Exhibit 99.3

Table of Contents

Summary | |

Earnings Press Release | 3 |

Fact Sheet | 6 |

| |

| |

Financial Information | |

Consolidated Statements of Operations | 7 |

Funds from Operations and Core Funds from Operations | 8 |

Net Operating Income and Core Net Operating Income | 9 |

Consolidated Balance Sheets | 10 |

Debt Summary | 11 |

Capital Structure | 12 |

| |

| |

Property Information | |

Same-Home Results – Quarterly Comparisons | 13 |

Top 20 Markets Summary | 14 |

Leasing Performance | 15 |

Acquisition, Renovation and Initial Leasing Rates | 16 |

| |

| |

Other Information | |

Top 20 Markets Home Price Appreciation Trends | 17 |

| |

| |

Definitions and Reconciliations | |

Defined Terms | 18 |

Reconciliation of Non-GAAP Financial Measures | 20 |

2

Earnings Press Release

American Homes 4 Rent Reports First Quarter 2015 Financial and Operating Results

AGOURA HILLS, California—American Homes 4 Rent (NYSE: AMH), a leading provider of high quality single-family homes for rent, today announced its financial and operating results for the quarter ended March 31, 2015.

Highlights

· | Core Funds from Operations (“Core FFO”) (as defined) for the first quarter of 2015 were $41.9 million, or $0.16 per FFO share, which represents a 33.3% increase per FFO share, compared to $28.1 million, or $0.12 per FFO share, for the same period in 2014. |

· | Net Operating Income from leased properties (“NOI”) for the quarter ended March 31, 2015, was $76.5 million, a 60.1% increase from $47.7 million for the quarter ended March 31, 2014. |

· | Total portfolio increased by 1,989 homes to 36,588 as of March 31, 2015, from 34,599 as of December 31, 2014. As of March 31, 2015, the Company had 31,183 leased properties, an increase of 2,933 leased properties from December 31, 2014. |

· | Continued solid leased percentage of 93.4% of properties that have been previously leased or rent-ready for more than 90 days and a total portfolio leased percentage of 85.2%. |

· | Maintained strong tenant renewal rate of 79.2% for the first quarter of 2015. |

· | Completed securitization transaction in March 2015, which raised gross proceeds of $552.8 million, with a duration-adjusted weighted-average coupon rate of 4.14% for a 30 year term, with an anticipated repayment date after 10 years. |

“We are pleased with our continued growth and strong operating results for the first quarter of 2015. Our outlook for the remainder of the year is optimistic as we project growth in revenue and operating results, as we stabilize our portfolio’s occupancy and drive rental rates,” stated David Singelyn, American Homes 4 Rent’s Chief Executive Officer.

First Quarter 2015 Financial Results

Total revenues increased 70.5% to $131.7 million for the first quarter of 2015 from $77.3 million for the first quarter of 2014. Revenue growth was primarily driven by continued strong leasing activity, as our average leased portfolio grew to 29,717 homes for the first quarter of 2015, compared to 18,997 homes for the first quarter of 2014.

NOI from leased properties increased 60.1% to $76.5 million for the first quarter of 2015, compared to $47.7 million for the first quarter of 2014. This increase was primarily due to substantial growth in rental income resulting from a larger number of leased properties.

Core FFO was $41.9 million, or $0.16 per FFO share, for the first quarter of 2015, compared to $28.1 million, or $0.12 per FFO share, for the first quarter of 2014.

Net loss totaled $8.3 million for the first quarter of 2015, compared to a net loss of $6.9 million for the first quarter of 2014.

NOI, FFO and Core FFO are supplemental non-GAAP financial measures. Reconciliations to GAAP measures are provided in a schedule accompanying this press release.

Portfolio

As of March 31, 2015, the Company had 31,183 leased properties, an increase of 2,933 properties from December 31, 2014. As of March 31, 2015, the leased percentage for properties that have been rent-ready for more than 90 days or initially leased after completing renovations was 93.4%, compared to 92.8% as of December 31, 2014.

3

Earnings Press Release (continued)

Investments

During the first quarter of 2015, the Company’s total portfolio grew by 1,989 homes to 36,588 homes as of March 31, 2015, compared to 34,599 homes as of December 31, 2014.

Capital Activities and Balance Sheet

In March 2015, the Company raised $552.8 million in gross proceeds through the issuance and sale of single-family rental pass-through certificates that represent beneficial ownership interests in a loan secured by 4,661 homes transferred to an affiliate from the Company’s portfolio of single-family properties. The offering had a duration-adjusted weighted-average coupon rate of 4.14% for a 30 year term, with an anticipated repayment date after ten years.

As of March 31, 2015, the Company had total outstanding debt of $2.2 billion with a weighted-average interest rate of 3.72% and a weighted-average term to maturity of 13.4 years. The Company’s $800 million credit facility, which bears interest at LIBOR plus 275 basis points, had an outstanding balance of $45.0 million at the end of the quarter, with available capacity of $755 million.

Additional information

A copy of the Company’s First Quarter 2015 Supplemental Information Package and this press release are available on our website at www.americanhomes4rent.com. This information has also been furnished to the SEC in a current report on Form 8-K.

Conference Call

A conference call is scheduled on Friday, May 8, 2015, at 11:00 a.m. Eastern Time to discuss the Company’s financial results for the quarter ended March 31, 2015, and to provide an update on its business. The domestic dial-in number is (877) 705-6003 (for U.S. and Canada) and the international dial-in number is (201) 493-6725 (passcode not required). A simultaneous audio webcast may be accessed by using the link at www.americanhomes4rent.com, under “For Investors.” A replay of the conference call may be accessed through May 22, 2015, by calling (877) 870-5176 (U.S. and Canada) or (858) 384-5517 (international), replay passcode number 13606877#, or by using the link at www.americanhomes4rent.com, under “For Investors.”

About American Homes 4 Rent

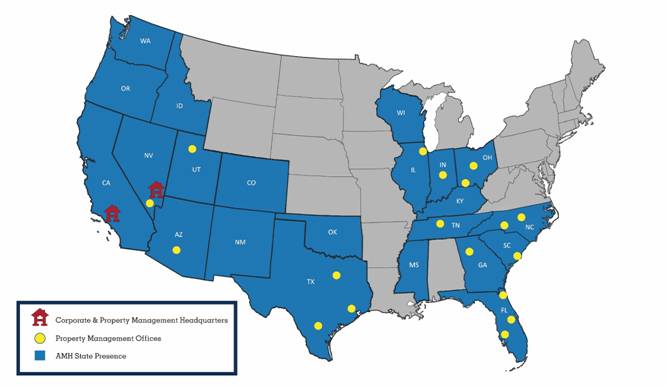

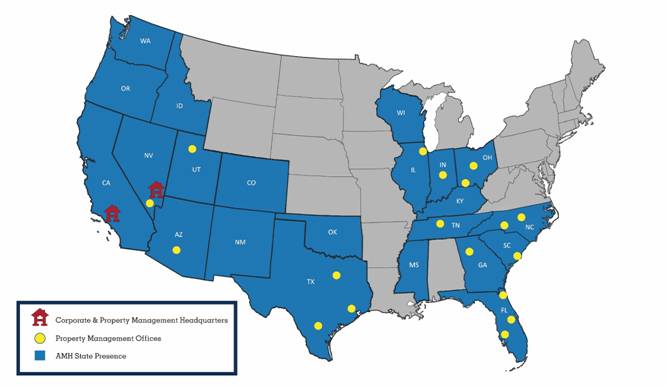

American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, renovating, leasing, and operating attractive, single-family homes as rental properties. As of March 31, 2015, we owned 36,588 single-family properties in selected submarkets in 22 states.

