- TMHC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Taylor Morrison Home (TMHC) DEF 14ADefinitive proxy

Filed: 16 Apr 21, 6:50am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material pursuant to § 240.14a-12 |

TAYLOR MORRISON HOME CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: | |

| ||

(2) |

Form,Schedule or Registration Statement No.: | |

| ||

(3) |

FilingParty: | |

| ||

(4) |

DateFiled: | |

|

Scottsdale, Arizona

April 16, 2021

Dear Stockholders:

You are cordially invited to attend the Taylor Morrison Home Corporation 2021 Annual Meeting of Stockholders on Wednesday, May 26, 2021 at 8:00 a.m. PT. The 2021 Annual Meeting will be a virtual meeting of stockholders. You will be able to attend the Annual Meeting, vote your shares electronically and submit your questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/TMHC2021. To participate in the meeting, you must have your 16-digit control number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. You will not be able to attend the 2021 Annual Meeting in person.

Our board of directors has fixed the close of business on March 30, 2021 as the record date for determining those holders of our common stock entitled to notice of, and to vote at, the Annual Meeting of Stockholders and any adjournments or postponements of the Annual Meeting of Stockholders.

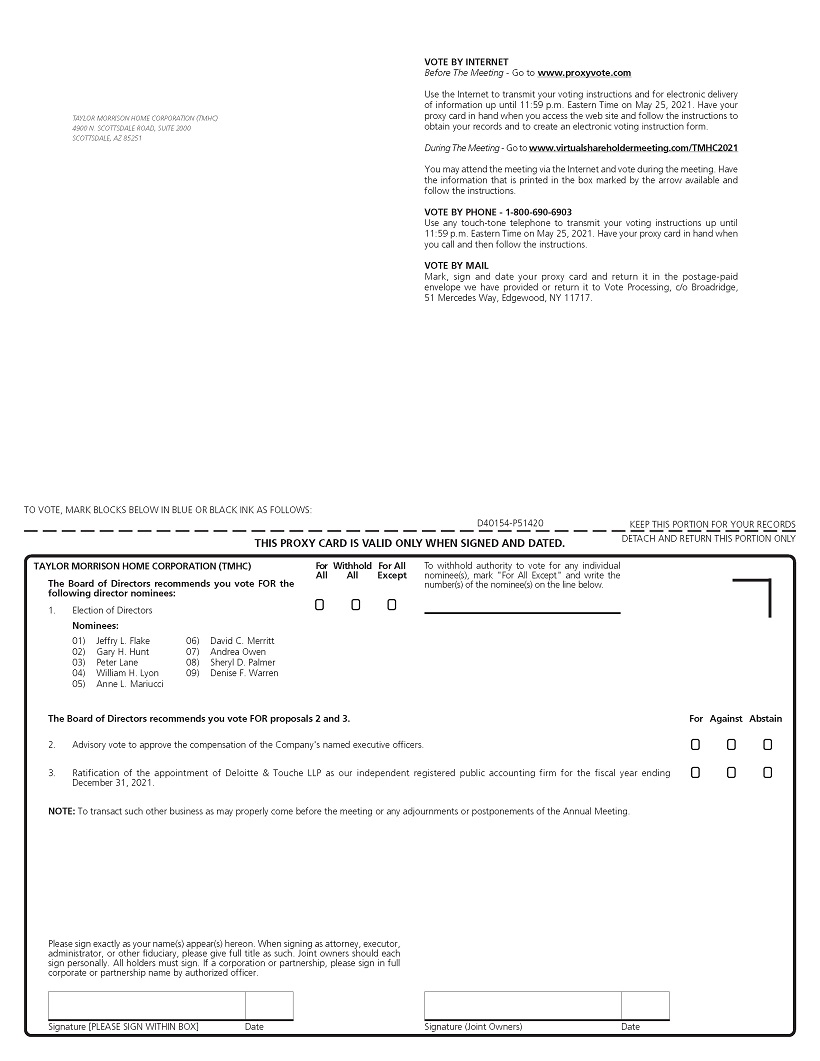

The Notice of Annual Meeting of Stockholders and Proxy Statement, both of which accompany this letter, provide details regarding the business to be conducted at the meeting, including proposals for the election of the directors named in this Proxy Statement to serve until the 2022 Annual Meeting of Stockholders (Proposal 1), an advisory vote to approve the compensation of our named executive officers (Proposal 2) and the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 3).

Our board of directors recommends that you vote “FOR” the director nominees named in this Proxy Statement and “FOR” each of Proposals 2 and 3. Each proposal is described in more detail in this Proxy Statement.

Your vote is very important. Please vote your shares promptly, whether or not you expect to attend the meeting. You may vote over the Internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy card or voting instruction form, as applicable.

Sincerely,

Sheryl D. Palmer

Chairman of the Board of Directors, President and Chief Executive Officer

TAYLOR MORRISON HOME CORPORATION

4900 N. Scottsdale Road, Suite 2000

Scottsdale, Arizona 85251

Notice of Annual Meeting of Stockholders

To be Held on May 26, 2021

The 2021 Annual Meeting of Stockholders of Taylor Morrison Home Corporation (the “Annual Meeting”) will be held on Wednesday, May 26, 2021 at 8:00 a.m. PT. You can attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/TMHC2021. You will need to have your 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting. The Annual Meeting will be held for the following purposes:

| 1. | To elect the directors named in this Proxy Statement and nominated by our board of directors to serve until the 2022 Annual Meeting of Stockholders; |

| 2. | To conduct an advisory vote to approve the compensation of our named executive officers; |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Only holders of record of our common stock at the close of business on March 30, 2021 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the Annual Meeting. A list of these stockholders will be open for examination by any stockholder electronically during the 2021 Annual Meeting at www.virtualshareholdermeeting.com/TMHC2021 when you enter your 16-digit control number.

This Notice of Annual Meeting of Stockholders and Proxy Statement are first being distributed or made available, as the case may be, on or about April 16, 2021.

| By order of the board of directors, |

|

Darrell C. Sherman Executive Vice President, Chief Legal Officer and Secretary |

Scottsdale, Arizona

April 16, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 26, 2021

THIS PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT: WWW.PROXYVOTE.COM

TABLE OF CONTENTS

|

TOC | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

PROXY STATEMENT SUMMARY

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the Proxy Statement before voting.

