Exhibit 99.1

IMPORTANT INFORMATION Forward-Looking Statements Certain statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain “forward-looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets. Others are more specific to our business and operations. These risks and uncertainties include, but are not limited to, economic downturn, the loss of key customers, suppliers or other business relationships; disruption to business operations; the inability to meet customer quality requirements; delayed readiness for the North American Auto Body Sheet market, the capacity and effectiveness of our hedging policy activities, failure to retain key employees, and other risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 20-F and as described from time to time in subsequent reports filed with the U.S. Securities and Exchange Commission. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not predictable or within our control. Consequently, actual results may differ materially from the forward-looking statements contained in this presentation. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

IMPORTANT INFORMATION Non-GAAP Measures This presentation includes information regarding certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA per metric ton, Free Cash Flow and Net debt. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. Adjusted EBITDA measures are frequently used by securities analysts, investors and other interested parties in their evaluation of Constellium and in comparison to other companies, many of which present an adjusted EBITDA-related performance measure when reporting their results. Adjusted EBITDA, Adjusted EBITDA per Metric Ton, Free Cash Flow and Net debt are not presentations made in accordance with IFRS and may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures supplement our IFRS disclosures and should not be considered an alternative to the IFRS measures. This presentation provides a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. We are not able to provide a reconciliation of Adjusted EBITDA guidance to net income, the comparable GAAP measure, because certain items that are excluded from Adjusted EBITDA cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of realized and unrealized gains and losses on derivative instruments, metal lag, impairment or restructuring charges, or taxes without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, our net income in the future. Financial Presentation Information Within this presentation, Constellium changed the presentation of net periodic benefit cost related to pension and other postretirement benefit plans. The interest component of net periodic benefit cost is now reported in finance costs in our income statement. These changes have been applied retrospectively. Accordingly, previously reported amounts for Cost of sales, Selling and administrative expenses, and Research and development expenses on Constellium’s consolidated income statement are recast to reflect these changes. As a result, previously reported amounts for Adjusted EBITDA on both a consolidated basis and for each of the Company’s segments have been updated to reflect these changes. See the appendix for additional information.

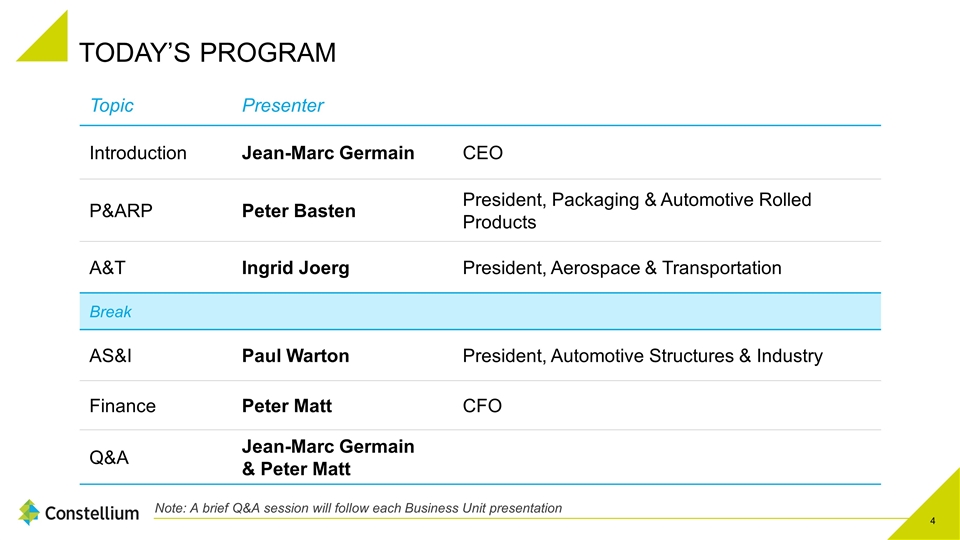

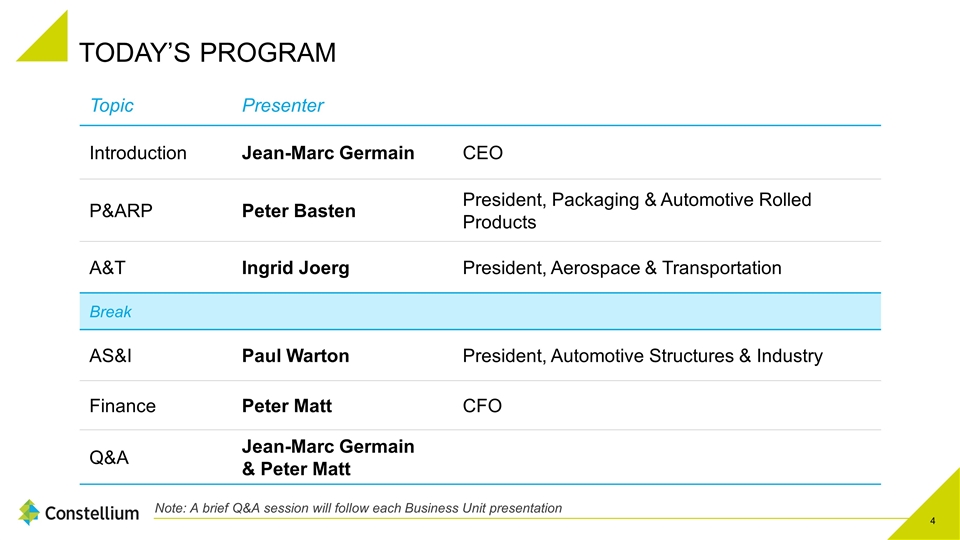

TODAY’S PROGRAM Note: A brief Q&A session will follow each Business Unit presentation Topic Presenter Introduction Jean-Marc Germain CEO P&ARP Peter Basten President, Packaging & Automotive Rolled Products A&T Ingrid Joerg President, Aerospace & Transportation Break AS&I Paul Warton President, Automotive Structures & Industry Finance Peter Matt CFO Q&A Jean-Marc Germain & Peter Matt

JEAN-MARC GERMAIN INTRODUCTION

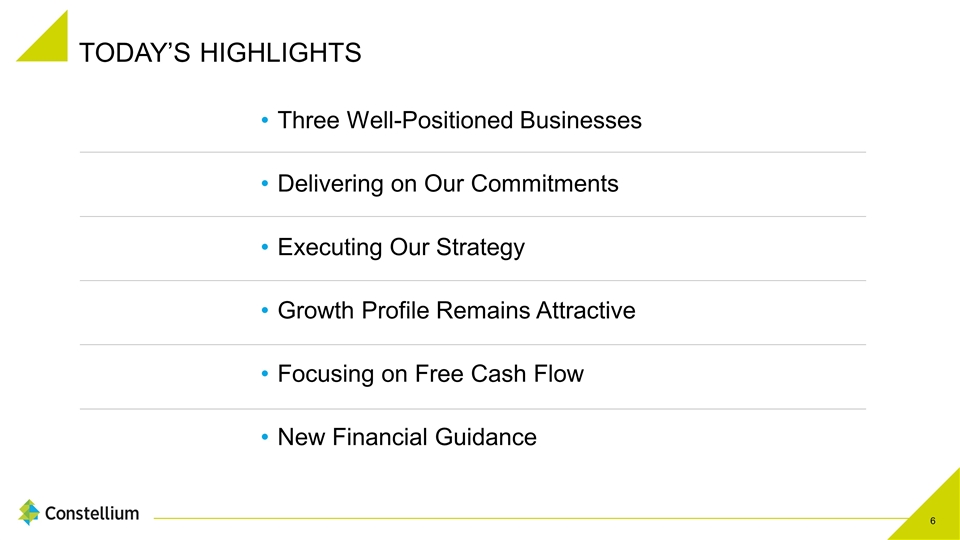

TODAY’S HIGHLIGHTS Three Well-Positioned Businesses Delivering on Our Commitments Executing Our Strategy Growth Profile Remains Attractive Focusing on Free Cash Flow New Financial Guidance

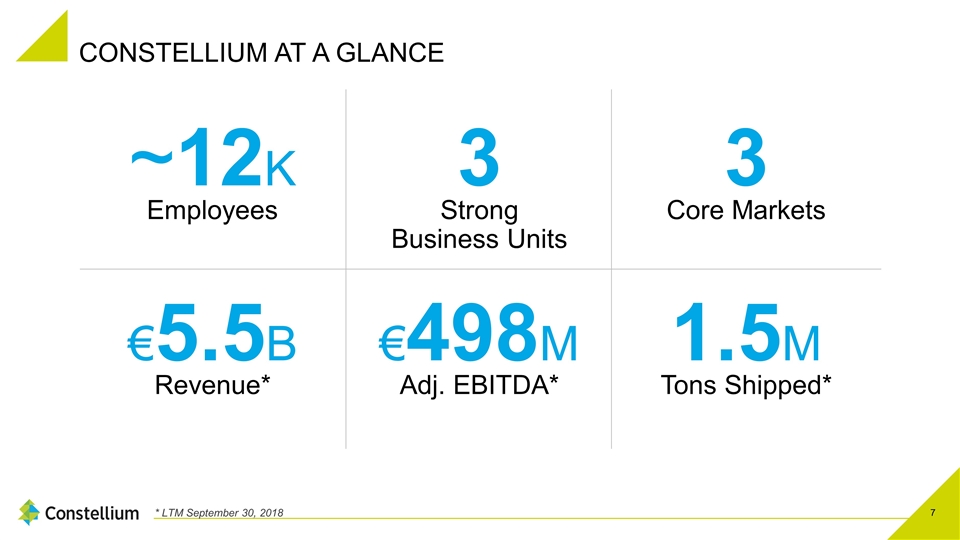

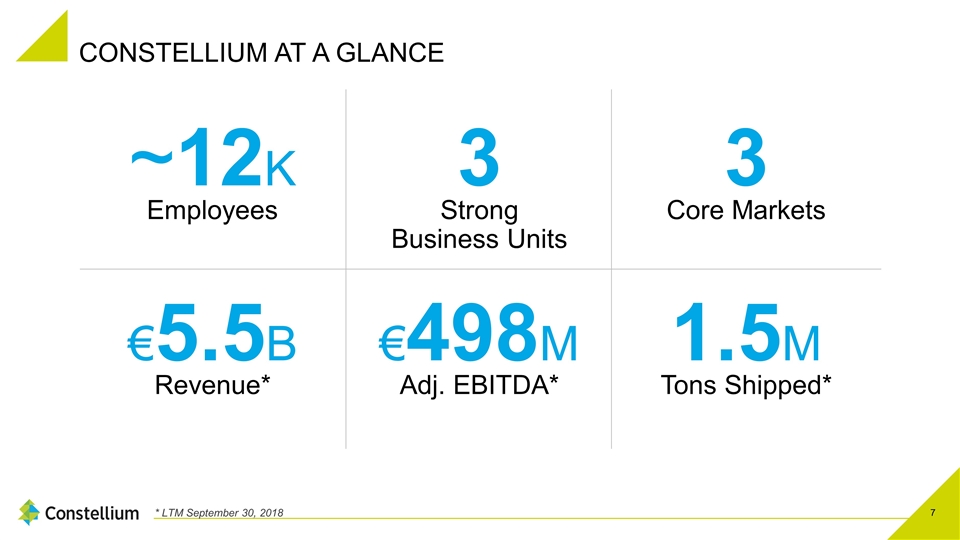

CONSTELLIUM AT A GLANCE ~12K Employees 3 Strong Business Units 3 Core Markets €5.5B Revenue* €498M Adj. EBITDA* 1.5M Tons Shipped* * LTM September 30, 2018

A GLOBAL LEADER WITH THREE STRONG BUSINESS UNITS Packaging & Automotive Rolled Products Automotive Structures & Industry Aerospace & Transportation €3.0B LTM REVENUE €1.4B LTM REVENUE €1.2B LTM REVENUE

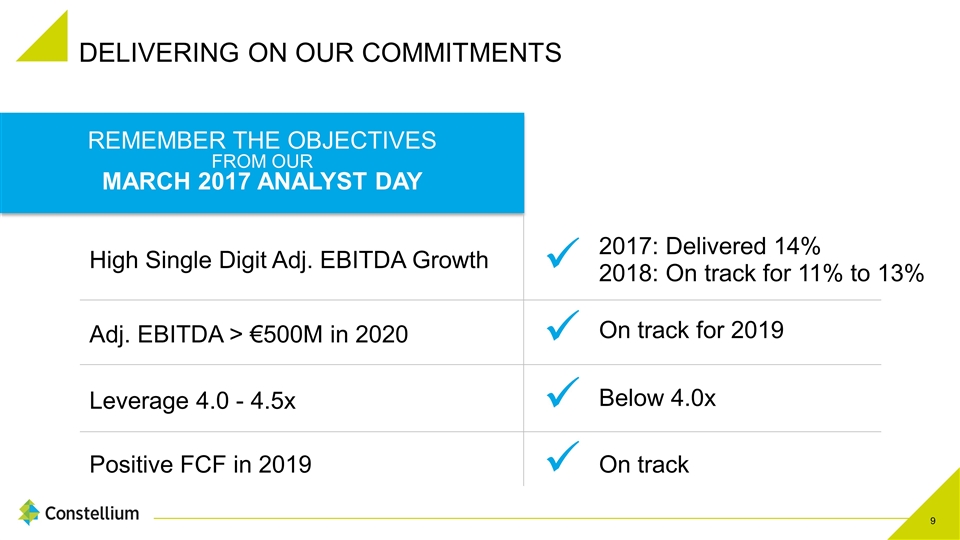

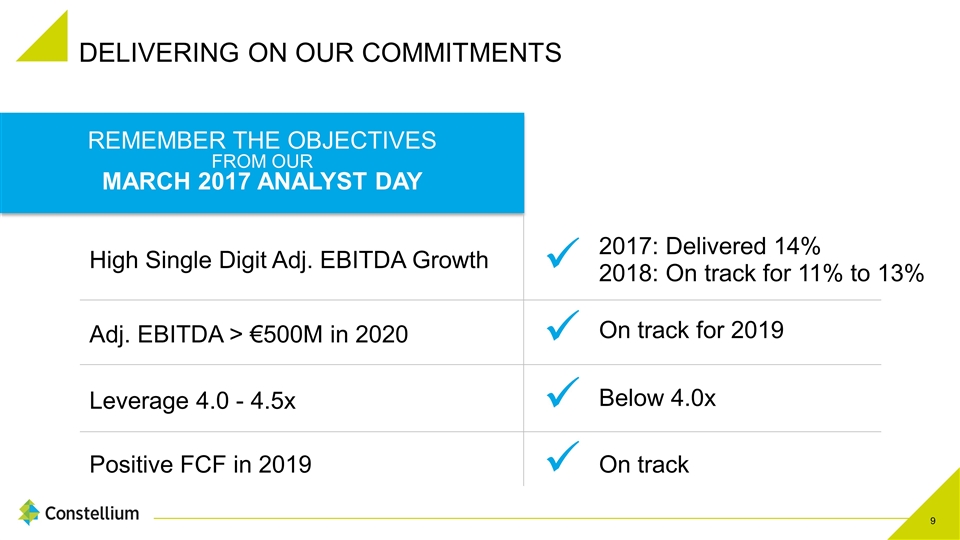

DELIVERING ON OUR COMMITMENTS REMEMBER THE OBJECTIVES FROM OUR MARCH 2017 ANALYST DAY High Single Digit Adj. EBITDA Growth 2017: Delivered 14% 2018: On track for 11% to 13% ü ü ü ü On track On track for 2019 Below 4.0x Adj. EBITDA > €500M in 2020 Leverage 4.0 - 4.5x Positive FCF in 2019

CLEAR BUSINESS STRATEGY Focus on High Value Products Grow Customer Connectivity Optimize Asset Utilization through Portfolio Management Harvest Returns from Investments Strict Cost Control and Continuous Improvement Increase Financial Flexibility DISCIPLINED EXECUTION TO DRIVE INCREASED VALUE

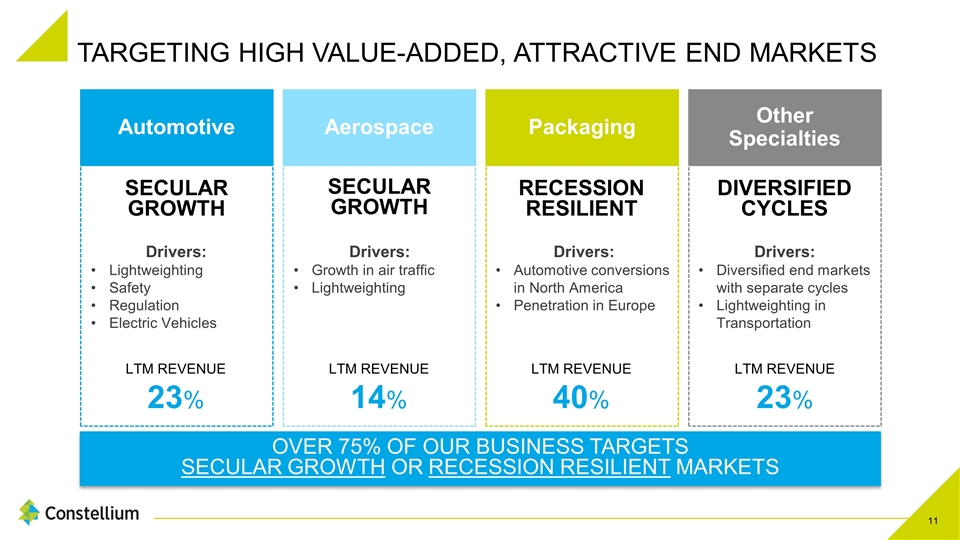

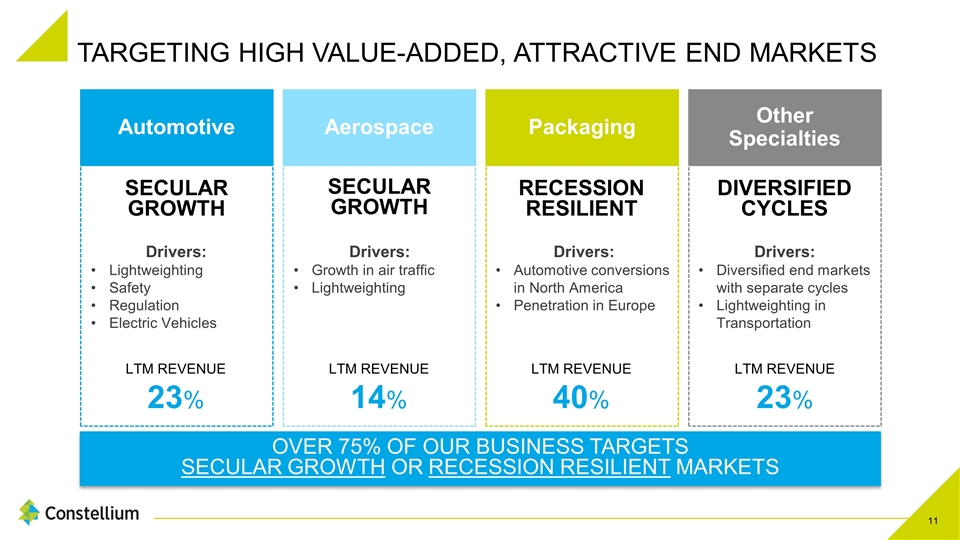

Automotive Aerospace Packaging Other Specialties TARGETING HIGH VALUE-ADDED, ATTRACTIVE END MARKETS SECULAR GROWTH LTM REVENUE 23% SECULAR GROWTH DIVERSIFIED CYCLES Drivers: Diversified end markets with separate cycles Lightweighting in Transportation Drivers: Growth in air traffic Lightweighting Drivers: Automotive conversions in North America Penetration in Europe Drivers: Lightweighting Safety Regulation Electric Vehicles RECESSION RESILIENT OVER 75% OF OUR BUSINESS TARGETS SECULAR GROWTH OR RECESSION RESILIENT MARKETS LTM REVENUE 14% LTM REVENUE 40% LTM REVENUE 23%

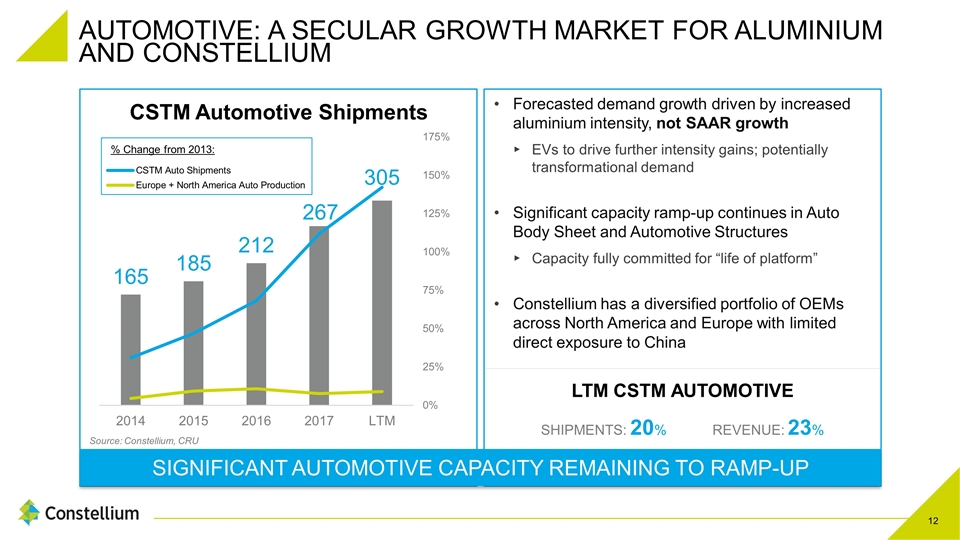

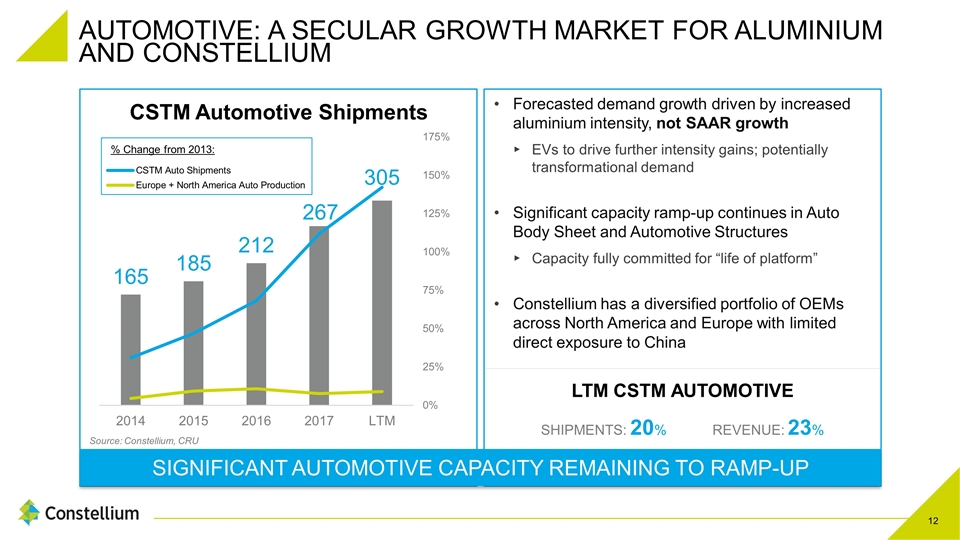

AUTOMOTIVE: A SECULAR GROWTH MARKET FOR ALUMINIUM AND CONSTELLIUM Forecasted demand growth driven by increased aluminium intensity, not SAAR growth EVs to drive further intensity gains; potentially transformational demand Significant capacity ramp-up continues in Auto Body Sheet and Automotive Structures Capacity fully committed for “life of platform” Constellium has a diversified portfolio of OEMs across North America and Europe with limited direct exposure to China SIGNIFICANT AUTOMOTIVE CAPACITY REMAINING TO RAMP-UP % Change from 2013: LTM CSTM AUTOMOTIVE SHIPMENTS: 20% REVENUE: 23% Source: Constellium, CRU

BOWLING GREEN TRANSACTION OFFERS A STRONG VALUE PROPOSITION SIGNIFICANT STRATEGIC BENEFITS FROM BOWLING GREEN ACQUISITION Rationale for Acquisition Targets the attractive North American Auto Body Sheet market Supports our global customers Capacity fully committed with customer contracts Provides significant growth potential in Adjusted EBITDA and Free Cash Flow Additional cold coil volumes to be supplied from Muscle Shoals over the medium-term Competitive cost buy vs. build Advanced in ramp-up and TWC build Simplifies organizational and corporate structure Transaction Terms Signed binding agreement Transaction price $100M plus the assumption of 49% of approximately $80M of third party debt at the joint venture Agreement for Logan to supply cold coils for up to 5 years Expect transaction to close in mid-January 2019

