|

Exhibit 99.1

|

WELCOME

FORWARD-LOOKING STATEMENTS

Certain statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain “forward looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets. Others are more specific to our business and operations. These risks and uncertainties include, but are not limited to, the ability of Constellium and Wise Metals to achieve expected synergies and the timing thereof, Constellium’s increased levels of indebtedness which could limit Constellium’s operating flexibility and opportunities; the potential failure to retain key employees, the loss of customers, suppliers and other business relationships; disruptions to business operations; slower or lower than expected growth in the North American market for Body-in-White aluminium rolled products, and other risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 20-F, and as described from time to time in subsequent reports filed with the U.S. Securities and Exchange Commission. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not pre control. Consequently, actual results may differ materially from the forward-looking statement presentation. We undertake no obligation to update or revise any forward-looking statement as a resu future events or otherwise, except as required by law.

NON-GAAP MEASURES

This presentation includes information regarding certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA per metric ton, Free Cash Flow and Net Debt. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. Adjusted EBITDA measures are frequently used by securities analysts, investors and other interested parties in their evaluation of Constellium and in comparison to other companies, many of which present an adjusted EBITDA-related performance measure when reporting their results. Adjusted EBITDA, Adjusted EBITDA per Metric Ton, Free Cash Flow and Net Debt are not presentations made in accordance with IFRS and may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures supplement our IFRS disclosures and should not be considered an alternative to the IFRS measures. This presentation provides a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures.

Opening remarks

JE A N—MA R C G E R M A I N

2016 WAS A PIVOTAL YEAR FOR CONSTELLIUM

STABILIZED BUSINESS FOLLOWING WISE ACQUISITION

Adjusted EBITDA increased by 10% at €377m with stable volumes

Significant operational improvements at Muscle Shoals

ADVANCED OUR STRATEGIC INITIATIVES

Major investments in rolling completed with production now ramping up:

2 | | new CALP lines (fully-owned in Europe, JV with UACJ Corp. in NA) |

Pusher furnace in Ravenswood, WV

2 | | greenfield auto structures plants in North America and Decin expansion in Europe |

IMPROVED COMPANY CAPITAL STRUCTURE, REDUCING INTEREST COSTS AND IMPROVING FLEXIBILITY

All debt now at Constellium level

First maturity not until 2021 2

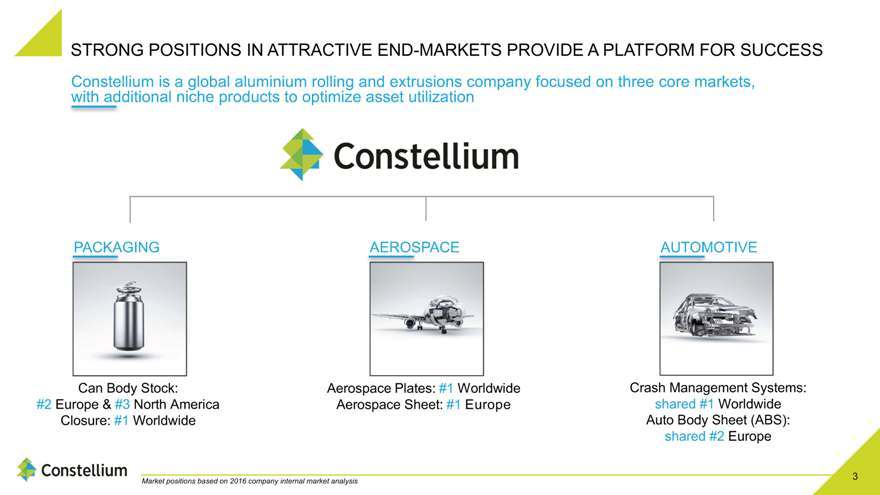

STRONG POSITIONS IN ATTRACTIVE END-MARKETS PROVIDE A PLATFORM FOR SUCCESS

Constellium is a global aluminium rolling and extrusions company focused on three core markets, with additional niche products to optimize asset utilization

PACKAGING

AEROSPACE

AUTOMOTIVE

Can Body Stock:

#2 Europe & #3 North America Closure: #1 Worldwide

Aerospace Plates: #1 Worldwide Aerospace Sheet: #1 Europe

Crash Management Systems: shared #1 Worldwide Auto Body Sheet (ABS): shared #2 Europe

Market positions based on 2016 company internal market analysis 3

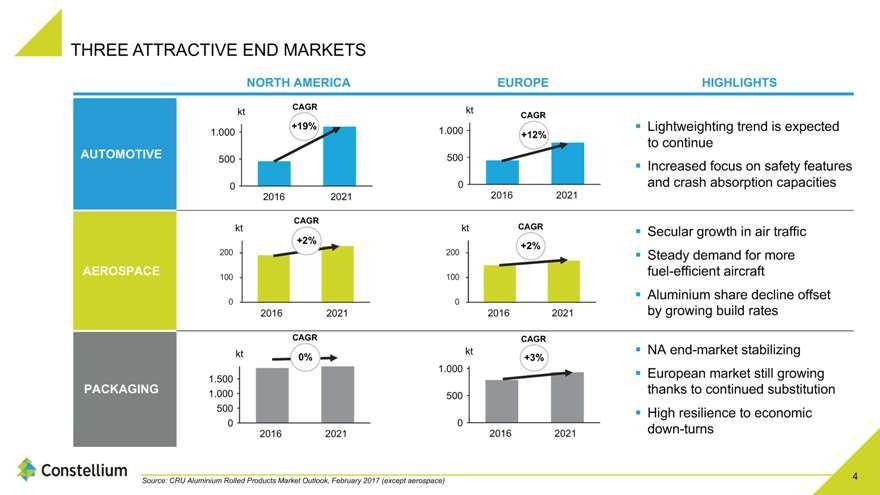

THREE ATTRACTIVE END MARKETS

NORTH AMERICA EUROPE HIGHLIGHTS

AUTOMOTIVE AEROSPACE PACKAGING

kt CAGR

500

0

2016 2021

CAGR

kt

+2%

200

100

0

2016 2021

CAGR kt 0%

1.500

1.000 500 0

2016 2021

kt CAGR

500

0

2016 2021

kt CAGR

+2%

200

100

0

2016 2021

CAGR

kt +3%

000

500

0

2016 2021

Lightweighting trend is expected to continue Increased focus on safety features and crash absorption capacities

Secular growth in air traffic Steady demand for more fuel-efficient aircraft Aluminium share decline offset by growing build rates

NA end-market stabilizing European market still growing thanks to continued substitution High resilience to economic down-turns

Source: CRU Aluminium Rolled Products Market Outlook, February 2017 (except aerospace)

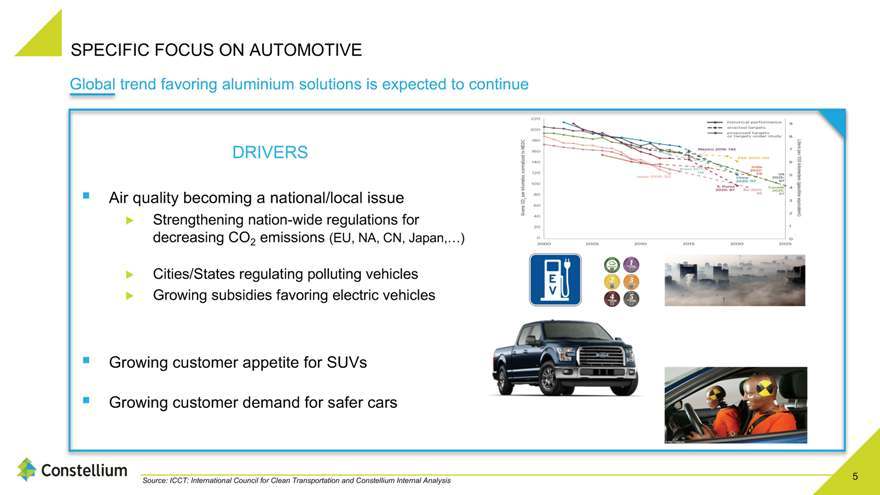

SPECIFIC FOCUS ON AUTOMOTIVE

Global trend favoring aluminium solutions is expected to continue

DRIVERS

Air quality becoming a national/local issue

Strengthening nation-wide regulations for

decreasing CO2 emissions (EU, NA, CN, Japan,…)

Cities/States regulating polluting vehicles

Growing subsidies favoring electric vehicles

Growing customer demand for safer cars

Growing customer appetite for SUVs

Source: ICCT: International Council for Clean Transportation and Constellium Internal Analysis

Air quality becoming a national/local issue

Strengthening nation-wide regulations for decreasing CO2 emissions (EU, NA, CN, Japan,…)

Cities/States regulating polluting vehicles

Growing subsidies favoring electric vehicles

Growing customer demand for safer cars

Growing customer appetite for SUVs

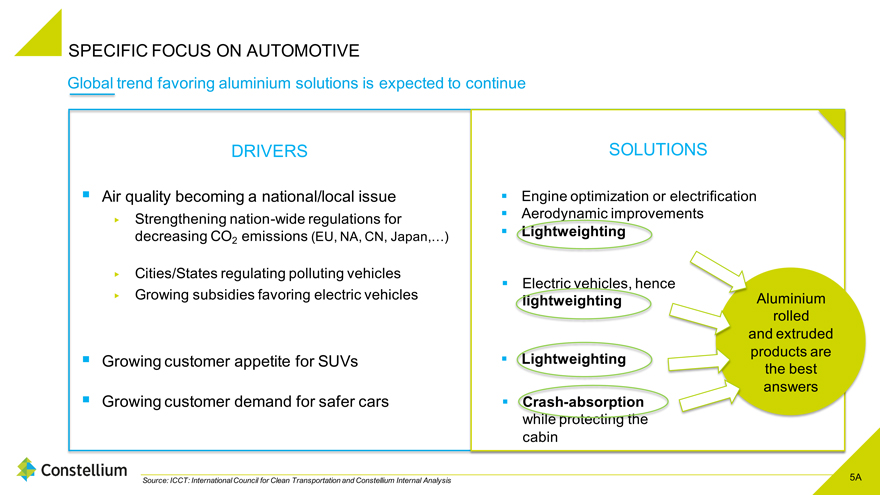

SPECIFIC FOCUS ON AUTOMOTIVE

DRIVERS

SOLUTIONS

Engine optimization or electrification

Aerodynamic improvements

Lightweighting

Lightweighting

Crash-absorption

while protecting the cabin

Electric vehicles, hence

lightweighting

Aluminium

rolled

and extruded

products are

the best

answers

5A

Source: ICCT: International Council for Clean Transportation and Constellium Internal Analysis

Global trend favoring aluminium solutions is expected to continue

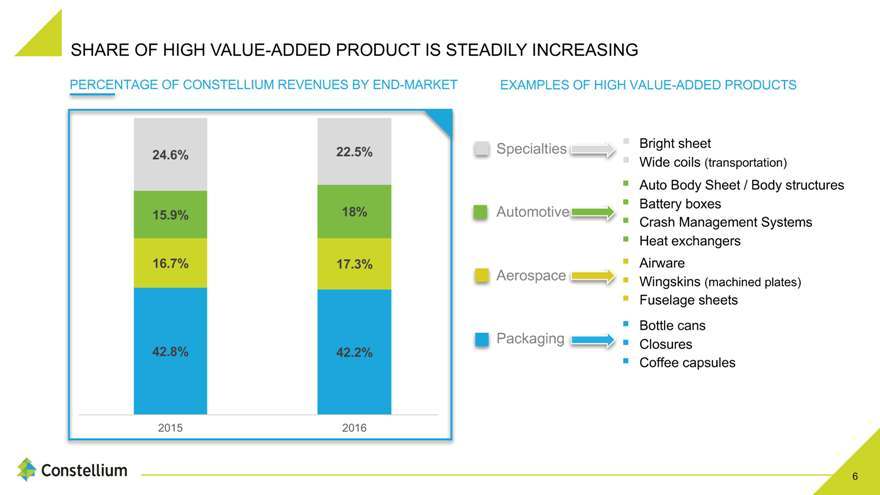

SHARE OF HIGH VALUE-ADDED PRODUCT IS STEADILY INCREASING

PERCENTAGE OF CONSTELLIUM REVENUES BY END-MARKET EXAMPLES OF HIGH VALUE-ADDED PRODUCTS

Specialties Bright sheet

Wide coils (transportation)

Auto Body Sheet / Body structures

Battery boxes

Automotive

Crash Management Systems

Heat exchangers

Aerospace Airware

Wingskins (machined plates)

