Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185732

PROSPECTUS

US FOODS, INC.

Offer to Exchange

All Outstanding

$975,000,000 aggregate principal amount of 8.5% Senior Notes due 2019 (the “Restricted Notes”)

for

$975,000,000 aggregate principal amount of 8.5% Senior Notes due 2019, the issuance of each of which has been registered under the Securities Act of 1933 (the “Exchange Notes”).

We refer herein to the foregoing offer to exchange as the “Exchange Offer.”

The Exchange Offer will expire at 12:00 midnight, New York City time at the end of May 2, 2013, unless we extend the Exchange Offer in our sole and absolute discretion.

The Exchange Notes:

| • | The terms of the Exchange Notes offered in the Exchange Offer are substantially identical to the terms of the Restricted Notes, except that the Exchange Notes are registered under the Securities Act of 1933, as amended (the “Securities Act”), and will not contain restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP or ISIN number from the Restricted Notes, and will not entitle their holders to registration rights. |

| • | Investing in the Exchange Notes involves risks. You should carefully review therisk factors beginning on page 14 of this prospectus before participating in the Exchange Offer. |

The Exchange Offer:

| • | No public market currently exists for the Exchange Notes (or the Restricted Notes), and the Exchange Notes will not be listed on any securities exchange or automated quotation system. |

| • | You may withdraw tenders of Restricted Notes at any time prior to the expiration or termination of the Exchange Offer. |

| • | Restricted Notes may be tendered only in minimum denominations of $2,000 and any integral multiple of $1,000 in excess thereof. |

The Guarantees:

| • | The Exchange Notes will be (as are the Restricted Notes) fully and unconditionally guaranteed on an unsecured basis by the subsidiaries indicated herein. |

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. A broker-dealer who acquired Restricted Notes as a result of market making or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes. We have agreed that, for a period of up to 90 days after the date of completion of the Exchange Offer, we will make this prospectus available for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission (the “SEC” or the “Commission”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 5, 2013.

Table of Contents

| 1 | ||||

| 14 | ||||

| 29 | ||||

| 31 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 49 | |||

| 67 | ||||

| 81 | ||||

| 85 | ||||

| 120 | ||||

| 124 | ||||

| 126 | ||||

| 136 | ||||

FORM, DENOMINATION, TRANSFER, EXCHANGE AND BOOK-ENTRY PROCEDURES FOR THE EXCHANGE NOTES | 194 | |||

| 197 | ||||

| 202 | ||||

| 203 | ||||

| 203 | ||||

| 203 | ||||

| 204 | ||||

| F-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to give you any information or to make any representations about the transaction we discuss in this prospectus other than as contained in this prospectus. If you are given any information or representation that is not discussed in this prospectus, you must not rely on that information. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date. The delivery of this prospectus shall not under any circumstances create any implication that the information contained herein is correct as of any time subsequent to the date hereof.

In making an investment decision, investors must rely on their own examination of the Issuer and the terms of the Exchange Offer, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense.

The Restricted Notes and the Exchange Notes have not been and will not be qualified under the securities laws of any province or territory of Canada. Neither the Restricted Notes nor the Exchange Notes are being offered or sold, directly or indirectly, in Canada or to or for the account of any resident of Canada in contravention of the securities laws of any province or territory thereof.

i

Table of Contents

THIS PROSPECTUS CONSTITUTES NEITHER AN OFFER TO EXCHANGE OR PURCHASE NOTES NOR A SOLICITATION OF CONSENTS IN ANY JURISDICTION IN WHICH, OR TO OR FROM ANY PERSON TO OR FROM WHOM, IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION UNDER APPLICABLE SECURITIES OR BLUE SKY LAWS.

MARKET AND INDUSTRY DATA

Information in this prospectus about the foodservice distribution industry, including our general expectations concerning the industry, are based on estimates prepared using data from various sources and on assumptions made by us. We believe data regarding the foodservice industry are inherently imprecise, but generally indicate our size and position within the industry. While we are not aware of any misstatements regarding any industry data presented in this prospectus, our estimates, in particular as they relate to our general expectations concerning the foodservice industry, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors.”

GENERAL INFORMATION

Our principal executive offices are located at 9399 West Higgins Road, Suite 500, Rosemont, Illinois 60018 and our telephone number there is (847) 720-8000. Our website address is www.usfoods.com. The information on our website is not deemed part of this prospectus.

Unless otherwise indicated or the context otherwise requires, in this prospectus, references to “US Foods,” “USF,” the “Company,” “we,” “us” and “our” mean US Foods, Inc. and its consolidated subsidiaries. US Foods was previously known as U.S. Foodservice, Inc. prior to November 4, 2011.

References to “USF Holding” means USF Holding Corp., our direct parent which owns all of the outstanding shares of common stock of US Foods.

While USF Holding is the parent of US Foods, the Exchange Notes and the Restricted Notes are the obligations of US Foods, as issuer, and not of USF Holding. In addition, USF Holding is not a guarantor of the Exchange Notes or the Restricted Notes.

ii

Table of Contents

This summary highlights selected information regarding us and should be read as an introduction to the more detailed information included elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in the Exchange Notes. You should read the following summary carefully together with the more detailed information, the section entitled “Risk Factors” beginning on page 14 and the audited consolidated financial statements of US Foods, including the accompanying notes, included elsewhere in this prospectus before making any investment decision.

Our Company

We are a leading foodservice distributor, and one of only two national foodservice distributors in the United States. In fiscal year 2012, we generated approximately $22 billion in net sales providing an important link between over 5,000 suppliers and our more than 200,000 foodservice customers nationwide. We offer an extensive array of fresh, frozen and dry food and non-food products with approximately 350,000 stock-keeping units or “SKUs” as well as value-added distribution services that meet specific customer needs. We have also developed what we believe to be one of the most extensive private label product portfolios in the foodservice distribution industry, representing approximately 30,000 SKUs and over $6 billion in net sales in fiscal year 2012. In addition, many of our customers depend on us for critical business functions, including product selection, menu preparation and costing strategies.

We market our food products through a sales force of approximately 5,000 associates to a diverse mix of foodservice customers. Our principal customers include independently owned, single location restaurants, regional concepts, national chains, hospitals, nursing homes, hotels and motels, country clubs, fitness centers, government and military organizations, colleges and universities and retail locations. Our customers are managed either locally or by our national sales team.

Due to the similarity of our operations across the country, we manage our operations as a single operating segment that encompasses 64 divisions nationwide. Our primary operating activities include providing a broad line of foodservice products and value-added distribution services focused on meeting the needs of our customers. We support our business with one of the largest private refrigerated fleets in the United States, with approximately 6,000 refrigerated trucks traveling approximately 230 million miles annually. We also provide our customers with expertise for their “center of the plate” needs through our Stock Yards brand and essential restaurant equipment and supplies through US Foods Culinary Equipment & Supplies.

Industry Overview

The foodservice distribution industry is highly fragmented with approximately 16,500 foodservice distributors nationwide. The foodservice distribution industry includes a wide spectrum of companies ranging from businesses selling a single category of product (e.g., produce) to large broadline distributors with many divisions and thousands of products across all categories. Recent trends show large-scale distributors taking market share from smaller regional and local distributors as a result of acquisitions of smaller distributors by larger distributors. We expect this trend to continue through additional acquisitions and also organically due to scale efficiencies inherent to larger distributors with broader product and value-added service offerings.

