Second Quarter 2017 Earnings Call July 27, 2017 Exhibit 99.2

Certain statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain “forward looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets. Others are more specific to our business and operations. These risks and uncertainties include, but are not limited to, the ability of Constellium and Wise Metals to achieve expected synergies and the timing thereof, Constellium’s increased levels of indebtedness which could limit Constellium’s operating flexibility and opportunities; the potential failure to retain key employees, the loss of customers, suppliers and other business relationships; disruptions to business operations; slower or lower than expected growth in the North American market for Body-in-White aluminium rolled products, and other risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 20-F, and as described from time to time in subsequent reports filed with the U.S. Securities and Exchange Commission. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not predictable or within our control. Consequently, actual results may differ materially from the forward-looking statements contained in this presentation. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Forward-looking statements

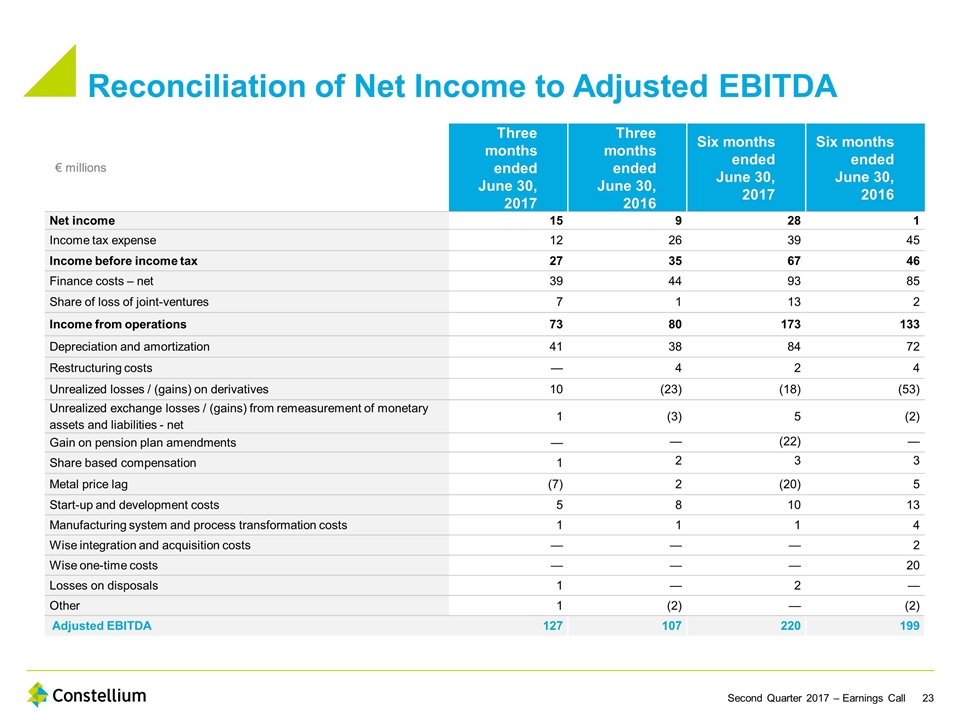

Non-GAAP measures This presentation includes information regarding certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA per metric ton, Free Cash Flow and Net Debt. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. Adjusted EBITDA measures are frequently used by securities analysts, investors and other interested parties in their evaluation of Constellium and in comparison to other companies, many of which present an adjusted EBITDA-related performance measure when reporting their results. Adjusted EBITDA, Adjusted EBITDA per Metric Ton, Free Cash Flow and Net Debt are not presentations made in accordance with IFRS and may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures supplement our IFRS disclosures and should not be considered an alternative to the IFRS measures. This presentation provides a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. We are not able to provide a reconciliation of Adjusted EBITDA guidance to net income, the comparable GAAP measure, because certain items that are excluded from adjusted EBITDA cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of realized and unrealized gains and losses on derivative instruments, metal lag, impairment or restructuring charges, or taxes without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, our net income in the future.

Jean-Marc Germain Chief Executive Officer

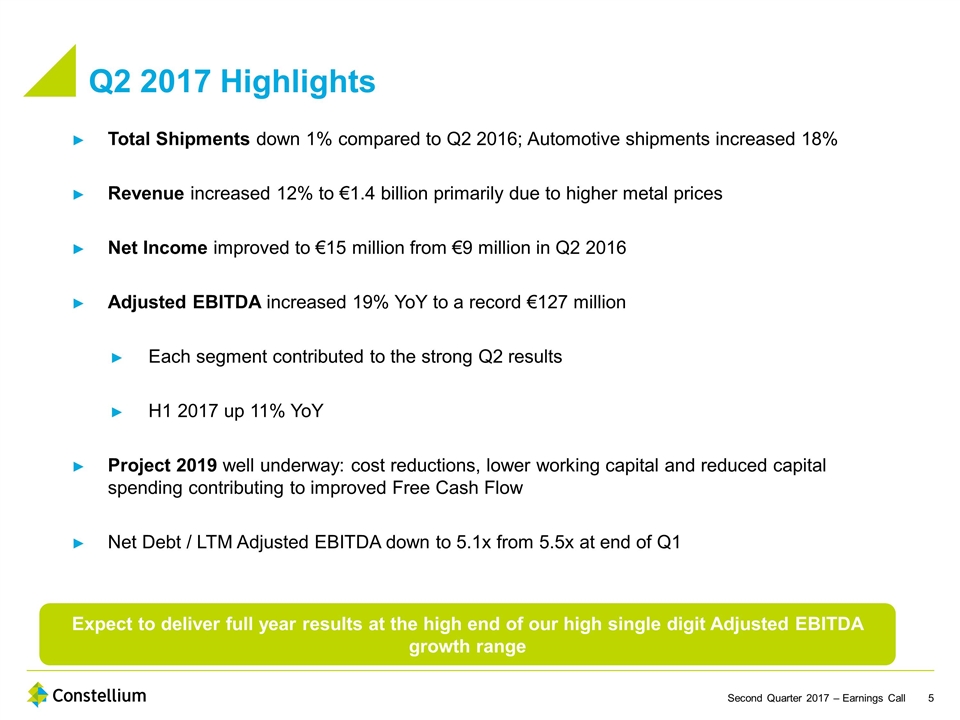

Q2 2017 Highlights Total Shipments down 1% compared to Q2 2016; Automotive shipments increased 18% Revenue increased 12% to €1.4 billion primarily due to higher metal prices Net Income improved to €15 million from €9 million in Q2 2016 Adjusted EBITDA increased 19% YoY to a record €127 million Each segment contributed to the strong Q2 results H1 2017 up 11% YoY Project 2019 well underway: cost reductions, lower working capital and reduced capital spending contributing to improved Free Cash Flow Net Debt / LTM Adjusted EBITDA down to 5.1x from 5.5x at end of Q1 Expect to deliver full year results at the high end of our high single digit Adjusted EBITDA growth range

