Investing in Development Understanding the Risk-Reward Profile | 2017

PATTERN ENERGY GROUP INC. PAGE Renewable energy is an essential part of today’s energy mix and is poised to become the major source of new energy supply in this century. Global investment in renewable generation reached $265 billion in 2015, nearly double the $130 billion investment in new fossil fuel generation1. Pattern Energy Group Inc. (“Pattern Energy” or the “Company”) is committed to capturing a significant share of the growth in the renewable market and has set a goal, as part of its Pattern 2020 vision, to double its portfolio to more than five gigawatts (“GW”) by 2020. The primary method of this growth will be through acquisitions from Pattern Development2. Executive Summary 1 Source: Bloomberg New Energy Finance & Frankfurt School-UNEP, “Global Trends in Renewable Energy Investment 2016.” 2 In this White Paper, Pattern Energy Group LP is referred to as “Pattern Development” for the period and events prior to December 2016, and Pattern Energy Group LP (“Pattern Development 1.0”) and Pattern Energy Group 2 LP (“Pattern Development 2.0”) are together referred to as “Pattern Development” for the period post December 2016. In addition to acquiring high- quality assets from Pattern Development, Pattern Energy also believes it can potentially improve shareholder returns through a modest initial investment in Pattern Development 2.0, securing a captive interest in development assets at a materially lower cost than buying operating assets from third parties. A modest investment of under $100 million would be one that is appropriate for both Pattern Energy’s size and retained cash flow and allows Pattern Energy to maintain its dividend, low risk profile and stable cash flows. EXECUTIVE SUMMARY 1

PATTERN ENERGY GROUP INC. PAGE Primary reasons for considering an investment in development A Proven Platform Since 2009, Pattern Development has built a reputation as one of the top developers in the renewable industry, successfully developing more than four GW of high-quality operating wind farms and delivering private equity returns to its investors. The management team has successfully completed more than 40 projects, raised more than $8 billion in capital from more than 40 institutions and purchased more than $3.5 billion of wind turbines from top manufacturers. A Strong Investment Thesis A disciplined, experienced development business offers one of the best risk-reward opportunities in the renewable energy value chain. The key drivers that support the thesis for investing in development are: » Strong returns – Targeted total pre-tax returns at the development business level of more than 15% and a multiple of invested capital (“MOIC”) of approximately 2.0x; » Yield compression - Significant de-risking of projects through long-term offtake contracts and other arrangements so that, during the construction phase, projects can be sold at a significant yield compression. For example, building assets at a 6-8x multiple of cash available for distribution (“CAFD”) and selling the assets at a 10-12x multiple; and » Managed capital – Managing capital in a disciplined manner, including 1) selecting good opportunities to invest in, 2) minimizing the capital at risk during the early development stages, and 3) minimizing the duration of the relatively higher capital outlays that are required once a project has achieved an advanced stage. EXECUTIVE SUMMARY 2

PATTERN ENERGY GROUP INC. PAGE Given Pattern Energy’s interest in potentially investing in the development business, the Company has prepared this White Paper as an introduction for investors not familiar with renewable power development. The White Paper addresses two core subjects and includes a number of actual project examples. 1. The Business Model and Investment Thesis 2. Renewable Energy Development Phases – a description of the various phases of development and what happens in each one This White Paper defines the renewable energy development business as the process of advancing renewable energy projects from identifying a “greenfield” site through the start of construction. Development encompasses all the activities within this time frame, including permitting, real estate acquisition, resource assessment, interconnection and transmission, community and political engagement, power marketing, financing and equipment procurement. EXECUTIVE SUMMARY 3 Pattern Development is active in wind, solar and transmission development in the United States (“U.S.”), Canada, Mexico, Chile and Japan, and each type of power development is different (e.g. solar tends to have lower barriers to entry compared to wind, while transmission tends to have comparatively higher barriers to entry). In order to more succinctly present the development process, this White Paper focuses solely on wind energy development in North America.

PATTERN ENERGY GROUP INC. PAGE Development Business Model A Strong Investment Thesis DEVELOPMENT BUSINESS MODEL When done right, renewable energy development offers one of the most compelling risk-reward trade-offs in the energy value chain. However, not all companies are able to consistently create the right mix of capital access, disciplined capital management, and development expertise to create value from a rapidly evolving industry. For those with the right mix, the development business model offers strong returns. At the core of this model is to “de-risk” projects. This is done through effective contracting, engineering, and operational management, so that a fully developed project can be constructed and put into operation with a significantly higher fair market value than what it cost to fully develop the project. Or, in other words, it could be “sold down” at a significant profit. The key elements to achieving this goal which are discussed below are: » Returns and yield compression » Capital management 4

