UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Liquid Holdings Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 21, 2014

Dear Stockholder:

The 2014 Annual Meeting of Stockholders of Liquid Holdings Group, Inc. will be held on Wednesday, May 21, 2014 at 10:00 a.m. New York City local time at the offices of Gibson, Dunn & Crutcher LLP located at 200 Park Avenue, 46th Floor, New York, NY 10166. Whether or not you plan to attend the annual meeting, we encourage you to vote as soon as possible by mailing a completed proxy card. Details regarding admission to the meeting and the business to be conducted are described in the accompanying Notice of 2014 Annual Meeting and Proxy Statement. Also provided is a copy of our 2013 Annual Report on Form 10-K.

As we prepare for our first annual meeting as a public company, we wanted to provide a brief update on our progress to date. 2013 can best be described as a year of base building. We recruited top-level talent to round out the management team, launched our products proactively in the second quarter, and completed our initial public offering in July. We built out our sales, marketing and client-services teams and added critical development talent. We expanded internationally through our first channel partner, Global Prime Partners. And most importantly, we introduced substantial functional enhancements to our software, something that we expect to continue.

We ended 2013 with 77 clients under contract and a developing pipeline of new business as we headed into 2014. Growing our client base and adding key strategic partnerships will remain an important focus throughout this year, as will the move of our platform to a more robust technology framework with MongoDB. Moreover, we intend to launch our newest initiative, “Liquid Mobile,” which will optimize our platform for use on mobile devices. We look forward to discussing these objectives with you when we meet in May.

Thank you for your ongoing support of Liquid. We look forward to seeing you at the meeting.

Very truly yours,

|  |

Victor R. Simone, Jr. Chairman of the Board | Brian M. Storms Chief Executive Officer and Director |

| Liquid Holdings Group, Inc. | 800 Third Avenue, 38th Floor, NY, NY, 10022 | 212.293.1836 |

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF LIQUID HOLDINGS GROUP, INC.:

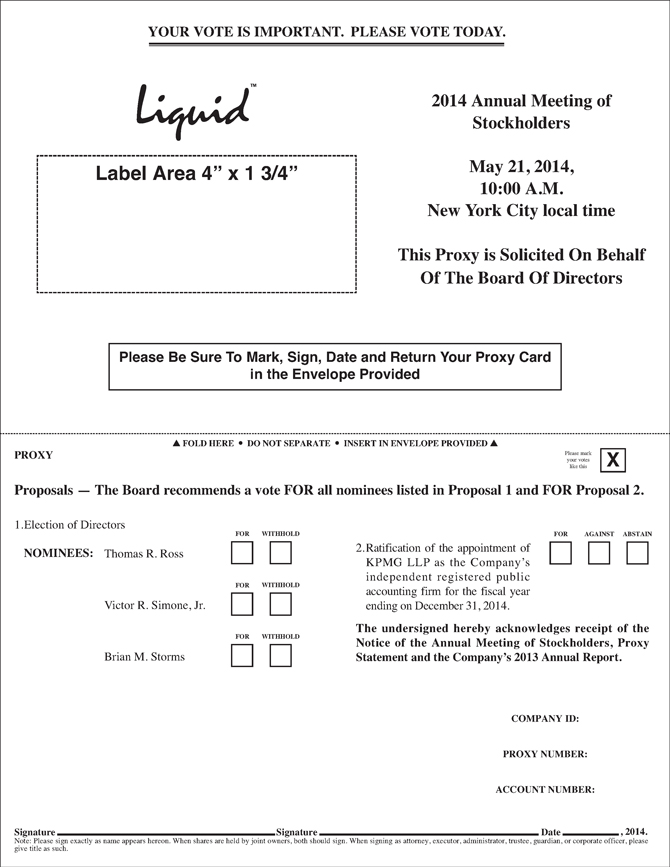

NOTICE IS HEREBY GIVEN that the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Liquid Holdings Group, Inc., a Delaware corporation, will be held on Wednesday, May 21, 2014 at 10:00 a.m., New York City local time, at the offices of Gibson, Dunn & Crutcher LLP, 200 Park Avenue, 46th Floor, New York, NY 10166, for the following purposes:

| | 1. | To elect as Class I directors the three nominees named in the proxy statement, each to serve a three-year term, and until their successors are duly elected and qualified, subject to earlier resignation or removal; |

| | | |

| | 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| | | |

| | 3. | To transact such other business as may properly come before the Annual Meeting or at any and all adjournments or postponements thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. We are not aware of any other business to come before the Annual Meeting.

Only stockholders of record at the close of business on April 1, 2014 are entitled to notice of, and to vote at, the Annual Meeting and any and all adjournments or postponements thereof.

By Order of the Board of Directors

Jose Ibietatorremendia

General Counsel & Secretary

New York, NY

April 21, 2014

ALL STOCKHOLDERS ARE INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THE PURPOSE OF RETURNING YOUR PROXY CARD. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A LEGAL PROXY ISSUED IN YOUR NAME.

| Liquid Holdings Group, Inc. | 800 Third Avenue, 38th Floor, NY, NY, 10022 | 212.293.1836 |

PROXY STATEMENT FOR 2014 ANNUAL MEETING OF STOCKHOLDERS

ABOUT THE ANNUAL MEETING

Who is soliciting my vote?

The Board of Directors of Liquid Holdings Group, Inc. (the “Board”) is soliciting your vote at the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Liquid Holdings Group, Inc. (“Liquid” or the “Company”).

When and where will the Annual Meeting take place?

The Annual Meeting will take place on Wednesday, May 21, 2014 at 10:00 a.m., New York City local time, at the offices of the Company’s outside counsel, Gibson, Dunn & Crutcher LLP, located at 200 Park Avenue, 46th Floor, New York, NY 10166.

What will I be voting on?

You will be voting on:

| | 1. | the election as Class I directors of three nominees, Victor R. Simone, Jr., Brian M. Storms and Thomas R. Ross, each to serve a three-year term, and until their successors are duly elected and qualified, subject to earlier resignation or removal; |

| | | |

| | 2. | the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| | | |

| | 3. | any such other business as may properly come before the Annual Meeting or at any and all adjournments, continuations or postponements thereof. |

An agenda and rules of procedure will be distributed at the Annual Meeting.

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| | • | | “FOR” each of Thomas R. Ross, Victor R. Simone, Jr. and Brian M. Storms; and |

| | | | |

| | • | | “FOR” ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

How many votes do I have?

You will have one vote for every share of Liquid common stock you owned as of April 1, 2014, our record date.

How do I vote?

You can vote either in person at the Annual Meeting or by proxy whether or not you attend the Annual Meeting.

To vote by proxy, you must fill out the enclosed proxy card, date and sign it, and return it in the enclosed postage-prepaid envelope.

If you want to vote in person at the Annual Meeting, and you hold your Liquid common stock through a brokerage firm, bank, broker-dealer, trust or other similar organization (that is, in street name), you must obtain a proxy from your broker and bring that proxy to the Annual Meeting.

Do I need a ticket to attend the Annual Meeting?

No, a stockholder planning to attend the Annual Meeting only need bring proof of their ownership of shares of the Company’s common stock as of April 1, 2014 (such as a copy of a brokerage statement or a DRS statement) and proof of identity for entrance to the Annual Meeting. When you arrive at the Annual Meeting, you may be asked to present photo identification, such as a driver’s license or passport.

