Exhibit 99.2

INVESTOR PRESENTATION August 2023

Forward Looking Statements This presentation contains forward - looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 . All statements other than statements of historical facts contained in this document, including but not limited to statements regarding possible or assumed future res ults of operations, business strategies, development plans, regulatory activities, market opportunity competitive position, potential growth opportunities, and the ef fec ts of competition, are forward - looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause TELA B io, Inc.’s (the “Company”) actual results, performance or achievements to be materially different from any future results, performance or achievements expresse d o r implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “expect,” “plan ,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these term s o r other similar expressions. The forward - looking statements in this presentation are only predictions. The Company has based these forward - looking statements largely on its curr ent expectations and projections about future events and financial trends that it believes may affect the Company’s business, financial condition and results of operations. These forward - looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions , s ome of which cannot be predicted or quantified and some of which are beyond the Company’s control, including, among others: the impact to the Company’s business fro m macroeconomic conditions, including the COVID - 19 pandemic or other public health crises, recessionary concerns, banking instability, increasing market interest rates, and inflationary pressures, potentially impacting our ability to market our products, demand for our products due to the deferral of elective procedures, th e labor and staffing environment in the healthcare industry, disruption in our supply chain, or pricing pressures concerning our products or the procedures using our pr oducts; our ability to achieve or sustain profitability; the Company's ability to gain market acceptance for the Company's products and to accurately forecast and meet cu stomer demand; the Company's ability to compete successfully; that data from earlier studies related to the Company’s products and interim data from ongoing studi es may not be replicated in later studies or indicative of future data, that data obtained from clinical studies utilizing the Company’s products may not be indicative of ou tcomes in other surgical settings; the Company's ability to enhance the Company's product offerings; development and manufacturing problems; capacity constraints or de lays in production of the Company's products; maintenance of coverage and adequate reimbursement for procedures using the Company's products; product d efe cts or failures. These and other risks and uncertainties are described more fully in the "Risk Factors" section and elsewhere in the Company's filings w ith the Securities and Exchange Commission and available at www.sec.gov. You should not rely on these forward - looking statements as predictions of future events . The events and circumstances reflected in the Company’s forward - looking statements may not be achieved or occur, and actual results could differ materially f rom those projected in the forward - looking statements. Moreover, the Company operates in a dynamic industry and economy. New risk factors and uncertainties may eme rge from time to time, and it is not possible for management to predict all risk factors and uncertainties that the Company may face. Except as required by ap pli cable law, we do not plan to publicly update or revise any forward - looking statements contained herein, whether as a result of any new information, future events, cha nged circumstances or otherwise.

TELA Bio, Inc. • Advanced reinforced tissue matrix portfolio supported by compelling clinical evidence • $2.2B US market opportunity 1 – still in early stages of growth • Driving commercial adoption with targeted direct - sales approach • Recent product launches in growing markets: robotic hernia surgery, plastic and reconstructive surgery • Broad intellectual property portfolio • Established DRG - based reimbursement pathway for hernia repair and robust GPO access • Highly accomplished executive team with proven track record 1 Management estimate. $2.2B total includes $1.5B hernia & abdominal wall reconstruction, $0.7B plastic reconstructive surgery. Redefining soft tissue preservation and restoration with a differentiated category of tissue reinforcement materials and supportive products

Complex, Moderate Ventral / Abdominal Wall Reconstruction Simple Ventral Hernia Repair Inguinal Hernia Repair Hiatal Hernia Repair ~60,000 ~345,000 ~665,000 ~40,000 $360M $515M $600M $40M 1 Sources: Millennium Research Group Reports, IMS Health Data; iData Research MedSKU 2 Management estimate. Market size based on volume and weighted average selling price for OviTex Annual Procedures 1 $1.5B 2 Robotic / Minimally Invasive Surgery Opportunity U.S. Hernia Surgery Market: ~$1.5 Billion Annual Opportunity Robotic / MIS compatible procedures total over 1M annually and have a potential market opportunity of up to $1.2B 2

OviTex Portfolio: Designed for a Range of Hernia Patients and Surgical Techniques • Coated resorbable synthetic meshes • Biologic meshes • Biologic meshes CONFIGURATION OviTex 2S 8 - layer device, with 2 “smooth sides” suitable for intraperitoneal placement Robot Compatible 1 : No Strength 2 : +++ Viscera Contact 3 : Yes OviTex 1S 6 - layer device, with “smooth side” suitable for intraperitoneal placement Robot Compatible 1 : Yes Strength 2 : ++ Viscera Contact 3 : Yes, smooth side COMPETITIVE SET • Coated resorbable synthetic meshes • Biologic meshes OviTex LPR 4 - layer device, with “smooth side” suitable for intraperitoneal placement Robot Compatible 1 : Yes Strength 2 : + Viscera Contact 3 : Yes, smooth side • Resorbable synthetic meshes • Biologic meshes OviTex 4 - layer device, not intended for intraperitoneal placement Robot Compatible 1 : Yes Strength 2 : + Viscera Contact 3 : Not recommended Images represent permanent polymer OviTex products. Resorbable polymer products have clear polymer. All trademarks and regist ere d marks are property of their respective owners. 1. Robot compatibility based on use of 10mm trocar. Robot compatibility of LPR and OviTex include sizes 400 cm 2 or less. Robot compatibility of OviTex 1S includes sizes 200 cm 2 or less 2. Biomechanical data on file. 3. Devices with a smooth side were shown to not adhere in an animal model. Rabbit data on file. Correlation to results in hum ans has not been established. Animal test results may not necessarily be indicative of human clinical performance. . Strattice Laparoscopic Phasix ST Bio - A SurgiMend Phasix Strattice XenMatrix SurgiMend Strattice XenMatrix SurgiMend Strattice XenMatrix Phasix ST

