Filed Pursuant to Rule 433

Registration No. 333-250061

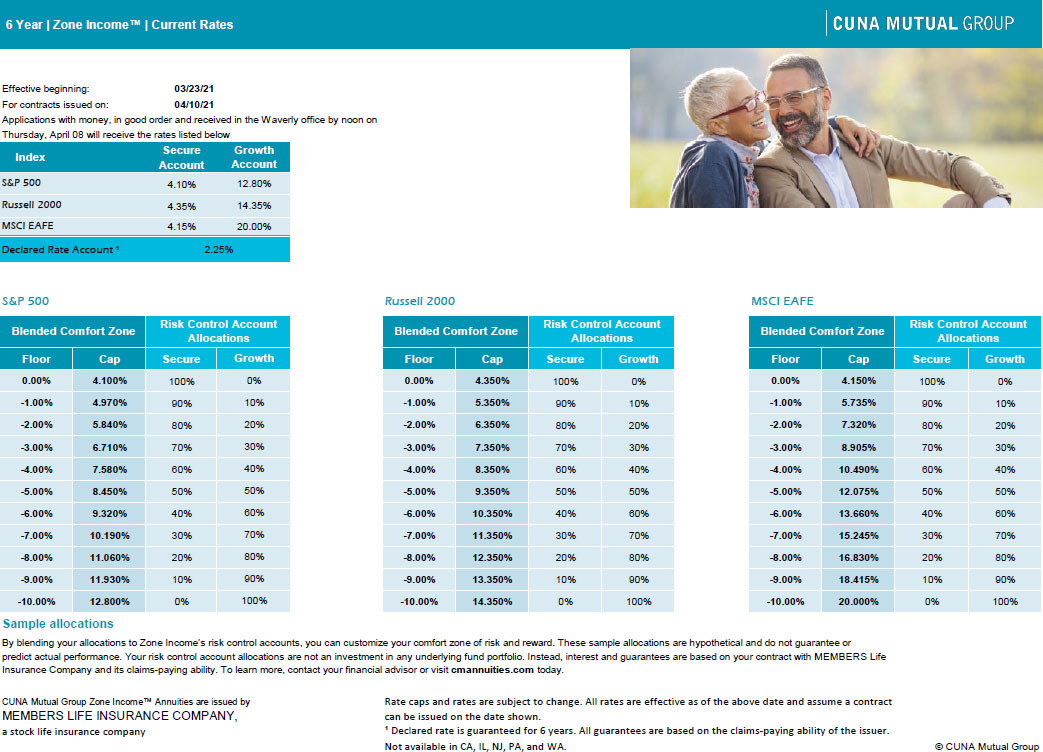

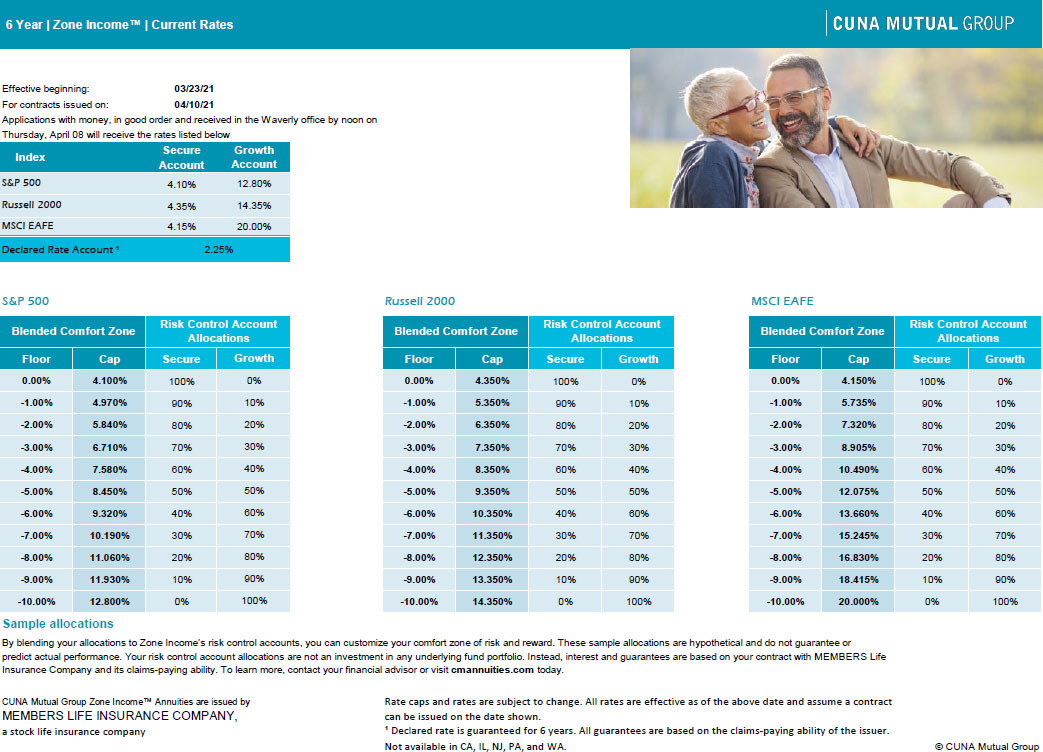

6 Year | Zone Income™ | Current Rates Effective beginning: 03/23/21 For contracts issued on: 04/10/21 Applications with money, in good order and received in the Waverly office by noon on Thursday, April 08 will receive the rates listed below Secure Growth Index Account Account S&P 500 4.10% 12.80% Russell 2000 4.35% 14.35% MSCI EAFE 4.15% 20.00% Declared Rate Account ¹ 2.25% S&P 500 Risk Control Account Blended Comfort Zone Allocations Floor Cap Secure Growth 0.00% 4.100% 100% 0% -1.00% 4.970% 90% 10% -2.00% 5.840% 80% 20% -3.00% 6.710% 70% 30% -4.00% 7.580% 60% 40% -5.00% 8.450% 50% 50% -6.00% 9.320% 40% 60% -7.00% 10.190% 30% 70% -8.00% 11.060% 20% 80% -9.00% 11.930% 10% 90% -10.00% 12.800% 0% 100% Russell 2000 Risk Control Account Blended Comfort Zone Allocations Floor Cap Secure Growth 0.00% 4.350% 100% 0% -1.00% 5.350% 90% 10% -2.00% 6.350% 80% 20% -3.00% 7.350% 70% 30% -4.00% 8.350% 60% 40% -5.00% 9.350% 50% 50% -6.00% 10.350% 40% 60% -7.00% 11.350% 30% 70% -8.00% 12.350% 20% 80% -9.00% 13.350% 10% 90% -10.00% 14.350% 0% 100% MSCI EAFE Risk Control Account Blended Comfort Zone Allocations