PROCEDURAL MATTERS

General

This Proxy Statement is being provided to stockholders of Liquid Holdings Group, Inc., a Delaware corporation (“Liquid,” the “Company,” “we,” “us,” or “our”), in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at our 2014 Annual Meeting of Stockholders (the “Annual Meeting”), to be held on Wednesday, May 21, 2014 at 10:00 a.m., New York City local time, and any adjournment or postponement thereof. Our Annual Meeting will be held at the offices of Gibson, Dunn & Crutcher LLP, 200 Park Avenue, 46th Floor, New York, NY 10166. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, or “fiscal 2013,” including our financial statements for fiscal 2013, is also enclosed. These proxy materials are first being mailed to stockholders on or about April 21, 2014.

Stockholders Entitled to Vote; Record Date

As of the close of business on April 1, 2014, the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting, there were issued and outstanding 24,771,828 shares of the Company’s common stock, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of common stock held by such stockholder. No shares of preferred stock of the Company were outstanding as of April 21, 2014.

Quorum; Voting Standard; Abstentions; Broker Non-Votes

The Company’s Bylaws provide that the holders of a majority in voting power of all issued and outstanding stock entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Shares that are voted “withhold” or “abstain” and broker non-votes (as defined below) are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting.

Directors are elected by a plurality of votes cast, which means that the three nominees who receive the most votes will be elected as directors. In Proposal 1, the election of directors, you may vote “for” a nominee or you may “withhold” your vote from that nominee. Votes that are withheld will not impact the election of that nominee (though pursuant to our Principles of Corporate Governance, in any uncontested election for directors, any nominee who receives more votes withheld from his or her election than votes for such election will promptly tender his or her resignation for the further consideration by the Board and its nominating and governance committee).

In Proposal 2, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 requires the affirmative vote of the holders of a majority in voting power of the shares of stock entitled to vote at the Annual Meeting, present in person or represented by proxy. With respect to this proposal, an “abstain” vote has the same effect as a vote “against” the proposal.

If you hold your common stock through a broker, the broker may be prevented from voting shares held in your brokerage account (a “broker non-vote”) unless you have given the broker specific voting instructions. Your broker has discretion to vote without your instructions on routine matters, such as Proposal 2, the ratification of the appointment of the Company’s independent registered public accounting firm. However, without your instructions your broker may not vote your shares on non-routine matters, such as Proposal 1, the election of directors. Accordingly, if you do not instruct your broker how to vote on Proposal 1, no votes will be cast on your behalf with respect to this proposal, resulting in a broker non-vote, which has no effect on the outcome. If you hold your common stock through a broker, it is critical that you instruct your broker on how to cast your vote if you want it to count.

Voting; Revocability of Proxies

Voting by attending the meeting.Stockholders whose shares are registered in their own names may vote their shares in person at the Annual Meeting. Stockholders whose shares are held beneficially through a brokerage firm, bank, broker-dealer, trust or other similar organization (that is, in street name) may be voted in person at the Annual Meeting only if such stockholders obtain a legal proxy from the broker, bank, trustee or nominee that holds their shares giving the stockholders the right to vote the shares and bring that proxy to the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions so that your vote will be counted if you later decide not to attend the Annual Meeting. A stockholder planning to attend the Annual Meeting must bring proof of ownership (such as a brokerage statement or DRS statement) and proof of identity for entrance to the Annual Meeting. In addition, when you arrive at the Annual Meeting, you may be asked to present photo identification, such as a driver’s license or passport, in order to enter the building where the meeting is being held.

Voting of proxies; Discretionary Voting.Stockholders may vote by returning a proxy card. If you wish to vote by proxy, please complete, sign and return the proxy card in the self-addressed, postage-prepaid envelope provided. All shares entitled to vote and represented by properly executed proxy cards received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxy cards. If you do not provide specific voting instructions on a properly executed proxy card, your shares will be voted as recommended by the Board of Directors.

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the Annual Meeting.

Effect of not casting your vote.If you hold your shares in street name it is critical that you cast your vote if you want it to count in the election of directors (Proposal 1 of this Proxy Statement). Your bank or broker will have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 2 of this Proxy Statement).

If you are a stockholder of record, it is also critical that you cast your vote. If you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

Revocability of proxy.You may revoke your proxy by (1) filing with the Secretary of the Company, at or before the taking of the vote at the Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy card relating to the same shares, or (2) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or should be sent to the Company’s principal executive offices, Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attention: Corporate Secretary.

If a broker, bank or other nominee holds your shares, you must contact them in order to find out how to change your vote.

Expenses of Solicitation

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any additional solicitation materials furnished to stockholders. In addition, the Company may arrange with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the stock held of record by such persons, and the Company will reimburse them for their reasonable, out-of-pocket expenses. The Company may use the services of the Company’s directors, officers and others to solicit proxies, personally or by telephone, without additional compensation.

Procedure for Submitting Stockholder Proposals

Any stockholder proposal intended to be included in the Company’s proxy statement for the 2015 annual meeting of stockholders of the Company must satisfy Securities and Exchange Commission, or SEC, regulations under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and be received by the Secretary of the Company at our principal executive offices, Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attention: Corporate Secretary, not later than the close of business on December 22, 2014.

Under the Company’s Bylaws, all proposals of stockholders intended to be presented at the 2015 annual meeting of stockholders of the Company, other than proposals intended for inclusion in the Company’s proxy statement pursuant to Rule 14a-8, must satisfy the requirements set forth in the advance notice of stockholder business provision under the Company’s Bylaws. Pursuant to the Bylaws, in order for stockholder business to be properly brought before a meeting by a stockholder, such stockholder must have given timely notice thereof in proper written form to the Secretary of the Company at the Company’s principal executive offices, Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attention: Corporate Secretary.

To be timely, a stockholder’s notice must be delivered to the Company’s principal executive offices not later than the close of business on the 90th day nor earlier than the close of business on the 120th day before the first anniversary of the preceding year’s annual meeting. However, if no annual meeting was held in the previous year or if the date of the annual meeting is advanced by more than 30 days prior to or delayed by more than 70 days after the one-year anniversary of the date of the previous year’s annual meeting, then notice must be delivered (a) not earlier than the close of business on the 120th day prior to such annual meeting and (b) not later than the close of business on the later of (i) the 90th day prior to such annual meeting or (ii) the tenth day following the day on which public announcement of the date of such annual meeting is first made. Stockholder proposals to be presented at the 2015 annual meeting of stockholders must be received by the Secretary of the Company at the Company’s principal executive offices not earlier than the close of business on January 21, 2015 nor later than the close of business on February 20, 2015.

The chairman of the meeting may refuse to acknowledge or introduce any such matter if notice of the matter is not received within the applicable deadlines or does not comply with the Company’s Bylaws. If a stockholder does not meet these deadlines, or does not satisfy the requirements of Rule 14a-4 of the Exchange Act, the persons named as proxies will be allowed to use their discretionary voting authority when and if the matter is raised at the meeting. You may contact the Company’s Secretary at our principal executive offices, at the address indicated above, for a copy of our current Bylaws, including the relevant provisions regarding the requirements for making stockholder proposals and nominating director candidates.