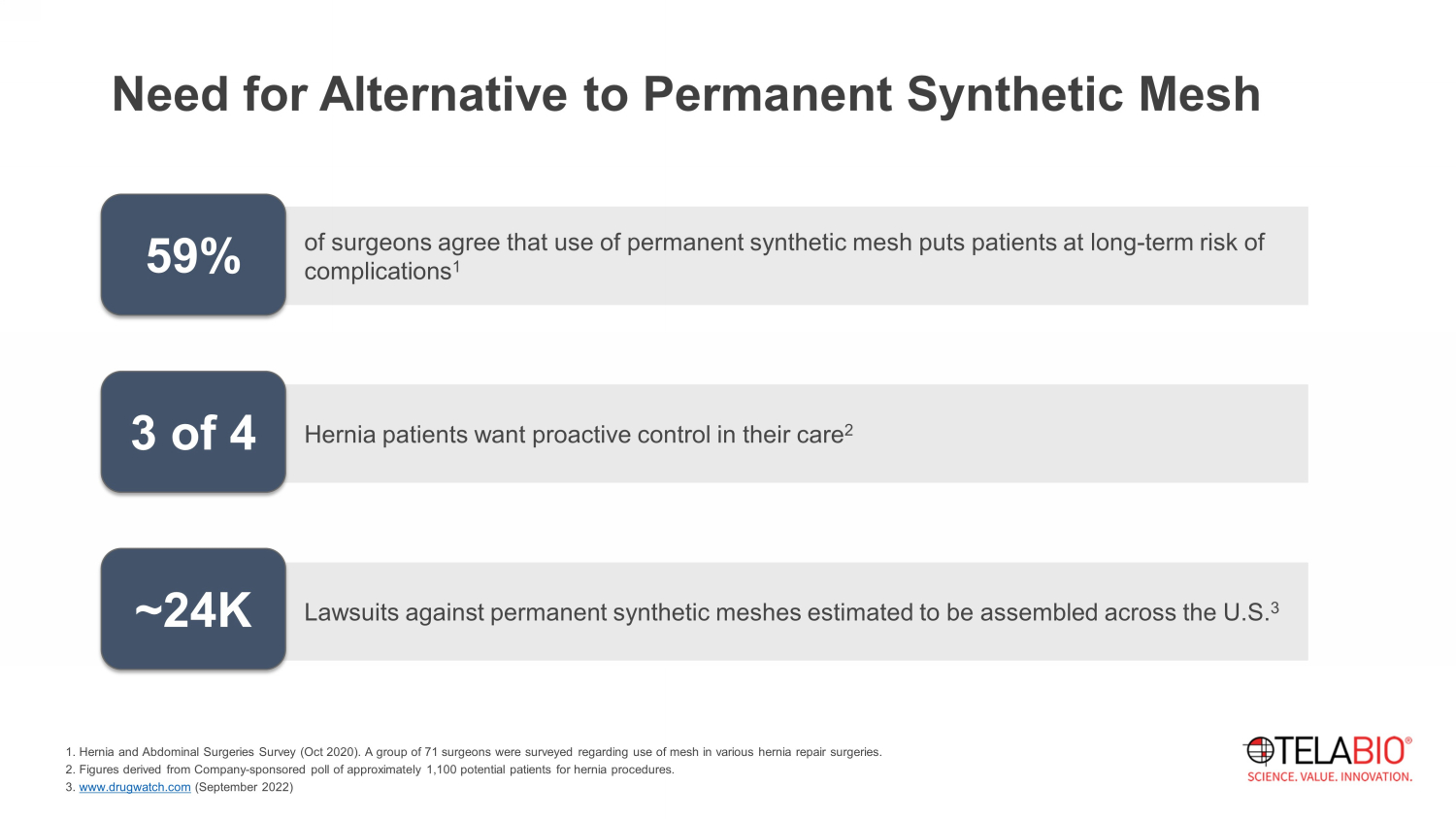

Lawsuits against permanent synthetic meshes estimated to be assembled across the U.S. 3 of surgeons agree that use of permanent synthetic mesh puts patients at long - term risk of complications 1 1. Hernia and Abdominal Surgeries Survey (Oct 2020). A group of 71 surgeons were surveyed regarding use of mesh in various hernia repai r surgeries. 2. Figures derived from Company - sponsored poll of approximately 1,100 potential patients for hernia procedures. 3. www.drugwatch.com (September 2022) 59% Hernia patients want proactive control in their care 2 3 of 4 ~ 24 K Need for Alternative to Permanent Synthetic Mesh

