EXECUTION VERSION [[3679594v16]] AMENDMENT NO. 5 dated as of January 26, 2018 (this “Amendment”), to the SECOND AMENDED AND RESTATED CREDIT AGREEMENT dated as of July 13, 2011 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”), among TAYLOR MORRISON COMMUNITIES, INC., a Delaware corporation (the “U.S. Borrower”), TMM HOLDINGS LIMITED PARTNERSHIP, a British Columbia limited partnership (“Holdings”), TAYLOR MORRISON HOLDINGS II, INC. (f/k/a MONARCH COMMUNITIES INC., and the surviving corporation of the amalgamation with Taylor Morrison Communities II, Inc.), a company continued under the laws of the province of British Columbia (“Canada Holdings”), TAYLOR MORRISON HOLDINGS, INC., a Delaware corporation (“U.S. Holdings”), TAYLOR MORRISON FINANCE, INC., a Delaware corporation (“U.S. FinCo”), each lender from time to time party thereto (each individually referred to therein as a “Lender” and collectively as “Lenders”) and CREDIT SUISSE AG, as administrative agent for the Lenders (in such capacity, the “Administrative Agent”). A. Holdings has requested that the Credit Agreement be amended as set forth herein. B. The Lenders are willing to so amend the Credit Agreement on the terms and subject to the conditions set forth herein. Accordingly, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, the parties hereto agree as follows: SECTION 1. Defined Terms. Capitalized terms used and not defined herein shall have the meanings assigned to such terms in the Credit Agreement. The rules of interpretation set forth in Section 1.2A of the Credit Agreement are hereby incorporated by reference herein, mutatis mutandis. SECTION 2. Assignments. (a) Effective as of the Amendment Effective Date (as defined below), each of the lenders listed on Exhibit A hereto under the captions “Departing Lenders” (the “Departing Lenders”), “Continuing Lenders” (the “Continuing Lenders”) and “Additional Lenders” (the “Additional Lenders”) shall sell, assign and transfer, or purchase and assume, as the case may be, such interests in (i) the Commitments and (ii) the participations in the Letters of Credit outstanding as of the Amendment Effective Date (the “Existing Letters of Credit”), in each case as shall be necessary in order that, after giving effect to all such assignments and purchases, the Commitments and the participations in the Existing Letters of Credit will be held by the Continuing Lenders and Additional Lenders ratably in accordance with their Commitments as set forth in Schedule 2.1 of the Credit Agreement, as amended by this

2 [[3679594v16]] Amendment. Each Lender purchasing interests of any type under this Section 2 shall be deemed to have purchased such interests from each Departing Lender and Continuing Lender selling interests of such type ratably in accordance with the amounts of such interests sold by them. The assignments and purchases provided for in this Section 2 shall be without recourse, warranty or representation, except that each assigning Lender shall be deemed to have represented that it is the legal and beneficial owner of the interests assigned by it and that such interests are free and clear of any adverse claim. (b) Each of the parties hereto hereby consents to the assignments and purchases provided for in paragraph (a) above and agrees that (i) each Additional Lender and each Continuing Lender that is purchasing interests in the Commitments and the Existing Letters of Credit pursuant to paragraph (a) above are Eligible Assignees permitted under Section 10.1 of the Credit Agreement, (ii) each Additional Lender shall become a “Lender” for all purposes of the Credit Agreement and the other Loan Documents, in accordance with the terms thereof and (iii) each Additional Lender and each Continuing Lender shall have all the rights and obligations of a Lender under the Credit Agreement with respect to the interests purchased by it pursuant to such paragraphs, in accordance with the terms thereof. SECTION 3. Commitments. Effective as of the Amendment Effective Date, (i) the Commitment of each Departing Lender shall terminate, (ii) the Commitment of each Continuing Lender and each Additional Lender shall be as set forth in Schedule 2.1 of the Credit Agreement, as amended by this Amendment, and (iii) each Departing Lender shall cease to be a party to the Credit Agreement and shall be released from all further obligations thereunder, in each case under this clause (iii) in accordance with terms of the Credit Agreement, including such terms with respect to continuing benefits under Sections 2.7 and 10.2 of the Credit Agreement which the Departing Lenders are entitled to. SECTION 4. Amendments. Effective as of the Amendment Effective Date, the Credit Agreement is hereby amended as follows: (a) Section 1.1 of the Credit Agreement is hereby amended by inserting the following new defined terms in the appropriate alphabetical order therein: “Amendment No. 5” means Amendment No. 5 dated as of January 26, 2018 to this Agreement. “Amendment No. 5 Effective Date” has the meaning assigned to the term “Amendment Effective Date” in Amendment No. 5. “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution.

