Investor HighlightsMANAGEMENT PRESENTATION MAY 23, 2017

2 LEGAL DISCLOSURES Forward-Looking Statements Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. We have based these forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment philosophy and diversified acquisition strategy, our ability to grow our portfolio and to create a cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic and real estate conditions that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation, May 23, 2017. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report for the year ended December 31, 2016 and the Company’s subsequent filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP) because we believe they help investors understand our performance. Any non-GAAP financial measures presented are not, and should not be viewed as, substitutes for financial measures required by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies.

SFR Industry Overview 3 OPERATIONAL OVERVIEW Cincinnati, OH

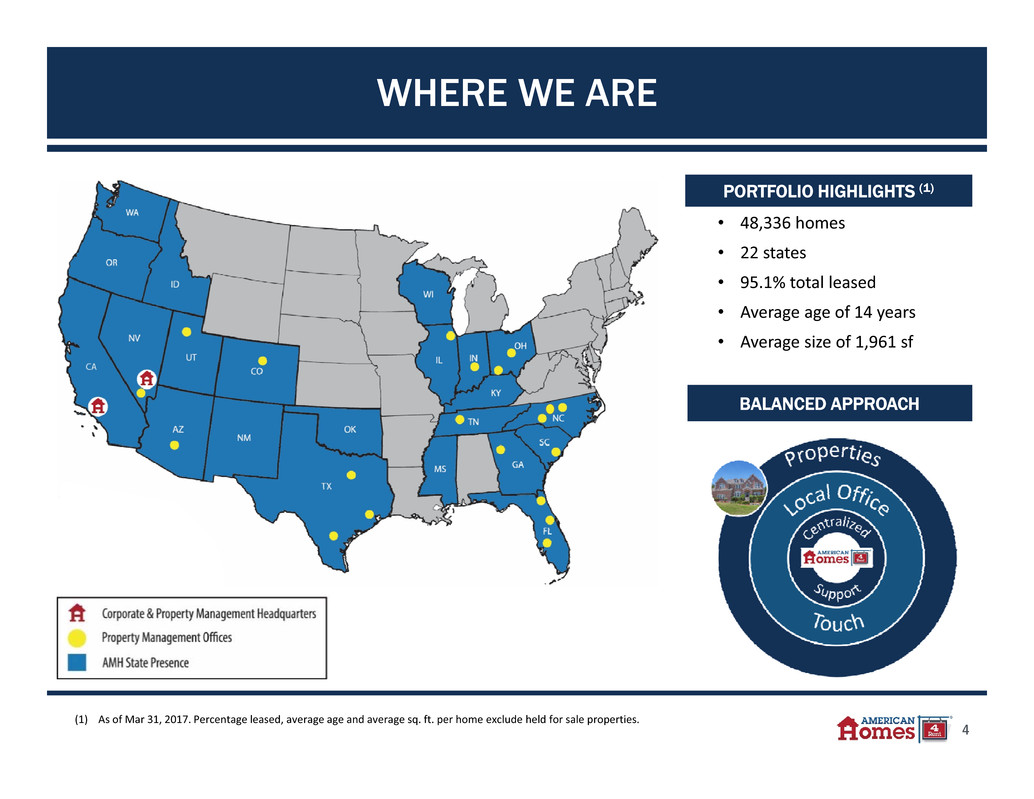

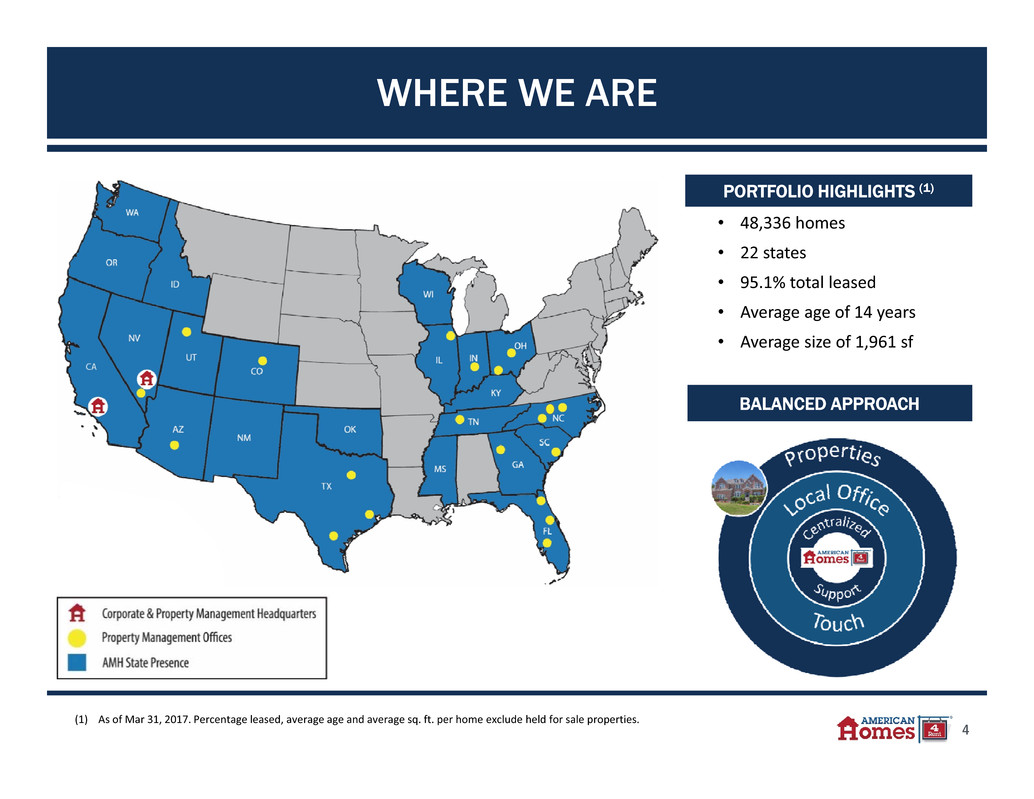

4 WHERE WE ARE (1) As of Mar 31, 2017. Percentage leased, average age and average sq. ft. per home exclude held for sale properties. • 48,336 homes • 22 states • 95.1% total leased • Average age of 14 years • Average size of 1,961 sf PORTFOLIO HIGHLIGHTS (1) BALANCED APPROACH

5 HOW WE GOT HERE

6 PROPERTY MANAGEMENT PLATFORM PROPERTIES PROCESSES PEOPLE

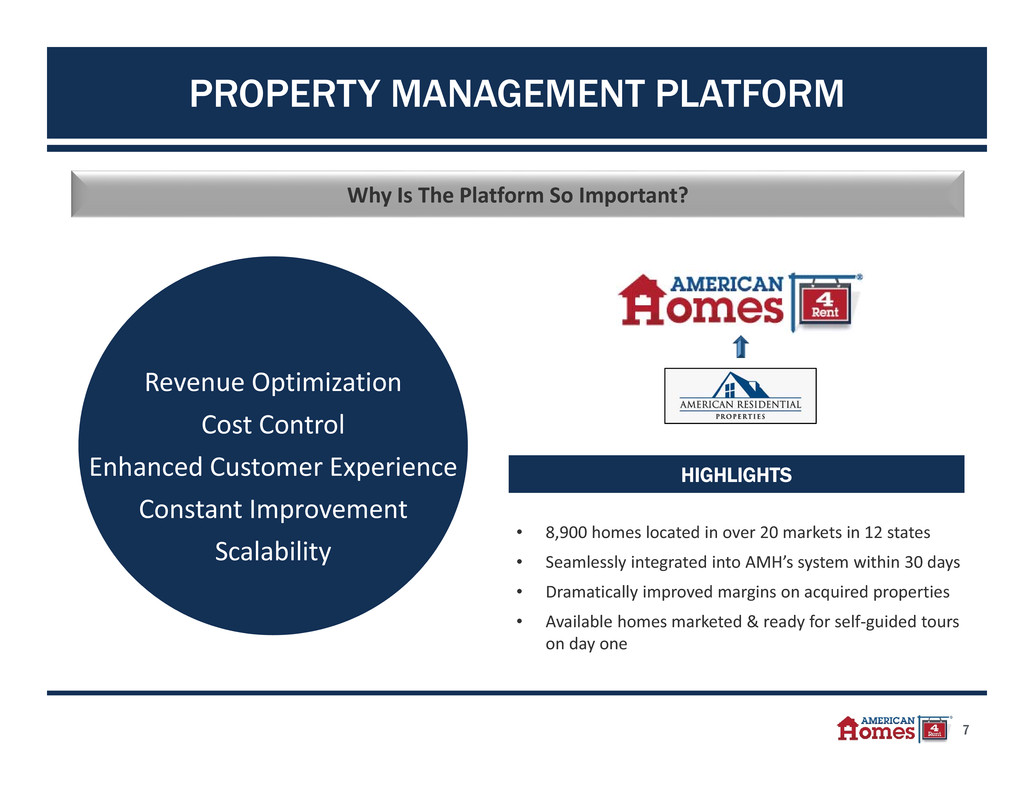

7 Revenue Optimization Cost Control Enhanced Customer Experience Constant Improvement Scalability Why Is The Platform So Important? PROPERTY MANAGEMENT PLATFORM • 8,900 homes located in over 20 markets in 12 states • Seamlessly integrated into AMH’s system within 30 days • Dramatically improved margins on acquired properties • Available homes marketed & ready for self‐guided tours on day one HIGHLIGHTS

AMH Highlights Section 8 PM OPERATIONS Dallas‐Fort Worth, TX

9 CENTRALIZED SUPPORT, LOCAL TOUCH SUPPORT • Control – Underwriting, pricing, lease administration • Efficiency – Ability to operate 7 days a week, 15 hours a day • Consistency – AH4R University • Innovation – Data driven

10 Operational Support • Training • Accounting • Maintenance • Call centers • Lease administration Boots on The Ground • Property inspections • Personal tenant interactions CENTRALIZED SUPPORT, LOCAL TOUCH Managerial Oversight • Local district office • District & field managers Salt Lake City District Office Seattle Portland Boise Las Vegas Support Center

11 CENTRALIZED SUPPORT, LOCAL TOUCH LOCAL TOUCH • Superior Customer Service • Tenant retention • Positive tenant behavior DISTRICT MANAGER LEASING TEAM PROPERTY MANAGEMENT TEAM FIELD TEAM • Eyes on the Assets • 125,000 inspections yearly • Manage Costs • Ensure quality

12 CENTRALIZED SUPPORT, LOCAL TOUCH FOCUS • Customer Service • Personal touch • Convenience • Our People • Intentional about culture • Minimizing Vacancy Period • Preservation of Asset Customer Service • Seamless Communication • Training • Turn Revolution • Tenant • Property Management • Vendors: Preferred In House Services KEY INITIATIVES

13 BEST IN CLASS SYSTEMS West Division Pricing Marketing Tenant Underwriting LeasingMove‐In PM & Maintenance Renewal / Move‐Out Turn Data & Feedback