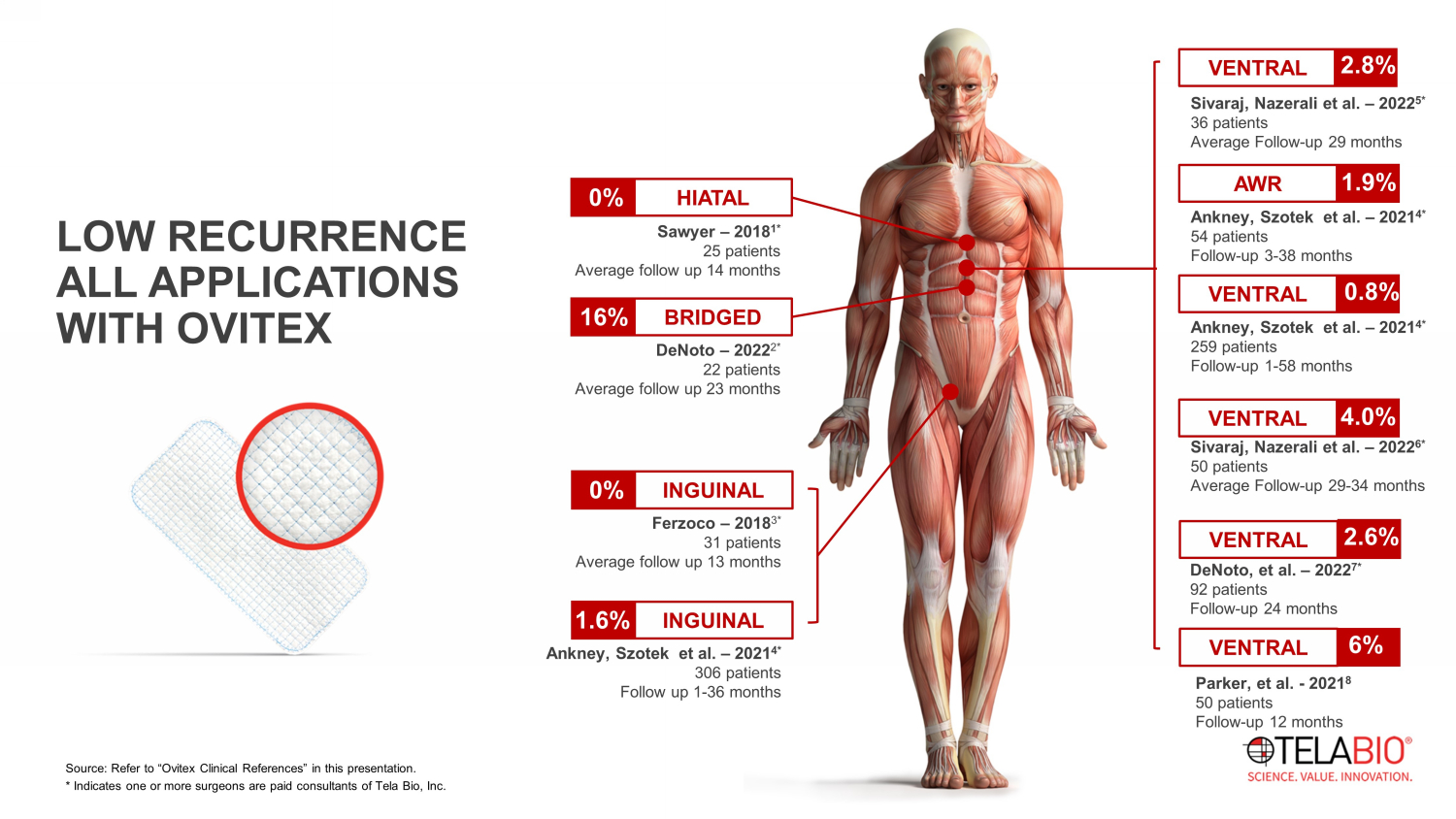

LOW RECURRENCE ALL APPLICATIONS WITH OVITEX Ankney , Szotek et al. – 2021 4 * 54 patients Follow - up 3 - 38 months Ferzoco – 2018 3 * 31 patients Average follow up 13 months INGUINAL 0% Ankney , Szotek et al. – 2021 4 * 306 patients Follow up 1 - 36 months INGUINAL 1.6% Sawyer – 2018 1 * 25 patients Average follow up 14 months HIATAL 0% DeNoto – 2022 2 * 22 patients Average follow up 23 months BRIDGED 16% AWR 1.9% Parker, et al. - 2021 8 50 patients Follow - up 12 months VENTRAL 6% DeNoto, et al. – 2022 7 * 92 patients Follow - up 24 months VENTRAL 2.6% Ankney , Szotek et al. – 2021 4 * 259 patients Follow - up 1 - 58 months VENTRAL 0.8% Sivaraj , Nazerali et al. – 2022 5 * 36 patients Average Follow - up 29 months VENTRAL 2.8% Source: Refer to “ Ovitex Clinical References” in this presentation. * Indicates one or more surgeons are paid consultants of Tela Bio, Inc. Sivaraj , Nazerali et al. – 2022 6 * 50 patients Average Follow - up 29 - 34 months VENTRAL 4.0%

