Franklin BSP Realty Trust Second Quarter 2024 Supplemental Information

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 2 Important Information The information herein relates to the Company’s business and financial information as of June 30, 2024 and does not reflect subsequent developments. Risk Factors Investing in and owning our common stock involves a high degree of risk. See the section entitled “Risk Factors” in our Annual Report on Form 10-K filed with the SEC on February 26, 2024, and the risk disclosures in our subsequent periodic reports filed with the SEC for a discussion of these risks. Forward-Looking Statements Certain statements included in this presentation are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of Franklin BSP Realty Trust, Inc. (“FBRT” or the “Company”) and may include the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause actual outcomes to differ materially from our forward-looking statements include macroeconomic factors in the United States including inflation, changing interest rates and economic contraction, impairments in the value of real estate property securing our loans or that we own, the extent of any recoveries on delinquent loans, and the financial stability of our borrowers, and the other factors set forth in the risk factors section of our most recent Form 10-K and Form 10-Q. The extent to which these factors impact us and our borrowers will depend on future developments, which are highly uncertain and cannot be predicted with confidence. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law. Additional Important Information The summary information provided in this presentation does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with us or any of our affiliated funds. There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations. Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances. The information contained herein is qualified in its entirety by reference to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. You may obtain a copy of the most recent Annual Report or Quarterly Report by calling (844) 785-4393 and/or visiting www.fbrtreit.com. This presentation contains information regarding FBRT’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Distributable Earnings. Please refer to the appendix for the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures. PAST PERFORMANCE IS NOT A GUARANTEE OR INDICATIVE OF FUTURE RESULTS. INVESTMENTS INVOLVE SIGNIFICANT RISKS, INCLUDING LOSS OF THE ENTIRE INVESTMENT. There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of the Company’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objective of the Company will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Please refer to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for a more complete list of risk factors. The following slides contain summaries of certain financial information about the Company. The information contained in this presentation is summary information that is intended to be considered in the context of our filings with the Securities and Exchange Commission and other public announcements that we may make, by press release or otherwise, from time to time.

FBRT 2Q 2024 Financial Update

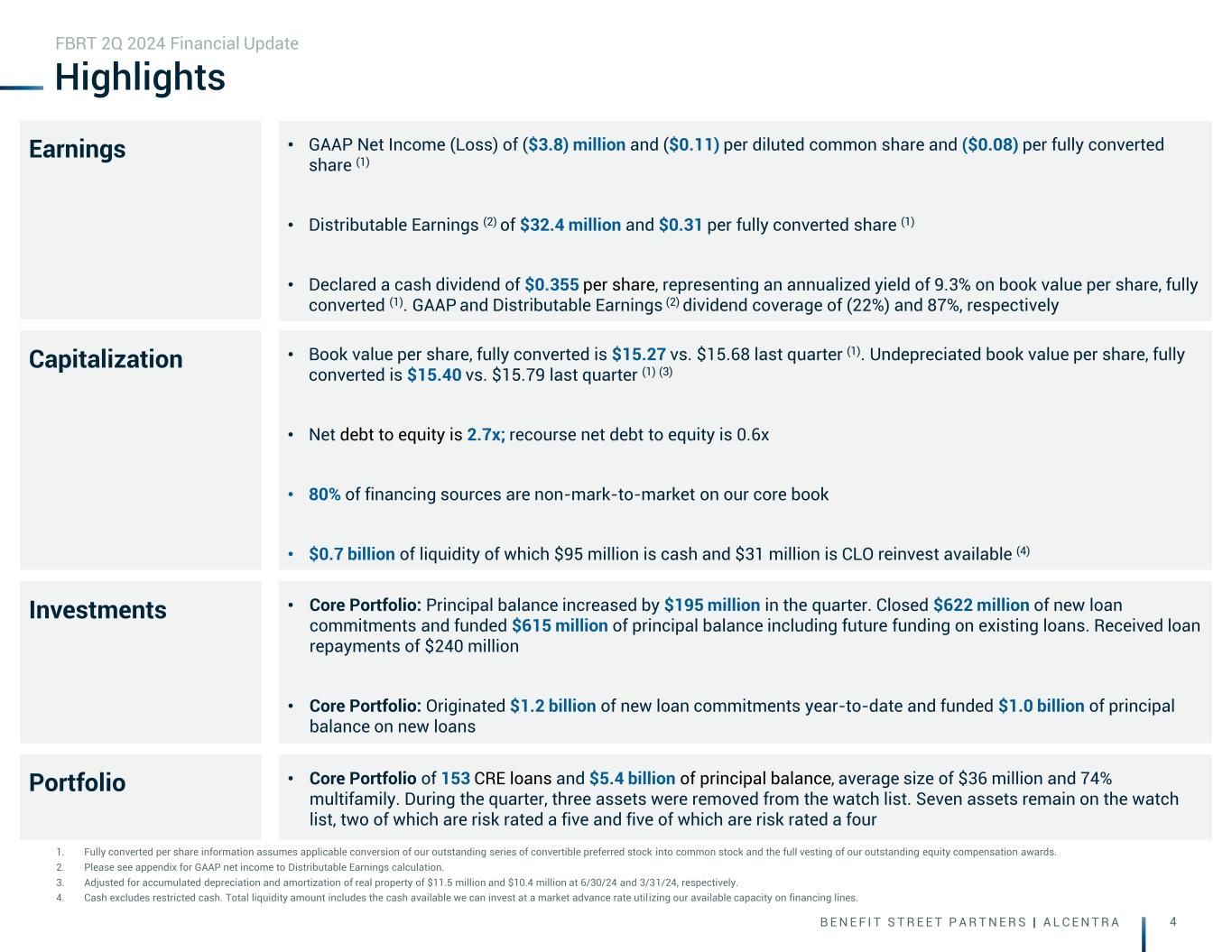

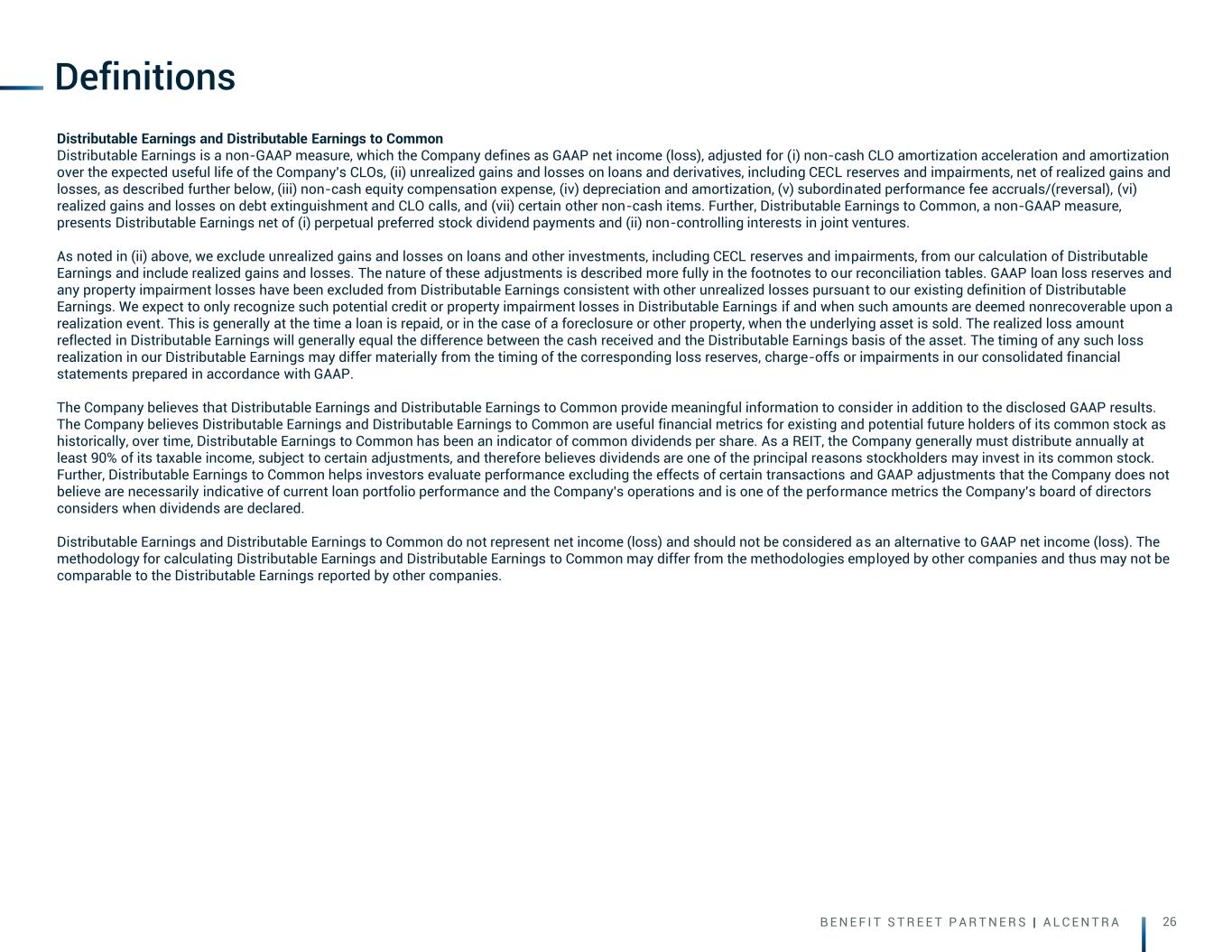

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 4 Highlights 1. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. 2. Please see appendix for GAAP net income to Distributable Earnings calculation. 3. Adjusted for accumulated depreciation and amortization of real property of $11.5 million and $10.4 million at 6/30/24 and 3/31/24, respectively. 4. Cash excludes restricted cash. Total liquidity amount includes the cash available we can invest at a market advance rate utilizing our available capacity on financing lines. FBRT 2Q 2024 Financial Update Earnings • GAAP Net Income (Loss) of ($3.8) million and ($0.11) per diluted common share and ($0.08) per fully converted share (1) • Distributable Earnings (2) of $32.4 million and $0.31 per fully converted share (1) • Declared a cash dividend of $0.355 per share, representing an annualized yield of 9.3% on book value per share, fully converted (1). GAAP and Distributable Earnings (2) dividend coverage of (22%) and 87%, respectively • Book value per share, fully converted is $15.27 vs. $15.68 last quarter (1). Undepreciated book value per share, fully converted is $15.40 vs. $15.79 last quarter (1) (3) • Net debt to equity is 2.7x; recourse net debt to equity is 0.6x • 80% of financing sources are non-mark-to-market on our core book • $0.7 billion of liquidity of which $95 million is cash and $31 million is CLO reinvest available (4) • Core Portfolio: Principal balance increased by $195 million in the quarter. Closed $622 million of new loan commitments and funded $615 million of principal balance including future funding on existing loans. Received loan repayments of $240 million • Core Portfolio: Originated $1.2 billion of new loan commitments year-to-date and funded $1.0 billion of principal balance on new loans • Core Portfolio of 153 CRE loans and $5.4 billion of principal balance, average size of $36 million and 74% multifamily. During the quarter, three assets were removed from the watch list. Seven assets remain on the watch list, two of which are risk rated a five and five of which are risk rated a four Capitalization Investments Portfolio

