Franklin BSP Realty Trust Supplemental Information Fourth Quarter 2022

Important Information 2 The information herein relates to the Company’s business and financial information as of December 31, 2022 and does not reflect subsequent developments. Risk Factors Investing in and owning our common stock involves a high degree of risk. See the section entitled “Risk Factors” in our Annual Report on Form 10-K filed with the SEC on February 25, 2022, and the risk disclosure in our subsequent SEC-filed periodic reports, for a discussion of these risks. Forward-Looking Statements Certain statements included in this presentation are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of Franklin BSP Realty Trust, Inc. (“FBRT” or the “Company”) and may include the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause actual outcomes to differ materially from our forward-looking statements include, macroeconomic factors in the United States including inflation, changing interest rates and economic contraction, the extent of any recoveries on delinquent loans, continuing adverse effects from the COVID-19 pandemic on our financial condition, operating results and cash flows, and the financial stability of our borrowers, and the other factors set forth in the risk factors section of our most recent Form 10-K and Form 10-Q. The extent to which these factors impact us and our borrowers will depend on future developments, which are highly uncertain and cannot be predicted with confidence. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law. Additional Important Information The summary information provided in this presentation does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with us or any of our affiliated funds. There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations. Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances. The information contained herein is qualified in its entirety by reference to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. You may obtain a copy of the most recent Annual Report or Quarterly Report by calling (844) 785-4393 and/or visiting www.fbrtreit.com. This presentation contains information regarding FBRT’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Distributable Earnings and Run-Rate Distributable Earnings. Please refer to the appendix for the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures. PAST PERFORMANCE IS NOT A GUARANTEE OR INDICATIVE OF FUTURE RESULTS. INVESTMENTS INVOLVE SIGNIFICANT RISKS, INCLUDING LOSS OF THE ENTIRE INVESTMENT. There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of the Company’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objective of the Company will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Please refer to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for a more complete list of risk factors. The following slides contain summaries of certain financial information about the Company. The information contained in this presentation is summary information that is intended to be considered in the context of our filings with the Securities and Exchange Commission and other public announcements that we may make, by press release or otherwise, from time to time.

FBRT 4Q 2022 Financial Update 3

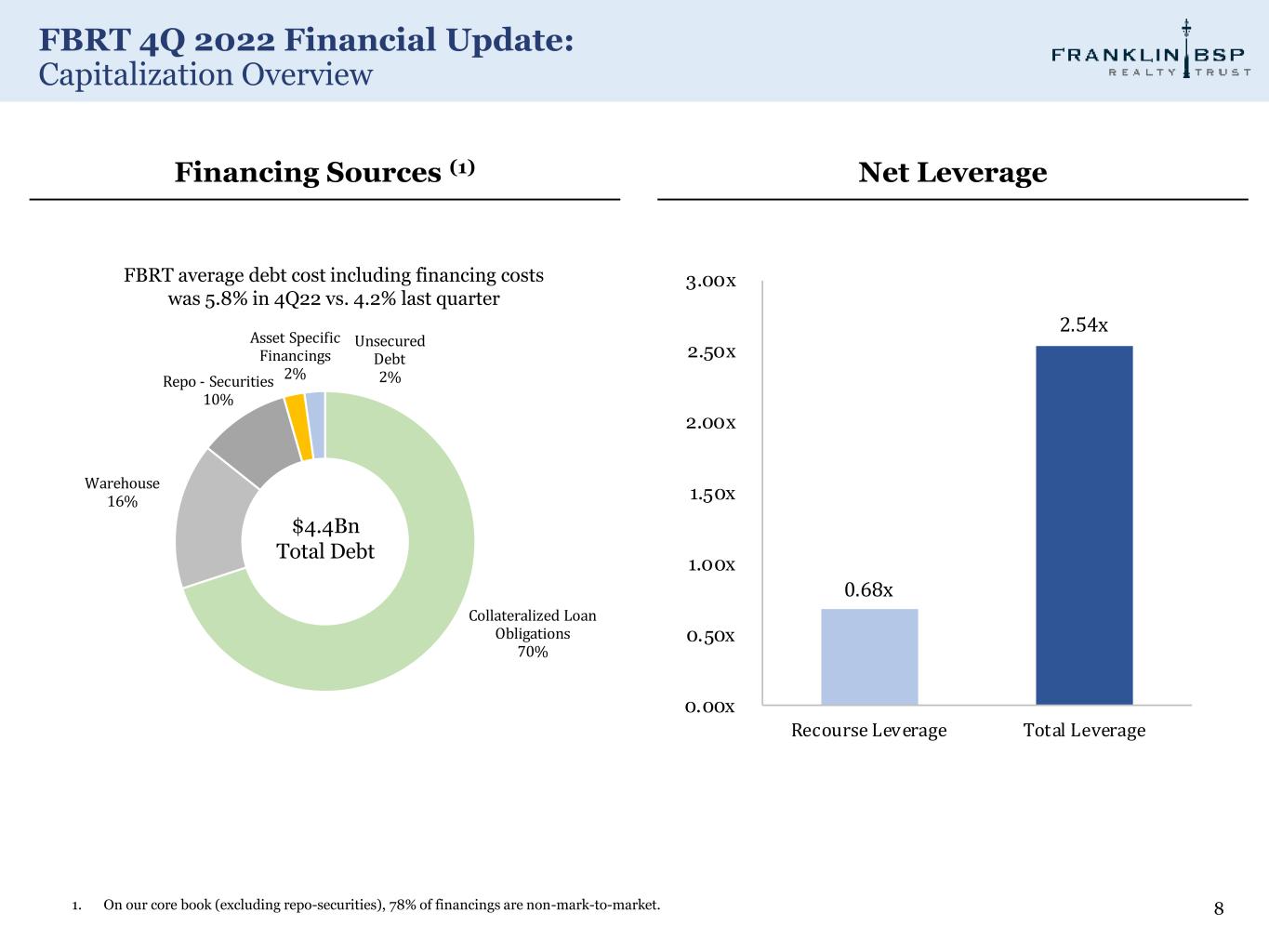

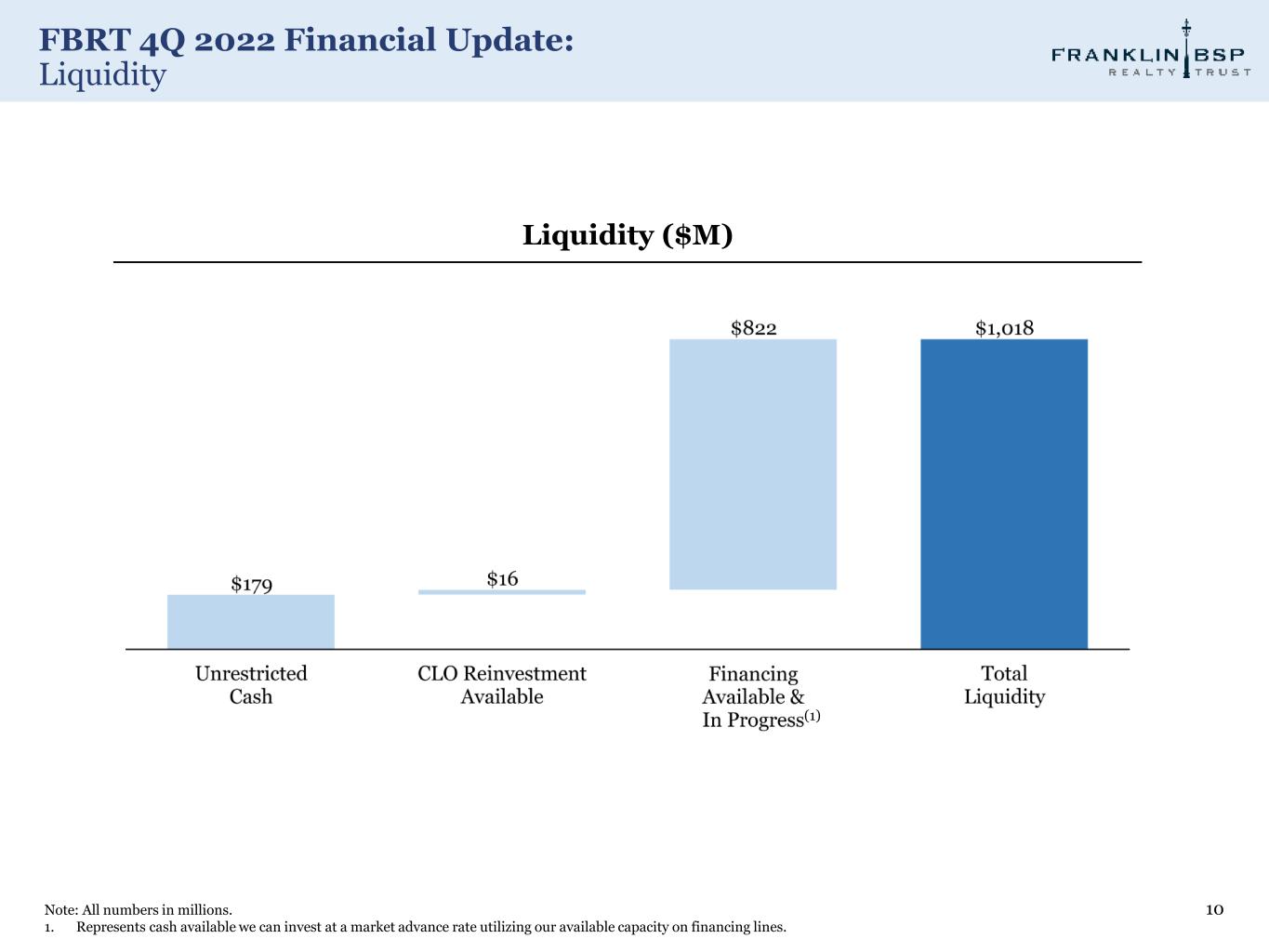

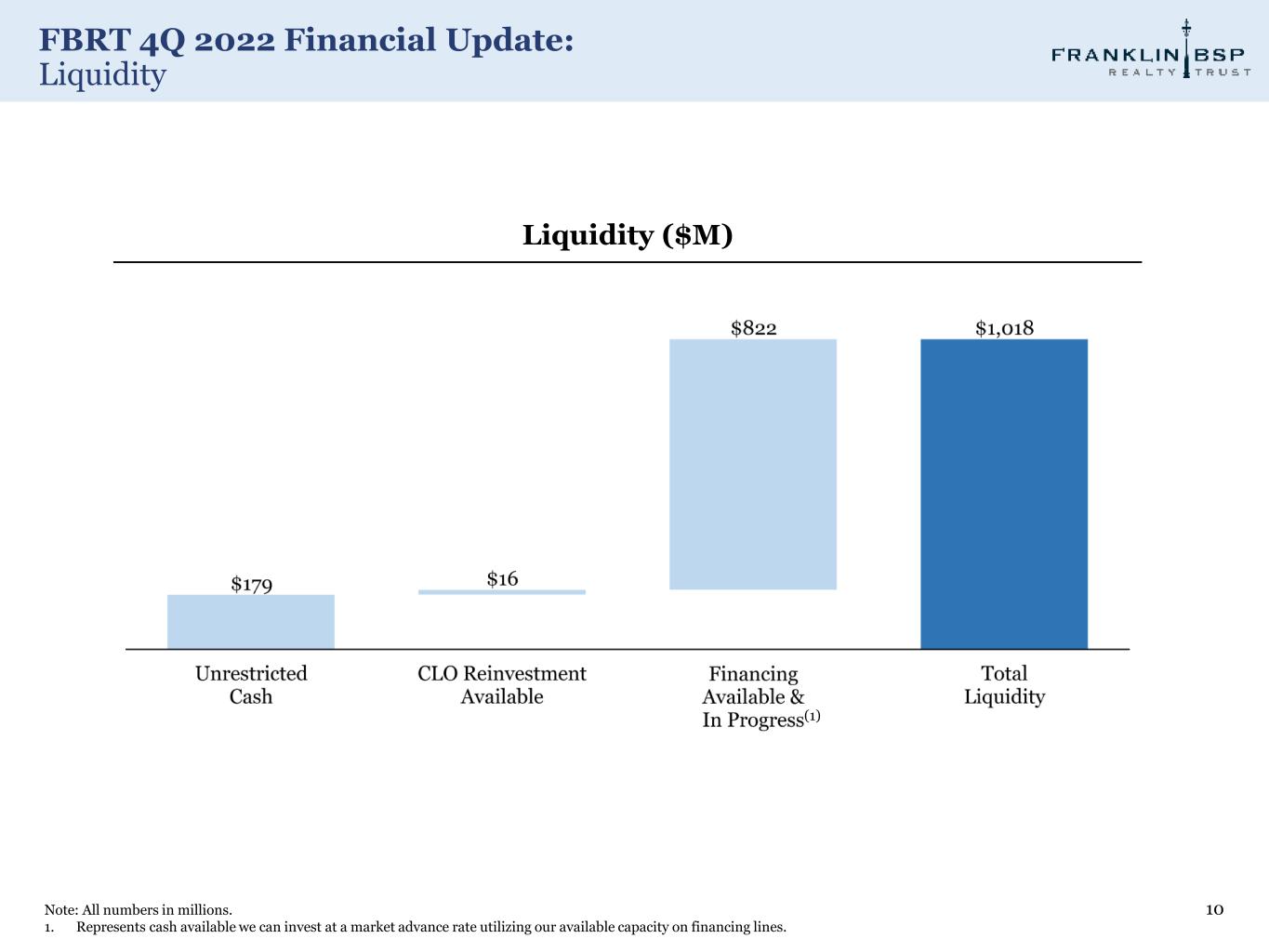

FBRT 4Q 2022 Financial Update: Fourth Quarter 2022 Highlights 4 1. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards. 2. Please see appendix for GAAP net income to Distributable Earnings and Run-Rate Distributable Earnings calculation. 3. Adjusted for accumulated depreciation and amortization of real property of $5.2 million. 4. Cash excludes restricted cash. Total liquidity amount includes the cash available we can invest at a market advance rate utilizing our available capacity on financing lines. Earnings ― GAAP Net Income of $27.2 million and $0.25 per diluted common share and $0.25 per fully converted share (1) ― Distributable Earnings (2) of $38.8 million and $0.37 per fully converted share (1) ― Declared a cash dividend of $0.355 per share, representing a yield of 9.0% on book value per share, fully converted (1). GAAP and Distributable Earnings (2) dividend coverage of 72% and 104%, respectively Capitalization ― Book value per share, fully converted is $15.78 vs. $15.84 last quarter (1). Undepreciated book value per share, fully converted is $15.84 (1), (3) ― Net debt to equity is 2.5x; recourse net debt to equity is 0.7x ― 78% of financing sources are non-mark-to-market on our core book ― $1.0 billion of liquidity of which $179 million is cash and $16 million is CLO reinvest available (4) ― In Q4 2022, FBRT repurchased 485k shares for $5.5 million. Year to date, FBRT has repurchased 1.4 million shares for $16.6 million. Benefit Street Partners L.L.C., our external advisor, has completed its $35 million share purchase program bringing total purchases and repurchases to $51.6 million. $48.4 million remains available under the company’s repurchase program Investments ― Core portfolio: closed $209 million of new loan commitments and funded $267 million of principal balance including future funding on existing loans. Received loan repayments of $247 million for a net growth in our loan portfolio of $21 million in the quarter ― Conduit: sold $52 million of conduit loans in the quarter Portfolio ― Core portfolio of 161 CRE loans and $5.3 billion of principal balance, average size of $33 million. During the quarter, two loans were added to the watch list, and three positions were added to foreclosure REO, two of which were previously on watch list. As of year-end, we had two non-performing loans

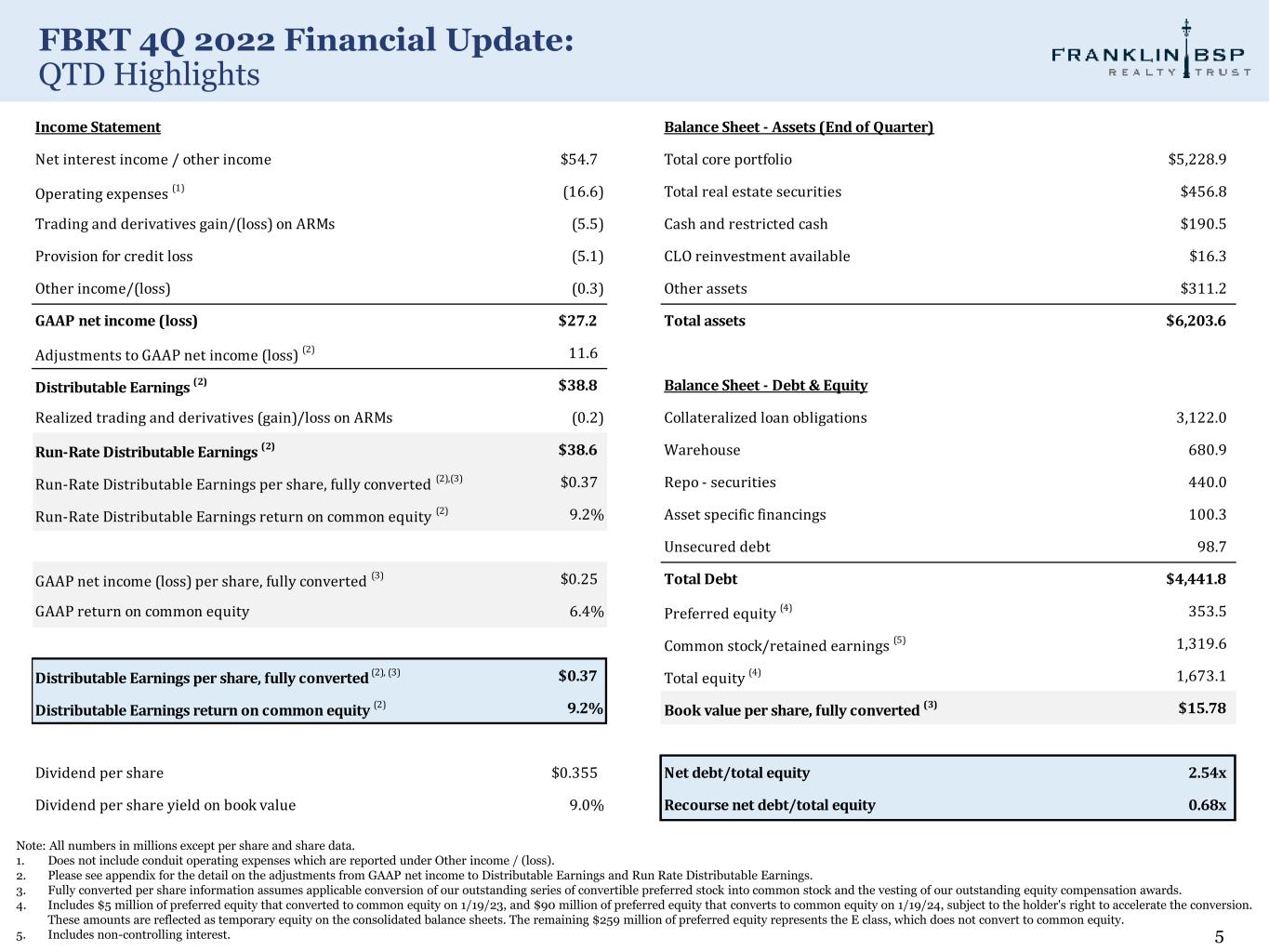

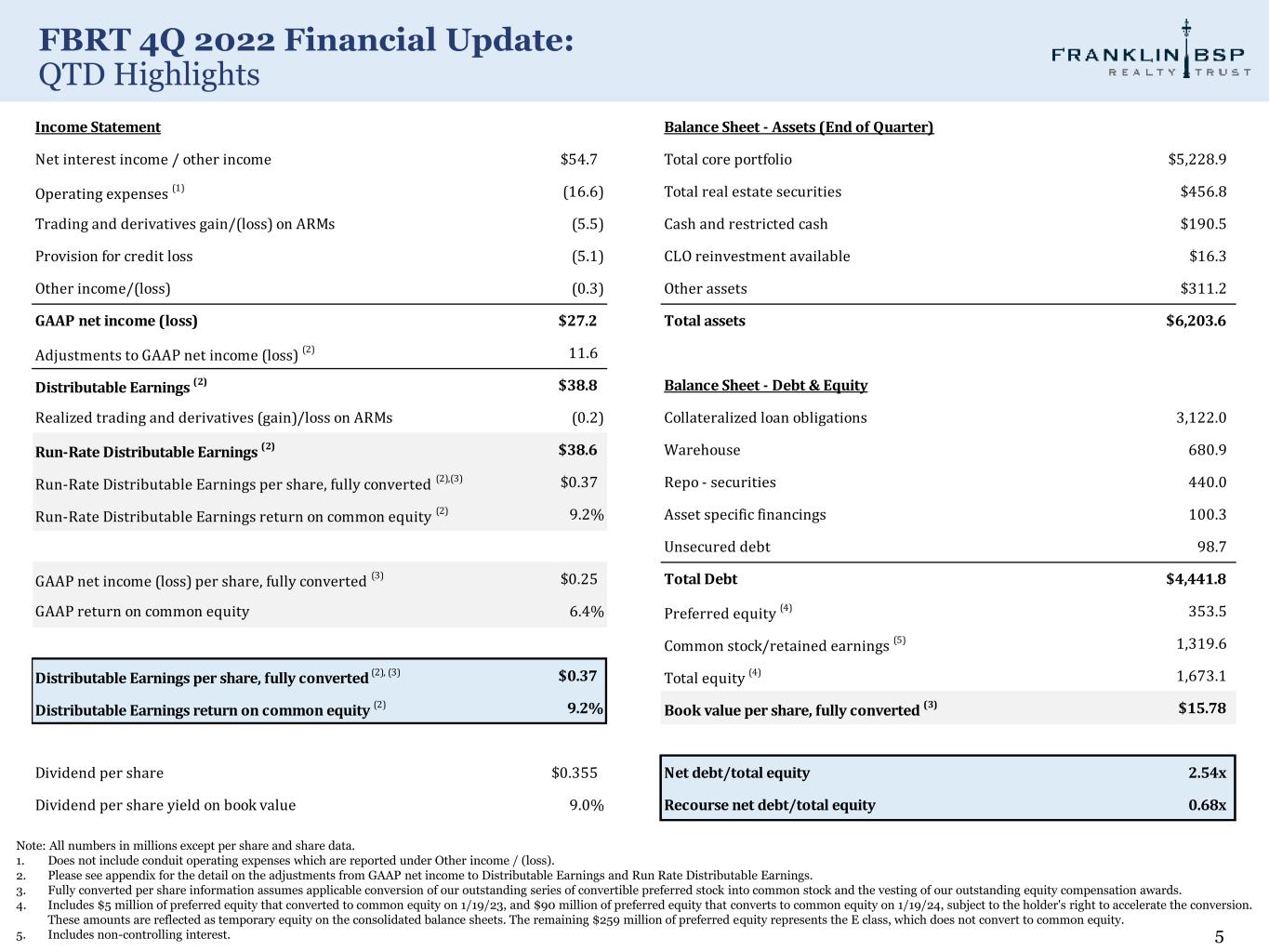

FBRT 4Q 2022 Financial Update: QTD Highlights 5 Note: All numbers in millions except per share and share data. 1. Does not include conduit operating expenses which are reported under Other income / (loss). 2. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings and Run Rate Distributable Earnings. 3. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards. 4. Includes $5 million of preferred equity that converted to common equity on 1/19/23, and $90 million of preferred equity that converts to common equity on 1/19/24, subject to the holder's right to accelerate the conversion. These amounts are reflected as temporary equity on the consolidated balance sheets. The remaining $259 million of preferred equity represents the E class, which does not convert to common equity. 5. Includes non-controlling interest. Income Statement Balance Sheet - Assets (End of Quarter) Net interest income / other income $54.7 Total core portfolio $5,228.9 Operating expenses (1) (16.6) Total real estate securities $456.8 Trading and derivatives gain/(loss) on ARMs (5.5) Cash and restricted cash $190.5 Provision for credit loss (5.1) CLO reinvestment available $16.3 Other income/(loss) (0.3) Other assets $311.2 GAAP net income (loss) $27.2 Total assets $6,203.6 Adjustments to GAAP net income (loss) (2) 11.6 Distributable Earnings (2) $38.8 Balance Sheet - Debt & Equity Realized trading and derivatives (gain)/loss on ARMs (0.2) Collateralized loan obligations 3,122.0 Run-Rate Distributable Earnings (2) $38.6 Warehouse 680.9 Run-Rate Distributable Earnings per share, fully converted (2),(3) $0.37 Repo - securities 440.0 Run-Rate Distributable Earnings return on common equity (2) 9.2% Asset specific financings 100.3 Unsecured debt 98.7 GAAP net income (loss) per share, fully converted (3) $0.25 Total Debt $4,441.8 GAAP return on common equity 6.4% Preferred equity (4) 353.5 Common stock/retained earnings (5) 1,319.6 Distributable Earnings per share, fully converted (2), (3) $0.37 Total equity (4) 1,673.1 Distributable Earnings return on common equity (2) 9.2% Book value per share, fully converted (3) $15.78 Dividend per share $0.355 Net debt/total equity 2.54x Dividend per share yield on book value 9.0% Recourse net debt/total equity 0.68x