Delivery of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders, unless the Company has received contrary instructions from one or more of the stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement and annual report. The Company will deliver promptly, upon written or oral request, a separate copy of the proxy statement and annual report to a stockholder at a shared address to which a single copy of the documents was delivered. If your proxy statement is being householded and you would like to receive separate copies now or in the future, or if you are receiving multiple copies and would like to receive a single copy, please contact us at (212) 293-1836, via our website at http://ir.liquidholdings.com/contactus.cfm, or in writing to Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attn: Corporate Secretary.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2014

The Notice and Proxy Statement and Annual Report are available on the web at http://www.cstproxy.com/liquidholdings/2014. In addition, you may obtain a copy of our Annual Report, including the financial statements and financial statement schedules, without charge by sending a written request to Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attn: Corporate Secretary.

DIRECTORS AND CORPORATE GOVERNANCE

Our Board of Directors consists of nine directors, including our Chief Executive Officer. Our certificate of incorporation provides that our Board of Directors consists of such number of directors as is determined from time to time by resolution adopted by a majority of the directors then in office, with any additional directorships resulting from an increase in the authorized number of directors or other vacancies filled by the directors then in office. Until the resignation of Mr. Richard Schaeffer from the Board in December 2013, the Board had consisted of eleven directors. Subsequent to Mr. Schaeffer’s resignation, the nominating and governance committee of the Board recommended that the size of the Board be reduced to ten, a recommendation that the full Board adopted.

Mr. Brian Ferdinand resigned as Vice Chairman of the Board and our Head of Corporate Strategy on April 18, 2014, but will remain a strategic advisor to the Company. The Board, acting on the recommendation of the nominating and governance committee, expects to conduct a search for an individual with a strong software technology background to fill the board vacancy.

Our Board of Directors is divided into three classes, with each director serving a three-year term, and one class being elected at each year’s annual meeting of stockholders. Messrs. Ross, Simone and Storms are Class I directors with an initial term expiring in 2014 and are standing for re-election at this Annual Meeting.Please see Proposal 1 in this Proxy Statement for more information about the election of our Class I directors.Any change in the number of directorships resulting from an increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. The division of our Board of Directors into three classes with staggered three-year terms may have the effect of delaying, deterring or preventing a change of our management or a change in control of us.

The names and certain information about members of our Board of Directors as of April 21, 2014 are set forth below. There are no family relationships among any of our directors or executive officers.

| Name | | Age | | Position(s) Held | | Director Since | | Class and Year in Which Term Will Expire |

| Victor R. Simone, Jr. | | 59 | | Chairman | | 2013 | | Class I, 2014 |

| | | | | | | | | |

| Brian M. Storms | | 59 | | Director and Chief Executive Officer | | 2012 | | Class I, 2014 |

| | | | | | | | | |

| Jay Bernstein | | 65 | | Director | | 2012 | | Class II, 2015 |

| | | | | | | | | |

| Darren Davy | | 47 | | Director | | 2012 | | Class III, 2016 |

| | | | | | | | | |

| David Francescani | | 71 | | Director | | 2012 | | Class II, 2015 |

| | | | | | | | | |

| Walter Raquet | | 69 | | Director | | 2013 | | Class III, 2016 |

| | | | | | | | | |

| Thomas R. Ross | | 57 | | Director | | 2012 | | Class I, 2014 |

| | | | | | | | | |

| Dennis Suskind | | 71 | | Director | | 2012 | | Class III, 2016 |

| | | | | | | | | |

| Allan Zavarro | | 68 | | Director | | 2013 | | Class II, 2015 |

Class I Directors Nominated for Election at the Annual Meeting

Thomas R. Rosshas served as a director of our company since November 2012. Mr. Ross is an energy trading professional and the former head of trading at BP North America. With over 30 years of experience in trading and risk management, his career spans London, New York and Chicago. Since 2009, Mr. Ross has been the owner of Carradale Partners LLC, an energy consulting firm. From 2006 to 2009, Mr. Ross oversaw BP’s North American crude and product trading operations, including offices in Calgary, Long Beach, Houston and Chicago with activities in exploration and production, refining and entrepreneurial trading in North and South America. He has been a member of the ICE Board of Directors and an active member of the NYMEX advisory committee.

Mr. Ross was selected to serve on our Board of Directors because he brings more than 30 years of background in trading and risk management.

Brian M. Stormshas served as Chief Executive Officer of our company since December 2012, as a director of our company since November 2012 and as Chairman of the Board from July 2013 until December 2013. He was previously Chairman and Chief Executive Officer of NYSE Blue, a global exchange company focused on environmental and sustainable energy markets that formed through the 2011 merger of APX, Inc., or APX, and BlueNext, S.A. Prior to the merger, since 2007 Mr. Storms was the Chairman and Chief Executive Officer of APX, a provider of market infrastructure for the environmental and energy markets. Mr. Storms has served on the board of directors of APX since 2007. Mr. Storms is the former Chairman and Chief Executive Officer of Marsh Inc., Mercer Human Resource Consulting S.A., and UBS Global Asset Management (Americas) Inc. Mr. Storms has previously held positions including President and Chief Operating Officer of Mitchell Hutchins Asset Management Inc.; President of the Prudential Investments mutual fund and annuity complex; Managing Director of the International Retirement Group of Fidelity Investments Institutional Services Company, Inc., or Fidelity; Senior Vice President and Director of Fidelity’s Banking Division; Chief Executive Officer and President of Financial Services Advisors, Inc., a subsidiary of J.K. Schofield & Co.; and Senior Vice President for IFSA Corporation. Mr. Storms received his bachelor’s degree from the State University of New York at Stony Brook.

Mr. Storms was selected to serve on our Board of Directors due to his extensive experience in the financial services industry and in the development and implementation of companies’ growth strategies.

Victor R. Simone, Jr.has served as a director of our company since March 2013 and as Chairman of the Board since December 2013. From 2006 until his retirement in 2009, Mr. Simone served as Global Head of the Principal Strategic Investments Group at Goldman Sachs Group, Inc., an investment banking firm. During his tenure at Goldman Sachs, Mr. Simone led the firm’s Global eBusiness Group, its Institutional Client Services Group, its Private Client Services Fixed Income Group, and also served as Chairman of the firm’s Innovation Committee and the Fixed Income Industry Groups. He joined Goldman Sachs in 1981 after working in the corporate banking department of the Chase Bank, and he was named a managing director at Goldman Sachs in 1997. He has served as chairman of the Boards of a number of financial technology companies, including Tradeweb Markets LLC, as well as in a variety of other board positions. He served as a director of Interactive Data Corporation from 2009 to 2010, served on the GETCO Advisory Board from 2010 to 2011, and served as a senior industry executive of Welsh, Carson, Anderson & Stowe from 2011 to 2012. He is currently a director of the Boston College Wall Street Executive Council, the Boston College Financial Advisory Board and the New York Fellowship. Mr. Simone received his bachelor’s degree from Boston College and his Masters of Business Administration from New York University.

Mr. Simone was selected to serve on our Board of Directors due to his extensive capital markets experience as a result of nearly three decades of senior management roles at Goldman Sachs.

Other Members of the Board of Directors

Jay Bernsteinhas served as a director of our company since November 2012. Since 1988, Mr. Bernstein has been Chairman and Chief Executive Officer of NIC Holding Corp, a privately owned company principally engaged in the business of trading petroleum on futures exchanges and spot markets in the Atlantic basin. He has also served as the President of Petroterminal de Panama S.A., a private company in Panama City, Panama. Mr. Bernstein is a member of the Chairman’s Council for the Long Island Philharmonic and the National Council for the Aspen Art Museum. He is a board member of Island Harvest and the Israel Museum in Jerusalem and serves on the Board of Trustees of the Washington Institute for Near East Policy. He received his bachelor’s degree from the University of Pennsylvania and graduate degrees from the American University Washington College of Law and Harvard Law School.

