First Internet Bancorp Investor Presentation Second Quarter 2016 Exhibit 99.1

Forward Looking Statement This presentation may contain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance or business of the Company. Forward-looking statements are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward-looking statements. Factors that may cause such differences include: failures of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial real estate and commercial and industrial loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; fluctuations in interest rates; general economic conditions; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the SEC. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. 2

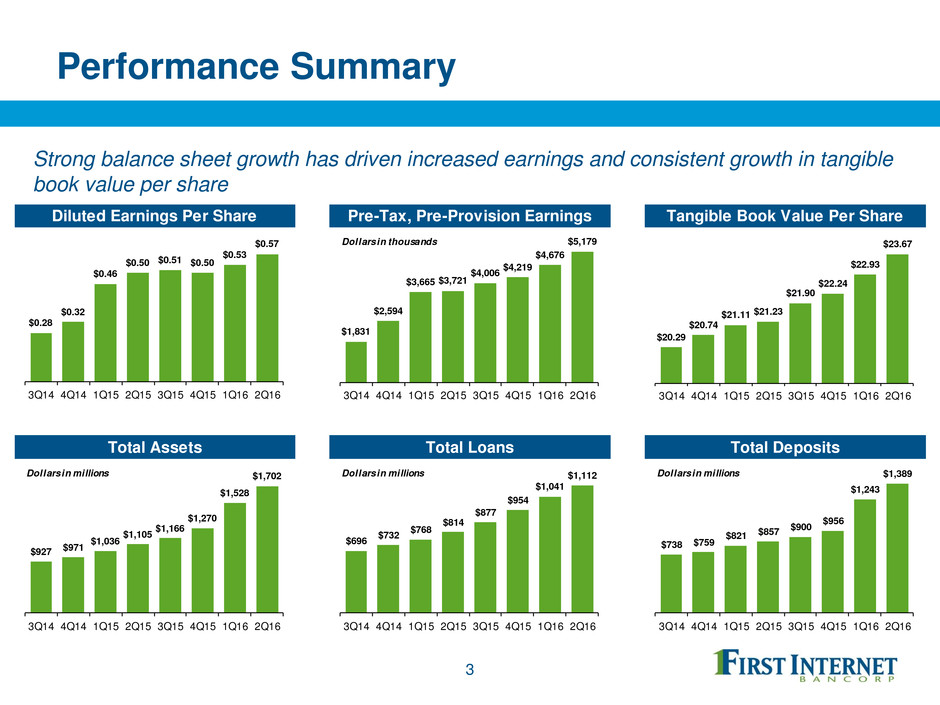

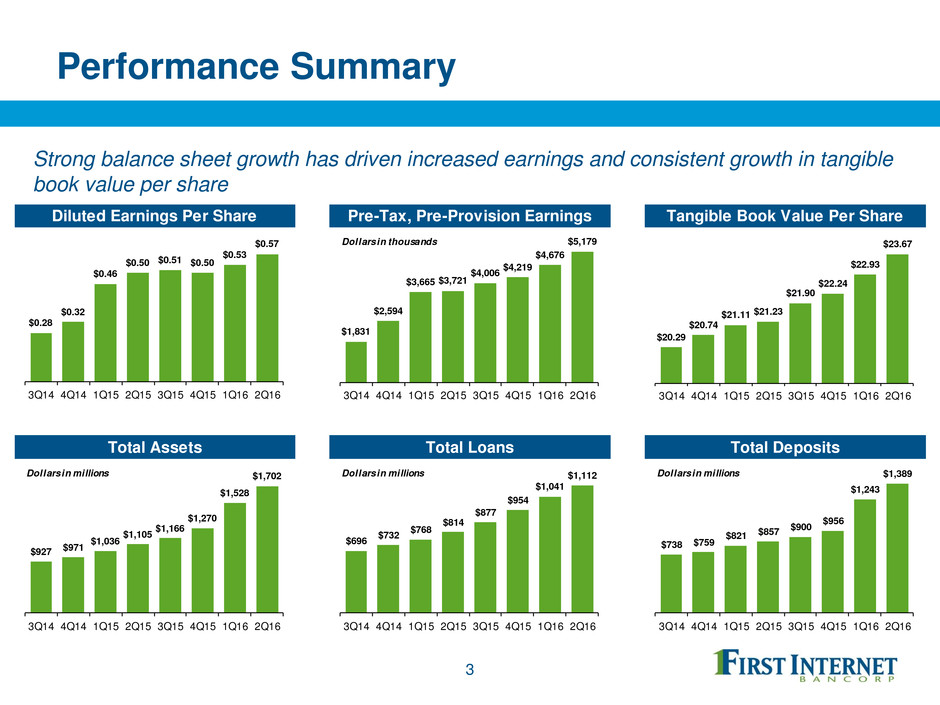

Performance Summary 3 Strong balance sheet growth has driven increased earnings and consistent growth in tangible book value per share Diluted Earnings Per Share Pre-Tax, Pre-Provision Earnings Tangible Book Value Per Share Total Assets Total Loans Total Deposits $0.28 $0.32 $0.46 $0.50 $0.51 $0.50 $0.53 $0.57 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 $1,831 $2,594 $3,665 $3,721 $4,006 $4,219 $4,676 $5,179 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Dollars in thousands $927 $971 $1,036 $1,105 $1,166 $1,270 $1,528 $1,702 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Dollars in millions $696 $732 $768 $814 $877 $954 $1,041 $1,112 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Dollars in millions $20.29 $20.74 $21.11 $21.23 $21.90 $22.24 $22.93 $23.67 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 $738 $759 $821 $857 $900 $956 $1,243 $1,389 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Dollars in millions

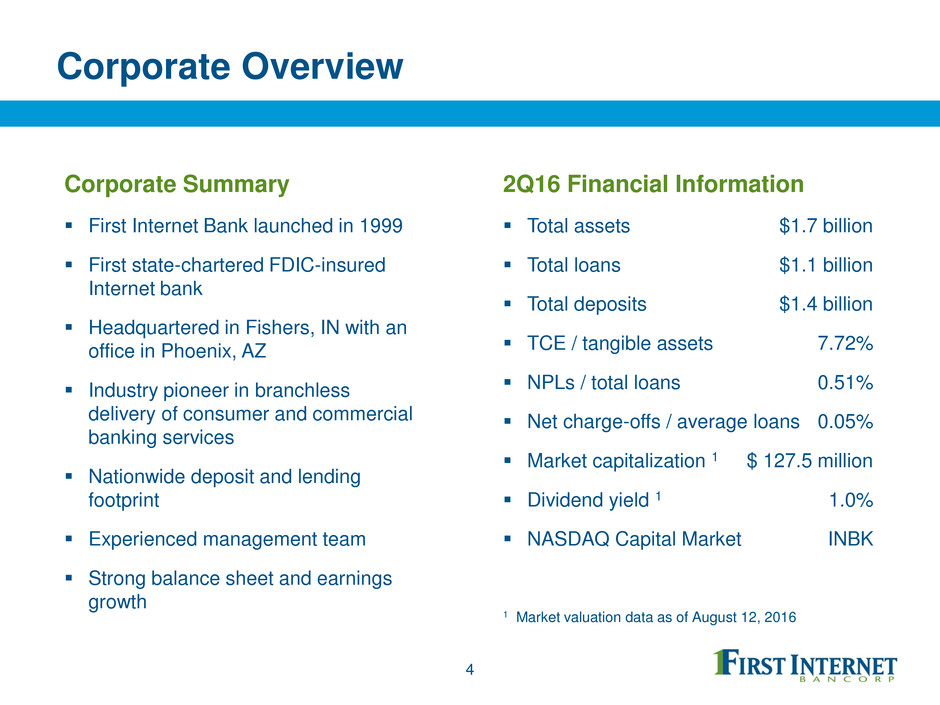

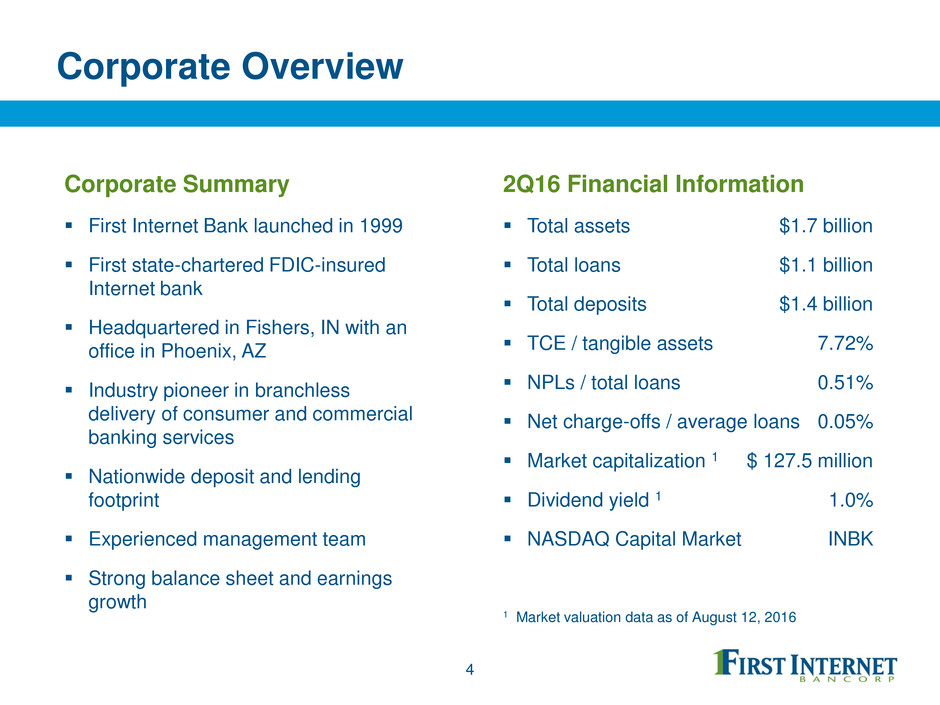

Corporate Overview Corporate Summary First Internet Bank launched in 1999 First state-chartered FDIC-insured Internet bank Headquartered in Fishers, IN with an office in Phoenix, AZ Industry pioneer in branchless delivery of consumer and commercial banking services Nationwide deposit and lending footprint Experienced management team Strong balance sheet and earnings growth 4 2Q16 Financial Information Total assets $1.7 billion Total loans $1.1 billion Total deposits $1.4 billion TCE / tangible assets 7.72% NPLs / total loans 0.51% Net charge-offs / average loans 0.05% Market capitalization 1 $ 127.5 million Dividend yield 1 1.0% NASDAQ Capital Market INBK 1 Market valuation data as of August 12, 2016