Annual Meeting of Stockholders

Date: | Wednesday, May 26, 2021 | |

Time: | 8:00 a.m. PT | |

Virtual Meeting: | This year’s meeting is a virtual stockholders meeting at www.virtualshareholdermeeting.com/TMHC2021. | |

Record Date: | March 30, 2021 | |

Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote per share. |

Proposals and Voting Recommendations

| Board Recommendation | Page | |||

Election of the director nominees named herein | For | 7 | ||

Advisory vote on the compensation of our named executive officers | For | 53 | ||

Ratification of the appointment of our independent auditor for fiscal 2021 | For | 54 |

Voting Methods

You can vote in one of four ways:

| Visit www.proxyvote.com to vote VIA THE INTERNET | |

| Call 1-800-690-6903 to vote BY TELEPHONE | |

| If you received printed proxy materials, sign, date and return your proxy card or voting instruction form, as applicable, in the prepaid enclosed envelope to vote BY MAIL | |

| You may also vote ONLINE during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/TMHC2021 and following the instructions. You will need the Control Number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials | |

To reduce our administrative and postage costs and the environmental impact of the Annual Meeting, we encourage stockholders to vote prior to the meeting via the Internet or by telephone, both of which are available 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 25, 2021. Stockholders may revoke their proxies at the times and in the manner described on page 4 of this Proxy Statement.

You will need to have your 16-digit control number included on your Notice of Internet Availability of Proxy Materials or, if you received a printed copy of the proxy materials, your proxy card or the instructions that accompanied your proxy materials to join the Annual Meeting and to vote during the Annual Meeting.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | i

GENERAL INFORMATION

|

TAYLOR MORRISON HOME CORPORATION

4900 N. Scottsdale Road, Suite 2000

Scottsdale, Arizona 85251

Proxy Statement

For the 2021 Annual Meeting of Stockholders

General Information Concerning Proxies and Voting at the Annual Meeting

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the board of directors of Taylor Morrison Home Corporation (the “Company,” “TMHC,” “we,” “us,” or “our”), a Delaware corporation, of proxies to be voted at our 2021 annual meeting of stockholders (the “Annual Meeting”) and at any adjournment or postponement of the Annual Meeting. In accordance with the rules of the Securities and Exchange Commission (“SEC”), on or about April 16, 2021, we sent a Notice of Internet Availability of Proxy Materials (the “Notice) (or, upon your request, will deliver printed versions of these proxy materials) and made available our proxy materials over the Internet to the holders of our common stock as of the close of business on March 30, 2021 (the “Record Date”).

Why is the Annual Meeting being webcast online?

Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders and other participants at the Annual Meeting, this year the Annual Meeting will be a virtual meeting of stockholders held via a live audio webcast. The virtual meeting will provide the same rights and advantages of a physical meeting. Stockholders will be able to present questions online during the meeting through www.virtualshareholdermeeting.com/TMHC2021, providing our stockholders with the opportunity for meaningful engagement with the Company.

How do I participate in the virtual meeting?

Our Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by live audio webcast. No physical in-person meeting will be held.

To participate in the meeting, you must have your 16-digit control number that is shown on your Notice or, if you received a printed copy of the proxy materials, on your proxy card or the instructions that accompanied your proxy materials. You may access the Annual Meeting by visiting www.virtualshareholdermeeting.com/TMHC2021. You will be able to submit questions during the meeting by typing in your question into the “ask a question” box on the meeting page. Should you require technical assistance, support will be available by dialing 1-800-586-1548 (US) or 1-303-562-9288 (international) during the meeting; these telephone numbers will also be displayed on the meeting webpage.

What information is included in this Proxy Statement?

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, our board of directors and board committees, corporate governance, the compensation of current directors and certain executive officers for the year ended December 31, 2020, and other information.

Who is entitled to vote?

Holders of our common stock at the close of business on the Record Date are entitled to vote at the Annual Meeting. As of the close of business on the Record Date, there were 128,731,939 shares of our common stock outstanding and entitled to vote.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 1

GENERAL INFORMATION

|

How many votes do I have?

On any matter that is submitted to a vote of our stockholders, holders are entitled to one vote per share of common stock held by them on the Record Date. Holders of our common stock are not entitled to cumulative voting in the election of directors.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most stockholders hold their shares through a bank, broker or other nominee rather than directly in their own name.

If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Limited, then you are a stockholder of record. As a stockholder of record, you may vote online during the Annual Meeting or vote by proxy. Whether or not you plan to virtually attend the Annual Meeting, we urge you to vote prior to the meeting over the Internet, by telephone or by filling out and returning a proxy card by mail to ensure your vote is counted.

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account.

Shares held in your name as the stockholder of record or beneficially in street name may be voted by you, while the polls remain open, at www.virtualshareholdermeeting.com/TMHC2021 during the meeting. You will need the 16-digit control number included on your Notice or, if you received a printed copy of the proxy materials, on your proxy card or the instructions that accompanied your proxy materials in order to be able to enter the meeting and to vote online during the meeting.

Even if you plan to participate in the online meeting, we recommend that you also submit your proxy or voting instructions as described above so that your vote will be counted if you later decide not to participate in the online meeting.

What am I voting on?

We are asking you to vote on the following matters in connection with the Annual Meeting:

| 1. | The election of the directors named in this Proxy Statement and nominated by our board of directors to serve until our annual meeting of stockholders to be held in 2022; |

| 2. | An advisory vote to approve the compensation of our named executive officers; and |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

We will also consider any other business that may properly come before the Annual Meeting. At the date of this Proxy Statement, we know of no business that will be brought before the Annual Meeting other than the matters set forth above.

How do I vote?

Vote by Internet

Stockholders of record may submit proxies over the Internet by following the instructions on the Notice or, if you requested printed copies of the proxy materials, the instructions on the printed proxy card. Most beneficial stockholders may vote by accessing the website specified on the voting instruction forms provided by their banks, brokers or other nominees. Please check your voting instruction form for Internet voting availability.

2 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

GENERAL INFORMATION

|

Vote by Telephone

Stockholders of record may submit proxies by telephone or mobile device by dialing (800) 690-6903 and following the recorded instructions. You will need the 16-digit number included on your Notice or, if you requested printed copies of the proxy materials, the instructions printed on the proxy card in order to vote by telephone. Most beneficial owners may vote using any telephone or mobile device from within the United States by calling the number specified on the voting instruction forms provided by their banks, brokers or other nominees.

Vote by Mail

Stockholders of record may submit proxies by mail by requesting a printed proxy card and completing, signing and dating the printed proxy card and mailing it in the pre-addressed envelopes that will accompany the printed proxy materials. Beneficial owners may vote by completing, signing and dating the voting instruction forms provided by their banks, brokers or other nominees and mailing them in the pre-addressed envelopes accompanying the voting instruction forms.

If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by that proxy as recommended by our board of directors. If you are a beneficial owner and you return your signed voting instruction form but do not indicate your voting preferences, please see “What are “broker non-votes”?” regarding whether your bank, broker or other nominee may vote your uninstructed shares on a particular proposal.

Vote Online at the Annual Meeting

All stockholders as of the close of business on the Record Date can vote online at the Annual Meeting. You may vote and submit questions while attending the meeting online via live audio webcast. Shares held in your name as the stockholder of record or beneficially in street name may be voted by you, while the polls remain open, at www.virtualshareholdermeeting.com/TMHC2021 during the meeting. You will need the 16-digit control number included on your Notice or, if you received a printed copy of the proxy materials, on your proxy card or the instructions that accompanied your proxy materials in order to be able to vote and enter the meeting. Even if you plan to attend the Annual Meeting, we recommend that you also vote either by telephone, by Internet or by mail so that your vote will be counted if you decide not to attend.