Mr. Bernstein was selected to serve on our Board of Directors due to his extensive experience and knowledge of futures trading and his extensive investment career.

Darren Davyhas served as a director of our company since November 2012. Mr. Davy is a founding partner of Davy Capital Management LLC, a registered investment advisory firm, a position he has held since 2009. Mr. Davy has over twenty-six years of experience as a trader and hedge fund manager. Having managed capital for Soros Fund Management, Brevan Howard Asset Management and Omega Advisors, Mr. Davy has extensive experience trading a broad range of financial instruments: fixed income, foreign exchange, commodities, options and futures. In addition to his skills as an investor, Mr. Davy has expertise in designing and building out risk management and risk analytic systems. Managing risk using many of his own proprietary tools and models has been an integral part of Mr. Davy’s success in preserving capital during periods of market turbulence. Mr. Davy began his investment career in January 1987 as a proprietary trader with Gerrard National Holdings in London, gained further experience in arbitrage trading at BNP Capital Markets in London, and went on to join Ross Capital in the early 1990s.

Mr. Davy was selected to serve on our Board of Directors due to his extensive investment career and demonstrated experience making investments in financial services companies.

David Francescanihas served as a director of our company since November 2012. As of the beginning of 2014, Mr. Francescani is Counsel to the New York office of Fish & Richardson, a leading intellectual property law firm in the U.S. Prior to that he was a principal at the firm, serving as Managing Principal of the New York office from 2004 to 2012 and on the firm’s Compe3nsation Committee from 2002 to 2006. Mr. Francescani joined Fish & Richardson in 2001. Prior to that, he was a partner at Darby & Darby, another intellectual property law firm, from 1969 to 1986 and 1992 to 1998. From 1986 to 1992, Mr. Francescani was General Counsel and an Executive Vice President at J.J. Kenny Co., Inc., a financial services company specializing in municipal bonds. His legal practice involves intellectual property litigation in the fields of computers, software, telecommunications, financial exchanges and proprietary trading systems. He has practiced in the field of intellectual property law for over 45 years and is registered to practice before the U.S. Patent and Trademark Office. Mr. Francescani received his bachelor’s degree from the University of Notre Dame and his law degree from the Notre Dame School of Law.

Mr. Francescani was selected to serve on our Board of Directors due to his extensive experience and knowledge of intellectual property law.

Walter Raquethas served as a director of our company since May 2013. Mr. Raquet is currently Chairman of Bolton LLC, an investment management company, which position he has held since 2012. Since 2012 he has served on the board of directors of Green Earth Technologies, Inc. From 2004 to 2011 he was Chairman of WR Platform Advisors LP, a technology platform and service provider of managed accounts for hedge fund investments. Mr. Raquet was a co-founder of Knight Capital Group, Inc., or Knight, where he served as Chief Operating Officer from its inception in 1995 until 2000 and as its Executive Vice President from 1998 through 2002. During that period he also served as a member of Knight’s board of directors. Prior to 2002, Mr. Raquet was a Senior Vice President with Spear, Leeds & Kellogg L.P./Troster Singer Corporation and a Partner at Herzog Heine & Geduld, LLC, where he directed the firm’s technology and marketing efforts. Mr. Raquet has also served previously as Corporate Controller for PaineWebber Group Inc., Executive Vice President of Cantor Fitzgerald, L.P. and Controller for Weeden & Co. L.P. Mr. Raquet is a certified public accountant and practiced at the accounting firm of PriceWaterhouseCoopers LLP. Mr. Raquet received his bachelor’s degree in accounting from New York University.

Mr. Raquet was selected to serve on our Board of Directors due to his extensive background and experience in the financial services industry and with corporate finance matters.

Dennis Suskindhas served as a director of our company since November 2012. Mr. Suskind held the title of general partner of Goldman Sachs until his retirement in 1991. Mr. Suskind currently serves on the board of the Chicago Mercantile Exchange, a position he has held since 2008. He also serves on the board of the Bridgehampton National Bank, where he is Vice Chairman, and as a trustee of the Marymount School in New York City. Mr. Suskind was among those elected as an inaugural member to the Futures Industry Association’s Hall of Fame in 2005. He previously served as Vice Chairman of NYMEX, Vice Chairman of COMEX, a member of the board of directors the Futures Industry Association, and a member of the board of International Precious Metals Institute. Mr. Suskind was President of the board of directors of the Arthur Ashe Institute for Urban Health at its inception and has served as a Member of the President’s Council of the Peconic Land Trust, President of Brown University’s Parents’ Council, Founding Member of Mt. Sinai’s Hospital Associates, the board of directors of the Nature Conservancy, and as a board member of the Collegiate School. From 2001 to 2004, Mr. Suskind held a Town Council seat in the Town of Southampton, New York. The Preservation League of New York State presented Mr. Suskind with its 2005 Pillar of New York Award.

Mr. Suskind was selected to serve on our Board of Directors due to his extensive knowledge of the industry and his significant corporate governance experience as a result of his service on the Board of Directors of numerous mercantile exchanges and industry groups.

Allan Zavarrohas served as a director of our company since March 2013. Mr. Zavarro is currently the president of A. Zavarro and Co. Inc., a provider of merger and acquisition consulting services for companies involved in the exchange clearing space, a position he has held since 2006. From 1997 to 2006 he was Chief Executive Officer of the Global Futures business at ABN AMRO. From 1992 until joining ABN AMRO, Mr. Zavarro worked for Citicorp as President and Chief Executive Officer of Citicorp Futures Corporation. Mr. Zavarro served as Account Executive, Branch Manager, Marketing Manager and Chief Executive of Merrill Lynch’s wholesale securities business, Broadcort Capital Corp., and Chief Executive of Merrill Lynch Futures Inc. He has previously served on the boards of Merrill Lynch Futures Inc., Broadcort Capital Corp., Citicorp Futures Corp., Citicorp Commodities Corp., Citicorp Global Asset Management, CM Capital Markets and the Futures Industry Association and has been a member of the NYSE, Chicago Mercantile Exchange, Chicago Board of Trade, and the NYMEX. Mr. Zavarro attended Southern Illinois University and the New York Institute of Finance and completed the Merrill Lynch Advanced Management Program in 1988.

Mr. Zavarro was selected to serve on our Board of Directors due to his extensive knowledge of the futures trading industry and his significant corporate governance experience due to service on many boards of directors.

Board Meetings

During fiscal 2013, our Board of Directors held six meetings and each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by the committees of the Board on which such director served (held during the period that he or she served). Directors are also expected to attend annual meetings of the stockholders of Liquid Holdings Group absent unusual circumstances. We did not hold an Annual Meeting of Stockholders in fiscal 2013.

The independent members of the Board of Directors also meet in regularly scheduled executive sessions without management present at least quarterly.

Director Independence

Our Board of Directors has determined that Messrs. Bernstein, Davy, Francescani, Raquet, Ross, Simone, Suskind and Zavarro are ‘‘independent’’ under the standards of The NASDAQ Global Market.

Corporate Governance and Committees of the Board of Directors

We and our Board of Directors regularly review and evaluate our corporate governance practices. The Board has adopted Principles of Corporate Governance that address the composition of and policies applicable to the Board of Directors. The Principles are available on our website at http://ir.liquidholdings.com/governance.cfm.