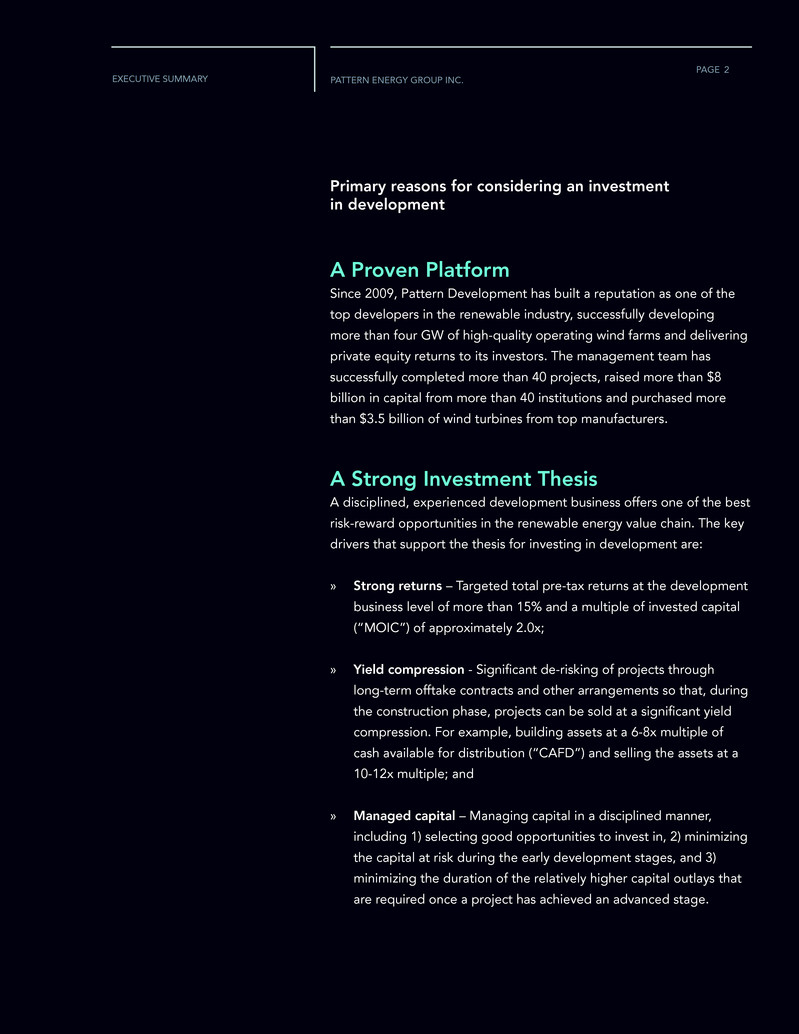

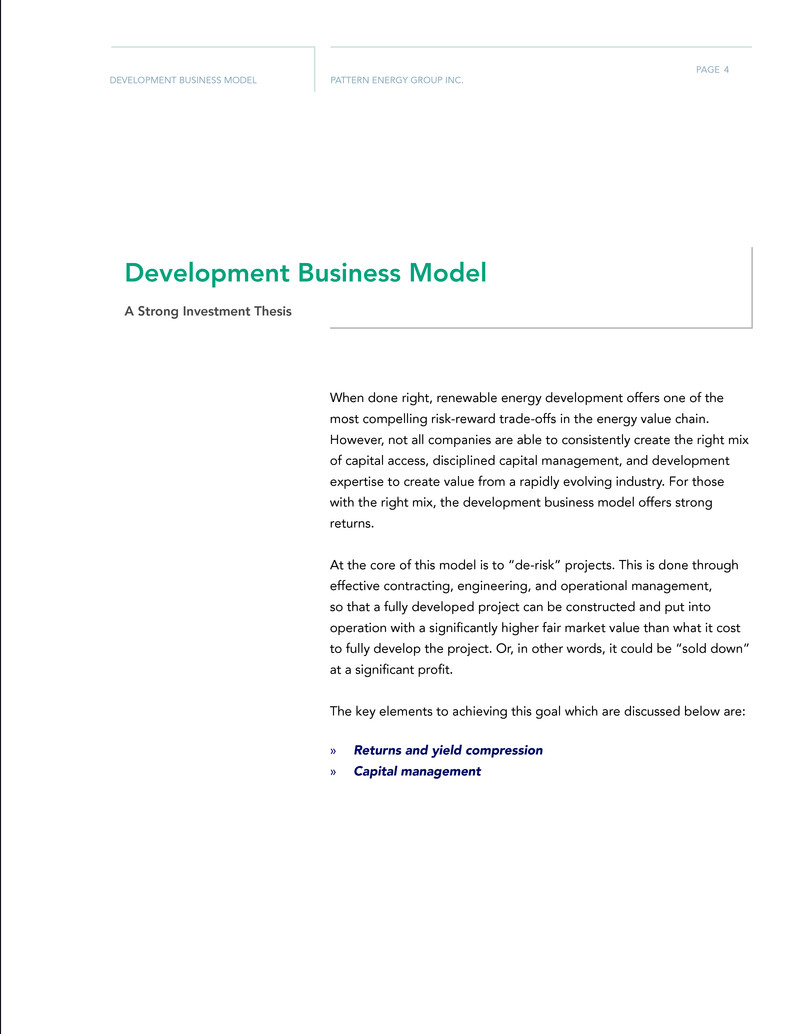

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT BUSINESS MODEL Construction03 Developer Equity Profits & Distribution Origination & Early Development 01 Development Overhead Early Stage Capital Recycled/ Repaid Capital Pre-construction & Financing 02 Pre-Finance CapEx Sale of Project 04 A developer makes money from capturing the delta between the cost to develop projects and the fair market value of those projects. This includes the costs associated with the overhead expenses for the business (people and buildings), taxes and the “dry- hole” costs associated with projects that do not proceed. This value differential is referred to as “yield compression” or “multiple expansion.” It is derived from the fact that a final owner’s required return for a long-term investment in a fully developed, de-risked project is much lower (e.g. 7-9% on an after-tax basis) than what is embedded in the returns required to develop and construct the facility (e.g. 10-15%). It is worth noting that the returns and yield compression of a project can vary widely depending on such factors as the level of risk removed from a de-risked project and the market conditions at the time of sale; FIGURE 1 Equity Investment Capital Recycling however, the numbers discussed in this paper are indicative of what Pattern Development has experienced. Yield compression can also be thought of as the difference between the cash flow (or CAFD) multiple on a build-period equity investment relative to that of a term-period equity investment. The build-period equity is typically a 6-8x multiple of CAFD on an approximate basis, although projects can range as low as 3x CAFD and as high as 9x CAFD, compared to a 10-12x multiple of CAFD for the term- period equity investment. The Example Project described on page 23, describes this math in more detail. The expected investment returns for a well-managed development business are in the range of 15% or higher targeted pre-tax returns at the corporate level and pre- tax approximately 2.0x MOIC. Returns and Yield Compression 5

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT BUSINESS MODEL For example, an investment of $10 million in a development business that obtains a 2.0x MOIC would generate $20 million in net receipts before tax. If it took four years from the date of that $10 million investment until the capital and profits were returned, it would generate approximately 19% pre-tax return on investment. The Example Project section describes how this typically works for a representative project. It outlines that for a 100 megawatt (“MW”) project, the developer invests approximately $16 million in “pre-construction” capital. Upon de-risking the project by closing financing and starting construction, and assuming that the developer holds the investment during construction, the investment level may rise to $40 million of construction equity (i.e., the equity portion of the project’s build cost), and produce a profit upon sale of approximately $20 million after return of capital. A developer may be able to manage down the construction equity to one-half the project-level investment, or approximately $20 million in this case, via the use of non-recourse “holdco” or “back-leverage” financing, while still achieving approximately the same amount of profit. Similarly, if the developer can sell the project upon the start of construction, the $20 million profit (subject to a small time- value-of-money discount) might be realized while having only invested the $16 million of pre- construction capital. Accounting implications A minority investor in a development business would typically account for its interest in that business as an unconsolidated investment using the equity method of accounting. It would initially reflect the investment at cost in the balance sheet on the line item “unconsolidated investments.” The investment would increase or decrease by additional contributions or distributions, as well as by its proportional interest in the earnings (losses). In addition, the proportional recognition of the interest in earnings (losses) would be reflected in the statement of operations in the line item “earnings of unconsolidated investments.” Under normal circumstances, the holder of such an interest would recognize CAFD from the distributions received from the development business, and it would reduce its adjusted earnings before interest, tax, depreciation and amortization. 6

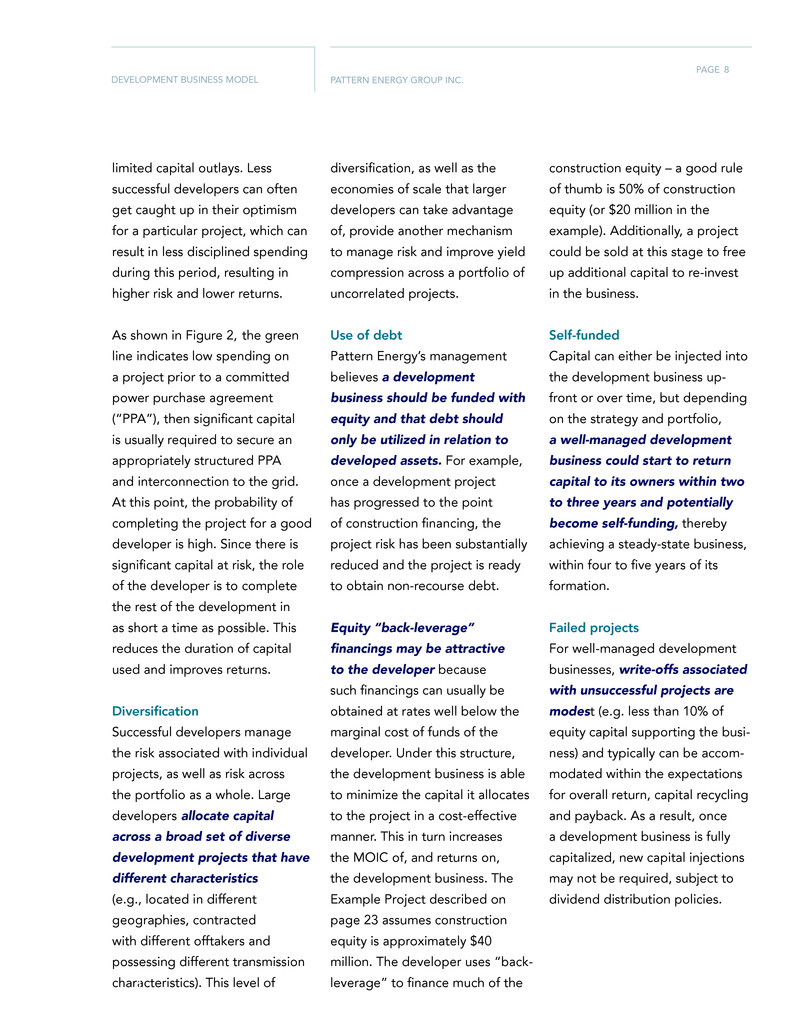

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT BUSINESS MODEL Capital Management At the heart of development is the business of capital and risk management. At the project level, the developer allocates capital based on risk limits defined by project-specific factors, such as environmental, transmission and land issues. At the corporate level, the developer manages a large portfolio of early stage, higher-risk, low-cost opportunities (referred to as the pipeline) and a smaller number of late stage, high value, lower-risk projects (referred to as advanced stage projects). Successful development is thus defined by the ability of the developer to prudently allocate resources (capital and human) to projects where an execution path to completion is clear and well defined. The most critical element to achieving a profitable development business is the ability to manage capital, which includes choosing good opportunities to invest in, minimizing the capital at risk during the early development stages, and minimizing the duration of the relatively higher capital outlays required once a project has achieved an advanced stage. The other factors that contribute to disciplined capital management include: limiting the number of “dry holes,” diversification of the development portfolio and the recycling of capital. As described below in the Renewable Energy Development Phases section, early development 100% 50% Risk Origination & Early Development Pre-construction & Financing Construction Sale $ Capital Outlay 0% Commence Land/Met Commence Env./Planning Execute PPA & Interconnection Commence Construction Commence Operations FIGURE 2 Risk Management is primarily focused on securing land control, data collection, community engagement, preliminary permitting, and offtake analysis. During the period when the project reaches mid- stage development and prior to executing an offtake agreement, discipline and experience is critical. A good developer will do enough permitting, engineering cost estimating and other work to be able to make a sound judgment on the probability of completing development with 7