3 [[3679594v16]] “Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule. “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution defined in clause (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means (a) any of the member states of the European Union, (b) Iceland, (c) Liechtenstein and (d) Norway. “EEA Resolution Authority” means any public administrative authority or any Person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor Person), as in effect from time to time. “Interpolated Rate” means, at any time, the rate per annum determined by the Administrative Agent (which determination shall be conclusive and binding absent manifest error) to be equal to the rate that results from interpolating on a linear basis between: (a) the Screen Rate for the longest period (for which that Screen Rate is available in Dollars) that is shorter than the Impacted Interest Period and (b) the Screen Rate for the shortest period (for which the Screen Rate is available in Dollars) that exceeds the Impacted Interest Period, in each case, at such time; provided that if the Interpolated Rate shall be less than 0.00%, such rate shall be deemed to be 0.00% for purposes of this Agreement. “Write-Down and Conversion Powers” means, with respect to any EEA Resolution Authority, the write-down and conversion powers of such EEA Resolution Authority from time to time under the Bail-In Legislation for the applicable EEA Member Country, which write-down and conversion powers are described in the EU Bail-In Legislation Schedule. (b) The definition of the term “Canadian Dollar Letter of Credit” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety as follows:

4 [[3679594v16]] “Canadian Dollar Letter of Credit” means any Letter of Credit denominated in Canadian Dollars. Notwithstanding the foregoing, from and after the Amendment No. 5 Effective Date, no Canadian Dollar Letters of Credit may be requested or issued under this Agreement. (c) The definition of the term “Canadian Loan” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety as follows: “Canadian Loan” means any Loan denominated in Canadian Dollars. Notwithstanding the foregoing, from and after the Amendment No. 5 Effective Date, no Canadian Loans may be requested or made under this Agreement. (d) The definition of the term “Canadian Sublimit” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety as follows: “Canadian Sublimit” means $0. (e) The definition of the term “Commitment Termination Date” in Section 1.1 of the Credit Agreement is hereby amended by deleting therefrom the words “April 12, 2019” and substituting therefor the words “January 26, 2022”. (f) The definition of the term “Eurodollar Base Rate” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety as follows: “Eurodollar Base Rate” shall mean, with respect to any borrowing of Eurodollar Rate Loans for any Interest Period, the rate per annum determined by the Administrative Agent at approximately 11:00 a.m., London time, on the date which is two Business Days prior to the beginning of such Interest Period by reference to the ICE Benchmark Administration Interest Settlement Rates for deposits in Dollars (as published by any service selected by the Administrative Agent which has been nominated by the ICE Benchmark Administration Limited (or its successor) as an authorized information vendor for the purpose of displaying such rates, in each case, the “Screen Rate”) for a period equal to such Interest Period; provided that, if such rate is not available at such time for such Interest Period (an “Impacted Interest Period”) for any reason, the “Eurodollar Base Rate” shall be the Interpolated Rate; provided further that, to the extent that an interest rate is not ascertainable pursuant to the foregoing provisions of this definition for any Interest Period, then the “Eurodollar Base Rate” shall mean (x) such other interbank rate with respect to such Interest Period set forth by any authorized service selected by the Administrative Agent that reflects an alternative index rate widely recognized in the U.S. syndicated loan market as the successor to the ICE Benchmark Administration Interest Settlement Rates for deposits in Dollars or (y) if there is no such authorized service with respect to an alternative index rate widely

