Table of Contents

|

| |

| Summary | |

| Earnings Press Release | |

| Fact Sheet | |

| | |

| Financial Information | |

| Condensed Consolidated Statements of Operations | |

| Funds from Operations | |

| Core Net Operating Income—Total Portfolio | |

| Same-Home Results—Quarterly Comparisons | |

| Same-Home Results—Sequential Quarterly Results | |

| Same-Home Results—Sequential Quarterly Metrics | |

| Same-Home Results—Operating Metrics by Market | |

| Condensed Consolidated Balance Sheets | |

| Debt Summary, Maturity Schedule and Interest Expense Reconciliation | |

| Capital Structure | |

| | |

| Property Information | |

| Top 20 Markets Summary | |

| Leasing Performance | |

| Scheduled Lease Expirations | |

| Top 20 Markets Home Price Appreciation Trends | |

| | |

| Other Information | |

| Disposition Summary | |

| Share Repurchase and ATM Share Issuance History | |

| 2018 Outlook | |

| Defined Terms and Non-GAAP Reconciliations | |

American Homes 4 Rent Reports First Quarter 2018 Financial and Operating Results

AGOURA HILLS, Calif., May 3, 2018—American Homes 4 Rent (NYSE: AMH) (the “Company”), a leading provider of high quality single-family homes for rent, today announced its financial and operating results for the quarter ended March 31, 2018.

Highlights

| |

| • | Total revenues increased 10.4% to $258.0 million for the first quarter of 2018 from $233.8 million for the first quarter of 2017. |

| |

| • | Net income attributable to common shareholders totaled $5.8 million, or $0.02 income per diluted share, for the first quarter of 2018, compared to a net loss attributable to common shareholders of $1.5 million, or a $0.01 loss per diluted share, for the first quarter of 2017. |

| |

| • | Improved total portfolio leasing percentage to 95.5% as of March 31, 2018, representing a 320 basis point increase from 92.3% as of December 31, 2017. |

| |

| • | Core Funds from Operations attributable to common share and unit holders for the first quarter of 2018 was $84.8 million, or $0.25 per FFO share and unit, compared to $76.8 million, or $0.26 per FFO share and unit, for the same period in 2017, which represents a 3.8% decrease on a per share and unit basis. |

| |

| • | Adjusted Funds from Operations attributable to common share and unit holders for the first quarter of 2018 was $74.7 million, or $0.22 per FFO share and unit, compared to $68.9 million, or $0.23 per FFO share and unit, for the same period in 2017, which represents a 4.3% decrease on a per share and unit basis. |

| |

| • | Same-Home portfolio leased percentage increased to 97.1% as of March 31, 2018, from 95.8% as of December 31, 2017, while achieving 3.9% growth in average monthly realized rent per property for the first quarter of 2018, compared to the same period in 2017. |

| |

| • | Core Net Operating Income ("Core NOI") margin on Same-Home properties was 64.0% for the first quarter of 2018, compared to 66.0% for the same period in 2017. |

| |

| • | Core NOI after capital expenditures from Same-Home properties decreased by 0.7% year-over-year for the quarter ended March 31, 2018. |

| |

| • | Issued $500.0 million of 4.25% unsecured senior notes due 2028 with an effective interest rate of 4.08% after reflecting the beneficial impact of a treasury rate lock (see “Capital Activities and Balance Sheet”). |

| |

| • | In April 2018, redeemed the Series C participating preferred shares through a conversion into 10,848,827 Class A common shares (see "Capital Activities and Balance Sheet"). |

“American Homes 4 Rent successfully achieved an important strategic objective during the first quarter of 2018, as we improved our total portfolio leased percentage to 95.5%, an increase of 320 basis points since year-end 2017,” stated David Singelyn, American Homes 4 Rent's Chief Executive Officer. “The accomplishment of this outstanding leasing result, prior to the spring leasing season and ahead of our initial expectations, demonstrates the power of our industry-leading platform. With our total portfolio leased percentage now above 95%, we are well positioned to translate the tremendous demand for single-family rentals into strong cash flow growth and value creation for our shareholders throughout the remainder of 2018.”

First Quarter 2018 Financial Results

Net income attributable to common shareholders totaled $5.8 million, or $0.02 income per diluted share, for the first quarter of 2018, compared to a net loss attributable to common shareholders of $1.5 million, or a $0.01 loss per diluted share, for the first quarter of 2017. This improvement was primarily attributable to higher revenues resulting from a larger number of leased properties and higher rental rates.

Earnings Press Release (continued)

Total revenues increased 10.4% to $258.0 million for the first quarter of 2018 from $233.8 million for the first quarter of 2017. Revenue growth was primarily driven by continued strong acquisition and leasing activity, as our average leased portfolio grew to 47,337 homes for the quarter ended March 31, 2018, compared to 45,042 homes for the quarter ended March 31, 2017.

Core NOI on our total portfolio increased 4.1% to $137.1 million for the first quarter of 2018, compared to $131.7 million for the first quarter of 2017. This increase was primarily due to growth in rental income resulting from a larger number of leased properties.

Core revenues from Same-Home properties increased 3.1% to $171.8 million for the first quarter of 2018, compared to $166.5 million for the first quarter of 2017. This growth was driven by a 3.9% increase in average monthly realized rents, offset by a 0.5% decline in average occupied days percentage caused by excess vacant inventory carried over from the fourth quarter of 2017. Note that we successfully absorbed this remaining excess inventory during the first quarter of 2018 and improved our Same-Home occupancy percentage to 95.9% as of March 31, 2018, representing a 90 basis point increase from 95.0% as of December 31, 2017. Core property operating expenses from Same-Home properties increased 9.3% from $56.6 million for the first quarter of 2017, to $61.9 million for the first quarter of 2018, which included one-time costs due to winter freeze damages in certain markets and elevated vacant inventory holding costs incurred prior to occupancy improvement. The remainder of this increase was primarily attributable to temporarily elevated turnover costs and property management expenses related to higher leasing volume during the first quarter of 2018.

Core NOI from Same-Home properties was $109.8 million and $109.9 million for the first quarters of 2018 and 2017, respectively. After capital expenditures, Core NOI from Same-Home properties decreased 0.7% to $103.8 million for the first quarter of 2018, compared to $104.6 million for the first quarter of 2017. The relatively flat Core NOI from Same-Home properties and decrease in Core NOI After Capital Expenditures from Same-Home properties was attributable to temporarily elevated turnover costs, property management expenses and capital expenditures related to higher leasing volume during the first quarter of 2018.

Core Funds from Operations attributable to common share and unit holders ("Core FFO attributable to common share and unit holders") was $84.8 million, or $0.25 per FFO share and unit, for the first quarter of 2018, compared to $76.8 million, or $0.26 per FFO share and unit, for the first quarter of 2017. Adjusted Funds from Operations attributable to common share and unit holders ("Adjusted FFO attributable to common share and unit holders") for the first quarter of 2018 was $74.7 million, or $0.22 per FFO share and unit, compared to $68.9 million, or $0.23 per FFO share and unit, for the first quarter of 2017.

Portfolio

As of March 31, 2018, the Company had 47,677 leased properties, an increase of 681 properties from December 31, 2017. As of March 31, 2018, the leased percentage on Same-Home properties was 97.1%, compared to 95.8% as of December 31, 2017.

Investments

As of March 31, 2018, the Company’s total portfolio consisted of 51,840 homes, including 1,892 properties to be disposed, compared to 51,239 homes as of December 31, 2017, including 310 properties to be disposed, an increase of 601 homes, which included 704 homes acquired and 103 homes sold or rescinded. The increase in properties to be disposed as of March 31, 2018, compared to December 31, 2017, is related to the Company’s expansion of our disposition program resulting from market and sub-market analysis, as well as individual property-level operational review.

Capital Activities and Balance Sheet

In February 2018, American Homes 4 Rent, L.P. (the "Operating Partnership") issued $500.0 million of 4.25% unsecured senior notes with a maturity date of February 15, 2028, which have been effectively hedged at 4.08% through the use of a treasury lock that was settled for a $9.6 million gain. Interest on the notes is payable semi-annually in arrears on February 15 and August 15

Earnings Press Release (continued)

of each year, commencing on August 15, 2018. The Operating Partnership received net proceeds of $494.0 million from this offering, after underwriting fees of approximately $3.2 million and a $2.8 million discount, and before estimated offering costs of $1.8 million. The Operating Partnership intends to use the net proceeds from this offering for general corporate purposes, including, without limitation, acquisition of properties, the repayment of outstanding indebtedness, capital expenditures, the expansion, redevelopment and/or improvement of our properties, working capital and other general purposes, including repurchases of securities.

In February 2018, the Company's board of trustees authorized the repurchase of up to $300.0 million of our outstanding Class A common shares and up to $250.0 million of our outstanding preferred shares. Common and preferred share repurchases may be made in the open market or in privately negotiated transactions. All repurchased shares are constructively retired and returned to an authorized and unissued status. During the first quarter of 2018, the Company repurchased 1.8 million of our Class A common shares for a total price of $35.0 million.

As of March 31, 2018, the Company had cash and cash equivalents of $203.9 million and had total outstanding debt of $2.9 billion, excluding unamortized discounts, the value of exchangeable senior notes classified within equity and unamortized deferred financing costs, with a weighted-average interest rate of 4.16% and a weighted-average term to maturity of 13.9 years. The Company’s $800.0 million revolving credit facility and $200.0 million term loan facility had outstanding borrowings of zero and $200.0 million, respectively, at the end of the quarter.

On April 5, 2018, the Company redeemed all 7,600,000 shares of the outstanding 5.5% Series C participating preferred shares through a conversion of those shares into Class A common shares, in accordance with the conversion terms in the Articles Supplementary. This resulted in 10,848,827 total Class A common shares issued from the redemption, based on a conversion ratio of 1.4275 Class A common shares issued per Series C participating preferred share.