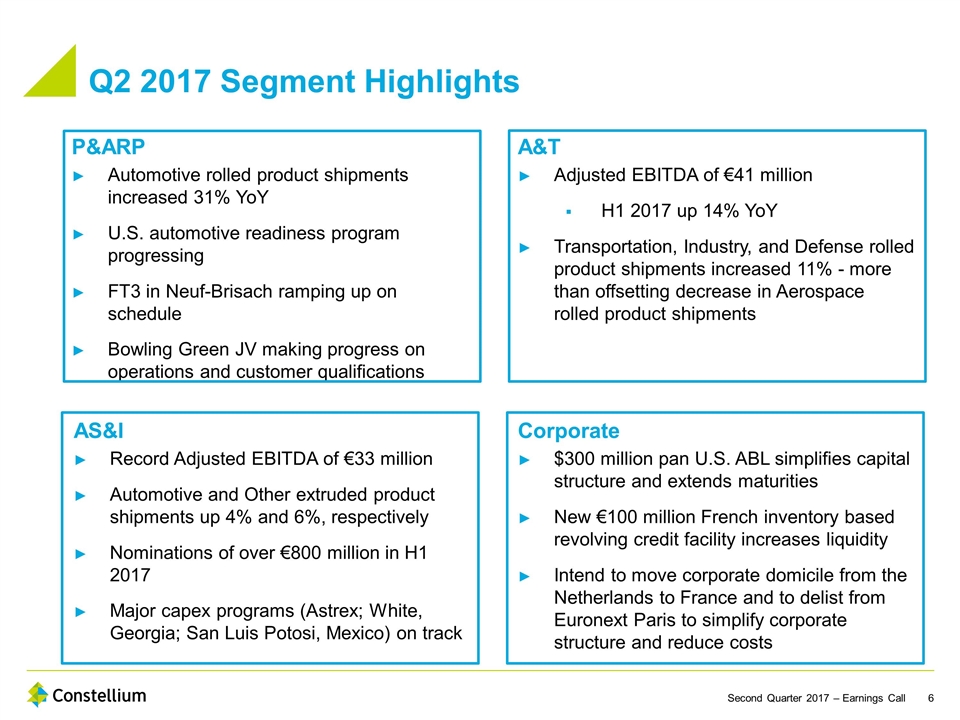

A&T Adjusted EBITDA of €41 million H1 2017 up 14% YoY Transportation, Industry, and Defense rolled product shipments increased 11% - more than offsetting decrease in Aerospace rolled product shipments Q2 2017 Segment Highlights P&ARP Automotive rolled product shipments increased 31% YoY U.S. automotive readiness program progressing FT3 in Neuf-Brisach ramping up on schedule Bowling Green JV making progress on operations and customer qualifications AS&I Record Adjusted EBITDA of €33 million Automotive and Other extruded product shipments up 4% and 6%, respectively Nominations of over €800 million in H1 2017 Major capex programs (Astrex; White, Georgia; San Luis Potosi, Mexico) on track Corporate $300 million pan U.S. ABL simplifies capital structure and extends maturities New €100 million French inventory based revolving credit facility increases liquidity Intend to move corporate domicile from the Netherlands to France and to delist from Euronext Paris to simplify corporate structure and reduce costs

Peter Matt Chief Financial Officer

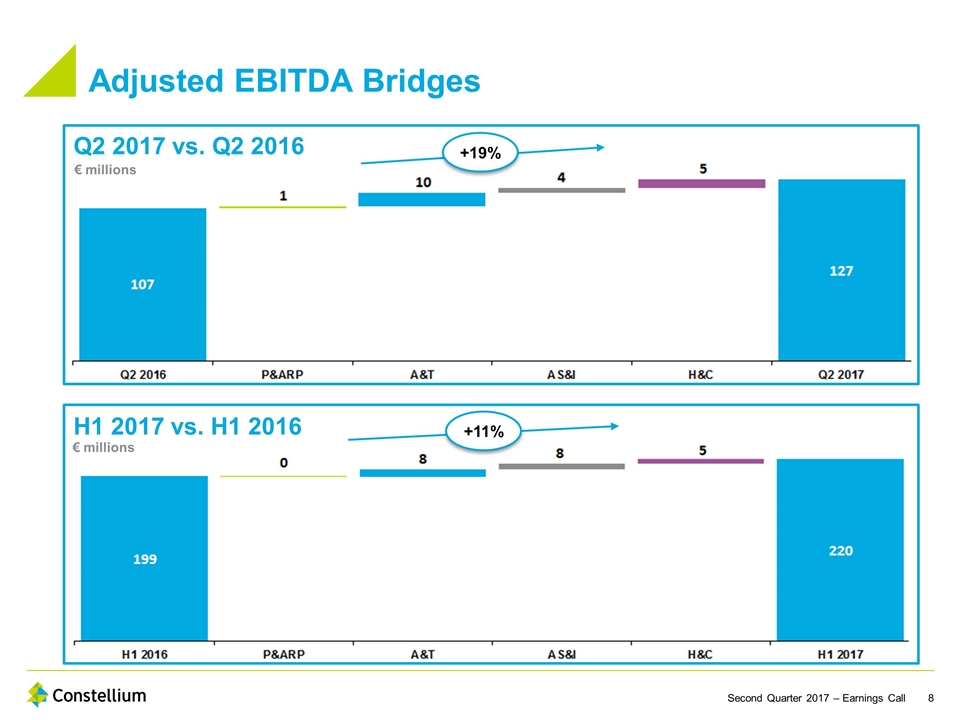

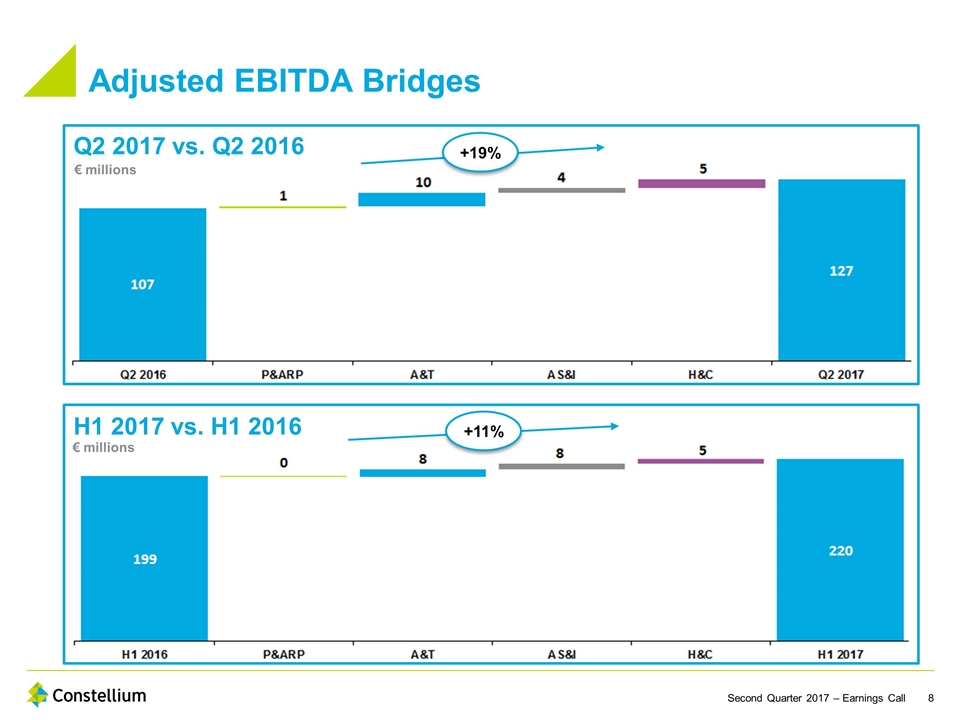

H1 2017 vs. H1 2016 Q2 2017 vs. Q2 2016 Adjusted EBITDA Bridges € millions +19% +11% € millions