5 [[3679594v16]] recognized as the successor to the ICE Benchmark Administration Interest Settlement Rates for deposits in Dollars, such other index rate as may be agreed to by the Administrative Agent and Borrower with the consent of the Requisite Lenders; provided further that the Eurodollar Base Rate with respect to any Loans shall be deemed to be not less than 0.00% per annum. (g) The definition of the term “Initial Yield” in Section 1.1 of the Credit Agreement is hereby amended by deleting therefrom the words “(i) any “Facility Fee Rate” applicable on the date of the calculation and (ii)”. (h) The definition of the term “Lender Default” in Section 1.1 of the Credit Agreement is hereby amended by inserting immediately after the words “any such proceeding or appointment” in clause (d) thereof the words “or becomes the subject of a Bail-In Action”. (i) The definition of the term “Letter of Credit Commitment” is hereby amended and restated in its entirety as follows: “Letter of Credit Commitment” means, with respect to each Issuing Bank, the commitment of such Issuing Bank to issue Letters of Credit hereunder as set forth on Schedule 3.1. The aggregate Letter of Credit Commitments of all Issuing Banks on the Amendment No. 5 Effective Date is $160,000,000. (j) The definition of the term “Revolving Loan Yield” in Section 1.1 of the Credit Agreement is hereby amended by deleting the parenthetical “(as increased by the Facility Fee Rate applicable on such date)” from clause (i) thereof. (k) Section 2.3A of the Credit Agreement is hereby amended and restated in its entirety as follows: A. Facility Fees. The Borrower agrees to pay to the Administrative Agent, for distribution to each Lender in proportion to that Lender’s Pro Rata Share of the Commitments, facility fees (the “Facility Fees”) for the period from and including the Amendment No. 5 Effective Date to and excluding the Commitment Termination Date equal to (i) the actual daily amount of the unused aggregate Commitments (i.e., the aggregate Commitments minus the Total Utilization of Commitments) multiplied by (ii) a rate per annum equal to the Facility Fee Rate at such time. In addition, the Facility Fees accrued with respect to the Commitment of a Defaulting Lender during the period prior to the time such Lender became a Defaulting Lender and unpaid at such time shall not be payable by the Borrower so long as such Lender shall be a Defaulting Lender except to the extent that the Facility Fees shall otherwise have been due and payable by the Borrower prior to such time; provided, that no Facility Fees shall

6 [[3679594v16]] accrue on the Commitment of a Defaulting Lender so long as such Lender shall be a Defaulting Lender. The Facility Fees shall be payable in arrears on the last Business Day in each of March, June, September and December of each year, commencing on March 31, 2018, and ending on the Commitment Termination Date, and shall be calculated based on the actual number of days elapsed over a 360-day year. (l) Section 3.2 of the Credit Agreement is hereby amended by inserting the following phrase at the end of the second sentence: ; provided that, subject to Section 3.6B, no Defaulting Lender shall be entitled to receive Letter of Credit fees pursuant to clause (i)(b) of this Section 3.2 for any period during which that Lender is a Defaulting Lender except to the extent allocable to its Pro Rata Share of the stated amount of Letters of Credit for which it has provided Cash Collateral. (m) Section 3.6B of the Credit Agreement is hereby amended by inserting at the end thereof the following: With respect to any Letter of Credit fee not required to be paid to any Defaulting Lender pursuant to Section 3.2, the U.S. Borrower shall (x) pay to each Lender that portion of any such fee with respect to participation in Letters of Credit that has been reallocated to such Lender pursuant to this Section and (y) without duplication of clause (x) above, pay to each Issuing Bank the amount of any such fee otherwise payable to such Defaulting Lender to the extent allocable to such Issuing Bank’s Fronting Exposure to such Defaulting Lender (subject to decreases in such Fronting Exposure pursuant to the terms hereof, including Section 3.6A and 3.6C). (n) Section 5.15 of the Credit Agreement is hereby amended and restated as follows: 5.15 Anti-Corruption Laws; Sanctions. A. Anti-Corruption Laws. Holdings, U.S. Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo, the U.S. Borrower, and each of their respective Subsidiaries and, to the Knowledge of Holdings and the Borrower, any director, officer, agent or employee of Holdings, U.S. Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo, the Borrower or any of their respective Subsidiaries are in compliance with all applicable sanctions administered or enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), the U.S.