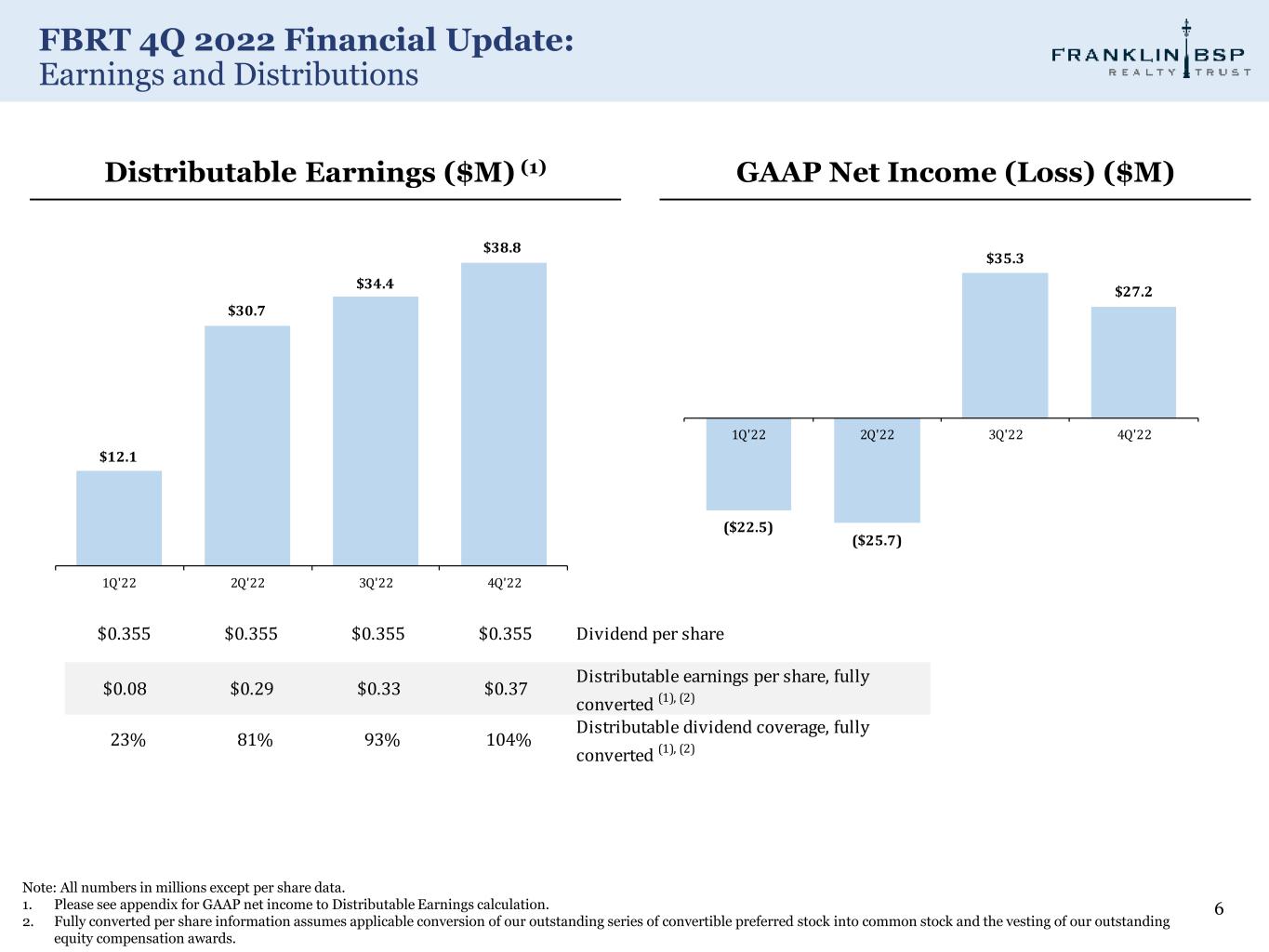

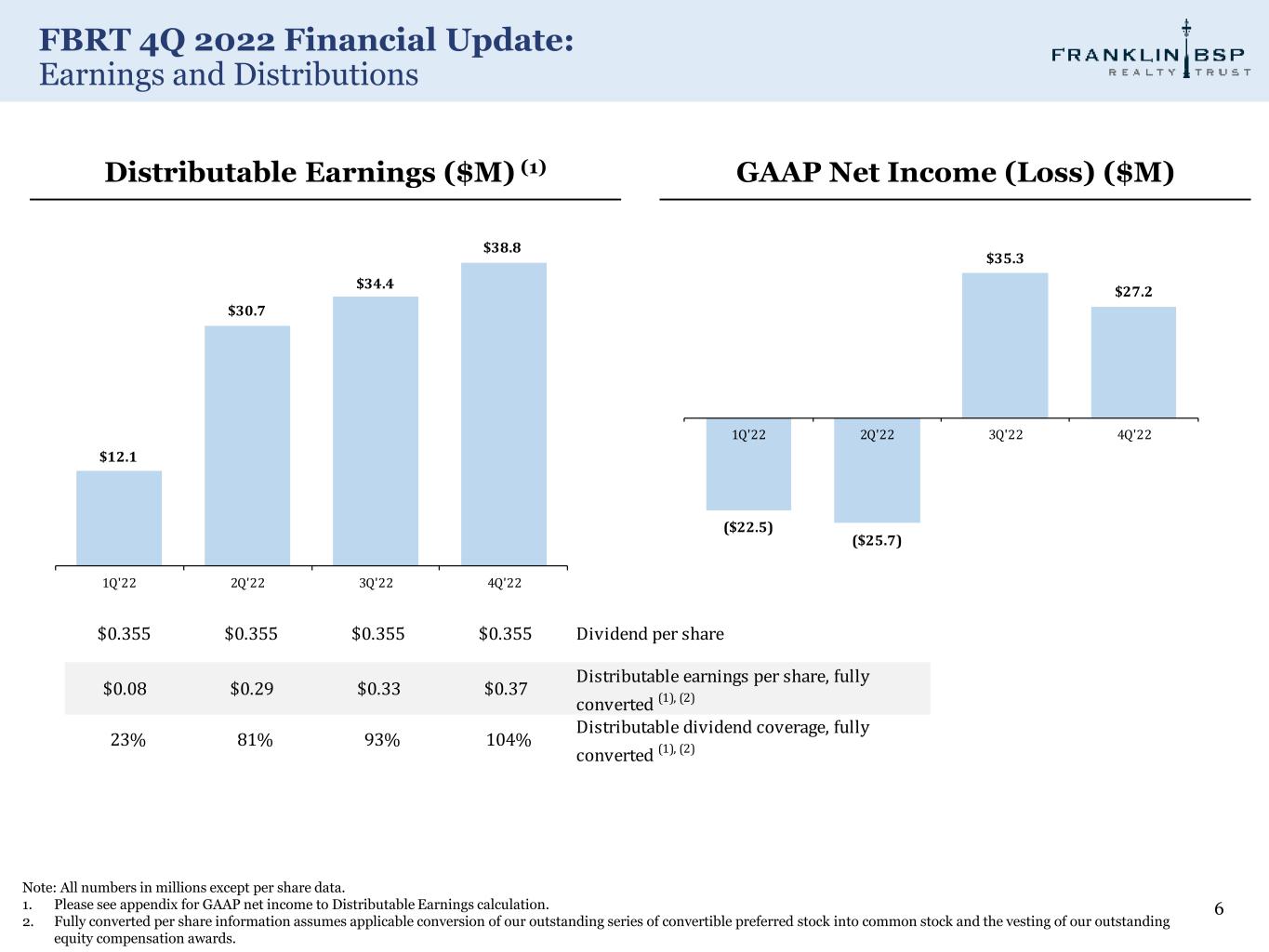

FBRT 4Q 2022 Financial Update: Earnings and Distributions 6 Note: All numbers in millions except per share data. 1. Please see appendix for GAAP net income to Distributable Earnings calculation. 2. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards. $12.1 $30.7 $34.4 $38.8 1Q'22 2Q'22 3Q'22 4Q'22 GAAP Net Income (Loss) ($M)Distributable Earnings ($M) (1) ($22.5) ($25.7) $35.3 $27.2 1Q'22 2Q'22 3Q'22 4Q'22 $0.355 $0.355 $0.355 $0.355 Dividend per share $0.08 $0.29 $0.33 $0.37 Distributable earnings per share, fully converted (1), (2) 23% 81% 93% 104% Distributable dividend coverage, fully converted (1), (2)

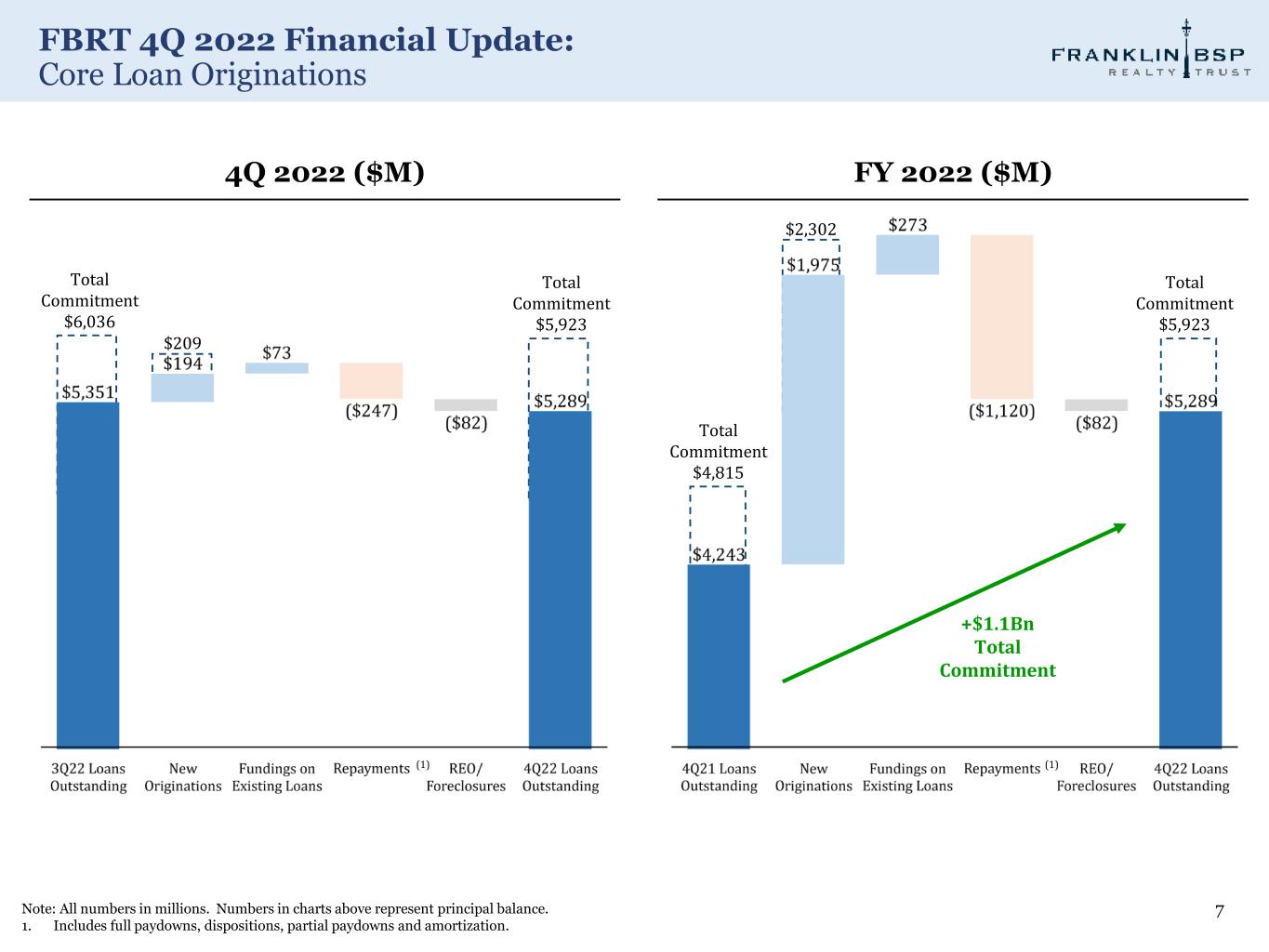

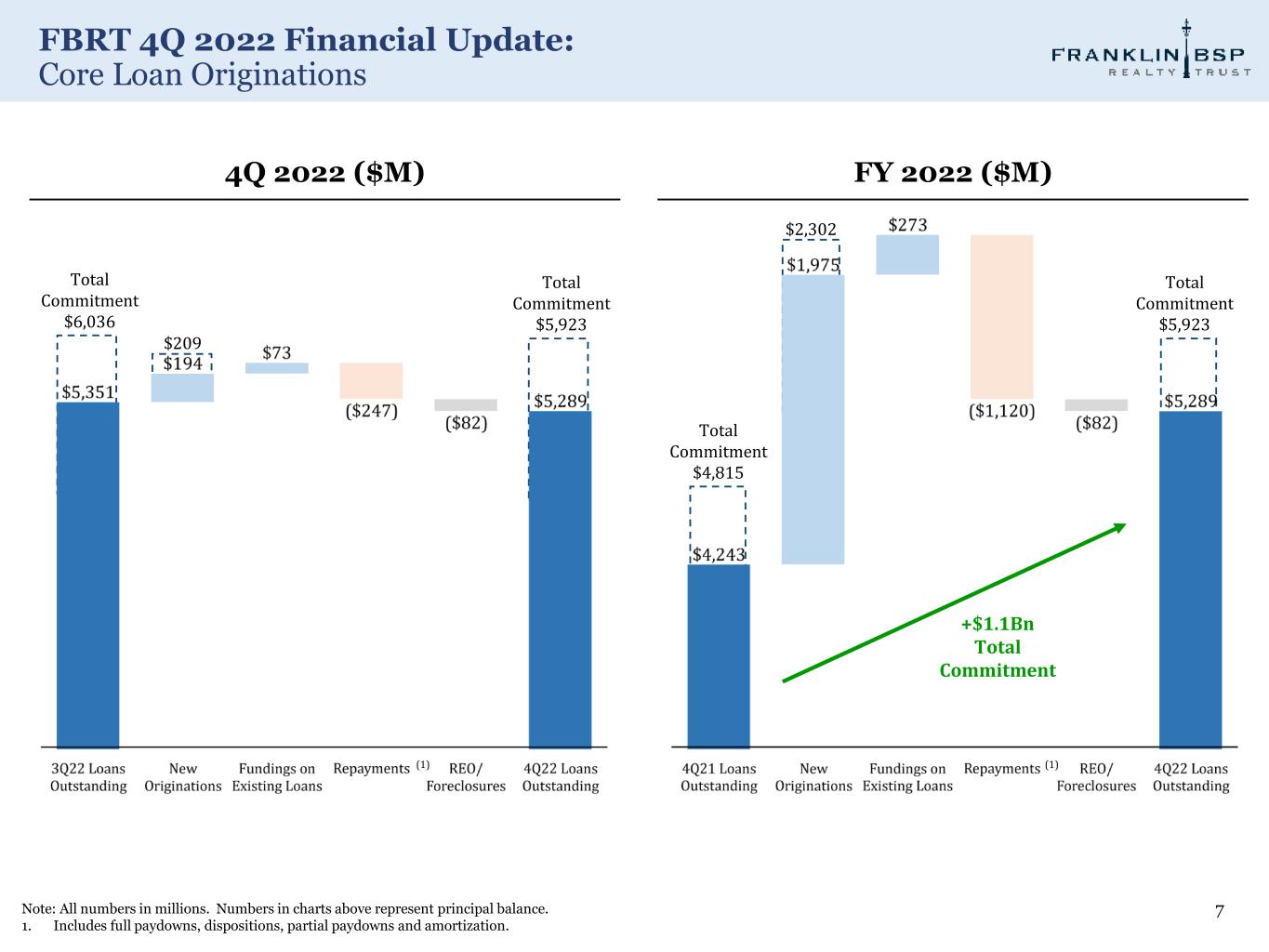

FBRT 4Q 2022 Financial Update: Core Loan Originations 7Note: All numbers in millions. Numbers in charts above represent principal balance. 1. Includes full paydowns, dispositions, partial paydowns and amortization. 4Q 2022 ($M) FY 2022 ($M) Total Commitment $5,923 $209 Total Commitment $6,036 (1)(1) Total Commitment $4,815 $2,302 Total Commitment $5,923 +$1.1Bn Total Commitment

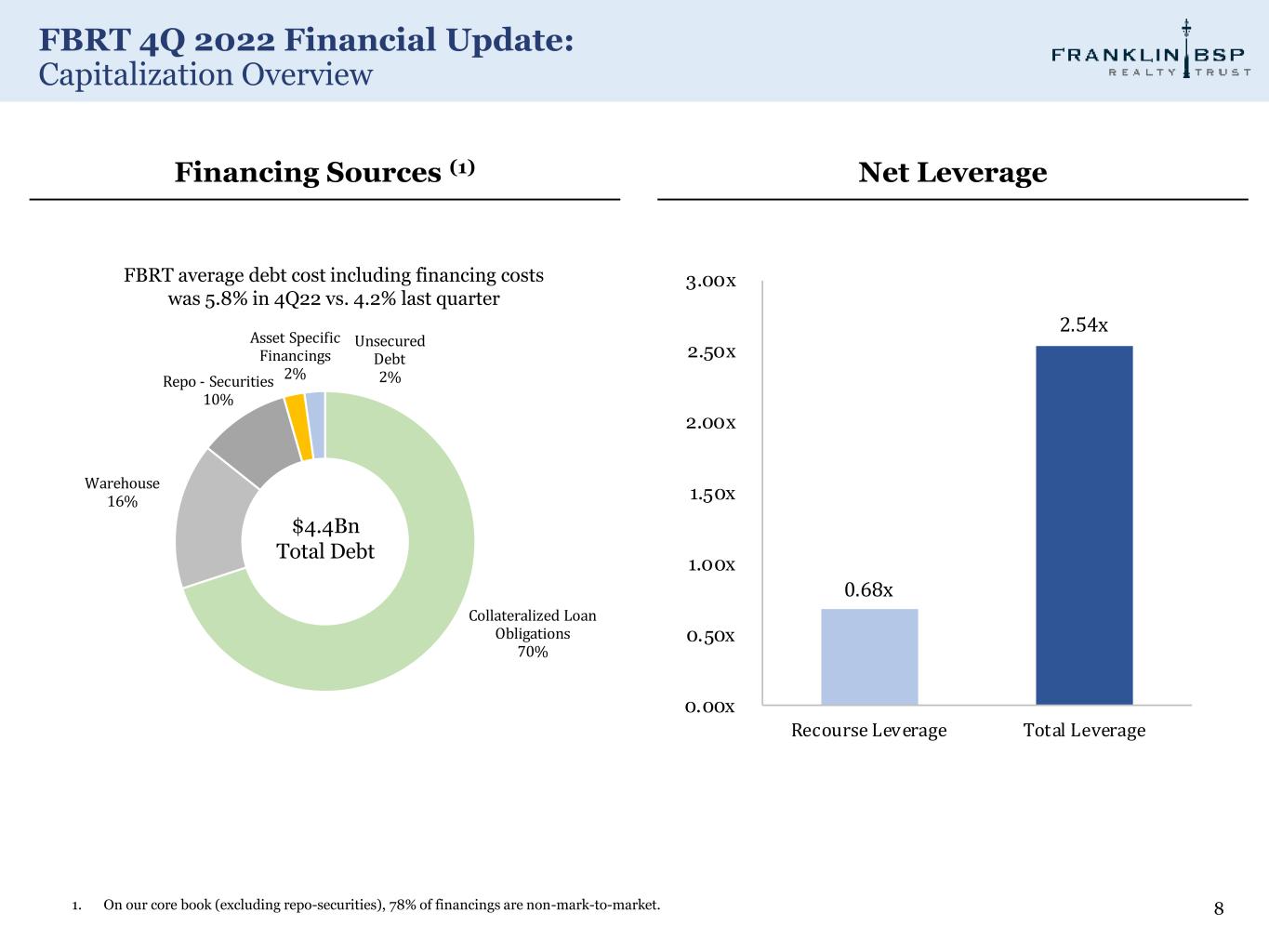

FBRT 4Q 2022 Financial Update: Capitalization Overview 1. On our core book (excluding repo-securities), 78% of financings are non-mark-to-market. 8 Collateralized Loan Obligations 70% Warehouse 16% Repo - Securities 10% Asset Specific Financings 2% Unsecured Debt 2% FBRT average debt cost including financing costs was 5.8% in 4Q22 vs. 4.2% last quarter $4.4Bn Total Debt 0.68x 2.54x 0.00x 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x Recourse Leverage Total Leverage Financing Sources (1) Net Leverage