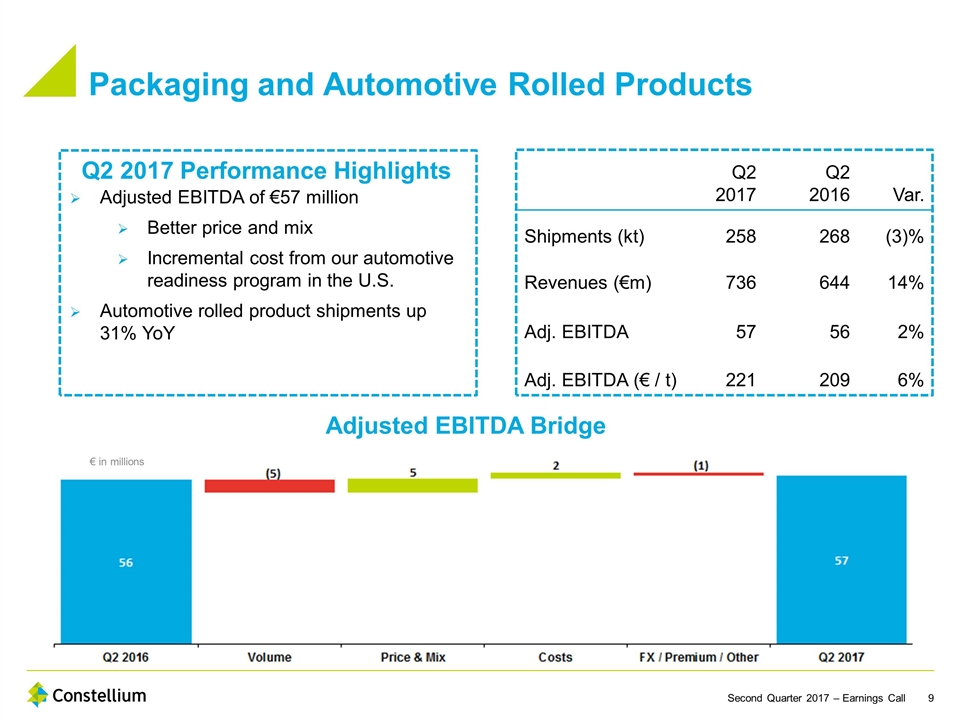

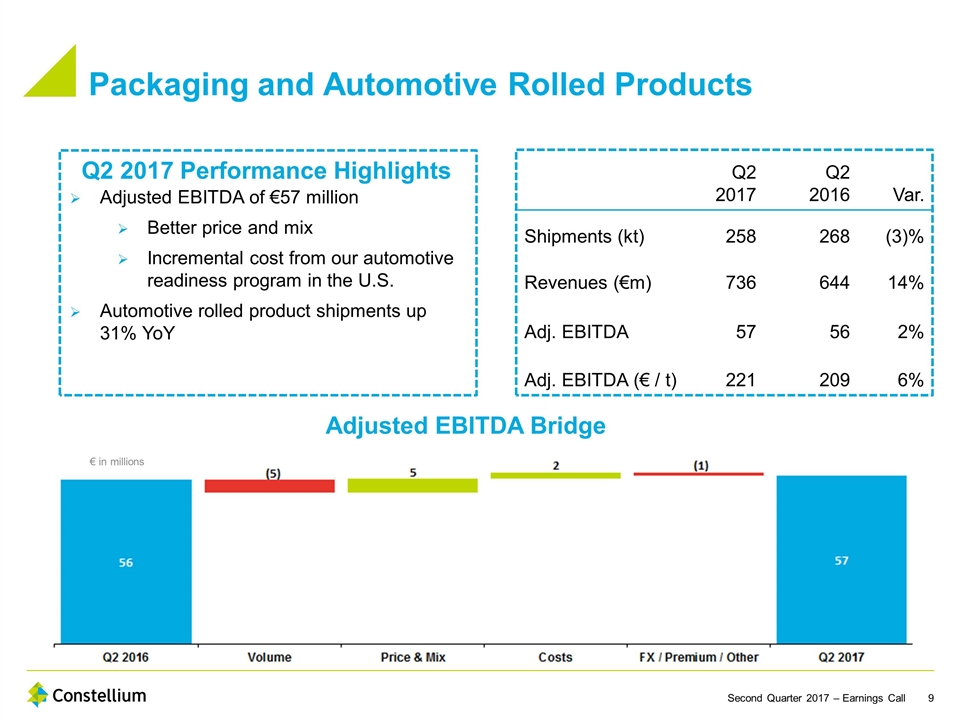

Q2 2017 Performance Highlights Adjusted EBITDA of €57 million Better price and mix Incremental cost from our automotive readiness program in the U.S. Automotive rolled product shipments up 31% YoY Packaging and Automotive Rolled Products Adjusted EBITDA Bridge € in millions Q2 2017 Q2 2016 Var. Shipments (kt) 258 268 (3)% Revenues (€m) 736 644 14% Adj. EBITDA 57 56 2% Adj. EBITDA (€ / t) 221 209 6%

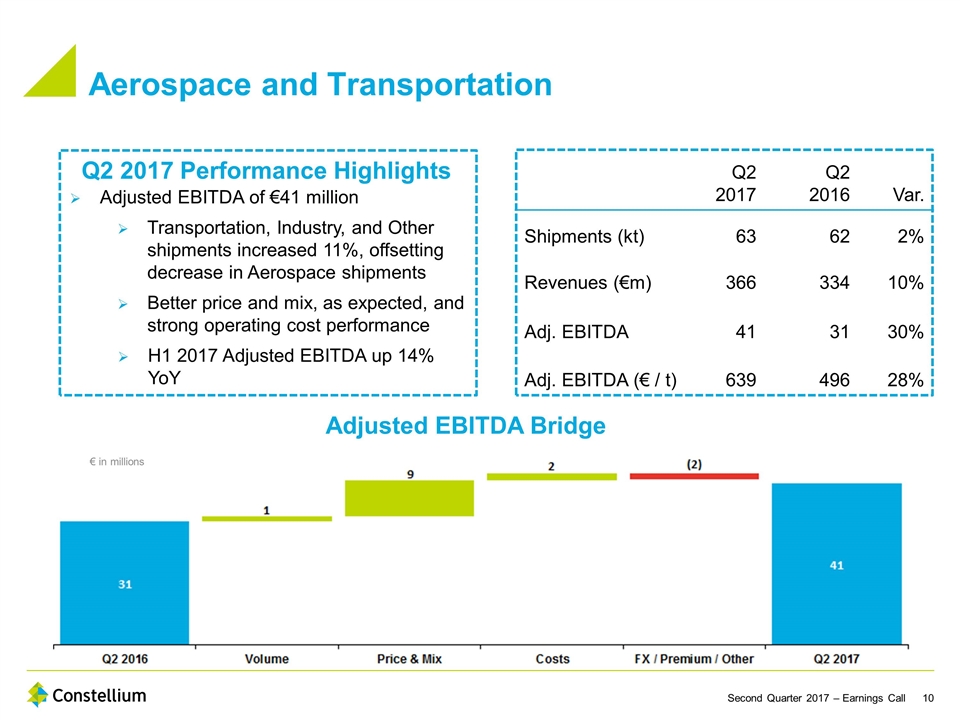

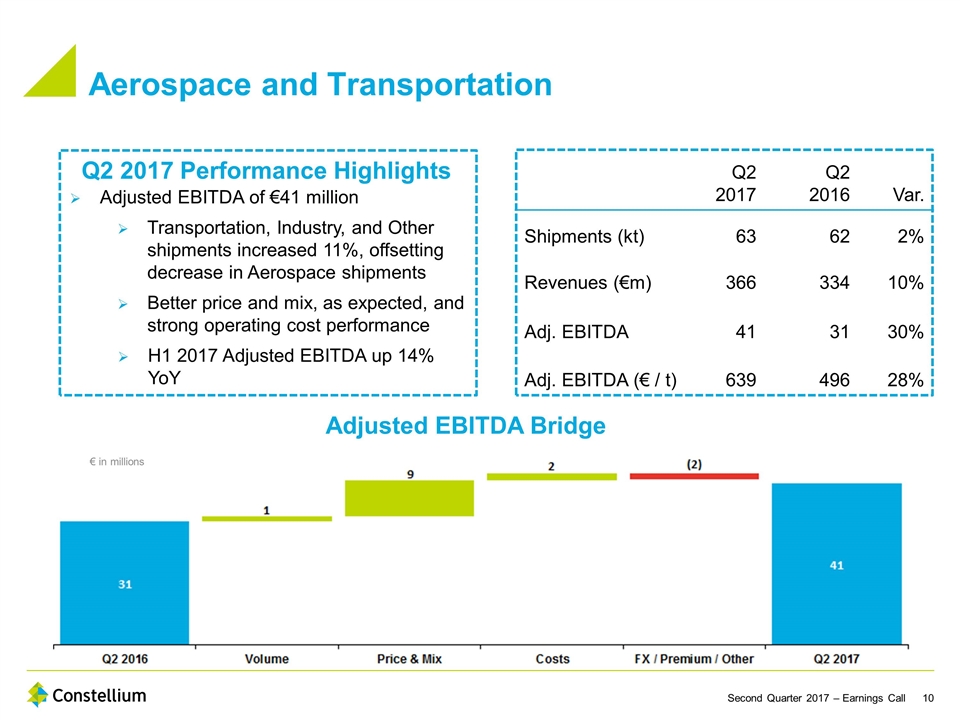

Q2 2017 Performance Highlights Adjusted EBITDA of €41 million Transportation, Industry, and Other shipments increased 11%, offsetting decrease in Aerospace shipments Better price and mix, as expected, and strong operating cost performance H1 2017 Adjusted EBITDA up 14% YoY Aerospace and Transportation Adjusted EBITDA Bridge € in millions Q2 2017 Q2 2016 Var. Shipments (kt) 63 62 2% Revenues (€m) 366 334 10% Adj. EBITDA 41 31 30% Adj. EBITDA (€ / t) 639 496 28%