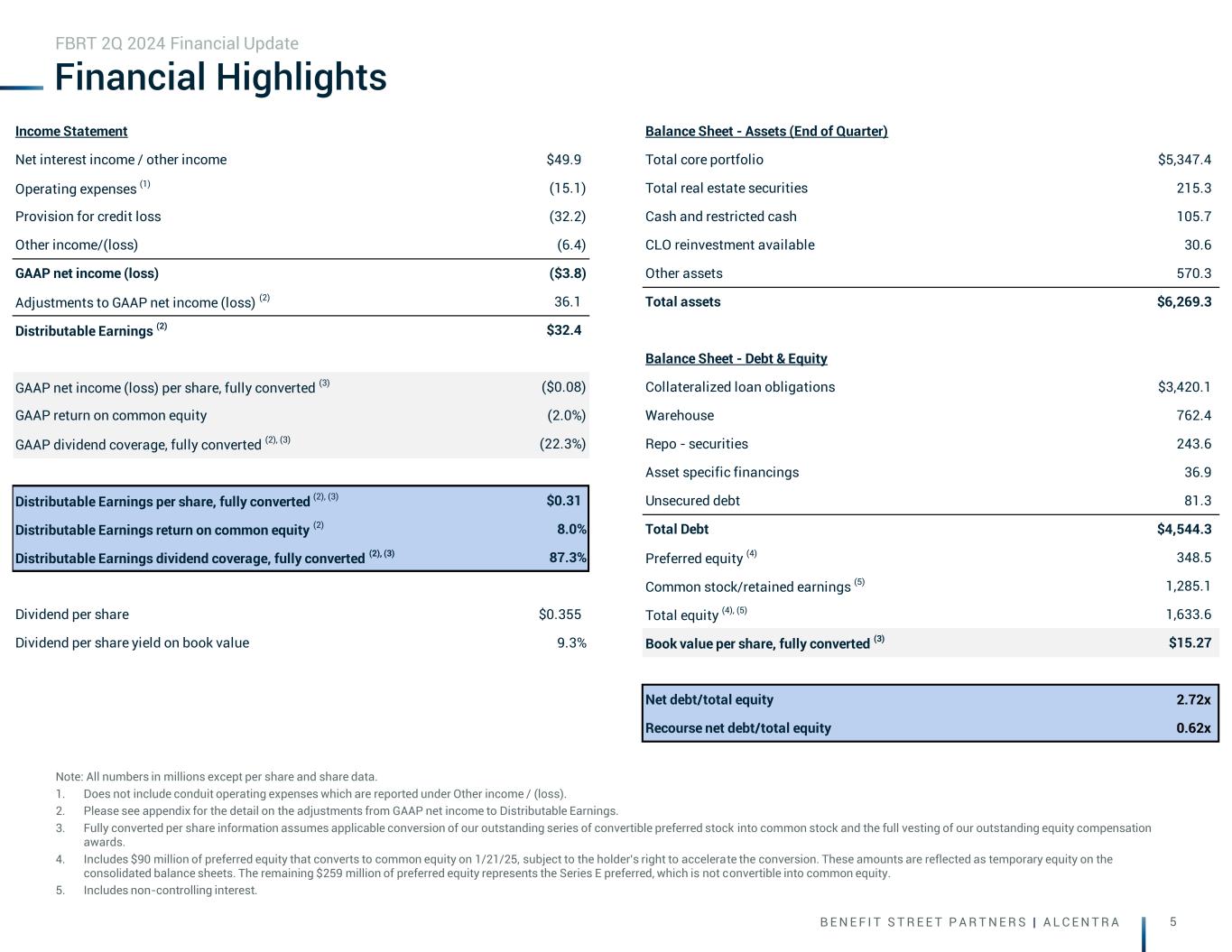

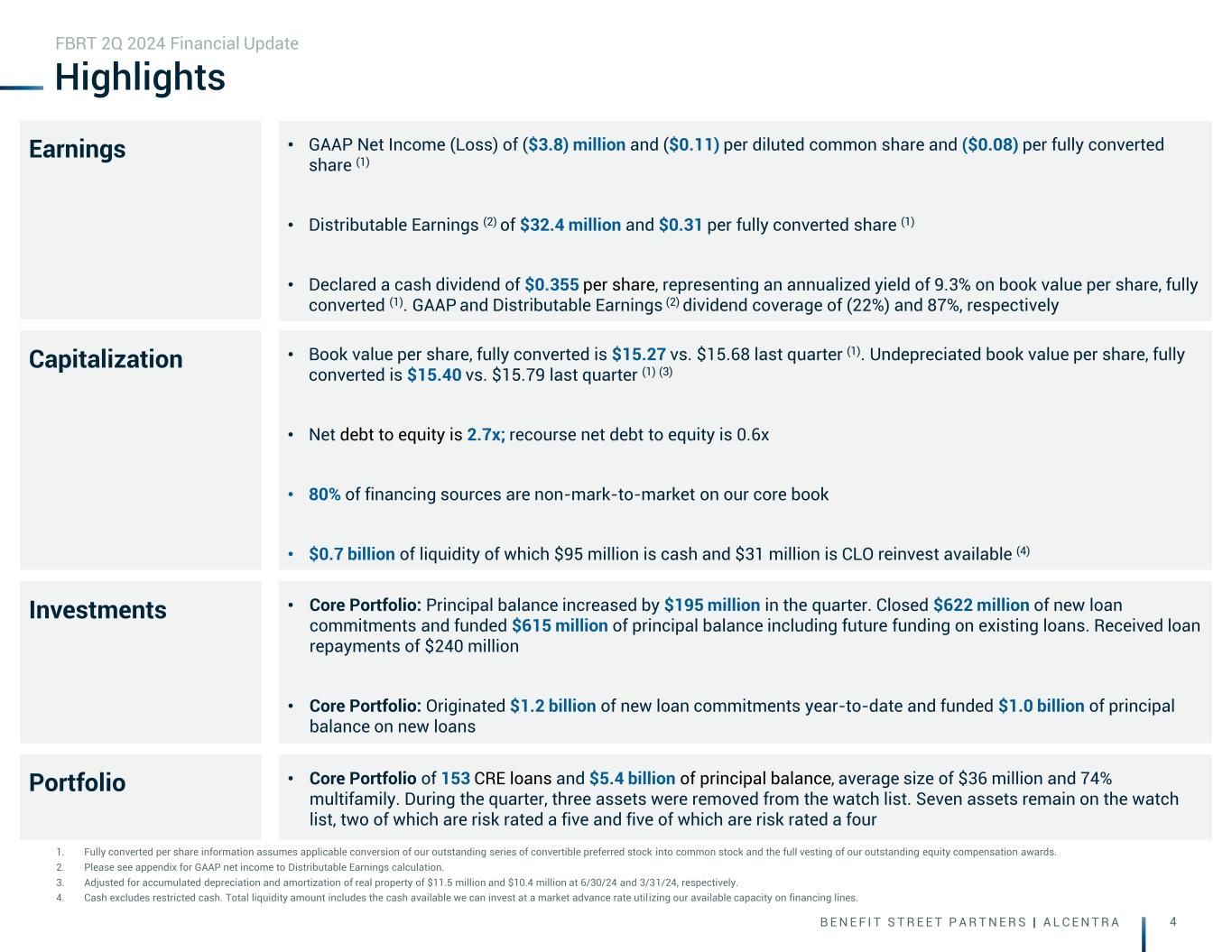

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 5 Income Statement Balance Sheet - Assets (End of Quarter) Net interest income / other income $49.9 Total core portfolio $5,347.4 Operating expenses (1) (15.1) Total real estate securities 215.3 Provision for credit loss (32.2) Cash and restricted cash 105.7 Other income/(loss) (6.4) CLO reinvestment available 30.6 GAAP net income (loss) ($3.8) Other assets 570.3 Adjustments to GAAP net income (loss) (2) 36.1 Total assets $6,269.3 Distributable Earnings (2) $32.4 Balance Sheet - Debt & Equity GAAP net income (loss) per share, fully converted (3) ($0.08) Collateralized loan obligations $3,420.1 GAAP return on common equity (2.0%) Warehouse 762.4 GAAP dividend coverage, fully converted (2), (3) (22.3%) Repo - securities 243.6 Asset specific financings 36.9 Distributable Earnings per share, fully converted (2), (3) $0.31 Unsecured debt 81.3 Distributable Earnings return on common equity (2) 8.0% Total Debt $4,544.3 Distributable Earnings dividend coverage, fully converted (2), (3) 87.3% Preferred equity (4) 348.5 Common stock/retained earnings (5) 1,285.1 Dividend per share $0.355 Total equity (4), (5) 1,633.6 Dividend per share yield on book value 9.3% Book value per share, fully converted (3) $15.27 Net debt/total equity 2.72x Recourse net debt/total equity 0.62x Financial Highlights Note: All numbers in millions except per share and share data. 1. Does not include conduit operating expenses which are reported under Other income / (loss). 2. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 3. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. 4. Includes $90 million of preferred equity that converts to common equity on 1/21/25, subject to the holder's right to accelerate the conversion. These amounts are reflected as temporary equity on the consolidated balance sheets. The remaining $259 million of preferred equity represents the Series E preferred, which is not convertible into common equity. 5. Includes non-controlling interest. FBRT 2Q 2024 Financial Update

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 6 Earnings & Distributions Note: All numbers in millions except per share data. 1. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 2. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. FBRT 2Q 2024 Financial Update Distributable Earnings ($M) (1) GAAP Net Income (Loss) ($M) 3Q'23 4Q'23 1Q'24 2Q'24 $0.355 $0.355 $0.355 $0.355 Dividend per share $0.43 $0.39 $0.41 $0.31 Distributable earnings per share, fully converted (1), (2) 120% 109% 115% 87% Distributable dividend coverage, fully converted (1), (2) $42.0 $39.3 $41.0 $32.4 3Q'23 4Q'23 1Q'24 2Q'24 $31.0 $30.0 $35.8 -$3.8 3Q'23 4Q'23 1Q'24 2Q'24

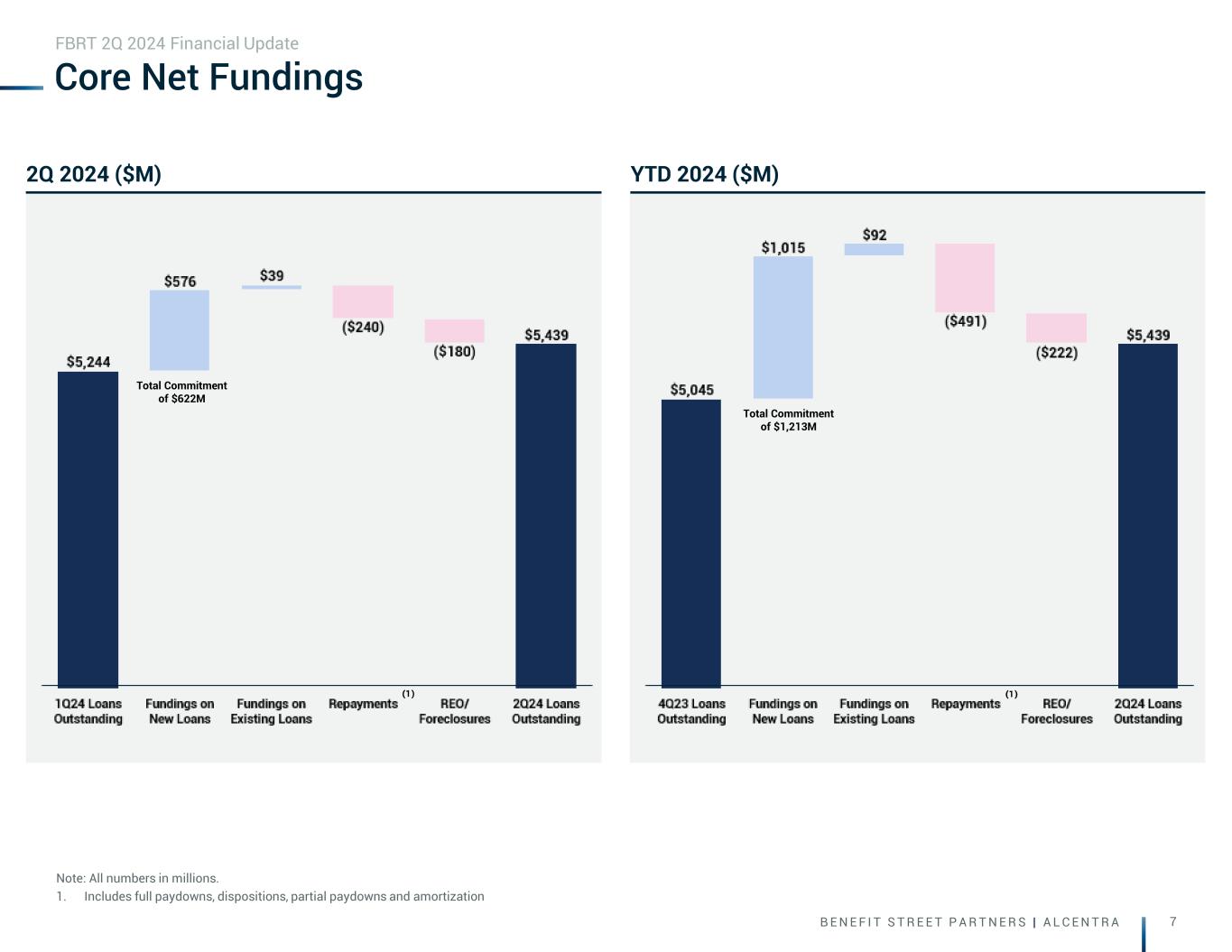

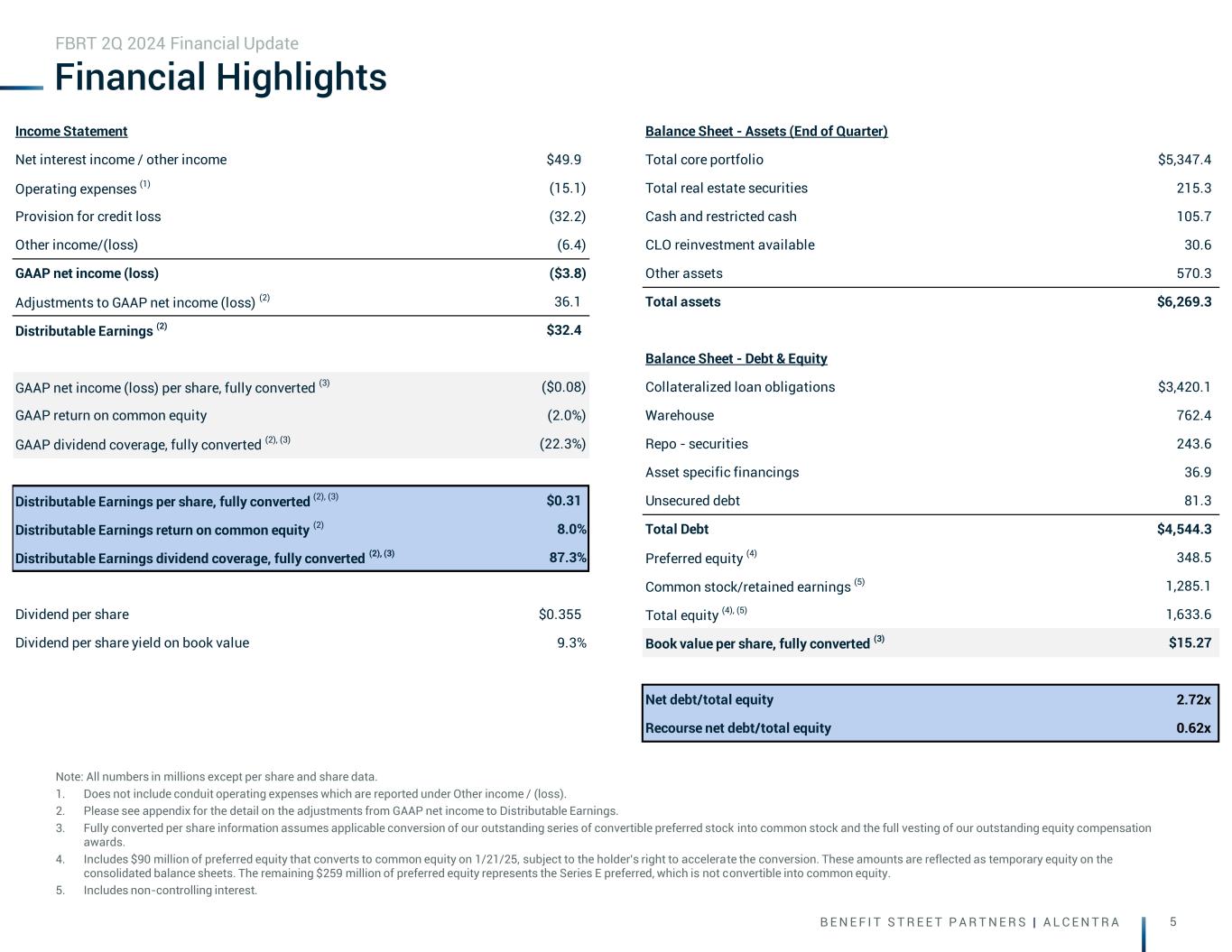

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 7 (1 )(1 ) (1 ) Note: All numbers in millions. 1. Includes full paydowns, dispositions, partial paydowns and amortization Core Net Fundings FBRT 2Q 2024 Financial Update 2Q 2024 ($M) YTD 2024 ($M) Total Commitment of $622M Total Commitment of $1,213M

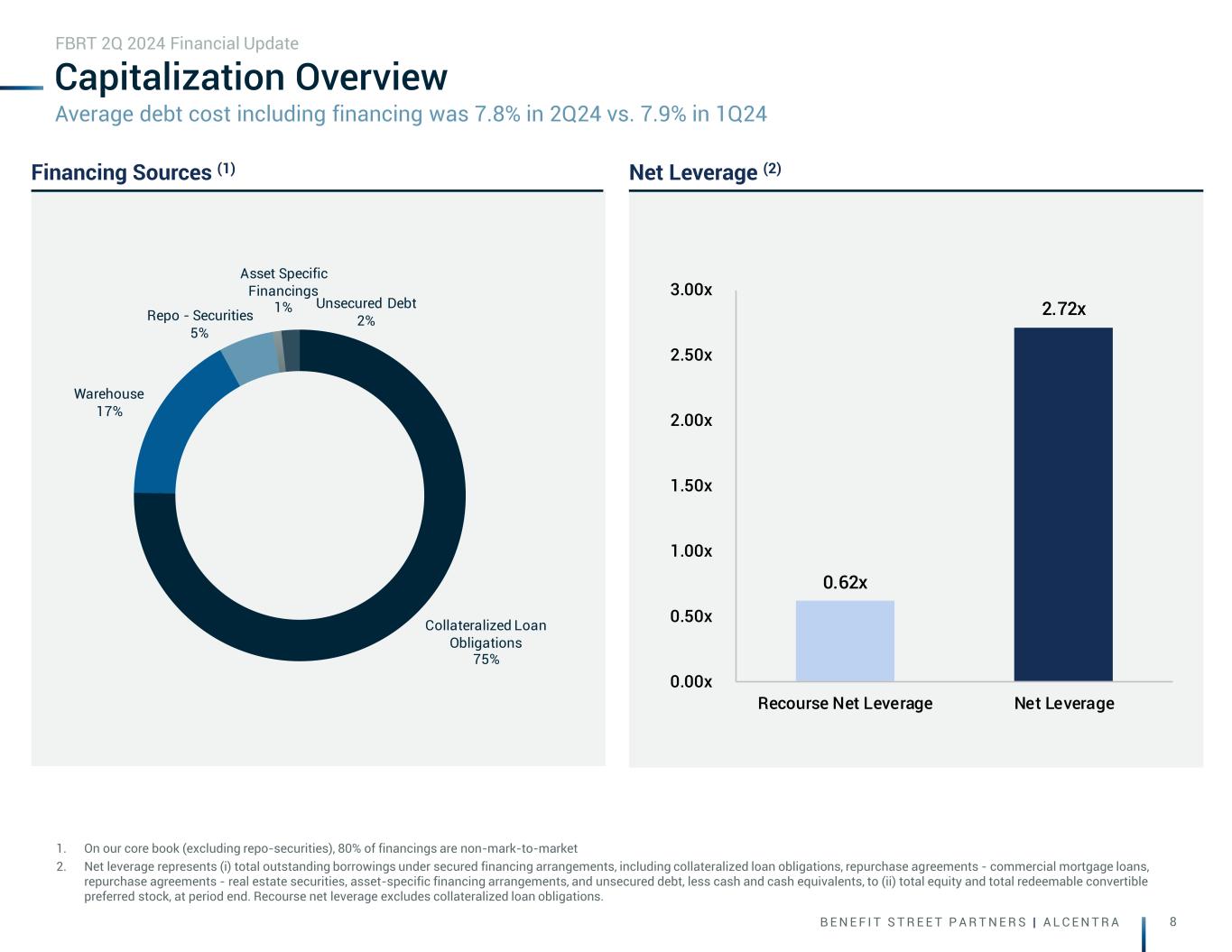

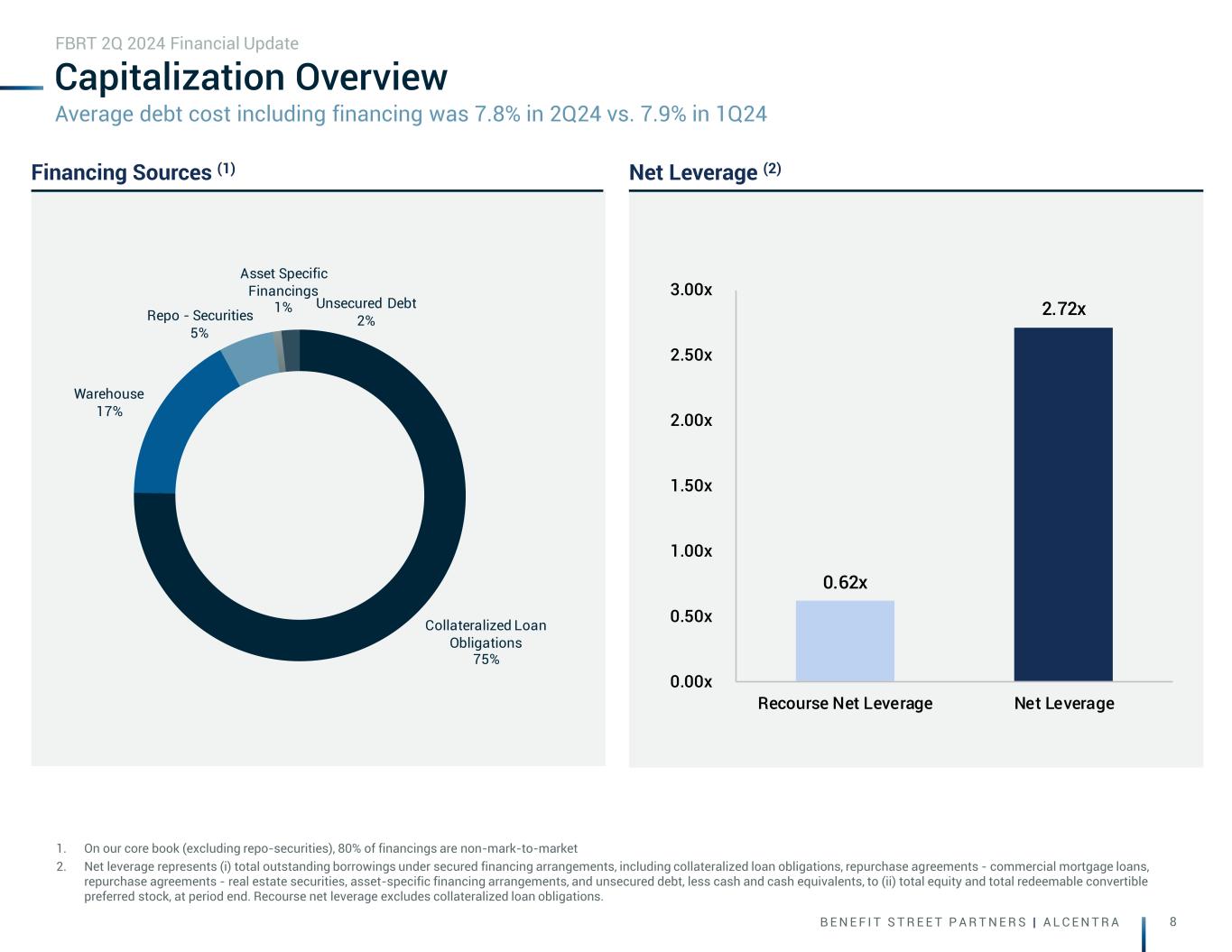

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 8 Capitalization Overview 1. On our core book (excluding repo-securities), 80% of financings are non-mark-to-market 2. Net leverage represents (i) total outstanding borrowings under secured financing arrangements, including collateralized loan obligations, repurchase agreements - commercial mortgage loans, repurchase agreements - real estate securities, asset-specific financing arrangements, and unsecured debt, less cash and cash equivalents, to (ii) total equity and total redeemable convertible preferred stock, at period end. Recourse net leverage excludes collateralized loan obligations. FBRT 2Q 2024 Financial Update Financing Sources (1) Net Leverage (2) Average debt cost including financing was 7.8% in 2Q24 vs. 7.9% in 1Q24 Collateralized Loan Obligations 75% Warehouse 17% Repo - Securities 5% Asset Specific Financings 1% Unsecured Debt 2% 0.62x 2.72x 0.00x 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x Recourse Net Leverage Net Leverage