1

Table of Contents

Based upon data provided by the USDA Economic Research Service, for over 25 years prior to 2008, the foodservice market in the United States was characterized by stable, predictable industry growth with annual year-over-year increases in total food purchases by dollar value. In 2008, the economic recession and dislocation in the financial markets adversely impacted the foodservice industry leading to unprecedented levels of decline, impacting both large and small operators. In 2010, as the macroeconomic environment began to recover, the foodservice market stabilized. The industry has since demonstrated signs of continued stabilization and modest growth, as consumer confidence and discretionary spending have strengthened.

Corporate History

On July 3, 2007, investment funds associated with or managed by Clayton, Dubilier & Rice, LLC (“CD&R”) and Kohlberg Kravis Roberts & Co (“KKR”, and together with CD&R, the “Sponsors”), through Restore Acquisition Corp., a wholly-owned subsidiary of USF Holding Corp., a corporation formed by the Sponsors, acquired all of the outstanding common shares of U.S. Foodservice and certain related assets from Koninklijke Ahold N.V. (“Ahold”) for approximately $7.2 billion including fees and expenses (the “Acquisition”). Restore Acquisition Corp. subsequently merged into U.S. Foodservice, resulting in U.S. Foodservice becoming a wholly-owned subsidiary of USF Holding Corp. In December 2007, U.S. Foodservice merged into its wholly-owned subsidiary, U.S. Foodservice, Inc. The Acquisition and the transactions related thereto are referred to in this prospectus as the “2007 Transactions.” In connection with our “US Foods” brand strategy, on November 4, 2011, U.S. Foodservice, Inc. changed its name to US Foods, Inc.

Sponsors’ Interest in Exchange Offer

An affiliate of one of our Sponsors, KKR, purchased $35 million of Restricted Notes in the initial private placement on May 11, 2011 of $400,000,000 aggregate principal amount of Restricted Notes (the “Original Senior Notes”) and an aggregate of $5.5 million of Restricted Notes in the initial private placements on December 6, 2012 and December 27, 2012 of $400,000,000 and $175,000,000 aggregate principal amount of Restricted Notes, respectively (collectively, the “Additional Senior Notes”). In connection with the initial private placements of Original Senior Notes and Additional Senior Notes, affiliates of KKR received an aggregate of approximately $2.3 million in underwriting discounts and fees. In addition, in connection with our issuance of Restricted Notes we entered into a registration rights agreement with the initial purchasers of the Restricted Notes, including an affiliate of KKR. We used net proceeds from the issuance of Additional Senior Notes on December 27, 2012 and cash on hand to repurchase $166 million in aggregate principal amount of 11.25%/12% Senior Subordinated Notes due 2017 (the “Senior Subordinated Notes”) held by an affiliate of CD&R at a price equal to 105.625% of the principal amount of such Senior Subordinated Notes, plus accrued and unpaid interest to the purchase date.

2

Table of Contents

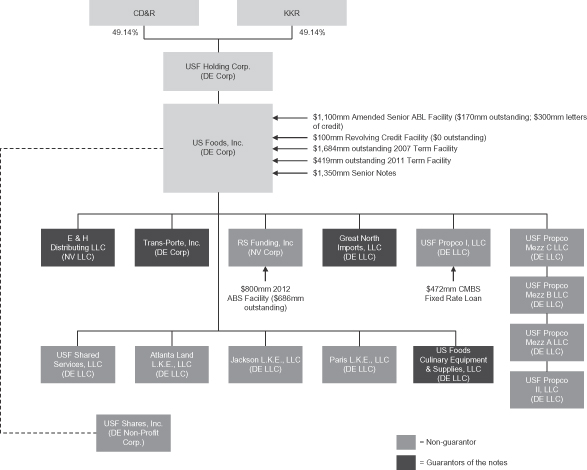

Ownership and Corporate Structure

The following diagram shows an overview of our corporate structure and debt structure as of December 29, 2012, adjusted to reflect the 2013 Refinancing (as defined below).

****

US Foods, Inc. is incorporated under the laws of the state of Delaware. Our corporate headquarters are located at 9399 West Higgins Road, Suite 500, Rosemont, Illinois 60018. Our telephone number is (847) 720-8000. We maintain a site on the World Wide Web at www.usfoods.com. Please note that the information found on our website is not a part of this prospectus and this web address is not an active hyperlink.

Summary of the Terms of the Exchange Offer

On May 11, 2011, US Foods completed a private placement of $400,000,000 aggregate principal amount of Original Senior Notes. The Original Senior Notes were issued under an indenture, dated May 11, 2011, by and among US Foods, the respective Subsidiary Guarantors (as defined below in “Summary of the Terms of the

3

Table of Contents

Exchange Notes”) and Wilmington Trust, National Association (successor by merger to Wilmington Trust FSB), as trustee (as the same may be amended, modified or supplemented from time to time, including pursuant to supplemental indentures, collectively, the “Indenture”). On December 6, 2012 and December 27, 2012, US Foods completed private placements of $400,000,000 and $175,000,000 aggregate principal amount of Additional Senior Notes, respectively. The Additional Senior Notes were issued pursuant to the first supplemental indenture, dated December 6, 2012, and the second supplemental indenture, dated December 27, 2012. The Additional Senior Notes, together with the Original Senior Notes, are treated as a single series for all purposes under the Indenture. We refer to the Original Senior Notes and the Additional Senior Notes collectively as the Restricted Notes. On January 16, 2013, US Foods completed a separate private placement of $375,000,000 aggregate principal amount of 8.5% Senior Notes due 2019 issued under the Indenture, and we are making a separate exchange offer with respect to those notes pursuant to a separate prospectus simultaneously with the Exchange Offer being made by this prospectus. We refer to all notes issued under the Indenture, collectively, as the Senior Notes The offerings of the Restricted Notes were made only to qualified institutional buyers under Rule 144A and to persons outside the United States under Regulation S, and accordingly were exempt from registration under the Securities Act.

General | In connection with the issuance of the Original Senior Notes, US Foods and the respective Subsidiary Guarantors entered into an exchange and registration rights agreement, dated May 11, 2011, with the initial purchasers of the Original Senior Notes as stated therein, and in connection with the issuance of the Additional Senior Notes, US Foods and the respective Subsidiary Guarantors entered into exchange and registration rights agreements, dated December 6, 2012 and December 27, 2012, with the initial purchasers of the Additional Senior Notes as stated therein (all such registration rights agreements with respect to the Restricted Notes, as the same may be amended, modified or supplemented from time to time, collectively, the “Registration Rights Agreements”). Pursuant to the Registration Rights Agreements, we agreed to use our commercially reasonable efforts to cause the registration statement of which this prospectus is a part to become effective within 690 days after the date of issuance of the Original Senior Notes. We further agreed to use our commercially reasonable efforts to commence the Exchange Offer promptly after the registration statement becomes effective and to hold the Exchange Offer open for the period required by applicable law. See “The Exchange Offer.” The terms of the Exchange Notes offered in the Exchange Offer are identical in all material respects to those of the Restricted Notes, except that the Exchange Notes: |

| • | will be registered under the Securities Act and therefore will not be subject to restrictions on transfer; |

| • | will not be subject to provisions relating to additional interest; |

| • | will bear a different CUSIP or ISIN number from the Restricted Notes; |

| • | will not entitle their holders to registration rights; and |

| • | will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the Restricted Notes. |