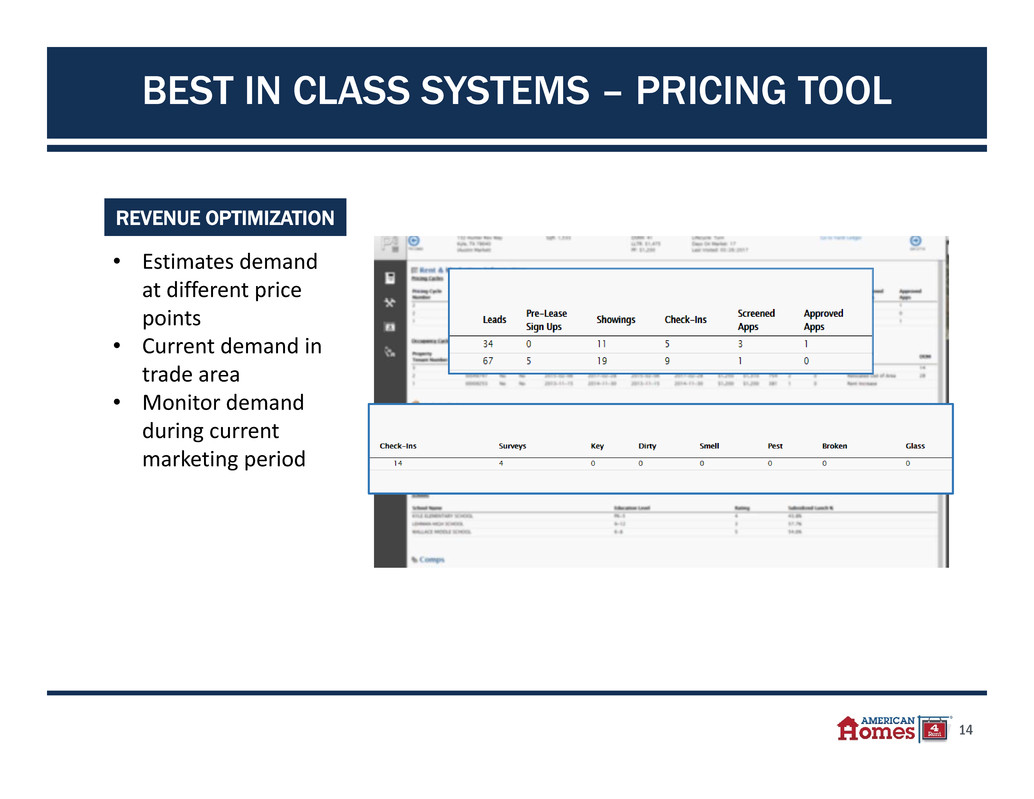

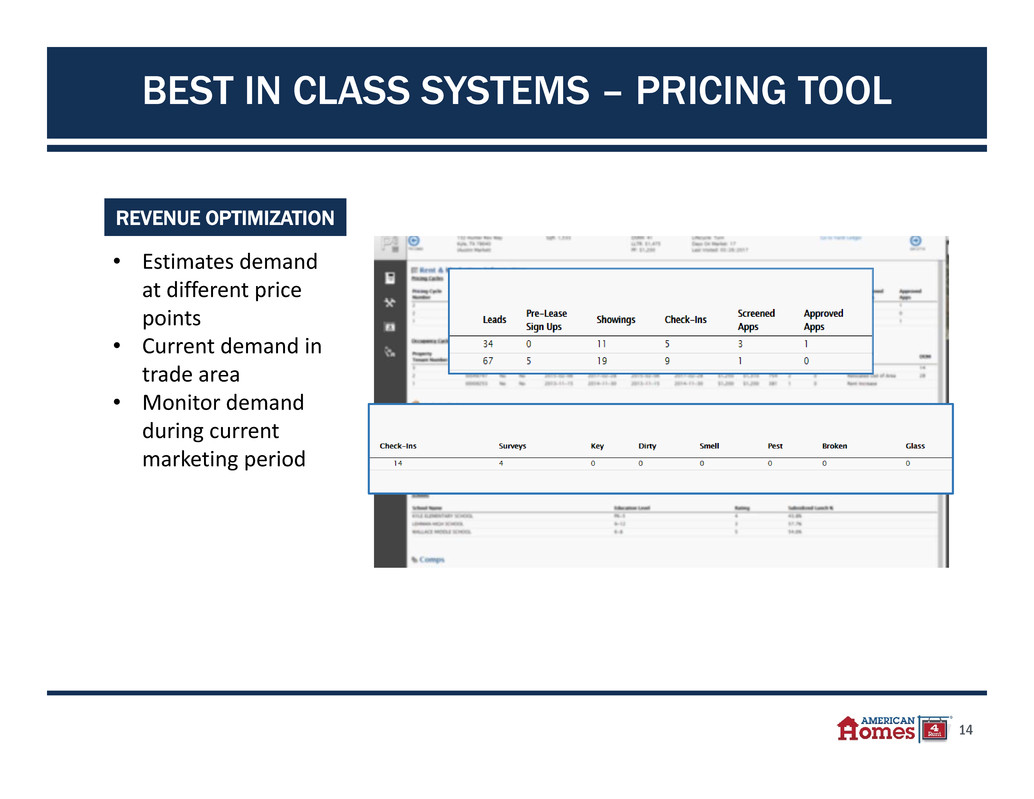

14 • Estimates demand at different price points • Current demand in trade area • Monitor demand during current marketing period REVENUE OPTIMIZATION BEST IN CLASS SYSTEMS – PRICING TOOL

15 • Visualization of internal and 3rd party inventory • Identify property fundamentals • Surrounding school data ASSET LEVEL PRICING BEST IN CLASS SYSTEMS – PRICING TOOL

16 OBJECTIVES • Manage costs • Reduce down time • Improve efficiencies BEST IN CLASS SYSTEMS – INSPECTION TOOL

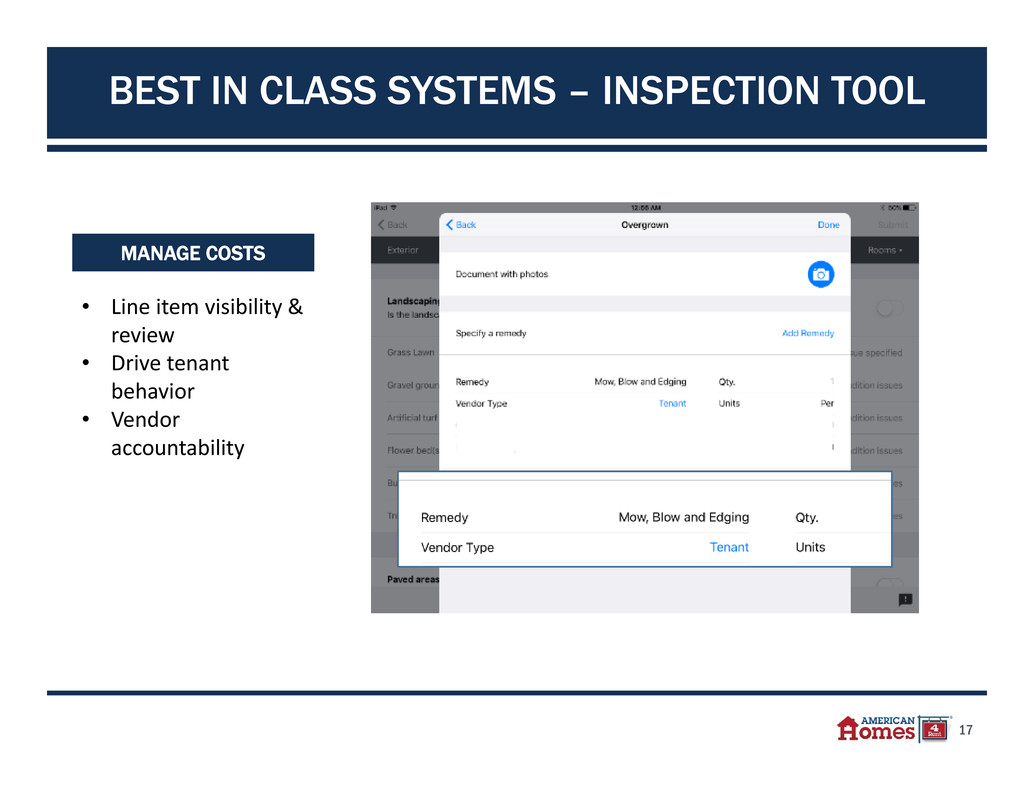

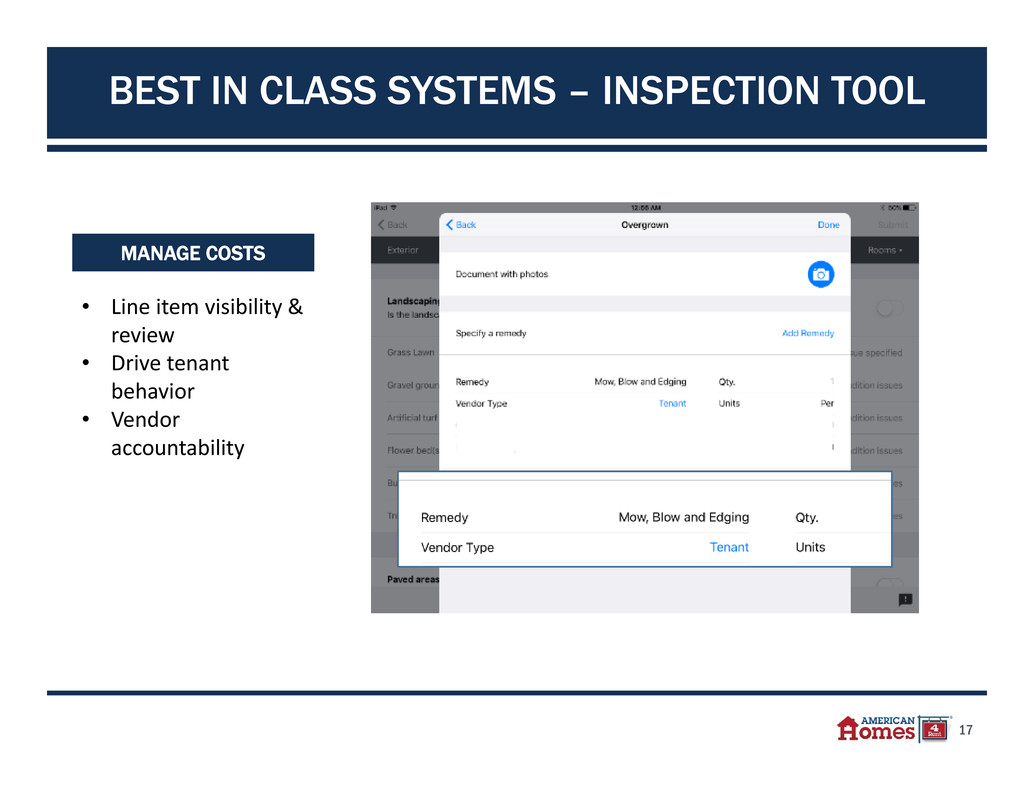

17 PRIMO MANAGE COSTS • Line item visibility & review • Drive tenant behavior • Vendor accountability BEST IN CLASS SYSTEMS – INSPECTION TOOL

18 PRIMO Speed Through Integration Website Accounting Work Flow Management BEST IN CLASS SYSTEMS – INSPECTION TOOL

19 EFFICIENCIES • Scheduling & workflow management • Reduce administrative time • Guided task and inspection script BEST IN CLASS SYSTEMS – INSPECTION TOOL

SFR Industry Overview 20 MARKETING & LEASING Jacksonville, FL

21 ELIMINATING THE TRADITIONAL SFR LEASING MODEL BOTTLENECKS 1. Yard Sign 2. Contact Agent or Leave Message 3. Schedule Showing or Call 4. Agent Shows Home 5. Complete Application at Leasing Office 6. Conduct Rental Underwriting 7. Approved Tenant 8. Tenant Move‐In Access Execution Best Case: 8 – 14 days The traditional SFR leasing model quickly showed its limitations in achieving required scale. Information

22 PROPERTY INFORMATION AWARENESS ONLINE SEARCH NEIGHBORHOOD SEARCH MLS NURTURE CAMPAIGNS • Zillow • Realtor.com • Rentals.com • Trulia • Yard sign • Referrals • Nurture campaigns to previous shoppers

23 PROPERTY INFORMATION

24 DIGITAL TRAFFIC 1.1 2.5 9.6 1.5 3.8 17.2 1.9 4.9 22.9 0 5 10 15 20 25 Unique Users Sessions Pageviews 2014 2015 2016 WEBSITE TRAFFIC (millions) 56.6% of page views in 2016 occurred on mobile devices