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT BUSINESS MODEL limited capital outlays. Less successful developers can often get caught up in their optimism for a particular project, which can result in less disciplined spending during this period, resulting in higher risk and lower returns. As shown in Figure 2, the green line indicates low spending on a project prior to a committed power purchase agreement (“PPA”), then significant capital is usually required to secure an appropriately structured PPA and interconnection to the grid. At this point, the probability of completing the project for a good developer is high. Since there is significant capital at risk, the role of the developer is to complete the rest of the development in as short a time as possible. This reduces the duration of capital used and improves returns. Diversification Successful developers manage the risk associated with individual projects, as well as risk across the portfolio as a whole. Large developers allocate capital across a broad set of diverse development projects that have different characteristics (e.g., located in different geographies, contracted with different offtakers and possessing different transmission characteristics). This level of diversification, as well as the economies of scale that larger developers can take advantage of, provide another mechanism to manage risk and improve yield compression across a portfolio of uncorrelated projects. Use of debt Pattern Energy’s management believes a development business should be funded with equity and that debt should only be utilized in relation to developed assets. For example, once a development project has progressed to the point of construction financing, the project risk has been substantially reduced and the project is ready to obtain non-recourse debt. Equity “back-leverage” financings may be attractive to the developer because such financings can usually be obtained at rates well below the marginal cost of funds of the developer. Under this structure, the development business is able to minimize the capital it allocates to the project in a cost-effective manner. This in turn increases the MOIC of, and returns on, the development business. The Example Project described on page 23 assumes construction equity is approximately $40 million. The developer uses “back- leverage” to finance much of the construction equity – a good rule of thumb is 50% of construction equity (or $20 million in the example). Additionally, a project could be sold at this stage to free up additional capital to re-invest in the business. Self-funded Capital can either be injected into the development business up- front or over time, but depending on the strategy and portfolio, a well-managed development business could start to return capital to its owners within two to three years and potentially become self-funding, thereby achieving a steady-state business, within four to five years of its formation. Failed projects For well-managed development businesses, write-offs associated with unsuccessful projects are modest (e.g. less than 10% of equity capital supporting the busi- ness) and typically can be accom- modated within the expectations for overall return, capital recycling and payback. As a result, once a development business is fully capitalized, new capital injections may not be required, subject to dividend distribution policies. 8

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT BUSINESS MODEL During the pre-construction and financing phase, the developer seeks construction financing, usually on a non-recourse basis. Under “non-recourse” project financings, lenders provide funds based solely on the value of the project’s assets and projected future cash flows, with limited or no support from the owner beyond its equity funding commitment. The high standard to meet for securing non-recourse funding requires that final permits are obtained and not Raising Non-Recourse Financing subject to appeal; land rights are finalized; interconnection and transmission rights are secured; construction-related agreements are executed; operating agreements are finalized; and revenue arrangements for the sale of energy and renewable credits (if applicable) are entered into with offtakers. This type of financing will generally support 70-90% of the project construction cost. The balance of funding is provided by the project sponsor or the developer as equity in the project and typically is funded at the beginning of construction. At the same time, the construction lenders require the developer to secure critical post- construction capital funding for the project. This means long-term debt (usually a term-out of the construction debt), or tax equity funding for a U.S. project using production tax credits (“PTCs”), is lined up at the close of construction financing. For the developer, at the point of the close of construction financing, both the construction and term equity required are known and defined. The end of pre-construction is often the point of maximum business exposure on a project (see Figure 2), but not necessarily the point of maximum capital at risk, and completion of the project should also be at the lowest risk. As a result, capital is managed to specific milestones to ensure capital exposure and risks line up. The costs typically incurred at this stage include: » Interconnection deposits to reserve firm transmission capacity; » PPA security deposits to secure the offtake agreement; » Equipment supply orders to reserve manufacturing space or lock in price; » Engineering or pre-construction work to hold schedule; and » Legal and other soft costs associated with securing the financing. The developer will also derive the final bank “underwriting” set of financial forecasts that is the basis for the large investment required to commence construction. The objective is generally to maximize the project’s net present value (“NPV”) while keeping capital at risk low. Successfully bringing a project to the point of closing non-recourse financing is an achievement that creates significant value as those projects are highly attractive to investors with a desire for low-risk, financially secure renewable energy facilities. 9

PATTERN ENERGY GROUP INC. PAGE Successful renewable energy development requires a highly skilled and experienced team capable of managing each of the development phases. This requires strong origination, negotiation, political and community engagement, permitting, scientific and strategic analysis capabilities, together with a rigorous focus on development risk management. Developers must also establish and maintain effective relationships with key contractors, financial institutions and offtake counterparties. These skills are essential to cultivating a broad portfolio of development projects. Renewable Energy Development Phases DEVELOPMENT PHASES 10 Blade Signing Event in Curry County - Broadview Wind Project