2018 Outlook |

| | |

| | | Full Year 2018 |

| Same-Home | | |

| Average Occupied Days Percentage | | 94.5% - 95.5% |

| Core revenues growth | | 3.5% - 4.5% |

| Core property operating expenses growth | | 4.0% - 5.0% |

| Core NOI After Capital Expenditures growth | | 3.0% - 4.0% |

| Core NOI margin | | 64.0% - 65.0% |

| Property tax expense growth | | 3.5% - 4.5% |

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures per property | | $1,950 - $2,100 |

| | | |

| Property Enhancing Capex | | $8 - $12 million |

| | | |

| General and administrative expense, excluding noncash share-based compensation | | $33.5 - $35.5 million |

| | | |

| Acquisition volume | | $400 - $600 million |

Note: The Company does not provide guidance for the most comparable GAAP financial measures of net income or loss, total revenues and property operating expenses, or a reconciliation of the above-listed forward-looking non-GAAP financial measures to the comparable GAAP financial measures because we are unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, net gain or loss on sales and impairment of single-family properties, casualty loss, Non-Same-Home revenues, Non-Same-Home property operating expenses and noncash fair value adjustments associated with remeasuring

Earnings Press Release (continued)

our participating preferred shares derivative liability to fair value. These items are uncertain, depend on various factors and could have a material impact on our GAAP results for the guidance period.

Additional Information

A copy of the Company’s First Quarter 2018 Earnings Release and Supplemental Information Package and this press release are available on our website at www.americanhomes4rent.com. This information has also been furnished to the SEC in a current report on Form 8-K.

Conference Call

A conference call is scheduled on Friday, May 4, 2018, at 11:00 a.m. Eastern Time to discuss the Company’s financial results for the quarter ended March 31, 2018, and to provide an update on its business. The domestic dial-in number is (877) 451-6152 (for U.S. and Canada) and the international dial-in number is (201) 389-0879 (passcode not required). A simultaneous audio webcast may be accessed by using the link at www.americanhomes4rent.com, under “For Investors.” A replay of the conference call may be accessed through Friday, May 18, 2018, by calling (844) 512-2921 (U.S. and Canada) or (412) 317-6671 (international), replay passcode number 13678521#, or by using the link at www.americanhomes4rent.com, under “For Investors.”

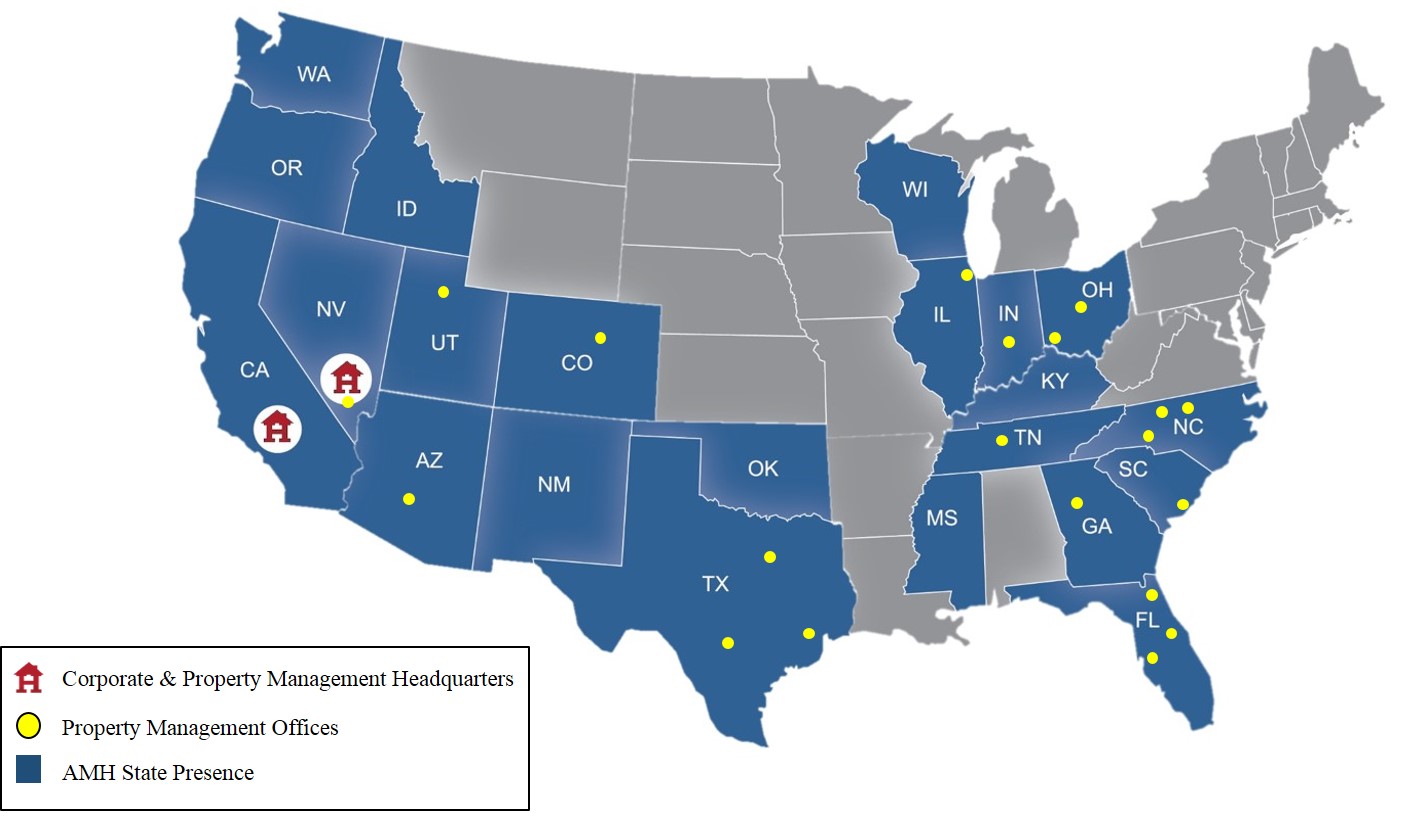

About American Homes 4 Rent

American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, renovating, leasing, and operating attractive, single-family homes as rental properties. As of March 31, 2018, we owned 51,840 single-family properties in selected submarkets in 22 states.

Forward-Looking Statements

This press release contains “forward-looking statements.” These forward-looking statements relate to beliefs, expectations or intentions and similar statements concerning matters that are not of historical fact and are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “intend,” “potential,” “plan,” “goal,” "outlook" or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this press release include, among others, our belief that our acquisition and homebuilding programs will result in continued growth and that we will continue to expand margins. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While the Company's management considers these expectations to be reasonable, they are inherently subject to risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update any forward-looking statements to conform to actual results or changes in its expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, and in the Company’s subsequent filings with the SEC.

Fact Sheet

(Amounts in thousands, except per share and property data)

(Unaudited)

|

| | | | | | | |

| | For the Three Months Ended

Mar 31, |

| | 2018 | | 2017 |

| Operating Data | | | |

| Net income (loss) attributable to common shareholders | $ | 5,814 |

| | $ | (1,490 | ) |

| Core revenues | $ | 218,856 |

| | $ | 202,201 |

|

| Core NOI | $ | 137,066 |

| | $ | 131,718 |

|

| Core NOI margin | 62.6 | % | | 65.1 | % |

| Platform Efficiency Percentage | 13.0 | % | | 12.7 | % |

| Adjusted EBITDA after Capex and Leasing Costs | $ | 119,538 |

| | $ | 116,106 |

|

| Adjusted EBITDA after Capex and Leasing Costs Margin | 53.8 | % | | 56.5 | % |

| Per FFO share and unit: | | | |

| FFO attributable to common share and unit holders | $ | 0.24 |

| | $ | 0.23 |

|

| Core FFO attributable to common share and unit holders | $ | 0.25 |

| | $ | 0.26 |

|

| Adjusted FFO attributable to common share and unit holders | $ | 0.22 |

| | $ | 0.23 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 | | Jun 30,

2017 | | Mar 31,

2017 |

| Selected Balance Sheet Information - end of period | | | | | | | | | |

| Single-family properties, net | $ | 8,169,080 |

| | $ | 8,064,980 |

| | $ | 7,802,499 |

| | $ | 7,633,784 |

| | $ | 7,542,196 |

|

| Total assets | $ | 8,958,033 |

| | $ | 8,608,768 |

| | $ | 8,509,876 |

| | $ | 8,146,307 |

| | $ | 8,490,605 |

|

| Outstanding borrowings under credit facilities, net | $ | 198,132 |

| | $ | 338,023 |

| | $ | 197,913 |

| | $ | 289,648 |

| | $ | 346,909 |

|

| Total Debt | $ | 2,871,649 |

| | $ | 2,517,216 |

| | $ | 2,382,871 |

| | $ | 2,480,787 |

| | $ | 2,999,587 |

|

| Total Market Capitalization | $ | 10,693,963 |

| | $ | 10,975,663 |

| | $ | 10,799,923 |

| | $ | 10,716,768 |

| | $ | 11,194,693 |

|

| Total Debt to Total Market Capitalization | 26.9 | % | | 22.9 | % | | 22.1 | % | | 23.1 | % | | 26.8 | % |

| Net Debt to Adjusted EBITDA | 5.1 x |

| | 4.8 x |

| | 4.2 x |

| | 4.8 x |

| | 5.1 x |

|

| NYSE AMH Class A common share closing price | $ | 20.08 |

| | $ | 21.84 |

| | $ | 21.71 |

| | $ | 22.57 |

| | $ | 22.96 |

|

|

| | | | | | | | | | | | | | |

| Portfolio Data - end of period | | | | | | | | | |

| Leased single-family properties | 47,677 |

| | 46,996 |

| | 46,026 |

| | 46,089 |

| | 45,285 |

|

| Occupied single-family properties | 47,095 |

| | 46,614 |

| | 45,660 |

| | 45,495 |

| | 44,941 |

|

| Single-family properties newly acquired and being renovated | 503 |

| | 980 |

| | 858 |

| | 508 |

| | 367 |

|

| Single-family properties being prepared for re-lease | 289 |

| | 372 |

| | 392 |

| | 161 |

| | 121 |

|

| Vacant single-family properties available for re-lease | 1,221 |

| | 1,902 |

| | 1,974 |

| | 1,521 |

| | 1,796 |

|

| Vacant single-family properties available for initial lease | 258 |

| | 679 |

| | 296 |

| | 121 |

| | 63 |

|

| Total single-family properties, excluding properties to be disposed | 49,948 |

| | 50,929 |

| | 49,546 |

| | 48,400 |

| | 47,632 |

|

| Single-family properties to be disposed (1) | 1,892 |

| | 310 |

| | 469 |

| | 582 |

| | 704 |

|

| Total single-family properties | 51,840 |

| | 51,239 |

| | 50,015 |

| | 48,982 |

| | 48,336 |

|

| Total leased percentage (2) | 95.5 | % | | 92.3 | % | | 92.9 | % | | 95.2 | % | | 95.1 | % |

