As filed with the Securities and Exchange Commission on February 8, 2013

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Cerberus Mortgage Capital, Inc.

(Exact name of registrant as specified in its governing instruments)

Cerberus Mortgage Capital, Inc.

c/o Cerberus Capital Management, L.P.

875 Third Avenue, 11th Floor

New York, New York 10022

(212) 891-2100

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices)

Jonathan A. Sebiri

c/o Cerberus Capital Management, L.P.

875 Third Avenue, 11th Floor

New York, New York 10022

(212) 891-2100

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

| Peter H. Ehrenberg, Esq. Michael J. Reinhardt, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas, 18th Floor New York, NY 10020 Tel (212) 262-6700 Fax (212) 262-7402 | Jay L. Bernstein, Esq. Andrew S. Epstein, Esq. Clifford Chance US LLP 31 West 52nd Street New York, NY 10019 Tel (212) 878-8000 Fax (212) 878-8375 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this registration statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1)(2) | Amount of registration fee | ||

|---|---|---|---|---|

Common Stock, par value $0.001 per share | $150,000,000 | $20,460 | ||

| ||||

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes the offering price of common stock that may be purchased upon the exercise of the over-allotment option. See "Underwriting."

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 8, 2013

PRELIMINARY PROSPECTUS

Shares

CERBERUS MORTGAGE CAPITAL, INC.

Common Stock

Cerberus Mortgage Capital, Inc. is a newly-organized Maryland corporation formed primarily to invest in, finance and manage a diversified portfolio of residential mortgage assets consisting of Agency and non-Agency residential mortgage-backed securities and other real estate-related assets. We will be externally managed and advised by Cerberus REIT Advisor LLC, or our Manager, a recently formed affiliate of Cerberus Capital Management, L.P., an investment adviser registered with the Securities and Exchange Commission.

This is our initial public offering and no public market currently exists for our common stock. We are offering shares of our common stock, par value $0.001 per share, as described in this prospectus. We expect the initial public offering price of our common stock to be $ per share. We intend to apply to list our common stock on the New York Stock Exchange under the symbol " ."

Concurrent with the closing of this offering, we will complete a private placement in which we expect to sell an aggregate of shares of our common stock to an affiliate of our Manager for $ per share. No placement agent fee or underwriting discount or commission will be payable by us with respect to any of the shares sold in this private placement.

We intend to elect and qualify to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes, commencing with our taxable year ending December 31, 2013. To assist us in qualifying as a REIT, stockholders are generally restricted from owning more than 9.8%, by value or number of shares, whichever is more restrictive, of our outstanding shares of common stock or capital stock. Our charter contains various other restrictions on the ownership and transfer of our common stock. See "Description of Capital Stock—Restrictions on Ownership and Transfer."

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 26 of this prospectus for a discussion of the following and other risks:

- •

- We have no operating history and may not be able to successfully operate our business, find suitable investments or generate sufficient revenue to make or sustain distributions to our stockholders.

- •

- Changes in interest rates may adversely affect the results of our operations and our financial position.

- •

- We intend to leverage our portfolio investments in our target assets, which may adversely affect our return on our investments and may reduce cash available for distributions to our stockholders.

- •

- We may change our target assets, financing strategy, investment guidelines and other operational policies without stockholder consent, which may adversely affect the market price of our common stock and our ability to make distributions to our stockholders.

- •

- Members of our management team have competing duties to Cerberus Capital Management, L.P. and certain of its affiliated entities, which could pose conflicts of interest that may result in decisions that are not in the best interests of our stockholders.

- •

- The termination of the management agreement, including the non-renewal of the agreement, may be difficult and costly, which may adversely affect our inclination to end our relationship with our Manager.

- •

- If we fail to qualify as a REIT, we will be subject to U.S. federal income tax as a regular corporation.

- •

- Maintenance of our exemption from registration under the Investment Company Act of 1940, as amended, and our qualification as a REIT impose limits on our operations.

| | Per Share | Total | ||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount(1) | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ |

- (1)

- Our Manager has agreed to pay the underwriters $ per share with respect to each share sold in this offering, representing the full underwriting discount payable with respect to the shares sold in this offering.

The underwriters may also purchase up to an additional shares of our common stock from us at the initial public offering price, less the underwriting discount, within 30 days after the date of this prospectus solely to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of common stock sold in this offering will be ready for delivery on or about , 2013.

Joint Book-Running Managers

| Citigroup | Deutsche Bank Securities | Wells Fargo Securities |

| Sandler O'Neill + Partners, L.P. | Maxim Group LLC | Nomura |

The date of this prospectus is , 2013.

TABLE OF CONTENTS

Glossary | ii | |

Prospectus Summary | 1 | |

The Offering | 24 | |

Risk Factors | 26 | |

Forward-Looking Statements | 88 | |

Use of Proceeds | 90 | |

Distribution Policy | 91 | |

Capitalization | 93 | |

Selected Financial Information | 94 | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | 95 | |

Business | 114 | |

Management | 131 | |

Our Manager and the Management Agreement | 145 | |

Principal Stockholders | 157 | |

Certain Relationships and Related Transactions | 159 | |

Description of Capital Stock | 163 | |

Shares Eligible for Future Sale | 169 | |

Certain Provisions of the Maryland General Corporation Law and Our Charter and Bylaws | 171 | |

U.S. Federal Income Tax Considerations | 175 | |

Underwriting | 199 | |

Legal Matters | 205 | |

Experts | 205 | |

Where You Can Find More Information | 205 | |

Index to Financial Statements | F-1 |

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or information to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus and any free writing prospectus is accurate only as of their respective dates, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

i

"ABS" means an asset-backed security.

"Agency" means a U.S. Government agency, such as Ginnie Mae, or a federally chartered corporation, such as Fannie Mae or Freddie Mac, which guarantees payments of principal and interest on RMBS.

"Agency certificates" mean Ginnie Mae, Fannie Mae or Freddie Mac certificates.

"Agency RMBS" mean U.S. Government agency RMBS, which are mortgage pass-through certificates backed by pools of residential mortgage loans issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac. Our Agency RMBS may also consist of Agency CMOs, which are securities that are structured by an Agency backed by mortgage pass-through certificates.

"Alt-A mortgage loans" mean residential mortgage loans made to borrowers whose qualifying mortgage characteristics do not conform to Agency underwriting guidelines. Generally, Alt-A mortgage loans allow homeowners to qualify for a mortgage loan with reduced or alternate forms of documentation.

"ARMs" mean adjustable-rate residential mortgage loans.

"CMOs" mean collateralized mortgage obligations.

"credit default swap"means a swap in which two parties select a reference asset, which may or may not be owned by either party, and one party receives payments from the other on a predetermined fixed or variable interest rate while the other party receives payments that are predicated upon certain credit events, which may include the bankruptcy of the obligor of a reference asset, the failure to pay principal or interest, or the acceleration of an obligation requiring payment prior to scheduled maturity.

"Fannie Mae" means the U.S. Federal National Mortgage Association.

"FHA" means the U.S. Federal Housing Administration.

"FHFA" means the U.S. Federal Housing Finance Agency. The FHFA was created on July 30, 2008, when the President of the United States signed into law the Housing and Economic Recovery Act of 2008.

