UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |||

Filed by a Party other than the Registrant | ☐ | |||

Check the appropriate box: |

☐ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ | Definitive Proxy Statement | |||

☐ | Definitive Additional Materials | |||

☐ | Soliciting Material Pursuant to §240.14a-12 |

LIGHTSTONE VALUE PLUS REIT III, INC.

(Name of Registrant as Specified In Its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||||

(1) | Title of each class of securities to which transaction applies: | |||||

(2) | Aggregate number of securities to which transaction applies: | |||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

(4) | Proposed maximum aggregate value of transaction: | |||||

(5) | Total fee paid: | |||||

☐ | Fee paid previously with preliminary materials. | |||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

(1) | Amount Previously Paid: | |||||

(2) | Form, Schedule or Registration Statement No.: | |||||

(3) | Filing Party: | |||||

(4) | Date Filed: | |||||

LIGHTSTONE VALUE PLUS REIT III, INC.

1985 Cedar Bridge Avenue, Suite 1

Lakewood, New Jersey 08701

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held December 16, 2021

To the Stockholders of Lightstone Value Plus REIT III, Inc.:

I am pleased to invite our stockholders to the 2021 Annual Meeting of Stockholders of Lightstone Value Plus REIT III, Inc., a Maryland corporation. The annual meeting will be held at 460 Park Avenue, 13th Floor, New York, New York, 10022, at 9:15 a.m., Eastern Standard Time, on December 16, 2021.

At the meeting, you will be asked to:

• consider and vote upon the election of three directors to serve until our 2022 Annual Meeting of Stockholders and until their successors are duly elected and qualify; and

• conduct such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

Our Board of Directors has fixed the close of business on October 5, 2021 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment or postponement thereof. Record holders of shares of our common stock at the close of business on the record date are entitled to notice of and to vote at the annual meeting.

For further information regarding the matters to be acted upon at the annual meeting, I urge you to carefully read the accompanying proxy statement. If you have questions about these proposals or would like additional copies of the proxy statement, please contact: Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701.

Whether you own a few or many shares and whether you plan to attend in person or not, it is important that your shares be voted on matters that come before the meeting. You may authorize a proxy to vote your shares by using a toll-free telephone number or via the Internet. Instructions for using these convenient services are provided on the enclosed proxy card and in the attached proxy statement. If you prefer, you may authorize a proxy by marking your voting instructions on the proxy card, signing and dating it, and mailing it in the postage paid return envelope provided. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the Board’s recommendation. If we do not hear from you after a reasonable amount of time, you may receive a telephone call from our proxy solicitor, Computershare Fund Services, reminding you to vote your shares.

You are cordially invited to attend the 2021 Annual Meeting of Stockholders. Your vote is important.

By Order of the Board of Directors,

Joseph Teichman

General Counsel and Secretary

Lakewood, New Jersey

October 19, 2021

LIGHTSTONE VALUE PLUS REIT III, INC.

PROXY STATEMENT

TABLE OF CONTENTS

i

LIGHTSTONE VALUE PLUS REIT III, INC.

1985 Cedar Bridge Avenue, Suite 1

Lakewood, New Jersey 08701

PROXY STATEMENT

INTRODUCTION

The accompanying proxy, mailed together with this proxy statement, is solicited by and on behalf of the board of directors (the “Board of Directors”) of Lightstone Value Plus REIT III, Inc., a Maryland corporation (which we refer to in this proxy statement as the “Company”), for use at the 2021 Annual Meeting of Stockholders and at any adjournment or postponement thereof. References in this proxy statement to “we,” “us,” “our” or like terms also refer to the Company, and references in this proxy statement to “you” refer to the stockholders of the Company. The mailing address of our principal executive offices is 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701. This proxy statement, the accompanying proxy card and notice of annual meeting are first being mailed to our stockholders on or about October 25, 2021. The 2020 Annual Report on Form 10-K was previously mailed to our stockholders on or about April 30, 2021.

Our Annual Report on Form 10-K for the year ended December 31, 2020 and the exhibits thereto may be accessed online through the Securities and Exchange Commission (the “SEC”) website at www.sec.gov. In addition, stockholders may request a copy of our 2020 Annual Report by writing or telephoning us at the following address: Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701, telephone (866) 792-8700.

1

INFORMATION ABOUT THE MEETING AND VOTING

What is the date of the annual meeting and where will it be held?

Our 2021 Annual Meeting of Stockholders will be held on December 16, 2021, at 9:15 a.m., Eastern Standard Time. The meeting will be held at 460 Park Avenue, 13th Floor, New York, New York, 10022.

What will I be voting on at the meeting?

At the meeting, you will be asked to:

• consider and vote upon the election of three directors to serve until our 2022 Annual Meeting of Stockholders and until their successors are duly elected and qualify; and

• conduct such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

The Board of Directors does not know of any matters that may be considered at the meeting other than the matters set forth in the items listed above.

Who can vote at the meeting?

The record date for the determination of holders of shares of our common stock, $0.01 par value per share (the “Common Stock”), entitled to notice of and to vote at the meeting, or any adjournment or postponement of the meeting, is the close of business on October 5, 2021. Accordingly, any holder of shares of Common Stock on the record date is entitled to notice of and to vote at the meeting. As of the record date, approximately 13.2 million shares of our Common Stock were issued and outstanding and entitled to vote at the meeting.

How many votes do I have?

Each share of Common Stock has one vote on each matter considered at the meeting or any adjournment or postponement thereof.

How can I vote?

You may vote in person at the meeting or by proxy. Stockholders may submit their votes by proxy by mail by completing, signing, dating and returning their proxy in the enclosed envelope. Stockholders also have the following two options for authorizing a proxy to vote their shares:

• via the Internet at www.proxy-direct.com/ ; or

• by telephone, by calling toll free (800) 337-3503.

For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, a convenient means of authorizing a proxy that also provides cost savings to us. In addition, when you authorize a proxy to vote your shares via the Internet or by telephone prior to the meeting date, your proxy authorization is recorded immediately and there is no risk that postal delays will cause your vote by proxy to arrive late and, therefore, not be counted. For further instructions on authorizing a proxy to vote your shares, see your proxy card enclosed with this proxy statement. You may also vote your shares at the meeting. If you attend the meeting, you may submit your vote in person, and any proxy that you authorized by mail, Internet or telephone will be superseded by the vote that you cast at the meeting.