7 [[3679594v16]] Department of State, the United Nations Security Council, the European Union or Her Majesty’s Treasury (“Sanctions”) and with the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (the “FCPA”) and any other applicable anti-corruption law, in all material respects. Holdings, U.S. Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo, the Borrower, and each of their respective Subsidiaries have instituted and maintain policies and procedures designed to ensure continued compliance with applicable Sanctions, the FCPA and any other applicable anti-corruption laws. (b) None of Holdings, U.S. Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo, the Borrower or any of their respective Subsidiaries nor, to the Knowledge of Holdings or the U.S. Borrower, any director, officer, agent or employee of Holdings, U.S. Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo, the Borrower or any of their respective Subsidiaries is currently (i) the target of any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department or (ii) located, organized or resident in a country or territory that is, or whose government is, the target of comprehensive Sanctions. (c) The Borrower will not, directly or indirectly, use the proceeds of the Loans or use the Letters of Credit, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person, (i) in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of the FCPA or any other applicable anti- corruption law, or (ii) (A) to fund any activities or business of or with any Person, or in any country or territory, that, at the time of such funding, is, or whose government is, the target of Sanctions, or (B) in any other manner that would result in a violation of Sanctions by any Person (including any Person participating in the Loans or Letters of Credit, whether as Administrative Agent, Arranger, Issuing Bank, Lender, underwriter, advisor, investor, or otherwise). (o) Section 6.9 of the Credit Agreement is hereby amended by inserting immediately after the words “or any entity that becomes a Restricted Subsidiary” in clause (a) thereof the words “or a Loan Party”. (p) Clause (a)(i) to the proviso to Section 7.6A of the Credit Agreement is hereby amended by inserting immediately after the words “or any territory thereof” the words “and, at least five Business Days prior to such merger, amalgamation or consolidation, the Administrative Agent and the Lenders shall have received all documentation and other information required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations”.

8 [[3679594v16]] (q) Section 7.6A of the Credit Agreement is hereby amended by amending and restating clause (iii) thereof in its entirety as follows: “Canada Holdings may sell, lease, transfer or otherwise dispose of any or all of its assets (upon voluntary liquidation or otherwise) to Holdings, U.S. Holdings or any one or more Subsidiaries of U.S. Holdings;”. (r) Section 7.6A of the Credit Agreement is hereby amended by inserting immediately after the words “or any one or more Subsidiaries of Canada Holdings” in clause (iv) thereof the words “and Canada Holdings may be merged, amalgamated or consolidated with or into Holdings, U.S. Holdings or any one or more Subsidiaries of U.S. Holdings”. (s) Section 10.25A of the Credit Agreement is hereby amended by inserting immediately after the words “that the Administrative Agent” in the first sentence thereof the words “and the Lenders”. (t) A new Section 10.27 of the Credit Agreement is hereby added to read as follows: 10.27 Acknowledgment and Consent to Bail-In of EEA Financial Institutions. Notwithstanding anything to the contrary in any Loan Document or in any other agreement, arrangement or understanding among the parties hereto, each party hereto acknowledges that any liability of any EEA Financial Institution arising under any Loan Document to the extent such liability is unsecured, may be subject to the Write-Down and Conversion Powers of any EEA Resolution Authority and agrees and consents to, and acknowledges and agrees to be bound by: (i) the application of any Write-Down and Conversion Powers by an EEA Resolution Authority to any such liabilities arising hereunder which may be payable to it by any party hereto that is an EEA Financial Institution; and (ii) the effects of any Bail-In Action on any such liability, including, if applicable, (a) a reduction in full or in part or cancellation of any such liability, (b) a conversion of all, or a portion of, such liability into shares or other instruments of ownership in such EEA Financial Institution, its parent entity or a bridge institution that may be issued to it or otherwise conferred on it, and that such shares or other instruments of ownership will be accepted by it in lieu of any rights with respect to any such liability under this Agreement or any other Loan Document or (c) the variation of the terms of such liability in connection with the exercise of the Write- Down and Conversion Powers of any EEA Resolution Authority.