Our Board of Directors has established standing executive, audit, human resources and compensation, and nominating and governance committees. The composition, duties and responsibilities of these committees are set forth below.Copies of the charters of these committees are available on our website at http://ir.liquidholdings.com/governance.cfm.

Executive Committee

Our Board of Directors has established an executive committee which is responsible for exercising all of the powers of our Board during intervals between meetings, except for those powers delegated to other Board committees and powers that may not be delegated to a committee of our Board under Delaware law, NASDAQ rules and regulations, or our Certificate of Incorporation or Bylaws.

Our executive committee consists of Messrs. Ross, Simone and Storms, with Mr. Storms serving as chairman. Our executive committee did not meet in 2013.

Audit Committee

Our Board of Directors has established an audit committee which is responsible for, among other matters: (1) appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; (2) discussing with our independent registered public accounting firm their independence from us; (3) reviewing with our independent registered public accounting firm the matters required to be reviewed by applicable auditing requirements; (4) approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; (5) overseeing the accounting and financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; (6) reviewing and monitoring our internal controls, disclosure controls and procedures and compliance with legal and regulatory requirements; (7) reviewing and discussing our practices with respect to risk assessment and risk management; and (8) establishing and overseeing procedures for handling reports of potential misconduct.

Our audit committee consists of Messrs. Raquet, Suskind and Zavarro, with Mr. Zavarro serving as chairman. Our Board of Directors has affirmatively determined that each of them meets the standards of independence for purposes of serving on an audit committee under Rule 10A-3 of the Exchange Act and the rules of The NASDAQ Global Market. Our Board has also determined that each of them qualifies as an ‘‘audit committee financial expert,’’ as such term is defined in SEC rules. Our audit committee met four times in 2013.

Human Resources and Compensation Committee

Our Board of Directors has established a human resources and compensation committee which is responsible for, among other matters: (1) reviewing officer and executive compensation goals, policies, plans and programs; (2) reviewing and approving or recommending to the Board or the independent directors, as applicable, the compensation of our directors, Chief Executive Officer and other executive officers; (3) reviewing and approving employment agreements and other similar arrangements between us and our officers and other key executives; (4) appointing and overseeing any compensation consultants; and (5) reviewing and monitoring management succession planning and development..

Our human resources and compensation committee consists of Messrs. Bernstein, Ross and Simone, with Mr. Ross serving as chairman. The composition of our human resources and compensation committee meets the standards for independence applicable to directors and compensation committee members under the rules of The NASDAQ Global Market. Each member of the human resources and compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code, as amended, or the Code. Our human resources and compensation committee met three times in 2013.

Nominating and Governance Committee

Our Board of Directors has established a nominating and governance committee which is responsible for, among other matters: (1) identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board of Directors; (2) overseeing the organization of our Board of Directors to discharge the board’s duties and responsibilities properly and efficiently; (3) developing and recommending to our Board of Directors a set of corporate governance principles; and (4) reviewing and approving related person transactions pursuant to our Related Person Transaction Policies and Procedures.

Our nominating and governance committee consists of Messrs. Francescani, Raquet and Simone, with Mr. Francescani serving as chairman. The composition of our nominating and governance committee meets the requirements for independence under current rules and regulations of the SEC and The NASDAQ Global Market. Our nominating and governance committee met once in 2013.

Board’s Role in Risk Oversight

The Board of Directors as a whole has responsibility for risk oversight. This oversight is conducted primarily through the Board’s audit and human resources and compensation committees, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees, with each committee chair reporting to the Board on the committee’s considerations and actions. The audit committee oversees risks associated with our financial statements, financial reporting and accounting policies and the human resources and compensation considers the risks related to the Company’s compensation policies and programs applicable to officers and employees. The committees receive regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Nominee Selection and Evaluation

Our nominating and governance committee uses a variety of methods for identifying and evaluating director nominees. The committee regularly assesses the appropriate size, composition and needs of the Board of Directors and its respective committees and the qualifications of candidates in light of these needs. In fulfilling its responsibility to identify and evaluate director nominees, the nominating and governance committee evaluates such nominees against the criteria it deems appropriate as well as the qualifications set out in our Principles of Corporate Governance and determined by the Board. The nominating and governance committee assesses the effectiveness of these criteria as part of the director selection and nomination process. These criteria include the following:

| 1. | Directors should be of the highest ethical character and share the Company’s values reflected in the Company’s Code of Business Conduct. |

| 2. | Directors should have reputations, both personal and professional, consistent with the image and reputation of the Company. |

| 3. | Directors should be highly accomplished in their respective fields, with superior credentials and recognition. |

| 4. | Each director should have relevant expertise and experience, as well as a commitment to representing the long-term interests of the stockholders, and be able to offer advice and guidance to the Chief Executive Officer based on that expertise, experience and commitment. |

| 5. | All outside directors on the Board should be and remain ‘‘independent,’’ not only as that term may be legally defined in relevant SEC and NASDAQ Global Market rules and regulations, but also without the appearance of any conflict in serving as a director. In addition, directors should be independent of any particular constituency and be able to represent all stockholders of the Company. |

| 6. | Each director should have the ability to exercise sound business judgment, with the willingness to take appropriate risks. |

| 7. | Each director should have the time required for preparation, participation and attendance at meetings of the Board of Directors and, if relevant, the Board’s committees. |

| 8. | Consideration should be given to developing a Board of Directors that is a diverse body, with diversity reflecting gender, ethnic background and professional experience. |

Candidates may come to the attention of our nominating and corporate governance committee through directors, stockholders (as described below) or management. If the nominating and governance committee believes that the Board of Directors requires additional candidates for nomination, the nominating and governance committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. The evaluation of these candidates may be based solely upon information provided to the nominating and governance committee or may also include discussions with persons familiar with the candidate, an interview of the candidate or other actions the nominating and governance committee deems appropriate, including the use of third parties to review candidates.

Stockholders may recommend director candidates for consideration by our nominating and governance committee. Recommendations must be submitted to Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022, Attention: Corporate Secretary, and must include:

| 1. | The name and address of the stockholder making the recommendation; |

| 2. | A representation that the stockholder is a holder of the company’s common stock; |

| 3. | Sufficient biographical information about the individual recommended in order to allow the committee to assess such individual’s qualifications and independence; and |

| 4. | Any other information the stockholder believes would be helpful to the committee in evaluating the individual recommended. |

The nominating and governance committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Board Leadership Structure

Mr. Simone, an independent director, serves as the Chairman of the Board. Prior to Mr. Simone’s elevation to the Chairmanship in December of 2013, Mr. Storms, our Chief Executive Officer and a director, served as Chairman of the Board. Our Board of Directors has determined that its current structure, with separate Chairman and CEO roles is in the best interests of the Company and its stockholders at this time.

A number of factors support the leadership structure chosen by the Board, including, among others:

| · | The Board believes this governance structure promotes balance between the Board's independent authority to oversee our business and the CEO and his management team who manage the business on a day-to-day basis. |

| · | The current separation of the Chairman and CEO roles allows the CEO to focus his time and energy on operating and managing Liquid and leverage the experience and perspectives of the Chairman. |

| · | The Chairman sets the agenda for, and presides over, board meetings and independent sessions and coordinates the work of the committees of our Board providing independent oversight and streamlining the CEO’s duties. |

| · | The Chairman serves as a liaison between the Board and senior management but having an independent chairman also enables non-management directors to raise issues and concerns for Board consideration without immediately involving management. |

The Board and its nominating and governance committee regularly review the Board leadership structure and at some point may decide that the best interests would be served by having one individual in the roles of Chairman and CEO.