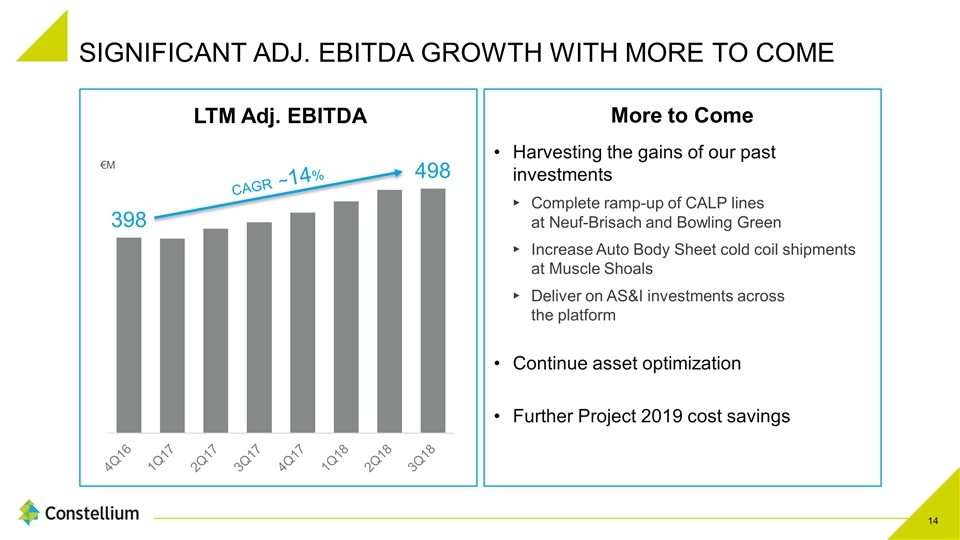

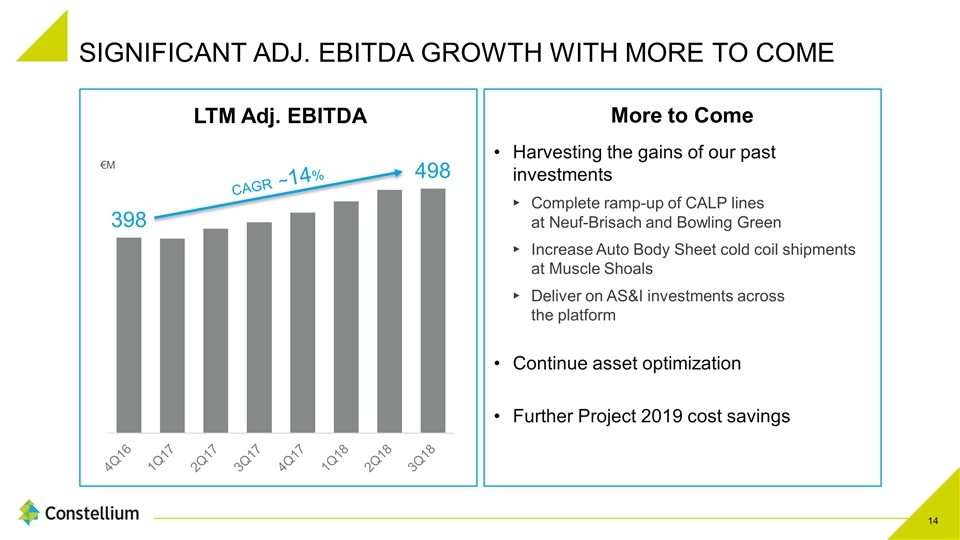

SIGNIFICANT ADJ. EBITDA GROWTH WITH MORE TO COME More to Come Harvesting the gains of our past investments Complete ramp-up of CALP lines at Neuf-Brisach and Bowling Green Increase Auto Body Sheet cold coil shipments at Muscle Shoals Deliver on AS&I investments across the platform Continue asset optimization Further Project 2019 cost savings €M CAGR ~14%

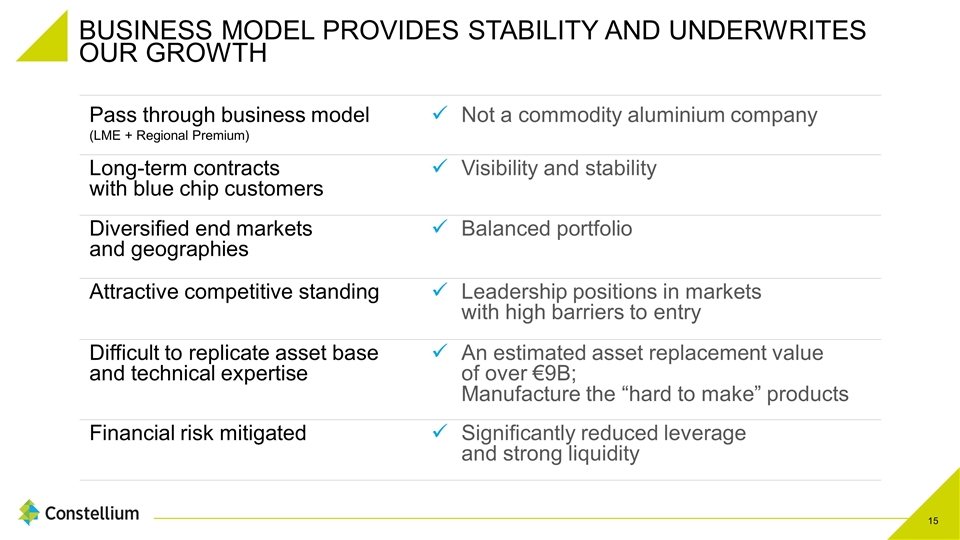

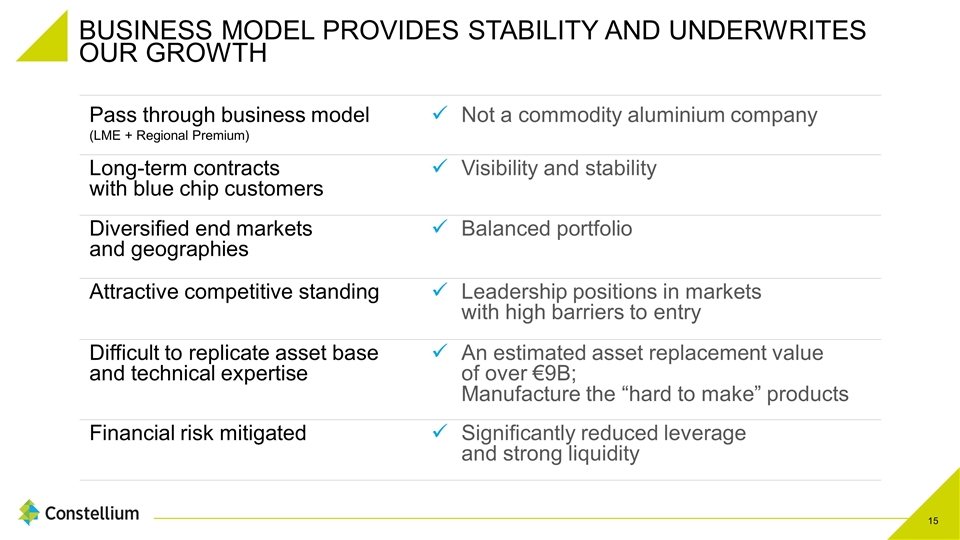

BUSINESS MODEL PROVIDES STABILITY AND UNDERWRITES OUR GROWTH Pass through business model (LME + Regional Premium) Not a commodity aluminium company Long-term contracts with blue chip customers Visibility and stability Diversified end markets and geographies Balanced portfolio Attractive competitive standing Leadership positions in markets with high barriers to entry Difficult to replicate asset base and technical expertise An estimated asset replacement value of over €9B; Manufacture the “hard to make” products Financial risk mitigated Significantly reduced leverage and strong liquidity

FREE CASH FLOW IS A PRIORITY DRIVING FCF ACCOUNTABILITY THROUGHOUT CONSTELLIUM Creating a Cash Culture Business Units and Corporate Function must own FCF generation Focus in every Business Review Management incentives aligned Doing what we need to do Growing Adjusted EBITDA Pushing for further Project 2019 cost savings Disciplined working capital management Reducing capex to €265M in 2019, including Bowling Green Our business model and strategy supports a strong FCF generation profile in 2019 and beyond

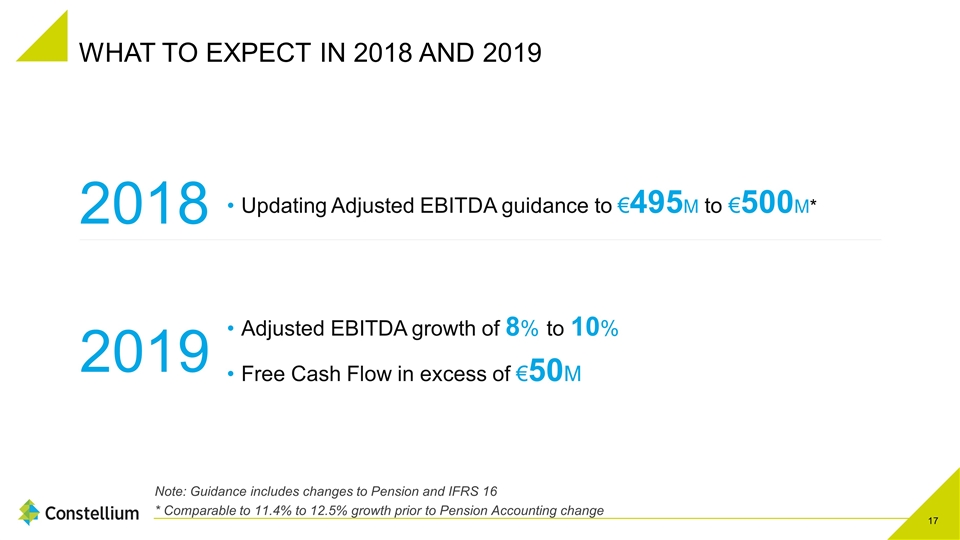

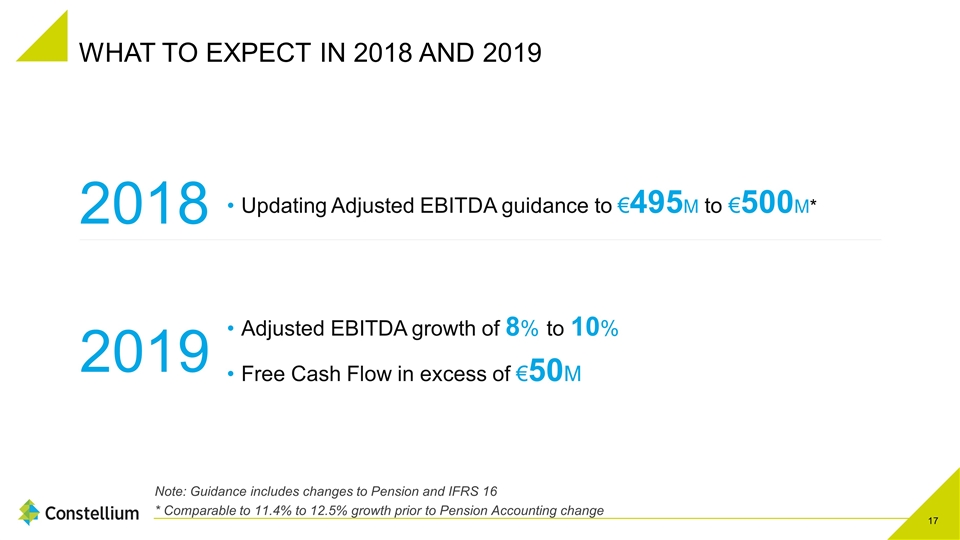

WHAT TO EXPECT IN 2018 AND 2019 Updating Adjusted EBITDA guidance to €495M to €500M* Adjusted EBITDA growth of 8% to 10% Free Cash Flow in excess of €50M Note: Guidance includes changes to Pension and IFRS 16 * Comparable to 11.4% to 12.5% growth prior to Pension Accounting change 2018 2019

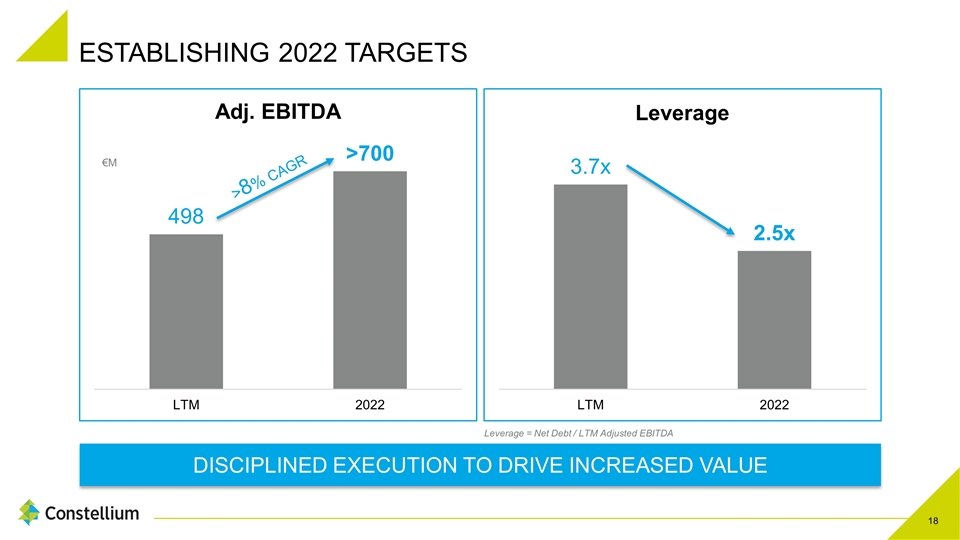

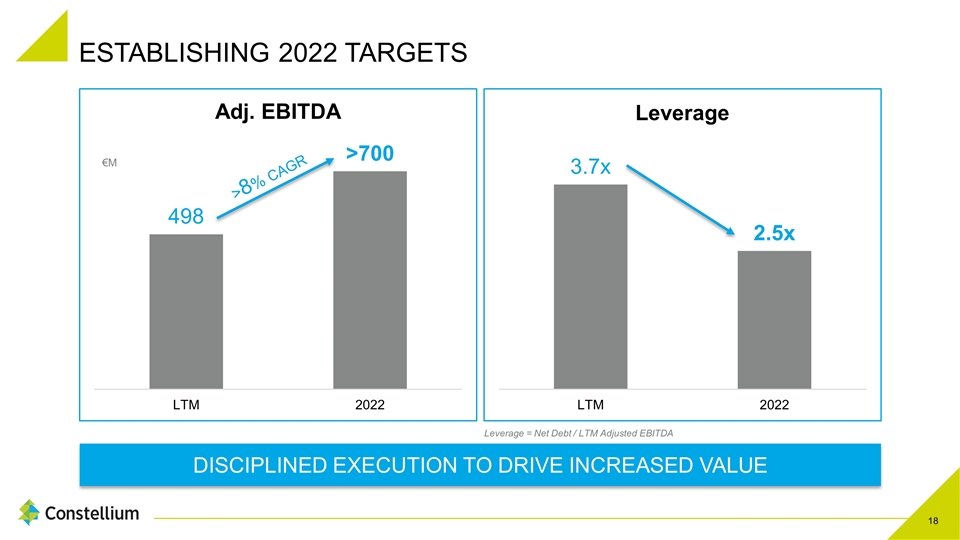

>8% CAGR ESTABLISHING 2022 TARGETS DISCIPLINED EXECUTION TO DRIVE INCREASED VALUE €M Leverage = Net Debt / LTM Adjusted EBITDA

TODAY’S PRESENTERS INGRID JOERG PRESIDENT, AEROSPACE & TRANSPORTATION PETER BASTEN PRESIDENT, PACKAGING & AUTOMOTIVE ROLLED PRODUCTS PAUL WARTON PRESIDENT, AUTOMOTIVE STRUCTURES & INDUSTRY PETER MATT CHIEF FINANCIAL OFFICER

PETER BASTEN PACKAGING & AUTOMOTIVE ROLLED PRODUCTS

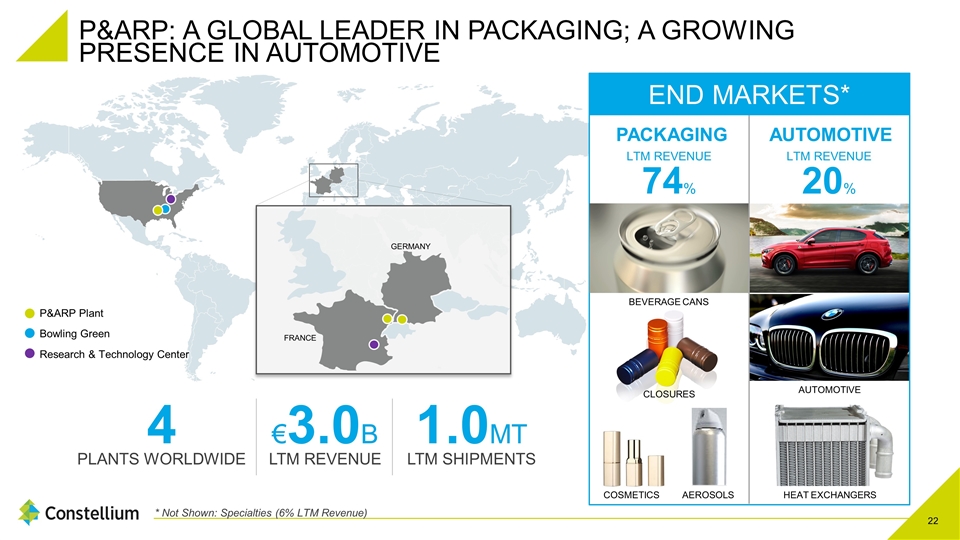

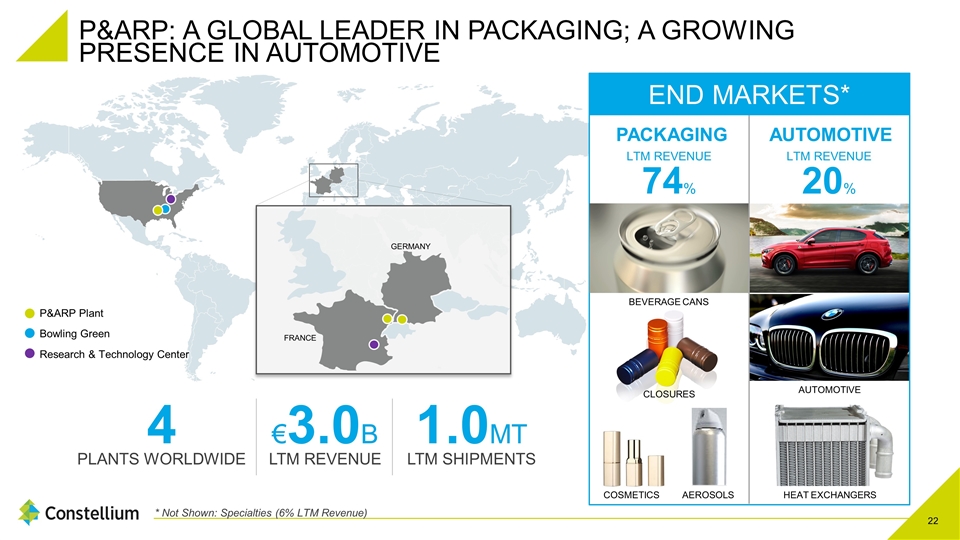

LTM REVENUE 74% AUTOMOTIVE P&ARP: A GLOBAL LEADER IN PACKAGING; A GROWING PRESENCE IN AUTOMOTIVE * Not Shown: Specialties (6% LTM Revenue) BEVERAGE CANS P&ARP Plant Bowling Green Research & Technology Center FRANCE GERMANY AEROSOLS COSMETICS 4 PLANTS WORLDWIDE €3.0B LTM REVENUE 1.0MT LTM SHIPMENTS END MARKETS* LTM REVENUE 20% HEAT EXCHANGERS AUTOMOTIVE PACKAGING CLOSURES

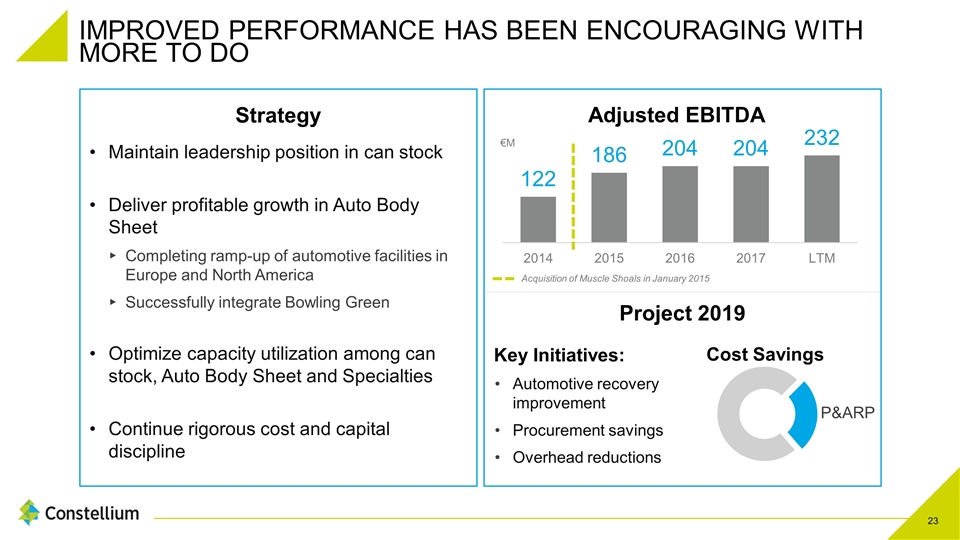

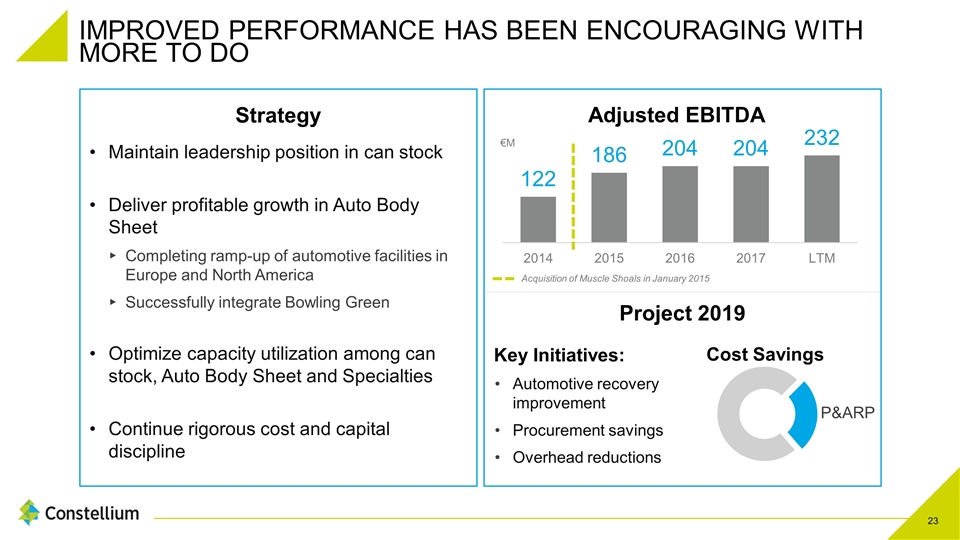

IMPROVED PERFORMANCE HAS BEEN ENCOURAGING WITH MORE TO DO Key Initiatives: Automotive recovery improvement Procurement savings Overhead reductions Acquisition of Muscle Shoals in January 2015 Cost Savings Project 2019 Strategy Maintain leadership position in can stock Deliver profitable growth in Auto Body Sheet Completing ramp-up of automotive facilities in Europe and North America Successfully integrate Bowling Green Optimize capacity utilization among can stock, Auto Body Sheet and Specialties Continue rigorous cost and capital discipline

