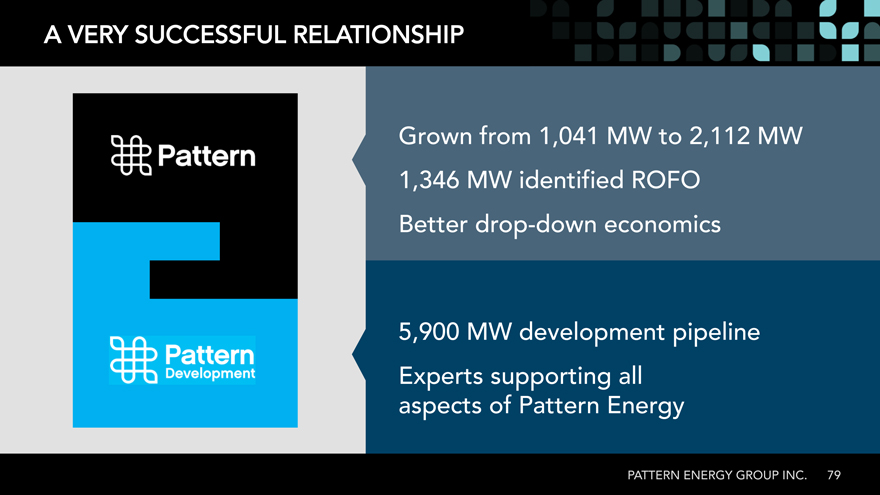

A VERY SUCCESSFUL RELATIONSHIP

Grown from 1,041 MW to 2,112 MW 1,346 MW identified ROFO

Better drop-down economics

5,900 MW development pipeline Experts supporting all aspects of Pattern Energy

PATTERN ENERGY GROUP INC 79.

ALIGNMENT HAS WORKED

Right of First Offer

Shared management Shared space

Material ownership

PATTERN ENERGY GROUP INC. 80

BUILDING ON OUR SUCCESS

No reintegration Drop downs operations date

Increased funding for expanding development Recognizes value of continued ownership

PATTERN ENERGY GROUP INC 81.

LEVERAGING THE RELATIONSHIP

82 Continuing to improve the relationship Selectively expanding markets Arranging construction bridge capital Joint acquisitions Participation in development Why Consider Development Ā?Development: 6-8X CAFD Ā?Acquisitions: 11-13X CAFD PATTERN ENERGY GROUP INC. Why Consider Development

_? Development: 6-8X CAFD _? Acquisitions: 11-13X CAFD

Pattern

QUESTION & ANSWER PANEL

Pattern

Mike Garland

WRAP UP

ADJUSTED EBITDA(1)

(NON-GAAP RECONCILATION)

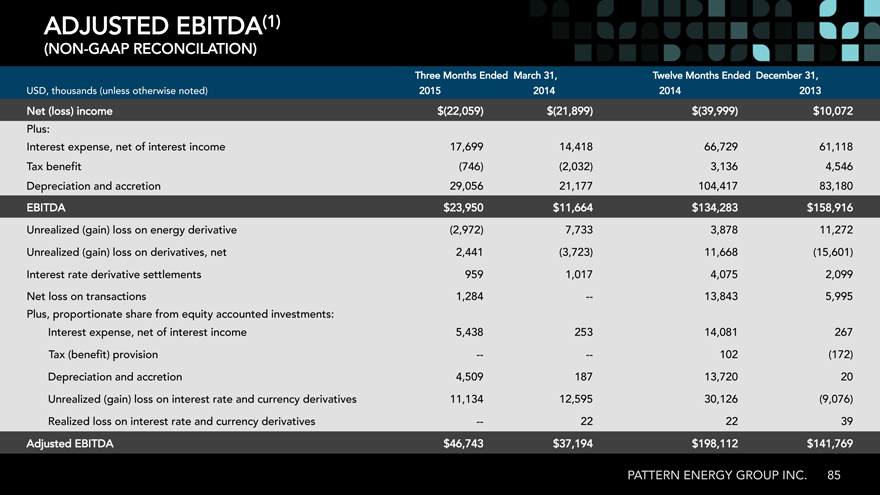

Three Months Ended March 31, Twelve Months Ended December 31, USD, thousands otherwise(unless noted) 20142015 20132014

Net income(loss) $(22,059) $(21,899) $(39,999) Plus: Interest expense, net of interest income 17,699 14,418 66,729 61,118 Tax benefit (746) (2,032) 3,136 4,546 Depreciation and accretion 29,056 21,177 104,417 83,180 EBITDA 23,950$ Unrealized loss(gain) on energy derivative (2,972) 7,733 3,878 11,272 Unrealized loss(gain) on derivatives, net 2,441 (3,723) 11,668 (15,601) Interest rate derivative settlements 959 1,017 4,075 2,099 Net loss on transactions 1,284 — 13,843 5,995 Plus, proportionate share from equity accounted investments: Interest expense, net of interest income 5,438 253 14,081 267 Tax provision(benefit) — — 102 (172) Depreciation and accretion 4,509 187 13,720 20 Unrealized loss(gain) on interest rate and currency derivatives 11,134 12,595 30,126 (9,076) Realized loss on interest rate and currency derivatives — 22 22 39 Adjusted EBITDA 46,743$