4

Table of Contents

The Exchange Offer | US Foods is offering to exchange up to $975,000,000 aggregate principal amount of its 8.5% Senior Notes due 2019, which have been registered under the Securities Act, for any and all of its Restricted Notes. |

| You may only exchange Restricted Notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Subject to the satisfaction or waiver of specified conditions, we will exchange the Exchange Notes for all Restricted Notes that are validly tendered and not validly withdrawn prior to the expiration of the Exchange Offer. We will cause the exchanges to be effected promptly after the expiration of the Exchange Offer. |

Resale of the Exchange Notes | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the Exchange Notes issued pursuant to the Exchange Offer in exchange for the Restricted Notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you are not our “affiliate” (as defined in Rule 405 under the Securities Act); |

| • | you are acquiring the Exchange Notes in the ordinary course of your business; |

| • | you do not have an arrangement or understanding with any person to participate in the distribution of the Exchange Notes (within the meaning of the Securities Act); |

| • | you are not engaged in, and do not intend to engage in, the distribution of the Exchange Notes; and |

| • | you are not acting on behalf of any person who could not truthfully make a representation to all of the foregoing. |

| If you are a broker-dealer and receive Exchange Notes for your own account in exchange for Restricted Notes that you acquired as a result of market-making activities or other trading activities, you must represent that you will deliver a prospectus in connection with any resale of the Exchange Notes. See “Plan of Distribution.” A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the Exchange Offer for a period of up to 90 days after the date of completion of the Exchange Offer. |

| Any holder of Restricted Notes who: |

| • | is our “affiliate” (as defined in Rule 405 under the Securities Act); |

| • | does not acquire the Exchange Notes in the ordinary course of its business; or |

5

Table of Contents

| • | tenders its Restricted Notes in the Exchange Offer with the intention to participate, or for the purpose of participating, in a distribution of Exchange Notes; |

| cannot rely on the position of the staff of the SEC enunciated in Morgan Stanley & Co. Incorporated (available June 5, 1991) and Exxon Capital Holdings Corporation (available May 13, 1988), as interpreted in Shearman & Sterling (available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the Exchange Notes. |

| You should read the discussion under the heading “The Exchange Offer” for further information regarding the Exchange Offer and resale of the Exchange Notes. |

Consequences of Failure to Exchange the Restricted Notes | You will continue to hold the Restricted Notes subject to their existing transfer restrictions if: |

| • | you do not tender your Restricted Notes; or |

| • | you tender your Restricted Notes and they are not accepted for exchange. |

| With some limited exceptions, we will have no obligation to register any Restricted Notes after we consummate the Exchange Offer. See “The Exchange Offer—Terms of the Exchange Offer” and “—Consequences of Failure to Exchange.” |

Effect on Holders of the Restricted Notes | Upon completion of the Exchange Offer, there may be no market for the Restricted Notes that remain outstanding and you may have difficulty selling them. |

| As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding Restricted Notes pursuant to the terms of the Exchange Offer, US Foods will have fulfilled a covenant under the Registration Rights Agreements and, accordingly, US Foods will not be obligated to pay additional interest pursuant to the Registration Rights Agreements. |

Expiration Date | The Exchange Offer will expire at 12:00 midnight, New York City time, at the end of May 2, 2013, or the “expiration date,” unless we extend the Exchange Offer, in which case expiration date means the latest date and time to which the Exchange Offer has been extended. |

Interest on the Exchange Notes | The Exchange Notes will accrue interest from the last interest payment date on which interest was paid on the Restricted Notes surrendered in exchange for Exchange Notes, or from the original |

6

Table of Contents

issue date of the Restricted Notes if no interest has been paid on the Restricted Notes surrendered in exchange for Exchange Notes, to the day before the expiration of the Exchange Offer and thereafter, at the applicable rate of interest per annum for the applicable Exchange Notes. However, if the Restricted Notes are surrendered for exchange on or after a record date (which is the close of business on the June 15 or December 15 immediately preceding the interest payment date, on June 30 and December 31 of each year, commencing on June 30, 2013) for an interest payment date that will occur on or after the date of such exchange and as to which interest will be paid, interest on the applicable Exchange Notes received in exchange for such Restricted Notes will accrue from the date of such interest payment date. |

Conditions to the Exchange Offer | The Exchange Offer is subject to several customary conditions. We will not be required to accept for exchange, or to issue Exchange Notes in exchange for, any Restricted Notes and may terminate or amend the Exchange Offer if we determine in our reasonable judgment that the Exchange Offer violates applicable law, any applicable interpretation of the SEC or its staff or any order of any governmental agency or court of competent jurisdiction. The foregoing conditions are for our sole benefit and may be waived by us. In addition, we will not accept for exchange any Restricted Notes tendered, and no Exchange Notes will be issued in exchange for any such Restricted Notes if, among other things: |

| • | at any time any stop order is threatened or in effect with respect to the registration statement of which this prospectus constitutes a part; or |

| • | at any time any stop order is threatened or in effect with respect to the qualification of the Indenture under the Trust Indenture Act of 1939, as amended. |

| See “The Exchange Offer—Conditions.” We reserve the right to terminate or amend the Exchange Offer at any time prior to the expiration date upon the occurrence of any of the foregoing events. |

Procedures for Tendering Restricted Notes | If you wish to participate in the Exchange Offer, you must submit required documentation and effect a tender of Restricted Notes pursuant to the procedures for book-entry transfer or other applicable procedures, all in accordance with the instructions described in this prospectus and in the letter of transmittal or electronic acceptance instruction. See “The Exchange Offer—Procedures for Tendering Restricted Notes,” “—Book-Entry Transfer” and “—Guaranteed Delivery Procedures.” |

| If you hold Restricted Notes through The Depository Trust Company (“DTC”) and wish to participate in the Exchange Offer, you must comply with the Automated Tender Offer Program procedures of DTC by which you will agree to be bound by the letter of transmittal. |

7

Table of Contents

| By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| • | you are not our “affiliate” (as defined in Rule 405 of the Securities Act); |

| • | you are acquiring the Exchange Notes in the ordinary course of your business; |

| • | you do not have an arrangement or understanding with any person to participate in the distribution of the Exchange Notes or the Restricted Notes (within the meaning of the Securities Act); |

| • | if you are not a broker-dealer, that you are not engaged in, and do not intend to engage in, the distribution of the Exchange Notes; |

| • | if you are a broker-dealer, that you will receive the Exchange Notes for your own account in exchange for Restricted Notes that were acquired as a result of market-making activities or other trading activities, and that you will deliver a prospectus in connection with any resale of such Exchange Notes; and |

| • | you are not acting on behalf of any person who could not truthfully make the foregoing representations. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of Restricted Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those Restricted Notes in the Exchange Offer, you should contact the registered holder promptly and instruct the registered holder to tender those Restricted Notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your Restricted Notes, either make appropriate arrangements to register ownership of the Restricted Notes in your name (subject to any restrictions in the Indenture) or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures | If you wish to tender your Restricted Notes, but cannot properly do so prior to the expiration date, you may tender your Restricted Notes according to the guaranteed delivery procedures set forth in “The Exchange Offer—Guaranteed Delivery Procedures.” |

