M&A Update - Compass to Acquire Christie’s International Real Estate and @properties December 2, 2024

Safe Harbor Statement This presentation includes forward-looking statements, which are statements other than statements of historical facts, and statements in the future tense. These statements include, but are not limited to, statements regarding the proposed transaction, expected timeline, our expected future performance, including expected financial results, and our expectations for operational achievements and synergies after the closing of the proposed transaction. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this presentation, and are subject to risks and uncertainties, including but not limited to: our ability to consummate the proposed transaction on the expected timeline or at all (including due to inability to obtain the necessary regulatory approvals or obtaining such approvals subject to conditions that are not anticipated), the risk that a condition of closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction might otherwise not occur, the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement, including in circumstances requiring us to pay a termination fee, the diversion of management time on transaction-related issues, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of @properties to retain its key agents and personnel, unexpected costs, charges or expenses resulting from the proposed transaction, potential litigation relating to the proposed transaction that could be instituted against the parties to the merger agreement or their respective directors, managers or officers, including the effects of any outcomes related thereto and other risks set forth in our annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q. Significant variation from the assumptions underlying our forward-looking statements could cause our actual results to vary, and the impact could be significant. Accordingly, actual results could differ materially from those predicted or implied or such uncertainties could cause adverse effects on our results. Reported results should not be considered as an indication of future performance. More information about factors that could adversely affect our business, financial condition and results of operations, or that could cause actual results to differ from those expressed or implied in our forward-looking statements is included under the captions “Risk Factors,” “Legal Proceedings” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q, copies of which are available on the Investor Relations page of our website at https://investors.compass.com/ and on the SEC website at www.sec.gov. All information herein speaks as of the date hereof and all forward-looking statements contained herein are based on information available to us as of the date hereof, and we do not assume any obligation to update these statements as a result of new information or future events. Undue reliance should not be placed on the forward-looking statements in this presentation. 2

Projected Financial Information This presentation contains certain projected financial information, including @properties’ Expected Year 1 Revenue, Expected Year 1 Pre-synergy Adjusted EBITDA and Expected Year 1 Adjusted EBITDA Margin, as well as Fully synergized Adjusted EBITDA multiple and cost synergies, which we prepared in good faith on a basis believed to be reasonable. Such projected financial information have not been prepared in conformity with generally accepted accounting principles (“GAAP”) or in conformance with the applicable accounting requirements of Regulation S-X related to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected. This projected financial information is provided for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. Projections are inherently uncertain due to a number of factors outside of our control. Accordingly, there can be no assurance that the projected results are indicative of the future performance of @properties or the combined company or that actual results will not differ materially from those presented in this presentation. Inclusion of the projected financial information in this presentation should not be regarded as a representation by any person that the results contained in this presentation will be achieved. Additionally, such projected financial information assumes that we receive all required regulatory approvals and close the proposed transaction in Q1 2025. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures, including @properties’ Expected Year 1 Pre-synergy Adjusted EBITDA and Expected Year 1 Adjusted EBITDA Margin. These measures may exclude certain expenses, gains and losses that may not be indicative of @properties’ operating results and business outlook, and, in each case, may be different from the non-GAAP financial measures used by other companies. We believe that these measures may assist investors in evaluating the proposed transaction and potential performance of @properties and the combined company. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with GAAP. 3