Will I be able to participate in the virtual meeting on the same basis as I would be able to participate in a live meeting?

The virtual meeting format for the Annual Meeting will enable full and equal participation by all of our stockholders from any place in the world at little to no cost. We believe that holding the Annual Meeting online will help support the health and well-being of our stockholders and other participants at the Annual Meeting as we navigate the public health impact of the COVID-19 outbreak.

We designed the format of the virtual meeting to ensure that our stockholders who attend our Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. In order to ensure such an experience, we will provide stockholders with the ability to submit appropriate questions real-time via the meeting website, limiting questions to one per stockholder and will answer as many questions submitted in accordance with the meeting rules of conduct as possible in the time allotted for the meeting without discrimination.

Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions regarding personal matters, including those related to employment issues, are not pertinent to meeting matters and therefore will not be answered.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, it means that your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the proxy cards or follow the instructions for any alternative voting procedures on each of the proxy cards or Notices of Internet Availability of Proxy Materials you receive.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 3

GENERAL INFORMATION

|

What can I do if I change my mind after I vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is exercised at the Annual Meeting by (a) delivering written notice stating that the proxy is revoked, bearing a date later than the proxy, to Taylor Morrison Home Corporation, 4900 N. Scottsdale Road, Suite 2000, Scottsdale, Arizona 85251, Attn: Chief Legal Officer and Secretary, (b) submitting a later-dated proxy relating to the same shares by mail, telephone or the Internet prior to the vote at the Annual Meeting or (c) attending the Annual Meeting and voting online. Stockholders of record may send a request for a new proxy card via e-mail to sendmaterial@proxyvote.com, or follow the instructions provided on the Notice of Internet Availability of Proxy Materials or proxy card to submit a new proxy via the Internet or by telephone. Stockholders of record may also request a new proxy card by calling 1-800-579-1639. If you are a beneficial stockholder, you may revoke your proxy or change your vote by following the separate instructions provided by your bank, broker or other nominee. To change your vote or revoke your proxy during the Annual Meeting, you must have your 16-Digit Control Number that is shown on your Notice or, if you received a printed copy of the proxy materials, on your proxy card or the instructions that accompanied your proxy materials.

What constitutes a quorum at the Annual Meeting?

Transaction of business at the Annual Meeting may occur only if a quorum is present. A quorum will be present if at least a majority of the voting power of our outstanding common stock entitled to vote at the meeting is present in person or represented by proxy. Your shares will be counted towards the quorum if you vote by mail, by telephone or through the Internet either before or during the Annual Meeting. Abstentions and shares represented by “broker non-votes” that are present and entitled to vote at the Annual Meeting are counted for purposes of determining a quorum.

If a quorum is not present, it is expected that the Annual Meeting will be adjourned or postponed in order to permit additional time for soliciting and obtaining additional proxies or votes, and, at any subsequent reconvening of the Annual Meeting, all proxies will be voted in the same manner as such proxies would have been voted at the original convening of the Annual Meeting, except for any proxies that have been effectively revoked or withdrawn, as discussed above under the heading “What can I do if I change my mind after I vote?”

What are “broker non-votes”?

A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote the shares on a proposal because the nominee does not have discretionary voting power for a particular item and has not received instructions from the beneficial owner regarding voting. Brokers who hold shares for the accounts of their clients have discretionary authority to vote shares if specific instructions are not given only with respect to “routine” items. If your shares are held by a bank, broker or other nominee on your behalf and you do not instruct the bank, broker or other nominee as to how to vote your shares on Proposals 1 or 2, the bank, broker or other nominee may not exercise discretion to vote on those proposals because these proposals are considered “non-routine” by the New York Stock Exchange (“NYSE”). With respect to Proposal 3 regarding the ratification of the appointment of our independent registered public accounting firm, the bank, broker or other nominee may exercise its discretion to vote for or against that proposal in the absence of your instructions.

4 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

GENERAL INFORMATION

|

What are the voting requirements to elect directors and approve each of the other proposals described in this Proxy Statement?

The table below summarizes the vote required to approve each proposal described in this Proxy Statement, how votes are counted and how our board of directors recommends you vote:

| Vote Required | Voting Options(1) | Board Recommendation | Broker Discretionary Voting Allowed | Impact of Broker Non-Vote | Impact of Vote | |||||||

Proposal 1: Election of directors | Greatest number of affirmative votes cast | “FOR” “WITHHOLD” | “FOR” | NO | NONE | NONE | ||||||

Proposal 2: Advisory vote to approve the compensation of our named executive officers |

Affirmative vote of a majority of shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter | “FOR” “AGAINST” “ABSTAIN” | “FOR” | NO | NONE | “AGAINST” | ||||||

Proposal 3: Ratification of appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 |

Affirmative vote of a majority of shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter | “FOR” “AGAINST” “ABSTAIN” | “FOR” | YES(2) | N/A | “AGAINST” |

| (1) | If you are a stockholder of record and just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” the director nominees listed herein and on the other proposals as recommended by our board of directors and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted upon. |

| (2) | As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal. Therefore, there will be no broker non-votes. |

Who will count the votes?

Representatives of the Company will act as inspectors of election. Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes.

Who will pay for the cost of this proxy solicitation?

We will bear the cost of the solicitation of proxies from our stockholders. In addition to solicitation by mail, our directors, officers and employees, without additional compensation, may solicit proxies from stockholders by telephone, by electronic communications, including by email, by letter, by facsimile, in person or otherwise. We will request banks, brokers or other nominees to forward copies of the proxy and other soliciting materials to persons for whom they hold shares of our common stock and to request authority for the exercise of proxies. In such cases, upon the request of the banks, brokers and other nominees, we will reimburse such holders for their reasonable expenses. We will also bear the cost of retaining any proxy solicitation firm, should we choose to retain one. We would expect the expenses associated with retaining any such proxy solicitation firm not to exceed $50,000.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice to each of our stockholders (other than those who have previously requested a printed copy of proxy materials) who held our common stock as of the Record Date. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or proxy card (or, for beneficial holders, the voting instruction form) and request to receive an electronic copy or printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request an electronic copy or printed copy may be found

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 5

GENERAL INFORMATION

|

in the Notice and in the proxy card (or, for beneficial holders, in the voting instruction form). In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the costs and environmental impact of the Annual Meeting.

When will we announce the results of the voting?

We expect to announce the final voting results by filing a Current Report on Form 8-K within four business days after the Annual Meeting. If the final voting results are unavailable at that time, we will file a Current Report on Form 8-K announcing the preliminary results, followed by an amended Current Report on Form 8-K within four business days of the day the final results are available.

6 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

|

Proposal 1: Election of Directors

Board Composition

Our board of directors currently consists of nine members, eight of whom our board of directors has affirmatively determined to be independent under the NYSE listing standards and our corporate governance documents.