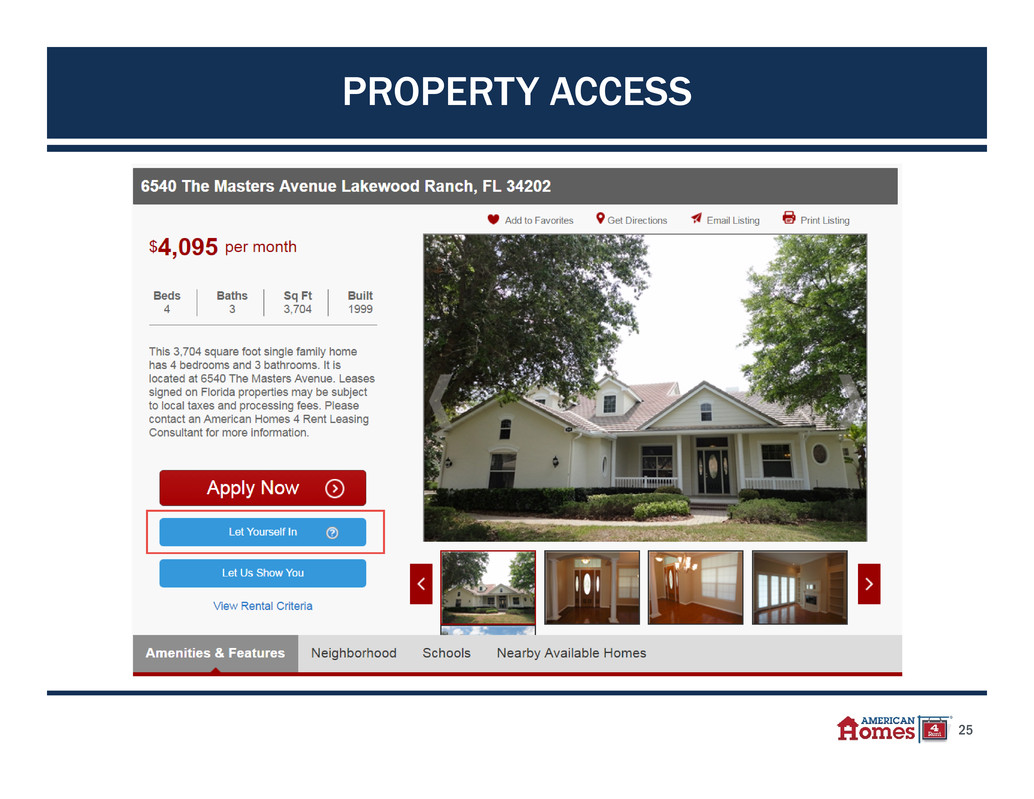

25 PROPERTY ACCESS

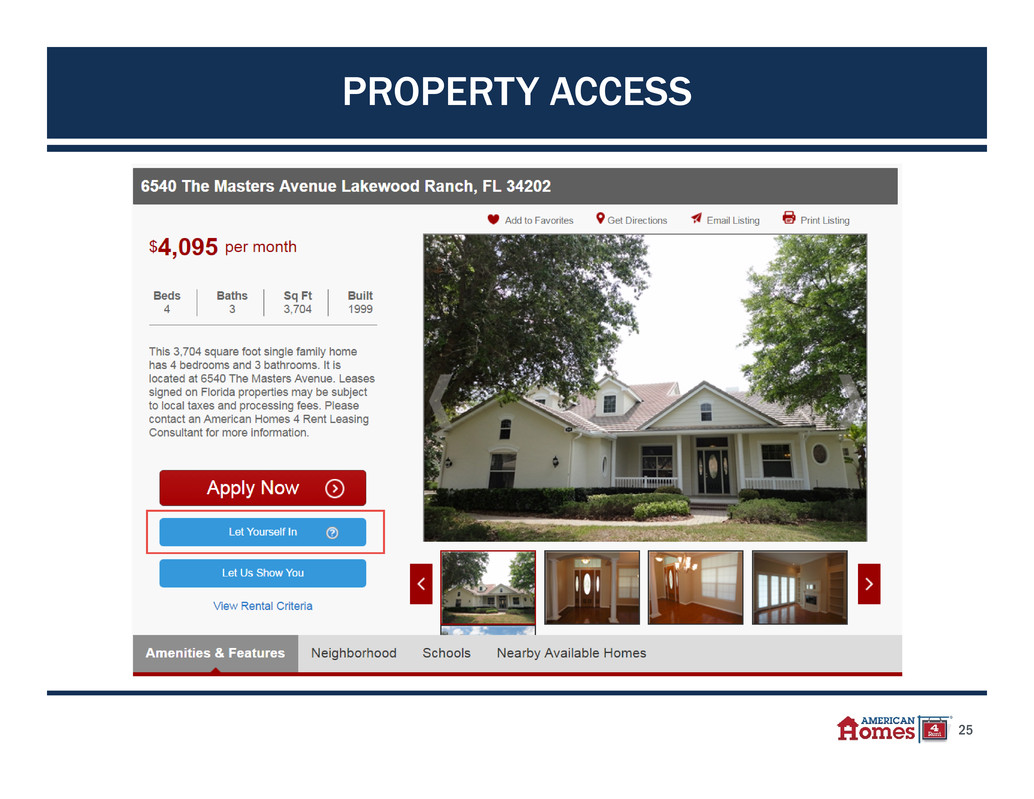

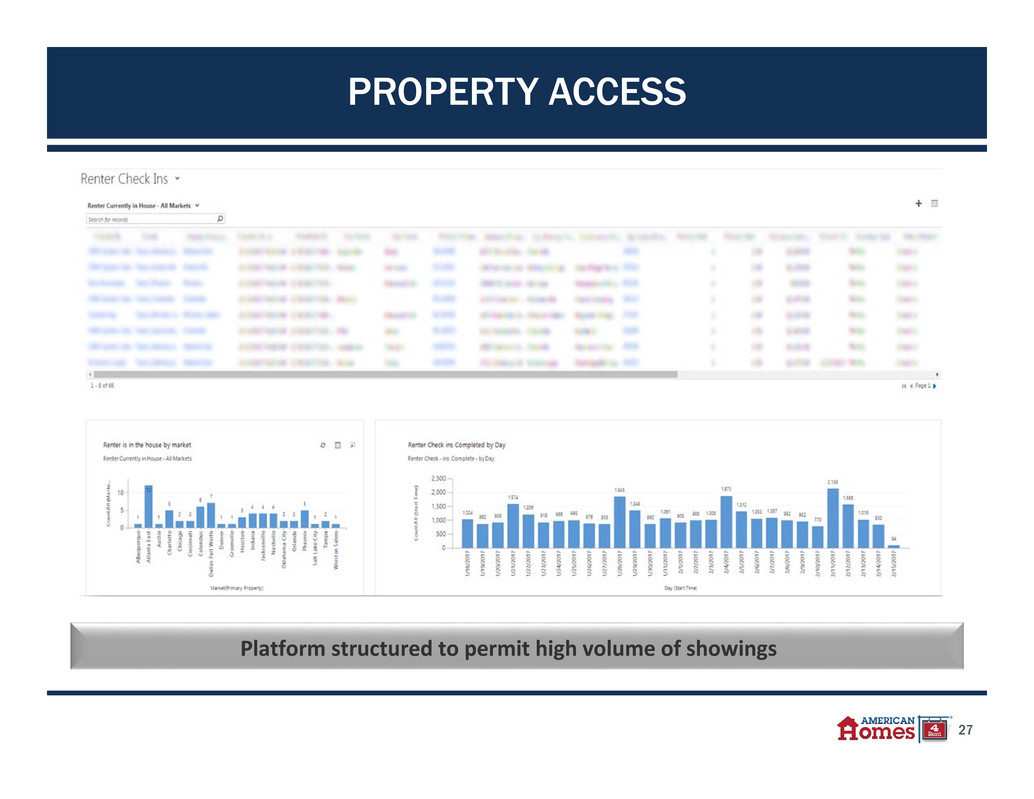

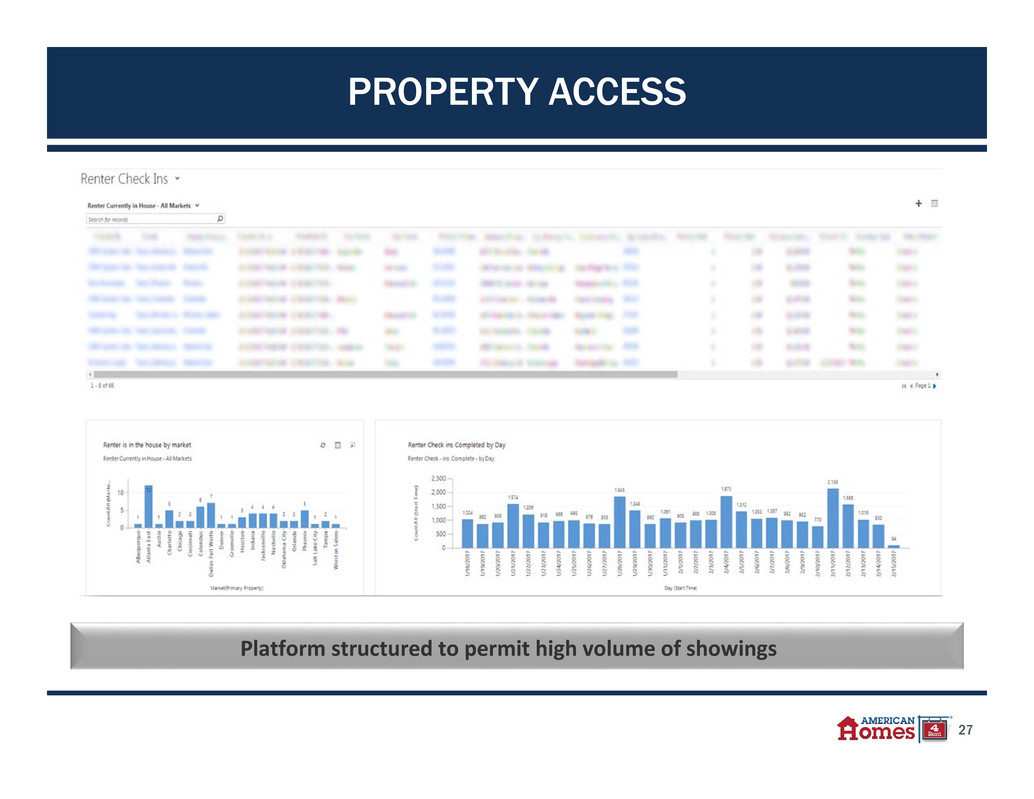

26 PROPERTY ACCESS CONTACT CENTER • Sales Development teams are highly accessible to handle inquiries regarding our properties, 7 days a week, 15 hours a day. • Identify needs, present product, qualify, create showings. • Handled 720,000 inbound sales calls in 2016. Over 300,000 Check Ins in 2016

27 Platform structured to permit high volume of showings PROPERTY ACCESS

28 Over 20,000 new leases executed in 2016 LEASE EXECUTION • Field Leasing • Underwriting • Lease writing 7 day a week operation

