First Quarter 2023 Earnings Call April 26, 2023 Exhibit 99.2

Certain statements contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain “forward-looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets, while others are more specific to our business and operations. These risks and uncertainties include, but are not limited to: market competition; economic downturn; disruption to business operations; the Russian war on Ukraine; the inability to meet customer demand and quality requirements; the loss of key customers, suppliers or other business relationships; supply disruptions; excessive inflation; the capacity and effectiveness of our hedging policy activities; the loss of key employees; levels of indebtedness which could limit our operating flexibility and opportunities; and other risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 20-F, and as described from time to time in subsequent reports filed with the U.S. Securities and Exchange Commission. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not predictable or within our control. Consequently, actual results may differ materially from the forward-looking statements contained in this press release. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Forward-Looking Statements

Non-GAAP Measures This presentation includes information regarding certain non-GAAP financial measures, including VAR, Adjusted EBITDA, Adjusted EBITDA per metric ton, Free Cash Flow and Net debt. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. Adjusted EBITDA measures are frequently used by securities analysts, investors and other interested parties in their evaluation of Constellium and in comparison to other companies, many of which present an adjusted EBITDA-related performance measure when reporting their results. VAR, Adjusted EBITDA, Adjusted EBITDA per Metric Ton, Free Cash Flow and Net debt are not presentations made in accordance with IFRS and may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures supplement our IFRS disclosures and should not be considered an alternative to the IFRS measures. This presentation provides a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. We are not able to provide a reconciliation of Adjusted EBITDA guidance to net income, the comparable GAAP measure, because certain items that are excluded from Adjusted EBITDA cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of realized and unrealized gains and losses on derivative instruments, metal lag, impairment or restructuring charges, or taxes without unreasonable efforts, and these items could significantly impact, either individually or in the aggregate, our net income in the future.

Jean-Marc Germain Chief Executive Officer

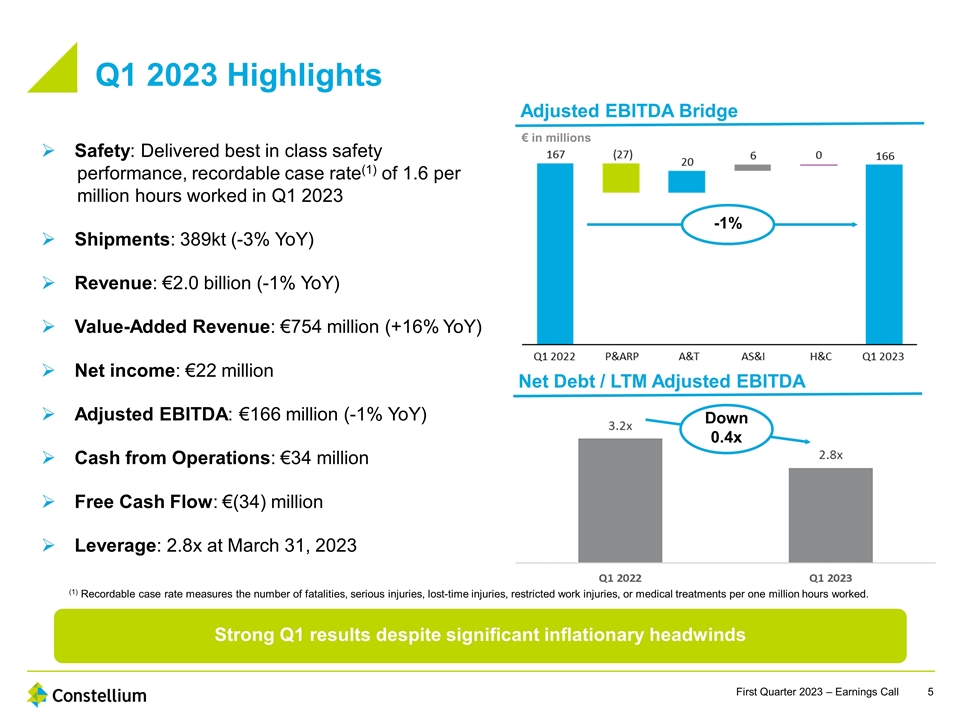

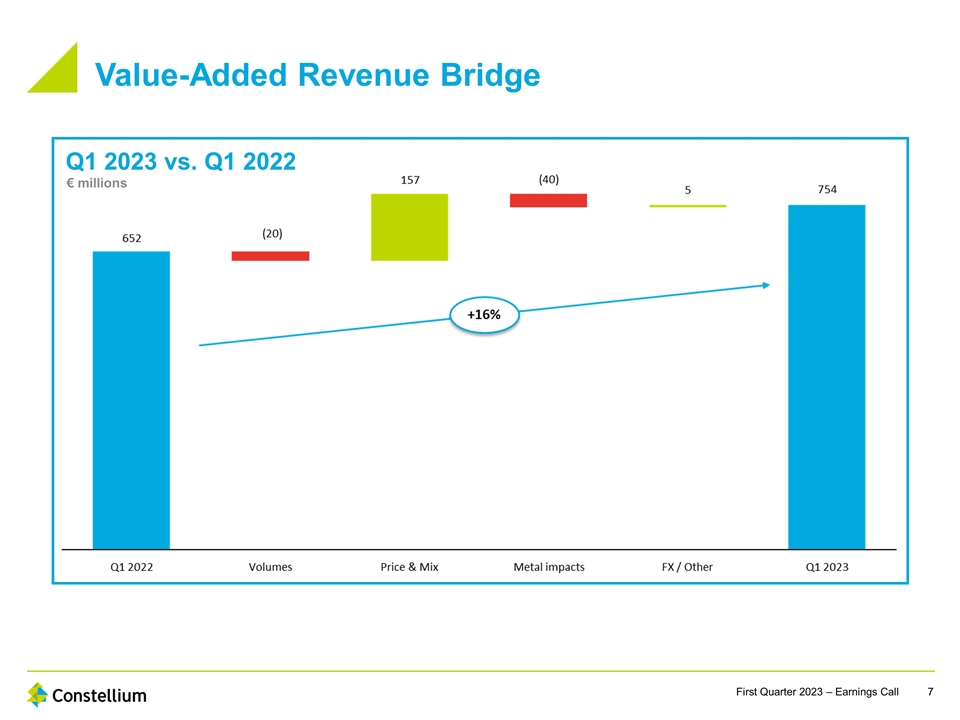

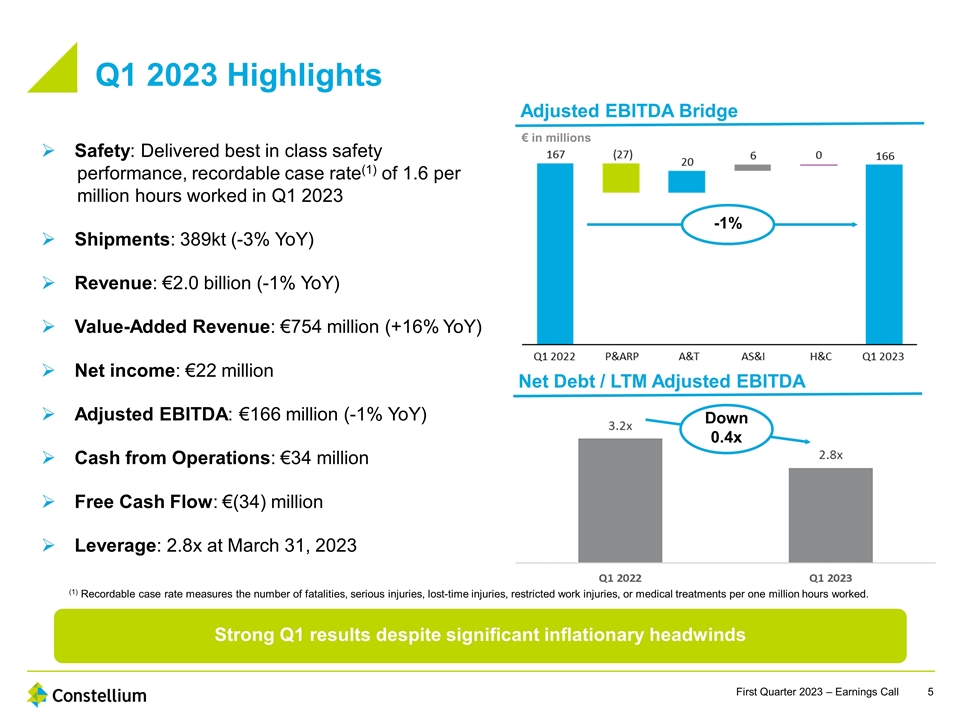

Ø Safety: Delivered best in class safety performance, recordable case rate(1) of 1.6 per million hours worked in Q1 2023 Ø Shipments: 389kt (-3% YoY) Ø Revenue: €2.0 billion (-1% YoY) Ø Value-Added Revenue: €754 million (+16% YoY) Ø Net income: €22 million Ø Adjusted EBITDA: €166 million (-1% YoY) Ø Cash from Operations: €34 million Ø Free Cash Flow: €(34) million Ø Leverage: 2.8x at March 31, 2023 Strong Q1 results despite significant inflationary headwinds Q1 2023 Highlights Adjusted EBITDA Bridge € in millions Net Debt / LTM Adjusted EBITDA (1) Recordable case rate measures the number of fatalities, serious injuries, lost-time injuries, restricted work injuries, or medical treatments per one million hours worked. Down 0.4x -1%