9 [[3679594v16]] (u) Schedule 2.1 of the Credit Agreement is hereby amended and restated in its entirety with Schedule 2.1 attached as Exhibit B to this Amendment. (v) Schedule 3.1 of the Credit Agreement is hereby amended and restated in its entirety with Schedule 3.1 attached as Exhibit E to this Amendment. SECTION 5. Representations and Warranties. To induce the other parties hereto to enter into this Agreement, each of Holdings, U.S. Holdings, Canada Holdings, U.S. FinCo and the U.S. Borrower, jointly and severally, hereby represents and warrants to the Administrative Agent and each of the other parties hereto that: (a) As of the Amendment Effective Date, each Loan Party has duly executed and delivered and authorized this Amendment and this Amendment constitutes the legal, valid and binding obligation of such Loan Party enforceable in accordance with its terms, subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization and other similar laws relating to or affecting creditors’ rights generally and general principles of equity (whether considered in a proceeding in equity or law). (b) As of the Amendment Effective Date, (i) the representations and warranties set forth in Section 5 of the Credit Agreement and in the other Loan Documents are true and correct in all material respects (unless qualified as to materiality or Material Adverse Effect, in which case such representations and warranties shall be true and correct in all respects) on and as of the Amendment Effective Date to the same extent as though made on and as of such date, except (x) to the extent such representations and warranties specifically relate to an earlier date, in which case such representations and warranties were true and correct in all material respects (unless qualified as to materiality or Material Adverse Effect, in which case such representations and warranties were true and correct in all respects) on and as of such earlier date, and (y) the reference to the Restatement Effective Date in Section 5.12 of the Credit Agreement shall, for purposes of this Section 3(b), be deemed to refer to the Amendment Effective Date, and (ii) no Default or Event of Default has occurred and is continuing. SECTION 6. Fees. On the Amendment Effective Date, the Borrower shall pay to the Administrative Agent, for the accounts of the Departing Lender(s) and the Continuing Lenders, the fees payable pursuant to Sections 2.3 and 3.2 of the Credit Agreement which have accrued for the period from the last date such fees were paid to but excluding the Amendment Effective Date. The fees described in this Section 6 shall be payable in immediately available funds. Once paid, such fees shall not be refundable under any circumstances. SECTION 7. Conditions to Effectiveness. The effectiveness of this Amendment is subject to the satisfaction or waiver, on or prior to January 26, 2018, of the following conditions precedent (the date on which all such conditions are satisfied or waived, the “Amendment Effective Date”):

10 [[3679594v16]] (a) The Administrative Agent (or its counsel) shall have received from each Loan Party and each Lender either (i) a counterpart of this Agreement signed on behalf of such parties or (ii) written evidence satisfactory to the Administrative Agent (which may include facsimile or other electronic transmission of a signed signature page of this Agreement) that such parties have signed a counterpart of this Agreement. (b) The Administrative Agent shall have received reimbursement of all costs and expenses required to be paid by the Loan Parties in connection with the transactions contemplated hereby. (c) The representations and warranties set forth in Section 5 shall be true and correct, and the Administrative Agent shall have received a certificate to that effect dated as of the Amendment Effective Date and executed by a Responsible Officer of Holdings. (d) The Administrative Agent and its counsel shall have received executed copies of favorable written opinions of Paul, Weiss, Rifkind, Wharton & Garrison LLP, counsel for the Loan Parties, and each local counsel listed on Exhibit C, in each case, in form and substance reasonably satisfactory to the Administrative Agent and its counsel, dated as of the Amendment Effective Date. (e) On or before the Amendment Effective Date, each Loan Party shall deliver or cause to be delivered to the Administrative Agent and each of the Lenders the following, each, unless otherwise noted, dated the Amendment Effective Date: (i) Certified copies of the certificate of incorporation, organization or formation, together with a good standing certificate, certificate of status or certificate of compliance (as applicable) from the applicable Governmental Authority of its jurisdiction of incorporation, organization or formation, each dated a recent date prior to the Amendment Effective Date (or, in lieu of such certificate of incorporation, organization or formation, a certification by a Responsible Officer that there has been no change to such certificate of incorporation, organization or formation since the most recent copy delivered to the Administrative Agent, together with a good standing certificate, certificate of status or certificate of compliance (as applicable) from the applicable Governmental Authority of its jurisdiction of incorporation, organization or formation dated a recent date prior to the Amendment Effective Date); (ii) Copies of its Organizational Documents, other than such Organizational Documents required to be delivered under clause (i) above, certified as of the Amendment Effective Date by its corporate secretary or an assistant secretary (or, in lieu of such Organizational Documents, a certification by a Responsible Officer that there has been no change to such Organizational Documents since the most recent copy delivered to the Administrative Agent);