4

Earnings Press Release (continued)

Forward-Looking Statements

This press release contains “forward-looking statements.” These forward-looking statements relate to beliefs, expectations or intentions and similar statements concerning matters that are not of historical fact and are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “intend,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this press release include, among others, our belief that we have a continuing significant opportunity to acquire quality single-family homes and to experience high tenant retention and rental rate increases. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While the Company’s management considers these expectations to be reasonable, they are inherently subject to risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update any forward-looking statements to conform to actual results or changes in its expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, and in the Company’s subsequent filings with the SEC.

Non-GAAP Financial Measures

This press release and the First Quarter 2015 Supplemental Information Package include FFO, Core FFO and NOI, which are non-GAAP financial measures. We believe these measures are helpful in understanding our financial performance and are widely used in the REIT industry. Because other REITs may not compute these financial measures in the same manner, FFO, Core FFO and NOI may not be comparable among REITs. In addition, FFO, Core FFO and NOI are not substitutes for net income / (loss) or cash flow from operations, as defined by GAAP, as measures of our liquidity, operating performance or ability to pay dividends. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in this press release and in the First Quarter 2015 Supplemental Information Package.

5

Fact Sheet

(Amounts in thousands, except share, per share and property data)

(Unaudited)

| | For the Three Months Ended |

| | Mar 31, |

| | 2015 | | 2014 |

Operating Data | | | | |

Rents from single-family properties | | $ | 120,680 | | $ | 73,761 |

Fees from single-family properties | | $ | 1,331 | | $ | 1,358 |

Tenant charge-backs | | $ | 8,372 | | $ | 1,890 |

Total revenues from single-family properties | | $ | 130,383 | | $ | 77,009 |

Total revenues | | $ | 131,748 | | $ | 77,278 |

Leased property operating expenses | | $ | 53,930 | | $ | 29,266 |

Net operating income | | $ | 76,453 | | $ | 47,743 |

Net operating income margin | | 58.6% | | 62.0% |

Core net operating income margin | | 63.3% | | 64.8% |

G&A expense as % of total revenues | | 4.7% | | 6.6% |

Annualized G&A expense as % of total assets | | 0.37% | | 0.45% |

| | Mar 31,

2015 | | Dec 31,

2014 | | Sep 30,

2014 | | Jun 30,

2014 |

Selected Balance Sheet Information - at end of period | | | | | | | | |

Single-family properties, net | | $ | 6,037,355 | | $ | 5,710,671 | | $ | 5,117,743 | | $ | 4,483,794 |

Total assets | | $ | 6,576,550 | | $ | 6,227,351 | | $ | 5,536,344 | | $ | 4,982,557 |

Outstanding borrowings under credit facility | | $ | 45,000 | | $ | 207,000 | | $ | 82,000 | | $ | 481,000 |

Asset-backed securitizations | | $ | 2,068,389 | | $ | 1,519,390 | | $ | 993,058 | | $ | 480,970 |

Secured note payable | | $ | 51,417 | | $ | 51,644 | | $ | - | | $ | - |

Total liabilities | | $ | 2,436,856 | | $ | 2,057,757 | | $ | 1,349,487 | | $ | 1,216,362 |

Total equity capitalization | | $ | 4,840,764 | | $ | 4,967,461 | | $ | 4,916,539 | | $ | 4,678,538 |

Total market capitalization | | $ | 7,005,570 | | $ | 6,745,495 | | $ | 5,991,597 | | $ | 5,640,508 |

NYSE AMH Class A common share closing price | | $ | 16.55 | | $ | 17.03 | | $ | 16.89 | | $ | 17.76 |

| | | | | | | | |

Portfolio Data - at end of period | | | | | | | | |

Occupied single-family properties | | 30,185 | | 27,528 | | 25,724 | | 21,999 |

Executed leases for future occupancy | | 998 | | 722 | | 437 | | 1,365 |

Total leased single-family properties | | 31,183 | | 28,250 | | 26,161 | | 23,364 |

Single-family properties in acquisition process | | 371 | | 384 | | 611 | | 577 |

Single-family properties being renovated | | 1,492 | | 2,502 | | 1,719 | | 1,179 |

Single-family properties being prepared for re-lease | | 838 | | 630 | | 295 | | 656 |

Vacant single-family properties available for re-lease | | 1,008 | | 1,305 | | 1,442 | | 617 |

Vacant single-family properties available for initial lease | | 1,661 | | 1,502 | | 610 | | 744 |

Single-family properties held for sale | | 35 | | 26 | | 39 | | 36 |

Total single-family properties | | 36,588 | | 34,599 | | 30,877 | | 27,173 |

Total stabilized properties | | 32,987 | | 29,961 | | 27,331 | | 24,242 |

Total leased percentage | | 85.2% | | 81.6% | | 84.7% | | 86.0% |

Total occupancy percentage | | 82.5% | | 79.6% | | 83.3% | | 81.0% |

Stabilized leased percentage | | 93.4% | | 92.8% | | 94.1% | | 94.7% |

Stabilized occupancy percentage | | 90.4% | | 90.5% | | 92.4% | | 89.0% |

Quarterly lease retention rate | | 68.1% | | 66.6% | | 68.4% | | 72.0% |

| | | | | | | | |

Other Data | | | | | | | | |

Distributions declared per common share | | $ | 0.05 | | $ | 0.05 | | $ | 0.05 | | $ | 0.05 |

Distributions declared per Series A preferred share | | $ | 0.31 | | $ | 0.31 | | $ | 0.31 | | $ | 0.31 |

Distributions declared per Series B preferred share | | $ | 0.31 | | $ | 0.31 | | $ | 0.31 | | $ | 0.31 |

Distributions declared per Series C preferred share | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.23 |

6

Consolidated Statements of Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

| | For the Three Months Ended |

| | Mar 31, |

| | 2015 | | 2014 |

Revenues: | | | | | | |

Rents from single-family properties | | $ | 120,680 | | | $ | 73,761 | |

Fees from single-family properties | | 1,331 | | | 1,358 | |

Tenant charge-backs | | 8,372 | | | 1,890 | |

Other | | 1,365 | | | 269 | |

Total revenues | | 131,748 | | | 77,278 | |

| | | | | | |

Expenses: | | | | | | |

Property operating expenses | | | | | | |

Leased single-family properties | | 53,930 | | | 29,266 | |

Vacant single-family properties and other | | 5,972 | | | 9,043 | |

General and administrative expense | | 6,131 | | | 5,074 | |

Interest expense | | 15,670 | | | 1,502 | |

Noncash share-based compensation expense | | 696 | | | 532 | |

Acquisition fees and costs expensed | | 5,908 | | | 452 | |

Depreciation and amortization | | 53,664 | | | 35,131 | |

Total expenses | | 141,971 | | | 81,000 | |

| | | | | | |

Remeasurement of Series E units | | 1,838 | | | (2,756 | ) |

Remeasurement of Preferred shares | | 120 | | | (457 | ) |

| | | | | | |

Net loss | | (8,265 | ) | | (6,935 | ) |

| | | | | | |

Noncontrolling interest | | 3,956 | | | 3,620 | |

Dividends on preferred shares | | 5,569 | | | 3,121 | |

| | | | | | |

Net loss attributable to common shareholders | | $ | (17,790 | ) | | $ | (13,676 | ) |

| | | | | | |

Weighted-average shares outstanding–basic and diluted | | 211,481,727 | | | 185,504,294 | |

| | | | | | |

Net loss attributable to common shareholders | | | | | | | | |

per share–basic and diluted | | $ | (0.08 | ) | | $ | (0.07 | ) |

Funds from Operations and Core Funds from Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

| | For the Three Months Ended

Mar 31, |

| | 2015 | | 2014 |

Net loss attributable to common shareholders | | $ | (17,790 | ) | | $ | (13,676 | ) |