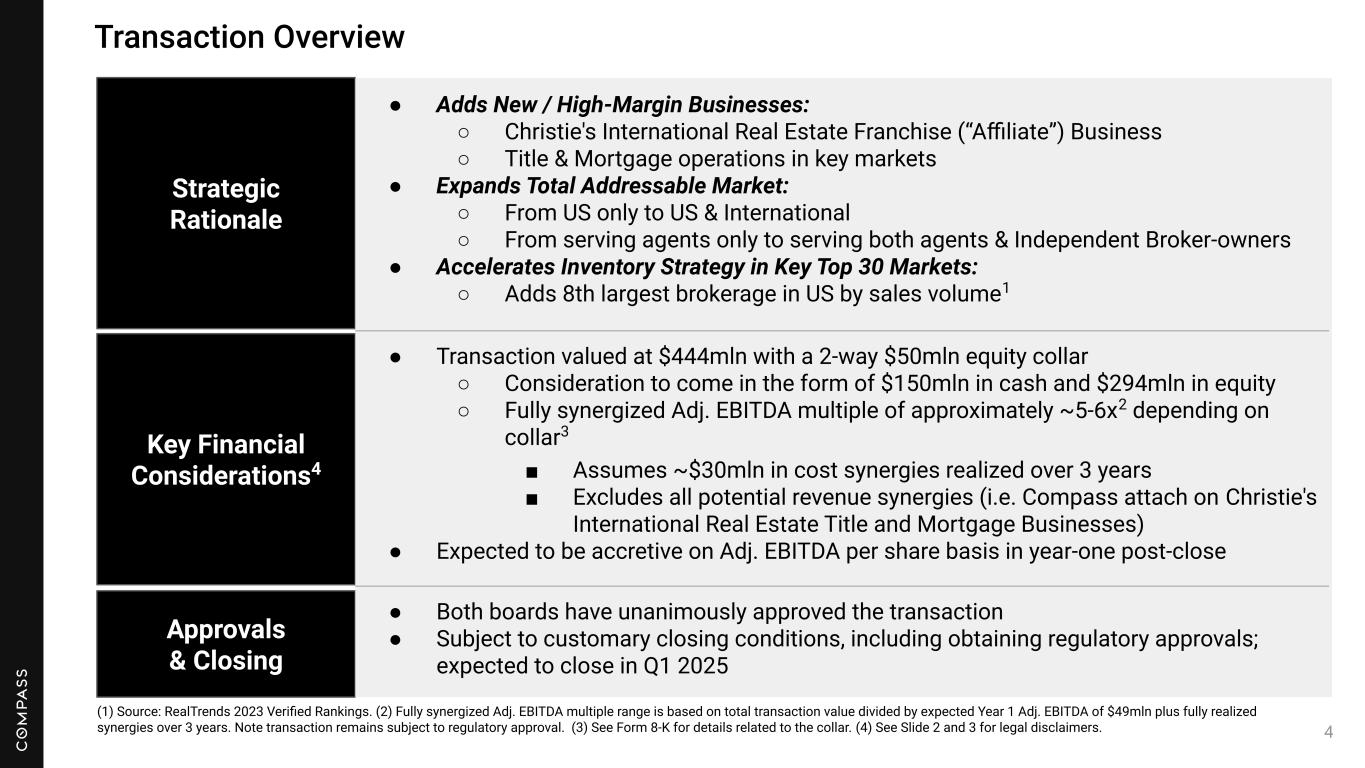

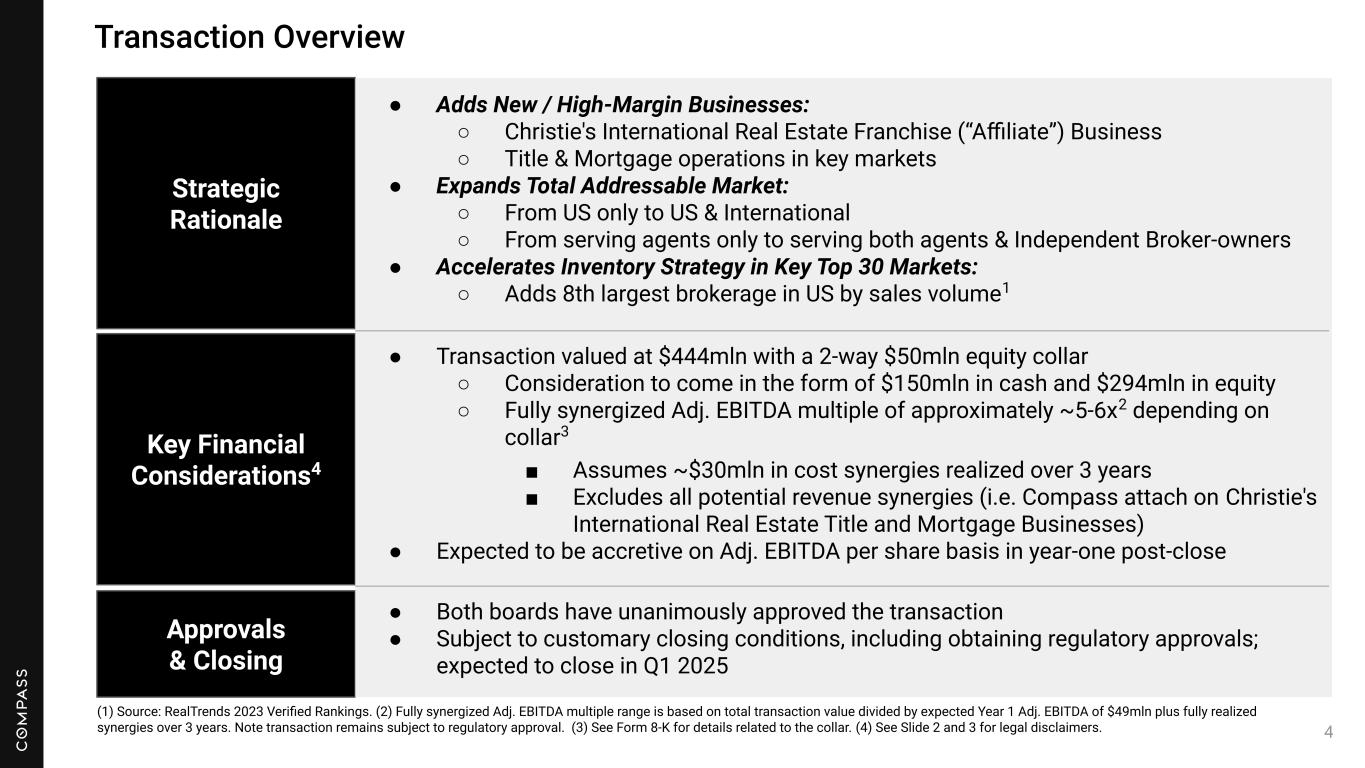

Transaction Overview Strategic Rationale Key Financial Considerations4 Approvals & Closing ● Both boards have unanimously approved the transaction ● Subject to customary closing conditions, including obtaining regulatory approvals; expected to close in Q1 2025 ● Adds New / High-Margin Businesses: ○ Christie's International Real Estate Franchise (“Affiliate”) Business ○ Title & Mortgage operations in key markets ● Expands Total Addressable Market: ○ From US only to US & International ○ From serving agents only to serving both agents & Independent Broker-owners ● Accelerates Inventory Strategy in Key Top 30 Markets: ○ Adds 8th largest brokerage in US by sales volume1 (1) Source: RealTrends 2023 Verified Rankings. (2) Fully synergized Adj. EBITDA multiple range is based on total transaction value divided by expected Year 1 Adj. EBITDA of $49mln plus fully realized synergies over 3 years. Note transaction remains subject to regulatory approval. (3) See Form 8-K for details related to the collar. (4) See Slide 2 and 3 for legal disclaimers. ● Transaction valued at $444mln with a 2-way $50mln equity collar ○ Consideration to come in the form of $150mln in cash and $294mln in equity ○ Fully synergized Adj. EBITDA multiple of approximately ~5-6x2 depending on collar3 ■ Assumes ~$30mln in cost synergies realized over 3 years ■ Excludes all potential revenue synergies (i.e. Compass attach on Christie's International Real Estate Title and Mortgage Businesses) ● Expected to be accretive on Adj. EBITDA per share basis in year-one post-close 4