Fuselage sheets Packaging Bottle cans

Closures

Coffee capsules

11

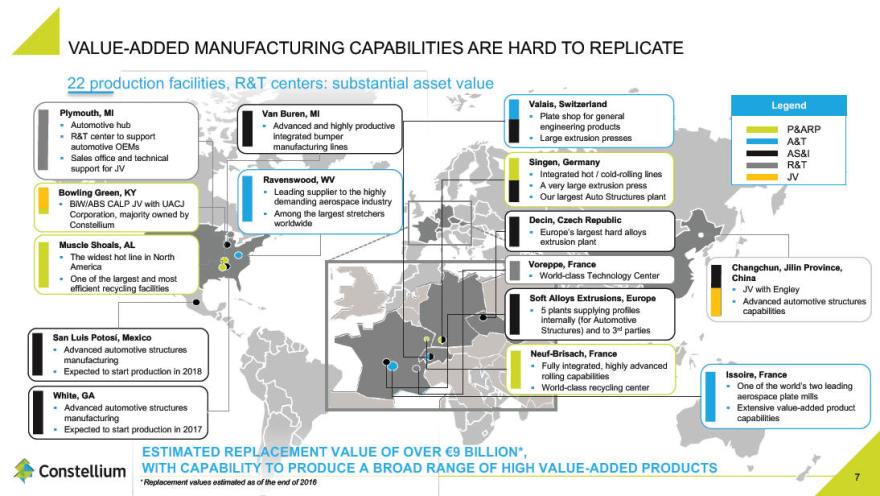

VALUE-ADDED MANUFACTURING CAPABILITIES ARE HARD TO REPLICATE

22 production facilities, R&T centers: substantial asset value

Plymouth, MI

Automotive hub

R&T center to support

automotive OEMs

Sales office and technical

support for JV

Bowling Green, KY

BiW/ABS CALP JV with UACJ

Corporation, majority owned by

Constellium

Muscle Shoals, AL

The widest hot line in North

America

One of the largest and most

efficient recycling facilities

San Luis Potosí, Mexico

Advanced automotive structures

manufacturing

Expected to start production in 2018

White, GA

Advanced automotive structures

manufacturing

Expected to start production in 2017

Van Buren, MI

Advanced and highly productive

integrated bumper

manufacturing lines

Ravenswood, WV

Leading supplier to the highly

demanding aerospace industry

Among the largest stretchers

Worldwide

Valais, Switzerland

Plate shop for general

engineering products

Large extrusion presses

Singen, Germany

Integrated hot / cold-rolling lines

A very large extrusion press

Our largest Auto Structures plant

Voreppe, France

World-class Technology Center

Soft Alloys Extrusions, Europe

5 | | plants supplying profiles |

internally (for Automotive

Structures) and to 3rd parties

Neuf-Brisach, France

Fully integrated, highly advanced

rolling capabilities

World-class recycling center

Changchun, Jilin Province,

China

JV with Engley

Advanced automotive structures

Capabilities

Issoire, France

One of the world’s two leading

aerospace plate mills

Extensive value-added product

Capabilities

ESTIMATED REPLACEMENT VALUE OF OVER €9 BILLION*,

WITH CAPABILITY TO PRODUCE A BROAD RANGE OF HIGH VALUE-ADDED PRODUCTS

*Replacement values estimated as of the end of 2016

12

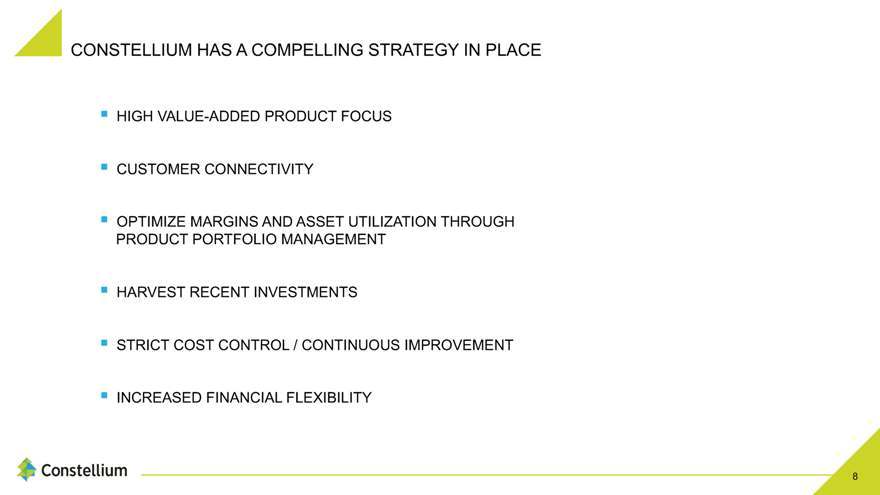

CONSTELLIUM HAS A COMPELLING STRATEGY IN PLACE

HIGH VALUE-ADDED PRODUCT FOCUS

CUSTOMER CONNECTIVITY

OPTIMIZE MARGINS AND ASSET UTILIZATION THROUGH

PRODUCT PORTFOLIO MANAGEMENT

HARVEST RECENT INVESTMENTS

STRICT COST CONTROL / CONTINUOUS IMPROVEMENT

INCREASED FINANCIAL FLEXIBILITY

13

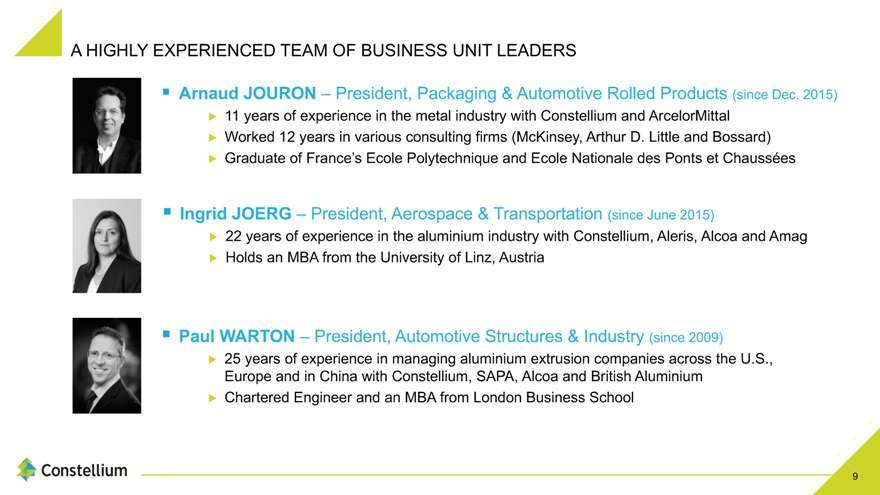

A HIGHLY EXPERIENCED TEAM OF BUSINESS UNIT LEADERS

Arnaud JOURON – President, Packaging & Automotive Rolled Products (since Dec. 2015)

11 years of experience in the metal industry with Constellium and ArcelorMittal

Worked 12 years in various consulting firms (McKinsey, Arthur D. Little and Bossard)

Graduate of France’s Ecole Polytechnique and Ecole Nationale des Ponts et Chaussées

Ingrid JOERG – President, Aerospace & Transportation (since June 2015)

22 years of experience in the aluminium industry with Constellium, Aleris, Alcoa and Amag

Holds an MBA from the University of Linz, Austria

Paul WARTON – President, Automotive Structures & Industry (since 2009)

25 years of experience in managing aluminium extrusion companies across the U.S., Europe and in China with Constellium, SAPA, Alcoa and British Aluminium

Chartered Engineer and an MBA from London Business School

14

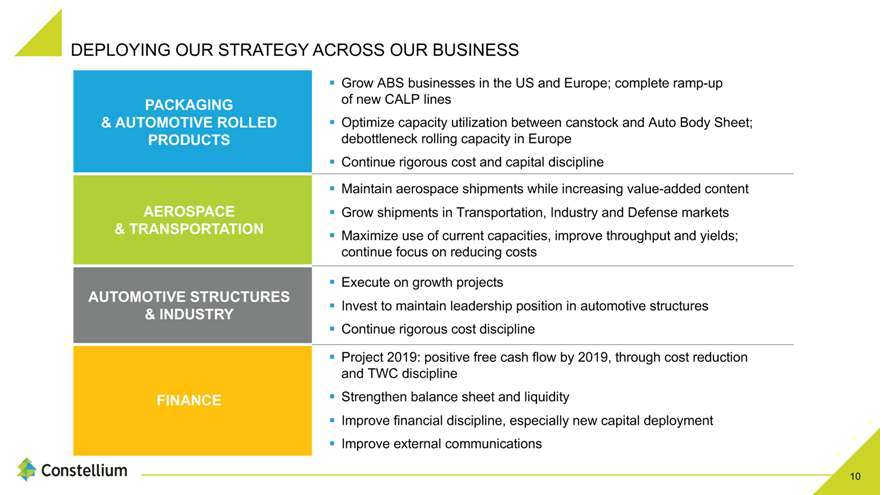

DEPLOYING OUR STRATEGY ACROSS OUR BUSINESS

PACKAGING

& AUTOMOTIVE ROLLED

PRODUCTS

AEROSPACE

& TRANSPORTATION

AUTOMOTIVE STRUCTURES

& INDUSTRY

FINANCE

Grow ABS businesses in the US and Europe; complete ramp-up of new CALP lines Optimize capacity utilization between canstock and Auto Body Sheet; debottleneck rolling capacity in Europe Continue rigorous cost and capital discipline

Maintain aerospace shipments while increasing value-added content Grow shipments in Transportation, Industry and Defense markets Maximize use of current capacities, improve throughput and yields; continue focus on reducing costs

Execute on growth projects

Invest to maintain leadership position in automotive structures Continue rigorous cost discipline

Project 2019: positive free cash flow by 2019, through cost reduction and TWC discipline Strengthen balance sheet and liquidity Improve financial discipline, especially new capital deployment Improve external communications

15

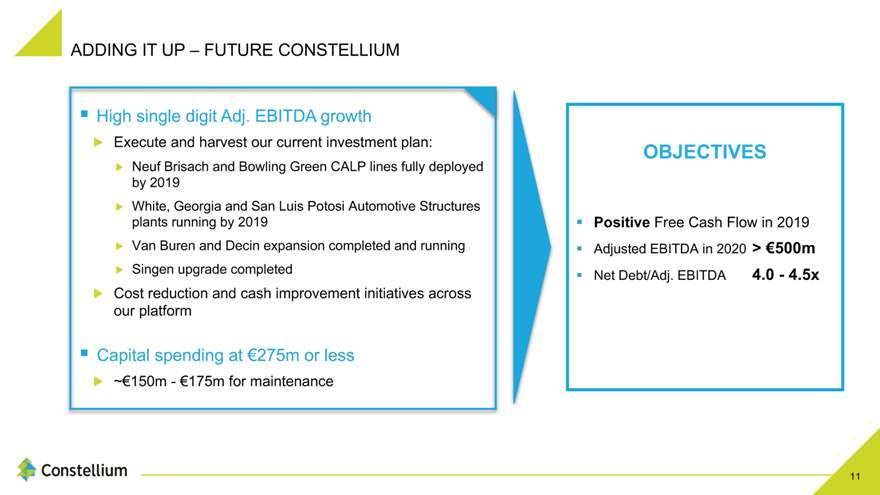

ADDING IT UP – FUTURE CONSTELLIUM

OBJECTIVES

Positive Free Cash Flow in 2019

Adjusted EBITDA in 2020 > €500m Net Debt/Adj. EBITDA 4.0—4.5x

High single digit Adj. EBITDA growth

Execute and harvest our current investment plan:

Neuf Brisach and Bowling Green CALP lines fully deployed

by 2019

White, Georgia and San Luis Potosi Automotive Structures

plants running by 2019

Van Buren and Decin expansion completed and running

Singen upgrade completed

Cost reduction and cash improvement initiatives across

our platform

Capital spending at €275m or less

~€150m—€175m for maintenance

16

Packaging &

Automotive Rolled Products

A R N A U D J O U R O N

17

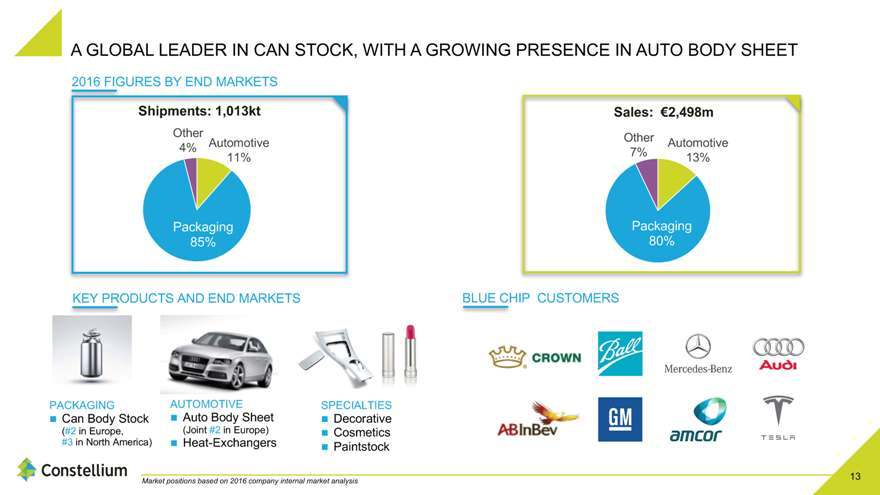

A GLOBAL LEADER IN CAN STOCK, WITH A GROWING PRESENCE IN AUTO BODY SHEET

2016 FIGURES BY END MARKETS

Shipments: 1,013kt Sales: €2,498m

Packaging

80%

Other

4% Automotive

11%

Packaging

85%

Other

7%

Automotive

13%

Packaging

80%

KEY PRODUCTS AND END MARKETS BLUE CHIP CUSTOMERS

PACKAGING

Can Body Stock

(#2 in Europe,

#3 in North America)

AUTOMOTIVE

Auto Body Sheet

(Joint #2 in Europe)

Heat-Exchangers

SPECIALTIES

Decorative

Cosmetics

Paintstock

Market positions based on 2016 company internal market analysis

18

14

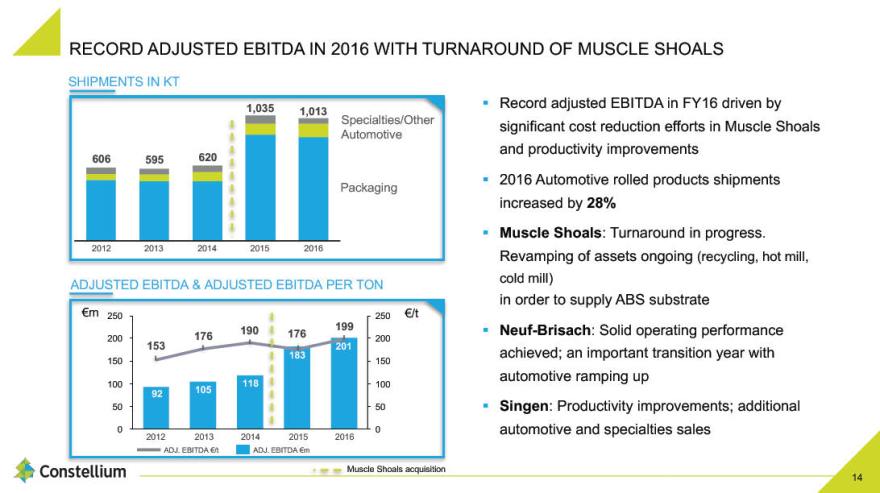

RECORD ADJUSTED EBITDA IN 2016 WITH TURNAROUND OF MUSCLE SHOALS

Record adjusted EBITDA in FY16 driven by

significant cost reduction efforts in Muscle Shoals

and productivity improvements

2016 Automotive rolled products shipments

increased by 28%

Muscle Shoals: Turnaround in progress.