Withdrawal Rights | Tenders of Restricted Notes may be withdrawn at any time prior to 12:00 midnight, New York City time, on the expiration date. To withdraw a tender of Restricted Notes, a written or facsimile transmission notice of withdrawal must be received by the Exchange Agent (as defined below) at its address set forth in “The Exchange Offer—Exchange Agent” prior to 12:00 midnight, New York City time, on the expiration date. |

8

Table of Contents

Acceptance of Restricted Notes and Delivery of Exchange Notes | Except in some circumstances, Restricted Notes that are validly tendered in the Exchange Offer prior to 12:00 midnight, New York City time, on the expiration date will be accepted for exchange. The Exchange Notes issued pursuant to the Exchange Offer will be delivered promptly following the expiration date. We may reject any and all Restricted Notes that we determine have not been properly tendered or any Restricted Notes the acceptance of which would, in the opinion of our counsel, be unlawful. We may waive any irregularities in the tender of the Restricted Notes. See “The Exchange Offer—Procedures for Tendering Restricted Notes,” “—Book-Entry Transfer,” and “—Guaranteed Delivery Procedures.” Subject to some limited exceptions, we will have no obligation to register any Restricted Notes after we consummate the Exchange Offer. See “The Exchange Offer—Registration Covenant.” |

Registration Rights | We agreed to file and obtain the effectiveness of a registration statement with respect to an offer to exchange the Restricted Notes for a new issue of notes registered under the Securities Act within 690 days after the issue date of the Original Senior Notes. We also agreed to file a shelf registration statement to effect resales of the Restricted Notes in certain circumstances. If an exchange offer for the Restricted Notes has not been consummated within 720 days following the issue date of the Original Senior Notes or a shelf registration statement is not declared effective within 90 days after the date on which the obligation to file arises, we may be required to pay you additional interest. See “Exchange Offer—Purpose and Effect of the Exchange Offer.” |

Material U.S. Federal Income Tax Considerations | We believe that the exchange of the Restricted Notes for the Exchange Notes will not constitute a taxable exchange for U.S. federal income tax purposes. See “Certain U.S. Federal Tax Considerations.” |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Exchange Notes in the Exchange Offer. See “Use of Proceeds.” |

Dissenters’ Rights | Holders of Restricted Notes do not have any appraisal or dissenters’ rights in connection with the Exchange Offer. |

Exchange Agent | Wilmington Trust, National Association is serving as the exchange agent for the Restricted Notes (the “Exchange Agent”). |

9

Table of Contents

Summary of the Terms of the Exchange Notes

The summary below describes the principal terms of the Exchange Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the Exchange Notes.

Issuer | US Foods, Inc. |

Exchange Notes Offered | $975,000,000 principal amount of 8.5% Senior Notes due 2019, which will have been registered under the Securities Act. |

Form and Denomination | Restricted Notes can only be exchanged for Exchange Notes in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

Maturity Date | The Exchange Notes will mature on June 30, 2019. |

Interest | Interest on the Exchange Notes will accrue at a rate of 8.5% per annum. Interest will be payable on June 30 and December 31 of each year, beginning on June 30, 2013. |

Ranking | The Exchange Notes will be our unsecured senior obligations and will: |

| • | rank senior in right of payment to our future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the Exchange Notes; |

| • | rank equally in right of payment to all of our existing and future debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the Exchange Notes; and |

| • | be effectively subordinated in right of payment to all of our existing and future secured debt, to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of each of our subsidiaries that is not a guarantor of the Exchange Notes. |

| Similarly, the Exchange Notes guarantees will be unsecured senior obligations of the guarantors and will: |

| • | rank senior in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are, by their terms, expressly subordinated in right of payment to the Exchange Notes; |

| • | rank equally in right of payment to all of the applicable guarantor’s existing and future debt and other obligations that are not, by their terms, expressly subordinated in right of payment to the Exchange Notes; and |

| • | be effectively subordinated in right of payment to all of the applicable guarantor’s existing and future secured debt, to the |

10

Table of Contents

extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of any subsidiary of a guarantor if that subsidiary is not also a guarantor of the Exchange Notes. |

| As of December 29, 2012, on an as adjusted basis to give effect to the 2013 Refinancing (as defined below), we estimate that we would have had $3,475 million of secured debt, excluding approximately $740 million that we expect to have available to borrow under our 2007 Term Facility, Revolving Credit Facility, Senior ABL Facility, and 2011 Term Facility (collectively, the “Senior Credit Facilities”), to which the Restricted Notes and Exchange Notes would be effectively subordinated, and that our subsidiaries that are not guarantors of the Restricted Notes and Exchange Notes would have had debt of approximately $1,158 million, consisting of debt of $686 million under our 2012 ABS Facility and debt of $472 million under our CMBS Fixed Rate Loan. See “Risk Factors—Risks Relating to Our Substantial Indebtedness—We have substantial debt, which could adversely affect our financial health and our ability to obtain financing in the future, react to changes in our business and make payments on our debt, including the Exchange Notes and the Restricted Notes.” We refer to the January 16, 2013 issuance of Senior Notes and repurchase of $355 million in aggregate principal amount of Senior Subordinated Notes, collectively, as the “2013 Refinancing.” |

Guarantees | Our material 100% owned domestic subsidiaries that guarantee our Senior Credit Facilities and the Restricted Notes (the “Subsidiary Guarantors”) will guarantee the Exchange Notes. |

Optional Redemption | At any time (which may be more than once) on or prior to June 30, 2014, we may redeem some or all of the Exchange Notes for cash at a redemption price equal to 100% of their principal amount plus an applicable make-whole premium (as described in “Description of Exchange Notes—Redemption—Optional Redemption”) plus accrued and unpaid interest to the redemption date. Beginning on June 30, 2014, we may redeem some or all of the Exchange Notes at the redemption prices listed under “Description of Exchange Notes—Redemption—Optional Redemption” plus accrued and unpaid interest to the redemption date. |

Optional Redemption after Certain Equity Offerings | At any time (which may be more than once) prior to June 30, 2014, we can choose to redeem up to 35% of the outstanding Exchange Notes with the net proceeds of certain equity offerings at a redemption price equal to 108.5% of the principal amount thereof plus accrued and unpaid interest, if any, so long as at least 50% of the original aggregate principal amount of the Exchange Notes remains outstanding immediately after such redemption. |

11

Table of Contents

Change of Control Offer | If we experience a change in control, we must give holders of Exchange Notes the opportunity to sell us their Exchange Notes at 101% of their face amount, plus accrued and unpaid interest (unless the Exchange Notes are or have been otherwise redeemed). Any such offer will comply with any applicable regulations under the federal securities laws, including Rule 14e-1 under the Exchange Act. |

| We might not be able to pay you the required price for Exchange Notes you present to us as a result of a change of control because we might not have enough funds at that time. See “Description of Exchange Notes—Change of Control.” |

Asset Sale Proceeds | If we or our subsidiaries engage in certain asset sales, we generally must either invest amounts equal to the net cash proceeds from such sales in our business within a period of time, prepay senior debt or make an offer to purchase a principal amount of the Exchange Notes equal to the excess net cash proceeds. The purchase price of the Exchange Notes will be 100% of their principal amount, plus accrued and unpaid interest. |

Certain Covenants | The Indenture contains covenants limiting our ability and the ability of our restricted subsidiaries to: |

| • | incur additional debt; |

| • | pay dividends or distributions on our capital stock or repurchase our capital stock; |

| • | issue stock of subsidiaries; |

| • | make certain investments; |

| • | create liens on our assets; |

| • | enter into transactions with affiliates; |

| • | merge or consolidate with another company; and |

| • | transfer and sell assets. |

| These covenants are subject to a number of important limitations and exceptions. See “Description of Exchange Notes—Certain Covenants.” |

Suspension of Covenants | Under the Indenture, in the event the Exchange Notes are rated investment grade and no default or event of default has occurred or is continuing, many of the covenants above will no longer apply for so long as the Exchange Notes remain rated investment grade. See “Description of Exchange Notes— Suspension of Covenants on Achievement of Investment Grade Rating.” |

12

Table of Contents

No Prior Market; No Listing | The Exchange Notes will be new securities for which there is currently no existing market and will not be listed on any securities exchange. We cannot assure you that a liquid market for the Exchange Notes will develop or be maintained. |

Risk Factors

You should consider carefully all of the information set forth in this prospectus and, in particular, the information under the heading “Risk Factors” beginning on page 14 before deciding to tender your outstanding Restricted Notes into the Exchange Offer.