PATTERN ENERGY GROUP INC. 85

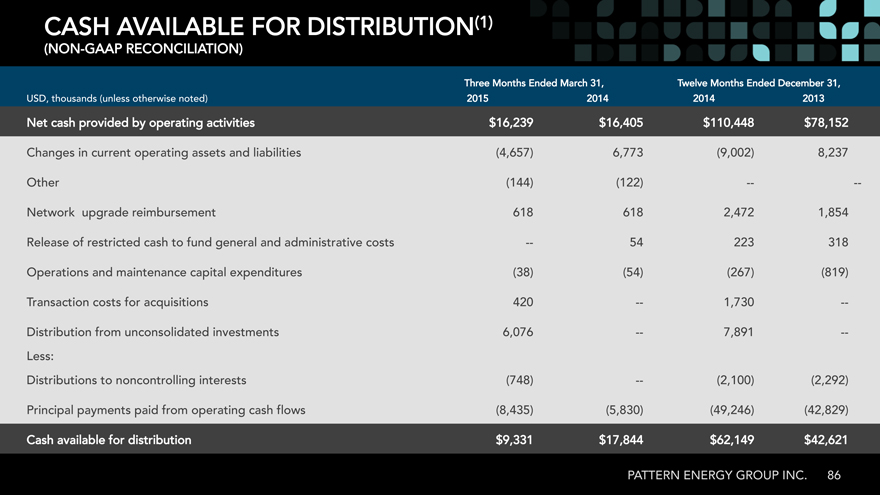

CASH AVAILABLE FOR DISTRIBUTION(1)

(NON-GAAP RECONCILIATION)

Three Months Ended March 31, Twelve Months Ended December 31, USD, thousands otherwise(unless noted) 2014 20132014

Net cash provided by operating activities 78,152$110,448$ Changes in current operating assets and liabilities (4,657) 6,773 8,237(9,002) Other (144) (122) — —Network upgrade reimbursement 618 1,8542,472618 Release of restricted cash to fund general and administrative costs — 31822354 Operations and maintenance capital expenditures (38) (54) (267) (819) Transaction costs for acquisitions 420 — 1,730 —

Distribution from unconsolidated investments 6,076 — 7,891 — Less: Distributions to noncontrolling interests (748) — (2,100) (2,292)

Principal payments paid from operating cash flows (8,435) (5,830) (49,246) (42,829) Cash available for distribution 42,621$62,149$ PATTERN ENERGY GROUP INC 86.

1 SUMMARY NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA represents net income before(loss) net interest expense, income taxes and depreciation and accretion, including our proportionate share of net interest expense, income taxes and depreciation and accretion for joint venture investments that are accounted for under the equity method Adjusted. EBITDA also excludes the effect of certain mark-to-market adjustments and infrequent items not related to normal or ongoing operations, such as early payment of debt and realized derivative gain or loss from refinancing transactions, and gain or loss related to acquisitions or divestituresWe. disclose Adjusted EBITDA, which is a non-U GAAP. measure, because management believes this metric assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that our management believes are not indicative of our core operating performance We. use Adjusted EBITDA to evaluate our operating performanceYou. should not consider Adjusted EBITDA as an alternative to net income determined(loss), in accordance with U . GAAP, or as an alternative to net cash provided by (used in) operating activities, determined in accordance with U . GAAP, as an indicator of our cash flows.

Adjusted EBITDA has limitations as an analytical tool Some. of these limitations are: Adjusted EBITDA:

?does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; ?does not reflect changes in, or cash requirements for, our working capital needs;

?does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; ?does not reflect our income tax expense or the cash requirement to pay our taxes; and ?does not reflect the effect of certain mark-to-market adjustments and non-recurring items;

?although depreciation and accretion are non-cash charges, the assets being depreciated and accreted will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and ?other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with U GAAP. .

Cash available for distribution represents net cash provided by (used in) operating activities as adjusted to add(i) or subtract changes in operating assets and liabilities, subtract(ii) net deposits into restricted cash accounts, which are required pursuant to the cash reserve requirements of financing agreements, to the extent they are paid from operating cash flows during a period, subtract(iii) cash distributions paid to noncontrolling interests, subtract(iv) scheduled project-level debt repayments in accordance with the related loan amortization schedule, to the extent they are paid from operating cash flows during a period, subtract(v) non-expansionary capital expenditures, to the extent they are paid from operating cash flows during a period, and adding(vi) cash distributions received from unconsolidated investments, to the extent such distributions were derived from operating cash flows, and add(vii) or subtract other items as necessary to present the cash flows we deem representative of our core business operations.

We disclose cash available for distribution because management recognizes that it will be used as a supplemental measure by investors and analysts to evaluate our liquidity. However, cash available for distribution has limitations as an analytical tool because it excludes depreciation and accretion, does not capture the level of capital expenditures necessary to maintain the operating performance of our projects, is not reduced for principal payments on our project indebtedness except to the extent it is paid from operating cash flows during a period, and excludes the effect of certain other cash flow items, all of which could have a material effect on our financial condition and results from operations Cash. available for distribution is a non-UGAAP. measure and should not be considered an alternative to net income net(loss), cash provided by (used in) operating activities or any other liquidity measure determined in accordance with U . GAAP, nor is it indicative of funds available to fund our cash needsIn. addition, our calculation of cash available for distribution is not necessarily comparable to cash available for distribution as calculated by other companies Investors. should not rely on this measure as a substitute for any UGAAP. measure, including net income and(loss) net cash provided by (used in) operating activities._

PATTERN ENERGY GROUP INC 87.