Jack Guo Chief Financial Officer

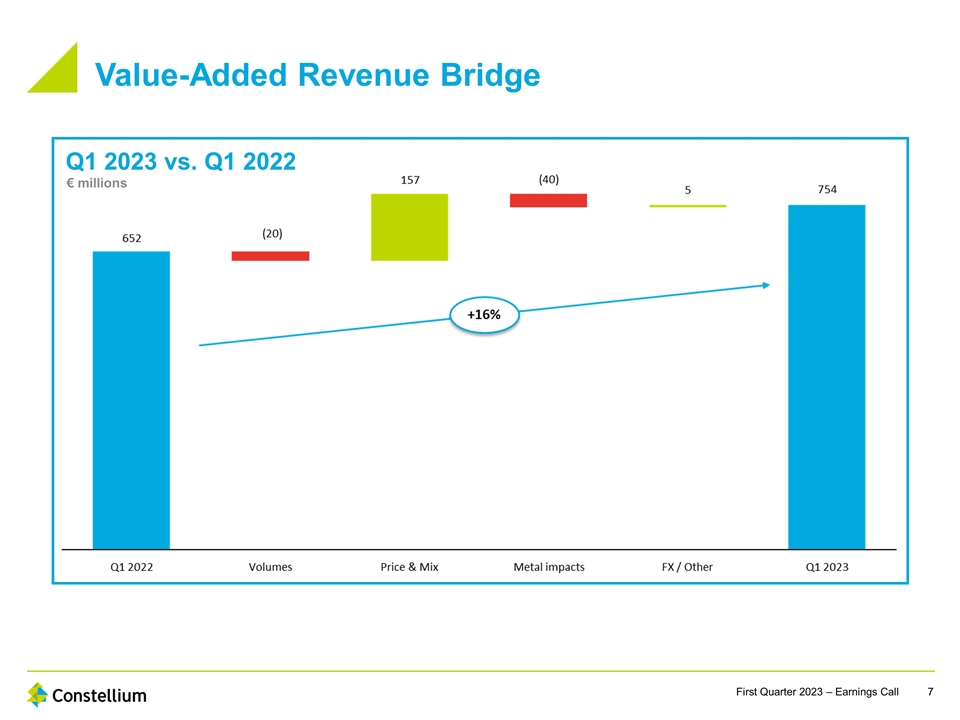

Value-Added Revenue Bridge Q1 2023 vs. Q1 2022 € millions

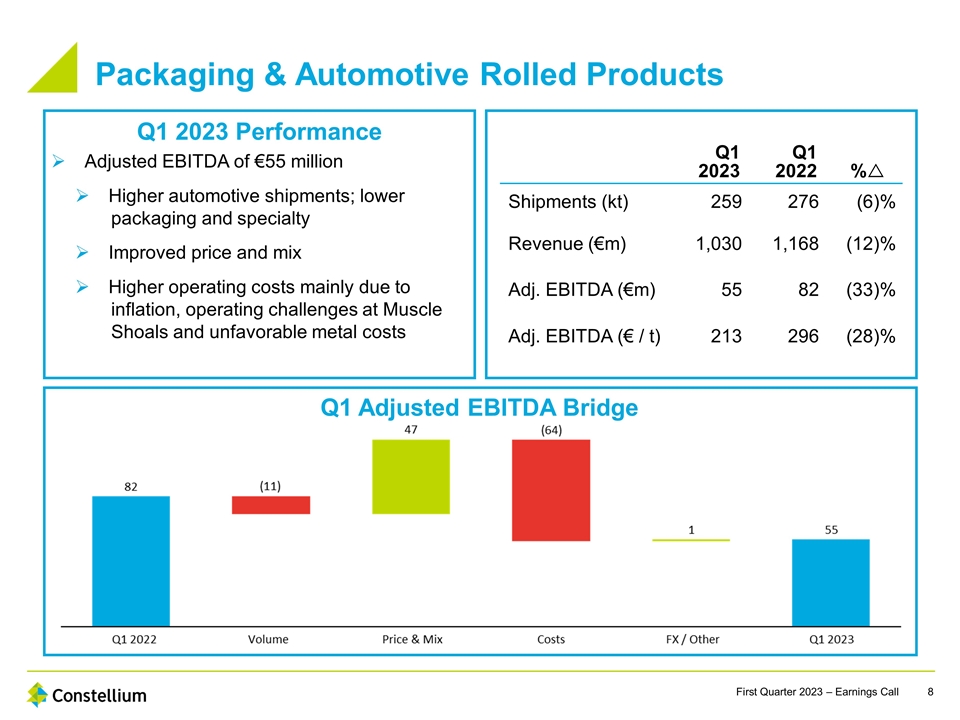

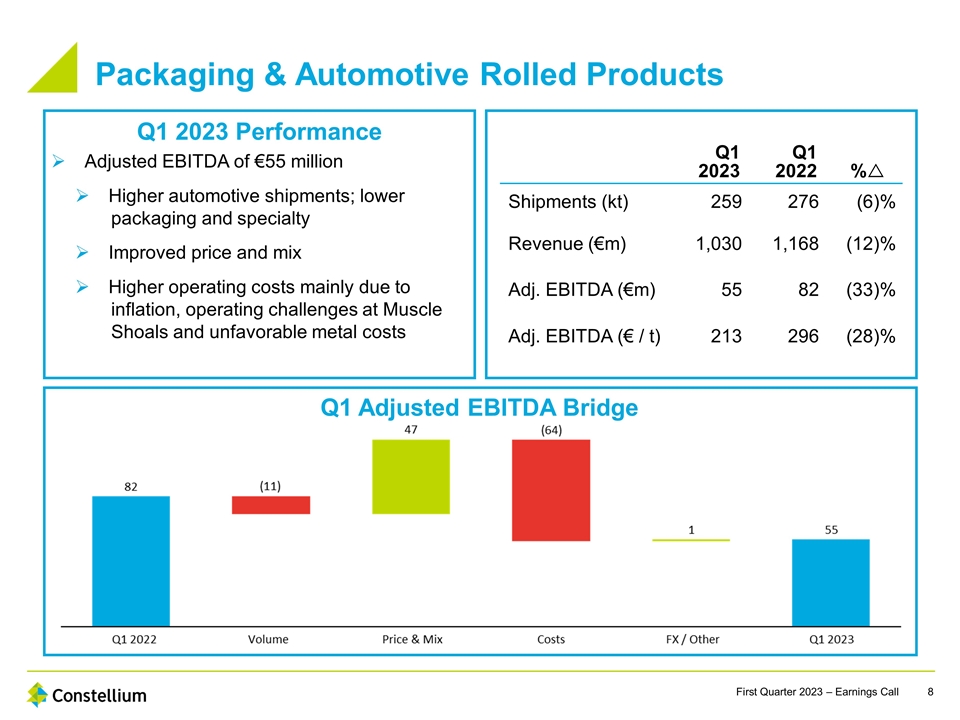

Q1 Adjusted EBITDA Bridge Packaging & Automotive Rolled Products Q1 2023 Q1 2022 %r Shipments (kt) 259 276 (6)% Revenue (€m) 1,030 1,168 (12)% Adj. EBITDA (€m) 55 82 (33)% Adj. EBITDA (€ / t) 213 296 (28)% Q1 2023 Performance Ø Adjusted EBITDA of €55 million Ø Higher automotive shipments; lower packaging and specialty Ø Improved price and mix Ø Higher operating costs mainly due to inflation, operating challenges at Muscle Shoals and unfavorable metal costs

Aerospace & Transportation Q1 2023 Q1 2022 %r Shipments (kt) 58 55 6% Revenue (€m) 452 385 17% Adj. EBITDA (€m) 73 53 37% Adj. EBITDA (€ / t) 1,246 961 30% Ø Adjusted EBITDA of €73 million Ø Higher aerospace shipments; lower TID shipments Ø Improved price and mix Ø Higher operating costs mainly due to inflation and production increases Q1 2023 Performance Q1 Adjusted EBITDA Bridge

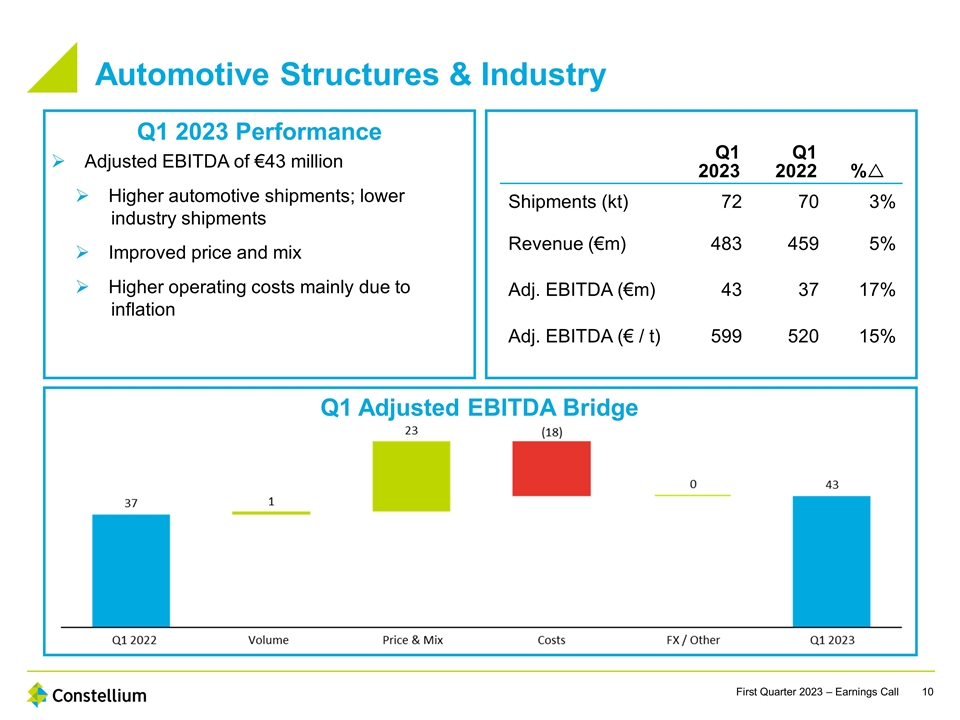

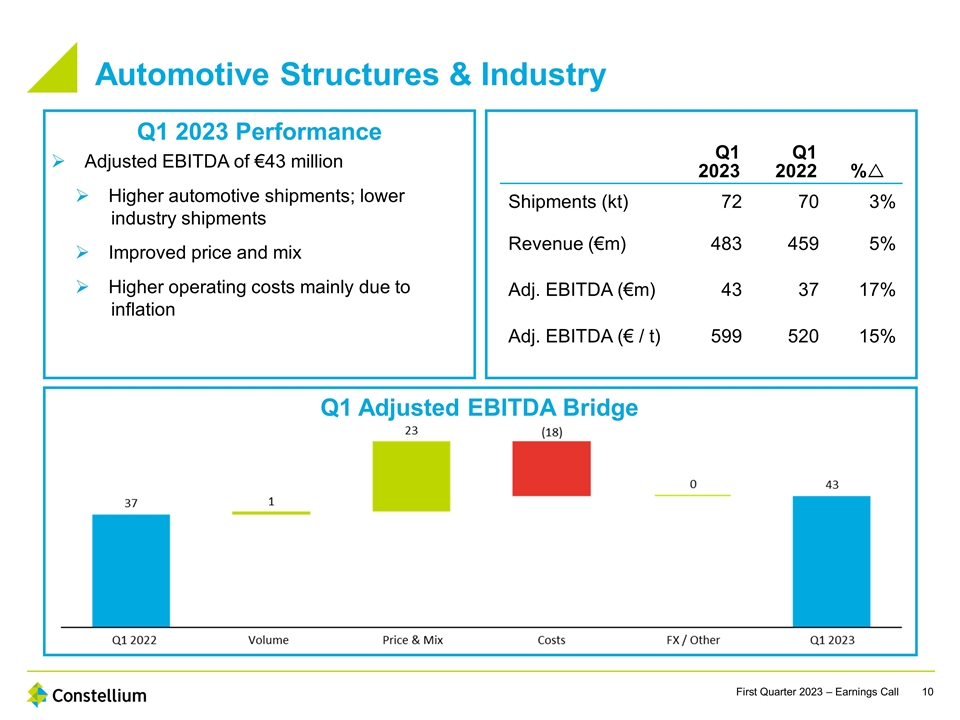

Q1 2023 Performance Automotive Structures & Industry Q1 2023 Q1 2022 %r Shipments (kt) 72 70 3% Revenue (€m) 483 459 5% Adj. EBITDA (€m) 43 37 17% Adj. EBITDA (€ / t) 599 520 15% Ø Adjusted EBITDA of €43 million Ø Higher automotive shipments; lower industry shipments Ø Improved price and mix Ø Higher operating costs mainly due to inflation Q1 Adjusted EBITDA Bridge