"forward sales"means an agreement to buy or sell an asset at a specified price with the transfer of the asset and payment in the future.

"Freddie Mac" means the U.S. Federal Home Loan Mortgage Corporation.

"FRMs" mean fixed-rate residential mortgage loans.

"Ginnie Mae" means the U.S. Government National Mortgage Association, a wholly-owned corporate instrumentality of the United States of America within the U.S. Department of Housing and Urban Development.

"GSE" means a U.S. Government-sponsored entity, such as Fannie Mae or Freddie Mac.

"HAMP" means the Home Affordable Modification Program, a U.S. federal program that provides homeowners with assistance in avoiding residential mortgage loan foreclosures through loan modifications.

"HARP" means the Home Affordable Refinance Program, a U.S. federal program that allows certain borrowers with Agency mortgages originated prior to June 1, 2009 to refinance their mortgages despite being unable to obtain traditional refinancing because the value of their homes has declined.

ii

"hedging instrument"means a financial instrument whose value or cash flow changes in response to the fair value of cash flow of a designated item, such as an interest rate or a currency exchange rate.

"hybrid ARMs" mean residential mortgage loans that have interest rates that are fixed for a specified period of time (typically three, five, seven or ten years) and, thereafter, adjust to an increment over a specified interest rate index.

"H4H" means the Hope for Homeowners Program, a U.S. federal program that allows certain distressed homeowners to refinance their mortgages into FHA-insured loans.

"interest rate cap"means a derivative that allows a party to hedge against rising interest rates. A party effects the hedge by entering into a contract under which it pays certain premiums on a notional dollar amount and, in exchange, when interest rates rise above certain targets, that party receives payments on the notional amount in respect of the higher interest rates.

"interest rate corridor"means a combination of interest rate caps, often of a duration of one to three years, which allows a party to hedge against the risk of interest rates rising within a certain range. A party hedges this risk by purchasing an interest rate cap at a specified interest rate and selling an interest rate cap with a higher interest rate. To the extent that interest rates rise within the range between the lower and higher interest rates, the party is hedged against that rise in interest rates.

"interest rate floor"means a derivative that allows a party to hedge against falling interest rates. A party effects the hedge by entering into a contract under which it pays certain premiums on a notional dollar amount and, in exchange, when interest rates fall below certain targets, that party receives payments on the notional amount in respect of the lower interest rates.

"interest rate sensitivity"means the measurement of changes in the valuation of an asset based on changes in certain interest rates.

"interest rate swap"means a derivative that allows a party to transfer cash flows from one interest rate to another party.

"jumbo mortgage loans" mean residential mortgage loans with an original principal balance in excess of the maximum amount permitted by the Agency underwriting guidelines.

"Markit IOS" is a synthetic total return swap index that references the interest component of 30-year fixed-rate Fannie Mae residential mortgage pools.

"Markit PrimeX" is a synthetic credit default swap index that tracks non-Agency prime U.S. RMBS.

"MBS" mean mortgage-backed securities.

"MHA®" is the Making Home Affordable program of the U.S. Department of the Treasury and the U.S. Department of Housing and Urban Development. MHA® is intended to help homeowners avoid foreclosure, stabilize the U.S. housing market, and improve the nation's economy. Both HAMP and HARP are programs under the MHA program.

"monoline insurance company"means an insurance company that provides insurance on bonds against the risk of loss associated with the failure of those bonds to pay principal and/or interest.

"mortgage loans" mean loans secured by real estate with a right to receive the payment of principal and interest on the loan (including servicing fees).

"mortgage servicing rights" or"MSRs" are rights to receive a portion of the servicing and other fees collected by servicers of mortgage loans.

iii

"non-Agency RMBS" mean RMBS that are not issued or guaranteed by an Agency, including investment grade (AAA through BBB rated) and non-investment grade (BB rated through unrated) classes.

"prime mortgage loans" mean residential mortgage loans that generally conform to Agency underwriting guidelines but do not carry any credit guarantee from either a U.S. Government agency or a GSE.

"RMBS" mean residential mortgage-backed securities.

"SBA" means the Small Business Administration.

"SIFMA" means the Securities Industry and Financial Markets Association.

"stripped security"means a security that represents the right to receive payments of principal or interest, but not both.

"swaption"means a financial instrument in which the owner of the instrument is given the option, but not the obligation, to enter into a specified swap.

"synthetic credit default swap"means a credit default swap in which neither party owns the reference asset.

"synthetic total return swap"means a total return swap in which neither party owns the reference asset.

"TBAs" mean forward-settling Agency RMBS where the pool is "to-be-announced." In a TBA, a buyer will agree to purchase, for future delivery, Agency RMBS with certain principal and interest terms and certain types of underlying collateral, but the particular Agency RMBS to be delivered is not identified until shortly before the TBA settlement date.

"total return swap"means a swap in which two parties select a reference asset, which may or may not be owned by either party, and one party receives payments from the other party on a predetermined fixed or variable interest rate while the other party receives payments from the first party based upon the economic performance of the reference asset.

iv

This summary highlights some of the information in this prospectus. It does not contain all of the information that you should consider before investing in our common stock. You should read carefully the more detailed information set forth under "Risk Factors" and the other information included in this prospectus. Except where the context suggests otherwise (1) the terms "Company," "we," "us," and "our" refer to Cerberus Mortgage Capital, Inc., a Maryland corporation, together with its consolidated subsidiaries; (2) the term "Manager" refers to Cerberus REIT Advisor LLC, a Delaware limited liability company, our external manager; (3) the term "CCM" refers to Cerberus Capital Management, L.P., a Delaware limited partnership; (4) the term "Cerberus" refers to CCM and the funds and accounts affiliated with CCM; and (5) the term "Cerberus RMBS Fund" refers to the Cerberus RMBS Opportunities Fund, L.P., a Delaware limited partnership. Unless indicated otherwise, the information in this prospectus assumes (i) the sale of common stock in this offering at a price of $ per share, (ii) the sale in a concurrent private placement to an affiliate of our Manager of shares of our common stock at the initial public offering price per share without payment of any underwriting discount or commission or placement agent fee, (iii) no exercise by the underwriters of their overallotment option to purchase up to an additional shares of our common stock, and (iv) no payment by us of any underwriting discount in connection with this offering.

Our Company

Cerberus Mortgage Capital, Inc. is a newly-organized Maryland corporation formed primarily to invest in, finance and manage a diversified portfolio of residential mortgage assets consisting of Agency and non-Agency RMBS and other real estate-related assets. We also intend to pursue, both during the initial period following the closing of this offering and opportunistically over time, a broad range of investments in residential mortgage whole loans and other real estate-related assets, including securitized financial assets, mortgage servicing rights, excess mortgage servicing rights and residential housing for lease, which, together with RMBS, we refer to as our target assets. We will seek to employ a flexible and relative value focused investment strategy and expect to reallocate capital from time to time among our target assets.