Revamping of assets ongoing (recycling, hot mill,

cold mill)

in order to supply ABS substrate

Neuf-Brisach: Solid operating performance

achieved; an important transition year with

automotive ramping up

Singen: Productivity improvements; additional

automotive and specialties sales

SHIPMENTS IN KT

ADJUSTED EBITDA & ADJUSTED EBITDA PER TON

1,035

Specialties/Other

595

2012

606

2014

620

2013 2016

1,013

2015

Automotive

Packaging

Muscle Shoals acquisition

92 105 118

183

201

0

50

100

150

200

250

0

50

100

150

200

250

2012 2013 2014 2015 2016

€m

ADJ. EBITDA €/t ADJ. EBITDA €m

€/t

176 176

153

190 199

19

15

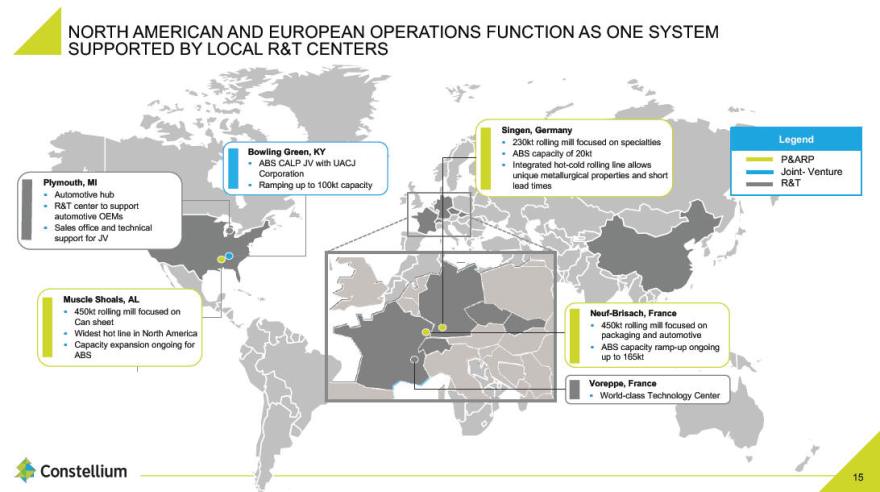

NORTH AMERICAN AND EUROPEAN OPERATIONS FUNCTION AS ONE SYSTEM

SUPPORTED BY LOCAL R&T CENTERS

Bowling Green, KY

ABS CALP JV with UACJ

Corporation

Ramping up to 100kt capacity

Voreppe, France

World-class Technology Center

Singen, Germany

230kt rolling mill focused on specialties

ABS capacity of 20kt

Integrated hot-cold rolling line allows

unique metallurgical properties and short

lead times

LLeeggeenndd

P&ARP

Joint- Venture

R&T

Muscle Shoals, AL

450kt rolling mill focused on

Can sheet

Widest hot line in North America

Capacity expansion ongoing for

ABS

Plymouth, MI

Automotive hub

R&T center to support

automotive OEMs

Sales office and technical

support for JV

Neuf-Brisach, France

450kt rolling mill focused on

packaging and automotive

ABS capacity ramp-up ongoing

up to 165kt

20

16

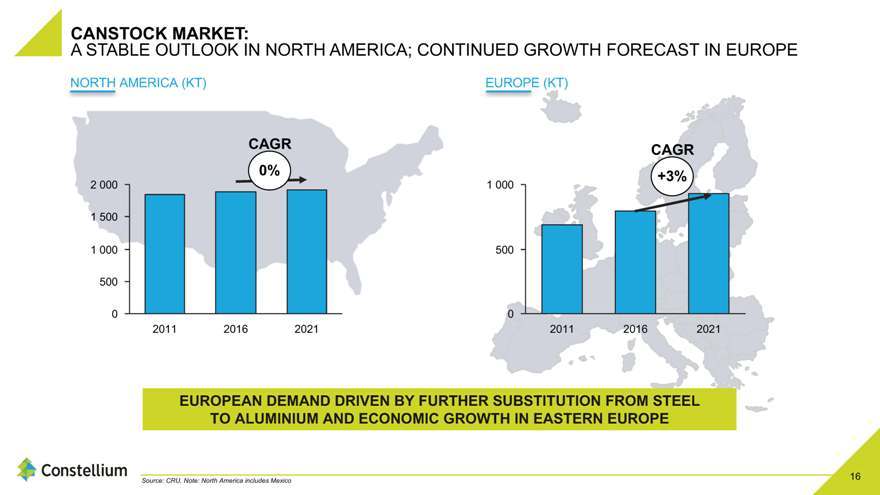

CANSTOCK MARKET:

A STABLE OUTLOOK IN NORTH AMERICA; CONTINUED GROWTH FORECAST IN EUROPE

Source: CRU. Note: North America includes Mexico

500

1 000

1 500

2 000

0

2011 2016 2021

0

1 000

500

+3%

2011 2016 2021

EUROPEAN DEMAND DRIVEN BY FURTHER SUBSTITUTION FROM STEEL

TO ALUMINIUM AND ECONOMIC GROWTH IN EASTERN EUROPE

NORTH AMERICA (KT) EUROPE (KT)

CAGR

0%

CAGR

21

17

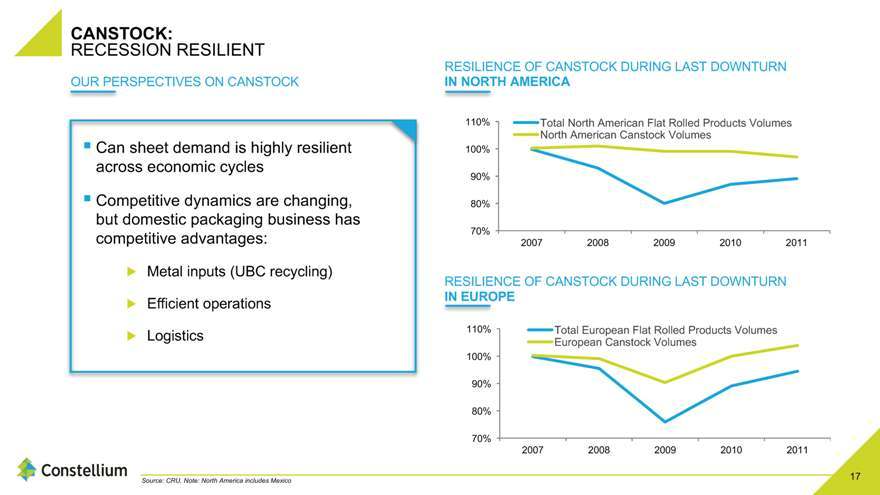

CANSTOCK:

RECESSION RESILIENT

RESILIENCE OF CANSTOCK DURING LAST DOWNTURN

IN NORTH AMERICA

RESILIENCE OF CANSTOCK DURING LAST DOWNTURN

IN EUROPE

OUR PERSPECTIVES ON CANSTOCK

Can sheet demand is highly resilient

across economic cycles

Competitive dynamics are changing,

but domestic packaging business has

competitive advantages:

Metal inputs (UBC recycling)

Efficient operations

Logistics

70%

80%

90%

100%

110%

2007 2008 2009 2010 2011

Total European Flat Rolled Products Volumes

European Canstock Volumes

70%

80%

90%

100%

110%

2007 2008 2009 2010 2011

Total North American Flat Rolled Products Volumes

North American Canstock Volumes

Source: CRU. Note: North America includes Mexico

22

18

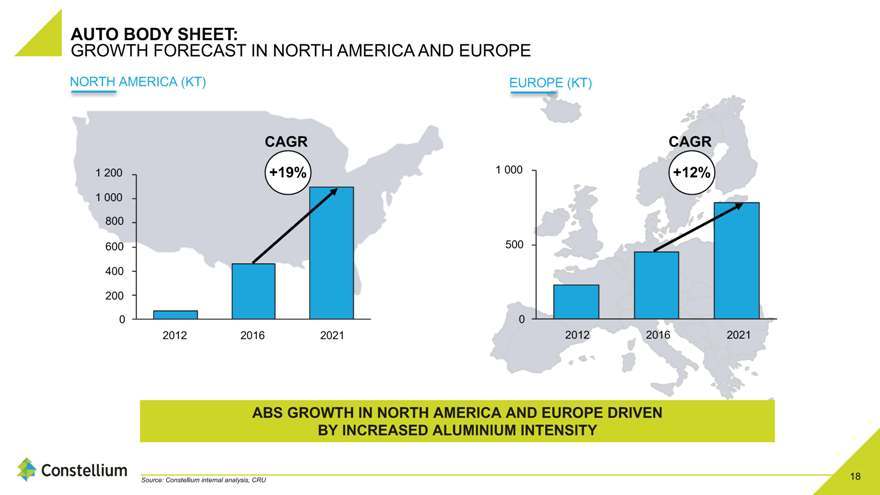

AUTO BODY SHEET:

GROWTH FORECAST IN NORTH AMERICA AND EUROPE

200

400

0

800

600

2012

+19%

2016 2021

0

500

2012 2016 2021

Source: Constellium internal analysis, CRU

NORTH AMERICA (KT) EUROPE (KT)

ABS GROWTH IN NORTH AMERICA AND EUROPE DRIVEN

BY INCREASED ALUMINIUM INTENSITY

CAGR

+12%

CAGR

23

19

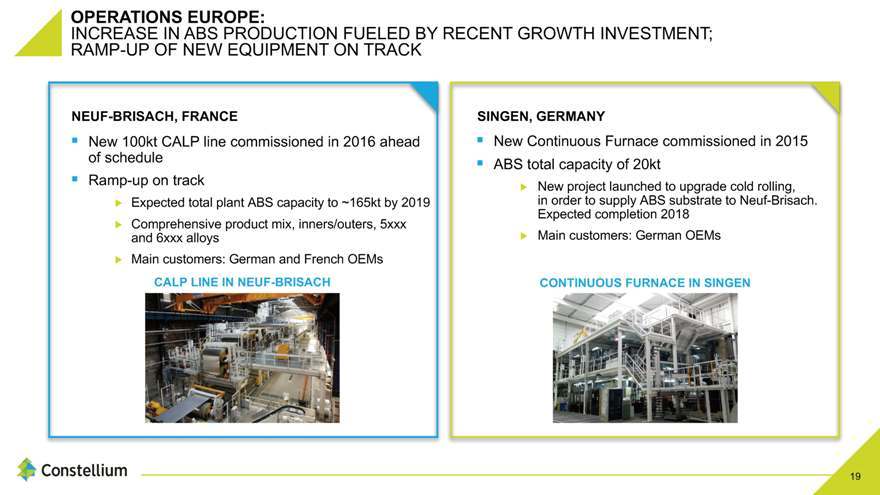

OPERATIONS EUROPE:

INCREASE IN ABS PRODUCTION FUELED BY RECENT GROWTH INVESTMENT;

RAMP-UP OF NEW EQUIPMENT ON TRACK

NEUF-BRISACH, FRANCE

New 100kt CALP line commissioned in 2016 ahead

of schedule

Ramp-up on track

Expected total plant ABS capacity to ~165kt by 2019

Comprehensive product mix, inners/outers, 5xxx

and 6xxx alloys

Main customers: German and French OEMs

CALP LINE IN NEUF-BRISACH

SINGEN, GERMANY

New Continuous Furnace commissioned in 2015

ABS total capacity of 20kt

New project launched to upgrade cold rolling,

in order to supply ABS substrate to Neuf-Brisach.

Expected completion 2018

Main customers: German OEMs

CONTINUOUS FURNACE IN SINGEN

24

20

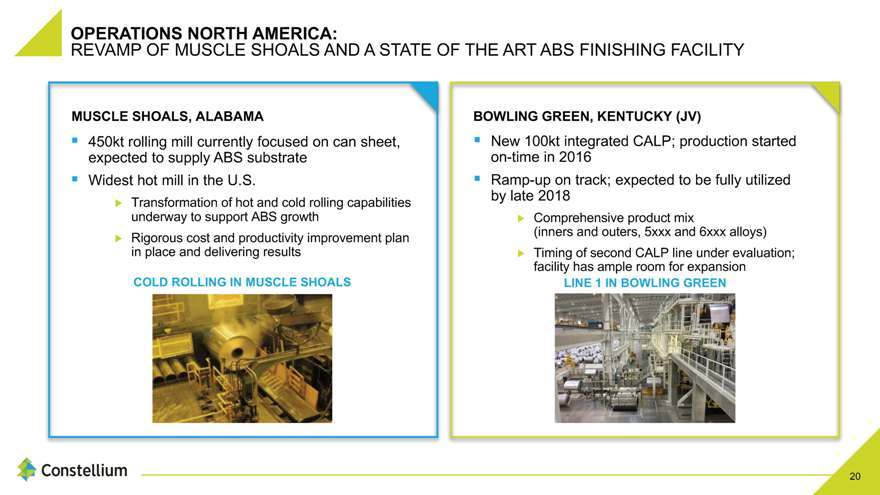

OPERATIONS NORTH AMERICA:

REVAMP OF MUSCLE SHOALS AND A STATE OF THE ART ABS FINISHING FACILITY

MUSCLE SHOALS, ALABAMA

450kt rolling mill currently focused on can sheet,

expected to supply ABS substrate

Widest hot mill in the U.S.