| Total Average Occupied Days Percentage | 91.4 | % | | 90.8 | % | | 93.2 | % | | 93.3 | % | | 93.5 | % |

| Same-Home leased percentage (38,828 properties) | 97.1 | % | | 95.8 | % | | 95.2 | % | | 96.5 | % | | 96.2 | % |

| Same-Home Average Occupied Days Percentage (38,828 properties) | 94.7 | % | | 94.0 | % | | 94.1 | % | | 95.0 | % | | 95.2 | % |

|

| | | | | | | | | | | | | | | | | | | |

| Other Data | | | | | | | | | |

| Distributions declared per common share | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

|

| Distributions declared per Series C participating preferred share (3) | $ | 0.34 |

| | $ | 0.34 |

| | $ | 0.34 |

| | $ | 0.34 |

| | $ | 0.34 |

|

| Distributions declared per Series D perpetual preferred share | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

|

| Distributions declared per Series E perpetual preferred share | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

|

| Distributions declared per Series F perpetual preferred share (4) | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.27 |

| | $ | — |

|

| Distributions declared per Series G perpetual preferred share (4) | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.30 |

| | $ | — |

| | $ | — |

|

| |

| (1) | As of March 31, 2018, represents 1,892 properties identified as part of the Company's disposition program, comprised of 574 properties identified for future sale and 1,318 properties classified as held for sale. |

| |

| (2) | Leased percentage is calculated based on total single-family properties, excluding properties to be disposed. |

| |

| (3) | All of the Series C participating preferred shares were converted into Class A common shares on April 5, 2018. |

| |

| (4) | Series F and G perpetual preferred shares offering close dates and initial dividend start dates were April 24, 2017, and July 17, 2017, respectively. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 7

|

Condensed Consolidated Statements of Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | |

| | For the Three Months Ended

Mar 31, |

| | 2018 | | 2017 |

| Revenues: | | | |

| Rents from single-family properties | $ | 218,023 |

| | $ | 201,107 |

|

| Fees from single-family properties | 2,833 |

| | 2,604 |

|

| Tenant charge-backs | 35,807 |

| | 28,373 |

|

| Other | 1,341 |

| | 1,670 |

|

| Total revenues | 258,004 |

| | 233,754 |

|

| | | | |

| Expenses: | | | |

| Property operating expenses | 100,987 |

| | 83,305 |

|

| Property management expenses | 18,987 |

| | 17,478 |

|

| General and administrative expense | 9,231 |

| | 9,295 |

|

| Interest expense | 29,301 |

| | 31,889 |

|

| Acquisition fees and costs expensed | 1,311 |

| | 1,096 |

|

| Depreciation and amortization | 79,303 |

| | 73,953 |

|

| Other | 827 |

| | 1,558 |

|

| Total expenses | 239,947 |

| | 218,574 |

|

| | | | |

| Gain on sale of single-family properties and other, net | 2,256 |

| | 2,026 |

|

| Remeasurement of participating preferred shares | 1,212 |

| | (5,410 | ) |

| | | | |

| Net income | 21,525 |

| | 11,796 |

|

| | | | |

| Noncontrolling interest | 1,114 |

| | (301 | ) |

| Dividends on preferred shares | 14,597 |

| | 13,587 |

|

| | | | |

| Net income (loss) attributable to common shareholders | $ | 5,814 |

| | $ | (1,490 | ) |

| | | | |

| Weighted-average shares outstanding: | | | |

| Basic | 286,183,429 | | 244,391,368 |

| Diluted | 286,727,863 | | 244,391,368 |

| | | | |

| Net income (loss) attributable to common shareholders per share: | | | |

| Basic | $ | 0.02 |

| | $ | (0.01 | ) |

| Diluted | $ | 0.02 |

| | $ | (0.01 | ) |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 8

|

Funds from Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | |

| | For the Three Months Ended

Mar 31, |

| | 2018 | | 2017 |

| Net income (loss) attributable to common shareholders | $ | 5,814 |

| | $ | (1,490 | ) |

| Adjustments: | | | |

| Noncontrolling interests in the Operating Partnership | 1,125 |

| | (339 | ) |

| Net (gain) on sale / impairment of single-family properties and other | (1,556 | ) | | (1,097 | ) |

| Depreciation and amortization | 79,303 |

| | 73,953 |

|

| Less: depreciation and amortization of non-real estate assets | (1,830 | ) | | (2,549 | ) |

| FFO attributable to common share and unit holders | $ | 82,856 |

| | $ | 68,478 |

|

| Adjustments: | | | |

| Acquisition fees and costs expensed | 1,311 |

| | 1,096 |

|

| Noncash share-based compensation - general and administrative | 598 |

| | 521 |

|

| Noncash share-based compensation - property management | 377 |

| | 417 |

|

| Noncash interest expense related to acquired debt | 900 |

| | 840 |

|

| Remeasurement of participating preferred shares | (1,212 | ) | | 5,410 |

|

| Core FFO attributable to common share and unit holders | $ | 84,830 |

| | $ | 76,762 |

|

| Recurring capital expenditures (1) | (7,386 | ) | | (6,397 | ) |

| Leasing costs | (2,723 | ) | | (1,482 | ) |

| Adjusted FFO attributable to common share and unit holders | $ | 74,721 |

| | $ | 68,883 |

|

| | | | |

| Per FFO share and unit: | | | |

| FFO attributable to common share and unit holders | $ | 0.24 |

| | $ | 0.23 |

|

| Core FFO attributable to common share and unit holders | $ | 0.25 |

| | $ | 0.26 |

|

| Adjusted FFO attributable to common share and unit holders | $ | 0.22 |

| | $ | 0.23 |

|

| | | | |

| Weighted-average FFO shares and units: | | | |

| Common shares outstanding | 286,183,429 |

| | 244,391,368 |

|

| Share-based compensation plan (2) | 544,434 |

| | 719,113 |

|

| Operating partnership units | 55,350,153 |

| | 55,555,960 |

|

| Total weighted-average FFO shares and units | 342,078,016 |

| | 300,666,441 |

|

| |

| (1) | As a portion of our homes are recently acquired and / or renovated, we estimate recurring capital expenditures for our entire portfolio by multiplying (a) current period actual recurring capital expenditures per Same-Home Property by (b) our total number of properties, excluding non-stabilized properties, properties identified for future sale as part of the Company's disposition program and properties classified as held for sale. |

| |

| (2) | Reflects the effect of potentially dilutive securities issuable upon the assumed vesting / exercise of restricted stock units and stock options. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 9

|

Core Net Operating Income - Total Portfolio

(Amounts in thousands)

(Unaudited)

|

| | | | | | | |

| | For the Three Months Ended

Mar 31, |

| | 2018 | | 2017 |

| Rents from single-family properties | $ | 218,023 |

| | $ | 201,107 |

|

| Fees from single-family properties | 2,833 |

| | 2,604 |

|

| Bad debt expense | (2,000 | ) | | (1,510 | ) |

| Core revenues | 218,856 |

| | 202,201 |

|

| | | | |

| Property tax expense | 39,090 |

| | 36,762 |

|

| HOA fees, net (1) | 4,477 |

| | 3,886 |

|

| R&M and turnover costs, net (1) | 18,739 |

| | 12,295 |

|

| Insurance | 2,047 |

| | 1,940 |

|

| Property management expenses, net (2) | 17,437 |

| | 15,600 |

|

| Core property operating expenses | 81,790 |

| | 70,483 |

|

| | | | |

| Core NOI | $ | 137,066 |

| | $ | 131,718 |

|

| Core NOI margin | 62.6 | % | | 65.1 | % |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended

Mar 31, 2018 |

| | Same-Home Properties | | Stabilized,

Non-Same-Home

Properties | | Non-Stabilized Former ARPI Properties | | Subtotal Same-Home, Stabilized and ARPI | | Other &

Held for Sale

Properties (3) | | Total

Single-Family

Properties |

| Property count | 38,828 |

| | 4,921 |

| | 3,598 |

| | 47,347 |

| | 4,493 |

| | 51,840 |

|

| | | | | | | | | | | | |

| Rents from single-family properties | $ | 171,312 |

| | $ | 21,840 |

| | $ | 14,466 |

| | $ | 207,618 |

| | $ | 10,405 |

| | $ | 218,023 |

|

| Fees from single-family properties | 1,990 |

| | 213 |

| | 236 |

| | 2,439 |

| | 394 |

| | 2,833 |

|

| Bad debt expense | (1,538 | ) | | (196 | ) | | (90 | ) | | (1,824 | ) | | (176 | ) | | (2,000 | ) |

| Core revenues | 171,764 |

| | 21,857 |

| | 14,612 |

| | 208,233 |

| | 10,623 |

| | 218,856 |

|

| | | | | | | | | | | | |

| Property tax expense | 29,989 |

| | 3,535 |

| | 2,623 |

| | 36,147 |

| | 2,943 |

| | 39,090 |

|

| HOA fees, net (1) | 3,378 |

| | 466 |

| | 360 |

| | 4,204 |

| | 273 |

| | 4,477 |

|

| R&M and turnover costs, net (1) | 13,645 |

| | 1,377 |

| | 1,251 |

| | 16,273 |

| | 2,466 |

| | 18,739 |

|

| Insurance | 1,531 |

| | 231 |

| | 137 |

| | 1,899 |

| | 148 |

| | 2,047 |

|

| Property management expenses, net (2) | 13,373 |

| | 1,695 |

| | 1,239 |

| | 16,307 |

| | 1,130 |

| | 17,437 |

|

| Core property operating expenses | 61,916 |

| | 7,304 |

| | 5,610 |

| | 74,830 |

| | 6,960 |

| | 81,790 |

|

| | | | | | | | | | | | |

| Core NOI | $ | 109,848 |

| | $ | 14,553 |

| | $ | 9,002 |

| | $ | 133,403 |

| | $ | 3,663 |

| | $ | 137,066 |

|

| Core NOI margin | 64.0 | % | | 66.6 | % | | 61.6 | % | | 64.1 | % | | 34.5 | % | | 62.6 | % |