Parker et al. 8 Sivaraj et al. 5 Total enrolled patients 50 OviTex 50 Polypropylene 36 OviTex 51 Strattice 17 Permacol 37 Surgimend Length of follow - up 12 months 12 months 28.6 months (median) 34.6 months (median) 58.4 months (median) 37.5 months (median) mVHWG 32% grade 2 68% grade 3 a 94% grade 2 6% grade 3 33% grade 1 58% grade 2 8% grade 3 17% grade 1 79% grade 2 4% grade 3 18% grade 1 71% grade 2 12% grade 3 40% grade 1 51% grade 2 9% grade 3 CDC wound class 70% CDC class II+ a 94% CDC class I 89% class I - II 86% class I - II 94% class I - II 91% class I - II Incidence of SSO 36%* 22%* 16.7%* 47.1%* 52.9%* 43.2%* Incidence of SSI - - 2.8% b 12.5% 11.8% 5.4% Recurrence rate 6% 12% 2.8% c 13.7% c 29.4% 24.3% Source: Refer to “Clinical References” in this presentation. Favorable Results of OviTex in Ventral Hernia Repair: Comparisons to synthetic mesh and leading generation one biologics *Overall complications including SSI a – OviTex patients were more complicated with a significantly higher mVHWG distribution and CDC wound classification compared to polypropylene patients b – OviTex patients experienced significantly less complications than patients receiving the other three biologics c - OviTex and Strattice patients had a statistically lower recurrence rate than patients receiving the other two biologics

* Kaplan - Meier survival estimate **No head - to - head clinical studies have been conducted. Due to differences in patient population, surgeons, surgical technique, and other variables, no direct comparisons of results can be made. For a comparative discussion of these studies, please see G. DeNoto , E.P. Ceppa , S.J. Pacella, M. Sawyer, G. Slayden , M. Takata, G. Tuma , J. Yunis, 24 - Month results of the BRAVO study: A prospective, multi - center study evaluating the clinical outcomes of a ventral hernia cohort treated with OviTex ® 1S permanent reinforced tissue matrix, Ann Medicine Surg 2022, 83, 104745 . Positive 24 - month BRAVO results in ventral hernia: OviTex performance contextualized alongside recent publications for leading competitive products DeNoto et al. (BRAVO) 7 Harris et al. (PRICE) 10 Roth et al. 11 Hope et al. (ATLAS) 12 Total enrolled patients 92 OviTex 82 Strattice 83 Ventralight ST or Bard Soft Mesh 121 Phasix 120 Phasix ST Length of follow - up 24 months 26 months 36 months 24 months mVHWG 78% grade 2 - 3 - - - CDC wound class 95% class I - II 90% class l - ll 93% class l - ll 100% class I 100% class I Surgical technique Open (65%) Laparoscopic (13%) Robotic (22%) Open Open Open Laparoscopic (55.8%) Robotic (44.2%) Incidence of SSO 38% (includes SSI) 21% (excludes SSI) 22% (excludes SSI) - 0.8% (includes SSI) Incidence of SSI 20.7% 39% 34% 9% * 0% Recurrence rate 2.6% * 40% (overall) 34% (class I wounds) 22% (overall) 28% (class I wounds) 17.9% * 31.7% * (overall) 18.6% * (defects < 7cm 2 ) Source: Refer to “Clinical References” in this presentation.