Ratio of Earnings to Fixed Charges

Our consolidated ratios of earnings to fixed charges for each of the periods indicated are as follows:

| Year Ended December 29, 2012 | Year Ended December 31, 2011 | Year Ended January 1, 2011 | Year Ended January 2, 2010 | Year Ended December 27, 2008 | ||||||

Ratio of earnings to fixed charges | (a) | (a) | 1.0 | (a) | (a) |

| (a) | Earnings (loss) from continuing operations before income taxes and fixed charges for the years ended December 29, 2012, December 31, 2011, January 2, 2010, and December 27, 2008, were inadequate to cover fixed charges for the period by $10.2 million, $147.4 million, $59.0 million, and $125.3 million, respectively. |

13

Table of Contents

You should carefully consider the risks and uncertainties set forth below as well as the other information contained in this prospectus before deciding to tender your outstanding Restricted Notes into the Exchange Offer. Any of the following risks and uncertainties could materially and adversely affect our business, financial condition, operating results or cash flow and we believe that the following information identifies the material risks and uncertainties affecting our company. In such a case, the trading price of the Exchange Notes could decline or we may not be able to make payments of interest and principal on the Exchange Notes, and you may lose all or part of your original investment.

Risks Relating to the Exchange Offer

You may have difficulty selling any Restricted Notes that you do not exchange.

If you do not exchange your Restricted Notes for Exchange Notes in the Exchange Offer, you will continue to be subject to restrictions on transfer of your Restricted Notes as set forth in the offering memorandum distributed in connection with the private placement of the Restricted Notes. In general, the Restricted Notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except in limited circumstances as required by the Registration Rights Agreements, we do not intend to register resales of the Restricted Notes under the Securities Act. The tender of Restricted Notes under the Exchange Offer will reduce the outstanding amount of the Restricted Notes, which may have an adverse effect upon, and increase the volatility of, the market prices of the Restricted Notes due to a reduction in liquidity.

You must comply with the procedures of the Exchange Offer in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for the Restricted Notes tendered and accepted for exchange pursuant to the Exchange Offer will be made only after you properly follow the procedures of the Exchange Offer. We are not required to notify you of defects or irregularities in tenders of Restricted Notes for exchange. The Restricted Notes that are not tendered or that are tendered but we do not accept for exchange will, following expiration of the Exchange Offer, continue to be subject to the existing transfer restrictions under the Securities Act and, upon expiration of the Exchange Offer, certain registration and other rights under the Registration Rights Agreements will terminate.

If you are a broker-dealer or participating in a distribution of the Exchange Notes, you may be required to deliver a prospectus and comply with other requirements.

If you tender your Restricted Notes for the purpose of participating in a distribution of the Exchange Notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the Exchange Notes. If you are a broker-dealer that receives Exchange Notes for your own account in exchange for Restricted Notes that you acquired as a result of market-making activities or any other trading activities, you will be required to represent that you will deliver a prospectus in connection with any resale of such Exchange Notes.

14

Table of Contents

Risks Relating to the Exchange Notes and the Restricted Notes

The Exchange Notes will be, and the Restricted Notes are, unsecured and subordinated to the rights of our and the guarantors’ existing and future secured creditors.

As of December 29, 2012, after giving effect to the 2013 Refinancing, we would have had $3,475 million of secured indebtedness.The Indenture, will permit us to incur a significant amount of secured indebtedness, including indebtedness under the Senior Credit Facilities, the 2012 ABS Facility, and our fixed rate term loan facility secured by mortgages on certain of our properties and pledges of equity interests in certain special purpose bankruptcy remote entities that directly or indirectly own certain of such properties (the “CMBS Fixed Rate Loan”). Indebtedness under the Senior Credit Facilities is secured by liens on substantially all of our assets (other than the assets securing the 2012 ABS Facility and the CMBS Fixed Rate Loan), including pledges of all or a portion of our interests in the capital stock of certain of our subsidiaries and certain designated receivables, inventory and motor vehicles collateral under our ABL Facility. The 2012 ABS Facility is secured by certain trade receivables and related assets of US Foods and certain of its subsidiaries, and the CMBS Fixed Rate Loan is secured by first mortgages on 38 owned properties consisting primarily of distribution centers and pledges of equity interests in certain special purpose bankruptcy remote entities that directly or indirectly own certain of such properties. The Exchange Notes will be, and the Restricted Notes are, unsecured and therefore do not have the benefit of such collateral. Accordingly, the Exchange Notes will be, and the Restricted Notes are, effectively subordinated to all such secured indebtedness to the extent of the assets securing such indebtedness. If an event of default occurs under the Senior Credit Facilities, the 2012 ABS Facility, or the CMBS Fixed Rate Loan, the applicable secured lenders will have a prior right to our assets, to the exclusion of the holders of the Exchange Notes and Restricted Notes, even if we are in default under the Exchange Notes or Restricted Notes. In that event, our assets would first be used to repay in full all indebtedness and other obligations secured by our assets (including all amounts outstanding under the Senior Credit Facilities, the 2012 ABS Facility, or the CMBS Fixed Rate Loan, as the case may be), resulting in all or a portion of our assets being unavailable to satisfy the claims of the holders of the Exchange Notes, Restricted Notes, and other unsecured indebtedness. Therefore, in the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization, or other bankruptcy proceeding, holders of Exchange Notes and Restricted Notes will participate in our remaining assets ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as such Restricted or Exchange Notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor. Further, if the lenders foreclose and sell the pledged interests in any subsidiary guarantor under the Exchange Notes or Restricted Notes, then that guarantor will be released from its guarantee of such Exchange Notes or Restricted Notes automatically and immediately upon the sale. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the Exchange Notes or Restricted Notes. As a result, holders of Exchange Notes and Restricted Notes may receive less, ratably, than holders of secured indebtedness.

The Restricted Notes are and the Exchange Notes will be effectively subordinated to the debt of our non-guarantor subsidiaries.