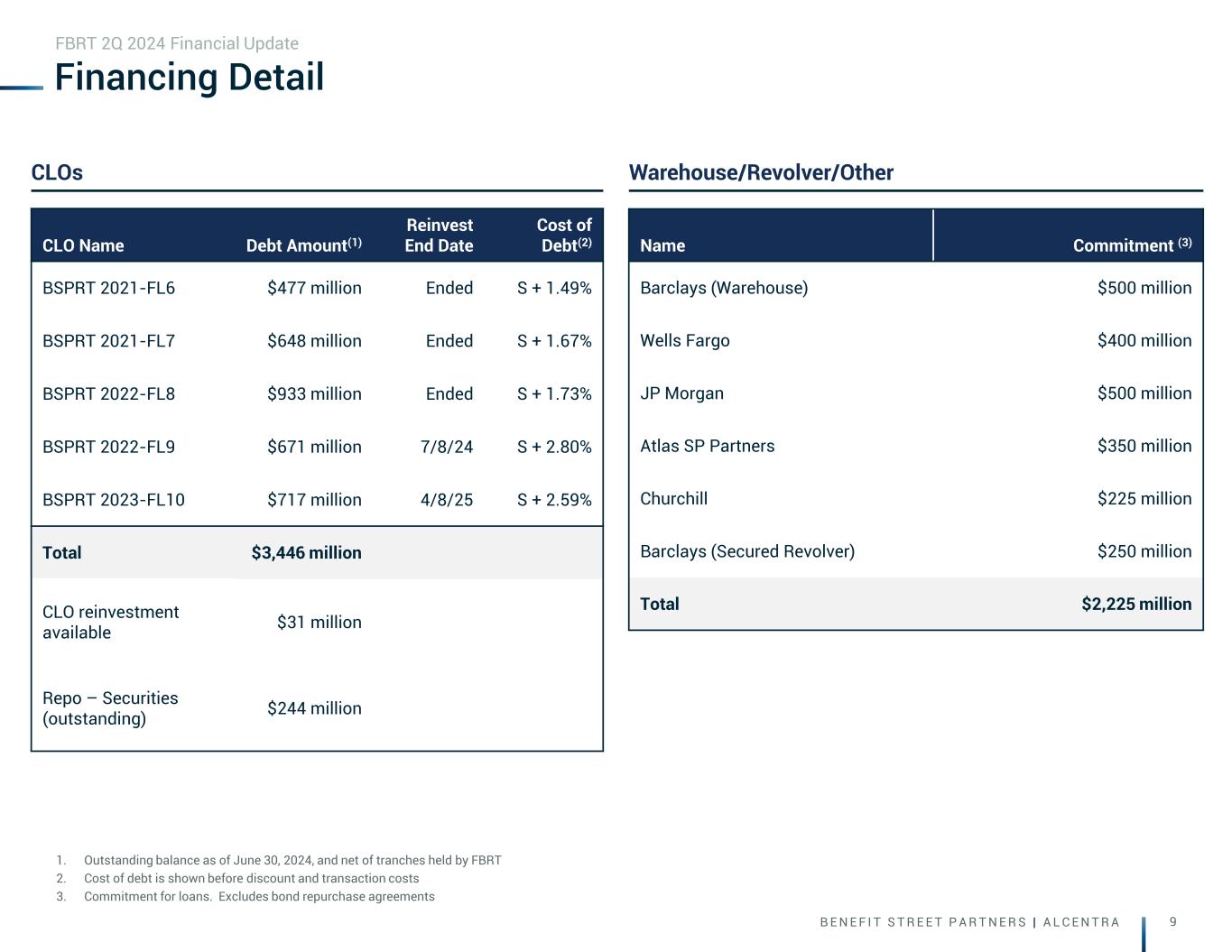

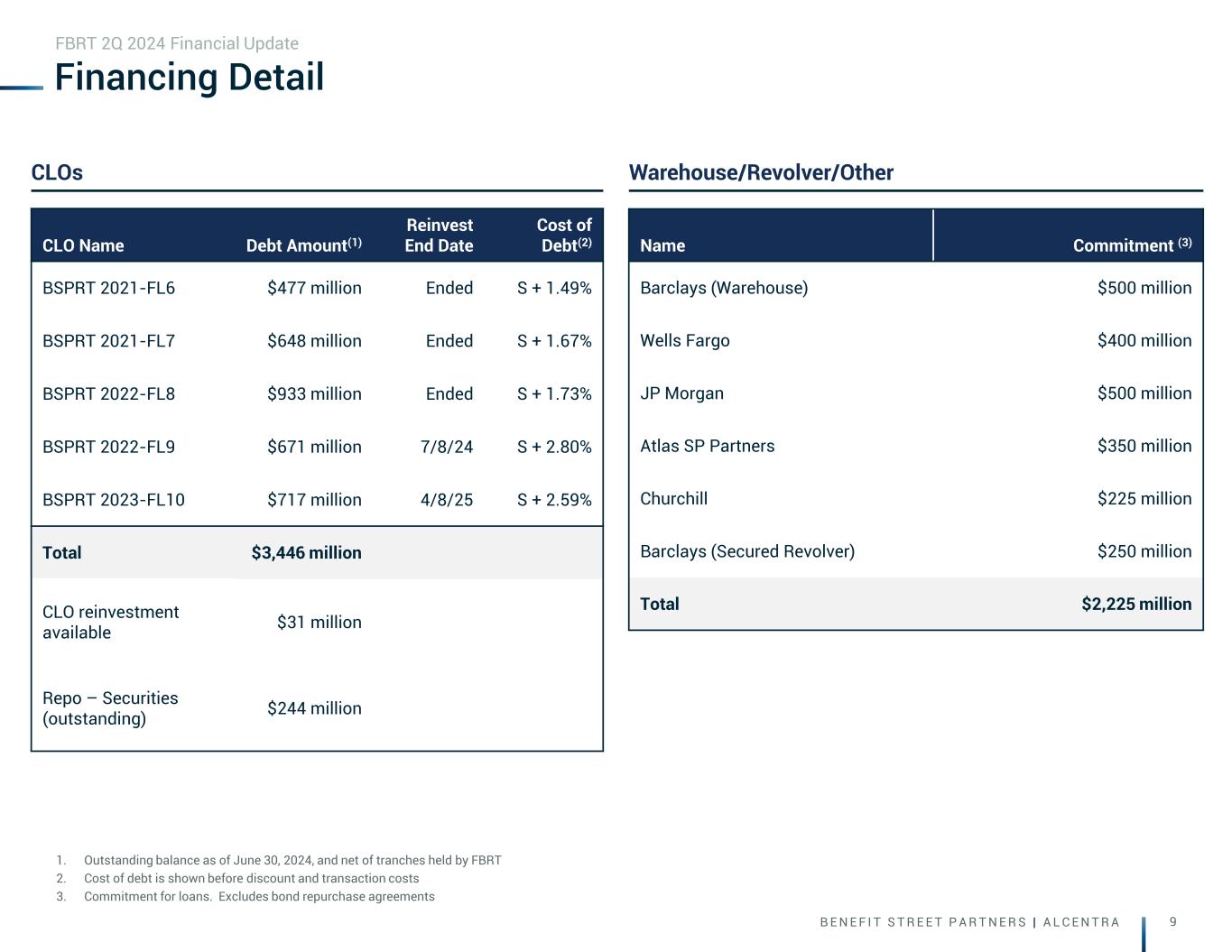

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 9 Financing Detail 1. Outstanding balance as of June 30, 2024, and net of tranches held by FBRT 2. Cost of debt is shown before discount and transaction costs 3. Commitment for loans. Excludes bond repurchase agreements FBRT 2Q 2024 Financial Update CLOs Warehouse/Revolver/Other CLO Name Debt Amount(1) Reinvest End Date Cost of Debt(2) BSPRT 2021-FL6 $477 million Ended S + 1.49% BSPRT 2021-FL7 $648 million Ended S + 1.67% BSPRT 2022-FL8 $933 million Ended S + 1.73% BSPRT 2022-FL9 $671 million 7/8/24 S + 2.80% BSPRT 2023-FL10 $717 million 4/8/25 S + 2.59% Total $3,446 million CLO reinvestment available $31 million Repo – Securities (outstanding) $244 million Name Commitment (3) Barclays (Warehouse) $500 million Wells Fargo $400 million JP Morgan $500 million Atlas SP Partners $350 million Churchill $225 million Barclays (Secured Revolver) $250 million Total $2,225 million

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 10 ( 1 ) Liquidity 1. Represents cash available at 6/30/2024 that we can invest at a market advance rate utilizing our available capacity on financing lines FBRT 2Q 2024 Financial Update Liquidity ($M)

Portfolio

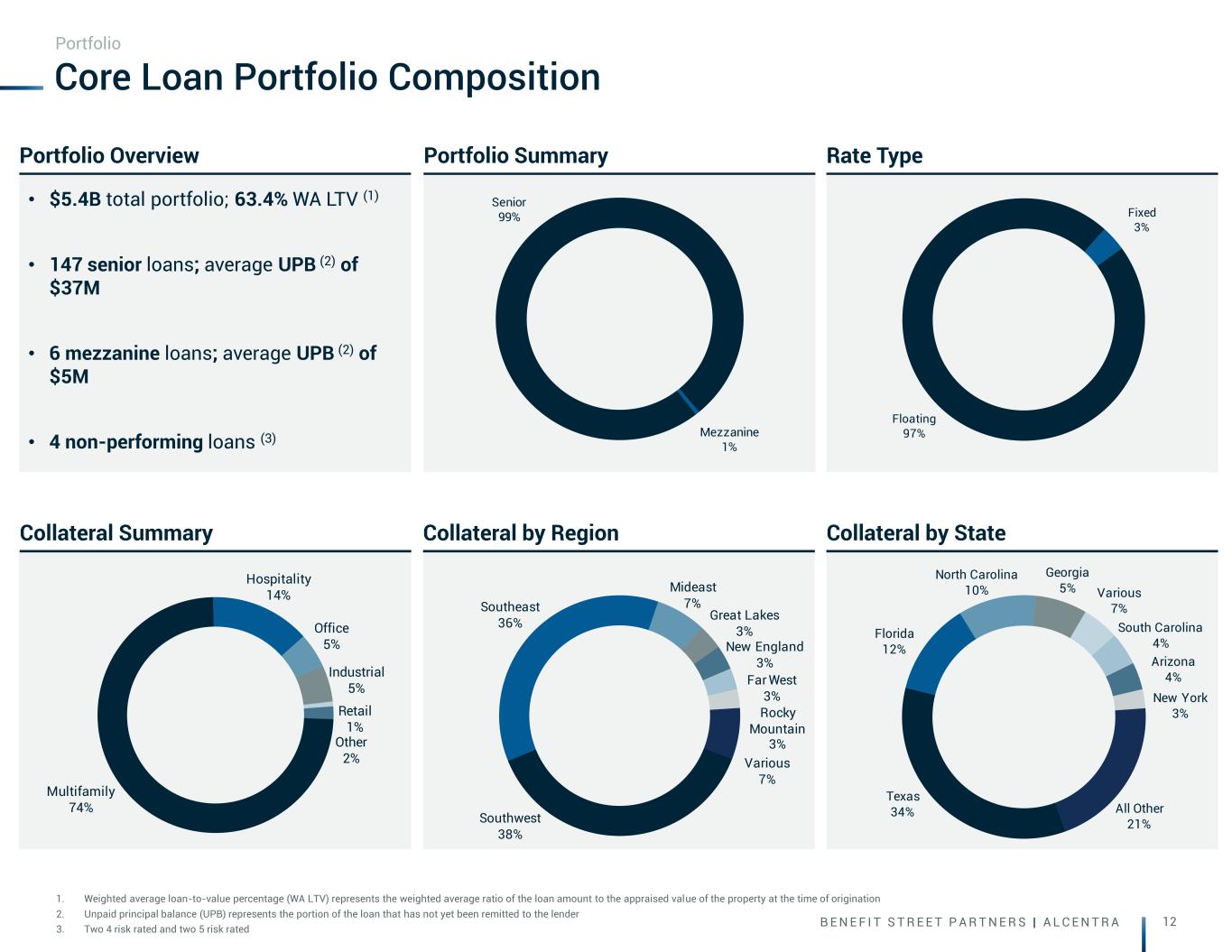

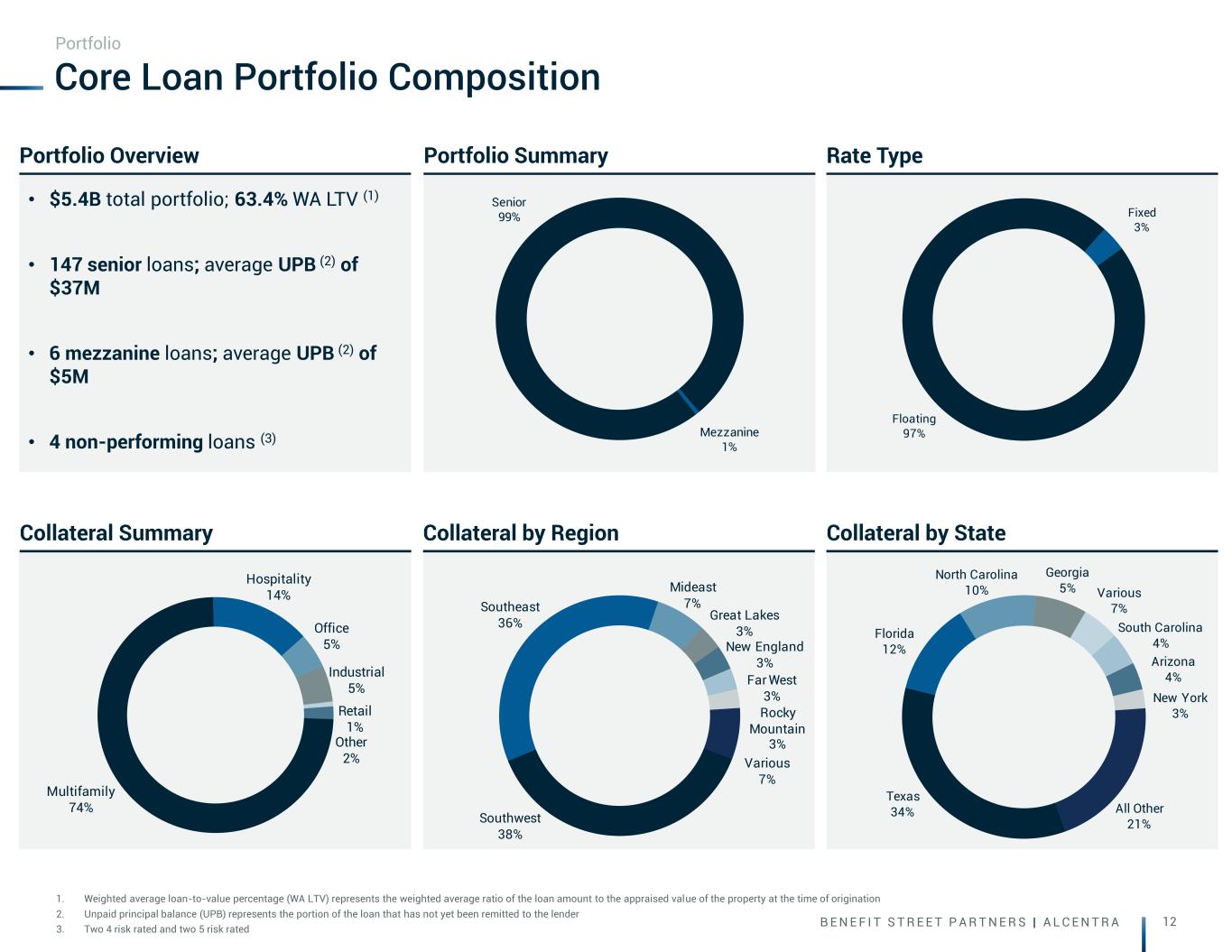

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 12 Portfolio Summary Rate Type Floating 97% Fixed 3% Collateral by Region Collateral by State Core Loan Portfolio Composition Portfolio • $5.4B total portfolio; 63.4% WA LTV (1) • 147 senior loans; average UPB (2) of $37M • 6 mezzanine loans; average UPB (2) of $5M • 4 non-performing loans (3) Portfolio Overview Collateral Summary 1. Weighted average loan-to-value percentage (WA LTV) represents the weighted average ratio of the loan amount to the appraised value of the property at the time of origination 2. Unpaid principal balance (UPB) represents the portion of the loan that has not yet been remitted to the lender 3. Two 4 risk rated and two 5 risk rated Multifamily 74% Hospitality 14% Office 5% Industrial 5% Retail 1% Other 2% Senior 99% Mezzanine 1% Southwest 38% Southeast 36% Mideast 7% Great Lakes 3% New England 3% Far West 3% Rocky Mountain 3% Various 7% Texas 34% Florida 12% North Carolina 10% Various 7% Georgia 5% South Carolina 4% Arizona 4% New York 3% All Other 21%