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

| |

| (3) | Includes 2,601 non-stabilized properties and 1,892 properties identified as part of the Company’s disposition program as of quarter end, comprised of 574 properties identified for future sale and 1,318 properties classified as held for sale. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 10

|

Same-Home Results – Quarterly Comparisons

(Amounts in thousands, except property and per property data)

(Unaudited) |

| | | | | | | | | | |

| | For the Three Months Ended

Mar 31, | | |

| | 2018 | | 2017 | | Change |

| Number of Same-Home properties | 38,828 |

| | 38,828 |

| | |

| Leased percentage as of period end | 97.1 | % | | 96.2 | % | | 0.9 | % |

| Occupancy percentage as of period end | 95.9 | % | | 95.5 | % | | 0.4 | % |

| Average Occupied Days Percentage | 94.7 | % | | 95.2 | % | | (0.5 | )% |

| Average Monthly Realized Rent per property | $ | 1,553 |

| | $ | 1,494 |

| | 3.9 | % |

| Turnover Rate | 8.5 | % | | 8.9 | % | | (0.4 | )% |

| Turnover Rate - TTM | 39.0 | % | | N/A |

| | |

| | | | | | |

| Core NOI: | | | | |

| Rents from single-family properties | $ | 171,312 |

| | $ | 165,728 |

| | 3.4 | % |

| Fees from single-family properties | 1,990 |

| | 1,992 |

| | (0.1 | )% |

| Bad debt expense | (1,538 | ) | | (1,197 | ) | | 28.5 | % |

| Core revenues | 171,764 |

| | 166,523 |

| | 3.1 | % |

| | | | | | |

| Property tax expense | 29,989 |

| | 29,621 |

| | 1.2 | % |

| HOA fees, net (1) | 3,378 |

| | 3,127 |

| | 8.0 | % |

| R&M and turnover costs, net (1) | 13,645 |

| | 9,600 |

| | 42.1 | % |

| Insurance | 1,531 |

| | 1,633 |

| | (6.2 | )% |

| Property management expenses, net (2) | 13,373 |

| | 12,651 |

| | 5.7 | % |

| Core property operating expenses | 61,916 |

| | 56,632 |

| | 9.3 | % |

| | | | | | |

| Core NOI | $ | 109,848 |

| | $ | 109,891 |

| | — | % |

| Core NOI margin | 64.0 | % | | 66.0 | % | | |

| | | | | | |

| Recurring Capital Expenditures | 6,054 |

| | 5,336 |

| | 13.5 | % |

| Core NOI After Capital Expenditures | $ | 103,794 |

| | $ | 104,555 |

| | (0.7 | )% |

| | | | | | |

| Property Enhancing Capex | | | | | |

| Resilient flooring program | $ | 1,337 |

| | $ | — |

| | — | % |

| | | | | | |

| Per property: | | | | | |

| Average Recurring Capital Expenditures | $ | 156 |

| | $ | 137 |

| | 13.5 | % |

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures | $ | 508 |

| | $ | 384 |

| | 32.5 | % |

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 11

|

Same-Home Results – Sequential Quarterly Results

(Amounts in thousands, except per property data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 | | Jun 30,

2017 | | Mar 31,

2017 |

| Core NOI: | | | | | | | | | |

| Rents from single-family properties | $ | 171,312 |

| | $ | 168,910 |

| | $ | 167,585 |

| | $ | 167,350 |

| | $ | 165,728 |

|

| Fees from single-family properties | 1,990 |

| | 1,976 |

| | 2,222 |

| | 2,077 |

| | 1,992 |

|

| Bad debt expense | (1,538 | ) | | (1,649 | ) | | (1,863 | ) | | (1,059 | ) | | (1,197 | ) |

| Core revenues | 171,764 |

| | 169,237 |

| | 167,944 |

| | 168,368 |

| | 166,523 |

|

| | | | | | | | | | |

| Property tax expense | 29,989 |

| | 29,692 |

| | 29,241 |

| | 29,330 |

| | 29,621 |

|

| HOA fees, net (1) | 3,378 |

| | 3,413 |

| | 3,353 |

| | 3,254 |

| | 3,127 |

|

| R&M and turnover costs, net (1) | 13,645 |

| | 11,525 |

| | 14,331 |

| | 12,489 |

| | 9,600 |

|

| Insurance | 1,531 |

| | 1,584 |

| | 1,559 |

| | 1,543 |

| | 1,633 |

|

| Property management expenses, net (2) | 13,373 |

| | 12,321 |

| | 12,582 |

| | 12,824 |

| | 12,651 |

|

| Core property operating expenses | 61,916 |

| | 58,535 |

| | 61,066 |

| | 59,440 |

| | 56,632 |

|

| | | | | | | | | | |

| Core NOI | $ | 109,848 |

| | $ | 110,702 |

| | $ | 106,878 |

| | $ | 108,928 |

| | $ | 109,891 |

|

| Core NOI margin | 64.0 | % | | 65.4 | % | | 63.6 | % | | 64.7 | % | | 66.0 | % |

| | | | | | | | | | |

| Recurring Capital Expenditures | 6,054 |

| | 5,941 |

| | 8,413 |

| | 6,983 |

| | 5,336 |

|

| Core NOI After Capital Expenditures | $ | 103,794 |

| | $ | 104,761 |

| | $ | 98,465 |

| | $ | 101,945 |

| | $ | 104,555 |

|

| | | | | | | | | | |

| Property Enhancing Capex | | | | | | | | | |

| Resilient flooring program | $ | 1,337 |

| | $ | 1,524 |

| | $ | 1,016 |

| | $ | 606 |

| | $ | — |

|

| | | | | | | | | | |

| Per property: | | | | | | | | | |

| Average Recurring Capital Expenditures | $ | 156 |

| | $ | 153 |

| | $ | 217 |

| | $ | 180 |

| | $ | 137 |

|

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures | $ | 508 |

| | $ | 449 |

| | $ | 586 |

| | $ | 502 |

| | $ | 384 |

|

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 12

|

Same-Home Results – Sequential Quarterly Metrics

Average Occupied Days Percentage

|

| | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 | | Jun 30,

2017 | | Mar 31,

2017 |

| Dallas-Fort Worth, TX | 94.3 | % | | 93.2 | % | | 92.9 | % | | 94.4 | % | | 95.1 | % |

| Atlanta, GA | 95.0 | % | | 95.6 | % | | 96.1 | % | | 96.2 | % | | 96.0 | % |

| Indianapolis, IN | 94.3 | % | | 94.2 | % | | 93.7 | % | | 94.2 | % | | 94.4 | % |

| Charlotte, NC | 93.5 | % | | 92.6 | % | | 94.0 | % | | 94.9 | % | | 94.9 | % |

| Houston, TX | 94.4 | % | | 93.5 | % | | 90.1 | % | | 91.9 | % | | 92.6 | % |

| Cincinnati, OH | 94.4 | % | | 94.0 | % | | 93.7 | % | | 94.5 | % | | 94.7 | % |

| Greater Chicago area, IL and IN | 96.5 | % | | 94.9 | % | | 94.8 | % | | 95.9 | % | | 96.6 | % |

| Phoenix, AZ | 96.5 | % | | 95.0 | % | | 95.6 | % | | 96.9 | % | | 96.4 | % |

| Nashville, TN | 92.8 | % | | 92.6 | % | | 92.3 | % | | 94.5 | % | | 95.1 | % |

| Tampa, FL | 94.7 | % | | 93.5 | % | | 94.1 | % | | 94.3 | % | | 95.2 | % |

| Raleigh, NC | 93.5 | % | | 93.7 | % | | 94.7 | % | | 94.6 | % | | 94.6 | % |

| Jacksonville, FL | 95.6 | % | | 95.5 | % | | 94.9 | % | | 95.8 | % | | 96.3 | % |

| Columbus, OH | 93.7 | % | | 92.5 | % | | 93.9 | % | | 96.3 | % | | 96.2 | % |

| Orlando, FL | 96.7 | % | | 96.6 | % | | 96.5 | % | | 95.6 | % | | 96.0 | % |

| Salt Lake City, UT | 95.2 | % | | 93.2 | % | | 94.2 | % | | 96.8 | % | | 97.2 | % |

| Las Vegas, NV | 96.7 | % | | 96.4 | % | | 97.0 | % | | 96.8 | % | | 96.6 | % |

| San Antonio, TX | 94.3 | % | | 92.8 | % | | 92.7 | % | | 94.4 | % | | 94.2 | % |

| Charleston, SC | 92.2 | % | | 93.5 | % | | 93.2 | % | | 92.7 | % | | 94.6 | % |

| Denver, CO | 97.0 | % | | 95.2 | % | | 95.4 | % | | 95.8 | % | | 95.0 | % |

| Greenville, SC | 90.3 | % | | 91.0 | % | | 90.4 | % | | 92.2 | % | | 91.8 | % |

| All Other (1) | 95.0 | % | | 94.0 | % | | 94.7 | % | | 95.4 | % | | 95.3 | % |

| Total / Average | 94.7 | % | | 94.0 | % | | 94.1 | % | | 95.0 | % | | 95.2 | % |