11 [[3679594v16]] (iii) A certification by a Responsible Officer, certified as of the Amendment Effective Date, that board resolutions or similar authorizing documents authorizing the execution, delivery and performance of this Amendment have been approved by the board of directors or similar governing body of each Loan Party and that such resolutions or documents are in full force and effect without modification or amendment; and (iv) An incumbency certificate of its Responsible Officers executing this Amendment (or, in lieu of such incumbency certificate, a certification by a Responsible Officer that there has been no change to such incumbency certificate since the most recent copy delivered to the Administrative Agent). (f) The Borrower shall have paid the fees required to be paid pursuant to Section 6 hereof. (g) The Borrower shall have paid (i) to the Administrative Agent, for the account of each Continuing Lender, an upfront fee in an amount equal to the sum of (A) 0.15% of the amount of such Continuing Lender’s Commitment under the Credit Agreement as in effect immediately prior to the Amendment Effective Date and (B) 0.35% of the amount by which such Continuing Lender’s Commitment under the Credit Agreement as in effect on the Amendment Effective Date, as amended by this Amendment, exceeds such Continuing Lender’s Commitment under the Credit Agreement as in effect immediately prior to the Amendment Effective Date and (ii) to the Administrative Agent, for the account of each Additional Lender, an upfront fee in an amount equal to 0.35% of the amount of such Additional Lender’s Commitment under the Credit Agreement as in effect on the Amendment Effective Date, as amended by this Amendment. The Administrative Agent shall notify the U.S. Borrower and the Lenders of the Amendment Effective Date, and such notice shall be conclusive and binding. SECTION 8. Consent and Reaffirmation. Each of the Loan Parties hereby (i) consents to this Amendment and the transactions contemplated hereby, (ii) agrees that, notwithstanding the effectiveness of this Amendment, the Guaranty and each of the other Loan Documents continues to be in full force and effect, (iii) affirms and confirms its guarantee (in the case of a Guarantor) of the Obligations pursuant to the Guaranty, all as provided in the Loan Documents, and (iv) acknowledges and agrees that such guarantee continues in full force and effect in respect of, the Obligations under the Credit Agreement and the other Loan Documents. The parties hereto expressly acknowledge that it is not their intention that this Amendment or any of the other Loan Documents executed or delivered pursuant hereto constitute a novation of any of the obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, but a modification thereof pursuant to the terms contained herein. SECTION 9. Loan Documents. This Amendment shall constitute a “Loan Document” for all purposes of the Credit Agreement and the other Loan Documents.

12 [[3679594v16]] SECTION 10. Counterparts. This Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or other electronic transmission shall be as effective as delivery of an original executed counterpart of this Amendment. SECTION 11. Governing Law. THIS AMENDMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK. SECTION 12. Headings. Section headings used herein are for convenience of reference only, are not part of this Amendment and shall not affect the construction of, or be taken into consideration in interpreting, this Amendment. SECTION 13. Tax Matters. For purposes of determining withholding Taxes imposed under FATCA, from and after the Amendment Effective Date, the U.S. Borrower and the Administrative Agent shall treat (and the Lenders hereby authorize the Administrative Agent to treat) the Credit Agreement as not qualifying as a “grandfathered obligation” within the meaning of Treasury Regulation Section 1.1471-2(b)(2)(i). [Remainder of page intentionally left blank]

SIGNATURE PAGE TO AMENDMENT NO. 5 TO THE TAYLOR MORRISON COMMUNITIES INC. SECOND AMENDED AND RESTATED CREDIT AGREEMENT DATED AS OF JULY 13, 2011, AS AMENDED NAME OF LENDER: MIZUHO BANK, LTD. By: CWC~, Na . John Davies Title: Authorized Signatory By: Name: Title *For any Lender requiring a second signature. [Signature Page to Amendment No. SJ

SIGNATURE PAGE TO AMENDMENT NO.S TO THE TAYLOR MORRISON COMMUNITIES INC. SECOND AMENDED AND RESTATED CREDIT AGREEMENT DATED AS OF JULY 13, 2011, AS AMENDED NAME OF LENDER: GOLDMAN SACHS BANK USA By: ame: Josh Rosenthal Title: Authorized Signatory [Signature Page to Amendment No. S]