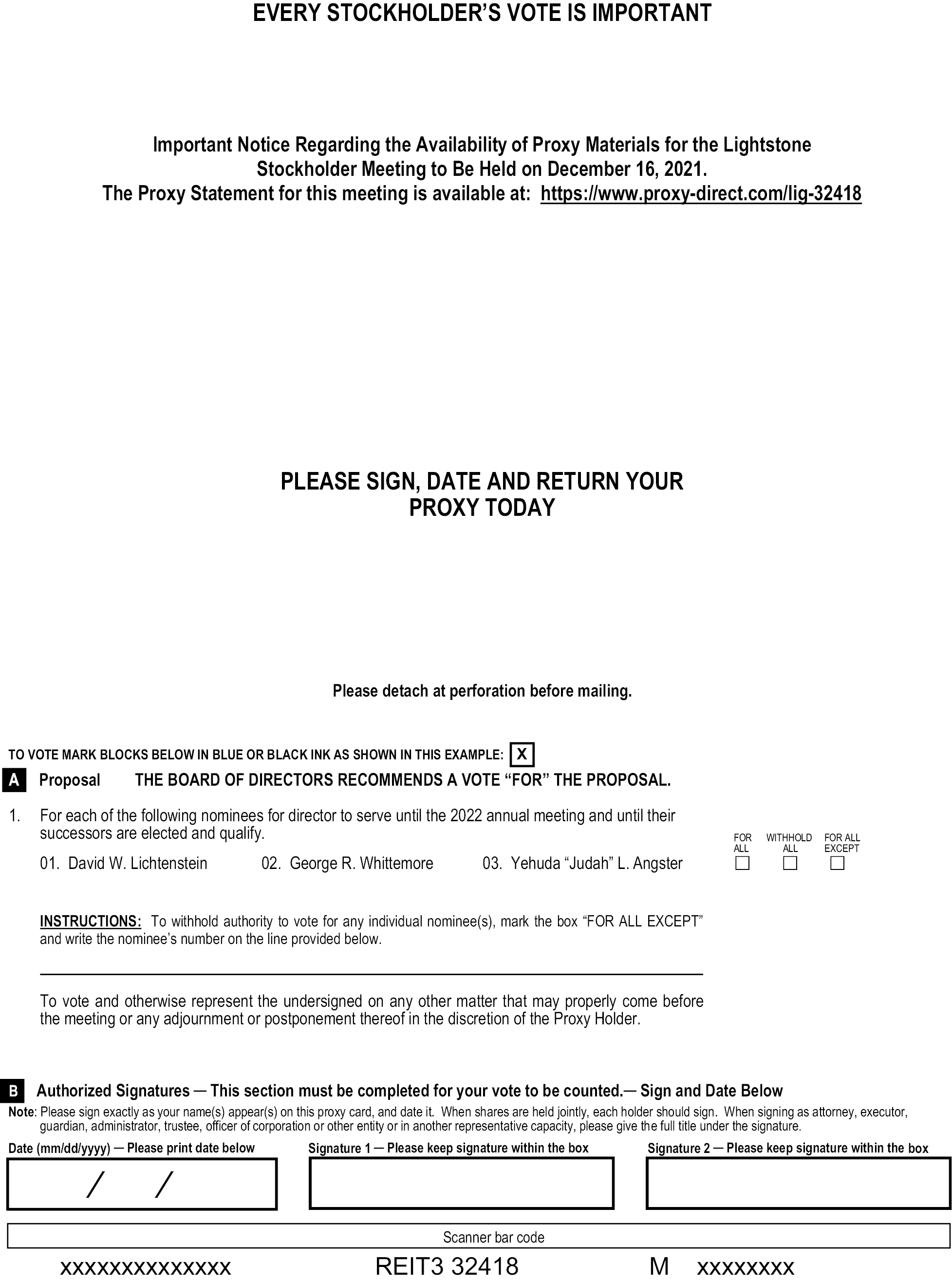

How will proxies be voted?

Shares represented by valid proxies will be voted at the meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted FOR each of the three nominees for director named in this proxy statement for election as director.

2

The Board of Directors does not intend to present, and has no information indicating that others will present, any business at the annual meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders. However, if other matters requiring the vote of our stockholders come before the meeting, it is the intention of the persons named in the accompanying proxy to vote the proxies held by them in their discretion.

How can I change my vote or revoke a proxy?

You have the unconditional right to revoke your proxy at any time prior to the voting thereof by (i) submitting a later-dated proxy either by telephone, via the Internet or in the mail to Computershare Fund Services (“CFS ”), whom we have retained to aid in the solicitation of proxies, at the following address: Proxy Tabulator, 2950 Express Drive South, Suite 210, Islandia, NY 11749, (ii) attending the meeting and voting in person or (iii) providing written notice to CFS. No written revocation of your proxy shall be effective, however, unless and until it is received at or prior to the meeting. Your attendance at the meeting without voting will not be sufficient to revoke a previous proxy authorization.

What if I return my proxy but do not mark it to show how I am voting?

If your proxy card is signed and returned without specifying your choices, your shares will be voted as recommended by the Board of Directors.

What are the board’s recommendations?

The Board of Directors recommends that you vote FOR each of the three nominees for director named in this proxy statement for election as director.

What votes are required to elect directors?

There is no cumulative voting in the election of our directors. Each director is elected by the affirmative vote of the holders of a majority of all shares of Common Stock entitled to vote who are present in person or by proxy at the meeting. Any shares deemed present at the meeting but not voted (whether by abstention or broker non-vote) have the same impact as a vote against the directors. A “broker non-vote” occurs when a broker who holds shares for the beneficial owner is deemed present for purposes of establishing a quorum for the meeting but does not vote on a proposal because the broker does not have discretionary voting authority for that proposal and has not received instructions from the beneficial owner of the shares.

What constitutes a “quorum”?

The presence at the meeting, in person or represented by proxy, of stockholders entitled to cast 50% of all the votes entitled to be cast at the meeting constitutes a quorum. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum.

Will you incur expenses in soliciting proxies?

We will bear all costs associated with soliciting proxies for the meeting. Solicitations may be made on behalf of the Board of Directors by mail, personal interview, telephone or other electronic means by our officers and other employees of Lightstone Value Plus REIT III, LLC (the “Advisor”), who will receive no additional compensation. We will request banks, brokers, custodians, nominees, fiduciaries and other record holders to forward copies of this proxy statement to people on whose behalf they hold shares of Common Stock and to request authority for the exercise of proxies by the record holders on behalf of those people. In compliance with the regulations of the SEC, we will reimburse such persons for reasonable expenses incurred by them in forwarding proxy materials to the beneficial owners of shares of our Common Stock.

We have also retained CFS to aid in the solicitation of proxies. We will pay CFS a fee of approximately $28,000 in addition to reimbursement of its reasonable out-of-pocket expenses. As the date of the meeting approaches, certain stockholders may receive a telephone call from a representative of CFS if their votes have not yet been received. Proxies that are obtained telephonically will be recorded in accordance with the procedures described below. The Board of Directors believes that these procedures are reasonably designed to ensure that both the identity of the stockholder casting the vote and the voting instructions of the stockholder are accurately determined.

3

In all cases where a telephonic proxy is solicited, the CFS representative is required to ask for each stockholder’s full name and address, or the zip code or employer identification number, and to confirm that the stockholder has received the proxy materials in the mail. If the stockholder is a corporation or other entity, the CFS representative is required to ask for the person’s title and confirmation that the person is authorized to direct the voting of the shares. If the information solicited agrees with the information provided to CFS, then the CFS representative has the responsibility to explain the process, read the proposal listed on the proxy card and ask for the stockholder’s instructions on the proposal. Although the CFS representative is permitted to answer questions about the process, he or she is not permitted to recommend to the stockholder how to vote, other than to read any recommendation set forth in this proxy statement. CFS will record the stockholder’s instructions on the card. Within 72 hours, the stockholder will be sent a letter or mailgram to confirm his or her vote and asking the stockholder to call CFS immediately if his or her instructions are not correctly reflected in the confirmation.

What does it mean if I receive more than one proxy card?

Some of your shares may be registered differently or held in a different account. You should authorize a proxy to vote the shares in each of your accounts by mail, by telephone or via the Internet. If you mail proxy cards, please sign, date and return each proxy card to ensure that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should contact Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701, or call us at (866) 792-8700. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us to, with the consent of affected stockholders, send a single set of any annual report, proxy statement, proxy statement combined with a prospectus or information statement to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card.

We will promptly deliver, upon written or oral request, a separate copy of our annual report or proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies to Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, New Jersey 08701, or call us at (866) 792-8700. Likewise, if your household currently receives multiple copies of disclosure documents and you would like to receive one set, please contact us.

Whom should I call for additional information about authorizing a proxy by mail, telephone or Internet to vote my shares?

Please call CFS, our proxy solicitor, at 1-866-963-6128.

How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal?

In order for a stockholder proposal to be properly submitted for presentation at our 2022 Annual Meeting, pursuant to our current bylaws we must receive written notice of the proposal at our executive offices during the period beginning on May 13, 2022, and ending at 5:00 p.m., Eastern Daylight Time, on June 14, 2022. If you wish to present a proposal for inclusion in the proxy material for next year’s annual meeting, we must receive written notice of your proposal at our executive offices no later than June 14, 2022. All proposals must contain the information specified in, and otherwise comply with, our bylaws. Proposals should be sent via registered, certified or express mail to: Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701, Attention: Joseph Teichman. For additional information, see the section in this proxy statement captioned “Stockholder Proposals for the 2022 Annual Meeting.”