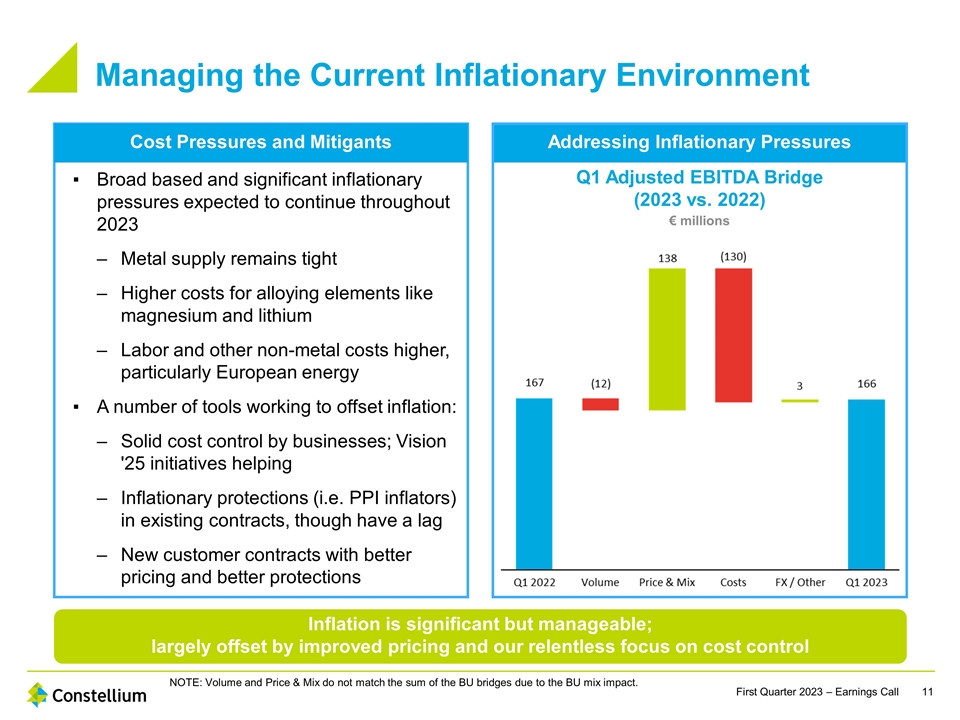

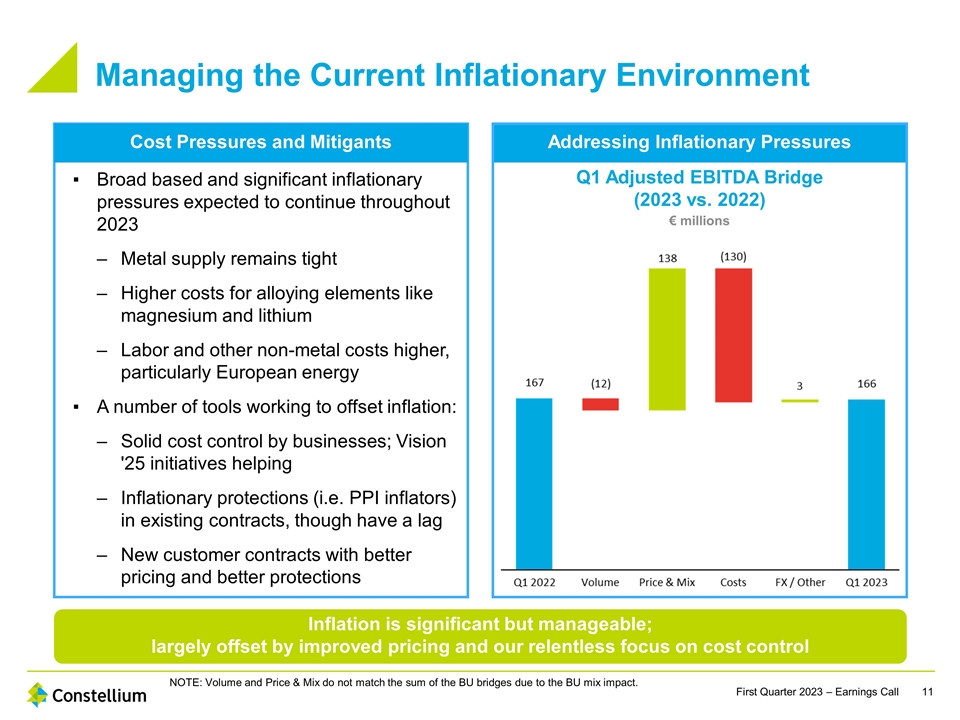

Broad based and significant inflationary pressures expected to continue throughout 2023 Metal supply remains tight Higher costs for alloying elements like magnesium and lithium Labor and other non-metal costs higher, particularly European energy A number of tools working to offset inflation: Solid cost control by businesses; Vision '25 initiatives helping Inflationary protections (i.e. PPI inflators) in existing contracts, though have a lag New customer contracts with better pricing and better protections Cost Pressures and Mitigants Managing the Current Inflationary Environment Inflation is significant but manageable; largely offset by improved pricing and our relentless focus on cost control Q1 Adjusted EBITDA Bridge (2023 vs. 2022) Addressing Inflationary Pressures € millions NOTE: Volume and Price & Mix do not match the sum of the BU bridges due to the BU mix impact.

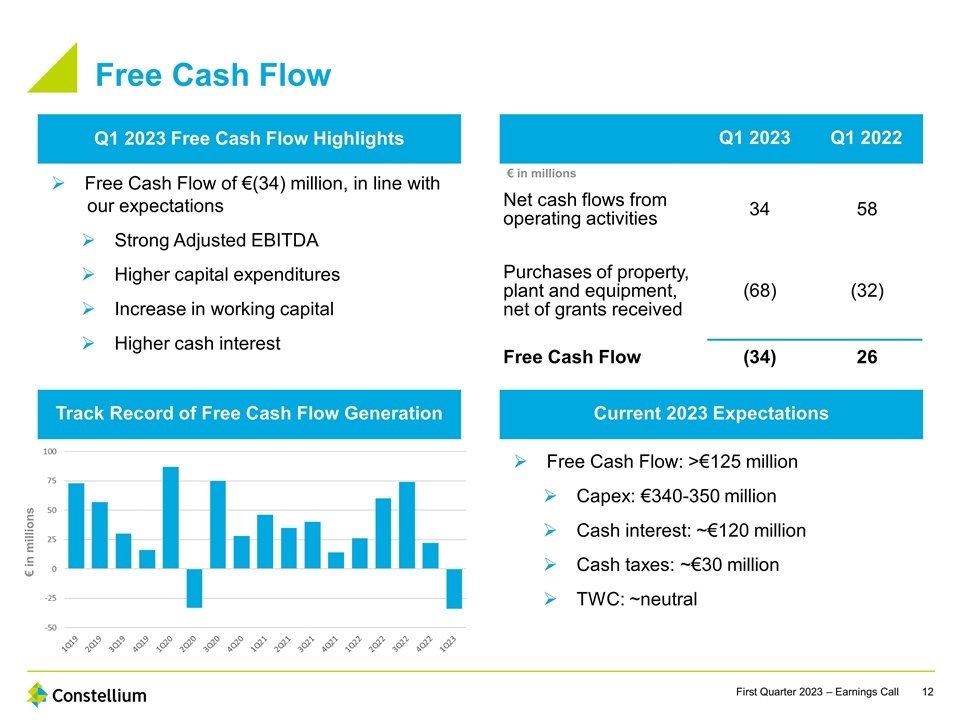

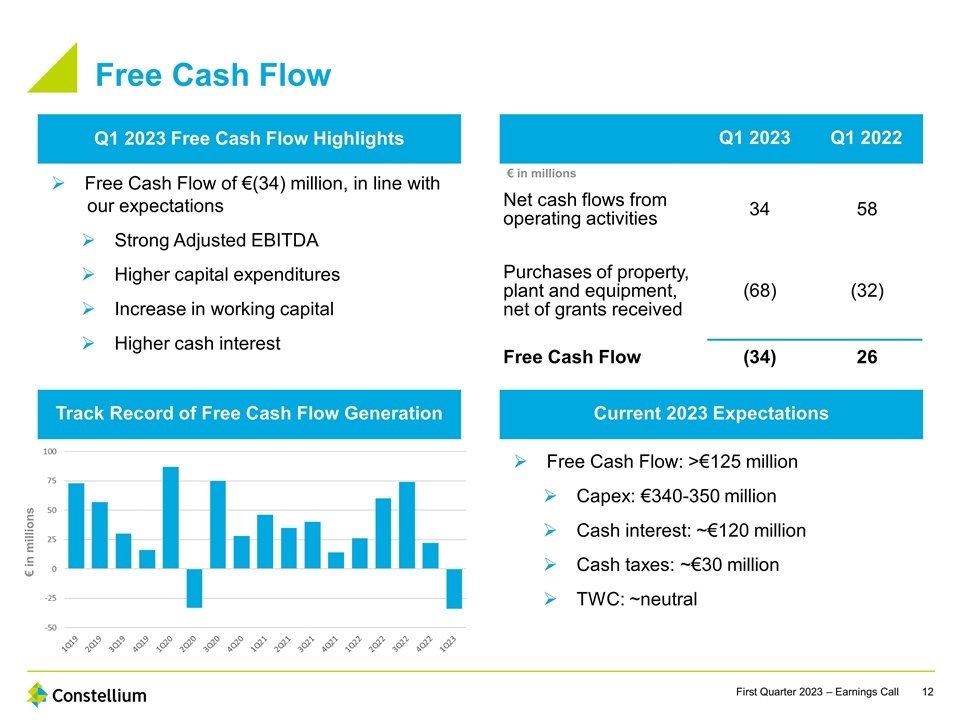

Free Cash Flow Q1 2023 Q1 2022 Q1 2023 Free Cash Flow Highlights Ø Free Cash Flow of €(34) million, in line with our expectations Ø Strong Adjusted EBITDA Ø Higher capital expenditures Ø Increase in working capital Ø Higher cash interest Net cash flows from operating activities 34 58 Purchases of property, plant and equipment, net of grants received (68) (32) Free Cash Flow (34) 26 Track Record of Free Cash Flow Generation Current 2023 Expectations Ø Free Cash Flow: >€125 million Ø Capex: €340-350 million Ø Cash interest: ~€120 million Ø Cash taxes: ~€30 million Ø TWC: ~neutral € in millions € in millions