Transformation of hot and cold rolling capabilities

underway to support ABS growth

Rigorous cost and productivity improvement plan

in place and delivering results

COLD ROLLING IN MUSCLE SHOALS

BOWLING GREEN, KENTUCKY (JV)

New 100kt integrated CALP; production started

on-time in 2016

Ramp-up on track; expected to be fully utilized

by late 2018

Comprehensive product mix

(inners and outers, 5xxx and 6xxx alloys)

Timing of second CALP line under evaluation;

facility has ample room for expansion

LINE 1 IN BOWLING GREEN

25

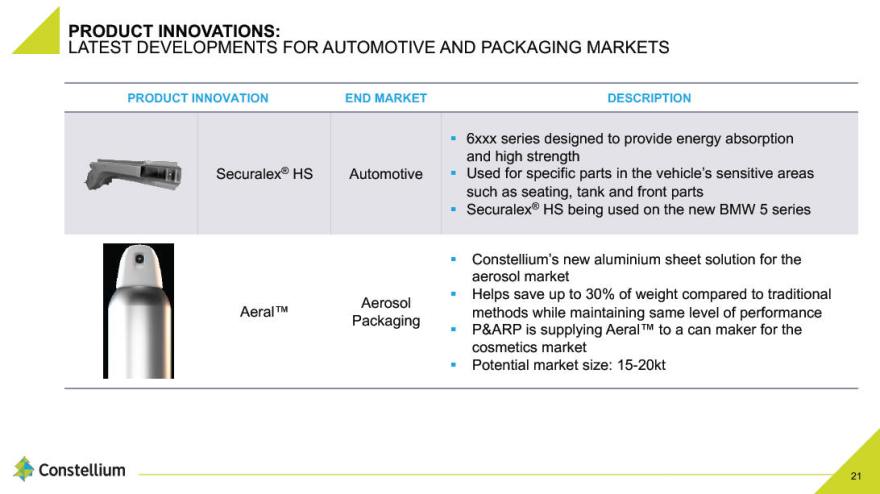

PRODUCT INNOVATIONS:

LATEST DEVELOPMENTS FOR AUTOMOTIVE AND PACKAGING MARKETS

PRODUCT INNOVATION END MARKET DESCRIPTION

6xxx series designed to provide energy absorption and high strength Securalex® HS Automotive Used for specific parts in the vehicle’s sensitive areas such as seating, tank and front parts

Securalex® HS being used on the new BMW 5 series

Constellium’s new aluminium sheet solution for the aerosol market

Helps save up to 30% of weight compared to traditional Aerosol Aeral™ methods while maintaining same level of performance Packaging

P&ARP is supplying Aeral™ to a can maker for the cosmetics market

Potential market size: 15-20kt

26

P&ARP HAS PASSED THE PEAK INVESTMENT PERIOD AND IS FOCUSED ON GENERATING CASH

OUR MAJOR INVESTMENTS ARE EITHER COMPLETED OR CLOSE TO COMPLETION:

New automotive finishing line in Neuf-Brisach, France, SOP July 2016

New automotive finishing line in Bowling Green, Kentucky, SOP September 2016

Hot and Cold rolling revamp in Muscle Shoals, Alabama, completion end 2017

P&ARP HAS LAUNCHED VARIOUS COST SAVING AND PRODUCTIVITY IMPROVEMENT INITIATIVES

For example:

Procurement

Equipment efficiency

Raw material yield

SPECIFIC ACTIONS LAUNCHED TO REDUCE TWC INCLUDING INVENTORY

27

ADDING IT UP – FUTURE P&ARP

GROW ABS BUSINESS IN THE U.S. AND EUROPE

OPTIMIZE CAPACITY UTILIZATION

CONTINUE RIGOROUS COST, WORKING CAPITAL AND CAPEX DISCIPLINE

28

Q&A

29

Aerospace & Transportation

IN GR ID J O E R G

30

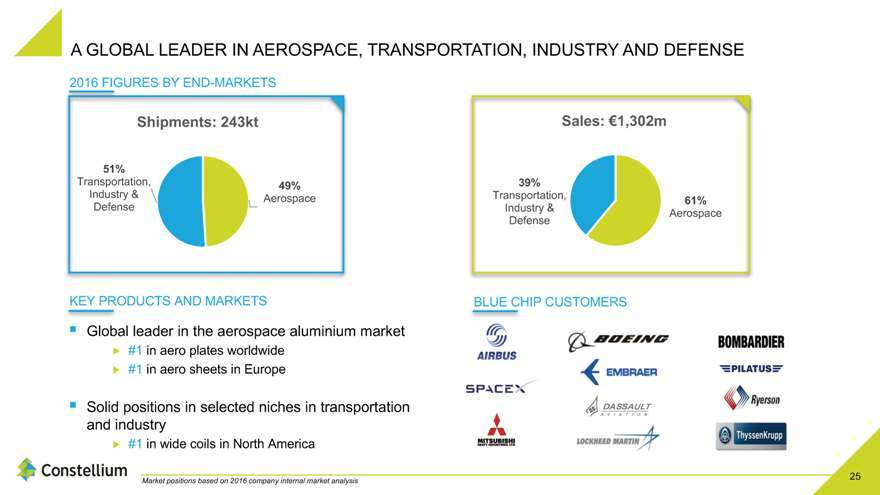

25

A GLOBAL LEADER IN AEROSPACE, TRANSPORTATION, INDUSTRY AND DEFENSE

Global leader in the aerospace aluminium market

#1 in aero plates worldwide

#1 in aero sheets in Europe

Solid positions in selected niches in transportation

and industry

#1 in wide coils in North America

61%

Aerospace

39%

Transportation,

Industry &

Defense

Sales: €1,302m

49%

Aerospace

51%

Transportation,

Industry &

Defense

Shipments: 243kt

Market positions based on 2016 company internal market analysis

2016 FIGURES BY END-MARKETS

KEY PRODUCTS AND MARKETS BLUE CHIP CUSTOMERS

31

26

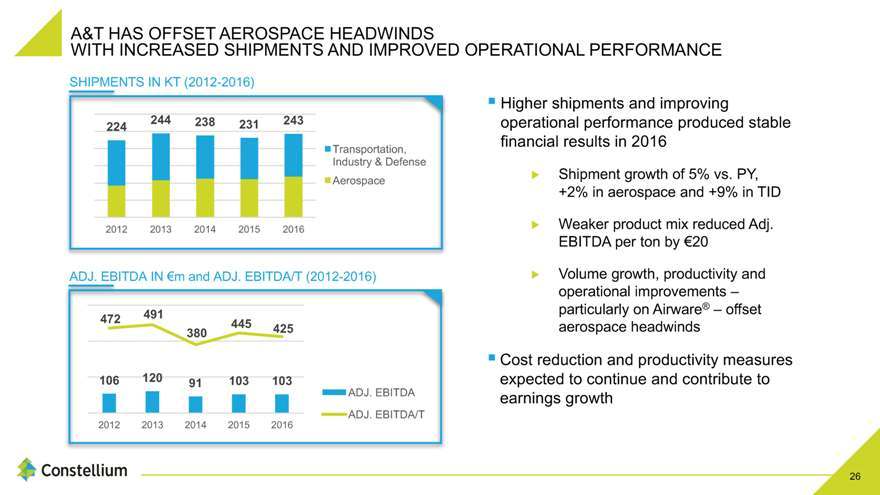

A&T HAS OFFSET AEROSPACE HEADWINDS

WITH INCREASED SHIPMENTS AND IMPROVED OPERATIONAL PERFORMANCE

Higher shipments and improving

operational performance produced stable

financial results in 2016

Shipment growth of 5% vs. PY,

+2% in aerospace and +9% in TID

Weaker product mix reduced Adj.

EBITDA per ton by €20

Volume growth, productivity and

operational improvements –

particularly on Airware® – offset

aerospace headwinds

Cost reduction and productivity measures

expected to continue and contribute to

earnings growth

224 244 238 231 243

2012 2013 2014 2015 2016

Transportation,

Industry & Defense

Aerospace

106 120 91 103 103

472 491

380

445 425

2012 2013 2014 2015 2016

ADJ. EBITDA

ADJ. EBITDA/T

SHIPMENTS IN KT (2012-2016)

ADJ. EBITDA IN €m and ADJ. EBITDA/T (2012-2016)