4

ELECTION OF DIRECTORS

General

The Board of Directors ultimately is responsible for directing the management of our business and affairs. We have no employees and have retained the Advisor to manage our day-to-day operations, including the acquisition of our properties. The Advisor is an affiliate of our Sponsor, The Lightstone Group (the “Sponsor”). The Board of Directors, including our independent directors, is responsible for monitoring and supervising the Advisor’s conduct of our day-to-day operations.

Our bylaws provide for a Board of Directors with no fewer than three and no more than ten directors, a majority of whom must be independent. An “independent director” is defined under our charter (the “Charter”) and means a person who is not, and within the last two years has not been, directly or indirectly associated with the Company, the Sponsor, the Advisor or any of their affiliates by virtue of:

• ownership of an interest in the Sponsor, the Advisor or any of their affiliates, other than the Company;

• employment by the Company, the Sponsor, the Advisors or any of their affiliates;

• service as an officer or director of the Sponsor, the Advisor or any of their affiliates, other than as a director of the Company;

• performance of services, other than as a director of the Company;

• service as a director of the Company or as a director of more than three real estate investment trusts organized by the Sponsor or advised by the Advisor; or

• maintenance of a material business or professional relationship with the Sponsor, the Advisor or any of their affiliates.

An independent director cannot be associated with us, the Sponsor or the Advisor as set forth above either directly or indirectly. An indirect association with the Sponsor or the Advisor includes circumstances in which a director’s spouse, parent, child, sibling, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in-law, is or has been associated with us, the Sponsor, the Advisor, or any of their affiliates.

A business or professional relationship is considered material if the aggregate gross revenue derived by the director from the Advisor or the Sponsor and their affiliates exceeds five percent of either the director’s annual gross income during either of the last two years or the director’s net worth on a fair market value basis.

We currently have three directors, two of whom are independent. Directors are elected annually by our stockholders, and there is no limit on the number of times a director may be elected to office. Each director serves until the next annual meeting of stockholders or (if longer) until his or her successor is duly elected and qualifies.

During 2020, the Board of Directors held six meetings including our annual stockholders’ meeting held on December 3, 2020. The entire Board of Directors was present at all of the meetings. The Board of Directors expects each director to attend annual meetings of stockholders when possible. We anticipate that all directors and nominees will attend our 2021 Annual Meeting of Stockholders.

Nominees for the Board of Directors

The Board of Directors has proposed the following nominees for election as directors, each to serve until our 2022 Annual Meeting of stockholders and until his successor is duly elected and qualifies: Messrs. David W. Lichtenstein, George R. Whittemore and Yehuda “Judah” L. Angster. Each nominee currently serves as a director.

5

The proxy holder named on the enclosed proxy card intends to vote FOR the election of each of the three nominees for director. If you do not wish your shares to be voted for particular nominees, please identify the exceptions in the designated space provided on the proxy card or, if you are authorizing a proxy to vote your shares by telephone or the Internet, follow the instructions provided when you authorize a proxy.

We know of no reason why any nominee will be unable to serve if elected. If, at the time of the meeting, one or more of the nominees should become unable to serve, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board of Directors. No proxy will be voted for a greater number of persons than the number of nominees described in this proxy statement.

The principal occupation and certain other information about the nominees are set forth below.

Name | Age | Year First | Business Experience and Principal Occupation; Directorships | |||

David Lichtenstein | 60 | 2008 | Mr. David Lichtenstein is our Chief Executive Officer and Chairman of our board of directors. Mr. Lichtenstein founded both American Shelter Corporation and The Lightstone Group. From 1988 to the present, Mr. Lichtenstein has served as Chairman of the Board of Directors and Chief Executive Officer of The Lightstone Group, directing all aspects of the acquisition, financing and management of a diverse portfolio of multifamily, lodging, retail and industrial properties located in 20 states and Puerto Rico. From June 2004 to the present, Mr. Lichtenstein has served as the Chairman of the Board of Directors and Chief Executive Officer of Lightstone Value Plus REIT I, Inc. (“Lightstone I”) and Chief Executive Officer of Lightstone Value Plus REIT LLC, its advisor. From April 2008 to the present, Mr. Lichtenstein has served as the Chairman of the Board of Directors and Chief Executive Offer of Lightstone Value Plus REIT II, Inc. (“Lightstone II”) and Lightstone Value Plus REIT II LLC, its advisor. From September 2014 to the present, Mr. Lichtenstein has served as Chairman of the Board of Directors and Chief Executive Officer of Lightstone Value Plus REIT IV, Inc., (“Lightstone IV”), and as Chief Executive Officer of Lightstone Real Estate Income LLC, its advisor. From October 2014 to the present, Mr. Lichtenstein has served as Chairman of the Board of Directors and Chief Executive Officer of Lightstone Enterprises Limited (“Lightstone Enterprises”). Mr. Lichtenstein was appointed Chairman Emeritus of the Board of Directors of Lightstone Value Plus REIT V, Inc. (“Lightstone V”) on August 31, 2021 and is Chairman and Chief Executive Officer of its advisor. Mr. Lichtenstein previously served as Chairman of the Board of Directors of Lightstone V from September 28, 2017 through August 30, 2021. From July 2015 to September 2020, Mr. Lichtenstein served as a member of the Board of Directors of the New York City Economic Development Corporation. Mr. Lichtenstein is also a member of the International Council of Shopping Centers and the National Association of Real Estate Investment Trusts, Inc., or NAREIT, an industry trade group, as well as a member of the Board of Directors of Touro College and New York Medical College. Mr. Lichtenstein has been selected to serve as a director due to his experience and networking relationships in the real estate industry, along with his experience in acquiring and financing real estate properties. Mr. Lichtenstein has been selected to serve as a director due to his experience and networking relationships in the real estate industry, along with his experience in acquiring and financing real estate properties. |

6

Name | Age | Year First | Business Experience and Principal Occupation; Directorships | |||

George R. Whittemore | 71 | 2008 | Mr. Whittemore is one of our independent directors and the Chairman of our Audit Committee. From July 2006 to the present, Mr. Whittemore has served as a member of the board of directors of Lightstone I, and from April 2008 to the present has served as a member of the board of directors of Lightstone II. Mr. Whittemore also presently serves as a Director and member of the Audit Committee of Village Bank Financial Corporation in Richmond, Virginia, a publicly traded company. Mr. Whittemore previously served as a as a Director of Condor Hospitality, Inc. in Norfolk, Nebraska, a publicly traded company, from November 1994 to March 2016. Mr. Whittemore previously served as a Director and Member of the Audit Committee of Prime Group Realty Trust from July 2005 until December 2012. Mr. Whittemore previously served as President and Chief Executive Officer of Condor Hospitality Trust, Inc. from November 2001 until August 2004 and as Senior Vice President and Director of both Anderson & Strudwick, Incorporated, a brokerage firm based in Richmond, Virginia, and Anderson & Strudwick Investment Corporation, from October 1996 until October 2001. Mr. Whittemore has also served as a Director, President and Managing Officer of Pioneer Federal Savings Bank and its parent, Pioneer Financial Corporation, from September 1982 until August 1994, and as President of Mills Value Adviser, Inc., a registered investment advisor. Mr. Whittemore is a graduate of the University of Richmond. Mr. Whittemore has been selected to serve as an independent director due to his extensive experience in accounting, banking, finance and real estate. | |||

Yehuda “Judah” L. Angster | 38 | 2021 | Mr. Angster is one of our independent directors. From November 2015 through August 2021, Mr. Angster served as a member of the board of directors of Lightstone I. Mr. Angster is currently the Chief executive Officer of CastleRock Equity Group in Florham Park, NJ. Before joining CastleRock Equity Group in June of 2015, Mr. Angster was the Vice President of Global Development for PCS Wireless, LLC in Florham Park NJ beginning in September 2012. Mr. Angster was the Internal Counsel for Empire Bank from June 2009 to September 2012. Mr. Angster earned his J.D. from the Pace University School of Law in May 2009. Mr. Angster earned a Bachelor of Talmudic Law from Tanenbaum Educational Center, Rockland, NY. Mr. Angster is licensed to practice law in New Jersey and New York. Mr. Angster has been selected to serve as an independent director due to his extensive experience in global business development and real estate transactions. |

The members of the Board of Directors unanimously recommend a vote “FOR” each of the nominees to be elected as directors.