At our 2018 Annual Meeting, our stockholders approved an amendment to our Amended and Restated Certificate of Incorporation to provide for the phased-in declassification of our board of directors. As a result, the entire board of directors will be elected on an annual basis beginning with the 2021 Annual Meeting.

For more information on the current composition of our board of directors, see “Corporate Governance—Information About Our Board of Directors—Process for Identifying and Nominating Directors” and “Corporate Governance—Board Structure and Operations—Composition of Our Board of Directors.”

Upon the recommendation of our nominating and governance committee, our board of directors has nominated Senator Flake, Messrs. Hunt, Lane, Lyon and Merritt, and Mses. Mariucci, Owen, Palmer and Warren for election as members of our board of directors. Each of our director nominees currently serves as a director and, if elected at the Annual Meeting, will serve as a director until our annual meeting of stockholders to be held in 2022 and until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal. Each of our director nominees has consented to being named as a nominee in this Proxy Statement and has agreed to serve if elected. If a nominee becomes unable to serve at the time the election occurs, proxies will be voted for another nominee designated by the board of directors unless the board chooses to reduce the number of directors serving on the board. The board of directors has no reason to believe that the nominees identified in this Proxy Statement will be unable or unwilling to serve as a director if elected.

Directors for Election to a One-Year Term Expiring at the 2022 Annual Meeting of Stockholders

JEFFRY L. FLAKE AGE 58 | Senator Flake has served as a director since February 2019. Senator Flake most recently served as a U.S. Senator representing Arizona from 2013 to 2019 and, prior to that, as a member of the U.S. House of Representatives from 2001 to 2013. During his time in the U.S. Senate, Senator Flake served on the Committees on Energy and Natural Resources, Foreign Relations and Judiciary. As a member of the House of Representatives, he served on the Appropriations, Natural Resources, Judiciary and Foreign Relations Committees. Senator Flake is a New York Times best-selling author and a frequent commentator on public policy. Senator Flake serves as a contributor to CNN. He was a Resident Fellow at the Kennedy School of Government at Harvard University and a visiting fellow at Arizona State University and Brigham Young University. Senator Flake holds a bachelor’s degree in international relations and a master’s degree in political science from Brigham Young University.

Senator Flake provides the Company with in-depth knowledge in the areas of public policy and governmental matters from his experience as a U.S. Senator and a member of the U.S. House of Representatives, which make him well qualified to serve on our board of directors.

|

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 7

PROPOSAL 1: ELECTION OF DIRECTORS

|

GARY H. HUNT AGE 72 | Gary H. Hunt has served as a director since February 2020. As a founding partner in 2001 and now the Vice Chairman of California Strategies, LLC, a full-service public affairs consulting firm. Mr. Hunt serves as a senior advisor to some of the largest master-planned community and real estate developers in the Western United States. Mr. Hunt also works or has worked with major national financial institutions and regional banks to manage projects through the real estate macro-economic restructuring and re-entitlement period. Previously, he was with The Irvine Company, one of the nation’s largest master planning and land development organizations, for 25 years, serving for ten years as its Executive Vice President and as a member of its Board of Directors and Executive Committee. Mr. Hunt led the company’s major entitlement, regional infrastructure, planning, legal and strategic government relations, as well as media and community relations activities. Since May 2016, Mr. Hunt has served on the board of Five Point Holdings, LLC, a publicly traded company, and was a member of the board and lead independent director of William Lyon Homes from October 2005 until our acquisition of William Lyon Homes in February 2020. In addition, Mr. Hunt serves on the boards of several private companies including Glenair Corporation, University of California, Irvine Foundation and Psomas Engineering Company. He formerly was Chairman of the Board of CT Realty and lead independent director of Grubb & Ellis Corporation, where he also served as interim President and CEO for a period of sixteen months.

Mr. Hunt brings extensive experience in the real estate industry and provides the board with additional insight on strategic, corporate governance and political matters, which make him well qualified to serve on our board of directors.

| |

PETER LANE AGE 56 | Mr. Lane has served as a director since June 2012 and as lead independent director since May 2017. Mr. Lane served as Chief Executive Officer of AXIP Energy Services, LP (formerly known as Valerus Compression Services, “AXIP”), an oilfield services company headquartered in Houston, Texas from 2010 to 2016. Prior to joining AXIP, Mr. Lane was an Operating Partner at TPG Global, LLC (“TPG”) from 2009 to 2011. Before TPG, Mr. Lane spent 12 years at Bain & Company (“Bain”), a global consulting firm, where he led the Dallas and Mexico City offices, as well as its oil and gas practice. He became a Partner at Bain in 2003. Mr. Lane currently serves on the board of directors of AXIP, The Bayou Companies, Rockall Energy and Goosehead Insurance, Inc. Mr. Lane holds a B.S. in physics from the University of Birmingham in the United Kingdom and an M.B.A. from the Wharton School at the University of Pennsylvania.

Mr. Lane brings extensive experience in business operations, finance and corporate governance to our board of directors. For these reasons, we believe he is well qualified to serve on our board of directors.

| |

WILLIAM H. LYON AGE 47 | William H. Lyon has served as a director since February 2020. Previously, he was the Executive Chairman and Chairman of the Board of William Lyon Homes from March 2016 until our acquisition of William Lyon Homes in February 2020. He also served as Chief Executive Officer of William Lyon Homes from March 2013 through July 2015, and as Co-Chief Executive Officer and Vice Chairman of the Board from July 2015 to March 2016. Since joining William Lyon Homes’ predecessor company in November 1997 as an assistant project manager, Mr. Lyon served in various capacities during his time with the company, including as a Project Manager, the Director of Corporate Development, the Director of Corporate Affairs, Vice President and Chief Administrative Officer, Executive Vice President and Chief Administrative Officer, and President and Chief Operating Officer. Mr. Lyon also actively served as the President of William Lyon Financial Services from June 2008 to April 2009, and was appointed to the William Lyon Homes board of directors in 2000. Mr. Lyon is a member of the Board of Directors of Commercial Bank of California and Pretend City Children’s Museum in Irvine, CA and an honorary Board member of The Bowers Museum in Santa Ana, CA. Mr. Lyon holds a dual B.S. in Industrial Engineering and Product Design from Stanford University.

Mr. Lyon brings to our Board significant executive and real estate development and homebuilding industry experience, which make him well qualified to serve on our board of directors.

|

8 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

|

ANNE L. MARIUCCI | Ms. Mariucci has served as a director since March 2014. Ms. Mariucci has over 30 years of experience in homebuilding and real estate. Prior to 2003, Ms. Mariucci held a number of executive senior management roles with Del Webb Corporation and was responsible for its large-scale community development and homebuilding business. She also served as President of Del Webb Corporation following its merger with Pulte Homes, Inc. She presently serves as a director of the following publicly traded companies: CoreCivic, Inc., Southwest Gas and Berry Petroleum. She also serves on the board of Banner Health, a national nonprofit health care provider. Since 2003, she has been affiliated with the private equity firms Hawkeye Partners, serving as a member of the Board of Advisors, and Glencoe Capital. She is a past director of the Arizona State Retirement System, Action Performance Companies, the Arizona Board of Regents (where she was its past Chairman) and the University of Arizona Health Network, as well as a past Trustee of the Urban Land Institute. She currently serves on the Board of Arizona State University Enterprise Partners, the parent organization of five ASU-affiliate companies. Ms. Mariucci received her undergraduate degree in accounting and finance from the University of Arizona and completed the corporate finance program at the Stanford University Graduate School of Business.