Our objective is to provide attractive risk-adjusted returns to our stockholders by generating income and capital appreciation through our investment strategies. We intend to achieve this objective by selectively acquiring a diversified portfolio of residential mortgage and other real-estate related assets through a comprehensive selection process, utilizing in-house research, proprietary credit and prepayment models, internal structuring capabilities and portfolio optimization. We intend to focus on the relative values of securities and other assets within each of our target assets, emphasizing investments with current income and capital appreciation potential while targeting asymmetrical return profiles that also seek to minimize downside risk. We believe our investment strategy will provide an opportunity to generate returns that do not track the returns of broader traditional fixed income markets. Nonetheless, actual returns on our assets will vary from quarter to quarter depending upon the actual performance of our assets and may not be fixed in amount.

We expect to use borrowings as part of our strategy. Depending on market conditions and the availability of financing to us, we expect that our primary financing sources will be through repurchase agreements, warehouse facilities, securitizations and re-securitizations, bank credit facilities (including term loans and revolving facilities) and public and private issuances of equity and debt securities as well as transaction or asset specific funding arrangements. Initially, we expect to finance our Agency RMBS acquisitions with borrowings under a series of short-term repurchase agreements. We plan to utilize securitization techniques, including re-securitizations, to acquire permanent non-recourse financing for non-Agency RMBS when possible and appropriate to enhance our returns, isolate unwanted risks and reduce our reliance on short-term repurchase agreements. We believe that non-Agency RMBS are well suited as an asset class for using re-securitizations to capitalize on arbitrage opportunities relating to pricing and valuations and to acquire permanent non-recourse funding.

1

We intend to purchase RMBS throughout the capital structure, including not only the highest rated AAA/Aaa securities but also securities rated below investment grade or unrated securities.

We believe Agency RMBS remain an attractive asset class as investors continue to seek incremental spreads in a low yield environment. We believe that the non-Agency RMBS market is less efficient than the Agency RMBS market, due to the idiosyncratic features of the securities and the non-homogeneous nature of the underlying collateral, including prime, Alt-A and subprime mortgage loans. There is typically a greater degree of credit risk and price risk in the non-Agency RMBS market, which in turn provides opportunities for us. There are varying levels of credit quality in the underlying collateral, which we believe will enable us to pursue diverse pricing alternatives based on our analyses of credit risk, interest rate risk and collateral value. Non-Agency RMBS have unique bond structures, which permit differentiation based on a variety of factors, including shifting interest payment amounts, over-collateralization, default trigger events and delinquency levers. Because non-Agency RMBS generally are comprised of collateral that do not have a guarantee of timely payment of interest or ultimate payment of principal, there typically are greater opportunities to purchase non-Agency RMBS at a discount to face value, or par, thereby providing enhanced return opportunities as compared to Agency RMBS.

In addition to Agency RMBS and non-Agency RMBS, we anticipate that our capital will be deployed and re-deployed in other target assets, including residential mortgage whole loans that we may purchase on the secondary market or through mortgage origination companies. Subject to our receipt of any necessary approvals, we may enter into purchase agreements to acquire MSRs and excess MSRs on portfolios of mortgage loans. Our investment thesis will include potentially purchasing mortgage originators that may provide us opportunities to acquire whole loans, mortgage servicers that may provide us opportunities to purchase MSRs and excess MSRs and broker-dealers that may facilitate our structuring and selling assets into securitizations. In addition, we may purchase vacant or occupied single and multi-family properties for lease and, subject to maintaining our qualification as a REIT, enter into derivative financial instruments, including, among others, collateralized debt obligations, or CDOs, collateralized loan obligations, or CLOs, and contracts based on synthetic indices, such as the Markit PrimeX or Markit IOS indices.

We have not made any investments in our target assets as of the date of this prospectus. Other than forming our company, we will not commence operations until we have completed this offering and the concurrent private placement.

We intend to elect and qualify to be taxed as a REIT for U.S. federal income tax purposes, commencing with our taxable year ending December 31, 2013. We generally will not be subject to U.S. federal income tax on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders and maintain our intended qualification as a REIT. We also intend to operate our business in a manner that will permit us to maintain our exemption from registration under the Investment Company Act of 1940, as amended (the "1940 Act").

Our Manager

We will be externally managed and advised by Cerberus REIT Advisor LLC, our Manager, a recently formed affiliate of CCM, an investment adviser registered with the U.S. Securities and Exchange Commission, or SEC. Our Manager will be responsible for administering our business activities and day-to-day operations, subject to the supervision and direction of our board of directors.

CCM is a leading, global alternative investment platform focused on four investment strategies: (i) distressed private equity; (ii) distressed securities and assets (residential and commercial mortgages, corporate debt, non-performing loans and structured products); (iii) commercial lending; and (iv) distressed real estate. Established in 1992, CCM had more than $20 billion of assets under management as of September 30, 2012. CCM is headquartered in New York and also has affiliate

2

offices in Chicago, Los Angeles, London, Madrid, Amsterdam, Frankfurt, Baarn (Netherlands), Beijing, Tokyo and Taipei.

As of November 1, 2012, CCM had 130 dedicated investment professionals. As of that date, 26 of CCM's Senior Managing Directors and Managing Directors have been employed by or associated with CCM for more than 10 years. These investment professionals are intently focused on risk mitigation in each of CCM's four investment strategies and employ various approaches to help achieve attractive risk-adjusted returns for CCM's investors, including diversification of investments, conservative use of leverage and an emphasis on downside protection.

In 2008, CCM hired a team of dedicated investment professionals to take advantage of the dislocation in the U.S. RMBS market as the composition of the market shifted away from non-Agency RMBS and toward Agency RMBS due to illiquidity and inefficient pricing of non-Agency RMBS risk. CCM hired Joshua Weintraub, our Co-Chief Investment Officer, and Brendan Garvey, our other Co-Chief Investment Officer, to lead its residential mortgage trading efforts. In October 2012, CCM expanded our team, hiring Jonathan A. Sebiri, our President and Chief Executive Officer, and David A. Essex, our Chief Financial Officer. CCM's residential mortgage platform now consists of 16 dedicated investment professionals with extensive mortgage expertise.

Cerberus invests throughout the residential mortgage market in search of superior risk-adjusted returns across various types of asset classes, including loans, securities, derivatives and structured products. The Cerberus RMBS Fund, which had approximately $1.5 billion in net asset value as of September 30, 2012, was formed in August 2011 as a dedicated fund focused on investments in RMBS and other residential mortgage-related assets. From inception through September 30, 2012, the Cerberus RMBS Fund has generated gross and net returns of 24.46% and 18.86%, respectively. See "Our Manager and the Management Agreement—Historical Performance of CCM."

Messrs. Sebiri, Weintraub and Garvey will, along with the rest of CCM's residential mortgage team, be primarily responsible for the management of our assets. They will be supported by an Investment Committee that includes CCM's founder, Stephen A. Feinberg. The CCM residential mortgage team has extensive and complementary expertise in security selection, credit analytics and building proprietary risk and evaluation systems, which will benefit us as we seek to achieve our investment objectives. We will have the benefit of CCM's larger organization, which invests across various asset classes outside of the residential mortgage market, to help provide a broad-based framework and support for key themes impacting the financial markets. The daily interaction with CCM's investment professionals will enable us to draw on the expertise and experience of CCM's global platform and to benefit from a shared culture, process and set of investment approaches. In addition, our Manager will rely on CCM's integrated financial, legal, compliance and administrative functions to manage our day-to-day operations.