7

The only standing committee of the Board of Directors is the audit committee (the “Audit Committee”). The Audit Committee consists of two members composed entirely of our independent directors. The Board of Directors has determined that each of our independent directors is independent within the meaning of the applicable (i) provisions set forth in the Charter and (ii) requirements set forth in the Securities Exchange Act of 1934, as amended (the “Exchange Act ”), and the applicable SEC rules.

Interested parties may communicate matters they wish to raise with the directors by writing to our Secretary at: Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701, Attention: Joseph Teichman. Mr. Teichman will deliver all appropriate communications to the Board of Directors no later than the next regularly scheduled meeting of the Board of Directors.

Audit Committee

The Board of Directors established an Audit Committee in December 2014. A copy of the charter of the Audit Committee is available on our website at www.lightstonecapitalmarkets.com or in print to any stockholder who requests it c/o Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, NJ 08701. Our Audit Committee consists of Messrs. George R. Whittemore and Yehuda “Judah” L. Angster. Mr. Whittemore is the chairman of our audit committee.

The Audit Committee, in performing its duties, monitors:

• our financial reporting process;

• the integrity of our financial statements;

• compliance with legal and regulatory requirements;

• the independence and qualifications of our independent and internal auditors, as applicable; and

• the performance of our independent and internal auditors, as applicable.

Each member of our Audit Committee is independent within the meaning of the applicable requirements set forth in or promulgated under the Exchange Act and within the meaning of the New York Stock Exchange (“NYSE”) listing standards. In addition, the Board of Directors has determined that Mr. Whittemore and Mr. Angster are qualified as “audit committee financial experts” within the meaning of the applicable rules promulgated by the SEC. Unless otherwise determined by the Board of Directors, no member of the Audit Committee may serve as a member of the audit committee of more than two other public companies.

During 2020, the Audit Committee held five meetings. Each of the Audit Committee members attended all of the meetings held by the Audit Committee, while he was a member of the Audit Committee, either in person or by telephone. The Audit Committee’s report on our financial statements for the fiscal year ended December 31, 2020 is discussed below under the heading “Audit Committee Report.”

Nominating the Board of Directors

The Board of Directors does not have a standing nominating committee for the purpose of nominating individuals to serve as directors. All members of our Board of Directors participate in the consideration of director nominees. The primary functions of the members of the Board of Directors relating to the consideration of director nominees is to identify individuals qualified to serve on the Board of Directors. We have not adopted a specific policy regarding the consideration of director nominees recommended to us by stockholders.

In determining the composition of the Board of Directors, our goals are to assemble a board that, as a whole, possesses the appropriate balance of professional and real estate industry knowledge, financial expertise and high-level management experience to bring a diverse set of skills and experiences to the board as a whole to oversee our business. The Board of Directors believes that diversity is an important attribute of the members of our Board of Directors and that the members should represent an array of backgrounds. To that end, our Board of Directors includes directors who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that we view as critical to effective functioning

8

of the board. The brief biographies in “Proposal One” include information, as of the date of this proxy, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the board to believe that the director should serve on the board.

The Board of Directors annually reviews the appropriate experience, skills and characteristics required of directors in the context of our business. This review includes, in the context of the perceived needs of the board at that time, issues of knowledge, experience, judgment and skills relating to the understanding of the real estate industry, accounting or financial expertise. The Board of Directors gives consideration to the members of the Board of Directors having a diverse mix of background and skills. This review also includes the candidate’s ability to attend regular board meetings and to devote a sufficient amount of time and effort in preparation for such meetings.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”), which is applicable to the directors, officers and employees of the Company and its subsidiaries and affiliates. The Code of Ethics covers topics including, but not limited to, conflicts of interest, confidentiality of information, full and fair disclosure, reporting of violations and compliance with laws and regulations. The Code of Ethics is available, free of charge, on our website at www.lightstonecapitalmarkets.com. You may also obtain a copy of the Code of Ethics by writing to: Lightstone Value Plus REIT III, Inc., 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701, Attention: Joseph Teichman. A waiver of the Code of Ethics for our Chief Executive Officer may be made only by the Board of Directors and will be promptly disclosed to the extent required by law. A waiver of the Code of Ethics for all other directors, officers and employees may be made only by our Chief Executive Officer or General Counsel, and shall be discussed with the Board of Directors as appropriate.

Board Leadership Structure

As noted above, our Board of Directors currently is comprised of two independent and one affiliated directors. Mr. Lichtenstein has served as Chairman of the Board of Directors since 2014 and serves as our Chief Executive Officer. Mr. Whittemore serves as the “presiding director” at any executive sessions of the independent directors, as defined under the rules of the NYSE. The Board of Directors believes that this provides an effective leadership model for the Company.

We recognize that different board leadership structures may be appropriate for companies in different situations, and that no one structure is suitable for all companies. We believe our current board leadership structure is optimal for us because it demonstrates to our investors and other stakeholders that the Company is under strong leadership, coordinated closely between Mr. Lichtenstein, who has over 20 years of real estate industry experience, and Mr. Whittemore, who has served various public and private entities as a key executive and officer over the past 20 years. In our judgment, the Company, like many U.S. companies, has been well-served by this leadership structure.

Board Role in Risk Oversight

Our Board of Directors is actively involved in overseeing our risk management through our Audit Committee. Under its charter, our Audit Committee is responsible for discussing guidelines and policies governing the process by which our senior management and our relevant departments assess and manage our exposure to risk, as well as our major financial risk exposures and the steps management has taken to monitor and control such exposures.

Director Independence

Our charter and bylaws provide for a Board of Directors with no fewer than three and no more than ten directors, a majority of whom must be independent. An “independent director” is defined under our Charter and means a person who is not, and within the last two years has not been, directly or indirectly associated with the Company, our Sponsor or our Advisor or any of their affiliates by virtue of:

• ownership of an interest in our Sponsor, our Advisor or any of their affiliates, other than the Company;

• employment by the Company, our Sponsor, our Advisor or any of their affiliates;

9

• service as an officer of our Sponsor, our Advisor or any of their affiliates, other than as a director of the Company;

• performance of services, other than as a director of the Company;

• service as a director of more than three real estate investment trusts organized or controlled by our Sponsor or advised by our Advisor; or

• maintenance of a material business or professional relationship with our Sponsor, our Advisor or any of their affiliates.

An independent director cannot be associated with us, our Sponsor or our Advisor as set forth above either directly or indirectly. An indirect association with our Sponsor or our Advisor includes circumstances in which a director’s spouse, parent, child, sibling, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in-law, is or has been associated with us, our Sponsor, our Advisor, or any of their affiliates.

A business or professional relationship is considered material if the aggregate gross revenue derived by the director from our Advisor or our Sponsor and their affiliates exceeds five percent of either the director’s annual gross income during either of the last two years or the director’s net worth on a fair market value basis.

The Board of Directors has considered the independence of each director and nominee for election as a director in accordance with the elements of independence set forth in the listing standards of the NYSE. Based upon information solicited from each nominee, the Board of Directors has affirmatively determined that George R. Whittemore and Yehuda “Judah” L. Angster have no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) and are “independent” within the meaning of the NYSE’s director independence standards and Audit Committee independence standards, as currently in effect.