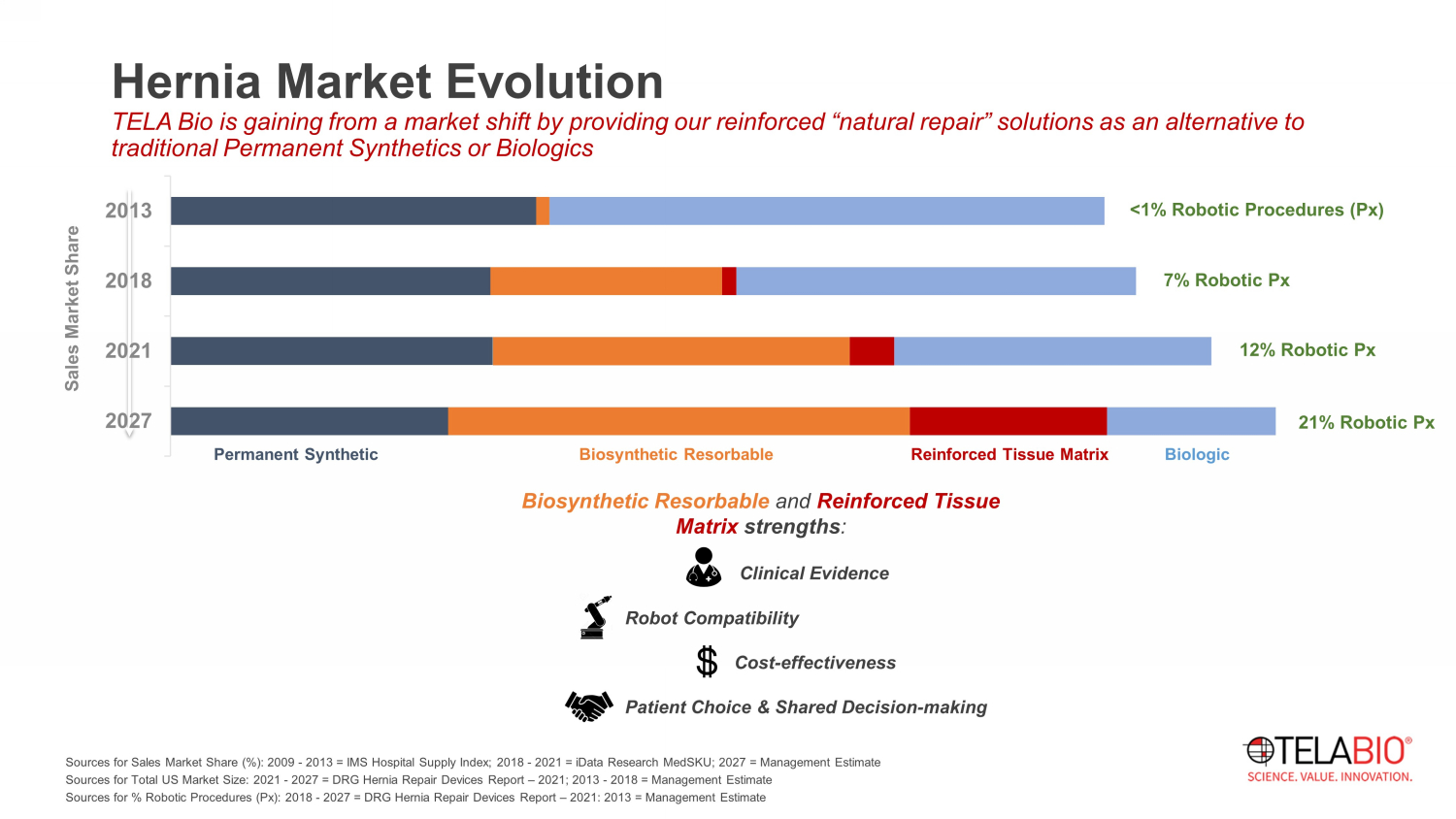

Permanent Synthetic Biologic Biosynthetic Resorbable Reinforced Tissue Matrix Sources for Sales Market Share (%): 2009 - 2013 = IMS Hospital Supply Index; 2018 - 2021 = iData Research MedSKU ; 2027 = Management Estimate Sources for Total US Market Size: 2021 - 2027 = DRG Hernia Repair Devices Report – 2021; 2013 - 2018 = Management Estimate Sources for % Robotic Procedures ( Px ): 2018 - 2027 = DRG Hernia Repair Devices Report – 2021: 2013 = Management Estimate 2027 2021 2018 2013 Sales Market Share Biosynthetic Resorbable and Reinforced Tissue Matrix strengths : Clinical Evidence Robot Compatibility Cost - effectiveness Patient Choice & Shared Decision - making <1% Robotic Procedures ( Px ) 7% Robotic Px 12% Robotic Px 21% Robotic Px Hernia Market Evolution TELA Bio is gaining from a market shift by providing our reinforced “natural repair” solutions as an alternative to traditional Permanent Synthetics or Biologics