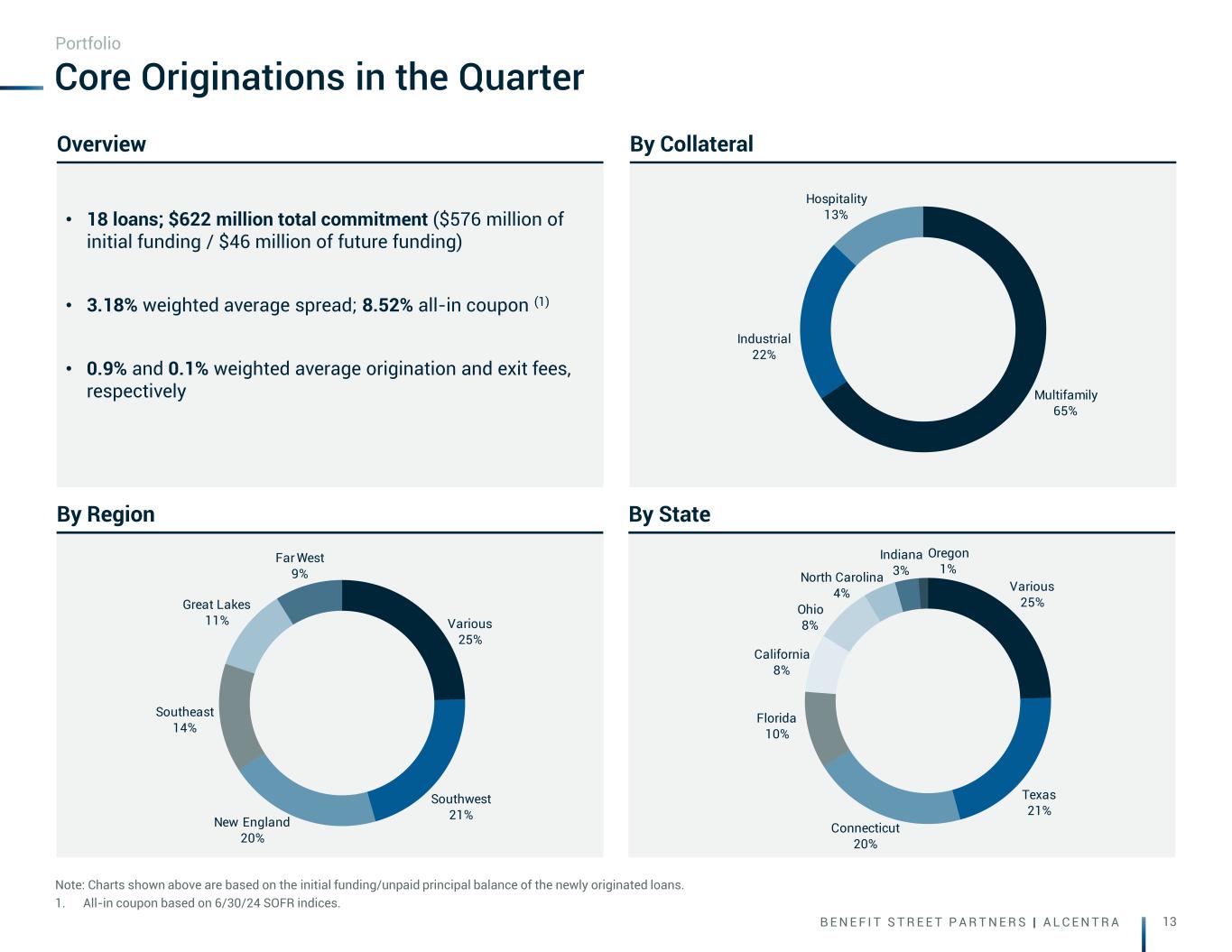

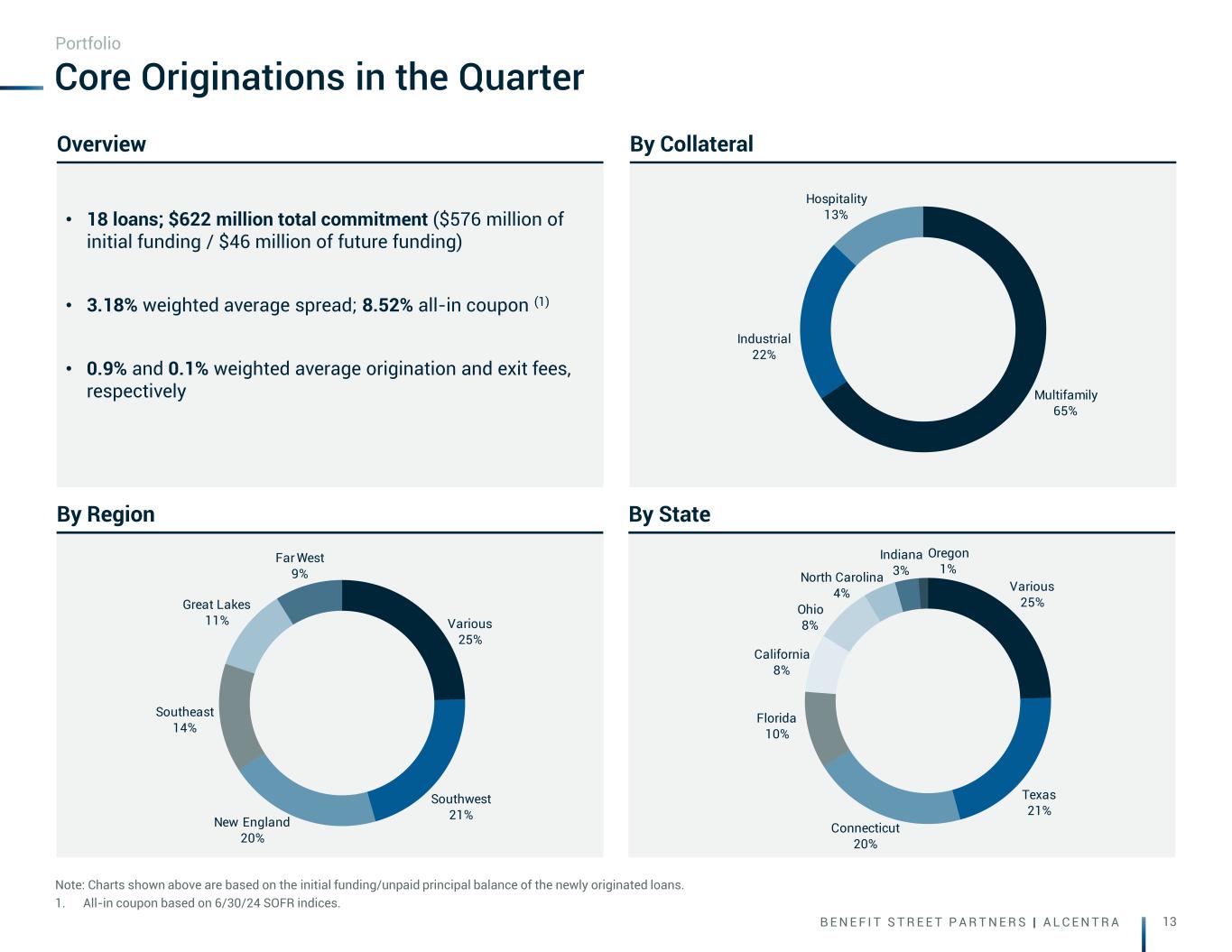

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 13 Multifamily 65% Industrial 22% Hospitality 13% By State By Collateral By Region Core Originations in the Quarter Note: Charts shown above are based on the initial funding/unpaid principal balance of the newly originated loans. 1. All-in coupon based on 6/30/24 SOFR indices. Portfolio • 18 loans; $622 million total commitment ($576 million of initial funding / $46 million of future funding) • 3.18% weighted average spread; 8.52% all-in coupon (1) • 0.9% and 0.1% weighted average origination and exit fees, respectively Overview Various 25% Southwest 21% New England 20% Southeast 14% Great Lakes 11% Far West 9% Various 25% Texas 21% Connecticut 20% Florida 10% California 8% Ohio 8% North Carolina 4% Indiana 3% Oregon 1%

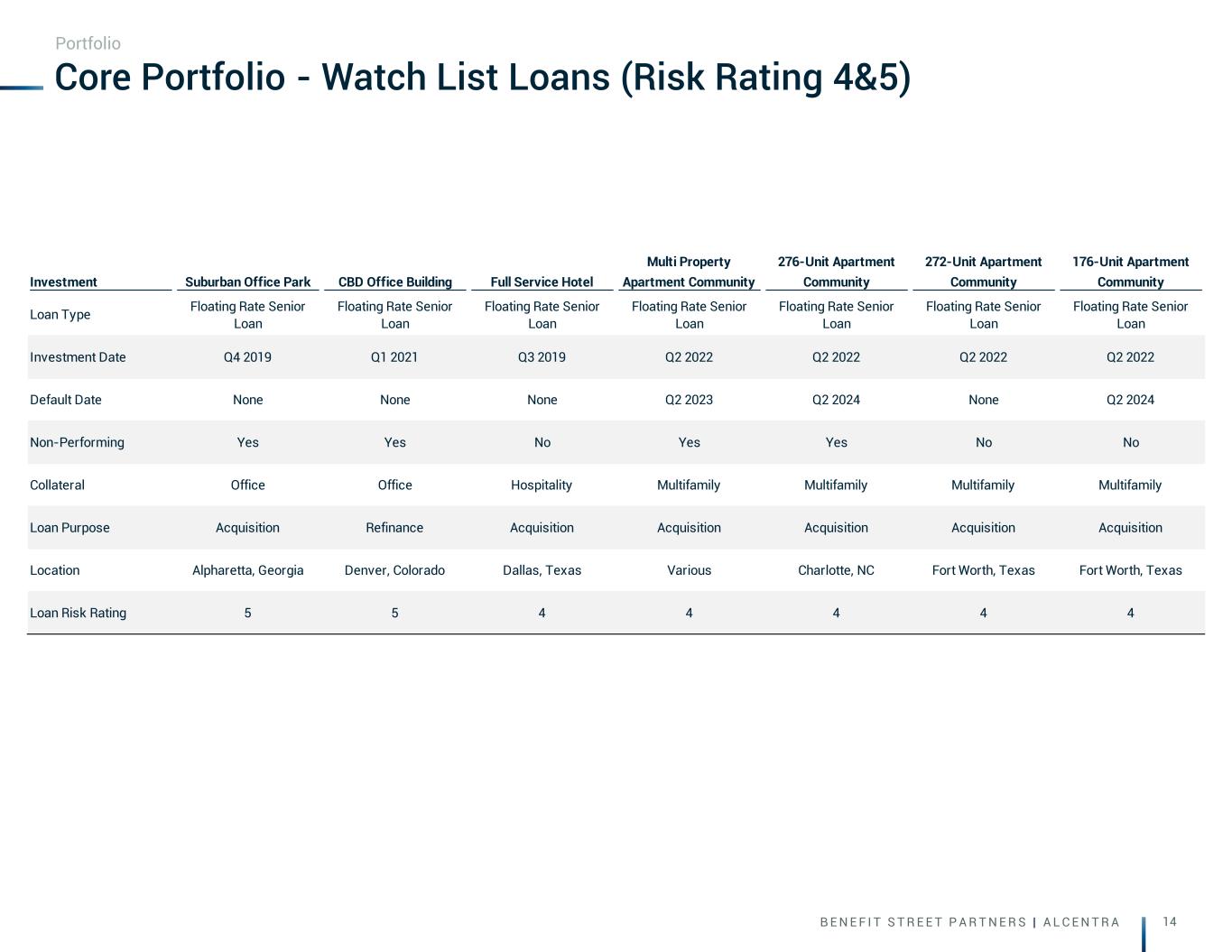

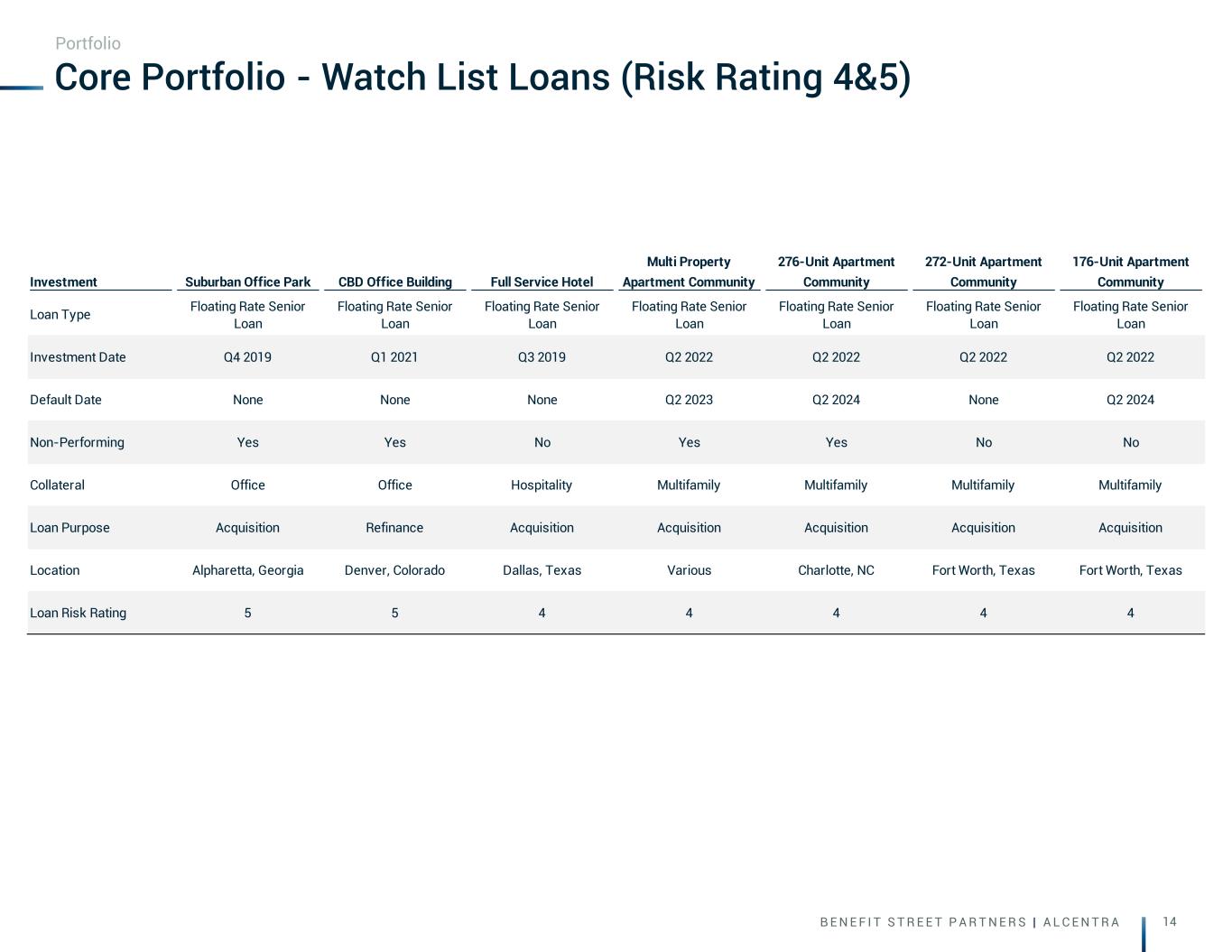

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 14 Core Portfolio - Watch List Loans (Risk Rating 4&5) Portfolio Investment Suburban Office Park CBD Office Building Full Service Hotel Multi Property Apartment Community 276-Unit Apartment Community 272-Unit Apartment Community 176-Unit Apartment Community Loan Type Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Investment Date Q4 2019 Q1 2021 Q3 2019 Q2 2022 Q2 2022 Q2 2022 Q2 2022 Default Date None None None Q2 2023 Q2 2024 None Q2 2024 Non-Performing Yes Yes No Yes Yes No No Collateral Office Office Hospitality Multifamily Multifamily Multifamily Multifamily Loan Purpose Acquisition Refinance Acquisition Acquisition Acquisition Acquisition Acquisition Location Alpharetta, Georgia Denver, Colorado Dallas, Texas Various Charlotte, NC Fort Worth, Texas Fort Worth, Texas Loan Risk Rating 5 5 4 4 4 4 4