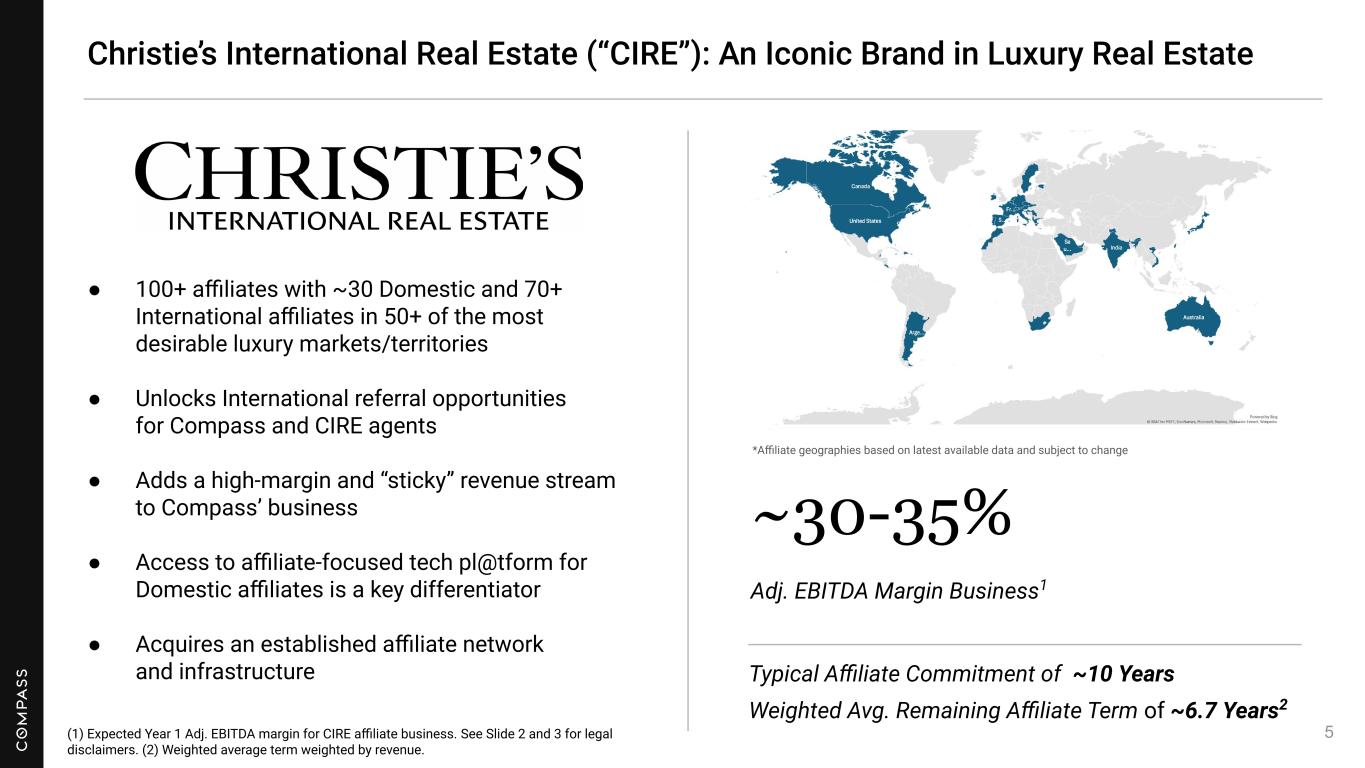

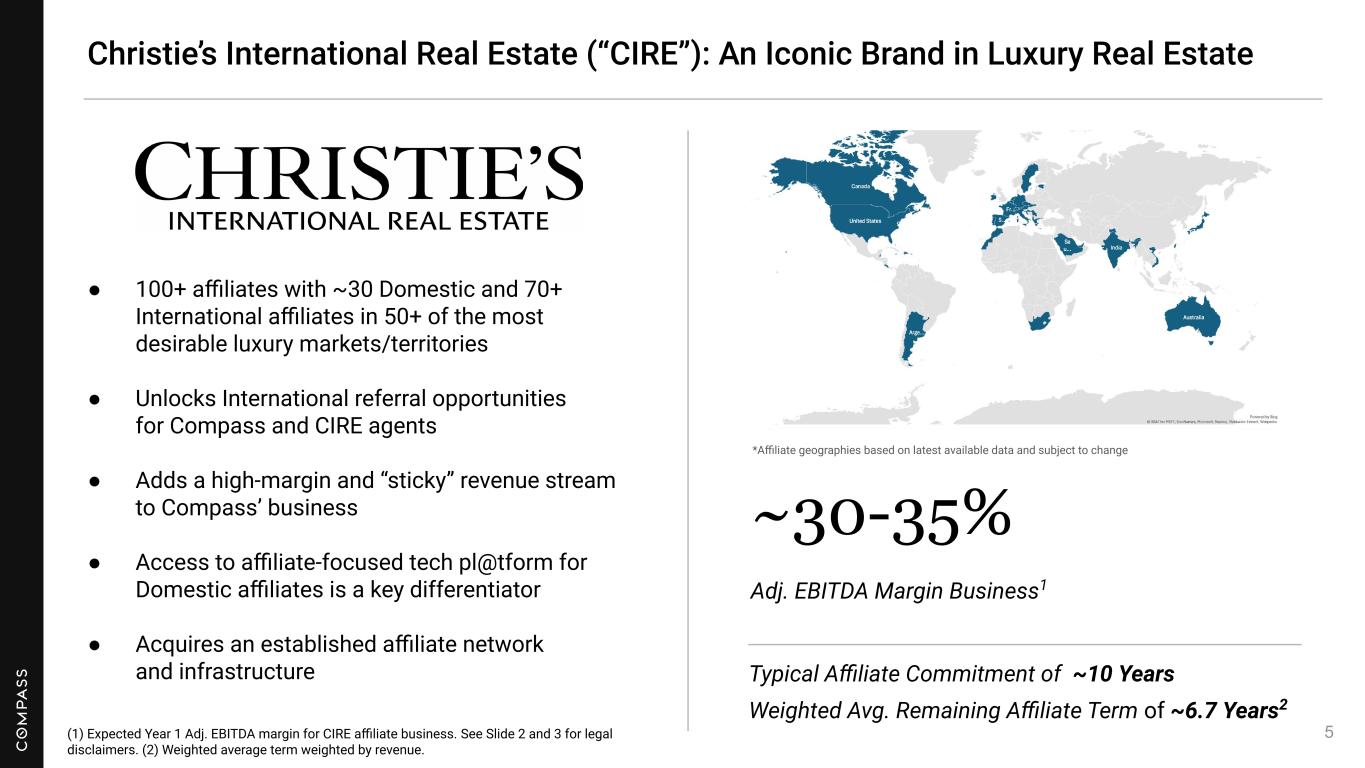

● 100+ affiliates with ~30 Domestic and 70+ International affiliates in 50+ of the most desirable luxury markets/territories ● Unlocks International referral opportunities for Compass and CIRE agents ● Adds a high-margin and “sticky” revenue stream to Compass’ business ● Access to affiliate-focused tech pl@tform for Domestic affiliates is a key differentiator ● Acquires an established affiliate network and infrastructure Christie’s International Real Estate (“CIRE”): An Iconic Brand in Luxury Real Estate (1) Expected Year 1 Adj. EBITDA margin for CIRE affiliate business. See Slide 2 and 3 for legal disclaimers. (2) Weighted average term weighted by revenue. 5 *Affiliate geographies based on latest available data and subject to change ~30-35% Adj. EBITDA Margin Business1 Weighted Avg. Remaining Affiliate Term of ~6.7 Years2 Typical Affiliate Commitment of ~10 Years