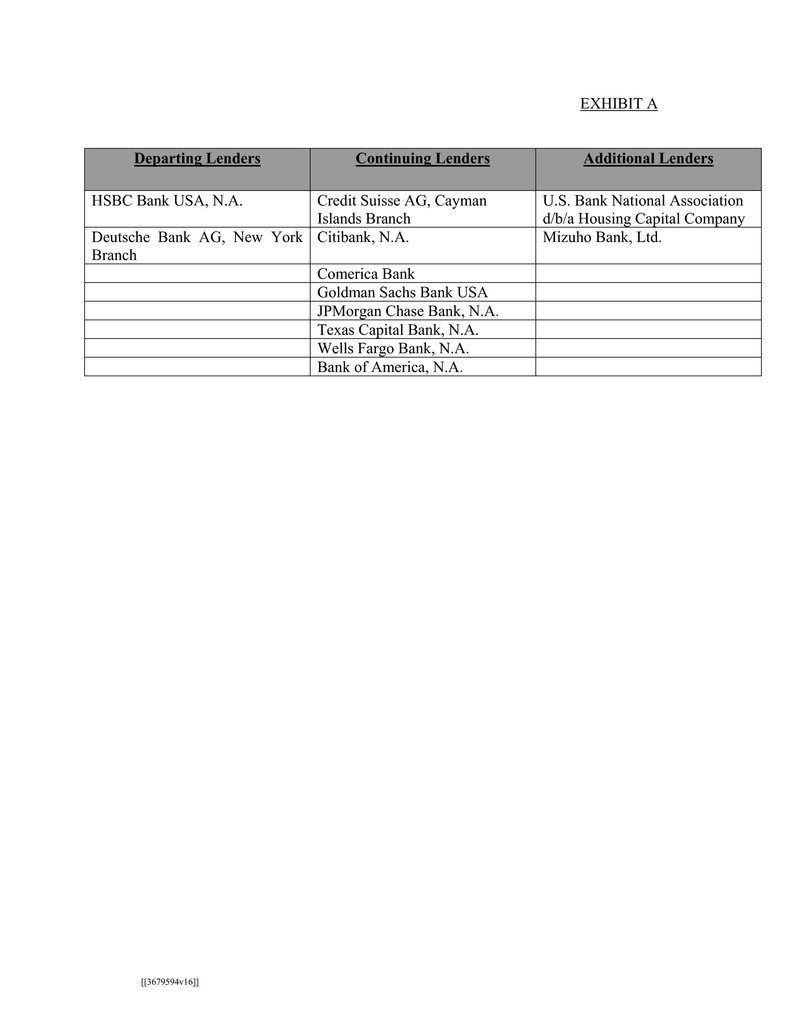

[[3679594v16]] EXHIBIT A Departing Lenders Continuing Lenders Additional Lenders HSBC Bank USA, N.A. Credit Suisse AG, Cayman Islands Branch U.S. Bank National Association d/b/a Housing Capital Company Deutsche Bank AG, New York Branch Citibank, N.A. Mizuho Bank, Ltd. Comerica Bank Goldman Sachs Bank USA JPMorgan Chase Bank, N.A. Texas Capital Bank, N.A. Wells Fargo Bank, N.A. Bank of America, N.A.

[[3679594v16]] EXHIBIT B Schedule 2.1 Commitments Lender Commitment Credit Suisse AG, Cayman Islands Branch $75,000,000 Citibank, N.A. $75,000,000 JPMorgan Chase Bank, N.A. $70,000,000 U.S. Bank National Association d/b/a Housing Capital Company $64,000,000 Mizuho Bank, Ltd. $49,000,000 Wells Fargo Bank, N.A. $39,000,000 Goldman Sachs Bank USA $34,000,000 Texas Capital Bank, N.A. $34,000,000 Bank of America, N.A. $31,000,000 Comerica Bank $29,000,000

[[3679594v16]] EXHIBIT C Local Counsel 1. Armbrust & Brown, PLLC, Texas counsel 2. GrayRobinson, P.A., Florida counsel 3. Holland & Hart LLP, Colorado counsel 4. Stikeman Elliot LLP, Canada counsel 5. Cox, Castle & Nicholson LLP, California counsel 6. Brier, Irish, Hubbard & Erhart, P.L.C., Arizona counsel 7. Meltzer, Purtill & Stelle LLC, Illinois counsel 8. Alexander Ricks PLLC, North Carolina counsel 9. Schreeder, Wheeler & Flint, LLP, Georgia counsel