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 15 Foreclosure Real Estate Owned (“REO”) Portfolio Investment Single Tenant Retail Portfolio CBD Office Complex 16-Building Apartment Complex Two Property Portfolio Apartment Communities 471-Unit Apartment Community 426-Unit Apartment Community Loan Investment Date Q2 2022 Q1 2020 Q1 2021 Q2 2022 Q2 2022 Q2 2018 Foreclosure / Deed-In-Lieu Date Q4 2022 - Q2 2023 Q3 2023 Q4 2023 Q2 2024 Q2 2024 Q2 2024 Collateral Type Retail Office Multifamily Multifamily Multifamily Multifamily Collateral Detail 21 Freestanding Retail Properties 124k Square Foot Office Complex 236-Unit Apartment Complex with 16 Buildings Two Property, Garden- Style Apartment Communities 471-Unit, Garden Style Apartment Community 426-Unit, High Rise Apartment Community Location Various Portland, Oregon Lubbock, Texas Mooresville / Chapel Hill, North Carolina Raleigh, North Carolina Cleveland, Ohio

Appendix

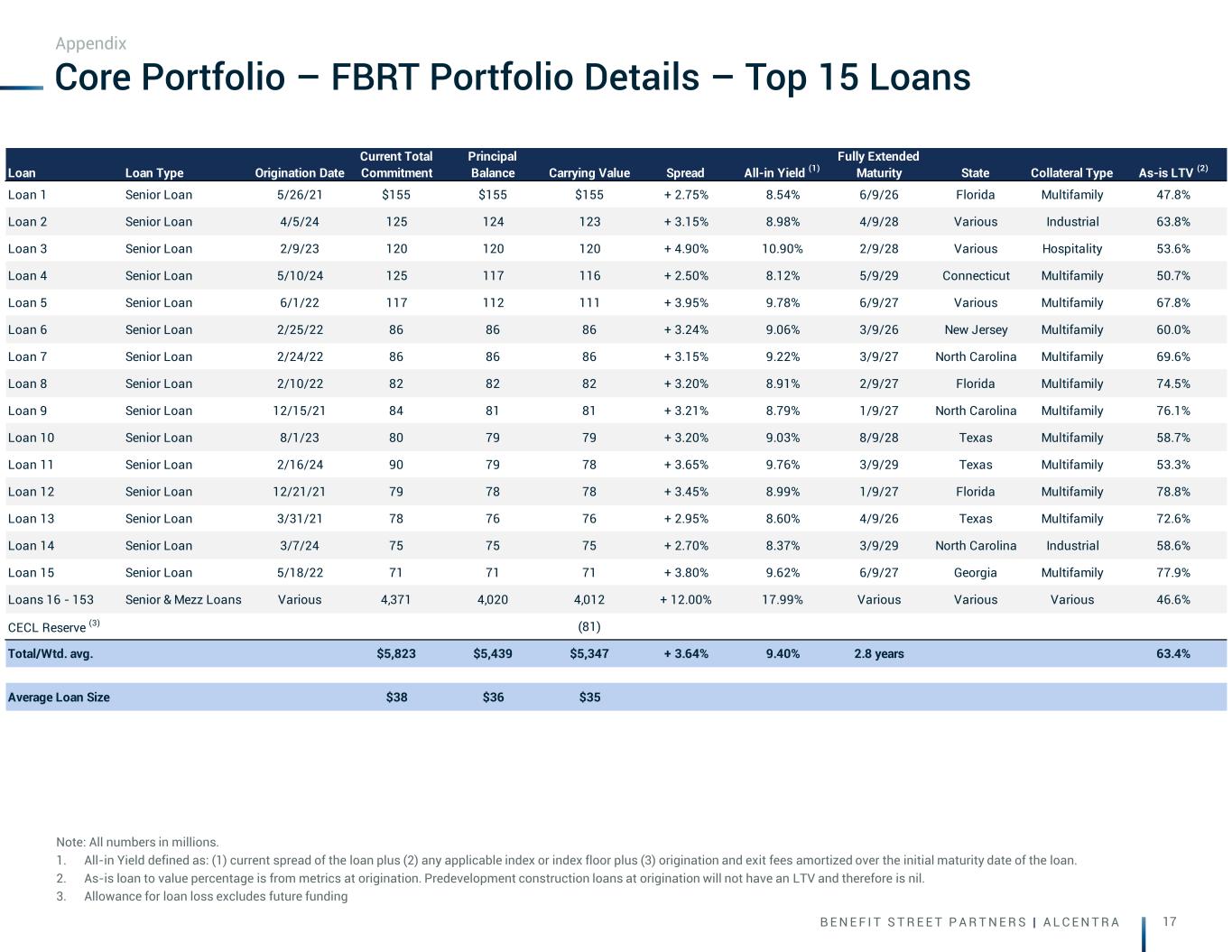

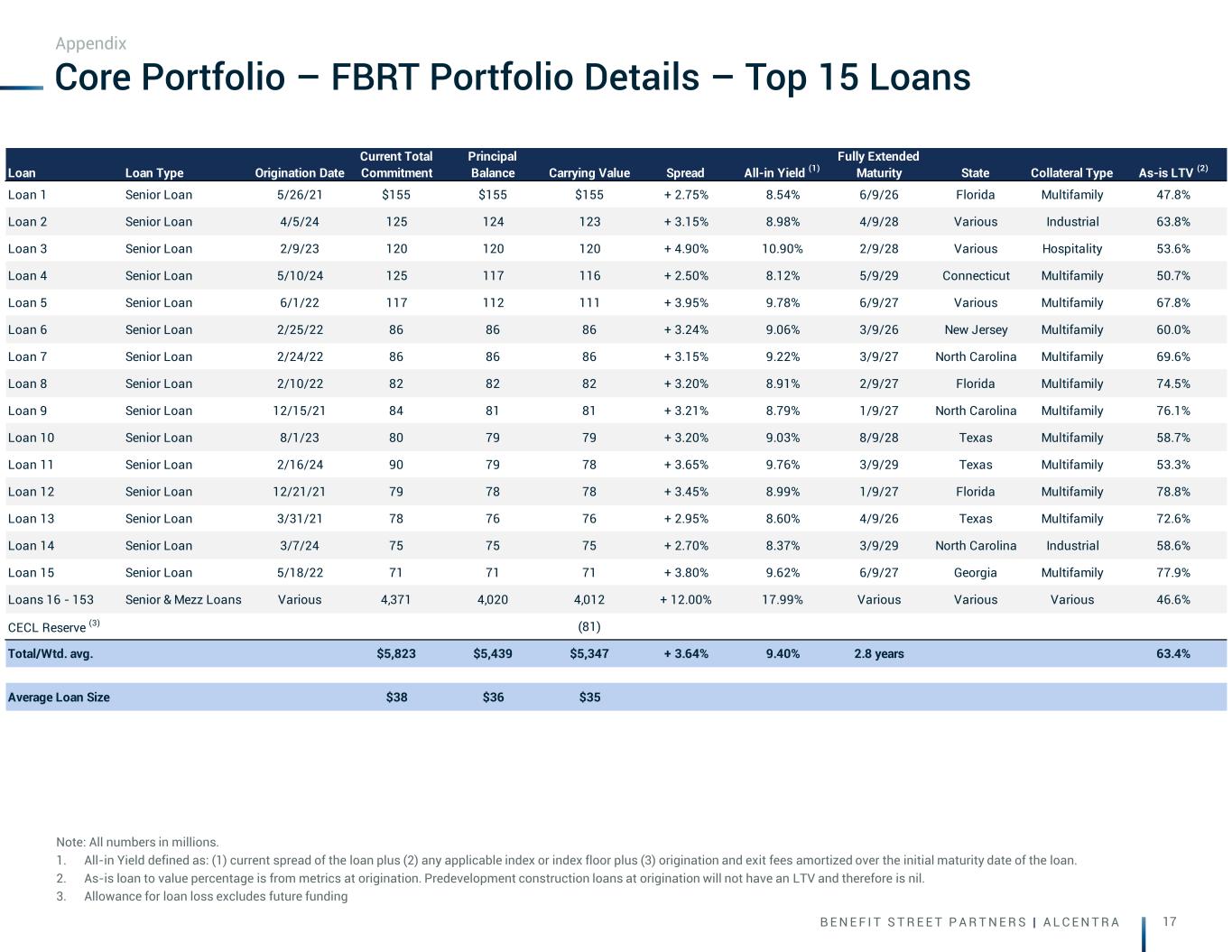

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 17 Core Portfolio – FBRT Portfolio Details – Top 15 Loans Note: All numbers in millions. 1. All-in Yield defined as: (1) current spread of the loan plus (2) any applicable index or index floor plus (3) origination and exit fees amortized over the initial maturity date of the loan. 2. As-is loan to value percentage is from metrics at origination. Predevelopment construction loans at origination will not have an LTV and therefore is nil. 3. Allowance for loan loss excludes future funding Appendix Loan Loan Type Origination Date Current Total Commitment Principal Balance Carrying Value Spread All-in Yield (1) Fully Extended Maturity State Collateral Type As-is LTV (2) Loan 1 Senior Loan 5/26/21 $155 $155 $155 + 2.75% 8.54% 6/9/26 Florida Multifamily 47.8% Loan 2 Senior Loan 4/5/24 125 124 123 + 3.15% 8.98% 4/9/28 Various Industrial 63.8% Loan 3 Senior Loan 2/9/23 120 120 120 + 4.90% 10.90% 2/9/28 Various Hospitality 53.6% Loan 4 Senior Loan 5/10/24 125 117 116 + 2.50% 8.12% 5/9/29 Connecticut Multifamily 50.7% Loan 5 Senior Loan 6/1/22 117 112 111 + 3.95% 9.78% 6/9/27 Various Multifamily 67.8% Loan 6 Senior Loan 2/25/22 86 86 86 + 3.24% 9.06% 3/9/26 New Jersey Multifamily 60.0% Loan 7 Senior Loan 2/24/22 86 86 86 + 3.15% 9.22% 3/9/27 North Carolina Multifamily 69.6% Loan 8 Senior Loan 2/10/22 82 82 82 + 3.20% 8.91% 2/9/27 Florida Multifamily 74.5% Loan 9 Senior Loan 12/15/21 84 81 81 + 3.21% 8.79% 1/9/27 North Carolina Multifamily 76.1% Loan 10 Senior Loan 8/1/23 80 79 79 + 3.20% 9.03% 8/9/28 Texas Multifamily 58.7% Loan 11 Senior Loan 2/16/24 90 79 78 + 3.65% 9.76% 3/9/29 Texas Multifamily 53.3% Loan 12 Senior Loan 12/21/21 79 78 78 + 3.45% 8.99% 1/9/27 Florida Multifamily 78.8% Loan 13 Senior Loan 3/31/21 78 76 76 + 2.95% 8.60% 4/9/26 Texas Multifamily 72.6% Loan 14 Senior Loan 3/7/24 75 75 75 + 2.70% 8.37% 3/9/29 North Carolina Industrial 58.6% Loan 15 Senior Loan 5/18/22 71 71 71 + 3.80% 9.62% 6/9/27 Georgia Multifamily 77.9% Loans 16 - 153 Senior & Mezz Loans Various 4,371 4,020 4,012 + 12.00% 17.99% Various Various Various 46.6% CECL Reserve (3) (81) Total/Wtd. avg. $5,823 $5,439 $5,347 + 3.64% 9.40% 2.8 years 63.4% Average Loan Size $38 $36 $35

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 18 Core Portfolio – Risk Ratings Note: Principal balance in millions. Watchlist loans are loans with a risk rating of 4 or 5 Appendix Risk Ratings Average risk rating was 2.3 for the quarter (no change from prior quarter) Risk Rating # of Loans - 119 27 5 2 Addition - 18 4 4 2 Reduction - 10 5 5 - +/- vs 1Q24 - 8 (1) (1) 2 Principal Balance - 4,072 1,076 222 68 Non-Performing - - - 2 2 Watch List - - - 5 2 0.0% 74.8% 19.8% 4.1% 1.3% 1 2 3 4 5

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 19 ($0.10) ($0.05) $0.00 $0.05 $0.10 -1.00% -0.50% 6/30/2024 +0.50% +1.00% Change in Floating Base Rate Indices Earnings Sensitivity Note: Reflects earnings impact of an increase in the floating-rate indices referenced by our portfolio, assuming no change in credit spreads, portfolio composition or asset performance Appendix EPS Sensitivity on Index Rates Positive earnings correlation to rising rates As of 7/15/24: 1M SOFR: 5.33% As of 6/30/24: 1M SOFR: 5.34%

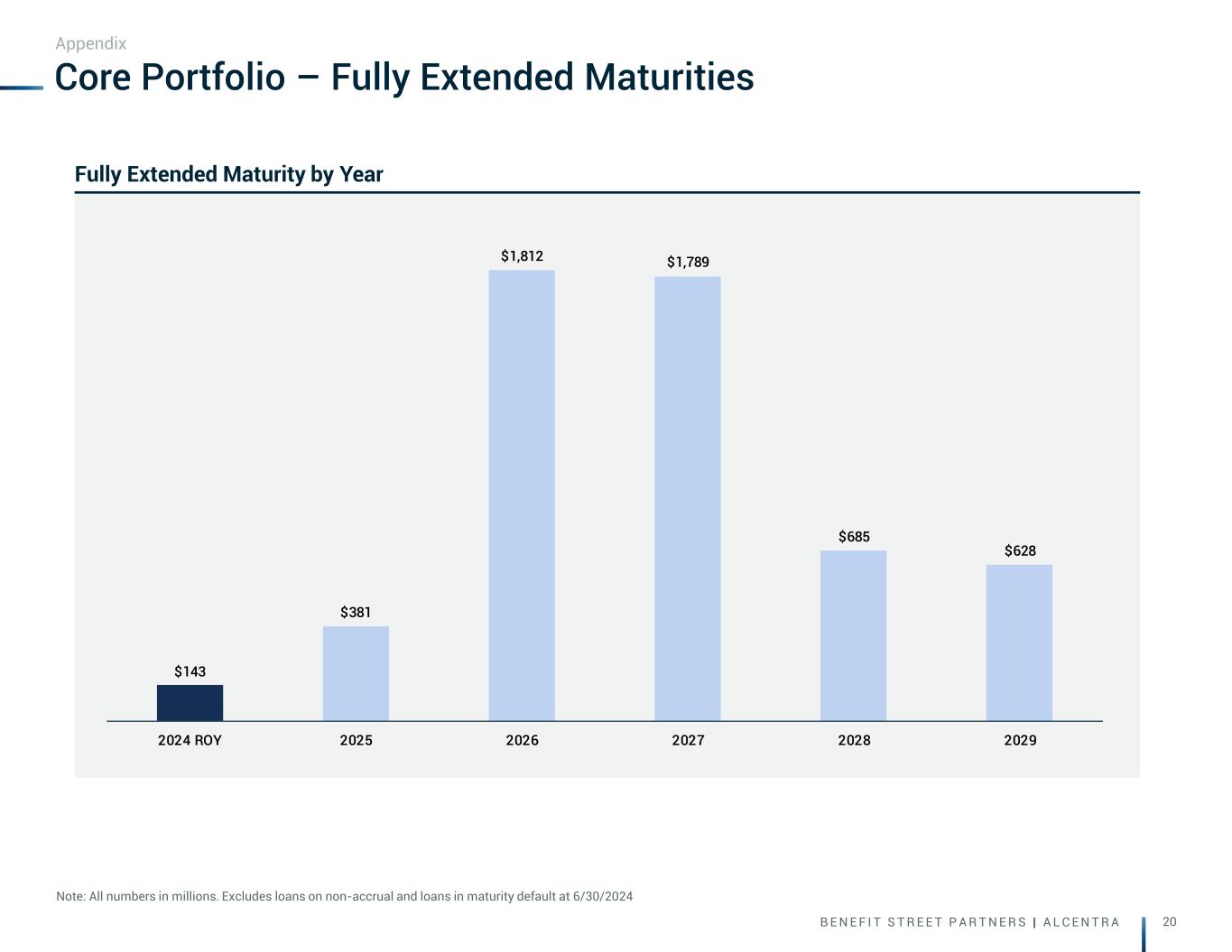

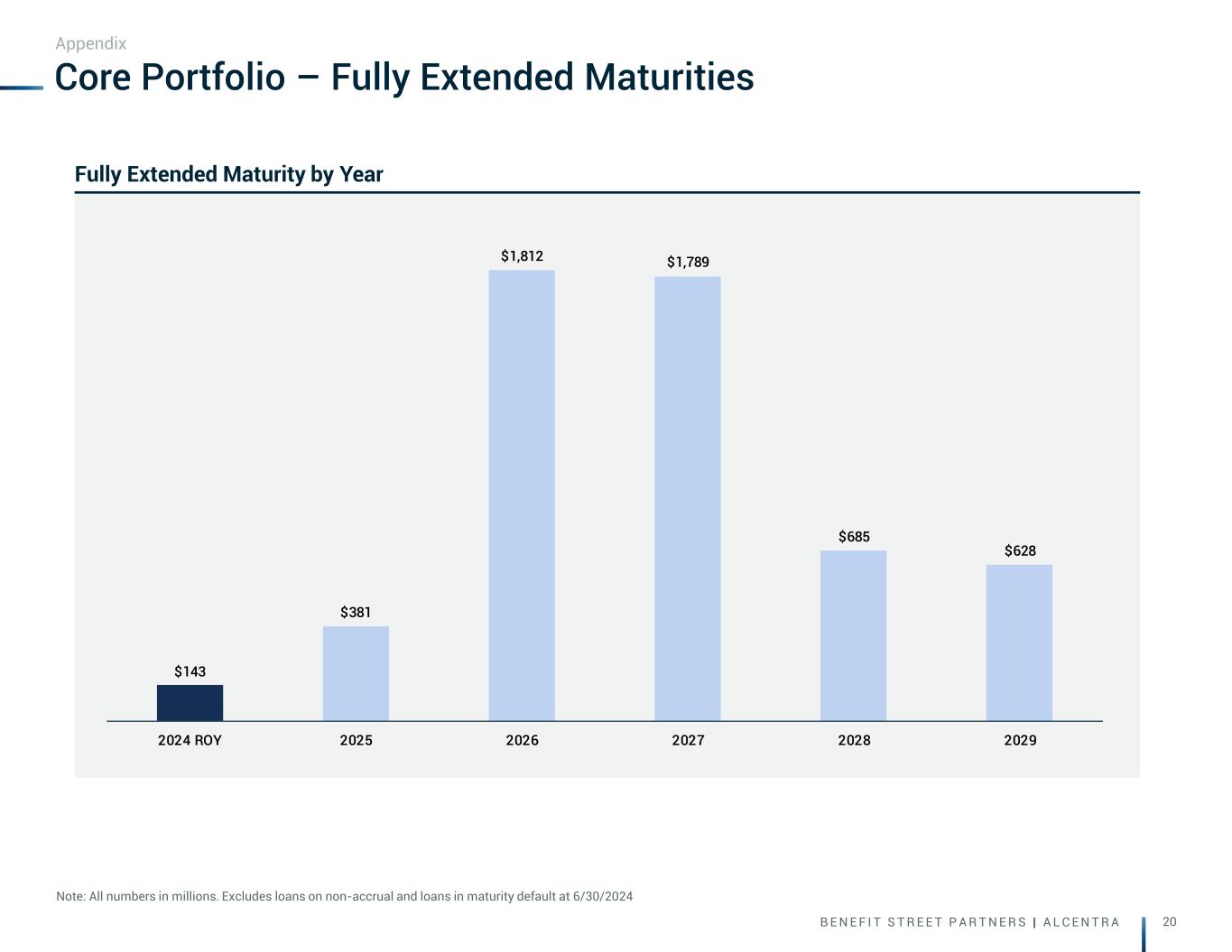

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 20 Core Portfolio – Fully Extended Maturities Note: All numbers in millions. Excludes loans on non-accrual and loans in maturity default at 6/30/2024 Appendix Fully Extended Maturity by Year $143 $381 $1,812 $1,789 $685 $628 2024 ROY 2025 2026 2027 2028 2029