Average Monthly Realized Rent per property

|

| | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 | | Jun 30,

2017 | | Mar 31,

2017 |

| Dallas-Fort Worth, TX | $ | 1,679 |

| | $ | 1,668 |

| | $ | 1,660 |

| | $ | 1,638 |

| | $ | 1,617 |

|

| Atlanta, GA | 1,497 |

| | 1,483 |

| | 1,474 |

| | 1,447 |

| | 1,417 |

|

| Indianapolis, IN | 1,366 |

| | 1,358 |

| | 1,345 |

| | 1,332 |

| | 1,317 |

|

| Charlotte, NC | 1,522 |

| | 1,521 |

| | 1,508 |

| | 1,491 |

| | 1,482 |

|

| Houston, TX | 1,619 |

| | 1,625 |

| | 1,608 |

| | 1,605 |

| | 1,600 |

|

| Cincinnati, OH | 1,536 |

| | 1,517 |

| | 1,509 |

| | 1,494 |

| | 1,477 |

|

| Greater Chicago area, IL and IN | 1,787 |

| | 1,777 |

| | 1,761 |

| | 1,732 |

| | 1,721 |

|

| Phoenix, AZ | 1,300 |

| | 1,283 |

| | 1,260 |

| | 1,240 |

| | 1,233 |

|

| Nashville, TN | 1,704 |

| | 1,685 |

| | 1,686 |

| | 1,664 |

| | 1,643 |

|

| Tampa, FL | 1,672 |

| | 1,668 |

| | 1,646 |

| | 1,645 |

| | 1,610 |

|

| Raleigh, NC | 1,486 |

| | 1,477 |

| | 1,468 |

| | 1,449 |

| | 1,437 |

|

| Jacksonville, FL | 1,466 |

| | 1,446 |

| | 1,433 |

| | 1,414 |

| | 1,399 |

|

| Columbus, OH | 1,540 |

| | 1,526 |

| | 1,518 |

| | 1,503 |

| | 1,482 |

|

| Orlando, FL | 1,579 |

| | 1,581 |

| | 1,534 |

| | 1,521 |

| | 1,507 |

|

| Salt Lake City, UT | 1,643 |

| | 1,627 |

| | 1,608 |

| | 1,576 |

| | 1,559 |

|

| Las Vegas, NV | 1,466 |

| | 1,449 |

| | 1,436 |

| | 1,422 |

| | 1,404 |

|

| San Antonio, TX | 1,483 |

| | 1,481 |

| | 1,475 |

| | 1,470 |

| | 1,458 |

|

| Charleston, SC | 1,591 |

| | 1,610 |

| | 1,592 |

| | 1,579 |

| | 1,553 |

|

| Denver, CO | 2,112 |

| | 2,083 |

| | 2,068 |

| | 2,056 |

| | 2,040 |

|

| Greenville, SC | 1,529 |

| | 1,525 |

| | 1,518 |

| | 1,518 |

| | 1,490 |

|

| All Other (1) | 1,501 |

| | 1,484 |

| | 1,473 |

| | 1,455 |

| | 1,430 |

|

| Total / Average | $ | 1,553 |

| | $ | 1,543 |

| | $ | 1,528 |

| | $ | 1,512 |

| | $ | 1,494 |

|

| |

| (1) | Represents 18 markets in 15 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 13

|

Same-Home Results – Operating Metrics by Market

|

| | | | | | | | | | | | | | | | | | |

| | Number of Properties | | Gross Book Value per Property | | % of 1Q18 NOI | | Avg. Change in Rent for Renewals (1) | | Avg. Change in Rent for Re-Leases (1) | | Avg. Blended Change in Rent (1) |

| Dallas-Fort Worth, TX | 3,414 |

| | $ | 162,230 |

| | 8.0 | % | | 4.0 | % | | 3.4 | % | | 3.7 | % |

| Atlanta, GA | 3,070 |

| | 164,996 |

| | 7.9 | % | | 4.6 | % | | 5.6 | % | | 5.0 | % |

| Indianapolis, IN | 2,783 |

| | 153,129 |

| | 6.0 | % | | 3.7 | % | | 2.8 | % | | 3.4 | % |

| Charlotte, NC | 2,431 |

| | 175,358 |

| | 6.6 | % | | 3.4 | % | | 0.1 | % | | 2.0 | % |

| Houston, TX | 2,153 |

| | 170,705 |

| | 4.7 | % | | 2.5 | % | | 2.7 | % | | 2.6 | % |

| Cincinnati, OH | 1,886 |

| | 173,368 |

| | 4.9 | % | | 3.5 | % | | 2.6 | % | | 3.2 | % |

| Greater Chicago area, IL and IN | 1,870 |

| | 180,451 |

| | 4.6 | % | | 3.3 | % | | 4.4 | % | | 3.6 | % |

| Phoenix, AZ | 1,818 |

| | 163,741 |

| | 4.3 | % | | 5.4 | % | | 7.3 | % | | 6.2 | % |

| Nashville, TN | 1,720 |

| | 205,934 |

| | 5.6 | % | | 3.6 | % | | 0.6 | % | | 2.3 | % |

| Tampa, FL | 1,611 |

| | 188,036 |

| | 4.2 | % | | 3.5 | % | | 1.9 | % | | 2.8 | % |

| Raleigh, NC | 1,601 |

| | 179,976 |

| | 4.3 | % | | 3.3 | % | | 2.4 | % | | 2.9 | % |

| Jacksonville, FL | 1,592 |

| | 153,763 |

| | 3.8 | % | | 3.8 | % | | 5.6 | % | | 4.5 | % |

| Columbus, OH | 1,434 |

| | 155,409 |

| | 3.6 | % | | 4.2 | % | | 1.8 | % | | 3.2 | % |

| Orlando, FL | 1,249 |

| | 170,008 |

| | 3.2 | % | | 4.3 | % | | 6.0 | % | | 5.0 | % |

| Salt Lake City, UT | 1,047 |

| | 221,100 |

| | 3.5 | % | | 4.7 | % | | 6.5 | % | | 5.7 | % |

| Las Vegas, NV | 978 |

| | 176,058 |

| | 2.7 | % | | 4.8 | % | | 5.1 | % | | 5.0 | % |

| San Antonio, TX | 880 |

| | 155,478 |

| | 1.9 | % | | 3.2 | % | | 2.1 | % | | 2.8 | % |

| Charleston, SC | 668 |

| | 180,052 |

| | 1.7 | % | | 3.1 | % | | 0.7 | % | | 2.0 | % |

| Denver, CO | 654 |

| | 275,459 |

| | 2.9 | % | | 4.1 | % | | 4.4 | % | | 4.2 | % |

| Greenville, SC | 636 |

| | 172,353 |

| | 1.5 | % | | 3.0 | % | | 1.8 | % | | 2.3 | % |

| All Other (2) | 5,333 |

| | 172,428 |

| | 14.1 | % | | 4.0 | % | | 3.5 | % | | 3.8 | % |

| Total / Average | 38,828 |

| | $ | 173,530 |

| | 100.0 | % | | 3.8 | % | | 3.4 | % | | 3.6 | % |

|

| | | | | | | | | | | | | | | | | | | |

| | Average Occupied Days Percentage | | Average Monthly Realized Rent per property |

| | 1Q18 QTD | | 1Q17 QTD | | Change | | 1Q18 QTD | | 1Q17 QTD | | Change |

| Dallas-Fort Worth, TX | 94.3 | % | | 95.1 | % | | (0.8 | )% | | $ | 1,679 |

| | $ | 1,617 |

| | 3.8 | % |

| Atlanta, GA | 95.0 | % | | 96.0 | % | | (1.0 | )% | | 1,497 |

| | 1,417 |

| | 5.6 | % |

| Indianapolis, IN | 94.3 | % | | 94.4 | % | | (0.1 | )% | | 1,366 |

| | 1,317 |

| | 3.7 | % |

| Charlotte, NC | 93.5 | % | | 94.9 | % | | (1.4 | )% | | 1,522 |

| | 1,482 |

| | 2.7 | % |

| Houston, TX | 94.4 | % | | 92.6 | % | | 1.8 | % | | 1,619 |

| | 1,600 |

| | 1.2 | % |

| Cincinnati, OH | 94.4 | % | | 94.7 | % | | (0.3 | )% | | 1,536 |

| | 1,477 |

| | 4.0 | % |

| Greater Chicago area, IL and IN | 96.5 | % | | 96.6 | % | | (0.1 | )% | | 1,787 |

| | 1,721 |

| | 3.8 | % |

| Phoenix, AZ | 96.5 | % | | 96.4 | % | | 0.1 | % | | 1,300 |

| | 1,233 |

| | 5.4 | % |

| Nashville, TN | 92.8 | % | | 95.1 | % | | (2.3 | )% | | 1,704 |

| | 1,643 |

| | 3.7 | % |

| Tampa, FL | 94.7 | % | | 95.2 | % | | (0.5 | )% | | 1,672 |

| | 1,610 |

| | 3.9 | % |

| Raleigh, NC | 93.5 | % | | 94.6 | % | | (1.1 | )% | | 1,486 |

| | 1,437 |

| | 3.4 | % |

| Jacksonville, FL | 95.6 | % | | 96.3 | % | | (0.7 | )% | | 1,466 |

| | 1,399 |

| | 4.8 | % |

| Columbus, OH | 93.7 | % | | 96.2 | % | | (2.5 | )% | | 1,540 |

| | 1,482 |

| | 3.9 | % |

| Orlando, FL | 96.7 | % | | 96.0 | % | | 0.7 | % | | 1,579 |

| | 1,507 |

| | 4.8 | % |

| Salt Lake City, UT | 95.2 | % | | 97.2 | % | | (2.0 | )% | | 1,643 |

| | 1,559 |

| | 5.4 | % |

| Las Vegas, NV | 96.7 | % | | 96.6 | % | | 0.1 | % | | 1,466 |

| | 1,404 |

| | 4.4 | % |

| San Antonio, TX | 94.3 | % | | 94.2 | % | | 0.1 | % | | 1,483 |

| | 1,458 |

| | 1.7 | % |

| Charleston, SC | 92.2 | % | | 94.6 | % | | (2.4 | )% | | 1,591 |

| | 1,553 |

| | 2.4 | % |

| Denver, CO | 97.0 | % | | 95.0 | % | | 2.0 | % | | 2,112 |

| | 2,040 |

| | 3.5 | % |

| Greenville, SC | 90.3 | % | | 91.8 | % | | (1.5 | )% | | 1,529 |

| | 1,490 |

| | 2.6 | % |

| All Other (2) | 95.0 | % | | 95.3 | % | | (0.3 | )% | | 1,501 |

| | 1,430 |

| | 5.0 | % |

| Total / Average | 94.7 | % | | 95.2 | % | | (0.5 | )% | | $ | 1,553 |

| | $ | 1,494 |

| | 3.9 | % |

| |

| (1) | Reflected for the three months ended March 31, 2018. |

| |

| (2) | Represents 18 markets in 15 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 14

|

Condensed Consolidated Balance Sheets

(Amounts in thousands)