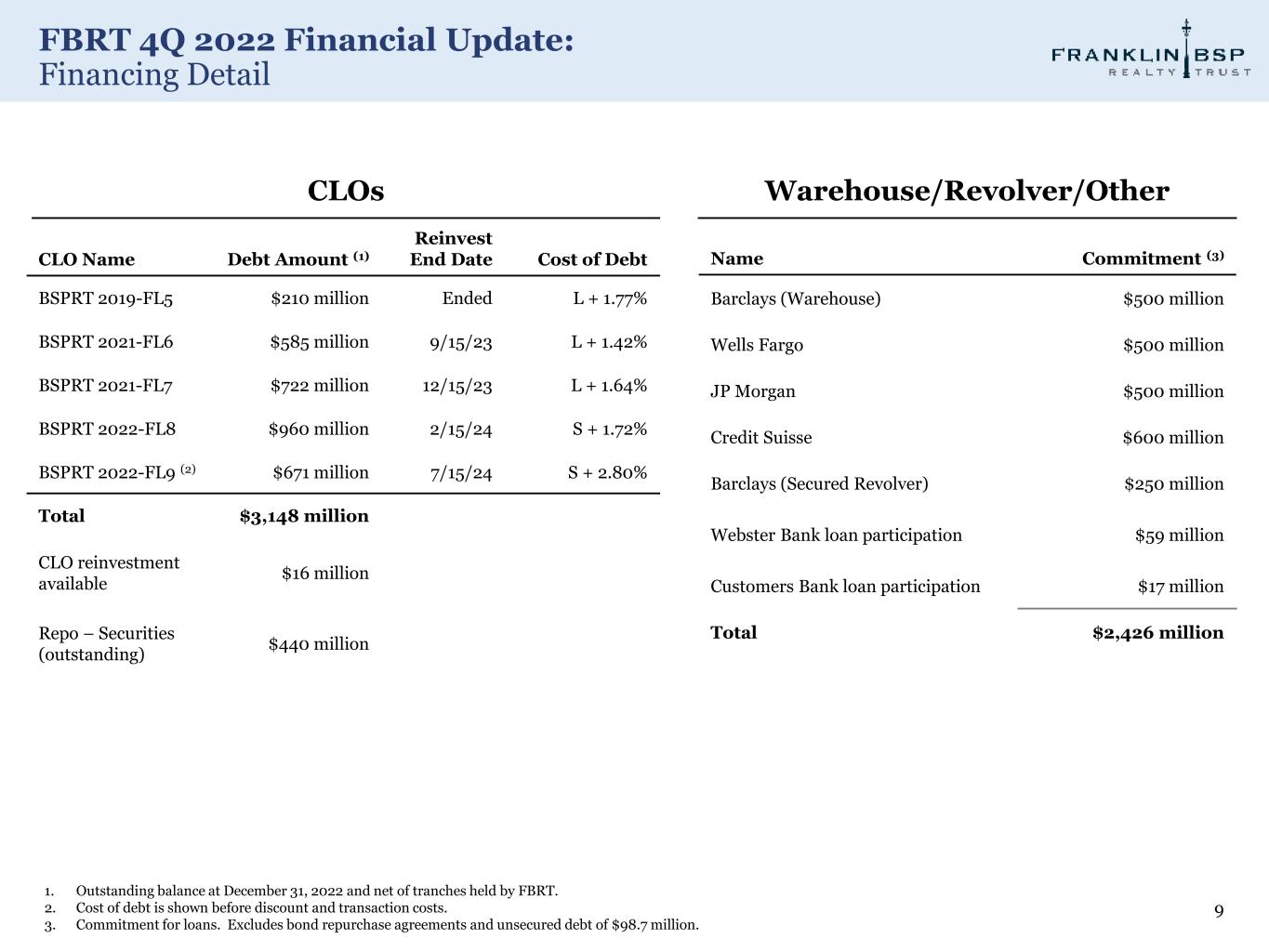

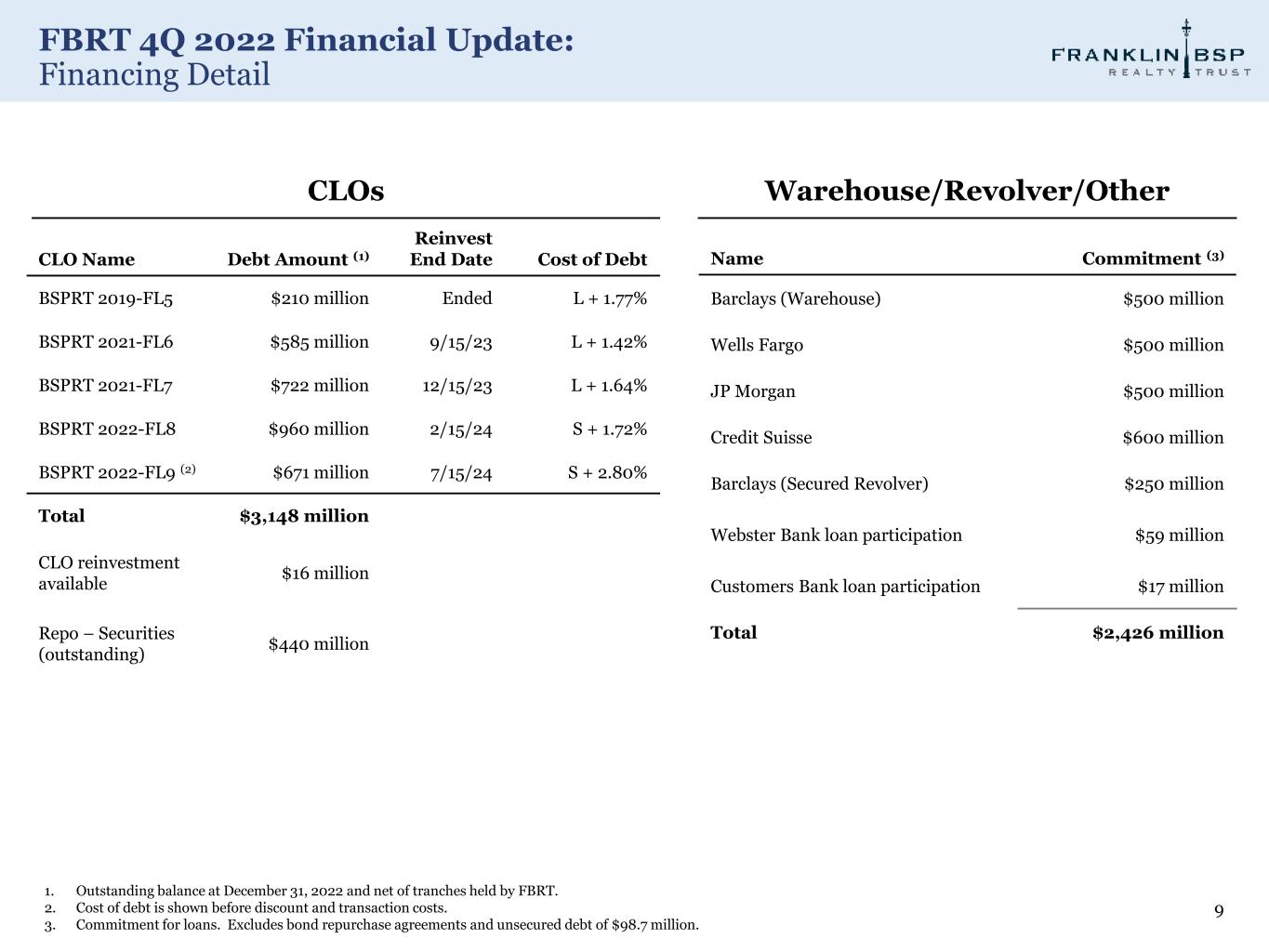

FBRT 4Q 2022 Financial Update: Financing Detail 9 1. Outstanding balance at December 31, 2022 and net of tranches held by FBRT. 2. Cost of debt is shown before discount and transaction costs. 3. Commitment for loans. Excludes bond repurchase agreements and unsecured debt of $98.7 million. CLO Name Debt Amount (1) Reinvest End Date Cost of Debt BSPRT 2019-FL5 $210 million Ended L + 1.77% BSPRT 2021-FL6 $585 million 9/15/23 L + 1.42% BSPRT 2021-FL7 $722 million 12/15/23 L + 1.64% BSPRT 2022-FL8 $960 million 2/15/24 S + 1.72% BSPRT 2022-FL9 (2) $671 million 7/15/24 S + 2.80% Total $3,148 million CLO reinvestment available $16 million Repo – Securities (outstanding) $440 million Name Commitment (3) Barclays (Warehouse) $500 million Wells Fargo $500 million JP Morgan $500 million Credit Suisse $600 million Barclays (Secured Revolver) $250 million Webster Bank loan participation $59 million Customers Bank loan participation $17 million Total $2,426 million CLOs Warehouse/Revolver/Other

FBRT 4Q 2022 Financial Update: Liquidity 10Note: All numbers in millions. 1. Represents cash available we can invest at a market advance rate utilizing our available capacity on financing lines. Liquidity ($M) (1)

Portfolio 11

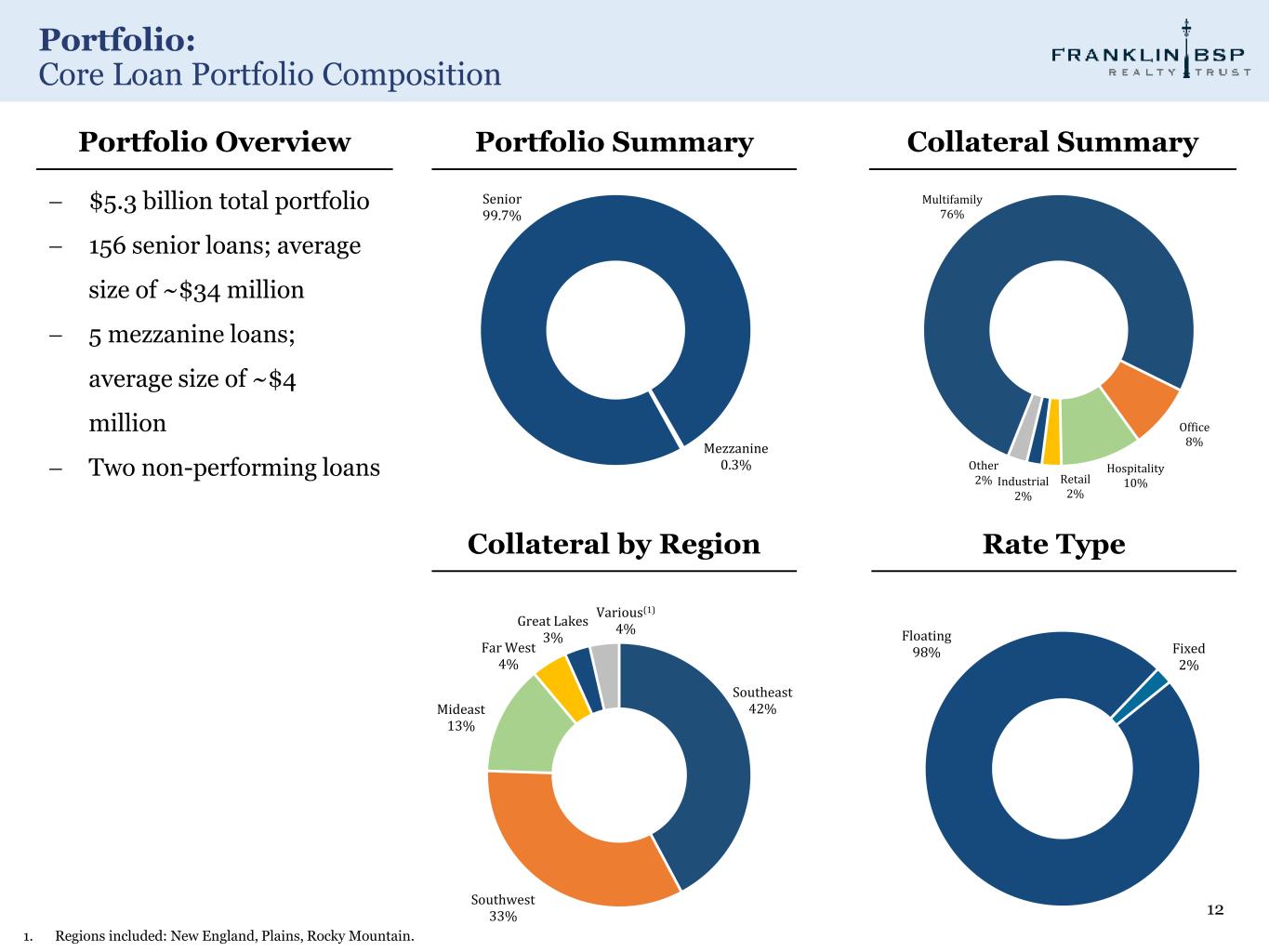

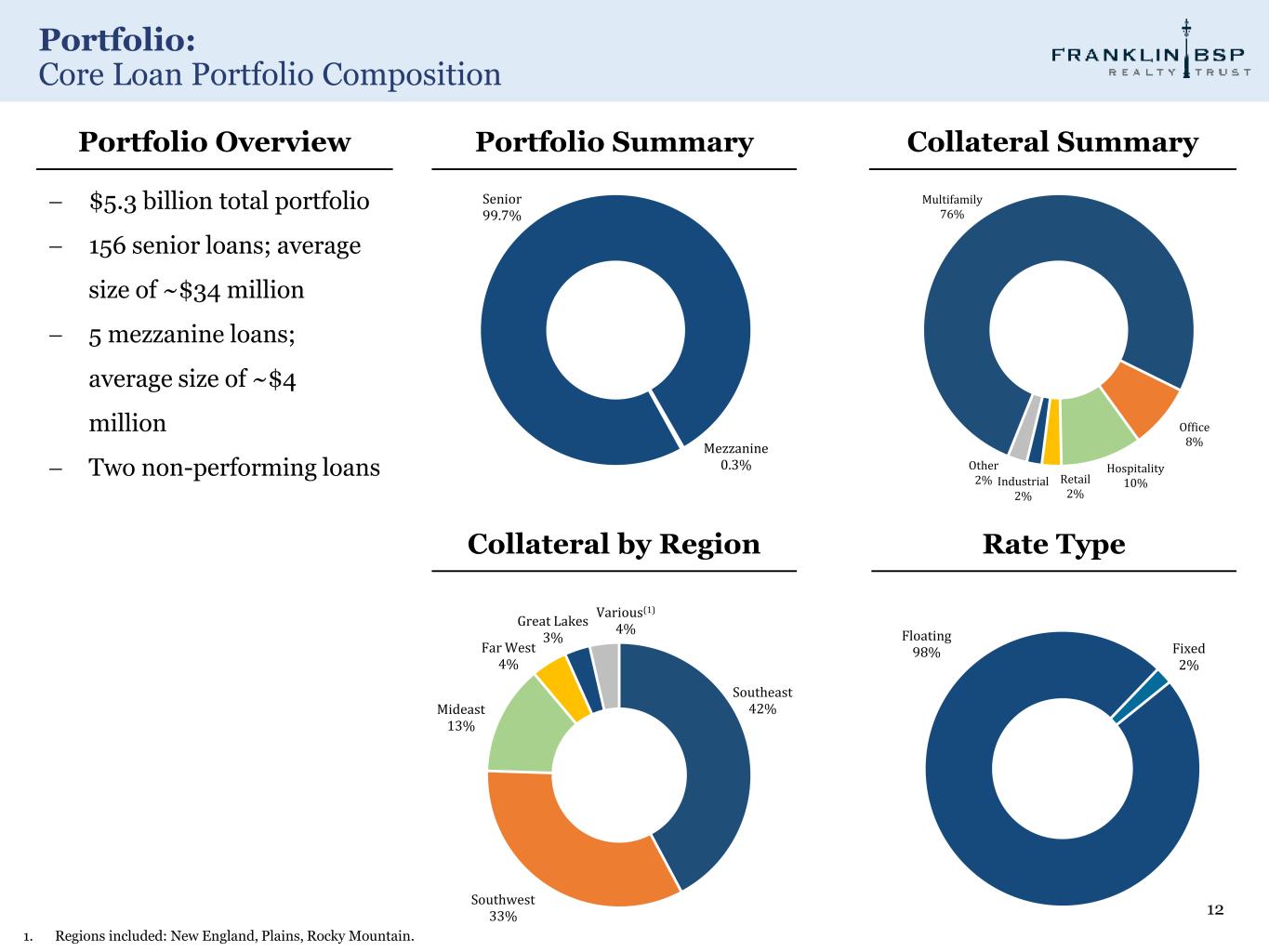

Portfolio: Core Loan Portfolio Composition 12 Mezzanine 0.3% Senior 99.7% Southeast 42% Southwest 33% Mideast 13% Far West 4% Great Lakes 3% Various(1) 4% Floating 98% Fixed 2% Portfolio Summary Collateral Summary Collateral by Region Rate Type Portfolio Overview − $5.3 billion total portfolio − 156 senior loans; average size of ~$34 million − 5 mezzanine loans; average size of ~$4 million − Two non-performing loans Multifamily 76% Office 8% Hospitality 10%Retail 2% Industrial 2% Other 2% 1. Regions included: New England, Plains, Rocky Mountain.

Portfolio: Core Originations in the Quarter 13 Note: All numbers in millions. Charts shown above are based on the initial funding/unpaid principal balance of the newly originated loans. 1. All-in coupon based on the 1- month SOFR index as of 12/31/22. − 8 loans; $209 million total commitment ($194 million of initial funding / $15 million of future funding) − 4.33% weighted average spread; 8.69% all-in coupon(1). 1.0% and 0.5% weighted average origination and exit fees, respectively By Collateral By Region By State Overview North Carolina 45% South Carolina 34% Texas 15% New York 6% Multifamily 79% Hospitality 21% Southeast 79% Southwest 15% Mideast 6%