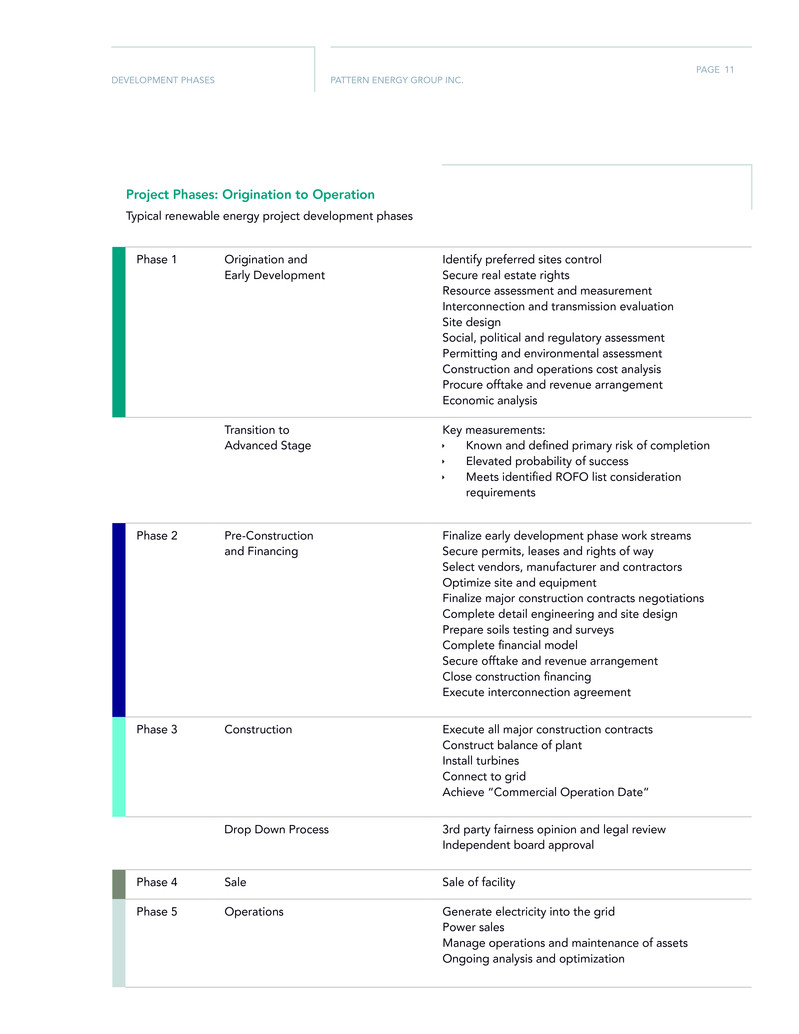

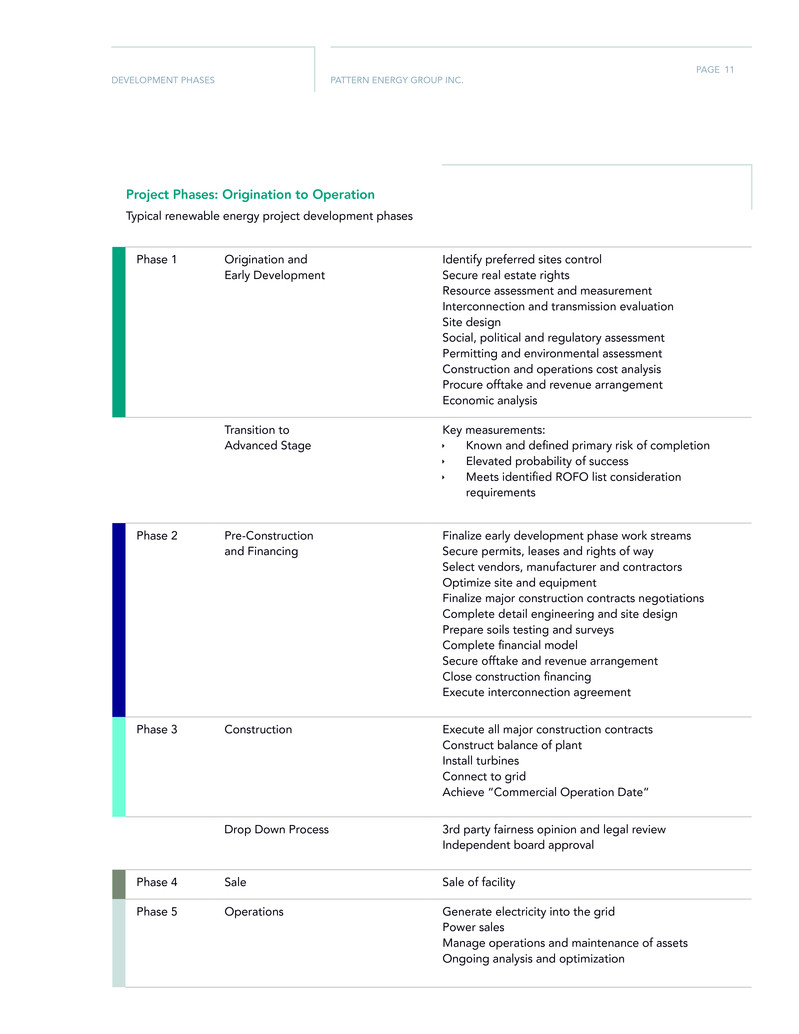

PATTERN ENERGY GROUP INC. PAGE Phase 1 Origination and Early Development Identify preferred sites control Secure real estate rights Resource assessment and measurement Interconnection and transmission evaluation Site design Social, political and regulatory assessment Permitting and environmental assessment Construction and operations cost analysis Procure offtake and revenue arrangement Economic analysis Transition to Advanced Stage Key measurements: Ì Known and defined primary risk of completion Ì Elevated probability of success Ì Meets identified ROFO list consideration requirements Phase 2 Pre-Construction and Financing Finalize early development phase work streams Secure permits, leases and rights of way Select vendors, manufacturer and contractors Optimize site and equipment Finalize major construction contracts negotiations Complete detail engineering and site design Prepare soils testing and surveys Complete financial model Secure offtake and revenue arrangement Close construction financing Execute interconnection agreement Phase 3 Construction Execute all major construction contracts Construct balance of plant Install turbines Connect to grid Achieve “Commercial Operation Date” Drop Down Process 3rd party fairness opinion and legal review Independent board approval Phase 4 Sale Sale of facility Phase 5 Operations Generate electricity into the grid Power sales Manage operations and maintenance of assets Ongoing analysis and optimization Project Phases: Origination to Operation Typical renewable energy project development phases DEVELOPMENT PHASES 11

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES Origination and Early Development During the origination and early development stage, projects are screened for the strength of renewable energy resources (wind speeds in this case); social, political, regulatory and market risks; availability in terms of the requisite interconnection transmission, land, permits and revenue agreements, and constructability. Projects that pass the screening process are either acquired or self-sourced, and development begins. Each project has a unique set of attributes which drive its development. The key success factor for the development of one project may be securing a permit (e.g. building on public land). In another project, securing permits may be relatively straightforward (e.g. when building on private land in low land use regulation states), but resolving other issues, such as access to transmission, may be the key success factor. In every project, however, development and origination will PHASE 1 require the developer to deal with the same basic set of scientific analysis, contractual rights and permits. A description of each is set out below. Real estate control Site control that reflects the long-term nature of renewable energy projects is obtained either through acquisition of the underlying real estate or, more often, a lease or right of use of the property. The developer typically secures an option to receive the necessary rights with minimal payments made during the development period prior to the commencement of construction. Resource assessment Information is collected from on-site meteorological towers (“met masts”), light detection and ranging sensors (“LIDARs”) and sonic detection and ranging sensors (“SODARS”), as well as from other statistically significant macro or long-term off-site reference sources, such as airports or weather stations. This information is used to refine estimates of site productivity and to identify potential turbine locations in order to optimize production. This assessment requires strong meteorological expertise to undertake analyses of on-site and reference weather data, site suitability, physical structures, power conversion of the technology and the impact of the equipment on itself (i.e. how upstream turbines can impact downstream production). These analyses are an essential tool for turbine selection, site suitability and forecasting. Data gathering periods range from one to five years or more depending on the complexity of the site and quality of the data. It is a sophisticated 12 Less Energetic More Energetic Wind Resource Map - Meikle Wind Wind Flow

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES process that has evolved to include the use of multiple models that estimate the long-term performance of different turbine technologies on a specific site. For example, in the past, an average long-term (20+ years) expected wind speed would be estimated and the single best turbine for that wind speed would be selected. Today, meteorologists can model each individual tower location and make adjustments for the specific turbine to be used, including different blade lengths or hub heights. These scientists can model the interaction of each turbine’s location and its effect on other turbines on the site. Social, political and regulatory assessment A project becomes a long-term part of the community where it is located, and each community has its own unique concerns and opportunities for helping the community. In the early stages of development, it is important to identify any policies at the state, provincial or local level that could be relevant to the project and how those policies may change over time. It is equally important to identify key stakeholders, ranging from local and state permitting authorities and elected officials to business owners and interested citizens, and determine what they care about and how best to engage with them. This requires direct and indirect forms of communication, such as creating project materials and a website, media briefings, town hall meetings, and one- on-one meetings. Often specific community benefits or design features are incorporated into the project. Working respectfully and transparently with all stakeholders is not only the right thing to do but is also good business practice. Interconnection evaluation Developers undertake comprehensive analyses of the requirements to interconnect a project to the transmission system, and assuming the analyses have a positive outcome, apply for interconnection. Numerous studies are required to confirm the ability to safely inject power into the system and to understand the impact of the project on the transmission system. Developers are required to identify if the facilities and system require upgrades, as well as the projected cost and schedule for the construction of those facilities and upgrades. Developers must also assess the potential for congestion or curtailment on the transmission system that could limit generation or create economic burdens on transferring power across the system. Working within the constraints of utility regulations, the developer often works closely with the relevant utility on the impact assessment of the power facility. Permitting and environmental assessment While there are numerous types of federal, state and local permits with varying requirements, many of the major permits associated with renewable energy projects require rigorous environmental impact assessments. Permit preparation typically involves siting and environmental studies, stakeholder engagement processes, and in many cases, management, mitigation and monitoring plans. Threatened and endangered species, cultural resources, and visual impacts are carefully assessed and mitigation plans are developed in coordination with the relevant stakeholders. 13