|

| | | | | | | |

| | Mar 31, 2018 | | Dec 31, 2017 |

| | (Unaudited) | | |

| Assets | | | |

| Single-family properties: | | | |

| Land | $ | 1,670,599 |

| | $ | 1,665,631 |

|

| Buildings and improvements | 7,286,264 |

| | 7,303,270 |

|

| Single-family properties held for sale, net | 201,693 |

| | 35,803 |

|

| | 9,158,556 |

| | 9,004,704 |

|

| Less: accumulated depreciation | (989,476 | ) | | (939,724 | ) |

| Single-family properties, net | 8,169,080 |

| | 8,064,980 |

|

| Cash and cash equivalents | 203,883 |

| | 46,156 |

|

| Restricted cash | 156,272 |

| | 136,667 |

|

| Rent and other receivables, net | 28,115 |

| | 30,144 |

|

| Escrow deposits, prepaid expenses and other assets | 241,707 |

| | 171,851 |

|

| Deferred costs and other intangibles, net | 13,031 |

| | 13,025 |

|

| Asset-backed securitization certificates | 25,666 |

| | 25,666 |

|

| Goodwill | 120,279 |

| | 120,279 |

|

| Total assets | $ | 8,958,033 |

| | $ | 8,608,768 |

|

| | | | |

| Liabilities | | | |

| Revolving credit facility | $ | — |

| | $ | 140,000 |

|

| Term loan facility, net | 198,132 |

| | 198,023 |

|

| Asset-backed securitizations, net | 1,973,242 |

| | 1,977,308 |

|

| Unsecured senior notes, net | 492,282 |

| | — |

|

| Exchangeable senior notes, net | 112,597 |

| | 111,697 |

|

| Secured note payable | 48,604 |

| | 48,859 |

|

| Accounts payable and accrued expenses | 262,267 |

| | 222,867 |

|

| Amounts payable to affiliates | 2,001 |

| | 4,720 |

|

| Participating preferred shares derivative liability | 28,258 |

| | 29,470 |

|

| Total liabilities | 3,117,383 |

| | 2,732,944 |

|

| | | | |

| Commitments and contingencies | | | |

| | | | |

| Equity | | | |

| Shareholders’ equity: | | | |

| Class A common shares | 2,844 |

| | 2,861 |

|

| Class B common shares | 6 |

| | 6 |

|

| Preferred shares | 384 |

| | 384 |

|

| Additional paid-in capital | 5,565,871 |

| | 5,600,256 |

|

| Accumulated deficit | (462,504 | ) | | (453,953 | ) |

| Accumulated other comprehensive income | 9,508 |

| | 75 |

|

| Total shareholders’ equity | 5,116,109 |

| | 5,149,629 |

|

| | | | |

| Noncontrolling interest | 724,541 |

| | 726,195 |

|

| Total equity | 5,840,650 |

| | 5,875,824 |

|

| | | | |

| Total liabilities and equity | $ | 8,958,033 |

| | $ | 8,608,768 |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 15

|

Debt Summary and Maturity Schedule as of March 31, 2018

(Amounts in thousands)

|

| | | | | | | | | | | | | | | | | | | |

| | Secured | | Unsecured | | Total Balance | | % of Total | | Interest

Rate (1) | | Years to Maturity (2) |

| Floating rate debt: | | | | | | | | | | | |

| Revolving credit facility (3) | $ | — |

| | $ | — |

| | $ | — |

| | — | % | | 3.08 | % | | 4.3 |

| Term loan facility (3) | — |

| | 200,000 |

| | 200,000 |

| | 7.0 | % | | 3.23 | % | | 4.3 |

| Total floating rate debt | — |

| | 200,000 |

| | 200,000 |

| | 7.0 | % | | 3.23 | % | | 4.3 |

| | | | | | | | | | | | |

| Fixed rate debt: | | | | | | | | | | | |

| AH4R 2014-SFR2 | 495,043 |

| | — |

| | 495,043 |

| | 17.2 | % | | 4.42 | % | | 6.5 |

| AH4R 2014-SFR3 | 510,721 |

| | — |

| | 510,721 |

| | 17.8 | % | | 4.40 | % | | 6.7 |

| AH4R 2015-SFR1 | 536,341 |

| | — |

| | 536,341 |

| | 18.7 | % | | 4.14 | % | | 27.0 |

| AH4R 2015-SFR2 | 465,940 |

| | — |

| | 465,940 |

| | 16.2 | % | | 4.36 | % | | 27.5 |

| Unsecured senior notes (4) | — |

| | 500,000 |

| | 500,000 |

| | 17.4 | % | | 4.08 | % | | 9.9 |

| Exchangeable senior notes | — |

| | 115,000 |

| | 115,000 |

| | 4.0 | % | | 3.25 | % | | 0.6 |

| Secured note payable | 48,604 |

| | — |

| | 48,604 |

| | 1.7 | % | | 4.06 | % | | 1.3 |

| Total fixed rate debt | 2,056,649 |

| | 615,000 |

| | 2,671,649 |

| | 93.0 | % | | 4.23 | % | | 14.6 |

| | | | | | | | | | | | |

| Total Debt | $ | 2,056,649 |

| | $ | 815,000 |

| | $ | 2,871,649 |

| | 100.0 | % | | 4.16 | % | | 13.9 |

| | | | | | | | | | | | |

| Unamortized discounts and loan costs | | | | | (46,792 | ) | | | | | | |

| Total debt per balance sheet | | | | | $ | 2,824,857 |

| | | | | | |

|

| | | | | | | | | | | | | | | |

| Year (2) | | Floating Rate | | Fixed Rate | | Total | | % of Total |

| Remaining 2018 | | $ | — |

| | $ | 131,290 |

| | $ | 131,290 |

| | 4.6 | % |

| 2019 | | — |

| | 68,564 |

| | 68,564 |

| | 2.4 | % |

| 2020 | | — |

| | 20,714 |

| | 20,714 |

| | 0.7 | % |

| 2021 | | — |

| | 20,714 |

| | 20,714 |

| | 0.7 | % |

| 2022 | | 200,000 |

| | 20,714 |

| | 220,714 |

| | 7.7 | % |

| 2023 | | — |

| | 20,714 |

| | 20,714 |

| | 0.7 | % |

| 2024 | | — |

| | 956,197 |

| | 956,197 |

| | 33.3 | % |

| 2025 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| 2026 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| 2027 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| Thereafter | | — |

| | 1,401,836 |

| | 1,401,836 |

| | 48.7 | % |

| Total | | $ | 200,000 |

| | $ | 2,671,649 |

| | $ | 2,871,649 |

| | 100.0 | % |

(1) Interest rates on floating rate debt reflect stated rates as of period end.

| |

| (2) | Years to maturity and maturity schedule reflect all debt on a fully extended basis. |

| |

| (3) | The interest rates shown above reflect the Company's LIBOR-based borrowing rates, based on 1-month LIBOR and applicable margin as of period end. Balances reflect borrowings outstanding as of March 31, 2018. |

| |

| (4) | The stated interest rate on the unsecured senior notes is 4.25%, which was effectively hedged to yield an interest rate of 4.08%. |

Interest Expense Reconciliation

|

| | | | | | | |

| | For the Three Months Ended

Mar 31, |

| (Amounts in thousands) | 2018 | | 2017 |

| Interest expense per income statement | $ | 29,301 |

| | $ | 31,889 |

|

| Less: noncash interest expense related to acquired debt | (900 | ) | | (840 | ) |

| Interest expense included in Core FFO attributable to common share and unit holders | 28,401 |

| | 31,049 |

|

| Less: amortization of discount, loan costs and cash flow hedge | (1,815 | ) | | (2,562 | ) |

| Add: capitalized interest | 2,436 |

| | 603 |

|

| Cash interest | $ | 29,022 |

| | $ | 29,090 |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 16

|

Capital Structure as of March 31, 2018

(Amounts in thousands, except share and per share data)

Total Capitalization

|

| | | | | | | | | | | |

| Total Debt | | | | $ | 2,871,649 |

| | 26.9 | % |

| | | | | | | |

| Total preferred shares at liquidation value | | | | 987,988 |

| | 9.2 | % |

| | | | | | | |

| Common equity at market value: | | | | | | |

| Common shares outstanding | | 285,004,736 |

| | | | |

| Operating partnership units | | 55,350,153 |

| | | | |

| Total shares and units | | 340,354,889 |

| | | | |

| NYSE AMH Class A common share closing price at March 31, 2018 | | $ | 20.08 |

| | | | |

| Market value of common shares and operating partnership units | | | | 6,834,326 |

| | 63.9 | % |

| | | | | | | |

| Total Market Capitalization | | | | $ | 10,693,963 |

| | 100.0 | % |

Preferred Shares

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Earliest Redemption Date | | Outstanding Shares | | Liquidation Value (1) | | Annual Dividend

Per Share | | Annual Dividend

Amount |

| Series | | | | Per Share | | Total | | |

| 5.500% Series C Participating Preferred Shares (2) | | 3/31/2018 | | 7,600,000 |

| | $ | 28.85 |

| | $ | 219,238 |

| | $ | 1.375 |

| | $ | 10,450 |

|

| 6.500% Series D Perpetual Preferred Shares | | 5/24/2021 | | 10,750,000 |

| | $ | 25.00 |

| | 268,750 |

| | $ | 1.625 |

| | 17,469 |

|

| 6.350% Series E Perpetual Preferred Shares | | 6/29/2021 | | 9,200,000 |

| | $ | 25.00 |

| | 230,000 |

| | $ | 1.588 |

| | 14,605 |

|

| 5.875% Series F Perpetual Preferred Shares | | 4/24/2022 | | 6,200,000 |

| | $ | 25.00 |

| | 155,000 |

| | $ | 1.469 |

| | 9,106 |

|

| 5.875% Series G Perpetual Preferred Shares | | 7/17/2022 | | 4,600,000 |

| | $ | 25.00 |

| | 115,000 |

| | $ | 1.469 |

| | 6,756 |

|

| Total preferred shares at liquidation value | | | | 38,350,000 |

| | | | $ | 987,988 |

| | | | $ | 58,386 |

|

| |

| (1) | Liquidation value for the Series C participating preferred shares reflects initial liquidation value of $25.00 per share, adjusted by most recent quarterly HPA adjustment calculation, which is made available under the “For Investors” page of the Company’s website. |

| |

| (2) | All of the outstanding Series C participating preferred shares were converted into 10,848,827 Class A common shares on April 5, 2018, based on a conversion ratio of 1.4275 common shares per preferred share in accordance with the conversion terms in the Articles Supplementary. |

|

| | | | | | | | |

| Credit Ratios | | | Credit Ratings | | | | |

| | | | | | | | |

| Net Debt to Adjusted EBITDA | 5.1 x |

| | Rating Agency | | Rating | | Outlook |

| Debt and Preferred Shares to Adjusted EBITDA | 7.6 x |

| | Moody's Investor Service | | Baa3 | | Stable |

| Fixed Charge Coverage | 3.0 x |

| | S&P Global Ratings | | BBB- | | Stable |

| Unencumbered Core NOI percentage | 63.4 | % | | | | | | |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 17

|

Top 20 Markets Summary as of March 31, 2018

Property Information (1)

|

| | | | | | | | | | | | | | |

| Market | | Number of

Properties | | Percentage

of Total

Properties | | Gross Book

Value per

Property | | Avg.