Differentiated Business Model Nationwide consumer banking provider Proven online / mobile retail deposit platform using scalable technology backed by exceptional customer service Low cost delivery channel creates customer value through competitive rates and low fees Commercial banking franchise focused on select local and national markets 5 National, award-winning online direct-to-consumer mortgage banking platform National, niche consumer lending segments with strong yields and asset quality Asset class and geographic diversity provides ability to generate top tier balance sheet and revenue growth funded by a loyal, efficient and growing deposit base Local National C&I – Central Indiana C&I – Arizona Investor CRE – Central Indiana Construction – Central Indiana Single tenant lease financing

Strategic Objectives Drive revenue growth and positive operating leverage Achieve consistent strong profitability Deploy capital in an accretive manner focused on building shareholder value Capitalize on consumer trends by capturing greater deposit market share among digital banking adopters Maintain strong asset quality and focus on disciplined risk management Expand asset generation channels to supplement growth and increase profitability Continue investing in technology to remain a digital banking leader and increase efficiency 6

7 Corporate Recognition First Internet Bank has been recognized for its innovation and is consistently ranked among the best banks to work for, enhancing its ability to attract and retain top-level talent TechPoint 2016 Mira Award “Tech-enabled Company of the Year” American Banker’s “Best Banks to Work For” 2015 2014 2013 Workplace Dynamics’ “Indianapolis Star Top Workplaces” 2016 2015 2014 “Best Places to Work in Indiana” 2016 2013 Mortgage Technology 2013 awarded top honors in the Online Mortgage Originator category

Consistent Balance Sheet Growth 8 Execution of the business strategy is driving consistent and sustainable balance sheet growth Total Assets Total Loans Total Deposits Loan Composition $636 $802 $971 $1,270 $1,702 2012 2013 2014 2015 2Q16 Dollars in millions $358 $501 $732 $954 $1,112 2012 2013 2014 2015 2Q16 Dollars in millions $531 $673 $759 $956 $1,389 2012 2013 2014 2015 2Q16 Dollars in millions 31% 42% 48% 61% 65% 33% 36% 38% 27% 22% 36% 22% 14% 12% 13% 2012 2013 2014 2015 2Q16 Commercial Residential Real Estate Consumer CAGR: 32.5% CAGR: 38.2% CAGR: 31.6%

Five Year Balance Sheet Growth Five year balance sheet growth rates far exceed the median rates for similar institutions INBK growth over this period has been primarily organic as opposed to through acquisitions 9 Source: Company data and SNL Financial; financial data as of June 30, 2016; peer data represents median value of component companies. SNL Micro Cap US Banks represent publicly traded micro cap banks with a market capitalization of less than $250 million; peer data based on index components as of June 30, 2016. Five Year Total Asset Growth Five Year Total Loan Growth Five Year Total Deposit Growth 218% 42% INBK SNL Micro Cap US Banks 213% 33% INBK SNL Micro Cap US Banks 216% 32% INBK SNL Micro Cap US Banks

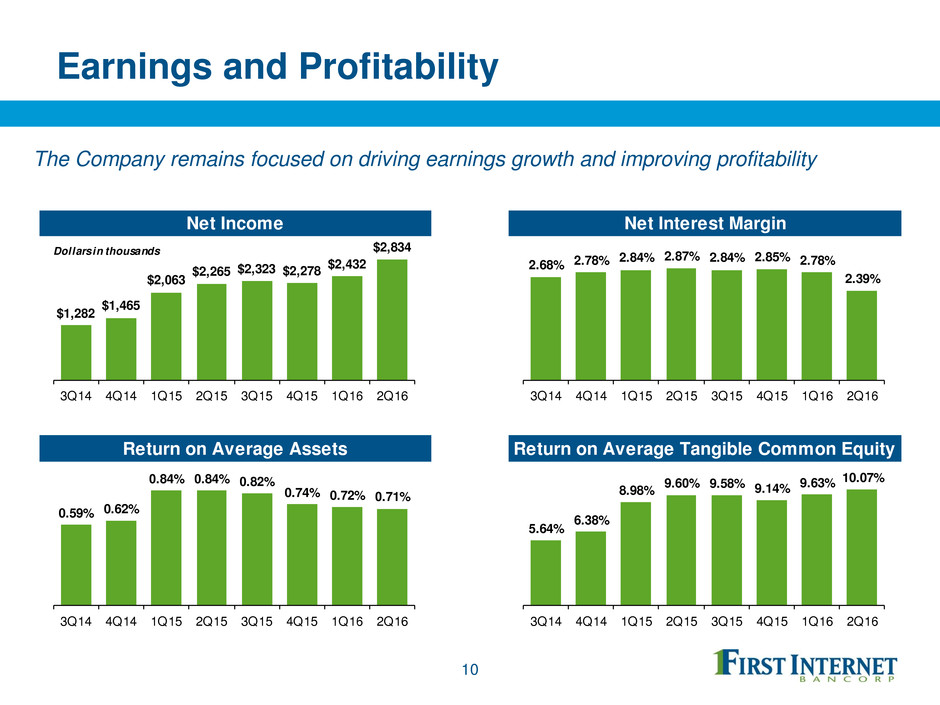

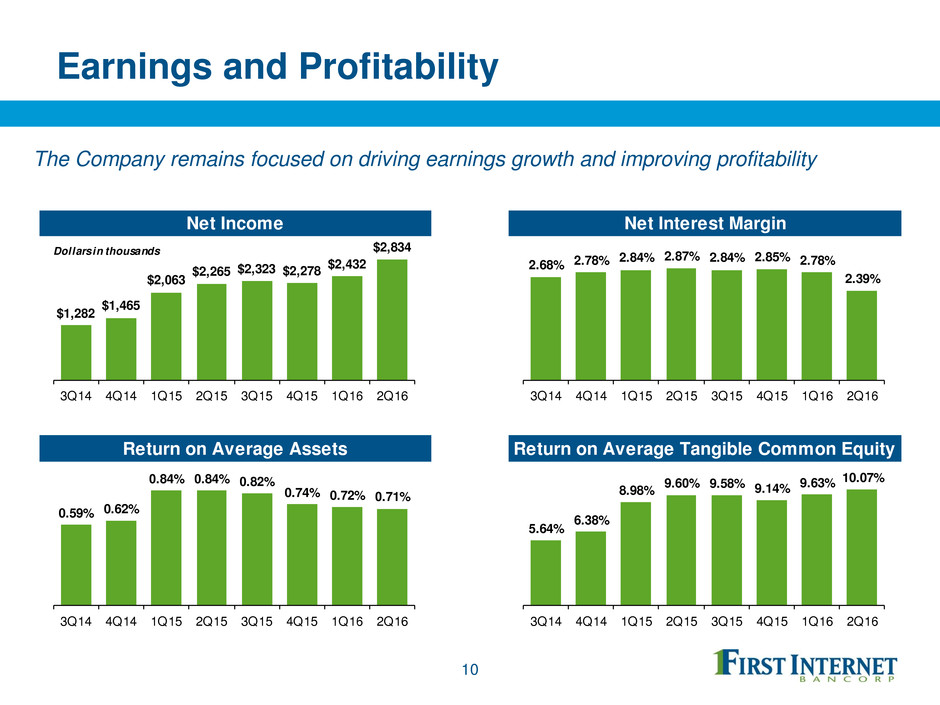

Earnings and Profitability 10 The Company remains focused on driving earnings growth and improving profitability Net Income Net Interest Margin Return on Average Assets Return on Average Tangible Common Equity $1,282 $1,465 $2,063 $2,265 $2,323 $2,278 $2,432 $2,834 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Dollars in thousands 2.68% 2.78% 2.84% 2.87% 2.84% 2.85% 2.78% 2.39% 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 0.59% 0.62% 0.84% 0.84% 0.82% 0.74% 0.72% 0.71% 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 5.64% 6.38% 8.98% 9.60% 9.58% 9.14% 9.63% 10.07% 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Strong Revenue and Earnings Growth 11 Strong asset generation and re-focused mortgage banking activities combined with disciplined expense management are driving revenue growth and positive operating leverage $7,616 $13,054 $5,785 $7,875 3Q14 2Q16 Net Interest Income + Noninterest Income Noninterest Expense Dollars in thousands Increase in quarterly noninterest expense: 36% Increase in quarterly revenue: 71% $5,673 $9,306 $1,943 $3,748 3Q14 2Q16 Net Interest Income Noninterest Income Dollars in thousands Increase in quarterly net interest income: 64% LTM mortgage banking revenue up 10% over prior LTM period