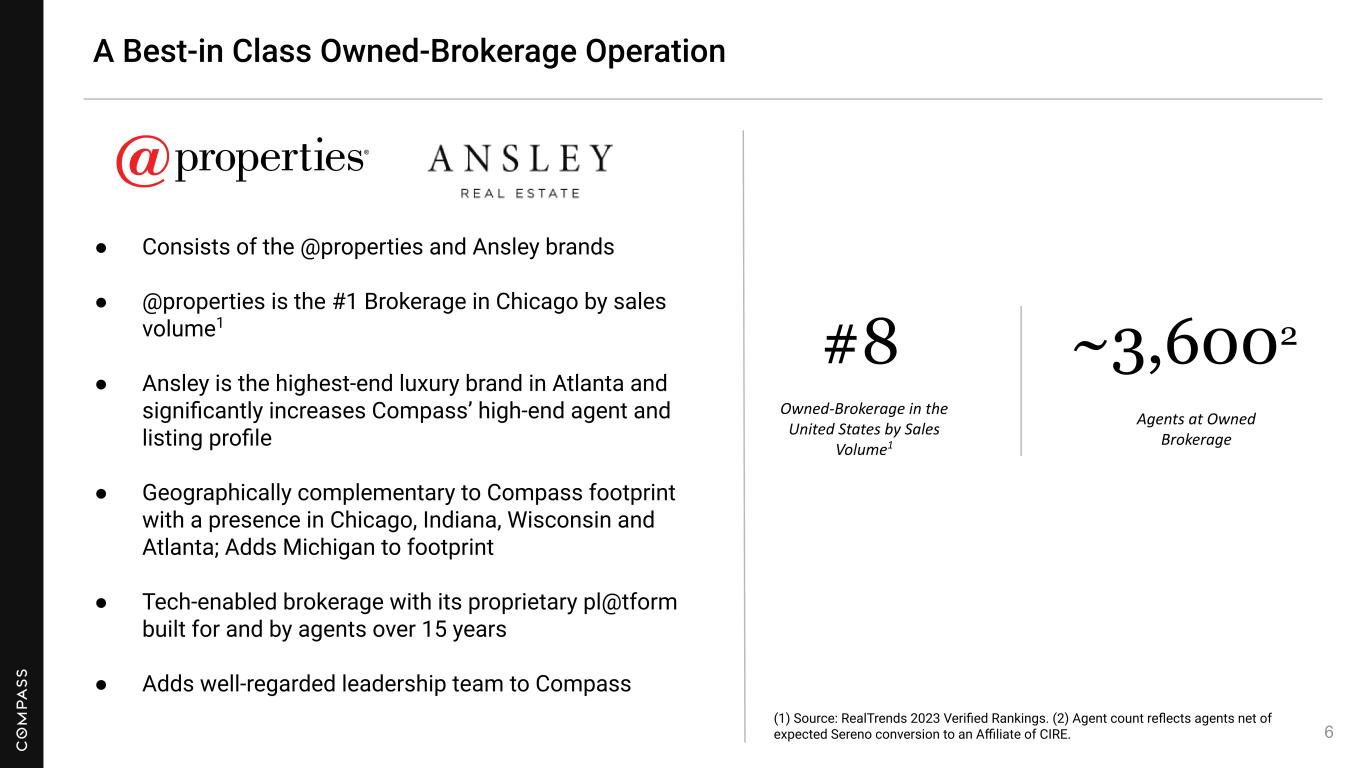

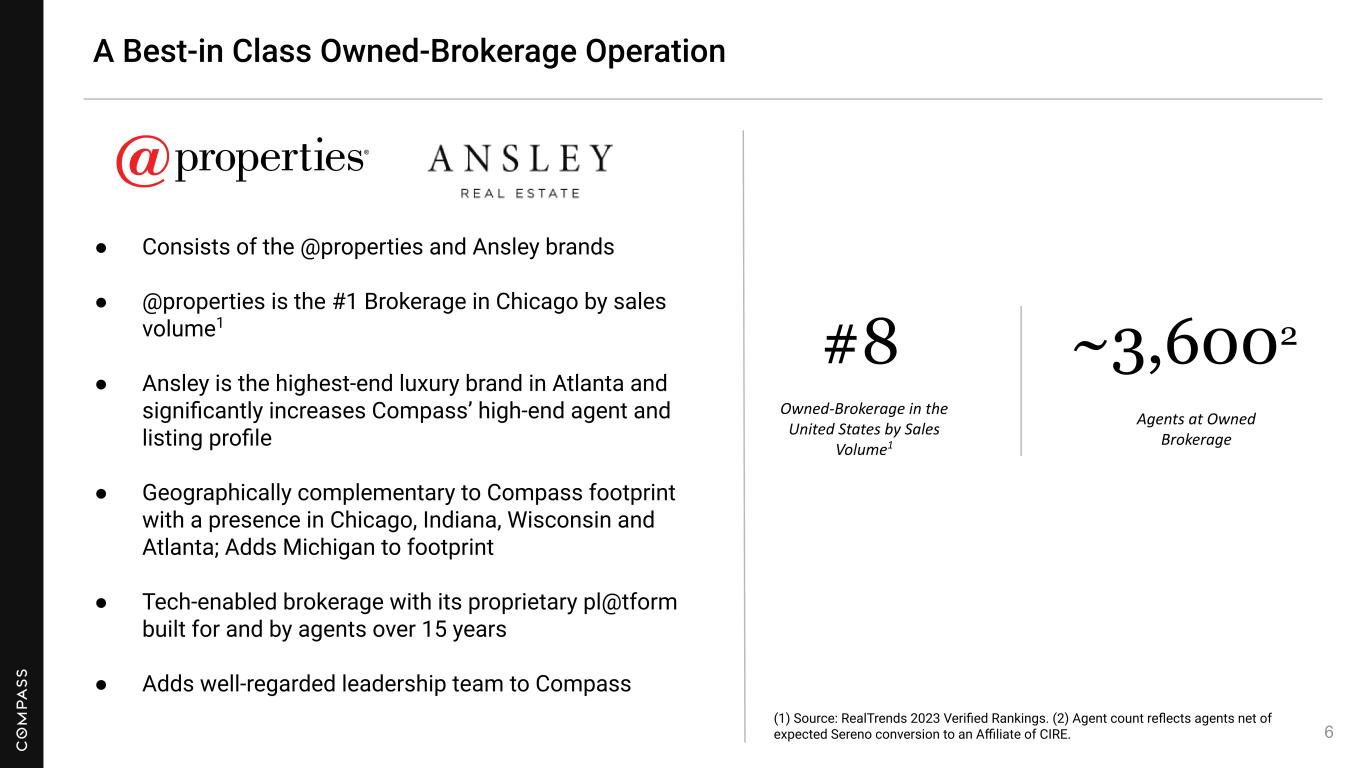

A Best-in Class Owned-Brokerage Operation 6 ● Consists of the @properties and Ansley brands ● @properties is the #1 Brokerage in Chicago by sales volume1 ● Ansley is the highest-end luxury brand in Atlanta and significantly increases Compass’ high-end agent and listing profile ● Geographically complementary to Compass footprint with a presence in Chicago, Indiana, Wisconsin and Atlanta; Adds Michigan to footprint ● Tech-enabled brokerage with its proprietary pl@tform built for and by agents over 15 years ● Adds well-regarded leadership team to Compass (1) Source: RealTrends 2023 Verified Rankings. (2) Agent count reflects agents net of expected Sereno conversion to an Affiliate of CIRE. Owned-Brokerage in the United States by Sales Volume1 Agents at Owned Brokerage #8 ~3,6002

Title and Mortgage Operation with Attractive Margins and Industry Leading Title Attach ● Adds strong integrated services brands in Proper Title & Proper Mortgage to portfolio ● Industry leading Title attach rates and Adj. EBITDA margins accretive to Compass averages ● Enhances Mortgage and Adds to Title presence in Chicago and Indiana ● A 10+ year-old profitable Title operation with tenured leadership and strong “attach motion” in an attorney-directed market ● Strategic Value to Business: Attorney-directed nature of Title business will allow for learnings to be applied to other Compass markets 7