Mr. Sebiri is our President and Chief Executive Officer. He was recently hired by CCM as a managing director, with responsibility for raising funds to enable CCM to implement its residential mortgage strategies. Mr. Sebiri has 23 years of experience in the residential mortgage market. From 2009 until October 2012, he served as a managing director of Nomura Securities International, Inc., where he specialized in the sourcing and distribution of distressed mortgage assets and organized a securitized mortgage distribution team. From 1989 to 2009, Mr. Sebiri served in various positions, most recently as a managing director, with Lehman Brothers and, after Barclays Capital acquired Lehman Brothers' investment banking and capital markets businesses, from 2008 to 2009, with Barclays Capital. During that period, Mr. Sebiri's primary areas of focus were fixed income sales and trading and structured product distribution, including MBS, RMBS, whole loans and CLOs.

Mr. Weintraub is our Co-Chief Investment Officer. He joined CCM in 2008 and is currently the head of RMBS Securities and Trading and a Senior Managing Director at CCM. While at CCM, Mr. Weintraub served as Vice Chairman of Residential Capital from 2008 to 2009. Prior to joining CCM, he spent eight years, from 2000 to 2008, at Bear, Stearns & Co. From 2000 to 2007,

3

Mr. Weintraub headed the Agency CMO, Mortgage Derivative and Pass Through businesses, and, in 2008, he co-headed U.S. Residential Mortgage, ABS, and CDO trading. Prior to joining Bear Stearns, from 1999 to 2000, Mr. Weintraub managed Agency and non-Agency CMO and derivative trading at Greenwich Capital. From 1993 to 1999, Mr. Weintraub traded whole loans and Agency and non-Agency CMOs at Lehman Brothers. From 1991 to 1993, Mr. Weintraub participated in and graduated from the Management Development Program for Operations and Systems at Chase Manhattan Bank.

Mr. Garvey is our other Co-Chief Investment Officer and also serves as a RMBS portfolio manager and as a Senior Managing Director of CCM. Mr. Garvey has 17 years of experience in the residential mortgage market as a portfolio manager, product specific trader and business unit head. Mr. Garvey joined CCM in 2008 as a RMBS portfolio manager. From 1997 to 2008, Mr. Garvey held various trading and management positions within Lehman Brothers, where he focused, ultimately as a head mortgage trader managing risk and trading operations in Agency ARMs, FHA/Veteran's Administration re-performing loans, mortgage servicing, non-Agency hybrid, fixed-rate, negative-amortizing whole loans and securities, non-Agency subordinates, and non-Agency residuals. From 1994 to 1997, Mr. Garvey was a portfolio manager at Fischer Francis Trees & Watts where he managed pension fund money benchmarked to the mortgage index by actively trading and hedging single family RMBS and associated mortgage derivatives.

Our Competitive Advantages

We believe that our ability to implement our investment objectives and manage a diversified portfolio for sustained attractive risk-adjusted returns through our Manager will be enhanced by the following competitive advantages:

Experienced Management Team

The senior members of CCM's residential mortgage team have extensive and complementary experience investing in, financing, trading and managing residential mortgage-related and distressed assets. We believe that our Manager's deep understanding of RMBS market fundamentals, as well as its ability to analyze, model and set value parameters around the individual mortgages that collateralize Agency RMBS and non-Agency RMBS, will enable our Manager to selectively acquire assets with compelling relative value opportunities and asymmetrical risk and reward return profiles. We also expect to benefit from our Manager's relationship with CCM, its senior advisors such as former U.S. Secretary of the Treasury John W. Snow, former U.S. Vice President J. Danforth Quayle and Stephen A. Feinberg, and its affiliated portfolio companies. These relationships provide our Manager with insights into broader economic trends and factors that could influence the mortgage market, including borrower and consumer behavior, leading economic indicators, legislative actions and governmental programs.

Flexible Investment Strategy

Our Manager's investment mandate will remain flexible, which will enable us to adapt to shifts in economic, real estate and capital market conditions, and to exploit inefficiencies in the residential mortgage market as attractive investment opportunities arise. Consistent with this strategy, our investment decisions will depend on prevailing market conditions and may change over time in response to opportunities available in different economic and capital market conditions. We believe this approach will allow us to identify undervalued opportunities in all market cycles across our target assets.

Credit Risk Management Experience

We intend to drive risk-adjusted returns by accepting mortgage credit exposure at levels that our Manager deems prudent as an integral part of our diversified investment strategy. Our management team is experienced in managing this risk through prudent asset selection, pre-acquisition due diligence,

4

post-acquisition performance monitoring, sales of assets when we identify negative credit trends, and the use of various types of credit enhancement techniques, including non-recourse financing, which limits our exposure to credit losses to the specific pool of mortgages subject to the non-recourse financing.

Disciplined Investment Approach

Our Manager will seek to identify relative value opportunities by evaluating historical loan performance based on mortgage credit and prepayment dynamics and structural nuances that may lead to pricing inefficiencies. In addition, our Manager's investment approach will be shaped by its analysis of the entire mortgage value chain, which includes the origination, servicing, securitization and administration aspects of the mortgage market. Toward that end, our Manager will use internal credit and prepayment modeling techniques to evaluate market opportunities.

Alignment of Our Manager's Interests

We have taken steps to structure our relationship with our Manager so that our interests and those of our Manager are closely aligned. Our equity incentive plans provide for participation by our Manager and by employees, advisors, consultants and other personnel of our Manager and its affiliates. In addition, an affiliate of our Manager has agreed to purchase shares of our common stock in a concurrent private placement, at the initial public offering price per share. We believe that the participation of our Manager and related persons in our equity incentive plans, together with the investment by an affiliate of our Manager in the concurrent private placement, will align our Manager's interests with our interests and will create an incentive to maximize returns for our stockholders.

Current Market Opportunities

Residential mortgage debt is one of the largest fixed income markets in the world, with approximately $10 trillion in residential debt outstanding as of September 30, 2012 according to the U.S. Federal Reserve. We believe that pricing inefficiencies exist across most mortgage sectors and capital structures, including in Agency and non-Agency RMBS, as well as mortgage servicing rights associated with these products. We believe our Manager can identify target assets that have asymmetric risk and reward profiles. We also believe that we can achieve attractive investment returns across a variety of market conditions and economic cycles.

According to CoreLogic®, as of September 30, 2012, 10.7 million (or 22%) of all U.S. residential properties with a mortgage were in a position of "negative equity," a term used to describe borrowers that have a mortgage loan with a higher principal balance than the fair market value of their homes. In the current environment, it is very difficult to refinance a mortgage for a borrower in negative equity, since credit standards are extremely tight, and, perhaps more importantly, without equity there is little or no chance to refinance outside of HARP, which is only available to borrowers who have Agency mortgage loans originated prior to June 1, 2009 and who are current in payments on those loans. Mortgage loans in negative equity may be priced at attractive discounts to par. In addition, we believe that there are attractive opportunities to purchase pools of loans at a discount to par that are eligible for HARP and accordingly have increased probabilities of prepayment.