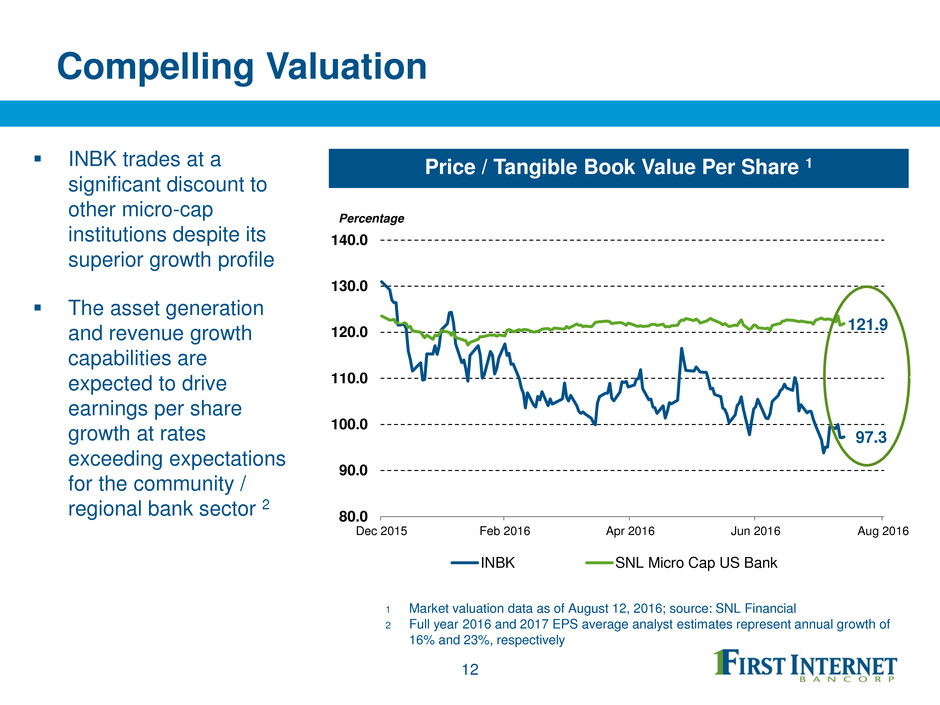

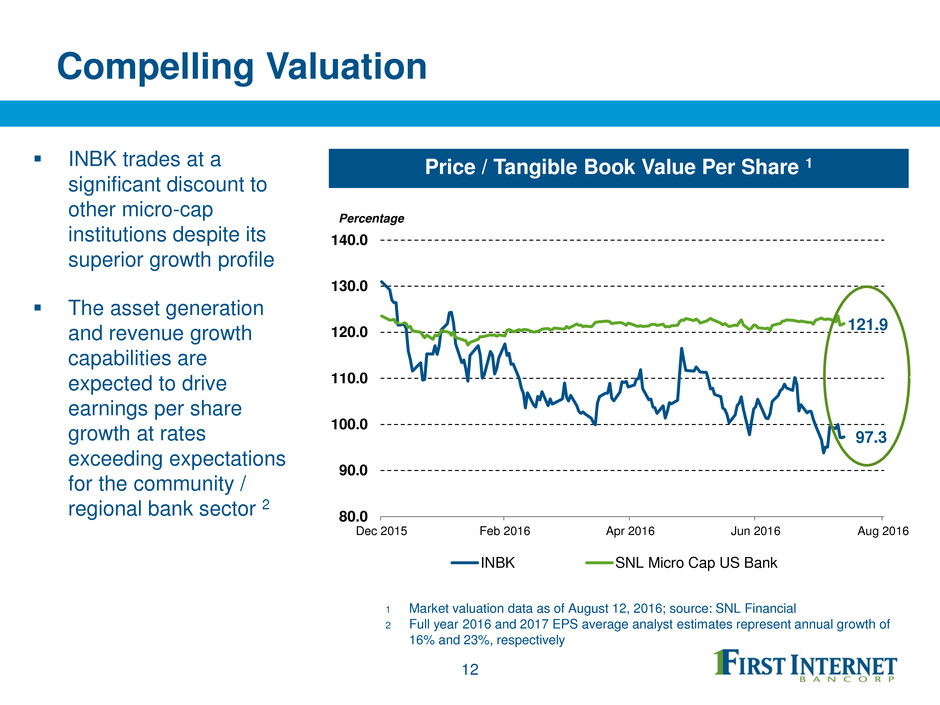

Compelling Valuation INBK trades at a significant discount to other micro-cap institutions despite its superior growth profile The asset generation and revenue growth capabilities are expected to drive earnings per share growth at rates exceeding expectations for the community / regional bank sector 2 12 Price / Tangible Book Value Per Share 1 80.0 90.0 100.0 110.0 120.0 130.0 140.0 Dec 2015 Feb 2016 Apr 2016 Jun 2016 Aug 2016 INBK SNL Micro Cap US Bank Percentage 121.9 97.3 1 Market valuation data as of August 12, 2016; source: SNL Financial 2 Full year 2016 and 2017 EPS average analyst estimates represent annual growth of 16% and 23%, respectively

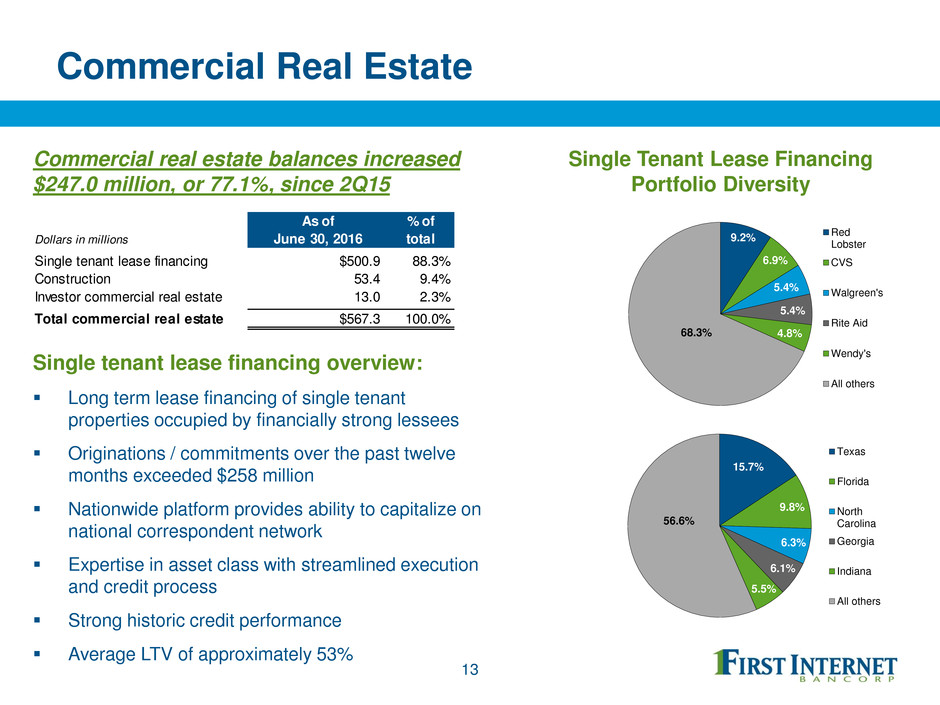

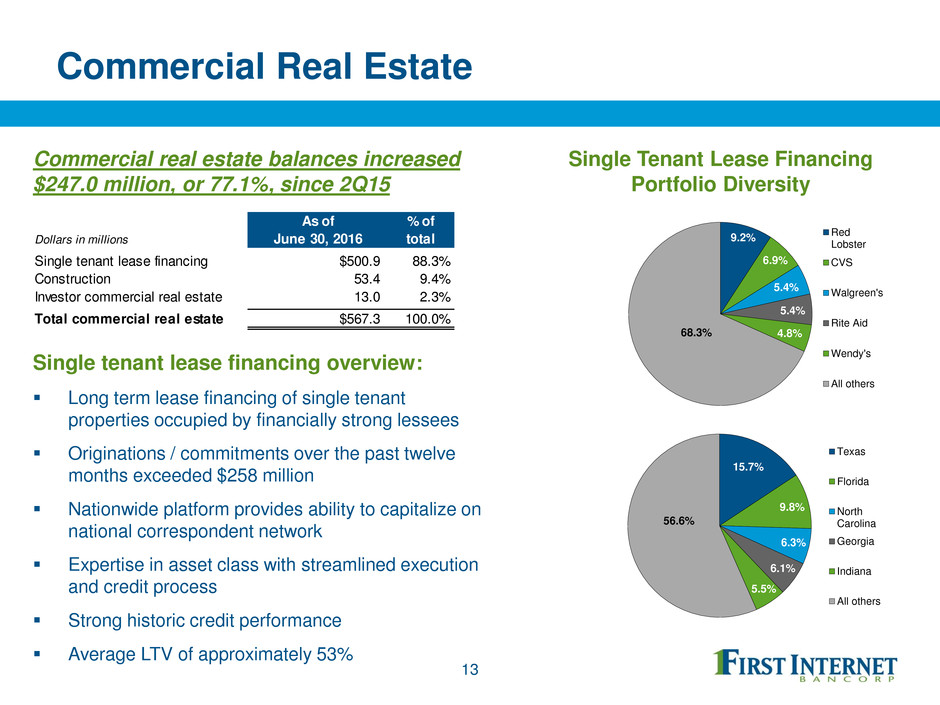

Commercial Real Estate Single tenant lease financing overview: Long term lease financing of single tenant properties occupied by financially strong lessees Originations / commitments over the past twelve months exceeded $258 million Nationwide platform provides ability to capitalize on national correspondent network Expertise in asset class with streamlined execution and credit process Strong historic credit performance Average LTV of approximately 53% 13 Commercial real estate balances increased $247.0 million, or 77.1%, since 2Q15 Single Tenant Lease Financing Portfolio Diversity As of % of Dollars in millions June 30, 2016 total Single tenant lease financing $500.9 88.3% Construction 53.4 9.4% Investor commercial real estate 13.0 2.3% Total commercial real estate $567.3 100.0% 9.2% 6.9% 5.4% 5.4% 4.8%68.3% Red Lobster CVS Walgreen's Rite Aid Wendy's All others 15.7% 9.8% 6.3% 6.1% 5.5% 56.6% Texas Florida North Carolina Georgia Indiana All others