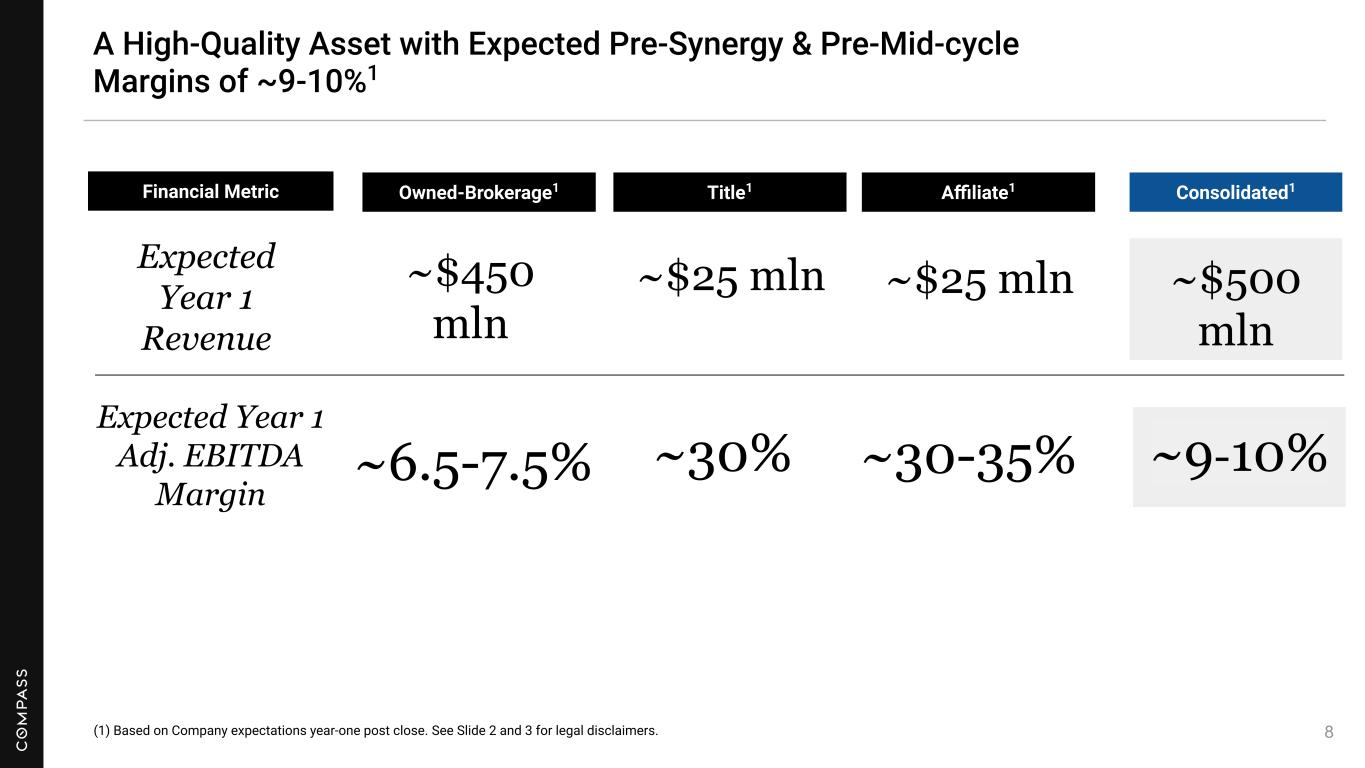

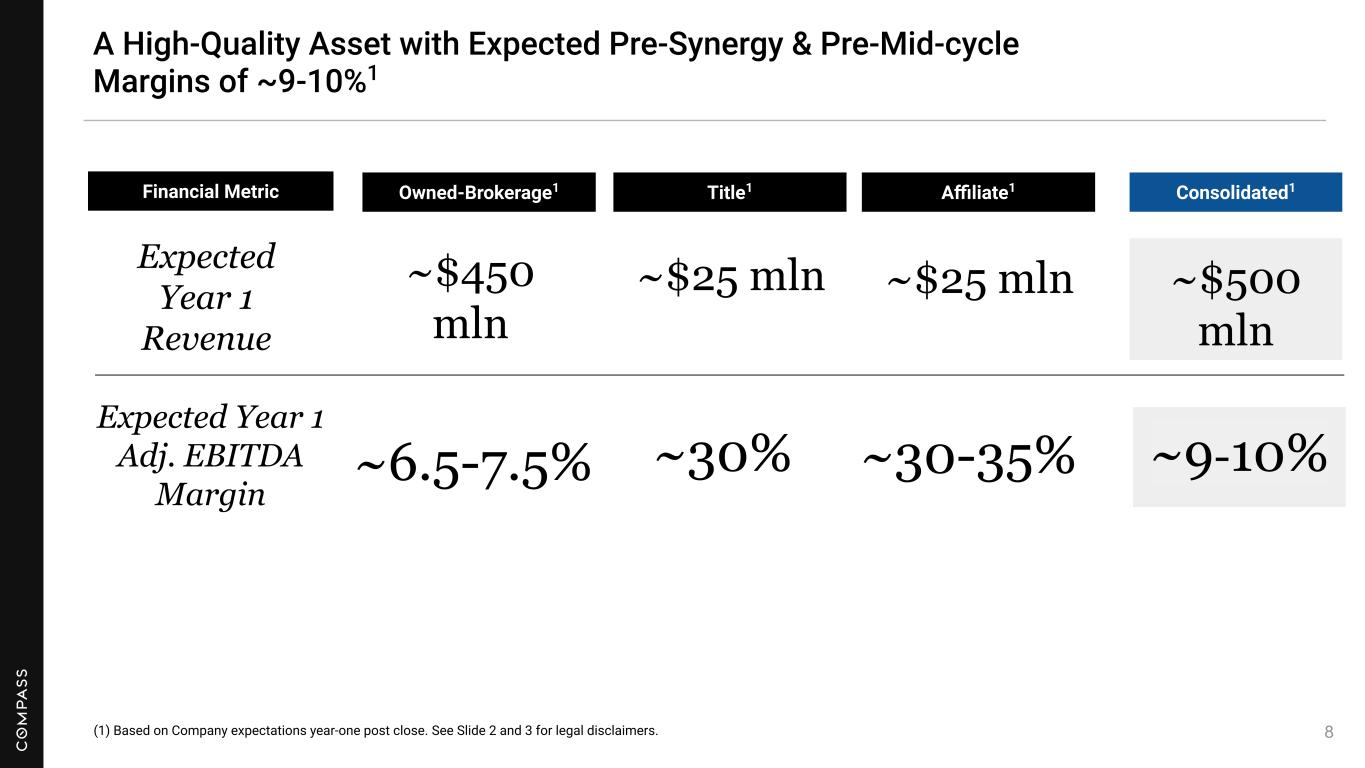

8 A High-Quality Asset with Expected Pre-Synergy & Pre-Mid-cycle Margins of ~9-10%1 (1) Based on Company expectations year-one post close. See Slide 2 and 3 for legal disclaimers. ~30-35%~6.5-7.5% Consolidated1 ~30% ~9-10% Financial Metric Expected Year 1 Revenue Expected Year 1 Adj. EBITDA Margin Owned-Brokerage1 Title1 Affiliate1 ~$450 mln ~$25 mln ~$25 mln ~$500 mln