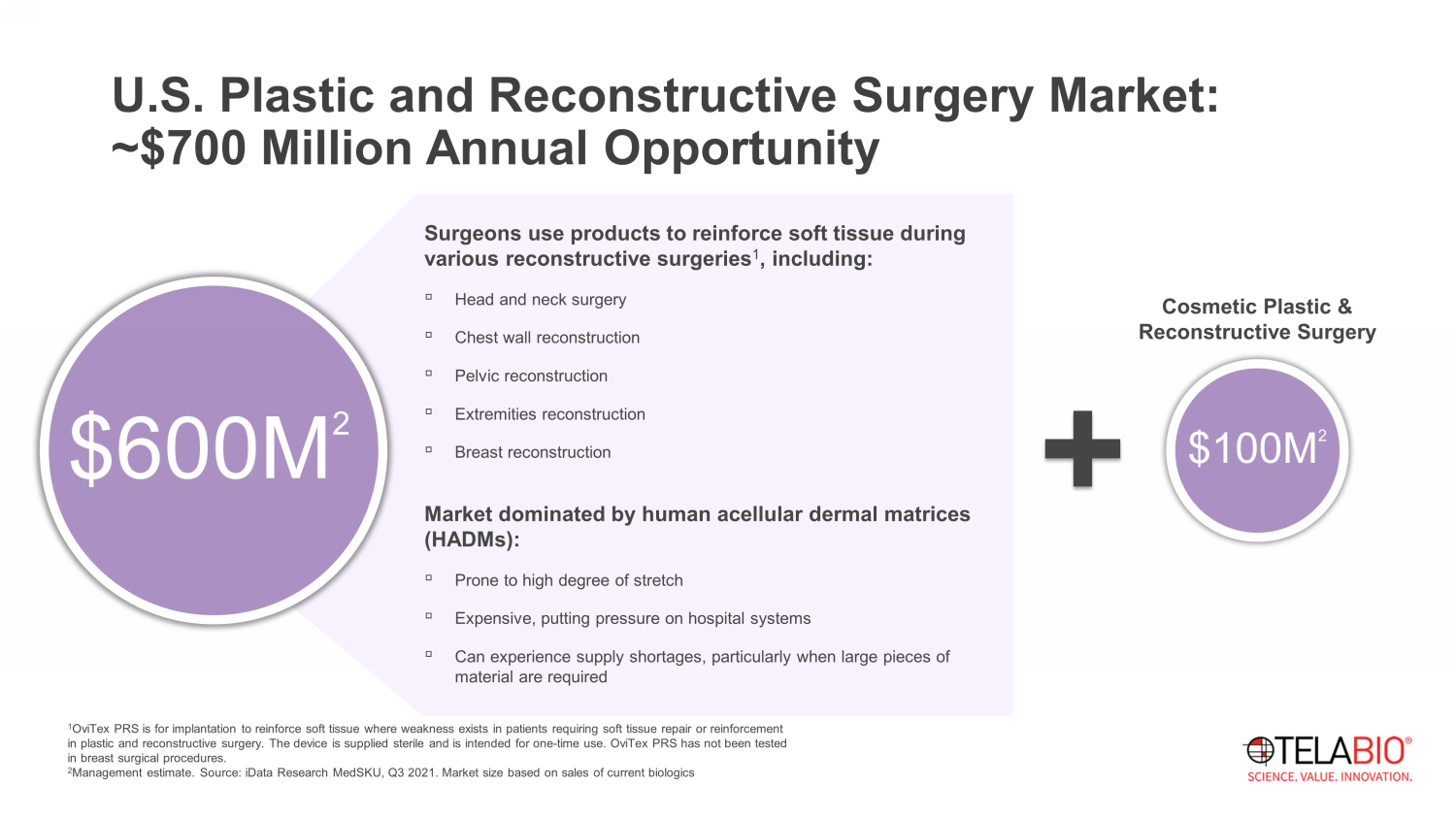

U.S. Plastic and Reconstructive Surgery Market: ~$700 Million Annual Opportunity Surgeons use products to reinforce soft tissue during various reconstructive surgeries 1 , including: ▫ Head and neck surgery ▫ Chest wall reconstruction ▫ Pelvic reconstruction ▫ Extremities reconstruction ▫ Breast reconstruction 1 OviTex PRS is for implantation to reinforce soft tissue where weakness exists in patients requiring soft tissue repair or rei nfo rcement in plastic and reconstructive surgery. The device is supplied sterile and is intended for one - time use. OviTex PRS has not been tested in breast surgical procedures. 2 Management estimate. Source: iData Research MedSKU , Q3 2021. Market size based on sales of current biologics Cosmetic Plastic & Reconstructive Surgery $600M 2 $100M 2 Market dominated by human acellular dermal matrices (HADMs): ▫ Prone to high degree of stretch ▫ Expensive, putting pressure on hospital systems ▫ Can experience supply shortages, particularly when large pieces of material are required

OviTex PRS: Specifically Designed for Plastic and Reconstructive Surgery An innovative reinforced tissue matrix designed to improve outcomes by facilitating fluid management and controlling degree and direction of stretch Product Features: ▫ Layers composed of biologic building block retain biologically significant macromolecules for tissue regeneration 1,2 ▫ Diamond embroidery pattern and stents allow for directional flexibility or sawtooth embroidery pattern to accommodate bi - directional stretch while providing stretch resistance. ▫ Distinct permeability elements in various configurations – e.g., micropores, macropores, and stents – designed to facilitate fluid management Available in both 2 - layer resorbable (polyglycolic acid) polymer, 3 - layer permanent (polypropylene) polymer, or 3 - layer resorbable (polylactic - co - glycolic acid) polymer reinforcing the same biologic material 1 . Certain configurations available in two or three layers, see product catalog more information. 2. Lun S, Irvine S.M., Johnson K.D., Fisher N.J., Floden E. W., Negron L., Dempsey S.G. , McLaughlin R.J., Vasudevamurthy M. , Ward B.R., May B.C., A functional extracellular matrix biomaterial derived from ovine forestomach, Biomaterials 31(16) ( 20 10) 4517 - 29. 3. ADM: Acellular Dermal Matrix. Overbeck N, Beierschmitt A, May BC, Qi S, Koch J. In - Vivo Evaluation of a Reinforced Ovine Biologic for Plastic and Reconstructi ve Procedures in a Non - human Primate Model of Soft Tissue Repair. Eplasty . 2022 Sep 14;22:e43. PMID: 36160663; PMCID: PMC9490877. Animal testing results may not be indicative of clinical performance. OviTex PRS compared to market leading human ADM 3 : ▫ Exhibited earlier host cell proliferation, collagen deposition and neovascularization ▫ Demonstrated tissue remodeling into mature, functional and organized collagen