32

27

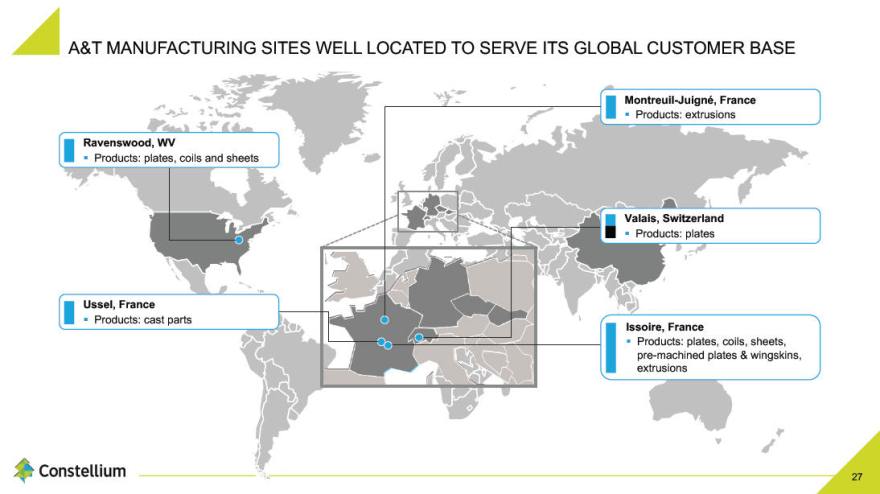

A&T MANUFACTURING SITES WELL LOCATED TO SERVE ITS GLOBAL CUSTOMER BASE

Ravenswood, WV

Products: plates, coils and sheets

Issoire, France

Products: plates, coils, sheets,

pre-machined plates & wingskins,

extrusions

Valais, Switzerland

Products: plates

Montreuil-Juigné, France

Products: extrusions

Ussel, France

Products: cast parts

33

28

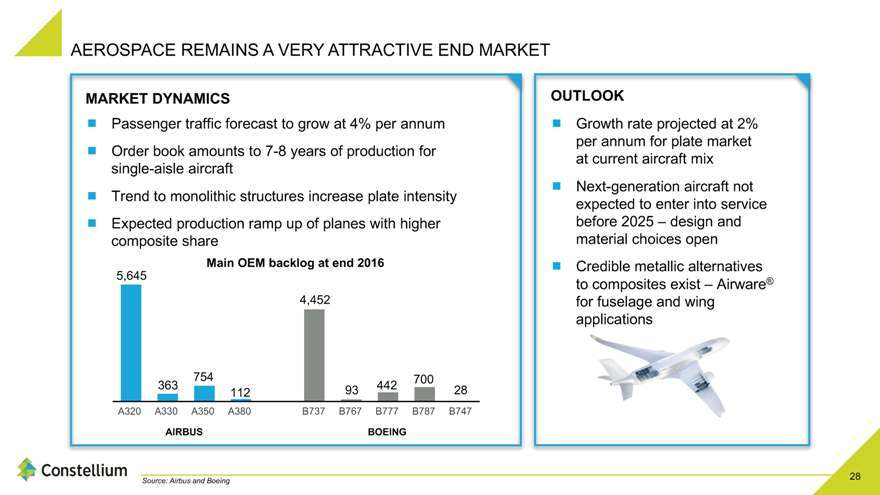

AEROSPACE REMAINS A VERY ATTRACTIVE END MARKET

A320 A330 A350 A380 B737 B767 B777 B787 B747

AIRBUS BOEING

Main OEM backlog at end 2016

MARKET DYNAMICS OUTLOOK

3/4 Growth rate projected at 2%

per annum for plate market

at current aircraft mix

3/4 Next-generation aircraft not

expected to enter into service

before 2025 – design and

material choices open

3/4 Credible metallic alternatives

to composites exist – Airware®

for fuselage and wing

applications

3/4 Passenger traffic forecast to grow at 4% per annum

3/4 Order book amounts to 7-8 years of production for

single-aisle aircraft

3/4 Trend to monolithic structures increase plate intensity

3/4 Expected production ramp up of planes with higher

composite share

Source: Airbus and Boeing

4,452

93 442 700

28

5,645

363

754

112

34

29

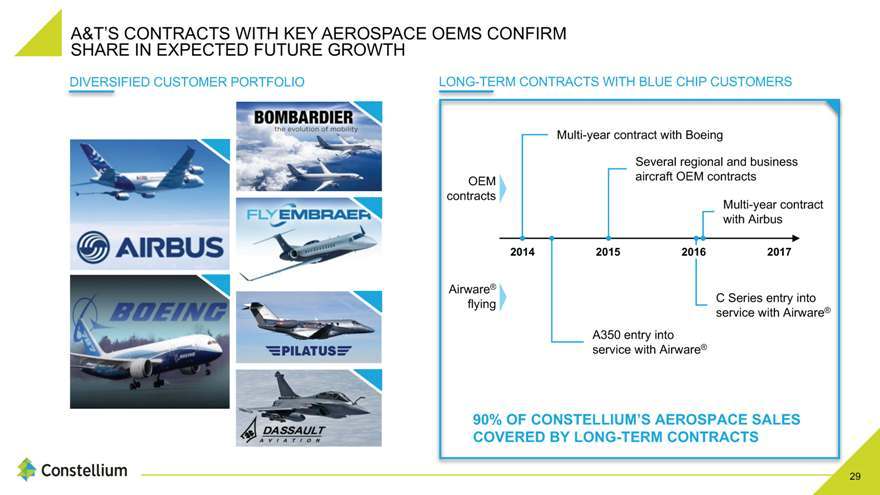

A&T’S CONTRACTS WITH KEY AEROSPACE OEMS CONFIRM

SHARE IN EXPECTED FUTURE GROWTH

Multi-year contract with Boeing

Several regional and business

aircraft OEM contracts

C Series entry into

service with Airware®

A350 entry into

service with Airware®

OEM

contracts

Airware®

flying

2014 2016 2017

Multi-year contract

with Airbus

2015

DIVERSIFIED CUSTOMER PORTFOLIO LONG-TERM CONTRACTS WITH BLUE CHIP CUSTOMERS

90% OF CONSTELLIUM’S AEROSPACE SALES

COVERED BY LONG-TERM CONTRACTS

35

30

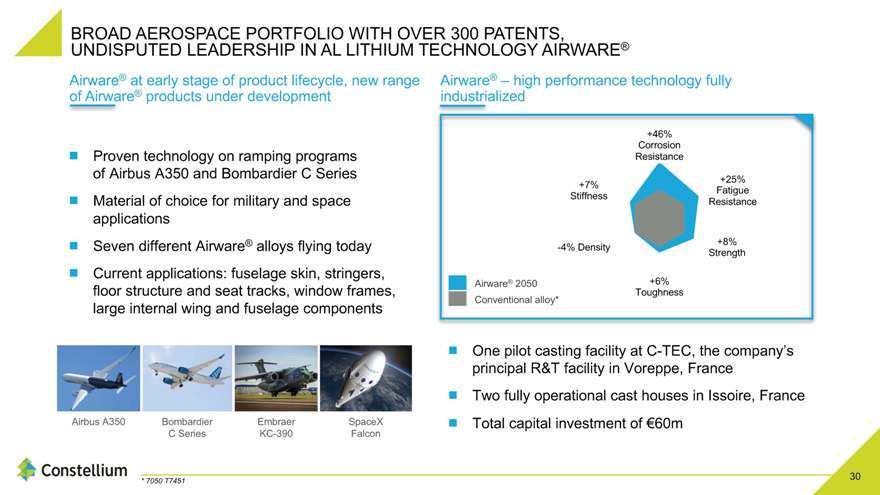

BROAD AEROSPACE PORTFOLIO WITH OVER 300 PATENTS,

UNDISPUTED LEADERSHIP IN AL LITHIUM TECHNOLOGY AIRWARE®

SpaceX

Falcon

Embraer

KC-390

Bombardier

C Series

Airbus A350

+46%

Corrosion

Resistance

+25%

Fatigue

Resistance

+8%

Strength

+6%

Toughness

-4% Density

+7%

Stiffness

Airware® 2050

Conventional alloy*

3/4 One pilot casting facility at C-TEC, the company’s

principal R&T facility in Voreppe, France

3/4 Two fully operational cast houses in Issoire, France

3/4 Total capital investment of €60m

Airware® at early stage of product lifecycle, new range

of Airware® products under development

Airware® – high performance technology fully

industrialized

3/4 Proven technology on ramping programs

of Airbus A350 and Bombardier C Series

3/4 Material of choice for military and space

applications

3/4 Seven different Airware® alloys flying today

3/4 Current applications: fuselage skin, stringers,

floor structure and seat tracks, window frames,

large internal wing and fuselage components

36

31

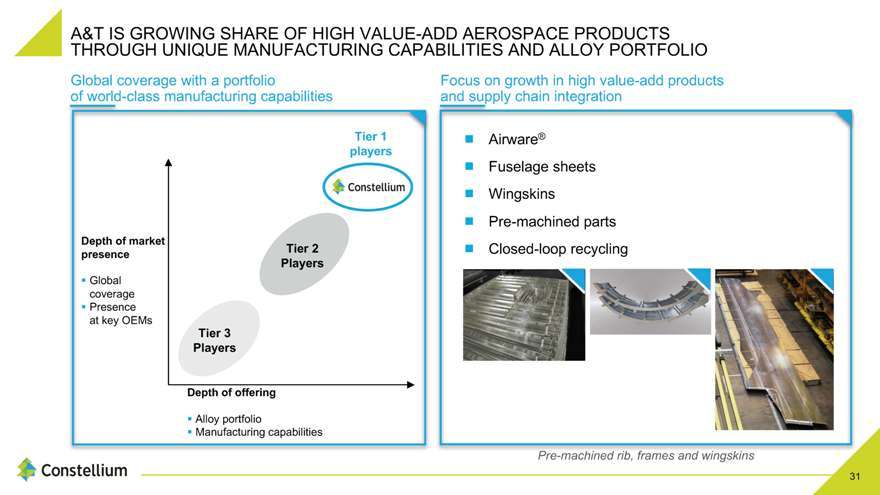

A&T IS GROWING SHARE OF HIGH VALUE-ADD AEROSPACE PRODUCTS

THROUGH UNIQUE MANUFACTURING CAPABILITIES AND ALLOY PORTFOLIO

3/4 Airware®

3/4 Fuselage sheets

3/4 Wingskins

3/4 Pre-machined parts

3/4 Closed-loop recycling

Depth of offering

Alloy portfolio

Manufacturing capabilities

Depth of market

presence

Global

coverage

Presence

at key OEMs

Tier 1

players

Tier 2

Players

Tier 3

Players

Focus on growth in high value-add products

and supply chain integration

Global coverage with a portfolio

of world-class manufacturing capabilities

Pre-machined rib, frames and wingskins

37

32

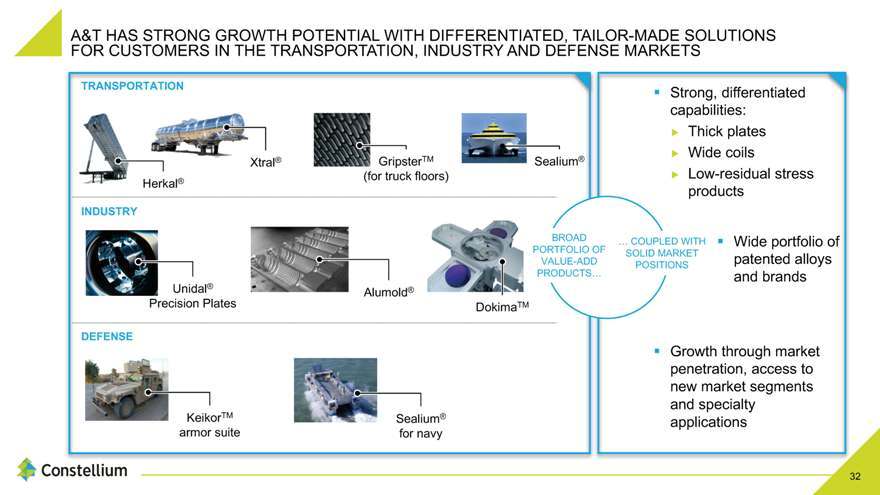

A&T HAS STRONG GROWTH POTENTIAL WITH DIFFERENTIATED, TAILOR-MADE SOLUTIONS

FOR CUSTOMERS IN THE TRANSPORTATION, INDUSTRY AND DEFENSE MARKETS

GripsterTM

(for truck floors)

Xtral® Sealium®

Unidal®

Precision Plates

Alumold®

DokimaTM

KeikorTM

armor suite

Sealium®

for navy

Herkal®

Wide portfolio of

patented alloys

and brands

TRANSPORTATION

INDUSTRY

DEFENSE

Strong, differentiated

capabilities:

Thick plates

Wide coils

Low-residual stress

products

Growth through market

penetration, access to

new market segments

and specialty

applications

BROAD

PORTFOLIO OF

VALUE-ADD

PRODUCTS…

… COUPLED WITH

SOLID MARKET

POSITIONS

38

33

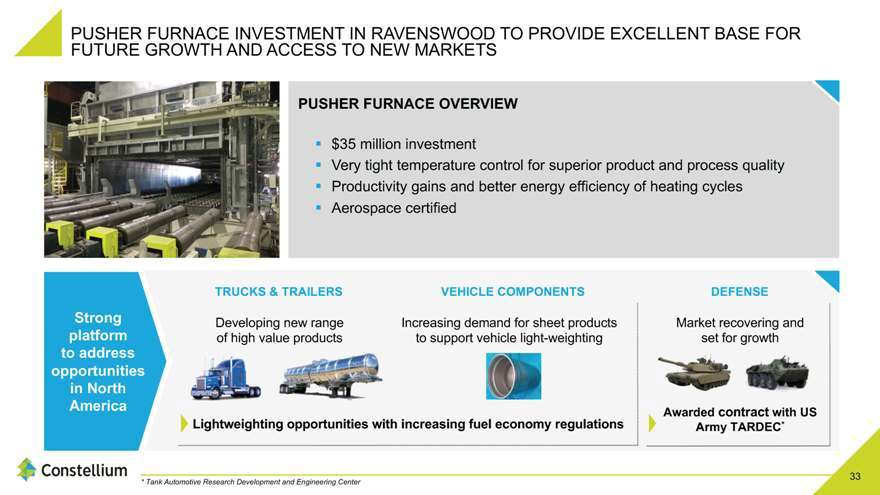

PUSHER FURNACE INVESTMENT IN RAVENSWOOD TO PROVIDE EXCELLENT BASE FOR

FUTURE GROWTH AND ACCESS TO NEW MARKETS

* Tank Automotive Research Development and Engineering Center

Developing new range

of high value products

Increasing demand for sheet products

to support vehicle light-weighting

Lightweighting opportunities with increasing fuel economy regulations

TRUCKS & TRAILERS VEHICLE COMPONENTS

Strong

platform

to address

opportunities

in North

America

DEFENSE

Market recovering and

set for growth

Awarded contract with US

Army TARDEC*

$35 million investment

Very tight temperature control for superior product and process quality

Productivity gains and better energy efficiency of heating cycles

Aerospace certified

PUSHER FURNACE OVERVIEW

39

34

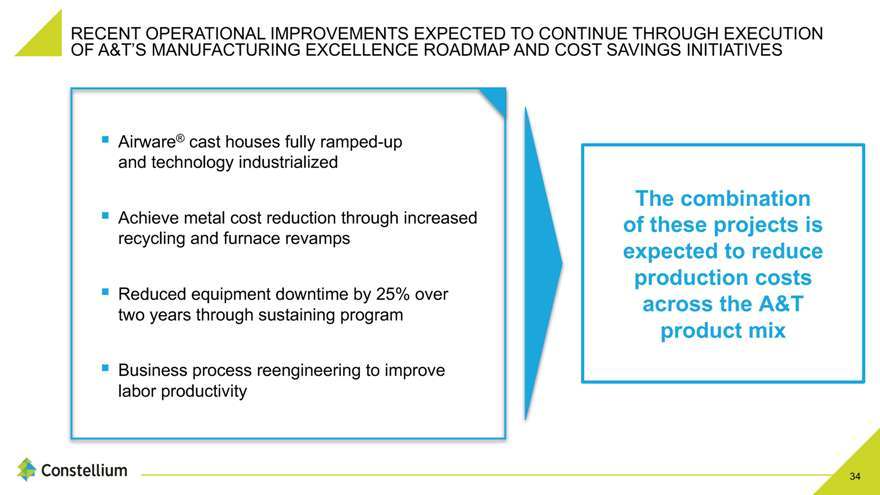

RECENT OPERATIONAL IMPROVEMENTS EXPECTED TO CONTINUE THROUGH EXECUTION

OF A&T’S MANUFACTURING EXCELLENCE ROADMAP AND COST SAVINGS INITIATIVES

Airware® cast houses fully ramped-up

and technology industrialized

Achieve metal cost reduction through increased

recycling and furnace revamps

Reduced equipment downtime by 25% over

two years through sustaining program

Business process reengineering to improve

labor productivity

The combination

of these projects is

expected to reduce

production costs

across the A&T

product mix

40

35

ADDING IT UP – FUTURE A&T

Increase share of value-add products in aerospace,

further develop downstream activities to improve customer intimacy

Grow in transportation, industry and defense through market penetration,

new market segments and specialty applications in niches

Leverage existing technology to innovate and keep A&T ahead of competition

Deliver operational excellence to satisfy customers,

increase productivity and reduce cost with recent investments

41

Q&A

42

P A U L W A R T O N

Automotive Structures

& Industry

43

27%

Automotive

Structures

18%

Extrusions for

Automotive

55%

Other

SHIPMENTS: 217kt

GLOBAL LEADER IN ALUMINIUM EXTRUDED SOLUTIONS TO OEMs,

STRONGLY POSITIONED IN ELECTRIC VEHICLE MARKET

37

2016 FIGURES BY END-MARKETS

KEY PRODUCTS AND END MARKETS BLUE CHIP CUSTOMERS

43%

Automotive

Structures

11%

Extrusions for Automotive

46%

Other

REVENUE: €1,002m

Automotive

market:

54%

AUTOMOTIVE STRUCTURES INDUSTRY

Market positions based on 2016 company internal market analysis

44

38

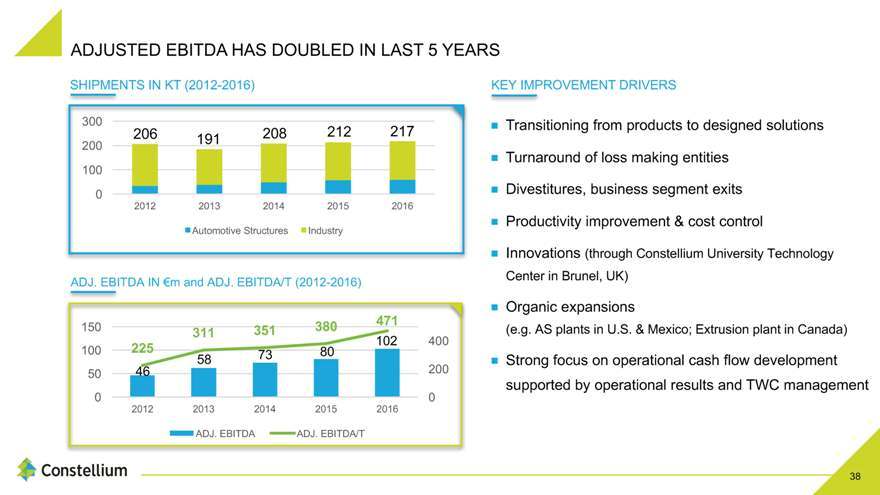

ADJUSTED EBITDA HAS DOUBLED IN LAST 5 YEARS

SHIPMENTS IN KT (2012-2016)

ADJ. EBITDA IN €m and ADJ. EBITDA/T (2012-2016)

KEY IMPROVEMENT DRIVERS

0

100

200

300

2012 2013 2014 2015 2016

Automotive Structures Industry

3/4 Transitioning from products to designed solutions

3/4 Turnaround of loss making entities

3/4 Divestitures, business segment exits

3/4 Productivity improvement & cost control

3/4 Innovations (through Constellium University Technology

Center in Brunel, UK)

3/4 Organic expansions

(e.g. AS plants in U.S. & Mexico; Extrusion plant in Canada)

3/4 Strong focus on operational cash flow development

supported by operational results and TWC management

206 191 208 212 217

225

311 351 380 471

0

200

400

0

50

100

150

2012 2013 2014 2015 2016

ADJ. EBITDA ADJ. EBITDA/T

46

58 73 80

102

45

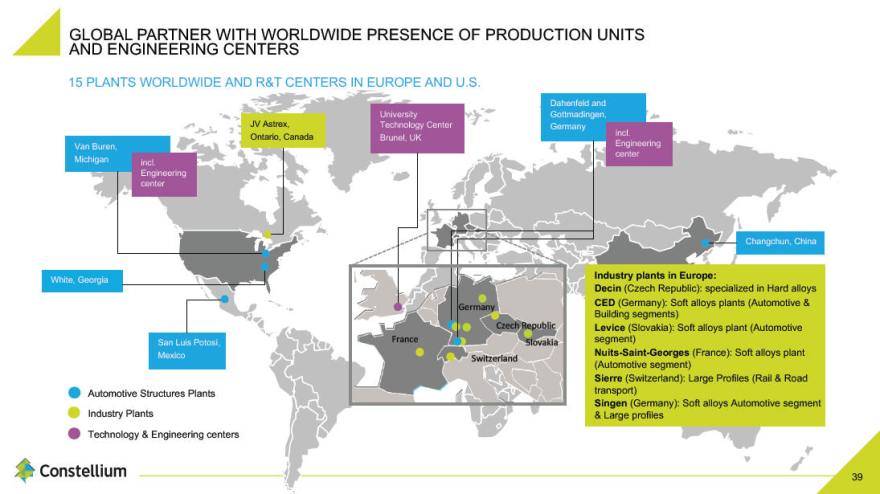

GLOBAL PARTNER WITH WORLDWIDE PRESENCE OF PRODUCTION UNITS

AND ENGINEERING CENTERS

Dahenfeld and

Gottmadingen,

Germany

Switzerland

Germany

France

Changchun, China

Van Buren,

Michigan

JV Astrex,

Ontario, Canada

White, Georgia

Czech Republic

San Luis Potosí, Slovakia

Mexico

Industry Plants

Automotive Structures Plants

University

Technology Center

Brunel, UK

Technology & Engineering centers

incl.