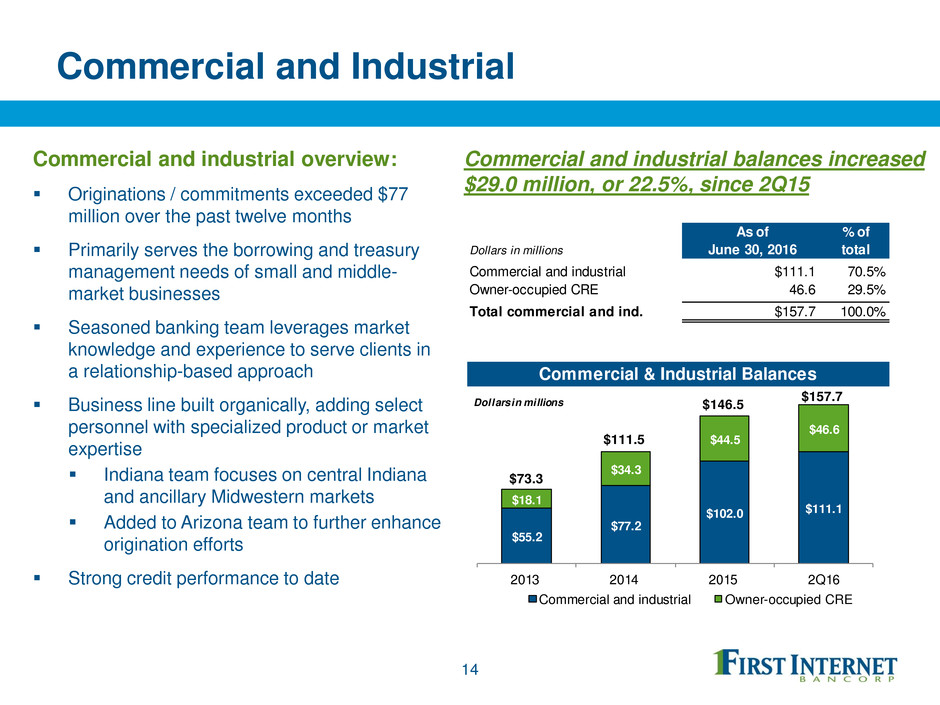

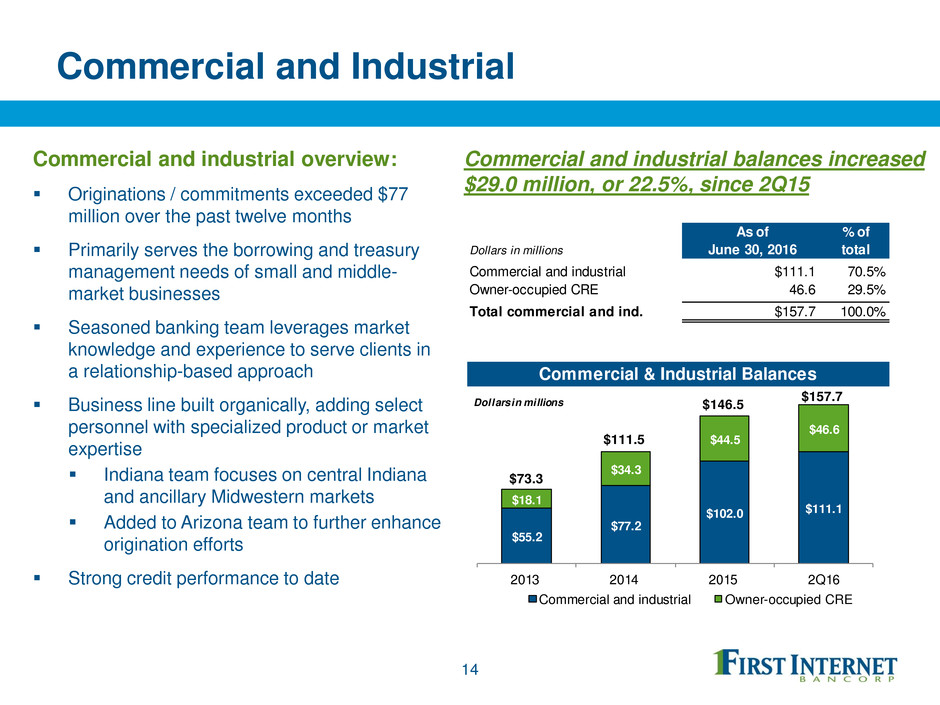

Commercial and Industrial Commercial and industrial overview: Originations / commitments exceeded $77 million over the past twelve months Primarily serves the borrowing and treasury management needs of small and middle- market businesses Seasoned banking team leverages market knowledge and experience to serve clients in a relationship-based approach Business line built organically, adding select personnel with specialized product or market expertise Indiana team focuses on central Indiana and ancillary Midwestern markets Added to Arizona team to further enhance origination efforts Strong credit performance to date 14 Commercial and industrial balances increased $29.0 million, or 22.5%, since 2Q15 As of % of Dollars in millions June 30, 2016 total Commercial and industrial $111.1 70.5% Owner-occupied CRE 46.6 29.5% Total commercial and ind. $157.7 100.0% Commercial & Industrial Balances $55.2 $77.2 $102.0 $111.1 $18.1 $34.3 $44.5 $46.6 2013 2014 2015 2Q16 Commercial and industrial Owner-occupied CRE Dollars in millions $73.3 $111.5 $146.5 $157.7

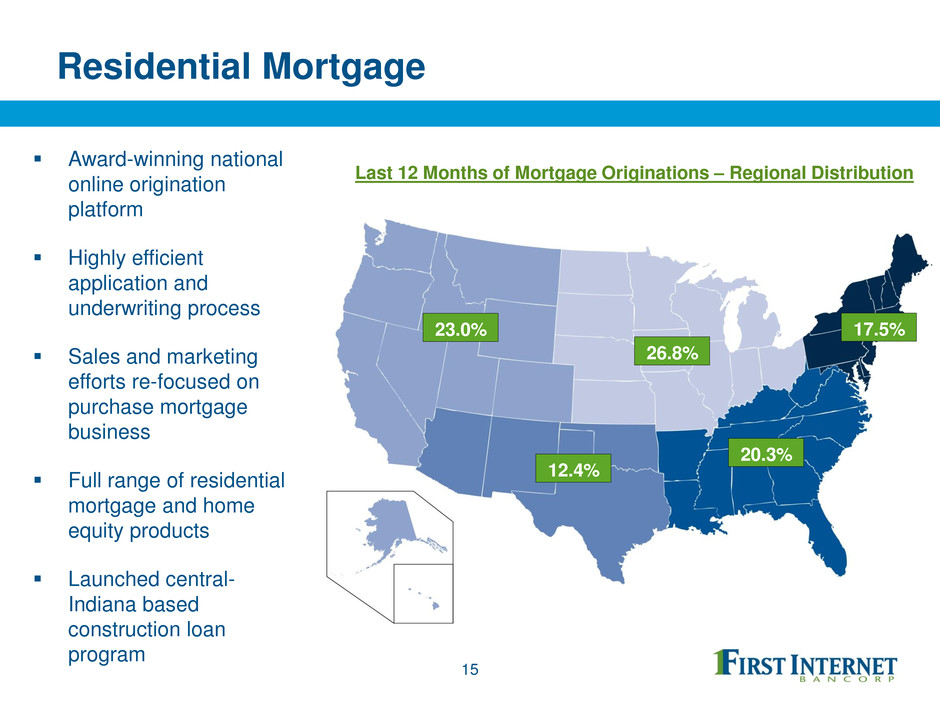

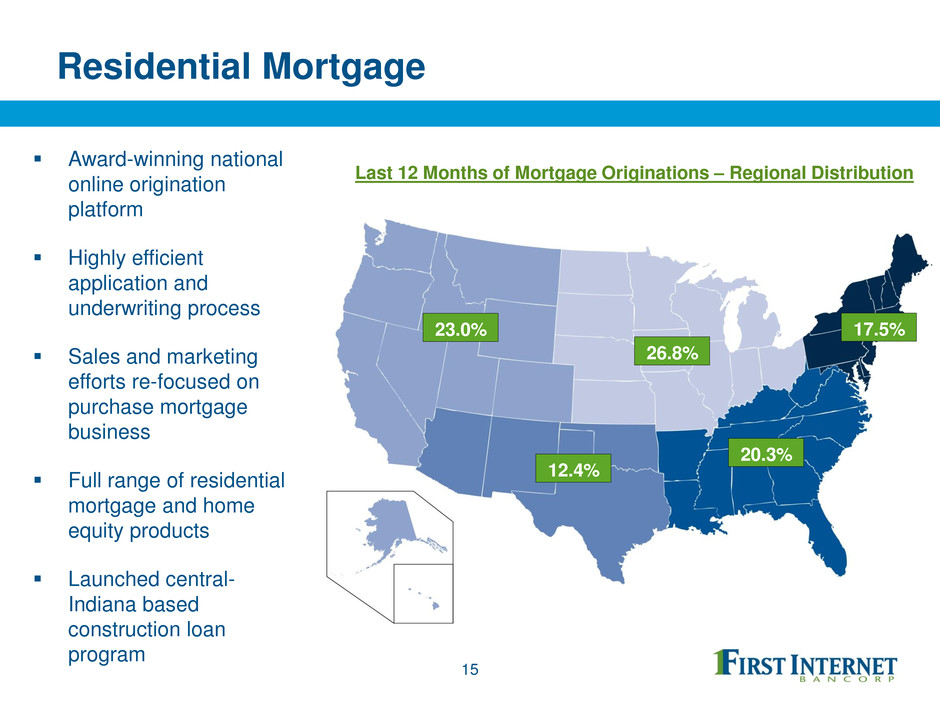

Residential Mortgage 15 Last 12 Months of Mortgage Originations – Regional Distribution Award-winning national online origination platform Highly efficient application and underwriting process Sales and marketing efforts re-focused on purchase mortgage business Full range of residential mortgage and home equity products Launched central- Indiana based construction loan program 23.0% 12.4% 26.8% 20.3% 17.5%