10

DIRECTOR AND EXECUTIVE COMPENSATION

Compensation of Our Directors

We have no standing compensation committee. Our entire Board of Directors determines matters relating to director and officer compensation. Our Board of Directors designs our director compensation with the goals of attracting and retaining highly qualified individuals to serve as independent directors and to fairly compensate them for their time and efforts. Because of our unique attributes as a REIT, service as an independent director on our Board of Directors requires broad expertise in the fields of real estate and real estate investment.

We pay our independent directors an annual fee of $40,000 and are responsible for reimbursement of their out-of-pocket expenses, as incurred.

Compensation of Our Executive Officers

We currently have no employees. Our Advisor performs our day-to-day management functions. Our executive officers are all employees of the Advisor. Our executive officers do not receive compensation from us for services rendered to us. Our executive officers are all employees of our Advisor and are compensated by our Advisor. As a result, our Board of Directors has determined that it is not necessary to establish a compensation committee. In addition, we do not have, and the Board of Directors has not considered, a compensation policy or program for our executive officers, and we have not included a “Compensation Discussion and Analysis” in this proxy statement. See “Certain Relationships and Related Party Transactions” below for a discussion of the fees paid to and services provided by our Advisor and Property Managers.

Compensation Committee Interlocks and Insider Participation

The Board of Directors in its entirety performs the duties typically delegated to a compensation committee. There are no interlocks or insider participation as to compensation decisions required to be disclosed pursuant to SEC regulations.

11

DIRECTORS AND EXECUTIVE OFFICERS

The following table presents certain information as of September 15, 2021 concerning each of our directors and officers serving in such capacity:

Name | Age | Principal Occupation and Positions Held | Served as | |||

David Lichtenstein | 60 | Chief Executive Officer and Chairman of the Board of Directors | 2014 | |||

George R. Whittemore | 71 | Director | 2014 | |||

Yehuda “Judah” L. Angster | 38 | Director | 2021 | |||

Mitchell Hochberg | 69 | President and Chief Operating Officer | N/A | |||

Joseph Teichman | 48 | General Counsel | N/A | |||

Seth Molod | 57 | Chief Financial Officer and Treasurer | N/A |

David Lichtenstein — for biographical information about Mr. Lichtenstein, see “Nominees for the Board of Directors.”

Yehuda “Judah” L. Angster — for biographical information about Mr. Angster, see “Nominees for the Board of Directors.”

George R. Whittemore — for biographical information about Mr. Whittemore, see “Nominees for the Board of Directors.”

Mitchell Hochberg is our President and Chief Operating Officer and also serves as President and Chief Operating Officer of Lightstone I, Lightstone II and Lightstone IV and their respective advisors. Mr. Hochberg also serves as the President of our Sponsor and as the President and Chief Operating Officer of our Advisor. From October 2014 to the present, Mr. Hochberg has served as President of Lightstone Enterprises. Mr. Hochberg was appointed Chief Executive Officer of Behringer Harvard Opportunity REIT I, Inc. (“OP 1”) and Lightstone V effective as of September 28, 2017. Additionally, on August 31, 2021, Mr. Hochberg was appointed as a director and Chairman of the Board of Directors of Lightstone V and will continue to serve as the Lightstone V’s Chief Executive Officer. Prior to joining The Lightstone Group in August 2012, Mr. Hochberg served as principal of Madden Real Estate Ventures from 2007 to August 2012 when it combined with our Sponsor. Mr. Hochberg held the position of President and Chief Operating Officer of Ian Schrager Company, a developer and manager of innovative luxury hotels and residential projects in the United States from early 2006 to early 2007 and prior to that Mr. Hochberg founded Spectrum Communities, a developer of luxury neighborhoods in the northeast of the United States, in 1985 where for 20 years he served as its President and Chief Executive Officer. Mr. Hochberg served a member of the board of directors of Belmond Ltd. from 2009 to April 2019. Additionally, Mr. Hochberg serves as Chairman of the board of directors of WMC Health. Mr. Hochberg received his law degree as a Harlan Fiske Stone Scholar from Columbia University School of Law and graduated magna cum laude from New York University College of Business and Public Administration with a Bachelor of Science degree in accounting and finance.

Joseph E. Teichman is our General Counsel and Secretary and also serves as General Counsel and Secretary of Lightstone I, Lightstone II and Lightstone IV and their respective advisors. From October 2014 to the present, Mr. Teichman has served as Secretary and a Director of Lightstone Enterprises. Mr. Teichman also serves as Executive Vice President and General Counsel of our Sponsor and as General Counsel of our Advisor. Prior to joining The Lightstone Group in January 2007, Mr. Teichman practiced law at the law firm of Paul, Weiss, Rifkind, Wharton & Garrison LLP in New York, NY from September 2001 to January 2007. Mr. Teichman earned a J.D. from the University of Pennsylvania Law School and a B.A. from Beth Medrash Govoha, Lakewood, New Jersey. Mr. Teichman is licensed to practice law in New York and New Jersey. Mr. Teichman is also a member of the Board of Directors of Yeshiva Orchos Chaim, Lakewood, New Jersey and was appointed to the Ocean County College Board of Trustees in February 2016.

12

Seth Molod is our Chief Financial Officer and Treasurer and also serves as the Chief Financial Officer and Treasurer of Lightstone I, Lightstone II, Lightstone IV and Lightstone V. Mr. Molod also serves as the Executive Vice President and Chief Financial Officer of our Sponsor and as the Chief Financial Officer of our Advisor and the advisors of Lightstone I, Lightstone II, Lightstone IV and Lightstone V. Prior to joining The Lightstone Group in August of 2018, Mr. Molod served as an Audit Partner, Chair of Real Estate Services and on the Executive Committee of Berdon LLP, a full service accounting, tax, financial and management advisory firm (“Berdon”). Mr. Molod joined Berdon in 1989. He has extensive experience advising some of the nation’s most prominent real estate owners, developers, managers, and investors in both commercial and residential projects. Mr. Molod has worked with many privately held real estate companies as well as institutional investors, REITs, and other public companies. Mr. Molod is a licensed certified public accountant in New Jersey and New York and a member of the American Institute of Certified Public Accountants. Mr. Molod holds a Bachelor of Business Administration degree in Accounting from Muhlenberg College.

13

STOCK OWNERSHIP BY DIRECTORS, OFFICERS AND CERTAIN STOCKHOLDERS

The following table presents certain information as of September 30, 2020 concerning:

• each person known by us to be the beneficial owner of more than 5% of our outstanding shares of Common Stock based solely upon the amounts and percentages contained in the public filings of such persons;

• each of our directors and executive officers serving in such capacity; and

• all of our directors and executive officers as a group:

Name and Address of Beneficial Owner(1) | Number of | Percent of | |||

David Lichtenstein(2) | 242,222 | 1.8 | % | ||

George R. Whittemore | — | — |

| ||

Yehuda “Judah” L. Angster | — | — |

| ||

Mitchell Hochberg | — | — |

| ||

Seth Molod | — | — |

| ||

Joseph Teichman | — | — |

| ||

Our directors and officers as a group (6 persons) | 242,222 | 1.8 | % | ||

____________

(1) The business address of each individual listed in the table is 1985 Cedar Bridge Avenue, Suite 1, Lakewood, New Jersey 08701.

(2) Includes 20,000 shares owned by our Advisor and 222,222 shares owned by an entity 100% owned by David Lichtenstein. Our Advisor is majority owned by David Lichtenstein. The beneficial owner’s business address is 1985 Cedar Bridge Avenue, Lakewood, New Jersey 08701.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires each director, officer and individual beneficially owning more than 10% of our Common Stock to file initial statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5) of our Common Stock with the SEC. Officers, directors and greater than 10% beneficial owners are required by SEC rules to furnish us with copies of all such forms they file. Based solely on a review of the copies of such forms furnished to us during and with respect to the fiscal year ended December 31, 2020, or written representations that no additional forms were required, we believe that all of our officers and directors and persons that beneficially own more than 10% of the outstanding shares of our Common Stock complied with these filing requirements in 2020.