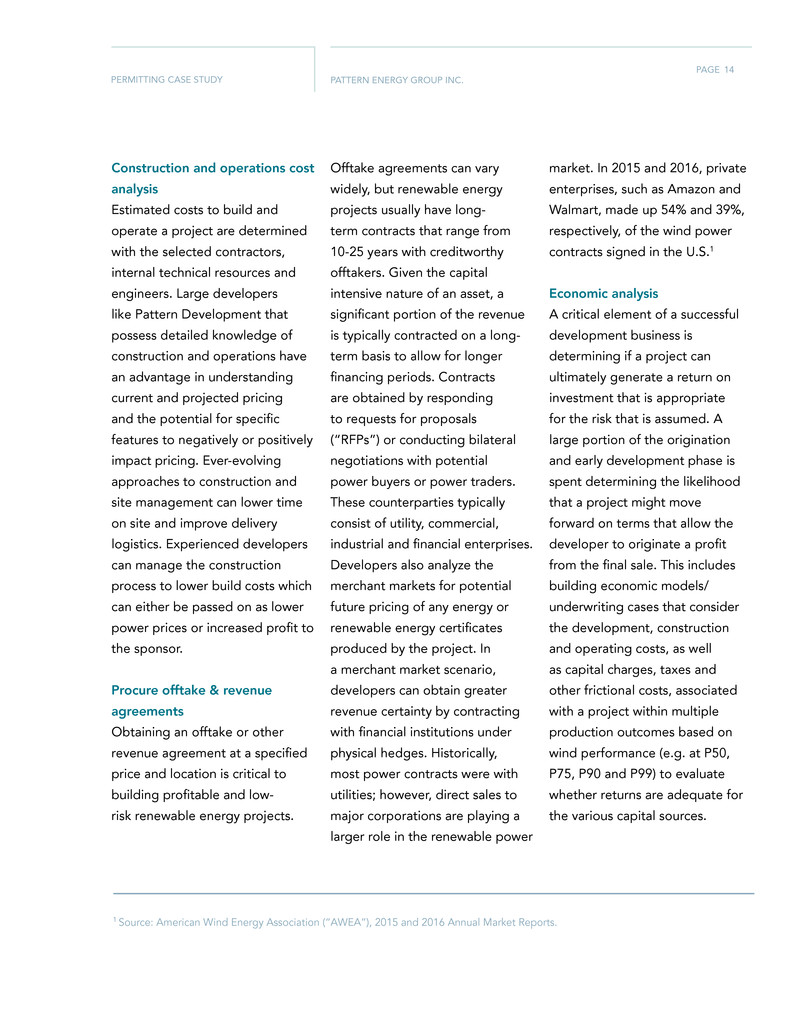

PATTERN ENERGY GROUP INC. PAGE PERMITTING CASE STUDY Construction and operations cost analysis Estimated costs to build and operate a project are determined with the selected contractors, internal technical resources and engineers. Large developers like Pattern Development that possess detailed knowledge of construction and operations have an advantage in understanding current and projected pricing and the potential for specific features to negatively or positively impact pricing. Ever-evolving approaches to construction and site management can lower time on site and improve delivery logistics. Experienced developers can manage the construction process to lower build costs which can either be passed on as lower power prices or increased profit to the sponsor. Procure offtake & revenue agreements Obtaining an offtake or other revenue agreement at a specified price and location is critical to building profitable and low- risk renewable energy projects. 1 Source: American Wind Energy Association (“AWEA”), 2015 and 2016 Annual Market Reports. Offtake agreements can vary widely, but renewable energy projects usually have long- term contracts that range from 10-25 years with creditworthy offtakers. Given the capital intensive nature of an asset, a significant portion of the revenue is typically contracted on a long- term basis to allow for longer financing periods. Contracts are obtained by responding to requests for proposals (“RFPs”) or conducting bilateral negotiations with potential power buyers or power traders. These counterparties typically consist of utility, commercial, industrial and financial enterprises. Developers also analyze the merchant markets for potential future pricing of any energy or renewable energy certificates produced by the project. In a merchant market scenario, developers can obtain greater revenue certainty by contracting with financial institutions under physical hedges. Historically, most power contracts were with utilities; however, direct sales to major corporations are playing a larger role in the renewable power market. In 2015 and 2016, private enterprises, such as Amazon and Walmart, made up 54% and 39%, respectively, of the wind power contracts signed in the U.S.1 Economic analysis A critical element of a successful development business is determining if a project can ultimately generate a return on investment that is appropriate for the risk that is assumed. A large portion of the origination and early development phase is spent determining the likelihood that a project might move forward on terms that allow the developer to originate a profit from the final sale. This includes building economic models/ underwriting cases that consider the development, construction and operating costs, as well as capital charges, taxes and other frictional costs, associated with a project within multiple production outcomes based on wind performance (e.g. at P50, P75, P90 and P99) to evaluate whether returns are adequate for the various capital sources. 14

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES Creating an Advanced Stage Project The core objective of the origination and early development phase is to create a revenue proposition (a PPA or hedge) that allows for a project to be constructed with adequate returns. An accurate estimate of these returns takes into consideration the real estate, resource assessment, interconnection, cost structure and permitting compliance perspectives to deliver a project with the best value, or one that will look much like Pattern Energy’s operating projects. The threshold for achieving a distinct revenue proposition can be defined as having created an “advanced stage project,” which would then move to the “pre-construction and financing phase” described below. While the developer may not have completed all aspects of the development at this point, once a project is an advanced stage project, the primary risk of completion relates to specific execution risk items that are relatively well understood and defined. For instance, this could be obtaining final permits, finalizing construction contracts, raising financing or executing/finalizing the offtake arrangement. While risks are always present, the probability of success is much higher at this stage. In fact, Pattern Development has successfully completed all the projects it designated as advanced stage. Advanced stage projects are also candidates for Pattern Energy’s list of identified ROFO (“iROFO”) projects. 15 Projects in the initial origination and early development phase are referred to as “pipeline projects.” From a value perspective, pipeline projects have significant potential for value creation, but there are key aspects in the overall commercial and economic viability that make it unclear whether individual pipeline projects will ultimately go forward. An experienced developer will keep a high number of projects in this pipeline stage, at minimal cost. This creates the most “option” value for the developer. The expectation is that only a subset of the pipeline projects will move forward and that the developer will write-off the remainder at a minimal cost. The projects that reach the stage where there is a high degree of confidence for successful completion are referred to as “Advanced Stage Projects.” This stage typically means the project has executed or qualifies for a PPA from a creditworthy offtaker. Experienced developers are able to secure a high percentage of pipeline projects while keeping the development losses to a minimum level.

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES - CASE STUDY Project Case Study Broadview Energy Projects The Broadview Energy projects were part of a development acquisition that lacked sufficient meteorological towers for Pattern Development to obtain the necessary confidence in the productivity of the projects. Consequently, soon after obtaining control of the development projects, Pattern Development added an incremental six met masts and a remote sensing device to more accurately define the horizontal and vertical gradient of the wind resource across the projects. In order to further characterize the long-term wind regime, the met masts were correlated to a long-term wind speed reference that extended the total wind data collection period to 16 years. Pattern Development undertook an extensive wind flow modeling exercise (using model types including linear, computational fluid dynamics, and weather-driven mesoscale) to map the sites’ wind potential. The meteorological team further took advantage of the newly installed met masts by utilizing modeling tools to create a more comprehensive picture of the available wind resource than otherwise available using the prior meteorological data. By combining the modeling campaign results with new site layout optimization tools that accounted for both energy generation and the build costs, the meteorological team created the lowest “levelized cost of energy” (or the lowest cost to produce the energy) while maximizing energy generation. The tool factored costs to topographic features 16 Wind Resource Data Analysis - Broadview Wind Projects