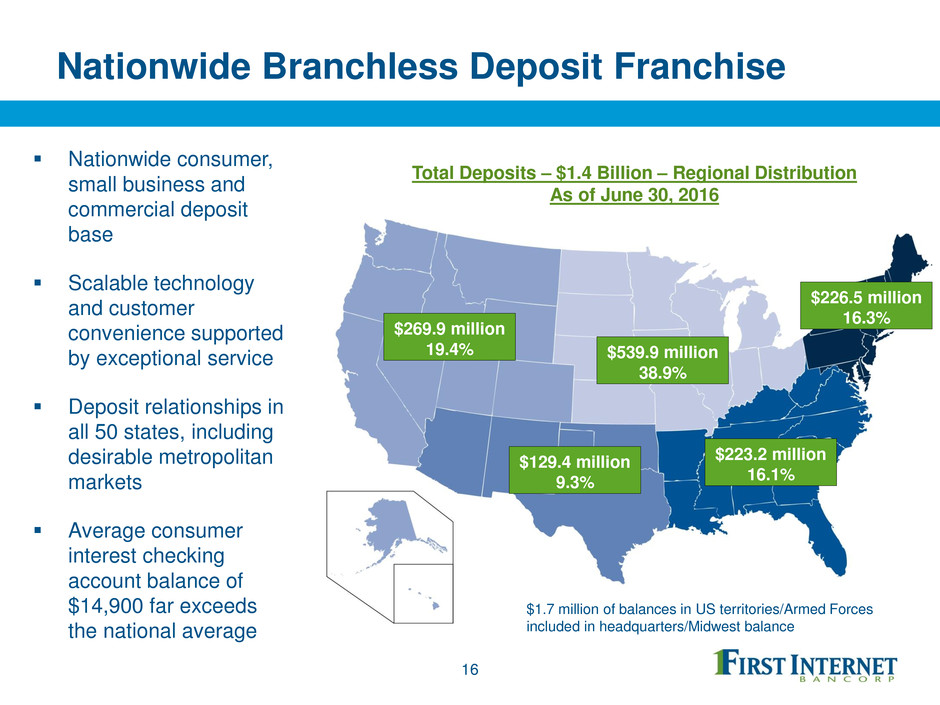

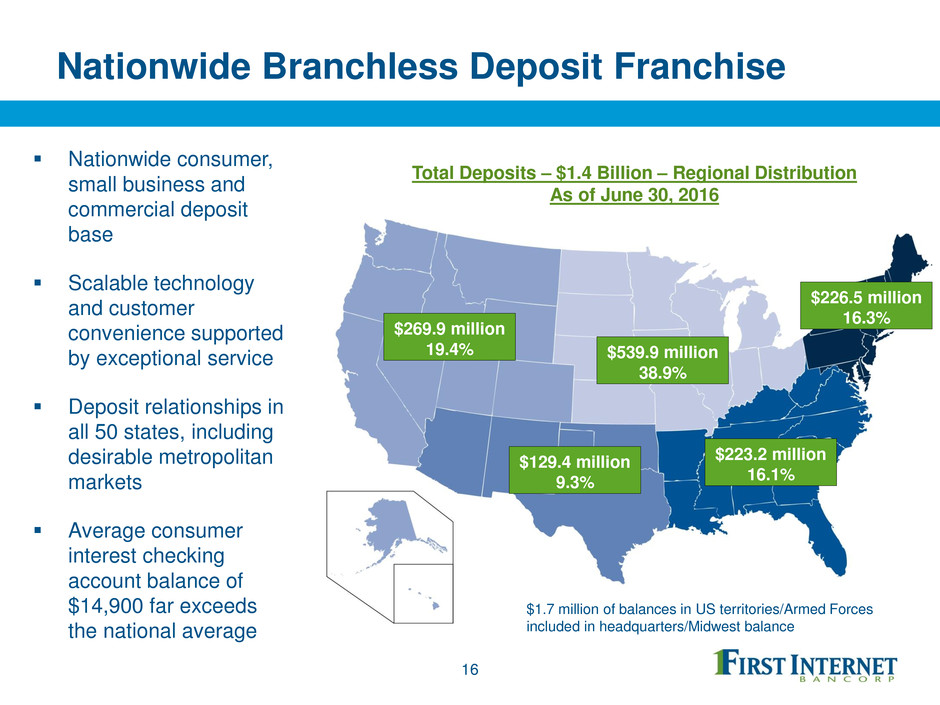

Nationwide Branchless Deposit Franchise 16 Total Deposits – $1.4 Billion – Regional Distribution As of June 30, 2016 Nationwide consumer, small business and commercial deposit base Scalable technology and customer convenience supported by exceptional service Deposit relationships in all 50 states, including desirable metropolitan markets Average consumer interest checking account balance of $14,900 far exceeds the national average $269.9 million 19.4% $129.4 million 9.3% $539.9 million 38.9% $223.2 million 16.1% $226.5 million 16.3% $1.7 million of balances in US territories/Armed Forces included in headquarters/Midwest balance

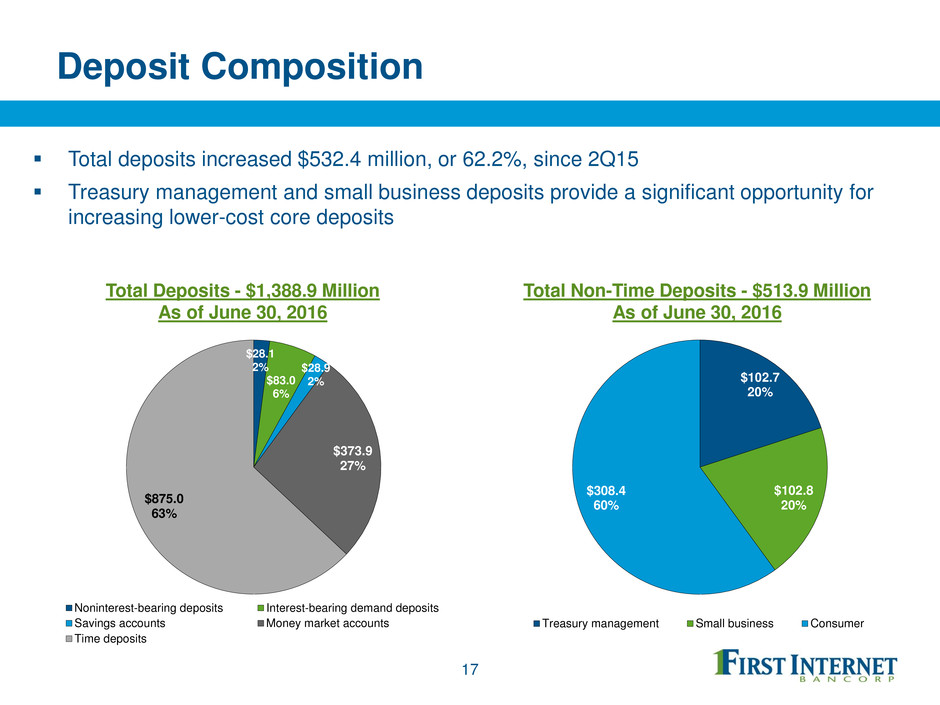

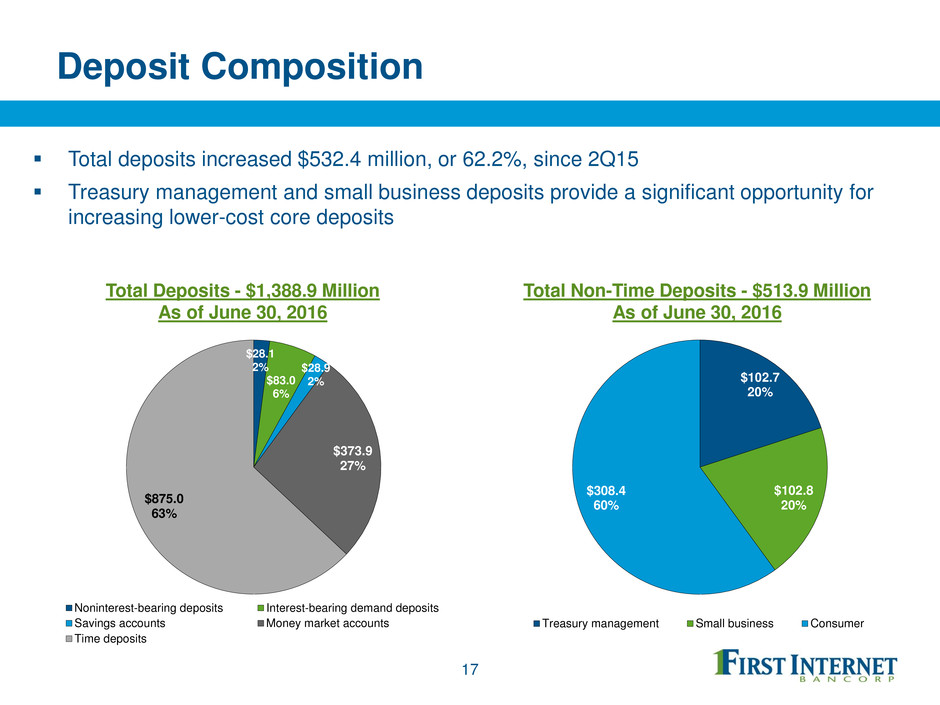

Deposit Composition Total deposits increased $532.4 million, or 62.2%, since 2Q15 Treasury management and small business deposits provide a significant opportunity for increasing lower-cost core deposits 17 Total Deposits - $1,388.9 Million As of June 30, 2016 Total Non-Time Deposits - $513.9 Million As of June 30, 2016 $28.1 2% $83.0 6% $28.9 2% $373.9 27% $875.0 63% Noninterest-bearing deposits Interest-bearing demand deposits Savings accounts Money market accounts Time deposits $102.7 20% $102.8 20% $308.4 60% Treasury management Small business Consumer