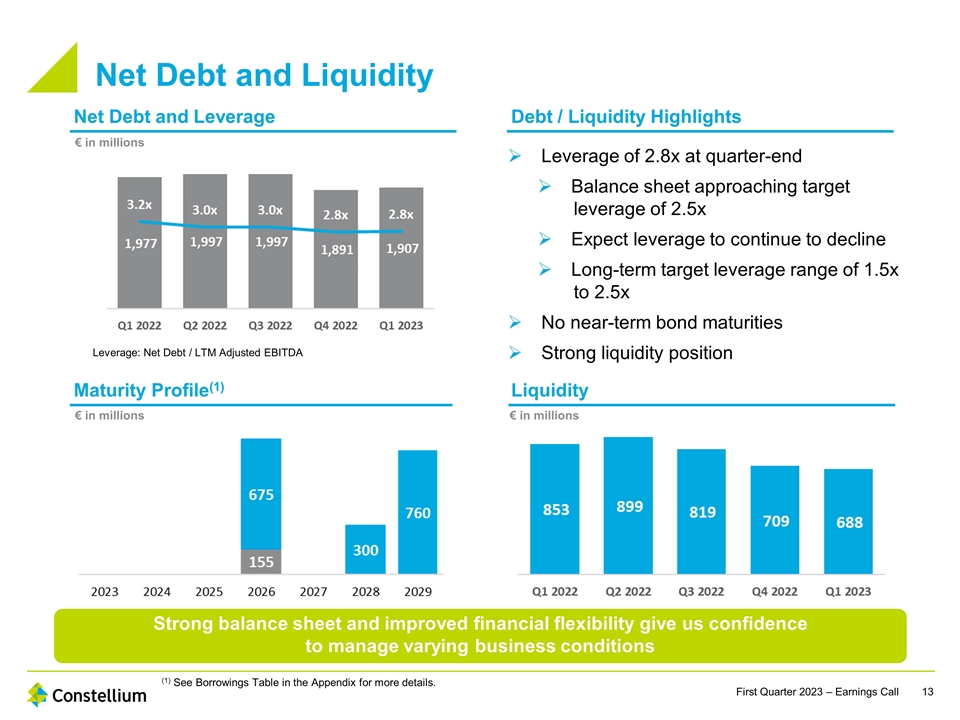

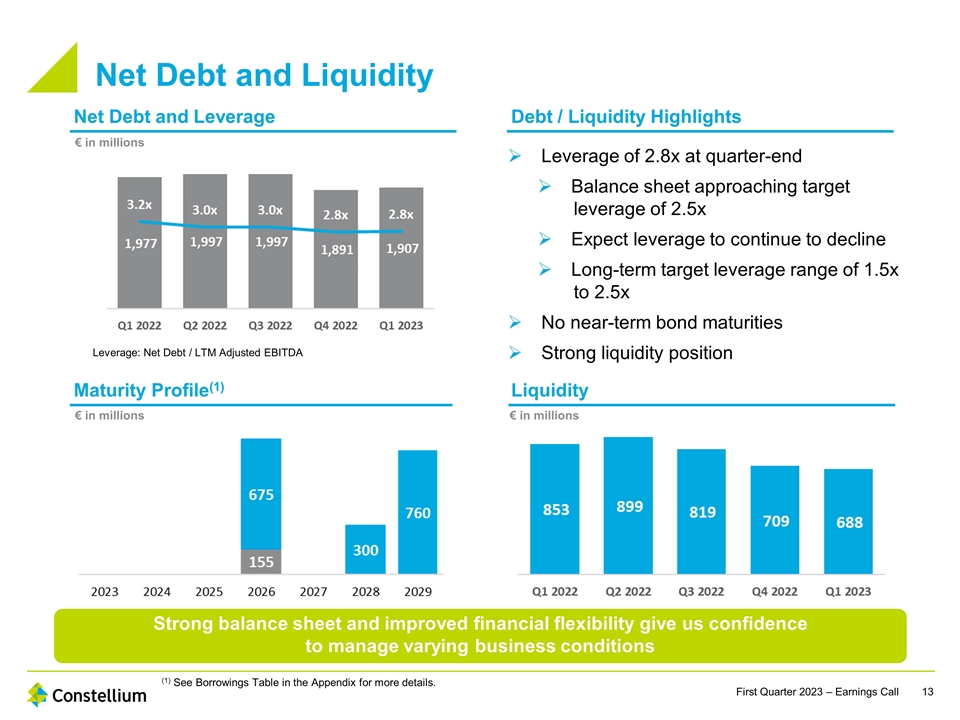

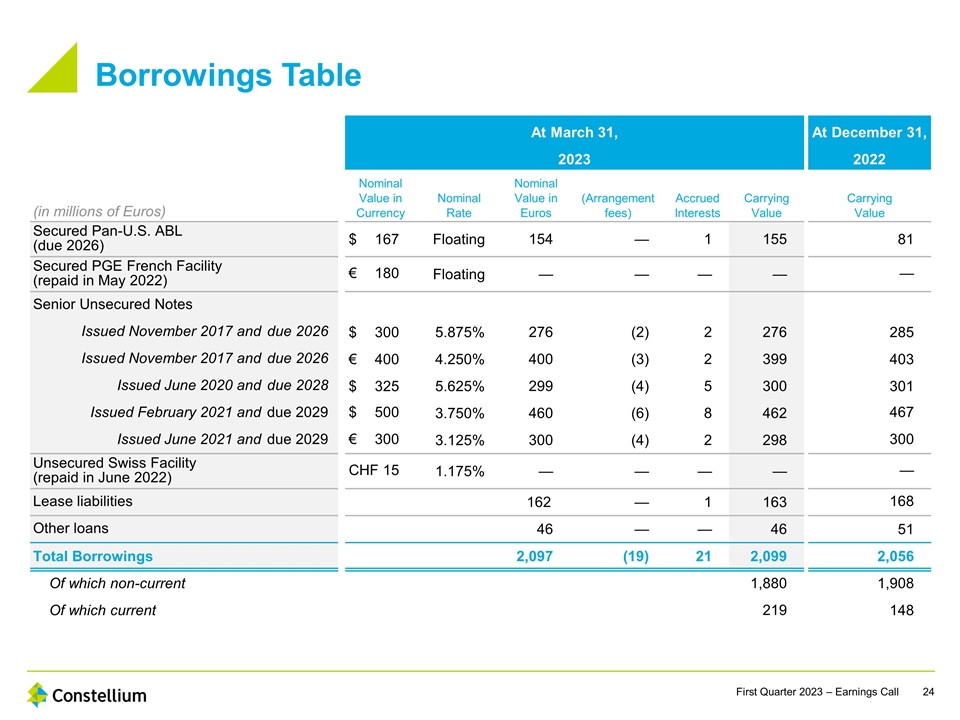

Ø Leverage of 2.8x at quarter-end Ø Balance sheet approaching target leverage of 2.5x Ø Expect leverage to continue to decline Ø Long-term target leverage range of 1.5x to 2.5x Ø No near-term bond maturities Ø Strong liquidity position € in millions Net Debt and Leverage Maturity Profile(1) Liquidity € in millions € in millions Leverage: Net Debt / LTM Adjusted EBITDA Debt / Liquidity Highlights Net Debt and Liquidity (1) See Borrowings Table in the Appendix for more details. Strong balance sheet and improved financial flexibility give us confidence to manage varying business conditions