The Restricted Notes are and the Exchange Notes will be guaranteed by our material 100% owned domestic subsidiaries that guarantee our debt under the Senior Credit Facilities; however, such notes are not guaranteed by the special purpose finance subsidiaries in connection with the 2012 ABS Facility and the CMBS Fixed Rate Loan and certain of our other subsidiaries. Payments on the Exchange Notes and Restricted Notes are only required to be made by us and the Subsidiary Guarantors. Accordingly, claims of holders of the Restricted Notes are and the Exchange Notes will be structurally subordinated to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. All obligations of our non-guarantor subsidiaries, including trade payables, will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon liquidation or otherwise, to us or a guarantor of the Exchange Notes or Restricted Notes. The non-guarantor subsidiaries will be permitted to incur additional debt in the future under the Indenture. As of December 29, 2012, on an as adjusted basis to give effect to the 2013 Refinancing, we estimate that our subsidiaries that are not guarantors of the Senior Notes would have had debt of approximately $1,158 million.

15

Table of Contents

As of December 29, 2012, our non-guarantor subsidiaries consisted principally of our special purpose finance subsidiaries in connection with the 2012 ABS Facility and the CMBS Fixed Rate Loan and would have accounted for approximately $1,181 million or 19.6% of our total assets. See “Description of Exchange Notes—Ranking.”

If the lenders under the Senior Credit Facilities release the guarantors under the credit agreements, those guarantors will be released from their guarantees of the Exchange Notes and Restricted Notes.

The lenders under the Senior Credit Facilities have the discretion to release the guarantees under the credit agreements. If a guarantor is no longer a guarantor of obligations under the Senior Credit Facilities or any other successor credit facility that may be then outstanding, then the guarantee of the Exchange Notes and Restricted Notes by such guarantor will be released automatically without action by, or consent of, any holder of the Exchange Notes and Restricted Notes or the trustee under the Indenture. See “Description of the Exchange Notes—Subsidiary Guarantees.” You will not have a claim as a creditor against any subsidiary that is no longer a guarantor of the Exchange Notes and Restricted Notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to claims of holders of such Exchange Notes and Restricted Notes.

We may be unable to raise funds necessary to finance the change of control repurchase offers required by the Indenture and the Senior Credit facilities may limit or prohibit the change of control repurchase offers required by the Indenture.

If we experience specified changes of control, we would be required to make an offer to purchase all of the outstanding Exchange Notes and Restricted Notes (unless otherwise redeemed) at a price equal to 101% of the principal amount thereof plus accrued and unpaid interest, if any, to the date of purchase unless we have exercised our rights to redeem the Exchange Notes and the Restricted Notes. The occurrence of specified events that would constitute a change of control will constitute a default under the Senior Credit Facilities. In addition, the Senior Credit Facilities may limit or prohibit the purchase of the Exchange Notes and the Restricted Notes by us in the event of a change of control, unless and until such time as the indebtedness under the Senior Credit Facilities is repaid in full. As a result, following a change of control event, we may not be able to repurchase Exchange Notes and Restricted Notes unless we first repay all indebtedness outstanding under the Senior Credit Facilities and any of our certain indebtedness that contains similar provisions, or obtain a waiver from the holders of such indebtedness to permit us to repurchase the Exchange Notes and the Restricted Notes. We may be unable to repay all of that indebtedness or obtain a waiver of that type. Any requirement to offer to repurchase outstanding Exchange Notes and Restricted Notes may therefore require us to refinance our other outstanding debt, which we may not be able to do on commercially reasonable terms, if at all. In addition, our failure to purchase the Exchange Notes and the Restricted Notes after a change of control in accordance with the terms of the Indenture would constitute an event of default under the Indenture, which in turn would result in a default under the Senior Credit Facilities.

Our inability to repay the indebtedness under the Senior Credit Facilities would also constitute an event of default under the Indenture, which could have materially adverse consequences to us and to the holders of the Exchange Notes and the Restricted Notes. Our future indebtedness may also require such indebtedness to be repurchased upon a change of control.

The definition of change in control in the Indenture includes the transfer of all or substantially all of our and our restricted subsidiaries assets, any merger or consolidation by us with another entity, pursuant to which persons other than USF Holding or our sponsors or affiliates of our sponsors own more than 50% of the voting stock of the surviving entity and the acquisition of beneficial ownership of more than 50% of the voting stock of USF Holding.

16

Table of Contents

The definition of “change of control” contained in the Indenture includes a disposition of all or substantially all of our assets and the assets of our restricted subsidiaries. Although there is a limited body of case law interpreting the phrase “all or substantially all,” there is no precise established definition of the phrase under applicable law. Accordingly, in certain circumstances there may be a degree of uncertainty as to whether a particular transaction would involve a disposition of “all or substantially all” of our assets. As a result, it may be unclear as to whether a change of control has occurred and whether we are required to make an offer to repurchase the Restricted Notes.

Federal and state fraudulent transfer laws may permit a court to void the Exchange Notes and Restricted Notes or the guarantees thereof, and if that occurs, you may not receive any payments with respect to the Exchange Notes and Restricted Notes.

Federal and state fraudulent transfer and conveyance statutes may apply to the issuance of the Exchange Notes and Restricted Notes and the incurrence of the guarantees thereof. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state, the Exchange Notes and Restricted Notes or the guarantees thereof could be voided as a fraudulent transfer or conveyance if we or any of the guarantors, as applicable, (a) issued the Exchange Notes or Restricted Notes or incurred the guarantees with the intent of hindering, delaying or defrauding creditors or (b) received less than reasonably equivalent value or fair consideration in return for either issuing the Exchange Notes or Restricted Notes or incurring the guarantees and, in the case of (b) only, one of the following is also true at the time thereof:

| • | we or such guarantor was insolvent or rendered insolvent by reason of the issuance of the Exchange Notes or Restricted Notes or the incurrence of the guarantees; |

| • | the issuance of the Exchange Notes or Restricted Notes or the incurrence of the guarantees left us or such guarantor with an unreasonably small amount of capital or assets to carry on its business; or |

| • | we or such guarantor intended to, or believed that we or it would, incur debts beyond our or its ability to pay as they mature. |

As a general matter, value is given for a transfer or an obligation if, in exchange for the transfer or obligation, property is transferred or a valid antecedent debt is satisfied. A court would likely find that we or a guarantor of the Exchange Notes or Restricted Notes did not receive reasonably equivalent value or fair consideration for the Exchange Notes or Restricted Notes or its guarantee, as applicable, to the extent we or such guarantor did not obtain a reasonably equivalent benefit from the issuance of the Exchange Notes or Restricted Notes or the incurrence of its guarantee, as applicable. To the extent that the 2007 Term Loans that were repaid or the Senior Subordinated Notes that were repurchased with the proceeds of the Additional Senior Notes or the guarantees thereof were not valid for the full amount thereof (including as a result of fraudulent conveyance laws), a court would likely find that we or such guarantors did not receive reasonably equivalent value or fair consideration in the amount of such 2007 Term Loans, such Senior Subordinated Notes, or the guarantees thereof for issuing the Additional Senior Notes or incurring the guarantees, as applicable. To the extent that any Restricted Notes for which Exchanged Notes are exchanged were not valid for the full amount thereof (including as a result of fraudulent conveyance laws), then a court would likely find that we or such guarantors did not receive reasonably equivalent value or fair consideration for the Exchange Notes or incurring the guarantees, as applicable. Although there is a risk a court could find otherwise, because the proceeds of the 2007 Term Loans and the Senior Subordinated Notes were retained by us and because the proceeds of the Restricted Notes were used primarily by us to repay the 2007 Term Loans, the ABL Facility, and the Senior Subordinated Notes, we believe it is unlikely that either the issuance of the Restricted Notes or the exchange of the Exchange Notes for the Restricted Notes would be found to be a fraudulent transfer.