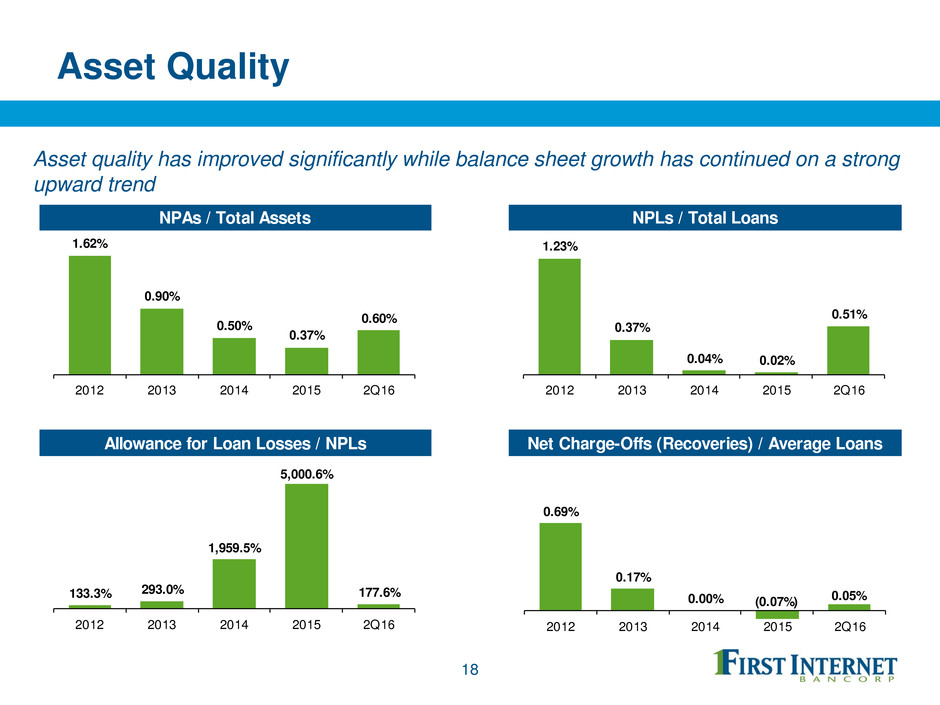

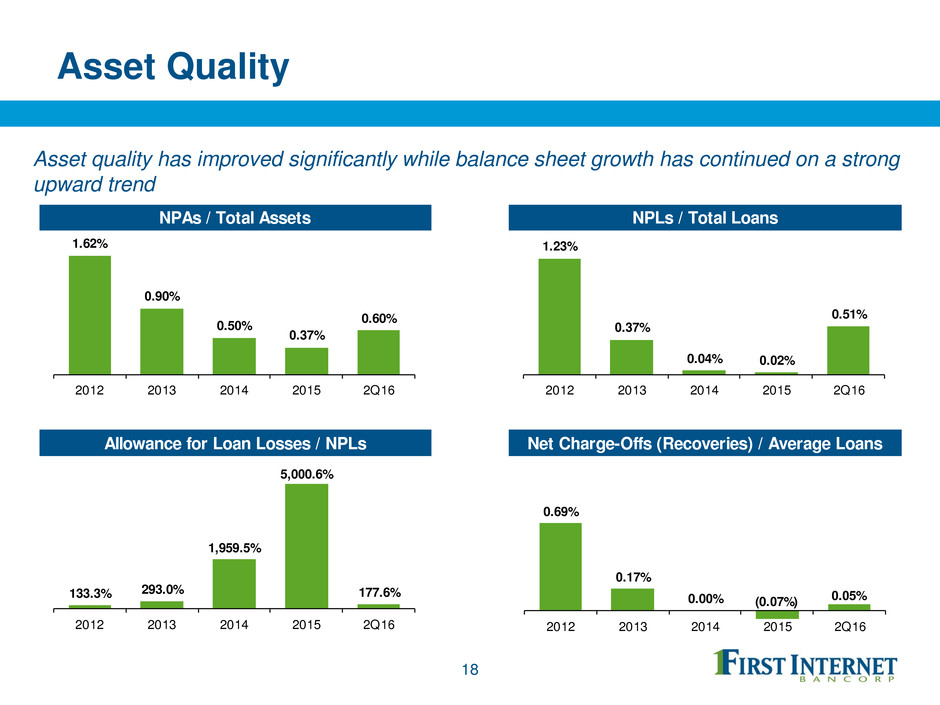

Asset Quality 18 Asset quality has improved significantly while balance sheet growth has continued on a strong upward trend NPAs / Total Assets NPLs / Total Loans Allowance for Loan Losses / NPLs Net Charge-Offs (Recoveries) / Average Loans 1.62% 0.90% 0.50% 0.37% 0.60% 2012 2013 2014 2015 2Q16 1.23% 0.37% 0.04% 0.02% 0.51% 2012 2013 2014 2015 2Q16 133.3% 293.0% 1,959.5% 5,000.6% 177.6% 2012 2013 2014 2015 2Q16 0.69% 0.17% 0.00% (0.07%) 0.05% 2012 2013 2014 2015 2Q16

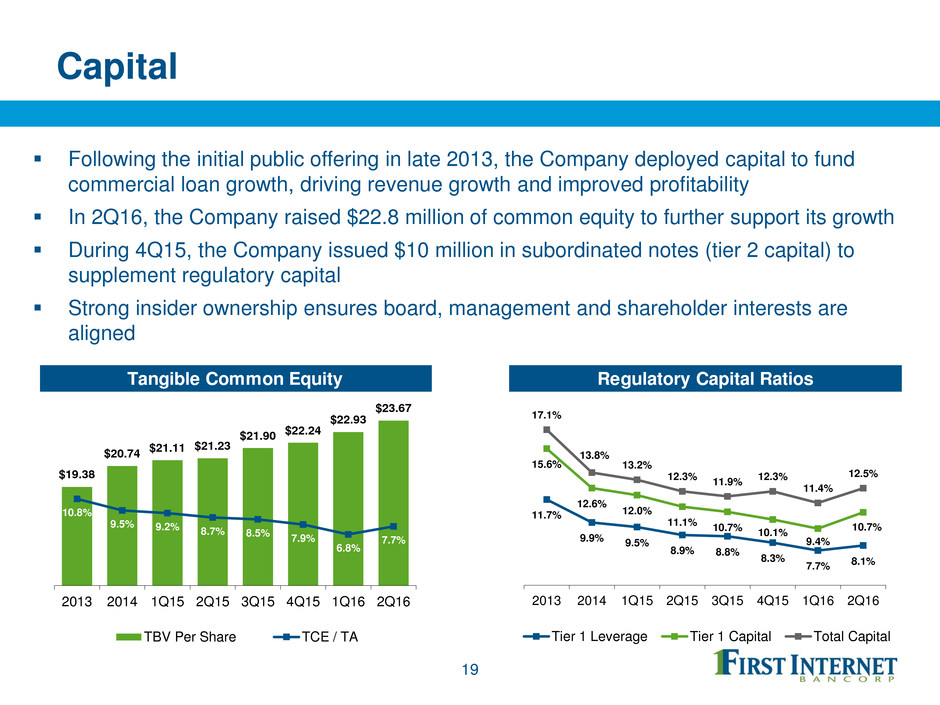

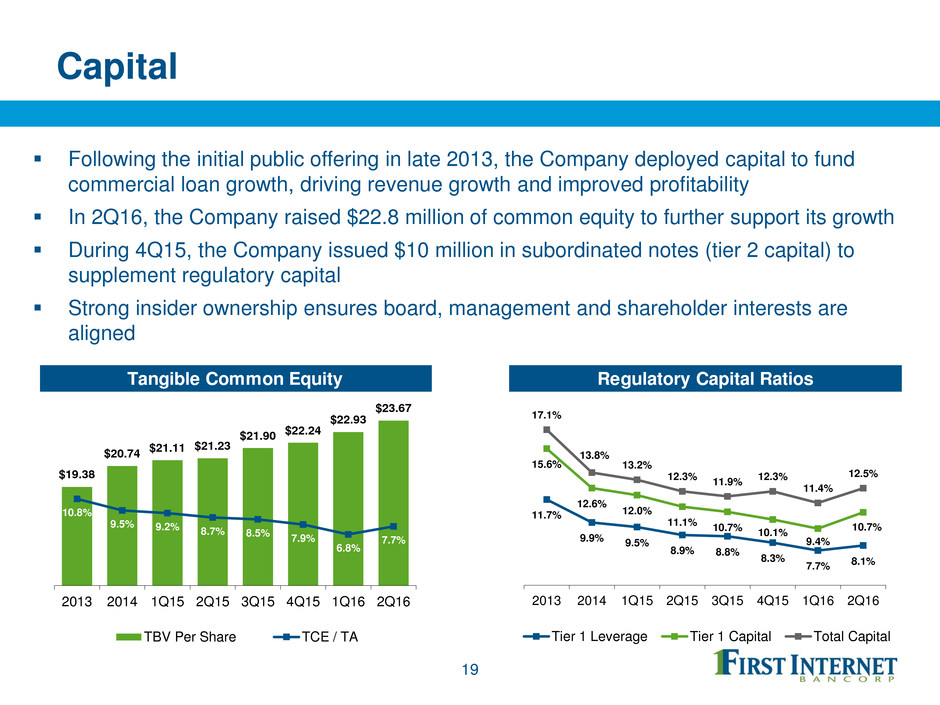

Capital 19 Following the initial public offering in late 2013, the Company deployed capital to fund commercial loan growth, driving revenue growth and improved profitability In 2Q16, the Company raised $22.8 million of common equity to further support its growth During 4Q15, the Company issued $10 million in subordinated notes (tier 2 capital) to supplement regulatory capital Strong insider ownership ensures board, management and shareholder interests are aligned Tangible Common Equity Regulatory Capital Ratios 11.7% 9.9% 9.5% 8.9% 8.8% 8.3% 7.7% 8.1% 15.6% 12.6% 12.0% 11.1% 10.7% 10.1% 9.4% 10.7% 17.1% 13.8% 13.2% 12.3% 11.9% 12.3% 11.4% 12.5% 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Tier 1 Leverage Tier 1 Capital Total Capital $19.38 $20.74 $21.11 $21.23 $21.90 $22.24 $22.93 $23.67 10.8% 9.5% 9.2% 8.7% 8.5% 7.9% 6.8% 7.7% 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 TBV Per Share TCE / TA