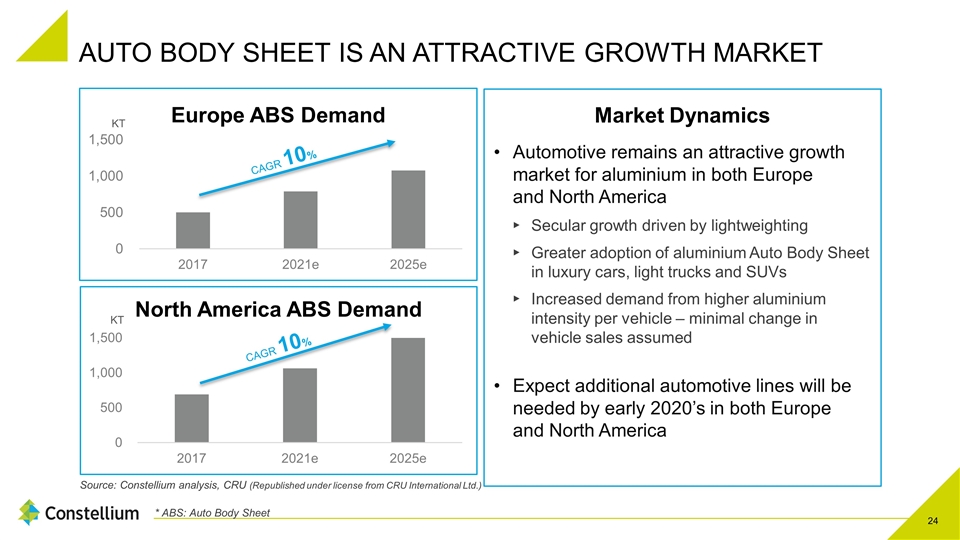

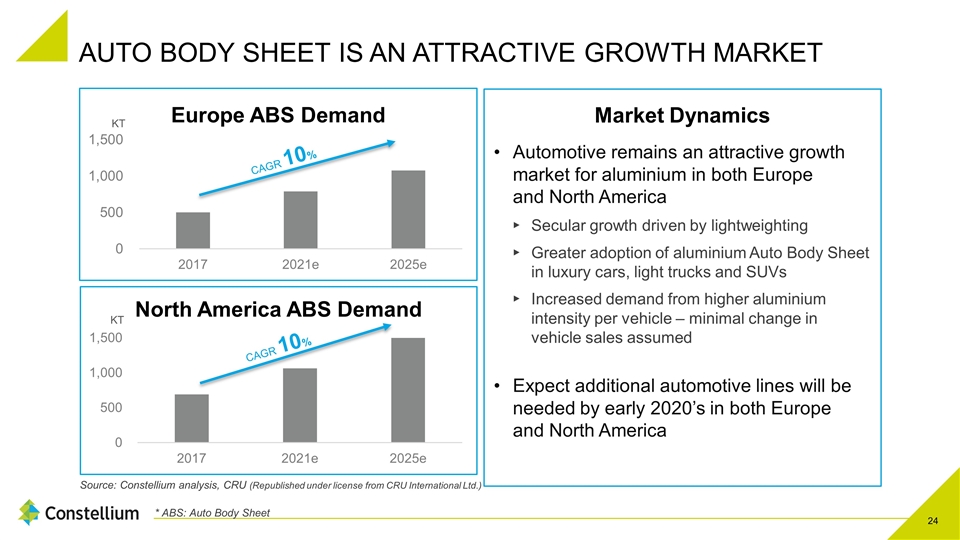

AUTO BODY SHEET IS AN ATTRACTIVE GROWTH MARKET * ABS: Auto Body Sheet Market Dynamics Automotive remains an attractive growth market for aluminium in both Europe and North America Secular growth driven by lightweighting Greater adoption of aluminium Auto Body Sheet in luxury cars, light trucks and SUVs Increased demand from higher aluminium intensity per vehicle – minimal change in vehicle sales assumed Expect additional automotive lines will be needed by early 2020’s in both Europe and North America KT Source: Constellium analysis, CRU (Republished under license from CRU International Ltd.) CAGR 10% KT CAGR 10%

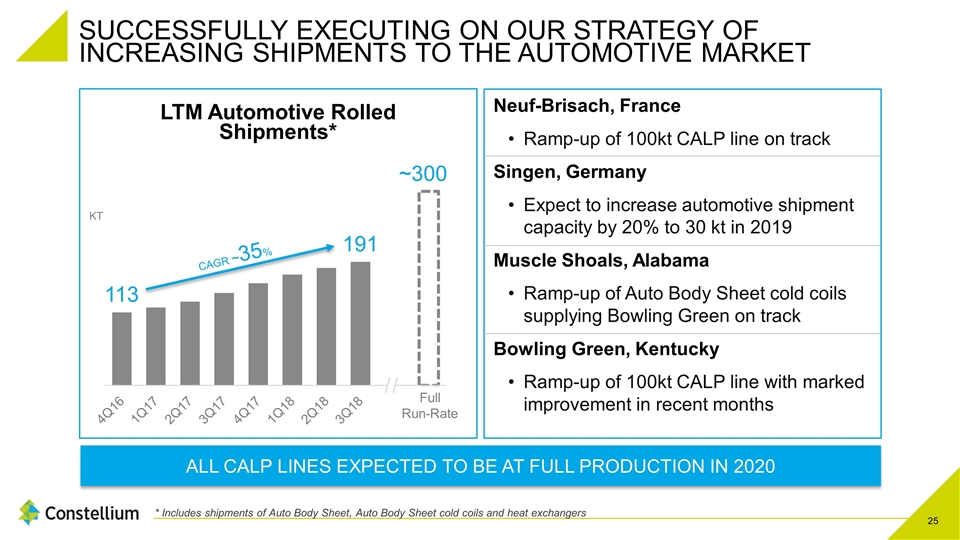

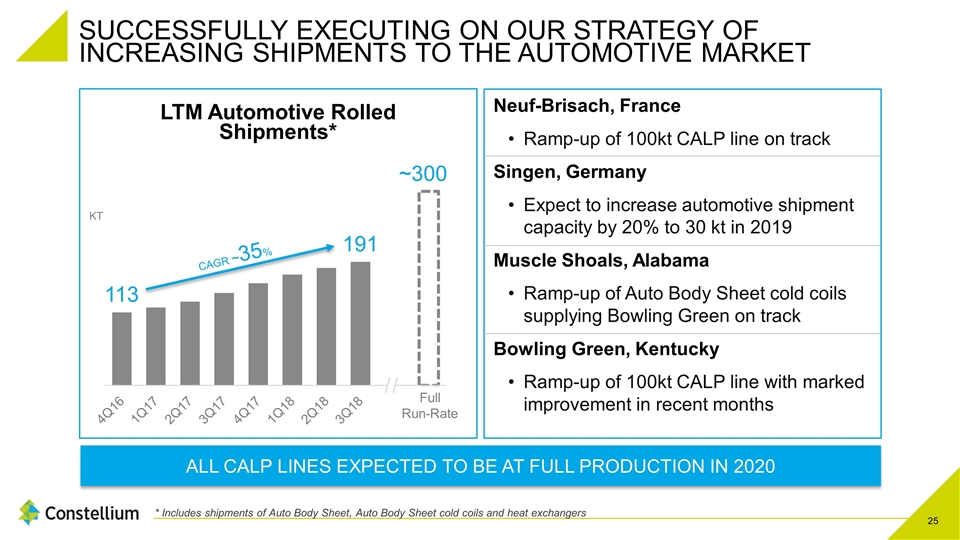

SUCCESSFULLY EXECUTING ON OUR STRATEGY OF INCREASING SHIPMENTS TO THE AUTOMOTIVE MARKET Neuf-Brisach, France Ramp-up of 100kt CALP line on track Singen, Germany Expect to increase automotive shipment capacity by 20% to 30 kt in 2019 Muscle Shoals, Alabama Ramp-up of Auto Body Sheet cold coils supplying Bowling Green on track Bowling Green, Kentucky Ramp-up of 100kt CALP line with marked improvement in recent months ALL CALP LINES EXPECTED TO BE AT FULL PRODUCTION IN 2020 KT Full Run-Rate * Includes shipments of Auto Body Sheet, Auto Body Sheet cold coils and heat exchangers CAGR ~35%

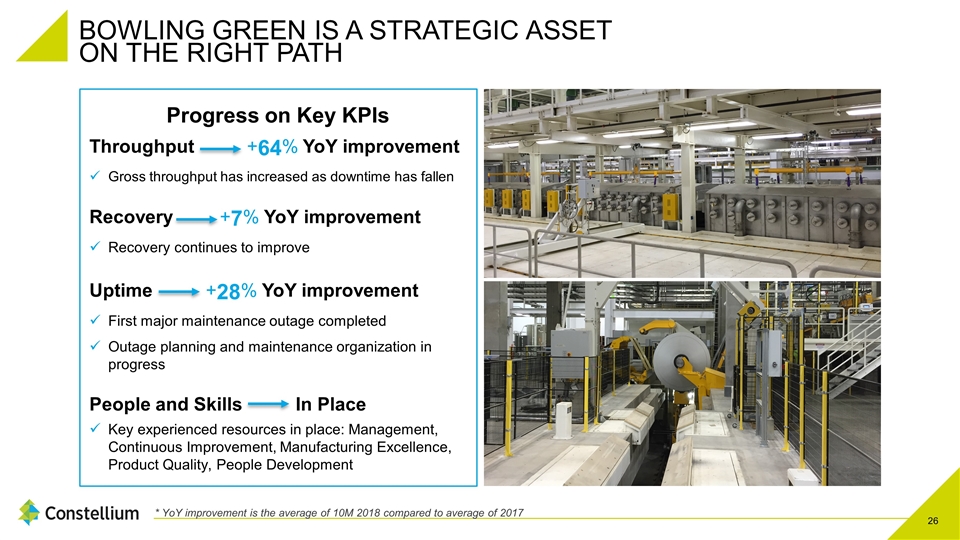

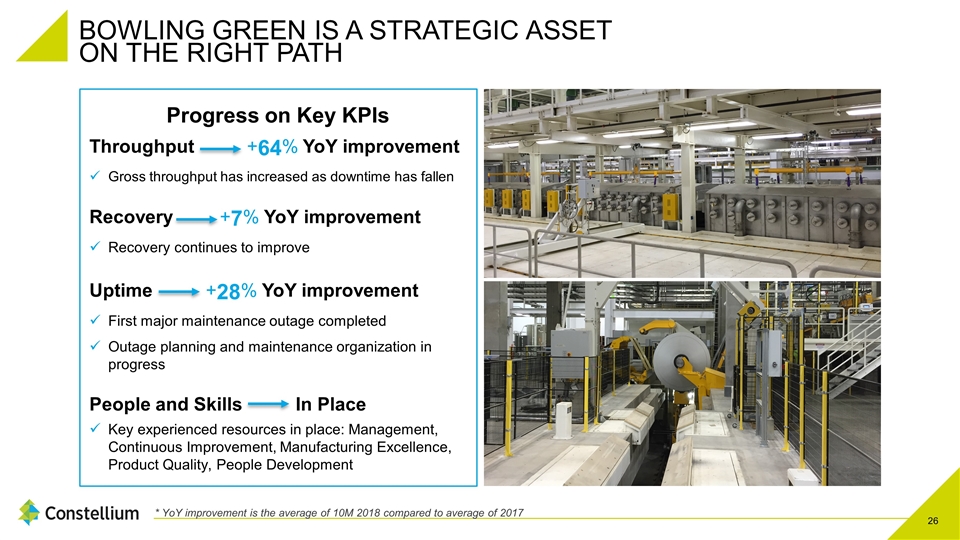

BOWLING GREEN IS A STRATEGIC ASSET ON THE RIGHT PATH * YoY improvement is the average of 10M 2018 compared to average of 2017 +64% Progress on Key KPIs Throughput +64% YoY improvement Gross throughput has increased as downtime has fallen Recovery +7% YoY improvement Recovery continues to improve Uptime +28% YoY improvement First major maintenance outage completed Outage planning and maintenance organization in progress People and Skills In Place Key experienced resources in place: Management, Continuous Improvement, Manufacturing Excellence, Product Quality, People Development

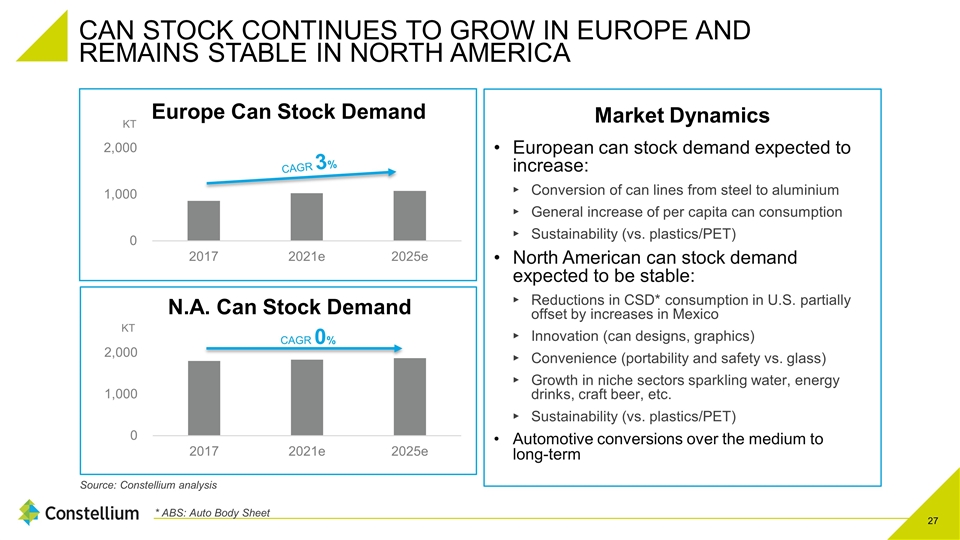

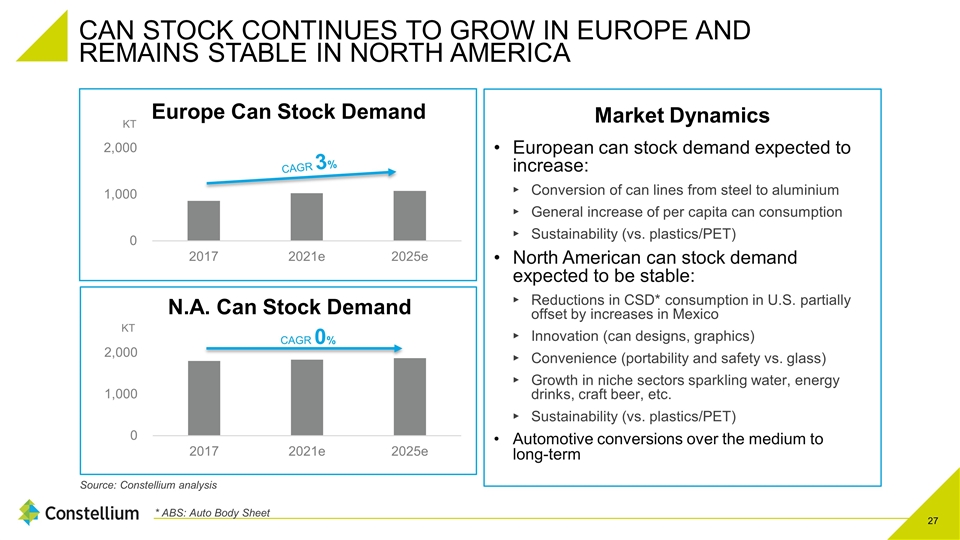

CAN STOCK CONTINUES TO GROW IN EUROPE AND REMAINS STABLE IN NORTH AMERICA * ABS: Auto Body Sheet Market Dynamics European can stock demand expected to increase: Conversion of can lines from steel to aluminium General increase of per capita can consumption Sustainability (vs. plastics/PET) North American can stock demand expected to be stable: Reductions in CSD* consumption in U.S. partially offset by increases in Mexico Innovation (can designs, graphics) Convenience (portability and safety vs. glass) Growth in niche sectors sparkling water, energy drinks, craft beer, etc. Sustainability (vs. plastics/PET) Automotive conversions over the medium to long-term KT Source: Constellium analysis KT CAGR 3% CAGR 0%

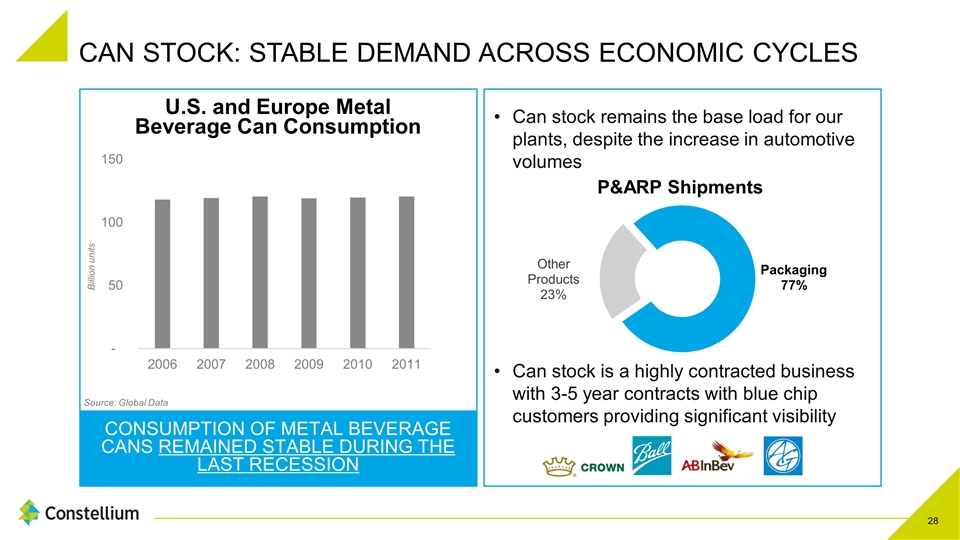

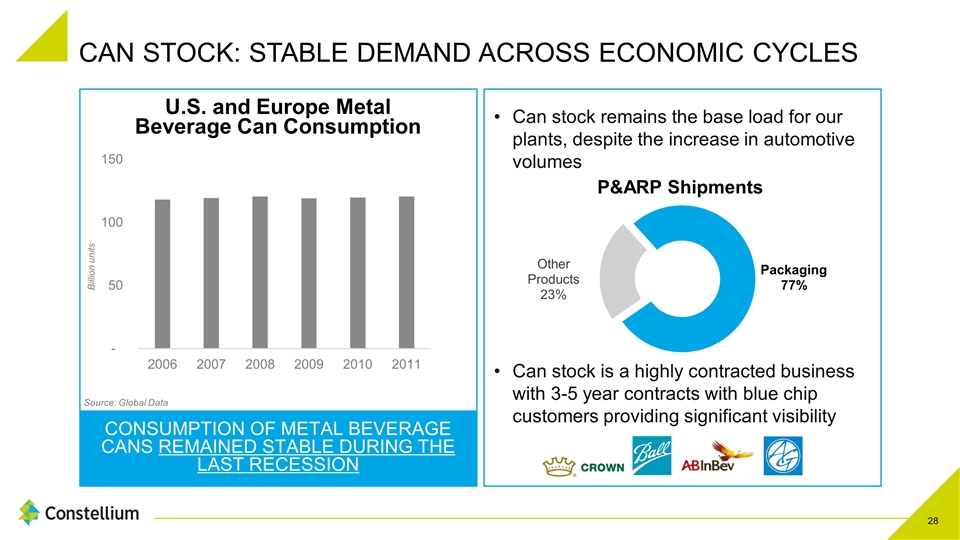

CAN STOCK: STABLE DEMAND ACROSS ECONOMIC CYCLES Can stock is a highly contracted business with 3-5 year contracts with blue chip customers providing significant visibility CONSUMPTION OF METAL BEVERAGE CANS REMAINED STABLE DURING THE LAST RECESSION Source: Global Data P&ARP Shipments Can stock remains the base load for our plants, despite the increase in automotive volumes Billion units

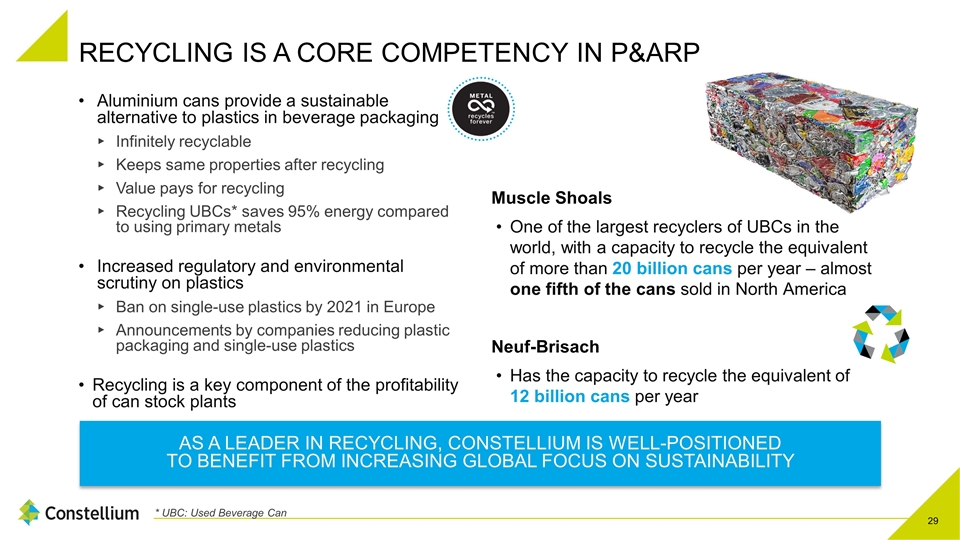

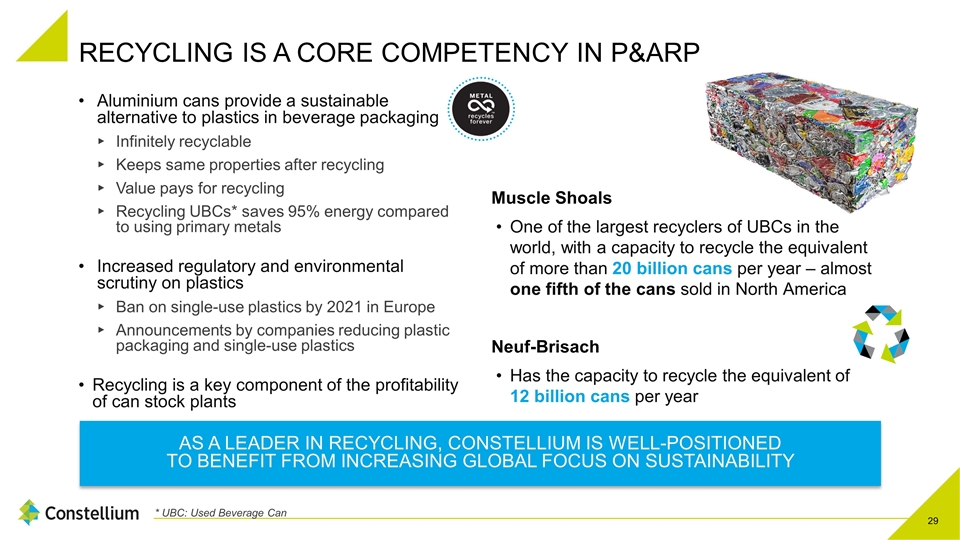

RECYCLING IS A CORE COMPETENCY IN P&ARP * UBC: Used Beverage Can Aluminium cans provide a sustainable alternative to plastics in beverage packaging Infinitely recyclable Keeps same properties after recycling Value pays for recycling Recycling UBCs* saves 95% energy compared to using primary metals Increased regulatory and environmental scrutiny on plastics Ban on single-use plastics by 2021 in Europe Announcements by companies reducing plastic packaging and single-use plastics Recycling is a key component of the profitability of can stock plants Muscle Shoals One of the largest recyclers of UBCs in the world, with a capacity to recycle the equivalent of more than 20 billion cans per year – almost one fifth of the cans sold in North America Neuf-Brisach Has the capacity to recycle the equivalent of 12 billion cans per year AS A LEADER IN RECYCLING, CONSTELLIUM IS WELL-POSITIONED TO BENEFIT FROM INCREASING GLOBAL FOCUS ON SUSTAINABILITY

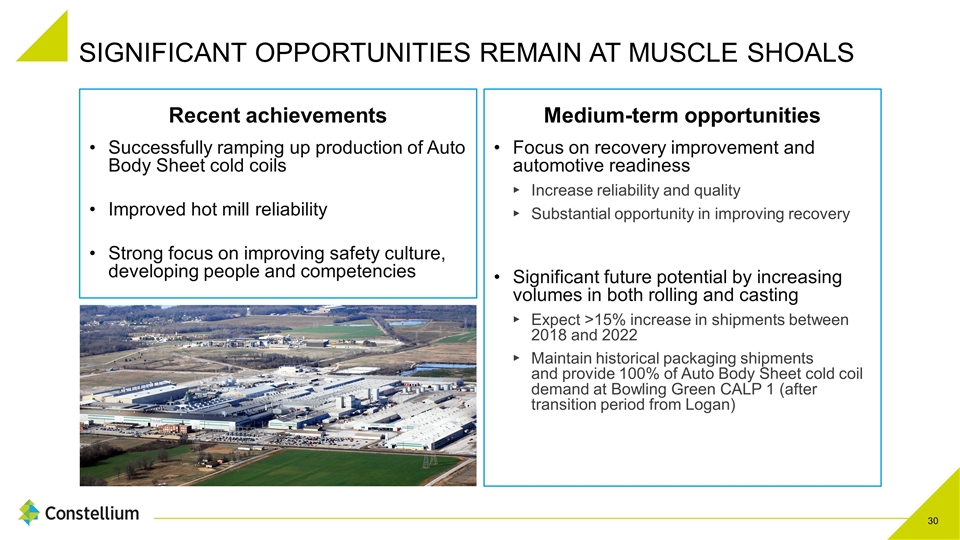

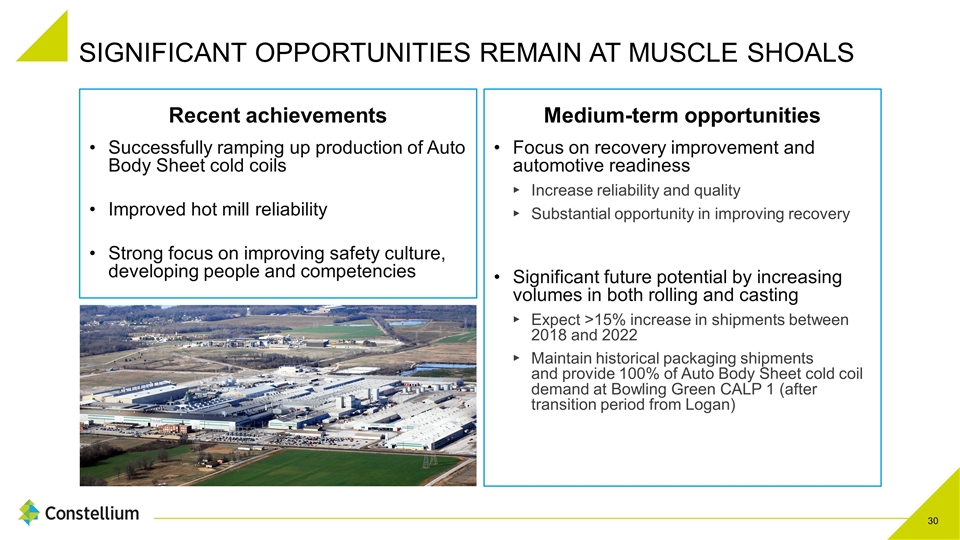

SIGNIFICANT OPPORTUNITIES REMAIN AT MUSCLE SHOALS Medium-term opportunities Focus on recovery improvement and automotive readiness Increase reliability and quality Substantial opportunity in improving recovery Significant future potential by increasing volumes in both rolling and casting Expect >15% increase in shipments between 2018 and 2022 Maintain historical packaging shipments and provide 100% of Auto Body Sheet cold coil demand at Bowling Green CALP 1 (after transition period from Logan) Recent achievements Successfully ramping up production of Auto Body Sheet cold coils Improved hot mill reliability Strong focus on improving safety culture, developing people and competencies