Adjustments: | | | | | | |

Noncontrolling interests in the Operating Partnership | | 3,869 | | | 3,715 | |

Depreciation and amortization | | 53,664 | | | 35,131 | |

Less: depreciation and amortization of non-real estate assets | | (2,154 | ) | | (936 | ) |

Less: outside interest in depreciation of partially owned properties | | (306 | ) | | (368 | ) |

Funds from operations | | $ | 37,283 | | | $ | 23,866 | |

Adjustments: | | | | | | |

Acquisition fees and costs expensed | | 5,908 | | | 452 | |

Noncash share-based compensation expense | | 696 | | | 532 | |

Remeasurement of Series E units | | (1,838 | ) | | 2,756 | |

Remeasurement of Preferred shares | | (120 | ) | | 457 | |

Core funds from operations | | $ | 41,929 | | | $ | 28,063 | |

| | | | | | |

FFO per weighted-average FFO share | | 0.14 | | | 0.10 | |

Core FFO per weighted-average FFO share | | 0.16 | | | 0.12 | |

| | | | | | |

Weighted-average FFO shares | | | | | | |

Weighted-average common shares outstanding | | 211,481,727 | | | 185,504,294 | |

Class A units | | 14,440,670 | | | 13,787,292 | |

Series C units | | 31,085,974 | | | 31,085,974 | |

Series D units | | 4,375,000 | | | 4,375,000 | |

Series E units | | 4,375,000 | | | 4,375,000 | |

Total weighted-average FFO shares | | 265,758,371 | | | 239,127,560 | |

FFO is a non-GAAP financial measure defined as net income or loss calculated in accordance with GAAP, excluding extraordinary items, as defined by GAAP, gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships and joint ventures.

Core FFO is a non-GAAP financial measure calculated by adjusting FFO for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense and (3) noncash fair value adjustments associated with remeasuring our Series E units liability and Preferred shares derivative liability to fair value.

Refer to Defined Terms and Reconciliation of Non-GAAP Financial Measures for further information and a reconciliation of FFO and Core FFO to net loss attributable to common shareholders, determined in accordance with GAAP.

8

Net Operating Income and Core Net Operating Income

(Amounts in thousands)

(Unaudited)

| | For the Three Months Ended |

| | Mar 31, |

| | 2015 | | 2014 |

Net Operating Income | | | | | | |

Rents from single-family properties | | $ | 120,680 | | | $ | 73,761 | |

Fees from single-family properties | | 1,331 | | | 1,358 | |

Tenant charge-backs | | 8,372 | | | 1,890 | |

Total revenues from single-family properties | | 130,383 | | | 77,009 | |

| | | | | | |

Leased property operating expenses | | 53,930 | | | 29,266 | |

| | | | | | |

Net operating income | | $ | 76,453 | | | $ | 47,743 | |

Net operating income margin | | 58.6 | % | | 62.0 | % |

| | | | | | |

Core Net Operating Income | | | | | | |

Rents from single-family properties | | 120,680 | | | 73,761 | |

Fees from single-family properties | | 1,331 | | | 1,358 | |

Bad debt expense | | (1,271 | ) | | (1,423 | ) |

Core revenues from single-family properties | | 120,740 | | | 73,696 | |

| | | | | | |

Leased property operating expenses | | 53,930 | | | 29,266 | |

Expenses reimbursed by tenant charge-backs | | (8,372 | ) | | (1,890 | ) |

Bad debt expense | | (1,271 | ) | | (1,423 | ) |

Core property operating expenses | | 44,287 | | | 25,953 | |

| | | | | | |

Core net operating income | | $ | 76,453 | | | $ | 47,743 | |

Core net operating income margin | | 63.3 | % | | 64.8 | % |

NOI is a supplemental non-GAAP financial measure defined as rents and fees from single-family properties and tenant charge-backs, less property operating expenses for leased single-family properties. Core NOI is also a supplemental non-GAAP financial measure defined as rents and fees from single-family properties, net of bad debt expense, less property operating expenses for leased single-family properties, excluding expenses reimbursed by tenant charge-backs and bad debt expense.

Refer to Defined Terms and Reconciliation of Non-GAAP Financial Measures for further information and a reconciliation of NOI and Core NOI to net loss, determined in accordance with GAAP.

9

Consolidated Balance Sheets

(Amounts in thousands)

(Unaudited)

| | Mar 31, 2015 | | Dec 31, 2014 |

Assets | | | | | | |

Single-family properties: | | | | | | |

Land | | $ | 1,166,186 | | | $ | 1,104,409 | |

Buildings and improvements | | 5,117,269 | | | 4,808,706 | |

Single-family properties held for sale | | 5,428 | | | 3,818 | |

| | 6,288,883 | | | 5,916,933 | |

Less: accumulated depreciation | | (251,528 | ) | | (206,262 | ) |

Single-family properties, net | | 6,037,355 | | | 5,710,671 | |

Cash and cash equivalents | | 115,693 | | | 108,787 | |

Restricted cash | | 86,446 | | | 77,198 | |

Rent and other receivables, net | | 11,289 | | | 11,009 | |

Escrow deposits, prepaid expenses and other assets | | 114,179 | | | 118,783 | |

Deferred costs and other intangibles, net | | 65,267 | | | 54,582 | |

Asset-backed securitization certificates | | 25,666 | | | 25,666 | |

Goodwill | | 120,655 | | | 120,655 | |

Total assets | | $ | 6,576,550 | | | $ | 6,227,351 | |

| | | | | | |

Liabilities | | | | | | |

Credit facility | | $ | 45,000 | | | $ | 207,000 | |

Asset-backed securitizations | | 2,068,389 | | | 1,519,390 | |

Secured note payable | | 51,417 | | | 51,644 | |

Accounts payable and accrued expenses | | 141,382 | | | 149,706 | |

Amounts payable to affiliates | | 2,609 | | | - | |

Contingently convertible Series E units liability | | 70,219 | | | 72,057 | |

Preferred shares derivative liability | | 57,840 | | | 57,960 | |

Total liabilities | | 2,436,856 | | | 2,057,757 | |

| | | | | | |

Commitments and contingencies | | | | | | |

| | | | | | |

Equity | | | | | | |

Shareholders’ equity: | | | | | | |

Class A common shares | | 2,108 | | | 2,108 | |

Class B common shares | | 6 | | | 6 | |

Preferred shares | | 171 | | | 171 | |

Additional paid-in capital | | 3,618,769 | | | 3,618,207 | |

Accumulated deficit | | (198,526 | ) | | (170,162 | ) |

Accumulated other comprehensive loss | | (229 | ) | | (229 | ) |

Total shareholders’ equity | | 3,422,299 | | | 3,450,101 | |

| | | | | | |

Noncontrolling interest | | 717,395 | | | 719,493 | |

Total equity | | 4,139,694 | | | 4,169,594 | |

| | | | | | |

Total liabilities and equity | | $ | 6,576,550 | | | $ | 6,227,351 | |

10

Debt Summary as of March 31, 2015

(Amounts in thousands)