Jean-Marc Germain Chief Executive Officer

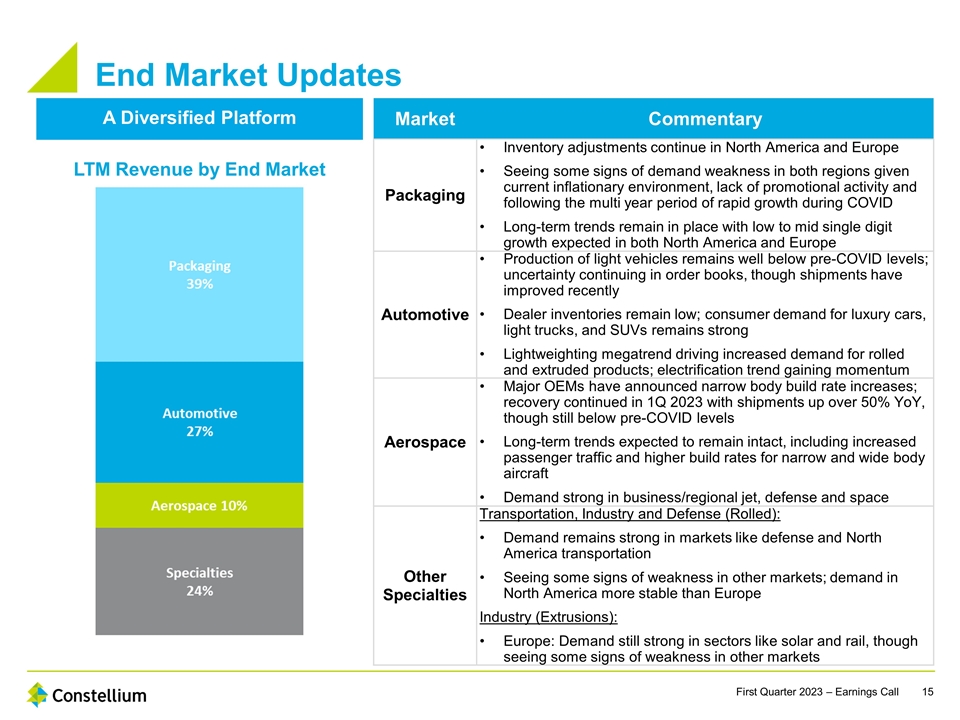

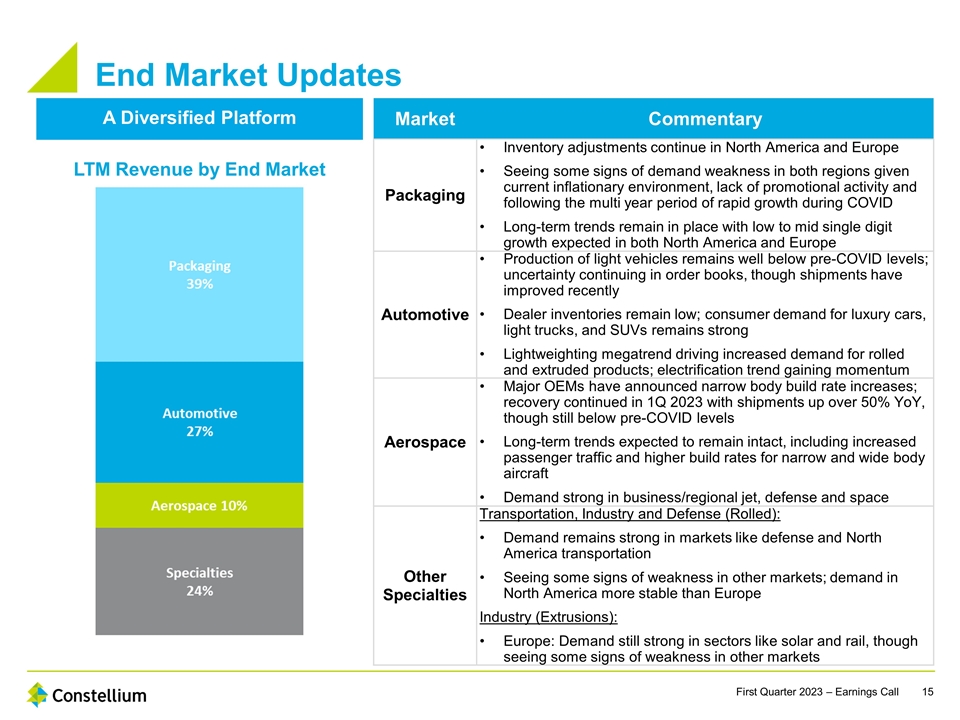

Market Commentary Packaging Inventory adjustments continue in North America and Europe Seeing some signs of demand weakness in both regions given current inflationary environment, lack of promotional activity and following the multi year period of rapid growth during COVID Long-term trends remain in place with low to mid single digit growth expected in both North America and Europe Automotive Production of light vehicles remains well below pre-COVID levels; uncertainty continuing in order books, though shipments have improved recently Dealer inventories remain low; consumer demand for luxury cars, light trucks, and SUVs remains strong Lightweighting megatrend driving increased demand for rolled and extruded products; electrification trend gaining momentum Aerospace Major OEMs have announced narrow body build rate increases; recovery continued in 1Q 2023 with shipments up over 50% YoY, though still below pre-COVID levels Long-term trends expected to remain intact, including increased passenger traffic and higher build rates for narrow and wide body aircraft Demand strong in business/regional jet, defense and space Other Specialties Transportation, Industry and Defense (Rolled): Demand remains strong in markets like defense and North America transportation Seeing some signs of weakness in other markets; demand in North America more stable than Europe Industry (Extrusions): Europe: Demand still strong in sectors like solar and rail, though seeing some signs of weakness in other markets A Diversified Platform LTM Revenue by End Market End Market Updates

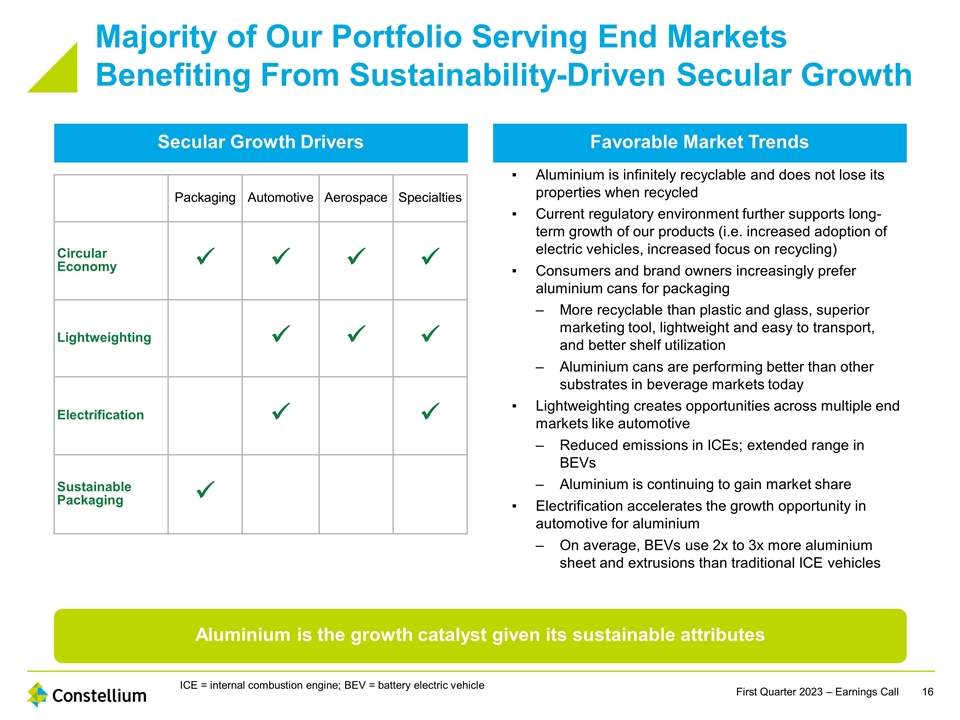

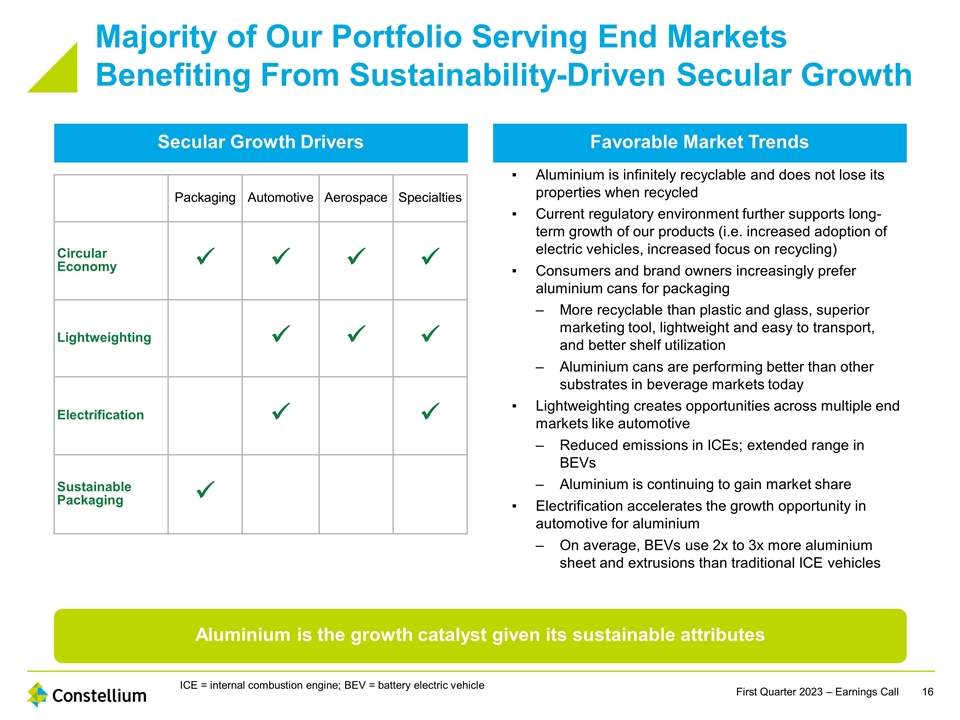

Packaging Automotive Aerospace Specialties Circular Economy ü ü ü ü Lightweighting ü ü ü Electrification ü ü Sustainable Packaging ü ICE = internal combustion engine; BEV = battery electric vehicle Majority of Our Portfolio Serving End Markets Benefiting From Sustainability-Driven Secular Growth Secular Growth Drivers Aluminium is the growth catalyst given its sustainable attributes Favorable Market Trends Aluminium is infinitely recyclable and does not lose its properties when recycled Current regulatory environment further supports long-term growth of our products (i.e. increased adoption of electric vehicles, increased focus on recycling) Consumers and brand owners increasingly prefer aluminium cans for packaging More recyclable than plastic and glass, superior marketing tool, lightweight and easy to transport, and better shelf utilization Aluminium cans are performing better than other substrates in beverage markets today Lightweighting creates opportunities across multiple end markets like automotive Reduced emissions in ICEs; extended range in BEVs Aluminium is continuing to gain market share Electrification accelerates the growth opportunity in automotive for aluminium On average, BEVs use 2x to 3x more aluminium sheet and extrusions than traditional ICE vehicles