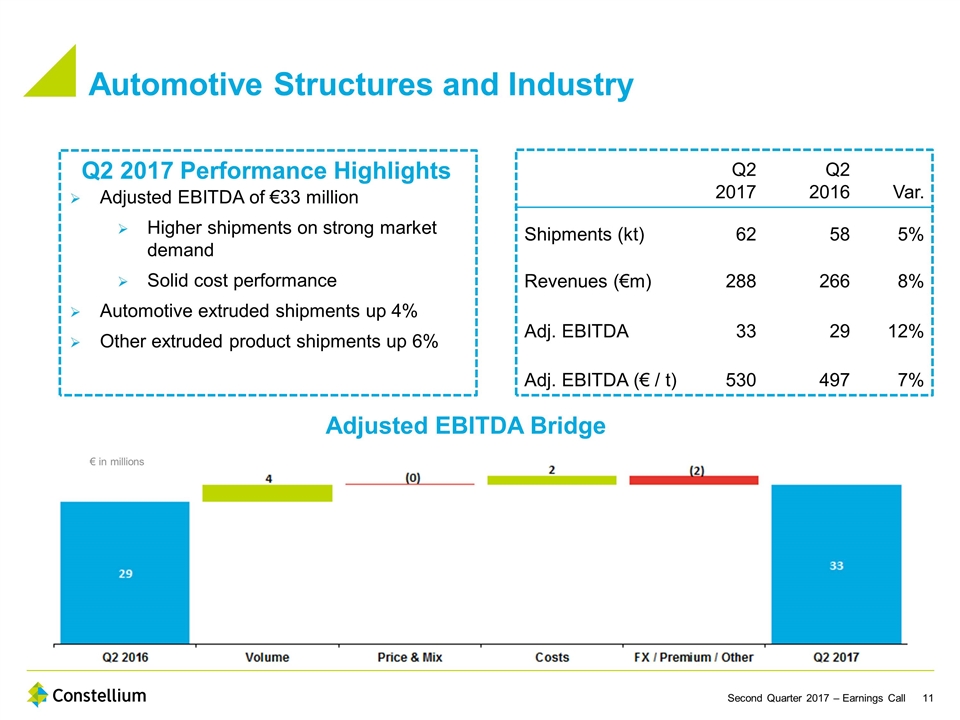

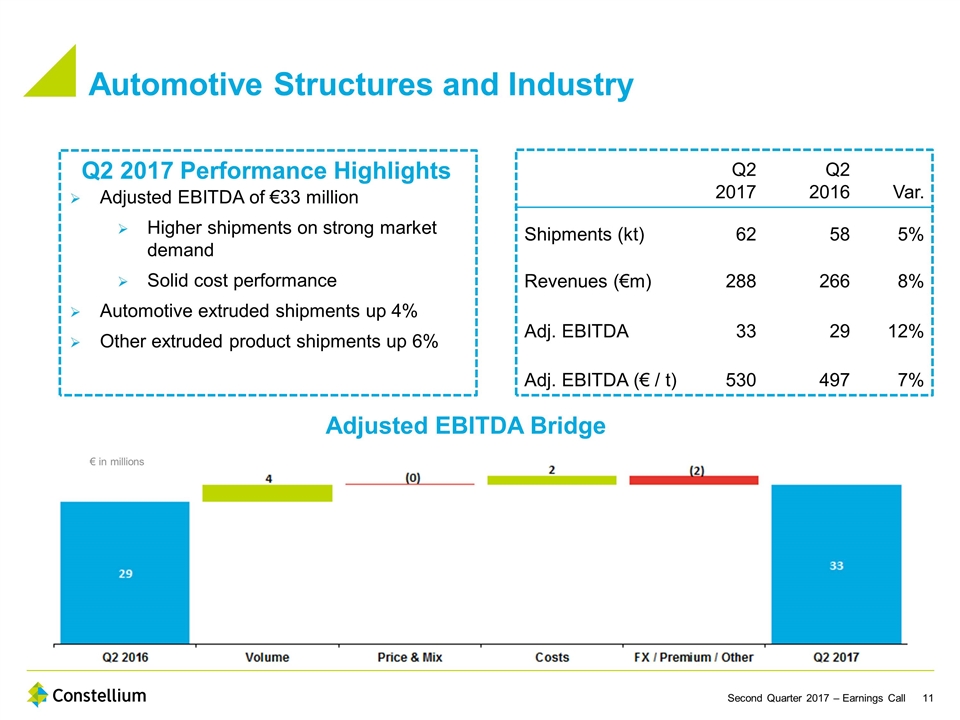

Q2 2017 Performance Highlights Automotive Structures and Industry Adjusted EBITDA Bridge € in millions Q2 2017 Q2 2016 Var. Shipments (kt) 62 58 5% Revenues (€m) 288 266 8% Adj. EBITDA 33 29 12% Adj. EBITDA (€ / t) 530 497 7% Adjusted EBITDA of €33 million Higher shipments on strong market demand Solid cost performance Automotive extruded shipments up 4% Other extruded product shipments up 6%