| | Balance | | % of Total | | Interest

Rate (1) | | Years to

Maturity |

Floating rate debt: | | | | | | | | | | | | |

Line of credit (2) | | $ | 45,000 | | | 2.1 | % | | 2.93 | % | | 3.5 | |

AH4R 2014-SFR1 (3) | | 477,363 | | | 22.0 | % | | 1.79 | % | | 4.2 | |

Total floating rate debt | | 522,363 | | | 24.1 | % | | 1.89 | % | | 4.1 | |

| | | | | | | | | | | | |

Fixed rate debt: | | | | | | | | | | | | |

AH4R 2014-SFR2 | | 511,151 | | | 23.6 | % | | 4.42 | % | | 9.5 | |

AH4R 2014-SFR3 | | 527,097 | | | 24.3 | % | | 4.40 | % | | 9.7 | |

AH4R 2015-SFR1 (4) | | 552,778 | | | 25.6 | % | | 4.14 | % | | 30.0 | |

Secured note payable | | 51,417 | | | 2.4 | % | | 4.06 | % | | 4.3 | |

Total fixed rate debt | | 1,642,443 | | | 75.9 | % | | 4.31 | % | | 16.3 | |

| | | | | | | | | | | | |

Total debt | | $ | 2,164,806 | | | 100.0 | % | | 3.72 | % | | 13.4 | |

(1) | Interest rate on floating rate debt is presented as of end of period. |

(2) | Our credit facility provides for borrowing capacity of up to $800 million through March 2016 and bears interest at LIBOR plus 2.75% (3.125% beginning in March 2017). Any outstanding borrowings upon expiration of the credit facility period in March 2016 will become due in September 2018. Balance reflects borrowings outstanding as of end of period. Years to maturity based on final maturity date in September 2018. |

(3) | AH4R 2014-SFR1 bears interest at a duration-weighted blended interest rate of LIBOR plus 1.54%. Years to maturity reflects a fully extended maturity date of June 2019, which is based on an initial two-year loan term and three, 12-month extension options, at the Company’s election, provided there is no event of default and compliance with certain other terms. |

(4) | AH4R 2015-SFR1 has a maturity date of April 9, 2045, with an anticipated repayment date of April 9, 2025. In the event the loan is not repaid on April 9, 2025, the interest rate on each component is increased to a rate per annum equal to the sum of 3% plus the greater of: (a) the initial interest rate and (b) a rate equal to the sum of (i) the bid side yield to maturity for the “on the run” United States Treasury note with a 10 year maturity plus the mid-market 10 year swap spread, plus (ii) the component spread for each component. |

Note: Total interest expense for the three months ended March 31, 2015, includes $2.0 million of loan cost amortization. Total interest expense capitalized during the three months ended March 31, 2015, was $4.6 million.

Debt Maturity Schedule

Year | | Floating

Rate (1) | | Fixed Rate | | Total | | % of Total | |

2015 | | $ | 3,608 | | $ | 12,635 | | $ | 16,243 | | 0.8% | |

2016 | | 4,810 | | 16,880 | | 21,690 | | 1.0% | |

2017 | | 4,810 | | 16,925 | | 21,735 | | 1.0% | |

2018 | | 49,810 | | 16,966 | | 66,776 | | 3.1% | |

2019 | | 459,325 | | 63,789 | | 523,114 | | 24.2% | |

2020 | | - | | 15,953 | | 15,953 | | 0.7% | |

2021 | | - | | 15,953 | | 15,953 | | 0.7% | |

2022 | | - | | 15,953 | | 15,953 | | 0.7% | |

2023 | | - | | 15,953 | | 15,953 | | 0.7% | |

2024 | | - | | 952,605 | | 952,605 | | 44.0% | |

Thereafter (2) | | - | | 498,831 | | 498,831 | | 23.1% | |

Total | | $ | 522,363 | | $ | 1,642,443 | | $ | 2,164,806 | | 100.0% | |

(1) | Reflects credit facility based on final maturity date of September 2018 and AH4R 2014-SFR1 based on fully extended maturity date of June 2019, which is based on an initial two-year loan term and three, 12-month extension options, at the Company’s election, provided there is no event of default and compliance with certain other terms. |

(2) | AH4R 2015-SFR1 has a maturity date of April 9, 2045, with an anticipated repayment date of April 9, 2025. In the event the loan is not repaid on April 9, 2025, the interest rate on each component is increased to a rate per annum equal to the sum of 3% plus the greater of: (a) the initial interest rate and (b) a rate equal to the sum of (i) the bid side yield to maturity for the “on the run” United States Treasury note with a 10 year maturity plus the mid-market 10 year swap spread, plus (ii) the component spread for each component. |

11

Capital Structure as of March 31, 2015

(Amounts in thousands, except share and per share data)

Total Capitalization

Floating rate debt | | | | $ | 522,363 | | | |

Fixed rate debt | | | | 1,642,443 | | | |

Total debt | | | | 2,164,806 | | 30.9 | % |

| | | | | | | |

Common shares outstanding (1) | | 211,487,164 | | | | | |

Operating partnership units (1) | | 54,276,644 | | | | | |

Total shares and units | | 265,763,808 | | | | | |

| | | | | | | |

Common share price at March 31, 2015 (2) | | $ | 16.55 | | | | | |

| | | | | | | |

Market value of common shares and operating partnership units | | | | 4,398,391 | | | |

Participating preferred shares (see below) | | | | 442,373 | | | |

Total equity capitalization | | | | 4,840,764 | | 69.1 | % |

| | | | | | | |

Total market capitalization | | | | $ | 7,005,570 | | 100.0 | % |

| | | | | | | | | |

(1) Reflects total common shares and operating partnership units outstanding as of end of period.

(2) Based on NYSE AMH Class A common share closing price.

Participating Preferred Shares

| | | | | | Initial | | Current | | Annual | | Annual | |

| | Initial Redemption | | Outstanding | | Liquidation Value | | Liquidation Value (2) | | Dividend | | Dividend | |

Series | | Period (1) | | Shares | | Per Share | | Total | | Per Share | | Total | | Per Share | | Amount | |

5.0% Series A | | 9/30/2017 - 9/30/2020 | | 5,060,000 | | $ | 25.00 | | $ | 126,500 | | $ | 26.09 | | $ | 132,006 | | $ | 1.250 | | $ | 6,325 | |

5.0% Series B | | 9/30/2017 - 9/30/2020 | | 4,400,000 | | $ | 25.00 | | 110,000 | | $ | 26.09 | | 114,788 | | $ | 1.250 | | 5,500 | |

5.5% Series C | | 3/31/2018 - 3/31/2021 | | 7,600,000 | | $ | 25.00 | | 190,000 | | $ | 25.73 | | 195,579 | | $ | 1.375 | | 10,450 | |

| | | | 17,060,000 | | | | $ | 426,500 | | | | $ | 442,373 | | | | $ | 22,275 | |

(1) Initial redemption period reflects the timeframe during which the Company has the option to redeem the preferred shares for cash or Class A common shares, at a redemption price equal to the initial liquidation value, adjusted by an amount equal to 50% of the cumulative change in value of an index based on the purchase prices of single-family properties located in our top 20 markets (the “HPA adjustment”), subject to a cap, such that the total internal rate of return, when considering the initial liquidation value, the HPA adjustment and the dividends up to, but excluding, the date of redemption, will not exceed 9.0%. If not redeemed by the end of the initial redemption period, the initial liquidation value will be adjusted by the HPA adjustment as of the end of the initial redemption period and the cumulative annual cash dividend rate will be prospectively increased to 10% of the adjusted liquidation value. Any time after the end of the initial liquidation period, the Company has the option to redeem the preferred shares for cash or Class A common shares, at a redemption price equal to the adjusted liquidation value.