14

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

David Lichtenstein serves as the Chairman of our Board of Directors and our Chief Executive Officer. Our Advisor and its affiliates and the Special Limited Partner are majority owned and controlled by Mr. Lichtenstein. We have or may entered into agreements with our Advisor and its affiliates to pay certain fees, as described below, in exchange for services performed or consideration given by these and other affiliated entities. As a majority owner of those entities, Mr. Lichtenstein benefits from fees and other compensation that they receive pursuant to these agreements.

Property Managers

Our Advisor has certain affiliates which may manage the properties we acquire. We also use other unaffiliated third-party property managers, principally for the management of our hospitality properties.

We have agreed to pay our property managers a monthly management fee in an amount not to exceed the fee customarily charged in arm’s-length transactions by others rendering similar services in the same geographic area for similar properties as determined by a survey of property managers in such area. We will reimburse our property managers for certain costs and expenses. We may also pay our property managers a separate fee for the one-time initial rent-up or leasing-up of newly constructed property in an amount not to exceed the fee customarily charged in arm’s length transactions by others rendering similar services in the same geographic area for similar properties as determined by a survey of brokers and agents in such area.

We may also engage our property managers to provide construction management services for some of our properties. We will pay a construction management fee in an amount of up to 5% of the cost of any improvements that our property managers undertake.

Advisor

We pay our Advisor an acquisition fee equal to 1.0% of the gross contractual purchase price (including any mortgage assumed) of each property purchased and reimburse our Advisor for expenses that it incurs in connection with the purchase of a property. Acquisition fees and expenses are capped at 5% of the gross contractual purchase price of a property.

Beginning on March 31, 2017, the date on which our Offering ended, the Advisor is paid an advisor asset management fee of one-twelfth (1/12) of 0.75% of our average invested assets and we will reimburse some expenses of the Advisor relating to asset management.

If our Advisor provides services in connection with the financing of an asset, assumption of a loan in connection with the acquisition of an asset or origination or refinancing of any loan on an asset, we may pay our Advisor a financing coordination fee equal to 0.75% of the amount available or outstanding under such financing.

For substantial services in connection with the sale of a property, we will pay to our Advisor a commission in an amount equal to the lesser of (a) one-half of a real estate commission that is reasonable, customary and competitive in light of the size, type and location of the property and (b) 2.0% of the contractual sales price of the property. The commission will not exceed the lesser of 6.0% of the contractual sales price or commission that is reasonable, customary and competitive in light of the size, type and location of the property

We may pay our Advisor an annual subordinated performance fee calculated on the basis of our annual return to holders of our Common Shares, payable annually in arrears, such that for any year in which holders of our Common Shares receive payment of a 6.0% annual cumulative, pre-tax, non-compounded return on their respective net investments, our Advisor will be entitled to 15.0% of the amount in excess of such 6.0% per annum return, provided, that the amount paid to the Advisor will not exceed 10.0% of the aggregate return for such year, and provided, further, that the annual subordinated performance fee will not be paid unless holders of our Common Shares receive a return of their respective net investments. From our inception through December 31, 2020, no annual subordinated performance fees were incurred.

We have agreements with the Advisor to pay certain fees in exchange for services performed by the Advisor and/or its affiliated entities. Additionally, our ability to secure financing and our real estate operations are dependent upon our Advisor and its affiliates to perform such services as provided in these agreements. As of December 31,

15

2020 and 2019, we owed the Advisor and its affiliated entities an aggregate of $292,447 and $451,337, respectively, which was principally for costs paid on our behalf, and is classified as due to related parties on the consolidated balance sheets.

The following table represents the fees incurred associated with the payments to our Advisor for the period indicated:

For the Years Ended December 31, | ||||||

2020 | 2019 | |||||

Disposition fee(1) | $ | — | $ | 39,200 | ||

Finance fees(2) | $ | — | $ | 303,750 | ||

Asset management fees (general and administrative costs) |

| 1,256,459 |

| 1,802,505 | ||

Construction management fees(3) |

| — |

| 4,954 | ||

Total | $ | 1,256,459 | $ | 2,150,409 | ||

____________

(1) Disposition fees of $39,200 were paid in connection with the disposition of the SpringHill Suites — Green Bay and expensed with the disposition’s closing costs.

(2) Finance fees of $303,750 were capitalized and are reflected in the carrying value of our investment in the Cove Joint Venture, which is included in investments in unconsolidated affiliated real estate entities on our consolidated balance sheets.

(3) Generally, capitalized and amortized over the estimated useful life of the associated asset.

Special Limited Partner

In connection with our Offering, which terminated on March 31, 2017, (Lightstone SLP III LLC, a Delaware limited liability company (the “Special Limited Partner”), purchased from the Operating Partnership an aggregate of approximately 242 Subordinated Participation Interests for consideration of $12.1 million. The Subordinated Participation Interests were each purchased for $50,000 in consideration and may be entitled to receive liquidation distributions upon the liquidation of Lightstone REIT III.

As the majority owner of the Special Limited Partner, Mr. Lichtenstein is the beneficial owner of a 99% interest in such Subordinated Participation Interests and will thus receive an indirect benefit from any distributions made in respect thereof.

These Subordinated Participation Interests entitle the Special Limited Partner to a portion of any regular and liquidation distributions that we make to stockholders, but only after stockholders have received a stated preferred return. From our inception through December 31, 2020, no distributions have been declared or paid on the Subordinated Participation Interests.

Hilton Garden Inn Joint Venture

On March 27, 2018, we and our Sponsor’s other public program, Lightstone II, acquired, through the Hilton Garden Inn Joint Venture, a 183-room, limited-service hotel located at 29-21 41st Avenue, Long Island City, New York (the “Hilton Garden Inn — Long Island City”) from an unrelated third party, for aggregate consideration of approximately $60.0 million, which consisted of $25.0 million of cash and $35.0 million of proceeds from a mortgage loan from a financial institution (the “Hilton Garden Inn Mortgage”), excluding closing and other related transaction costs. We and Lightstone REIT II each have a 50.0% membership interest in the Hilton Garden Inn Joint Venture.

We paid approximately $12.9 million for a 50.0% membership interest in the Hilton Garden Inn Joint Venture. Our membership interest in the Hilton Garden Inn Joint Venture is a co-managing interest. We account for our membership interest in the Hilton Garden Inn Joint Venture in accordance with the equity method of accounting because it exerts significant influence over but does not control the Hilton Garden Inn Joint Venture. All capital contributions and distributions of earnings from the Hilton Garden Inn Joint Venture are made on a pro rata basis in proportion to each member’s equity interest percentage. Any distributions in excess of earnings from the Hilton Garden Inn Joint Venture are made to the members pursuant to the terms of the Hilton Garden Inn Joint Venture’s operating agreement. We commenced recording our allocated portion of profit/loss and cash distributions beginning as of March 27, 2018 with respect to our membership interest of 50.0% in the Hilton Garden Inn Joint Venture.

16

In light of the impact of the COVID-19 pandemic on the operating results of the Hilton Garden Inn — Long Island City, the Hilton Garden Inn Joint Venture has entered into certain amendments with respect the Hilton Garden Inn Mortgage as discussed below.

On June 2, 2020, the Hilton Garden Inn Mortgage was amended to provide for (i) the deferral of the six monthly debt service payments aggregating $0.9 million for the period from April 1, 2020 through September 30, 2020 until March 27, 2023; (ii) a 100 bps reduction in the interest rate spread to LIBOR + 2.15%, subject to a 4.03% floor, for the six-month period from September 1, 2020 through February 28, 2021; (iii) the Hilton Garden Inn Joint Venture pre-funding $1.2 million into a cash collateral reserve account to cover the six monthly debt service payments due from October 1, 2020 through March 1, 2021; and (iv) waiver of all financial covenants for quarter-end periods before June 30, 2021.