29 Platform structured to provide visibility and transparency to leasing activity LEASE EXECUTION

SFR Industry Overview 30 HOME MAINTENANCE Houston, TX

31 MAINTENANCE OBJECTIVES Property Preservation Customer Service Cost Control $

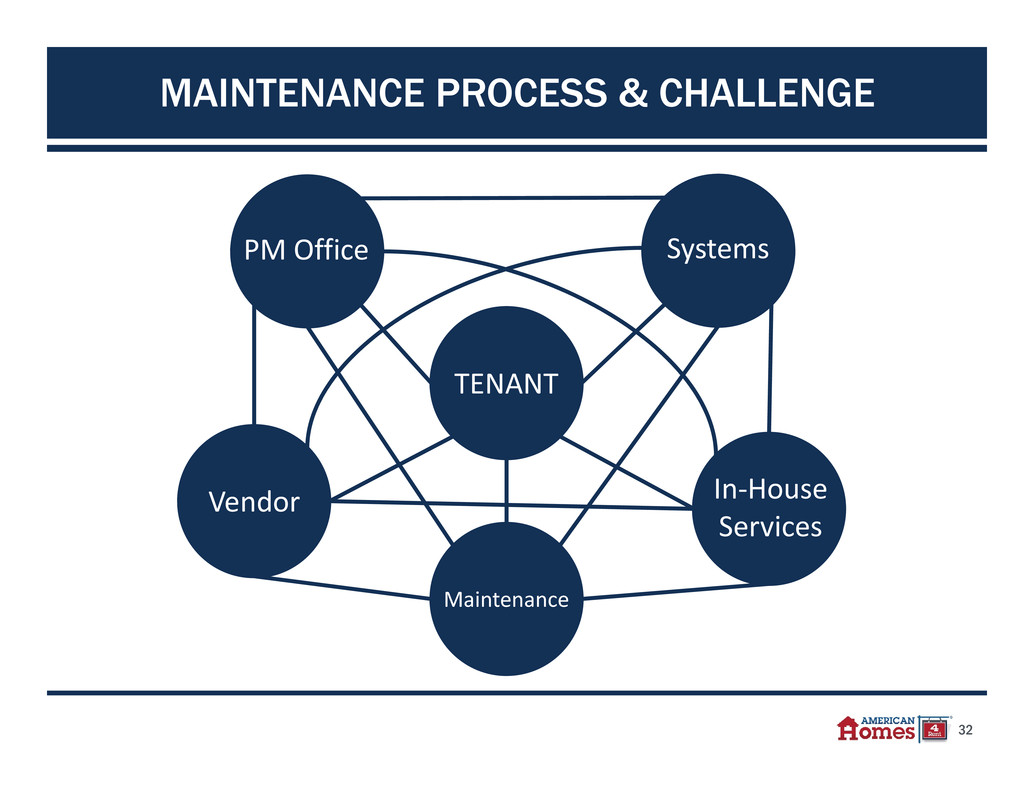

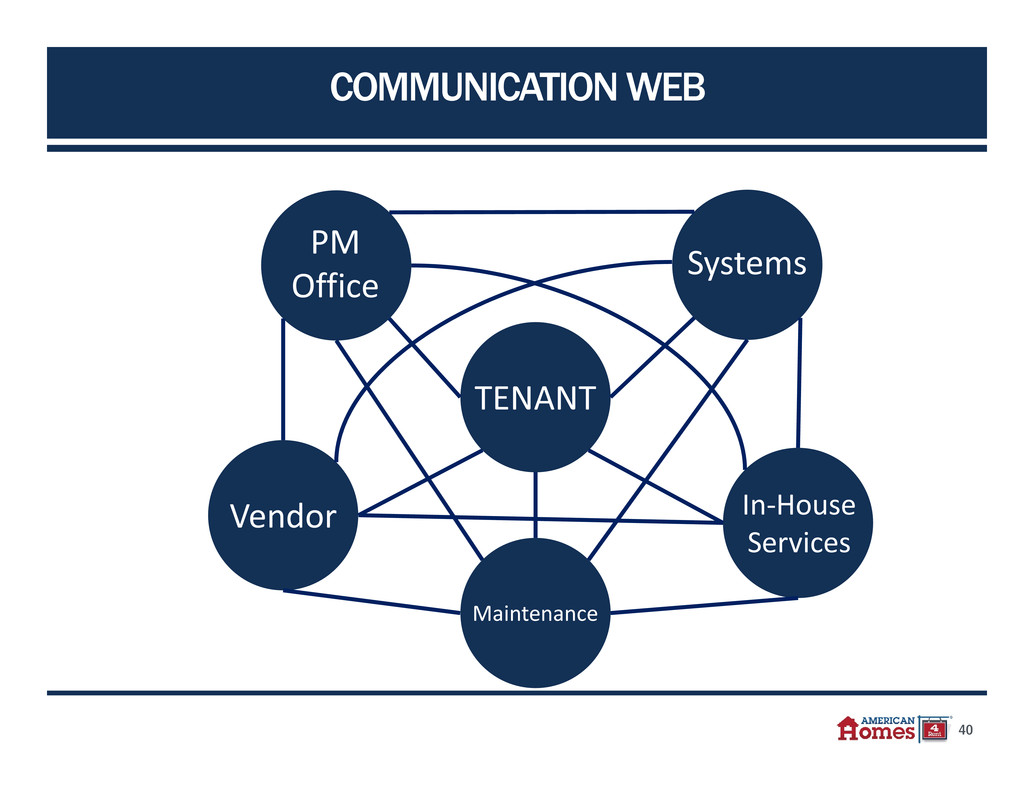

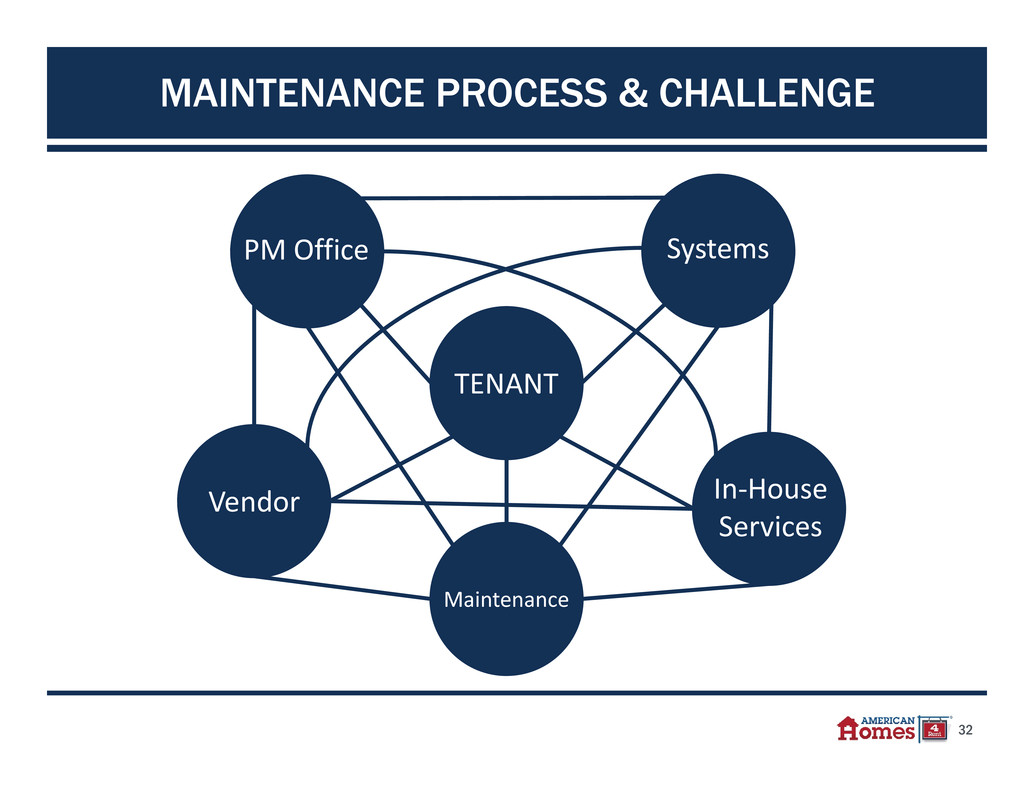

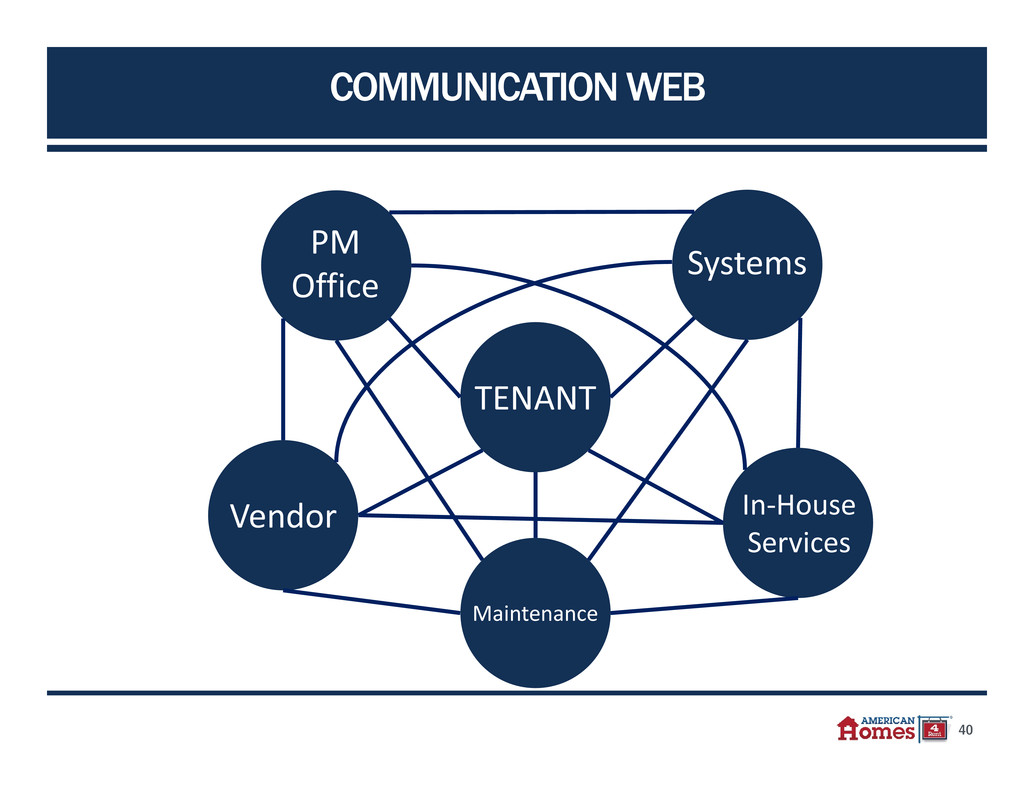

32 MAINTENANCE PROCESS & CHALLENGE Vendor PM Office In‐House Services TENANT Systems Maintenance

33 Intake Diagnosis Resolution MAINTENANCE PROCESS

34 MAINTENANCE PROCESS - INTAKE I n t a k e Online PM Office Call Center