(2) Current liquidation value reflects initial liquidation value, adjusted by most recent quarterly HPA adjustment calculation, which is made available under the “For Investors” page of the Company’s website.

12

Same-Home Results – Quarterly Comparisons

(Amounts in thousands, except property data)

| | For the Three Months Ended | | |

| | Mar 31, | | |

| | 2015 | | 2014 | | % Change |

Number of Same-Home properties | | 13,446 | | 13,446 | | |

Leased percentage as of period end | | 94.8% | | 94.6% | | |

Occupancy percentage as of period end | | 93.1% | | 94.5% | | |

Average leased percentage | | 93.9% | | 95.1% | | |

Average occupancy percentage | | 92.3% | | 94.6% | | |

Average scheduled monthly rent (1) | | $ | 1,409 | | $ | 1,374 | | |

| | | | | | |

Core Net Operating Income from Same-Home Properties: | | | | | | |

Rents from single-family properties | | $ | 52,368 | | $ | 51,593 | | 1.5% |

Fees from single-family properties | | 476 | | 439 | | 8.4% |

Bad debt | | (561) | | (1,194) | | (53.0%) |

Core revenues from Same-Home properties | | 52,283 | | 50,838 | | 2.8% |

| | | | | | |

Property tax | | 8,985 | | 8,156 | | 10.2% |

HOA fees, net of tenant charge-backs | | 1,252 | | 1,334 | | (6.1%) |

R&M and turnover costs, net of tenant charge-backs | | 3,842 | | 4,102 | | (6.3%) |

Insurance | | 870 | | 974 | | (10.7%) |

Property management | | 4,508 | | 4,288 | | 5.1% |

Core property operating expenses from Same-Home properties | | 19,457 | | 18,854 | | 3.2% |

| | | | | | |

Core net operating income from Same-Home properties | | $ | 32,826 | | $ | 31,984 | | 2.6% |

| | For the Three Months Ended | | |

| | Mar 31, | | |

| | 2015 | | 2014 | | |

Capital expenditures | | $ | 3,304,886 | | $ | 3,629,633 | | |

Average quarterly capital expenditures per property | | $ | 246 | | $ | 270 | | |

Annualized average quarterly capital expenditures per property | | $ | 983 | | $ | 1,080 | | |

| | | | Gross Book | | | | | | | | | | Average Scheduled |

| | Number of | | Value per | | % of | | Average Occupancy Percentage | | Monthly Rent (1) |

| | Properties | | Property | | Q1 15 NOI | | Q1 15 | | Q1 14 | | % Change | | Q1 15 | | Q1 14 | | % Change |

Indianapolis, IN | | 1,234 | | $ | 149,801 | | 7.0% | | 88.6% | | 97.1% | | (8.5%) | | $ | 1,245 | | $ | 1,223 | | 1.8% |

Dallas-Fort Worth, TX | | 1,144 | | 166,504 | | 9.1% | | 93.8% | | 94.8% | | (1.0%) | | 1,522 | | 1,473 | | 3.4% |

Atlanta, GA | | 993 | | 173,263 | | 7.4% | | 94.6% | | 94.5% | | 0.1% | | 1,381 | | 1,338 | | 3.2% |

Phoenix, AZ | | 806 | | 152,811 | | 5.1% | | 92.6% | | 91.1% | | 1.5% | | 1,138 | | 1,113 | | 2.2% |

Nashville, TN | | 719 | | 207,212 | | 7.2% | | 92.7% | | 95.5% | | (2.9%) | | 1,543 | | 1,493 | | 3.3% |

Charlotte, NC | | 677 | | 174,018 | | 5.6% | | 92.3% | | 95.9% | | (3.6%) | | 1,358 | | 1,318 | | 3.0% |

Cincinnati, OH | | 664 | | 176,656 | | 4.7% | | 89.7% | | 94.5% | | (4.8%) | | 1,427 | | 1,397 | | 2.1% |

Tampa, FL | | 664 | | 199,738 | | 4.9% | | 94.0% | | 90.5% | | 3.5% | | 1,570 | | 1,548 | | 1.4% |

Jacksonville, FL | | 632 | | 155,284 | | 4.2% | | 93.4% | | 92.3% | | 1.0% | | 1,324 | | 1,297 | | 2.1% |

Houston, TX | | 620 | | 188,114 | | 4.5% | | 92.0% | | 95.1% | | (3.1%) | | 1,586 | | 1,530 | | 3.6% |

All Other (2) | | 5,293 | | 179,105 | | 40.4% | | 92.4% | | 94.9% | | (2.5%) | | 1,422 | | 1,392 | | 2.2% |

Total / Average | | 13,446 | | $ | 174,777 | | 100.0% | | 92.3% | | 94.6% | | (2.2%) | | $ | 1,409 | | $ | 1,374 | | 2.5% |

(1) Average scheduled monthly rent as of end of period.

(2) Represents 31 markets in 19 states.

13

Top 20 Markets Summary

Property Information

Market | | Number of

Properties | | Percentage

of Total

Properties | | Gross Book

Value

($ millions) | | Gross Book

Value per

Property | | Avg.

Sq. Ft. | | Avg. Age

(years) |

Dallas-Fort Worth, TX | | 3,013 | | 8.2% | | $ | 480.0 | | $ | 159,310 | | 2,136 | | 11.4 |

Indianapolis, IN | | 2,760 | | 7.5% | | 419.5 | | 151,993 | | 1,935 | | 12.6 |

Atlanta, GA | | 2,407 | | 6.6% | | 388.8 | | 161,529 | | 2,106 | | 14.3 |

Charlotte, NC | | 2,151 | | 5.9% | | 370.9 | | 172,431 | | 2,004 | | 12.0 |

Greater Chicago area, IL and IN | | 2,009 | | 5.5% | | 352.2 | | 175,311 | | 1,899 | | 13.5 |

Houston, TX | | 1,928 | | 5.3% | | 332.3 | | 172,355 | | 2,229 | | 10.6 |

Cincinnati, OH | | 1,814 | | 5.0% | | 311.5 | | 171,720 | | 1,846 | | 13.0 |

Tampa, FL | | 1,520 | | 4.2% | | 286.1 | | 188,224 | | 1,986 | | 11.3 |

Jacksonville, FL | | 1,436 | | 3.9% | | 214.6 | | 149,443 | | 1,916 | | 11.1 |

Nashville, TN | | 1,423 | | 3.9% | | 295.5 | | 207,660 | | 2,212 | | 10.7 |

Raleigh, NC | | 1,415 | | 3.9% | | 254.4 | | 179,788 | | 1,883 | | 10.9 |

Phoenix, AZ | | 1,380 | | 3.8% | | 219.5 | | 159,058 | | 1,819 | | 12.7 |

Columbus, OH | | 1,354 | | 3.7% | | 206.1 | | 152,216 | | 1,826 | | 13.7 |

Salt Lake City, UT | | 1,050 | | 2.9% | | 229.1 | | 218,190 | | 2,131 | | 13.9 |

Orlando, FL | | 1,045 | | 2.9% | | 175.9 | | 168,325 | | 1,891 | | 13.3 |

Las Vegas, NV | | 909 | | 2.5% | | 159.6 | | 175,578 | | 1,865 | | 12.5 |

San Antonio, TX | | 853 | | 2.3% | | 129.0 | | 151,231 | | 1,990 | | 13.7 |

Denver, CO | | 666 | | 1.8% | | 178.6 | | 268,168 | | 2,142 | | 15.4 |

Austin, TX | | 664 | | 1.8% | | 98.4 | | 148,193 | | 1,847 | | 10.9 |

Greenville, SC | | 597 | | 1.6% | | 101.1 | | 169,347 | | 1,922 | | 11.7 |

All Other (1) | | 6,194 | | 16.8% | | 1,085.8 | | 175,301 | | 1,834 | | 11.8 |

Total / Average | | 36,588 | | 100.0% | | $ | 6,288.9 | | $ | 171,885 | | 1,966 | | 12.3 |