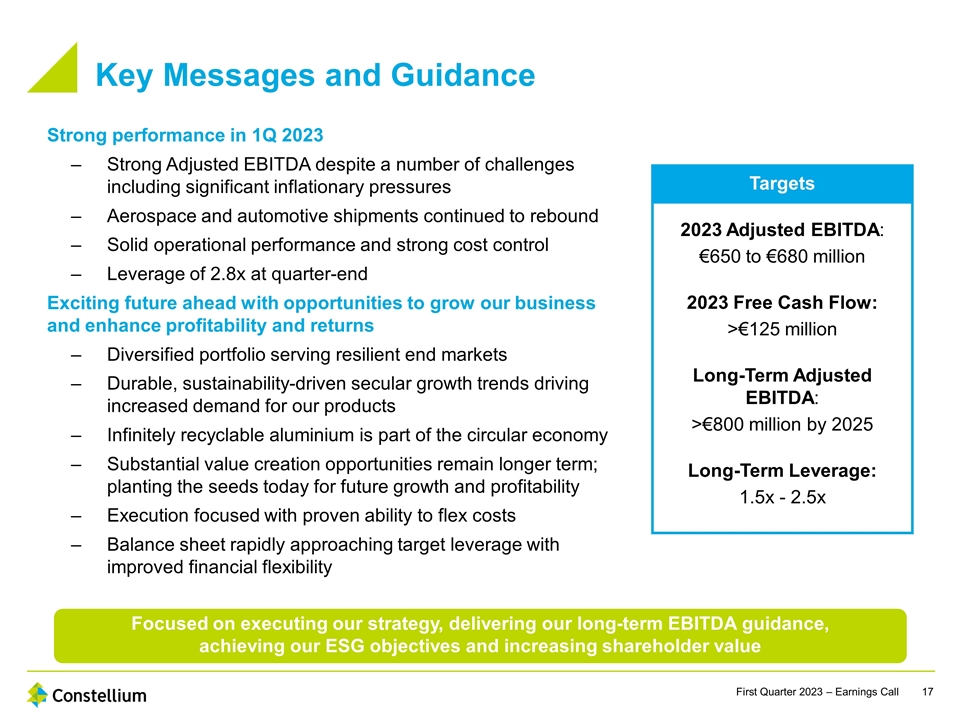

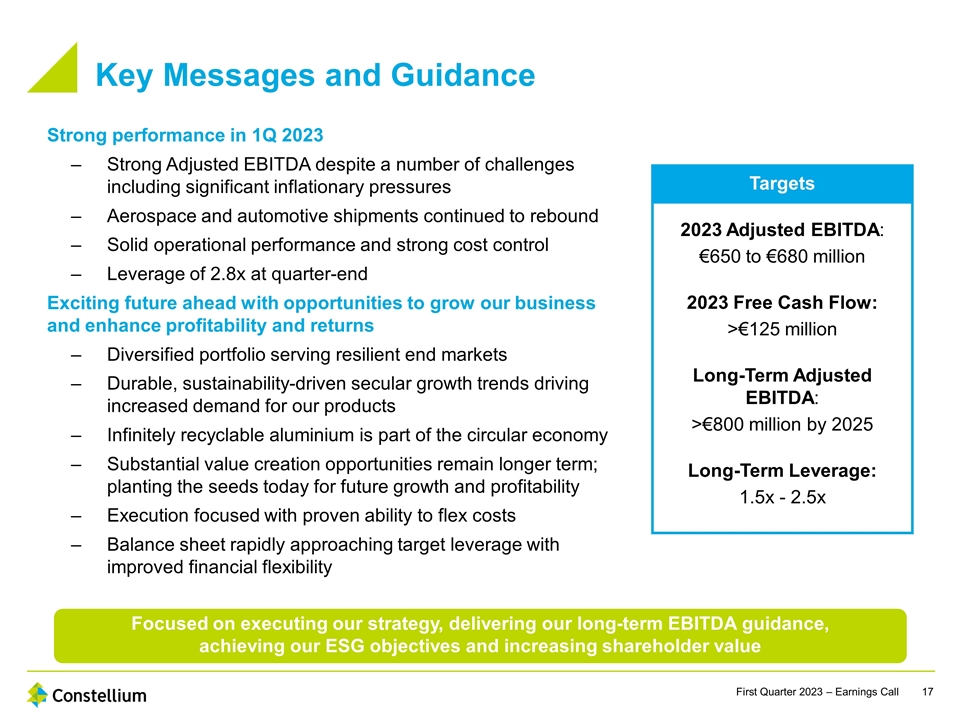

Targets Strong performance in 1Q 2023 Strong Adjusted EBITDA despite a number of challenges including significant inflationary pressures Aerospace and automotive shipments continued to rebound Solid operational performance and strong cost control Leverage of 2.8x at quarter-end Exciting future ahead with opportunities to grow our business and enhance profitability and returns Diversified portfolio serving resilient end markets Durable, sustainability-driven secular growth trends driving increased demand for our products Infinitely recyclable aluminium is part of the circular economy Substantial value creation opportunities remain longer term; planting the seeds today for future growth and profitability Execution focused with proven ability to flex costs Balance sheet rapidly approaching target leverage with improved financial flexibility Key Messages and Guidance 2023 Adjusted EBITDA: €650 to €680 million 2023 Free Cash Flow: >€125 million Long-Term Adjusted EBITDA: >€800 million by 2025 Long-Term Leverage: 1.5x - 2.5x Focused on executing our strategy, delivering our long-term EBITDA guidance, achieving our ESG objectives and increasing shareholder value

Appendix

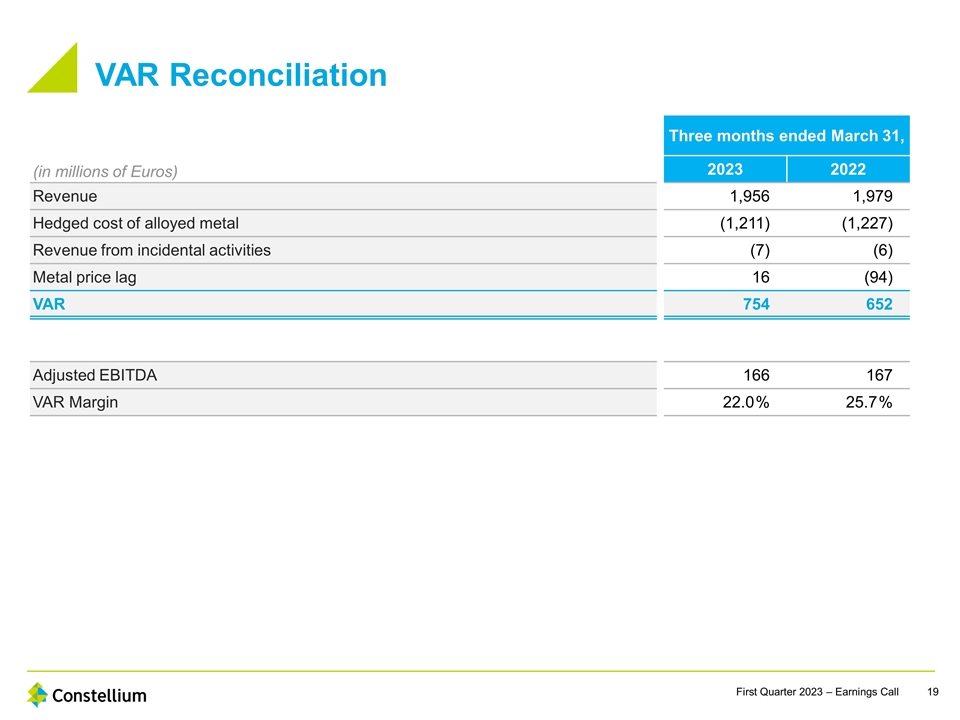

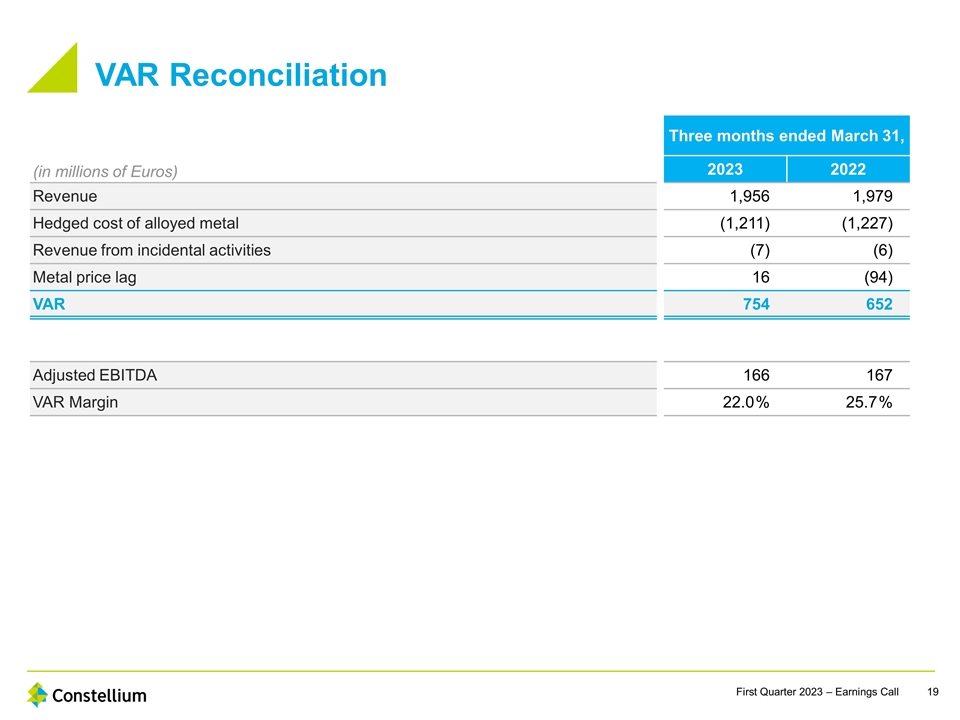

Three months ended March 31, (in millions of Euros) 2023 2022 Revenue 1,956 1,979 Hedged cost of alloyed metal (1,211) (1,227) Revenue from incidental activities (7) (6) Metal price lag 16 (94) VAR 754 652 Adjusted EBITDA 166 167 VAR Margin 22.0% 25.7% VAR Reconciliation