Ms. Mariucci brings extensive experience in real estate, homebuilding and corporate governance. For these reasons, we believe she is well qualified to serve on our board of directors.

| |

DAVID C. MERRITT | Mr. Merritt has served as a director since June 2013. From March 2009 through December 2013, he was the president of BC Partners, Inc., a financial advisory firm. Mr. Merritt is a director of Charter Communications, Inc., a publicly traded company, and currently serves as Chairman of its audit committee. Mr. Merritt previously served on the board of directors of Calpine Corporation. From 1975 to 1999, Mr. Merritt was an audit and consulting partner of KPMG, serving in a variety of capacities during his years with the firm, including national partner in charge of the media and entertainment practice. Mr. Merritt holds a B.S. degree in Business and Accounting from California State University—Northridge.

As a seasoned director and audit committee chair with extensive accounting, financial reporting and audit committee experience, Mr. Merritt brings a strong background in leadership, governance and corporate finance to the Company’s board of directors.

| |

ANDREA (ANDI) OWEN AGE 55 | Ms. Owen has served as a director since July 2018. Since August 2018, she has served as the Chief Executive Officer and member of the Board of Directors for Herman Miller, Inc., a globally recognized design and innovation company. Herman Miller provides furnishings and related technologies and services to solve problems for people wherever they live, work, learn, heal and play. As CEO, Andi is overseeing Herman Miller’s aggressive growth strategy to reach untapped market potential around the world while leading the company’s worldwide operations. Prior to joining Herman Miller, Ms. Owen served in various executive roles at The Gap Inc. for 25 years, most recently as the Global President, Banana Republic from 2014 to 2017 and as the Executive Vice President/General Manager of Gap Global Outlet from 2010 to 2014. Andi is passionate about using design thinking to solve complex problems, leveraging innovation to improve people’s lives, and using business as a force for good. She is often asked to express her views on diversity, equity, and inclusion; sustainability; the future of the workplace and distributed work models. Andi holds a Bachelor of Arts degree from the College of William and Mary and completed Harvard Business School’s Advanced Management Program. She also completed Harvard’s intensive, first-of-its-kind course, Women on Boards: Succeeding as a Corporate Director. Andi is a member of the Board of Directors of The National Association of Manufacturers, member of the Board of Directors for Susan G. Koeman and Chairperson of the Board of Directors of HAY ApS. She is also active in the community, serving as a member of the BIFMA Board, The Right Place, Inc., Business Leaders for Michigan, and the Herman Miller Foundation.

Ms. Owen brings extensive experience in consumer products businesses, marketing and executive leadership, which make her well qualified to serve on our board of directors.

|

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 9

PROPOSAL 1: ELECTION OF DIRECTORS

|

SHERYL D. PALMER AGE 59 | Ms. Palmer became our predecessor company’s President and Chief Executive Officer and a member of its board of directors in August 2007 after previously serving as Executive Vice President for the West Region of Morrison Homes. She has also served as our Chairman of the board since May 2017. Her previous experience includes senior leadership roles at Blackhawk Corp. and Pulte Homes/Del Webb Corporation, each homebuilders and developers of retirement communities, where she last held the title of Nevada Area President at Pulte/Del Webb Corporation and Division President at Blackhawk Corp. Ms. Palmer brings over 30 years of cross-functional building experience to her position, including leadership in land acquisition, sales and marketing, development and operations management. In addition to her employment with the Company, Ms. Palmer currently serves as a member of the board of directors and the audit and compensation committees of Interface, Inc., a leading publicly traded global manufacturer of modular carpet, as a member of the board of directors and executive committee of HomeAid America, a national non-profit that works with the local building industry to build and renovate multi-unit shelters for homeless families, Chairman of the Board of Directors for Building Talent Foundation, and the Executive Committee of the Joint Center for Housing Studies at Harvard University.

We believe Ms. Palmer’s over 30 years of industry experience make her a valuable member of our board of directors. In addition, as our President and Chief Executive Officer, it is appropriate for her to be a member of our board.

| |

DENISE F. WARREN AGE 57 | Ms. Warren has served as a director since July 2018. Since June 2016, she has served as the Chief Executive Officer of Netlyst, LLC, a consulting and advisory firm that focuses on digital business growth and scaling consumer and business-to-business recurring revenue streams. From June 2015 to March 2016, she served as the Tribune Publishing Company’s President of Digital and Chief Executive Officer of East Coast Publishing and Executive Vice President of Tribune Publishing Company. In her 26 years with The New York Times Company, she served in various executive leadership positions including Executive Vice President, Digital Products and Services, General Manager of NYTimes.com and Senior Vice President and Chief Advertising Officer. Ms. Warren formerly served as a director, a member of the audit committee and chair of the nominating and governance committee of Monotype Imaging Holdings Inc., a publicly traded provider of design assets, technology and expertise, and as a director and member of the audit committee of Electronic Arts Inc., a publicly traded digital interactive entertainment company. Ms. Warren also currently serves on the board of directors of Naviga, a Vista Equity Partners privately backed software technology company. Ms. Warren holds a B.S. in management from Tulane University and an M.B.A. in communications and media management from Fordham University.

We believe Ms. Warren’s long experience in digital marketing, business operations and corporate governance make her well qualified to serve on our board of directors.

|

In the vote on the election of the director nominees, stockholders may:

| • | vote FOR the nominee; or |

| • | WITHHOLD votes for the nominee. |

Unless you elect to vote differently by so indicating on your signed proxy, your shares will be voted FOR the board of directors’ nominees. The nine director nominees receiving the greatest number of votes cast at the Annual Meeting, even if less than a majority, will be elected. Proxies marked “withhold” and broker non-votes will have no effect on the outcome of this proposal. If a nominee ceases to be a candidate for election by the time of the Annual Meeting (a contingency that the board does not expect to occur), such proxies may be voted by the proxyholders in accordance with the recommendation of our board of directors.

The Board of Directors Recommends a Vote “FOR” the Above-Named Director Nominees.

10 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE

|

We believe that effective corporate governance is critical to our ability to create long-term value for our stockholders. We have adopted and implemented charters, policies, procedures and controls that we believe promote and enhance corporate governance, accountability and responsibility and create a culture of honesty and integrity at our company. Our Corporate Governance Guidelines, Code of Conduct and Ethics, various other governance-related information and board committee charters are available on the Investor Relations page of our corporate website at www.taylormorrison.com under the category “Corporate Governance.”