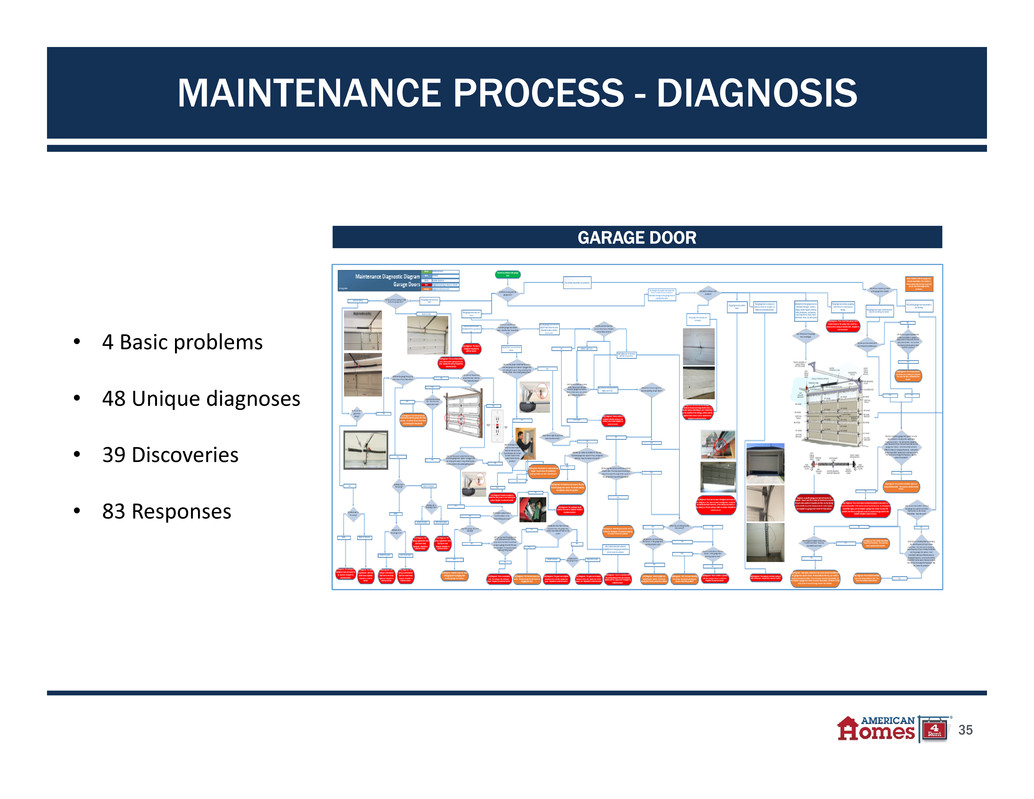

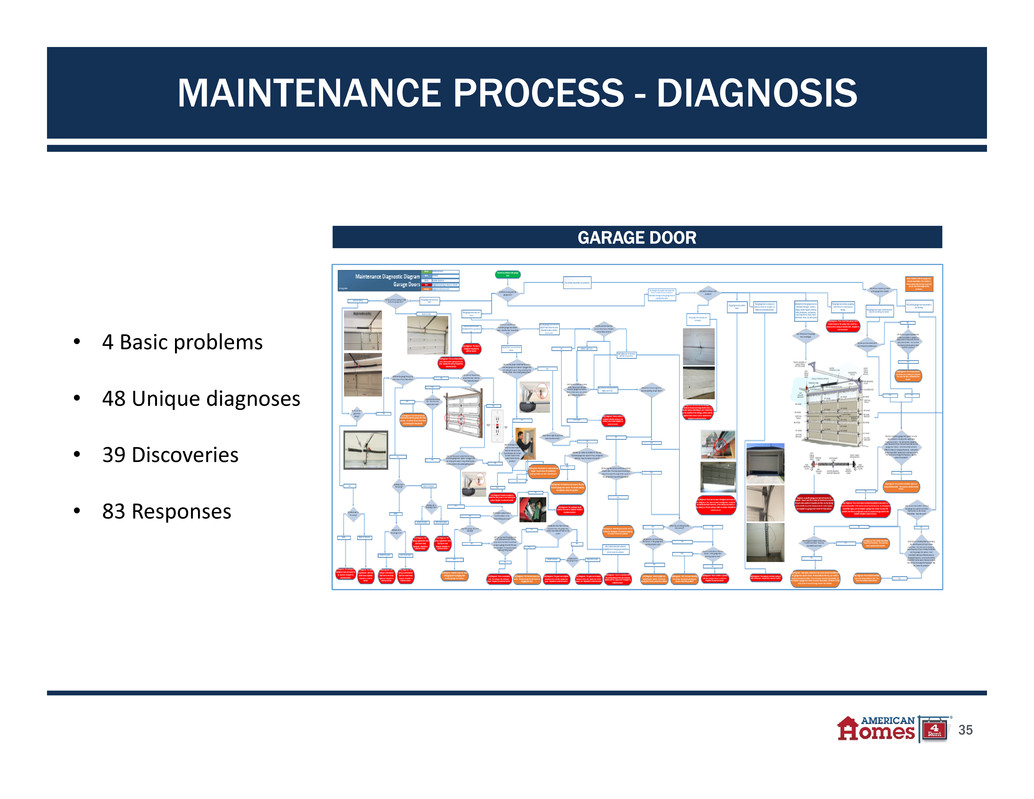

35 GARAGE DOOR • 4 Basic problems • 48 Unique diagnoses • 39 Discoveries • 83 Responses MAINTENANCE PROCESS - DIAGNOSIS

36 Asset Catalog Appliances HVAC Water Heaters MAINTENANCE PROCESS - DIAGNOSIS

37 HVAC Supervisor Coordinator Coordinator TRADE SPECIALIST Coordinator MAINTENANCE PROCESS - DIAGNOSIS

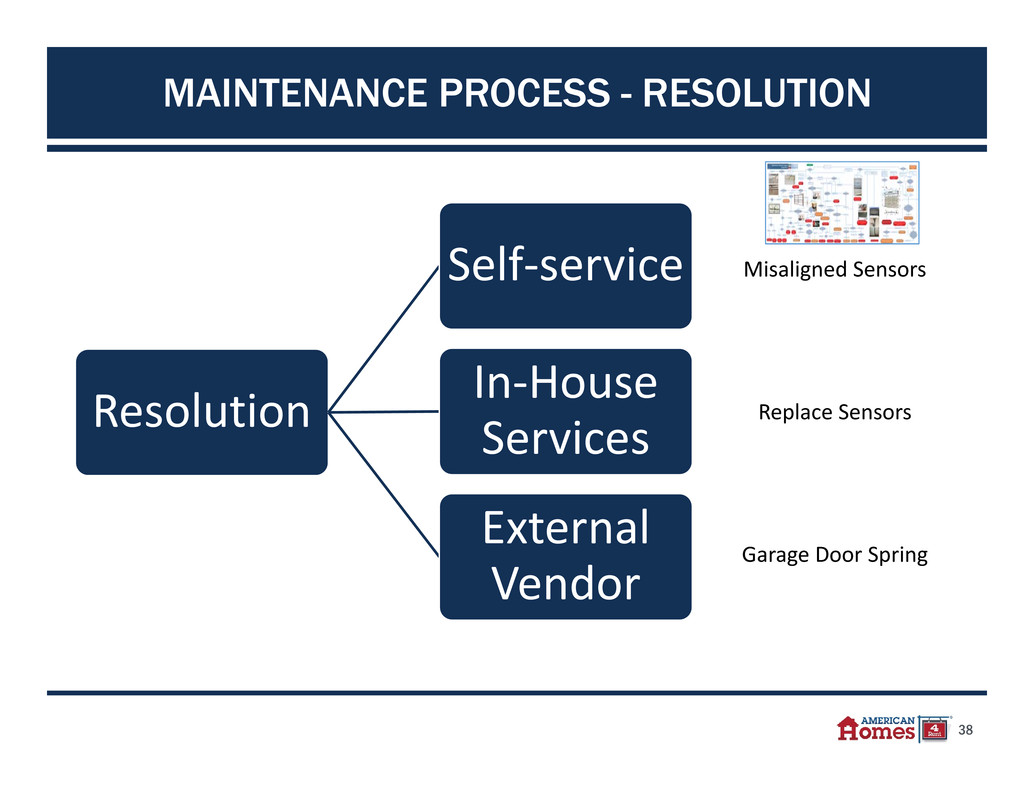

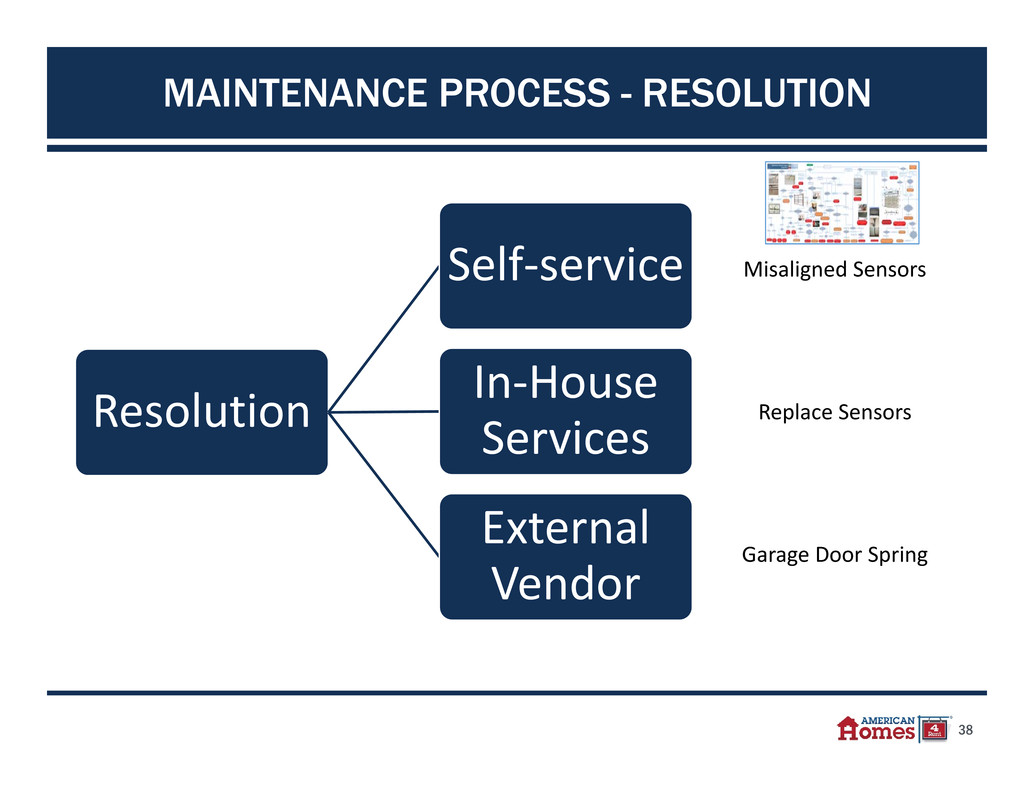

38 Resolution Self‐service In‐House Services External Vendor MAINTENANCE PROCESS - RESOLUTION Misaligned Sensors Replace Sensors Garage Door Spring

