Kindred Biosciences Announces First Quarter 2020 Financial Results

San Francisco, California (May 7, 2020) - Kindred Biosciences, Inc. (NASDAQ: KIN), a biopharmaceutical company focused on saving and improving the lives of pets, today announced financial results for the first quarter ended March 31, 2020 and provided updates on its programs. For the first quarter 2020, KindredBio reported net product revenues of $0.6 million and a net loss of $22.8 million, or $0.58 per share, which includes non-recurring charges of $5.1 million.

“We are very pleased with the recent close of the $43 million Mirataz transaction. We look forward to continuing to build value in our promising pipeline,” said KindredBio’s Chief Executive Officer, Richard Chin, M.D. “With the positive results from the IL-4/13 SINK pilot study we now have eight positive pilot studies in a row, which is a remarkable achievement, and speaks to the quality of our development capabilities.”

Development and Corporate Updates

Biologics Candidates

•The scale up process for KIND-016, a fully caninized, high-affinity monoclonal antibody targeting interleukin (IL)-31 for the treatment of atopic dermatitis in dogs, is proceeding as planned and the pivotal study remains on track to start in the second half of 2020.

•On March 24, 2020 KindredBio announced positive results from the pilot field efficacy study of its canine IL-4/13 SINK molecule, a canine fusion protein targeting IL-4 and IL-13 for the treatment of atopic dermatitis in dogs. A higher treatment success rate was observed in the KIND-025 group over the placebo group from week 1 through week 4. Positive efficacy signals were also detected with other endpoints including 20mm or higher reduction from baseline in PVAS score.

•On December 16, 2019, KindredBio unveiled positive results from its randomized, placebo-controlled laboratory pilot study of KIND-032, a fully caninized monoclonal antibody targeting IL-4R for the treatment of atopic dermatitis in dogs. A second pilot study to further assess efficacy and dosing is planned for mid-2020. The IL-4 pathway is a key driver of the inflammation that underlies atopic dermatitis. KIND-032 binds to the IL-4 receptor on the surface of immune cells. The KIND-032 program is advancing ahead of schedule and is being prioritized ahead of IL-4/13 SINK.

•Pivotal studies for KIND-030, a monoclonal antibody targeting canine parvovirus, are expected to be completed in 2020 and the approval timeline is on track.

•The pivotal efficacy study for KindredBio’s feline recombinant erythropoietin was initiated in the fourth quarter. Due to COVID-19, a number of veterinary clinics are not conducting clinical trials currently. KindredBio is actively implementing practices consistent with guidance provided by the U.S. Food and Drug Administration on studies conducted during the COVID-19 pandemic to minimize the impact on timelines. An update will be provided with the second quarter results.

•The pilot field effectiveness study for KindredBio's anti-TNF antibody for canine inflammatory bowel disease is underway. Due to COVID-19, a number of veterinary clinics are not conducting clinical trials currently, and completion is now expected to extend beyond the first half of 2020. KindredBio is actively implementing practices consistent with guidance provided by the U.S. Food and Drug Administration on studies conducted during the COVID-19 pandemic to minimize the impact on timelines. An update will be provided with the second quarter results.

Mirataz

•KindredBio recorded Mirataz® (mirtazapine transdermal ointment) net product revenues of $0.6 million in the first quarter, reflecting limited distributor stocking during the Mirataz sale negotiation. Sales of Mirataz from distributors to veterinary clinics reached a record $1.6 million in the quarter, underscoring continued growth in customer adoption. On April 15, 2020 KindredBio completed the sale of Mirataz to Dechra Pharmaceuticals PLC for an upfront payment of $43 million, and royalties on worldwide sales. Dechra

plans to launch Mirataz in the UK and the European Union, and intends to conduct the necessary regulatory activities to achieve approvals in other key international markets. Royalties on future global sales of Mirataz by Dechra will be recorded by KindredBio as revenue.

KindredBio Equine

Pending the strategic evaluation of the future direction of the equine franchise, development of all candidates has been put on hold.

•On November 25, 2019, KindredBio announced that the U.S. Food and Drug Administration approved Zimeta for the control of pyrexia in horses. KindredBio recorded net product revenues of $7,000 in the first three months of the year, reflecting expected limited activity during the winter months and a downturn in equine transportation as a result of COVID-19. An application for Zimeta was made in Canada in November, with anticipated approval in the second quarter of 2020.