Leasing Information

| | Total Portfolio | | Stabilized Properties |

| | | | | | Avg. Scheduled | | | | | | Total |

| | Leased | | Occupancy | | Monthly Rent | | Leased | | Occupancy | | Stabilized |

Market | | Percentage | | Percentage | | Per Property | | Percentage | | Percentage | | Properties |

Dallas-Fort Worth, TX | | 90.4% | | 87.5% | | $ | 1,509 | | 96.0% | | 92.9% | | 2,800 |

Indianapolis, IN | | 84.1% | | 81.0% | | 1,285 | | 90.1% | | 86.7% | | 2,566 |

Atlanta, GA | | 83.4% | | 81.8% | | 1,318 | | 95.0% | | 93.2% | | 2,081 |

Charlotte, NC | | 81.4% | | 79.1% | | 1,352 | | 93.7% | | 91.1% | | 1,852 |

Greater Chicago area, IL and IN | | 84.8% | | 81.5% | | 1,664 | | 94.1% | | 90.4% | | 1,788 |

Houston, TX | | 80.9% | | 78.1% | | 1,582 | | 92.6% | | 89.3% | | 1,640 |

Cincinnati, OH | | 89.6% | | 85.6% | | 1,420 | | 92.9% | | 88.7% | | 1,736 |

Tampa, FL | | 92.2% | | 89.9% | | 1,524 | | 94.6% | | 92.2% | | 1,468 |

Jacksonville, FL | | 83.6% | | 81.3% | | 1,306 | | 95.0% | | 92.4% | | 1,245 |

Nashville, TN | | 86.8% | | 83.8% | | 1,559 | | 95.2% | | 91.8% | | 1,274 |

Raleigh, NC | | 80.6% | | 77.1% | | 1,349 | | 91.7% | | 87.7% | | 1,240 |

Phoenix, AZ | | 95.1% | | 93.6% | | 1,113 | | 95.1% | | 93.6% | | 1,367 |

Columbus, OH | | 87.7% | | 83.7% | | 1,388 | | 93.3% | | 88.9% | | 1,245 |

Salt Lake City, UT | | 77.4% | | 75.3% | | 1,471 | | 93.8% | | 91.2% | | 866 |

Orlando, FL | | 86.4% | | 83.3% | | 1,401 | | 93.9% | | 90.5% | | 951 |

Las Vegas, NV | | 95.3% | | 93.3% | | 1,310 | | 95.3% | | 93.2% | | 872 |

San Antonio, TX | | 86.8% | | 84.8% | | 1,344 | | 95.3% | | 93.1% | | 770 |

Denver, CO | | 80.5% | | 76.3% | | 1,790 | | 92.7% | | 87.8% | | 574 |

Austin, TX | | 87.8% | | 85.7% | | 1,323 | | 94.9% | | 92.6% | | 608 |

Greenville, SC | | 74.5% | | 70.4% | | 1,393 | | 82.1% | | 77.5% | | 537 |

All Other (1) | | 82.8% | | 80.3% | | 1,379 | | 92.2% | | 89.4% | | 5,507 |

Total / Average | | 85.2% | | 82.5% | | $ | 1,411 | | 93.4% | | 90.4% | | 32,987 |

(1) Represents 31 markets in 19 states.

14

American Homes 4 Rent

Leasing Performance

Renewal / Retention Rates

| | Lease | | Expiration Outcome | | Early | | Renewal | | Retention |

| | Expirations (1) | | Renewed (2) | | Move-out | | Terminations (3) | | Rate | | Rate |

Q1 2015 | | 4,969 | | 3,936 | | 1,033 | | 814 | | 79.2% | | 68.1% |

(1) Reflects total non-month-to-month leases scheduled to expire during the quarter ended March 31, 2015.

(2) Represents total renewed leases (including both non-month-to-month and month-to-month renewals) during the quarter ended March 31, 2015.

(3) Includes non-month-to-month tenant move-outs during the quarter ended March 31, 2015, in advance of contractual expiration scheduled after March 31, 2015.

Scheduled Lease Expirations

| | MTM | | Q2 2015 | | Q3 2015 | | Q4 2015 | | Q1 2016 | | Thereafter |

Lease expirations | | 1,220 | | 7,994 | | 7,655 | | 5,134 | | 7,943 | | 1,237 |

Renewal / Re-Lease Spreads

| | Renewals | | Re-Leases |

| | | | Avg Change | | | | Avg Change |

| | Number of | | in | | Number of | | in |

Market | | Leases | | Rent (1) | | Leases | | Rent (2) |

Dallas-Fort Worth, TX | | 374 | | 3.4% | | 237 | | 2.2% |

Indianapolis, IN | | 165 | | 3.3% | | 190 | | 0.7% |

Atlanta, GA | | 307 | | 3.4% | | 109 | | 2.5% |

Charlotte, NC | | 156 | | 3.1% | | 126 | | 1.9% |

Greater Chicago area, IL and IN | | 122 | | 1.9% | | 101 | | 0.8% |

Cincinnati, OH | | 105 | | 2.2% | | 124 | | 0.2% |

Houston, TX | | 223 | | 3.2% | | 89 | | 2.3% |

Tampa, FL | | 125 | | 2.5% | | 131 | | (0.6%) |

Phoenix, AZ | | 183 | | 3.1% | | 144 | | 1.3% |

Jacksonville, FL | | 121 | | 2.9% | | 108 | | (0.1%) |

All Other (3) | | 1,274 | | 3.1% | | 997 | | 1.0% |

Total | | 3,155 | | 3.6% | | 2,356 | | 1.1% |

(1) Represents average percentage change in rent on non-month-to-month lease renewals during the quarter ended March 31, 2015.

(2) Reflects average percentage change in annual rent on properties re-leased during the quarter ended March 31, 2015, compared to annual rent of the previous expired lease for each individual property.

(3) Represents 31 markets in 19 states.