39 PRIME Maintenance Management MAINTENANCE PROCESS - RESOLUTION

40 COMMUNICATION WEB Vendor PM Office TENANT Systems Maintenance In‐House Services

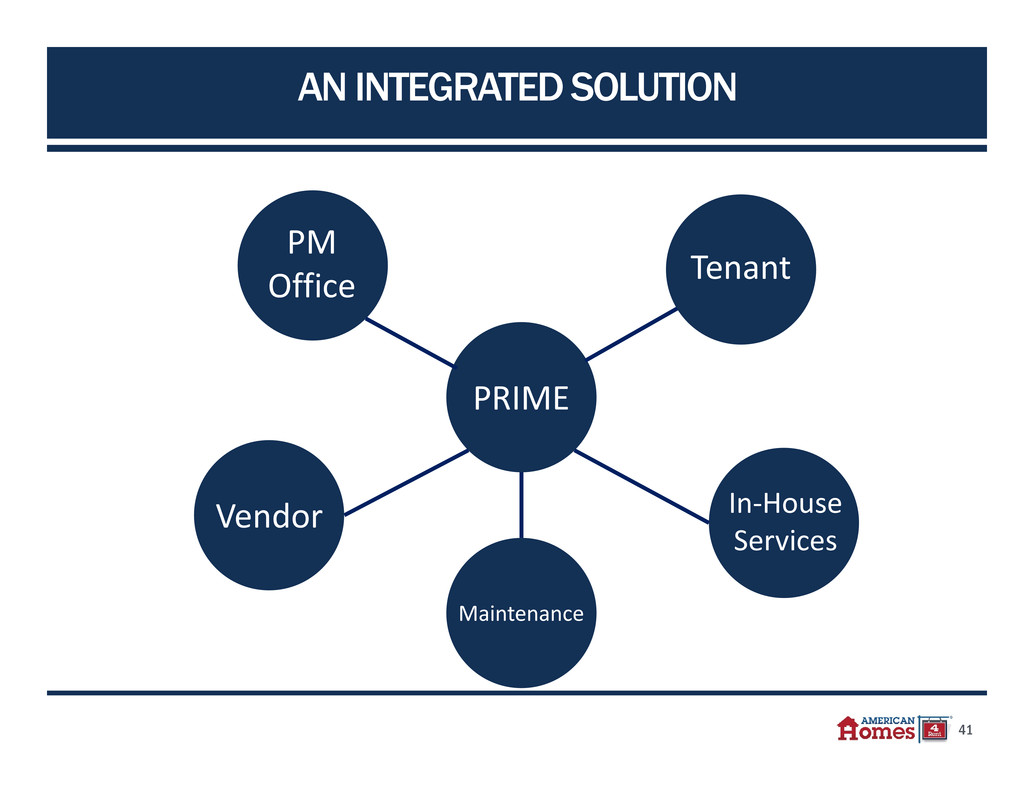

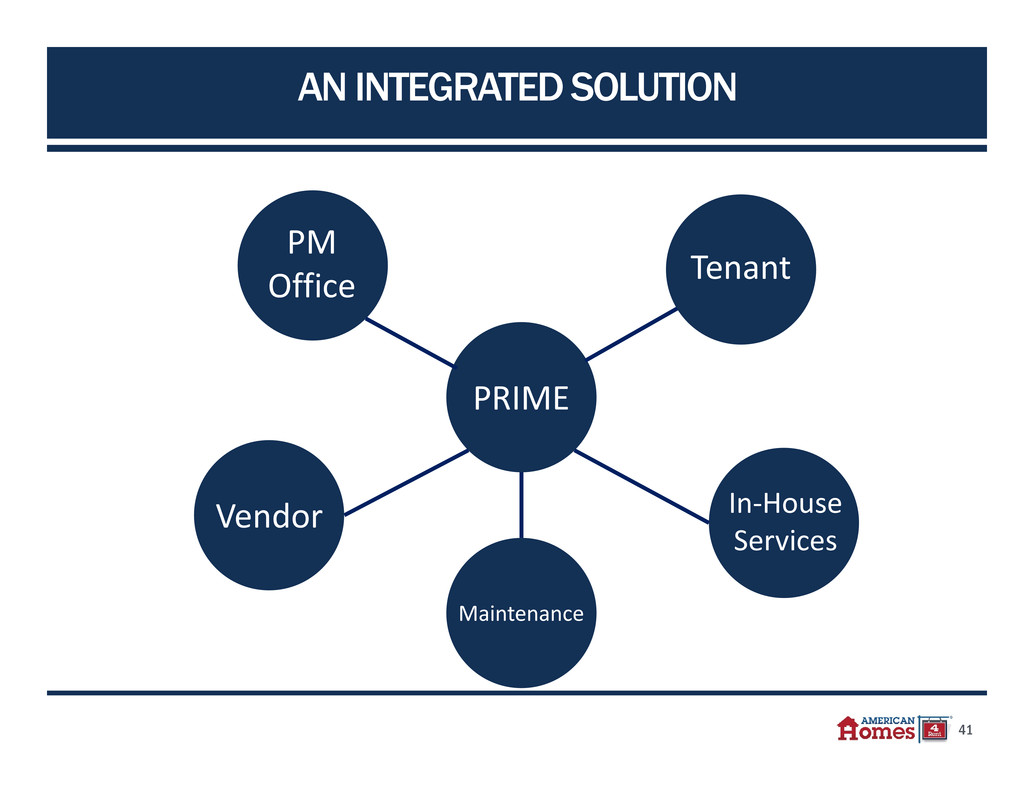

41 Vendor PM Office In‐House Services PRIME Tenant Maintenance AN INTEGRATED SOLUTION

SFR Industry Overview 42 IN‐HOUSE SERVICES Houston, TX

43 IN-HOUSE SERVICES PROGRAM OBJECTIVE • Reduces costs • Increase customer satisfaction • Property preservation • 70 technicians & vehicles • Cover 90% of our portfolio • More work orders than top 10 vendors combined (YTD 2017) PROGRAM OVERVIEW

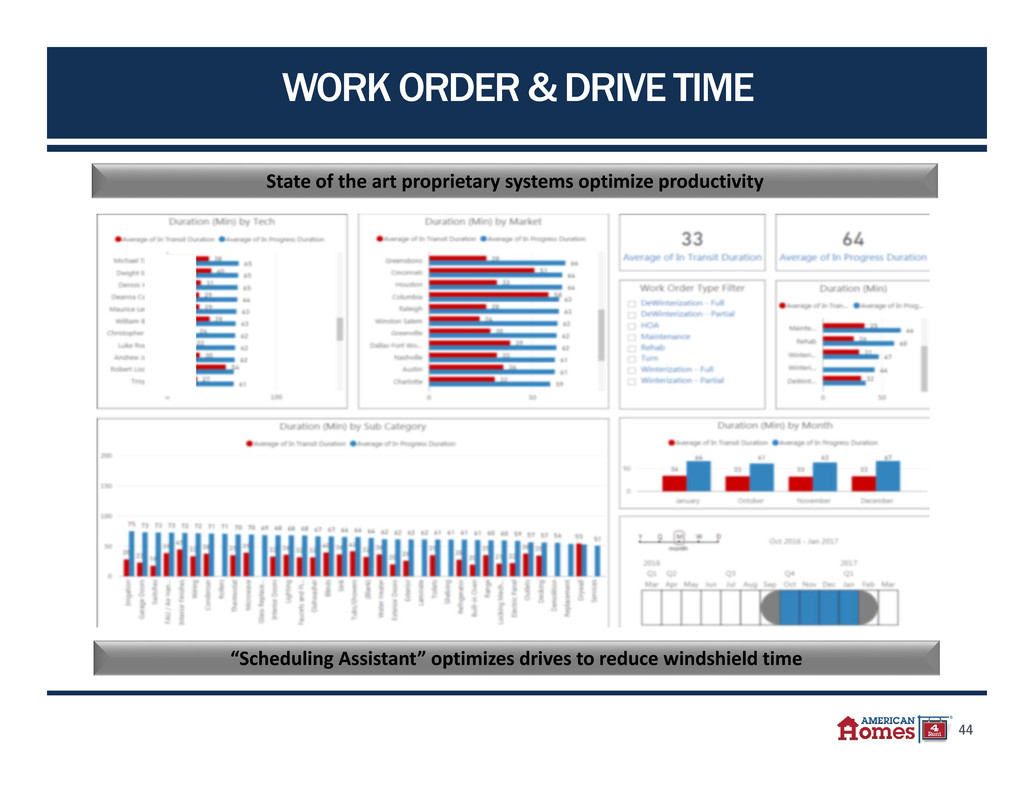

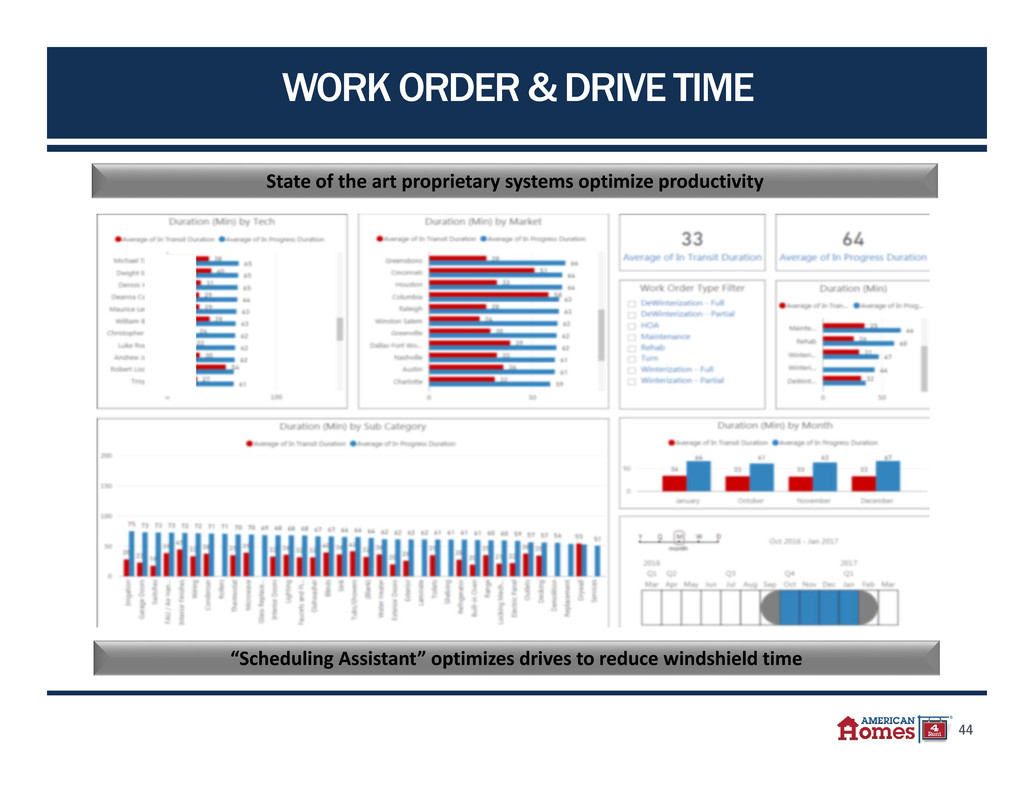

44 WORK ORDER & DRIVE TIME State of the art proprietary systems optimize productivity “Scheduling Assistant” optimizes drives to reduce windshield time

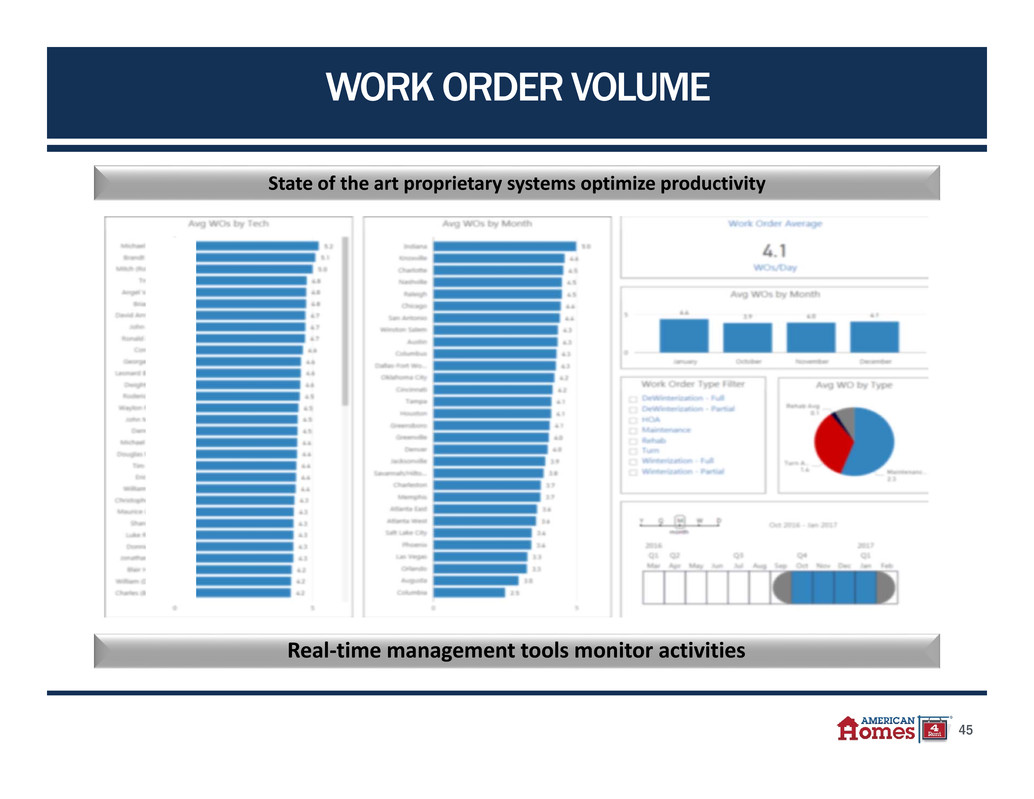

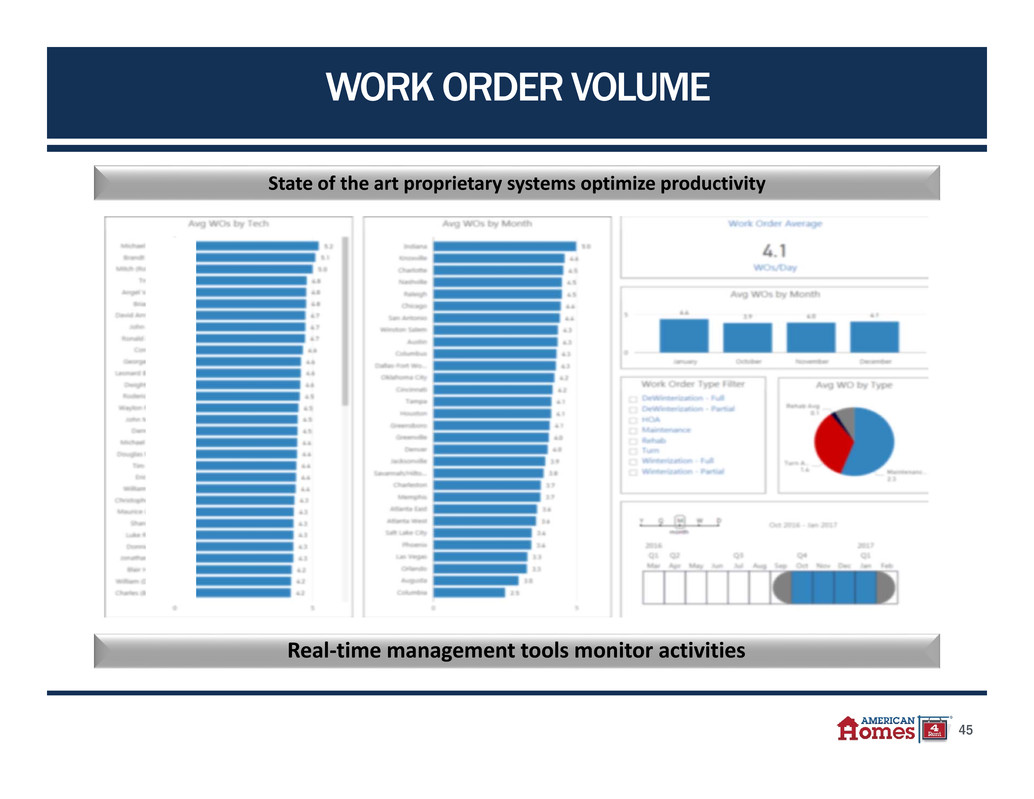

45 WORK ORDER VOLUME State of the art proprietary systems optimize productivity Real‐time management tools monitor activities