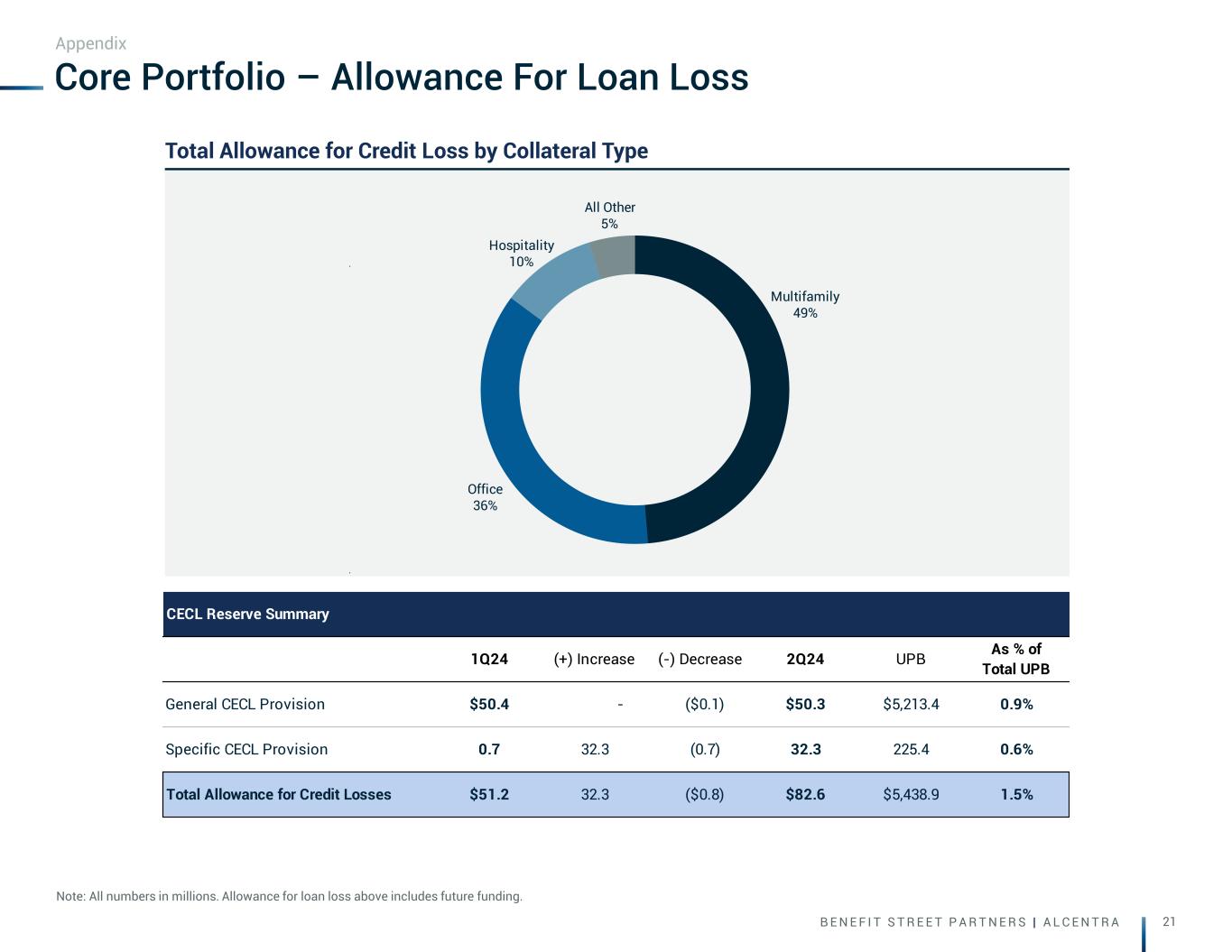

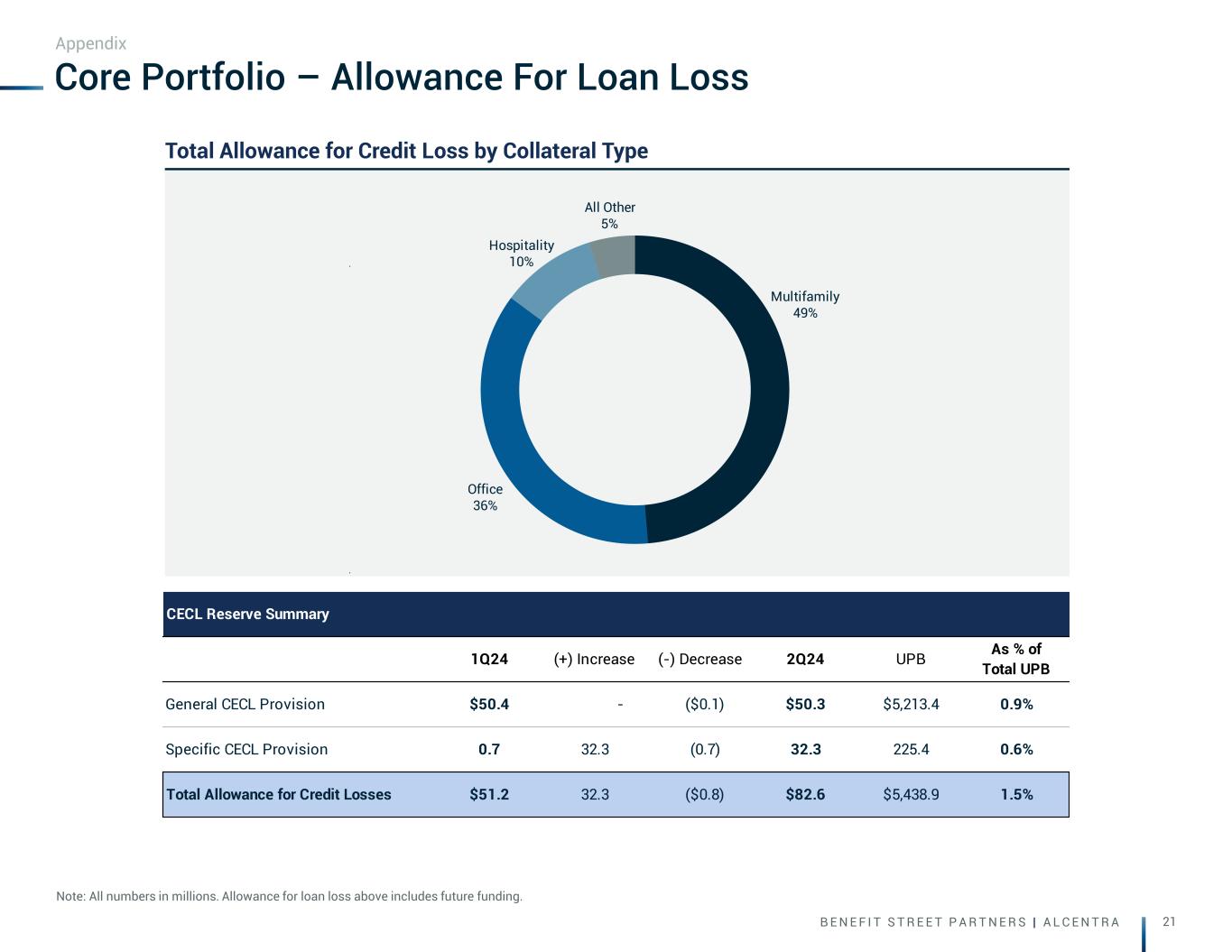

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 21 Multifamily 49% Office 36% Hospitality 10% All Other 5% Core Portfolio – Allowance For Loan Loss Note: All numbers in millions. Allowance for loan loss above includes future funding. Appendix Total Allowance for Credit Loss by Collateral Type CECL Reserve Summary 1Q24 (+) Increase (-) Decrease 2Q24 UPB As % of Total UPB General CECL Provision $50.4 - ($0.1) $50.3 $5,213.4 0.9% Specific CECL Provision 0.7 32.3 (0.7) 32.3 225.4 0.6% Total Allowance for Credit Losses $51.2 32.3 ($0.8) $82.6 $5,438.9 1.5%