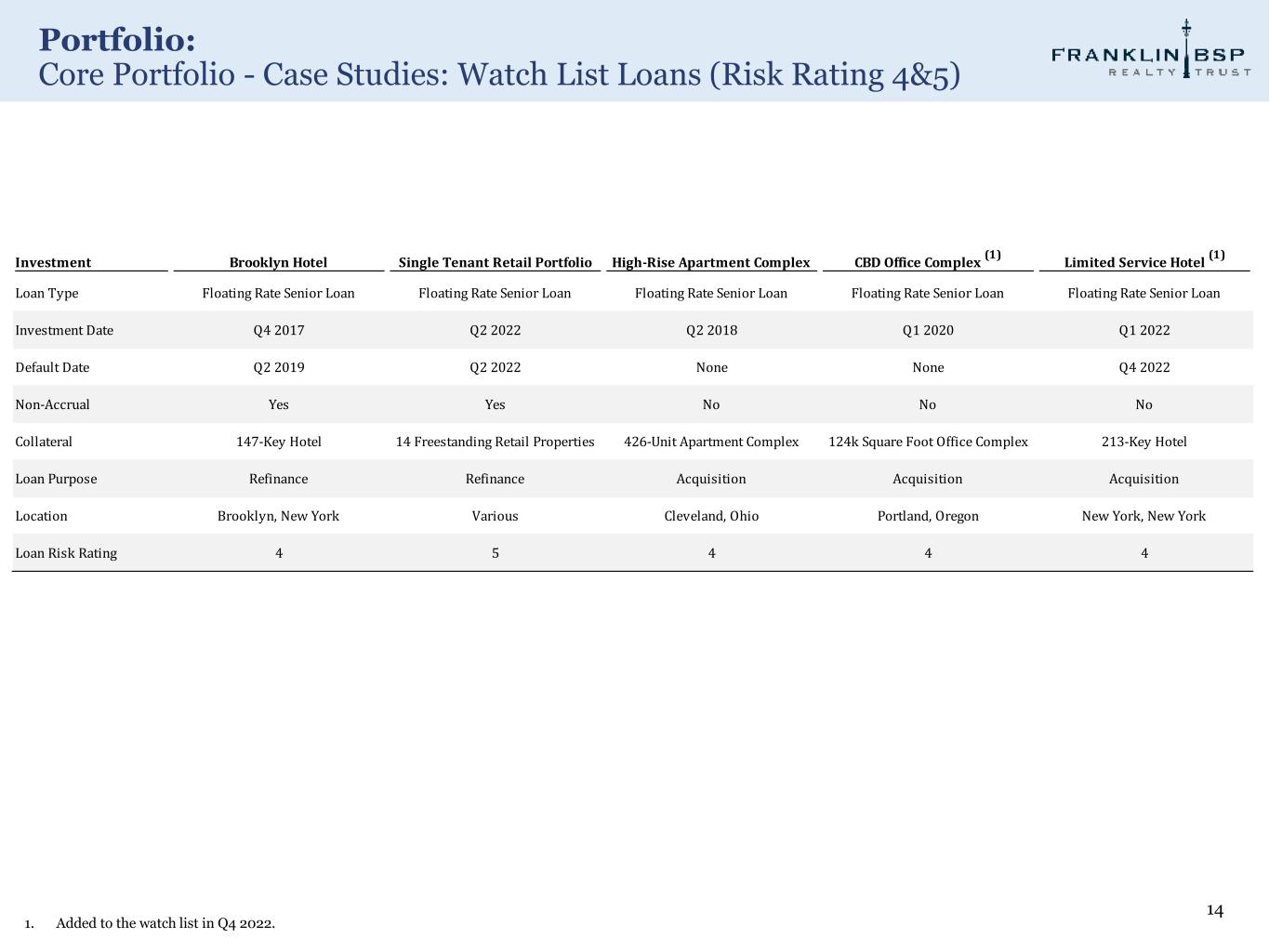

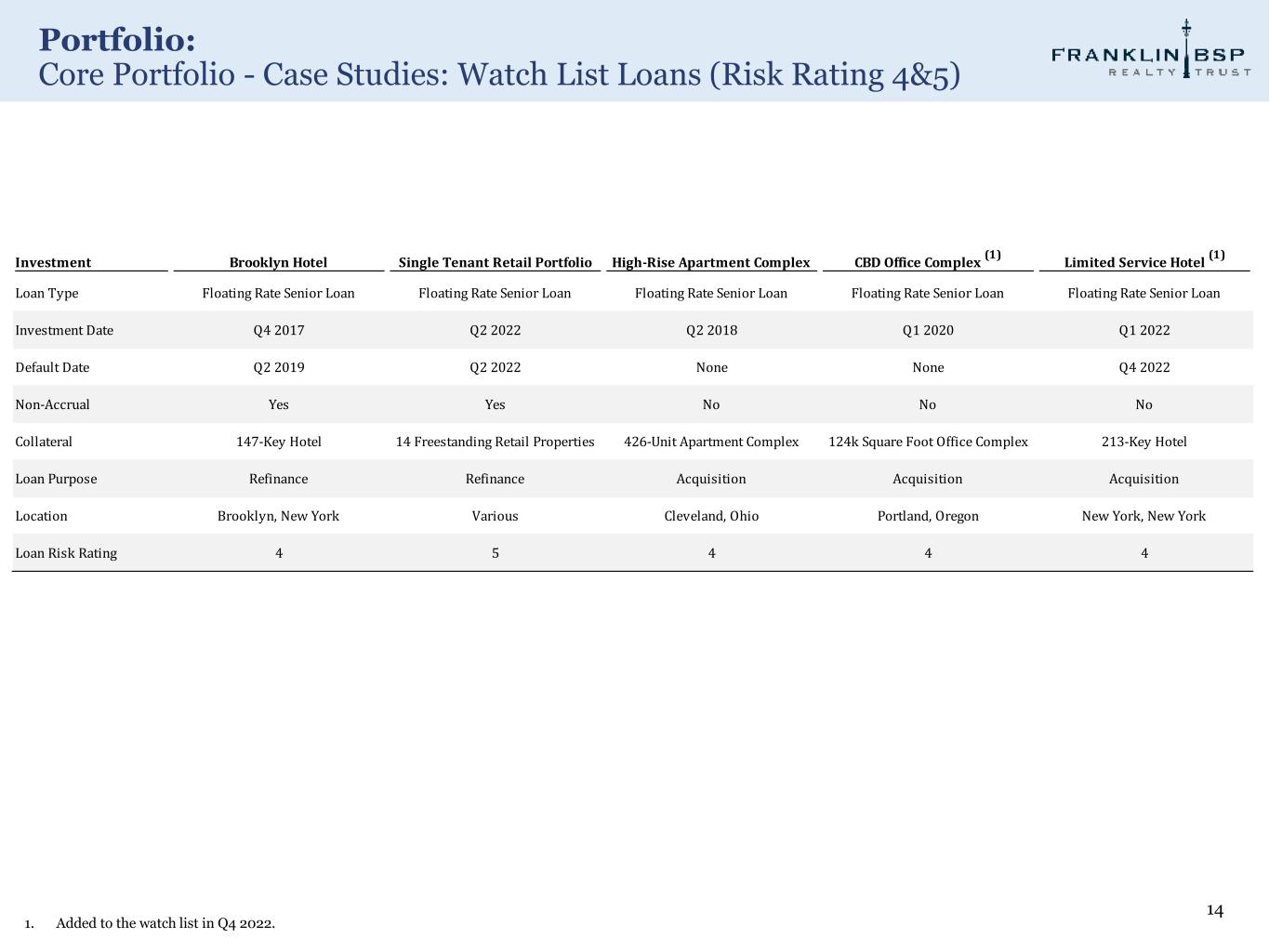

Portfolio: Core Portfolio - Case Studies: Watch List Loans (Risk Rating 4&5) 14 Investment Brooklyn Hotel Single Tenant Retail Portfolio High-Rise Apartment Complex CBD Office Complex (1) Limited Service Hotel (1) Loan Type Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Investment Date Q4 2017 Q2 2022 Q2 2018 Q1 2020 Q1 2022 Default Date Q2 2019 Q2 2022 None None Q4 2022 Non-Accrual Yes Yes No No No Collateral 147-Key Hotel 14 Freestanding Retail Properties 426-Unit Apartment Complex 124k Square Foot Office Complex 213-Key Hotel Loan Purpose Refinance Refinance Acquisition Acquisition Acquisition Location Brooklyn, New York Various Cleveland, Ohio Portland, Oregon New York, New York Loan Risk Rating 4 5 4 4 4 1. Added to the watch list in Q4 2022.

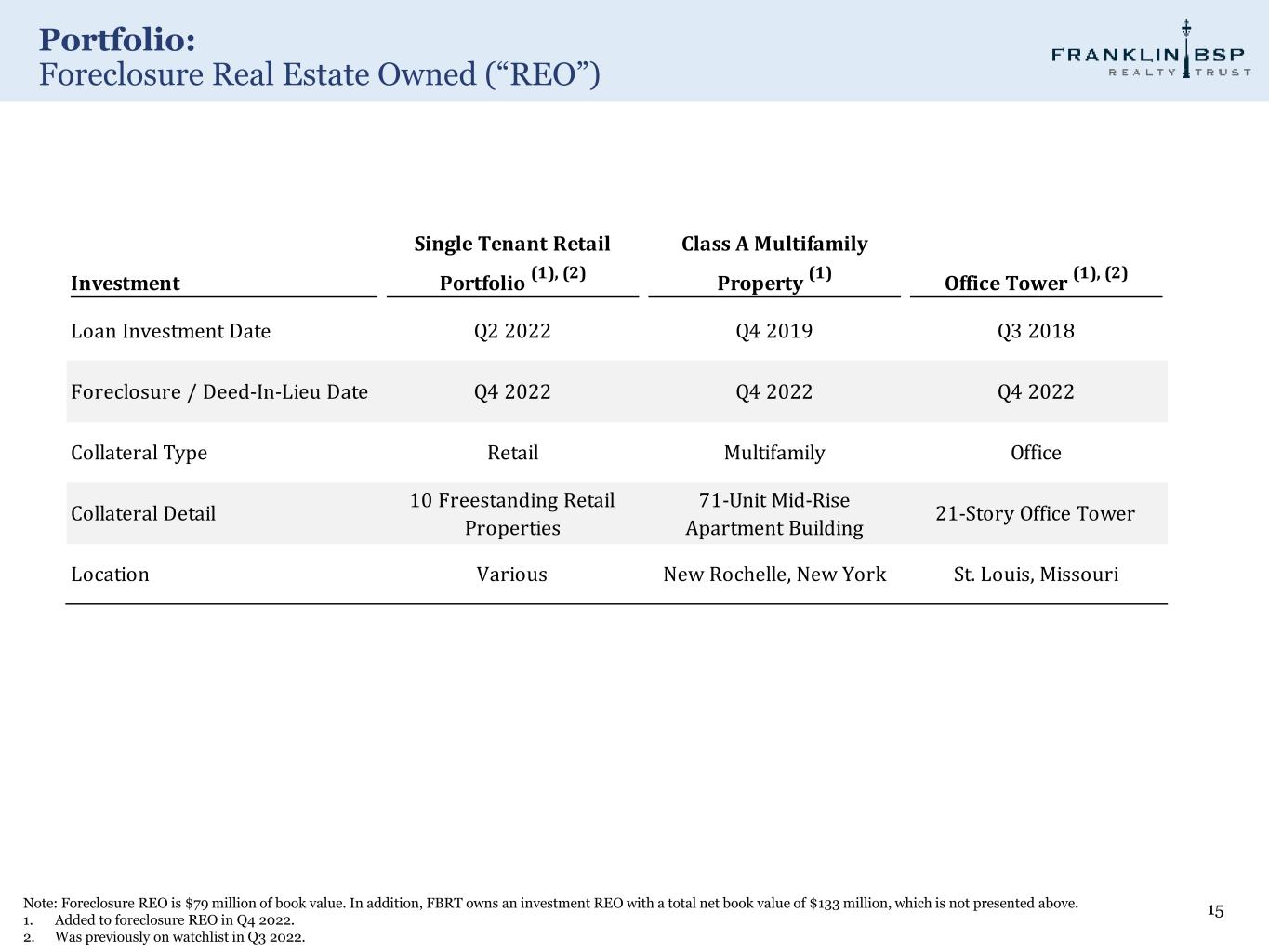

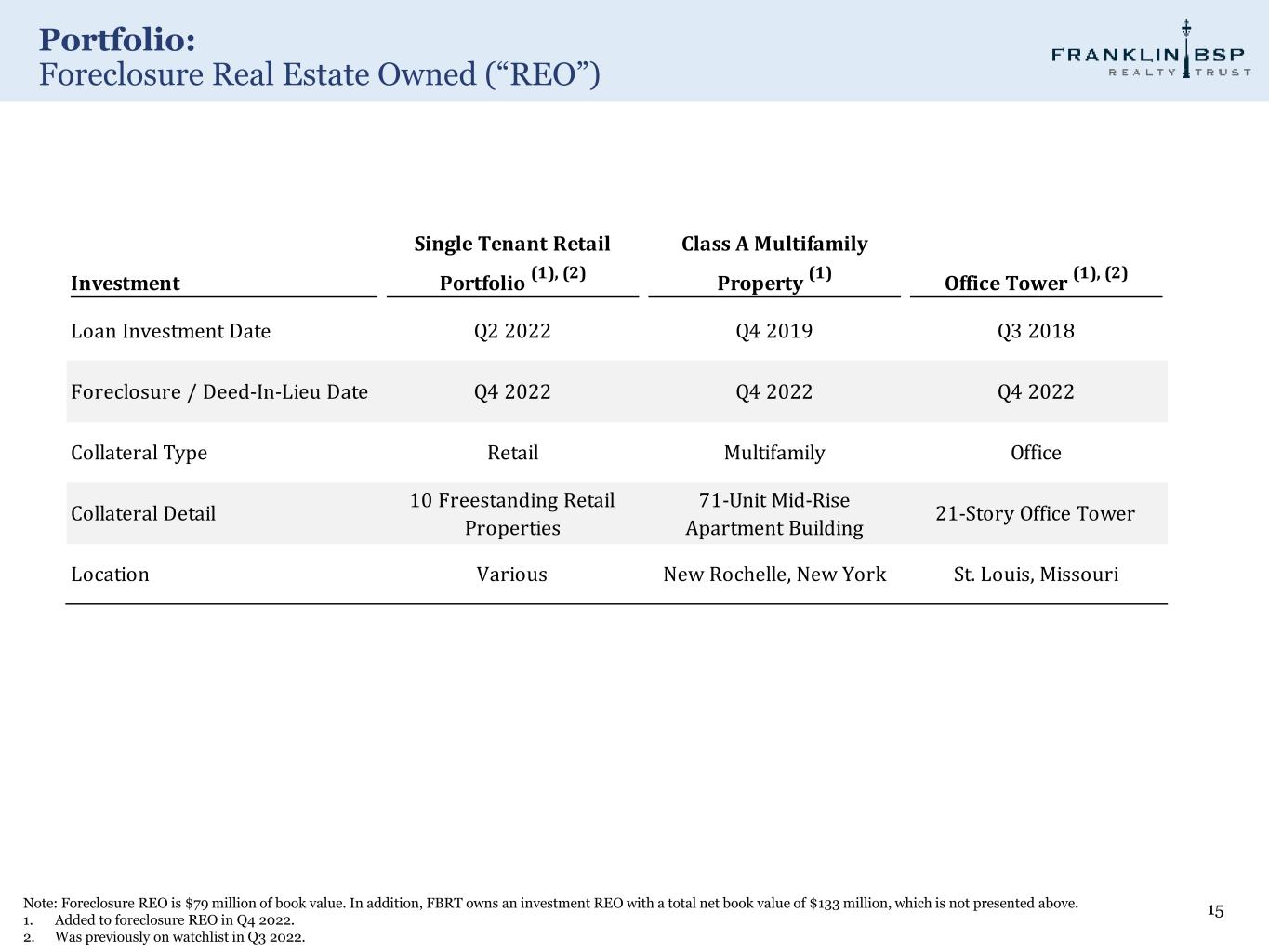

Portfolio: Foreclosure Real Estate Owned (“REO”) 15 Investment Single Tenant Retail Portfolio (1), (2) Class A Multifamily Property (1) Office Tower (1), (2) Loan Investment Date Q2 2022 Q4 2019 Q3 2018 Foreclosure / Deed-In-Lieu Date Q4 2022 Q4 2022 Q4 2022 Collateral Type Retail Multifamily Office Collateral Detail 10 Freestanding Retail Properties 71-Unit Mid-Rise Apartment Building 21-Story Office Tower Location Various New Rochelle, New York St. Louis, Missouri Note: Foreclosure REO is $79 million of book value. In addition, FBRT owns an investment REO with a total net book value of $133 million, which is not presented above. 1. Added to foreclosure REO in Q4 2022. 2. Was previously on watchlist in Q3 2022.

Appendix 16

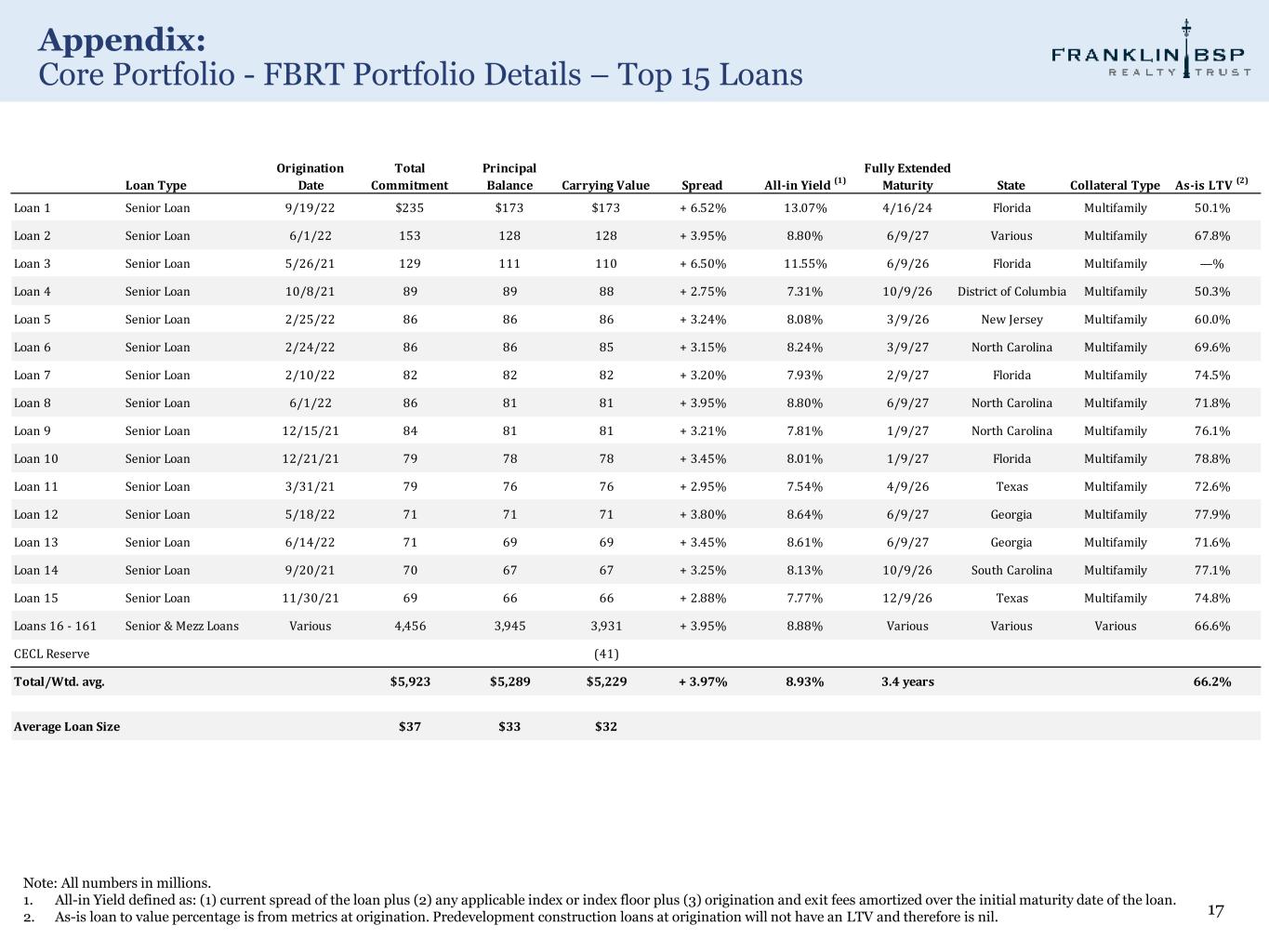

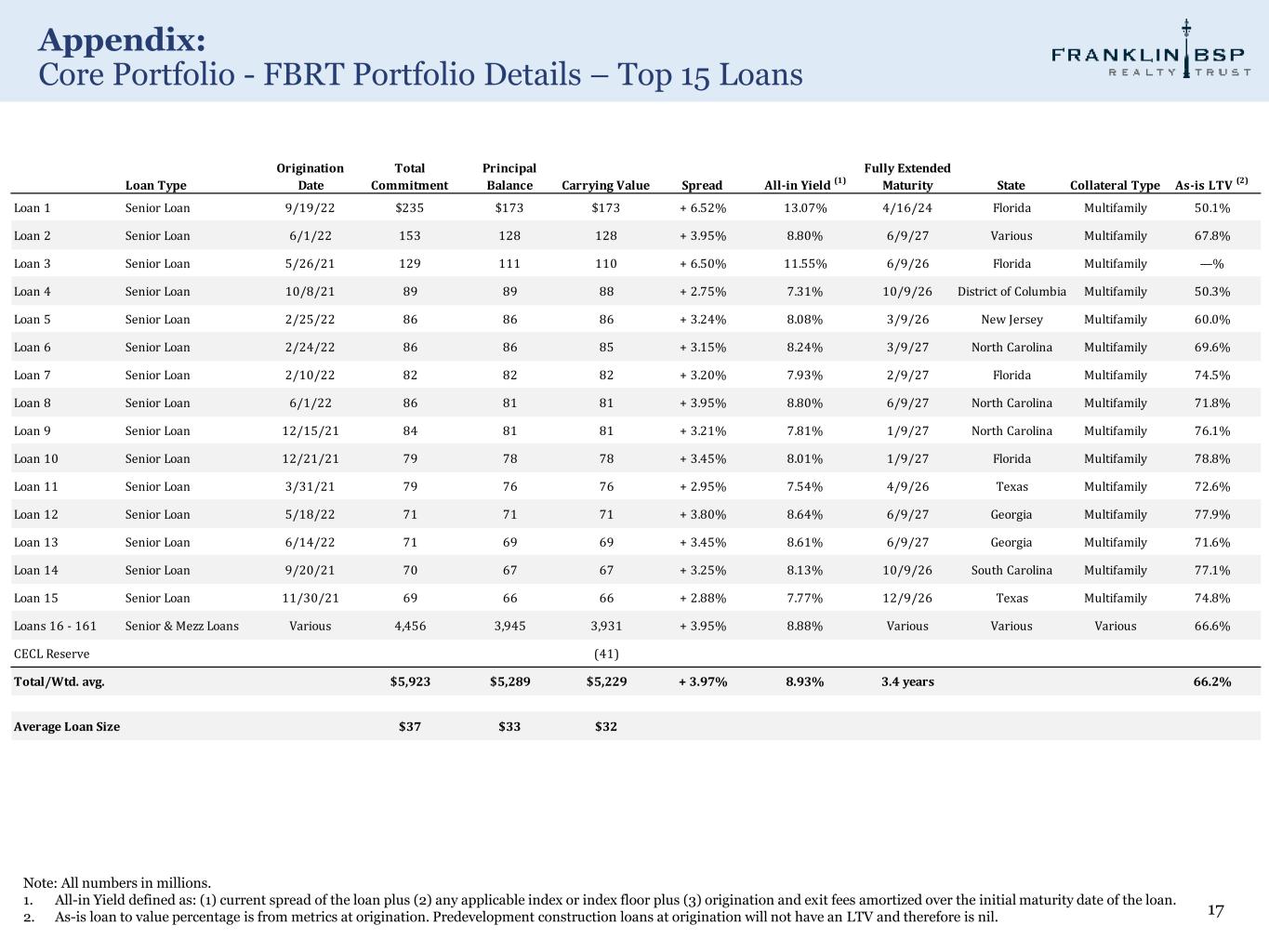

Appendix: Core Portfolio - FBRT Portfolio Details – Top 15 Loans 17 Note: All numbers in millions. 1. All-in Yield defined as: (1) current spread of the loan plus (2) any applicable index or index floor plus (3) origination and exit fees amortized over the initial maturity date of the loan. 2. As-is loan to value percentage is from metrics at origination. Predevelopment construction loans at origination will not have an LTV and therefore is nil. Loan Type Origination Date Total Commitment Principal Balance Carrying Value Spread All-in Yield (1) Fully Extended Maturity State Collateral Type As-is LTV (2) Loan 1 Senior Loan 9/19/22 $235 $173 $173 + 6.52% 13.07% 4/16/24 Florida Multifamily 50.1% Loan 2 Senior Loan 6/1/22 153 128 128 + 3.95% 8.80% 6/9/27 Various Multifamily 67.8% Loan 3 Senior Loan 5/26/21 129 111 110 + 6.50% 11.55% 6/9/26 Florida Multifamily —% Loan 4 Senior Loan 10/8/21 89 89 88 + 2.75% 7.31% 10/9/26 District of Columbia Multifamily 50.3% Loan 5 Senior Loan 2/25/22 86 86 86 + 3.24% 8.08% 3/9/26 New Jersey Multifamily 60.0% Loan 6 Senior Loan 2/24/22 86 86 85 + 3.15% 8.24% 3/9/27 North Carolina Multifamily 69.6% Loan 7 Senior Loan 2/10/22 82 82 82 + 3.20% 7.93% 2/9/27 Florida Multifamily 74.5% Loan 8 Senior Loan 6/1/22 86 81 81 + 3.95% 8.80% 6/9/27 North Carolina Multifamily 71.8% Loan 9 Senior Loan 12/15/21 84 81 81 + 3.21% 7.81% 1/9/27 North Carolina Multifamily 76.1% Loan 10 Senior Loan 12/21/21 79 78 78 + 3.45% 8.01% 1/9/27 Florida Multifamily 78.8% Loan 11 Senior Loan 3/31/21 79 76 76 + 2.95% 7.54% 4/9/26 Texas Multifamily 72.6% Loan 12 Senior Loan 5/18/22 71 71 71 + 3.80% 8.64% 6/9/27 Georgia Multifamily 77.9% Loan 13 Senior Loan 6/14/22 71 69 69 + 3.45% 8.61% 6/9/27 Georgia Multifamily 71.6% Loan 14 Senior Loan 9/20/21 70 67 67 + 3.25% 8.13% 10/9/26 South Carolina Multifamily 77.1% Loan 15 Senior Loan 11/30/21 69 66 66 + 2.88% 7.77% 12/9/26 Texas Multifamily 74.8% Loans 16 - 161 Senior & Mezz Loans Various 4,456 3,945 3,931 + 3.95% 8.88% Various Various Various 66.6% CECL Reserve (41) Total/Wtd. avg. $5,923 $5,289 $5,229 + 3.97% 8.93% 3.4 years 66.2% Average Loan Size $37 $33 $32