Additionally, on April 7, 2021, the Hilton Garden Inn Joint Venture and the lender further amended the terms of the Hilton Garden Inn Mortgage to provide for (i) the Hilton Garden Inn Joint Venture to make a principal paydown of $1.7 million; (ii) the Hilton Garden Inn Joint Venture to fund an additional $0.7 million into the cash collateral reserve account; (iii) a waiver of all financial covenants for quarter-end periods through September 30, 2021 with a phased-in gradual return to the full financial covenant requirements over the quarter-end periods beginning December 31, 2021 through December 31, 2022; (iv) a 11-month interest-only payment period from May 1, 2021 through March 31, 2022; and (v) certain restrictions on distributions to the members of the Hilton Garden Inn Joint Venture during the interest-only payment period.

Subsequent to our acquisition of our 50.0% membership interest in the Hilton Garden Joint Venture through June 30, 2021, it has made an aggregate of $2.8 million of additional capital contributions, of which $1.3 million was made during the second quarter of 2021 and received aggregate distributions of $2.0 million, of which $0.5 million was received during the second quarter of 2021.

The Williamsburg Moxy Hotel Joint Venture

On July 30, 2021, we and our Sponsor’s other public program, Lightstone IV, formed a joint venture (the “Williamsburg Moxy Hotel Joint Venture”), pursuant to which we acquired 25% of the Lightstone IV’s membership interest in the Bedford Avenue Holdings LLC for aggregate consideration of $7.9 million.

Bedford Avenue Holdings LLC previously acquired four adjacent parcels of land located at 353-361 Bedford Avenue in Brooklyn, New York, on which it is developing and constructing a 210-room branded hotel.

As a result, we and Lightstone IV have 25% and 75% membership interests, respectively, in the Williamsburg Moxy Hotel Joint Venture.

Additional, on August 5, 2021, Williamsburg Moxy Hotel Joint Venture entered into a recourse construction loan facility for up to $77.0 million (the “Williamsburg Construction Loan”) scheduled to mature on February 5, 2024, with two, six-month extension options, subject to certain conditions. The Williamsburg Construction Loan bears interest at LIBOR plus 9.00%, subject to a 9.50% floor, with monthly interest-only payments based on LIBOR plus 7.50% with the accrued and unpaid interest due at maturity. The Williamsburg Construction Loan is collateralized by the Williamsburg Moxy Hotel. The Williamsburg Moxy Hotel Joint Venture received initial proceeds of $16.0 million under the Williamsburg Construction Loan and repaid the Williamsburg Mortgage ($16.0 million) in full. As a result, the Williamsburg Construction Loan has remaining availability of $61.0 million.

The Cove Joint Venture

On January 31, 2017, we, through our wholly owned subsidiary, REIT III COVE LLC along with LSG Cove LLC, an affiliate of the Sponsor and a related party, REIT IV COVE LLC, a wholly owned subsidiary of Lightstone Real Estate Income Trust, Inc. (“Lightstone IV”), a real estate investment trust also sponsored by the Sponsor and a related party and Maximus Cove Investor LLC (“Maximus”), an unrelated third party, completed the acquisition of all of RP Cove, L.L.C’s membership interest in RP Maximus Cove, L.L.C. (the “Cove Joint Venture”) for aggregate consideration of approximately $255.0 million (the “Cove Transaction”). The Cove Joint Venture owned and operated The Cove at Tiburon (“the Cove”), a 281-unit, luxury waterfront multifamily residential property located in Tiburon, California from January 31, 2017 through February 12, 2020 (see below). Prior to entering into The Cove Transaction, Maximus previously owned a separate noncontrolling interest in the Cove Joint Venture.

17

We paid approximately $20.0 million for a 22.5% membership interest in the Cove Joint Venture. Our ownership interest in the Cove Joint Venture was a non-managing interest. We determined that the Cove Joint Venture was a variable interest entity but we were not the primary beneficiary. We accounted for our ownership interest in the Cove Joint Venture in accordance with the equity method of accounting because it exerted significant influence over but did not control the Cove Joint Venture. We commenced recording its allocated portion of profit/loss and cash distributions beginning as of January 31, 2017 with respect to our 22.5% membership interest in the Cove Joint Venture.

Subsequent to our acquisition of our 22.5% membership interest in the Cove Joint Venture, it made an aggregate of $2.6 million of additional capital contributions and received aggregate distributions of $0.9 million. All of these additional capital contributions were made and distributions received in periods prior to 2020.

On December 17, 2019, REIT III Cove LLC, REIT IV Cove LLC, LSG Cove LLC (collectively, the “Redeemers”), Maximus and the Cove Joint Venture entered into a redemption agreement (the “Redemption Agreement”), pursuant to which the Cove Joint Venture would redeem the membership interests of the Redeemers for an aggregate redemption price of approximately $87.6 million.

On February 12, 2020, the Cove Joint Venture completed the redemption of the Redeemers’ membership interests in the Cove Joint Venture pursuant to the terms of the Redemption Agreement for an aggregate redemption price of approximately $87.6 million. In connection, with the redemption of our 22.5% membership interest in the Cove Joint Venture, we received proceeds of approximately $21.9 million which resulted in a gain on the disposition of investment in unconsolidated affiliated real estate entity of approximately $7.9 million during the first quarter of 2020. As a result of the redemption of our 22.5% membership interest in the Cove Joint Venture on February 12, 2020, we no longer had an ownership interest in the Cove Joint Venture.

During August 2020, we received $0.1 million of additional proceeds related to the redemption of our membership interest in the Cove Joint Venture and recognized a gain on the disposition of investment in unconsolidated affiliated real estate entity of $0.1 million during the third quarter of 2020. As a result, we have recognized an aggregate gain on the disposition of investment in unconsolidated affiliated real estate entity of approximately $8.0 million during the year ended December 31, 2020.

Review, Approval or Ratification of Transactions with Related Persons

Our Charter generally requires that any transactions between us and our Sponsor, our Advisor, our directors, or their affiliates must be approved by a majority of our directors (including a majority of Independent Directors) not otherwise interested in the transaction. In addition, our Board of Directors has adopted a policy relating to the review, approval and ratification of transactions with related persons. This policy applies to any transaction, the amount of which exceeds $120,000, between us and any person who is a director, executive officer or the beneficial owner of more than 5% of any class of our voting securities. Any such related person transaction is subject to approval by the Board of Directors. The Board of Directors will decide whether or not to approve a related party transaction and will generally approve only those transactions that do not create a conflict of interest. The Board of Directors (including a majority of the Independent Directors) has approved the transactions disclosed in this section titled “Certain Relationships and Related Party Transactions.”

18

REGISTERED PUBLIC ACCOUNTING FIRM

EisnerAmper LLP audited our financial statements for the years ended December 31, 2020 and 2019. EisnerAmper LLP reports directly to our Audit Committee. The Audit Committee reviewed the audit and nonaudit services performed by EisnerAmper LLP, as well as the fees charged by EisnerAmper LLP for such services. In its review of the nonaudit service fees, the Audit Committee considered whether the provision of such services is compatible with maintaining the independence of EisnerAmper LLP.

One or more representatives of EisnerAmper LLP have been invited and are expected to be present at the 2021 Annual Meeting of Stockholders. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The following table presents the aggregate fees billed to the Company for the years ended December 31, 2020 and 2019 by the Company’s principal accounting firm:

2020 | 2019 | |||||

Audit Fees(a) | $ | 210,000 | $ | 202,650 | ||

Audit-Related Fees(b) |

| 1,500 |

| 12,500 | ||

Tax Fees(c) |

| 87,836 |

| 79,560 | ||

Total Fees | $ | 299,336 | $ | 294,710 | ||

____________

(a) Fees for audit services consisted of the audit of the Company’s annual consolidated financial statements and interim reviews, including services normally provided in connection with statutory and regulatory filings including registration statement consents.