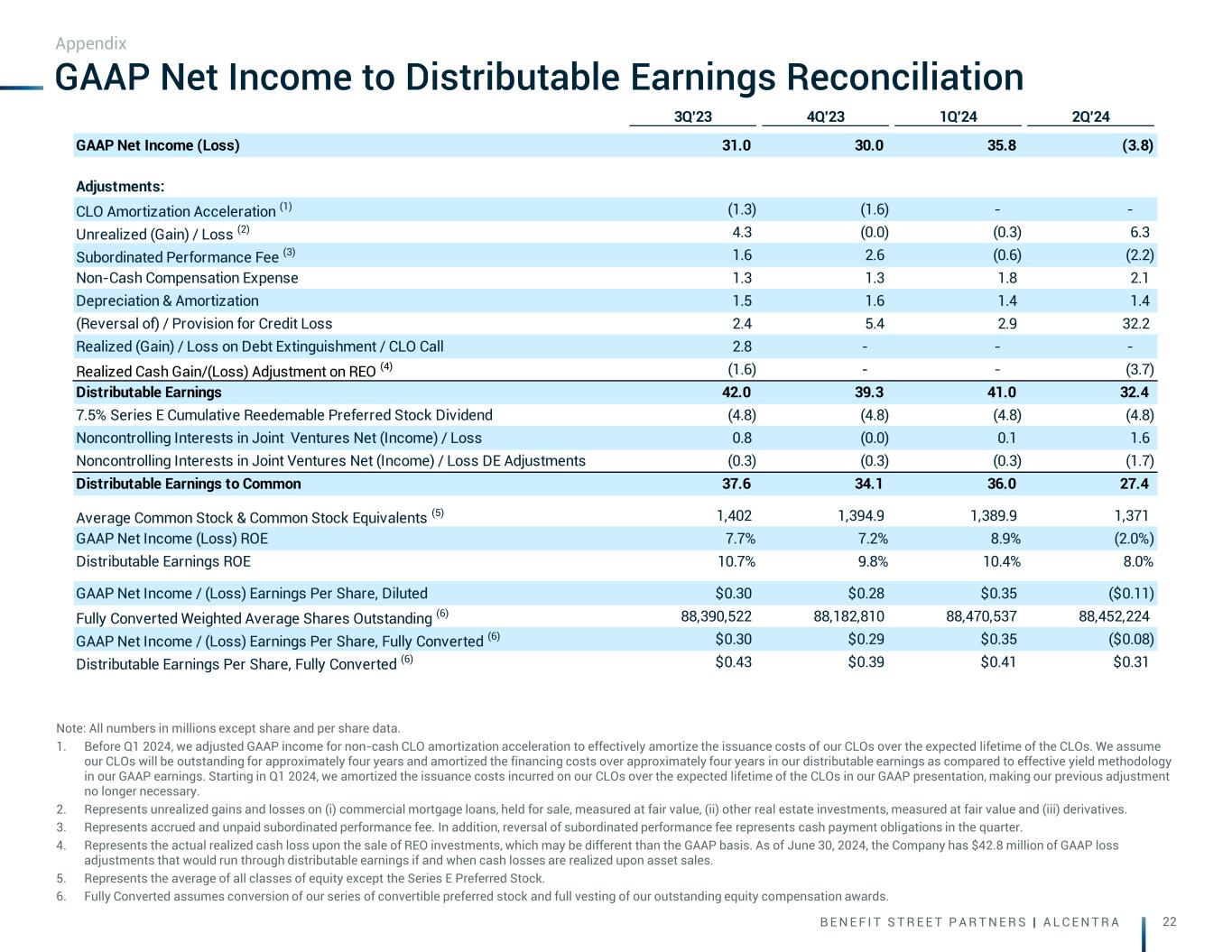

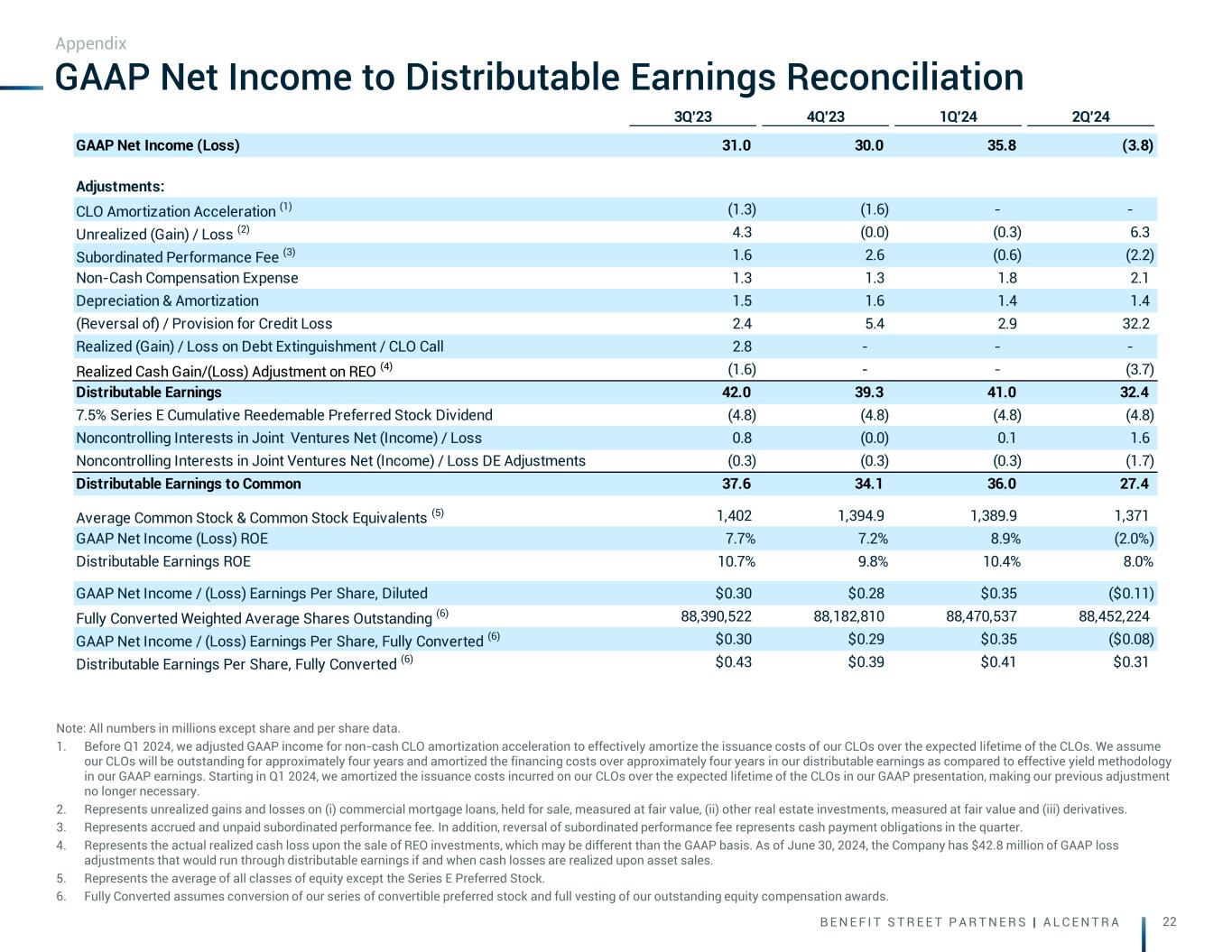

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 22 3Q'23 4Q'23 1Q'24 2Q'24 GAAP Net Income (Loss) 31.0 30.0 35.8 (3.8) Adjustments: CLO Amortization Acceleration (1) (1.3) (1.6) - - Unrealized (Gain) / Loss (2) 4.3 (0.0) (0.3) 6.3 Subordinated Performance Fee (3) 1.6 2.6 (0.6) (2.2) Non-Cash Compensation Expense 1.3 1.3 1.8 2.1 Depreciation & Amortization 1.5 1.6 1.4 1.4 (Reversal of) / Provision for Credit Loss 2.4 5.4 2.9 32.2 Realized (Gain) / Loss on Debt Extinguishment / CLO Call 2.8 - - - Realized Cash Gain/(Loss) Adjustment on REO (4) (1.6) - - (3.7) Distributable Earnings 42.0 39.3 41.0 32.4 7.5% Series E Cumulative Reedemable Preferred Stock Dividend (4.8) (4.8) (4.8) (4.8) Noncontrolling Interests in Joint Ventures Net (Income) / Loss 0.8 (0.0) 0.1 1.6 Noncontrolling Interests in Joint Ventures Net (Income) / Loss DE Adjustments (0.3) (0.3) (0.3) (1.7) Distributable Earnings to Common 37.6 34.1 36.0 27.4 Average Common Stock & Common Stock Equivalents (5) 1,402 1,394.9 1,389.9 1,371 GAAP Net Income (Loss) ROE 7.7% 7.2% 8.9% (2.0%) Distributable Earnings ROE 10.7% 9.8% 10.4% 8.0% GAAP Net Income / (Loss) Earnings Per Share, Diluted $0.30 $0.28 $0.35 ($0.11) Fully Converted Weighted Average Shares Outstanding (6) 88,390,522 88,182,810 88,470,537 88,452,224 GAAP Net Income / (Loss) Earnings Per Share, Fully Converted (6) $0.30 $0.29 $0.35 ($0.08) Distributable Earnings Per Share, Fully Converted (6) $0.43 $0.39 $0.41 $0.31 GAAP Net Income to Distributable Earnings Reconciliation Note: All numbers in millions except share and per share data. 1. Before Q1 2024, we adjusted GAAP income for non-cash CLO amortization acceleration to effectively amortize the issuance costs of our CLOs over the expected lifetime of the CLOs. We assume our CLOs will be outstanding for approximately four years and amortized the financing costs over approximately four years in our distributable earnings as compared to effective yield methodology in our GAAP earnings. Starting in Q1 2024, we amortized the issuance costs incurred on our CLOs over the expected lifetime of the CLOs in our GAAP presentation, making our previous adjustment no longer necessary. 2. Represents unrealized gains and losses on (i) commercial mortgage loans, held for sale, measured at fair value, (ii) other real estate investments, measured at fair value and (iii) derivatives. 3. Represents accrued and unpaid subordinated performance fee. In addition, reversal of subordinated performance fee represents cash payment obligations in the quarter. 4. Represents the actual realized cash loss upon the sale of REO investments, which may be different than the GAAP basis. As of June 30, 2024, the Company has $42.8 million of GAAP loss adjustments that would run through distributable earnings if and when cash losses are realized upon asset sales. 5. Represents the average of all classes of equity except the Series E Preferred Stock. 6. Fully Converted assumes conversion of our series of convertible preferred stock and full vesting of our outstanding equity compensation awards. Appendix

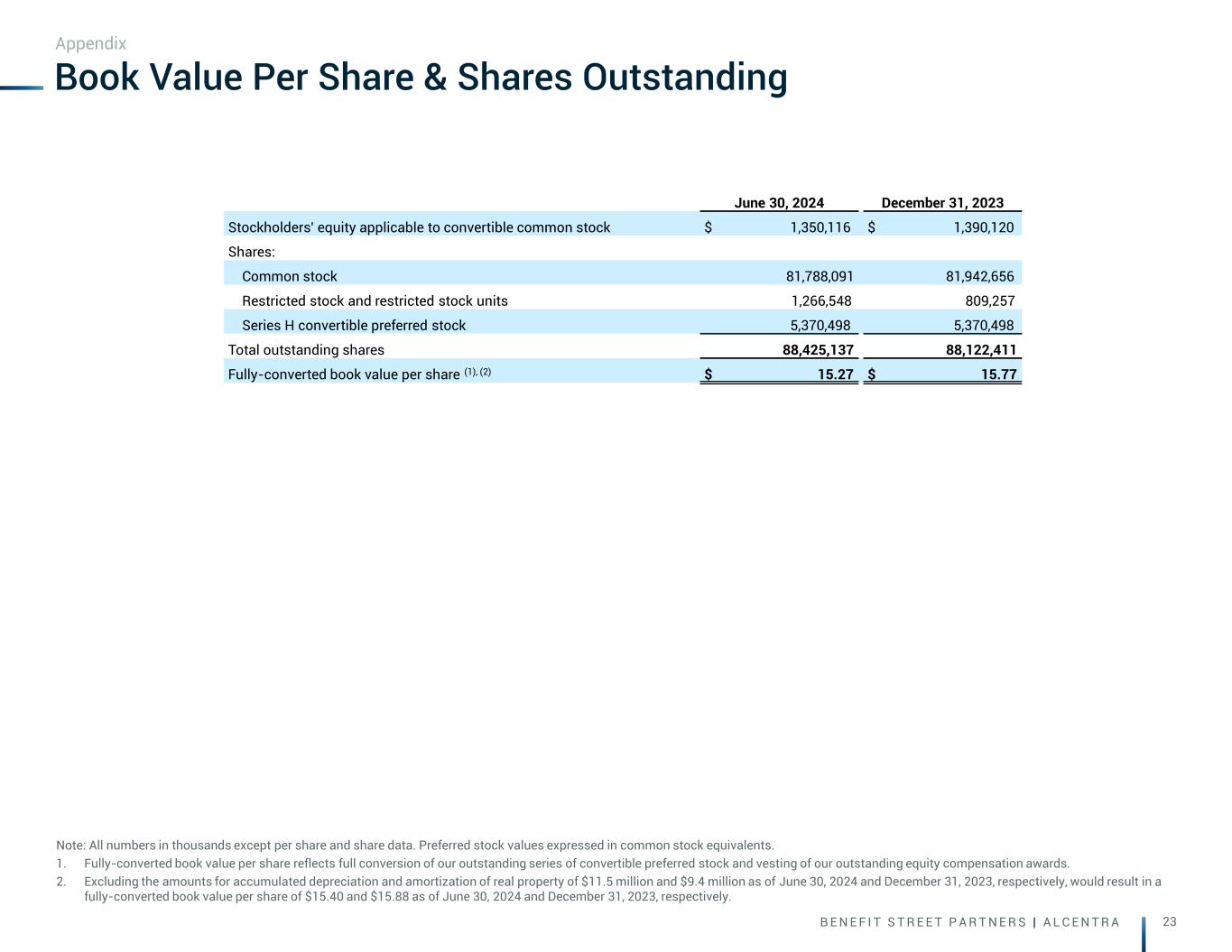

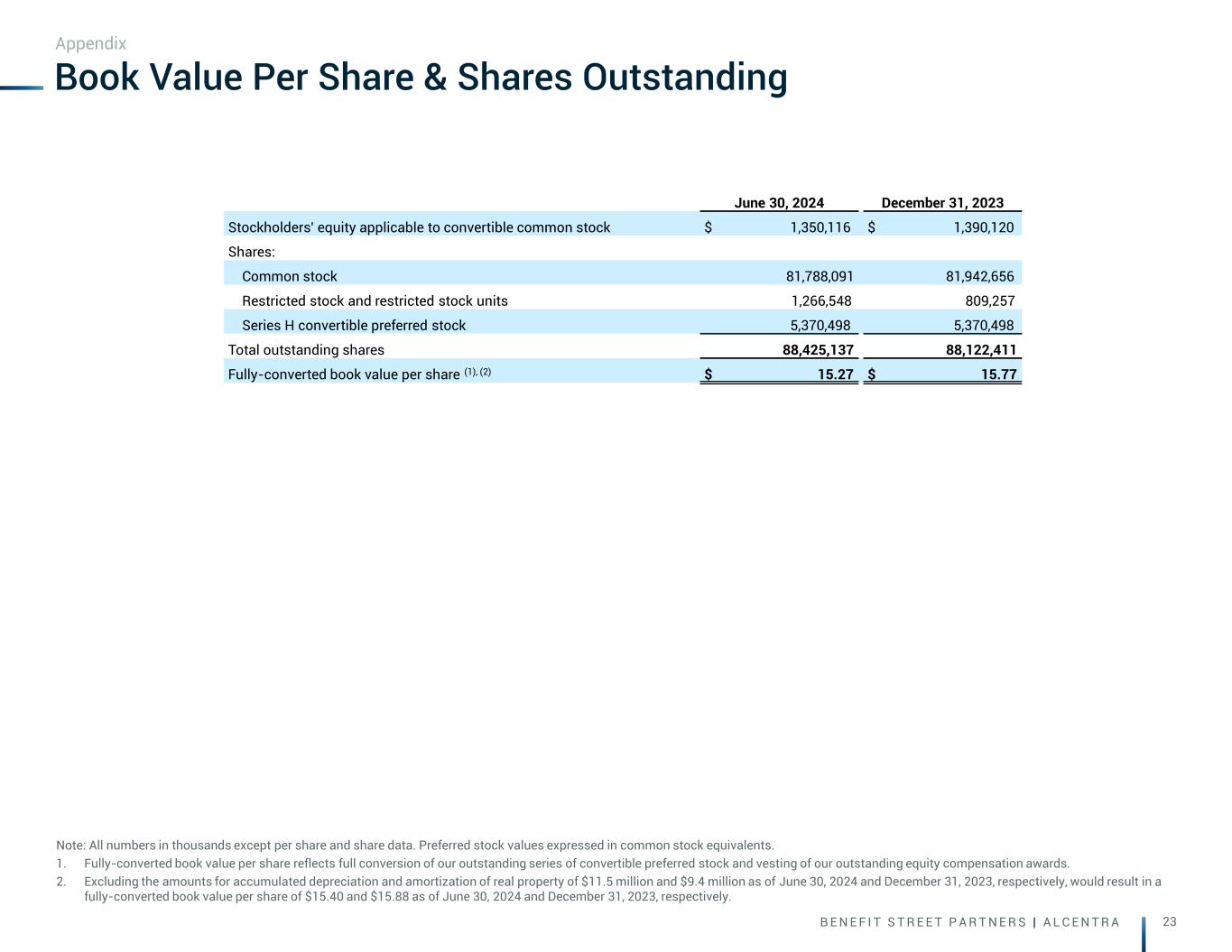

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 23 Book Value Per Share & Shares Outstanding Note: All numbers in thousands except per share and share data. Preferred stock values expressed in common stock equivalents. 1. Fully-converted book value per share reflects full conversion of our outstanding series of convertible preferred stock and vesting of our outstanding equity compensation awards. 2. Excluding the amounts for accumulated depreciation and amortization of real property of $11.5 million and $9.4 million as of June 30, 2024 and December 31, 2023, respectively, would result in a fully-converted book value per share of $15.40 and $15.88 as of June 30, 2024 and December 31, 2023, respectively. Appendix June 30, 2024 December 31, 2023 Stockholders' equity applicable to convertible common stock $ 1,350,116 $ 1,390,120 Shares: Common stock 81,788,091 81,942,656 Restricted stock and restricted stock units 1,266,548 809,257 Series H convertible preferred stock 5,370,498 5,370,498 Total outstanding shares 88,425,137 88,122,411 Fully-converted book value per share (1), (2) $ 15.27 $ 15.77