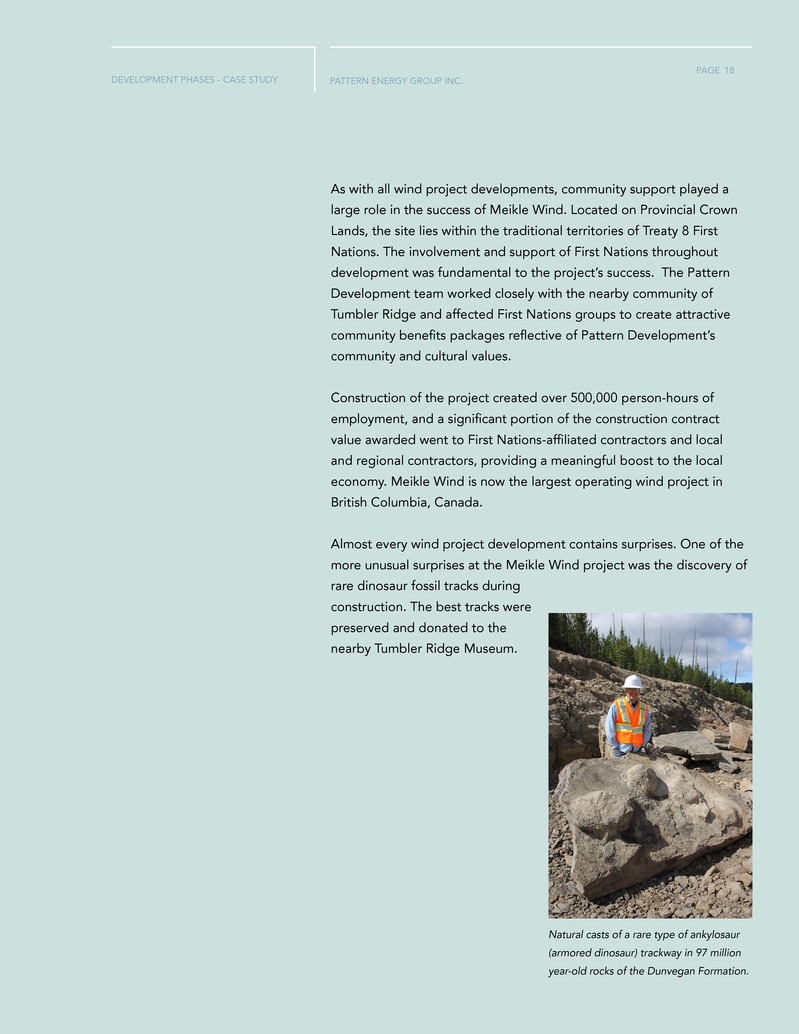

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES - CASE STUDY as part of the calculation. The layout also underwent a quality-control process that applied learnings from observed operational tendencies of the layout performance of similar projects in the Pattern Energy fleet. By applying operational data considerations during development, Pattern Development leveraged proprietary data to build the Broadview Energy projects better and more efficient. The layout design process also incorporated the concept of “overbuilding” by using additional turbines so the actual project capacity exceeds the maximum capacity allowed to be injected into the grid. During periods when total energy production is less than the maximum capacity allowed to be injected into the grid, the additional turbines included in the overbuild enable the project to generate more energy than the project would generate with fewer turbines. The meteorological team used a new time-series based energy-capture technique to model the effect of the production cap on an hourly basis. Then working with third parties to evaluate turbine performance using data from Pattern Energy’s operational facilities, Pattern Development ensured stakeholders such as lenders were comfortable with the production estimates. Project Case Study Meikle Wind The Meikle Wind project, acquired by Pattern Development as an early-stage development opportunity in 2013, demonstrates many of the concepts described above. Immediately after acquiring the project, Pattern Development focused on optimizing and improving its economic viability. Utilizing its meteorological capabilities to optimize 17 forecast production, Pattern Development efficiently exploited differing terrain and wind conditions by selecting and locating different types of turbines on the project site. Pattern Development also worked closely with BC Hydro, the PPA offtaker for the project, to develop a mutually acceptable arrangement, balancing BC Hydro’s needs for cost-effective energy and maintaining a viable project for Pattern Development. Additionally, the project’s comparatively long-term (25-year) PPA and strong fundamentals enabled the project to receive non-recourse project construction to term financing with a long-term (22-year) amortization profile and a fixed-rate swap.

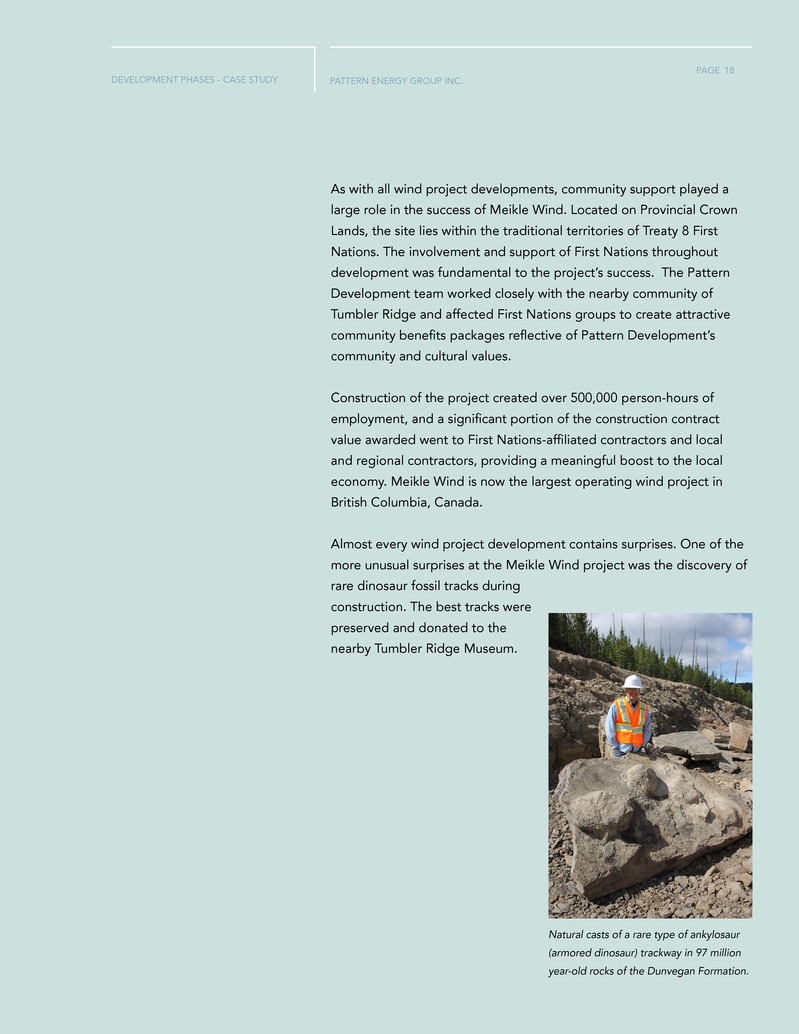

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES - CASE STUDY Natural casts of a rare type of ankylosaur (armored dinosaur) trackway in 97 million year-old rocks of the Dunvegan Formation. rare dinosaur fossil tracks during construction. The best tracks were preserved and donated to the nearby Tumbler Ridge Museum. As with all wind project developments, community support played a large role in the success of Meikle Wind. Located on Provincial Crown Lands, the site lies within the traditional territories of Treaty 8 First Nations. The involvement and support of First Nations throughout development was fundamental to the project’s success. The Pattern Development team worked closely with the nearby community of Tumbler Ridge and affected First Nations groups to create attractive community benefits packages reflective of Pattern Development’s community and cultural values. Construction of the project created over 500,000 person-hours of employment, and a significant portion of the construction contract value awarded went to First Nations-affiliated contractors and local and regional contractors, providing a meaningful boost to the local economy. Meikle Wind is now the largest operating wind project in British Columbia, Canada. Almost every wind project development contains surprises. One of the more unusual surprises at the Meikle Wind project was the discovery of 18

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES Once a project transitions to the advanced stage, pre- construction and financing activities commence. Managing this stage of development involves completing activities required to build the project without material risk of loss of the project and managing schedule delays or changes to the economic parameters established in the revenue proposition. At this stage, all aspects of the origination and early development stage work streams are finalized. Final contracts are executed and detailed engineering and plant drawings are completed. Large developers execute the engineering, procurement and construction work together with Pre-Construction & Financing PHASE 2 1 BOP contracts relate to civil and electrical work (outside the turbines), such as roads, turbine foundations, met mast foundations, monitoring systems, cable networks, and buildings/facilities. experienced contractors. The developer manages the interface between the balance of plant (“BOP”)1 contractors, turbine vendor and the other contractors. The developer typically procures the turbines and towers directly from the equipment vendors and executes the construction of the facility under fixed-priced, fixed- schedule contracts with credible construction contractors. Under the terms of these contracts, it is the construction contractors and the vendors that bear nearly all the risk for the completion of construction rather than the developer. 19