15

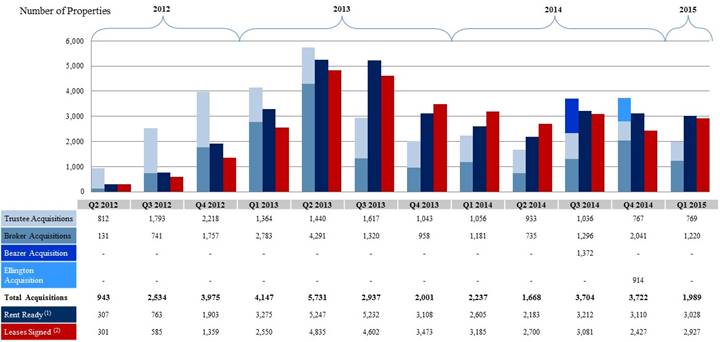

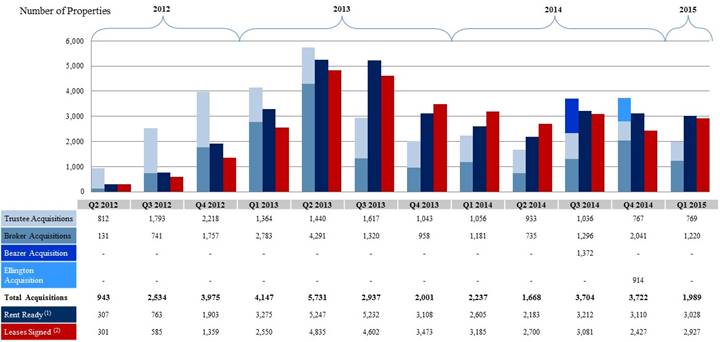

Acquisition, Renovation and Initial Leasing Rates

(1) “Rent Ready” includes properties for which initial construction has been completed during each quarter. Q3 2014 includes 1,338 renovated properties acquired as part of the Beazer Rental Homes portfolio. Q4 2014 includes 896 renovated properties acquired as part of the Ellington Housing Single-Family portfolio.

(2) “Leases Signed” includes the number of initial leases signed each quarter (includes Pre-Existing Leases). Q3 2014 includes 1,236 leased properties acquired as part of the Beazer Rental Homes portfolio. Q4 2014 includes 880 leased properties acquired as part of the Ellington Housing Single-Family portfolio.

16

American Homes 4 Rent

Top 20 Markets Home Price Appreciation Trends

The table below summarizes historic changes in the House Price Index of the Federal Housing Finance Agency (“FHFA”), known as the Quarterly Purchase-Only Index, specifically the non-seasonally adjusted “Purchase-Only Index” for the “100 Largest Metropolitan Statistical Areas”, which is used for purposes of computing the “HPA Factor” for our 5% Series A participating preferred shares, 5% Series B participating preferred shares and 5.5% Series C participating preferred shares as described in the prospectuses for those securities.

| | HPA Index (1) | | HPA |

| | Dec 31, | | Mar 31, | | Jun 30, | | Sep 30, | | Dec 31, | | Mar 31, | | Jun 30, | | Sep 30, | | Dec 31, | | Index |

Market | | 2012 | | 2013 | | 2013 | | 2013 | | 2013 | | 2014 | | 2014 | | 2014 | | 2014 | | Change |

Dallas-Fort Worth, TX (2) | | 100.0 | | 100.6 | | 106.0 | | 106.9 | | 108.4 | | 109.7 | | 113.3 | | 115.7 | | 115.1 | | 15.1% |

Indianapolis, IN | | 100.0 | | 104.6 | | 107.9 | | 110.0 | | 106.5 | | 109.3 | | 112.6 | | 112.2 | | 112.0 | | 12.0% |

Atlanta, GA | | 100.0 | | 103.4 | | 115.9 | | 113.8 | | 114.4 | | 119.7 | | 122.6 | | 122.0 | | 122.7 | | 22.7% |

Charlotte, NC | | 100.0 | | 104.8 | | 102.5 | | 112.6 | | 114.0 | | 109.9 | | 116.9 | | 116.1 | | 118.5 | | 18.5% |

Greater Chicago area, IL and IN | | 100.0 | | 101.7 | | 140.2 | | 111.0 | | 111.4 | | 109.0 | | 115.5 | | 116.8 | | 116.5 | | 16.5% |

Houston, TX | | 100.0 | | 101.6 | | 107.6 | | 108.2 | | 110.7 | | 114.6 | | 117.1 | | 121.0 | | 122.9 | | 22.9% |

Cincinnati, OH | | 100.0 | | 100.0 | | 105.4 | | 107.6 | | 104.9 | | 106.3 | | 111.1 | | 111.7 | | 110.8 | | 10.8% |

Tampa, FL | | 100.0 | | 101.3 | | 168.2 | | 111.3 | | 112.6 | | 113.4 | | 115.4 | | 119.1 | | 120.9 | | 20.9% |

Jacksonville, FL | | 100.0 | | 107.7 | | 110.1 | | 111.8 | | 113.4 | | 110.6 | | 115.8 | | 122.3 | | 121.8 | | 21.8% |

Nashville, TN | | 100.0 | | 102.3 | | 87.6 | | 108.6 | | 111.1 | | 110.7 | | 116.5 | | 118.3 | | 117.9 | | 17.9% |

Raleigh, NC | | 100.0 | | 102.3 | | 125.1 | | 107.5 | | 106.6 | | 108.3 | | 112.7 | | 111.2 | | 113.4 | | 13.4% |

Phoenix, AZ | | 100.0 | | 102.7 | | 101.0 | | 115.4 | | 117.6 | | 118.8 | | 122.4 | | 121.5 | | 123.8 | | 23.8% |

Columbus, OH | | 100.0 | | 102.4 | | 80.6 | | 111.3 | | 109.4 | | 110.9 | | 115.4 | | 115.0 | | 113.5 | | 13.5% |

Salt Lake City, UT | | 100.0 | | 104.7 | | 66.8 | | 109.9 | | 109.0 | | 110.4 | | 115.5 | | 114.9 | | 114.4 | | 14.4% |

Orlando, FL | | 100.0 | | 100.7 | | 107.6 | | 110.7 | | 110.3 | | 112.9 | | 116.2 | | 116.7 | | 122.1 | | 22.1% |

Las Vegas, NV | | 100.0 | | 101.8 | | 151.3 | | 121.1 | | 124.9 | | 130.8 | | 132.6 | | 137.9 | | 140.3 | | 40.3% |

San Antonio, TX | | 100.0 | | 98.9 | | 91.6 | | 100.1 | | 99.9 | | 104.6 | | 105.6 | | 106.9 | | 105.4 | | 5.4% |

Denver, CO | | 100.0 | | 100.6 | | 54.6 | | 109.3 | | 111.1 | | 113.5 | | 118.5 | | 118.6 | | 121.3 | | 21.3% |

Austin, TX | | 100.0 | | 101.6 | | 109.6 | | 111.4 | | 110.1 | | 115.1 | | 120.7 | | 121.1 | | 120.9 | | 20.9% |

Greenville, SC | | 100.0 | | 98.3 | | 123.1 | | 109.7 | | 104.8 | | 106.2 | | 112.8 | | 114.6 | | 111.8 | | 11.8% |

Average | | | | | | | | | | | | | | | | | | | | 18.3% |

(1) Updates to the Quarterly Purchase-Only Index are released by the FHFA on approximately the 20th day of the second month following quarter-end. Accordingly, information in the above table has been presented through December 31, 2014. For the illustrative purposes of this table, the HPA Index has been indexed as of December 31, 2012, and, as such, HPA Index values presented are relative measures calculated in relation to the baseline index value of 100.0 as of December 31, 2012.

(2) Our Dallas-Fort Worth, TX market is comprised of the Dallas-Plano-Irving and Fort Worth-Arlington Metropolitan Divisions.