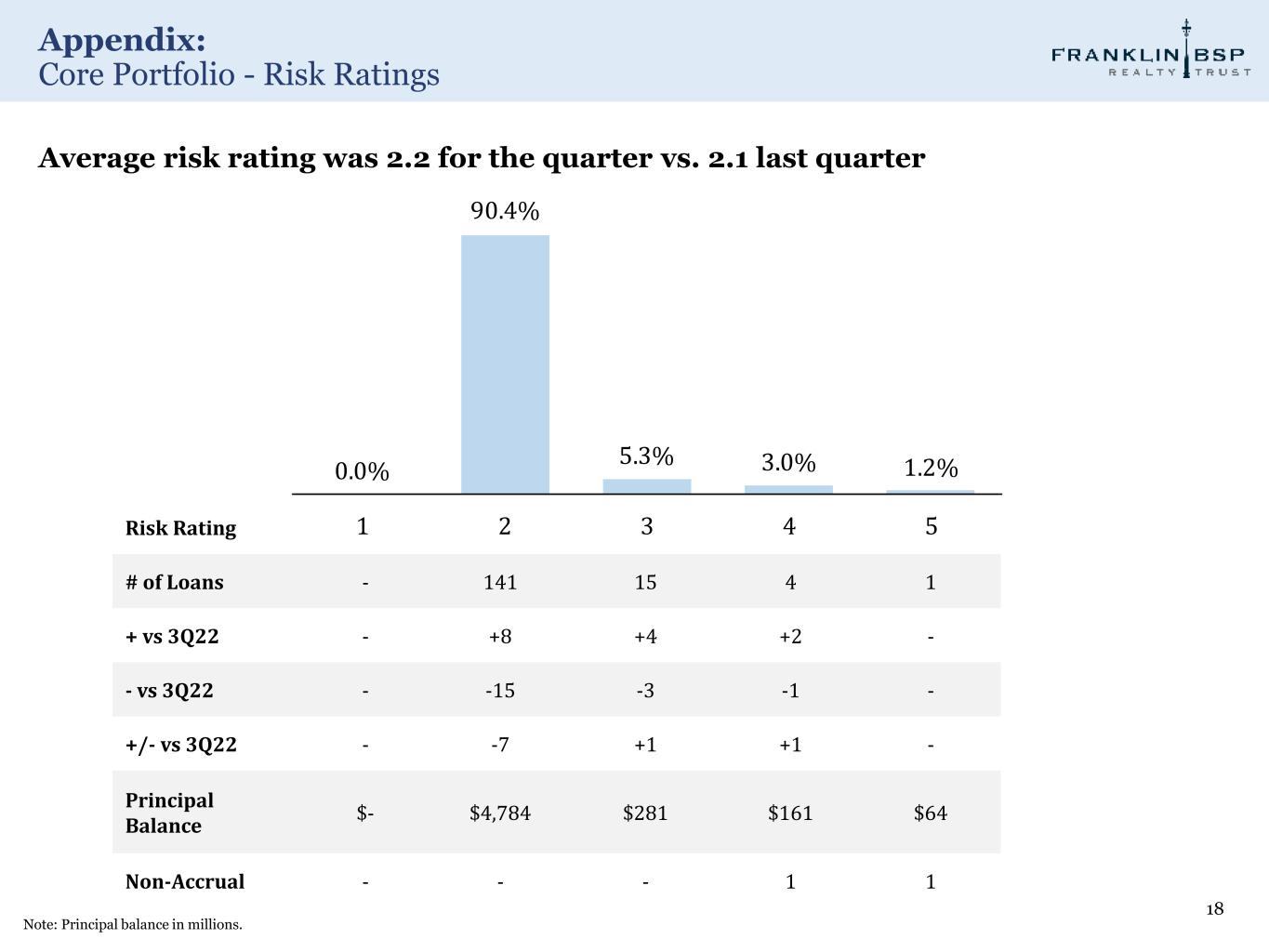

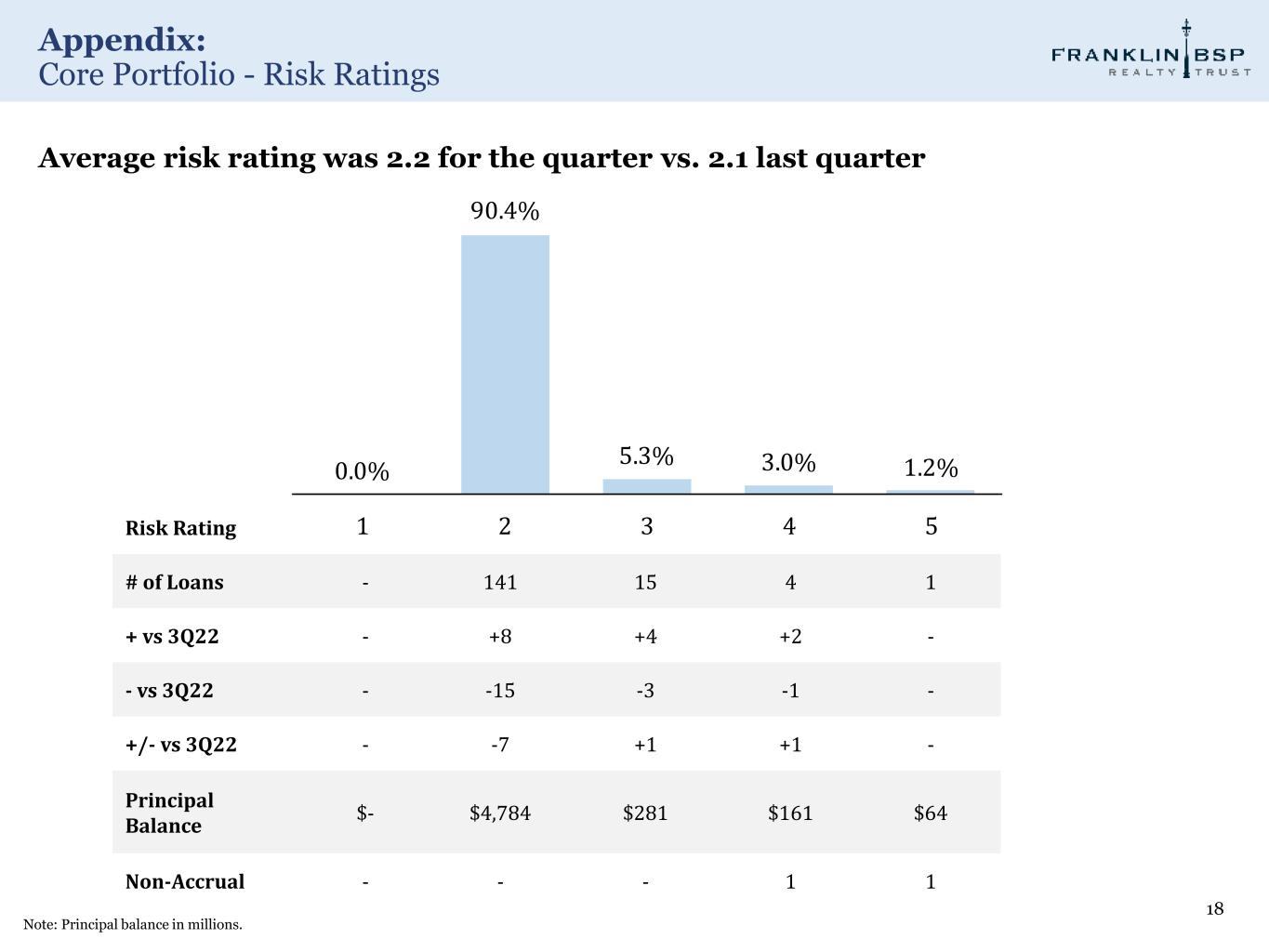

Appendix: Core Portfolio - Risk Ratings 18 Note: Principal balance in millions. Average risk rating was 2.2 for the quarter vs. 2.1 last quarter Risk Rating # of Loans - 141 15 4 1 + vs 3Q22 - +8 +4 +2 - - vs 3Q22 - -15 -3 -1 - +/- vs 3Q22 - -7 +1 +1 - Principal Balance $- $4,784 $281 $161 $64 Non-Accrual - - - 1 1 0.0% 90.4% 5.3% 3.0% 1.2% 1 2 3 4 5

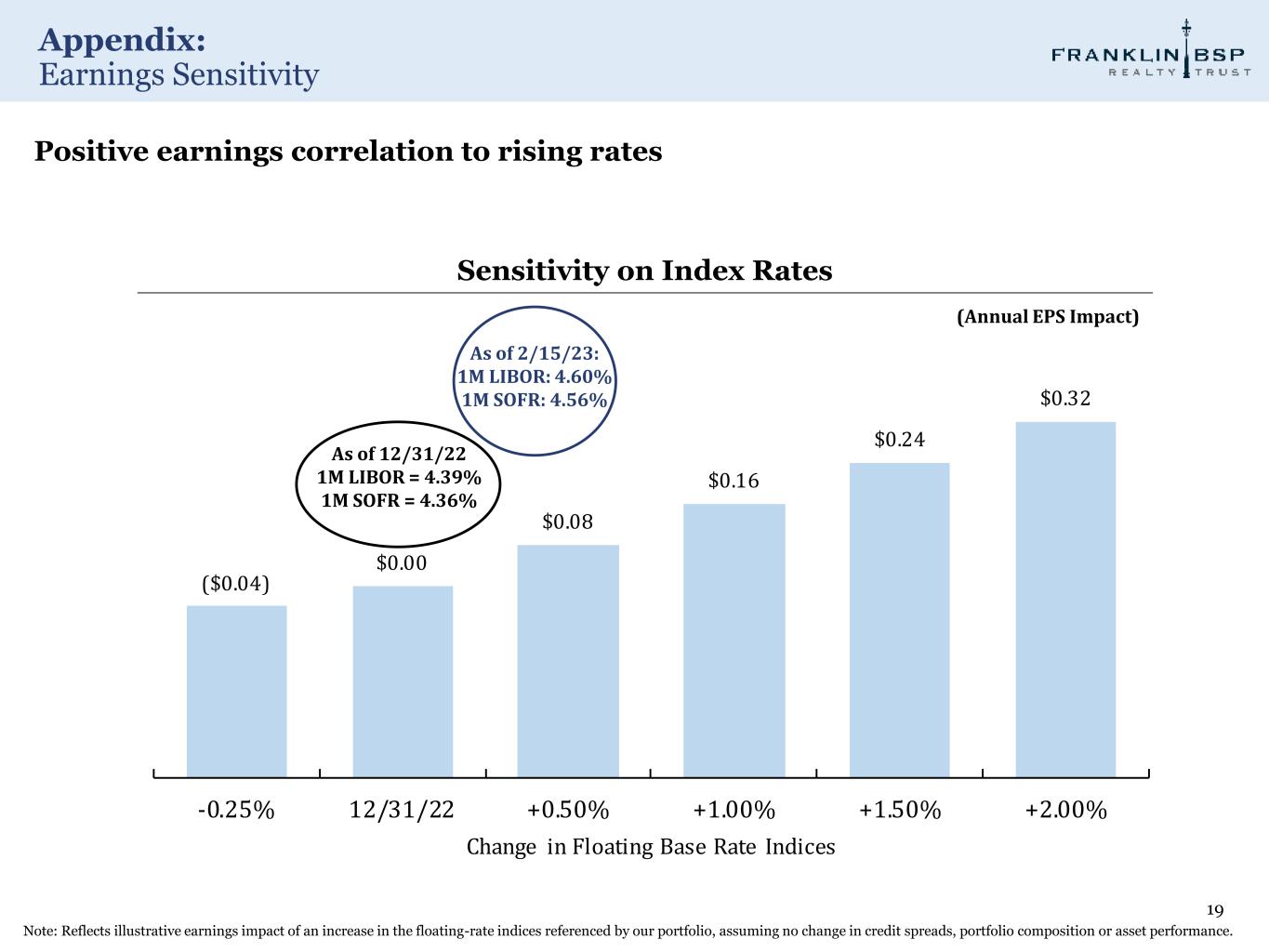

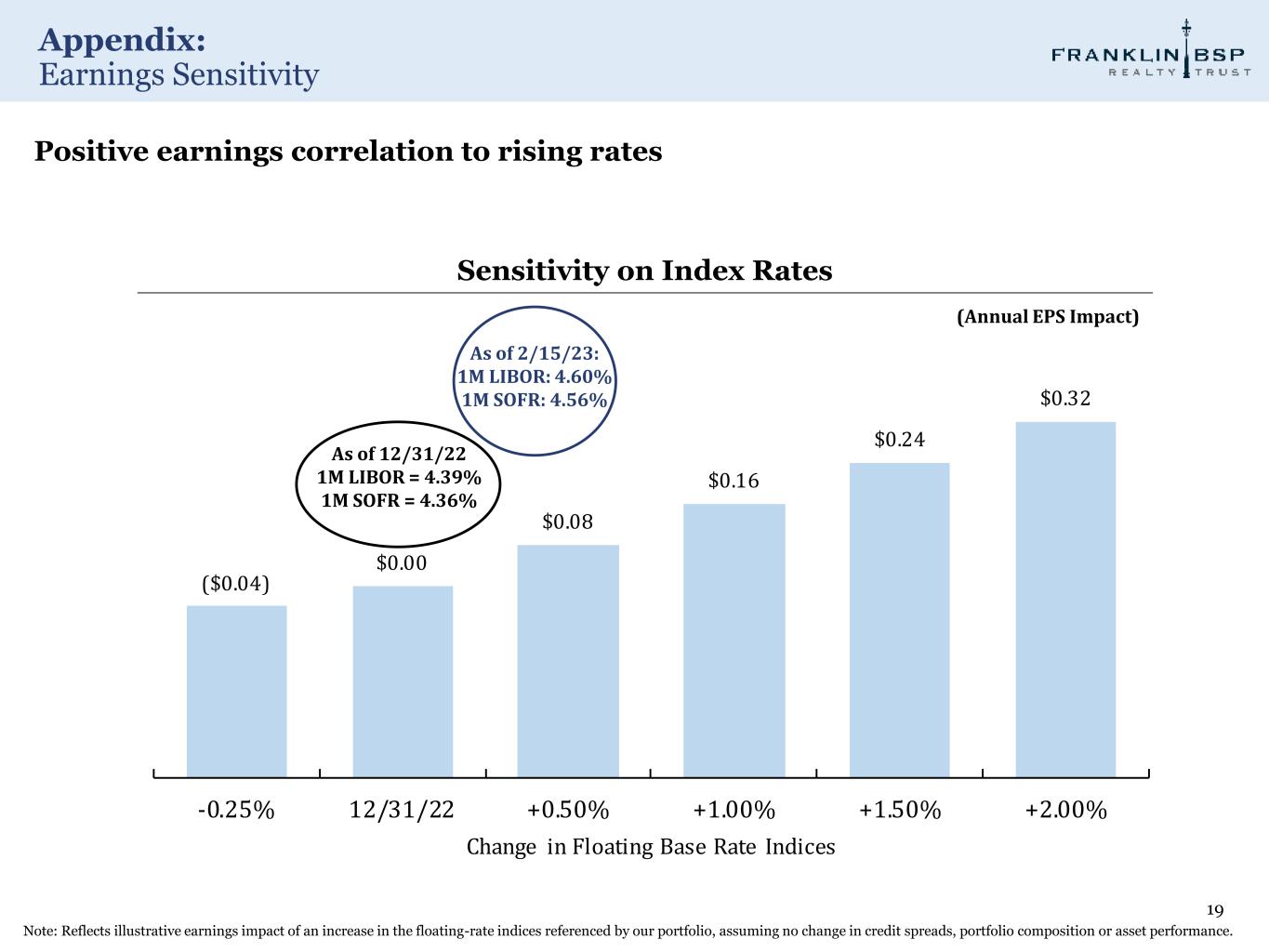

Appendix: Earnings Sensitivity 19 Note: Reflects illustrative earnings impact of an increase in the floating-rate indices referenced by our portfolio, assuming no change in credit spreads, portfolio composition or asset performance. ($0.04) $0.00 $0.08 $0.16 $0.24 $0.32 -0.25% 12/31/22 +0.50% +1.00% +1.50% +2.00% Change in Floating Base Rate Indices Positive earnings correlation to rising rates Sensitivity on Index Rates (Annual EPS Impact) As of 2/15/23: 1M LIBOR: 4.60% 1M SOFR: 4.56% As of 12/31/22 1M LIBOR = 4.39% 1M SOFR = 4.36%

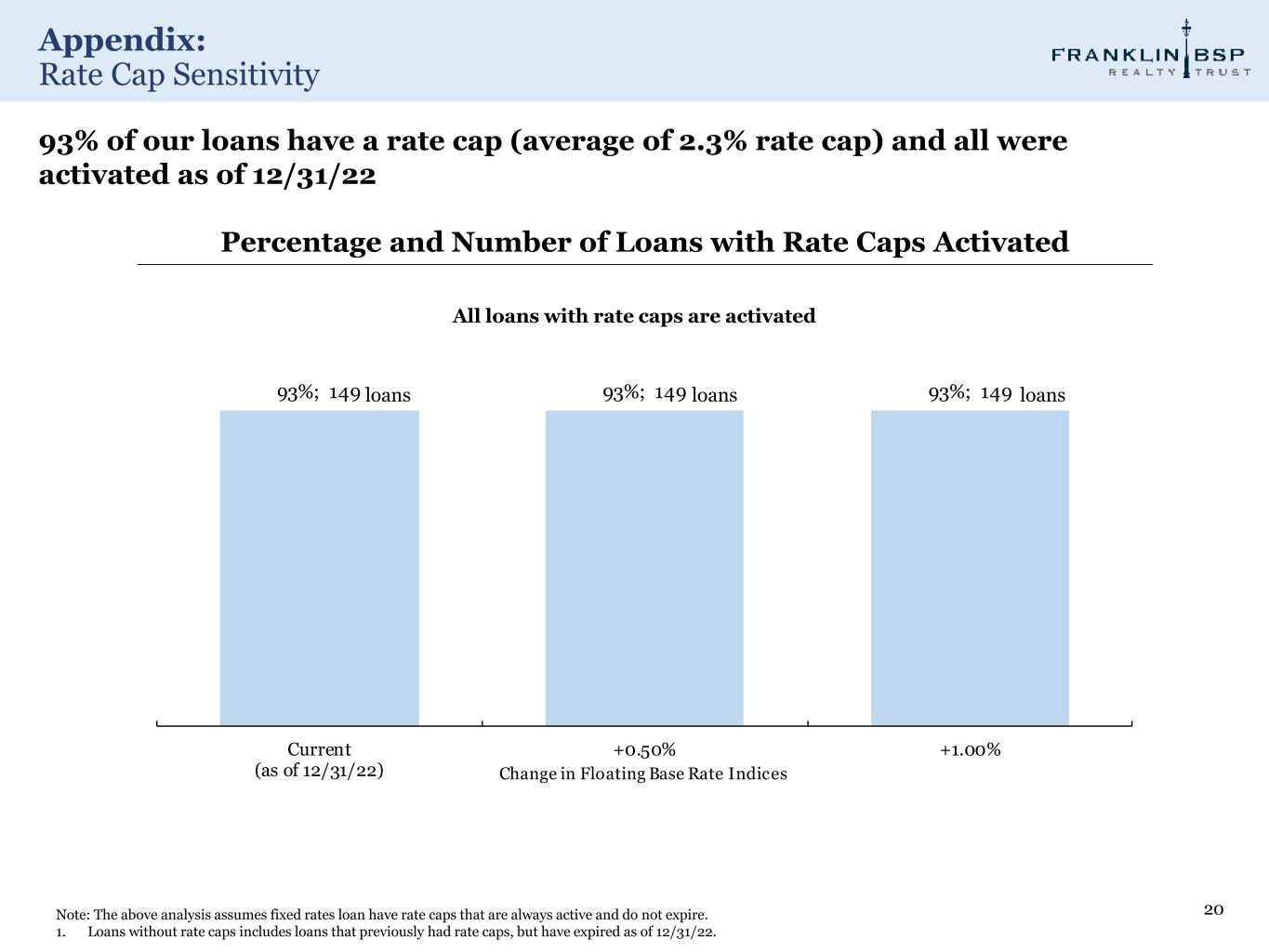

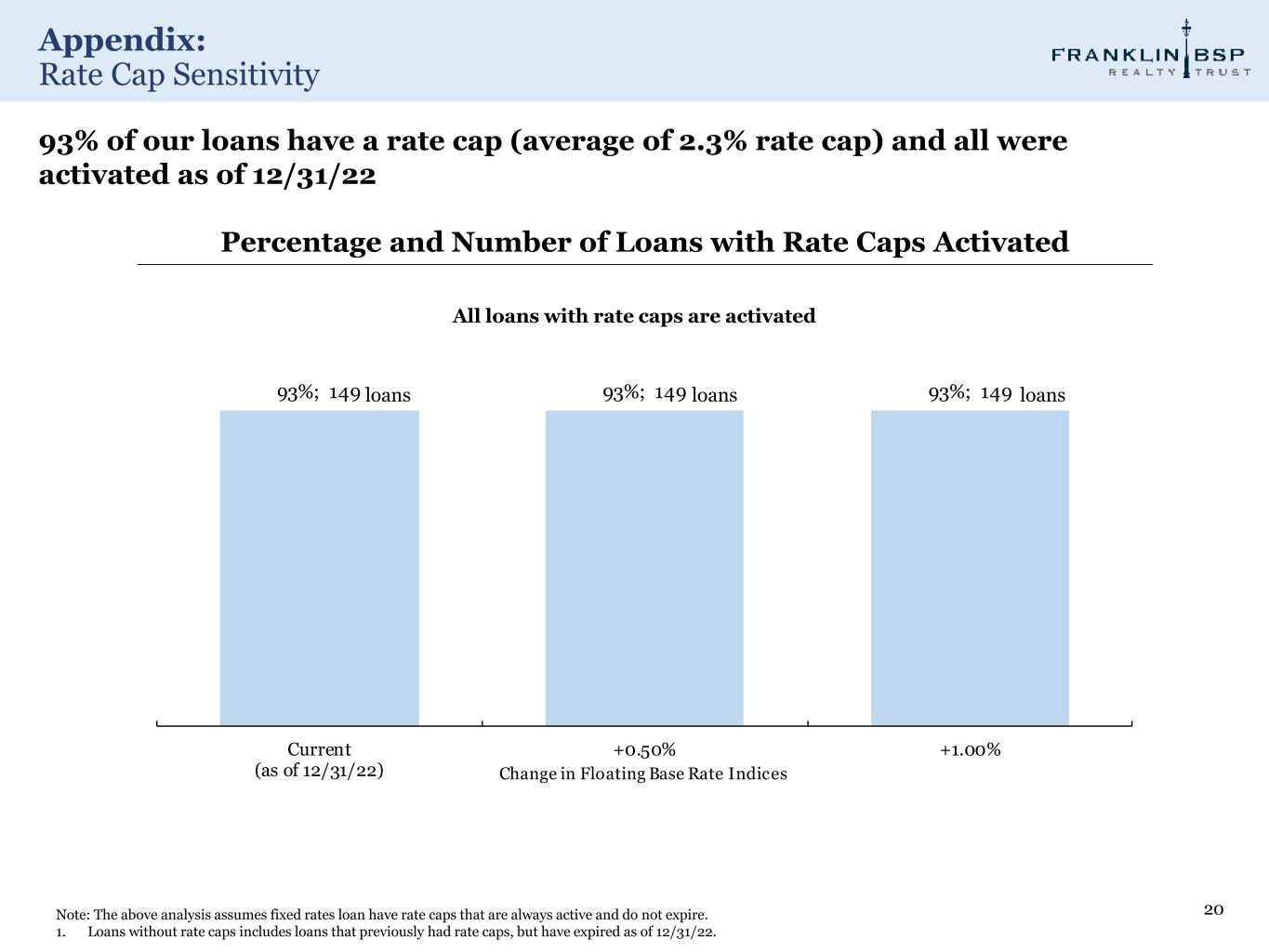

Appendix: Rate Cap Sensitivity 20Note: The above analysis assumes fixed rates loan have rate caps that are always active and do not expire. 1. Loans without rate caps includes loans that previously had rate caps, but have expired as of 12/31/22. 93%; 149 93%; 149 93%; 149 Current (as of 12/31/22) +0.50% +1.00% Change in Floating Base Rate Indices All loans with rate caps are activated 93% of our loans have a rate cap (average of 2.3% rate cap) and all were activated as of 12/31/22 Percentage and Number of Loans with Rate Caps Activated loans loans loans