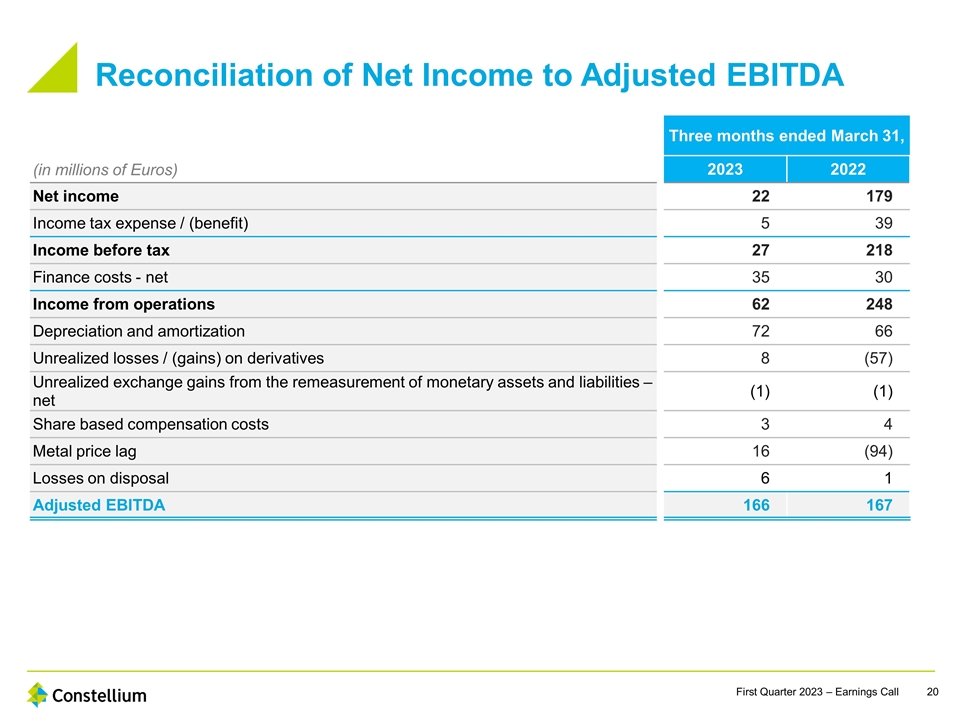

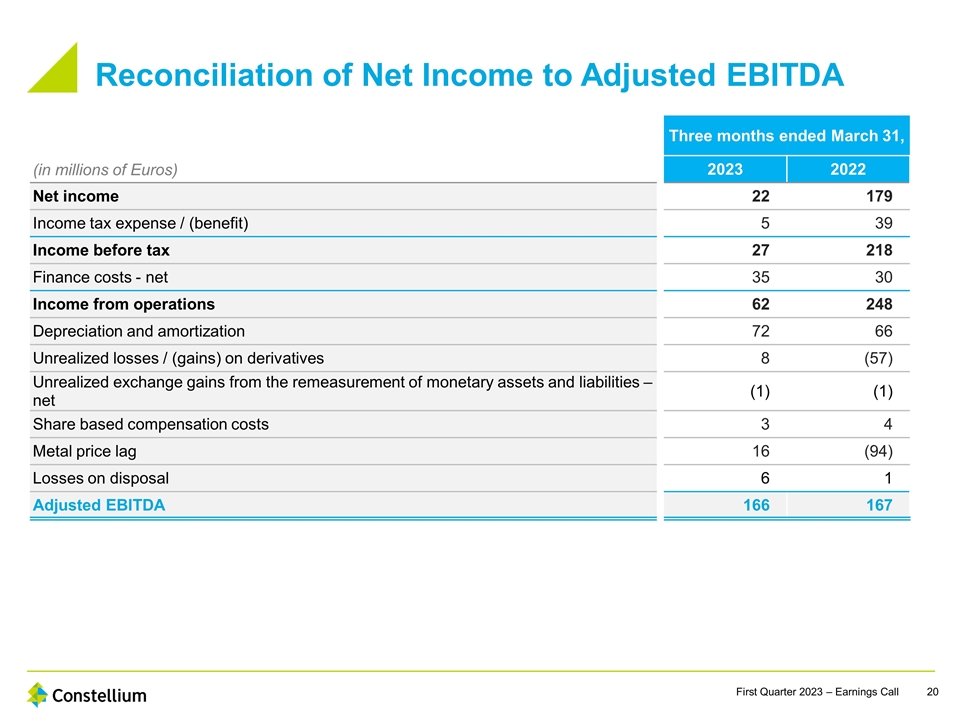

Three months ended March 31, (in millions of Euros) 2023 2022 Net income 22 179 Income tax expense / (benefit) 5 39 Income before tax 27 218 Finance costs - net 35 30 Income from operations 62 248 Depreciation and amortization 72 66 Unrealized losses / (gains) on derivatives 8 (57) Unrealized exchange gains from the remeasurement of monetary assets and liabilities – net (1) (1) Share based compensation costs 3 4 Metal price lag 16 (94) Losses on disposal 6 1 Adjusted EBITDA 166 167 Reconciliation of Net Income to Adjusted EBITDA

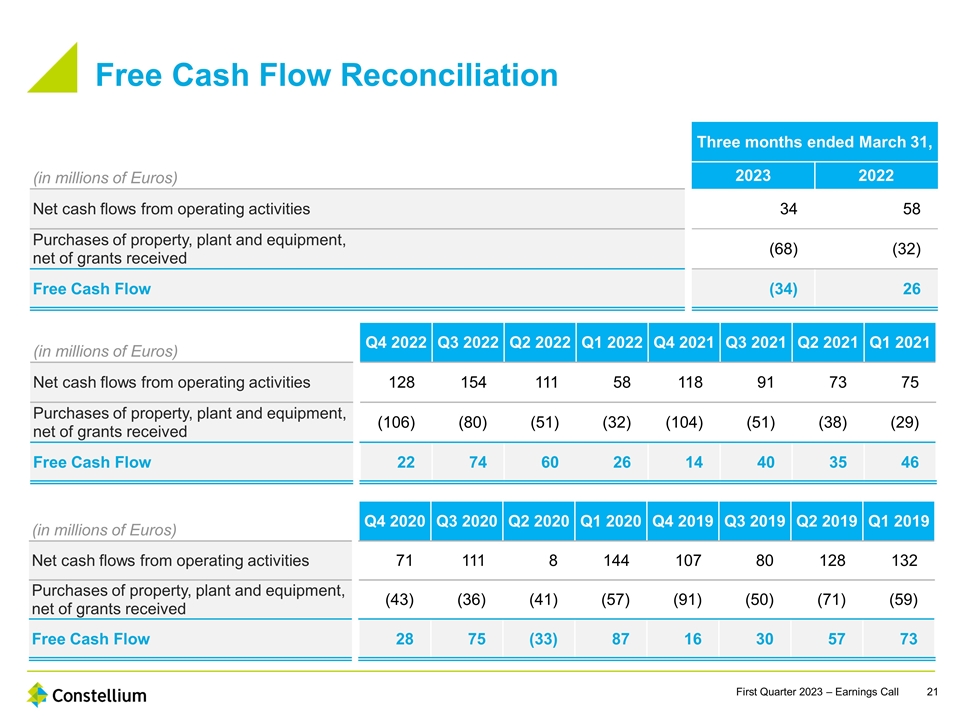

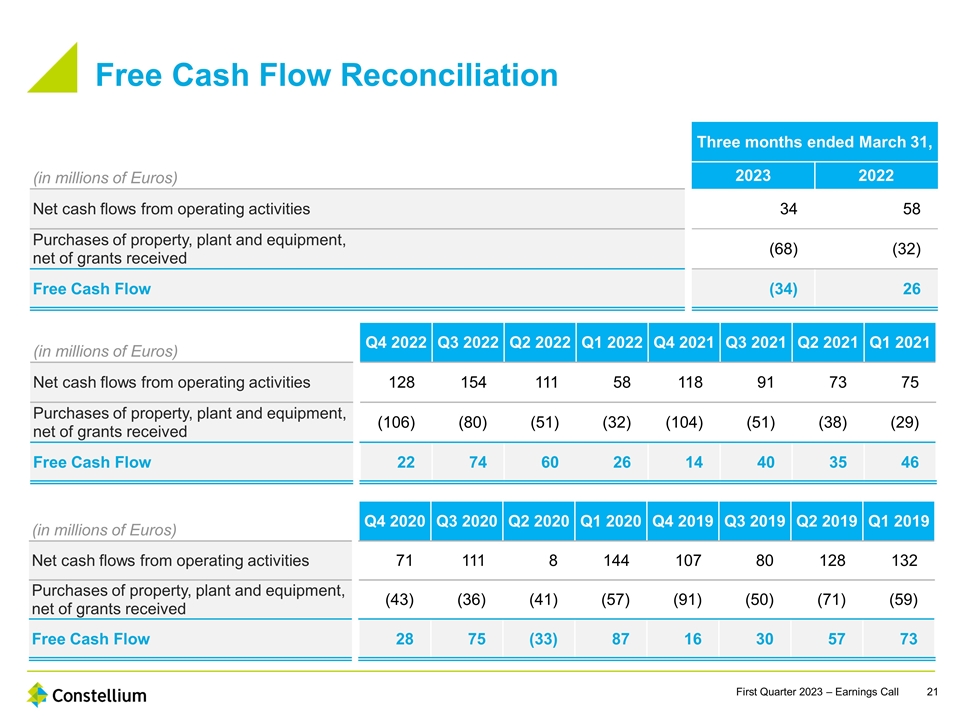

(in millions of Euros) Three months ended March 31, 2023 2022 Net cash flows from operating activities 34 58 Purchases of property, plant and equipment, net of grants received (68) (32) Free Cash Flow (34) 26 Free Cash Flow Reconciliation (in millions of Euros) Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021 Net cash flows from operating activities 128 154 111 58 118 91 73 75 Purchases of property, plant and equipment, net of grants received (106) (80) (51) (32) (104) (51) (38) (29) Free Cash Flow 22 74 60 26 14 40 35 46 (in millions of Euros) Q4 2020 Q3 2020 Q2 2020 Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 Net cash flows from operating activities 71 111 8 144 107 80 128 132 Purchases of property, plant and equipment, net of grants received (43) (36) (41) (57) (91) (50) (71) (59) Free Cash Flow 28 75 (33) 87 16 30 57 73