THE ROAD AHEAD FOR P&ARP Maintain leadership position in can stock Complete ramp-up of automotive facilities in Europe and North America and successfully integrate Bowling Green Deliver on improvements at Muscle Shoals Continue to focus on and deliver operational excellence, productivity and cost reductions

INGRID JOERG AEROSPACE & TRANSPORTATION

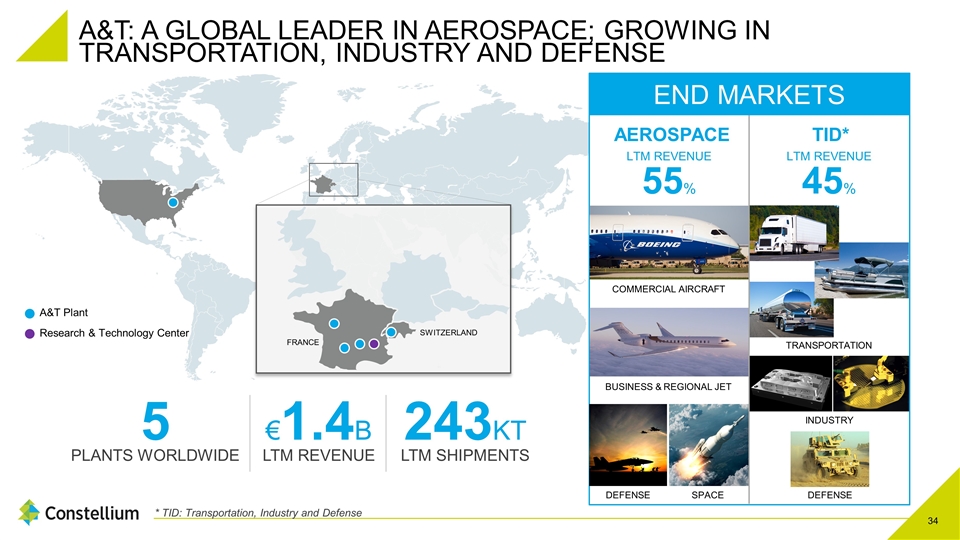

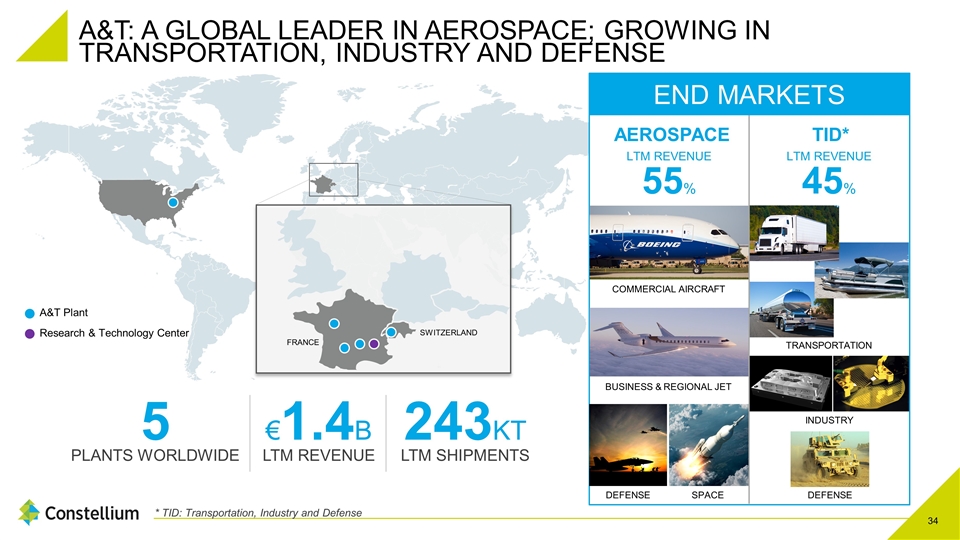

LTM REVENUE 55% TID* END MARKETS LTM REVENUE 45% AEROSPACE A&T: A GLOBAL LEADER IN AEROSPACE; GROWING IN TRANSPORTATION, INDUSTRY AND DEFENSE * TID: Transportation, Industry and Defense FRANCE SWITZERLAND 5 PLANTS WORLDWIDE €1.4B LTM REVENUE 243KT LTM SHIPMENTS BUSINESS & REGIONAL JET COMMERCIAL AIRCRAFT SPACE DEFENSE TRANSPORTATION INDUSTRY DEFENSE A&T Plant Research & Technology Center

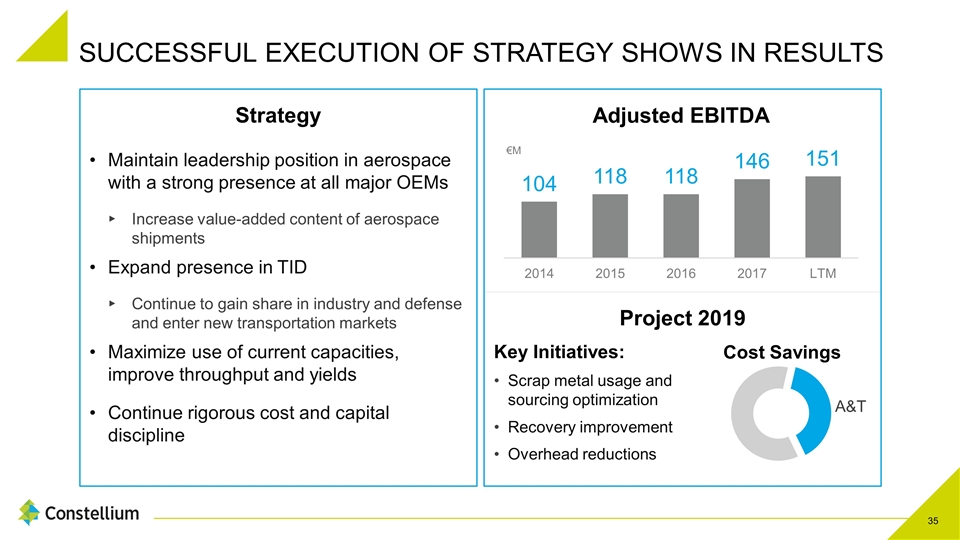

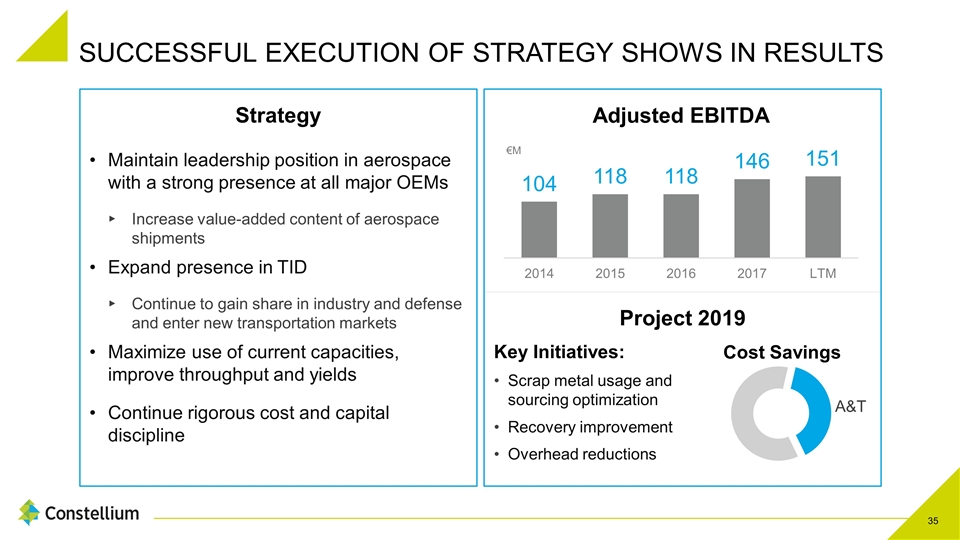

SUCCESSFUL EXECUTION OF STRATEGY SHOWS IN RESULTS Key Initiatives: Scrap metal usage and sourcing optimization Recovery improvement Overhead reductions Strategy Maintain leadership position in aerospace with a strong presence at all major OEMs Increase value-added content of aerospace shipments Expand presence in TID Continue to gain share in industry and defense and enter new transportation markets Maximize use of current capacities, improve throughput and yields Continue rigorous cost and capital discipline €M Cost Savings Project 2019

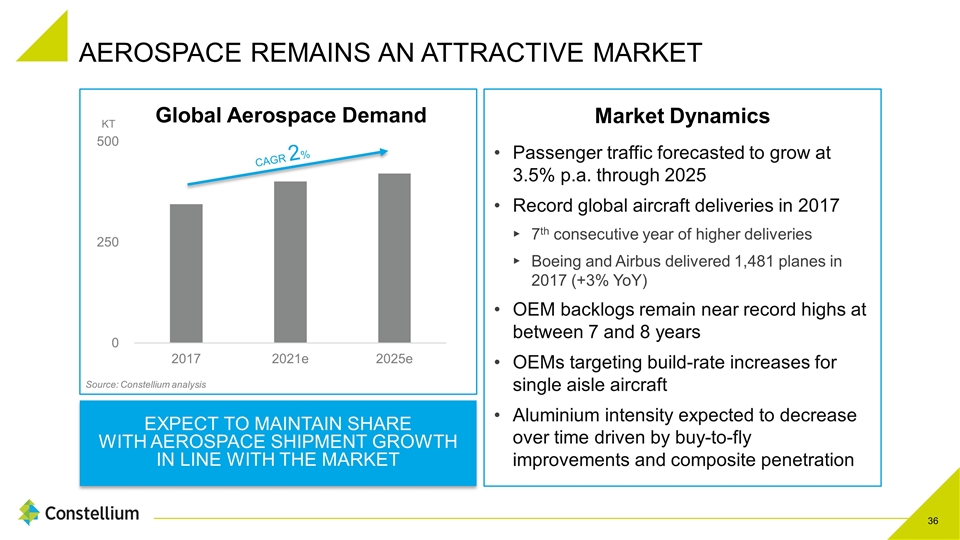

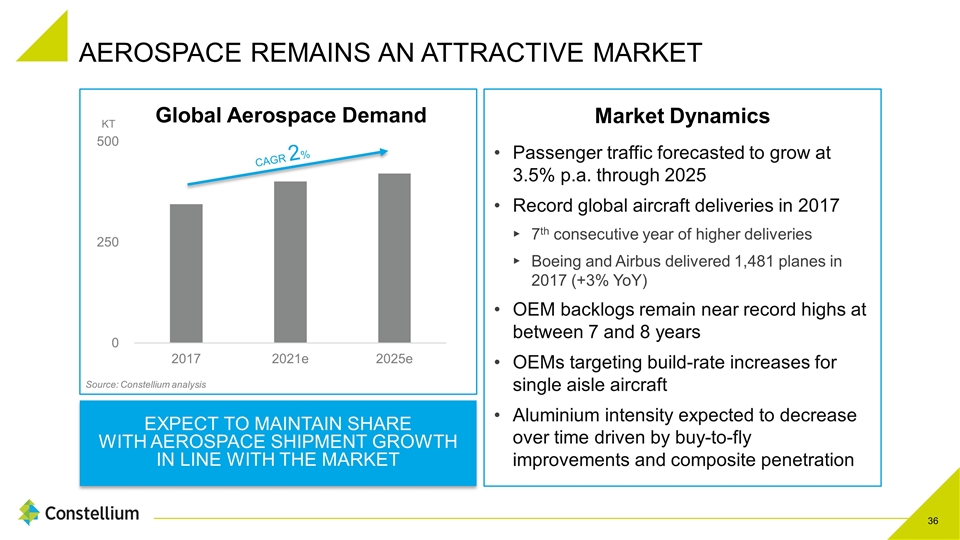

AEROSPACE REMAINS AN ATTRACTIVE MARKET Market Dynamics Passenger traffic forecasted to grow at 3.5% p.a. through 2025 Record global aircraft deliveries in 2017 7th consecutive year of higher deliveries Boeing and Airbus delivered 1,481 planes in 2017 (+3% YoY) OEM backlogs remain near record highs at between 7 and 8 years OEMs targeting build-rate increases for single aisle aircraft Aluminium intensity expected to decrease over time driven by buy-to-fly improvements and composite penetration Source: Constellium analysis KT EXPECT TO MAINTAIN SHARE WITH AEROSPACE SHIPMENT GROWTH IN LINE WITH THE MARKET CAGR 2%

INTEGRATED SERVICE OFFER DRIVES VALUE FOR AEROSPACE CUSTOMERS Crucial development partner for customers due to outstanding R&D capabilities More than 300 aerospace patents State-of-the-art R&D center Creating value by vertically integrating aerospace supply chain, from closed loop recycling to parts pre-machining: Simplifies supply chain and shortens lead time Preserves metal value through closed loop recycling of aerospace-grade alloys Optimizes working capital and reduces cost of final product SINGLE AISLE COCKPIT FRAME WINGSKIN

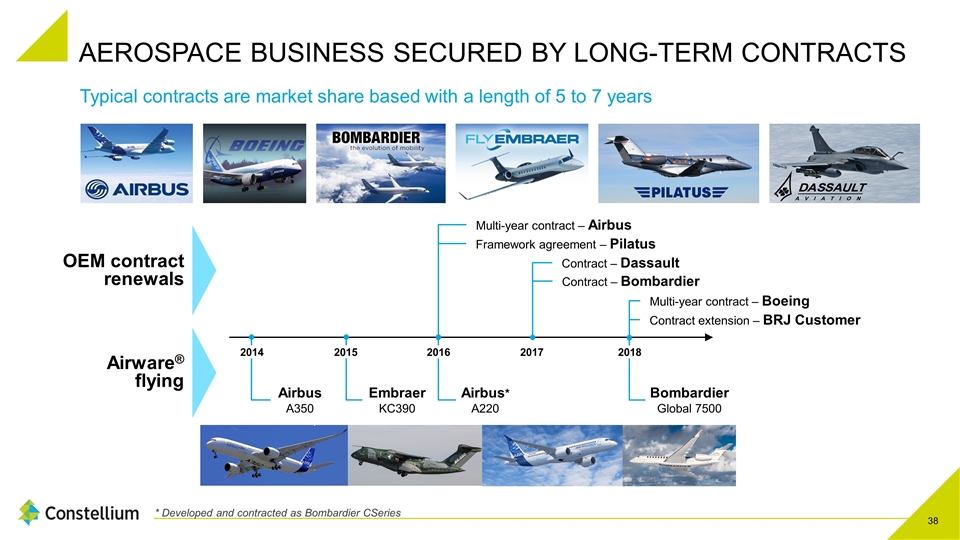

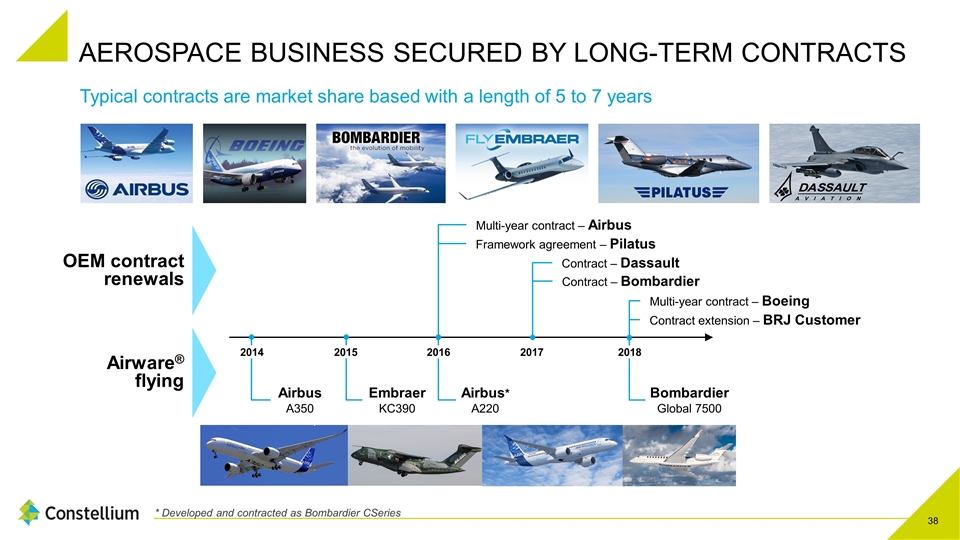

Contract extension – BRJ Customer AEROSPACE BUSINESS SECURED BY LONG-TERM CONTRACTS Typical contracts are market share based with a length of 5 to 7 years * Developed and contracted as Bombardier CSeries Multi-year contract – Airbus Contract – Dassault Airbus A350 OEM contract renewals Airware® flying 2017 Framework agreement – Pilatus Multi-year contract – Boeing 2014 Embraer KC390 2015 Airbus* A220 Bombardier Global 7500 2018 2016 Contract – Bombardier

Space Began in 2002 with the NASA Space Shuttle Adopted by leading space launch platforms AIRWARE ® offers a combination of unique strength and weight properties for structural sections A GLOBAL LEADER IN ALUMINIUM LITHIUM TECHNOLOGY SPACE SHUTTLE EXTERNAL TANK AIRBUS A350 WING COMPONENTS AND EXTRUSIONS AIRBUS A220 FUSELAGE AND EXTRUSIONS Our proprietary AIRWARE ® product is a proven metallic alternative to composites with seven different alloys flying today Commercial Aircraft Proven technology on ramping programs of several aerospace OEMs Current applications: fuselage skin, stringers, floor structure and seat tracks, window frames, large internal wing and fuselage components Also the material of choice for military applications FALCON HEAVY NEW EXAMPLE ORION MULTI-PURPOSE CREW VEHICLE

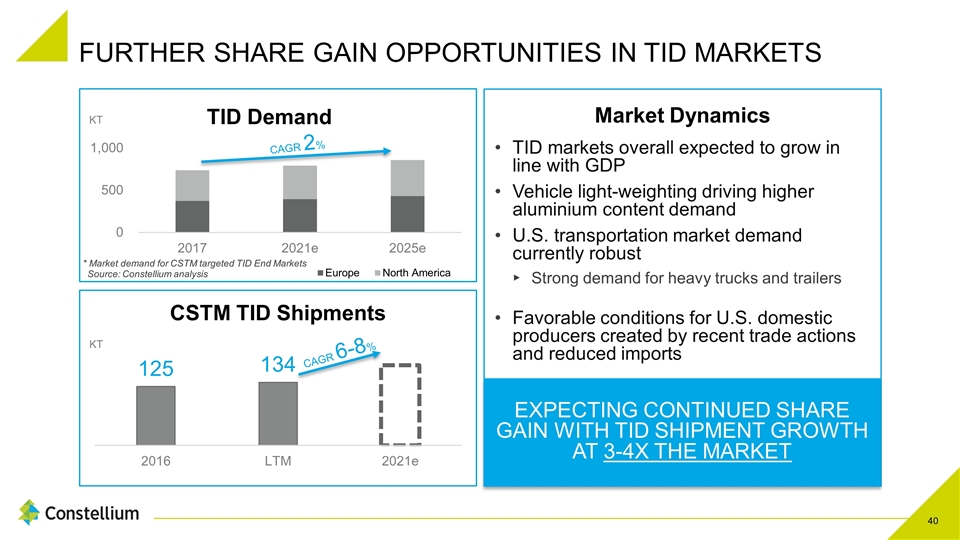

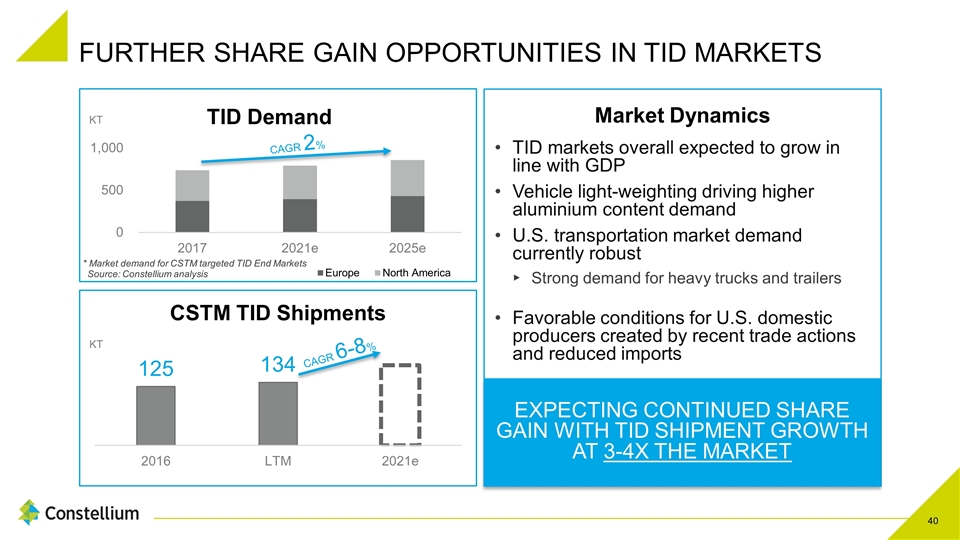

EXPECTING CONTINUED SHARE GAIN WITH TID SHIPMENT GROWTH AT 3-4X THE MARKET FURTHER SHARE GAIN OPPORTUNITIES IN TID MARKETS Market Dynamics TID markets overall expected to grow in line with GDP Vehicle light-weighting driving higher aluminium content demand U.S. transportation market demand currently robust Strong demand for heavy trucks and trailers Favorable conditions for U.S. domestic producers created by recent trade actions and reduced imports * Market demand for CSTM targeted TID End Markets KT KT Source: Constellium analysis CAGR 6-8% CAGR 2%

INDUSTRY AND DEFENSE: TARGETING HIGH-VALUE NICHES Unidal® Alumold® Dokima® Keikor® armor suite Sealium® for navy AlplanTM Beyond Precision Differentiated Industrial Plate Capabilities Thick plates Low-residual stress products Tight dimensional tolerances Healthy Portfolio of Recognized Products Defense Plate Growth Aluminium is material of choice for vehicle light-weighting