Engineering

center

incl.

Engineering

center

Industry plants in Europe:

Decin (Czech Republic): specialized in Hard alloys

CED (Germany): Soft alloys plants (Automotive &

Building segments)

Levice (Slovakia): Soft alloys plant (Automotive

segment)

Nuits-Saint-Georges (France): Soft alloys plant

(Automotive segment)

Sierre (Switzerland): Large Profiles (Rail & Road

transport)

Singen (Germany): Soft alloys Automotive segment

& Large profiles

15 PLANTS WORLDWIDE AND R&T CENTERS IN EUROPE AND U.S.

39

46

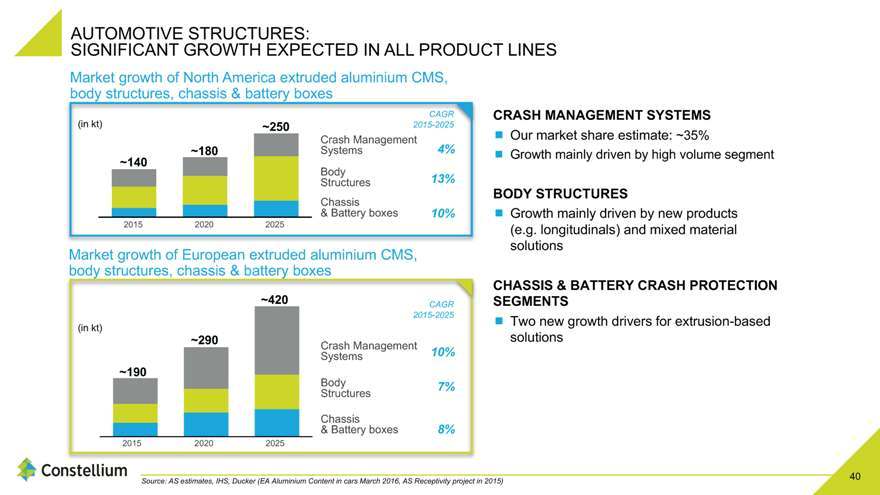

AUTOMOTIVE STRUCTURES:

SIGNIFICANT GROWTH EXPECTED IN ALL PRODUCT LINES

Market growth of North America extruded aluminium CMS,

body structures, chassis & battery boxes

Source: AS estimates, IHS, Ducker (EA Aluminium Content in cars March 2016, AS Receptivity project in 2015)

(in kt)

(in kt)

Chassis

& Battery boxes

2015 2020 2025

2015 2020 2025

Body

Structures

Crash Management

Systems

CAGR

2015-2025

4%

13%

10%

~140

~180

~250

~190

~290

~420

Market growth of European extruded aluminium CMS,

body structures, chassis & battery boxes

Chassis

& Battery boxes

Body

Structures

Crash Management

Systems

CAGR

2015-2025

10%

7%

8%

CRASH MANAGEMENT SYSTEMS

3/4 Our market share estimate: ~35%

3/4 Growth mainly driven by high volume segment

BODY STRUCTURES

3/4 Growth mainly driven by new products

(e.g. longitudinals) and mixed material

solutions

CHASSIS & BATTERY CRASH PROTECTION

SEGMENTS

3/4 Two new growth drivers for extrusion-based

solutions

40

47

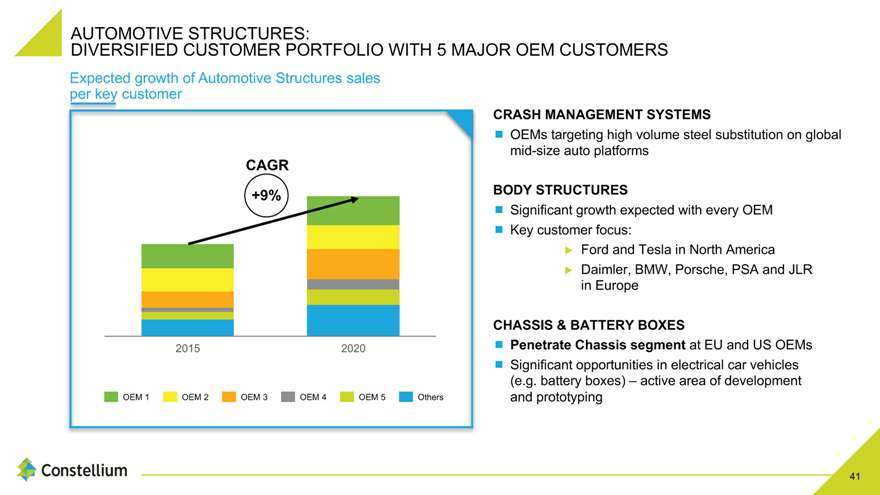

AUTOMOTIVE STRUCTURES:

DIVERSIFIED CUSTOMER PORTFOLIO WITH 5 MAJOR OEM CUSTOMERS

Expected growth of Automotive Structures sales

per key customer

41

CRASH MANAGEMENT SYSTEMS

3/4 OEMs targeting high volume steel substitution on global

mid-size auto platforms

BODY STRUCTURES

3/4 Significant growth expected with every OEM

3/4 Key customer focus:

Ford and Tesla in North America

Daimler, BMW, Porsche, PSA and JLR

in Europe

CHASSIS & BATTERY BOXES

3/4 Penetrate Chassis segment at EU and US OEMs

3/4 Significant opportunities in electrical car vehicles

(e.g. battery boxes) – active area of development

and prototyping

+9%

2015 2020

OEM 1 OEM 2 OEM 3 OEM 4 OEM 5 Others

CAGR

48

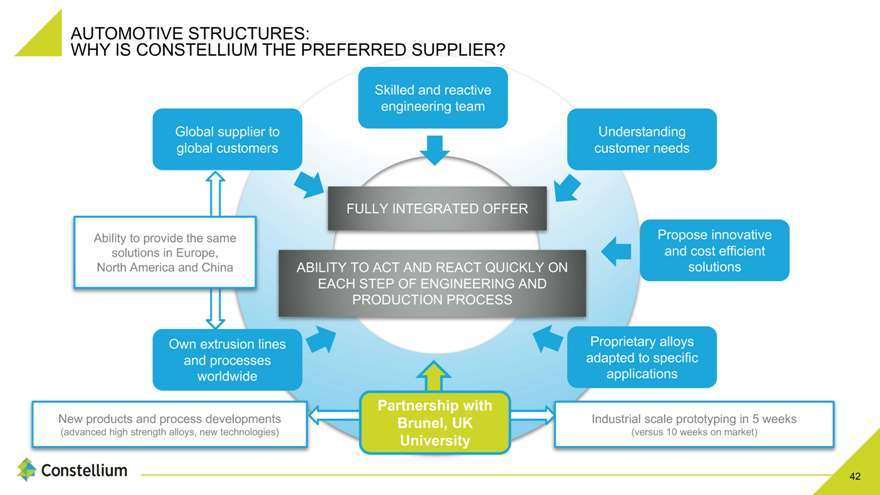

AUTOMOTIVE STRUCTURES:

WHY IS CONSTELLIUM THE PREFERRED SUPPLIER?

42

FULLY INTEGRATED OFFER

ABILITY TO ACT AND REACT QUICKLY ON

EACH STEP OF ENGINEERING AND

PRODUCTION PROCESS

New products and process developments

(advanced high strength alloys, new technologies)

Industrial scale prototyping in 5 weeks

(versus 10 weeks on market)

Skilled and reactive

engineering team

Proprietary alloys

adapted to specific

applications

Own extrusion lines

and processes

worldwide

Global supplier to

global customers

Propose innovative

and cost efficient

solutions

Understanding

customer needs

Ability to provide the same

solutions in Europe,

North America and China

Partnership with

Brunel, UK

University

49

ENGINEERING

AUTOMOTIVE STRUCTURES:

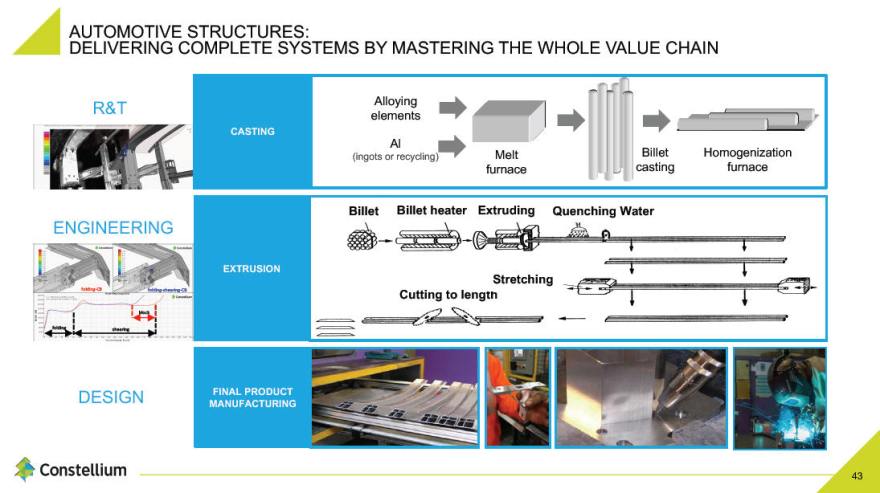

DELIVERING COMPLETE SYSTEMS BY MASTERING THE WHOLE VALUE CHAIN

43

DESIGN

R&T

Melt

furnace

Billet

casting

Alloying

elements

Al

(ingots or recycling) Homogenization

furnace

folding-CB folding-shearing-CB

folding shearing

block

CASTING

Billet Billet heater Extruding Quenching Water

Cutting to length

Stretching

EXTRUSION

FINAL PRODUCT

MANUFACTURING

50

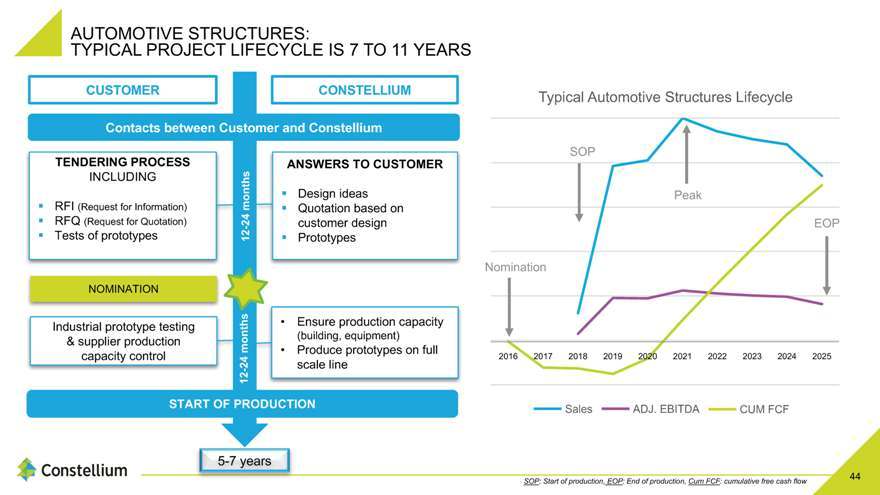

AUTOMOTIVE STRUCTURES:

TYPICAL PROJECT LIFECYCLE IS 7 TO 11 YEARS

44

Contacts between Customer and Constellium

START OF PRODUCTION

CUSTOMER CONSTELLIUM

TENDERING PROCESS

INCLUDING

RFI (Request for Information)

RFQ (Request for Quotation)

Tests of prototypes

ANSWERS TO CUSTOMER

Design ideas

Quotation based on

customer design

Prototypes

Industrial prototype testing

& supplier production

capacity control

Ensure production capacity

(building, equipment)

Produce prototypes on full

scale line

12-24 months 12-24 months

5-7 years

NOMINATION

SOP: Start of production, EOP: End of production, Cum FCF: cumulative free cash flow

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Typical Automotive Structures Lifecycle

Nomination

SOP

Peak

EOP

Sales ADJ. EBITDA CUM FCF

51

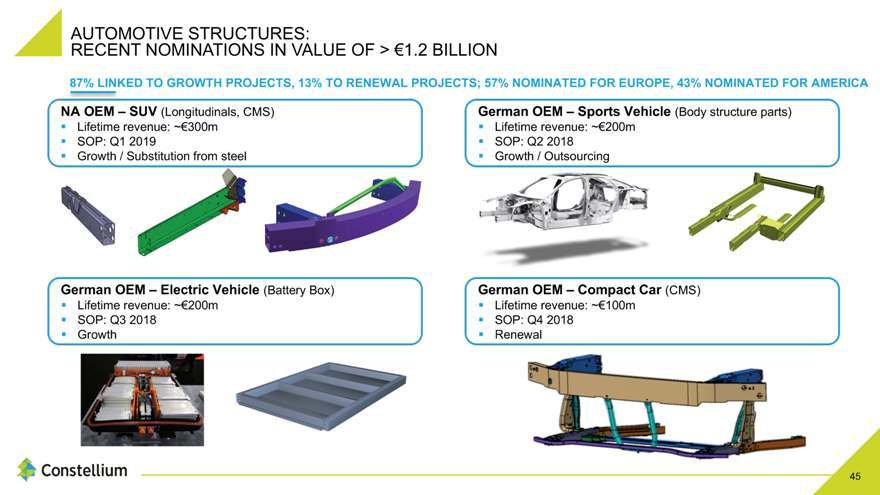

87% LINKED TO GROWTH PROJECTS, 13% TO RENEWAL PROJECTS; 57% NOMINATED FOR EUROPE, 43% NOMINATED FOR AMERICA

AUTOMOTIVE STRUCTURES:

RECENT NOMINATIONS IN VALUE OF > €1.2 BILLION

45

German OEM – Sports Vehicle (Body structure parts)

Lifetime revenue: ~€200m

SOP: Q2 2018

Growth / Outsourcing

NA OEM – SUV (Longitudinals, CMS)

Lifetime revenue: ~€300m

SOP: Q1 2019

Growth / Substitution from steel

German OEM – Electric Vehicle (Battery Box)

Lifetime revenue: ~€200m

SOP: Q3 2018

Growth

German OEM – Compact Car (CMS)