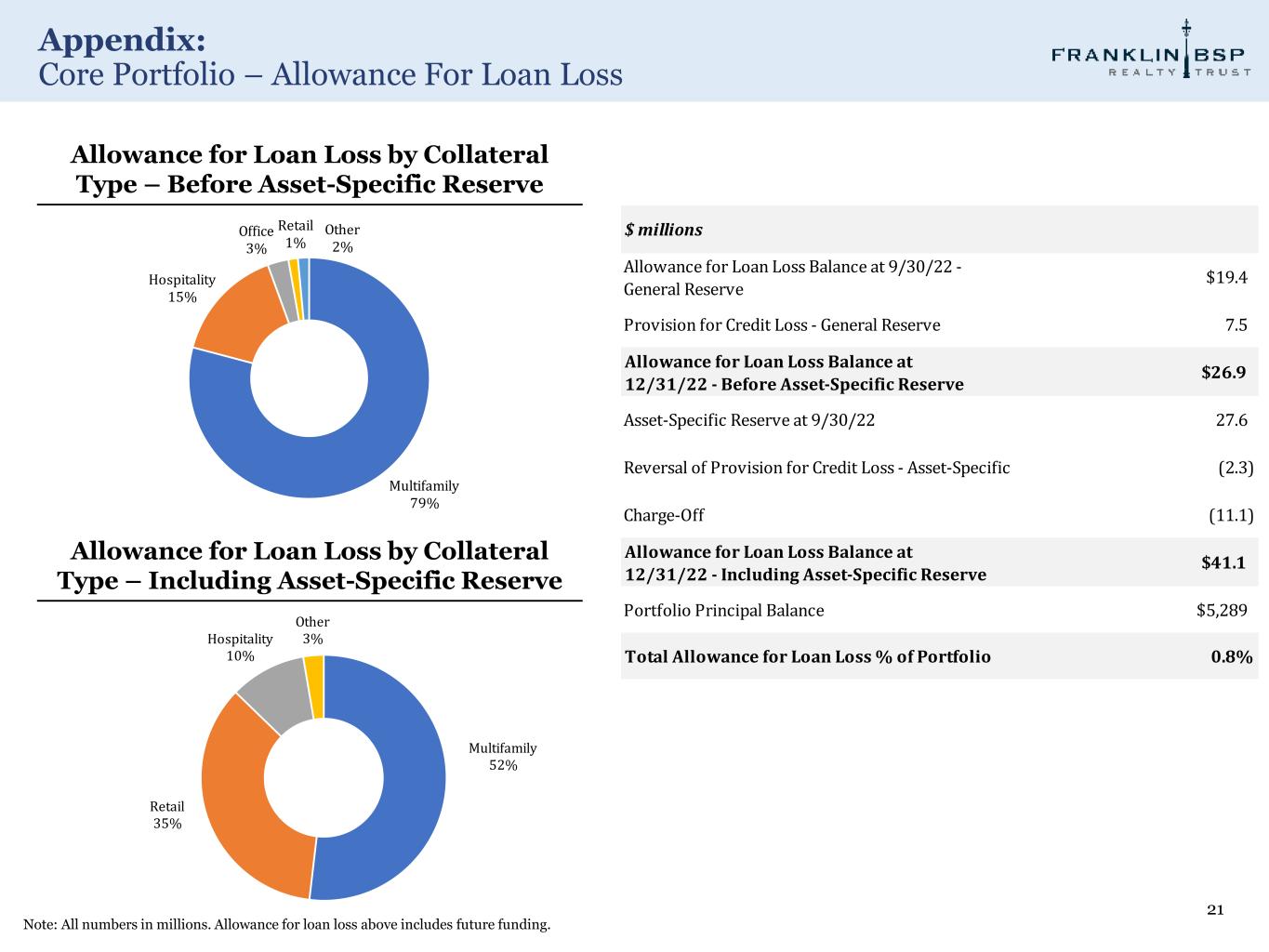

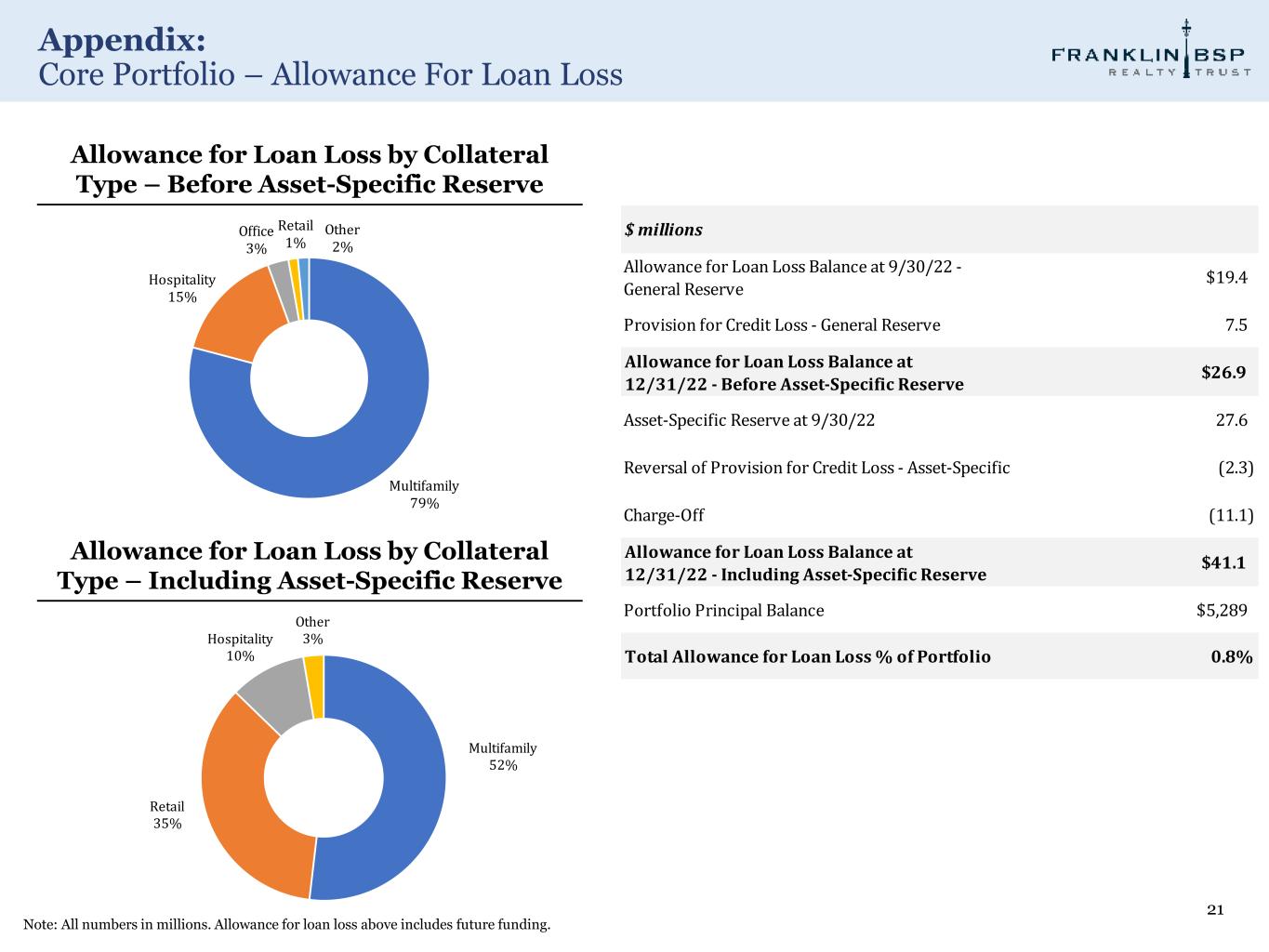

Appendix: Core Portfolio – Allowance For Loan Loss 21 Note: All numbers in millions. Allowance for loan loss above includes future funding. Allowance for Loan Loss by Collateral Type – Before Asset-Specific Reserve Allowance for Loan Loss by Collateral Type – Including Asset-Specific Reserve Multifamily 79% Hospitality 15% Office 3% Retail 1% Other 2% Multifamily 52% Retail 35% Hospitality 10% Other 3% $ millions Allowance for Loan Loss Balance at 9/30/22 - General Reserve $19.4 Provision for Credit Loss - General Reserve 7.5 Allowance for Loan Loss Balance at 12/31/22 - Before Asset-Specific Reserve $26.9 Asset-Specific Reserve at 9/30/22 27.6 Reversal of Provision for Credit Loss - Asset-Specific (2.3) Charge-Off (11.1) Allowance for Loan Loss Balance at 12/31/22 - Including Asset-Specific Reserve $41.1 Portfolio Principal Balance $5,289 Total Allowance for Loan Loss % of Portfolio 0.8%

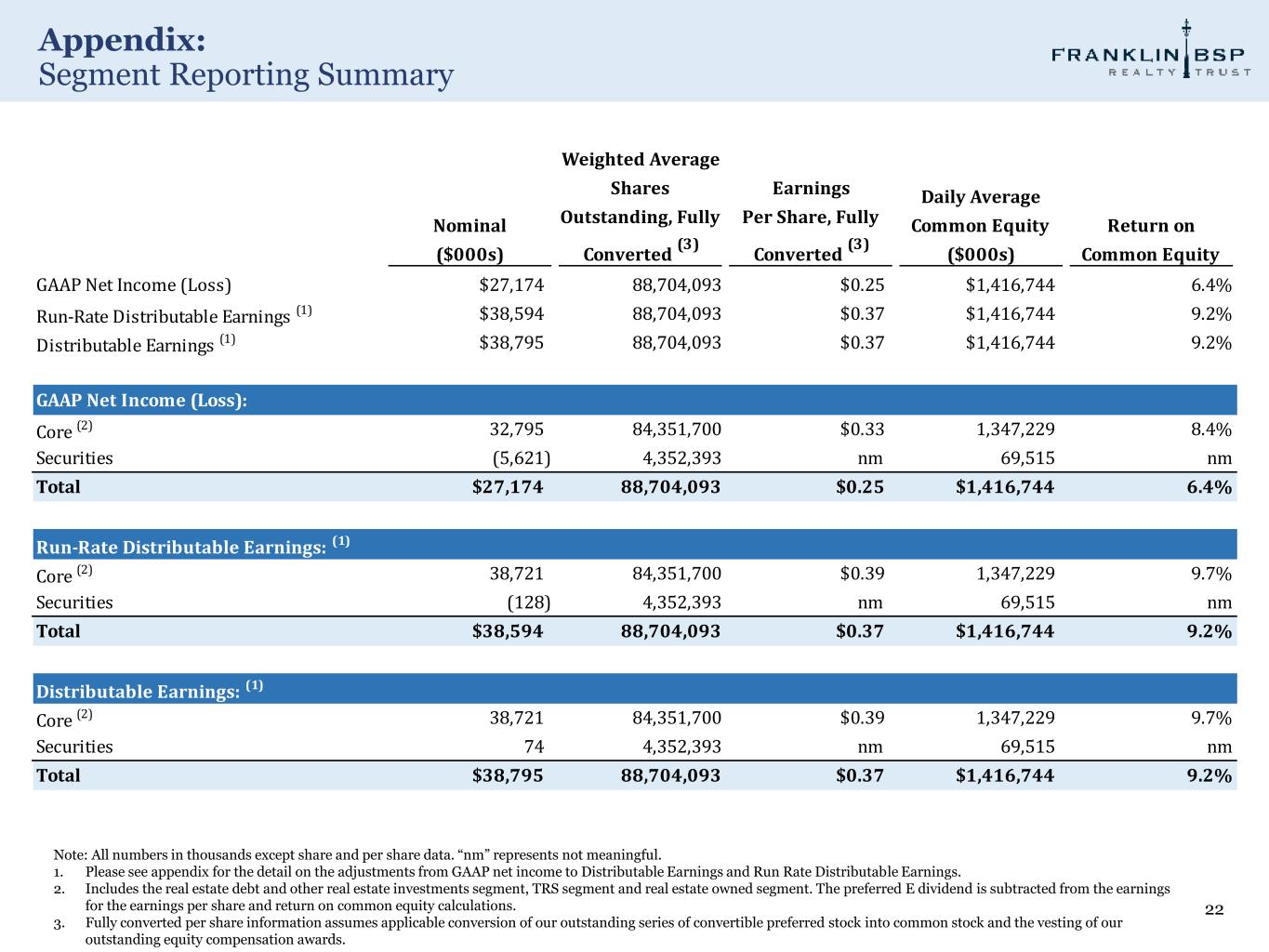

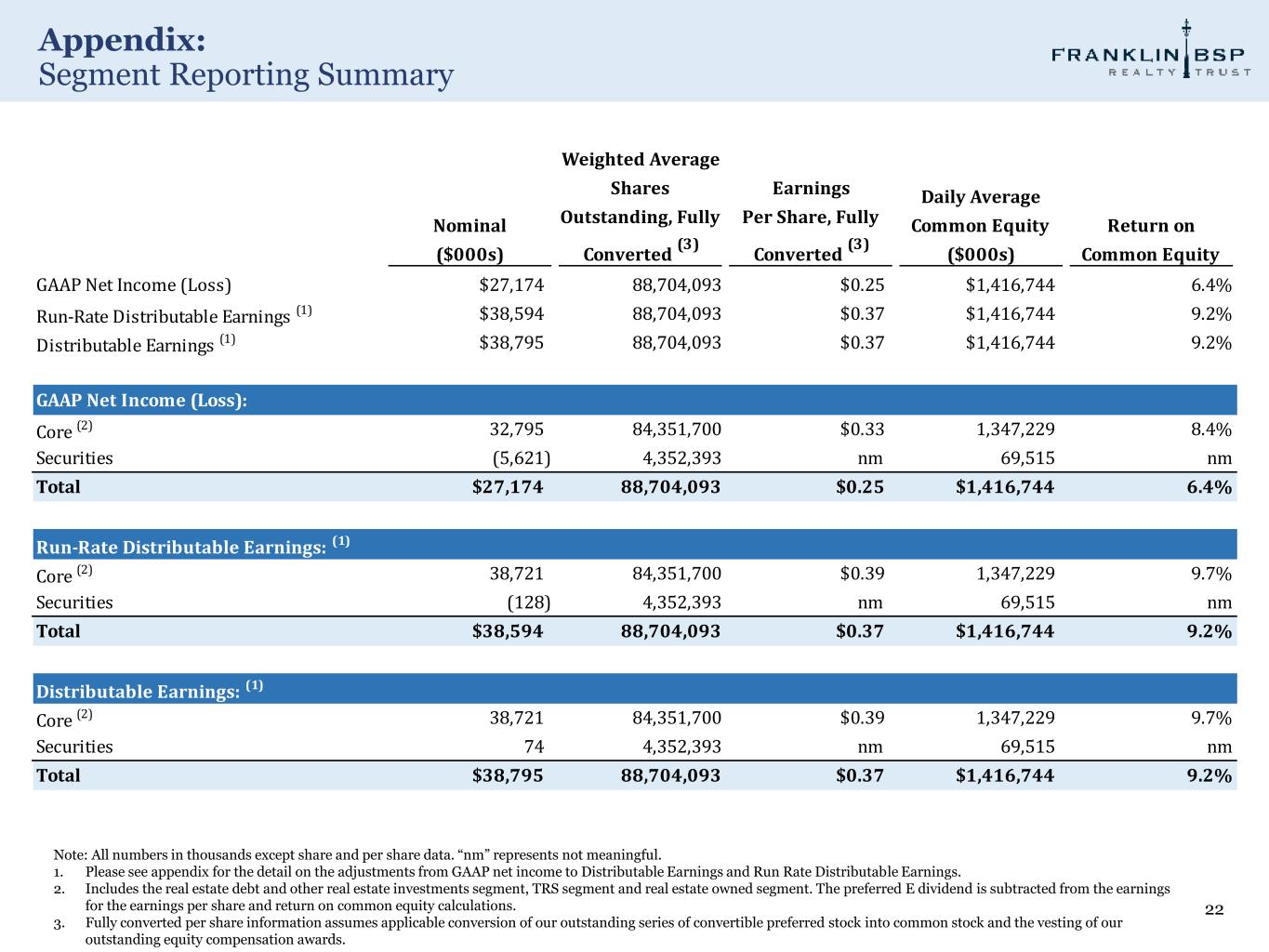

Appendix: Segment Reporting Summary 22 Note: All numbers in thousands except share and per share data. “nm” represents not meaningful. 1. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings and Run Rate Distributable Earnings. 2. Includes the real estate debt and other real estate investments segment, TRS segment and real estate owned segment. The preferred E dividend is subtracted from the earnings for the earnings per share and return on common equity calculations. 3. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards. Nominal ($000s) Weighted Average Shares Outstanding, Fully Converted (3) Earnings Per Share, Fully Converted (3) Daily Average Common Equity ($000s) Return on Common Equity GAAP Net Income (Loss) $27,174 88,704,093 $0.25 $1,416,744 6.4% Run-Rate Distributable Earnings (1) $38,594 88,704,093 $0.37 $1,416,744 9.2% Distributable Earnings (1) $38,795 88,704,093 $0.37 $1,416,744 9.2% GAAP Net Income (Loss): Core (2) 32,795 84,351,700 $0.33 1,347,229 8.4% Securities (5,621) 4,352,393 nm 69,515 nm Total $27,174 88,704,093 $0.25 $1,416,744 6.4% Run-Rate Distributable Earnings: (1) Core (2) 38,721 84,351,700 $0.39 1,347,229 9.7% Securities (128) 4,352,393 nm 69,515 nm Total $38,594 88,704,093 $0.37 $1,416,744 9.2% Distributable Earnings: (1) Core (2) 38,721 84,351,700 $0.39 1,347,229 9.7% Securities 74 4,352,393 nm 69,515 nm Total $38,795 88,704,093 $0.37 $1,416,744 9.2%