Sq. Ft. | | Avg. Age

(years) |

| Atlanta, GA | | 4,631 | | 9.3 | % | | $ | 170,752 |

| | 2,144 |

| | 16.4 |

| Dallas-Fort Worth, TX | | 4,307 | | 8.6 | % | | 162,597 |

| | 2,118 |

| | 14.3 |

| Charlotte, NC | | 3,476 | | 7.0 | % | | 186,644 |

| | 2,079 |

| | 14.5 |

| Houston, TX | | 3,122 | | 6.3 | % | | 160,639 |

| | 2,106 |

| | 12.3 |

| Phoenix, AZ | | 2,920 | | 5.8 | % | | 166,487 |

| | 1,824 |

| | 15.1 |

| Indianapolis, IN | | 2,892 | | 5.8 | % | | 151,607 |

| | 1,933 |

| | 15.5 |

| Nashville, TN | | 2,613 | | 5.2 | % | | 205,287 |

| | 2,115 |

| | 13.8 |

| Jacksonville, FL | | 2,047 | | 4.1 | % | | 166,555 |

| | 1,936 |

| | 13.6 |

| Tampa, FL | | 2,047 | | 4.1 | % | | 191,628 |

| | 1,945 |

| | 14.1 |

| Raleigh, NC | | 2,018 | | 4.0 | % | | 182,427 |

| | 1,880 |

| | 13.3 |

| Cincinnati, OH | | 1,992 | | 4.0 | % | | 173,265 |

| | 1,853 |

| | 15.7 |

| Columbus, OH | | 1,978 | | 4.0 | % | | 167,819 |

| | 1,867 |

| | 16.4 |

| Greater Chicago area, IL and IN | | 1,881 | | 3.8 | % | | 180,935 |

| | 1,880 |

| | 16.6 |

| Orlando, FL | | 1,661 | | 3.3 | % | | 174,729 |

| | 1,885 |

| | 16.8 |

| Salt Lake City, UT | | 1,292 | | 2.6 | % | | 234,497 |

| | 2,165 |

| | 16.8 |

| Las Vegas, NV | | 1,022 | | 2.0 | % | | 175,294 |

| | 1,840 |

| | 15.2 |

| San Antonio, TX | | 1,015 | | 2.0 | % | | 157,356 |

| | 2,013 |

| | 14.6 |

| Charleston, SC | | 1,001 | | 2.0 | % | | 190,402 |

| | 1,942 |

| | 11.8 |

| Savannah/Hilton Head, SC | | 816 | | 1.6 | % | | 175,411 |

| | 1,843 |

| | 11.6 |

| Winston Salem, NC | | 787 | | 1.6 | % | | 151,730 |

| | 1,741 |

| | 14.3 |

| All Other (4) | | 6,430 | | 12.9 | % | | 194,383 |

| | 1,906 |

| | 13.9 |

| Total / Average | | 49,948 | | 100.0 | % | | $ | 177,304 |

| | 1,980 |

| | 14.7 |

Leasing Information (1)

|

| | | | | | | | | | | | | | | | | | | |

| Market | | Leased

Percentage (2) | | Avg. Occupied Days

Percentage (3) | | Avg. Monthly Realized Rent

per property (3) | | Avg. Change in Rent for Renewals (3) | | Avg. Change in Rent for Re-Leases (3) | | Avg. Blended Change in

Rent (3) |

| Atlanta, GA | | 94.3 | % | | 90.7 | % | | $ | 1,488 |

| | 4.7 | % | | 5.8 | % | | 5.1 | % |

| Dallas-Fort Worth, TX | | 96.9 | % | | 93.6 | % | | 1,677 |

| | 4.1 | % | | 3.3 | % | | 3.8 | % |

| Charlotte, NC | | 95.1 | % | | 87.9 | % | | 1,527 |

| | 3.4 | % | | 0.5 | % | | 2.2 | % |

| Houston, TX | | 92.5 | % | | 90.2 | % | | 1,586 |

| | 2.4 | % | | 3.1 | % | | 2.6 | % |

| Phoenix, AZ | | 97.1 | % | | 93.5 | % | | 1,283 |

| | 5.6 | % | | 7.7 | % | | 6.4 | % |

| Indianapolis, IN | | 96.8 | % | | 94.5 | % | | 1,359 |

| | 3.7 | % | | 2.7 | % | | 3.4 | % |

| Nashville, TN | | 95.4 | % | | 91.6 | % | | 1,679 |

| | 3.6 | % | | 1.0 | % | | 2.6 | % |

| Jacksonville, FL | | 96.7 | % | | 91.5 | % | | 1,487 |

| | 3.8 | % | | 5.8 | % | | 4.6 | % |

| Tampa, FL | | 96.7 | % | | 92.6 | % | | 1,650 |

| | 3.6 | % | | 2.2 | % | | 2.9 | % |

| Raleigh, NC | | 95.0 | % | | 89.9 | % | | 1,474 |

| | 3.3 | % | | 2.6 | % | | 3.0 | % |

| Cincinnati, OH | | 96.7 | % | | 94.2 | % | | 1,536 |

| | 3.6 | % | | 2.7 | % | | 3.3 | % |

| Columbus, OH | | 95.2 | % | | 86.9 | % | | 1,551 |

| | 4.3 | % | | 2.0 | % | | 3.3 | % |

| Greater Chicago area, IL and IN | | 98.5 | % | | 96.2 | % | | 1,788 |

| | 3.3 | % | | 4.1 | % | | 3.5 | % |

| Orlando, FL | | 97.1 | % | | 94.1 | % | | 1,570 |

| | 4.3 | % | | 6.5 | % | | 5.2 | % |

| Salt Lake City, UT | | 86.7 | % | | 80.4 | % | | 1,646 |

| | 4.7 | % | | 6.5 | % | | 5.7 | % |

| Las Vegas, NV | | 98.4 | % | | 96.6 | % | | 1,458 |

| | 4.8 | % | | 5.3 | % | | 5.0 | % |

| San Antonio, TX | | 96.9 | % | | 93.7 | % | | 1,489 |

| | 3.3 | % | | 2.0 | % | | 2.7 | % |

| Charleston, SC | | 90.0 | % | | 85.0 | % | | 1,607 |

| | 3.2 | % | | 1.3 | % | | 2.4 | % |

| Savannah/Hilton Head, SC | | 93.6 | % | | 87.1 | % | | 1,482 |

| | 3.1 | % | | 2.7 | % | | 2.9 | % |

| Winston Salem, NC | | 97.3 | % | | 93.5 | % | | 1,286 |

| | 3.5 | % | | 3.2 | % | | 3.4 | % |

| All Other (4) | | 95.2 | % | | 91.4 | % | | 1,602 |

| | 4.1 | % | | 3.6 | % | | 3.9 | % |

| Total / Average | | 95.5 | % | | 91.4 | % | | $ | 1,545 |

| | 3.9 | % | | 3.6 | % | | 3.7 | % |

| |

| (1) | Property and leasing information excludes properties to be disposed. |

| |

| (2) | Reflected as of period end. |

| |

| (3) | Reflected for the three months ended March 31, 2018. |

| |

| (4) | Represents 18 markets in 15 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 18

|

Leasing Performance

|

| | | | | | | | | | | | | | | |

| | | 1Q18 | | 4Q17 | | 3Q17 | | 2Q17 | | 1Q17 |

| Average Change in Rent for Renewals | | 3.9 | % | | 4.2 | % | | 3.6 | % | | 3.2 | % | | 3.1 | % |

| Average Change in Rent for Re-leases | | 3.6 | % | | 1.6 | % | | 4.9 | % | | 6.1 | % | | 4.0 | % |

| Average Blended Change in Rent | | 3.7 | % | | 3.0 | % | | 4.1 | % | | 4.4 | % | | 3.5 | % |

Scheduled Lease Expirations

|

| | | | | | | | | | | | |

| | | MTM | | 2Q18 | | 3Q18 | | 4Q18 | | 1Q19 | | Thereafter |

| Lease expirations | | 2,133 | | 11,912 | | 11,537 | | 7,849 | | 11,684 | | 2,562 |