Director Communications

Stockholders and other interested parties may communicate with the Chairman of the Board, or with any and all other members of the Board of Directors, by mail to the Company’s principal executive offices addressed to the intended recipient and care of our Corporate Secretary or by email to directors@liquidholdings.com. The Corporate Secretary will maintain a log of such communications and transmit them promptly to the identified recipient, unless there are safety or security concerns that mitigate against further transmission. The intended recipient shall be advised of any communication withheld for safety or security reasons as soon as practicable.

Director Compensation

The following table sets forth the total cash and equity compensation paid to our non-employee directors for their service on the Board of Directors and committees of the Board of Directors during fiscal 2013:

Name(1) | | Fees Earned or

Paid in Cash

($)(2) | | | Stock Awards ($)(3) | | | All Other

Compensation

($)(4) | | | Total

($) | |

| Jay Bernstein | | | 33,982 | | | | 95,943 | | | | — | | | | 129,925 | |

| Darren Davy | | | 62,328 | | | | 95,943 | | | | — | | | | 158,271 | |

| David Francescani | | | 48,520 | | | | 95,943 | | | | — | | | | 144,463 | |

| Walter Raquet | | | 36,525 | | | | 95,943 | | | | — | | | | 132,468 | |

| Thomas R. Ross | | | 75,414 | | | | 95,943 | | | | 327,622 | | | | 498,979 | |

| Richard Schaeffer(5) | | | 20,347 | | | | 95,943 | | | | — | | | | 116,290 | |

| Victor R. Simone, Jr. | | | 37,255 | | | | 95,943 | | | | — | | | | 133,198 | |

| Dennis Suskind | | | 50,702 | | | | 95,943 | | | | 48,750 | | | | 195,395 | |

| Allan Zavarro | | | 44,885 | | | | 95,943 | | | | 40,250 | | | | 181,078 | |

| (1) | Former directors Edward Feigeles, Robert Keller and Nigel Kneafsey did not receive any compensation for service as a member of the Board of Directors in 2013. |

| (2) | In lieu of receiving a cash retainer with respect to service during the fourth quarter of 2013, each director other than Mr. Schaeffer will receive restricted stock units in 2014 with a grant date fair value equal to $10,000. This column also includes RSUs granted on October 4, 2013 in lieu of a cash retainer with respect to service during the period up to and including September 30, 2013, which RSUs will vest on the earlier of (a) one year from the grant date and (b) the day before the next annual meeting of our stockholders. Each restricted stock unit represents a right to receive one common share as of the date of vesting. The shares of common stock underlying the restricted stock units will be delivered to the person on the date that is six months following his separation from service as a member of the Board of Directors. |

| (3) | This column includes the value of RSU awards awarded to certain directors during 2013 and which vested immediately, based upon the grant date fair value, as determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB Topic 718”). The assumptions used to calculate the valuation of the awards for fiscal 2013 are set forth in Note 8 to the Liquid Holdings Group Consolidated Financial Statements in its Annual Report on Form 10-K for the period ended December 31, 2013. The shares of common stock underlying the restricted stock units will be delivered to the person on the date that is six months following his separation from service as a member of the Board of Directors. As of December 31, 2013, the following number of director stock awards were outstanding: 15,277 shares for Mr. Bernstein, 18,888 shares for Mr. Davy, 17,129 shares for Mr. Francescani, 15,601 shares for Mr. Raquet, 20,555 shares for Mr. Ross, 14,814 shares for Mr. Schaeffer, 15,694 shares for Mr. Simone, 17,407 shares for Mr. Suskind and 16,666 shares for Mr. Zavarro. As of December 31, 2013, no director stock options were outstanding. |

| (4) | This column includes sales of shares by our founders to certain of our directors at prices below fair value. |

| (5) | Mr. Schaeffer resigned from the Board of Directors on December 23, 2013. |

Narrative to Director Compensation Table

We did not pay any compensation to our directors in 2013 other than the stock awards described above, including the restricted stock units awards given in October 2013 in lieu of a cash retainer with respect to the service of the directors during 2012 and 2013 and the restricted stock unit awards earned but not yet paid with respect to the service of the directors during the fourth quarter of 2013. We believe that attracting and retaining qualified non-employee directors is critical to our future growth. Our non-employee directors receive compensation that is commensurate with the compensation that is offered to directors of companies that are similar to ours. We have not compensated, and do not expect to compensate, directors that are our employees for their service on our Board of Directors. Our policy is to reimburse our directors for reasonable out-of-pocket expenses that they incur in connection with their service as directors, in accordance with our general expense reimbursement policies.

The Board of Directors periodically evaluates the compensation of our non-employee directors, including with input from Lyons, Benenson & Company Inc., the human resources and compensation committee’s compensation consultant, and upon the recommendation of such committee. The human resources and compensation committee has reviewed its relationship with Lyons, Benenson & Company Inc., taking into consideration its independence and the existence of any potential conflicts of interest, and has determined that the engagement of the firm did not raise any conflict of interest.

Compensation Committee Interlocks

None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or compensation committee.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, among others, to file with the SEC and The NASDAQ Global Market an initial report of ownership of our stock on Form 3 and reports of changes in ownership on Form 4 or Form 5. Persons subject to Section 16 are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. As a matter of practice, we assist our executive officers and directors in preparing initial ownership reports and reporting ownership changes, and typically file those reports on their behalf. Based solely on a review of the copies of such forms in our possession and written representations that no other reports were required, we believe that during fiscal year 2013 all of our executive officers and directors filed the required reports on a timely basis under Section 16(a), except that a Form 4 filed by Mr. Shifrin reporting shares of our common stock withheld by us to cover taxes associated with settlement of restricted stock units that vested was inadvertently filed late.

Code of Business Conduct

Our Board of Directors has adopted a code of business conduct applicable to our employees, directors and officers, including our principal executive, financial and accounting officers, or persons performing similar functions, in accordance with applicable U.S. federal securities laws and the corporate governance rules of The NASDAQ Global Market. The full text of our code is published on our corporate governance website located at http://ir.liquidholdings.com/governance.cfm. We intend to disclose future amendments to certain provisions of our code, or waivers of such provisions granted by our Board of Directors to executive officers and directors, on the website within four business days following the date of such amendment or waiver.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following tables set forth certain information with respect to the beneficial ownership of our capital stock as of March 25, 2014 by:

| · | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| · | each of our named executive officers; |

| · | each of our directors; and |

| · | all of our directors and executive officers as a group. |

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated in the footnotes below, based on information supplied to us by or on behalf of the stockholders, the persons and entities named in the table below have sole voting and sole investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership is based on 24,771,828 common shares outstanding as of March 25, 2014. Unless otherwise indicated in the footnotes to the table, the address of each beneficial owner listed in the table below is c/o Liquid Holdings Group, Inc., 800 Third Avenue, 38th Floor, New York, NY 10022.