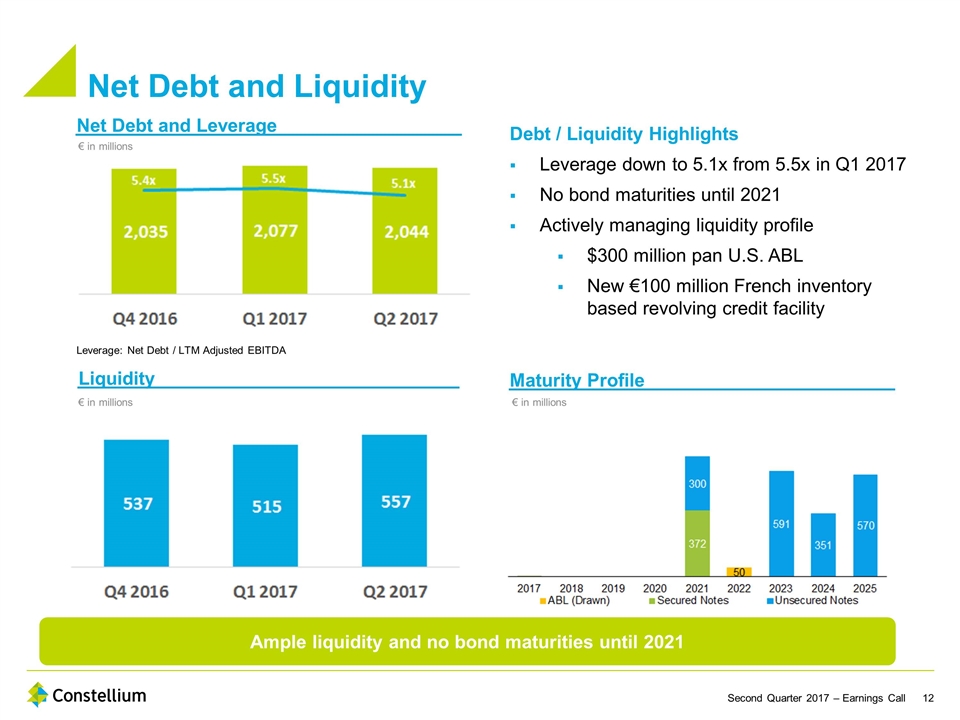

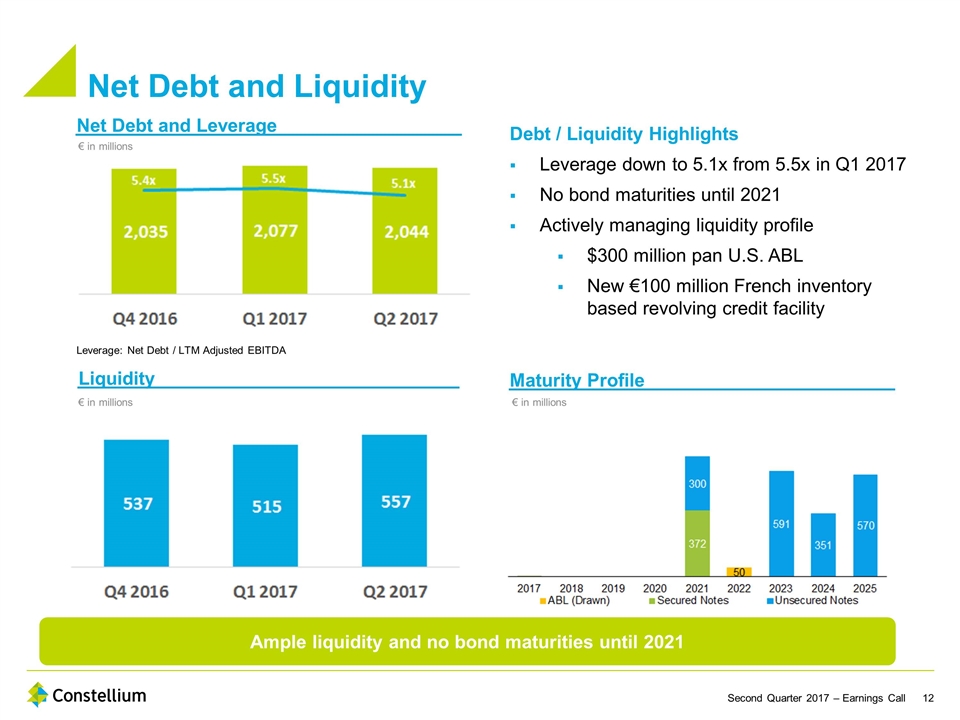

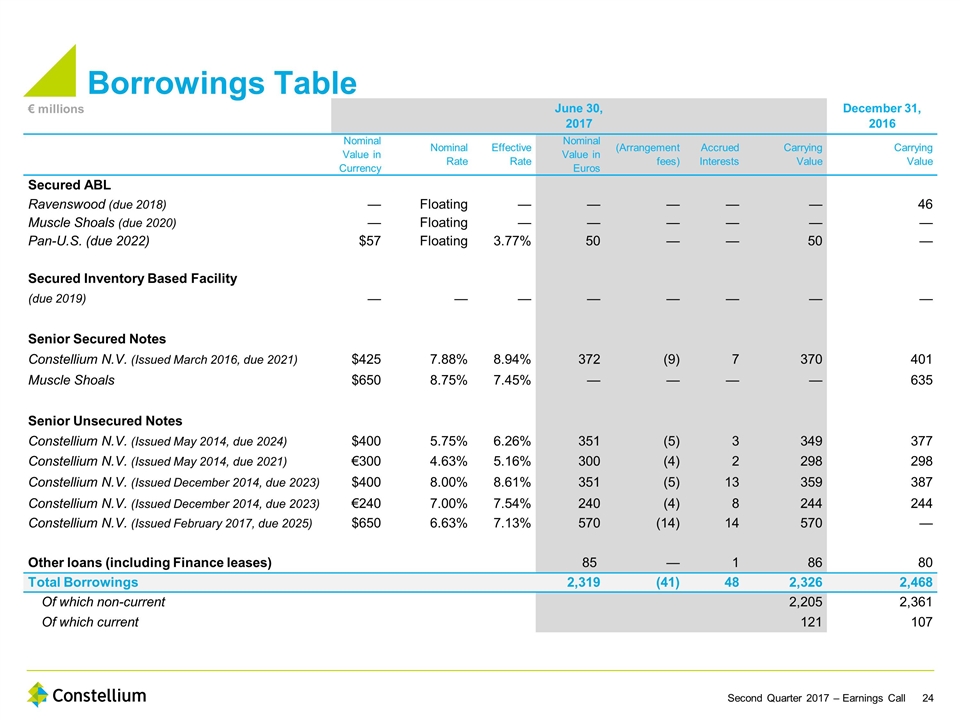

Net Debt and Liquidity € in millions Net Debt and Leverage Liquidity Maturity Profile Debt / Liquidity Highlights Leverage down to 5.1x from 5.5x in Q1 2017 No bond maturities until 2021 Actively managing liquidity profile $300 million pan U.S. ABL New €100 million French inventory based revolving credit facility Ample liquidity and no bond maturities until 2021 € in millions € in millions Leverage: Net Debt / LTM Adjusted EBITDA

Project 2019 Project 2019 initiatives underway and already showing benefits Launched Project 2019 in Q1 2017 Project organization and governance in place €10 million of annual run rate cost savings achieved through Q2 2017; wide range of additional initiatives underway Better working capital performance On plan to reduce capital spending to €275 million

Intend to Move Corporate Domicile to France Better aligns corporate cost structure with earnings profile Expected to simplify corporate structure, reduce corporate costs and provide benefit from additional potential tax savings Subject to shareholder approval Completion expected by mid-2018 Will also start the process of delisting from Euronext Paris to further reduce cost and complexity Expecting significant benefits with minimal disruption to shareholders

Jean-Marc Germain Chief Executive Officer

End-market Updates Automotive: North America: Constellium customer platforms increasing in Q2 despite lower U.S. Automotive SAAR Europe: Constellium customer platforms growing at or faster than the slightly improved market Aerospace: OEM build rates higher in 2017 than 2016 as narrow body ramp up more than offsets wide body declines OEM backlogs remain near record highs Packaging: Market remains stable BiW/ABS conversions should help North American market balance over the long term Conversion from steel to aluminium driving growth in Europe Pressure from customers on payment terms Transportation, Industry and Defense: Strong industry and defense markets in Europe and North America Weakness continues in North American transportation market

Financial Guidance and H2 2017 Outlook Updating 2017 Adjusted EBITDA guidance to the high end of the high single-digit growth range Expect normal seasonality and weaker Adjusted EBITDA generation in H2 2017 as compared to H1 2017 Expect weaker H2 2017 Free Cash Flow compared to H1 2017 due to lower Adjusted EBITDA, higher capital expenditures and potential working capital pressure Continue to expect high single digit Adjusted EBITDA growth annually over the next three years, leading to over €500 million in 2020 Targeting positive Free Cash Flow in 2019 Net Debt / Adjusted EBITDA target range of 4.0x - 4.5x