TELA Bio is growing each factor that contributes to sales, providing for multi - year, long - term growth 2021: 40 - 45 reps 1H22: 57 reps 2022: 61 reps 2023: 75 - 80 reps Driving Revenue Growth Rep Productivity Sales Force Size Product Portfolio GPO Access Clinical Data $ales • Playbook90 training and assessment • 3 - 6 mos. to breakeven • TELA LIVE • Cadaver Labs • Clinical Development Specialists • AboutHernia website • BRAVO 24 - month data: 2.6% recurrence • >30 published or presented works >1,600 hospitals ~4,400 hospitals R&D and BD Third National GPO More to come

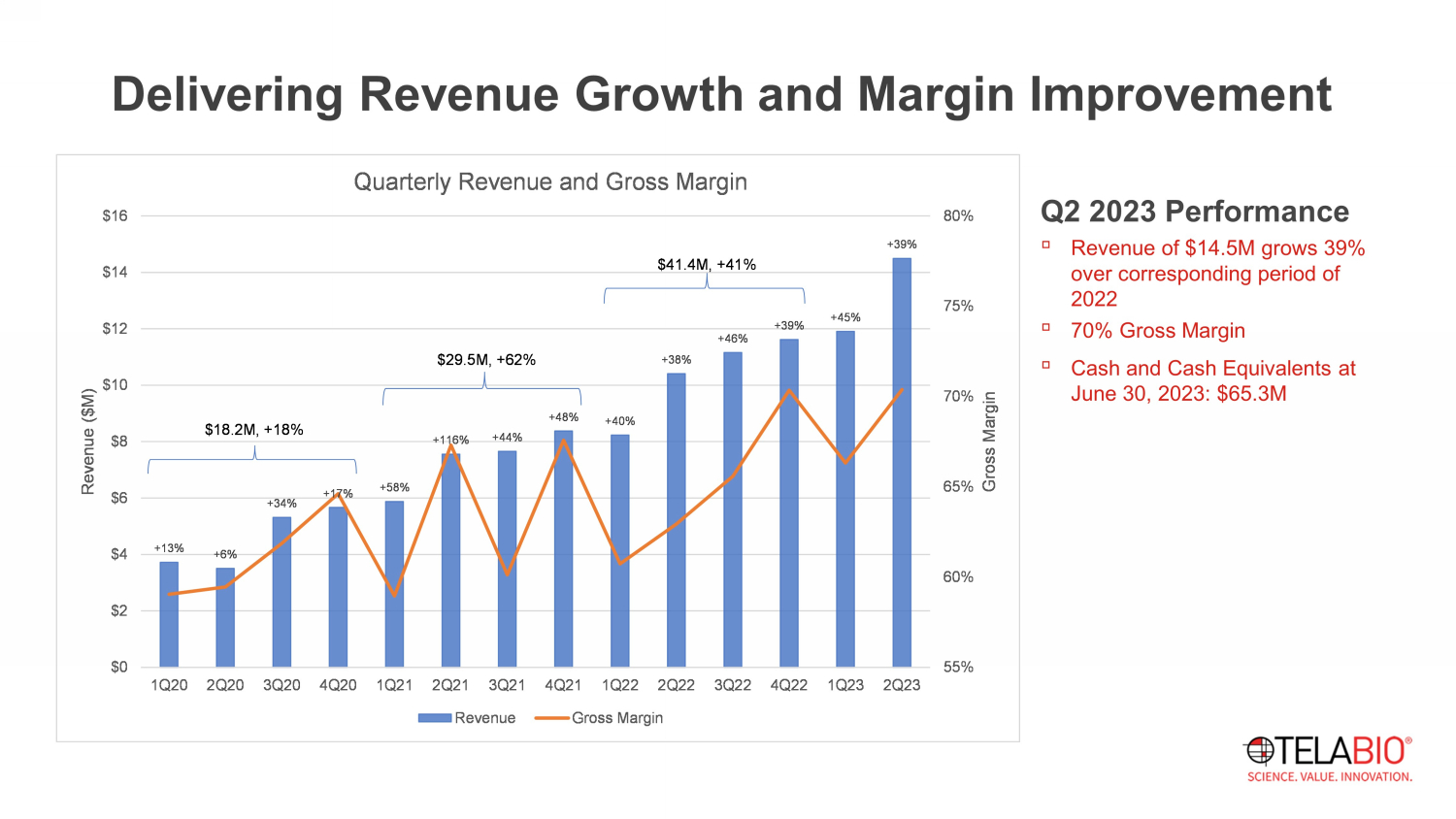

Delivering Revenue Growth and Margin Improvement Q2 2023 Performance ▫ Revenue of $14.5M grows 39% over corresponding period of 2022 ▫ 70% Gross Margin ▫ Cash and Cash Equivalents at June 30, 2023: $65.3M +13% +6% +34% +17% +58% +116% +44% +48% +40% +38% +46% +39% +45% +39% 55% 60% 65% 70% 75% 80% $0 $2 $4 $6 $8 $10 $12 $14 $16 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Gross Margin Revenue ($M) Quarterly Revenue and Gross Margin Revenue Gross Margin $18.2M, +18% $29.5M, +62% $41.4M, +41%