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES Construction PHASE 3 The construction phase is characterized by the commitment of all major contractual parties to complete a project. All the capital required to construct the project is in place, including required contingency to allow for unforeseen circumstances not fully covered in the construction and supply contracts. The major counterparties include the offtaker, the equipment vendors, construction contractors, landowners and the system operator. At this stage, the risk to successfully completing the project is low when the developer is working with experienced contractors. As a result, there is minimal risk that the project will not be completed once full construction commences. Optimizing the design of projects requires considerable expertise and a focus on long- term operations. Experienced contractors help to minimize the potential issues that can impact operational costs. For example, many small design features that are important to the profitability of the project may be overlooked by less experienced (or short- term focused) owners, resulting in increased long-term operational risks and costs. A simple example is that underground transmission cables can require connections, known as “splices,” that have a higher risk of failure than non- spliced lines. In the final analysis, good judgment and experience pays off. Long-term focused, experienced owners would consider incurring slightly higher construction costs to enable easier operations and maintenance over the 25-year life of the wind project. Once construction of the project has been completed, and the facility has been commissioned and interconnected to the grid, the project achieves its commercial operations date (“COD”). From this point forward, the fully operational project generates electricity and sells power. 20

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES Since the formation of Pattern Development, the Pattern Development construction team has successfully managed construction of 19 wind and solar projects (with gross capacity of over 2.8 GW) and brought all to completion within budget and on schedule.1 Pattern Development Construction Track Record Project Rated Capacity MW Within Budget On Schedule Hatchet Ridge 101 �3 �3 St. Joseph 138 �3 �3 Spring Valley 152 �3 �3 Santa Isabel 101 �3 �3 Ocotillo 265 �3 �3 El Arrayan 115 �3 �3 South Kent 270 �3 �3 Grand Renewable 149 �3 �3 Panhandle 1 218 �3 �3 Panhandle 2 182 �3 �3 K2 270 �3 �3 Armow 180 �3 �3 Logan’s Gap 200 �3 �3 Amazon Fowler Ridge 150 �3 �3 Conejo Solar1 104 �3 Meikle 180 �3 �3 Futtsu Solar 42 �3 �3 Kanagi Solar 14 �3 �3 Broadview 324 �3 �3 Ohorayama 33 in construction Belle River 100 in construction Mont Sainte-Marguerite 147 in construction 2 Pattern Development Construction Projects 3 1 Conejo Solar was two months delayed. 2”Within budget” means within the board-approved budget (including contingency). 3”On schedule” means achieved commercial operations prior to the term conversion deadline under the project construction credit facilities. 21

PATTERN ENERGY GROUP INC. PAGE DEVELOPMENT PHASES - CASE STUDY In 2009 and 2010, Pattern Development was constructing its first project in Canada, the St. Joseph Wind Farm in southern Manitoba. This project is located in an ancient lakebed that has silted in over the centuries. As a result, below the surface is 150 feet of mud that has virtually no structural support to sustain a wind turbine. Additionally, the Red River flows through its northern boundary which makes it prone to flooding. To overcome the design challenges associated with the soil conditions, Pattern Development worked with various design firms to create an innovative foundation of pipe piling and integrated concrete cap, which provided the necessary support for the wind turbines. To overcome the effects of potential flooding, Pattern Development worked with the BOP firm and turbine supplier to ensure that the entire electrical infrastructure was either capable of being submerged in water or sufficiently elevated well above historical averages. All of the design effort and planning were tested during its construction, as the project suffered four different significant weather events that flooded the region to historic levels, including a 100-year flood. In order to properly sequence and plan the work around the affected areas, these events required daily collaboration with the BOP contractor and the wind turbine supplier. Pattern Development and the construction contractors successfully delivered the St. Joseph Wind Farm project without delay and within the original budget. Project Case Study St. Joseph Wind Farm 22

PATTERN ENERGY GROUP INC. PAGE EXAMPLE PROJECT This section expands on the example introduced in the Development Business Model description of the economics of a project as it moves through the stages of development. The example below is a generic project as each project can have slightly different attributes, but it is highly indicative and comparable to actual projects completed by Pattern Development. In this scenario, the economics relate to a 100 MW project that has a development period of 24 months, a construction period of 12 months, and an all-in total projected cost to construct of $160 million, inclusive of all hard and soft costs, contingency costs, interest during construction, fees and other expenses. Once the project achieves commercial operations, it has a fair market value of $180 million and generates CAFD of approximately $5.5 million per year. Project at a Glance Project Size 100 MW All-in project cost to construct $160 million $120 million non recourse financing $40 million developer’s equity Time to COD 36 months Development 24 months Construction 12 months Fair market value of asset $180 million CAFD per annum $5.5 million An Example Project 23