Our board of directors consists of a majority of independent directors, and all of our standing committees are fully independent.

Information About Our Board of Directors

Director Independence

Our board of directors consults with our legal counsel to ensure that the board’s independence determinations are consistent with relevant securities and other laws and regulations regarding director independence. To assist in the board’s independence determinations, each director completes materials designed to identify any relationships that could affect the director’s independence. In addition, through discussions among our directors, an analysis of independence is undertaken by the nominating and governance committee, and an affirmative determination is made by the board of directors. The board of directors has determined that Mses. Mariucci, Owen and Warren, Senator Flake and Messrs. Hunt, Lane, Lyon and Merritt are “independent,” as such term is defined by the applicable rules and regulations of the NYSE. Additionally, each of these directors meets the categorical standards for independence established by our board of directors, as set forth in our Corporate Governance Guidelines.

Director Qualifications

The board of directors has delegated to the nominating and governance committee the responsibility of reviewing and recommending nominees for membership of the board of directors. Although we have no formal policy addressing diversity, the nominating and governance committee seeks candidates from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. When considering the addition of new board members or filling vacancies, the nominating and governance committee will strive for the inclusion of diverse groups, including, where appropriate, diversity of age, gender, race, ethnicity, professional experience, knowledge, and viewpoints. The assessment of these candidates includes, among other factors, an individual’s independence, which determination is based upon applicable NYSE rules, applicable SEC rules and regulations, our Corporate Governance Guidelines and input from legal counsel, if necessary, as well as consideration of age, skills, character and experience, and a policy of promoting diversity, in the context of the needs of the Company. Other characteristics, including, but not limited to, the director nominee’s material relationships with us, time availability, service on other boards of directors and their committees or any other characteristics which may prove relevant at any given time, are also reviewed by the nominating and governance committee for purposes of determining a director nominee’s qualification.

In the case of incumbent directors whose terms of office are set to expire, the nominating and governance committee reviews such directors’ overall service to our Company during their respective term, including the number of meetings attended, level of participation, quality of performance and any relationships and transactions that might impair such directors’ independence. In addition, pursuant to our Corporate Governance Guidelines, no person shall be nominated by the board of directors to serve as a director after he or she has passed his or her 72nd birthday, unless the nominating and governance committee has voted to waive the mandatory retirement age for such director at the time of nomination. Consistent with our Corporate Governance Guidelines, the nominating and governance committee has determined to waive the mandatory retirement age with respect to Mr. Hunt, who has reached the age of 72, in connection with his nomination in light of our recent acquisition of William Lyon Homes and Mr. Hunt’s deep expertise in land acquisition strategies.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 11

CORPORATE GOVERNANCE

|

Process for Identifying and Nominating Directors

Nominees for our board of directors are recommended by the nominating and governance committee, which may utilize a variety of methods for identifying nominees for director. Candidates may come to the attention of the nominating and governance committee through current board members, management, professional search firms, stockholders or other persons. The nominating and governance committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation.

The nominating and governance committee will consider nominees proposed by our stockholders in accordance with the provisions contained in our amended and restated by-laws (our “By-laws”). Each notice of nomination submitted in this manner must contain the information specified in our By-laws, including, but not limited to, information with respect to the beneficial ownership of our common stock or derivative securities that have a value associated with our common stock held by the proposing stockholder and its associates and any voting or similar agreement the proposing stockholder has entered into with respect to our common stock. To be timely, the notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary of the date of the prior year’s annual meeting of stockholders. If the annual meeting of stockholders is advanced by more than 30 days, or delayed by more than 60 days, from the anniversary of the preceding year’s annual meeting of stockholders, or if no annual meeting of stockholders was held in the preceding year, notice by the stockholder, to be timely, must be received no earlier than the 120th day prior to the annual meeting of stockholders and no later than the later of (1) the 90th day prior to the annual meeting of stockholders and (2) the tenth day following the day on which we notify stockholders of the date of the annual meeting of stockholders, either by mail or other public disclosure.

The foregoing description of the advance notice provisions of our By-laws is a summary and is qualified in its entirety by reference to the full text of our By-laws. Accordingly, we advise you to review our By-laws for additional stipulations relating to the process for nominating directors, including advance notice of director nominations and stockholder proposals. See also “Additional Information—Submission of Stockholder Proposals at Next Year’s Annual Meeting.”

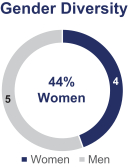

Consistent with the Company’s Corporate Governance Guidelines, the nominating and governance committee seeks director candidates from diverse professional and personal backgrounds who combine a broad spectrum of experience and expertise. While the Board has not adopted a formal policy with respect to the consideration of diversity in identifying director nominees, the nominating and governance committee and the Board believe that considering diversity is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its stockholders, and it is one of the many factors that they consider when identifying individuals for Board membership.

In addition, we believe that diversity with respect to tenure is important in order to provide for both fresh perspectives and deep experience and knowledge of the Company. Therefore, we aim to maintain an appropriate balance of tenure across our directors. In furtherance of the Board’s active role in Board succession planning, the Board has appointed five new directors since 2018.

The composition of our Board reflects those efforts and the importance of diversity to the Board. Of our nine directors:

|  |

12 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE

|

| ||

Board Structure and Operations

Composition of Our Board of Directors

In accordance with our Certificate of Incorporation and By-laws, the number of directors on our board is determined from time to time by our board of directors and is currently a nine-member board. Each director elected or appointed to the board will hold office for a term expiring at the annual meeting of stockholders following his or her election or appointment and until his or her successor has been duly elected and qualified, or until his or her earlier death, disqualification, resignation or removal. Subject to the special rights of the holders of one or more series of preferred stock, vacancies and newly created directorships on the board of directors may be filled at any time by the remaining directors.

Board Leadership Structure

Our board of directors does not currently have a policy as to whether the role of Chairman of our board of directors and the Chief Executive Officer should be separate. Our board of directors believes that the Company and its stockholders are best served by maintaining the flexibility to determine whether the Chairman and Chief Executive Officer positions should be separated or combined at a given point in time in order to provide appropriate leadership for us at that time. In addition, our Corporate Governance Guidelines provide that, in order to maintain the independent integrity of our board of directors, if the Chairman of the board is not an independent director, the board of directors may appoint an independent director as lead director.

The board of directors understands that no single approach to board leadership is universally accepted and that the appropriate leadership structure may vary based on several factors, such as a company’s size, industry, operations, history and culture. Accordingly, our board of directors, with the assistance of the nominating and governance committee, assesses its leadership structure in light of these factors and the current environment to achieve the optimal model for us and for our stockholders. The board has determined that, at this time, it is in our and our stockholders’ best interests that our President and Chief Executive Officer serve as Chairman and that Peter Lane serve as our lead independent director with such role and responsibilities as set forth our Corporate Governance Guidelines, including presiding at all meetings at which the Chairman of the board is not present, as well as at all executive sessions of the independent directors.