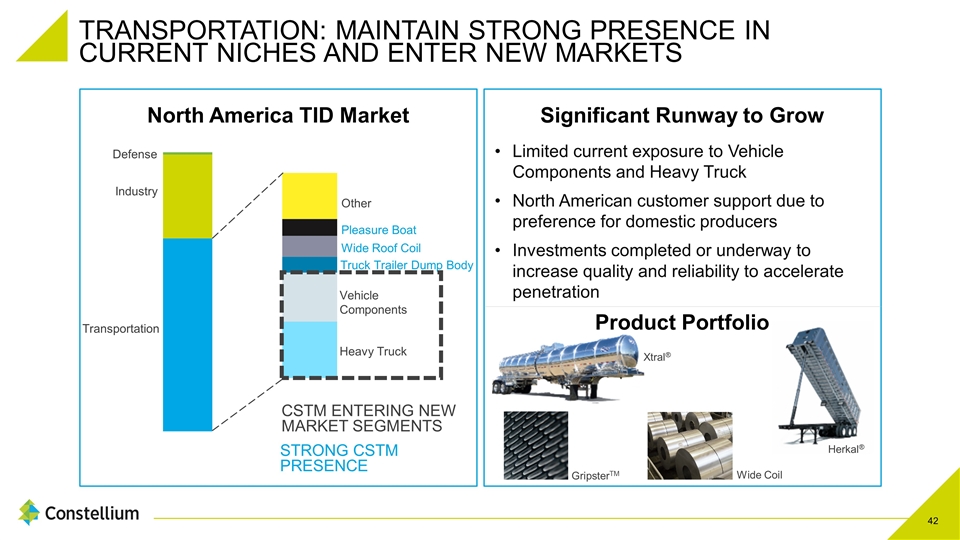

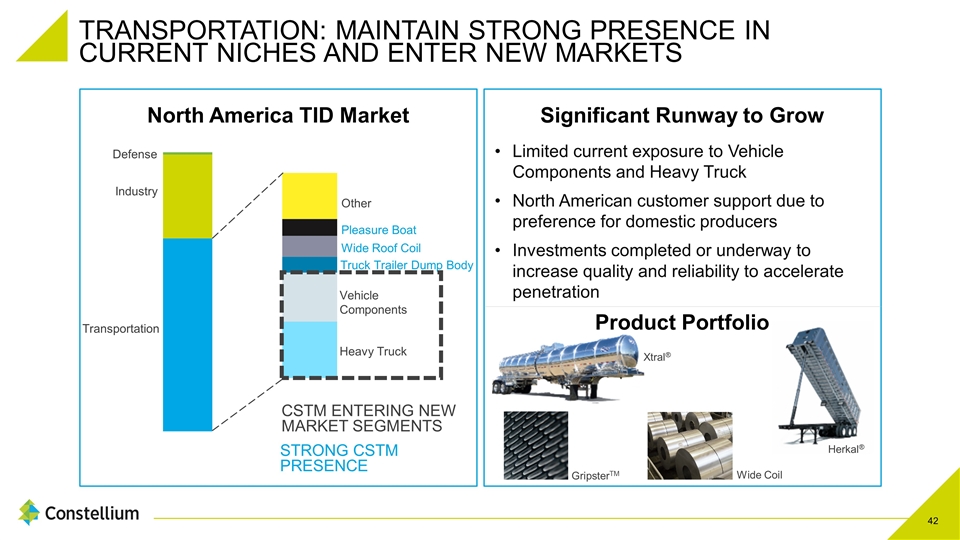

TRANSPORTATION: MAINTAIN STRONG PRESENCE IN CURRENT NICHES AND ENTER NEW MARKETS Industry Transportation Defense North America TID Market Other Pleasure Boat Wide Roof Coil Truck Trailer Dump Body Vehicle Components Heavy Truck STRONG CSTM PRESENCE GripsterTM Xtral® Wide Coil Herkal® CSTM ENTERING NEW MARKET SEGMENTS Product Portfolio Significant Runway to Grow Limited current exposure to Vehicle Components and Heavy Truck North American customer support due to preference for domestic producers Investments completed or underway to increase quality and reliability to accelerate penetration

THE ROAD AHEAD FOR A&T Increase share of value-add products in Aerospace Grow in Transportation, Industry and Defense through niche specialty applications and penetrating new market segments Leverage technology advantage to keep A&T ahead of the competitors Continue to focus on and deliver operational excellence, productivity and cost reductions

PAUL WARTON AUTOMOTIVE STRUCTURES & INDUSTRY

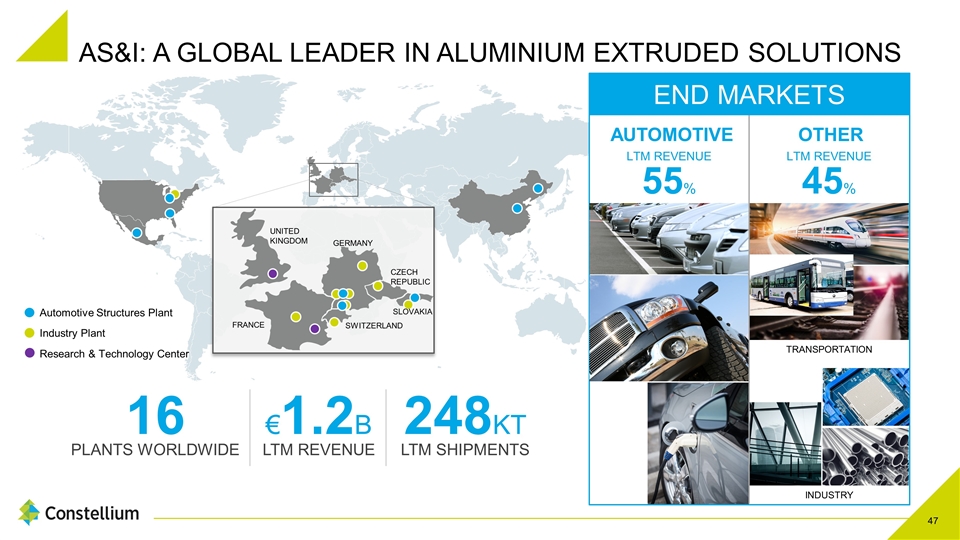

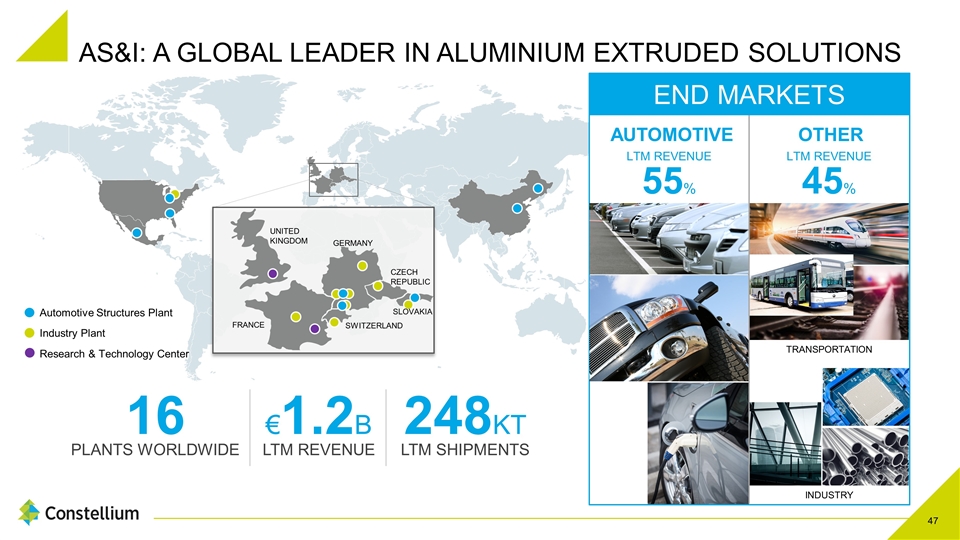

AS&I: A GLOBAL LEADER IN ALUMINIUM EXTRUDED SOLUTIONS FRANCE GERMANY SWITZERLAND CZECH REPUBLIC SLOVAKIA UNITED KINGDOM 16 PLANTS WORLDWIDE €1.2B LTM REVENUE 248KT LTM SHIPMENTS Automotive Structures Plant Industry Plant Research & Technology Center LTM REVENUE 55% OTHER END MARKETS LTM REVENUE 45% AUTOMOTIVE TRANSPORTATION INDUSTRY

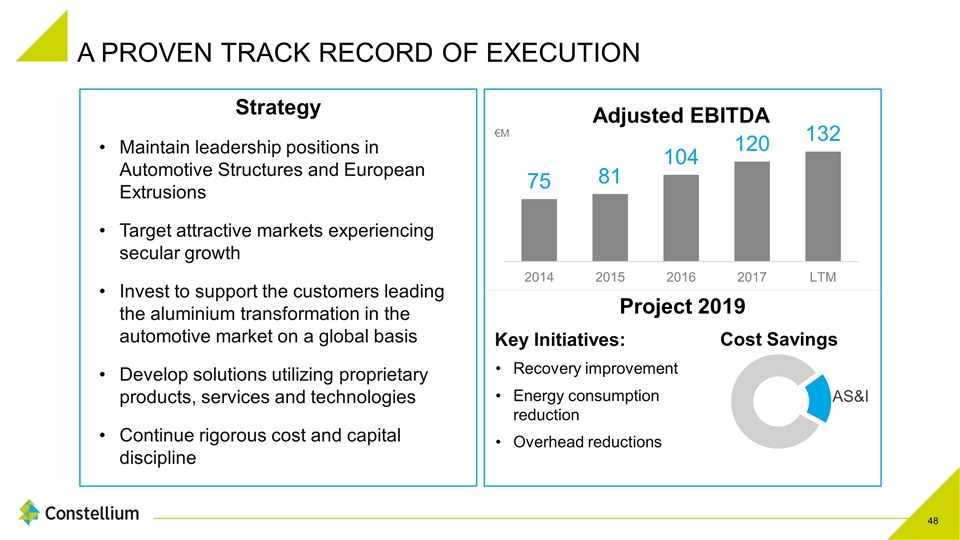

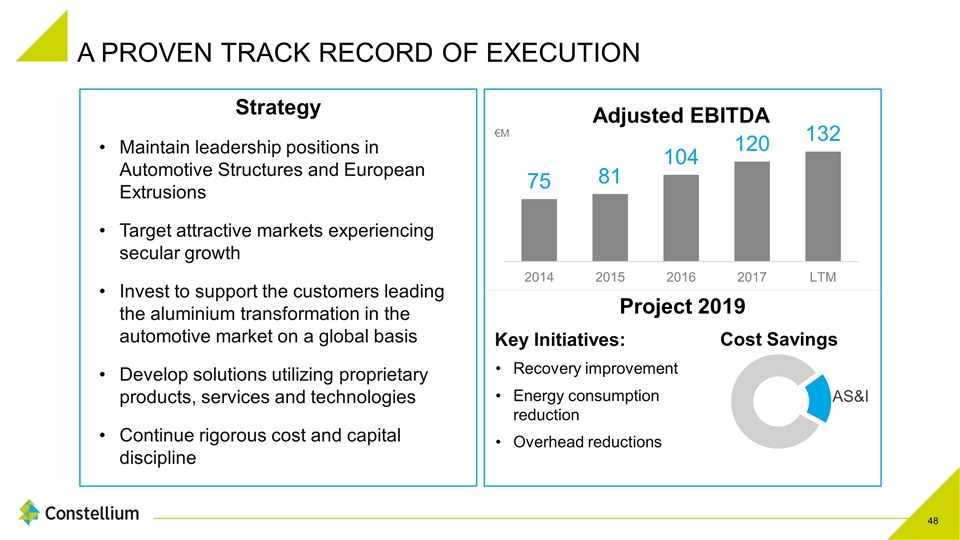

A PROVEN TRACK RECORD OF EXECUTION Strategy Maintain leadership positions in Automotive Structures and European Extrusions Target attractive markets experiencing secular growth Invest to support the customers leading the aluminium transformation in the automotive market on a global basis Develop solutions utilizing proprietary products, services and technologies Continue rigorous cost and capital discipline Cost Savings Project 2019 €M Key Initiatives: Recovery improvement Energy consumption reduction Overhead reductions

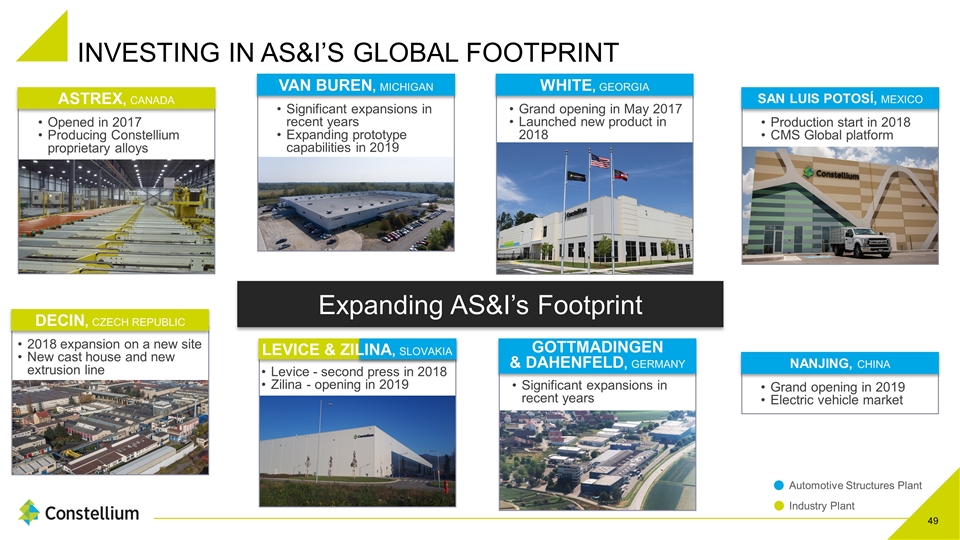

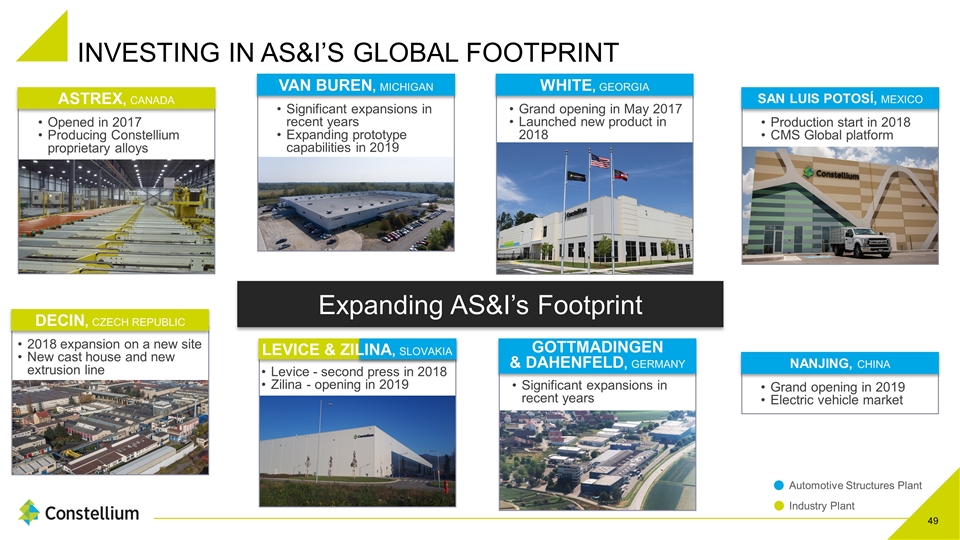

Expanding AS&I’s Footprint INVESTING IN AS&I’S GLOBAL FOOTPRINT ASTREX, CANADA Opened in 2017 Producing Constellium proprietary alloys Automotive Structures Plant Industry Plant DECIN, CZECH REPUBLIC 2018 expansion on a new site New cast house and new extrusion line VAN BUREN, MICHIGAN Significant expansions in recent years Expanding prototype capabilities in 2019 WHITE, GEORGIA Grand opening in May 2017 Launched new product in 2018 SAN LUIS POTOSÍ, MEXICO Production start in 2018 CMS Global platform GOTTMADINGEN & DAHENFELD, GERMANY Significant expansions in recent years NANJING, CHINA Grand opening in 2019 Electric vehicle market Levice - second press in 2018 Zilina - opening in 2019 LEVICE & ZILINA, SLOVAKIA

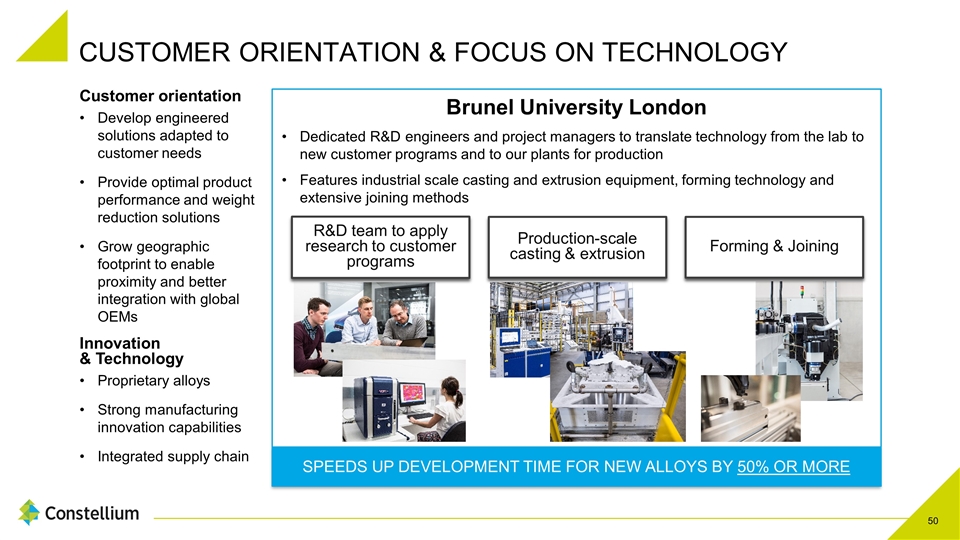

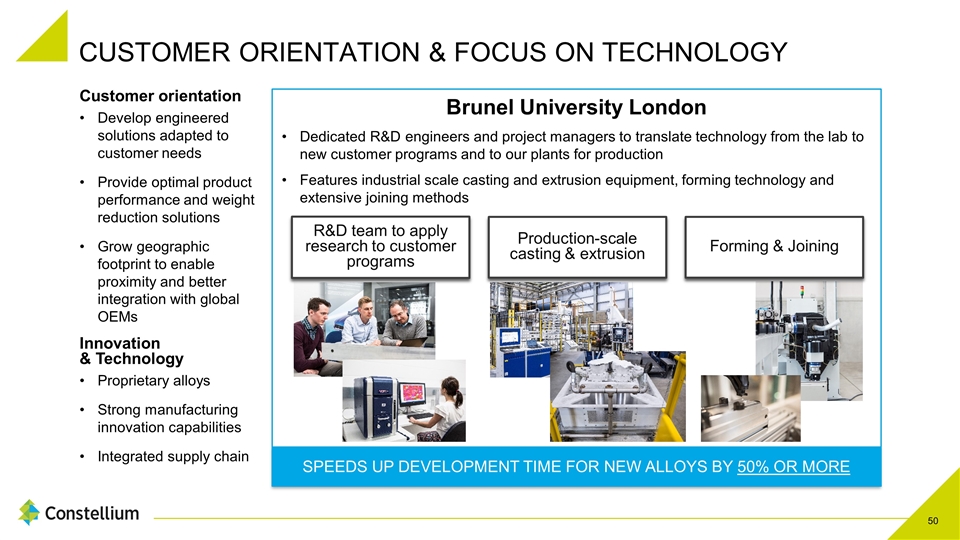

SPEEDS UP DEVELOPMENT TIME FOR NEW ALLOYS BY 50% OR MORE CUSTOMER ORIENTATION & FOCUS ON TECHNOLOGY R&D team to apply research to customer programs Customer orientation Develop engineered solutions adapted to customer needs Provide optimal product performance and weight reduction solutions Grow geographic footprint to enable proximity and better integration with global OEMs Innovation & Technology Proprietary alloys Strong manufacturing innovation capabilities Integrated supply chain Brunel University London Dedicated R&D engineers and project managers to translate technology from the lab to new customer programs and to our plants for production Features industrial scale casting and extrusion equipment, forming technology and extensive joining methods Production-scale casting & extrusion Forming & Joining

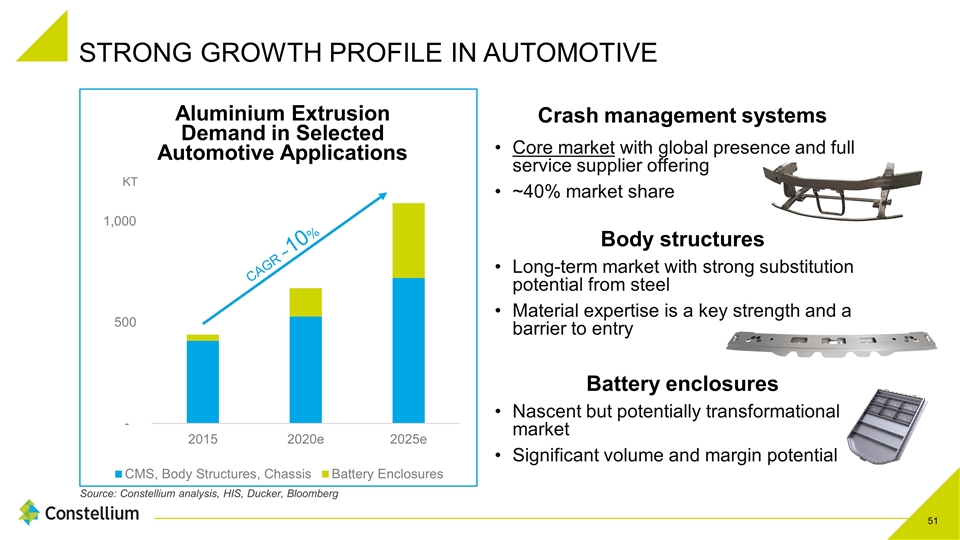

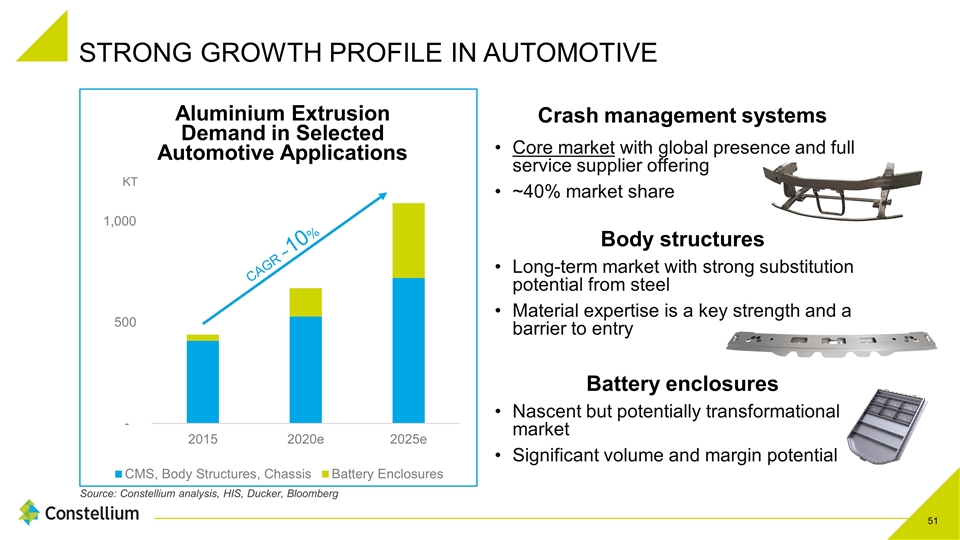

STRONG GROWTH PROFILE IN AUTOMOTIVE Source: Constellium analysis, HIS, Ducker, Bloomberg KT CAGR ~10% Crash management systems Core market with global presence and full service supplier offering ~40% market share Body structures Long-term market with strong substitution potential from steel Material expertise is a key strength and a barrier to entry Battery enclosures Nascent but potentially transformational market Significant volume and margin potential

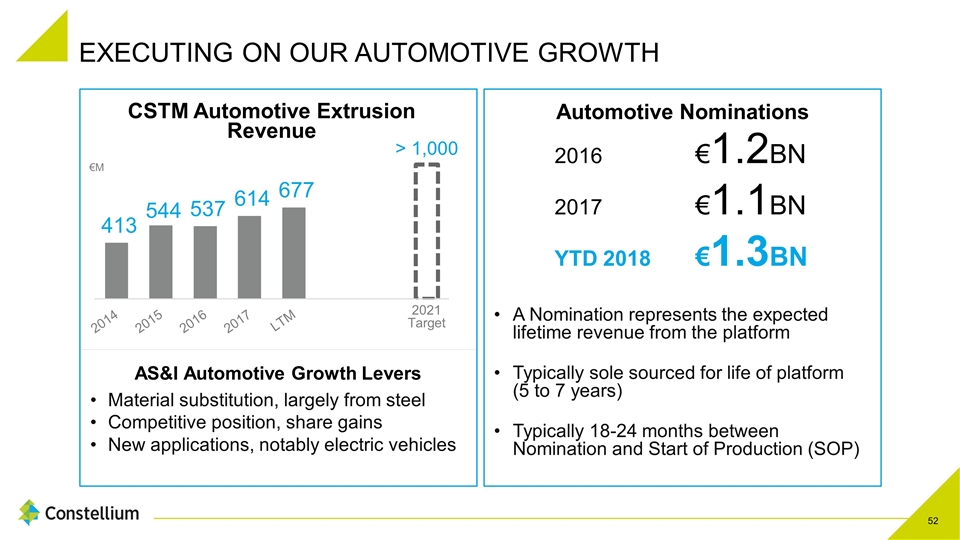

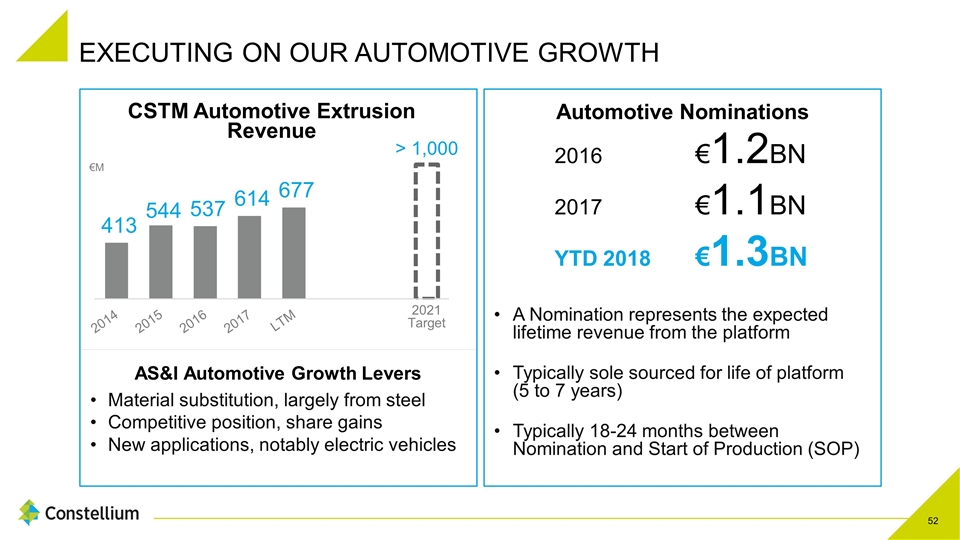

EXECUTING ON OUR AUTOMOTIVE GROWTH AS&I Automotive Growth Levers Material substitution, largely from steel Competitive position, share gains New applications, notably electric vehicles 2016€1.2BN 2017 €1.1BN YTD 2018€1.3BN Automotive Nominations A Nomination represents the expected lifetime revenue from the platform Typically sole sourced for life of platform (5 to 7 years) Typically 18-24 months between Nomination and Start of Production (SOP) €M 2021 Target