We cannot be certain as to the standards a court would use to determine whether or not we or any guarantor was insolvent at the relevant time or, regardless of the standard that a court uses, whether the Exchange Notes or

17

Table of Contents

Restricted Notes or the guarantees would be subordinated to our or any of the guarantors’ other debt. In general, however, a court would deem an entity insolvent if:

| • | the sum of its debts, including contingent and unliquidated liabilities, was greater than the fair saleable value of all of its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they became due. |

If a court were to find that the issuance of the Exchange Notes or Restricted Notes or the incurrence of a guarantee was a fraudulent transfer or conveyance, the court could void the payment obligations under the Exchange Notes or Restricted Notes or that guarantee, could subordinate the Exchange Notes or Restricted Notes or that guarantee to presently existing and future indebtedness of us or the applicable guarantor or could require the holders of the Exchange Notes or Restricted Notes to repay any amounts received with respect to the Exchange Notes or Restricted Notes or that guarantee. In the event of a finding that a fraudulent transfer or conveyance occurred, you may not receive any repayment on the Exchange Notes or Restricted Notes.

The indenture contains a “savings clause” intended to limit each guarantor’s liability under its guarantee to the maximum amount that it could incur without causing the guarantee to be a fraudulent transfer under applicable law. There can be no assurance that this provision will be upheld as intended.

There is currently no market for the Exchange Notes or the Restricted Notes. We cannot assure you that an active trading market will develop for the Exchange Notes or the Restricted Notes.

The Exchange Notes are new securities for which there presently is no established market. Accordingly, we cannot give you any assurance as to the development or liquidity of any market for the Exchange Notes or the Restricted Notes. We do not intend to apply for listing of the Exchange Notes or the Restricted Notes on any securities exchange or for quotation of the Exchange Notes or the Restricted Notes through any national securities association.

Even if a trading market for the Exchange Notes or the Restricted Notes does develop, you may not be able to sell your Exchange Notes or the Restricted Notes at a particular time, if at all, or you may not be able to obtain the price you desire for your Exchange Notes or the Restricted Notes. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial fluctuations in the price of securities. If the Exchange Notes or the Restricted Notes are traded after their initial issuance, they may trade at a discount from their initial offering price depending on many factors, including prevailing interest rates, the market for similar securities, our credit rating, the interest of securities dealers in making a market for the Exchange Notes or the Restricted Notes, the price of any other securities we issue, our performance, prospects, operating results and financial condition, as well as of other companies in our industry.

The liquidity of, and trading market for, the Exchange Notes or the Restricted Notes also may be adversely affected by general declines in the market or by declines in the market for similar securities. Such declines may adversely affect such liquidity and trading markets independent of our financial performance and prospects.

Many covenants contained in the Indenture will no longer apply if the Exchange Notes or the Restricted Notes achieve certain investment grade ratings, and you will lose the protection afforded by such covenants.

The Exchange Notes and the Restricted Notes offered hereby have not been rated at investment grade, and the Indenture contains certain covenants that are typical for similar “high yield” debt securities. If, at any time after the issue date of the Exchange Notes, the Exchange Notes or the Restricted Notes receive certain investment grade ratings and no default or event of default has occurred and is continuing under the Indenture, certain covenants will no longer apply, including covenants that limit our ability to incur additional indebtedness, make

18

Table of Contents

restricted payments and sell certain assets and the covenant limiting our ability to consummate certain change of control transactions will be suspended. These covenants, other than the change in control covenant, fall away until maturity of the Exchange Notes or the Restricted Notes, and as a result you will not regain the protection of these covenants even if the Exchange Notes or the Restricted Notes were to be subsequently downgraded to below investment grade. See “Description of the Exchange Notes—Suspension of Covenants on Achievement of Investment Grade Rating.”

Risks Relating to Our Substantial Indebtedness

We have substantial debt, which could adversely affect our financial health and our ability to obtain financing in the future, react to changes in our business and make payments on our debt, including the Exchange Notes and the Restricted Notes.

As of December 29, 2012, after giving effect to the 2013 Refinancing, we would have had an aggregate principal amount of approximately $4,847 million of outstanding debt.

Our substantial debt could have important consequences to holders of the Exchange Notes and the Restricted Notes. Because of our substantial debt:

| • | our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, acquisitions or general corporate purposes and our ability to satisfy our obligations with respect to our indebtedness, including the Exchange Notes and the Restricted Notes, may be impaired in the future; |

| • | a substantial portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes (for example, approximately $286 million was dedicated to the payment of interest for the fiscal year ended December 29, 2012); |

| • | we are exposed to the risk of increased interest rates because a portion of our borrowings, including under the Senior Credit Facilities and the 2012 ABS Facility, are at variable rates of interest; |

| • | it may be more difficult for us to satisfy our obligations to our lenders, resulting in possible defaults on and acceleration of such indebtedness; |

| • | we may be more vulnerable to general adverse economic and industry conditions; |

| • | we may be at a competitive disadvantage compared to our competitors with less debt or comparable debt at more favorable interest rates and they, as a result, may be better positioned to withstand economic downturns; |

| • | our ability to refinance indebtedness may be limited or the associated costs may increase; and |

| • | our flexibility to adjust to changing market conditions and ability to withstand competitive pressures could be limited, or we may be prevented from carrying out capital spending that is necessary or important to our growth strategy and efforts to improve operating margins or our business. |

Despite our indebtedness levels, we and our subsidiaries may be able to incur substantially more debt, including secured debt. This could further exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the Indenture do not fully prohibit us or our subsidiaries from doing so. As of December 29, 2012, after giving effect to the 2013 Refinancing, we would have had commitments for additional borrowings under our senior secured revolving credit facility (the “Revolving Credit Facility”), our asset-based senior secured revolving loan facility (the “Senior ABL Facility”) and our new 2012 ABS facility (the “2012 ABS Facility” and together with our prior ABS facility, the “ABS Facilities”) of $1,144 million (of which approximately $740 million was

19

Table of Contents

available based on our borrowing base), all of which were secured. All of those borrowings and any other secured indebtedness permitted under the agreements governing such credit facilities and indentures are effectively senior to the Exchange Notes and Restricted Notes to the extent of the value of the assets securing such indebtedness. If new debt is added to our current debt levels, the related risks that we now face would increase and we may not be able to meet all our debt obligations, including the repayment of the Exchange Notes and the Restricted Notes. In addition, the Indenture does not prevent us from incurring obligations that do not constitute indebtedness.

The agreements and instruments governing our debt contain restrictions and limitations that could significantly impact our ability to operate our business and adversely affect the holders of the Exchange Notes and the Restricted Notes.

The Senior Credit Facilities and the Indenture contain covenants that, among other things, restrict our ability to:

| • | dispose of assets; |

| • | incur additional indebtedness (including guarantees of additional indebtedness); |

| • | pay dividends and make certain payments; |

| • | make voluntary prepayments on the Restricted Notes or Exchange Notes or make amendments to the terms thereof; |

| • | create liens on assets; |

| • | make investments (including joint ventures); |

| • | engage in mergers, consolidations or sales of all or substantially all of our assets; |

| • | engage in certain transactions with affiliates; |

| • | change the business conducted by us; and |

| • | amend specific debt agreements. |

In addition, if borrowing availability under the Senior ABL Facility plus the amount of cash and cash equivalents held by us falls below a specified threshold of $100 million, the borrowers are required to comply with a minimum fixed charge coverage ratio of 1 to 1. In addition, if our borrowing availability under the Senior ABL Facility falls below $110 million, additional reporting responsibilities are triggered under the ABL Facility and the ABS Facility.