We believe further reform of the GSEs will accelerate the demand for private capital into the housing finance sector, and that we will be in a position to capitalize on this opportunity to target asymmetrical return profiles in new residential mortgage-related assets. In addition, government initiatives, such as quantitative easing, may make the RMBS investment opportunity more attractive. These initiatives may result in increased levels of prepayments, creating value, in particular, in RMBS purchased at a discount to par.

5

Although housing fundamentals have improved in comparison to the period from late 2007 through 2011, we believe RMBS prices continue to reflect delinquency and prepayment experience over a severely depressed economic cycle. We believe that the lowest quality and least creditworthy borrowers have generally left the mortgage pools through voluntary or forced attrition and that the remaining borrowers have a higher likelihood of paying their mortgage obligations.

Mortgage cash flows are sensitive to both credit and prepayment factors, the impacts of which factors are often not correlated. We believe that traditional investors focus on either credit or prepayment analysis, but not both, thereby creating investment opportunities for skilled investors such as us that focus on both factors. We intend to use our understanding of prepayment and credit environments, and how they relate to the structure of RMBS, to identify attractive investment opportunities across mortgage sectors.

We believe that changes in the RMBS investor landscape will result in future price volatility that will also create favorable new investment opportunities. Banks, insurance companies and money managers holding RMBS remain sensitive to downgrades and at the same time face new capital regulations and accounting standards potentially motivating such holders to become sellers. In addition, Fannie Mae and Freddie Mac are winding down their investment portfolios, thereby impacting the supply and demand dynamic in the RMBS market. The dealer community also generally has shown a diminished tolerance for holding non-investment grade RMBS on their balance sheets, further impacting demand for non-Agency RMBS.

In December 2012, the Federal Open Market Committee, or FOMC, announced an extension of its quantitative easing. The FOMC announced that it intends to hold the U.S. federal funds rate near zero "as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well-anchored." The FOMC indicated that it views this guidance to be "consistent with its earlier date-based guidance" that projected that rates would continue at current rates until mid-2015. We believe that such actions are a reflection of, among other factors, the fallout from the dislocation in the U.S. housing market and persistent levels of high unemployment, which in turn are creating numerous attractive investment opportunities in the U.S. housing market.

Our Investment Strategy

Our investment strategy will involve selectively constructing a portfolio of diversified assets that will provide attractive risk-adjusted returns to our stockholders over the long-term through a combination of dividends and capital appreciation.

We will rely on our Manager's experience in (i) using credit and prepayment analysis to assess prior and future loan performance, (ii) identifying market pricing inefficiencies through evaluation of the entire mortgage value chain, which includes the origination, servicing, securitization and administration aspects of the mortgage market, and (iii) targeting securities that reflect our Manager's views as to both macro economic conditions and relative valuations in the market in order to isolate unwanted risk. In addition, our Manager will target investments that accentuate its views on loan performance, as it believes it can purchase securities that can position us to maximize potential returns while providing downside protection. We expect that our Manager's diversified approach to building a portfolio and its wealth of product knowledge and industry relationships will allow us to benefit in a variety of market and economic conditions.

In making investment decisions on our behalf, our Manager will incorporate its views on loan performance based on an analysis of loan-level data, the mortgage industry, borrower behavior and housing market dynamics. At the individual loan level underlying our target RMBS assets, our Manager will seek to identify loan outcome potentials across various credit and prepayment cycles. This

6

approach involves studying historical loan performance to determine relationships between loan characteristics and loan performance, as well as evaluating the impact of industry factors, analyzing performance variability among borrowers and segmenting the loan universe according to outcome sensitivity. Our Manager's mortgage industry analysis typically involves examining industry factors such as servicer and originator constraints and pressures, government sponsored housing initiatives and legal rulings and pending litigation. Our Manager intends to use this industry analysis to estimate the potential cash flow impact of the foregoing factors and to seek to identify sectors in the U.S. RMBS market where loan performance is expected to outperform market expectations without any improvements in the housing market or the general economy.

We expect to invest in Agency and non-Agency RMBS and other potential target assets. We expect to purchase assets with a view to holding them for investment. However, in order to maximize returns and manage portfolio risk while remaining opportunistic, we may dispose of assets earlier than anticipated or hold assets longer than anticipated, depending upon prevailing market conditions, credit performance, availability of leverage or other factors regarding a particular security or our capital position.

Our Target Assets

We intend primarily to invest in, finance and manage a diversified portfolio of residential mortgage assets, consisting of Agency and non-Agency RMBS as well as other real estate-related assets, including the principal assets set forth in each of the following asset classes:

| Agency Mortgage Investments | • Residential mortgage pass-through certificates, representing interests in "pools" of mortgage loans secured by residential real property where payments of both interest and principal on the securities are made monthly to holders of the security. Agency residential mortgage pass-through certificates are based solely on loans for which the principal and interest payments are guaranteed by an Agency. | |

• Agency CMOs, representing securities that are structured from residential mortgage pass-through certificates. Agency CMOs are based on residential mortgage pass-through certificates where the "pool" of mortgage loans secured by the mortgage pass-through certificate on which the CMOs are based consists of loans for which the principal and interest payments are guaranteed by an Agency. | ||

• Interest only Agency RMBS, representing a type of stripped security that only entitles the holder to interest payments. The yield to maturity of interest only Agency RMBS is extremely sensitive to the rate of principal payments (particularly prepayments) on the underlying pool of mortgages. |

7

• Inverse interest only Agency RMBS, representing a type of stripped security that has a coupon with an inverse relationship to its index and is subject to caps and floors. Inverse interest only Agency RMBS entitle the holder to interest only payments based on a notional principal balance, which is typically equal to a fixed rate of interest on the notional principal balance less a floating rate of interest on the notional principal balance that adjusts according to an index subject to set minimum and maximum rates. The value of inverse interest only Agency RMBS will generally decrease when its related index rate increases and increase when its related index rate decreases. | ||

• "To-be-announced" forward contracts, or TBAs, representing agreements to purchase, for future delivery, Agency RMBS with certain principal and interest terms and certain types of underlying collateral, but the particular Agency RMBS to be delivered is not identified. | ||

Non-Agency Mortgage Investments | • Non-Agency RMBS, representing securities backed by residential mortgages that are not guaranteed by an Agency, such as Alt-A mortgage loans, subprime mortgage loans and prime mortgage loans. Non-Agency RMBS may benefit from credit enhancement derived from structural elements, such as subordination, overcollateralization or insurance provided by a monoline insurance company. | |

• Residential mortgage whole loans that have not been securitized but which may be purchased for future pooling in securitizations, including prime and non-prime mortgage loans and performing, re-performing, sub-performing and non-performing mortgage loans. | ||

Other Investments | • Other Agency MBS, representing securities for which the principal and interest payments are guaranteed by a GSE, but for which the underlying mortgage loans are secured by real property other than single family residences. | |

• Mortgage servicing rights, or MSRs, on a portfolio of securitized mortgage loans, including the direct acquisition of uncertificated servicing rights interests or indirect acquisition through the purchase of certificated servicing rights interests, total return swaps or other transactions that offer servicing rights economics. | ||

• Excess MSRs, representing a portion of the fee paid to mortgage servicers. | ||