Floor Cap Secure Growth 0.00% 4.150% 100% 0% -1.00% 5.735% 90% 10% -2.00% 7.320% 80% 20% -3.00% 8.905% 70% 30% -4.00% 10.490% 60% 40% -5.00% 12.075% 50% 50% -6.00% 13.660% 40% 60% -7.00% 15.245% 30% 70% -8.00% 16.830% 20% 80% -9.00% 18.415% 10% 90% -10.00% 20.000% 0% 100% Sample allocations By blending your allocations to Zone Income’s risk control accounts, you can customize your comfort zone of risk and reward. These sample allocations are hypothetical and do not guarantee or predict actual performance. Your risk control account allocations are not an investment in any underlying fund portfolio. Instead, interest and guarantees are based on your contract with MEMBERS Life Insurance Company and its claims-paying ability. To learn more, contact your financial advisor or visit cmannuities.com today. CUNA Mutual Group Zone Income™ Annuities are issued by Rate caps and rates are subject to change. All rates are effective as of the above date and assume a contract MEMBERS LIFE INSURANCE COMPANY, can be issued on the date shown. a stock life insurance company ¹ Declared rate is guaranteed for 6 years. All guarantees are based on the claims-paying ability of the issuer. Not available in CA, IL, NJ, PA, and WA. © CUNA Mutual Group