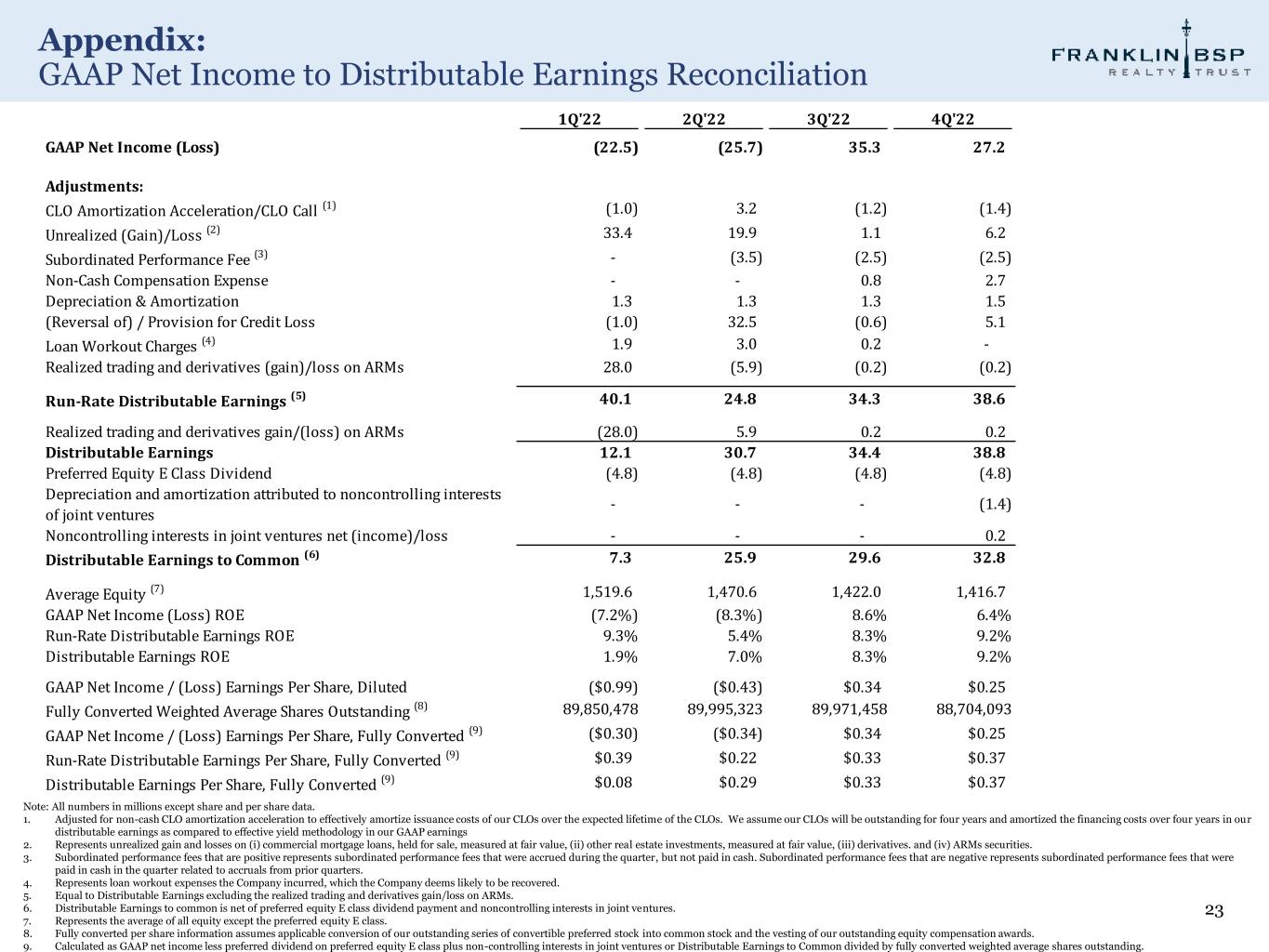

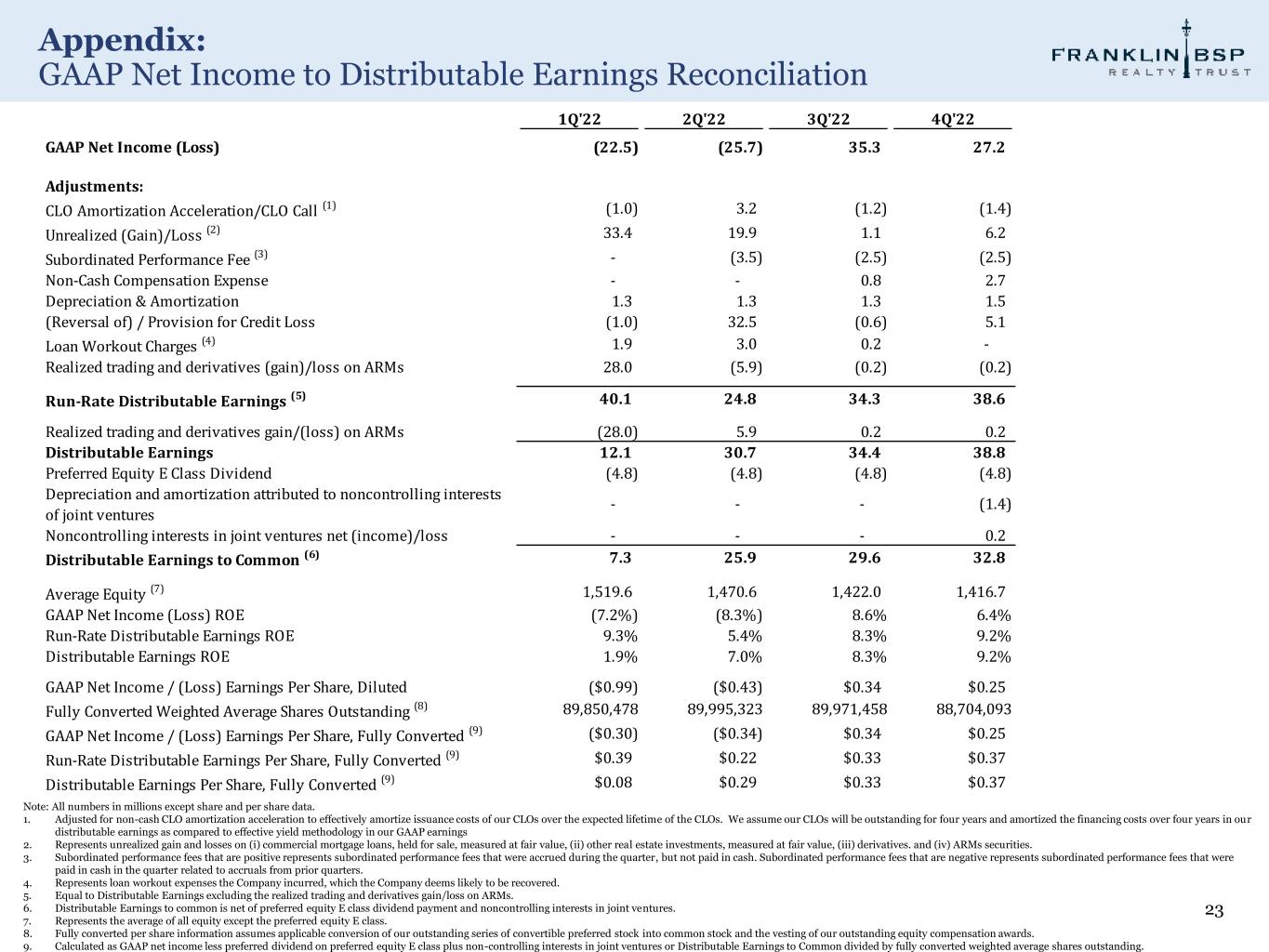

Appendix: GAAP Net Income to Distributable Earnings Reconciliation 23 Note: All numbers in millions except share and per share data. 1. Adjusted for non-cash CLO amortization acceleration to effectively amortize issuance costs of our CLOs over the expected lifetime of the CLOs. We assume our CLOs will be outstanding for four years and amortized the financing costs over four years in our distributable earnings as compared to effective yield methodology in our GAAP earnings 2. Represents unrealized gain and losses on (i) commercial mortgage loans, held for sale, measured at fair value, (ii) other real estate investments, measured at fair value, (iii) derivatives. and (iv) ARMs securities. 3. Subordinated performance fees that are positive represents subordinated performance fees that were accrued during the quarter, but not paid in cash. Subordinated performance fees that are negative represents subordinated performance fees that were paid in cash in the quarter related to accruals from prior quarters. 4. Represents loan workout expenses the Company incurred, which the Company deems likely to be recovered. 5. Equal to Distributable Earnings excluding the realized trading and derivatives gain/loss on ARMs. 6. Distributable Earnings to common is net of preferred equity E class dividend payment and noncontrolling interests in joint ventures. 7. Represents the average of all equity except the preferred equity E class. 8. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards. 9. Calculated as GAAP net income less preferred dividend on preferred equity E class plus non-controlling interests in joint ventures or Distributable Earnings to Common divided by fully converted weighted average shares outstanding. 1Q'22 2Q'22 3Q'22 4Q'22 GAAP Net Income (Loss) (22.5) (25.7) 35.3 27.2 Adjustments: CLO Amortization Acceleration/CLO Call (1) (1.0) 3.2 (1.2) (1.4) Unrealized (Gain)/Loss (2) 33.4 19.9 1.1 6.2 Subordinated Performance Fee (3) - (3.5) (2.5) (2.5) Non-Cash Compensation Expense - - 0.8 2.7 Depreciation & Amortization 1.3 1.3 1.3 1.5 (Reversal of) / Provision for Credit Loss (1.0) 32.5 (0.6) 5.1 Loan Workout Charges (4) 1.9 3.0 0.2 - Realized trading and derivatives (gain)/loss on ARMs 28.0 (5.9) (0.2) (0.2) Run-Rate Distributable Earnings (5) 40.1 24.8 34.3 38.6 Realized trading and derivatives gain/(loss) on ARMs (28.0) 5.9 0.2 0.2 Distributable Earnings 12.1 30.7 34.4 38.8 Preferred Equity E Class Dividend (4.8) (4.8) (4.8) (4.8) Depreciation and amortization attributed to noncontrolling interests of joint ventures - - - (1.4) Noncontrolling interests in joint ventures net (income)/loss - - - 0.2 Distributable Earnings to Common (6) 7.3 25.9 29.6 32.8 Average Equity (7) 1,519.6 1,470.6 1,422.0 1,416.7 GAAP Net Income (Loss) ROE (7.2%) (8.3%) 8.6% 6.4% Run-Rate Distributable Earnings ROE 9.3% 5.4% 8.3% 9.2% Distributable Earnings ROE 1.9% 7.0% 8.3% 9.2% GAAP Net Income / (Loss) Earnings Per Share, Diluted ($0.99) ($0.43) $0.34 $0.25 Fully Converted Weighted Average Shares Outstanding (8) 89,850,478 89,995,323 89,971,458 88,704,093 GAAP Net Income / (Loss) Earnings Per Share, Fully Converted (9) ($0.30) ($0.34) $0.34 $0.25 Run-Rate Distributable Earnings Per Share, Fully Converted (9) $0.39 $0.22 $0.33 $0.37 Distributable Earnings Per Share, Fully Converted (9) $0.08 $0.29 $0.33 $0.37

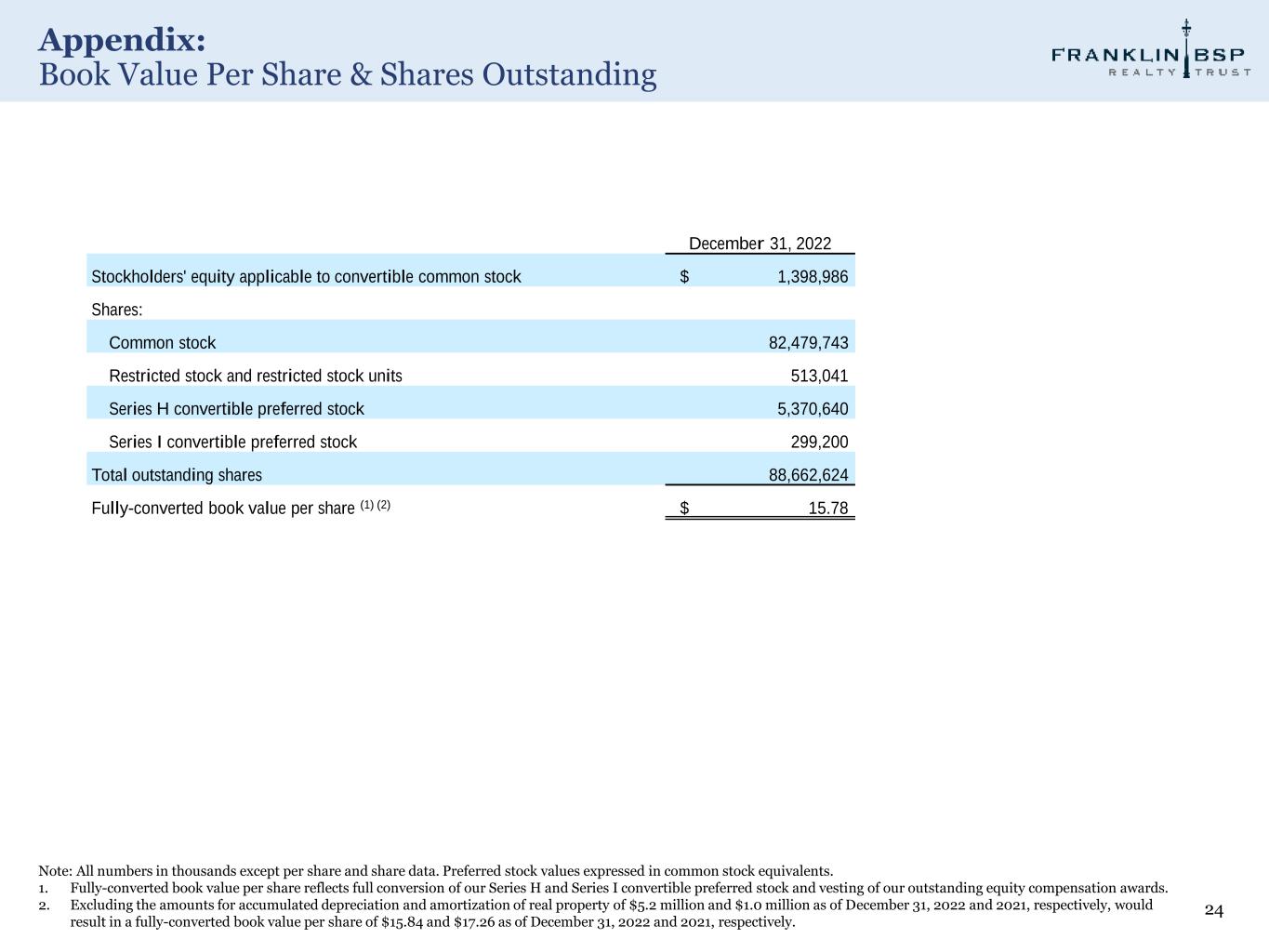

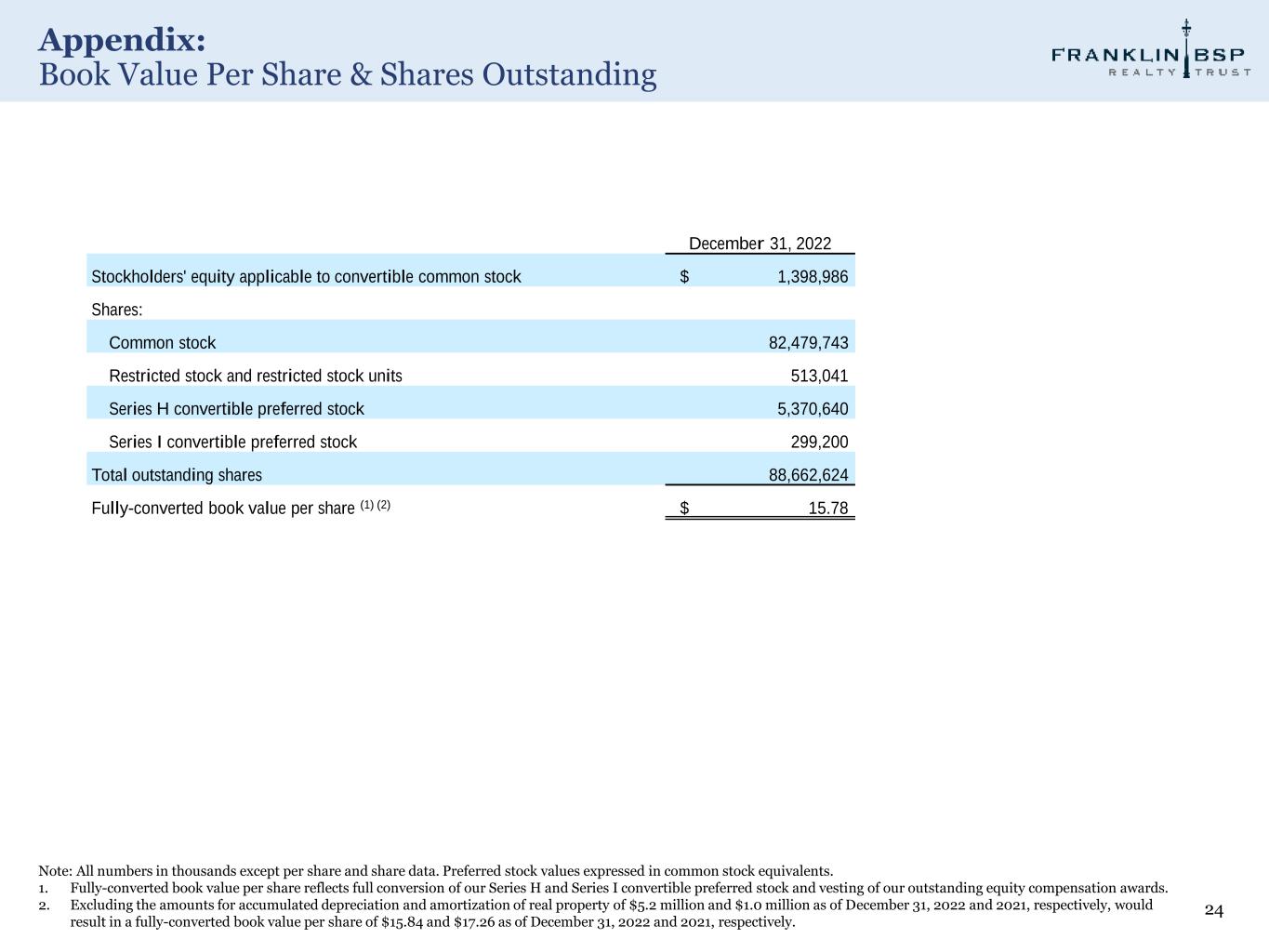

Appendix: Book Value Per Share & Shares Outstanding 24 Note: All numbers in thousands except per share and share data. Preferred stock values expressed in common stock equivalents. 1. Fully-converted book value per share reflects full conversion of our Series H and Series I convertible preferred stock and vesting of our outstanding equity compensation awards. 2. Excluding the amounts for accumulated depreciation and amortization of real property of $5.2 million and $1.0 million as of December 31, 2022 and 2021, respectively, would result in a fully-converted book value per share of $15.84 and $17.26 as of December 31, 2022 and 2021, respectively. December 31, 2022 Stockholders' equity applicable to convertible common stock $ 1,398,986 Shares: Common stock 82,479,743 Restricted stock and restricted stock units 513,041 Series H convertible preferred stock 5,370,640 Series I convertible preferred stock 299,200 Total outstanding shares 88,662,624 Fully-converted book value per share (1) (2) $ 15.78