Lifetime revenue: ~€100m

SOP: Q4 2018

Renewal

52

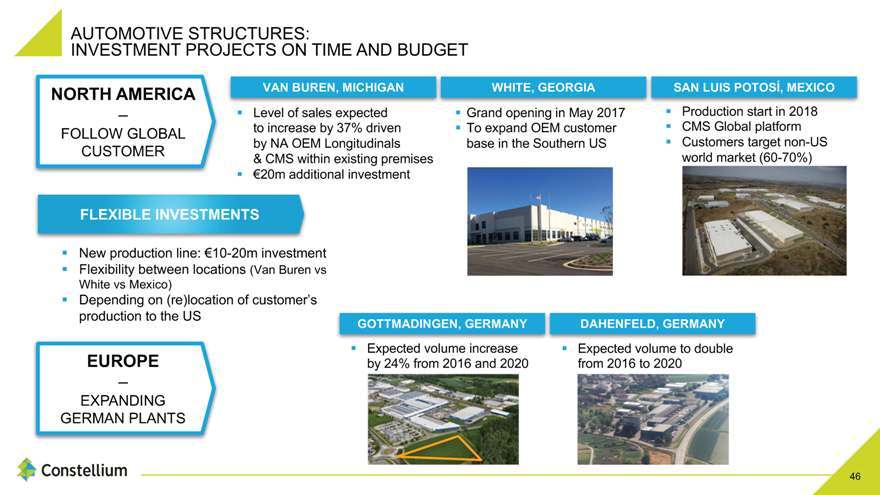

AUTOMOTIVE STRUCTURES:

INVESTMENT PROJECTS ON TIME AND BUDGET

46

Expected volume to double

from 2016 to 2020

Expected volume increase

EUROPE by 24% from 2016 and 2020

–

EXPANDING

GERMAN PLANTS

GOTTMADINGEN, GERMANY DAHENFELD, GERMANY

FLEXIBLE INVESTMENTS

New production line: €10-20m investment

Flexibility between locations (Van Buren vs

White vs Mexico)

Depending on (re)location of customer’s

production to the US

Production start in 2018

CMS Global platform

Customers target non-US

world market (60-70%)

Grand opening in May 2017

To expand OEM customer

base in the Southern US

Level of sales expected

to increase by 37% driven

by NA OEM Longitudinals

& CMS within existing premises

€20m additional investment

NORTH AMERICA

–

FOLLOW GLOBAL

CUSTOMER

VAN BUREN, MICHIGAN WHITE, GEORGIA SAN LUIS POTOSÍ, MEXICO

53

INDUSTRY:

CURRENT INVESTMENT PROJECTS TO SUPPORT AUTOMOTIVE STRUCTURES

47

Upgrade existing Soft alloys extrusions plants to follow the growth of Automotive Structures

Protect IP of proprietary alloys & processes

Maintain leadership position as OEM preferred material development partner

EUROPE

–

UPGRADE

& EXPAND

FULLY-OWNED SOFT ALLOYS EXTRUSIONS PLANTS (GERMANY, FRANCE, SLOVAKIA)

Produce Constellium proprietary

alloys

Protect the IP

NORTH AMERICA

–

UPSTREAM

CONTROL

ASTREX JV, ONTARIO (CANADA)

A true material development partner

Optimized supply chain

Speed to market: prototype & serial

production

IMPORTANCE OF

INDUSTRY FOR AUTO

STRUCTURES

54

INDUSTRY:

EXAMPLE OF CURRENT INVESTMENT PROJECT TO GROW AND DIVERSIFY OUR

PORTFOLIO OF EXTRUDED-BASED SOLUTIONS FOR THE AUTOMOTIVE MARKET

48

DECIN

Expansion on a new site, a few kilometers away from the historic site:

A new casthouse (40kt of hard alloys billet capacity)

A new extrusion line with variable extrusion power

Downstream equipment

Products:

Forging stock applications in automotive

Battery boxes for hybrid and full-electric vehicles

Machined parts for chassis and other structural applications

Timeline: expected start of production in 2019

LEVICE

Well established qualified position with scalable capacity

Development of battery boxes and machined parts for transportation

EUROPE

–

UPGRADE

& EXPAND

With specific focus

on Eastern Europe

DECIN (CZECH REPUBLIC) AND LEVICE (SLOVAKIA)

55

ADDING IT UP – FUTURE AS&I

AS&I OPERATES IN HIGHLY ATTRACTIVE MARKETS THAT ARE EXPECTED TO GROW

CLEAR STRATEGIC OBJECTIVES

Retain leadership position in extrusion-based solutions for structural automotive parts (worldwide) and in the EU hard alloy extrusions market

CUSTOMER ORIENTED

A partner, developing engineered solutions adapted to customer needs

A provider of optimal product performance and weight reduction solutions

A steadily growing geographic footprint enabling proximity and best service to global OEMs

FOCUS ON INNOVATION AND TECHNOLOGY

Strong innovation capabilities both internally and through external partnerships (e.g. UTC in Brunel)

Developed advanced high strength 6xxx alloys

Integrated supply chain with ability to act on each step of production process (from billet casting to final product)

SEIZING OPPORTUNITIES

Expected further growth into new segments (chassis, battery box, longitudinals)

Downstream development potential both in Rail and Hard alloys to raise entry barrier

EXPERIENCED LEADERSHIP TEAM

Extensive global industry knowledge with a demonstrated track record

Year on year double digit Adj. EBITDA increase since 2010

AS&I HAS BECOME THE MARKET LEADER IN TERMS OF GROWTH & FINANCIAL RESULTS AND WILL CONTINUE TO DELIVER ON BOTH GROWTH & PROFITABILITY

49

Q&A

63

P E T E R M A T T

Finance

64

FOCUS ON FREE CASH FLOW

- PROJECT 2019

Reduce costs

Lower trade working capital

Reduce capital spending

RIGOROUS CAPITAL

DISCIPLINE

Optimize existing assets

IRR/payback metrics for growth and cost savings projects

STRENGTHEN BALANCE

SHEET AND LIQUIDITY

Sustainable Adjusted EBITDA growth

Cash flow improvement

Sufficient liquidity

Deleveraging

IMPROVE COMMUNICATIONS

WITH FINANCIAL COMMUNITY

Deliver on commitments

Shorten financial reporting cycle

Improve visibility

51

FINANCE PRIORITIES

65

52

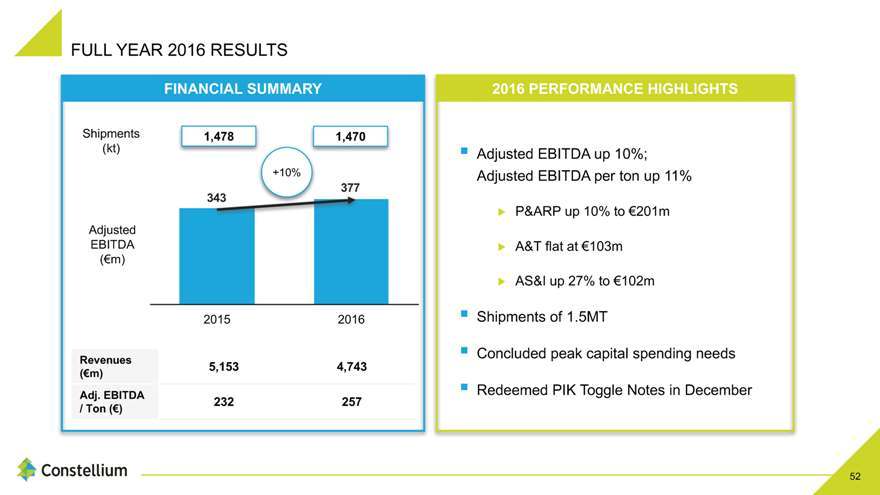

FULL YEAR 2016 RESULTS

Adjusted EBITDA up 10%;

Adjusted EBITDA per ton up 11%

P&ARP up 10% to €201m

A&T flat at €103m

AS&I up 27% to €102m

Shipments of 1.5MT

Concluded peak capital spending needs

Redeemed PIK Toggle Notes in December

377

343

2015 2016

Revenues

Adj. EBITDA

/ Ton (€) 232 257

Shipments 1,478 1,470

(kt)

Adjusted

EBITDA

+10%

FINANCIAL SUMMARY 2016 PERFORMANCE HIGHLIGHTS

66

P&ARP

Over 90% of Packaging shipments secured under firm contracts

Continued system wide cost reduction and productivity gains

A&T

~90% of Aerospace and ~45% of TID shipments secured

under firm contracts

Q1 2017 weaker product mix with transition to new aerospace

contracts; Q2 2017 expected to be strong

AS&I

~70% of shipments secured under firm contracts

Demand remains robust and supported by competitive cost structure

Realizing benefits of recent Automotive Structures investments

53

CONFIDENCE IN 2017

SIGNIFICANT VISIBILITY INTO 2017 ADJUSTED EBITDA GROWTH

67

54

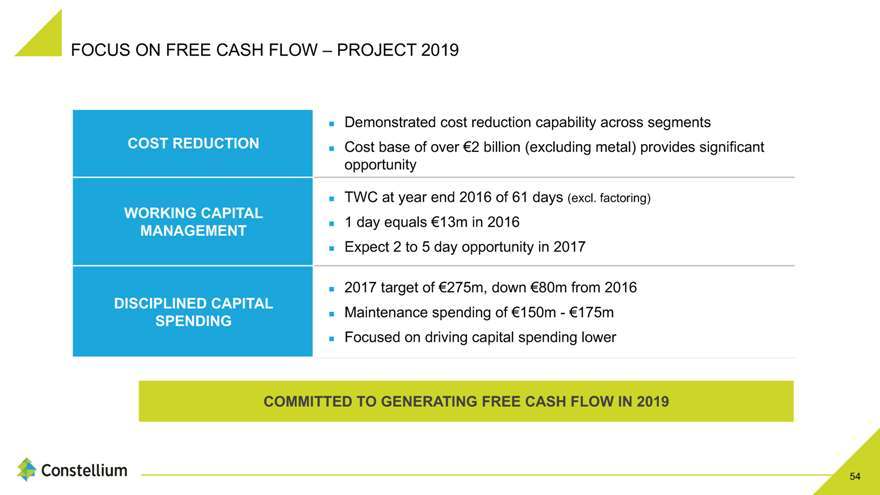

FOCUS ON FREE CASH FLOW – PROJECT 2019

COST REDUCTION

3/4 Demonstrated cost reduction capability across segments

3/4 Cost base of over €2 billion (excluding metal) provides significant

opportunity

WORKING CAPITAL

MANAGEMENT

3/4 TWC at year end 2016 of 61 days (excl. factoring)

3/4 | | 1 day equals €13m in 2016 |

3/4 Expect 2 to 5 day opportunity in 2017

DISCIPLINED CAPITAL

SPENDING

3/4 2017 target of €275m, down €80m from 2016

3/4 Maintenance spending of €150m—€175m

3/4 Focused on driving capital spending lower

COMMITTED TO GENERATING FREE CASH FLOW IN 2019

68

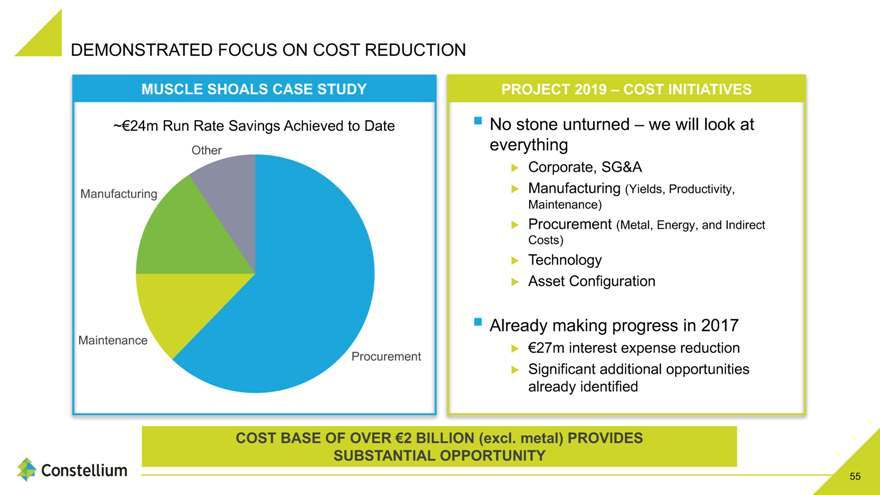

55

DEMONSTRATED FOCUS ON COST REDUCTION

No stone unturned – we will look at

everything

Corporate, SG&A

Manufacturing (Yields, Productivity,

Maintenance)

Procurement (Metal, Energy, and Indirect

Costs)