CLINICAL REFERENCES 1. Sawyer, M.A.J. New Ovine Polymer - Reinforced Bioscaffold in Hiatal Hernia Repair. Jsls J Soc Laparoendosc Surg 2018, 22, e2018.00057, doi:10.4293/jsls.2018.00057. 2. DeNoto, G. Bridged Repair of Large Ventral Hernia Defects Using an Ovine Reinforced Biologic: A Case Series. Ann Medicine Sur g 7 5, 103446, doi:10.1016/j.amsu.2022.103446. 3. Ferzoco, S. Available and Emerging Technologies for Assessing Intraoperative Tissue Perfusion during Complex Ventral Hernia R epa ir Procedures. Open Access Surg 2013, 1, doi:10.2147/oas.s55335. 4. Ankney , C.; Banaschak , C.; Sowers, B.; Szotek , P. Minimizing Retained Foreign Body in Hernia Repair Using a Novel Technique: Reinforced Biologic Augmented Repair ( ReBAR ). J Clin Medical Res 2021, doi:10.37191/mapsci - 2582 - 4333 - 3(4) - 073. 5. Sivaraj , D.; Henn, D.; Fischer, K.S.; Kim, T.S.; Black, C.K.; Lin, J.Q.; Barrera, J.A.; Leeolou , M.C.; Makarewicz , N.S.; Chen, K.; et al. Reinforced Biologic Mesh Reduces Postoperative Complications Compared to Biologic Mesh after Ventral Hernia Repair. Plastic Reconstr Surg - Global Open 2022, 10, e4083, doi:10.1097/gox.0000000000004083. 6. Sivaraj , D.; Henn, D.; Fischer, K.S.; Kim, T.S.; Black, C.K.; Lin, J.Q.; Barrera, J.A.; Leeolou , M.C.; Makarewicz , N.S.; Chen, K.; et al. Reinforced Biologic Mesh Reduces Postoperative Complications Compared to Biologic Mesh after Ventral Hernia Repair. Plastic Reconstr Surg - Global Open 2022, 10, e4083, doi:10.1097/gox.0000000000004083. 7. DeNoto, G.; Ceppa, E.P.; Pacella, S.J.; Sawyer, M.; Slayden, G.; Takata, M.; Tuma, G.; Yunis, J. 24 - Month Results of the BRAVO S tudy: A Prospective, Multi - Center Study Evaluating the Clinical Outcomes of a Ventral Hernia Cohort Treated with OviTex ® 1S Permanent Reinforced Tissue Matrix. Ann Medicine Surg 2022, 83, 104745, doi:10.1016/j.amsu.2022.104745. 8. Parker, M.J.; Kim, R.C.; Barrio, M.; Socas , J.; Reed, L.R.; Nakeeb , A.; House, M.G.; Ceppa, E.P. A Novel Biosynthetic Scaffold Mesh Reinforcement Affords the Lowest Hernia Recurrence in the Highest - Risk Patients. Surg Endosc 2021, 35, 5173 – 5178, doi:10.1007/s00464 - 020 - 08009 - 1. 9. Banaschak , C.; Szotek, P. Robotic Reinforced Biologic Augmented Repair ( ReBAR ) of Over 150 Inguinal Hernias: 2 Year Outcomes. Presented at: 2022 American Hernia Society (AHS) Meeting, September 14 - 16, 2022, Charlotte, NC. 10. Harris, H.W.; Primus, F.; Young, C.; Carter, J.T.; Lin, M.; Mukhtar, R.A.; Yeh, B.; Allen, I.E.; Freise , C.; Kim, E.; et al. Preventing Recurrence in Clean and Contaminated Hernias Using Biologic Versus Synthetic Mesh in Ventral Hernia Repair: The PRICE Randomized Clinical Trial. Ann Surg 2021, 273, 648 – 655, doi:10.1097/sl a.0000000000004336. 11. Roth, J.S.; Anthone , G.J.; Selzer, D.J.; Poulose , B.K.; Pierce, R.A.; Bittner, J.G.; Hope, W.W.; Dunn, R.M.; Martindale, R.G.; Goldblatt, M.I.; et al. Prospective, Multicent er Study of P4HB (PhasixTM) Mesh for Hernia Repair in Cohort at Risk for Complications: 3 - Year Follow - Up. Ann Medicine Surg 2021, 61, 1 – 7, doi:10 .1016/j.amsu.2020.12.002. 12. Hope, W.W.; El - Ghazzawy , A.G.; Winterstein , B.A.; Blatnik , J.A.; Davis, S.S.; Greenberg, J.A.; Sanchez, N.C.; Pauli, E.M.; Tseng, D.M.; LeBlanc, K.A.; et al. A Prospective, Multicent er Trial of a Long - Term Bioabsorbable Mesh with Sepra Technology in Cohort of Challenging Laparoscopic Ventral or Incisional Hernia Repairs (ATLAS Trial). Ann Medicine Surg 2022, 73 , 103156, doi:10.1016/j.amsu.2021.103156.