| Name of Beneficial Owner | | Number of

Shares

Beneficially

Owned | | | Percentage

of Shares

Beneficially

Owned | |

| Executive Officers and Directors: | | | | | | | | |

| Brian M. Storms(1) | | | 1,268,202 | | | | 5.12 | % |

| Brian Ferdinand(1)(2) | | | 5,214,647 | | | | 21.05 | % |

| Kenneth Shifrin(1) | | | * | | | | — | |

| Robert O’Boyle(3) | | | * | | | | — | |

| Jose Ibietatorremendia(1)(4) | | | * | | | | — | |

| James Lee(5) | | | * | | | | — | |

| Jay Bernstein(1)(6) | | | 444,274 | | | | 1.79 | % |

| Darren Davy(1) | | | 271,920 | | | | 1.09 | % |

| David Francescani(1) | | | * | | | | * | |

| Walter Raquet(1) | | | * | | | | — | |

| Thomas R. Ross(1)(7) | | | 316,507 | | | | 1.28 | % |

| Victor R. Simone, Jr.(1) | | | * | | | | * | |

| Dennis Suskind(1) | | | * | | | | * | |

| Allan Zavarro(1) | | | * | | | | * | |

| All Directors and Executive Officers as a Group (14 persons) | | | 7,993,117 | | | | 32.02 | % |

| Other 5% Stockholders: | | | | | | | | |

| Douglas J. Von Allmen(8) | | | 6,015,308 | | | | 24.28 | % |

| Robert Keller(9) | | | 1,588,889 | | | | 6.41 | % |

| Richard Schaeffer(1)(10) | | | 2,161,739 | | | | 8.73 | % |

* Less than 1%.

| | (1) | These individuals hold restricted stock units in the following amounts, each RSU representing a right to receive one common share subject to vesting or other delivery conditions not expected to occur within 60 days of March 25, 2014: Mr. Bernstein – 15,277 RSUs; Mr. Davy – 18,888 RSUs; Mr. Ferdinand – 170,637 RSUs; Mr. Francescani – 17,129 RSUs; Mr. Ibietatorremendia – 30,802 RSUs; Mr. Raquet – 15,601 RSUs; Mr. Ross – 20,555 RSUs; Mr. Schaeffer – 14,814 RSUs; Mr. Shifrin – 64,192 RSUs; Mr. Simone – 15,694 RSUs; Mr. Storms – 253,343 RSUs; Mr. Suskind – 17,407 RSUs; Mr. Zavarro – 16,666 RSUs. Such RSUs are not reflected in the above table. |

| | (2) | Consists of (a) 2,963,652 common shares held by Ferdinand Holdings, LLC, a Delaware limited liability company of which Mr. Ferdinand is the managing member, (b) 654,943 common shares held by Ferdinand Trading II LLC, a Delaware limited liability company of which Mr. Ferdinand is the managing member, (c) 259,953 common shares held by LT World Limited LLC, a Delaware limited liability company of which Mr. Ferdinand is the managing member, (d) 1,012,049 common shares held by Mr. Ferdinand directly, (e) 153,413 common shares held by LT World Partners LLC, a Delaware limited liability company of which Mr. Ferdinand is the managing member and (f) 170,637 RSUs held by Mr. Ferdinand directly. Mr. Ferdinand resigned as Vice Chairman of the Board and our Head of Corporate Strategy effective April 18, 2014. |

| | (3) | Mr. O’Boyle, our Executive Vice President of Sales and Marketing, has been granted 30,377 RSUs and options to acquire 60,946 shares of common stock, which RSUs and options are subject to vesting conditions not expected to occur within 60 days of March 25, 2014. Such RSUs and the shares of common stock underlying the options are not reflected in the above table. In addition, the table does not reflect the 45,566 RSUs that would be granted and immediately vest in the event that our market capitalization reached $300 million or more over a consecutive sixty (60) day period. |

| | (4) | Mr. Ibietatorremendia, our General Counsel and Secretary, has been granted options to acquire 30,802 shares of common stock, which options are subject to vesting conditions not expected to occur within 60 days of March 25, 2014. The shares of common stock underlying the options are not reflected in the above table. |

| | (5) | Mr. Lee, our Chief Administrative Officer, has been granted options to acquire 76,000 shares of common stock, which options are subject to vesting conditions not expected to occur within 60 days of March 25, 2014. Such options are not reflected in the above table. |

| | (6) | Consists of (a) 270,607 common shares held by Mr. Bernstein and (b) 173,667 common shares held by a trust for which Mr. Bernstein’s spouse shares voting and investment power. Mr. Bernstein disclaims beneficial ownership of the shares held by the trust. |

| | (7) | Consists of (a) 222,743 common shares held by the Thomas R. Ross Irrevocable Trust dated December 20, 2012 and (b) 93,764 common shares held by Mr. Ross. Mr. Ross disclaims beneficial ownership of the shares held by the trust. |

| | (8) | Consists of (a) 4,994,994 common shares held by D&L Partners, L.P., (b) 219,556 common shares held by Von Allmen Partners, L.P., (c) 110,258 common shares held by NGNG, Inc. and (d) 690,500 common shares held by Von Allmen Dynasty Trust (the “Trust”). Mr. Von Allmen’s spouse is the Trustee of the Trust and each of she and the Trust have sole power to vote or direct the vote of and to dispose or direct the disposition of the 690,500 shares of Common Stock held by the Trust. The address of each of these shareholders is 9 Isla Bahia Drive, Ft. Lauderdale, FL 33316. |

| | (9) | Consists of (a) 933,946 common shares held by CMK Keller Holdings, LLC, a Delaware limited liability company of which Mr. Keller is the managing member and (b) 654,943 common shares held by Ferris Ventures, LLC, a Delaware limited liability company of which Mr. Keller is the managing member. |

| | (10) | Consists of (a) 1,238,846 common shares held by Mr. Schaeffer directly, (b) 296,085 common shares held by Schaeffer Holdings LLC, a Delaware limited liability company of which Mr. Schaeffer is the managing member and (c) 626,808 common shares held by Schaeffer Group LLC, a Delaware limited liability company of which Mr. Schaeffer is the managing member. |

Certain Relationships and Related Party Transactions

In July 2013, our Board adopted our Related Person Transaction Policies and Procedures (the “Related Person Policy”), which are administered by the nominating and governance committee of the Board per its charter. Under the Related Person Policy, the committee will review the material facts of all “Interested Transactions” that require the Committee’s approval and either approve or disapprove of the entry into such transactions. “Interested Transactions” are defined as transactions in which we are a party, the amount involved exceeds $120,000, and any of our directors, executive officers or holders of more than 5% of our capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

In determining whether to approve or ratify an Interested Transaction, the committee will take into account, among other factors it deems appropriate, whether the Interested Transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

In addition to the compensation arrangements discussed above in the section titled “Director Compensation” and below in the section titled “Executive Compensation,” the following is a description of each related party transaction since January 1, 2013. Transactions occurring prior to our July 2013 conversion from a limited liability company to a corporation (and the adoption of our Related Person Policy) were approved by our Board of Managers and/or by the required vote of our members.

LLC Reorganization

On July 24, 2013, we effected a reorganization pursuant to which each holder of our outstanding common units contributed to us all of the right, title and interest in and to such outstanding common units in exchange for a proportionate number of shares of our common stock. Unless otherwise indicated, or the context otherwise requires, all information is presented giving effect to this reorganization and the related conversion of our common units into shares of our common stock at a ratio of 10,606.81 shares of common stock for each common unit.

Transactions with Related and Certain Other Parties

Investment by Douglas J. Von Allmen. On April 5, 2013, we issued an additional 720,498 common shares to an entity controlled by Mr. Von Allmen pursuant to a subscription agreement into which we entered with him on that date. On May 14, 2013, an entity controlled by Mr. Keller; Mr. Storms and three employees transferred a total of 104,431 shares to an entity controlled by Mr. Von Allmen pursuant to share transfer agreements. On May 15, 2013, an entity controlled by Mr. Schaeffer sold 191,616 shares to an entity controlled by Mr. Von Allmen pursuant to a share transfer agreement.