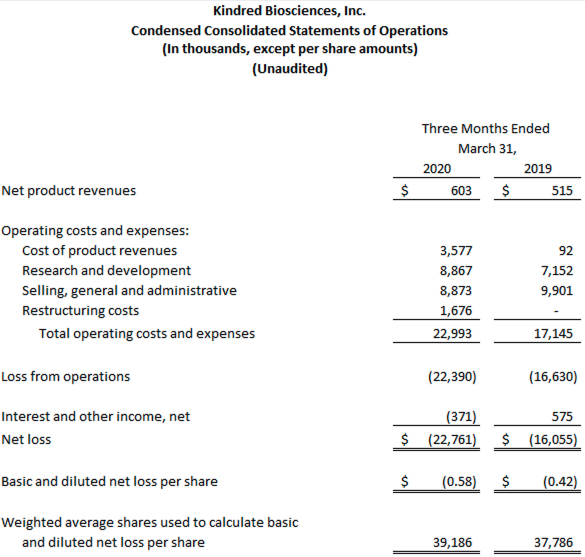

First Quarter 2020 Financial Results

For the quarter ended March 31, 2020, KindredBio reported a net loss of $22.8 million or $0.58 per share, as compared to a net loss of $16.1 million or $0.42 per share, for the same period in 2019.

The Company recorded $0.6 million in net product revenues for Mirataz for the quarter ended March 31, 2020, compared to $0.5 million for the same period in 2019. Net product revenues for Zimeta IV were $7,000 in the first quarter. Zimeta IV became commercially available in December 2019.

The cost of product sales totaled $82,000 in the first quarter of 2020, compared to $92,000 in the same period in 2019, resulting in a gross margin of 86% and 82%, respectively. The Company recorded a $3.5 million inventory write-off on Mirataz, due to the transition to Dechra brand labelling.

Research and development expenses for the quarter ended March 31, 2020 were $8.9 million, compared to $7.2 million for the same period in 2019. The $1.7 million increase was primarily due to the inclusion of expenses from the Kansas facility as it began to manufacture clinical trial material. Prior to the first quarter, construction and commissioning expenditures associated with the Kansas facility had been categorized as general and administrative expenses. Stock based compensation expense for the first quarter of 2020 was $0.6 million, as compared to $0.4 million for the same period in 2019.

Selling, general and administrative expenses for the 2020 and 2019 first quarters were $8.9 million and $9.9 million, respectively. The $1.0 million year-over-year decrease was mainly due to the recategorization of Kansas plant expenditures as research and development expenses, offset by higher legal fees. Stock based compensation expense was $1.5 million for the 2020 first quarter, versus $1.4 million in the year-ago period.

The Company recorded a restructuring charge of $1.7 million in the first quarter of 2020 as a result of the strategic realignment and associated workforce reduction communicated in the fourth quarter 2019 results.

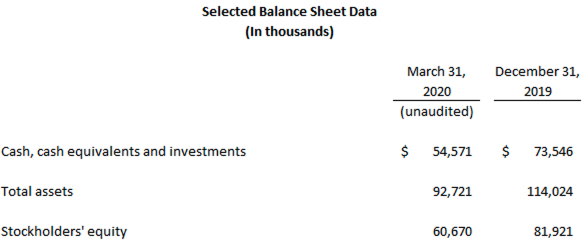

As of March 31, 2020, KindredBio had $54.6 million in cash, cash equivalents and investments, compared with $73.5 million as of December 31, 2019. Net cash used in operating activities for the first quarter of 2020 was approximately $17.1 million, reflecting a full organizational structure. The Company also invested approximately $1.4 million in capital expenditures for the purchase of associated lab and manufacturing equipment for the Kansas facility.

On April 15, 2020, KindredBio completed the sale of Mirataz to Dechra Pharmaceuticals for an upfront payment of $43 million, of which 10% shall be held in escrow for up to 18 months post closing.

With respect to spending in 2020, the Company remains focused on advancing its core biologics pipeline and programs, including the commencement of multiple pivotal studies. KindredBio anticipates operating expenses of between $57 million and $59 million, excluding the impact of stock-based compensation expense and the impact of acquisitions, if any. The 2020 operating expense includes the beforementioned one-time restructuring charge and

first quarter expenditures that reflect a full organizational structure. KindredBio also plans to invest $3.0 million to $4.0 million in capital expenditures on lab and manufacturing equipment for its biologics programs in 2020. KindredBio believes its existing cash, cash equivalents, investments, proceeds from the Mirataz sale, revenues from anticipated partnerships, and additional drawdown of $30 million from its debt facility, which is contingent on the achievement of certain milestones, will be sufficient to fund the current operating plan through 2022.