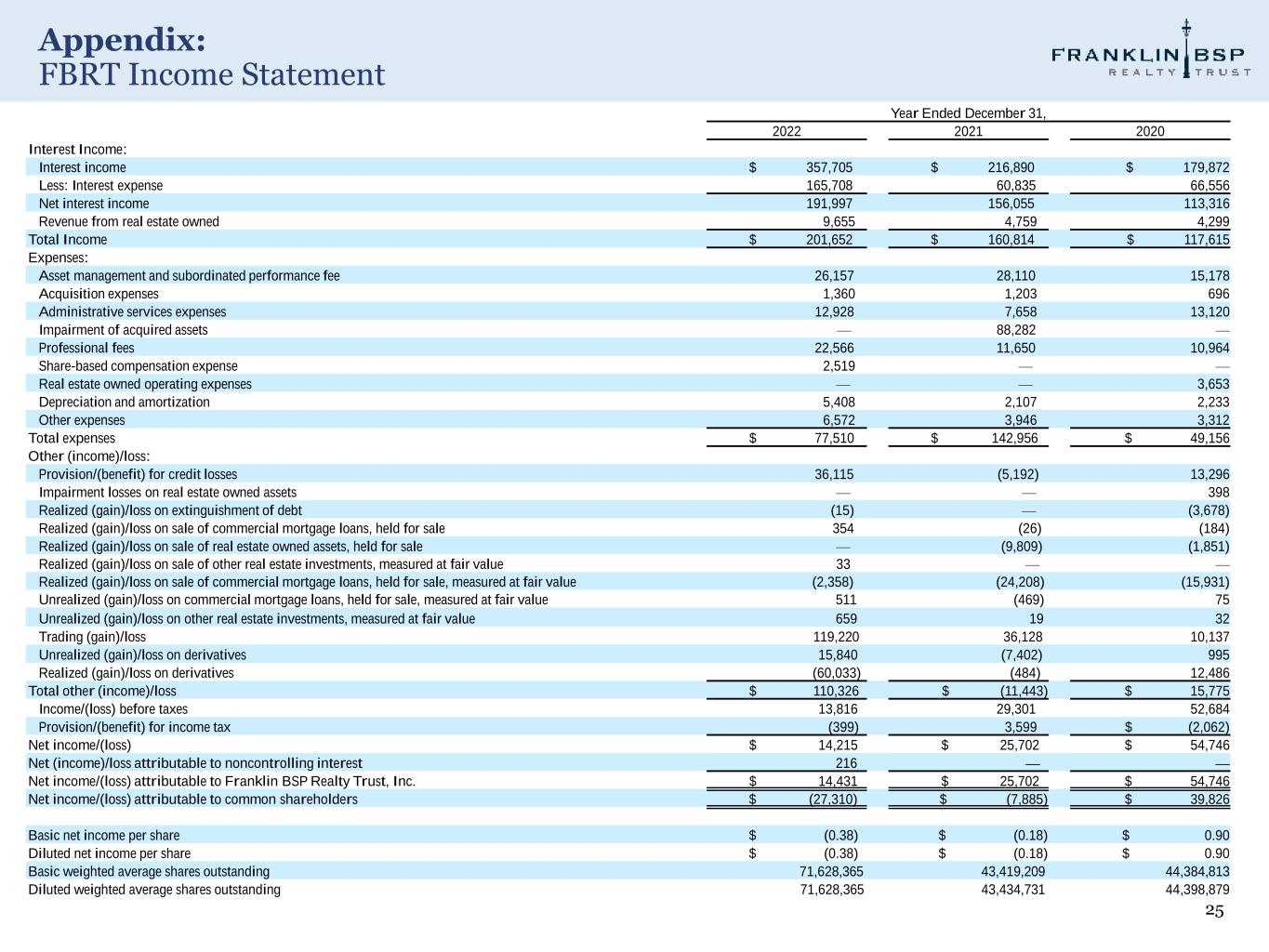

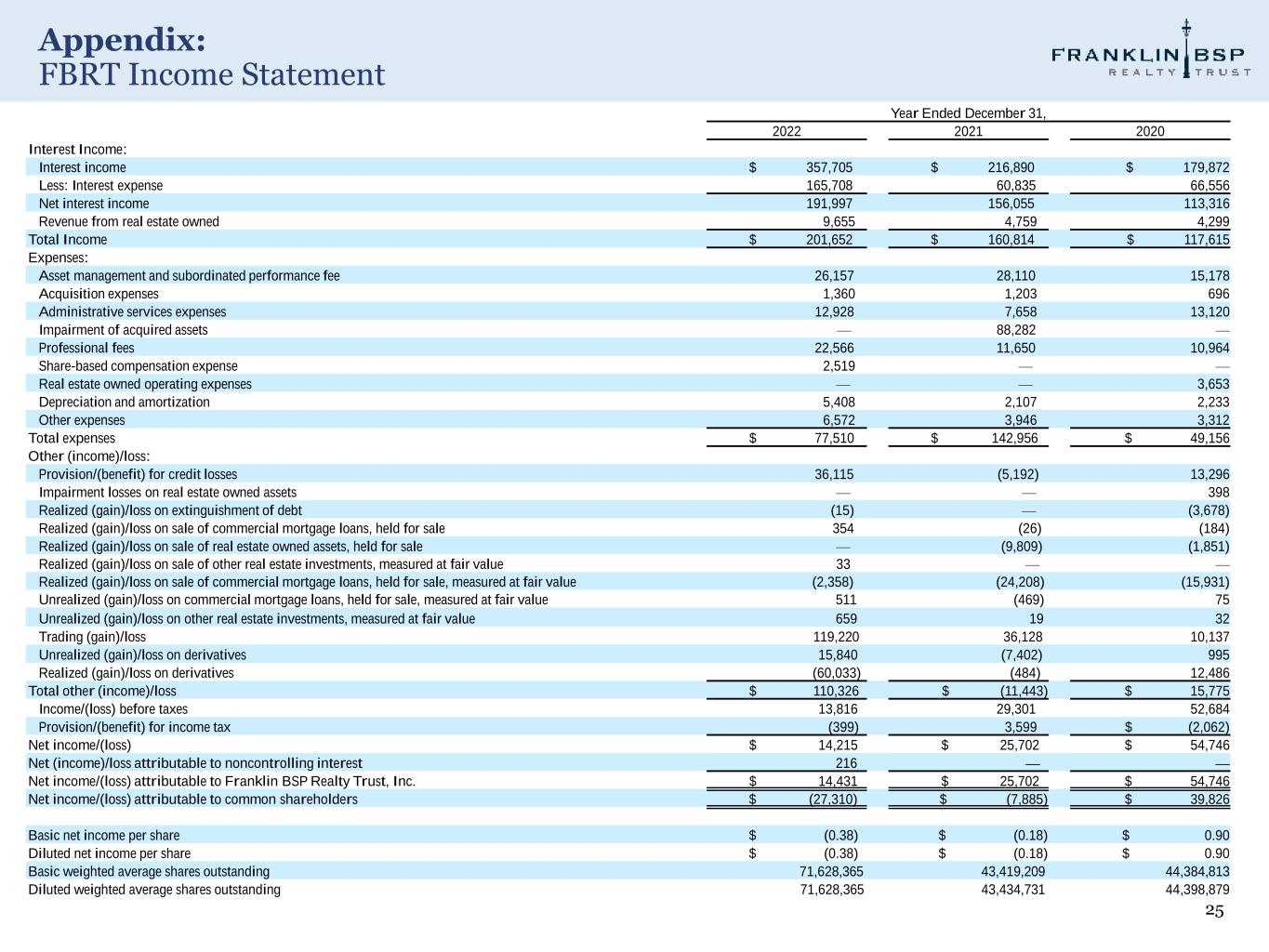

25 Appendix: FBRT Income Statement Year Ended December 31, 2022 2021 2020 Interest Income: Interest income $ 357,705 $ 216,890 $ 179,872 Less: Interest expense 165,708 60,835 66,556 Net interest income 191,997 156,055 113,316 Revenue from real estate owned 9,655 4,759 4,299 Total Income $ 201,652 $ 160,814 $ 117,615 Expenses: Asset management and subordinated performance fee 26,157 28,110 15,178 Acquisition expenses 1,360 1,203 696 Administrative services expenses 12,928 7,658 13,120 Impairment of acquired assets — 88,282 — Professional fees 22,566 11,650 10,964 Share-based compensation expense 2,519 — — Real estate owned operating expenses — — 3,653 Depreciation and amortization 5,408 2,107 2,233 Other expenses 6,572 3,946 3,312 Total expenses $ 77,510 $ 142,956 $ 49,156 Other (income)/loss: Provision/(benefit) for credit losses 36,115 (5,192) 13,296 Impairment losses on real estate owned assets — — 398 Realized (gain)/loss on extinguishment of debt (15) — (3,678) Realized (gain)/loss on sale of commercial mortgage loans, held for sale 354 (26) (184) Realized (gain)/loss on sale of real estate owned assets, held for sale — (9,809) (1,851) Realized (gain)/loss on sale of other real estate investments, measured at fair value 33 — — Realized (gain)/loss on sale of commercial mortgage loans, held for sale, measured at fair value (2,358) (24,208) (15,931) Unrealized (gain)/loss on commercial mortgage loans, held for sale, measured at fair value 511 (469) 75 Unrealized (gain)/loss on other real estate investments, measured at fair value 659 19 32 Trading (gain)/loss 119,220 36,128 10,137 Unrealized (gain)/loss on derivatives 15,840 (7,402) 995 Realized (gain)/loss on derivatives (60,033) (484) 12,486 Total other (income)/loss $ 110,326 $ (11,443) $ 15,775 Income/(loss) before taxes 13,816 29,301 52,684 Provision/(benefit) for income tax (399) 3,599 $ (2,062) Net income/(loss) $ 14,215 $ 25,702 $ 54,746 Net (income)/loss attributable to noncontrolling interest 216 — — Net income/(loss) attributable to Franklin BSP Realty Trust, Inc. $ 14,431 $ 25,702 $ 54,746 Net income/(loss) attributable to common shareholders $ (27,310) $ (7,885) $ 39,826 Basic net income per share $ (0.38) $ (0.18) $ 0.90 Diluted net income per share $ (0.38) $ (0.18) $ 0.90 Basic weighted average shares outstanding 71,628,365 43,419,209 44,384,813 Diluted weighted average shares outstanding 71,628,365 43,434,731 44,398,879

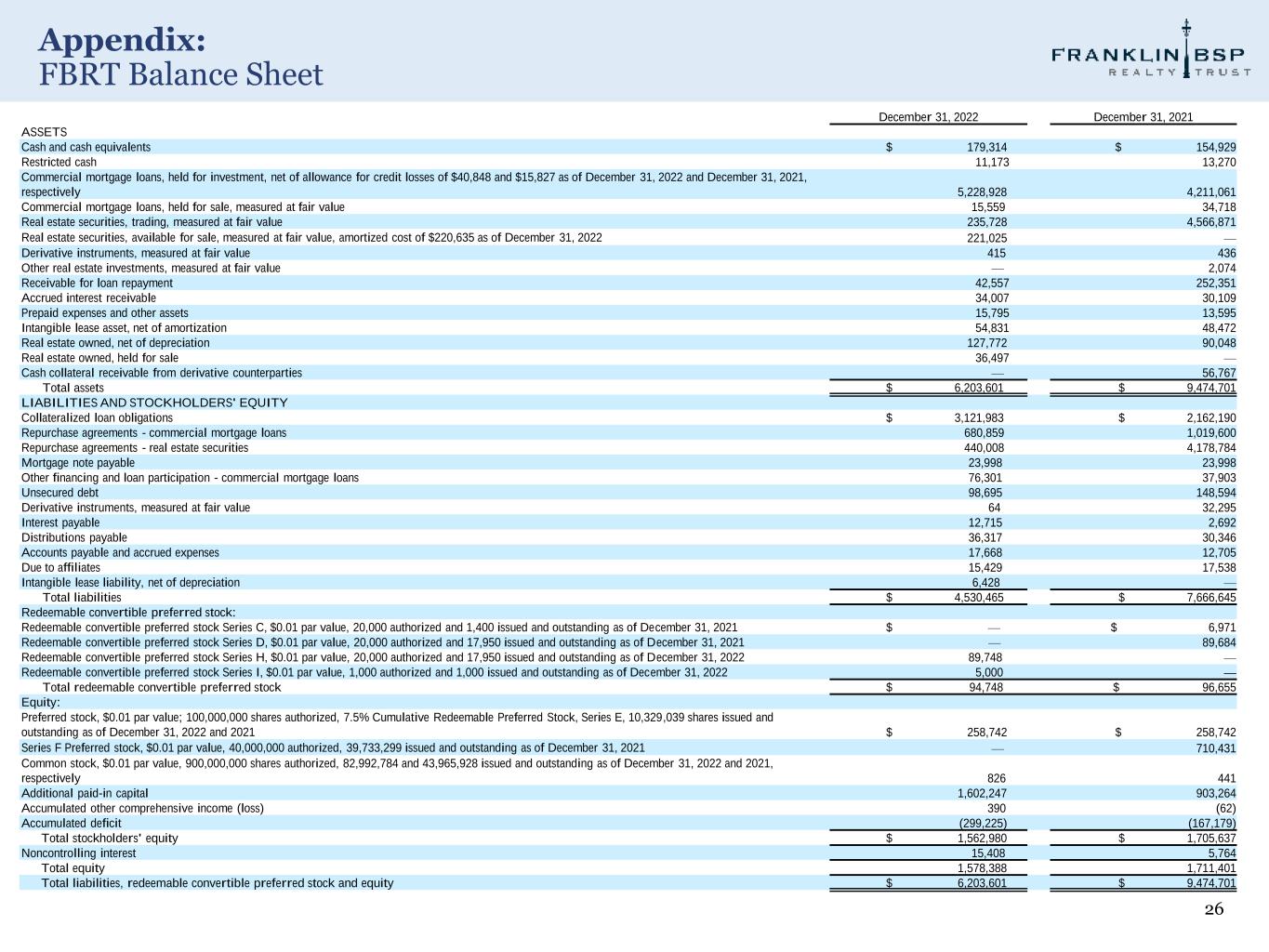

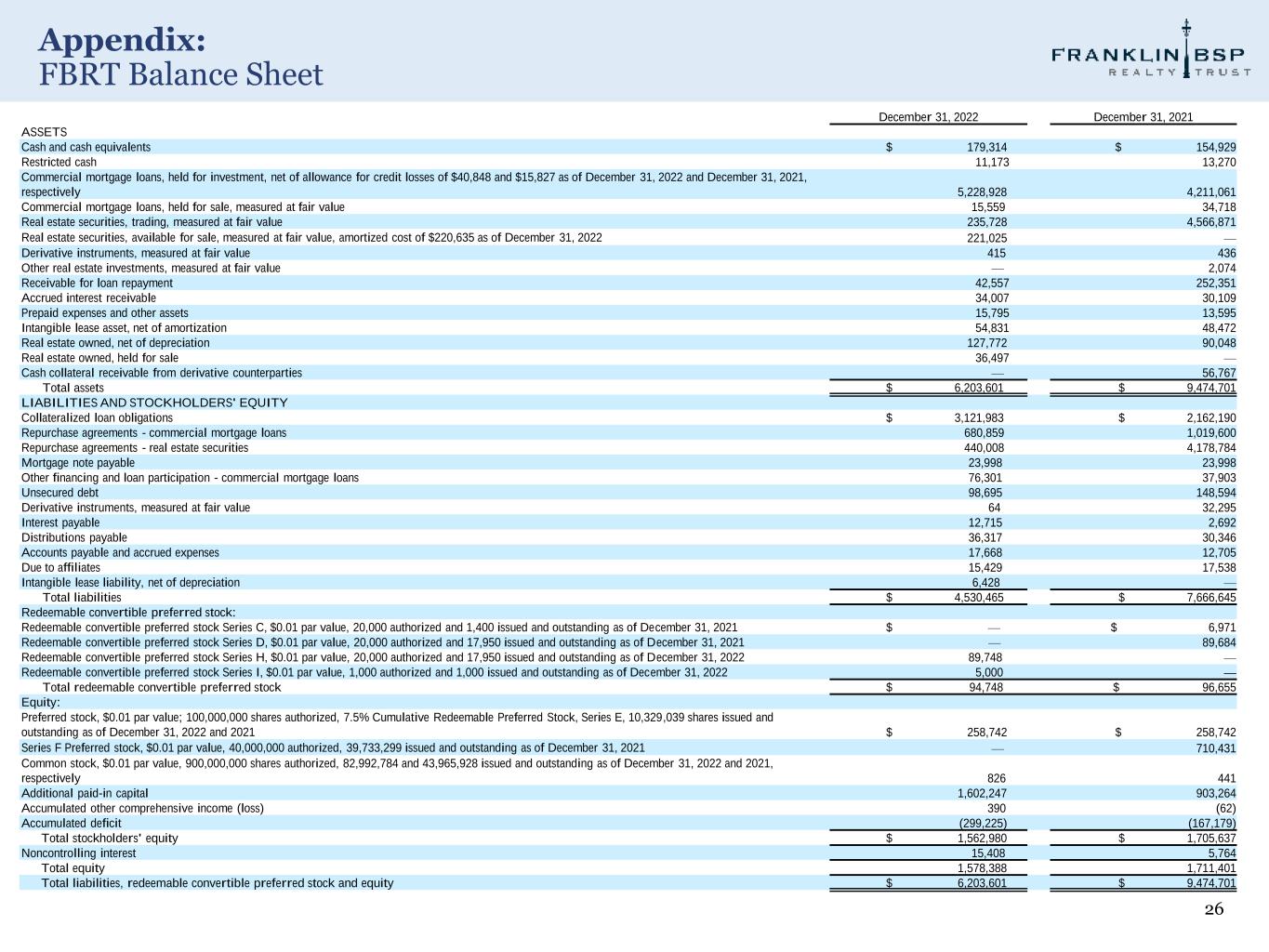

26 Appendix: FBRT Balance Sheet December 31, 2022 December 31, 2021 ASSETS Cash and cash equivalents $ 179,314 $ 154,929 Restricted cash 11,173 13,270 Commercial mortgage loans, held for investment, net of allowance for credit losses of $40,848 and $15,827 as of December 31, 2022 and December 31, 2021, respectively 5,228,928 4,211,061 Commercial mortgage loans, held for sale, measured at fair value 15,559 34,718 Real estate securities, trading, measured at fair value 235,728 4,566,871 Real estate securities, available for sale, measured at fair value, amortized cost of $220,635 as of December 31, 2022 221,025 — Derivative instruments, measured at fair value 415 436 Other real estate investments, measured at fair value — 2,074 Receivable for loan repayment 42,557 252,351 Accrued interest receivable 34,007 30,109 Prepaid expenses and other assets 15,795 13,595 Intangible lease asset, net of amortization 54,831 48,472 Real estate owned, net of depreciation 127,772 90,048 Real estate owned, held for sale 36,497 — Cash collateral receivable from derivative counterparties — 56,767 Total assets $ 6,203,601 $ 9,474,701 LIABILITIES AND STOCKHOLDERS' EQUITY Collateralized loan obligations $ 3,121,983 $ 2,162,190 Repurchase agreements - commercial mortgage loans 680,859 1,019,600 Repurchase agreements - real estate securities 440,008 4,178,784 Mortgage note payable 23,998 23,998 Other financing and loan participation - commercial mortgage loans 76,301 37,903 Unsecured debt 98,695 148,594 Derivative instruments, measured at fair value 64 32,295 Interest payable 12,715 2,692 Distributions payable 36,317 30,346 Accounts payable and accrued expenses 17,668 12,705 Due to affiliates 15,429 17,538 Intangible lease liability, net of depreciation 6,428 — Total liabilities $ 4,530,465 $ 7,666,645 Redeemable convertible preferred stock: Redeemable convertible preferred stock Series C, $0.01 par value, 20,000 authorized and 1,400 issued and outstanding as of December 31, 2021 $ — $ 6,971 Redeemable convertible preferred stock Series D, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of December 31, 2021 — 89,684 Redeemable convertible preferred stock Series H, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of December 31, 2022 89,748 — Redeemable convertible preferred stock Series I, $0.01 par value, 1,000 authorized and 1,000 issued and outstanding as of December 31, 2022 5,000 — Total redeemable convertible preferred stock $ 94,748 $ 96,655 Equity: Preferred stock, $0.01 par value; 100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred Stock, Series E, 10,329,039 shares issued and outstanding as of December 31, 2022 and 2021 $ 258,742 $ 258,742 Series F Preferred stock, $0.01 par value, 40,000,000 authorized, 39,733,299 issued and outstanding as of December 31, 2021 — 710,431 Common stock, $0.01 par value, 900,000,000 shares authorized, 82,992,784 and 43,965,928 issued and outstanding as of December 31, 2022 and 2021, respectively 826 441 Additional paid-in capital 1,602,247 903,264 Accumulated other comprehensive income (loss) 390 (62) Accumulated deficit (299,225) (167,179) Total stockholders' equity $ 1,562,980 $ 1,705,637 Noncontrolling interest 15,408 5,764 Total equity 1,578,388 1,711,401 Total liabilities, redeemable convertible preferred stock and equity $ 6,203,601 $ 9,474,701

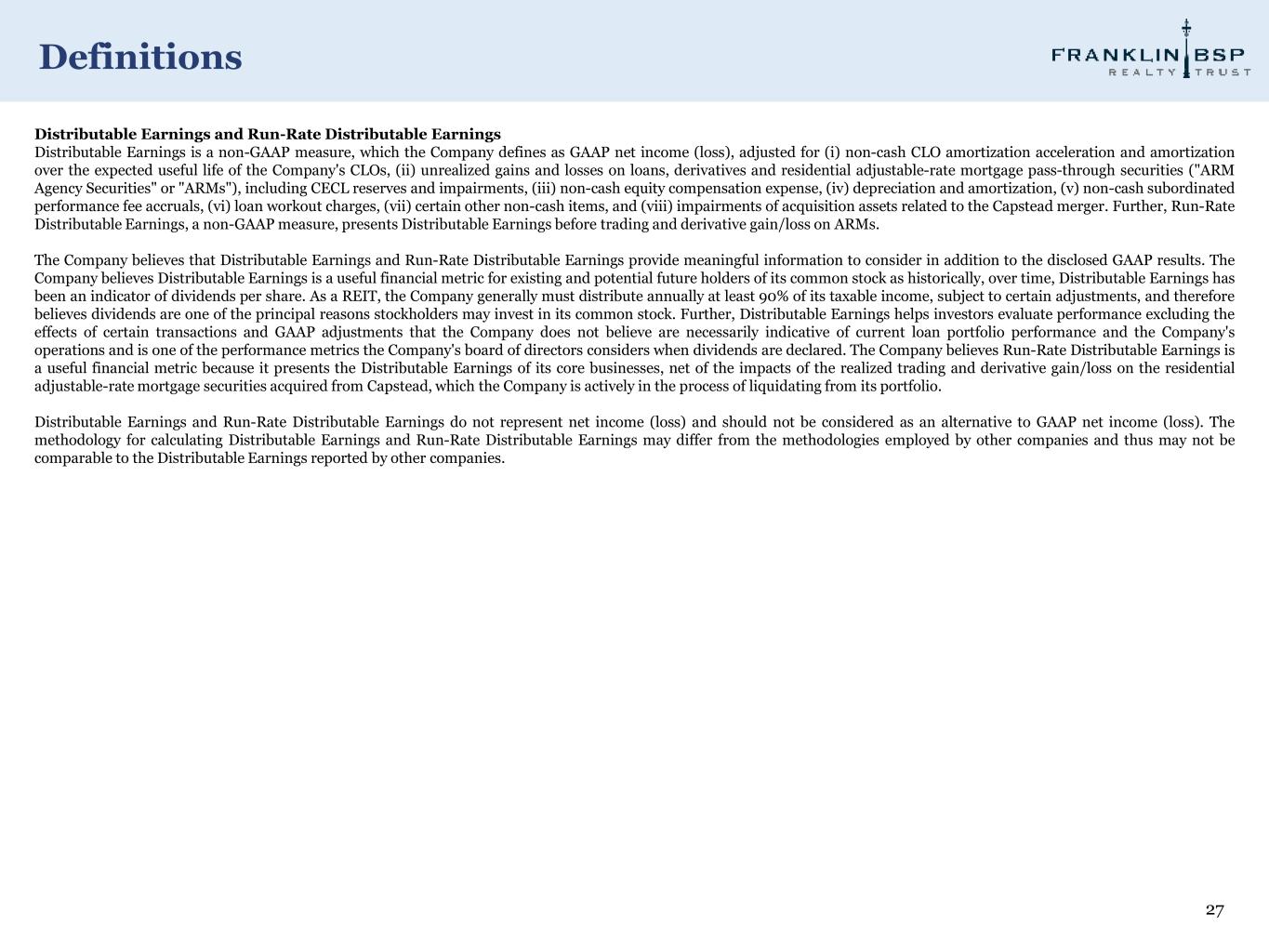

27 Definitions Distributable Earnings and Run-Rate Distributable Earnings Distributable Earnings is a non-GAAP measure, which the Company defines as GAAP net income (loss), adjusted for (i) non-cash CLO amortization acceleration and amortization over the expected useful life of the Company's CLOs, (ii) unrealized gains and losses on loans, derivatives and residential adjustable-rate mortgage pass-through securities ("ARM Agency Securities" or "ARMs"), including CECL reserves and impairments, (iii) non-cash equity compensation expense, (iv) depreciation and amortization, (v) non-cash subordinated performance fee accruals, (vi) loan workout charges, (vii) certain other non-cash items, and (viii) impairments of acquisition assets related to the Capstead merger. Further, Run-Rate Distributable Earnings, a non-GAAP measure, presents Distributable Earnings before trading and derivative gain/loss on ARMs. The Company believes that Distributable Earnings and Run-Rate Distributable Earnings provide meaningful information to consider in addition to the disclosed GAAP results. The Company believes Distributable Earnings is a useful financial metric for existing and potential future holders of its common stock as historically, over time, Distributable Earnings has been an indicator of dividends per share. As a REIT, the Company generally must distribute annually at least 90% of its taxable income, subject to certain adjustments, and therefore believes dividends are one of the principal reasons stockholders may invest in its common stock. Further, Distributable Earnings helps investors evaluate performance excluding the effects of certain transactions and GAAP adjustments that the Company does not believe are necessarily indicative of current loan portfolio performance and the Company's operations and is one of the performance metrics the Company's board of directors considers when dividends are declared. The Company believes Run-Rate Distributable Earnings is a useful financial metric because it presents the Distributable Earnings of its core businesses, net of the impacts of the realized trading and derivative gain/loss on the residential adjustable-rate mortgage securities acquired from Capstead, which the Company is actively in the process of liquidating from its portfolio. Distributable Earnings and Run-Rate Distributable Earnings do not represent net income (loss) and should not be considered as an alternative to GAAP net income (loss). The methodology for calculating Distributable Earnings and Run-Rate Distributable Earnings may differ from the methodologies employed by other companies and thus may not be comparable to the Distributable Earnings reported by other companies.