• Floating rate and inverse floating rate securities. | ||

• Vacant or occupied single and multi-family residential real properties in certain metropolitan areas across the United States, acquired for investment and rented for income. |

8

• Derivative financial instruments, including, among others, CDOs, CLOs and contracts based on synthetic indices, such as the Markit PrimeX or Markit IOS indices, as well as instruments in the rates market, including, but not limited to, cash treasury notes, interest-rate swaps, futures, caps/floors, options and swaptions. | ||

• Other real-estate related investments, including common stock, preferred stock and debt of other real estate-related entities, including mortgage origination companies, or real estate-related products that we may acquire from companies, such as mortgage originators that may provide us opportunities to acquire whole loans, mortgage servicers that may provide us opportunities to purchase excess servicing rights, and broker-dealers that may facilitate our structuring and selling assets into securitizations. | ||

• Investment grade and non-investment grade debt and equity tranches of securitizations backed by various asset classes including, but not limited to, small balance commercial mortgages, aircraft, automobiles, credit cards, equipment, manufactured housing, franchises, recreational vehicles and student loans. |

Certain MSRs, derivative financial instruments, ABS and TBAs may not be real estate assets for purposes of the 75% asset test applicable to REITs and generally do not generate qualifying income for purposes of the 75% gross income test applicable to REITs. We may also need regulatory approvals prior to investing in MSRs and excess MSRs. As a result, we may be limited in our ability to invest in such assets.

Subject to prevailing market conditions at the time of purchase, we currently expect that we will deploy and re-deploy the net proceeds from this offering and the concurrent private placement to purchase our target assets in the following approximate relative percentages of our total portfolio: approximately % Agency RMBS and approximately % non-Agency RMBS and other investments. We anticipate that we will be able to reach our intended deployment of the net proceeds from this offering and the concurrent private placement within approximately one to three months after the closing of this offering and the concurrent private placement. However, depending on the availability of appropriate investment opportunities and subject to prevailing market conditions, we cannot assure you that we will be able to identify a sufficient amount of investments within this time frame.

The foregoing list of potential target assets is not intended to be exhaustive. We may also invest in real estate-related assets not identified above. Over time, we anticipate that we may originate as well as acquire some of our real estate-related assets. In addition, we may invest in non-real estate-related assets, including, without limitation, other non-real estate-related ABS, corporate loans and unsecured debt of any issuer (whether U.S. or non-U.S.). We may also engage in investment, hedging or financing techniques other than those described in this prospectus. In addition, we may make such investments either directly or indirectly (through derivatives, real estate mortgage investment conduits, or REMICs, or other securitization vehicles, grantor trusts or other investment trusts or otherwise). All of the foregoing is subject to our maintaining our qualification as a REIT and our exemption from registration under the 1940 Act.

9

Investment Guidelines

Our board of directors will adopt a broad set of investment guidelines that sets forth our target asset classes and other criteria to be used by our Manager to evaluate specific assets as well as our overall portfolio composition. Our Manager will make determinations as to the percentage of our assets that will be invested in each of our target asset classes, consistent with the investment guidelines adopted by our board of directors, the limits necessary to maintain our qualification as a REIT and our exemption under the 1940 Act and CCM's written policies and procedures, which we refer to as the Cerberus Allocation Policy, for the allocation of investment opportunities among us and the pooled investment vehicles and managed accounts managed or sponsored by CCM, its affiliates or our Manager. We expect our Manager's investment decisions will depend on prevailing market conditions and may change over time in response to opportunities available in different interest rate, economic and credit environments. We cannot predict the percentage of our assets that will be invested in any of our target asset classes at any given time. We believe that the anticipated diversification of our portfolio of assets, our Manager's investment professionals' extensive experience in investing in RMBS and our other target assets, and the flexibility of our strategy will position us to achieve attractive risk-adjusted returns under a variety of market conditions and economic cycles.

Our investment guidelines may be changed from time to time by our board of directors without the approval of our stockholders. Any changes to our investment guidelines will be disclosed in our next required public report following the approval of such changes by our board of directors, including a majority of our independent directors.

Our Financing Strategy and Leverage

We expect to use borrowings as part of our strategy. Depending on market conditions, we expect that our primary financing sources will be through repurchase agreements, warehouse facilities, securitizations and re-securitizations, bank credit facilities (including term loans and revolving facilities) and public and private issuances of equity and debt securities as well as transaction or asset specific funding arrangements. We expect to vary the maturities of our borrowed funds to attempt to produce lower borrowing costs and reduce interest rate risk. We expect that our repurchase facility borrowings generally will have maturities of less than one year.

We intend to utilize leverage by securitizing or re-securitizing target assets and other assets that we acquire. Securitization is the process of aggregating, or pooling, debt and issuing new financial instruments that are repaid primarily from the cash flows, servicing, collection or other liquidation of the underlying pooled debt. Re-securitization is the process of pooling already securitized financial instruments and creating new financial instruments that are repaid solely (or mostly) from the collection or other liquidation of the already securitized financial instruments.

We intend to use leverage for the primary purpose of financing our portfolio and not for the purpose of speculating on changes in interest rates. Our charter and bylaws do not limit the minimum or maximum amount of leverage that we may incur, and we are not required to maintain any particular debt-to-equity leverage ratio. We expect that with respect to Agency RMBS, over time, we will employ leverage (measured on a debt-to-equity basis) of between and times and that with respect to non-Agency RMBS and other investments, over time, we will employ leverage (measured on a debt-to-equity basis) of between and times. Our board of directors may change our leverage guidelines at any time without the consent of our stockholders.

Our Hedging Strategy

We may use a variety of strategies to hedge a portion of our exposure to interest rate, prepayment and credit risk to the extent that our Manager believes that hedges are prudent, taking into account our investment strategy, overall market conditions, the level of volatility in the mortgage market, the

10

size of our investment portfolio, the cost of the hedging transactions and our intention to qualify as a REIT and remain exempt from registration as an investment company under the 1940 Act. As a result, we may not hedge certain interest rate, prepayment or credit risks of certain target assets if our Manager believes that bearing such risks enhances our return relative to our risk/return profile.

We will rely on the expertise of our Manager's investment professionals to manage these risks on our behalf. In performing this analysis, our Manager expects to actively employ portfolio-wide and security-specific risk measurement and management processes in our daily operations through tools which will include software and services licensed or purchased from third parties, in addition to proprietary systems and analytical methods developed internally. There can be no assurance, however, that these tools and other risk management techniques described above will protect us from interest rate, prepayment and credit risks.

The nature of these risks and the primary hedging techniques associated with such risks that we may employ are summarized below.

Interest Rate Risk. We will be subject to interest rate risk in connection with our investments, our repurchase agreements and our other financing agreements. Our repurchase agreements will generally have a duration of less than one year and we expect will be periodically refinanced at current market rates. We may mitigate this risk through hedging techniques to lock in the spread between the interest we earn on our assets and the interest we pay on our borrowing costs. These hedging techniques may include interest rate swap agreements, interest rate swaptions, interest rate caps or floor contracts, interest rate corridors, futures or forward contracts and other derivative investments.