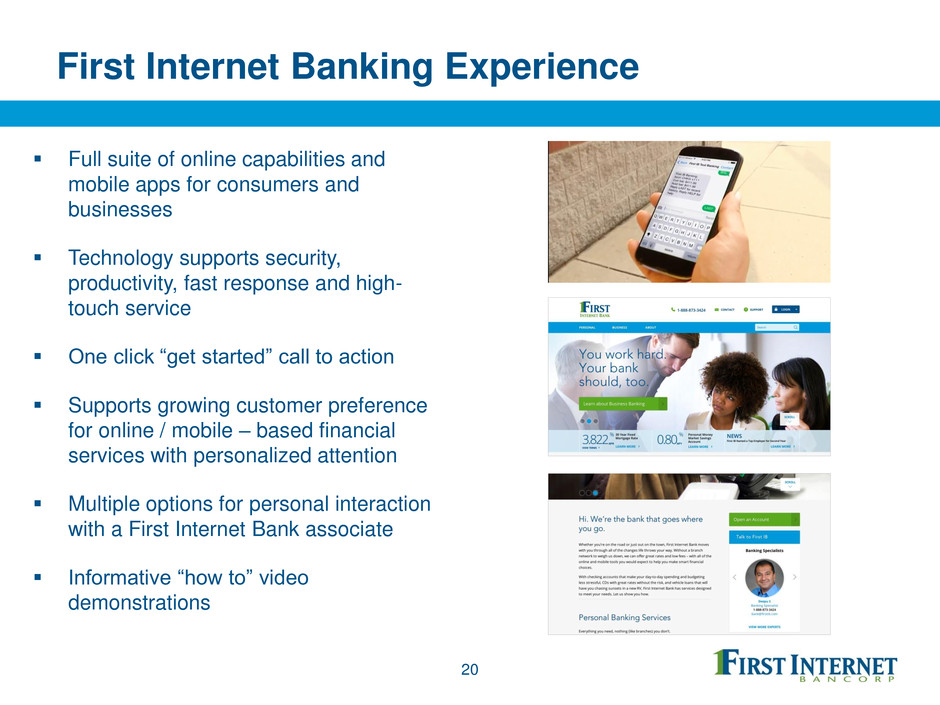

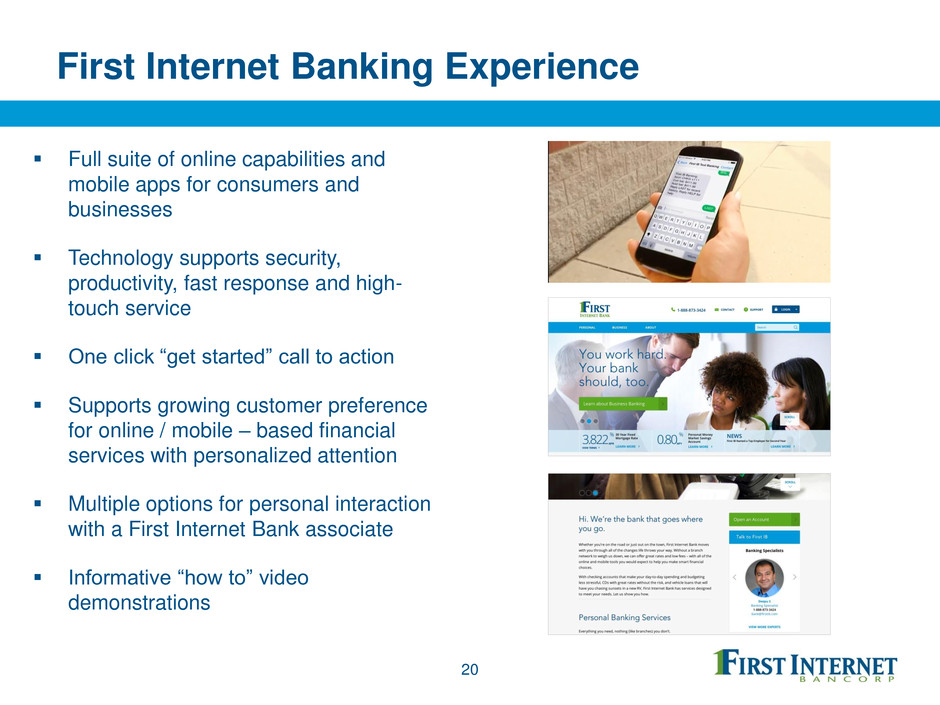

20 First Internet Banking Experience Full suite of online capabilities and mobile apps for consumers and businesses Technology supports security, productivity, fast response and high- touch service One click “get started” call to action Supports growing customer preference for online / mobile – based financial services with personalized attention Multiple options for personal interaction with a First Internet Bank associate Informative “how to” video demonstrations

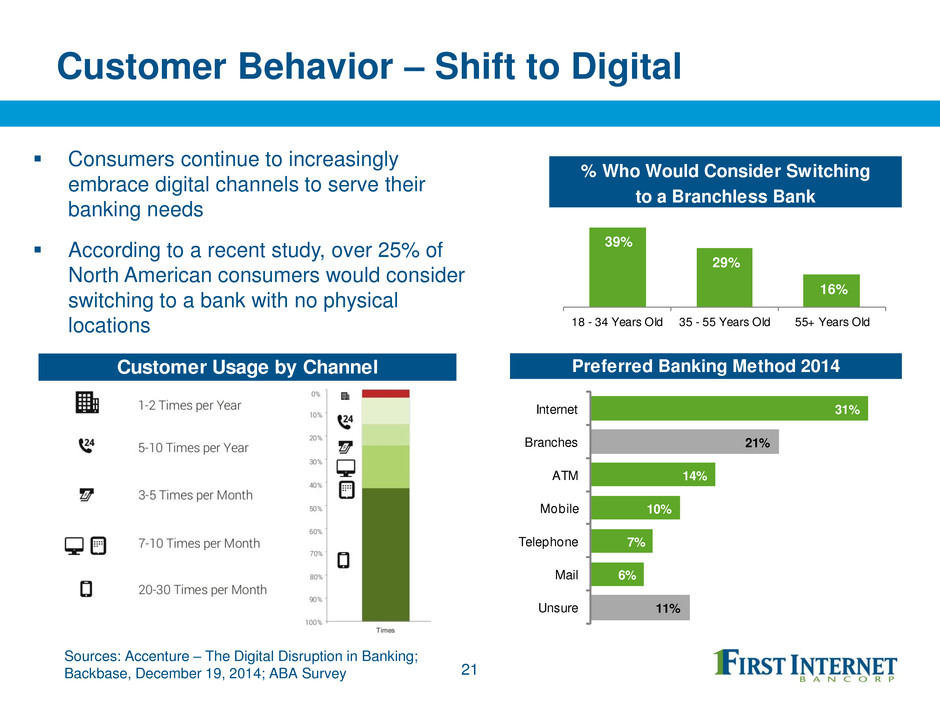

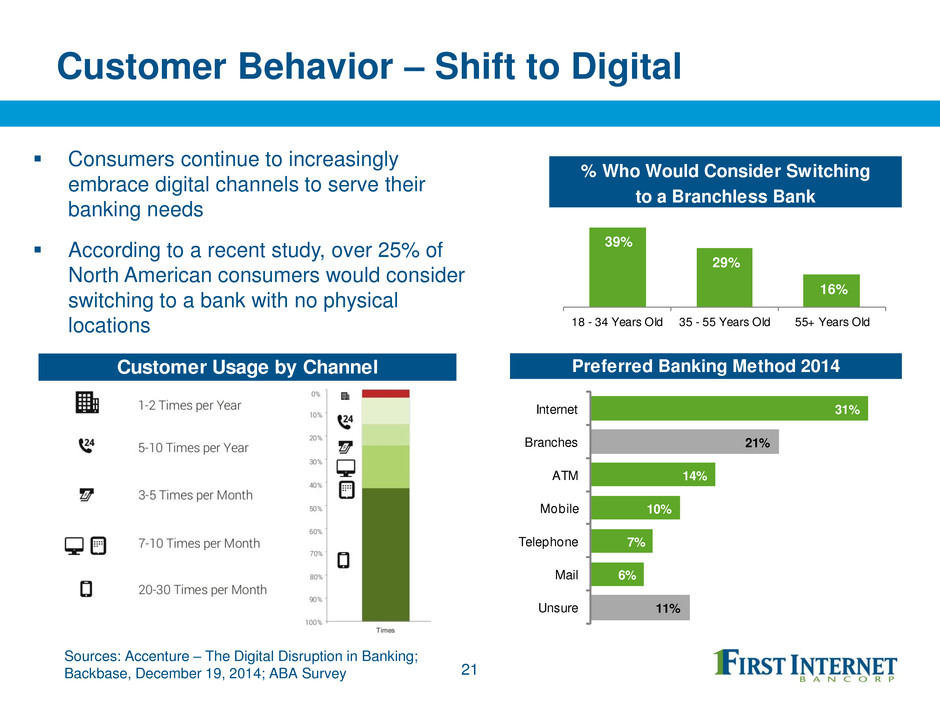

Customer Behavior – Shift to Digital Consumers continue to increasingly embrace digital channels to serve their banking needs According to a recent study, over 25% of North American consumers would consider switching to a bank with no physical locations 21 Sources: Accenture – The Digital Disruption in Banking; Backbase, December 19, 2014; ABA Survey Customer Usage by Channel Preferred Banking Method 2014 31% 21% 14% 10% 7% 6% 11% Internet Branches ATM Mobile Telephone Mail Unsure % Who Would Consider Switching to a Branchless Bank 39% 29% 16% 18 - 34 Years Old 35 - 55 Years Old 55+ Years Old