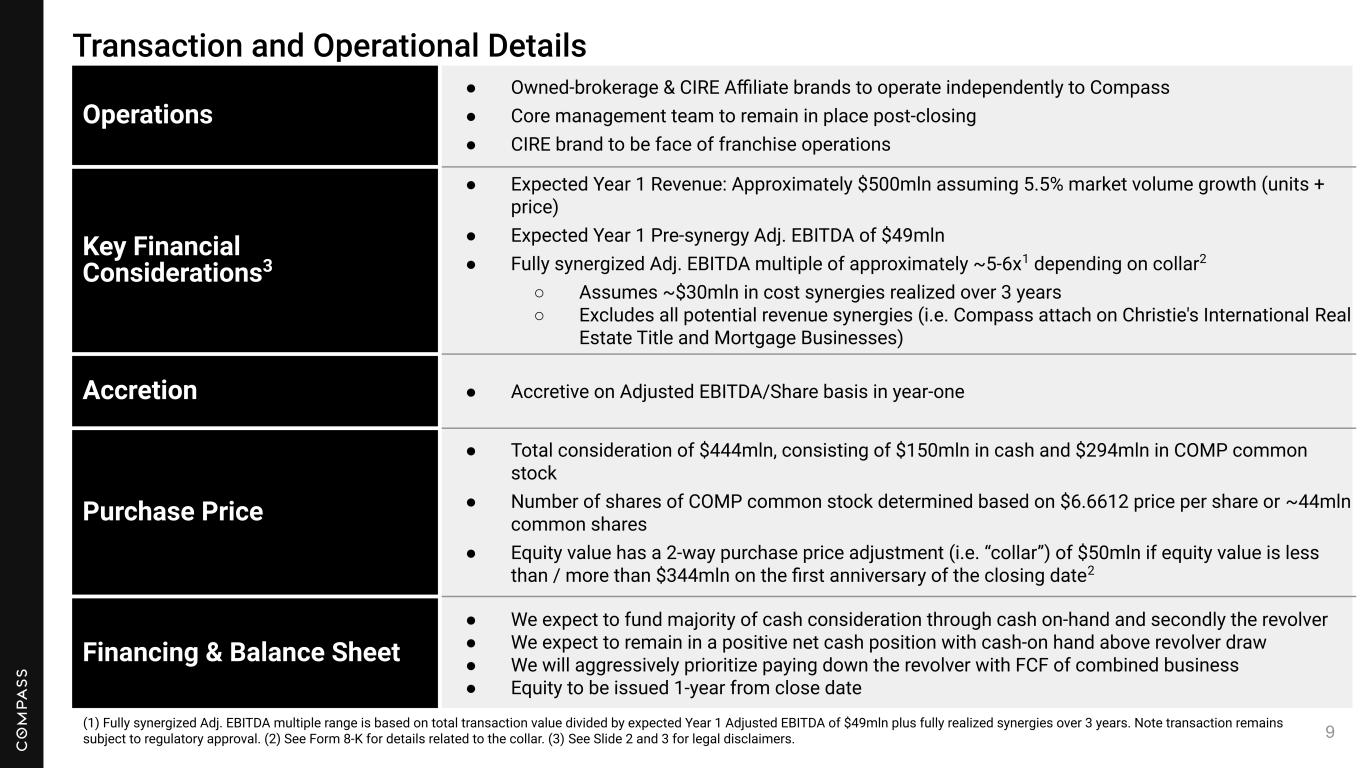

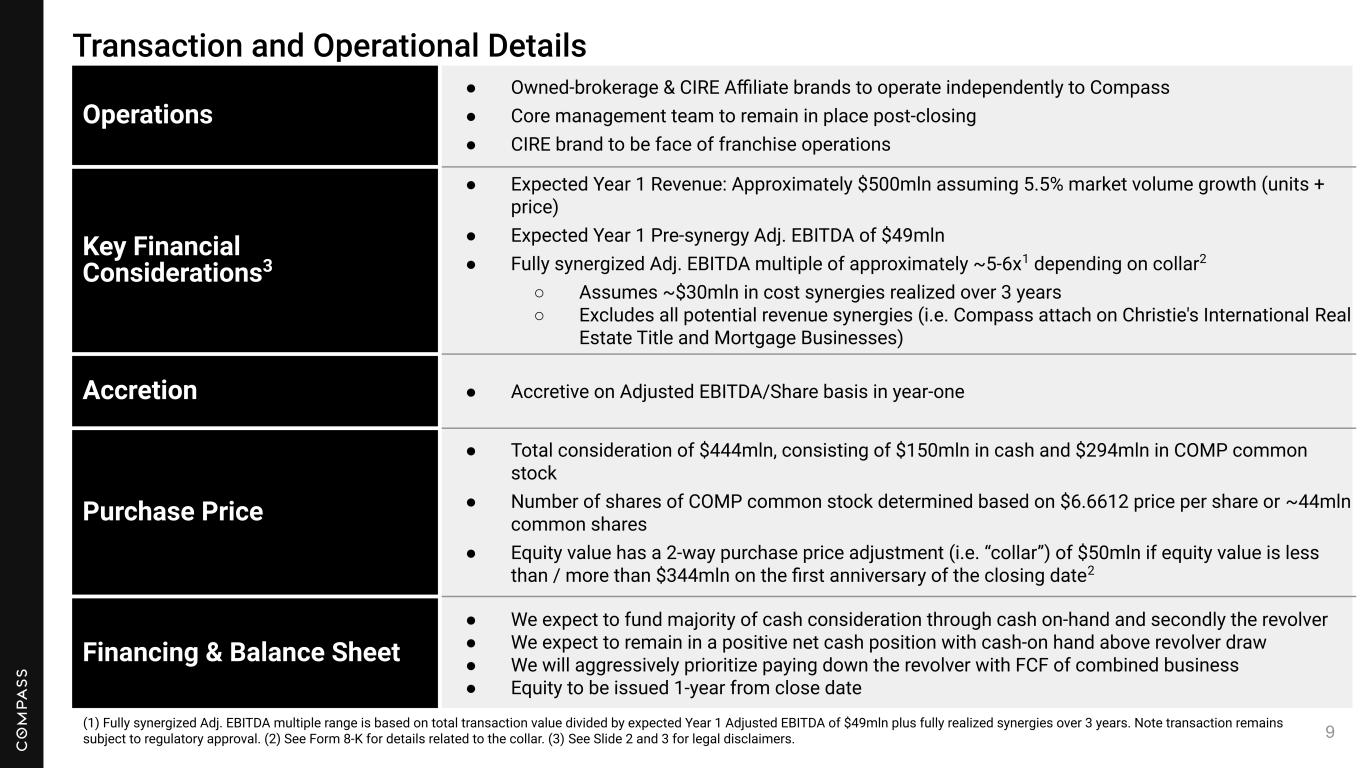

Transaction and Operational Details Operations ● Owned-brokerage & CIRE Affiliate brands to operate independently to Compass ● Core management team to remain in place post-closing ● CIRE brand to be face of franchise operations Key Financial Considerations3332 ● Expected Year 1 Revenue: Approximately $500mln assuming 5.5% market volume growth (units + price) ● Expected Year 1 Pre-synergy Adj. EBITDA of $49mln ● Fully synergized Adj. EBITDA multiple of approximately ~5-6x1 depending on collar2 ○ Assumes ~$30mln in cost synergies realized over 3 years ○ Excludes all potential revenue synergies (i.e. Compass attach on Christie's International Real Estate Title and Mortgage Businesses) Accretion ● Accretive on Adjusted EBITDA/Share basis in year-one Purchase Price ● Total consideration of $444mln, consisting of $150mln in cash and $294mln in COMP common stock ● Number of shares of COMP common stock determined based on $6.6612 price per share or ~44mln common shares ● Equity value has a 2-way purchase price adjustment (i.e. “collar”) of $50mln if equity value is less than / more than $344mln on the first anniversary of the closing date2 Financing & Balance Sheet ● We expect to fund majority of cash consideration through cash on-hand and secondly the revolver ● We expect to remain in a positive net cash position with cash-on hand above revolver draw ● We will aggressively prioritize paying down the revolver with FCF of combined business ● Equity to be issued 1-year from close date 9(1) Fully synergized Adj. EBITDA multiple range is based on total transaction value divided by expected Year 1 Adjusted EBITDA of $49mln plus fully realized synergies over 3 years. Note transaction remains subject to regulatory approval. (2) See Form 8-K for details related to the collar. (3) See Slide 2 and 3 for legal disclaimers.

Summary: A Transaction that Creates Compelling Shareholder Value Adds High-margin & “Sticky” Franchise Revenue Stream to P&L Accelerates Inventory Strategy, Providing Immediate Local Scale in Key Top 30 Markets Adds High-margin Integrated Service Businesses with Above Industry Attach Rates Expands Addressable Market to: 1. International; and 2. Serving Independent Broker Through Franchise Business

Investor Contact Soham Bhonsle Investorrelations@compass.com