Technology

Asset Configuration

Already making progress in 2017

€27m interest expense reduction

Significant additional opportunities

already identified

Other

Manufacturing

Maintenance

Procurement

~€24m Run Rate Savings Achieved to Date

COST BASE OF OVER €2 BILLION (excl. metal) PROVIDES

SUBSTANTIAL OPPORTUNITY

MUSCLE SHOALS CASE STUDY PROJECT 2019 – COST INITIATIVES

69

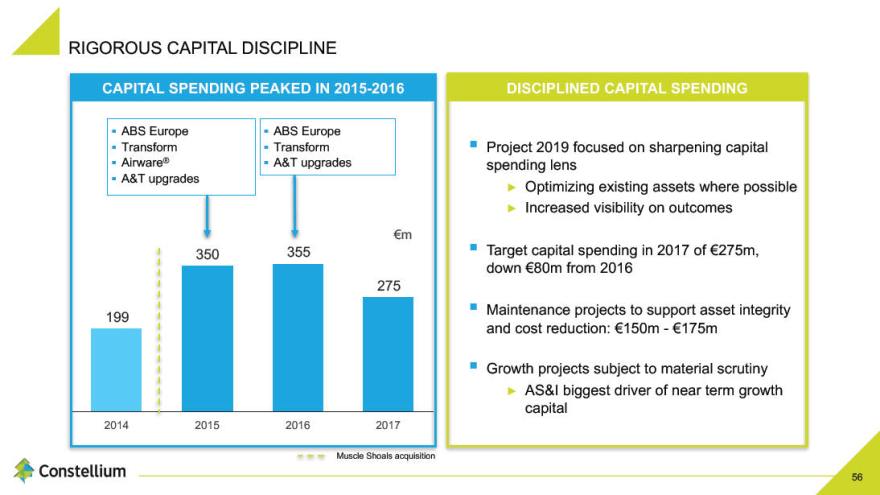

56

RIGOROUS CAPITAL DISCIPLINE

Project 2019 focused on sharpening capital

spending lens

Optimizing existing assets where possible

Increased visibility on outcomes

Target capital spending in 2017 of €275m,

down €80m from 2016

Maintenance projects to support asset integrity

and cost reduction: €150m—€175m

Growth projects subject to material scrutiny

AS&I biggest driver of near term growth

capital

ABS Europe

Transform

A&T upgrades

ABS Europe

Transform

Airware®

A&T upgrades

€m

350 355

199

275

2014 2015 2016 2017

CAPITAL SPENDING PEAKED IN 2015-2016 DISCIPLINED CAPITAL SPENDING

Muscle Shoals acquisition

70

57

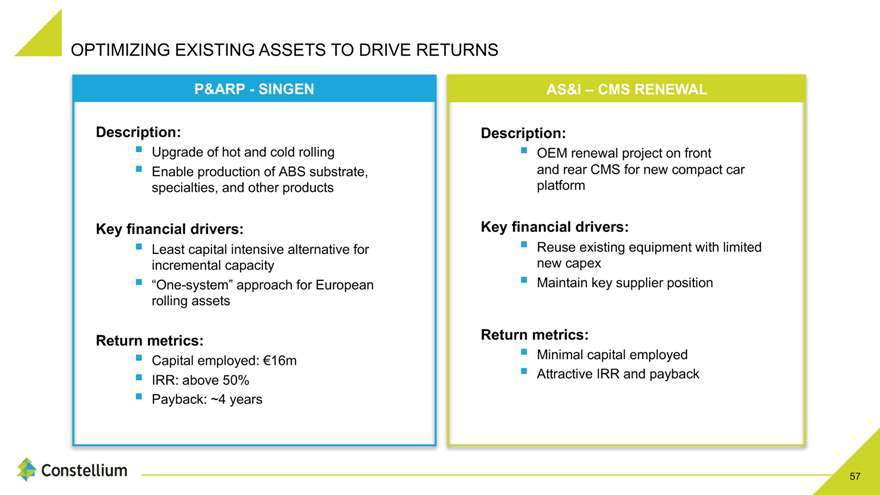

OPTIMIZING EXISTING ASSETS TO DRIVE RETURNS

Description:

Upgrade of hot and cold rolling

Enable production of ABS substrate,

specialties, and other products

Key financial drivers:

Least capital intensive alternative for

incremental capacity

“One-system” approach for European

rolling assets

Return metrics:

Capital employed: €16m

IRR: above 50%

Payback: ~4 years

Description:

OEM renewal project on front

and rear CMS for new compact car

platform

Key financial drivers:

Reuse existing equipment with limited

new capex

Maintain key supplier position

Return metrics:

Minimal capital employed

Attractive IRR and payback

P&ARP—SINGEN AS&I – CMS RENEWAL

71

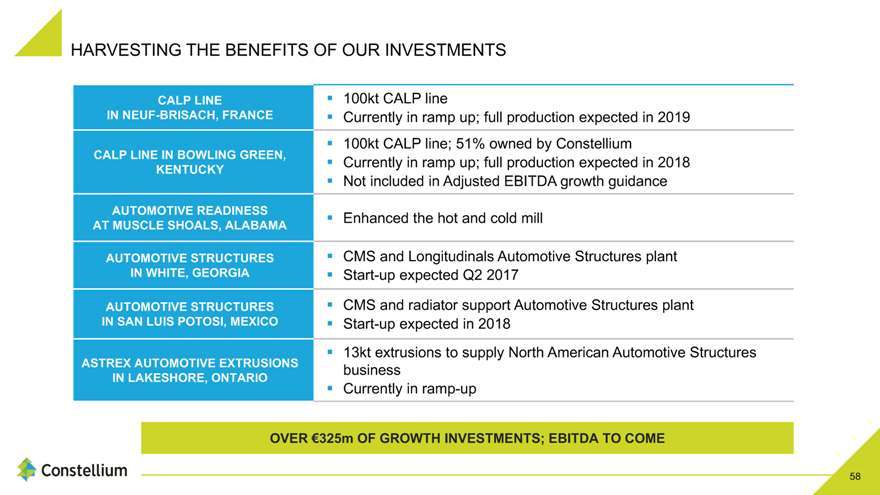

CALP LINE

IN NEUF-BRISACH, FRANCE

100kt CALP line

Currently in ramp up; full production expected in 2019

CALP LINE IN BOWLING GREEN,

KENTUCKY

100kt CALP line; 51% owned by Constellium

Currently in ramp up; full production expected in 2018

Not included in Adjusted EBITDA growth guidance

AUTOMOTIVE READINESS

AT MUSCLE SHOALS, ALABAMA Enhanced the hot and cold mill

AUTOMOTIVE STRUCTURES

IN WHITE, GEORGIA

CMS and Longitudinals Automotive Structures plant

Start-up expected Q2 2017

AUTOMOTIVE STRUCTURES

IN SAN LUIS POTOSI, MEXICO

CMS and radiator support Automotive Structures plant

Start-up expected in 2018

ASTREX AUTOMOTIVE EXTRUSIONS

IN LAKESHORE, ONTARIO

13kt extrusions to supply North American Automotive Structures

business

Currently in ramp-up

58

HARVESTING THE BENEFITS OF OUR INVESTMENTS

OVER €325m OF GROWTH INVESTMENTS; EBITDA TO COME

72

59

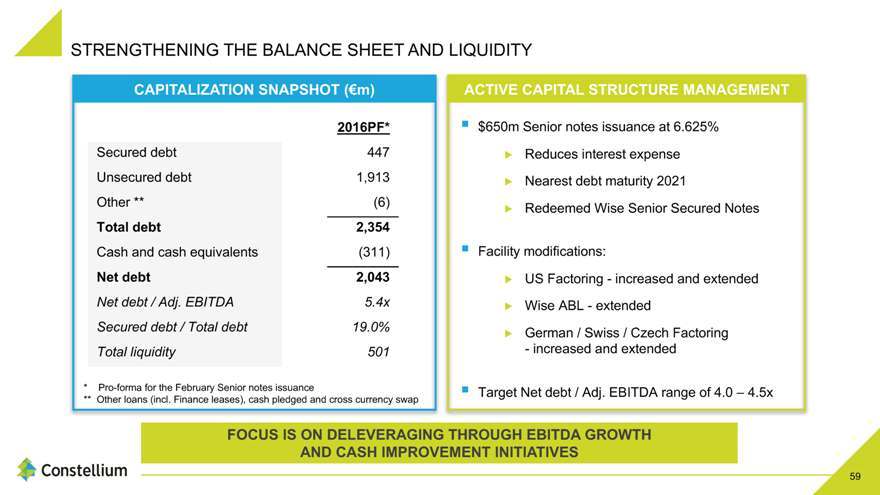

STRENGTHENING THE BALANCE SHEET AND LIQUIDITY

$650m Senior notes issuance at 6.625%

Reduces interest expense

Nearest debt maturity 2021

Redeemed Wise Senior Secured Notes

Facility modifications:

US Factoring—increased and extended

Wise ABL—extended

German / Swiss / Czech Factoring

- increased and extended

Target Net debt / Adj. EBITDA range of 4.0 – 4.5x

2016PF*

Secured debt 447

Unsecured debt 1,913

Other ** (6)

Total debt 2,354

Cash and cash equivalents (311)

Net debt 2,043

Net debt / Adj. EBITDA 5.4x

Secured debt / Total debt 19.0%

Total liquidity 501

FOCUS IS ON DELEVERAGING THROUGH EBITDA GROWTH

AND CASH IMPROVEMENT INITIATIVES

* Pro-forma for the February Senior notes issuance

** Other loans (incl. Finance leases), cash pledged and cross currency swap

CAPITALIZATION SNAPSHOT (€m) ACTIVE CAPITAL STRUCTURE MANAGEMENT

73

60

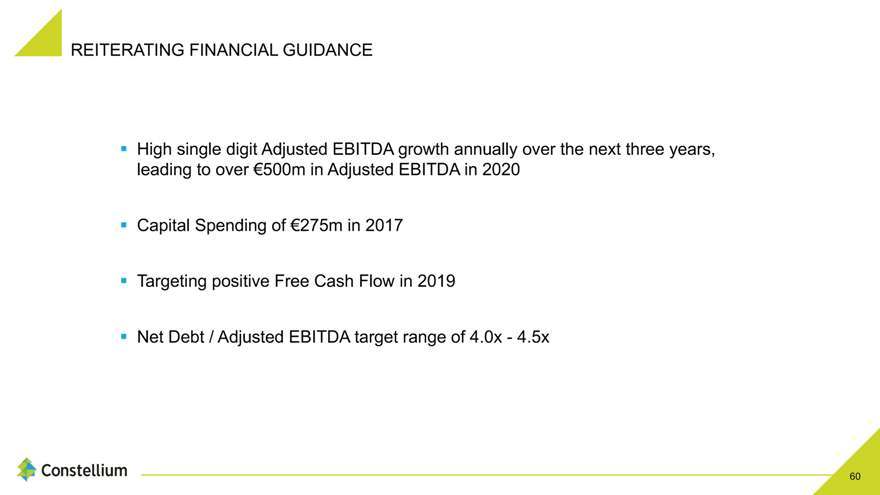

REITERATING FINANCIAL GUIDANCE

High single digit Adjusted EBITDA growth annually over the next three years,

leading to over €500m in Adjusted EBITDA in 2020

Capital Spending of €275m in 2017

Targeting positive Free Cash Flow in 2019

Net Debt / Adjusted EBITDA target range of 4.0x—4.5x

74

Q&A

75

61

KEY TAKEAWAYS

STRONG MARKET POSITIONS IN ATTRACTIVE END-MARKETS PROVIDE PLATFORM FOR SUCCESS

A COMPELLING STRATEGY IN PLACE WITH STRONG LEADERSHIP TEAM TO EXECUTE

FOCUSED ON COST REDUCTION AND CAPITAL DISCIPLINE

WELL POSITIONED TO DELIVER ON HIGH SINGLE DIGIT ADJUSTED EBITDA GROWTH TARGET

COMMITTED TO BUILDING FINANCIAL FLEXIBILITY AND DELEVERAGING

TARGETING FREE CASH FLOW POSITIVE IN 2019

76

Appendix

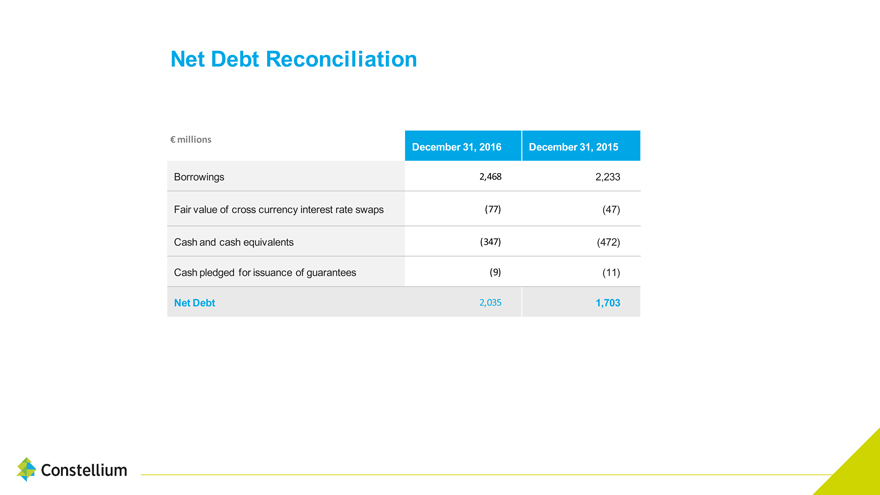

Net Debt Reconciliation December 31, 2016 December 31, 2015

Borrowings 2,468 2,233

Fair value of cross currency interest rate swaps (77) (47)

Cash and cash equivalents (347) (472)

Cash pledged for issuance of guarantees (9) (11)

Net Debt 2,035 1,703

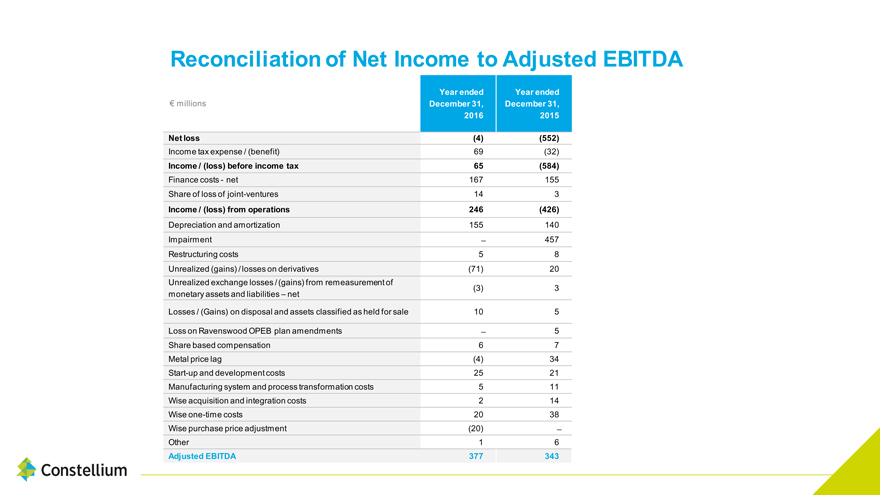

Reconciliation of Net Income to Adjusted EBITDA € millions Year ended

December 31, 2016 Year ended

December 31, 2015

Net loss (4) (552)

Income tax expense / (benefit) 69 (32)

Income / (loss) before income tax 65 (584)

Finance costs - net 167 155

Share of loss of joint-ventures 14 3

Income / (loss) from operations 246 (426)

Depreciation and amortization 155 140

Impairment 457

Restructuring costs 5 8

Unrealized (gains) / losses on derivatives (71) 20

Unrealized exchange losses / (gains) from remeasurement of monetary assets and liabilities – net (3) 3

Losses / (Gains) on disposal and assets classified as held for sale 10 5

Loss on Ravenswood OPEB plan amendments 5

Share based compensation 6 7

Metal price lag (4) 34

Start-up and development costs 25 21

Manufacturing system and process transformation costs 5 11

Wise acquisition and integration costs 2 14

Wise one-time costs 20 38

Wise purchase price adjustment (20)

Other 1 6

Adjusted EBITDA 377 343

ANALYST

DAY

NYC

WELCOME