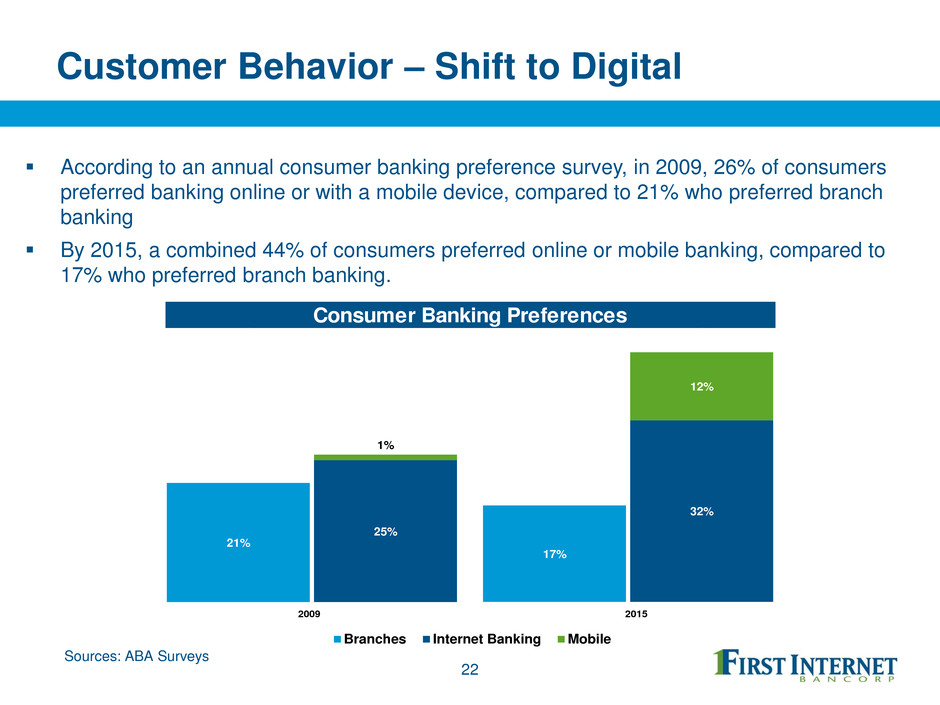

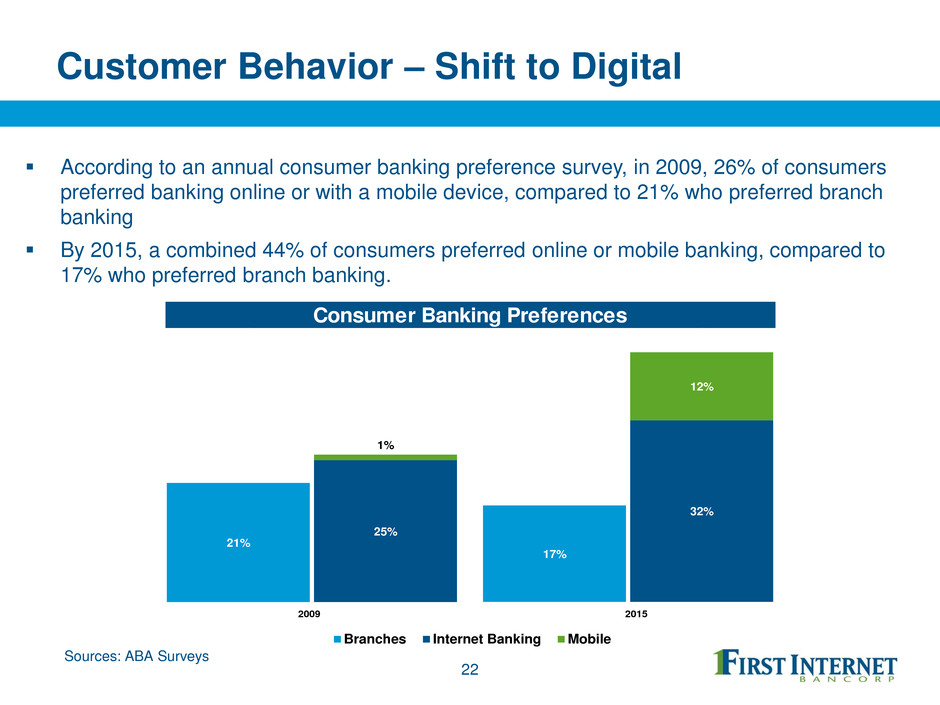

Customer Behavior – Shift to Digital According to an annual consumer banking preference survey, in 2009, 26% of consumers preferred banking online or with a mobile device, compared to 21% who preferred branch banking By 2015, a combined 44% of consumers preferred online or mobile banking, compared to 17% who preferred branch banking. 22 Sources: ABA Surveys Consumer Banking Preferences 21% 17% 25% 32% 1% 12% Branches Internet Banking Mobile 21% 17% 25% 32% 1% 12% Branches Internet Banking Mobile 21% 17% 25% 32% 1% 12% Branches Internet Banking Mobile 009 2015

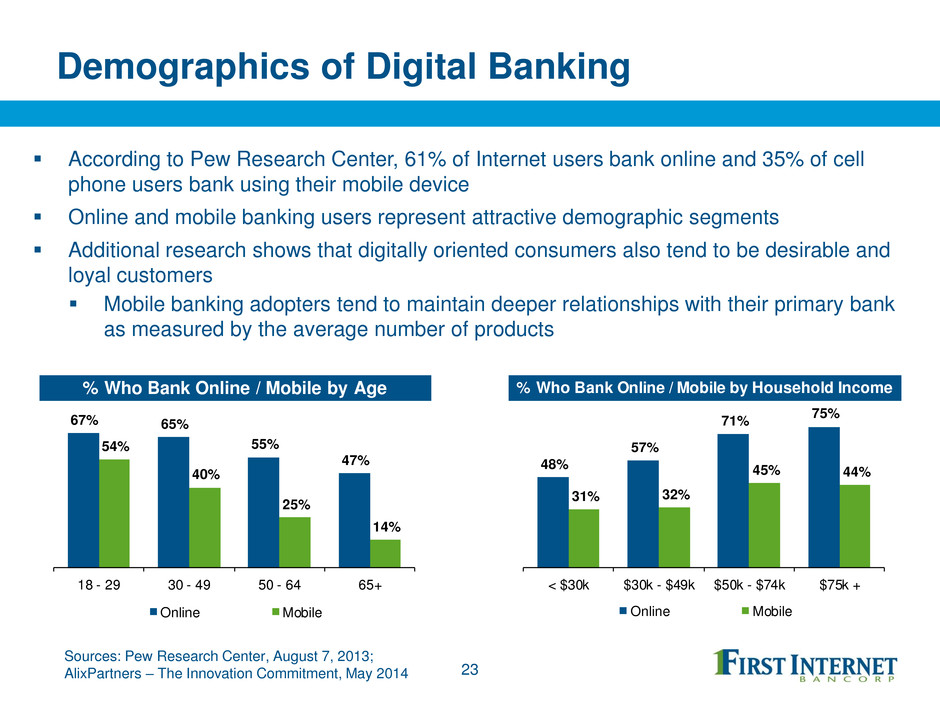

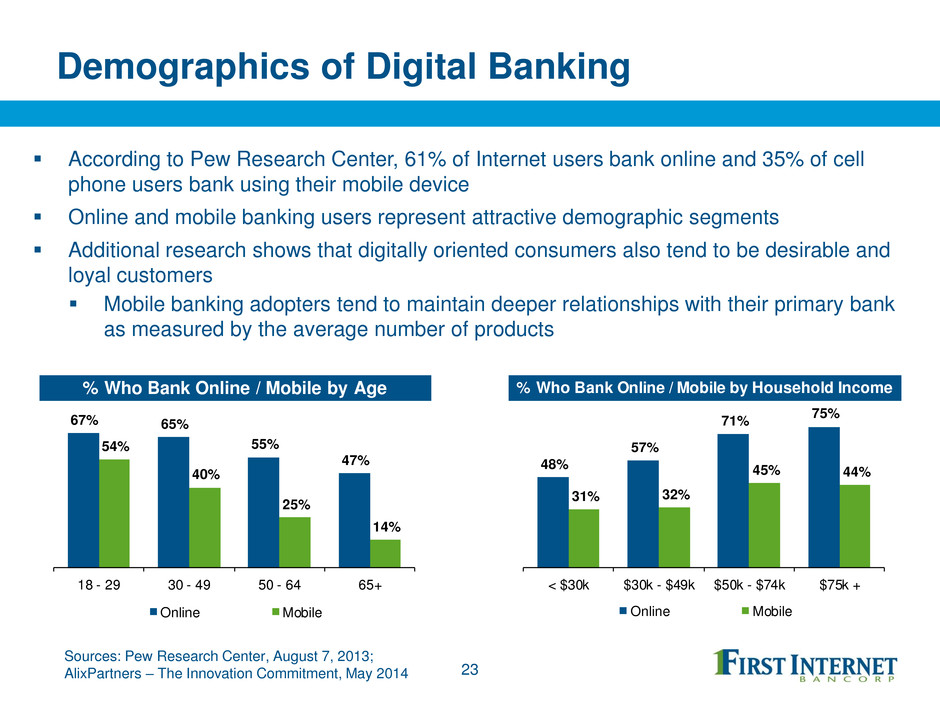

23 Demographics of Digital Banking According to Pew Research Center, 61% of Internet users bank online and 35% of cell phone users bank using their mobile device Online and mobile banking users represent attractive demographic segments Additional research shows that digitally oriented consumers also tend to be desirable and loyal customers Mobile banking adopters tend to maintain deeper relationships with their primary bank as measured by the average number of products Sources: Pew Research Center, August 7, 2013; AlixPartners – The Innovation Commitment, May 2014 % Who Bank Online / Mobile by Age % Who Bank Online / Mobile by Household Income 67% 65% 55% 47% 54% 40% 25% 14% 18 - 29 30 - 49 50 - 64 65+ Online Mobile 48% 57% 71% 75% 31% 32% 45% 44% < $30k $30k - $49k $50k - $74k $75k + Online Mobile

Investment Summary Strong earnings growth and rapidly improving profitability Demonstrated track record of deploying capital to fuel loan growth while maintaining strong asset quality Investments in commercial lending platform are producing results Geographic and credit product diversity provide ability to generate sustained balance sheet growth Consumer banking platform well-positioned to capitalize on changing consumer preferences Full service, technology-driven model will deliver increasing efficiency Strong management team committed to building shareholder value 24

First Internet Bancorp Investor Presentation Second Quarter 2016