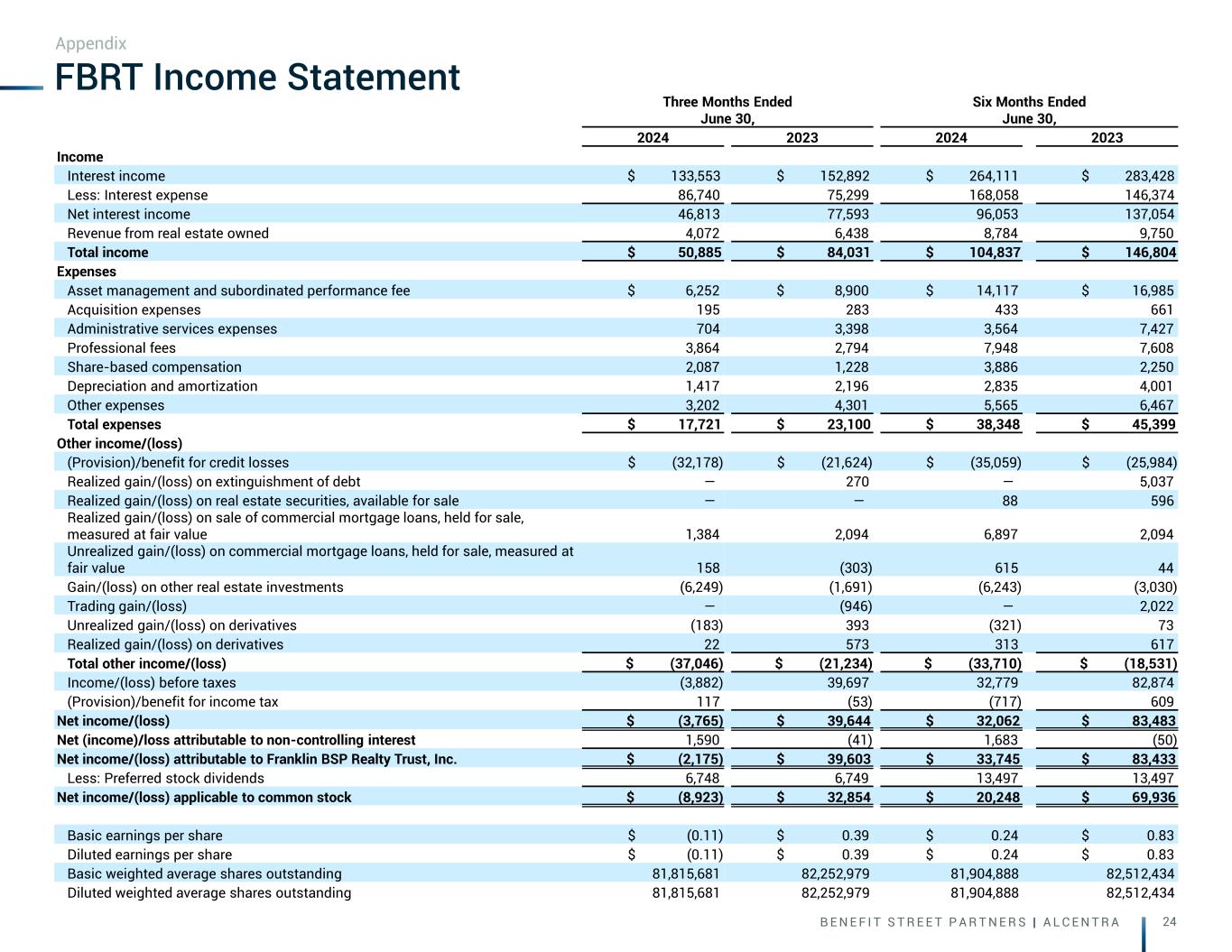

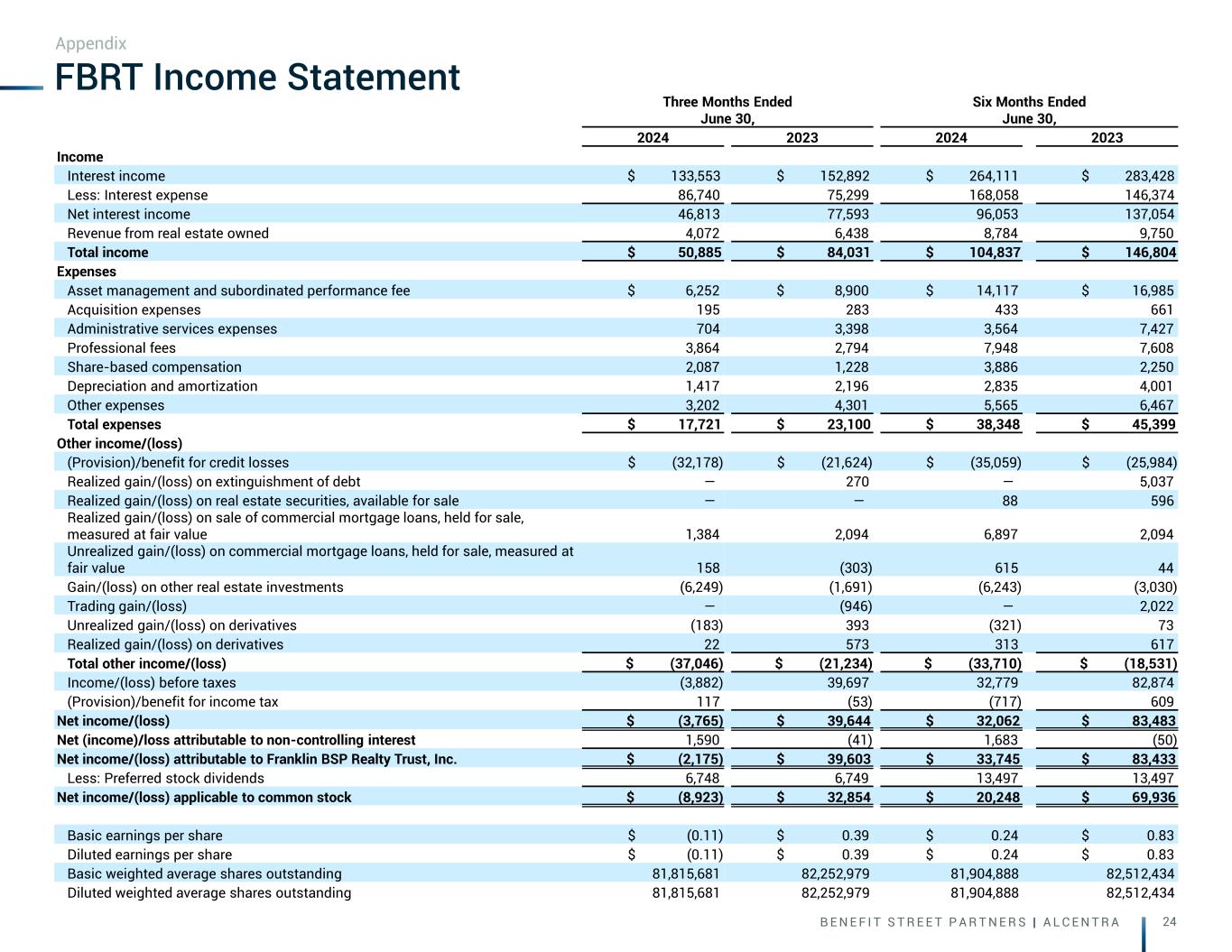

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 24 FBRT Income Statement Appendix Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Income Interest income $ 133,553 $ 152,892 $ 264,111 $ 283,428 Less: Interest expense 86,740 75,299 168,058 146,374 Net interest income 46,813 77,593 96,053 137,054 Revenue from real estate owned 4,072 6,438 8,784 9,750 Total income $ 50,885 $ 84,031 $ 104,837 $ 146,804 Expenses Asset management and subordinated performance fee $ 6,252 $ 8,900 $ 14,117 $ 16,985 Acquisition expenses 195 283 433 661 Administrative services expenses 704 3,398 3,564 7,427 Professional fees 3,864 2,794 7,948 7,608 Share-based compensation 2,087 1,228 3,886 2,250 Depreciation and amortization 1,417 2,196 2,835 4,001 Other expenses 3,202 4,301 5,565 6,467 Total expenses $ 17,721 $ 23,100 $ 38,348 $ 45,399 Other income/(loss) (Provision)/benefit for credit losses $ (32,178) $ (21,624) $ (35,059) $ (25,984) Realized gain/(loss) on extinguishment of debt — 270 — 5,037 Realized gain/(loss) on real estate securities, available for sale — — 88 596 Realized gain/(loss) on sale of commercial mortgage loans, held for sale, measured at fair value 1,384 2,094 6,897 2,094 Unrealized gain/(loss) on commercial mortgage loans, held for sale, measured at fair value 158 (303) 615 44 Gain/(loss) on other real estate investments (6,249) (1,691) (6,243) (3,030) Trading gain/(loss) — (946) — 2,022 Unrealized gain/(loss) on derivatives (183) 393 (321) 73 Realized gain/(loss) on derivatives 22 573 313 617 Total other income/(loss) $ (37,046) $ (21,234) $ (33,710) $ (18,531) Income/(loss) before taxes (3,882) 39,697 32,779 82,874 (Provision)/benefit for income tax 117 (53) (717) 609 Net income/(loss) $ (3,765) $ 39,644 $ 32,062 $ 83,483 Net (income)/loss attributable to non-controlling interest 1,590 (41) 1,683 (50) Net income/(loss) attributable to Franklin BSP Realty Trust, Inc. $ (2,175) $ 39,603 $ 33,745 $ 83,433 Less: Preferred stock dividends 6,748 6,749 13,497 13,497 Net income/(loss) applicable to common stock $ (8,923) $ 32,854 $ 20,248 $ 69,936 Basic earnings per share $ (0.11) $ 0.39 $ 0.24 $ 0.83 Diluted earnings per share $ (0.11) $ 0.39 $ 0.24 $ 0.83 Basic weighted average shares outstanding 81,815,681 82,252,979 81,904,888 82,512,434 Diluted weighted average shares outstanding 81,815,681 82,252,979 81,904,888 82,512,434

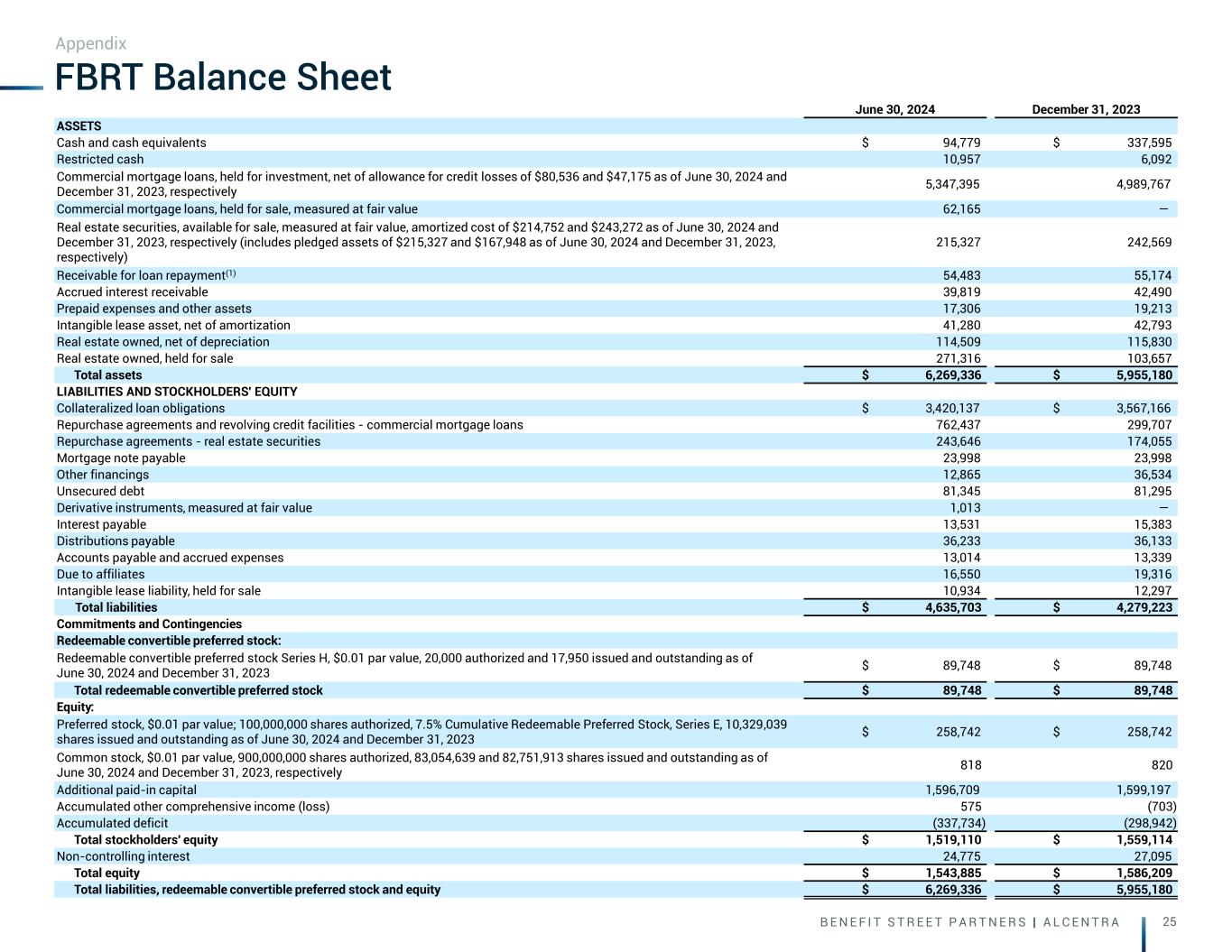

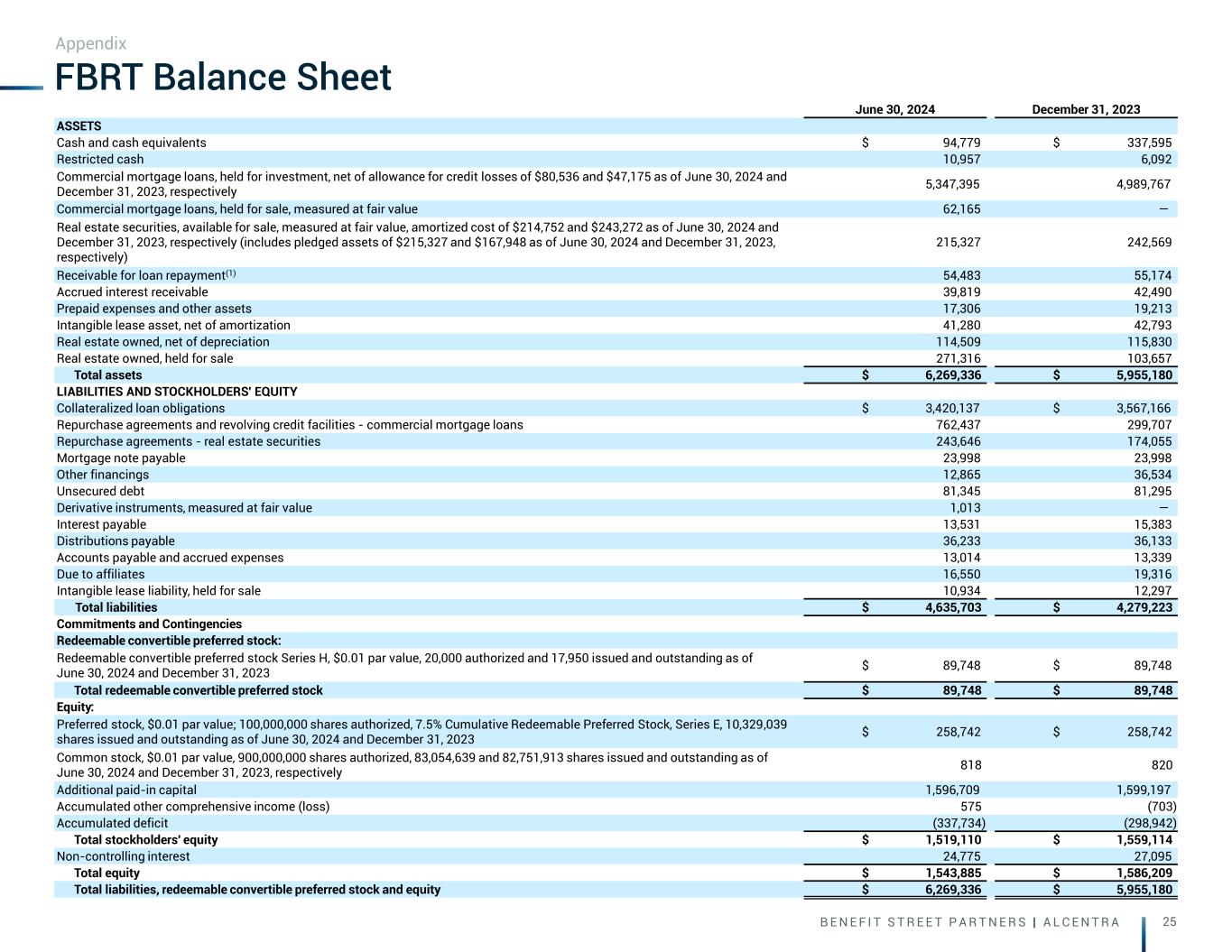

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 25 FBRT Balance Sheet Appendix June 30, 2024 December 31, 2023 ASSETS Cash and cash equivalents $ 94,779 $ 337,595 Restricted cash 10,957 6,092 Commercial mortgage loans, held for investment, net of allowance for credit losses of $80,536 and $47,175 as of June 30, 2024 and December 31, 2023, respectively 5,347,395 4,989,767 Commercial mortgage loans, held for sale, measured at fair value 62,165 — Real estate securities, available for sale, measured at fair value, amortized cost of $214,752 and $243,272 as of June 30, 2024 and December 31, 2023, respectively (includes pledged assets of $215,327 and $167,948 as of June 30, 2024 and December 31, 2023, respectively) 215,327 242,569 Receivable for loan repayment(1) 54,483 55,174 Accrued interest receivable 39,819 42,490 Prepaid expenses and other assets 17,306 19,213 Intangible lease asset, net of amortization 41,280 42,793 Real estate owned, net of depreciation 114,509 115,830 Real estate owned, held for sale 271,316 103,657 Total assets $ 6,269,336 $ 5,955,180 LIABILITIES AND STOCKHOLDERS' EQUITY Collateralized loan obligations $ 3,420,137 $ 3,567,166 Repurchase agreements and revolving credit facilities - commercial mortgage loans 762,437 299,707 Repurchase agreements - real estate securities 243,646 174,055 Mortgage note payable 23,998 23,998 Other financings 12,865 36,534 Unsecured debt 81,345 81,295 Derivative instruments, measured at fair value 1,013 — Interest payable 13,531 15,383 Distributions payable 36,233 36,133 Accounts payable and accrued expenses 13,014 13,339 Due to affiliates 16,550 19,316 Intangible lease liability, held for sale 10,934 12,297 Total liabilities $ 4,635,703 $ 4,279,223 Commitments and Contingencies Redeemable convertible preferred stock: Redeemable convertible preferred stock Series H, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of June 30, 2024 and December 31, 2023 $ 89,748 $ 89,748 Total redeemable convertible preferred stock $ 89,748 $ 89,748 Equity: Preferred stock, $0.01 par value; 100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred Stock, Series E, 10,329,039 shares issued and outstanding as of June 30, 2024 and December 31, 2023 $ 258,742 $ 258,742 Common stock, $0.01 par value, 900,000,000 shares authorized, 83,054,639 and 82,751,913 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively 818 820 Additional paid-in capital 1,596,709 1,599,197 Accumulated other comprehensive income (loss) 575 (703) Accumulated deficit (337,734) (298,942) Total stockholders' equity $ 1,519,110 $ 1,559,114 Non-controlling interest 24,775 27,095 Total equity $ 1,543,885 $ 1,586,209 Total liabilities, redeemable convertible preferred stock and equity $ 6,269,336 $ 5,955,180

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 26 Definitions Distributable Earnings and Distributable Earnings to Common Distributable Earnings is a non-GAAP measure, which the Company defines as GAAP net income (loss), adjusted for (i) non-cash CLO amortization acceleration and amortization over the expected useful life of the Company's CLOs, (ii) unrealized gains and losses on loans and derivatives, including CECL reserves and impairments, net of realized gains and losses, as described further below, (iii) non-cash equity compensation expense, (iv) depreciation and amortization, (v) subordinated performance fee accruals/(reversal), (vi) realized gains and losses on debt extinguishment and CLO calls, and (vii) certain other non-cash items. Further, Distributable Earnings to Common, a non-GAAP measure, presents Distributable Earnings net of (i) perpetual preferred stock dividend payments and (ii) non-controlling interests in joint ventures. As noted in (ii) above, we exclude unrealized gains and losses on loans and other investments, including CECL reserves and impairments, from our calculation of Distributable Earnings and include realized gains and losses. The nature of these adjustments is described more fully in the footnotes to our reconciliation tables. GAAP loan loss reserves and any property impairment losses have been excluded from Distributable Earnings consistent with other unrealized losses pursuant to our existing definition of Distributable Earnings. We expect to only recognize such potential credit or property impairment losses in Distributable Earnings if and when such amounts are deemed nonrecoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. The realized loss amount reflected in Distributable Earnings will generally equal the difference between the cash received and the Distributable Earnings basis of the asset. The timing of any such loss realization in our Distributable Earnings may differ materially from the timing of the corresponding loss reserves, charge-offs or impairments in our consolidated financial statements prepared in accordance with GAAP. The Company believes that Distributable Earnings and Distributable Earnings to Common provide meaningful information to consider in addition to the disclosed GAAP results. The Company believes Distributable Earnings and Distributable Earnings to Common are useful financial metrics for existing and potential future holders of its common stock as historically, over time, Distributable Earnings to Common has been an indicator of common dividends per share. As a REIT, the Company generally must distribute annually at least 90% of its taxable income, subject to certain adjustments, and therefore believes dividends are one of the principal reasons stockholders may invest in its common stock. Further, Distributable Earnings to Common helps investors evaluate performance excluding the effects of certain transactions and GAAP adjustments that the Company does not believe are necessarily indicative of current loan portfolio performance and the Company's operations and is one of the performance metrics the Company's board of directors considers when dividends are declared. Distributable Earnings and Distributable Earnings to Common do not represent net income (loss) and should not be considered as an alternative to GAAP net income (loss). The methodology for calculating Distributable Earnings and Distributable Earnings to Common may differ from the methodologies employed by other companies and thus may not be comparable to the Distributable Earnings reported by other companies.

www.benefitstreetpartners.com www.alcentra.com London Cannon Place 78 Cannon Street London EC4N 6HL UK New York 9 West 57th Street Suite 4920 New York NY 10019 USA West Palm Beach 360 South Rosemary Avenue Suite 1510 West Palm Beach FL 33401 USA New York 1345 Avenue of the Americas Suite 32A New York NY 10105 USA Boston 399 Boylston Street Suite 901 Boston MA 02116 USA