(b) Fees for audit-related services related to audits of entities that the Company has acquired.

(c) Fees for tax services.

Audit Committee’s Pre-Approval Policies and Procedures

The Audit Committee must approve any fee for services to be performed by the independent registered public accounting firm in advance of the services being performed. In considering the nature of the services provided by the independent auditor, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the independent auditor and the Company’s management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the related requirements of the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

All services rendered by EisnerAmper LLP for the years ended December 31, 2020 and 2019 were approved by the Audit Committee.

19

To the Directors of Lightstone Value Plus REIT III, Inc.:

We have reviewed and discussed with management Lightstone Value Plus REIT III, Inc.’s audited consolidated financial statements as of and for the year ended December 31, 2020.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 16, “Communication with Audit Committees,” as amended, as adopted by the Public Company Accounting Oversight Board.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommend to the board of directors that the consolidated financial statements referred to above be included in Lightstone Value Plus REIT III, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2020.

Audit Committee

George R. Whittemore

Yehuda “Judah” L. Angster

20

To the Stockholders of Lightstone Value Plus REIT III, Inc.:

We have reviewed the Company’s policies and determined that they are in the best interest of the Company’s stockholders. Set forth below is a discussion of the basis for that determination.

General

The Company has and intends to continue to primarily acquire full-service or select-service hotels, including extended-stay hotels. Even though the Company has and intends to continue primarily to acquire hotels, it has and may continue to purchase other types of real estate.

Assets other than hotels may include, without limitation, office buildings, shopping centers, business and industrial parks, manufacturing facilities, single-tenant properties, multifamily properties, student housing properties, warehouses and distribution facilities and medical office properties. The Company has and expects to invest mainly in direct real estate investments and other equity interests; however, it may also invest in debt interests, which may include bridge or mezzanine loans, including in furtherance of a loan-to-own strategy. We have not established any limits on the percentage of our portfolio that may be comprised of various categories of assets which present differing levels of risk.

Financing Policies

The Company has and intends to continue to utilize leverage to acquire its properties. The number of different properties the Company will acquire will be affected by numerous factors, including, the amount of funds available to us. When interest rates on mortgage loans are high or financing is otherwise unavailable on terms that are satisfactory to the Company, the Company may purchase certain properties for cash with the intention of obtaining a mortgage loan for a portion of the purchase price at a later time. There is no limitation on the amount the Company may invest in any single property or on the amount the Company can borrow for the purchase of any property.

The Company has and intends to continue to limit its aggregate long-term permanent borrowings to 75% of the aggregate fair market value of all properties unless any excess borrowing is approved by a majority of the independent directors and is disclosed to the Company’s stockholders. The Company may also incur short-term indebtedness, having a maturity of two years or less. By operating on a leveraged basis, the Company may have more funds available for investment in properties. This may allow the Company to make more investments than would otherwise be possible, resulting in a more diversified portfolio. Although the Company’s liability for the repayment of indebtedness is expected to be limited to the value of the property securing the liability and the rents or profits derived therefrom, the Company’s use of leveraging increases the risk of default on the mortgage payments and a resulting foreclosure of a particular property. To the extent that the Company does not obtain mortgage loans on the Company’s properties, the Company’s ability to acquire additional properties will be restricted. The Company will endeavor to obtain financing on the most favorable terms available.

Policy on Sale or Disposition of Properties

The Company’s Board will determine whether a particular property should be sold or otherwise disposed of after considering the relevant factors, including performance or projected performance of the property and market conditions, with a view toward achieving its principal investment objectives.

The Company currently intends to hold its properties for a period of up to eight years from the termination of the Company’s initial public offering, which occurred on March 31, 2017. At a future date, the Company’s Board may decide to liquidate the Company, list its shares on a national stock exchange, sell its properties individually or merge or otherwise consolidate the Company with a publicly-traded REIT or seek stockholder approval to amend its charter to remove the requirement that the Company must either list its stock on a national securities exchange or seek stockholder approval to adopt a plan of liquidation of the corporation on or before March 31, 2025. Alternatively, the Company may merge with, or otherwise be acquired by, the Sponsor or its affiliates. The Company may, however, sell properties prior to such time and if so, may invest the proceeds from any sale, financing, refinancing or other disposition of its properties into additional properties. Alternatively, the Company may use these proceeds to fund maintenance or repair of existing properties or to increase reserves for such purposes. The

21

Company may choose to reinvest the proceeds from the sale, financing and refinancing of its properties to increase its real estate assets and its net income. Notwithstanding this policy, the Board, in its discretion, may distribute all or part of the proceeds from the sale, financing, refinancing or other disposition of all or any of the Company’s properties to the Company’s stockholders. In determining whether to distribute these proceeds to stockholders, the Board will consider, among other factors, the desirability of properties available for purchase, real estate market conditions, the likelihood of the listing of the Company’s shares on a national securities exchange and compliance with the applicable requirements under federal income tax laws.

When the Company sells a property, it intends to obtain an all-cash sale price. However, the Company may take a purchase money obligation secured by a mortgage on the property as partial payment, and there are no limitations or restrictions on the Company’s ability to take such purchase money obligations. The terms of payment to the Company will be affected by custom in the area in which the property being sold is located and the then prevailing economic conditions. If the Company receives notes and other property instead of cash from sales, these proceeds, other than any interest payable on these proceeds, will not be available for distributions until and to the extent the notes or other property are actually paid, sold, refinanced or otherwise disposed. Therefore, the distribution of the proceeds of a sale to the stockholders may be delayed until that time. In these cases, the Company will receive payments in cash and other property in the year of sale in an amount less than the selling price and subsequent payments will be spread over a number of years.

Independent Directors

George R. Whittemore

Yehuda “Judah” L. Angster

22

OTHER MATTERS PRESENTED FOR ACTION AT THE 2021

Annual Meeting OF STOCKHOLDERS

Our Board of Directors does not intend to present for consideration at the 2021 Annual Meeting of stockholders any matter other than those specifically set forth in the Notice of Annual Meeting of Stockholders. If any other matter is properly presented for consideration at the meeting, the persons named in the proxy will vote thereon pursuant to the discretionary authority conferred by the proxy.

23

STOCKHOLDER PROPOSALS FOR THE 2022 Annual Meeting

Stockholder Proposals in the Proxy Statement

Rule 14a-8 under the Exchange Act addresses when a company must include a stockholder’s proposal in its proxy statement and identify the proposal in its form of proxy when the company holds an annual or special meeting of stockholders. Under Rule 14a-8, in order for a stockholder proposal to be considered or inclusion in the proxy statement and proxy card relating to our 2022 Annual Meeting of stockholders, the proposal must be received at our principal executive offices no later than June 14, 2022.

Stockholder Proposals and Nominations for Directors to Be Presented at Meeting

For any proposal that is not submitted for inclusion in our proxy material for the 2022 Annual Meeting of stockholders but is instead sought to be presented directly at that meeting, Rule 14a-4(c) under the Exchange Act permits our management to exercise discretionary voting authority under proxies it solicits unless we receive timely notice of the proposal in accordance with the procedures set forth in our bylaws. Under our current bylaws, for a stockholder proposal to be properly submitted for presentation at our 2022 Annual Meeting of Stockholders, our Secretary must receive written notice of the proposal at our principal executive offices during the period beginning on May 13, 2022 and ending at 5:00 p.m., Eastern Daylight Time, on June 14, 2022 and must contain information specified in our bylaws, including:

1. as to each director nominee,

• the name, age, business address, and residence address of the nominee;

• the class, series and number of any shares of stock of the Company beneficially owned by the nominee;

• the date such shares were acquired and the investment intent of such acquisitions;

• all other information relating to the nominee that is required under Regulation 14A under the Exchange Act to be disclosed in solicitations of proxies for election of directors in an election contest (even if an election contest is not involved) or is otherwise required; and