The board of directors believes that Ms. Palmer’s dual role is appropriate, given her extensive industry experience, as well as the depth and breadth of her institutional knowledge of the Company’s business, having served at length in a leadership position at the Company and on our board of directors. The board of directors further believes that this combined role of Chairman and Chief Executive Officer, counterbalanced by a lead independent director, is most suitable for us at this time and is in the best interest of our stockholders because it provides the optimal balance between independent oversight of management and unified leadership (i.e., the appropriate balance of authority between those persons charged with overseeing the Company and those who manage it on a day-to-day basis), promotes the development and execution of our strategy and facilitates the flow of information between management and the board of directors, which are essential to effective corporate governance.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 13

CORPORATE GOVERNANCE

|

Board’s Role in Risk Oversight

Our board of directors exercises oversight of risk management consistent with its duties to the Company and its subsidiaries.

The audit committee is responsible for discussing with management our major financial, credit, liquidity and other risk exposures, as well as our risk assessment and risk management policies. The audit committee works directly with members of senior management and our internal audit staff to review and assess our risk management initiatives, including our compliance programs and cybersecurity initiatives, and reports as appropriate to the board. In addition, the audit committee meets as appropriate (1) as a committee to discuss our risk management guidelines and policies and risk exposures and (2) with our independent auditors to review our internal control environment and other risk exposures.

The compensation committee oversees the management of risks relating to our executive compensation programs and employee benefit plans. In the fulfillment of its duties, the compensation committee reviews at least annually our executive compensation programs, meets regularly with management to understand the financial, human resources and stockholder implications of compensation decisions and reports as appropriate to the board.

The board of directors as a whole also engages in the oversight of risk in various ways.

| • | During the course of each year, the board of directors reviews the structure and operation of various departments and functions of our company, including its risk management and internal audit functions. In these reviews, the board of directors discusses with management the risks affecting those departments and functions and management’s approaches to mitigating those risks. |

| • | The board of directors reviews and approves each year’s management operating plan. These reviews cover risks that could affect the management operating plan and measures to cope with those risks. |

| • | In its review and approval of our annual reports on Form 10-K, the board of directors reviews our business and related risks, including as described in the “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the document. The audit committee updates this review quarterly in connection with the preparation of our quarterly reports on Form 10-Q. |

| • | Management must obtain the approval of the board of directors before proceeding with any land acquisition above a pre-established threshold. When the board of directors reviews particular transactions and initiatives that require board approval, or that otherwise merit the board of directors’ involvement, the board of directors generally includes related risk analysis and mitigation plans among the matters addressed with management. |

In addition to the foregoing, the Company has an enterprise risk management (“ERM”) committee. The ERM committee consists of members of our management team who work with other key members of management to identify, monitor and evaluate the Company’s risks and develop an approach to address and mitigate each identified risk. Each quarter, and more frequently, if necessary, the ERM committee reports its findings and recommendations to the audit committee, which then reports to the board of directors.

As part of its risk oversight regarding cybersecurity, the ERM committee works with the Company’s Chief Information Officer and the Company’s Cyber-Risk Management Subcommittee (composed of the heads of the Company’s information technology, internal audit and risk management groups) to review on a quarterly basis, or more frequently as necessary, any cyber incidents and the results from the Company’s security self-audits. This cybersecurity evaluation forms a part of the ERM committee’s quarterly reports to the audit committee and the audit committee’s quarterly reports to the board of directors. Our board of directors also receives on an annual basis, or more frequently as necessary, a report from the Company’s Chief Information Officer and/or the Vice President of Information Technology regarding cyber risk matters affecting the Company.

The day-to-day identification and management of risk is the responsibility of our management. As market conditions, industry practices, regulatory requirements and the demands of our business evolve, management and the board of directors intend to respond with appropriate adaptations to risk management and oversight.

Response to COVID-19

Transparent and honest communication has always been at the cornerstone of our business philosophy. Throughout the COVID-19 crisis, we have drawn upon our ability to communicate candidly and rapidly—along with our robust ERM processes—to ensure that our team members, customers and trades are kept healthy and safe while ensuring operational continuity and stewardship of our business.

14 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE

|

Upon the onset of the COVID-19 pandemic, our leadership team created a COVID-19 Task Force to help facilitate the Company’s response to the pandemic. In close communication and coordination with our Board, our response efforts have been led by our CEO, members of our ERM committee and the COVID-19 Task Force, with assistance from a senior outside healthcare consultant.

We have taken and will continue to take proactive and preventive measures to help minimize risk of COVID-19 in our communities—both inside and outside of the organization. During the onset of the pandemic, the task force held daily meetings to adjust our response, informed by the latest recommendations from the Centers for Disease Control and Prevention (CDC) as well as state and local governments. The task force continues to meet regularly to discuss, among other things, recent infection and related trends and the latest CDC guidance. The task force determines the appropriate protocols and procedures to maintain health and safety within the organization and with our customers and trade partners.

Early in the unfolding of the crisis, we applied our emergency protocols focused on the safety of our team members, customers and communities. We are providing additional paid time off to any team member who tests positive for COVID-19 and our protocols address everything from personal safety precautions, resident and homeowner association safety, travel restrictions, work-from-home policies, sales and marketing procedures, warranty and customer service communications, field construction site operations and information technology and cybersecurity.

To help our team members stay apprised of the latest information, we shared communication resources for our team members to connect and ask questions about our response to the current situation through our hotline, corporate email addresses and a dedicated internal webpage. In addition to routine CEO communications directly to our team members, we have instituted company-wide Huddles, led by our CEO, to address the actions we are taking to mitigate COVID-19’s impact on our team members and business.

Meetings of our Board of Directors

Our board of directors and its committees meet periodically during the year, hold special meetings as needed and act by written consent from time to time as deemed appropriate. During 2020, our board of directors met six times.

During 2020, no incumbent director attended fewer than 75% of the aggregate of (a) the total number of meetings of the board of directors and (b) the total number of meetings held by all committees of the board of directors on which such director served.

Each of our directors is encouraged, but is not required, to attend our annual meetings of stockholders. All of our then serving directors attended our 2020 annual meeting of stockholders.

Executive Sessions of our Board of Directors

Generally, an executive session of the independent directors is held in conjunction with each regularly scheduled board meeting and at other times as deemed appropriate. Our lead independent director presides over such executive sessions.

Committees of Our Board of Directors

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and governance committee. Each of the standing committees operates pursuant to a written charter, which is available on our corporate website at www.taylormorrison.com on the Investor Relations page under the category “Corporate Governance.” The following is a brief description of our committees, including their membership and responsibilities.