Legal Representation. We retain the law firm of Fish & Richardson, of which David Francescani, one of our directors, is Counsel, to perform legal services from time to time. We have paid Fish & Richardson $83,703 for legal services rendered during 2013, and as of April 4, 2014 have no unpaid balance.

Transactions with QuantX. QuantX, a related party as a result of certain past or present relationships with Messrs. Ferdinand, Keller, Schaeffer, Von Allmen and Michael Tew, which is not a part of and is not consolidated under Liquid Holdings Group, operates as a principal-only trading firm domiciled in the United Kingdom trading solely for its own account. QuantX is a customer of our technology platform, which it then markets to its own members, thereby providing us with a source of customer referrals. For the year ended December 31, 2013, a total of $2,119,720 in software services revenues were recognized by us from QuantX.

Transactions with Directors. In 2013, we and/or certain of our founders sold common stock to certain of our directors at prices below fair value; as such we have recorded these sales as share-based payments. We have described below the sale of shares in which the difference between the purchase price and the fair value of the shares is in excess of $120,000. We note that this information has been reported as director compensation for 2013.

On January 15, 2013, SHAF Holdings, LLC, of which Mr. Schaeffer, one of our founders and a former Executive Chairman, is the managing member, sold to our director Tom Ross a 0.5% ownership interest for an aggregate purchase price of $375,000. We estimated the fair value of the shares sold at $702,622. As a result of this sale below fair value, we recorded a 2013 share-based compensation expense of $327,622.

On May 10, 2013, CMK Keller Holdings, LLC, of which our former director Mr. Keller is the managing member, transferred to Mr. Ferdinand 191,616 shares for no monetary consideration. We estimated the fair value of the shares transferred at $1,445,000. As a result of this transfer below fair value, we recorded a share-based compensation expense in the second quarter of 2013.

On May 14, 2013, CMK Keller Holdings, LLC sold Mr. Storms 766,466 shares for $5,000,000. We estimated the fair value of the shares sold at $5,780,000. As a result of this sale below fair value, we recorded a 2013 share-based compensation expense in the second quarter of 2013.

On June 20, 2013, CMK Keller Holdings, LLC transferred to LT World Limited LLC, an entity controlled by Mr. Ferdinand, 191,558 shares for no monetary consideration. We estimated the fair value of the shares transferred at $1,445,000. As a result of this transfer below fair value, we recorded a share-based compensation expense in the second quarter of 2013.

On June 3, 2013, we entered into a consulting agreement with Mr. Schaeffer pursuant to which he will provide relationship management and sales and marketing consulting services to the Company for a twelve-month term. The consulting agreement provides for $12,500 per month as compensation for his services. In addition to the fees provided under the June 3, 3013 consulting agreement, Mr. Schaeffer received fees for his service as a director of the Company.

On June 13, 2013, Mr. Schaeffer loaned us $250,000 to be payable in full on December 13, 2013. The loan bears interest on the unpaid principal balance at a rate of 4% per annum until the earlier of payment in full or December 13, 2013, after which time any amount of unpaid principal or interest will bear interest at a rate of 6% per annum. The proceeds of the loan were used for general working capital requirements of the company. On August 1, 2013, we repaid the principal balance of the loan in full. The amount of interest paid on the loan totaled $1,370.

On July 1, 2013, Ferdinand Holdings, LLC loaned us $250,000 to be payable in full on December 31, 2013. The loan bears interest on the unpaid balance at a rate of 4% per annum until the earlier of payment in full or December 31, 2013, after which any amount of unpaid principal or interest will bear interest at a rate of 6% per annum. The proceeds of the loan were used for general working capital requirements of the company. On August 1, 2013, we repaid the principal balance of the loan in full. The amount of interest paid on the loan totaled $877.

On July 11, 2013, Mr. Ross loaned us $250,000 to be payable in full on January 10, 2014. The loan bears interest on the unpaid principal balance at a rate of 4% per annum until the earlier of payment in full or January 10, 2014, after which any amount of unpaid principal or interest will bear interest at a rate of 6% per annum. The proceeds of the loan were used for general working capital requirements of the company. On August 1, 2013, we repaid the principal balance of the loan in full. The amount of interest paid on the loan totaled $603.

We purchased 105,000 shares of our common stock from Mr. Storms, our CEO and a Director, at a price of $8.415 per share in connection with the consummation of our initial public offering. The price per share equaled the public offering price per share received by us in the offering, less an amount equal to the underwriting discount paid per share to the underwriter in the offering.

Transaction with David Solimine. On May 1, 2013, entities controlled by Messrs. Ferdinand, Keller, Schaeffer and David Solimine entered into an agreement to transfer Mr. Solimine 2.75% of our common shares outstanding as of the date of the agreement. Pursuant to an anti-dilution provision to maintain Mr. Solimine’s 2.75% ownership interest in the Company, that agreement provides that Messrs. Ferdinand, Keller and Schaeffer may owe Mr. Solimine common shares if we issue additional shares during the period beginning May 1, 2013 and ending on the earliest of immediately prior to the consummation of our initial public offering and January 1, 2015. We agreed that if any of Messrs. Ferdinand, Keller and Schaeffer did not deliver those shares, the Company would be obligated to issue anti-dilution shares to Mr. Solimine. The shares were delivered by the stockholders as required and the Company is no longer subject to this obligation.

Bonus to Robert Keller. On May 1, 2013, we entered into a letter agreement with Mr. Keller ending his employment as senior managing director with the Company. Pursuant to that agreement, we agreed that if our initial public offering were consummated prior to December 1, 2014, we would pay Mr. Keller a cash bonus equal to the difference between (i) $275,000 times the number of days between May 15, 2012 and the date of the consummation of our initial public offering divided by 365 and (ii) $75,000. Pursuant to this agreement, we paid to Mr. Keller $254,247 on August 1, 2013.

Transaction with Solomon Yakoby. On June 24, 2013, entities controlled by Messrs. Ferdinand, Schaeffer and Solomon Yakoby entered into an agreement to transfer to Mr. Yakoby 67,035 common shares.

Participation in Initial Public Offering. Messrs. Ferdinand and Von Allmen purchased an aggregate of $16.2 million of shares of our common stock in our initial public offering at the initial public offering price per share. The shares purchased by Mr. Ferdinand were purchased from us directly at $9 per share, and not from the underwriter, and no underwriting discount was payable by us or by Mr. Ferdinand on such shares. We did, however, pay a fee on such shares to the underwriter, which fee was in the same amount as the underwriting discount. The shares purchased by Mr. Ferdinand reduced the aggregate number of shares offered to investors generally in the underwritten offering.

Sub-lease of Hoboken Offıce from APX, Inc.On October 1, 2013, we entered into a four-month sublease agreement (the ‘‘Hoboken Sublease’’) at a monthly rate of $23,247 for approximately 7,200 square feet of office space in Hoboken, New Jersey to be used for certain back-office operations. The Hoboken Sublease included a transfer to the company of the existing equipment located in the space and an agreement to allow the sublessor to use a portion of the space not being used by us for up to nine months. It was entered into with APX, Inc., an entity in which Mr. Storms and Mr. Ibietatorremendia have an interest in and on the board of which they serve as members. In March 2014 we entered into a new five-year lease for the same office space.