Top 20 Markets Home Price Appreciation Trends

The table below summarizes historic changes in the House Price Index of the Federal Housing Finance Agency (“FHFA”), known as the Quarterly Purchase-Only Index, specifically the non-seasonally adjusted “Purchase-Only Index” for the “100 Largest Metropolitan Statistical Areas”, which was used for purposes of computing the “HPA Factor” for our 5.5% Series C participating preferred shares as described in the prospectus for those securities.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | HPA Index (1) | | HPA Index Change |

| Market | | Dec 31,

2012 | | Dec 31,

2013 | | Dec 31,

2014 | | Dec 31,

2015 | | Dec 31,

2016 | | Mar 31,

2017 | | Jun 30,

2017 | | Sep 30,

2017 | | Dec 31,

2017 | |

| Dallas-Fort Worth, TX (2) | | 100.0 |

| | 108.4 |

| | 115.2 |

| | 127.6 |

| | 140.1 |

| | 143.4 |

| | 150.0 |

| | 152.4 |

| | 153.7 |

| | 53.7 | % |

| Indianapolis, IN | | 100.0 |

| | 106.4 |

| | 112.3 |

| | 117.8 |

| | 124.5 |

| | 123.4 |

| | 131.5 |

| | 132.6 |

| | 134.2 |

| | 34.2 | % |

| Atlanta, GA | | 100.0 |

| | 114.2 |

| | 122.3 |

| | 132.0 |

| | 143.0 |

| | 144.4 |

| | 152.3 |

| | 153.8 |

| | 152.6 |

| | 52.6 | % |

| Charlotte, NC | | 100.0 |

| | 113.4 |

| | 118.8 |

| | 126.8 |

| | 136.6 |

| | 142.4 |

| | 144.0 |

| | 144.4 |

| | 148.2 |

| | 48.2 | % |

| Greater Chicago area, IL and IN | | 100.0 |

| | 111.0 |

| | 115.1 |

| | 118.8 |

| | 126.3 |

| | 125.9 |

| | 129.9 |

| | 131.1 |

| | 130.5 |

| | 30.5 | % |

| Houston, TX | | 100.0 |

| | 110.8 |

| | 123.1 |

| | 130.1 |

| | 133.0 |

| | 132.7 |

| | 133.6 |

| | 133.9 |

| | 137.0 |

| | 37.0 | % |

| Cincinnati, OH | | 100.0 |

| | 104.9 |

| | 111.2 |

| | 115.7 |

| | 121.4 |

| | 121.0 |

| | 126.8 |

| | 129.6 |

| | 128.3 |

| | 28.3 | % |

| Tampa, FL | | 100.0 |

| | 113.0 |

| | 121.1 |

| | 132.3 |

| | 149.1 |

| | 149.9 |

| | 158.1 |

| | 158.6 |

| | 160.4 |

| | 60.4 | % |

| Jacksonville, FL | | 100.0 |

| | 114.2 |

| | 121.7 |

| | 127.7 |

| | 142.3 |

| | 147.8 |

| | 148.2 |

| | 154.0 |

| | 150.6 |

| | 50.6 | % |

| Nashville, TN | | 100.0 |

| | 111.0 |

| | 117.4 |

| | 131.1 |

| | 141.1 |

| | 145.9 |

| | 151.5 |

| | 151.7 |

| | 156.6 |

| | 56.6 | % |

| Raleigh, NC | | 100.0 |

| | 106.7 |

| | 111.6 |

| | 120.0 |

| | 130.8 |

| | 132.1 |

| | 137.9 |

| | 135.0 |

| | 135.8 |

| | 35.8 | % |

| Phoenix, AZ | | 100.0 |

| | 118.0 |

| | 123.3 |

| | 135.9 |

| | 146.1 |

| | 147.6 |

| | 151.8 |

| | 155.6 |

| | 157.2 |

| | 57.2 | % |

| Columbus, OH | | 100.0 |

| | 108.9 |

| | 114.5 |

| | 120.8 |

| | 131.5 |

| | 127.5 |

| | 138.8 |

| | 141.4 |

| | 141.8 |

| | 41.8 | % |

| Salt Lake City, UT | | 100.0 |

| | 109.4 |

| | 114.5 |

| | 123.2 |

| | 133.0 |

| | 138.3 |

| | 142.1 |

| | 145.3 |

| | 146.5 |

| | 46.5 | % |

| Orlando, FL | | 100.0 |

| | 110.3 |

| | 123.5 |

| | 135.4 |

| | 144.9 |

| | 149.8 |

| | 154.4 |

| | 155.4 |

| | 158.9 |

| | 58.9 | % |

| Las Vegas, NV | | 100.0 |

| | 125.1 |

| | 141.3 |

| | 149.0 |

| | 161.5 |

| | 164.3 |

| | 170.3 |

| | 177.1 |

| | 182.0 |

| | 82.0 | % |

| San Antonio, TX | | 100.0 |

| | 101.1 |

| | 108.0 |

| | 113.9 |

| | 124.7 |

| | 127.2 |

| | 133.6 |

| | 131.8 |

| | 133.8 |

| | 33.8 | % |

| Denver, CO | | 100.0 |

| | 111.0 |

| | 121.5 |

| | 136.5 |

| | 149.9 |

| | 156.7 |

| | 162.9 |

| | 163.3 |

| | 165.5 |

| | 65.5 | % |

| Austin, TX | | 100.0 |

| | 110.1 |

| | 122.2 |

| | 133.9 |

| | 145.7 |

| | 145.8 |

| | 153.1 |

| | 154.0 |

| | 153.2 |

| | 53.2 | % |

| Greenville, SC | | 100.0 |

| | 104.1 |

| | 110.8 |

| | 117.8 |

| | 127.6 |

| | 126.9 |

| | 129.6 |

| | 134.2 |

| | 134.9 |

| | 34.9 | % |

| Average | | | | | | | | | | | | | | | | | | | | 48.1 | % |

| |

| (1) | Updates to the Quarterly Purchase-Only Index are released by the FHFA on approximately the 20th day of the second month following quarter-end. Accordingly, information in the above table has been presented through December 31, 2017. For the illustrative purposes of this table, the HPA Index has been indexed as of December 31, 2012, and, as such, HPA Index values presented are relative measures calculated in relation to the baseline index value of 100.0 as of December 31, 2012. |

| |

| (2) | Our Dallas-Fort Worth, TX market is comprised of the Dallas-Plano-Irving and Fort Worth-Arlington Metropolitan Divisions. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 19

|

Disposition Summary

(Amounts in thousands, except property data)

|

| | | | | | | | | | | | | | | | |

| | | Single-Family Properties (1) | | Single-Family Properties Sold 1Q18 |

| Market | | Held for Sale | | Identified for Future Sale | | Total Disposition Program | | Number

of Properties | | Net Proceeds |

| Oklahoma City, OK | | 25 |

| | 384 |

| | 409 |

| | — |

| | $ | — |

|

| Corpus Christi, TX | | 240 |

| | — |

| | 240 |

| | — |

| | — |

|

| Greater Chicago area, IL and IN | | 228 |

| | 9 |

| | 237 |

| | 64 |

| | 3,681 |

|

| Augusta, GA | | 191 |

| | 17 |

| | 208 |

| | — |

| | — |

|

| Central Valley, CA | | 168 |

| | 20 |

| | 188 |

| | 9 |

| | 1,900 |

|

| Columbia, SC | | 78 |

| | 79 |

| | 157 |

| | — |

| | — |

|

| Austin, TX | | 69 |

| | 22 |

| | 91 |

| | — |

| | — |

|

| Dallas-Fort Worth, TX | | 52 |

| | 3 |

| | 55 |

| | 3 |

| | 515 |

|

| Raleigh, NC | | 45 |

| | — |

| | 45 |

| | 2 |

| | 170 |

|

| Inland Empire, CA | | 44 |

| | — |

| | 44 |

| | 3 |

| | 683 |

|

| Houston, TX | | 31 |

| | 9 |

| | 40 |

| | — |

| | — |

|

| Atlanta, GA | | 28 |

| | 2 |

| | 30 |

| | 3 |

| | 479 |

|

| Miami, FL | | 18 |

| | 10 |

| | 28 |

| | 5 |

| | 1,486 |

|

| Tampa, FL | | 12 |

| | 1 |

| | 13 |

| | — |

| | — |

|

| Nashville, TN | | 11 |

| | — |

| | 11 |

| | 2 |

| | 429 |

|

| Columbus, OH | | 7 |

| | 3 |

| | 10 |

| | — |

| | — |

|

| San Antonio, TX | | 7 |

| | 2 |

| | 9 |

| | 1 |

| | 136 |

|

| Orlando, FL | | 7 |

| | 1 |

| | 8 |

| | 2 |

| | 335 |

|

| Phoenix, AZ | | 7 |

| | — |

| | 7 |

| | 2 |

| | 336 |

|

| Milwaukee, WI | | 7 |

| | — |

| | 7 |

| | — |

| | — |

|

| All Other (2) | | 43 |

| | 12 |

| | 55 |

| | 7 |

| | 1,317 |

|

| Total | | 1,318 |

| | 574 |

| | 1,892 |

| | 103 |

| | $ | 11,467 |

|

| |

| (2) | Represents 15 markets in 12 states. |

Share Repurchase and ATM Share Issuance History

(Amounts in thousands, except share and per share data)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Share Repurchases | | ATM Share Issuances |

| Quarterly Period | | Common Shares Repurchased | | Purchase Price | | Avg. Price Paid Per Share | | Common Shares Issued | | Gross Proceeds | | Avg. Issuance Price Per Share |

| 1Q17 | | — |

| | $ | — |

| | $ | — |

| | 629,532 |

| | $ | 14,304 |

| | $ | 22.72 |

|

| 2Q17 | | — |

| | — |

| | — |

| | 222,073 |

| | 5,066 |

| | 22.81 |

|

| 3Q17 | | — |

| | — |

| | — |

| | 1,181,493 |

| | 26,855 |

| | 22.73 |

|

| 4Q17 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| 1Q18 | | 1,804,163 |

| | 34,933 |

| | 19.36 |

| | — |

| | — |

| | — |

|

| Total | | 1,804,163 |

| | $ | 34,933 |

| | $ | 19.36 |

| | 2,033,098 |

| | $ | 46,225 |

| | $ | 22.74 |

|

| | | | | | | | | | | | | |

| | | Remaining authorization: |

| | $ | 265,067 |

| | | | Remaining authorization: |

| | $ | 500,000 |

| | |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 20

|

2018 Outlook |

| | |

| | | Full Year 2018 |

| Same-Home | | |

| Average Occupied Days Percentage | | 94.5% - 95.5% |

| Core revenues growth | | 3.5% - 4.5% |

| Core property operating expenses growth | | 4.0% - 5.0% |

| Core NOI After Capital Expenditures growth | | 3.0% - 4.0% |

| Core NOI margin | | 64.0% - 65.0% |

| Property tax expense growth | | 3.5% - 4.5% |

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures per property | | $1,950 - $2,100 |

| | | |

| Property Enhancing Capex | | $8 - $12 million |

| | | |

| General and administrative expense, excluding noncash share-based compensation | | $33.5 - $35.5 million |

| | | |

| Acquisition volume | | $400 - $600 million |