46 FIRST TRIP COMPLETIONS System monitors status of follow‐up jobs State of the art proprietary systems optimize productivity

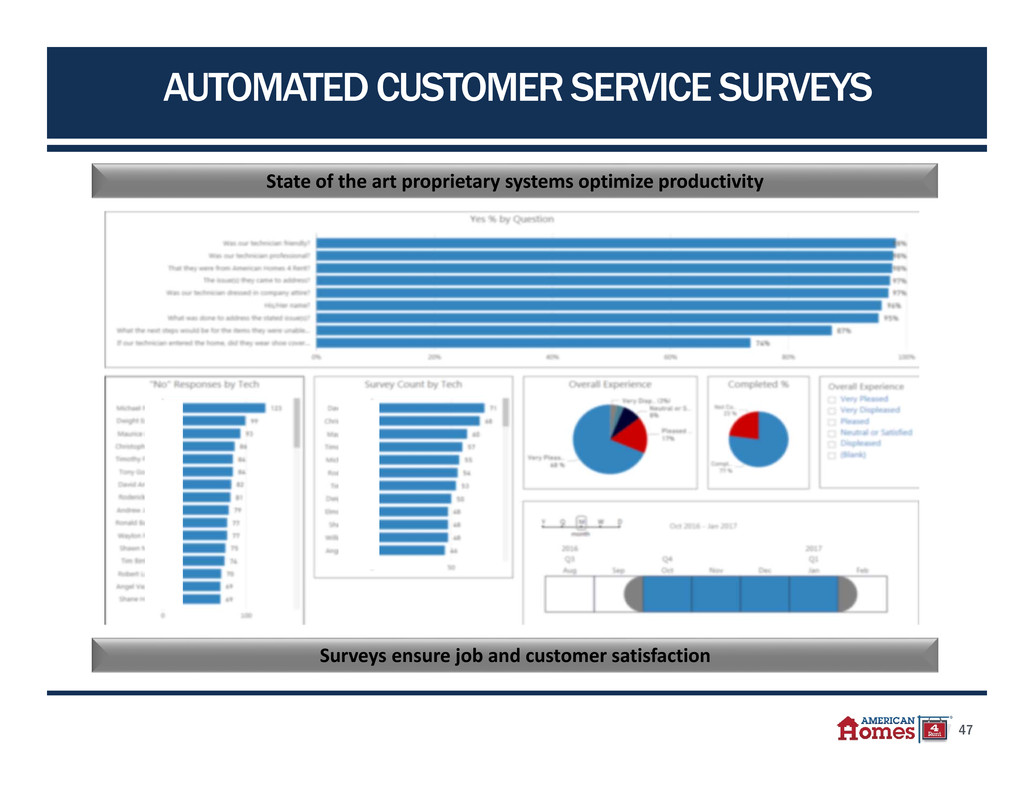

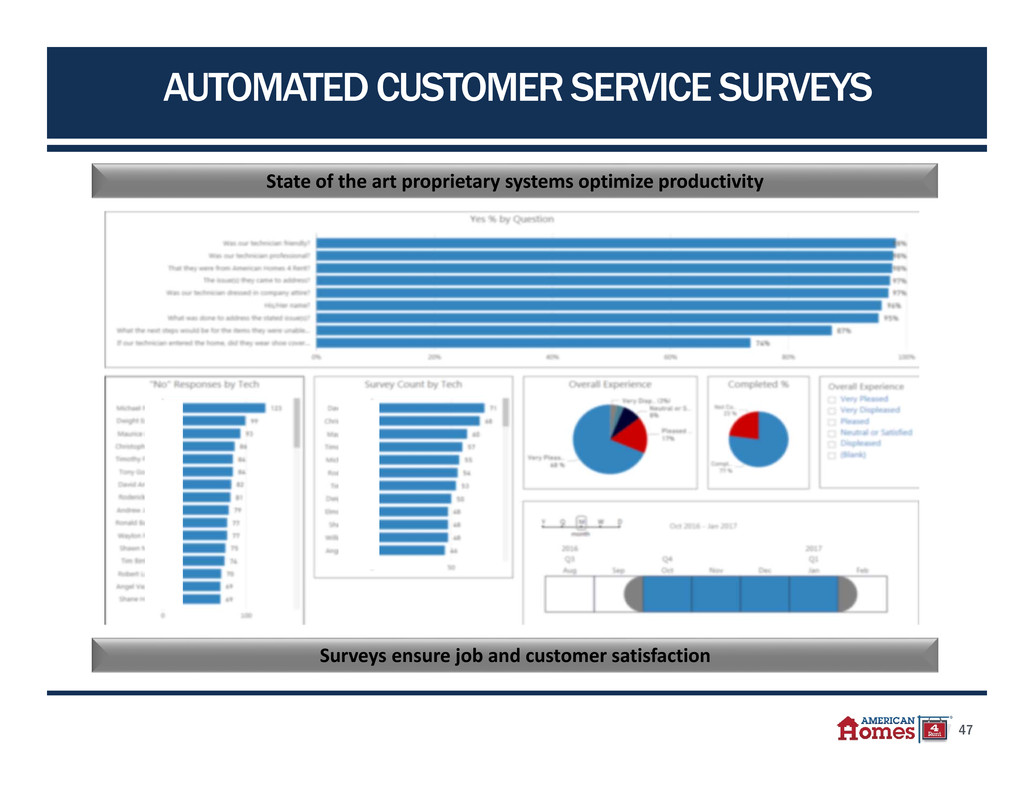

47 AUTOMATED CUSTOMER SERVICE SURVEYS Surveys ensure job and customer satisfaction State of the art proprietary systems optimize productivity