Prepayment Risk. Residential borrowers are generally able to prepay their mortgage loans at par at any time, without penalty. This feature creates several risks, especially for securities purchased at prices in excess of par (premium securities) or interest-only securities that have a notional value tied to the underlying mortgage loans. While prepayment rates are currently below historical levels due to the number of negative equity borrowers, in the event of prepayment we may experience a return of principal on our investments earlier than anticipated, and we may have to re-invest that principal at lower yields. In order to manage our prepayment and interest rate risks, we will monitor, among other things, our "duration gap" and our "convexity exposure," particularly with our interest only, or IO, securities. Duration gap is the relative expected percentage change in market value of our assets that would be caused by an incremental parallel change in short and long-term interest rates. Convexity exposure relates to the impact upon the duration of a mortgage security when the interest rate and prepayment environment change. In addition, we may use derivatives for hedging, including (i) Markit structured finance indices, which are synthetic total return swaps that reference the interest and principal components of Agency pools, and (ii) other prepayment linked products.

Credit Risk. We intend to accept mortgage credit exposure at levels that our Manager deems prudent as an integral part of our diversified investment strategy. Therefore, we may retain all or a portion of the credit risk on our residential mortgages as well as on the loans underlying our non-Agency RMBS. We will seek to manage this risk through prudent asset selection, pre-acquisition due diligence, post-acquisition performance monitoring, sales of assets when we identify negative credit trends, the use of various types of credit enhancements, including non-recourse financing, which limits our exposure to credit losses to the specific pool of mortgages subject to the non-recourse financing, and, subject to maintaining our qualification as a REIT and exemption from registration as an investment company under the 1940 Act, through the use of derivative financial instruments, that may include reference assets comprised of indices of RMBS. Our overall management of credit exposure may also include the use of credit default swaps or other financial derivatives that our Manager believes are appropriate. Additionally, we intend to vary the percentage mix of our non-Agency mortgage investments and Agency mortgage investments in an effort to actively adjust our credit exposure and to improve the risk/return profile of our investment portfolio.

11

Summary Risk Factors

An investment in shares of our common stock involves various risks. You should consider carefully the risks discussed below and under the heading "Risk Factors" beginning on page 26 of this prospectus before purchasing our common stock. If any of the following risks occurs, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose some or all of your investment.

- •

- We have no operating history and may not be able to successfully operate our business, find suitable investments or generate sufficient revenue to make or sustain distributions to our stockholders

- •

- We will operate in a highly competitive market for investment opportunities and competition may limit our ability to acquire desirable investments in our target assets and could also affect the pricing of these securities.

- •

- Actions of the U.S. Government, including the U.S. Congress, U.S. Federal Reserve, U.S. Treasury and other governmental and regulatory bodies, to stabilize or reform the financial markets, or market responses to those actions, may not achieve the intended effect and may adversely affect our business.

- •

- Difficult conditions in the mortgage and residential real estate markets, the financial markets and the economy generally may cause the market value of our assets to decline, and these conditions may not improve in the near future.

- •

- Mortgage loan modification and refinancing programs and future legislative action may adversely affect the value of and our returns on our target assets.

- •

- We will be subject to the risk that U.S. Government agencies and/or GSEs may not be able to fully satisfy their guarantees of Agency RMBS or that these guarantee obligations may be repudiated, which may adversely affect the value of our assets and our ability to sell or finance these securities.

- •

- The mortgage loans that we may acquire, and the mortgage and other loans underlying the RMBS that we may acquire, may be subject to delinquency, foreclosure and loss, which could result in losses to us.

- •

- We may be affected by alleged or actual deficiencies in foreclosure practices of third parties, as well as related delays in the foreclosure process.

- •

- Certain of our investments will be recorded at fair value, and quoted prices or observable inputs may not be available to determine such value, resulting in the use of significant unobservable inputs to determine value.

- •

- An increase in interest rates may cause a decrease in the volume of certain of our assets, which could adversely affect our ability to acquire assets that satisfy our investment objectives and to generate income and make distributions.

- •

- The lack of liquidity in our investments may adversely affect our business, including our ability to value and sell our assets.

- •

- Changes in prepayment rates may adversely affect our profitability.

- •

- Maintenance of our 1940 Act exemption imposes limits on our operations and the laws and regulations governing the 1940 Act exemption may change in a manner that adversely affects our operations.

12

- •

- Failure to maintain our exemption from registration under the 1940 Act could negatively affect the value of our common stock, the sustainability of our business model and our ability to make distributions to stockholders.

- •

- If a counterparty to our repurchase transactions defaults on its obligation to resell the underlying security back to us at the end of the transaction term, or if the value of the underlying security has declined as of the end of that term, or if we default on our obligations under the repurchase agreement, we will lose money on our repurchase transactions.

- •

- Failure to procure adequate repurchase agreement financing, which generally has short terms, or to renew or replace repurchase agreement financing as it matures, would adversely affect our results of operations.

- •

- An increase in our borrowing costs relative to the interest that we receive on investments in our target assets may materially and adversely affect our profitability and cash available for distribution to our stockholders.

- •

- We may enter into hedging transactions that could expose us to contingent liabilities in the future and adversely impact our financial condition.

- •

- We will depend on our Manager and its key personnel for our success and upon our Manager's access to CCM's investment professionals. We may not find a suitable replacement for our Manager if our management agreement is terminated or if key personnel leave the employment of our Manager or CCM or otherwise become unavailable to us.

- •

- Our Manager does not have experience operating a REIT or a public company or maintaining our exemption from registration under the 1940 Act.

- •

- There are various conflicts of interest in our relationship with CCM and Cerberus which could result in decisions that are not in the best interests of our stockholders. In addition, other Cerberus entities may participate pursuant to the Cerberus Allocation Policy in purchases of our target assets as part of their respective investment strategies and such participation may adversely affect or reduce the scope of opportunities otherwise available to us.

- •

- The termination of our management agreement may be difficult and costly, which may materially and adversely affect our inclination to end our relationship with our Manager.

- •

- We have not established a minimum distribution payment level and we cannot assure you of our ability to pay distributions in the future.

- •

- We may pay distributions from offering proceeds, borrowings or the sale of assets to the extent that distributions exceed earnings or cash flow from our operations.

- •

- If we do not qualify as a REIT or fail to remain qualified as a REIT, we will be subject to U.S. federal income tax as a regular corporation and could face a substantial tax liability, which would reduce the amount of cash available for distribution to our stockholders.

- •

- Complying with REIT requirements may cause us to liquidate or forgo otherwise attractive investment opportunities.

13

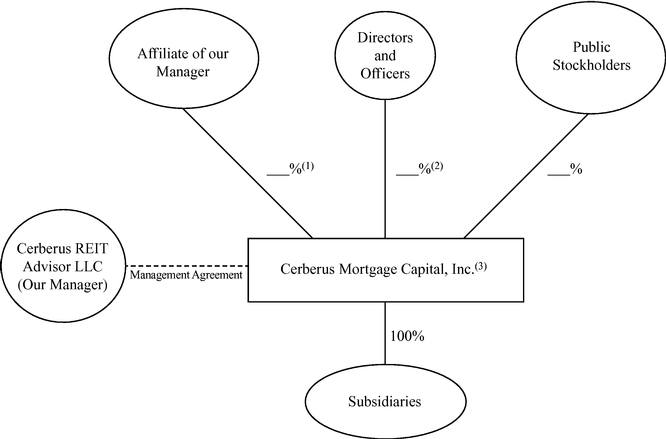

Our Structure

We were organized as a Maryland corporation on November 14, 2012. We will be externally managed by our Manager. The following chart shows our anticipated structure after giving effect to this offering and the concurrent private placement to an affiliate of our Manager:

- (1)

- Consists of shares of our common stock to be issued and sold to an affiliate of our Manager in a concurrent private placement.