Appendix

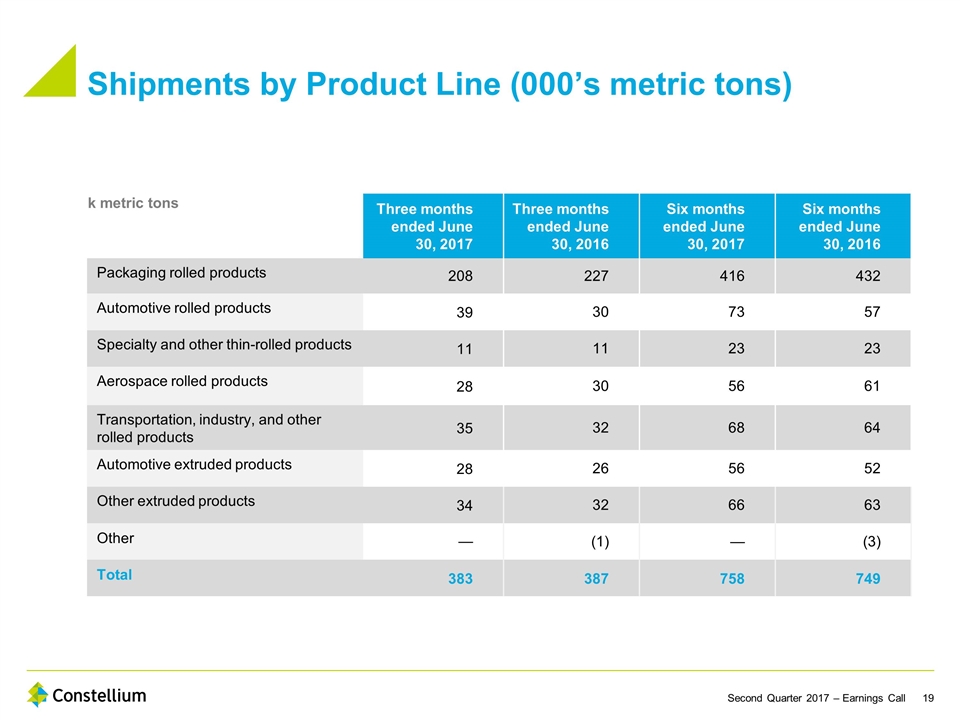

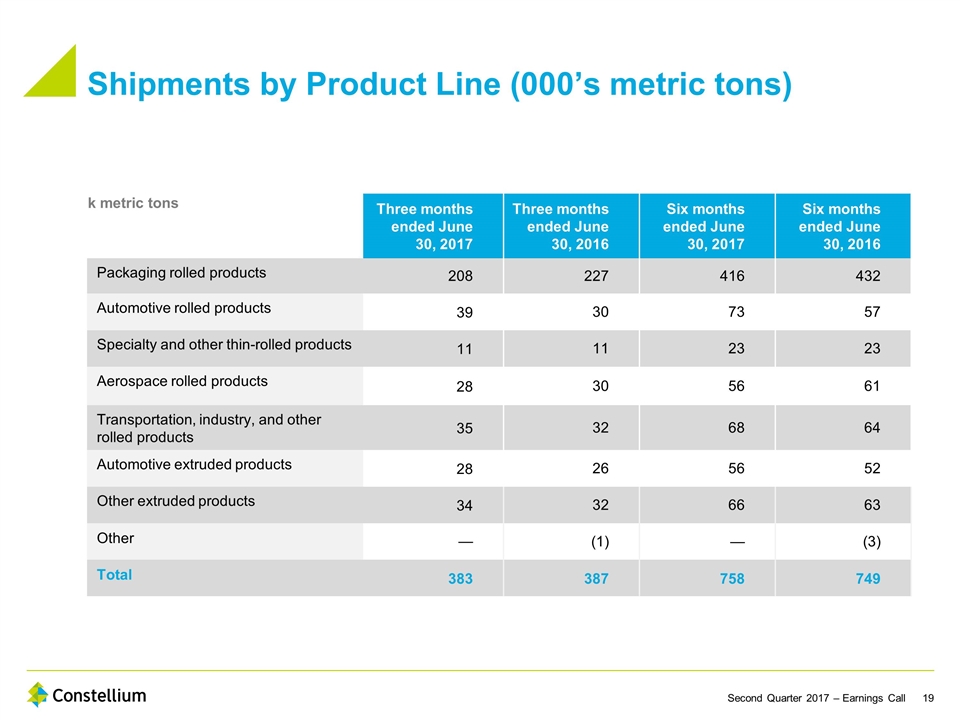

Shipments by Product Line (000’s metric tons) Three months ended June 30, 2017 Three months ended June 30, 2016 Six months ended June 30, 2017 Six months ended June 30, 2016 Packaging rolled products 208 227 416 432 Automotive rolled products 39 30 73 57 Specialty and other thin-rolled products 11 11 23 23 Aerospace rolled products 28 30 56 61 Transportation, industry, and other rolled products 35 32 68 64 Automotive extruded products 28 26 56 52 Other extruded products 34 32 66 63 Other — (1) — (3) Total 383 387 758 749 k metric tons

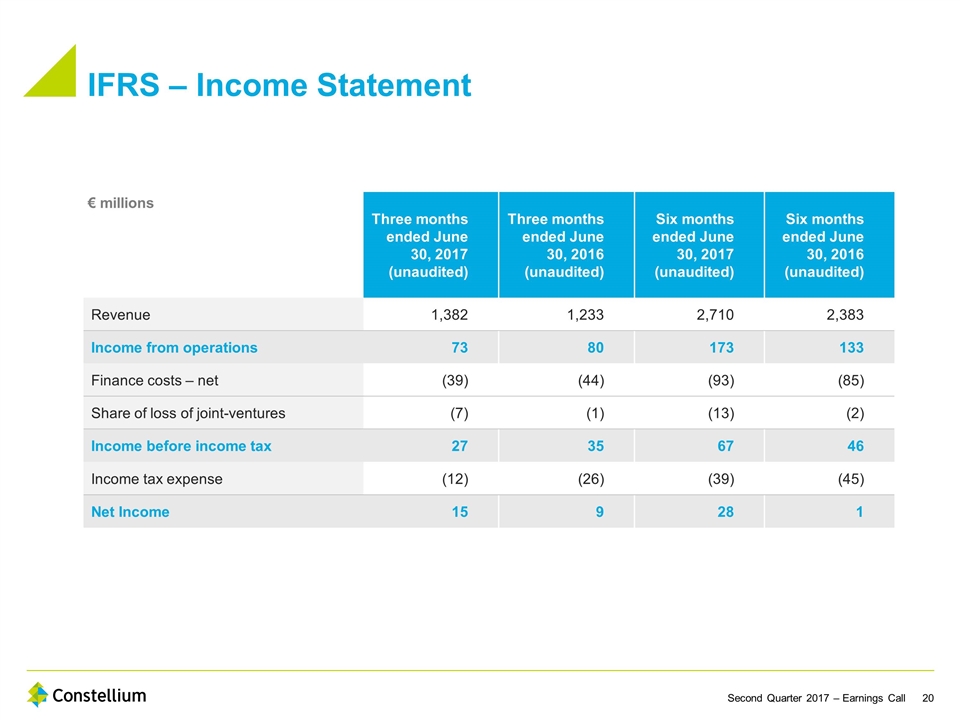

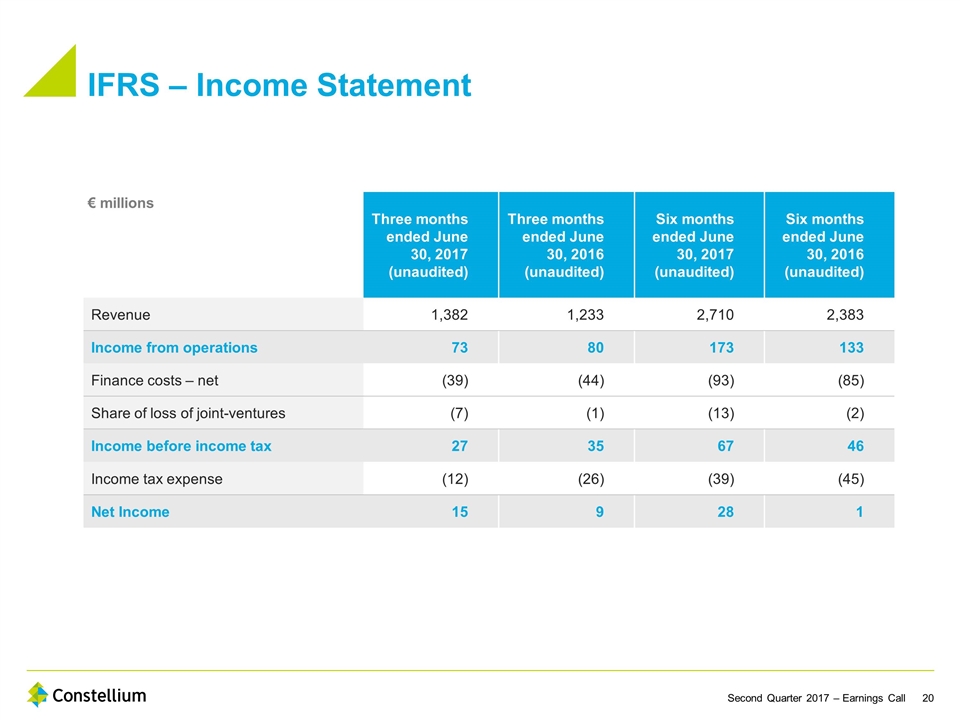

IFRS – Income Statement Three months ended June 30, 2017 (unaudited) Three months ended June 30, 2016 (unaudited) Six months ended June 30, 2017 (unaudited) Six months ended June 30, 2016 (unaudited) Revenue 1,382 1,233 2,710 2,383 Income from operations 73 80 173 133 Finance costs – net (39) (44) (93) (85) Share of loss of joint-ventures (7) (1) (13) (2) Income before income tax 27 35 67 46 Income tax expense (12) (26) (39) (45) Net Income 15 9 28 1 € millions