Our ability to comply with these provisions in future periods will depend on our ongoing financial and operating performance, which in turn will be subject to economic conditions and to financial, market and competitive factors, many of which are beyond our control. Our ability to comply with these provisions in future periods will also depend substantially on the pricing of our products, our success at implementing cost reduction initiatives and our ability to successfully implement our overall business strategy.

The Indenture contains restrictive covenants similar to those of the Senior Credit Facilities that will further limit our and our restricted subsidiaries ability to take certain actions.

The restrictions in the Indenture and the terms of the Senior Credit Facilities, the 2012 ABS Facility, and the CMBS Fixed Rate Loan may prevent us from taking actions that we believe would be in the best interest of our business, and may make it difficult for us to successfully execute our business strategy or effectively compete with companies that are not similarly restricted. We may also incur future debt obligations that might subject us to additional restrictive covenants that could affect our financial and operational flexibility. We cannot assure you that we will be granted waivers or amendments to these agreements if for any reason we are unable to comply with these agreements, or that we will be able to refinance our debt on terms acceptable to us, or at all.

20

Table of Contents

Our ability to comply with the covenants and restrictions contained in the Senior Credit Facilities, the 2012 ABS Facility and the CMBS Fixed Rate Loan, and the Indenture may be affected by economic, financial and industry conditions beyond our control. The breach of any of these covenants or restrictions could result in a default under the Senior Credit Facilities, the 2012 ABS Facility and the CMBS Fixed Rate Loan or our indentures that would permit the applicable lenders or noteholders, as the case may be, to declare all amounts outstanding thereunder to be due and payable, together with accrued and unpaid interest. If we are unable to repay debt, lenders having secured obligations, such as the lenders under the Senior Credit Facilities, the 2012 ABS Facility and the CMBS Fixed Rate Loan, could proceed against the collateral securing the debt. In any such case, we may be unable to borrow under the Senior Credit Facilities, the 2012 ABS Facility and the CMBS Fixed Rate Loan and may not be able to repay the amounts due under the Senior Credit Facilities, the 2012 ABS Facility, the CMBS Fixed Rate Loan, the Restricted Notes, and the Exchange Notes. This could have serious consequences to our financial condition and results of operations and could cause us to become bankrupt or insolvent.

Our ability to generate the significant amount of cash needed to pay interest and principal on the Exchange Notes and the Restricted Notes and service our other debt and our ability to refinance all or a portion of our indebtedness or obtain additional financing depends on many factors beyond our control.

Our ability to make scheduled payments on, or to refinance our obligations under, our debt will depend on our financial and operating performance, which, in turn, will be subject to prevailing economic and competitive conditions and to the financial and business factors, many of which may be beyond our control, described under “Risk Factors—Risks Relating to Our Business” below.

If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek to obtain additional equity capital or restructure our debt. In the future, our cash flow and capital resources may not be sufficient for payments of interest on and principal of our debt, and such alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations.

The Revolving Credit Facility will mature in July 2013. The 2012 ABS Facility will mature in 2015. The Senior ABL Facility will mature in 2016. On December 6, 2012, we repaid a portion of the loans under our senior secured term loan (such facility, the “2007 Term Facility” and loans under such facility, the “2007 Term Loans”) with a portion of the proceeds from the issuance of the Additional Senior Notes and cash on hand and further amended the 2007 Term Facility, primarily to extend to March 31, 2017, the maturity of the portion of the 2007 Term Loans maturing on July 3, 2014 that was not repaid (such amendment, the “Second 2007 Term Facility Amendment”). As a result of the Second 2007 Term Facility Amendment, all of the outstanding 2007 Term Loans will mature in 2017. The CMBS Fixed Rate Loan will also mature in 2017. The Senior Notes (including the Restricted Notes and Exchange Notes) will mature in 2019. As a result, we may be required to refinance any outstanding amounts under our other credit facilities prior to or concurrently with the maturity date of the Restricted Notes and Exchange Notes. We cannot assure you that we will be able to refinance any of our indebtedness or obtain additional financing, particularly because of our anticipated high levels of debt and the debt incurrence restrictions imposed by the agreements governing our debt, as well as prevailing market conditions. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our Senior Credit Facilities and the Indenture restrict our ability to dispose of assets and use the proceeds from any such dispositions. In addition, the terms of the 2012 ABS Facility significantly restrict our ability to dispose of the receivables that are collateral thereunder, and the terms of the CMBS Fixed Rate Loan significantly restrict our ability to dispose of the properties that are collateral thereunder. As a result, we cannot assure you we will be able to consummate those sales, or if we do, what the timing of the sales will be or whether the proceeds that we realize will be adequate to meet debt service obligations when due.

21

Table of Contents

An increase in interest rates would increase the cost of servicing our debt and could reduce our profitability.

A significant portion of our outstanding debt, including under the Senior Credit Facilities and the 2012 ABS Facility, bear interest at variable rates. As a result, an increase in interest rates, whether because of an increase in market interest rates or a decrease in our creditworthiness, would increase the cost of servicing our debt and could materially reduce our profitability and cash flows. The impact of such an increase would be more significant for us than it would be for some other companies because of our substantial debt.

Risks Relating to Our Business

Our business is a low margin business and our profitability is directly impacted by cost inflation, commodity volatility and other factors.

The foodservice distribution industry is characterized by relatively high inventory turnover with relatively low profit margins. We make a significant portion of our sales at prices that are based on the cost of products we sell plus a percentage margin. As a result, our profit levels may be negatively impacted during periods of product cost deflation, even though our gross profit percentage may remain relatively constant. Prolonged periods of product cost inflation also may have a negative impact on our profit margins and earnings to the extent such product cost increases are not able to be passed on to customers due to resistance to higher prices or negatively impact consumer spending. In addition, periods of rapid inflation may negatively impact our business due to the timing needed to pass on such increases, as well as the impact it may have on discretionary spending by consumers.

Competition in our industry is intense, and we may not be able to compete successfully.

Foodservice distribution is highly competitive. While there is currently only one other national broadline distributor, there are numerous smaller regional, local and specialty distributors. These distributors often align themselves with other smaller distributors through purchasing cooperatives and marketing groups to enhance their geographic reach, private label offerings, overall purchasing power, cost efficiencies and ability to meet customer requirements for national or multi-regional distribution. These suppliers also rely on local presence as a source of competitive advantage and may have lower costs and other competitive advantages due to geographic proximity. We generally do not have exclusive service agreements with our customers, and our customers may switch to other distributors if those distributors can offer lower prices, differentiated products or customer service that is perceived to be superior. We believe that most purchasing decisions in the foodservice distribution industry are based on the quality and price of the product and a distributor’s ability to completely and accurately fill orders and provide timely deliveries.

Increased competition has caused the foodservice distribution industry to undergo changes as distributors seek to lower costs, further increasing pressure on the industry’s profit margins. Continued consolidation in the industry, heightened competition among our suppliers, significant pricing initiatives or discount programs established by competitors, new entrants and trends towards vertical integration could create additional competitive pressures that reduce margins and adversely affect our business, financial condition and results of operations.

We rely on third-party suppliers and our business may be impacted by interruption of supplies or increases in product costs.