- (2)

- Consists of restricted shares of common stock to be granted to our independent directors under our 2013 equity incentive plans upon the completion of this offering and the concurrent private placement.

- (3)

- Cerberus Mortgage Capital, Inc. is a holding company. We will conduct our business primarily through one or more subsidiaries.

The chart above does not give effect to (i) up to shares of our common stock that we may issue and sell upon the exercise of the underwriters' overallotment option, or (ii) an aggregate of additional shares of our common stock available for future grants under our 2013 equity incentive plans to our Manager, to officers, employees, advisors, consultants and other personnel of our Manager and to our independent directors, officers, employees, advisors, consultants and other personnel. For a description of our 2013 equity incentive plans, see "Management—2013 Equity Incentive Plans."

14

Our Management Agreement

We will be externally managed and advised by our Manager, an affiliate of CCM. Pursuant to the terms of a management agreement between us and our Manager, our Manager will be responsible for administering our business activities and day-to-day operations and will provide us with our management team and appropriate support personnel. Our Manager will at all times be subject to the supervision of our board of directors and has only such functions and authority as our board delegates to it. We do not expect to have any employees.

We will enter into a management agreement with our Manager effective upon the closing of this offering and the concurrent private placement. Pursuant to the terms of the management agreement, our Manager will implement our business strategy and perform certain services for us, subject to supervision and direction by our board of directors. Our Manager will be responsible for, among other duties: (1) performing all of our day-to-day functions, (2) determining investment criteria in conjunction with our board of directors, (3) sourcing, analyzing and executing asset acquisitions, sales and financings, (4) performing asset management duties and (5) performing financial and accounting management. Our Manager has an Investment Committee that will include Stephen Feinberg, Joshua Weintraub, Brendan Garvey, Frank Bruno and Lee Millstein, each of whom is a Senior Managing Director of CCM. Messrs Weintraub and Garvey are also our Manager's Co-Chief Investment Officers. The Investment Committee will advise and consult with our Manager's senior management team with respect to our investment strategy, investment portfolio holdings, sourcing, financing strategy, and leverage strategy and investment guidelines.

The initial term of the management agreement will extend for three years from the closing of this offering and the concurrent private placement, with one-year renewal terms starting on the third anniversary of the closing. Our independent directors will review our Manager's performance annually and, following the initial term, we may give notice of our intention not to renew the management agreement upon the affirmative vote of at least two-thirds of our independent directors, but only if such non-renewal results from: (1) our Manager's unsatisfactory performance that is materially detrimental to us or (2) our determination that the management fees payable to our Manager are not fair, subject to our Manager's right to prevent non-renewal based on unfair fees by accepting a reduction of management fees agreed to by at least two-thirds of our independent directors. We must provide our Manager with 180 days prior notice of a termination effected by our non-renewal. Upon such a termination, referred to herein as a termination by us without cause, we will pay our Manager a termination fee as described in the table below. We may also terminate the management agreement, without payment of a termination fee, for cause, as defined in the management agreement. Our Manager may terminate the management agreement if we become regulated as an investment company under the 1940 Act, with such termination deemed to occur immediately before such event, in which case we would not be required to pay a termination fee to our Manager. Our Manager may also decline to renew the management agreement following the initial term by providing us with 180 days written notice, in which case we would not be required to pay a termination fee and the agreement will terminate on the next anniversary date of the agreement following the delivery of such notice. If, however, our Manager terminates the management agreement as a result of our material breach, we would be required to pay a termination fee. The management agreement will renew automatically unless terminated by either party.

All of our officers and the investment personnel and other support personnel provided by our Manager are employees of CCM. Because neither we nor our Manager have any employees, our Manager will enter into an administrative services agreement with CCM, pursuant to which our Manager will have access to CCM's employees, infrastructure, business relationships, management expertise, information technologies, capital raising capabilities, legal and compliance functions, accounting, treasury and investor relations capabilities, to enable our Manager to fulfill all of its

15

responsibilities under the management agreement. We are not a party to the administrative services agreement. Therefore, we do not have any recourse against CCM if it does not fulfill its obligations under the administrative services agreement or elects to assign the agreement to an affiliate. In addition, under the management agreement between us and our Manager, neither our Manager nor any of its affiliates will be liable for any of their acts or omissions under the agreement except for those constituting bad faith, gross negligence or reckless disregard of their duties.

The following table summarizes the fees and expense reimbursements that we will pay to our Manager:

Type | Description | Payment | ||

|---|---|---|---|---|

| Base Management Fee | Our Manager will be entitled to a base management fee payable in cash, equal to 1.50% per annum, calculated and payable quarterly in arrears, of our stockholders' equity. For purposes of calculating the base management fee, our "stockholders' equity" means the sum of the net proceeds from any issuances of our equity securities since inception (allocated on a pro rata daily basis for such issuances during the fiscal quarter of any such issuance), plus our retained earnings at the end of the most recently completed quarter (as determined in accordance with U.S. GAAP), without taking into account any non-cash equity compensation expense incurred in current or prior periods), less any amount that we pay for repurchases of our shares of common stock, excluding any unrealized gains or losses or other non-cash items that have impacted stockholders' equity as reported in our financial statements prepared in accordance with U.S. GAAP (regardless of whether such items are included in other comprehensive income or loss, or in net income). This amount will be adjusted to exclude one-time events pursuant to changes in U.S. GAAP, and certain other non-cash charges after discussions between our Manager and our independent directors and after approval by a majority of our independent directors. If, for any given quarter, our stockholders' equity as calculated above is negative, our Manager will not be entitled to receive a base management fee for that quarter. | Quarterly in cash | ||

Assuming that we sell shares of common stock in this offering (which assumes no exercise of the underwriters' overallotment option) and shares in the concurrent private placement, the management fee payable to our Manager for the 12-month period beginning on , 2013 (assuming no additional equity is issued within this 12-month period) would be approximately $ million. |

16

Type | Description | Payment | ||

|---|---|---|---|---|

| Expense Reimbursement | We will reimburse our Manager for legal, accounting, due diligence, asset management, securitization, property management, brokerage, leasing and other services that outside professionals or outside consultants would otherwise perform. We will pay the documented costs for these services. | Monthly in cash | ||

We will also reimburse our Manager for our pro rata share of the following items that we share with other affiliates of CCM: infrastructure, technology, rent, telephone, utilities, office furniture, equipment, machinery and other office, internal and overhead expenses attributable to the personnel of our Manager and its affiliates required to operate our business. These expenses will be allocated to us based upon the proportion of our total assets as compared to the total RMBS and real estate-related assets managed by our Manager or its personnel for us and Cerberus. | ||||