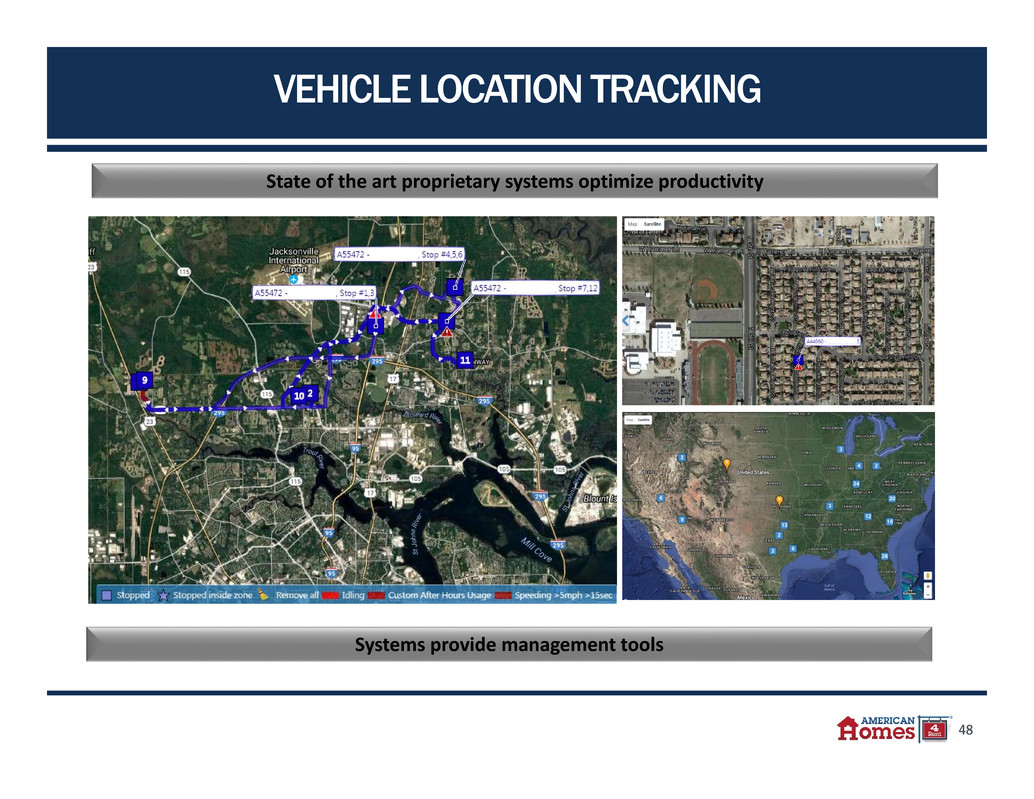

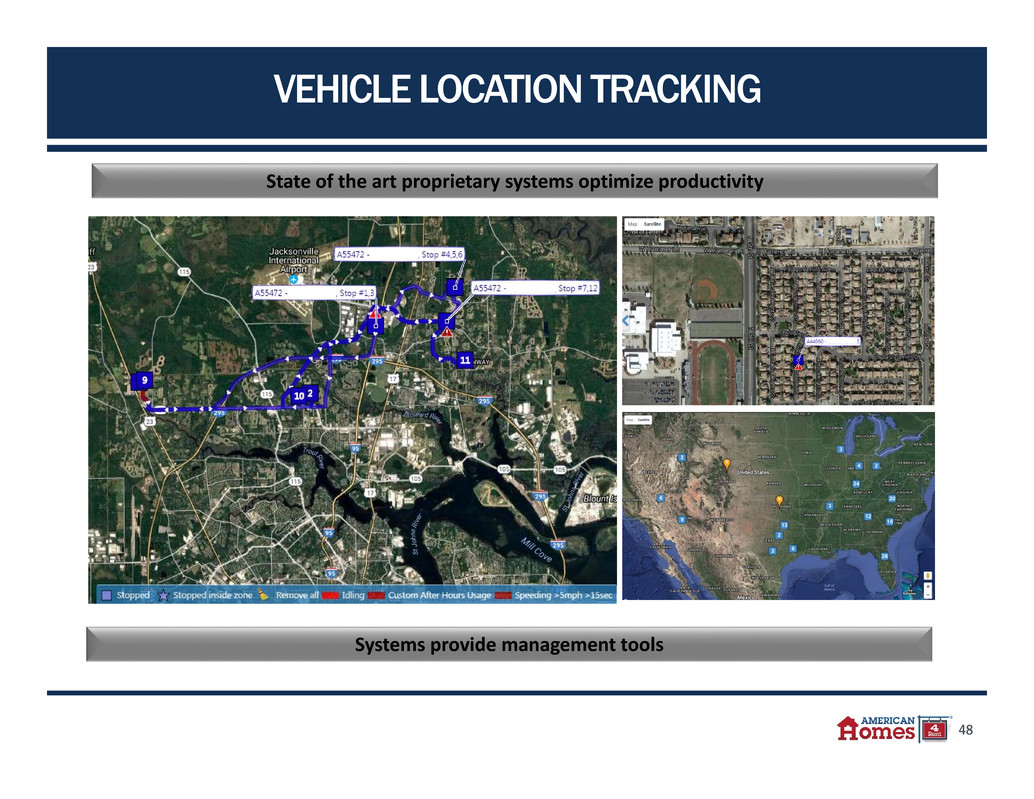

48 VEHICLE LOCATION TRACKING Systems provide management tools State of the art proprietary systems optimize productivity

AMH Highlights Section 49 Houston, TXFINANCIAL REVIEW

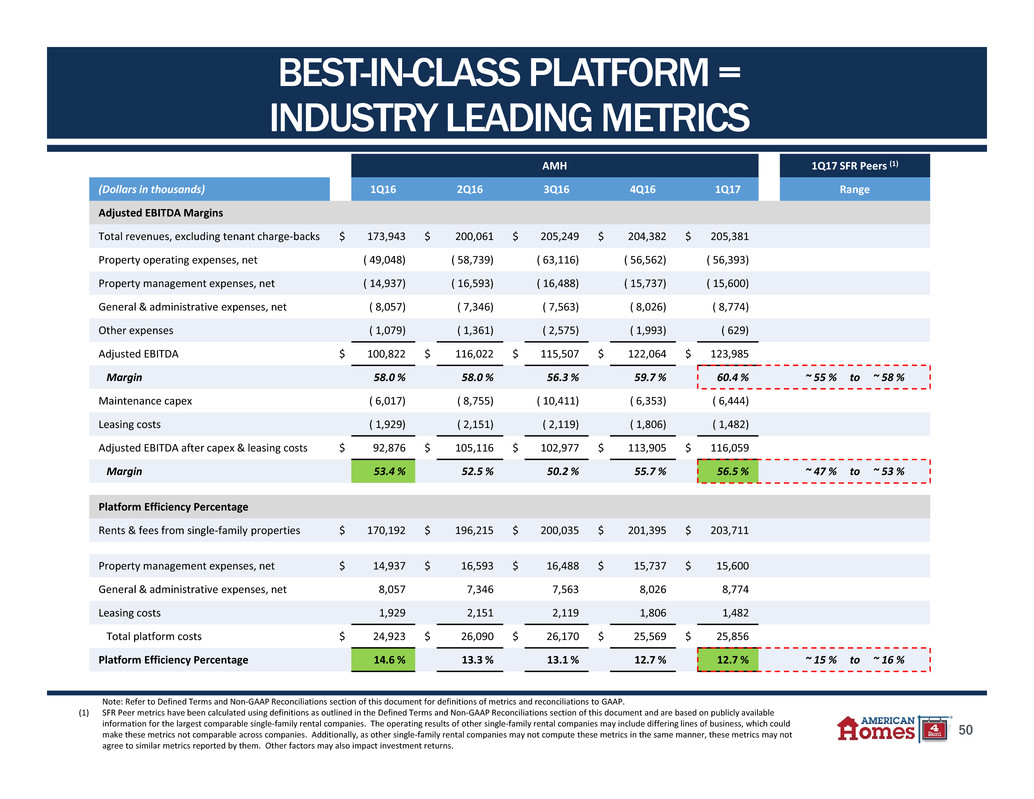

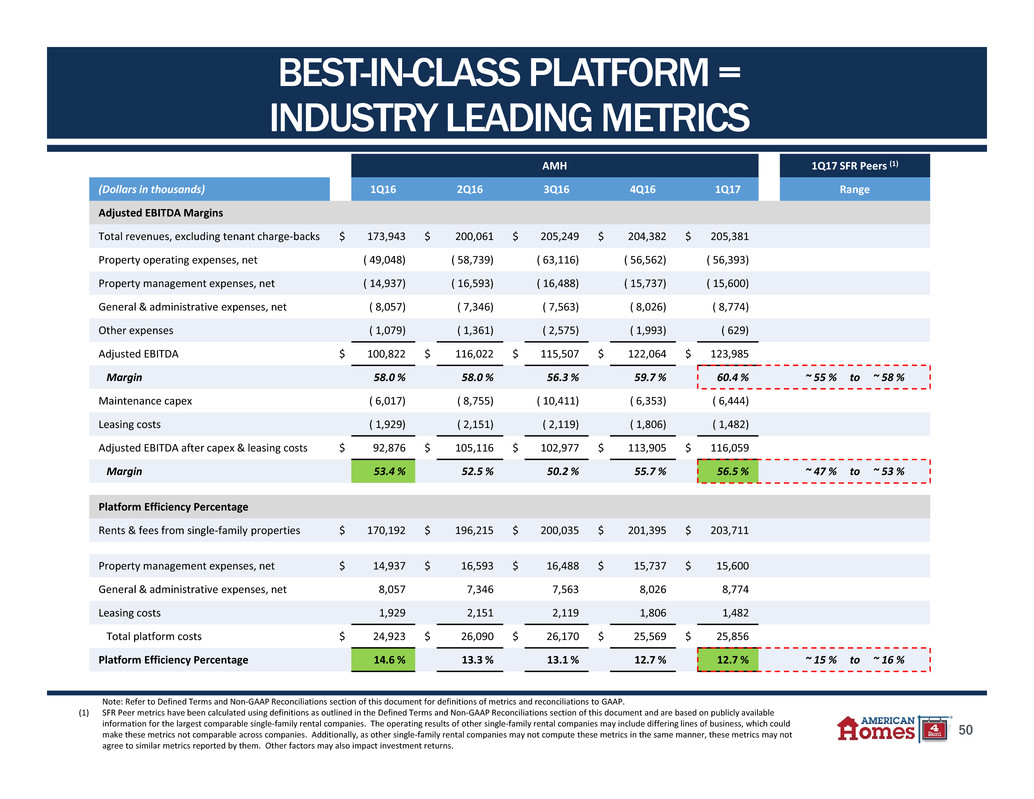

50 BEST-IN-CLASS PLATFORM = INDUSTRY LEADING METRICS AMH 1Q17 SFR Peers (1) (Dollars in thousands) 1Q16 2Q16 3Q16 4Q16 1Q17 Range Adjusted EBITDA Margins Total revenues, excluding tenant charge‐backs $ 173,943 $ 200,061 $ 205,249 $ 204,382 $ 205,381 Property operating expenses, net ( 49,048) ( 58,739) ( 63,116) ( 56,562) ( 56,393) Property management expenses, net ( 14,937) ( 16,593) ( 16,488) ( 15,737) ( 15,600) General & administrative expenses, net ( 8,057) ( 7,346) ( 7,563) ( 8,026) ( 8,774) Other expenses ( 1,079) ( 1,361) ( 2,575) ( 1,993) ( 629) Adjusted EBITDA $ 100,822 $ 116,022 $ 115,507 $ 122,064 $ 123,985 Margin 58.0 % 58.0 % 56.3 % 59.7 % 60.4 % ~ 55 % to ~ 58 % Maintenance capex ( 6,017) ( 8,755) ( 10,411) ( 6,353) ( 6,444) Leasing costs ( 1,929) ( 2,151) ( 2,119) ( 1,806) ( 1,482) Adjusted EBITDA after capex & leasing costs $ 92,876 $ 105,116 $ 102,977 $ 113,905 $ 116,059 Margin 53.4 % 52.5 % 50.2 % 55.7 % 56.5 % ~ 47 % to ~ 53 % Platform Efficiency Percentage Rents & fees from single‐family properties $ 170,192 $ 196,215 $ 200,035 $ 201,395 $ 203,711 Property management expenses, net $ 14,937 $ 16,593 $ 16,488 $ 15,737 $ 15,600 General & administrative expenses, net 8,057 7,346 7,563 8,026 8,774 Leasing costs 1,929 2,151 2,119 1,806 1,482 Total platform costs $ 24,923 $ 26,090 $ 26,170 $ 25,569 $ 25,856 Platform Efficiency Percentage 14.6 % 13.3 % 13.1 % 12.7 % 12.7 % ~ 15 % to ~ 16 % Note: Refer to Defined Terms and Non‐GAAP Reconciliations section of this document for definitions of metrics and reconciliations to GAAP. (1) SFR Peer metrics have been calculated using definitions as outlined in the Defined Terms and Non‐GAAP Reconciliations section of this document and are based on publicly available information for the largest comparable single‐family rental companies. The operating results of other single‐family rental companies may include differing lines of business, which could make these metrics not comparable across companies. Additionally, as other single‐family rental companies may not compute these metrics in the same manner, these metrics may not agree to similar metrics reported by them. Other factors may also impact investment returns.

AMH Highlights Section 51 Las Vegas, NVAPPENDIX

52 Mar 31, 2016 Jun 30, 2016 Sep 30, 2016 Dec 31, 2016 Mar 31, 2017 Net (loss) income attributable to common shareholders (4,377)$ (10,404)$ (21,152)$ 2,391$ (1,490)$ Dividends on preferred shares 5,569 7,412 13,669 13,587 13,587 Noncontroll ing interest 3,836 (761) 7,316 (6,640) (301) Net income (loss) 5,028 (3,753) (167) 9,338 11,796 Interest expense 30,977 35,481 32,851 31,538 31,889 Depreciation and amortization 69,517 79,604 75,392 74,164 73,953 EBITDA 105,522 111,332 108,076 115,040 117,638 Noncash share‐based compensation expense (1) 870 983 891 892 938 Acquisition fees and costs expensed 5,653 3,489 1,757 544 1,096 (Gain) loss on sale / impairment of single‐family properties and other, net (60) 68 (11,115) 1,508 (1,097) Loss on early extinguishment of debt ‐ ‐ 13,408 ‐ ‐ Gain on conversion of Series E units (11,463) ‐ ‐ ‐ ‐ Remeasurement of participating preferred shares 300 150 2,490 4,080 5,410 Adjusted EBITDA 100,822 116,022 115,507 122,064 123,985 Maintenance capex 6,017 8,755 10,411 6,353 6,444 Leasing costs 1,929 2,151 2,119 1,806 1,482 Adjusted EBITDA after capex & leasing costs 92,876$ 105,116$ 102,977$ 113,905$ 116,059$ For the Three Months Ended DEFINED TERMS AND NON-GAAP RECONCILIATIONS (1) Represents total noncash share-based compensation expense, which is included within general and administrative expense and property management expenses. EBITDA, Adjusted EBITDA and Adjusted EBITDA after CapEx and Leasing Costs EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and others as a supplemental measure of performance. Adjusted EBITDA is a supplemental non-GAAP financial measure calculated by adjusting EBITDA for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) net gain or loss on sale / impairment of single- family properties and other, (3) noncash share-based compensation expense, (4) gain or loss on early extinguishment of debt, (5) gain or loss on conversion of convertible units and (6) noncash fair value adjustments associated with remeasuring our participating preferred shares derivative liability to fair value. Adjusted EBITDA after CapEx and Leasing Costs is a supplemental non-GAAP financial measure calculated by adjusting Adjusted EBITDA for (1) maintenance capital expenditures and (2) leasing costs. We consider Adjusted EBITDA and Adjusted EBITDA after CapEx and Leasing Costs to be meaningful financial measures of operating performance because they exclude the impact of various income and expense items that are not indicative of operating performance. The following is a reconciliation of net (loss) income attributable to common shareholders, determined in accordance with GAAP, to EBITDA, Adjusted EBITDA and Adjusted EBITDA after CapEx and Leasing Costs for the trailing five quarters (amounts in thousands):

53 DEFINED TERMS AND NON-GAAP RECONCILIATIONS Platform Efficiency Percentage Platform Efficiency Percentage is calculated by dividing management costs, which include (1) property management expenses, net of tenant charge-backs and excluding noncash share-based compensation expense, (2) general and administrative expense, excluding noncash share-based compensation expense and (3) leasing costs, by total portfolio rents and fees. (Dollars in thousands) Mar 31, 2016 Jun 30, 2016 Sep 30, 2016 Dec 31, 2016 Mar 31, 2017 Property management expenses 14,937$ 16,593$ 16,488$ 15,737$ 15,600$ General and administrative expense 8,057 7,346 7,563 8,026 8,774 Leasing costs 1,929 2,151 2,119 1,806 1,482 Total management costs 24,923$ 26,090$ 26,170$ 25,569$ 25,856$ Rents from single‐family properties 167,995$ 193,491$ 197,137$ 198,980$ 201,107$ Fees from single‐family properties 2,197 2,724 2,898 2,415 2,604 Total portfolio rents and fees 170,192$ 196,215$ 200,035$ 201,395$ 203,711$ Platform Efficiency Percentage 14.6% 13.3% 13.1% 12.7% 12.7% For the Three Months Ended (1) Excludes noncash share-based compensation expense related to centralized and field property management employees. (2) Excludes noncash share-based compensation expense related to corporate administrative employees. (1) (2)