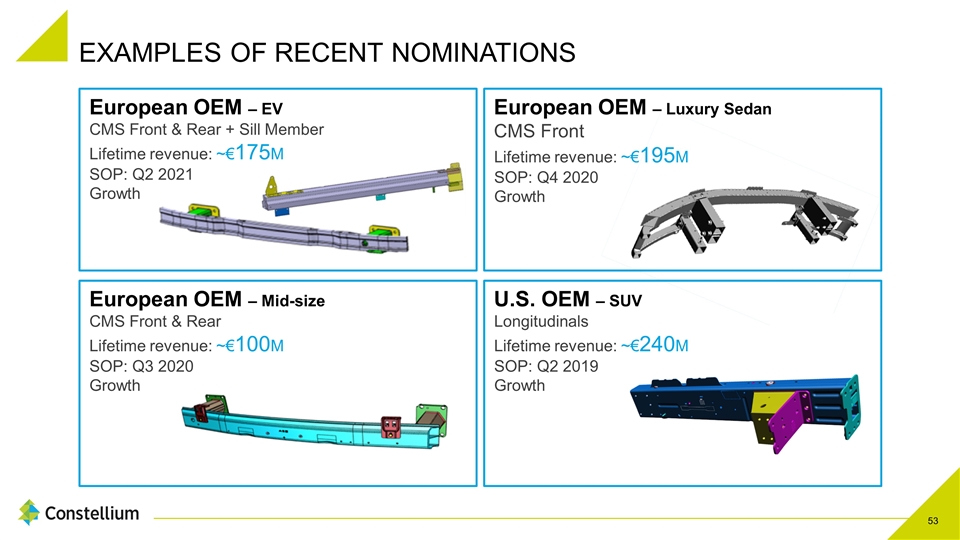

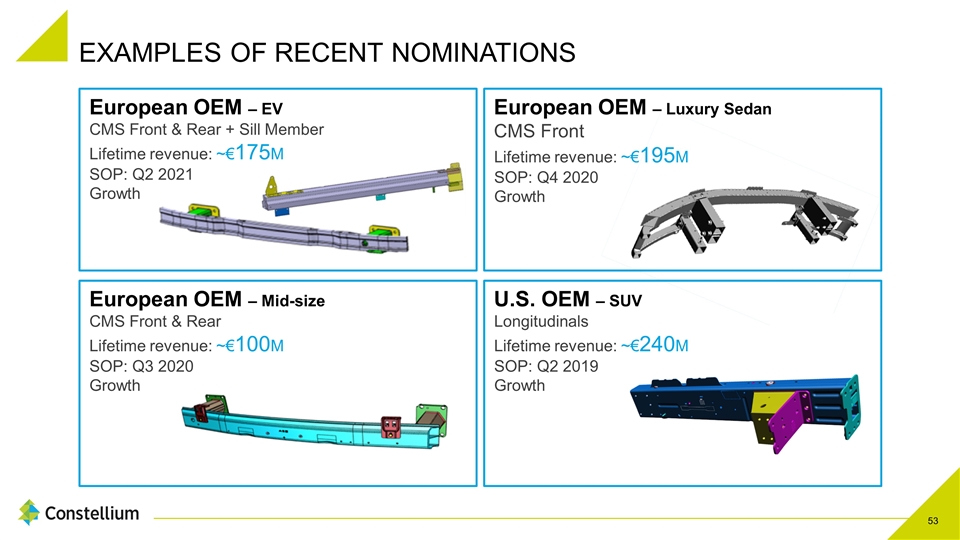

European OEM – Luxury Sedan CMS Front Lifetime revenue: ~€195M SOP: Q4 2020 Growth EXAMPLES OF RECENT NOMINATIONS European OEM – EV CMS Front & Rear + Sill Member Lifetime revenue: ~€175M SOP: Q2 2021 Growth U.S. OEM – SUV Longitudinals Lifetime revenue: ~€240M SOP: Q2 2019 Growth European OEM – Mid-size CMS Front & Rear Lifetime revenue: ~€100M SOP: Q3 2020 Growth

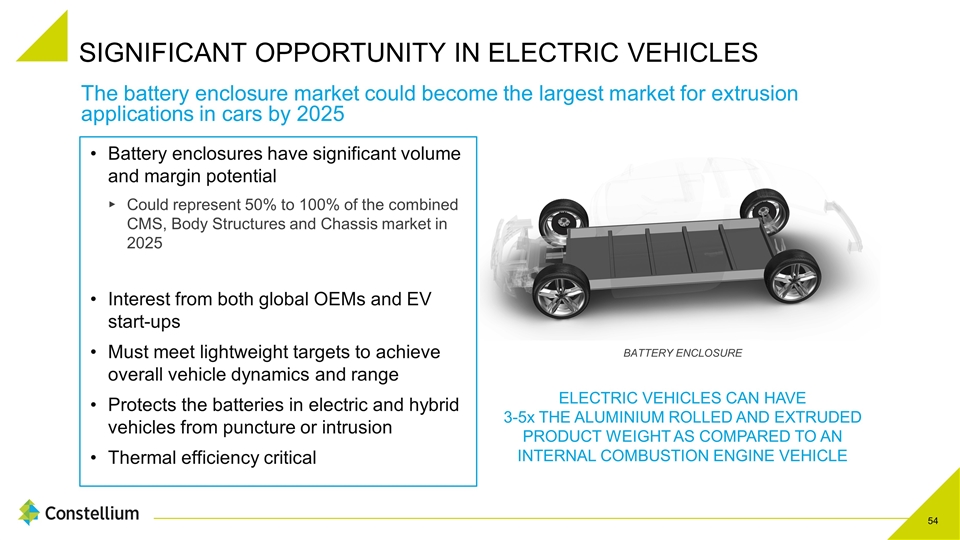

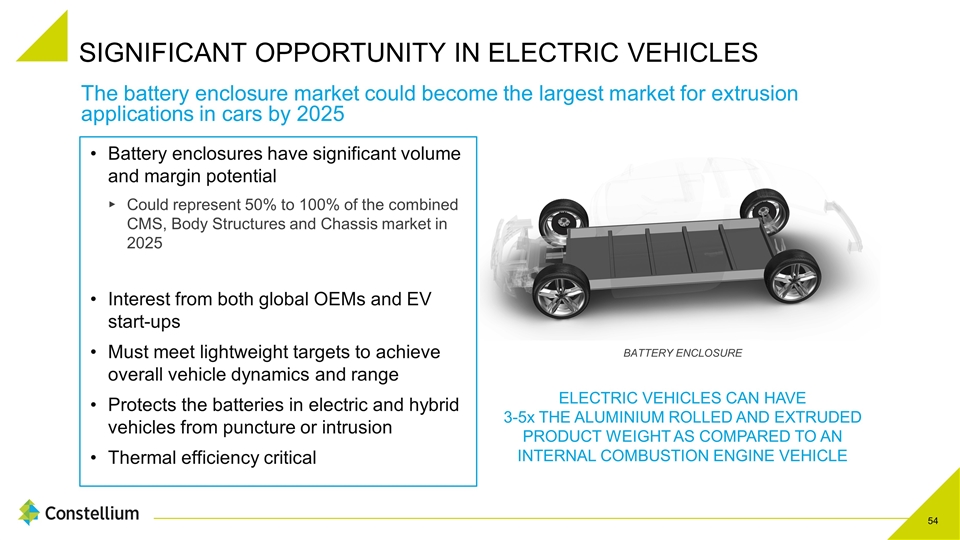

SIGNIFICANT OPPORTUNITY IN ELECTRIC VEHICLES The battery enclosure market could become the largest market for extrusion applications in cars by 2025 Battery enclosures have significant volume and margin potential Could represent 50% to 100% of the combined CMS, Body Structures and Chassis market in 2025 Interest from both global OEMs and EV start-ups Must meet lightweight targets to achieve overall vehicle dynamics and range Protects the batteries in electric and hybrid vehicles from puncture or intrusion Thermal efficiency critical ELECTRIC VEHICLES CAN HAVE 3-5x THE ALUMINIUM ROLLED AND EXTRUDED PRODUCT WEIGHT AS COMPARED TO AN INTERNAL COMBUSTION ENGINE VEHICLE BATTERY ENCLOSURE

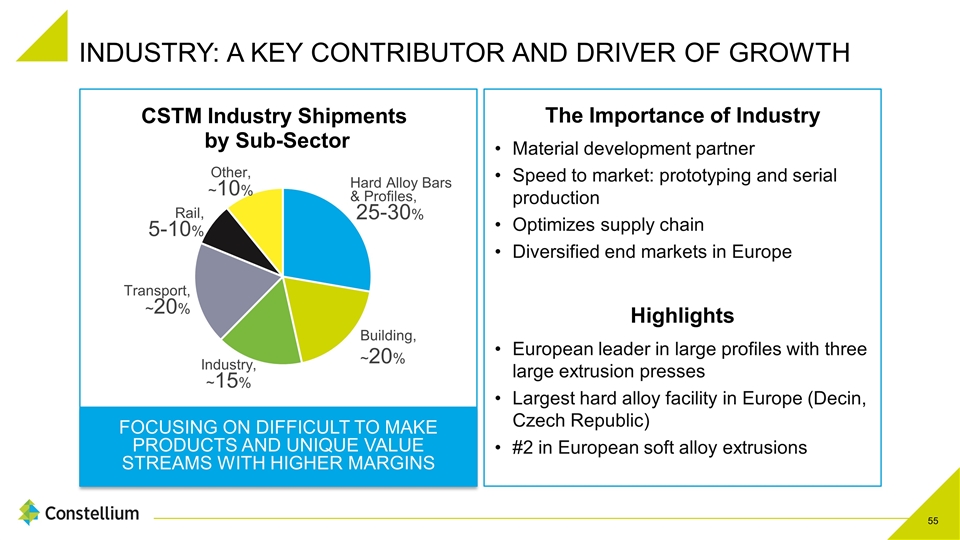

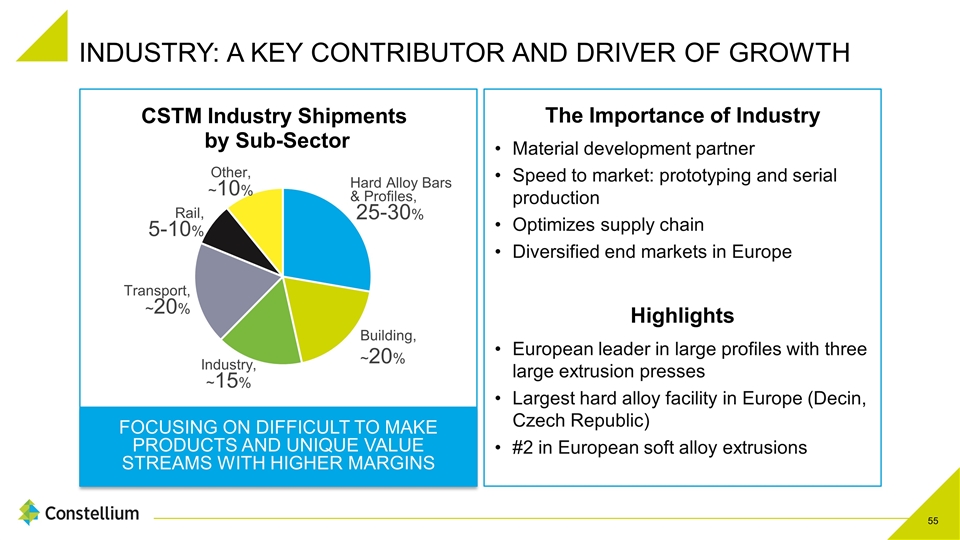

FOCUSING ON DIFFICULT TO MAKE PRODUCTS AND UNIQUE VALUE STREAMS WITH HIGHER MARGINS INDUSTRY: A KEY CONTRIBUTOR AND DRIVER OF GROWTH The Importance of Industry Material development partner Speed to market: prototyping and serial production Optimizes supply chain Diversified end markets in Europe Highlights European leader in large profiles with three large extrusion presses Largest hard alloy facility in Europe (Decin, Czech Republic) #2 in European soft alloy extrusions

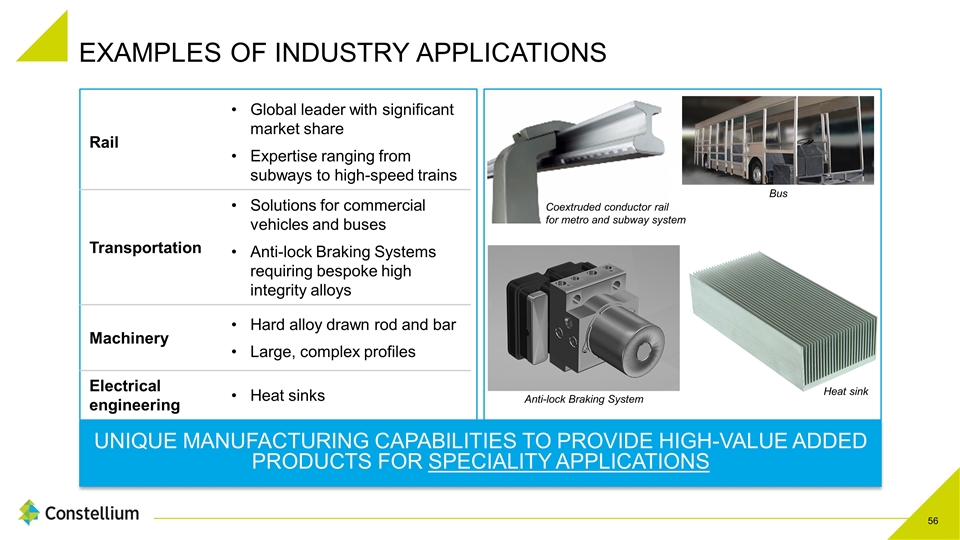

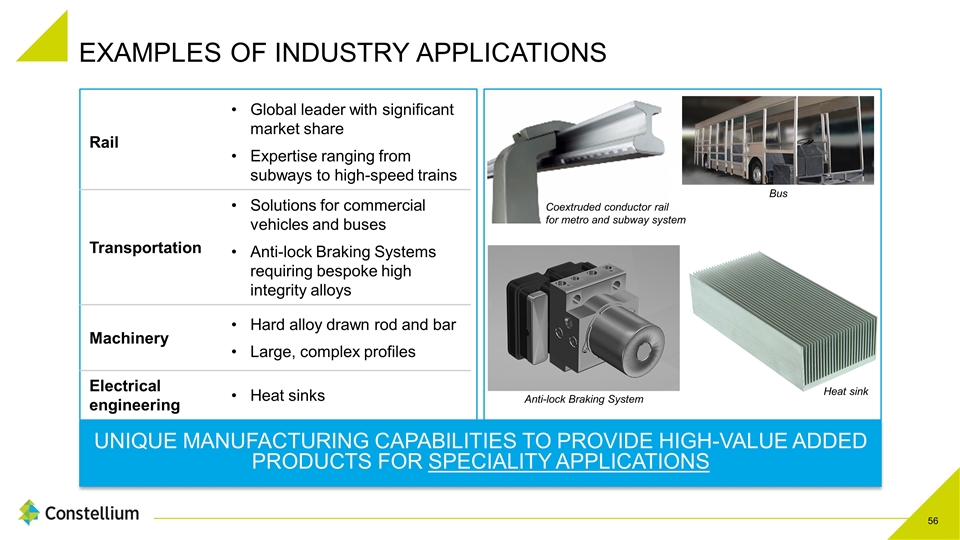

EXAMPLES OF INDUSTRY APPLICATIONS Anti-lock Braking System Coextruded conductor rail for metro and subway system Bus Heat sink UNIQUE MANUFACTURING CAPABILITIES TO PROVIDE HIGH-VALUE ADDED PRODUCTS FOR SPECIALITY APPLICATIONS Rail Global leader with significant market share Expertise ranging from subways to high-speed trains Transportation Solutions for commercial vehicles and buses Anti-lock Braking Systems requiring bespoke high integrity alloys Machinery Hard alloy drawn rod and bar Large, complex profiles Electrical engineering Heat sinks

THE ROAD AHEAD FOR AS&I Maintain leadership positions in Automotive Structures and European Extrusions and deliver on profitable growth Target highly attractive markets that are expected to experience secular growth Ramp up our recent investments Continue to expand footprint to support our customers Develop solutions utilizing proprietary products, services and technologies Focus on and deliver operational excellence, productivity and cost reductions

PETER MATT FINANCE

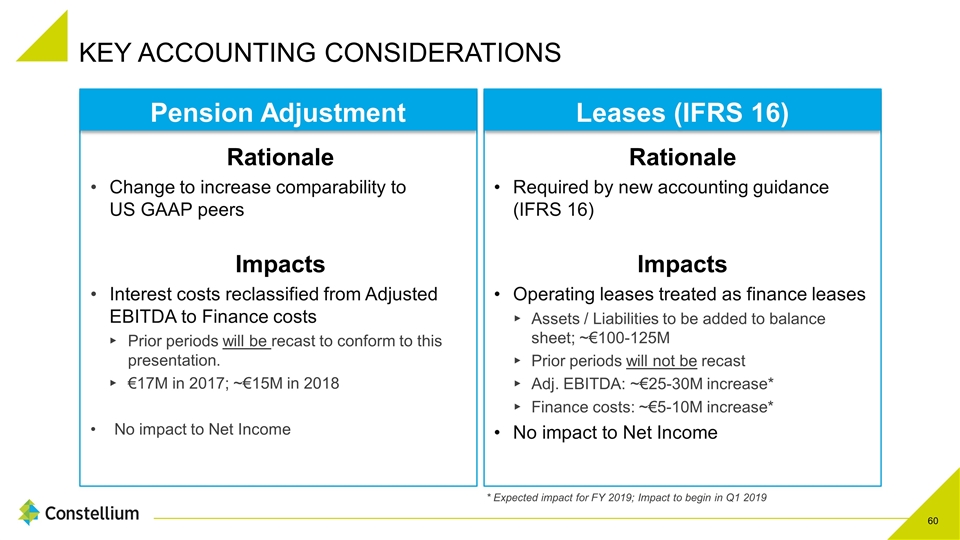

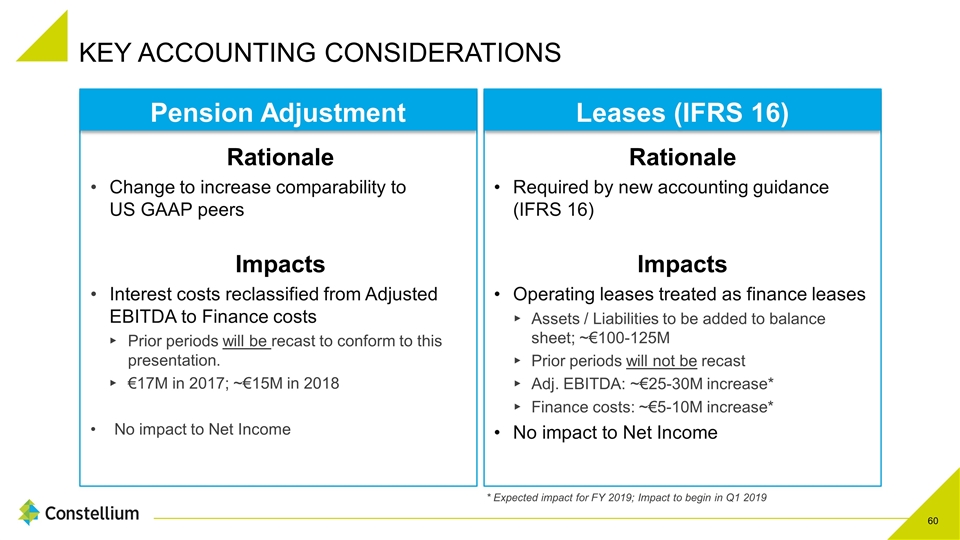

KEY ACCOUNTING CONSIDERATIONS Rationale Change to increase comparability to US GAAP peers Impacts Interest costs reclassified from Adjusted EBITDA to Finance costs Prior periods will be recast to conform to this presentation. €17M in 2017; ~€15M in 2018 No impact to Net Income Rationale Required by new accounting guidance (IFRS 16) Impacts Operating leases treated as finance leases Assets / Liabilities to be added to balance sheet; ~€100-125M Prior periods will not be recast Adj. EBITDA: ~€25-30M increase* Finance costs: ~€5-10M increase* No impact to Net Income Pension Adjustment Leases (IFRS 16) * Expected impact for FY 2019; Impact to begin in Q1 2019

FINANCE PRIORITIES Push Finance Priorities Throughout the Organization Deliver on Project 2019 Rigorous Capital Discipline Improve the Balance Sheet Drive Free Cash Flow Generation

PUSH FINANCE PRIORITIES THROUGHOUT THE ORGANIZATION Partner with Our Business Units Every Employee Can Make a Difference Measuring Performance to Drive Improvement Holding Ourselves Accountable Finance Priorities Reduce Costs Capital Discipline Financial Flexibility

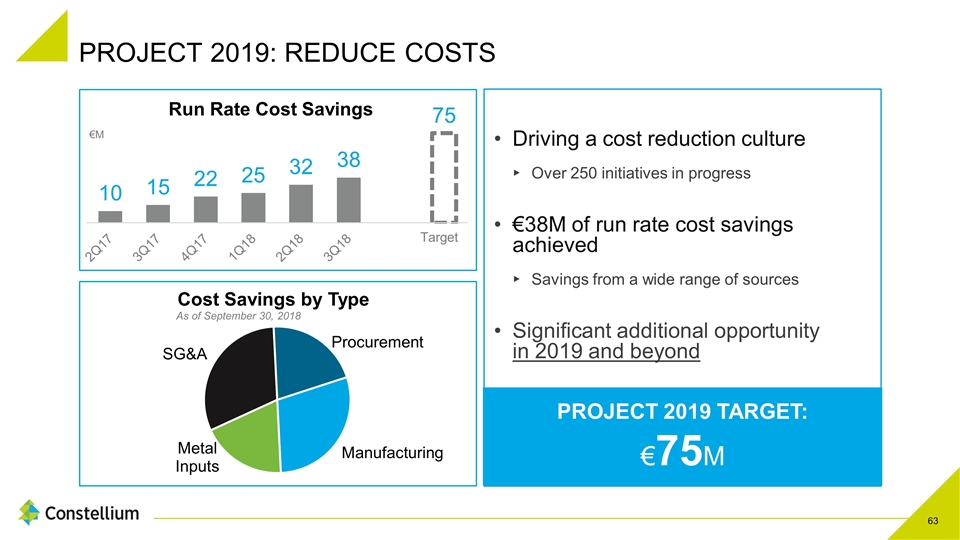

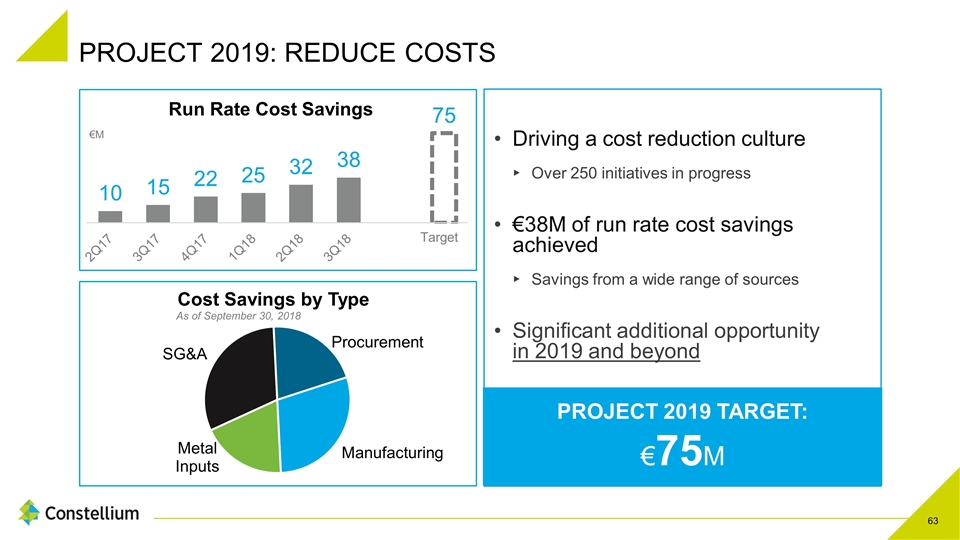

PROJECT 2019: REDUCE COSTS Driving a cost reduction culture Over 250 initiatives in progress €38M of run rate cost savings achieved Savings from a wide range of sources Significant additional opportunity in 2019 and beyond PROJECT 2019 TARGET: €75M As of September 30, 2018 Target €M