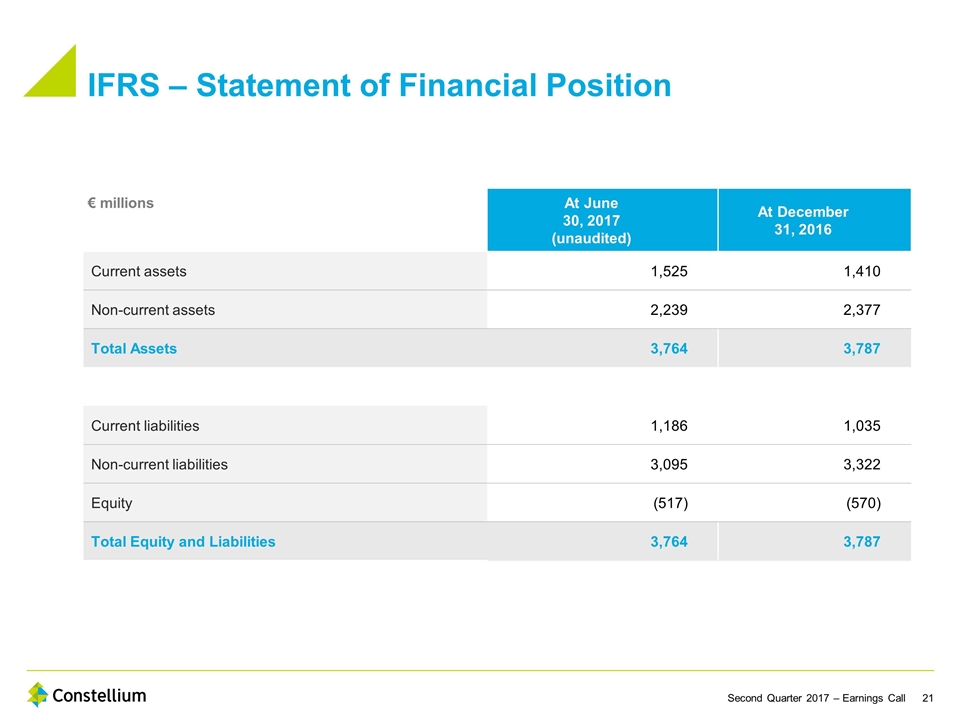

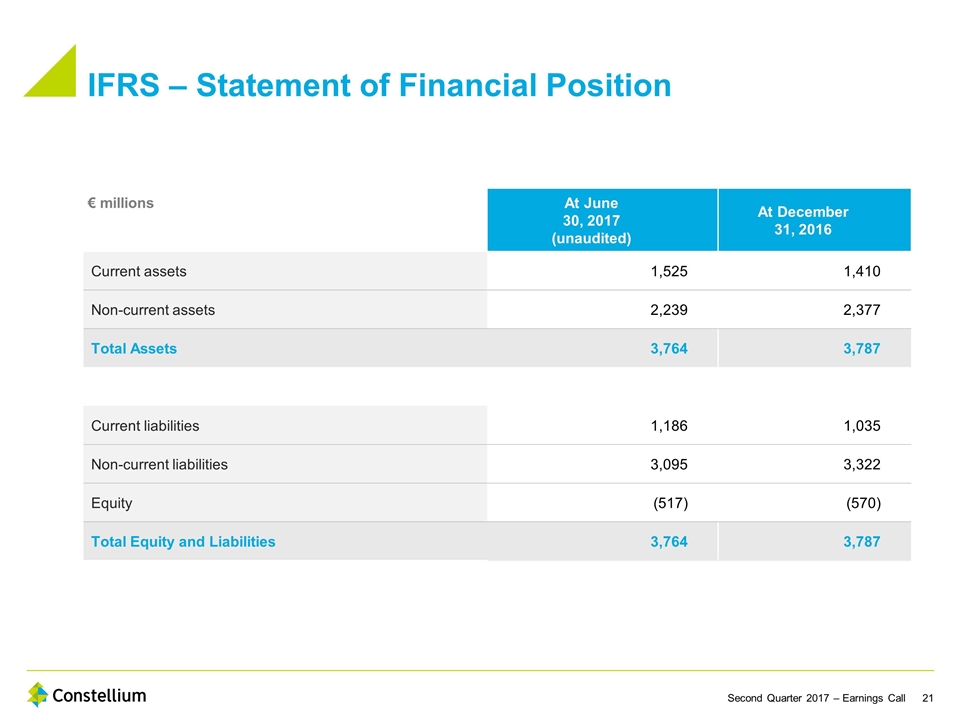

IFRS – Statement of Financial Position At June 30, 2017 (unaudited) At December 31, 2016 Current assets 1,525 1,410 Non-current assets 2,239 2,377 Total Assets 3,764 3,787 Current liabilities 1,186 1,035 Non-current liabilities 3,095 3,322 Equity (517) (570) Total Equity and Liabilities 3,764 3,787 € millions

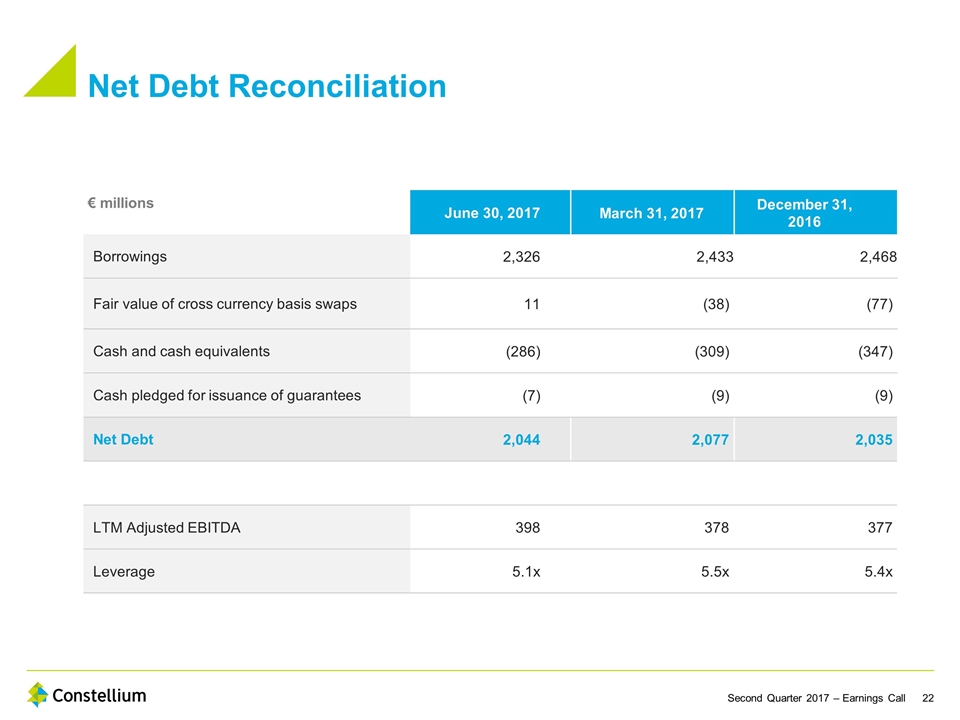

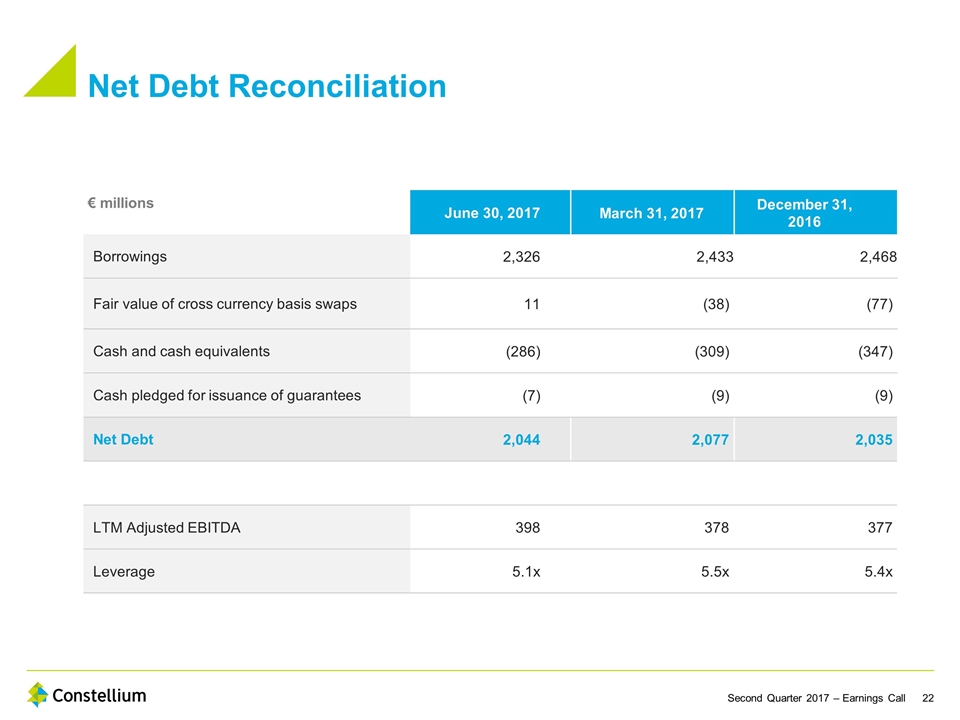

Net Debt Reconciliation June 30, 2017 March 31, 2017 December 31, 2016 Borrowings 2,326 2,433 2,468 Fair value of cross currency basis swaps 11 (38) (77) Cash and cash equivalents (286) (309) (347) Cash pledged for issuance of guarantees (7) (9) (9) Net Debt 2,044 2,077 2,035 LTM Adjusted EBITDA 398 378 377 Leverage 5.1x 5.5x 5.4x € millions