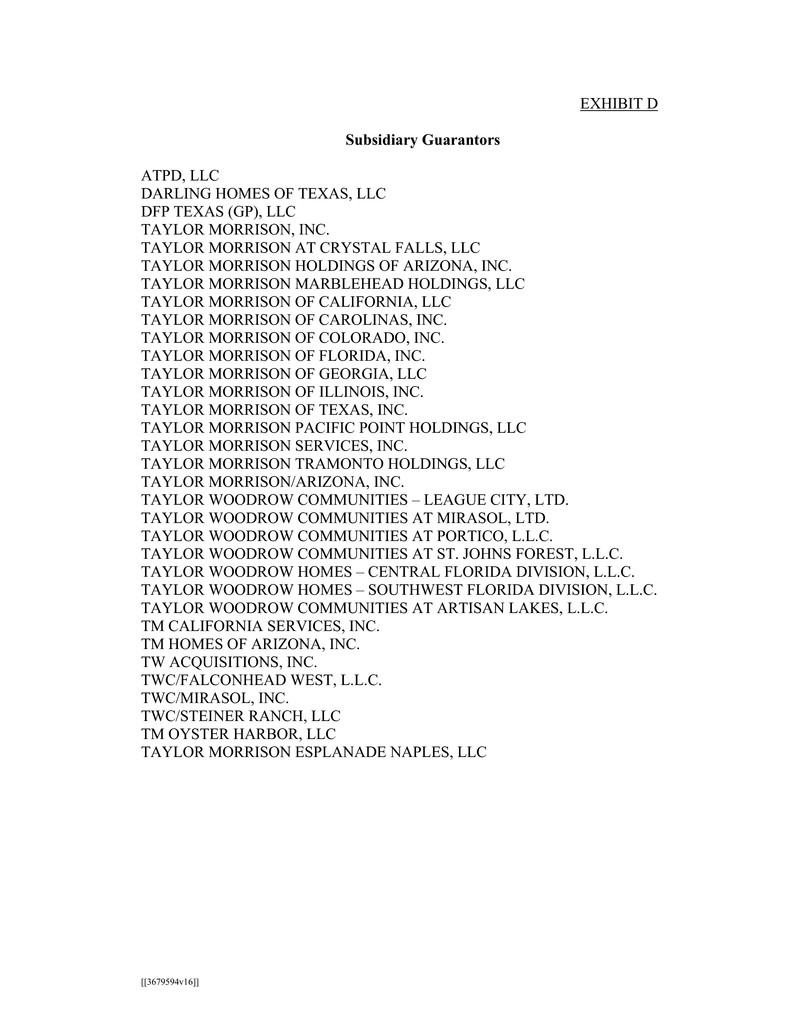

[[3679594v16]] EXHIBIT D Subsidiary Guarantors ATPD, LLC DARLING HOMES OF TEXAS, LLC DFP TEXAS (GP), LLC TAYLOR MORRISON, INC. TAYLOR MORRISON AT CRYSTAL FALLS, LLC TAYLOR MORRISON HOLDINGS OF ARIZONA, INC. TAYLOR MORRISON MARBLEHEAD HOLDINGS, LLC TAYLOR MORRISON OF CALIFORNIA, LLC TAYLOR MORRISON OF CAROLINAS, INC. TAYLOR MORRISON OF COLORADO, INC. TAYLOR MORRISON OF FLORIDA, INC. TAYLOR MORRISON OF GEORGIA, LLC TAYLOR MORRISON OF ILLINOIS, INC. TAYLOR MORRISON OF TEXAS, INC. TAYLOR MORRISON PACIFIC POINT HOLDINGS, LLC TAYLOR MORRISON SERVICES, INC. TAYLOR MORRISON TRAMONTO HOLDINGS, LLC TAYLOR MORRISON/ARIZONA, INC. TAYLOR WOODROW COMMUNITIES – LEAGUE CITY, LTD. TAYLOR WOODROW COMMUNITIES AT MIRASOL, LTD. TAYLOR WOODROW COMMUNITIES AT PORTICO, L.L.C. TAYLOR WOODROW COMMUNITIES AT ST. JOHNS FOREST, L.L.C. TAYLOR WOODROW HOMES – CENTRAL FLORIDA DIVISION, L.L.C. TAYLOR WOODROW HOMES – SOUTHWEST FLORIDA DIVISION, L.L.C. TAYLOR WOODROW COMMUNITIES AT ARTISAN LAKES, L.L.C. TM CALIFORNIA SERVICES, INC. TM HOMES OF ARIZONA, INC. TW ACQUISITIONS, INC. TWC/FALCONHEAD WEST, L.L.C. TWC/MIRASOL, INC. TWC/STEINER RANCH, LLC TM OYSTER HARBOR, LLC TAYLOR MORRISON ESPLANADE NAPLES, LLC

[[3679594v16]] EXHIBIT E Schedule 3.1 Letter of Credit Commitments Lender Commitment Credit Suisse AG, Cayman Islands Branch $40,000,000 Citibank, N.A. $40,000,000 JPMorgan Chase Bank, N.A. $40,000,000 Goldman Sachs Bank USA $40,000,000