17

American Homes 4 Rent

Defined Terms

Equity Capitalization Equity capitalization includes market value of all common shares and operating partnership units (based on NYSE AMH Class A common share closing price at end of respective period) and current liquidation value of preferred shares at end of respective period. FFO / Core FFO FFO is a non-GAAP financial measure that we calculate in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”), which defines FFO as net income or loss calculated in accordance with GAAP, excluding extraordinary items, as defined by GAAP, gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships and joint ventures. Core FFO is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute Core FFO by adjusting FFO for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) noncash share-based compensation expense and (3) noncash fair value adjustments associated with remeasuring our Series E units liability and Preferred shares derivative liability to fair value. We present FFO and FFO per FFO share because we consider FFO to be an important measure of the performance of real estate companies, as do many analysts in evaluating our Company. We believe that FFO is a helpful measure of a REIT’s performance since FFO excludes depreciation, which is included in computing net income and assumes the value of real estate diminishes predictably over time. We believe that real estate values fluctuate due to market conditions and in response to inflation. We also believe that Core FFO and Core FFO per FFO share are helpful to investors as supplemental measures of the operating performance of our Company as they allow investors to compare our operating performance to prior | | | reporting periods without the effect of certain items that, by nature, are not comparable from period to period. FFO and Core FFO are not a substitute for net cash flow provided by operating activities or net loss per share, as determined in accordance with GAAP, as a measure of our liquidity, operating performance or ability to pay dividends. FFO and Core FFO also are not necessarily indicative of cash available to fund future cash needs. Because other REITs may not compute FFO and Core FFO in the same manner, FFO and Core FFO may not be comparable among REITs. Refer to Funds from Operations and Core Funds from Operations for a reconciliation of FFO and Core FFO to net loss attributable to common shareholders, determined in accordance with GAAP. FFO Shares FFO shares includes weighted-average common shares outstanding and assumes full conversion of all operating partnership units outstanding, at end of respective period. Leased Property A property is classified as leased upon the execution (i.e., signature) of a lease agreement. Market Capitalization Market capitalization includes equity capitalization, principal balances on asset-backed securitizations and secured note payable and borrowings outstanding under our credit facility at end of respective period. NOI / Core NOI NOI is a supplemental non-GAAP financial measure that we define as rents and fees from single-family properties and tenant charge-backs, less property operating expenses for leased single-family properties. Core NOI is also a supplemental non-GAAP financial measure that we define as rents and fees from single-family properties, net of bad debt expense, less property operating expenses for leased single-family properties, excluding expenses reimbursed by tenant charge-backs and bad debt expense. |

18

American Homes 4 Rent

Defined Terms (continued)

NOI and Core NOI also exclude remeasurement of preferred shares, remeasurement of Series E units, depreciation and amortization, acquisition fees and costs expensed, noncash share-based compensation expense, interest expense, general and administrative expense, property operating expenses for vacant single-family properties and other and other revenues. We consider NOI to be a meaningful financial measure because we believe it is helpful to investors in understanding the operating performance of our leased single-family properties. Additionally, we believe Core NOI is helpful to our investors as it better reflects the operating margin performance of our leased single-family properties and excludes the impact of certain operating expenses that are reimbursed through tenant charge-backs. NOI and Core NOI should be considered only as supplements to net loss as measures of our performance. NOI and Core NOI should not be used as measures of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. NOI and Core NOI also should not be used as substitutes for net loss or net cash flows from operating activities (as computed in accordance with GAAP). Refer to Reconciliation of Non-GAAP Financial Measures for a reconciliation of NOI and Core NOI to net loss, determined in accordance with GAAP. Occupied Property A property is classified as occupied upon commencement (i.e., start date) of a lease agreement, which can occur contemporaneously with or subsequent to execution (i.e., signature). | | | Re-Lease Spread Re-Lease spreads are calculated as the percentage change in annual rent on properties re-leased during the period, compared to annual rent of the previous expired lease for each individual property. Renewal Rate Renewal rate is calculated as the number of renewed leases in a given period divided by total number of lease expirations during the same period. Renewal Spread Renewal spreads are calculated as the percentage change in rent on non-month-to-month lease renewals during the period. Retention Rate Retention rate is calculated as the number of renewed leases in a given period divided by the sum of total lease expirations and early terminations during the same period. Same-Home Property A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period presented under comparison. Stabilized Property A property is classified as stabilized once it has been renovated and then initially leased or available for rent for a period greater than 90 days. |

19

Reconciliation of Non-GAAP Financial Measures

The following is a reconciliation of net loss, determined in accordance with GAAP, to NOI and Core NOI for the three months ended March 31, 2015 and 2014 (amounts in thousands):

| | For the Three Months Ended | |

| | Mar 31, | |

| | 2015 | | 2014 | |

Net loss | | $ | (8,265) | | $ | (6,935) | |

Remeasurement of Preferred shares | | (120) | | 457 | |

Remeasurement of Series E units | | (1,838) | | 2,756 | |

Depreciation and amortization | | 53,664 | | 35,131 | |

Acquisition fees and costs expensed | | 5,908 | | 452 | |

Noncash share-based compensation expense | | 696 | | 532 | |

Interest expense | | 15,670 | | 1,502 | |

General and administrative expense | | 6,131 | | 5,074 | |

Property operating expenses for vacant | | | | | |

single-family properties and other | | 5,972 | | 9,043 | |

Other revenues | | (1,365) | | (269) | |

Net operating income | | 76,453 | | 47,743 | |

Tenant charge-backs | | 8,372 | | 1,890 | |

Expenses reimbursed by tenant charge-backs | | (8,372) | | (1,890) | |

Bad debt expense excluded from operating expenses | | 1,271 | | 1,423 | |

Bad debt expense included in revenues | | (1,271) | | (1,423) | |

Core net operating income | | $ | 76,453 | | $ | 47,743 | |

20

American Homes 4 Rent

Corporate Information | Executive Management |

American Homes 4 Rent | David P. Singelyn |

30601 Agoura Road, Suite 200 | Chief Executive Officer |

Agoura Hills, CA 91301 | |

Phone: (805) 413-5300 | Jack Corrigan |

Website: www.americanhomes4rent.com | Chief Operating Officer |

| |

Investor Relations | Diana M. Laing |

Phone: (855) 794-AH4R (2447) | Chief Financial Officer |

Email: investors@ah4r.com | |

Research Coverage

Bank of America / Merrill Lynch | Jana Galan | jana.galan@baml.com | (646) 855-3081 |

| | | |

FBR Capital Markets & Co | Steve Stelmach | sstelmach@fbr.com | (703) 312-1848 |

| | | |

GS Global Investment Research | Andrew Rosivach | andrew.rosivach@gs.com | (212) 902-2796 |

| | | |

JP Morgan Securities | Anthony Paolone | anthony.paolone@jpmorgan.com | (212) 622-6682 |

| | | |

Keefe, Bruyette & Woods, Inc. | Jade Rahmani | jrahmani@kbw.com | (212) 887-3882 |

| | | |

Morgan Stanley | Haendel St Juste | haendel.stjuste@morganstanely.com | (212) 761-0071 |

| | | |

Raymond James & Associates, Inc. | Buck Horne | buck.horne@raymondjames.com | (727) 567-2561 |

| | | |

Susquehanna Financial Group | Jack Micenko | jack.micenko@sig.com | (212) 514-4892 |

| | | |

Wells Fargo | Jeff Donnely | jeff.donnely@wellsfargo.com | (617) 603-4262 |

| | | |

Zelman & Associates | Dan Oppenheim | dan@zelmanassociates.com | (212) 993-5830 |