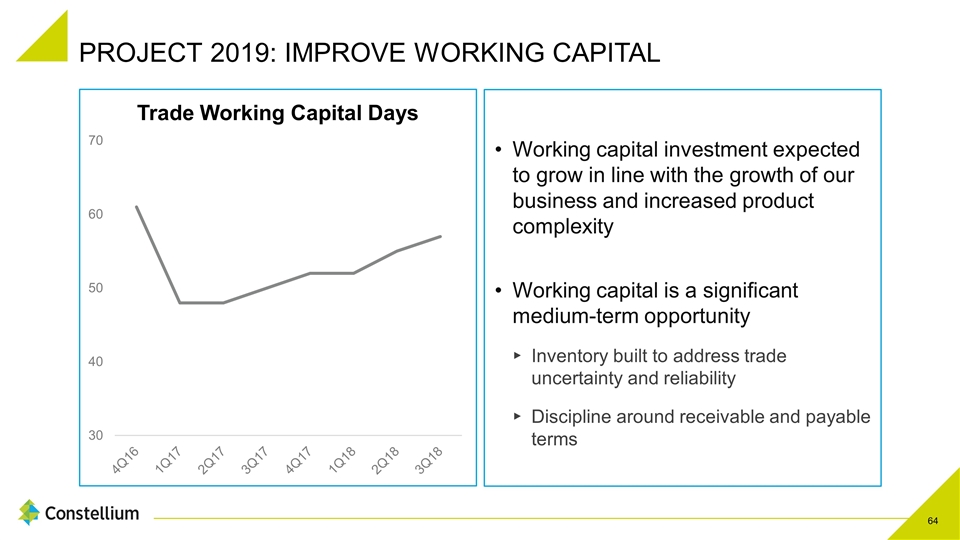

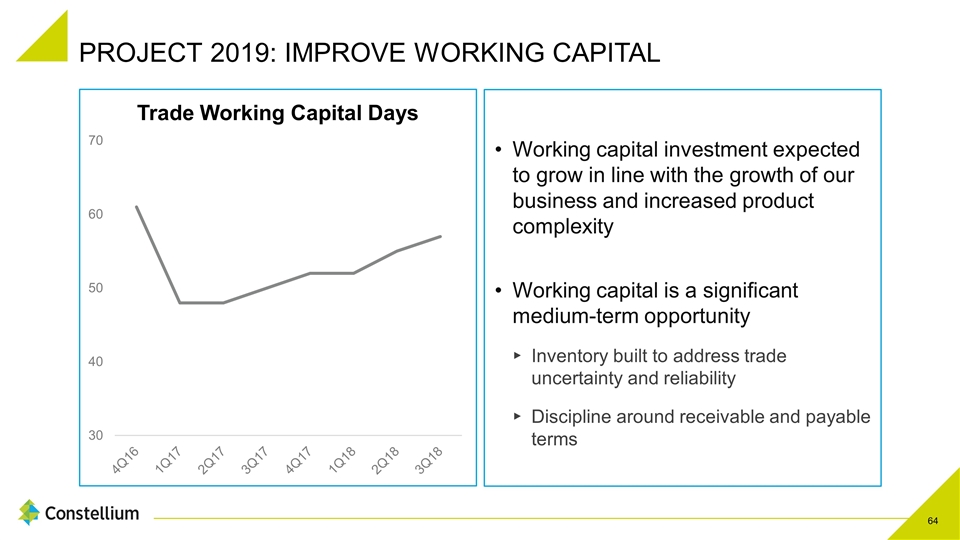

PROJECT 2019: IMPROVE WORKING CAPITAL Working capital investment expected to grow in line with the growth of our business and increased product complexity Working capital is a significant medium-term opportunity Inventory built to address trade uncertainty and reliability Discipline around receivable and payable terms

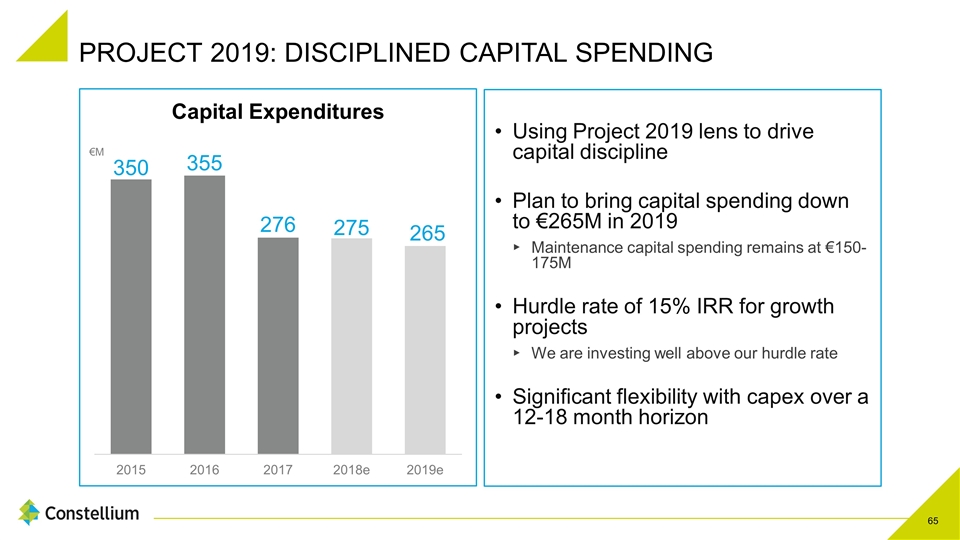

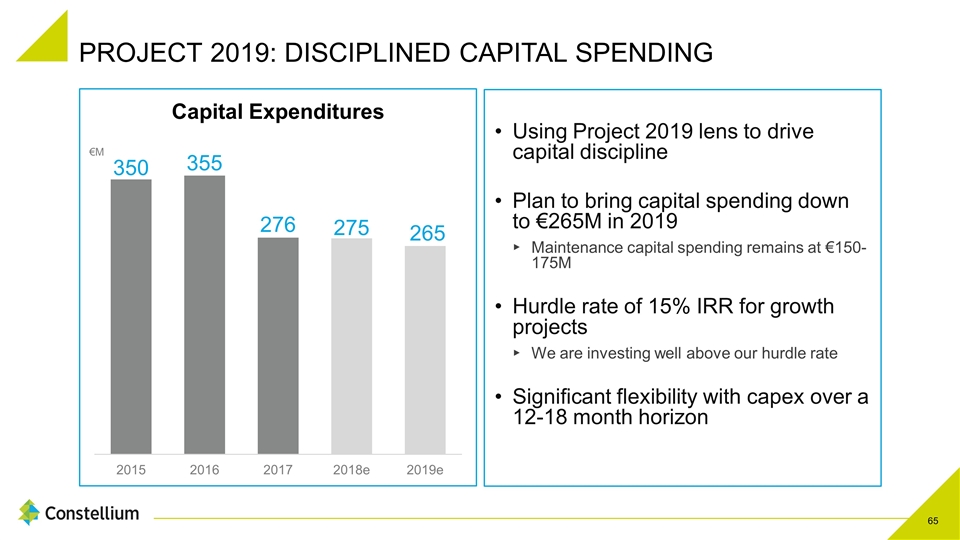

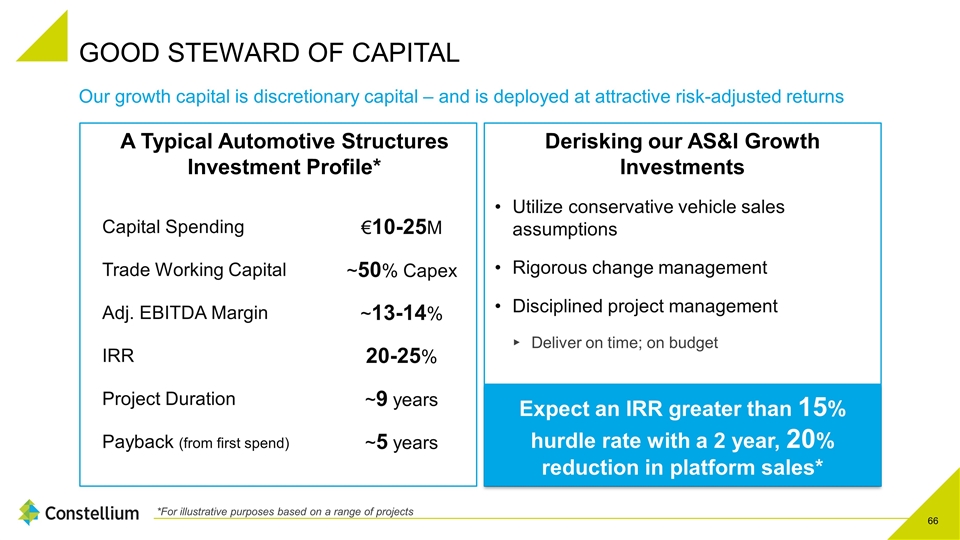

PROJECT 2019: DISCIPLINED CAPITAL SPENDING Using Project 2019 lens to drive capital discipline Plan to bring capital spending down to €265M in 2019 Maintenance capital spending remains at €150-175M Hurdle rate of 15% IRR for growth projects We are investing well above our hurdle rate Significant flexibility with capex over a 12-18 month horizon €M

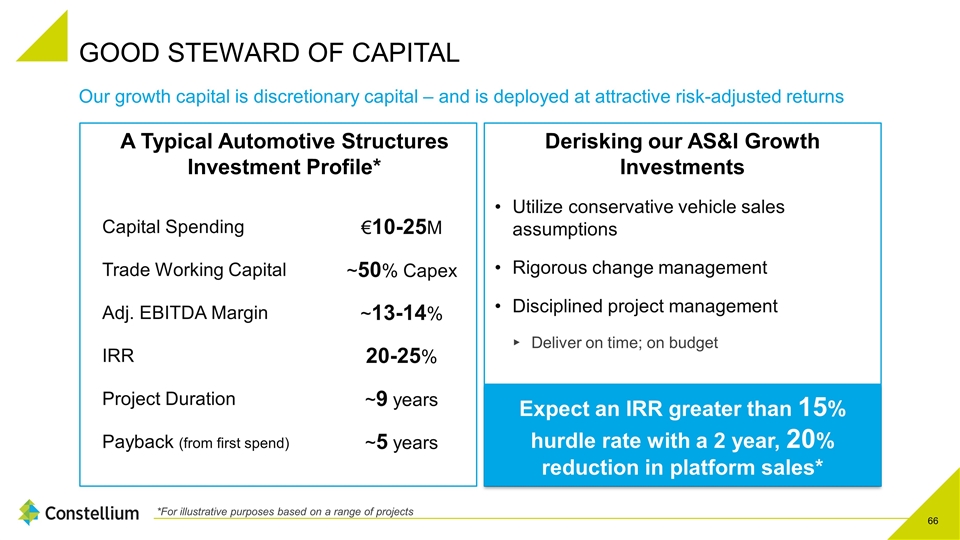

GOOD STEWARD OF CAPITAL Our growth capital is discretionary capital – and is deployed at attractive risk-adjusted returns A Typical Automotive Structures Investment Profile* Capital Spending €10-25M Trade Working Capital ~50% Capex Adj. EBITDA Margin ~13-14% IRR 20-25% Project Duration ~9 years Payback (from first spend) ~5 years *For illustrative purposes based on a range of projects Derisking our AS&I Growth Investments Utilize conservative vehicle sales assumptions Rigorous change management Disciplined project management Deliver on time; on budget Expect an IRR greater than 15% hurdle rate with a 2 year, 20% reduction in platform sales*

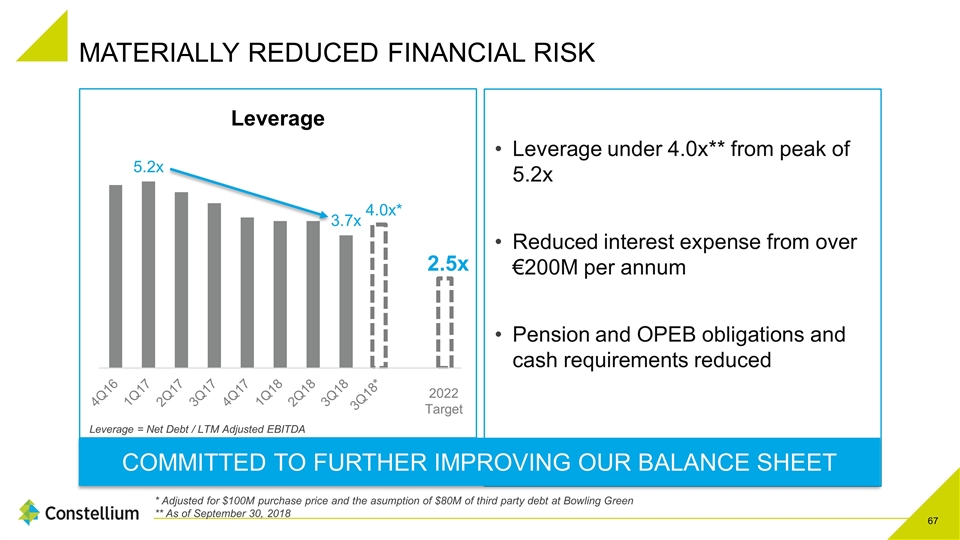

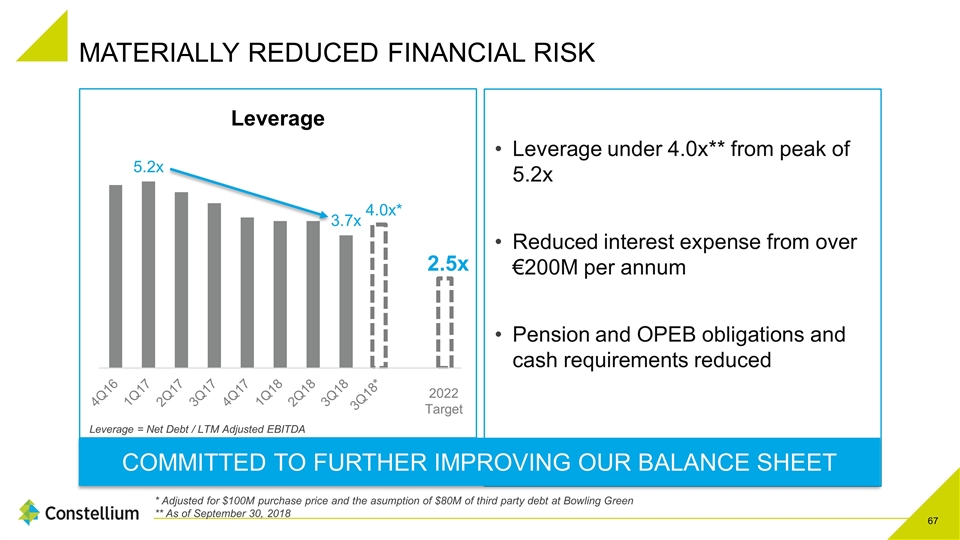

MATERIALLY REDUCED FINANCIAL RISK Leverage under 4.0x** from peak of 5.2x Reduced interest expense from over €200M per annum Pension and OPEB obligations and cash requirements reduced * Adjusted for $100M purchase price and the asumption of $80M of third party debt at Bowling Green ** As of September 30, 2018 Leverage = Net Debt / LTM Adjusted EBITDA 2022 Target COMMITTED TO FURTHER IMPROVING OUR BALANCE SHEET 2.5x

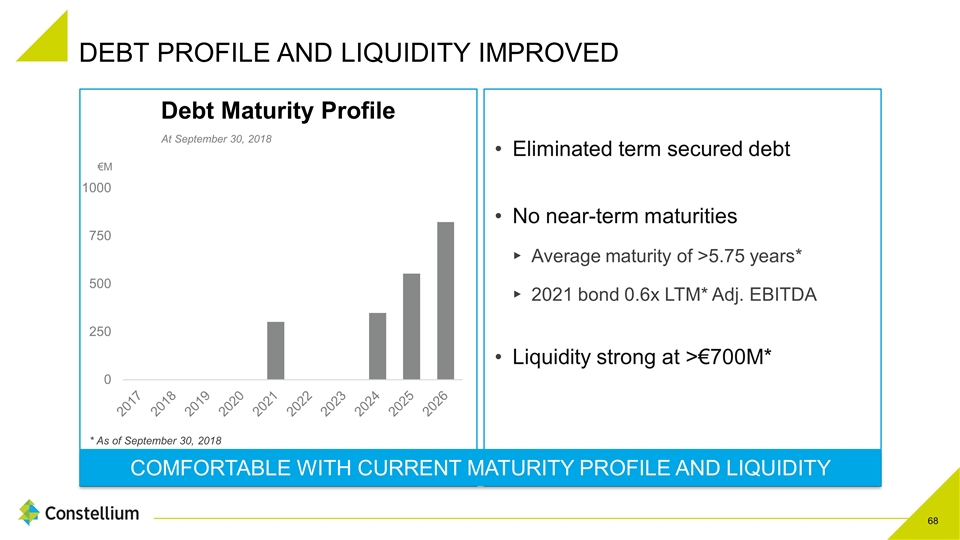

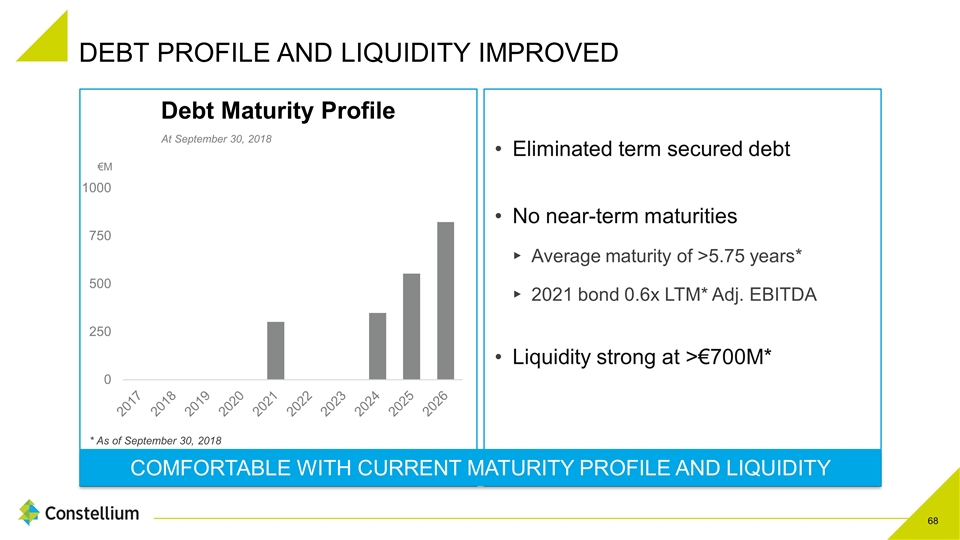

DEBT PROFILE AND LIQUIDITY IMPROVED Eliminated term secured debt No near-term maturities Average maturity of >5.75 years* 2021 bond 0.6x LTM* Adj. EBITDA Liquidity strong at >€700M* COMFORTABLE WITH CURRENT MATURITY PROFILE AND LIQUIDITY Debt Maturity Profile * As of September 30, 2018

DRIVE FREE CASH FLOW GENERATION Increase Adjusted EBITDA Reduce Interest Expense Improve Working Capital Maintain Capital Discipline UTILIZE PROJECT 2019 TO DRIVE ACCOUNTABILITY THROUGHOUT CONSTELLIUM

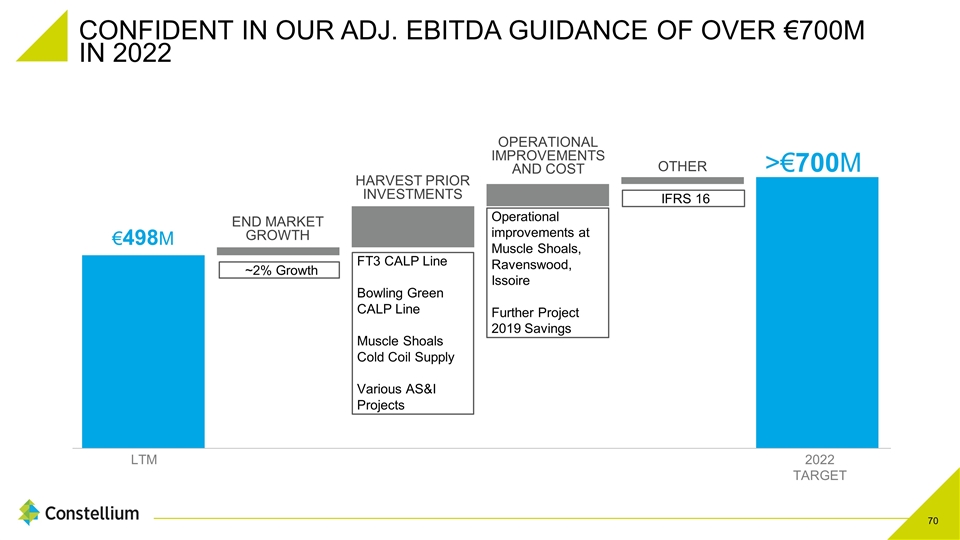

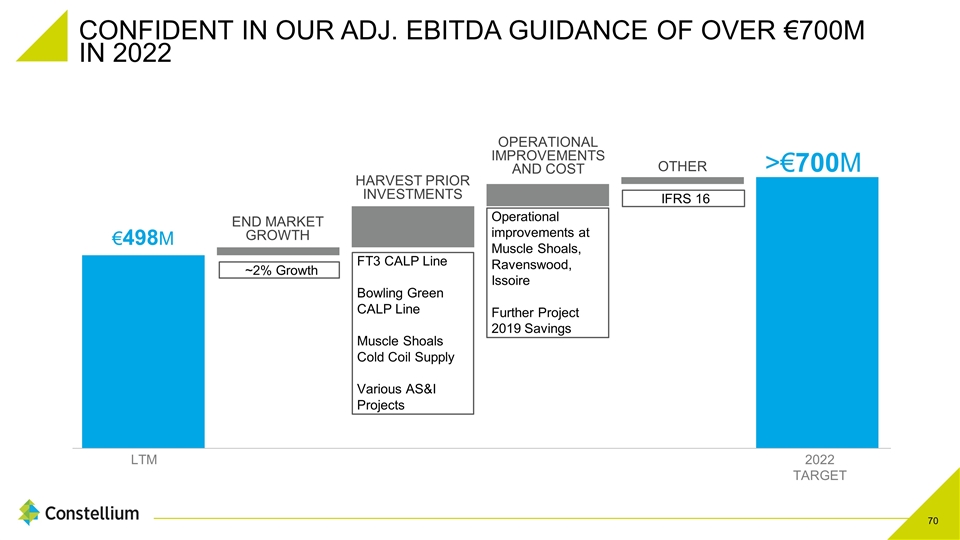

CONFIDENT IN OUR ADJ. EBITDA GUIDANCE OF OVER €700M IN 2022 HARVEST PRIOR INVESTMENTS OPERATIONAL IMPROVEMENTS AND COST OTHER ~2% Growth FT3 CALP Line Bowling Green CALP Line Muscle Shoals Cold Coil Supply Various AS&I Projects END MARKET GROWTH Operational improvements at Muscle Shoals, Ravenswood, Issoire Further Project 2019 Savings LTM 2022 TARGET IFRS 16