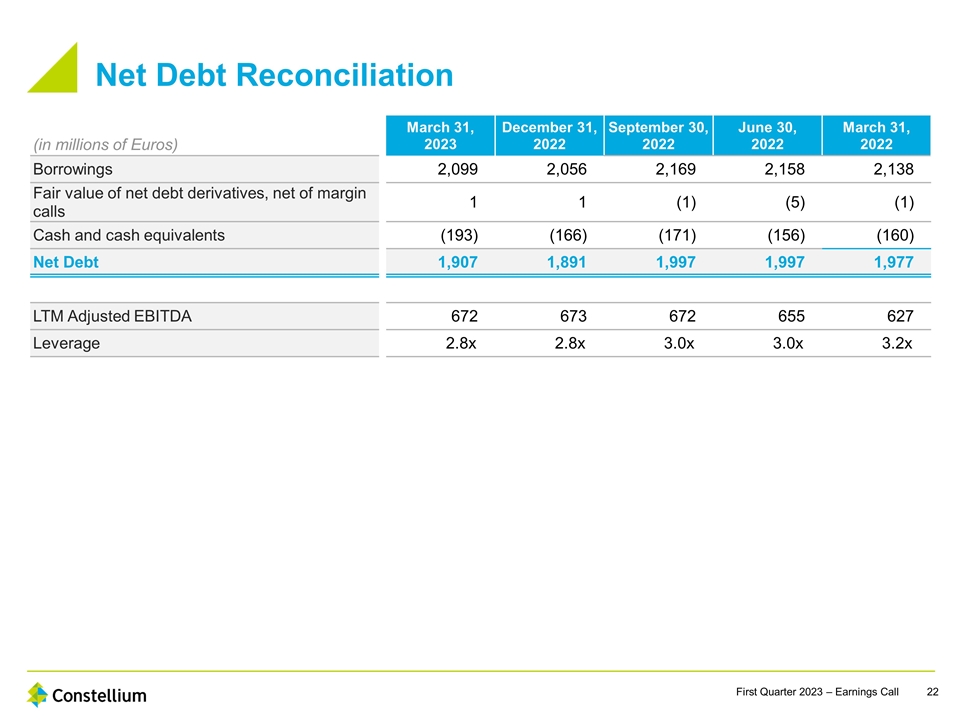

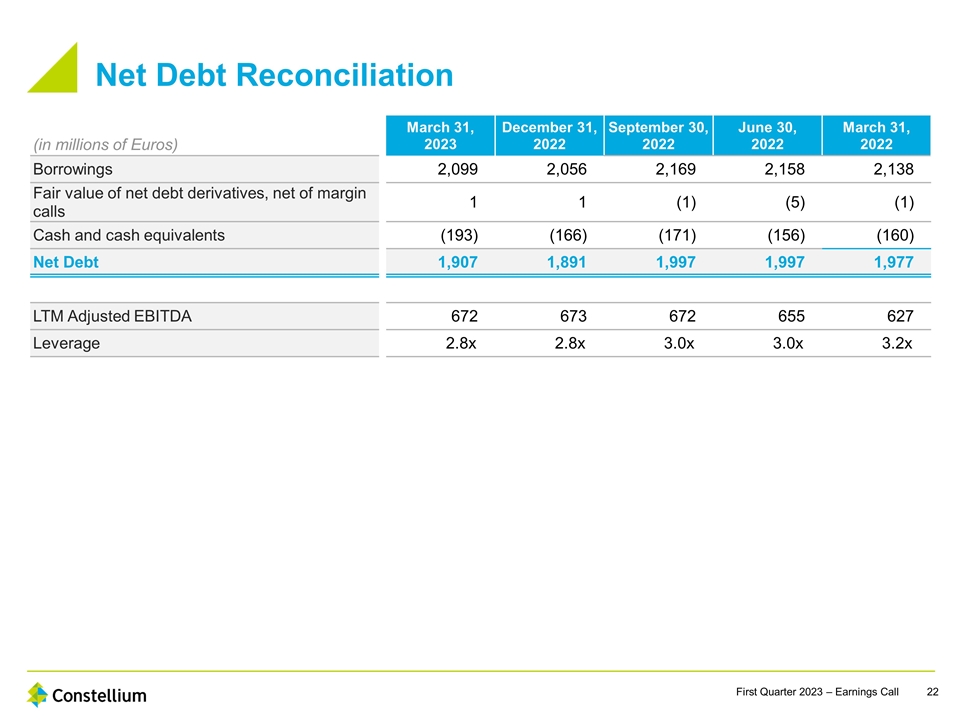

(in millions of Euros) March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Borrowings 2,099 2,056 2,169 2,158 2,138 Fair value of net debt derivatives, net of margin calls 1 1 (1) (5) (1) Cash and cash equivalents (193) (166) (171) (156) (160) Net Debt 1,907 1,891 1,997 1,997 1,977 LTM Adjusted EBITDA 672 673 672 655 627 Leverage 2.8x 2.8x 3.0x 3.0x 3.2x Net Debt Reconciliation

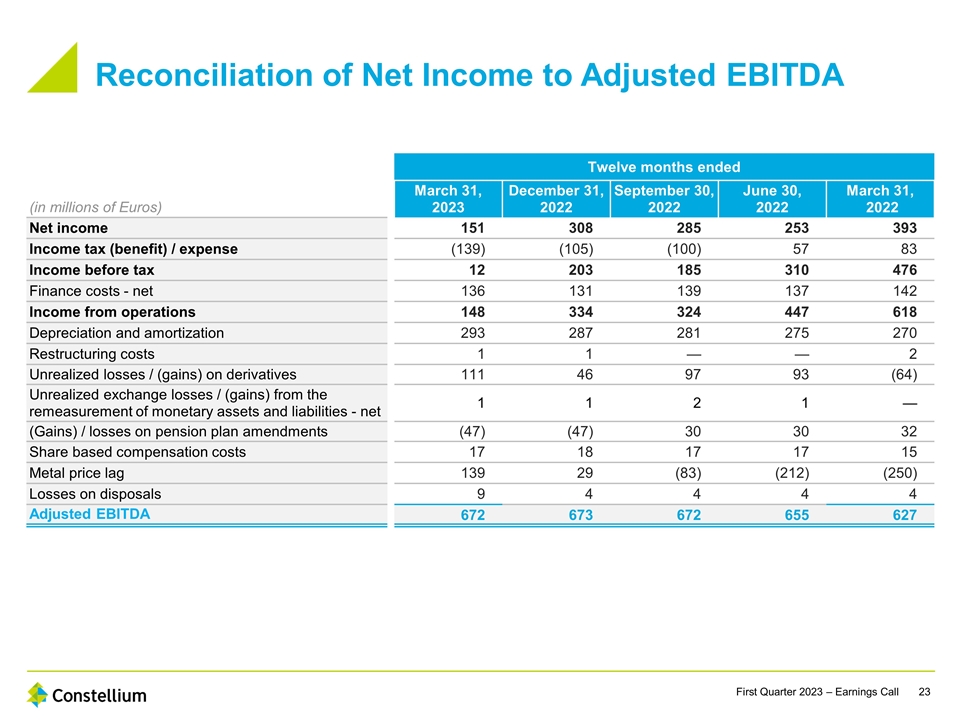

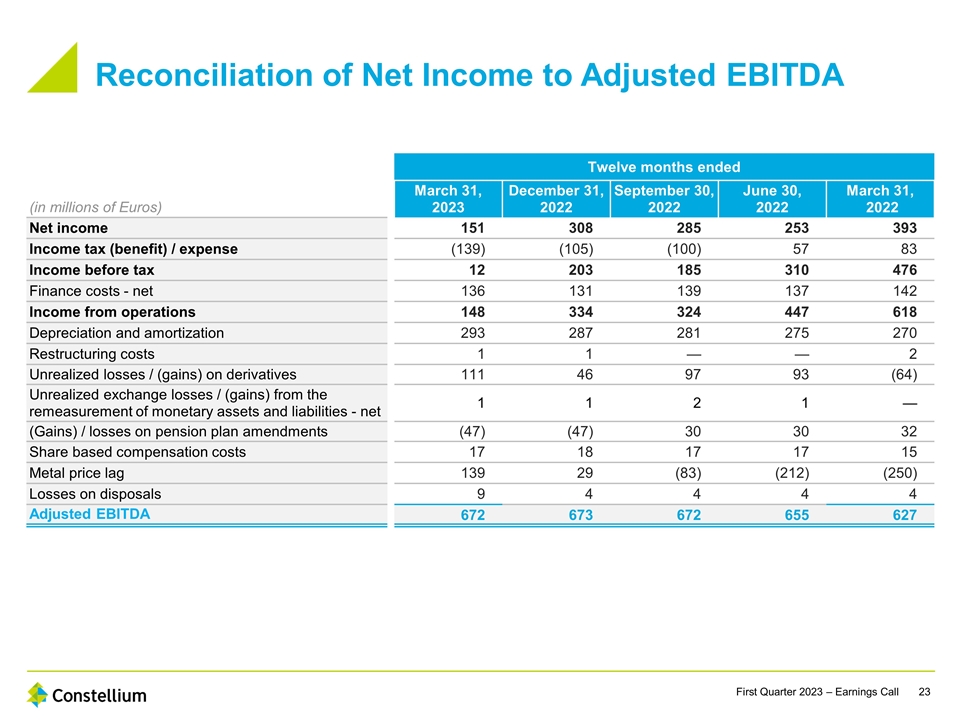

Twelve months ended (in millions of Euros) March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 Net income 151 308 285 253 393 Income tax (benefit) / expense (139) (105) (100) 57 83 Income before tax 12 203 185 310 476 Finance costs - net 136 131 139 137 142 Income from operations 148 334 324 447 618 Depreciation and amortization 293 287 281 275 270 Restructuring costs 1 1 — — 2 Unrealized losses / (gains) on derivatives 111 46 97 93 (64) Unrealized exchange losses / (gains) from the remeasurement of monetary assets and liabilities - net 1 1 2 1 — (Gains) / losses on pension plan amendments (47) (47) 30 30 32 Share based compensation costs 17 18 17 17 15 Metal price lag 139 29 (83) (212) (250) Losses on disposals 9 4 4 4 4 Adjusted EBITDA 672 673 672 655 627 Reconciliation of Net Income to Adjusted EBITDA

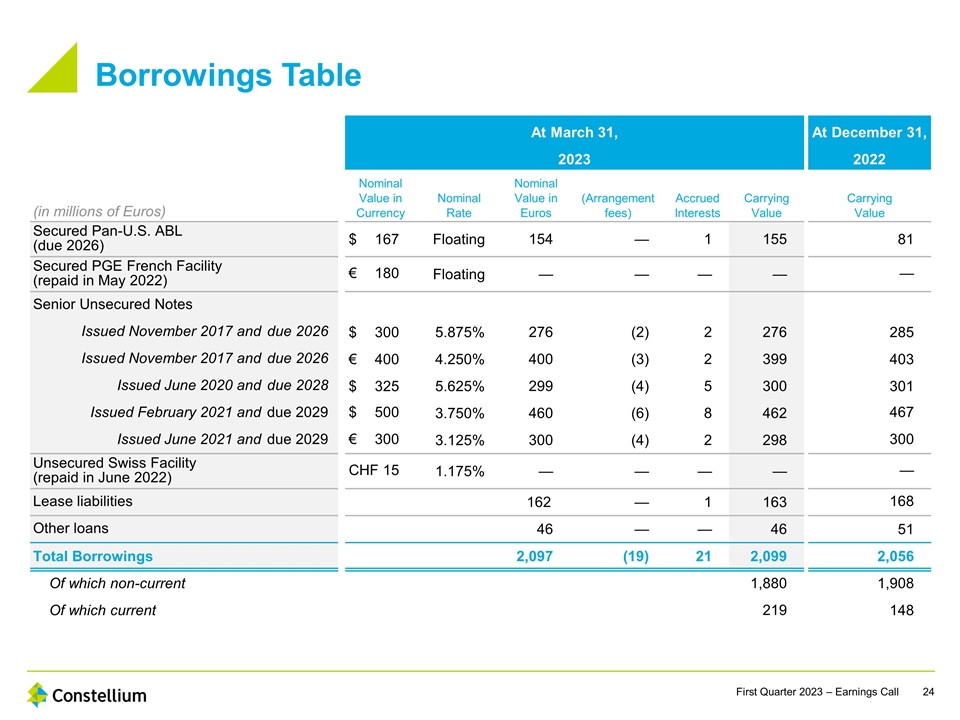

At March 31, At December 31, 2023 2022 (in millions of Euros) Nominal Value in Currency Nominal Rate Nominal Value in Euros (Arrangement fees) Accrued Interests Carrying Value Carrying Value Secured Pan-U.S. ABL(due 2026) $167 Floating 154 — 1 155 81 Secured PGE French Facility (repaid in May 2022) €180 Floating — — — — — Senior Unsecured Notes Issued November 2017 and due 2026 $300 5.875% 276 (2) 2 276 285 Issued November 2017 and due 2026 €400 4.250% 400 (3) 2 399 403 Issued June 2020 and due 2028 $325 5.625% 299 (4) 5 300 301 Issued February 2021 and due 2029 $500 3.750% 460 (6) 8 462 467 Issued June 2021 and due 2029 €300 3.125% 300 (4) 2 298 300 Unsecured Swiss Facility (repaid in June 2022) CHF15 1.175% — — — — — Lease liabilities 162 — 1 163 168 Other loans 46 — — 46 51 Total Borrowings 2,097 (19) 21 2,099 2,056 Of which non-current 1,880 1,908 Of which current 219 148 Borrowings Table