Audit Committee

Our audit committee assists the board in fulfilling its responsibilities by overseeing, among other things, (1) the integrity of financial information and other information provided to stockholders, investors and others; (2) the performance of our internal audit function and systems of internal controls; (3) our compliance with legal and regulatory requirements; and (4) risk management and oversight of our ERM committee. The audit committee also has direct responsibility for the appointment, compensation, retention (including termination) and oversight of our independent

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 15

CORPORATE GOVERNANCE

|

auditors and is responsible for the preparation of an audit committee report to be included in our annual proxy statement as required by the SEC. The audit committee also reviews and approves related person transactions in accordance with our Related Person Transaction Policy. See “Certain Relationships and Related Person Transactions–Related Person Transaction Policy.” During 2020, the audit committee met 12 times.

As of the date of this Proxy Statement, our audit committee was comprised of Mr. Merritt (Chairman), Ms. Mariucci and Ms. Warren. Under NYSE rules and SEC requirements, our audit committee must be comprised entirely of independent directors. Our board of directors has determined that each member of our audit committee has the financial literacy required by NYSE rules, is “independent” as defined under the independence requirements of the NYSE and the SEC applicable to audit committee members and qualifies as an “audit committee financial expert” as that term is defined under SEC rules. Information about our audit committee members’ past business and educational experience is included under the caption “Proposal 1: Election of Directors.”

Compensation Committee

Our compensation committee, among other things, reviews and recommends policies and plans relating to the compensation and benefits of our directors, employees and certain other persons providing services to our Company, and is responsible for approving the compensation of our Chief Executive Officer and other executive officers. Our compensation committee also administers our clawback policies and stock ownership guidelines, as well as our incentive plans, our annual bonus plan and other benefit programs. The compensation committee has delegated authority to our Chief Executive Officer to issue equity awards to employees other than to executive officers and certain other senior members of our management. If at any time the compensation committee includes a member who is not a “non-employee director” within the meaning of Rule 16b-3 under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, then either a subcommittee comprised entirely of individuals who are non-employee directors or the board of directors will approve any grants of equity-based compensation made to any individual who is subject to Section 16 of the Exchange Act. The compensation committee has the sole authority to retain and terminate any compensation consultant to assist in the evaluation of employee compensation and to approve the consultant’s fees and other terms and conditions of the consultant’s retention. During 2020, the compensation committee met six times.

As of the date of this Proxy Statement, our compensation committee was comprised of Ms. Mariucci (Chair), Mr. Hunt, Mr. Lane and Ms. Owen. Under NYSE rules, our compensation committee must be comprised entirely of independent directors. Our board of directors has determined that each member of our compensation committee is “independent” as defined under the independence requirements of the NYSE applicable to compensation committee members.

For additional discussion of the processes and procedures the compensation committee has used for the consideration and determination of executive officer and director compensation, please see “Compensation Discussion and Analysis.”

Nominating and Governance Committee

Our nominating and governance committee, among other things, provides assistance to the board of directors in identifying and recommending individuals qualified to serve as directors of our Company, reviews the composition of the board of directors and periodically evaluates the performance of the board of directors and its committees. The nominating and governance committee also recommends our various board committee memberships based upon, among other considerations, a director’s available time commitment, applicable regulatory considerations, background and/or the skill set it deems appropriate to adequately perform the responsibilities of the applicable committee. In addition, the nominating and governance committee develops and recommends corporate governance policies and procedures for us, including our Corporate Governance Guidelines, and monitors and reviews compliance with those policies. The nominating and governance committee also oversees the Company’s policies and practices relating to environmental stewardship, corporate social responsibility and other public policy issues significant to the Company, including as documented in the Company’s corporate responsibility report. During 2020, the nominating and governance committee met three times.

As of the date of this Proxy Statement, our nominating and governance committee was comprised of Mr. Lane (Chairman), Senator Flake and Mr. Merritt. Under NYSE rules, our nominating and governance committee must be comprised entirely of independent directors. Our board of directors has determined that each of Senator Flake and

16 | Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE

|

Messrs. Lane and Merritt are “independent” as defined under the independence requirements of the NYSE applicable to nominating and governance committee members.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee in 2020 was, at any time during 2020 or at any other time, an officer or employee of the Company, and none had or has any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. None of our executive officers has served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee during 2020.

Corporate Governance Guidelines and Code of Conduct and Ethics

Our board of directors has adopted Corporate Governance Guidelines and a Code of Conduct and Ethics that are applicable to all members of our board of directors, executive officers and employees. We have posted these documents on the Investor Relations page of our corporate website at www.taylormorrison.com under the category “Corporate Governance.” We intend to post amendments to or waivers of, if any, certain provisions of our Code of Conduct and Ethics (to the extent applicable to our directors, our executive officers, including our principal executive officer and principal financial officer, or our principal accounting officer or controller, or persons performing similar functions) at this location on our website.

We have a securities trading policy that sets forth guidelines and restrictions on transactions involving our stock, which are applicable to our employees, including our executive officers, and our directors. Our policy prohibits hedging, including, among other things, purchases of stock on margin, calls or similar options on Company stock or from selling our stock short. These types of transactions would allow employees to own Company stock without the full risks and rewards of ownership. When that occurs, employees or directors may no longer have the same objectives as our other stockholders and, therefore, such transactions involving our stock are prohibited.

Our Board has delegated oversight responsibility over the Company’s corporate responsibility matters to the nominating and governance committee. In this capacity, the nominating and governance committee reviews and considers the Company’s policies and practices relating to environmental stewardship, corporate social responsibility and other public policy issues significant to the Company, including as documented in the Company’s corporate responsibility report.

The Company published its inaugural ESG report in April 2019 and published its latest report in April 2021. The reports demonstrate the Company’s commitment to integrating sustainable values into all aspects of its business and are intended to showcase in a single format how the Company makes corporate responsibility core to its business. The reports reference the Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) standards in several instances spanning environmental, social and governance performance indicators. The reports signal a significant advance in the Company’s ESG reporting and transparency efforts. A copy of our most recent ESG report is available on our company website at http://investors.taylormorrison.com/financial-reports under “ESG Reports.” The information contained on or accessible through the Taylor Morrison website, including the Company’s ESG report, is not considered part of this proxy statement. Further inquiries about our ESG practices and policies can be directed to ESG@taylormorrison.com.

Taylor Morrison Home Corporation Notice of 2021 Annual Meeting of Stockholders and Proxy Statement | 17

DIRECTOR COMPENSATION

|

Directors who are our employees are not separately compensated by us for their service on our board of directors. For our other directors, referred to collectively as “non-employee directors,” we pay an annual cash retainer for their service on our board, which is payable to such directors in quarterly installments in arrears. The amount of the annual cash retainer depends on whether the director serves as a member or as chairman on any committees of the board of directors.

For 2020, our non-employee directors were entitled to receive the following compensation:

| • | A base annual cash retainer of $75,000. |

| • | An additional $35,000 annual cash retainer for the Lead Independent Director of our board of directors. |

| • | An additional $40,000, $30,000 and $20,000 annual cash retainer for the chairman of the audit committee, compensation committee and nominating and governance committee, respectively. |