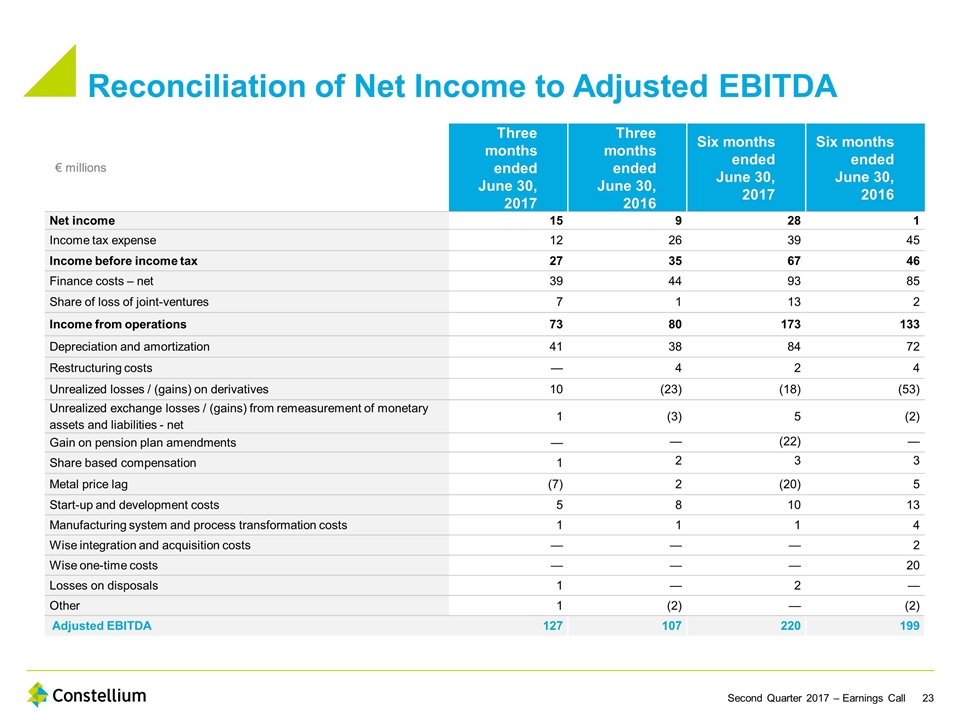

Reconciliation of Net Income to Adjusted EBITDA € millions Three months ended June 30, 2017 Three months ended June 30, 2016 Six months ended June 30, 2017 Six months ended June 30, 2016 Net income 15 9 28 1 Income tax expense 12 26 39 45 Income before income tax 27 35 67 46 Finance costs – net 39 44 93 85 Share of loss of joint-ventures 7 1 13 2 Income from operations 73 80 173 133 Depreciation and amortization 41 38 84 72 Restructuring costs — 4 2 4 Unrealized losses / (gains) on derivatives 10 (23) (18) (53) Unrealized exchange losses / (gains) from remeasurement of monetary assets and liabilities - net 1 (3) 5 (2) Gain on pension plan amendments — — (22) — Share based compensation 1 2 3 3 Metal price lag (7) 2 (20) 5 Start-up and development costs 5 8 10 13 Manufacturing system and process transformation costs 1 1 1 4 Wise integration and acquisition costs — — — 2 Wise one-time costs — — — 20 Losses on disposals 1 — 2 — Other 1 (2) — (2) Adjusted EBITDA 127 107 220 199

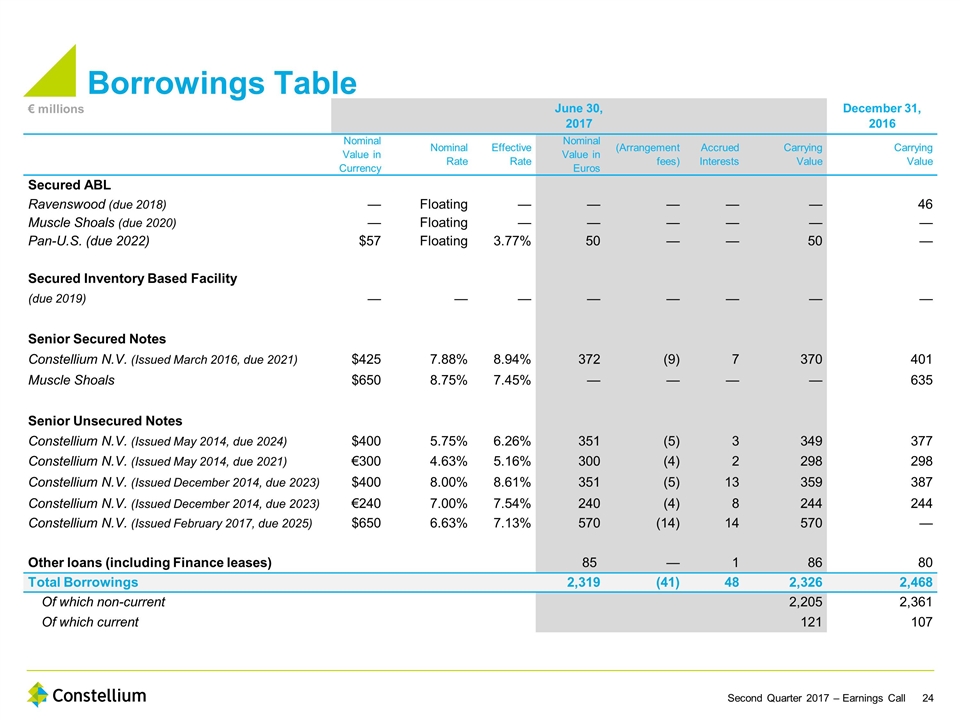

Borrowings Table € millions June 30, 2017 December 31, 2016 Nominal Value in Currency Nominal Rate Effective Rate Nominal Value in Euros (Arrangement fees) Accrued Interests Carrying Value Carrying Value Secured ABL Ravenswood (due 2018) — Floating — — — — — 46 Muscle Shoals (due 2020) — Floating — — — — — — Pan-U.S. (due 2022) $57 Floating 3.77% 50 — — 50 — Secured Inventory Based Facility (due 2019) — — — — — — — — Senior Secured Notes Constellium N.V. (Issued March 2016, due 2021) $425 7.88% 8.94% 372 (9) 7 370 401 Muscle Shoals $650 8.75% 7.45% — — — — 635 Senior Unsecured Notes Constellium N.V. (Issued May 2014, due 2024) $400 5.75% 6.26% 351 (5) 3 349 377 Constellium N.V. (Issued May 2014, due 2021) €300 4.63% 5.16% 300 (4) 2 298 298 Constellium N.V. (Issued December 2014, due 2023) $400 8.00% 8.61% 351 (5) 13 359 387 Constellium N.V. (Issued December 2014, due 2023) €240 7.00% 7.54% 240 (4) 8 244 244 Constellium N.V. (Issued February 2017, due 2025) $650 6.63% 7.13% 570 (14) 14 570 — Other loans (including Finance leases) 85 — 1 86 80 Total Borrowings 2,319 (41) 48 2,326 2,468 Of which non-current 2,205 2,361 Of which current 121 107