Webcast and Conference Call

KindredBio will host a conference call and webcast today at 4:30 p.m. Eastern time/1:30 p.m. Pacific time. Interested parties may access the call by dialing toll-free (855) 433-0927 from the US, or (484) 756-4262 internationally, and using conference ID 4476025. The call will be webcast live here, with a replay available at that link for 30 days.

Important Safety Information

ZimetaTM (dipyrone injection) should not be used more frequently than every 12 hours. For use in horses only. Do not use in horses with a hypersensitivity to dipyrone, horses intended for human consumption or any food producing animals, including lactating dairy animals. Not for use in humans, avoid contact with skin and keep out of reach of children. Take care to avoid accidental self-injection and use routine precautions when handling and using loaded syringes. Prior to use, horses should undergo a thorough history and physical examination by a veterinarian. Monitor for signs of abnormal bleeding and use caution in horses at risk for hemorrhage. Concurrent use with other NSAIDs, corticosteroids and drugs associated with kidney toxicity, should be avoided. As a class, NSAIDs may be associated with gastrointestinal, kidney, and liver toxicity. The most common adverse reactions observed during clinical trials were elevated glucose conversion enzymes, decreased blood protein, and gastric ulcers. Please see the full Prescribing Information.

About Kindred Biosciences

Kindred Biosciences is a biopharmaceutical company developing innovative biologics focused on saving and improving the lives of pets. Its mission is to bring to pets the same kinds of safe and effective medicines that human family members enjoy. The Company’s strategy is to identify targets that have already demonstrated safety and efficacy in humans and to develop therapeutics based on these validated targets for dogs and cats. KindredBio has a deep pipeline of novel biologics in development across many therapeutic classes, alongside state-of-the-art biologics manufacturing capabilities and a broad intellectual property portfolio.

For more information, visit: www.kindredbio.com

Forward-Looking Statements This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding our expectations about the trials, regulatory approval, manufacturing, distribution and commercialization of our current and future product candidates, and statements regarding our anticipated revenues, expenses, margins, profits and use of cash.

These forward-looking statements are based on our current expectations. These statements are not promises or guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results to be materially different from any future results expressed or implied by the forward-looking statements. These risks include, but are not limited to, the following: our limited operating history and expectations of losses for the foreseeable future; the absence of significant revenue from our products and our product candidates for the foreseeable future; the likelihood that our revenue will vary from quarter to quarter; our potential inability to obtain any necessary additional financing; our substantial dependence on the success of our products and our lead product candidates which may not be successfully commercialized even if they are approved for marketing; the effect of competition; our potential inability to obtain regulatory approval for our existing or future product candidates; our dependence on third parties to conduct some of our development activities; our dependence upon third-party manufacturers for supplies of our products and our product candidates and the potential inability of these manufacturers to deliver a sufficient amount of supplies on a timely basis; the uncertain effect of the COVID-19

pandemic on our business, results of operations and financial condition; uncertainties regarding the outcomes of trials regarding our product candidates; our potential failure to attract and retain senior management and key scientific personnel; uncertainty about our ability to enter into satisfactory agreements with third-party licensees of our biologic products or to develop a satisfactory sales organization for our equine small molecule products; our significant costs of operating as a public company; potential cyber-attacks on our information technology systems or on our third-party providers’ information technology systems, which could disrupt our operations; our potential inability to repay the secured indebtedness that we have incurred from third-party lenders, and the restrictions on our business activities that are contained in our loan agreement with these lenders; the risk that our 2020 strategic realignment plan will result in unanticipated costs or revenue shortfalls; uncertainty about the amount of royalties that we will receive from the sale of Mirataz® to Dechra Pharmaceuticals PLC; our potential inability to obtain and maintain patent protection and other intellectual property protection for our products and our product candidates; potential claims by third parties alleging our infringement of their patents and other intellectual property rights; our potential failure to comply with regulatory requirements, which are subject to change on an ongoing basis; the potential volatility of our stock price; and the significant control over our business by our principal stockholders and management.

For a further description of these risks and other risks that we face, please see the risk factors described in our filings with the U.S. Securities and Exchange Commission (the SEC), including the risk factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K and any subsequent updates that may be contained in our Quarterly Reports on Form 10-Q filed with the SEC. As a result of the risks described above and in our filings with the SEC, actual results may differ materially from those indicated by the forward-looking statements made in this press release. Forward-looking statements contained in this press release speak only as of the date of this press release and we undertake no obligation to update or revise these statements, except as may be required by law.

The results stated in this press release have not been reviewed by the Food and Drug Administration or the United States Department of Agriculture Center for Veterinary Biologics, as applicable.

Contacts

For investor inquiries: Katja Buhrer

Katja.buhrer@kindredbio.com

(917) 969-3438