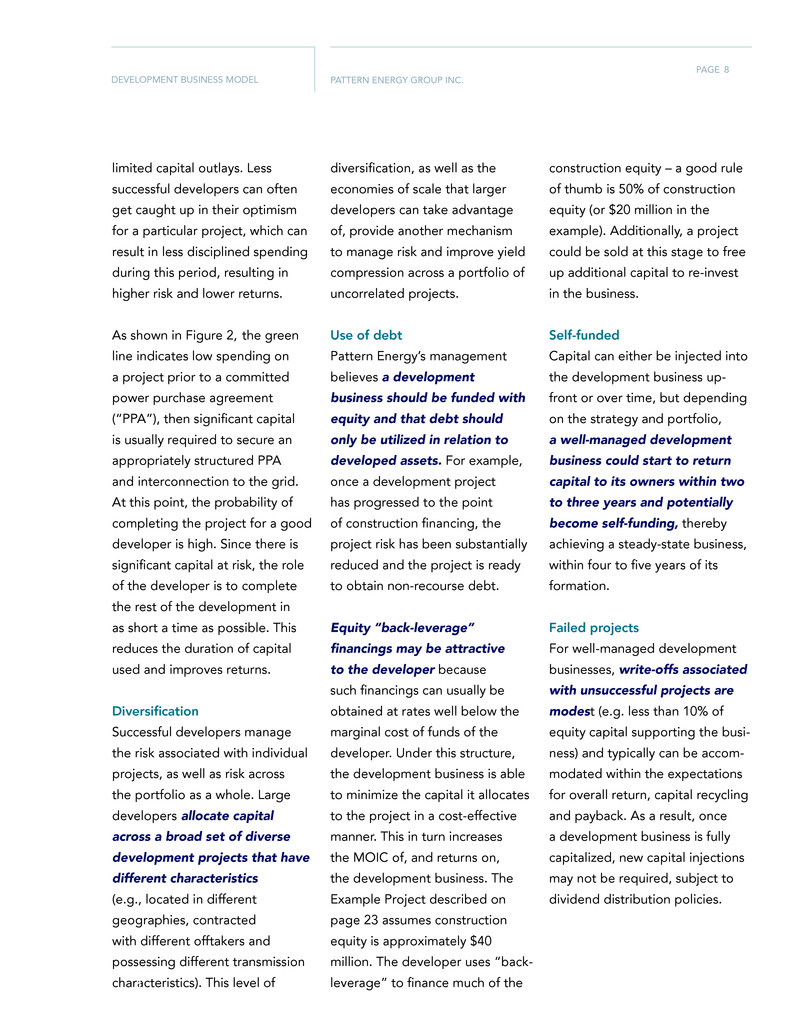

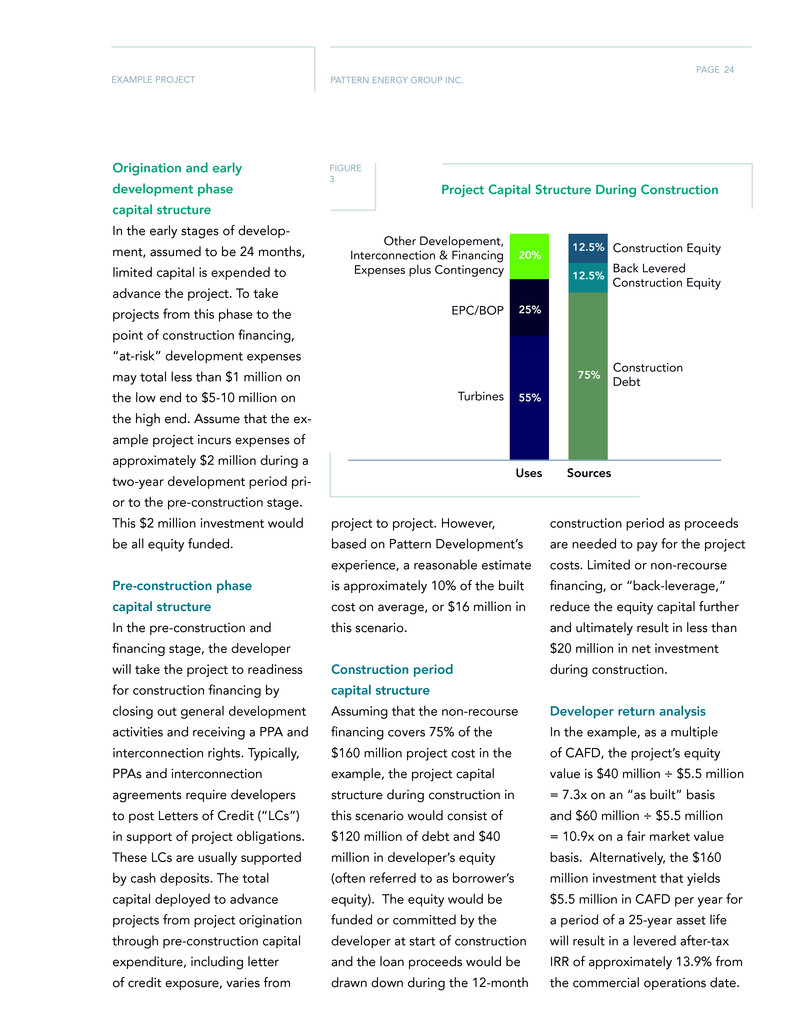

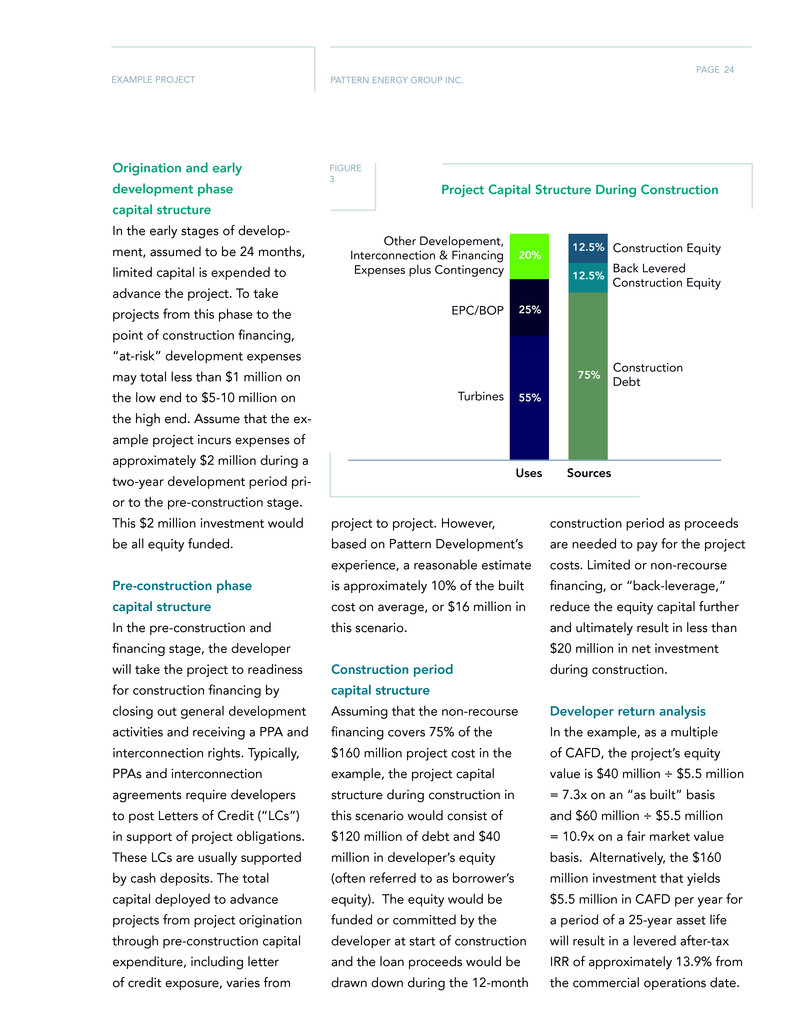

PATTERN ENERGY GROUP INC. PAGE EXAMPLE PROJECT Origination and early development phase capital structure In the early stages of develop- ment, assumed to be 24 months, limited capital is expended to advance the project. To take projects from this phase to the point of construction financing, “at-risk” development expenses may total less than $1 million on the low end to $5-10 million on the high end. Assume that the ex- ample project incurs expenses of approximately $2 million during a two-year development period pri- or to the pre-construction stage. This $2 million investment would be all equity funded. Pre-construction phase capital structure In the pre-construction and financing stage, the developer will take the project to readiness for construction financing by closing out general development activities and receiving a PPA and interconnection rights. Typically, PPAs and interconnection agreements require developers to post Letters of Credit (“LCs”) in support of project obligations. These LCs are usually supported by cash deposits. The total capital deployed to advance projects from project origination through pre-construction capital expenditure, including letter of credit exposure, varies from construction period as proceeds are needed to pay for the project costs. Limited or non-recourse financing, or “back-leverage,” reduce the equity capital further and ultimately result in less than $20 million in net investment during construction. Developer return analysis In the example, as a multiple of CAFD, the project’s equity value is $40 million ÷ $5.5 million = 7.3x on an “as built” basis and $60 million ÷ $5.5 million = 10.9x on a fair market value basis. Alternatively, the $160 million investment that yields $5.5 million in CAFD per year for a period of a 25-year asset life will result in a levered after-tax IRR of approximately 13.9% from the commercial operations date. project to project. However, based on Pattern Development’s experience, a reasonable estimate is approximately 10% of the built cost on average, or $16 million in this scenario. Construction period capital structure Assuming that the non-recourse financing covers 75% of the $160 million project cost in the example, the project capital structure during construction in this scenario would consist of $120 million of debt and $40 million in developer’s equity (often referred to as borrower’s equity). The equity would be funded or committed by the developer at start of construction and the loan proceeds would be drawn down during the 12-month Uses Sources Construction Debt Back Levered Construction Equity Construction Equity20% 12.5% 12.5% 75% 25% 55% Other Developement, Interconnection & Financing Expenses plus Contingency EPC/BOP Turbines FIGURE 3 Project Capital Structure During Construction 24

PATTERN ENERGY GROUP INC. PAGE SUMMATION On sell-down at the commercial operations date, assuming the $180 million purchase price, the levered after-tax IRR would be approximately 8.1%, generating 5.8% (or 580 basis points) of “yield compression.” Per-share accretion analysis Assume a company with $1.8 billion market capitalization, 6% yield and 80% targeted payout ratio, invested $60 million to buy the example project using funds from an equity raise, corporate debt and a portion of existing CAFD. If the investment produced incremental CAFD of $5.5 million ($4.5 million after servicing corporate debt), accretion arising from that investment would be around 1.8%. Assuming the same facts, except that the company invested $40 million to develop, build and own the example project, accretion arising from that investment would be around 2.8%, which represents more than a 50% increase from buying the developed project. In summation, renewable energy development offers ever-growing opportunities both domestically and abroad. Although the process has certain risks associated with it, an experienced, disciplined team can effectively manage those risks to generate high quality assets and attractive returns for its investors. Should you have any questions, please don’t hesitate to contact us at: Pattern Energy Group Inc. Investor Relations ir@patternenergy.com Economic Conclusions In summary, the following conclusions can be drawn: » A well-managed project can progress through the early development and origination phases, which are typically the longer duration and higher risk periods for an individual project, on a limited amount of capital – less than 2% of build cost. » The point of maximum business risk exposure, typically approximately 10% of build cost, is usually during the pre- construction stage immediately prior to the beginning of construction. » The point of maximum capital at risk is usually upon close of construction financing and full commencement of construction – typically approximately 40% of build cost. While the capital is higher at this stage than during the pre- construction stage, this capital is lower risk in nature. The primary risks at this stage relate to construction completion and sell-down price of the equity interest. Summation Disclaimer Any investment in Pattern Development 2.0 would be subject to approval by Pattern Energy’s Conflicts Committee and Board of Directors. The content provided in this White Paper is intended solely for general information purposes. The case studies, hypotheticals and other information in the White Paper do not constitute estimates, forecasts or assurances that similar future circumstances will result in similar results. The White Paper in no way constitutes the provision of investment advice. Pattern Energy does not accept liability for direct or indirect losses resulting from using, relying or acting upon information in the White Paper. 25