6 Year | Zone Income™ | Current Rates Important Disclosures Annuities are long-term insurance products designed for retirement purposes. Many registered annuities offer four main features: (1) a selection of investment options, (2) tax-deferred earnings accumulation, (3) guaranteed lifetime payout options, and (4) death benefit options. Before investing, consider the annuity’s investment objectives, risks, charges and expenses. The prospectus contains this and other information. Please read it carefully. This brochure must also be accompanied by a fact sheet for the selected initial index period. To obtain a prospectus and fact sheet, contact your advisor, log on to cmannuities.com, or call 888.888.3940. This material is informational only and is not investment advice. If you need advice regarding your financial goals and investment needs, contact a financial advisor. All guarantees are backed by the claims-paying ability of MEMBERS Life Insurance Company (MEMBERS Life) and do not extend to the performance of the underlying accounts which can fluctuate with changes in market conditions. Annuity contract values, death benefits and other values fluctuate based on the performance of the investment options and may be worth more or less than your total purchase payment when surrendered. Withdrawals may be subject to surrender charges, and may also be subject to a market value adjustment (MVA). The MVA can have a positive or negative impact on contract values, depending on how interest rates have changed since the contract was issued. Surrender charges range from 0% to 9% during the initial index period. You may not invest directly in an index. Rate caps vary by index and by risk control account and can be adjusted annually on risk control account anniversary, subject to a minimum rate cap of 1% and a bailout provision. A bailout rate is set for each risk control account. If the rate cap for a given year is declared below that rate, you may withdraw value from that risk control account without surrender charge or MVA. You’ll have 30 days after your risk control account anniversary to make this withdrawal. Withdrawals of taxable amounts are subject to ordinary income tax, and if taken before age 59½ may be subject to a 10% federal tax penalty. If you are considering purchasing an annuity as an IRA or other tax-qualified plan, you should consider benefits other than tax deferral since those plans already provide tax-deferred status. MEMBERS Life does not provide tax or legal advice. Contact a licensed professional. The CUNA Mutual Zone Income, the “Product,” has been developed solely by CUNA Mutual Group. The “Product” is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by CMFG Life Insurance Company (CMFG Life), the parent company of MEMBERS Life Insurance Company (MEMBERS Life). Standard & Poor’s,® S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by CMFG Life. This product is not sponsored, endorsed, sold or promoted by SPDJI, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in this product nor do they have any liability for any errors, omissions or interruptions of the S&P 500 Index. The S&P 500 Index does not include dividends paid by the underlying companies. This product is not sponsored, endorsed, issued, sold or promoted by MSCI, and MSCI bears no liability with respect to this product or any index on which it is based. The prospectus contains a more detailed description of the limited relationship MSCI has with CMFG Life and any related products. All rights in the Russell 2000 Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “Russell,®” “FTSE Russell,®” and “Russell 2000® Index” are trade mark(s) of the relevant LSE Group company and are used by any other LSE Group company under license. The Index is calculated by or on behalf of the LSE Group company or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the [Product][Fund]. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Product or the suitability of the Index for the purpose to which it is being put by MEMBERS Life Insurance Company. CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Annuities are issued by CMFG Life and MEMBERS Life and distributed by their affiliate, CUNA Brokerage Services, Inc., member FINRA/SIPC, a registered broker/dealer and investment advisor, 2000 Heritage Way, Waverly, IA, 50677. CMFG Life and MEMBERS Life are stock insurance companies. MEMBERS® is a registered trademark of CMFG Life. Investment and insurance products are not federally insured, may involve investment risk, may lose value and are not obligations of or guaranteed by any depository or lending institution. All contracts and forms may vary by state, and may not be available in all states or through all broker/dealers. Base policy forms 2018-RILA and 2018-RILA(ID). Not a deposit • Not guaranteed by any bank or credit union • May lose value Not FDIC/NCUA insured • Not insured by any federal government agency ZIA-2544777.3-0321-0423 © CUNA Mutual Group