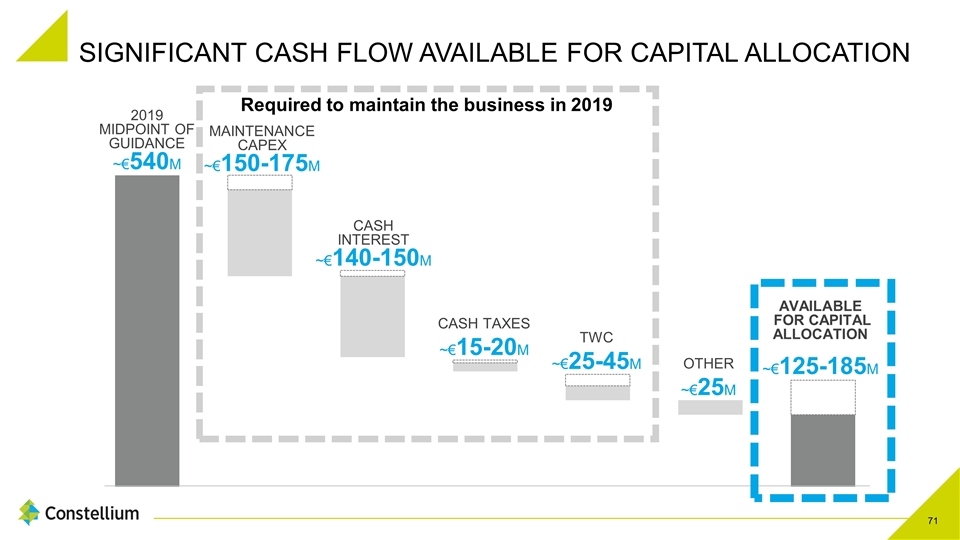

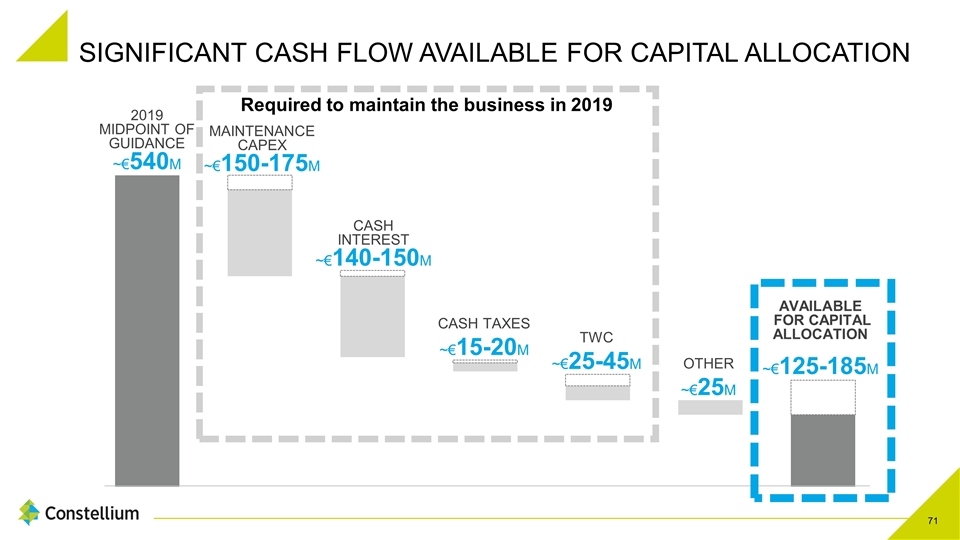

SIGNIFICANT CASH FLOW AVAILABLE FOR CAPITAL ALLOCATION CASH INTEREST ~€140-150M CASH TAXES ~€15-20M TWC ~€25-45M AVAILABLE FOR CAPITAL ALLOCATION ~€125-185M MAINTENANCE CAPEX ~€150-175M Required to maintain the business in 2019 2019 MIDPOINT OF GUIDANCE ~€540M OTHER ~€25M

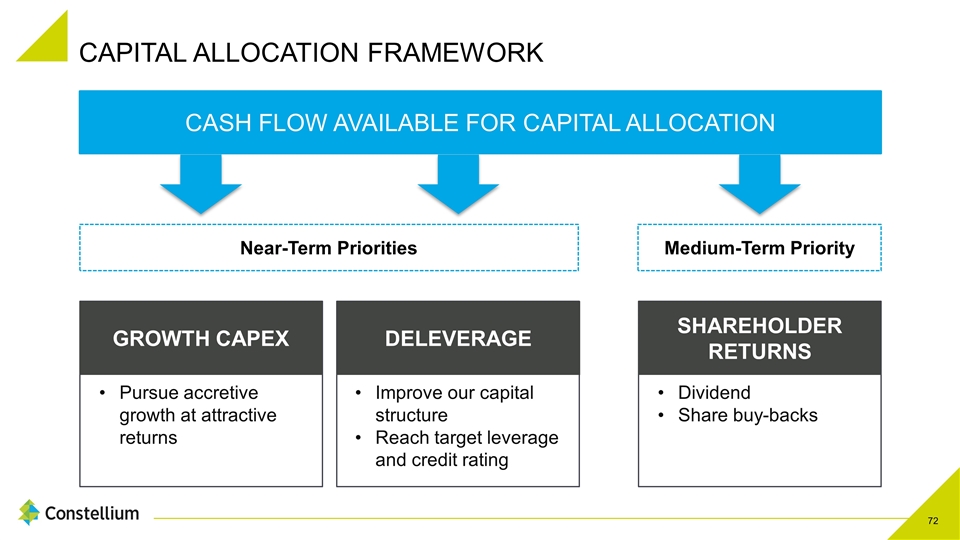

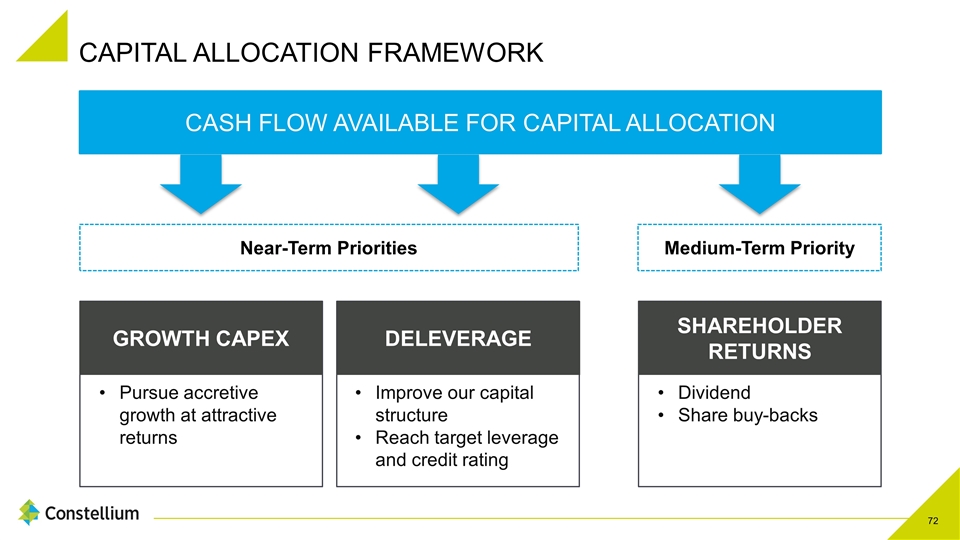

Near-Term Priorities CAPITAL ALLOCATION FRAMEWORK CASH FLOW AVAILABLE FOR CAPITAL ALLOCATION GROWTH CAPEX DELEVERAGE SHAREHOLDER RETURNS Pursue accretive growth at attractive returns Improve our capital structure Reach target leverage and credit rating Dividend Share buy-backs Medium-Term Priority

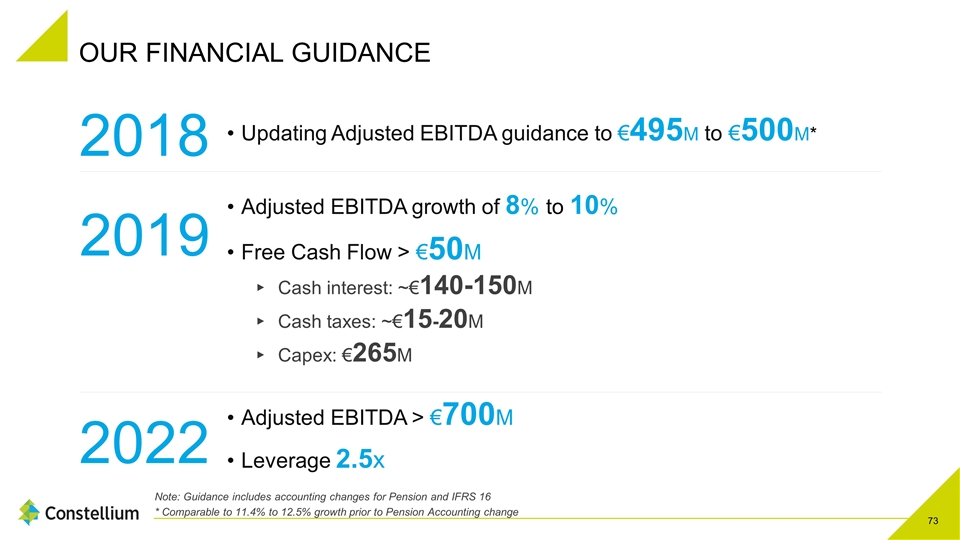

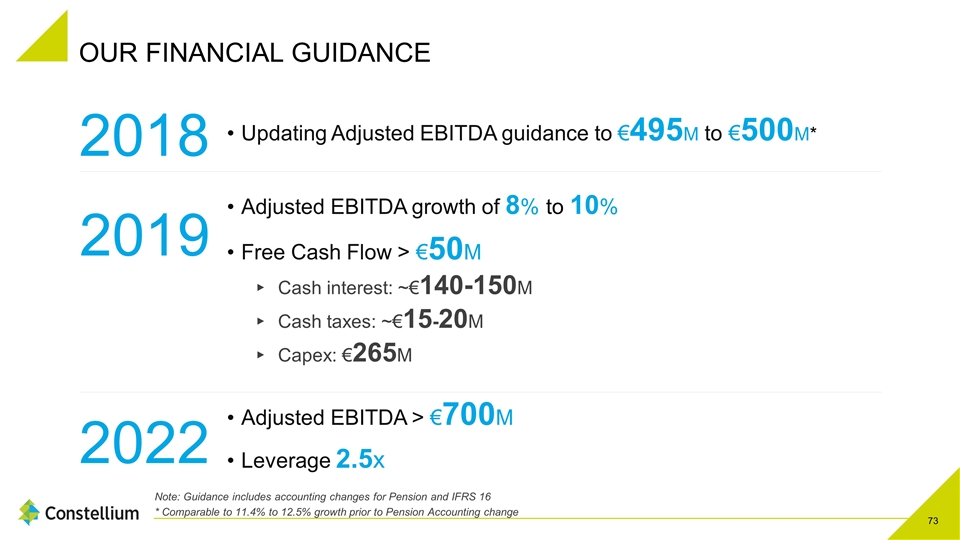

OUR FINANCIAL GUIDANCE Note: Guidance includes accounting changes for Pension and IFRS 16 * Comparable to 11.4% to 12.5% growth prior to Pension Accounting change Updating Adjusted EBITDA guidance to €495M to €500M* Adjusted EBITDA growth of 8% to 10% Free Cash Flow > €50M Cash interest: ~€140-150M Cash taxes: ~€15-20M Capex: €265M Adjusted EBITDA > €700M Leverage 2.5x 2018 2019 2022

Investor Contact Ryan Wentling +1 (443) 988 0600 investor-relations@constellium.com

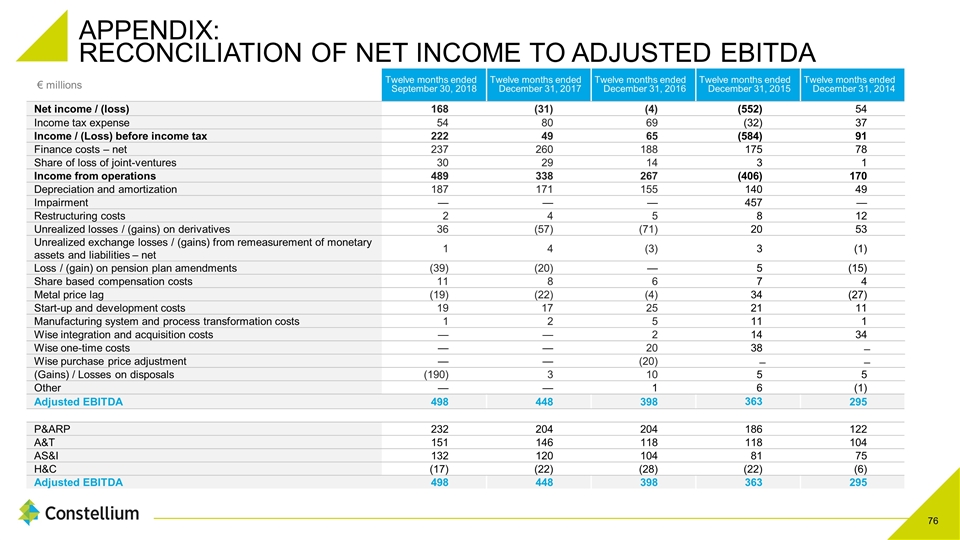

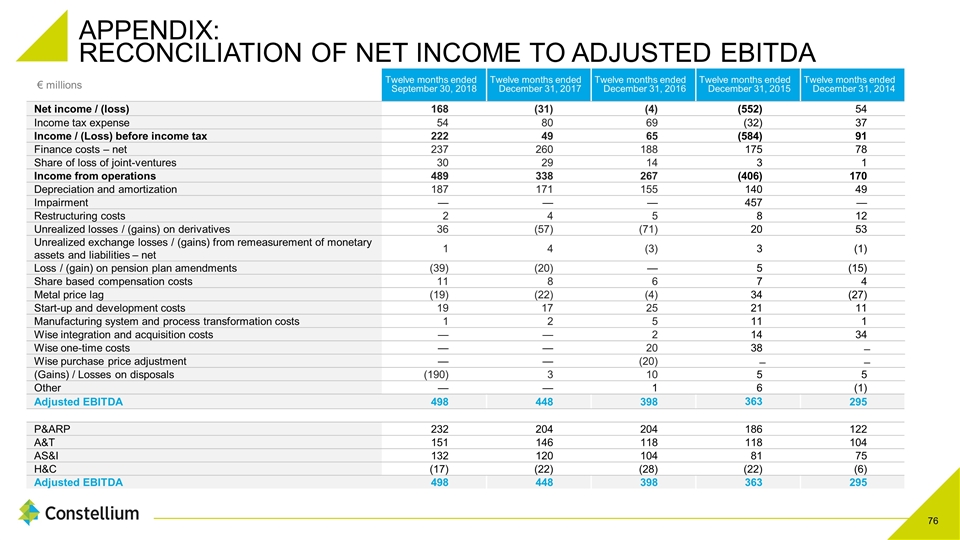

APPENDIX: RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA € millions Twelve months ended September 30, 2018 Twelve months ended December 31, 2017 Twelve months ended December 31, 2016 Twelve months ended December 31, 2015 Twelve months ended December 31, 2014 Net income / (loss) 168 (31) (4) (552) 54 Income tax expense 54 80 69 (32) 37 Income / (Loss) before income tax 222 49 65 (584) 91 Finance costs – net 237 260 188 175 78 Share of loss of joint-ventures 30 29 14 3 1 Income from operations 489 338 267 (406) 170 Depreciation and amortization 187 171 155 140 49 Impairment — — — 457 — Restructuring costs 2 4 5 8 12 Unrealized losses / (gains) on derivatives 36 (57) (71) 20 53 Unrealized exchange losses / (gains) from remeasurement of monetary assets and liabilities – net 1 4 (3) 3 (1) Loss / (gain) on pension plan amendments (39) (20) — 5 (15) Share based compensation costs 11 8 6 7 4 Metal price lag (19) (22) (4) 34 (27) Start-up and development costs 19 17 25 21 11 Manufacturing system and process transformation costs 1 2 5 11 1 Wise integration and acquisition costs — — 2 14 34 Wise one-time costs — — 20 38 ̶ Wise purchase price adjustment — — (20) ̶ ̶ (Gains) / Losses on disposals (190) 3 10 5 5 Other — — 1 6 (1) Adjusted EBITDA 498 448 398 363 295 P&ARP 232 204 204 186 122 A&T 151 146 118 118 104 AS&I 132 120 104 81 75 H&C (17) (22) (28) (22) (6) Adjusted EBITDA 498 448 398 363 295

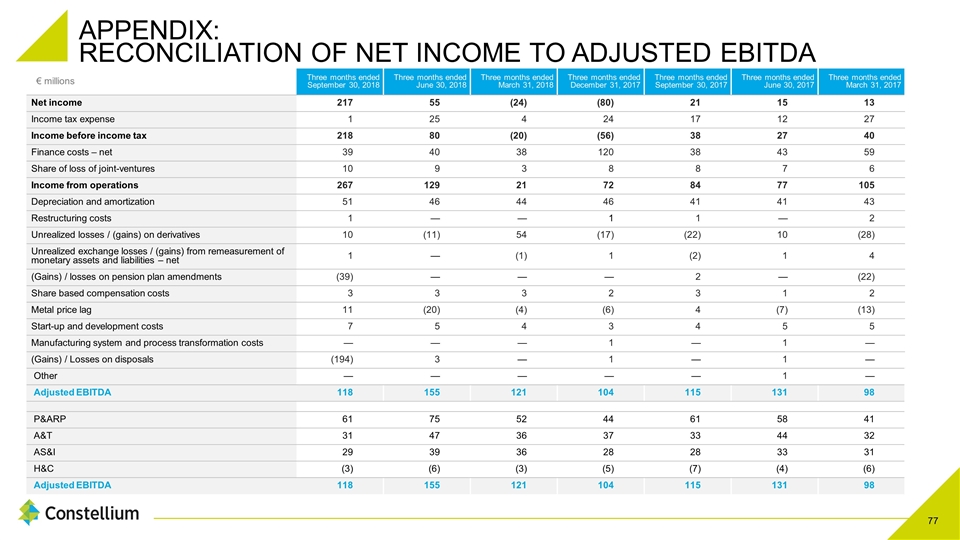

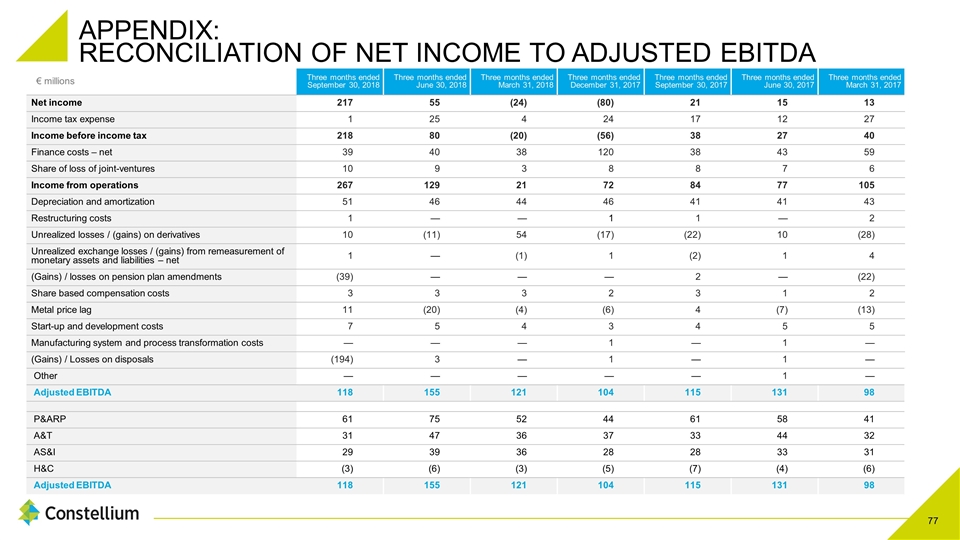

APPENDIX: RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA € millions Three months ended September 30, 2018 Three months ended June 30, 2018 Three months ended March 31, 2018 Three months ended December 31, 2017 Three months ended September 30, 2017 Three months ended June 30, 2017 Three months ended March 31, 2017 Net income 217 55 (24) (80) 21 15 13 Income tax expense 1 25 4 24 17 12 27 Income before income tax 218 80 (20) (56) 38 27 40 Finance costs – net 39 40 38 120 38 43 59 Share of loss of joint-ventures 10 9 3 8 8 7 6 Income from operations 267 129 21 72 84 77 105 Depreciation and amortization 51 46 44 46 41 41 43 Restructuring costs 1 — — 1 1 — 2 Unrealized losses / (gains) on derivatives 10 (11) 54 (17) (22) 10 (28) Unrealized exchange losses / (gains) from remeasurement of monetary assets and liabilities – net 1 — (1) 1 (2) 1 4 (Gains) / losses on pension plan amendments (39) — — — 2 — (22) Share based compensation costs 3 3 3 2 3 1 2 Metal price lag 11 (20) (4) (6) 4 (7) (13) Start-up and development costs 7 5 4 3 4 5 5 Manufacturing system and process transformation costs — — — 1 — 1 — (Gains) / Losses on disposals (194) 3 — 1 — 1 — Other — — — — — 1 — Adjusted EBITDA 118 155 121 104 115 131 98 P&ARP 61 75 52 44 61 58 41 A&T 31 47 36 37 33 44 32 AS&I 29 39 36 28 28 33 31 H&C (3) (6) (3) (5) (7) (4) (6) Adjusted EBITDA 118 155 121 104 115 131 98

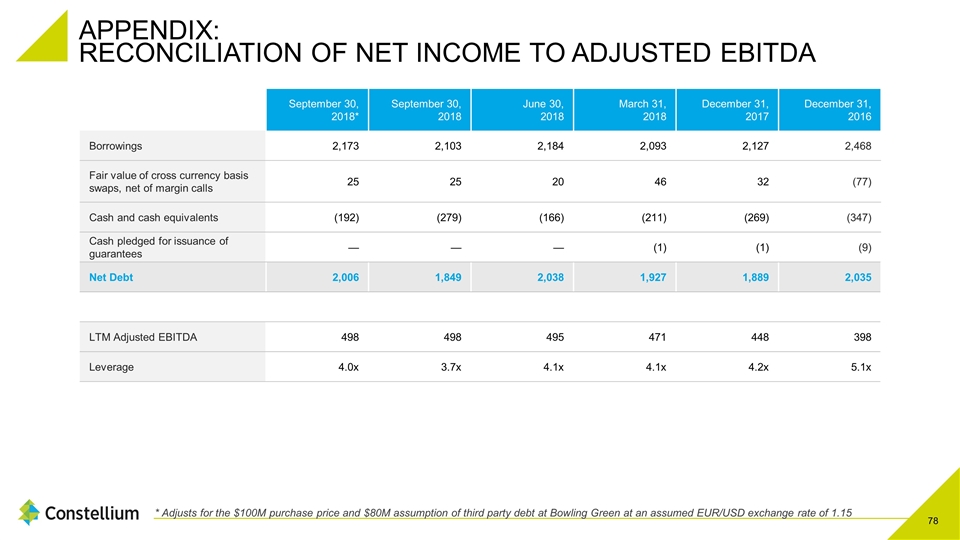

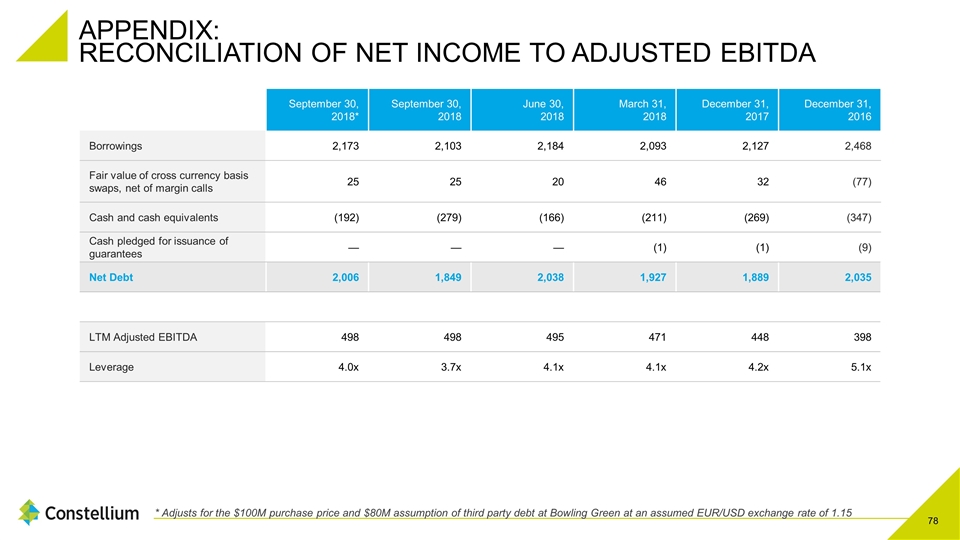

APPENDIX: RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA * Adjusts for the $100M purchase price and $80M assumption of third party debt at Bowling Green at an assumed EUR/USD exchange rate of 1.15 September 30, 2018* September 30, 2018 June 30, 2018 March 31, 2018 December 31, 2017 December 31, 2016 Borrowings 2,173 2,103 2,184 2,093 2,127 2,468 Fair value of cross currency basis swaps, net of margin calls 25 25 20 46 32 (77) Cash and cash equivalents (192) (279) (166) (211) (269) (347) Cash pledged for issuance of guarantees — — — (1) (1) (9) Net Debt 2,006 1,849 2,038 1,927 1,889 2,035 LTM Adjusted EBITDA 498 498 495 471 448 398 Leverage 4.0x 3.7x 4.1x 4.1x 4.2x 5.1x